UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2023

OR

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______ to _______

Commission File Number 1-37816

ALCOA CORPORATION

(Exact name of registrant as specified in its charter)

|

Delaware (State or other jurisdiction of incorporation or organization) |

|

81-1789115 (I.R.S. Employer Identification No.) |

|

|

|

|

201 Isabella Street, Suite 500, Pittsburgh, Pennsylvania (Address of principal executive offices) |

|

15212-5858 (Zip Code) |

(Registrant’s telephone number, including area code): 412-315-2900

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, par value $0.01 per share |

|

AA |

|

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

☒ |

|

Accelerated filer |

☐ |

Non-accelerated filer |

☐ |

|

Smaller reporting company |

☐ |

Emerging growth company |

☐ |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☑

The aggregate market value of the registrant’s voting stock held by non-affiliates at June 30, 2023 was approximately $6.0 billion, based on the closing price per share of Common Stock on June 30, 2023 of $33.93 as reported on the New York Stock Exchange.

As of February 16, 2024, there were 179,558,990 shares of the registrant’s common stock, par value $0.01 per share, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Part III of this Form 10-K incorporates by reference certain information from the registrant’s Definitive Proxy Statement for its 2024 Annual Meeting of Stockholders to be filed pursuant to Regulation 14A.

TABLE OF CONTENTS

|

|

|

Page |

|

|

|

|

|

|

|

|

Item 1. |

|

|

1 |

|

|

Item 1A. |

|

|

16 |

|

|

Item 1B. |

|

|

30 |

|

|

Item 1C. |

|

|

31 |

|

|

Item 2. |

|

|

32 |

|

|

Item 3. |

|

|

44 |

|

|

Item 4. |

|

|

45 |

|

|

|

|

|

|

|

|

Item 5. |

|

|

46 |

|

|

Item 6. |

|

|

47 |

|

|

Item 7. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

48 |

|

Item 7A. |

|

|

71 |

|

|

Item 8. |

|

|

72 |

|

|

Item 9. |

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

|

134 |

|

Item 9A. |

|

|

134 |

|

|

Item 9B. |

|

|

134 |

|

|

Item 9C. |

|

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

|

134 |

|

|

|

|

|

|

|

Item 10. |

|

|

134 |

|

|

Item 11. |

|

|

135 |

|

|

Item 12. |

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

|

135 |

|

Item 13. |

|

Certain Relationships and Related Transactions, and Director Independence |

|

135 |

|

Item 14. |

|

|

135 |

|

|

|

|

|

|

|

|

Item 15. |

|

|

136 |

|

|

Item 16. |

|

|

139 |

|

|

|

|

|

140 |

|

|

Note on Incorporation by Reference

In this Form 10-K, selected items of information and data are incorporated by reference to portions of Alcoa Corporation’s Definitive Proxy Statement for its 2024 Annual Meeting of Stockholders (Proxy Statement), which will be filed with the Securities and Exchange Commission within 120 days after the end of Alcoa Corporation’s fiscal year ended December 31, 2023. Unless otherwise provided herein, any reference in this Form 10-K to disclosures in the Proxy Statement shall constitute incorporation by reference of only that specific disclosure into this Form 10-K.

PART I

Item 1. Business.

(dollars in millions, except per-share amounts, average realized prices, and average cost amounts)

The Company

Alcoa Corporation, a Delaware corporation (the Company), is active in all aspects of the upstream aluminum industry with bauxite mining, alumina refining, and aluminum smelting and casting. The Company has direct and indirect ownership of 27 locations across nine countries on six continents.

The Company’s operations in 2023 comprised two reportable business segments: Alumina and Aluminum. The Alumina segment primarily consists of a series of affiliated operating entities held in Alcoa World Alumina and Chemicals, a global, unincorporated joint venture between Alcoa and Alumina Limited (described below). The Aluminum segment consists of the Company’s aluminum smelting and casting operations along with most of the Company’s energy production assets.

Aluminum, as an element, is abundant in the earth’s crust, but a multi-step process is required to manufacture finished aluminum metal. Aluminum metal is produced by refining alumina oxide from bauxite into alumina, which is then smelted into aluminum and can be cast into many shapes and forms.

Alcoa smelts and casts aluminum in various shapes and sizes for global customers, including developing and creating various alloy combinations for specific applications.

Aluminum metal is a commodity traded on the London Metal Exchange (LME) and priced daily. Additionally, alumina is subject to market pricing through the Alumina Price Index (API), which is calculated by the Company based on the weighted average of a prior month’s daily spot prices published by the following three indices: CRU Metallurgical Grade Alumina Price, Platts Metals Daily Alumina PAX Price, and FastMarkets Metal Bulletin Non-Ferrous Metals Alumina Index. As a result, the prices of both aluminum and alumina are subject to significant volatility and, therefore, influence the operating results of Alcoa.

Alcoa Corporation became an independent, publicly traded company on November 1, 2016, following its separation (the Separation Transaction) from its former parent company, Alcoa Inc. References herein to “ParentCo” refer to Alcoa Inc. and its consolidated subsidiaries through October 31, 2016, at which time it was renamed Arconic Inc. (Arconic) and since has been subsequently renamed Howmet Aerospace Inc.

Business Strategy

Alcoa's business strategy is designed to create shareholder value while aligning with our purpose, vision, and values.

In the near term, the Company has an acute focus on the strategic priority of reducing complexity and developing a portfolio of mining, refining, and smelting assets that is profitable, safe, stable, low cost, low carbon emitting, and supported by a strong balance sheet. To achieve this, Alcoa is prioritizing maintaining a lean overhead structure, operating with excellence, and actively managing our asset portfolio. In 2019, the Company announced a five-year strategic portfolio review of its smelting and refining capacity to improve cost positioning, or curtail, close, or divest 1.5 million and 4 million metric tons of smelting and refining capacity, respectively. Through January 2024, Alcoa continued to make progress on the portfolio review completing its review of refining capacity and reaching approximately 93 percent of its target for smelting capacity. This focus on operational stability and portfolio transformation results in a reduction in complexity and improved cash generation to support the Company’s capital allocation framework.

At the same time, Alcoa maintains two additional strategic priorities for creating value into the long term: advance sustainably and drive returns. To advance sustainably, the Company seeks to increase value from a leading sustainability position, which includes the industry’s most comprehensive suite of products made with lower carbon emissions. The SustanaTM brand, includes EcoDuraTM aluminum (recycled content), EcoLumTM aluminum (low carbon), and EcoSourceTM alumina (also low carbon). These products create a differentiated position for Alcoa, serve growing markets focused on lowering carbon emissions, and provide competitive advantages that the Company can build on. Additionally, the Company has the goal of being the lowest emitter of carbon dioxide among all global aluminum companies, per ton of emissions in both smelting and refining, and aims to move its aluminum asset portfolio to a first quartile cost position relative to other aluminum producers upon completion of our portfolio review. In 2023, Alcoa exceeded its target of 85 percent of its smelting portfolio being powered by renewable energy, attaining 87 percent. Renewable energy is derived from natural processes that are replenished constantly, such as sunlight, wind, and hydropower.

1

The third strategic priority is drive returns. To do so, the Company is developing targeted growth opportunities that leverage its competitive advantages to meet the evolving demands of stakeholders and customers and create lasting sources of value. Through active research and development projects, Alcoa is seeking to innovate breakthrough technologies to revolutionize its impact and that of its customers. These have the potential to drive value by reducing costs, improving efficiency, and reducing greenhouse gas emissions in both alumina refining and aluminum smelting. The roadmap of technologies under development includes:

To enable these strategic priorities, the Company strives to have a performance culture with an action orientation that delivers results, straightforward communication, empowered employees, and aligned goals.

See Part II Item 7 of this Form 10-K in Management’s Discussion and Analysis of Financial Condition and Results of Operations under caption Business Update for more information.

Joint Ventures

Alcoa World Alumina and Chemicals (AWAC)

AWAC is an unincorporated global joint venture between Alcoa Corporation and Alumina Limited, a company incorporated under the laws of the Commonwealth of Australia and listed on the Australian Securities Exchange. AWAC consists of a number of affiliated entities that own, operate, or have an interest in bauxite mines and alumina refineries, as well as an aluminum smelter, in seven countries. Alcoa Corporation owns 60% and Alumina Limited owns 40% of these entities, directly or indirectly, with such entities being consolidated by Alcoa Corporation for financial reporting purposes. The scope of AWAC generally includes the mining of bauxite and other aluminous ores; the refining, production, and sale of smelter grade and non-metallurgical alumina; and the production of certain primary aluminum products.

Alcoa provides the operating management for AWAC, which is subject to direction provided by the Strategic Council of AWAC. The Strategic Council consists of five members, three of whom are appointed by Alcoa (of which one is the Chair) and two of whom are appointed by Alumina Limited (of which one is the Deputy Chair). Matters are decided by a majority vote with certain matters requiring approval by at least 80% of the members, including: changes to the scope of AWAC; changes in the dividend policy; equity calls in aggregate greater than $1,000 in any year; sales of all or a majority of the AWAC assets; loans from AWAC companies to Alcoa or Alumina Limited; certain acquisitions, divestitures, expansions, curtailments or closures; certain related-party transactions; financial derivatives, hedges or swap transactions; a decision by AWAC entities to file for insolvency; and changes to pricing formula in certain offtake agreements which may be entered into between AWAC entities and Alcoa or Alumina Limited.

AWAC Operations

AWAC entities’ assets include the following interests:

2

Exclusivity

Under the terms of their joint venture agreements, Alcoa and Alumina Limited have agreed that, subject to certain exceptions, AWAC is their exclusive vehicle for their investments, operations or participation in the bauxite and alumina business, and they will not compete with AWAC in those businesses. In the event of a change of control of either Alcoa or Alumina Limited, this exclusivity and non-compete restriction will terminate, and the partners will then have opportunities to unilaterally pursue bauxite or alumina projects outside of or within AWAC, subject to certain conditions provided in the Amended and Restated Charter of the Strategic Council.

Equity Calls

The cash flow of AWAC and borrowings are the preferred sources of funding for the needs of AWAC. An equity call can be made on 30 days’ notice, subject to certain limitations, in the event the aggregate annual capital budget of AWAC requires an equity contribution from Alcoa and Alumina Limited.

Dividend Policy

AWAC will generally be required to distribute at least 50% of the prior calendar quarter’s net income of each AWAC entity, and certain AWAC entities will also be required to pay a distribution every three months equal to the amount of available cash above specified thresholds and subject to the forecast cash needs of the AWAC entity.

Leveraging Policy

Debt of AWAC is subject to a limit of 30% of total capital (defined as the sum of debt (net of cash) plus any noncontrolling interest plus shareholder equity). The AWAC joint venture has raised a limited amount of debt to fund growth projects as permitted under Alcoa’s revolving credit line and in accordance with the joint venture partnership agreements.

Saudi Arabia Joint Venture

In December 2009, Alcoa entered into a joint venture with the Saudi Arabian Mining Company (Ma’aden), which was formed by the government of Saudi Arabia to develop its mineral resources and create a fully integrated aluminum complex in Saudi Arabia. Ma’aden is listed on the Saudi Stock Exchange (Tadawul). The joint venture complex includes a bauxite mine with estimated capacity of 5 million dry metric tons per year; an alumina refinery with a capacity of 1.8 million metric tons per year (mtpy); and an aluminum smelter with a capacity of 804,000 mtpy.

The joint venture is currently comprised of two entities: the Ma’aden Bauxite and Alumina Company (MBAC) and the Ma’aden Aluminium Company (MAC). Ma’aden owns a 74.9% interest in the MBAC and MAC joint venture. Alcoa owns a 25.1% interest in MAC, which holds the smelter; AWAC holds a 25.1% interest in MBAC, which holds the mine and refinery. The refinery and smelter are located within the Ras Al Khair industrial zone on the east coast of Saudi Arabia.

Pursuant to the joint venture agreement between Alcoa and Ma’aden, Alcoa is permitted to sell all of its shares in both MBAC and MAC collectively, for which Ma’aden has a right of first refusal. In addition, upon the occurrence of an unremedied event of default by Alcoa, Ma’aden may purchase, or, upon the occurrence of an unremedied event of default by Ma’aden, Alcoa may sell, its interest in the joint venture for consideration that varies depending on the time of the default.

3

ELYSIS

ELYSIS Limited Partnership is between wholly-owned subsidiaries of Alcoa (48.235%) and Rio Tinto Alcan Inc. (Rio Tinto) (48.235%), respectively, and Investissement Québec (3.53%), a company wholly-owned by the Government of Québec, Canada. The purpose of ELYSIS is to advance larger scale development and commercialization of its patent-protected technology that eliminates direct greenhouse gas emissions from the traditional aluminum smelting process and, in the production of aluminum, instead emits oxygen. Alcoa first developed the inert anode technology for the aluminum smelting process that served as the basis for the formation of ELYSIS in 2018. Development scale quantities of aluminum produced by ELYSIS have been sold for commercial purposes, including to RONAL Group for the wheels for the Audi eTron GT. ELYSIS has also supplied metal to Apple Inc., a non-equity investor in the technology, for use in some of its products such as the 16-inch MacBook Pro and the iPhone SE.

Others

The Company is party to several other joint ventures and consortia. See additional details within each business segment discussion below.

The Aluminerie de Bécancour Inc. (ABI) smelter is a joint venture between Alcoa and Rio Tinto located in Bécancour, Québec. Alcoa owns 74.95% of the joint venture through its 50% equity investment in Pechiney Reynolds Quebec, Inc., which owns a 50.1% share of the smelter, and two wholly-owned Canadian subsidiaries, which own 49.9% of the smelter. Rio Tinto owns the remaining 25.05% interest in the joint venture through its 50% ownership in Pechiney Reynolds Quebec, Inc.

CBG is a joint venture between Boké Investment Company (51%) and the Government of Guinea (49%) for the operation of a bauxite mine in the Boké region of Guinea. Boké Investment Company is owned 100% by Halco (Mining) Inc.; AWA LLC holds a 45% interest in Halco. AWA LLC is part of the AWAC group of companies and is ultimately owned 60% by Alcoa and 40% by Alumina Limited.

