UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 18, 2023 |

Hancock Whitney Corporation

(Exact name of Registrant as Specified in Its Charter)

Mississippi |

001-36872 |

64-0693170 |

||

(State or Other Jurisdiction |

(Commission File Number) |

(IRS Employer |

||

|

|

|

|

|

|

Hancock Whitney Plaza 2510 14th Street |

|

|||

Gulfport, Mississippi |

|

39501 |

||

(Address of Principal Executive Offices) |

|

(Zip Code) |

||

Registrant’s Telephone Number, Including Area Code: (228) 868-4727 |

|

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Securities registered pursuant to Section 12(b) of the Act:

|

|

Trading |

|

|

COMMON STOCK, $3.33 PAR VALUE |

|

HWC |

|

The Nasdaq Stock Market LLC |

6.25% SUBORDINATED NOTES |

|

HWCPZ |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On September 20, 2023, the Company is participating in the Stephens 13th Annual Bank Forum. The conference is not being webcast. The investor presentation included as Exhibit 99.1 to this current report on Form 8-K contains reference slides which will be used during the conference. These slides provide select updated mid-quarter data, including net interest margin (NIM), the balance sheet, and asset quality.

In accordance with the General Instruction B.2 of Form 8-K, the information furnished in Item 7.01 and Exhibit 99.1 of this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall the information be deemed incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Exhibit |

Description |

99.1 |

|

104 |

Cover Page Interactive Data File (embedded within the inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

HANCOCK WHITNEY CORPORATION |

|

|

|

|

Date: |

September 18, 2023 |

By: |

/s/ Michael M. Achary |

|

|

|

Michael M. Achary |

Mid-Quarter Update 9/18/2023 Exhibit 99.1

This presentation contains forward-looking statements within the meaning of section 27A of the Securities Act of 1933, as amended, and section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements that we may make include statements regarding our expectations of our performance and financial condition, balance sheet and revenue growth, the provision for credit losses, capital levels, deposits (including growth, pricing, and betas), investment portfolio, other sources of liquidity, loan growth expectations, management’s predictions about charge-offs for loans, general economic business conditions in our local markets, the impacts related to Russia’s military action in Ukraine, Federal Reserve action with respect to interest rates, the adequacy of our enterprise risk management framework, potential claims, damages, penalties, fines and reputational damage resulting from pending or future litigation, regulatory proceedings and enforcement actions, as well as the impact of recent negative developments affecting the banking industry and the resulting media coverage; the potential impact of future business combinations on our performance and financial condition, including our ability to successfully integrate the businesses, success of revenue-generating and cost reduction initiatives, the effectiveness of derivative financial instruments and hedging activities to manage risks, projected tax rates, increased cybersecurity risks, including potential business disruptions or financial losses, the adequacy of our internal controls over financial reporting, the financial impact of regulatory requirements and tax reform legislation, the impact of reference rate reform, deposit trends, credit quality trends, the impact of natural or man-made disasters, the impact of current and future economic conditions, including the effects of declines in the real estate market, high unemployment, inflationary pressures, elevated interest rates and slowdowns in economic growth, as well as the financial stress on borrowers as a result of the foregoing, net interest margin trends, future expense levels, future profitability, improvements in expense to revenue (efficiency) ratio, purchase accounting impacts, accretion levels and expected returns. Also, any statement that does not describe historical or current facts is a forward-looking statement. These statements often include the words “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “forecast,” “goals,” “targets,” “initiatives,” “focus,” “potentially,” “probably,” “projects,” “outlook," or similar expressions or future conditional verbs such as “may,” “will,” “should,” “would,” and “could.” Forward-looking statements are based upon the current beliefs and expectations of management and on information currently available to management. Our statements speak as of the date hereof, and we do not assume any obligation to update these statements or to update the reasons why actual results could differ from those contained in such statements in light of new information or future events. Forward-looking statements are subject to significant risks and uncertainties. Any forward-looking statement made in this presentation is subject to the safe harbor protections set forth in the Private Securities Litigation Reform Act of 1995. Investors are cautioned against placing undue reliance on such statements. Actual results may differ materially from those set forth in the forward-looking statements. Additional factors that could cause actual results to differ materially from those described in the forward-looking statements can be found in Part I, “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022, Part II, “Item 1A. Risk Factors” in our Quarterly Report on Form 10-Q for the period ended March 31, 2023, and in other periodic reports that we file with the SEC. Important cautionary statement about forward-looking statements HNCOCK WHITNEY 2

