UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________

FORM 8-K

_______________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 14, 2023

_______________

Patterson-UTI Energy, Inc.

(Exact name of Registrant as Specified in Its Charter)

_______________

Delaware |

1-39270 |

75-2504748 |

|

(State or Other Jurisdiction of Incorporation ) |

(Commission File Number) |

(IRS Employer Identification No.) |

10713 W. Sam Houston Pkwy N., Suite 800, Houston, Texas |

|

77064 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: 281-765-7100

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

Common Stock, $0.01 Par Value |

|

PTEN |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.☐

Item 7.01. Regulation FD Disclosure.

Patterson-UTI Energy, Inc. ("Patterson-UTI") will deliver the investor presentation attached as Exhibit 99.1 to this Current Report on Form 8-K, which is incorporated herein by reference.

The information furnished pursuant to Item 7.01, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, shall not otherwise be subject to the liabilities of that section and shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated therein by reference. The furnishing of these slides is not intended to constitute a representation that such information is required by Regulation FD or that the materials they contain include material information that is not otherwise publicly available.

Item 8.01 Other Events.

To the extent required, the information included in Item 7.01 of this Current Report on Form 8-K is incorporated by reference into this Item 8.01.

Important Information for Stockholders

In connection with the proposed merger between NexTier Oilfield Solutions Inc. ("NexTier") and Patterson-UTI (the "NexTier Merger"), Patterson-UTI has filed, and the Securities and Exchange Commission (the "SEC") declared effective on July 31, 2023, a registration statement on Form S-4 (the “Registration Statement”), which contains a joint proxy statement of Patterson-UTI and NexTier and a prospectus of Patterson-UTI (the “Joint Proxy Statement/Prospectus”). Patterson-UTI and NexTier commenced the mailing of the Joint Proxy Statement/Prospectus to Patterson-UTI’s stockholders and NexTier’s stockholders on or about August 1, 2023. Each of Patterson-UTI and NexTier also may file other relevant documents with the SEC regarding the NexTier Merger. No offering of securities shall be made, except by means of the Joint Proxy Statement/Prospectus. INVESTORS AND STOCKHOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, JOINT PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS THAT MAY BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE NEXTIER MERGER. Investors and shareholders are able to obtain free copies of these documents and other documents containing important information about Patterson-UTI and NexTier once such documents are filed with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Patterson-UTI are available free of charge on Patterson-UTI’s website at http://www.patenergy.com or by contacting Patterson-UTI’s Investor Relations Department by phone at (281) 765-7170. Copies of the documents filed with the SEC by NexTier are available free of charge on NexTier’s website at https://nextierofs.com or by contacting NexTier’s Investor Relations Department by phone at (346) 242-0519.

No Offer or Solicitation

This communication is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote in any jurisdiction pursuant to the NexTier Merger or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. Subject to certain exceptions to be approved by the relevant regulators or certain facts to be ascertained, the public offer will not be made directly or indirectly, in or into any jurisdiction where to do so would constitute a violation of the laws of such jurisdiction, or by use of the mails or by any means or instrumentality (including without limitation, facsimile transmission, telephone and the internet) of interstate or foreign commerce, or any facility of a national securities exchange, of any such jurisdiction.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

99.1 |

|

|

|

|

|

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

*Filed previously.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: August 14, 2023 |

|

|

||

|

|

Patterson-UTI Energy, Inc. |

||

|

|

|

|

|

|

|

By: |

|

/s/ C. Andrew Smith |

|

|

|

|

Name: C. Andrew Smith |

|

|

|

|

Title: Executive Vice President and Chief Financial Officer |

Patterson-UTI Energy, Inc. Piper Sandler & Co. Meetings with Investors August 14-16, 2023

Cautionary Statement Regarding Forward-Looking Statements This presentation and any oral statements made in connection with this presentation include forward-looking statements which are protected as forward-looking statements under the Private Securities Litigation Reform Act of 1995 that are not limited to historical facts, but reflect Patterson-UTI Energy, Inc.’s (“Patterson-UTI”) current beliefs, expectations or intentions regarding future events. Words such as “anticipate,” “believe,” “budgeted,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “potential,” “project,” “pursue,” “should,” “strategy,” “target,” or “will,” and similar expressions are intended to identify such forward-looking statements. The statements in this presentation and any oral statements made in connection with this presentation that are not historical statements, including statements regarding Patterson-UTI’s future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are not historical facts, are forward-looking statements within the meaning of the federal securities laws. These statements are subject to numerous risks and uncertainties, many of which are beyond Patterson-UTI’s control, which could cause actual results to differ materially from the results expressed or implied by the statements. The statements include, without limitation, projections as to the anticipated benefits of the acquisition of Ulterra Drilling Technologies, L.P. (“Ulterra”) and the proposed merger of Patterson-UTI and NexTier Oilfield Solutions Inc. (“NexTier”), the impact of the transactions on Patterson-UTI’s future financial and operating results, and synergies from the transactions, are based on management’s estimates, assumptions and projections, and are subject to significant uncertainties and other factors, many of which are beyond Patterson-UTI’s control. These factors and risks include, but are not limited to, adverse oil and natural gas industry conditions; global economic conditions, including inflationary pressures and risks of economic downturns or recessions in the United States and elsewhere; volatility in customer spending and in oil and natural gas prices that could adversely affect demand for Patterson-UTI’s services and their associated effect on rates; excess availability of land drilling rigs, pressure pumping and directional drilling equipment, including as a result of reactivation, improvement or construction; competition and demand for Patterson-UTI’s services; the impact of the ongoing conflict in Ukraine; strength and financial resources of competitors; utilization, margins and planned capital expenditures; liabilities from operational risks for which Patterson-UTI does not have and receive full indemnification or insurance; operating hazards attendant to the oil and natural gas business; failure by customers to pay or satisfy their contractual obligations (particularly with respect to fixed-term contracts); the ability to realize backlog; specialization of methods, equipment and services and new technologies, including the ability to develop and obtain satisfactory returns from new technology; the ability to retain management and field personnel; loss of key customers; shortages, delays in delivery, and interruptions in supply, of equipment and materials; cybersecurity events; synergies, costs and financial and operating impacts of acquisitions and the NexTier proposed merger; difficulty in building and deploying new equipment; governmental regulation; climate legislation, regulation and other related risks; environmental, social and governance practices, including the perception thereof; environmental risks and ability to satisfy future environmental costs; technology-related disputes; legal proceedings and actions by governmental or other regulatory agencies; the ability to effectively identify and enter new markets; public health crises, pandemics and epidemics; weather; operating costs; expansion and development trends of the oil and natural gas industry; ability to obtain insurance coverage on commercially reasonable terms; financial flexibility; interest rate volatility; adverse credit and equity market conditions; availability of capital and the ability to repay indebtedness when due; our return of capital to stockholders; stock price volatility; and compliance with covenants under Patterson-UTI’s debt agreements; and other risk factors and additional information. In addition, material risks that could cause actual results to differ from forward-looking statements include: the inherent uncertainty associated with financial or other projections; the prompt and effective integration of Patterson-UTI’s, NexTier’s and Ulterra’s businesses and the ability to achieve the anticipated synergies and value-creation contemplated by the transactions; the risk associated with Patterson-UTI’s and NexTier’s ability to obtain the approval of the proposed merger by their shareholders required to consummate the proposed merger and the timing of the closing of the proposed merger, including the risk that the conditions to the proposed merger are not satisfied on a timely basis or at all and the failure of the proposed merger to close for any other reason; unanticipated difficulties or expenditures relating to the transactions; the response of shareholders, business partners and retention as a result of the announcement and completion of the transactions; and the diversion of management time on transaction related issues. Additional information concerning factors that could cause actual results to differ materially from those in the forward-looking statements is contained from time to time in Patterson-UTI’s SEC filings, which are available through the Securities and Exchange Commission’s (“SEC”) Electronic Data Gathering and Analysis Retrieval System (EDGAR) at http://www.sec.gov, or Patterson-UTI’s website at http://www.patenergy.com. Patterson-UTI undertakes no obligation to publicly update or revise any forward-looking statement. Important Information for Stockholders In connection with the proposed merger of Patterson-UTI and NexTier, Patterson-UTI has filed, and the SEC declared effective on July 31, 2023, a registration statement on Form S-4 (the “Registration Statement”), which contains a joint proxy statement of Patterson-UTI and NexTier and a prospectus of Patterson-UTI (the “Joint Proxy Statement/Prospectus”). Patterson-UTI and NexTier commenced the mailing of the Joint Proxy Statement/Prospectus to Patterson-UTI’s stockholders and NexTier’s stockholders on or about August 1, 2023. Each of Patterson-UTI and NexTier also may file other relevant documents with the SEC regarding the proposed merger. No offering of securities shall be made, except by means of the Joint Proxy Statement/Prospectus. INVESTORS AND STOCKHOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, JOINT PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS THAT MAY BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. Investors and shareholders are able to obtain free copies of these documents and other documents containing important information about Patterson-UTI and NexTier once such documents are filed with the SEC through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Patterson-UTI are available free of charge on Patterson-UTI’s website at http://www.patenergy.com or by contacting Patterson-UTI’s Investor Relations Department by phone at (281) 765-7170. Copies of the documents filed with the SEC by NexTier are available free of charge on NexTier’s website at https://nextierofs.com or by contacting NexTier’s Investor Relations Department by phone at (346) 242-0519. No Offer or Solicitation This presentation is not intended to and does not constitute an offer to sell or the solicitation of an offer to subscribe for or buy or an invitation to purchase or subscribe for any securities or the solicitation of any vote in any jurisdiction pursuant to the proposed merger or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law. Subject to certain exceptions to be approved by the relevant regulators or certain facts to be ascertained, the public offer will not be made directly or indirectly, in or into any jurisdiction where to do so would constitute a violation of the laws of such jurisdiction, or by use of the mails or by any means or instrumentality (including without limitation, facsimile transmission, telephone and the internet) of interstate or foreign commerce, or any facility of a national securities exchange, of any such jurisdiction.

