UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

OR

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission file number: 1-36313

METALLUS INC.

(Exact name of registrant as specified in its charter)

|

||

|

|

|

Ohio |

|

46-4024951 |

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

1835 Dueber Avenue SW, Canton, OH |

|

44706 |

(Address of principal executive offices) |

|

(Zip Code) |

330.471.7000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934:

Title of each class |

|

Trading symbol |

|

Name of exchange in which registered |

Common shares |

|

MTUS |

|

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this Chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

☒ |

|

Accelerated filer |

☐ |

Non-accelerated filer |

☐ |

|

Smaller reporting company |

☐ |

|

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial reporting accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of June 30, 2023, the aggregate market value of the registrant’s common stock held by non-affiliates was $903,279,470 based on the closing sale price as reported on the New York Stock Exchange for that date.

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

Class |

|

Outstanding at February 15, 2024 |

Common Shares, without par value |

|

43,889,467 |

DOCUMENTS INCORPORATED BY REFERENCE

Document |

|

Parts Into Which Incorporated |

Proxy Statement for the 2024 Annual Meeting of Shareholders |

|

Part III |

Metallus Inc.

Table of Contents

2

Part I.

Item 1. Business

Overview

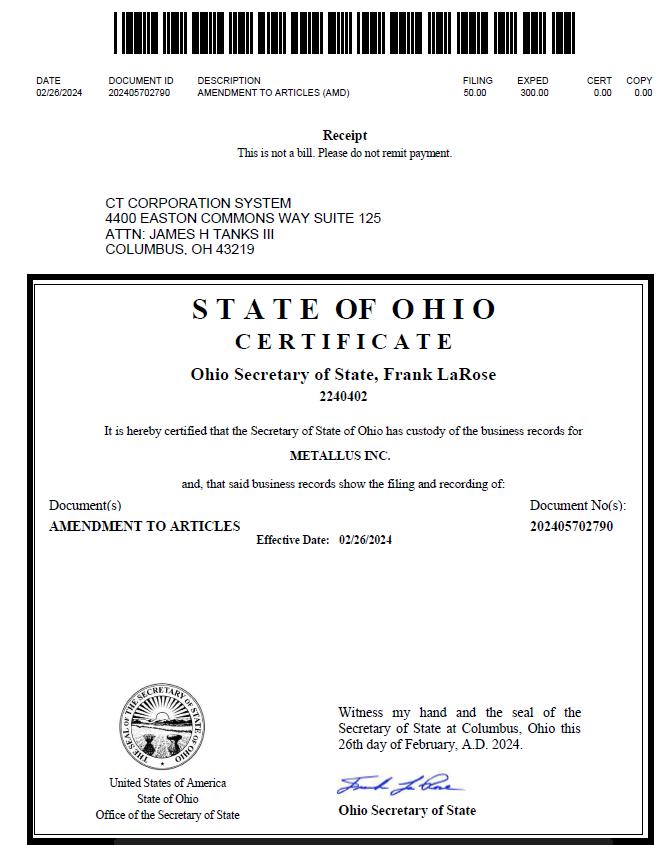

Metallus Inc., formerly known as TimkenSteel Corporation, ("we", "us", "our", the "Company" or "Metallus") was incorporated in Ohio on October 24, 2013, and became an independent, publicly traded company as the result of a spinoff from The Timken Company ("Timken") on June 30, 2014. In the spinoff, Timken transferred to us all of the assets and generally all of the liabilities related to Timken’s steel business. On January 10, 2024, the Company announced its intent to change the name to Metallus, which became effective on February 26, 2024.

We manufacture alloy steel, as well as carbon and micro-alloy steel, using electric arc furnace ("EAF") technology. Our portfolio includes special bar quality (“SBQ”) bars, seamless mechanical tubing (“tubes”), manufactured components such as precision steel components, and billets. Additionally, we manage raw material recycling programs, which are used internally as a feeder system for our melt operations and allow us to sell scrap not used in our operations to third parties. Our products and solutions are used in a diverse range of demanding applications in the following end-markets: industrial; automotive; aerospace & defense; and energy.

SBQ steel is made to restrictive chemical compositions and high internal purity levels and is used in critical mechanical applications. We make these products from nearly 100% recycled steel, using our expertise in raw materials to create high-quality specialty metal products. We focus on creating tailored products for our respective end-markets. Our engineers are experts in both materials and applications, so we can work closely with each customer to deliver flexible solutions related to our products as well as to their applications and supply chains.

The SBQ bar, tube, and billet production processes take place at our Canton, Ohio manufacturing location. This location accounts for all of the SBQ bars, seamless mechanical tubes and billets we produce and includes three manufacturing facilities: the Faircrest, Harrison, and Gambrinus facilities. Our production of manufactured components takes place at two downstream manufacturing facilities: Tryon Peak (Columbus, North Carolina) and St. Clair (Eaton, Ohio). Many of the production processes are integrated, and the manufacturing facilities produce products that are sold in all of our end-markets. As a result, investments in our facilities and resource allocation decisions affecting our operations are designed to benefit the overall business, not any specific aspect of the business.

Our annual melt capacity is approximately 1.2 million tons and our shipment capacity is approximately 0.9 million tons.

Operating Segments

We conduct our business activities and report financial results as one business segment. The presentation of financial results as one reportable segment is consistent with the way we operate our business and is consistent with the manner in which the Chief Operating Decision Maker ("CODM") evaluates performance and makes resource and operating decisions for the business as described above. Furthermore, the Company notes that monitoring financial results as one reportable segment helps the CODM manage costs on a consolidated basis, consistent with the integrated nature of our operations.

Industry Segments and Geographical Financial Information

Information required by this Item is incorporated herein by reference to “Note 3 - Segment Information” in the Notes to the Consolidated Financial Statements.

Strengths and Strategy

Our customers are at the core of everything we do, from how we make our strong, sustainable steel to the markets we serve.

We bring to every project a greater understanding of metallurgy and the critical elements required for a quality product. We prioritize collaboration with our customers to ensure that the solutions we deliver meet their specifications and expectations. From design to delivery, and beyond, our knowledgeable customer service team supports the entire project lifecycle to keep our customers informed and preserve lasting partnerships.

3

Special bar quality (SBQ) steel is our niche, and our capabilities extend into tubing and manufactured components. Our customers benefit from our expertise; over 70% of our sales representatives, account managers, and technical service team members have engineering backgrounds. We apply this knowledge through product design and investments in our manufacturing capabilities. We also care about our customers, and provide tailored solutions built on a technical foundation through our:

Major Customers

We sell products and services that are used in a range of demanding applications around the world. We have approximately 350 diverse customers in the following end-markets: industrial; automotive; aerospace & defense; and energy. No one customer accounted for 10% or more of net sales in 2023.

Products

We believe we produce some of the cleanest, highest performing alloy air-melted steels in the world for our customers’ most demanding applications. We leverage our technical knowledge, development expertise and production and engineering capabilities across all of our products and end-markets to deliver high-performance products to our customers.

SBQ Steel Bar, Seamless Mechanical Steel Tubes, and Billets. Our focus is on alloy steel, although in total we manufacture more than 500 grades of high-performance alloy, carbon, and micro-alloy steel, sold as bars, tubes and billets. These products are custom-made in a variety of chemistries, lengths and finishes. Our metallurgical expertise and what we believe to be unique operational capabilities drive high-value solutions for industrial, automotive, aerospace & defense and energy customers. Our specialty metals are featured in a wide variety of end products including: gears; hubs; axles; crankshafts and motor shafts; oil country drill pipe; bits and collars; bearing races and rolling elements; bushings; fuel injectors; wind energy shafts; anti-friction bearings; artillery and mortar bodies; and other demanding applications where mechanical power transmission is critical to the end customer.

