UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 20, 2024 |

Cineverse Corp.

(Exact name of Registrant as Specified in Its Charter)

Delaware |

001-31810 |

22-3720962 |

||

(State or Other Jurisdiction |

(Commission File Number) |

(IRS Employer |

||

|

|

|

|

|

|

224 W. 35th St. Suite 500, #947 |

|

|||

New York, New York |

|

10001 |

||

(Address of Principal Executive Offices) |

|

(Zip Code) |

||

Registrant’s Telephone Number, Including Area Code: 212 206-8600 |

Not Applicable |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Securities registered pursuant to Section 12(b) of the Act:

|

|

Trading |

|

|

CLASS A COMMON STOCK, PAR VALUE $0.001 PER SHARE |

|

CNVS |

|

The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On March 20, 2024, the Company posted to the Company’s website at www.cineverse.com an investor presentation to be used from time to time at conferences and in meetings with investors and analysts. A copy of the investor presentation is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein. The information set forth in this Item 7.01 is intended to be furnished under Item 7.01 of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section. In addition, this information shall not be incorporated by reference into any registration statement filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Item 9.01 Regulation FD Disclosure.

99.1 |

|

|

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

Date: |

March 20, 2024 |

By: |

/s/ Gary S. Loffredo |

|

|

Name: Title: |

Gary S. Loffredo |

INVESTOR PRESENTATION A leading innovator in entertainment technology since 2000 Cineverse(Nasdaq: CNVS)March 2024

FORWARD-LOOKINGSTATEMENTS Investors are cautioned that certain statements contained in this document, as well as some statements in press releases and some oral statements of Cineverse officials during presentations about Cineverse, along with Cineverse's filings with the Securities and Exchange Commission, including Cineverse's current reports on Form 8-K, quarterly reports on Form 10-Q and annual reports on Form 10-K, are "forward-looking'' statements within the meaning of the Private Securities Litigation Reform Act of 1995 (the "Act‘’). Forward-looking statements include statements that are predictive in nature, which depend upon or refer to future events or conditions, which include words such as "expects," "anticipates,'' "intends,'' "plans,'' "could," "might," "believes,'' "seeks," "estimates'' or similar expressions. In addition, any statements concerning future financial performance (including future revenues, earnings or growth rates), ongoing business strategies or prospects, and possible future actions, which may be provided by Cineverse's management, are also forward-looking statements as defined by the Act. Forward-looking statements are based on current expectations and projections about future events and are subject to various risks, uncertainties and assumptions about Cineverse, its technology, economic and market factors and the industries in which Cineverse does business, among other things. These statements are not guarantees of future performance and Cineverse undertakes no specific obligation or intention to update these statements after the date of this presentation.

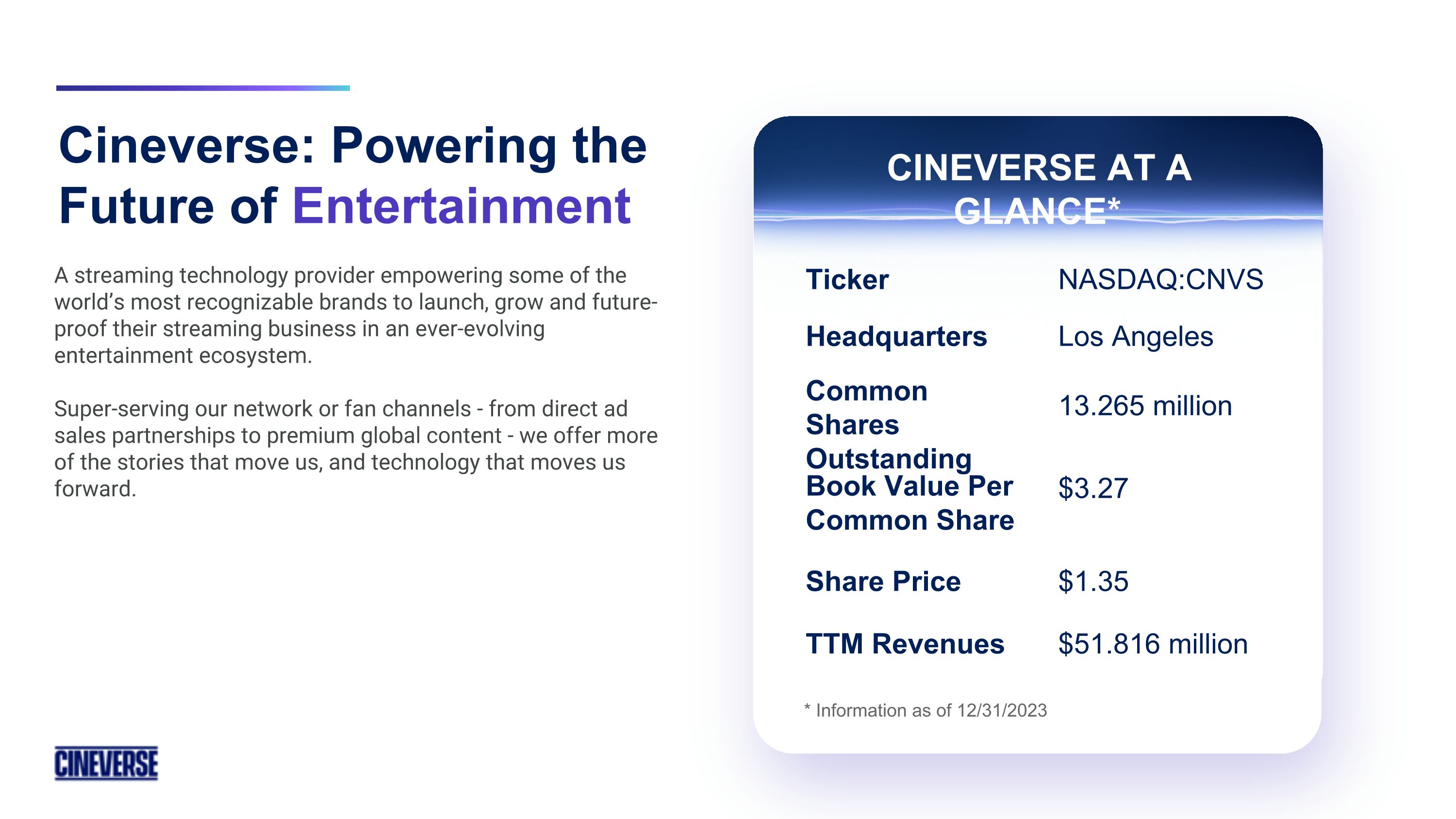

Cineverse: Powering the Future of Entertainment A streaming technology provider empowering some of the world’s most recognizable brands to launch, grow and future-proof their streaming business in an ever-evolving entertainment ecosystem. Super-serving our network or fan channels - from direct ad sales partnerships to premium global content - we offer more of the stories that move us, and technology that moves us forward. CINEVERSE AT A GLANCE* Ticker Headquarters Common Shares Outstanding Book Value Per Common Share TTM Revenues * Information as of 12/31/2023 NASDAQ:CNVS Los Angeles 13.265 million $3.27 $51.816 million Share Price $1.35

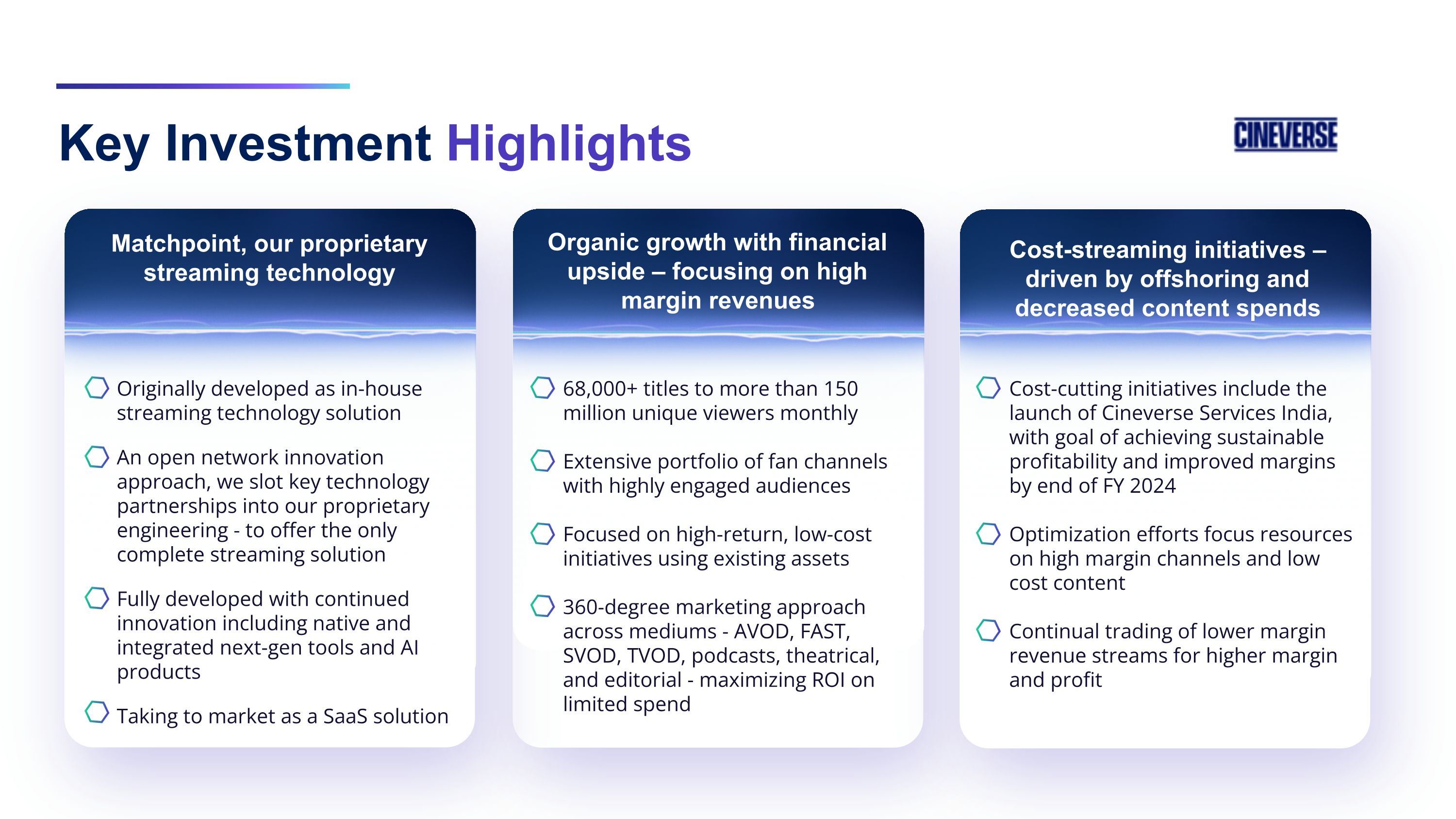

Key Investment Highlights Matchpoint, our proprietary streaming technology Organic growth with financial upside – focusing on high margin revenues Cost-streaming initiatives – driven by offshoring and decreased content spends Originally developed as in-house streaming technology solution An open network innovation approach, we slot key technology partnerships into our proprietary engineering - to offer the only complete streaming solution Fully developed with continued innovation including native and integrated next-gen tools and AI products Taking to market as a SaaS solution 68,000+ titles to more than 150 million unique viewers monthly Extensive portfolio of fan channels with highly engaged audiences Focused on high-return, low-cost initiatives using existing assets 360-degree marketing approach across mediums - AVOD, FAST, SVOD, TVOD, podcasts, theatrical, and editorial - maximizing ROI on limited spend Cost-cutting initiatives include the launch of Cineverse Services India, with goal of achieving sustainable profitability and improved margins by end of FY 2024 Optimization efforts focus resources on high margin channels and low cost content Continual trading of lower margin revenue streams for higher margin and profit