Patterson-UTI Energy The addition of NexTier Oilfield Solutions and Ulterra Drilling Technologies advances our strategy to enhance our positions in both drilling and completions, areas where Patterson-UTI has a strong 45-year history of operations and innovation.

A leading provider of drilling and completions services in the U.S. Strong cash generation Focused on shareholder returns A leading revenue generator in North America >$7 billion of combined enterprise value Increased stock trading liquidity $2.0 billion of combined 1H23 annualized Adjusted EBITDA $200 million of annual synergies expected within 18 months Committed to returning 50% of free cash flow to shareholders through dividends and share repurchases* Returned more than $1.2 billion to shareholders in the last 10+ years Patterson-UTI - The Combined Company * For purposes of the shareholder return target, the Company defines free cash flow as net cash provided by operating activities less capital expenditures. The shareholder return target, including the amount and timing of any dividend payments and/or share repurchases are subject to the discretion of the Company's Board of Directors and will depend upon business conditions, results of operations, financial condition, terms of the Company's debt agreements and other factors.

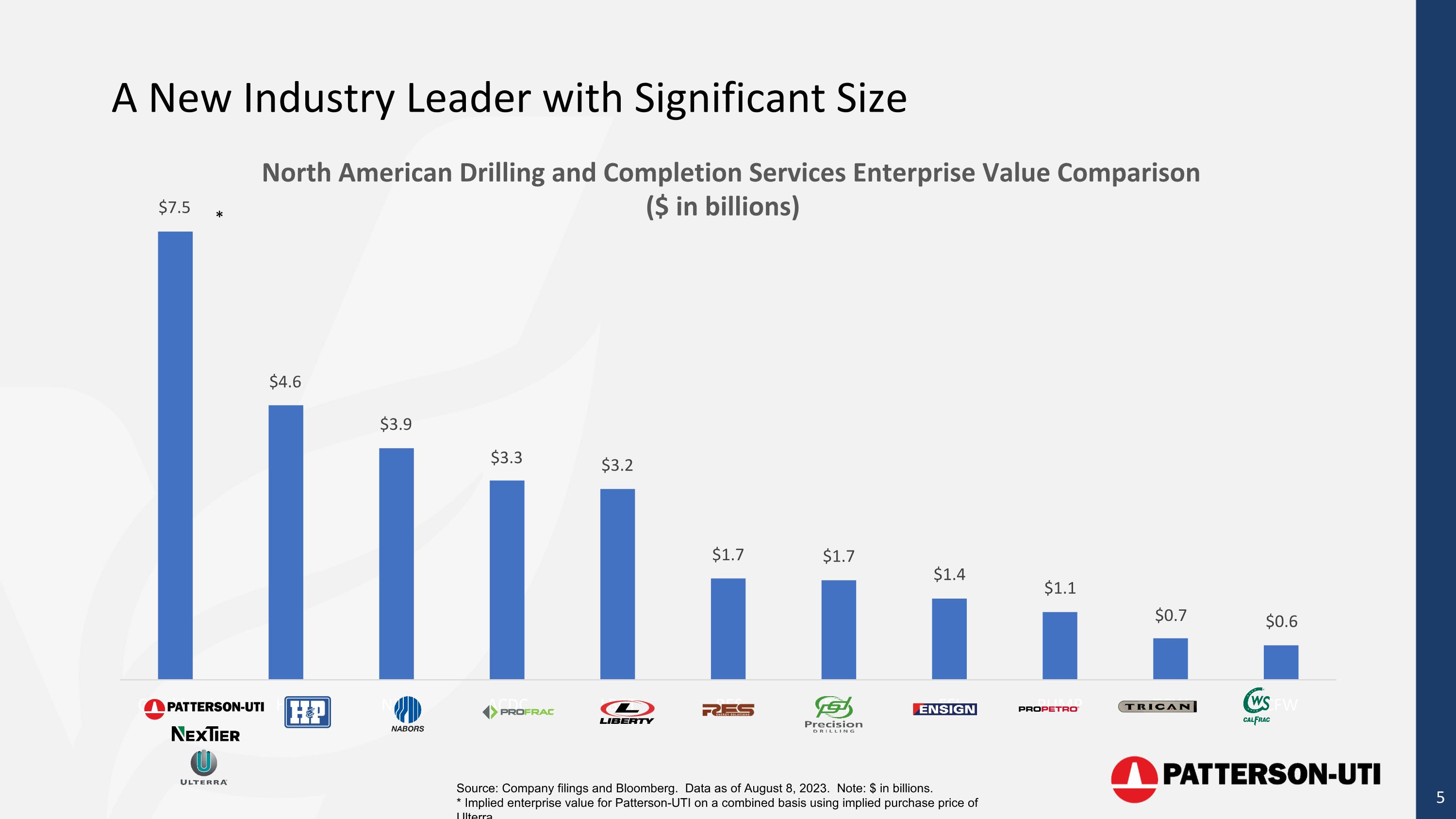

A New Industry Leader with Significant Size Source: Company filings and Bloomberg. Data as of August 8, 2023. Note: $ in billions. * Implied enterprise value for Patterson-UTI on a combined basis using implied purchase price of Ulterra. *

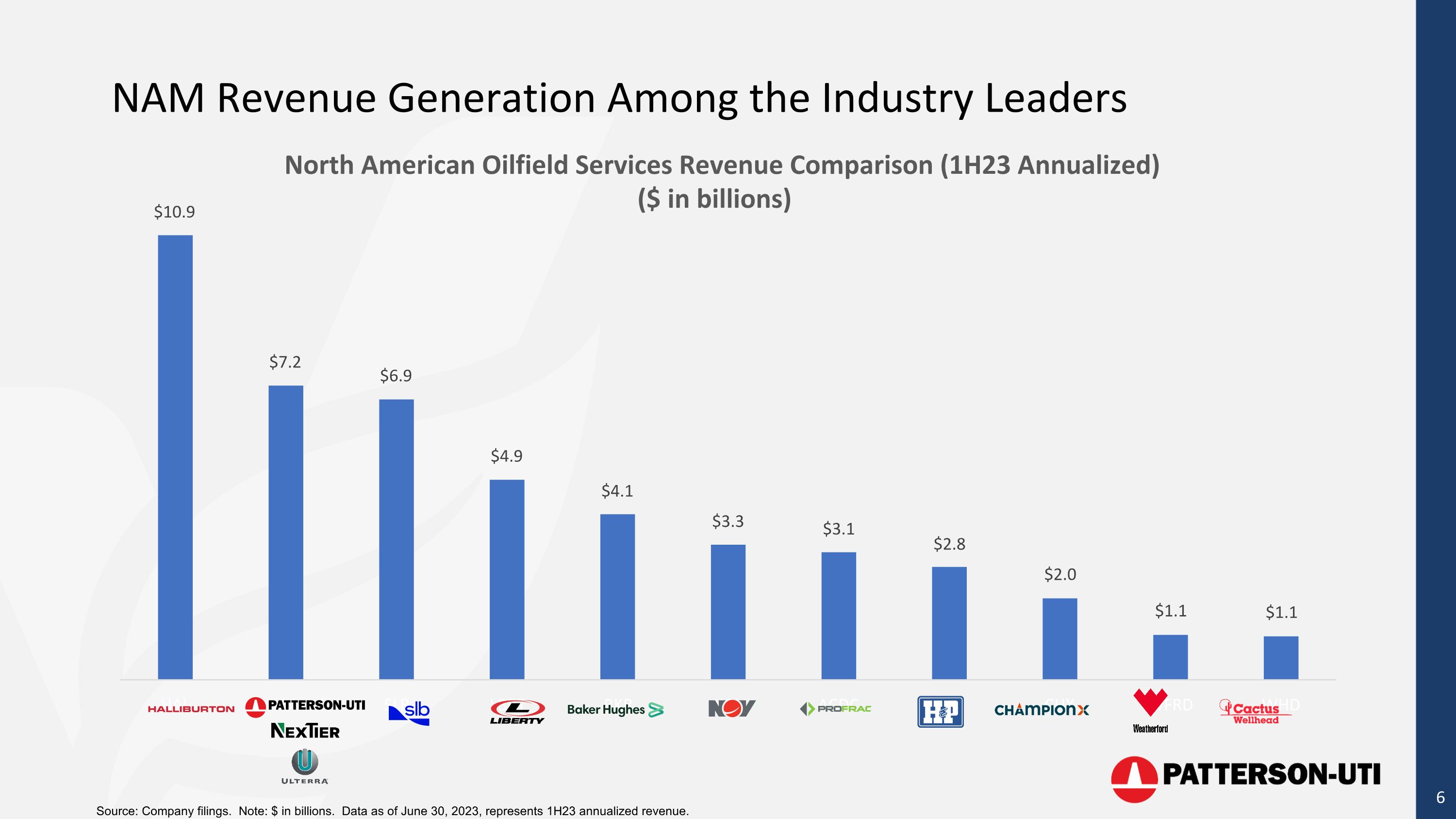

NAM Revenue Generation Among the Industry Leaders Source: Company filings. Note: $ in billions. Data as of June 30, 2023, represents 1H23 annualized revenue.

