UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended December 31, 2023

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____________ to _____________

Commission File Number: 001-34719

S&W SEED COMPANY

(Exact Name of Registrant as Specified in Its Charter)

Nevada |

|

27-1275784 |

|

(State or Other Jurisdiction of Incorporation or Organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

|

2101 Ken Pratt Blvd, Suite 201, Longmont, CO |

|

80501 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

(720) 506-9191

(Registrant's Telephone Number, Including Area Code)

Securities Registered Pursuant to Section 12(b) of the Act:

Title of Each Class |

Trading Symbol(s) |

Name of Each Exchange on Which Registered |

Common Stock, par value $0.001 per share |

SANW |

The Nasdaq Capital Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large, accelerated filer |

☐ |

|

Accelerated filer |

☐ |

Non-accelerated filer |

☒ |

|

Smaller reporting company |

☒ |

Emerging growth company |

☐ |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

The number of shares outstanding of common stock of the registrant as of February 7, 2024 was 43,314,975.

S&W SEED COMPANY

TABLE OF CONTENTS

|

|

Page No. |

||

Item 1. |

|

|

4 |

|

|

|

Condensed Consolidated Balance Sheets at December 31, 2023 and June 30, 2023 |

|

4 |

|

|

|

5 |

|

|

|

|

6 |

|

|

|

|

7 |

|

|

|

Condensed Consolidated Statements of Cash Flows for the Six Months Ended December 31, 2023 and 2022 |

|

8 |

|

|

|

9 |

|

Item 2. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

26 |

Item 3. |

|

|

37 |

|

Item 4. |

|

|

37 |

|

|

|

38 |

||

Item 1. |

|

|

38 |

|

Item 1A. |

|

|

38 |

|

Item 2. |

|

|

38 |

|

Item 3. |

|

|

38 |

|

Item 4. |

|

|

38 |

|

Item 5. |

|

|

38 |

|

Item 6. |

|

|

39 |

1

FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act. All statements other than statements of historical fact could be deemed forward-looking statements, including, but not limited to: statements concerning our loan agreements, including our ability to comply with and/or secure refinancing for such loan agreements; the potential effects of global macroeconomic events and the COVID-19 pandemic on our business; the plans, strategies and objectives of management for our future operations, including our expectations for new product introductions during fiscal 2024; our implementation of our recently implemented strategic review (which includes our plans to reduce annual operating expenses) our recent partnership with Shell and its role in enabling us to reduce our operating expenses and sharpen our focus on key growth priorities; our ability to raise capital in the future; expected development, performance or market acceptance relating to our products or services or our ability to expand our grower or customer bases or to diversify our product offerings; future economic conditions or performance; our ability to retain key employees; and our assumptions, expectations and beliefs underlying any of the foregoing. These forward-looking statements are often identified by the use of words such as, but not limited to, “anticipate,” “believe,” “can,” “continue,” “could,” “designed,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “project,” “seek,” “should,” “target,” “will,” “would,” and similar expressions or variations intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. We have based these forward-looking statements on our current expectations about future events. Such forward-looking statements are subject to risks, uncertainties and other important factors, including certain assumptions, that, if they never materialize or prove incorrect, could cause our actual results and the timing of certain events to differ materially from future results expressed or implied by such forward-looking statements. Risks, uncertainties and assumptions include the following:

2

You are urged to carefully review the disclosures made concerning risks and uncertainties that may affect our business or operating results, which include, among others, those described above.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, level of activity, performance or achievements. Many factors discussed in this Quarterly Report on Form 10-Q, some of which are beyond our control, will be important in determining our future performance. Consequently, these statements are inherently uncertain and actual results may differ materially from those that might be anticipated from the forward-looking statements. In light of these and other uncertainties, you should not regard the inclusion of a forward-looking statement in this Quarterly Report on Form 10-Q as a representation by us that our plans and objectives will be achieved, and you should not place undue reliance on such forward-looking statements. All forward-looking statements included herein are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. Furthermore, such forward-looking statements represent our views as of, and speak only as of, the date of this Quarterly Report on Form 10-Q, and such statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. We undertake no obligation to publicly update any forward-looking statements, or to update the reasons why actual results could differ materially from those anticipated in any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

When used in this Quarterly Report on Form 10-Q, the terms “we,” “us,” “our,” “the Company,” “S&W” and “S&W Seed” refer to S&W Seed Company and its subsidiaries or, as the context may require, S&W Seed Company only. Our fiscal year ends on June 30, and accordingly, the terms “fiscal 2024,” “fiscal 2023” and “fiscal 2022” in this Quarterly Report on Form 10-Q refer to the respective fiscal year ended June 30, 2024, 2023 and 2022, respectively, with corresponding meanings to any fiscal year reference beyond such dates. Trademarks, service marks and trade names of other companies appearing in this report are the property of their respective holders.

3

PART I

FINANCIAL INFORMATION

Item 1. Financial Statements

S&W SEED COMPANY

CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

ASSETS |

|

As of |

|

|

As of |

|

||

CURRENT ASSETS |

|

|||||||

Cash and cash equivalents |

|

$ |

1,114,370 |

|

|

$ |

3,398,793 |

|

Accounts receivable, net |

|

|

19,983,583 |

|

|

|

24,622,727 |

|

Notes receivable, net |

|

|

6,974,357 |

|

|

|

6,846,897 |

|

Inventories, net |

|

|

46,008,080 |

|

|

|

45,098,268 |

|

Prepaid expenses and other current assets |

|

|

2,974,177 |

|

|

|

4,099,027 |

|

TOTAL CURRENT ASSETS |

|

|

77,054,567 |

|

|

|

84,065,712 |

|

Property, plant and equipment, net |

|

|

10,350,887 |

|

|

|

10,082,168 |

|

Intellectual property, net |

|

|

20,958,076 |

|

|

|

21,650,534 |

|

Other intangibles, net |

|

|

7,808,412 |

|

|

|

8,082,325 |

|

Right of use assets - operating leases |

|

|

2,825,742 |

|

|

|

2,983,303 |

|

Equity method investments |

|

|

21,624,643 |

|

|

|

23,059,705 |

|

Other assets |

|

|

3,051,182 |

|

|

|

2,066,081 |

|

TOTAL ASSETS |

|

$ |

143,673,509 |

|

|

$ |

151,989,828 |

|

|

|

|

|

|

|

|

||

LIABILITIES, MEZZANINE EQUITY AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

