UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 2, 2024

KINTARA THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

Nevada |

|

001-37823 |

|

99-0360497 |

|

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

|

|

9920 Pacific Heights Blvd, Suite 150 San Diego, CA |

|

|

|

92121 |

(Address of principal executive office) |

|

|

|

(Zip Code) |

Registrant’s telephone number, including area code: (858) 350-4364

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock |

|

KTRA |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

Agreement and Plan of Merger

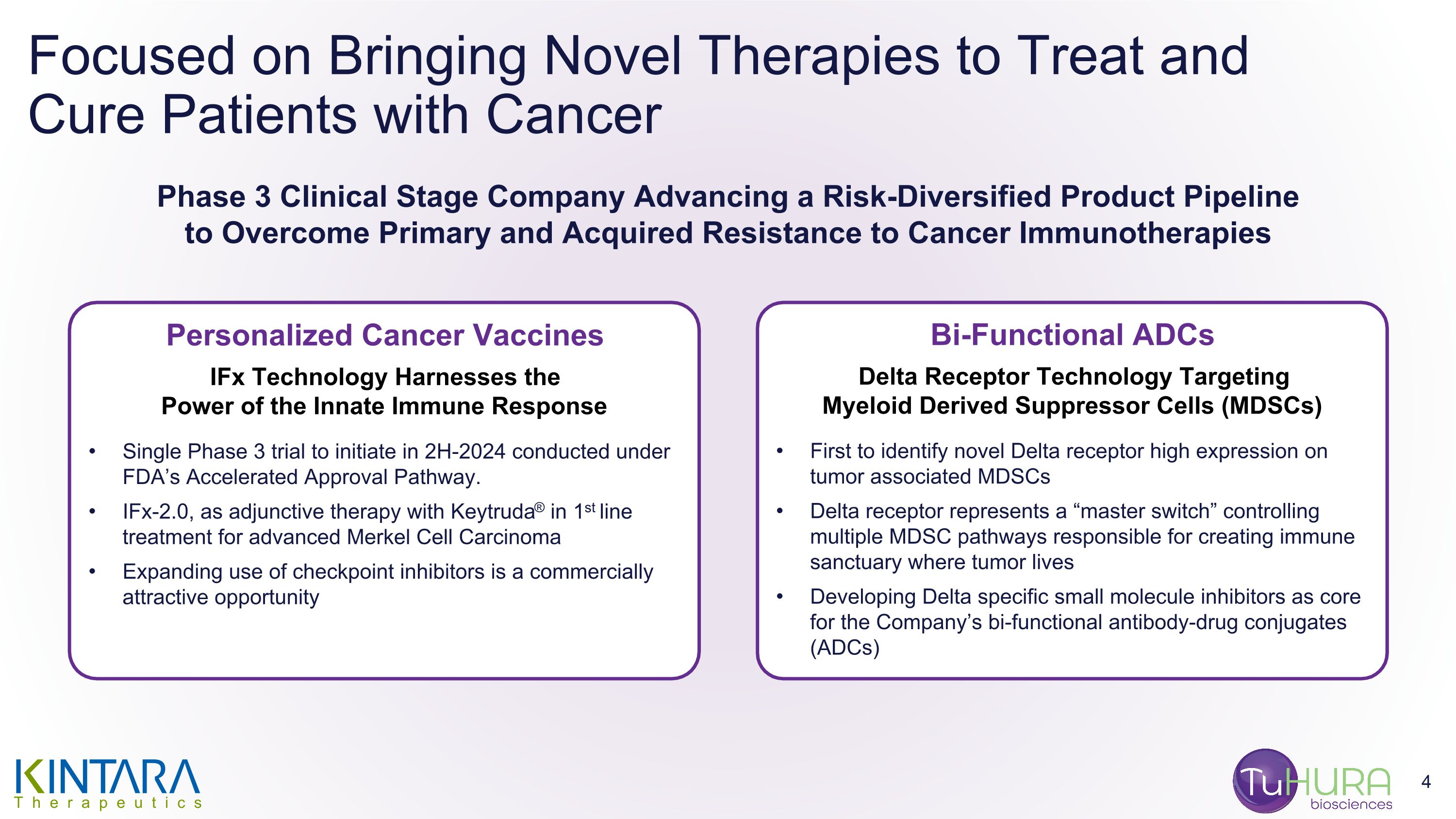

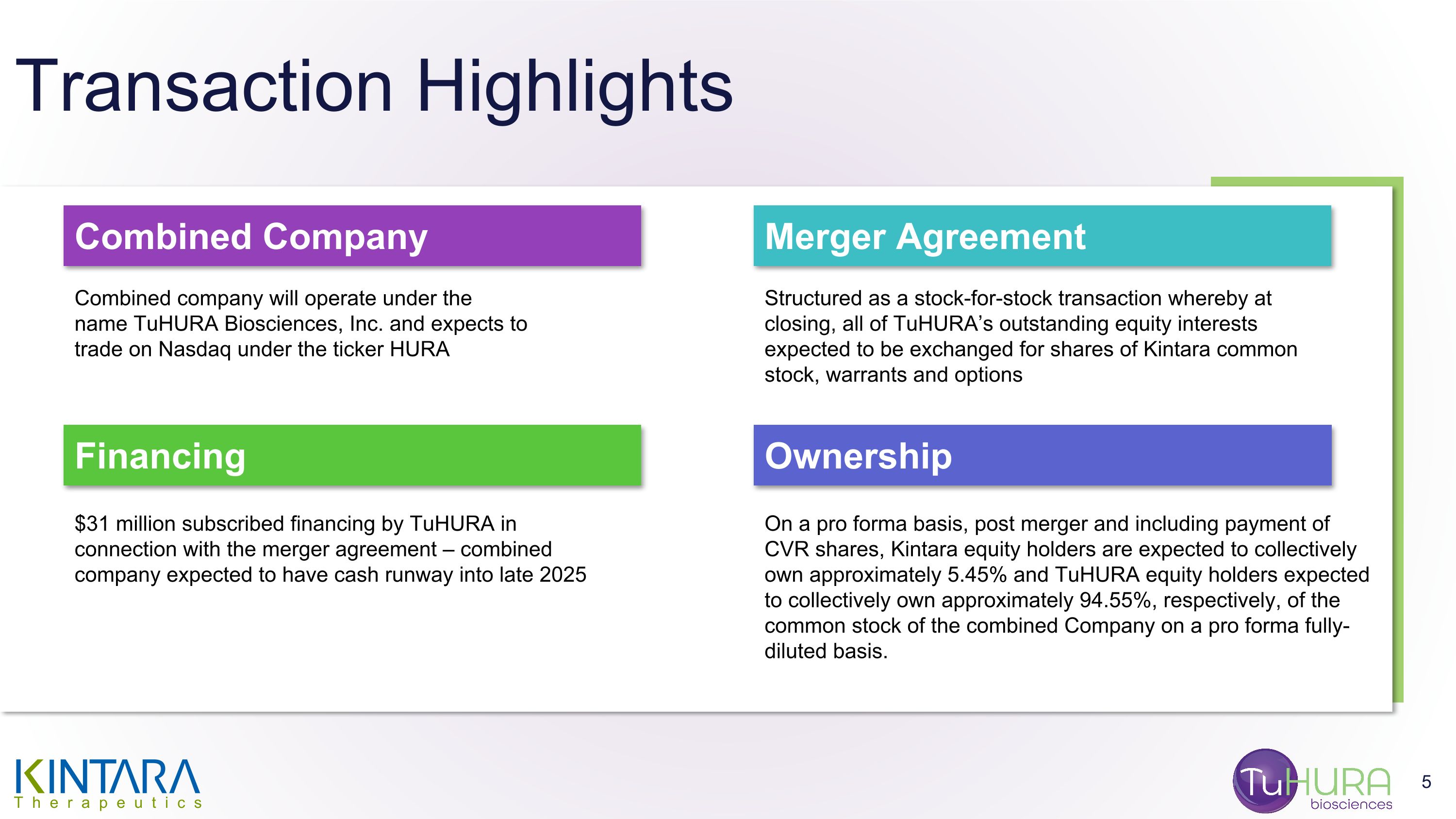

On April 2, 2024, Kintara Therapeutics, Inc. (“Kintara”), Kayak Mergeco, Inc., a wholly-owned subsidiary of Kintara incorporated in the State of Delaware (“Merger Sub”), and TuHURA Biosciences, Inc., a Delaware corporation (“TuHURA”), entered into an Agreement and Plan of Merger (the “Merger Agreement”) pursuant to which Merger Sub will merge with and into TuHURA, with TuHURA surviving the merger and becoming a direct, wholly-owned subsidiary of Kintara (the “Merger”). The Merger is expected to be completed in the third quarter of 2024.

Subject to the terms and conditions of the Merger Agreement, at the effective time of the Merger (the “Effective Time”), (i) each then-outstanding share of TuHURA common stock, par value $0.001 per share (the “TuHURA Common Stock”) (other than any shares held in treasury and Dissenting Shares (as defined in the Merger Agreement)) will be converted into shares of Kintara common stock, par value $0.001 per share (the “Kintara Common Stock”) equal to the Exchange Ratio, as such term is defined in the Merger Agreement and described below, (ii) each then-outstanding TuHURA stock option will be assumed and converted into an option to purchase shares of Kintara Common Stock, subject to certain adjustments as set forth in the Merger Agreement, and (iii) each then-outstanding warrant to purchase shares of TuHURA Common Stock (the “TuHURA Warrants”) will be assumed and converted into and exchangeable for a warrant of like tenor entitling the holder to purchase shares of Kintara Common Stock, subject to certain adjustments as set forth in the Merger Agreement. In addition to the foregoing, the Merger Agreement provides that, at the closing of the Merger, the corporate name of Kintara will be changed to “TuHURA Biosciences, Inc.”

