UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED: SEPTEMBER 30, 2023

-OR-

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______________ to __________________

Commission File No. 1-33145

SALLY BEAUTY HOLDINGS, INC.

(Exact name of registrant as specified in its charter)

Delaware |

|

36-2257936 |

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

3001 Colorado Boulevard |

|

76210 |

Denton, Texas |

|

(Zip Code) |

(Address of principal executive offices) |

|

|

(940) 898-7500

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

Common Stock, par value $.01 per share |

|

SBH |

|

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

☒ |

Accelerated filer |

☐ |

|

Non-accelerated filer |

☐ |

Smaller reporting company |

☐ |

Emerging growth company |

☐ |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of registrant’s common stock held by non-affiliates of the registrant, based upon the closing price of a share of the registrant’s common stock on March 31, 2023, was approximately $1,670,896,000. At November 10, 2023, there were 106,284,089 shares of the registrant’s common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement relating to the registrant’s 2023 Annual Meeting of Stockholders are incorporated by reference into Part III of this Annual Report on Form 10-K where indicated.

TABLE OF CONTENTS

|

|

|

Page |

|

|

PART I |

|

|

|

ITEM 1. |

|

1 |

|

|

ITEM 1A. |

|

10 |

|

|

ITEM 1B. |

|

21 |

|

|

ITEM 2. |

|

22 |

|

|

ITEM 3. |

|

24 |

|

|

ITEM 4. |

|

24 |

|

|

|

|

|

|

|

|

PART II |

|

|

|

ITEM 5. |

|

25 |

|

|

ITEM 6. |

|

26 |

|

|

ITEM 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

|

27 |

|

ITEM 7A. |

|

36 |

|

|

ITEM 8. |

|

37 |

|

|

ITEM 9. |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

|

37 |

|

ITEM 9A. |

|

38 |

|

|

ITEM 9B. |

|

39 |

|

|

|

|

|

|

|

|

PART III |

|

|

|

ITEM 10. |

|

40 |

|

|

ITEM 11. |

|

40 |

|

|

ITEM 12. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS |

|

40 |

|

ITEM 13. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

|

41 |

|

ITEM 14. |

|

41 |

|

|

|

|

|

|

|

|

PART IV |

|

|

|

ITEM 15. |

|

42 |

|

|

ITEM 16. |

|

44 |

|

i

In this Annual Report, references to “the Company,” “Sally Beauty,” “SBH,” “our company,” “we,” “our,” “ours” and “us” refer to Sally Beauty Holdings, Inc. and its consolidated subsidiaries unless otherwise indicated or the context otherwise requires.

CAUTIONARY NOTICE REGARDING FORWARD-LOOKING STATEMENTS

Statements in this Annual Report on Form 10-K and in the documents incorporated by reference herein which are not purely historical facts or which depend upon future events may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which we refer to as the Exchange Act. Words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” “project,” “target,” “can,” “could,” “may,” “should,” “will,” “would,” “might,” “anticipates” or similar expressions may also identify such forward-looking statements.

Readers are cautioned not to place undue reliance on forward-looking statements as such statements speak only as of the date they were made and involve risks and uncertainties that could cause actual events or results to differ materially from the events or results described in the forward-looking statements. The most important factors which could cause our actual results to differ from our forward-looking statements are set forth in our description of risk factors in Item 1A to this Annual Report on Form 10-K, which should be read in conjunction with the forward-looking statements in this report. Forward-looking statements speak only as of the date they are made, and we do not undertake any obligation to update any forward-looking statement.

The events described in the forward-looking statements might not occur or might occur to a different extent or at a different time than we have described. As a result, our actual results may differ materially from the results contemplated by these forward-looking statements.

ii

PARTI

ITEM 1. BUSINESS

Our Company

Sally Beauty Holdings is a leading international specialty retailer and distributor of professional beauty supplies. As experts in hair color and care, we aim to empower our customers to express themselves through their hair and beyond. We operate two business segments that offer beauty products in key categories, including hair care, hair color, styling tools and nails.

Sally Beauty Supply (“SBS”) – An omni-channel retailer that offers professional-quality beauty supplies at attractive prices and provides education to retail consumers and salon professionals throughout North America, South America and Europe. SBS operates primarily through retail stores (generally operating under the Sally Beauty banner) and digital platforms, including our www.sallybeauty.com website and a mobile commerce-based app.

Beauty Systems Group (“BSG”) – A leading full-service omni-channel distributor that offers professional beauty supplies exclusively to salons and salon professionals throughout the U.S. and Canada. These salon professionals primarily rely on just-in-time inventory due to capital constraints and limited warehouse and shelf space. BSG operates through company-operated stores (generally operating under the Cosmo Prof banner), franchised stores, distributor sales consultants (“DSCs”) and digital platforms, including our www.cosmoprofbeauty.com website, a mobile commerce-based app and chain portals.

The breadth, depth and professional quality of our hair color and care assortment provides us with a differentiated core business in an industry which is otherwise fragmented. Due to our long history, brand heritage, product and process-specific knowledge and training of associates, we provide unmatched hair color and care expertise to consumers. We also have strong positioning with suppliers given our focus and economies of scale of purchasing. By operating in a variety of channels, we are able to reach broad, diversified geographies and customer segments using a variety of product assortments and tactics.

Operating and Growth Strategy

Our operating and growth strategy is guided by our vision to own professional hair color and care for both the do-it-yourself (“DIY”) enthusiast and professional stylist. SBS’s differentiation is to offer a vast array of hair color and care solutions for in-home use, and this is supported by the content and education we provide our customers. While at BSG, we are the largest North American distributor of professional hair color and care, offering stylists and salons the most extensive portfolio of third-party brands in the market.

We remain focused on driving top line growth and profitability by executing on our strategic initiatives:

Customer Centricity

Our DIY customers and professional stylists value the services, education and innovation we provide. We continue to build customer centricity through our value-added services and concepts, including Studio by Sally, Cosmo Prof Direct, Licensed Colorist on Demand (“LCOD”), Happy Beauty Co. and Walmart.com digital marketplace. As we gain insights and customer feedback from these concepts, we believe there are opportunities for us to expand on these concepts further and to provide growth beyond our core.

Owned Brands and Innovation

We believe our focus on growing our owned brands at SBS and innovating will help us attract new customers and keep long-term relationships with existing customers. During the fiscal year, we expanded our owned brand portfolio with the launch of bondbar and brought to market many innovative products from new and key vendors. At BSG, we launched brands like Amika, Wella’s Ultimate Repair and Danger Jones, and expanded our distribution with Color Wow. Additionally, at the end of the fiscal year, we expanded our distribution rights and significantly strengthened BSG’s position in a strategically important market with the asset acquisition of Goldwell of New York. Going into next fiscal year, we are focused on expanding on our owned brand offerings to drive higher sales penetration, increasing our BSG distribution footprint through expanding high-profile brands, and bringing to market innovation across our key categories of hair care and hair color.

