ROC

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended December 31, 2023

OR

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from |

|

to |

|

|

Commission File Number: 001-41827

MEI Pharma, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

DELAWARE |

|

51-0407811 |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

11455 El Camino Real Suite 250, San Diego, CA 92130

(Address of principal executive offices) (Zip Code)

(858) 369-7100

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, $0.00000002 par value |

|

MEIP |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of large accelerated filer, accelerated filer, smaller reporting company, and emerging growth company in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

Non-accelerated filer |

|

☒ |

|

Smaller reporting company |

|

☒ |

Emerging growth company |

|

☐ |

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of February 9, 2024, the number of shares outstanding of the issuer’s common stock, $0.00000002 par value, was 6,662,857.

MEI PHARMA, INC.

Table of Contents

|

|

|

|

|

|

|

|

|

|

|

Page |

|

|

|

|

|

||||

PART I |

|

|

|

3 |

|

|

|

|

|

||||

Item 1. |

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

Condensed Consolidated Statements of Stockholders’ Equity (Unaudited) |

|

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

Notes to Condensed Consolidated Financial Statements (Unaudited) |

|

|

7 |

|

|

|

|

|

|

|

|

Item 2. |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

|

|

20 |

|

|

|

|

|

|

|

|

Item 3. |

|

|

|

32 |

|

|

|

|

|

|

|

|

|

Item 4. |

|

|

|

32 |

|

|

|

|

|

||||

PART II |

|

|

|

34 |

|

|

|

|

|

|

|

|

|

Item 1. |

|

|

|

34 |

|

|

|

|

|

|

|

|

|

Item 1A. |

|

|

|

34 |

|

|

|

|

|

|

|

|

|

Item 2. |

|

|

|

34 |

|

|

|

|

|

|

|

|

|

Item 3. |

|

|

|

34 |

|

|

|

|

|

|

|

|

|

Item 4. |

|

|

|

34 |

|

|

|

|

|

|

|

|

|

Item 5. |

|

|

|

34 |

|

|

|

|

|

|

|

|

|

Item 6. |

|

|

|

35 |

|

|

|

|

|||||

|

|

36 |

|

|||

2

PART I FINANCIAL INFORMATION

Item 1. Condensed Consolidated Financial Statements

MEI PHARMA, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except par value data)

|

|

December 31, |

|

|

June 30, |

|

||

|

|

2023 |

|

|

2023 |

|

||

|

|

(Unaudited) |

|

|

|

|

||

ASSETS |

|

|

|

|

|

|

||

Current assets: |

|

|

|

|

|

|

||

Cash and cash equivalents |

|

$ |

5,174 |

|

|

$ |

16,906 |

|

Short-term investments |

|

|

54,306 |

|

|

|

83,787 |

|

Unbilled receivables |

|

|

— |

|

|

|

85 |

|

Prepaid expenses and other current assets |

|

|

6,692 |

|

|

|

6,750 |

|

Total current assets |

|

|

66,172 |

|

|

|

107,528 |

|

Operating lease right-of-use asset |

|

|

11,222 |

|

|

|

11,972 |

|

Property and equipment, net |

|

|

1,144 |

|

|

|

1,309 |

|

Total assets |

|

$ |

78,538 |

|

|

$ |

120,809 |

|

|

|

|

|

|

|

|

||

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

||

Current liabilities: |

|

|

|

|

|

|

||

Accounts payable |

|

$ |

1,378 |

|

|

$ |

6,134 |

|

Accrued liabilities |

|

|

5,645 |

|

|

|

12,461 |

|

Deferred revenue |

|

|

— |

|

|

|

317 |

|

Operating lease liability |

|

|

1,015 |

|

|

|

1,428 |

|

Total current liabilities |

|

|

8,038 |

|

|

|

20,340 |

|

Deferred revenue, long-term |

|

|

— |

|

|

|

64,545 |

|

Operating lease liability, long-term |

|

|

11,012 |

|

|

|

11,300 |

|

Total liabilities |

|

|

19,050 |

|

|

|

96,185 |

|

Commitments and contingencies (Note 6) |

|

|

|

|

|

|

||

Stockholders’ equity: |

|

|

|

|

|

|

||

Preferred stock, $0.01 par value; 100 shares authorized; none outstanding |

|

|

— |

|

|

|

— |

|

Common stock, $0.00000002 par value; 226,000 shares authorized; 6,663 |

|

|

— |

|

|

|

— |

|

Additional paid-in capital |

|

|

420,174 |

|

|

|

430,621 |

|

Accumulated deficit |

|

|

(360,686 |

) |

|

|

(405,997 |

) |

Total stockholders’ equity |

|

|

59,488 |

|

|

|

24,624 |

|

Total liabilities and stockholders’ equity |

|

$ |

78,538 |

|

|

$ |

120,809 |

|

See accompanying notes to condensed consolidated financial statements (unaudited).

3

MEI PHARMA, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(In thousands, except per share amounts)

|

|

For the Three Months Ended December 31, |

|

|

For the Six Months Ended December 31, |

|

||||||||||

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

||||

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Revenue from customers |

|

$ |

— |

|

|

$ |

32,735 |

|

|

$ |

752 |

|

|

$ |

41,465 |

|

Revenue from collaboration agreements |

|

|

— |

|

|

|

— |

|

|

|

64,545 |

|

|

|

— |

|

Total revenues |

|

|

— |

|

|

|

32,735 |

|

|

|

65,297 |

|

|

|

41,465 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Research and development |

|

|

3,912 |

|

|

|

15,313 |

|

|

|

7,397 |

|

|

|

34,776 |

|

General and administrative |

|

|

8,018 |

|

|

|

8,496 |

|

|

|

14,549 |

|

|

|

15,982 |

|

Total operating expenses |

|

|

11,930 |

|

|

|

23,809 |

|

|

|

21,946 |

|

|

|

50,758 |

|

(Loss) income from operations |

|

|

(11,930 |

) |

|

|

8,926 |

|

|

|

43,351 |

|

|

|

(9,293 |

) |

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Change in fair value of warrant liability |

|

|

— |

|

|

|

486 |

|

|

|

— |

|

|

|

1,603 |

|

Interest and dividend income |

|

|

869 |

|

|

|

845 |

|

|

|

1,963 |

|

|

|

1,325 |

|

Other expense, net |

|

|

(2 |

) |

|

|

(4 |

) |

|

|

(3 |

) |

|

|

(6 |

) |

Total other income, net |

|

|

867 |

|

|

|

1,327 |

|

|

|

1,960 |

|

|

|

2,922 |

|

Net (loss) income |

|

$ |

(11,063 |

) |

|

$ |

10,253 |

|

|

$ |

45,311 |

|

|

$ |

(6,371 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Net (loss) income per share - basic and diluted |

|

$ |

(1.66 |

) |

|

$ |

1.54 |

|

|

$ |

6.80 |

|

|

$ |

(0.96 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Weighted-average shares used in computing net (loss) |

|

|

6,663 |

|

|

|

6,663 |

|

|

|

6,663 |

|

|

|

6,663 |

|

See accompanying notes to condensed consolidated financial statements (unaudited).

