UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 15, 2024

ADTRAN Holdings, Inc.

(Exact name of Registrant as Specified in Its Charter)

Delaware |

001-41446 |

87-2164282 |

|

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

|

901 Explorer Boulevard Huntsville, Alabama |

|

35806-2807 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (256) 963-8000

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol |

|

Name of exchange on which registered |

Common Stock, Par Value $0.01 |

|

ADTN |

|

The NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

Item 2.02 Results of Operations and Financial Condition.

Final Financial Results for the Fourth Quarter and Twelve Months Ended December 31, 2023

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. On February 26, 2024, ADTRAN Holdings, Inc. (the “Company”) issued a press release (the “February 26th Press Release”) announcing its preliminary financial results for the fourth quarter and twelve months ended December 31, 2023 (the “Preliminary Financial Results”). The February 26th Press Release and an accompanying investor presentation were attached as Exhibits 99.1 and 99.2, respectively, to the Company’s Current Report on Form 8-K furnished with the Securities and Exchange Commission (the “SEC”) on February 27, 2024. On March 15, 2024, the Company will file its Annual Report on Form 10-K for the fiscal year ended December 31, 2023 containing the Company’s audited consolidated financial statements as of and for the year ended December 31, 2023. This Current Report on Form 8-K is being furnished to provide the final financial results of the Company for the fourth quarter and twelve months ended December 31, 2023 (the “Final Financial Results”), reflecting certain adjustments to the Preliminary Financial Results, as described herein. The Final Financial Results and an updated investor presentation are attached hereto as Exhibits 99.1 and 99.2, respectively, and are incorporated herein by reference.

Exhibits 99.1 and 99.2 to this Current Report on Form 8-K reflect the following material adjustments to correct errors between the Preliminary Financial Results previously reported and the Final Financial Results, as applicable:

The adjustments outlined above did not have any impact on, or result in any change to, the Condensed Consolidated Statements of (Loss) Income or any of the non-GAAP measures presented in the February 26th Earnings Release.

The following table summarizes the material adjustments and other final reclassifications to the preliminary Condensed Consolidated Balance Sheet items as of December 31, 2023 (unaudited) (in thousands):

|

|

December 31, 2023 |

|

|||||||||

(In thousands) |

|

As Reported |

|

|

Adjustment |

|

|

As Revised |

|

|||

Other receivables |

|

$ |

22,408 |

|

|

$ |

(4,958 |

) |

|

$ |

17,450 |

|

Income tax receivable |

|

$ |

— |

|

|

$ |

7,933 |

|

|

$ |

7,933 |

|

Total Current Assets |

|

$ |

733,880 |

|

|

$ |

2,976 |

|

|

$ |

736,856 |

|

Total Assets |

|

$ |

1,679,536 |

|

|

$ |

2,976 |

|

|

$ |

1,682,512 |

|

Income tax payable |

|

$ |

2,245 |

|

|

$ |

2,976 |

|

|

$ |

5,221 |

|

Total Current Liabilities |

|

$ |

276,535 |

|

|

$ |

2,976 |

|

|

$ |

279,511 |

|

Total Liabilities |

|

$ |

633,958 |

|

|

$ |

2,976 |

|

|

$ |

636,934 |

|

Additional paid-in capital |

|

$ |

774,579 |

|

|

$ |

20,725 |

|

|

$ |

795,304 |

|

Accumulated other comprehensive income |

|

$ |

68,186 |

|

|

$ |

(20,725 |

) |

|

$ |

47,461 |

|

Total Equity |

|

$ |

593,822 |

|

|

$ |

— |

|

|

$ |

593,822 |

|

Total Liabilities and Equity |

|

$ |

1,679,536 |

|

|

$ |

2,976 |

|

|

$ |

1,682,512 |

|

The following table summarizes the material adjustments and other final reclassifications to the preliminary Condensed Consolidated Statements of Cash Flow items as of December 31, 2023 (unaudited) (in thousands):

|

|

December 31, 2023 |

|

|||||||||

(In thousands) |

|

As Reported |

|

|

Adjustment |

|

|

As Revised |

|

|||

|

|

|

|

|

|

|

|

|

|

|||

Accounts receivable, net |

|

$ |

58,283 |

|

|

$ |

7,329 |

|

|

$ |

65,612 |

|

Other receivables |

|

$ |

10,560 |

|

|

$ |

(245 |

) |

|

$ |

10,315 |

|

Income taxes receivable |

|

$ |

— |

|

|

$ |

(2,637 |

) |

|

$ |

(2,637 |

) |

Income taxes payable |

|

$ |

(6,820 |

) |

|

$ |

2,881 |

|

|

$ |

(3,939 |

) |

Net cash (used in) provided by operating activities |

|

$ |

(52,932 |

) |

|

$ |

7,328 |

|

|

$ |

(45,604 |

) |

Proceeds from beneficial interests in securitized accounts receivable |

|

$ |

8,547 |

|

|

$ |

(7,329 |

) |

|

$ |

1,218 |

|

Net cash (used in) provided by investing activities |

|

$ |

(24,875 |

) |

|

$ |

(7,329 |

) |

|

$ |

(32,204 |

) |

The following table summarizes the material adjustments to the preliminary Condensed Consolidated Balance Sheets items as of December 31, 2022 (unaudited) (in thousands):

|

|

December 31, 2022 |

|

|||||||||

(In thousands) |

|

As Reported |

|

|

Adjustment |

|

|

As Revised |

|

|||

Accumulated other comprehensive income (loss) |

|

$ |

46,713 |

|

|

$ |

(20,587 |

) |

|

$ |

26,126 |

|

Non-controlling interest |

|

$ |

309,072 |

|

|

$ |

20,587 |

|

|

$ |

329,659 |

|

Total Equity |

|

$ |

1,303,613 |

|

|

$ |

— |

|

|

$ |

1,303,613 |

|

Restated Non-GAAP Financial Measures Resulting from Restated GAAP Financial Statements for the Quarters Ended March 31, 2023, June 30, 2023 and September 30, 2023

On March 15, 2024, the Company made available certain supplemental non-GAAP information for the reporting periods covered in the Company’s Quarterly Reports on Form 10-Q/A for the quarters ended March 31, 2023, June 30, 2023 and September 30, 2023, which were filed with the SEC on March 14, 2024 (the “Forms 10/A”). The Forms 10-Q/A were filed in order to, among other things, restate the Company’s condensed consolidated financial statements for the quarter ended March 31, 2023, the quarter and six months ended June 30, 2023, and the quarter and nine months ended September 30, 2023 (the “Reporting Periods”). Specifically, the Company has made available for each of the Reporting Periods corrected non-GAAP financial measures and reconciliation tables for (i) non-GAAP net loss attributable to the Company, (ii) non-GAAP net (loss) income attributable to the non-controlling interest, and (iii) non-GAAP loss per share - basic and diluted, attributable to the Company. No other non-GAAP financial measures were affected by the restatements of the Company’s financial statements for the Reporting Periods. A copy of the supplemental information is furnished as Exhibit 99.3 to this Current Report on Form 8-K and incorporated by reference herein.

The information included in, or furnished with, Item 2.02 of this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

Exhibit Number |

Description |

99.1 |

|

99.2 |

|

99.3 |

|

104 |

Cover Page Interactive Data File – the cover page iXBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: March 15, 2024 |

ADTRAN Holdings, Inc.

By: /s/ Ulrich Dopfer Chief Financial Officer (Duly Authorized Officer and Principal Financial Officer) |

|

|

EXHIBIT 99.1

Final Financial Results for the Fourth Quarter and Twelve Months Ended December 31, 2023

On February 26, 2024, ADTRAN Holdings, Inc. (the “Company”) issued a press release (the “February 26th Press Release”) announcing its preliminary financial results for the fourth quarter and twelve months ended December 31, 2023 (the “Preliminary Financial Results”). The February 26th Press Release and an accompanying investor presentation were attached as Exhibits 99.1 and 99.2, respectively, to the Company’s Current Report on Form 8-K furnished with the Securities and Exchange Commission (the “SEC”) on February 27, 2024. On March 15, 2024, the Company will file its Annual Report on Form 10-K for the fiscal year ended December 31, 2023 containing the Company’s audited consolidated financial statements as of and for the year ended December 31, 2023. Final financial results of the Company for the fourth quarter and twelve months ended December 31, 2023 (the “Final Financial Results”), reflecting certain adjustments to the Preliminary Financial Results, as described in the Current Report on Form 8-K filed on March 15, 2024 are set forth herein (with the adjusted information identified by a “^”).

Condensed Consolidated Balance Sheets

(Unaudited)

(In thousands)

ASSETS |

|

December 31, |

|

|

December 31, |

|

|

||

Current Assets |

|

|

|

|

|

|

|

||

Cash and cash equivalents |

|

$ |

87,167 |

|

|

$ |

108,644 |

|

|

Short-term investments |

|

|

— |

|

|

|

340 |

|

|

Accounts receivable, net |

|

|

216,445 |

|

|

|

279,435 |

|

|

Other receivables |

|

|

17,450 |

|

^ |

|

32,831 |

|

|

Income tax receivable |

|

|

7,933 |

|

^ |

|

— |

|

|

Inventory, net |

|

|

362,295 |

|

|

|

427,531 |

|

|

Prepaid expenses and other current assets |

|

|

45,566 |

|

|

|

33,577 |

|

|

Total Current Assets |

|

|

736,856 |

|

^ |

|

882,358 |

|

|

Property, plant and equipment, net |

|

|

123,020 |

|

|

|

110,699 |

|

|

Deferred tax assets, net |

|

|

25,787 |

|

|

|

67,839 |

|

|

Goodwill |

|

|

353,415 |

|

|

|

381,724 |

|

|

Intangibles, net |

|

|

327,985 |

|

|

|

401,211 |

|

|

Other non-current assets |

|

|

87,706 |

|

|

|

66,998 |

|

|

Long-term investments |

|

|

27,743 |

|

|

|

32,665 |

|

|

Total Assets |

|

$ |

1,682,512 |

|

^ |

$ |

1,943,494 |

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

||

Current Liabilities |

|

|

|

|

|

|

|

||

Accounts payable |

|

$ |

162,922 |

|

|

$ |

237,699 |

|

|

Revolving credit agreements outstanding |

|

|

— |

|

|

|

35,936 |

|

|

Notes payable |

|

|

— |

|

|

|

24,598 |

|

|

Unearned revenue |

|

|

46,731 |

|

|

|

41,193 |

|

|

Accrued expenses and other liabilities |

|

|

37,607 |

|

|

|

35,235 |

|

|

Accrued wages and benefits |

|

|

27,030 |

|

|

|

44,882 |

|

|

Income tax payable, net |

|

|

5,221 |

|

^ |

|

9,032 |

|

|

Total Current Liabilities |

|

|

279,511 |

|

^ |

|

428,575 |

|

|

Non-current revolving credit agreement outstanding |

|

|

195,000 |

|

|

|

60,000 |

|

|

Deferred tax liabilities |

|

|

35,655 |

|

|

|

61,629 |

|

|

Non-current unearned revenue |

|

|

25,109 |

|

|

|

19,239 |

|

|

Non-current pension liability |

|

|

12,543 |

|

|

|

10,624 |

|

|

Deferred compensation liability |

|

|

29,039 |

|

|

|

26,668 |

|

|

Non-current lease obligations |

|

|

31,420 |

|

|

|

22,807 |

|

|

Other non-current liabilities |

|

|

28,657 |

|

|

|

10,339 |

|

|

Total Liabilities |

|

|

636,934 |

|

^ |

|

639,881 |

|

|

Redeemable Non-Controlling Interest |

|

|

451,756 |

|

|

|

— |

|

|

Equity |

|

|

|

|

|

|

|

||

Common stock |

|

|

790 |

|

|

|

781 |

|

|

Additional paid-in capital |

|

|

795,304 |

|

^ |

|

895,834 |

|

|

Accumulated other comprehensive income |

|

|

47,461 |

|

^ |

|

26,126 |

|

^ |

Retained (deficit) earnings |

|

|

(243,908 |

) |

|

|

55,338 |

|

|

Treasury stock |

|

|

(5,825 |

) |

|

|

(4,125 |

) |

|

Non-controlling interest |

|

|

— |

|

|

|

329,659 |

|

^ |

Total Equity |

|

|

593,822 |

|

|

|

1,303,613 |

|

|

Total Liabilities and Equity |

|

$ |

1,682,512 |

|

^ |

$ |

1,943,494 |

|

|

Condensed Consolidated Statements of Loss

(Unaudited)

(In thousands)

|

|

Three Months Ended |

|

|

Twelve Months Ended |

|

||||||||||

|

|

December 31, |

|

|

December 31, |

|

||||||||||

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

||||

Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Network Solutions |

|

$ |

180,405 |

|

|

$ |

317,487 |

|

|

$ |

974,389 |

|

|

$ |

916,793 |

|

Services & Support |

|

|

45,074 |

|

|

|

40,784 |

|

|

|

174,711 |

|

|

|

108,743 |

|

Total Revenue |

|

|

225,479 |

|

|

|

358,271 |

|

|

|

1,149,100 |

|

|

|

1,025,536 |

|

Cost of Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Network Solutions |

|

|

126,248 |

|

|

|

233,925 |

|

|

|

722,582 |

|

|

|

647,105 |

|

Network Solutions - Inventory Write Down |

|

|

3,270 |

|

|

|

— |

|

|

|

24,313 |

|

|

|

— |

|

Services & Support |

|

|

17,496 |

|

|

|

16,943 |

|

|

|

69,142 |

|

|

|

51,179 |

|

Total Cost of Revenue |

|

|

147,014 |

|

|

|

250,868 |

|

|

|

816,037 |

|

|

|

698,284 |

|

Gross Profit |

|

|

78,465 |

|

|

|

107,403 |

|

|

|

333,063 |

|

|

|

327,252 |

|

Selling, general and administrative expenses |

|

|

61,262 |

|

|

|

78,243 |

|

|

|

258,149 |

|

|

|

208,889 |

|

Research and development expenses |

|

|

54,818 |

|

|

|

61,570 |

|

|

|

258,311 |

|

|

|

173,757 |

|

Asset impairment |

|

|

— |

|

|

|

464 |

|

|

|

— |

|

|

|

17,433 |

|

Goodwill impairment |

|

|

— |

|

|

|

— |

|

|

|

37,874 |

|

|

|

— |

|

Operating Loss |

|

|

(37,615 |

) |

|

|

(32,874 |

) |

|

|

(221,271 |

) |

|

|

(72,827 |

) |

Interest and dividend income |

|

|

1,157 |

|

|

|

1,355 |

|

|

|

2,340 |

|

|

|

2,123 |

|

Interest expense |

|

|

(4,441 |

) |

|

|

(2,010 |

) |

|

|

(16,299 |

) |

|

|

(3,437 |

) |

Net investment gain (loss) |

|

|

1,683 |

|

|

|

(587 |

) |

|

|

2,754 |

|

|

|

(11,339 |

) |

Other income, net |

|

|

(3,448 |

) |

|

|

11,568 |

|

|

|

1,266 |

|

|

|

14,517 |

|

Loss Before Income Taxes |

|

|

(42,664 |

) |

|

|

(22,548 |

) |

|

|

(231,210 |

) |

|

|

(70,963 |

) |

Income tax (expense) benefit |

|

|

(64,362 |

) |

|

|

57,503 |

|

|

|

(28,133 |

) |

|

|

62,075 |

|

Net (Loss) Income |

|

$ |

(107,026 |

) |

|

$ |

34,955 |

|

|

$ |

(259,343 |

) |

|

$ |

(8,888 |

) |

Net Income (loss) attributable to non-controlling interest |

|

|

2,919 |

|

|

|

(3,926 |

) |

|

|

8,345 |

|

|

|

(6,851 |

) |

Net (Loss) Income attributable to ADTRAN Holdings, Inc. |

|

$ |

(109,945 |

) |

|

$ |

38,881 |

|

|

$ |

(267,688 |

) |

|

$ |

(2,037 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Weighted average shares outstanding – basic |

|

|

78,530 |

|

|

|

77,659 |

|

|

|

78,416 |

|

|

|

62,346 |

|

Weighted average shares outstanding – diluted |

|

|

78,530 |

|

|

|

79,243 |

|

|

|

78,416 |

|

|

|

62,346 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

(Loss) Earnings per common share attributable to ADTRAN Holdings, Inc. – basic |

|

$ |

(1.40 |

) |

|

$ |

0.50 |

|

|

$ |

(3.41 |

) |

|

$ |

(0.03 |

) |

(Loss) Earnings per common share attributable to ADTRAN Holdings, Inc. – diluted |

|

$ |

(1.40 |

) |

|

$ |

0.49 |

|

|

$ |

(3.41 |

) |

|

$ |

(0.03 |

) |

Condensed Consolidated Statements of Cash Flows

(Unaudited)