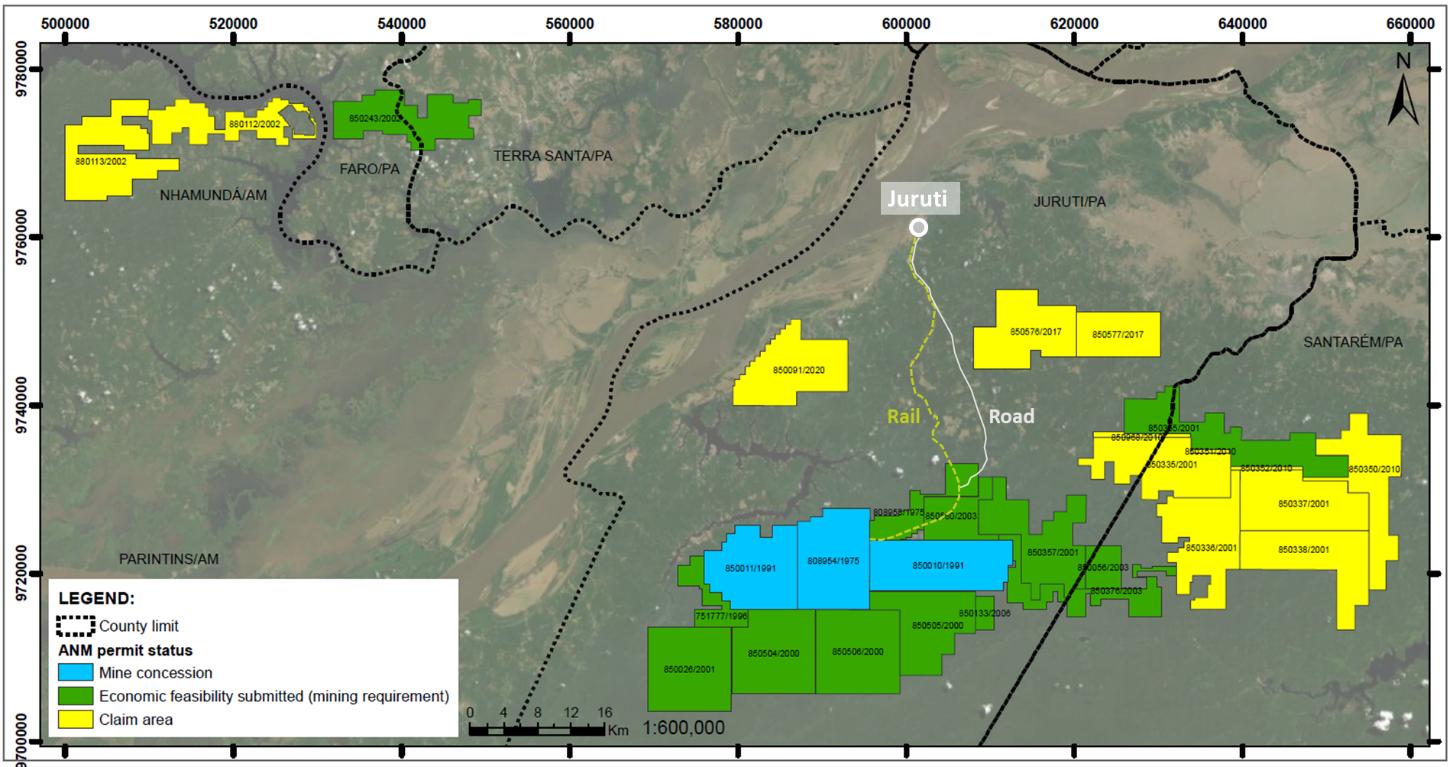

On April 30, 2022, Alcoa completed the sale of its investment in Mineração Rio Do Norte (MRN) for proceeds of $10. An additional $30 in cash could be paid to the Company in the future if certain post-closing conditions related to future MRN mine development are satisfied. Related to this transaction, the Company recorded an asset impairment of $58 in the first quarter of 2022 in Restructuring and other charges, net on the Statement of Consolidated Operations. In addition, the Company entered into several bauxite offtake agreements with South32 Minerals S.A. (South32). to provide bauxite supply for existing long-term supply contracts.

Alumar is an unincorporated joint venture for the operation of a refinery, smelter, and casthouse in Brazil. The refinery is owned by AWAB (39.96%), Rio Tinto (10%), Alcoa Alumínio (14.04%), and South32 (36%). AWAB is part of the AWAC group of companies and is ultimately owned 60% by Alcoa and 40% by Alumina Limited. With respect to Rio Tinto and South32, the named company or an affiliate thereof holds the interest. The smelter and casthouse are owned by Alcoa Alumínio (60%) and South32 (40%).

Strathcona calciner is a joint venture between affiliates of Alcoa and Rio Tinto. Calcined coke is used as a raw material in aluminum smelting. The calciner is owned by Alcoa (39%) and Rio Tinto (61%).

Hydropower

Machadinho Hydro Power Plant (HPP) is a consortium located on the Pelotas River in southern Brazil in which the Company has a 27.3% ownership interest through Alcoa Alumínio. The remaining ownership interests are held by unrelated third parties.

Barra Grande HPP is a joint venture located on the Pelotas River in southern Brazil in which the Company has a 42.2% ownership interest through Alcoa Alumínio. The remaining ownership interests are held by unrelated third parties.

Estreito HPP is a consortium between Alcoa Alumínio, through Estreito Energia S.A. (25.5%) and unrelated third parties located on the Tocantins River, northern Brazil.

Serra do Facão HPP is a joint venture between Alcoa Alumínio (35%) and unrelated third parties located on the Sao Marcos River, central Brazil.

Manicouagan Power Limited Partnership (Manicouagan) is a joint venture between affiliates of Alcoa and Hydro-Québec. Manicouagan owns and operates the 335 megawatt McCormick hydroelectric project, which is located on the Manicouagan River in the Province of Québec, Canada. Alcoa owns 40% of the joint venture.

4

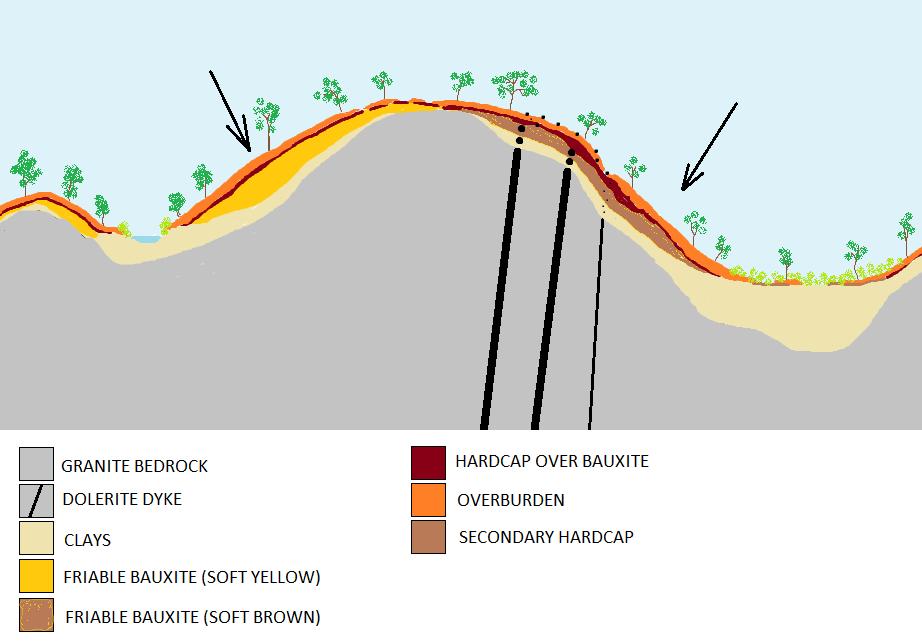

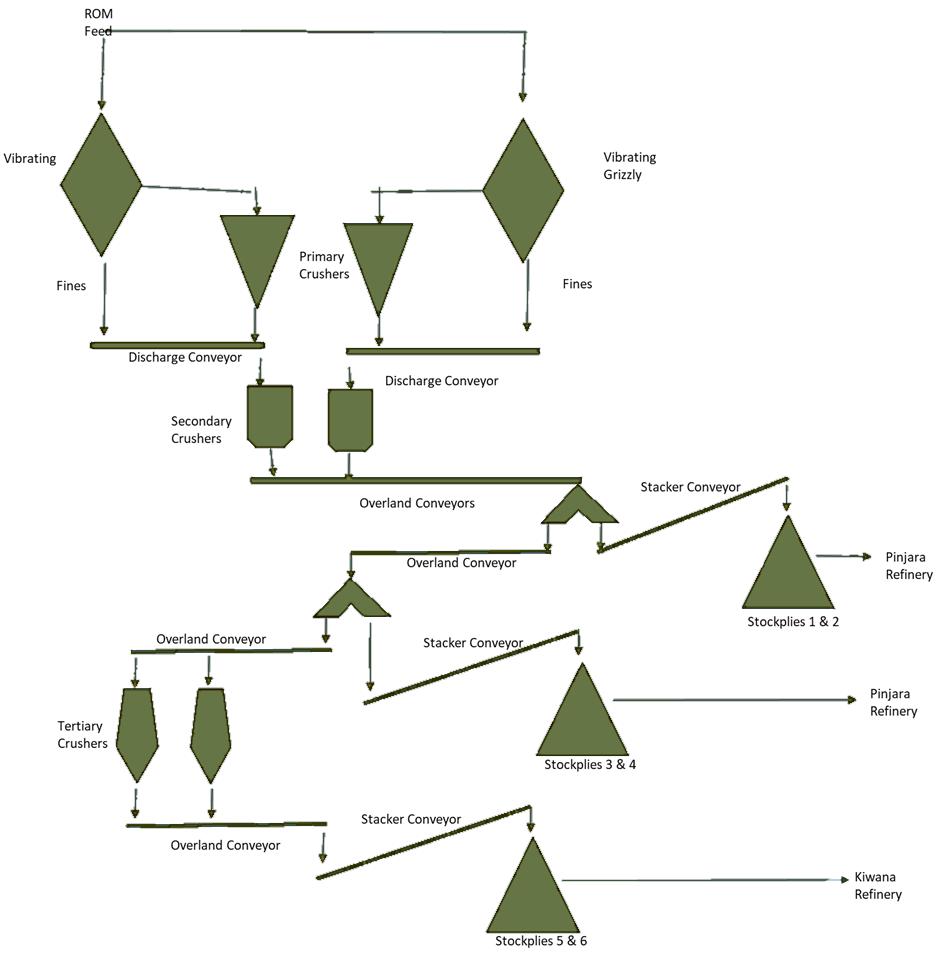

Alumina

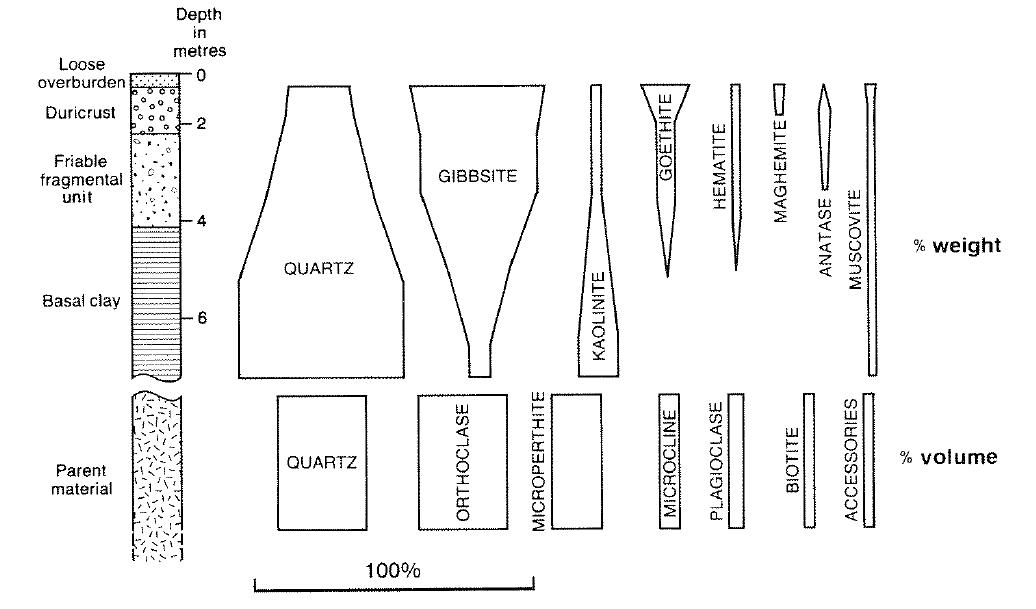

This segment consists of the Company’s worldwide refining system, including the mining of bauxite, which is then refined into alumina, a compound of aluminum and oxygen that is the raw material used by smelters to produce aluminum metal. Bauxite is the principal raw material used to produce alumina and contains various aluminum hydroxide minerals, the most important of which are gibbsite and boehmite. Bauxite is refined into alumina using the Bayer process. The Company obtains bauxite from its own resources, including those belonging to AWAC, as well as through long-term and short-term contracts and mining leases. Tons of bauxite are reported on a zero-moisture basis in millions of dry metric tons (mdmt) unless otherwise stated.

Alcoa’s alumina sales are made to customers globally and are typically priced by reference to published spot market prices. The Company produces smelter grade alumina and non-metallurgical grade alumina. The Company’s largest customer for smelter grade alumina is its own aluminum smelters, which in 2023 accounted for approximately 32 percent of its total alumina shipments. A small portion of the alumina (non-metallurgical grade) is sold to third-party customers who process it into industrial chemical products. This segment also includes AWAC’s 25.1% share of MBAC.

