UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 19, 2023 |

Cytokinetics, Incorporated

(Exact name of Registrant as Specified in Its Charter)

Delaware |

000-50633 |

94-3291317 |

||

(State or Other Jurisdiction |

(Commission File Number) |

(IRS Employer |

||

|

|

|

|

|

350 Oyster Point Boulevard |

|

|||

South San Francisco, California |

|

94080 |

||

(Address of Principal Executive Offices) |

|

(Zip Code) |

||

Registrant’s Telephone Number, Including Area Code: (650) 624-3000 |

N/A |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Securities registered pursuant to Section 12(b) of the Act:

|

|

Trading |

|

|

Common Stock, $0.001 par value |

|

CYTK |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

Cytokinetics, Incorporated is furnishing with this Current Report on Form 8-K a copy of a presentation, entitled New Horizons in Hypercontractility, that will be presented today at its virtual Investor and Analyst Day event. The information in these slides shall not be deemed “filed” for purposes of the Securities Exchange Act of 1934, as amended, nor shall it be incorporated by reference in any filing under the Securities Exchange Act of 1934, as amended, or the Securities Act of 1933, as amended, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d)

99.1 Investor and Analyst Day Presentation.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

CYTOKINETICS, INCORPORATED |

|

|

|

|

Date: |

October 19, 2023 |

By: |

/s/ John O. Faurescu |

|

|

|

John O. Faurescu, Esq. |

©2023 CYTOKINETICS, All Rights Reserved. CYTOKINETICS® and the C-shaped logo are registered trademarks of Cytokinetics in the U.S. and certain other countries.

Forward-Looking Statements This Presentation contains forward-looking statements for purposes of the Private Securities Litigation Reform Act of 1995 (the “Act”). Cytokinetics disclaims any intent or obligation to update these forward-looking statements and claims the protection of the Act's Safe Harbor for forward-looking statements. Examples of such statements include, but are not limited to, statements related Cytokinetics’ research and development and commercial readiness activities, including the initiation, conduct, design, enrollment, progress, continuation, completion, timing and results of clinical trials (including, but not limited to, SEQUOIA-HCM, MAPLE-HCM, and ACACIA-HCM), projections regarding growing prevalence, low survival rates and market opportunity in heart failure, hypertrophic cardiomyopathy (HCM) or heart failure with preserved ejection fraction (HFpEF); projections regarding the size of the addressable patient population for aficamten, omecamtiv mecarbil, or CK-586; the Cytokinetics’ commercial readiness for aficamten or omecamtiv mecarbil; the likelihood of approval and timing for regulatory approval of aficamten, omecamtiv mecarbil or any of our other drug candidates; the submission of a new drug application (NDA) to the FDA for aficamten in 2025, if ever; the timing of any potential commercial launch of our product candidates, if approved; commercial opportunities for our product candidates; the potential for aficamten to be first in line therapy for HCM; the potential REMS program for aficamten or any other differentiation from other therapies for HCM; Cytokinetics’ cash runway, future cash balances and estimated cash expenditures; interactions with the FDA; the properties, potential benefits and commercial potential of aficamten, omecamtiv mecarbil, CK-586 and Cytokinetics’ other drug candidates. Such statements are based on management's current expectations; but actual results may differ materially due to various risks and uncertainties, including, but not limited to, potential difficulties or delays in the development, testing, regulatory approvals for trial commencement, progression or product sale or manufacturing, or production of Cytokinetics’ drug candidates that could slow or prevent clinical development or product approval, including risks that current and past results of clinical trials or preclinical studies may not be indicative of future clinical trial results, patient enrollment for or conduct of clinical trials may be difficult or delayed, Cytokinetics’ drug candidates may have adverse side effects or inadequate therapeutic efficacy, the FDA or foreign regulatory agencies may delay or limit Cytokinetics’ ability to conduct clinical trials, and Cytokinetics may be unable to obtain or maintain patent or trade secret protection for its intellectual property; Cytokinetics may incur unanticipated research, development and other costs or be unable to obtain financing necessary to conduct development of its products; standards of care may change, rendering Cytokinetics’ drug candidates obsolete; and competitive products or alternative therapies may be developed by others for the treatment of indications Cytokinetics’ drug candidates and potential drug candidates may target. These forward-looking statements speak only as of the date they are made, and Cytokinetics undertakes no obligation to subsequently update any such statement, except as required by law. For further information regarding these and other risks related to Cytokinetics’ business, investors should consult Cytokinetics’ filings with the Securities and Exchange Commission (the “SEC”).

Company Speakers Robert Blum President & CEO Fady Malik, M.D., Ph.D. EVP, Research & Development Andrew Callos EVP, Chief Commercial Officer Stuart Kupfer, M.D. SVP, Chief Medical Officer Steve Heitner, M.D. VP, Clinical Research & Therapeutic Area Lead, Cardiovascular Diane Weiser SVP, Corporate Communications & Investor Relations John Jacoppi VP, US Marketing for Aficamten Jeff Lotz VP, US Sales & Operations Daniel Jacoby, M.D. Senior Medical Director, Clinical Research Cardiovascular

Expert Speakers Theodore Abraham, M.D., FACC, FASE Meyer Friedman Distinguished Professor of Medicine, Division of Cardiology, University of California, San Francisco; Co-director, UCSF HCM Center of Excellence; Director, UCSF Adult Cardiac Echocardiography Laboratory Caroline Coats, Ph.D. Clinical Senior Lecturer, School of Cardiovascular & Metabolic Health, University of Glasgow Carolyn Ho, M.D. Associate Professor, Harvard Medical School, Medical Director of the Cardiovascular Genetics Center Megan Link Person Living with HCM Actual patient who consents and agrees to appear.

Today’s Agenda Topic Presenter Welcome Diane Weiser, SVP, Corporate Communications & Investor Relations Building a Specialty Cardiology Franchise Robert Blum, President & CEO Cardiac Myosin Inhibition Fady Malik, M.D., Ph.D., EVP, Research & Development HCM Landscape Andrew Callos, EVP, Chief Commercial Officer Aficamten: Development Program Stuart Kupfer, M.D., SVP, Chief Medical Officer Steve Heitner, M.D., VP, Clinical Research & Therapeutic Area Lead, Cardiovascular Daniel Jacoby, M.D., Senior Medical Director, Clinical Research Cardiovascular 5 Minute Break HCM Patient Perspective Diane Weiser, SVP, Corporate Communications & Investor Relations Megan Link, Person Living with HCM Aficamten: Commercial Readiness John Jacoppi, VP, US Marketing for Aficamten Andrew Callos, EVP, Chief Commercial Officer Jeff Lotz, VP, US Sales & Operations HCM KOL Panel Fady Malik, M.D., Ph.D., EVP, Research & Development Theodore Abraham, M.D., FACC, FASE Caroline Coats, Ph.D. Carolyn Ho, M.D. HFpEF Landscape & CK-586 Development Program Stuart Kupfer, M.D., SVP, Chief Medical Officer Q&A Session Diane Weiser, SVP, Corporate Communications & Investor Relations Closing Remarks Robert Blum, President & CEO

Building a Specialty Cardiology Franchise Robert Blum President & CEO

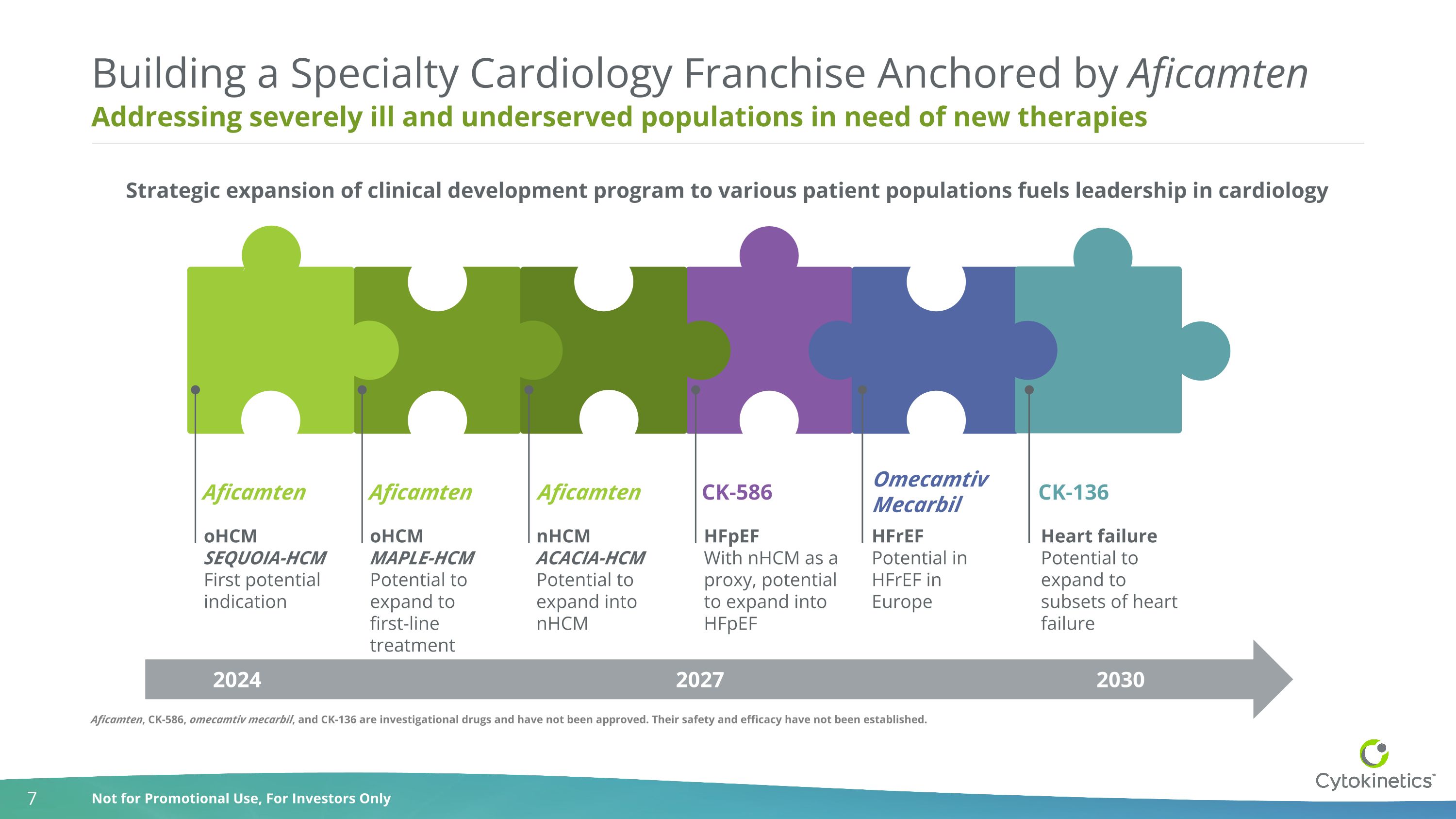

Addressing severely ill and underserved populations in need of new therapies Building a Specialty Cardiology Franchise Anchored by Aficamten oHCM MAPLE-HCM Potential to expand to first-line treatment nHCM ACACIA-HCM Potential to expand into nHCM Strategic expansion of clinical development program to various patient populations fuels leadership in cardiology oHCM SEQUOIA-HCM First potential indication Heart failure Potential to expand to subsets of heart failure 2024 2030 2027 HFrEF Potential in HFrEF in Europe Aficamten Aficamten Aficamten HFpEF With nHCM as a proxy, potential to expand into HFpEF CK-586 Omecamtiv Mecarbil CK-136 Aficamten, CK-586, omecamtiv mecarbil, and CK-136 are investigational drugs and have not been approved. Their safety and efficacy have not been established.

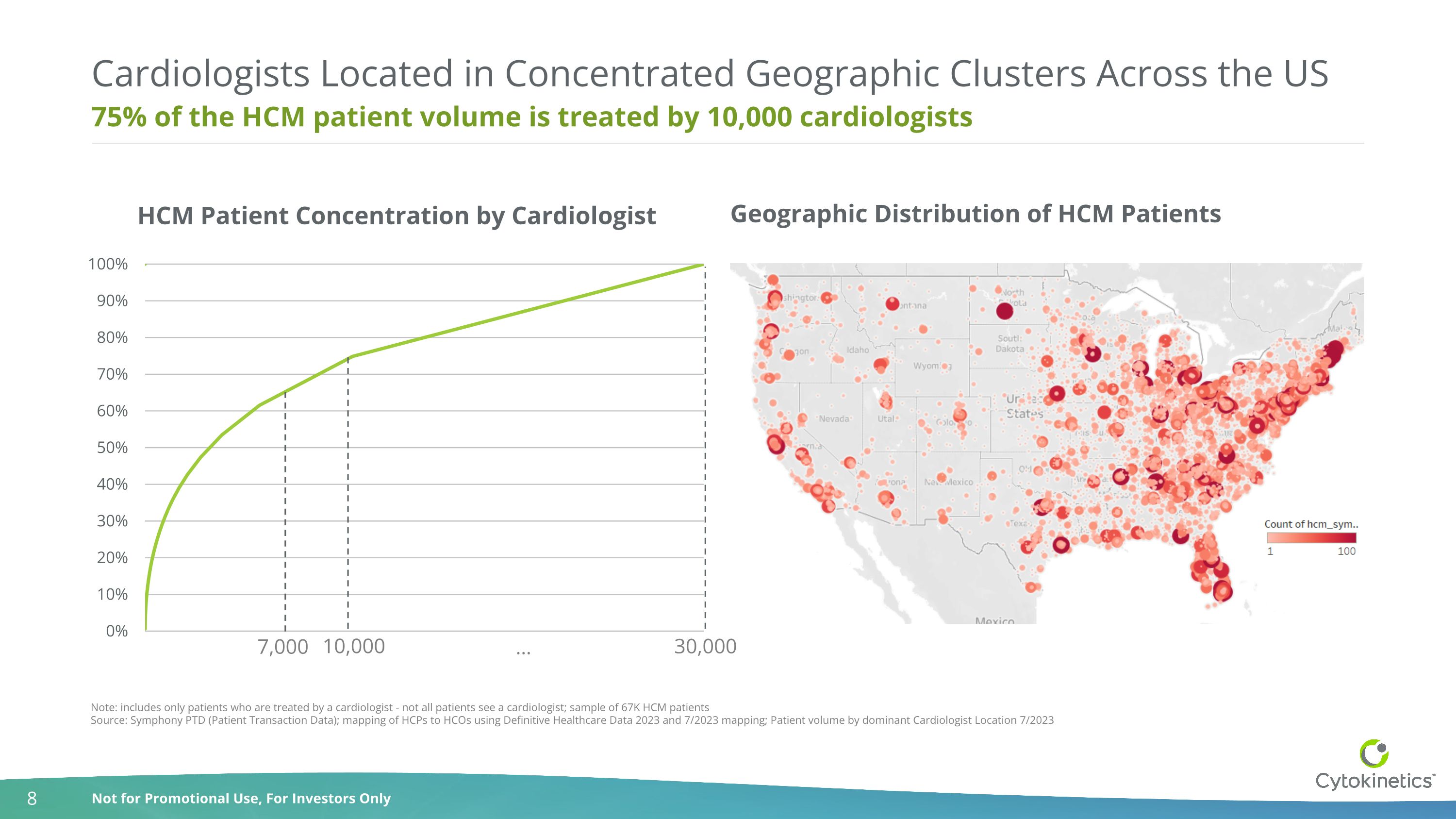

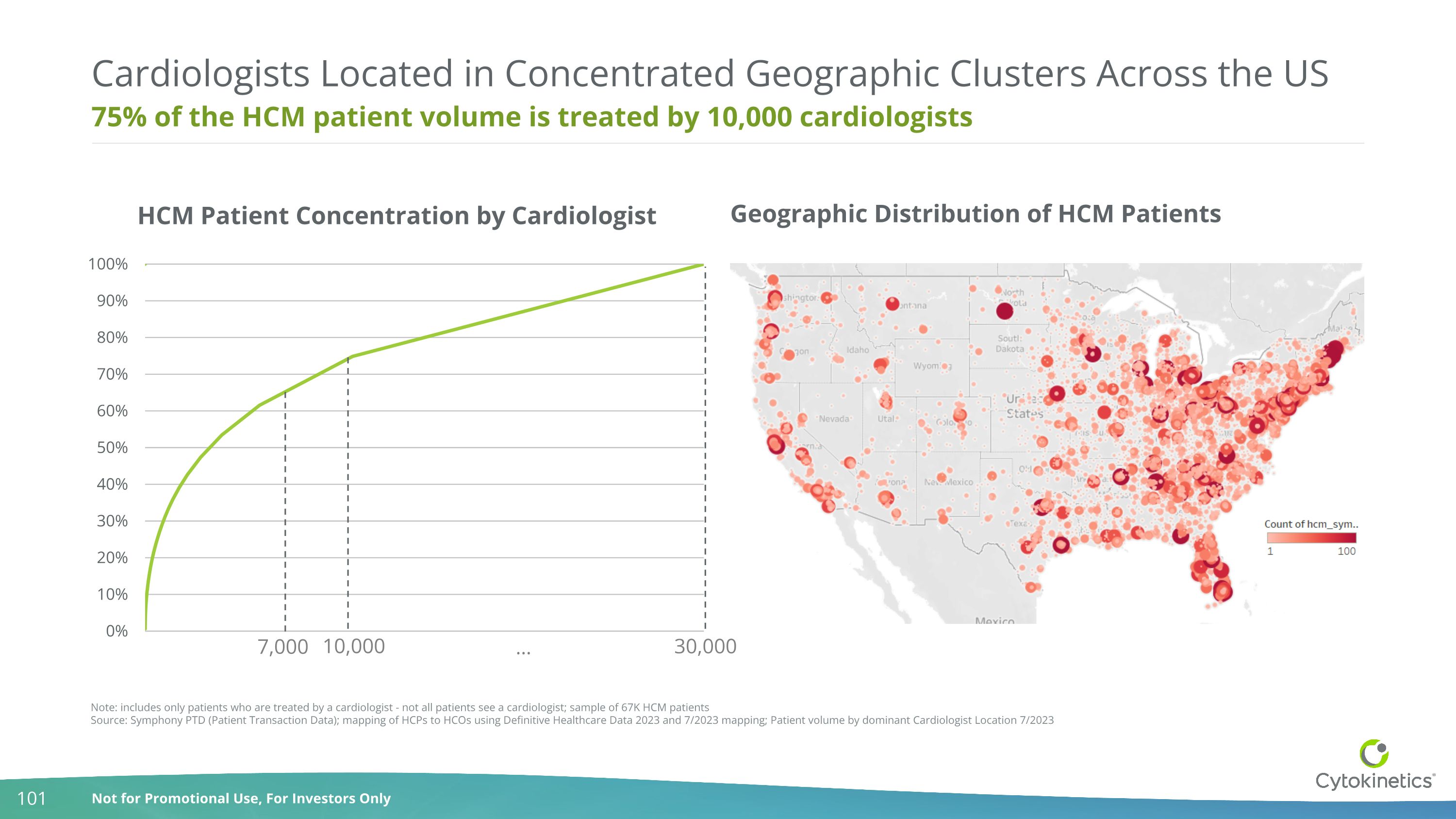

75% of the HCM patient volume is treated by 10,000 cardiologists Cardiologists Located in Concentrated Geographic Clusters Across the US Note: includes only patients who are treated by a cardiologist - not all patients see a cardiologist; sample of 67K HCM patients Source: Symphony PTD (Patient Transaction Data); mapping of HCPs to HCOs using Definitive Healthcare Data 2023 and 7/2023 mapping; Patient volume by dominant Cardiologist Location 7/2023 10,000 30,000 … Geographic Distribution of HCM Patients 7,000 HCM Patient Concentration by Cardiologist

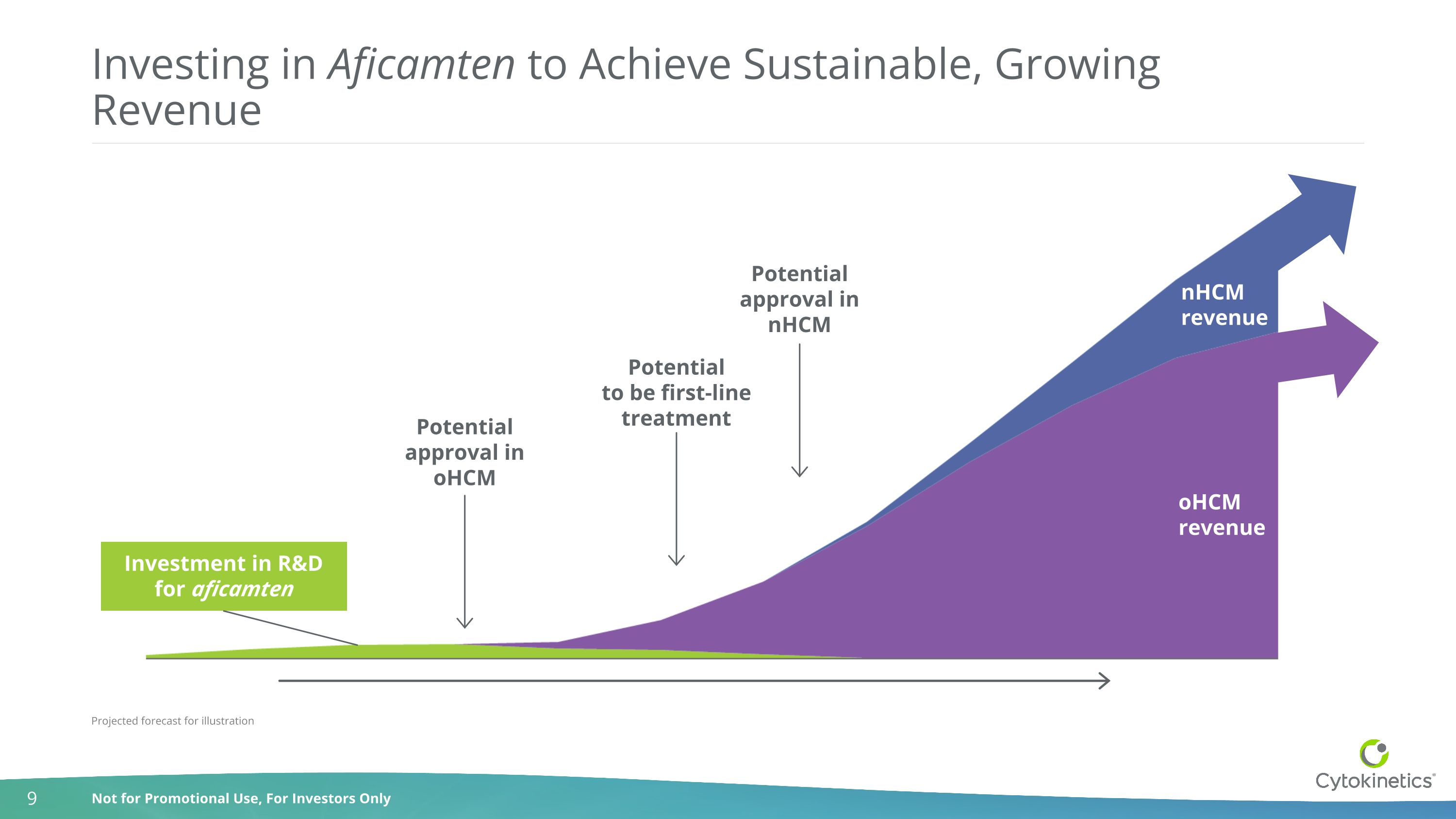

Investing in Aficamten to Achieve Sustainable, Growing Revenue Investment in R&D for aficamten oHCM revenue nHCM revenue Potential approval in oHCM Potential approval in nHCM Potential to be first-line treatment Projected forecast for illustration

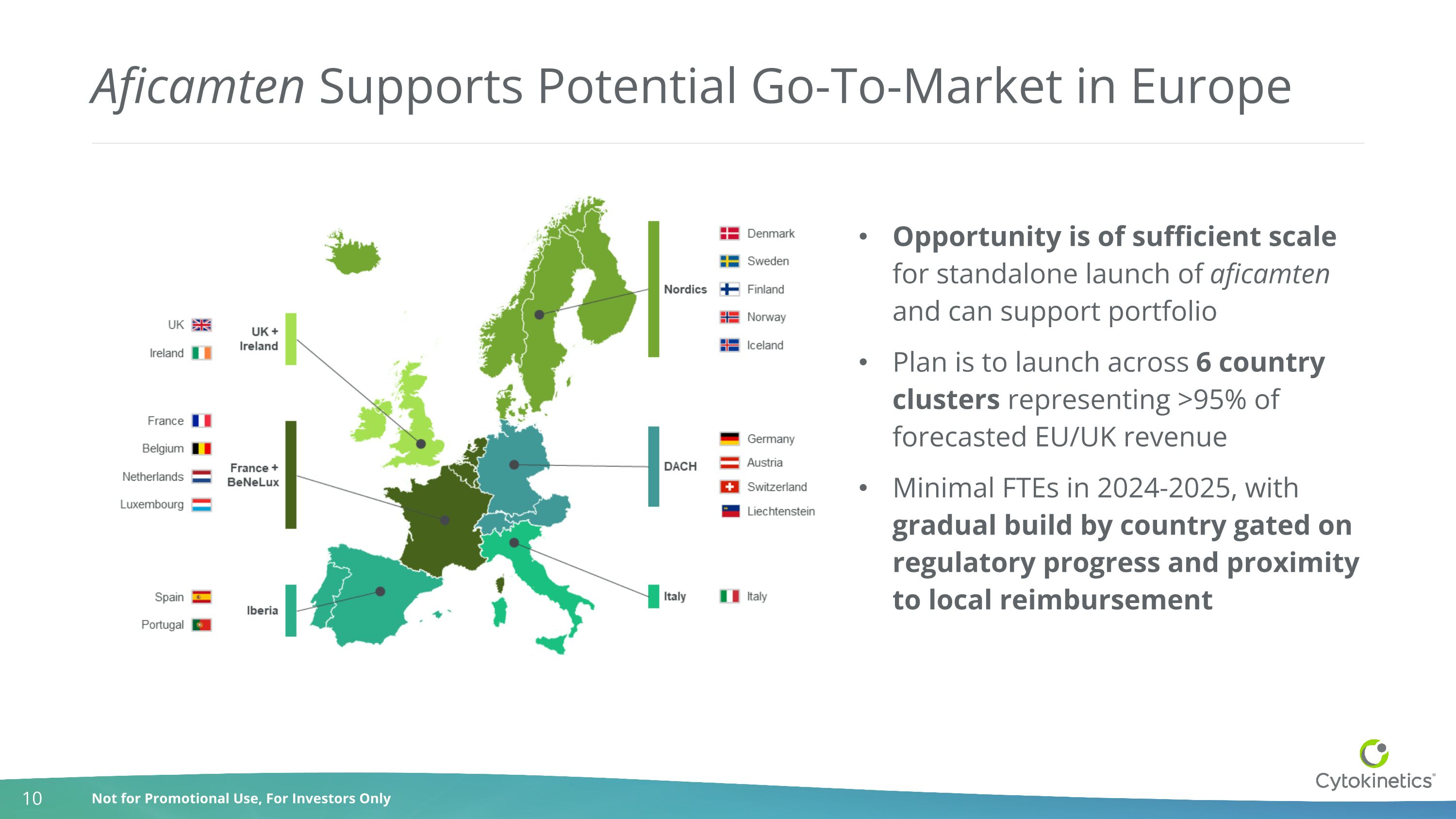

Aficamten Supports Potential Go-To-Market in Europe Opportunity is of sufficient scale for standalone launch of aficamten and can support portfolio Plan is to launch across 6 country clusters representing >95% of forecasted EU/UK revenue Minimal FTEs in 2024-2025, with gradual build by country gated on regulatory progress and proximity to local reimbursement

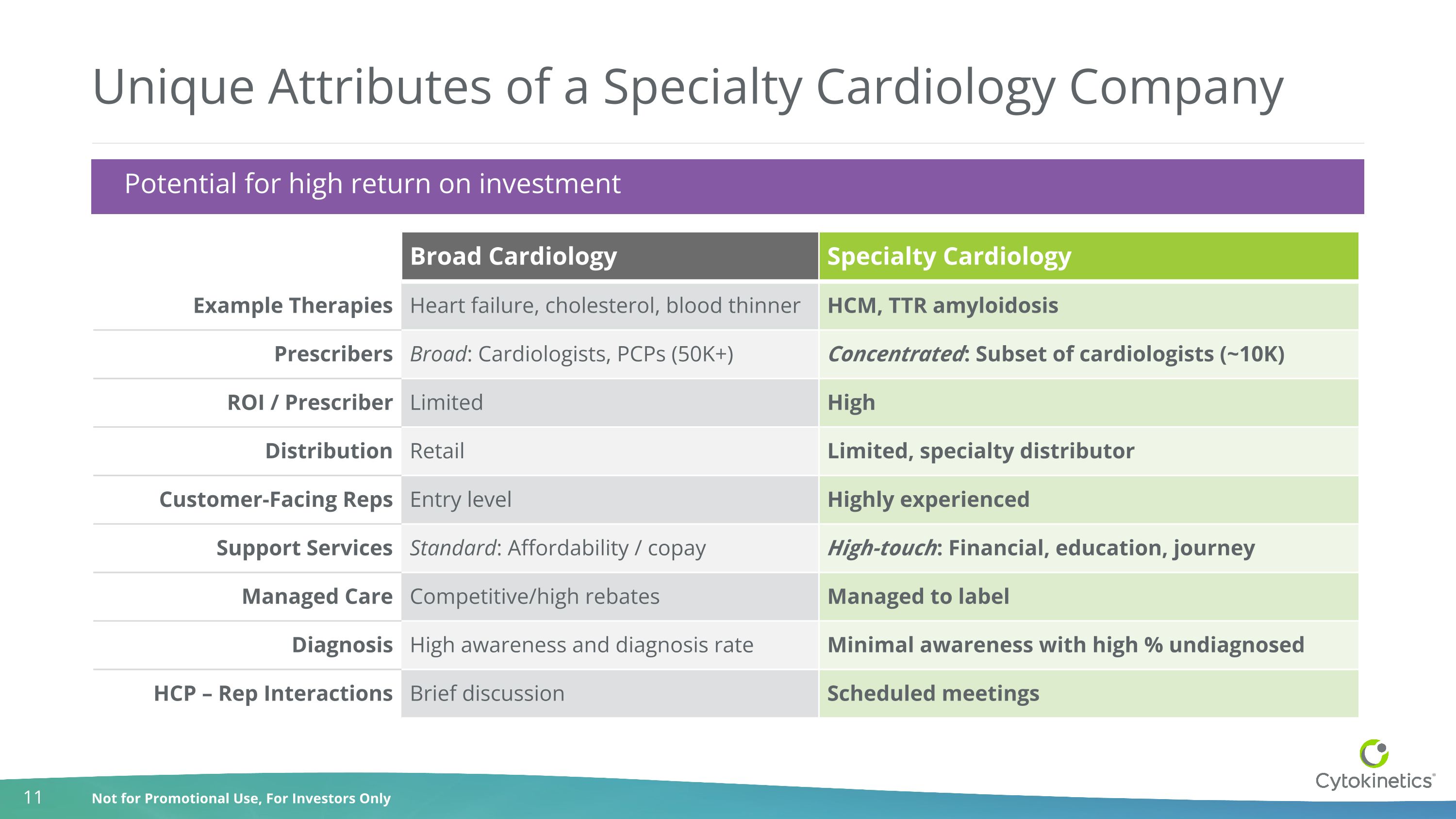

Unique Attributes of a Specialty Cardiology Company Broad Cardiology Specialty Cardiology Example Therapies Heart failure, cholesterol, blood thinner HCM, TTR amyloidosis Prescribers Broad: Cardiologists, PCPs (50K+) Concentrated: Subset of cardiologists (~10K) ROI / Prescriber Limited High Distribution Retail Limited, specialty distributor Customer-Facing Reps Entry level Highly experienced Support Services Standard: Affordability / copay High-touch: Financial, education, journey Managed Care Competitive/high rebates Managed to label Diagnosis High awareness and diagnosis rate Minimal awareness with high % undiagnosed HCP – Rep Interactions Brief discussion Scheduled meetings Potential for high return on investment

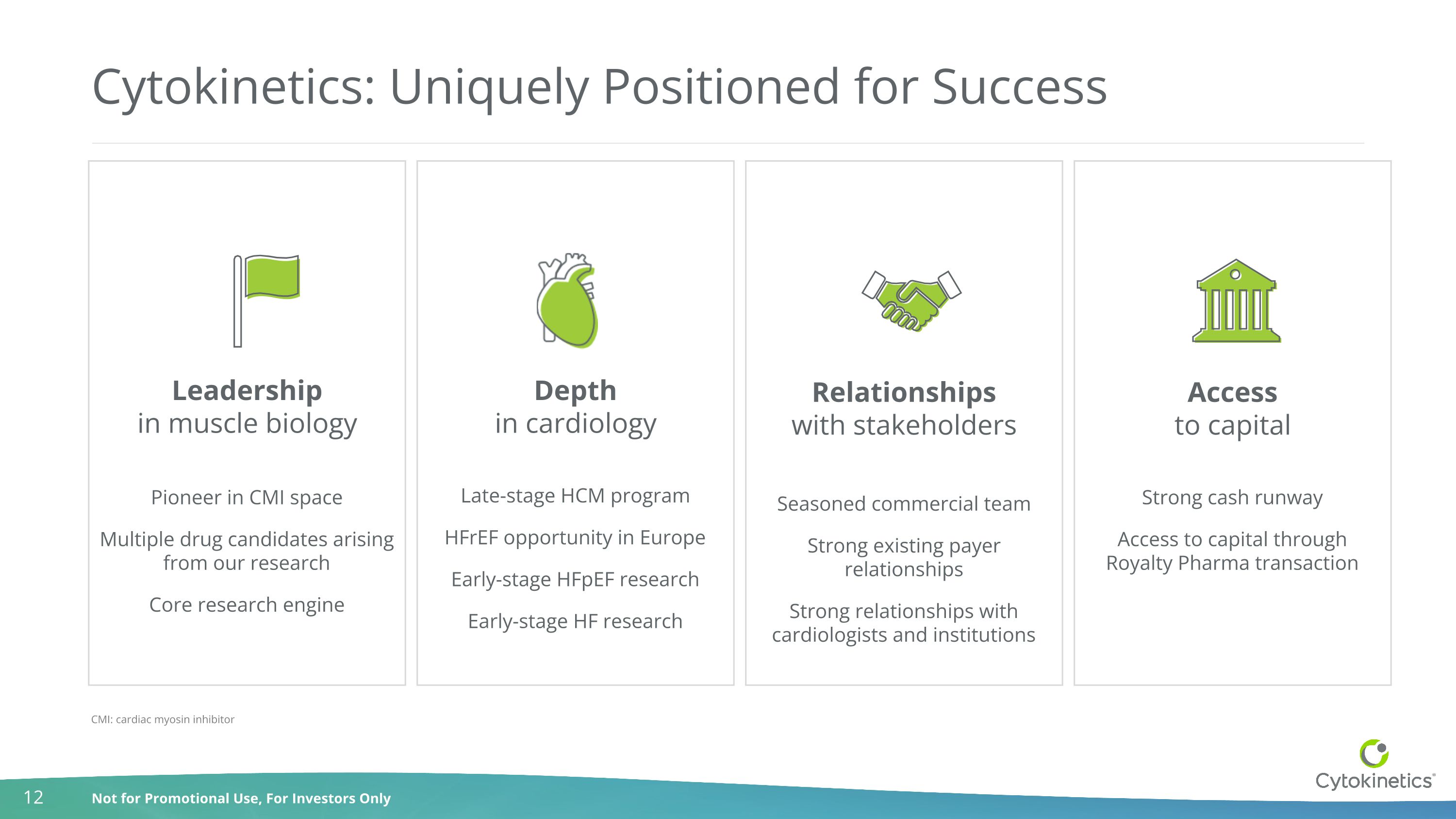

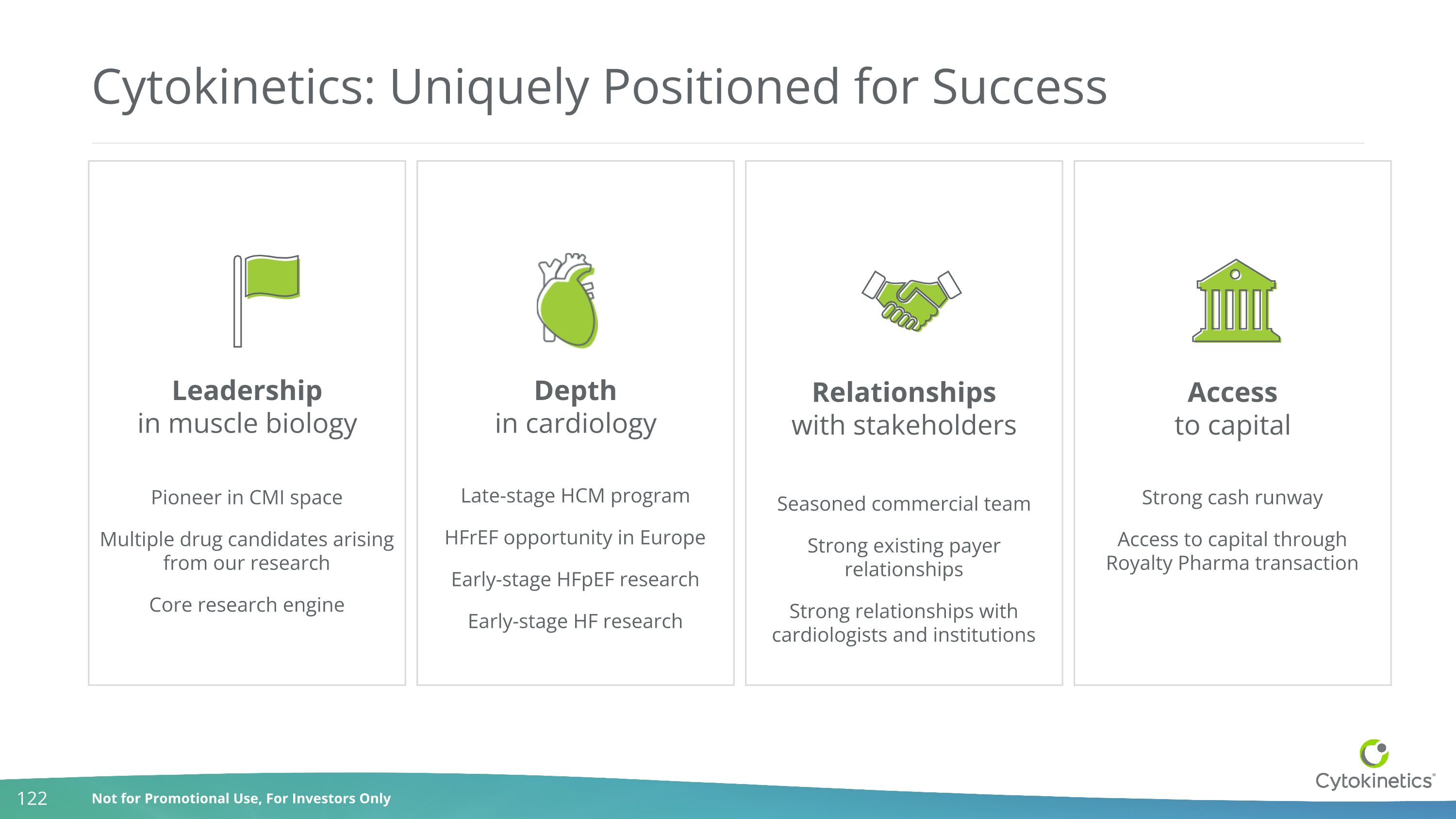

Strong cash runway Access to capital through Royalty Pharma transaction Pioneer in CMI space Multiple drug candidates arising from our research Core research engine Cytokinetics: Uniquely Positioned for Success Late-stage HCM program HFrEF opportunity in Europe Early-stage HFpEF research Early-stage HF research Seasoned commercial team Strong existing payer relationships Strong relationships with cardiologists and institutions Leadership in muscle biology Depth in cardiology Relationships with stakeholders Access to capital CMI: cardiac myosin inhibitor

Cardiac Myosin Inhibition Fady Malik, M.D., Ph.D. EVP, Research & Development

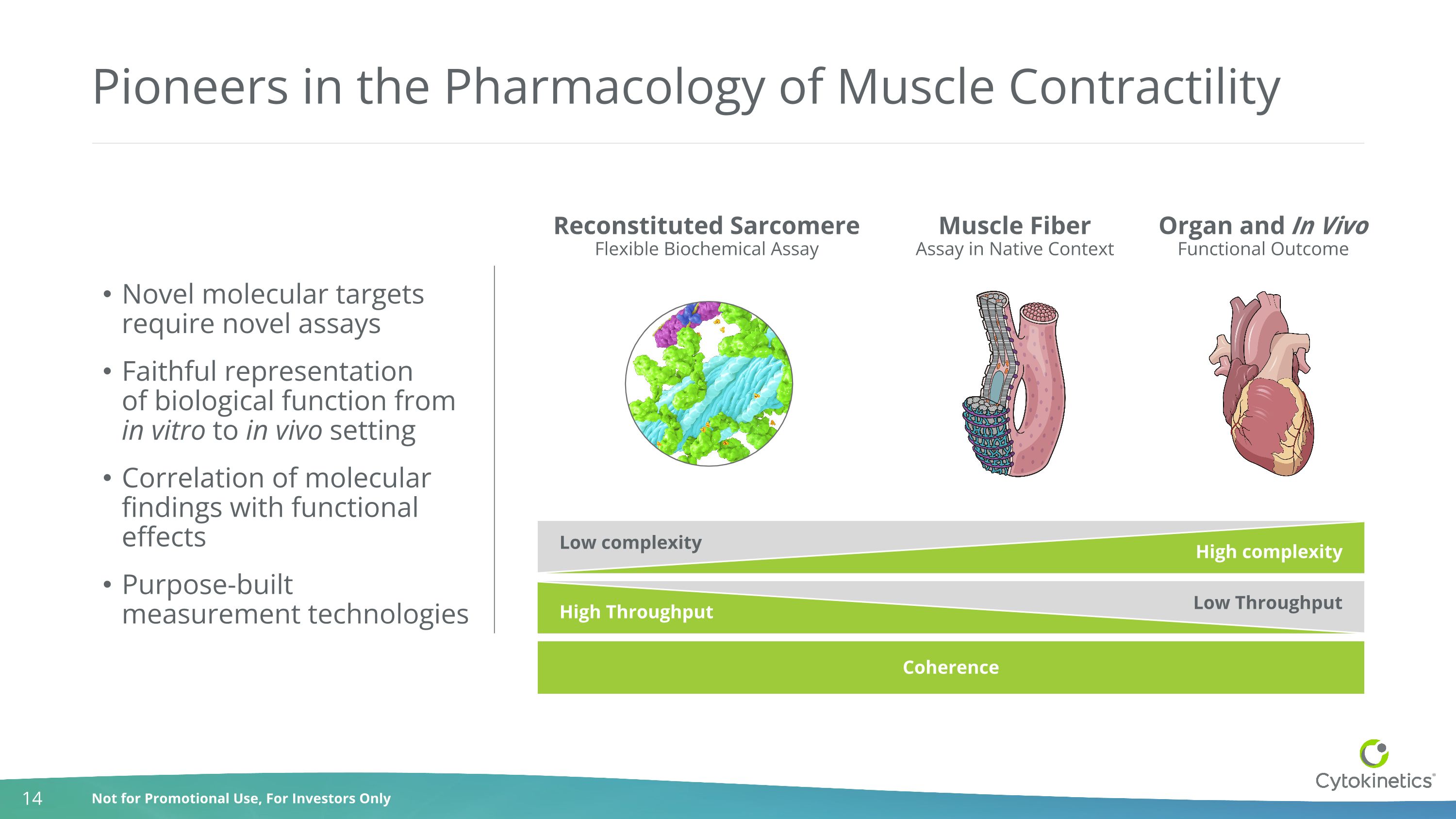

Pioneers in the Pharmacology of Muscle Contractility Reconstituted Sarcomere Flexible Biochemical Assay Muscle Fiber Assay in Native Context Organ and In Vivo Functional Outcome Novel molecular targets require novel assays Faithful representation of biological function from in vitro to in vivo setting Correlation of molecular findings with functional effects Purpose-built measurement technologies Low Throughput High Throughput Coherence Low complexity High complexity

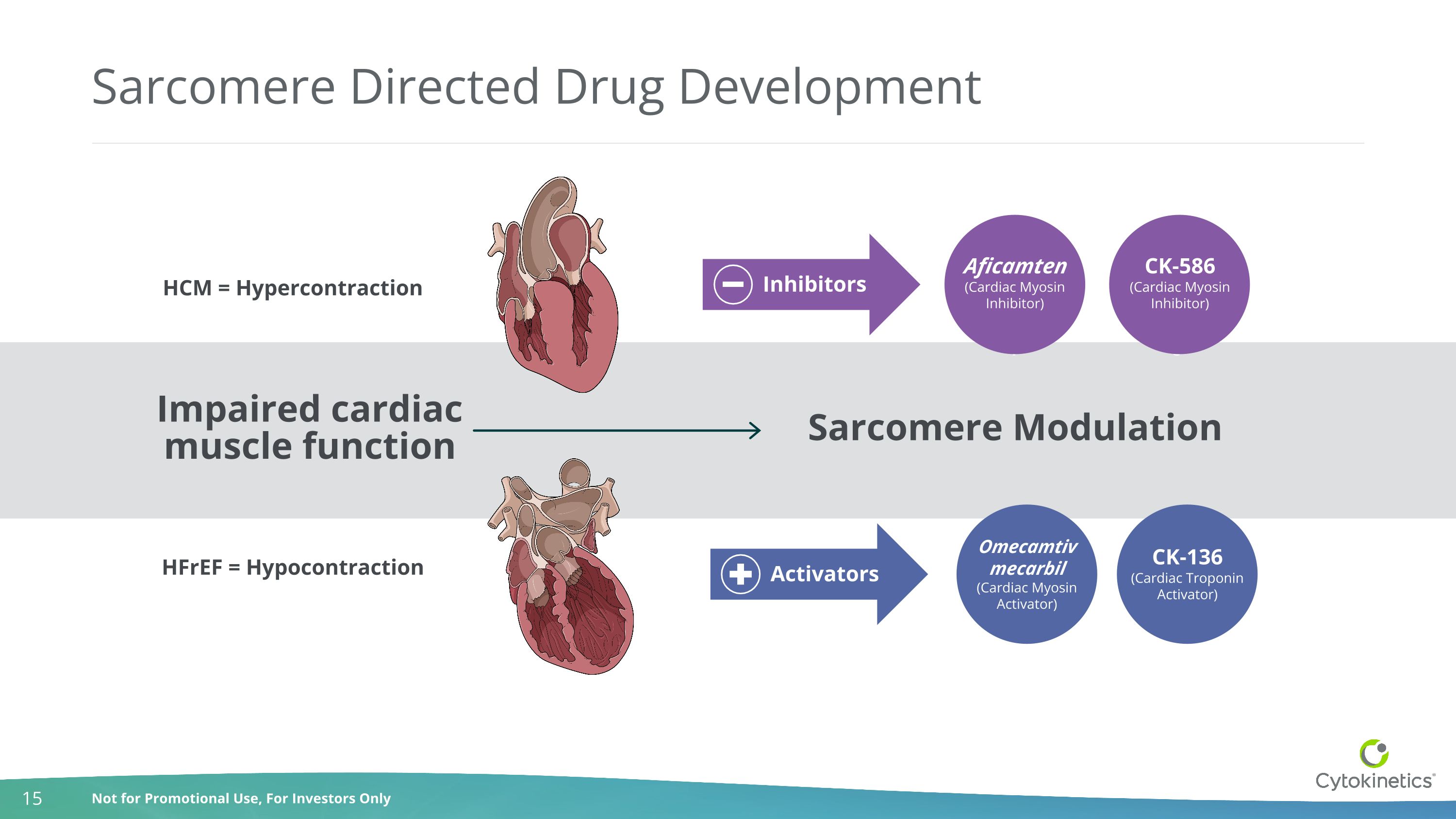

Sarcomere Directed Drug Development HCM = Hypercontraction HFrEF = Hypocontraction Impaired cardiac muscle function Sarcomere Modulation Activators CK-136 (Cardiac Troponin Activator) Omecamtiv mecarbil(Cardiac Myosin Activator) PII PC CK-586 (Cardiac Myosin Inhibitor) Aficamten(Cardiac Myosin Inhibitor) Inhibitors