On a pro forma basis, TuHURA equityholders would own approximately 97.15% of the combined company on an “as converted” to Kintara Common Stock basis (or 94.55% of the combined company after giving effect to the issuance of the CVR Shares (as defined below)) and Kintara equityholders as of immediately prior to the Effective Time would own approximately 2.85% of the combined company (or 5.45% of the combined company after giving effect to the issuance of the CVR Shares) (excluding in each such case the effect of out-of-the-money options and warrants of Kintara that will remain outstanding after the Merger). The Exchange Ratio will be equal to the quotient obtained by dividing (a) the Company Merger Shares by (b) the Company Outstanding Shares, as those terms are defined and further described in the Merger Agreement, which has the effect and purpose of determining the number of shares to be issued to TuHURA stockholders (or issuable to TuHURA option and warrant holders in respect of such options and warrants) based on the relative valuations and fully-diluted shares of each of Kintara and TuHURA as of immediately prior to the closing of the Merger. For purposes of calculating the Exchange Ratio, (i) shares of Kintara Common Stock underlying Kintara stock options and warrants outstanding as of immediately prior to the closing of the Merger with an exercise price per share of greater than or equal to $0.20 (subject to adjustment pursuant to the Merger Agreement) will be disregarded, (ii) all shares of Kintara preferred stock, par value $0.001 per share (“Kintara Preferred Stock”) will be deemed outstanding on an “as converted” to Kintara Common Stock basis and (iii) all shares of TuHURA Common Stock underlying TuHURA stock options and warrants will be deemed to be outstanding.

In connection with the Merger, Kintara will seek the approval of its stockholders to, among other things, (a) approve the Merger Agreement and the transactions contemplated thereby, (b) if deemed necessary by the parties, amend Kintara’s articles of incorporation (x) to increase the number of authorized shares of Kintara Common Stock and/or (y) to effect a reverse stock split of Kintara Common Stock, (c) elect the post-closing directors of Kintara as contemplated by the Merger Agreement, (d) approve the reincorporation of Kintara from the State of Delaware to the State of Nevada and (e) approve a new equity compensation plan in a form approved by Kintara and TuHURA ((a), (b) and (c), collectively, the “Required Kintara Stockholder Proposals” and (a), (b), (c), (d) and (e), collectively, the “Kintara Stockholder Matters”).

Each of Kintara and TuHURA has agreed to customary representations, warranties and covenants in the Merger Agreement, including, among others, covenants relating to (1) obtaining the requisite approval of its respective stockholders, (2) non-solicitation of alternative acquisition proposals, (3) the conduct of its respective business during the period between the signing of the Merger Agreement and the closing of the Merger and (4) Kintara filing with the U.S. Securities and Exchange Commission (the “SEC”) and causing to become effective a registration statement to register the shares of Kintara Common Stock to be issued in connection with the Merger (the “Registration Statement”).

Consummation of the Merger is subject to certain closing conditions, including, among other things, (1) approval by the requisite Kintara stockholders of the Required Kintara Stockholder Proposals, (2) adoption and approval by the requisite TuHURA stockholders of the Merger Agreement and the transactions contemplated thereby, (3) the effectiveness of the Registration Statement, (4) the Parent Closing Net Cash (as defined in the Merger Agreement) being no less than $750,000 if the Effective Time is on or before June 30, 2024; $625,000 if the Effective Time is between July 1, 2024 and July 31, 2024; 500,000 if the Effective Time is between August 1, 2024 and August 31, 2024; or $0 if the Effective Time is on or after September 1, 2024, (5) the holders of at least 50% of TuHURA’s outstanding shares of common stock on an “as converted” basis (which includes the outstanding shares of TuHURA’s common stock and preferred stock) executing Lock-Up Agreements (as defined below), and (6) TuHURA receiving an aggregate amount of cash no less than $20 million from the offering of its convertible notes. Each party’s obligation to consummate the Merger is also subject to other specified customary conditions, including regarding the accuracy of the representations and warranties of the other party, subject to the applicable materiality standard, and the performance in all material respects by the other party of its obligations under the Merger Agreement required to be performed on or prior to the date of the closing of the Merger.

The Merger Agreement contains certain termination rights for both Kintara and TuHURA, including the right to terminate the Merger Agreement in the event of a triggering event tied to an adverse recommendation change or an acquisition proposal. In addition, either Kintara or TuHURA may terminate the Merger Agreement if the Merger is not consummated on or before November 1, 2024 (the “End Date”), provided that the End Date may be extended by either party for up to sixty (60) days in the event that the SEC has not declared effective the Registration Statement by the date which is sixty (60) days prior to the End Date. Upon termination of the Merger Agreement under specified circumstances, Kintara may be required to pay TuHURA a termination fee of $1 million or reimburse TuHURA’s expenses up to a maximum of $750,000, and TuHURA may be required to pay Kintara a termination fee of $1 million or reimburse TuHURA’s expenses up to a maximum of $750,000.

At the Effective Time, the board of directors of Kintara (the “Board”) is expected to consist of five members, four of whom will be designated by TuHURA and one of whom will be designated by Kintara. At the Effective Time, the officers of TuHURA as of immediately prior to the Effective Time will become the officers of Kintara.

Certain Agreements Related to the Merger

Support Agreements

Concurrently with the execution of the Merger Agreement, (i) certain stockholders of TuHURA have entered into support agreements with Kintara and TuHURA to vote all of their shares of capital stock of TuHURA in favor of the adoption and approval of the Merger Agreement and the transactions contemplated thereby (the “TuHURA Support Agreement”) and (ii) officers and directors of Kintara (solely in their respective capacities as Kintara stockholders) have entered into support agreements with Kintara and TuHURA to vote all of their shares of capital stock of Kintara in favor of the Kintara Stockholder Matters and against any alternative acquisition proposals (the “Kintara Support Agreement”).

Lock-Up Agreements

Concurrently with the execution of the Merger Agreement, certain stockholders of TuHURA and Robert Hoffman, the Chief Executive Officer of Kintara, have entered into lock-up agreements (the “Lock-Up Agreement”), pursuant to which, subject to specified exceptions, they have agreed not to transfer their shares of Kintara Common Stock during the 180-day period following the closing of the Merger. In addition, under the Merger Agreement, additional stockholders of TuHURA, representing no less than 50% of TuHURA’s outstanding shares of common stock on an “as converted” basis (which includes the outstanding shares of TuHURA’s common stock and preferred stock) executing Lock-Up Agreements prior to the closing of the Merger.

