UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2023

OR

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-39471

HERITAGE GLOBAL INC.

(Exact name of registrant as specified in its charter)

FLORIDA |

59-2291344 |

(State or Other Jurisdiction of |

(I.R.S. Employer Identification No.) |

12625 High Bluff Drive, Suite 305, San Diego, CA 92130

(Address of Principal Executive Offices)

(858) 847-0659

(Registrant’s Telephone Number)

N/A

(Registrant’s Former Name)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class Trading Symbol(s) Name of each exchange on which registered

Common stock, $0.01 par value HGBL The Nasdaq Stock Market LLC

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer |

☐ |

|

Accelerated Filer |

☐ |

Non-Accelerated Filer |

☒ |

|

Smaller reporting company |

☒ |

|

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate the number of shares outstanding of each of the issuer's classes of common stock, as of the latest practicable date:

As of August 1, 2023, there were 37,145,151 shares of common stock outstanding, $0.01 par value.

TABLE OF CONTENTS

Part I. |

|

|

|

|

|

Item 1. |

3 |

|

|

|

|

|

Condensed Consolidated Balance Sheets as of June 30, 2023 (unaudited) and December 31, 2022 |

3 |

|

|

|

|

4 |

|

|

|

|

|

5 |

|

|

|

|

|

6 |

|

|

|

|

|

7 |

|

|

|

|

Item 2. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

21 |

|

|

|

Item 3. |

Quantitative and Qualitative Disclosures About Market Risk |

31 |

|

|

|

Item 4. |

Controls and Procedures |

31 |

|

|

|

Part II. |

|

|

|

|

|

Item 1. |

32 |

|

|

|

|

Item 1A. |

32 |

|

|

|

|

Item 2. |

32 |

|

|

|

|

Item 3. |

32 |

|

|

|

|

Item 4. |

32 |

|

|

|

|

Item 5. |

32 |

|

|

|

|

Item 6. |

33 |

|

|

|

|

|

34 |

2

PART I – FINANCIAL INFORMATION

Item 1 – Financial Statements.

HERITAGE GLOBAL INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands of US dollars, except share and per share amounts)

|

|

|

|

|

|

|

||

|

|

June 30, 2023 |

|

|

December 31, 2022 |

|

||

ASSETS |

|

(unaudited) |

|

|

|

|

||

Current assets: |

|

|

|

|

|

|

||

Cash and cash equivalents |

|

$ |

15,035 |

|

|

$ |

12,667 |

|

Accounts receivable, net |

|

|

2,912 |

|

|

|

988 |

|

Current portion of notes receivable, net |

|

|

8,569 |

|

|

|

4,505 |

|

Inventory – equipment |

|

|

5,049 |

|

|

|

4,619 |

|

Other current assets |

|

|

988 |

|

|

|

1,113 |

|

Total current assets |

|

|

32,553 |

|

|

|

23,892 |

|

Non-current portion of notes receivable, net |

|

|

6,400 |

|

|

|

4,245 |

|

Equity method investments |

|

|

15,778 |

|

|

|

13,973 |

|

Right-of-use assets |

|

|

2,856 |

|

|

|

2,776 |

|

Property and equipment, net |

|

|

1,745 |

|

|

|

1,571 |

|

Intangible assets, net |

|

|

3,949 |

|

|

|

4,144 |

|

Goodwill |

|

|

7,446 |

|

|

|

7,446 |

|

Deferred tax assets |

|

|

9,085 |

|

|

|

9,449 |

|

Other assets |

|

|

70 |

|

|

|

64 |

|

Total assets |

|

$ |

79,882 |

|

|

$ |

67,560 |

|

|

|

|

|

|

|

|

||

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

||

Current liabilities: |

|

|

|

|

|

|

||

Accounts payable and accrued liabilities |

|

$ |

6,531 |

|

|

$ |

8,924 |

|

Payables to sellers |

|

|

8,085 |

|

|

|

3,188 |

|

Current portion of third party debt |

|

|

1,681 |

|

|

|

3,411 |

|

Current portion of lease liabilities |

|

|

777 |

|

|

|

703 |

|

Total current liabilities |

|

|

17,074 |

|

|

|

16,226 |

|

Non-current portion of third party debt |

|

|

6,382 |

|

|

|

871 |

|

Non-current portion of lease liabilities |

|

|

2,181 |

|

|

|

2,164 |

|

Total liabilities |

|

|

25,637 |

|

|

|

19,261 |

|

|

|

|

|

|

|

|

||

Stockholders’ equity: |

|

|

|

|

|

|

||

Preferred stock, $10.00 par value, authorized 10,000,000 shares; issued and outstanding 563 and 565 shares of Series N as of June 30, 2023 and December 31, 2022, respectively; with liquidation preference over common stockholders equivalent to $1,000 per share |

|

|

6 |

|

|

|

6 |

|

Common stock, $0.01 par value, authorized 300,000,000 shares; issued 37,145,151 and 36,932,177 shares as of June 30, 2023 and December 31, 2022, respectively; and outstanding 36,901,683 and 36,688,709 shares as June 30, 2023 and December 31, 2022, respectively |

|

|

371 |

|

|

|

369 |

|

Additional paid-in capital |

|

|

294,156 |

|

|

|

293,589 |

|

Accumulated deficit |

|

|

(239,893 |

) |

|

|

(245,270 |

) |

Treasury stock at cost, 243,468 shares as of June 30, 2023 and December 31, 2022 |

|

|

(395 |

) |

|

|

(395 |

) |

Total stockholders’ equity |

|

|

54,245 |

|

|

|

48,299 |

|

Total liabilities and stockholders’ equity |

|

$ |

79,882 |

|

|

$ |

67,560 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

3

HERITAGE GLOBAL INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(In thousands of US dollars, except share and per share amounts)

(unaudited)

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

||||||||||

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

||||

Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Services revenue |

|

$ |

9,810 |

|

|

$ |

4,595 |

|

|

$ |

20,055 |

|

|

$ |

8,763 |

|

Asset sales |

|

|

3,288 |

|

|

|

6,470 |

|

|

|

9,655 |

|

|

|

11,659 |

|

Total revenues |

|

|

13,098 |

|

|

|

11,065 |

|

|

|

29,710 |

|

|

|

20,422 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Operating costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Cost of services revenue |

