UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the Month of March 2024

(Commission File No. 001-41636)

Oculis Holding AG

(Translation of registrant's name into English)

Bahnhofstrasse 7

CH-6300

Zug, Switzerland

(Address of registrant’s principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ |

Form 40-F ☐ |

INFORMATION CONTAINED IN THIS REPORT ON FORM 6-K

On March 18, 2024, Oculis Holding AG (the “Registrant”) issued a press release announcing its financial results for the fiscal year ended December 31, 2023. Copies of the press release, the Registrant’s 2023 IFRS consolidated financial statements, 2023 Statutory Financial Statements and 2023 Compensation Report are furnished as Exhibits 99.1, 99.2, 99.3 and 99.4, respectively, to this Report on Form 6-K.

EXHIBIT INDEX

Exhibit |

|

Description |

99.1 |

|

|

99.2 |

|

IFRS consolidated financial statements as of and for the year ended December 31, 2023 |

99.3 |

|

|

99.4 |

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

OCULIS HOLDING AG |

||

|

|

|

|

|||

Date: March 19, 2024 |

|

|

|

By: |

|

/s/ Riad Sherif |

|

|

|

|

|

|

Chief Executive Officer |

Exhibit 99.1

Oculis Reports Q4 and Full Year 2023 Financial Results and Update on Company Progress

ZUG, Switzerland, and BOSTON, March 18, 2024 (GLOBE NEWSWIRE) -- Oculis Holding AG (Nasdaq: OCS) (“Oculis” or the “Company”), a global biopharmaceutical company purposefully driven to save sight and improve eye care, today announced fourth quarter and full year financial results for the period ended December 31, 2023, and an overview of the Company’s progress.

Riad Sherif M.D., Chief Executive Officer of Oculis:

“2023 was a remarkable milestone-rich year for Oculis. Following our listing on NASDAQ, we had two positive Phase 3 data readouts with OCS-01, the first topical candidate with compelling data in DME, and achieved a strong close of the year with the initiation of three clinical trials, including the OCS-02 Phase 2b RELIEF trial in DED. As our innovative and diversified pipeline continues to advance, we remain laser-focused on delivering our key programs: OCS-01 in DME, OCS-02 in DED and OCS-05 in Acute Optic Neuritis. We are confident and excited as we move into a catalyst-rich 2024 and look forward to updating everyone on the upcoming RELIEF trial readout planned in Q2, the second Phase 3 OPTIMIZE-2 trial readout of OCS-01 in ocular surgery in Q4, which will allow us to submit our first NDA, in addition to the ACUITY trial readout of OCS-05 in Acute Optic Neuritis, also planned in Q4. I would like to thank our exceptional team and all our partners for their great contribution but also for their commitment towards our mission to save sight and improve eye care.”

Q4 2023 and Recent Highlights

1

Upcoming Clinical Milestones

In 2024, the Company is focused on advancing its innovative pipeline and planned clinical development programs including:

Q2 2024

Q4 2024

Q4 and Full Year 2023 Financial Highlights

2

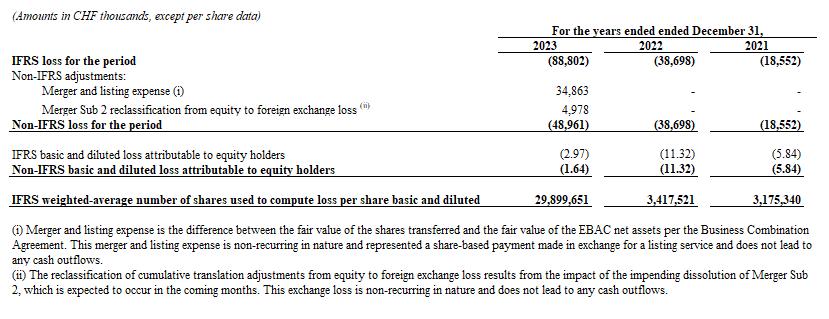

Non-IFRS Financial Information

This press release contains financial measures that do not comply with International Financial Reporting Standards (IFRS) including non-IFRS net loss for the full year 2023, and non-IFRS net loss per common share for the same period. These non-IFRS financial measures exclude the impact of items that the Company’s management believes affect comparability or underlying business trends. These measures supplement the Company’s financial results prepared in accordance with IFRS. The Company’s management uses these measures to better analyze its financial results and better estimate its financial outlook. In management’s opinion, these non-IFRS measures are useful to investors and other users of the Company's financial statements by providing greater transparency into the ongoing operating performance of the Company and its future outlook. Such measures should not be deemed to be an alternative to IFRS requirements.

The non-IFRS measures for the reported periods reflect adjustments made to exclude:

The non-IFRS measures presented here are also unlikely to be comparable with non-IFRS disclosures released by other companies. See the “Reconciliation of Non-IFRS Measures

3

(Unaudited)” table below for a reconciliation of these non-IFRS measures to the most directly comparable IFRS measures.

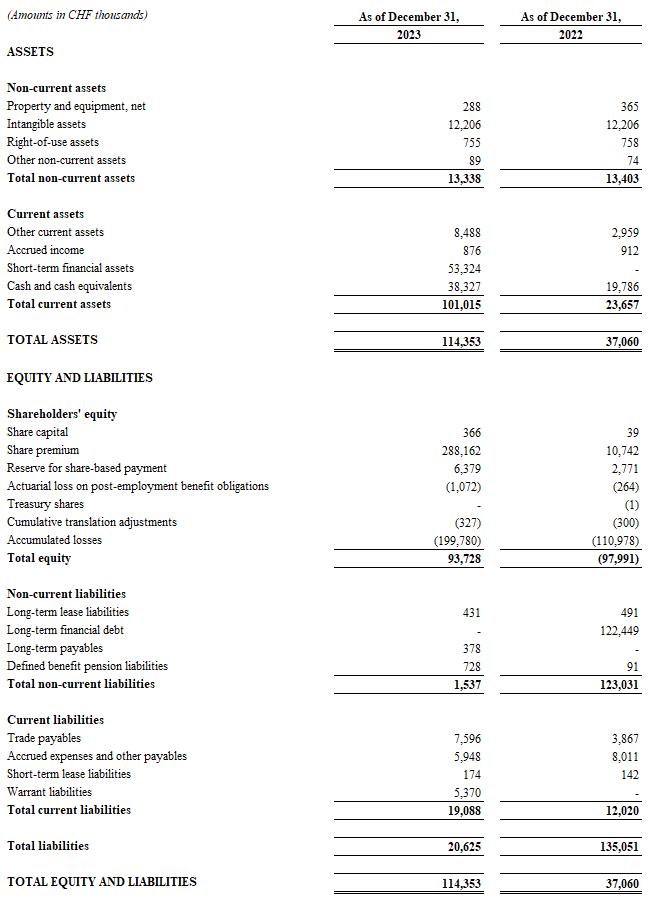

Consolidated Statements of Financial Position

4

5

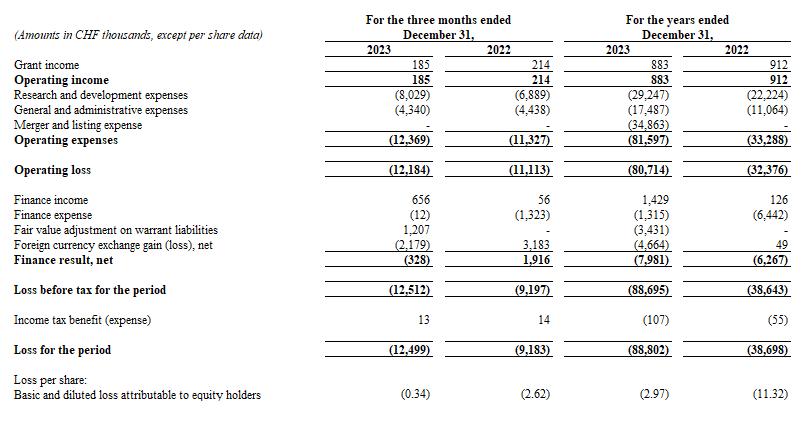

Consolidated Statements of Loss

Reconciliation of Non-IFRS Measures (Unaudited)