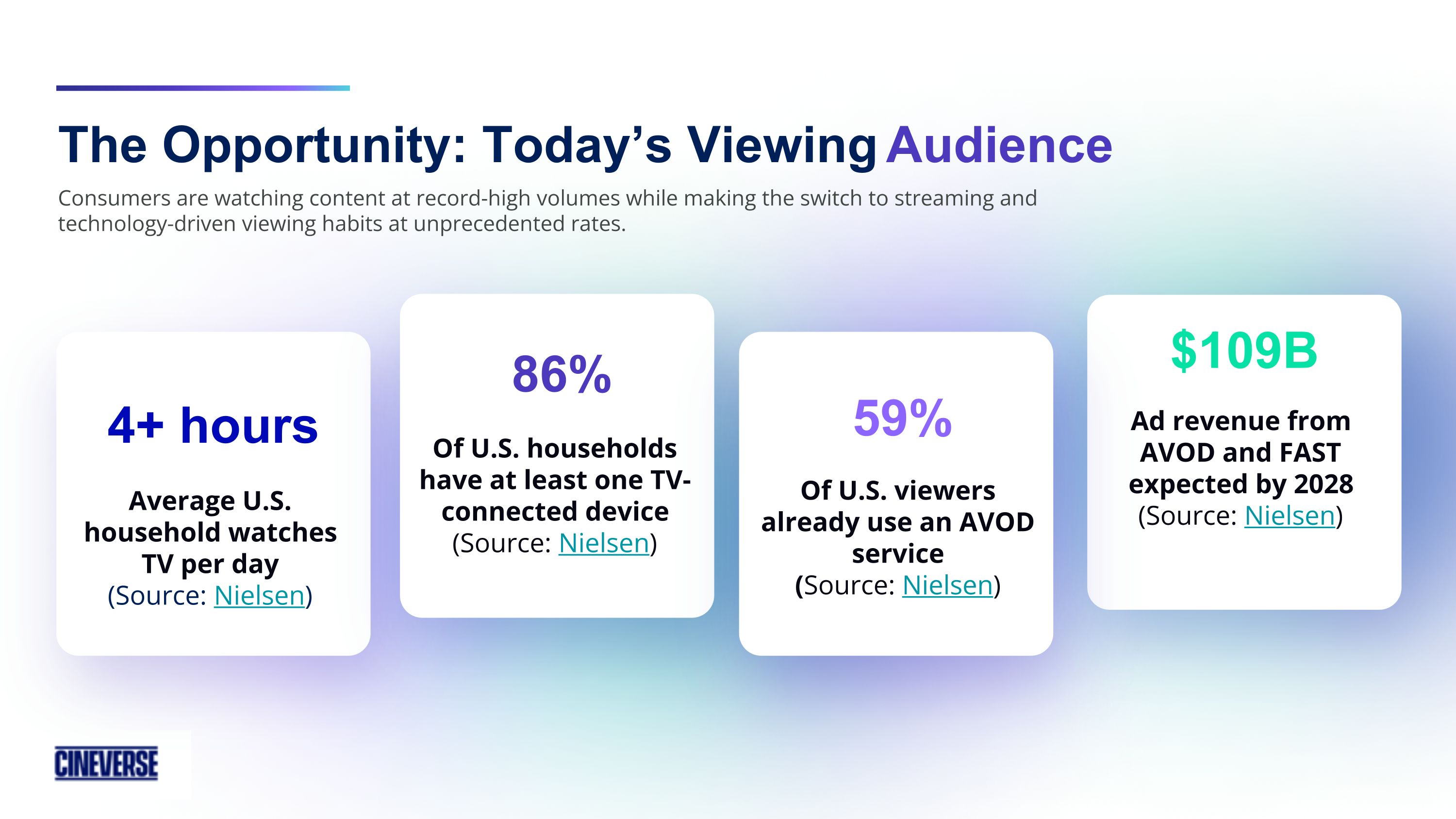

The Opportunity: Today’s Viewing Audience 4+ hours 86% 59% $109B Average U.S. household watches TV per day (Source: Nielsen) Of U.S. households have at least one TV-connected device (Source: Nielsen) Of U.S. viewers already use an AVOD service(Source: Nielsen) Ad revenue from AVOD and FAST expected by 2028(Source: Nielsen) Consumers are watching content at record-high volumes while making the switch to streaming and technology-driven viewing habits at unprecedented rates.

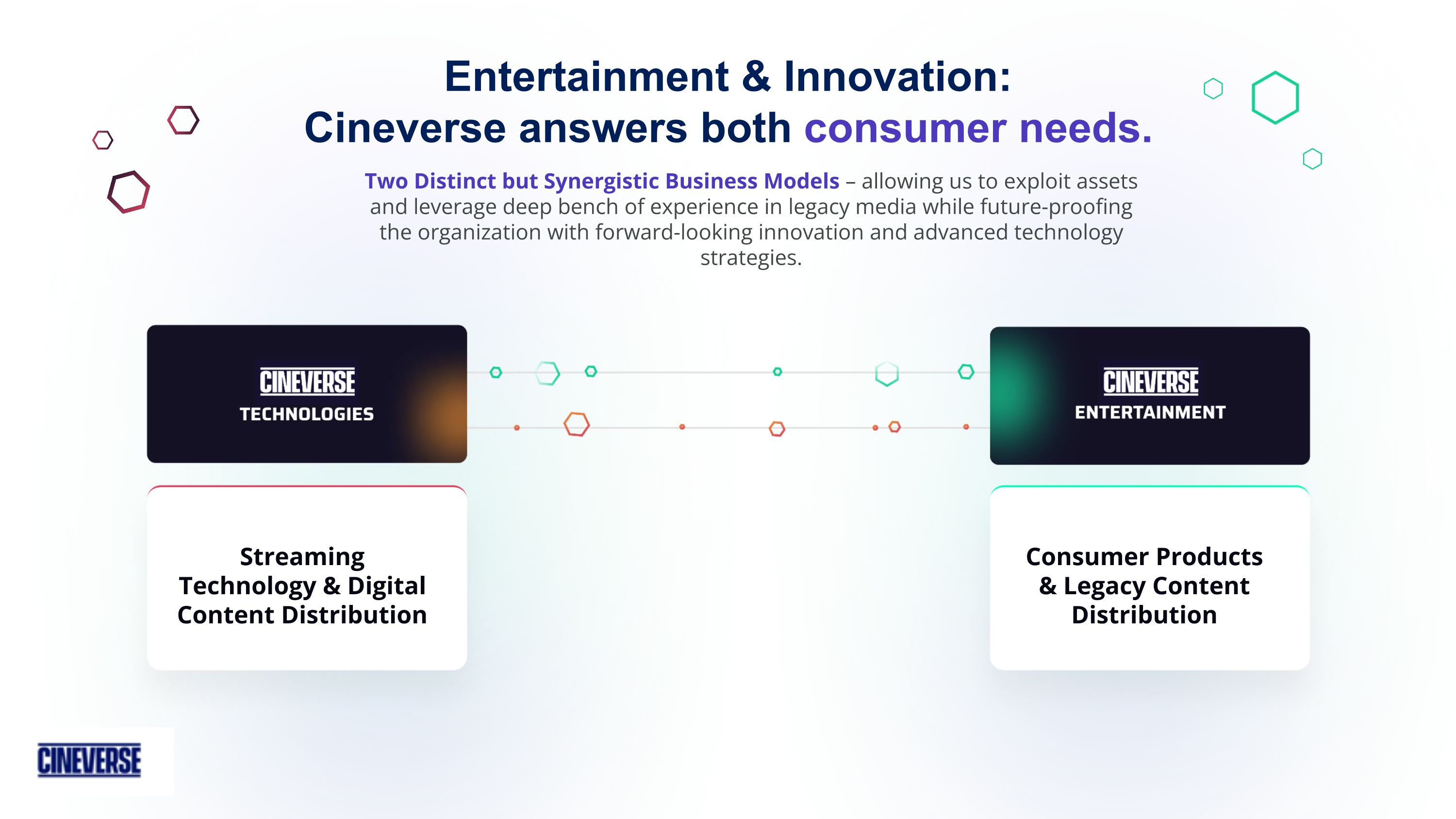

Entertainment & Innovation: Cineverse answers both consumer needs. Two Distinct but Synergistic Business Models – allowing us to exploit assets and leverage deep bench of experience in legacy media while future-proofing the organization with forward-looking innovation and advanced technology strategies. Streaming Technology & Digital Content Distribution Consumer Products & Legacy Content Distribution

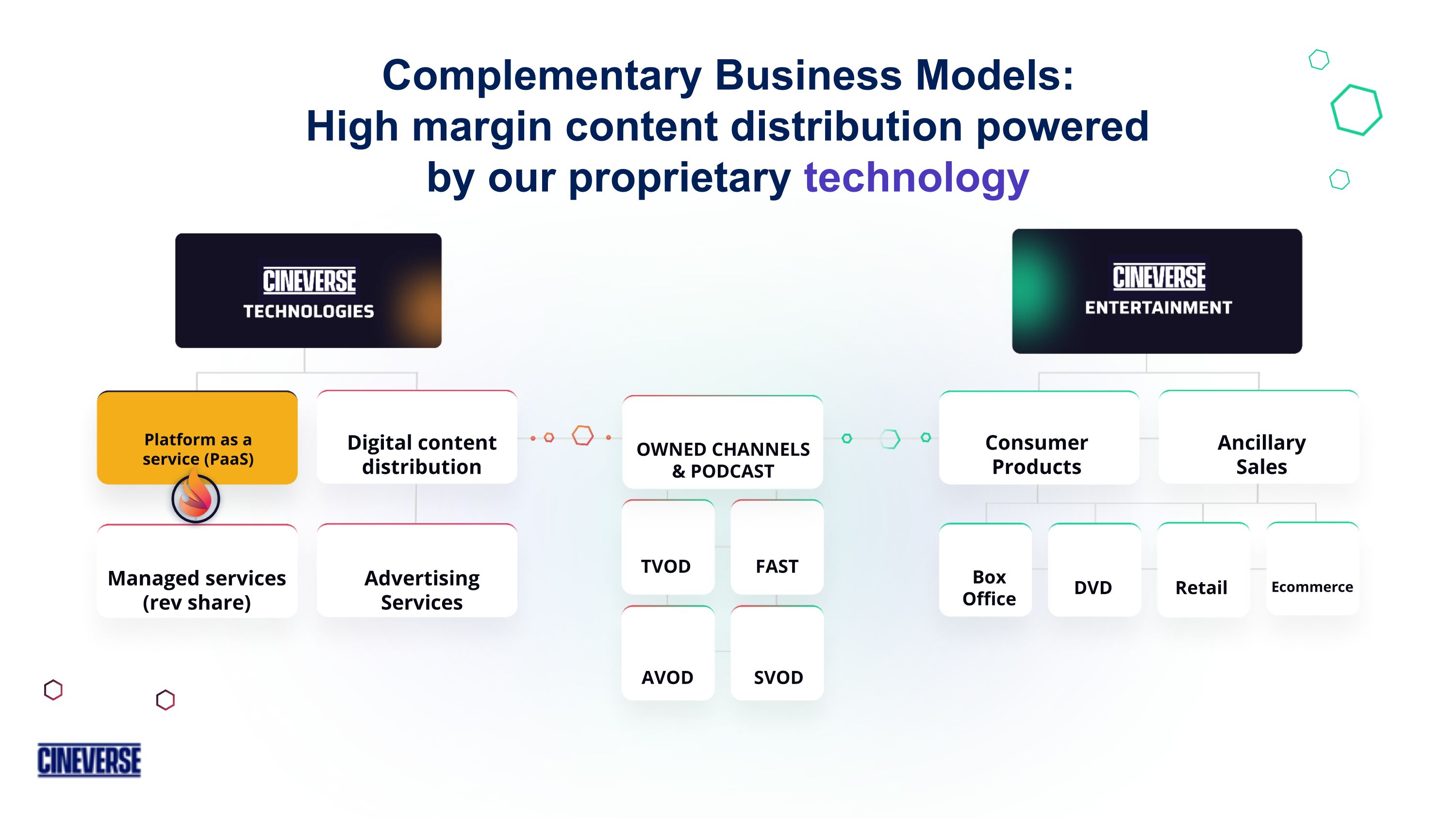

Complementary Business Models: High margin content distribution powered by our proprietary technology Platform as aservice (PaaS) Digital contentdistribution Managed services(rev share) AdvertisingServices OWNED CHANNELS& PODCAST TVOD FAST AVOD SVOD Consumer Products Ancillary Sales Box Office DVD Retail Ecommerce