||

CURRENT LIABILITIES |

|

|

|

|

|

|

||

Accounts payable |

|

$ |

14,891,078 |

|

|

$ |

13,312,180 |

|

Deferred revenue |

|

|

5,504,204 |

|

|

|

464,707 |

|

Accrued expenses and other current liabilities |

|

|

6,004,829 |

|

|

|

8,804,456 |

|

Current portion of working capital lines of credit, net |

|

|

43,597,213 |

|

|

|

44,900,779 |

|

Current portion of long-term debt, net |

|

|

4,445,442 |

|

|

|

3,808,761 |

|

TOTAL CURRENT LIABILITIES |

|

|

74,442,766 |

|

|

|

71,290,883 |

|

Long-term debt, net, less current portion |

|

|

4,862,340 |

|

|

|

4,499,334 |

|

Other non-current liabilities |

|

|

2,063,641 |

|

|

|

2,102,030 |

|

TOTAL LIABILITIES |

|

|

81,368,747 |

|

|

|

77,892,247 |

|

MEZZANINE EQUITY |

|

|

|

|

|

|

||

Preferred stock, $0.001 par value; 3,323 shares authorized; 1,695 issued and outstanding at December 31, 2023 and June 30, 2023 |

|

|

5,518,624 |

|

|

|

5,274,148 |

|

TOTAL MEZZANINE EQUITY |

|

|

5,518,624 |

|

|

|

5,274,148 |

|

STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

||

Common stock, $0.001 par value; 75,000,000 shares authorized; 43,317,044 issued and 43,292,044 outstanding at December 31, 2023; 43,004,011 issued and 42,979,011 outstanding at June 30, 2023 |

|

|

43,317 |

|

|

|

43,004 |

|

Treasury stock, at cost, 25,000 shares |

|

|

(134,196 |

) |

|

|

(134,196 |

) |

Additional paid-in capital |

|

|

168,270,300 |

|

|

|

167,768,104 |

|

Accumulated deficit |

|

|

(104,595,765 |

) |

|

|

(91,932,808 |

) |

Accumulated other comprehensive loss |

|

|

(6,832,156 |

) |

|

|

(6,987,791 |

) |

Non-controlling interests |

|

|

34,638 |

|

|

|

67,120 |

|

TOTAL STOCKHOLDERS' EQUITY |

|

|

56,786,138 |

|

|

|

68,823,433 |

|

TOTAL LIABILITIES, MEZZANINE EQUITY AND STOCKHOLDERS' EQUITY |

|

$ |

143,673,509 |

|

|

$ |

151,989,828 |

|

See notes to condensed consolidated financial statements.

4

S&W SEED COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(UNAUDITED)

|

|

Three Months Ended |

|

|

Six Months Ended |

|

|||||||||

|

|

2023 |

|

2022 |

|

|

2023 |

|

|

2022 |

|

||||

Revenue |

|

$ |

10,864,809 |

|

$ |

12,937,802 |

|

|

$ |

27,297,275 |

|

|

$ |

32,803,667 |

|

Cost of revenue |

|

|

7,575,685 |

|

|

10,188,511 |

|

|

|

18,996,837 |

|

|

|

25,549,865 |

|

Gross profit |

|

|

3,289,124 |

|

|

2,749,291 |

|

|

|

8,300,438 |

|

|

|

7,253,802 |

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

||||

Selling, general and administrative expenses |

|

|

5,892,922 |

|

|

6,242,212 |

|

|

|

11,679,502 |

|

|

|

11,298,469 |

|

Research and development expenses |

|

|

994,648 |

|

|

1,503,473 |

|

|

|

2,081,160 |

|

|

|

3,018,853 |

|

Depreciation and amortization |

|

|

1,076,019 |

|

|

1,253,904 |

|

|

|

2,145,042 |

|

|

|

2,590,338 |

|

Gain on disposal of property, plant and equipment |

|

|

(68,734 |

) |

|

(751 |

) |

|

|

(101,690 |

) |

|

|

(4,411 |

) |

Total operating expenses |

|

|

7,894,855 |

|

|

8,998,838 |

|

|

|

15,804,014 |

|

|

|

16,903,249 |

|

Loss from operations |

|

|

(4,605,731 |

) |

|

(6,249,547 |

) |

|

|

(7,503,576 |

) |

|

|

(9,649,447 |

) |

Other (income) expense |

|

|

|

|

|

|

|

|

|

|

|

||||

Foreign currency loss |

|

|

244,298 |

|

|

176,624 |

|

|

|

616,486 |

|

|

|

367,539 |

|

Gain on sale of equity investment |

|

|

— |

|

|

(32,030 |

) |

|

|

— |

|

|

|

(32,030 |

) |

Gain on disposal of intangible assets |

|

|

— |

|

|

(1,796,252 |

) |

|

|

— |

|

|

|

(1,796,252 |

) |

Interest expense - amortization of debt discount |

|

|

446,017 |

|

|

578,112 |

|

|

|

901,591 |

|

|

|

861,755 |

|

Interest expense, net |

|

|

1,337,992 |

|

|

1,092,327 |

|

|

|

2,743,759 |

|

|

|

1,879,006 |

|

Other (income) expenses |

|

|

(59,336 |

) |

|

546 |

|

|

|

(96,896 |

) |

|

|

(43,724 |

) |

Loss before income taxes |

|

|

(6,574,702 |

) |

|

(6,268,874 |

) |

|

|

(11,668,516 |

) |

|

|

(10,885,741 |

) |

Benefit from income taxes |

|

|

(756,985 |

) |

|

(282,296 |

) |

|

|

(755,778 |

) |

|

|

(383,960 |

) |

Loss before equity in net earnings of affiliates |

|

|

(5,817,717 |

) |

|

(5,986,578 |

) |

|

|

(10,912,738 |

) |

|

|

(10,501,781 |

) |

Equity in loss of equity method investees, net of tax |

|

|

676,329 |

|

|

4,015 |

|

|

|

1,538,225 |

|

|

|

4,015 |

|

Net loss |

|

$ |

(6,494,046 |

) |

$ |

(5,990,593 |

) |

|

$ |

(12,450,963 |

) |

|

$ |

(10,505,796 |

) |

Loss attributable to non-controlling interests |

|

|

(25,194 |

) |

|

(4,588 |

) |

|

|

(32,482 |

) |

|

|

(10,850 |

) |

Net loss attributable to S&W Seed Company |

|

$ |

(6,468,852 |

) |

$ |

(5,986,005 |

) |

|

$ |

(12,418,481 |

) |

|

$ |

(10,494,946 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Calculation of net loss per share: |

