UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 6, 2023 |

WORTHINGTON INDUSTRIES, INC.

(Exact name of Registrant as Specified in Its Charter)

Ohio |

001-08399 |

31-1189815 |

||

(State or Other Jurisdiction |

(Commission File Number) |

(IRS Employer |

||

|

|

|

|

|

200 West Old Wilson Bridge Road |

|

|||

Columbus, Ohio |

|

43085 |

||

(Address of Principal Executive Offices) |

|

(Zip Code) |

||

Registrant’s Telephone Number, Including Area Code: (614) 438-3210 |

|

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Securities registered pursuant to Section 12(b) of the Act:

|

|

Trading |

|

|

Common Shares, Without Par Value |

|

WOR |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

B. Andrew Rose, President & CEO and Joseph B. Hayek, Vice President and Chief Financial Officer of Worthington Industries, Inc. (the “Company”) will present at the Baird 2023 Global Industrials Conference in Chicago on November 8, 2023. The presentations will take place at 11:15 a.m. ET. The presentation will be webcast live and available for replay on the Company’s website at: https://ir.worthingtonindustries.com. Slides in connection with the presentation are furnished in this Current Report on Form 8-K, pursuant to this Item 7.01, as Exhibit 99.1, and are incorporated herein by reference.

This presentation will include information related to the Company’s previously announced plan to separate (the “Planned Separation”) into two independent, publicly traded companies – one company is expected to be comprised of the Company’s Steel Processing business (and will be referred to as Worthington Steel), and the other company is expected to be comprised of the Company’s Consumer Products, Building Products and Sustainable Energy Solutions businesses (and will be referred to as Worthington Enterprises).

Completion of the Planned Separation is subject to, among other things, general market conditions, finalization of the capital structure of the two companies, completion of steps necessary to qualify the Planned Separation as a tax-free transaction, receipt of regulatory approvals and final approval by the Company’s Board of Directors. The Company may, at any time and for any reason until the proposed transaction is complete, abandon the Planned Separation or modify or change its terms, including the individual businesses and components of each of the two companies. There can be no assurance regarding the ultimate timing of the Planned Separation or that the Planned Separation will ultimately occur.

The information furnished under Item 7.01 in this Current Report on Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section and shall not be deemed incorporated by reference in any filing made by the Company under the Securities Act of 1933 or the Exchange Act, except as set forth by specific reference in such filing. This Current Report on Form 8-K shall not be deemed an admission as to the materiality of any information in this Current Report on Form 8-K that is being disclosed pursuant to Regulation FD.

Safe Harbor Statement

Selected statements contained in this Current Report on Form 8-K constitute “forward-looking statements,” as that term is used in the Private Securities Litigation Reform Act of 1995 (the “Act”). The Company wishes to take advantage of the Safe Harbor provisions included in the Act. Forward-looking statements reflect the Company’s current expectations, estimates or projections concerning future results or events. These statements are often identified by the use of forward-looking words or phrases such as “believe,” “expect,” “anticipate,” “may,” “could,” “should,” “would,” “intend,” “plan,” “will,” “likely,” “estimate,” “project,” “position,” “strategy,” “target,” “aim,” “seek,” “foresee,” or other similar words or phrases. These forward-looking statements include, without limitation, statements relating to: future or expected cash positions, liquidity and ability to access financial markets and capital; outlook, strategy or business plans; the intended separation (the “Separation”) of the Company’s Steel Processing business (“Worthington Steel”) from the Company’s other businesses (“New Worthington”); the timing and method of the Separation; the anticipated benefits of the Separation; the expected financial and operational performance of, and future opportunities for, each of the two independent, publicly-traded companies following the Separation; the tax treatment of the Separation transaction; the leadership of each of the two independent, publicly-traded companies following the Separation; the ever-changing effects of the novel coronavirus (“COVID-19”) pandemic and the various responses of governmental and nongovernmental authorities thereto (such as fiscal stimulus packages, quarantines, shut downs and other restrictions on travel and commercial, social or other activities) on economies (local, national and international) and markets, and on our customers, counterparties, employees and third-party service providers; future or expected growth, growth potential, forward momentum, performance, competitive position, sales, volumes, cash flows, earnings, margins, balance sheet strengths, debt, financial condition or other financial measures; pricing trends for raw materials and finished goods and the impact of pricing changes; the ability to improve or maintain margins; expected demand or demand trends for the Company or its markets; additions to product lines and opportunities to participate in new markets; expected benefits from transformation and innovation efforts; the ability to improve performance and competitive position at the Company’s operations; anticipated working capital needs, capital expenditures and asset sales; anticipated improvements and efficiencies in costs, operations, sales, inventory management, sourcing and the supply chain and the results thereof; projected profitability potential; the ability to make acquisitions and the projected timing, results, benefits, costs, charges and expenditures related to acquisitions, joint ventures, headcount reductions and facility dispositions, shutdowns and consolidations; projected capacity and the alignment of operations with demand; the ability to operate profitably and generate cash in down markets; the ability to capture and maintain market share and to develop or take advantage of future opportunities, customer initiatives, new businesses, new products and new markets; expectations for Company and customer inventories, jobs and orders; expectations for the economy and markets or improvements therein; expectations for generating improving and sustainable earnings, earnings potential, margins or shareholder value; effects of judicial rulings; and other non-historical matters.

Because they are based on beliefs, estimates and assumptions, forward-looking statements are inherently subject to risks and uncertainties that could cause actual results to differ materially from those projected. Any number of factors could affect actual results, including, without limitation, those that follow: obtaining final approval of the Separation by the Worthington Industries, Inc. Board of Directors; the uncertainty of obtaining regulatory approvals in connection with the Separation, including rulings from the Internal Revenue Service; the ability to satisfy the necessary closing conditions to complete the Separation on a timely basis, or at all; the Company’s ability to successfully separate the two independent companies and realize the anticipated benefits of the Separation; the effect of conditions in national and worldwide financial markets, including inflation, increases in interest rates and economic recession, and with respect to the ability of financial institutions to provide capital; the risks, uncertainties and impacts related to the COVID-19 pandemic – the duration, extent and severity of which are impossible to predict, including the possibility of future resurgence in the spread of COVID-19 or variants thereof – and the availability, effectiveness and acceptance of vaccines, and other actual or potential public health emergencies and actions taken by governmental authorities or others in connection therewith; the effect of national, regional and global economic conditions generally and within major product markets, including significant economic disruptions from COVID-19, the actions taken in connection therewith and the implementation of related fiscal stimulus packages; the impact of tariffs, the adoption of trade restrictions affecting the Company’s products or suppliers, a United States (“U.S.”) withdrawal from or significant renegotiation of trade agreements, the occurrence of trade wars, the closing of border crossings, and other changes in trade regulations or relationships; changing commodity prices and/or supply; product demand and pricing; changes in product mix, product substitution and market acceptance of the Company’s products; volatility or fluctuations in the pricing, quality or availability of raw materials (particularly steel), supplies, transportation, utilities, labor and other items required by operations (especially in light of the COVID-19 pandemic and Russia’s invasion of Ukraine); effects of sourcing and supply chain constraints; the outcome of adverse claims experience with respect to workers’ compensation, product recalls or product liability, casualty events or other matters; effects of facility closures and the consolidation of operations; the effect of financial difficulties, consolidation and other changes within the steel, automotive, construction and other industries in which the Company participates; failure to maintain appropriate levels of inventories; financial difficulties (including bankruptcy filings) of original equipment manufacturers, end-users and customers, suppliers, joint venture partners and others with whom the Company does business; the ability to realize targeted expense reductions from headcount reductions, facility closures and other cost reduction efforts; the ability to realize cost savings and operational, sales and sourcing improvements and efficiencies, and other expected benefits from transformation initiatives, on a timely basis; the overall success of, and the ability to integrate, newly-acquired businesses and joint ventures, maintain and develop their customers, and achieve synergies and other expected benefits and cost savings therefrom; capacity levels and efficiencies, within facilities, within major product markets and within the industries in which the Company participates as a whole; the effect of disruption in the business of suppliers, customers, facilities and shipping operations due to adverse weather, casualty events, equipment breakdowns, labor shortages, interruption in utility services, civil unrest, international conflicts (especially in light of Russia’s invasion of Ukraine), terrorist activities or other causes; changes in customer demand, inventories, spending patterns, product choices, and supplier choices; risks associated with doing business internationally, including economic, political and social instability (especially in light of Russia’s invasion of Ukraine), foreign currency exchange rate exposure and the acceptance of the Company’s products in global markets; the ability to improve and maintain processes and business practices to keep pace with the economic, competitive and technological environment; the effect of inflation, interest rate increases and economic recession, as well as potential adverse impacts as a result of the Inflation Reduction Act of 2022, which may negatively impact the Company’s operations and financial results; deviation of actual results from estimates and/or assumptions used by the Company in the application of its significant accounting policies; the level of imports and import prices in the Company’s markets; the impact of environmental laws and regulations or the actions of the U.S. Environmental Protection Agency or similar regulators which increase costs or limit the Company’s ability to use or sell certain products; the impact of increasing environmental, greenhouse gas emission and sustainability regulations and considerations; the impact of judicial rulings and governmental regulations, both in the U.S. and abroad, including those adopted by the U.S. Securities and Exchange Commission and other governmental agencies as contemplated by the Coronavirus Aid, Relief and Economic Security (CARES) Act, the Consolidated Appropriations Act, 2021, the American Rescue Plan Act of 2021, and the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010; the effect of healthcare laws in the U.S. and potential changes for such laws, which may increase the Company’s healthcare and other costs and negatively impact the Company’s operations and financial results; the effects of tax laws in the U.S. and potential changes for such laws, which may increase the Company’s costs and negatively impact its operations and financial results; cyber security risks; the effects of privacy and information security laws and standards; and other risks described from time to time in the filings of Worthington Industries, Inc. with the U.S. Securities and Exchange Commission, including those described in “Part I – Item 1A. – Risk Factors” of the Annual Report on Form 10-K of Worthington Industries, Inc. for the fiscal year ended May 31, 2023.

The Company notes these factors for investors as contemplated by the Act. It is impossible to predict or identify all potential risk factors. Consequently, you should not consider the foregoing list to be a complete set of all potential risks and uncertainties. Any forward-looking statements in this Current Report on Form 8-K are based on current information as of the date of this Current Report on Form 8-K, and the Company assumes no obligation to correct or update any such statements in the future, except as required by applicable law.

Item 9.01 Financial Statements and Exhibits.

(a) through (c): Not applicable.

(d) Exhibits:

The following exhibits are included with this Current Report on Form 8‑K:

Exhibit No. |

|

Description |

|

|

|

99.1 |

|

|

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

WORTHINGTON INDUSTRIES, INC. |

|

|

|

|

Date: |

November 6, 2023 |

By: |

/s/Patrick J. Kennedy |

|

|

|

Patrick J. Kennedy, Vice President - |

November 8, 2023 2023 Global industrial conference Andy Rose – President & CEO Joe Hayek - CFO