- 1 -

Efficiency and Optimization

During the fiscal year, we were able to substantially complete our distribution center consolidation and store optimization plan (the “Plan”), resulting in strong sales recapture rates and cost savings. We also set in motion our Fuel for Growth (“FFG”) initiative. FFG is a mandate to rethink the way we work, generating cost savings and modernizing key parts of our business. For example, our transition to pooled distribution and ongoing changes to our store shipping frequency has lowered our transportation costs. We believe these efficiency and optimization initiatives will help us offset inflationary pressures and continued growth investments in the upcoming fiscal year.

We believe focusing in these areas will position our company for future growth, further enhance our ability to meet our customers where they are, and attract new customers.

Store Design and Locations

Sally Beauty Supply

SBS has retail stores in the U.S. (including Puerto Rico), Canada, Mexico, the United Kingdom, Ireland, Belgium, France, Germany, the Netherlands, Spain and Chile. Stores are designed to highlight our extensive product offerings and differentiated position in hair color, hair care, styling tools and nails. We apply strong category management processes, including store specific planograms, to maintain consistent merchandise presentation across our store base. In the U.S. and Canada, our average store offers an average of 7,000 beauty products and is approximately 1,650 square feet in size. Stores are typically located in strip shopping centers, which are occupied by other high traffic retailers such as grocery stores, mass merchants and home improvement centers. Store formats, including average size and product selection, vary by marketplace to meet the needs of the customer.

We calibrate store renewals, remodels and expansions between new and existing geographies. In existing marketplaces, we add stores to provide additional coverage and strategically close or relocate underperforming stores as necessary. In new marketplaces, SBS selects geographic areas and store sites on the basis of demographic information, the quality and nature of neighboring tenants, store visibility and location accessibility. SBS generally seeks to expand in geographically contiguous areas to leverage its expertise.

During the fiscal year, we began testing two new store concepts, Happy Beauty Co. and Studio by Sally.

Happy Beauty Co. is a unique new retail store concept that brings to market an engaging beauty experience with thousands of quality products priced under $10 in an accessible, fun and expressive environment. Stores feature both third-party brands and our owned brands encompassing four key categories: cosmetics & facial care, bath & body, nails and hair. The initial pilot stores were opened in the Dallas/Ft. Worth, Texas and Phoenix, Arizona markets. If our pilot stores are successful, we believe there is an opportunity for 500-1,000 locations across the U.S.

Studio by Sally is a new pilot store concept that adds an in-person educational salon experience where licensed stylists will train and educate customers, empowering them to personally achieve their desired results. As of September 30, 2023, we have six Studio by Sally pilot stores opened in various markets and have been encouraged with the results. Looking to fiscal year 2024, we anticipate converting up to 30 additional stores. Longer term, we anticipate a mix of conversions and relocations, and we believe there is an opportunity to scale to over 100 Studio by Sally locations throughout the U.S. in the coming years.

SBS’s store count for the last three fiscal years is summarized in the following table:

|

|

Fiscal Year |

|

|

|||||||||

|

|

2023 |

|

|

2022 |

|

|

2021 |

|

|

|||

Beginning store count |

|

|

3,439 |

|

|

|

3,549 |

|

|

|

3,653 |

|

|

Opened (1) |

|

|

54 |

|

|

|

47 |

|

|

|

71 |

|

|

Closed (2) |

|

|

(345 |

) |

|

|

(155 |

) |

|

|

(168 |

) |

|

Franchises closed |

|

|

— |

|

|

|

(2 |

) |

|

|

(7 |

) |

|

Ending store count |

|

|

3,148 |

|

|

|

3,439 |

|

|

|

3,549 |

|

|

(1) Includes ten pilot stores for Happy Beauty Company opened in fiscal year 2023.

(2) In fiscal years 2023 and 2022, we closed 294 stores and 36 stores, respectively, in connection with our Distribution Center Consolidation and Store Optimization Plan (“the Plan”).

Beauty Systems Group

- 2 -

BSG stores, including franchise-based Armstrong McCall stores, are designed to highlight our extensive product offerings to salons and salon professionals. Our stores, on average, offer approximately 8,000 professional beauty products tailored to the territory and are segmented into distinctive areas arranged by product type, with certain areas dedicated to leading third-party brands. Our company-operated stores average approximately 2,700 square feet and are located primarily in secondary strip shopping centers, being a destination exclusively for licensed cosmetologists.

BSG’s store count for the last three fiscal years is summarized in the following table:

|

|

Fiscal Year |

|

|

|||||||||

|

|

2023 |

|

|

2022 |

|

|

2021 |

|

|

|||

Beginning store count |

|

|

1,355 |

|

|

|

1,362 |

|

|

|

1,385 |

|

|

Opened |

|

|

38 |

|

|

|

54 |

|

|

|

59 |

|

|

Closed (1) |

|

|

(55 |

) |

|

|

(61 |

) |

|

|

(80 |

) |

|

Franchises opened |

|

|

— |

|

|

|

2 |

|

|

|

1 |

|

|

Franchises closed |

|

|

— |

|

|

|

(2 |

) |

|

|

(3 |

) |

|

Ending store count |

|

|

1,338 |

|

|

|

1,355 |

|

|

|

1,362 |

|

|

(1) In fiscal years 2023 and 2022, we closed 26 stores and 7 stores, respectively, in connection with the Plan.

Merchandise

We believe our product offerings, led by our hair color and care categories, provide us a competitive advantage. During the last three fiscal years, our hair color and care products made up approximately 70% of our total consolidated sales. Key products included within our sales categories are as follows:

Additionally, as a top destination to shop for professional color and care, our goal is to be in-stock in these core categories at every opportunity.

Sally Beauty Supply

SBS carries an extensive selection of leading third-party, owned and exclusive-labeled brand professional beauty supplies across a variety of product categories. As leaders in the beauty industry, we believe we are uniquely positioned to adapt and innovate within our brands, partnerships and product offerings to provide the looks customers want. We believe this focus helps us attract new customers and keep long-term relationships with existing customers. During the fiscal year, we have invested more into marketing of our owned brands and launched our new owned branded vegan product line – bondbar – that’s SLS/SLES-free, paraben-free, phthalate-free and cruelty-free. Continuing the success of bondbar's initial launch of hair repair products, we expanded the brand's product line to include a full shade range of permanent hair color with built-in bonding technology during the fiscal year and will be expanding our assortment for color and care lines in fiscal year 2024. These initiatives have helped deliver an increase in our owned brands sales penetration, resulting in higher SBS profit margins.

We believe that our owned and exclusive-labeled brands, available only at SBS, offer equal or better quality than leading third-party brands. During the last three fiscal years, our SBS U.S. and Canada-owned and exclusive-labeled brand sales accounted for approximately 48%, 45%, and 45%, respectively.

Beauty Systems Group

BSG carries an extensive selection of leading, third-party branded products, many of which are under exclusive distributions rights, at competitive prices across a variety of product categories. We have exclusive and non-exclusive distribution rights with several key vendors for well-known brands in certain geographies and continue to pursue the acquisition of additional distribution rights. As the largest North American distributor of professional hair color and care, carrying an extensive selection of branded merchandise is critical to maintaining relationships with our professional customers.