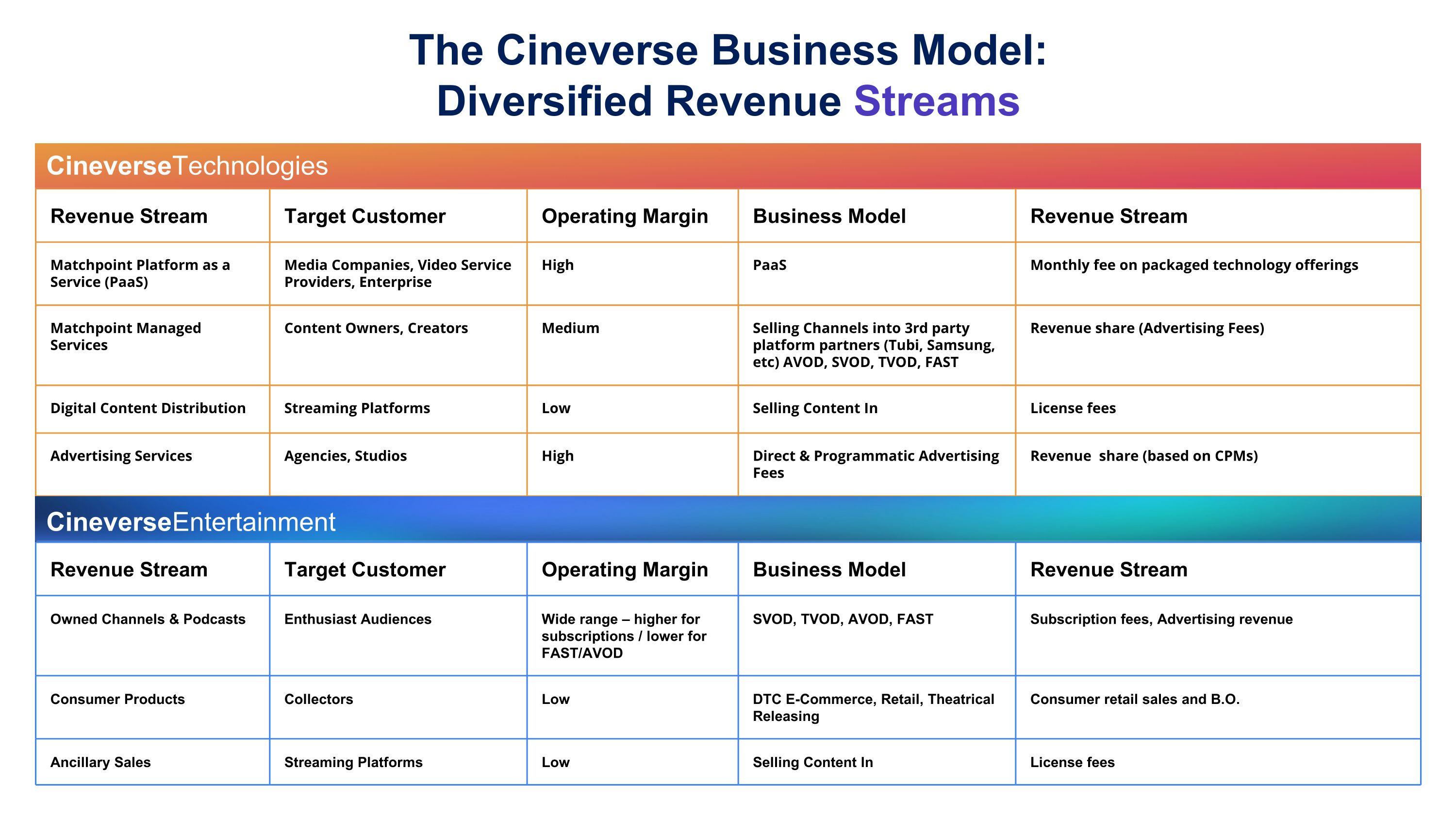

Revenue Stream Target Customer Operating Margin Business Model Revenue Stream Matchpoint Platform as a Service (PaaS) Media Companies, Video Service Providers, Enterprise High PaaS Monthly fee on packaged technology offerings Matchpoint Managed Services Content Owners, Creators Medium Selling Channels into 3rd party platform partners (Tubi, Samsung, etc) AVOD, SVOD, TVOD, FAST Revenue share (Advertising Fees) Digital Content Distribution Streaming Platforms Low Selling Content In License fees Advertising Services Agencies, Studios High Direct & Programmatic Advertising Fees Revenue share (based on CPMs) Revenue Stream Target Customer Operating Margin Business Model Revenue Stream Owned Channels & Podcasts Enthusiast Audiences Wide range – higher for subscriptions / lower for FAST/AVOD SVOD, TVOD, AVOD, FAST Subscription fees, Advertising revenue Consumer Products Collectors Low DTC E-Commerce, Retail, Theatrical Releasing Consumer retail sales and B.O. Ancillary Sales Streaming Platforms Low Selling Content In License fees CineverseTechnologies CineverseEntertainment The Cineverse Business Model: Diversified Revenue Streams

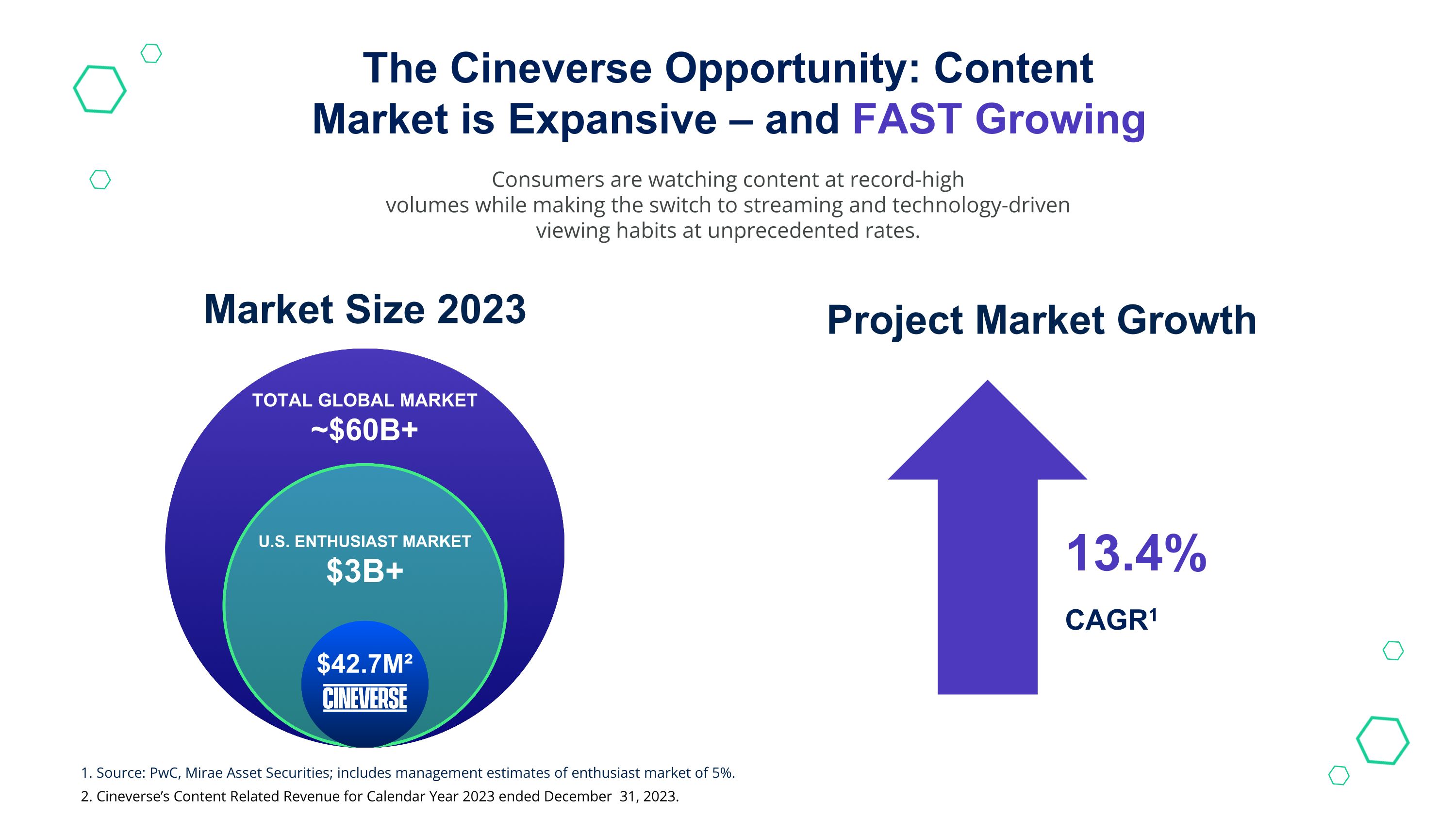

Consumers are watching content at record-high volumes while making the switch to streaming and technology-driven viewing habits at unprecedented rates. U.S. ENTHUSIAST MARKET $3B+ TOTAL GLOBAL MARKET ~$60B+ The Cineverse Opportunity: Content Market is Expansive – and FAST Growing $42.7M² Market Size 2023 13.4% CAGR1 Project Market Growth 1. Source: PwC, Mirae Asset Securities; includes management estimates of enthusiast market of 5%. 2. Cineverse’s Content Related Revenue for Calendar Year 2023 ended December 31, 2023.

Ample Headroom on Our Streaming Technology Target Market S-M media companies are expanding into FAST, while publishers enter the market. TM TAM Global Film Production & Distribution Market $76.7 BN FAST Market $7.2 BN 13.22% CAGR 1. Source: Statista, 2023 2. Source: Statista, 2023

The Cineverse AI Opportunity $250B Total AI Market $2-2.5T Total AI Market in next 8 years $165B Generative AI in five years $55B Video Gen AI segment 30K Fortune 500 mentions have risen from under 500 in ‘22 to 30,000+ in ‘23 THE AI MARKET Our already developed next-gen technologies and infrastructure position us uniquely to serve emerging markets – offering unparalleled insights and data orchestration. Cineverse & AI: Where We Are Today The Cineverse AI Roadmap We are also deploying innovative consumer-centric tools and capabilities such as Cinesearch AI: cineSearch AI announcement led to our highest trading day ever at 32M shares – nearly 3x our 2nd best in ‘20 Matchpoint already employs advanced machine learning and computer vision to analyze video content for streaming We have already developed 5 AI modules to automate tasks, and another 6 partnerships to extend the platform’s AI capabilities – fully integrated into our product Planning to launch AI-powered products to address the needs of the entertainment and technology sectors – which process vast amounts of video-centric data at scale AI will act as disruptor for localization, QC, encoding, encryption, etc – we are primed to jump on this market opportunity

STREAM BIG Launch and grow your streaming business. All-in-one place. Matchpoint’s innovative, complete OTT solution lets you get to market fast – at a price that makes sense.

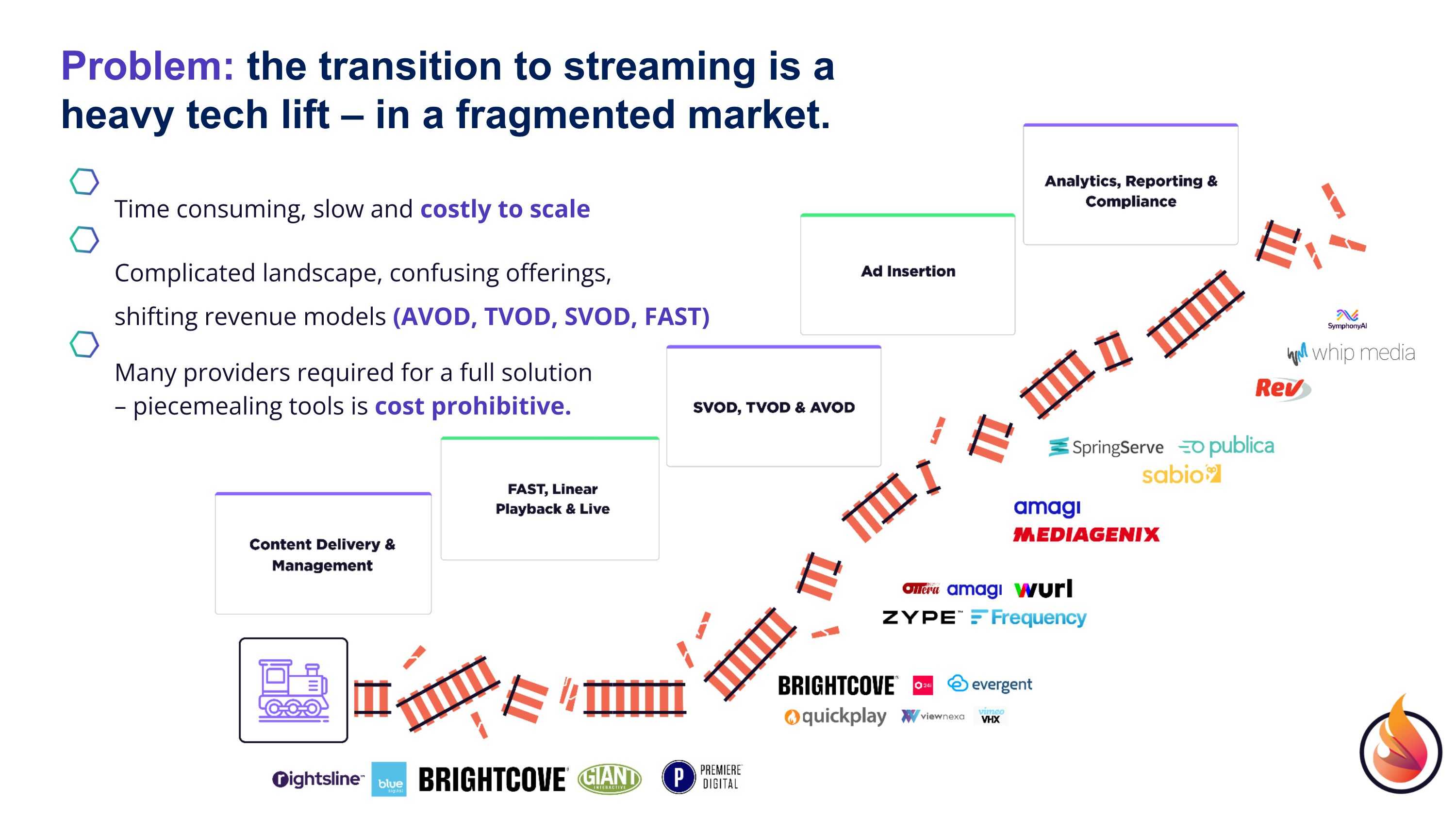

Problem: the transition to streaming is a heavy tech lift – in a fragmented market. Time consuming, slow and costly to scale Complicated landscape, confusing offerings, shifting revenue models (AVOD, TVOD, SVOD, FAST) Many providers required for a full solution – piecemealing tools is cost prohibitive.

