UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of October 2023

Commission File Number: 001-40618

Stevanato Group S.p.A.

(Translation of registrant’s name into English)

Via Molinella 17

35017 Piombino Dese – Padua

Italy

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40‑F.

Form 20-F ☒ Form 40-F ☐

EXHIBIT INDEX

The following exhibits are furnished as part of this Form 6-K:

Exhibit |

Description |

99.1 |

Registrant's presentation for the investor conference call held on October 31, 2023 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

Stevanato Group S.p.A. |

|

|

|

|

|

Date: October 31, 2023 |

|

By: |

/s/ Franco Moro |

|

|

Name: |

Franco Moro |

|

|

Title: |

Chief Executive Officer |

Stevanato Group Q3 2023 Financial Results October 31, 2023 Exhibit 99.1

Forward-Looking Statements This presentation may include forward-looking statements. The words "expect,” "reiterating,” “continue,” “assumes," "rise," “position,” "strong," "increased," "benefiting," "expected," "remain," "can," "shift," "growing," "deliver," "are delivering," "build," "will," "stronger," "driving," "durable," "growth," "sustainable," "adding," "solid," "drive," "enhancing," "implementing," "remains," "are winning," "are seeing," "favorable," and similar expressions (or their negative) identify certain of these forward-looking statements. These forward-looking statements are statements regarding the Company's intentions, beliefs or current expectations concerning, among other things, the investments the Company expects to make, the expansion of manufacturing capacity, the Company’s plans regarding its presence in the U.S., its capital expenditure guidance, business strategies, the Company’s capacity to meet future market demands and support preparedness for future public health emergencies, and results of operations. The forward-looking statements in this presentation are based on numerous assumptions regarding the Company’s present and future business strategies and the environment in which the Company will operate in the future. Forward-looking statements involve inherent known and unknown risks, uncertainties and contingencies because they relate to events and depend on circumstances that may or may not occur in the future and may cause the actual results, performance or achievements of the Company to be materially different from those expressed or implied by such forward looking statements. Many of these risks and uncertainties relate to factors that are beyond the Company's ability to control or estimate precisely, such as future market conditions, currency fluctuations, the behavior of other market participants, the actions of regulators and other factors such as the Company's ability to continue to obtain financing to meet its liquidity needs, changes in the political, social and regulatory framework in which the Company operates or in economic or technological trends or conditions. For a description of the risks that could cause the Company’s future results to differ from those expressed in any such forward looking statements, refer to the risk factors discussed in the Company’s most recent annual report on Form 20-F filed with the U.S. Securities and Exchange Commission. Readers should therefore not place undue reliance on these statements, particularly not in connection with any contract or investment decision. Except as required by law, the Company assumes no obligation to update any such forward-looking statements. Non-GAAP Financial Information This presentation contains non-GAAP financial measures. Please refer to the tables included in this presentation for a reconciliation of non-GAAP financial measures. Management monitors and evaluates its operating and financial performance using several non-GAAP financial measures, including Constant Currency Revenue, EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Operating Profit, Adjusted Operating Profit Margin, Adjusted Income Taxes, Adjusted Net Profit, Adjusted Diluted EPS, Capital Employed, Net Cash, Free Cash Flow and CAPEX. The Company believes that these non-GAAP financial measures provide useful and relevant information regarding its performance and improve its ability to assess its financial condition. While similar measures are widely used in the industry in which the Company operates, the financial measures it uses may not be comparable to other similarly titled measures used by other companies, nor are they intended to be substitutes for measures of financial performance or financial position as prepared in accordance with IFRS. Safe Harbor Statement Q3 2023 Financial Results

Stevanato Group Second Quarter 2023 Financial Results Earnings Call FrancoStevanato Executive Chairman FrancoMoro CEO MarcoDal Lago CFO LisaMiles SVP IR Q3 2023 Financial Results

Franco Stevanato Executive Chairman 4 Q3 2023 Financial Results

Substantial Progress in Building Durable Organic Growth Double-digit revenue growth and adj. EBITDA margin of 27.5% in Q3 23. Q3 23 Engineering Segment revenue fell short of our expectations due to the timing of revenue. We remain confident that we can achieve our FY 2023 Guidance. Business fundamentals remain strong. The exclusive focus on BioPharma coupled with our unique value proposition of integrated end-to-end solutions, helped position us as a leading global partner of choice in the industry. We are benefiting from secular macro trends such as aging populations, the rise in biologics and biosimilars, and the shift towards the self-administration of medicine. We operate in growing end markets – particularly biologics – and we have built a leadership position in GLP1s, monoclonal antibodies, and mRNA applications. Already present in three out of four potential blockbusters approved by FDA in 2022 (all of which are biologics). Biologics, mostly administered by injection, are delivering breakthrough results in patient care, but tend to be costly, and more challenging to manufacture due to their sensitive nature. These factors are driving demand for high-performing drug containment solutions to ensure treatment integrity and stability. Global pipeline of drugs in development is at record levels with more than 60% in injectable formats. Q3 2023 Financial Results Positive trends position us well to capitalize on the favorable secular tailwinds. We are executing against our strategic priorities to deliver sustainable organic growth and build shareholder value __________ *Adjusted EBITDA margin is a non-GAAP financial measures. Please refer to slides 15-19 for a reconciliation of non-GAAP measures.