|

|

1,807 |

|

|

|

910 |

|

|

|

4,147 |

|

|

|

1,664 |

|

Cost of asset sales |

|

|

1,935 |

|

|

|

5,631 |

|

|

|

6,270 |

|

|

|

9,033 |

|

Selling, general and administrative |

|

|

6,440 |

|

|

|

4,939 |

|

|

|

12,740 |

|

|

|

9,214 |

|

Depreciation and amortization |

|

|

121 |

|

|

|

133 |

|

|

|

241 |

|

|

|

266 |

|

Total operating costs and expenses |

|

|

10,303 |

|

|

|

11,613 |

|

|

|

23,398 |

|

|

|

20,177 |

|

Earnings of equity method investments |

|

|

306 |

|

|

|

4,172 |

|

|

683 |

|

|

|

4,254 |

|

|

Operating income |

|

|

3,101 |

|

|

|

3,624 |

|

|

|

6,995 |

|

|

|

4,499 |

|

Interest expense, net |

|

|

(101 |

) |

|

|

(37 |

) |

|

|

(169 |

) |

|

|

(75 |

) |

Income before income tax expense |

|

|

3,000 |

|

|

|

3,587 |

|

|

|

6,826 |

|

|

|

4,424 |

|

Income tax expense |

|

|

221 |

|

|

|

1,009 |

|

|

|

1,218 |

|

|

|

1,201 |

|

Net income |

|

$ |

2,779 |

|

|

$ |

2,578 |

|

|

$ |

5,608 |

|

|

$ |

3,223 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Weighted average common shares outstanding – basic |

|

|

36,700,830 |

|

|

|

36,103,198 |

|

|

|

36,627,200 |

|

|

|

36,053,729 |

|

Weighted average common shares outstanding – diluted |

|

|

37,651,694 |

|

|

|

36,999,614 |

|

|

|

37,504,023 |

|

|

|

36,846,539 |

|

Net income per share – basic |

|

$ |

0.08 |

|

|

$ |

0.07 |

|

|

$ |

0.15 |

|

|

$ |

0.09 |

|

Net income per share – diluted |

|

$ |

0.07 |

|

|

$ |

0.07 |

|

|

$ |

0.15 |

|

|

$ |

0.09 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

HERITAGE GLOBAL INC.

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

(In thousands of US dollars, except share amounts)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

Additional |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

Preferred stock |

|

|

Common stock |

|

|

paid-in |

|

|

Accumulated |

|

|

Treasury stock |

|

|

|

|

||||||||||||||||||

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

capital |

|

|

deficit |

|

|

Shares |

|

|

Amount |

|

|

Total |

|

|||||||||

Balance as of December 31, 2022 |

|

|

565 |

|

|

$ |

6 |

|

|

|

36,932,177 |

|

|

$ |

369 |

|

|

$ |

293,589 |

|

|

$ |

(245,270 |

) |

|

$ |

243,468 |

|

|

$ |

(395 |

) |

|

$ |

48,299 |

|

Cumulative change in accounting principle (Note 2) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(231 |

) |

|

|

— |

|

|

|

— |

|

|

|

(231 |

) |

Balance as of January 1, 2023 (as adjusted |

|

|

565 |

|

|

|

6 |

|

|

|

36,932,177 |

|

|

|

369 |

|

|

|

293,589 |

|

|

|

(245,501 |

) |

|

|

243,468 |

|

|

|

(395 |

) |

|

|

48,068 |

|

Issuance of common stock from stock option awards |

|

|

— |

|

|

|

— |

|

|

|

31,191 |

|

|

|

— |

|

|

|

5 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

5 |

|

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

179 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

179 |

|

Issuance of restricted common stock |

|

|

— |

|

|

|

— |

|

|

|

134,592 |

|

|

|

2 |

|

|

|

150 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

152 |

|

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,829 |

|

|

|

— |

|

|

|

— |

|

|

|

2,829 |

|

Balance as of March 31, 2023 |

|

|

565 |

|

|

|

6 |

|

|

|

37,097,960 |

|

|

|

371 |

|

|

|

293,923 |

|

|

|

(242,672 |

) |

|

|

243,468 |

|

|

|

(395 |

) |

|

|

51,233 |

|

Issuance of common stock from stock option awards |

|

|

— |

|

|

|

— |

|

|

|

32,111 |

|

|

|

— |

|

|

|

5 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

5 |

|

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

228 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

228 |

|

Issuance of restricted common stock |

|

|

— |

|

|

|

— |

|

|

|

15,000 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Issuance of common stock due to conversion of Series N Preferred stock |

|

|

(2 |

) |

|

|

— |

|

|

|

80 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,779 |

|

|

|

— |

|

|

|

— |

|

|

|

2,779 |

|

Balance as of June 30, 2023 |

|

|

563 |

|

|

$ |

6 |

|

|

|

37,145,151 |

|

|

$ |

371 |

|

|

$ |

294,156 |

|

|

$ |

(239,893 |

) |

|

$ |

243,468 |

|

|

$ |

(395 |

) |

|

$ |

54,245 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

Additional |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

Preferred stock |

|

|

Common stock |

|

|

paid-in |

|

|

Accumulated |

|

|

Treasury stock |

|

|

|

|

||||||||||||||||||

|

|

Shares |

|

|

Amount |

|

|

Shares |

|

|

Amount |

|

|

capital |

|

|

deficit |

|

|

Shares |

|

|

Amount |

|

|

Total |

|

|||||||||

Balance as of December 31, 2021 |

|

|

565 |

|

|

$ |

6 |

|

|

|

36,574,702 |

|

|

$ |

366 |

|

|

$ |

293,030 |

|

|

$ |

(260,763 |

) |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

32,639 |

|

Issuance of common stock from stock option awards |

|

|

— |

|

|

|

— |

|

|

|

103,135 |

|

|

|

1 |

|

|

|

(24 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(23 |

) |

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

106 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

106 |

|

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

645 |

|

|

|

— |

|

|

|

— |

|

|

|

645 |

|

Balance as of March 31, 2022 |

|

|

565 |

|

|

|

6 |

|

|

|

36,677,837 |

|

|

|

367 |

|

|

|

293,112 |

|

|

|

(260,118 |

) |

|

|

— |

|

|

|

— |

|

|

|

33,367 |

|

Issuance of common stock from stock option awards |

|

|

— |

|

|

|

— |

|

|

|

56,250 |

|

|

|

— |

|

|

|

25 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

25 |

|

Stock-based compensation expense |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

108 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

108 |

|

Repurchase of common stock |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

71,512 |

|

|

|

(105 |

) |

|

|

(105 |

) |

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,578 |

|

|

|

— |

|

|

|

— |

|

|

|

2,578 |

|

Balance as of June 30, 2022 |

|

|

565 |

|

|

$ |

6 |

|

|

|

36,734,087 |

|

|

$ |

367 |

|

|

$ |

293,245 |

|

|

$ |

(257,540 |

) |

|

$ |

71,512 |

|

|

$ |

(105 |

) |

|

$ |

35,973 |

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

5

HERITAGE GLOBAL INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands of US dollars)