- 3 -

Marketing and Advertising

Sally Beauty Supply

We target existing and potential customers through an integrated marketing approach designed to reach the customer through a variety of media channels, including digital advertising, e-mail, social media, text messaging, mobile app push notifications, direct mail, radio and experiential advertising.

SBS’s marketing initiatives are designed to drive customer traffic through added education, content and community building. We leverage a combination of internal and external influencers/content experts to educate and make customers feel confident about DIY hair color, hair care, nails and other beauty trends. Our external influencers consist of content creators and/or professional stylists who are DIY experts in their areas of focus and aim to inspire, educate and empower beauty enthusiasts. Additionally, our internal Sally Beauty Associate Affiliate Program encourages our associates to share their unique expertise with customers on social media to curate a community of inspiring, diverse creators who are using SBS merchandise for their DIY beauty, nails, hair and self-expression.

Beauty Systems Group

BSG’s marketing programs are designed to promote its extensive selection of brand name products at competitive prices and to educate, motivate and empower existing and potential customers. We work closely with our vendors to provide promotional offers for certain products to target existing and potential customers. We distribute promotional material through multiple channels, including print mail, e-mail, SMS, mobile app push notifications, social media, trade shows, educational events, store personnel and DSCs. As of September 30, 2023, we had a network of 670 DSCs who personally consult, support and sell directly to salons and salon professionals. In addition, we believe that our digital platforms enhance other efforts intended to promote awareness of our products by salons and salon professionals.

Customer Loyalty

In the U.S. and Canada, our Sally Beauty Rewards Program is designed to earn SBS customer loyalty and was recognized as one of “America’s Best Loyalty Programs” by Newsweek & Statista in 2022 and 2023. The program is free to join, and it provides our loyalty customers the ability to earn points on their SBS purchases, that convert to Sally Beauty Rewards when certain thresholds are attained. Through the program, these customers may also receive exclusive savings and personalized marketing offers.

|

|

Fiscal Year |

||||

|

|

2023 |

|

2022 |

|

2021 |

Sally Beauty Reward members |

|

15.6 million |

|

16.3 million |

|

15.9 million |

% of Sales |

|

76.3% |

|

75.7% |

|

72.5% |

In the U.S., we also offer our SBS customers the opportunity to apply for the Sally Beauty Rewards Credit Card that provides additional benefits to being a Sally Beauty Rewards member. Additionally, we offer our SBS professional customers and BSG customers the opportunity to apply for the Cosmo Prof Rewards Credit Card, which provides discounts on Cosmo Prof purchases or points through the Sally Beauty Rewards Program on SBS purchases.

Through these programs, we are able to collect valuable point-of-sale customer data as a means of increasing our understanding of customers and enhancing our ability to personalize our marketing. We will continue to monitor and evolve our Sally Beauty Rewards Program in an effort to further enhance the customer experience and promote repeat sales from both retail customers and salon professionals. Outside the U.S. and Canada, our customer loyalty and marketing programs vary by marketplace.

Digital Strategy

We continue to grow our digital footprint, not only through our marketing and customer relationship efforts, but also through our digital platforms in each segment. We believe we are uniquely positioned to continue expanding our digital sales penetration thanks to our omni-channel business model, which enables us to meet our customers where they are; in store or online, or through a hybrid approach such as our “buy online, pick up in store” (BOPIS) option. Additionally, our digital strategy of enhancing our customer centricity aims to expand our services ecosystem to support professional stylists as well as increase education and expertise to inspire and support all of our customers.

- 4 -

To that end, we are excited to continue our digital expansion through our recent initiatives, such as our stylist platform, Cosmo Prof Direct, powered by Salon HQ and our new Licensed Colorist on Demand ("LCOD") featured on our website, www.sallybeauty.com.

In BSG, Cosmo Prof Direct is a platform that gives our stylists the ability to curate a product selection from thousands of choices and enable clients to purchase directly from their shops without having to hold inventory. During the fiscal year, the platform has continued to expand, ending the fiscal year with more than 4,300 digital storefronts. We continue to gain traction as stylists gaining a deeper understanding of how they can leverage this resource to profitably grow their business.

In SBS, we recently launched LCOD to provide our customers with a more engaging shopping experience. Our LCOD is a digital-focused initiative where customers can live chat by text, voice or video with a licensed colorist to learn more about our hair color product offerings and how to use our products to achieve their desired results. This online option is available in all 50 states and appears as a chat box when customers are browsing our selection of hair color merchandise. While still in its initial launch phase, we are gaining valuable insights and customer feedback. Furthermore, during the fiscal year, we launched a digital marketplace selling initiative with Walmart.com, and are expanding to other online sites to fuel digital sales growth and attract new customers to our Sally brands.

Distribution

We currently receive our merchandise through several distribution centers in the U.S. and various other countries. Our distribution centers service our stores, orders from our DSCs and ship-to-customer orders through various freight carriers. We procure our owned-branded merchandise through domestic and foreign vendors and work closely with our overseas vendors to fulfill production orders and schedule ocean and freight carriers to deliver to our distribution centers.

Over the past several years, we have made significant investments in our end-to-end supply chain systems and processes to build a best-in-class merchandising and supply chain platform for the future. As a result, earlier this fiscal year, we started testing a new shipping frequency from our distribution centers to a limited population of SBS and BSG stores by leveraging investments within our supply chain systems. This change has resulted in improved labor productivity, reduced freight costs and has lowered our carbon emissions, while allowing us to maintain healthy in-stock levels. Based on the positive results from the test, we are expanding this program to the majority of our remaining SBS and BSG store fleet throughout the U.S. and Canada.

Additionally, customers are looking for more convenient options for receiving merchandise, which is helping drive their purchasing decisions. As such, we have made significant investments to “meet them where they are.” When ordering through our digital platforms, our customers can select different fulfillment options, including: BOPIS; deliver by common carrier (from store or distribution centers); and 2-hour delivery. Introduced in fiscal year 2021, our BOPIS and 2-hour delivery methods have continued to see increased traction. For the fiscal years 2023, 2022 and 2021, BOPIS and 2-hour delivery has made up approximately 42%, 33%, and 19%, respectively, of our SBS U.S and Canada sales through our digital platforms.

Seasonality

Our business is generally not seasonal, but typically has higher sales in our first quarter related to the holiday sales period.

Our Competition

The primary competitive factors in our industry are: the price of branded and owned-brand products; exclusive distribution contracts; the quality, perceived value, brand name recognition, packaging and variety of the products sold; customer service; efficiency of distribution networks; and the availability of desirable store locations.

SBS competes primarily with beauty product wholesale and retail outlets, including local and regional open-line beauty supply stores, professional-only beauty supply stores, mass merchandisers, online retailers, drug stores, department stores and supermarkets as well as salons that sell hair care products. BSG competes primarily with beauty product wholesale suppliers, including online retailers and manufacturers selling their products directly to salons and salon professionals.