4

MEI PHARMA, INC.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(Unaudited)

(In thousands)

|

|

Common |

|

|

Additional |

|

|

Accumulated |

|

|

Total |

|

||||

Balance at June 30, 2023 |

|

|

6,663 |

|

|

$ |

430,621 |

|

|

$ |

(405,997 |

) |

|

$ |

24,624 |

|

Net income |

|

|

— |

|

|

|

— |

|

|

|

56,374 |

|

|

|

56,374 |

|

Share-based compensation |

|

|

— |

|

|

|

363 |

|

|

|

|

|

|

363 |

|

|

Balance at September 30, 2023 |

|

|

6,663 |

|

|

|

430,984 |

|

|

|

(349,623 |

) |

|

|

81,361 |

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

(11,063 |

) |

|

|

(11,063 |

) |

Cash dividends declared ($1.75 per share) |

|

|

— |

|

|

|

(11,660 |

) |

|

|

— |

|

|

|

(11,660 |

) |

Share-based compensation |

|

|

— |

|

|

|

850 |

|

|

|

— |

|

|

|

850 |

|

Balance at December 31, 2023 |

|

|

6,663 |

|

|

$ |

420,174 |

|

|

$ |

(360,686 |

) |

|

$ |

59,488 |

|

|

|

Common |

|

|

Additional |

|

|

Accumulated |

|

|

Total |

|

||||

Balance at June 30, 2022 |

|

|

6,658 |

|

|

$ |

426,572 |

|

|

$ |

(374,159 |

) |

|

$ |

52,413 |

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

(16,624 |

) |

|

|

(16,624 |

) |

Issuance of common stock for vested restricted stock units |

|

|

5 |

|

|

|

(40 |

) |

|

|

— |

|

|

|

(40 |

) |

Share-based compensation |

|

|

— |

|

|

|

1,559 |

|

|

|

— |

|

|

|

1,559 |

|

Balance at September 30, 2022 |

|

|

6,663 |

|

|

|

428,091 |

|

|

|

(390,783 |

) |

|

|

37,308 |

|

Net income |

|

|

— |

|

|

|

— |

|

|

|

10,253 |

|

|

|

10,253 |

|

Share-based compensation |

|

|

— |

|

|

|

813 |

|

|

|

— |

|

|

|

813 |

|

Balance at December 31, 2022 |

|

|

6,663 |

|

|

$ |

428,904 |

|

|

$ |

(380,530 |

) |

|

$ |

48,374 |

|

See accompanying notes to condensed consolidated financial statements (unaudited).

5

MEI PHARMA, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(In thousands)

|

|

For the Six Months Ended December 31, |

|

|||||

|

|

2023 |

|

|

2022 |

|

||

Cash flows from operating activities: |

|

|

|

|

|

|

||

Net income (loss) |

|

$ |

45,311 |

|

|

$ |

(6,371 |

) |

Adjustments to reconcile net income (loss) to net cash used in operating activities: |

|

|

|

|

|

|

||

Change in fair value of warrant liability |

|

|

— |

|

|

|

(1,603 |

) |

Share-based compensation |

|

|

1,213 |

|

|

|

2,372 |

|

Noncash lease expense |

|

|

750 |

|

|

|

703 |

|

Depreciation expense |

|

|

172 |

|

|

|

191 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

||

Unbilled receivables |

|

|

85 |

|

|

|

4,340 |

|

Prepaid expenses and other current assets |

|

|

58 |

|

|

|

262 |

|

Accounts payable |

|

|

(4,756 |

) |

|

|

(3,851 |

) |

Accrued liabilities |

|

|

(6,816 |

) |

|

|

3,526 |

|

Deferred revenue |

|

|

(64,862 |

) |

|

|

(28,002 |

) |

Operating lease liability |

|

|

(701 |

) |

|

|

(619 |

) |

Net cash used in operating activities |

|

|

(29,546 |

) |

|

|

(29,052 |

) |

|

|

|

|

|

|

|

||

Cash flows from investing activities: |

|

|

|

|

|

|

||

Purchases of short-term investments |

|

|

(33,938 |

) |

|

|

(67,862 |

) |

Proceeds from maturity of short-term investments |

|

|

63,419 |

|

|

|

92,118 |

|

Proceeds from the sale of property and equipment |

|

|

— |

|

|

|

13 |

|

Purchases of property and equipment |

|

|

(7 |

) |

|

|

— |

|

Net cash provided by investing activities |

|

|

29,474 |

|

|

|

24,269 |

|

|

|

|

|

|

|

|

||

Cash flows from financing activities: |

|

|

|

|

|

|

||

Payments of tax withholdings related to vesting of restricted stock units |

|

|

— |

|

|

|

(40 |

) |

Payment of cash dividend |

|

|

(11,660 |

) |

|

|

— |

|

Net cash used in financing activities |

|

|

(11,660 |

) |

|

|

(40 |

) |

Net decrease in cash and cash equivalents |

|

|

(11,732 |

) |

|

|

(4,823 |

) |

Cash and cash equivalents at beginning of the period |

|

|

16,906 |

|

|

|

15,740 |

|

Cash and cash equivalents at end of the period |

|

$ |

5,174 |

|

|

$ |

10,917 |

|

|

|

|

|

|

|

|

||

Supplemental cash flow information: |

|

|

|

|

|

|

||

Operating lease right-of-use assets obtained in exchange for operating |

|

$ |

— |

|

|

$ |

4,347 |

|

|

|

|

|

|

|

|

||

See accompanying notes to condensed consolidated financial statements (unaudited).