Notes to Investors FORWARD LOOKING STATEMENTS. Worthington Industries, Inc. (the “Company” or “Worthington”) wishes to take advantage of the Safe Harbor provisions included in the Private Securities Litigation Reform Act of 1995 (the “Act”). Statements by the Company relating to the intended separation of Worthington’s Steel Processing business; the timing and method of the separation; the anticipated benefits of the separation; the expected financial and operating performance of, and future opportunities for, each company following the separation; the tax treatment of the transaction; the leadership of each company following the separation; and other non-historical matters constitute “forward-looking statements” within the meaning of the Act. Forward-looking statements may be characterized by terms such as “believe,” “anticipate,” “should,” “would,” “intend,” “plan,” “will,” “expect,” “estimate,” “project,” “positioned,” “strategy,” “targets,” “aims,” “seeks,” “sees” and similar expressions. Because they are based on beliefs, estimates and assumptions, forward-looking statements are inherently subject to risks and uncertainties that could cause actual results to differ materially from those projected. Any number of factors could affect actual results, including, without limitation, the final approval of the separation by our board of directors; the uncertainty of obtaining regulatory approvals in connection with the separation; the ability to satisfy the necessary closing conditions to complete the separation on a timely basis, or at all; our ability to successfully separate the two companies and realize the anticipated benefits of the separation; the risks, uncertainties and impacts, for both the Company’s business and the planned separation, related to the United Auto Workers strikes against Ford, General Motors and Stellantis North America (the “Detroit Three automakers”), and the associated impact on companies that supply the Detroit Three automakers, the duration and scope of which are impossible to predict; the effect of conditions in national and worldwide financial markets, including inflation, increases in interest rates and economic recession, and with respect to the ability of financial institutions to provide capital; the impact of tariffs, the adoption of trade restrictions affecting the Company’s products or suppliers, a United States withdrawal from or significant renegotiation of trade agreements, the occurrence of trade wars, the closing of border crossings, and other changes in trade regulations or relationships; changing oil prices and/or supply; product demand and pricing; changes in product mix, product substitution and market acceptance of the Company’s products; volatility or fluctuations in the pricing, quality or availability of raw materials (particularly steel), supplies, transportation, utilities, labor and other items required by operations (especially in light of Russia’s invasion of Ukraine); effects of sourcing and supply chain constraints; the outcome of adverse claims experience with respect to workers’ compensation, product recalls or product liability, casualty events or other matters; effects of facility closures and the consolidation of operations; the effect of financial difficulties, consolidation and other changes within the steel, automotive, construction and other industries in which the Company participates; failure to maintain appropriate levels of inventories; financial difficulties (including bankruptcy filings) of original equipment manufacturers, end-users and customers, suppliers, joint venture partners and others with whom the Company does business; the ability to realize targeted expense reductions from headcount reductions, facility closures and other cost reduction efforts; the ability to realize cost savings and operational, sales and sourcing improvements and efficiencies, and other expected benefits from transformation initiatives, on a timely basis; the overall success of, and the ability to integrate, newly-acquired businesses and joint ventures, maintain and develop their customers, and achieve synergies and other expected benefits and cost savings therefrom; capacity levels and efficiencies, within facilities, within major product markets and within the industries in which the Company participates as a whole; the effect of disruption in the business of suppliers, customers, facilities and shipping operations due to adverse weather, casualty events, equipment breakdowns, labor shortages, interruption in utility services, civil unrest, international conflicts (especially in light of Russia’s invasion of Ukraine), terrorist activities or other causes; changes in customer demand, inventories, spending patterns, product choices, and supplier choices; risks associated with doing business internationally, including economic, political and social instability (especially in light of Russia’s invasion of Ukraine), foreign currency exchange rate exposure and the acceptance of the Company’s products in global markets; the ability to improve and maintain processes and business practices to keep pace with the economic, competitive and technological environment; the effect of inflation, interest rate increases and economic recession, as well as potential adverse impacts as a result of the Inflation Reduction Act of 2022, which may negatively impact the Company’s operations and financial results; deviation of actual results from estimates and/or assumptions used by the Company in the application of its significant accounting policies; the level of imports and import prices in the Company’s markets; the impact of environmental laws and regulations or the actions of the United States Environmental Protection Agency or similar regulators which increase costs or limit the Company’s ability to use or sell certain products; the impact of increasing environmental, greenhouse gas emission and sustainability considerations or regulations; the impact of judicial rulings and governmental regulations, both in the United States and abroad, including those adopted by the United States Securities and Exchange Commission (“SEC”) and other governmental agencies as contemplated by the Coronavirus Aid, Relief and Economic Security (CARES) Act, the Consolidated Appropriations Act, 2021, the American Rescue Act of 2021, and the Dodd-Frank Wall Street Reform and the Consumer Protection Act of 2010; the effect of healthcare laws in the United States and potential changes for such laws, especially in light of the COVID-19 pandemic which may increase the Company’s healthcare and other costs and negatively impact the Company’s operations and financial results; the effect of tax laws in the U.S. and potential changes for such laws, which may increase the Company's costs and negatively impact its operations and financial results; cyber security risks; the effects of privacy and information security laws and standards; and other risks described from time to time in the filings of Worthington Industries, Inc. with the SEC, including those described in “Part I — Item 1A. — Risk Factors” of Worthington’s Annual Report on Form 10-K for the fiscal year ended May 31, 2023, and its subsequent filings with the SEC. Forward-looking statements should be construed in the light of such risks. Readers are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date made. Worthington does not undertake, and hereby disclaim, any obligation to update any forward-looking statements, whether as a result of new information, future developments or otherwise. 2