|

|

|

|

|

|

|

|

|

|

|

||||

Net loss attributable to S&W Seed Company |

|

$ |

(6,468,852 |

) |

$ |

(5,986,005 |

) |

|

$ |

(12,418,481 |

) |

|

$ |

(10,494,946 |

) |

Dividends accrued for participating securities and accretion |

|

|

(124,431 |

) |

|

(114,062 |

) |

|

|

(244,476 |

) |

|

|

(228,123 |

) |

Net loss attributable to common shareholders |

|

$ |

(6,593,283 |

) |

$ |

(6,100,067 |

) |

|

$ |

(12,662,957 |

) |

|

$ |

(10,723,069 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Net loss attributable to S&W Seed Company per common share, basic and diluted |

|

$ |

(0.15 |

) |

$ |

(0.14 |

) |

|

$ |

(0.29 |

) |

|

$ |

(0.25 |

) |

Weighted average number of common shares outstanding, basic and diluted |

|

|

43,091,438 |

|

|

42,651,270 |

|

|

|

43,050,329 |

|

|

|

42,627,645 |

|

See notes to condensed consolidated financial statements.

5

S&W SEED COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(UNAUDITED)

|

|

Three Months Ended |

|

|

Six Months Ended |

|

||||||||||

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

||||

Net loss |

|

$ |

(6,494,046 |

) |

|

$ |

(5,990,593 |

) |

|

$ |

(12,450,963 |

) |

|

$ |

(10,505,796 |

) |

Foreign currency translation adjustment, net of income taxes |

|

|

316,614 |

|

|

|

539,520 |

|

|

|

155,635 |

|

|

|

(174,775 |

) |

Comprehensive loss |

|

|

(6,177,432 |

) |

|

|

(5,451,073 |

) |

|

|

(12,295,328 |

) |

|

|

(10,680,571 |

) |

Comprehensive loss attributable to non-controlling interests |

|

|

(25,194 |

) |

|

|

(4,588 |

) |

|

|

(32,482 |

) |

|

|

(10,850 |

) |

Comprehensive loss attributable to S&W Seed Company |

|

$ |

(6,152,238 |

) |

|

$ |

(5,446,485 |

) |

|

$ |

(12,262,846 |

) |

|

$ |

(10,669,721 |

) |

See notes to condensed consolidated financial statements.

6

S&W SEED COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF MEZZANINE EQUITY AND STOCKHOLDERS’ EQUITY

(UNAUDITED)

|

|

Mezzanine Equity |

|

|

Shareholders' Equity |

|

||||||||||||||||||||||||||||||||||||||

|

|

Preferred Stock |

|

|

Common Stock |

|

|

Treasury Stock |

|

|

Additional |

|

|

Accumulated |

|

|

Non- |

|

|

Accumulated |

|

|

Total |

|

||||||||||||||||||||

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Deficit |

|

|

Interests |

|

|

Loss |

|

|

Equity |

|

|||||||||||

Balance, September 30, 2022 |

|

|

1,695 |

|

|

$ |

4,918,880 |

|

|

|

42,632,585 |

|

|

$ |

42,633 |

|

|

|

(25,000 |

) |

|

$ |

(134,196 |

) |

|

$ |

164,486,927 |

|

|

$ |

(110,496,559 |

) |

|

$ |

35,576 |

|

|

$ |

(7,274,895 |

) |

|

$ |

46,659,486 |

|

Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

305,894 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

305,894 |

|

Series B detachable warrant |

|

|

— |

|

|

|

25,838 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(25,838 |

) |

|

|

— |

|

|

|

— |

|

|

|

(25,838 |

) |

Accrued dividends on Series B convertible preferred stock |

|

|

— |

|

|

|

88,224 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(88,224 |

) |

|

|

— |

|

|

|

— |

|

|

|

(88,224 |

) |

Net issuance to settle RSUs |

|

|

— |

|

|

|

— |

|

|

|

155,838 |

|

|

|

155 |

|

|

|

— |

|

|

|

— |

|

|

|

(4,894 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(4,739 |

) |

Subordinated loan & security agreement warrants |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

656,427 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

656,427 |

|

Other comprehensive income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

539,520 |

|

|

|

539,520 |

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(5,986,005 |

) |

|

|

(4,588 |

) |

|

|

— |

|

|

|

(5,990,593 |

) |

Balance, December 31, 2022 |

|

|

1,695 |

|

|

$ |

5,032,942 |

|

|

|

42,788,423 |

|

|

$ |

42,788 |

|

|

|

(25,000 |

) |

|

$ |

(134,196 |

) |

|

$ |

165,444,354 |

|

|

$ |

(116,596,626 |

) |

|

$ |

30,988 |

|

|

$ |

(6,735,375 |

) |

|

$ |

42,051,933 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Balance, September 30, 2023 |

|

|

1,695 |

|

|

$ |

5,394,193 |

|

|

|

43,047,951 |

|

|

$ |

43,048 |

|

|

|

(25,000 |

) |

|

$ |

(134,196 |

) |

|

$ |

168,011,474 |

|

|

$ |

(98,002,482 |

) |

|

$ |

59,832 |

|

|

$ |

(7,148,770 |

) |

|

$ |

62,828,906 |

|

Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

283,327 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

283,327 |

|

Series B detachable warrant |

|

|

— |

|

|

|

25,838 |

|

|

|

— |

|

|

|

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(25,838 |

) |

|

|

— |

|

|

|

— |

|

|

|

(25,838 |

) |

|

Accrued dividends on Series B convertible preferred stock |

|

|

— |

|

|

|

98,593 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(98,593 |

) |

|

|

— |

|

|

|

— |

|

|

|

(98,593 |

) |

Net issuance to settle RSUs |

|

|

— |

|

|

|

— |

|

|

|

269,093 |

|

|

|

269 |

|

|

|

— |

|

|

|

— |

|

|

|

(11,919 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(11,650 |

) |

Proceeds from sale of common stock, net of expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(12,582 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(12,582 |