Strong Cash Flow Generation Combination of Patterson-UTI, NexTier, and Ulterra expected to be accretive to earnings per share and free cash flow in 2024 $200 million of annual synergies expected within 18 months $2.0 billion of combined 1H23 annualized Adjusted EBITDA

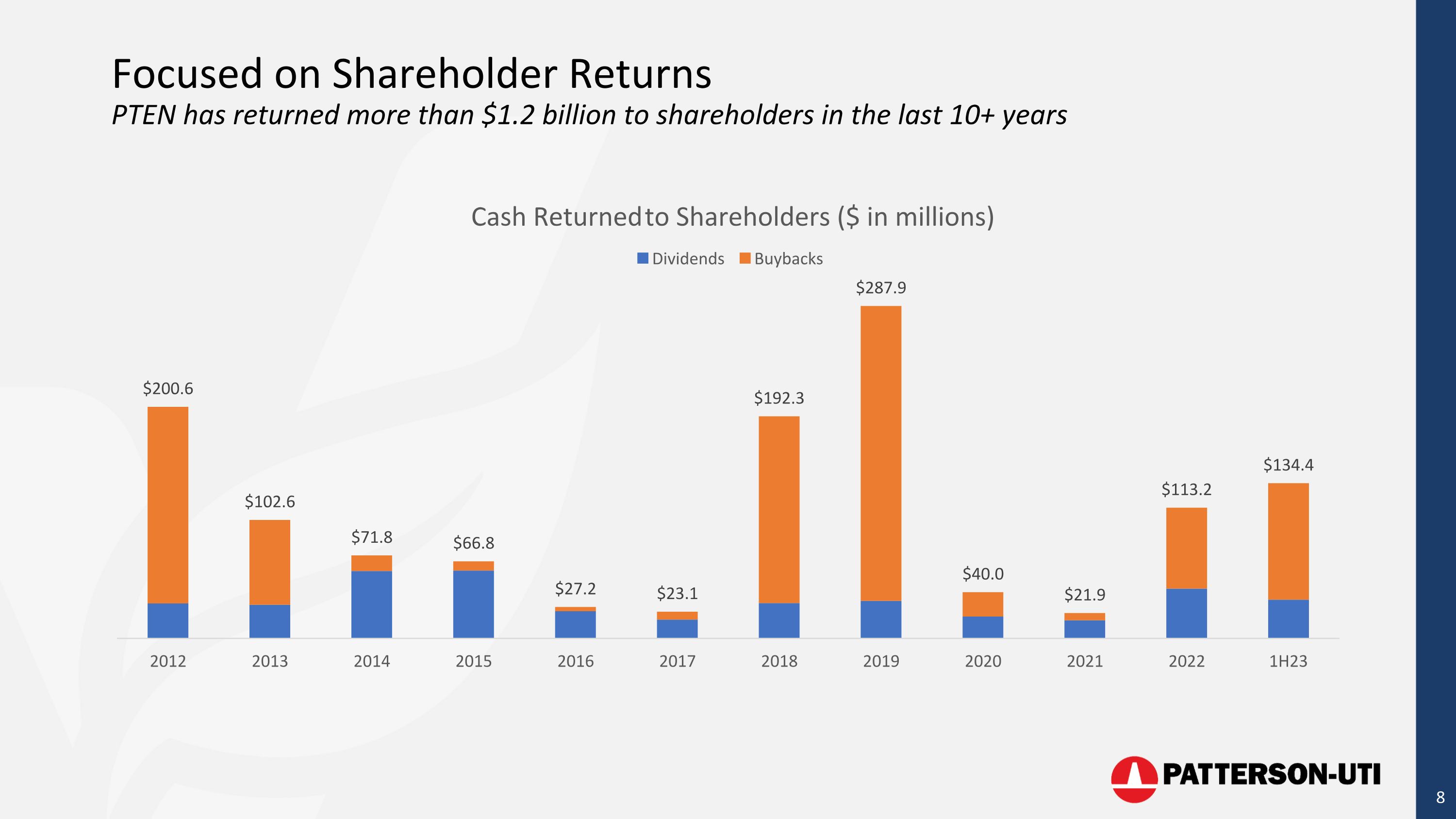

Focused on Shareholder Returns PTEN has returned more than $1.2 billion to shareholders in the last 10+ years

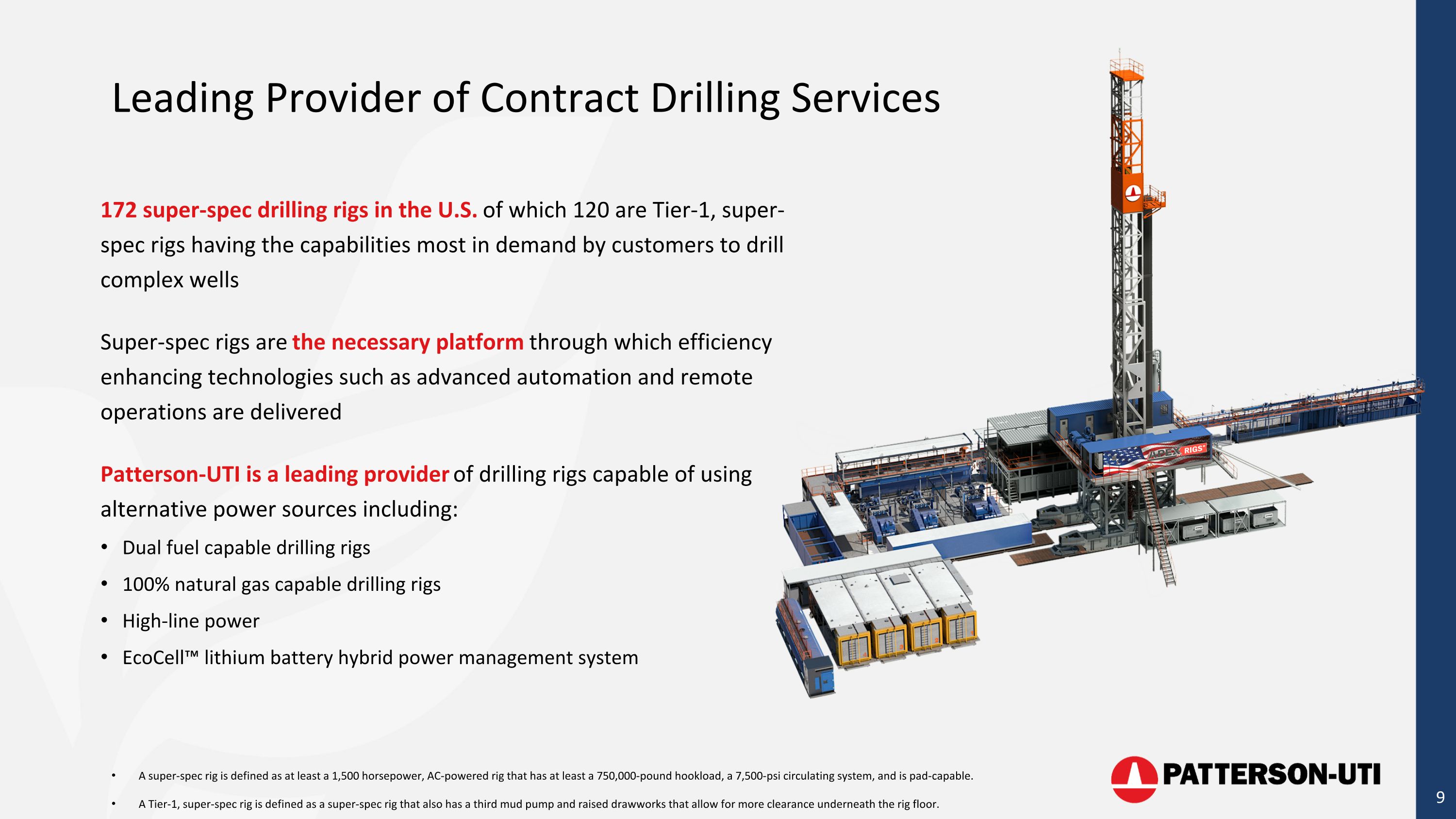

Leading Provider of Contract Drilling Services A super-spec rig is defined as at least a 1,500 horsepower, AC-powered rig that has at least a 750,000-pound hookload, a 7,500-psi circulating system, and is pad-capable. A Tier-1, super-spec rig is defined as a super-spec rig that also has a third mud pump and raised drawworks that allow for more clearance underneath the rig floor. 172 super-spec drilling rigs in the U.S. of which 120 are Tier-1, super-spec rigs having the capabilities most in demand by customers to drill complex wells Super-spec rigs are the necessary platform through which efficiency enhancing technologies such as advanced automation and remote operations are delivered Patterson-UTI is a leading provider of drilling rigs capable of using alternative power sources including: Dual fuel capable drilling rigs 100% natural gas capable drilling rigs High-line power EcoCell™ lithium battery hybrid power management system