6

MEI PHARMA, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

1. Description of Business and Basis of Presentation

Description of Business

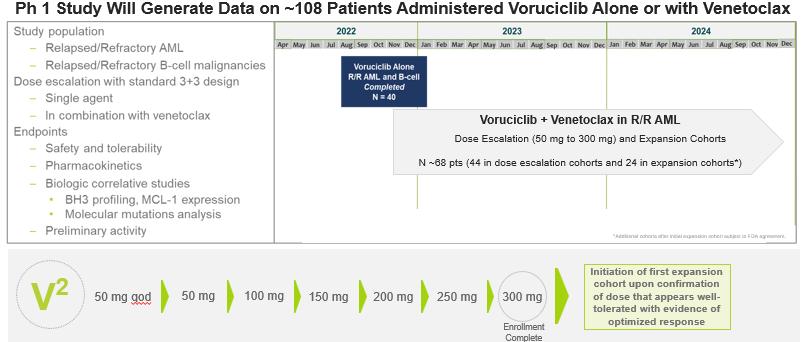

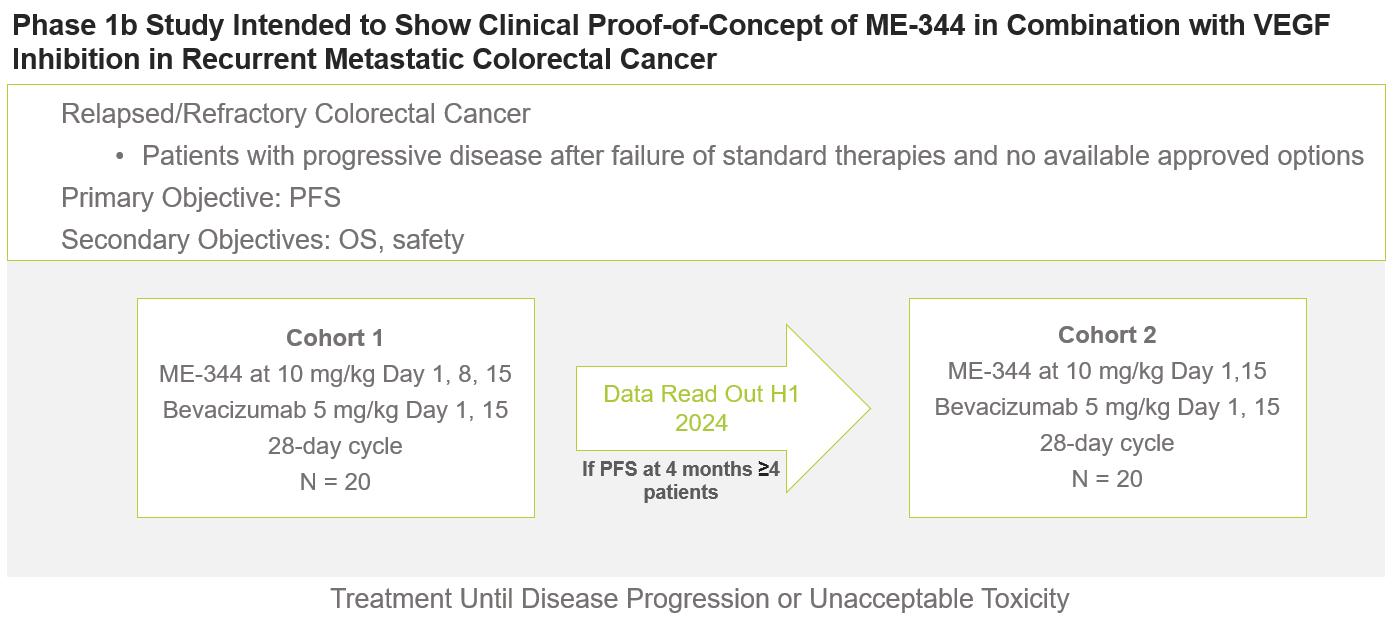

MEI Pharma, Inc. (Nasdaq: MEIP) is a clinical-stage pharmaceutical company committed to developing novel and differentiated cancer therapies. We build our pipeline by acquiring promising cancer agents and creating value in programs through development, strategic partnerships, and out-licensing or commercialization, as appropriate. Our approach to oncology drug development is to evaluate our drug candidates in combinations with standard-of-care therapies to overcome known resistance mechanisms and address clear medical needs to provide improved patient benefit. Our pipeline includes voruciclib, an oral cyclin-dependent kinase 9 (CDK9) inhibitor, and ME-344, an intravenous small molecule inhibitor of mitochondrial oxidative phosphorylation (OXPHOS).

Reverse Stock Split

On April 14, 2023, we amended our Certificate of Incorporation to affect a combination of our issued and outstanding common stock at a ratio of one-for-twenty (Reverse Stock Split). The par value and authorized shares of our common stock were not adjusted as a result of the Reverse Stock Split. The Reverse Stock Split was effective on April 14, 2023, with a market effective date of April 17, 2023. All historical share, stock option, restricted stock unit, warrant and per share amounts have been adjusted to reflect the Reverse Stock Split for all periods presented.

Current Events

Cooperation Agreement

On October 31, 2023, we announced our entry into a Cooperation Agreement (Cooperation Agreement) with Anson Funds and Cable Car Capital which, among other non-financial related items as described within the overview section of Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations, provided for a capital return to stockholders in the form of a dividend in the amount of $1.75 per share of common stock, as further discussed below. Additionally, the Cooperation Agreement contemplates a potential second return of capital of not to exceed $9.33 million (Potential Second Return of Capital) if authorized by the board of directors (Board) should our ongoing ME-344 Phase 1b trial fail to meet certain defined endpoints or our Board determines not to proceed with a second cohort. The Potential Second Return of Capital may take the form of a dividend or tender offer and is subject to Board approval as well as modification associated with applicable requirements under Delaware law, as detailed in the Cooperation Agreement.

As part of the Cooperation Agreement, Anson and Cable Car withdrew their consent solicitation and agreed to abide by customary standstill provisions. Additionally, we reimbursed Anson and Cable Car’s fees and expenses related to their engagement with us as of the date of the Cooperation Agreement, in an amount of $1.1 million, which is recorded within general and administrative expenses in the condensed consolidated statements of operations as of December 31, 2023.

Cash Dividend

On November 6, 2023, pursuant to the Cooperation Agreement, the Board declared a special cash dividend of $1.75 per share of common stock, to stockholders of record at the close of business on November 17, 2023. The total dividend of $11.7 million was paid on December 6, 2023 and was recorded as a reduction of additional paid-in capital in the condensed consolidated statements of stockholders' equity, as we have an accumulated deficit, rather than retained earnings.

Liquidity

We have accumulated losses of $360.7 million since inception and expect to incur operating losses and generate negative cash flows from operations for the foreseeable future. As of December 31, 2023, we had $59.5 million in cash and cash equivalents and short-term investments. We believe that these resources will be sufficient to meet our obligations and fund our liquidity and capital expenditure requirements for at least the next 12 months from the issuance of these condensed consolidated financial statements. Our current business operations are focused on continuing the clinical development of our drug candidates. Changes to our research and development plans or other changes affecting our operating expenses may affect actual future use of existing cash resources. Our research and development expenses are expected to increase in the foreseeable future. We cannot determine with certainty costs associated with ongoing and future clinical trials or the regulatory approval process. The duration, costs and timing associated with the development of our product candidates will depend on a variety of factors, including uncertainties associated with the results of our clinical trials.

7

To date, we have obtained cash and funded our operations primarily through equity financings and license agreements. In order to continue the development of our drug candidates, at some point in the future we expect to pursue one or more capital transactions, whether through the sale of equity securities, debt financing, license agreements or entry into strategic partnerships. There can be no assurance that we will be able to continue to raise additional capital in the future.

Basis of Presentation and Principles of Consolidation

The condensed consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the U.S. (U.S. GAAP) for interim financial information and in accordance with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, the accompanying financial statements do not include all of the information and notes required by U.S. GAAP for complete financial statements. In the opinion of management, the accompanying condensed consolidated financial statements reflect all adjustments (consisting of normal recurring adjustments) that are necessary for a fair statement of the financial position, results of operations and cash flows for the periods presented.

The accompanying unaudited condensed consolidated financial statements include the accounts of MEI Pharma, Inc. and our wholly owned subsidiary, Meadow Merger Sub, Inc. We have eliminated all significant intercompany accounts and transactions in consolidation.

The accompanying unaudited condensed consolidated financial statements for the quarterly period ended December 31, 2023 should be read in conjunction with the audited financial statements and notes thereto as of and for the fiscal year ended June 30, 2023, included in our Annual Report on Form 10-K filed with the Securities and Exchange Commission on September 26, 2023 (2023 Annual Report). Interim results are not necessarily indicative of results for a full year. The Company has evaluated subsequent events through the date the condensed consolidated financial statements were issued.

2. Summary of Significant Accounting Policies

There have been no material changes to our significant accounting policies from those described in the notes to our audited condensed consolidated financial statements contained in the 2023 Annual Report.

