UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 14, 2023

NOVANTA INC.

(Exact name of registrant as specified in is charter)

New Brunswick, Canada |

001-35083 |

98-0110412 |

|

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

|

125 Middlesex Turnpike Bedford, Massachusetts |

|

01730 |

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (781) 266-5700

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common shares, no par value |

|

NOVT |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On November 14, 2023, Novanta Corporation (the “Buyer”), a wholly-owned subsidiary of Novanta Inc. (the “Company”), entered into a Securities Purchase Agreement (the “Purchase Agreement”) with Motion Solutions Holdings LLC (the “Seller”) and Motion Solutions Parent Corp. (“Motion Solutions”). The Purchase Agreement provides that, upon the terms and subject to the conditions set forth in the Purchase Agreement, the Buyer agrees to acquire the issued and outstanding capital stock of Motion Solutions (the “Acquisition”).

Pursuant to the terms of the Purchase Agreement, the Buyer has agreed to pay the Seller a purchase price of $189.0 million in cash upon the closing of the Acquisition, subject to certain customary closing conditions and purchase price adjustments for cash on hand, indebtedness and net working capital, as defined in the Purchase Agreement. A portion of the purchase price will be placed in escrow upon the closing of the Acquisition to satisfy these purchase price adjustment obligations.

The completion of the Acquisition is subject to certain conditions, including the expiration or termination of the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended. The Acquisition is expected to be completed in the first quarter of 2024. The Buyer intends to fund the Acquisition using cash on hand and by drawing on the Company’s revolving credit facility.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of A Registrant.

The information set forth in Item 1.01 in connection with the planned drawdown on the Company’s revolving credit facility to fund a substantial majority of the purchase price for the Acquisition is incorporated in this Item 2.03 by reference.

Item 7.01 Regulation FD Disclosure.

On November 14, 2023, the Company issued a press release announcing the signing of the Purchase Agreement. A copy of this press release is attached hereto as Exhibit 99.1.

Also on November 14, 2023, the Company will hold a conference call to discuss the Acquisition. A copy of the conference call presentation is attached hereto as Exhibit 99.2 and is also available on the Company’s website, https://www.novanta.com, in the Investor Relations section.

The information contained in this Current Report, including Exhibit 99.1 and Exhibit 99.2, is furnished under this Item 7.01 and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or incorporated by reference in any filing thereunder or under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Forward-Looking Statements

Certain statements in this Form 8-K are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and are based on current expectations and assumptions that are subject to risks and uncertainties. All statements contained in this Form 8-K that do not relate to matters of historical fact should be considered forward-looking statements, and are generally identified by words such as “expect,” “intend,” “anticipate,” “estimate,” “believe,” “future,” “could,” “should,” “plan,” “aim,” and other similar expressions.

These forward-looking statements include, but are not limited to, statements regarding the ability of the parties to consummate the proposed transaction; the ability of the parties to satisfy the conditions precedent to consummation of the proposed transaction, including the ability to secure the applicable regulatory approvals on the terms expected, at all or in a timely manner; our ability to successfully integrate Motion Solutions, and our ability to implement our plans, forecasts and other expectations with respect to Motion Solutions’ business after the completion of the acquisition and realize expected synergies; the effect of the announcement of the proposed transaction on the ability of Motion Solutions to retain and hire key personnel and maintain relationships with its key business partners and customers, and others with whom it does business, or on its operating results and businesses generally; risks associated with the disruption of Motion Solutions management's attention from ongoing business operations due to the proposed transaction; significant costs associated with the proposed transaction; sources of funding for the Motion Solutions acquisition; benefits of the Motion Solutions acquisition; our expectation that Motion Solutions expands Novanta’s position in medical and life science markets, such as spatial biology, genomics, proteomics, medical robotics, and lab automation; our expectation that the Motion Solutions acquisition will create stronger partnerships with our original equipment manufacturer customers to help us accelerate our strategic goals with an ability to cross sell to our mutual customers; Motion Solutions’ expected 2023 revenues; and other statements that are not historical facts.

