UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): January 26, 2024

|

First US Bancshares, Inc. |

|

(Exact Name of Registrant as Specified in Charter)

Delaware |

0-14549 |

63-0843362 |

|

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

3291 U.S. Highway 280

Birmingham, Alabama 35243

(Address of Principal Executive Offices, including Zip Code)

Registrant’s telephone number, including area code: (205) 582-1200

N/A

(Former Name or Former Address, if Changed Since Last Report)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, $0.01 par value |

FUSB |

The Nasdaq Stock Market LLC |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§230.405 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 |

Regulation FD Disclosure |

First US Bancshares, Inc. (“FUSB”) has prepared investor presentation materials, which are being furnished as Exhibit 99.1 to this report. These materials include, among other things, a review of financial results and trends through the period ended December 31, 2023. The materials are intended to be made available to shareholders, analysts and investors, including investor groups participating in forums such as sponsored investor conferences, during the quarter ending March 31, 2024, or until updated materials are furnished. A copy of the materials will be available on FUSB’s investor relations website, which may be accessed at firstusbank.com.

The information contained herein is being furnished pursuant to Item 7.01 of Form 8-K, “Regulation FD Disclosure.” This information shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 |

Financial Statements and Exhibits. |

(d) |

Exhibits. |

|

The exhibit listed below in the Exhibit Index is being furnished pursuant to Regulation FD as part of this report and shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act or incorporated by reference into any filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

|

Exhibit Number |

Exhibit |

99.1 |

|

104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: January 26, 2024 |

FIRST US BANCSHARES, INC. |

|

|

|

|

|

By: |

/s/ Thomas S. Elley |

|

Name: |

Thomas S. Elley |

|

|

Senior Executive Vice President, Treasurer and Assistant Secretary, |

|

|

Chief Financial Officer and Principal Accounting Officer |

Investor Presentation As of December 31, 2023 Exhibit 99.1

Forward-Looking Statements This presentation of First US Bancshares, Inc. (“FUSB” or the “Company”) contains forward-looking statements, as defined by federal securities laws. Statements contained in this presentation that are not historical facts, including without limitation all statements relating to FUSB’s future financial and operational results, are forward-looking statements. These statements may address issues that involve significant risks, uncertainties, estimates and assumptions made by FUSB’s senior management. FUSB undertakes no obligation to update these statements following the date of this presentation, except as required by law. In addition, FUSB, through its senior management, may make from time to time forward-looking public statements concerning the matters described herein. Such forward-looking statements are necessarily estimates reflecting the best judgment of FUSB’s senior management based upon current information and involve a number of risks and uncertainties. Certain factors that could affect the accuracy of such forward-looking statements and cause actual results to differ materially from those projected in such forward-looking statements are identified in the public filings made by the Company with the SEC, and forward-looking statements contained in this presentation or in other public statements of the Company or its senior management should be considered in light of those factors. Such factors may include risks related to the Company's credit, including that if loan losses are greater than anticipated; the impact of national and local market conditions on the Company's business and operations; the rate of growth (or lack thereof) in the economy generally and in the Company’s service areas; strong competition in the banking industry; the impact of changes in interest rates and monetary policy on the Company’s performance and financial condition; the discontinuation of LIBOR as an interest rate benchmark; the impact of technological changes in the banking and financial service industries and potential information system failures; cybersecurity and data privacy threats; the costs of complying with extensive governmental regulation; the impact of changing accounting standards and tax laws on the Company's allowance for credit losses and financial results; the possibility that acquisitions may not produce anticipated results and result in unforeseen integration difficulties; and other risk factors described from time to time in the Company’s public filings, including, but not limited to, the Company’s most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q for the quarter ended September 30, 2023. Relative to the Company’s dividend policy, the payment of cash dividends is subject to the discretion of the Board of Directors and will be determined in light of then-current conditions, including the Company’s earnings, leverage, operations, financial conditions, capital requirements and other factors deemed relevant by the Board of Directors. In the future, the Board of Directors may change the Company’s dividend policy, including the frequency or amount of any dividend, in light of then-existing conditions.

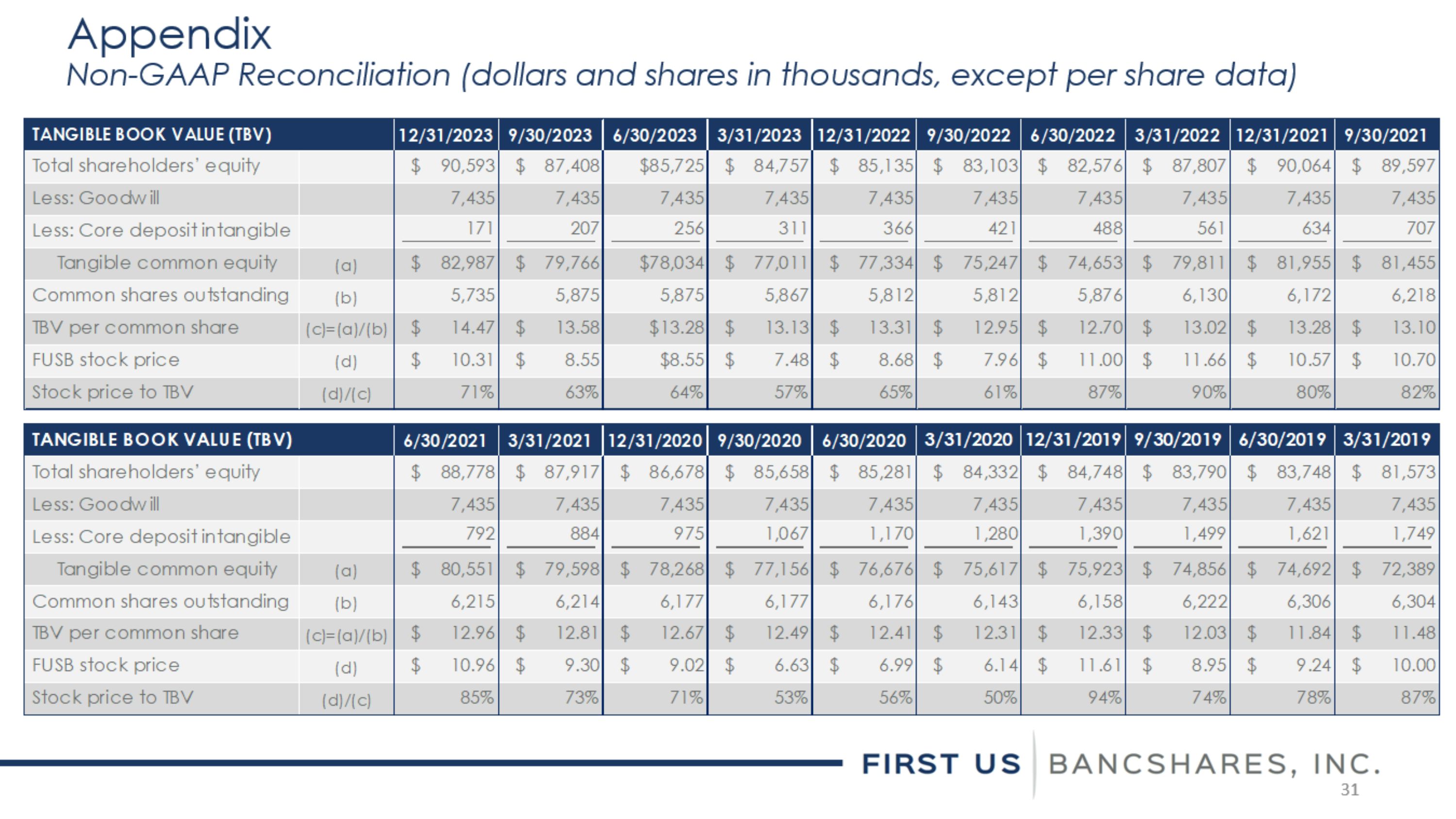

Presentation Disclosure This presentation has been prepared by FUSB solely for informational purposes based on its own information, as well as information from public sources. This presentation has been prepared to assist interested parties in making their own evaluation of FUSB and does not purport to contain all of the information that may be relevant. In all cases, interested parties should conduct their own investigation and analysis of FUSB and the information included in this presentation or other information provided by or on behalf of FUSB. This presentation does not constitute an offer to sell or a solicitation of an offer to buy any securities of FUSB by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation. Neither the SEC nor any state securities commission has approved or disapproved of the securities of FUSB or passed upon the accuracy or adequacy of this presentation. Any representation to the contrary is a criminal offense. Except as otherwise indicated, this presentation speaks as of the date indicated on the cover page. The delivery of this presentation shall not, under any circumstances, create any implication that there has been no change in the affairs of FUSB after such date. This presentation includes unaudited financial measures that have been prepared other than in accordance with generally accepted accounting principles in the United States (“non-GAAP financial measures”), including tangible book value per common share, return on average tangible common equity and tangible common equity to tangible assets. FUSB presents non-GAAP financial measures when it believes that the additional information is useful and meaningful to management and investors. Non-GAAP financial measures do not have any standardized meaning and, therefore, may not be comparable to similar measures presented by other companies. The presentation of non-GAAP financial measures is not intended to be a substitute for, and should not be considered in isolation from, the financial measures reported in accordance with GAAP. See the Appendix to this presentation for a reconciliation of certain non-GAAP financial measures to the comparable GAAP measures. Quarterly data presented herein have not been audited by FUSB’s independent registered public accounting firm.

Contents Corporate Profile 5 Strategic Focus 8 2023 Full Year and 4Q2023 Highlights 12 Deposit Composition 13 Loan Portfolio Trends 14 Recent Financial Trends 19 5 Year Financial Trends 23 Risk Management – Capital, Liquidity and Market Sensitivity 26 Appendix: Non-GAAP Reconciliation 29