Risks and Uncertainties

Use of Estimates

The preparation of consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. On an ongoing basis, we evaluate our estimates, including those related to the valuation of share-based awards, the discount rate used in estimating the present value of the right-of-use assets and lease liabilities, clinical trial accruals and the assessment of our ability to fund our operations for at least the next 12 months from the date of issuance of these condensed consolidated financial statements. We base our estimates on historical experience and other market-specific or other relevant assumptions that we believe to be reasonable under the circumstances. Estimates are assessed each reporting period and updated to reflect current information. As future events and their effects cannot be determined with precision, actual results may materially differ from those estimates or assumptions.

Segment Reporting

Operating segments are identified as components of an enterprise about which separate discrete financial information is available for evaluation by our chief operating decision-maker (CODM), our Chief Executive Officer, in making decisions regarding resource allocation and assessing performance. The CODM views its operations and manages its business in one operating segment.

Concentrations of Credit Risk

Financial instruments that potentially subject us to significant concentrations of credit risk consist primarily of cash, cash equivalents and short-term investments. Deposits in our checking and money market accounts are maintained in federally insured financial institutions and are subject to federally insured limits or limits set by the Securities Investor Protection Corporation.

We attempt to minimize credit risk associated with our cash, cash equivalents and short-term investments by periodically evaluating the credit quality of our primary financial institutions. Our investment portfolio is maintained in accordance with our investment policy, which is designed to preserve capital, safeguard funds and limit exposure to risk. While we maintain cash deposits in Federal Deposit Insurance Corporation insured financial institutions in excess of federally insured limits, we do not believe that we are exposed to significant credit risk due to the financial position of the depository institutions in which those deposits are held. We have not experienced any losses on such accounts.

8

Short-term Investments

Short-term investments are marketable securities with original maturities greater than three months but less than one year from date of purchase. As of December 31, 2023 and June 30, 2023, our short-term investments consisted of $54.3 million and $83.8 million, respectively, in United States government securities. The short-term investments held as of December 31, 2023 and June 30, 2023 are considered to be held to maturity and are carried at amortized cost. As of December 31, 2023 and June 30, 2023, the gross unrealized gains and losses were immaterial.

Dividends

Due to our history of net losses, we have elected to first reduce our additional paid-in capital (APIC) to zero by the amount of dividends/return of capital approved by our Board. Any dividends/return of capital approved by our Board, in excess of our APIC, if any, will be recorded as an adjustment to our accumulated deficit.

Revenue Recognition

Revenues from Customers

In accordance with ASC Topic 606, Revenue from Contracts with Customers (Topic 606), we recognize revenue when control of the promised goods or services is transferred to our customers, in an amount that reflects the consideration we expect to be entitled to in exchange for those goods or services. For enforceable contracts with our customers, we first identify the distinct performance obligations, or accounting units, within the contract. Performance obligations are commitments in a contract to transfer a distinct good or service to the customer.

Payments received under commercial arrangements, such as licensing technology rights, may include non-refundable fees at the inception of the arrangements, milestone payments for specific achievements designated in the agreements, and royalties on the sale of products. At the inception of arrangements that include milestone payments, we use judgment to evaluate whether the milestones are probable of being achieved, and we estimate the amount, if any, to include in the transaction price using the most likely method. If it is probable that a significant revenue reversal will not occur, the estimated amount is included in the transaction price. Milestone payments that are not within our or the licensee’s control, such as regulatory approvals, are not included in the transaction price until those approvals are received. At the end of each reporting period, we re-evaluate the probability of achievement of development milestones and any related constraint and, as necessary, we adjust our estimate of the overall transaction price.

We may enter into arrangements that consist of multiple performance obligations. Such arrangements may include any combination of our deliverables. To the extent a contract includes multiple promised deliverables, we apply judgment to determine whether promised deliverables are capable of being distinct and are distinct within the context of the contract. If these criteria are not met, the promised deliverables are accounted for as a combined performance obligation. For arrangements with multiple distinct performance obligations, we allocate variable consideration related to our 50-50 cost share for development services directly to the associated performance obligation and then allocate the remaining consideration among the performance obligations based on their relative stand-alone selling price.

Stand-alone selling price is the price at which we would sell a promised good or service separately to the customer. When not directly observable, we typically estimate the stand-alone selling price for each distinct performance obligation. Variable consideration that relates specifically to our efforts to satisfy specific performance obligations is allocated entirely to those performance obligations. Other components of the transaction price are allocated based on the relative stand-alone selling price, over which management has applied significant judgment. We develop assumptions that require judgment to determine the stand-alone selling price for license-related performance obligations, which may include forecasted revenues, development timelines, reimbursement rates for personnel costs, discount rates and probabilities of technical, regulatory and commercial success. We estimate stand-alone selling price for research and development performance obligations by forecasting the expected costs of satisfying a performance obligation plus an appropriate margin.

In the case of a license that is a distinct performance obligation, we recognize revenue allocated to the license from non-refundable, up-front fees at the point in time when the license is transferred to the licensee and the licensee can use and benefit from the license. For licenses that are bundled with other distinct or combined obligations, we use judgment to assess the nature of the performance obligation to determine whether the performance obligation is satisfied over time or at a point in time and, if over time, the appropriate method of measuring progress for purposes of recognizing revenue. If the performance obligation is satisfied over time, we evaluate the measure of progress each reporting period and, if necessary, adjust the measure of performance and related revenue recognition.

9

The selection of the method to measure progress towards completion requires judgment and is based on the nature of the products or services to be provided. Revenue is recorded proportionally as costs are incurred. We generally use the cost-to-cost measure of progress because it best depicts the transfer of control to the customer which occurs as we incur costs. Under the cost-to-cost measure of progress, the extent of progress towards completion is measured based on the ratio of costs incurred to date to the total estimated costs at completion of the performance obligation (an input method under Topic 606). We use judgment to estimate the total cost expected to complete the research and development performance obligations, which include subcontractors’ costs, labor, materials, other direct costs and an allocation of indirect costs. We evaluate these cost estimates and the progress each reporting period and, as necessary, we adjust the measure of progress and related revenue recognition.

For arrangements that include sales-based or usage-based royalties, we recognize revenue at the later of (i) when the related sales occur or (ii) when the performance obligation to which some or all of the royalty has been allocated has been satisfied or partially satisfied. To date, we have not recognized any sales-based or usage-based royalty revenue from license agreements.

In connection with our April 2020 Kyowa Kirin Co., Ltd. (KKC) License, Development and Commercialization Agreement (the KKC Commercialization Agreement) described in Note 7. License Agreements, we performed development services related to our 50-50 cost sharing arrangement for which revenue was recognized over time. Additionally, from time to time, we performed services for KKC at their request, the costs of which were fully reimbursed to us. We recorded the reimbursement for such pass-through services as revenue at 100% of reimbursed costs, as control of the additional services for KKC was transferred at the time we incurred such costs. The costs of these services are recognized in the condensed consolidated statements of operations as research and development expense. The cost of these services was recognized in the condensed consolidated statements of operations as research and development expense.