These forward-looking statements are neither promises nor guarantees, but involve risks and uncertainties that may cause actual results to differ materially from those contained in the forward-looking statements. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of various important factors, including, but not limited to, the following: economic and political conditions and the effects of these conditions on our customers’ businesses, capital expenditures and level of business activities; risks associated with epidemics or pandemics, and other events outside our control; our dependence upon our ability to respond to fluctuations in product demand; our ability to continually innovate, introduce new products timely, and successfully commercialize our innovations; failure to introduce new products in a timely manner; customer order timing and other similar factors may cause fluctuations in our operating results; cyberattacks, disruptions or other breaches in security of our and our third-party providers’ information technology systems; our failure to comply with data privacy regulations; changes in interest rates, credit ratings or foreign currency exchange rates; risks associated with our operations in foreign countries; our increased use of outsourcing in foreign countries; risks associated with increased outsourcing of components manufacturing; our exposure to increased tariffs, trade restrictions or taxes on our products; the continuing impact of “Brexit”; violations of our intellectual property rights and our ability to protect our intellectual property against infringement by third parties; risk of losing our competitive advantage; failure to successfully integrate recent and future acquisitions into our business; our ability to attract and retain key personnel; our restructuring and realignment activities and disruptions to our operations as a result of consolidation of our operations; product defects or problems integrating our products with other vendors’ products; disruptions in the supply of certain key components or other goods from our suppliers; our failure to accurately forecast component and raw material requirements leading to excess inventories or delays in the delivery of our products; production difficulties and product delivery delays or disruptions; our exposure to medical device regulations, which may impede or hinder the approval or sale of our products and, in some cases, may ultimately result in an inability to obtain approval of certain products or may result in the recall or seizure of previously approved products; potential penalties for violating foreign and U.S. federal, and state healthcare laws and regulations; impact of healthcare industry cost containment and healthcare reform measures; changes in governmental regulations affecting our business or products; our failure to implement new information technology systems and software successfully; our failure to realize the full value of our intangible assets; reliance on original equipment manufacturer customers; increasing scrutiny and changing expectations from investors, customers, and governments with respect to Environmental, Social and Governance policies and practices; our exposure to the credit risk of some of our customers and in weakened markets; being subject to U.S. federal income taxation even though we are a non-U.S. corporation; changes in tax laws and fluctuations in our effective tax rates; any need for additional capital to adequately respond to business challenges or opportunities and repay or refinance our existing indebtedness, which may not be available on acceptable terms or at all; our existing indebtedness limiting our ability to engage in certain activities; volatility in the market price for our common shares; and our failure to maintain appropriate internal controls in the future.

Other important risk factors that could affect the outcome of the events set forth in these statements and that could affect the Company’s operating results and financial condition are discussed in Item 1A of Novanta Inc.’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as updated by Novanta Inc.’s Quarterly Report on Form 10-Q for the quarterly period ended September 29, 2023 and as further updated by its subsequent filings with the Securities and Exchange Commission (“SEC”), and its future filings with the SEC. These forward-looking statements are based on Novanta Inc.’s beliefs and assumptions and on information currently available to Novanta Inc. Novanta Inc. disclaims any obligation to publicly update or revise any forward-looking statements as a result of developments occurring after the date of this Form 8-K except as required by law.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit Number |

|

Description |

99.1 |

|

|

99.2 |

|

Investor Conference Call Presentation, dated November 14, 2023 |

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

Novanta Inc. |

|

|

|

|

|

Date: November 14, 2023 |

|

By: |

/s/ Robert J. Buckley |

|

|

|

Robert J. Buckley |

|

|

|

Chief Financial Officer |

Exhibit 99.1

FOR IMMEDIATE RELEASE

November 14, 2023

Novanta announces agreement to acquire Motion Solutions

BEDFORD, Massachusetts, November 14, 2023 -- Novanta Inc. (Nasdaq: NOVT) (“Novanta” or the "Company"), a trusted technology partner to medical and advanced technology equipment manufacturers, announced today that it has entered into a definitive agreement to acquire Motion Solutions, a leading provider of highly engineered integrated solutions, for cash consideration of $189 million, subject to customary purchase price adjustments and closing conditions, including applicable regulatory approvals.

Motion Solutions is a trusted engineering partner to market-leading original equipment manufacturers (“OEMs”) in medical, life sciences, and advanced industrial applications. Motion Solutions designs and manufactures high-precision, customized subsystems and components, specializing in proprietary precision motion and advanced motion control solutions. The business has over 110 employees and is headquartered in Irvine, California.