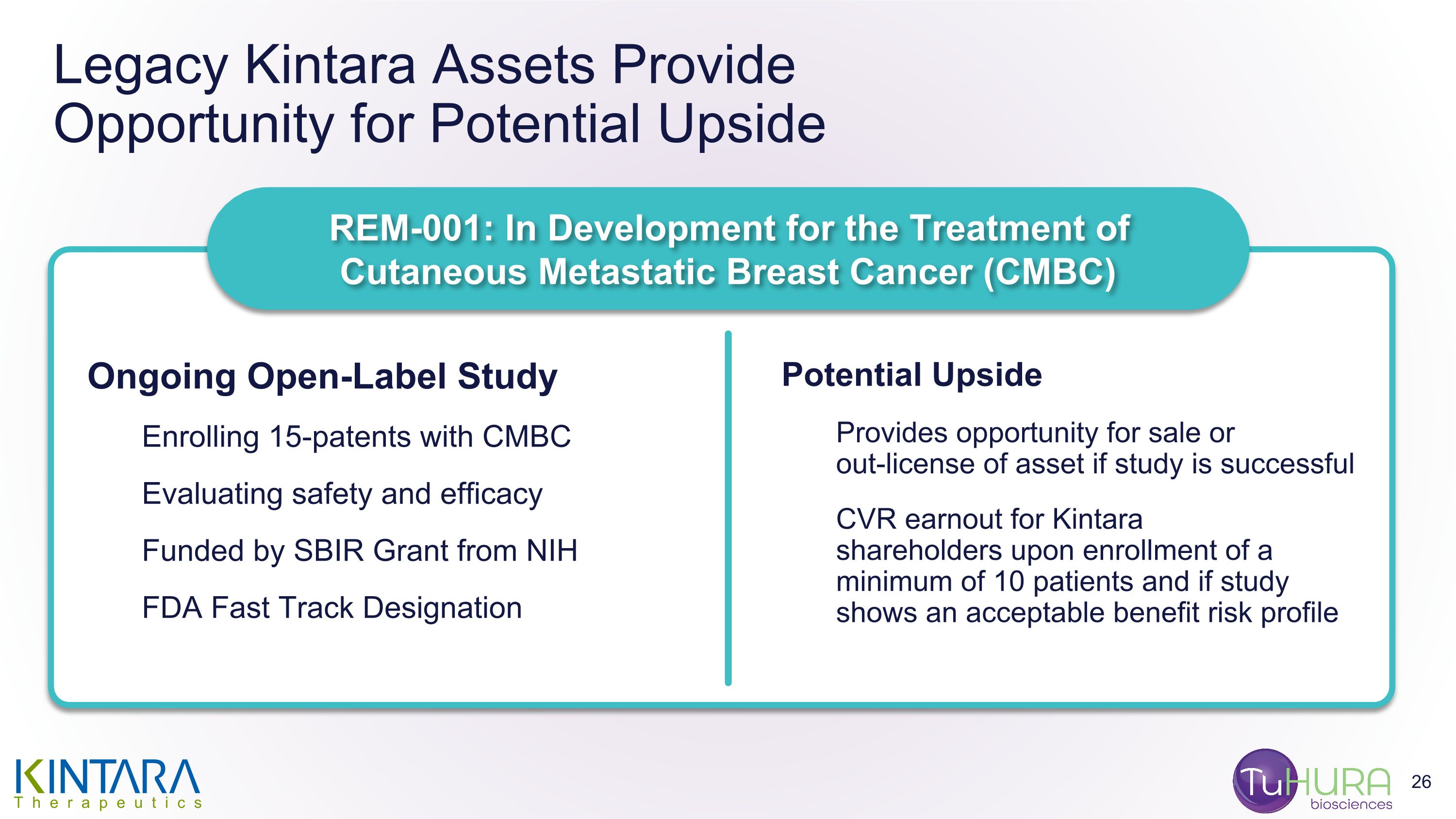

Contingent Value Rights Agreement

At or prior to the Effective Time, Kintara will enter into a Contingent Value Rights Agreement (the “CVR Agreement”) with Mountain Share Transfer Inc. (“Rights Agent”), pursuant to which Kintara Common Stock holders, Kintara Series C Preferred Stock holders and Kintara Common Stock warrant holders, in each case, as of record as of the close of business on the business day immediately prior to the Effective Time, will receive one contingent value right (each, a “CVR”) for each outstanding share of Kintara Common Stock held by such stockholder (or, in the case of the warrants and holders of Series C Kintara Preferred Stock, each share of Kintara Common Stock for which such warrant is exercisable or which such Series C Kintara Preferred Stock is settable into as of such date). Each CVR shall entitle the holder thereof to receive its portion of 53,897,125 shares of Kintara Common Stock (the “CVR Shares”) if Kintara (i) enrolls a minimum of ten cutaneous metastic breast cancer patients in a study to determine whether a dose of REM-001 lower than 1.2 mg/kg elicits a treatment effect similar to that seen in prior studies of REM-001 at the 1.2 mg/kg dose and (ii) such patients enrolled in the study complete eight weeks of follow-up, in each case, on or before December 31, 2025 (the “Milestone”).

The payment date for the CVR Shares will be within 10 business days after the rights agent receives the CVR Shares as the payment for achievement of the Milestone. In the event that the Milestone is not achieved, holders of the CVRs will not receive any CVR Shares pursuant to the CVR Agreement. There can be no assurances that any holders of CVRs will receive any CVR Shares with respect thereto.

The CVRs are not transferable, except in certain limited circumstances as will be provided in the CVR Agreement, will not be certificated or evidenced by any instrument and will not be listed for trading on any exchange.

The preceding summaries do not purport to be complete and are qualified in their entirety by reference to the Merger Agreement, the form of Kintara Support Agreement, the form of TuHURA Support Agreement, the form of Lock-Up Agreement and the form of Contingent Value Rights Agreement, which are filed as Exhibits 2.1, 10.1, 10.2, 10.3 and 10.4, respectively, and which are incorporated herein by reference. The Merger Agreement has been attached as an exhibit to this Current Report on Form 8-K to provide investors and securityholders with information regarding its terms. It is not intended to provide any other factual information about TuHURA or Kintara or to modify or supplement any factual disclosures about Kintara in its public reports filed with the SEC. The Merger Agreement includes representations, warranties and covenants of TuHURA, Kintara and Merger Sub made solely for the purpose of the Merger Agreement and solely for the benefit of the parties thereto in connection with the negotiated terms of the Merger Agreement. Investors should not rely on the representations, warranties and covenants in the Merger Agreement or any descriptions thereof as characterizations of the actual state of facts or conditions of TuHURA, Kintara or any of their respective affiliates. Moreover, certain of those representations and warranties may not be accurate or complete as of any specified date, may be subject to a contractual standard of materiality different from those generally applicable to SEC filings or may have been used for purposes of allocating risk among the parties to the Merger Agreement, rather than establishing matters of fact.

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Executive Bonus

On April 2, 2024, the Board approved a one-time special bonus to Mr. Hoffman in the amount of $327,030 for his service as Kintara’s Chief Executive Officer.

Director Fees

As previously disclosed, on November 20, 2023, the Board agreed to defer payments of fees earned by directors for serving on the Board. On April 2, 2024, the Board agreed to (i) resume the payment of fees earned by directors for serving on the Board and (ii) pay an aggregate of $93,000 in accrued fees to such directors.

Item 7.01. Regulation FD Disclosure.

On April 3, 2024 Kintara and TuHURA issued a joint press release announcing the execution of the Merger Agreement. Following the publication of the press release, Kintara and TuHURA will host a joint conference call at 8:30 a.m. (Eastern Time) on April 3, 2024, via webcast, to discuss the proposed Merger. In addition, Kintara and TuHURA provided supplemental information regarding the Merger in a joint investor presentation. Copies of the press release, the conference call transcript and the investor presentation are attached hereto as Exhibit 99.1, Exhibit 99.2, and Exhibit 99.3, respectively. The press release, conference call transcript, the investor presentation, and the information set forth therein shall not be deemed to be filed for purposes of Section 18 of the Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise be subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act.

Item 8.01. Other Events.

In connection with the proposed Merger, TuHURA has a $31 million subscribed financing of convertible notes. Pursuant to their terms, the convertible notes will automatically convert into shares of TuHURA common stock prior to the Effective Time and be exchanged for Kintara Common Stock pursuant to the Exchange Ratio.

Forward-Looking Statements

This Current Report on Form 8-K and the press release attached hereto as Exhibit 99.1 contain forward-looking statements based upon Kintara’s and TuHURA’s current expectations. This communication contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are identified by terminology such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “should,” “would,” “project,” “plan,” “expect,” “goal,” “seek,” “future,” “likely” or the negative or plural of these words or similar expressions. These statements are only predictions. Kintara and TuHURA have based these forward-looking statements largely on their then-current expectations and projections about future events, as well as the beliefs and assumptions of management. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond each of Kintara’s and TuHURA’s control, and actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, including but not limited to: (i) the risk that the conditions to the closing or consummation of the proposed Merger are not satisfied, including the failure to obtain stockholder approval for the proposed Merger; (ii) uncertainties as to the timing of the consummation of the proposed Merger and the ability of each of Kintara and TuHURA to consummate the transactions contemplated by the proposed Merger; (iii) risks related to Kintara’s and TuHURA’s ability to correctly estimate their respective operating expenses and expenses associated with the proposed Merger, as applicable, as well as uncertainties regarding the impact any delay in the closing would have on the anticipated cash resources of the resulting combined company upon closing and other events and unanticipated spending and costs that could reduce the combined company’s cash resources; (iv) the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the proposed Merger by either Kintara or TuHURA; (v) the effect of the announcement or pendency of the proposed Merger on Kintara’s or TuHURA’s business relationships, operating results and business generally; (vi) costs related to the proposed Merger; (vii) the outcome of any legal proceedings that may be instituted against Kintara, TuHURA, or any of their respective directors or officers related to the Merger Agreement or the transactions contemplated thereby; (vii) the ability of Kintara or TuHURA to protect their respective intellectual property rights; (viii) competitive responses to the proposed Merger; (ix) unexpected costs, charges or expenses resulting from the proposed Merger; (x) whether the combined business of TuHURA and Kintara will be successful; (xi) legislative, regulatory, political and economic developments; and (xii) additional risks described in the “Risk Factors” section of Kintara’s Annual Report on Form 10-K for the fiscal year ended June 30, 2023 filed with the SEC. Additional assumptions, risks and uncertainties are described in detail in Kintara’s registration statements, reports and other filings with the SEC, which are available on Kintara’s website, and at www.sec.gov. Accordingly, you should not rely upon forward-looking statements as predictions of future events. Neither Kintara nor TuHURA can assure you that the events and circumstances reflected in the forward-looking statements will be achieved or occur, and actual results could differ materially from those projected in the forward-looking statements. The forward-looking statements made in this communication relate only to events as of the date on which the statements are made. Except as required by applicable law or regulation, Kintara and TuHURA undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. Investors should not assume that any lack of update to a previously issued “forward-looking statement” constitutes a reaffirmation of that statement.

Additional Information about the Proposed Merger and Where to Find It

This Current Report on Form 8-K does not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities or a solicitation of any vote or approval. This Current Report on Form 8-K relates to the proposed Merger of Kintara and TuHURA. In connection with the proposed Merger, Kintara will file a Registration Statement on Form S-4, which will include a document that serves as a prospectus and proxy statement of Kintara (the “proxy statement/prospectus”), and Kintara will file other documents regarding the proposed Merger with the SEC. No offering of securities shall be made, except by means of a prospectus meeting the requirements of Section 10 of the Securities Act. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY, WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT STOCKHOLDERS SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING THE PROPOSED MERGER. A definitive proxy statement/prospectus will be sent to Kintara’s stockholders. Investors and security holders will be able to obtain these documents (when available) free of charge from the SEC’s website at www.sec.gov. In addition, investors and stockholders should note that Kintara communicates with investors and the public using its website (www.kintara.com), the investor relations website (https://www.kintara.com/investors) where anyone will be able to obtain free copies of the proxy statement/prospectus and other documents filed by Kintara with the SEC, and stockholders are urged to read the proxy statement/prospectus and the other relevant materials when they become available before making any voting or investment decision with respect to the proposed Merger.