We recognized revenue associated with the KKC Commercialization Agreement for the periods presented (in thousands):

|

|

For the Three Months Ended December 31, |

|

|

For the Six Months Ended December 31, |

|

||||||||||

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

||||

Timing of Revenue Recognition: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Services performed over time |

|

$ |

— |

|

|

$ |

32,473 |

|

|

$ |

743 |

|

|

$ |

40,832 |

|

Pass through services at a point in time |

|

|

— |

|

|

|

262 |

|

|

|

9 |

|

|

|

633 |

|

|

|

$ |

— |

|

|

$ |

32,735 |

|

|

$ |

752 |

|

|

$ |

41,465 |

|

Contract Balances

Accounts receivables are included in prepaid expenses and other current assets, and contract liabilities are included in deferred revenue and deferred revenue, long-term, in our condensed consolidated balance sheets. Our contract liabilities accounted for under Topic 606 relate to the amount of initial upfront consideration allocated to the development services performance obligations. Contract liabilities are recognized over the duration of the performance obligations based on the costs incurred relative to total expected costs.

As of December 31, 2023, June 30, 2023 and June 30, 2022, we had no balances in accounts receivable. Contract balances are as follows (in thousands):

|

|

December 31, 2023 |

|

|

June 30, 2023 |

|

June 30, 2022 |

|

|||

Unbilled receivables |

|

$ |

— |

|

|

$ |

85 |

|

$ |

10,044 |

|

Contract liabilities included in deferred revenue and deferred |

|

$ |

— |

|

|

$ |

317 |

|

$ |

30,900 |

|

10

A reconciliation of the beginning and ending amount of contract liabilities, which are primarily related to the combined performance obligation for the transfer of development services under the KKC Commercialization Agreement, which are a separate performance obligation in the Company’s contracts pursuant to research plans under the agreements, was as follows for the periods presented, (in thousands):

|

|

December 31, 2023 |

|

|

June 30, 2023 |

|

||

Beginning balance |

|

$ |

317 |

|

|

$ |

30,900 |

|

Recognized as revenue: |

|

|

|

|

|

|

||

Revenue recognized upon satisfaction of performance obligations |

|

|

(317 |

) |

|

|

(5,411 |

) |

Revenue recognized from change in estimate for performance obligations |

|

|

— |

|

|

|

(16,565 |

) |

Revenue recognized for performance obligations that will no longer |

|

|

— |

|

|

|

(8,607 |

) |

Ending balance |

|

$ |

— |

|

|

$ |

317 |

|

The timing of revenue recognition, invoicing and cash collections results in billed accounts receivable and unbilled receivables (contract assets) and deferred revenue (contract liabilities). We invoice our customers in accordance with agreed-upon contractual terms, typically at periodic intervals or upon achievement of contractual milestones. Invoicing may occur subsequent to revenue recognition, resulting in unbilled receivables. We may receive advance payments from our customers before revenue is recognized, resulting in contract liabilities. The unbilled receivables and deferred revenue reported on the condensed consolidated balance sheets related to the KKC Commercialization Agreement.

Revenues from Collaborators

At contract inception, we assess whether the collaboration arrangements are within the scope of ASC Topic 808, Collaborative Arrangements (Topic 808), to determine whether such arrangements involve joint operating activities performed by parties that are both active participants in the activities and exposed to significant risks and rewards dependent on the commercial success of such activities. This assessment is performed based on the responsibilities of all parties in the arrangement. For collaboration arrangements within the scope of Topic 808 that contain multiple units of account, we first determine which units of account within the arrangement are within the scope of Topic 808 and which elements are within the scope of Topic 606. For units of account within collaboration arrangements that are accounted for pursuant to Topic 808, an appropriate recognition method is determined and applied consistently, by analogy to authoritative accounting literature. For elements of collaboration arrangements that are accounted for pursuant to Topic 606, we recognize revenue as discussed above. Consideration received that does not meet the requirements to satisfy Topic 606 revenue recognition criteria is recorded as deferred revenue in the accompanying condensed consolidated balance sheets, classified as either current or long-term deferred revenue based on our best estimate of when such amounts will be recognized.

Net Income (Loss) Per Share

Basic and diluted net income (loss) per share is computed using the weighted-average number of shares of common stock outstanding during the period, less any shares subject to repurchase or forfeiture. There were no shares of common stock subject to repurchase or forfeiture for the three and six months ended December 31, 2023 and 2022. Diluted net income (loss) per share is computed based on the sum of the weighted-average number of common shares and potentially dilutive common shares outstanding during the period determined using the treasury-stock and if-converted methods.

For purposes of the diluted net income (loss) per share calculation for the three and six months ended December 31, 2023, potentially dilutive securities are excluded from the calculation of diluted net income (loss) per share because their weighted-average exercise prices were above our weighted-average share price as of December 31, 2023; therefore, basic and diluted net income (loss) per share were the same for the three and six months ended December 31, 2023. For purposes of the diluted net income (loss) per share calculation for the three and six months ended December 31, 2022, potentially dilutive securities are excluded from the calculation of diluted net income (loss) per share because their effect would be anti-dilutive and, therefore, basic and diluted net income (loss) per share were the same for the three and six months ended December 31, 2022.

11

The following table presents potentially dilutive shares excluded from the calculation of diluted net income (loss) per share (in thousands):

|

|

For the Three Months Ended December 31, |

|

|

For the Six Months Ended December 31, |

|

||||||||||

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

||||

Stock options |

|

|

1,398 |

|

|

|

1,372 |

|

|

|

1,398 |

|

|

|

1,380 |

|

Warrants |

|

|

103 |

|

|

|

802 |

|

|

|

103 |

|

|

|

802 |

|

Restricted stock units |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Total anti-dilutive shares |

|

|

1,501 |

|

|

|

2,174 |

|

|

|

1,501 |

|

|

|

2,182 |

|

Recent Accounting Pronouncement

Recently Adopted

In June 2016, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update No. 2016-13, Financial Instruments–Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments (ASU 2016-13), as amended. The amendments in ASU 2016-13 require, among other things, financial assets measured at amortized cost basis to be presented at the net amount expected to be collected as compared to previous U.S. GAAP which delayed recognition until it was probable a loss had been incurred. The amendments in ASU 2016-13 are effective for fiscal years beginning after December 15, 2022, including interim periods within those fiscal years, with early adoption permitted. The adoption of ASU 2016-13 did not have a material impact on our financial statements and related disclosures.

We do not believe other recently issued but not yet effective accounting standards, if currently adopted, would have a material effect on our condensed consolidated financial position, results of operations and cash flows.

Recently Issued

From time to time, new accounting pronouncements are issued by the FASB or other standards setting bodies that are adopted as of the specified effective date. We believe the impact of recently issued standards, other than those noted below, and any issued but not yet effective standards will not have a material impact on its condensed consolidated financial statements upon adoption.

In November 2023, the FASB issued ASU No. 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures, which requires a public entity to disclose significant segment expenses and other segment items on an annual and interim basis and provide in interim periods all disclosures about a reportable segment’s profit or loss and assets that are currently required annually. Additionally, it requires a public entity to disclose the title and position of the Chief Operating Decision Maker. This ASU does not change how a public entity identifies its operating segments, aggregates them, or applies the quantitative thresholds to determine its reportable segments. The new standard is effective for fiscal years beginning after December 15, 2023, and interim periods within fiscal years beginning after December 15, 2024, with early adoption permitted. A public entity should apply the amendments in this ASU retrospectively to all prior periods presented in the financial statements. We expect this ASU to only impact our disclosures with no impacts to our results of operations, cash flows and financial condition.