"Motion Solutions is an exciting business with intelligent subsystem competencies within attractive medical and precision medicine markets,” said Matthijs Glastra, Chair and Chief Executive Officer of Novanta. “The business adds complementary motion subsystem solutions to Novanta’s product portfolio, giving us greater exposure to leading OEM customers in markets such as spatial biology, genomics, proteomics, medical robotics, and lab automation. In addition, the transaction gives us opportunity to design unique solutions for our mutual OEM customer base combining Novanta’s and Motion Solutions’ capabilities.”

Motion Solution is expected to generate approximately $85 million in revenue in 2023. The transaction will be financed using available cash and borrowings under the Company’s revolving credit facility.

Conference Call Information

The Company will host a conference call on Tuesday, November 14, 2023 at 5:00 p.m. ET to discuss the transaction. Matthijs Glastra, Chair and Chief Executive Officer, and Robert Buckley, Chief Financial Officer, will host the conference call. To access the call, please dial (888) 346-3959 prior to the scheduled conference call time. Alternatively, the conference call can be accessed online via a live webcast on the Events & Presentations page of the Investors section of the Company’s website at www.novanta.com.

A replay of the audio webcast will be available approximately three hours after the conclusion of the call in the Investor Relations section of the Company’s website at www.novanta.com. The replay will remain available until Monday, February 13, 2024.

Safe Harbor and Forward-Looking Information

Certain statements in this release are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and are based on current expectations and assumptions that are subject to risks and uncertainties. All statements contained in this news release that do not relate to matters of historical fact should be considered forward-looking statements, and are generally identified by words such as “expect,” “intend,” “anticipate,” “estimate,” “believe,” “future,” “could,” “should,” “plan,” “aim,” and other similar expressions. These forward-looking statements include, but are not limited to, statements regarding the ability of the parties to consummate the proposed transaction; the ability of the parties to satisfy the conditions precedent to consummation of the proposed transaction, including the ability to secure the applicable regulatory approvals on the terms expected, at all or in a timely manner; our ability to successfully integrate Motion Solutions, and our ability to implement our plans, forecasts and other expectations with respect to Motion Solutions’ business after the completion of the acquisition and realize expected synergies; the effect of the announcement of the proposed transaction on the ability of Motion Solutions to retain and hire key personnel and maintain relationships with its key business partners and customers, and others with whom it does business, or on its operating results and businesses generally; risks associated with the disruption of Motion Solutions management's attention from ongoing business operations due to the proposed transaction; significant costs associated with the proposed transaction; sources of funding for the Motion Solutions acquisition; benefits of the Motion Solutions acquisition; our expectation that Motion Solutions expands Novanta’s position in medical and life science markets, such as spatial biology, genomics, proteomics, medical robotics, and lab automation; our expectation that the Motion Solutions acquisition will create stronger partnerships with our original equipment manufacturer customers to help us accelerate our strategic goals with an ability to cross sell to our mutual customers; Motion Solutions’ expected 2023 revenues; and other statements that are not historical facts.

These forward-looking statements are neither promises nor guarantees, but involve risks and uncertainties that may cause actual results to differ materially from those contained in the forward-looking statements. Our actual results could differ materially from those anticipated in these forward-looking statements for many reasons, including, but not limited to, the following: economic and political conditions and the effects of these conditions on our customers’ businesses, capital expenditures and level of business activities; risks associated with epidemics or pandemics, and other events outside our control; our dependence upon our ability to respond to fluctuations in product demand; our ability to continually innovate, introduce new products timely, and successfully commercialize our innovations; failure to introduce new products in a timely manner; customer order timing and other similar factors may cause fluctuations in our operating results; cyberattacks, disruptions or other breaches in security of our and our third-party providers’ information technology systems; our failure to comply with data privacy regulations; changes in interest rates, credit ratings or foreign currency exchange rates; risks associated with our operations in foreign countries; our increased use of outsourcing in foreign countries; risks associated with increased outsourcing of components manufacturing; our exposure to increased tariffs, trade restrictions or taxes on our products; the continuing impact of “Brexit”; violations of our intellectual property rights and our ability to protect our intellectual property against infringement by third parties; risk of losing our competitive advantage; our failure to successfully integrate recent and future acquisitions into our business; our ability to attract and retain key personnel; our restructuring and realignment activities and disruptions to our operations as a result of consolidation of our operations; product defects or problems integrating our products with other vendors’ products; disruptions in the supply of certain key components or other goods from our suppliers; our failure to accurately forecast component and raw material requirements leading to excess inventories or delays in