We face competition from certain manufacturers that use their own sales forces to distribute their professional beauty products directly or that align themselves with our competitors. Some of these manufacturers are vertically integrated through the acquisition of distributors and stores.

- 5 -

We also face competition from authorized and unauthorized retailers as well as internet sites offering professional salon-only products.

Our Suppliers

We purchase our merchandise directly from manufacturers through supply contracts and purchase orders. For fiscal year 2023, our five largest suppliers – Henkel AG & Co. KGaA; Wella Company; the Professional Products Division of L'Oreal USA S/D, Inc., or L’Oreal; John Paul Mitchell Systems; and Kao Corporation – accounted for approximately 43% of our consolidated merchandise purchases. We have developed long-standing, relationships, some of which are exclusive, with these suppliers and many others, which we believe is core to our competitive advantage. We purchase products from these and many other manufacturers on an at-will basis or under contracts which can generally be terminated without cause upon 90 days or less notice or expire without express rights of renewal.

Intellectual Property

In the U.S. and in other countries where we operate, we have registered or legally protected trademarks, copyrights, internet domain names, service marks and trade names that are used to promote and market our business, stores, digital platforms and products. We believe many of these are well recognized and have significant value, including but not limited to: Sally®, Sally Beauty®, Cosmo Prof®, Armstrong McCall®, ION® and Beyond the Zone®.

Our Company Purpose & Values

Our Company Purpose & Values are intended to establish our rallying cry and focus our teams on the impact we intend to have in the world.

Our Purpose: TO INSPIRE A MORE COLORFUL, CONFIDENT AND WELCOMING WORLD

Our Values:

More information on our Purpose & Values can be found at: www.sallybeautyholdings.com/our-company/purpose-and-values.

Human Capital Management

As of September 30, 2023, we had approximately 27,000 global associates, including approximately 13,000 full-time associates. We believe they are our greatest asset with their combined skills, knowledge, work/life experiences and capabilities. At the front line interacting with our customers or behind-the-scenes supporting our field teams, our associates play a major role in our business. While we often emphasize our technology-based transformations and our wide variety of professional beauty products as key attributes, nothing happens or succeeds without our people.

In return for what they do for us, among many other things, we strive to:

- 6 -

Associate Health & Safety

We strive to create a safe and healthy work environment for all associates

We place a high value on the health and safety of our associates, customers, suppliers and vendors. This commitment is evidenced, in part, by our background check policy for new hires, training and policy implementations related to handling both associate and customer incidents, partnerships to maintain the stores and make necessary repairs, as well as ongoing support in the field and at the support center.

Additionally, we value our partnerships with suppliers and vendors and understand the impact they can have on our associates. Thus, SBH has included rules governing their conduct, both with respect to expectations while interacting with our associates and, with our foreign suppliers, assurances that they too are providing a safe and healthy working environment for their associates.

Labor Practices

We provide competitive wages and benefits in a positive work environment where we focus on doing what is right

We are an Equal Opportunity Employer with up-to-date policies, procedures and practices with respect to such important issues as safety, discrimination, harassment and retaliation. We provide focused training on these issues to our associates and managers.

We clearly communicate that any concerns related to issues such as discrimination, harassment, retaliation – and other issues such as wage law compliance and fraud – should be reported immediately. We also communicate the avenues available to our associates to do so through our “SBH CARES” communications and posters. The reporting avenues include options to do so by phone or online through our “Employee Concern Line” and to do so anonymously if an associate prefers to take that approach.

We ensure compliance with other important labor and employment law issues through a variety of processes and procedures, using both internal and external expertise and resources.

We also emphasize the importance of taking care of our associates in our Company’s Code of Business Conduct and Ethics, the standard of conduct that applies to all of our associates, executive officers and Board of Directors. The Code reflects the core principles of conducting our business as a good corporate citizen in compliance with all laws, rules and regulations applicable to us and the conduct business with regard for the welfare of our associates and providing equal opportunity to all associates and job applicants. You can review this important document at http://investor.sallybeautyholdings.com.

Associate Engagement, Development and Culture

We live our values, listen to our associates and take action

We make significant efforts to ensure our associates are informed, engaged and excited about the work they are doing and contributions they are making to our Company and our customers. We are committed to providing associates with what they need to thrive and grow their career. We significantly invest in our talent processes and set clear expectations around leadership competencies and our cultural values at all levels in the organization. At SBH, we consider the whole end-to-end talent cycle of an associate to ensure we select exceptional people to represent our business and best serve our customer. This includes robust interviewing processes as well as comprehensive onboarding programs to ensure new hires are set up to succeed in their early stages of joining SBH. There is also a strong cadence on completing regular cycles of performance management, linked to our Company values and leadership competencies, as well as regular reviews of our talent and succession pipelines.

Importantly, we devote significant effort and resources to the development of our associates, including providing almost all of our associates access to state-of-the-art learning management systems. We use these platforms to provide specifically designed and interactive award-winning e-learning courses in sales and service, product and hair knowledge, compliance training, and health and safety.

We also place significant value and attention on responding to feedback and input from associates. This includes surveys regarding issues such as Diversity, Inclusion & Belonging and our annual engagement survey. We review our team’s input and comments, identify common themes and set out action plans to respond. We believe listening is crucial, but taking action and making commitments are even more important.

A core focus of our associate engagement and culture are our efforts focused on Diversity, Inclusion & Belonging, discussed below.

- 7 -

Diversity, Inclusion & Belonging

At Sally Beauty we celebrate differences, inclusivity and self-expression. This fundamental aspect of SBH’s culture is rooted in our belief that beauty is for everyone, and everyone should find their own path to beauty. Our associates and our customers care about celebrating diversity and self-expression. We want our Company and our stores to be places where all of our associates and customers feel valued for who they are and experience a sense of belonging.

We come together to create a culture for “One & All”

Diversity, Inclusion & Belonging are at the heart of who we are as a Company – at the Board level, throughout our global workforce and in our shared commitment to serving a diverse customer base and their communities.

Our Diversity, Inclusion & Belonging Mission Statement:

We find beauty in YOU!

Finding beauty in diversity is in our DNA because our differences are what make us beautiful. Our diversity, inclusivity and self-expression are what fuel our innovation and growth.

At SBH, we come together to create a culture for ONE & ALL.

At the Board Level: Our Board’s composition leads the Company’s commitment to Diversity, Inclusion and Belonging. Having diverse voices on our Board enhances the Board’s expertise, broadens its viewpoint and sets the tone to encourage leaders at all levels of the Company to listen to the concerns of our associates and customers alike. Our Compensation & Talent Committee provides hands-on oversight and guidance of our Diversity, Inclusion & Belonging initiatives. Our Board believes listening and responding to diverse voices is crucial to the Company’s success and long-term sustainability.

In Our Workforce: Our SBH Team in the U.S. & Canada is approximately 90% women and approximately 50% people of color. This year, Newsweek recognized SBH among America’s Greatest Workplaces, America’s Greatest Workplaces for Diversity and America’s Greatest Workplaces for Women. We recognize and celebrate the bedrock values of workforce diversity, inclusion, belonging and engagement within our teams. For us, these are key drivers of the success of the business, as our associates should – and do – reflect the various qualities of our customers and what they desire and expect from SBH.