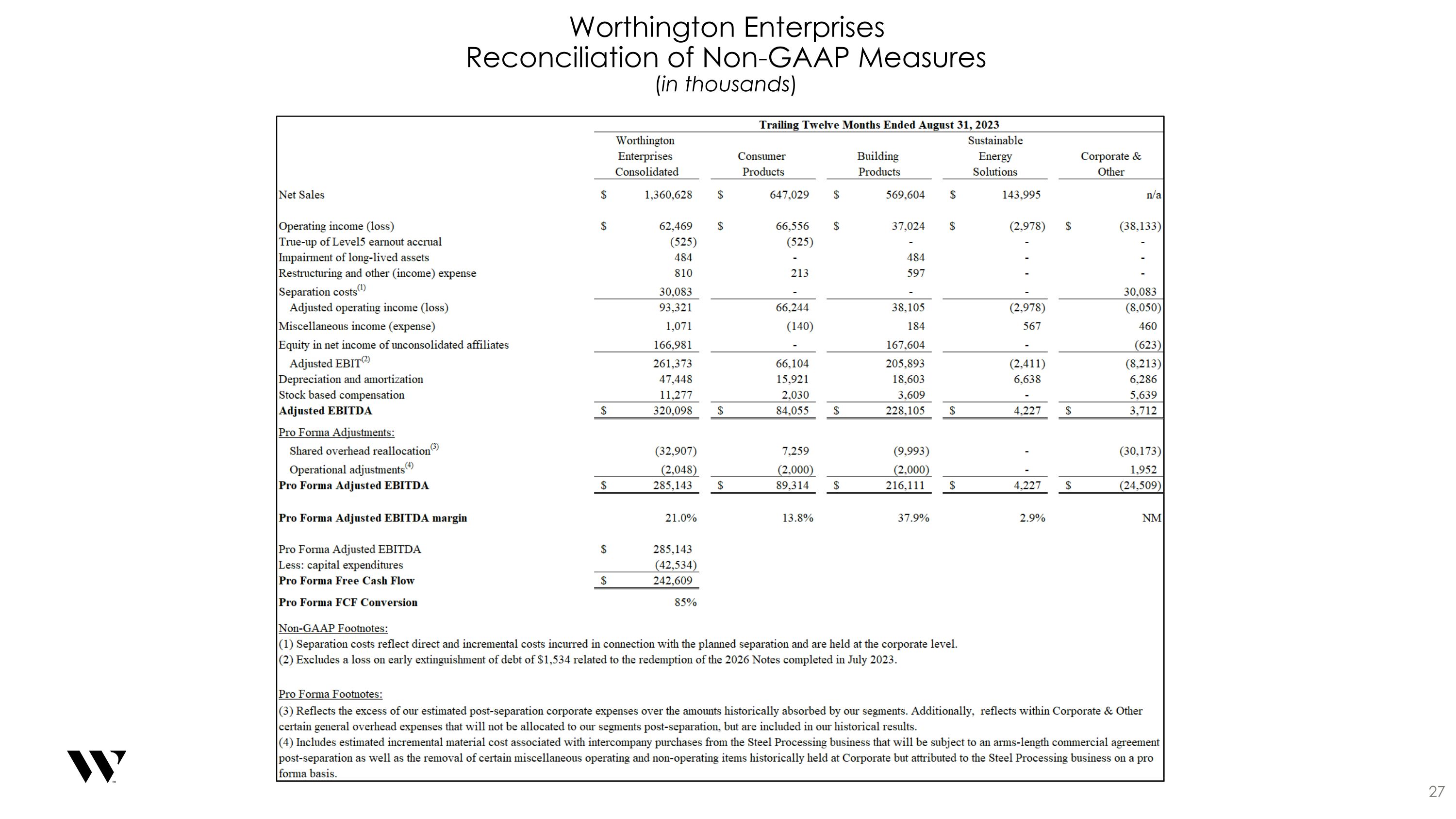

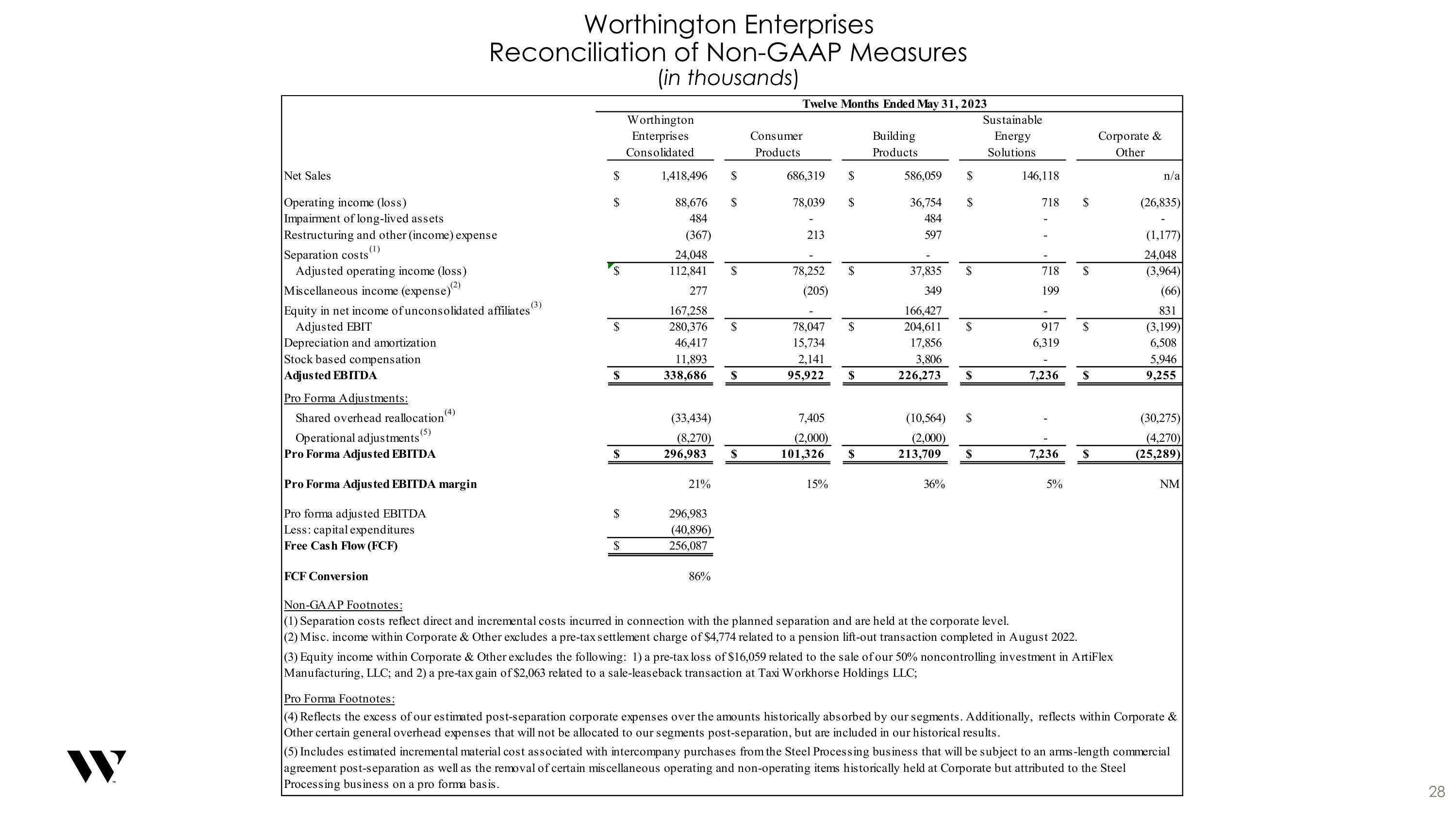

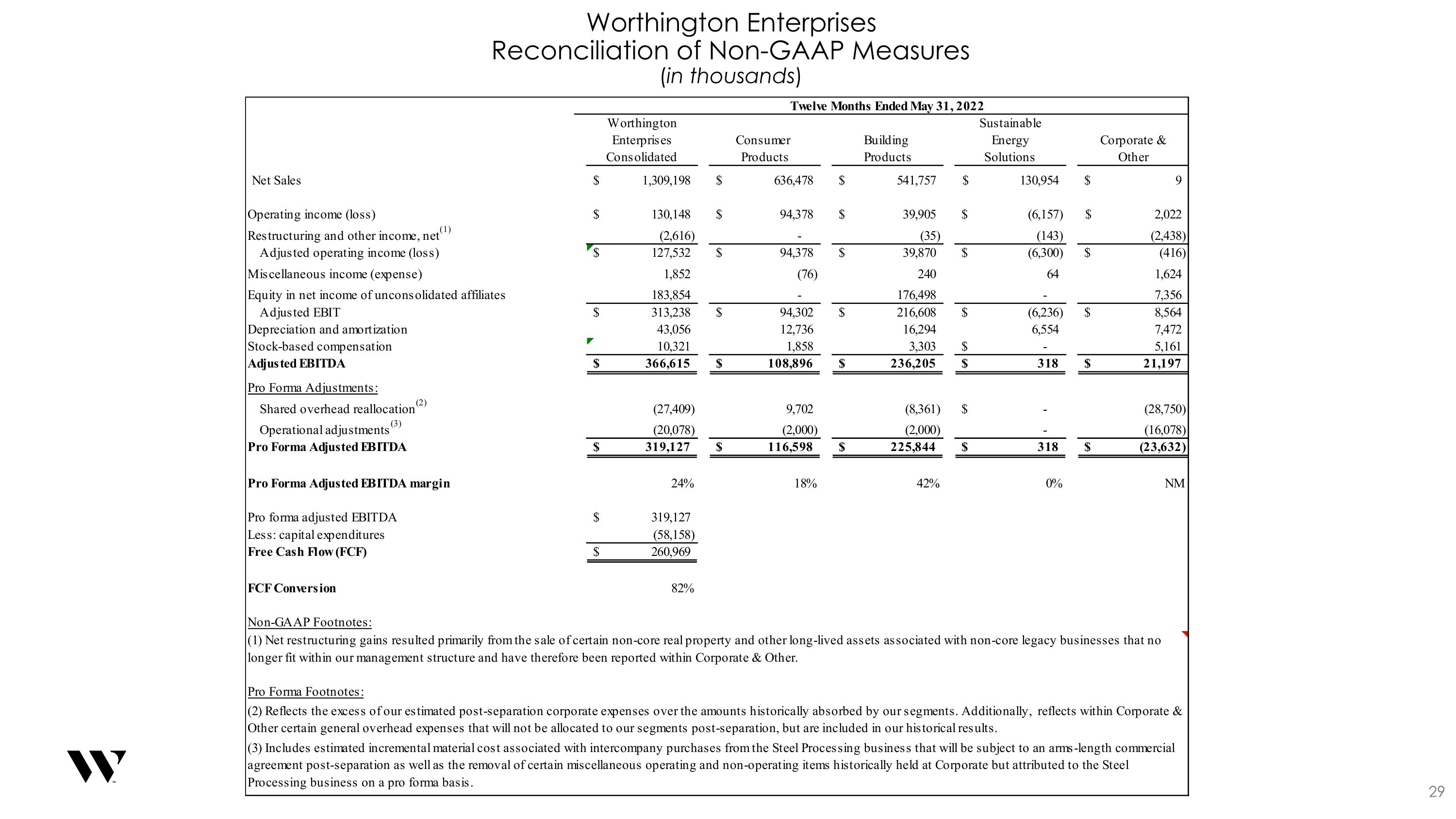

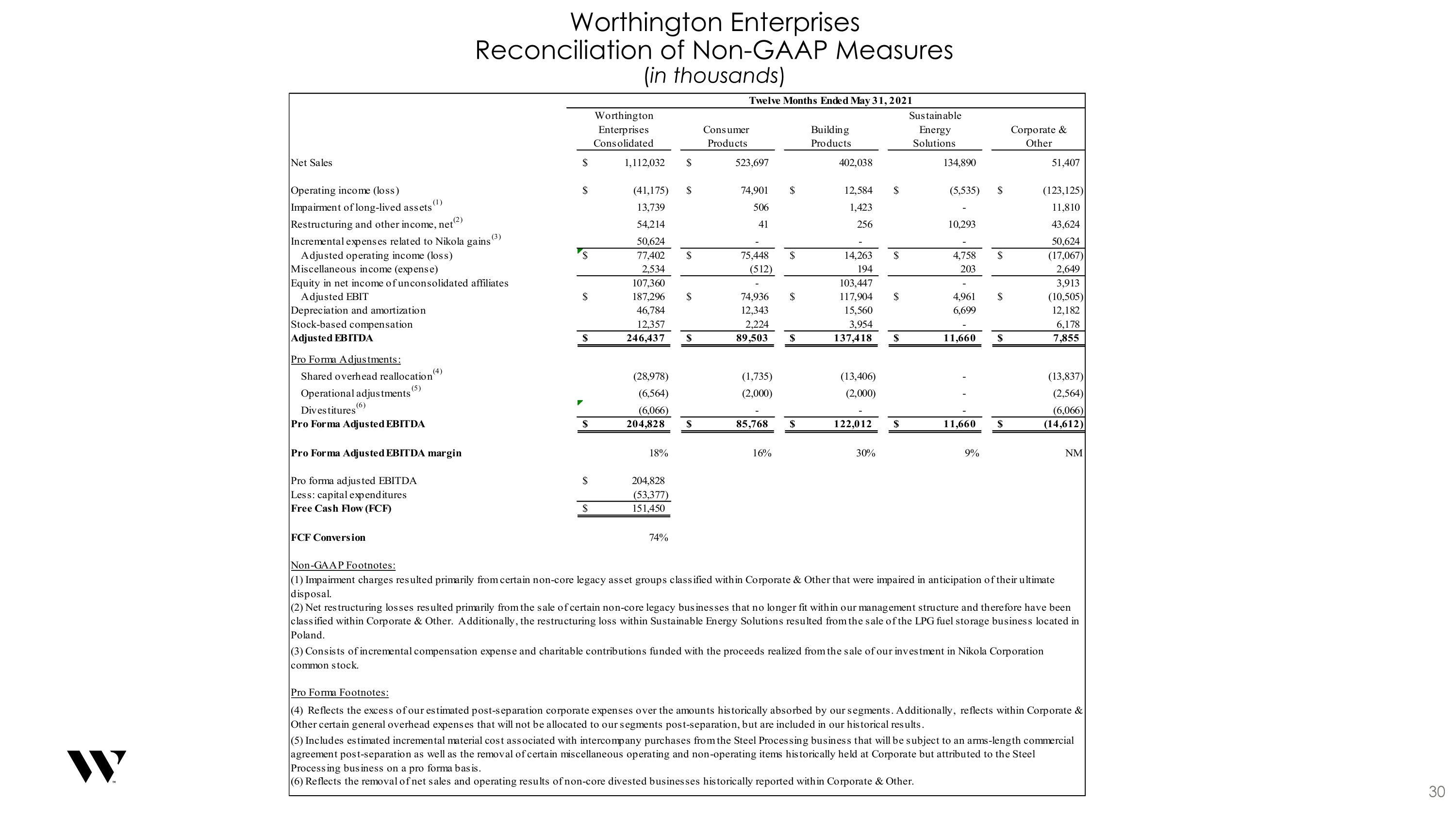

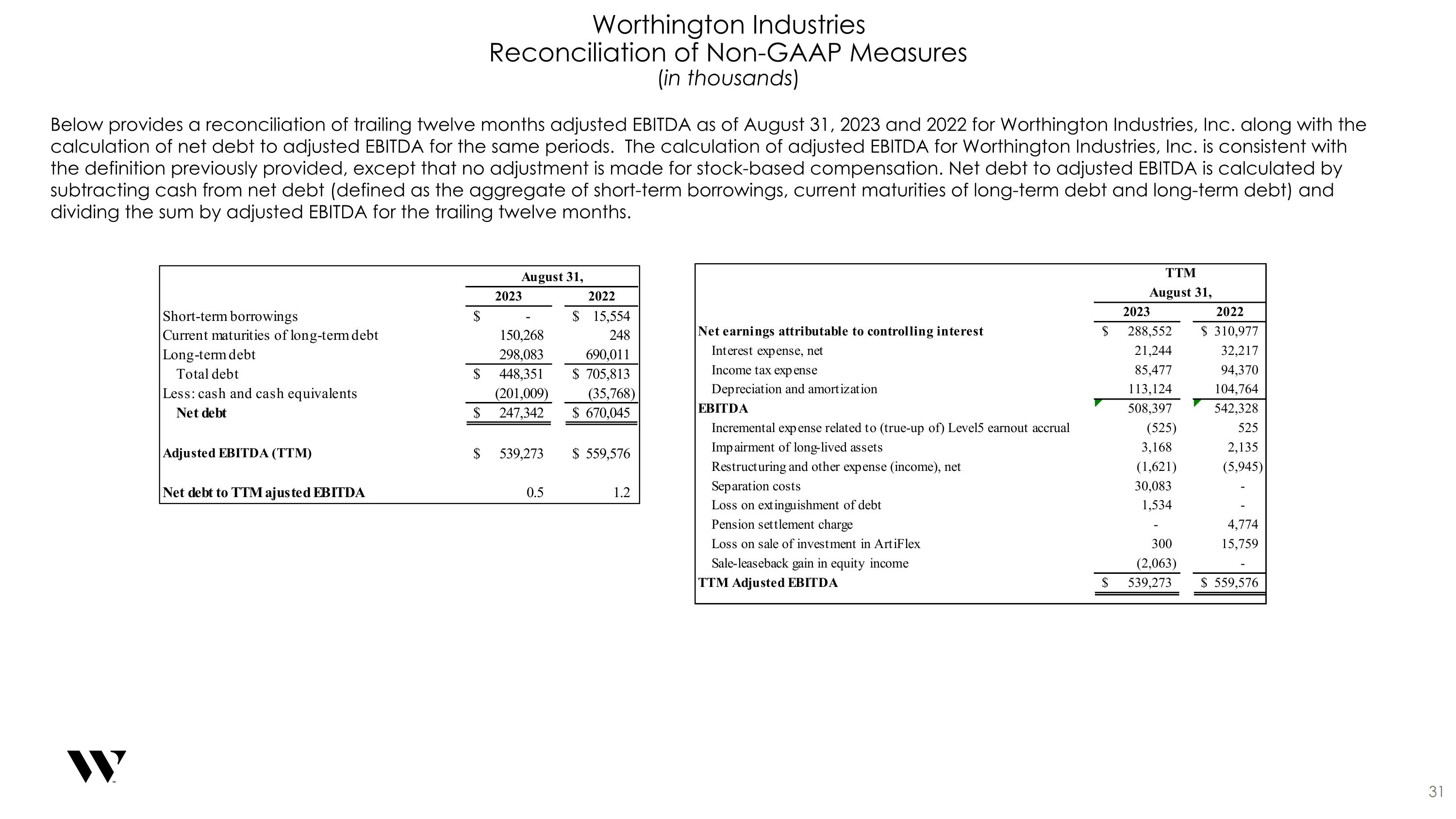

Notes to Investors 3 PRO FORMA FINANCIAL INFORMATION. Unless otherwise specified, all financial data and operating metrics included in these materials are presented on a pro forma basis giving effect to the reorganization and the planned separation of the Steel Processing business, as described in the Form 10 filed with the Securities and Exchange Commission, and divested operations historically presented within Other. NON-GAAP MEASURES. These materials include certain financial measures that are not calculated in accordance with U.S. generally accepted accounting principles, or GAAP. Management believes these non-GAAP measures provide useful supplemental information on the performance of the Company’s ongoing operations and should not be considered as an alternative to the comparable GAAP measure. Additionally, management believes these non-GAAP measures allow for meaningful comparisons and analysis of trends in the Company’s businesses and enables investors to evaluate operations and future prospects in the same manner as management. A reconciliation of each non-GAAP measure to its most directly comparable GAAP measure is included in the Appendix. The following provides an explanation of each non-GAAP measure presented in these materials: Adjusted EBITDA is defined as Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization, and consists of EBITDA (calculated by adding or subtracting, as appropriate, interest expense, income tax expense and depreciation and amortization to/from net earnings attributable to controlling interest), which is further adjusted to exclude impairment and restructuring charges (gains) as well as other items that management believes are not reflective of, and thus should not be included when evaluating the performance of its ongoing operations, including incremental costs associated with the planned separation. Adjusted EBITDA also excludes stock-based compensation due to its non-cash nature. In prior periods, Adjusted EBITDA did not exclude stock-based compensation. However, management now believes that further excluding stock-based compensation from Adjusted EBITDA is useful to better understand the financial performance of our business and to facilitate a better comparison of our results to those of our peer companies over multiple periods given that this item may vary between companies for reasons unrelated to overall operating performance. Impairment charges are excluded from adjusted EBITDA because they do not occur in the ordinary course of our ongoing business operations, are inherently unpredictable in timing and amount, and are non-cash, which we believe facilitates the comparison of historical, current and forecasted financial results Restructuring activities, which can result in both discrete gains and/or losses, consist of established programs that are not part of our ongoing operations, such as divestitures, closing or consolidating facilities, employee severance (including rationalizing headcount or other significant changes in personnel), and realignment of existing operations (including changes to management structure in response to underlying performance and/or changing market conditions). Adjusted EBITDA Margin is calculated by dividing Adjusted EBITDA by net sales. Free Cash Flow is defined as Adjusted EBITDA less capital expenditures. Free Cash Flow Conversion is calculated by dividing Free Cash by Adjusted EBITDA.