) |

Other comprehensive income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

316,614 |

|

|

|

316,614 |

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(6,468,852 |

) |

|

|

(25,194 |

) |

|

|

— |

|

|

|

(6,494,046 |

) |

Balance, December 31, 2023 |

|

|

1,695 |

|

|

$ |

5,518,624 |

|

|

|

43,317,044 |

|

|

$ |

43,317 |

|

|

|

(25,000 |

) |

|

$ |

(134,196 |

) |

|

$ |

168,270,300 |

|

|

$ |

(104,595,765 |

) |

|

$ |

34,638 |

|

|

$ |

(6,832,156 |

) |

|

$ |

56,786,138 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

Mezzanine Equity |

|

|

Shareholders' Equity |

|

||||||||||||||||||||||||||||||||||||||

|

|

Preferred Stock |

|

|

Common Stock |

|

|

Treasury Stock |

|

|

Additional |

|

|

Accumulated |

|

|

Non- |

|

|

Accumulated |

|

|

Total |

|

||||||||||||||||||||

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Deficit |

|

|

Interests |

|

|

Loss |

|

|

Equity |

|

|||||||||||

Balance, June 30, 2022 |

|

|

1,695 |

|

|

$ |

4,804,819 |

|

|

|

42,608,758 |

|

|

$ |

42,609 |

|

|

|

(25,000 |

) |

|

$ |

(134,196 |

) |

|

$ |

163,892,575 |

|

|

$ |

(105,873,557 |

) |

|

$ |

41,838 |

|

|

$ |

(6,560,600 |

) |

|

$ |

51,408,669 |

|

Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

762,006 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

762,006 |

|

Subordinated loan & security agreement warrants |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

802,901 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

802,901 |

|

Series B detachable warrant |

|

|

— |

|

|

|

51,676 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(51,676 |

) |

|

|

— |

|

|

|

— |

|

|

|

(51,676 |

) |

Accrued dividends on Series B convertible preferred stock |

|

|

— |

|

|

|

176,447 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(176,447 |

) |

|

|

— |

|

|

|

— |

|

|

|

(176,447 |

) |

Net issuance to settle RSUs |

|

|

— |

|

|

|

— |

|

|

|

179,665 |

|

|

|

179 |

|

|

|

— |

|

|

|

— |

|

|

|

(13,128 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(12,949 |

) |

Other comprehensive loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(174,775 |

) |

|

|

(174,775 |

) |

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(10,494,946 |

) |

|

|

(10,850 |

) |

|

|

— |

|

|

|

(10,505,796 |

) |

Balance, December 31, 2022 |

|

|

1,695 |

|

|

$ |

5,032,942 |

|

|

|

42,788,423 |

|

|

$ |

42,788 |

|

|

|

(25,000 |

) |

|

$ |

(134,196 |

) |

|

$ |

165,444,354 |

|

|

$ |

(116,596,626 |

) |

|

$ |

30,988 |

|

|

$ |

(6,735,375 |

) |

|

$ |

42,051,933 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Balance, June 30, 2023 |

|

|

1,695 |

|

|

$ |

5,274,148 |

|

|

|

43,004,011 |

|

|

$ |

43,004 |

|

|

|

(25,000 |

) |

|

$ |

(134,196 |

) |

|

$ |

167,768,104 |

|

|

$ |

(91,932,808 |

) |

|

$ |

67,120 |

|

|

$ |

(6,987,791 |

) |

|

$ |

68,823,433 |

|

Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

695,147 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

695,147 |

|

Series B detachable warrant |

|

|

— |

|

|

|

51,676 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(51,676 |

) |

|

|

— |

|

|

|

— |

|

|

|

(51,676 |

) |

Accrued dividends on Series B convertible preferred stock |

|

|

— |

|

|

|

192,800 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(192,800 |

) |

|

|

— |

|

|

|

— |

|

|

|

(192,800 |

) |

Net issuance to settle RSUs |

|

|

— |

|

|

|

— |

|

|

|

313,033 |

|

|

|

313 |

|

|

|

— |

|

|

|

— |

|

|

|

(27,139 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(26,826 |

) |

Proceeds from sale of common stock, net of expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(165,812 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(165,812 |

) |

Other comprehensive income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

155,635 |

|

|

|

155,635 |

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(12,418,481 |

) |

|

|

(32,482 |

) |

|

|

— |

|

|

|

(12,450,963 |

) |

Balance, December 31, 2023 |

|

|

1,695 |

|

|

$ |

5,518,624 |

|

|

|

43,317,044 |

|

|

$ |

43,317 |

|

|

|

(25,000 |

) |

|

$ |

(134,196 |

) |

|

$ |

168,270,300 |

|

|

$ |

(104,595,765 |

) |

|

$ |

34,638 |

|

|

$ |

(6,832,156 |

) |

|

$ |

56,786,138 |

|

See notes to condensed consolidated financial statements.