During the fiscal year, we further embedded the Company’s Employee Resource Groups (ERGs), with our first four groups that represent our Black, Hispanic, Women and LGBTQ+ associates. These ERGS have made a meaningful impact on our team and business, and we will continue to connect and engage them on how we do business, how we best serve our customers, and how we enhance our team and culture.

In Our Customer Base: Our customers span the entire continuum of gender and ethnic diversity. We sell beauty products to treat and style every kind of hair; we deliver a tailored assortment of beauty products that serve the local communities where our over 3,500 U.S. and Canada stores are located. Serving the diverse demographics and needs of our customers drives a culture and workforce that embraces and reflects the communities we serve.

We will continue to develop and evolve how we enhance Diversity, Inclusion & Belonging throughout SBH. We recognize the value these initiatives bring to our Company, our associates, our customers and the communities we serve.

More information on our approach to Diversity, Inclusion & Belonging can be found at: www.sallybeautyholdings.com/our-company/diversity-inclusion-and-belonging.

Regulation

We are subject to a number of U.S., federal, state and local laws and regulations as well as the laws and regulations applicable in each foreign country or jurisdiction in which we do business. These laws and regulations govern, among other things, the composition, packaging, labeling and safety of the products we sell, the methods we use to sell these products and the methods we use to import these products.

For example, in the U.S., most of the products we sell and the content and methods of advertising and marketing utilized are subject to both federal and state regulations administered by a host of federal and state agencies, including, in each case, one or more of the following: the Food and Drug Administration, or FDA, the Federal Trade Commission and the Consumer Products Safety Commission. The transportation and disposal of many of our products are also subject to federal and state regulation. State and local agencies regulate many aspects of our business. We also face comprehensive regulation outside the U.S., focused primarily on product labeling and safety issues.

- 8 -

We believe we are in material compliance with the laws and regulations we are subject to, although no assurance can be provided that this will remain true going forward or that we will not be required to incur meaningful expenses complying with such laws and regulations.

As of September 30, 2023, we supplied franchised stores primarily located in the U.S. As a result of these franchisor-franchisee relationships, we are subject to regulation when offering and selling franchises. The applicable laws and regulations affect our business practices, as franchisor, in a number of ways, including restrictions placed upon the offering, renewal, termination and disapproval of assignment of franchises. To date, these laws and regulations have not had a material effect upon our operations.

Access to Public Filings

Our Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q, our Current Reports on Form 8-K and amendments to such reports are available, without charge, on our website, www.sallybeautyholdings.com, as soon as reasonably possible after they are filed electronically with the Securities and Exchange Commission, or SEC, under the Exchange Act. The SEC maintains an internet site that contains our reports, proxy and information statements, and other information we file electronically with the SEC at www.sec.gov. We will provide copies of such reports to any person, without charge, upon written request to our Investor Relations Department at our principal office. The information found on our website shall not be considered to be part of this or any other report filed with or furnished to the SEC.

- 9 -

ITEM 1A. RISK FACTORS

Important risk factors that could materially affect our business, financial condition or results of operations in future periods are described below. These factors are not intended to be an all-encompassing list of risks and uncertainties and are not the only risks and uncertainties we face. Additional risks not currently known to us, or we currently deem to be immaterial, also may materially adversely affect our business, financial condition or results of operations in future periods.

Operational, Strategic and General Business Risks

The beauty products distribution industry is highly competitive and is consolidating.

We face significant competition from other beauty stores and outlets, salons, mass merchandisers, online retailers, drug stores and supermarkets. The primary competitive factors in the beauty products distribution industry are price, quality, perceived value, consumer brand name recognition, packaging and variety and availability, customer service, desirable store locations, in-stock inventory and, with respect to e-commerce, look and feel of website and delivery times and costs. Competitive conditions may limit our ability to maintain prices or may require us to reduce prices in efforts to retain business or channel share, particularly because customers are able to quickly and conveniently comparison shop and determine real-time product availability using digital tools, which can lead to decisions driven solely by price, the functionality of the digital tools, or a combination of these and other factors. Some of our competitors have greater financial and other resources than we do and are less leveraged than our business and may therefore be able to spend more aggressively on advertising and promotional activities and respond more effectively to changing business and economic conditions. Furthermore, there are few significant barriers to entry into the marketplace for most of the products we sell making it easy for new market entrants to compete with us. We expect existing competitors, business partners and new entrants to the beauty products distribution industry to constantly revise or improve their business models in response to challenges from competing businesses, including ours. If these competitors introduce changes or developments that we cannot address in a timely or cost-effective manner, our business may be adversely affected.

In addition, our industry is consolidating, which may give our suppliers and our competitors increased negotiating leverage and greater marketing resources. For instance, we may lose customers if those competitors which have broad geographic reach attract additional salons (individual and chain) that are currently BSG customers, or if professional beauty supply manufacturers align themselves with our competitors or begin selling direct to customers. Not only does consolidation in distribution pose risks from competing distributors, but it may also place more leverage in the hands of certain manufacturers, resulting in smaller margins on products sold through our network.

If we are unable to compete effectively in our marketplace or if competitors divert our customers away from our networks, it would adversely impact our business, financial condition and results of operations.

We may be unable to anticipate and effectively respond to changes in consumer preferences and buying trends in a timely manner.

Our success depends in part on our ability, and our distributed third-party brands' ability, to anticipate, gauge and react in a timely manner to changes in consumer spending patterns and preferences for specific beauty products. If we or the brands we distribute do not timely identify and properly respond to evolving trends and changing consumer demands for beauty products in the geographies in which we compete, our sales may decline significantly. Furthermore, we may accumulate additional inventory and be required to mark down unsold inventory to prices that are significantly lower than normal prices, which would adversely impact our margins and could further adversely impact our business, financial condition and results of operations. Additionally, a large percentage of our SBS product sales come from our owned and exclusive-label brand products. The development and promotion of these owned and exclusive-label brand products often occur well before these products are sold in our stores. As a result, the success of these owned and exclusive-label brand products is largely dependent on our ability to develop products that meet future consumer preferences at prices that are acceptable to our customers. Furthermore, we may have to spend a significant amount on the advertising and marketing of our owned and exclusive-label brands to drive customer awareness of these brands. There can be no assurance that any new owned and exclusive-label brand will meet consumer preferences, gain acceptance among our customer base or generate sales to become profitable or to cover the costs of its development and promotion.

- 10 -

We expect continuously changing fashion-related trends and consumer tastes to influence future demand for beauty products. Changes in consumer tastes, fashion trends and brand reputation can have an impact on our financial performance. If we or third-party brands we distribute are unable to anticipate and respond to trends in the marketplace for beauty products and changing consumer demands and/or maintain a strong brand reputation, our business could suffer.

Our future success depends in part on our ability to successfully implement our strategic initiatives to improve the customer experience, attract new customers and improve the sales productivity of our stores.