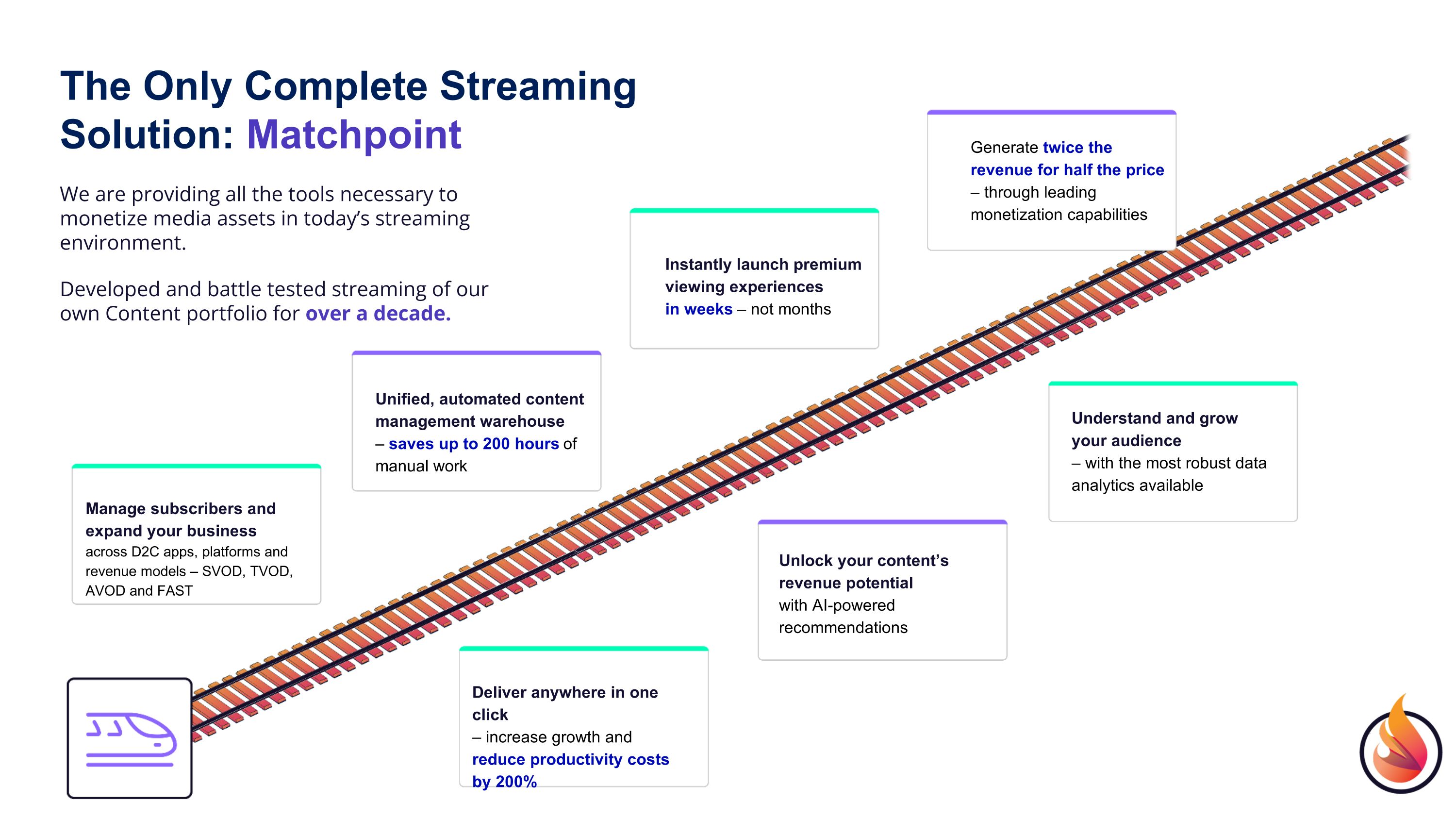

Deliver anywhere in one click– increase growth and reduce productivity costs by 200% Instantly launch premium viewing experiencesin weeks – not months Manage subscribers and expand your business across D2C apps, platforms and revenue models – SVOD, TVOD, AVOD and FAST Generate twice the revenue for half the price– through leading monetization capabilities Unlock your content’s revenue potentialwith AI-powered recommendations Understand and grow your audience– with the most robust data analytics available Unified, automated content management warehouse – saves up to 200 hours of manual work The Only Complete Streaming Solution: Matchpoint Developed and battle tested streaming of our own Content portfolio for over a decade. We are providing all the tools necessary to monetize media assets in today’s streaming environment.

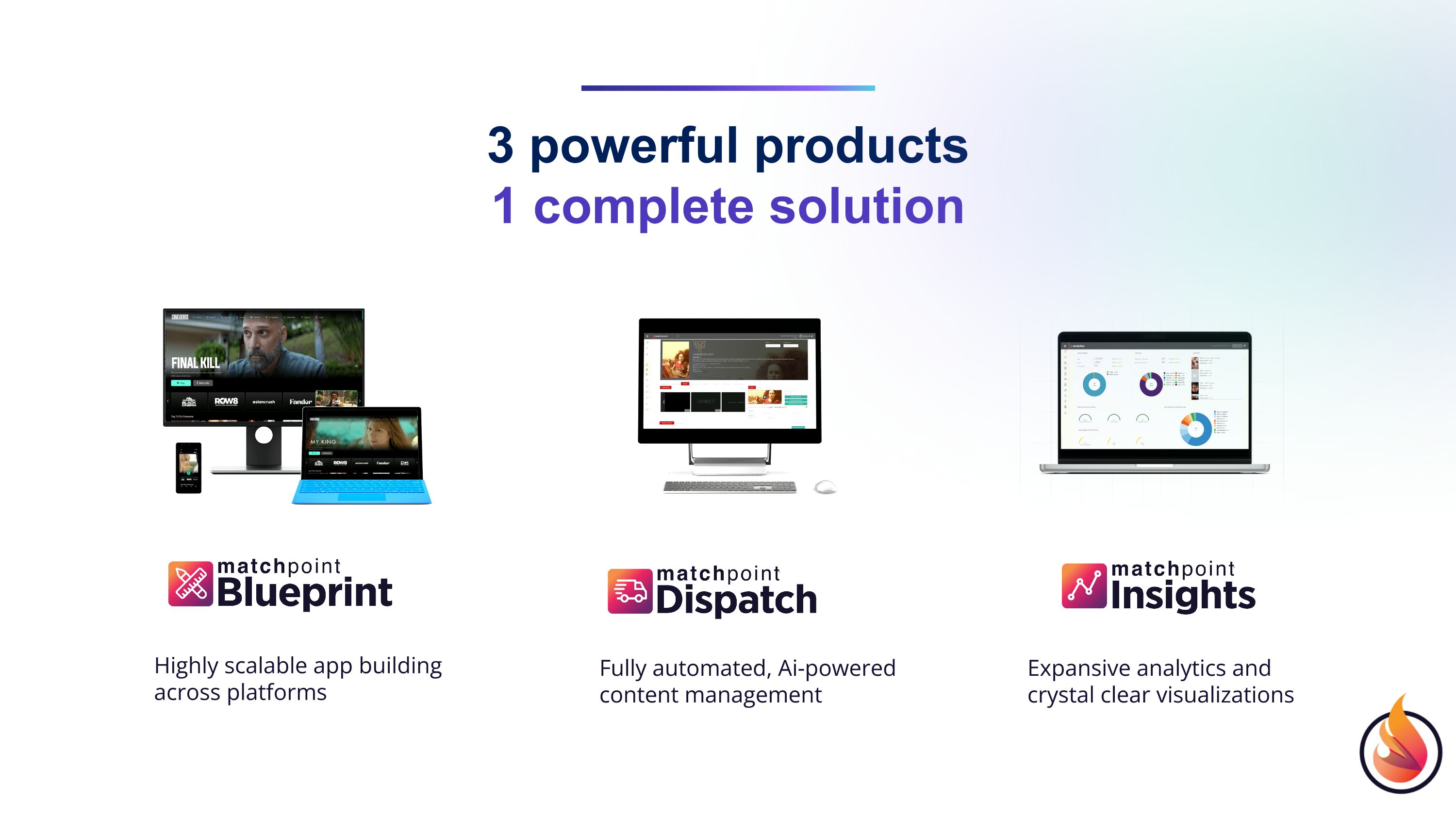

Highly scalable app building across platforms Fully automated, Ai-powered content management Expansive analytics and crystal clear visualizations 3 powerful products 1 complete solution

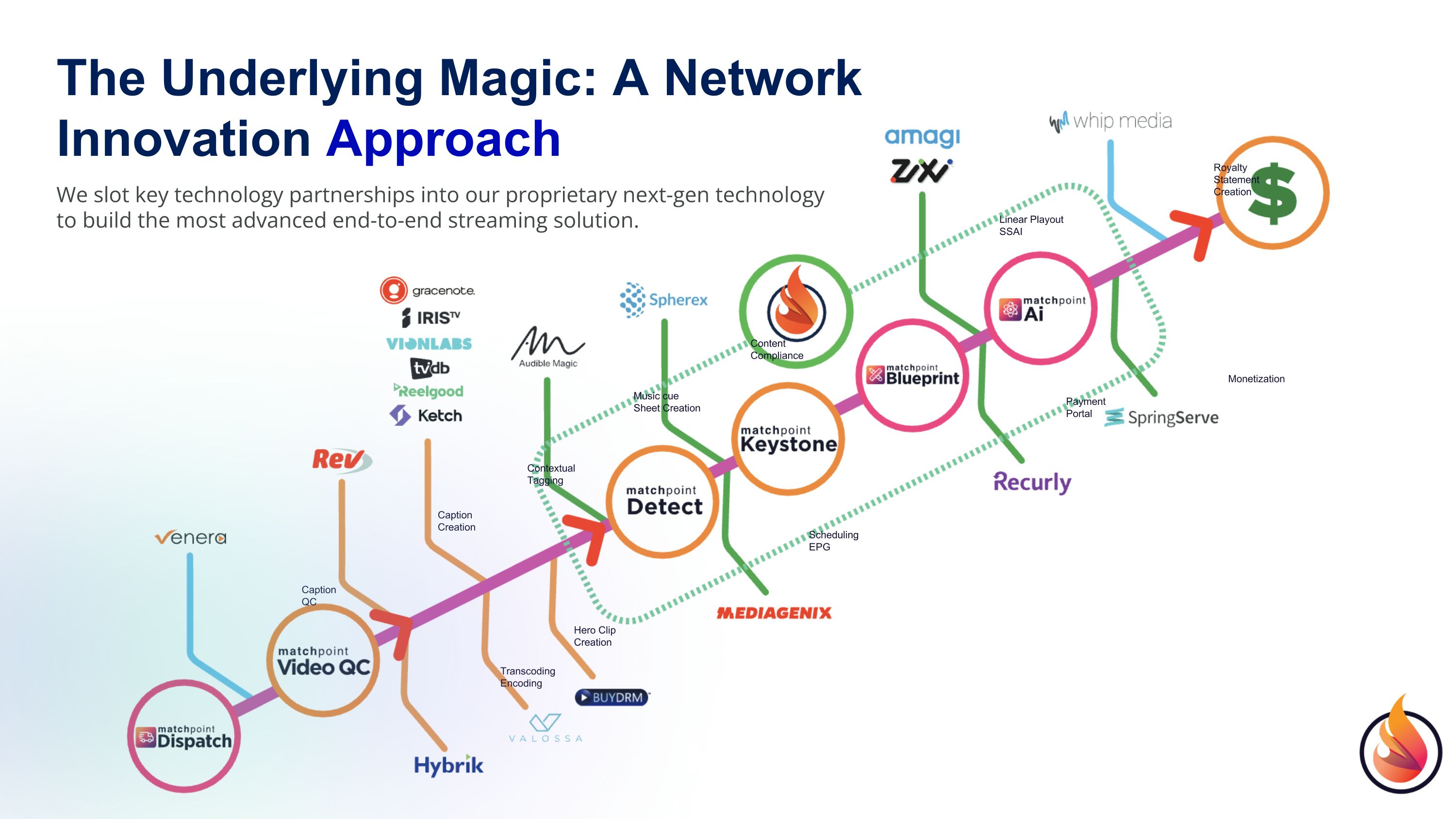

The Underlying Magic: A Network Innovation Approach We slot key technology partnerships into our proprietary next-gen technology to build the most advanced end-to-end streaming solution. Caption QC Caption Creation Contextual Tagging Transcoding Encoding Hero Clip Creation Scheduling EPG Payment Portal Monetization Music cue Sheet Creation Content Compliance Linear Playout SSAI Royalty Statement Creation