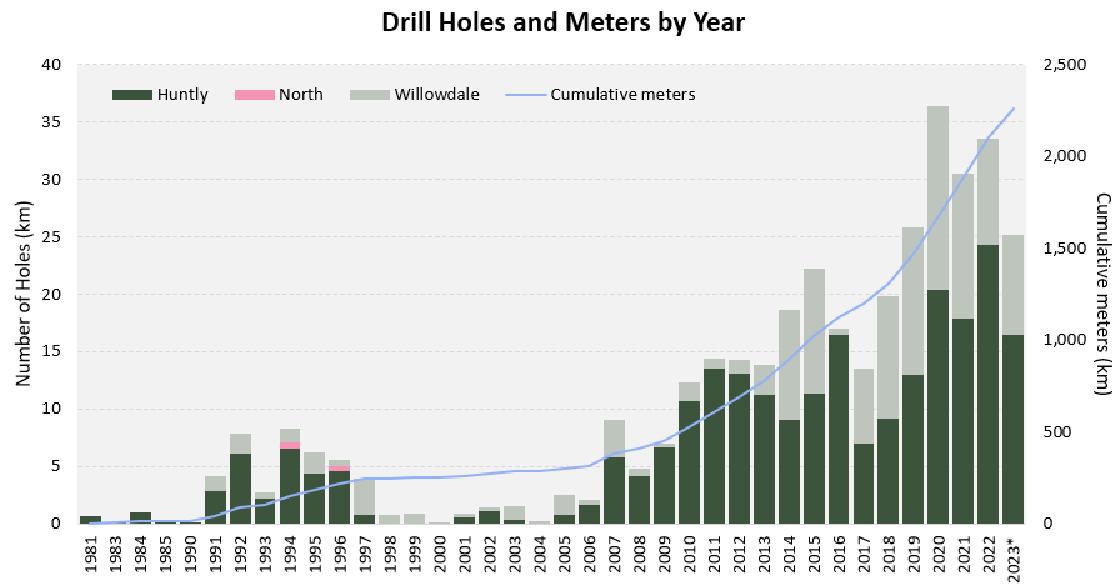

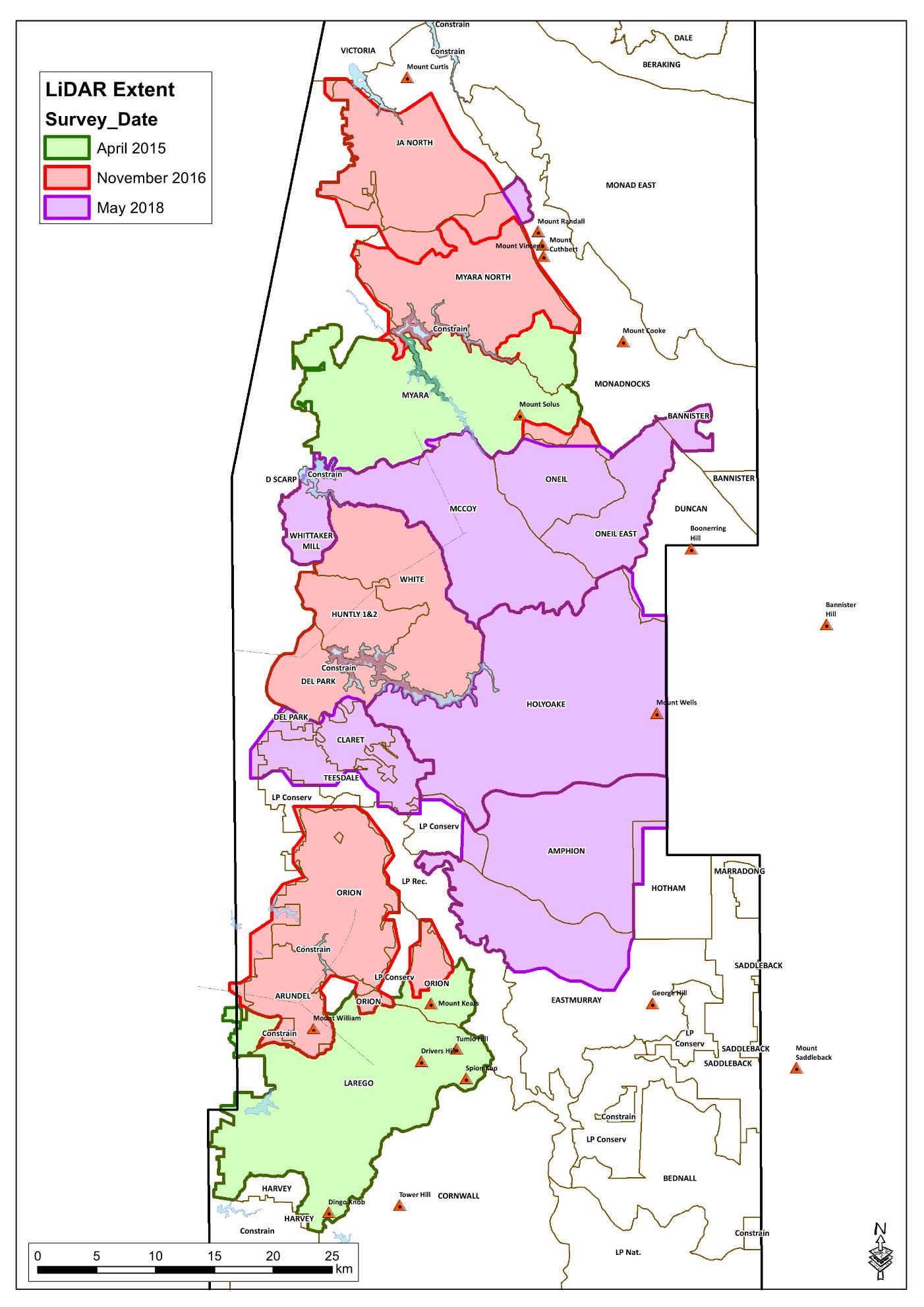

In 2023, Alcoa-operated mines, mines operated by partnerships in which Alcoa, including AWAC, has equity interests, and bauxite offtake agreements supplied 83 percent of volume to Alcoa refineries and the remaining 17 percent was sold to third-party customers. Alcoa-operated mines produced 36.3 mdmt of bauxite and mines operated by partnerships produced 4.7 mdmt of bauxite on a proportional equity basis, for a total Company bauxite production of 41.0 mdmt.

On April 30, 2022, Alcoa completed the sale of its investment in MRN. The Company entered into several bauxite offtake agreements with South32 to provide bauxite supply for existing long-term supply contracts.

Based on the terms of its bauxite supply contracts, the amount of bauxite AWAC purchases from its minority-owned joint ventures, MRN (until its sale in April 2022) and CBG, differ from its proportional equity in those mines. Therefore, in 2023, Alcoa had access to 45.2 mdmt of production from its portfolio of bauxite interests and bauxite offtake and supply agreements and sold 7.6 mdmt of bauxite to third parties; 37.6 mdmt of bauxite was delivered to Alcoa refineries.

The Company primarily sells alumina through contracts containing two pricing components: (1) the API price basis and (2) a negotiated adjustment basis that takes into account various factors, including freight, quality, customer location, and market conditions, as well as through fixed price spot sales. In 2023, approximately 95 percent of the Company’s smelter grade alumina shipments to third parties were sold on an adjusted API price or fixed price spot basis.

Beginning in January 2023, financial information for the activities of the bauxite mines and the alumina refineries was combined into the Alumina segment and the Company began reporting its financial results in the following two segments: (i) Alumina and (ii) Aluminum. Accordingly, segment information for all prior periods presented was updated to reflect the new segment structure in Quarterly Report on Form 10-Q and Annual Report on Form 10-K filings.