We are continuing the implementation of a significant number of strategic initiatives designed to enhance our customer centricity, increase our owned brand sales penetration, improve operational efficiency and optimize our capabilities, including through closure of underperforming stores and consolidation of distribution centers. There can be no assurance that these or future strategic initiatives will be successful. Furthermore, we are investing significant resources in these initiatives and the costs of the initiatives may outweigh their benefits. If these strategic initiatives are not successful, our comparative sales will suffer and our growth prospects, financial results, profitability and cash flows will also be adversely impacted.

Our restructuring plans may not be successful, or we may not fully realize the expected cost savings and/or operating efficiencies.

Our ability to grow profitably depends in large part on our ability to successfully control or reduce our operating expenses. In furtherance of this strategy, we have engaged and continue to engage in activities to reduce or control costs, some of which are complicated and require us to expend significant resources to implement. Over the past several years, we have implemented, and plan to continue to implement, plans to transform the Company for the future and support long-term sales growth and profitability. These programs are intended to touch all aspects of the business, enhance operating capabilities and create greater efficiencies. These strategic plans present potential risks that may impair our ability to achieve anticipated operating enhancements and efficiencies and/or cost reductions.

We depend upon manufacturers who may be unable to provide products of adequate quality or who may be unwilling to continue to supply products to us.

We do not manufacture any products we sell and instead purchase our products from recognized brand manufacturers and private label fillers. We depend on a limited number of manufacturers for a significant percentage of the products we sell.

Additionally, since we purchase products from many manufacturers and fillers under at-will contracts and contracts which can be terminated without cause upon 90 days’ notice or less, or which expire without express rights of renewal, manufacturers and fillers could discontinue sales to us immediately or upon short notice. Some of our contracts with manufacturers may be terminated if we fail to meet specified minimum purchase requirements. If minimum purchase requirements are not met, we do not have contractual assurances of continued supply. In lieu of termination, a manufacturer may also change the terms upon which it sells, for example, by raising prices or broadening distribution to third parties. For these and other reasons, we may not be able to acquire desired merchandise in sufficient quantities or on acceptable terms in the future.

Changes in SBS’s and BSG’s relationships with suppliers occur often and could positively or negatively impact the net sales and operating earnings of both business segments. Some of our suppliers may seek to decrease their reliance on distribution intermediaries, including full-service/exclusive and open-line distributors like BSG and SBS, by promoting their own distribution channels. These suppliers may offer advantages, such as lower prices, when their products are purchased from distribution channels they control. If our access to supplier-provided products were to diminish relative to our competitors or we were not able to purchase products at the same prices as our competitors, our business could be materially and adversely affected. Also, consolidation among suppliers may increase their negotiating leverage, thereby providing them with competitive advantages that may increase our costs and reduce our revenues, adversely affecting our business, financial condition and results of operations. Therefore, there can be no assurance that the impact of these developments, if they were to occur, will not adversely impact revenue or margins or that our efforts to mitigate the impact of these developments will be successful.

Furthermore, from time to time, we receive shipments of product from our suppliers that fail to conform to our quality control standards. A failure in our quality control program may result in diminished inventory levels and product quality, which in turn may result in increased order cancellations and product returns, decreased consumer demand for our products, or product recalls, any of which may have a material adverse effect on our results of operations and financial condition.

- 11 -

Any significant interruption in the supply of products by manufacturers and fillers or disruptions in our supply chain infrastructure could disrupt our ability to deliver merchandise to our stores and customers in a timely manner, which could have a material adverse effect on our business, financial condition and results of operations.

Manufacturers and owned and exclusive-label brand fillers of beauty supply products are subject to certain risks that could adversely impact their ability to provide us with their products on a timely basis, including inability to procure ingredients, industrial accidents, environmental events, strikes and other labor disputes, union organizing activity, disruptions in logistics or information systems, loss or impairment of key manufacturing sites, product quality control, safety, licensing requirements and other regulatory issues, as well as natural disasters, pandemics and other external factors over which neither they nor we have control.

In addition, we directly source many of our owned and exclusive-label brand products, including, but not limited to, styling tools, salon equipment, sundries and other promotional products, from foreign third-party manufacturers and many of our vendors also use overseas sourcing to manufacture some or all of their products. Any event causing a sudden disruption of manufacturing or imports from such foreign countries, including the imposition of additional or increased import restrictions, duties or tariffs, political instability, local business practices, legal or economic restrictions on overseas suppliers’ ability to produce and deliver products or acts of war or terrorism or pandemics, could materially harm our operations to the extent they affect the production, shipment or receipt of merchandise. Our operating results depend to some extent on the orderly operation of our receiving and distribution processes, which depend on manufacturers’ adherence to shipping schedules and our effective management of our distribution facilities and capacity.

Fluctuations in the price, availability and quality of inventory may result in higher cost of goods, which we may not be able to pass on to the customers.

Our suppliers frequently attempt to pass on higher production costs, which have generally increased as a result of inflation over the past few years, which may impact our ability to maintain or grow our margins. The price and availability of raw materials may be impacted by inflation, demand, regulation, weather and other factors. Additionally, manufacturers have and may continue to have increases in other manufacturing costs, such as transportation, labor and benefit costs. These increases in production costs result in higher merchandise costs to us. We may not always be able to pass on those cost increases to our customers, which could have a material adverse effect on our business, financial condition and results of operations.

Our e-commerce businesses may be unsuccessful or, if successful, may redirect sales from our stores.

We offer many of our beauty products for sale through our e-commerce businesses in the U.S. (such as www.sallybeauty.com, www.cosmoprofbeauty.com, www.cosmoprofequipment.com and mobile commerce-based apps) and abroad. We have recently undertaken a number of initiatives to significantly advance our digital commerce capabilities and grow our e-commerce businesses. As a result, we are more susceptible to risks and difficulties frequently experienced by internet-based businesses, including risks related to our ability to attract and retain customers on a cost-effective basis and our ability to operate, support, expand and develop our e-commerce operations, websites and software and other related operational systems. Furthermore, our e-commerce businesses face significant competition from larger retailers with more established e-commerce platforms as well as online retailers, including Amazon, and on-line store e-commerce platforms such as Shopify.

Although we believe our participation in both e-commerce and physical store sales is a distinct advantage for us due to synergies and the potential for new customers, supporting product offerings through both of these channels could create issues that have the potential to adversely affect our results of operations. For example, growth in our e-commerce business relative to in-store sales may result in dilution of operating margin and profit due to higher delivery expenses incurred in our e-commerce sales. Furthermore, if our e-commerce businesses successfully grow, they may do so in part by attracting existing customers, rather than new customers, who choose to purchase products from us online rather than from our physical stores, thereby reducing the financial performance of our stores. In addition, offering different products through each channel could cause conflicts and cause some of our current or potential internet customers to consider competing distributors of beauty products.