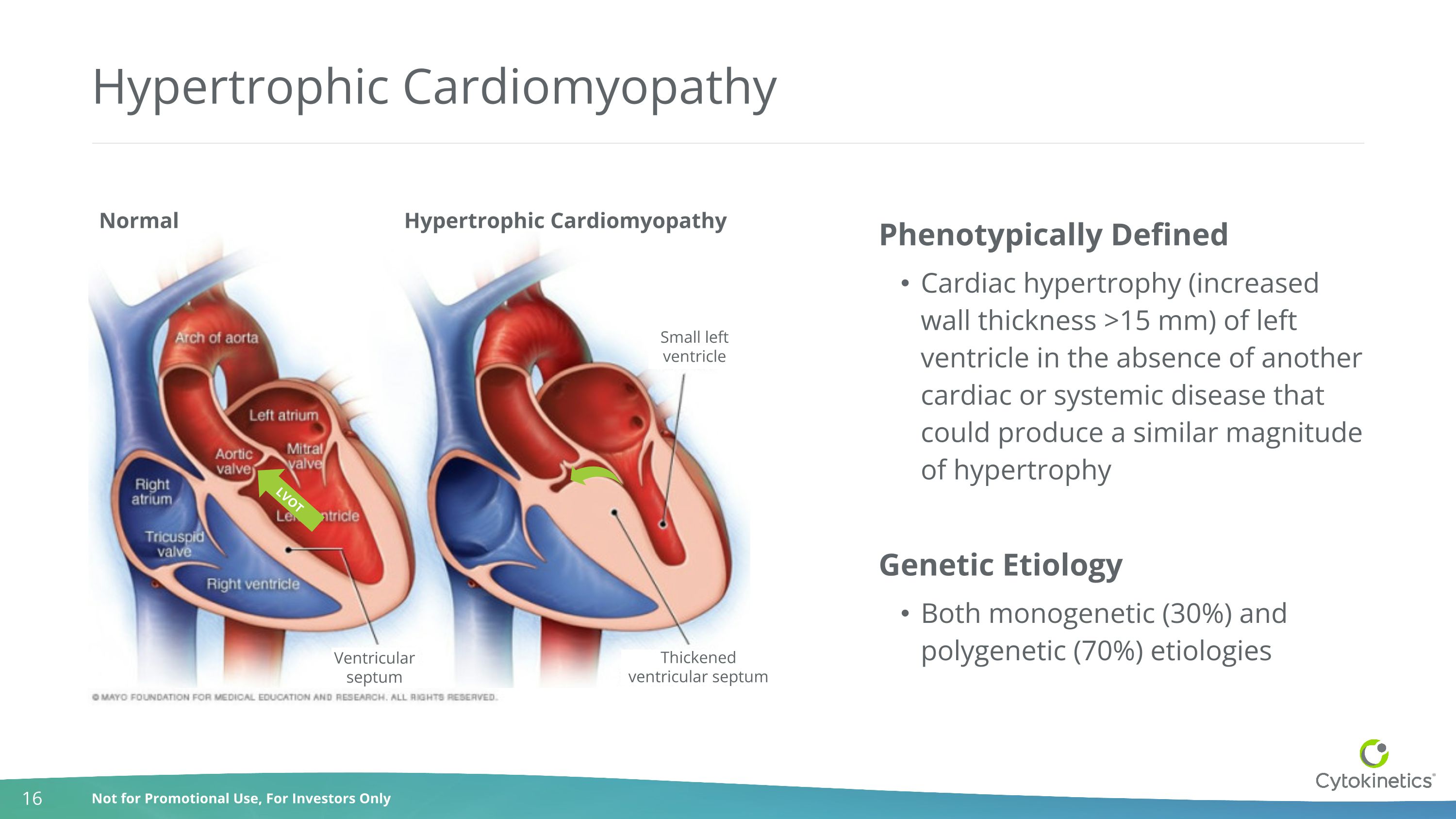

Hypertrophic Cardiomyopathy Phenotypically Defined Cardiac hypertrophy (increased wall thickness >15 mm) of left ventricle in the absence of another cardiac or systemic disease that could produce a similar magnitude of hypertrophy Genetic Etiology Both monogenetic (30%) and polygenetic (70%) etiologies LVOT Normal Hypertrophic Cardiomyopathy Small left ventricle Thickened ventricular septum Ventricular septum

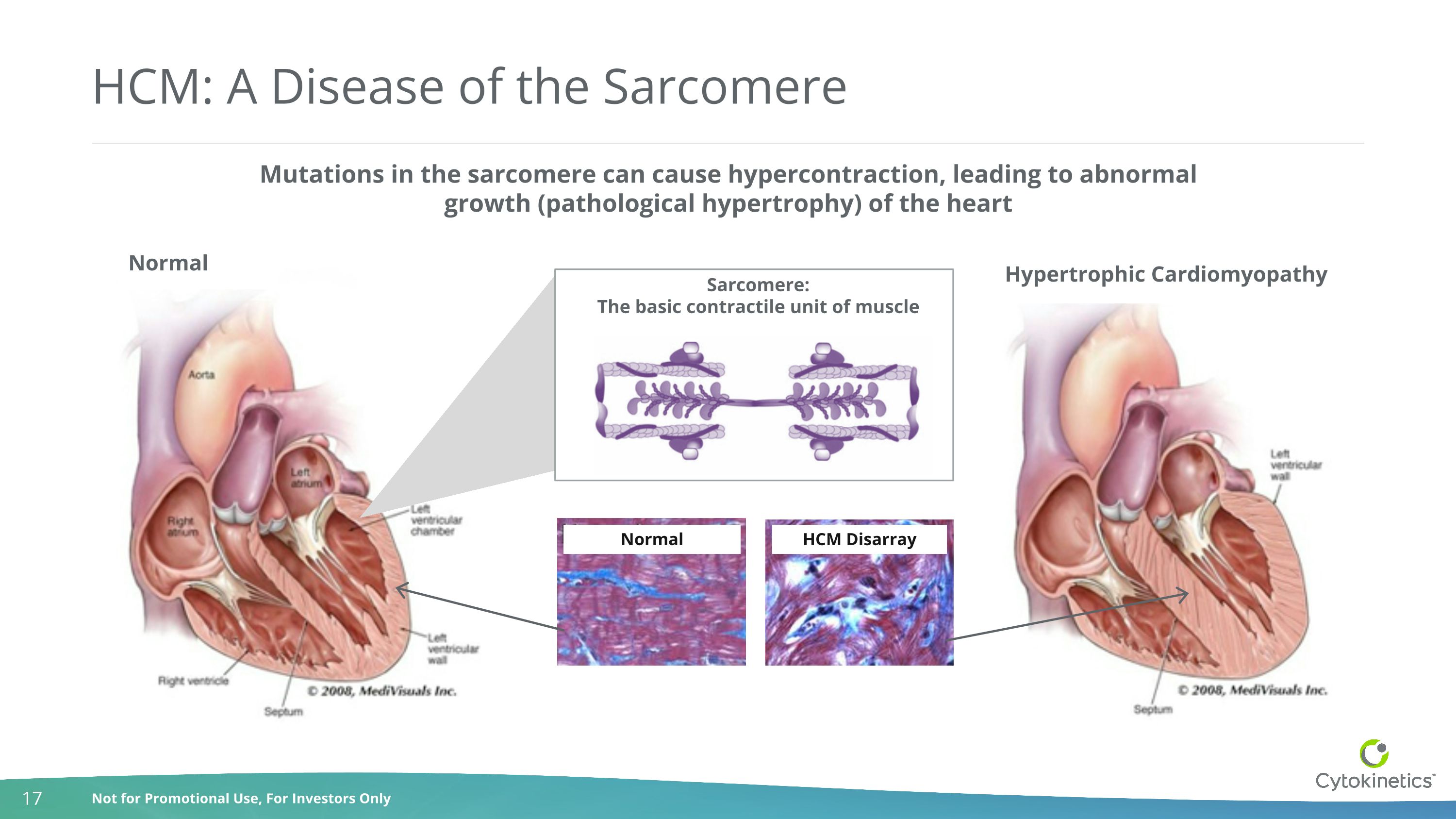

Hypertrophic Cardiomyopathy Mutations in the sarcomere can cause hypercontraction, leading to abnormal growth (pathological hypertrophy) of the heart Sarcomere: The basic contractile unit of muscle HCM: A Disease of the Sarcomere Normal HCM Disarray Normal

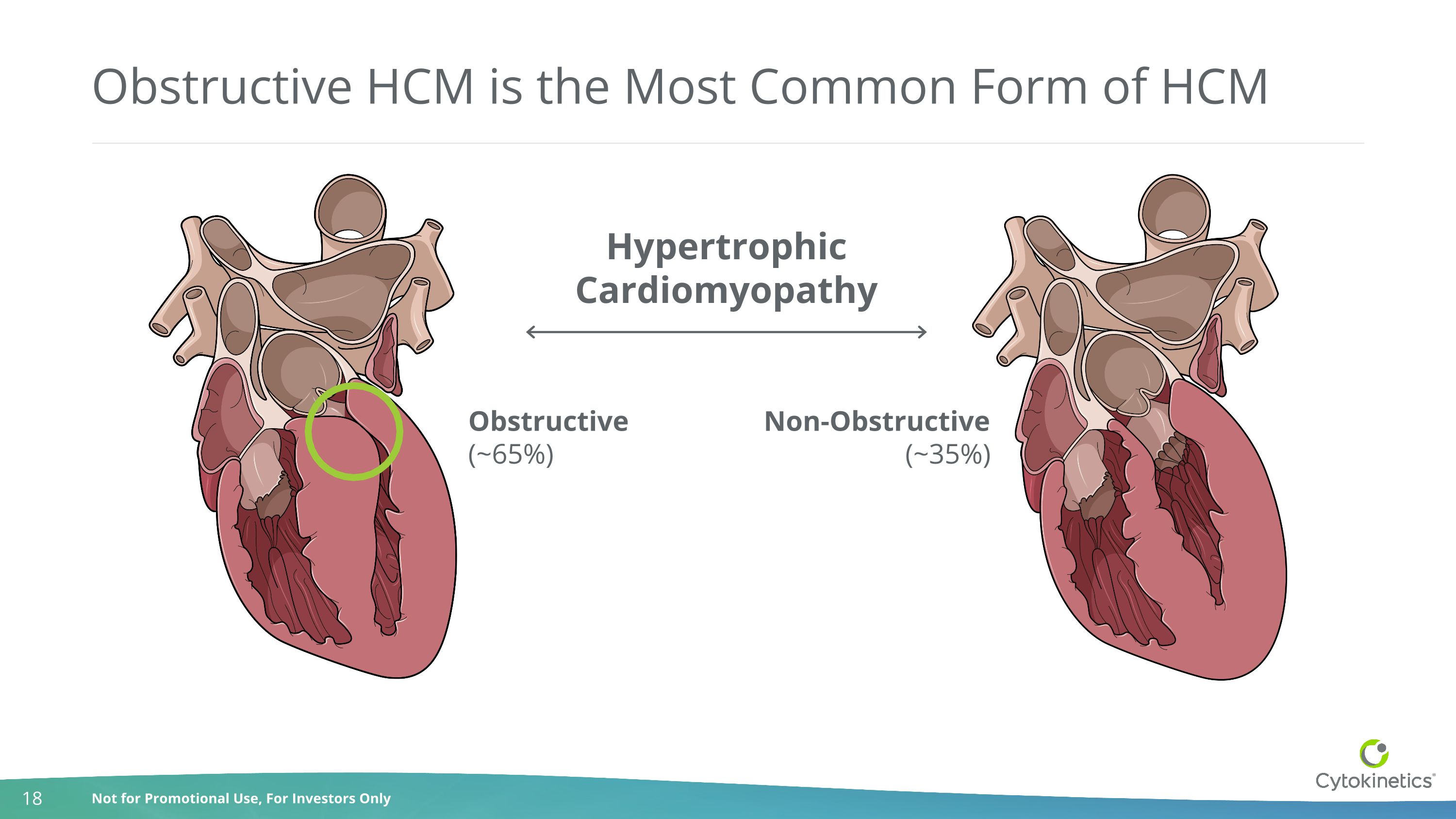

Obstructive HCM is the Most Common Form of HCM Obstructive(~65%) Non-Obstructive(~35%) HypertrophicCardiomyopathy

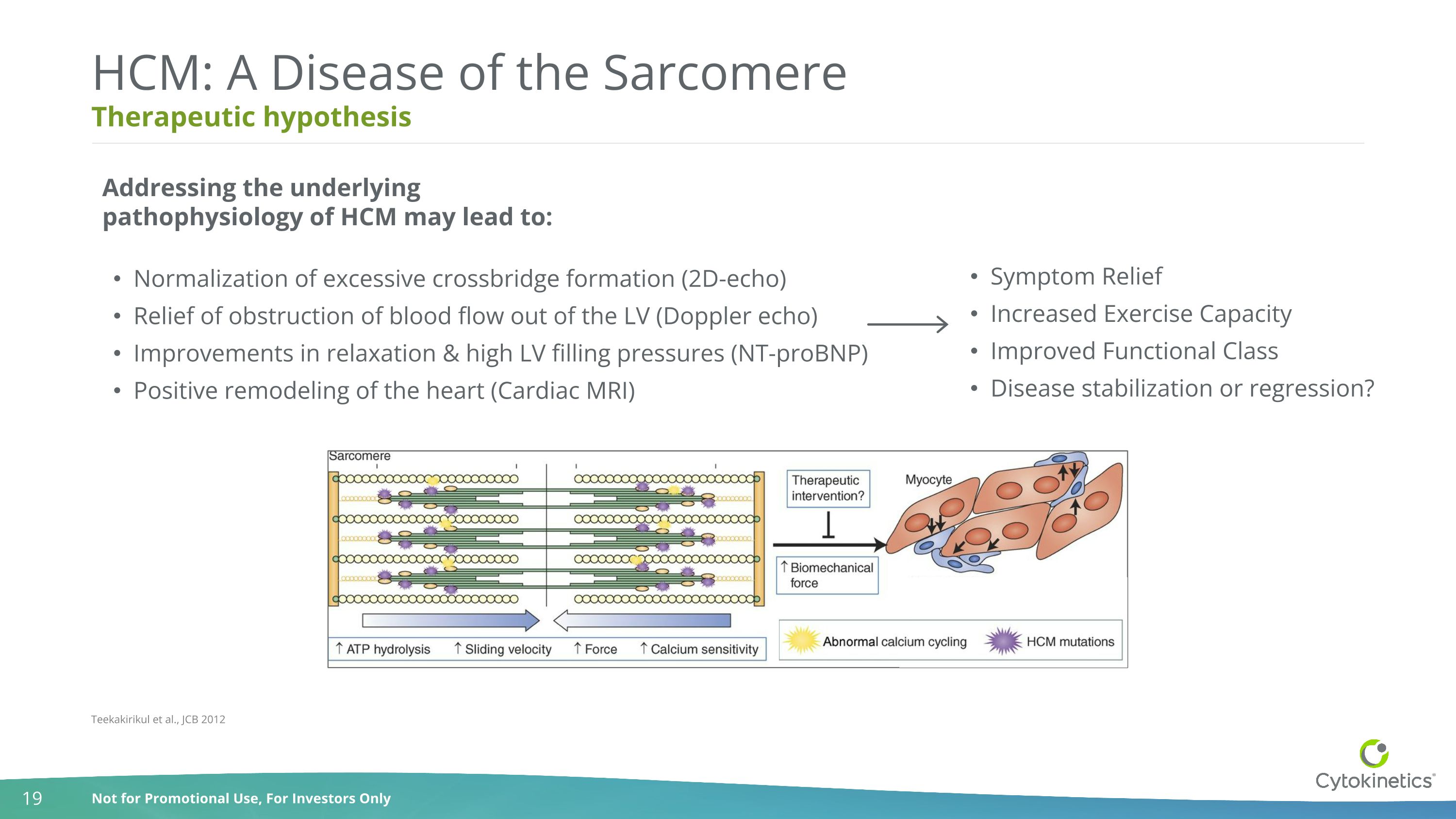

Therapeutic hypothesis HCM: A Disease of the Sarcomere Normalization of excessive crossbridge formation (2D-echo) Relief of obstruction of blood flow out of the LV (Doppler echo) Improvements in relaxation & high LV filling pressures (NT-proBNP) Positive remodeling of the heart (Cardiac MRI) Teekakirikul et al., JCB 2012 Symptom Relief Increased Exercise Capacity Improved Functional Class Disease stabilization or regression? Addressing the underlying pathophysiology of HCM may lead to:

Cardiac Myosin Inhibitors: Aspirational Target Profile Precise Dosing Simplicity of Use Rapid Reversibility Symptom relief as early as within 2 weeks initiation and dose adjustment possible biweekly if indicated Echo guided dose titration allows both dose increases and decreases at the patient visit No off-target effects and use in combination with β-blockers, CCB, Disopyramide, and/or Ranolazine Down-titration to adjust dose or washout of pharmacodynamic effect within 2 weeks Rapid Onset Aficamten is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established.

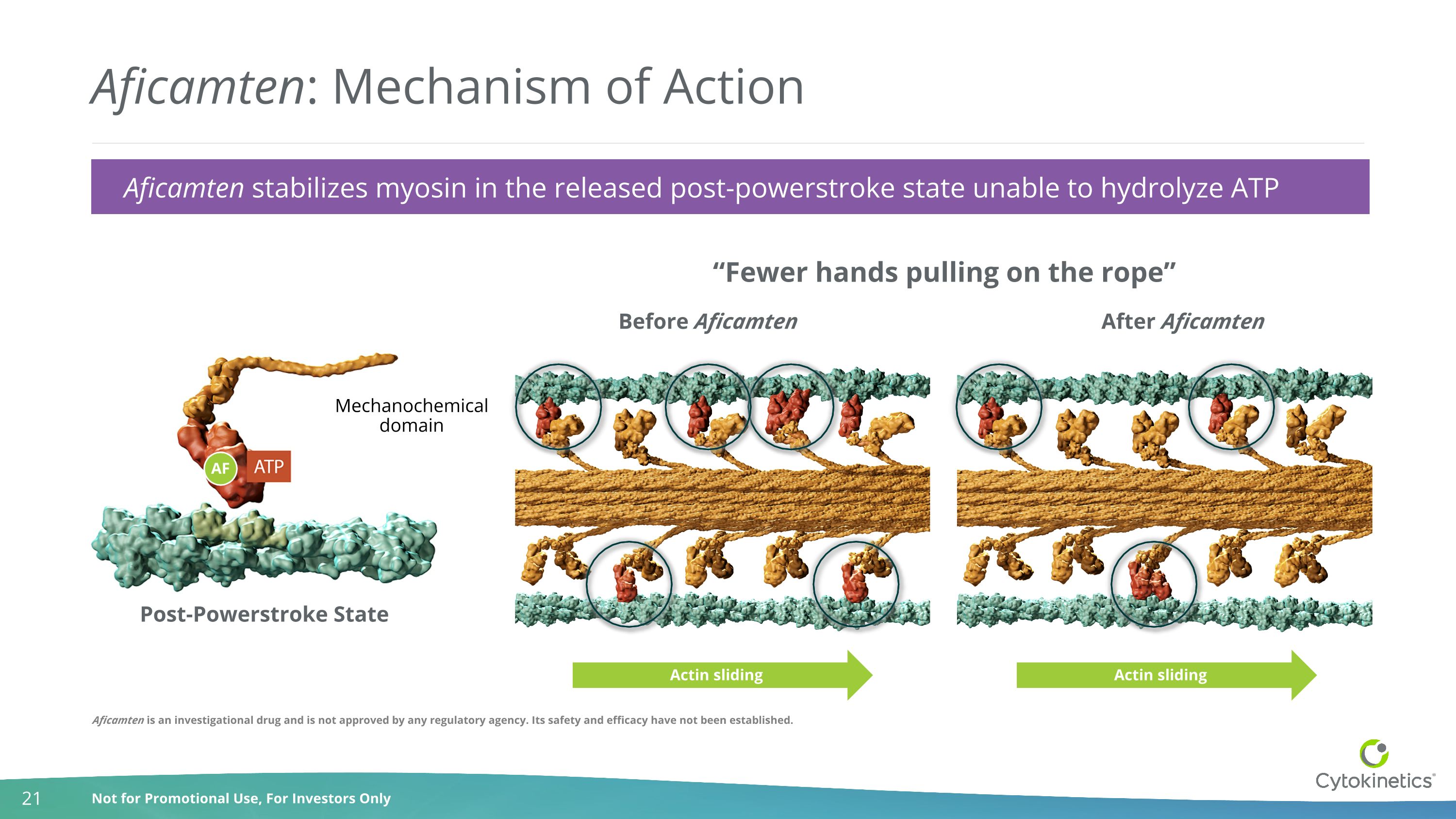

Aficamten: Mechanism of Action Post-Powerstroke State Before Aficamten After Aficamten Mechanochemical domain AF Actin sliding Actin sliding “Fewer hands pulling on the rope” Aficamten stabilizes myosin in the released post-powerstroke state unable to hydrolyze ATP Aficamten is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established.

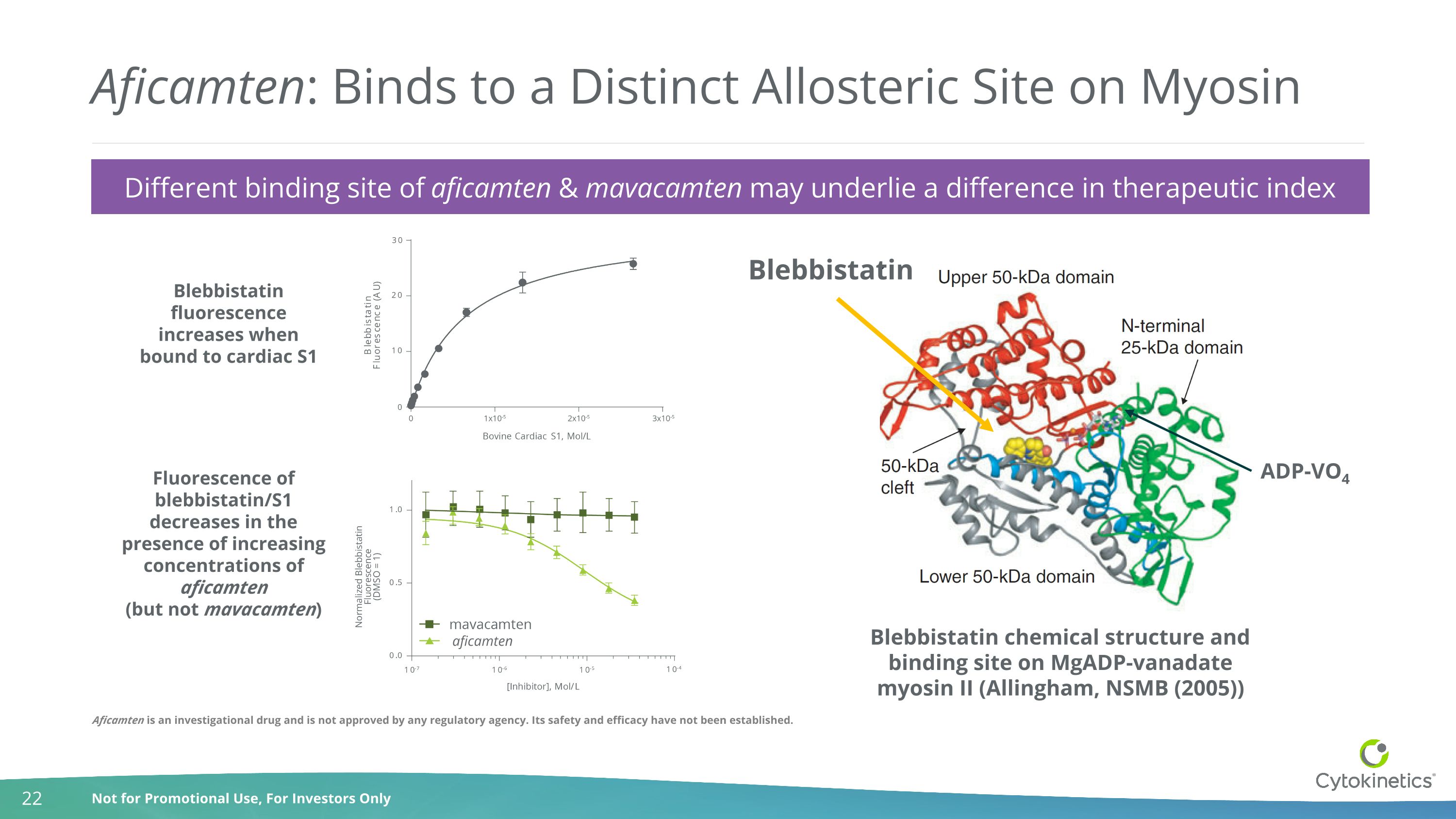

Aficamten: Binds to a Distinct Allosteric Site on Myosin Blebbistatin chemical structure and binding site on MgADP-vanadate myosin II (Allingham, NSMB (2005)) Blebbistatin fluorescence increases when bound to cardiac S1 Fluorescence of blebbistatin/S1 decreases in the presence of increasing concentrations of aficamten (but not mavacamten) ADP-VO4 Blebbistatin Different binding site of aficamten & mavacamten may underlie a difference in therapeutic index aficamten Aficamten is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established.

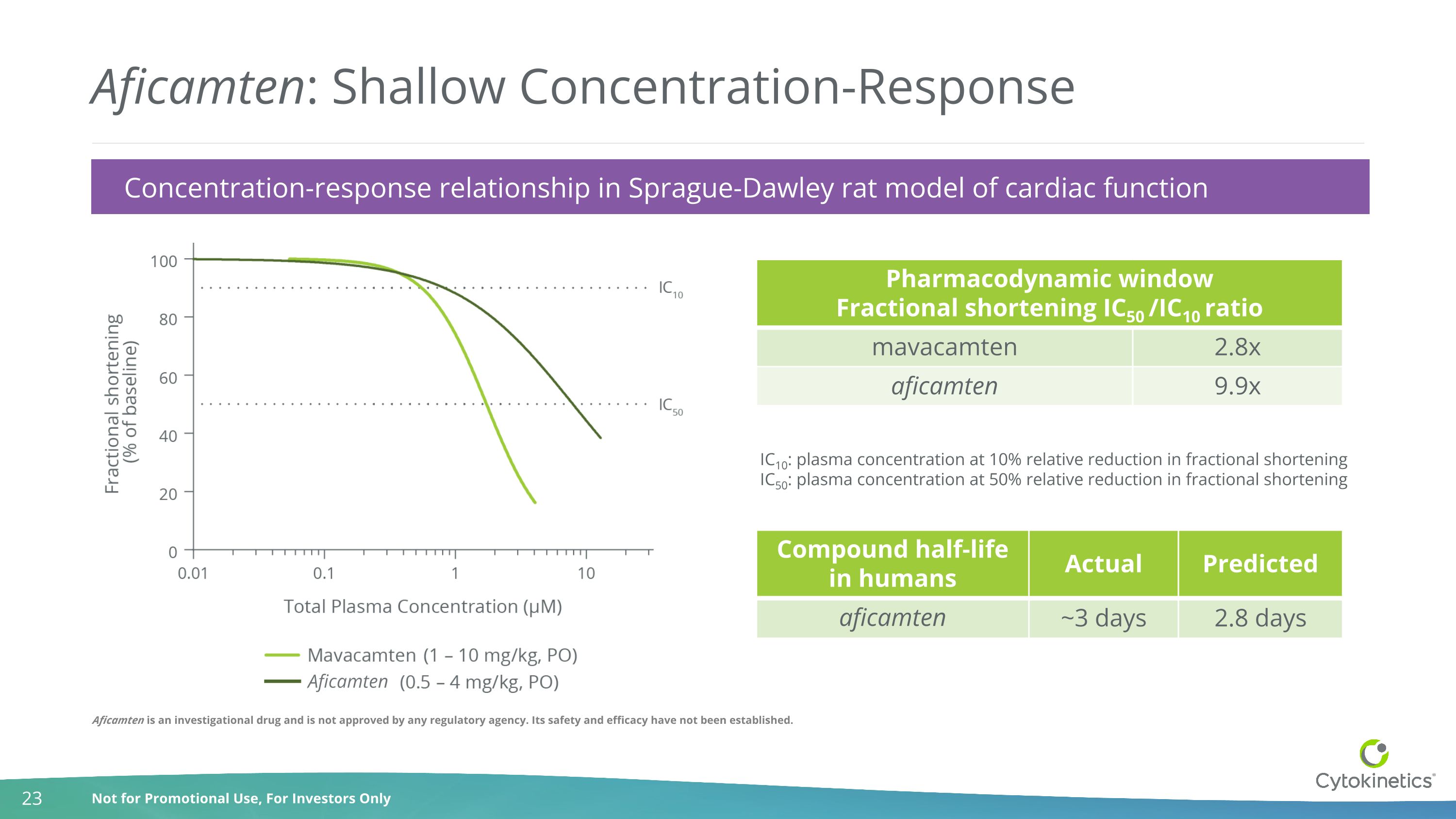

Aficamten: Shallow Concentration-Response Pharmacodynamic window Fractional shortening IC50 /IC10 ratio mavacamten 2.8x aficamten 9.9x IC10: plasma concentration at 10% relative reduction in fractional shortening IC50: plasma concentration at 50% relative reduction in fractional shortening Compound half-life in humans Actual Predicted aficamten ~3 days 2.8 days Concentration-response relationship in Sprague-Dawley rat model of cardiac function Aficamten Aficamten is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established.

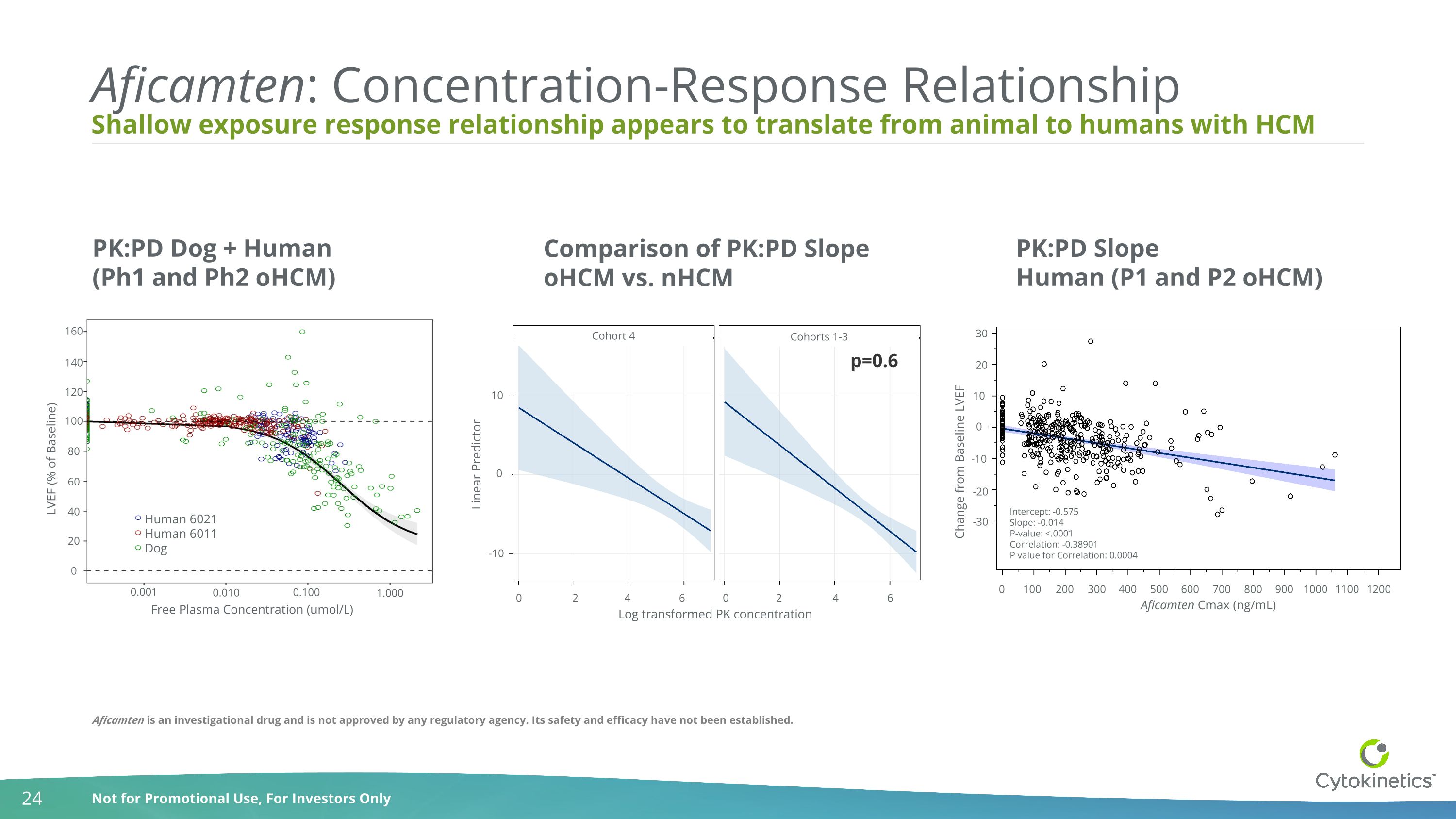

p=0.6 Log transformed PK concentration 0 2 4 6 0 2 4 6 -10 0 10 Linear Predictor Cohort 4 Cohorts 1-3 Shallow exposure response relationship appears to translate from animal to humans with HCM Aficamten: Concentration-Response Relationship PK:PD Dog + Human (Ph1 and Ph2 oHCM) PK:PD Slope Human (P1 and P2 oHCM) Aficamten is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established. LVEF (% of Baseline) Free Plasma Concentration (umol/L) Human 6021 Human 6011 Dog 160 140 120 100 80 60 40 20 0 0.001 Comparison of PK:PD Slope oHCM vs. nHCM 0.010 0.100 1.000 0 100 200 300 400 500 600 700 800 900 1000 1100 1200 Aficamten Cmax (ng/mL) Change from Baseline LVEF -30 -20 -10 0 10 20 30 Intercept: -0.575 Slope: -0.014 P-value: <.0001 Correlation: -0.38901 P value for Correlation: 0.0004

HCM Landscape Andrew Callos EVP, Chief Commercial Officer

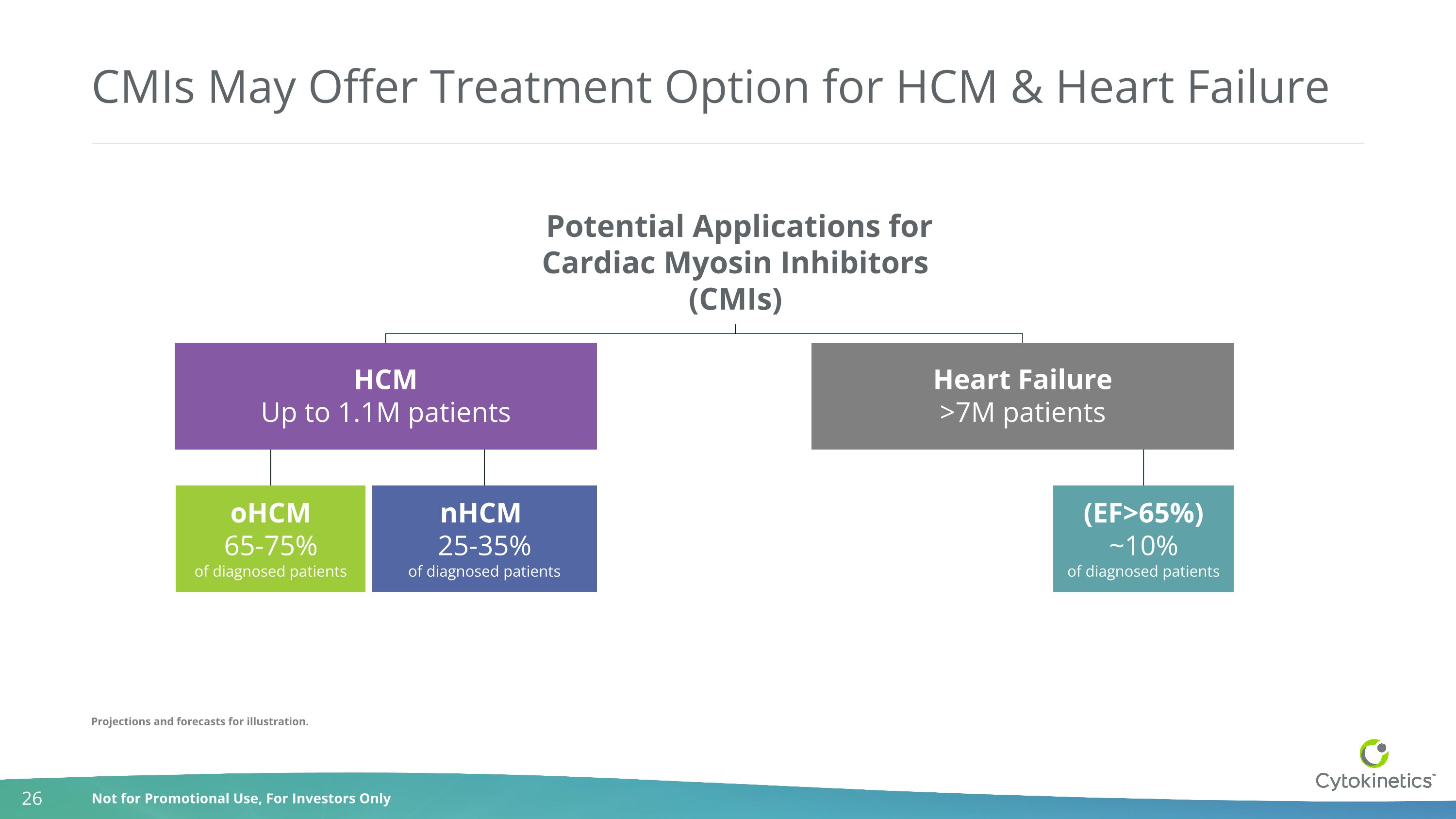

CMIs May Offer Treatment Option for HCM & Heart Failure HCM Up to 1.1M patients Heart Failure >7M patients Potential Applications for Cardiac Myosin Inhibitors (CMIs) oHCM 65-75% of diagnosed patients nHCM 25-35% of diagnosed patients (EF>65%) ~10% of diagnosed patients Projections and forecasts for illustration.

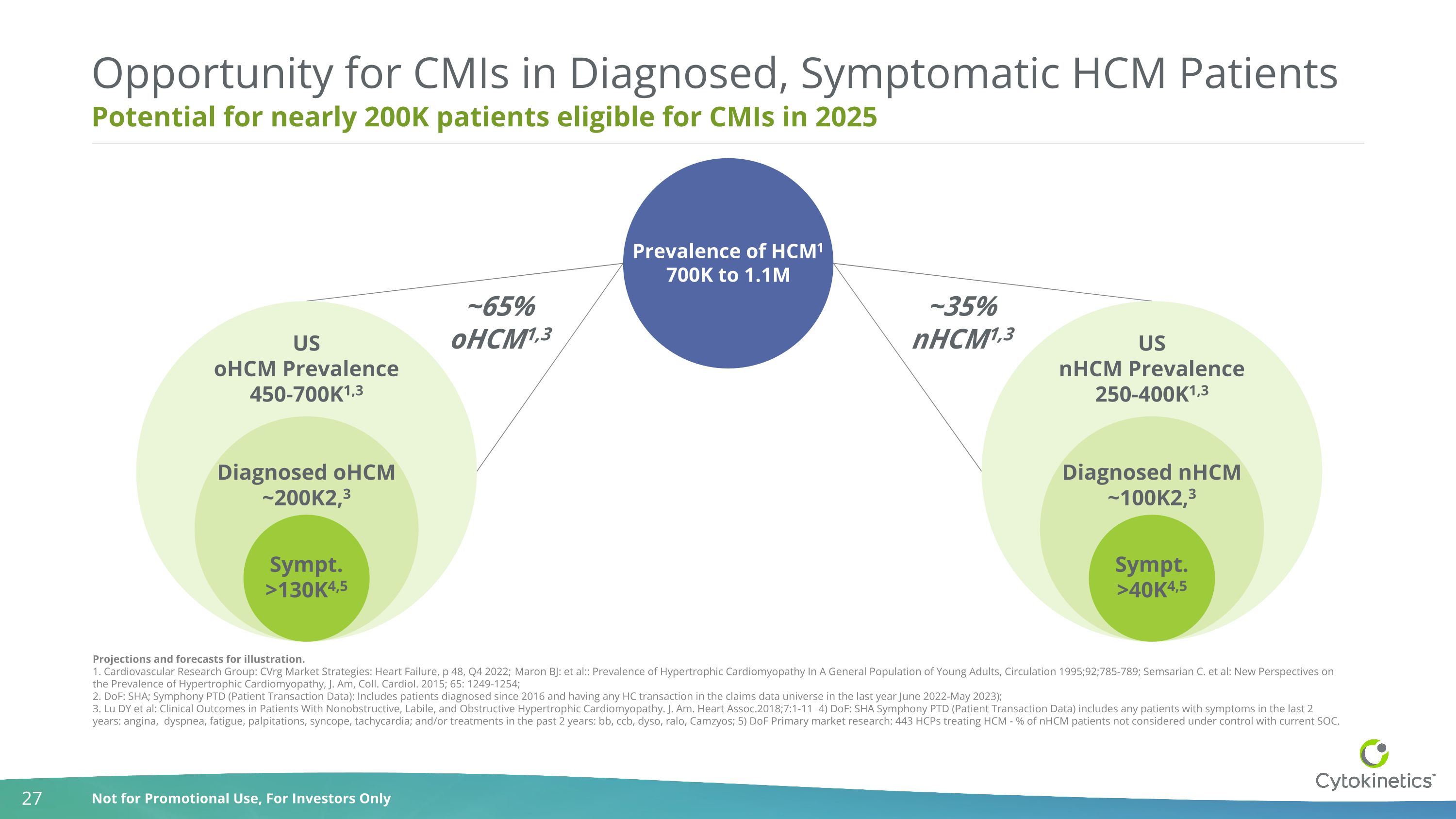

Potential for nearly 200K patients eligible for CMIs in 2025 Opportunity for CMIs in Diagnosed, Symptomatic HCM Patients Projections and forecasts for illustration. 1. Cardiovascular Research Group: CVrg Market Strategies: Heart Failure, p 48, Q4 2022; Maron BJ: et al:: Prevalence of Hypertrophic Cardiomyopathy In A General Population of Young Adults, Circulation 1995;92;785-789; Semsarian C. et al: New Perspectives on the Prevalence of Hypertrophic Cardiomyopathy, J. Am, Coll. Cardiol. 2015; 65: 1249-1254; 2. DoF: SHA; Symphony PTD (Patient Transaction Data): Includes patients diagnosed since 2016 and having any HC transaction in the claims data universe in the last year June 2022-May 2023); 3. Lu DY et al: Clinical Outcomes in Patients With Nonobstructive, Labile, and Obstructive Hypertrophic Cardiomyopathy. J. Am. Heart Assoc.2018;7:1-11 4) DoF: SHA Symphony PTD (Patient Transaction Data) includes any patients with symptoms in the last 2 years: angina, dyspnea, fatigue, palpitations, syncope, tachycardia; and/or treatments in the past 2 years: bb, ccb, dyso, ralo, Camzyos; 5) DoF Primary market research: 443 HCPs treating HCM - % of nHCM patients not considered under control with current SOC. Prevalence of HCM1 700K to 1.1M ~35% nHCM1,3 ~65% oHCM1,3 US oHCM Prevalence450-700K1,3 Diagnosed HCM~300K2 Sympt. >130K4,5 Diagnosed oHCM ~200K2,3 US nHCM Prevalence250-400K1,3 Sympt. >40K4,5 Diagnosed nHCM ~100K2,3

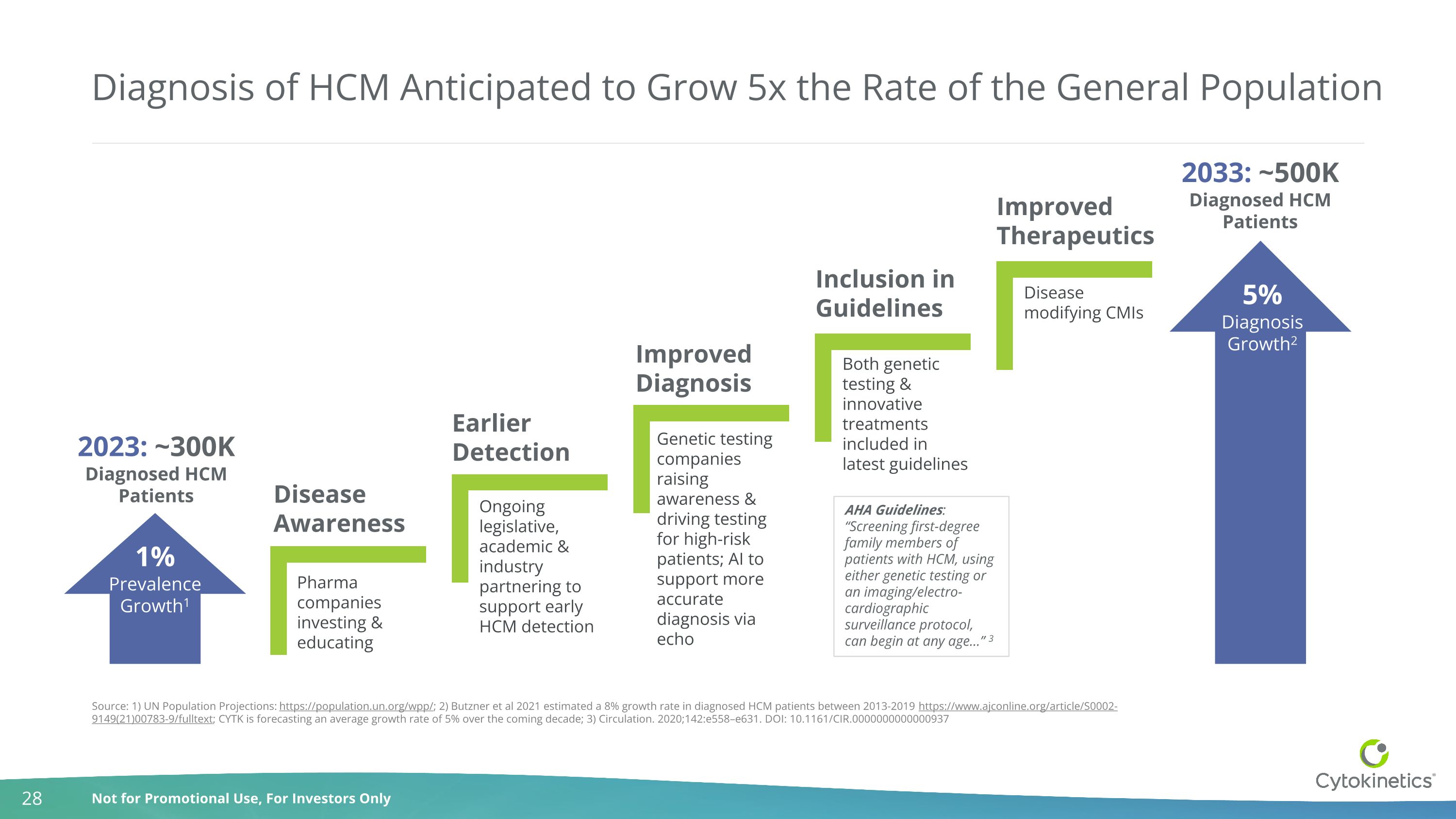

Diagnosis of HCM Anticipated to Grow 5x the Rate of the General Population Disease Awareness Inclusion in Guidelines Earlier Detection 1% Prevalence Growth1 5% Diagnosis Growth2 Improved Therapeutics 2023: ~300K Diagnosed HCM Patients 2033: ~500K Diagnosed HCM Patients Source: 1) UN Population Projections: https://population.un.org/wpp/; 2) Butzner et al 2021 estimated a 8% growth rate in diagnosed HCM patients between 2013-2019 https://www.ajconline.org/article/S0002-9149(21)00783-9/fulltext; CYTK is forecasting an average growth rate of 5% over the coming decade; 3) Circulation. 2020;142:e558–e631. DOI: 10.1161/CIR.0000000000000937 Genetic testing companies raising awareness & driving testing for high-risk patients; AI to support more accurate diagnosis via echo Pharma companies investing & educating Improved Diagnosis Ongoing legislative, academic & industry partnering to support early HCM detection Both genetic testing & innovative treatments included in latest guidelines Disease modifying CMIs AHA Guidelines: “Screening first-degree family members of patients with HCM, using either genetic testing or an imaging/electro-cardiographic surveillance protocol, can begin at any age…” 3

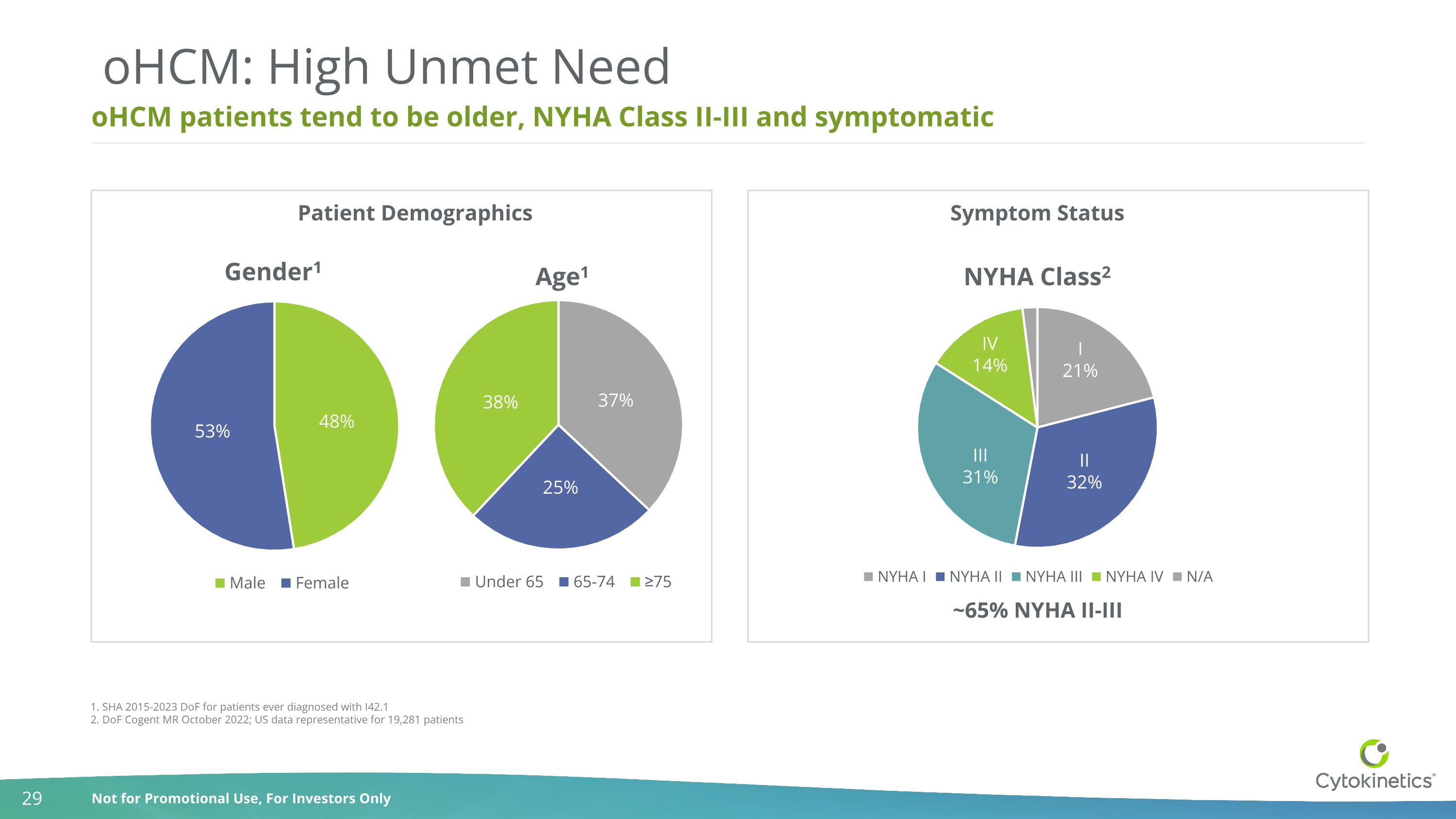

oHCM patients tend to be older, NYHA Class II-III and symptomatic oHCM: High Unmet Need 1. SHA 2015-2023 DoF for patients ever diagnosed with I42.1 2. DoF Cogent MR October 2022; US data representative for 19,281 patients ~65% NYHA II-III Patient Demographics Symptom Status