(unaudited)

|

|

Six Months Ended June 30, |

|

|||||

|

|

2023 |

|

|

2022 |

|

||

Cash flows provided by operating activities: |

|

|

|

|

|

|

||

Net income |

|

$ |

5,608 |

|

|

$ |

3,223 |

|

Adjustments to reconcile net income to net cash provided by operating |

|

|

|

|

|

|

||

Amortization of deferred issuance costs and fees |

|

|

40 |

|

|

|

111 |

|

Earnings of equity method investments |

|

|

(683 |

) |

|

|

(4,254 |

) |

Noncash credit loss expense |

|

|

90 |

|

|

|

— |

|

Noncash lease expense |

|

|

326 |

|

|

|

251 |

|

Depreciation and amortization |

|

|

241 |

|

|

|

266 |

|

Deferred taxes |

|

|

448 |

|

|

|

496 |

|

Stock-based compensation expense |

|

|

407 |

|

|

|

214 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

||

Accounts receivable |

|

|

(1,937 |

) |

|

|

820 |

|

Inventory – equipment |

|

|

(430 |

) |

|

|

(701 |

) |

Other current assets |

|

|

119 |

|

|

|

274 |

|

Accounts payable and accrued liabilities |

|

|

(2,147 |

) |

|

|

967 |

|

Payables to sellers |

|

|

4,897 |

|

|

|

(309 |

) |

Lease liabilities |

|

|

(316 |

) |

|

|

(239 |

) |

Net cash provided by operating activities |

|

|

6,663 |

|

|

|

1,119 |

|

|

|

|

|

|

|

|

||

Cash flows (used in) provided by investing activities: |

|

|

|

|

|

|

||

Investment in notes receivable |

|

|

(18,698 |

) |

|

|

— |

|

Payments received on notes receivable |

|

|

3,381 |

|

|

|

1,522 |

|

Cash received on transfer of notes receivable to partners |

|

|

8,851 |

|

|

|

— |

|

Investment in equity method investments |

|

|

(4,249 |

) |

|

|

(6,107 |

) |

Return of investment in equity method investments |

|

|

2,260 |

|

|

|

2,048 |

|

Cash distributions from equity method investments |

|

|

683 |

|

|

|

4,753 |

|

Purchase of property and equipment |

|

|

(220 |

) |

|

|

(39 |

) |

Net cash (used in) provided by investing activities |

|

|

(7,992 |

) |

|

|

2,177 |

|

|

|

|

|

|

|

|

||

Cash flows provided by (used in) financing activities: |

|

|

|

|

|

|

||

Proceeds from debt payable to third parties |

|

|

11,400 |

|

|

|

— |

|

Repayment of debt payable to third parties |

|

|

(7,619 |

) |

|

|

(739 |

) |

Proceeds from issuance of common stock from stock option awards |

|

|

33 |

|

|

|

34 |

|

Payments of tax withholdings related to issuance of restricted common stock and stock option awards |

|

|

(117 |

) |

|

|

(32 |

) |

Repurchase of common stock |

|

|

— |

|

|

|

(105 |

) |

Net cash provided by (used in) financing activities |

|

|

3,697 |

|

|

|

(842 |

) |

Net increase in cash and cash equivalents |

|

|

2,368 |

|

|

|

2,454 |

|

Cash and cash equivalents as of beginning of period |

|

|

12,667 |

|

|

|

13,622 |

|

Cash and cash equivalents as of end of period |

|

$ |

15,035 |

|

|

$ |

16,076 |

|

|

|

|

|

|

|

|

||

Supplemental cash flow information: |

|

|

|

|

|

|

||

Cash paid for taxes |

|

$ |

519 |

|

|

$ |

273 |

|

Cash paid for interest |

|

$ |

244 |

|

|

$ |

65 |

|

Noncash change in Right-of-use assets |

|

$ |

405 |

|

|

$ |

251 |

|

Noncash change in Lease liabilities |

|

$ |

405 |

|

|

$ |

239 |

|

|

|

|

|

|

|

|

||

The accompanying notes are an integral part of these condensed consolidated financial statements.

6

HERITAGE GLOBAL INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

Note 1 –Basis of Presentation

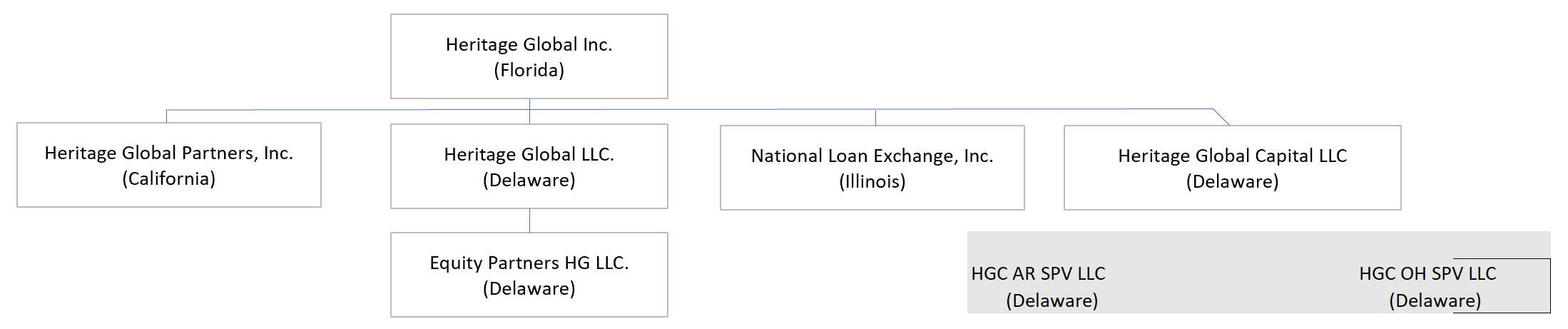

These unaudited condensed consolidated interim financial statements include the accounts of Heritage Global Inc. together with its subsidiaries, including Heritage Global Partners, Inc. (“HGP”), National Loan Exchange Inc. (“NLEX”), Heritage Global LLC (“HG LLC”), Heritage Global Capital LLC (“HGC”), and Heritage ALT LLC (“ALT”). These entities, collectively, are referred to as “HG,” the “Company,” “we” or “our” in these consolidated financial statements. These consolidated financial statements were prepared in conformity with generally accepted accounting principles in the United States of America (“GAAP”), as outlined in the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) and include the assets, liabilities, revenues, and expenses of all subsidiaries over which HG exercises control. All significant intercompany accounts and transactions have been eliminated upon consolidation.

The Company began its operations in 2009 with the establishment of HG LLC. The business was subsequently expanded by the acquisitions of HGP, NLEX, and ALT in 2012, 2014, and 2021 respectively, and the creation of HGC in 2019. As a result, HG is positioned to provide an array of value-added capital and financial asset solutions: auction and appraisal services, traditional asset disposition sales, and specialty financing solutions. The Company’s reportable segments consist of Auction and Liquidation, through HGP, Refurbishment & Resale, through ALT, Brokerage, through NLEX and Specialty Lending, through HGC.