- 12 -

In addition, offering products through our e-commerce channels (particularly directly to consumers through our professional business) could cause some of our current or potential vendors to consider competing internet offerings of their products either directly or through competing distributors. As we continue to grow our e-commerce businesses, the impact of attracting existing rather than new customers, of conflicts between product offerings online and through our stores, and of opening up our channels to increased internet competition could have a material adverse impact on our business, financial condition and results of operations, including operating margin, profit, future growth and comparative sales. Furthermore, our recent initiatives to upgrade our e-commerce platforms may not be successful in driving traffic to our websites and increasing our online sales in the long term, which could adversely impact our net sales.

Diversion of professional products sold by BSG could have an adverse impact on our revenues.

The majority of the products that BSG sells, including those sold by our Armstrong McCall franchisees, are meant to be used exclusively by salons and individual salon professionals or sold exclusively to their retail consumers. However, despite our efforts to prevent diversion, incidents of product diversion occur, whereby our products are sold by these purchasers (and possibly by other bulk purchasers such as franchisees) to wholesalers and ultimately to general merchandise retailers, among others. These retailers, in turn, sell such products to consumers. The diverted product may be old, tainted or damaged and sold through unapproved outlets, all of which could diminish the value of the particular brand. In addition, such diversion may result in lower net sales for BSG should consumers choose to purchase diverted products from retailers rather than purchasing from our customers or choose other products altogether because of the perceived loss of brand prestige. Furthermore, in many instances, BSG is subject to certain anti-diversion obligations under these manufacturers’ contracts, that if violated may result in the termination of such contracts. In addition, our investigation and enforcement of these anti-diversion obligations may require us to cease selling to customers suspected of diversion which could impact BSG’s net sales.

The loss of exclusive distribution rights with key vendors could have a material adverse effect on our business, financial condition and results of operations.

We have exclusive and non-exclusive distribution rights with several key vendors for well-known brands in certain geographies. If key vendors ceased granting us exclusive distribution rights, or decided to utilize other distribution channels for their products, therefore widening the availability of these products in other channels, the revenue we earn from the sale of such products could be negatively impacted, which could have a material adverse effect on our business, financial condition and results of operations.

BSG’s financial results are affected by the financial results of BSG’s franchised-based business (Armstrong McCall).

BSG receives revenue from its sale of products to Armstrong McCall franchisees. Accordingly, a portion of BSG’s financial results is dependent upon the operational and financial success of these franchisees, including their implementation of BSG’s strategic plans. If sales trends or economic conditions worsen for Armstrong McCall’s franchisees, their financial results may worsen. Additionally, the failure of Armstrong McCall franchisees to renew their franchise agreements, any requirement that Armstrong McCall restructure its franchise agreements in connection with such renewals, or any failure of Armstrong McCall to meet its obligations under its franchise agreements, could result in decreased revenues for BSG or create legal issues with our franchisees or with manufacturers.

Furthermore, our franchisees may not run the stores and sales teams according to our standards, which could have a material adverse effect on our brand reputation and our business.

If we are unable to optimize our store base by profitably opening and operating new stores and closing less profitable stores, our business, financial condition and results of operations may be adversely affected.

Our future growth strategy depends in part on our ability to optimize and profitably operate our stores in existing and additional geographic areas, including in international geographies, and to close underperforming stores. While the capital requirements to open an SBS or BSG store, excluding inventory, vary from geography to geography, such capital requirements have historically been relatively low in the U.S. and Canada. Despite these relatively low opening costs, we may not be able to open all the new stores we plan to open and we may be unable to optimize our store base by closing stores that are underperforming or open stores that are profitable, any of which could have a material adverse impact on our business, financial condition and results of operations.

- 13 -

Furthermore, we may incur costs associated with the closure of underperforming stores and such store closures may adversely impact our revenues.

In addition, as we continue to open new stores, our management – as well as our financial, distribution and information systems – and other resources will be subject to greater demands. If our personnel and systems are unable to successfully manage this increased burden, our business, financial condition and results of operations may be materially affected.

If our marketing, advertising and promotional programs are unsuccessful, our results of operations and financial condition could be adversely affected.

If our marketing, advertising and promotional programs are unsuccessful, our results of operations and financial condition could be adversely affected. Customer traffic and demand for our merchandise are influenced by our advertising, marketing and promotional activities. We use marketing, advertising and promotional programs to attract customers through various media, including social media, websites, mobile applications, e-mail, and print. Our future growth and profitability will depend in part upon the effectiveness and efficiency of our advertising and marketing programs. Further, disruption to certain media channels could have a material adverse effect on our results of operations and financial condition.

In particular, there has been a substantial increase in the use of social media platforms – including blogs, social media websites and other forms of digital communications – and the influence of social medial influencers in the beauty products industry. Furthermore, social media advertising and marketing continues to increase in importance as consumers are paying less attention to more traditional media. As a result, the success of our marketing and advertising programs are increasingly dependent on the effectiveness of industry influencers that we engage to promote our products. Furthermore, actions taken by these individuals could harm our brand image. Our marketing efforts through social media platforms and influencers may not be successful and the availability of these platforms may make it easier for smaller competitors to compete with us.

Negative commentary regarding us or the products we sell may be also posted on social media platforms or other electronic means at any time and may be adverse to our reputation or business. Customers value readily available information and often act on such information without further investigation and without regard to its accuracy. Any harm to us or the products we sell may be immediate without allowing us an opportunity for redress or correction.

If we fail to attract and retain highly skilled management and other personnel at all levels of the Company, our business, financial condition and results of operations may be harmed.

Our success has depended, and will continue to depend, in large part on our ability to attract and retain senior executives who possess extensive knowledge, experience and managerial skill applicable to our business. Significant leadership changes or executive management transitions involve inherent risk and any failure to ensure the effective transfer of knowledge and a smooth transition could hinder our strategic planning, execution and future performance. In addition, from time to time, key executive personnel leave our Company, and we may not be successful in attracting, integrating and retaining the personnel required to grow and operate our business profitably. While we strive to mitigate the negative impact associated with the loss of a key executive employee, an unsuccessful transition or loss could significantly disrupt our operations and could have a material adverse effect on our business, financial condition and results of operations.

We are also dependent on recruiting, training, motivating, managing and retaining our store employees that interact with our customers on a daily basis. Many team members are in entry-level or part-time positions with historically high turnover rates. Competition for these types of qualified employees, especially in light of recent labor shortages among entry-level workers, is intense and the failure to attract, retain and properly train qualified and motivated employees could result in decreased customer satisfaction, loss of customers and lower sales. In addition, our ability to meet our labor needs while controlling labor costs is subject to numerous external factors, including market pressures with respect to prevailing wage rates, unemployment levels, and health and other insurance costs; the impact of legislation or regulations governing labor relations, immigration, minimum wage and healthcare benefits; changing demographics; and our reputation within the labor market. Our inability to control our labor costs could affect our results of operations and result in lower margins in our two segments.

- 14 -

We may not be successful in introducing additional store concepts.

We may, from time to time, seek to develop and introduce new store concepts. Our ability to succeed in the early stages of new concepts could require significant capital expenditures and management attention. Additionally, any new concept is subject to certain risks, including customer acceptance, competition, product differentiation, challenges relating to economies of scale in merchandise sourcing and the ability to attract and retain qualified personnel, including management and designers. There can be no assurance that we will be able to develop and grow these or any other new concepts to a point where they will become profitable, or generate positive cash flow. If we cannot successfully develop and grow these new concepts, our financial condition and results of operations may be adversely impacted.