(In thousands)

|

|

Twelve Months Ended |

|

|||||

|

|

2023 |

|

|

2022 |

|

||

Cash flows from operating activities: |

|

|

|

|

|

|

||

Net Loss |

|

$ |

(259,343 |

) |

|

$ |

(8,888 |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

||

Depreciation and amortization |

|

|

112,949 |

|

|

|

67,553 |

|

Asset impairment |

|

|

— |

|

|

|

17,433 |

|

Goodwill impairment |

|

|

37,874 |

|

|

|

— |

|

Amortization of debt issuance cost |

|

|

862 |

|

|

|

288 |

|

(Accretion) amortization on available-for-sale investments, net |

|

|

(22 |

) |

|

|

19 |

|

(Gain) loss on investments |

|

|

(2,900 |

) |

|

|

9,826 |

|

Net loss on disposal of property, plant and equipment |

|

|

458 |

|

|

|

152 |

|

Stock-based compensation expense |

|

|

16,016 |

|

|

|

28,322 |

|

Deferred income taxes |

|

|

15,558 |

|

|

|

(62,388 |

) |

Inventory write down |

|

|

24,313 |

|

|

|

— |

|

Inventory reserves |

|

|

25,546 |

|

|

|

(2,363 |

) |

Other, net |

|

|

(2,942 |

) |

|

|

— |

|

Change in operating assets and liabilities: |

|

|

|

|

|

|

||

Accounts receivable, net |

|

|

65,612 |

|

^ |

|

788 |

|

Other receivables |

|

|

10,315 |

|

^ |

|

(20,088 |

) |

Income taxes receivable |

|

|

(2,637 |

) |

^ |

|

— |

|

Inventory |

|

|

20,537 |

|

|

|

(73,237 |

) |

Prepaid expenses other current assets and other assets |

|

|

(29,883 |

) |

|

|

(7,116 |

) |

Accounts payable |

|

|

(91,907 |

) |

|

|

28,105 |

|

Accrued expenses and other liabilities |

|

|

17,929 |

|

|

|

(20,483 |

) |

Income taxes payable, net |

|

|

(3,939 |

) |

^ |

|

(2,151 |

) |

Net cash used in operating activities |

|

|

(45,604 |

) |

^ |

|

(44,228 |

) |

Cash flows from investing activities: |

|

|

|

|

|

|

||

Purchases of property, plant and equipment |

|

|

(43,121 |

) |

|

|

(17,072 |

) |

Proceeds from sales and maturities of available-for-sale investments |

|

|

10,567 |

|

|

|

51,661 |

|

Purchases of available-for-sale investments |

|

|

(868 |

) |

|

|

(23,899 |

) |

Proceeds from beneficial interests in securitized accounts receivable |

|

|

1,218 |

|

^ |

|

1,126 |

|

Proceeds from disposals of property, plant and equipment |

|

|

— |

|

|

|

12 |

|

Insurance proceeds received |

|

|

— |

|

|

|

— |

|

Acquisition of business, net of cash acquired |

|

|

— |

|

|

|

44,003 |

|

Net cash (used in) provided by investing activities |

|

|

(32,204 |

) |

^ |

|

55,831 |

|

Cash flows from financing activities: |

|

|

|

|

|

|

||

Tax withholdings related to stock-based compensation settlements |

|

|

(6,458 |

) |

|

|

(4,253 |

) |

Proceeds from stock option exercises |

|

|

540 |

|

|

|

6,904 |

|

Dividend payments |

|

|

(21,237 |

) |

|

|

(22,885 |

) |

Proceeds from receivables purchase agreement |

|

|

14,099 |

|

|

|

— |

|

Proceeds from draw on revolving credit agreements |

|

|

163,733 |

|

|

|

141,887 |

|

Repayment of revolving credit agreements |

|

|

(64,987 |

) |

|

|

(48,000 |

) |

Redemption of redeemable non-controlling interest |

|

|

(1,224 |

) |

|

|

— |

|

Payment of debt issuance cost |

|

|

(708 |

) |

|

|

(3,015 |

) |

Repayment of notes payable |

|

|

(24,891 |

) |

|

|

(17,702 |

) |

Net cash provided by financing activities |

|

|

58,867 |

|

|

|

52,936 |

|

Net (decrease) increase in cash and cash equivalents |

|

|

(18,941 |

) |

|

|

64,539 |

|

Effect of exchange rate changes |

|

|

(2,536 |

) |

|

|

(12,713 |

) |

Cash and cash equivalents, beginning of year |

|

|

108,644 |

|

|

|

56,818 |

|

Cash and cash equivalents, end of year |

|

$ |

87,167 |

|

|

$ |

108,644 |

|

|

|

|

|

|

|

|

||

Supplemental disclosure of cash financing activities |

|

|

|

|

|

|

||

Cash paid for interest |

|

$ |

12,596 |

|

|

$ |

1,728 |

|

Cash paid for income taxes |

|

$ |

18,552 |

|

|

$ |

3,832 |

|

Cash used in operating activities related to operating leases |

|

$ |

9,682 |

|

|

$ |

5,229 |

|

Supplemental disclosure of non-cash investing activities |

|

|

|

|

|

|

||

Right-of-use assets obtained in exchange for lease obligations |

|

$ |

17,865 |

|

|

$ |

3,410 |

|

Purchases of property, plant and equipment included in accounts payable |

|

$ |

1,298 |

|

|

$ |

1,165 |

|

Adtran Networks common shares exchanged in acquisition |

|

$ |

— |

|

|

$ |

565,491 |

|

Adtran Networks options assumed in acquisition |

|

$ |

— |

|

|

$ |

12,769 |

|

Non-controlling interest related to Adtran Networks |

|

$ |

— |

|

|

$ |

316,415 |

|

On February 26, 2024, ADTRAN Holdings, Inc. (the “Company”) issued a press release (the “February 26th Press Release”) announcing its preliminary financial results for the fourth quarter and twelve months ended December 31, 2023 (the “Preliminary Financial Results”). The February 26th Press Release and an accompanying investor presentation were attached as Exhibits 99.1 and 99.2, respectively, to the Company’s Current Report on Form 8-K furnished with the Securities and Exchange Commission (the “SEC”) on February 27, 2024. On March 15, 2024, the Company will file its Annual Report on Form 10-K for the fiscal year ended December 31, 2023 containing the Company’s audited consolidated financial statements as of and for the year ended December 31, 2023. The updated investor presentation based upon the final financial results of the Company for the fourth quarter and twelve months ended December 31, 2023 is provided below. Exhibit 99.2 ADTRAN Holdings, Inc. Investor Presentation with Final Financial Results for the Fourth Quarter and Twelve Months Ended December 31, 2023

Adtran Holdings Investor presentation March 15, 2024

Cautionary note regarding forward-looking statements Statements contained in this presentation which are not historical facts, such as those relating to expectations regarding earnings, expenses and margin; the ability of ADTRAN Holdings, Inc. (“ADTRAN Holdings”) to reduce expenses in the coming year and the amount thereof through its implementation of the business efficiency program; and ADTRAN Holdings’ strategy, outlook and financial guidance, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements can also generally be identified by the use of words such as “believe,” “expect,” “intend,” “estimate,” “anticipate,” “will,” “may,” “could” and similar expressions. In addition, ADTRAN Holdings, through its senior management, may from time to time make forward-looking public statements concerning the matters described herein. All such projections and other forward-looking information speak only as of the date hereof, and ADTRAN Holdings undertakes no duty to publicly update or revise such forward-looking information, whether as a result of new information, future events, or otherwise, except to the extent as may be required by law. All such forward-looking statements are necessarily estimates and reflect management’s best judgment based upon current information. Actual events or results may differ materially from those anticipated in these forward-looking statements as a result of a variety of factors. While it is impossible to identify all such factors, factors which have caused and may in the future cause actual events or results to differ materially from those estimated by ADTRAN Holdings include, but are not limited to: (i) risks and uncertainties relating to ADTRAN Holdings’ ability to reduce expenditures and the impact of such reductions on its financial results and financial condition; (ii) the risk of fluctuations in revenue due to lengthy sales and approval processes required by major and other service providers for new products, as well as ongoing tighter inventory management of ADTRAN Holdings’ customers; (iii) risks and uncertainties relating to the recent restatements of our previously issued consolidated financial statements and ongoing material weaknesses in our internal control over financial reporting; (iv) risks and uncertainties related to the completed business combination between the Company, ADTRAN, Inc. (“ADTRAN”) and Adtran Networks SE (“Adtran Networks”);(v) the risk posed by potential breaches of information systems and cyber-attacks; (vi) the risk that ADTRAN Holdings may not be able to effectively compete, including through product improvements and development; and (vii) other risks set forth in ADTRAN Holdings’ public filings made with the Securities and Exchange Commission (the “SEC”), including its Annual Report on Form 10-K for the year ended December 31, 2022 and Form 10‑Q for the quarterly period ended September 30, 2023, as well as its Form 10‑K for the year ended December 31, 2023 to be filed with the SEC.

Introduction and business model 1

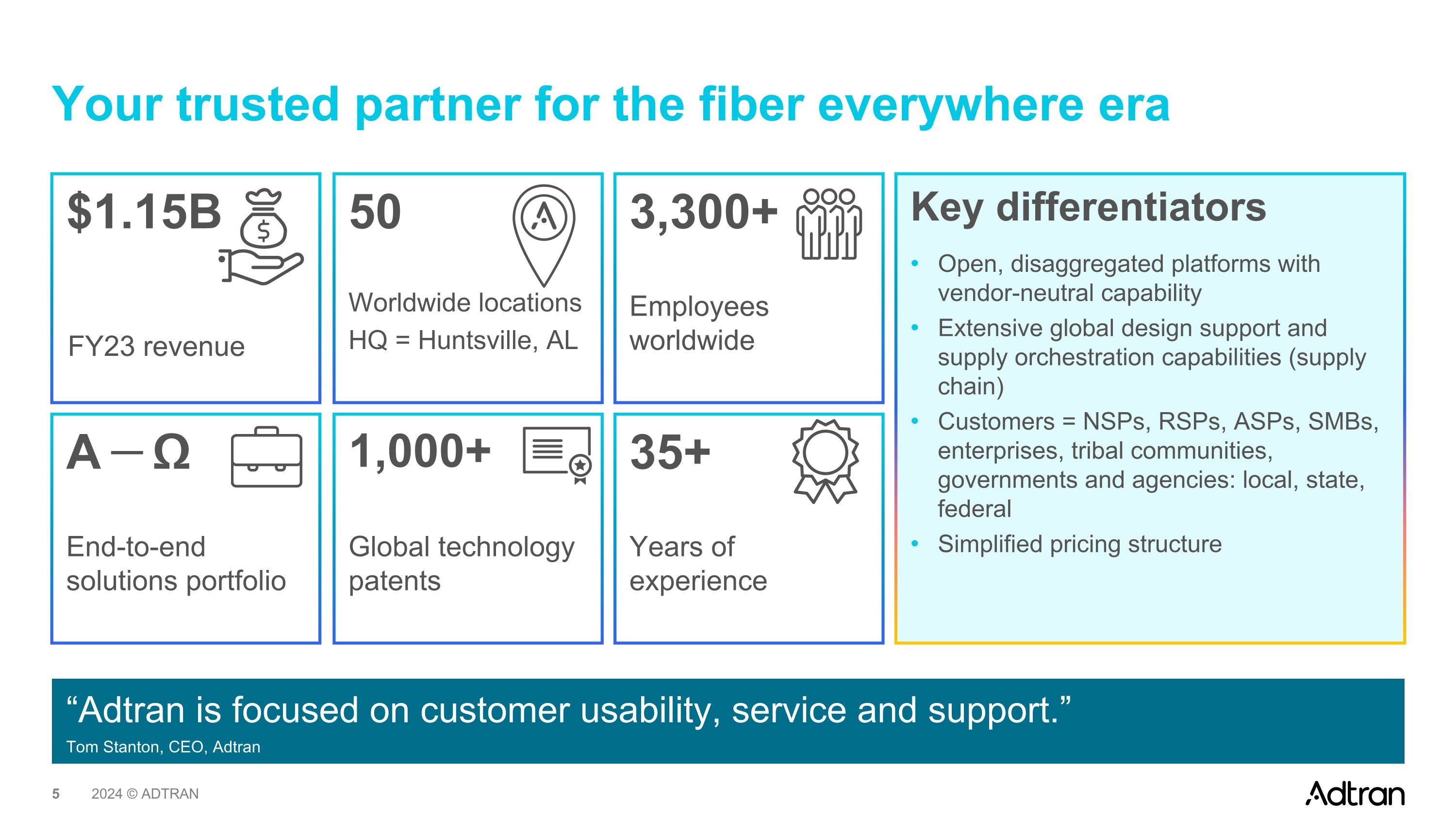

1,000+ Global technology patents 3,300+ Employees worldwide $1.15B FY23 revenue 50 Key differentiators Open, disaggregated platforms with vendor-neutral capability Extensive global design support and supply orchestration capabilities (supply chain) Customers = NSPs, RSPs, ASPs, SMBs, enterprises, tribal communities, governments and agencies: local, state, federal Simplified pricing structure 35+ Years of experience Α — Ω End-to-end solutions portfolio Your trusted partner for the fiber everywhere era “Adtran is focused on customer usability, service and support.” Tom Stanton, CEO, Adtran Worldwide locations HQ = Huntsville, AL

OUR VISION is to enable a fully-connected world, where the power and freedom to communicate is available to everyone, everywhere, in a secure, efficient and sustainable environment.

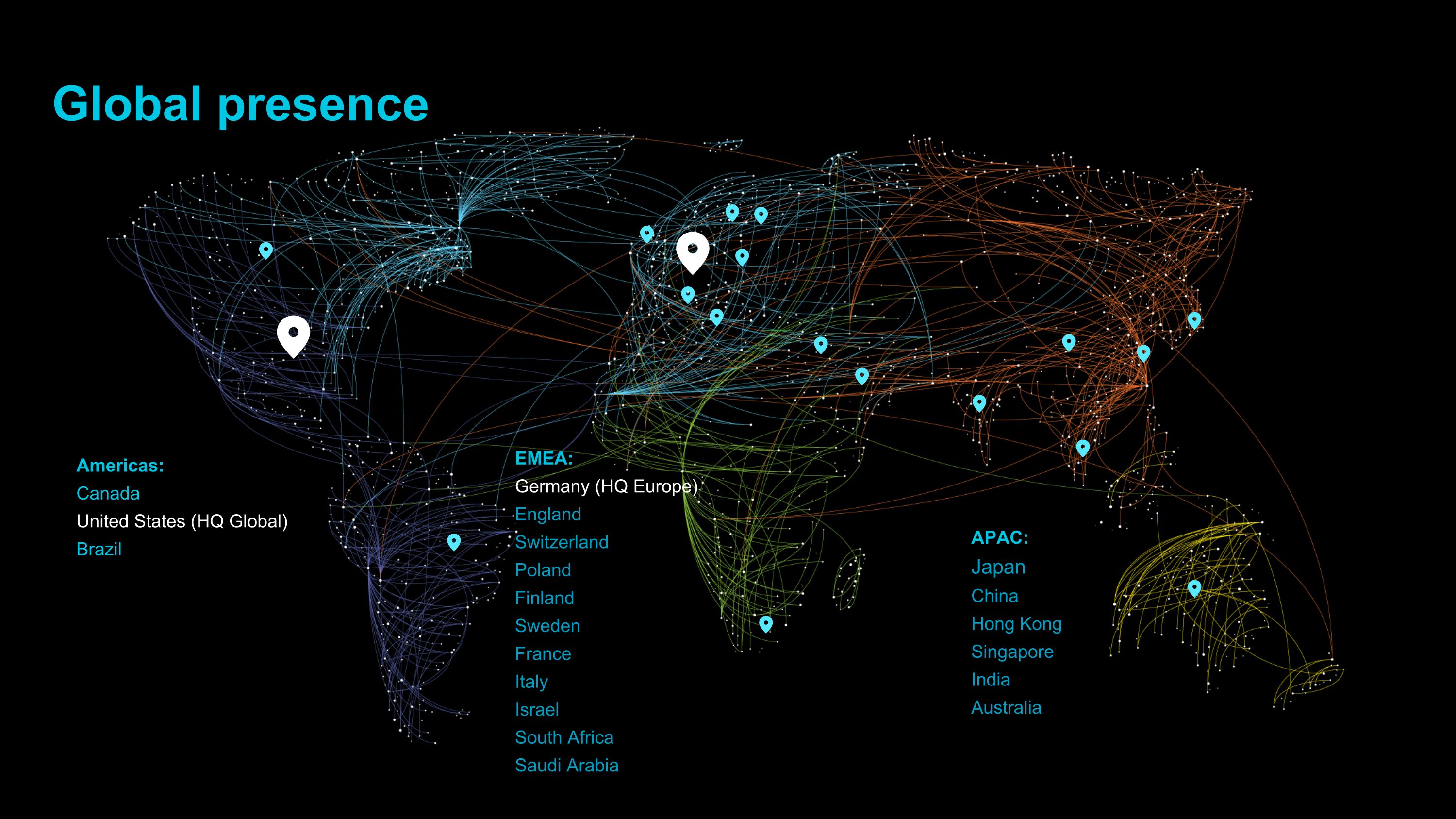

Global presence Americas: Canada United States (HQ Global) Brazil APAC: Japan China Hong Kong Singapore India Australia EMEA: Germany (HQ Europe) England Switzerland Poland Finland Sweden France Italy Israel South Africa Saudi Arabia

