UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 03, 2024 |

Lindsay Corporation

(Exact name of Registrant as Specified in Its Charter)

Delaware |

1-13419 |

47-0554096 |

||

(State or Other Jurisdiction |

(Commission File Number) |

(IRS Employer |

||

|

|

|

|

|

|

18135 Burke Street Suite 100 |

|

|||

Omaha, Nebraska |

|

68022 |

||

(Address of Principal Executive Offices) |

|

(Zip Code) |

||

Registrant’s Telephone Number, Including Area Code: (402) 829-6800 |

|

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Securities registered pursuant to Section 12(b) of the Act:

|

|

Trading |

|

|

Common Stock, $1.00 par value |

|

LNN |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On April 4, 2024, Lindsay Corporation (the “Company”) issued a press release announcing the Company’s results of operations for its second quarter ended February 29, 2024. A copy of the press release is furnished herewith as Exhibit 99.1.

In addition, a copy of the slide presentation to be used during the Company’s fiscal 2024 second quarter investor conference call at 11:00 a.m. Eastern Time on April 4, 2024 is furnished herewith as Exhibit 99.2.

Item 7.01 Regulation FD Disclosure.

On April 3, 2024, the Company agreed to acquire a 49.9% non-controlling minority interest in Pessl Instruments GmbH (“Pessl”), an Austrian company that provides agricultural technology solutions focused on field monitoring systems such as weather stations and soil moisture probes. The agreement includes a call option that, if exercised, would allow the Company to acquire the remainder of Pessl’s outstanding shares based on Pessl’s future earnings at certain dates between approximately two-and-a-half and five years after the date of the agreement. The transaction is expected to close in the second half of the Company’s fiscal 2024, subject to customary closing conditions and regulatory approvals. A copy of the press release announcing the transaction is furnished herewith as Exhibit 99.3.

Item 9.01 Financial Statements and Exhibits.

99.1 Earnings Press Release, dated April 4, 2024, issued by the Company.

99.2 Slide Presentation for Fiscal 2024 Second Quarter Investor Conference Call on April 4, 2024.

99.3 Pessl Investment Press Release, dated April 3, 2024, issued by the Company.

104 Cover Page Interactive Data File (embedded within the Inline XBRL document).

In accordance with General Instruction B.2 of Form 8-K, the information contained in Items 2.02 and 7.01 of this Current Report on Form 8-K, including Exhibits 99.1, 99.2, and 99.3 attached hereto, is being “furnished” and, as such, shall not be deemed to be “filed” for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

LINDSAY CORPORATION |

|

|

|

|

Date: |

April 4, 2024 |

By: |

/s/ Brian L. Ketcham |

|

|

|

Brian L. Ketcham, Senior Vice President and Chief Financial Officer |

q

|

|

Exhibit 99.1

18135 BURKE ST. OMAHA, NE 68022 TEL: 402-829-6800 FAX: 402-829-6836 |

Lindsay Corporation Reports Second Quarter Fiscal 2024 Results

Irrigation demand in North America remains stable while market activity in Brazil declines; infrastructure results deliver meaningful margin expansion

OMAHA, Neb., April 4, 2024—Lindsay Corporation (NYSE: LNN), a leading global manufacturer and distributor of irrigation and infrastructure equipment and technology, today announced results for its second quarter ended on February 29, 2024.

Key Highlights

“Demand for irrigation equipment in North America remained stable during our second quarter and in line with our expectations, supported by grower investment from the carryover impact of solid farm profits realized last year," said Randy Wood, President and Chief Executive Officer. "In Brazil, a significant drop in commodity prices during the quarter coupled with the anticipated impact of reduced yields for the current crop has reduced grower profitability and curtailed near-term capital investment capacity. In our infrastructure business, we are pleased with the continued growth of our Road Zipper System™ leasing business, which continues to represent a greater proportion of our infrastructure segment revenues with this sales mix accretive to Lindsay's overall margin profile."

"We continue to invest in our innovation strategy, driving value creation through our advanced technology platforms. During the second quarter we successfully launched the next generation of our industry leading FieldNET™ platform that provides growers with an intuitive and easy-to-use interface with enhanced capabilities for precision irrigation management. In January, we announced plans to invest more than $50 million to expand and modernize our largest global manufacturing facility located in Lindsay, NE. This includes implementation of Industry 4.0 technologies, including data connectivity, analytics, artificial intelligence and additional automation and robotics. This investment will accelerate our ability to bring our latest innovations to market, and it aligns with our capital allocation priorities and commitment to leverage state-of-the art technology across our global operations."

Second Quarter Summary

Consolidated Financial Summary |

|

Second Quarter |

||||||

(dollars in millions, except per share amounts) |

|

FY2024 |

|

FY2023 |

|

$ Change |

|

% Change |

|

|

|

|

|

|

|

|

|

Total revenues |

|

$151.5 |

|

$166.2 |

|

($14.7) |

|

(9%) |

Operating income |

|

$22.1 |

|

$27.3 |

|

($5.2) |

|

(19%) |

Operating margin |

|

14.6% |

|

16.4% |

|

|

|

|

Net earnings |

|

$18.1 |

|

$18.1 |

|

$0.0 |

|

0% |

Diluted earnings per share |

|

$1.64 |

|

$1.63 |

|

$0.01 |

|

1% |

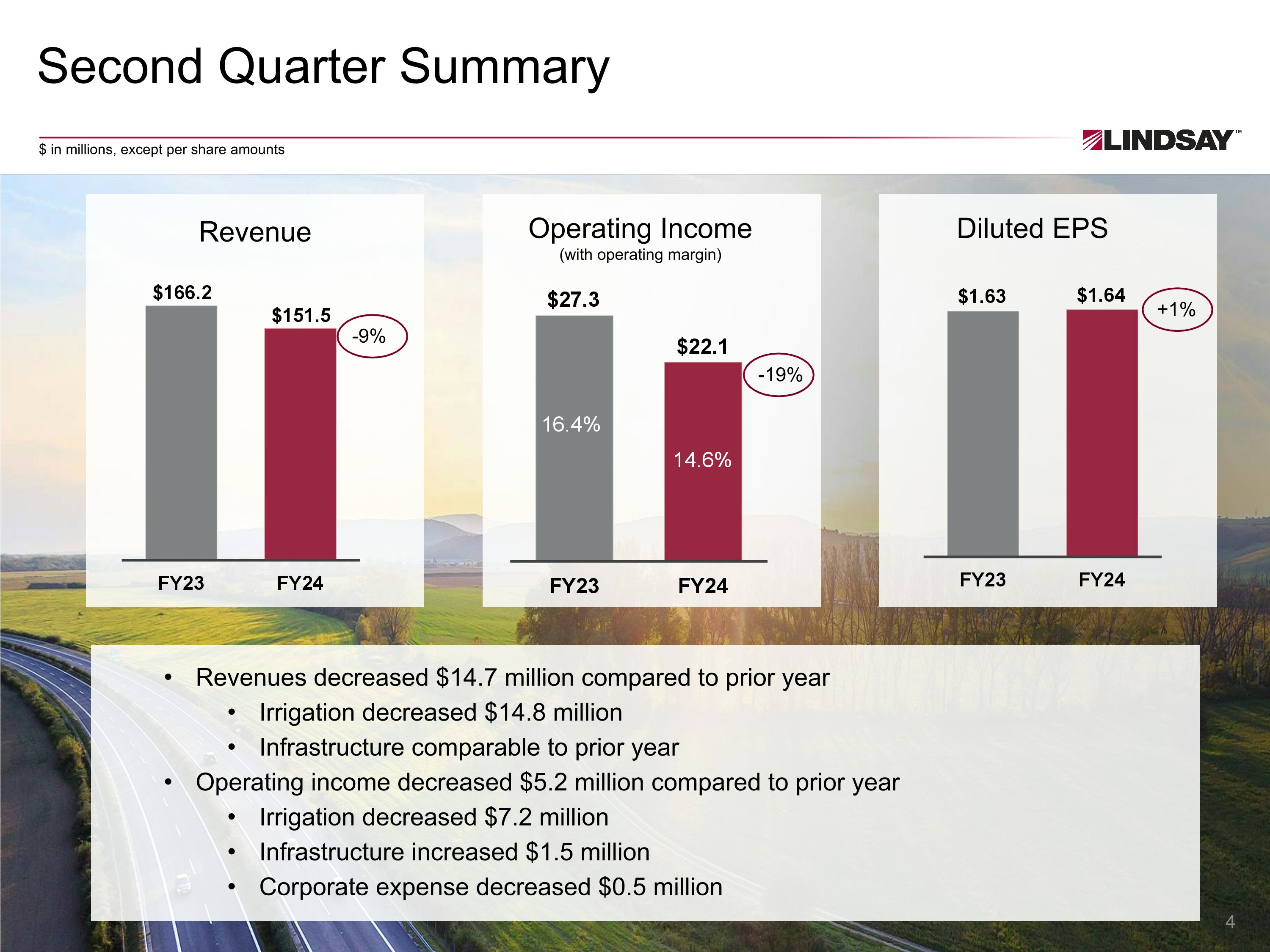

Revenues for the quarter were $151.5 million, a decrease of $14.7 million, or 9 percent, compared to revenues of $166.2 million in the prior year second quarter. The decrease resulted from lower irrigation segment revenues as infrastructure revenues were comparable to the prior year second quarter.