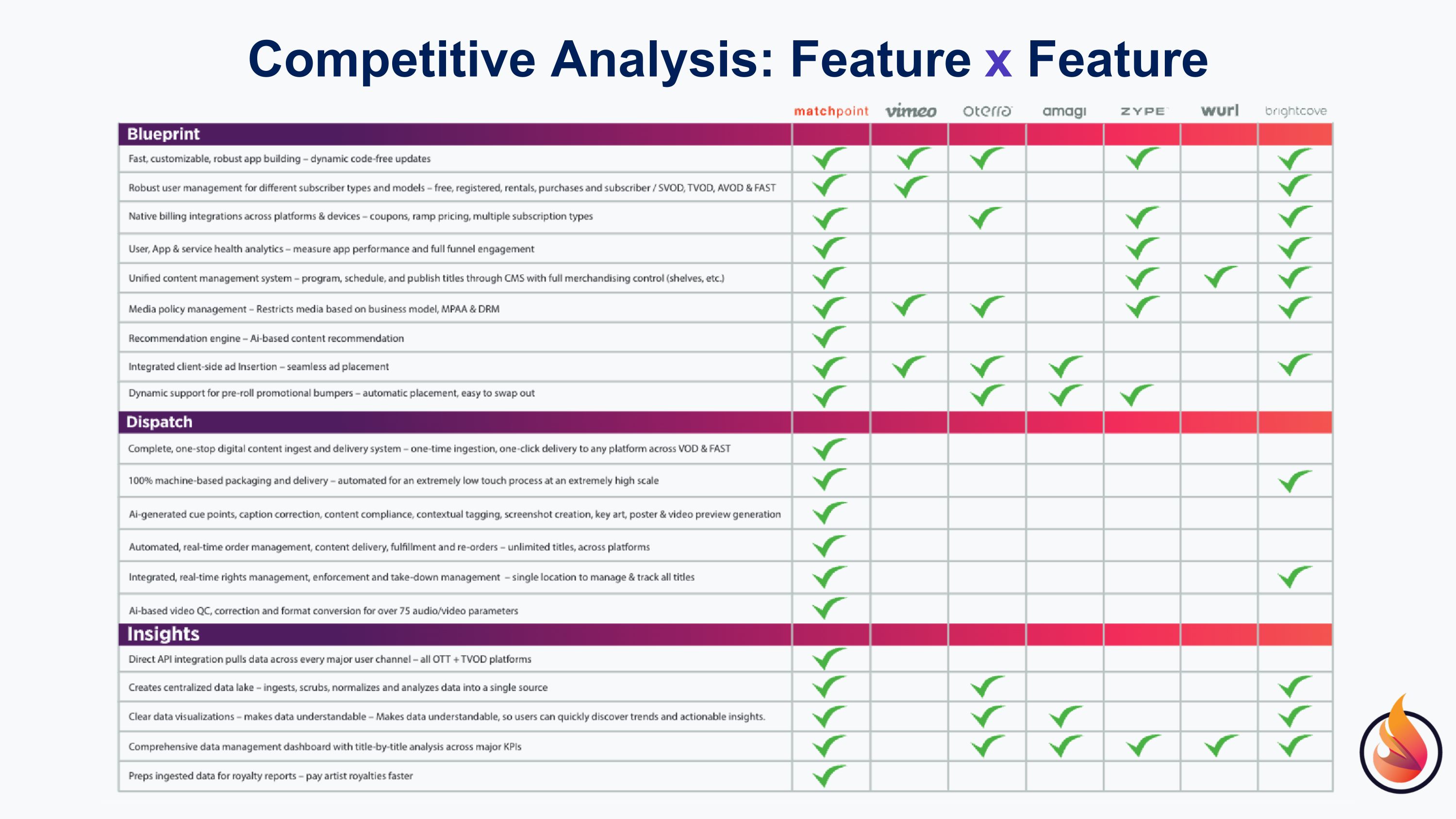

Competitive Analysis: Feature x Feature

Discover the reel world.

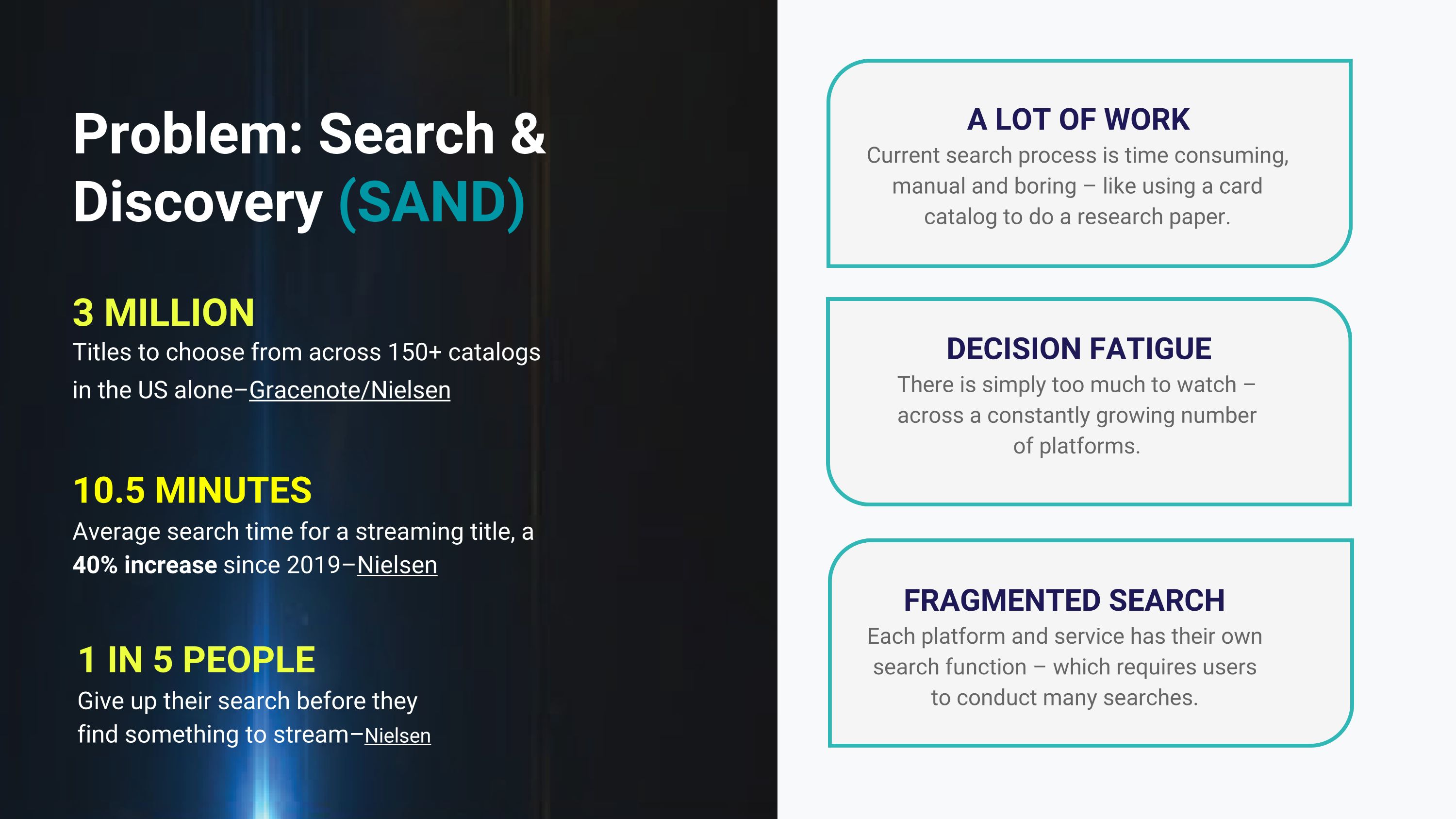

Problem: Search & Discovery (SAND) Titles to choose from across 150+ catalogs in the US alone–Gracenote/Nielsen 1 IN 5 PEOPLE Give up their search before they find something to stream–Nielsen 10.5 MINUTES Average search time for a streaming title, a 40% increase since 2019–Nielsen A LOT OF WORK Current search process is time consuming, manual and boring – like using a card catalog to do a research paper. DECISION FATIGUE There is simply too much to watch – across a constantly growing number of platforms. FRAGMENTED SEARCH Each platform and service has their own search function – which requires users to conduct many searches. 3 MILLION

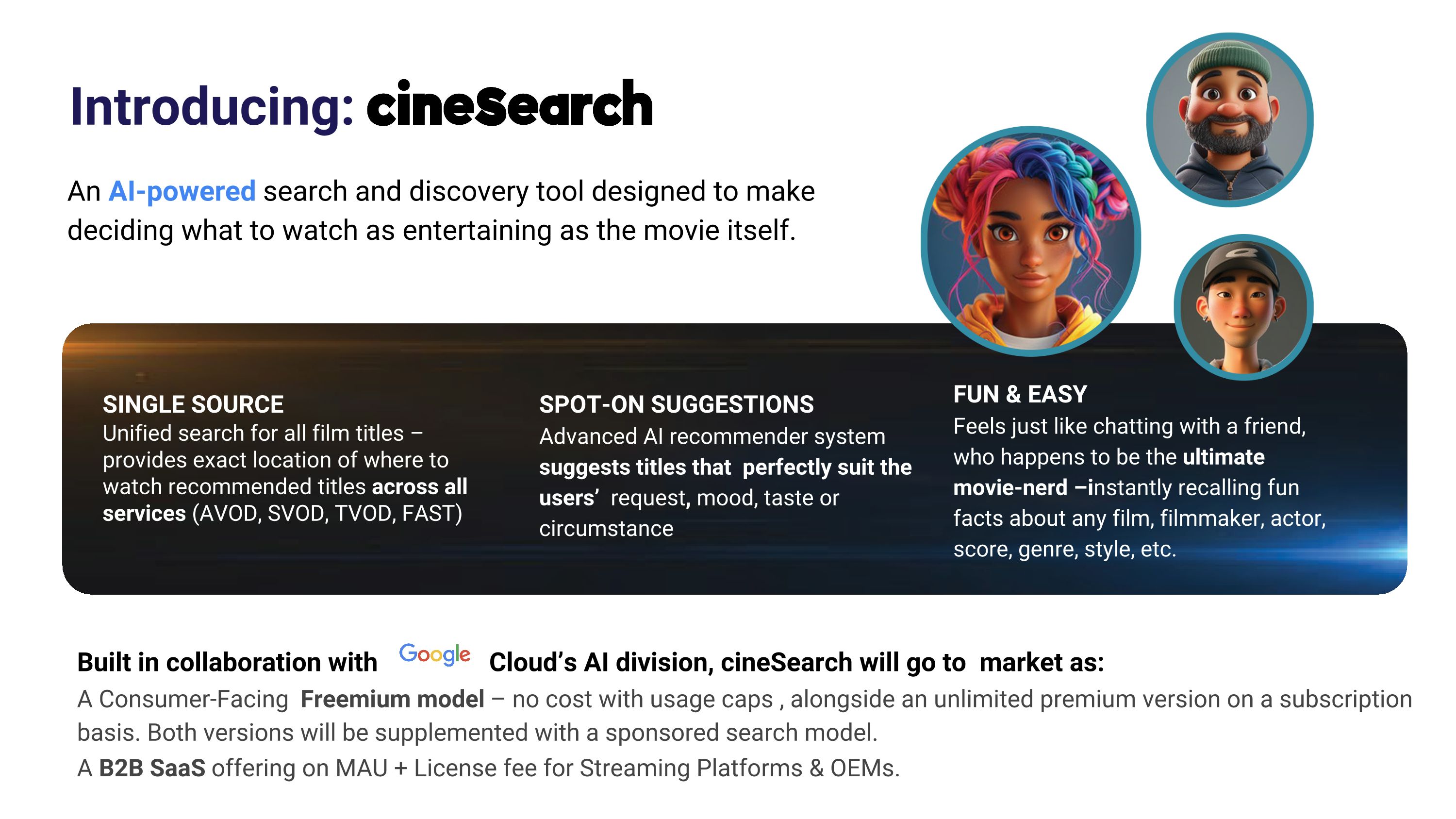

Introducing: An AI-powered search and discovery tool designed to make deciding what to watch as entertaining as the movie itself. SINGLE SOURCE Unified search for all film titles – provides exact location of where to watch recommended titles across all services (AVOD, SVOD, TVOD, FAST) SPOT-ON SUGGESTIONS Advanced AI recommender system suggests titles that perfectly suit the users’ request, mood, taste or circumstance FUN & EASY Feels just like chatting with a friend, who happens to be the ultimate movie-nerd –instantly recalling fun facts about any film, filmmaker, actor, score, genre, style, etc. Built in collaboration with Cloud’s AI division, cineSearch will go to market as: A Consumer-Facing Freemium model – no cost with usage caps , alongside an unlimited premium version on a subscription basis. Both versions will be supplemented with a sponsored search model. A B2B SaaS offering on MAU + License fee for Streaming Platforms & OEMs.