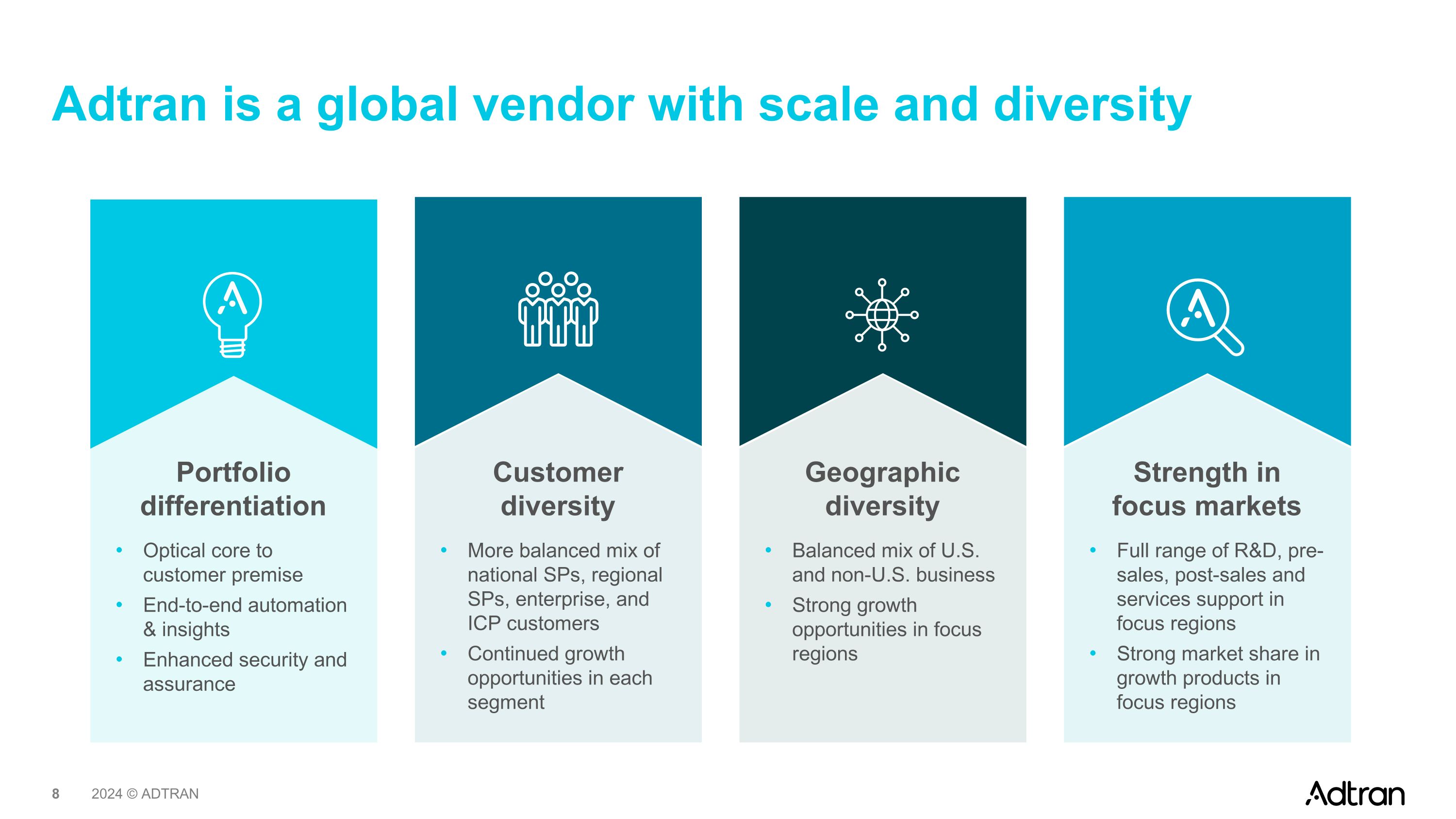

Adtran is a global vendor with scale and diversity Portfolio differentiation Customer diversity Geographic diversity Strength in focus markets Optical core to customer premise End-to-end automation & insights Enhanced security and assurance More balanced mix of national SPs, regional SPs, enterprise, and ICP customers Continued growth opportunities in each segment Balanced mix of U.S. and non-U.S. business Strong growth opportunities in focus regions Full range of R&D, pre-sales, post-sales and services support in focus regions Strong market share in growth products in focus regions

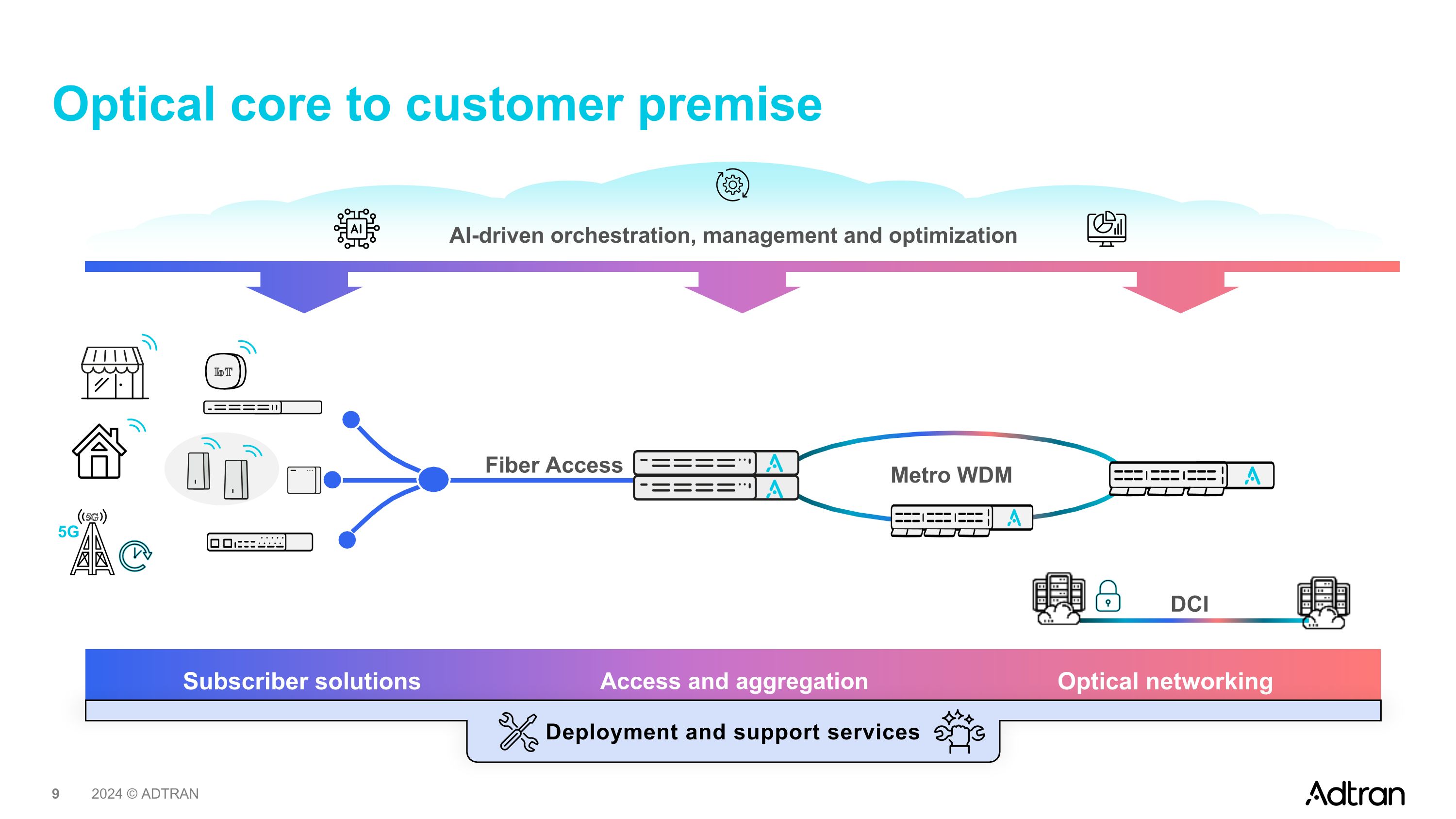

Optical core to customer premise 10G PON ONT Optical networking Access and aggregation Subscriber solutions Deployment and support services AI-driven orchestration, management and optimization Metro WDM 5G DCI Fiber Access

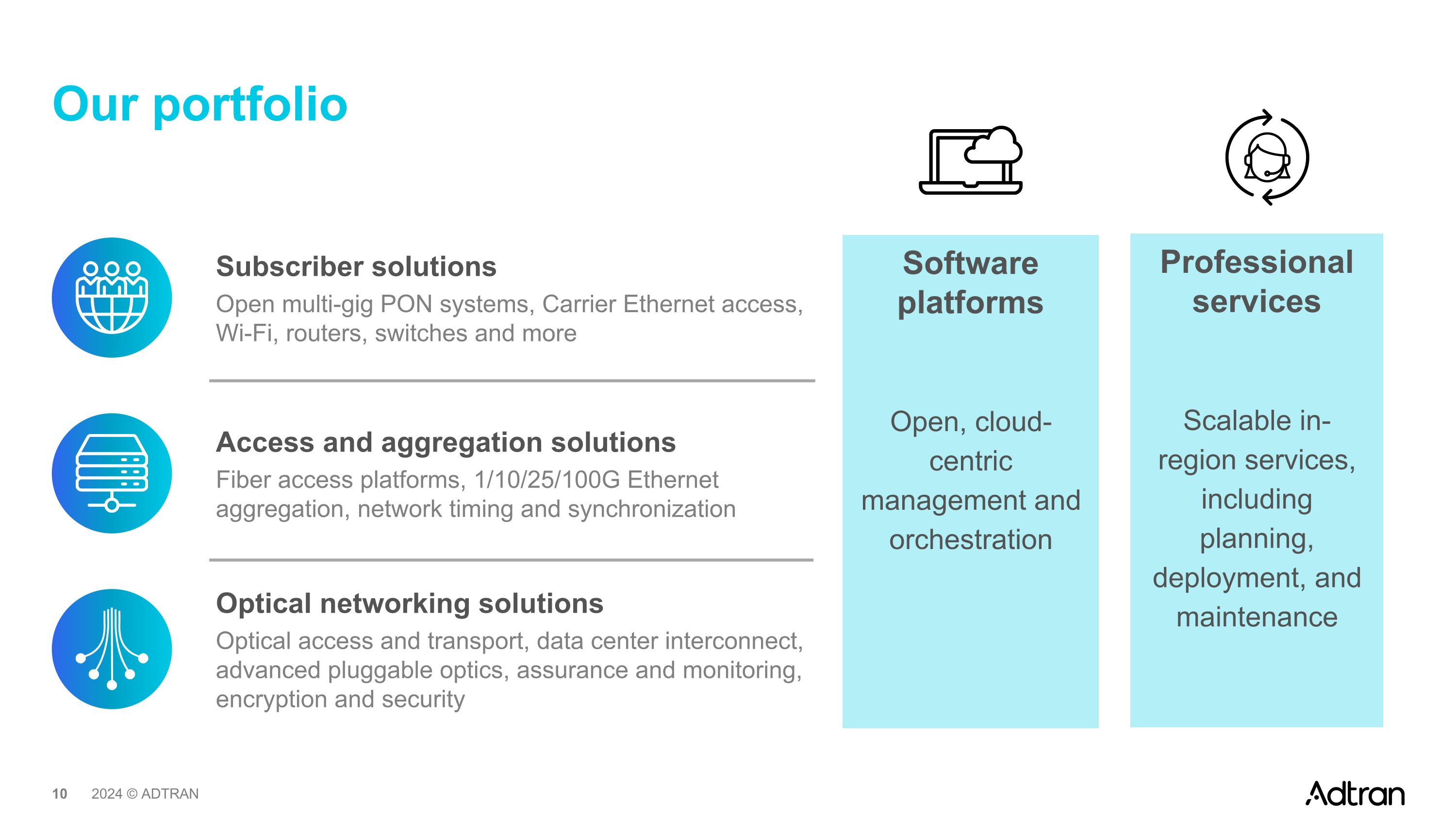

Our portfolio Subscriber solutions Open multi-gig PON systems, Carrier Ethernet access, Wi-Fi, routers, switches and more Access and aggregation solutions Fiber access platforms, 1/10/25/100G Ethernet aggregation, network timing and synchronization Optical networking solutions Optical access and transport, data center interconnect, advanced pluggable optics, assurance and monitoring, encryption and security Software platforms Open, cloud-centric management and orchestration Professional services Scalable in-region services, including planning, deployment, and maintenance

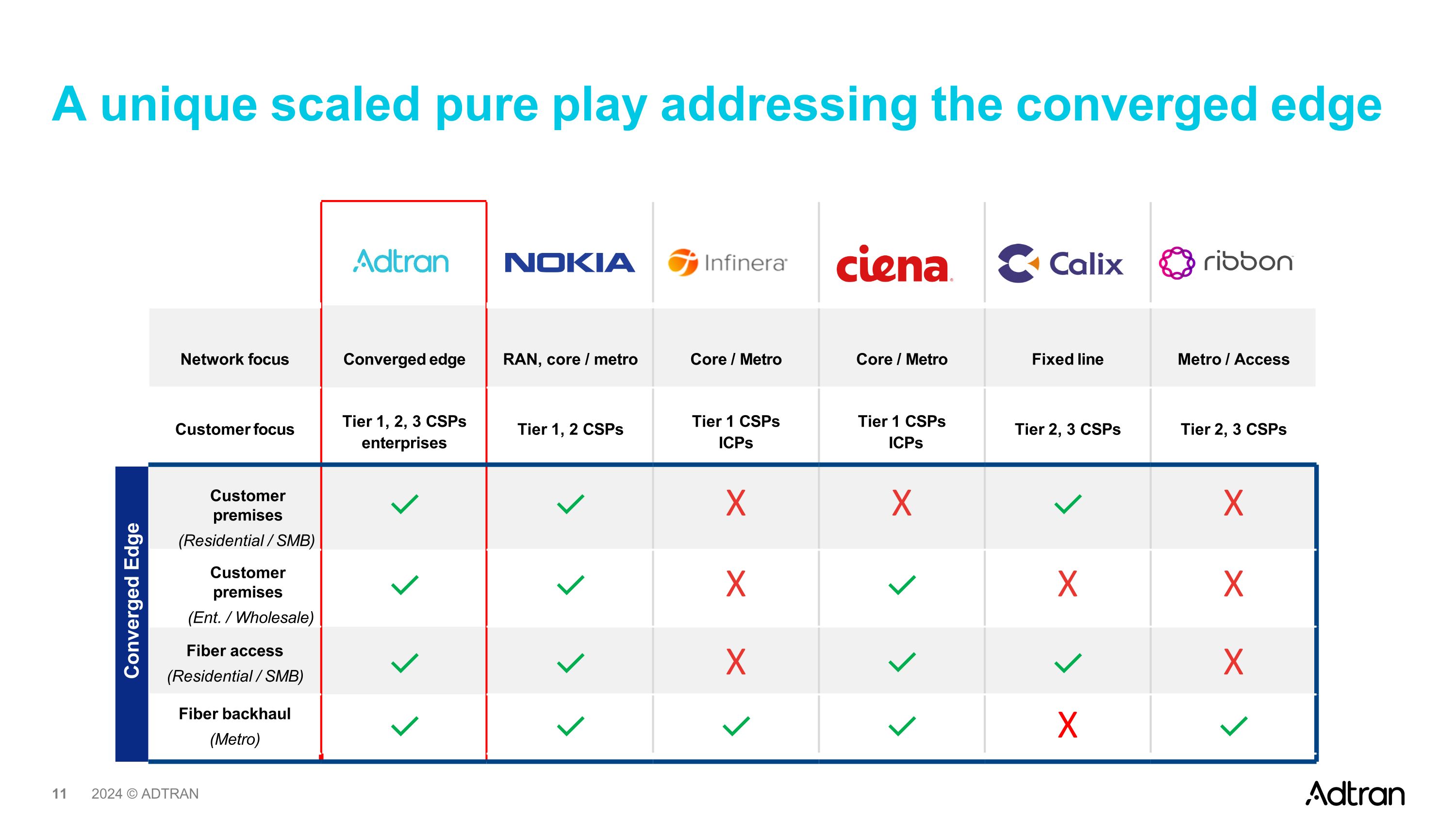

A unique scaled pure play addressing the converged edge Network focus Converged edge RAN, core / metro Core / Metro Core / Metro Fixed line Metro / Access Customer focus Tier 1, 2, 3 CSPs enterprises Tier 1, 2 CSPs Tier 1 CSPs ICPs Tier 1 CSPs ICPs Tier 2, 3 CSPs Tier 2, 3 CSPs Customer premises (Residential / SMB) ✓ ✓ X X ✓ X Customer premises (Ent. / Wholesale) ✓ ✓ X ✓ X X Fiber access (Residential / SMB) ✓ ✓ X ✓ ✓ X Fiber backhaul (Metro) ✓ ✓ ✓ ✓ X ✓ Converged Edge