The Company prepared the unaudited condensed consolidated interim financial statements included herein pursuant to the rules and regulations of the United States Securities and Exchange Commission (the “SEC”). In the opinion of management, these condensed financial statements reflect all adjustments that are necessary to present fairly the results for the interim periods included herein. Certain information and footnote disclosures normally included in financial statements prepared in accordance with GAAP have been condensed or omitted pursuant to such rules and regulations; however, the Company believes that the disclosures are appropriate. These condensed consolidated financial statements should be read in conjunction with the audited consolidated financial statements and the notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC on March 24, 2023 (the “Form 10-K”).

The results of operations for the three and six-month periods ended June 30, 2023 are not necessarily indicative of those operating results to be expected for any subsequent interim period or for the entire year ending December 31, 2023. The accompanying Condensed Consolidated Balance Sheet as of December 31, 2022 has been derived from the audited consolidated balance sheet as of December 31, 2022, contained in the Company’s Form 10-K.

Repurchase Program

The Company’s Board of Directors authorized a share repurchase program on May 5, 2022 (“2022 Repurchase Program”), which permits the Company to purchase up to an aggregate of $4.0 million in common shares over a three year period ending in June of 2025. As of June 30, 2023, the Company had approximately $3.6 million in remaining aggregate dollar value of shares that may be purchased under the program. There were no shares repurchased in the open market for the six months ended June 30, 2023.

7

Note 2 – Summary of Significant Accounting Policies

Use of estimates

The preparation of the Company’s unaudited condensed consolidated interim financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements, as well as the reported amounts of revenues and expenses during the reporting period. Management bases its estimates and judgments on historical experience and various other factors that are believed to be reasonable under the circumstances. Actual results could differ from those estimates.

Significant estimates include the assessment of collectability of revenue recognized and the valuation of accounts receivable and notes receivable, inventory, investments, goodwill and intangible assets, liabilities, deferred income tax assets and liabilities including projecting future years’ taxable income, and stock-based compensation. These estimates have the potential to significantly impact our condensed consolidated interim financial statements, either because of the significance of the financial statement item to which they relate, or because they require judgment and estimation due to the uncertainty involved in measuring, at a specific point in time, events that are continuous in nature.

Reclassifications

Certain prior year balances within the condensed consolidated financial statements have been reclassified to conform to current year presentation.

Revenue recognition

The Company recognizes revenue in accordance with ASC Topic 606, Revenue from Contracts with Customers (“ASC 606”) and ASC Topic 310, Receivables (“ASC 310”).

Services revenue generally consists of commissions and fees from providing auction services, appraisals, brokering of sales transactions, and secured lending. Asset sales revenue generally consists of proceeds obtained through sales of purchased assets. With the exception of revenue generated within our Specialty Lending segment, revenue is recognized for both services revenue and asset sales revenue based on the ASC 606 standard recognition model, which consists of the following: (1) an agreement exists between two or more parties that creates enforceable rights and obligations, (2) the performance obligations are clearly identified, (3) the transaction price has been determined, (4) the transaction price has been properly allocated to each performance obligation, and (5) the entity satisfies a performance obligation by transferring a promised good or service to a customer for each of the entities.

All services and asset sales revenue from contracts with customers consists of three reportable segments: Auction and Liquidation, Refurbishment & Resale, and Brokerage. Generally, revenue is recognized at the point in time in which the performance obligation has been satisfied and full consideration is received. The exception to recognition at a point in time occurs when certain contracts provide for advance payments recognized over a period of time. Services revenue recognized over a period of time is not material in comparison to total revenues (less than 1% of total revenues for the three months ended June 30, 2023), and therefore not reported on a disaggregated basis. Further, as certain contracts stipulate that the customer make advance payments, amounts not recognized within the reporting period are considered deferred revenue and the Company’s “contract liability”. The deferred revenue balance was approximately $1.1 million as of June 30, 2023 and $0.4 million as of December 31, 2022 and is reflected in accounts payable and accrued liabilities on the condensed consolidated balance sheet. The deferred revenue balance is primarily related to customer deposits on asset sales within the Refurbishment & Resale segment. The Company records receivables in certain situations based on timing of payments for Auction and Liquidation transactions held at the end of the reporting period; however, revenue is generally recognized in the period that the Company satisfies the performance obligation and cash is collected. The Company does not record a “contract asset” for partially satisfied performance obligations.

For auction services and brokerage sale transactions, funds are typically collected from buyers and are held by the Company on the seller's behalf. The funds are included in cash and cash equivalents in the condensed consolidated balance sheets. The Company releases the funds to the seller, less the Company's commission and other fees due, after the buyer has accepted the goods. The amount of cash held on behalf of the sellers is recorded as payables to sellers in the accompanying condensed consolidated balance sheets.

The Company evaluates revenue from Auction and Liquidation and Brokerage segment transactions in accordance with the accounting guidance to determine whether to report such revenue on a gross or net basis. The Company has determined that it acts as an agent for its fee based transactions and therefore reports the revenue from transactions in which the Company acts as an agent on a net basis.

8

The Company also earns income through transactions that involve the Company acting jointly with one or more additional purchasers or lenders, pursuant to a partnership, joint venture or limited liability company (“LLC”) agreement (collectively, “Joint Ventures”). For these transactions, in which the Company’s ownership share meets the criteria for the equity method investments under ASC Topic 323, Equity Method and Joint Ventures (“ASC 323”), the Company does not record revenue or expense. Instead, the Company’s proportionate share of the net income (loss) is reported as earnings of equity method investments. In general, the Joint Ventures apply the same revenue recognition and other accounting policies as the Company.

Through our Specialty Lending segment, the Company provides specialty financing solutions to investors in charged-off and nonperforming asset portfolios. The Company recognizes revenue generated by lending activity in accordance with ASC 310. Fees collected in relation to the issuance of loans include loan origination fees, interest income, portfolio monitoring fees, and a backend profit share percentage related to the underlying asset portfolio.

The loan origination fees are offset with any direct origination costs and are deferred upon issuance of the loan and amortized over the lives of the related loans, as an adjustment to interest income. The interest method is used to arrive at a periodic interest cost (including amortization) that will represent a level effective rate on the sum of the face amount of the debt and (plus or minus) the unamortized premium or discount and expense at the beginning of each period.

The monitoring fees and the backend profit share are considered a separate earnings process as compared to the origination fees and interest income. Monitoring fees are recorded at the agreed upon rate, and at the moment in which payments are made by the borrower. The backend profit share is recognized in accordance with the agreed upon rate at the time in which the amount is realizable and earned. The recognition policy was established due to the uncertainty of timing of the amount of backend profit share which will be realized.

Specialty Lending - Concentration and credit risk

As of June 30, 2023, the Company held a gross balance of investments in notes receivable of $30.5 million, recorded in both notes receivable and equity method investments, and consisting of one borrower’s note balance of approximately $22.2 million, or 73% as of June 30, 2023, down from 77% as of March 31, 2023. The Company does not intend to hold highly concentrated balances due from one borrower as part of its long-term strategy but may, in the short term, have concentration risk on its path to an established and diversified portfolio.