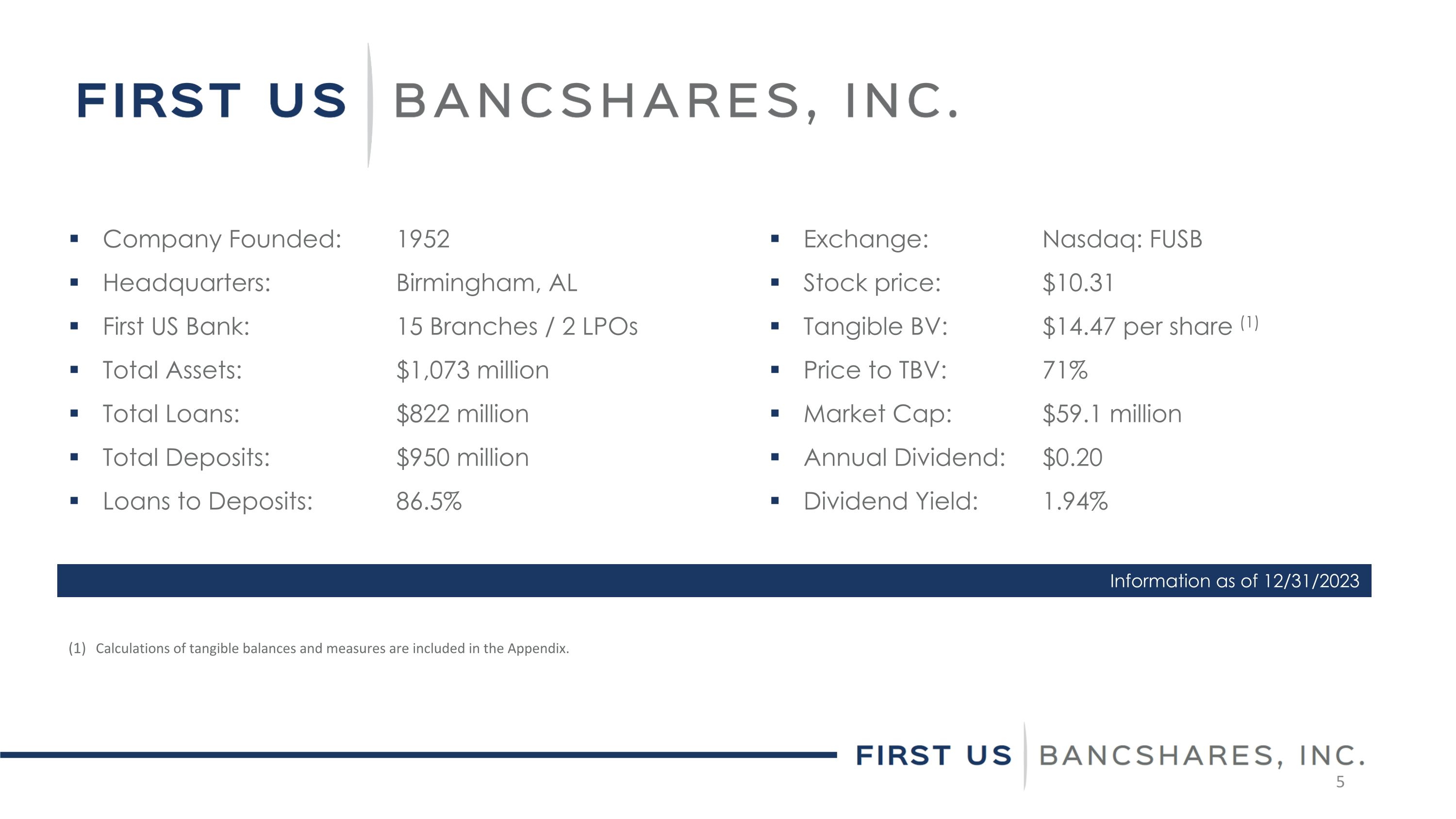

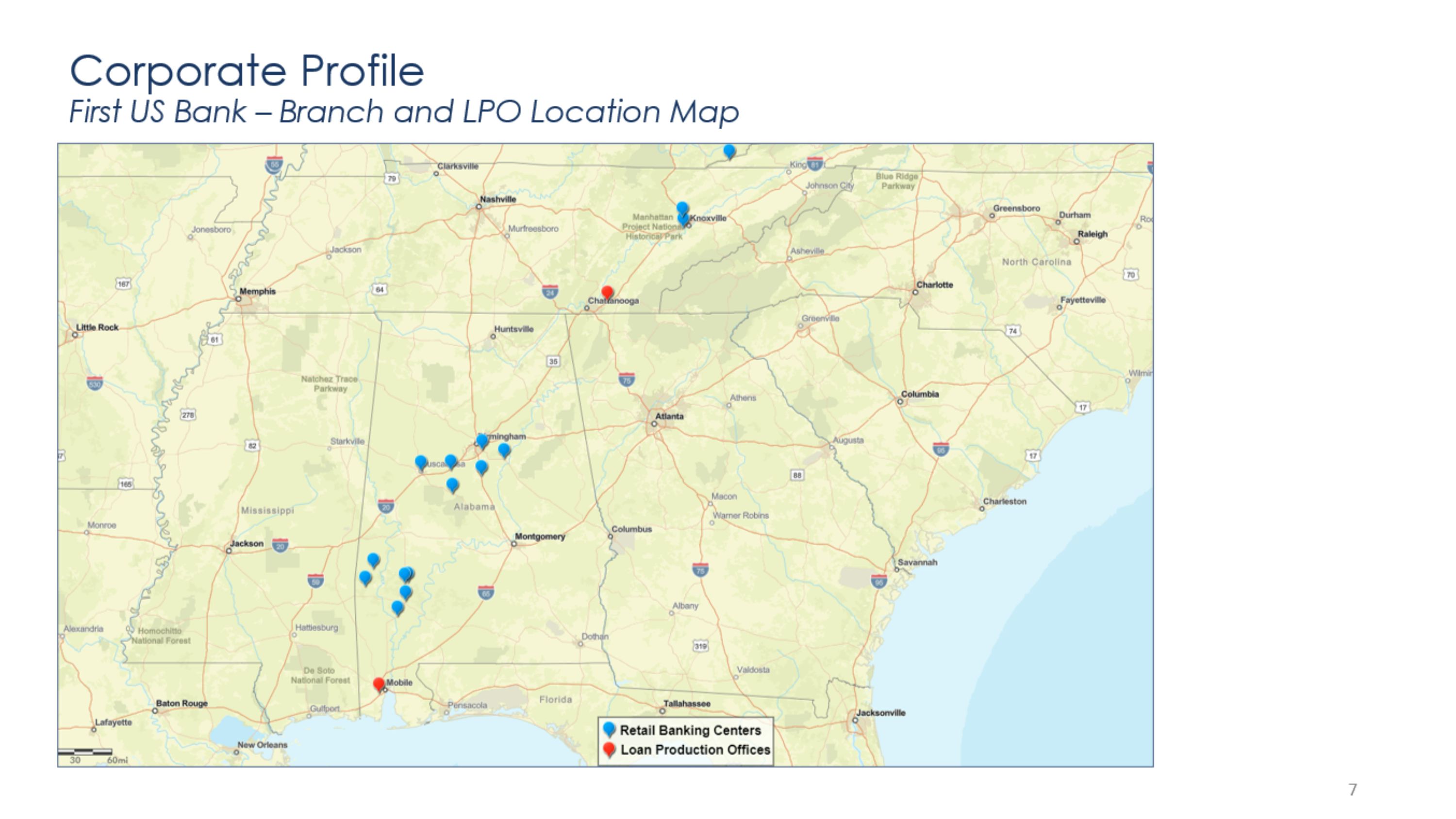

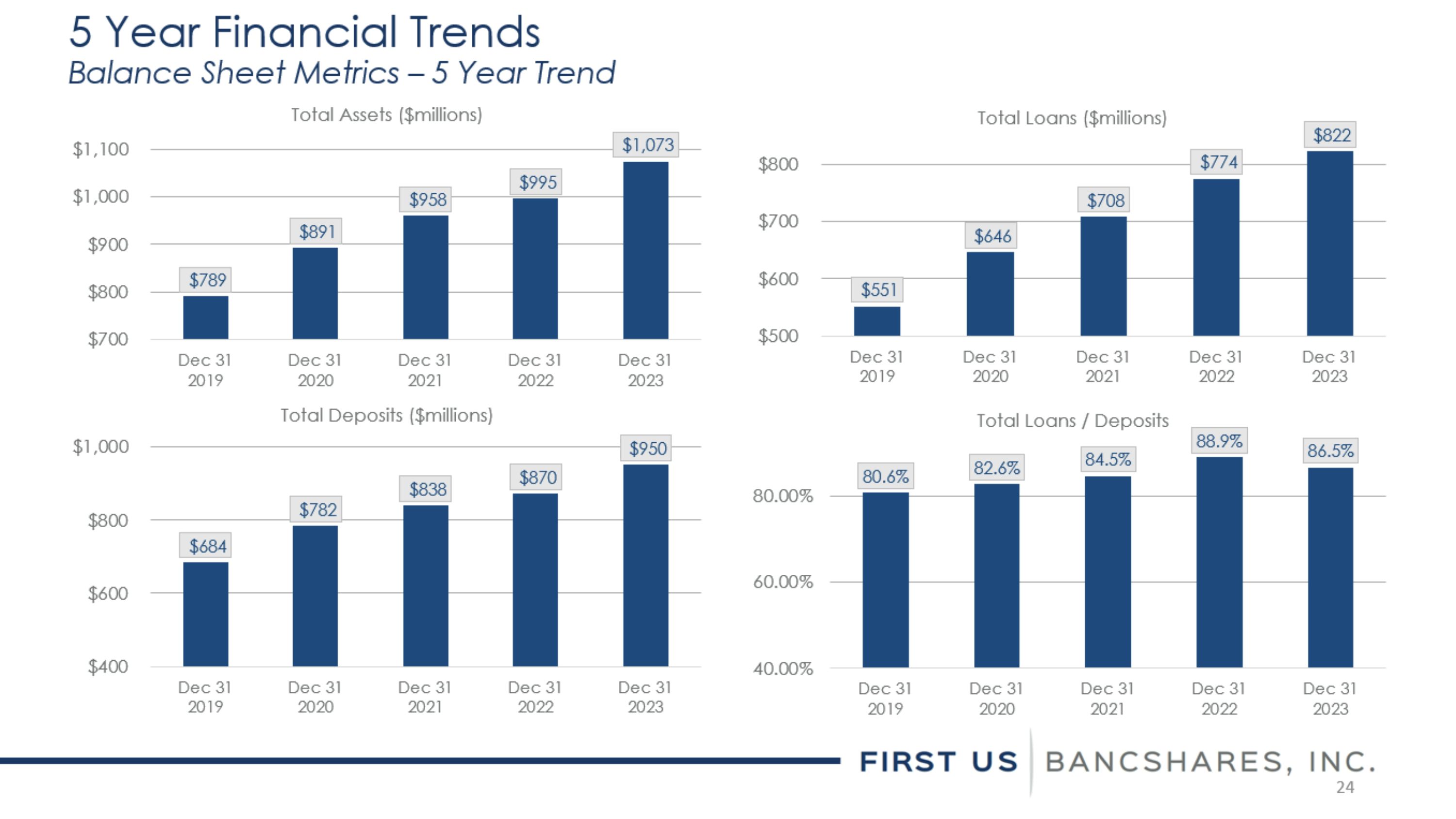

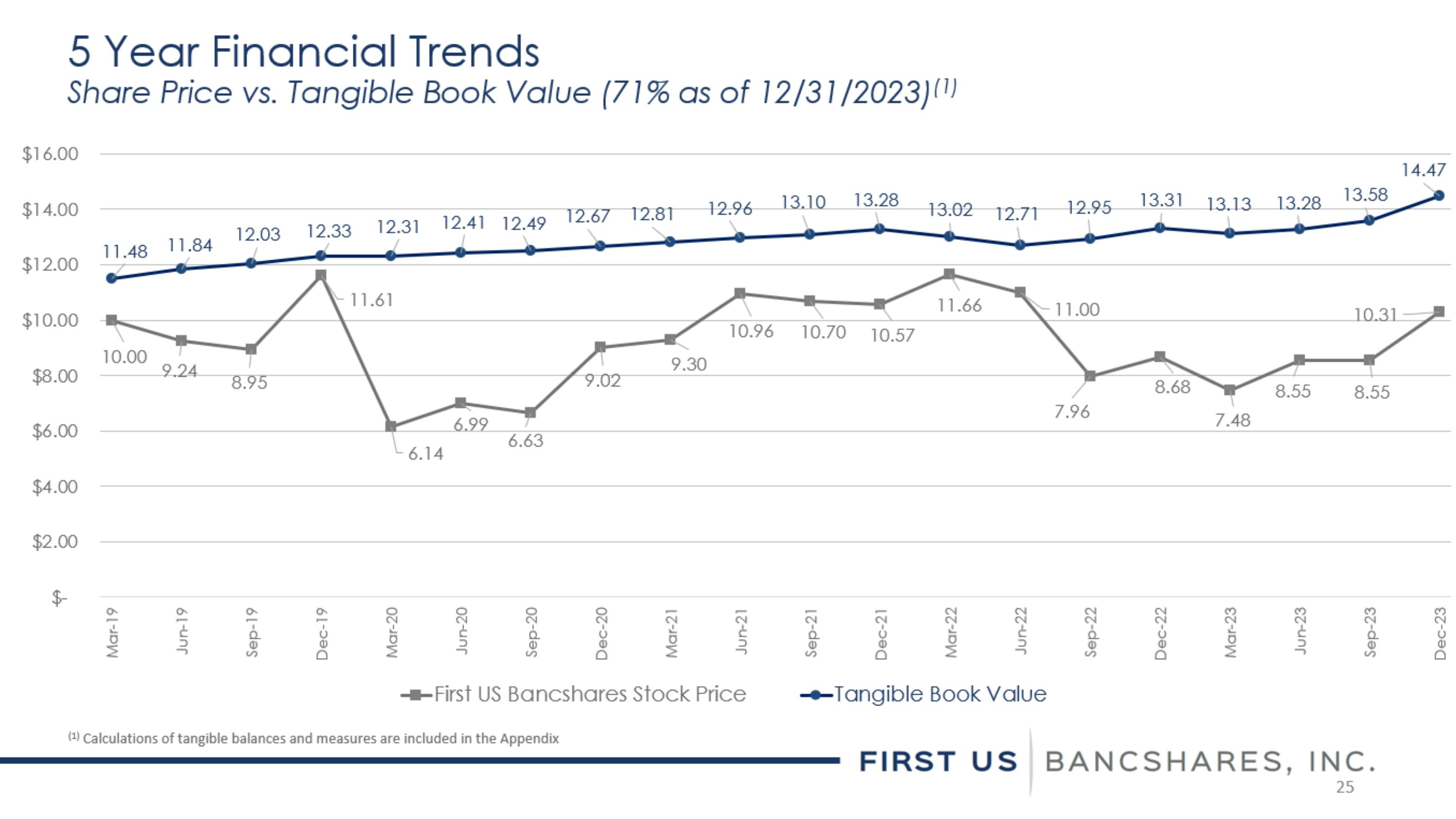

Company Founded: 1952 Headquarters: Birmingham, AL First US Bank: 15 Branches / 2 LPOs Total Assets: $1,073 million Total Loans: $822 million Total Deposits: $950 million Loans to Deposits: 86.5% Exchange: Nasdaq: FUSB Stock price: $10.31 Tangible BV: $14.47 per share (1) Price to TBV: 71% Market Cap: $59.1 million Annual Dividend: $0.20 Dividend Yield: 1.94% Information as of 12/31/2023 Calculations of tangible balances and measures are included in the Appendix.