Operating income for the quarter was $22.1 million, a decrease of $5.2 million, or 19 percent, compared to operating income of $27.3 million in the prior year second quarter. Operating margin was 14.6 percent of sales, compared to 16.4 percent of sales in the prior year quarter. The decrease in operating income and operating margin resulted primarily from lower revenues and the resulting impact from deleverage of fixed operating expenses as gross margin was similar to the prior year second quarter.

Net earnings for the quarter were $18.1 million, or $1.64 per diluted share, compared with net earnings of $18.1 million, or $1.63 per diluted share, for the prior year second quarter. The impact of lower operating income was favorably offset by higher other income and a lower effective tax rate compared to the prior year second quarter.

1

Other income benefited from increased interest income and favorable foreign currency translation results compared to the prior year second quarter. Income tax expense for the quarter included the realization of a one-time tax benefit of $1.1 million in Brazil.

Second Quarter Segment Results

Irrigation Segment |

|

Second Quarter |

||||||

(dollars in millions) |

|

FY2024 |

|

FY2023 |

|

$ Change |

|

% Change |

Revenues: |

|

|

|

|

|

|

|

|

North America |

|

$82.8 |

|

$90.4 |

|

($7.6) |

|

(8%) |

International |

|

$50.2 |

|

$57.4 |

|

($7.2) |

|

(13%) |

Total revenues |

|

$133.0 |

|

$147.8 |

|

($14.8) |

|

(10%) |

Operating income |

|

$25.6 |

|

$32.8 |

|

($7.2) |

|

(22%) |

Operating margin |

|

19.3% |

|

22.2% |

|

|

|

|

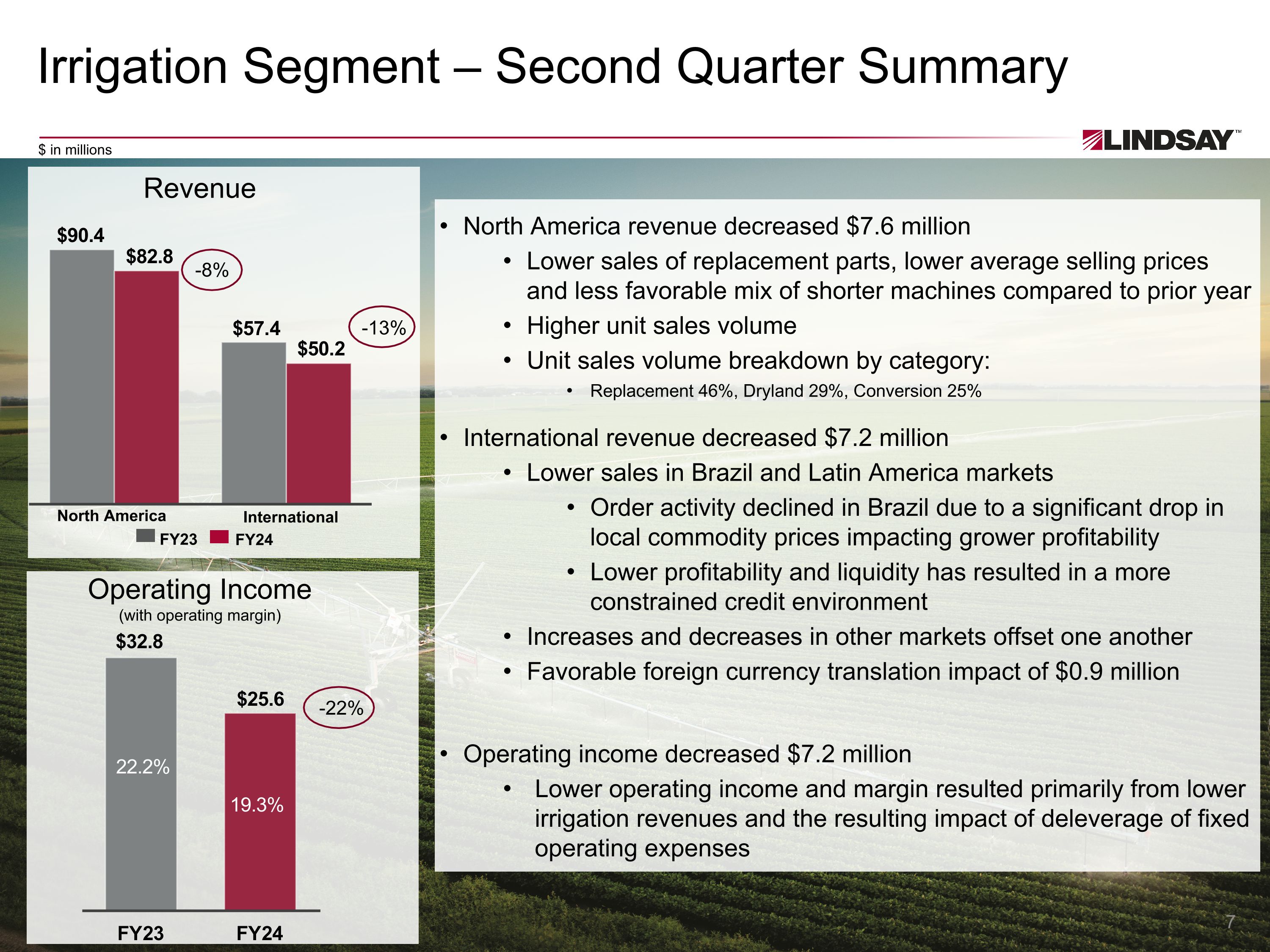

Irrigation segment revenues for the quarter were $133.0 million, a decrease of $14.8 million, or 10 percent, compared to $147.8 million in the prior year second quarter. North America irrigation revenues of $82.8 million decreased $7.6 million, or 8 percent, compared to the prior year second quarter. The majority of the decrease resulted from lower sales of replacement parts, along with slightly lower average selling prices and the impact of a less favorable mix of shorter machines compared to the prior year second quarter. This decrease was partially offset by moderately higher unit sales volume compared to the prior year second quarter.

International irrigation revenues of $50.2 million decreased $7.2 million, or 13 percent, compared to the prior year second quarter. The decrease resulted primarily from lower sales volumes in Brazil and other Latin America markets compared to the prior year second quarter while the impact of small increases and decreases in other markets primarily offset one another. In Brazil, order activity declined due to a significant drop in local commodity prices during the quarter which has negatively impacted the outlook for grower profitability and available liquidity. This dynamic has also resulted in a more constrained credit environment which is limiting growers' ability to invest in irrigation equipment. The decrease in revenues was partially offset by the favorable effects of foreign currency translation of approximately $0.9 million compared to the prior year second quarter.

Irrigation segment operating income for the quarter was $25.6 million, a decrease of $7.2 million, or 22 percent, compared to the prior year second quarter. Operating margin was 19.3 percent of sales, compared to 22.2 percent of sales in the prior year second quarter. Lower operating income and operating margin resulted primarily from lower revenues and the resulting impact from deleverage of fixed operating expenses.