In December 2023, the FASB issued ASU No. 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures, which focuses on the rate reconciliation and income taxes paid. ASU No. 2023-09 requires a public business entity (PBE) to disclose, on an annual basis, a tabular rate reconciliation using both percentages and currency amounts, broken out into specified categories with certain reconciling items further broken out by nature and jurisdiction to the extent those items exceed a specified threshold. In addition, all entities are required to disclose income taxes paid, net of refunds received disaggregated by federal, state/local, and foreign and by jurisdiction if the amount is at least 5% of total income tax payments, net of refunds received. For PBEs, the new standard is effective for annual periods beginning after December 15, 2024, with early adoption permitted. An entity may apply the amendments in this ASU prospectively by providing the revised disclosures for the period ending December 31, 2025 and continuing to provide the pre-ASU disclosures for the prior periods, or may apply the amendments retrospectively by providing the revised disclosures for all period presented. We expect this ASU to only impact our disclosures with no impacts to our results of operations, cash flows, and financial condition.

12

3. Balance Sheet Details

Property and Equipment, Net

Property and equipment, net consisted of the following (in thousands):

|

|

December 31, 2023 |

|

|

June 30, 2023 |

|

||

Furniture and equipment |

|

$ |

1,381 |

|

|

$ |

1,374 |

|

Leasehold improvements |

|

|

969 |

|

|

|

969 |

|

|

|

|

2,350 |

|

|

|

2,343 |

|

Less: accumulated depreciation |

|

|

(1,206 |

) |

|

|

(1,034 |

) |

Property and equipment, net |

|

$ |

1,144 |

|

|

$ |

1,309 |

|

Depreciation expense of property and equipment for the three months ended December 31, 2023 and 2022 were $85,000 and $92,000, respectively. Depreciation expense of property and equipment for the six months ended December 31, 2023 and 2022 are presented in the condensed consolidated statements of cash flows.

Accrued Liabilities

Accrued liabilities consisted of the following (in thousands):

|

|

|

|

|

|

|

||

|

|

December 31, 2023 |

|

|

June 30, 2023 |

|

||

Accrued pre-clinical and clinical trial expenses |

|

$ |

810 |

|

|

$ |

3,663 |

|

Accrued compensation and benefits(1) |

|

|

2,236 |

|

|

|

7,189 |

|

Accrued legal and professional services |

|

|

1,541 |

|

|

|

1,423 |

|

Accrued reimbursement to KKC |

|

|

892 |

|

|

|

— |

|

Other |

|

|

166 |

|

|

|

186 |

|

Total accrued liabilities |

|

$ |

5,645 |

|

|

$ |

12,461 |

|

(1) Includes $0.2 million and $1.0 million of one-time termination employee benefits as of December 31, 2023 and June 30, 2023, respectively, as more fully described in Note 5. One-time Employee Termination Benefits.

4. Fair Value Measurements

The carrying amounts of financial instruments such as cash equivalents, short-term investments and accounts payable approximate the related fair values due to the short-term maturities of these instruments. We invest our excess cash in financial instruments which are readily convertible into cash, such as money market funds and U.S. government securities. Cash equivalents and short-term investments are classified as Level 1 as defined by the fair value hierarchy. As of December 31, 2023 and June 30, 2023, we had no assets or liabilities measured on a recurring or non-recurring basis.

In May 2018, we issued warrants in connection with a private placement of our shares of common stock. Pursuant to the terms of the warrants, we could have been required to settle the warrants in cash in the event of an acquisition of us and, as a result, the warrants were required to be measured at fair value and reported as a liability in the condensed consolidated balance sheets. We recorded the fair value of the warrants upon issuance using the Black-Scholes valuation model and were required to revalue the warrants at each reporting date with any changes in fair value recorded in our condensed consolidated statement of operations through their expiration in May 2023. The valuation of the warrants were considered under Level 3 of the fair value hierarchy due to the need to use assumptions in the valuation that were both significant to the fair value measurement and unobservable. Inputs used to determine estimated fair value of the warrant liabilities included the estimated fair value of the underlying stock at the valuation date, the estimated term of the warrants, risk-free interest rates, expected dividends and the expected volatility of the underlying stock. The significant unobservable inputs used in the fair value measurement of the warrant liabilities were the volatility rate and the estimated term of the warrants. Generally, increases (decreases) in the fair value of the underlying stock and estimated term would result in a directionally similar impact to the fair value measurement. The change in the fair value of the Level 3 warrant liability is reflected in the condensed consolidated statements of operations for the three and six months ended December 31, 2022. During the three months ended December 31, 2023 and the year ended June 30, 2023, there were no transfers into or out of Level 3 of the fair value hierarchy.

13

To calculate the fair value of the warrant liability as of June 30, 2023, the following assumptions were used:

Risk-free interest rate |

|

|

4.4 |

% |

Expected life (years) |

|

|

0.5 |

|

Expected volatility |

|

|

128.7 |

% |

Dividend yield |

|

|

— |

% |

Weighted-average grant date fair value |

|

$ |

0.02 |

|

The following table sets forth a summary of changes in the estimated fair value of our Level 3 warrant liability for the six months ended December 31, 2022 (in thousands):

|

|

|

|

|

Balance as of June 30, 2022 |

|

$ |

1,603 |

|

Change in estimated fair value of liability classified warrants |

|

|

(1,603 |

) |

Balance as of December 31, 2022 |

|

$ |

— |

|

5. One-time Employee Termination Benefits

In connection with our joint decision to discontinue development of zandelisib outside of Japan, in December 2022, we announced a realignment of our clinical development efforts that streamlined our organization towards the continued clinical development of our two earlier clinical-stage assets, voruciclib and ME-344. As a result, our Board approved a staggered workforce reduction (the Reduction in Force) affecting 28 employees in December 2022 and an additional 26 employees through June 2023, representing an aggregate 51% Reduction in Force. For the three and six months ended December 31, 2022, we recorded one-time employee benefits of $0.8 million and $0.4 million, within research and development expense and general and administrative expense, respectively, associated with the termination of 18 employees in research and development departments and 10 employees in general and administrative departments. For the three months ended December 31, 2023, we recorded additional one-time employee benefits of $141,000 and $168,000, within research and development expense and general and administrative expense, respectively, associated with the termination of two and three additional research and development and general and administrative employees. For the six months ended December 31, 2023, we recorded additional one-time employee termination benefits of $169,000 and $168,000 within research and development expense and general and administrative expense, respectively, associated with the termination of six additional employees, three each within research and development and general and administrative departments.

The following table summarizes our activity related to one-time employee termination benefits included in accrued liabilities (in thousands):

|

|

One-time Employee Termination Benefits |

|

|

Balance at June 30, 2023 |

|

$ |

993 |

|

Increase in accrued restructuring |

|

|

337 |

|

Cash payments |

|

|

(1,105 |

) |

Balance at December 31, 2023 |

|

$ |

225 |

|

6. Commitments and Contingencies

We have contracted with various consultants and third parties to assist us in pre-clinical research and development and clinical trials work for our leading drug compounds. The contracts are terminable at any time but obligate us to reimburse the providers for any time or costs incurred through the date of termination. We also have employment agreements with certain of our current employees that provide for severance payments and accelerated vesting for share-based awards if their employment is terminated under specified circumstances.