-ENDS-

6

About Oculis

Oculis is a global biopharmaceutical company (Nasdaq: OCS) purposefully driven to save sight and improve eye care. Oculis’ highly differentiated pipeline comprises multiple innovative product candidates in development. It includes OCS-01, a topical eye drop candidate for diabetic macular edema (DME) and for the treatment of inflammation and pain following cataract surgery; OCS-02, a topical biologic anti-TNFα eye drop candidate for dry eye disease (DED) and for non-infectious anterior uveitis; and OCS-05, a disease modifying candidate for acute optic neuritis (AON) and other neuro-ophthalmic disorders such as glaucoma, diabetic retinopathy, geographic atrophy, and neurotrophic keratitis. Headquartered in Switzerland and with operations in the U.S., Oculis’ goal is to deliver life-changing treatments to patients worldwide. The company is led by an experienced management team with a successful track record and is supported by leading international healthcare investors.

For more information, please visit: www.oculis.com

Oculis Contacts

Ms. Sylvia Cheung, CFO

sylvia.cheung@oculis.com

Investor & Media Relations

LifeSci Advisors

Corey Davis, Ph.D.

cdavis@lifesciadvisors.com

1-212-915-2577

Cautionary Statement Regarding Forward Looking Statements

This press release contains forward-looking statements and information. For example, statements regarding the potential benefits of OCS-01, OCS-02 and OCS-05, including patient impact and market opportunity; the potential of OCS-01 for treating front- and back-of-the-eye diseases; the potential for OCS-01 to become a new standard of care with the first once-daily, topical, preservative-free corticosteroid for treating inflammation and pain following ocular surgery; the potential of OCS-01 for the treatment of DME, inflammation and pain following ocular surgery and CME; the potential of OCS-02 for treating DED; the potential of OCS-02 to become the first approved topical anti- TNFα for DED; the potential of OCS-05 for treating AON and other neuro-ophthalmic disorders; expected cash runway; expected future milestones and catalysts, including the timing of completing enrolment in the RELIEF trial, topline results for OPTIMIZE-2 and ACUITY trials and IND status for OCS-05; the initiation, timing, progress and results of Oculis’ clinical and preclinical studies; Oculis’ research and development programs, regulatory and business strategy, future development plans, and management; Oculis’ ability to advance product candidates into, and successfully complete, clinical trials; and the timing or likelihood of regulatory filings and approvals, are forward-looking. All forward-looking statements are based on estimates and assumptions that, while considered reasonable by Oculis and its management, are inherently uncertain and are inherently subject to risks, variability and contingencies, many of which are beyond Oculis’ control.

7

These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by an investor as, a guarantee, assurance, prediction or definitive statement of a fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. All forward-looking statements are subject to risks, uncertainties and other factors that may cause actual results to differ materially from those that we expected and/or those expressed or implied by such forward-looking statements. Forward-looking statements are subject to numerous conditions, many of which are beyond the control of Oculis, including those set forth in the Risk Factors section of Oculis’ annual report on Form 20-F and any other documents filed with the U.S. Securities and Exchange Commission (the “SEC”). Copies of these documents are available on the SEC’s website, www.sec.gov. Oculis undertakes no obligation to update these statements for revisions or changes after the date of this release, except as required by law.

8

Exhibit 99.2

Oculis Holding AG

Consolidated Financial Statements

|

Oculis Holding AG Zug Report of the statutory auditor to the General Meeting on the consolidated financial statements 2023 |

Report of the statutory auditor

to the General Meeting of Oculis Holding AG

Zug

Report on the audit of the consolidated financial statements

Opinion

We have audited the consolidated financial statements of Oculis Holding AG and its subsidiaries (the Group), which comprise the consolidated statement of financial position as of December 31, 2023, and the consolidated statement of loss, the consolidated statement of comprehensive loss, the consolidated statement of changes in equity, the consolidated statement of cash flows for the year then ended, and notes to the consolidated financial statements, including material accounting policy information.

In our opinion, the accompanying consolidated financial statements give a true and fair view of the consolidated financial position of the Group as of December 31, 2023 and its consolidated financial performance and its consolidated cash flows for the year then ended in accordance with IFRS Accounting Standards and comply with Swiss law.

Basis for opinion

We conducted our audit in accordance with Swiss law, International Standards on Auditing (ISAs) and Swiss Standards on Auditing (SA-CH). Our responsibilities under those provisions and standards are further described in the 'Auditor’s responsibilities for the audit of the consolidated financial statements' section of our report. We are independent of the Group in accordance with the provisions of Swiss law and the requirements of the Swiss audit profession, as well as the International Code of Ethics for Professional Accountants (including International Independence Standards) issued by the International Ethics Standards Board for Accountants (IESBA Code), and we have fulfilled our other ethical responsibilities in accordance with these requirements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Our audit approach

Overview |

Overall Group materiality: CHF 2,580 thousand |

|

We concluded full scope audit work at 3 entities, which addressed over 95% of Group’s total operating expenses. In addition, specified procedures were performed on a further 3 entities representing a further 3% of the Group’s total operating expenses. |

|

As key audit matter the following area of focus has been identified: Accounting Impact of the Capital Reorganization |

|

PricewaterhouseCoopers SA, avenue C.-F. Ramuz 45, case postale, 1001 Lausanne, Switzerland Téléphone: +41 58 792 81 00, www.pwc.ch PricewaterhouseCoopers SA is a member of the global PricewaterhouseCoopers network of firms, each of which is a separate and independent legal entity. |

Materiality

The scope of our audit was influenced by our application of materiality. Our audit opinion aims to provide reasonable assurance that the consolidated financial statements are free from material misstatement. Misstatements may arise due to fraud or error. They are considered material if, individually or in aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of the consolidated financial statements.

Based on our professional judgement, we determined certain quantitative thresholds for materiality, including the overall Group materiality for the consolidated financial statements as a whole as set out in the table below. These, together with qualitative considerations, helped us to determine the scope of our audit and the nature, timing and extent of our audit procedures and to evaluate the effect of misstatements, both individually and in aggregate, on the consolidated financial statements as a whole.

Overall Group materiality |

CHF 2,580 thousand |

Benchmark applied |

Adjusted loss before tax |

Rationale for the materiality benchmark applied |

We chose adjusted loss before tax as the benchmark, to be aligned with the common practice in the U.S. for clinical stage life science companies while considering non-recurring items related to the capital reorganization. In addition, in our view, the applied benchmark is aligned with investors and Audit Committee expectations. |

We agreed with the Audit Committee that we would report to them misstatements above CHF 258 thousand identified during our audit as well as any misstatements below that amount which, in our view, warranted reporting for qualitative reasons.