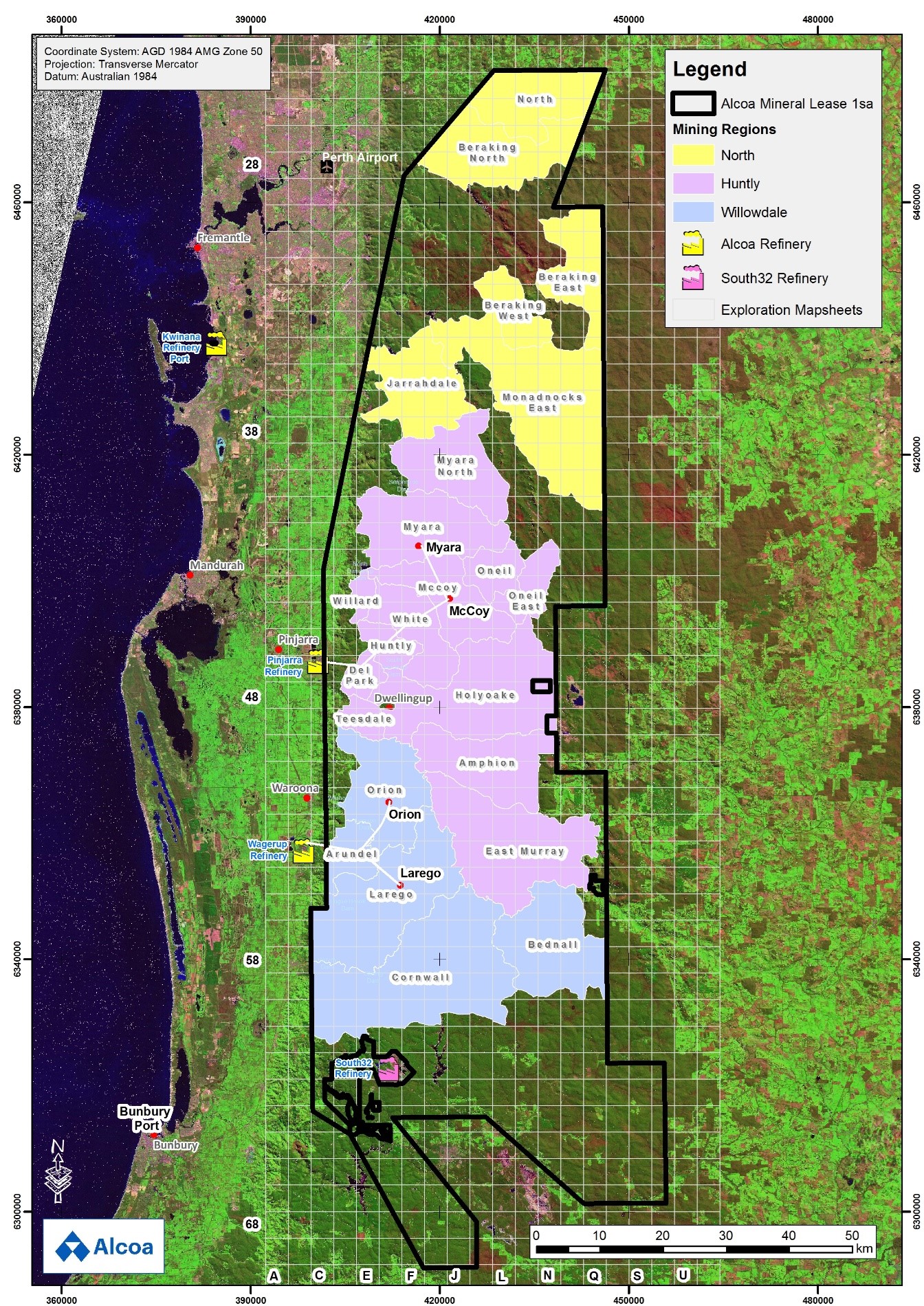

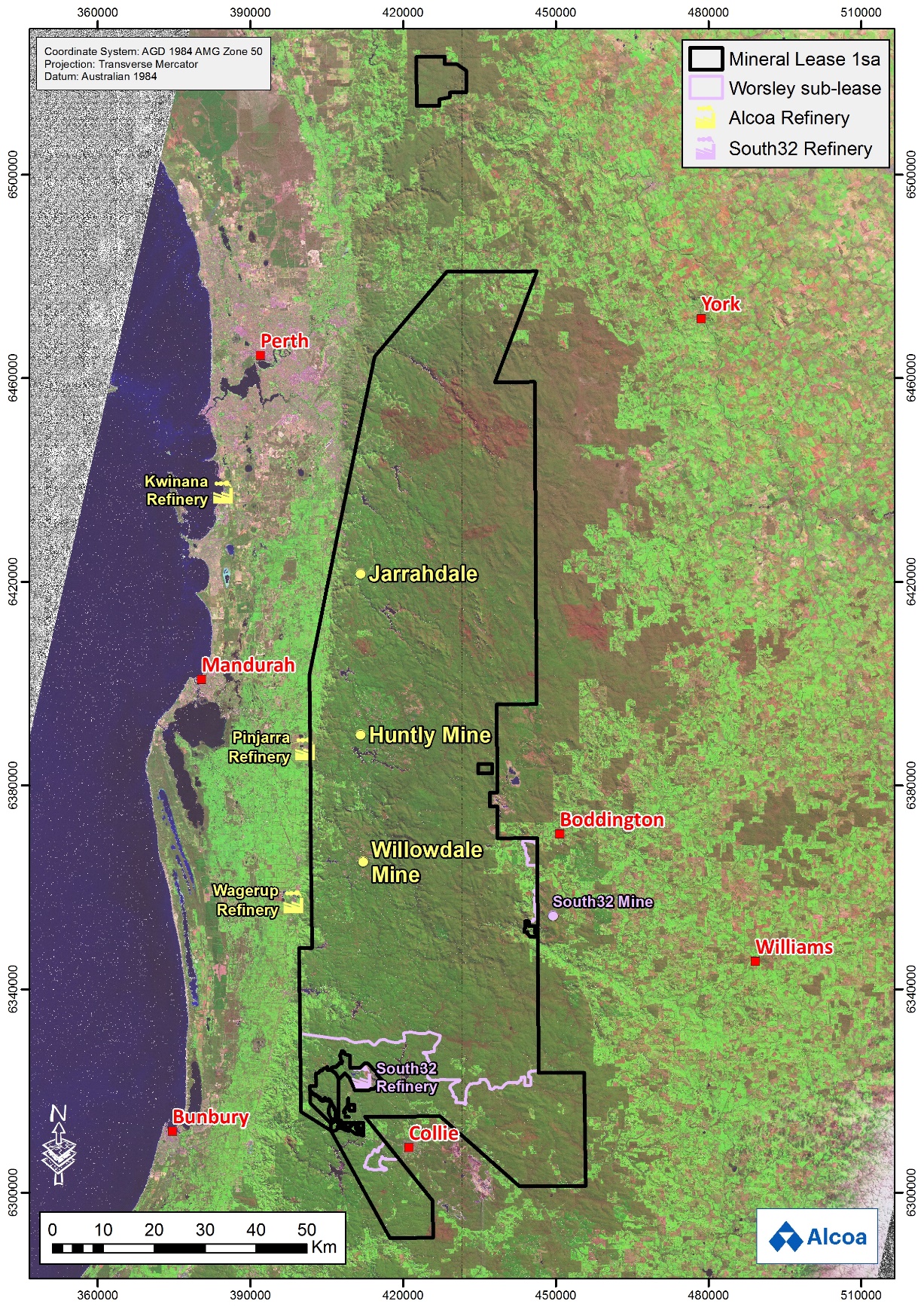

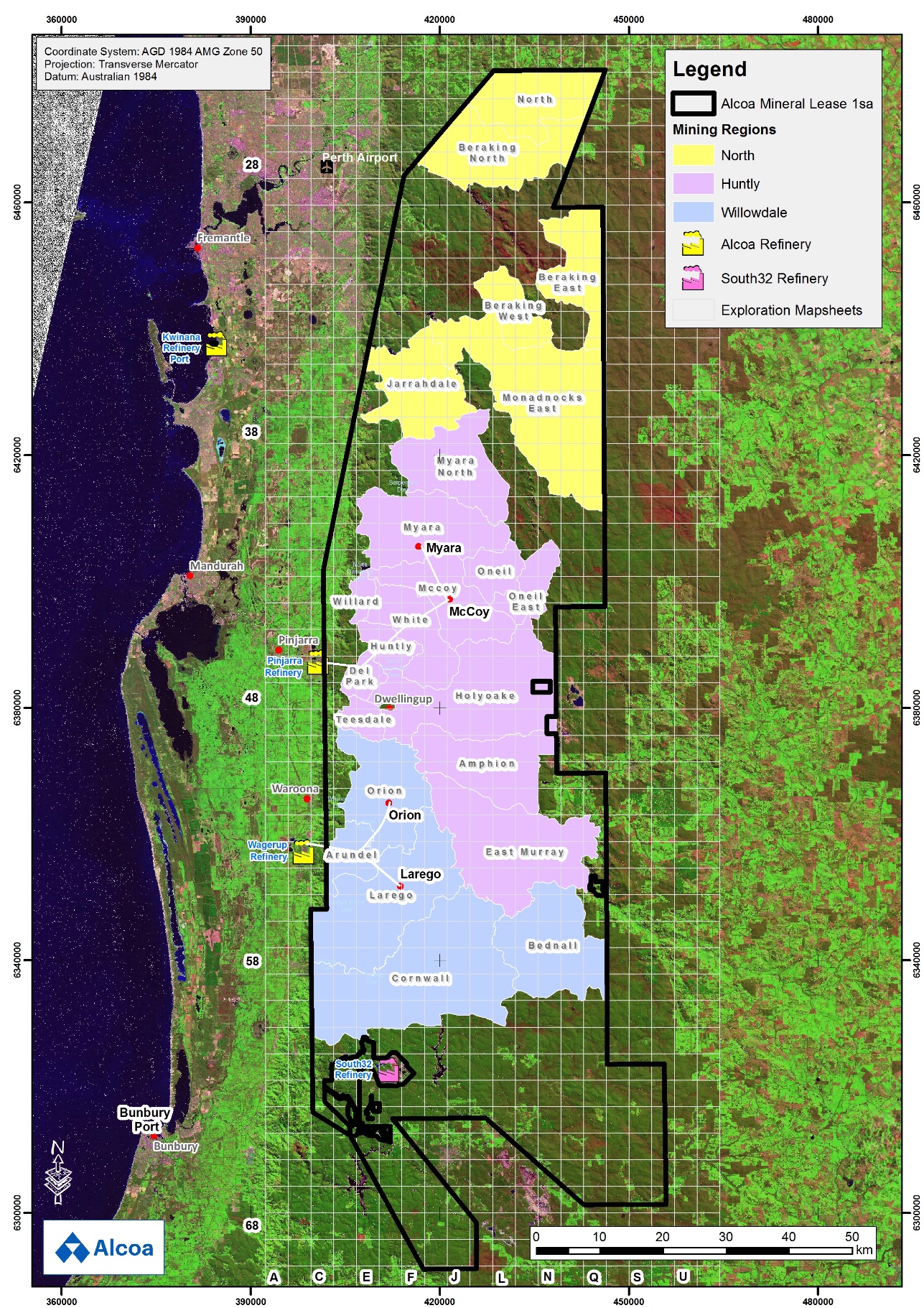

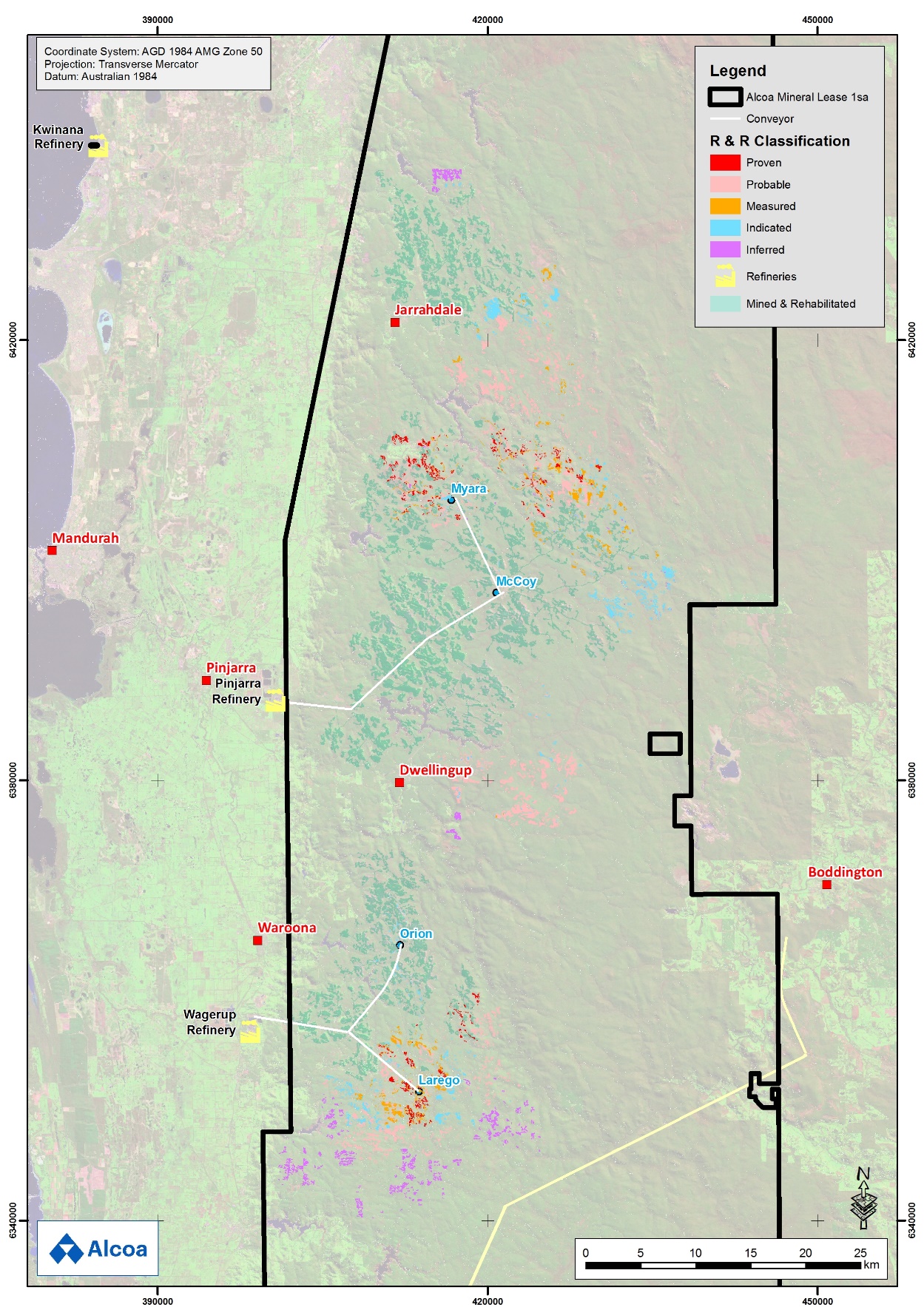

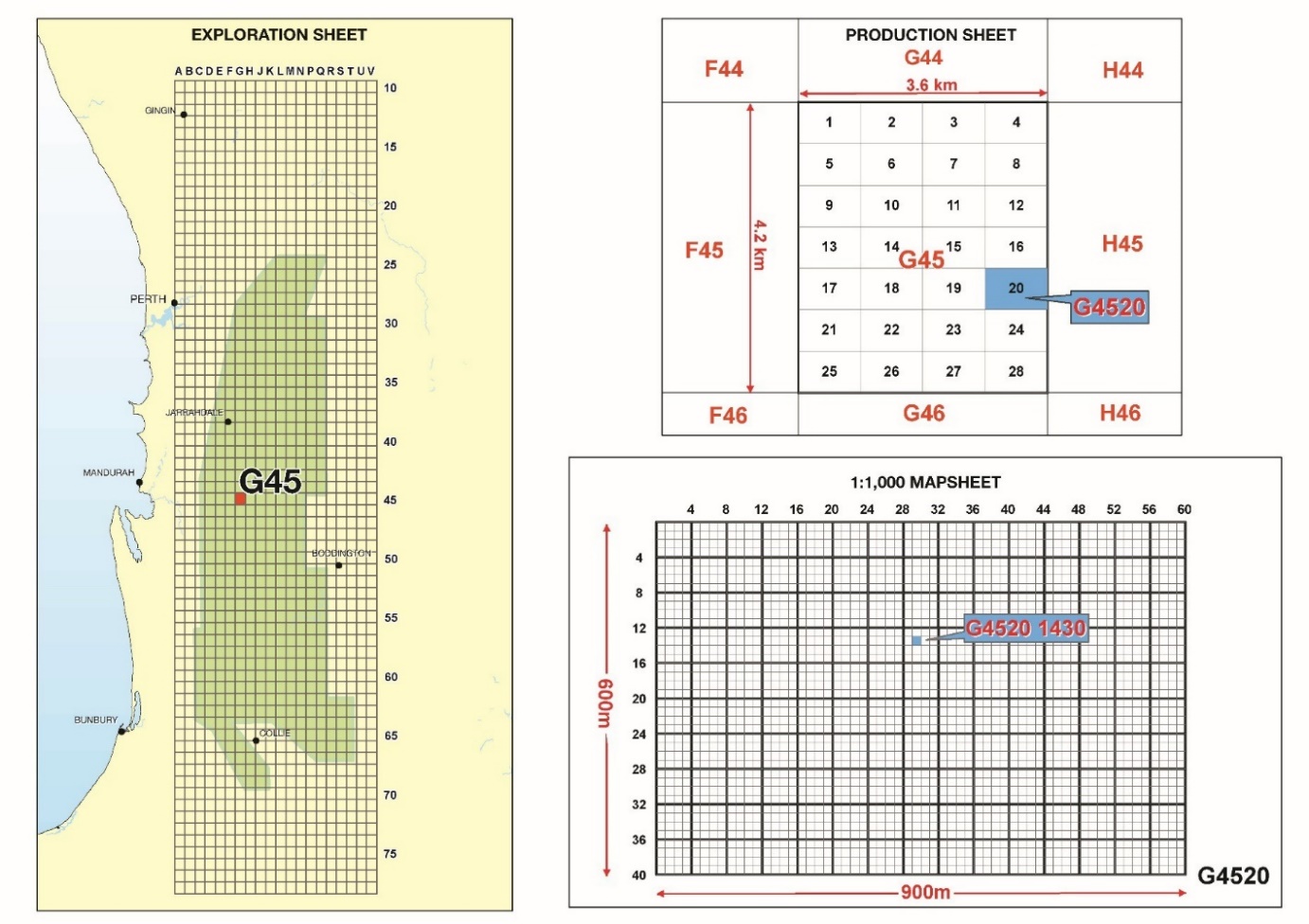

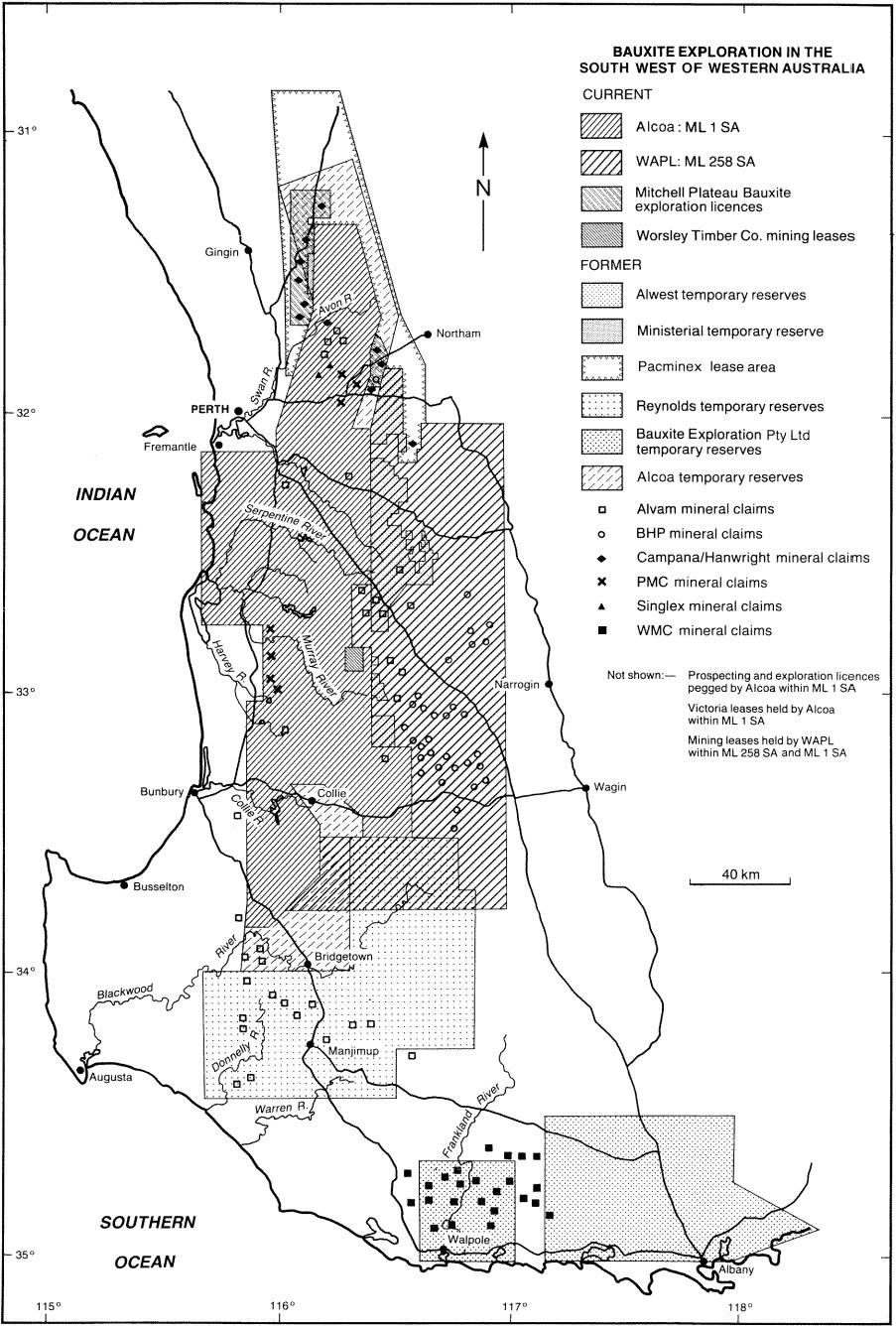

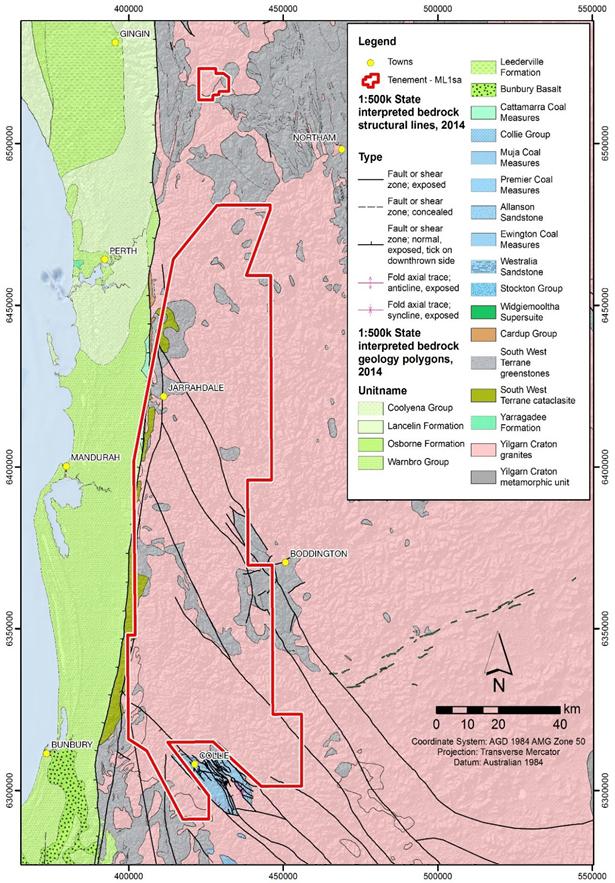

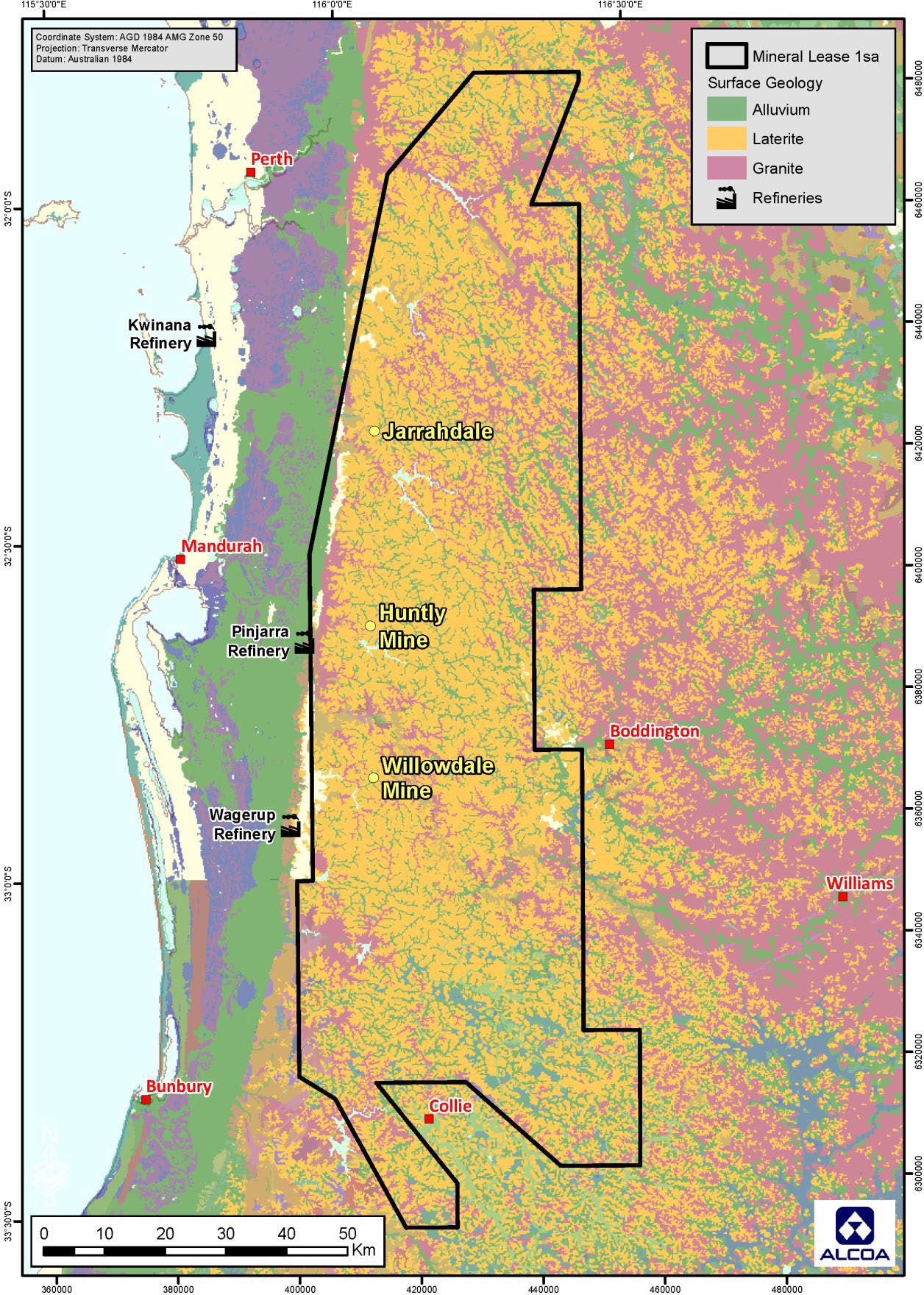