Manufactured Components. In addition to our customized steels, we also custom-make precision components that provide us with the opportunity to further expand our market for bar and tube products and capture additional sales. These products provide customers, especially those in the automotive end-market, with ready-to-finish components that simplify vendor management, streamline supply chains and often cost less than other alternatives. We also customize products and services for the industrial, aerospace & defense and energy end-markets.

Sales and Distribution

Our sales force is made up largely of engineers that are backed by a team of metallurgists and other technical experts. While most of our products are sold directly to original equipment ("OE") manufacturers, a portion of our sales are made through authorized distributors and steel service centers, representing approximately 25% of net sales during 2023. The majority of our customers are served through individually negotiated price agreements.

Competition

The steel industry, both domestically and globally, is highly competitive and is expected to remain so. Maintaining high standards of asset reliability, product quality and customer service, while keeping production costs competitive, is essential to our ability to compete with domestic and foreign manufacturers of alloy steel and mechanical components. For bar products less than 6-inch in diameter, the primary competitor is foreign-owned domestic producer Gerdau Special Steel North America (a unit of Brazilian steelmaker Gerdau, S.A). For bar products up to 9-inch in diameter, domestic producers Steel Dynamics, Inc. and Nucor Corporation (in some cases up to 10-inch) are our principal competitors. For very large bars from 10 to 16 inches in diameter, offshore producers as well as specialty forging companies in North America such as Scot Forge and Frisa are the primary competitors.

4

For seamless mechanical tubing, offshore producers such as Tenaris, S.A., Vallourec, S.A. and TMK Group are our primary competitors, as well as the foreign-owned domestic producer ArcelorMittal Tubular Products (a unit of Luxembourg-based ArcelorMittal, S.A.). We also provide unique manufactured steel products and supply chain solutions to our customers in the industrial, automotive, aerospace & defense and energy end-markets. Manufactured component competitors include both integrated and non-integrated component producers.

Lead Time

The lead time for our products varies based on product type and specifications. As of the date of this filing, our lead times for bar products currently extend to April and tube product lead times extend into May 2024.

Raw Materials

The principal raw materials that we use to manufacture steel are recycled scrap metal, chrome, nickel, molybdenum oxide, vanadium and other alloy materials. Raw materials comprise a significant portion of the steelmaking cost structure and are subject to price and availability changes due to global demand fluctuations and local supply limitations. Proper selection and management of raw materials can have a significant impact on procurement cost, steelmaking energy costs, mill productivity and ability to adapt to supply chain constraints. In addition to accessing scrap and alloys through the open market, we have established a scrap return supply chain with many of our customers. This part of our business leverages our knowledge of the raw material supply industry and an extensive network of relationships that result in steady, reliable supply from our raw material sources.

In the ordinary course of business, we are exposed to the volatility of the costs of our raw materials. For example, the impact of global conflicts could exacerbate inflationary pressures throughout the global economy and lead to potential market disruptions, such as significant volatility in commodity prices and supply chain disruptions. Although our business has not been materially impacted by current conflicts to date, it is difficult to predict the extent to which our operations, or those of our suppliers, will be impacted in the future.

Whenever possible, we manage our exposure to commodity risks primarily through the use of supplier pricing agreements that enable us to establish the purchase prices for certain inputs that are used in our manufacturing process. We also utilize a raw material and natural gas surcharge mechanism when pricing products to our customers.

There are two components of our raw material surcharge. One component is related to the scrap metal content in our finished product and is based on the published No. 1 busheling scrap index. The other component is related to alloy material content in our finished product and is based on published prices for nickel, molybdenum, vanadium, chrome, and manganese. The natural gas surcharge is only applicable when the price of natural gas exceeds a certain dollar amount per MMBtu.

Our surcharge mechanisms are designed to mitigate the impact of increases or decreases in raw material costs, although generally with a lag effect. This timing effect can result in raw material spread whereby costs can be over- or under-recovered in certain periods. While the surcharge generally protects gross profit, it has the effect of diluting gross margin as a percent of sales.

Faircrest Melt Shop Unplanned Downtime

During the second half of 2022, the Faircrest melt shop experienced unplanned operational downtime. During the fourth quarter of 2022, the Company recognized an insurance recovery of $33.0 million related to the 2022 unplanned downtime, of which $13.0 million was received in the fourth quarter of 2022 and $20.0 million was received in the first quarter of 2023. Additionally, during the third quarter of 2022, the Company recognized an insurance recovery of $1.5 million related to an unplanned outage at our Faircrest facility in November 2021.

During 2023, the Company recognized insurance recoveries of $31.3 million related to the 2022 Faircrest melt shop unplanned downtime, of which $11.3 million was received during 2023 and $20.0 million was received in the first quarter of 2024. The 2022 insurance claims were closed as of the first quarter of 2024.

For further information related to previous insurance recoveries, refer to "Note 7 - Other (Income) Expense, net" in the Notes to the Consolidated Financial Statements for additional information.

5

Environmental Matters and Governmental Regulations

We consider compliance with environmental regulations and environmental sustainability a key strategic focus area and integral to our responsibility as a good corporate citizen. All our domestic steel making and processing operations, and our water treatment plant, have obtained and maintain ISO 14001 certification.

We believe we have established appropriate reserves to cover our environmental expenses. We have a well-established environmental compliance audit program that measures performance against applicable laws as well as against internal standards that have been established for all facilities.

We have been identified as a potentially responsible party under the Clean Air Act ("CAA"), Clean Water Act ("CWA"), Toxic Substances Control Act ("TSCA"), the Resource Conservation and Recovery Act ("RCRA"), as well as other laws. We continue to monitor regulations relevant to our Company to ensure we remain compliant. This includes, but is not limited to, regulations such as the CAA, CWA, TSCA, and the RCRA.

Additionally, we continue to monitor any future carbon regulation. On February 19, 2021, the U.S. rejoined the Paris Agreement, which includes pledging to reduce U.S. greenhouse gas ("GHG") emissions. To date, the U.S. Congress has not legislated carbon constraints on businesses. It is difficult to predict the possible effect of compliance with future requirements that differ from existing ones both domestically and internationally.

From time to time, we may be a party to lawsuits, claims or other proceedings related to environmental matters and/or receive notices of potential violations of environmental laws and regulations from the EPA and similar state or local authorities. We recorded reserves for such environmental matters of $0.6 million and $0.1 million as of December 31, 2023 and 2022, respectively. Accruals related to such environmental matters represent management’s best estimate of the fees and costs associated with these matters. Although it is not possible to predict with certainty the outcome of such matters, management believes the ultimate disposition of these matters should not have a material adverse effect on our consolidated financial position, results of operations or cash flows.

Legal Proceedings

Information required by this section is incorporated herein by reference to “Item 3. Legal Proceedings.”

Patents, Trademarks and Licenses

While we own a number of U.S. and foreign patents, trademarks, licenses and copyrights, none are material to our products and production processes.

Governance and Environmental Stewardship

Metallus is committed to promoting the long-term interests of shareholders and building public trust through good governance practices. We are committed to operating in accordance with the highest standards of ethics and integrity, and maintaining robust programs focused on compliance. To ensure effective and responsive governance, we regularly review and update our policies and procedures and the charters for our Board committees, and regularly evaluate director skills, qualifications, and experience.