Infrastructure Segment |

|

Second Quarter |

||||||

(dollars in millions) |

|

FY2024 |

|

FY2023 |

|

$ Change |

|

% Change |

|

|

|

|

|

|

|

|

|

Total revenues |

|

$18.5 |

|

$18.5 |

|

$0.0 |

|

0% |

Operating income |

|

$3.5 |

|

$2.0 |

|

$1.5 |

|

74% |

Operating margin |

|

19.0% |

|

10.9% |

|

|

|

|

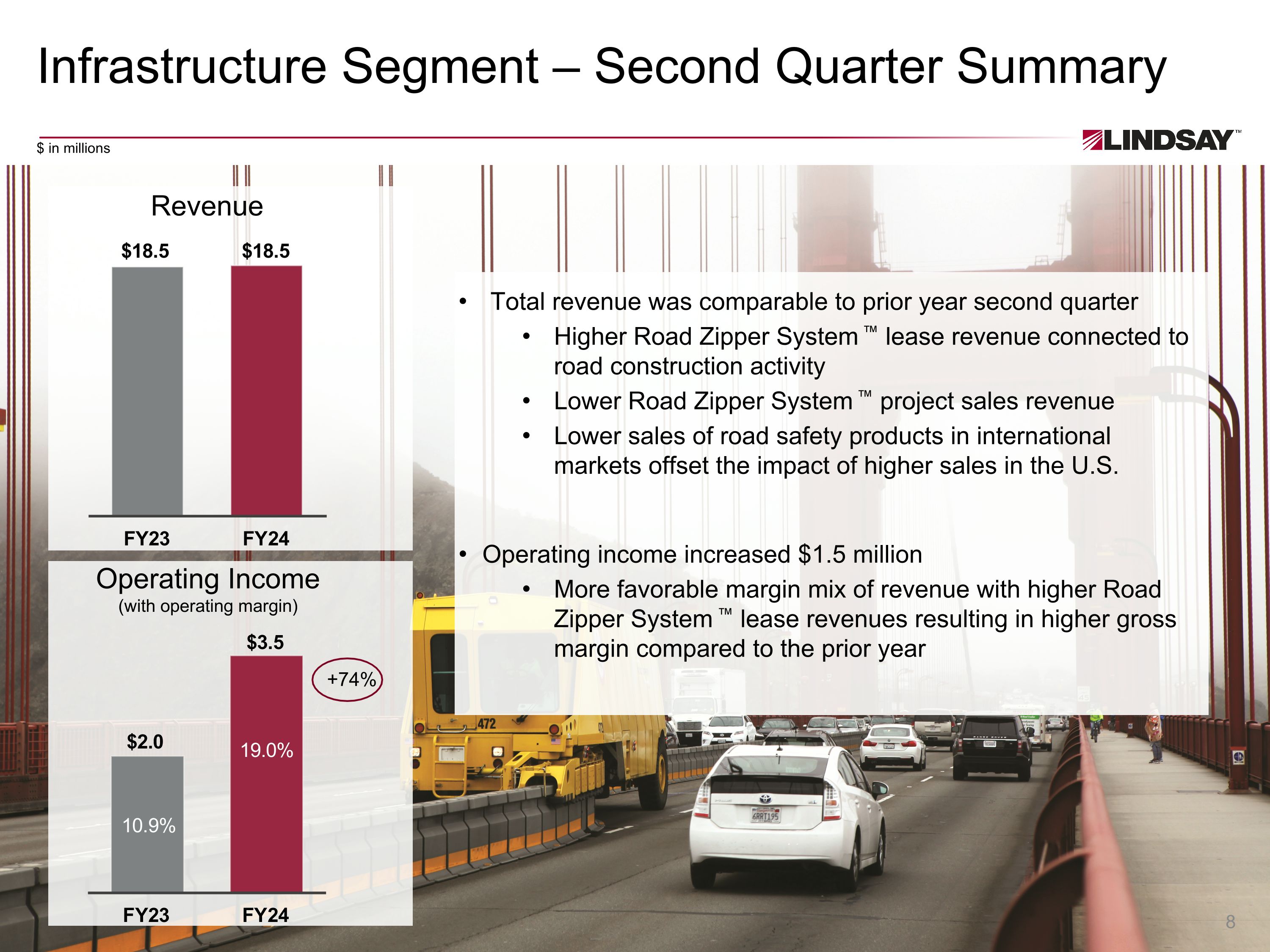

Infrastructure segment revenues for the quarter of $18.5 million were comparable to the prior year second quarter. An increase in Road Zipper System lease revenues was offset by lower Road Zipper System project sales and lower sales of road safety products compared to the prior year second quarter.

Infrastructure segment operating income for the quarter was $3.5 million, an increase of $1.5 million, or 74 percent, compared to the prior year second quarter. Operating margin was 19.0 percent of sales, compared to 10.9 percent of sales in the prior year second quarter. Increased operating income and operating margin resulted from a more favorable margin mix of revenues with higher Road Zipper System lease revenues compared to the prior year second quarter.

The backlog of unfilled orders as of February 29, 2024, was $94.2 million compared with $95.2 million as of February 28, 2023. Included in these backlogs are amounts of $20.3 million and $5.4 million, respectively, for orders that are not expected to be fulfilled within the subsequent twelve months.

Outlook

Mr. Wood concluded, “The USDA recently released the initial projection for 2024 U.S. net farm income which reflects a substantial decline compared to 2023 levels and was below broader market expectations. The forecasted decline, if realized, could negatively affect demand for irrigation equipment during the remainder of our fiscal 2024. We remain confident in the growth opportunity in South America end markets and Brazil in particular; however we expect current market conditions to temper demand for irrigation equipment at least in the near term."

2

“In our infrastructure business, we expect continued growth in our Road Zipper System lease revenues through increased construction activity supported by growth in U.S. infrastructure spending. We also continue to execute our Road Zipper System project sales pipeline, however the timing of implementation remains challenging to forecast due to the number of variables involved in executing these projects.”

Second Quarter Conference Call

Lindsay’s fiscal 2024 second quarter investor conference call is scheduled for 11:00 a.m. Eastern Time today. Interested investors may participate in the call by dialing (833) 535-2202 in the U.S., or (412) 902-6745 internationally, and requesting the Lindsay Corporation call. Additionally, the conference call will be simulcast live on the Internet and can be accessed via the investor relations section of the Company's Web site, www.lindsay.com. Replays of the conference call will remain on our Web site through the next quarterly earnings release. The Company will have a slide presentation available to augment management's formal presentation, which will also be accessible via the Company's Web site.

About the Company

Lindsay Corporation (NYSE: LNN) is a leading global manufacturer and distributor of irrigation and infrastructure equipment and technology. Established in 1955, the company has been at the forefront of research and development of innovative solutions to meet the food, fuel, fiber and transportation needs of the world’s rapidly growing population. The Lindsay family of irrigation brands includes Zimmatic® center pivot and lateral move agricultural irrigation systems, FieldNET® and FieldWise® remote irrigation management, FieldNET Advisor™ irrigation scheduling technology, and industrial IoT solutions. Also a global leader in the transportation industry, Lindsay Transportation Solutions manufactures equipment to improve road safety and keep traffic moving on the world’s roads, bridges and tunnels, through the Barrier Systems®, Road Zipper® and Snoline™ brands. For more information about Lindsay Corporation, visit www.lindsay.com.

Concerning Forward-looking Statements

This release contains forward-looking statements that are subject to risks and uncertainties, and which reflect management’s current beliefs and estimates of future economic circumstances, industry conditions, Company performance and financial results. You can find a discussion of many of these risks and uncertainties in the annual, quarterly and current reports that the Company files with the Securities and Exchange Commission. Forward-looking statements include information concerning possible or assumed future results of operations and planned financing of the Company and those statements preceded by, followed by or including the words “anticipate,” “estimate,” “believe,” “intend,” "expect," "outlook," "could," "may," "should," “will,” or similar expressions. For these statements, the Company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. The Company undertakes no obligation to update any forward-looking information contained in this press release.

For further information, contact:

|

|

|

|

LINDSAY CORPORATION: |

|

Alpha IR: |

|

Alicia Pfeifer |

|

Joe Caminiti or Stephen Poe |

|

Vice President, Investor Relations & Treasury |

|

312-445-2870 |

|

402-933-6429 |

|

LNN@alpha-ir.com |

|

Alicia.Pfeifer@lindsay.com |

|

|

|

3

LINDSAY CORPORATION AND SUBSIDIARIES |

|

|||||||||||||||||||

CONDENSED CONSOLIDATED STATEMENTS OF EARNINGS |

|

|||||||||||||||||||

(Unaudited) |

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

Three months ended |

|

|

Six months ended |

|

||||||||||||||

(in thousands, except per share amounts) |

|

|

February 29, |

|

|

|

February 28, |

|

|

|

February 29, |

|

|

|

February 28, |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Operating revenues |

|

$ |

|

151,519 |

|

|

$ |

|

166,241 |

|

|

$ |

|

312,877 |

|

|

$ |

|

342,400 |

|

Cost of operating revenues |

|

|

|

102,565 |

|

|

|

|

111,983 |

|

|

|

|

214,018 |

|

|

|

|

235,122 |

|

Gross profit |

|

|

|

48,954 |

|

|

|

|

54,258 |

|

|

|

|

98,859 |

|

|

|

|

107,278 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Selling expense |

|

|

|

9,498 |

|

|

|

|

8,733 |

|

|

|

|

19,315 |

|

|

|

|

18,410 |

|

General and administrative expense |

|

|

|

13,466 |

|

|

|

|

13,739 |

|

|

|

|

28,128 |

|

|

|

|

28,176 |

|

Engineering and research expense |

|

|

|

3,892 |

|

|

|

|

4,521 |

|

|

|

|

8,244 |

|

|

|

|

8,829 |

|

Total operating expenses |

|

|

|

26,856 |

|

|

|

|

26,993 |

|

|

|

|

55,687 |

|

|

|

|

55,415 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Operating income |

|

|

|

22,098 |

|

|

|

|

27,265 |

|

|

|

|

43,172 |

|

|

|

|

51,863 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Interest expense |

|

|

|

(830 |

) |

|

|

|

(1,038 |

) |

|

|

|

(1,707 |

) |

|

|

|

(1,947 |

) |

Interest income |

|

|

|

1,295 |

|

|

|

|

490 |

|

|

|

|

2,363 |

|

|

|

|

865 |

|

Other income (expense), net |

|

|

|

134 |

|

|

|

|

(984 |

) |

|

|

|

(136 |

) |

|

|

|

(1,043 |

) |

Total other income (expense) |

|

|

|

599 |

|

|

|

|

(1,532 |

) |

|

|

|

520 |

|

|

|

|

(2,125 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Earnings before income taxes |