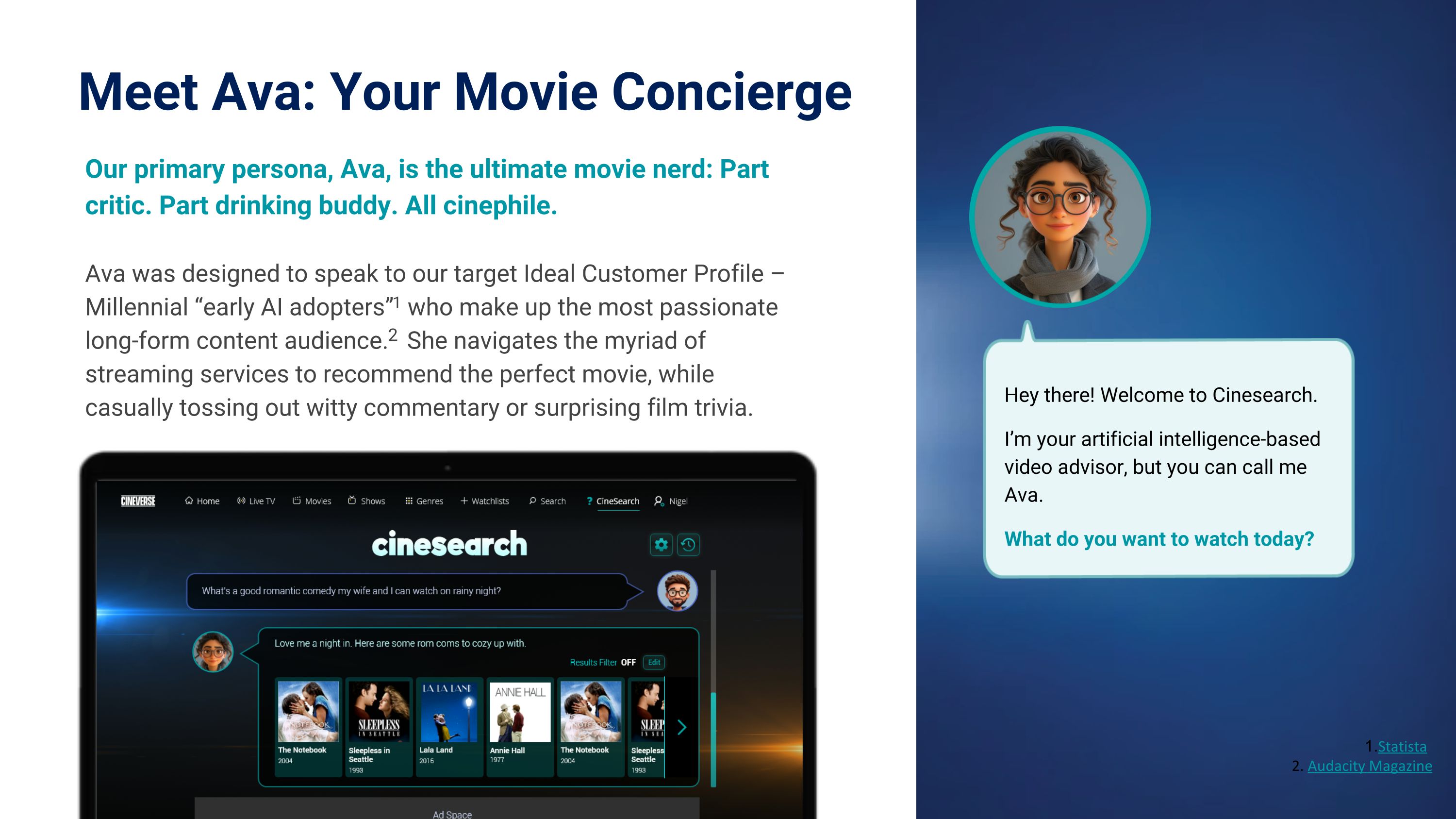

Meet Ava: Your Movie Concierge Our primary persona, Ava, is the ultimate movie nerd: Part critic. Part drinking buddy. All cinephile. Ava was designed to speak to our target Ideal Customer Profile – Millennial “early AI adopters”1 who make up the most passionate long-form content audience.2 She navigates the myriad of streaming services to recommend the perfect movie, while casually tossing out witty commentary or surprising film trivia. 1.Statista 2. Audacity Magazine Hey there! Welcome to Cinesearch. I’m your artificial intelligence-based video advisor, but you can call me Ava. What do you want to watch today?

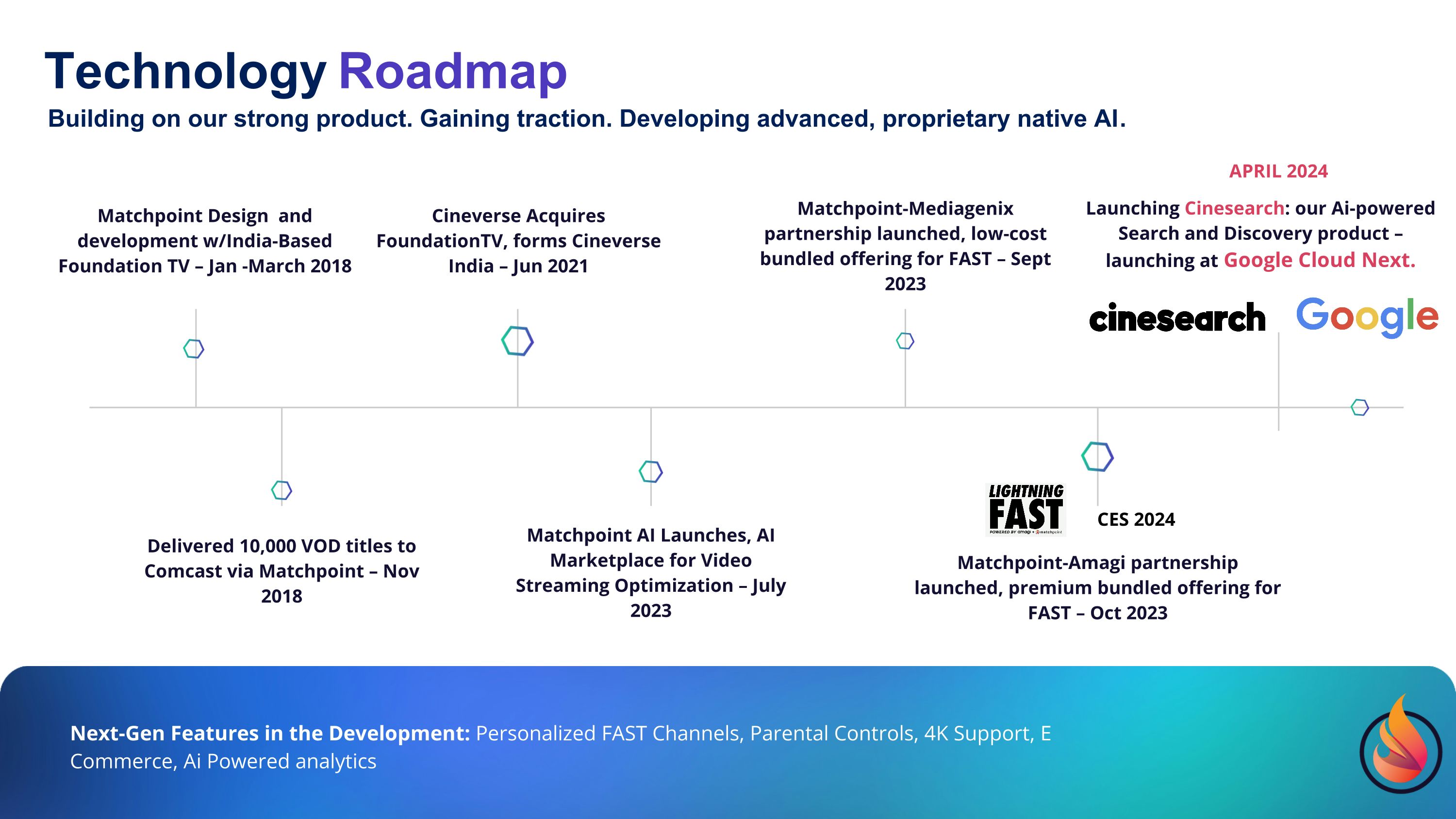

Building on our strong product. Gaining traction. Developing advanced, proprietary native AI. Launching Cinesearch: our Ai-powered Search and Discovery product – launching at Google Cloud Next. Matchpoint-Mediagenix partnership launched, low-cost bundled offering for FAST – Sept 2023 Cineverse Acquires FoundationTV, forms Cineverse India – Jun 2021 Matchpoint Design and development w/India-Based Foundation TV – Jan -March 2018 Delivered 10,000 VOD titles to Comcast via Matchpoint – Nov 2018 Matchpoint AI Launches, AI Marketplace for Video Streaming Optimization – July 2023 Matchpoint-Amagi partnership launched, premium bundled offering for FAST – Oct 2023 Next-Gen Features in the Development: Personalized FAST Channels, Parental Controls, 4K Support, E Commerce, Ai Powered analytics Technology Roadmap CES 2024 APRIL 2024

Cineverse is Matchpoint in Action. Built by Content Owners. Trusted by Content Owners. We’re on a mission to uplift storytellers and entertain fans with the power of technology. Expansive Distribution Capabilities Advantage Advanced, proprietary streaming technology – built in-house by India-based R&D team. The Network of highly engaged super-served fan channels Unique 360 Omnichannel Marketing Approach

Cineverse’s diverse network of Fan channels enables reach across highly engaged audiences of all genres.

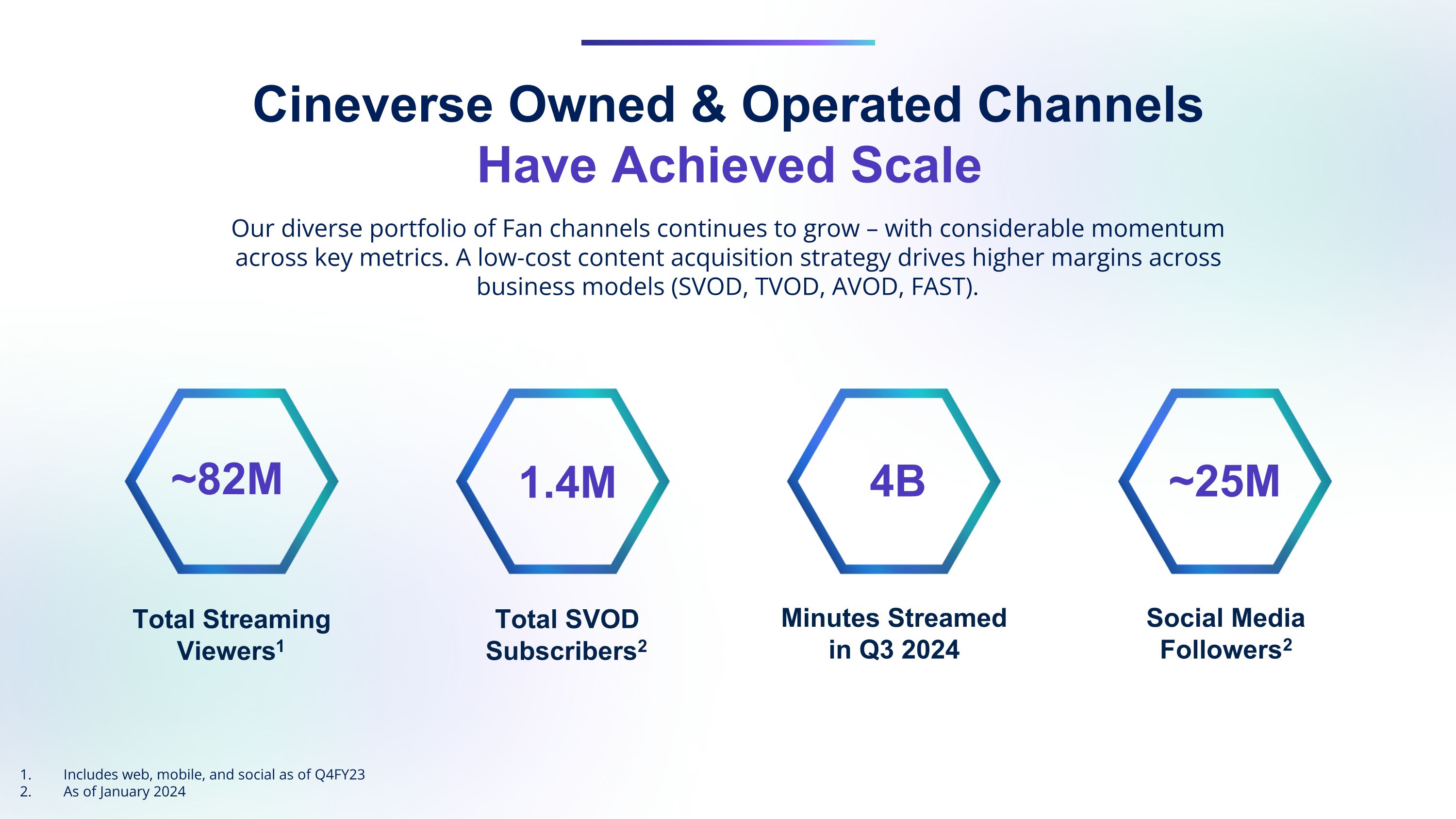

Cineverse Owned & Operated Channels Have Achieved Scale Our diverse portfolio of Fan channels continues to grow – with considerable momentum across key metrics. A low-cost content acquisition strategy drives higher margins across business models (SVOD, TVOD, AVOD, FAST). ~82M 1.4M Total Streaming Viewers1 Total SVOD Subscribers2 4B Minutes Streamed in Q3 2024 ~25M Social Media Followers2 Includes web, mobile, and social as of Q4FY23 As of January 2024

You can find Cineverse Channelson most major platforms.

Super-Serving Fan Audiences in the Longtail DISTRIBUTIONExploit premium content assets through all “windows” – theatrical, digital, and home entertainment. CONSUMER GOODSEngage fast-growing collectibles market with limited edition DVD/Blu Ray sets and merchandise.