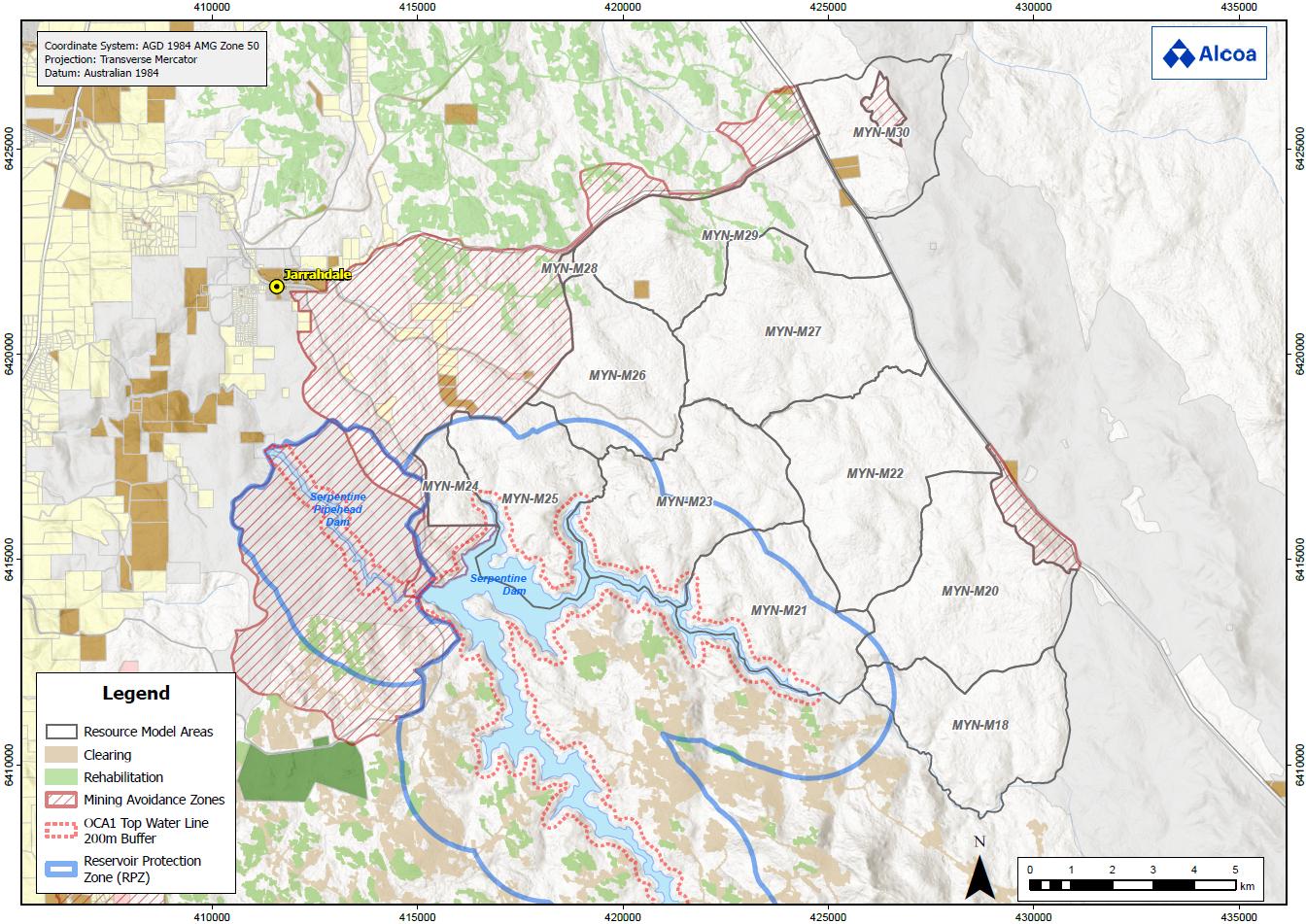

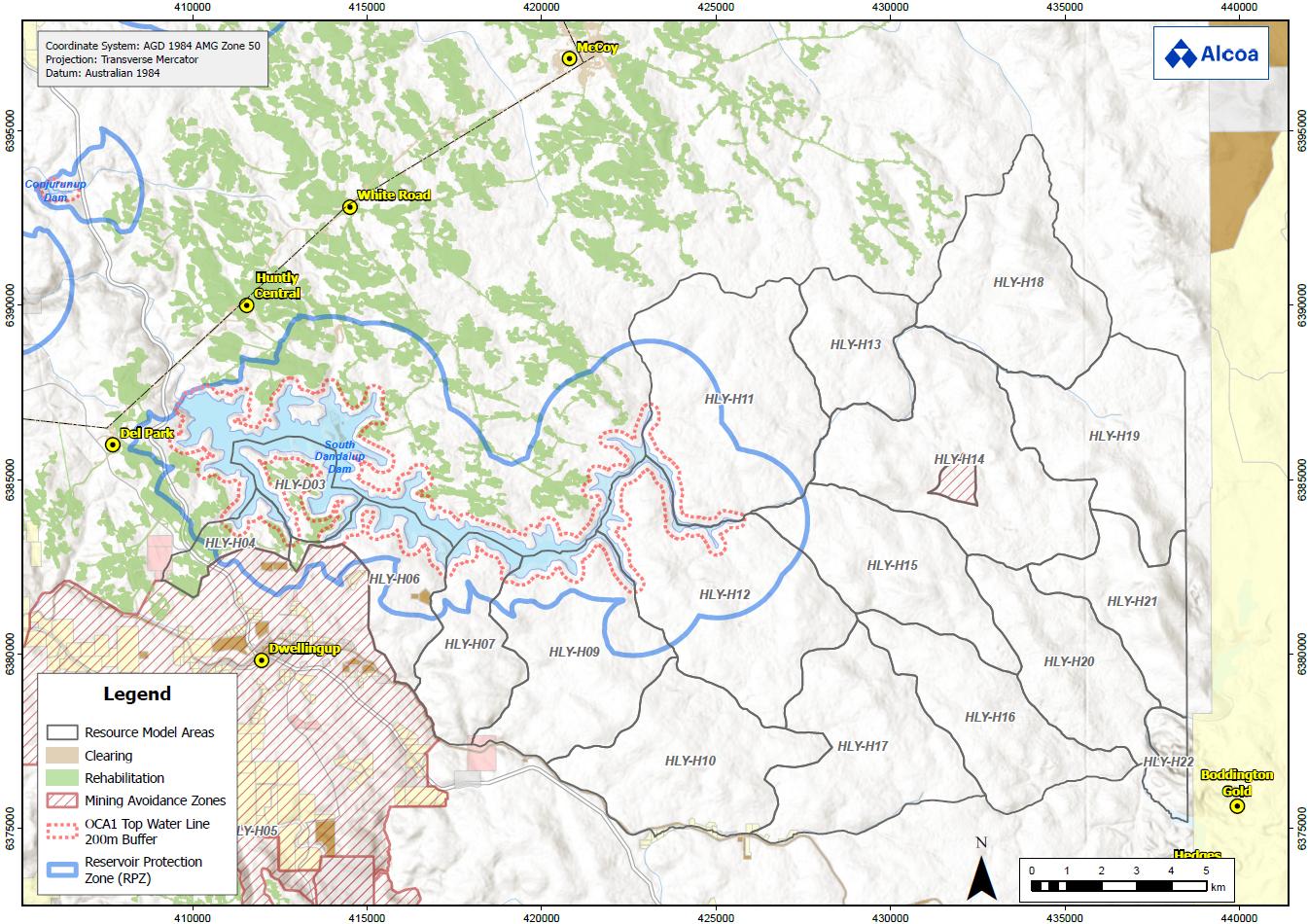

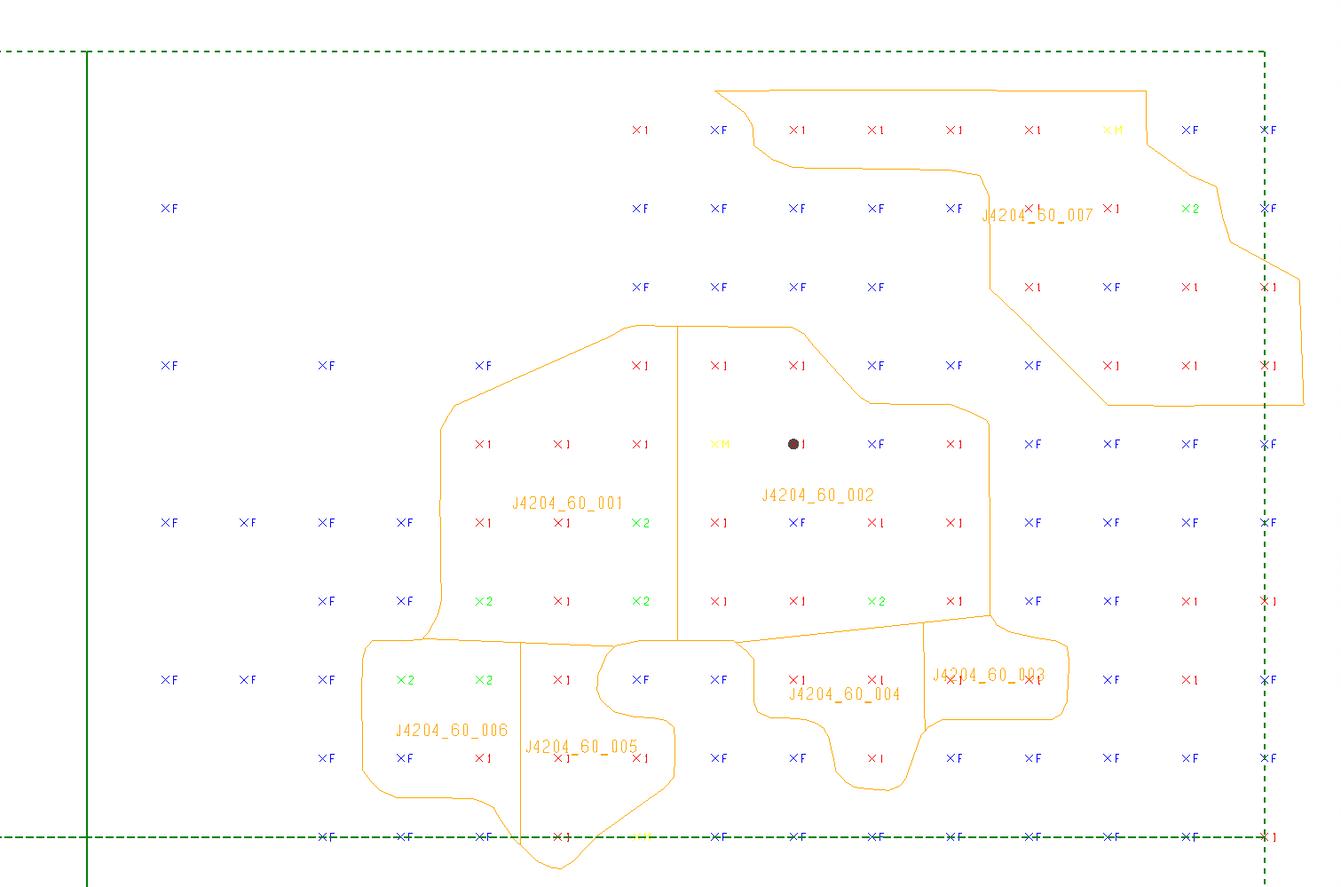

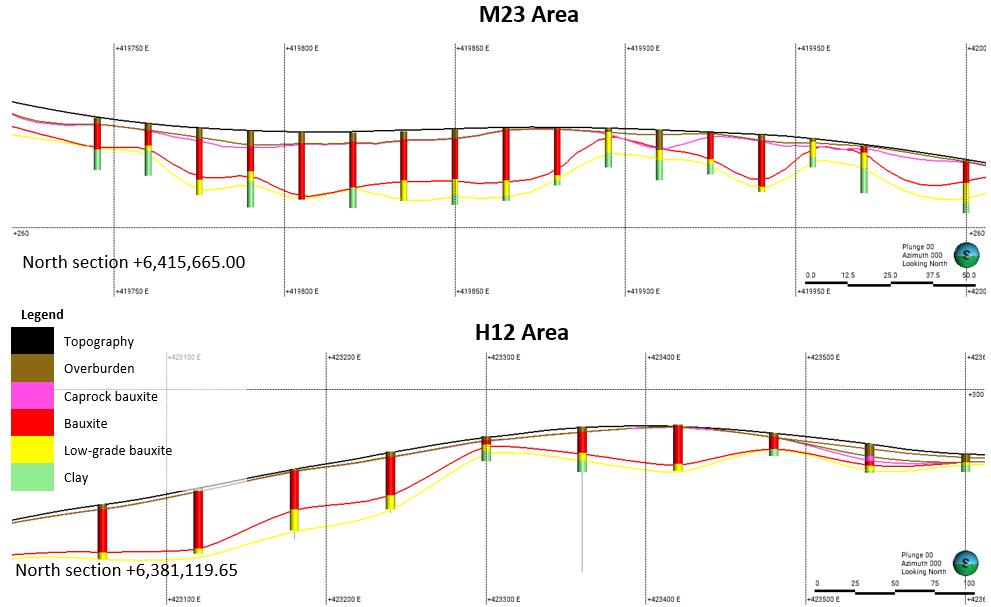

Information regarding the Company’s bauxite mining properties and bauxite mineral resources and reserves is included in Part 1 Item 2 of this Form 10-K.