7

S&W SEED COMPANY

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

|

|

Six Months Ended December 31, |

|

|||||

|

|

2023 |

|

|

2022 |

|

||

CASH FLOWS FROM OPERATING ACTIVITIES |

|

|

|

|

|

|

||

Net loss |

|

$ |

(12,450,963 |

) |

|

$ |

(10,505,796 |

) |

Adjustments to reconcile net income (loss) from operating activities to net |

|

|

|

|

|

|

||

cash used in operating activities: |

|

|

|

|

|

|

||

Stock-based compensation |

|

|

695,147 |

|

|

|

762,006 |

|

Bad debt expense |

|

|

472,411 |

|

|

|

(125,209 |

) |

Inventory write-down |

|

|

787,085 |

|

|

|

685,200 |

|

Depreciation and amortization |

|

|

2,145,042 |

|

|

|

2,590,338 |

|

Gain on disposal of property, plant and equipment |

|

|

(101,690 |

) |

|

|

(4,411 |

) |

Gain on disposal of intangible assets |

|

|

— |

|

|

|

(1,796,252 |

) |

Gain on sale of equity investment |

|

|

— |

|

|

|

(32,030 |

) |

Equity in loss of equity method investees, net of tax |

|

|

1,538,225 |

|

|

|

4,015 |

|

Change in deferred tax provision |

|

|

(712,063 |

) |

|

|

(259,747 |

) |

Change in foreign exchange contracts |

|

|

(639,143 |

) |

|

|

19,466 |

|

Foreign currency transactions |

|

|

1,276,525 |

|

|

|

(200,666 |

) |

Amortization of debt discount |

|

|

901,591 |

|

|

|

861,755 |

|

Accretion of note receivable |

|

|

(127,476 |

) |

|

|

— |

|

Changes in: |

|

|

|

|

|

|

||

Accounts receivable |

|

|

4,326,500 |

|

|

|

(3,968,108 |

) |

Inventories |

|

|

(1,300,241 |

) |

|

|

557,442 |

|

Prepaid expenses and other current assets |

|

|

356,779 |

|

|

|

20,736 |

|

Other non-current assets |

|

|

47,015 |

|

|

|

(677,938 |

) |

Accounts payable |

|

|

1,381,305 |

|

|

|

(385,529 |

) |

Deferred revenue |

|

|

5,039,497 |

|

|

|

5,578,365 |

|

Accrued expenses and other current liabilities |

|

|

(2,231,490 |

) |

|

|

(1,256,423 |

) |

Other non-current liabilities |

|

|

32,768 |

|

|

|

(207,625 |

) |

Net cash provided by (used in) operating activities |

|

|

1,436,824 |

|

|

|

(8,340,411 |

) |

CASH FLOWS FROM INVESTING ACTIVITIES |

|

|

|

|

|

|

||

Additions to property, plant and equipment |

|

|

(1,077,055 |

) |

|

|

(154,997 |

) |

Proceeds from disposal of property, plant and equipment |

|

|

160,958 |

|

|

|

3,660 |

|

Capital contributions to partnerships |

|

|

(88,543 |

) |

|

|

(59,242 |

) |

Proceeds from partnership transaction |

|

|

— |

|

|

|

2,000,000 |

|

Net proceeds from sale of equity investment |

|

|

— |

|

|

|

400,000 |

|

Net cash provided by (used in) investing activities |

|

|

(1,004,640 |

) |

|

|

2,189,421 |

|

CASH FLOWS FROM FINANCING ACTIVITIES |

|

|

|

|

|

|

||

Net proceeds from sale of common stock |

|

|

(165,812 |

) |

|

|

— |

|

Taxes paid related to net share settlements of stock-based compensation awards |

|

|

(26,825 |

) |

|

|

(12,949 |

) |

Borrowings and repayments on lines of credit, net |

|

|

(2,762,758 |

) |

|

|

6,598,076 |

|

Borrowings of long-term debt |

|

|

595,175 |

|

|

|

285,005 |

|

Repayments of long-term debt |

|

|

(152,214 |

) |

|

|

(1,063,661 |

) |

Debt issuance costs |

|

|

(237,278 |

) |

|

|

(359,527 |

) |

Net cash provided by (used in) financing activities |

|

|

(2,749,712 |

) |

|

|

5,446,944 |

|

EFFECT OF EXCHANGE RATE CHANGES ON CASH |

|

|

33,105 |

|

|

|

(24,290 |

) |

NET DECREASE IN CASH & CASH EQUIVALENTS |

|

|

(2,284,423 |

) |

|

|

(728,336 |

) |

CASH AND CASH EQUIVALENTS, beginning of the period |

|

|

3,398,793 |

|

|

|

2,056,508 |

|

CASH AND CASH EQUIVALENTS, end of period |

|

$ |

1,114,370 |

|

|

$ |

1,328,172 |

|

See notes to condensed consolidated financial statements.

8

S&W SEED COMPANY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

NOTE 1 - GENERAL

The Company is a global multi-crop, middle-market agricultural company that is principally engaged in breeding, growing, processing and selling agricultural seeds. The Company operates seed cleaning and processing facilities, which are located in Texas, New South Wales and South Australia. The Company’s seed products are primarily grown under contract by farmers. The Company is currently focused on growing sales of their proprietary and traited products specifically through the expansion of Double TeamTM for forage and grain sorghum products, improving margins through pricing and operational efficiencies, and developing the camelina market via a recently formed partnership.

Basis of Presentation

The accompanying condensed consolidated financial statements are unaudited and, in the Company’s opinion, include all adjustments, consisting of normal recurring adjustments and accruals, necessary for a fair statement of the Company’s condensed consolidated balance sheets, statements of operations, comprehensive loss, cash flows and mezzanine equity and stockholders’ equity for the periods presented. Operating results for the periods presented are not necessarily indicative of the results to be expected for the full year ending June 30, 2024. Certain information and disclosures normally included in financial statements prepared in accordance with GAAP have been omitted in accordance with the rules and regulations of the SEC. These condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements and accompanying notes included in the Annual Report on Form 10-K for the fiscal year ended June 30, 2023, as filed with the SEC.

Certain prior period information has been reclassified to conform to the current period presentation.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make certain estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Estimates are adjusted to reflect actual experience when necessary. Significant estimates and assumptions affect many items in the financial statements. These include allowance for doubtful trade receivables, inventory valuation, the carrying value of the Company's equity investments, asset impairments, provisions for income taxes, grower accruals (an estimate of amounts payable to farmers who grow seed for the Company), contingencies and litigation. Significant estimates and assumptions are also used to establish the fair value and useful lives of depreciable tangible and certain intangible assets as well as valuing stock-based compensation. Actual results may differ from those estimates and assumptions, and such results may affect income, financial position or cash flows.

The Company believes the estimates and assumptions underlying the accompanying condensed consolidated financial statements are reasonable and supportable based on the information available at the time the financial statements were prepared. However, certain adverse geopolitical and macroeconomic events, such as the ongoing military conflict between Ukraine and Russia and related sanctions, the armed conflict in Sudan, the war between Israel and Hamas, and uncertain market conditions, including higher inflation and supply chain disruptions, have, among other things, negatively impacted the global economy, created significant volatility and disruption of financial markets, and significantly increased economic and demand uncertainty. These factors make many of the estimates and assumptions reflected in these condensed consolidated financial statements inherently less certain. Therefore, actual results may ultimately differ from those estimates to a greater degree than historically.

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Liquidity and Going Concern

The Company is not profitable and has recorded negative cash flows for the last several years. For the six months ended December 31, 2023, the Company reported a net loss of $12.5 million. While the Company did report net cash provided by operations of $1.4 million for the six months ended December 31, 2023, it expects this to be negative in fiscal 2024. The positive cash flow in operations for the six months ended December 31, 2023 was largely due to changes in operating assets and liabilities. As of December 31, 2023, the Company had cash on hand of $1.1 million. The Company had $2.4 million of unused availability from its working capital facilities as of December 31, 2023 (see Note 8 for further discussion). In relation to the partnerships formed in fiscal 2023, the Company received $1.0 million from Trigall Genetics S.A., or Trigall, in January 2024 and received $6.0 million from Equilon Enterprises LLC (dba Shell Oil Products, or Shell) in February 2024. The Company is obligated to make an additional $0.3 million in capital contributions to Trigall Australia Pty Ltd, or Trigall Australia, through June 2025.