MarcoDal LagoChief Financial Officer 6 Q3 2023 Financial Results

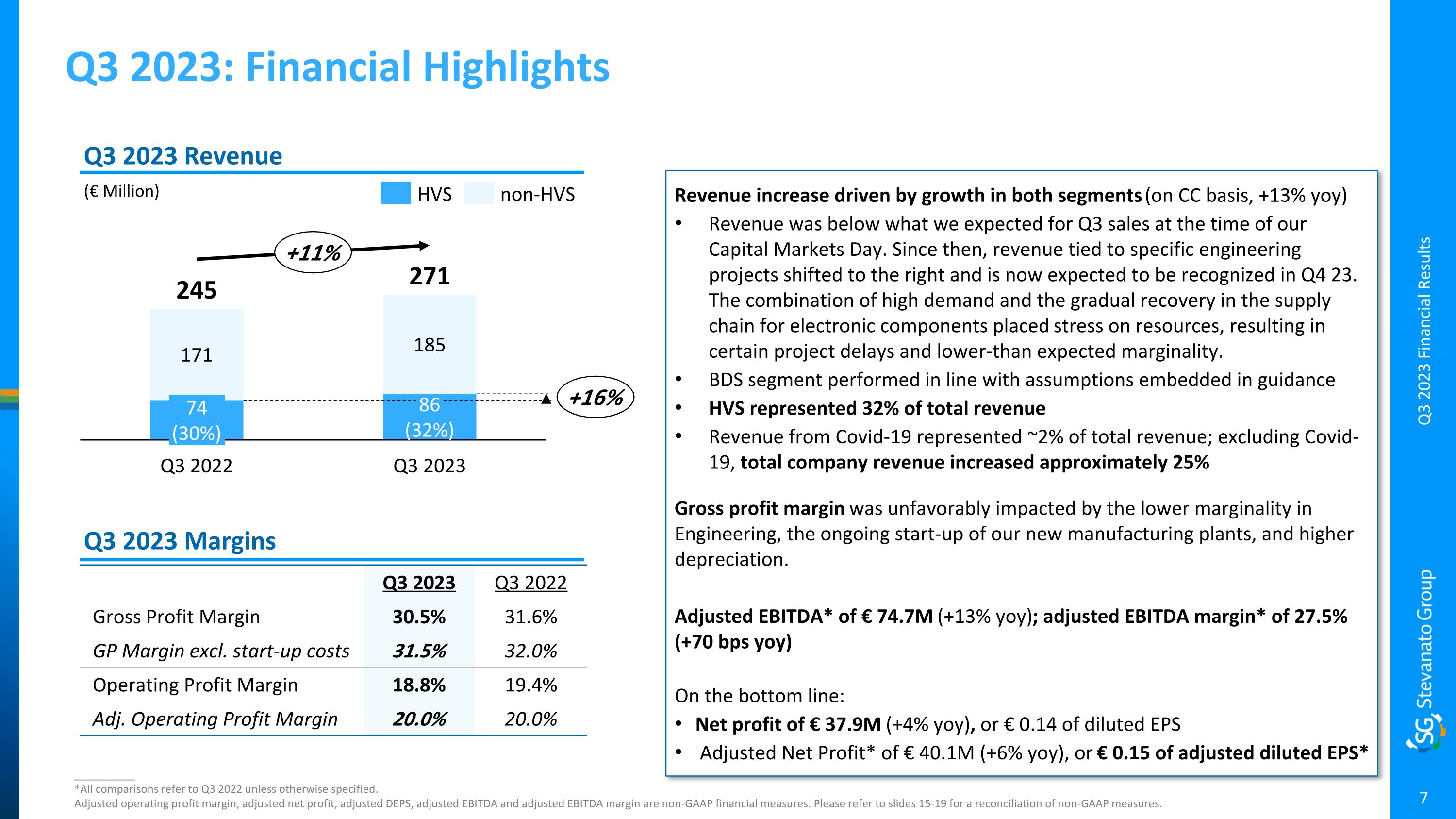

Q3 2023: Financial Highlights __________ *All comparisons refer to Q3 2022 unless otherwise specified. Adjusted operating profit margin, adjusted net profit, adjusted DEPS, adjusted EBITDA and adjusted EBITDA margin are non-GAAP financial measures. Please refer to slides 15-19 for a reconciliation of non-GAAP measures. (€ Million) Q3 2023 Revenue Q3 2023 Margins Q3 2023 Q3 2022 Gross Profit Margin 30.5% 31.6% GP Margin excl. start-up costs 31.5% 32.0% Operating Profit Margin 18.8% 19.4% Adj. Operating Profit Margin 20.0% 20.0% Q3 2023 Financial Results Q3 2022 74(30%) 86(32%) Q3 2023 245 271 171 185 +16% +11% HVS non-HVS Revenue increase driven by growth in both segments (on CC basis, +13% yoy) Revenue was below what we expected for Q3 sales at the time of our Capital Markets Day. Since then, revenue tied to specific engineering projects shifted to the right and is now expected to be recognized in Q4 23. The combination of high demand and the gradual recovery in the supply chain for electronic components placed stress on resources, resulting in certain project delays and lower-than expected marginality. BDS segment performed in line with assumptions embedded in guidance HVS represented 32% of total revenue Revenue from Covid-19 represented ~2% of total revenue; excluding Covid-19, total company revenue increased approximately 25% Gross profit margin was unfavorably impacted by the lower marginality in Engineering, the ongoing start-up of our new manufacturing plants, and higher depreciation. Adjusted EBITDA* of € 74.7M (+13% yoy); adjusted EBITDA margin* of 27.5% (+70 bps yoy) On the bottom line: Net profit of € 37.9M (+4% yoy), or € 0.14 of diluted EPS Adjusted Net Profit* of € 40.1M (+6% yoy), or € 0.15 of adjusted diluted EPS*