Alcoa’s alumina refining facilities and its worldwide alumina capacity stated in metric tons per year (mtpy) as of December 31, 2023 are shown in the following table:

Country |

|

Facility |

|

Nameplate |

|

|

Alcoa |

|

||

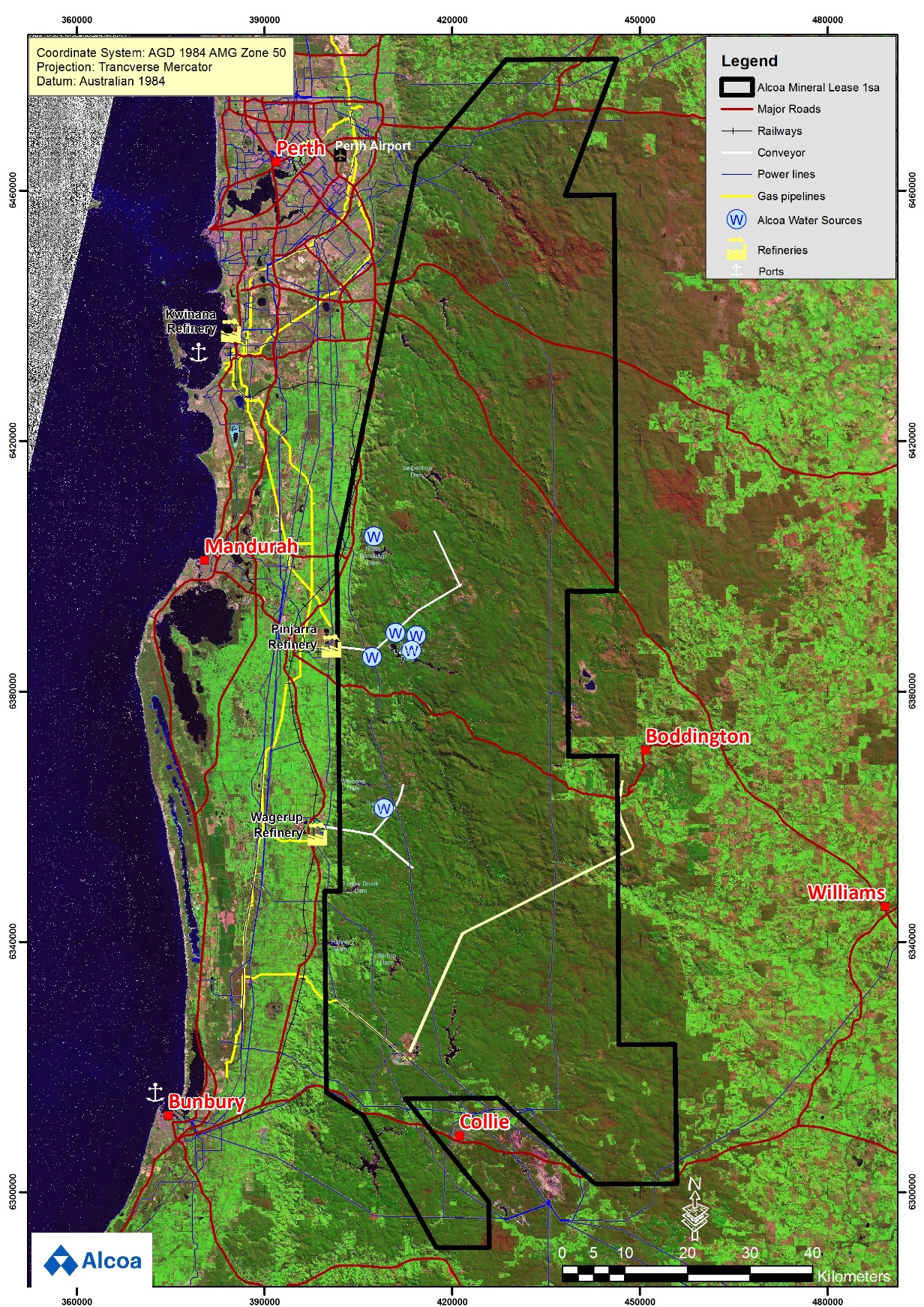

Australia (AofA) |

|

Kwinana |

|

|

2,190 |

|

|

|

2,190 |

|

|

|

Pinjarra |

|

|

4,700 |

|

|

|

4,700 |

|

|

|

Wagerup |

|

|

2,879 |

|

|

|

2,879 |

|

Brazil |

|

Poços de Caldas |

|

|

390 |

|

|

|

390 |

|

|

|

São Luís (Alumar) |

|

|

3,860 |

|

|

|

2,084 |

|

Spain |

|

San Ciprián |

|

|

1,600 |

|

|

|

1,600 |

|

TOTAL |

|

|

|

|

15,619 |

|

|

|

13,843 |

|

5

Equity Interests: |

|

|

|

|

|

|

|

|

||

Country |

|

Facility |

|

Nameplate |

|

|

Alcoa |

|

||

Saudi Arabia |

|

Ras Al Khair (MBAC) |

|

|

1,800 |

|

|

|

452 |

|

As of December 31, 2023, Alcoa had approximately 1,452,000 mtpy of idle capacity relative to total Alcoa consolidated capacity of 13,843,000 mtpy. Idle capacity of 800,000 mtpy at the San Ciprián refinery is due to the partial curtailment of the refinery in 2022, 438,000 mtpy of idle capacity at the Kwinana refinery is due to the partial curtailment in 2023, and 214,000 mtpy of idle capacity at the Poços de Caldas facility is a result of the previous full curtailment of the Poços de Caldas smelter.

In October 2019, the Company announced a five-year review of our production assets that includes a range of potential outcomes for these facilities to improve cost positioning, including curtailment, closure, or divestiture. The review includes 4 million metric tons of global refining capacity, of which 2,305,000 mtpy of capacity has been permanently closed since the announced review. In January 2024, the Company announced an additional curtailment of 2,190,000 mpty of capacity through the full curtailment of the Kwinana refinery beginning in the second quarter of 2024. The refinery has been operating at approximately 80 percent of its nameplate capacity since January 2023, when the Company reduced production by decreasing process flows and taking offline one of five digesters in response to a domestic natural gas shortage in Western Australia due to production challenges experienced by key gas suppliers. While the supply of natural gas improved in April 2023, the Company kept the one digester offline due to the prolonged annual mine plan approvals process.

In 2022, production at the San Ciprián refinery was reduced to approximately 50 percent of the 1.6 million metric tons of annual capacity to mitigate the financial impact of high natural gas costs. In December 2023, the Company initiated engagement with government stakeholders and workers’ representatives to discuss ongoing financial difficulties at the San Ciprián operations, identify all potential forms of relief, and work collaboratively on a long-term solution.

Aluminum

This segment currently consists of (i) the Company’s worldwide smelting and casthouse system and (ii) a portfolio of energy assets in Brazil, Canada, and the United States. The smelting operations produce molten primary aluminum, which is then formed by the casting operations into either common alloy ingot (e.g., t-bar, sow, standard ingot) or into value add ingot products (e.g., foundry, billet, rod, and slab). The energy assets supply power to external customers in Brazil and the United States, as well as internal customers in the Aluminum segment (Baie-Comeau (Canada) smelter and Warrick (Indiana) smelter) and, to a lesser extent, the Alumina segment (Brazilian refineries). This segment also includes Alcoa’s 25.1% share of MAC, the smelting joint venture company in Saudi Arabia.

Smelting and Casting Operations

Contracts for primary aluminum vary widely in duration, from multi-year supply contracts to spot purchases. Pricing for primary aluminum products is typically comprised of three components: (i) the published LME aluminum price for commodity grade P1020 aluminum, (ii) the published regional premium applicable to the delivery locale, and (iii) a negotiated product premium that accounts for factors such as shape and alloy.

6

Alcoa’s primary aluminum facilities and its global smelting capacity stated in metric tons per year (mtpy) as of December 31, 2023 are shown in the following table:

Country |

|

Facility |

|

Nameplate |

|

|

Alcoa |

|

||

Australia |

|

Portland |

|

|

358 |

|

|

|

197 |

|

Brazil |

|

Poços de Caldas2 |

|

N/A |

|

|

N/A |

|

||

|

|

São Luís (Alumar) |

|

|

447 |

|

|

|

268 |

|

Canada |

|

Baie Comeau, Québec |

|

|

324 |

|

|

|

324 |

|

|

|

Bécancour, Québec |

|

|

467 |

|

|

|

350 |

|

|

|

Deschambault, Québec |

|

|

287 |

|

|

|

287 |

|

Iceland |

|

Fjarðaál |

|

|

351 |

|

|

|

351 |

|

Norway |

|

Lista |

|

|

95 |

|

|

|

95 |

|

|

|

Mosjøen |

|

|

200 |

|

|

|

200 |

|

Spain |

|

San Ciprián |

|

|

228 |

|

|

|

228 |

|

United States |

|

Massena West, NY |

|

|

130 |

|

|

|

130 |

|

|

|

Evansville, IN (Warrick) |

|

|

215 |

|

|

|

215 |

|

TOTAL |

|

|

|

|

3,102 |

|

|

|

2,645 |

|

Equity Interests: |

|

|

|

|

|

|

|

|

||

Country |

|

Facility |

|

Nameplate |

|

|

Alcoa |

|

||

Saudi Arabia |

|

Ras Al Khair (MAC) |

|

|

804 |

|

|

|

202 |

|

The Company’s five-year review of our production assets first announced in October 2019 includes 1.5 million metric tons of smelting capacity. The portfolio review includes evaluations to improve cost positioning, including curtailments, closures, or divestitures. As of December 31, 2023, the Company had approximately 465,000 mtpy of idle smelting capacity relative to total Alcoa consolidated capacity of 2,645,000 mtpy. The idle capacity includes 228,000 mtpy of idle capacity at the San Ciprián smelter, 84,000 mtpy of idle capacity at the Alumar smelter, 80,000 mtpy of idle capacity at the Warrick smelter, 42,000 mtpy of idle capacity at the Portland smelter, and 31,000 mtpy of idle capacity at the Lista smelter.

During the fourth quarter of 2023, Alcoa began the restart of 54,000 mtpy of capacity at its Warrick Operations site (Indiana) that was curtailed in July 2022 due to operational challenges related to labor shortages in the region. The Company also approved the permanent closure of 54,000 mtpy of previously curtailed capacity (which had not operated since 2016) to prepare the site for future capital investments for improved casting capabilities.

During 2023, the Company continued the controlled pace for the restart of the Alumar smelter in São Luís, Brazil. The site was operating at approximately 69 percent of the site’s total annual capacity of 268,000 mtpy (Alcoa share) as of December 31, 2023.

In the fourth quarter of 2023, Alcoa began the restart of 16,000 mtpy of previously curtailed capacity at the Portland smelter. The smelter had previously been operating at approximately 75 percent of the site’s total annual capacity of 197,000 mtpy (Alcoa share) since March 2023 due to instability and challenges related to the production of rodded anodes. The site was operating at approximately 79 percent of its capacity as of December 31, 2023.

The Company announced the closure of the previously curtailed Intalco aluminum smelter (279,000 mtpy) after evaluating various options for the asset in March 2023. The facility has been fully curtailed since 2020.

7

The San Ciprián smelter was curtailed in January 2022, as a result of an agreement with the workers’ representatives in December 2021. In February 2023, under the terms of an amended viability agreement, Alcoa agreed to a phased restart of the smelter beginning in January 2024, to operate an initial complement of approximately 6 percent of total pots, to restart all pots by October 1, 2025 and to maintain 75 percent of the annual capacity of 228 kmt from October 1, 2025 until the end of 2026. In December 2023, the Company initiated engagement with government stakeholders and workers’ representatives to discuss ongoing financial difficulties at the San Ciprián operations, identify all potential forms of relief, and work collaboratively on a long-term solution. In January 2024, the Company began the restart process for the initial complement of pots in accordance with terms of the viability agreement while the discussions on future solutions progress.

Energy Facilities and Sources

In 2023, energy comprised approximately 25% of the Company’s total alumina refining production costs and electric power comprised approximately 23% of the Company’s primary aluminum production costs.

Electricity markets are regional and are limited by physical and regulatory constraints, including the physical inability to transport electricity efficiently over long distances, the design of the electric grid, including interconnections, and the regulatory structure imposed by various federal and state entities.

Electricity contracts may be short-term (real-time or day ahead) or years in duration, and contracts can be executed for immediate delivery or years in advance. Pricing may be fixed, indexed to an underlying fuel source or other index such as LME, cost-based, or based on regional market pricing. In 2023, Alcoa generated approximately 9% of the power used at its smelters worldwide and generally purchased the remainder under long-term arrangements.

The following table sets forth the electricity generation capacity and 2023 generation of facilities in which Alcoa Corporation has an ownership interest. See also the Joint Ventures section above.

Country |

|

Facility |

|

Alcoa Corporation Consolidated |

|

|

2023 Generation |

|

||

Brazil |

|

Barra Grande |

|

|

150 |

|

|

|

1,315,097 |

|

|

|

Estreito |

|

|

155 |

|

|

|

1,360,074 |

|

|

|

Machadinho |

|

|

126 |

|

|

|

1,057,770 |

|

|

|

Serra do Facão |

|

|

60 |

|

|

|

525,600 |

|

Canada |

|

Manicouagan |

|

|

133 |

|

|

|

1,161,190 |

|

United States |

|

Warrick |

|

|

657 |

|

|

|

3,640,522 |

|

TOTAL |

|

|

|

|

1,281 |

|

|

|

9,060,253 |

|

The figures in this table are presented in megawatts (MW) and megawatt hours (MWh), respectively.

Each facility listed above generates hydroelectric power except the Warrick facility, which generates substantially all of the power used by the Warrick smelting facility from the co-located Warrick power plant using coal reserves from the Alcoa-owned Liberty Mine and coal purchased from third parties at nearby coal reserves. Liberty Mine has a production capacity of approximately 0.8 million tons per year. During 2023, approximately 33% of the generation from the Warrick power plant was sold into the market under its current operating permits. Alcoa Power Generating Inc., a subsidiary of the Company, also owns certain Federal Energy Regulatory Commission (FERC)-regulated transmission assets in Indiana, Tennessee, New York, and Washington.

The consolidated capacity of the Brazilian energy facilities shown above in MW is the assured energy, representing approximately 53% of hydropower plant nominal capacity. The Brazilian hydroelectric facilities produce energy which is transmitted across the national grid to Alcoa’s refineries in Brazil and the excess generation capacity is sold into the market.

8

Below is an overview of our external energy for our smelters and refineries.

|

External Energy Source |

|

Region |

Electricity |

Natural Gas |

North America |

Québec, Canada Alcoa’s smelter located in Baie-Comeau, Quebec, purchases approximately 25 percent of its electricity needs from Manicouagan Power Limited Partnership. Otherwise, all electricity consumed by the three smelters in Québec is purchased under contracts with Hydro-Québec that expire on December 31, 2029.

Massena, New York (Massena West) The Massena West smelter in New York receives power from the New York Power Authority (NYPA) pursuant to a contract between Alcoa and NYPA that expires in March 2026.

|

Alcoa generally procures natural gas on a competitive bid basis from a variety of sources, including natural gas producers and independent gas marketers. Contract pricing for gas is typically based on a published industry index such as the New York Mercantile Exchange (NYMEX). |

Australia |

Portland This smelter purchases power from the National Electricity Market (NEM) variable spot market in the state of Victoria. During 2021, the smelter entered into fixed-for-floating swap contracts with AGL Hydro Partnership, Origin Energy Electricity Limited, and Alinta Energy CEA Trading Pty Ltd, for a combined 515 MW. In addition, in November 2021 the Portland Aluminium joint venture announced the restart of 35,000 mtpy of idle capacity (19,000 mtpy Alcoa share), and the smelter entered into an additional fixed-for-floating swap contract with AGL Hydro Partnership for 72 MW. These swap contracts for a combined 587 MW expire on June 30, 2026.

In August 2023, the smelter entered into a nine-year fixed-for-floating swap contract with AGL Hydro Partnership for 300 MW effective July 1, 2026, when current contracts end.

Each of these swap contracts manage exposure to the variable energy rates from the NEM spot market.

|

Western Australia AofA uses gas to co-generate steam and electricity for its alumina refining processes at the Kwinana, Pinjarra and Wagerup refineries, and to fuel the calcination furnaces at each site. In 2015, AofA secured a significant portion of gas supplies to 2032. In 2020 and 2022, AofA contracted for additional gas supplies starting in 2024. On a combined basis, AofA’s gas supply arrangements are expected to cover approximately 80 percent of the refineries’ gas requirements through 2027, with decreasing percentages thereafter through 2032.

On January 8, 2024, the Company announced the full curtailment of the Kwinana refinery beginning in the second quarter of 2024. The Company is evaluating alternatives to resell, swap or redeploy the gas secured for the Kwinana refinery when fully curtailed.

|

9

|

External Energy Source |

|

Region |

Electricity |

Natural Gas |

Europe |

San Ciprián, Spain The San Ciprián smelter was fully curtailed in January 2022 pursuant to the agreement reached with the workers’ representatives on December 29, 2021. The smelter purchased its reduced electricity requirements under a bilateral spot power contract that expired on June 30, 2022.