The Company does not evaluate concentration risk solely based on balance due from specific borrowers, but also considers the number of portfolio purchases, type of charged off accounts within the portfolio, and the seller of the portfolio when determining the overall risk. Of the balance due from one borrower of $22.2 million, there are 26 distinct loan agreements, the underlying portfolio of accounts are diversified throughout FinTech, installment loans and credit card accounts, and further diversified amongst four separate sellers of these charged off portfolios.

The Company mitigates this concentration risk as follows. The Company requires, and monitors, security from each borrower consisting of their charged off and nonperforming receivable portfolios. The Company engages in a due diligence process that leverages its valuation expertise. In the event of default, the Company is entitled to call the unpaid interest and principal balances and receive all collections directly. The Company may also recover its investment by engaging a third party to collect on the underlying charged off or nonperforming receivable portfolio or the underlying portfolio can be sold through the Company's Brokerage segment. In certain cases, the Company’s recovery options may be subject to concurrence of the originator or other prior holder of the assets. From inception of the specialty lending program through June 30, 2023, the Company has incurred no actual credit losses.

9

Recently adopted accounting pronouncement

On January 1, 2023, the Company adopted ASU 2016-13, Financial Instruments – Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments (“ASC 326”). ASC 326 requires the application of a credit loss model based prospectively on current expected credit losses (CECL), and replaces the previous model based retrospectively on past incurred losses.

The Company adopted ASC 326 using the modified retrospective method for all financial assets measured at amortized cost, of which the Company reported only accounts receivable and notes receivable as of December 31, 2022. Results for reporting periods beginning January 1, 2023 are presented under ASC 326, whereas prior periods continue to be reported under previously acceptable GAAP.

Accounts receivable are expected to be collected in less than one year and are therefore classified as current assets. Notes receivable are reported within current and non-current assets based upon the timing of expected collection. Management’s intent is to hold notes receivable for the foreseeable future or until maturity or payoff.

The reserve for credit losses required by the adoption of ASC 326 is a valuation account that is deducted from (or added to) the accounts receivable’s and to the notes receivable’s amortized cost basis in order to present on the condensed consolidated balance sheets the net amount expected to be collected. The credit loss expense, and subsequent adjustments to such losses, are recorded as a provision for (or reversal of) credit loss expense in the condensed consolidated statements of income.

Estimating future credit losses requires significant judgment by management. Significant judgments include, but are not limited to, assessing the debtors’ current financial condition, assessing current economic conditions and the extent to which they are relevant to the existing characteristics of the Company’s accounts and notes receivables, assessing the relevance of the estimated life of notes receivable, and determining the level of reliance on historical experience in light of economic conditions. The Company will continually review and update, when necessary, all such relevant judgments and assessments in determining the reserves for credit losses.

The Company previously estimated that the adoption of ASC 326 would result in an adjustment to accumulated deficit on January 1, 2023 of between $0.3 million and $0.4 million. Upon finalizing the execution of the implementation controls and processes, management arrived at a combined reserve for credit losses of $0.3 million for accounts receivable and notes receivable, offset by the cumulative income tax effect of $0.1 million. Consequently, the cumulative effect of the implementation of ASC 326 resulted in an adjustment to retained earnings of $0.2 million as of January 1, 2023. For additional information see Note 3 – Accounts Receivable, net. and Note 4 – Notes Receivable, net.

Reserve for Credit Losses - Accounts Receivable

The Company carries accounts receivable at the face amounts less a reserve for estimated credit losses. As of December 31, 2022, an allowance for doubtful accounts of $0.1 million had been recorded. Going forward, the Company estimates its reserve for credit losses using relevant available information from internal and external sources relating to past events, current conditions and reasonable and supportable forecasts.

The Company only extends credit to entities and institutions of significance, such as well-known academic institutions and US government agencies. Consequently, historical accounts receivable credit losses are nearly zero, which provides the starting point for management’s assessment of the reserve for credit losses for its accounts receivable.

The Company elected to base its estimation of expected credit losses for accounts receivable on historical credit loss experience. However, in assessing relevant information including its assessment of current conditions, management determined that a credit loss allowance slightly higher than its historical data would indicate is appropriate for certain of its revenue generating activities.

As of December 31, 2022 and under previously acceptable GAAP, the Company recorded a $0.1 million allowance for doubtful accounts for accounts receivable. Using a revised basis for estimation under ASC 326, the Company increased the reserve for credit losses against its accounts receivable balances by approximately $10,000. Consequently, to reflect the cumulative effects of the adoption of ASC 326, the Company recorded an additional reserve for credit losses and an increase to accumulated deficit of approximately $10,000 on the January 1, 2023 condensed consolidated balance sheets, and the balance of the reserve for credit losses was therefore $0.1 million as of January 1, 2023.

10

Reserve for Credit Losses - Notes Receivable

Notes receivable are reported at amortized cost, net of a reserve for credit losses. Amortized cost is the principal balance outstanding, net of deferred fees and costs on originated loans. Non-performing notes receivable are charged off against the reserve when management has confirmed the note to be uncollectable. Expected recoveries do not exceed the aggregate of amounts previously charged off and expected to be charged off. No amounts were recorded as a reserve for credit losses to notes receivable as of December 31, 2022.

Under ASC 326, the Company elected to evaluate notes receivable as a single pool, as the risk characteristics of all individual notes receivable and borrowers are similar. Management estimates the reserve balance using relevant available information from internal and external sources relating to past events, current conditions and reasonable and supportable forecasts. Historical credit loss experience typically provides the basis for an estimation of expected credit losses; however, the Company lacks sufficient data upon which to base an historical estimation. Additionally, since the Company began recording notes receivable on the condensed consolidated balance sheets, the Company has recorded no actual credit losses to notes receivable.

Lacking historical internal data upon which to base a reserve for credit losses to notes receivable, the Company, under ASC 326, elected to base its reserve on external credit loss experience data. Management observes that the Company's notes receivable are similar in character to transactions undertaken by smaller banking institutions. The Company elected to base its estimation of expected credit losses on the Scaled Current Expected Credit Loss (CECL) Allowance Loss Estimator ("SCALE rate") available from the Federal Reserve, which was 1.3205% as of December 31, 2022. The SCALE rate methodology is endorsed by the FASB and the Conference of State Bank Supervisors. Management determined under ASC 326 that the SCALE rate, a generally applicable rate, may be appropriately adjusted by its assessment of observable facts and relevant circumstances indicating that the factors analyzed in the determination of the SCALE rate may not conform to the Company's operations and borrower assessments. However, in conducting its assessment of these factors, management concluded that no adjustment to the SCALE rate is warranted as of December 31, 2022.