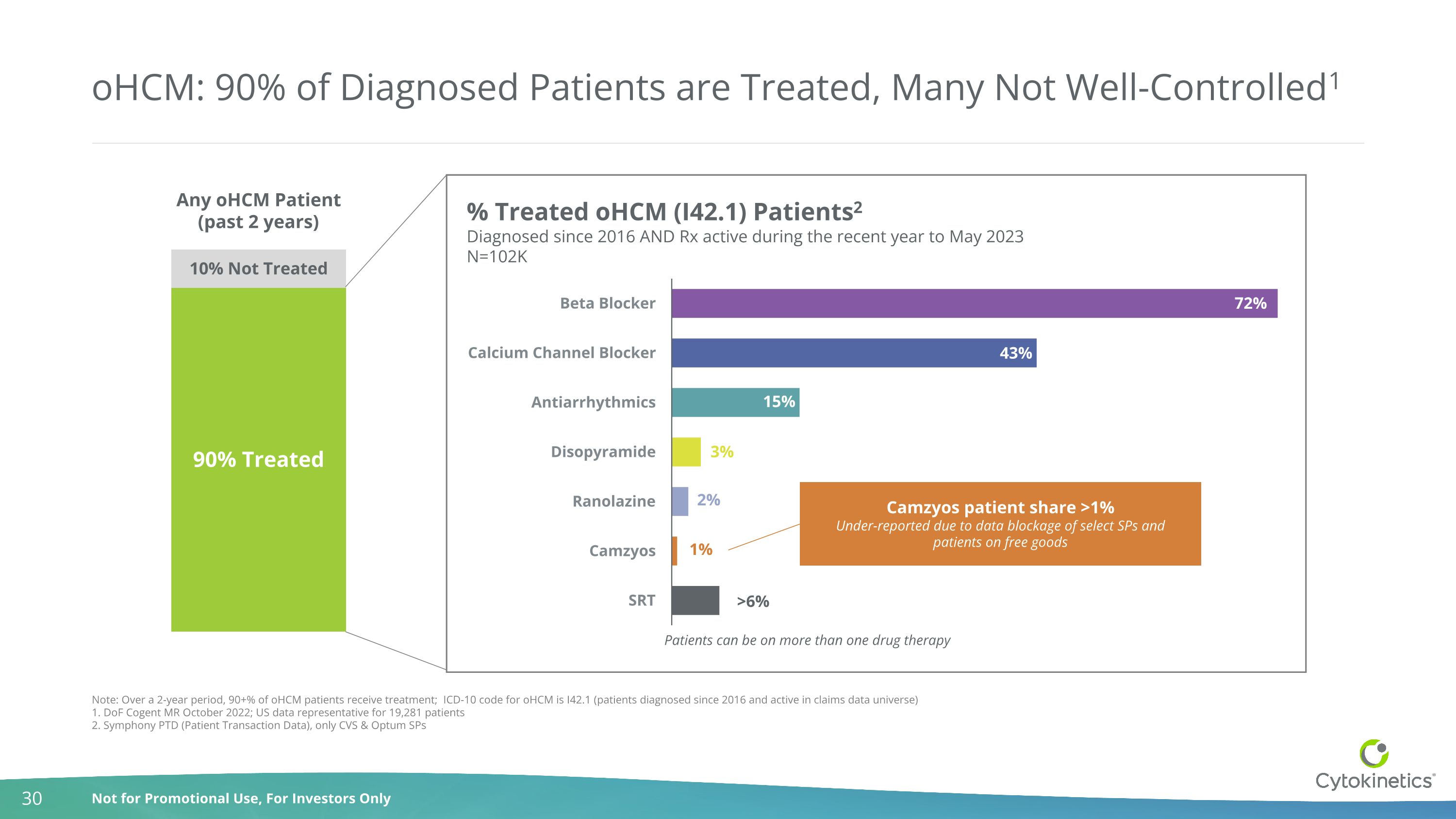

oHCM: 90% of Diagnosed Patients are Treated, Many Not Well-Controlled1 Camzyos patient share >1% Under-reported due to data blockage of select SPs and patients on free goods Patients can be on more than one drug therapy 90% Treated 10% Not Treated Any oHCM Patient (past 2 years) Note: Over a 2-year period, 90+% of oHCM patients receive treatment; ICD-10 code for oHCM is I42.1 (patients diagnosed since 2016 and active in claims data universe) 1. DoF Cogent MR October 2022; US data representative for 19,281 patients 2. Symphony PTD (Patient Transaction Data), only CVS & Optum SPs % Treated oHCM (I42.1) Patients2 Diagnosed since 2016 AND Rx active during the recent year to May 2023 N=102K

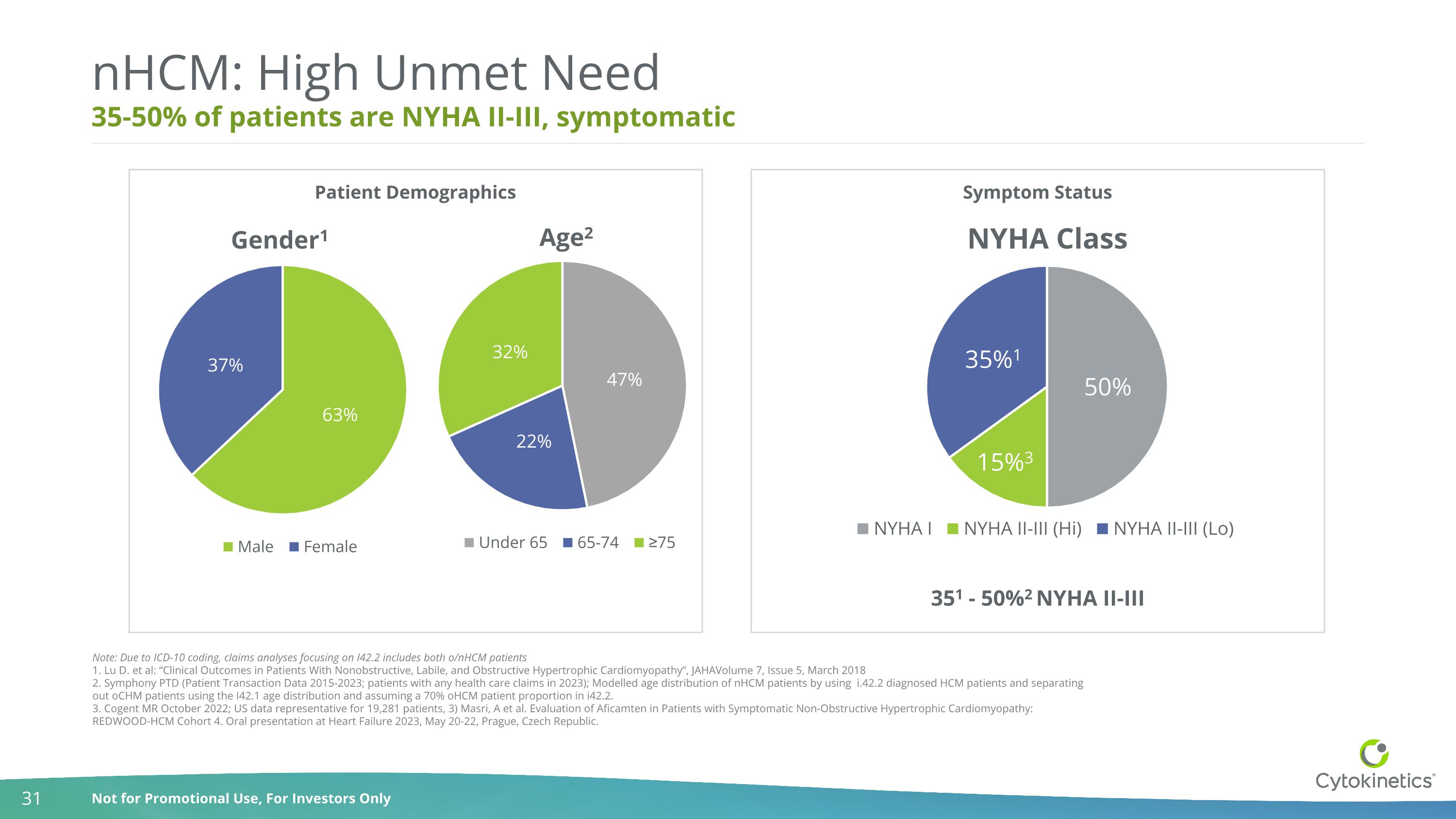

35-50% of patients are NYHA II-III, symptomatic nHCM: High Unmet Need Note: Due to ICD-10 coding, claims analyses focusing on I42.2 includes both o/nHCM patients 1. Lu D. et al: “Clinical Outcomes in Patients With Nonobstructive, Labile, and Obstructive Hypertrophic Cardiomyopathy”, JAHAVolume 7, Issue 5, March 2018 2. Symphony PTD (Patient Transaction Data 2015-2023; patients with any health care claims in 2023); Modelled age distribution of nHCM patients by using i.42.2 diagnosed HCM patients and separating out oCHM patients using the I42.1 age distribution and assuming a 70% oHCM patient proportion in i42.2. 3. Cogent MR October 2022; US data representative for 19,281 patients, 3) Masri, A et al. Evaluation of Aficamten in Patients with Symptomatic Non-Obstructive Hypertrophic Cardiomyopathy: REDWOOD-HCM Cohort 4. Oral presentation at Heart Failure 2023, May 20-22, Prague, Czech Republic. 351 - 50%2 NYHA II-III Patient Demographics Symptom Status

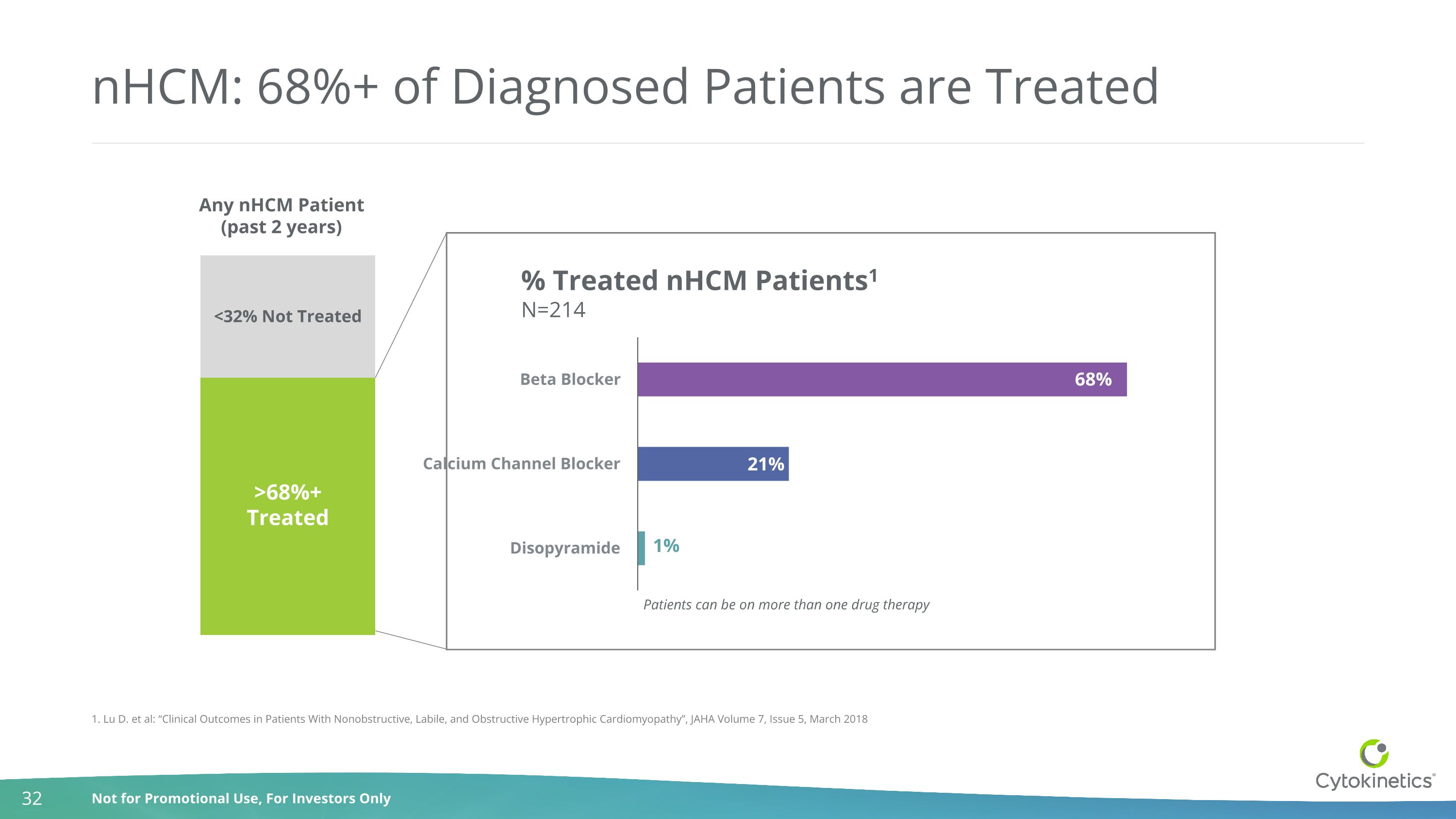

nHCM: 68%+ of Diagnosed Patients are Treated 1. Lu D. et al: “Clinical Outcomes in Patients With Nonobstructive, Labile, and Obstructive Hypertrophic Cardiomyopathy”, JAHA Volume 7, Issue 5, March 2018 >68%+ Treated <32% Not Treated Any nHCM Patient (past 2 years) % Treated nHCM Patients1 N=214 Patients can be on more than one drug therapy

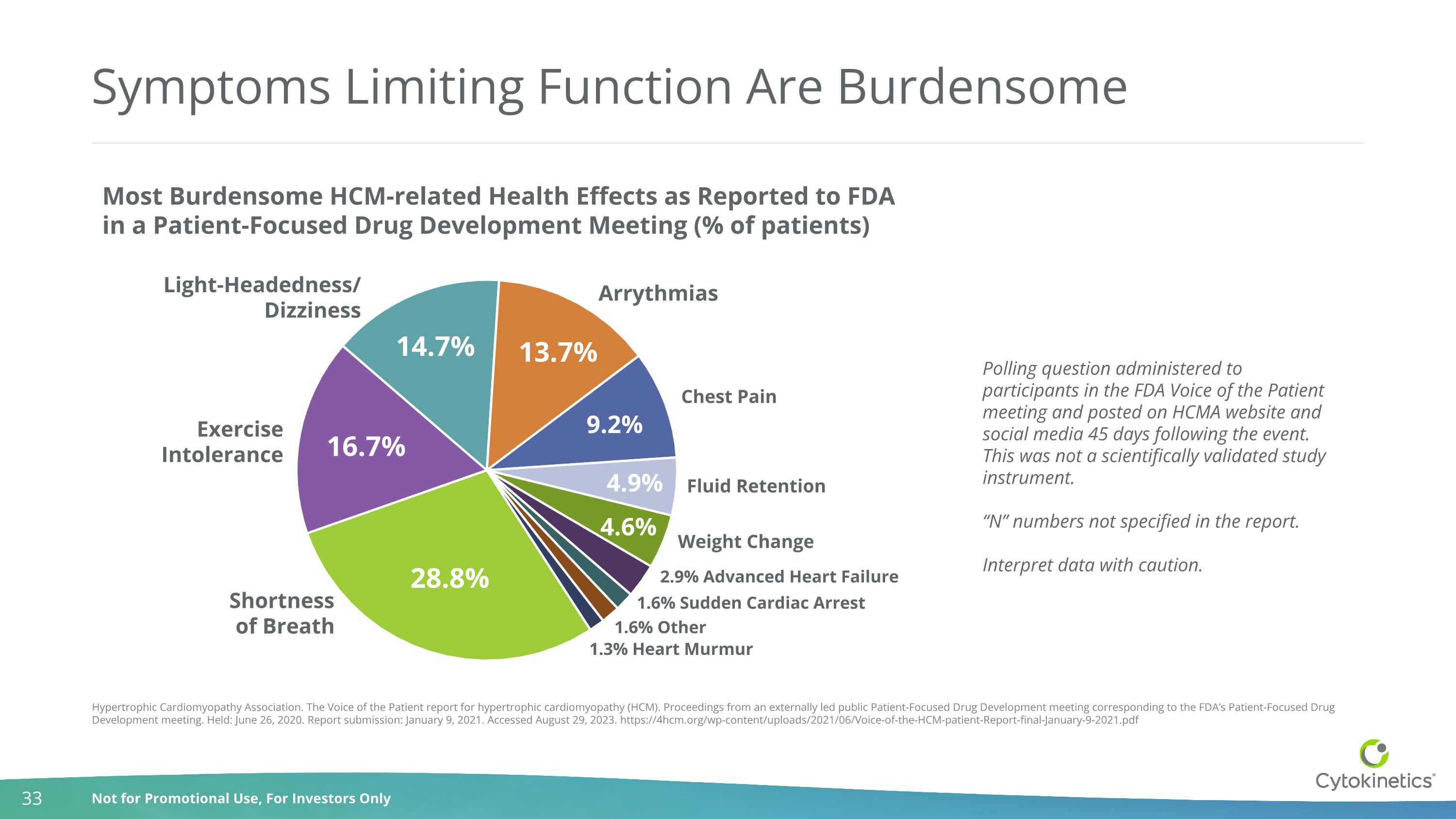

Symptoms Limiting Function Are Burdensome Hypertrophic Cardiomyopathy Association. The Voice of the Patient report for hypertrophic cardiomyopathy (HCM). Proceedings from an externally led public Patient-Focused Drug Development meeting corresponding to the FDA’s Patient-Focused Drug Development meeting. Held: June 26, 2020. Report submission: January 9, 2021. Accessed August 29, 2023. https://4hcm.org/wp-content/uploads/2021/06/Voice-of-the-HCM-patient-Report-final-January-9-2021.pdf Polling question administered to participants in the FDA Voice of the Patient meeting and posted on HCMA website and social media 45 days following the event. This was not a scientifically validated study instrument. “N” numbers not specified in the report. Interpret data with caution. Most Burdensome HCM-related Health Effects as Reported to FDA in a Patient-Focused Drug Development Meeting (% of patients) Shortness of Breath Exercise Intolerance Light-Headedness/ Dizziness Arrythmias Chest Pain Fluid Retention Weight Change 2.9% Advanced Heart Failure 1.6% Sudden Cardiac Arrest 1.6% Other 1.3% Heart Murmur 14.7% 16.7% 28.8% 13.7% 9.2% 4.9% 4.6%

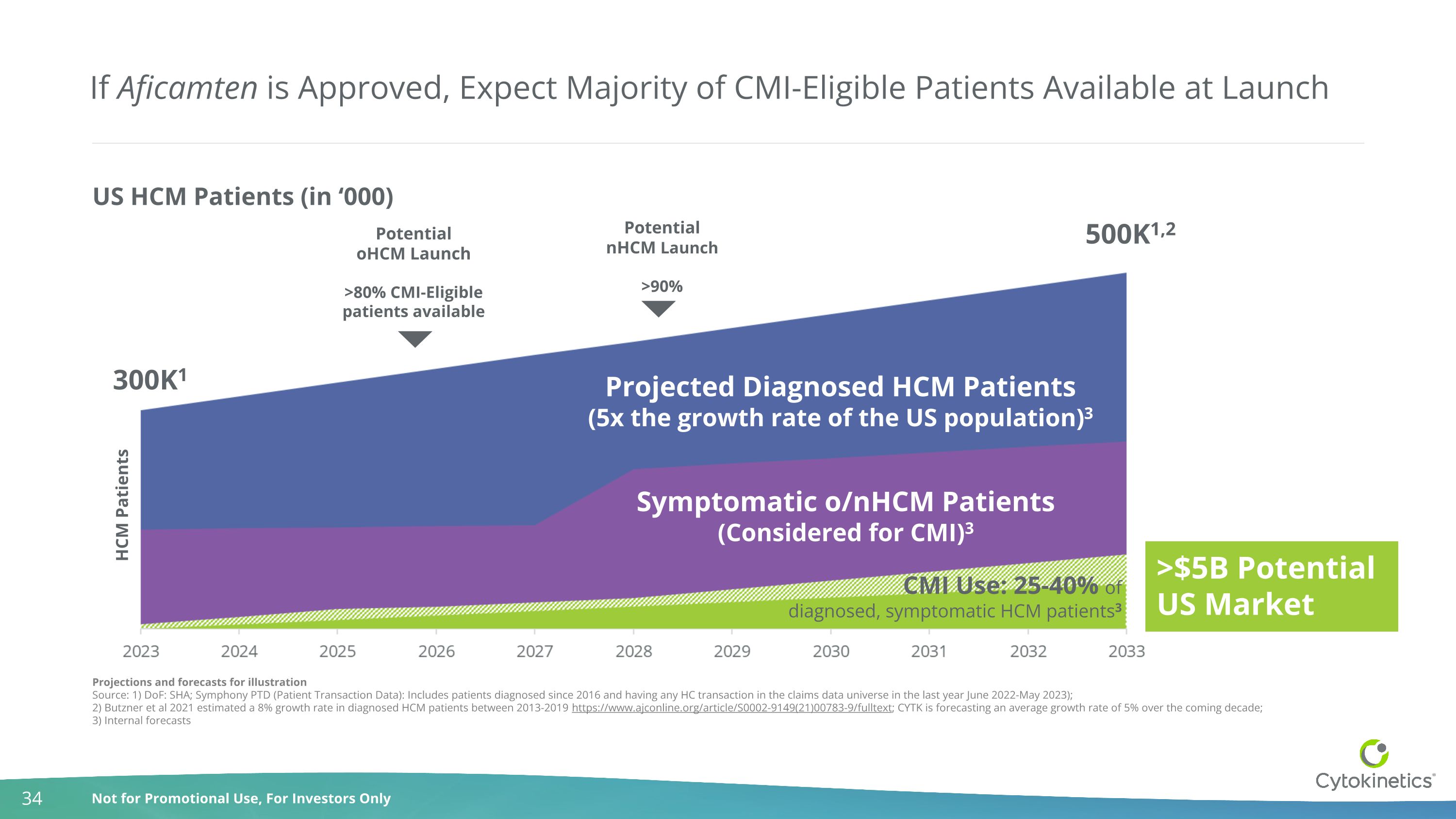

If Aficamten is Approved, Expect Majority of CMI-Eligible Patients Available at Launch Projections and forecasts for illustration Source: 1) DoF: SHA; Symphony PTD (Patient Transaction Data): Includes patients diagnosed since 2016 and having any HC transaction in the claims data universe in the last year June 2022-May 2023); 2) Butzner et al 2021 estimated a 8% growth rate in diagnosed HCM patients between 2013-2019 https://www.ajconline.org/article/S0002-9149(21)00783-9/fulltext; CYTK is forecasting an average growth rate of 5% over the coming decade; 3) Internal forecasts Projected Diagnosed HCM Patients (5x the growth rate of the US population)3 Potential oHCM Launch >80% CMI-Eligible patients available Potential nHCM Launch >90% US HCM Patients (in ‘000) CMI Use: 25-40% of diagnosed, symptomatic HCM patients3 300K1 500K1,2 HCM Patients Symptomatic o/nHCM Patients (Considered for CMI)3 >$5B Potential US Market

Aficamten: Development Program Aficamten is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established.

REDWOOD-HCM: oHCM Stuart Kupfer, M.D. SVP, Chief Medical Officer Aficamten is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established.

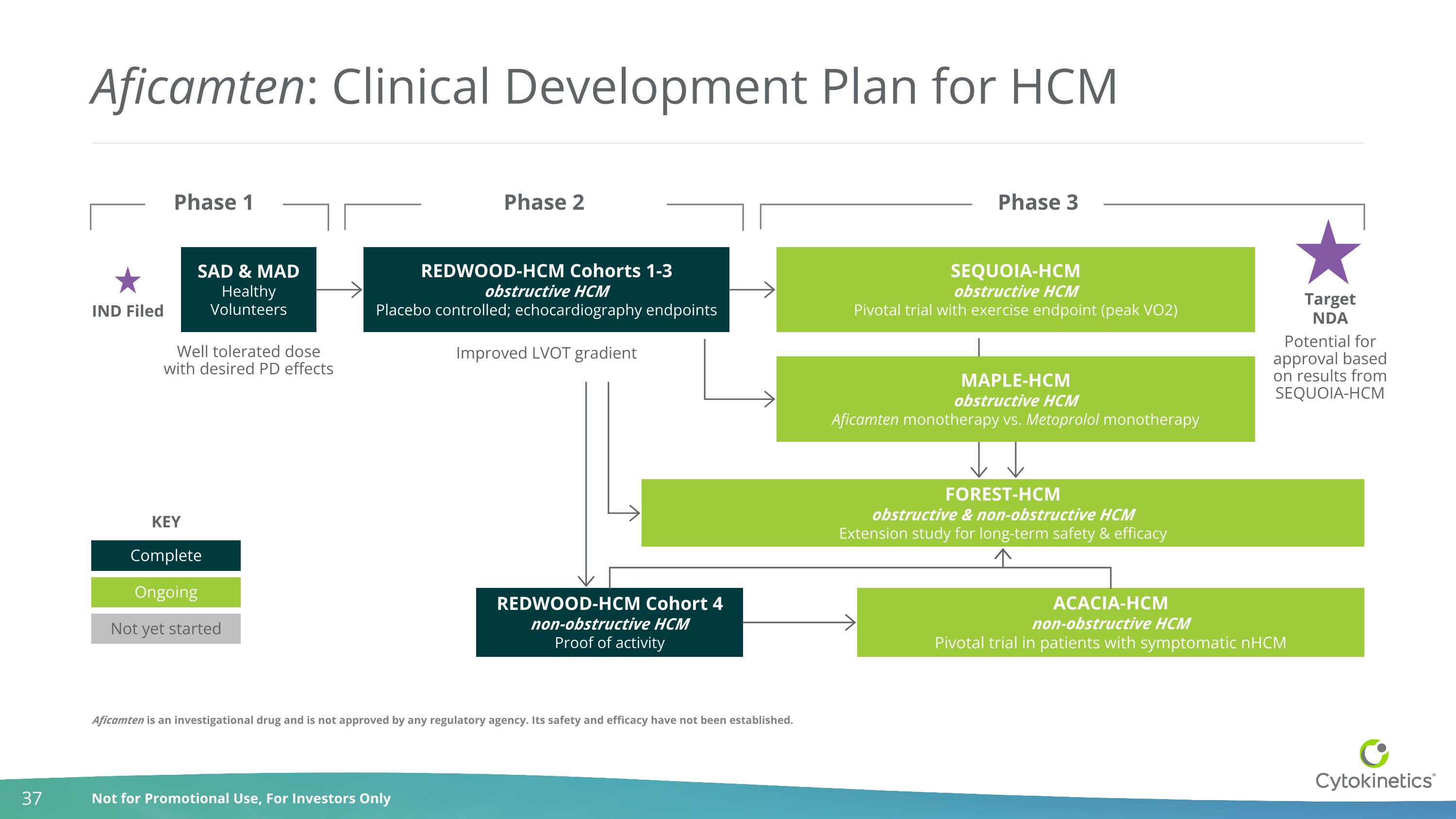

Aficamten: Clinical Development Plan for HCM Well tolerated dose with desired PD effects REDWOOD-HCM Cohorts 1-3 obstructive HCM Placebo controlled; echocardiography endpoints SEQUOIA-HCM obstructive HCM Pivotal trial with exercise endpoint (peak VO2) FOREST-HCM obstructive & non-obstructive HCM Extension study for long-term safety & efficacy SAD & MAD Healthy Volunteers REDWOOD-HCM Cohort 4 non-obstructive HCM Proof of activity ACACIA-HCM non-obstructive HCM Pivotal trial in patients with symptomatic nHCM IND Filed Target NDA Improved LVOT gradient Potential for approval based on results from SEQUOIA-HCM Phase 1 Phase 2 Phase 3 MAPLE-HCM obstructive HCM Aficamten monotherapy vs. Metoprolol monotherapy Complete Ongoing Not yet started KEY Aficamten is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established.

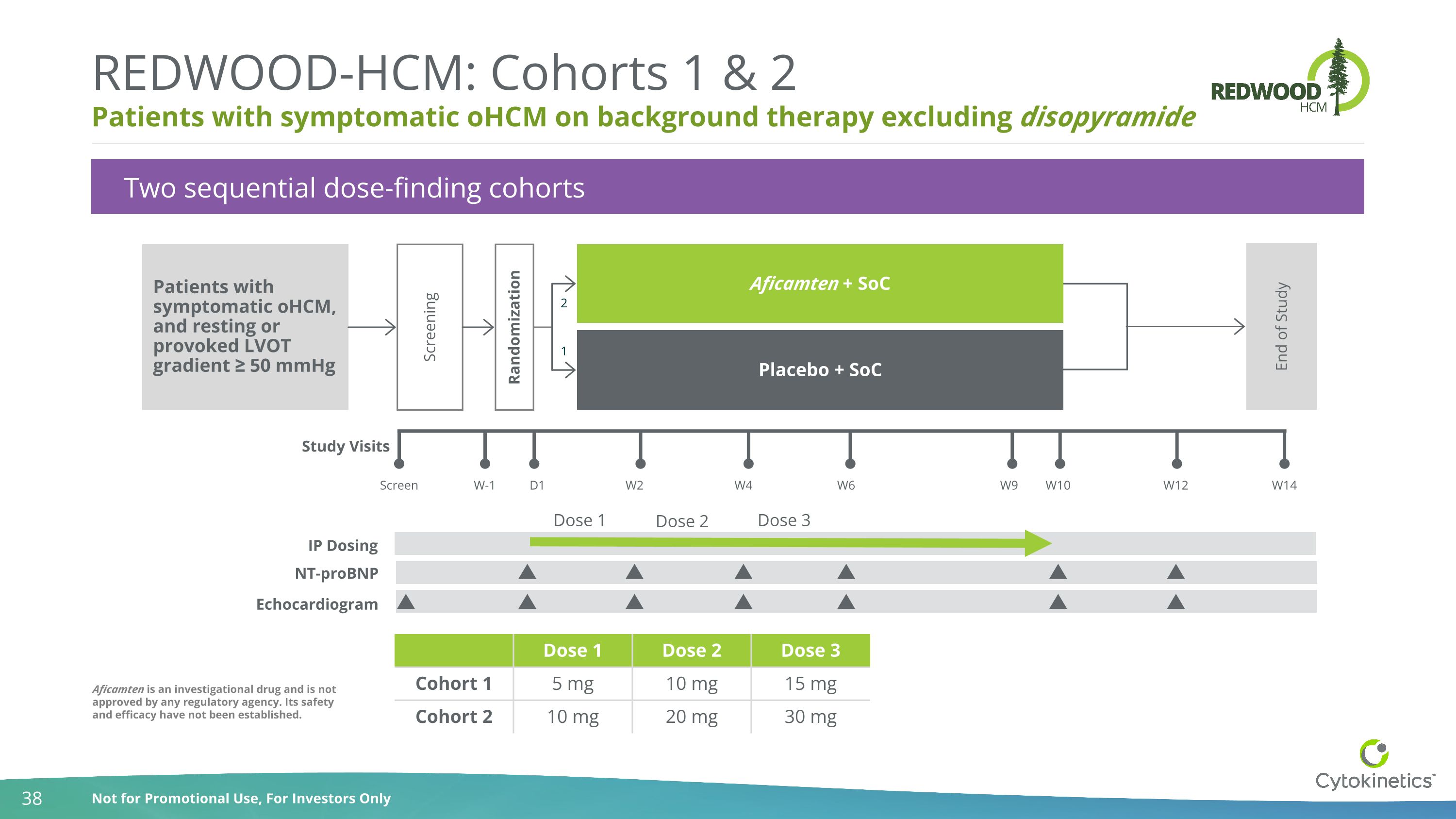

Patients with symptomatic oHCM on background therapy excluding disopyramide REDWOOD-HCM: Cohorts 1 & 2 Two sequential dose-finding cohorts NT-proBNP Echocardiogram Dose 1 Dose 2 Dose 3 Patients with symptomatic oHCM, and resting or provoked LVOT gradient ≥ 50 mmHg Study Visits Screen W-1 D1 W2 W4 W6 W9 W10 W12 W14 Screening Randomization Aficamten + SoC Placebo + SoC End of Study 1 2 IP Dosing Dose 1 Dose 2 Dose 3 Cohort 1 5 mg 10 mg 15 mg Cohort 2 10 mg 20 mg 30 mg Aficamten is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established.

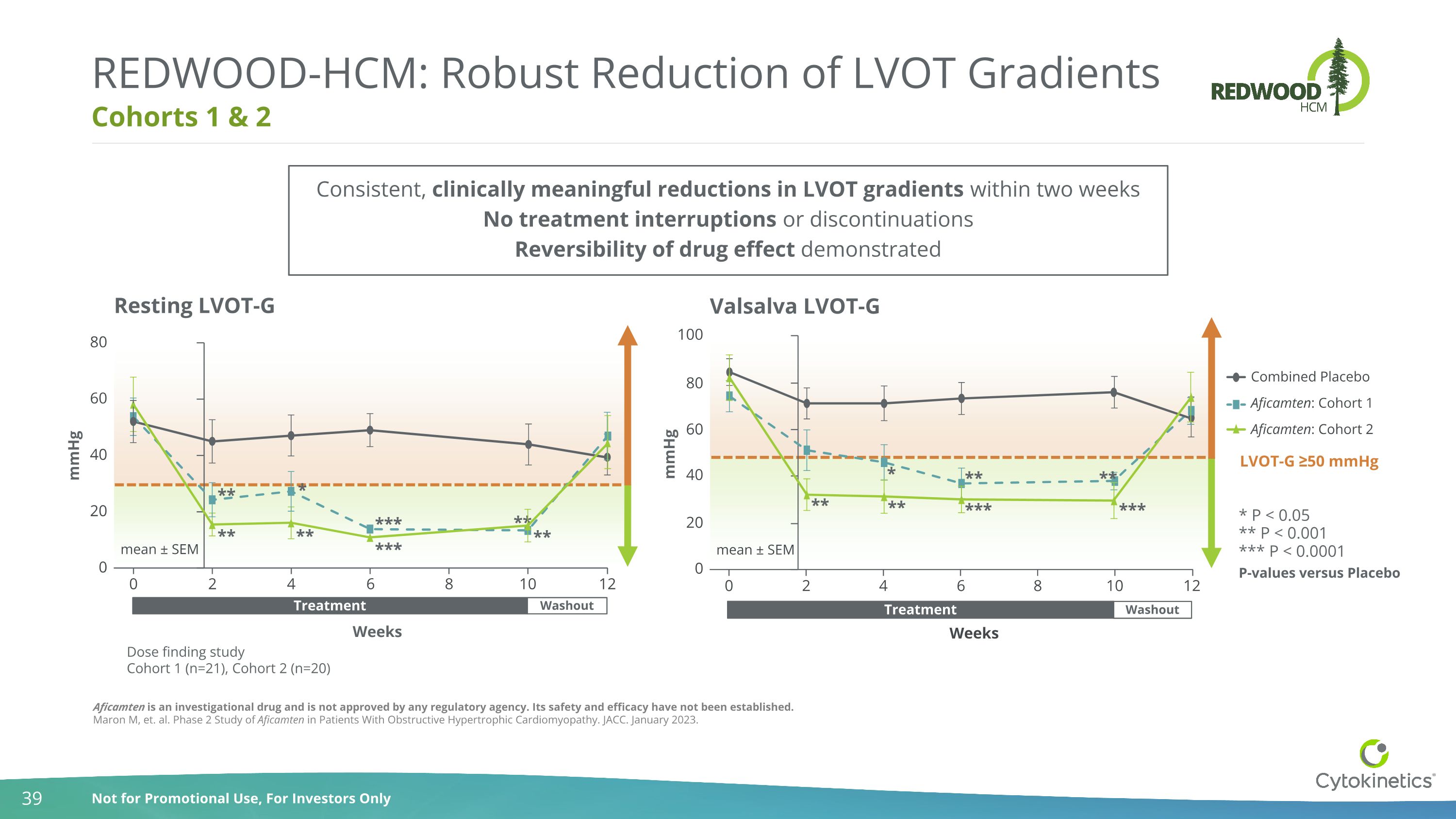

Cohorts 1 & 2 REDWOOD-HCM: Robust Reduction of LVOT Gradients Aficamten is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established. Maron M, et. al. Phase 2 Study of Aficamten in Patients With Obstructive Hypertrophic Cardiomyopathy. JACC. January 2023. Weeks Dose finding study Cohort 1 (n=21), Cohort 2 (n=20) Weeks 0 2 4 6 8 10 0 20 40 60 80 mmHg Resting LVOT-G mean ± SEM 12 ** *** * ** ** *** ** ** Washout Treatment 0 2 4 6 8 10 0 20 40 60 100 mmHg Valsalva LVOT-G mean ± SEM 80 12 Combined Placebo Aficamten: Cohort 1 Aficamten: Cohort 2 ** ** * ** *** *** ** LVOT-G ≥50 mmHg * P < 0.05 *** P < 0.0001 P-values versus Placebo ** P < 0.001 Washout Treatment Consistent, clinically meaningful reductions in LVOT gradients within two weeks No treatment interruptions or discontinuations Reversibility of drug effect demonstrated

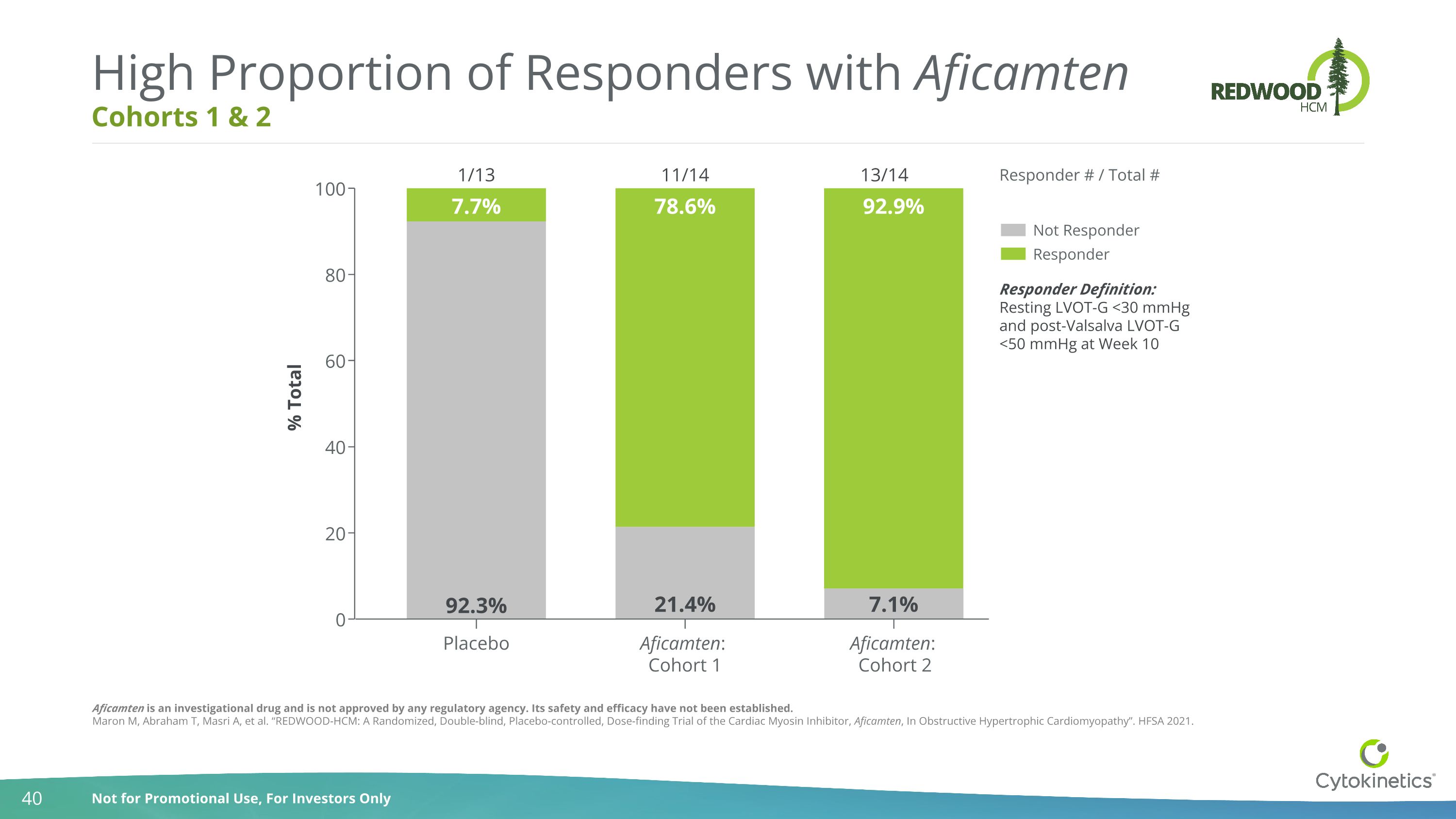

Cohorts 1 & 2 High Proportion of Responders with Aficamten Responder Definition: Resting LVOT-G <30 mmHg and post-Valsalva LVOT-G <50 mmHg at Week 10 1/13 11/14 13/14 Responder # / Total # Placebo Aficamten: Cohort 1 0 20 40 60 80 100 % Total Not Responder Responder 21.4% 7.1% 7.7% 78.6% 92.9% 92.3% Aficamten: Cohort 2 Aficamten is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established. Maron M, Abraham T, Masri A, et al. “REDWOOD-HCM: A Randomized, Double-blind, Placebo-controlled, Dose-finding Trial of the Cardiac Myosin Inhibitor, Aficamten, In Obstructive Hypertrophic Cardiomyopathy”. HFSA 2021.

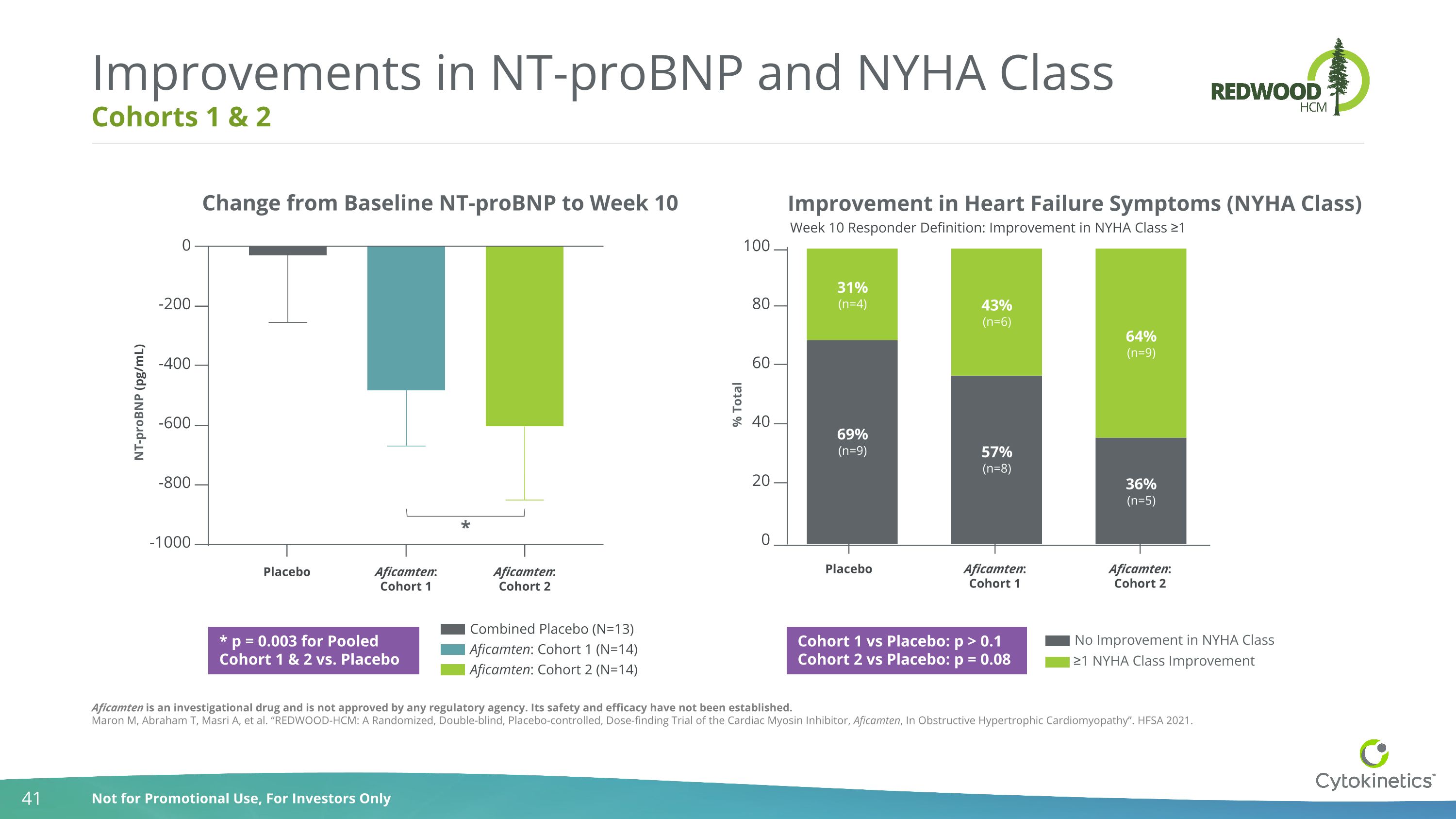

Cohorts 1 & 2 Improvements in NT-proBNP and NYHA Class Change from Baseline NT-proBNP to Week 10 * p = 0.003 for Pooled Cohort 1 & 2 vs. Placebo 0 -200 -400 -600 -800 -1000 NT-proBNP (pg/mL) * Placebo Aficamten:Cohort 1 Aficamten:Cohort 2 Combined Placebo (N=13) Aficamten: Cohort 1 (N=14) Aficamten: Cohort 2 (N=14) Improvement in Heart Failure Symptoms (NYHA Class) 100 80 60 40 20 0 % Total Placebo Aficamten:Cohort 1 Aficamten:Cohort 2 Cohort 1 vs Placebo: p > 0.1 Cohort 2 vs Placebo: p = 0.08 Week 10 Responder Definition: Improvement in NYHA Class ≥1 No Improvement in NYHA Class ≥1 NYHA Class Improvement Aficamten is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established. Maron M, Abraham T, Masri A, et al. “REDWOOD-HCM: A Randomized, Double-blind, Placebo-controlled, Dose-finding Trial of the Cardiac Myosin Inhibitor, Aficamten, In Obstructive Hypertrophic Cardiomyopathy”. HFSA 2021.

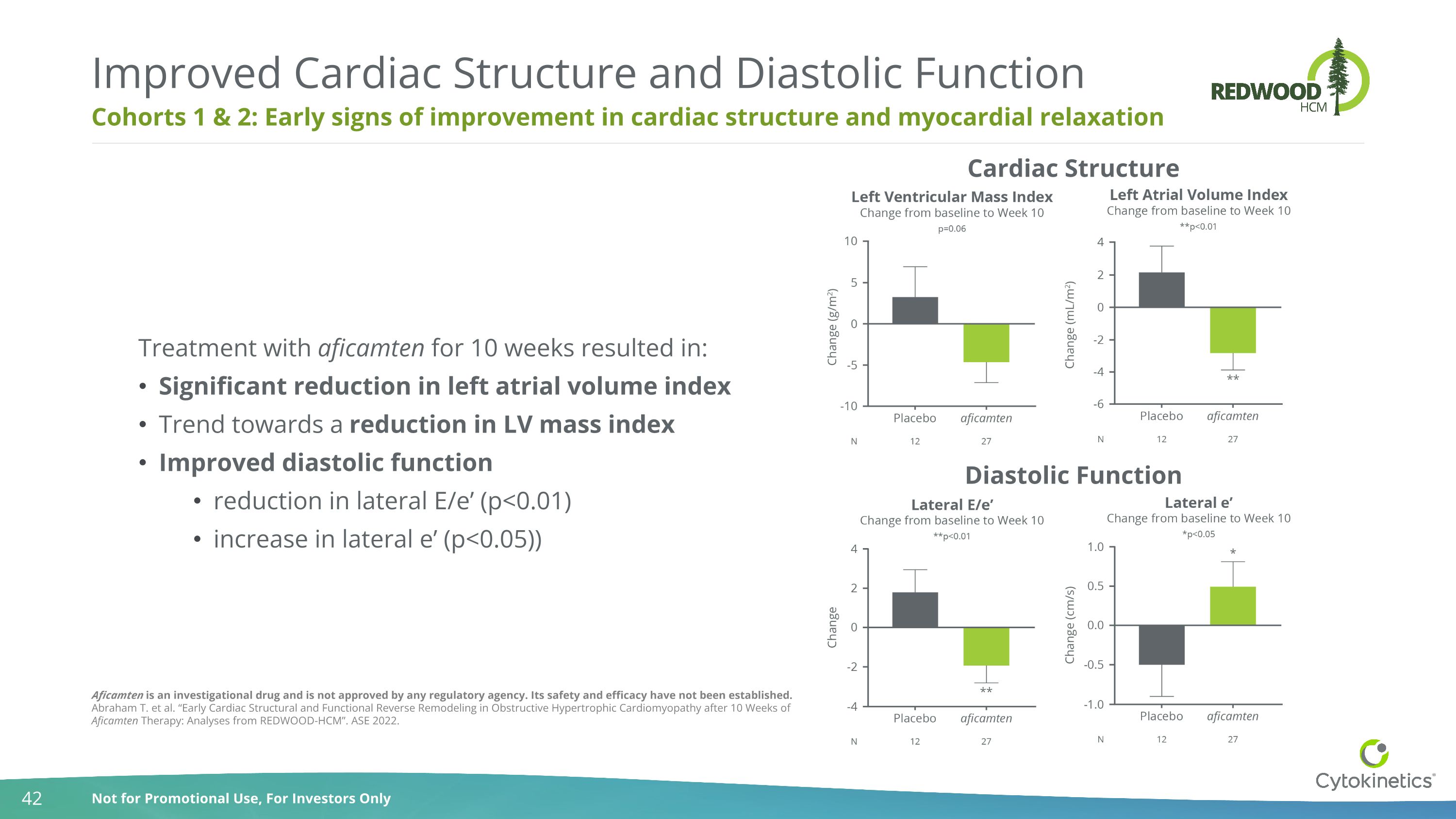

Cohorts 1 & 2: Early signs of improvement in cardiac structure and myocardial relaxation Improved Cardiac Structure and Diastolic Function Treatment with aficamten for 10 weeks resulted in: Significant reduction in left atrial volume index Trend towards a reduction in LV mass index Improved diastolic function reduction in lateral E/e’ (p<0.01) increase in lateral e’ (p<0.05)) Diastolic Function Cardiac Structure Aficamten is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established. Abraham T. et al. “Early Cardiac Structural and Functional Reverse Remodeling in Obstructive Hypertrophic Cardiomyopathy after 10 Weeks of Aficamten Therapy: Analyses from REDWOOD-HCM”. ASE 2022.