Participants in the Solicitation

Kintara, TuHURA and their respective directors and executive officers and other members of management and employees and certain of their respective significant stockholders may be deemed to be participants in the solicitation of proxies from Kintara and TuHURA stockholders in respect of the proposed Merger. Information about Kintara’s directors and executive officers is available in Kintara’s proxy statement, which was filed with the SEC on September 11, 2023 for the 2023 Annual Meeting of Stockholders, Kintara’s Annual Report on Form 10-K for the fiscal year ended June 30, 2023, which was filed with the SEC on September 18, 2023. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the proxy solicitation and a description of their direct and indirect interests, by security holding or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC regarding the proposed Merger when they become available. Investors should read the proxy statement/prospectus carefully when it becomes available before making any voting or investment decisions. You may obtain free copies of these documents from the SEC and Kintara as indicated above.

No Offer or Solicitation

This Current Report on Form 8-K shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

Exhibit No. |

|

Description |

|

|

|

2.1* |

|

|

10.1 |

|

|

10.2 |

|

|

10.3 |

|

|

10.4 |

|

|

99.1 |

|

Press release of Kintara Therapeutics, Inc. issued April 3, 2024 |

99.2 |

|

|

99.3 |

|

|

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

*Schedules have been omitted pursuant to Item 601(a)(5) of Regulation S-K. Kintara hereby undertakes to furnish copies of any of the omitted schedules upon request by the SEC.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

KINTARA THERAPEUTICS, INC. |

||

|

|

|

||

Date: April 3, 2024 |

|

By: |

|

/s/ Robert E. Hoffman |

|

|

|

|

Name: Robert E. Hoffman |

|

|

|

|

Title: Chief Executive Officer |

Exhibit 2.1

Execution Version

AGREEMENT AND PLAN OF MERGER

by and among

KINTARA THERAPEUTICS, INC.,

KAYAK MERGECO, INC.

and

TUHURA BIOSCIENCES, INC.

Dated as of April 2, 2024

TABLE OF CONTENTS

Page

ARTICLE I CERTAIN GOVERNANCE MATTERS |

3 |

Section 1.1 Parent Matters |

3 |

Section 1.2 Surviving Company Matters |

3 |

ARTICLE II THE MERGER |

4 |

Section 2.1 Incorporation of Merger Sub |

4 |

Section 2.2 The Merger |

4 |

Section 2.3 Closing |

4 |

Section 2.4 Effective Time |

4 |

Section 2.5 Effects of the Merger |

4 |

ARTICLE III EFFECT ON THE CAPITAL STOCK OF THE CONSTITUENT COMPANIES; EXCHANGE OF CERTIFICATES |

5 |

Section 3.1 Conversion of Capital Stock |

5 |

Section 3.2 Treatment of Options and Warrants |

7 |

Section 3.3 Exchange and Payment |

8 |

Section 3.4 Withholding Rights |

10 |

Section 3.5 Dissenters Rights |

10 |

Section 3.6 Contingent Value Right |

10 |

Section 3.7 Second Merger |

11 |

ARTICLE IV REPRESENTATIONS AND WARRANTIES OF THE COMPANY |

11 |

Section 4.1 Organization, Standing and Power |

12 |

Section 4.2 Capital Stock |

12 |

Section 4.3 Subsidiaries |

14 |

Section 4.4 Authority |

14 |

Section 4.5 No Conflict; Consents and Approvals |

15 |

Section 4.6 Financial Statements |

16 |

Section 4.7 No Undisclosed Liabilities |

17 |

Section 4.8 Absence of Certain Changes or Events |

17 |

Section 4.9 Litigation |

18 |

Section 4.10 Compliance with Laws |

18 |

Section 4.11 Health Care Regulatory Matters |

18 |

Section 4.12 Benefit Plans |

21 |

Section 4.13 Labor and Employment Matters |

23 |

Section 4.14 Environmental Matters |

25 |

Section 4.15 Taxes |

26 |

Section 4.16 Contracts |

28 |

Section 4.17 Insurance |

29 |

-i-

Section 4.18 Properties |

29 |

Section 4.19 Intellectual Property |

30 |

Section 4.20 Takeover Law |

32 |

Section 4.21 No Rights Plan |

32 |

Section 4.22 Related Party Transactions |

32 |

Section 4.23 Certain Payments |

32 |

Section 4.24 Brokers |

33 |

Section 4.25 No Other Representations and Warranties |

33 |

ARTICLE V REPRESENTATIONS AND WARRANTIES OF PARENT AND MERGER SUB |

33 |

Section 5.1 Organization, Standing and Power |

33 |

Section 5.2 Capital Stock |

34 |

Section 5.3 Subsidiaries |

35 |

Section 5.4 Authority |

36 |

Section 5.5 No Conflict; Consents and Approvals |

36 |

Section 5.6 SEC Reports; Financial Statements |

37 |

Section 5.7 No Undisclosed Liabilities |

39 |

Section 5.8 Absence of Certain Changes or Events |

39 |

Section 5.9 Litigation |

40 |

Section 5.10 Compliance with Laws |

40 |

Section 5.11 Health Care Regulatory Matters |

40 |

Section 5.12 Benefit Plans |

42 |

Section 5.13 Labor and Employment Matters |

44 |

Section 5.14 Environmental Matters |

46 |

Section 5.15 Taxes |

47 |

Section 5.16 Contracts |

49 |

Section 5.17 Insurance |

49 |

Section 5.18 Properties |

50 |

Section 5.19 Intellectual Property |

50 |

Section 5.20 Related Party Transactions |

52 |

Section 5.21 Certain Payments |

52 |

Section 5.22 Brokers |

52 |

Section 5.23 Opinion of Financial Advisor |

52 |

Section 5.24 Merger Sub |

53 |

Section 5.25 No Other Representations or Warranties |

53 |

ARTICLE VI COVENANTS |

53 |

Section 6.1 Operation of Parent’s Business |

53 |

Section 6.2 Operation of the Company’s Business |

55 |

Section 6.3 Access and Investigation |

57 |

Section 6.4 No Solicitation |

58 |

Section 6.5 Notification of Certain Matters |

59 |

Section 6.6 Registration Statement; Proxy Statement |

60 |

Section 6.7 Company Stockholder Written Consent |

62 |

-ii-

Section 6.8 Stockholders’ Meeting |

64 |

Section 6.9 Efforts; Transaction Litigation |

66 |

Section 6.10 Indemnification, Exculpation and Insurance |

67 |

Section 6.11 Disclosure |

68 |

Section 6.12 Listing |

69 |

Section 6.13 Section 16 Matters |

69 |

Section 6.14 Employee Matters |

69 |

Section 6.15 Takeover Law |

70 |

Section 6.16 Tax Matters |

70 |

Section 6.17 Calculation of the Exchange Ratio |

71 |

Section 6.18 Obligations of Merger Sub |

72 |

Section 6.19 Officers and Directors |

72 |

Section 6.20 Termination of Certain Agreements and Rights |

72 |

Section 6.21 Allocation Certificate; Net Cash Schedule |

72 |

Section 6.22 Parent SEC Documents |

73 |

Section 6.23 Legends |

73 |

Section 6.24 Reincorporation Covenants |

73 |

ARTICLE VII CONDITIONS PRECEDENT |

73 |

Section 7.1 Conditions Precedent to Each Party’s Obligation to Effect the Merger |

73 |

Section 7.2 Additional Conditions Precedent to Obligations of Parent and Merger Sub |