The Metallus Code of Conduct sets forth policies covering a broad range of subjects, including antitrust and competition, corruption and bribery, conflicts of interest, inside information, accurate financial records, harassment, environment, health and safety and intellectual property, among other matters, and requires strict adherence to laws and regulations applicable to the Company’s business. We have also adopted an insider trading policy, which prohibits insider trading in our securities while possessing material nonpublic information and applies to all employees, including officers and directors. In addition, in accordance with our Supplier Code of Conduct, we seek to work with suppliers that share our core values. We are also committed to the protection and advancement of human rights, as further described below under “Human Capital – Commitment to Human Rights.”

6

As part of our commitment to environmental stewardship, we continuously seek to improve the efficiency and cleanliness of our EAF operations while delivering quality projects and services that help our customers succeed. We employ proactive environmental practices that focus on maintaining clean air, water and land, and comply with environmental rules and regulations. Innovation, collaboration and stakeholder engagement are embedded within our environmental programs. Our Board of Directors oversees our sustainability strategy, including receiving regular updates from senior leadership and reviewing sustainability-related risks and opportunities annually.

In October 2021, the Company announced the following 2030 environmental goals, compared with a 2018 baseline:

The Company’s 2030 targets for GHG emissions, energy consumption and fresh water withdrawn are based on an absolute or total reduction in the amount of GHG emissions, energy consumption and fresh water withdrawn as compared to a 2018 baseline. In contrast, the Company’s waste-to-landfill target is based on an intensity or percentage reduction of waste-to-landfill per ton of steel shipped as compared to a 2018 baseline. All 2030 targets are based on the Company’s operating assets as of 2018 and do not account for any future inorganic growth or other expansion of the Company's facilities or operating assets, for which an adjustment to the absolute reduction may be required. The Company selected 2018 as the baseline year as it aligns with the baseline used in the Company’s Sustainability Accounting Standards Board (SASB) disclosure. Following the publication of steel sector guidance and standards in 2023 by the Global Steel Climate Council (GSCC), the Company has evaluated its existing goals and performance. The Company intends to submit a science-based target aligned with the GSCC's Steel Climate Standard for validation by an accredited third-party organization, which may result in refreshed environmental goals.

We have allocated approximately $3 million of capital expenditures per year through 2030 to achieve our long-term sustainability goals, including safety- and environmental-related projects. In 2023, actual capital expenditure spend was approximately $4 million related to these initiatives, which primarily related to safety projects.

Learn more about our governance and environmental stewardship on the Sustainability section of our website at www.metallus.com.

Human Capital

Employment

At December 31, 2023, we had approximately 1,840 employees, with approximately 64% of our employees covered under a collective bargaining agreement.

On October 29, 2021, the United Steelworkers ("USW") Local 1123 voted to ratify a new four-year contract (the “Contract”). The Contract, which is in effect until September 27, 2025, provides Metallus' Canton-based bargaining employees an increase to base wages every year, competitive healthcare and retirement benefits for all members, as well as a continued focus on employee wellbeing as well as safe and sustainable operations. The Contract covers approximately 1,170 bargaining employees at the Company’s Canton, Ohio operations.

Health and safety

At Metallus, our core value of Safety First expresses our belief that the health and well-being of our fellow employees is essential to our ability to achieve our mission to be an industry-leading provider of high-quality specialty metals and to deliver exceptional value for our customers, employees and investors. Building and maintaining a culture of safety empowers each of us as individuals, and collectively as a Company, to successfully grow. Our commitment to safety is rooted in the recognition that our personal actions affect the safety and performance of others. This sense of responsibility drives engagement through increased awareness of the vital role each team member plays in promoting a safe work environment while maintaining our commitment to best-in-class quality in our processes and products.

7

We recognize the need and are committed to improving the Company's safety culture. During 2022, we introduced new safety training focused on the core elements of improving the safety culture and performance while helping to understand the direct impact human factors have on all of us. In 2023, we built on this foundation with additional training regarding human factors which positively influence safety, performance and reliability outcomes. We invested approximately $10 million in 2023 in Company-wide safety training, equipment and improved safety processes in an effort to ensure we are creating a lasting culture of safety. We expect to invest approximately $7 million in 2024 to further expand these efforts. To reinforce the importance of operating safely and responsibly, a safety metric (comprised of both leading and lagging indicators beginning in 2023) is included in our annual incentive compensation plan for all salaried employees.

Belonging and inclusion

At Metallus, we believe our people are our strongest assets. Creating an atmosphere that provides a sense of belonging and inclusion are fundamental to our strategic imperative to attract and retain top talent. We foster a culture that lends a variety of perspectives and expertise to our operations and reflects the communities in which we operate. We recognize that a diverse workforce and an inclusive, engaging culture has enabled us to deliver innovative solutions throughout the life of our business and is key to our continued business success. Within our organization, we maintain employee resource groups (ERGs) which further promote belonging and inclusion. We have an advisory council comprised of senior leaders in the Company and the executive sponsors of our ERGs to help establish priorities to advance the Company's objectives. In 2023, our ERGs expanded their programming and employee engagement with the support of the advisory council. Metallus is also proudly involved in several organizations that promote and foster belonging and inclusion in our community and industry.

Compensation and total rewards

We provide competitive compensation programs to help meet the needs of our employees. Our programs are designed to support the profitable growth of our business; attract, reward, and retain the talent we need to succeed; support the health and overall well-being of our employees; and reinforce a performance-based culture.

In addition to base compensation, we offer quarterly and annual incentive compensation, stock awards, and participation in various retirement plans. Our Company also provides employer-sponsored health and wellness benefits to our employees.

Employee retention

We seek to retain the best people by providing them with opportunities to grow, build skills and be appreciated for their contributions as they work to serve our customers. We are committed to living our Core Values and building a culture that embodies the principles of our Cultural Framework.

Core Values |

|

Cultural Framework |

Safety First |

|

Care |

Customer Driven |

|

Communicate |

Best in Class Quality |

|

Collaborate |

Innovative and Collaborative |

|

Follow-Through |

Ethical and Responsible |

|

Follow-Up |

Our employees are critical to our success and are the reason we are able to execute at a high level. We believe a continuous focus on Company culture and employee engagement will help us provide high quality products to our customers. In 2023, we conducted quarterly surveys to gather insight into the level of employee engagement at Metallus and other factors that contribute to a successful workplace. These surveys help to ensure we are continuously listening to our employees and measuring our progress. We regularly communicate with our employees regarding survey results and actions being taken in response.

We diligently track our employee retention and management regularly evaluates our employees’ retention risk. For 2023, we ended the year with an overall voluntary turnover rate of approximately 8.9 percent, comprised of approximately 7.5 percent for salaried and approximately 9.5 percent for hourly employees.

8

This compares to an overall voluntary turnover rate of approximately 16 percent in 2022 and 10 percent in 2021. The voluntary turnover rate in 2023 was driven primarily by normal retirements and a continuing competitive labor market.

Employee training and development

At Metallus, we believe that our vision moves us forward and our people drive our success. That is why it is a core component of our strategy to invest in talent and leadership development at all levels of the Company. We invest significant resources to develop talent with the right capabilities to deliver the growth and innovation needed to support our business strategy. In 2023, we continued and expanded upon many of the programs first introduced in 2022 and aimed at developing leadership and other professional skills and capabilities, including Perpetual's High-Performing Teams, Thayer Leadership Principles, negotiation skills and supervisor training, as well as an apprentice program for mechanical and electric maintainers. We also offer an educational reimbursement program to assist employees with the cost of obtaining certain undergraduate or graduate degrees. Metallus encourages our employees to constantly learn and grow and has aligned our performance management system to support this focus on continuous learning and development.