|

|

|

22,697 |

|

|

|

|

25,733 |

|

|

|

|

43,692 |

|

|

|

|

49,738 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Income tax expense |

|

|

|

4,574 |

|

|

|

|

7,681 |

|

|

|

|

10,550 |

|

|

|

|

13,469 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Net earnings |

|

$ |

|

18,123 |

|

|

$ |

|

18,052 |

|

|

$ |

|

33,142 |

|

|

$ |

|

36,269 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Basic |

|

$ |

|

1.64 |

|

|

$ |

|

1.64 |

|

|

$ |

|

3.01 |

|

|

$ |

|

3.30 |

|

Diluted |

|

$ |

|

1.64 |

|

|

$ |

|

1.63 |

|

|

$ |

|

2.99 |

|

|

$ |

|

3.28 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Shares used in computing earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Basic |

|

|

|

11,033 |

|

|

|

|

11,007 |

|

|

|

|

11,025 |

|

|

|

|

10,998 |

|

Diluted |

|

|

|

11,074 |

|

|

|

|

11,063 |

|

|

|

|

11,067 |

|

|

|

|

11,068 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Cash dividends declared per share |

|

$ |

|

0.35 |

|

|

$ |

|

0.34 |

|

|

$ |

|

0.70 |

|

|

$ |

|

0.68 |

|

4

LINDSAY CORPORATION AND SUBSIDIARIES |

|

|||||||||||||||||||

SUMMARY OPERATING RESULTS |

|

|||||||||||||||||||

(Unaudited) |

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

Three months ended |

|

|

|

Six months ended |

|

|||||||||||||

(in thousands) |

|

|

February 29, |

|

|

|

February 28, |

|

|

|

February 29, |

|

|

|

February 28, |

|

||||

Operating revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Irrigation: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

North America |

|

$ |

|

82,845 |

|

|

$ |

|

90,354 |

|

|

$ |

|

172,222 |

|

|

$ |

|

174,288 |

|

International |

|

|

|

50,173 |

|

|

|

|

57,422 |

|

|

|

|

100,964 |

|

|

|

|

125,571 |

|

Irrigation segment |

|

|

|

133,018 |

|

|

|

|

147,776 |

|

|

|

|

273,186 |

|

|

|

|

299,859 |

|

Infrastructure segment |

|

|

|

18,501 |

|

|

|

|

18,465 |

|

|

|

|

39,691 |

|

|

|

|

42,541 |

|

Total operating revenues |

|

$ |

|

151,519 |

|

|

$ |

|

166,241 |

|

|

$ |

|

312,877 |

|

|

$ |

|

342,400 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Operating income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Irrigation segment |

|

$ |

|

25,649 |

|

|

$ |

|

32,820 |

|

|

$ |

|

50,956 |

|

|

$ |

|

61,461 |

|

Infrastructure segment |

|

|

|

3,506 |

|

|

|

|

2,019 |

|

|

|

|

7,125 |

|

|

|

|

5,391 |

|

Corporate |

|

|

|

(7,057 |

) |

|

|

|

(7,574 |

) |

|

|

|

(14,909 |

) |

|

|

|

(14,989 |

) |

Total operating income |

|

$ |

|

22,098 |

|

|

$ |

|

27,265 |

|

|

$ |

|

43,172 |

|

|

$ |

|

51,863 |

|

The Company manages its business activities in two reportable segments as follows:

Irrigation – This reporting segment includes the manufacture and marketing of center pivot, lateral move, and hose reel irrigation systems, as well as various innovative technology solutions such as GPS positioning and guidance, variable rate irrigation, remote irrigation management and scheduling technology, irrigation consulting and design and industrial IoT solutions.

Infrastructure – This reporting segment includes the manufacture and marketing of movable barriers, specialty barriers, crash cushions and end terminals, and road marking and road safety equipment.

5

LINDSAY CORPORATION AND SUBSIDIARIES |

|

||||||||||||||

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

||||||||||||||

(Unaudited) |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

(in thousands) |

|

February 29, |

|

|

February 28, |

|

|

August 31, |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|||

Current assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|||

Cash and cash equivalents |

|

$ |

|

133,415 |

|

|

$ |

|

97,675 |

|

|

$ |

|

160,755 |

|

Marketable securities |

|

|

|

17,219 |

|

|

|

|

8,763 |

|

|

|

|

5,556 |

|

Receivables, net |

|

|

|

153,624 |

|

|

|

|

167,007 |

|

|

|

|

144,774 |

|

Inventories, net |

|

|

|

167,334 |

|

|

|

|

178,703 |

|

|

|

|

155,932 |

|

Other current assets |

|

|

|

29,121 |

|

|

|

|

27,973 |

|

|

|

|

20,467 |

|

Total current assets |

|

|

|

500,713 |

|

|

|

|

480,121 |

|

|

|

|

487,484 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Property, plant, and equipment, net |

|

|

|

110,691 |

|

|

|

|

93,838 |

|

|

|

|

99,681 |

|

Intangibles, net |

|

|

|

26,277 |

|

|

|

|

17,329 |

|

|

|

|

27,719 |

|

Goodwill |

|

|

|

84,099 |

|

|

|

|

67,409 |

|

|

|

|

83,121 |

|

Operating lease right-of-use assets |

|

|

|

16,755 |

|

|

|

|

17,984 |

|

|

|

|

17,036 |

|

Deferred income tax assets |

|

|

|

9,203 |

|

|

|

|

9,518 |

|

|

|

|

10,885 |

|

Other noncurrent assets |

|

|

|

17,542 |

|

|

|

|

22,881 |

|

|

|

|

19,734 |

|

Total assets |

|

$ |

|

765,280 |

|

|

$ |

|

709,080 |

|

|

$ |

|

745,660 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|||

Current liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|||

Accounts payable |

|

$ |

|

47,903 |

|

|

$ |

|

52,998 |

|

|

$ |

|

44,278 |

|

Current portion of long-term debt |

|

|

|

228 |

|

|

|

|

224 |

|

|

|

|

226 |

|

Other current liabilities |

|

|

|

81,147 |

|

|

|

|

79,566 |

|

|

|

|

91,604 |

|

Total current liabilities |

|

|

|

129,278 |

|

|

|

|

132,788 |

|

|

|

|

136,108 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Pension benefits liabilities |

|

|

|

4,234 |

|

|

|

|

4,733 |

|

|

|

|

4,382 |

|

Long-term debt |

|

|

|

115,075 |

|

|

|

|

115,253 |

|

|

|

|

115,164 |

|

Operating lease liabilities |

|

|

|

16,936 |

|

|

|

|

18,659 |

|

|

|

|

17,689 |

|

Deferred income tax liabilities |

|

|

|

677 |

|

|

|

|

702 |

|

|

|

|

689 |

|

Other noncurrent liabilities |

|

|

|

16,046 |

|

|

|

|

14,673 |

|

|

|

|

15,977 |

|

Total liabilities |

|

|

|

282,246 |

|

|

|

|

286,808 |

|

|

|

|

290,009 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Shareholders' equity: |

|

|

|

|

|

|

|

|

|

|

|

|

|||

Preferred stock |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

— |

|

Common stock |

|

|

|

19,122 |

|

|

|

|

19,091 |

|

|

|

|

19,094 |

|

Capital in excess of stated value |

|

|

|

101,060 |

|

|

|

|

94,834 |

|

|

|

|

98,508 |

|

Retained earnings |

|

|

|

661,715 |

|

|

|

|

607,784 |

|

|

|

|

636,297 |

|

Less treasury stock - at cost |

|

|

|

(277,238 |

) |

|

|

|

(277,238 |

) |

|

|

|

(277,238 |

) |

Accumulated other comprehensive loss, net |

|

|

|

(21,625 |

) |

|

|

|

(22,199 |

) |

|

|

|

(21,010 |

) |

Total shareholders' equity |

|

|

|

483,034 |

|

|

|

|

422,272 |

|

|

|

|

455,651 |

|

Total liabilities and shareholders' equity |

|

$ |

|

765,280 |

|

|

$ |

|

709,080 |

|

|

$ |

|

745,660 |

|

6

LINDSAY CORPORATION AND SUBSIDIARIES |

|

||||||||

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

|

||||||||

(Unaudited) |

|

||||||||

|

|

|

|

|

|

|

|

||

|

Six months ended |

|

|||||||

(in thousands) |

|

February 29, 2024 |

|

|

|

February 28, 2023 |

|

||

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

||

Net earnings |

$ |

|

33,142 |

|

|

$ |

|

36,269 |

|

Adjustments to reconcile net earnings to net cash provided by operating activities: |