Litigation

From time to time, we may be involved in various lawsuits, legal proceedings, or claims that arise in the ordinary course of business. Management believes there are no claims or actions pending against us as of December 31, 2023 which will have, individually or in the aggregate, a material adverse effect on its business, liquidity, financial position, or results of operations. Litigation, however, is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business.

14

Indemnification

In accordance with our amended and restated certificate of incorporation and bylaws, we have indemnification obligations to our officers and directors for certain events or occurrences, subject to certain limits, while they are serving in such capacity. There have been no claims to date, and we have a directors and officers liability insurance policy that may enable it to recover a portion of any amounts paid for future claims.

Presage License Agreement

As discussed in Note 8. Other License Agreements, we are party to a license agreement with Presage Biosciences, Inc. (Presage) under which we may be required to make future payments upon the achievement of certain development, regulatory and commercial milestones, as well as potential future royalties based upon net sales. As of December 31, 2023, we had not accrued any amounts for potential future payments as achievement of the milestones had not been met.

Potential Return of Capital

As discussed in Note 1. Description of Business and Basis of Presentation, under certain circumstances, we could potentially be obligated to pay a Potential Second Return of Capital, if authorized by our Board should our ongoing ME-344 Phase 1b trial fail to meet certain defined endpoints or our Board determines not to proceed with a second cohort. The Potential Second Return of Capital may take the form of a dividend or tender offer and is subject to Board approval as well as modification associated with applicable requirements under Delaware law, as detailed in the Cooperation Agreement. As of December 31, 2023, our Board has not declared the Potential Second Return of Capital and, therefore, we have not accrued a liability related to it.

7. License Agreements

Kyowa Kirin Co., Ltd. License, Development and Commercialization Agreement

In April 2020, we entered into the KKC Commercialization Agreement pursuant to which we granted to KKC a co-exclusive, sublicensable, payment-bearing license under certain patents and know-how controlled by us to develop and commercialize zandelisib and any pharmaceutical product containing zandelisib for all human indications in the U.S. (the U.S. License), and an exclusive (subject to certain retained rights to perform obligations under the KKC Commercialization Agreement), sublicensable, payment-bearing, license under certain patents and know-how controlled by us to develop and commercialize zandelisib and any pharmaceutical product containing zandelisib for all human indications in countries outside of the U.S. KKC granted to us a co-exclusive, sublicensable, license under certain patents and know-how controlled by KKC to develop and commercialize zandelisib for all human indications in the U.S., and a co-exclusive, sublicensable, royalty-free, fully paid license under certain patents and know-how controlled by KKC to perform our obligations in the Ex-U.S. KKC also paid us an initial nonrefundable payment of $100.0 million.

In November 2022, we and KKC jointly decided to discontinue zandelisib development in the U.S. and in May 2023, KKC decided to discontinue development of zandelisib in Japan. Considering the decisions to discontinue worldwide development of zandelisib the parties entered into a Termination Agreement on July 14, 2023, agreeing to mutually terminate the global KKC Commercialization Agreement. Pursuant to the Termination Agreement, we regained full, global rights to develop, manufacture and commercialize zandelisib, subject to KKC's limited rights to use for compassionate use (as more specifically defined in the Termination Agreement) in certain expanded access programs for the existing patients who have been enrolled in Japanese clinical trials sponsored by KKC until November 30, 2027, and for which KKC is fully liable; each party released the other party from any and all claims or demands arising from the original KKC Commercialization Agreement excluding certain surviving claims; however, we are obligated to deliver a discrete quantity of materials to facilitate KKCs compassionate use activities.

We determined the KKC Commercialization Agreement was a collaborative arrangement in accordance with Topic 808 which contained multiple units of account, as we and KKC were both active participants in the development and commercialization activities and were exposed to significant risks and rewards dependent on commercial success of the activities of the arrangement. We determined the U.S. License was a separate unit of account under the scope of Topic 808 and was not a deliverable under Topic 606, while the license issued to KKC within its territory and related development services was within the scope of Topic 606. See discussion within the Revenue Recognition subsection of Note 2. Summary of Significant Accounting Policies.

We evaluated the Termination Agreement under ASC 606 and determined it met the requirements of a contract modification which changed the scope of the KKC Commercialization Agreement, and the remaining goods and services associated with the wind-down activities to be transferred. The cost of satisfying our performance obligation to provide compassionate use supply to KKC was determined to be de minimis and, therefore, immaterial within the context of the KKC Commercialization Agreement. As of September 30, 2023 activities associated with the compassionate use supply were completed.

15

With the execution of the Termination Agreement, we regained full, global rights (subject to KKC's limited rights for compassionate use) and KKC has no further rights to develop, use or commercialize zandelisib in the U.S., nor do we have any remaining performance obligations. All consideration received from KKC was nonrefundable, therefore, the remaining long-term deferred revenue as of June 30, 2023, of $64.5 million allocated to the U.S. License obligation accounted for under Topic 808 at inception of the KKC Commercialization Agreement was recognized as revenue from collaboration agreements in the three months ended September 30, 2023, utilizing contract termination analogous to guidance provided in Topic 606. We recognized the remaining transaction price of $0.3 million of deferred revenue during the three months ended September 30, 2023, as any remaining performance obligations under the KKC Commercialization Agreement were determined to be de minimis as of September 30, 2023. Therefore, as of September 30, 2023, all deferred revenue associated with the KKC Commercialization Agreement had been recognized.

8. Other License Agreements

Presage License Agreement

In September 2017, we, as licensee, entered into a License Agreement with Presage. Under the terms of the license agreement, Presage granted to us exclusive worldwide rights to develop, manufacture and commercialize voruciclib, a clinical-stage, oral and selective CDK inhibitor, and related compounds. In exchange, we paid $2.9 million to Presage. With respect to the first indication, an incremental $2.0 million payment, due upon dosing of the first subject in the first registration trial, will be owed to Presage, for total payments of $4.9 million prior to receipt of marketing approval of the first indication in the U.S., EU or Japan. Additional potential payments of up to $179.0 million will be due upon the achievement of certain development, regulatory and commercial milestones. We will also pay mid-single digit tiered royalties on the net sales of any product successfully developed. As an alternative to milestone and royalty payments related to countries in which we sublicense product rights, we will pay to Presage a tiered percentage (which decreases as product development progresses) of amounts received from such sublicensees. During the three and six months ended December 31, 2023 and 2022 we made no payments under the Presage license agreement.