Commitment to Human Rights

At Metallus, we are committed to the protection and advancement of human rights. We recognize our responsibility for the Company's culture and the impact our practices have on society as a whole. Being ethical and responsible at our core means that we believe in treating all people with dignity and respect, from our workplaces to our supply chain partners. Fundamental human rights go beyond any policy - they are inherent to all human beings, regardless of race, sex, nationality, ethnicity, religion or other status, and are embedded throughout our organization. As further detailed in our applicable policies, Metallus does not tolerate harassment or disrespect of an individual for any reason, and we strictly forbid any form of child labor, forced labor or slavery, or human trafficking at any of our facilities or within our supply chain. In 2023, Metallus published a new supplier code of conduct outlining our expectations for suppliers in the areas human rights, ethical business practices, responsible sourcing, environmental sustainability and information security. Our supplier code of conduct, along with standalone policies on human rights, child and forced labor, conflict minerals and human trafficking, can be found on the Sustainability page of our website at www.metallus.com. These policies, together with our Code of Conduct, include additional details regarding our commitment to human rights.

More information on Metallus' corporate responsibility can be found on the Sustainability page of our website at www.metallus.com.

Available Information

We use our Investor Relations website at http://investors.metallus.com, as a channel for routine distribution of important information, including news releases, analyst presentations and financial information. We post filings (including our annual, quarterly and current reports on Forms 10-K, 10-Q and 8-K, respectively; our proxy statements; and any amendments to those reports or statements) as soon as reasonably practicable after they are electronically filed with, or furnished to, the Securities and Exchange Commission ("SEC"). All such postings and filings are available on our website free of charge. In addition, our website allows investors and other interested persons to sign up to automatically receive e-mail alerts when we post news releases and financial information on our website. The SEC also maintains a website, www.sec.gov, which contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC. The information contained on or accessible through, including any reports available on, our website, or on any other website referred to in this Annual Report on Form 10-K is not incorporated by reference into this Annual Report unless expressly noted.

9

Item 1A. Risk Factors

The following are certain risk factors that could affect our business, financial condition and results of operations. The risks that are highlighted below are not the only ones we face. You should carefully consider each of the following risks and all of the other information contained in this Annual Report on Form 10-K. Some of these risks relate principally to our business and the industry in which we operate, while others relate principally to our debt, the securities markets in general, and ownership of our common shares. If any of the following risks actually occur, our business, financial condition or results of operations could be negatively affected.

Risks Relating to Our Industry and Our Business

Competition in the steel industry, together with potential global overcapacity, could result in significant pricing pressure for our products.

Competition within the steel industry, both domestically and worldwide, is intense and is expected to remain so. The steel industry has historically been characterized by periods of excess global capacity and supply. Excess global capacity and supply has negatively affected and could continue to negatively affect domestic steel prices, which could adversely impact our results of operations and financial condition. High levels of steel imports into the U.S. could exacerbate a decrease in domestic steel prices.

In an effort to protect the domestic steel industry, the United States government continues to maintain tariffs, duties and quotas for certain steel products imported from a number of countries into the United States. As these tariffs, duties and quotas continue to change, or are repealed, it could result in substantial imports of foreign steel and create pressure on United States steel prices and the overall industry. This could have a material adverse effect on our operations.

We are dependent on our key customers.

As a result of our dependence on our key customers, we could experience a material adverse effect on our business, financial condition and results of operations if any of the following, among other things, were to occur: (a) a loss of any key customer, or a material amount of business from such key customer; (b) the insolvency or bankruptcy of any key customer; (c) a declining market in which customers reduce orders; or (d) a strike or work stoppage at a key customer facility, which could affect both its suppliers and customers. For the year ended December 31, 2023, sales to our 10 largest customers accounted for approximately 46% of our net sales. Additionally, customers continue to demand stronger and lighter products, among other adaptations to traditional products. We may not be successful in meeting these technological challenges and there may be increased liability exposure connected with the supply of additional products and services.

Any change in the operation of our raw material surcharge mechanisms, a raw material market index or the availability or cost of raw materials could materially affect our revenues, earnings, and cash flows.

We require substantial amounts of raw materials, including scrap metal and alloys, to operate our business. The majority of our customer agreements contain surcharge pricing provisions that are designed to enable us to recover raw material cost increases. The surcharges are generally tied to a market index for that specific raw material. Historically, many raw material market indices have reflected significant fluctuations. Any change in a raw material market index could materially affect our revenues. Any change in the relationship between the market indices and our underlying costs could materially affect our revenues, earnings, and cash flow. Additionally, fluctuation in the cost of certain alloys not covered by a raw material surcharge could materially affect our revenues, earnings, and cash flow.

We rely on third parties to supply certain raw materials that are critical to the manufacture of our products. Purchase prices and availability of these critical raw materials are subject to volatility. At any given time we may be unable to obtain an adequate supply of these critical raw materials on a timely basis, on acceptable price and other terms, or at all. If suppliers increase the price of critical raw materials, we may not have alternative sources of supply. In addition, to the extent we have quoted prices to customers and accepted customer orders or entered into agreements for products prior to purchasing necessary raw materials, we may be unable to raise the price of products to cover all or part of the increased cost of the raw materials.

10

The cost and availability of electricity and natural gas are also subject to volatile market conditions.

Steel producers like us consume large amounts of energy. We rely on third parties for the supply of energy resources we consume in our steelmaking activities. The prices for and availability of electricity, natural gas, oil and other energy resources are also subject to volatile market conditions, often affected by weather conditions as well as political and economic factors beyond our control. Any increase in the prices for electricity, natural gas, oil and other energy resources could materially affect our costs and therefore our earnings and cash flows.

As a large consumer of electricity and gas, we must have dependable delivery in order to operate. Accordingly, we are at risk in the event of an energy disruption. Prolonged black-outs or brown-outs or disruptions caused by natural disasters or governmental action would substantially disrupt our production.

Moreover, many of our finished steel products are delivered by truck. Unforeseen fluctuations in the price of fuel would also have a negative impact on our costs or on the costs of many of our customers.

In addition, changes in certain environmental laws and regulations, including those that may impose output limitations or higher costs associated with climate change or greenhouse gas emissions, could substantially increase the cost of manufacturing and raw materials, such as energy, to us and other U.S. steel producers.

Unexpected equipment failures or other disruptions of our operations may increase our costs and reduce our sales and earnings due to production curtailments or shutdowns.

Interruptions in production capabilities would likely increase our production costs and reduce sales and earnings for the affected period. In addition to equipment failures, our facilities and information technology systems are also subject to the risk of catastrophic loss due to unanticipated events such as fires, explosions or violent weather conditions. Our manufacturing processes are dependent upon critical pieces of equipment for which there may be only limited or no production alternatives, such as furnaces, continuous casters and rolling equipment, as well as electrical equipment, such as transformers, and this equipment may, on occasion, be out of service as a result of unanticipated failures. In the future, we may experience material plant shutdowns or periods of reduced production as a result of these types of equipment failures, which could cause us to lose or prevent us from taking advantage of various business opportunities or prevent us from responding to competitive pressures. There can be no assurance that our insurance coverage for these types of events will be adequate or continue to be available on terms acceptable to us.