the delivery of our products; production difficulties and product delivery delays or disruptions; our exposure to medical device regulations, which may impede or hinder the approval or sale of our products and, in some cases, may ultimately result in an inability to obtain approval of certain products or may result in the recall or seizure of previously approved products; potential penalties for violating foreign and U.S. federal, and state healthcare laws and regulations; impact of healthcare industry cost containment and healthcare reform measures; changes in governmental regulations affecting our business or products; our failure to implement new information technology systems and software successfully; our failure to realize the full value of our intangible assets; increasing scrutiny and changing expectations from investors, customers, and governments with respect to Environmental, Social and Governance policies and practices; our reliance on original equipment manufacturer customers; being subject to U.S. federal income taxation even though we are a non-U.S. corporation; changes in tax laws, and fluctuations in our effective tax rates; our exposure to the credit risk of some of our customers and in weakened markets; any need for additional capital to adequately respond to business challenges or opportunities and repay or refinance our existing indebtedness, which may not be available on acceptable terms or at all; our existing indebtedness limiting our ability to engage in certain activities; volatility in the market price for our common shares; and our failure to maintain appropriate internal controls in the future.

Other important risk factors that could affect the outcome of the events set forth in these statements and that could affect the Company’s operating results and financial condition are discussed in Item 1A of our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as updated by our Quarterly Report on Form 10-Q for the quarterly period ended September 29, 2023 and other subsequent filings with the Securities and Exchange Commission. Such statements are based on the Company’s beliefs and assumptions and on information currently available to the Company. The Company disclaims any obligation to publicly update or revise any information included in this release or any forward-looking statements as a result of developments occurring after the date of this document except as required by law.

About Novanta

Novanta is a leading global supplier of core technology solutions that give medical and advanced industrial original equipment manufacturers a competitive advantage. We combine deep proprietary technology expertise and competencies in precision medicine and manufacturing, medical solutions, and robotics and automation with a proven ability to solve complex technical challenges. This enables Novanta to engineer core components and sub-systems that deliver extreme precision and performance, tailored to our customers' demanding applications. The driving force behind our growth is the team of innovative professionals who share a commitment to innovation and customer success. Novanta’s common shares are quoted on Nasdaq under the ticker symbol “NOVT.”

More information about Novanta is available on the Company’s website at www.novanta.com. For additional information, please contact Novanta Investor Relations at (781) 266-5137 or InvestorRelations@novanta.com.

Novanta Inc.

Investor Relations Contact:

Ray Nash

(781) 266-5137

Novanta to acquire Motion Solutions November 14, 2023 announcement NASDAQ: NOVT Exhibit 99.2

Safe Harbor Statement 2 Certain statements in this presentation, including those related to the Motion Solutions acquisition, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and are based on current expectations and assumptions that are subject to risks and uncertainties which may cause results to differ materially from those set forth in this presentation. All statements contained in this presentation that do not relate to matters of historical fact should be considered forward-looking statements, and are generally identified by words such as “expect,” “intend,” “anticipate,” “estimate,” “believe,” “future,” “could,” “should,” “plan,” “aim,” and other similar expressions. These forward-looking statements include, but are not limited to, statements regarding the ability of the parties to consummate the proposed transaction in the first quarter of 2024 or at all; the ability of the parties to satisfy the conditions precedent to consummation of the proposed transaction, including the ability to secure the applicable regulatory approvals on the terms expected, at all or in a timely manner; the Company’s ability to successfully integrate Motion Solutions, and ability to implement its plans, forecasts and other expectations with respect to Motion Solutions’ business after the completion of the acquisition and realize expected synergies; the effect of the announcement of the proposed transaction on the ability of Motion Solutions to retain and hire key personnel and maintain relationships with its key business partners and customers, and others with whom it does business, or on its operating results and businesses generally; risks associated with the disruption of Motion Solutions’ management's attention from ongoing business operations due to the proposed transaction; significant costs associated with the proposed transaction; sources of funding for the Motion Solutions acquisition; our expectation that Motion Solutions expands Novanta’s position in medical and life science markets, such as spatial biology, genomics, proteomics, medical robotics, and lab automation; our expectation that the Motion Solutions acquisition will create stronger partnerships with the Company’s original equipment manufacturer customers to help the Company accelerate its strategic goals with an ability to cross sell to mutual customers; Motion Solutions’ expected 2023 revenues; the acquisition’s expected return on investment capital and impact on the Company’s gross margin; the Company’s expectation that the Motion Solutions acquisition will be accretive to its revenue growth; and other statements that are not historical facts. Other important risk factors that could affect the outcome of the events set forth in these statements and that could affect the Company’s operating results and financial condition are discussed in Item 1A of our Annual Report on Form 10-K for the fiscal year ended December 31, 2022, as updated by our Quarterly Report on Form 10-Q for the quarterly period ended September 29, 2023 and other subsequent filings with the Securities and Exchange Commission ("SEC"). Actual results, events and performance may differ materially from those anticipated in these forward-looking statements. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Such statements are based on the Company’s beliefs and assumptions and on information currently available to the Company. Please also see “Safe Harbor and Forward-Looking Information” in the Company’s most recent Form 8-K filed with the SEC regarding this proposed acquisition for more information. The Company neither updates nor confirms any guidance regarding the future operating results of the Company which may have been given prior to this presentation and disclaims any obligation to publicly update or revise any information included in this release or any forward-looking statements as a result of developments occurring after the date of this document except as required by law.