In February 2023, the Company reached an updated viability agreement with the workers’ representatives to commence the restart process in phases beginning in January 2024.

In anticipation of the phased restart beginning in 2024, Alcoa entered into two long-term power purchase agreements (PPAs) with renewable energy providers in 2022 for up to 75 percent of the smelter’s future power needs. In 2023, relevant authorities denied some permits related to the development of windfarms included in the PPAs and the PPAs are now expected to supply up to 50 percent of the smelter’s future power needs at its full capacity. The supply of energy will continue to depend on the permitting and development of the remaining windfarms included in the PPAs. As the Company engages stakeholders for a long-term solution for San Ciprián operations, it also continues discussions with other generators to secure long-term power.

Lista and Mosjøen, Norway Beginning in 2017, Alcoa entered into several long-term power purchase agreements, which secured approximately 50 percent of the necessary power for the Norwegian smelters for the period of 2020 to 2035.

In 2023, approximately 25 percent of the necessary power at the Mosjøen smelter was purchased at spot rates.

Beginning in 2022, the Company acted to mitigate spot energy pricing at the Lista smelter which was partially curtailed in August 2022. In July 2022, the Company entered into a fixed price power agreement effective for the fourth quarter of 2022 through December 31, 2023. In February 2023, the agreement was amended with improved fixed pricing and lower volume commitments. During 2023, the Company amended an existing long-term power agreement to fix the price for 2024 for a portion of the smelter’s power requirements and entered into additional fixed price contracts for nearly all of the remaining power requirements for the smelter for 2024.

Financial compensation of the indirect carbon emissions costs passed through in the electricity bill is received in accordance with EU Commission Guidelines and the Norwegian compensation regime.

Iceland Landsvirkjun, the Icelandic national power company, supplies competitively priced electricity from a hydroelectric facility to Alcoa’s Fjarðaál smelter under a 40-year power contract, which will expire in 2047 with a price renegotiation effective from 2028.

|

Spain The San Ciprián refinery has been operating at 50 percent of its capacity since the third quarter of 2022.

In January 2022, Naturgy terminated its contract supplying 50 percent of the refinery’s natural gas demand until June 2022 and 25 percent from July to December 2022. Subsequent to February 2022, the Company has access to adequate supply at spot gas rates. |

10

|

External Energy Source |

|

Region |

Electricity |

Natural Gas |

South America |

Alumar The Alumar smelter was operating at 69 percent of the site’s total annual capacity of 268 kmt (Alcoa share) as of December 31, 2023, following the restart that was announced in September 2021.

Alcoa entered into several short-term power purchase agreements which secured substantially all of the necessary power for its share of the Alumar smelter for the restart period in 2022 through the end of 2023.

Alcoa also entered into multiple long-term power purchase agreements which collectively secured all of the necessary power for its share of the Alumar smelter for the period of 2024 through 2038. All short- and long-term power secured is from renewable sources. |

|

Sources and Availability of Raw Materials

The Company believes that the raw materials necessary to its business are and will continue to be available and that the sources and availability of such raw materials are currently adequate. Generally, materials are purchased from third-party suppliers under competitively priced supply contracts or bidding arrangements. Substantially all of the raw materials required to manufacture our products are available from more than one supplier. Some sources of these raw materials are located in countries that may be subject to unstable political and economic conditions, which could disrupt supply or affect the price of these materials.

Certain raw materials, such as caustic soda and calcined petroleum coke, may be subject to significant price volatility which could impact our financial results.

Alcoa sources bauxite from its own resources, including AWAC entities, and believes its present sources of bauxite on a global basis are sufficient to meet the forecasted requirements of its alumina refining operations for the foreseeable future.

Certain alumina refineries generate electricity through the digestor process that meets or exceeds their power needs, while others purchase electricity from third-party suppliers.

For each metric ton (mt) of alumina produced, Alcoa consumes the following amounts of the identified raw material inputs (approximate range across relevant facilities):

Raw Material |

|

Units |

|

Consumption per mt of Alumina |

Bauxite |

|

mt |

|

2.2 – 4.1 |

Caustic soda |

|

kg |

|

60 – 100 |

Electricity |

|

kWh |

|

170 to 320 total consumed |

Fuel oil and natural gas |

|

GJ |

|

6 – 13.8 |

Lime (CaO) |

|

kg |

|

6 – 60 |

For each metric ton of aluminum produced, Alcoa consumes the following amounts of the identified raw material inputs (approximate range across relevant facilities):

Raw Material |

|

Units |

|

Consumption per mt of Primary Aluminum |

Alumina |

|

mt |

|

1.91 – 1.94 |

Aluminum fluoride |

|

kg |

|

11.2 – 20.9 |

Calcined petroleum coke |

|

mt |

|

0.32 – 0.39 |

Cathode blocks |

|

mt |

|

0.004 – 0.009 |

Electricity |

|

kWh |

|

13.27 – 16.78 |

Liquid pitch |

|

mt |

|

0.08 – 0.10 |

Natural gas |

|

mcf |

|

2.0 – 5.6 |

Certain aluminum we produce includes alloying materials. Because of the number of different types of elements that can be used to produce various alloys, providing a range of such elements would not be meaningful. With the exception of a very small number of internally used products, Alcoa produces its aluminum alloys in adherence to an Aluminum Association (of which Alcoa is an active member) standard, which uses a specific designation system to identify alloy types. In general, each alloy type has a major alloying element other than aluminum but will also include lesser amounts of other constituents.

11

Competition

Alcoa is subject to highly competitive conditions in all aspects of the aluminum supply chain in which it competes. With our business segments operating in close proximity to our broad, worldwide customer base, we endeavor to meet customer demand in key markets in North America, South America, Europe, the Middle East, Australia, and China.

We compete with a variety of both U.S. and non-U.S. companies in all major markets across the aluminum supply chain. Competitors include bauxite miners who supply to the third-party bauxite market, alumina suppliers, refiners and producers, commodity traders, aluminum producers, and producers of alternative materials such as steel, titanium, copper, carbon fiber, composites, plastic, and glass.

With the Sustana brand, including EcoDura aluminum (recycled content), EcoLum aluminum (low carbon), and EcoSource alumina (also low carbon), the Company is well positioned to compete with others in offering products to help customers achieve their decarbonization goals.

Alumina

We are the world’s largest alumina producer outside of China. The alumina market is global and highly competitive, with many active suppliers, producers, and commodity traders. The majority of our product is sold in the form of smelter grade alumina. Our main competitors in the third-party alumina market are Aluminum Corporation of China, South32, Hangzhou Jinjiang Group, Rio Tinto, and Norsk Hydro ASA. In recent years, there has been significant growth in alumina refining in China and Indonesia.

Key factors influencing competition in the alumina market include cost position, price, reliability of bauxite supply, quality, and proximity to customers and end markets. We had an average cost position in the first quartile of global alumina production in 2023. Increased production costs in 2023 caused by lower bauxite grade in Australia, the San Ciprián refinery curtailment, and operational issues in Brazil could place Alumina in the second quartile in 2024. Our refineries are strategically located near low-cost bauxite mines, which provide a long-term supply of bauxite to our refineries. Our alumina refineries include sophisticated refining technology to maximize efficiency with the bauxite grades from these internal mines.

We are among the world’s largest bauxite miners. The majority of bauxite mined globally is converted to alumina for the production of aluminum. In 2023, Alcoa-operated mines, mines operated by partnerships, and bauxite offtake agreements supplied approximately 83% of volume to Alcoa refineries and approximately 17% of Alcoa’s bauxite shipments were sold to third-party customers.

Our principal competitors in the third-party bauxite market include Rio Tinto and multiple suppliers from Guinea, Australia, and Brazil, among other countries. We compete largely based on bauxite quality, price, and logistics, as well as strategically located long-term bauxite resources in Brazil and Guinea, which is home to the world’s largest reserves of high-quality metallurgical grade bauxite.

Aluminum

In our Aluminum segment, competition is dependent upon the type of product we are selling.

The market for primary aluminum is global, and demand for aluminum varies widely from region to region. We compete with commodity traders, such as Glencore, Trafigura, J. Aron and Gerald Group, and aluminum producers, such as Emirates Global Aluminum, Norsk Hydro ASA, Rio Tinto, Century Aluminum and Vedanta Aluminum Ltd.

Several of the most critical competitive factors in our industry are product quality, production costs (including source, reliability of supply, and cost of energy), price, access and proximity to raw materials, customers and end markets, timeliness of delivery, customer service (including technical support), product innovation, and breadth of offerings. Where aluminum products compete with other materials, the characteristics of aluminum are also a significant factor, particularly its light weight, strength, and recyclability.

The strength of our position in the primary aluminum market is largely attributable to: our integrated supply chain; long-term energy arrangements; the ability of our casthouses to provide customers with a diverse product portfolio in terms of shapes and alloys; and our decreasing demand for fossil fuels, as approximately 87% of the aluminum smelting portfolio operated by the Company was powered by renewable (primarily hydropower) energy sources in 2023. The Company intends to continue to focus on optimizing capacity utilization.

12

Patents, Trade Secrets and Trademarks

The Company believes that its domestic and international patent, trade secret and trademark assets provide it with a competitive advantage. The Company’s rights under its intellectual property, as well as the technology and products made and sold under them, are important to the Company as a whole and, to varying degrees, important to each business segment. Alcoa’s business as a whole is not, however, materially dependent on any single patent, trade secret or trademark. As a result of product development and technological advancement, the Company continues to pursue patent protection in jurisdictions throughout the world. As of December 31, 2023, Alcoa’s worldwide patent portfolio consisted of approximately 420 granted patents and approximately 170 pending patent applications. The Company also has a number of domestic and international registered trademarks that have significant recognition within the markets that are served, including the name “Alcoa” and the Alcoa symbol. Patents may exist for 20 years from filing date, and trademarks may have an indefinite life based upon continued use.

Government Regulations and Environmental Matters

Alcoa’s global operations subject it to compliance with various types of government laws, regulations, permits, and other requirements which often provide discretion to government authorities and could be interpreted, applied, or modified in ways to make the Company’s operations or compliance activities more costly. These laws and regulations include those relating to safety and health, environmental protection and compliance, tailings management, data privacy and security, anti-corruption, human rights, competition, and trade, such as tariffs or other import or export restrictions that may increase the cost of raw material or cross-border shipments and impact our ability to do business with certain countries or individuals. Though we cannot predict the collective potential adverse impact of the expanding body of laws, regulations, and interpretations, we believe that we are in compliance with such laws and regulations in all material respects and do not expect that continued compliance with such regulations will have a material effect upon capital expenditures, earnings, or our competitive position. For a discussion of the risks associated with certain applicable laws and regulations, see Part I Item 1A of this Form 10-K.

Environmental

Alcoa is subject to extensive federal, state/provincial, and local environmental laws and regulations and other requirements, in the U.S. and abroad, including those relating to the release or discharge of materials into the air, water and soil, waste management, pollution prevention measures, the generation, storage, handling, use, transportation and disposal of hazardous materials, and the exposure of persons to hazardous materials.

Alcoa is committed to the Global Industry Standard on Tailings Management (GISTM), an integrated approach to the management and operations of our tailings storage facilities to enhance the safety of these facilities. In August 2023, Alcoa’s impoundments with very high or extreme consequence classification were audited by an independent third party and assessed as in conformance with GISTM as required by the International Council on Mining and Metals Conformance Protocol. This represents the first phase of implementation with lower consequence impoundment conformance required by August 2025.

Additionally, we are and may become subject to various laws and regulations related to the disclosures of emissions, the impact of climate change to our business, and plans to reduce such emissions. Recent laws and regulations pertaining to climate change and greenhouse gas emissions have been implemented or are being considered. We continue to monitor the development and implementation of such laws and regulations and continue to assess the extent of potential disclosures or other reporting requirements.

We maintain remediation and reclamation plans for various sites, and we manage environmental assessments and cleanups at approximately 60 locations, which include currently owned or operated facilities and adjoining properties, previously owned or operated facilities and adjoining properties, and waste sites, such as U.S. Superfund (Comprehensive Environmental Response, Compensation and Liability Act (CERCLA)) sites. In 2023, capital expenditures for new or expanded facilities for environmental control were approximately $126 and approximately $180 is expected in 2024. See Part II Item 8 of this Form 10-K in Note S to the Consolidated Financial Statements under caption Contingencies for additional information.

Safety and Health

We are subject to a broad range of foreign, federal, state, and local laws and regulations relating to occupational health and safety, and our safety program includes measures required for compliance. We have incurred, and will continue to incur, capital expenditures to meet our health and safety compliance requirements, as well as to continually improve our safety systems.

For a discussion of the risks associated with certain applicable laws and regulations, see Part I Item 1A of this Form 10-K.

13

Human Capital Resources

Our core values – Act with Integrity, Operate with Excellence, Care for People, and Lead with Courage – guide us as a company, including our approach to human capital management. We believe that our people are our greatest asset. The success and growth of our business depend in large part on our ability to attract, develop, and retain a diverse population of talented, qualified, and highly skilled employees at all levels of our organization, including the individuals who comprise our global workforce, our executive officers and other key personnel.

Our Company policies, including the Code of Conduct and Ethics, Harassment and Bullying Free Workplace Policy, and EHS Vision, Values, Mission, and Policy, support our mission to advance our Company culture and core values. Alcoa maintains a Human Rights Policy that applies globally to the Company, its partnerships, and other business associates, which incorporates international human rights principles encompassed in the Universal Declaration of Human Rights, the International Labor Organization’s Declaration on Fundamental Principles and Rights at Work, the United Nations Global Compact, and the United Nations Guiding Principles on Business and Human Rights.

Employees

As of December 31, 2023, Alcoa had approximately 13,600 employees in 17 countries. Approximately 10,000 of our global employees are covered by collective bargaining agreements with certain unions and varying expiration dates, including approximately 1,000 employees in the U.S., 2,000 employees in Europe, 1,400 employees in Canada, 2,800 employees in South America, and 2,800 employees in Australia. Approximately 900 U.S. employees are covered by a collective bargaining agreement in place with the United Steelworkers (USW). There are also U.S. collective bargaining agreements in place, with varying expiration dates, with the International Association of Machinists and Aerospace Workers (IAM) and the International Brotherhood of Electric Workers (IBEW).

Safety and Health

The safety and health of our employees, contractors, temporary workers, and visitors are top priorities and key to our ability to attract and retain talent. We aspire to work safely, all the time, everywhere. We strive to foster a culture of hazard and risk awareness, the effective understanding and use of our safe systems of work, proactive incident reporting, and knowledge sharing.

Our safety programs and systems are designed to prevent loss of life and serious injury at our locations and include rigorous safety standards and controls, periodic risk-based audits, a formal and standardized process for investigating fatal and serious injury incidents (including potential incidents), management of critical risks and safety hazards, and efforts to eliminate hazards or implement controls to prevent and mitigate risks. We have operating standards based on human performance, which teach employees how to anticipate and recognize situations where errors are likely to occur, which help enable us to predict, reduce, manage, and prevent fatalities and injuries.

We strive to maintain a culture of speaking up, where incidents are reported and ideas are shared. We integrate our temporary workers, contractors, and visitors into our safety programs and data.

Inclusion, Diversity, and Equity

Alcoa's vision is to provide trusting workplaces that are safe, respectful, and inclusive and that reflect the communities in which we operate. Our aim is to build a more inclusive culture where inclusion, diversity, and equity (IDE) is embedded in our actions and employees feel valued, empowered, and respected.