74 |

Section 7.3 Additional Conditions Precedent to Obligation of the Company |

76 |

ARTICLE VIII TERMINATION |

77 |

Section 8.1 Termination |

77 |

Section 8.2 Effect of Termination |

79 |

Section 8.3 Expenses; Termination Fees |

79 |

ARTICLE IX GENERAL PROVISIONS |

82 |

Section 9.1 Non-survival of Representations and Warranties |

82 |

Section 9.2 Amendment or Supplement |

82 |

Section 9.3 Waiver |

82 |

Section 9.4 Notices |

82 |

Section 9.5 Certain Definitions |

83 |

Section 9.6 Interpretation |

89 |

Section 9.7 Entire Agreement |

89 |

Section 9.8 No Third Party Beneficiaries |

89 |

Section 9.9 Governing Law |

90 |

Section 9.10 Submission to Jurisdiction |

90 |

Section 9.11 Assignment; Successors |

90 |

Section 9.12 Other Remedies; Specific Performance |

91 |

Section 9.13 Currency |

91 |

-iii-

Section 9.14 Further Assurances |

91 |

Section 9.15 Severability |

91 |

Section 9.16 Waiver of Jury Trial |

91 |

Section 9.17 Counterparts |

91 |

Section 9.18 Facsimile or .pdf Signature |

92 |

Section 9.19 No Presumption Against Drafting Party |

92 |

EXHIBITS

Exhibit A-1 Form of Parent Support Agreement

Exhibit A-2 Form of Company Support Agreement

Exhibit B Form of Lock-Up Agreement

Exhibit C Illustrative Calculation of Exchange Ratio

Exhibit D Form of CVR Agreement

-iv-

INDEX OF DEFINED TERMS

Definition Section

2024 Incentive Plan |

6.8(a) |

AAA |

6.18(e) |

Acceptable Confidentiality Agreement |

9.5(a) |

Accounting Firm |

6.18(e) |

Acquisition Inquiry |

9.5(b) |

Acquisition Proposal |

9.5(c) |

Acquisition Transaction |

9.5(d) |

Action |

4.9 |

Affiliate |

9.5(e) |

Aggregate Valuation |

3.1(a)(i) |

Agreement |

Preamble |

Allocation Certificate |

6.22 |

Anticipated Closing Date |

9.5(f) |

Assumed Option |

3.2(a) |

Book-Entry Shares |

3.3(d) |

Business Day |

9.5(g) |

Cash and Cash Equivalents |

9.5(h) |

Closing |

2.3 |

Closing Date |

2.3 |

COBRA |

4.12(c)(iv) |

Code |

Recitals |

Committed Funds |

3.1(a)(v) |

Company |

Preamble |

Company Allocation Percentage |

3.1(a)(ii) |

Company Audited S-4 Financial Statements |

6.6(e) |

Company Balance Sheet |

9.5(i) |

Company Board |

4.4(b) |

Company Board Adverse Recommendation Change |

6.7(d) |

Company Board Recommendation |

6.7(c) |

Company Bylaws |

4.1(b) |

Company Capitalization Representations |

9.5(i) |

Company Charter |

4.1(b) |

Company Common Stock |

Recitals |

Company Contract |

9.5(k) |

Company Convertible Notes |

3.1(a)(iv) |

Company Disclosure Letter |

Article IV |

Company Equity Plan |

3.2(a) |

Company Financial Statements |

4.6(a) |

Company Fundamental Representations |

9.5(j) |

Company Interim S-4 Financial Statements |

6.6(e) |

Company Merger Shares |

3.1(a)(iii) |

Company Option |

3.2(a) |

v

Company Outstanding Shares |

Section 3.1(a)(iv) |

Company Owned IP |

9.5(k), 9.5(t) |

Company Plans |

4.12(a) |

Company Preferred Stock |

4.2(a) |

Company Products |

4.11(c) |

Company Real Estate Leases |

4.18(c) |

Company Registered IP |

4.19(a) |

Company Required S-4 Information |

6.6(d) |

Company S-4 Financial Statements |

6.6(e) |

Company Stock Awards |

4.2(b) |

Company Stockholder Approval |

Recitals |

Company Stockholder Written Consent |

6.7(a) |

Company Termination Fee |

8.3(b) |

Company Triggering Event |

9.5(l) |

Company Valuation |

3.1(a)(v) |

Company Warrant |

3.2(b) |

Confidential Agreement |

9.5(m) |

Contract |

4.5(a)(iii) |

control |

9.5(n) |

Covered Person |

5.2(d) |

CVR |

3.6(a) |

CVR Agreement |

3.6(a) |

CVR Distribution |

3.6(a) |

D&O Indemnified Parties |

6.10(a) |

DGCL |

Recitals |

Dispute Notice |

6.18(b) |

Disqualifying Event |

5.2(d) |

Dissenting Shares |

3.5 |

Effective Time |

2.4 |

End Date |

8.1(b) |

Environmental Law |

4.14(b) |

ERISA |

4.12(a) |

Exchange Act |

4.5(b) |

Exchange Agent |

3.3(a) |

Exchange Fund |

3.3(a) |

Exchange Ratio |

3.1(a) |

Exchange Ratio Statement |

6.18(a) |

Excluded Shares |

3.1(c) |

FDA |

4.11(c) |

FDA Ethics Policy |

4.11(i) |

FDCA |

4.11(d) |

Form S-4 |

6.6(a) |

GAAP |

4.6(a) |

Governmental Entity |

4.5(b) |

Hazardous Substance |

4.14(c) |

Health Care Laws |

9.5(o) |

-vi-

Intellectual Property |

9.5(p) |

Intended Tax Treatment |

Recitals |

IRS |

4.12(a) |

IT Systems |

4.19(g) |

Key Employee |

9.5(q) |

knowledge |

9.5(r) |

Law |

4.5(a)(iv) |

Liability |

4.7 |

Liens |

4.5(a)(i) |

Lock-Up Agreements |

Recitals |

Material Adverse Effect |

4.1(a) |

Material Contracts |

4.16(a) |

Measurement Date |

5.2(a) |

Merger |

Recitals |

Merger Consideration |

3.1(a) |

Merger Filings |

2.4 |

Merger Sub |

Preamble |

Nasdaq |

9.5(s) |

Nasdaq Listing Application |

6.12 |

Net Cash Calculation |

6.8 |

Net Cash Schedule |

6.8 |

Notice Period |

6.7(d) |

Ordinary Course Agreement |

4.15(g) |

Ordinary Course of Business |

9.5(u) |

Parent |

Preamble |

Parent Allocation Percentage |

3.1(a)(vi) |

Parent Board |

5.4(b) |

Parent Board Adverse Recommendation Change |

6.8(c) |

Parent Board Recommendation |

6.8(b) |

Parent Bylaws |

1.1(b) |

Parent Capitalization Representations |

9.5(w) |

Parent Charter |

1.1(a) |

Parent Closing Cash |

9.5(v) |

Parent Common Stock |

Recitals |

Parent Disclosure Letter |

Article V |

Parent Fundament Representations |

9.5(y) |

Parent IT Systems |

5.19(d) |

Parent Material Adverse Effect |

5.1(a) |

Parent Material Contracts |

5.16(a) |

Parent Notice Period |

6.8(c) |

Parent Options |

3.1(a)(vii) |

Parent Outstanding Shares |

3.1(a)(vii) |

Parent Owned IP |

9.5(w) |

Parent Plans |

5.12(a) |

Parent Preferred Stock |

5.2(a) |

Parent Products |

5.11(c) |

-vii-

Parent Real Estate Leases |

5.18(c) |

Parent Registered IP |

5.19(a) |

Parent RSUs |

3.1(a)(vii) |

Parent SEC Documents |

5.6(a) |

Parent Stockholder Approval |

9.5(x) |

Parent Stockholder Matters |

6.8(a) |

Parent Stockholder Meeting |

6.8(a) |

Parent Termination Fee |

8.3(f) |

Parent Triggering Event |

9.5(y) |

Parent Valuation |

3.1(a)(viii) |

Parent Warrants |

3.1(a)(vii) |

PBGC |

4.12(c)(iii) |

Pension Plan |

4.12(b) |

Permits |

4.1 |

Permitted Alternative Agreement |

9.5(z) |

Permitted Liens |

4.18(a) |

Person |

9.5(aa) |

Personal Information |

4.19(h) |

Post-Closing Parent Shares |

3.1(a)(ix) |

Pre-Closing Period |

6.1(a) |

Privacy Laws |

4.19(h) |

Proxy Statement |

6.6(a) |

Registration Statement |

6.6(a) |

Reincorporation |

1.1(a) |

Replacement Warrant |

3.2(b) |

Representative |

9.5(bb) |

Required Parent Stockholder Proposals |

6.8(a) |

Response Date |

6.18(b) |

Rights Agent |

3.6(b) |

Safety Notices |

4.11(g) |

Sarbanes-Oxley Act |

5.6(a) |

SEC |

9.5(cc) |

SEC Documents |

6.23 |

Securities Act |

4.5(b) |

Stockholder Notice |

6.7(b) |

Subsequent Transaction |

9.5(dd) |

Subsidiary |

9.5(ee) |

Superior Offer |

9.5(ff) |

Surviving Company |

2.2 |

Takeover Laws |

4.2 |

Tax Action |

4.15(d) |

Tax Return |

9.5(gg) |

Taxes |

9.5(hh) |

Trade Secrets |

9.5(p) |

Transaction Expenses |

9.5(ii) |

Transaction Litigation |

6.9(b) |

-viii-

WARN Act |

4.13(d) |

-ix-

AGREEMENT AND PLAN OF MERGER

THIS AGREEMENT AND PLAN OF MERGER (this “Agreement”), dated as of April 2, 2024, by and among Kintara Therapeutics, Inc., a Nevada corporation (which shall reincorporate as a Delaware corporation in connection with the consummation of the transactions contemplated hereby) (“Parent”), Kayak Mergeco, Inc., a Delaware corporation and a wholly owned subsidiary of Parent (“Merger Sub”), and TuHURA Biosciences, Inc., a Delaware corporation (the “Company”).

RECITALS

WHEREAS, prior to the consummation of the Merger (as defined below), Parent shall continue out of the State of Nevada and into the State of Delaware so as to re-domicile as and become a Delaware corporation;

WHEREAS, Parent and the Company intend to effect a merger of Merger Sub with and into the Company (the “Merger”) in accordance with this Agreement and the General Corporation Law of the State of Delaware (the “DGCL”). Upon consummation of the Merger, Merger Sub will cease to exist and the Company will become a wholly owned subsidiary of Parent;

WHEREAS, for United States federal income tax purposes, it is intended that (i) the Merger (together with the Second Merger (as defined below) if the Second Merger is required by Section 3.7) shall qualify as a “reorganization” within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended (the “Code”), and (ii) the reincorporation of Parent from Nevada to Delaware shall be treated as a separate “reorganization” of Parent under Section 368(a)(1)(F) of the Code (the “Intended Tax Treatment“) and (iii) this Agreement shall constitute a “plan of reorganization” within the meaning of Treasury Regulations Sections 1.368-2(g) and 1.368-3(a) with respect to each reorganization;

WHEREAS, the Board of Directors of the Company has deemed it advisable and in the best interests of the Company and its stockholders that the Company engage in the Merger and the transactions contemplated by this Agreement, including the Reincorporation (as defined below) and, if required by Section 3.7, the Second Merger;