General Economic, Market and Foreign Risks

The political, social and economic conditions in the geographies we serve may affect consumer purchases of discretionary items such as beauty products and salon services, which could have a material adverse effect on our business, financial condition and results of operations.

Our results of operations may be materially affected by conditions in the global capital markets and the economy and regulatory environment generally, both in the U.S. and internationally. Concerns over inflation, rising interest rates, labor shortages, energy costs, geopolitical issues, uncertainty with respect to elections, terrorism, civil unrest, the availability and cost of credit, the mortgage market, and the real estate and other financial markets in the U.S. and Europe have contributed to increased volatility and diminished expectations for the U.S. and certain foreign economies. We appeal to a wide demographic consumer profile and offer an extensive selection of beauty products sold directly to retail consumers and salons and salon professionals. Continued uncertainty in the economy could adversely impact consumer purchases of discretionary items such as beauty products as well as adversely impact the frequency of salon services performed by professionals using products purchased from us. Factors that could affect consumers’ willingness to make such discretionary purchases include: inflation, general business conditions, levels of employment, interest rates, tax rates, the availability of consumer credit and consumer confidence in future economic conditions. A prolonged economic downturn or acute recession can adversely affect consumer spending habits and result in lower than expected net sales. The economic climate could also adversely affect our vendors. The occurrence of any of these events could have a material adverse effect on our business, financial condition and results of operations.

In addition, the disruption to the global economy and to our business, along with any sustained decline in our stock price, could lead to triggering events that may indicate that the carrying value of certain assets – including inventories, accounts receivables, long-lived assets, intangibles and goodwill – may not be recoverable, which could lead to impairment or other asset write-downs in the future.

Price inflation for labor, materials and services, could adversely affect our business, results of operations and financial condition.

We experienced considerable price inflation in costs for labor, materials and services during the past two years. While inflation is stabilizing, we may not be able to continue to pass through inflationary cost increases and, if inflationary pressures are sustained, we may only be able to recoup a portion of our increased costs in future periods. Our ability to raise prices to reflect increased costs may also be limited by competitive conditions in the market for our products.

The occurrence of natural disasters or acts of violence or terrorism could adversely affect our operations and financial performance.

The occurrence of natural disasters (the severity and frequency of which may be exacerbated by climate change) or acts of violence, terrorism or civil unrest could result in physical damage to our properties, the temporary closure of stores or distribution centers, the temporary lack of an adequate work force, the temporary or long-term disruption in the supply of products (or a substantial increase in the cost of those products) from domestic or foreign suppliers, the temporary disruption in the delivery of goods to our distribution centers (or a substantial increase in the cost of those deliveries), the temporary reduction in the availability of products in our stores and/or the temporary reduction in visits to stores by customers. If one or more natural disasters or acts of violence or terrorism were to impact our business, we could, among other things, incur significantly higher costs and longer lead times associated with distributing products. Furthermore, insurance costs associated with our business may rise significantly in the event of a large scale natural disaster or act of violence or terrorism.

- 15 -

Currency exchange rate fluctuations could result in higher costs and decreased margins and earnings.

Many of our products are sold outside of the United States. As a result, we conduct transactions in various currencies, which increase our exposure to fluctuations in foreign currency exchange rates relative to the U.S. dollar and recently these foreign currencies have in general weakened significantly against the U.S. dollar. Our international revenues and expenses generally are derived from sales and operations in foreign currencies, and these revenues and expenses could be affected by currency fluctuations, including amounts recorded in foreign currencies and translated into U.S. dollars for consolidated financial reporting. Currency exchange rate fluctuations could also disrupt the business of the independent manufacturers that produce our products by making their purchases of raw materials as well as transportation and freight, more expensive and more difficult to finance. Foreign currency fluctuations could have an adverse effect on our results of operations and financial condition.

We are subject to risks related to our international operations.

We operate on a global basis, and approximately 10% of our net revenues from continuing operations in fiscal year 2023, were generated outside North America. Non-U.S. operations are subject to many risks and uncertainties, including ongoing instability or changes in a country’s or region’s economic, regulatory or political conditions, including inflation, recession, interest rate fluctuations, sovereign default risk and actual or anticipated military or political conflicts, labor market disruptions, sanctions, boycotts, new or increased tariffs, quotas, exchange or price controls, trade barriers or other restrictions on foreign businesses, our failure to effectively and timely implement processes and policies across our diverse operations and employee base and difficulties and costs associated with complying with a wide variety of complex and potentially conflicting regulations across multiple jurisdictions. Non-U.S. operations also increase the risk of non-compliance with U.S. laws and regulations applicable to such non-U.S. operations, such as those relating to sanctions, boycotts and improper payments.

In addition, sudden disruptions in business conditions as a consequence of events such as terrorist attacks, war or other military action or the threat of further attacks, including the wars in Ukraine and in the Middle East, pandemics or other crises or vulnerabilities or as a result of adverse weather conditions or climate changes, may have an impact on consumer spending, which could have a material adverse effect on our business, prospects, financial condition, results of operations, cash flows as well as the trading price of our securities.

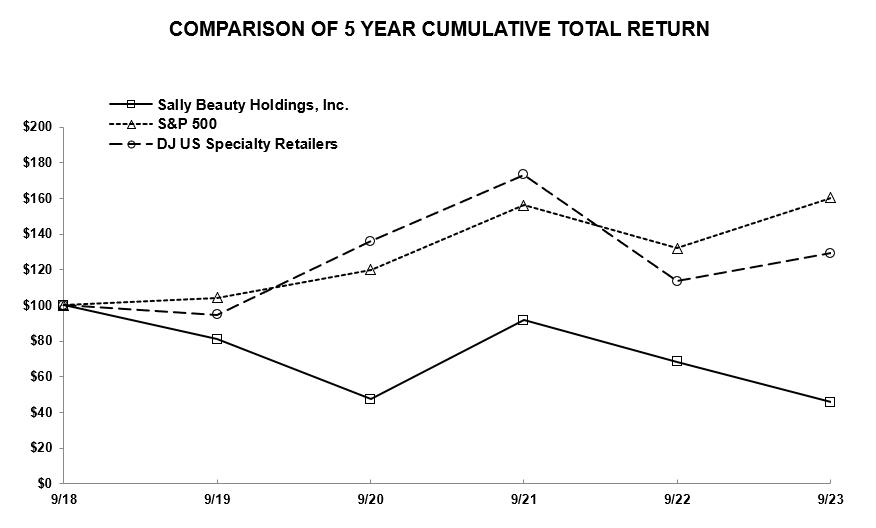

A reduction in traffic to, or the closing of, other retailers in shopping areas where our SBS stores are located could significantly reduce our sales and leave us with excess inventory, which could have a material adverse effect on our business, financial condition, profitability and cash flows.