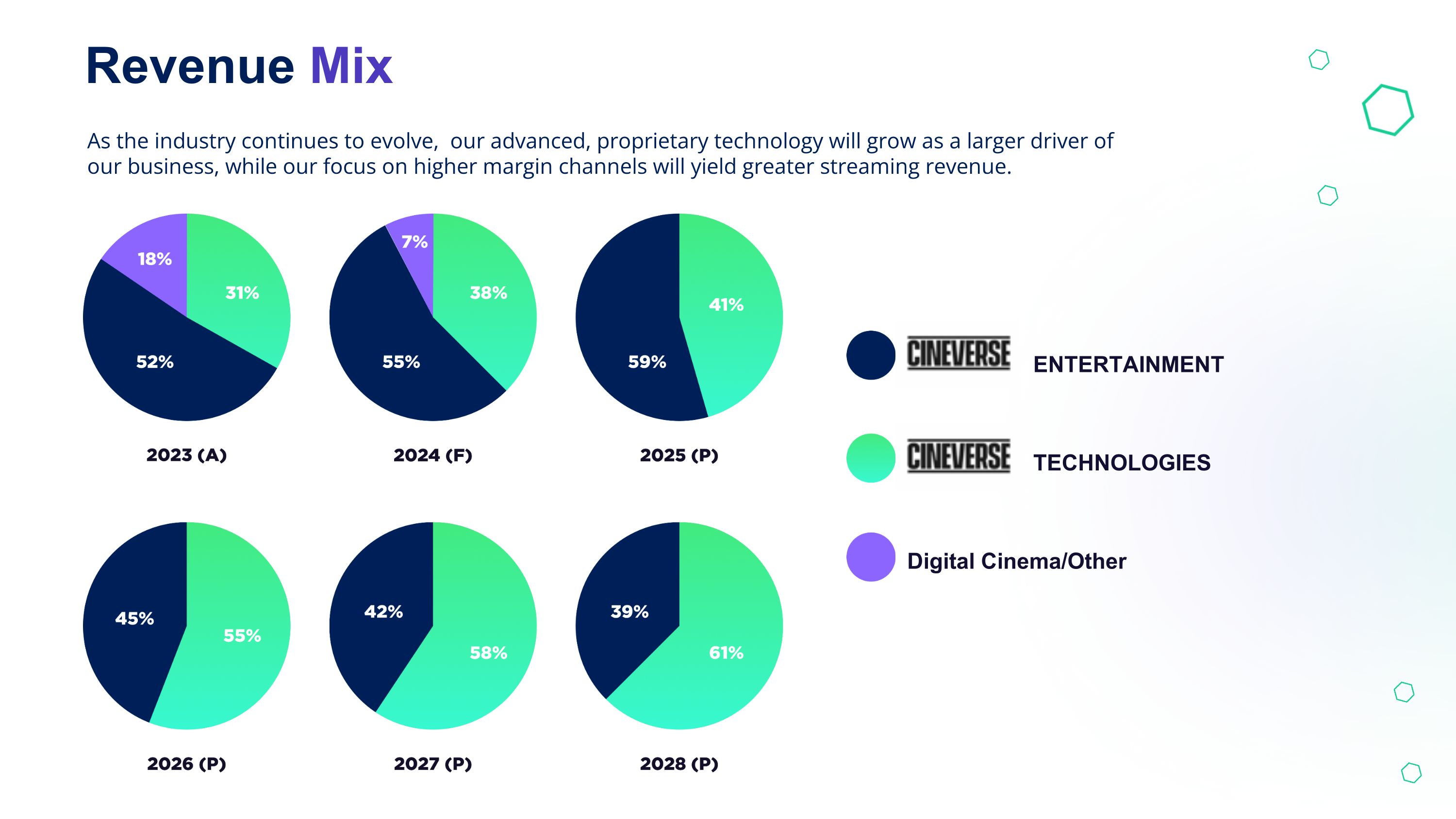

Revenue Mix As the industry continues to evolve, our advanced, proprietary technology will grow as a larger driver of our business, while our focus on higher margin channels will yield greater streaming revenue. Digital Cinema/Other TECHNOLOGIES ENTERTAINMENT

Who we are today - a global team Cineverse Services India: Offshore division brings major cost-savings and work-efficiency upside – fully owned by the Company. Robust R & D team based in India – developing advanced, AI powered technology. Evolution into revenue-generating services from our India team.

Living our Values: The Cineverse Team Reflects Diversity of Voice As fierce champions of storytellers and fans, we believe that trusting and empowering creators to tell their unique story is good for business – keeping fans engaged with access to entertainment they can’t find anywhere else. Our commitment to hire and develop diverse and dynamic professionals furthers this mission – bringing more stories to more people. “ Our Leadership: 22% Female 40% POC at the VP level or above Our Global team: 40% Female 68% POC

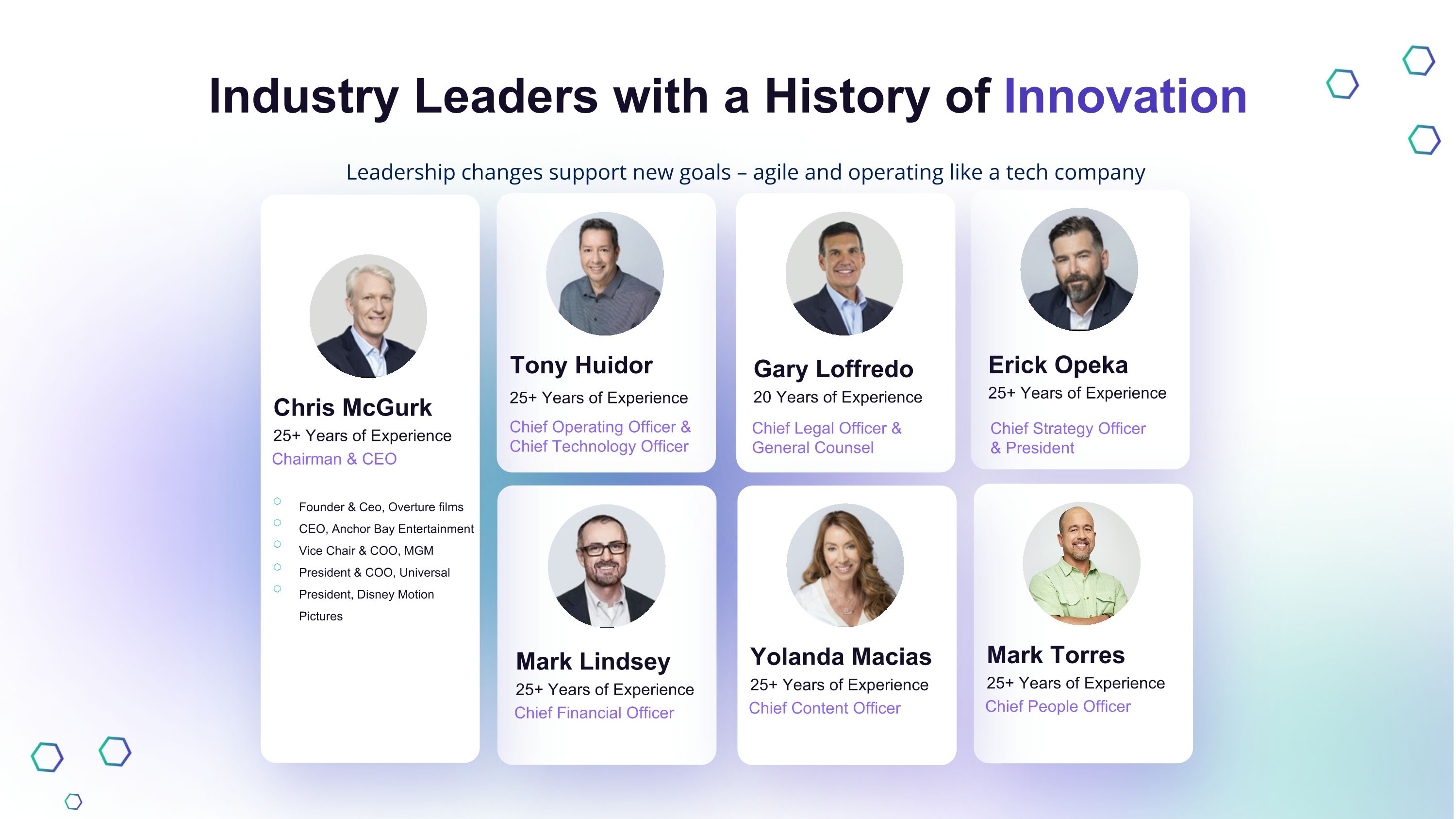

Chief Operating Officer & Chief Technology Officer Chris McGurk 25+ Years of Experience Founder & Ceo, Overture films CEO, Anchor Bay Entertainment Vice Chair & COO, MGM President & COO, Universal President, Disney Motion Pictures Industry Leaders with a History of Innovation Leadership changes support new goals – agile and operating like a tech company Chairman & CEO Mark Lindsey 25+ Years of Experience Chief Financial Officer Tony Huidor 25+ Years of Experience Erick Opeka 25+ Years of Experience Chief Strategy Officer & President Gary Loffredo 20 Years of Experience Chief Legal Officer & General Counsel Mark Torres 25+ Years of Experience Chief People Officer Yolanda Macias 25+ Years of Experience Chief Content Officer

Key Takeaways Leveraging our library assets across our extensive portfolio of fan channel assets, combined with a 360-degree marketing approach to our family of Fan brands provides high margin, organic growth. Cost-streaming and initiatives – driven by offshoring and decreased content spends – bring major work-efficiency upsides and organizational agility. Our battle-tested proprietary streaming technology, which currently powers all of our streaming content, is poised to drive an increasing portion of our revenue mix – newly launched as a whitelabel PaaS product and strategically partnered with streaming technology Unicorn, Amagi.

Financial Results YTD Q3 FY 2024 (9 months ended December 31, 2023)

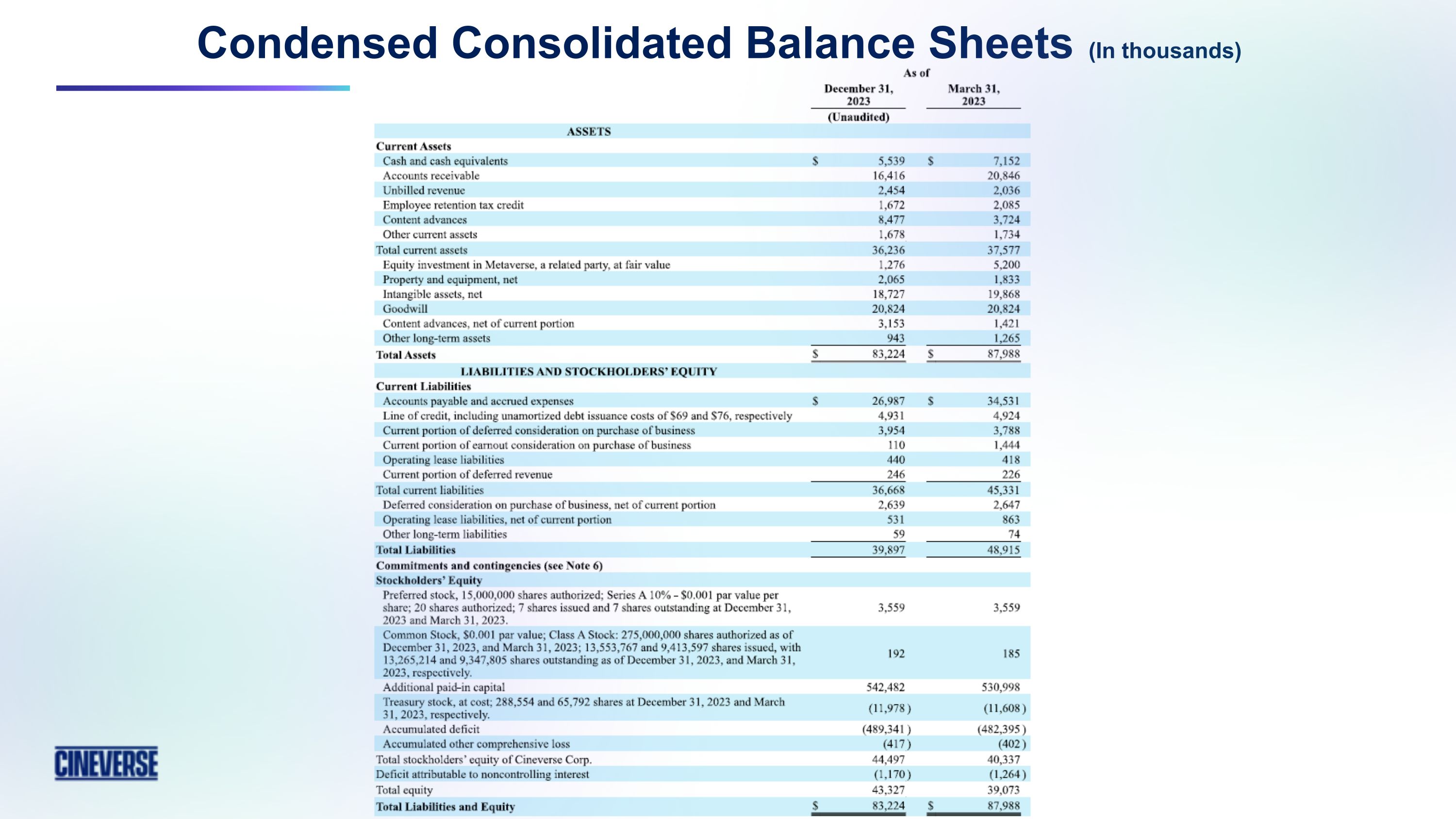

Condensed Consolidated Balance Sheets (In thousands)