The Planned Separation Will Create Two Market-Leading, Independent Public Companies A market-leader with premier brands in attractive end markets in Consumer Products, Building Products, and Sustainable Energy Solutions High margins and asset-light business model enable strong cash flow generation Growth strategy driven by focus on sustainable, technology-enabled solutions disrupting mature markets A best-in-class, value-added steel processor with a blue-chip customer base in growing end-markets A market-leader in electrical steel laminations and automotive lightweighting solutions capitalizing on electrification, sustainability and infrastructure spending Sophisticated supply chain and pricing solutions to manage complex programs for customers, grow market share and increase margins Andy Rose Chief Executive Officer Geoff Gilmore Chief Executive Officer Joseph Hayek Chief Financial Officer Tim Adams Chief Financial Officer Improved Strategic Focus and Differentiated Investment Theses 4 Worthington Enterprises Worthington Steel

Worthington Enterprises is a Compelling Standalone Investment Story…. Strategic Focus Enhanced focus on strategic priorities Timing We have now achieved the scale, financial strength and capabilities to operate on a standalone basis Differentiation Compelling and distinct growth strategy Flexibility Tailored decision-making and strategic capital allocation decisions Aligned Investor Base Clear-cut value proposition and differentiated investment thesis with comparable company peers Tailored Capital Structures Strong balance sheet and free cash flow to execute on strategic M&A 5 Worthington Enterprises is positioned to deliver long-term growth and sustainable value creation …and Now is the Right Time to Separate

Worthington Enterprises Key Investment Highlights 1 TTM figures as of Q1 FY24. Sales exclude pro-rata share of unconsolidated JV sales. Percentages do not add up to 100% due to rounding. NET SALES OF $1.4 BILLION1 Net Sales by End-Market1 Building Products Sustainable Energy Solutions Consumer Products 6 Founded in 1955 Established Portfolio of Market-Leading Brands with High Barriers to Entry Strong Underlying Secular Trends Enabling Steady Long-Term Growth Business Model Drives High Free Cash Flow and Returns Worthington Business System Accelerates Growth and Profitability Innovation For Highly Engineered Products Drives Incremental Sales and Margin Guided by Our Philosophy – a People-First, Performance-Based Culture Low Leverage and Ample Liquidity Provides Financial Flexibility

Established Portfolio of Market-Leading Brands… 80%+ of Adjusted EBITDA comes from brands and products with leading market positions Camping Fuel Metal Framing Ceiling Suspension Systems Vertical Residential Heating Tanks Portable Helium Tanks Hand Torch And Fuels Well WaterTanks 7 Note: FY2023 period. North America only. Based on management estimates.

…With High Barriers-to-Entry Innovative Products and Services – Driving Innovation Into Mature Markets Robust Industry Knowledge – 68-Year History Providing Specialized, Technical Industry Expertise Reliability, Speed & Product Quality – Exceptional Quality, Service, and Supply Chain Solutions Manufacturing at Scale – Automation Enabling Enhanced Efficiency in Production Across Niche Markets Highly Engineered Solutions – Meeting Rigorous Specifications in Highly Regulated Markets 8 High Margin, Asset-Light Business Model, Generating Strong Cash Flow and Returns

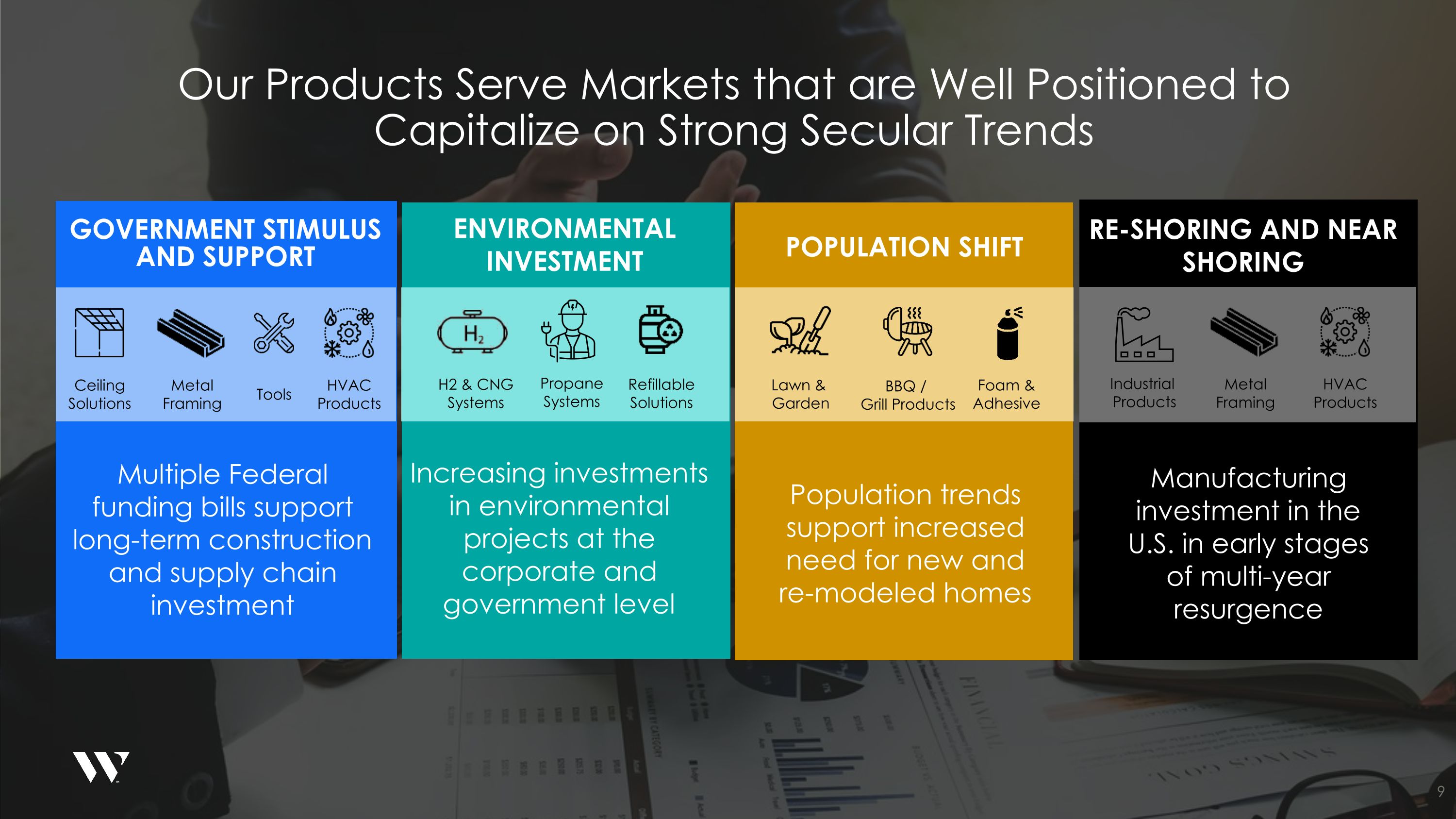

Our Products Serve Markets that are Well Positioned to Capitalize on Strong Secular Trends Re-shoring and Near Shoring 9 Propane Systems Government Stimulus and Support CeilingSolutions Tools HVACProducts MetalFraming Multiple Federal funding bills support long-term construction and supply chain investment Environmental Investment H2 & CNG Systems RefillableSolutions Increasing investments in environmental projects at the corporate and government level Manufacturing investment in the U.S. in early stages of multi-year resurgence Population trends support increased need for new and re-modeled homes Population Shift Lawn & Garden BBQ / Grill Products Propane Systems Foam & Adhesive MetalFraming Industrial Products HVACProducts

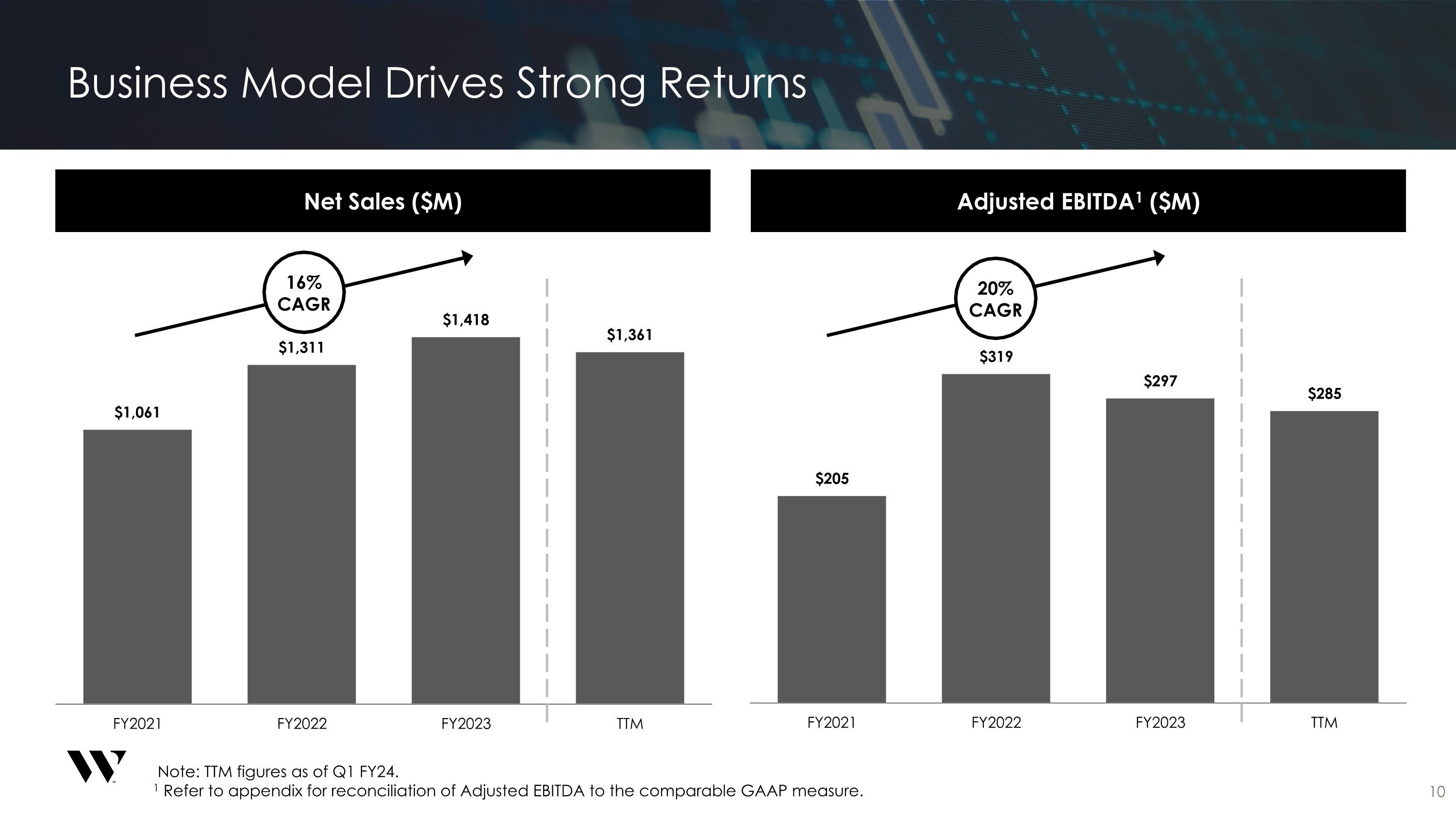

Business Model Drives Strong Returns Net Sales ($M) Adjusted EBITDA1 ($M) 10 Note: TTM figures as of Q1 FY24. 1 Refer to appendix for reconciliation of Adjusted EBITDA to the comparable GAAP measure. 16%CAGR 20%CAGR