Corporate Profile Senior Leadership Team James F. House President and Chief Executive Officer Veteran banker with SouthTrust Bank for 31 years Business consultant 2005 to 2009 focusing on management, investments, and commercial and consumer lending issues Florida Division President with BankTrust from 2009 to 2011 Tenure at FUSB began November 2011 Thomas S. Elley Senior Executive Vice President, Chief Financial Officer CPA holding various positions with Deloitte & Touche LLP over 13-year period Previous banking positions with Regions Financial Corp., Iberiabank Corp., and SouthTrust Bank Tenure at FUSB began October 2013 David P. McCullum Senior Executive Vice President, Commercial Lending Veteran commercial banker with Regions Financial Corporation and AmSouth Bank for 20 years CPA Tenure at FUSB began July 2015 William C. Mitchell Senior Executive Vice President, Consumer Lending Veteran consumer lender with 34 years of lending experience CEO and President of Acceptance Loan Company, Inc. (Bank Subsidiary) from 2007 to 2019 Tenure at FUSB began May 1997 Phillip R. Wheat Senior Executive Vice President, Chief Information and Operations Officer Veteran IT and Operations manager with 34 years of experience Experienced in acquisitions, branding, cost mitigation, cyber security, and digital transformation Tenure at FUSB began April 2013 Eric H. Mabowitz Senior Executive Vice President, Chief Risk Officer Veteran Risk and Operations manager with 36 years of experience MBA Tenure at FUSB began March 2008

Corporate ProfileFirst US Bank – Branch and LPO Location Map

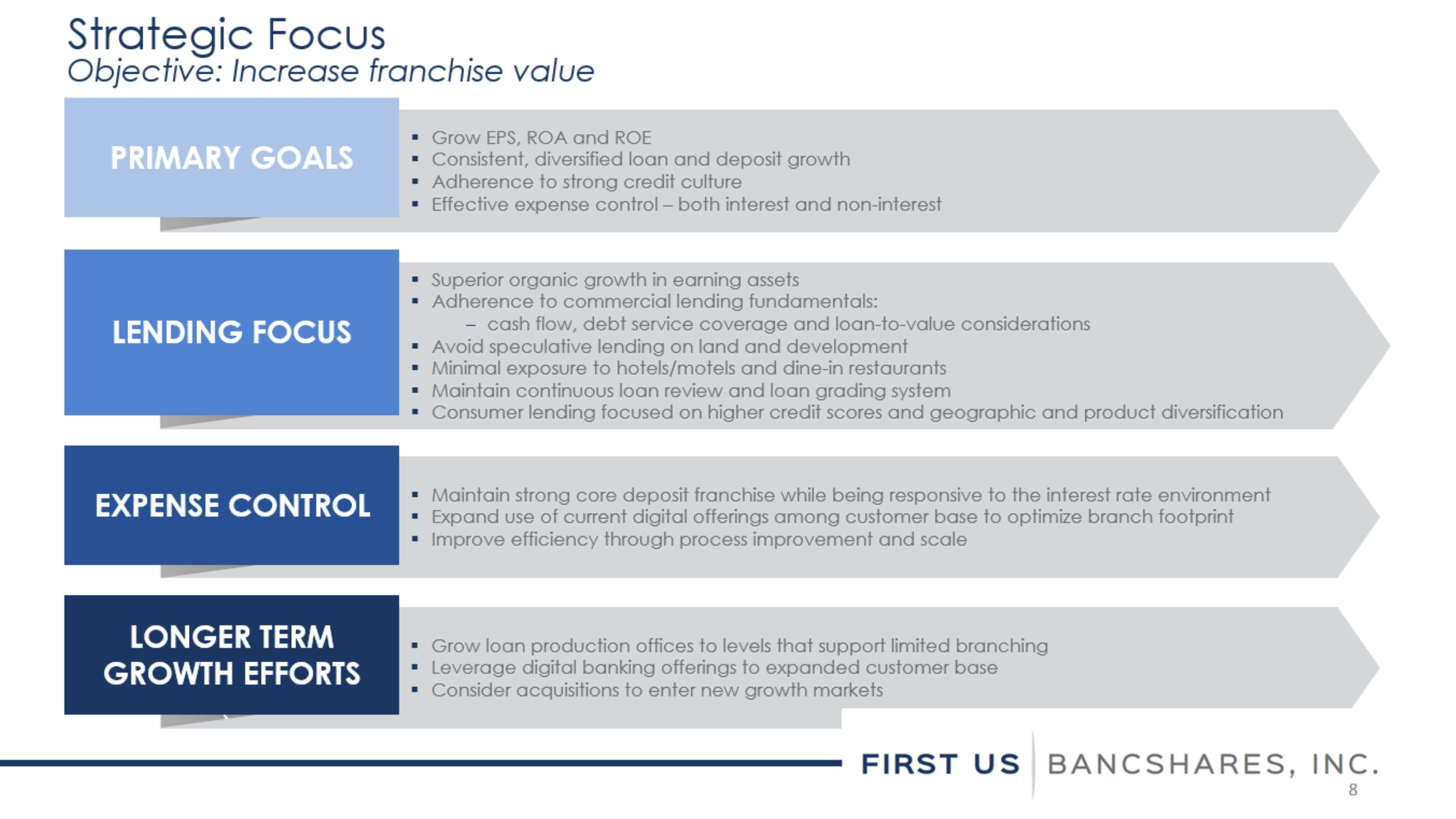

` PRIMARY GOALS Grow EPS, ROA and ROE Consistent, diversified loan and deposit growth Adherence to strong credit culture Effective expense control – both interest and non-interest LENDING FOCUS EXPENSE CONTROL LONGER TERM GROWTH EFFORTS Superior organic growth in earning assets Adherence to commercial lending fundamentals: cash flow, debt service coverage and loan-to-value considerations Avoid speculative lending on land and development Minimal exposure to hotels/motels and dine-in restaurants Maintain continuous loan review and loan grading system Consumer lending focused on higher credit scores and geographic and product diversification Strategic Focus Objective: Increase franchise value Maintain strong core deposit franchise while being responsive to the interest rate environment Expand use of current digital offerings among customer base to optimize branch footprint Improve efficiency through process improvement and scale Grow loan production offices to levels that support limited branching Leverage digital banking offerings to expanded customer base Consider acquisitions to enter new growth markets

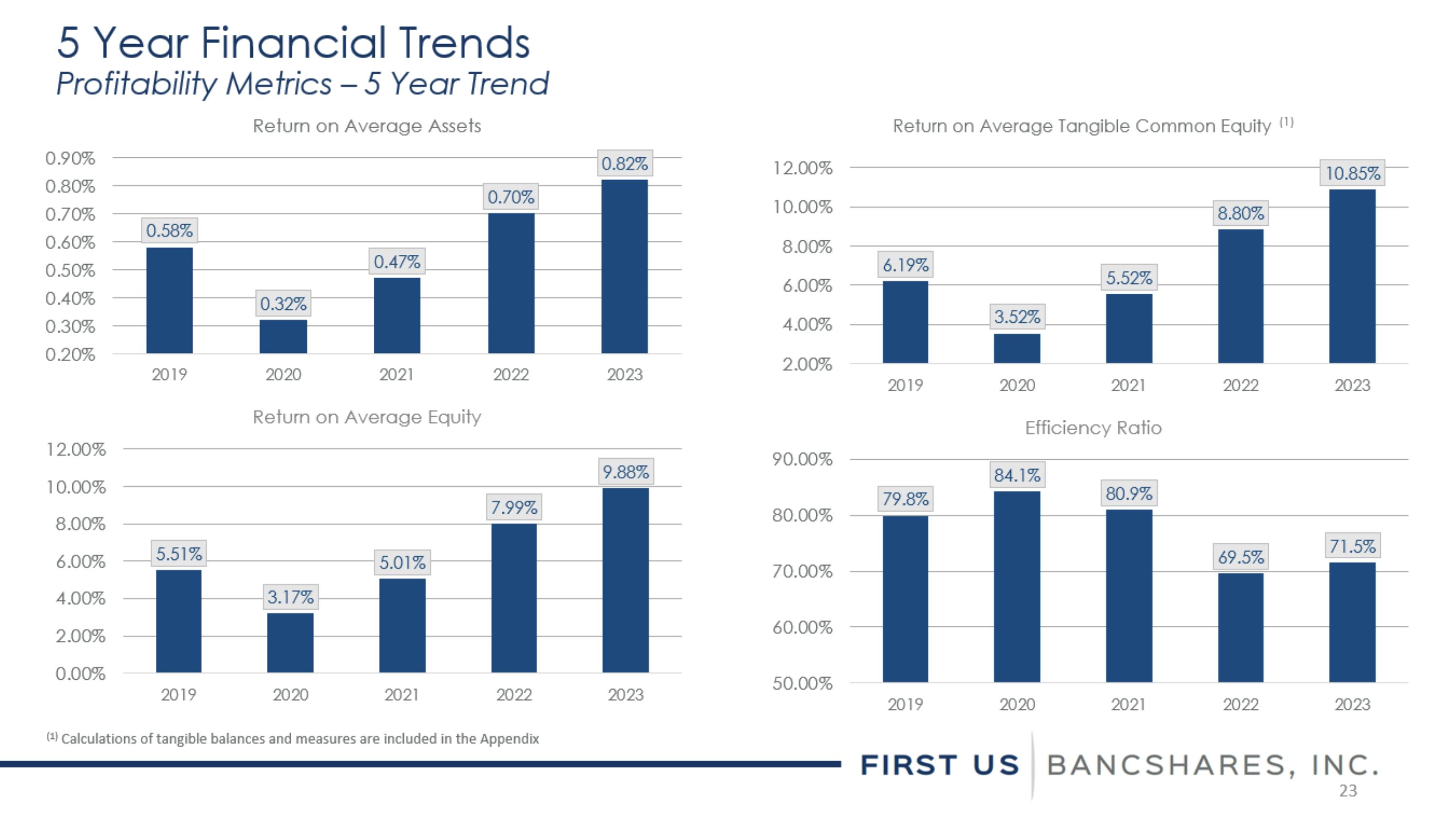

Strategic Focus Update on Impact of Strategic Initiatives – Legal Dissolution of ALC During 4Q2023, the Company legally dissolved its wholly owned consumer loan-focused subsidiary, Acceptance Loan Company, Inc. (“ALC”) after transferring all remaining assets and liabilities to the Bank via intercompany transactions. This represented the culmination of a two+ year strategic initiative designed to reduce expenses, fortify asset quality, and focus the Company’s loan growth efforts. The initiative was launched in September 2021 when the Company ceased new business at ALC and closed all of its branch lending locations. The initiative was expected to both reduce the Company’s expense structure and ultimately improve asset quality following the paydown of ALC’s loans. Historically, ALC’s loans produced significantly higher levels of charge-offs than the Bank’s other loan portfolios. 2022 Impact: In 2022 the Company realized substantial improvement in earnings and operating efficiency largely due to the ALC initiative, combined with other smaller efficiency efforts. However, charge-offs of ALC’s loans remained elevated in 2022 as the run-off of the ALC loan portfolio commenced. A summary of key performance ratios impacted by the strategic initiatives includes the following: $4.7 million, or 14.3%, reduction in non-interest expense, comparing 2022 to 2021 Increase in return on tangible common equity (1) to 8.80% in 2022, compared to 5.52% in 2021 Increase in return on average assets to 0.70% in 2022, compared to 0.47% in 2021 Increase in net charge-offs as a percentage of average loans to 0.30% in 2022, compared to 0.16% in 2021 2023 Impact: In 2023, the Company continued to benefit from the improvements in operating efficiency gained in 2022. In addition, the Company’s asset quality trends began to benefit from improved charge-off experience as the ALC portfolio continued to diminish. Key performance ratios for the Company are summarized as follows: Decrease in provision for credit losses to $0.3 million in 2023, compared to $3.3 million in 2022 Decrease in net charge-offs as a percentage of average loans to 0.14% 2023, compared to 0.30% in 2022 Increase in return on tangible common equity (1) to 10.85% for 2023, compared to 8.80% in 2022 Increase in return on average assets to 0.82% for 2023, compared to 0.70% in 2022 The Bank will continue to manage the remaining loans from ALC’s portfolio, which totaled $10.5 million as of December 31, 2023, through final resolution. Calculations of tangible balances and measures are included in the Appendix.