Audit scope

We tailored the scope of our audit in order to perform sufficient work to enable us to provide an opinion on the consolidated financial statements as a whole, taking into account the structure of the Group, the accounting processes and controls, and the industry in which the Group operates.

Oculis is a global biopharmaceutical company purposefully driven to save sight and improve eye care. Headquartered in Switzerland, the Group also has operations in the U.S., Iceland, France and Hong-Kong.

The Group’s financial statements are a consolidation of 7 reporting units. We identified 3 reporting units that, in our view, required a full scope audit due to their size or risk characteristics. Specified procedures were also carried out at a further 3 reporting entities to give appropriate coverage of material balances. The majority of the audit procedures was performed by the Group auditor out of Switzerland.

Key audit matters

Key audit matters are those matters that, in our professional judgement, were of most significance in our audit of the consolidated financial statements of the current period. These matters were addressed in the context of our audit of the consolidated financial statements as a whole, and in forming our opinion thereon, and we do not provide a separate opinion on these matters.

Accounting Impact of the Capital Reorganization

Key audit matter |

|

How our audit addressed the key audit matter |

As described in Notes 2, 4, 5, 7C, 13, 15, 16 and 18 to the consolidated financial statements, as of March 2, 2023, a capital reorganization took place within the Group as a result of the merger with European Biotech Acquisition Corp. (“EBAC”), and resulted in the listing of Oculis Holding AG on the NASDAQ. The accounting treatment for the capital reorganization entailed a high degree of complexity including the impact related to the |

|

Addressing the matter involved performing procedures and evaluating audit evidence. These procedures included, among others: -

obtaining a detailed understanding of the transaction through inquiries with management and review of management’s reorganization

|

|

3 Oculis Holding AG | Report of the statutory auditor to the General Meeting |

|

issuance of both ordinary shares to EBAC and Legacy Oculis (formerly Oculis SA) stockholders as well as contingently issuable shares. Despite EBAC being the legal acquirer, Legacy Oculis was determined to be the accounting acquirer for financial reporting purposes. As a result, Oculis incurred merger and listing expense of CHF 34,863 thousand corresponding with charges associated with the capital reorganization, which included non-cash issuance charge representing the difference in the fair value of equity in instruments held by EBAC stockholders over the fair value of identifiable net assets of EBAC. Also, the transaction was accounted for a capital reorganization. Legacy Oculis and EBAC incurred costs directly related to the capital reorganization (“Transaction costs”) of CHF 4,821 thousand associated with equity issuance, which qualify for capitalization and are accounted for as a deduction of share premium. To capture costs associated with the new equity, the Group allocated non-directly attributable capitalizable transaction costs to the various transaction components at the percentages of 38% and 62% for new shares and old shares, respectively. The principal considerations for our determination that performing procedures relating to the accounting impact of the capital reorganization is a key audit matter are the significant complexities and judgements of the capital reorganization that required a high degree of IFRS technical knowledge. This in turn led to a high degree of audit effort in applying procedures relating to the accounting impact of the capital reorganization to the consolidated financial statements. |

|

step-plan and how this was effectuated through the associated accounting entries; -

tracing the details of the accounting entries to the underlying agreements and cash movements as applicable;

-

we assessed, with the support of financial reporting specialists (i) the accounting treatment under IFRS of the impact of the capital reorganization, (ii) the accounting treatment of the non-cash issuance costs and (iii) the accounting treatment of the capitalizable transaction costs.

On the basis of the procedures performed, we consider that the significant judgements applied and conclusions drawn by management with respect to the Accounting Impact of the Capital Reorganization were reasonable. |

Other information

The Board of Directors is responsible for the other information. The other information comprises the information included in the annual report, but does not include the financial statements, the consolidated financial statements, the compensation report and our auditor’s reports thereon.

Our opinion on the consolidated financial statements does not cover the other information and we do not express any form of assurance conclusion thereon.

In connection with our audit of the consolidated financial statements, our responsibility is to read the other information and, in doing so, consider whether the other information is materially inconsistent with the consolidated financial statements or our knowledge obtained in the audit, or otherwise appears to be materially misstated.

If, based on the work we have performed, we conclude that there is a material misstatement of this other information, we are required to report that fact. We have nothing to report in this regard.

Board of Directors' responsibilities for the consolidated financial statements

The Board of Directors is responsible for the preparation of consolidated financial statements that give a true and fair view in accordance with IFRS Accounting Standards and the provisions of Swiss law, and for such internal control as the Board of Directors determines is necessary to enable the preparation of consolidated financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the consolidated financial statements, the Board of Directors is responsible for assessing the Group's ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern

|

4 Oculis Holding AG | Report of the statutory auditor to the General Meeting |

basis of accounting unless the Board of Directors either intends to liquidate the Group or to cease operations, or has no realistic alternative but to do so.

Auditor’s responsibilities for the audit of the consolidated financial statements

Our objectives are to obtain reasonable assurance about whether the consolidated financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with Swiss law, ISAs and SA-CH will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these consolidated financial statements.

As part of an audit in accordance with Swiss law, ISAs and SA-CH, we exercise professional judgement and maintain professional scepticism throughout the audit. We also:

We communicate with the Board of Directors or its relevant committee regarding, among other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal control that we identify during our audit.

We also provide the Board of Directors or its relevant committee with a statement that we have complied with relevant ethical requirements regarding independence, and communicate with them regarding all relationships and other matters that may reasonably be thought to bear on our independence, and where applicable, actions taken to eliminate threats or safeguards applied.

From the matters communicated with the Board of Directors or its relevant committee, we determine those matters that were of most significance in the audit of the consolidated financial statements of the current period and are therefore the key audit matters. We describe these matters in our auditor’s report unless law or regulation precludes public disclosure about the matter or when, in extremely rare circumstances, we determine that a matter should not be communicated in our report because the adverse consequences of doing so would reasonably be expected to outweigh the public interest benefits of such communication.

|

5 Oculis Holding AG | Report of the statutory auditor to the General Meeting |

Report on other legal and regulatory requirements

In accordance with article 728a para. 1 item 3 CO and PS-CH 890, we confirm the existence of an internal control system that has been designed, pursuant to the instructions of the Board of Directors, for the preparation of the consolidated financial statements.

We recommend that the consolidated financial statements submitted to you be approved.