As of December 31, 2022 and under previously acceptable GAAP, the Company recorded no reserve for credit losses to notes receivable. Using a revised basis for estimation under ASC 326, management determined the cumulative reserve for credit losses of $0.2 million was appropriate for notes receivable recorded on the condensed consolidated balance sheets as of December 31, 2022. Consequently, to reflect the cumulative effects of the adoption of ASC 326, the Company recorded the reserve for credit losses and an increase to accumulated deficit of $0.2 million on the January 1, 2023 condensed consolidated balance sheets, and balance of the reserve for credit losses was therefore $0.2 million as of January 1, 2023.

Note 3 – Accounts Receivable, net

The Company’s accounts receivable, net consists of accounts receivables recorded in the ordinary course of business associated with the recognition of revenue from contracts with customers. As of December 31, 2022, accounts receivable, net recorded on the consolidated balance sheets was $1.0 million, consisting of accounts receivable of $1.1 million offset by an allowance for doubtful accounts of $0.1 million. On January 1 2023, the Company recorded an additional reserve for credit losses for accounts receivable in accordance with ASC 326, as described in Note 1 – Basis of Presentation, Recently Adopted Accounting Pronouncement. The cumulative effect as of December 31, 2022 of the modified retrospective method of adoption of ASC 326 required the Company to record on the consolidated balance sheets as of January 1, 2023 an additional reserve to accounts receivable for credit losses of approximately $10,000 for the estimated credit losses attributable to accounts receivable as of December 31, 2022.

The following presents the adjustment to accounts receivable, net as a result of the implementation of ASC 326 on January 1, 2023 (in thousands):

Accounts receivable as of December 31, 2022 |

|

$ |

1,110 |

|

|

|

|

|

|

Allowance for doubtful accounts as of December 31, 2022 |

|

|

(122 |

) |

Cumulative effect of the implementation of ASC 326 |

|

|

(10 |

) |

Beginning balance of reserve for credit losses as of January 1, 2023 |

|

|

(132 |

) |

Accounts receivable, net of reserve for credit losses as of January 1, 2023 |

|

$ |

978 |

|

In accordance with ASC 326, the Company performs a review of accounts receivables on a quarterly basis. During the six months ended June 30, 2023, the Company recorded no material adjustments for credit losses in selling, general and administrative expense on the condensed consolidated statement of income related to accounts receivable. As of June 30, 2023, the reserve for credit losses was approximately $0.1 million.

11

Note 4 – Notes Receivable, net

The Company’s notes receivable, net consists of investments in loans to buyers of charged-off and nonperforming receivable portfolios. As of June 30, 2023 and December 31, 2022, the Company’s outstanding notes receivables, net of unamortized deferred fees and costs on originated loans, and adjusted for the reserve for credit losses was $15.0 million and $8.5 million, respectively. The activity during the six months ended June 30, 2023 includes the additional investment in notes receivable of approximately $18.7 million, which was offset by principal payments made by borrowers of approximately $3.4 million, the transfer of notes to partners of approximately $8.9 million, adjustments to the deferred fees and costs balance and the reserve for credit losses totaling approximately $0.1 million.

On January 1, 2023, the Company recorded an allowance for credit losses for notes receivable in accordance with ASC 326, as described in Note 2 – Summary of Significant Accounting Policies. The cumulative effects as of December 31, 2022 of the modified retrospective method of adoption of ASC 326 required the Company to record on the condensed consolidated balance sheets as of January 1, 2023 a reserve for credit losses to notes receivable of $0.1 million for the estimated credit losses to notes receivable as of December 31, 2022.

The following presents the adjustment to notes receivable, net as a result of the implementation of ASC 326 on January 1, 2023 (in thousands):

Notes receivable, net as of December 31, 2022 |

|

$ |

8,750 |

|

|

|

|

|

|

Reserve for credit losses of December 31, 2022 |

|

|

— |

|

Cumulative effect of the implementation of ASC 326 |

|

|

(119 |

) |

Beginning balance of reserve for credit losses as of January 1, 2023 |

|

|

(119 |

) |

Notes receivable, net of reserve for credit losses as of January 1, 2023 |

|

$ |

8,631 |

|

|

|

|

|

|

In accordance with ASC 326, the Company performs a review of notes receivables on a quarterly basis. During the six months ended June 30, 2023, the Company recorded a provision for credit losses in selling, general and administrative expense on the condensed consolidated statement of income of $0.1 million. As of June 30, 2023, the reserve for credit losses was approximately $0.2 million. The provision relates primarily to the change in the outstanding balance of notes receivable.

To date, the Company has recorded no actual credit losses on notes receivable.

12

Note 5 – Stock-based Compensation

As of June 30, 2023, the Company had four stock-based compensation plans, which are described more fully in Note 17 – Stockholders' Equity - Stock-Based Compensation Plans of the Company's audited consolidated financial statements for the year ended December 31, 2022 contained in the Company’s Form 10-K.

At the Company's 2022 Annual Meeting of Shareholders, the Company's shareholders approved the 2022 Heritage Global Inc. Equity Incentive Plan, which replaces the Heritage Global Inc. 2016 Plan, and authorized the issuance of an aggregate of 3.5 million shares of Common Stock for awards made after June 8, 2022.

Stock Options

During the six months ended June 30, 2023, the Company issued options to purchase 395,000 shares of common stock to certain of the Company’s employees. During the same period, the Company canceled no options to purchase common stock as a result of employee resignations.

The following summarizes the changes in common stock options for the six months ended June 30, 2023:

|

|

Options |

|

|

Weighted |

|

|

Weighted |

|

|

Aggregate Intrinsic Value (In thousands) |

|

||||

Outstanding as of December 31, 2022 |

|

|

2,027,350 |

|

|

$ |

1.38 |

|

|

|

7.3 |

|

|

$ |

2,112 |

|

Granted |

|

|

395,000 |

|

|

$ |

2.84 |

|

|

|

|

|

|

|

||

Exercised |

|

|

(76,500 |

) |

|

$ |

0.53 |

|

|

|

|

|

|

|

||

Outstanding as of June 30, 2023 |

|

|

2,345,850 |

|

|

$ |

1.65 |

|

|

|

7.2 |

|

|

$ |

4,622 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Options exercisable as of June 30, 2023 |

|

|

1,157,350 |

|

|

$ |

1.10 |

|

|

|

5.7 |

|

|

$ |

2,921 |

|

The Company recognized stock-based compensation expense related to common stock options of $0.4 million for the six months ended June 30, 2023. As of June 30, 2023, there was approximately $1.6 million of unrecognized stock-based compensation expense related to unvested common stock options outstanding, which is expected to be recognized over a weighted average period of 2.7 years.

Restricted Stock

Restricted stock awards represent a right to receive shares of common stock at a future date determined in accordance with the participant’s award agreement. There is no exercise price and no monetary payment required for receipt of restricted stock awards or the shares issued in settlement of the award. Instead, consideration is furnished in the form of the participant’s services to the Company. Compensation cost for these awards is based on the fair value of the shares of common stock on the date of grant and recognized as compensation expense on a straight-line basis over the requisite service period.