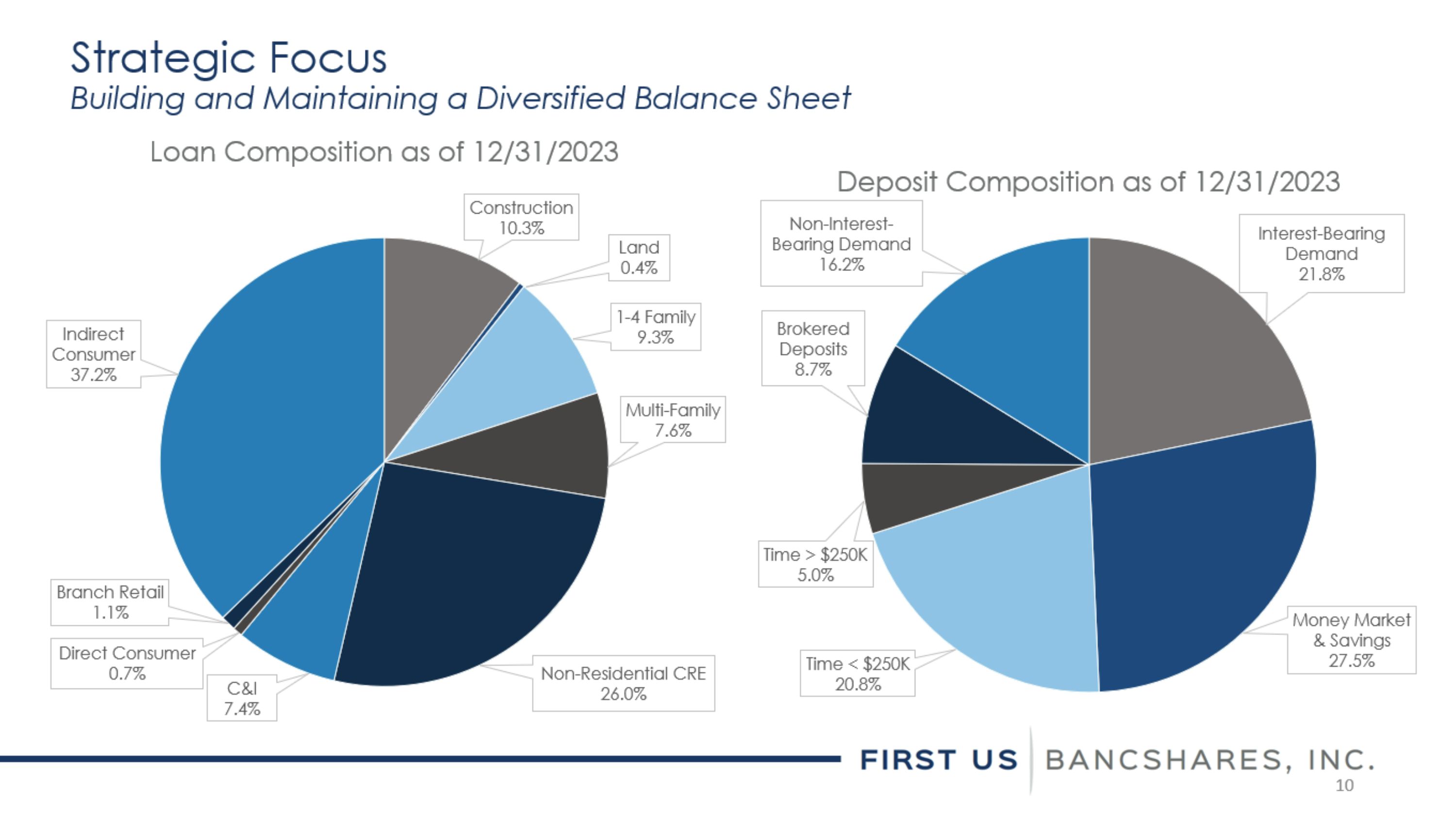

Strategic Focus Building and Maintaining a Diversified Balance Sheet Loan Composition as of 12/31/2023 Deposit Composition as of 12/31/2023

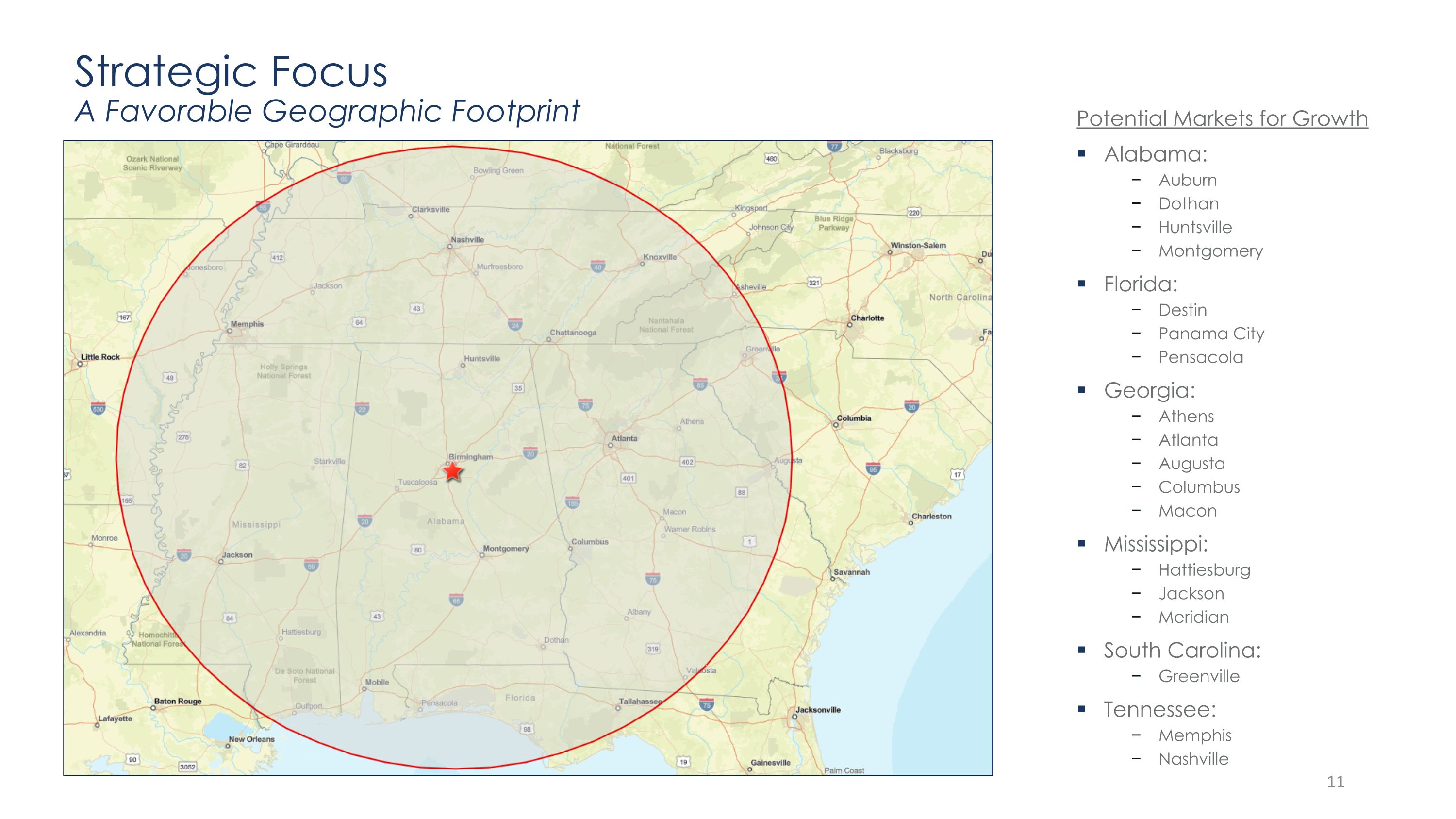

Strategic Focus A Favorable Geographic Footprint Potential Markets for Growth Alabama: Auburn Dothan Huntsville Montgomery Florida: Destin Panama City Pensacola Georgia: Athens Atlanta Augusta Columbus Macon Mississippi: Hattiesburg Jackson Meridian South Carolina: Greenville Tennessee: Memphis Nashville

Continued Earnings Improvement 25.5% diluted EPS growth, comparing 2023 to 2022 Diluted EPS of $1.33 in 2023, compared to $1.06 in 2022 4Q2023 diluted EPS of $0.36, compared to $0.33 in 3Q2023, and $0.35 in 4Q2022 Increased earnings driven by improved net interest income, and reduced provision for credit losses on loans $0.4 million increase in pre-provision net interest income, comparing 2023 to 2022, due to loan growth $3.0 million decrease in provision for credit losses, comparing 2023 to 2022, due, in part, to improved credit quality following ALC cessation of business Net charge-offs decreased to $1.1 million in 2023, compared to $2.2 million in 2022 Legacy ALC loans contributed only $0.2 million in net charge-offs in 2023, compared to $1.9 million in 2022 Year-over-year earnings improvement partially offset by reduction in non-interest income of $0.1 million and increase in non-interest expense of $1.1 million Earnings headwinds continued from margin compression throughout 2023 Full year net interest margin of 3.87% in 2023, compared to 4.07% in 2022 4Q2023 net interest margin of 3.67%, compared to 3.79% in 3Q2023 and 4.27% in 4Q2022 Year-over-Year Balance Sheet Trends Loan growth of $47.9 million, or 6.2%, during 2023 Growth driven by indirect consumer, commercial construction, and non-farm, non-residential commercial real estate loans Growth in non-brokered deposits of $60.0 million, or 7.4%, comparing 12/31/2023 to 12/31/2022 Uninsured/unsecured deposits totaled $200.3 million as of 12/31/2023, compared to $148.3 million as of 12/31/2022 Readily available liquidity improved to $375.3 million as of 12/31/2023, compared to $166.4 million as of 12/31/2022 2023 Full Year and 4Q2023 Highlights