WHEREAS, the Board of Directors of the Company has unanimously approved this Agreement and the Merger, with the Company continuing as the Surviving Company (as defined below), after the Effective Time (as defined below), pursuant to which each share of common stock, par value $0.001 per share, of the Company (the “Company Common Stock”) shall be converted into the right to receive a number of shares of common stock, par value $0.001 per share, of Parent (the “Parent Common Stock”) equal to the Exchange Ratio (as defined below), upon the terms and subject to the conditions set forth in this Agreement;

WHEREAS, Merger Sub is a newly incorporated Delaware corporation that is wholly owned by Parent, and has been formed for the sole purpose of effecting the Merger;

WHEREAS, the respective Boards of Directors of Parent and Merger Sub have each unanimously approved this Agreement and the Merger; WHEREAS, Parent, Merger Sub and the Company each desire to make certain representations, warranties, covenants and agreements in connection with the Merger and also to prescribe certain conditions to the Merger as specified herein;

WHEREAS, concurrently with the execution and delivery of this Agreement and as a condition and inducement to the Company’s willingness to enter into this Agreement, the officers and directors of Parent have entered into Parent Support Agreements, dated as of the date of this Agreement, in the form attached hereto as Exhibit A-1, pursuant to which such holders have, subject to the terms and conditions set forth therein, agreed to vote all of their shares of capital stock of Parent in favor of the Parent Stockholder Matters;

WHEREAS, concurrently with the execution and delivery of this Agreement and as a condition and inducement to Parent’s willingness to enter into this Agreement, the officers, directors and stockholders of the Company listed on Section A-1 of the Company Disclosure Letter which represents at least fifty percent (50%) of the outstanding shares of Company Common Stock on an “as-converted” basis (which includes the outstanding shares of Company Common Stock and Company Preferred Stock), have entered into Company Support Agreements, dated as of the date of this Agreement, in the form attached hereto as Exhibit A-2, pursuant to which such holders have, subject to the terms and conditions set forth therein, agreed to vote all of their shares of capital stock of the Company in favor of the adoption of this Agreement and the transactions contemplated thereby;

WHEREAS, concurrently with the execution and delivery of this Agreement and as a condition and inducement to each of Parent and the Company’s willingness to enter into this Agreement, the chief executive officer of Parent, solely in his capacity as a stockholder of Parent, and all of the officers, all of the directors and the stockholders of the of the Company listed on Section A-2 of the Company Disclosure Letter, each solely in their capacity as stockholders of the Company, will execute lock-up agreements in the form attached hereto as Exhibit B (the “Lock-Up Agreements”); and

WHEREAS, no later than the second (2nd) Business Day after the Registration Statement is declared effective under the Securities Act, the holders of shares of capital stock of the Company sufficient to adopt and approve this Agreement and the transactions contemplated hereby as required under the DGCL and the Company’s Certificate of Incorporation and Bylaws, including (i) the holders of at least a majority of the outstanding shares of Company Common Stock, (ii) the holders of at least a majority of the outstanding shares of Company Preferred Stock, voting on an aggregate basis and (iii) the holders of at least a majority of the outstanding shares of each series of Company Preferred Stock, voting as each individual series, will execute and deliver an action by written consent adopting this Agreement and approving the transactions contemplated hereby, in form and substance reasonably acceptable to Parent (the “Company Stockholder Approval”).

AGREEMENT

NOW, THEREFORE, in consideration of the premises, and of the representations, warranties, covenants and agreements contained herein, and intending to be legally bound hereby, the parties hereto hereby agree as follows:

-2-

ARTICLE I

CERTAIN GOVERNANCE MATTERS

Section 1.1 Parent Matters.

(a) Parent Reincorporation and Articles of Incorporation. Before the Effective Time and after the receipt of the Parent Stockholder Approval, Parent shall continue out of the State of Nevada and into the State of Delaware so as to re-domicile as and become a Delaware corporation pursuant to the applicable provisions of the Nevada Business Corporation Act and the DGCL (the “Reincorporation”). The Certificate of Incorporation of Parent after the Reincorporation (the “Parent Charter”) shall be in the form and substance reasonably agreed to by Parent and the Company prior to the Effective Time. As of the Effective Time, the Certificate of Incorporation of Parent shall be identical to the Parent Charter immediately prior to the Effective Time, until thereafter amended in accordance with its terms and as provided by applicable Law; provided, however, that at the Effective Time, subject to obtaining the Parent Stockholder Approval, Parent shall file an amendment to its Parent Charter to (i) change the name of Parent to “TuHURA Biosciences, Inc.”, (ii) effect the Nasdaq Reverse Split and/or increase the number of authorized shares of Parent Common Stock (to the extent applicable and necessary) and (iii) make such other changes as are mutually agreeable to Parent and the Company.

(b) Parent Bylaws. As of the Effective Time, the Bylaws of Parent (the “Parent Bylaws”) shall be identical to the Bylaws of Parent immediately prior to the Effective Time, until thereafter amended in accordance with their terms and as provided by applicable Law; provided, however, that the Parent Bylaws shall include such changes as are mutually agreeable to Parent and the Company.

(c) Parent Board of Directors. The parties shall take all action necessary (including, to the extent necessary, procuring the resignation or removal of any directors on the Parent Board immediately prior to the Effective Time) so that, as of the Effective Time, the number of directors that comprise the full Parent Board shall be five (5), with four (4) individuals to be designated by the Company and one (1) individual to be designated by Parent, with such designations to be made by the respective party so entitled no later than twenty (20) days after the date hereof.

(d) Parent Officers. The officers of the Company immediately prior to the Effective Time shall be the officers of Parent immediately after the Effective Time.

Section 1.2 Surviving Company Matters.

(a) Surviving Company Certificate of Incorporation. At the Effective Time, the Certificate of Incorporation of the Surviving Company shall be amended to read in its entirety as the Certificate of Incorporation of Merger Sub (except that references to the name of Merger Sub shall be replaced by references to the name of the Surviving Company), until thereafter amended in accordance with applicable Law.

(b) Surviving Company Bylaws. At the Effective Time, the Bylaws of the Surviving Company shall be amended to read in their entirety as the Bylaws of Merger Sub (except that references to the name of Merger Sub shall be replaced by references to the name of the Surviving Company), until thereafter amended in accordance with applicable Law.

-3-

(c) Surviving Company Directors and Officers. The directors and officers of the Company immediately prior to the Effective Time shall the be directors and officers of the Surviving Company immediately after the Effective Time, each to hold office in accordance with the Certificate of Incorporation and Bylaws of the Surviving Company.

ARTICLE II

THE MERGER

Section 2.1 Incorporation of Merger Sub. Parent has caused Merger Sub to be incorporated under the laws of the State of Delaware.

Section 2.2 The Merger. Upon the terms and subject to the conditions set forth in this Agreement and in accordance with the DGCL, at the Effective Time, Merger Sub shall be merged with and into the Company. Following the Merger, the separate corporate existence of Merger Sub shall cease, and the Company shall continue as the surviving corporation in the Merger (the “Surviving Company”) and a wholly owned subsidiary of Parent.

Section 2.3 Closing. The closing of the Merger (the “Closing”) shall take place as promptly as practicable (but in no event later than the second Business Day following the satisfaction or waiver of the last to be satisfied or waived of the conditions set forth in ARTICLE VII, other than those conditions that by their nature are to be satisfied at the Closing, but subject to the satisfaction or waiver of each of such conditions), or at such other date, time or place as agreed to in writing by Parent and the Company, remotely by electronic exchange of documents. The date on which the Closing occurs is referred to in this Agreement as the “Closing Date.”

Section 2.4 Effective Time. Upon the terms and subject to the provisions of this Agreement, at the Closing, the parties shall cause a certificate of merger meeting the applicable requirements of the DGCL (the “Merger Filing”) relating to the Merger to be properly executed and filed with the Secretary of State of the State of Delaware in accordance with the terms and conditions of the DGCL and in such form as is reasonably satisfactory to both Parent and the Company. The Merger shall become effective at the later of the times of acceptance of the Merger Filing with the Secretary of State of the State of Delaware in accordance with the DGCL or at such later time which the parties hereto shall have agreed and designated in the Merger Filing as the effective time of the Merger (the “Effective Time” ).

Section 2.5 Effects of the Merger. At and after the Effective Time, the Merger shall have the effects set forth in this Agreement and in the relevant provisions of the DGCL. Without limiting the generality of the foregoing, and subject thereto, at the Effective Time, all the property, rights, privileges, powers and franchises of the Company and Merger Sub shall vest in the Surviving Company, and all debts, liabilities and duties of the Company and Merger Sub shall become the debts, liabilities and duties of the Surviving Company.

-4-

ARTICLE III

EFFECT ON THE CAPITAL STOCK OF THE CONSTITUENT COMPANIES; EXCHANGE OF CERTIFICATES

Section 3.1 Conversion of Capital Stock. At the Effective Time, by virtue of the Merger and without any action on the part of Parent, Merger Sub, the Company or the holders of any shares of capital stock of the Parent, Merger Sub or the Company:

(a) Each share of Company Common Stock issued and outstanding immediately prior to the Effective Time (other than any Excluded Shares or Dissenting Shares) shall thereupon be converted into and become exchangeable for a number of shares of Parent Common Stock equal to the Exchange Ratio (the “Merger Consideration”). As of the Effective Time, all such shares of Company Common Stock shall no longer be outstanding and shall automatically be cancelled and shall cease to exist, and shall thereafter only represent the right to receive the Merger Consideration, any dividends or other distributions payable pursuant to Section 3.3(c), without interest. For the avoidance of doubt, as of the Effective Time, no shares of the capital stock of the Company shall be outstanding other than the Company Common Stock. For purposes of this Agreement, the “Exchange Ratio” shall mean, subject to Section 3.1(e), the ratio (rounded to four decimal places) equal to the quotient obtained by dividing (a) the Company Merger Shares by (b) the Company Outstanding Shares, in which:

(i) “Aggregate Valuation” means the sum of (A) the Company Valuation, plus (B) the Parent Valuation.