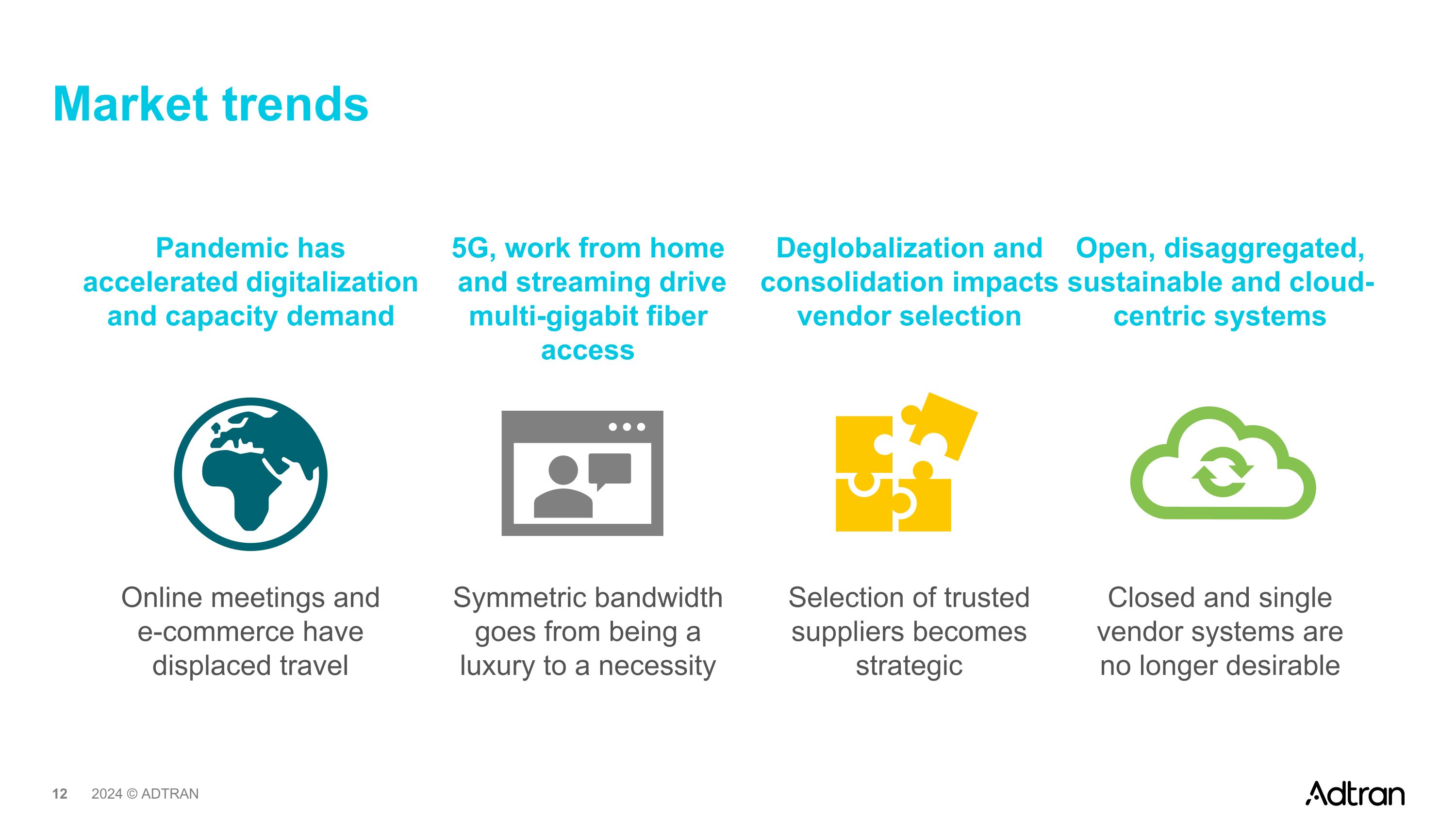

Market trends Pandemic has accelerated digitalization and capacity demand 5G, work from home and streaming drive multi-gigabit fiber access Deglobalization and consolidation impacts vendor selection Open, disaggregated, sustainable and cloud-centric systems Online meetings and e-commerce have displaced travel Symmetric bandwidth goes from being a luxury to a necessity Selection of trusted suppliers becomes strategic Closed and single vendor systems are no longer desirable

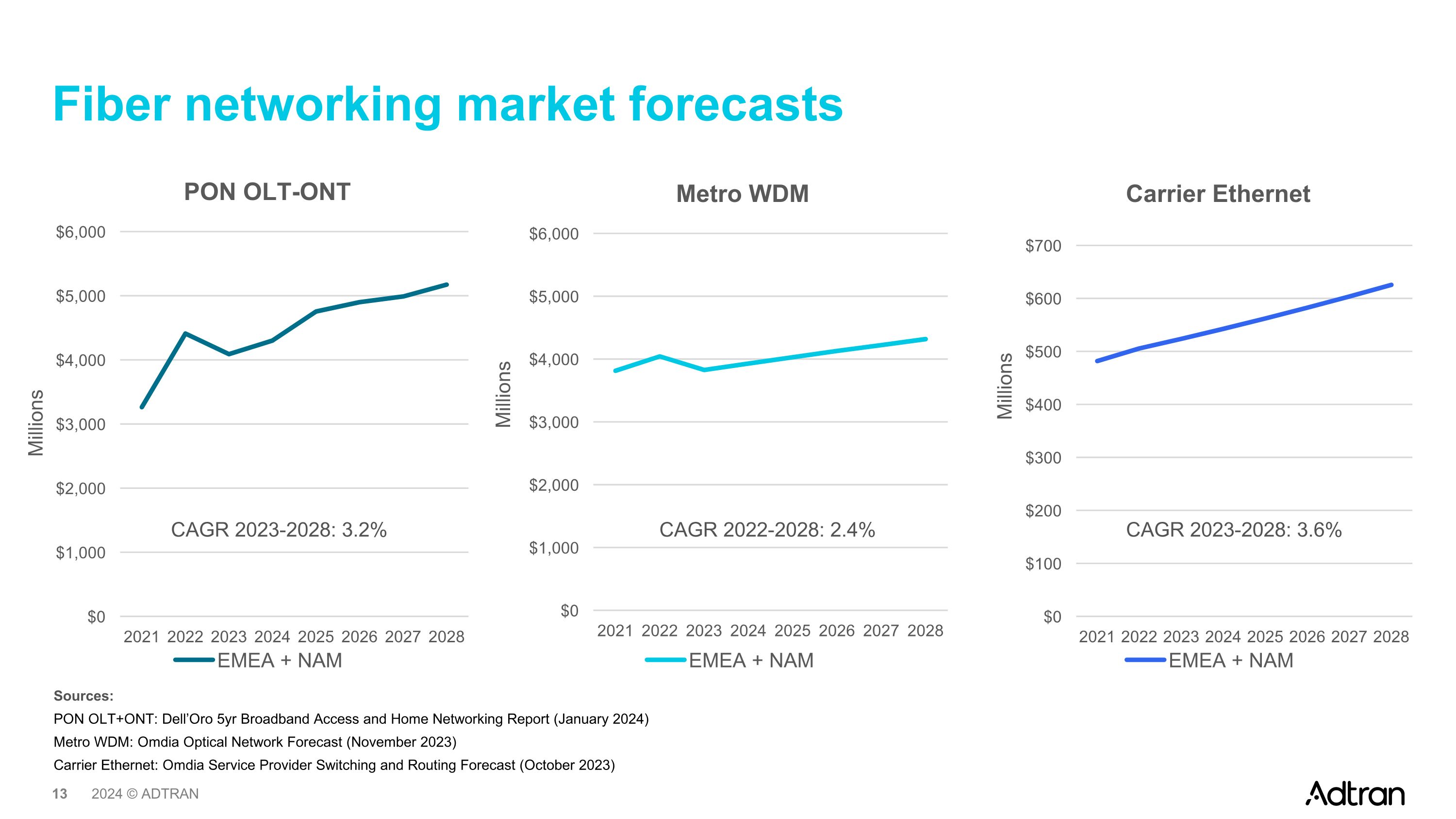

Fiber networking market forecasts CAGR 2023-2028: 3.2% CAGR 2022-2028: 2.4% CAGR 2023-2028: 3.6% Sources: PON OLT+ONT: Dell’Oro 5yr Broadband Access and Home Networking Report (January 2024) Metro WDM: Omdia Optical Network Forecast (November 2023) Carrier Ethernet: Omdia Service Provider Switching and Routing Forecast (October 2023)

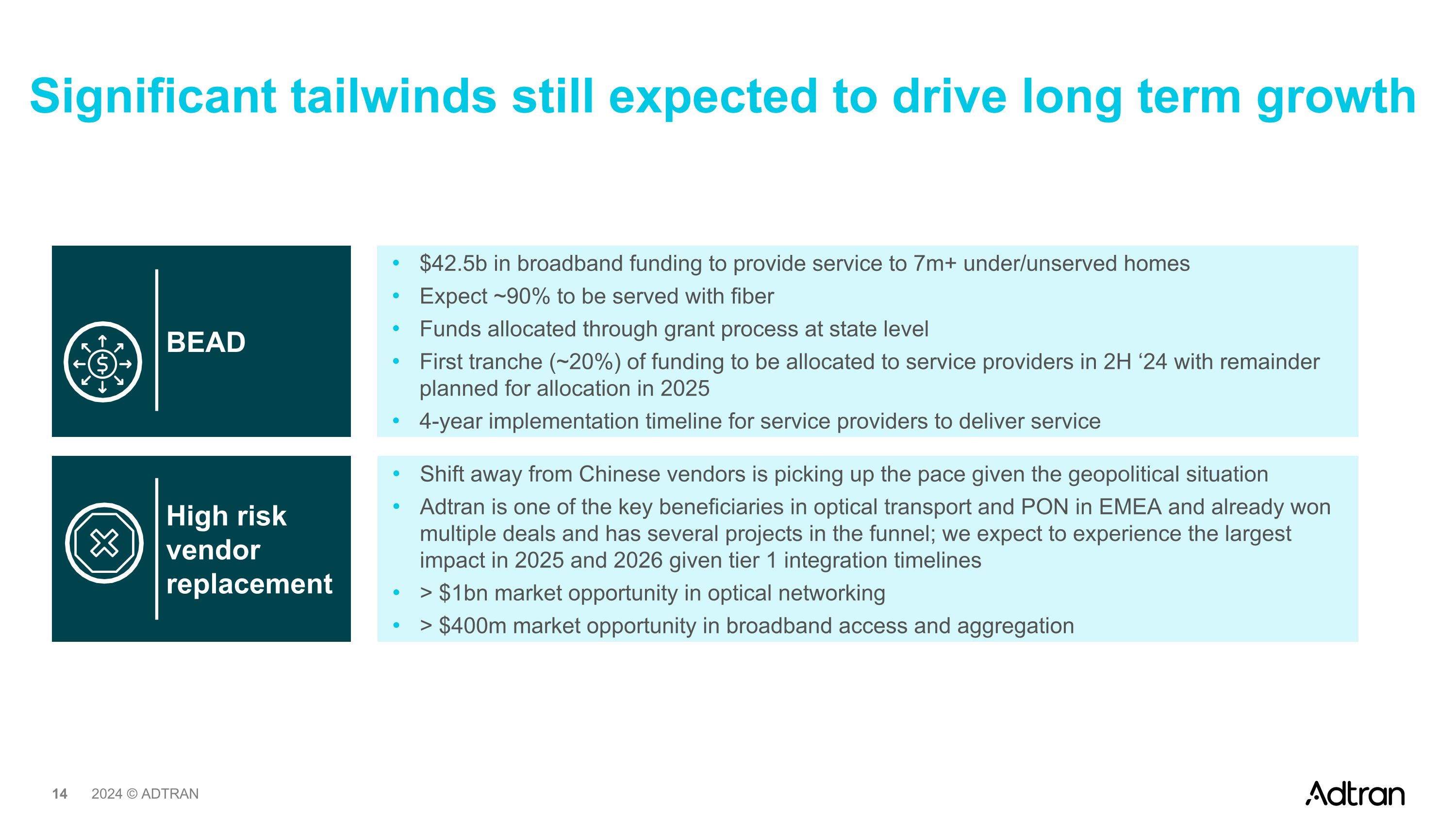

Significant tailwinds still expected to drive long term growth BEAD High risk vendor replacement $42.5b in broadband funding to provide service to 7m+ under/unserved homes Expect ~90% to be served with fiber Funds allocated through grant process at state level First tranche (~20%) of funding to be allocated to service providers in 2H ‘24 with remainder planned for allocation in 2025 4-year implementation timeline for service providers to deliver service Shift away from Chinese vendors is picking up the pace given the geopolitical situation Adtran is one of the key beneficiaries in optical transport and PON in EMEA and already won multiple deals and has several projects in the funnel; we expect to experience the largest impact in 2025 and 2026 given tier 1 integration timelines > $1bn market opportunity in optical networking > $400m market opportunity in broadband access and aggregation

Corporate social responsibility EcoVadis Adtran, Inc. Adtran Networks CDP B- Climate change2023 A- Adtran Inc. Adtran SE Environmental Sustainability is integral part of product strategy through process-based product ecodesign and lifecycle assessment (LCA) Involvement of supply chain based on Integrity Next supplier onboarding ISO certificated (ISO 14001 EMS, ISO 50001 EnMS) Ratings Social Event sponsoring, volunteer hours at non-profit organizations and donations Dedicated human capital management Employee-driven diversity, equity & inclusion (DE&I) task force to support a diverse and inclusive workforce Strictly following ILO requirements Governance Comprehensive ethics and compliance policy, code of conduct and processes Dedicated human rights policy and supplier of conduct Dedicated engagement in security - ISO 27001-certified 59th percentile 96th percentile Both, EEE sector and global average are C

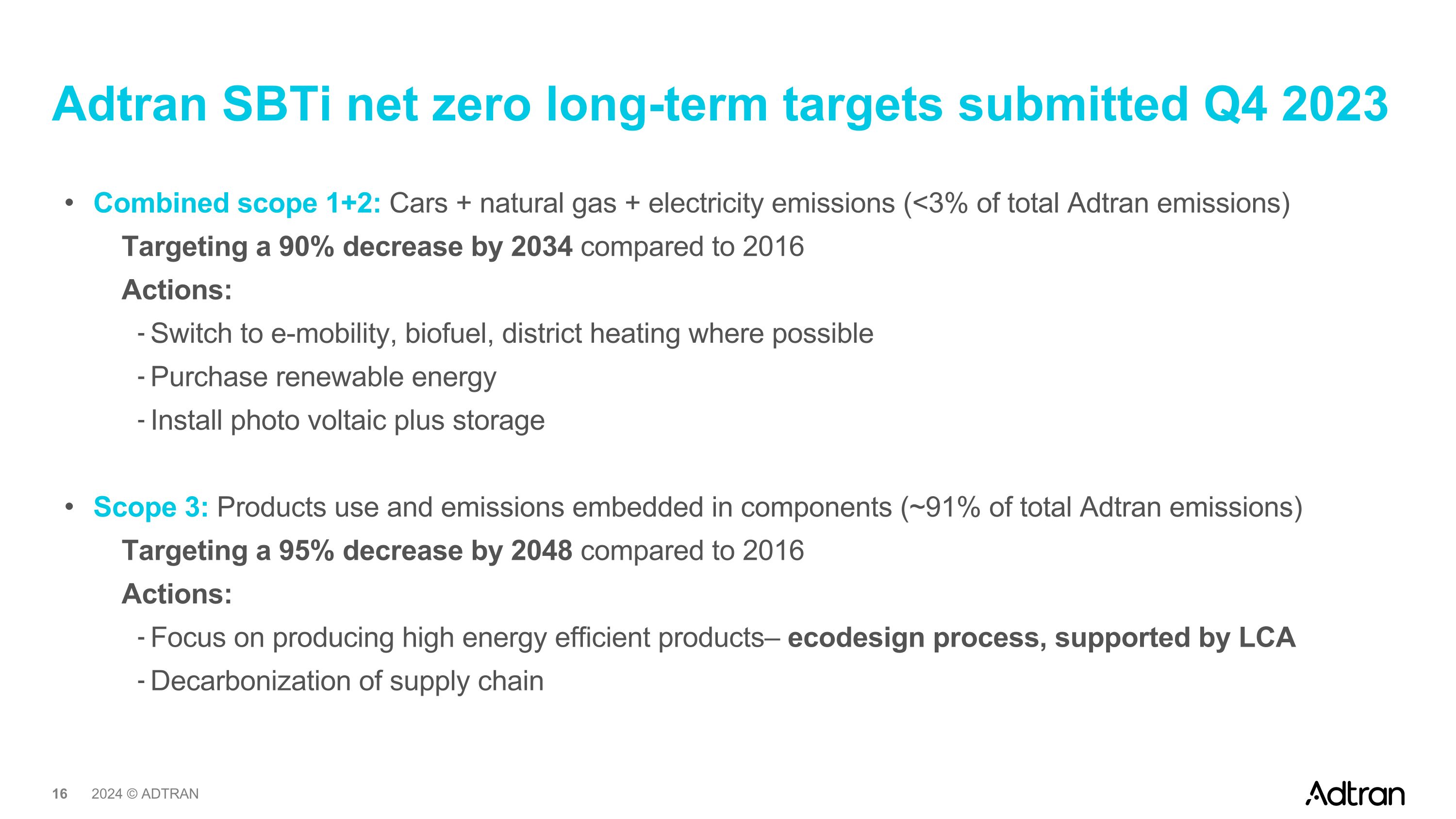

Adtran SBTi net zero long-term targets submitted Q4 2023 Combined scope 1+2: Cars + natural gas + electricity emissions (<3% of total Adtran emissions) Targeting a 90% decrease by 2034 compared to 2016 Actions: Switch to e-mobility, biofuel, district heating where possible Purchase renewable energy Install photo voltaic plus storage Scope 3: Products use and emissions embedded in components (~91% of total Adtran emissions) Targeting a 95% decrease by 2048 compared to 2016 Actions: Focus on producing high energy efficient products– ecodesign process, supported by LCA Decarbonization of supply chain

Why Adtran? Differentiated portfolio from optical core to customer premise with a balanced mix of large and regional Service provider, enterprise, and ICP customers Differentiation and diversification The historic demand for fiber is supported by public/private stimulus to deploy fiber-based broadband networks paired with the replacement of high-risk vendors in Europe Unprecedented market opportunity Strong commitment to corporate social responsibility, as well as environmental, social and governance Strong commitment to ESG Implementation of a comprehensive business efficiency program targeting a leaner, efficient and profitable company with expected margins in the low teens in 2025 Substantial transformation of operating model