A Leader in U.S. Land Completions Services Combined company will be the second largest pressure pumping company in the U.S., owning 3.3 million horsepower Nearly 2/3 of the combined company’s fleet will be dual-fuel capable, reducing fuel costs and lowering emissions and making the combined company the largest operator of natural gas powered frac fleets Wellsite integration offers opportunities to improve profitability in a capital efficient manner: Power Solutions natural gas fueling business Proppant last mile logistics and wellsite storage Wireline and pumpdown Reservoir Engineering

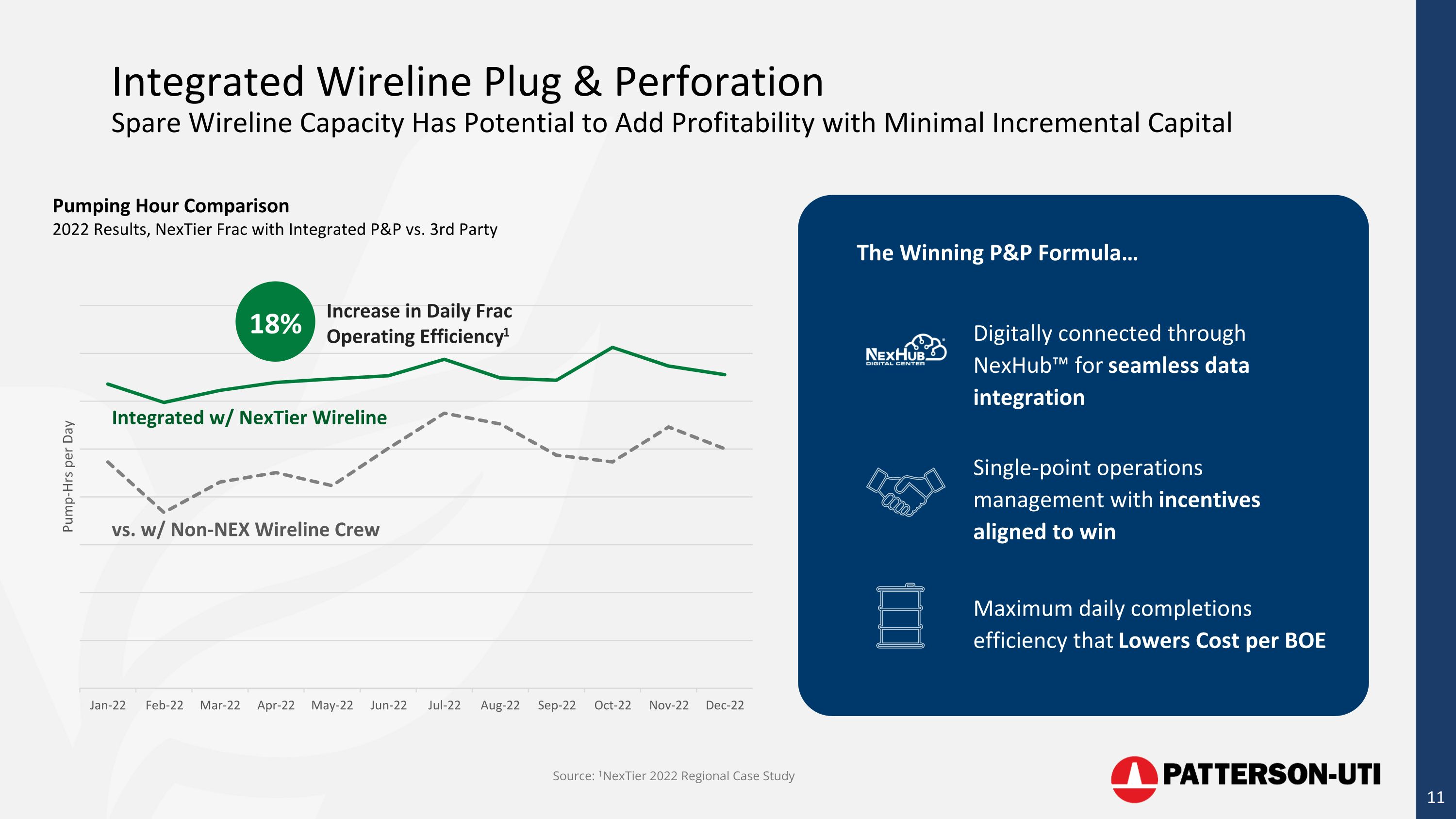

Pumping Hour Comparison 2022 Results, NexTier Frac with Integrated P&P vs. 3rd Party vs. w/ Non-NEX Wireline Crew Integrated w/ NexTier Wireline Increase in Daily Frac Operating Efficiency1 18% Source: 1NexTier 2022 Regional Case Study Integrated Wireline Plug & PerforationSpare Wireline Capacity Has Potential to Add Profitability with Minimal Incremental Capital The Winning P&P Formula… Digitally connected through NexHub™ for seamless data integration Single-point operations management with incentives aligned to win Maximum daily completions efficiency that Lowers Cost per BOE

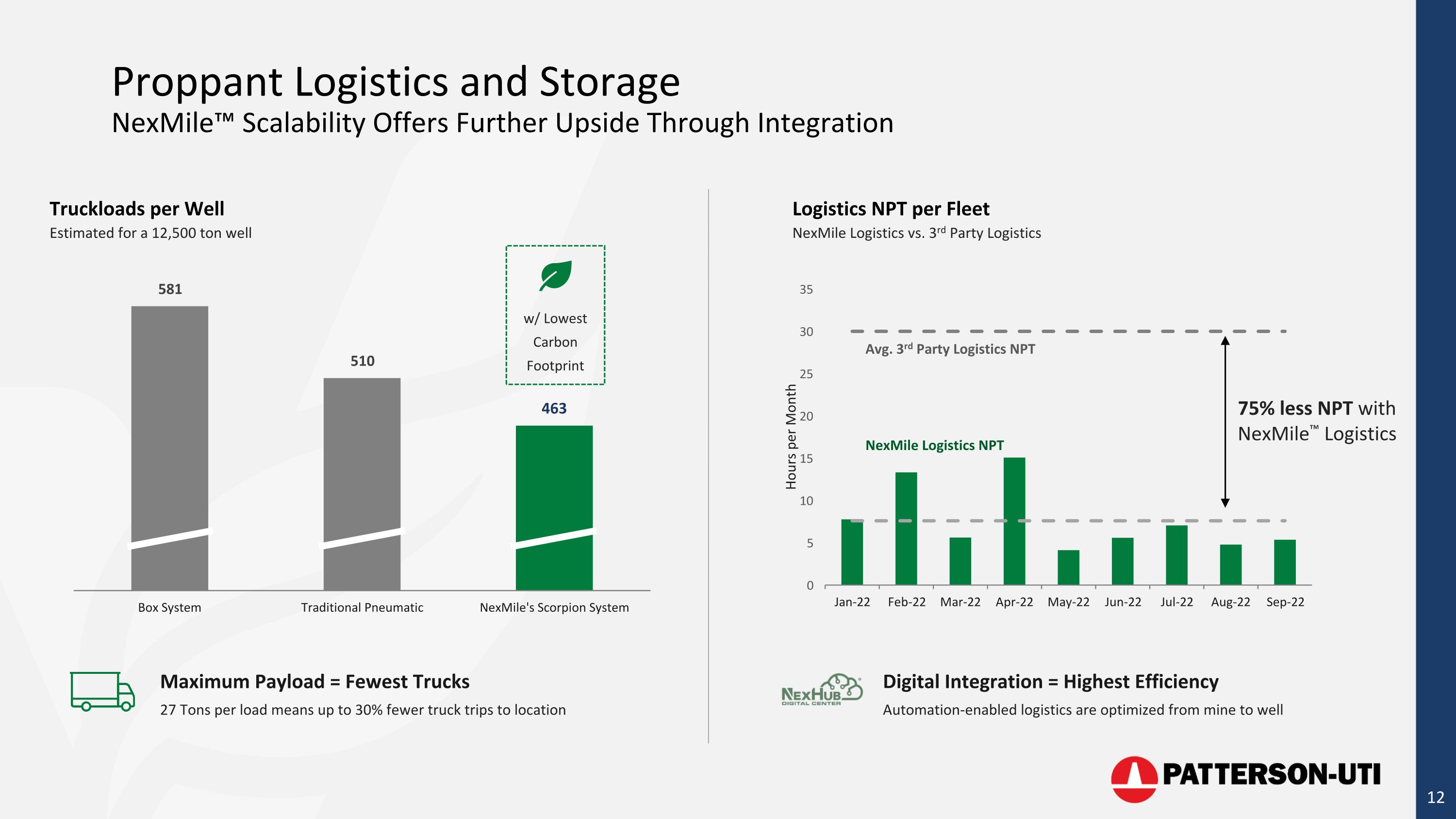

Truckloads per Well Estimated for a 12,500 ton well w/ Lowest Carbon Footprint Maximum Payload = Fewest Trucks 27 Tons per load means up to 30% fewer truck trips to location 75% less NPT with NexMile™ Logistics Logistics NPT per Fleet NexMile Logistics vs. 3rd Party Logistics Digital Integration = Highest Efficiency Automation-enabled logistics are optimized from mine to well Avg. 3rd Party Logistics NPT NexMile Logistics NPT Proppant Logistics and StorageNexMile™ Scalability Offers Further Upside Through Integration