As of December 31, 2023, women comprised approximately 19 percent of our global workforce. We also recognize the benefits and importance of diversity among our senior management. Of the seven Executive Officers, 43 percent are women and 14 percent are racially/ethnically diverse.

In 2023, we continued our IDE strategic efforts with leadership from our new Global Head of IDE and four inclusion groups: AWARE – Alcoans working actively for racial-ethnic equality; EAGLE, our LGBT+ Equality inclusion group; AWN – Alcoa Women’s Network; and ABLE - Alcoans moving beyond limited expectations.

14

Available Information

The Company’s internet website address is www.alcoa.com. Alcoa makes available free of charge on or through its website its Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to those reports as soon as reasonably practicable after the Company electronically files such material with, or furnishes it to, the Securities and Exchange Commission (the SEC). These documents can be accessed on the investor relations portion of our website www.alcoa.com/investors. This information can also be found on the SEC’s internet website, www.sec.gov. The information on the Company’s website is included as an inactive textual reference only and is not a part of, or incorporated by reference in, this Annual Report on Form 10-K.

Dissemination of Company Information

Alcoa Corporation intends to make future announcements regarding Company developments and financial performance through its website, www.alcoa.com, as well as through press releases, filings with the SEC, conference calls, and webcasts.

Information about our Executive Officers

The names, ages, positions, and areas of responsibility of the executive officers of the Company as of the filing date of this Form 10-K are listed below.

William F. Oplinger, 57, has served as President and Chief Executive Officer of Alcoa Corporation since September 24, 2023. Mr. Oplinger served as Executive Vice President and Chief Operations Officer of the Company from February 2023 until his appointment as President and Chief Executive Officer. From November 2016 through January 2023, Mr. Oplinger was Executive Vice President and Chief Financial Officer of the Company. Prior to this, Mr. Oplinger served as Executive Vice President and Chief Financial Officer of ParentCo from April 1, 2013 to November 2016. Mr. Oplinger joined ParentCo in 2000, and through 2013 held key corporate positions in financial analysis and planning and also served as Director of Investor Relations. Mr. Oplinger also held principal positions in the ParentCo’s Global Primary Products division, including as Controller, Operational Excellence Director, Chief Financial Officer, and Chief Operating Officer.

Molly S. Beerman, 60, has served as Executive Vice President and Chief Financial Officer of Alcoa Corporation since February 1, 2023. Prior to this, Ms. Beerman was Senior Vice President and Controller of the Company from November 2019 through January 2023 and Vice President and Controller from December 2016 through October 2019. Ms. Beerman was Director, Global Shared Services Strategy and Solutions from November to December 2016. In 2016, Ms. Beerman held a consulting role with the Finance Department of ParentCo. From 2012 to 2015, Ms. Beerman served as Vice President, Finance and Administration for a non-profit organization focused on community issues. Prior to that, Ms. Beerman was employed by ParentCo from 2001 to 2012, having held several roles in the finance function and eventually becoming the director of global procurement center of excellence from 2008 to 2012. Ms. Beerman is a certified public accountant.

Renato Bacchi, 47, has served as Executive Vice President and Chief Commercial Officer of Alcoa Corporation since August 1, 2023. He leads the Company’s sales and trading, marketing, supply chain, commercial operations, procurement, and transformation and oversees the Company’s global energy assets and innovation and technology programs. Mr. Bacchi was Executive Vice President and Chief Strategy and Innovation Officer of Alcoa Corporation from February 2023 to August 2023. Previously, he was Executive Vice President and Chief Strategy Officer from February 2022 through January 2023, Senior Vice President and Treasurer from November 2019 through January 2022, and Vice President and Treasurer from November 2016 through October 2019. Prior to the Separation Transaction, Mr. Bacchi served as the Assistant Treasurer of ParentCo from October 2014 through October 2016 and the Director, Corporate Treasury from 2012 to 2014. Prior to this time, Mr. Bacchi held various roles of increasing responsibility in areas including finance, strategy, procurement, energy and sales. Mr. Bacchi joined ParentCo in Brazil in 1997.

Nicol A. Gagstetter, 45, has served as Executive Vice President and Chief External Affairs Officer of Alcoa Corporation since October 1, 2023. Ms. Gagstetter is responsible for global external affairs, communications, and sustainability, and she oversees the Alcoa Foundation. Ms. Gagstetter was the Global Head of Environment and Social, Copper Industrial Assets at Glencore International AG, a commodity trading and mining company, from August 2021 through September 2023. Previously, she held a variety of progressive leadership roles and positions across external affairs, sustainability, and marketing in Rio Tinto’s Commercial, Minerals, and Copper groups from 2008 to 2021.

Andrew J. A. Hastings, 49, has served as Executive Vice President and General Counsel of Alcoa Corporation since September 1, 2023. Mr. Hastings has overall responsibility for the Company’s global legal, compliance, governance, and security matters. Prior to joining the Company, Mr. Hastings was Senior Vice President and General Counsel at Lundin Mining Corporation, a mine owner and operator, from February 2019 through August 2023. Previously, Mr. Hastings held progressive legal and commercial roles at Barrick Gold Corporation, a mining company, most recently as Vice President, Joint Venture Governance from May 2018 to February 2019.

15

Tammi A. Jones, 44, has served as Executive Vice President and Chief Human Resources Officer of Alcoa Corporation since April 1, 2020. Ms. Jones oversees all aspects of human resources management, including talent and recruitment, compensation and benefits, diversity, inclusion, and equity, training and development, and labor relations. Ms. Jones served as Vice President, Compensation and Benefits of Alcoa Corporation from January 2019 through March 2020 and was the Director, Organizational Effectiveness from April 2017 to December 2018. From April 2015 through March 2017, Ms. Jones served as Human Resources Director, Aluminum (at ParentCo until the Separation Transaction), and she served as Human Resources Director for ParentCo Wheels and Transportation Products from April 2013 to April 2015. Ms. Jones joined ParentCo in 2006 and held a variety of human resource positions at ParentCo, including Human Resources Director, Europe Building & Construction and Human Resources Director, UK and Ireland in ParentCo’s Building and Construction Systems division.

Matthew T. Reed, 51, has served as Executive Vice President and Chief Operations Officer of Alcoa Corporation since January 1, 2024. Mr. Reed is responsible for the daily operations of the Company’s global bauxite, alumina, and aluminum assets. Mr. Reed was previously Vice President Operations, Australia and President, Alcoa of Australia from June 2023, when he joined the Company, through December 2023. Prior to joining Alcoa, Mr. Reed was the Operations Executive (Chief Operations Officer) of OZ Minerals Limited, a mining company based in South Australia, from September 2021 through May 2023. He was General Manager, Projects at OZ Minerals Limited from January 2021 through August 2021. Previously, Mr. Reed was the Executive Managing Director (Chief Operating Officer) at SIMEC Mining, a mining company based in South Australia, from September 2017 through December 2020.

Item 1A. Risk Factors.

There are inherent risks associated with Alcoa’s business and industry. In addition to the factors discussed elsewhere in this report, the following risks and uncertainties could have a material adverse effect on our business, financial condition, or results of operations, including causing Alcoa’s actual results to differ materially from those projected in any forward-looking statements. Although the risks are organized by heading, and each risk is described separately, many of the risks are interrelated. You should not interpret the disclosure of any risk factor to imply that the risk has not already materialized. While we believe we have identified and discussed below the key risk factors affecting our business, there may be additional risks and uncertainties that are not presently known to Alcoa or that Alcoa currently deems immaterial that also may materially adversely affect us in future periods. See Part II Item 7 of this Form 10-K in Management’s Discussion and Analysis of Financial Condition and Results of Operations under the caption Forward-Looking Statements.

Industry and Global Market Risks

The aluminum industry and aluminum end-use markets are highly cyclical and are influenced by several factors, including global economic conditions, the Chinese market, and overall consumer confidence.

The nature of the industries in which our customers operate causes demand for our products to be cyclical, creating potential uncertainty regarding future profitability. The demand for aluminum is sensitive to, and impacted by, demand for the finished goods manufactured by our customers in industries, such as the commercial construction, transportation, and automotive industries, which may change as a result of factors beyond our control. The demand for aluminum is also highly correlated to economic growth, and we could be adversely affected by large or sudden shifts in the global inventory of aluminum and the resulting market price impacts.

We believe the long-term prospects for aluminum and aluminum products are positive; however, we are unable to predict the future course of industry variables or the strength of the global economy and the effects of government intervention. Our business, financial condition, and results of operations may be materially affected by the conditions in the global economy generally, including inflationary and recessionary conditions, and in global capital markets, including in the end markets and geographic regions in which we and our customers operate. Many of the markets in which our customers participate are also cyclical in nature and experience significant fluctuations in demand for their products based on economic and geopolitical conditions, consumer demand, raw material and energy costs, foreign exchange rates, and government actions. Many of these factors are beyond our control.

The Chinese market is a significant source of global demand for, and supply of, commodities, including aluminum. Chinese production rates of aluminum, both from new construction and installed smelting capacity, can fluctuate based on Chinese government policy, such as the level of enforcement of production capacity limits and/or licenses and environmental policies. In addition, industry overcapacity, a sustained slowdown in Chinese aluminum demand, or a significant slowdown in other markets, that is not offset by decreases in supply of aluminum or increased aluminum demand in emerging economies, such as India, Brazil, and several Southeast Asian countries, could have an adverse effect on the global supply and demand for aluminum and aluminum prices. Also, changes in the aluminum market can cause changes in the alumina and bauxite markets, which could also materially affect our business, financial condition, or results of operations. As a result of these factors, our profitability is subject to significant fluctuation.

16

A decline in consumer and business confidence and spending, severe reductions in the availability and cost of credit, and volatility in the capital and credit markets could adversely affect the business and economic environment in which we operate and the profitability of our business. We are also exposed to risks associated with the creditworthiness of our suppliers and customers. If the availability of credit to fund or support the continuation and expansion of our customers’ business operations is curtailed or if the cost of that credit is increased, the resulting inability of our customers or of their customers to either access credit or absorb the increased cost of that credit could adversely affect our business by reducing our sales or by increasing our exposure to losses from uncollectible customer accounts. These conditions and a disruption of the credit markets could also result in financial instability of some of our suppliers and customers. The consequences of such adverse effects could include the interruption of production at the facilities of our customers, the reduction, delay or cancellation of customer orders, delays or interruptions of the supply of raw materials we purchase, and bankruptcy of customers, suppliers, or other creditors. Any of these events could adversely affect our business, financial condition, and results of operations.

We have in the past and could in the future be materially adversely affected by volatility and declines in aluminum and alumina demand and prices, including global, regional, and product-specific prices, or by significant changes in production costs which are linked to LME or other commodities.

The overall price of primary aluminum consists of several components: (i) the underlying base metal component, which is typically based on quoted prices from the LME; (ii) the regional premium, which comprises the incremental price over the base LME component that is associated with the physical delivery of metal to a particular region (e.g., the Midwest premium for metal sold in the United States); and (iii) the product premium, which represents the incremental price for receiving physical metal in a particular shape (e.g., foundry, billet, slab, rod, etc.) and/or alloy. Each of the above three components has its own drivers of variability.

The LME price volatility is typically driven by macroeconomic factors (including geopolitical instability), global supply and demand of aluminum (including expectations for growth, contraction, and the level of global inventories), and trading activity of financial investors. In 2023, LME cash prices reached a high of $2,636 per metric ton in January 2023 and a low of $2,069 per metric ton in August 2023.

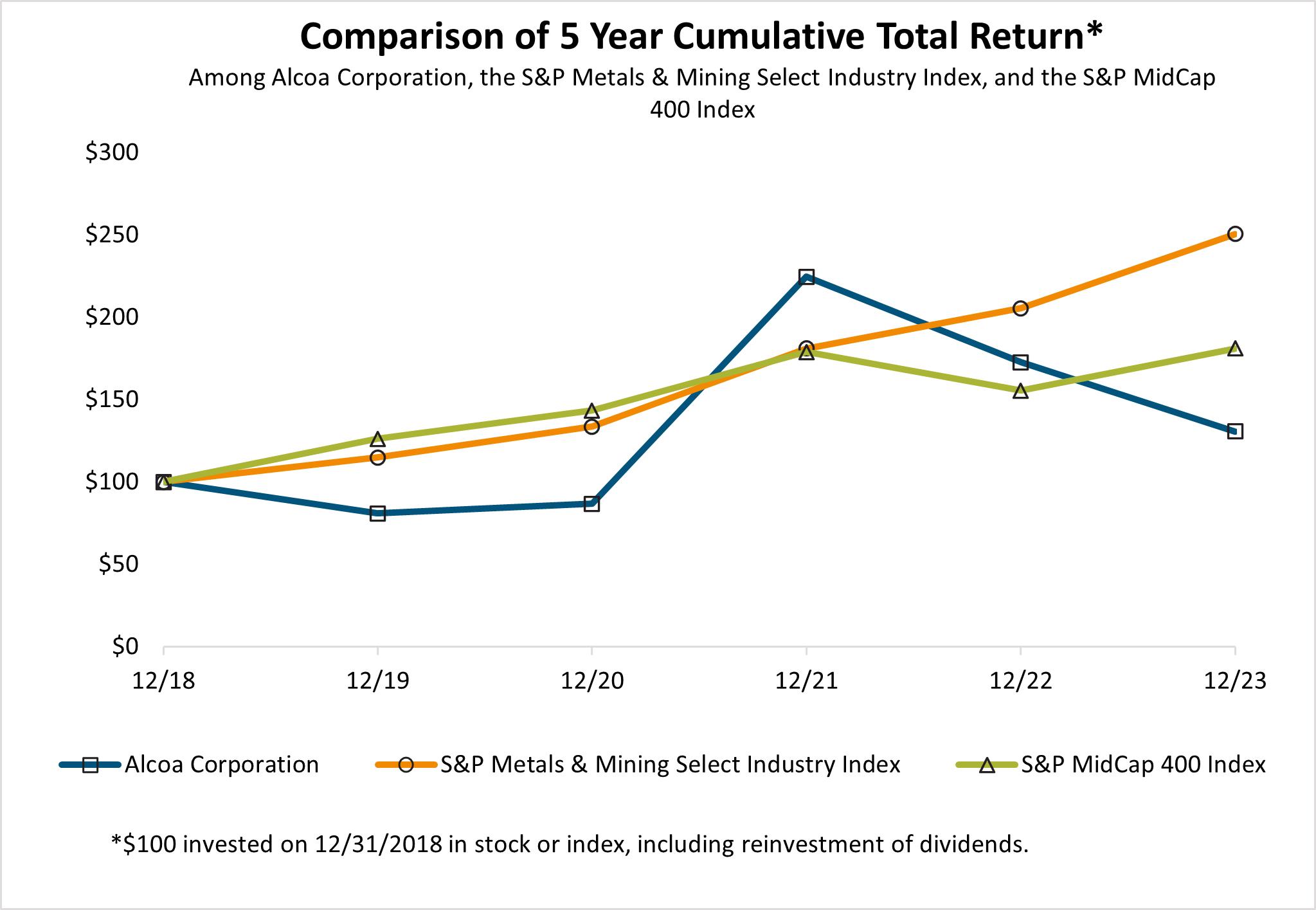

While global inventories remained consistent in 2023, high inventories could lead to a reduction in the price of aluminum and declines in the LME price have had a negative impact on our business, financial condition, and results of operations. Similarly, it is possible that persistently high inventories of Russian origin aluminum stocks in LME warehouses could have a negative impact on LME pricing. Regional premiums tend to vary based on the supply of and demand for metal in a particular region, associated transportation costs, and import tariffs. Product premiums generally are a function of supply and demand for a given primary aluminum shape and alloy combination in a particular region. Periods of industry overcapacity may also result in a weak aluminum pricing environment.