Business update 5

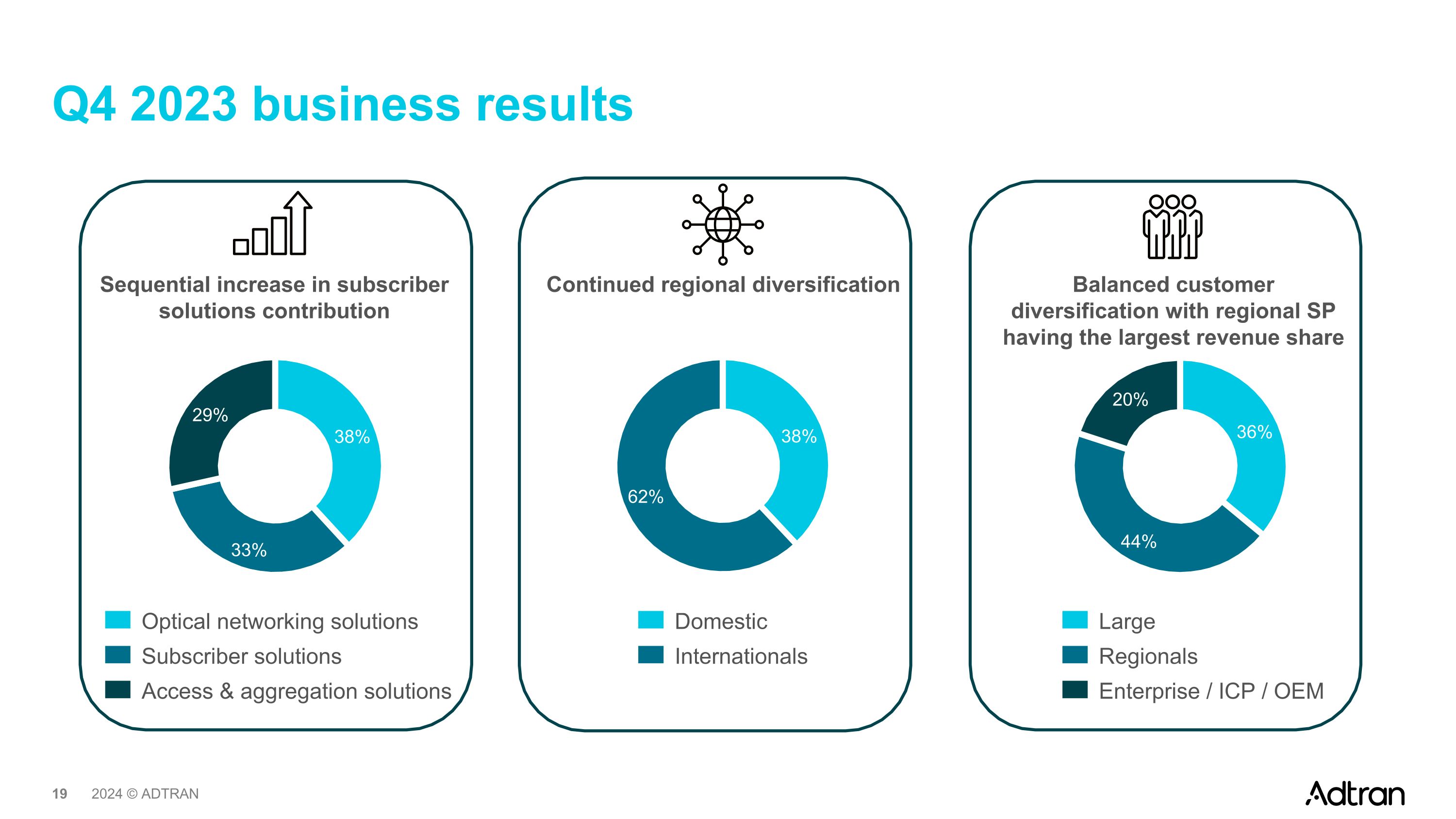

Q4 2023 business results Sequential increase in subscriber solutions contribution Optical networking solutions Subscriber solutions Access & aggregation solutions Continued regional diversification Balanced customer diversification with regional SP having the largest revenue share Large Regionals Enterprise / ICP / OEM Domestic Internationals

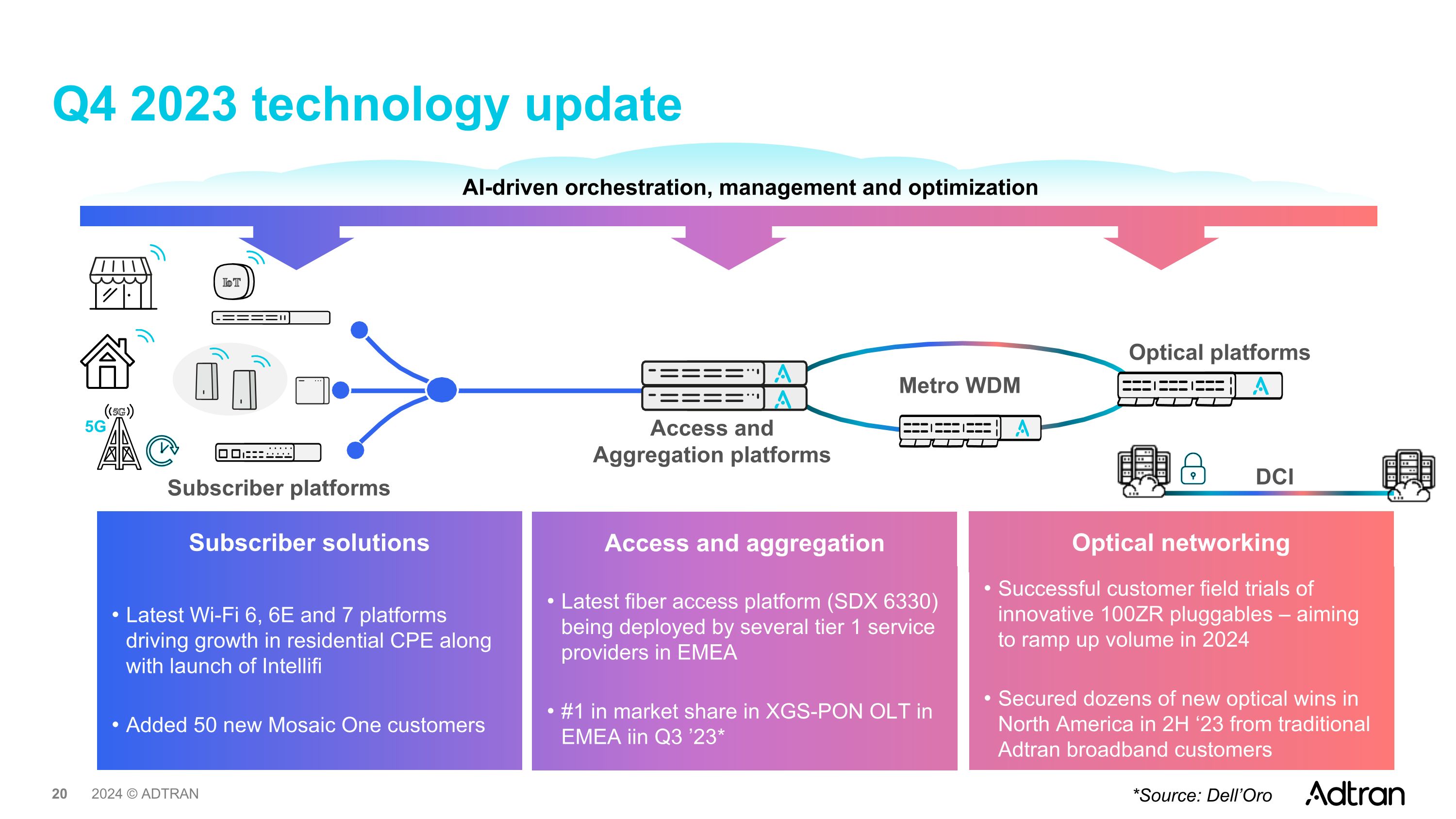

Q4 2023 technology update Metro WDM 5G Optical platforms Access and Aggregation platforms Subscriber platforms Optical networking Access and aggregation Subscriber solutions Latest Wi-Fi 6, 6E and 7 platforms driving growth in residential CPE along with launch of Intellifi Added 50 new Mosaic One customers Latest fiber access platform (SDX 6330) being deployed by several tier 1 service providers in EMEA #1 in market share in XGS-PON OLT in EMEA iin Q3 ’23* Successful customer field trials of innovative 100ZR pluggables – aiming to ramp up volume in 2024 Secured dozens of new optical wins in North America in 2H ‘23 from traditional Adtran broadband customers DCI AI-driven orchestration, management and optimization *Source: Dell’Oro

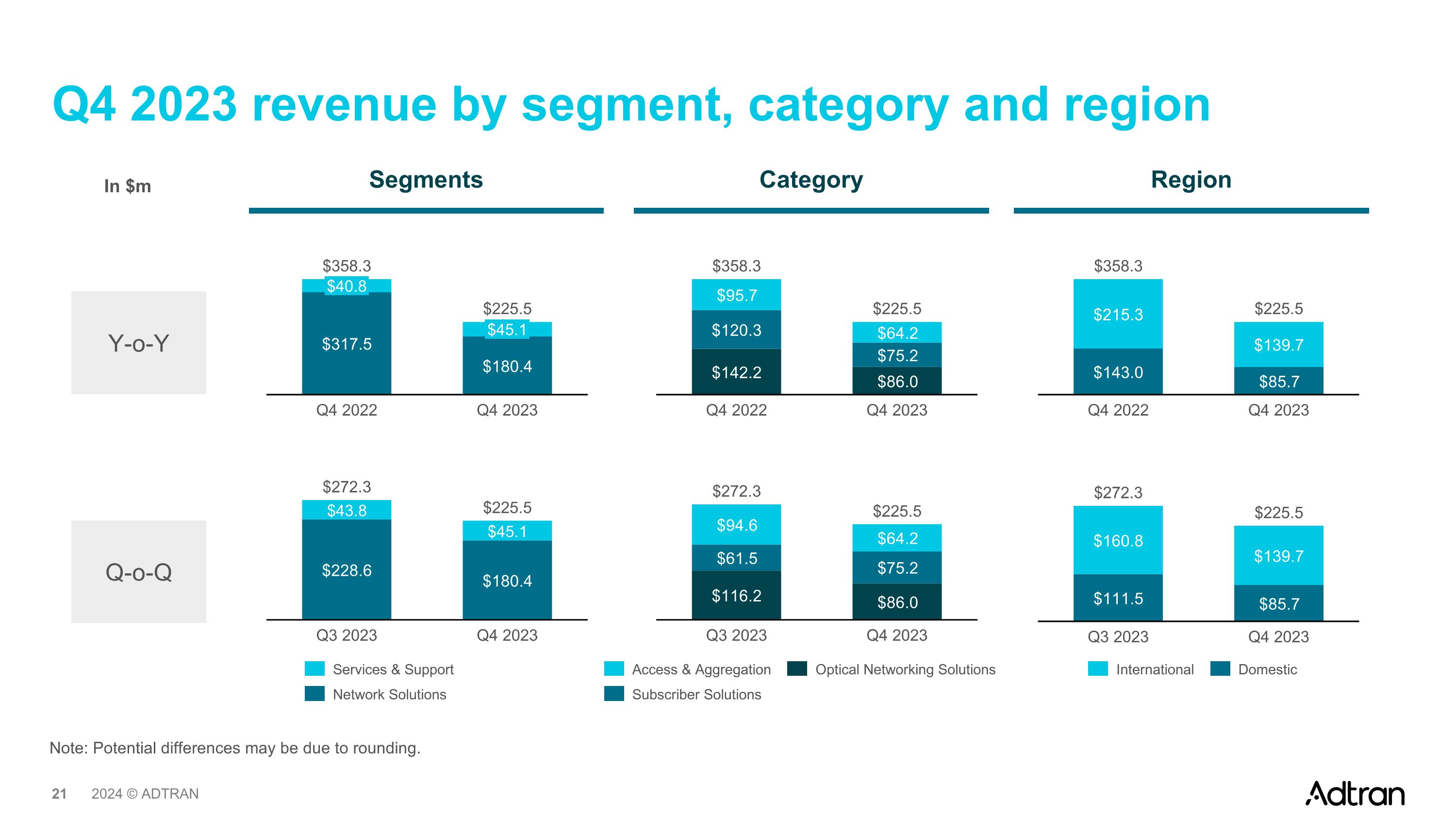

Q4 2023 revenue by segment, category and region Category Region $40.8 Q4 2022 $45.1 Q4 2023 $358.3 $225.5 Services & Support Network Solutions Q3 2023 Q4 2023 $272.3 $225.5 Y-o-Y Q-o-Q Q4 2022 Q4 2023 $358.3 $225.5 Access & Aggregation Subscriber Solutions Optical Networking Solutions Q3 2023 Q4 2023 $272.3 $225.5 Q4 2022 Q4 2023 $358.3 $225.5 International Domestic Q3 2023 Q4 2023 $272.3 $225.5 In $m Segments Note: Potential differences may be due to rounding.

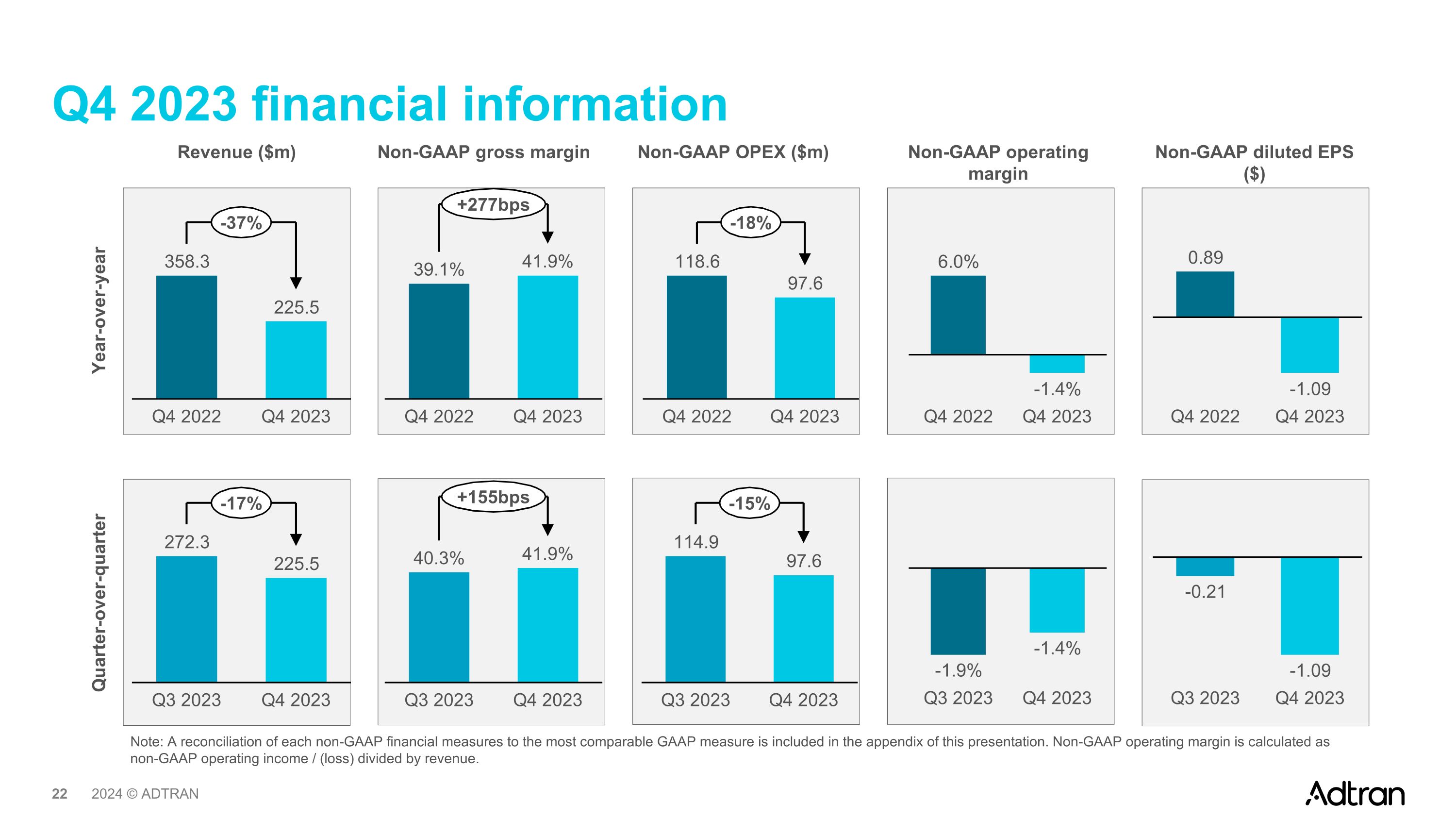

Q4 2023 financial information Q4 2022 Q4 2023 -37% Q4 2022 Q4 2023 39.1% 41.9% +277bps Q4 2022 Q4 2023 -18% Q4 2022 Q4 2023 Q4 2022 Q4 2023 Q3 2023 Q4 2023 -17% Q3 2023 Q4 2023 40.3% 41.9% +155bps Q3 2023 Q4 2023 -15% Q3 2023 Q4 2023 Q3 2023 Q4 2023 Revenue ($m) Non-GAAP gross margin Non-GAAP OPEX ($m) Non-GAAP operating margin Non-GAAP diluted EPS ($) Year-over-year Quarter-over-quarter Note: A reconciliation of each non-GAAP financial measures to the most comparable GAAP measure is included in the appendix of this presentation. Non-GAAP operating margin is calculated as non-GAAP operating income / (loss) divided by revenue.