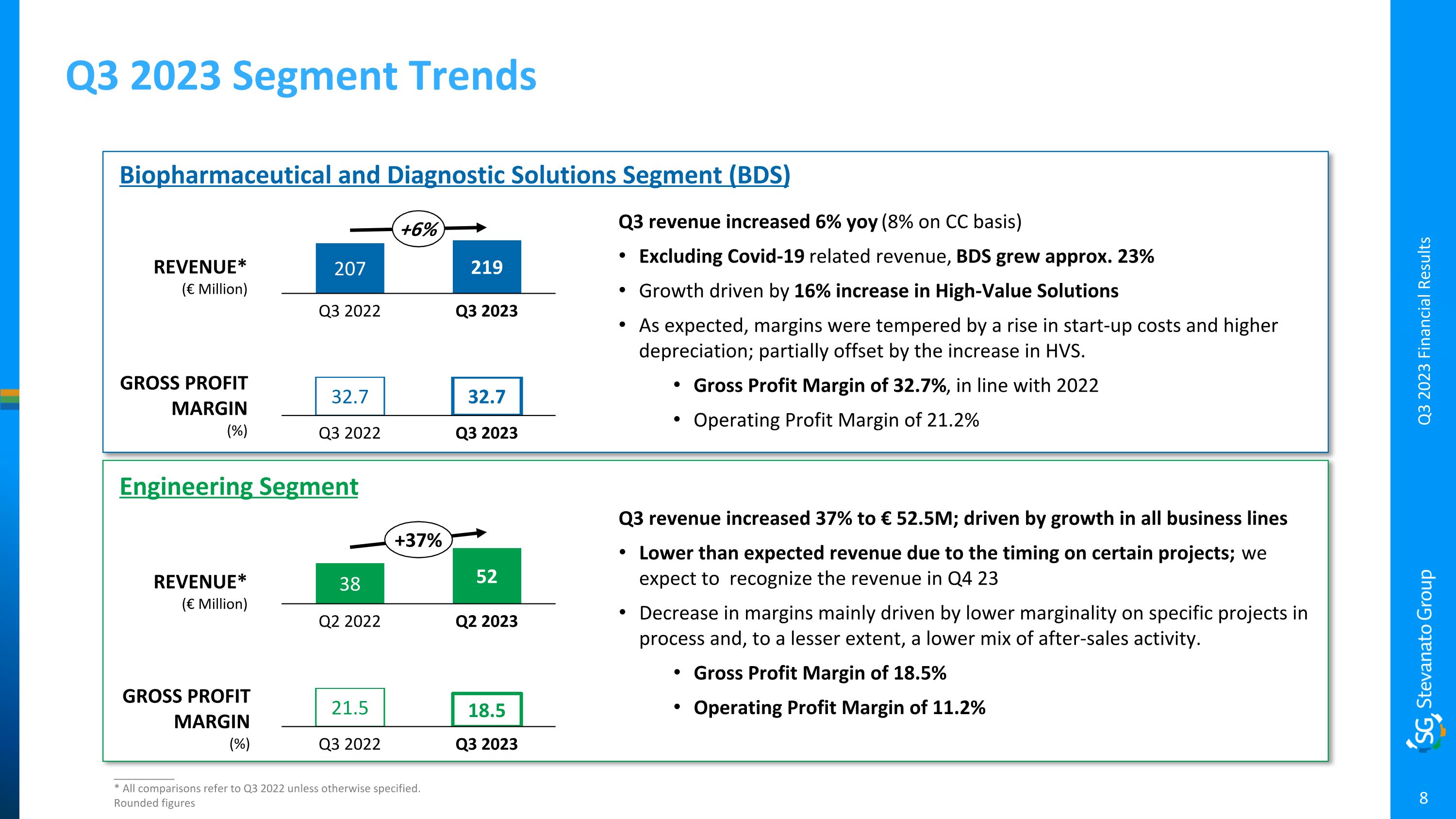

Q3 2023 Segment Trends __________ * All comparisons refer to Q3 2022 unless otherwise specified. Rounded figures 207 Q3 2022 219 Q3 2023 +6% Q3 revenue increased 6% yoy (8% on CC basis) Excluding Covid-19 related revenue, BDS grew approx. 23% Growth driven by 16% increase in High-Value Solutions As expected, margins were tempered by a rise in start-up costs and higher depreciation; partially offset by the increase in HVS. Gross Profit Margin of 32.7%, in line with 2022 Operating Profit Margin of 21.2% Biopharmaceutical and Diagnostic Solutions Segment (BDS) REVENUE* (€ Million) GROSS PROFIT MARGIN (%) Engineering Segment 32.7 32.7 Q3 2022 Q3 2023 38 Q2 2022 52 Q2 2023 +37% Q3 revenue increased 37% to € 52.5M; driven by growth in all business lines Lower than expected revenue due to the timing on certain projects; we expect to recognize the revenue in Q4 23 Decrease in margins mainly driven by lower marginality on specific projects in process and, to a lesser extent, a lower mix of after-sales activity. Gross Profit Margin of 18.5% Operating Profit Margin of 11.2% REVENUE* (€ Million) GROSS PROFIT MARGIN (%) Q3 2022 Q3 2023 21.5 18.5 Q3 2023 Financial Results