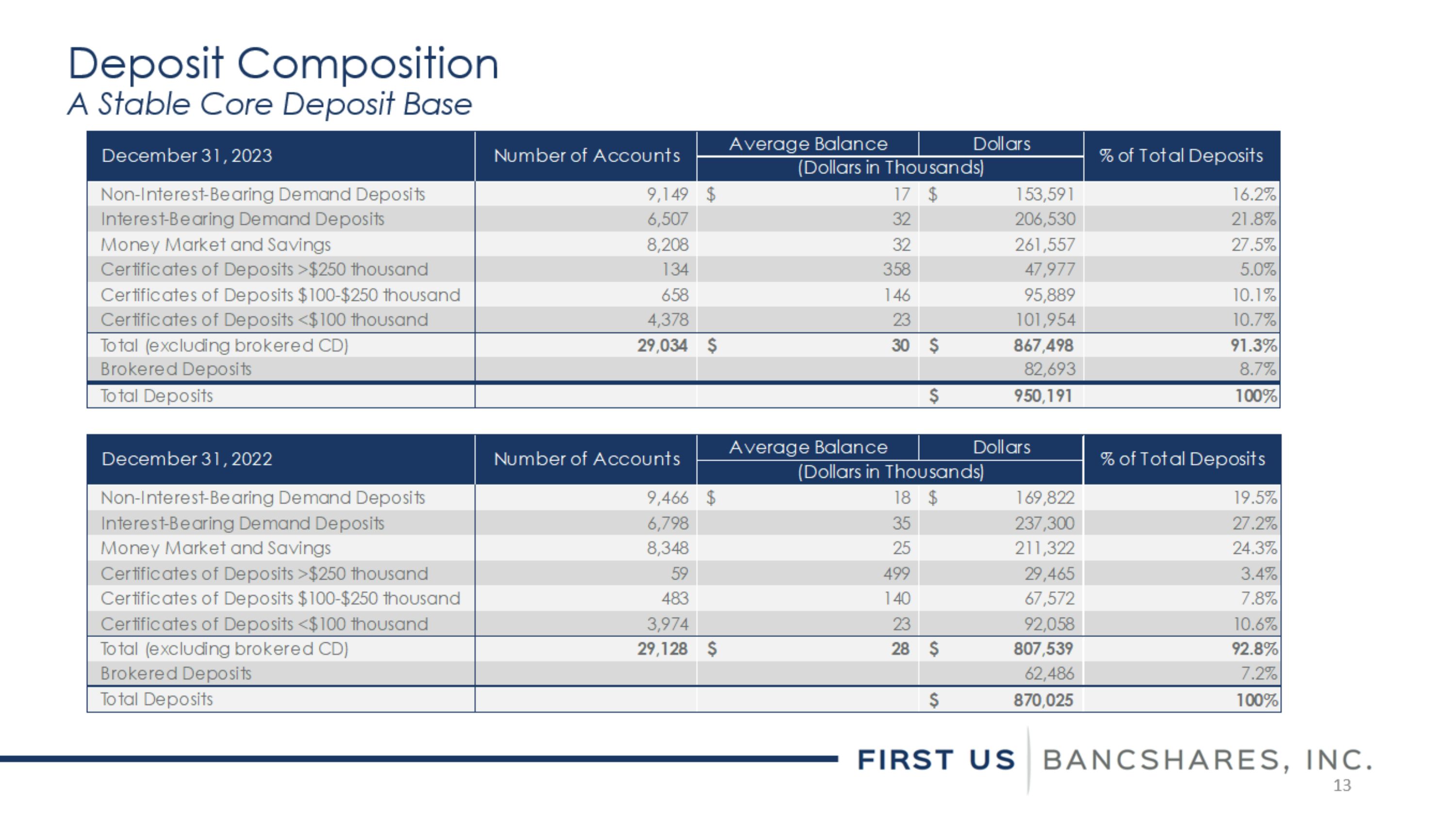

Deposit Composition A Stable Core Deposit Base

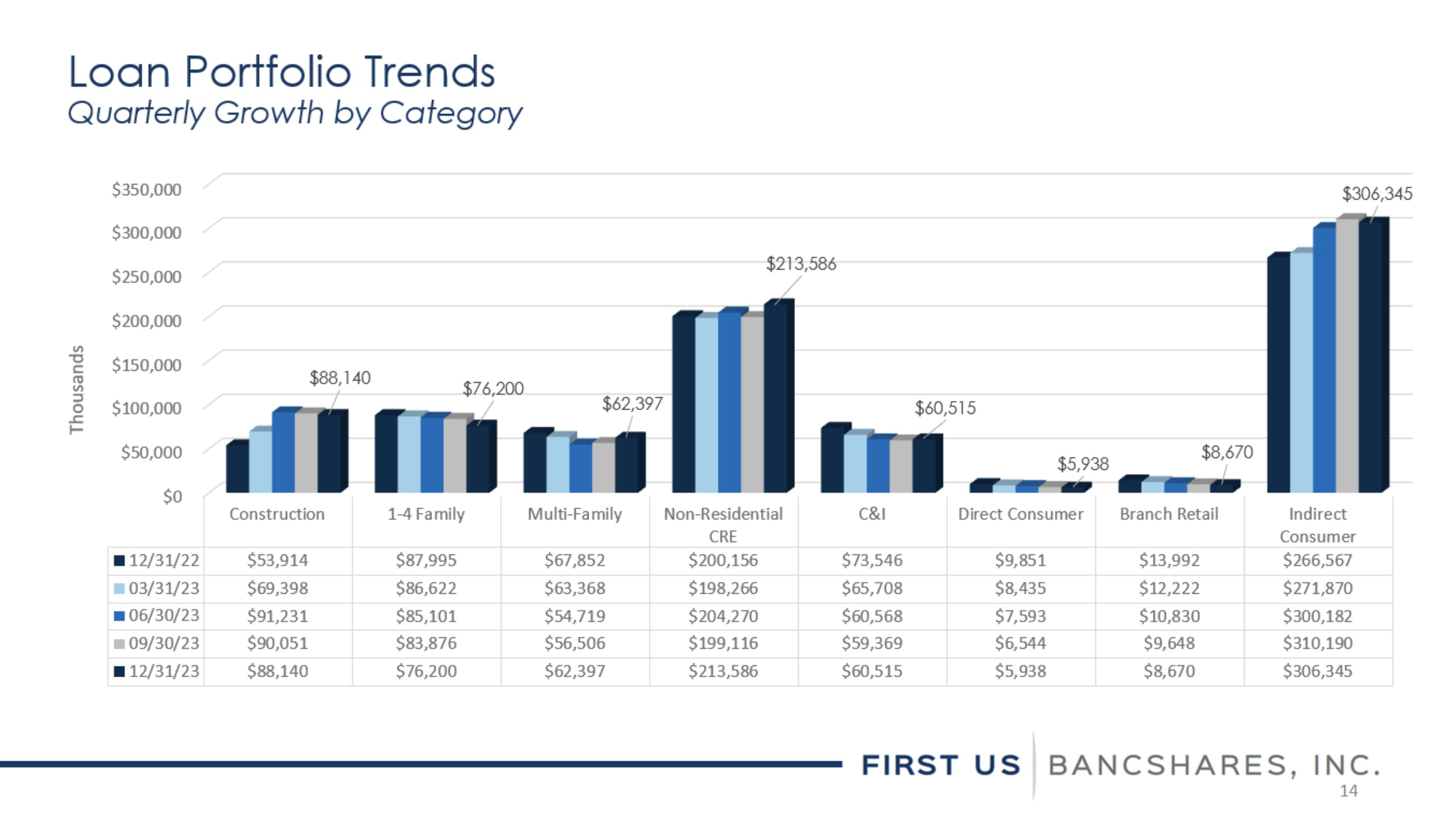

Loan Portfolio Trends Quarterly Growth by Category

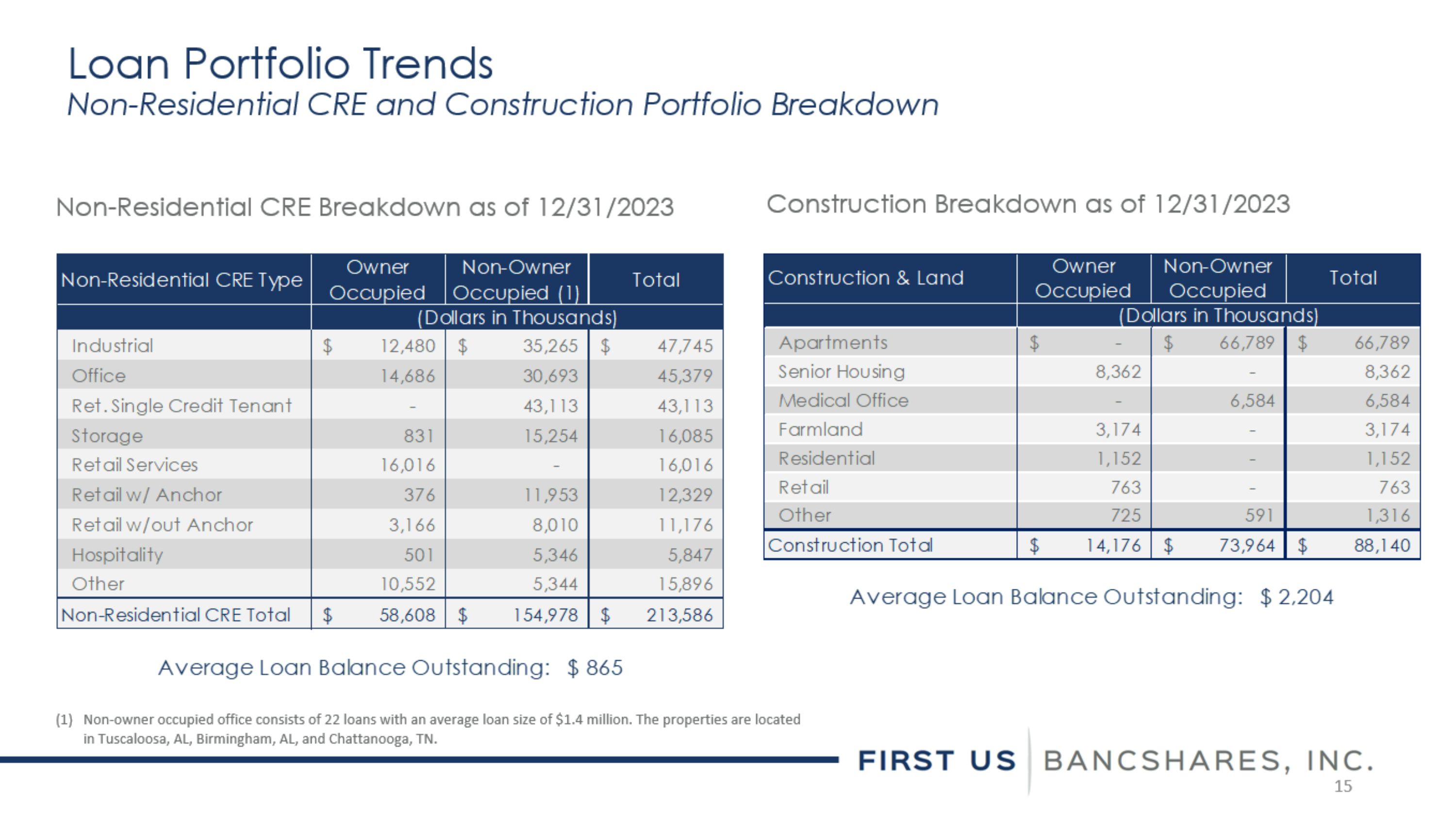

Loan Portfolio Trends Non-Residential CRE and Construction Portfolio Breakdown Non-Residential CRE Breakdown as of 12/31/2023 Construction Breakdown as of 12/31/2023 Non-owner occupied office consists of 22 loans with an average loan size of $1.4 million. The properties are located in Tuscaloosa, AL, Birmingham, AL, and Chattanooga, TN.

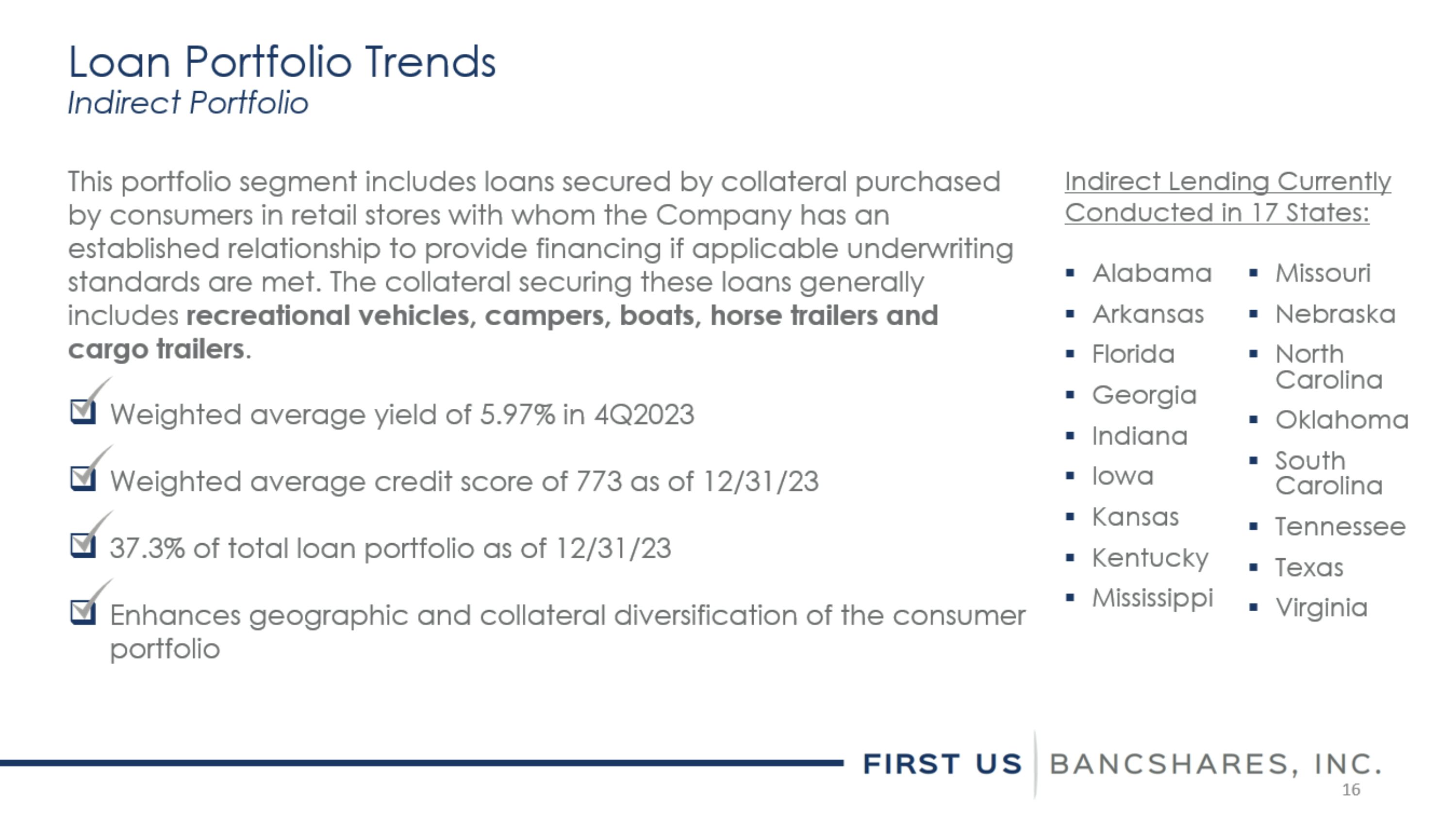

Loan Portfolio Trends Indirect Portfolio This portfolio segment includes loans secured by collateral purchased by consumers in retail stores with whom the Company has an established relationship to provide financing if applicable underwriting standards are met. The collateral securing these loans generally includes recreational vehicles, campers, boats, horse trailers and cargo trailers. Weighted average yield of 5.97% in 4Q2023 Weighted average credit score of 773 as of 12/31/23 37.3% of total loan portfolio as of 12/31/23 Enhances geographic and collateral diversification of the consumer portfolio Indirect Lending Currently Conducted in 17 States: Alabama Arkansas Florida Georgia Indiana Iowa Kansas Kentucky Mississippi Missouri Nebraska North Carolina Oklahoma South Carolina Tennessee Texas Virginia