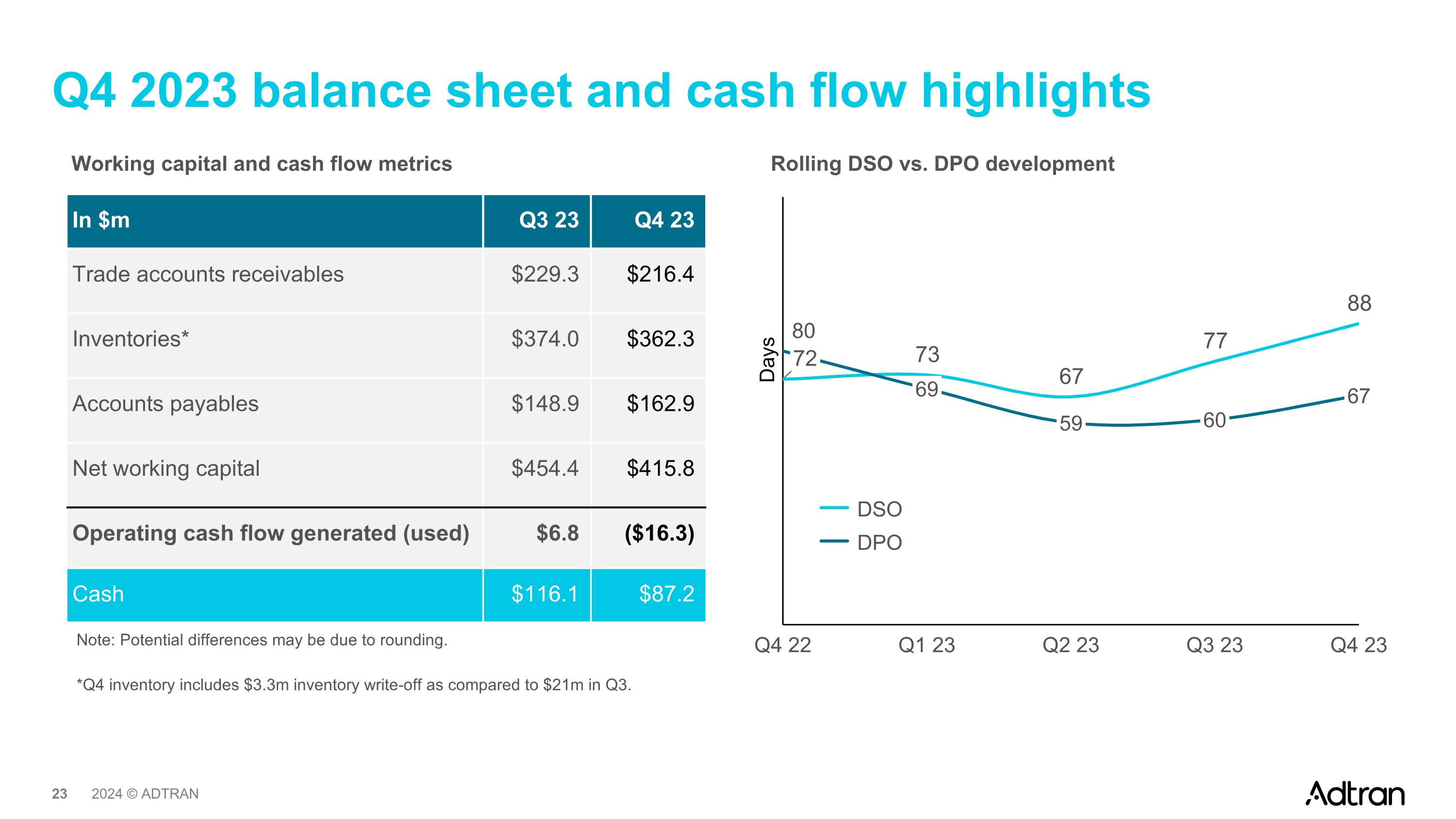

Q4 2023 balance sheet and cash flow highlights In $m Q3 23 Q4 23 Trade accounts receivables $229.3 $216.4 Inventories* $374.0 $362.3 Accounts payables $148.9 $162.9 Net working capital $454.4 $415.8 Operating cash flow generated (used) $6.8 ($16.3) Cash $116.1 $87.2 72 Q4 22 69 Q1 23 59 Q2 23 60 Q3 23 67 Q4 23 DSO DPO Working capital and cash flow metrics Rolling DSO vs. DPO development Note: Potential differences may be due to rounding. *Q4 inventory includes $3.3m inventory write-off as compared to $21m in Q3. Days

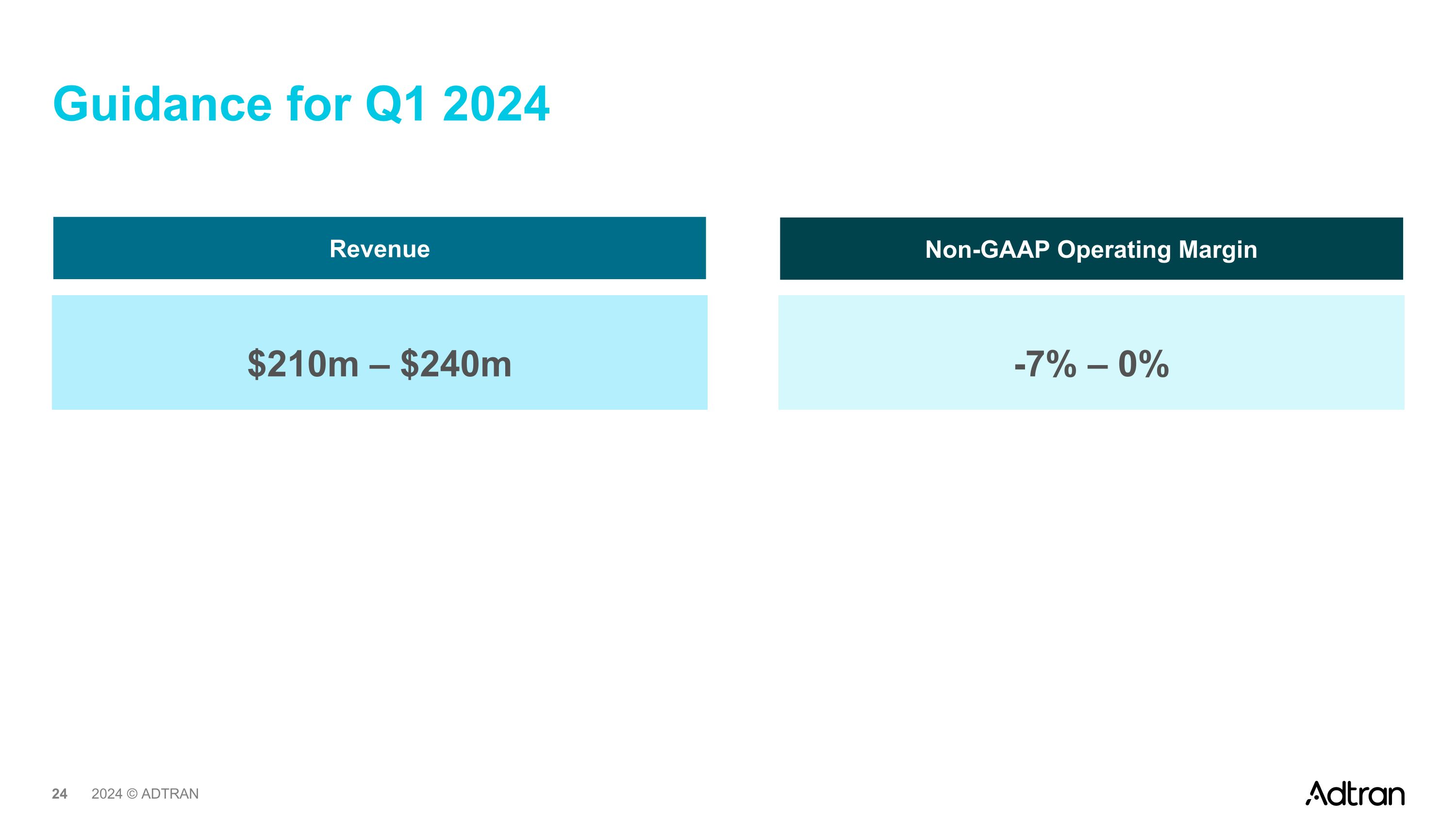

Guidance for Q1 2024 $210m – $240m Revenue -7% – 0% Non-GAAP Operating Margin

Appendix 6

Financial calendar 13-15 May, 2024 Equity Forum German Spring Conference 2024 Frankfurt 27 Feb, 2024 Fourth quarter 2023 earnings call, conference call

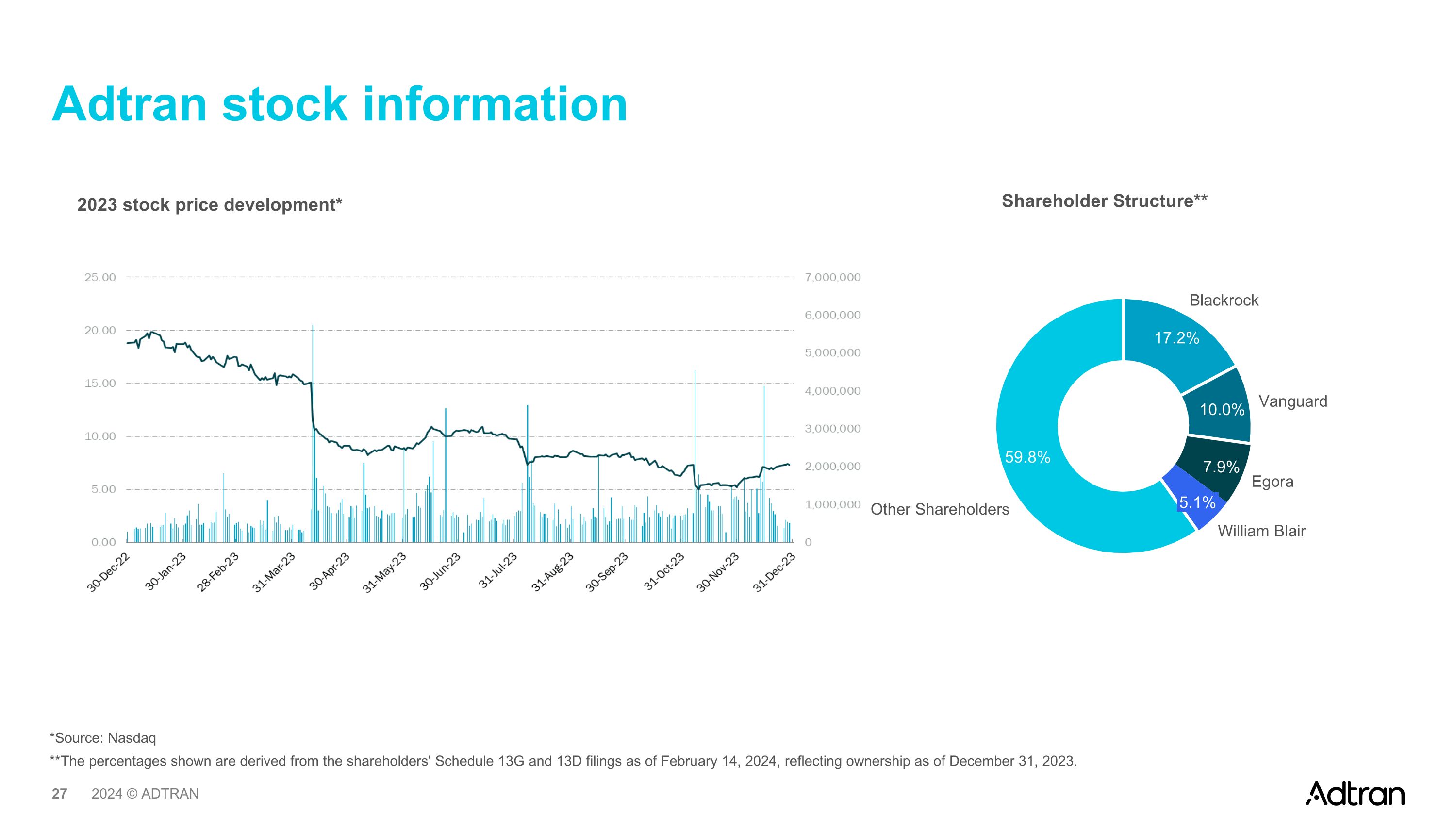

Adtran stock information Blackrock Vanguard Egora 5.1% William Blair Other Shareholders 2023 stock price development* Shareholder Structure** *Source: Nasdaq **The percentages shown are derived from the shareholders' Schedule 13G and 13D filings as of February 14, 2024, reflecting ownership as of December 31, 2023.

Explanation of Use of Non-GAAP Financial Measures Set forth in the tables below are reconciliations of gross profit, gross margin, operating expenses, operating loss, other (expense) income, net (loss) income inclusive of the non-controlling interest, net (loss) income attributable to the Company, net income (loss) attributable to the non-controlling interest, and (loss) earnings per share - basic and diluted, attributable to the Company, in each case as reported based on generally accepted accounting principles in the United States (“GAAP”), to non-GAAP gross profit, non-GAAP gross margin, non-GAAP operating expenses, non-GAAP operating (loss) income, non-GAAP other (expense) income, non-GAAP net (loss) income inclusive of the non-controlling interest, non-GAAP net (loss) income attributable to the Company, non-GAAP net income attributable to the non-controlling interest, and non-GAAP (loss) earnings per share - basic and diluted, attributable to the Company, respectively. Such non-GAAP measures exclude acquisition related expenses, amortization and adjustments (consisting of intangible amortization of backlog, developed technology, customer relationships, and trade names acquired in connection with business combinations and amortization of inventory fair value adjustments), stock-based compensation expense, amortization of pension actuarial losses, deferred compensation adjustments, integration expenses, restructuring expenses, asset and goodwill impairments, and the tax effect of these adjustments to net income. These measures are used by management in our ongoing planning and annual budgeting processes. Additionally, we believe the presentation of these non-GAAP measures when combined with the presentation of the most directly comparable GAAP financial measure, is beneficial to the overall understanding of ongoing operating performance of the Company. These non-GAAP financial measures are not prepared in accordance with, or an alternative for, GAAP and therefore should not be considered in isolation or as a substitution for analysis of our results as reported under GAAP. Additionally, our calculation of non-GAAP measures may not be comparable to similar measures calculated by other companies.

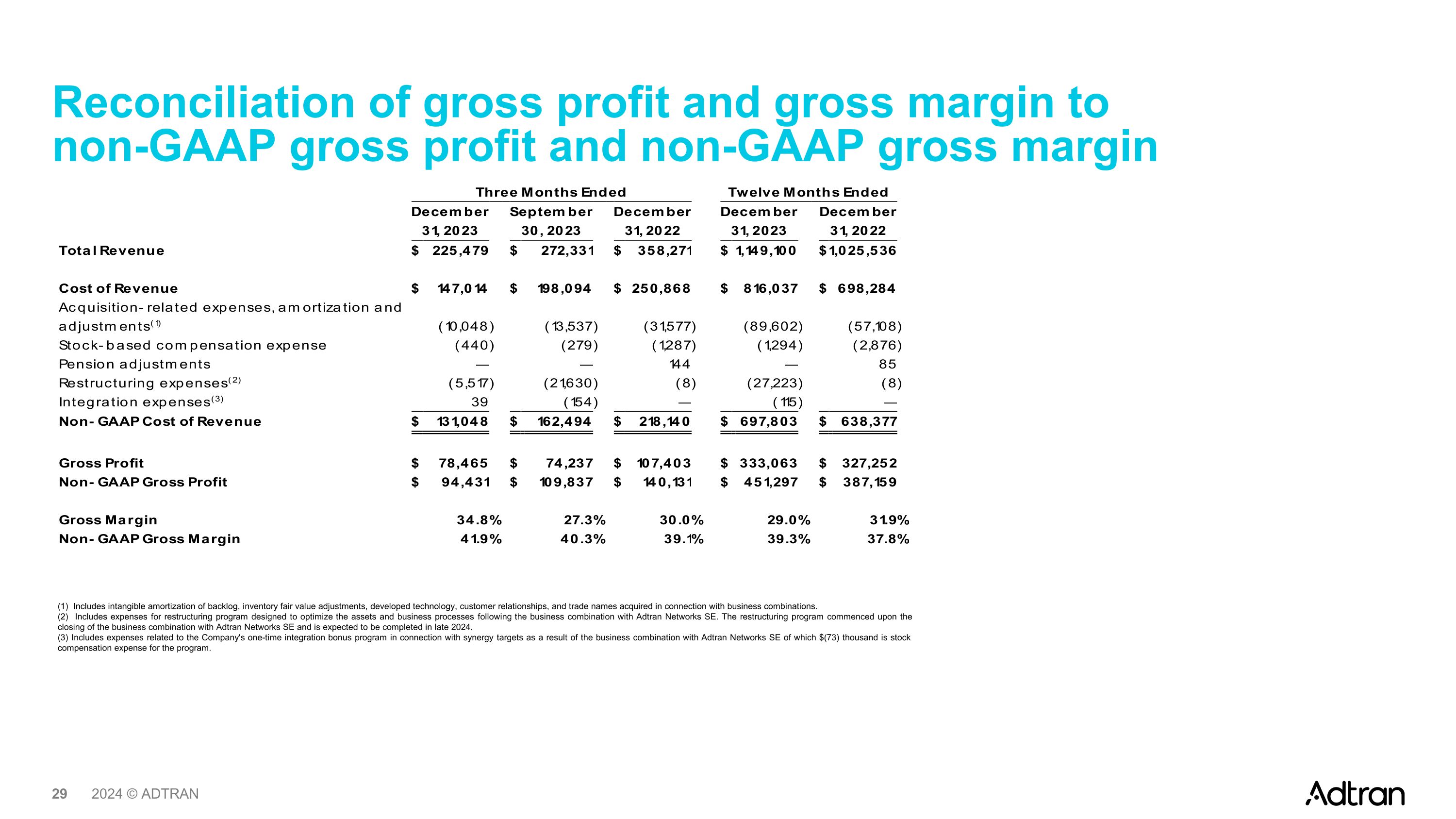

Reconciliation of gross profit and gross margin to non-GAAP gross profit and non-GAAP gross margin (1) Includes intangible amortization of backlog, inventory fair value adjustments, developed technology, customer relationships, and trade names acquired in connection with business combinations. (2) Includes expenses for restructuring program designed to optimize the assets and business processes following the business combination with Adtran Networks SE. The restructuring program commenced upon the closing of the business combination with Adtran Networks SE and is expected to be completed in late 2024. (3) Includes expenses related to the Company's one-time integration bonus program in connection with synergy targets as a result of the business combination with Adtran Networks SE of which $(73) thousand is stock compensation expense for the program.