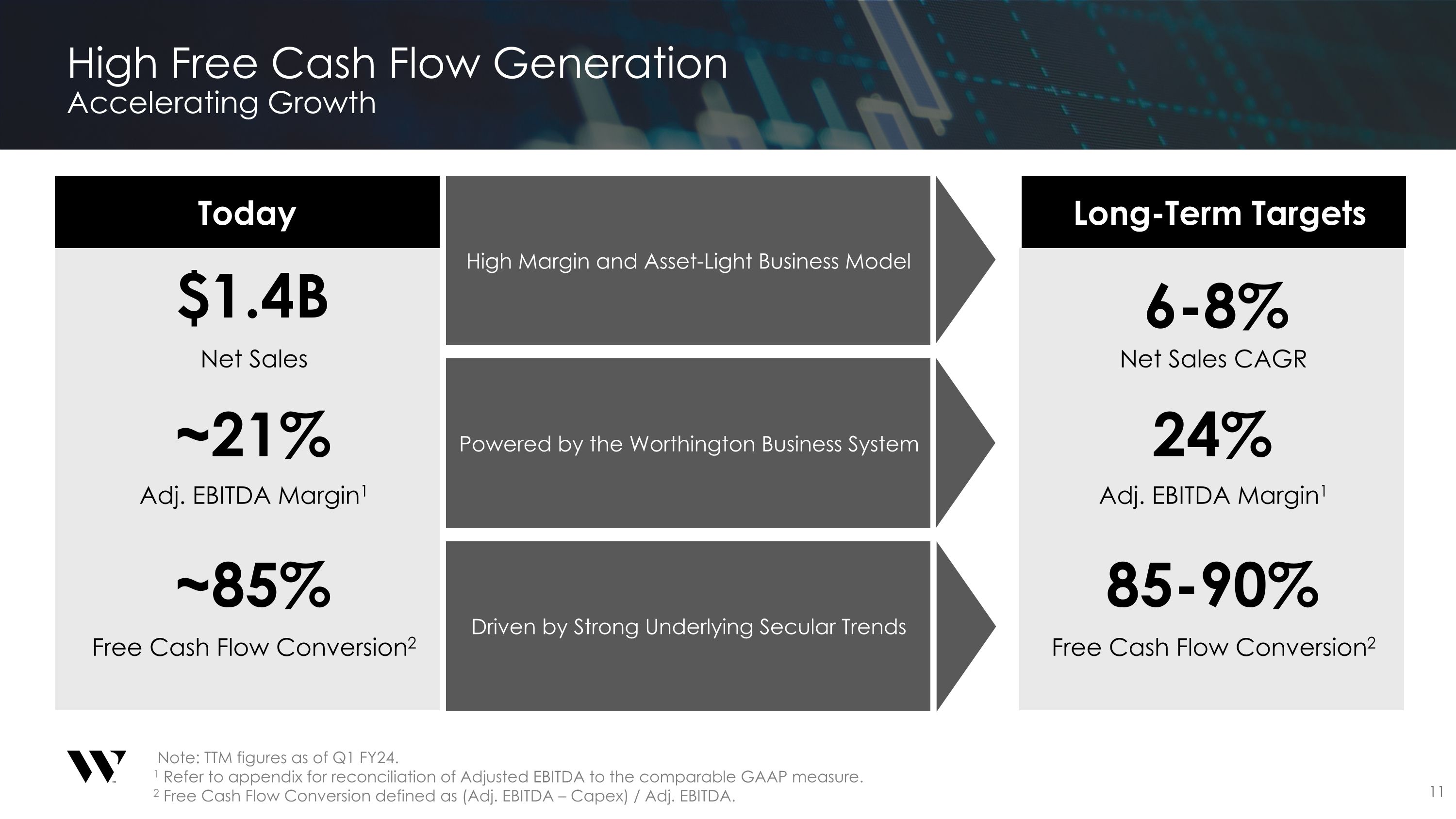

High Free Cash Flow Generation Accelerating Growth Net Sales CAGR 24% Adj. EBITDA Margin1 85-90% Free Cash Flow Conversion2 $1.4B Net Sales ~21% Adj. EBITDA Margin1 ~85% Free Cash Flow Conversion2 11 High Margin and Asset-Light Business Model Powered by the Worthington Business System Driven by Strong Underlying Secular Trends Long-Term Targets Today Note: TTM figures as of Q1 FY24.1 Refer to appendix for reconciliation of Adjusted EBITDA to the comparable GAAP measure.2 Free Cash Flow Conversion defined as (Adj. EBITDA – Capex) / Adj. EBITDA. 6-8%

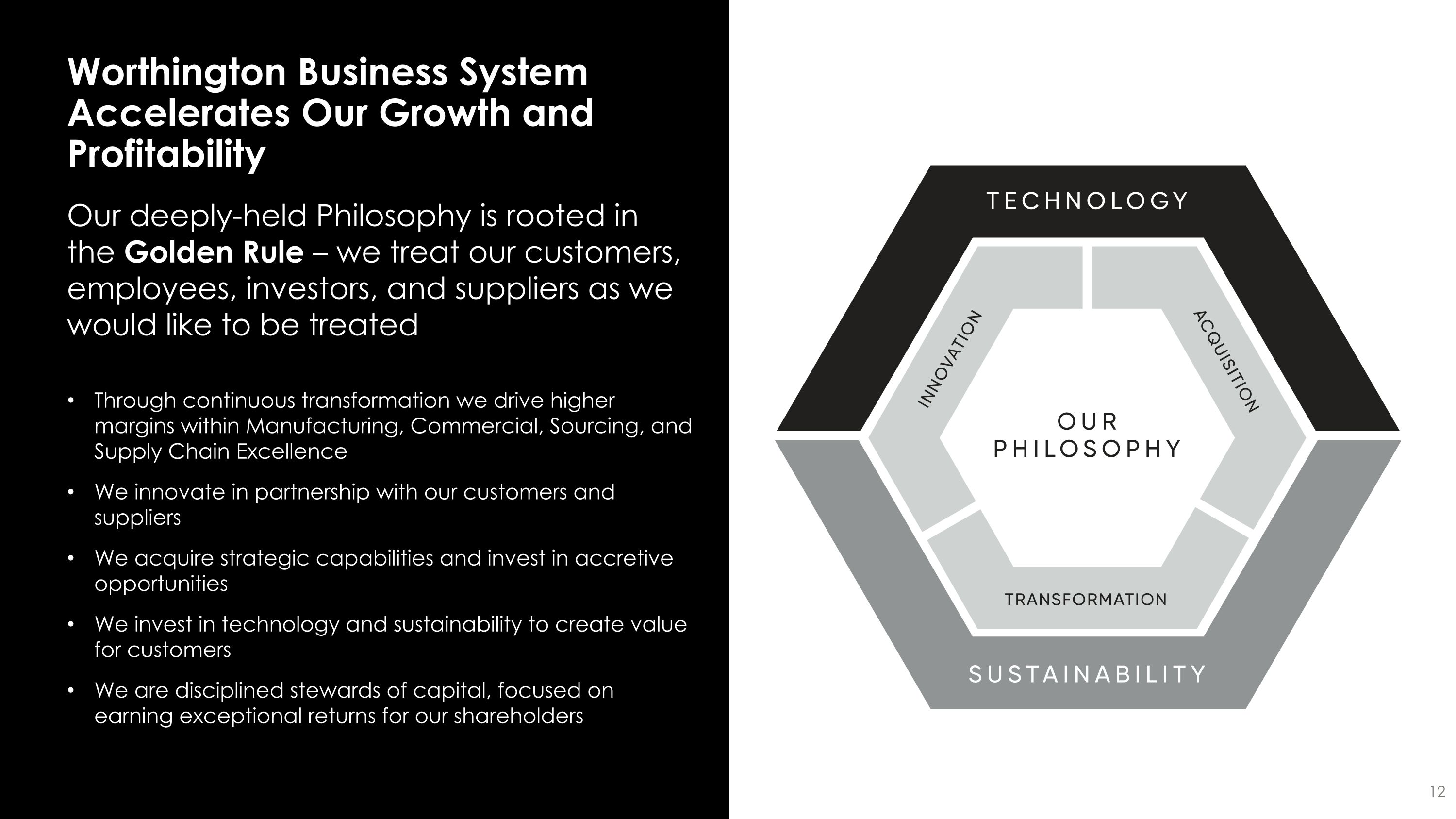

Worthington Business System Accelerates Our Growth and Profitability Our deeply-held Philosophy is rooted in the Golden Rule – we treat our customers, employees, investors, and suppliers as we would like to be treated Through continuous transformation we drive higher margins within Manufacturing, Commercial, Sourcing, and Supply Chain Excellence We innovate in partnership with our customers and suppliers We acquire strategic capabilities and invest in accretive opportunities We invest in technology and sustainability to create value for customers We are disciplined stewards of capital, focused on earning exceptional returns for our shareholders 12

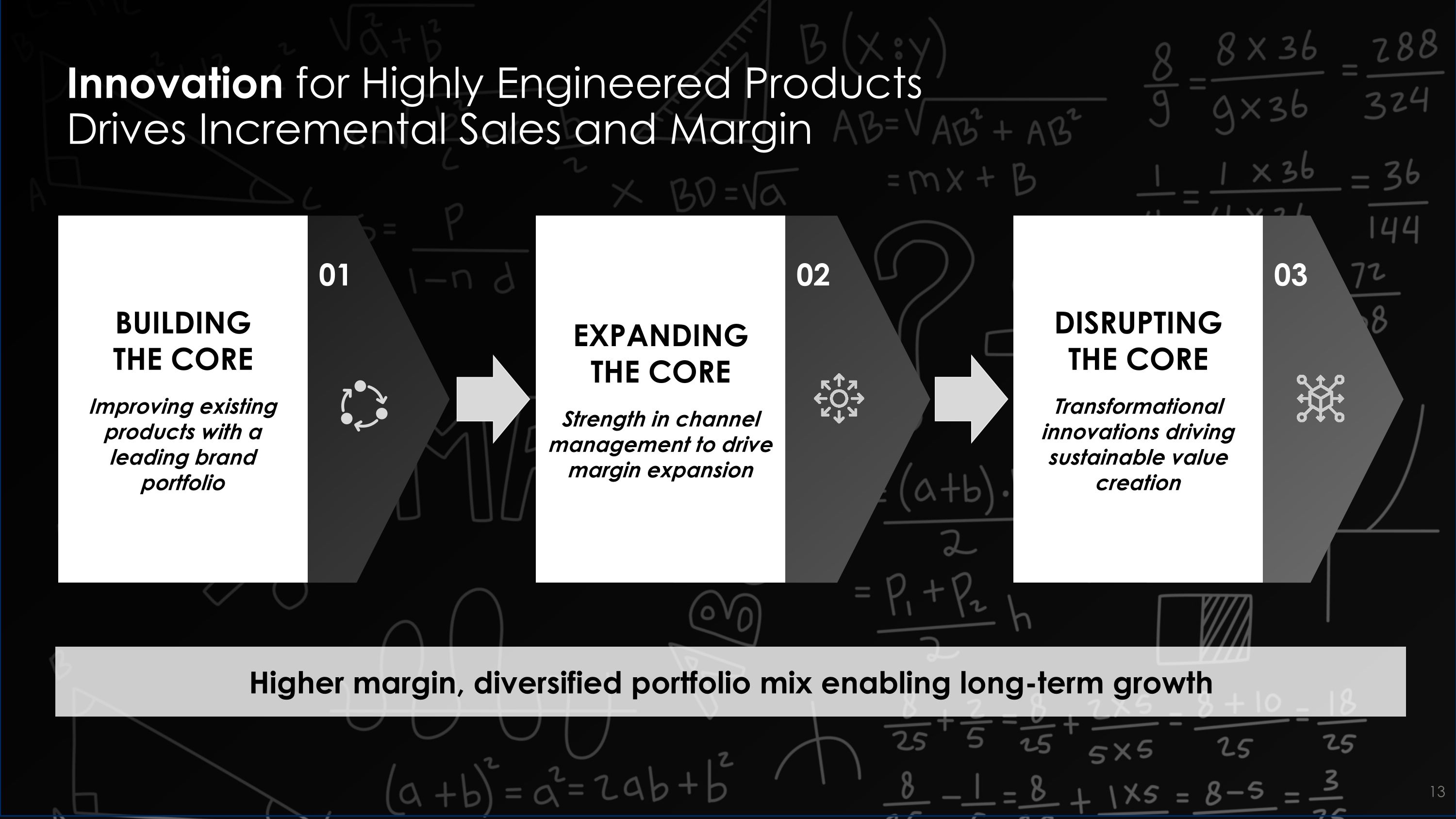

Innovation for Highly Engineered Products Drives Incremental Sales and Margin BUILDING THE CORE Improving existingproducts with a leading brand portfolio 01 02 EXPANDING THE CORE Strength in channel management to drive margin expansion 03 DISRUPTING THE CORE Transformational innovations driving sustainable value creation 13 Higher margin, diversified portfolio mix enabling long-term growth