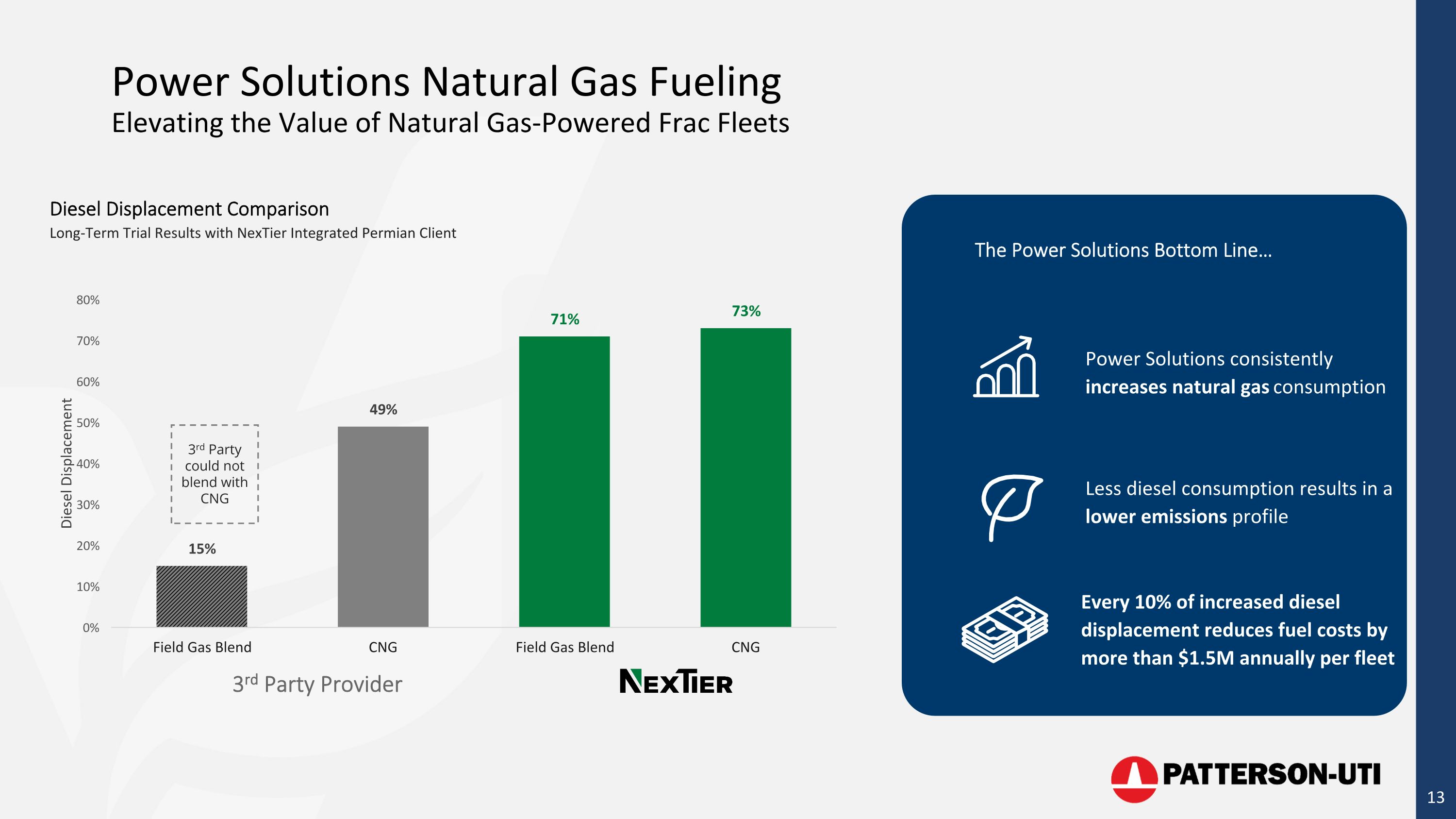

Power Solutions consistently increases natural gas consumption The Power Solutions Bottom Line… Every 10% of increased diesel displacement reduces fuel costs by more than $1.5M annually per fleet 3rd Party Provider 3rd Party could not blend with CNG Power Solutions Natural Gas FuelingElevating the Value of Natural Gas-Powered Frac Fleets Diesel Displacement Comparison Long-Term Trial Results with NexTier Integrated Permian Client Less diesel consumption results in a lower emissions profile

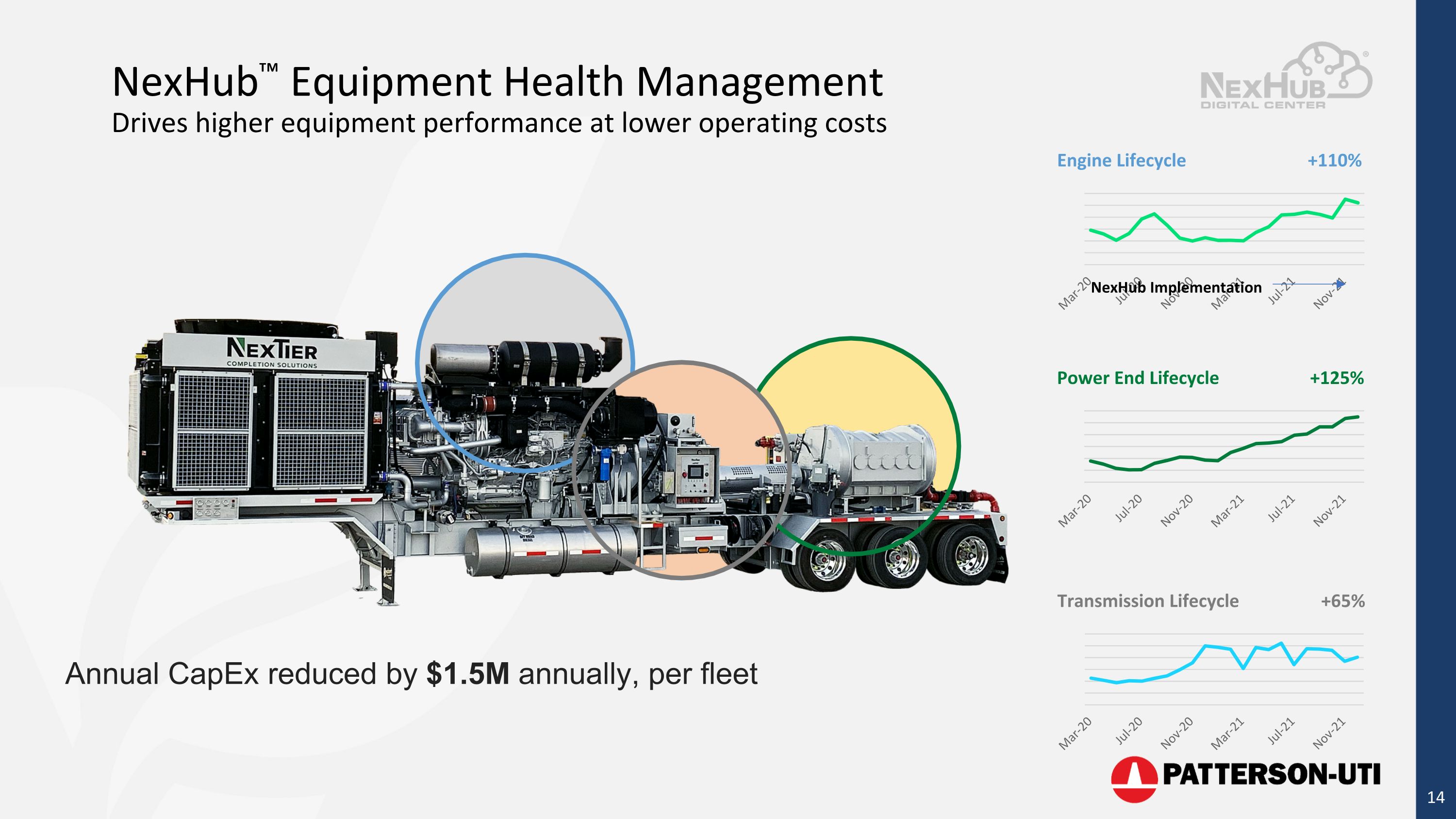

NexHub™ Equipment Health Management Drives higher equipment performance at lower operating costs +110% Engine Lifecycle +125% Power End Lifecycle +65% Transmission Lifecycle Annual CapEx reduced by $1.5M annually, per fleet NexHub Implementation