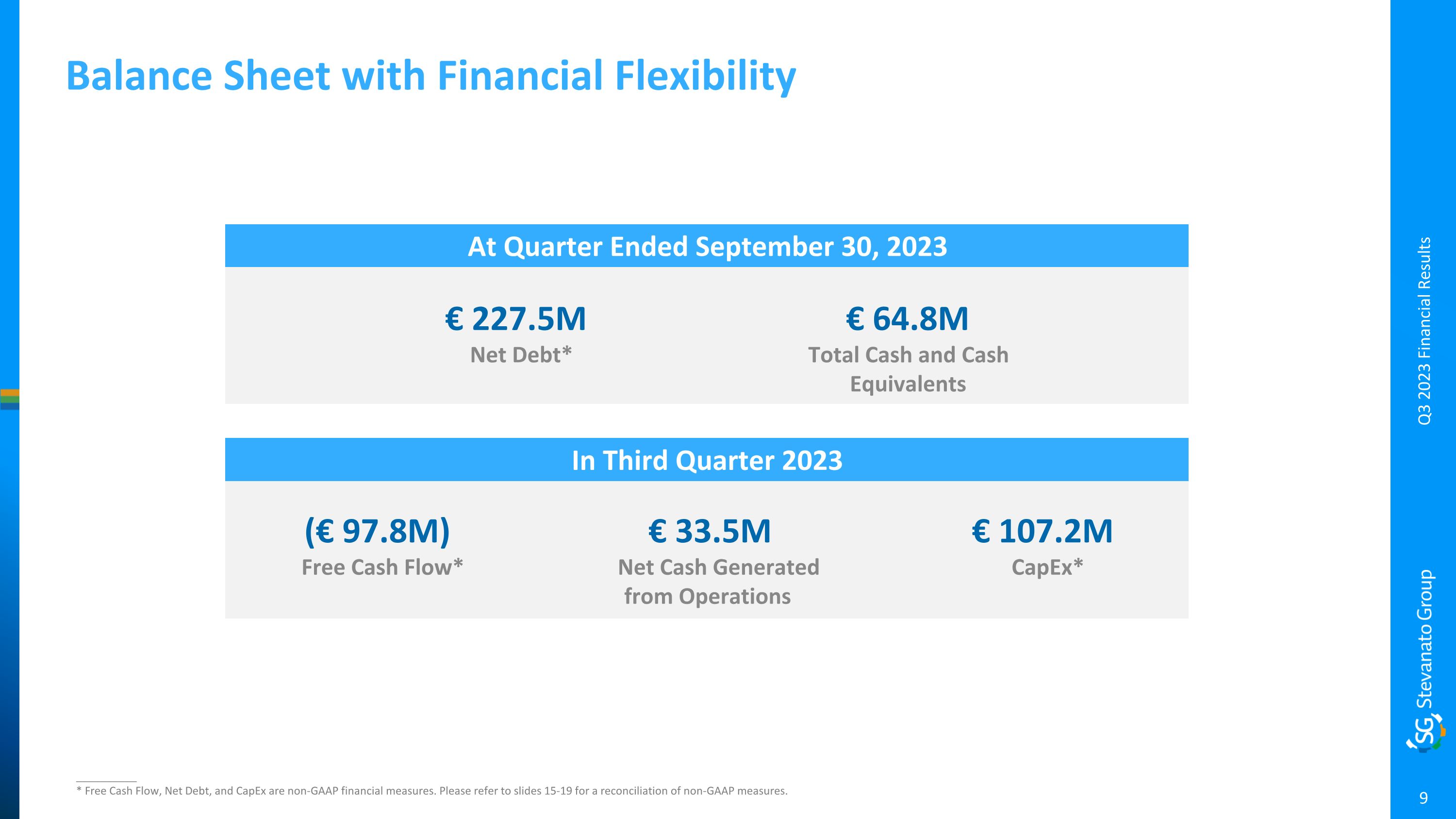

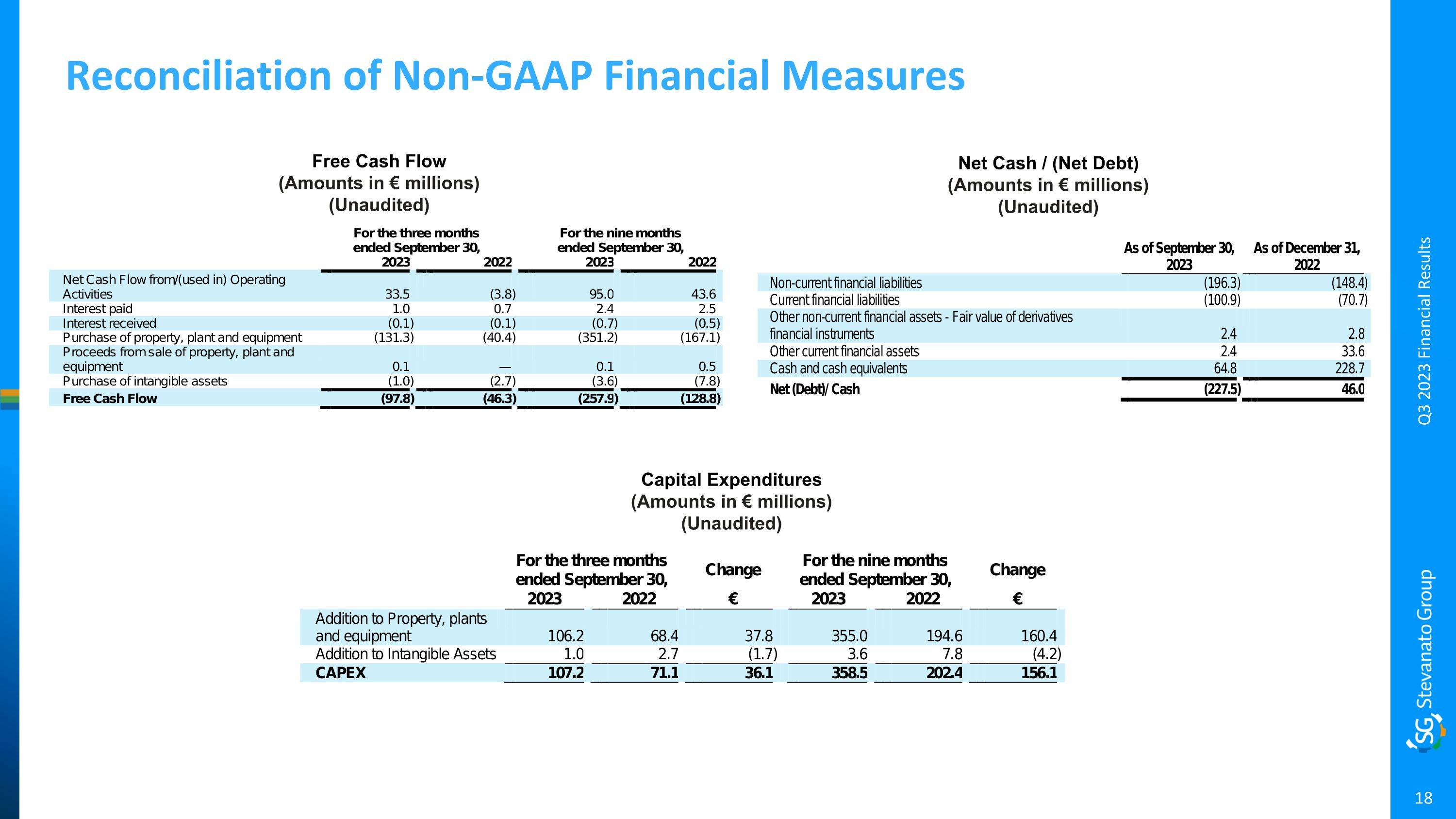

In Third Quarter 2023 Balance Sheet with Financial Flexibility At Quarter Ended September 30, 2023 __________ * Free Cash Flow, Net Debt, and CapEx are non-GAAP financial measures. Please refer to slides 15-19 for a reconciliation of non-GAAP measures. Q3 2023 Financial Results (€ 97.8M) Free Cash Flow* € 227.5M Net Debt* € 64.8M Total Cash and Cash Equivalents € 107.2M CapEx* € 33.5M Net Cash Generated from Operations