Cohorts 1 – 3 REDWOOD-HCM: Selected Safety Observations No treatment interruptions or discontinuations No patients met the “stopping criteria” of LVEF < 40% Transient and asymptomatic decrease in LVEF < 50% in 2 of 41 aficamten-treated patients in Cohort 2 2 SAEs in 41 aficamten-treated patients, neither related to aficamten No imbalance in treatment-emergent AEs between aficamten and placebo in Cohorts 1 & 2 Similar safety profile for aficamten in combination with disopyramide in Cohort 3 Aficamten is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established.

FOREST-HCM Steve Heitner, M.D. VP, Clinical Research & Therapeutic Area Lead, Cardiovascular Aficamten is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established.

FOREST-HCM: Sustained Efficacy with Aficamten Aficamten appears to result in sustained treatment effect in oHCM patients More than 200 patients are currently enrolled in FOREST-HCM 143 patients were available for this analysis (data cut Sept 15, 2023) Almost all those eligible have chosen to participate Long-term data is available in some patients for greater than 2 years Sustained efficacy for duration of treatment Relief of symptoms Reductions in resting and Valsalva LVOT-G Improved cardiac biomarkers Most are longer eligible for invasive therapies per societal guidelines Aficamten is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established.

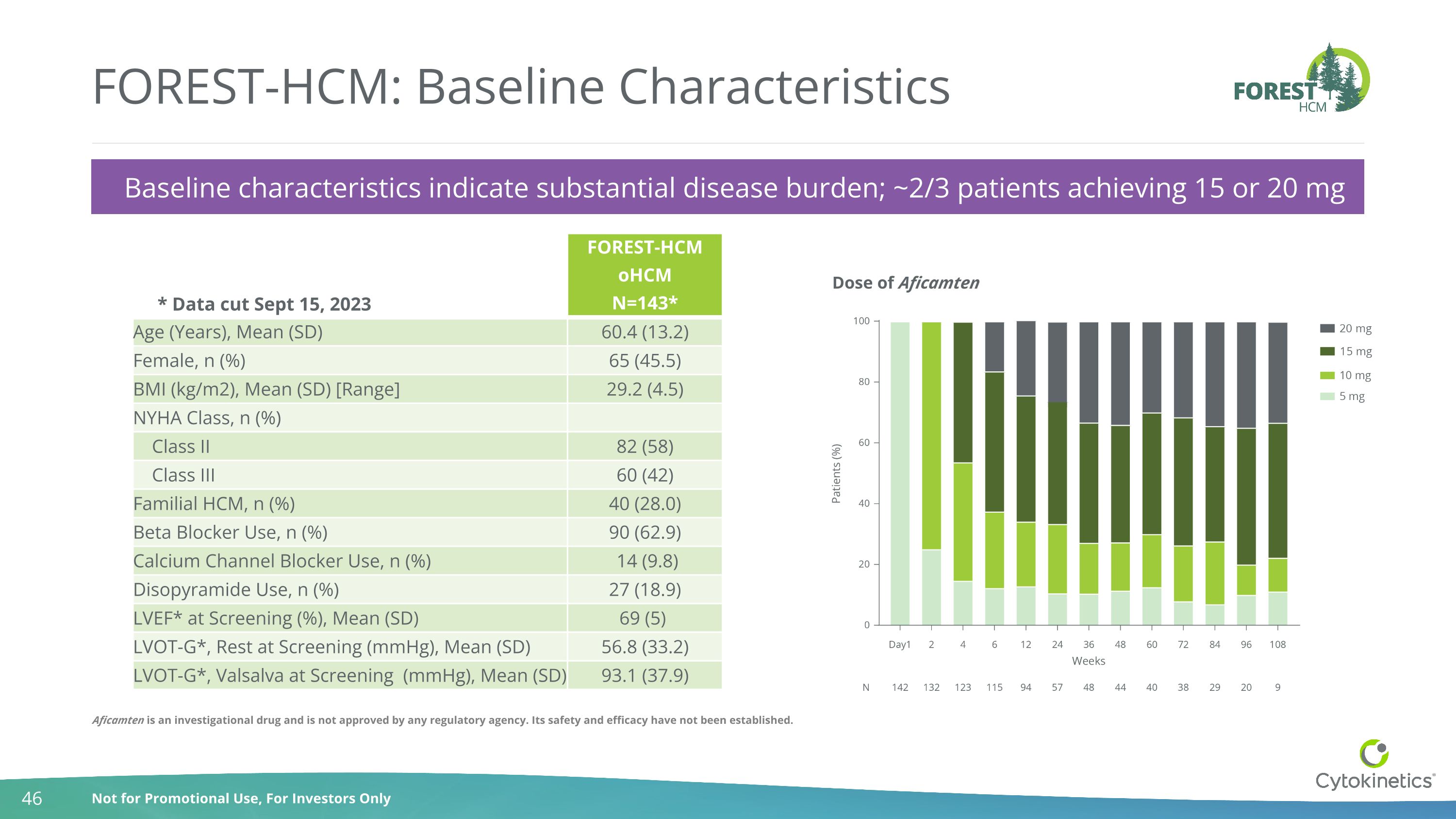

FOREST-HCM: Baseline Characteristics Baseline characteristics indicate substantial disease burden; ~2/3 patients achieving 15 or 20 mg FOREST-HCM oHCM N=143* Age (Years), Mean (SD) 60.4 (13.2) Female, n (%) 65 (45.5) BMI (kg/m2), Mean (SD) [Range] 29.2 (4.5) NYHA Class, n (%) Class II 82 (58) Class III 60 (42) Familial HCM, n (%) 40 (28.0) Beta Blocker Use, n (%) 90 (62.9) Calcium Channel Blocker Use, n (%) 14 (9.8) Disopyramide Use, n (%) 27 (18.9) LVEF* at Screening (%), Mean (SD) 69 (5) LVOT-G*, Rest at Screening (mmHg), Mean (SD) 56.8 (33.2) LVOT-G*, Valsalva at Screening (mmHg), Mean (SD) 93.1 (37.9) * Data cut Sept 15, 2023 Dose of Aficamten Aficamten is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established.

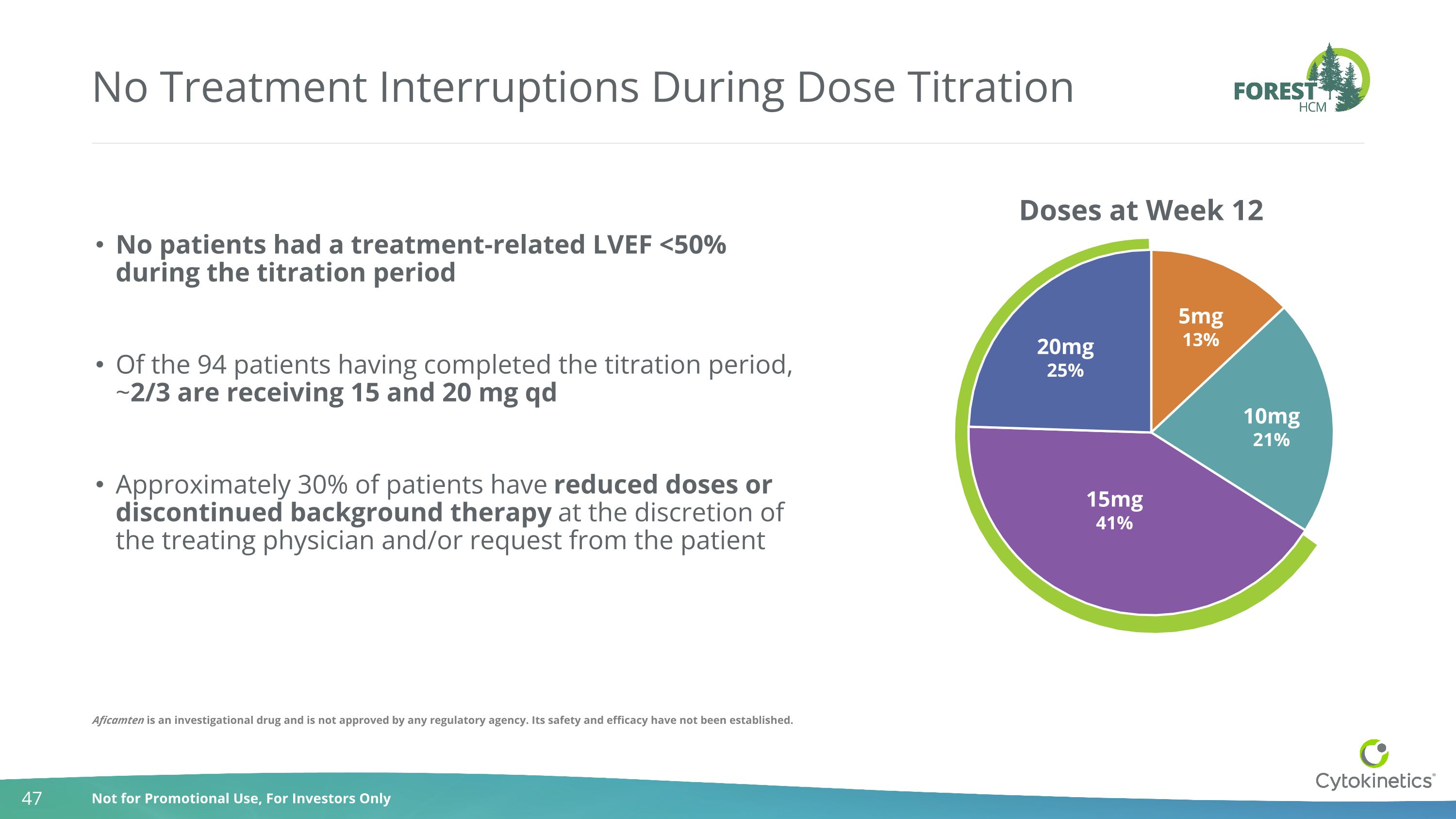

No Treatment Interruptions During Dose Titration No patients had a treatment-related LVEF <50% during the titration period Of the 94 patients having completed the titration period, ~2/3 are receiving 15 and 20 mg qd Approximately 30% of patients have reduced doses or discontinued background therapy at the discretion of the treating physician and/or request from the patient Aficamten is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established.

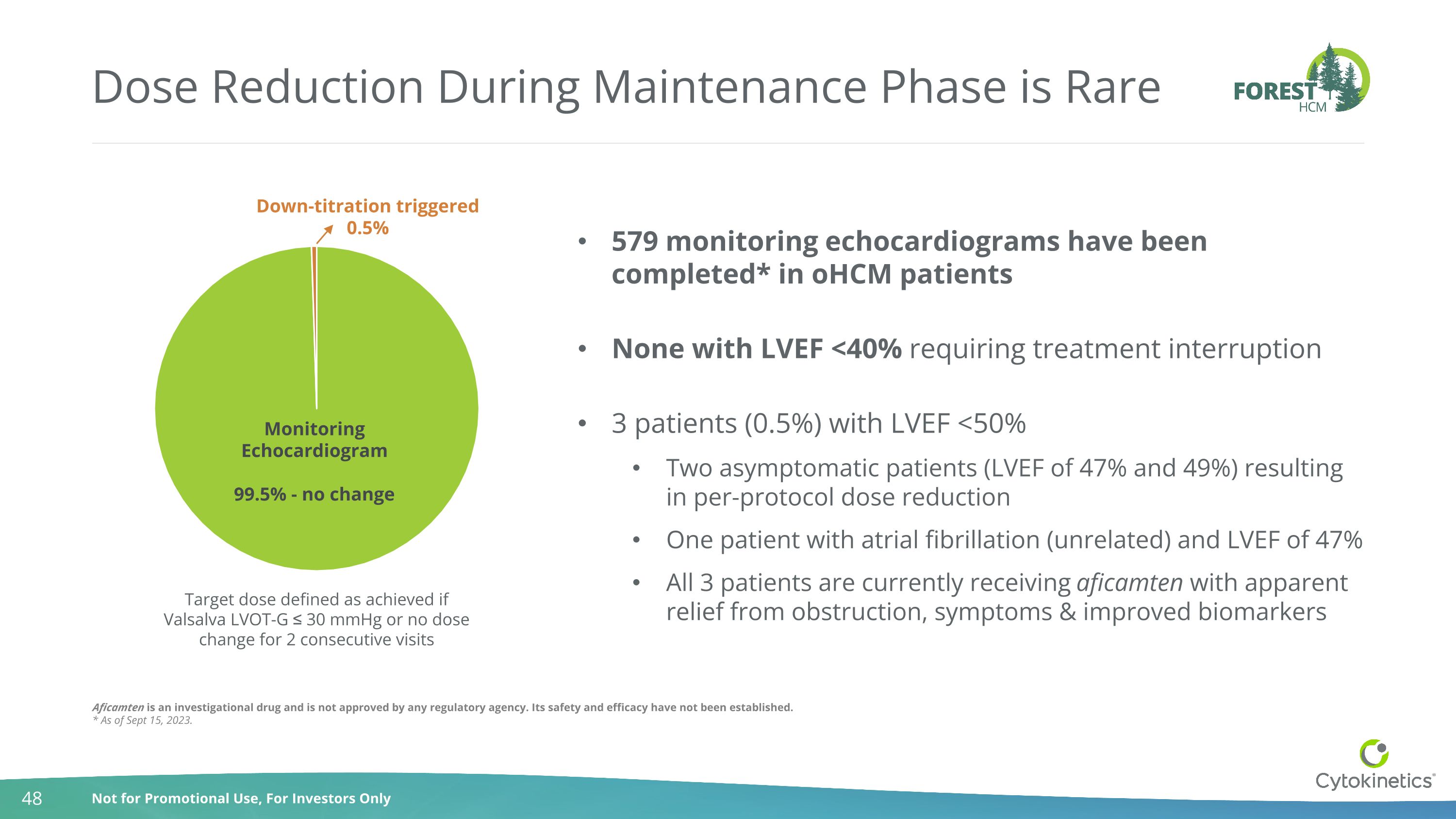

Dose Reduction During Maintenance Phase is Rare Target dose defined as achieved if Valsalva LVOT-G ≤ 30 mmHg or no dose change for 2 consecutive visits 579 monitoring echocardiograms have been completed* in oHCM patients None with LVEF <40% requiring treatment interruption 3 patients (0.5%) with LVEF <50% Two asymptomatic patients (LVEF of 47% and 49%) resulting in per-protocol dose reduction One patient with atrial fibrillation (unrelated) and LVEF of 47% All 3 patients are currently receiving aficamten with apparent relief from obstruction, symptoms & improved biomarkers Aficamten is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established. * As of Sept 15, 2023.

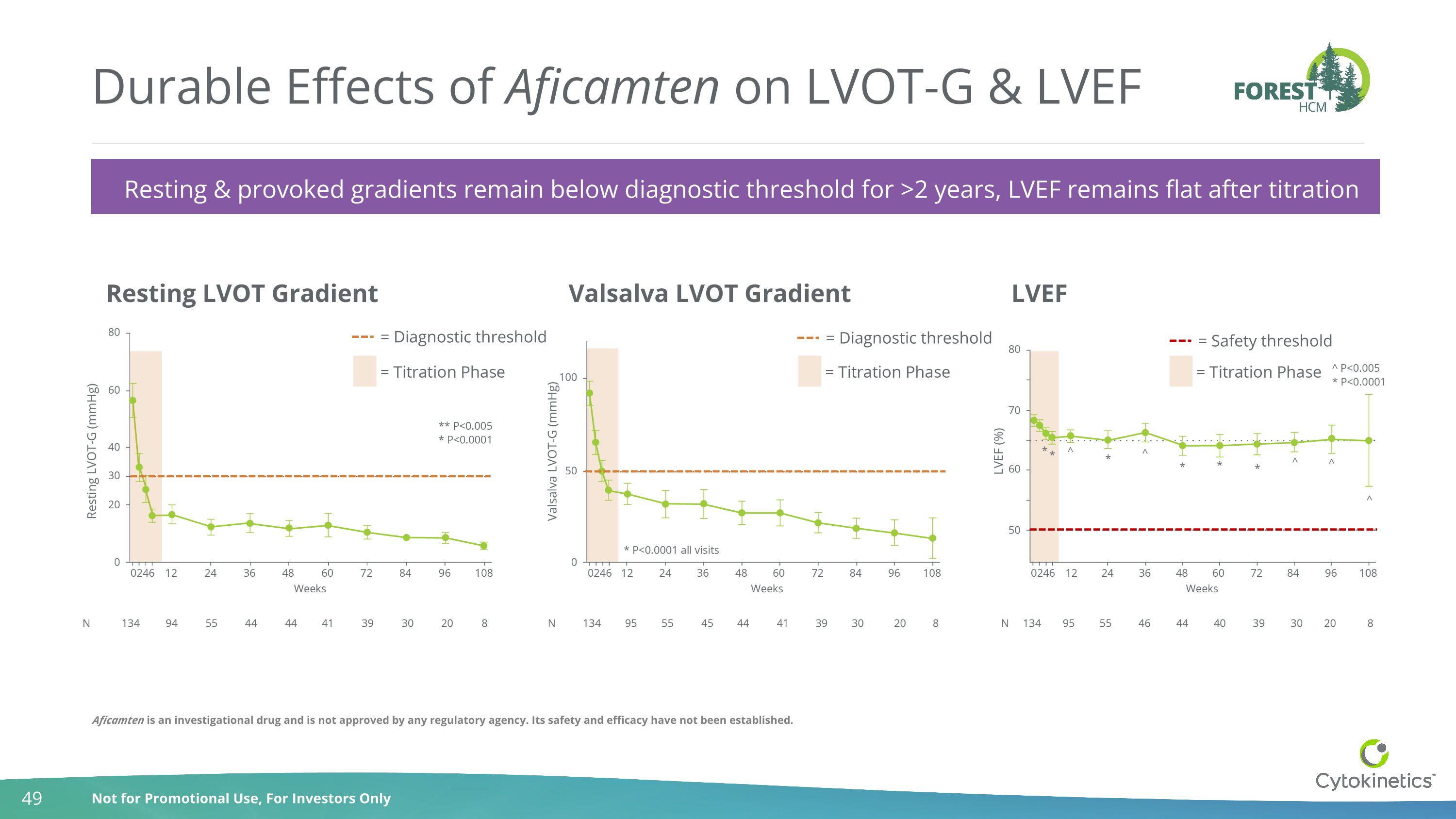

Durable Effects of Aficamten on LVOT-G & LVEF Resting & provoked gradients remain below diagnostic threshold for >2 years, LVEF remains flat after titration Resting LVOT Gradient Valsalva LVOT Gradient LVEF = Diagnostic threshold = Diagnostic threshold = Safety threshold Aficamten is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established.

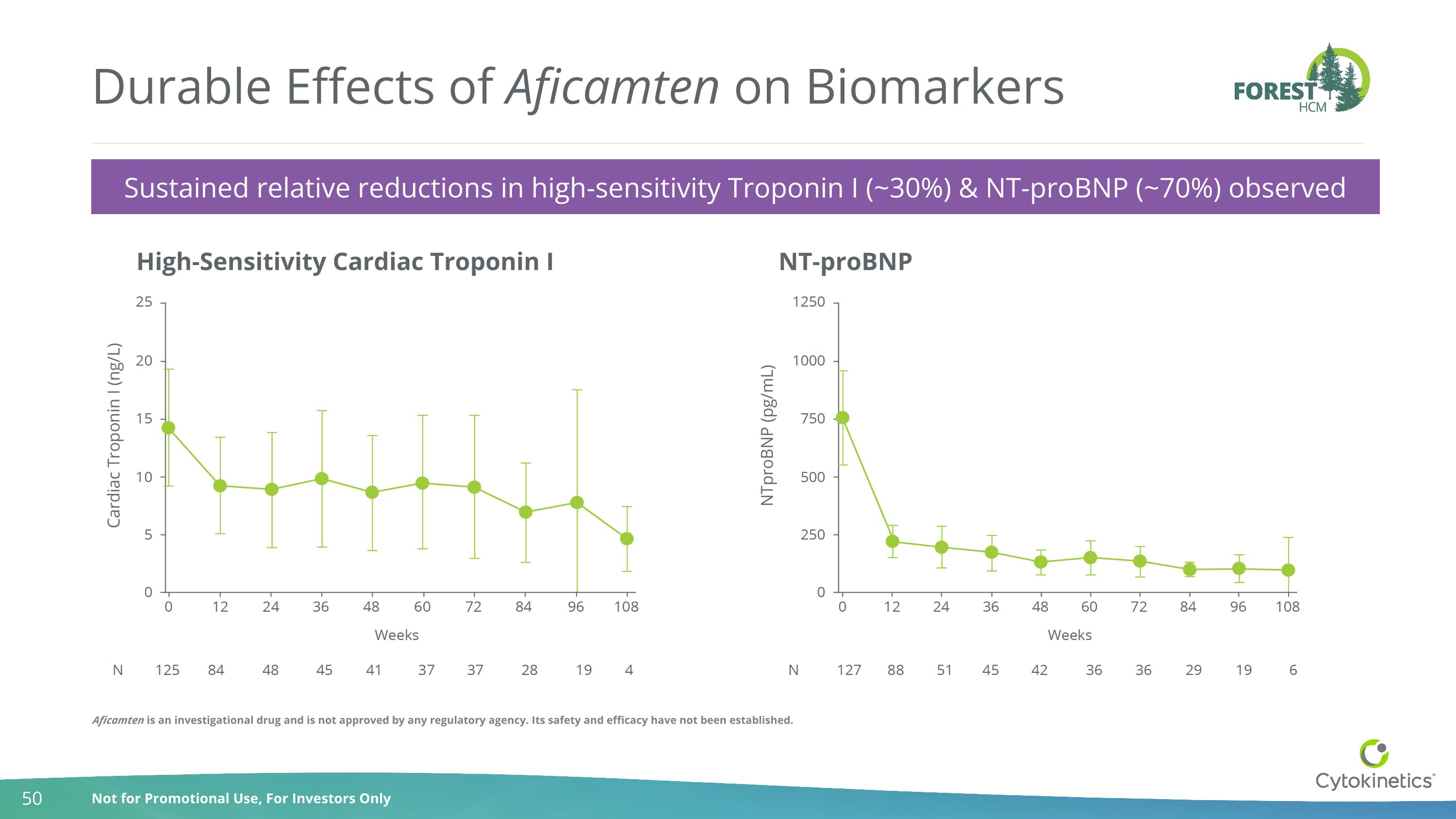

Sustained relative reductions in high-sensitivity Troponin I (~30%) & NT-proBNP (~70%) observed Durable Effects of Aficamten on Biomarkers High-Sensitivity Cardiac Troponin I NT-proBNP Aficamten is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established.

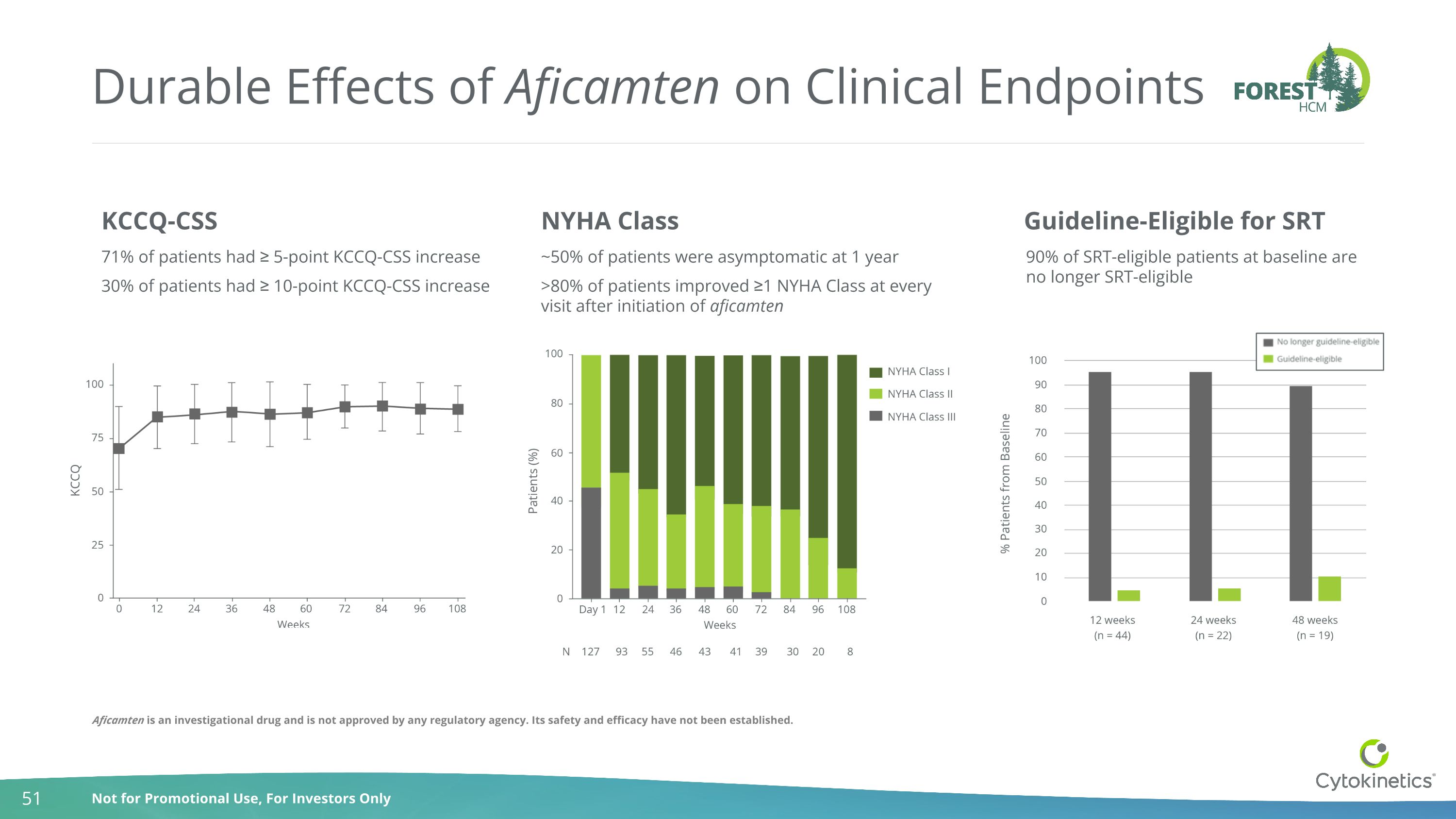

Durable Effects of Aficamten on Clinical Endpoints 90% of SRT-eligible patients at baseline are no longer SRT-eligible KCCQ-CSS NYHA Class Guideline-Eligible for SRT ~50% of patients were asymptomatic at 1 year >80% of patients improved ≥1 NYHA Class at every visit after initiation of aficamten 71% of patients had ≥ 5-point KCCQ-CSS increase 30% of patients had ≥ 10-point KCCQ-CSS increase Aficamten is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established.

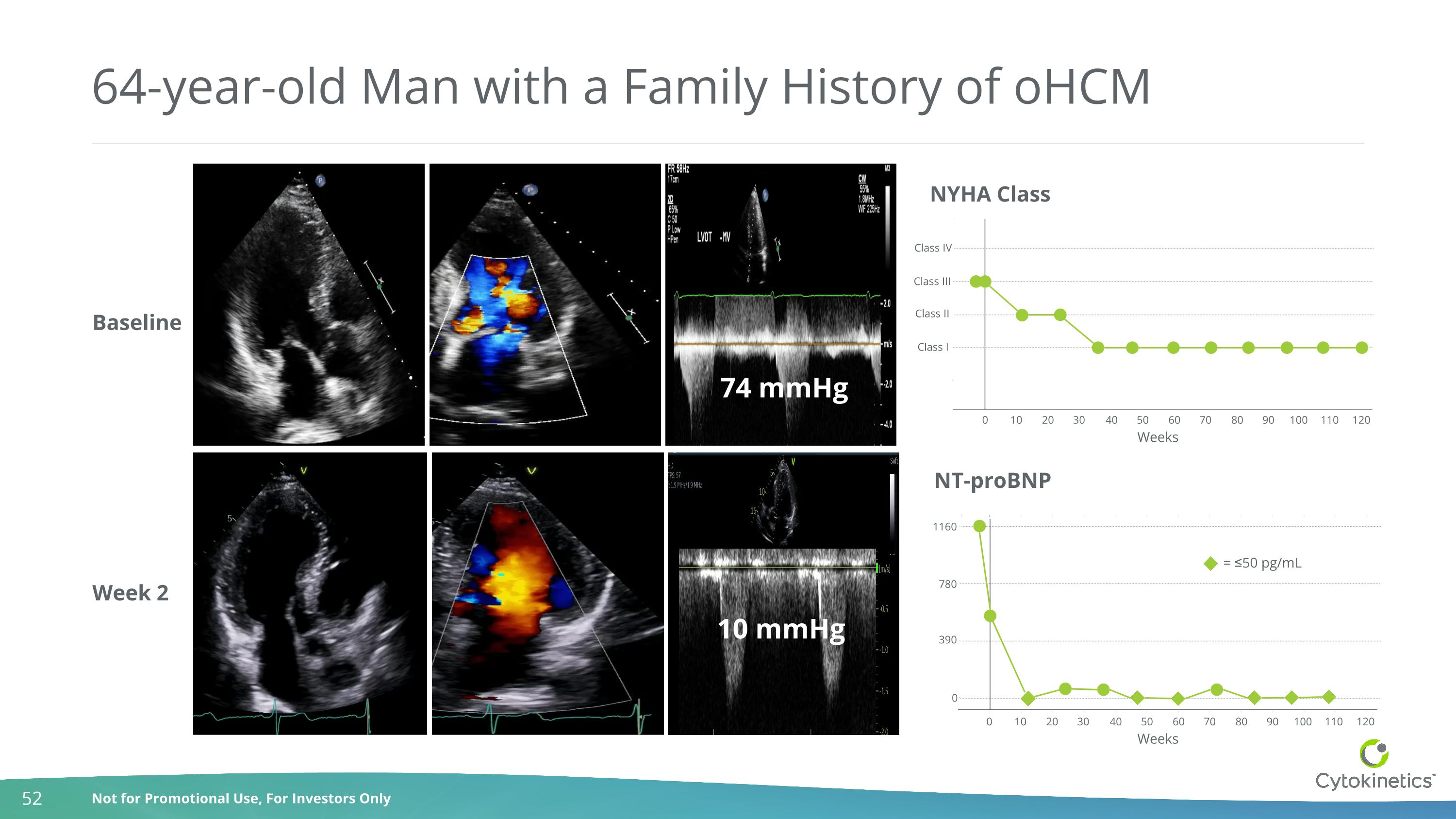

10 mmHg 74 mmHg 64-year-old Man with a Family History of oHCM Week 2 Baseline NYHA Class Class IV Class III Class II Class I 0 10 20 30 40 50 60 70 80 90 100 110 120 NT-proBNP 0 10 20 30 40 50 60 70 80 90 100 110 120 1160 780 390 0 = ≤50 pg/mL Weeks Weeks

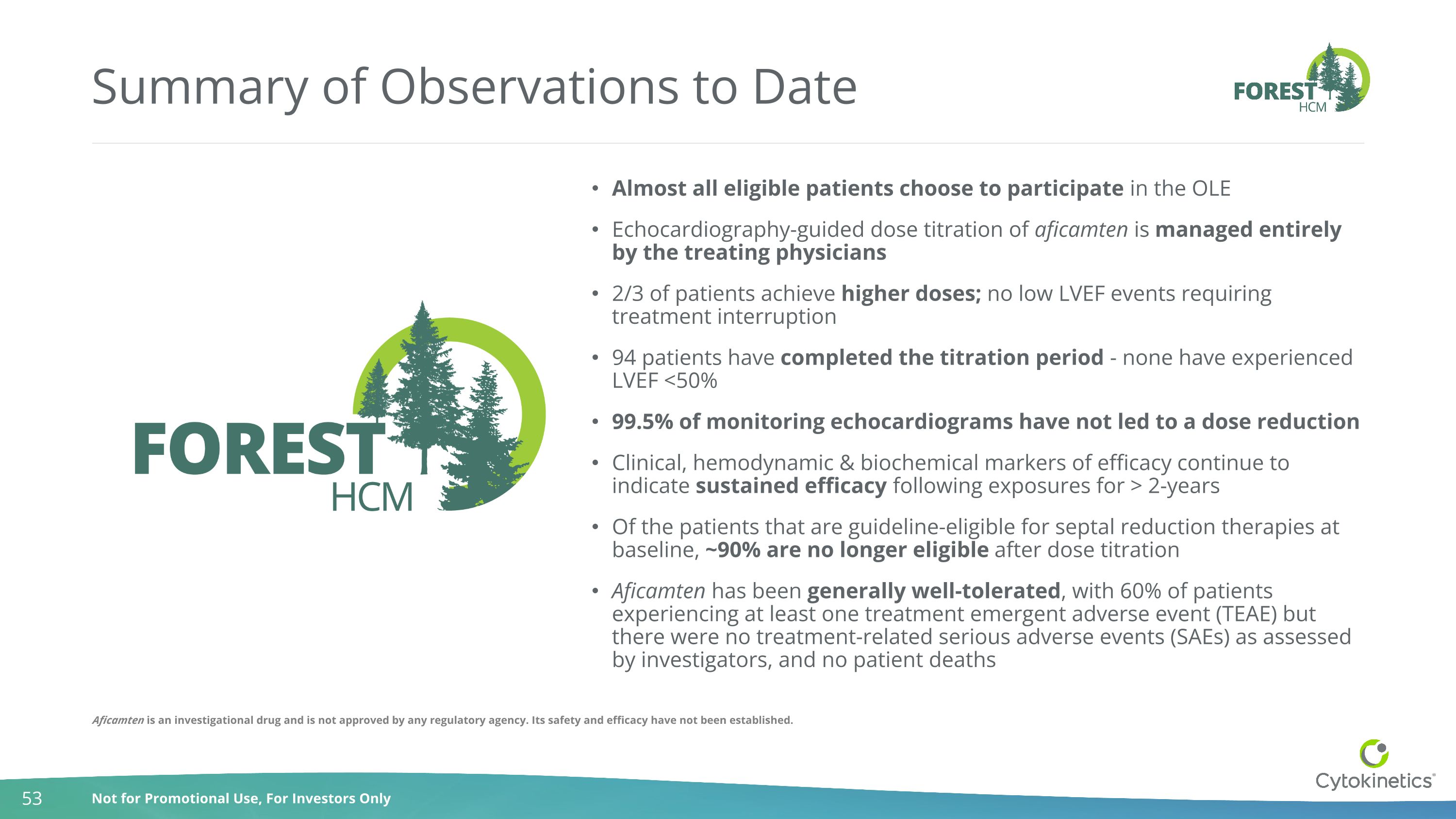

Summary of Observations to Date Almost all eligible patients choose to participate in the OLE Echocardiography-guided dose titration of aficamten is managed entirely by the treating physicians 2/3 of patients achieve higher doses; no low LVEF events requiring treatment interruption 94 patients have completed the titration period - none have experienced LVEF <50% 99.5% of monitoring echocardiograms have not led to a dose reduction Clinical, hemodynamic & biochemical markers of efficacy continue to indicate sustained efficacy following exposures for > 2-years Of the patients that are guideline-eligible for septal reduction therapies at baseline, ~90% are no longer eligible after dose titration Aficamten has been generally well-tolerated, with 60% of patients experiencing at least one treatment emergent adverse event (TEAE) but there were no treatment-related serious adverse events (SAEs) as assessed by investigators, and no patient deaths Aficamten is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established.

SEQUOIA-HCM Daniel Jacoby, M.D. Senior Medical Director, Clinical Research Cardiovascular Aficamten is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established.

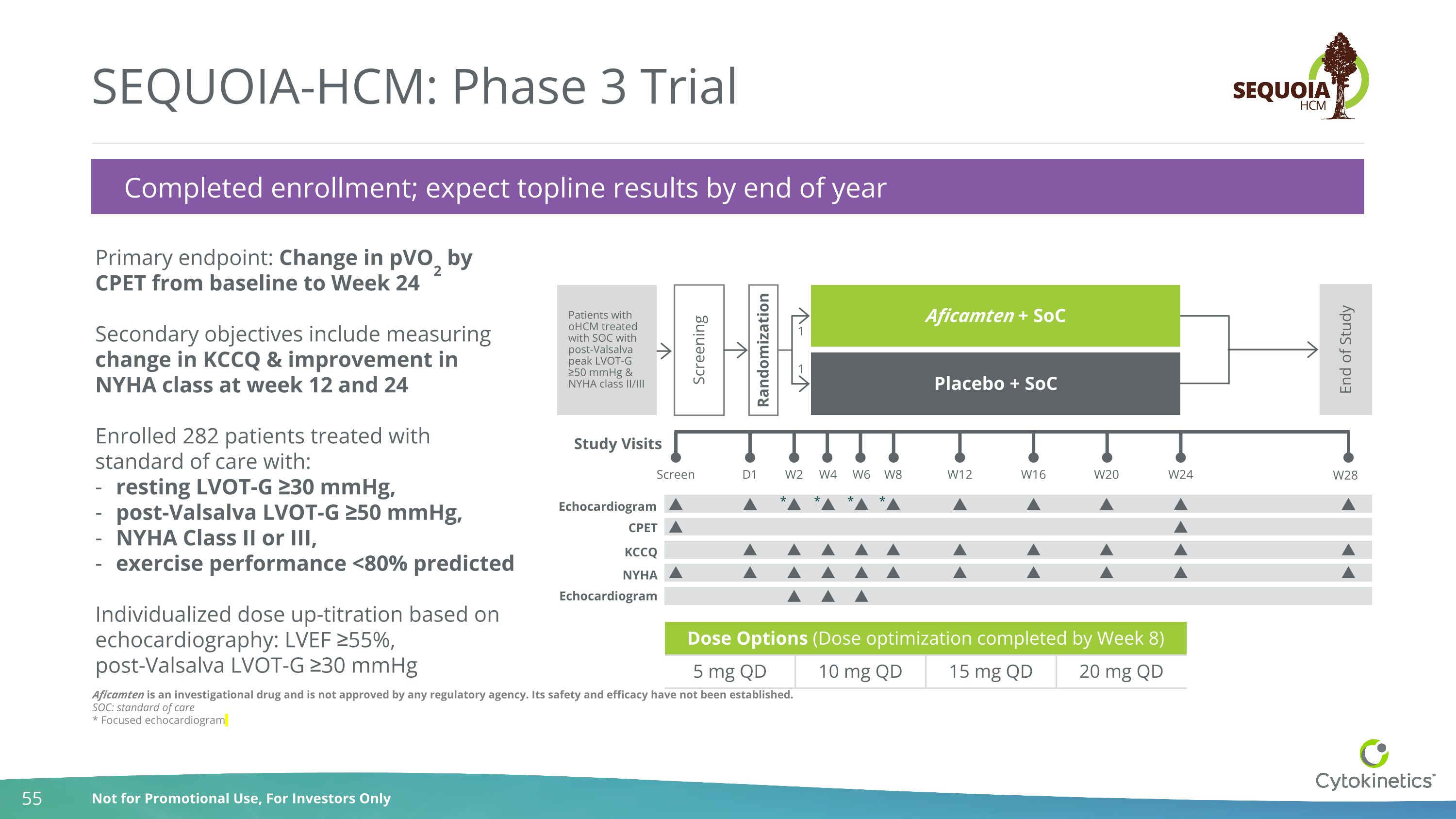

Aficamten is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established. SOC: standard of care * Focused echocardiogram SEQUOIA-HCM: Phase 3 Trial Completed enrollment; expect topline results by end of year Dose Options (Dose optimization completed by Week 8) Dose 2 Dose 3 5 mg QD 10 mg QD 15 mg QD 20 mg QD Primary endpoint: Change in pVO2 by CPET from baseline to Week 24 Secondary objectives include measuring change in KCCQ & improvement in NYHA class at week 12 and 24 Enrolled 282 patients treated with standard of care with: resting LVOT-G ≥30 mmHg, post-Valsalva LVOT-G ≥50 mmHg, NYHA Class II or III, exercise performance <80% predicted Individualized dose up-titration based on echocardiography: LVEF ≥55%, post-Valsalva LVOT-G ≥30 mmHg CPET KCCQ Study Visits Screen W2 D1 W4 W6 W16 W20 W24 W28 Screening Randomization Aficamten + SoC Placebo + SoC End of Study 1 1 Echocardiogram W12 W8 NYHA Echocardiogram * * * * Patients with oHCM treated with SOC with post-Valsalva peak LVOT-G ≥50 mmHg & NYHA class II/III

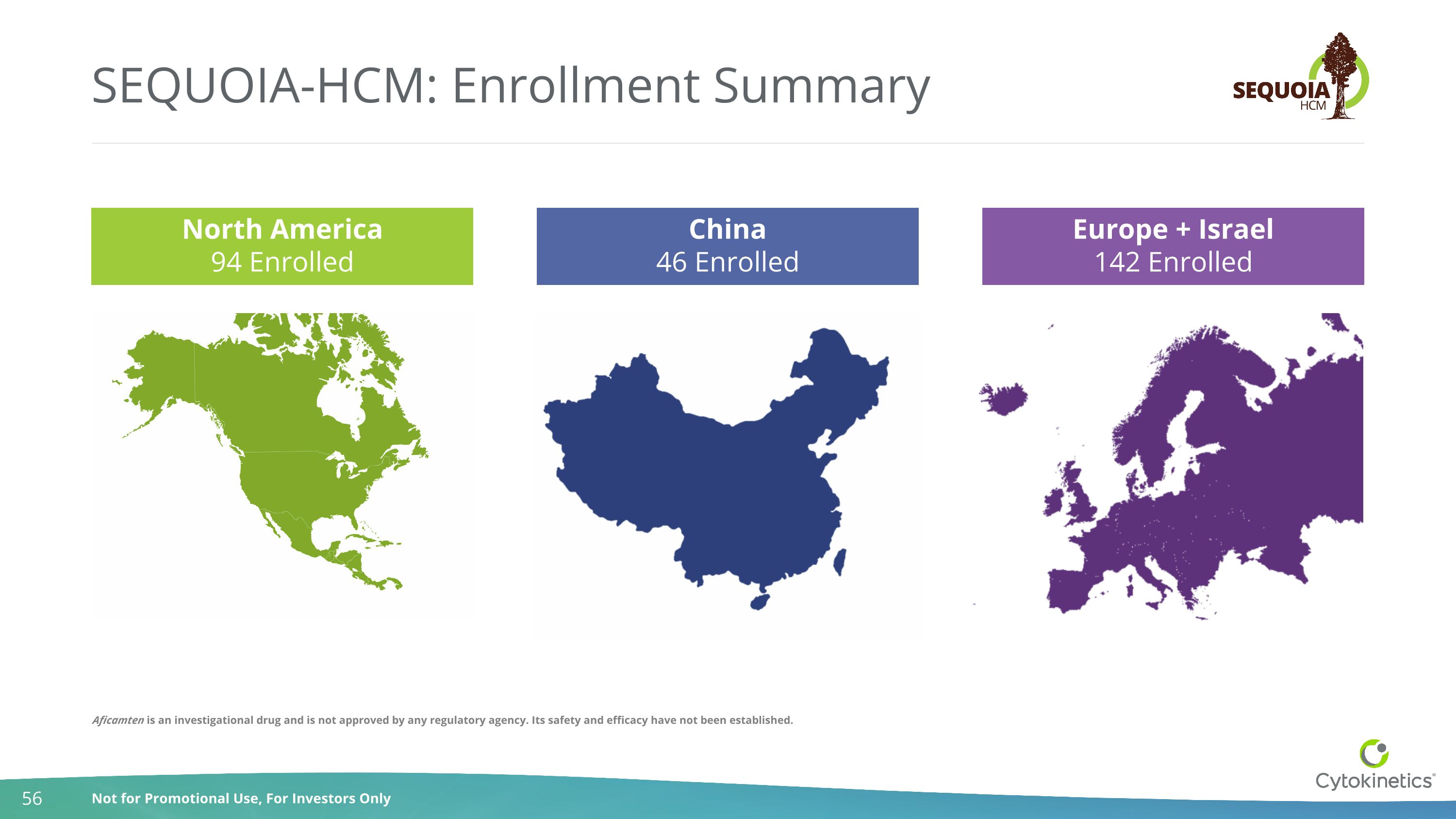

SEQUOIA-HCM: Enrollment Summary Europe + Israel 142 Enrolled China 46 Enrolled North America 94 Enrolled Aficamten is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established.

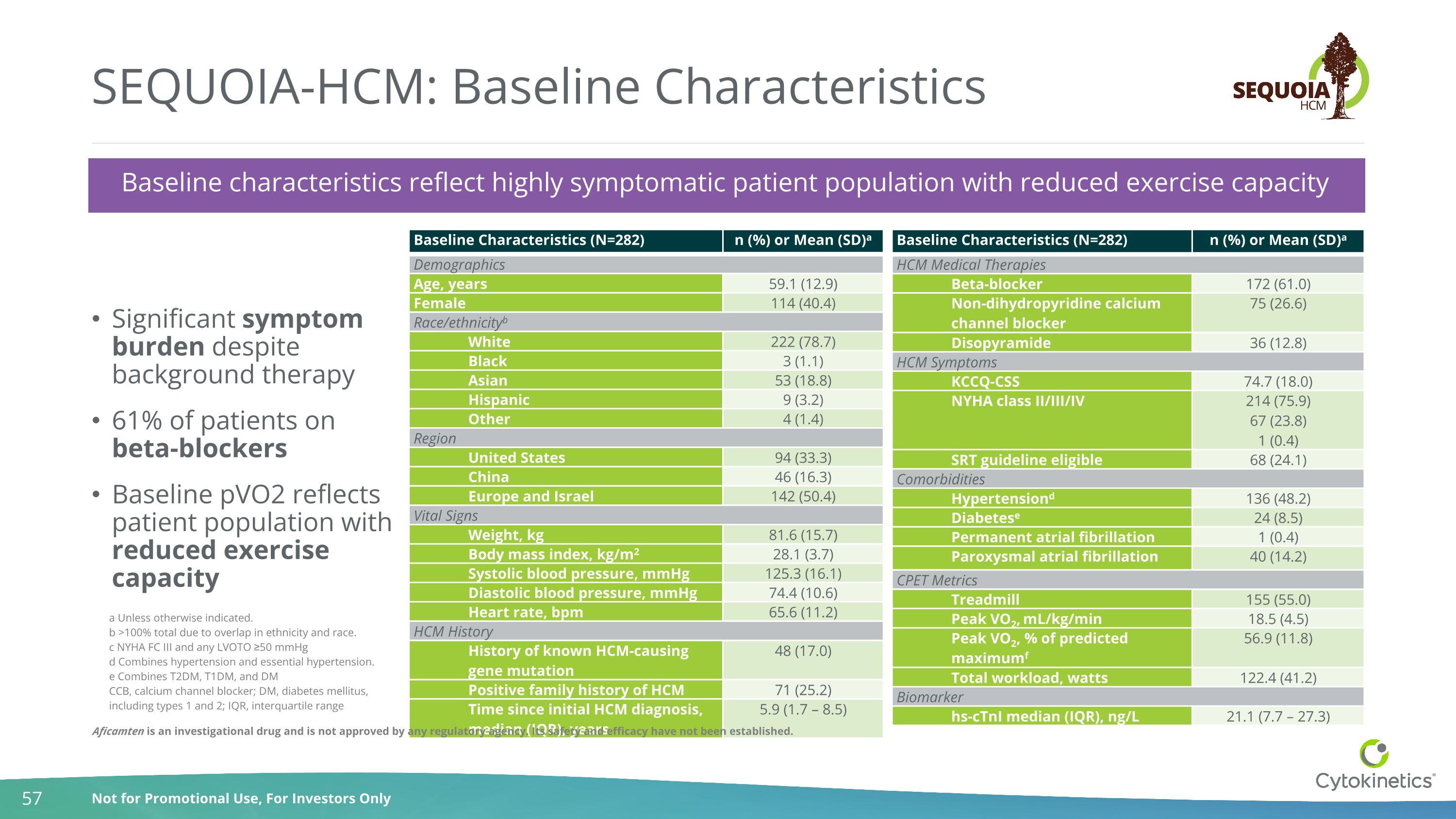

SEQUOIA-HCM: Baseline Characteristics Significant symptom burden despite background therapy 61% of patients on beta-blockers Baseline pVO2 reflects patient population with reduced exercise capacity Baseline Characteristics (N=282) n (%) or Mean (SD)a Demographics Age, years 59.1 (12.9) Female 114 (40.4) Race/ethnicityb White 222 (78.7) Black 3 (1.1) Asian 53 (18.8) Hispanic 9 (3.2) Other 4 (1.4) Region United States 94 (33.3) China 46 (16.3) Europe and Israel 142 (50.4) Vital Signs Weight, kg 81.6 (15.7) Body mass index, kg/m2 28.1 (3.7) Systolic blood pressure, mmHg 125.3 (16.1) Diastolic blood pressure, mmHg 74.4 (10.6) Heart rate, bpm 65.6 (11.2) HCM History History of known HCM-causing gene mutation 48 (17.0) Positive family history of HCM 71 (25.2) Time since initial HCM diagnosis, median (IQR), years 5.9 (1.7 – 8.5) Baseline Characteristics (N=282) n (%) or Mean (SD)a HCM Medical Therapies Beta-blocker 172 (61.0) Non-dihydropyridine calcium channel blocker 75 (26.6) Disopyramide 36 (12.8) HCM Symptoms KCCQ-CSS 74.7 (18.0) NYHA class II/III/IV 214 (75.9) 67 (23.8) 1 (0.4) SRT guideline eligible 68 (24.1) Comorbidities Hypertensiond 136 (48.2) Diabetese 24 (8.5) Permanent atrial fibrillation 1 (0.4) Paroxysmal atrial fibrillation 40 (14.2) CPET Metrics Treadmill 155 (55.0) Peak VO2, mL/kg/min 18.5 (4.5) Peak VO2, % of predicted maximumf 56.9 (11.8) Total workload, watts 122.4 (41.2) Biomarker hs-cTnI median (IQR), ng/L 21.1 (7.7 – 27.3) Baseline characteristics reflect highly symptomatic patient population with reduced exercise capacity a Unless otherwise indicated. b >100% total due to overlap in ethnicity and race. c NYHA FC III and any LVOTO ≥50 mmHg d Combines hypertension and essential hypertension. e Combines T2DM, T1DM, and DM CCB, calcium channel blocker; DM, diabetes mellitus, including types 1 and 2; IQR, interquartile range Aficamten is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established.