|

|

|

|

|

|

|

||

Depreciation and amortization |

|

|

10,574 |

|

|

|

|

9,695 |

|

Provision for uncollectible accounts receivable |

|

|

249 |

|

|

|

|

834 |

|

Deferred income taxes |

|

|

1,488 |

|

|

|

|

(185 |

) |

Share-based compensation expense |

|

|

3,335 |

|

|

|

|

3,089 |

|

Unrealized foreign currency transaction (gain) loss |

|

|

(94 |

) |

|

|

|

878 |

|

Other, net |

|

|

150 |

|

|

|

|

354 |

|

Changes in assets and liabilities: |

|

|

|

|

|

|

|

||

Receivables |

|

|

(9,349 |

) |

|

|

|

(28,707 |

) |

Inventories |

|

|

(12,003 |

) |

|

|

|

14,014 |

|

Other current assets |

|

|

(7,009 |

) |

|

|

|

1,635 |

|

Accounts payable |

|

|

3,792 |

|

|

|

|

(6,178 |

) |

Other current liabilities |

|

|

(15,186 |

) |

|

|

|

(25,553 |

) |

Other noncurrent assets and liabilities |

|

|

3,047 |

|

|

|

|

1,742 |

|

Net cash provided by operating activities |

|

|

12,136 |

|

|

|

|

7,887 |

|

|

|

|

|

|

|

|

|

||

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

||

Purchases of property, plant, and equipment |

|

|

(18,773 |

) |

|

|

|

(7,222 |

) |

Purchases of marketable securities |

|

|

(15,042 |

) |

|

|

|

— |

|

Proceeds from maturities of marketable securities |

|

|

3,525 |

|

|

|

|

2,725 |

|

Other investing activities, net |

|

|

(540 |

) |

|

|

|

(1,214 |

) |

Net cash used in investing activities |

|

|

(30,830 |

) |

|

|

|

(5,711 |

) |

|

|

|

|

|

|

|

|

||

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

||

Proceeds from exercise of stock options |

|

|

479 |

|

|

|

|

— |

|

Dividends paid |

|

|

(7,724 |

) |

|

|

|

(7,485 |

) |

Common stock withheld for payroll tax obligations |

|

|

(1,575 |

) |

|

|

|

(2,471 |

) |

Other financing activities, net |

|

|

229 |

|

|

|

|

128 |

|

Net cash used in financing activities |

|

|

(8,591 |

) |

|

|

|

(9,828 |

) |

|

|

|

|

|

|

|

|

||

Effect of exchange rate changes on cash and cash equivalents |

|

|

(55 |

) |

|

|

|

279 |

|

Net change in cash and cash equivalents |

|

|

(27,340 |

) |

|

|

|

(7,373 |

) |

Cash and cash equivalents, beginning of period |

|

|

160,755 |

|

|

|

|

105,048 |

|

Cash and cash equivalents, end of period |

$ |

|

133,415 |

|

|

$ |

|

97,675 |

|

|

|

|

|

|

|

|

|

||

7

2nd Quarter Fiscal 2024 Earnings Slide Deck Exhibit 99.2

Safe-Harbor Statement This presentation contains forward-looking statements that are subject to risks and uncertainties, and which reflect management’s current beliefs and estimates of future economic circumstances, industry conditions, Company performance, financial results and planned financing. You can find a discussion of many of these risks and uncertainties in the annual, quarterly and current reports that the Company files with the Securities and Exchange Commission. Investors should understand that a number of factors could cause future economic and industry conditions and the Company’s actual financial condition and results of operations to differ materially from management’s beliefs expressed in the forward-looking statements contained in this presentation. These factors include those outlined in the “Risk Factors” section of the Company’s most recent annual report on Form 10-K filed with the Securities and Exchange Commission, and investors are urged to review these factors when considering the forward-looking statements contained in this presentation. For these statements, the Company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. For additional financial statement information, please see the Company’s earnings release dated April 4, 2024.

Second Quarter Key Messages North America irrigation unit sales volume increases during the second quarter and year-to-date is supported by the carryover impact of solid 2023 farm profits A forecasted decline in 2024 U.S. net farm income, if realized, could negatively impact demand for irrigation equipment during the remainder of fiscal 2024 Reduced outlook for grower profitability and liquidity in Brazil tempers demand for irrigation equipment in the near term Increased Road Zipper System™ lease revenues support accretive sales mix shift and improved infrastructure results

Second Quarter Summary Revenues decreased $14.7 million compared to prior year Irrigation decreased $14.8 million Infrastructure comparable to prior year Operating income decreased $5.2 million compared to prior year Irrigation decreased $7.2 million Infrastructure increased $1.5 million Corporate expense decreased $0.5 million $ in millions, except per share amounts -9% -19% +1% Revenue Operating Income (with operating margin) Diluted EPS