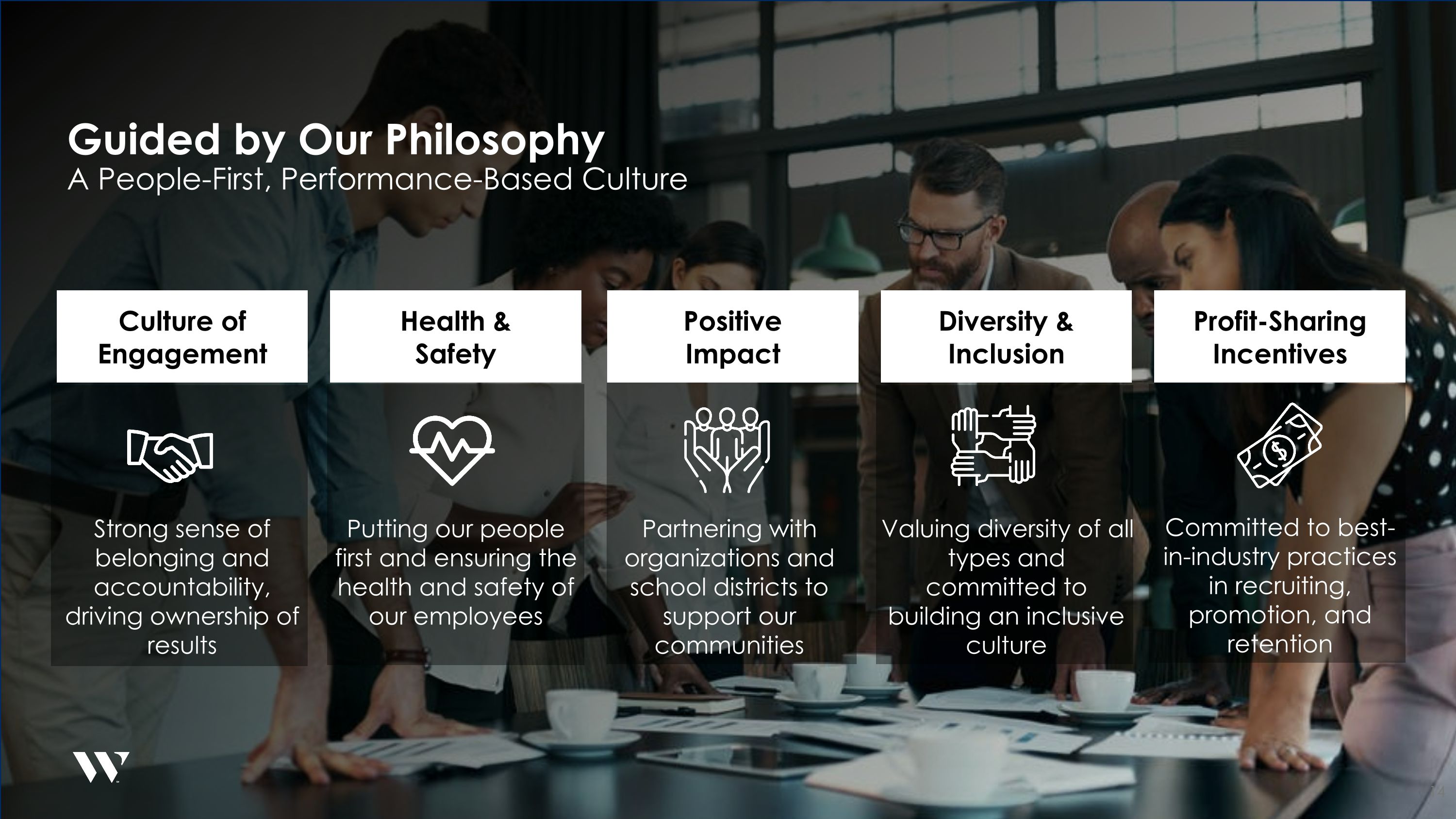

Guided by Our Philosophy A People-First, Performance-Based Culture Health & Safety Putting our people first and ensuring the health and safety of our employees Profit-Sharing Incentives Committed to best-in-industry practices in recruiting, promotion, and retention Diversity & Inclusion Valuing diversity of all types and committed to building an inclusive culture Positive Impact Partnering with organizations and school districts to support our communities Culture of Engagement Strong sense of belonging and accountability, driving ownership of results 14

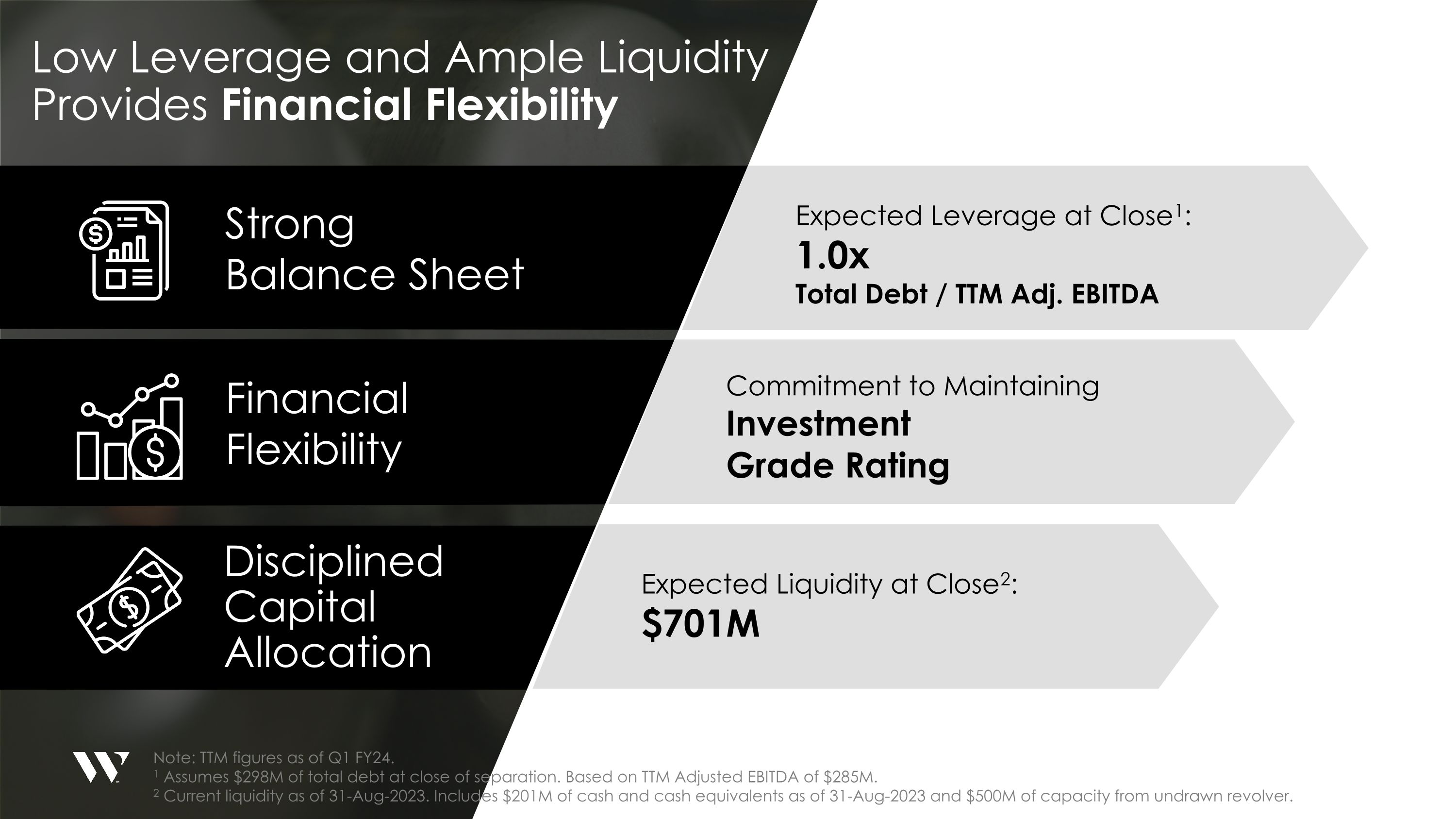

Low Leverage and Ample Liquidity Provides Financial Flexibility Strong Balance Sheet 15 Financial Flexibility Disciplined Capital Allocation Note: TTM figures as of Q1 FY24.1 Assumes $298M of total debt at close of separation. Based on TTM Adjusted EBITDA of $285M. 2 Current liquidity as of 31-Aug-2023. Includes $201M of cash and cash equivalents as of 31-Aug-2023 and $500M of capacity from undrawn revolver. Commitment to Maintaining Investment Grade Rating Expected Liquidity at Close2: $701M Expected Leverage at Close1: 1.0x Total Debt / TTM Adj. EBITDA

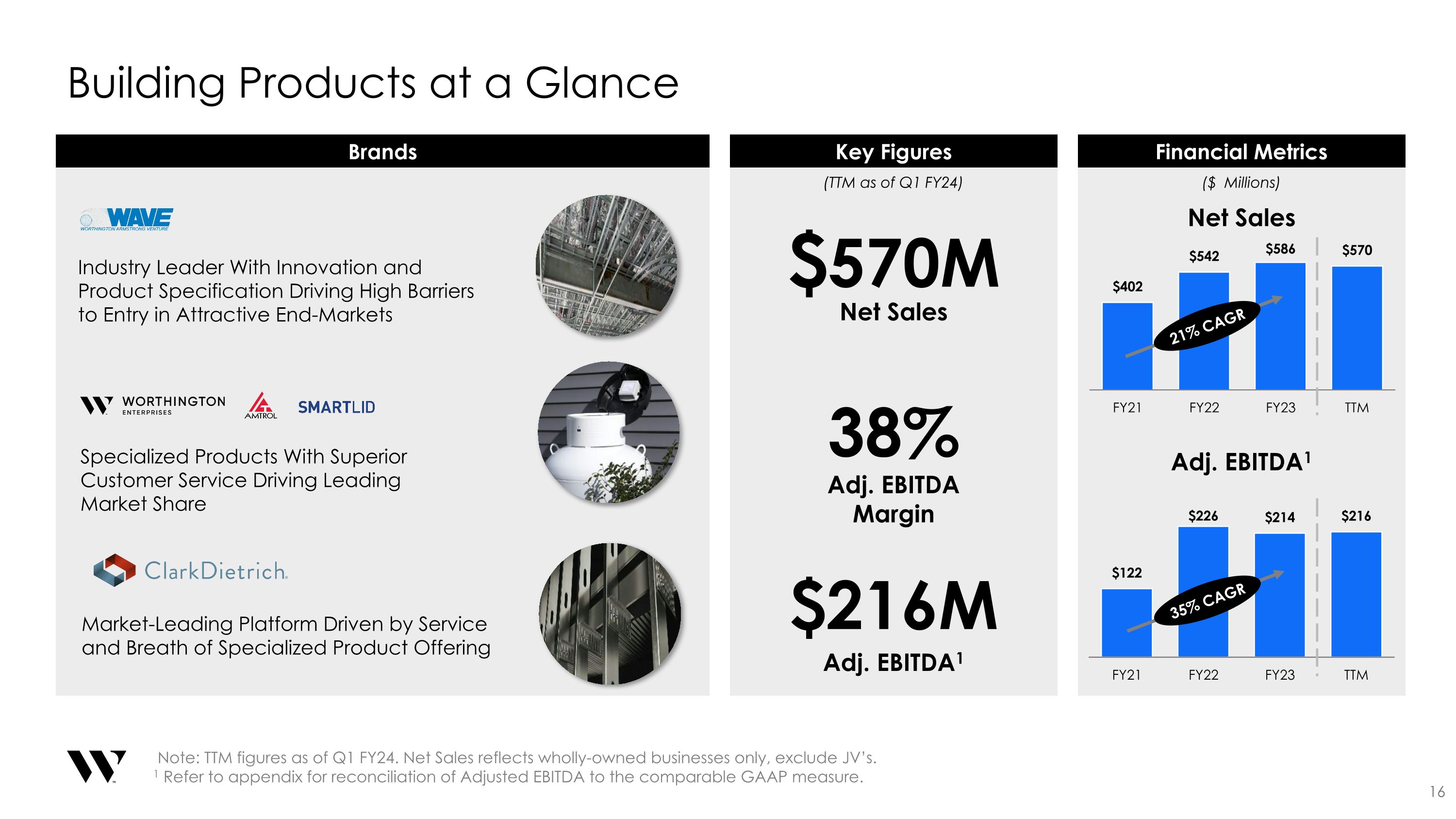

Building Products at a Glance Brands Financial Metrics Key Figures $570M Net Sales 38% Adj. EBITDA Margin $216M Adj. EBITDA1 Adj. EBITDA1 ($ Millions) Specialized Products With Superior Customer Service Driving Leading Market Share Industry Leader With Innovation and Product Specification Driving High Barriers to Entry in Attractive End-Markets Market-Leading Platform Driven by Service and Breath of Specialized Product Offering Net Sales 16 (TTM as of Q1 FY24) Note: TTM figures as of Q1 FY24. Net Sales reflects wholly-owned businesses only, exclude JV’s.1 Refer to appendix for reconciliation of Adjusted EBITDA to the comparable GAAP measure. 21% CAGR 35% CAGR