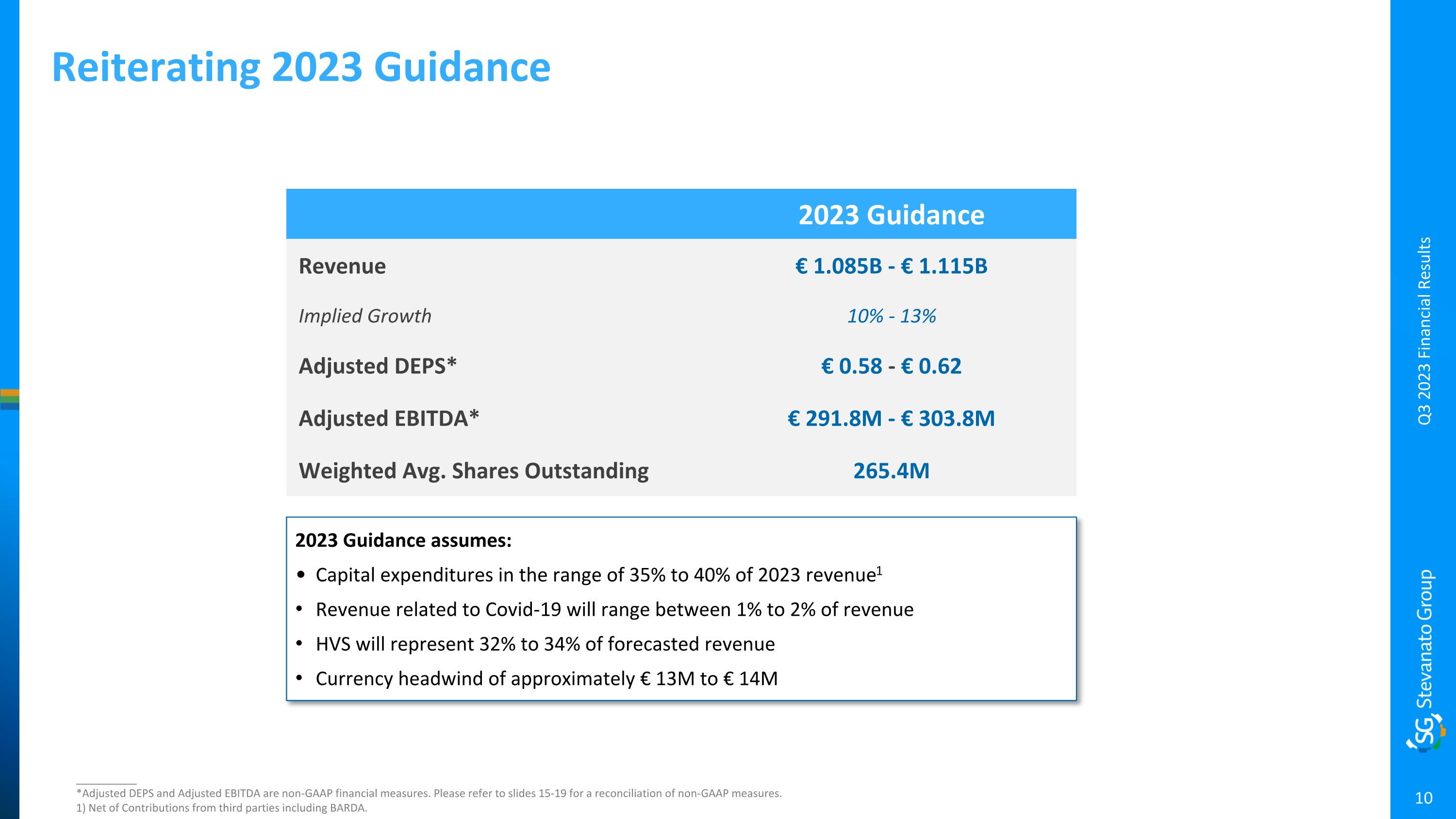

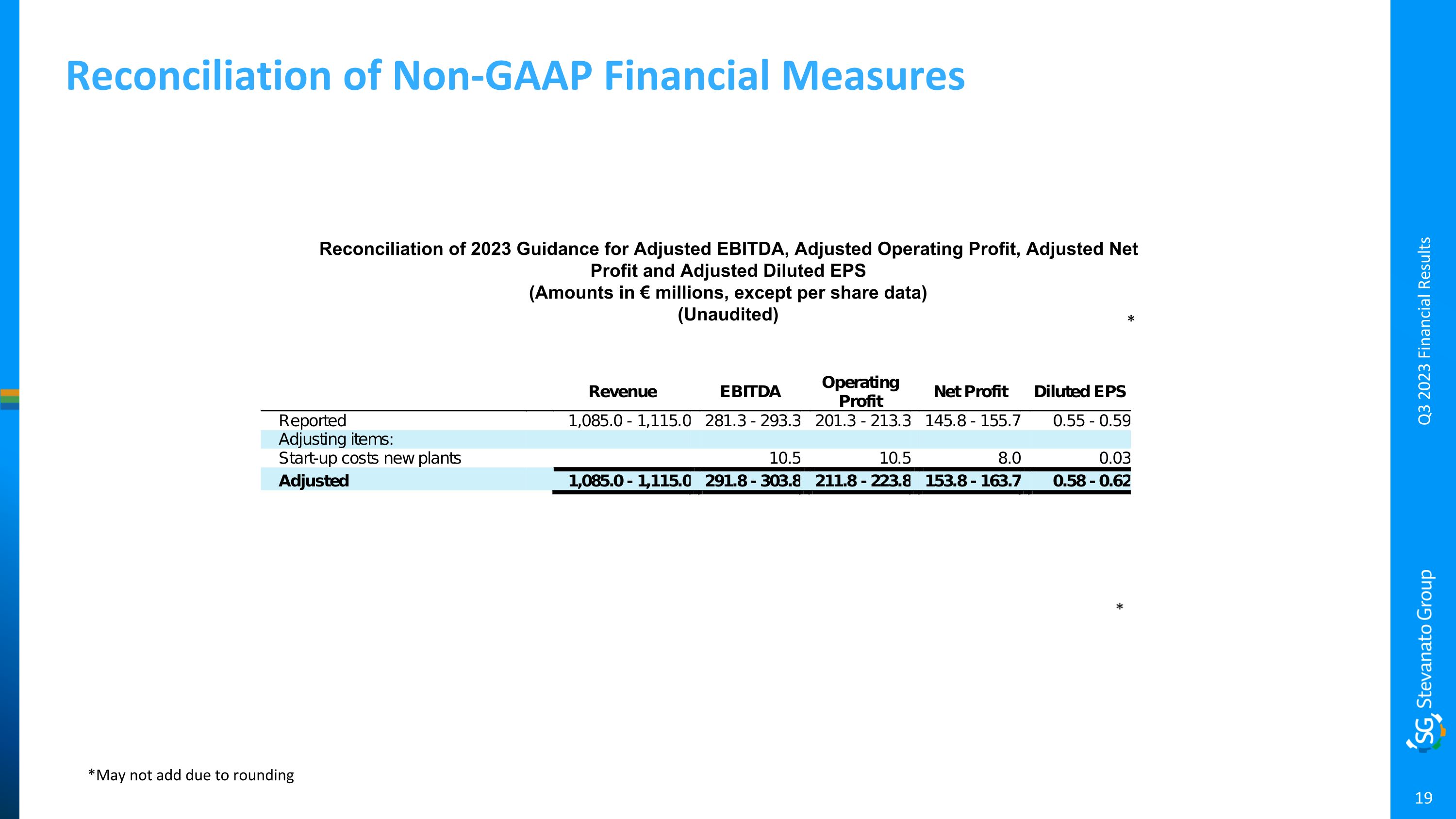

2023 Guidance assumes: Capital expenditures in the range of 35% to 40% of 2023 revenue1 Revenue related to Covid-19 will range between 1% to 2% of revenue HVS will represent 32% to 34% of forecasted revenue Currency headwind of approximately € 13M to € 14M Reiterating 2023 Guidance __________ *Adjusted DEPS and Adjusted EBITDA are non-GAAP financial measures. Please refer to slides 15-19 for a reconciliation of non-GAAP measures. 1) Net of Contributions from third parties including BARDA. Q3 2023 Financial Results 2023 Guidance Revenue € 1.085B - € 1.115B Implied Growth 10% - 13% Adjusted DEPS* € 0.58 - € 0.62 Adjusted EBITDA* € 291.8M - € 303.8M Weighted Avg. Shares Outstanding 265.4M