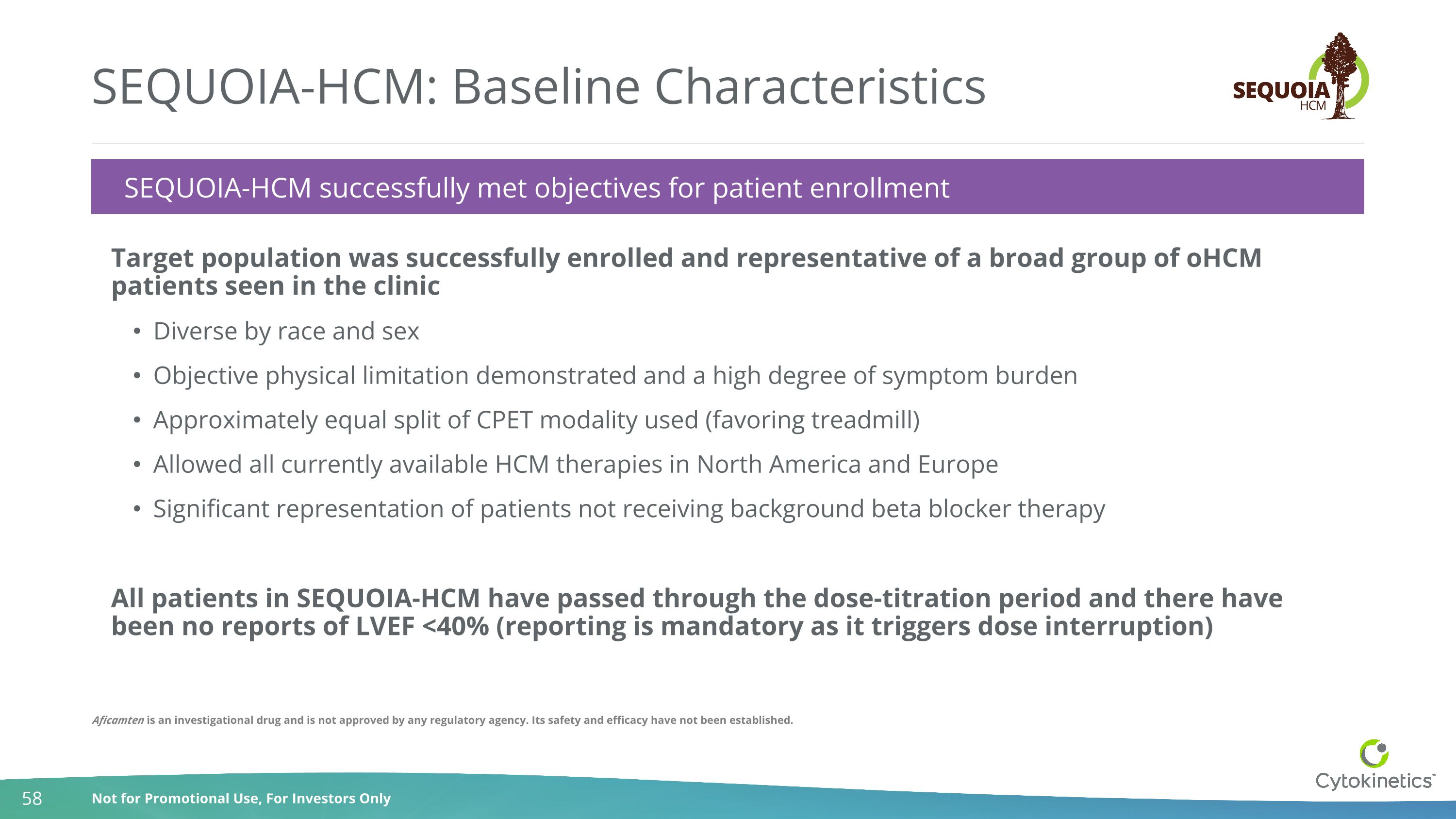

SEQUOIA-HCM: Baseline Characteristics Baseline Characteristics Target population was successfully enrolled and representative of a broad group of oHCM patients seen in the clinic Diverse by race and sex Objective physical limitation demonstrated and a high degree of symptom burden Approximately equal split of CPET modality used (favoring treadmill) Allowed all currently available HCM therapies in North America and Europe Significant representation of patients not receiving background beta blocker therapy All patients in SEQUOIA-HCM have passed through the dose-titration period and there have been no reports of LVEF <40% (reporting is mandatory as it triggers dose interruption) SEQUOIA-HCM successfully met objectives for patient enrollment Aficamten is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established.

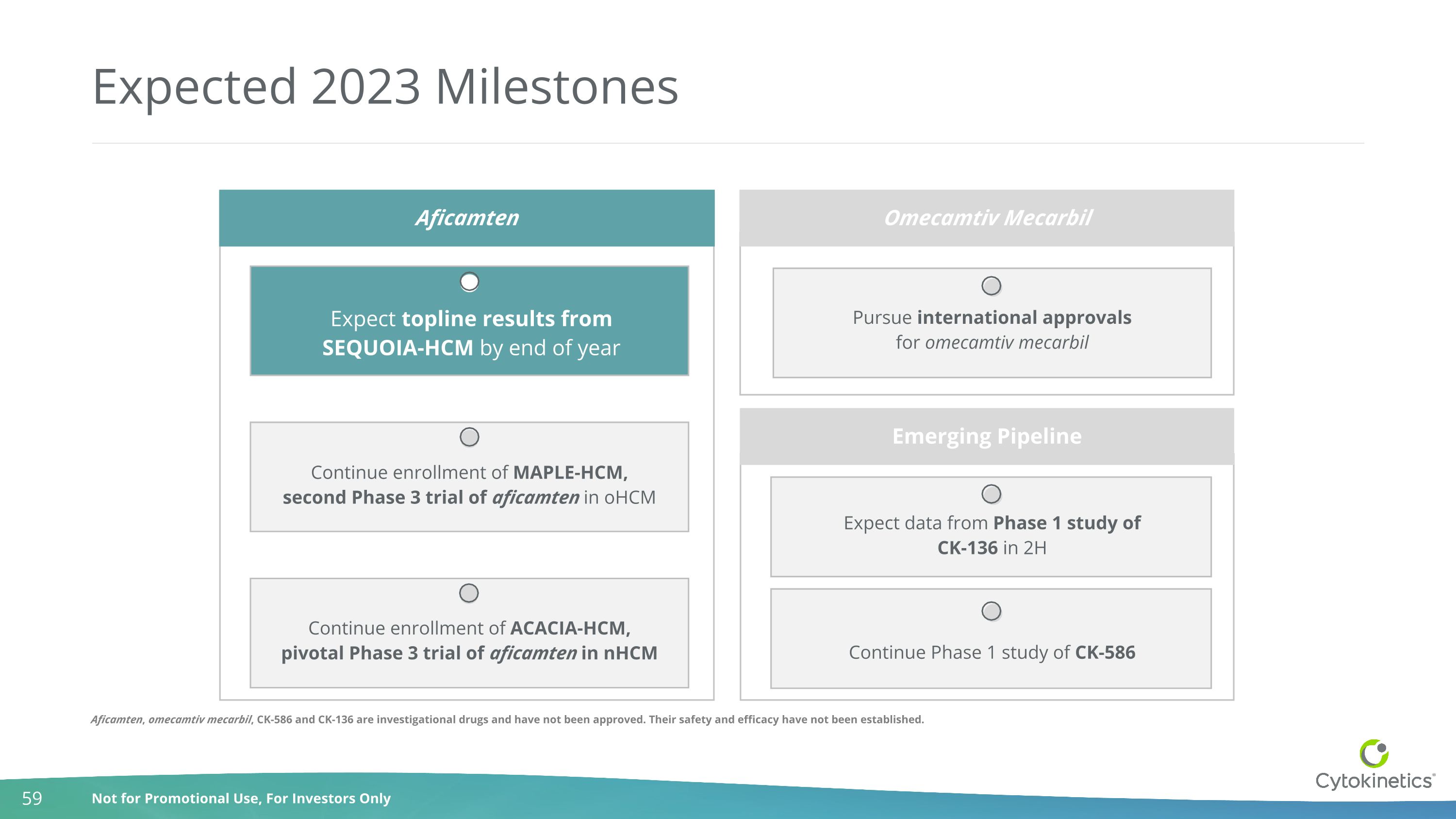

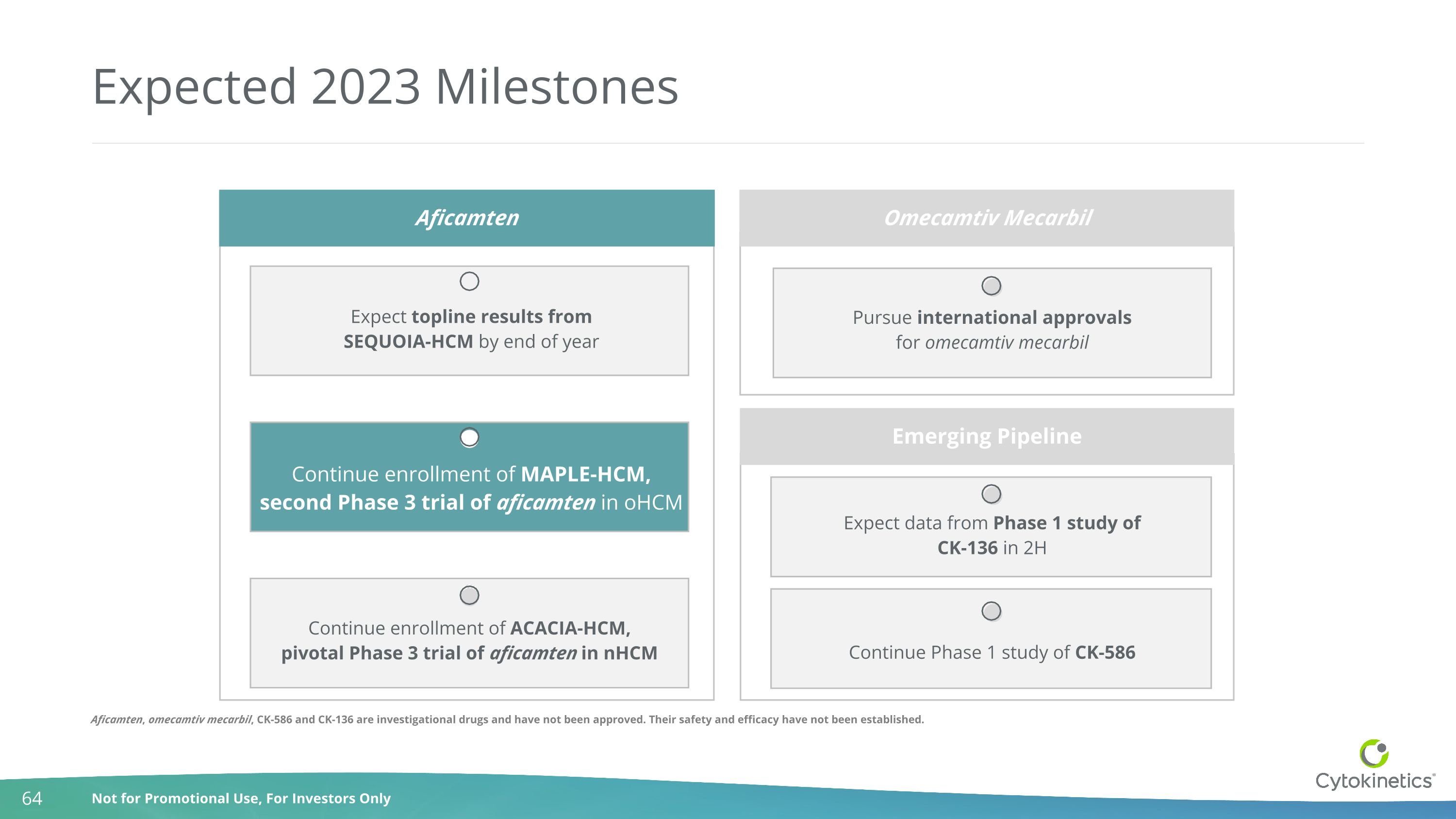

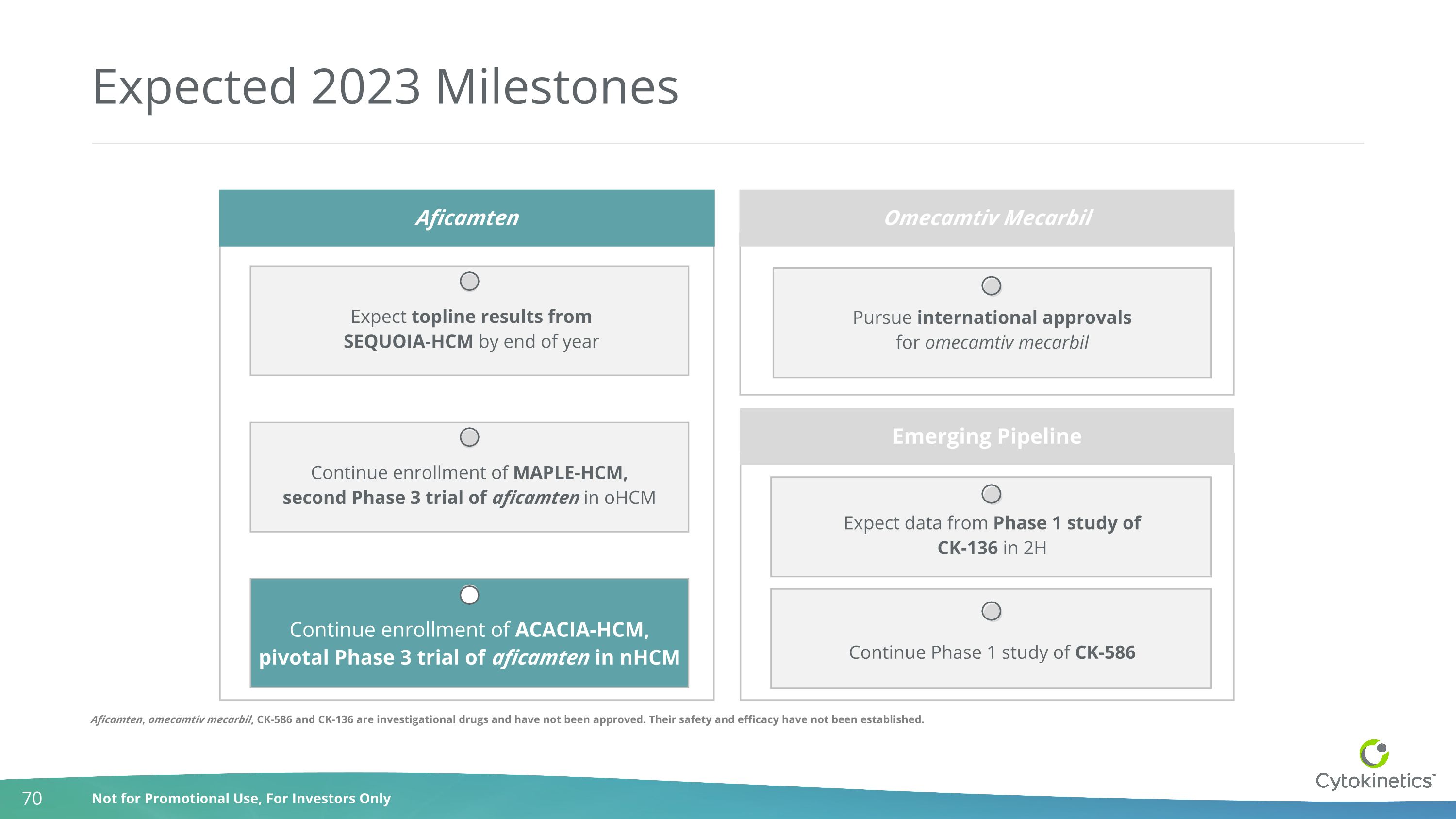

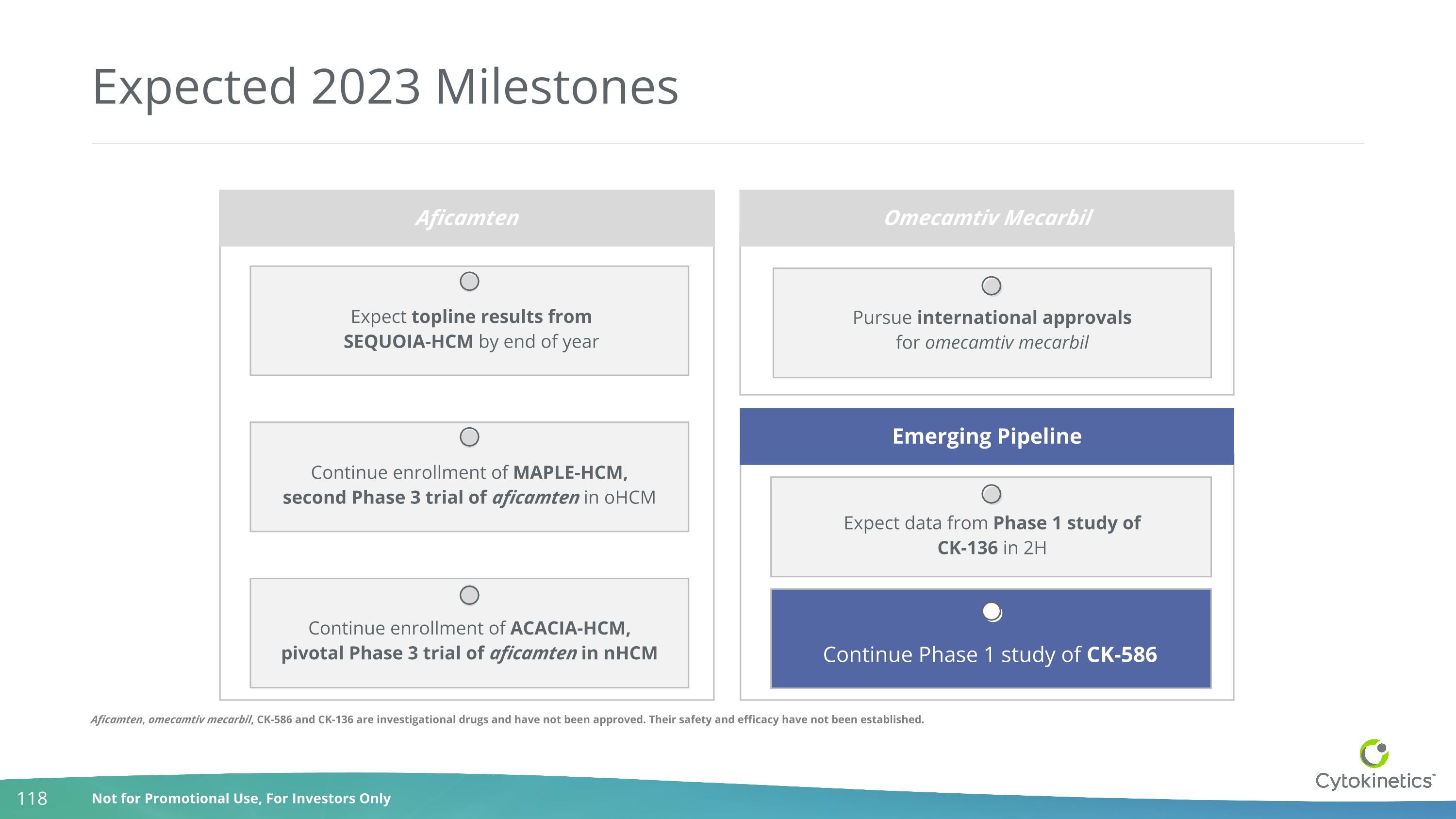

Continue enrollment of ACACIA-HCM, pivotal Phase 3 trial of aficamten in nHCM Expected 2023 Milestones Aficamten Aficamten Continue enrollment of MAPLE-HCM, second Phase 3 trial of aficamten in oHCM Omecamtiv Mecarbil Pursue international approvals for omecamtiv mecarbil Emerging Pipeline Expect data from Phase 1 study of CK-136 in 2H Continue Phase 1 study of CK-586 Expect topline results from SEQUOIA-HCM by end of year Aficamten, omecamtiv mecarbil, CK-586 and CK-136 are investigational drugs and have not been approved. Their safety and efficacy have not been established.

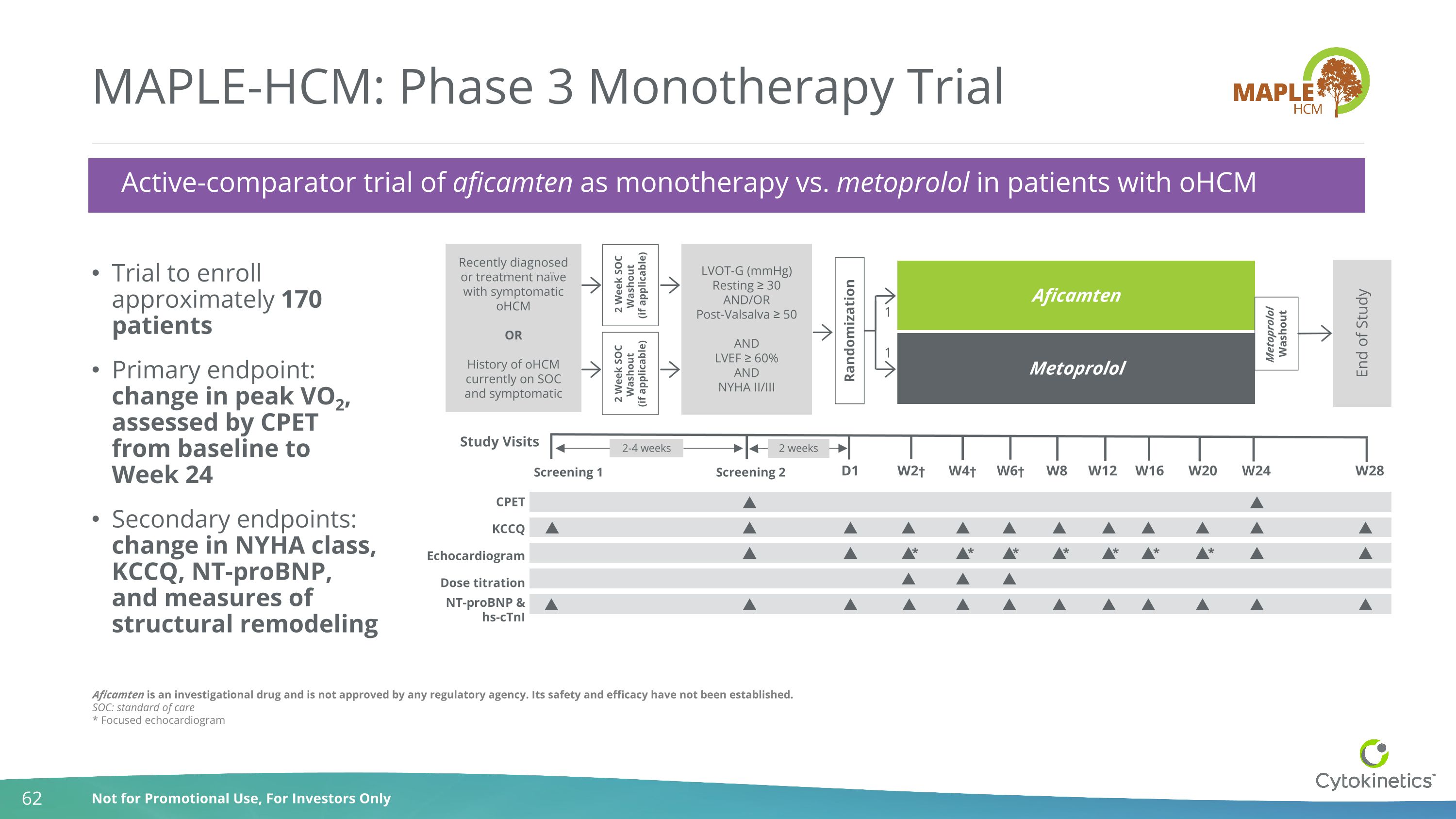

MAPLE-HCM Daniel Jacoby, M.D. Senior Medical Director, Clinical Research Cardiovascular Aficamten is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established.

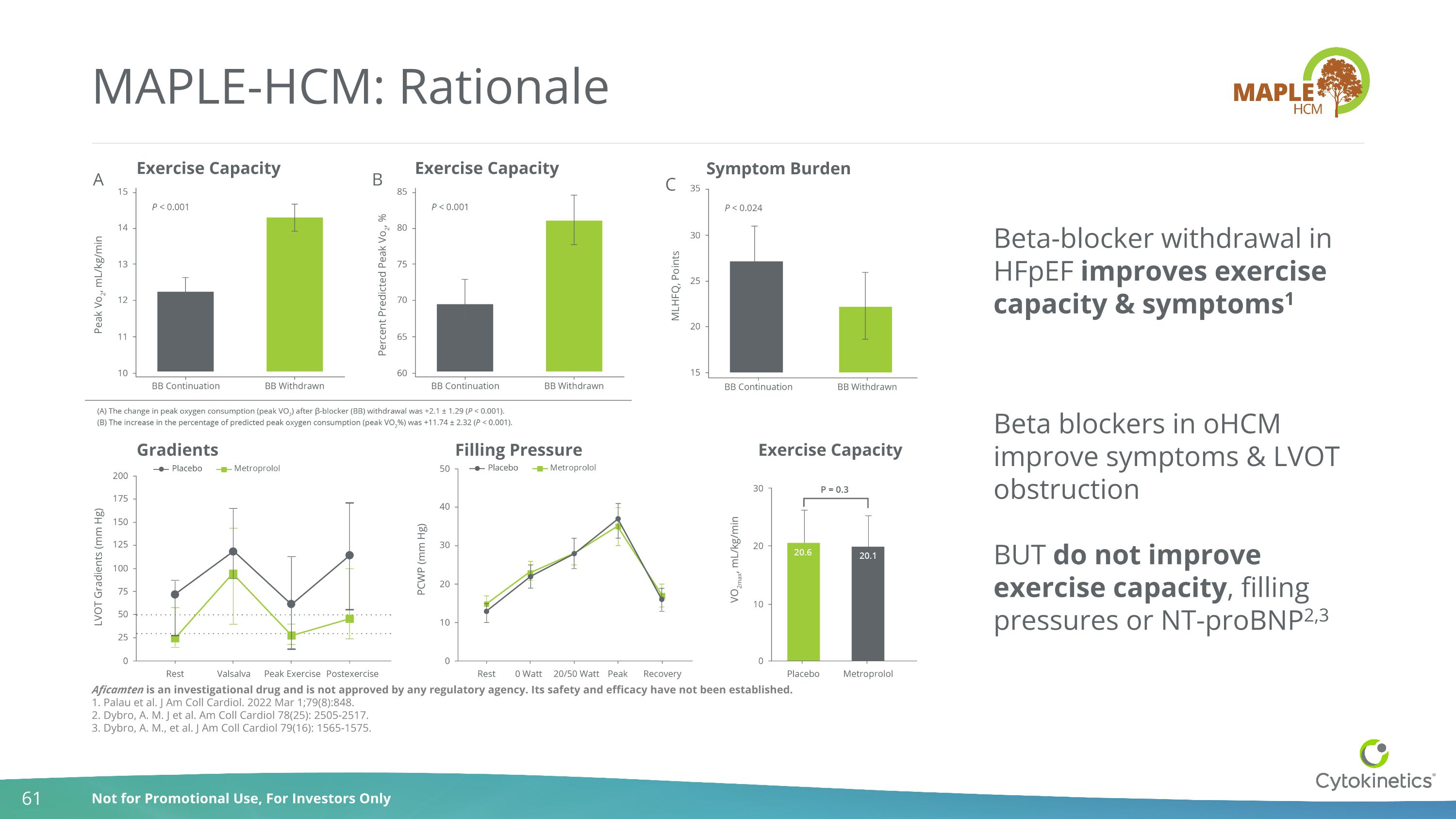

Filling Pressure Gradients Symptom Burden Exercise Capacity Exercise Capacity MAPLE-HCM: Rationale Beta-blocker withdrawal in HFpEF improves exercise capacity & symptoms1 Beta blockers in oHCM improve symptoms & LVOT obstruction BUT do not improve exercise capacity, filling pressures or NT-proBNP2,3 Exercise Capacity Aficamten is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established. 1. Palau et al. J Am Coll Cardiol. 2022 Mar 1;79(8):848. 2. Dybro, A. M. J et al. Am Coll Cardiol 78(25): 2505-2517. 3. Dybro, A. M., et al. J Am Coll Cardiol 79(16): 1565-1575.

Aficamten is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established. SOC: standard of care * Focused echocardiogram MAPLE-HCM: Phase 3 Monotherapy Trial Trial to enroll approximately 170 patients Primary endpoint: change in peak VO2, assessed by CPET from baseline to Week 24 Secondary endpoints: change in NYHA class, KCCQ, NT-proBNP, and measures of structural remodeling Active-comparator trial of aficamten as monotherapy vs. metoprolol in patients with oHCM Randomization Aficamten Metoprolol End of Study Study Visits Screening 2 KCCQ Echocardiogram Dose titration D1 W6† W4† W2† W8 W12 NT-proBNP & hs-cTnI W28 Screening 1 LVOT-G (mmHg) Resting ≥ 30 AND/OR Post-Valsalva ≥ 50 AND LVEF ≥ 60% AND NYHA II/III Recently diagnosed or treatment naïve with symptomatic oHCM OR History of oHCM currently on SOC and symptomatic 1 1 2-4 weeks W24 W16 W20 2 weeks CPET 2 Week SOC Washout (if applicable) Metoprolol Washout 2 Week SOC Washout (if applicable) * * * * * * *

MAPLE-HCM: Evolving the Treatment Paradigm Pending favorable results, MAPLE-HCM has the potential to evolve the treatment paradigm by potentially: Supporting the rationale for first-line use in HCM treatment guidelines Demonstrating efficacy in an earlier diagnosed patient population Demonstrating more favorable side effect profile of aficamten vs. metoprolol in oHCM Demonstrating structural remodeling as a secondary endpoint (disease modification) Aficamten is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established.

Continue enrollment of ACACIA-HCM, pivotal Phase 3 trial of aficamten in nHCM Expected 2023 Milestones Aficamten Aficamten Continue enrollment of MAPLE-HCM, second Phase 3 trial of aficamten in oHCM Omecamtiv Mecarbil Pursue international approvals for omecamtiv mecarbil Emerging Pipeline Expect data from Phase 1 study of CK-136 in 2H Continue Phase 1 study of CK-586 Expect topline results from SEQUOIA-HCM by end of year Aficamten, omecamtiv mecarbil, CK-586 and CK-136 are investigational drugs and have not been approved. Their safety and efficacy have not been established.

REDWOOD-HCM: nHCM ACACIA-HCM Steve Heitner, M.D. VP, Clinical Research & Therapeutic Area Lead, Cardiovascular Aficamten is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established.

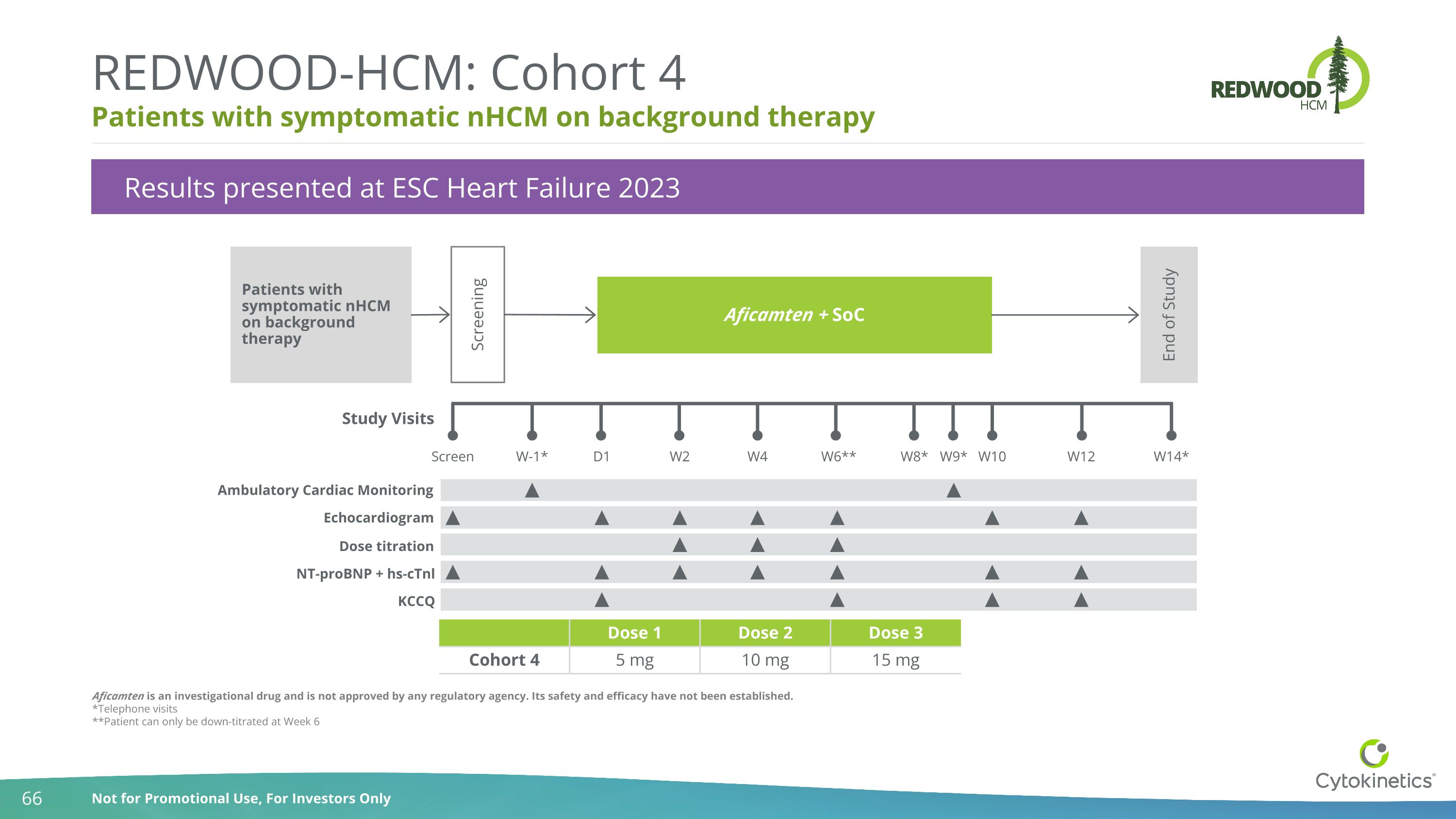

Aficamten is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established. *Telephone visits **Patient can only be down-titrated at Week 6 Patients with symptomatic nHCM on background therapy REDWOOD-HCM: Cohort 4 Dose 1 Dose 2 Dose 3 Cohort 4 5 mg 10 mg 15 mg Results presented at ESC Heart Failure 2023 Patients with symptomatic nHCM on background therapy Study Visits Screen W-1* D1 W2 W8* W9* W10 W14* Screening Aficamten + SoC End of Study Ambulatory Cardiac Monitoring W6** W4 Echocardiogram W12 Dose titration NT-proBNP + hs-cTnl KCCQ

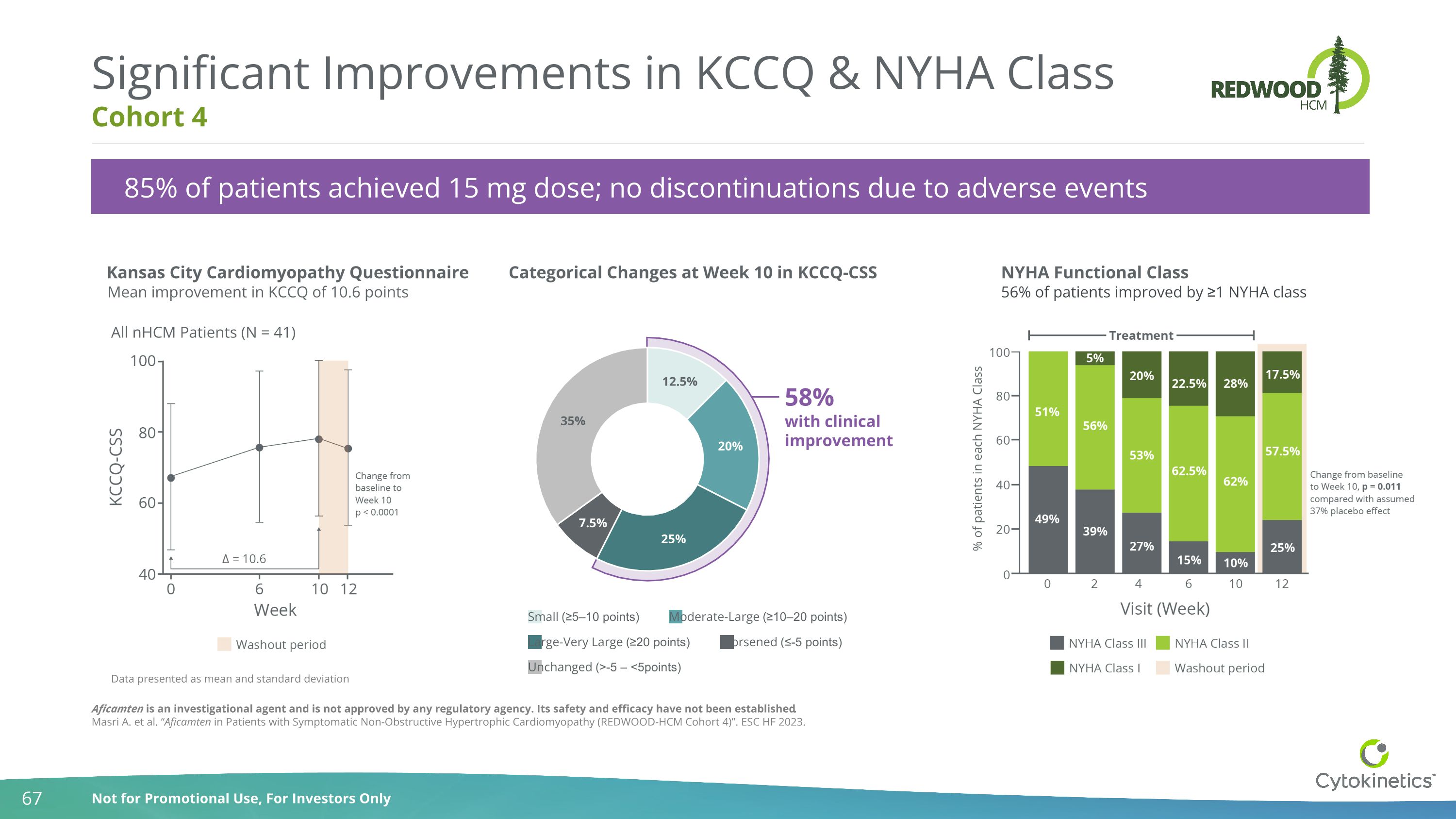

Cohort 4 Significant Improvements in KCCQ & NYHA Class Kansas City Cardiomyopathy Questionnaire Categorical Changes at Week 10 in KCCQ-CSS NYHA Functional Class 56% of patients improved by ≥1 NYHA class Mean improvement in KCCQ of 10.6 points 85% of patients achieved 15 mg dose; no discontinuations due to adverse events Aficamten is an investigational agent and is not approved by any regulatory agency. Its safety and efficacy have not been established. Masri A. et al. “Aficamten in Patients with Symptomatic Non-Obstructive Hypertrophic Cardiomyopathy (REDWOOD-HCM Cohort 4)”. ESC HF 2023. All nHCM Patients (N = 41) Data presented as mean and standard deviation 58% with clinical improvement Small (≥5–10 points) Moderate-Large (≥10–20 points) Large-Very Large (≥20 points) Worsened (≤-5 points) Unchanged (>-5 – <5points)

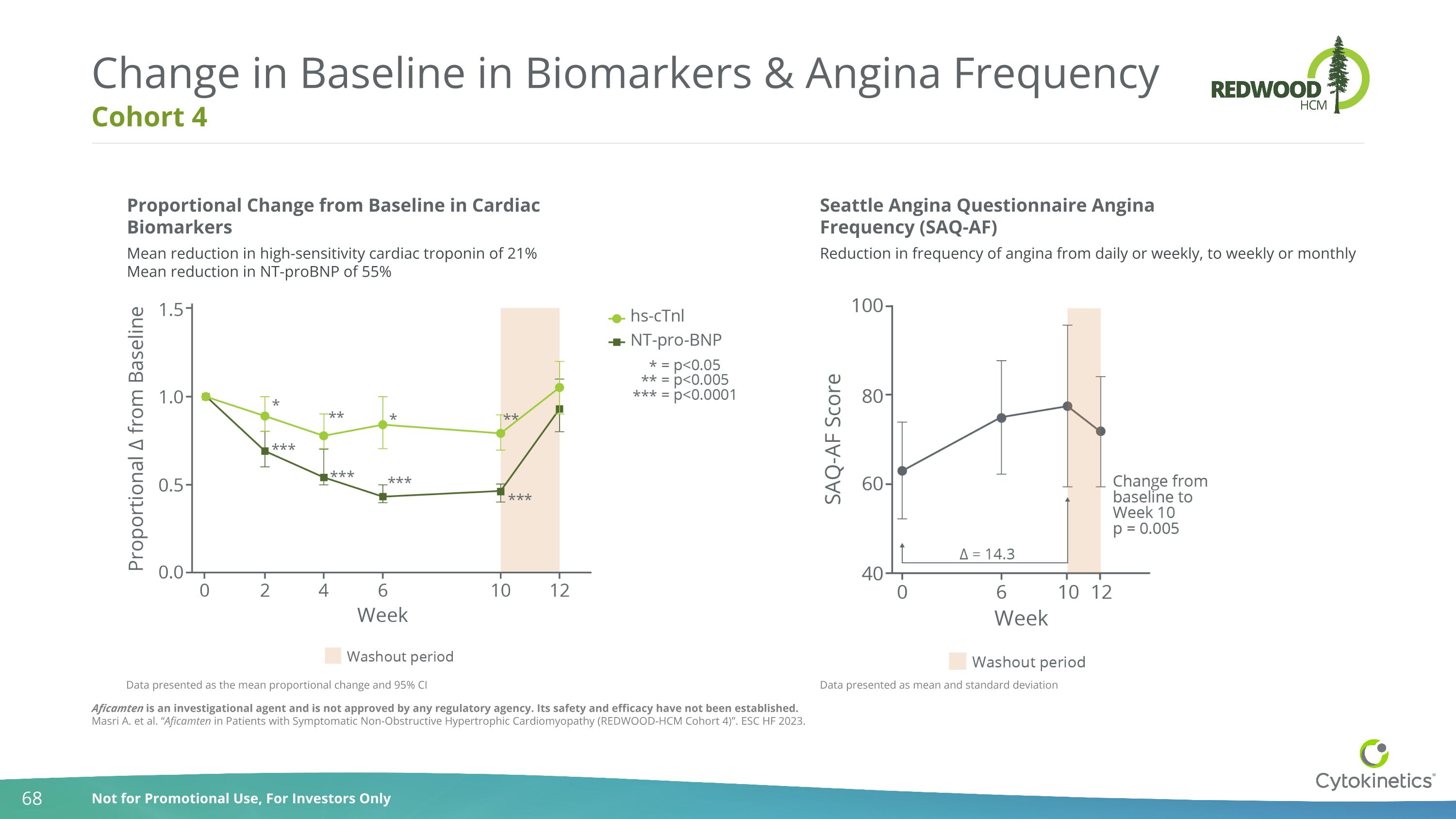

Cohort 4 Change in Baseline in Biomarkers & Angina Frequency Proportional Change from Baseline in Cardiac Biomarkers Mean reduction in high-sensitivity cardiac troponin of 21% Mean reduction in NT-proBNP of 55% Seattle Angina Questionnaire Angina Frequency (SAQ-AF) Reduction in frequency of angina from daily or weekly, to weekly or monthly Data presented as mean and standard deviation Data presented as the mean proportional change and 95% CI Aficamten is an investigational agent and is not approved by any regulatory agency. Its safety and efficacy have not been established. Masri A. et al. “Aficamten in Patients with Symptomatic Non-Obstructive Hypertrophic Cardiomyopathy (REDWOOD-HCM Cohort 4)”. ESC HF 2023.

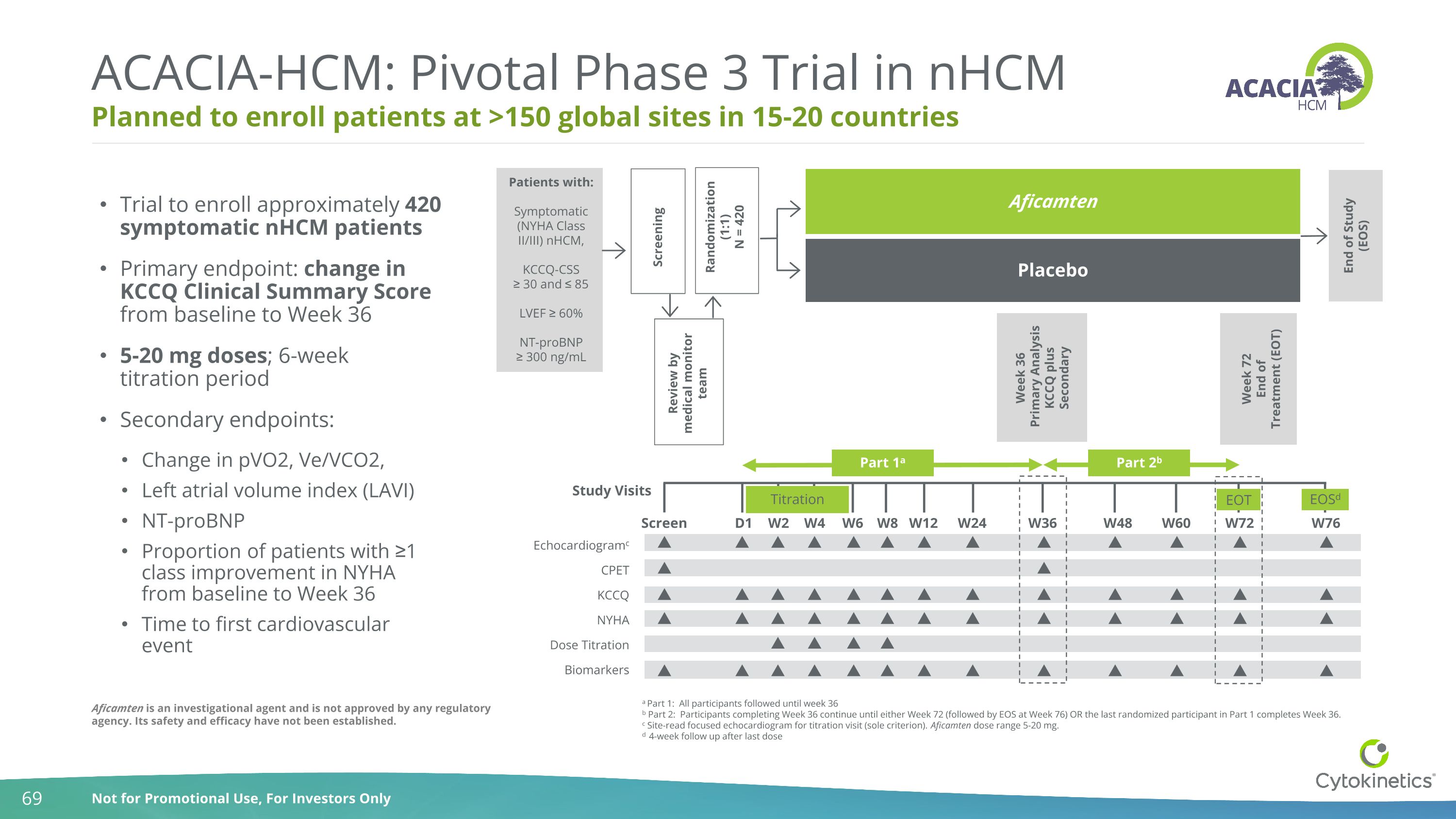

Patients with: Symptomatic (NYHA Class II/III) nHCM, KCCQ-CSS ≥ 30 and ≤ 85 LVEF ≥ 60% NT-proBNP ≥ 300 ng/mL Study Visits CPET KCCQ Echocardiogramc Dose Titration Biomarkers NYHA Placebo Aficamten End of Study (EOS) Week 36 Primary Analysis KCCQ plus Secondary Week 72 End of Treatment (EOT) Screening Part 1a Part 2b Randomization (1:1) N = 420 Review by medical monitor team W6 Screen D1 W2 W4 W8 W24 W12 W36 W72 W76 W48 W60 Titration EOT EOSd a Part 1: All participants followed until week 36 b Part 2: Participants completing Week 36 continue until either Week 72 (followed by EOS at Week 76) OR the last randomized participant in Part 1 completes Week 36. c Site-read focused echocardiogram for titration visit (sole criterion). Aficamten dose range 5-20 mg. d 4-week follow up after last dose Trial to enroll approximately 420 symptomatic nHCM patients Primary endpoint: change in KCCQ Clinical Summary Score from baseline to Week 36 5-20 mg doses; 6-week titration period Secondary endpoints: Change in pVO2, Ve/VCO2, Left atrial volume index (LAVI) NT-proBNP Proportion of patients with ≥1 class improvement in NYHA from baseline to Week 36 Time to first cardiovascular event Planned to enroll patients at >150 global sites in 15-20 countries ACACIA-HCM: Pivotal Phase 3 Trial in nHCM Aficamten is an investigational agent and is not approved by any regulatory agency. Its safety and efficacy have not been established.

Continue enrollment of ACACIA-HCM, pivotal Phase 3 trial of aficamten in nHCM Expected 2023 Milestones Aficamten Aficamten Continue enrollment of MAPLE-HCM, second Phase 3 trial of aficamten in oHCM Omecamtiv Mecarbil Pursue international approvals for omecamtiv mecarbil Emerging Pipeline Expect data from Phase 1 study of CK-136 in 2H Continue Phase 1 study of CK-586 Expect topline results from SEQUOIA-HCM by end of year Aficamten, omecamtiv mecarbil, CK-586 and CK-136 are investigational drugs and have not been approved. Their safety and efficacy have not been established.