On June 1, 2018, the Company granted 600,000 shares of Company restricted common stock in connection with the Addendum to the Employment Agreements of David Ludwig and Tom Ludwig. The shares were subject to certain restrictions on transfer and a right of repurchase over five years. The shares fully vested as of May 31, 2023.

On March 30, 2021, the Company and Scott West entered into a Separation Agreement and General Release (the “Separation Agreement”). Under the terms of the Separation Agreement, Mr. West’s separation from the Company was effective on March 31, 2021. On April 8, 2021, the Company granted 25,000 shares of the Company’s restricted common stock, for which the risk of forfeiture lapsed on April 8, 2023. In addition, the Separation Agreement provides for customary mutual releases by the Company and Mr. West, and the Separation Agreement includes confidentiality, non-disparagement and other obligations. The full amount of the restricted common stock was expensed as of March 31, 2021 and fully vested as of April 8, 2023.

On August 3, 2022, the Company granted 115,000 shares of Company restricted common stock to non-executive directors under the 2022 Heritage Global Inc. Equity Incentive Plan. Of these restricted stock shares granted during 2022, 40,000 shares were granted with a vesting term that was completed prior to the grant date due to a delay in the Company’s ability to grant such shares, and the remaining 75,000 shares vested in full on March 31, 2023.

On March 1, 2023, the Company granted 97,290 shares of Company restricted common stock to employees under the 2022 Heritage Global Inc. Equity Incentive Plan. The restricted stock shares vest on March 1, 2024.

13

On March 31, 2023, the Company granted 75,000 shares of Company restricted common stock to non-executive directors under the 2022 Heritage Global Inc. Equity Incentive Plan. The restricted stock shares vest on March 31, 2024.

On April 1, 2023, the Company granted 15,000 shares of Company restricted common stock to one non-executive director under the 2022 Heritage Global Inc. Equity Incentive Plan. The restricted stock shares vest on April 1, 2024.

The Company determined the fair value of the shares awarded by using the closing price of our common stock as of the grant date. Stock-based compensation expense related to the restricted stock awards was approximately $0.1 million for the six months ended June 30, 2023. The unrecognized stock-based compensation expense as of June 30, 2023, was approximately $0.2 million.

Note 6 – Equity Method Investments

In November 2018, CPFH LLC, of which the Company holds a 25% share, was formed to purchase certain real estate assets among partners in a joint venture. In March 2020, HGC Origination I LLC and HGC Funding I LLC were formed as joint ventures with a partner for purposes of conducting business relating to the sourcing, origination and funding of loans to debt purchasing clients. In April 2022, KNFH LLC, of which the Company holds a 25% share, was formed to purchase certain real estate assets and machinery and equipment among partners in a joint venture. In December 2022, DHC8 LLC, of which the Company holds a 13.33% share, was formed to provide funding and receive principal and interest payments as a result of the initial investment. In May 2023, HGC MPG Funding LLC, of which the company holds a 25% share, was formed as a joint venture with a partner for purposes of conducting business relating to the sourcing, origination and funding of loans to debt purchasing clients. CPFH LLC, KNFH LLC and DHC8 LLC are joint ventures formed in connection with the Company’s Industrial Assets Division, whereas HGC Origination I LLC and HGC Funding I LLC, and HGC MPG Funding LLC were formed in connection with the Financial Assets Division. The Company has significant influence over the operations and financial policies of each of its equity method investments.

The table below details the Company’s joint venture revenues and earnings during the six months ended June 30, 2023 and 2022 (in thousands):

|

|

Six Months Ended June 30, |

|

|||||

|

|

2023 |

|

|

2022 |

|

||

Revenues: |

|

|

|

|

|

|

||

CPFH LLC |

|

$ |

— |

|

|

$ |

31,021 |

|

KNFH LLC |

|

|

303 |

|

|

|

4,578 |

|

DHC8 LLC |

|

|

821 |

|

|

|

— |

|

HGC Origination I LLC and HGC Funding I LLC |

|

|

2,541 |

|

|

|

860 |

|

HGC MPG Funding LLC |

|

|

118 |

|

|

|

— |

|

Total revenues |

|

$ |

3,783 |

|

|

$ |

36,459 |

|

|

|

|

|

|

|

|

||

Operating income (loss): |

|

|

|

|

|

|

||

CPFH LLC |

|

$ |

— |

|

|

$ |

15,318 |

|

KNFH LLC |

|

|

(141 |

) |

|

|

873 |

|

DHC8 LLC |

|

|

701 |

|

|

|

— |

|

HGC Origination I LLC and HGC Funding I LLC |

|

|

2,562 |

|

|

|

838 |

|

HGC MPG Funding LLC |

|

|

118 |

|

|

|

— |

|

Total operating income |

|

$ |

3,240 |

|

|

$ |

17,029 |

|

14

The table below details the summarized components of assets and liabilities of the Company’s joint ventures, as of June 30, 2023 and December 31, 2022 (in thousands):

|

|

June 30, |

|

|

December 31, |

|

||

|

|

2023 |

|

|

2022 |

|

||

Assets: |

|

|

|

|

|

|

||

KNFH LLC |

|

$ |

297 |

|

|

$ |

— |

|

DHC8 LLC |

|

|

7,922 |

|

|

|

8,561 |

|

HGC Origination I LLC and HGC Funding I LLC |

|

|

46,340 |

|

|

|

53,385 |

|

HGC MPG Funding LLC |

|

|

13,386 |

|

|

|

— |

|

Total assets |

|

$ |

67,945 |

|

|

$ |

61,946 |

|

|

|

|

|

|

|

|

||

Liabilities: |

|

|

|

|

|

|

||

KNFH LLC |

|

$ |

285 |

|

|

$ |

47 |

|

DHC8 LLC |

|

|

1,144 |

|

|

|

1,028 |

|

HGC Origination I LLC and HGC Funding I LLC |

|

|

— |

|

|

|

1,504 |

|

HGC MPG Funding LLC |

|

|

— |

|

|

|

— |

|

Total liabilities |

|

$ |

1,429 |

|

|

$ |

2,579 |

|

Note 7 – Earnings Per Share

The Company is required, in periods in which it has net income, to calculate basic earnings per share (“basic EPS”) using the two-class method. The two-class method is required because the Company’s shares of Series N preferred stock, each of which is convertible to 40 common shares, have the right to receive dividends or dividend equivalents should the Company declare dividends on its common stock. Under the two-class method, earnings for the period are allocated on a pro-rata basis to the common and preferred stockholders. The weighted-average number of common and preferred shares outstanding during the period is then used to calculate basic EPS for each class of shares. For the three months ended June 30, 2023 and 2022, the earnings allocated to the outstanding preferred shares were not material.