Motion Solutions Profile ~$85M Annual Sales 8% to 10% CAGR ~65% Medical / Life Sciences >110 Employees Trusted engineering partner to market-leading OEMs in medical, life sciences, and advanced industrial applications.

MOTION SOLUTIONS OVERVIEW Trusted engineering partner to market-leading OEMs in medical, life sciences, and advanced industrial applications. Designs and manufactures high-precision, customized subsystems and components Proprietary competences in precision motion and advanced motion subsystem control and automation solutions. Deal rationale Confidential and Proprietary Deepens presence into secular growth precision medicine applications Offers new intelligent subsystems through combined Novanta and Motion Solution capabilities Strong business model and culture fit Great team Transaction offers attractive returns

Key Customer Growthand Channel Expansion Synergistic with existing Novanta customer base Opens new opportunities to expand into leading precision medicine OEM customers Improves Precision Medicine competency of Novanta's salesforce Outstanding Strategic Fit Deepens Presence in Precision Medicine New subsystem solution capability, targeting life sciences, spatial biology, proteomics, single cell and DNA applications Increases opportunity to design into long-cycle, sticky applications with secular and structural long-term growth Increases Novanta’s Subsystem Capability and Exposure Increases proprietary IP around intelligent precision motion subsystems Adds deep Precision Medicine and Precision Manufacturing application knowledge Increases Value of Novanta’s Solutions Offering Designed into OEM systems on a sole source basis Offer new solutions through combined Novanta and Motion Solution capabilities

Strong Presence in Medical and Life Science Intelligent Motion Subsystems are Critical for sample positioning and alignment in Medical and Life Science Applications Deep, long-term OEM customer partnerships enabled by strong engineer-to-engineer relationships History of quality and reliability leading to higher, stickier content with OEM next-gen systems Strong long-term partnershipwith leading OEM customers