5 Minute Break The program will return shortly.

HCM Patient Perspective Megan Link, Person Living with HCM Actual patient who consents and agrees to appear.

Aficamten: Commercial Readiness Aficamten is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established.

New Market Research & Preliminary Positioning John Jacoppi VP, US Marketing for Aficamten

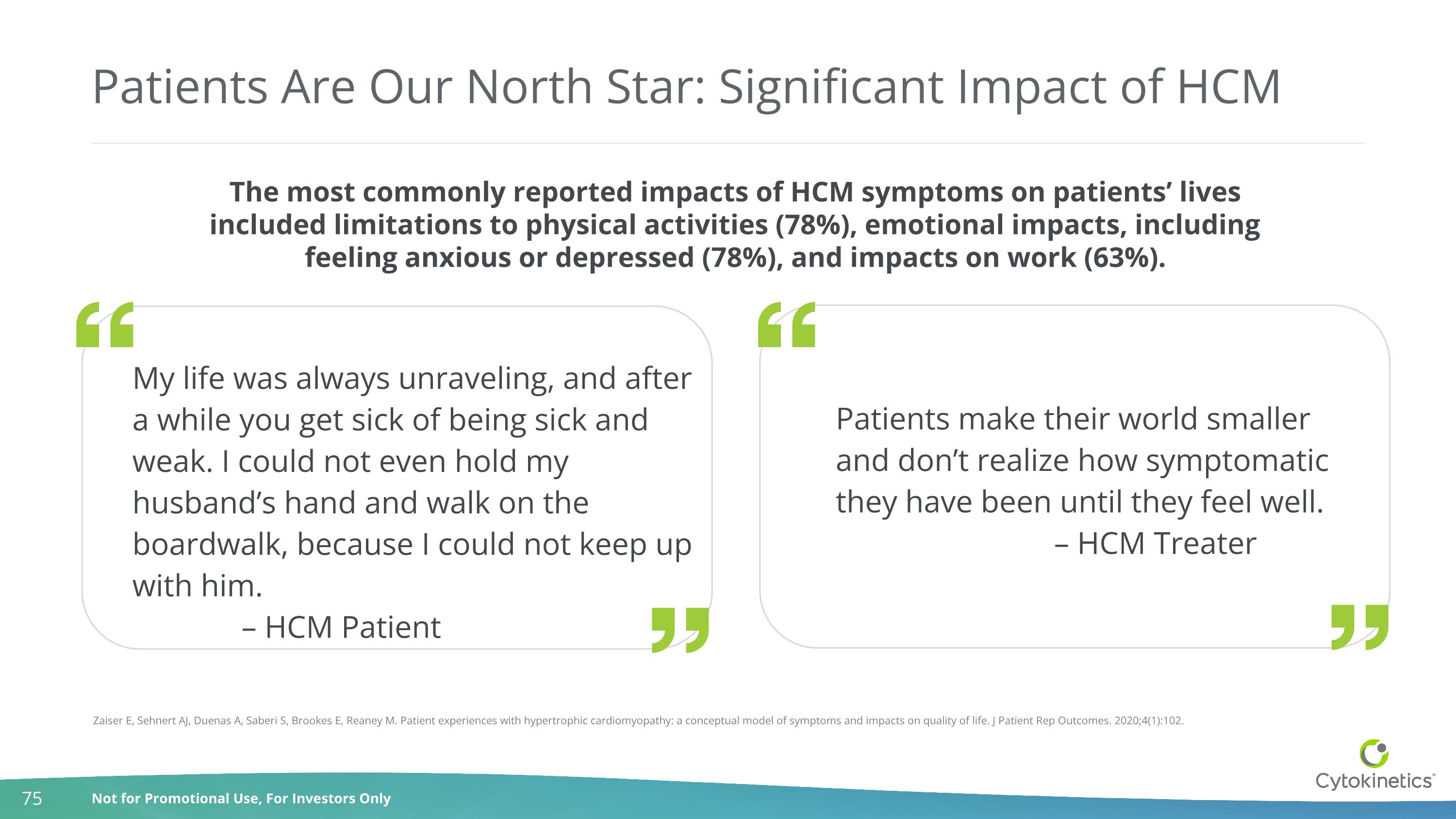

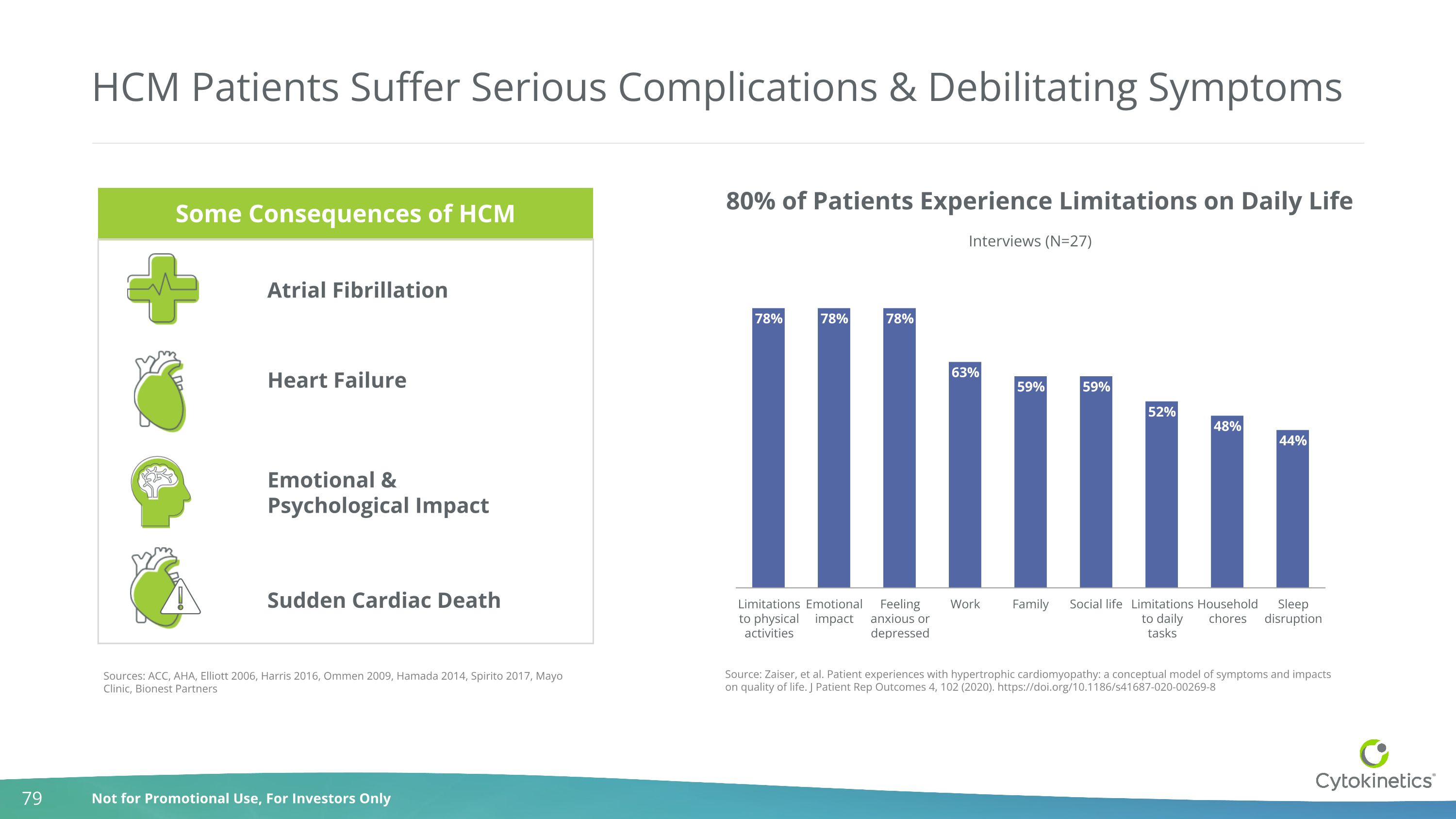

Patients Are Our North Star: Significant Impact of HCM The most commonly reported impacts of HCM symptoms on patients’ lives included limitations to physical activities (78%), emotional impacts, including feeling anxious or depressed (78%), and impacts on work (63%). My life was always unraveling, and after a while you get sick of being sick and weak. I could not even hold my husband’s hand and walk on the boardwalk, because I could not keep up with him. – HCM Patient Patients make their world smaller and don’t realize how symptomatic they have been until they feel well. – HCM Treater Zaiser E, Sehnert AJ, Duenas A, Saberi S, Brookes E, Reaney M. Patient experiences with hypertrophic cardiomyopathy: a conceptual model of symptoms and impacts on quality of life. J Patient Rep Outcomes. 2020;4(1):102.

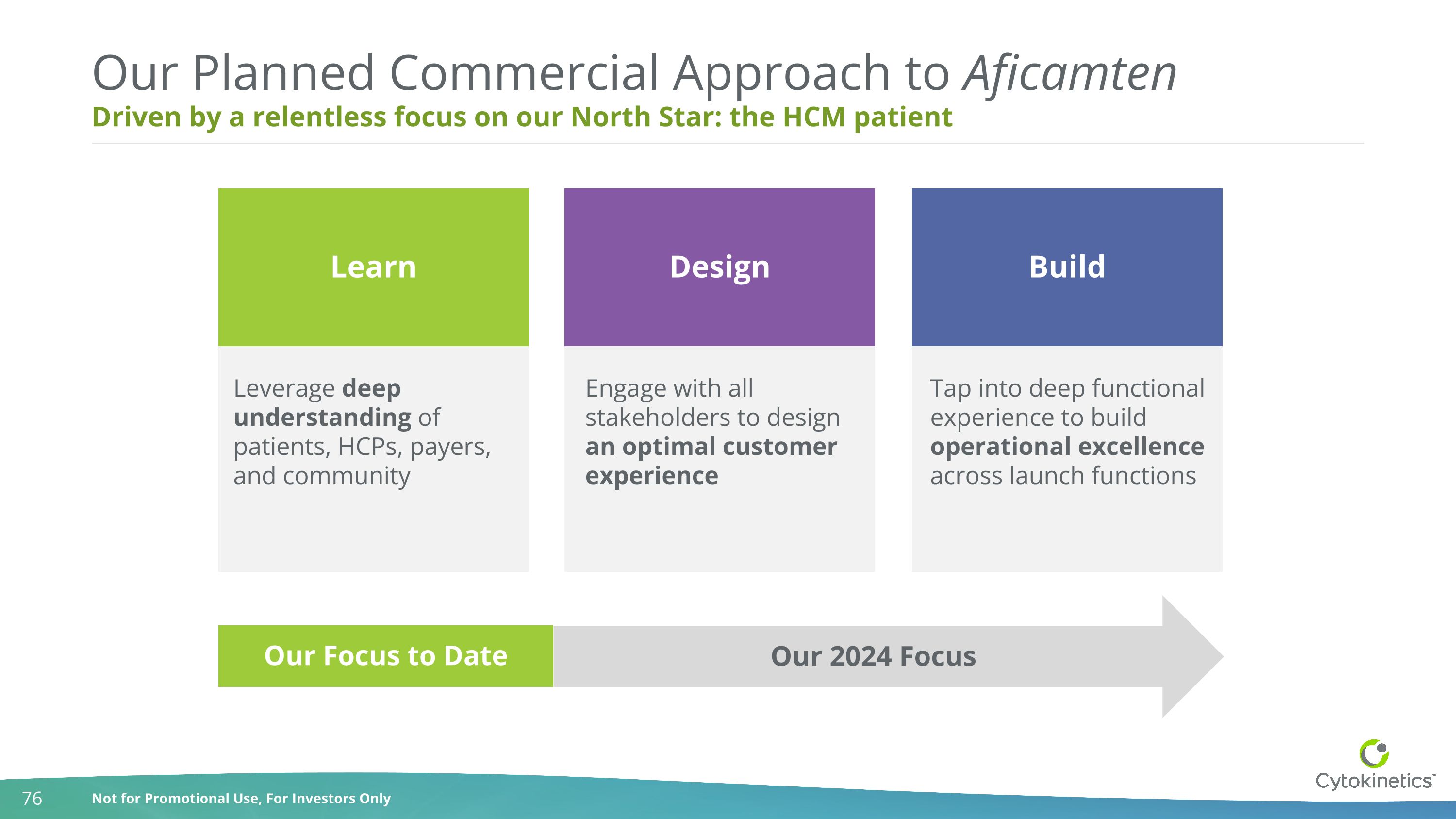

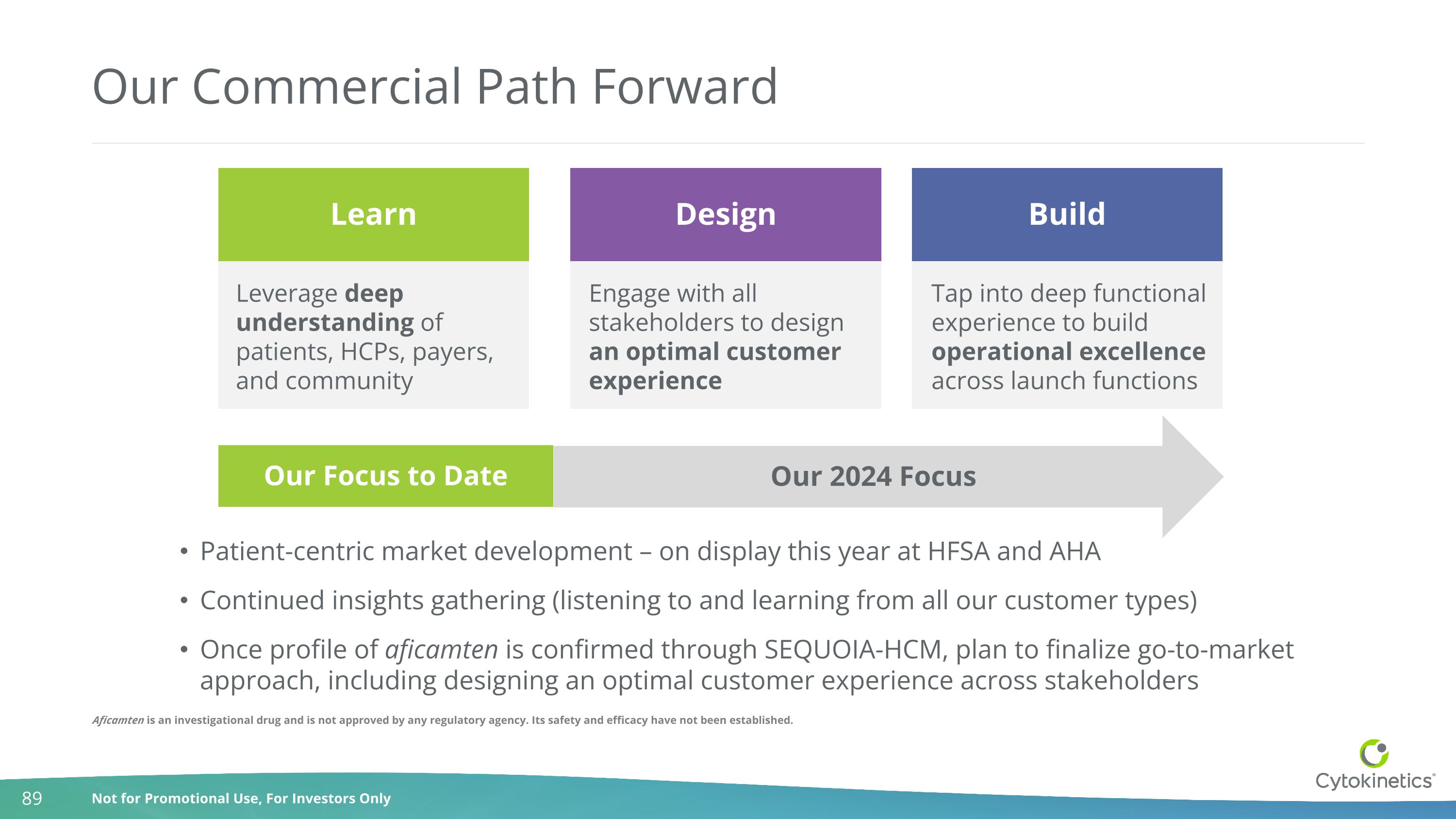

Driven by a relentless focus on our North Star: the HCM patient Our Planned Commercial Approach to Aficamten Leverage deep understanding of patients, HCPs, payers, and community Tap into deep functional experience to build operational excellence across launch functions Engage with all stakeholders to design an optimal customer experience Learn Design Build Our 2024 Focus Our Focus to Date

Deep Understanding & Insights Gathered Over Last 18 Months Cytokinetics has completed 14 primary market research projects with >831 HCPs, including cardiologists, NP/PAs, and others Cytokinetics has completed 5 primary market research projects with >163 HCM patients & their loved ones

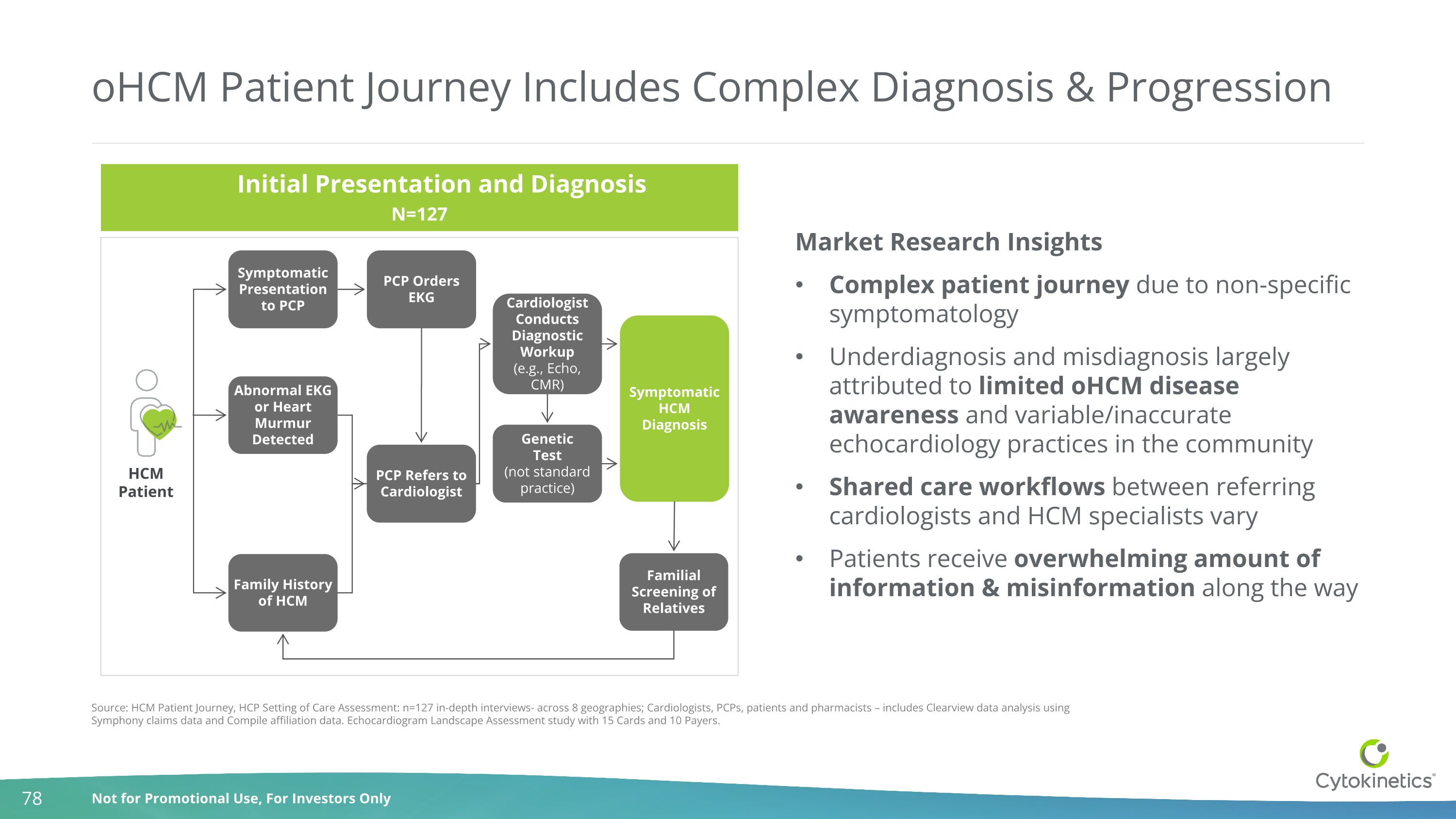

oHCM Patient Journey Includes Complex Diagnosis & Progression Symptomatic Presentation to PCP PCP Orders EKG PCP Refers to Cardiologist Genetic Test (not standard practice) Symptomatic HCM Diagnosis Abnormal EKG or Heart Murmur Detected Family History of HCM Cardiologist Conducts Diagnostic Workup (e.g., Echo, CMR) Familial Screening of Relatives Initial Presentation and Diagnosis N=127 Source: HCM Patient Journey, HCP Setting of Care Assessment: n=127 in-depth interviews- across 8 geographies; Cardiologists, PCPs, patients and pharmacists – includes Clearview data analysis using Symphony claims data and Compile affiliation data. Echocardiogram Landscape Assessment study with 15 Cards and 10 Payers. Market Research Insights Complex patient journey due to non-specific symptomatology Underdiagnosis and misdiagnosis largely attributed to limited oHCM disease awareness and variable/inaccurate echocardiology practices in the community Shared care workflows between referring cardiologists and HCM specialists vary Patients receive overwhelming amount of information & misinformation along the way HCM Patient

HCM Patients Suffer Serious Complications & Debilitating Symptoms Sources: ACC, AHA, Elliott 2006, Harris 2016, Ommen 2009, Hamada 2014, Spirito 2017, Mayo Clinic, Bionest Partners Sudden Cardiac Death Atrial Fibrillation Heart Failure Emotional & Psychological Impact 80% of Patients Experience Limitations on Daily Life Source: Zaiser, et al. Patient experiences with hypertrophic cardiomyopathy: a conceptual model of symptoms and impacts on quality of life. J Patient Rep Outcomes 4, 102 (2020). https://doi.org/10.1186/s41687-020-00269-8 Some Consequences of HCM Some Consequences of HCM

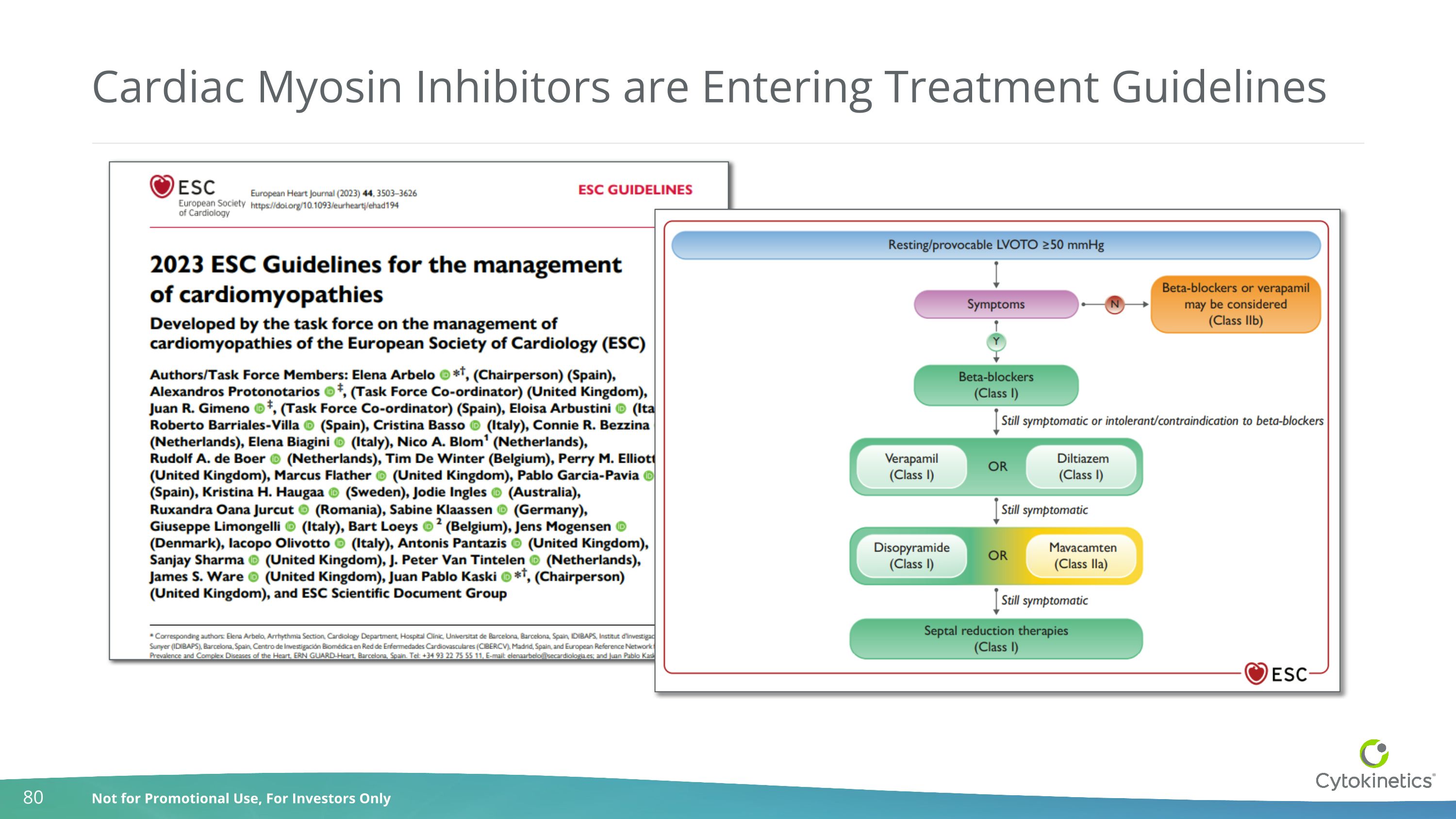

Cardiac Myosin Inhibitors are Entering Treatment Guidelines

CMIs Have Transformed Patients’ Lives Selected example for illustration There was an incredible moment in clinic yesterday when I was able to tell a patient that her disease appeared to be “reversing”. This is the first time in my life I have used those words. Cardiac myosin inhibitors for hypertrophic cardiomyopathy are game changing. – Dr. Euan Ashley, Stanford

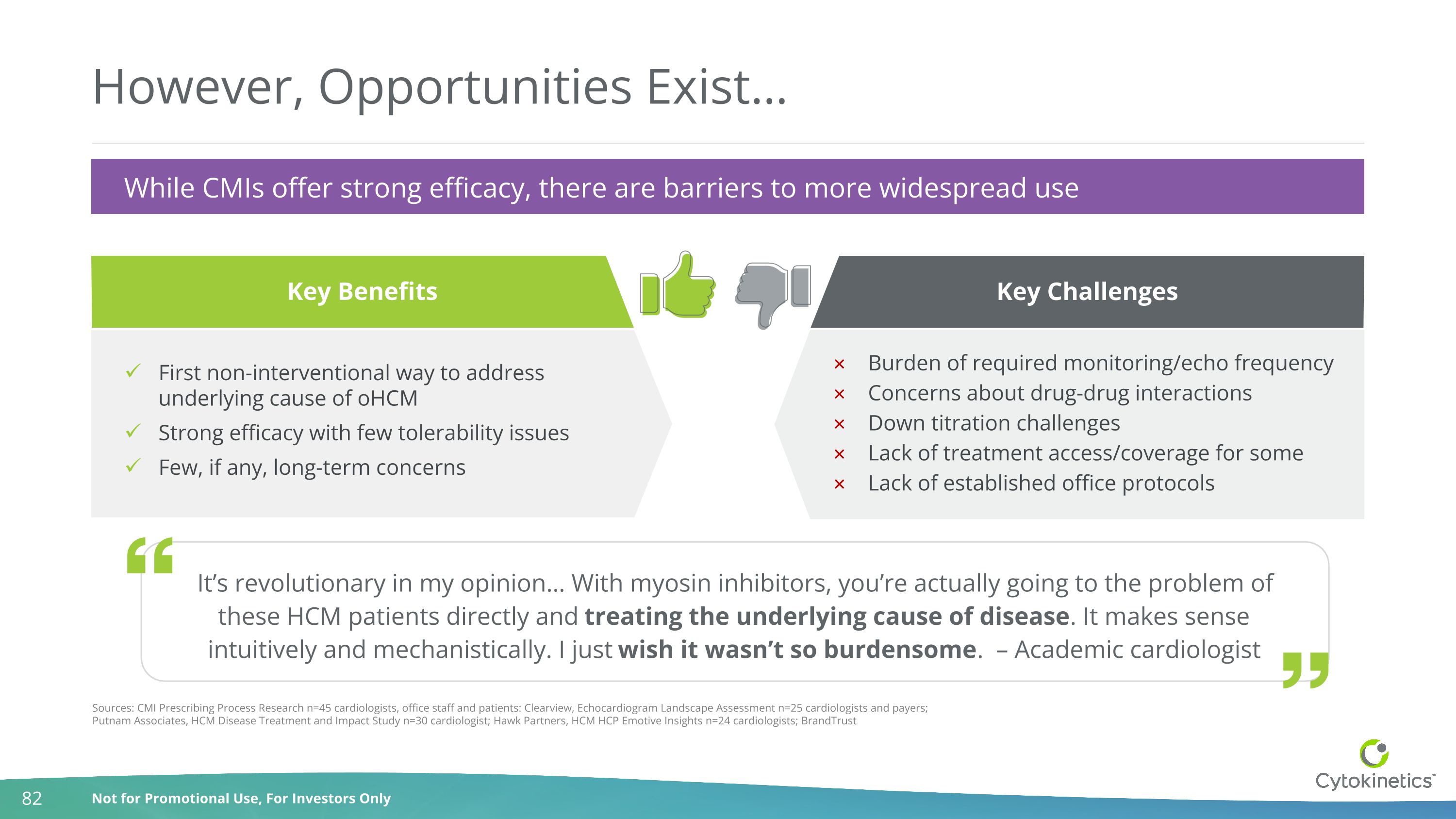

However, Opportunities Exist… Key Benefits First non-interventional way to address underlying cause of oHCM Strong efficacy with few tolerability issues Few, if any, long-term concerns Key Challenges Burden of required monitoring/echo frequency Concerns about drug-drug interactions Down titration challenges Lack of treatment access/coverage for some Lack of established office protocols Sources: CMI Prescribing Process Research n=45 cardiologists, office staff and patients: Clearview, Echocardiogram Landscape Assessment n=25 cardiologists and payers; Putnam Associates, HCM Disease Treatment and Impact Study n=30 cardiologist; Hawk Partners, HCM HCP Emotive Insights n=24 cardiologists; BrandTrust While CMIs offer strong efficacy, there are barriers to more widespread use It’s revolutionary in my opinion… With myosin inhibitors, you’re actually going to the problem of these HCM patients directly and treating the underlying cause of disease. It makes sense intuitively and mechanistically. I just wish it wasn’t so burdensome. – Academic cardiologist

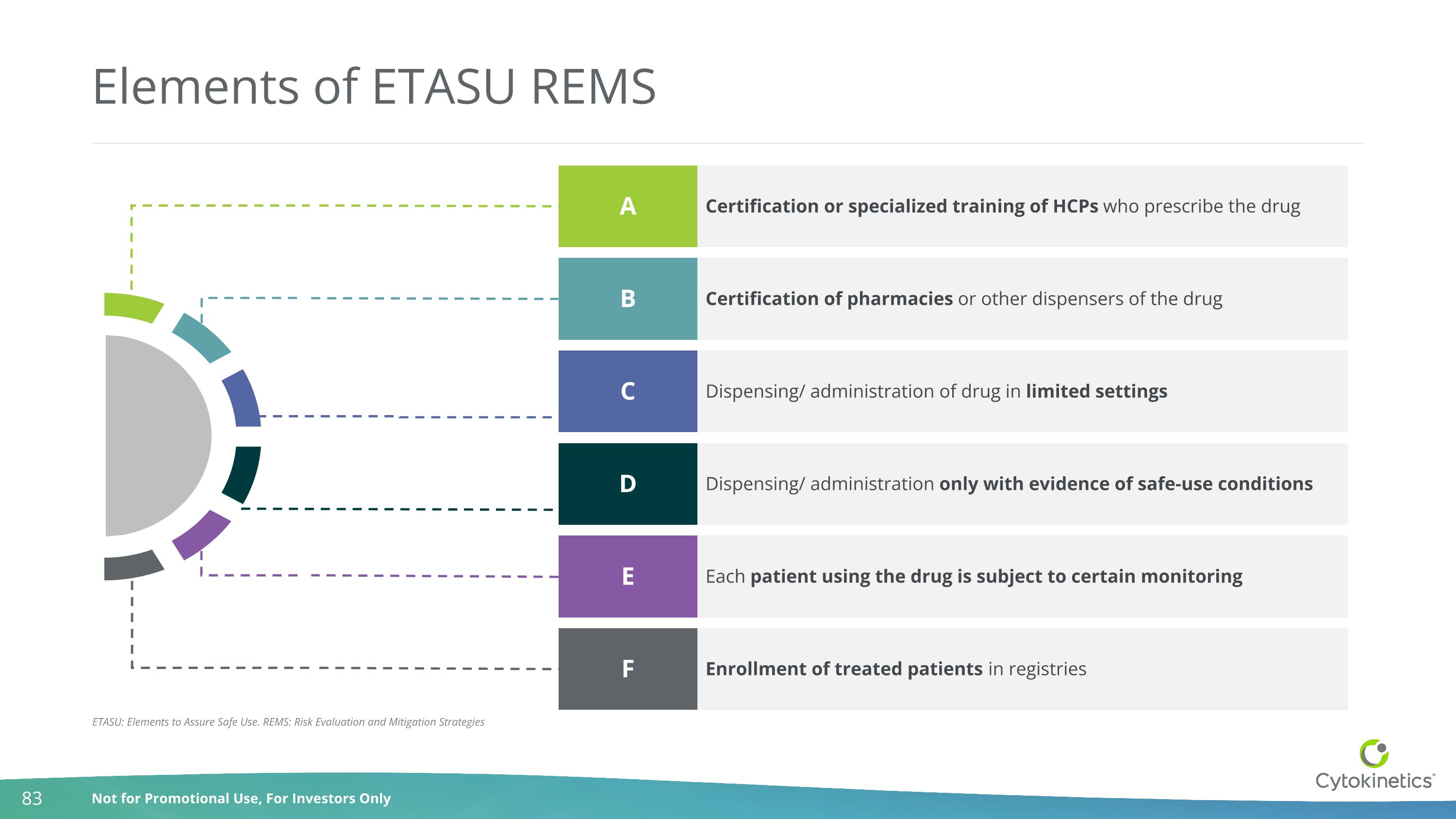

Elements of ETASU REMS Certification or specialized training of HCPs who prescribe the drug A Certification of pharmacies or other dispensers of the drug B Dispensing/ administration of drug in limited settings C Dispensing/ administration only with evidence of safe-use conditions D Each patient using the drug is subject to certain monitoring E Enrollment of treated patients in registries F ETASU: Elements to Assure Safe Use. REMS: Risk Evaluation and Mitigation Strategies

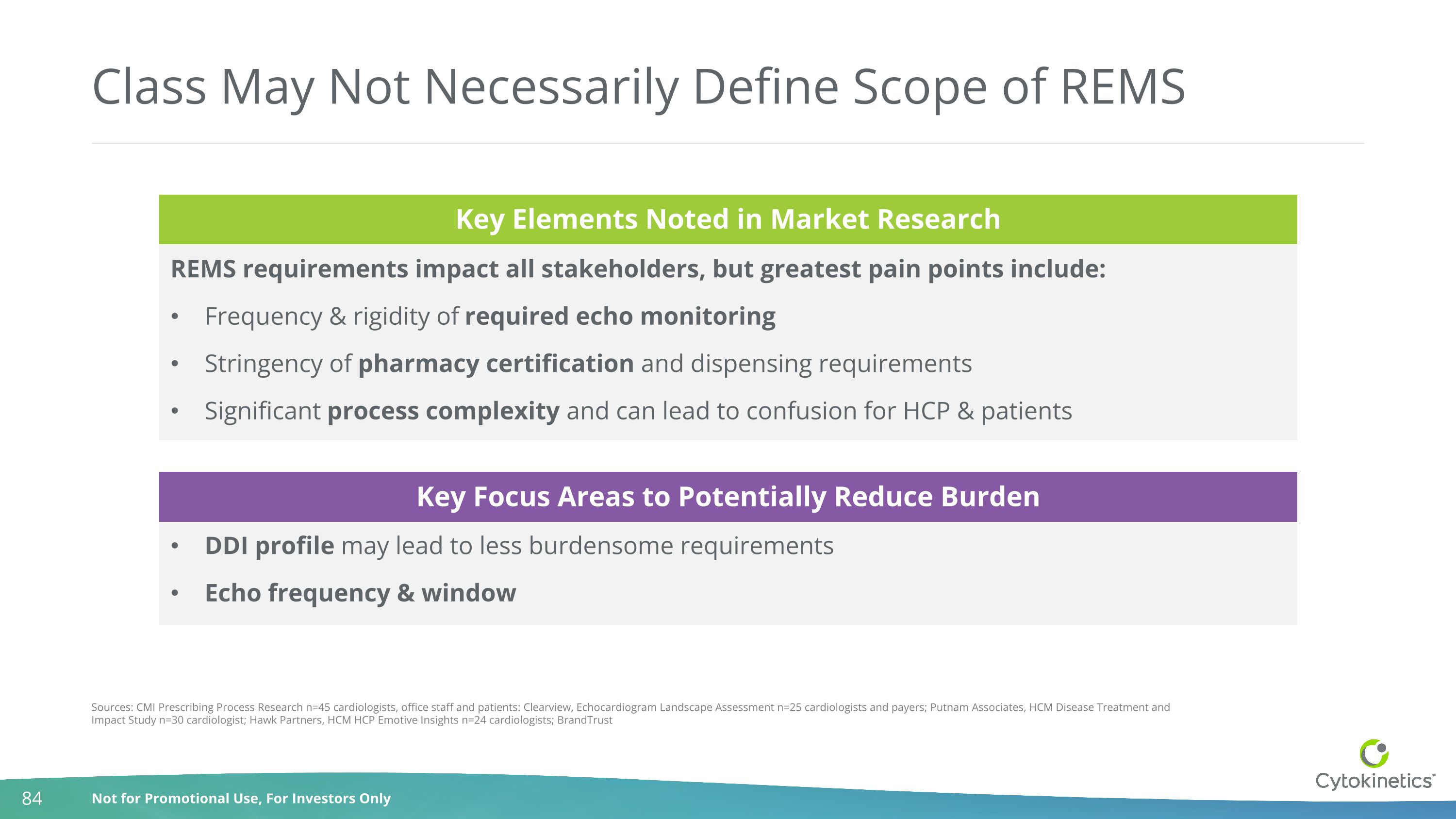

Class May Not Necessarily Define Scope of REMS REMS requirements impact all stakeholders, but greatest pain points include: Frequency & rigidity of required echo monitoring Stringency of pharmacy certification and dispensing requirements Significant process complexity and can lead to confusion for HCP & patients DDI profile may lead to less burdensome requirements Echo frequency & window Sources: CMI Prescribing Process Research n=45 cardiologists, office staff and patients: Clearview, Echocardiogram Landscape Assessment n=25 cardiologists and payers; Putnam Associates, HCM Disease Treatment and Impact Study n=30 cardiologist; Hawk Partners, HCM HCP Emotive Insights n=24 cardiologists; BrandTrust Key Elements Noted in Market Research Key Focus Areas to Potentially Reduce Burden

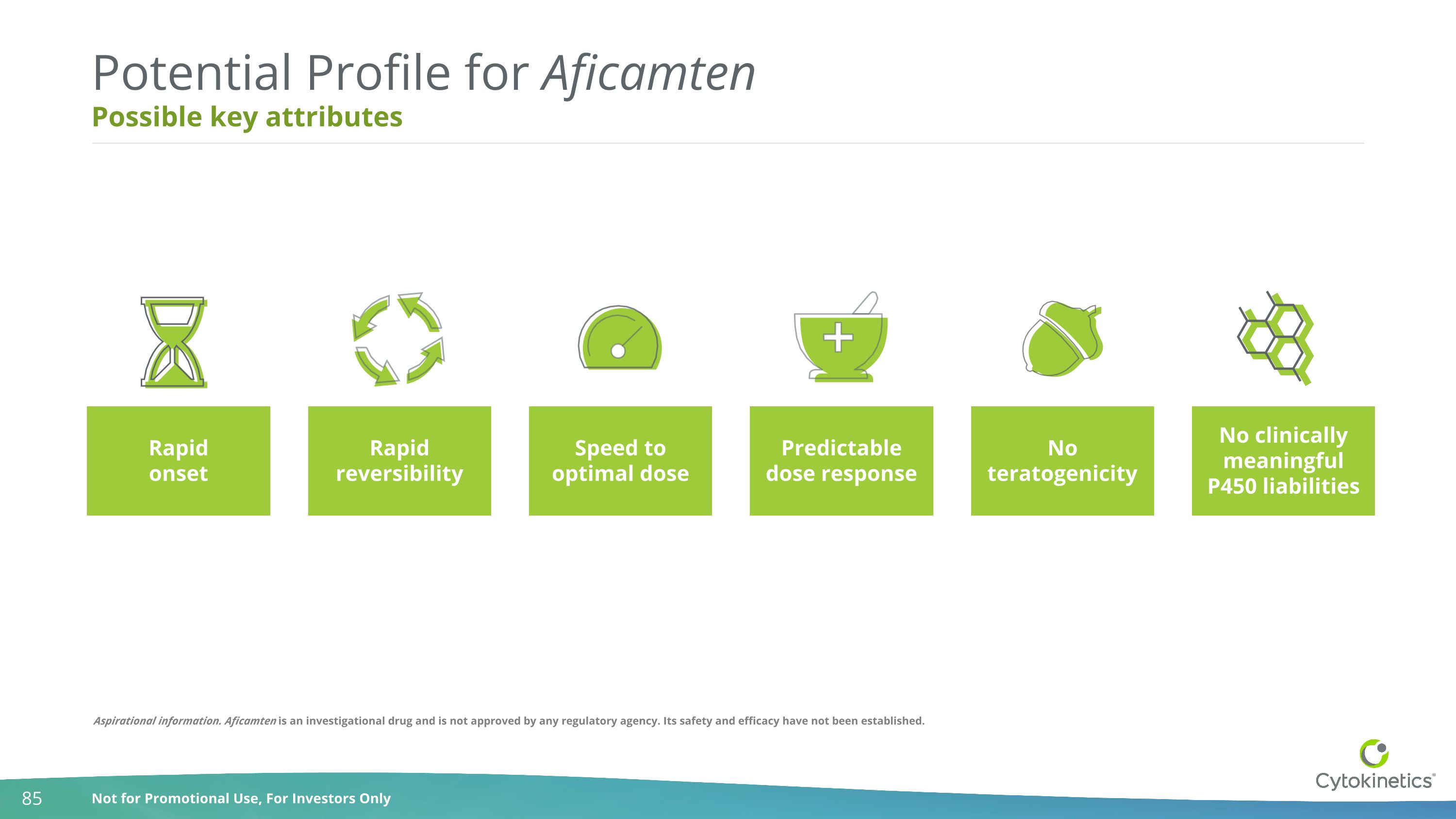

Possible key attributes Potential Profile for Aficamten Predictable dose response Rapid reversibility Speed to optimal dose No clinically meaningful P450 liabilities Rapid onset No teratogenicity Aspirational information. Aficamten is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established.

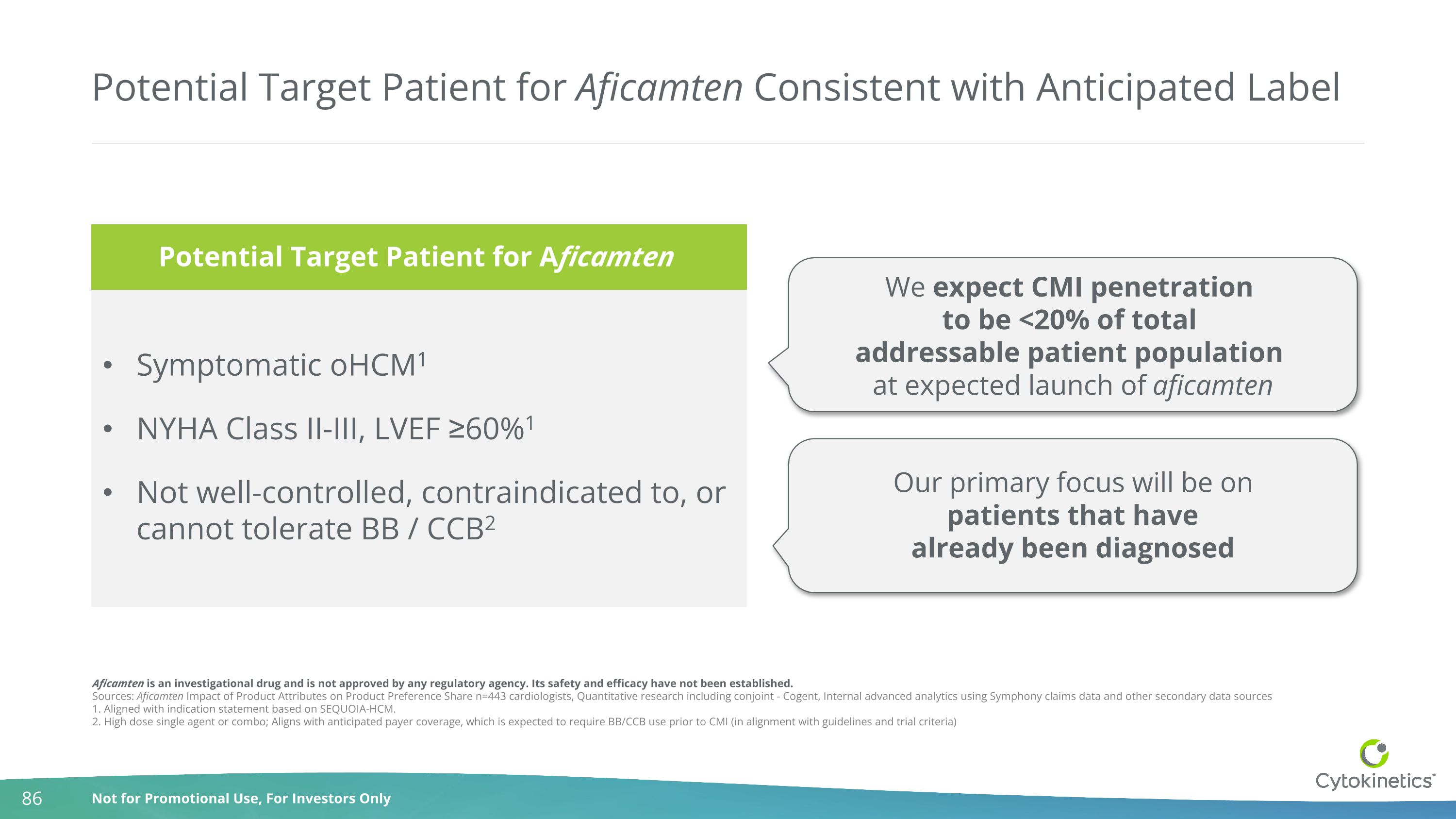

Potential Target Patient for Aficamten Consistent with Anticipated Label Symptomatic oHCM1 NYHA Class II-III, LVEF ≥60%1 Not well-controlled, contraindicated to, or cannot tolerate BB / CCB2 We expect CMI penetration to be <20% of total addressable patient population at expected launch of aficamten Our primary focus will be on patients that have already been diagnosed Aficamten is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established. Sources: Aficamten Impact of Product Attributes on Product Preference Share n=443 cardiologists, Quantitative research including conjoint - Cogent, Internal advanced analytics using Symphony claims data and other secondary data sources 1. Aligned with indication statement based on SEQUOIA-HCM. 2. High dose single agent or combo; Aligns with anticipated payer coverage, which is expected to require BB/CCB use prior to CMI (in alignment with guidelines and trial criteria) Potential Target Patient for Aficamten

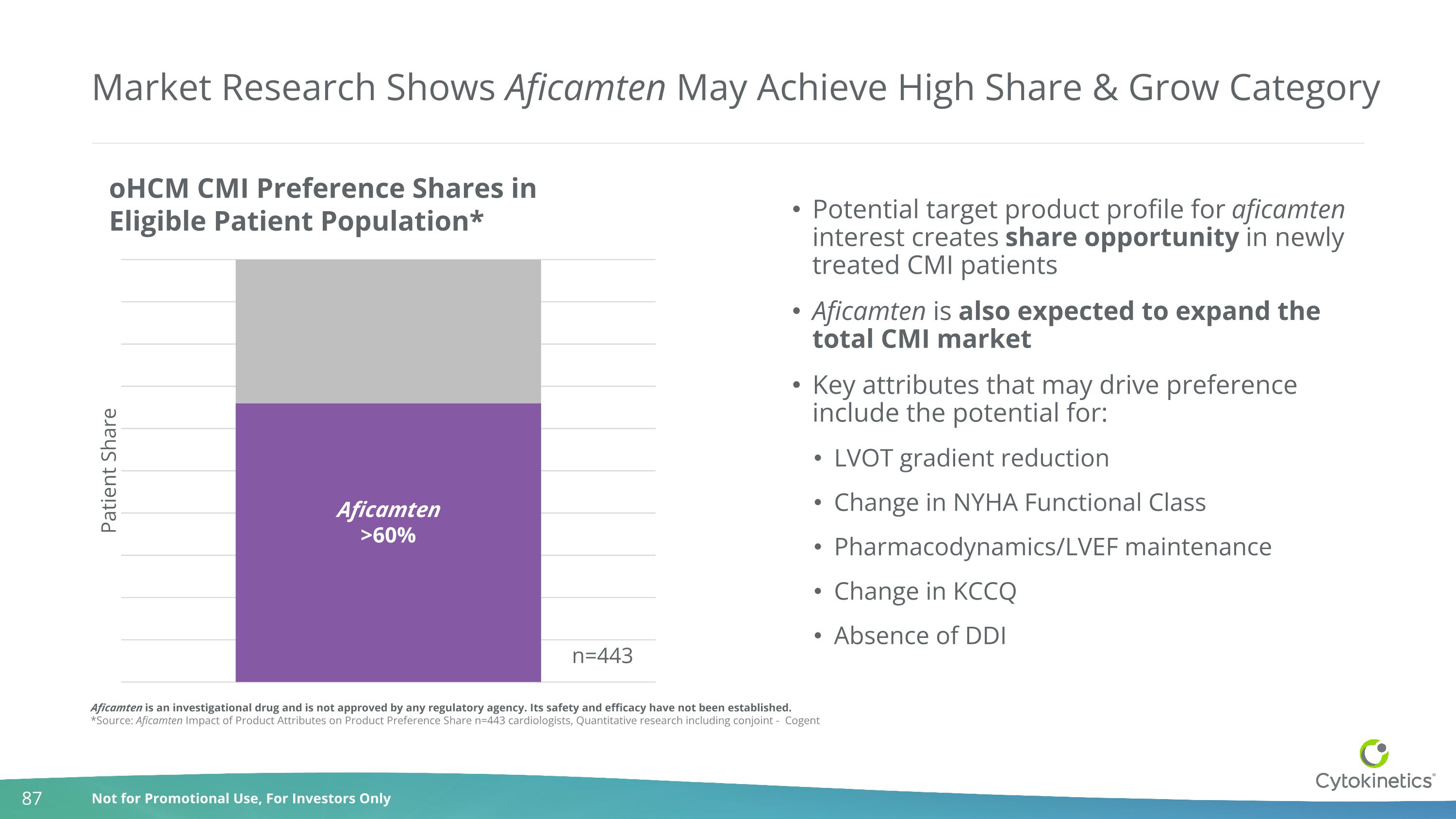

Market Research Shows Aficamten May Achieve High Share & Grow Category Aficamten >60% Potential target product profile for aficamten interest creates share opportunity in newly treated CMI patients Aficamten is also expected to expand the total CMI market Key attributes that may drive preference include the potential for: LVOT gradient reduction Change in NYHA Functional Class Pharmacodynamics/LVEF maintenance Change in KCCQ Absence of DDI Aficamten is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established. *Source: Aficamten Impact of Product Attributes on Product Preference Share n=443 cardiologists, Quantitative research including conjoint - Cogent n=443 oHCM CMI Preference Shares in Eligible Patient Population*

Our Brand Vision for Aficamten Aficamten exists to… elevate the standardof care in HCM Aficamten is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established.