Franco Moro Chief Executive Officer 11 Q3 2023 Financial Results

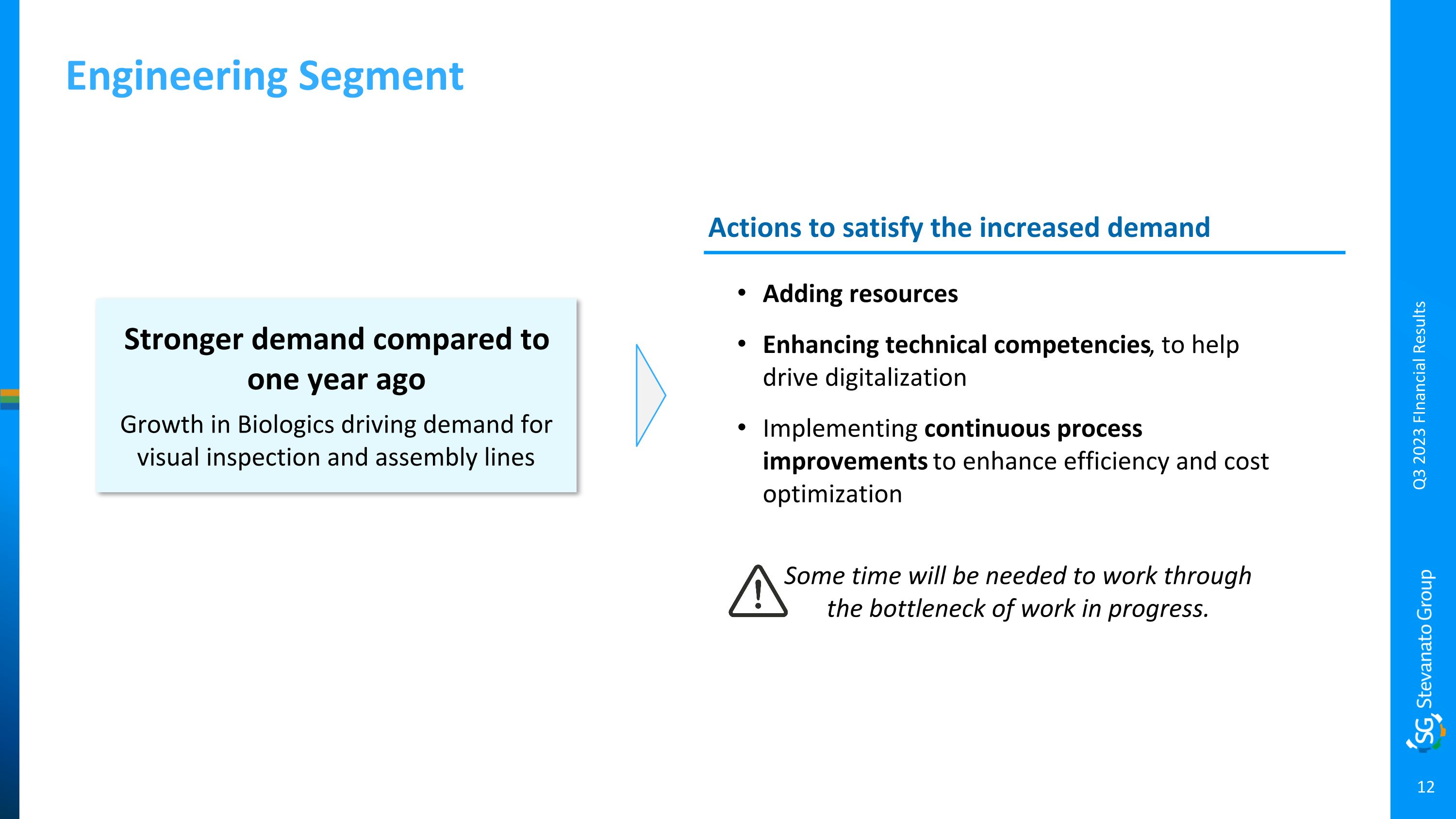

Q3 2023 FInancial Results Engineering Segment Actions to satisfy the increased demand Adding resources Enhancing technical competencies, to help drive digitalization Implementing continuous process improvements to enhance efficiency and cost optimization Some time will be needed to work through the bottleneck of work in progress. Stronger demand compared to one year ago Growth in Biologics driving demand for visual inspection and assembly lines