Our operating results depend in part on continued successful research, development and marketing of products and services.

The success of products and services depends on their initial and continued acceptance by our customers. Our business is affected, to varying degrees, by technological change and corresponding shifts in customer demand, which could result in unpredictable product transitions or shortened life cycles. We may experience difficulties or delays in the research, development, production, or marketing of products and services that may prevent us from recouping or realizing a return on the investments required to bring products and services to market.

New technologies in the steel industry may: (a) improve cost competitiveness; (b) increase production capabilities; or (c) improve operational efficiency compared to our current production methods. However, we may not have sufficient capital to invest in such technologies or to make certain capital improvements, and may, from time to time, incur cost over-runs and difficulties adapting and fully integrating these technologies or capital improvements into our existing operations. We may also encounter control or production restrictions, or not realize the cost benefit from such capital-intensive technology adaptations or capital improvements to our current production processes.

We are subject to extensive environmental, health and safety laws and regulations, which impose substantial costs and limitations on our operations. Future environmental, health and safety compliance may include additional requirements related to sustainability, climate change, and greenhouse gas emissions, and be more costly than we expect.

We are subject to extensive federal, state, and local environmental, health and safety laws and regulations concerning matters such as worker health and safety, air emissions, wastewater discharges, hazardous material and solid and hazardous waste use, generation, handling, treatment and disposal and the investigation and remediation of contamination. We are subject to the risk of substantial liability and limitations on our operations due to such laws and regulations.

11

The risks of substantial costs and liabilities related to compliance with these laws and regulations, which tend to become more stringent over time, are an inherent part of our business, and future conditions may develop, arise or be discovered that create substantial environmental compliance or remediation or other liabilities and costs.

Compliance with environmental, health and safety legislation and regulatory requirements may prove to be more limiting and costly than we anticipate. To date, we have committed significant expenditures in our efforts to achieve and maintain compliance with these requirements, and we expect that we will continue to make these expenditures related to such compliance in the future. From time to time, we may be subject to legal proceedings brought by private parties or governmental authorities with respect to environmental matters, including matters involving alleged contamination, property damage or personal injury. New laws and regulations, including those that may relate to emissions of greenhouse gases, stricter enforcement of existing laws and regulations, the discovery of previously unknown contamination or the imposition of new clean-up requirements, could require us to incur costs or become the basis for new or increased liabilities that could have a material adverse effect on our business, financial condition or results of operations.

We may also see an increase in costs relating to our steelmaking assets that emit relatively significant amounts of greenhouse gases as a result of new and existing legal and regulatory initiatives related to climate change. The United States government and various government agencies have introduced or are considering regulatory changes in response to climate change, including regulations aimed at reducing greenhouse gases through emissions standards, renewable energy targets, carbon emission pricing, and similar initiatives, and requiring heightened environmental monitoring and disclosures. These initiatives aimed at reducing greenhouse gas emissions may impact our operations directly or through our suppliers or customers, including increased environmental reporting, emissions control, capital equipment, energy, and other costs to comply. Any future climate change and greenhouse gas regulations could negatively impact our ability (and that of our customers and suppliers) to compete with companies situated in areas not subject to such regulations. Until the timing, scope and extent of any future legal and regulatory initiatives become known, we cannot predict the effect on our business, financial condition or results of operations.

While we are taking steps to significantly reduce our greenhouse gas emissions, there is no guarantee that we will be able to achieve our goals. Additionally, any costs related to the reduction of greenhouse gas emissions may be higher than we anticipated.

Product liability, warranty and product quality claims could adversely affect our operating results.

We produce high-performance carbon and alloy steel, sold as bars, tubes and billets in a variety of chemistries, lengths and finishes designed for our customers’ demanding applications. Failure of the materials that are included in our customers’ applications could give rise to product liability or warranty claims. If we fail to meet a customer’s specifications for its products, we may be subject to product quality costs and claims. A successful warranty or product liability claim against us could have a material adverse effect on our business ,financial condition and results of operations.

Work stoppages or similar difficulties could significantly disrupt our operations, reduce our revenues and materially affect our earnings.

A work stoppage at one or more of our facilities could have a material adverse effect on our business, financial condition and results of operations. As of December 31, 2023, approximately 64% of our employees were covered under a collective bargaining agreement that expires in September 2025. Any failure to negotiate and conclude a new collective bargaining agreement with the union when the existing agreement expires could cause work interruptions or stoppages. Also, if one or more of our customers were to experience a work stoppage, that customer may halt or limit purchases of our products, which could have a material adverse effect on our business, financial condition and results of operations.

A significant portion of our manufacturing facilities are located in Stark County, Ohio, which increases the risk of a significant disruption to our business as a result of unforeseeable developments in this geographic area.

It is possible that we could experience prolonged periods of reduced production due to unforeseen catastrophic events occurring in or around our manufacturing facilities in Stark County, Ohio. As a result, we may be unable to shift manufacturing capabilities to alternate locations, accept materials from suppliers, meet customer shipment deadlines or address other significant issues, any of which could have a material adverse effect on our business, financial condition or results of operations.

12

We have significant pension and retiree health care costs, as well as future cash contribution requirements, which may negatively affect our results of operations and cash flows.

We maintain retiree health care and defined benefit pension plans covering many of our domestic employees and former employees upon their retirement. These benefit plans have significant liabilities that are not fully funded, which will require additional cash funding in future years. Minimum contributions to domestic qualified pension plans are regulated under the Employee Retirement Income Security Act of 1974 ("ERISA") and the Pension Protection Act of 2006 ("PPA").

The level of cash funding for our defined benefit pension plans in future years depends upon various factors, including voluntary contributions that we may make, future pension plan asset performance, actual interest rates, union negotiated benefit changes, future government regulations, and other factors, many of which are not within our control. In addition, assets held by the trusts for our pension plan and our trust for retiree health care and life insurance benefits are subject to the risks, uncertainties and variability of the financial markets. See “Note 15 - Retirement and Postretirement Plans” in the Notes to the Consolidated Financial Statements for a discussion of assumptions and further information associated with these benefit plans.

Our business is capital-intensive, and if there are downturns in the industries we serve, we may be forced to significantly curtail or suspend operations with respect to those industries, which could result in our recording asset impairment charges or taking other measures that may adversely affect our results of operations and profitability.

Our business operations are capital-intensive. If there are downturns in the industries we serve, we may be forced to significantly curtail or suspend our operations with respect to those industries, including laying-off employees, recording asset impairment charges and other measures. In addition, we may not realize the benefits or expected returns from announced plans, programs, initiatives and capital investments. Any of these events could adversely affect our results of operations and profitability.

We may incur restructuring and impairment charges that could materially affect our profitability.

Changes in business or economic conditions, or our business strategy, may result in actions that require us to incur restructuring and impairment charges in the future, which could have a material adverse effect on our earnings. For additional information on current restructuring and impairment charges, refer to “Note 5 - Restructuring Charges” and “Note 6 - Disposition of Non-Core Assets” in the Notes to Consolidated Financial Statements.

We may not be able to execute successfully on our strategic imperatives or achieve the intended results.

Our strategic imperatives are centered around people, profitability, process improvement, business development, and sustainability. These focus areas are intended to drive sustainable through-cycle profitability while maintaining a strong balance sheet and cash flow. If we are unsuccessful in executing on our strategic imperatives, it could negatively impact profitability and liquidity, requiring us to alter our strategy.