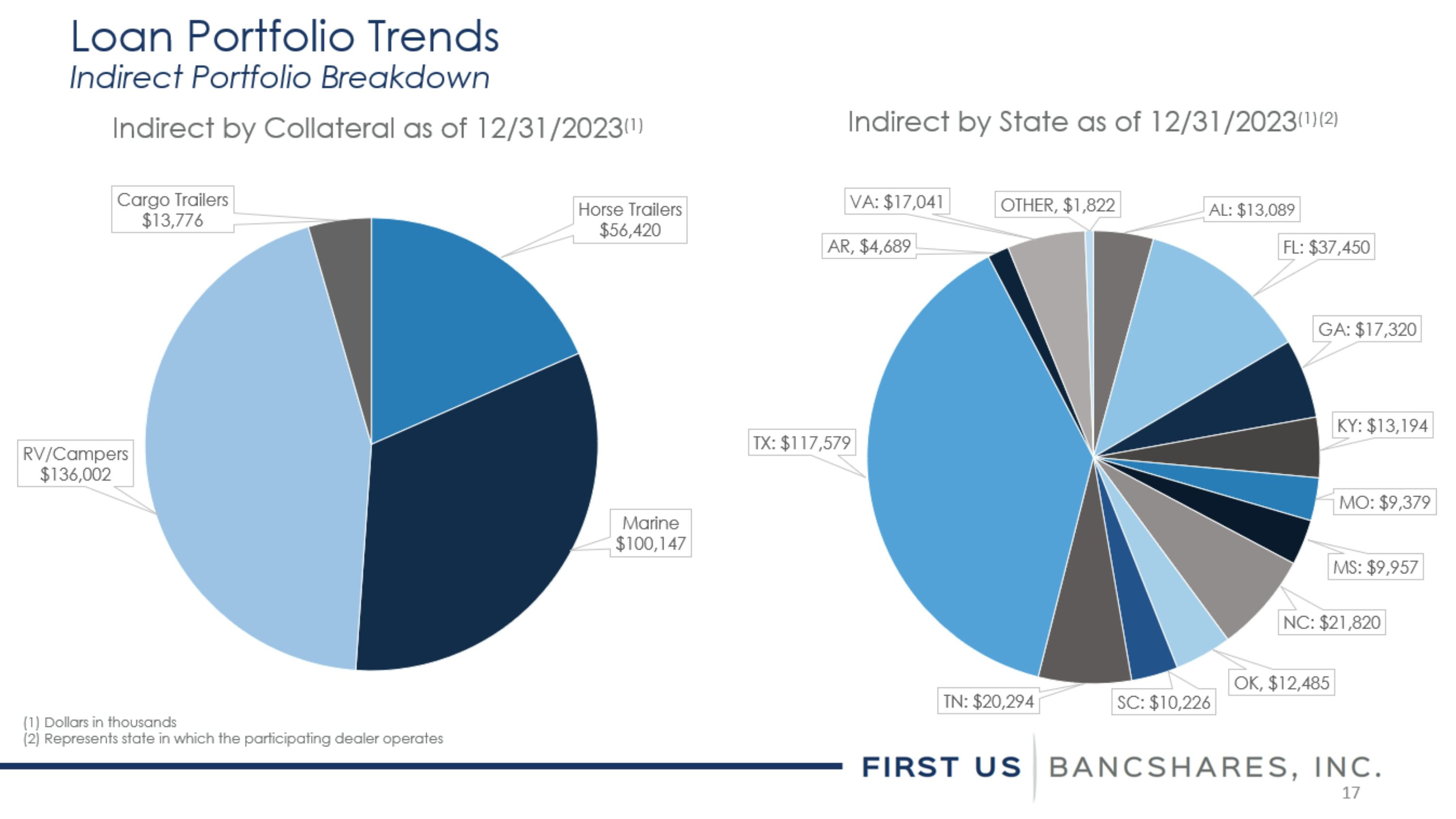

Loan Portfolio Trends Indirect Portfolio Breakdown Indirect by Collateral as of 12/31/2023(1) Indirect by State as of 12/31/2023(1)(2) (1) Dollars in thousands (2) Represents state in which the participating dealer operates

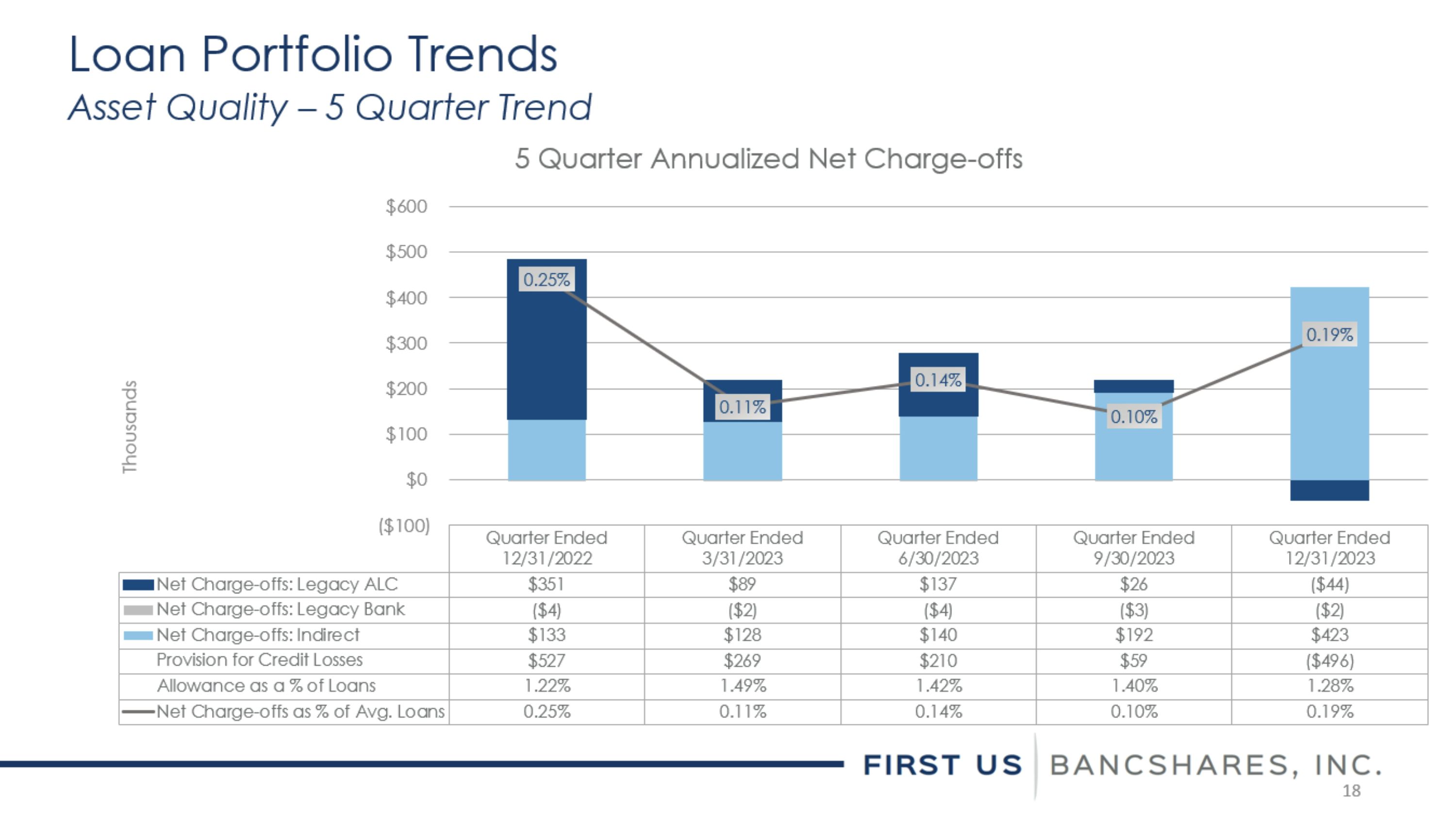

Loan Portfolio Trends Asset Quality – 5 Quarter Trend 5 Quarter Annualized Net Charge-offs

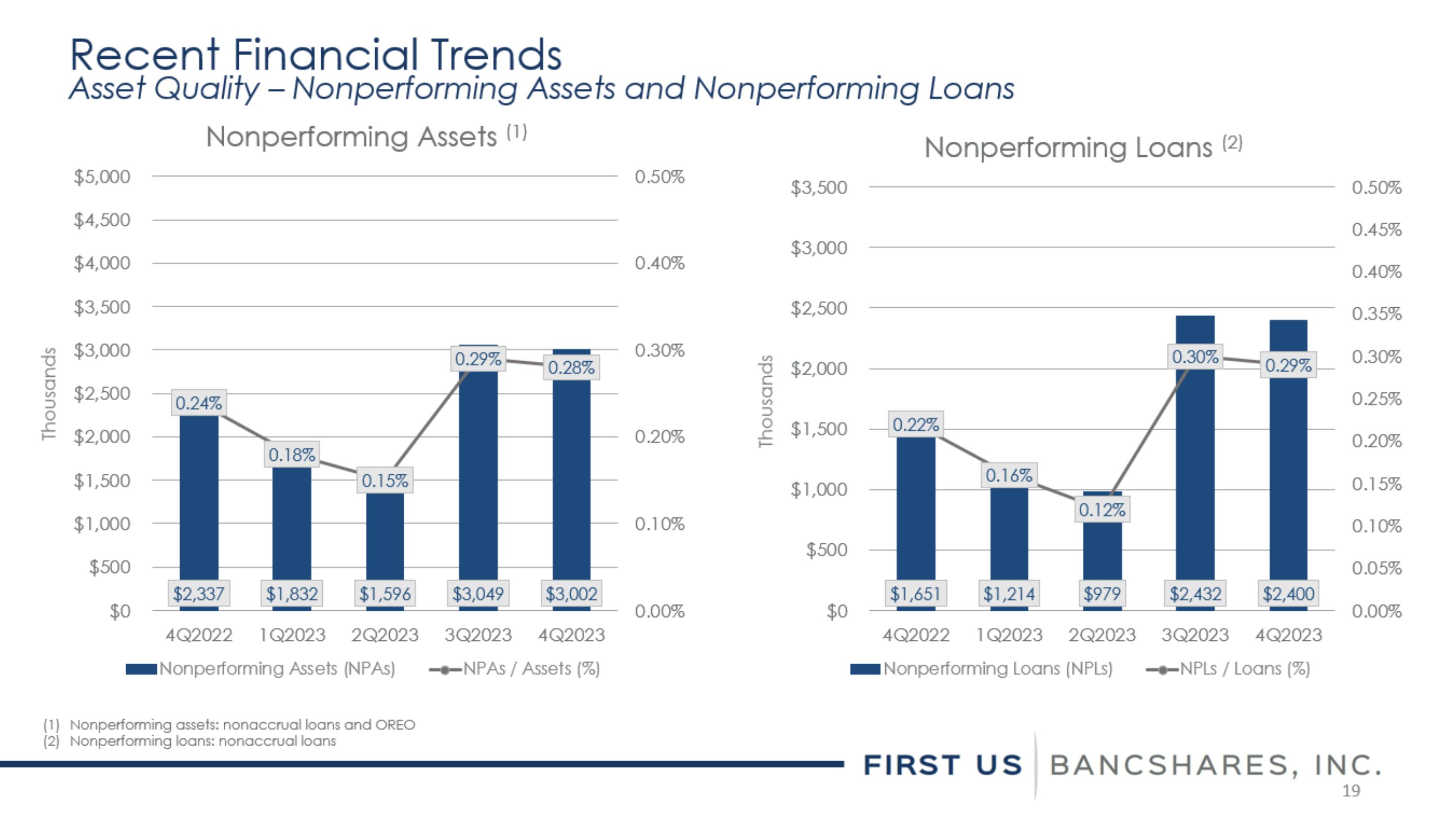

Recent Financial Trends Asset Quality – Nonperforming Assets and Nonperforming Loans Nonperforming Assets (1) Nonperforming Loans (2) Nonperforming assets: nonaccrual loans and OREO Nonperforming loans: nonaccrual loans

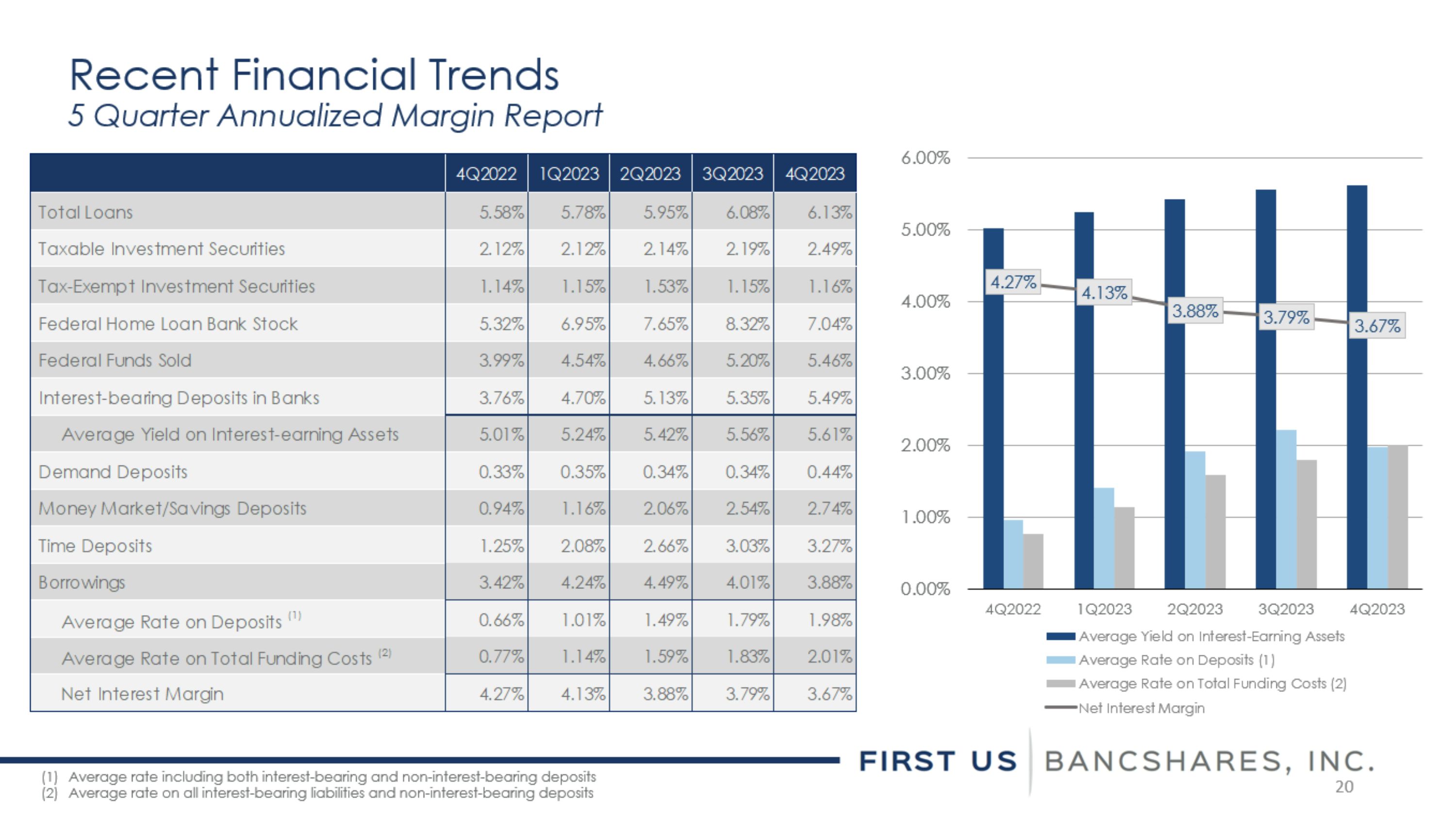

Recent Financial Trends 5 Quarter Annualized Margin Report Average rate including both interest-bearing and non-interest-bearing deposits Average rate on all interest-bearing liabilities and non-interest-bearing deposits