Our Commercial Path Forward Leverage deep understanding of patients, HCPs, payers, and community Tap into deep functional experience to build operational excellence across launch functions Engage with all stakeholders to design an optimal customer experience Learn Design Build Our 2024 Focus Our Focus to Date Patient-centric market development – on display this year at HFSA and AHA Continued insights gathering (listening to and learning from all our customer types) Once profile of aficamten is confirmed through SEQUOIA-HCM, plan to finalize go-to-market approach, including designing an optimal customer experience across stakeholders Aficamten is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established.

Payer Landscape Andrew Callos EVP, Chief Commercial Officer

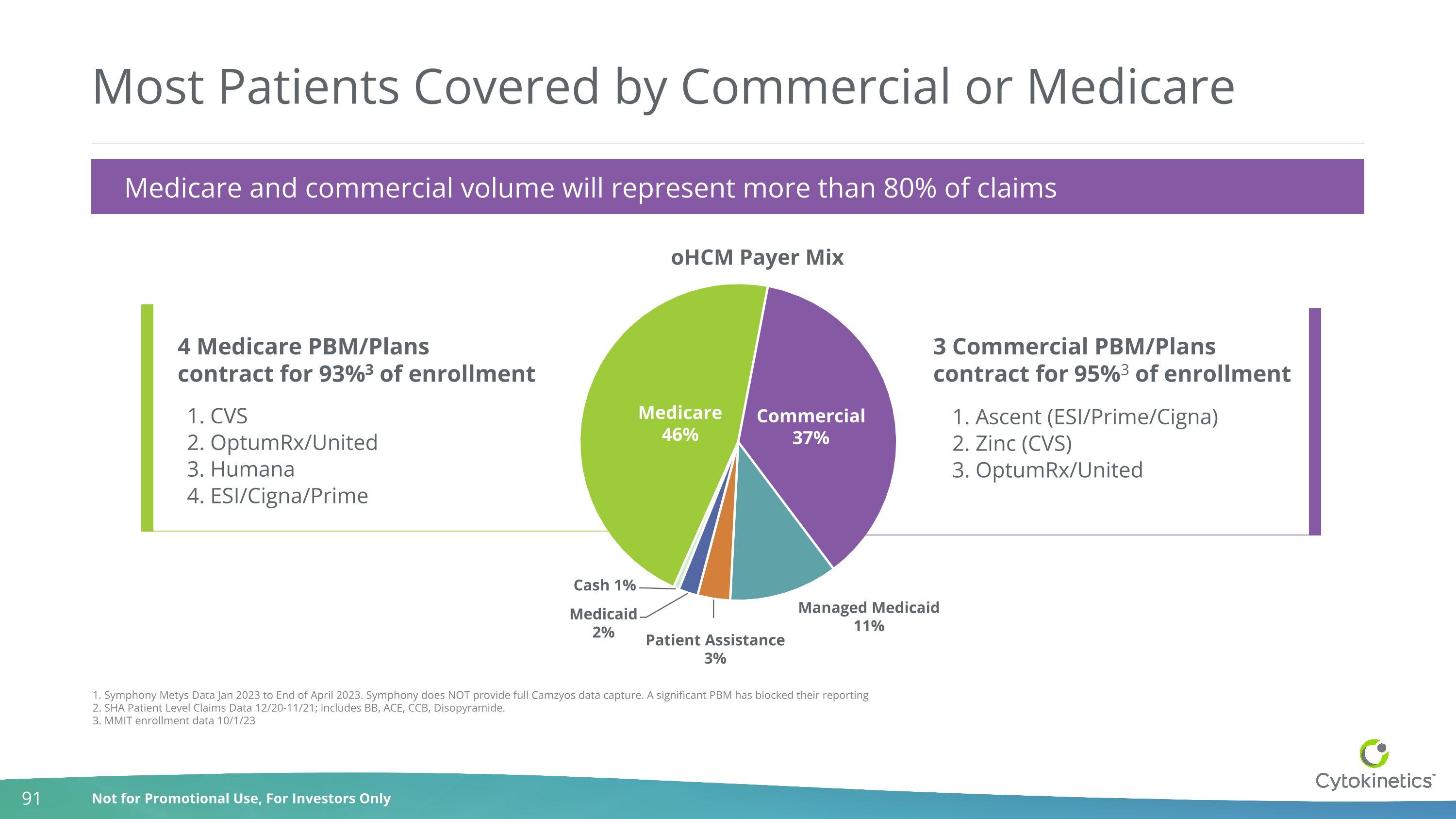

Most Patients Covered by Commercial or Medicare 1. Symphony Metys Data Jan 2023 to End of April 2023. Symphony does NOT provide full Camzyos data capture. A significant PBM has blocked their reporting 2. SHA Patient Level Claims Data 12/20-11/21; includes BB, ACE, CCB, Disopyramide. 3. MMIT enrollment data 10/1/23 3 Commercial PBM/Plans contract for 95%3 of enrollment 4 Medicare PBM/Plans contract for 93%3 of enrollment 1. Ascent (ESI/Prime/Cigna) 2. Zinc (CVS) 3. OptumRx/United 1. CVS 2. OptumRx/United 3. Humana 4. ESI/Cigna/Prime 1,2 Medicare and commercial volume will represent more than 80% of claims

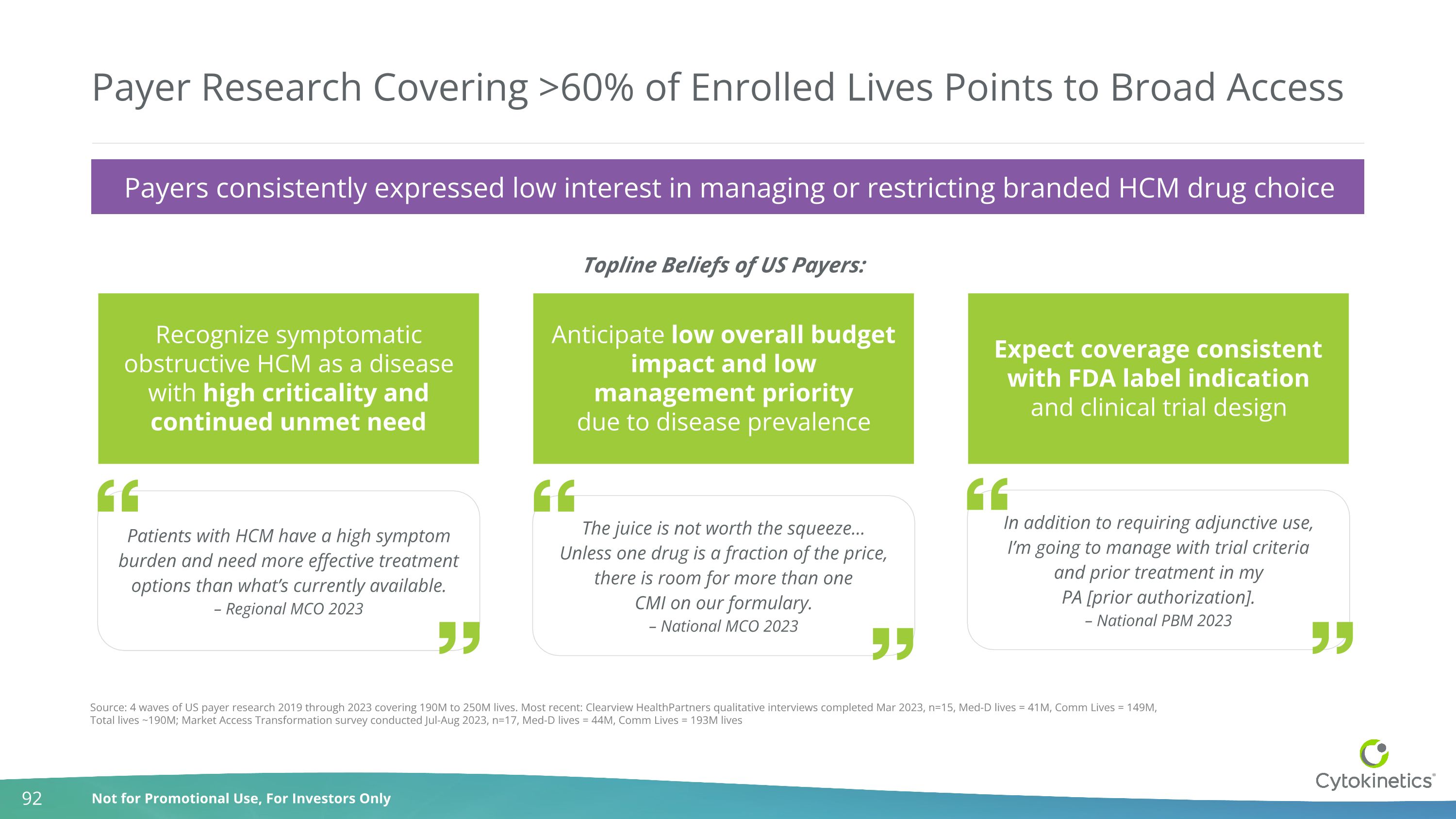

Payer Research Covering >60% of Enrolled Lives Points to Broad Access Source: 4 waves of US payer research 2019 through 2023 covering 190M to 250M lives. Most recent: Clearview HealthPartners qualitative interviews completed Mar 2023, n=15, Med-D lives = 41M, Comm Lives = 149M, Total lives ~190M; Market Access Transformation survey conducted Jul-Aug 2023, n=17, Med-D lives = 44M, Comm Lives = 193M lives Recognize symptomatic obstructive HCM as a disease with high criticality and continued unmet need Patients with HCM have a high symptom burden and need more effective treatment options than what’s currently available. – Regional MCO 2023 Anticipate low overall budget impact and low management priority due to disease prevalence The juice is not worth the squeeze… Unless one drug is a fraction of the price, there is room for more than one CMI on our formulary. – National MCO 2023 Expect coverage consistent with FDA label indication and clinical trial design In addition to requiring adjunctive use, I’m going to manage with trial criteria and prior treatment in my PA [prior authorization]. – National PBM 2023 Topline Beliefs of US Payers: Payers consistently expressed low interest in managing or restricting branded HCM drug choice

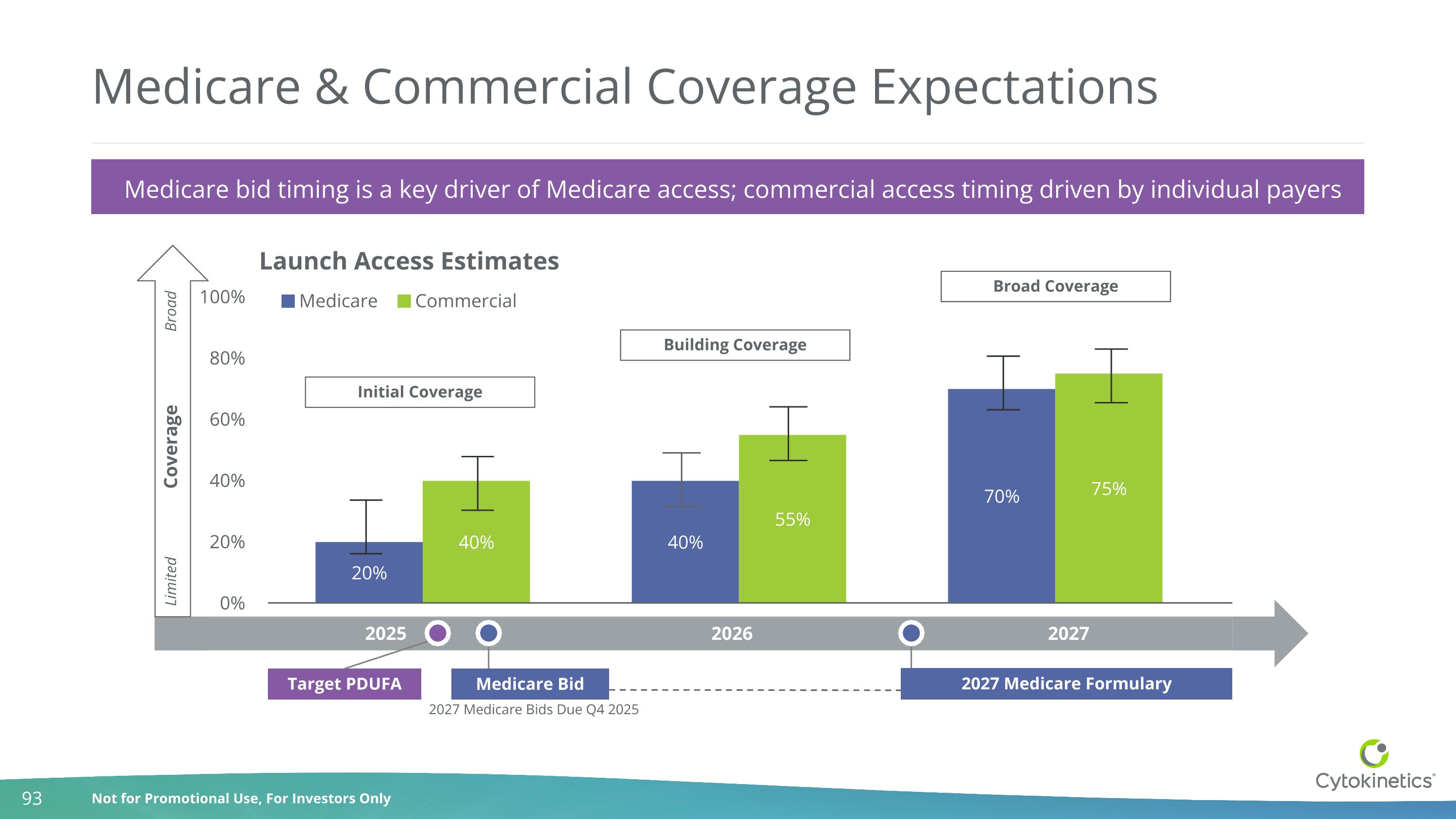

Medicare & Commercial Coverage Expectations 2025 2026 2027 Coverage Broad Limited 2027 Medicare Bids Due Q4 2025 Building Coverage Broad Coverage Launch Access Estimates Initial Coverage Target PDUFA Medicare Bid 2027 Medicare Formulary Medicare bid timing is a key driver of Medicare access; commercial access timing driven by individual payers

Experienced Market Access Team to Accelerate Access Collectively, ~300 years of payer/PBM relationship experience ~250 product launches, including ~100 CV products Average of 30+ Years of experience per Account Director Strong & extensive customer relationship experience

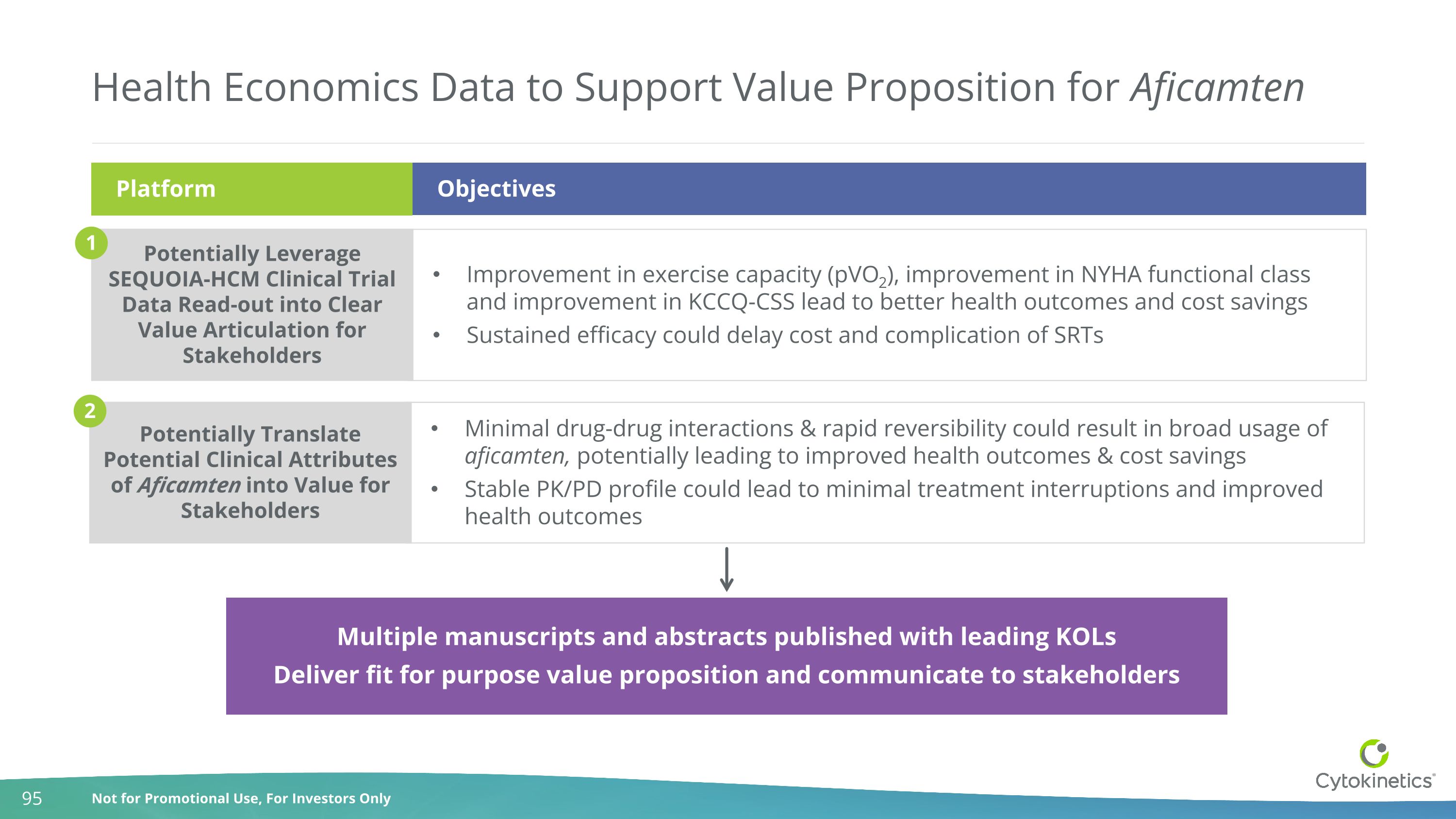

Improvement in exercise capacity (pVO2), improvement in NYHA functional class and improvement in KCCQ-CSS lead to better health outcomes and cost savings Sustained efficacy could delay cost and complication of SRTs Minimal drug-drug interactions & rapid reversibility could result in broad usage of aficamten, potentially leading to improved health outcomes & cost savings Stable PK/PD profile could lead to minimal treatment interruptions and improved health outcomes Health Economics Data to Support Value Proposition for Aficamten Platform Potentially Leverage SEQUOIA-HCM Clinical Trial Data Read-out into Clear Value Articulation for Stakeholders Potentially Translate Potential Clinical Attributes of Aficamten into Value for Stakeholders 1 2 Multiple manuscripts and abstracts published with leading KOLs Deliver fit for purpose value proposition and communicate to stakeholders Objectives

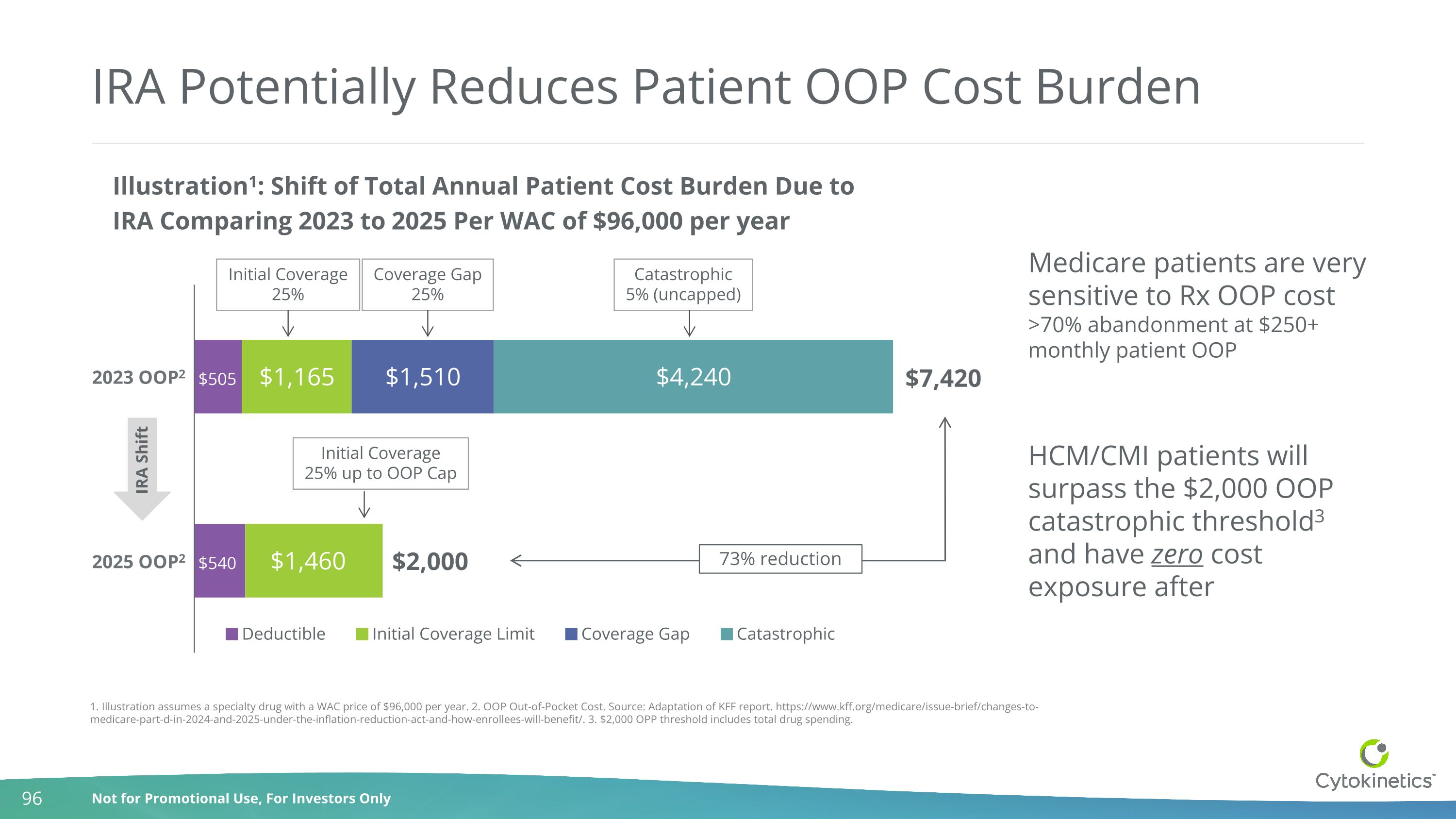

IRA Potentially Reduces Patient OOP Cost Burden $7,420 $2,000 Initial Coverage25% Coverage Gap25% Catastrophic5% (uncapped) IRA Shift Initial Coverage25% up to OOP Cap 73% reduction 2 2 1. Illustration assumes a specialty drug with a WAC price of $96,000 per year. 2. OOP Out-of-Pocket Cost. Source: Adaptation of KFF report. https://www.kff.org/medicare/issue-brief/changes-to-medicare-part-d-in-2024-and-2025-under-the-inflation-reduction-act-and-how-enrollees-will-benefit/. 3. $2,000 OPP threshold includes total drug spending. Medicare patients are very sensitive to Rx OOP cost >70% abandonment at $250+ monthly patient OOP HCM/CMI patients will surpass the $2,000 OOP catastrophic threshold3 and have zero cost exposure after 2023 OOP2 2025 OOP2

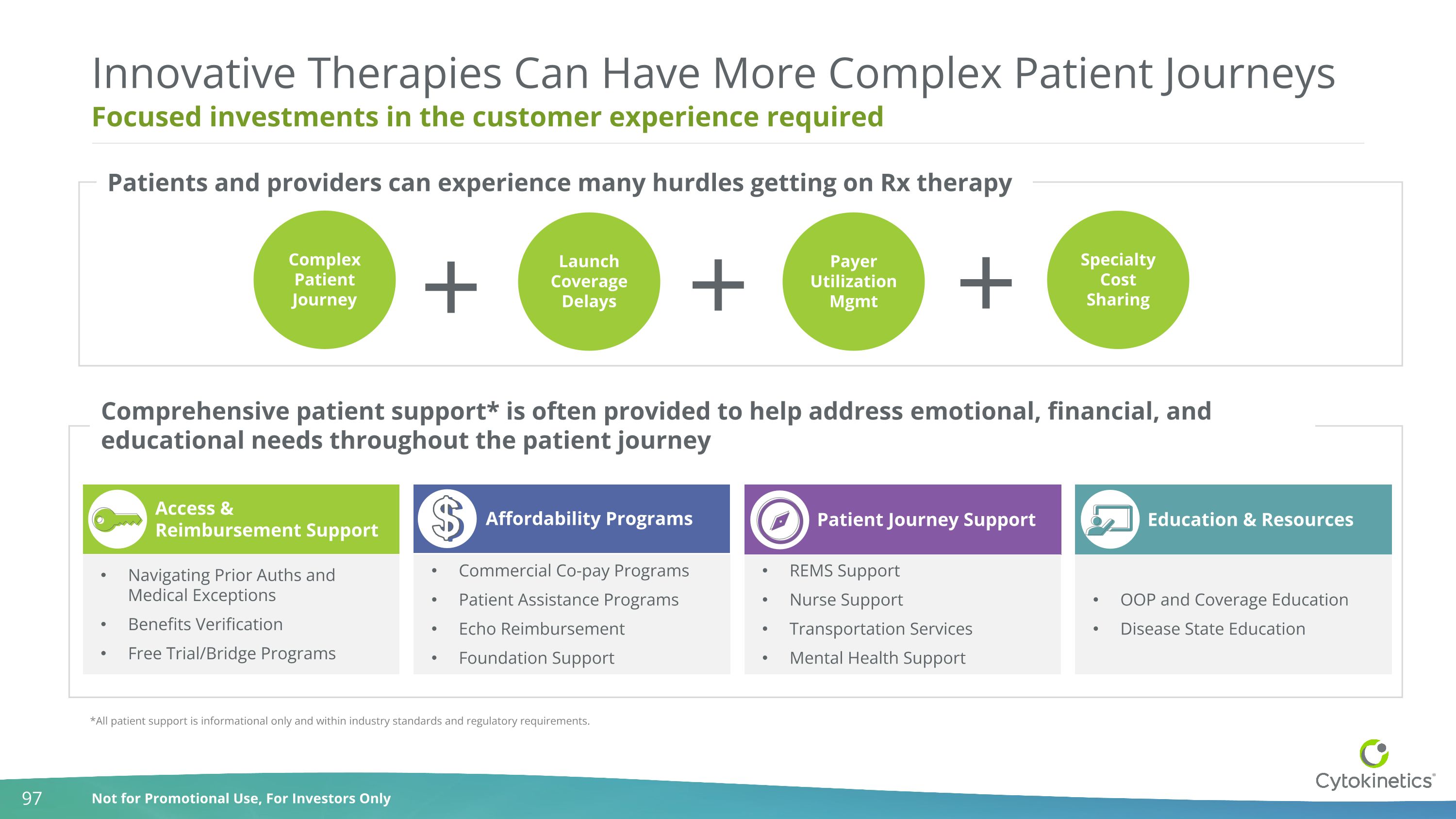

Focused investments in the customer experience required Innovative Therapies Can Have More Complex Patient Journeys Complex Patient Journey Launch Coverage Delays Payer Utilization Mgmt Specialty Cost Sharing Access & Reimbursement Support Navigating Prior Auths and Medical Exceptions Benefits Verification Free Trial/Bridge Programs Affordability Programs Commercial Co-pay Programs Patient Assistance Programs Echo Reimbursement Foundation Support Patient Journey Support REMS Support Nurse Support Transportation Services Mental Health Support Education & Resources OOP and Coverage Education Disease State Education *All patient support is informational only and within industry standards and regulatory requirements. Patients and providers can experience many hurdles getting on Rx therapy Comprehensive patient support* is often provided to help address emotional, financial, and educational needs throughout the patient journey

Planned Sales Strategy Jeff Lotz VP, US Sales and Operations

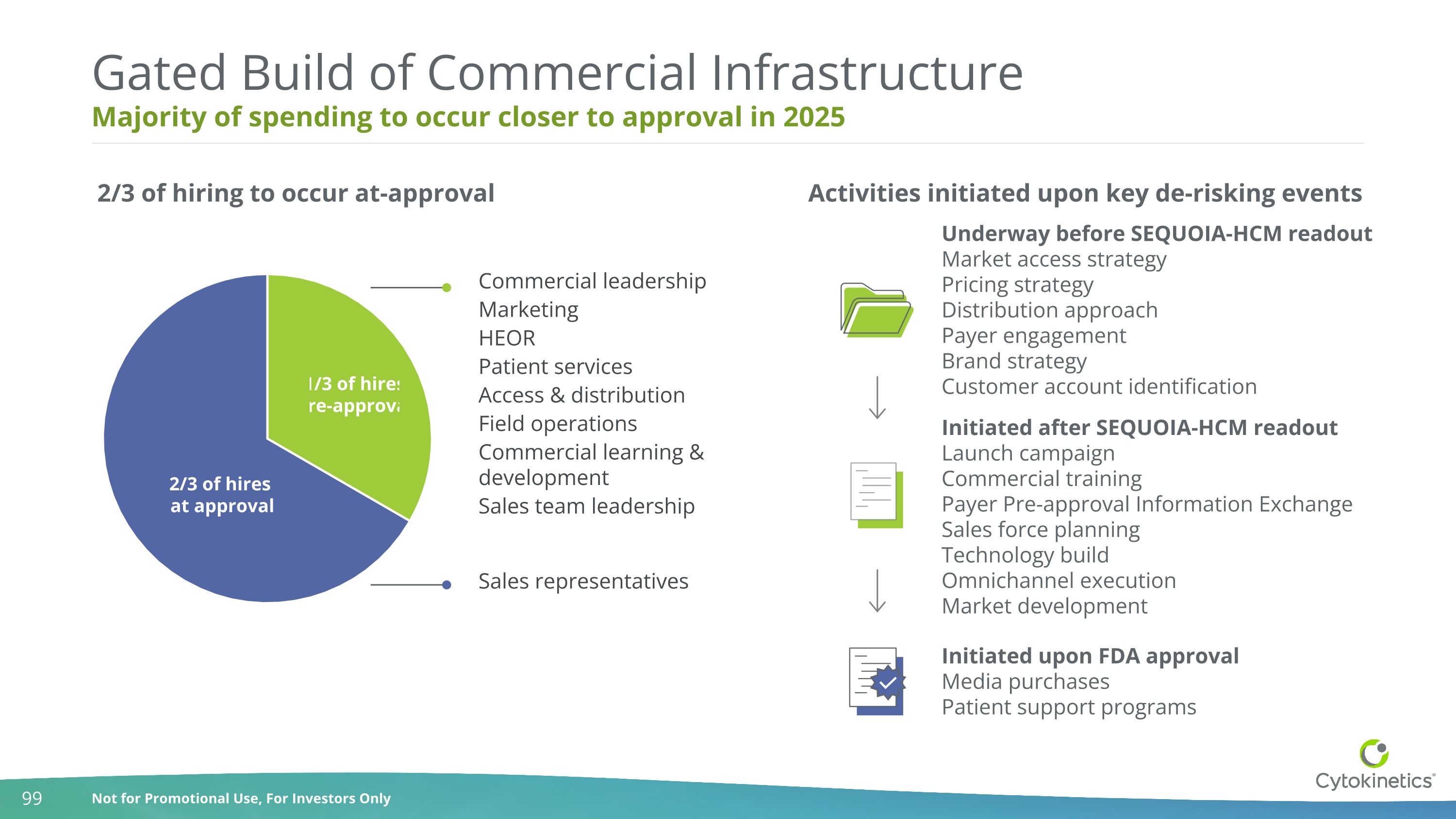

Majority of spending to occur closer to approval in 2025 Gated Build of Commercial Infrastructure 1/3 of hires pre-approval 2/3 of hires at approval Underway before SEQUOIA-HCM readout Market access strategy Pricing strategy Distribution approach Payer engagement Brand strategy Customer account identification Initiated after SEQUOIA-HCM readout Launch campaign Commercial training Payer Pre-approval Information Exchange Sales force planning Technology build Omnichannel execution Market development Initiated upon FDA approval Media purchases Patient support programs Commercial leadership Marketing HEOR Patient services Access & distribution Field operations Commercial learning & development Sales team leadership Sales representatives 2/3 of hiring to occur at-approval Activities initiated upon key de-risking events

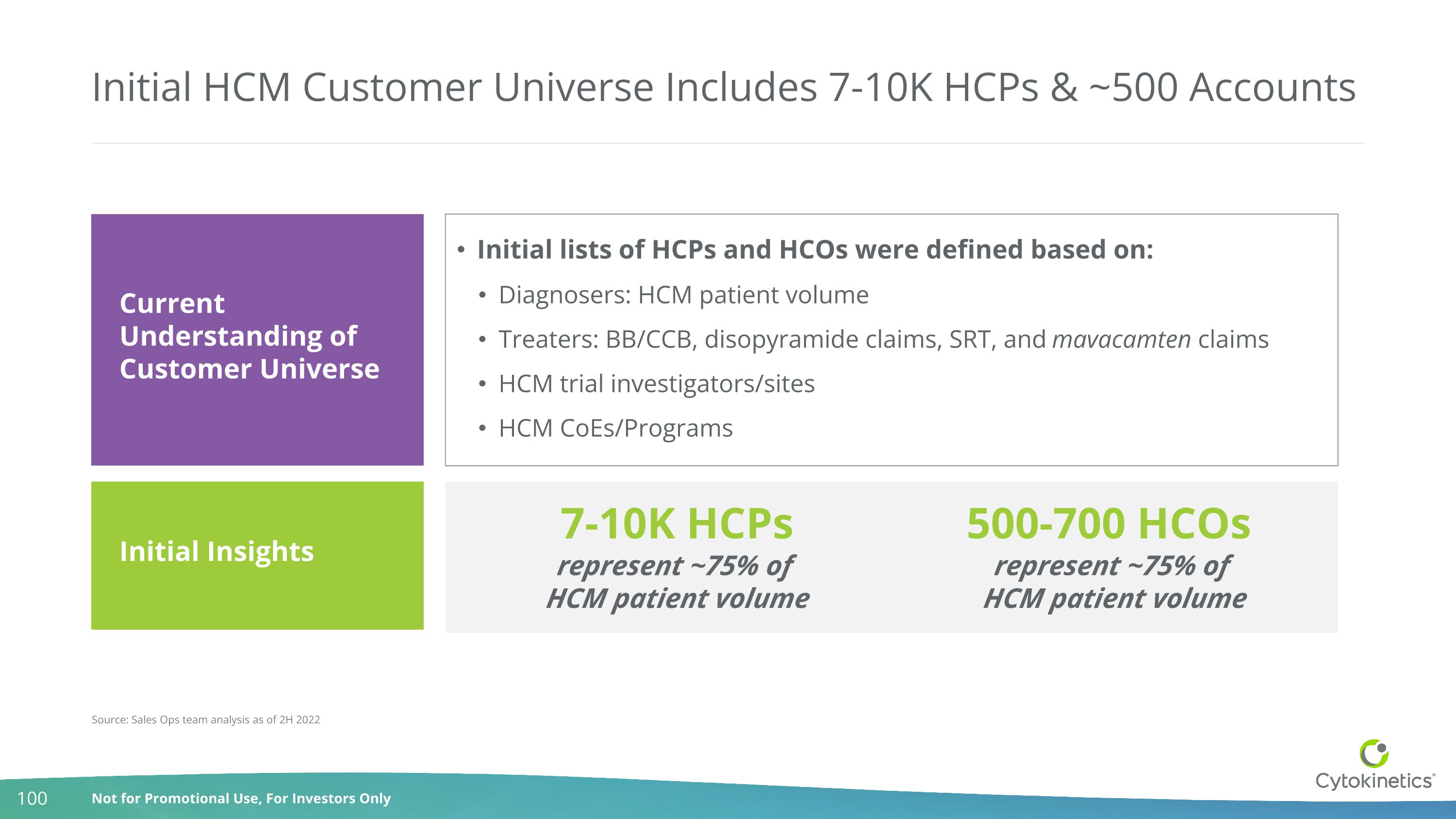

Initial HCM Customer Universe Includes 7-10K HCPs & ~500 Accounts Initial lists of HCPs and HCOs were defined based on: Diagnosers: HCM patient volume Treaters: BB/CCB, disopyramide claims, SRT, and mavacamten claims HCM trial investigators/sites HCM CoEs/Programs Source: Sales Ops team analysis as of 2H 2022 Current Understanding of Customer Universe 7-10K HCPs represent ~75% of HCM patient volume 500-700 HCOs represent ~75% of HCM patient volume Initial Insights

75% of the HCM patient volume is treated by 10,000 cardiologists Cardiologists Located in Concentrated Geographic Clusters Across the US Note: includes only patients who are treated by a cardiologist - not all patients see a cardiologist; sample of 67K HCM patients Source: Symphony PTD (Patient Transaction Data); mapping of HCPs to HCOs using Definitive Healthcare Data 2023 and 7/2023 mapping; Patient volume by dominant Cardiologist Location 7/2023 10,000 30,000 … Geographic Distribution of HCM Patients 7,000 HCM Patient Concentration by Cardiologist

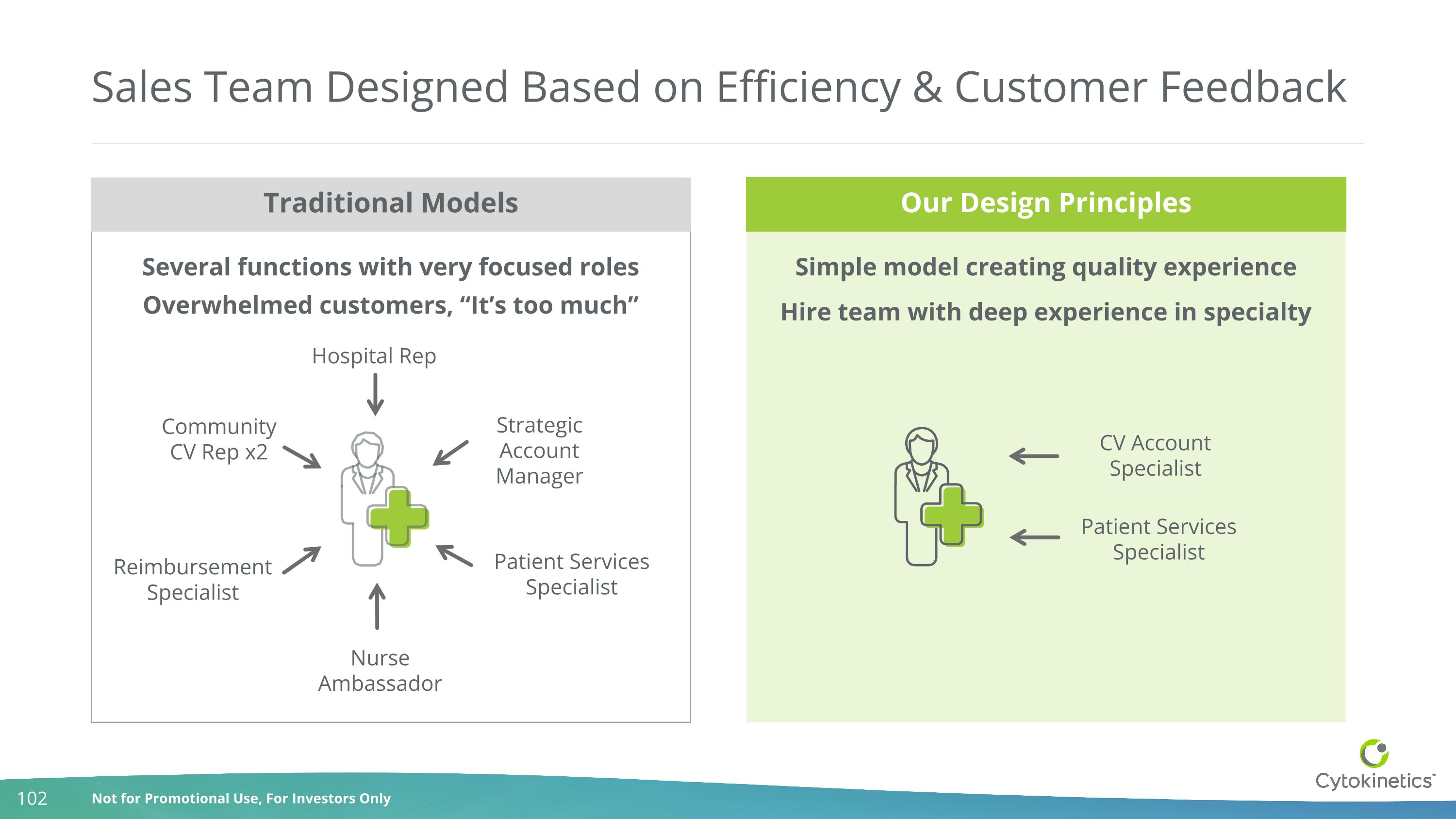

Several functions with very focused roles Overwhelmed customers, “It’s too much” Sales Team Designed Based on Efficiency & Customer Feedback Simple model creating quality experience Hire team with deep experience in specialty Traditional Models Our Design Principles CV Account Specialist Patient Services Specialist Community CV Rep x2 Hospital Rep Strategic Account Manager Reimbursement Specialist Nurse Ambassador Patient Services Specialist

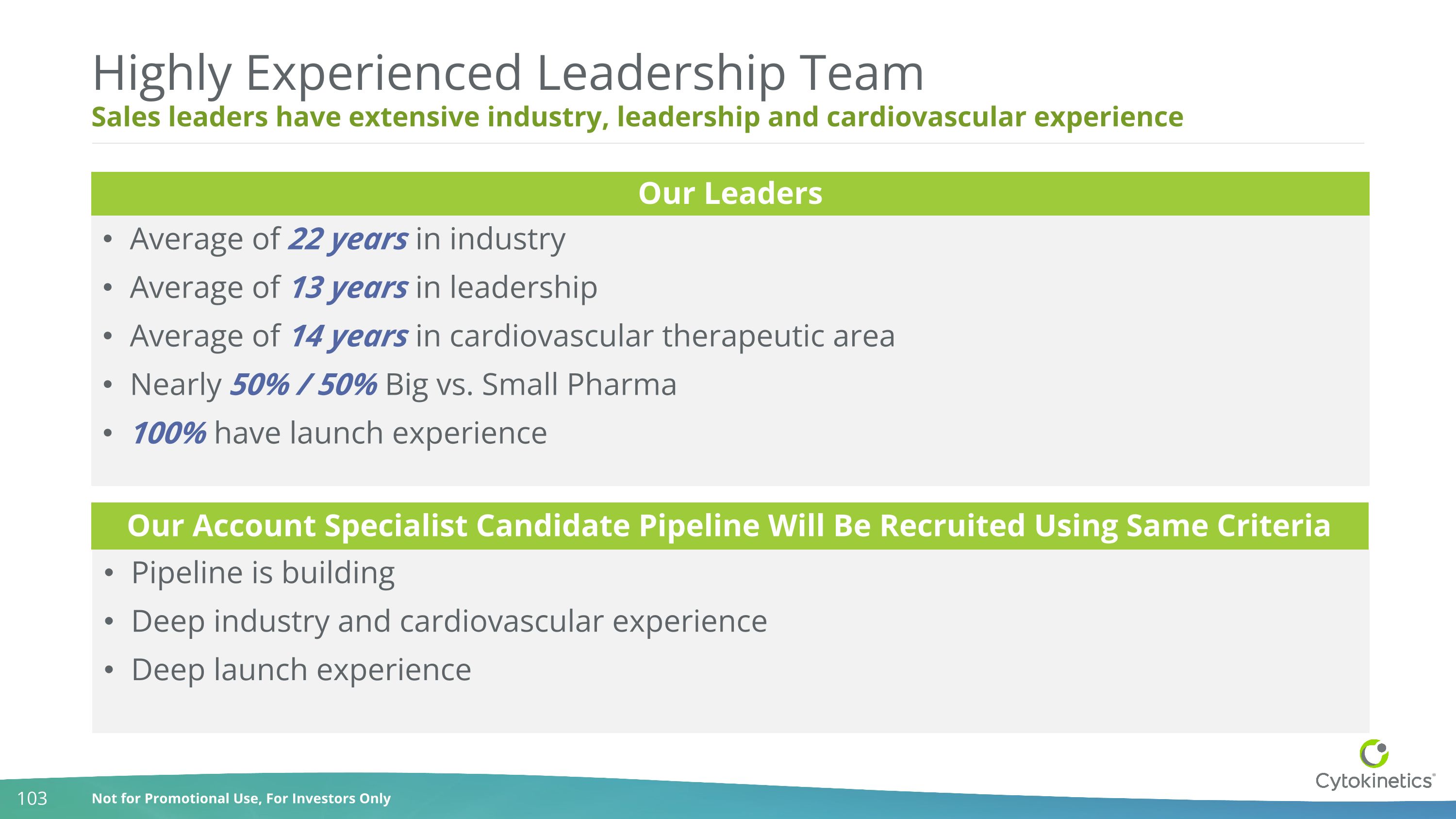

Sales leaders have extensive industry, leadership and cardiovascular experience Highly Experienced Leadership Team Average of 22 years in industry Average of 13 years in leadership Average of 14 years in cardiovascular therapeutic area Nearly 50% / 50% Big vs. Small Pharma 100% have launch experience Our Leaders Pipeline is building Deep industry and cardiovascular experience Deep launch experience Our Account Specialist Candidate Pipeline Will Be Recruited Using Same Criteria

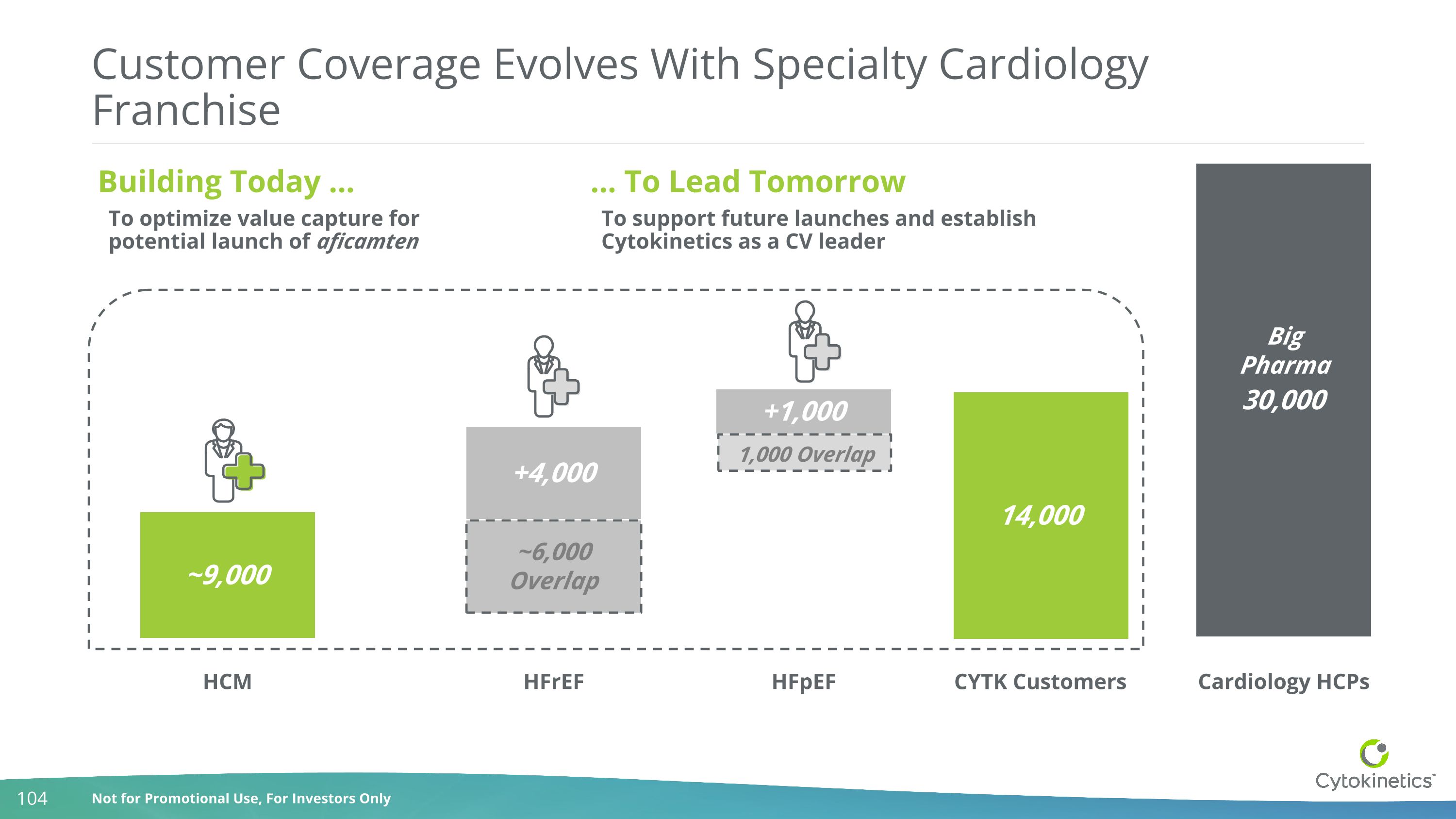

Customer Coverage Evolves With Specialty Cardiology Franchise 30,000 ~9,000 +4,000 +1,000 14,000 HCM HFrEF HFpEF Cardiology HCPs Building Today … … To Lead Tomorrow ~6,000 Overlap 1,000 Overlap To optimize value capture for potential launch of aficamten To support future launches and establish Cytokinetics as a CV leader Big Pharma CYTK Customers

HCM KOL Panel

HCM KOL Panel Theodore Abraham, M.D., FACC, FASE Meyer Friedman Distinguished Professor of Medicine, Division of Cardiology, University of California, San Francisco; Co-director, UCSF HCM Center of Excellence; Director, UCSF Adult Cardiac Echocardiography Laboratory Caroline Coats, Ph.D. Clinical Senior Lecturer, School of Cardiovascular & Metabolic Health, University of Glasgow Carolyn Ho, M.D. Associate Professor, Harvard Medical School, Medical Director of the Cardiovascular Genetics Center Fady Malik, M.D., Ph.D. EVP, Research & Development MODERATED BY

HFpEF Landscape & CK-586 Stuart Kupfer, M.D. SVP, Chief Medical Officer CK-586 is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established.