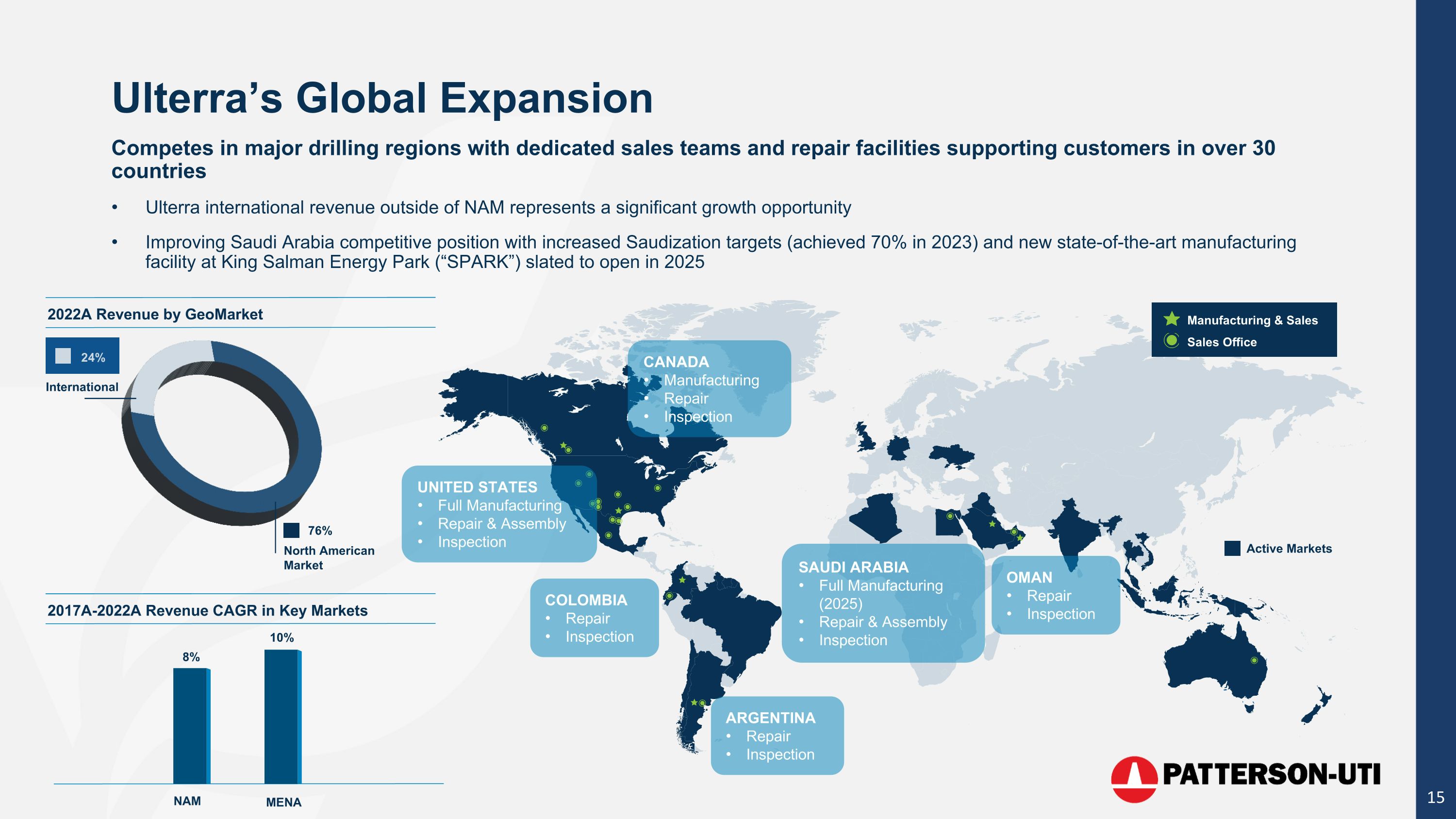

Competes in major drilling regions with dedicated sales teams and repair facilities supporting customers in over 30 countries Ulterra international revenue outside of NAM represents a significant growth opportunity Improving Saudi Arabia competitive position with increased Saudization targets (achieved 70% in 2023) and new state-of-the-art manufacturing facility at King Salman Energy Park (“SPARK”) slated to open in 2025 Ulterra’s Global Expansion Manufacturing & Sales Sales Office Active Markets UNITED STATES Full Manufacturing Repair & Assembly Inspection COLOMBIA Repair Inspection ARGENTINA Repair Inspection CANADA Manufacturing Repair Inspection SAUDI ARABIA Full Manufacturing(2025) Repair & Assembly Inspection OMAN Repair Inspection International North American Market 24% 76% 2022A Revenue by GeoMarket 8% 10% NAM MENA 2017A-2022A Revenue CAGR in Key Markets

Drill Bit Market Characteristics PDC Drill Bit Overview Polycrystalline Diamond Compact (PDC) Drill Bits Represent ~90% of the bits used in the U.S. oil & gas industry Drill bits drive drilling speed (ROP), duration (footage drilled) and tool face control (staying in the pay zone), resulting in material increases to drilling efficiency and the overall profitability of a well Highly technical products requiring patented technology and significant subject-matter experts Performance is critical Track record of success builds strong customer relationships U.S. land operators consume approximately 5 bits per well Used bits are repaired and refurbished for the next customer 16

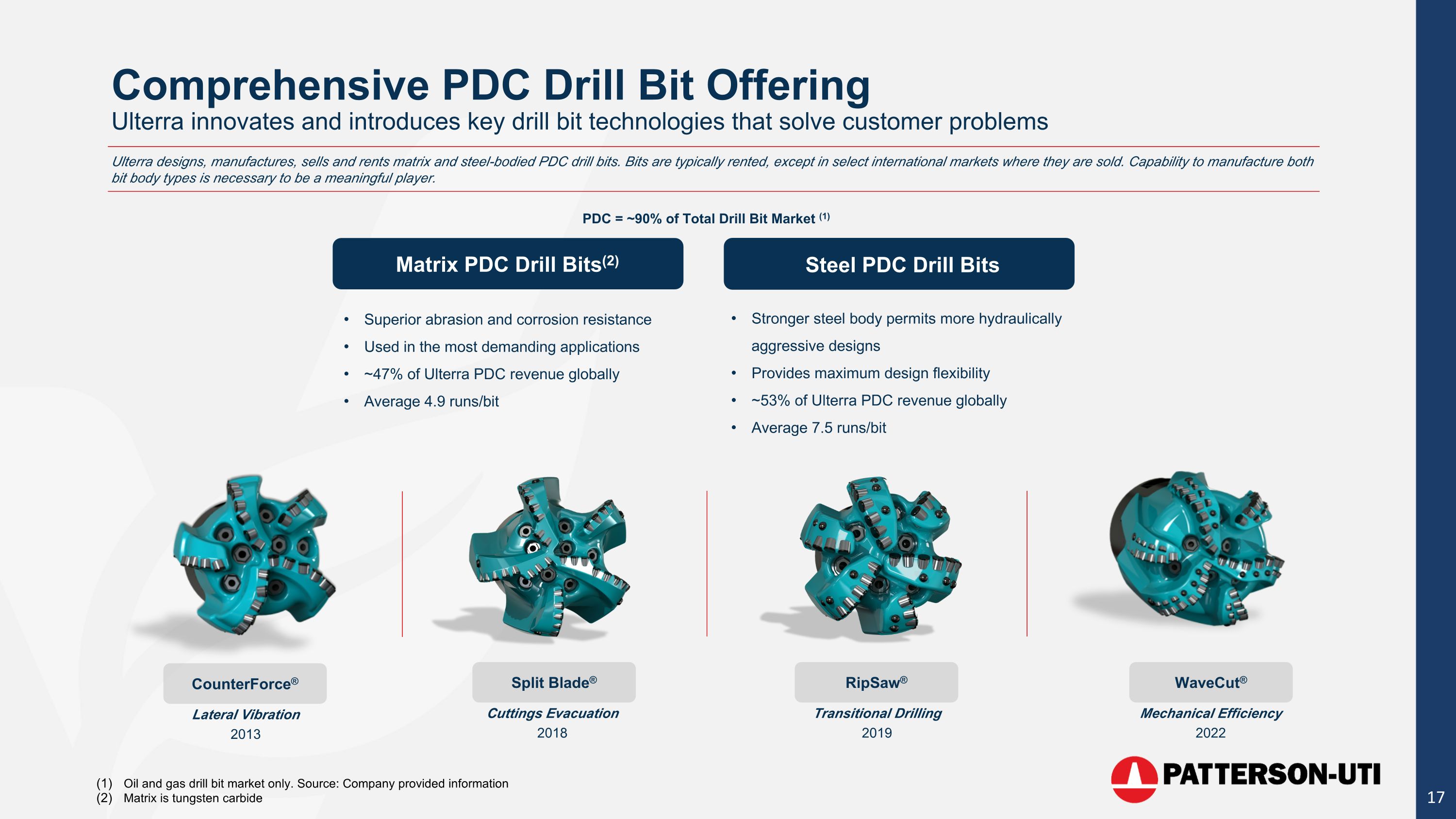

Comprehensive PDC Drill Bit OfferingUlterra innovates and introduces key drill bit technologies that solve customer problems Oil and gas drill bit market only. Source: Company provided information Matrix is tungsten carbide CounterForce® Split Blade® RipSaw® WaveCut® Lateral Vibration 2013 Cuttings Evacuation 2018 Transitional Drilling 2019 Mechanical Efficiency 2022 Matrix PDC Drill Bits(2) Steel PDC Drill Bits Superior abrasion and corrosion resistance Used in the most demanding applications ~47% of Ulterra PDC revenue globally Average 4.9 runs/bit Stronger steel body permits more hydraulically aggressive designs Provides maximum design flexibility ~53% of Ulterra PDC revenue globally Average 7.5 runs/bit PDC = ~90% of Total Drill Bit Market (1) Ulterra designs, manufactures, sells and rents matrix and steel-bodied PDC drill bits. Bits are typically rented, except in select international markets where they are sold. Capability to manufacture both bit body types is necessary to be a meaningful player.