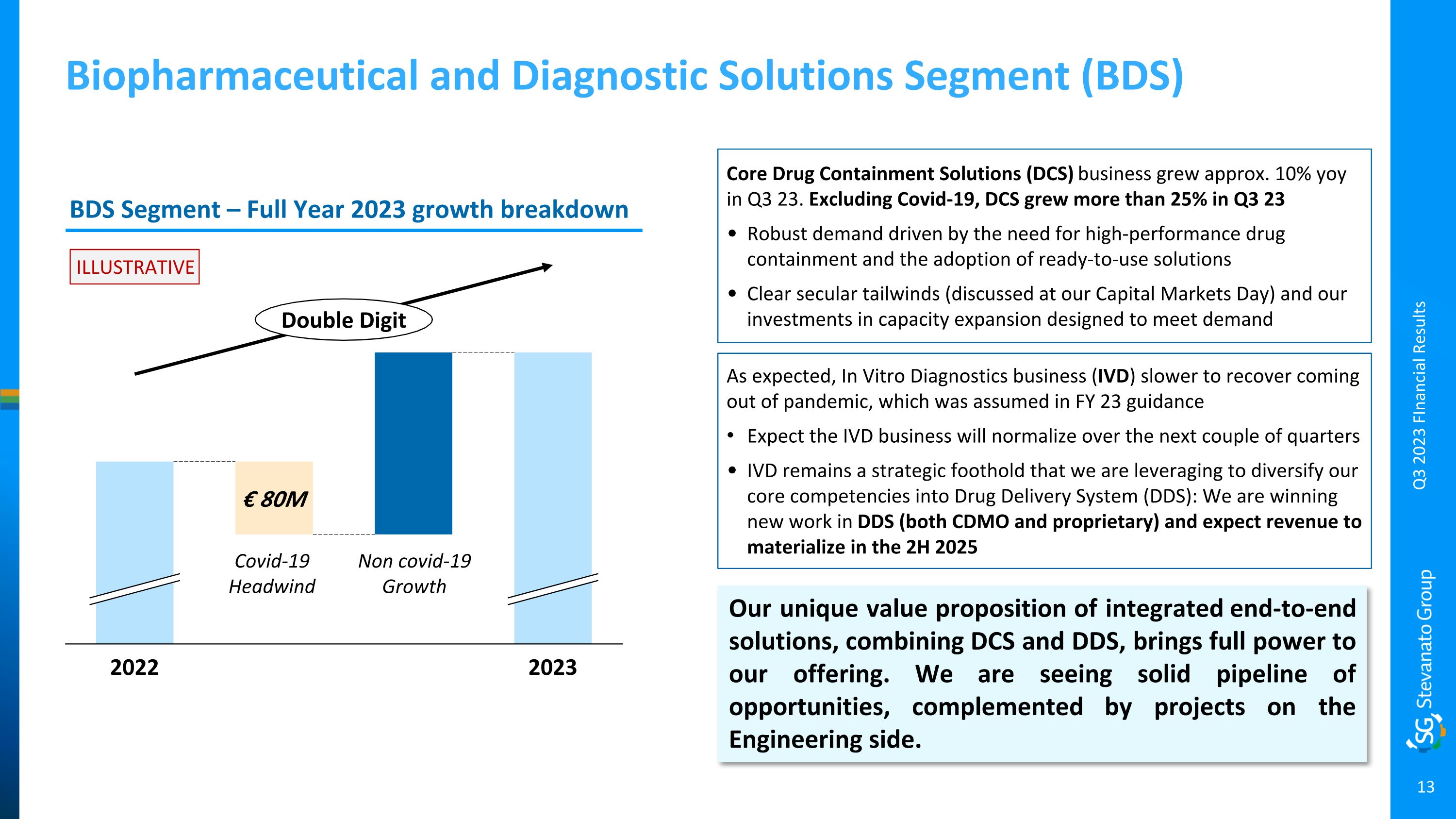

Q3 2023 FInancial Results Biopharmaceutical and Diagnostic Solutions Segment (BDS) 2022 2023 Double Digit ILLUSTRATIVE Covid-19 Headwind Non covid-19 Growth BDS Segment – Full Year 2023 growth breakdown Core Drug Containment Solutions (DCS) business grew approx. 10% yoy in Q3 23. Excluding Covid-19, DCS grew more than 25% in Q3 23 Robust demand driven by the need for high-performance drug containment and the adoption of ready-to-use solutions Clear secular tailwinds (discussed at our Capital Markets Day) and our investments in capacity expansion designed to meet demand As expected, In Vitro Diagnostics business (IVD) slower to recover coming out of pandemic, which was assumed in FY 23 guidance Expect the IVD business will normalize over the next couple of quarters IVD remains a strategic foothold that we are leveraging to diversify our core competencies into Drug Delivery System (DDS): We are winning new work in DDS (both CDMO and proprietary) and expect revenue to materialize in the 2H 2025 Our unique value proposition of integrated end-to-end solutions, combining DCS and DDS, brings full power to our offering. We are seeing solid pipeline of opportunities, complemented by projects on the Engineering side.

Q3 2022 FInancial Results Reiterating our 2023 Guidance, as we continue to see positive long-term trends. We are operating in an environment of favorable demand, growing end markets and multi-year secular drivers. GlobalExpansion HVSGrowth R&DInnovation Multi-YearPipeline

Reconciliation of Non-GAAP Financial Measures (Unaudited) This presentation contains non-GAAP financial measures. Please refer to the tables included in this presentation for a reconciliation of non-GAAP measures. Management monitors and evaluates our operating and financial performance using several non-GAAP financial measures, including Constant Currency Revenue, EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Operating Profit, Adjusted Operating Profit Margin, Adjusted Income Taxes, Adjusted Net Profit, Adjusted Diluted EPS, Capital Employed, Net Cash, Free Cash Flow, and CapEx. We believe that these non-GAAP financial measures provide useful and relevant information regarding our performance and improve our ability to assess our financial condition. While similar measures are widely used in the industry in which we operate, the financial measures we use may not be comparable to other similarly titled measures used by other companies, nor are they intended to be substitutes for measures of financial performance or financial position as prepared in accordance with IFRS. 15 Notes to Non-GAAP Financial Measures Q3 2023 Financial Results

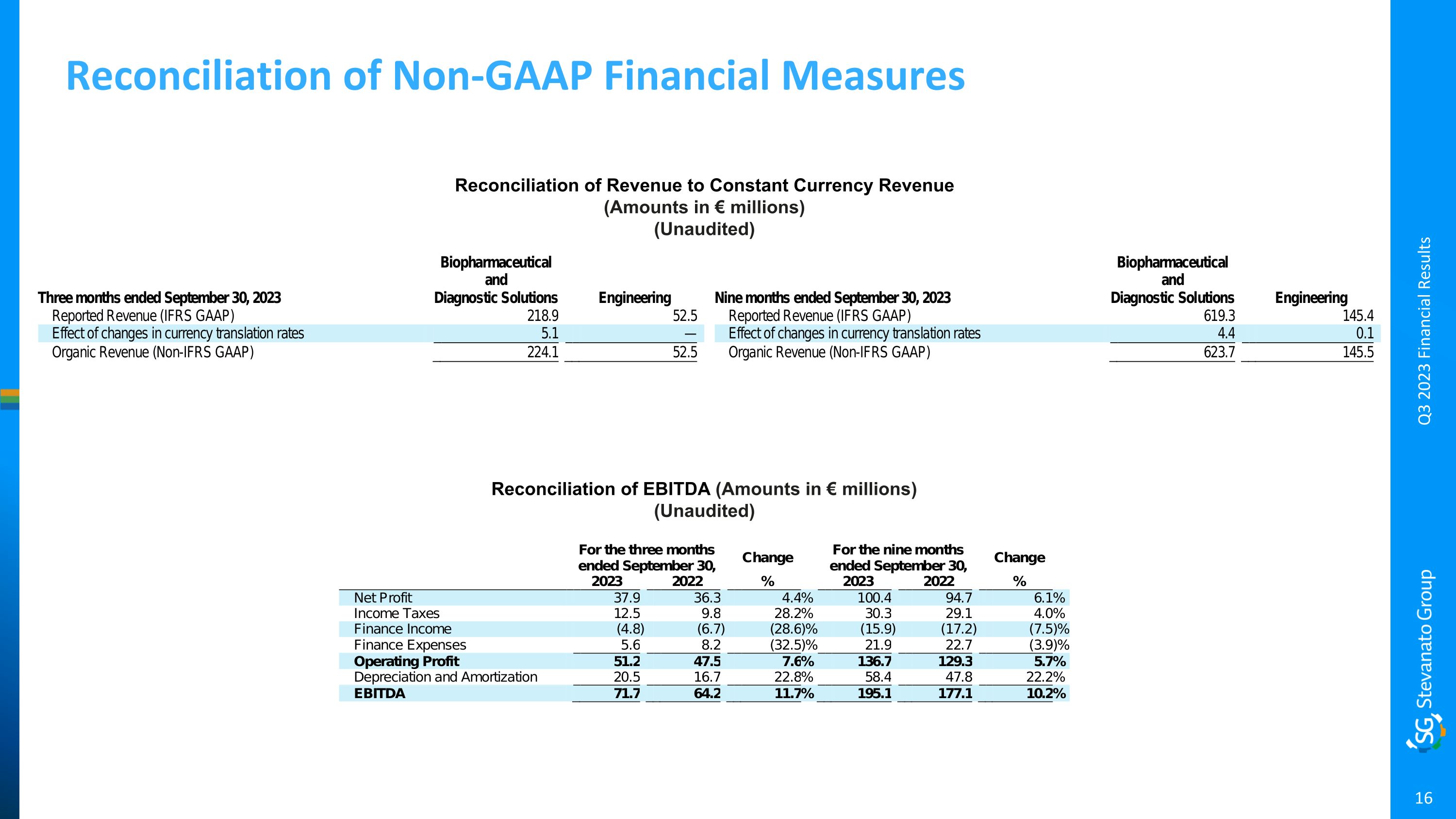

Reconciliation of Non-GAAP Financial Measures Reconciliation of Revenue to Constant Currency Revenue (Amounts in € millions) (Unaudited) Q3 2023 Financial Results Reconciliation of EBITDA (Amounts in € millions) (Unaudited)