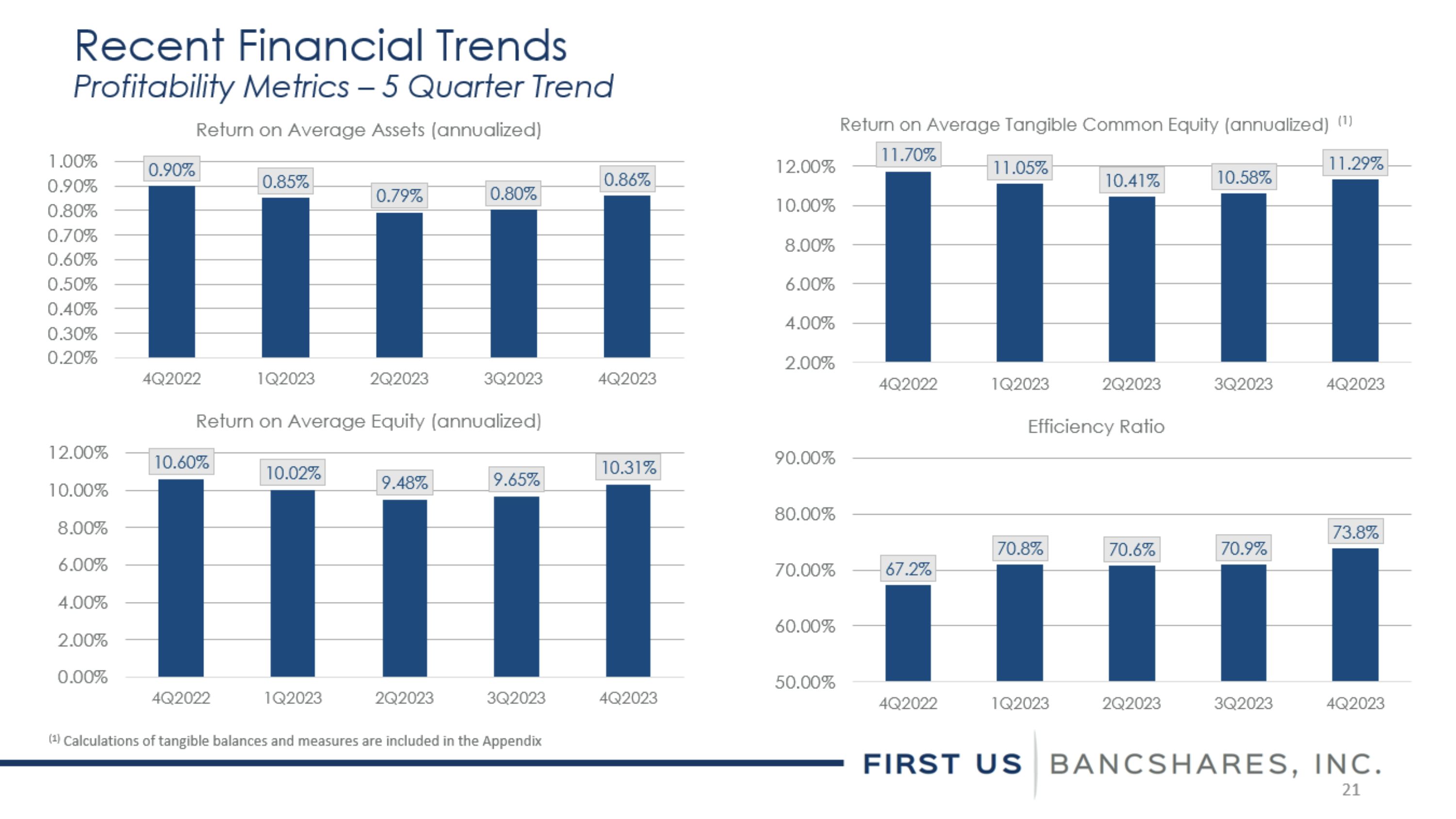

Recent Financial Trends Profitability Metrics – 5 Quarter Trend (1) Calculations of tangible balances and measures are included in the Appendix

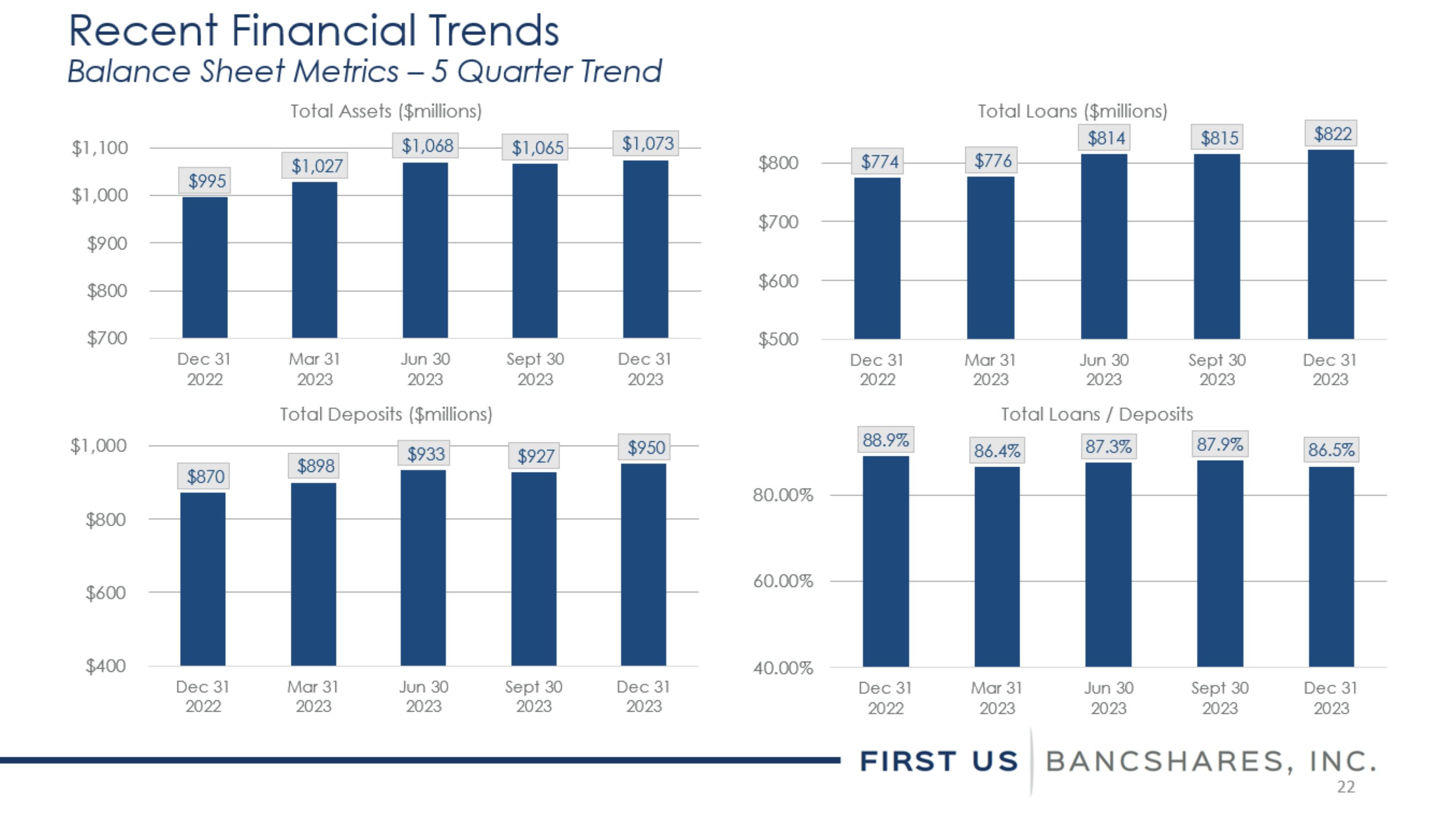

Recent Financial Trends Balance Sheet Metrics – 5 Quarter Trend

5 Year Financial Trends Profitability Metrics – 5 Year Trend (1) Calculations of tangible balances and measures are included in the Appendix

5 Year Financial Trends Balance Sheet Metrics – 5 Year Trend

5 Year Financial Trends Share Price vs. Tangible Book Value (71% as of 12/31/2023)(1) (1) Calculations of tangible balances and measures are included in the Appendix

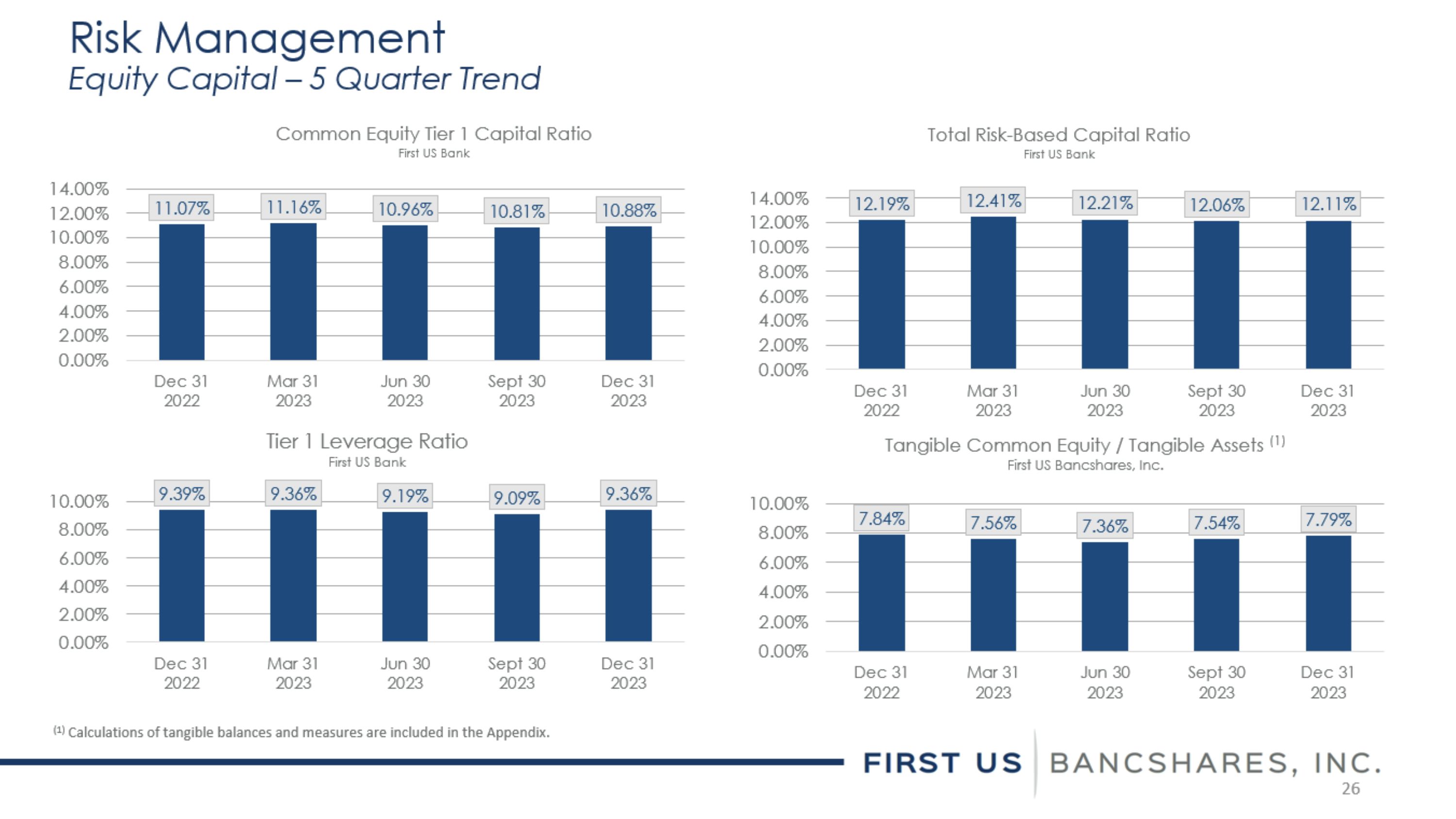

Risk Management Equity Capital – 5 Quarter Trend (1) Calculations of tangible balances and measures are included in the Appendix.