PricewaterhouseCoopers SA

/s/ Michael Foley |

/s/ Alex Fuhrer |

|

Licensed audit expert Auditor in charge |

Licensed audit expert |

Lausanne, March 19, 2024

|

6 Oculis Holding AG | Report of the statutory auditor to the General Meeting |

Oculis Holding AG, Zug

Consolidated Statements of Financial Position

(in CHF thousands)

|

|

|

|

As of December 31, |

|

|

As of December 31, |

|

||

|

|

Note |

|

2023 |

|

|

2022 |

|

||

ASSETS |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

Non-current assets |

|

|

|

|

|

|

|

|

||

Property and equipment, net |

|

8 |

|

|

288 |

|

|

|

365 |

|

Intangible assets |

|

9 |

|

|

12,206 |

|

|

|

12,206 |

|

Right-of-use assets |

|

10 |

|

|

755 |

|

|

|

758 |

|

Other non-current assets |

|

|

|

|

89 |

|

|

|

74 |

|

Total non-current assets |

|

|

|

|

13,338 |

|

|

|

13,403 |

|

|

|

|

|

|

|

|

|

|

||

Current assets |

|

|

|

|

|

|

|

|

||

Other current assets |

|

11 |

|

|

8,488 |

|

|

|

2,959 |

|

Accrued income |

|

11 |

|

|

876 |

|

|

|

912 |

|

Short-term financial assets |

|

14 |

|

|

53,324 |

|

|

|

- |

|

Cash and cash equivalents |

|

14 |

|

|

38,327 |

|

|

|

19,786 |

|

Total current assets |

|

|

|

|

101,015 |

|

|

|

23,657 |

|

|

|

|

|

|

|

|

|

|

||

TOTAL ASSETS |

|

|

|

|

114,353 |

|

|

|

37,060 |

|

|

|

|

|

|

|

|

|

|

||

EQUITY AND LIABILITIES |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

||

Shareholders' equity |

|

|

|

|

|

|

|

|

||

Share capital |

|

16 |

|

|

366 |

|

|

|

39 |

|

Share premium |

|

16 |

|

|

288,162 |

|

|

|

10,742 |

|

Reserve for share-based payment |

|

13 |

|

|

6,379 |

|

|

|

2,771 |

|

Actuarial loss on post-employment benefit obligations |

|

12 |

|

|

(1,072 |

) |

|

|

(264 |

) |

Treasury shares |

|

16 |

|

|

- |

|

|

|

(1 |

) |

Cumulative translation adjustments |

|

|

|

|

(327 |

) |

|

|

(300 |

) |

Accumulated losses |

|

|

|

|

(199,780 |

) |

|

|

(110,978 |

) |

Total equity |

|

|

|

|

93,728 |

|

|

|

(97,991 |

) |

|

|

|

|

|

|

|

|

|

||

Non-current liabilities |

|

|

|

|

|

|

|

|

||

Long-term lease liabilities |

|

10 |

|

|

431 |

|

|

|

491 |

|

Long-term financial debt |

|

15 |

|

|

- |

|

|

|

122,449 |

|

Long-term payables |

|

|

|

|

378 |

|

|

|

- |

|

Defined benefit pension liabilities |

|

12 |

|

|

728 |

|

|

|

91 |

|

Total non-current liabilities |

|

|

|

|

1,537 |

|

|

|

123,031 |

|

|

|

|

|

|

|

|

|

|

||

Current liabilities |

|

|

|

|

|

|

|

|

||

Trade payables |

|

|

|

|

7,596 |

|

|

|

3,867 |

|

Accrued expenses and other payables |

|

17 |

|

|

5,948 |

|

|

|

8,011 |

|

Short-term lease liabilities |

|

10 |

|

|

174 |

|

|

|

142 |

|

Warrant liabilities |

|

18 |

|

|

5,370 |

|

|

|

- |

|

Total current liabilities |

|

|

|

|

19,088 |

|

|

|

12,020 |

|

|

|

|

|

|

|

|

|

|

||

Total liabilities |

|

|

|

|

20,625 |

|

|

|

135,051 |

|

|

|

|

|

|

|

|

|

|

||

TOTAL EQUITY AND LIABILITIES |

|

|

|

|

114,353 |

|

|

|

37,060 |

|

The accompanying notes form an integral part of the consolidated financial statements.

1

Oculis Holding AG, Zug

Consolidated Statements of Loss

(in CHF thousands, except loss per share data)

|

|

|

|

For the years ended December 31, |

|

|||||||||

|

|

Note |

|

2023 |

|

|

2022 |

|

|

2021 |

|

|||

Grant income |

|

7. (A) / 11 |

|

|

883 |

|

|

|

912 |

|

|

|

960 |

|

Operating income |

|

|

|

|

883 |

|

|

|

912 |

|

|

|

960 |

|

Research and development expenses |

|

7. (B) |

|

|

(29,247 |

) |

|

|

(22,224 |

) |

|

|

(9,568 |

) |

General and administrative expenses |

|

7. (B) |

|

|

(17,487 |

) |

|

|

(11,064 |

) |

|

|

(4,624 |

) |

Merger and listing expense |

|

7. (B) |

|

|

(34,863 |

) |

|

|

- |

|

|

|

- |

|

Operating expenses |

|

|

|

|

(81,597 |

) |

|

|

(33,288 |

) |

|

|

(14,192 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|||

Operating loss |

|

|

|

|

(80,714 |

) |

|

|

(32,376 |

) |

|

|

(13,232 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|||

Finance income |

|

7. (C) |

|

|

1,429 |

|

|

|

126 |

|

|

|

21 |

|

Finance expense |

|

7. (C) |

|

|

(1,315 |

) |

|

|

(6,442 |

) |

|

|

(5,120 |

) |

Fair value adjustment on warrant liabilities |

|

7. (C) / 18 |

|

|

(3,431 |

) |

|

|

- |

|

|

|

- |

|

Foreign currency exchange (loss) gain |

|

7. (C) |

|

|

(4,664 |

) |

|

|

49 |

|

|

|

(193 |

) |

Finance result |

|

|

|

|

(7,981 |

) |

|

|

(6,267 |

) |

|

|

(5,292 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|||

Loss before tax for the period |

|

|

|

|

(88,695 |

) |

|

|

(38,643 |

) |

|

|

(18,524 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|||

Income tax expense |

|

7. (D) |

|

|

(107 |

) |

|

|

(55 |

) |

|

|

(27 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|||

Loss for the period |

|

|

|

|

(88,802 |

) |

|

|

(38,698 |

) |

|

|

(18,552 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|||

Loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|||

Basic and diluted loss attributable to equity holders |

|

22 |

|

|

(2.97 |

) |

|

|

(11.32 |

) |

|

|

(5.84 |

) |

The accompanying notes form an integral part of the consolidated financial statements.

2

Oculis Holding AG, Zug

Consolidated Statements of Comprehensive Loss

(in CHF thousands)

|

|

|

|

For the years ended December 31, |

|

|||||||||

|

Note |

|

|

2023 |

|

|

2022 |

|

|

2021 |

|

|||

Loss for the period |

|

|

|

|

(88,802 |

) |

|

|

(38,698 |

) |

|

|

(18,552 |

) |

Other comprehensive loss |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|||

Items that will not be reclassified to profit or loss: |

|

|

|

|

|

|

|

|

|

|

|

|||

Actuarial gains/(losses) of defined benefit plans |

12 |

|

|

|

(808 |

) |

|

|

744 |

|

|

|

88 |

|

Items that may be reclassified subsequently to profit or loss: |

|

|

|

|

|

|

|

|

|

|

|

|||

Foreign currency translation differences |

2. (D) |

|

|

|

(5,005 |

) |

|

|

3 |

|

|

|

(28 |

) |

Foreign currency translation differences recycling |

5 |

|

|

|

4,978 |

|

|

|

- |

|

|

|

- |

|

Other comprehensive profit/(loss) for the period |

|

|

|

|

(835 |

) |

|

|

747 |

|

|

|

60 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Total comprehensive loss for the period |

|

|

|

|

(89,637 |

) |

|

|

(37,951 |

) |

|

|

(18,492 |

) |

The accompanying notes form an integral part of the consolidated financial statements.