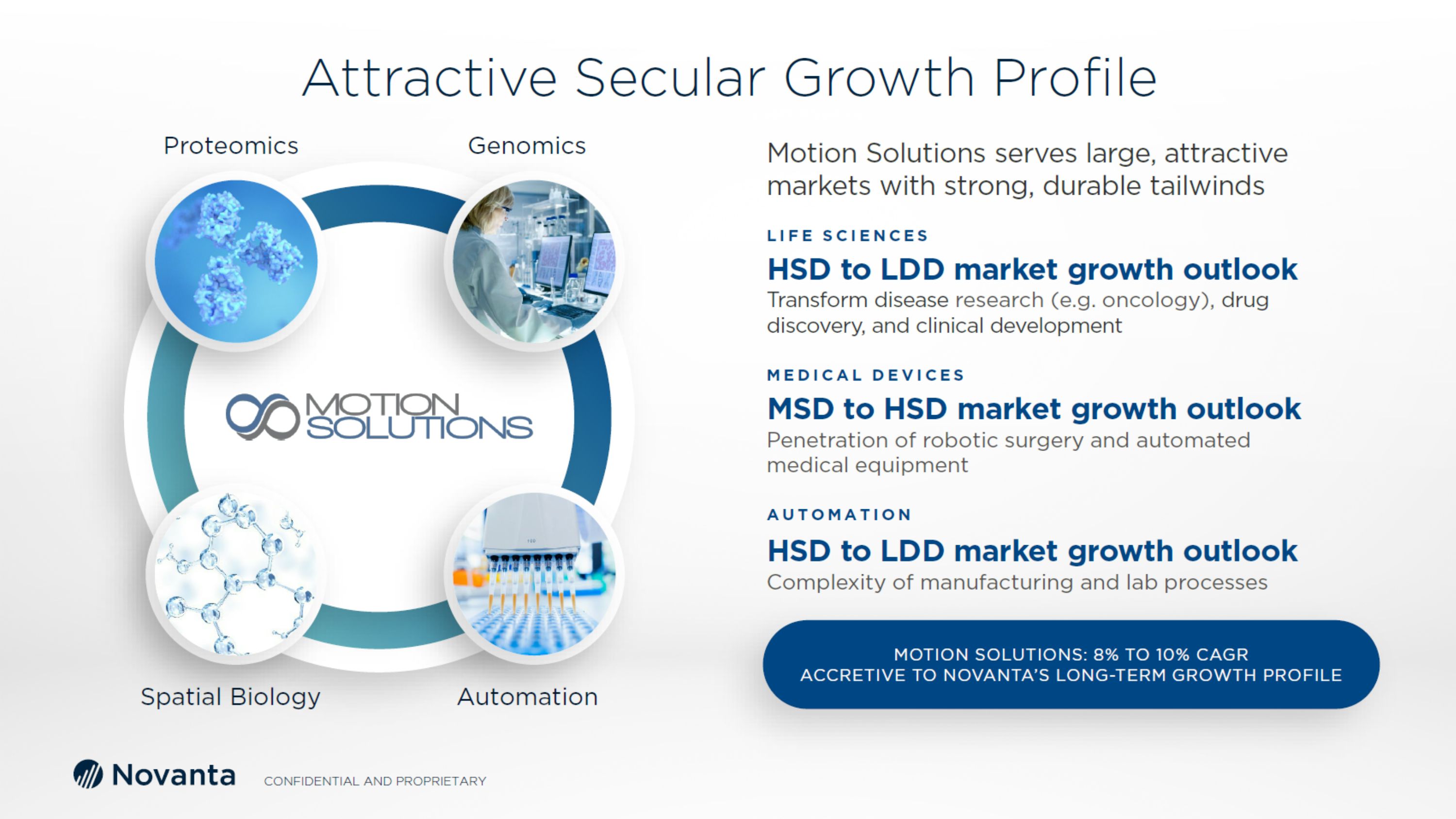

Attractive Secular Growth Profile Motion Solutions serves large, attractive markets with strong, durable tailwinds Motion solutions: 8% to 10% CAGR accretive to Novanta’s long-term growth profile Proteomics Genomics Spatial Biology Automation Life sciences HSD to LDD market growth outlookTransform disease research (e.g. oncology), drug discovery, and clinical development Medical Devices MSD to HSD market growth outlookPenetration of robotic surgery and automated medical equipment Automation HSD to LDD market growth outlookComplexity of manufacturing and lab processes