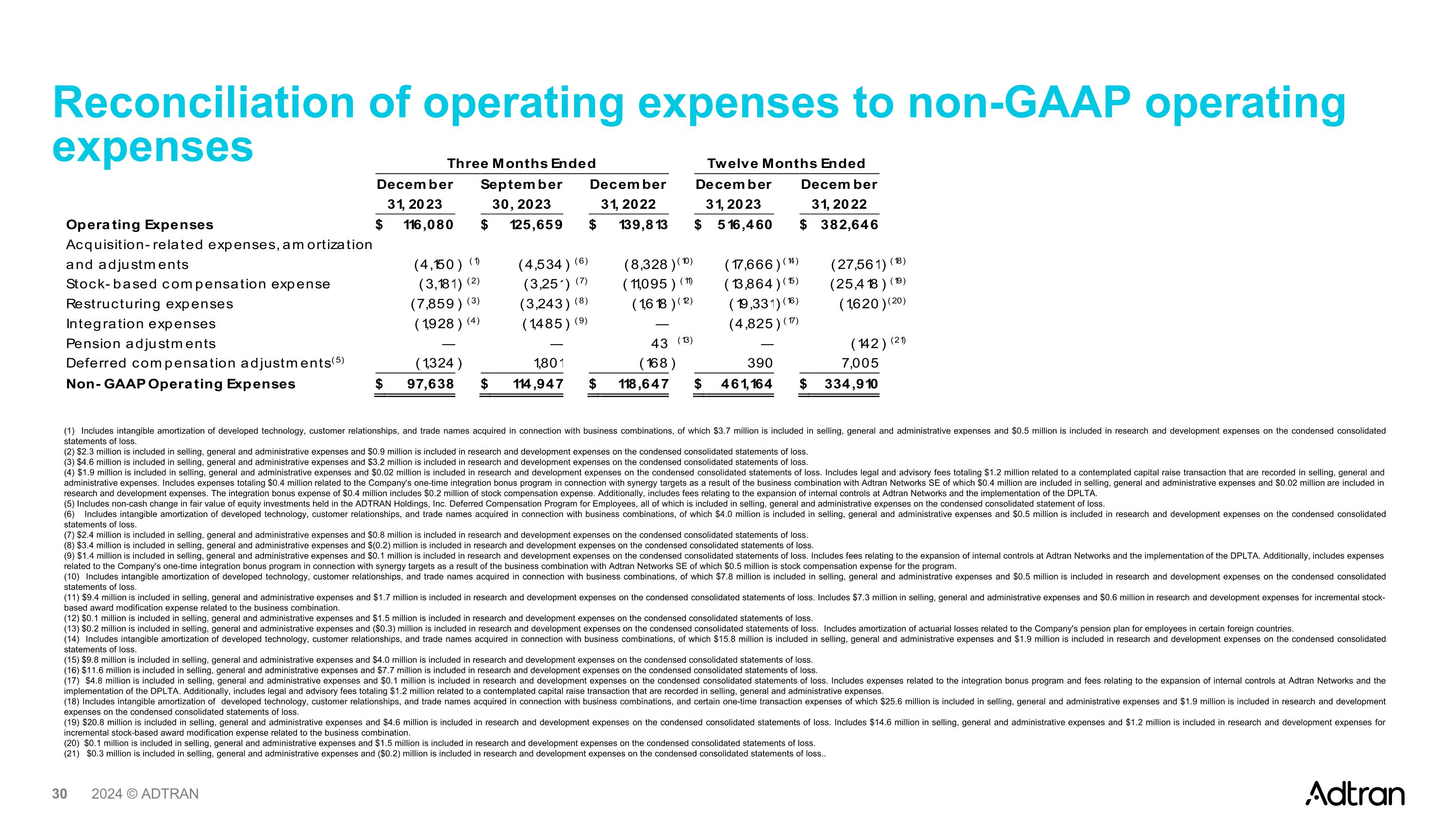

Reconciliation of operating expenses to non-GAAP operating expenses (1) Includes intangible amortization of developed technology, customer relationships, and trade names acquired in connection with business combinations, of which $3.7 million is included in selling, general and administrative expenses and $0.5 million is included in research and development expenses on the condensed consolidated statements of loss. (2) $2.3 million is included in selling, general and administrative expenses and $0.9 million is included in research and development expenses on the condensed consolidated statements of loss. (3) $4.6 million is included in selling, general and administrative expenses and $3.2 million is included in research and development expenses on the condensed consolidated statements of loss. (4) $1.9 million is included in selling, general and administrative expenses and $0.02 million is included in research and development expenses on the condensed consolidated statements of loss. Includes legal and advisory fees totaling $1.2 million related to a contemplated capital raise transaction that are recorded in selling, general and administrative expenses. Includes expenses totaling $0.4 million related to the Company's one-time integration bonus program in connection with synergy targets as a result of the business combination with Adtran Networks SE of which $0.4 million are included in selling, general and administrative expenses and $0.02 million are included in research and development expenses. The integration bonus expense of $0.4 million includes $0.2 million of stock compensation expense. Additionally, includes fees relating to the expansion of internal controls at Adtran Networks and the implementation of the DPLTA. (5) Includes non-cash change in fair value of equity investments held in the ADTRAN Holdings, Inc. Deferred Compensation Program for Employees, all of which is included in selling, general and administrative expenses on the condensed consolidated statement of loss. (6) Includes intangible amortization of developed technology, customer relationships, and trade names acquired in connection with business combinations, of which $4.0 million is included in selling, general and administrative expenses and $0.5 million is included in research and development expenses on the condensed consolidated statements of loss. (7) $2.4 million is included in selling, general and administrative expenses and $0.8 million is included in research and development expenses on the condensed consolidated statements of loss. (8) $3.4 million is included in selling, general and administrative expenses and $(0.2) million is included in research and development expenses on the condensed consolidated statements of loss. (9) $1.4 million is included in selling, general and administrative expenses and $0.1 million is included in research and development expenses on the condensed consolidated statements of loss. Includes fees relating to the expansion of internal controls at Adtran Networks and the implementation of the DPLTA. Additionally, includes expenses related to the Company's one-time integration bonus program in connection with synergy targets as a result of the business combination with Adtran Networks SE of which $0.5 million is stock compensation expense for the program. (10) Includes intangible amortization of developed technology, customer relationships, and trade names acquired in connection with business combinations, of which $7.8 million is included in selling, general and administrative expenses and $0.5 million is included in research and development expenses on the condensed consolidated statements of loss. (11) $9.4 million is included in selling, general and administrative expenses and $1.7 million is included in research and development expenses on the condensed consolidated statements of loss. Includes $7.3 million in selling, general and administrative expenses and $0.6 million in research and development expenses for incremental stock-based award modification expense related to the business combination. (12) $0.1 million is included in selling, general and administrative expenses and $1.5 million is included in research and development expenses on the condensed consolidated statements of loss. (13) $0.2 million is included in selling, general and administrative expenses and ($0.3) million is included in research and development expenses on the condensed consolidated statements of loss. Includes amortization of actuarial losses related to the Company's pension plan for employees in certain foreign countries. (14) Includes intangible amortization of developed technology, customer relationships, and trade names acquired in connection with business combinations, of which $15.8 million is included in selling, general and administrative expenses and $1.9 million is included in research and development expenses on the condensed consolidated statements of loss. (15) $9.8 million is included in selling, general and administrative expenses and $4.0 million is included in research and development expenses on the condensed consolidated statements of loss. (16) $11.6 million is included in selling, general and administrative expenses and $7.7 million is included in research and development expenses on the condensed consolidated statements of loss. (17) $4.8 million is included in selling, general and administrative expenses and $0.1 million is included in research and development expenses on the condensed consolidated statements of loss. Includes expenses related to the integration bonus program and fees relating to the expansion of internal controls at Adtran Networks and the implementation of the DPLTA. Additionally, includes legal and advisory fees totaling $1.2 million related to a contemplated capital raise transaction that are recorded in selling, general and administrative expenses. (18) Includes intangible amortization of developed technology, customer relationships, and trade names acquired in connection with business combinations, and certain one-time transaction expenses of which $25.6 million is included in selling, general and administrative expenses and $1.9 million is included in research and development expenses on the condensed consolidated statements of loss. (19) $20.8 million is included in selling, general and administrative expenses and $4.6 million is included in research and development expenses on the condensed consolidated statements of loss. Includes $14.6 million in selling, general and administrative expenses and $1.2 million is included in research and development expenses for incremental stock-based award modification expense related to the business combination. (20) $0.1 million is included in selling, general and administrative expenses and $1.5 million is included in research and development expenses on the condensed consolidated statements of loss. (21) $0.3 million is included in selling, general and administrative expenses and ($0.2) million is included in research and development expenses on the condensed consolidated statements of loss..

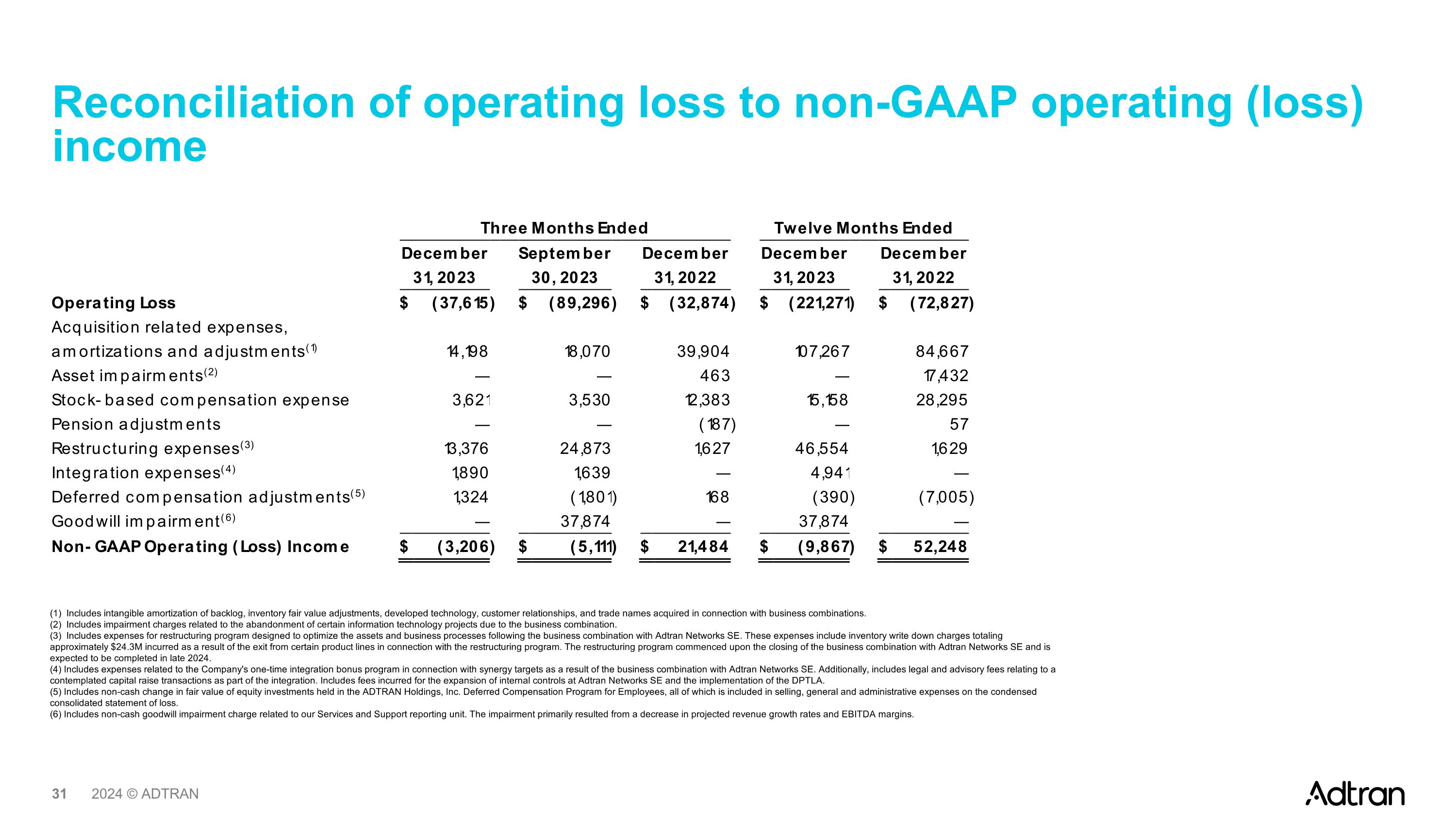

Reconciliation of operating loss to non-GAAP operating (loss) income (1) Includes intangible amortization of backlog, inventory fair value adjustments, developed technology, customer relationships, and trade names acquired in connection with business combinations. (2) Includes impairment charges related to the abandonment of certain information technology projects due to the business combination. (3) Includes expenses for restructuring program designed to optimize the assets and business processes following the business combination with Adtran Networks SE. These expenses include inventory write down charges totaling approximately $24.3M incurred as a result of the exit from certain product lines in connection with the restructuring program. The restructuring program commenced upon the closing of the business combination with Adtran Networks SE and is expected to be completed in late 2024. (4) Includes expenses related to the Company's one-time integration bonus program in connection with synergy targets as a result of the business combination with Adtran Networks SE. Additionally, includes legal and advisory fees relating to a contemplated capital raise transactions as part of the integration. Includes fees incurred for the expansion of internal controls at Adtran Networks SE and the implementation of the DPTLA. (5) Includes non-cash change in fair value of equity investments held in the ADTRAN Holdings, Inc. Deferred Compensation Program for Employees, all of which is included in selling, general and administrative expenses on the condensed consolidated statement of loss. (6) Includes non-cash goodwill impairment charge related to our Services and Support reporting unit. The impairment primarily resulted from a decrease in projected revenue growth rates and EBITDA margins.

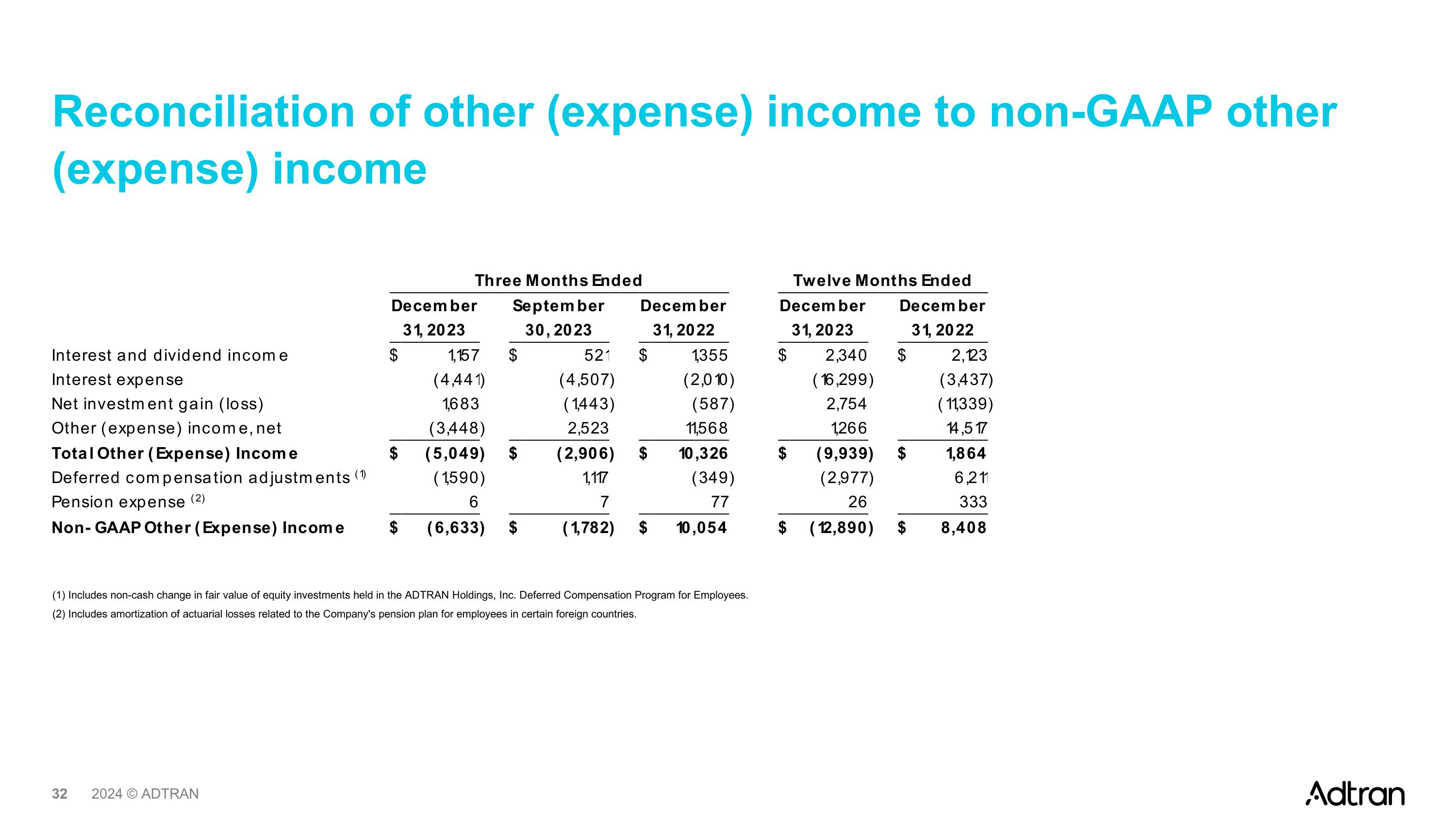

Reconciliation of other (expense) income to non-GAAP other (expense) income (1) Includes non-cash change in fair value of equity investments held in the ADTRAN Holdings, Inc. Deferred Compensation Program for Employees. (2) Includes amortization of actuarial losses related to the Company's pension plan for employees in certain foreign countries.