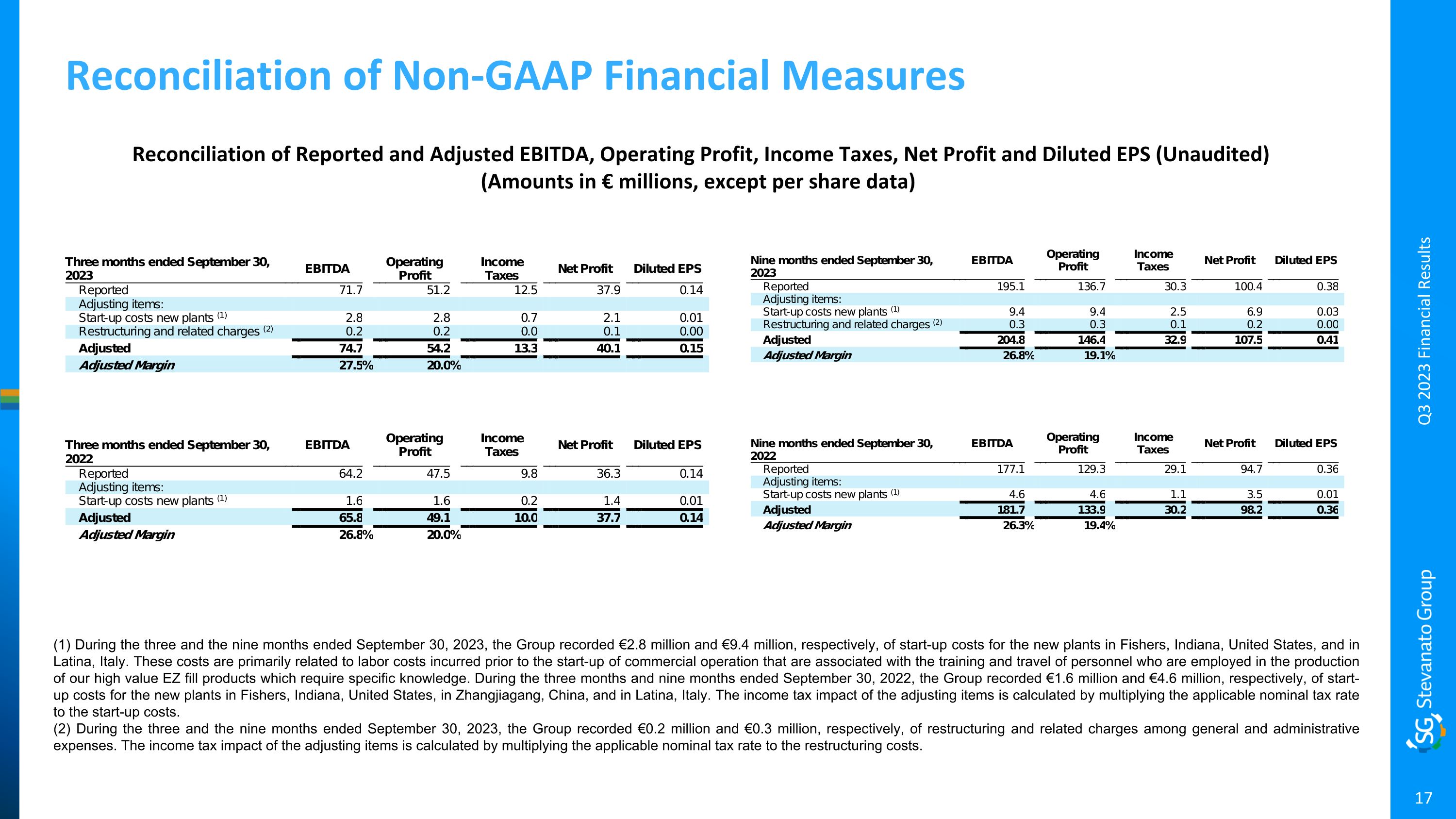

Reconciliation of Reported and Adjusted EBITDA, Operating Profit, Income Taxes, Net Profit and Diluted EPS (Unaudited)(Amounts in € millions, except per share data) Reconciliation of Non-GAAP Financial Measures (1) During the three and the nine months ended September 30, 2023, the Group recorded €2.8 million and €9.4 million, respectively, of start-up costs for the new plants in Fishers, Indiana, United States, and in Latina, Italy. These costs are primarily related to labor costs incurred prior to the start-up of commercial operation that are associated with the training and travel of personnel who are employed in the production of our high value EZ fill products which require specific knowledge. During the three months and nine months ended September 30, 2022, the Group recorded €1.6 million and €4.6 million, respectively, of start-up costs for the new plants in Fishers, Indiana, United States, in Zhangjiagang, China, and in Latina, Italy. The income tax impact of the adjusting items is calculated by multiplying the applicable nominal tax rate to the start-up costs. (2) During the three and the nine months ended September 30, 2023, the Group recorded €0.2 million and €0.3 million, respectively, of restructuring and related charges among general and administrative expenses. The income tax impact of the adjusting items is calculated by multiplying the applicable nominal tax rate to the restructuring costs. Q3 2023 Financial Results

Reconciliation of Non-GAAP Financial Measures Free Cash Flow (Amounts in € millions) (Unaudited) Q3 2023 Financial Results Net Cash / (Net Debt) (Amounts in € millions) (Unaudited) Capital Expenditures (Amounts in € millions) (Unaudited)

Reconciliation of Non-GAAP Financial Measures Reconciliation of 2023 Guidance for Adjusted EBITDA, Adjusted Operating Profit, Adjusted Net Profit and Adjusted Diluted EPS (Amounts in € millions, except per share data) (Unaudited) Q3 2023 Financial Results *May not add due to rounding *