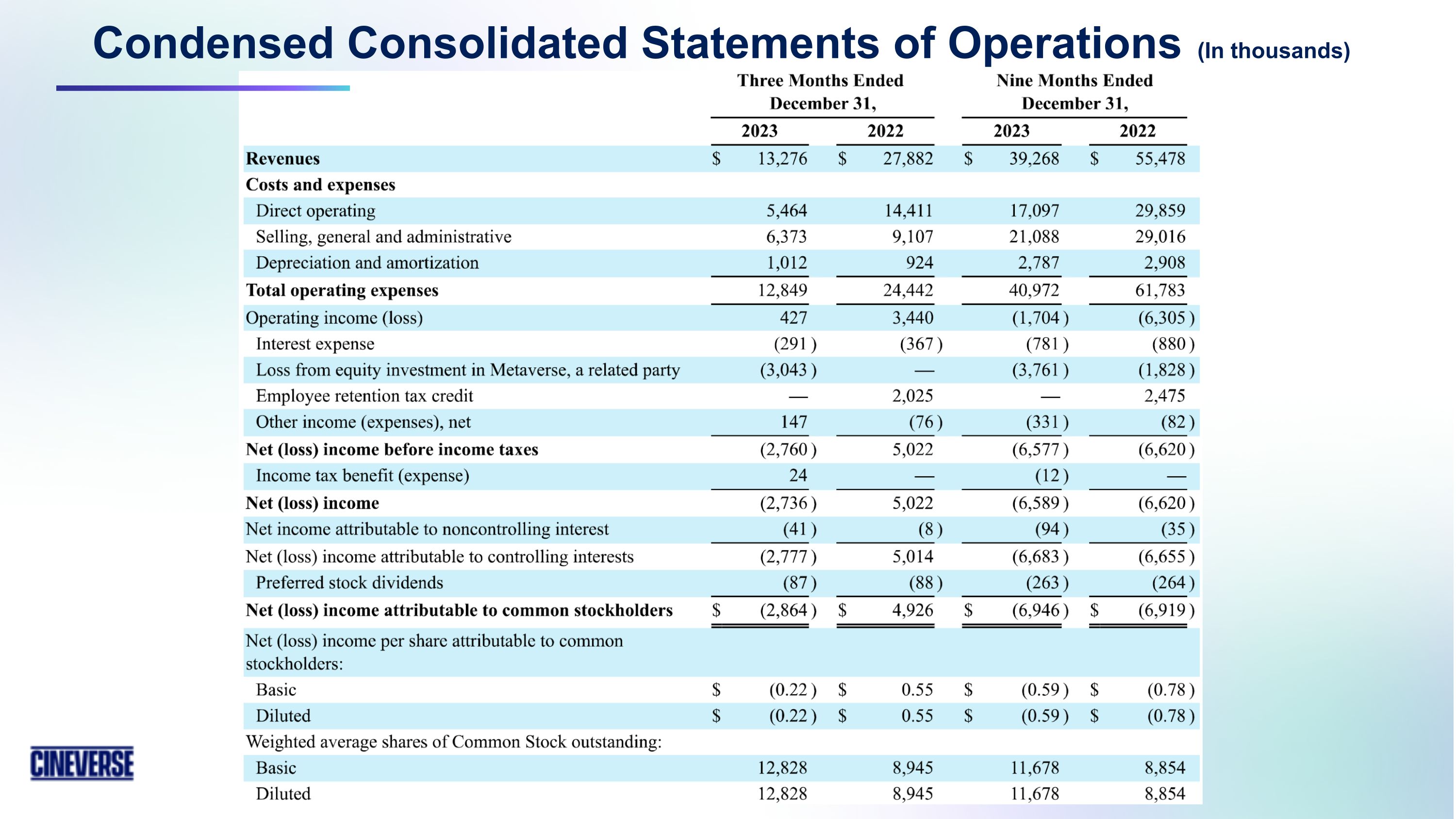

Condensed Consolidated Statements of Operations (In thousands)

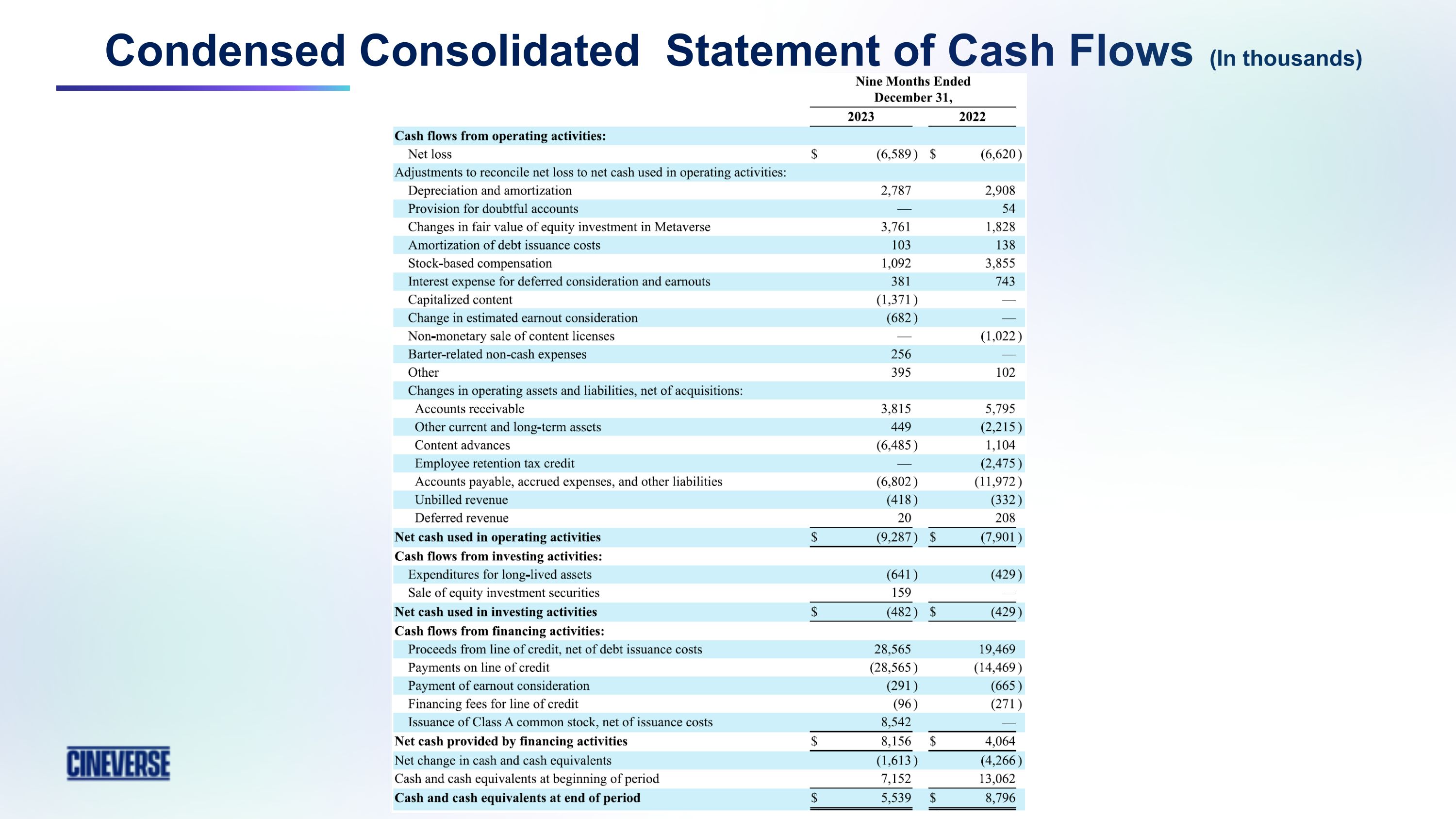

Condensed Consolidated Statement of Cash Flows (In thousands)

CONTACT email@email.com cineverse.com

APPENDIX

Matchpoint Managed Services Case Study: MeatEater Coming off successful Netflix run, had more than 200 hours of original content – but couldn’t monetize the assets or scale. Lacked the infrastructure to deliver on signed deals.They were headed toward breach of contract. Projected Cineverse Revenue: $180,000 net for year 1 The Results: Successfully fulfilled contractual obligations Full channel set to be launched in 2 month’s time – 50% faster than industry standard Leveraging wide social reach to promote channel launch The Challenge: Leading authority on hunting and fishing. Founded by NY Times bestselling author, Steve Rinella.

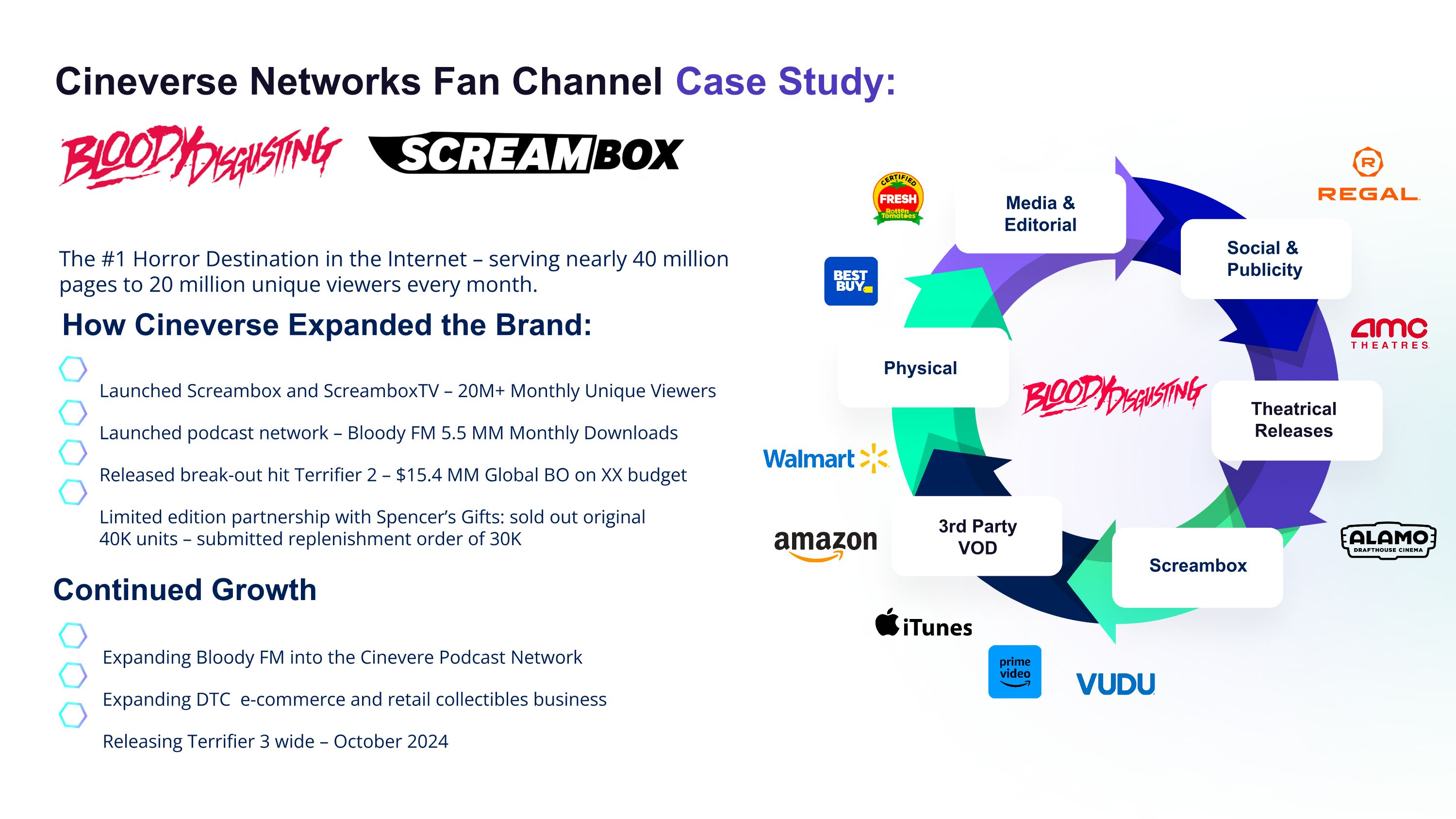

Cineverse Networks Fan Channel Case Study: The #1 Horror Destination in the Internet – serving nearly 40 million pages to 20 million unique viewers every month. How Cineverse Expanded the Brand: Launched Screambox and ScreamboxTV – 20M+ Monthly Unique Viewers Launched podcast network – Bloody FM 5.5 MM Monthly Downloads Released break-out hit Terrifier 2 – $15.4 MM Global BO on XX budget Limited edition partnership with Spencer’s Gifts: sold out original 40K units – submitted replenishment order of 30K Continued Growth Expanding Bloody FM into the Cinevere Podcast Network Expanding DTC e-commerce and retail collectibles business Releasing Terrifier 3 wide – October 2024 Screambox Physical 3rd Party VOD TheatricalReleases Media & Editorial Social & Publicity