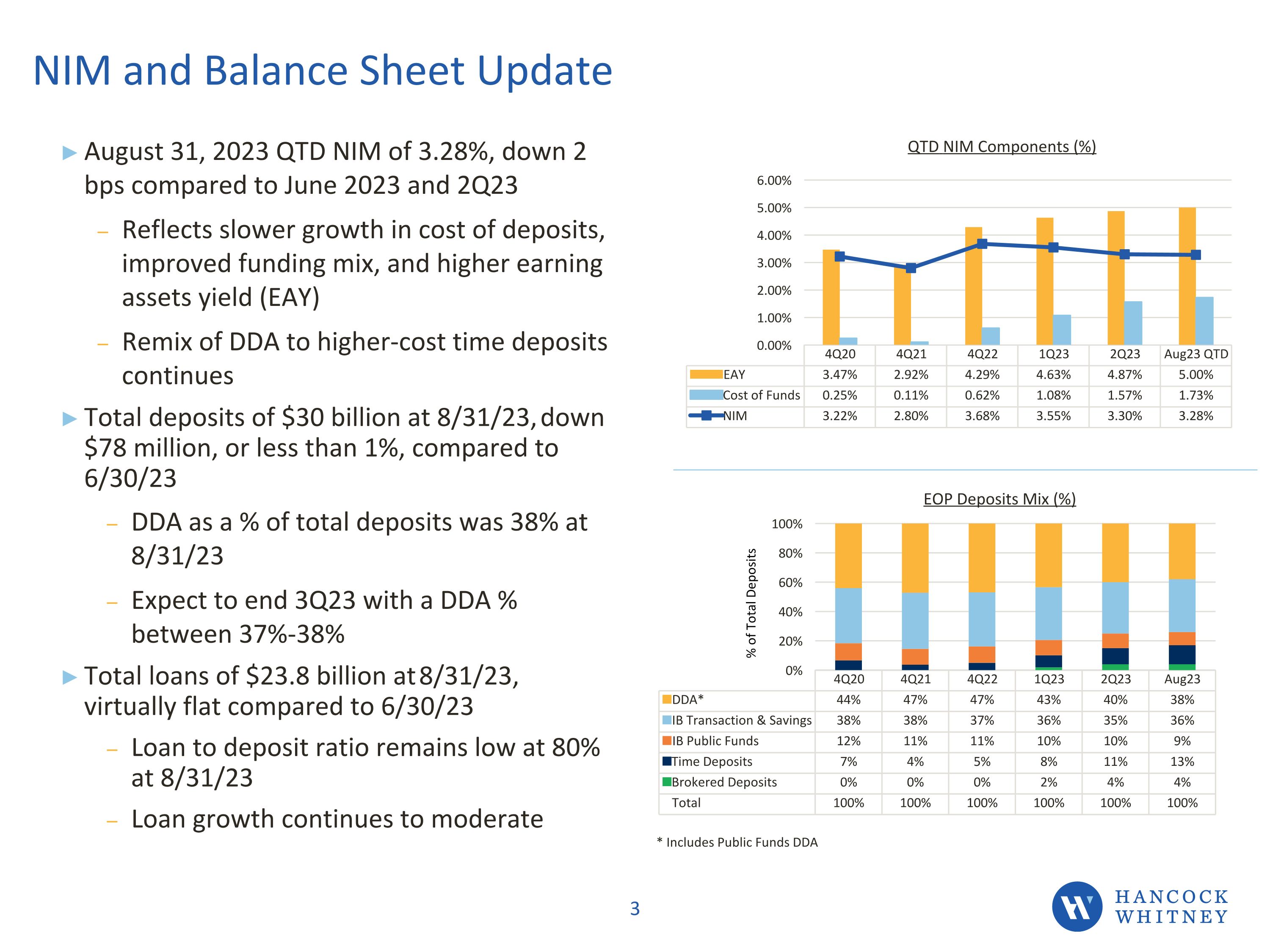

August 31, 2023 QTD NIM of 3.28%, down 2 bps compared to June 2023 and 2Q23 Reflects slower growth in cost of deposits, improved funding mix, and higher earning assets yield (EAY) Remix of DDA to higher-cost time deposits continues Total deposits of $30 billion at 8/31/23, down $78 million, or less than 1%, compared to 6/30/23 DDA as a % of total deposits was 38% at 8/31/23 Expect to end 3Q23 with a DDA % between 37%-38% Total loans of $23.8 billion at 8/31/23, virtually flat compared to 6/30/23 Loan to deposit ratio remains low at 80% at 8/31/23 Loan growth continues to moderate NIM and Balance Sheet Update 0.60% 0.50% 0.40% 0.30% 0.20% 0.10% Mar-20 Apr-20 May-20 Jun 20 Jul-20 Aug-20 Sep-20 Oct-20 Nov-20 Dec-20 Mar-21e .59% .41% .33% .29% .25% .21% .20% .19% .17% .17% .13% 3.40% 3.30% 3.20% 3.10% 3.00% 2.90% 2.80% 3Q20 NIM (TE) Impact of Securities Portfolio Purchase/Premium amortization Impact of change in earnings asset mix Lower cost of deposits Net impact of interest reversals and recoveries/loan fees accretion 4Q20 NIM (TE) 0.02% 0.06% 0.05% 0.02% 5.00% 4.00% 3.00% 2.00% 1.00% 0.00% 4Q19 1Q20 2Q20 3Q20 4Q20 4.69% 3.43% 2.56% 0.76% 4.56% 3.41% 2.53% 0.67% 4.04% 3.23% 2.47% 0.38% 3.95% 3.23% 2.31% 0.30% 3.99% 3.22% 2.23% 0.25% Loan Yield Securities Yield Cost of Fund NIM HNCOCK WHITNEY 18 Line chart EOP Deposits Mix (%) * Includes Public Funds DDA % of Total Deposits QTD NIM Components (%)

Asset Quality Update Total Deposits 12/31/20 $s in millions Time Deposits (retail) $1,835 7% Time Deposits (brokered) $14 ― Interest-bearing public funds $3,235 12% Interest-bearing transaction & savings $10,414 37% Noninterest bearing $12,200 44% $s in billions Avg Qtrly Deposits LQA EOP growth $28.0 $26.0 $24.0 $22.0 $20.0 $18.0 $16.0 1Q20 $24.3 20% 2Q20 $26.7 37% 3Q20 $26.8 -4% 4Q20 $27.0 10% 1Q21 $27.0 10% HNCOCK WHITNEY 15 Expect higher provision and net charge-offs in 3Q23 Increase driven by a $30 million charge-off on a 13.7% participation in a syndicated credit Excluding above “idiosyncratic” charge-off, 3Q23 net charge-offs expected to be within normal quarterly range Expect 3Q23 ACL Coverage to range between 1.40% - 1.45% Not experiencing broad signs of weakness among any industry, collateral type, or geography