(ii) “Company Allocation Percentage” means the quotient (rounded to four decimal places) determined by dividing (A) the Company Valuation by (B) the Aggregate Valuation.

(iii) “Company Merger Shares” means the product determined by multiplying (A) the Post-Closing Parent Shares by (B) the Company Allocation Percentage.

(iv) “Company Outstanding Shares” means, subject to Section 3.1(e), the total number of shares of Company Common Stock outstanding immediately prior to the Effective Time expressed on a fully diluted and as-converted-to-Company Common Stock basis, assuming, without limitation or duplication, (A) the exercise of all Company Options (as defined below) and Company Warrants (as defined below) outstanding as of immediately prior to the Effective Time; (B) the conversion of all convertible promissory notes of the Company (the “Company Convertible Notes”) into Company Common Stock; and (C) the issuance of shares of Company Common Stock in respect of all other options, warrants or rights to receive such shares that will be outstanding immediately after the Effective Time.

(v) “Company Valuation” means $190,753,000; provided, however, that if the Company receives (x) less than $30,753,000 (the “Committed Funds”) before the Effective Time in their convertible note financing, the “Company Valuation” will be reduced by the difference between the Committed Funds and those funds actually received by the Company in connection with the convertible note financing or (y) more than the Committed Funds before the Effective Time in their convertible note financing, the “Company Valuation” will be increased by the difference between those funds actually received by the Company in connection with the convertible note financing and the Committed Funds.

-5-

(vi) “Parent Allocation Percentage” the quotient (rounded to four decimal places) determined by dividing (A) the Parent Valuation by (B) the Aggregate Valuation.

(vii) “Parent Outstanding Shares” means, subject to Section 3.1(e), the sum of (i) total number of shares of Parent Common Stock and Parent Preferred Stock (including, for the avoidance of doubt, any shares of Parent Common Stock or Parent Preferred Stock payable as dividends on any Parent Preferred Stock or to be paid on such shares regardless of whether or not such dividend would accrue or be payable prior to or after the Effective Time) outstanding immediately prior to the Effective Time expressed on a fully diluted and as-converted-to-Parent Common Stock basis, and assuming the exercise of options to purchase shares of Parent Common Stock (the “Parent Options”) and warrants to acquire shares of Parent Common Stock (the “Parent Warrants”) and the settlement of restricted stock units that can be settled in shares of Parent Common Stock (the “Parent RSUs”) (using the treasury stock method), and other derivative rights of Parent, plus (ii) the number of shares of Parent Common Stock that is included in the CVR Payment Amount (as defined in the CVR Agreement) as of the date of the CVR Agreement and without regard to whether the Milestone (as defined in the CVR Agreement) is achieved. Notwithstanding any of the foregoing, any Parent Options and Parent Warrants with an exercise price equal to, or greater than, $0.20 per share (subject to Section 3.1(e)) shall not be included in the total number of shares of Parent Common Stock outstanding for purposes of determining the Parent Outstanding Shares.

(viii) “Parent Valuation” means $11,000,000.

(ix) “Post-Closing Parent Shares” means the quotient determined by dividing (A) the Parent Outstanding Shares by (B) the Parent Allocation Percentage.

For the avoidance of doubt and for illustrative purposes only, a sample “Exchange Ratio” calculation is attached hereto as Exhibit C.

(b) At the Effective Time, each share of Parent Common Stock issued and outstanding immediately prior to the Effective Time shall remain outstanding. Immediately following the Effective Time, shares of Parent Common Stock, if any, owned by the Surviving Company shall be surrendered to Parent without payment therefor.

(c) Each share of Company Common Stock held in the treasury of the Company or owned, directly or indirectly, by Parent or Merger Sub immediately prior to the Effective Time (collectively, “Excluded Shares”) shall automatically be cancelled and shall cease to exist, and no consideration shall be delivered in exchange therefor.

(d) Each share of common stock, par value $0.001 per share, of Merger Sub issued and outstanding immediately prior to the Effective Time shall be converted into and become one validly issued, fully paid and nonassessable share of common stock, par value $0.001 per share, of the Surviving Company.

-6-

(e) For purposes of calculating the Company Outstanding Shares and Parent Outstanding Shares, the calculation of the Exchange Ratio shall be adjusted to reflect fully the appropriate effect of any stock split, split-up, reverse stock split (including the Nasdaq Reverse Split to the extent such split has not previously been taken into account in calculating the Exchange Ratio), stock dividend or distribution of securities convertible into Company Common Stock or Parent Common Stock, reorganization, recapitalization, reclassification or other like change with respect to the Company Common Stock or Parent Common Stock having a record date occurring on or after the date of this Agreement and prior to the Effective Time; provided, that nothing in this Section 3.1(e) shall be construed to permit the Company or Parent to take any action with respect to its securities that is prohibited by the terms of this Agreement.

Section 3.2 Treatment of Options and Warrants.

(a) At the Effective Time, each outstanding option (each, a “Company Option”) to purchase shares of Company Common Stock granted under the Company’s Amended and Restated Equity Incentive Plan adopted on January 13, 2019 (the “Company Equity Plan”), whether vested or unvested, that is outstanding immediately prior to the Effective Time shall, at the Effective Time, cease to represent a right to acquire shares of Company Common Stock and shall be assumed and converted, at the Effective Time, into an option to purchase shares of Parent Common Stock (an “Assumed Option”), on the same terms and conditions (including any forfeiture and post-termination exercise provisions, but not taking into account any accelerated vesting provided for in the Company Equity Plan or in the related award document by reason of the transactions contemplated hereby) as were applicable to such Company Option as of immediately prior to the Effective Time; provided, however, that (i) the number of shares of Parent Common Stock subject to each such Assumed Option shall be equal to the number of shares of Company Common Stock subject to each Company Option immediately prior to the Effective Time multiplied by the Exchange Ratio, (ii) the exercise price per share of such Assumed Option shall be the exercise price per share of such Option immediately prior to the Effective Time divided by the Exchange Ratio, and (iii) from and after the Effective Time, (x) references to the “Company” under the Company Equity Plan shall be deemed to refer to Parent, (y) references to the “Board” under the Company Equity Plan shall be deemed to refer to the Parent Board, and (z) the committee that administers the Company Equity Plan shall be a committee established by the Parent Board. In all other material respects, the Assumed Options shall continue to be governed by the terms of the Company Equity Plan from and after the Effective Time, subject to such additional modifications as the Parent Board (or a committee appointed by the Parent Board) deems appropriate to reflect the Merger. Notwithstanding the foregoing, the exercise price and the number of shares of Parent Common Stock subject to each such Assumed Option shall be subject to such adjustments as are necessary in order to avoid the imposition of any additional Taxes under Section 409A of the Code (and regulations issued by the IRS thereunder) or, in the case of any Assumed Option to which Section 422 of the Code applies as of the Effective Time, in order to satisfy the requirements of Section 424(a) of the Code (and regulations issued by the IRS thereunder).

(b) Each warrant entitling the holder to purchase shares of Company Common Stock (each, a “Company Warrant”) issued and outstanding immediately prior to the Effective Time shall thereupon be converted into and become exchangeable for a warrant of like tenor entitling the holder to purchase shares of Parent Common Stock (each, a “Replacement Warrant”)

-7-

that complies with and satisfies the applicable terms and conditions of the applicable warrant agreement between the Company and the holder of the Company Warrant and providing that such Replacement Warrant shall be exercisable for a number of shares of Parent Common Stock equal to the product of (i) the number of shares of Company Common Stock that would have been issuable upon exercise of the Company Warrant and (ii) the Exchange Ratio, and such Replacement Warrant shall have an exercise price per share equal to: (i) the exercise price per share of Company Common Stock otherwise purchasable pursuant to such Company Warrant, divided by (ii) the Exchange Ratio.

(c) Prior to the Effective Time, the Company shall take all action necessary for the adjustment of the Company Options and Company Warrants under this Section 3.2 (including, but not limited to, with respect to the Company Options, the waiver of any provisions providing for accelerated vesting by reason of the transactions contemplated hereby). The Company shall ensure that, as of the Effective Time, no holder of a Company Option (or former holder of a Company Option) or a participant in the Company Equity Plan or any holder of a Company Warrant (or former holder of a Company Warrant) shall have any rights thereunder to acquire, or other rights in respect of, the capital stock of the Company, the Surviving Company or any of their Subsidiaries, or any other equity interest therein.

(d) As soon as practicable following the Effective Time, Parent shall use its reasonable best efforts to file a registration statement on Form S-8 (or any successor form, or if Form S-8 is not available, other appropriate forms) with respect to the shares of Parent Common Stock, on an as-converted basis, subject to the Assumed Options.

Section 3.3 Exchange and Payment.

(a) Promptly after the Effective Time, Parent shall cause a bank or trust company designated by Parent (the “Exchange Agent”) to issue and send to each holder of shares of Company Common Stock, other than with respect to Excluded Shares or Dissenting Shares, (1) that number of whole shares of Parent Common Stock to which such holder of shares of Company Common Stock shall have become entitled pursuant to the provisions of Section 3.1(a) (which shall be in book-entry form unless a physical certificate is requested), and (2) any dividends or other distributions payable pursuant to Section 3.3(c). No interest will be paid or accrued on any unpaid dividends and distributions, if any, payable to holders of shares of Company Common Stock. Each share of Company Common Stock shall be deemed after the Effective Time to represent only the right to receive the Merger Consideration payable in respect thereof, any dividends or other distributions payable pursuant to Section 3.3(c). All book-entry shares of Parent Common Stock, certificates representing shares of Parent Common Stock, dividends, distributions and cash deposited with the Exchange Agent are hereinafter referred to as the “Exchange Fund.”