BeiGene Collaboration

In October 2018, we entered into a clinical collaboration with BeiGene, Ltd. (BeiGene) to evaluate the safety and efficacy of zandelisib in combination with BeiGene’s zanubrutinib (marketed as Brukinsa®), an inhibitor of Bruton’s tyrosine kinase, for the treatment of patients with B-cell malignancies. Under the terms of the clinical collaboration agreement, we amended our ongoing Phase 1b trial to include evaluation of zandelisib in combination with zanubrutinib in patients with B-cell malignancies. Study costs are being shared equally by the parties, and we agreed to supply zandelisib and BeiGene agreed to supply zanubrutinib. We record the costs reimbursed by BeiGene as a reduction of our research and development expenses. We retained full commercial rights for zandelisib and BeiGene retained full commercial rights for zanubrutinib. With the discontinuation of the zandelisib program outside of Japan, this clinical collaboration was terminated on September 28, 2023. During the three and six months ended December 31, 2023, we recorded approximately none and $0.1 million, respectively, in costs reimbursements, as a reduction of research and development costs in the condensed consolidated statements of operations. During the three and six months ended December 31, 2022, we recorded approximately $0.2 million and $0.3 million, respectively, in costs reimbursements, as a reduction of research and development costs in the condensed consolidated statements of operations.

9. Leases

In July 2020, we entered into a lease agreement (the Initial Lease Agreement) for approximately 32,800 square feet of office space in San Diego, California. The Lease Agreement was scheduled to expire in March 2028 but was extended by 20 months to November 2029 in accordance with the amended lease agreement we entered into in January 2022 (the Amended Lease Agreement). The Initial and Amended Lease Agreements are collectively referred to as the Lease Agreements. The Lease Agreements contain rent escalations over the lease term. In addition, the Lease Agreements contain an option to renew and extend the lease term, which is not included in the determination of the right-of-use (ROU) asset and operating lease liability, as it was not reasonably certain to be exercised. Upon commencement of the Amended Lease Agreement, to extend the lease term, we recognized an additional operating lease ROU asset and a corresponding operating lease liability. The Lease Agreements include variable non-lease components (e.g., common area maintenance, maintenance, etc.) that are not included in the ROU asset and operating lease liability and are reflected as an expense in the period incurred as a component of the lease cost.

The Amended Lease Agreement also provides for an additional 12,300 square feet of office space adjacent to our current office in San Diego. Upon taking control of the additional office space on July 1, 2022, we recognized operating lease ROU assets obtained in exchange for operating lease liabilities of $4.3 million.

16

The total operating lease costs for the Lease Agreements were as follows for the periods presented (in thousands):

|

|

For the Three Months Ended December 31, |

|

|

For the Six Months Ended December 31, |

|

||||||||||

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

||||

Operating lease cost |

|

$ |

609 |

|

|

$ |

608 |

|

|

$ |

1,217 |

|

|

$ |

1,217 |

|

Variable lease costs |

|

|

12 |

|

|

|

17 |

|

|

|

24 |

|

|

|

35 |

|

Total lease costs included in general and administrative expenses |

|

$ |

621 |

|

|

$ |

625 |

|

|

$ |

1,241 |

|

|

$ |

1,252 |

|

Supplemental cash flow information related to our operating leases was as follows for the periods presented (in thousands):

|

|

For the Three Months Ended December 31, |

|

|

For the Six Months Ended December 31, |

|

||||||||||

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

||||

Cash paid for amount included in the measurement |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Operating cash flows from operating leases |

|

$ |

583 |

|

|

$ |

567 |

|

|

$ |

1,167 |

|

|

$ |

1,133 |

|

The following is a schedule of the future minimum lease payments under the Lease Agreements, reconciled to the operating lease liability, as of December 31, 2023 (in thousands):

Remainder of fiscal year ending June 30, 2024 |

|

$ |

1,167 |

|

Years ending June 30, |

|

|

|

|

2025 |

|

|

1,913 |

|

2026 |

|

|

2,477 |

|

2027 |

|

|

2,551 |

|

2028 |

|

|

2,715 |

|

Thereafter |

|

|

4,385 |

|

Total lease payments |

|

|

15,208 |

|

Less: Present value discount |

|

|

(3,181 |

) |

Total operating lease liability |

|

$ |

12,027 |

|

|

|

|

|

|

Balance Sheet Classification - Operating Leases |

|

|

|

|

Operating lease liability |

|

$ |

1,015 |

|

Operating lease liability, long-term |

|

|

11,012 |

|

Total operating lease liability |

|

$ |

12,027 |

|

|

|

|

|

|

Other Balance Sheet Information - Operating Leases |

|

|

|

|

Weighted-average remaining lease term (in years) |

|

|

5.9 |

|

Weighted-average discount rate |

|

|

7.50 |

% |

10. Stockholders’ Equity

Equity Transactions

Warrants

In May 2023, outstanding warrants to purchase 802,949 shares of our common stock expired. The warrants were fully vested and exercisable at a price of $50.80 per share. Prior to their expiration, the warrants had been previously revalued to zero as of December 31, 2022. All corresponding changes in fair value were recorded as a component of other income (expense) in our condensed consolidated statements of operations. No warrants were exercised during the three and six months ended December 31, 2022.

As of December 31, 2023, we have warrants outstanding to purchase 102,513 shares of our common stock issued to Torreya Partners in October 2022. The warrants are fully vested and exercisable at a price of $6.80 per share and expire in October 2027. No warrants were exercised during the three and six months ended December 31, 2023 or 2022.

17

Description of Capital Stock

Our total authorized share capital is 226,100,000 shares consisting of 226,000,000 shares of common stock, $0.00000002 par value per share, and 100,000 shares of preferred stock, $0.01 par value per share.

Common Stock

The holders of common stock are entitled to one vote per share. In the event of a liquidation, dissolution or winding up of our affairs, holders of the common stock will be entitled to share ratably in all our assets that are remaining after payment of our liabilities and the liquidation preference of any outstanding shares of preferred stock. All outstanding shares of common stock are fully paid and non-assessable. The rights, preferences and privileges of holders of common stock are subject to any series of preferred stock that we have issued or that we may issue in the future. The holders of common stock have no preemptive rights and are not subject to future calls or assessments by us.

Preferred Stock

Our Board has the authority to issue up to 100,000 shares of preferred stock with a par value of $0.01 per share in one or more series and to fix the rights, preferences, privileges and restrictions in respect of that preferred stock, including dividend rights, dividend rates, conversion rights, voting rights, terms of redemption (including sinking fund provisions), redemption prices and liquidation preferences, and the number of shares constituting such series and the designation of any such series, without future vote or action by the stockholders. Therefore, the Board, without the approval of the stockholders, could authorize the issuance of preferred stock with voting, conversion and other rights that could affect the voting power, dividend and other rights of the holders of shares or that could have the effect of delaying, deferring or preventing a change of control. There were no shares of preferred stock outstanding as of December 31, 2023 and June 30, 2023.

Rights Agreement

On October 1, 2023, our Board approved and adopted a Rights Agreement (Rights Agreement) by and between us and Computershare, Inc., as Rights Agent (as defined in the Rights Agreement). Pursuant to the Rights Agreement, the Board declared a dividend of one preferred share purchase right (each a Right) for each outstanding share of our common stock, par value $0.00000002 (each a Common Share and collectively, the Common Shares). The Rights are distributable to stockholders of record as of the close of business on October 12, 2023. One Right also will be issued together with each Common Share issued by us after October 12, 2023, but before the Distribution Date, as defined in the Rights Agreement (or the earlier of the redemption or expiration of the Rights) and, in certain circumstances, after the Distribution Date.

11. Share-based Compensation