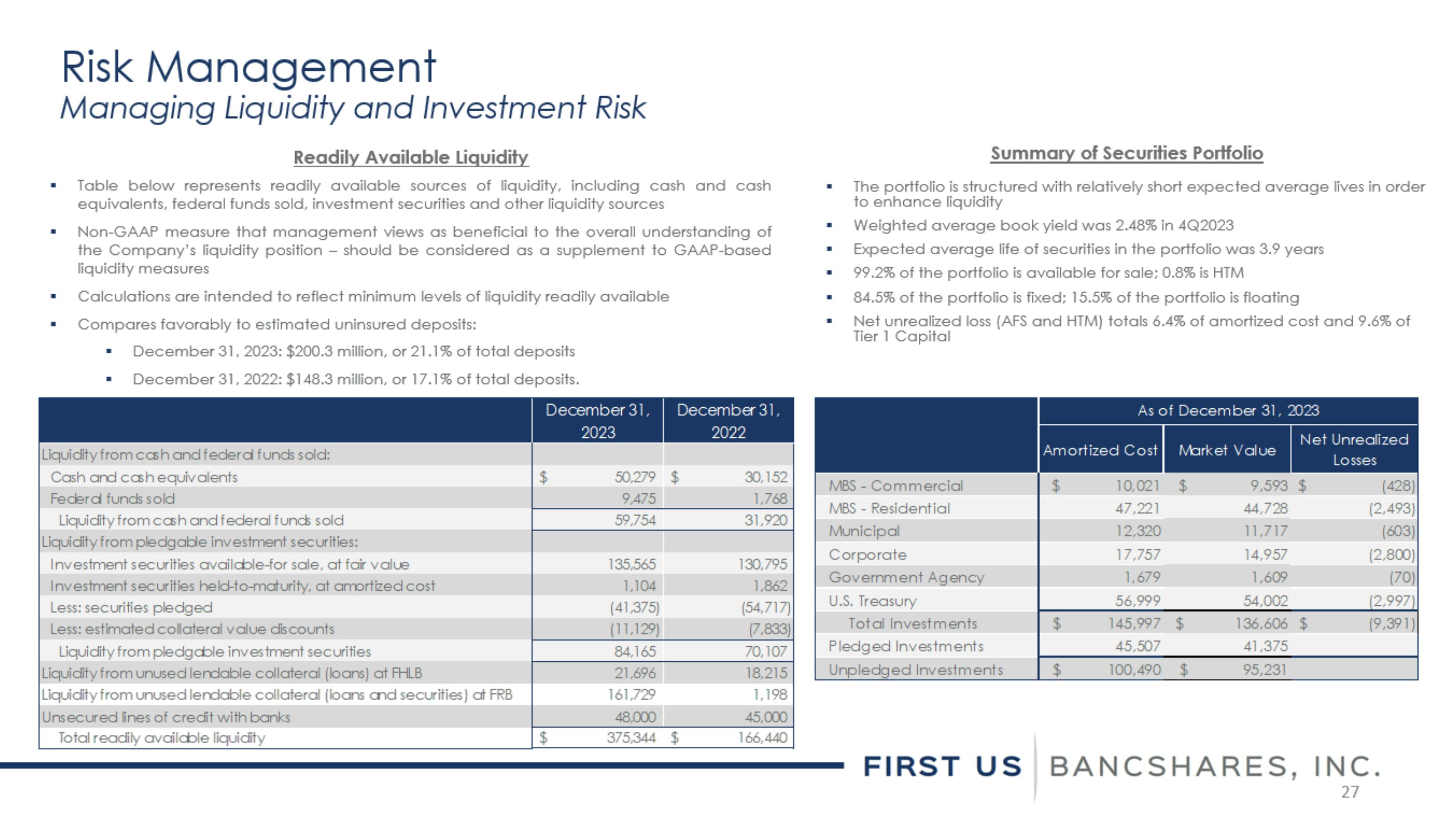

Risk Management Managing Liquidity and Investment Risk Summary of Securities Portfolio The portfolio is structured with relatively short expected average lives in order to enhance liquidity Weighted average book yield was 2.48% in 4Q2023 Expected average life of securities in the portfolio was 3.9 years 99.2% of the portfolio is available for sale; 0.8% is HTM 84.5% of the portfolio is fixed; 15.5% of the portfolio is floating Net unrealized loss (AFS and HTM) totals 6.4% of amortized cost and 9.6% of Tier 1 Capital Readily Available Liquidity Table below represents readily available sources of liquidity, including cash and cash equivalents, federal funds sold, investment securities and other liquidity sources Non-GAAP measure that management views as beneficial to the overall understanding of the Company’s liquidity position – should be considered as a supplement to GAAP-based liquidity measures Calculations are intended to reflect minimum levels of liquidity readily available Compares favorably to estimated uninsured deposits: December 31, 2023: $200.3 million, or 21.1% of total deposits December 31, 2022: $148.3 million, or 17.1% of total deposits.

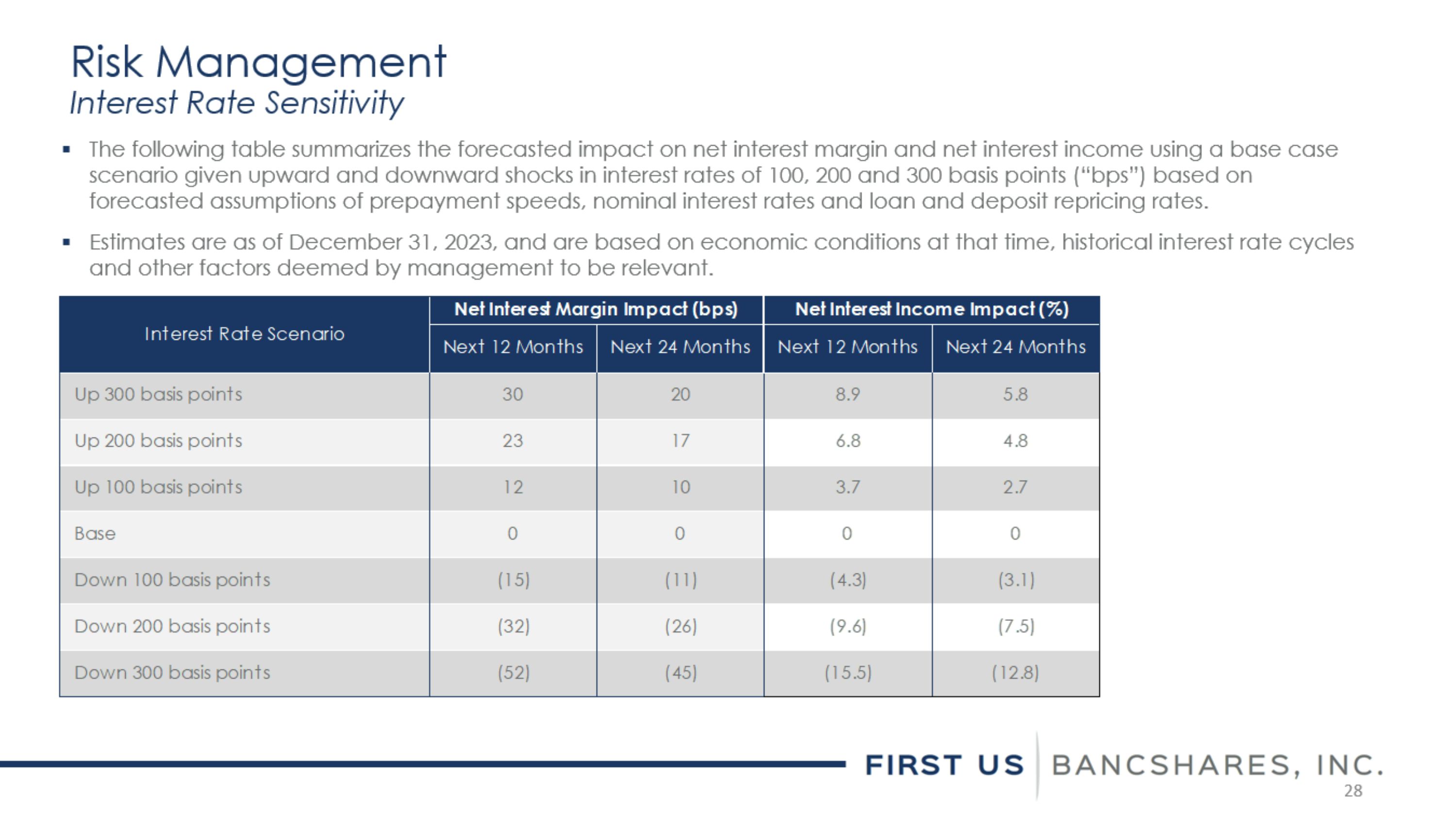

Risk Management Interest Rate Sensitivity The following table summarizes the forecasted impact on net interest margin and net interest income using a base case scenario given upward and downward shocks in interest rates of 100, 200 and 300 basis points (“bps”) based on forecasted assumptions of prepayment speeds, nominal interest rates and loan and deposit repricing rates. Estimates are as of December 31, 2023, and are based on economic conditions at that time, historical interest rate cycles and other factors deemed by management to be relevant.

Appendix Non-GAAP Reconciliations

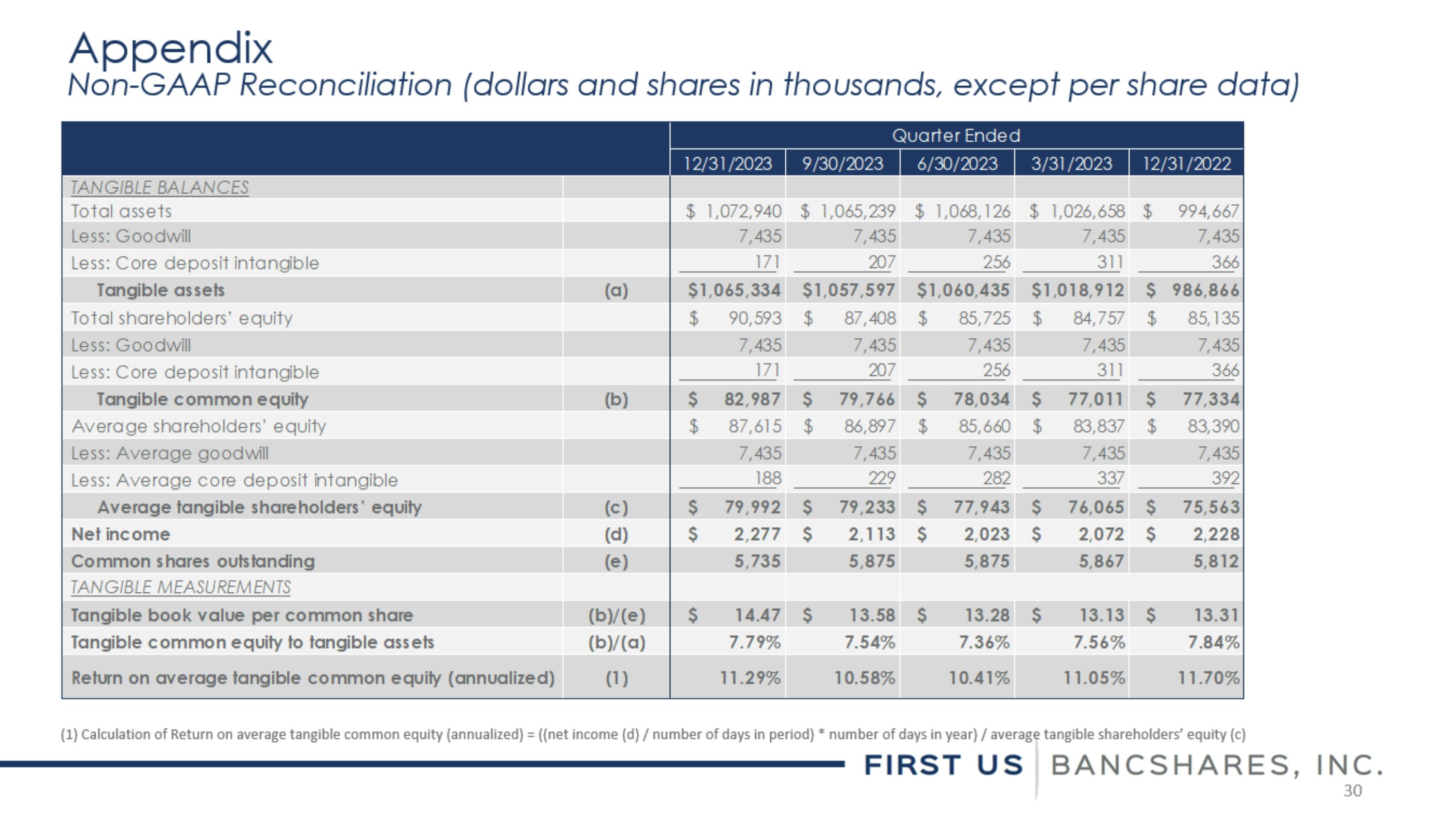

Appendix Non-GAAP Reconciliation (dollars and shares in thousands, except per share data) (1) Calculation of Return on average tangible common equity (annualized) = ((net income (d) / number of days in period) * number of days in year) / average tangible shareholders’ equity (c)

Appendix Non-GAAP Reconciliation (dollars and shares in thousands, except per share data)

www.firstusbank.com Contact: Thomas S. Elley Chief Financial Officer telley@firstusbank.com 205.582.1200