Expectations relating to environmental, social and governance (“ESG”) matters and/or our reporting of such matters could expose us to potential liabilities, increased costs, reputational harm and other negative impacts on our business.

There is an increasing focus from investors, customers, employees, and other stakeholders concerning sustainability and ESG matters, and an increasing number of investors and customers are requiring companies to disclose sustainability and ESG policies, practices and metrics. Our customers may require us to implement sustainability and ESG responsibility procedures or standards before they continue to do business with us. In addition, some investors use ESG criteria to guide their investment strategies, and may not invest in us, or divest their holdings of us, if they believe our policies relating to ESG matters are inadequate or, on the other hand, have a negative response to such policies as a result of anti-ESG sentiment. Additionally, we may face reputational challenges in the event that our sustainability and ESG policies, practices and metrics do not meet the standards set by certain constituencies, which are often inconsistent in approach. Furthermore, standards for tracking and reporting on sustainability and ESG matters have not been harmonized and continue to evolve. Our processes and controls for reporting of sustainability and ESG matters may not always comply with evolving and disparate standards for identifying, measuring, and reporting such metrics, our interpretation of reporting standards may differ from those of others, and such standards may change over time, any of which could result in significant revisions to our performance metrics, goals or reported progress in achieving such goals.

13

There can be no assurance of the extent to which any of our ESG targets and goals will be achieved, if at all; we could fail, or be perceived to fail, in our achievement of any such initiatives, targets or goals, or we could fail in fully and accurately reporting our progress on any such initiatives, targets and goals. Any failure, or perceived failure, by us to achieve our goals, further our initiatives, adhere to our public statements, comply with federal, state or international ESG laws and regulations, or meet evolving and varied stakeholder expectations and standards could result in legal and regulatory proceedings against us and materially adversely affect our business, reputation, results of operations, financial condition and stock price.

We may not be able to complete or successfully integrate future acquisitions into our business, which could adversely affect our business and results of operations

We intend to consider growth opportunities through the acquisition of assets or companies and routinely review acquisition opportunities. We cannot predict whether we will be successful in identifying suitable acquisition candidates or pursuing acquisition opportunities or whether we will be able to achieve the strategic and other objectives related to such acquisitions. Acquisitions involve numerous risks, including difficulty determining appropriate valuation, integrating operations, information systems, technologies, services and products of the acquired product lines or business, personnel turnover, and the diversion of management’s attention from other business matters. Depending upon the nature, size, and timing of future acquisitions, we may be required to raise additional financing. Further, we may not be able to successfully integrate any acquired business with our existing businesses or recognize the expected benefits from a completed acquisition in the timeframe that we anticipate, or at all, which could adversely affect our business and results of operations.

Risks Related to Our Debt

Deterioration in our asset borrowing base could adversely affect our financial health and restrict our ability to borrow necessary cash to support the needs of our business and fulfill our pension obligations.

As of December 31, 2023, we had outstanding debt of $13.2 million and our total liquidity was $539.4 million.

If our asset borrowing base, cash flows, and capital resources are insufficient to support the needs of our business, we may be forced to reduce or delay investments and capital expenditures, or to sell assets, seek additional capital or restructure or refinance our debt. These alternative measures may not be successful and we could face substantial liquidity problems that might require us to refinance all or a portion of our debt on or before maturity, and we cannot assure you that we will be able to refinance any of our debt on commercially reasonable terms or at all.

Restrictive covenants in the agreements governing our indebtedness may restrict our ability to operate our business, which may affect the market price of our common shares.

On September 30, 2022, the Company, as borrower, and certain domestic subsidiaries of the Company, as subsidiary guarantors (the “Subsidiary Guarantors”), entered into a Fourth Amended and Restated Credit Agreement (the “Amended Credit Agreement”), with JPMorgan Chase Bank, N.A., as administrative agent (the “Administrative Agent”), and the lenders party thereto (collectively, the “Lenders”), which further amended and restated the Company’s secured Third Amended and Restated Credit Agreement, dated as of October 15, 2019.

A breach of any of our covenants in the agreements governing our indebtedness could result in a default, which could allow the lenders to declare all amounts outstanding under the applicable debt immediately due and payable and which may affect the market price of our common shares. We may also be prevented from taking advantage of business opportunities that arise because of the limitations imposed on us by the restrictive covenants under our indebtedness. Refer to “Note 14 - Financing Arrangements” in the Notes to the Consolidated Financial Statements for more detail on the Amended Credit Agreement.

14

The conditional conversion feature of the Convertible Notes, if triggered, may adversely affect our financial condition and operating results.

In the event the conditional conversion feature of the Convertible Notes (refer to “Note 14 - Financing Arrangements” in the Notes to the Consolidated Financial Statements) is triggered, holders of Convertible Notes will be entitled to convert the Convertible Notes at any time during specified periods at their option. If one or more holders elect to convert their Convertible Notes, unless we elect to satisfy our conversion obligation by delivering solely our common shares (other than paying cash in lieu of delivering any fractional share), we would be required to settle a portion or all of our conversion obligation through the payment of cash, which could adversely affect our liquidity.

Our capital resources may not be adequate to provide for all of our cash requirements, and we are exposed to risks associated with financial, credit, capital and banking markets.

In the ordinary course of business, we will seek to access competitive financial, credit, capital and/or banking markets. Currently, we believe we have adequate capital available to meet our reasonably anticipated business needs based on our historic financial performance, as well as our expected financial position. However, if we need to obtain additional financing in the future, to the extent our access to competitive financial, credit, capital and/or banking markets was to be impaired, our operations, financial results and cash flows could be adversely impacted.

Risks Related to Our Common Shares

The price of our common shares may fluctuate significantly.

The market price of our common shares may fluctuate significantly in response to many factors, including:

Many of the factors listed above are beyond our control. These factors may cause the market price of our common shares to decline, regardless of our financial condition, results of operations, business or prospects.

15

Conversion of the Convertible Notes may dilute ownership interest of our shareholders or may otherwise depress the market price of our common shares.

The conversion of some or all of the Convertible Notes may dilute the ownership interest of our shareholders. On conversion of the Convertible Notes, we have the option to pay or deliver, as the case may be, cash, common shares, or a combination of cash and common shares. If we elect to settle our conversion obligation in common shares or a combination of cash and common shares, this could adversely affect prevailing market prices over our common shares.

We may issue preferred shares with terms that could dilute the voting power or reduce the value of our common shares.

Our articles of incorporation authorize us to issue, without the approval of our shareholders, one or more classes or series of preferred shares having such designation, powers, preferences and relative, participating, optional and other special rights, including preferences over our common shares respecting dividends and distributions, as our Board of Directors generally may determine. The terms of one or more classes or series of preferred shares could dilute the voting power or reduce the value of our common shares. For example, we could grant holders of preferred shares the right to elect some number of our directors in all events or on the happening of specified events or the right to veto specified transactions. Similarly, the repurchase or redemption rights or liquidation preferences we could assign to holders of preferred shares could affect the residual value of the common shares.

Provisions in our corporate documents and Ohio law could have the effect of delaying, deferring or preventing a change in control of us, even if that change may be considered beneficial by some of our shareholders, which could reduce the market price of our common shares.

The existence of some provisions of our articles of incorporation and regulations and Ohio law could have the effect of delaying, deferring or preventing a change in control of us that a shareholder may consider favorable. These provisions include:

As an Ohio corporation, we are subject to Chapter 1704 of the Ohio Revised Code. Chapter 1704 prohibits certain corporations from engaging in a “Chapter 1704 transaction” (described below) with an “interested shareholder” for a period of three years after the date of the transaction in which the person became an interested shareholder, unless, among other things, prior to the interested shareholder’s share acquisition date, the directors of the corporation have approved the transaction or the purchase of shares on the share acquisition date.