Second Quarter and YTD Financial Summary

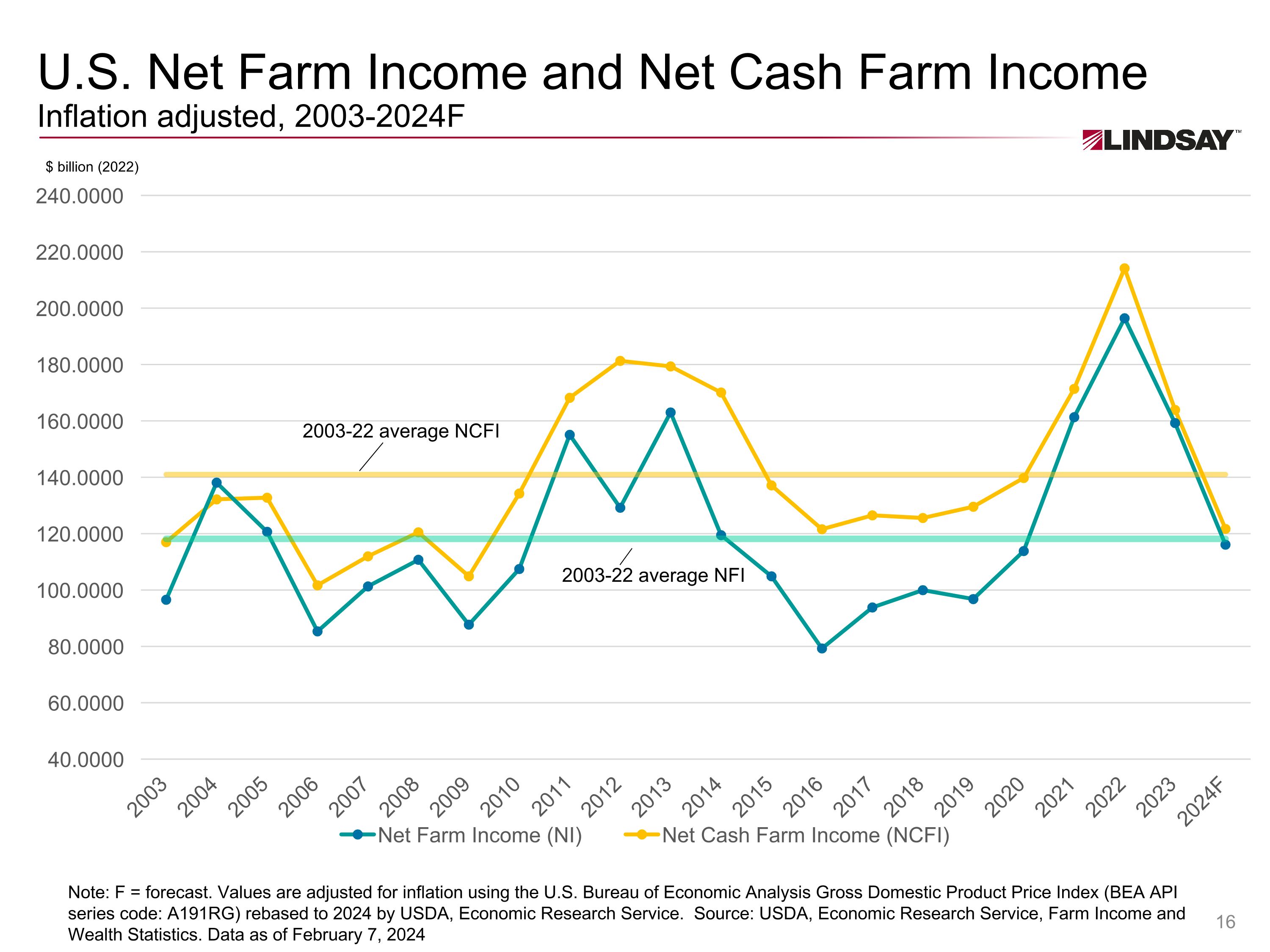

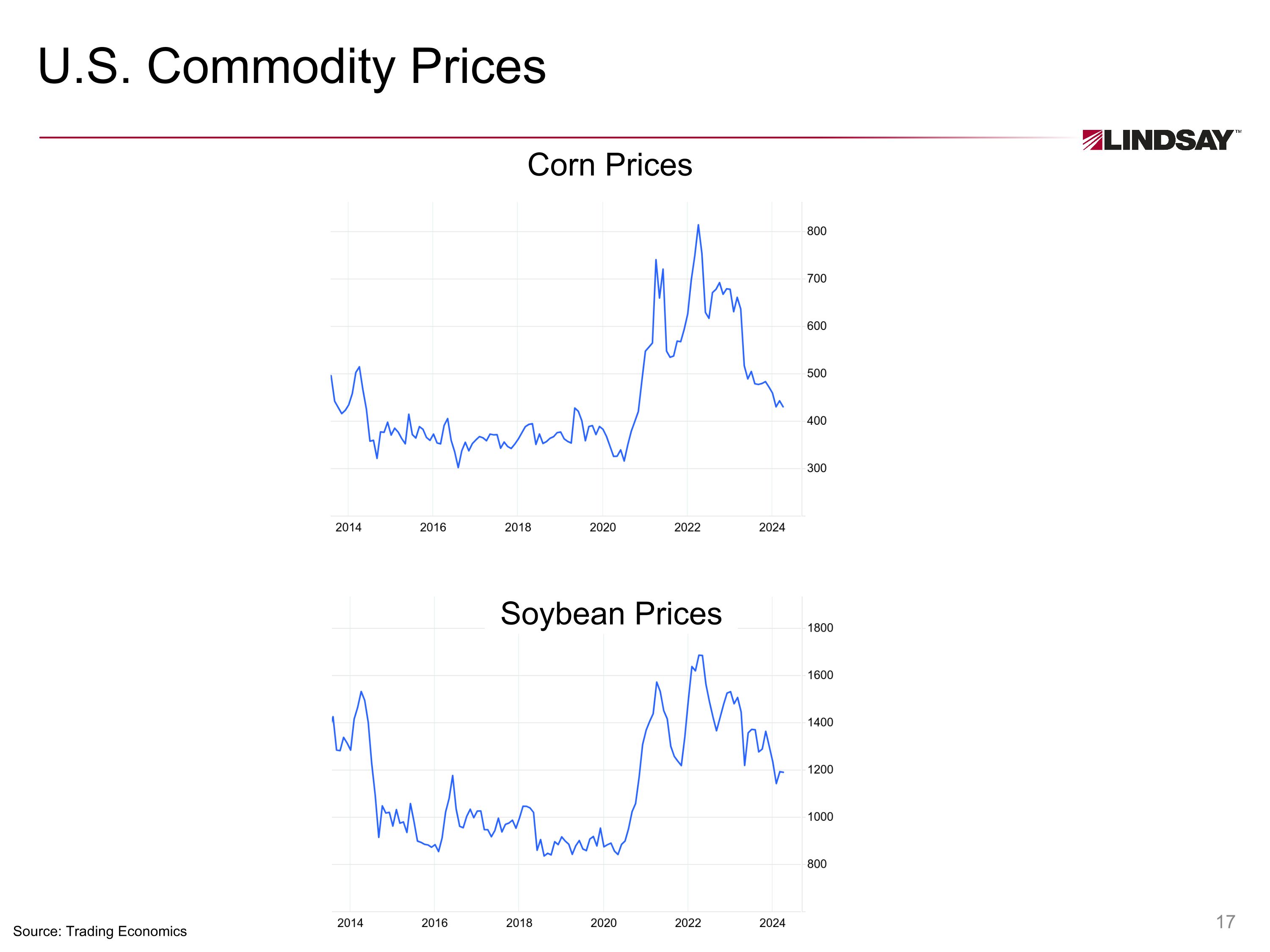

Current Market Factors As of February 2024, U.S. corn prices have decreased 35 percent and U.S. soybean prices have decreased 25 percent from price levels prevailing in February 2023 In February 2024, the USDA estimated 2024 U.S. net farm income to be $116.1 billion, a decrease of 26 percent from 2023 U.S. net farm income of $155.9 billion Decrease in government support payments of 16 percent Decrease in cash receipts for crops of 6 percent Increase in cash expenses of 4 percent U.S, farm balance sheets remain strong following three years of solid profitability In Brazil, a 20 percent drop in cash soybean prices from December 2023 to February 2024, coupled with lower yield expectations, is negatively impacting the outlook for grower profitability and available liquidity Irrigation Infrastructure Infrastructure Investment and Jobs Act (IIJA) funding marks the largest infusion of federal investment into infrastructure projects in more than a decade Includes $110 billion in incremental federal funding for roads, bridges, and other transportation projects The additional funding is expected to support higher demand in the U.S. for Lindsay products and solutions Annual 2023 contract awards reflected an increase of 19 percent for highways and an increase of 12 percent for bridges compared to 2022 Public capital spending for highways and bridges expected to grow approximately 13 percent in calendar 2024 The timing and scope of construction projects can be impacted by a variety of factors

Irrigation Segment – Second Quarter Summary North America revenue decreased $7.6 million Lower sales of replacement parts, lower average selling prices and less favorable mix of shorter machines compared to prior year Higher unit sales volume Unit sales volume breakdown by category: Replacement 46%, Dryland 29%, Conversion 25% International revenue decreased $7.2 million Lower sales in Brazil and Latin America markets Order activity declined in Brazil due to a significant drop in local commodity prices impacting grower profitability Lower profitability and liquidity has resulted in a more constrained credit environment Increases and decreases in other markets offset one another Favorable foreign currency translation impact of $0.9 million Operating income decreased $7.2 million Lower operating income and margin resulted primarily from lower irrigation revenues and the resulting impact of deleverage of fixed operating expenses Revenue North America International FY23 FY24 $ in millions -13% -22% -8% Operating Income (with operating margin)

Infrastructure Segment – Second Quarter Summary Total revenue was comparable to prior year second quarter Higher Road Zipper System ™ lease revenue connected to road construction activity Lower Road Zipper System ™ project sales revenue Lower sales of road safety products in international markets offset the impact of higher sales in the U.S. Operating income increased $1.5 million More favorable margin mix of revenue with higher Road Zipper System ™ lease revenues resulting in higher gross margin compared to the prior year Revenue $ in millions +74% Operating Income (with operating margin)

Innovation Leadership: Addressing Global Megatrends Capitalizingon globalmegatrends FoodSecurity WaterScarcity LandAvailability MobilitySafety Increased Safety Standards Aging Infrastructure Megatrends Innovation Leadership Innovative sustainable solutions for growers across the globe Mobilizing global populations safelyand sustainably

Strong Commitment to Sustainable Practices Our mission is to conserve natural resources, expand our world’s potential, and enhance the quality of life for people. Investing in sustainable technologies Improving our operational footprint Empowering and protecting our people Engaging inour local communities Operatingwithintegrity 1 2 3 4 5

Summary Balance Sheet and Liquidity As of February 29, 2024, available liquidity of $200.6 million, with $150.6 million in cash, cash equivalents and marketable securities and $50.0 million available under revolving credit facility Well-positioned with a strong balance sheet to continue to execute our capital allocation strategy and create value for shareholders.