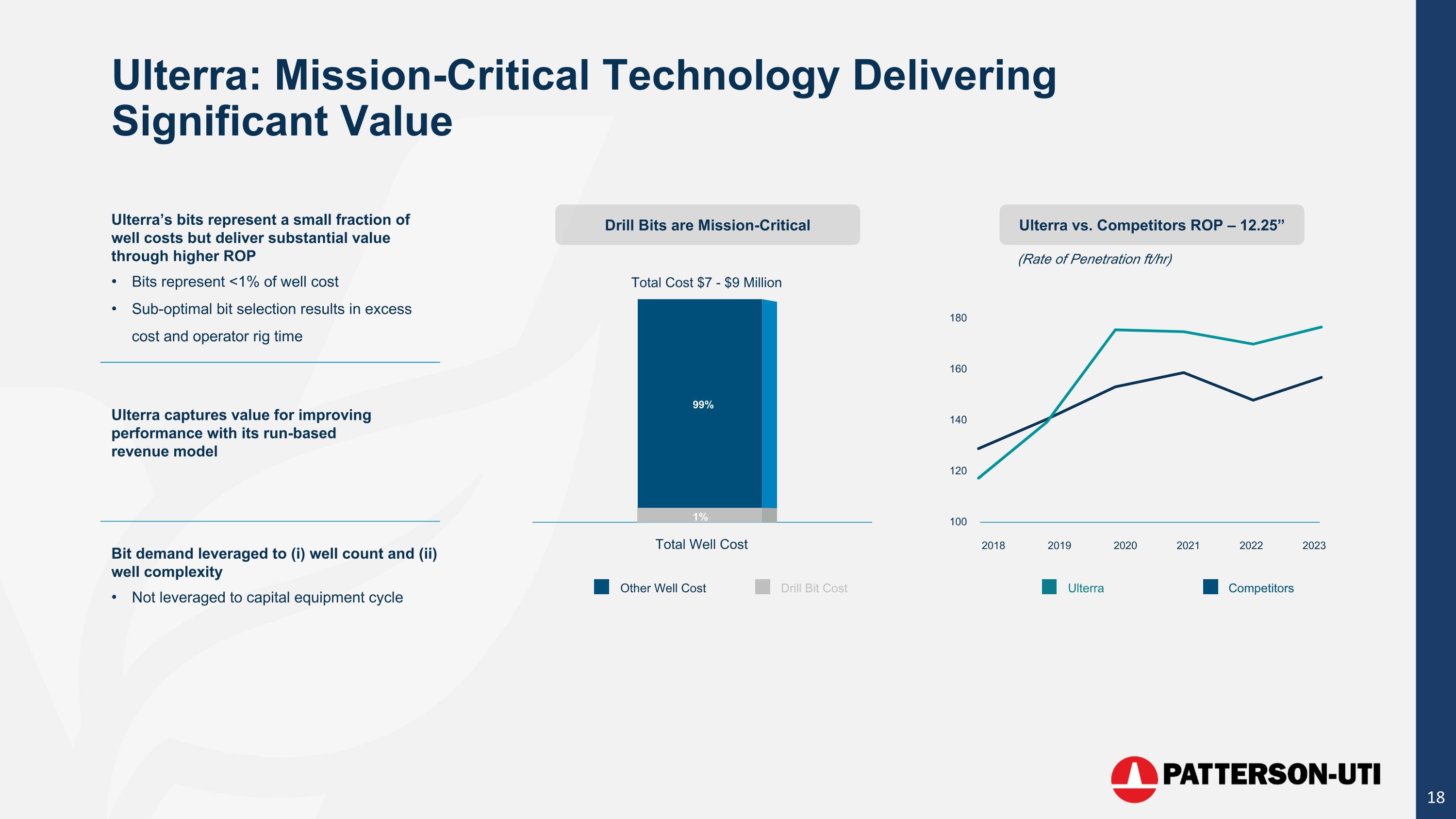

Ulterra: Mission-Critical Technology Delivering Significant Value Ulterra’s bits represent a small fraction of well costs but deliver substantial value through higher ROP Bits represent <1% of well cost Sub-optimal bit selection results in excess cost and operator rig time Ulterra captures value for improving performance with its run-based revenue model Bit demand leveraged to (i) well count and (ii) well complexity Not leveraged to capital equipment cycle Drill Bits are Mission-Critical Ulterra vs. Competitors ROP – 12.25” (Rate of Penetration ft/hr) Total Cost $7 - $9 Million Total Well Cost 99% 1% Other Well Cost Drill Bit Cost Ulterra Competitors 180 160 140 120 100 2018 2019 2020 2021 2022 2023

Advanced Manufacturing & Repair Capabilities Source: Management records 1 Estimated sq. ft. upon completion of new facility estimated to be online by 2025 with full manufacturing capabilities Leduc, Alberta (40,800 sq. ft.) Saudi Arabia (80,000 sq. ft.) 1 Fort Worth, Texas (114,000 sq. ft.) Global Manufacturing & Repair Facilities Global Repair Facilities Colombia Argentina Oman Rapid prototyping at scale All product engineering is in-house Ability to redesign or field test new materials to meet specific customer needs Extensive tracking and reporting of each bit body and cutter technology with just-in-time inventory for parts Lean inventory ensures that the latest technologies are rapidly deployed to the field Distributed repair facilities enable drill bits to be refurbished and returned to the field rapidly, resulting in lean inventory, supporting strong thru-cycle margins and global expansion New build of any existing design within 10 days Repair and redeploy drill bits in as little as 48 hours New designs engineered in as little as a week