In periods in which the Company records a net loss, basic loss per share is calculated by dividing the loss attributable to common stockholders by the weighted-average number of common shares outstanding during the period. As the preferred stock does not participate in losses, the two-class method is not used in periods in which the Company records a net loss.

Stock options and other potential common shares are included in the calculation of diluted earnings per share (“diluted EPS”). In calculating diluted EPS, such shares are assumed to be exercised or converted, except when their effect would be anti-dilutive.

The table below shows the calculation of the number of shares used in computing diluted EPS:

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

||||||||||

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

||||

Basic weighted average shares outstanding |

|

|

36,700,830 |

|

|

|

36,103,198 |

|

|

|

36,627,200 |

|

|

|

36,053,729 |

|

Treasury stock effect of common stock options and restricted stock awards |

|

|

950,864 |

|

|

|

896,416 |

|

|

|

876,823 |

|

|

|

792,810 |

|

Diluted weighted average common shares outstanding |

|

|

37,651,694 |

|

|

|

36,999,614 |

|

|

|

37,504,023 |

|

|

|

36,846,539 |

|

For the six months ended June 30, 2023 and 2022, there were potential common shares of 0.7 million and 1.1 million, respectively, that were excluded from the computation of diluted EPS, as the inclusion of such common shares would have been anti-dilutive. For the three months ended June 30, 2023 and 2022 there were potential common shares of 0.8 million and 1.0 million, respectively, that were excluded from the computation of diluted EPS, as the inclusion of such common shares would have been anti-dilutive.

15

Note 8 – Leases

The Company leases office and warehouse space in four locations: Del Mar, California, Hayward, California, San Diego, California and Edwardsville, Illinois. The Company determined that all of its lease arrangements are classified as operating leases.

On August 12, 2022, the Company entered into an agreement with Liberty Industrial Park, LLC pursuant to which the Company leases 6,627 square feet of industrial space in San Diego, California. The lease has a commencement date of September 1, 2022. It provides for an initial monthly base rent of $11,266, which increases on an annual basis to $13,180 per month in the final year. In addition, the Company is obligated to pay its share of maintenance costs of common areas.

On June 1, 2023, the Company amended its Edwardsville office building lease with David Ludwig, extending the term of the agreement to May 31, 2027 and setting rent amounts for the new term. It provides for an initial monthly base rent of $9,412, which increases on an annual basis to $9,914 per month in the final year.

The right-of-use assets and lease liabilities for each lease location are as follows (in thousands):

|

|

June 30, |

|

|

December 31, |

|

||

|

|

2023 |

|

|

2022 |

|

||

Right-of-use assets: |

|

|

|

|

|

|

||

Del Mar, CA |

|

$ |

262 |

|

|

$ |

336 |

|

Hayward, CA |

|

|

1,664 |

|

|

|

1,800 |

|

San Diego, CA |

|

|

535 |

|

|

|

590 |

|

Edwardsville, IL |

|

|

395 |

|

|

|

50 |

|

Total right-of-use assets |

|

$ |

2,856 |

|

|

$ |

2,776 |

|

|

|

|

|

|

|

|

||

Lease liabilities |

|

|

|

|

|

|

||

Del Mar, CA |

|

$ |

283 |

|

|

$ |

360 |

|

Hayward, CA |

|

|

1,726 |

|

|

|

1,852 |

|

San Diego, CA |

|

|

553 |

|

|

|

605 |

|

Edwardsville, IL |

|

|

396 |

|

|

|

50 |

|

Total lease liabilities |

|

$ |

2,958 |

|

|

$ |

2,867 |

|

The Company’s leases generally do not provide an implicit rate, and, therefore, the Company uses its incremental borrowing rate as the discount rate when measuring operating lease liabilities. The incremental borrowing rate represents an estimate of the interest rate the Company would incur at lease commencement to borrow an amount equal to the lease payments on a collateralized basis over the term of a lease within a particular currency environment. The Company used its incremental borrowing rate as of January 1, 2019 for operating leases that commenced prior to that date. As of January 1, 2019, the Company’s incremental borrowing rate was 5.25%. For leases commencing after January 1, 2019 the Company uses its incremental borrowing rate at time of commencement. On September 1, 2022 and June 1, 2023, the Company’s incremental borrowing rate was 5.50%. and 7.25%, respectively. The weighted average remaining lease term for operating leases is 4.6 years and the weighted average discount rate is 5.35% as of June 30, 2023.

Lease expense is recognized on a straight-line basis over the lease term. For the six months ended June 30, 2023 and 2022, lease expense was approximately $0.4 million and $0.3 million, respectively. As of June 30, 2023, undiscounted future minimum lease payments related to leases that have initial or remaining lease terms in excess of one year are as follows (in thousands):

2023 (remainder of year from July 1, 2023 to December 31, 2023) |

|

$ |

385 |

|

2024 |

|

|

789 |

|

2025 |

|

|

662 |

|

2026 |

|

|

649 |

|

2027 |

|

|

546 |

|

Thereafter |

|

|

312 |

|

Total undiscounted future minimum lease payments |

|

|

3,343 |

|

Less: imputed interest |

|

|

(385 |

) |

Present value of lease liabilities |

|

$ |

2,958 |

|

16

Note 9 – Intangible Assets and Goodwill

Intangible assets

The Company’s identifiable intangible assets are associated with its acquisitions of HGP in 2012, NLEX in 2014 and ALT in 2021, as shown in the table below (in thousands except for lives), and are amortized using the straight-line method over their remaining estimated useful lives. The Company’s tradename that was acquired as part of the acquisition of NLEX in 2014 has an indefinite life and therefore is not amortized.

|

|

Remaining |

|

|

Carrying Value |

|

|

|

|

|

Carrying Value |

|

||||

|

|

Life |

|

|

December 31, |

|

|

|

|

|

June 30, |

|

||||

|

|

(years) |

|

|

2022 |

|

|

Amortization |

|

|

2023 |

|

||||

Amortized intangible assets: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Trade Name (HGP) |

|

|

1.5 |

|

|

$ |

257 |

|

|

$ |

(64 |

) |

|

$ |

193 |

|

Trade Name (ALT) |

|

|

18.2 |

|

|

|

607 |

|

|

|

(16 |

) |

|

|

591 |

|

Vendor Relationship (ALT) |

|

|

3.2 |

|

|

|

843 |

|

|

|

(115 |

) |

|

|

728 |

|

Total amortized intangible assets |

|

|

|

|

|

1,707 |

|

|

|

(195 |

) |

|

|

1,512 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Unamortized intangible assets: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Trade Name (NLEX) |

|

N/A |

|

|

|

2,437 |

|

|

|

— |

|

|

|

2,437 |

|

|

Total intangible assets |

|

|

|

|

$ |

4,144 |

|

|

$ |

(195 |

) |

|

$ |

3,949 |

|

|

Amortization expense during the six months ended June 30, 2023 and 2022 was $0.2 million. The Company estimates that the residual value for intangible assets is not significant.