9

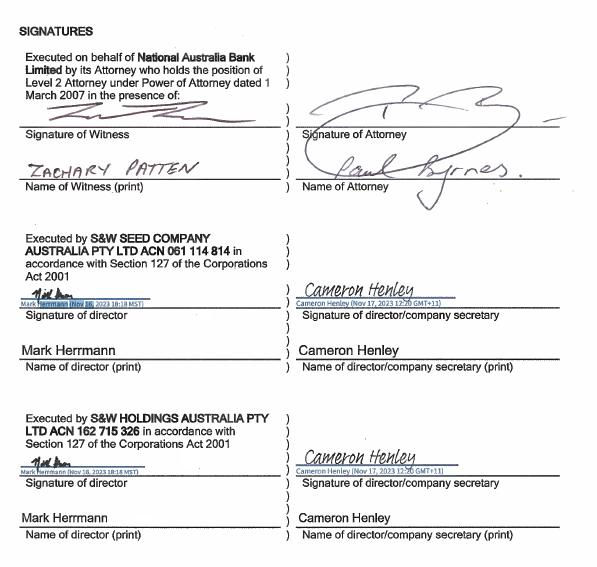

The Company’s Amended and Restated Loan and Security Agreement, or the Amended CIBC Loan Agreement, with CIBC Bank USA, or CIBC, and its debt facilities with National Australia Bank, or NAB, under the NAB Finance Agreement, contain various operating and financial covenants (refer to Note 8). Adverse geopolitical and macroeconomic events and other factors affecting the Company’s results of operations have increased the risk of the Company’s inability to comply with these covenants, which could result in acceleration of its repayment obligations and foreclosure on its pledged assets. The Amended CIBC Loan Agreement as presently in effect requires the Company to meet minimum adjusted EBITDA levels on a quarterly basis and the NAB Finance Agreement includes an undertaking that requires the Company to maintain a net related entity position of not more than USD $18.5 million and a minimum interest cover ratio at each fiscal year-end. As of December 31, 2023, the Company was in compliance with the CIBC minimum adjusted EBITDA covenant as well as the NAB net related entity position covenant. While the Company was in compliance with these covenants, there can be no assurance the Company will be successful in meeting its covenants or securing future waivers and/or amendments from its lenders. Currently, the Company does not expect to meet certain of these covenants in fiscal 2024. If the Company is unsuccessful in meeting its covenants or securing future waivers and/or amendments from its lenders and cannot obtain other financing, it may need to reduce the scope of its operations, repay amounts owed to its lenders and/or sell certain assets. Further, if the Company cannot renew or obtain other financing when its two major debt facilities with CIBC and NAB expire on August 31, 2024 and March 31, 2025, respectively, it may need to reduce the scope of its operations, repay amounts owed to its lenders and/or sell certain assets. These operating and liquidity factors raise substantial doubt regarding the Company’s ability to continue as a going concern. The Company’s condensed consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

Cost of Revenue

The Company records purchasing and receiving costs, inspection costs and warehousing costs in Cost of revenue. When the Company is required to pay for outward freight and/or the costs incurred to deliver products to its customers, the costs are included in Cost of revenue.

Cash and Cash Equivalents

For financial statement presentation purposes, the Company considers time deposits, certificates of deposit and all highly liquid investments with original maturities of three months or less to be cash and cash equivalents. At times, cash and cash equivalents balances exceed amounts insured by the Federal Deposit Insurance Corporation. Cash balances located outside of the United States may not be insured and totaled $220,188 and $191,766 on December 31, 2023 and June 30, 2023, respectively. Cash balances residing in the United States exceeding the Federal Deposit Insurance Corporation limit of $250,000 totaled $664,182 and $2,957,028 on December 31, 2023 and June 30, 2023, respectively.

International Operations

The Company translates its foreign operations’ assets and liabilities denominated in foreign currencies into U.S. dollars at the current rates of exchange as of the balance sheet date and income and expense items at the average exchange rate for the reporting period. Translation adjustments resulting from exchange rate fluctuations are recorded in the cumulative translation account, a component of accumulated other comprehensive income (loss). Gains or losses from foreign currency transactions are included in the condensed consolidated statement of operations. For the three months ended December 31, 2023, a $0.7 million foreign currency transaction loss was recognized within Cost of revenue and a $0.2 million foreign currency loss was recorded to Other (income) expense. For the three months ended December 31, 2022, a $0.8 million foreign currency loss was recognized within Cost of revenue and a $0.2 million foreign currency loss was recorded to Other (income) expense. For the six months ended December 31, 2023, a $0.0 million foreign currency transaction loss was recognized within Cost of revenue and a $0.6 million foreign currency loss was recorded to Other (income) expense. For the six months ended December 31, 2022, a $0.2 million foreign currency gain was recognized within Cost of revenue and a $0.4 million foreign currency loss was recorded to Other (income) expense.

Accounts Receivable

The Company provides an allowance for doubtful trade receivables equal to the estimated uncollectible amounts. Prior to July 1, 2023, that estimate is based on historical collection experience, current economic and market conditions and a review of the current status of each customer’s trade accounts receivable. Effective July 1, 2023, in determining the Company's reserve for credit losses, receivables are assigned an expected loss based on historical information adjusted for forward-looking economic factors. The allowance for doubtful trade receivables was $535,855 and $209,757 on December 31, 2023 and June 30, 2023, respectively.

Inventories

Inventories consist of seed and packaging materials.

Inventories are stated at the lower of cost or net realizable value, and an inventory reserve permanently reduces the cost basis of inventory. Inventories are valued as follows: Actual cost is used to value raw materials such as packaging materials, as well as goods in process. Costs for substantially all finished goods, which include the cost of carryover crops from the previous year, are valued at actual cost. Actual cost for finished goods includes plant conditioning and packaging costs, direct labor and raw materials and manufacturing overhead costs based on normal capacity. The Company records abnormal amounts of idle facility expense, freight, handling costs and wasted material (spoilage) as current period charges and allocates fixed production overhead to the costs of finished goods based on the normal capacity of the production facilities.

10

Inventory is periodically reviewed to determine if it is marketable, obsolete or impaired. Inventory that is determined to be obsolete or impaired is written off to expense at the time the impairment is identified. Inventory quality is a function of germination percentage. Our experience has shown that our alfalfa seed quality tends to be stable under proper storage conditions; therefore, we do not view inventory obsolescence for alfalfa seed as a material concern. Hybrid crops (sorghum and sunflower) seed quality may be affected by warehouse storage pests such as insects and rodents. The Company maintains a strict pest control program to mitigate risk and maximize hybrid seed quality.