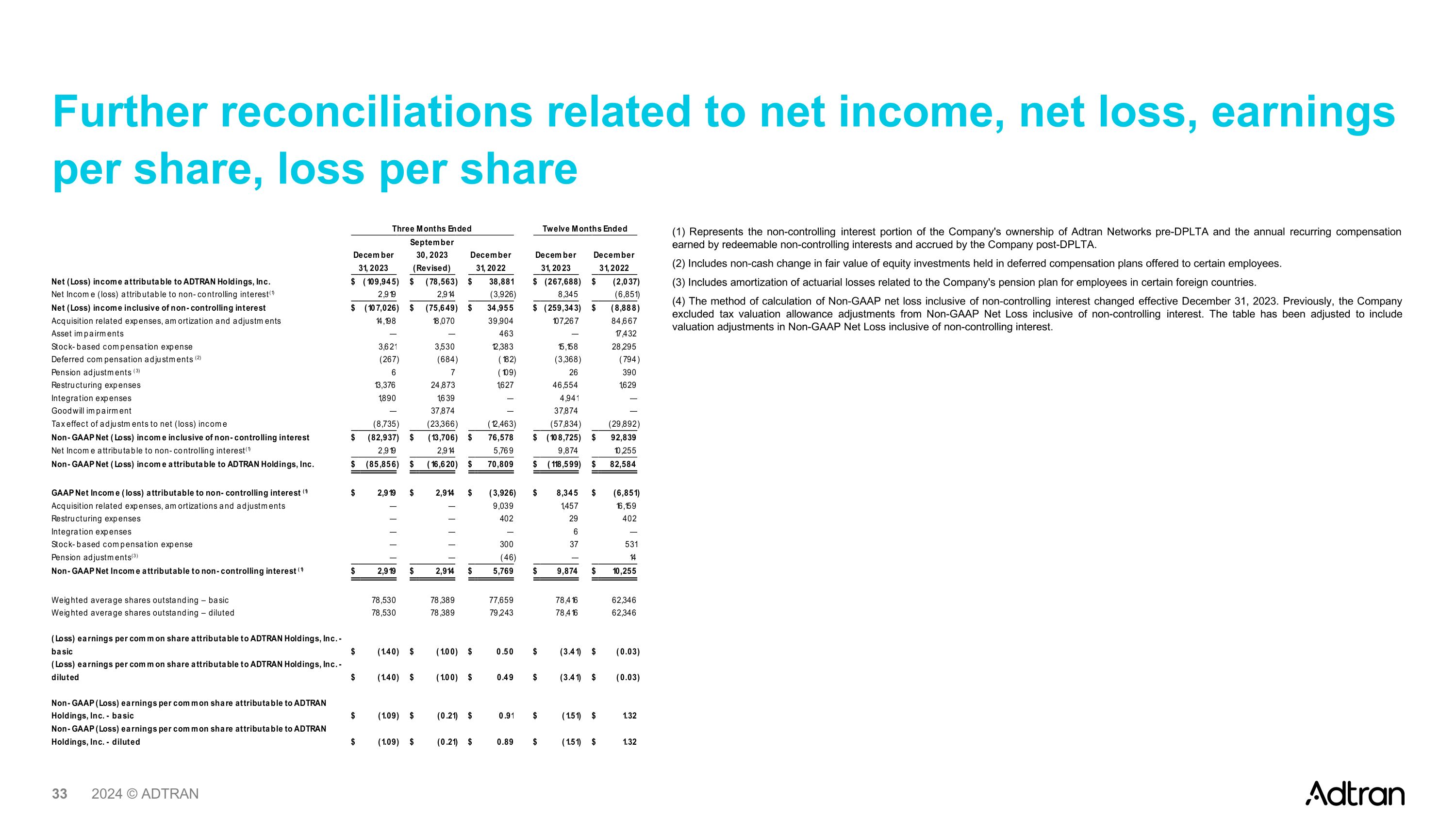

Further reconciliations related to net income, net loss, earnings per share, loss per share (1) Represents the non-controlling interest portion of the Company's ownership of Adtran Networks pre-DPLTA and the annual recurring compensation earned by redeemable non-controlling interests and accrued by the Company post-DPLTA. (2) Includes non-cash change in fair value of equity investments held in deferred compensation plans offered to certain employees. (3) Includes amortization of actuarial losses related to the Company's pension plan for employees in certain foreign countries. (4) The method of calculation of Non-GAAP net loss inclusive of non-controlling interest changed effective December 31, 2023. Previously, the Company excluded tax valuation allowance adjustments from Non-GAAP Net Loss inclusive of non-controlling interest. The table has been adjusted to include valuation adjustments in Non-GAAP Net Loss inclusive of non-controlling interest.

Thank you

EXHIBIT 99.3

Supplemental Non-GAAP Financial Measures

ADTRAN Holdings, Inc. (the “Company”) is providing the following tables to present certain non-GAAP information for the reporting periods covered in the Company’s Quarterly Reports on Form 10-Q/A (the “Amended Quarterly Reports”) for the quarters ended March 31, 2023, June 30, 2023 and September 30, 2023, which were filed with the Securities and Exchange Commission on March 14, 2024.

As previously reported, the Company filed the Amended Quarterly Reports in order to, among other items, restate the presentation of the results attributable to the non-controlling interest, net loss attributable to the Company, and loss per common share attributable to the Company for each of the reporting periods covered by the Amended Quarterly Reports (collectively, the “Non-Reliance Periods”). In addition to results prepared in accordance with U.S. generally accepted accounting principles (“GAAP”) presented in the Amended Quarterly Reports’ financial statements, the Company provides herein corrected non-GAAP measures and reconciliation tables for non-GAAP net loss attributable to the Company, non-GAAP net (loss) income attributable to the non-controlling interest, and non-GAAP loss per share - basic and diluted, attributable to the Company for each of the Non-Reliance Periods. No other non-GAAP measures were affected by the restatements to the Company’s financial statements for the Non-Reliance Periods.

Set forth in the tables below are reconciliations of net (loss) income inclusive of the non-controlling interest, net income (loss) attributable to the non-controlling interest, net (loss) income attributable to the Company, and (loss) earnings per share - basic and diluted, attributable to the Company, in each case as reported based on GAAP, to non-GAAP net (loss) income inclusive of the non-controlling interest, non-GAAP net income attributable to the non-controlling interest, non-GAAP net (loss) income attributable to the Company, and non-GAAP (loss) earnings per share - basic and diluted, attributable to the Company, respectively. Such non-GAAP measures exclude acquisition related expenses, amortization and adjustments (consisting of intangible amortization of backlog, developed technology, customer relationships, and trade names acquired in connection with business combinations and amortization of inventory fair value adjustments), stock-based compensation expense, amortization of pension actuarial losses, deferred compensation adjustments, integration expenses, restructuring expenses, goodwill impairments, and the tax effect of these adjustments to net income. These measures are used by management in our ongoing planning and annual budgeting processes. Additionally, we believe the presentation of these non-GAAP measures when combined with the presentation of the most directly comparable GAAP financial measure, is beneficial to the overall understanding of ongoing operating performance of the Company.

These non-GAAP financial measures are not prepared in accordance with, or an alternative for, GAAP and therefore should not be considered in isolation or as a substitution for analysis of our results as reported under GAAP. Additionally, our calculation of non-GAAP measures may not be comparable to similar measures calculated by other companies.

Supplemental Information

Reconciliation of Net Loss inclusive of Non-Controlling Interest to

Non-GAAP Net Loss inclusive of Non-Controlling Interest

(Unaudited)

and

Reconciliation of Net Loss attributable to Non-Controlling Interest to

Non-GAAP Net Income attributable to Non-Controlling Interest

(Unaudited)

and

Reconciliation of Net Loss attributable to ADTRAN Holdings, Inc. and

Loss per Common Share attributable to ADTRAN Holdings, Inc. – Basic and Diluted to

Non-GAAP Net Loss attributable to ADTRAN Holdings, Inc. and

Non-GAAP Loss per Common Share attributable to ADTRAN Holdings, Inc. – Basic and Diluted

(Unaudited)

(In thousands, except per share amounts)

|

|

For the Three Months Ended |

|

|

|||||||||

|

|

As Reported |

|

|

Adjustment |

|

|

As Restated |

|

|

|||

Net Loss attributable to ADTRAN Holdings, Inc. |

|

$ |

(34,464 |

) |

|

$ |

(5,619 |

) |

|

$ |

(40,083 |

) |

|

Net Loss attributable to non-controlling interest(1) |

|

|

(5,989 |

) |

|

|

5,619 |

|

|

|

(370 |

) |

|

Net Loss inclusive of non-controlling interest |

|

$ |

(40,453 |

) |

|

$ |

— |

|

|

$ |

(40,453 |

) |

|

Acquisition related expenses, amortization and adjustments |

|

|

37,162 |

|

|

|

— |

|

|

|

37,162 |

|

|

Stock-based compensation expense |

|

|

3,698 |

|

|

|

— |

|

|

|

3,698 |

|

|

Deferred compensation adjustments (2) |

|

|

(856 |

) |

|

|

— |

|

|

|

(856 |

) |

|

Pension adjustments (3) |

|

|

7 |

|

|

|

— |

|

|

|

7 |

|

|

Restructuring expenses |

|

|

2,437 |

|

|

|

— |

|

|

|

2,437 |

|

|

Integration expenses |

|

|

849 |

|

|

|

— |

|

|

|

849 |

|

|

Tax effect of adjustments to net loss |

|

|

(12,307 |

) |

|

|

— |

|

|

|

(12,307 |

) |

|

Non-GAAP Net Loss inclusive of non-controlling interest(4) |

|

$ |

(9,463 |

) |

|

$ |

— |

|

|

$ |

(9,463 |

) |

|

Less: Non-GAAP Net (Loss) Income attributable to non-controlling interest(1) |

|

|

(4,460 |

) |

|

|

5,619 |

|

|

|

1,159 |

|

|

Non-GAAP Net Loss attributable to ADTRAN Holdings, Inc. |

|

$ |

(5,003 |

) |

|

$ |

(5,619 |

) |

|

$ |

(10,622 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|||

GAAP Net Loss attributable to non-controlling interest (1) |

|

$ |

(5,989 |

) |

|

$ |

5,619 |

|

|

$ |

(370 |

) |

|

Acquisition related expenses, amortizations and adjustments |

|

|

1,457 |

|

|

|

— |

|

|

|

1,457 |

|

|

Restructuring expenses |

|

|

29 |

|

|

|

— |

|

|

|

29 |

|

|

Integration expenses |

|

|

6 |

|

|

|

— |

|

|

|

6 |

|

|

Stock-based compensation expense |

|

|

37 |

|

|

|

— |

|

|

|

37 |

|

|

Non-GAAP Net (Loss) Income attributable to non-controlling interest (1) |

|

$ |

(4,460 |

) |

|

$ |

5,619 |

|

|

$ |

1,159 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Weighted average shares outstanding – basic |

|

|

78,358 |

|

|

|

78,358 |

|

|

|

78,358 |

|

|

Weighted average shares outstanding – diluted |

|

|

78,358 |

|

|

|

78,358 |

|

|

|

78,358 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Loss per common share attributable to ADTRAN Holdings, Inc. - basic |

|

$ |

(0.44 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.51 |

) |

|

Loss per common share attributable to ADTRAN Holdings, Inc. - diluted |

|

$ |

(0.44 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.51 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|||

Non-GAAP Loss per common share attributable to ADTRAN Holdings, Inc. - basic |

|

$ |

(0.06 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.14 |

) |

|

Non-GAAP Loss per common share attributable to ADTRAN Holdings, Inc. - diluted |

|

$ |

(0.06 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.14 |

) |

|

(1) Represents the non-controlling interest portion of the Company's ownership of Adtran Networks pre-DPLTA and the annual recurring compensation earned by redeemable non-controlling interests and accrued by the Company post-DPLTA.

(2) Includes non-cash change in fair value of equity investments held in deferred compensation plans offered to certain employees.

(3) Includes amortization of actuarial losses related to the Company's pension plan for employees in certain foreign countries.

(4) The method of calculation of Non-GAAP net loss inclusive of non-controlling interest changed effective December 31, 2023. Previously, the Company excluded tax valuation allowance adjustments from Non-GAAP Net Loss inclusive of non-controlling interest. The table has been adjusted to include valuation allowance adjustments in Non-GAAP Net Loss inclusive of non-controlling interest.

Supplemental Information

Reconciliation of Loss inclusive of Non-Controlling Interest to

Non-GAAP Net Loss inclusive of Non-Controlling Interest

(Unaudited)

and

Reconciliation of Net Income attributable to Non-Controlling Interest to

Non-GAAP Net Income attributable to Non-Controlling Interest

(Unaudited)

and

Reconciliation of Net Loss attributable to ADTRAN Holdings, Inc. and

Loss per Common Share attributable to ADTRAN Holdings, Inc. – Basic and Diluted to

Non-GAAP Net Loss attributable to ADTRAN Holdings, Inc. and

Non-GAAP Loss per Common Share attributable to ADTRAN Holdings, Inc. – Basic and Diluted

(Unaudited)

(In thousands, except per share amounts)

|

|

For the Three Months Ended |

|

|

For the Six Months Ended |

|

|

||||||||||||||||||

|

|

As Reported |

|

|

Adjustment |

|

|

As Restated |

|

|

As Reported |

|

|

Adjustment |

|

|

As Restated |

|

|

||||||

Net Loss attributable to ADTRAN Holdings, Inc. |

|

$ |

(33,334 |

) |

|

$ |

(5,762 |

) |

|

$ |

(39,096 |

) |

|

$ |

(67,798 |

) |

|

$ |

(11,382 |

) |

|

$ |

(79,180 |

) |

|

Net (Loss) Income attributable to non-controlling interest(1) |

|

|

(2,881 |

) |

|

|

5,762 |

|

|

|

2,881 |

|

|

|

(8,870 |

) |

|

|

11,382 |

|

|

|

2,512 |

|

|

Net Loss inclusive of non-controlling interest |

|

$ |

(36,215 |

) |

|

$ |

— |

|

|

$ |

(36,215 |

) |

|

$ |

(76,668 |

) |

|

$ |

— |

|

|

$ |

(76,668 |

) |

|

Acquisition related expenses, amortization and adjustments |

|

|

37,837 |

|

|

|

— |

|

|

|

37,837 |

|

|

|

74,999 |

|

|

|

— |

|

|

|

74,999 |

|

|

Stock-based compensation expense |

|

|

4,309 |

|

|

|

— |

|

|

|

4,309 |

|

|

|

8,007 |

|

|

|

— |

|

|

|

8,007 |

|

|

Deferred compensation adjustments (2) |

|

|

(1,561 |

) |

|

|

— |

|

|

|

(1,561 |

) |

|

|

(2,417 |

) |

|

|

— |

|

|

|

(2,417 |

) |

|

Pension adjustments (3) |

|

|

6 |

|

|

|

— |

|

|

|

6 |

|

|

|

13 |

|

|

|

— |

|

|

|

13 |

|

|

Restructuring expenses |

|

|

5,868 |

|

|

|

— |

|

|

|

5,868 |

|

|

|

8,305 |

|

|

|

— |

|

|

|

8,305 |

|

|

Integration expenses |

|

|

563 |

|

|

|

— |

|

|

|

563 |

|

|

|

1,412 |

|

|

|

— |

|

|

|

1,412 |

|

|

Goodwill impairment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Tax effect of adjustments to net loss |

|

|

(13,426 |

) |

|

|

— |

|

|

|

(13,426 |

) |

|

|

(25,733 |

) |

|

|

— |

|

|

|

(25,733 |

) |

|

Non-GAAP Net Loss inclusive of non-controlling interest(4) |

|

$ |

(2,619 |

) |

|

$ |

— |

|

|

$ |

(2,619 |

) |

|

$ |

(12,082 |

) |

|

$ |

- |

|

|

$ |

(12,082 |

) |

|

Less: Non-GAAP Net (Loss) Income attributable to non-controlling interest(1) |

|

|

(2,881 |

) |

|

|

5,762 |

|

|

|

2,881 |

|

|

|

(7,341 |

) |

|

|

11,382 |

|

|

|

4,041 |

|

|

Non-GAAP Net Income (Loss) attributable to ADTRAN Holdings, Inc. |

|

$ |

262 |

|

|

$ |

(5,762 |

) |

|

$ |

(5,500 |

) |

|

$ |

(4,741 |

) |

|

$ |

(11,382 |

) |

|

$ |

(16,123 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

GAAP Net (loss) Income attributable to non-controlling interest (1) |

|

$ |

(2,881 |

) |

|

$ |

5,762 |

|

|

$ |

2,881 |

|

|

$ |

(8,870 |

) |

|

$ |

11,382 |

|

|

$ |

2,512 |

|

|

Acquisition related expenses, amortizations and adjustments |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,457 |

|

|

|

— |

|

|

|

1,457 |

|

|

Restructuring expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

29 |

|

|

|

— |

|

|

|

29 |

|

|

Integration expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

6 |

|

|

|

— |

|

|

|

6 |

|

|

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

37 |

|

|

|

— |

|

|

|

37 |

|

|

Non-GAAP Net (Loss) Income attributable to non-controlling interest (1) |

|

$ |

(2,881 |

) |

|

$ |

5,762 |

|

|

$ |

2,881 |

|

|

$ |

(7,341 |

) |

|

$ |

11,382 |

|

|

$ |

4,041 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Weighted average shares outstanding – basic |

|

|

78,366 |

|

|

|

78,366 |

|

|

|

78,366 |

|

|

|

78,364 |

|

|

|

78,364 |

|

|

|

78,364 |

|

|

Weighted average shares outstanding – diluted |

|

|

78,366 |

|

|

|

78,366 |

|

|

|

78,366 |

|

|

|

78,364 |

|

|

|

78,364 |

|

|

|

78,364 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Loss per common share attributable to ADTRAN Holdings, Inc. - basic |

|

$ |

(0.43 |

) |

|