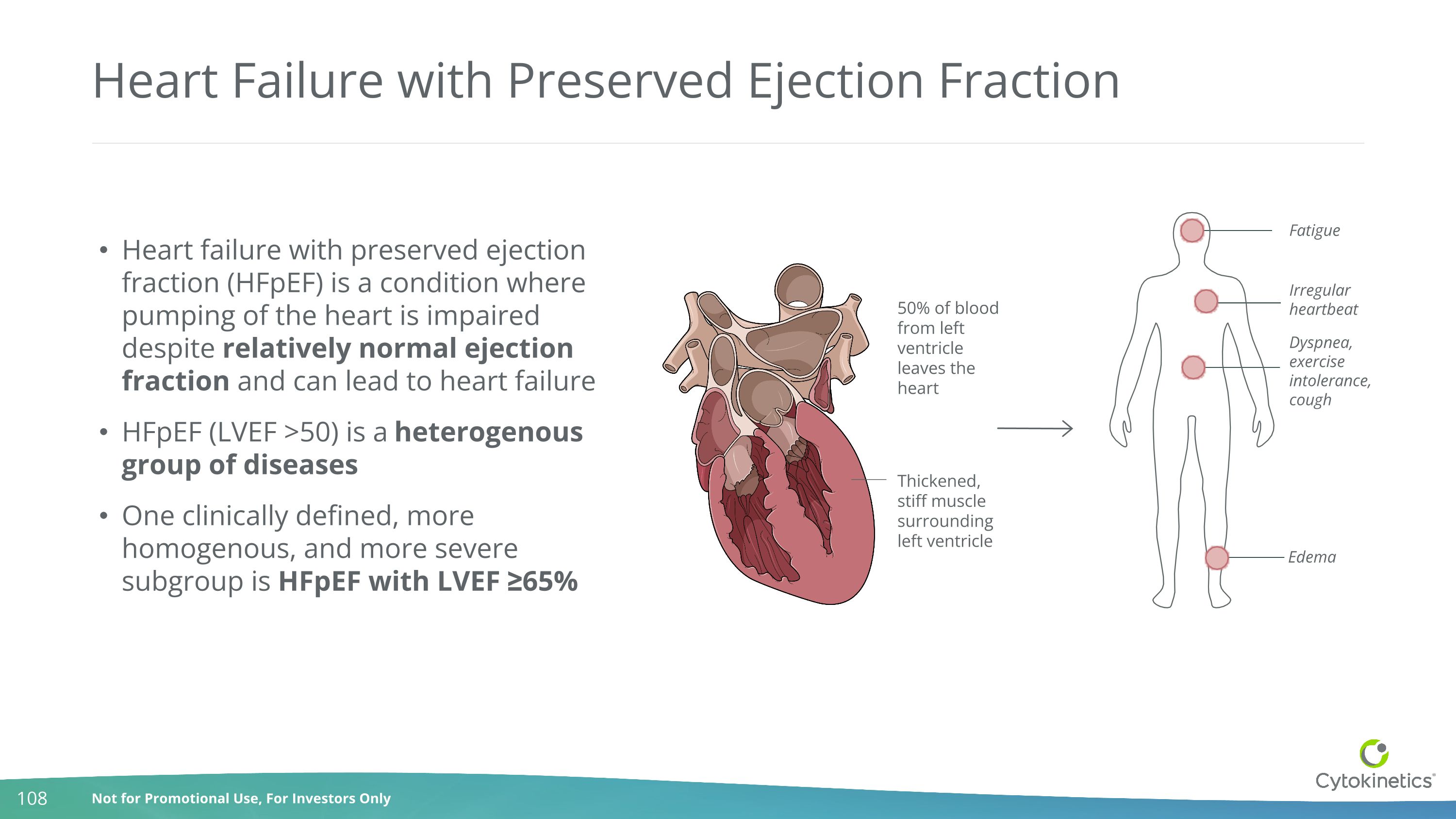

Heart Failure with Preserved Ejection Fraction Thickened, stiff muscle surrounding left ventricle Irregular heartbeat Edema Dyspnea, exercise intolerance, cough Fatigue Heart failure with preserved ejection fraction (HFpEF) is a condition where pumping of the heart is impaired despite relatively normal ejection fraction and can lead to heart failure HFpEF (LVEF >50) is a heterogenous group of diseases One clinically defined, more homogenous, and more severe subgroup is HFpEF with LVEF ≥65% 50% of blood from left ventricle leaves the heart

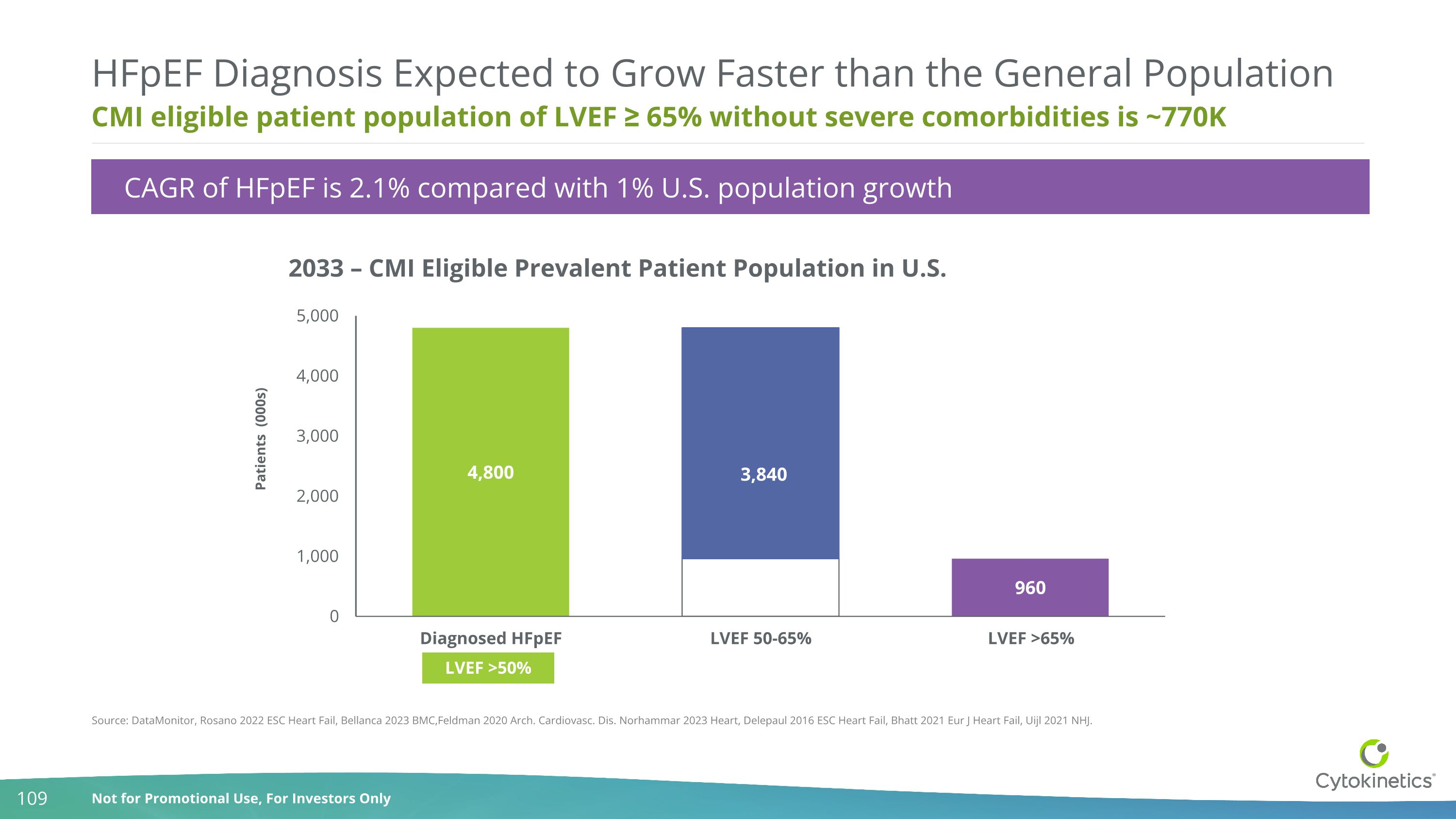

CMI eligible patient population of LVEF ≥ 65% without severe comorbidities is ~770K HFpEF Diagnosis Expected to Grow Faster than the General Population 2033 – CMI Eligible Prevalent Patient Population in U.S. Source: DataMonitor, Rosano 2022 ESC Heart Fail, Bellanca 2023 BMC,Feldman 2020 Arch. Cardiovasc. Dis. Norhammar 2023 Heart, Delepaul 2016 ESC Heart Fail, Bhatt 2021 Eur J Heart Fail, Uijl 2021 NHJ. 3,840 Patients (000s) LVEF >50% CAGR of HFpEF is 2.1% compared with 1% U.S. population growth

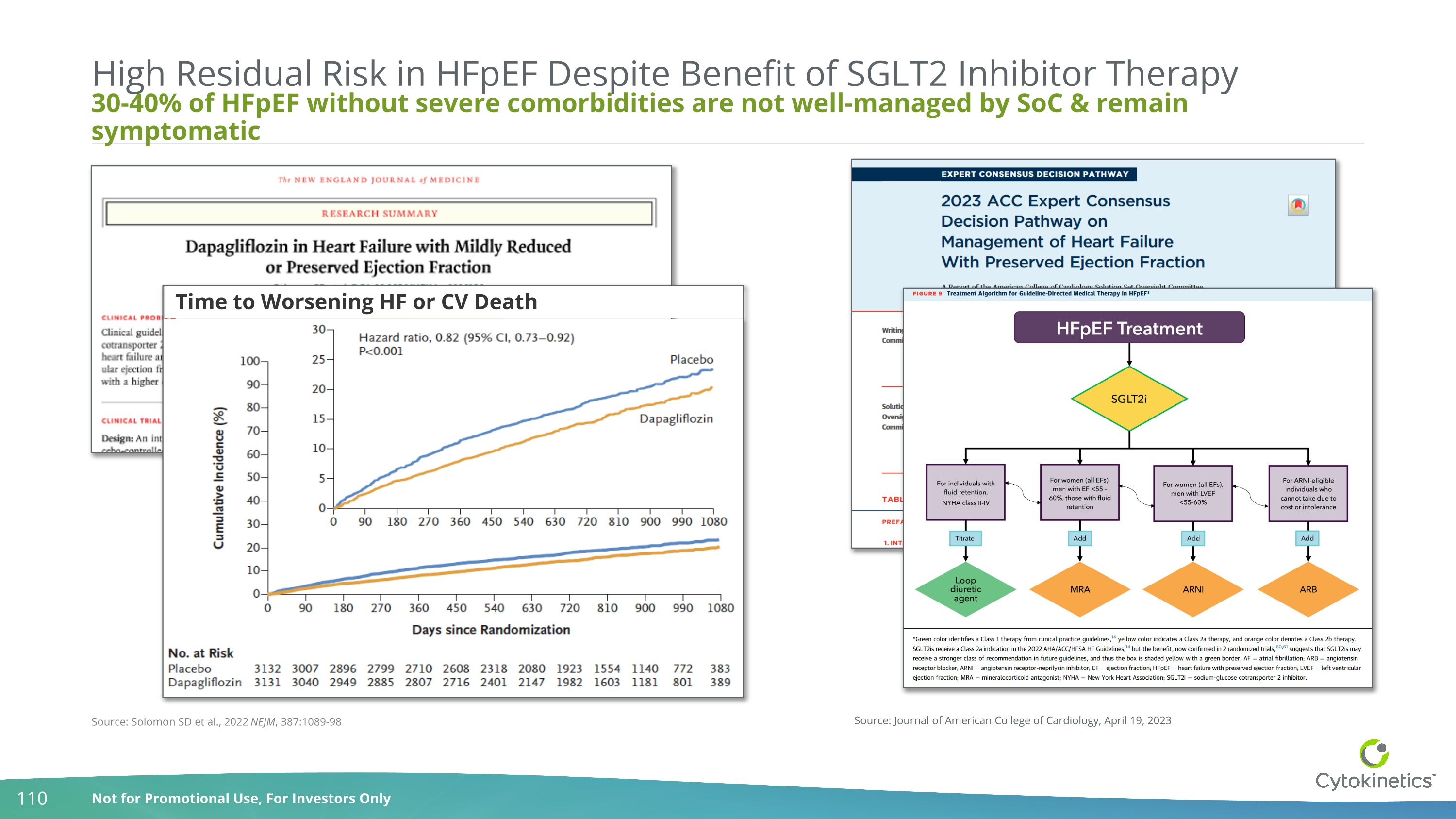

30-40% of HFpEF without severe comorbidities are not well-managed by SoC & remain symptomatic High Residual Risk in HFpEF Despite Benefit of SGLT2 Inhibitor Therapy Source: Journal of American College of Cardiology, April 19, 2023 Time to Worsening HF or CV Death Source: Solomon SD et al., 2022 NEJM, 387:1089-98

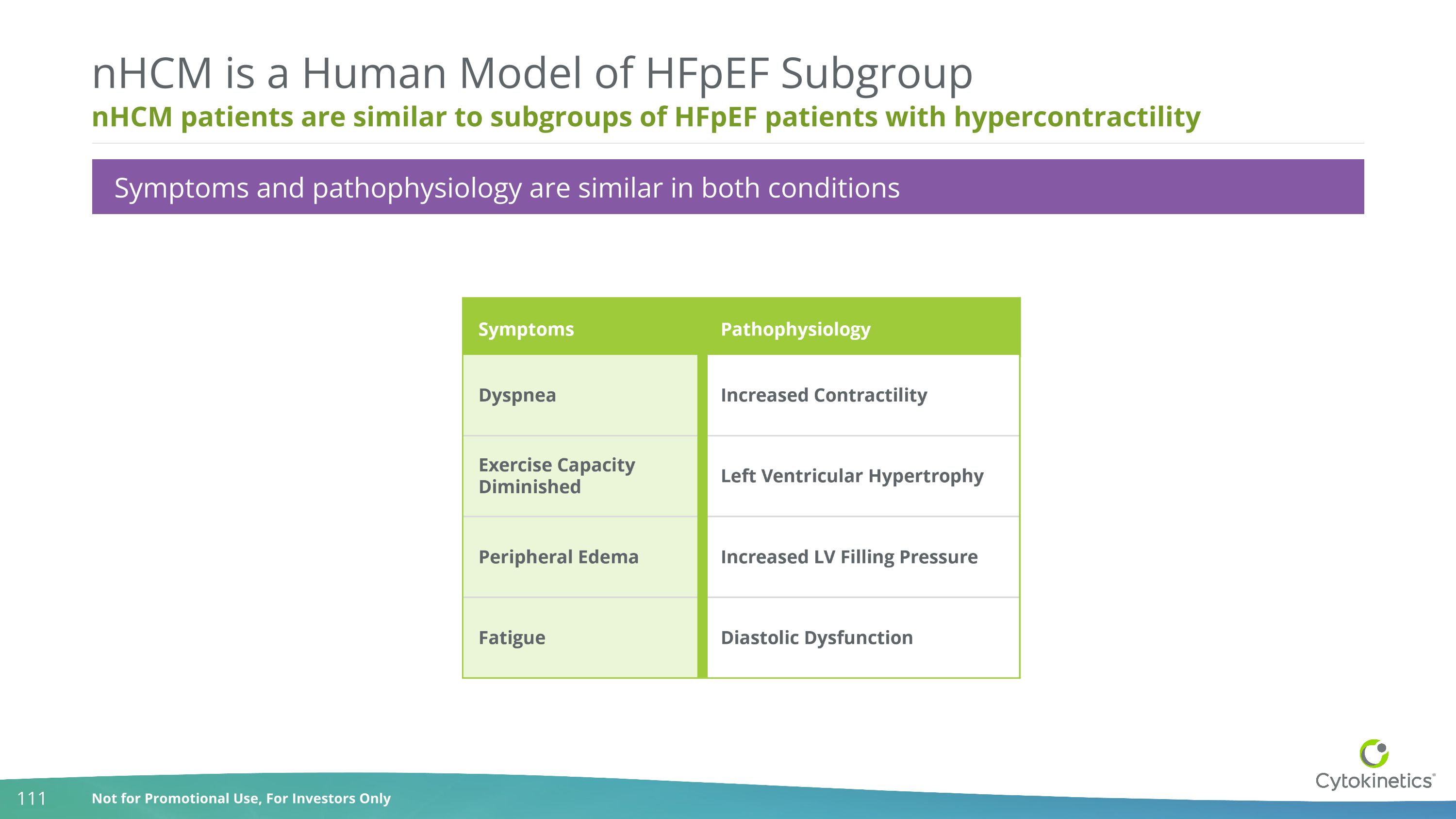

nHCM patients are similar to subgroups of HFpEF patients with hypercontractility nHCM is a Human Model of HFpEF Subgroup Symptoms and pathophysiology are similar in both conditions

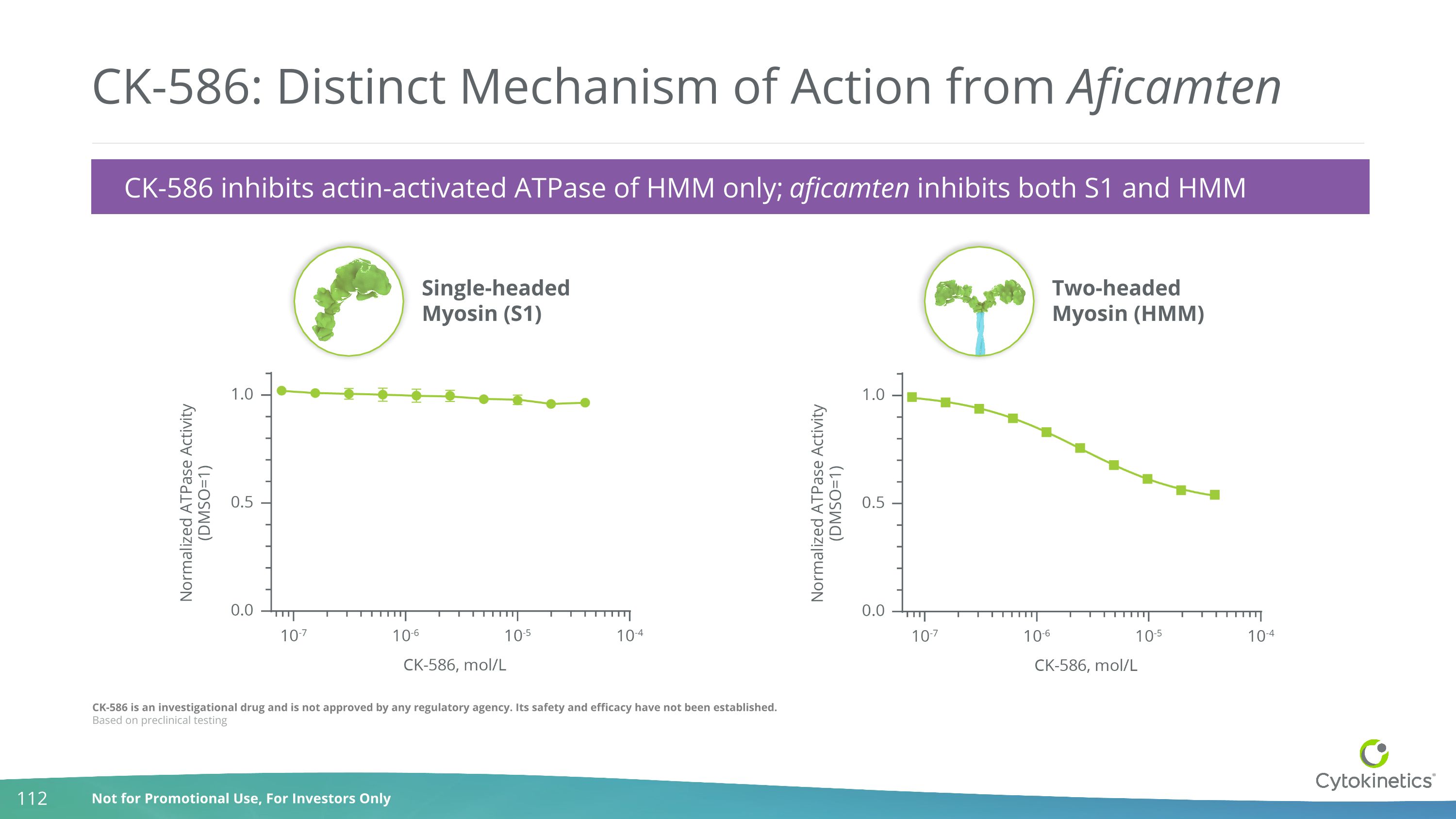

CK-586 is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established. Based on preclinical testing CK-586: Distinct Mechanism of Action from Aficamten Single-headedMyosin (S1) Two-headedMyosin (HMM) CK-586 inhibits actin-activated ATPase of HMM only; aficamten inhibits both S1 and HMM

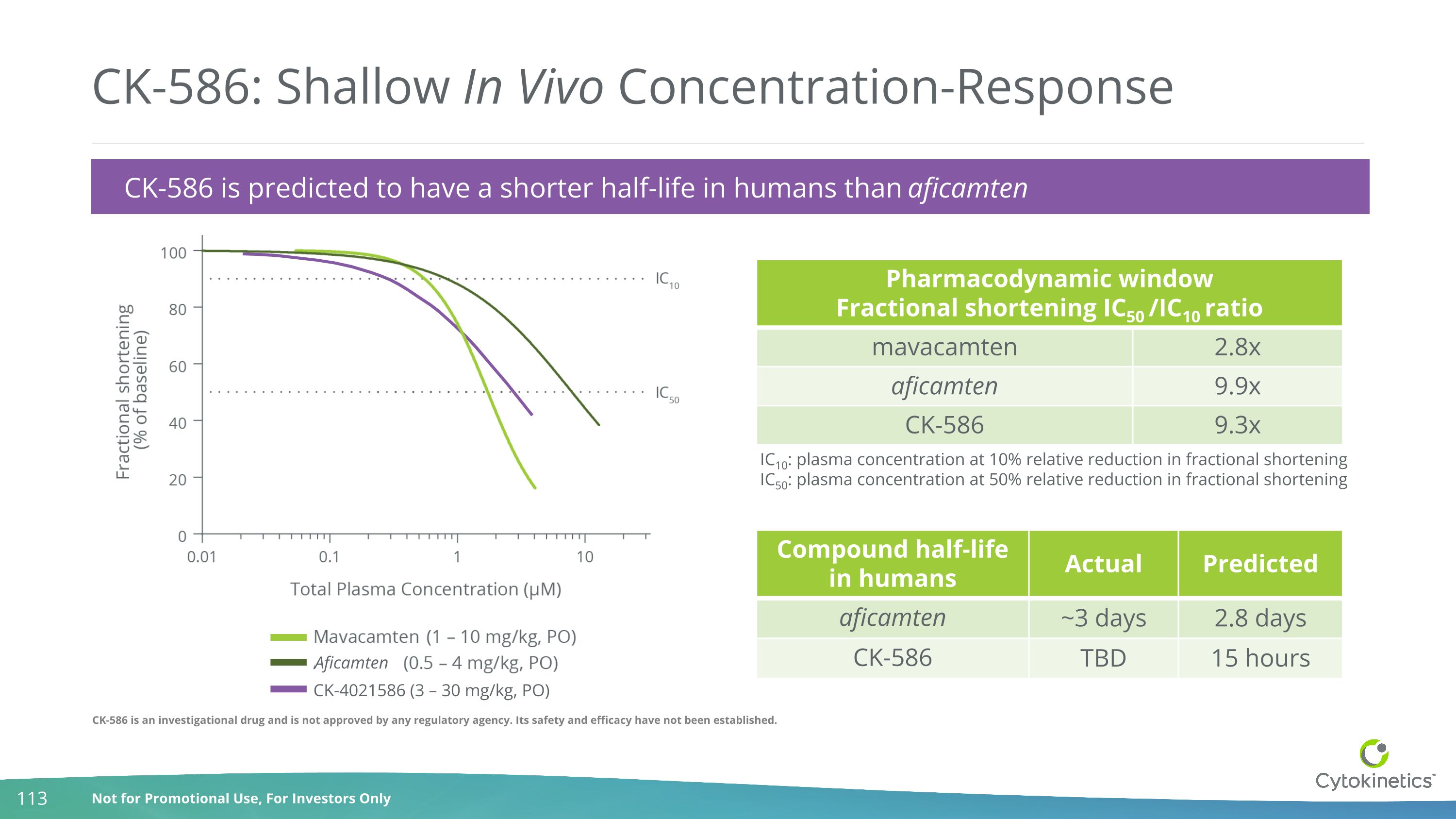

CK-586 is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established. CK-586: Shallow In Vivo Concentration-Response CK-586 is predicted to have a shorter half-life in humans than aficamten Pharmacodynamic window Fractional shortening IC50 /IC10 ratio mavacamten 2.8x aficamten 9.9x CK-586 9.3x IC10: plasma concentration at 10% relative reduction in fractional shortening IC50: plasma concentration at 50% relative reduction in fractional shortening Compound half-life in humans Actual Predicted aficamten ~3 days 2.8 days CK-586 TBD 15 hours Aficamten CK-4021586 (3 – 30 mg/kg, PO)

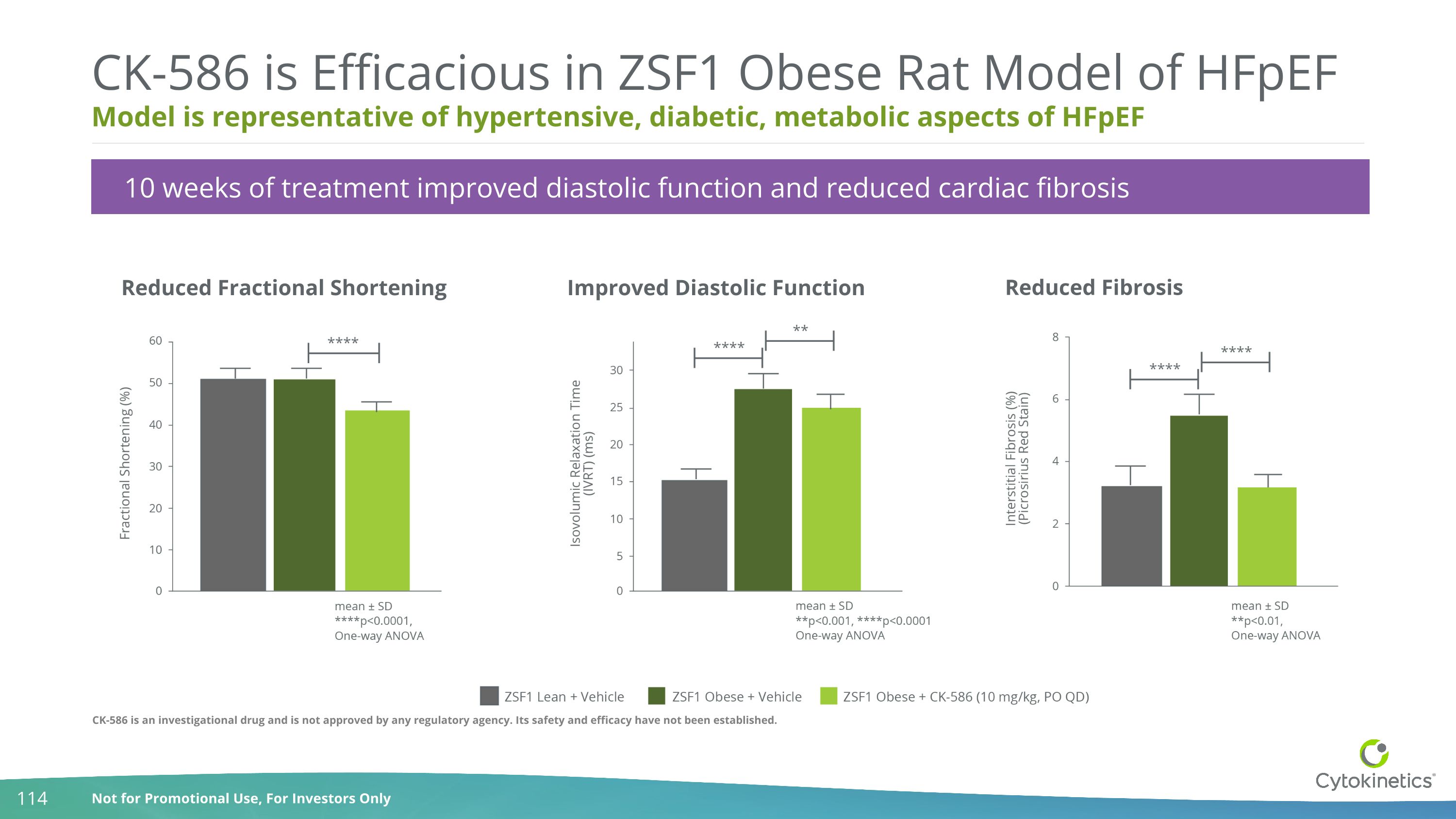

Model is representative of hypertensive, diabetic, metabolic aspects of HFpEF CK-586 is Efficacious in ZSF1 Obese Rat Model of HFpEF Reduced Fractional Shortening Improved Diastolic Function Reduced Fibrosis 10 weeks of treatment improved diastolic function and reduced cardiac fibrosis CK-586 is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established.

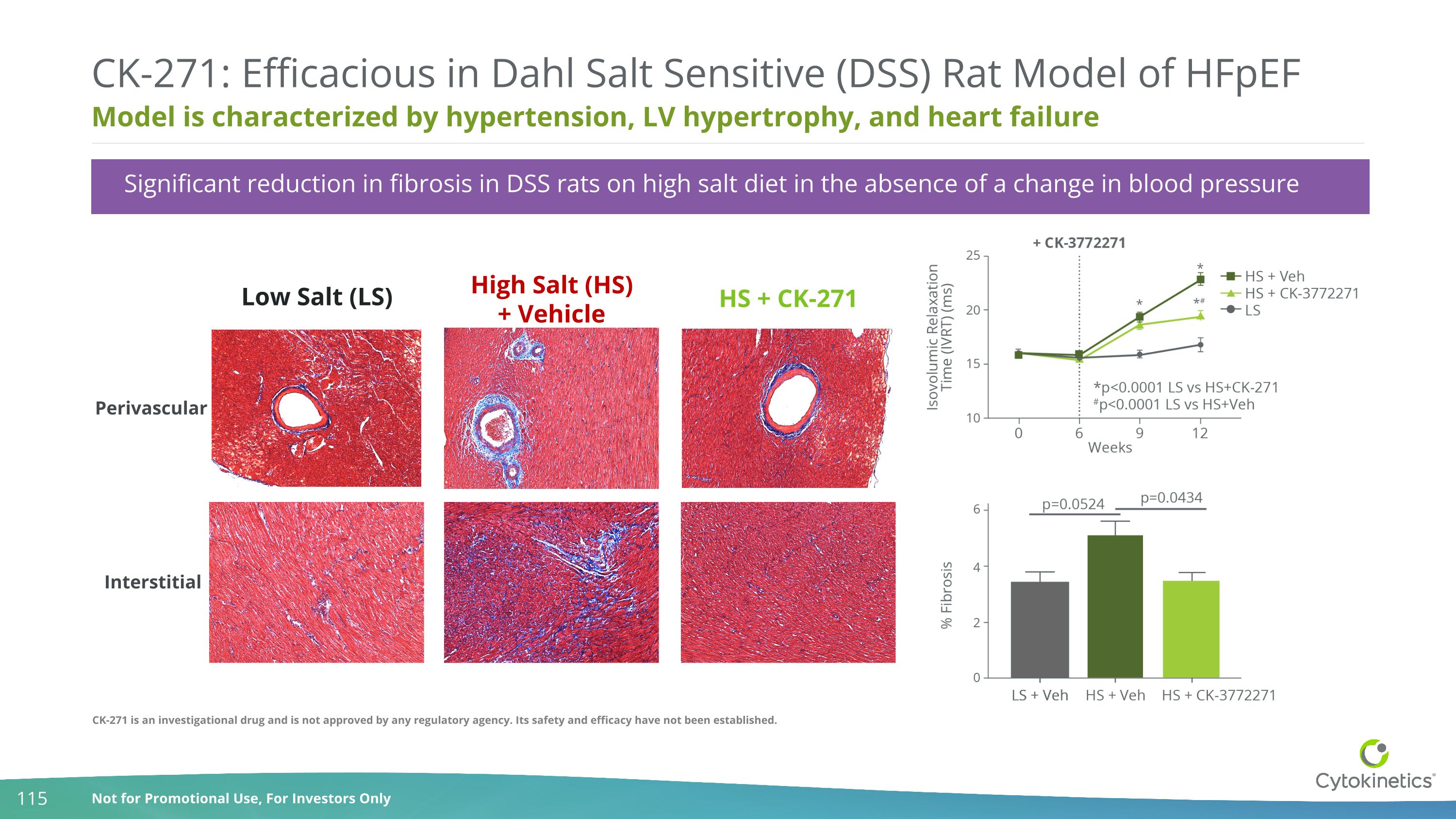

Significant reduction in fibrosis in DSS rats on high salt diet in the absence of a change in blood pressure Model is characterized by hypertension, LV hypertrophy, and heart failure CK-271: Efficacious in Dahl Salt Sensitive (DSS) Rat Model of HFpEF Perivascular Interstitial Low Salt (LS) High Salt (HS) + Vehicle HS + CK-271 CK-271 is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established.

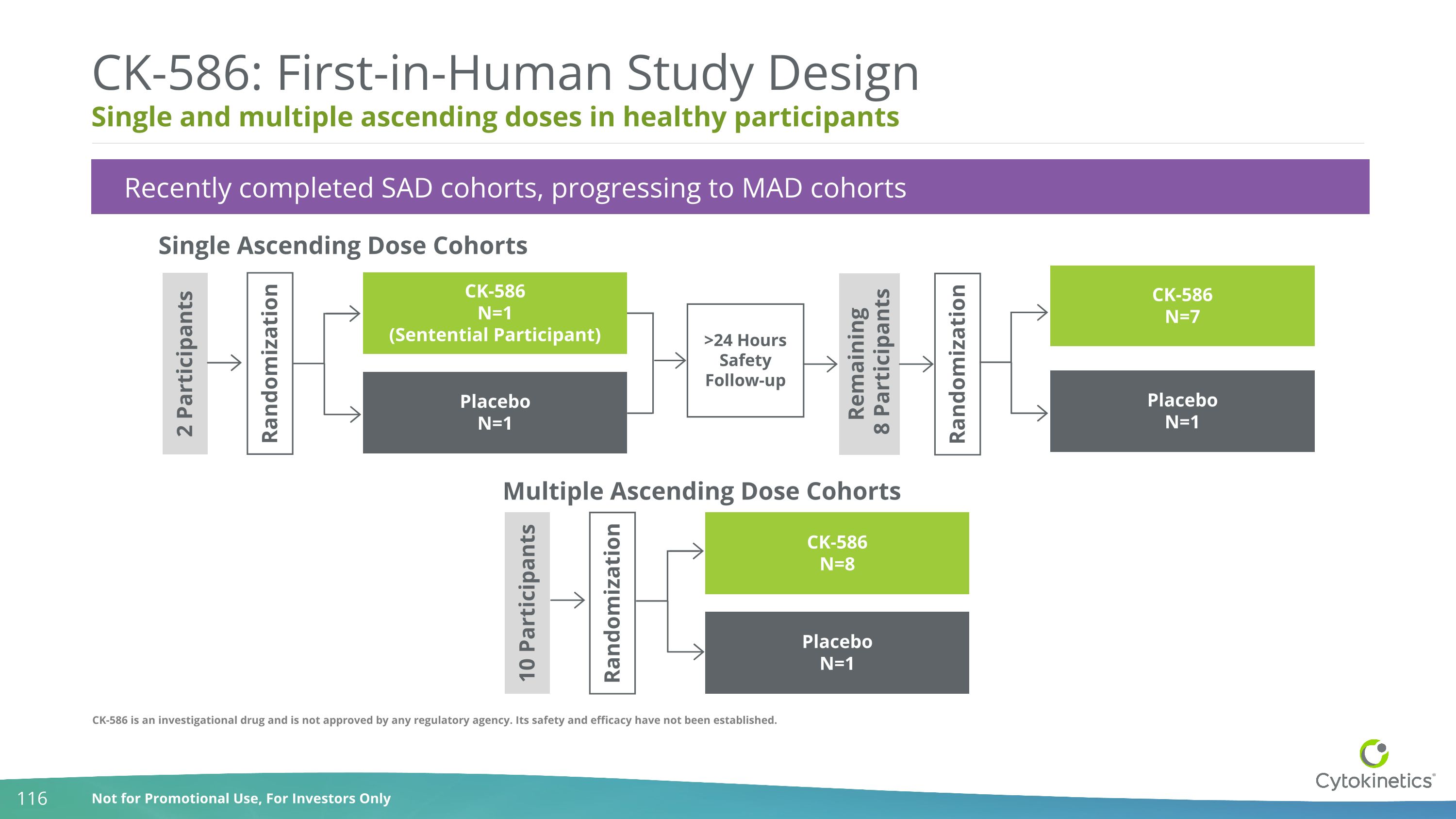

Single and multiple ascending doses in healthy participants CK-586: First-in-Human Study Design Single Ascending Dose Cohorts Recently completed SAD cohorts, progressing to MAD cohorts 2 Participants CK-586 N=1 (Sentential Participant) Placebo N=1 CK-586 N=7 Placebo N=1 >24 Hours Safety Follow-up Randomization Remaining 8 Participants Randomization Multiple Ascending Dose Cohorts CK-586 N=8 Placebo N=1 10 Participants Randomization CK-586 is an investigational drug and is not approved by any regulatory agency. Its safety and efficacy have not been established.

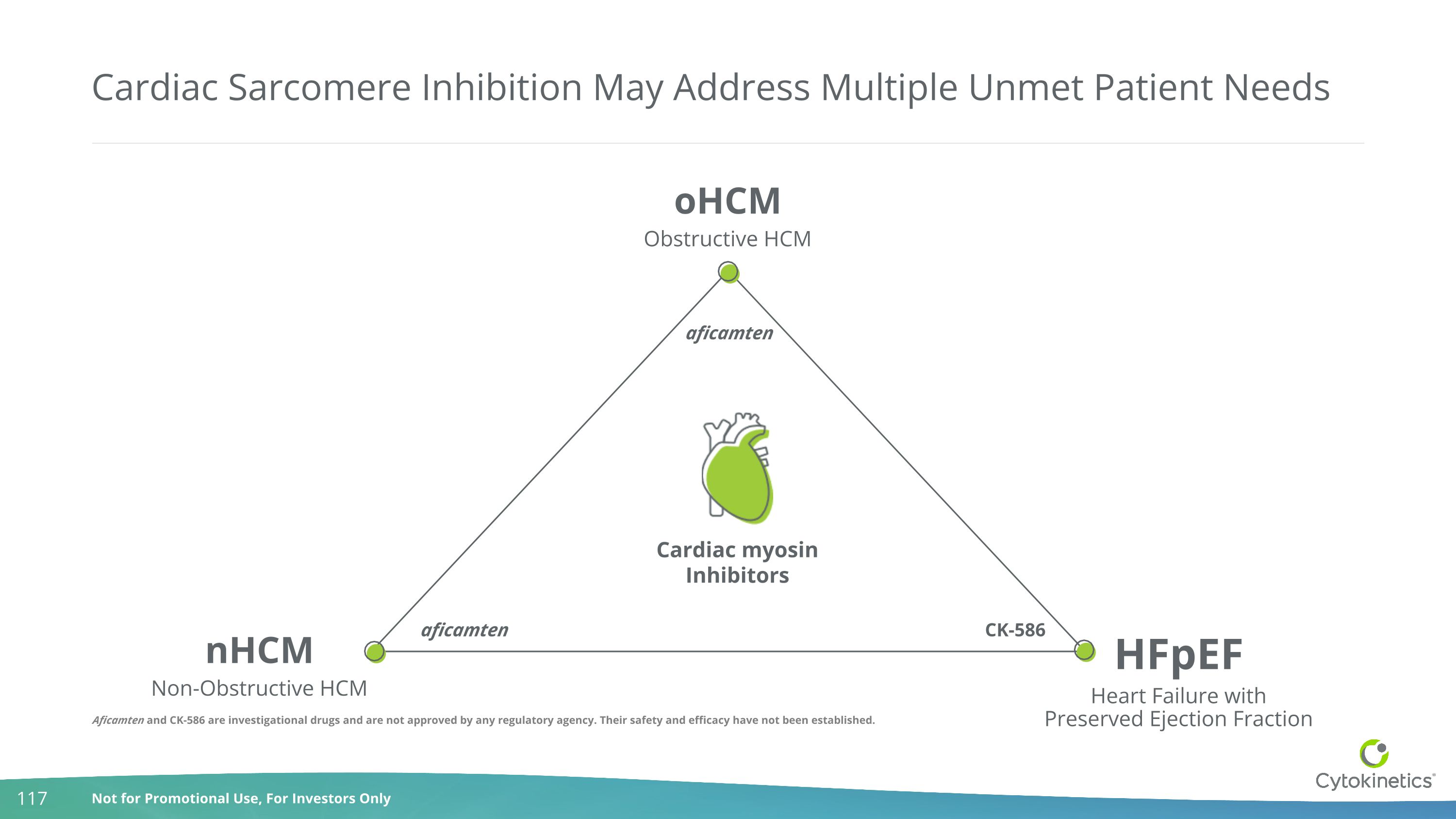

Cardiac Sarcomere Inhibition May Address Multiple Unmet Patient Needs nHCM Non-Obstructive HCM HFpEF Heart Failure withPreserved Ejection Fraction oHCM Obstructive HCM Cardiac myosin Inhibitors aficamten aficamten CK-586 Aficamten and CK-586 are investigational drugs and are not approved by any regulatory agency. Their safety and efficacy have not been established.

Continue enrollment of ACACIA-HCM, pivotal Phase 3 trial of aficamten in nHCM Expected 2023 Milestones Aficamten Aficamten Continue enrollment of MAPLE-HCM, second Phase 3 trial of aficamten in oHCM Omecamtiv Mecarbil Pursue international approvals for omecamtiv mecarbil Emerging Pipeline Expect data from Phase 1 study of CK-136 in 2H Continue Phase 1 study of CK-586 Expect topline results from SEQUOIA-HCM by end of year Aficamten, omecamtiv mecarbil, CK-586 and CK-136 are investigational drugs and have not been approved. Their safety and efficacy have not been established.

Q&A

Closing Remarks Robert Blum President & CEO

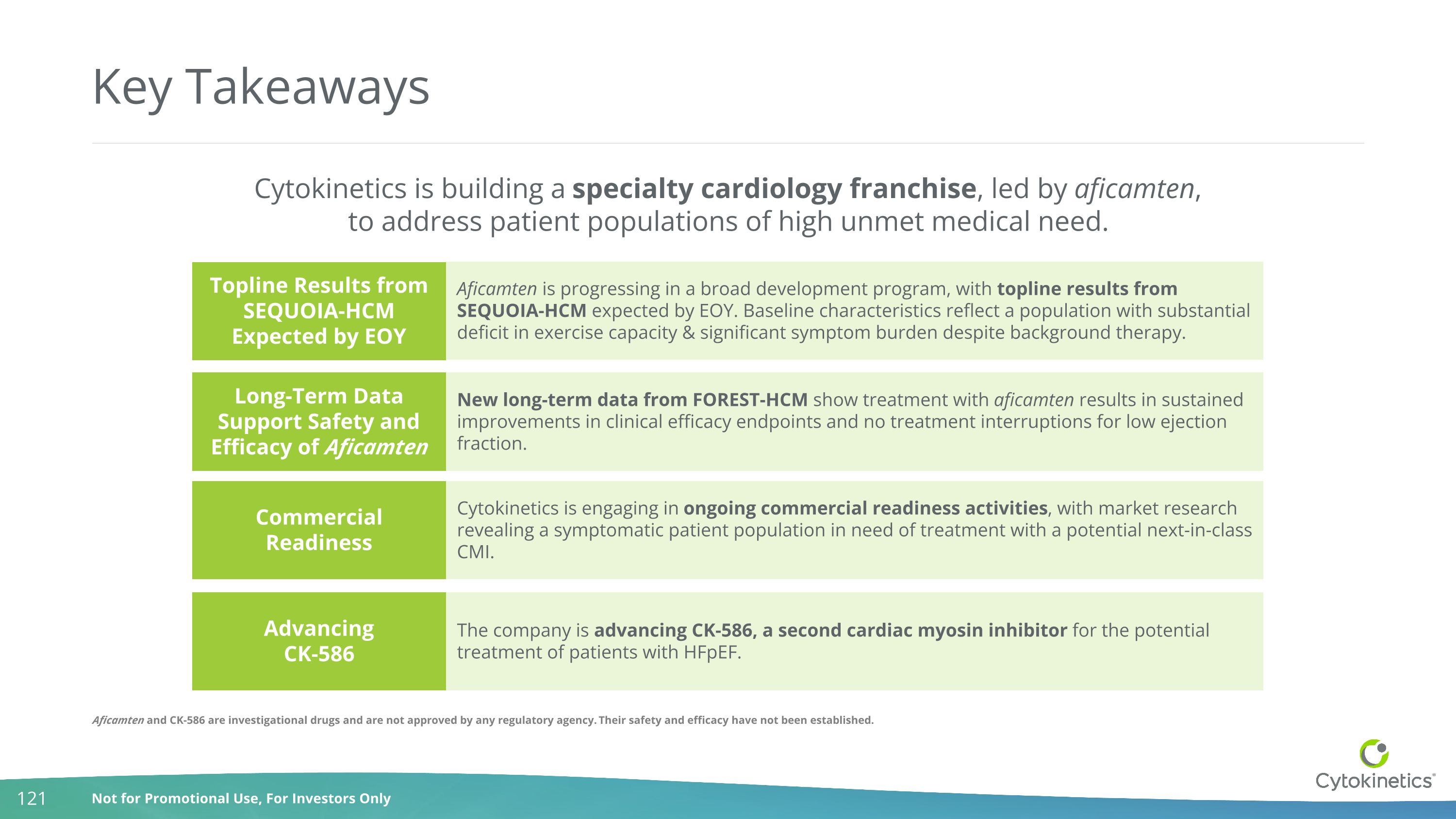

Key Takeaways Cytokinetics is building a specialty cardiology franchise, led by aficamten, to address patient populations of high unmet medical need. Topline Results from SEQUOIA-HCM Expected by EOY Long-Term Data Support Safety and Efficacy of Aficamten Commercial Readiness Advancing CK-586 Aficamten is progressing in a broad development program, with topline results from SEQUOIA-HCM expected by EOY. Baseline characteristics reflect a population with substantial deficit in exercise capacity & significant symptom burden despite background therapy. New long-term data from FOREST-HCM show treatment with aficamten results in sustained improvements in clinical efficacy endpoints and no treatment interruptions for low ejection fraction. Cytokinetics is engaging in ongoing commercial readiness activities, with market research revealing a symptomatic patient population in need of treatment with a potential next-in-class CMI. The company is advancing CK-586, a second cardiac myosin inhibitor for the potential treatment of patients with HFpEF. Aficamten and CK-586 are investigational drugs and are not approved by any regulatory agency. Their safety and efficacy have not been established.

Strong cash runway Access to capital through Royalty Pharma transaction Pioneer in CMI space Multiple drug candidates arising from our research Core research engine Cytokinetics: Uniquely Positioned for Success Late-stage HCM program HFrEF opportunity in Europe Early-stage HFpEF research Early-stage HF research Seasoned commercial team Strong existing payer relationships Strong relationships with cardiologists and institutions Leadership in muscle biology Depth in cardiology Relationships with stakeholders Access to capital

Solid Financial Foundation & Prudent Spending Strong cash position Access to additional capital Gated spending

Expected 2023 Milestones Aficamten Aficamten Continue enrollment of MAPLE-HCM, second Phase 3 trial of aficamten in oHCM Omecamtiv Mecarbil Pursue international approvals for omecamtiv mecarbil Emerging Pipeline Expect data from Phase 1 study of CK-136 in 2H Continue Phase 1 study of CK-586 Expect topline results from SEQUOIA-HCM by end of year Continue enrollment of ACACIA-HCM, pivotal Phase 3 trial of aficamten in nHCM Aficamten, omecamtiv mecarbil, CK-586 and CK-136 are investigational drugs and have not been approved. Their safety and efficacy have not been established.

Thank You ©2023 CYTOKINETICS, All Rights Reserved. CYTOKINETICS® and the C-shaped logo are registered trademarks of Cytokinetics in the U.S. and certain other countries.