3

Oculis Holding AG, Zug

Consolidated Statements of Changes in Equity

(in CHF thousands, except share numbers)

|

|

Legacy Oculis share capital |

|

Legacy Oculis treasury shares |

|

|

Oculis share capital |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

Note |

|

Shares |

|

Share capital |

|

Shares |

|

Treasury shares |

|

|

Shares |

|

Share capital |

|

Share premium |

|

Reserve for share-based payment |

|

Cumulative translation adjustment |

|

Actuarial loss on post-employment benefit obligations |

|

Accumulated losses |

|

Total |

Balance as of December 31, 2020 (as previously reported) |

|

|

|

2,967,155 |

|

297 |

|

(100,000) |

|

(100) |

|

|

- |

|

- |

|

9,609 |

|

1,640 |

|

(275) |

|

(1,096) |

|

(53,728) |

|

(43,654) |

Retroactive application of the recapitalization due to the business combination |

|

5 / 2 (B) / 16 |

|

424,985 |

|

(263) |

|

(14,323) |

|

99 |

|

|

- |

|

- |

|

164 |

|

- |

|

- |

|

- |

|

- |

|

- |

Balance as of January 1, (effect of the recapitalization) |

|

|

|

3,392,140 |

|

34 |

|

(114,323) |

|

(1) |

|

|

- |

|

- |

|

9,773 |

|

1,640 |

|

(275) |

|

(1,096) |

|

(53,728) |

|

(43,654) |

Loss for the period |

|

|

|

- |

|

- |

|

- |

|

- |

|

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

(18,552) |

|

(18,552) |

Other comprehensive profit/(loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Actuarial gain on post-employment benefit obligations |

|

4. (C) / 12 |

|

- |

|

- |

|

- |

|

- |

|

|

- |

|

- |

|

- |

|

- |

|

- |

|

88 |

|

- |

|

88 |

Foreign currency translation differences |

|

2. (D) |

|

- |

|

- |

|

- |

|

- |

|

|

- |

|

- |

|

- |

|

- |

|

(28) |

|

- |

|

- |

|

(28) |

Total comprehensive loss for the period |

|

|

|

- |

|

- |

|

- |

|

- |

|

|

- |

|

- |

|

- |

|

- |

|

(28) |

|

88 |

|

(18,552) |

|

(18,492) |

Share-based compensation expense |

|

13 |

|

- |

|

- |

|

- |

|

- |

|

|

- |

|

- |

|

- |

|

328 |

|

- |

|

- |

|

- |

|

328 |

Restricted shares awards |

|

|

|

441,419 |

|

4 |

|

- |

|

- |

|

|

- |

|

- |

|

872 |

|

- |

|

- |

|

- |

|

- |

|

876 |

Transaction costs |

|

|

|

- |

|

- |

|

- |

|

- |

|

|

- |

|

- |

|

(12) |

|

- |

|

- |

|

- |

|

- |

|

(12) |

Balance as of December 31, 2021 (effect of the recapitalization) |

|

|

|

3,833,559 |

|

38 |

|

(114,323) |

|

(1) |

|

|

- |

|

- |

|

10,632 |

|

1,967 |

|

(303) |

|

(1,008) |

|

(72,280) |

|

(60,955) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of December 31, 2021 (as previously reported) |

|

|

|

3,353,271 |

|

335 |

|

(100,000) |

|

(100) |

|

|

- |

|

- |

|

10,434 |

|

1,967 |

|

(303) |

|

(1,008) |

|

(72,280) |

|

(60,955) |

Retroactive application of the recapitalization due to the business combination |

|

5 / 2 (B) / 16 |

|

480,288 |

|

(297) |

|

(14,323) |

|

99 |

|

|

- |

|

- |

|

198 |

|

- |

|

- |

|

- |

|

- |

|

- |

Balance as of January 1, 2022 (effect of the recapitalization) |

|

|

|

3,833,559 |

|

38 |

|

(114,323) |

|

(1) |

|

|

- |

|

- |

|

10,632 |

|

1,967 |

|

(303) |

|

(1,008) |

|

(72,280) |

|

(60,955) |

Loss for the period |

|

|

|

- |

|

- |

|

- |

|

- |

|

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

(38,698) |

|

(38,698) |

Other comprehensive profit/(loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Actuarial gain on post-employment benefit obligations |

|

4. (C) / 12 |

|

- |

|

- |

|

- |

|

- |

|

|

- |

|

- |

|

- |

|

- |

|

- |

|

744 |

|

- |

|

744 |

Foreign currency translation differences |

|

2. (D) |

|

- |

|

- |

|

- |

|

- |

|

|

- |

|

- |

|

- |

|

- |

|

3 |

|

- |

|

- |

|

3 |

Total comprehensive loss for the period |

|

|

|

- |

|

- |

|

- |

|

- |

|

|

- |

|

- |

|

- |

|

- |

|

3 |

|

744 |

|

(38,698) |

|

(37,951) |

Share-based compensation expense |

|

13 |

|

- |

|

- |

|

- |

|

- |

|

|

- |

|

- |

|

- |

|

804 |

|

- |

|

- |

|

- |

|

804 |

Transaction costs |

|

|

|

- |

|

- |

|

- |

|

- |

|

|

- |

|

- |

|

(9) |

|

- |

|

- |

|

- |

|

- |

|

(9) |

Stock option exercised |

|

13 |

|

61,163 |

|

1 |

|

- |

|

- |

|

|

- |

|

- |

|

119 |

|

- |

|

- |

|

- |

|

- |

|

120 |

Balance as of December 31, 2022 (effect of the recapitalization) |

|

|

|

3,894,722 |

|

39 |

|

(114,323) |

|

(1) |

|

|

- |

|

- |

|

10,742 |

|

2,771 |

|

(300) |

|

(264) |

|

(110,978) |

|

(97,991) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of December 31, 2022 (as previously reported) |

|

|

|

3,406,771 |

|

340 |

|

(100,000) |

|

(100) |

|

|

- |

|

- |

|

10,540 |

|

2,771 |

|

(300) |

|

(264) |

|

(110,978) |

|

(97,991) |

Retroactive application of the recapitalization due to the business combination |

|

5 / 2 (B) / 16 |

|

487,951 |

|

(301) |

|

(14,323) |

|

99 |

|

|

- |

|

- |

|

202 |

|

- |

|

- |

|

- |

|

- |

|

- |

Balance as of January 1, 2023 (effect of the recapitalization) |

|

|

|

3,894,722 |

|

39 |

|

(114,323) |

|

(1) |

|

|

- |

|

- |

|

10,742 |

|

2,771 |

|

(300) |

|

(264) |

|

(110,978) |

|

(97,991) |

Loss for the period |

|

|

|

- |

|

- |

|

- |

|

- |

|

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

(88,802) |

|

(88,802) |

Other comprehensive profit/(loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Actuarial loss on post-employment benefit obligations |