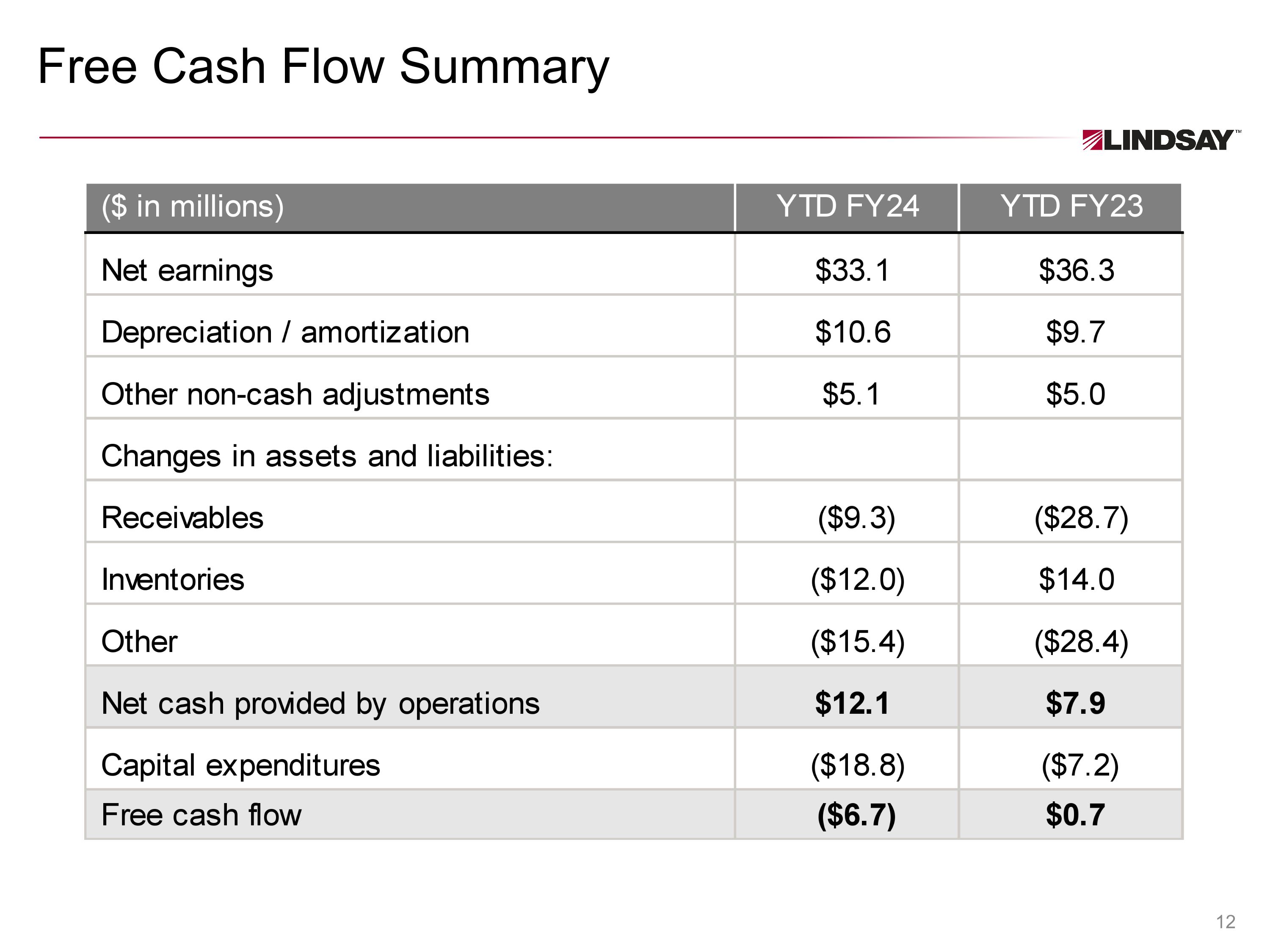

Free Cash Flow Summary

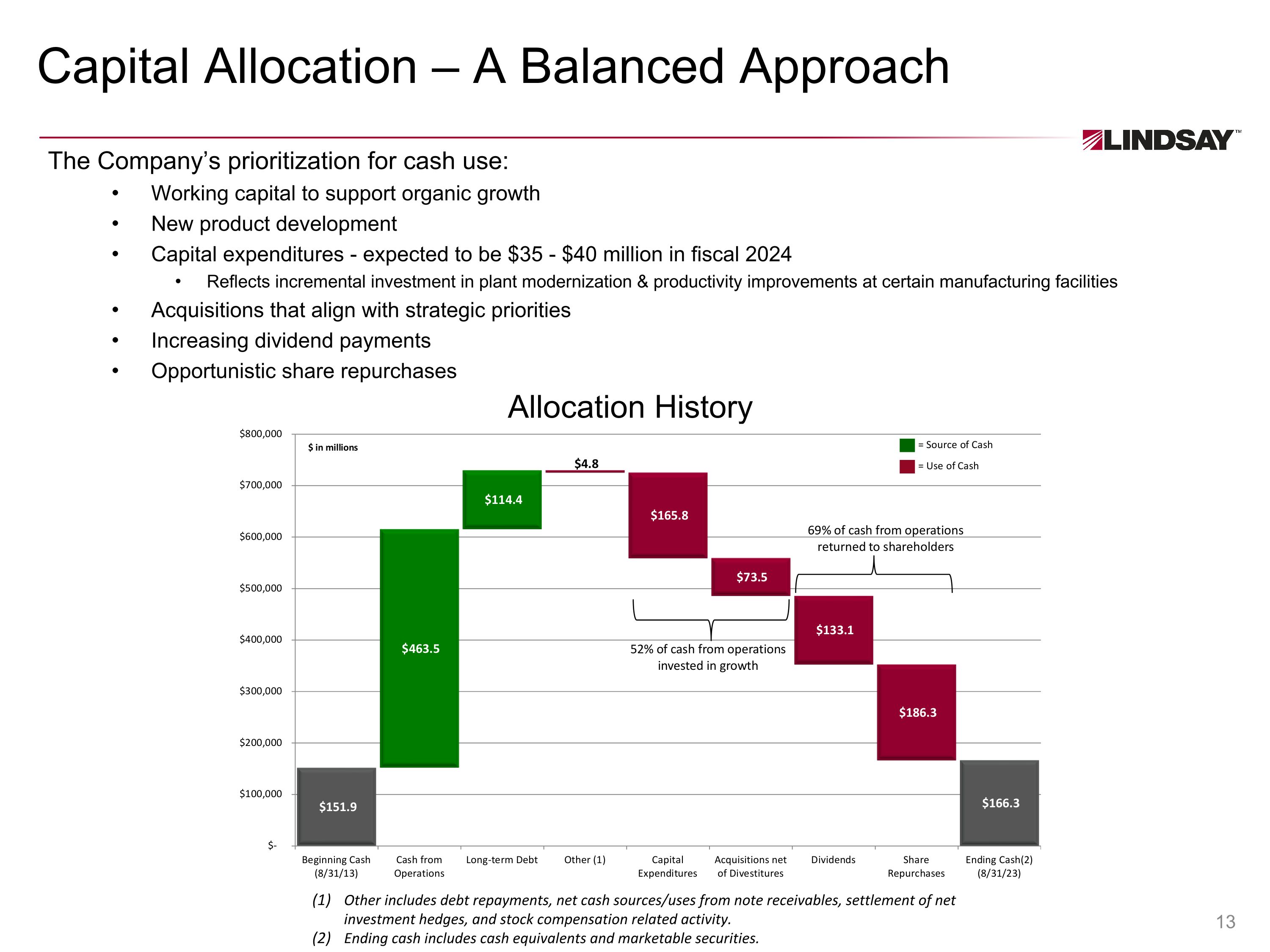

Capital Allocation – A Balanced Approach The Company’s prioritization for cash use: Working capital to support organic growth New product development Capital expenditures - expected to be $35 - $40 million in fiscal 2024 Reflects incremental investment in plant modernization & productivity improvements at certain manufacturing facilities Acquisitions that align with strategic priorities Increasing dividend payments Opportunistic share repurchases Allocation History Other includes debt repayments, net cash sources/uses from note receivables, settlement of net investment hedges, and stock compensation related activity. Ending cash includes cash equivalents and marketable securities.

Five-Year Financial Goals(Annual Averages) Organic RevenueGrowth >7% OperatingMargin >14% ROIC >12% EPS Growth >10%

Appendix

U.S. Net Farm Income and Net Cash Farm IncomeInflation adjusted, 2003-2024F 2003-22 average NCFI Note: F = forecast. Values are adjusted for inflation using the U.S. Bureau of Economic Analysis Gross Domestic Product Price Index (BEA API series code: A191RG) rebased to 2024 by USDA, Economic Research Service. Source: USDA, Economic Research Service, Farm Income and Wealth Statistics. Data as of February 7, 2024 $ billion (2022) 2003-22 average NFI