After the three-year moratorium period, the corporation may not consummate a Chapter 1704 transaction unless, among other things, it is approved by the affirmative vote of the holders of at least two-thirds of the voting power in the election of directors and the holders of a majority of the voting shares, excluding all shares beneficially owned by an interested shareholder or an affiliate or associate of an interested shareholder, or the shareholders receive certain minimum consideration for their shares. A Chapter 1704 transaction includes certain mergers, sales of assets, consolidations, combinations and majority share acquisitions involving an interested shareholder. An interested shareholder is defined to include, with limited exceptions, any person who, together with affiliates and associates, is the beneficial owner of a sufficient number of shares of the corporation to entitle the person, directly or indirectly, alone or with others, to exercise or direct the exercise of 10% or more of the voting power in the election of directors after taking into account all of the person’s beneficially owned shares that are not then outstanding.

We are also subject to Section 1701.831 of the Ohio Revised Code, which requires the prior authorization of the shareholders of certain corporations in order for any person to acquire, either directly or indirectly, shares of that corporation that would entitle the acquiring person to exercise or direct the exercise of 20% or more of the voting power of that corporation in the election of directors or to exceed specified other percentages of voting power.

16

The acquiring person may complete the proposed acquisition only if the acquisition is approved by the affirmative vote of the holders of at least a majority of the voting power of all shares entitled to vote in the election of directors represented at the meeting, excluding the voting power of all “interested shares.” Interested shares include any shares held by the acquiring person and those held by officers and directors of the corporation.

We believe these provisions protect our shareholders from coercive or otherwise unfair takeover tactics by requiring potential acquirors to negotiate with our Board of Directors and by providing our Board of Directors with more time to assess any acquisition proposal, and are not intended to make our Company immune from takeovers. However, these provisions apply even if the offer may be considered beneficial by some shareholders and could delay, defer or prevent an acquisition that our Board of Directors determines is not in the best interests of our Company and our shareholders, which under certain circumstances could reduce the market price of our common shares.

General Risk Factors

Weakness in global economic conditions or in any of the industries or geographic regions in which we or our customers operate, as well as the cyclical nature of our customers’ businesses generally or sustained uncertainty in financial markets, could adversely impact our revenues and profitability by reducing demand and margins.

Our results of operations may be materially affected by conditions in the global economy generally and in global capital markets. There has been volatility in the capital markets and in the end-markets and geographic regions in which we or our customers operate, which has negatively affected our revenues at times. Many of the markets in which our customers participate are also cyclical in nature and experience significant fluctuations in demand for our steel products based on economic conditions, consumer demand, raw material and energy costs, and government actions, and many of these factors are beyond our control.

A decline in consumer and business confidence and spending, together with severe reductions in the availability and increased cost of credit, as well as volatility in the capital and credit markets, could adversely affect the business and economic environment in which we operate and the profitability of our business. We also are exposed to risks associated with the creditworthiness of our suppliers and customers. If the availability of credit to fund or support the continuation and expansion of our customers’ business operations is curtailed or if the cost of that credit is increased, the resulting inability of our customers or of their customers to either access credit or absorb the increased cost of that credit could adversely affect our business by reducing our sales or by increasing our exposure to losses from uncollectible customer accounts. These conditions and a disruption of the credit markets could also result in financial instability of some of our suppliers and customers. The consequences of such adverse effects could include the interruption of production at the facilities of our customers, the reduction, delay or cancellation of customer orders, delays or interruptions of the supply of raw materials or other inputs we purchase, and bankruptcy of customers, suppliers or other creditors. Any of these events could adversely affect our profitability, cash flow and financial condition.

We may be subject to risks relating to our information technology systems and cybersecurity.

We rely on information technology systems to process, transmit and store electronic information and manage and operate our business. We face the challenge of supporting our older systems and implementing upgrades when necessary. Additionally, a breach in security could expose us and our customers and suppliers to risks of misuse of confidential information, manipulation and destruction of data, production downtimes and operations disruptions, which in turn could adversely affect our reputation, competitive position, business or results of operations. While we have taken reasonable steps to protect the Company from cybersecurity risks and security breaches (including enhancing our firewall, workstation, email security and network monitoring and alerting capabilities, and training employees around phishing, malware and other cybersecurity risks), and we have policies and procedures to prevent or limit the impact of systems failures, interruptions, and security breaches, there can be no assurance that such events will not occur or that they will be adequately addressed if they do occur. Although we rely on commonly used security and processing systems to provide the security and authentication necessary to effect the secure transmission of data, these precautions may not protect our systems from all potential compromises or breaches of security.

17

If we are unable to attract and retain key personnel, our business could be materially adversely affected.

Our business substantially depends on the continued service of key members of our management. The loss of the services of a significant number of members of our management could have a material adverse effect on our business. Modern steel-making uses specialized techniques and advanced equipment that requires experienced engineers and skilled laborers. Our future success will depend on our ability to attract and retain highly skilled personnel and senior management professionals. Competition for employees is intense, and we could experience difficulty from time to time in hiring and retaining the personnel necessary to support our business. Additionally, costs to attract and retain employees may be increased given the competitive labor market. If we do not succeed in retaining our current employees and attracting new high-quality employees, our business could be materially adversely affected.

We are subject to a wide variety of domestic and foreign laws and regulations that could adversely affect our results of operations, cash flow or financial condition.

We are subject to a wide variety of domestic and foreign laws and regulations, and legal compliance risks, including securities laws, tax laws, employment and pension-related laws, competition laws, U.S. and foreign export and trading laws, privacy laws and laws governing improper business practices. We are affected by new laws and regulations, and changes to existing laws and regulations, including interpretations by courts and regulators.

Compliance with the laws and regulations described above or with other applicable foreign, federal, state and local laws and regulations currently in effect or that may be adopted in the future could materially adversely affect our competitive position, operating results, financial condition and liquidity.

Pandemics, epidemics, widespread illness or other health issues could adversely affect the Company's operations and financial results, including cash flows and liquidity.

Although it is not possible to predict the impact of pandemics, epidemics, widespread illness or other health issues, on our business, results of operations, financial position or cash flows, such impacts that may be material include, but are not limited to: (i) reduced sales and profit levels; (ii) slower collection of accounts receivable and potential increases in uncollectible accounts receivable; (iii) increased operational risks as a result of manufacturing facility disruptions; (iv) delays and disruptions in the availability of and timely delivery of materials and components used in our operations, as well as increased costs for such material and components, and (v) increased cybersecurity risks including vulnerability to security breaches, information technology disruptions and other similar events as a result of a substantial number of employees utilizing remote work arrangements.

If our internal controls are found to be ineffective, our financial results or our stock price may be adversely affected.

Our most recent evaluation resulted in our conclusion that, as of December 31, 2023, our internal control over financial reporting was effective. We believe that we currently have adequate internal control procedures in place for future periods. However, if our internal control over financial reporting is found to be ineffective, investors may lose confidence in the reliability of our financial statements, which may adversely affect our stock price.

Item 1B. Unresolved Staff Comments

None.