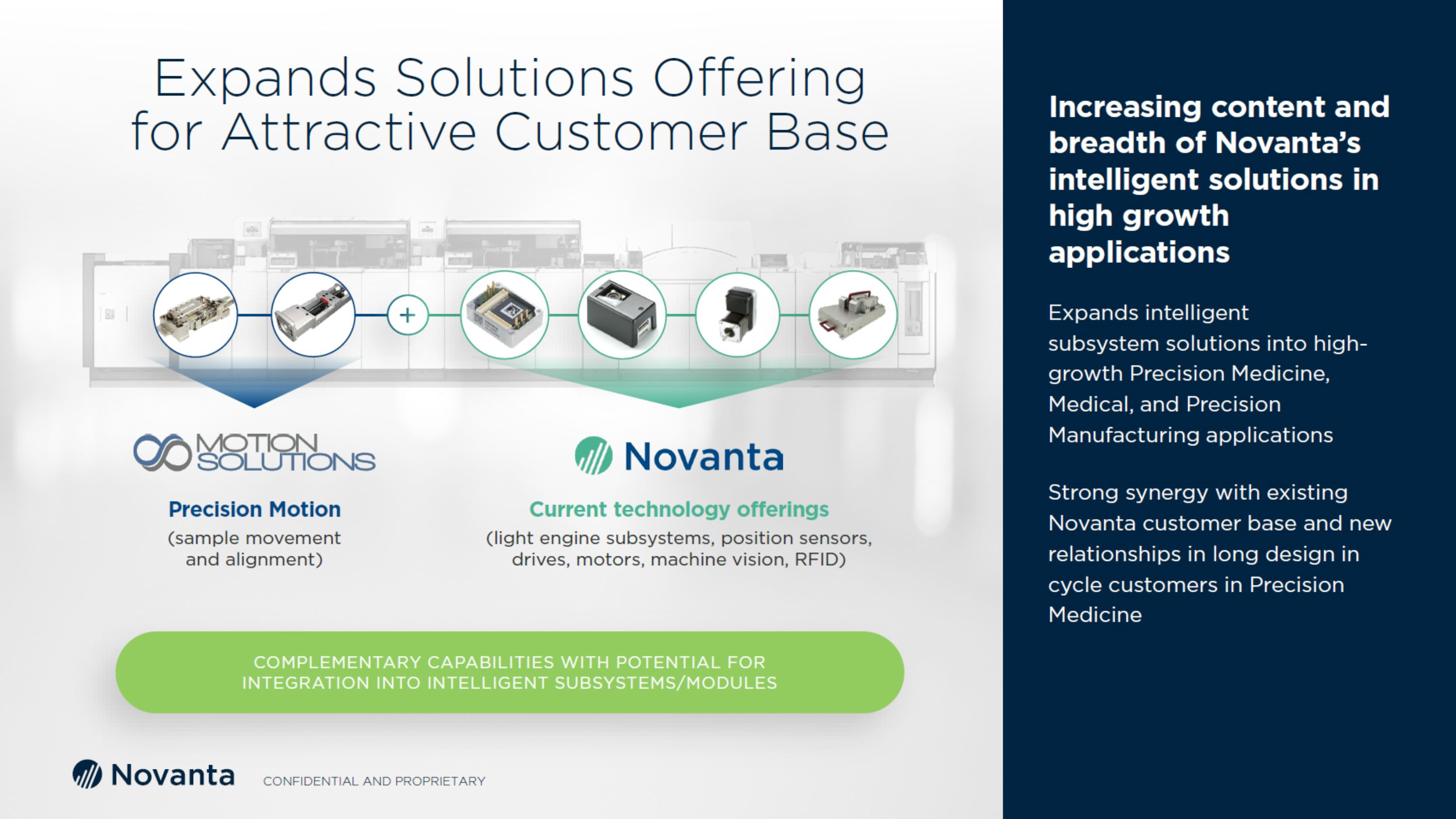

Expands Solutions Offering for Attractive Customer Base Increasing content and breadth of Novanta’s intelligent solutions in high growth applications Expands intelligent subsystem solutions into high-growth Precision Medicine, Medical, and Precision Manufacturing applications Strong synergy with existing Novanta customer base and new relationships in long design in cycle customers in Precision Medicine Complementary capabilities with potential for integration into intelligent subsystems/modules Precision Motion (sample movement and alignment) Current technology offerings (light engine subsystems, position sensors, drives, motors, machine vision, RFID) +

Adds New Talent and Capabilities ~110 employees, including significant engineering competencies +300 years of aggregate design experience in engineering team Close collaboration with customer R&D and engineering teams Market reputation for electromechanical expertise, with active presence in industry forums Headquartered in Irvine, California, with new cutting-edge facility Located in close proximity to large Life Science and Medical customer base Large clean room capacity, dedicated R&D labs Rapid prototyping capabilities Large-assembly capabilities CAPABILITIES FACILITY

Financial Highlights Upfront Purchase Price $189M Annual Sales ~$85M ROIC +10% by Year 3 Revenue growth rate accretive Adj. Gross Margin % dilutive Year 1 Adj. EBITDA Multiple ~12x FINANCIAL PROFILE Expected to close in 1Q24, financed through credit facility @ 6.6% cost of debt

Thank You

Advanced Motion SubsystemsCustomized Solutions, Precision Stages, Piezo Stages Precision motion ComponentsControls, Drives, Motors, Gearheads, Sensors, Safety Motion Solutions Product Offerings