Components of inventory are as follows:

|

|

As of |

|

|

As of |

|

||

|

|

December 31, 2023 |

|

|

June 30, 2023 |

|

||

Raw materials and supplies |

|

$ |

2,840,364 |

|

|

$ |

3,309,211 |

|

Work in progress |

|

|

8,811,322 |

|

|

|

6,409,554 |

|

Finished goods |

|

|

34,356,394 |

|

|

|

35,379,503 |

|

Inventories, net |

|

$ |

46,008,080 |

|

|

$ |

45,098,268 |

|

Property, Plant and Equipment

Property, plant and equipment is depreciated using the straight-line method over the estimated useful life of the asset - periods of 5 to 35 years for buildings, 3 to 20 years for machinery and equipment, and 3 to 5 years for vehicles.

Intangible Assets

Intangible assets acquired in business acquisitions are reported at their initial fair value less accumulated amortization. Intangible assets are amortized using the straight-line method over the estimated useful life of the asset. Periods of 10 to 30 years for technology/IP/germplasm, 5 to 20 years for customer relationships and trade names and 10 to 20 for other intangible assets. The weighted average estimated useful lives are 25 years for technology/IP/germplasm, 19 years for customer relationships, 16 years for trade names, and 18 years for other intangible assets as of December 31, 2023.

Investments

In fiscal 2023, the Company entered into two partnerships resulting in a 34% ownership interest in Vision Bioenergy Oilseeds LLC, or Vision Bioenergy, and a 20% ownership interest in Trigall Australia Pty Ltd, or Trigall Australia. Following the initial recording of each investment, the Company assesses and records its share of equity earnings from each investment on a quarterly basis, resulting in the investment carrying value increasing or decreasing depending on whether a gain or loss is recorded. For Trigall Australia, the Company is also required to make capital contributions, which increases the carrying value of the investment.

Research and Development Costs

The Company is engaged in ongoing research and development, or R&D, of proprietary seed varieties. All R&D costs must be charged to expense as incurred. Accordingly, internal R&D costs are expensed as incurred. Third-party R&D costs are expensed when the contracted work has been performed or as milestone results have been achieved. The costs associated with equipment or facilities acquired or constructed for R&D activities that have alternative future uses are capitalized and depreciated on a straight-line basis over the estimated useful life of the asset.

Income Taxes

Deferred tax assets and liabilities are determined based on differences between the financial statement and tax basis of assets and liabilities, as well as a consideration of net operating loss and credit carry forwards, using enacted tax rates in effect for the period in which the differences are expected to impact taxable income. A valuation allowance is established, when necessary, to reduce deferred tax assets to the amount that is more likely than not to be realized. The Company’s effective tax rate for the three and six months ended December 31, 2023 and 2022 has been affected by the valuation allowance on the Company’s deferred tax assets.

Net Income (Loss) Per Common Share Data

The Company computes earnings per share using the two-class method. The two-class method requires an earnings allocation formula that determines earnings per share for common shareholders and participating security holders according to dividends declared and participating rights in undistributed earnings. The Company's Series B Preferred Stock and related warrant, or Series B Warrant (see Note 14 of the Notes to Consolidated Financial Statements included in the Company's Annual Report on Form 10-K for the year ended June 30, 2023, as filed with the SEC), are participating securities because holders of such shares have non-forfeitable dividend rights and participate in any undistributed earnings with common stock. Under the two-class method, total dividends provided to the holders of participating securities and undistributed earnings allocated to participating securities, are subtracted from net income attributable to the Company in determining net loss attributable to common shareholders in the two-class earnings per share, or EPS, calculation.

11

Accretion to the redemption value for the Series B Preferred Stock is also treated as a deemed dividend and subtracted from net income attributable to shareholders. There were no undistributed earnings to allocate to the participating securities in the three and six month periods ended December 31, 2023 and 2022.

The calculation of net loss per common share is shown in the table below:

|

|

Three Months Ended |

|

|

Six Months Ended |

|

||||||||||

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

||||

Numerator: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Net loss attributable to S&W Seed Company |

|

$ |

(6,468,852 |

) |

|

$ |

(5,986,005 |

) |

|

$ |

(12,418,481 |

) |

|

$ |

(10,494,946 |

) |

Dividends accrued for participating securities |

|

|

(98,593 |

) |

|

|

(88,224 |

) |

|

|

(192,800 |

) |

|

|

(176,447 |

) |

Accretion of Series B Preferred Stock redemption value |

|

|

(25,838 |

) |

|

|

(25,838 |

) |

|

|

(51,676 |

) |

|

|

(51,676 |

) |

Numerator for net loss per common share - basic and diluted |

|

$ |

(6,593,283 |

) |

|

$ |

(6,100,067 |

) |

|

$ |

(12,662,957 |

) |

|

$ |

(10,723,069 |

) |

Denominator: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Weighted average shares outstanding - basic and diluted |

|

|

43,091,438 |

|

|

|

42,651,270 |

|

|

|

43,050,329 |

|

|

|

42,627,645 |

|

Net loss per common share - basic and diluted |

|

$ |

(0.15 |

) |

|

$ |

(0.14 |

) |

|

$ |

(0.29 |

) |

|

$ |

(0.25 |

) |

Anti-dilutive shares, which have been excluded from the computation of diluted income (loss) per share, included 5,119,016 employee stock options, 1,695,000 shares issuable upon conversion of the Series B Convertible Preferred Stock, warrants to purchase 2,633,400 shares of common stock related to the MFP Loan Agreement (as defined below), 559,350 warrants issued with the Company's Series B Convertible Preferred Stock, and 1,001,099 restricted stock units. The terms and conditions of these securities are more fully described in Note 11 and Note 12 in these condensed consolidated financial statements and in Note 13 and Note 14 of the Notes to Consolidated Financial Statements included in the Company's Annual Report on Form 10-K for the year ended June 30, 2023, as filed with the SEC. For the period ended December 31, 2023 and 2022, all potentially dilutive shares were anti-dilutive and excluded from the calculation of diluted loss per share because net losses were recognized.

Concentrations

Two customers accounted for 28% and one customer accounted for 17% of the Company's revenue for the three and six months ended December 31, 2023, respectively. One customer accounted for 8% and 11% of the Company's revenue for the three and six months ended December 31, 2022, respectively.

Two customers accounted for 37% of the Company's accounts receivable as of December 31, 2023 and no one customer accounted for more than 10% of the Company’s accounts receivable as of June 30, 2023.