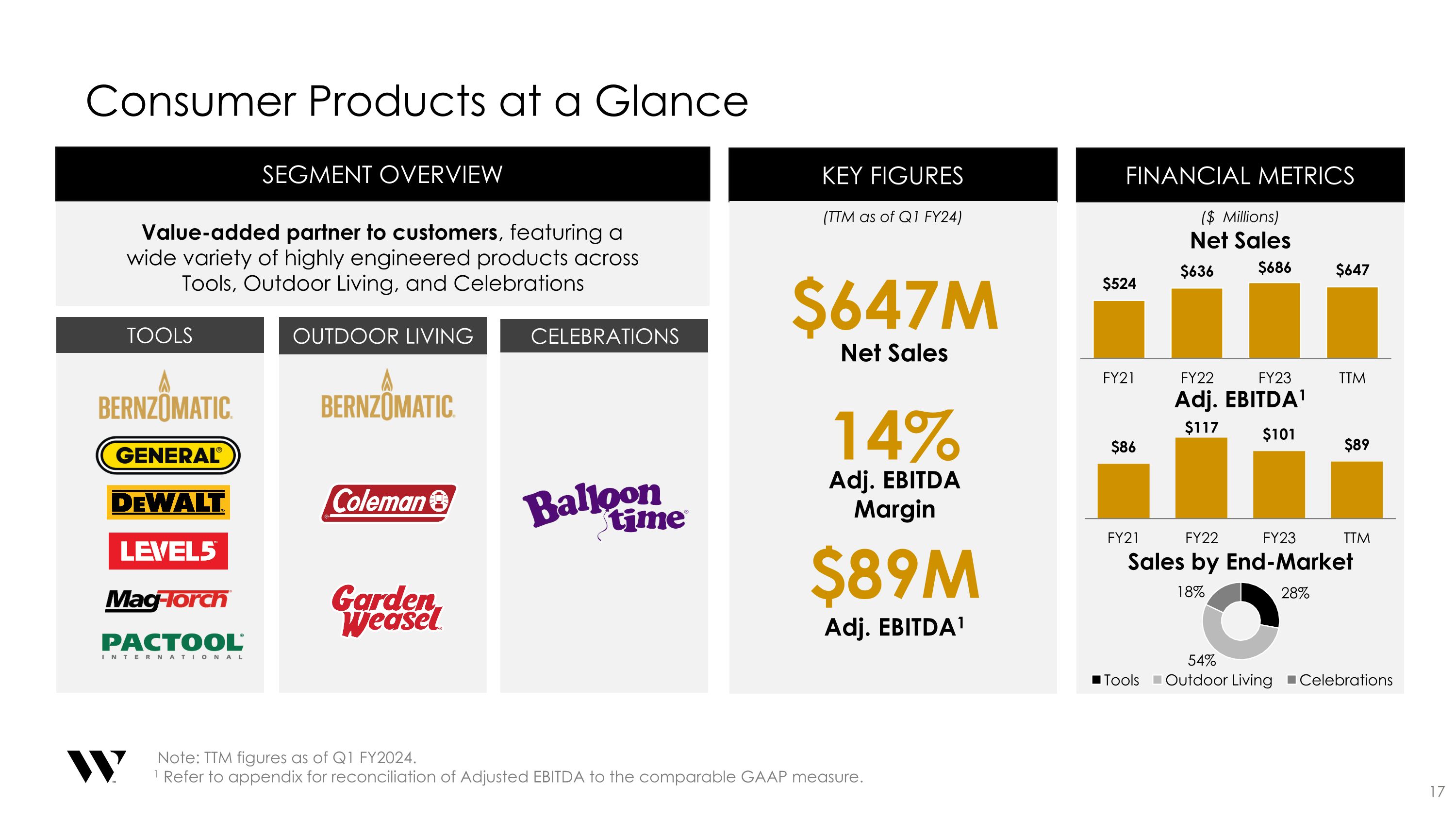

Segment Overview Value-added partner to customers, featuring a wide variety of highly engineered products across Tools, Outdoor Living, and Celebrations Tools Outdoor Living Celebrations 17 Key Figures $647M Net Sales 14% Adj. EBITDA Margin $89M Adj. EBITDA1 (TTM as of Q1 FY24) Financial Metrics Net Sales Adj. EBITDA1 ($ Millions) Sales by End-Market Note: TTM figures as of Q1 FY2024.1 Refer to appendix for reconciliation of Adjusted EBITDA to the comparable GAAP measure. Consumer Products at a Glance

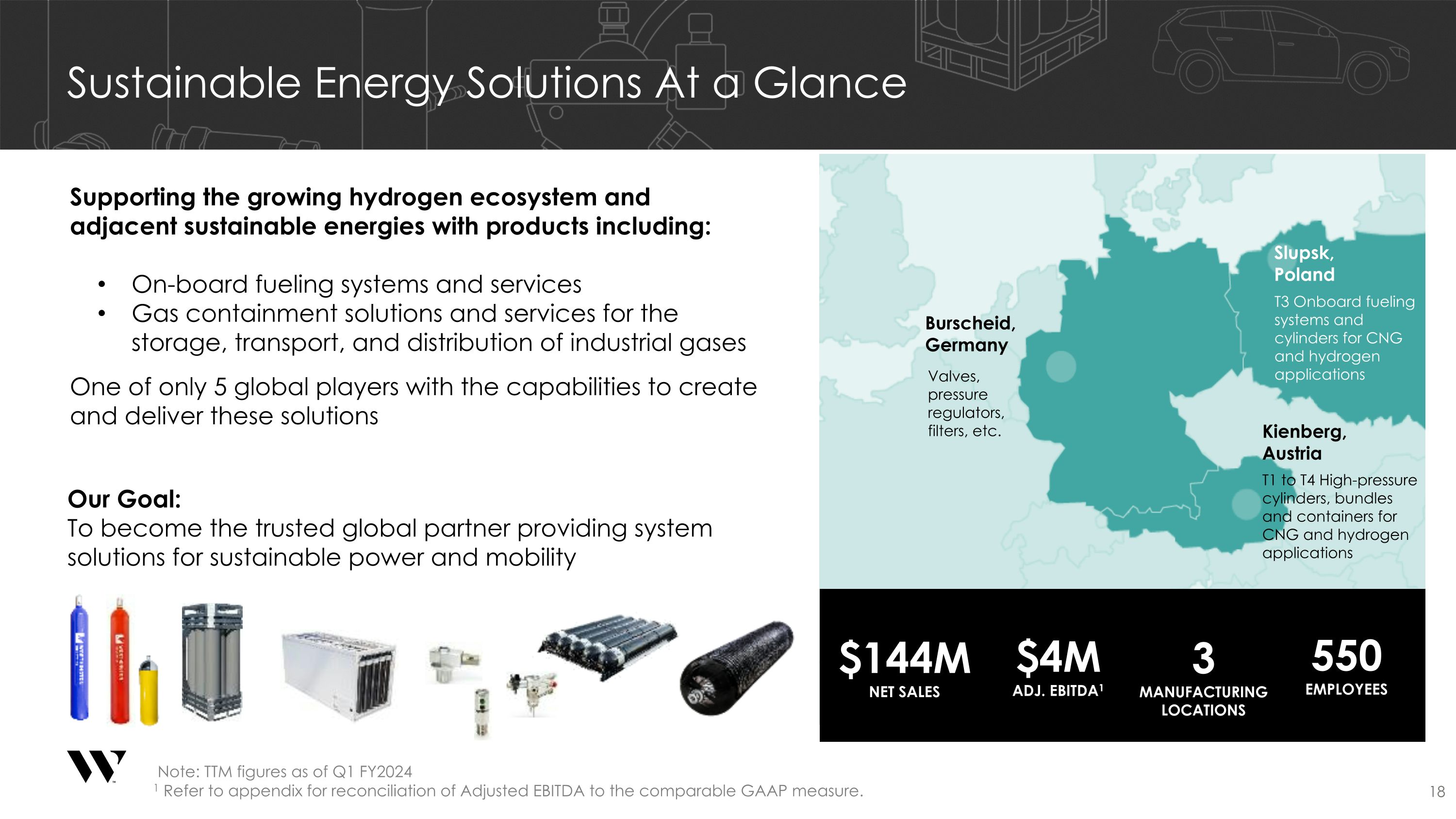

Sustainable Energy Solutions At a Glance Valves, pressure regulators, filters, etc. T1 to T4 High-pressure cylinders, bundles and containers for CNG and hydrogen applications Slupsk, Poland Kienberg, Austria Burscheid, Germany T3 Onboard fueling systems and cylinders for CNG and hydrogen applications Our Goal: To become the trusted global partner providing system solutions for sustainable power and mobility Supporting the growing hydrogen ecosystem and adjacent sustainable energies with products including: On-board fueling systems and services Gas containment solutions and services for the storage, transport, and distribution of industrial gases One of only 5 global players with the capabilities to create and deliver these solutions 18 Note: TTM figures as of Q1 FY2024 1 Refer to appendix for reconciliation of Adjusted EBITDA to the comparable GAAP measure. 550 EMPLOYEES $144M NET SALES 3 MANUFACTURING LOCATIONS $4M ADJ. EBITDA1

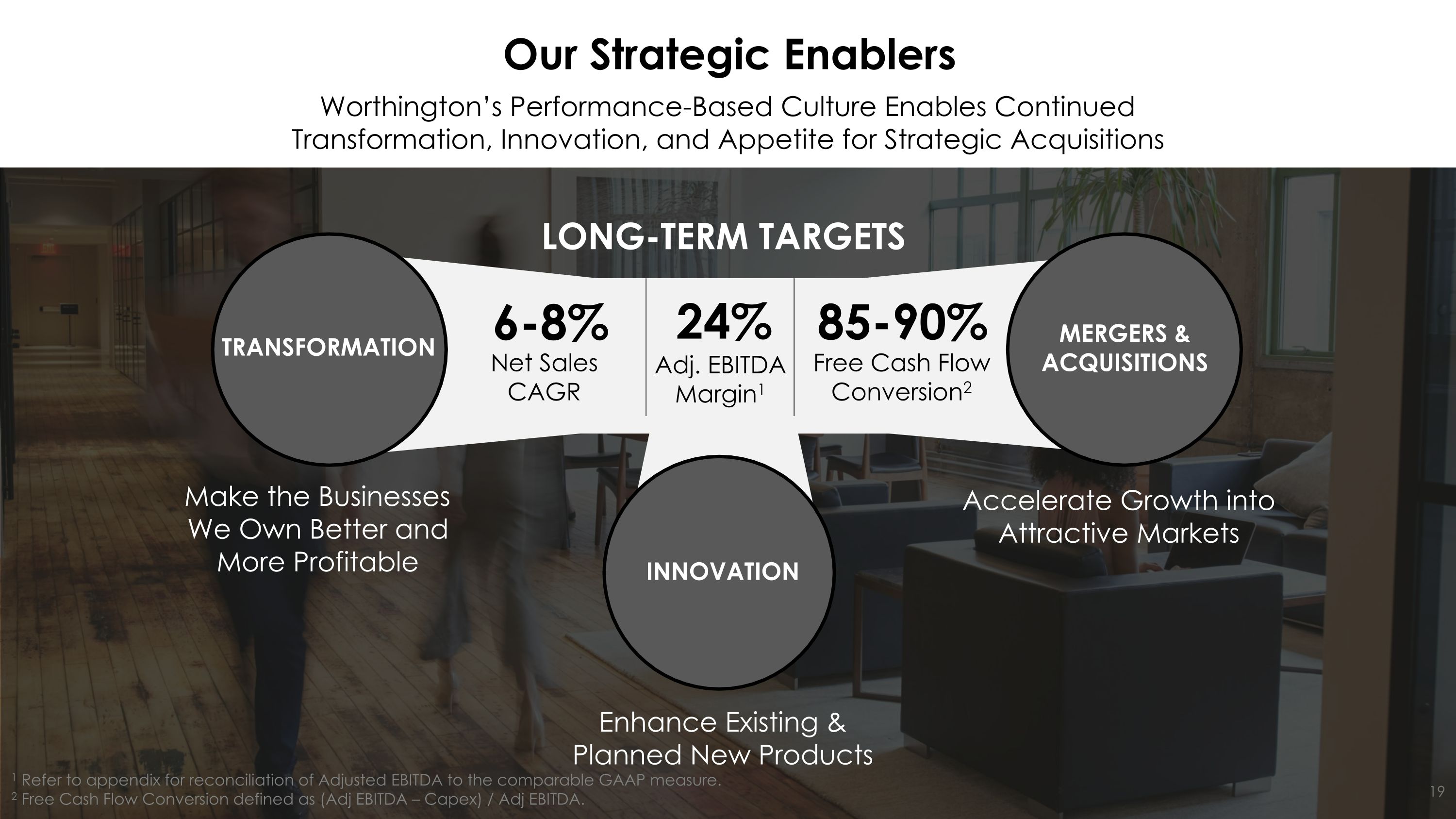

Our Strategic Enablers Worthington’s Performance-Based Culture Enables Continued Transformation, Innovation, and Appetite for Strategic Acquisitions 1 Refer to appendix for reconciliation of Adjusted EBITDA to the comparable GAAP measure.2 Free Cash Flow Conversion defined as (Adj EBITDA – Capex) / Adj EBITDA. 19 Make the Businesses We Own Better and More Profitable INNOVATION Accelerate Growth into Attractive Markets Net Sales CAGR 6-8% 24% Adj. EBITDA Margin1 85-90% Free Cash Flow Conversion2 Long-term Targets Enhance Existing & Planned New Products TRANSFORMATION Mergers & Acquisitions