(b) If payment of the Merger Consideration is to be made to a Person other than the Person in whose name the share of Company Common Stock is registered, it shall be a condition of payment that such share of Company Common Stock shall be properly transferred and that the Person requesting such payment shall have paid any transfer and other Taxes required by reason of the payment of the Merger Consideration to a Person other than the registered holder of such share of Company Common Stock or shall have established to the satisfaction of Parent that such Tax is not applicable.

-8-

(c) Notwithstanding anything in the foregoing to the contrary, other than the CVRs (as defined below), holders of shares of Company Common Stock who are entitled to receive shares of Parent Common Stock under this ARTICLE III shall be paid (A) at the time of payment of such Parent Common Stock by the Exchange Agent under Section 3.3(a), the amount of dividends or other distributions with a record date after the Effective Time theretofore paid with respect to such whole shares of Parent Common Stock, and (B) at the appropriate payment date, the amount of dividends or other distributions with a record date after the Effective Time but prior to the time of such payment by the Exchange Agent under Section 3.3(a) and a payment date subsequent to the time of such payment by the Exchange Agent under Section 3.3(a) payable with respect to such whole shares of Parent Common Stock.

(d) The Merger Consideration, any dividends or other distributions payable pursuant to Section 3.3(c) in accordance with the terms of this ARTICLE III shall be deemed to have been issued and paid in full satisfaction of all rights pertaining to the shares of Company Common Stock. At the Effective Time, the stock transfer books of the Company shall be closed and there shall be no further registration of transfers of the shares of Company Common Stock that were outstanding immediately prior to the Effective Time. If, after the Effective Time, transfer is sought for uncertificated shares of Company Common Stock represented by book entry (“Book-Entry Shares”), such Book-Entry Shares shall be cancelled and exchanged as provided in this ARTICLE III.

(e) Fractional shares of Parent Common Stock otherwise issuable upon consummation of the Merger shall be rounded up or down to the nearest whole share. Any fractional shares of Parent Common Stock a holder of shares of Company Common Stock upon the conversion of shares of Company Common Stock would otherwise be entitled to receive shall be aggregated together first and prior to eliminating fractional shares.

(f) Any portion of the Exchange Fund that remains undistributed or unallocated to the holders of Book-Entry Shares six months after the Effective Time shall be delivered to the Surviving Company, upon demand, and any remaining holders of Book-Entry Shares (except to the extent representing Excluded Shares or Dissenting Shares) shall thereafter look only to the Surviving Company, as general creditors thereof, for payment of the Merger Consideration, any unpaid dividends or other distributions payable pursuant to Section 3.3(c) (subject to abandoned property, escheat or other similar laws), without interest.

(g) None of Parent, the Surviving Company, the Exchange Agent or any other Person shall be liable to any Person in respect of shares of Parent Common Stock, dividends or other distributions with respect thereto properly delivered to a public official pursuant to any applicable abandoned property, escheat or similar Law. If any Book-Entry Shares shall not have been allocated their Merger Consideration prior to two (2) years after the Effective Time (or immediately prior to such earlier date on which the related Merger Consideration (and all dividends or other distributions with respect to shares of Parent Common Stock) would otherwise escheat to or become the property of any Governmental Entity), any such Merger Consideration (and such dividends, distributions and cash) in respect thereof shall, to the extent permitted by applicable Law, become the property of the Surviving Company, free and clear of all claims or interest of any Person previously entitled thereto.

-9-

(h) The Exchange Agent shall invest any cash included in the Exchange Fund as directed by Parent on a daily basis. Any interest and other income resulting from such investments shall be paid to Parent.

Section 3.4 Withholding Rights. Parent, Merger Sub, the Surviving Company and the Exchange Agent shall each be entitled to deduct and withhold, or cause to be deducted and withheld, from any amounts payable under this Agreement or the CVR Agreement such amounts as Parent, Merger Sub, the Surviving Company or the Exchange Agent reasonably determines it is required to deduct and withheld under the Code, or any provision of state, local or foreign Tax Law. To the extent that amounts are so deducted and withheld and are remitted to the applicable Taxing authority, such amounts shall be treated for all purposes of this Agreement as having been paid to the Person in respect of whom such deduction and withholding was made.

Section 3.5 Dissenters Rights. Notwithstanding anything in this Agreement to the contrary, each share of the Company Common Stock (other than Excluded Shares) outstanding immediately prior to the Effective Time and held by a holder who is entitled to demand and has properly demanded appraisal for such shares of the Company Common Stock in accordance with Section 262 of the DGCL (“Dissenting Shares”), shall not be converted into or be exchangeable for the right to receive a portion of the Merger Consideration unless and until such holder fails to perfect or withdraws or otherwise loses such holder’s right to appraisal and payment under the DGCL. If, after the Effective Time, any such holder fails to perfect or withdraws or loses such holder’s right to appraisal, such Dissenting Shares shall thereupon be treated as if they had been converted as of the Effective Time into the right to receive the portion of the Merger Consideration, if any, to which such holder is entitled pursuant to Section 3.1(a), without interest. The Company shall give Parent (a) prompt notice of any demands received by the Company for appraisal of any shares of the Company Common Stock issued and outstanding immediately prior to the Effective Time, attempted written withdrawals of such demands, and any other instruments served pursuant to the DGCL and received by the Company relating to stockholders’ rights to appraisal with respect to the Merger and (b) the opportunity to participate in all negotiations and proceedings with respect to any exercise of such appraisal rights under the DGCL. The Company shall not, except with the prior written consent of Parent, which shall not be unreasonably withheld, conditioned or delayed, voluntarily make any payment with respect to any demands for payment of fair value for capital stock of the Company, offer to settle or settle any such demands or approve any withdrawal of any such demands.

Section 3.6 Contingent Value Right.

(a) Prior to the Effective Time, the Board of Directors of Parent shall declare a distribution (the “CVR Distribution”) to the holders of Parent Common Stock, the holders of Parent Warrants and the holders of Series C Parent Preferred Stock that are entitled to the CVR Distribution, in each case, of record as of immediately prior to the Effective Time of the right to receive, less applicable withholding taxes (or less CVRs with a value, in the determination of Parent, equal to the applicable withholding taxes), one contingent value right (each, a “CVR”) for each outstanding share of Parent Common Stock held by such stockholder as of such date (or, in the case of Parent Warrants and holders of Series C Parent Preferred Stock that are entitled to the CVR Distribution, each share of Parent Common Stock for which such Parent Warrant is exercisable or which such Series C Parent Preferred Stock is convertible into), with each such CVR representing the right to receive contingent payments upon the occurrence of certain events set forth in, and subject to and in accordance with the terms and conditions of, the Contingent Value Rights Agreement in the form attached hereto as Exhibit D (the “CVR Agreement”).

-10-

The record date for the CVR Distribution shall be the close of business on the Business Day immediately prior to the Closing Date (or such other date before the Closing Date so that the CVR Distribution will be made to stockholders, holders of Parent Warrants and holders of Series C Parent Preferred Stock immediately prior to the Effective Time) and the payment date for which shall be three (3) Business Days after the Effective Time; provided that the payment of such distribution may be conditioned upon the occurrence of the Effective Time (and, for the avoidance of doubt, Parent Stockholder Approval).

(b) Parent and a rights agent to be appointed by Parent (the “Rights Agent”) shall, at or prior to the Effective Time, duly authorize, execute and deliver the CVR Agreement, in the form attached hereto as Exhibit D, subject to any reasonable revisions to the CVR Agreement that are requested by such Rights Agent and are reasonably acceptable to Parent and the Company. Parent agrees to pay the fees and expenses of the Rights Agent in connection with this Agreement and as agreed upon in writing and to reimburse the Rights Agent for all reasonable, documented and necessary out-of-pocket- expenses incurred by the Rights Agent in connection with the administration by the Rights Agent of its duties hereunder and thereunder.

Section 3.7 Second Merger. If the demands for appraisal of shares of the Company Common Stock in accordance with Section 262 of the DGCL in connection with the Merger are such that, if such demands were perfected and the related appraisal rights were not withdrawn or lost, the Merger would fail to qualify as a “reorganization” described in Section 368(a)(2)(E) of the Code, Parent shall, as promptly as practical following the Merger, and as part of an integrated transaction with the Merger for federal income tax purposes, cause the Company to be merged with and into a limited liability company directly wholly-owned by Parent that is formed specifically for purposes of such merger and is treated for federal income tax purposes as an entity whose separate existence from Parent is disregarded, with such limited liability company surviving such merger (such merger, the “Second Merger”); provided that the Second Merger will not be required if, prior to the Second Merger, sufficient demands for appraisal fail to be perfected or related appraisal rights are withdrawn or lost so that the Merger would qualify as a “reorganization” described in Section 368(a)(2)(E) of the Code.

ARTICLE IV

REPRESENTATIONS AND WARRANTIES OF THE COMPANY

Except as set forth in the corresponding section or subsection of the disclosure letter delivered by the Company to Parent immediately prior to the execution of this Agreement (the “Company Disclosure Letter”), the Company represents and warrants to Parent and Merger Sub as follows:

Section 4.1 Organization, Standing and Power.

-11-