The Company sells a substantial portion of its products to international customers (see Note 4). Sales to international markets represented 48% and 81% of revenue during the three months ended December 31, 2023 and 2022, respectively. Sales to international markets represented 68% and 86% of revenue during the six months ended December 31, 2023 and 2022, respectively. The net book value of fixed assets located outside the United States was 31% of total fixed assets on December 31, 2023 and June 30, 2023.

Derivative Financial Instruments

The Company’s subsidiary, S&W Australia, is exposed to foreign currency exchange rate fluctuations in the normal course of its business, which the Company at times manages through the use of foreign currency derivative financial instruments.

The Company has entered into foreign currency forward contracts and foreign currency call options (see Note 9) and accounts for these instruments in accordance with ASC Topic 815, “Derivatives and Hedging,” which establishes accounting and reporting standards requiring that derivative instruments be recorded on the balance sheet as either an asset or liability measured at fair value. The Company’s foreign currency contracts and options are not designated as hedging instruments under ASC 815; accordingly, changes in the fair value are recorded in current period earnings.

Premiums paid for foreign currency options with strike prices below the spot market price when acquired represent the time value of the option, as there is no intrinsic value. Such premiums are recorded as a current asset and amortized over the option term. Currency options are measured at fair value if the market price at the reporting date exceeds the strike price. When the strike price exceeds the market price, no liability is recorded as the Company has no obligation to exercise the options.

Fair Value of Financial Instruments

The Company discloses assets and liabilities that are recognized and measured at fair value, presented in a three-tier fair value hierarchy, as follows:

12

The carrying value of cash and cash equivalents, accounts payable, short-term and all long-term borrowings, as reflected in the condensed consolidated balance sheets, approximate fair value because of the short-term maturity of these instruments or interest rates commensurate with market rates. There have been no changes in operations and/or credit characteristics since the date of issuance that could impact the relationship between interest rate and market rates.

S&W received a $6.0 million note receivable due from Shell in connection with the Vision Bioenergy partnership transaction (see Note 7). The note, which is due in February 2024, was initially recorded at its $5.7 million present value discounted at a rate of 4.4%, which is our estimated discount rate for similar instruments. The receivable balance is being accreted to the full receivable amount on a straight-line basis over the remaining receivable term due to its short-term maturity. The receivable balance was $6.0 million as of December 31, 2023. This payment was received by the Company in February 2024.

Also in conjunction with the Vision Bioenergy partnership transaction, S&W received a one-time option, or Purchase Option, exercisable at any time on or before the fifth anniversary of the closing of the partnership transaction, to repurchase a 6% membership interest from Shell. The option repurchase prices range between approximately $7.1 and $12.0 million, depending on the date on which such purchase is completed. The Purchase Option was valued at $0.7 million using a lattice option valuation model. The valuation model incorporated significant, unobservable inputs including a discounted cash flow model based on management projections of future Vision Bioenergy results and an estimate of the current per share value of Vision Bioenergy shares. In the model, the estimate of the current per share value was discounted to account for lack of control and marketability, which were considered to be part of the unit of account given the restrictions of the limited liability company agreement that governs the ownership rights of the members. Other unobservable inputs included the risk-free rates and the estimated future stock volatility based on the historical stock price volatilities of other market participants. A full fair value analysis will be performed at each fiscal year-end or when there is an indication that there may be an impairment to the valuation. Management will estimate and adjust the balance for interim periods. A fair value analysis was performed as of June 30, 2023, which resulted in no material adjustment to the fair value. No indicators have been identified for the six months ended December 31, 2023 to suggest any material change in the fair value of the purchase option. As such, there is no indication of impairment for the six months ended December 31, 2023.

Quantitative information about Level 3 fair value measurement is as follows:

|

|

Fair Value as of December 31, 2023 |

|

|

Valuation Technique |

|

Unobservable Input |

|

Range |

|

Purchase Option |

|

$ |

695,000 |

|

|

Option Model |

|

Risk-free rate |

|

3.8% - 4.9% |

|

|

|

|

|

|

|

Stock price volatility |

|

60% - 65% |

|

|

|

|

|

|

|

|

Lack of control premium |

|

13% |

|

|

|

|

|

|

|

|

Lack of marketability premium |

|

30% |

|

Assets and liabilities that are recognized and measured at fair value on a recurring basis are categorized as follows:

|

|

Fair Value Measurements as of December 31, 2023 Using: |

|

|||||||||

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|||

Foreign exchange contract liability |

|

$ |

— |

|

|

$ |

203,440 |

|

|

$ |

— |

|

Note receivable due from Shell |

|

|

— |

|

|

|

5,974,366 |

|

|

|

— |

|

Vision Bioenergy interest purchase option |

|

|

— |

|

|

|

— |

|

|

|

695,000 |

|

Total |

|

$ |

— |

|

|

$ |

6,177,806 |

|

|

$ |

695,000 |

|

|

|

Fair Value Measurements as of June 30, 2023 Using: |

|

|||||||||

|

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|||

Foreign exchange contract liability |

|

$ |

— |

|

|

$ |

849,033 |

|

|

$ |

— |

|

Note receivable due from Shell |

|

|

— |

|

|

|

5,846,890 |

|

|

|

— |

|

Vision Bioenergy interest purchase option |

|

|

— |

|

|

|

— |

|

|

|

695,000 |

|

Total |

|

$ |

— |

|

|

$ |

6,695,923 |

|

|

$ |

695,000 |

|

Recent Adopted Accounting Pronouncements

Effective July 1, 2023, the Company adopted ASU 2016-13, Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments, which was subsequently amended in November 2018 through ASU No. 201819, Codification Improvements to Topic 326, Financial Instruments – Credit Losses (“ASU 2016-13”). The amended guidance requires entities to estimate lifetime expected credit losses for trade and other receivables, including those that are current with respect to payment terms, along with other financial instruments which may result in earlier recognition of credit losses.

13

The Company evaluated its existing methodology for estimating an allowance for doubtful accounts and the risk profile of its receivables portfolio and developed a model that includes the qualitative and forecasting aspects of the “expected loss” model under the amended guidance. In determining the Company’s reserve for credit losses, receivables are assigned an expected loss based on historical information adjusted for forward-looking economic factors. The adoption of ASU 2016-13 did not have a material impact on the Company’s condensed consolidated financial statements.

We have evaluated all other issued and unadopted Accounting Standards Updates and believe the adoption of these standards will not have a material impact on our condensed consolidated statements of operations, comprehensive income, balance sheets, or cash flows.

NOTE 3 - LEASES