Item 1C. Cyber Security

Our cybersecurity program is led by a team of skilled cybersecurity professionals, including dedicated internal cybersecurity resources and external advisors. In the normal course of business, we may collect and store sensitive information, including proprietary and confidential business information, trade secrets, intellectual property, sensitive third-party information and employee information. We maintain a robust cybersecurity incident response plan, which details the incident response procedures, tactical and strategic team membership, and points of contact related to the response processes. The Company also maintains a detailed decision-tree-based playbook which is a supplement to the plan and focuses on specific types of incidents and the appropriate response steps.

18

Cybersecurity is an important part of our Enterprise Risk Management (“ERM”) program, and the Company seeks to address cybersecurity risks through a comprehensive, cross-functional approach. The Company’s cybersecurity policies, standards, processes, and practices for assessing, identifying and managing material risks from cybersecurity threats and responding to cybersecurity incidents are fully integrated into the Company’s ERM program. The plan and playbook are structured to align with the National Institute of Standards and Technology (“NIST”) Cybersecurity framework practices. The plan and playbook are reviewed at least annually. In addition, we maintain insurance that includes cybersecurity coverage.

The Company adheres to a periodic, third-party facilitated testing exercise of the cybersecurity incident response plan and playbook with the Company's tactical and strategic team members. The teams are comprised of key members of the organization and external advisors who hold critical importance in the handling of cybersecurity events. The exercise covers response procedures for prevalent cybersecurity incidents including but not limited to phishing, third-party breaches, and a standard incident response process. The documentation helps leaders make appropriate, pre-planned decisions. To assist, appendices detailing generalized incident response checklists and workflows from the Cybersecurity & Infrastructure Security Agency ("CISA") and the NIST are referenced and used as a framework. Lastly, the response plans contain instructions on collecting and incorporating lessons learned after a successful identification and remediation of a security event. The information security team also works in partnership with the Company's internal audit team to review information technology-related internal controls with our external auditor as part of our overall internal controls process.

In light of the pervasive and increasing threat from cyberattacks, the Board of Directors, with input from management, assesses the measures implemented by us to mitigate and prevent cyberattacks. The Company’s Information Technology (“IT”) leadership team consults with and provides regular updates to the Board of Directors, as well as our chief executive officer and other members of our senior management team, as appropriate, on technology and cybersecurity matters, the status of projects to strengthen our information security systems, assessments of the information security program, timely reports regarding any cybersecurity incident that meets established reporting thresholds, and emerging threat landscape. In addition, the Company has an IT governance committee, which is comprised of the chief executive officer, IT and other officers of the Company. The IT governance committee meets quarterly, and as necessary, to discuss the cybersecurity program and other relevant topics. The IT team also consults regularly with the Board of Director’s cybersecurity expert in between meetings. Our program is evaluated by internal and external experts with the results of those reviews reported to senior management and the Board of Directors, at least semi-annually. The Board of Directors has oversight responsibility for our data security practices and we believe the Board of Directors has the requisite skills and awareness into the design and operation of our data security practices to fulfill this responsibility effectively.

As of the date of this report, we are not aware of any material risks from cybersecurity threats that have materially affected or are reasonably likely to materially affect the Company, including our business strategy, results of operations or financial condition.

See “Risk Factors – General Risk Factors” for additional information about the risks to our business associated with a breach or compromise to our information security systems.

Item 2. Properties

We are headquartered in Canton, Ohio, on a campus of owned facilities that are adjacent to our steelmaking operations.

We have manufacturing facilities at multiple locations in the United States. These manufacturing facilities are located in Canton and Eaton, Ohio and Columbus, North Carolina. In addition to these owned manufacturing facilities, we lease a distribution facility in Mexico. The aggregate floor area of these facilities is 3.6 million square feet, of which approximately twelve thousand square feet is leased and the rest is owned. The buildings occupied by us are principally made of brick, steel, reinforced concrete and concrete block construction.

19

Our facilities vary in age and condition, and each of them has an active maintenance program to ensure a safe operating environment and to keep the facilities in good condition. We believe our facilities are in satisfactory operating condition and are suitable and adequate to conduct our business and support future growth.

Our melt capacity utilization was 70%, 63% and 73% for the years ended December 31, 2023, 2022 and 2021, respectively.

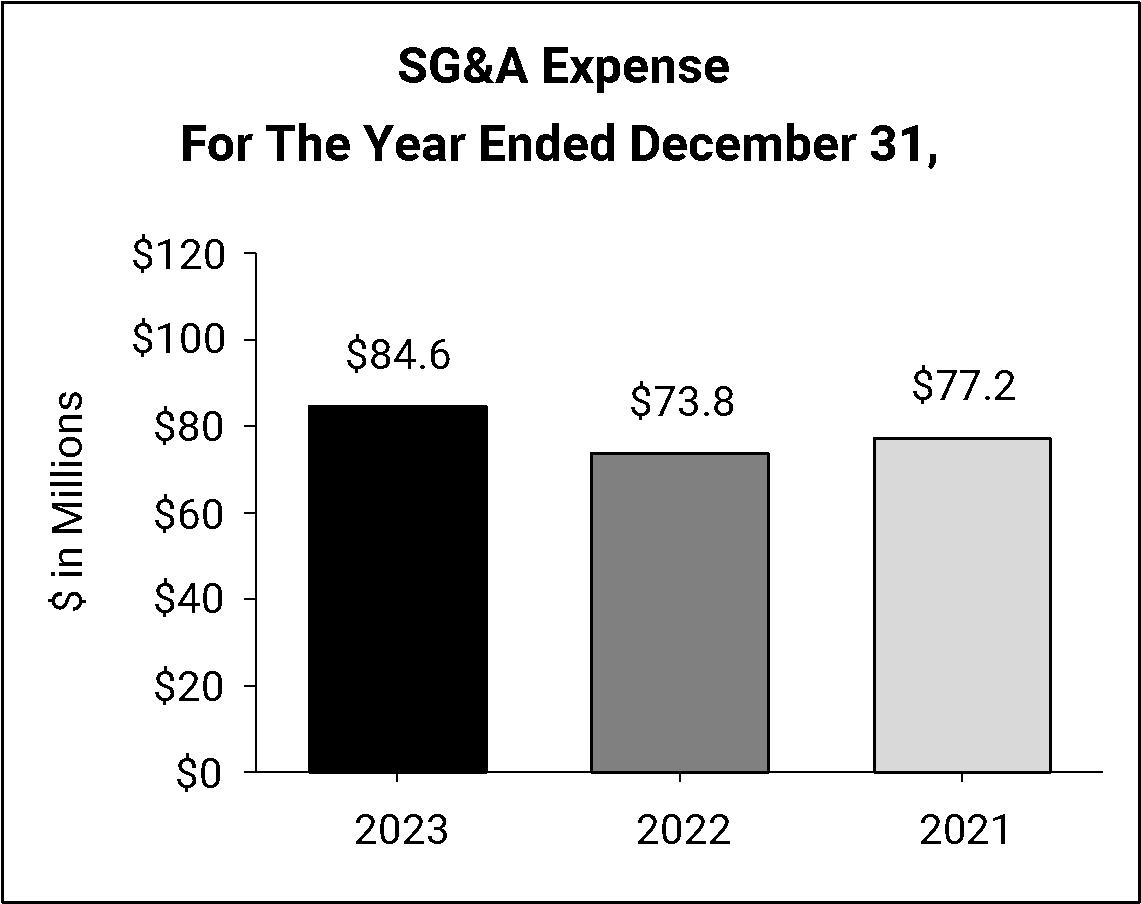

Item 3. Legal Proceedings