U.S. Commodity Prices Soybean Prices Source: Trading Economics Corn Prices

Soybean Cash Price Index – Brazil Source:Cepea

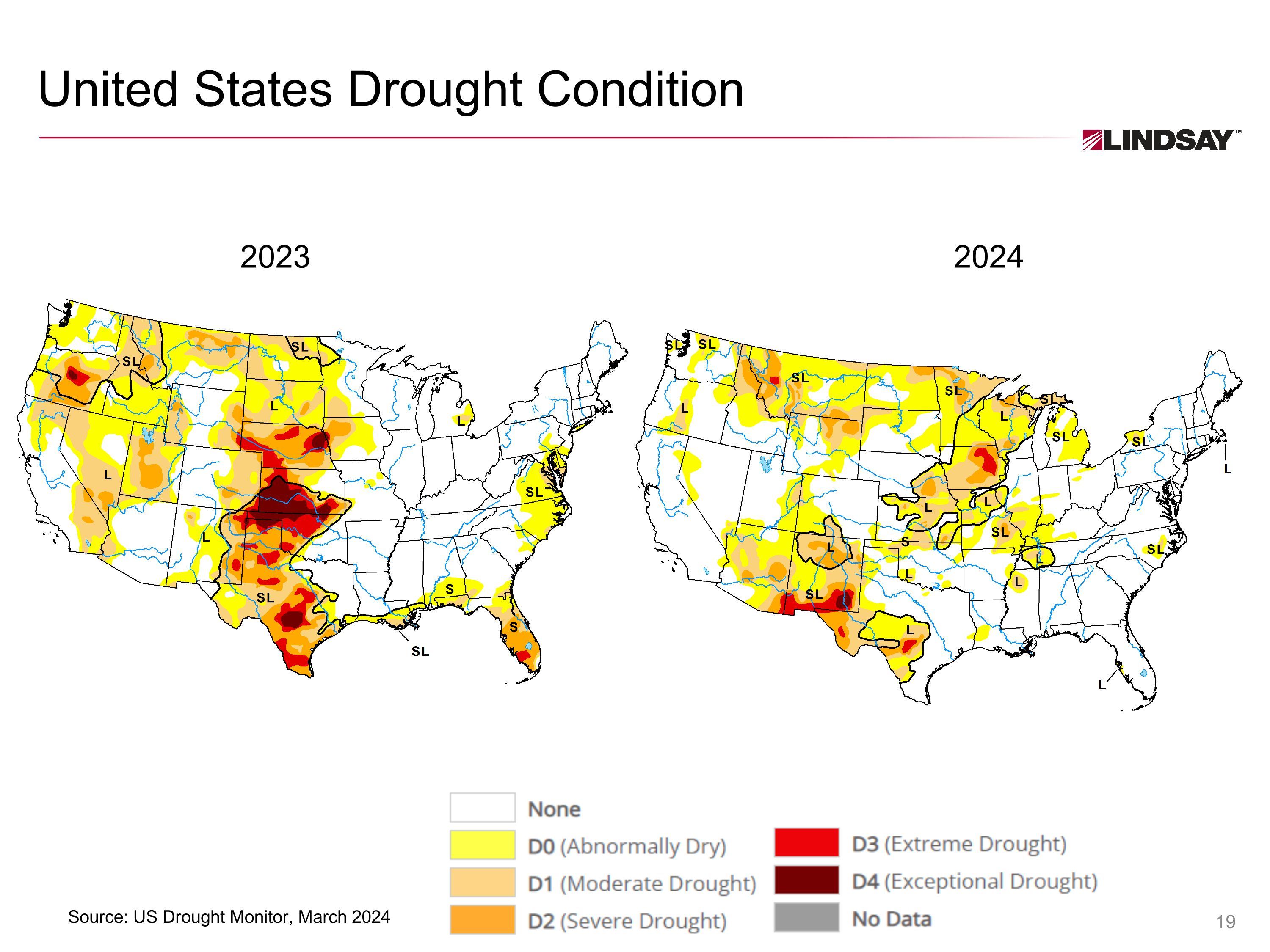

United States Drought Condition Source: US Drought Monitor, March 2024 2023 2024

|

|

Exhibit 99.3

Lindsay Announces Agreement to Acquire a Minority Interest in

Pessl Instruments

Strategic investment builds on previously announced partnership and will enhance Lindsay’s and Pessl’s leading technology solutions for agricultural producers around the globe.

OMAHA, Neb., April 3, 2024 – Lindsay Corporation (NYSE: LNN), a leading global manufacturer and distributor of irrigation and infrastructure equipment and technology, today announced it has agreed to acquire a 49.9 percent minority interest in Austria-based Pessl Instruments GmbH, with an option to acquire the remainder of the company at a later date. Pessl is a leading global provider of advanced agricultural technology solutions under the METOS® brand and offers IoT hardware and software tools for informed decision-making, including field monitoring systems with a wide array of agronomic data points that inform Lindsay’s award-winning FieldNET® remote irrigation management platform. This investment by Lindsay comes less than a year after the two companies had initially entered into a strategic partnership, announced in May of 2023, to leverage the combined expertise of both companies and expand value enhancement to growers.

Pessl boasts more than 80,000 connected in-field data collection devices globally, with 50,000 active customers using its FieldClimate online interface. These connected devices include weather stations, soil moisture probes, insect monitoring traps, crop monitoring cameras, soil and nutrient sampling, machine and asset trackers, and other sensors providing real-time data on key agronomic health indicators. Coupled with Lindsay’s FieldNET Advisor™ platform, which synthesizes millions of data points to make custom recommendations to growers for precise, efficient water application, METOS® and FieldNET® provide a leading-edge solution that opens the door for ground-breaking future innovations in the utilization of artificial intelligence in agriculture, grounded in measurable, precise, and instantaneous data validation.

“Lindsay remains committed to providing world-class solutions to growers around the globe while also delivering incredible value for our shareholders,” said Randy Wood, President and CEO of Lindsay. “This investment broadens and strengthens our existing partnership with Pessl, accelerating innovations in water management, increasing our global reach, and providing new solutions needed to conserve natural resources and expand our world’s potential. I’m excited to see how our teams work together to revolutionize the way data is used to inform smart decisions and to maximize our world’s precious resources.”

The investment will strengthen both Lindsay’s and Pessl’s leadership positions in key global markets, enabling Pessl to benefit from Lindsay’s leading position in row crop applications and Lindsay to benefit from Pessl’s leading position in specialty crop applications.

Lindsay • 18135 Burke St., Suite 100 • Omaha, NE 68022 USA • 1.800.829.5300 • 402.829.6800 • www.lindsay.com

|

|

Last year, the two organizations announced a strategic partnership that has already revealed synergistic potential to unlock incremental value and problem-solving solutions for agricultural producers worldwide. This formal investment will make Lindsay and Pessl, together, the clear global in-field connected irrigation device leader.

Gottfried Pessl, CEO & Founder of Pessl, shared “Over the last year, we have had the opportunity to connect with farmers worldwide and demonstrate how they can leverage the combined potential of METOS hardware and software solutions and Lindsay’s suite of agtech products. The feedback has been fantastic, and the results speak for themselves. We are excited about the potential this investment provides, the innovation it will facilitate, and the opportunity to expand and further integrate with Lindsay, a proven leader in agtech.”

The transaction is expected to close in the second half of fiscal 2024, subject to customary closing conditions including regulatory approvals.

About Lindsay Corporation

Lindsay Corporation (NYSE: LNN) is a leading global manufacturer and distributor of irrigation and infrastructure equipment and technology. Established in 1955, the company has been at the forefront of research and development of innovative solutions to meet the food, fuel, fiber and transportation needs of the world’s rapidly growing population. The Lindsay family of irrigation brands includes Zimmatic® center pivot and lateral move agricultural irrigation systems, FieldNET® and FieldWise® remote irrigation management, FieldNET Advisor™ irrigation scheduling technology, and industrial IoT solutions. Also a global leader in the transportation industry, Lindsay Transportation Solutions manufactures equipment to improve road safety and keep traffic moving on the world’s roads, bridges and tunnels, through the Barrier Systems®, Road Zipper® and Snoline™ brands. For more information about Lindsay Corporation, visit www.lindsay.com.

FieldNET, FieldNET Advisor, Zimmatic, FieldWise, Barrier Systems, Road Zipper and Snoline are trademarks or registered trademarks of Lindsay Corporation and/or its affiliates.

About Pessl Instruments GmbH

For almost 40 years, Pessl has been offering tools for informed decision-making. A complete range of wireless, solar powered monitoring systems under the METOS® brand, and an online platform FieldClimate are applicable in all climate zones and can be used in various industries and for various purposes – from agriculture to research, hydrology, meteorology, flood warning, snow removal, sports turf, smart city and many more.

Over the years, METOS® has become a global brand with local support and has managed to reach out to almost every corner of the world. The METOS® brand lasts longer, performs better, is easier to use and offers you the lowest total cost of ownership.

Lindsay • 18135 Burke St., Suite 100 • Omaha, NE 68022 USA • 1.800.829.5300 • 402.829.6800 • www.lindsay.com

|

|

For more information about Pessl, visit www.metos.global.

FieldClimate and METOS are trademarks or registered trademarks of Pessl Instruments GmbH and/or its affiliates.

This release contains forward-looking statements that are subject to risks and uncertainties, such as the satisfaction of the transaction’s customary closing conditions including regulatory approvals, and which reflect management's current beliefs and estimates of future economic circumstances, industry conditions, company performance, and financial results. You can find a discussion of many of these risks and uncertainties in the annual, quarterly and current reports that Lindsay Corporation files with the Securities and Exchange Commission. Forward-looking statements include information concerning possible or assumed future results of operations and those statements preceded by, followed by or including the words "anticipate," "estimate," "believe," "intend," "expect," "outlook," "could," "may," "should," "will," or similar expressions. For these statements, Lindsay Corporation claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Lindsay Corporation undertakes no obligation to update any forward-looking information contained in this press release.

For further information, contact:

|

|

|

|

Lindsay Corporation: |

|

Pessl Instruments GmbH: |

|

Alicia Pfeifer |

|

Neža JANČIČ |

|

Vice President, Investor Relations & Treasury |

|

+43 31 72 55 21 |

|

+1 402-933-6429 |

|

Neza.Jancic@metos.at |

|

Alicia.Pfeifer@lindsay.com |

|

|

|

Lindsay • 18135 Burke St., Suite 100 • Omaha, NE 68022 USA • 1.800.829.5300 • 402.829.6800 • www.lindsay.com