|

4. (C) / 12 |

|

- |

|

- |

|

- |

|

- |

|

|

- |

|

- |

|

- |

|

- |

|

- |

|

(808) |

|

- |

|

(808) |

Foreign currency translation differences |

|

2. (D) |

|

- |

|

- |

|

- |

|

- |

|

|

- |

|

- |

|

- |

|

- |

|

(5,005) |

|

- |

|

- |

|

(5,005) |

Foreign currency translation differences recycling |

|

5 |

|

- |

|

- |

|

- |

|

- |

|

|

- |

|

- |

|

- |

|

- |

|

4,978 |

|

- |

|

- |

|

4,978 |

Total comprehensive loss for the period |

|

|

|

- |

|

- |

|

- |

|

- |

|

|

- |

|

- |

|

- |

|

- |

|

(27) |

|

(808) |

|

(88,802) |

|

(89,637) |

Share-based compensation expense |

|

13 |

|

- |

|

- |

|

- |

|

- |

|

|

- |

|

- |

|

- |

|

3,608 |

|

- |

|

- |

|

- |

|

3,608 |

Conversion of Legacy Oculis ordinary shares and treasury shares into Oculis ordinary shares |

|

5 / 16 |

|

(3,894,722) |

|

(39) |

|

114,323 |

|

1 |

|

|

3,780,399 |

|

38 |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

Conversion of Legacy Oculis long-term financial debt into Oculis ordinary shares |

|

5 / 15 / 16 |

|

- |

|

- |

|

- |

|

- |

|

|

16,496,603 |

|

165 |

|

124,637 |

|

- |

|

- |

|

- |

|

- |

|

124,802 |

Issuance of ordinary shares to PIPE investors |

|

5 / 16 |

|

- |

|

- |

|

- |

|

- |

|

|

7,118,891 |

|

71 |

|

66,983 |

|

- |

|

- |

|

- |

|

- |

|

67,054 |

Issuance of ordinary shares under CLA |

|

5 / 16 |

|

- |

|

- |

|

- |

|

- |

|

|

1,967,000 |

|

20 |

|

18,348 |

|

- |

|

- |

|

- |

|

- |

|

18,368 |

Issuance of ordinary shares to EBAC shareholders |

|

5 / 16 |

|

- |

|

- |

|

- |

|

- |

|

|

3,370,480 |

|

33 |

|

35,492 |

|

- |

|

- |

|

- |

|

- |

|

35,525 |

Transaction costs related to the business combination |

|

5 / 16 |

|

- |

|

- |

|

- |

|

- |

|

|

- |

|

- |

|

(4,821) |

|

- |

|

- |

|

- |

|

- |

|

(4,821) |

Proceeds from sale of shares in public offering |

|

5 / 16 |

|

- |

|

- |

|

- |

|

- |

|

|

3,654,234 |

|

36 |

|

38,143 |

|

- |

|

- |

|

- |

|

- |

|

38,179 |

Transaction costs related to the public offering |

|

5 / 16 |

|

- |

|

- |

|

- |

|

- |

|

|

- |

|

- |

|

(3,361) |

|

- |

|

- |

|

- |

|

- |

|

(3,361) |

Stock option exercised |

|

13 / 16 |

|

- |

|

- |

|

- |

|

- |

|

|

112,942 |

|

1 |

|

273 |

|

- |

|

- |

|

- |

|

- |

|

274 |

Issuance of shares in connection with warrant exercises |

|

16 / 18 |

|

- |

|

- |

|

- |

|

- |

|

|

149,156 |

|

2 |

|

1,726 |

|

- |

|

- |

|

- |

|

- |

|

1,728 |

Balance as of December 31, 2023 |

|

|

|

- |

|

- |

|

- |

|

- |

|

|

36,649,705 |

|

366 |

|

288,162 |

|

6,379 |

|

(327) |

|

(1,072) |

|

(199,780) |

|

93,728 |

The accompanying notes form an integral part of the consolidated financial statements.

4

Oculis Holding AG, Zug

Consolidated Statements of Cash Flows

(in CHF thousands)