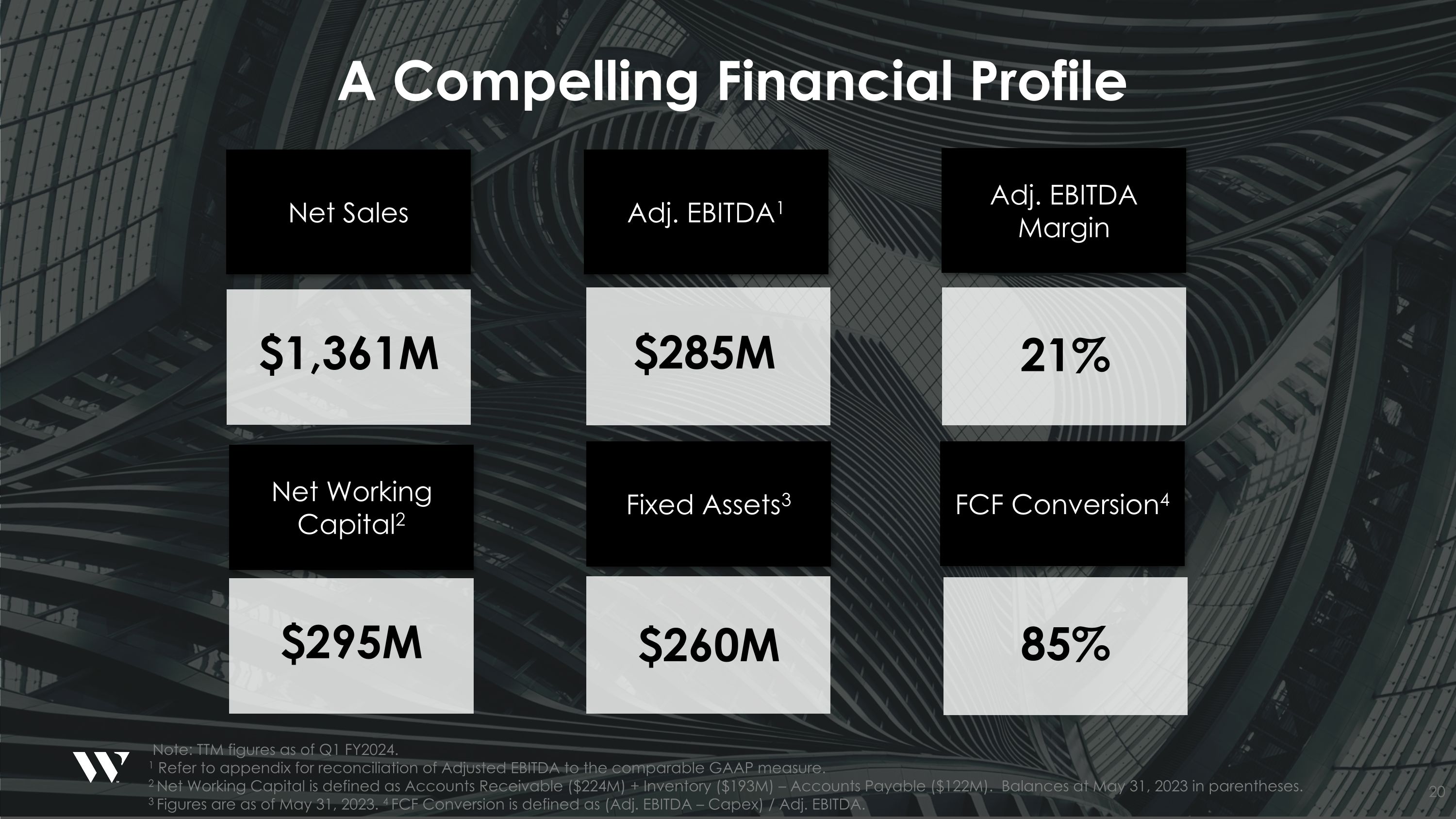

A Compelling Financial Profile Net Sales Adj. EBITDA1 Adj. EBITDA Margin $1,361M 21% $285M 20 Note: TTM figures as of Q1 FY2024.1 Refer to appendix for reconciliation of Adjusted EBITDA to the comparable GAAP measure. 2 Net Working Capital is defined as Accounts Receivable ($224M) + Inventory ($193M) – Accounts Payable ($122M). Balances at May 31, 2023 in parentheses. 3 Figures are as of May 31, 2023. 4 FCF Conversion is defined as (Adj. EBITDA – Capex) / Adj. EBITDA. Net Working Capital2 Fixed Assets3 FCF Conversion4 $295M 85% $260M

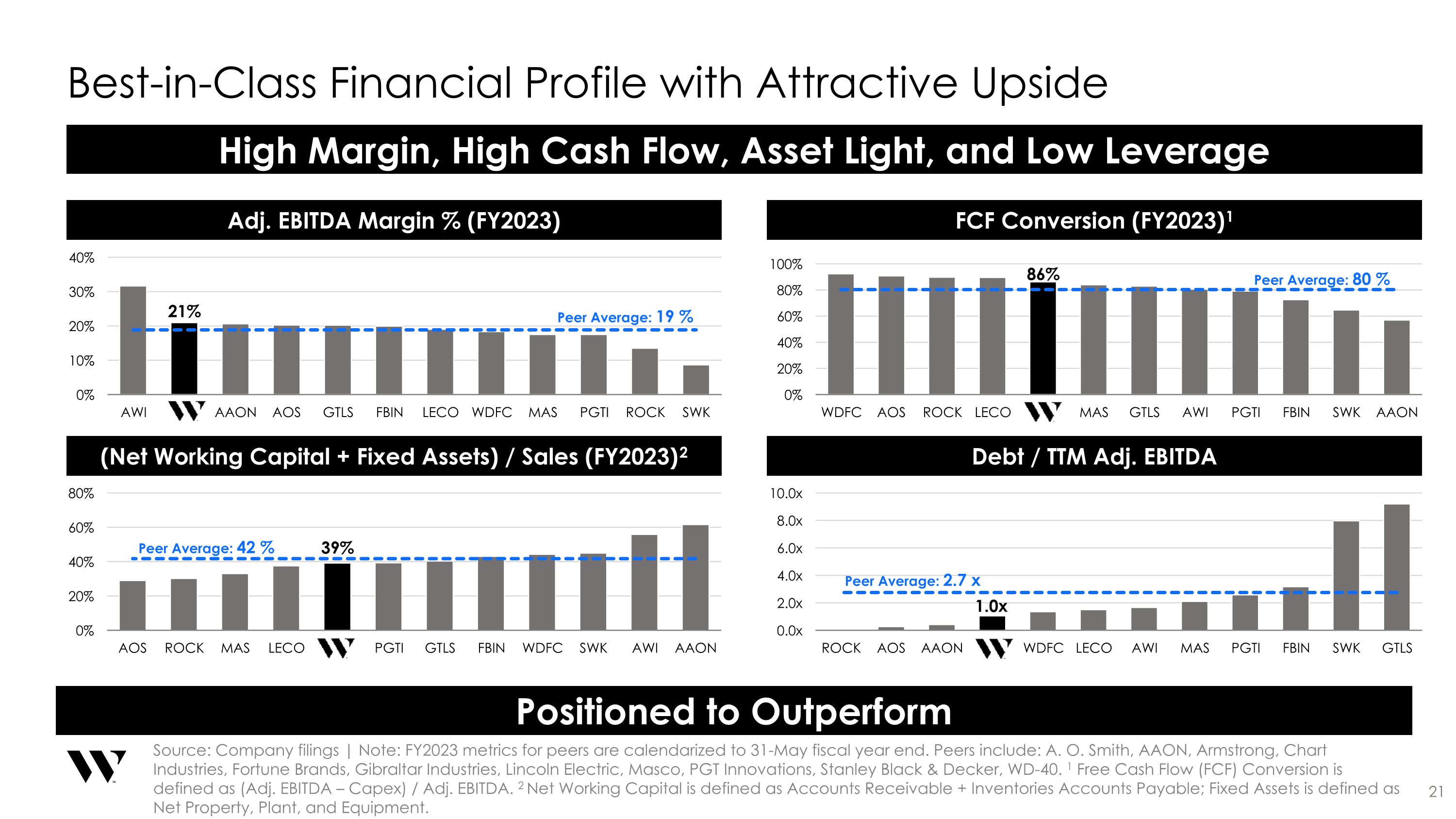

Best-in-Class Financial Profile with Attractive Upside 21 Source: Company filings | Note: FY2023 metrics for peers are calendarized to 31-May fiscal year end. Peers include: A. O. Smith, AAON, Armstrong, Chart Industries, Fortune Brands, Gibraltar Industries, Lincoln Electric, Masco, PGT Innovations, Stanley Black & Decker, WD-40. 1 Free Cash Flow (FCF) Conversion is defined as (Adj. EBITDA – Capex) / Adj. EBITDA. 2 Net Working Capital is defined as Accounts Receivable + Inventories Accounts Payable; Fixed Assets is defined as Net Property, Plant, and Equipment. Positioned to Outperform Adj. EBITDA Margin % (FY2023) High Margin, High Cash Flow, Asset Light, and Low Leverage FCF Conversion (FY2023)1 (Net Working Capital + Fixed Assets) / Sales (FY2023)2 Debt / TTM Adj. EBITDA Peer Average: 19 % Peer Average: 80 % Peer Average: 42 % Peer Average: 2.7 x

Long-Term Capital Allocation Priorities ORGANIC GROWTH Brand, Innovation, and Channel investments Investments in automation and R&D initiatives High-returning Capex investments 22 Targeted M&A CAPITAL RETURN Build out core businesses and selectively grow into new markets Create value via channel and supply chain synergies Enhance capabilities allowing for faster integration and synergies Modest quarterly dividend payments Opportunistic share buybacks

Worthington Enterprises Key Investment Highlights 1 TTM figures as of Q1 FY24. Sales exclude pro-rata share of unconsolidated JV sales. Percentages do not add up to 100% due to rounding. NET SALES OF $1.4 BILLION1 Net Sales by End-Market1 Building Products Sustainable Energy Solutions Consumer Products 23 Founded in 1955 Established Portfolio of Market-Leading Brands with High Barriers to Entry Strong Underlying Secular Trends Enabling Steady Long-Term Growth Business Model Drives High Free Cash Flow and Returns Worthington Business System Accelerates Growth and Profitability Innovation For Highly Engineered Products Drives Incremental Sales and Margin Guided by Our Philosophy – a People-First, Performance-Based Culture Low Leverage and Ample Liquidity Provides Financial Flexibility

Appendix

Update on Separation Into Two World-Class Companies Note: There can be no assurance that the spin-off will occur or, if it does occur, its terms or timing. 25 Key Events Expected Timing Public Announcement of Separation September 29, 2022 Amended Worthington Enterprises Revolver Credit Facility Effectiveness September 27, 2023 Public Form 10 Filing October 4, 2023 Investor Day Presentation October 11, 2023 Target for Start of Regular Way Trading December 2023

26 EARNINGS The first corporate goal for Worthington Industries is to earn money for its shareholders and increase the value of their investment. We believe that the best measurement of the accomplishment of our goal is consistent growth in earnings per share. OUR GOLDEN RULE We treat our customers, employees, investors and suppliers, as we would like to be treated. PEOPLE We are dedicated to the belief that people are our most important asset. We believe people respond to recognition, opportunity to grow and fair compensation. We believe that compensation should be directly related to job performance and therefore use incentives, profit sharing or otherwise, in every possible situation. From employees we expect an honest day's work for an honest day's pay We believe in the philosophy of continued employment for all Worthington people. In filling job openings, every effort is expended to find candidates within Worthington, its divisions or subsidiaries. CUSTOMERS Without the customer and their need for our products and services we have nothing. We will exert every effort to see that the customer’s quality and service requirements are met. Once a commitment is made to a customer, every effort is made to fulfill that obligation. SUPPLIERS We cannot operate profitably without those who supply the quality materials we need. We ask that suppliers be competitive in the marketplace with regard to quality, pricing, delivery and volume purchased. We are a loyal customer to suppliers who meet our quality and service requirements through all market conditions. ORGANIZATION We believe in a divisionalized organizational structure with responsibility for performance resting with the head of each operation. All managers are given the operating latitude and authority to accomplish their responsibilities within our corporate goals and objectives. In keeping with this philosophy, we do not create excessive corporate procedures. If procedures are necessary within a particular company operation, that manager creates them. We believe in a small corporate staff and support group to service the needs of our shareholders and operating units as requested. COMMUNICATION We communicate through every possible channel with our customers, employees, shareholders, suppliers and financial community. CITIZENSHIP Worthington Steel practices good citizenship at all levels. We conduct our business in a professional and ethical manner. We encourage all our people to actively participate in community affairs We support worthwhile community causes. Our Philosophyadopted in 1961, is the foundation of our culture

Worthington Enterprises Reconciliation of Non-GAAP Measures(in thousands) 27

Worthington Enterprises Reconciliation of Non-GAAP Measures(in thousands) 28

Worthington Enterprises Reconciliation of Non-GAAP Measures(in thousands) 29

Worthington Enterprises Reconciliation of Non-GAAP Measures(in thousands) 30

Worthington Industries Reconciliation of Non-GAAP Measures(in thousands) Below provides a reconciliation of trailing twelve months adjusted EBITDA as of August 31, 2023 and 2022 for Worthington Industries, Inc. along with the calculation of net debt to adjusted EBITDA for the same periods. The calculation of adjusted EBITDA for Worthington Industries, Inc. is consistent with the definition previously provided, except that no adjustment is made for stock-based compensation. Net debt to adjusted EBITDA is calculated by subtracting cash from net debt (defined as the aggregate of short-term borrowings, current maturities of long-term debt and long-term debt) and dividing the sum by adjusted EBITDA for the trailing twelve months. 31