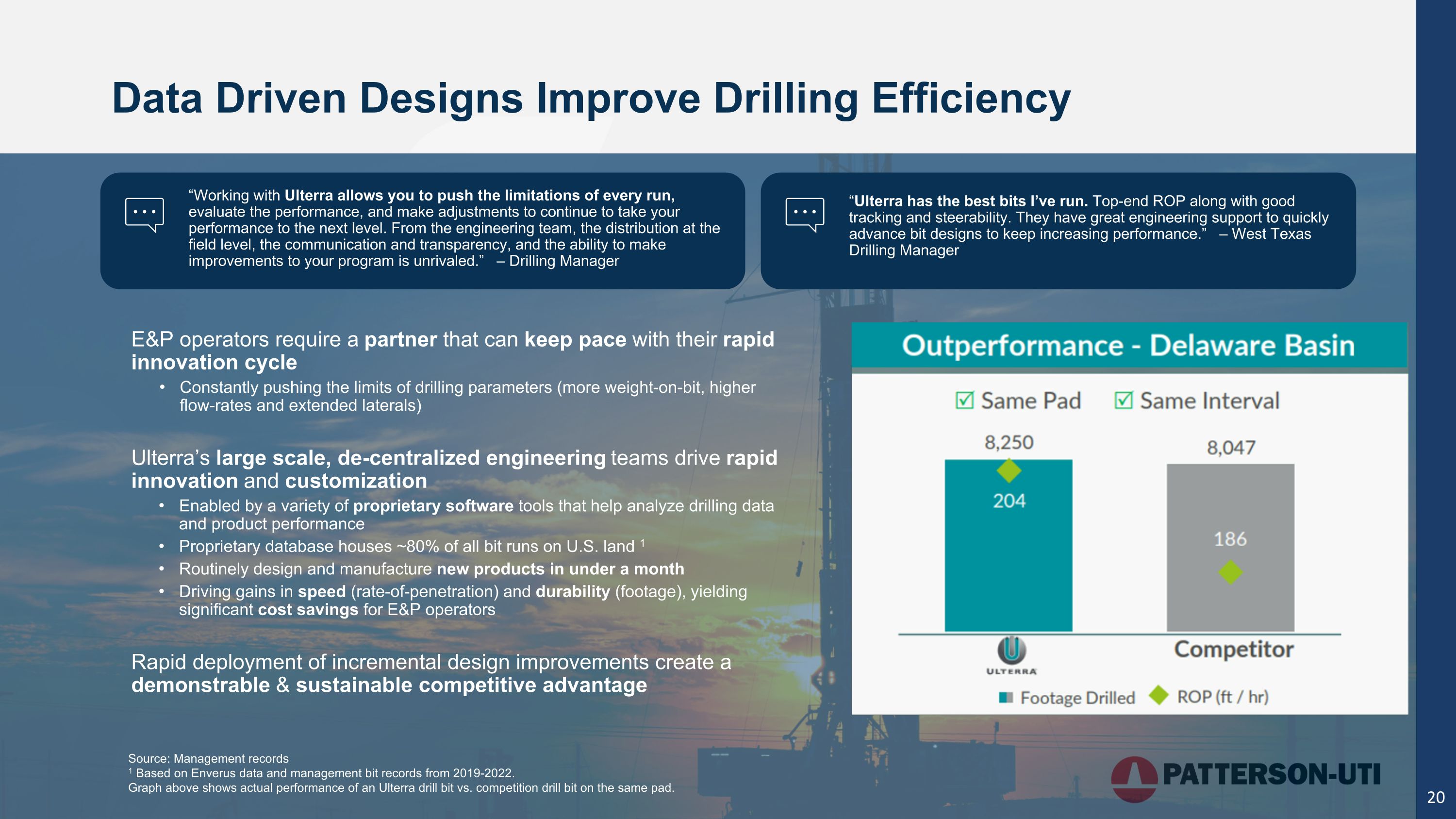

Data Driven Designs Improve Drilling Efficiency E&P operators require a partner that can keep pace with their rapid innovation cycle Constantly pushing the limits of drilling parameters (more weight-on-bit, higher flow-rates and extended laterals) Ulterra’s large scale, de-centralized engineering teams drive rapid innovation and customization Enabled by a variety of proprietary software tools that help analyze drilling data and product performance Proprietary database houses ~80% of all bit runs on U.S. land 1 Routinely design and manufacture new products in under a month Driving gains in speed (rate-of-penetration) and durability (footage), yielding significant cost savings for E&P operators Rapid deployment of incremental design improvements create a demonstrable & sustainable competitive advantage Source: Management records 1 Based on Enverus data and management bit records from 2019-2022. Graph above shows actual performance of an Ulterra drill bit vs. competition drill bit on the same pad. “Working with Ulterra allows you to push the limitations of every run, evaluate the performance, and make adjustments to continue to take your performance to the next level. From the engineering team, the distribution at the field level, the communication and transparency, and the ability to make improvements to your program is unrivaled.” – Drilling Manager “Ulterra has the best bits I’ve run. Top-end ROP along with good tracking and steerability. They have great engineering support to quickly advance bit designs to keep increasing performance.” – West Texas Drilling Manager

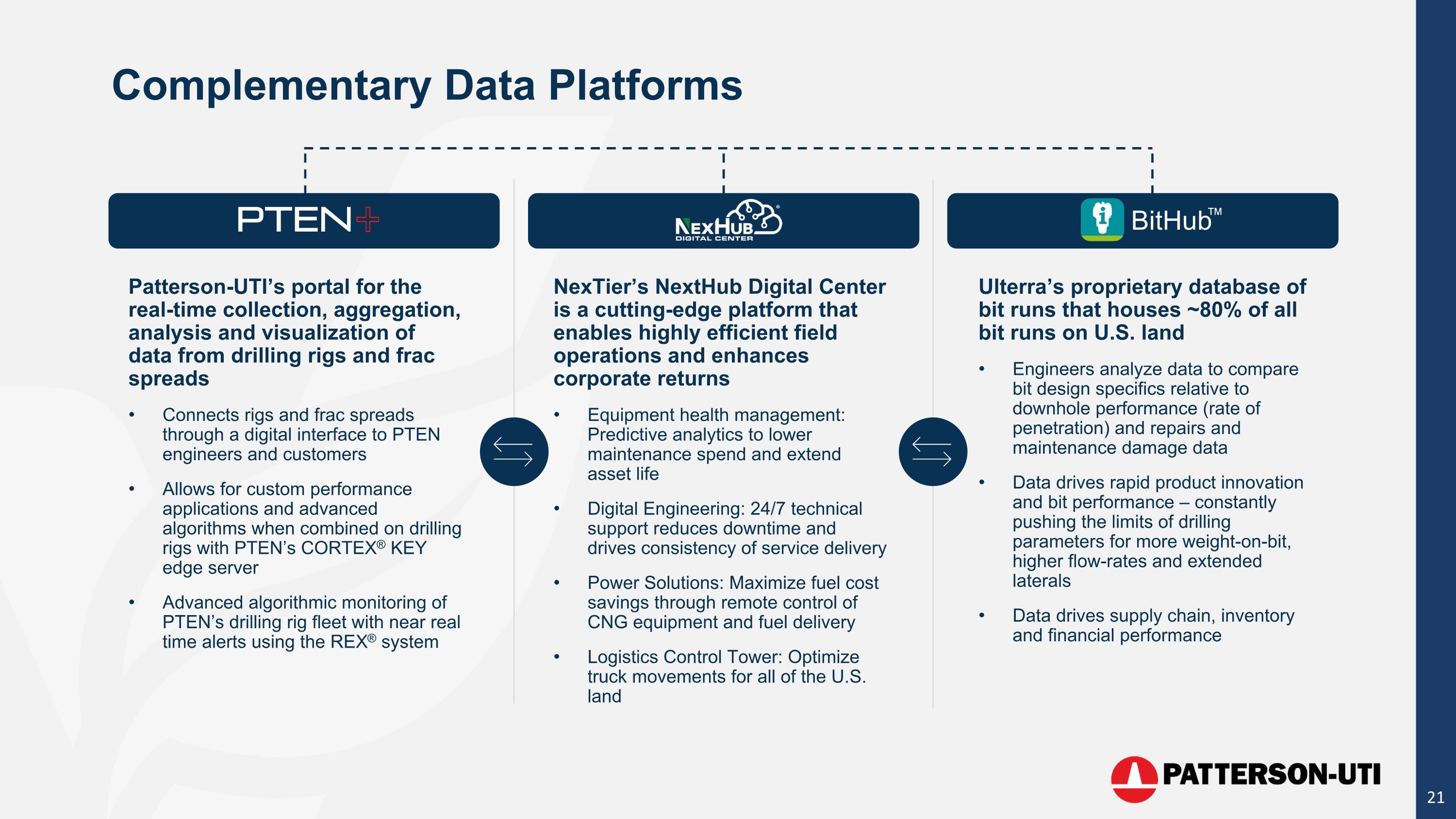

Patterson-UTI’s portal for the real-time collection, aggregation, analysis and visualization of data from drilling rigs and frac spreads Connects rigs and frac spreads through a digital interface to PTEN engineers and customers Allows for custom performance applications and advanced algorithms when combined on drilling rigs with PTEN’s CORTEX® KEY edge server Advanced algorithmic monitoring of PTEN’s drilling rig fleet with near real time alerts using the REX® system Complementary Data Platforms Ulterra’s proprietary database of bit runs that houses ~80% of all bit runs on U.S. land Engineers analyze data to compare bit design specifics relative to downhole performance (rate of penetration) and repairs and maintenance damage data Data drives rapid product innovation and bit performance – constantly pushing the limits of drilling parameters for more weight-on-bit, higher flow-rates and extended laterals Data drives supply chain, inventory and financial performance NexTier’s NextHub Digital Center is a cutting-edge platform that enables highly efficient field operations and enhances corporate returns Equipment health management: Predictive analytics to lower maintenance spend and extend asset life Digital Engineering: 24/7 technical support reduces downtime and drives consistency of service delivery Power Solutions: Maximize fuel cost savings through remote control of CNG equipment and fuel delivery Logistics Control Tower: Optimize truck movements for all of the U.S. land

Ulterra’s Attractive Organic Growth Channels to New Markets Source: Ulterra management records Downhole Tools Geothermal Engineered in-house Uniquely placed in the Bottom Hole Assembly (“BHA”) to provide maximum protection of the mud motor or rotary steerable, Measurement-While-Drilling tool (“MWD”), and drill bit Reduces drilling dysfunction by mitigating shock & vibration in the BHA improving drilling efficiency Leveraging close, long-tenured relationships with E&P Operators to field test tools Focused on the Haynesville and Northeast Demonstrated gains in drilling efficiency with the operator Planned introduction to Permian Basin in Q1’24 Active discussions for several utility-scale geothermal opportunities in 2H’23 Wells consume more drill bits than a commensurate oil & gas interval Drilled multiple geothermal wells in North America Participated in drilling of the Utah FORGE (DOE funded research center for geothermal) test well in Q4’20 with strong results Dedicated sales team targeting US & Australian copper & lithium mining opportunities Actively engaged in US lithium mining Purpose-built tools designed to increase drilling efficiency in harder rock formations Significant cross-over from oil & gas drill bit designs SoftDrive® performs a similar function as TorkBusterTD® TorkBusterTD® U616M Mining SoftDrive® RPS616