|

|

|

|

For the years ended December 31, |

|

|||||||||

|

|

Note |

|

2023 |

|

|

2022 |

|

|

2021 |

|

|||

Operating activities |

|

|

|

|

|

|

|

|

|

|

|

|||

Loss before tax for the period |

|

|

|

|

(88,695 |

) |

|

|

(38,643 |

) |

|

|

(18,524 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|||

Non-cash adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|||

- Financial result |

|

|

|

|

3,454 |

|

|

|

(500 |

) |

|

|

53 |

|

- Depreciation of property and equipment |

|

8 |

|

|

125 |

|

|

|

132 |

|

|

|

88 |

|

- Depreciation of right-of-use assets |

|

10 |

|

|

162 |

|

|

|

167 |

|

|

|

147 |

|

- Share-based compensation expense |

|

13 |

|

|

3,608 |

|

|

|

804 |

|

|

|

328 |

|

- Payroll expenses related to restricted stock |

|

13 / 16 |

|

|

- |

|

|

|

- |

|

|

|

876 |

|

- Interest expense on Series B and C preferred shares |

|

15 / 7.(C) |

|

|

1,266 |

|

|

|

6,343 |

|

|

|

4,996 |

|

- Interest on lease liabilities |

|

10 |

|

|

42 |

|

|

|

45 |

|

|

|

49 |

|

- Post-employment benefits |

|

12 |

|

|

(171 |

) |

|

|

(9 |

) |

|

|

(139 |

) |

- Non-realized foreign exchange differences |

|

15 / 7.(C) |

|

|

(30 |

) |

|

|

583 |

|

|

|

(792 |

) |

- Fair value adjustment on warrant liabilities |

|

18 |

|

|

3,431 |

|

|

|

- |

|

|

|

- |

|

- Merger and listing expense |

|

5 |

|

|

34,863 |

|

|

|

- |

|

|

|

- |

|

Working capital adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|||

- De/(Increase) in other current assets |

|

11 |

|

|

(5,556 |

) |

|

|

(1,796 |

) |

|

|

(731 |

) |

- De/(Increase) in accrued income |

|

11 |

|

|

36 |

|

|

|

(152 |

) |

|

|

233 |

|

- Changes in receivables/payables from/to related parties |

|

|

|

|

- |

|

|

|

- |

|

|

|

29 |

|

- (De)/Increase in trade payables |

|

|

|

|

3,729 |

|

|

|

3,043 |

|

|

|

30 |

|

- (De)/Increase in accrued expenses and other payables |

|

17 |

|

|

(11,549 |

) |

|

|

4,903 |

|

|

|

(352 |

) |

- (De)/Increase in other operating assets/liabilities |

|

|

|

|

(29 |

) |

|

|

- |

|

|

|

- |

|

- (De)/Increase in long-term payables |

|

|

|

|

378 |

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Interest received |

|

|

|

|

1,238 |

|

|

|

126 |

|

|

|

- |

|

Interest paid on lease liabilities |

|

|

|

|

(46 |

) |

|

|

(100 |

) |

|

|

(116 |

) |

Taxes paid |

|

|

|

|

(101 |

) |

|

|

(20 |

) |

|

|

- |

|

Net cash outflow from operating activities |

|

|

|

|

(53,845 |

) |

|

|

(25,074 |

) |

|

|

(13,825 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|||

Investing activities |

|

|

|

|

|

|

|

|

|

|

|

|||

Payment for purchase of property and equipment, net |

|

8 |

|

|

(48 |

) |

|

|

(65 |

) |

|

|

(28 |

) |

Payment for short-term financial assets, net |

|

14 |

|

|

(54,163 |

) |

|

|

- |

|

|

|

- |

|

Payment for purchase of intangible assets |

|

9 |

|

|

- |

|

|

|

(3,483 |

) |

|

|

- |

|

Net cash outflow from investing activities |

|

|

|

|

(54,211 |

) |

|

|

(3,548 |

) |

|

|

(28 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|||

Financing activities |

|

|

|

|

|

|

|

|

|

|

|

|||

Proceeds from the shares issued to PIPE investors |

|

5 |

|

|

67,054 |

|

|

|

- |

|

|

|

- |

|

Proceeds from the shares issued to CLA investors |

|

5 |

|

|

18,368 |

|

|

|

- |

|

|

|

- |

|

Proceeds from EBAC non-redeemed shareholders |

|

5 |

|

|

12,014 |

|

|

|

- |

|

|

|

- |

|

Transaction costs related to the business combination |

|

5 |

|

|

(4,607 |

) |

|

|

(214 |

) |

|

|

- |

|

Proceeds from sale of shares in public offering |

|

5 |

|

|

38,179 |

|

|

|

- |

|

|

|

- |

|

Transactions costs related to equity issuance in public offering |

|

5 |

|

|

(2,983 |

) |

|

|

- |

|

|

|

- |

|

Proceeds from exercises of warrants |

|

18 |

|

|

1,531 |

|

|

|

- |

|

|

|

- |

|

Proceeds from stock options exercised |

|

13 / 16 |

|

|

274 |

|

|

|

120 |

|

|

|

- |

|

Proceeds from issuance of preferred shares, classified as liabilities |

|

15 |

|

|

- |

|

|

|

2,030 |

|

|

|

56,096 |

|

Transaction costs for issuance of preferred shares, classified as liabilities/capital increase |

|

|

|

|

- |

|

|

|

(63 |

) |

|

|

(804 |

) |

Principal payment of lease obligations |

|

10 |

|

|

(158 |

) |

|

|

(159 |

) |

|

|

(98 |

) |

Net cash inflow from financing activities |

|

|

|

|

129,672 |

|

|

|

1,714 |

|

|

|

55,194 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Increase/(Decrease) in cash and cash equivalents |

|

|

|

|

21,616 |

|

|

|

(26,909 |

) |

|

|

41,341 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Cash and cash equivalents, beginning of period |

|

14 |

|

|

19,786 |

|

|

|

46,277 |

|

|

|

4,952 |

|

Effect of foreign exchange rate changes |

|

|

|

|

(3,075 |

) |

|

|

418 |

|

|

|

(16 |

) |

Cash and cash equivalents, end of period |

|

14 |

|

|

38,327 |

|

|

|

19,786 |

|

|

|

46,277 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Net cash and cash equivalents variation |

|

|

|

|

21,616 |

|

|

|

(26,909 |

) |

|

|

41,341 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Supplemental Non-Cash Financing Information |

|

|

|

|

|

|

|

|

|

|

|

|||

Transaction costs recorded in accrued expenses and other payables/trade payables |

|

|

|

|

378 |

|

|

|

356 |

|

|

|

- |

|

The accompanying notes form an integral part of the consolidated financial statements.

5

Oculis Holding AG, Zug

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

Oculis Holding AG ("Oculis" or "the Company") is a stock corporation ("Aktiengesellschaft") with its registered office at Bahnhofstrasse 7, CH-6300, Zug, Switzerland. It was incorporated under the laws of Switzerland on October 31, 2022.

The Company controls six wholly-owned subsidiaries: Oculis Operations GmbH ("Oculis Operations") with its registered office in Lausanne, Switzerland, which was incorporated in Zug, Switzerland on December 27, 2022, Oculis ehf ("Oculis Iceland"), which was incorporated in Reykjavik, Iceland on October 28, 2003, Oculis France Sàrl ("Oculis France") which was incorporated in Paris, France on March 27, 2020, Oculis US, Inc. ("Oculis US") with its registered office in Newton MA, USA, which was incorporated in Delaware, USA, on May 26, 2020, Oculis HK, Limited ("Oculis HK") which was incorporated in Hong Kong, China on June 1, 2021 and Oculis Merger Sub II Company ("Merger Sub 2") which was incorporated in the Cayman Islands on January 3, 2023 and is pending dissolution which will be completed in April 2024. The Company and its wholly-owned subsidiaries form the Oculis Group (the "Group"). Prior to the Business Combination (as defined in Note 5), Oculis SA ("Legacy Oculis"), which was incorporated in Lausanne, Switzerland on December 11, 2017, and its wholly-owned subsidiaries Oculis Iceland, Oculis France, Oculis U.S. and Oculis HK formed the Oculis group. On July 6, 2023, Legacy Oculis merged with and into Oculis Operations, and the separate corporate existence of Legacy Oculis ceased. Oculis Operations is the surviving company and remains a wholly-owned subsidiary of Oculis.

The purpose of the Company is the research, study, development, manufacture, promotion, sale and marketing of pharmaceutical products and substances as well as the purchase, sale and exploitation of intellectual property rights, such as patents and licenses, in the field of ophthalmology. As a global biopharmaceutical company, Oculis is developing treatments to save sight and improve eye care with breakthrough innovations. The Company’s differentiated pipeline includes candidates for topical retinal treatments, topical biologics and disease modifying treatments.

The consolidated financial statements of Oculis as of and for the year ended December 31, 2023, were approved and authorized for issue by the Company's Board of Directors on March 15, 2024.

The Group's accounts are prepared on a going concern basis. To date, the Group has financed its cash requirements primarily from share issuances, as well as government research and development grants. The recent business combination with European Biotech Acquisition Corp. (“EBAC”) and the listing in NASDAQ early in March 2023 raised additional funding to secure business continuity as explained under note 5. The Board of Directors believes that the Group has the ability to meet its financial obligations for at least the next 12 months.

The Company is a late clinical stage company and is exposed to all the risks inherent to establishing a business. Inherent to the Company’s business are various risks and uncertainties, including the substantial uncertainty as to whether current projects will succeed. The Company’s success may depend in part upon its ability to (i) establish and maintain a strong patent position and protection, (ii) enter into collaborations with partners in the biotech and pharmaceutical industry, (iii) successfully move its product candidates through clinical development, and (iv) attract and retain key personnel. The Company’s success is subject to its ability to be able to raise capital to support its operations. To date, the Company has financed its cash requirements primarily through the sale of its preferred stock, proceeds from the Business Combination, PIPE Financing and conversion of CLA and the sale of its common stock. Shareholders should note that the long-term viability of the Company is dependent on its ability to raise additional capital to finance its future operations. The Company will continue to evaluate additional funding through public or private financings, debt financing or collaboration agreements. The Company cannot be certain that additional funding will be available on acceptable terms, or at all. If the Company is unable to raise additional capital when required or on acceptable terms, it may have to (i) significantly delay, scale back or discontinue the development of one or more product candidates; (ii) seek collaborators for product candidates at an earlier stage than otherwise would be desirable and on terms that are less favorable than might otherwise be available; or (iii) relinquish or otherwise dispose of rights to product candidates that the Company would otherwise seek to develop itself, on unfavorable terms.

The consolidated financial statements of Oculis are prepared in accordance with IFRS Accounting Standards ("IFRS") as issued by the International Accounting Standards Board (“IASB”).

Prior to consummation of the Business Combination on March 2, 2023, the audited consolidated financial statements as of and for the year ended December 31, 2022 were issued for Legacy Oculis and its subsidiaries. Legacy Oculis became a wholly-owned subsidiary of the Company as a result of the Business Combination. In accordance with the BCA and described in Note 5, Oculis issued 3,780,399 ordinary shares to Legacy Oculis shareholders in exchange for 3,306,771 Legacy Oculis ordinary shares (after cancellation of 100,000 Legacy Oculis treasury shares) at the Exchange Ratio.

6

The number of ordinary shares, and the number of ordinary shares within the loss per share held by the shareholders prior to the Business Combination have been adjusted by the Exchange Ratio to reflect the equivalent number of ordinary shares in the Company.

Reclassifications: given the immateriality of amounts recorded in financial assets and deferred income tax assets as of December 31, 2023 and 2022, these line items have been aggregated into Other non-current assets in the Consolidated Statements of Financial Position presented herein.

The policies set out below are consistently applied to all the years presented. The consolidated financial statements have been prepared under the historical cost convention, unless stated otherwise in the accounting policies in Note 3.

The totals are calculated with the original unit amounts, which could lead to rounding differences. These differences in thousands of units are not changed in order to keep the accuracy of the original data.

The consolidated financial statements of the Group are expressed in CHF, which is the Company's functional and presentation currency. The functional currency of the Company's subsidiaries is the local currency except for Oculis Iceland whose functional currency is CHF.

Assets and liabilities of foreign operations are translated into CHF at the rate of exchange prevailing at the reporting date and their statements of profit or loss are translated at yearly average exchange rates. The exchange differences arising on translation for consolidation are recognized in other comprehensive income.

The principal accounting policies adopted in the preparation of these financial statements are set out below. The policies set out below are consistently applied to all the years presented, unless otherwise stated.

The Company presents assets and liabilities in the balance sheet based on current/non-current classification. The Company classifies all amounts to be realized or settled within 12 months after the reporting period to be current and all other amounts to be non-current.

Foreign currency transactions are translated into the functional currency, Swiss Francs (CHF), using prevailing exchange rates at the dates of the transactions. Monetary assets and liabilities denominated in foreign currencies are translated into CHF at rates of exchange prevailing at reporting date. Any gains or losses from these translations are included in the statements of loss in the period in which they arise.

Oculis has six wholly owned subsidiaries, including Oculis Operations, Oculis Iceland, Oculis France, Oculis US, Oculis HK and Merger Sub 2. The Company's consolidated financial statements present the aggregate of the six Group entities, after elimination of intra-group transactions, balances, investments and capital.

The Company is managed and operated as one business. A single management team that reports to the Chief Executive Officer comprehensively manages the entire business and accordingly, has one reporting segment.

The Company has locations in five countries: Switzerland, Iceland, France, USA and Hong Kong. An analysis of non-current assets by geographic region is presented in Note 6.

All leases are accounted for by recognizing a right-of-use asset and a lease liability except for leases of low value assets and leases with a duration of 12 months or less.

Lease liabilities are measured at the present value of the expected contractual payments due to the lessor over the lease term, with the discount rate determined by reference to the rate inherent in the lease unless this is not readily determinable, in which case the Group’s incremental borrowing rate on commencement date of the lease is used. Variable lease payments are only included in the measurement of the lease liability if they depend on an index or rate and remain unchanged throughout the lease term.

7

Other variable lease payments are expensed.

On initial recognition, the carrying value of the lease liability also includes amounts expected to be payable under any residual value guarantee, and the exercise price of any purchase option granted in favor of the group if it is reasonably certain to assess that option.

Right-of-use assets are initially measured at the amount of the lease liability, reduced for any lease incentives received, and increased for lease payments made at or before commencement of the lease and initial direct costs incurred.

Subsequent to the initial measurement, lease liabilities increase as a result of interest charged at a constant rate on the balance outstanding and are reduced for lease payments made. Right-of-use assets are depreciated on a straight-line basis over the remaining expected term of the lease or over the remaining economic life of the asset if this is judged to be shorter than the lease term.

When the Company revises its estimate of the term of any lease, it adjusts the carrying amount of the lease liability to reflect the expected payments over the revised term, which are discounted using a revised discount rate. The carrying value of lease liabilities is similarly revised if the variable future lease payments dependent on a rate or index is revised. In both cases, an equivalent adjustment is made to the carrying value of the right-of-use asset, with the revised carrying amount being amortized over the remaining lease term. If the carrying amount of the right-of-use asset is adjusted to zero, any further reduction is recognized in profit or loss.

Grant income is recognized where there is reasonable assurance that the grant will be received and all attaching conditions will be complied with, and in the year when the related expenses are incurred.

Taxes reported in the consolidated statements of loss include current and deferred taxes on profit. Taxes on income are accrued in the same periods as the revenues and expenses to which they relate.

Deferred tax is the tax attributable to the temporary differences that appear when taxation authorities recognize and measure assets and liabilities with rules that differ from those of the consolidated accounts. Deferred income tax is calculated using the liability method and determined using tax rates and laws that have been enacted or substantively enacted by the balance sheet date and are expected to apply when the related deferred income tax asset is realized, or the deferred income tax liability is settled. Any changes to the tax rates are recognized in the consolidated statements of loss unless related to items directly recognized in equity or other comprehensive loss.

Deferred income tax is recognized on temporary differences arising between the tax bases of assets and liabilities and their carrying amounts in the consolidated financial statements. Deferred income tax assets are recognized only to the extent that it is probable that future taxable profit will be available against which the temporary differences or the unused tax losses can be utilized. Deferred income tax assets from tax credit carry forwards are recognized to the extent that the national tax authority confirms the eligibility of such a claim and that the realization of the related tax benefit through future taxable profits is probable. Deferred income tax assets and liabilities are offset when there is a legally enforceable right to offset current tax assets against current tax liabilities and when the deferred income tax assets and liabilities relate to income taxes levied by the same taxation authority on either the same taxable entity or different taxable entities where there is an intention to settle the balances on a net basis.

The Company presents basic earnings / (loss) per share for each period in the financial statements. The earnings (loss) per share is calculated by dividing the earnings / (loss) of the period by the weighted average number of shares outstanding during the period. Diluted earnings per share, applicable in case of positive result, reflect the potential dilution that could occur if dilutive securities such as warrants or share options were exercised into common shares.

Judgment was required in determining the classification of the preferred shares issued by the Company as either equity or liabilities. The preferred shareholders hold certain preference rights that include preferential distribution of proceeds in the case of liquidity events as defined in the shareholder agreements. Under IAS 32 the Company classified the Preferred Shares as liabilities. This applied to Series A, B and C shares as per Note 15.

The Company considers all highly liquid investments with an original maturity of less than 3 months at the date of purchase to be cash equivalents. Cash and cash equivalents are recorded at cost, which approximates fair value.

Short-term financial assets consist of fixed term bank deposits with maturities between three and six months. Short-term financial assets are held in order to collect contractual cash flows made of payments of principal and interests.

8

Short-term financial assets are measured at amortized cost (approximates fair value) and are subsequently measured using the effective interest method. This method allocates interest income over the relevant period by applying the effective interest rate to the carrying amount of the asset. Gains and losses are recognized in the consolidated statements of loss when the asset is derecognized, modified or impaired.

The Company measures certain financial assets and liabilities at fair value on a recurring basis, including warrants. Fair value is the price the Company would receive to sell an asset or pay to transfer a liability in an orderly transaction with a market participant at the measurement date. The Company uses a three-level hierarchy that prioritizes fair value measurements based on the types of inputs used, as follows: