UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended June 30, 2023

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to___________

Commission File Number: 001-36247

Meta Materials Inc.

(Exact Name of Registrant as Specified in its Charter)

Nevada |

74-3237581 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

|

|

60 Highfield Park Drive Dartmouth, Nova Scotia, Canada |

B3A 4R9 |

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (902) 482-5729

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

Common Stock, par value $0.001 per share |

MMAT |

Nasdaq Capital Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

Non-accelerated filer |

☒ |

Smaller reporting company |

☒ |

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of August 7, 2023, the registrant had 477,261,145 shares of common stock, $0.001 par value per share, outstanding.

TABLE OF CONTENTS

2

FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains forward-looking statements within the meaning of the federal securities laws, which statements involve substantial risks and uncertainties. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans or intentions. Forward-looking statements contained in this Quarterly Report on Form 10-Q include statements about:

We caution you that the foregoing list may not contain all of the forward-looking statements made in this Quarterly Report on Form 10-Q.

You should not rely upon forward-looking statements as predictions of future events. We have based these forward-looking statements contained in this Quarterly Report on Form 10-Q largely on our current expectations and projections about future events and trends that we believe may affect our business, financial condition, results of operations, business strategy, short-term and long-term business operations and objectives and financial needs. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in Part II, Item 1A, "Risk Factors" in this Quarterly Report on Form 10-Q. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for us to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the future events and trends discussed in this Quarterly Report on Form 10-Q may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

3

The forward-looking statements made in this Quarterly Report on Form 10-Q relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this Quarterly Report on Form 10-Q to reflect events or circumstances after the date of this Quarterly Report on Form 10-Q or to reflect new information or the occurrence of unanticipated events, except as required by law. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments we may make.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this Quarterly Report on Form 10-Q, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

4

SUMMARY OF RISK FACTORS

Below is a summary of the principal factors that could materially harm our business, operating results and/or financial condition, impair our future prospects or cause the price of our common stock to decline. This summary does not address all of the risks that we face. Additional discussion of the risks summarized in this risk factor summary, and other risks that we face, can be found below under the heading “Risk Factors” and should be carefully considered, together with other information in this Quarterly Report on Form 10-Q and our other filings with the Securities and Exchange Commission, or the SEC, before making an investment decision regarding our common stock.

5

6

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements

META MATERIALS INC.

CONDENSED CONSOLIDATED INTERIM BALANCE SHEETS (UNAUDITED)

|

|

As of |

|

|

As of |

|

||

|

|

June 30, 2023 |

|

|

December 31, 2022 |

|

||

Assets |

|

|

|

|

|

|

||

Current assets: |

|

|

|

|

|

|

||

Cash and cash equivalents |

|

$ |

13,955,519 |

|

|

$ |

10,090,858 |

|

Restricted cash |

|

|

514,350 |

|

|

|

1,720,613 |

|

Accounts and other receivables |

|

|

1,251,004 |

|

|

|

902,718 |

|

Notes receivable, net of allowance for credit loss |

|

|

333,300 |

|

|

|

2,211,900 |

|

Inventory |

|

|

477,197 |

|

|

|

468,027 |

|

Prepaid expenses and other current assets |

|

|

3,294,151 |

|

|

|

7,202,099 |

|

Due from related parties |

|

|

8,722 |

|

|

|

8,461 |

|

Total current assets |

|

|

19,834,243 |

|

|

|

22,604,676 |

|

Intangible assets, net |

|

|

53,906,464 |

|

|

|

56,313,317 |

|

Property, plant and equipment, net |

|

|

47,680,219 |

|

|

|

42,674,699 |

|

Operating lease right-of-use ("ROU") assets |

|

|

7,437,981 |

|

|

|

5,576,824 |

|

Goodwill |

|

|

— |

|

|

|

281,748,466 |

|

Total assets |

|

$ |

128,858,907 |

|

|

$ |

408,917,982 |

|

Liabilities and stockholders’ equity |

|

|

|

|

|

|

||

Current liabilities |

|

|

|

|

|

|

||

Trade and other payables |

|

$ |

11,664,885 |

|

|

$ |

16,694,211 |

|

Restructuring costs accrual |

|

|

942,770 |

|

|

|

— |

|

Current portion of long-term debt |

|

|

547,336 |

|

|

|

483,226 |

|

Current portion of deferred revenues |

|

|

743,255 |

|

|

|

730,501 |

|

Current portion of deferred government assistance |

|

|

825,132 |

|

|

|

799,490 |

|

Funding obligation |

|

|

981,873 |

|

|

|

— |

|

Current portion of operating lease liabilities |

|

|

1,059,105 |

|

|

|

967,126 |

|

Total current liabilities |

|

|

16,764,356 |

|

|

|

19,674,554 |

|

Deferred revenues |

|

|

467,405 |

|

|

|

479,808 |

|

Deferred government assistance |

|

|

394,945 |

|

|

|

319,017 |

|

Deferred tax liability |

|

|

2,491,922 |

|

|

|

3,253,985 |

|

Long-term operating lease liabilities |

|

|

5,309,123 |

|

|

|

3,375,031 |

|

Funding obligation |

|

|

— |

|

|

|

180,705 |

|

Long-term debt |

|

|

3,181,271 |

|

|

|

3,070,729 |

|

Total liabilities |

|

$ |

28,609,022 |

|

|

$ |

30,353,829 |

|

Stockholders’ equity |

|

|

|

|

|

|

||

Common stock - $0.001 par value; 1,000,000,000 shares authorized, 471,881,955 shares issued and outstanding at June 30, 2023, and $0.001 par value; 1,000,000,000 shares authorized, 362,247,867 shares issued and outstanding at December 31, 2022 |

|

|

450,059 |

|

|

|

340,425 |

|

Additional paid-in capital |

|

|

626,124,206 |

|

|

|

590,962,866 |

|

Accumulated other comprehensive loss |

|

|

(4,480,988 |

) |

|

|

(5,242,810 |

) |

Accumulated deficit |

|

|

(521,843,392 |

) |

|

|

(207,496,328 |

) |

Total stockholders’ equity |

|

|

100,249,885 |

|

|

|

378,564,153 |

|

Total liabilities and stockholders’ equity |

|

$ |

128,858,907 |

|

|

$ |

408,917,982 |

|

Commitments and contingencies (Note 21)

Subsequent events (Note 22)

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

7

META MATERIALS INC.

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS (UNAUDITED)

|

|

Three months ended |

|

Six months ended |

||||

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

Revenue: |

|

|

|

|

|

|

|

|

Product sales |

|

$22,907 |

|

$334,113 |

|

$81,606 |

|

$502,240 |

Development revenue |

|

2,007,617 |

|

2,989,614 |

|

3,361,177 |

|

5,796,182 |

Total revenue |

|

2,030,524 |

|

3,323,727 |

|

3,442,783 |

|

6,298,422 |

Cost of sales (exclusive of items shown separately below) |

|

758,618 |

|

701,283 |

|

1,345,646 |

|

1,407,533 |

Depreciation and amortization expense included in cost of sales |

|

17,296 |

|

18,850 |

|

27,343 |

|

40,659 |

Stock-based compensation expense included in cost of sales |

|

(2,936) |

|

157,818 |

|

140,969 |

|

208,471 |

Gross profit |

|

1,257,546 |

|

2,445,776 |

|

1,928,825 |

|

4,641,759 |

Operating expenses: |

|

|

|

|

|

|

|

|

Selling & marketing |

|

780,233 |

|

951,750 |

|

3,087,586 |

|

1,967,850 |

General & administrative |

|

5,913,267 |

|

11,300,296 |

|

12,682,706 |

|

21,202,836 |

Research & development |

|

5,059,614 |

|

4,118,781 |

|

10,120,370 |

|

7,208,206 |

Depreciation & amortization expense |

|

3,358,527 |

|

1,801,319 |

|

6,593,022 |

|

3,453,504 |

Stock-based compensation expense |

|

(2,807,086) |

|

3,915,612 |

|

(948,647) |

|

7,860,400 |

Restructuring expense |

|

1,469,149 |

|

— |

|

1,469,149 |

|

— |

Goodwill impairment |

|

282,173,053 |

|

— |

|

282,173,053 |

|

— |

Total operating expenses |

|

295,946,757 |

|

22,087,758 |

|

315,177,239 |

|

41,692,796 |

Loss from operations |

|

(294,689,211) |

|

(19,641,982) |

|

(313,248,414) |

|

(37,051,037) |

Interest expense, net |

|

(4,522) |

|

(142,055) |

|

(117,520) |

|

(306,489) |

Gain (loss) on foreign exchange, net |

|

1,162,273 |

|

(971,713) |

|

1,447,184 |

|

(823,322) |

Other expenses, net |

|

(740,005) |

|

(336,993) |

|

(1,318,125) |

|

(1,346,436) |

Total other income (expense), net |

|

417,746 |

|

(1,450,761) |

|

11,539 |

|

(2,476,247) |

Loss before income taxes |

|

(294,271,465) |

|

(21,092,743) |

|

(313,236,875) |

|

(39,527,284) |

Income tax recovery |

|

618,079 |

|

109,985 |

|

914,811 |

|

109,985 |

Net loss |

|

$(293,653,386) |

|

$(20,982,758) |

|

$(312,322,064) |

|

$(39,417,299) |

Other comprehensive income (loss), net of tax |

|

|

|

|

|

|

|

|

Foreign currency translation gain (loss) |

|

439,035 |

|

(3,056,676) |

|

761,822 |

|

(2,151,294) |

Total other comprehensive income (loss) |

|

439,035 |

|

(3,056,676) |

|

761,822 |

|

(2,151,294) |

Comprehensive loss |

|

$(293,214,351) |

|

$(24,039,434) |

|

$(311,560,242) |

|

$(41,568,593) |

Basic and diluted loss per share |

|

$(0.65) |

|

$(0.07) |

|

$(0.76) |

|

$(0.13) |

Weighted average number of shares outstanding - basic and diluted |

|

452,837,999 |

|

301,488,660 |

|

411,090,600 |

|

293,481,943 |

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

8

META MATERIALS INC.

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY (UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

Accumulated |

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

Additional |

|

|

Other |

|

|

|

|

|

Total |

|

||||||

|

|

Common Stock |

|

|

Paid-in |

|

|

Comprehensive |

|

|

Accumulated |

|

|

Stockholders’ |

|

|||||||||

|

|

Shares |

|

|

Amount |

|

|

Capital |

|

|

Income (Loss) |

|

|

Deficit |

|

|

Equity |

|

||||||

Balance, April 1, 2023 |

|

|

383,744,889 |

|

|

$ |

361,922 |

|

|

$ |

603,693,239 |

|

|

$ |

(4,920,023 |

) |

|

$ |

(226,165,006 |

) |

|

$ |

372,970,132 |

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(293,653,386 |

) |

|

|

(293,653,386 |

) |

Other comprehensive income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

439,035 |

|

|

|

— |

|

|

|

439,035 |

|

Issuance of common stock and warrants |

|

|

87,791,213 |

|

|

|

87,791 |

|

|

|

25,759,947 |

|

|

|

— |

|

|

|

— |

|

|

|

25,847,738 |

|

Stock issuance costs |

|

|

— |

|

|

|

— |

|

|

|

(2,883,446 |

) |

|

|

— |

|

|

|

— |

|

|

|

(2,883,446 |

) |

Exercise of stock options and warrants |

|

|

1,017 |

|

|

|

1 |

|

|

|

284 |

|

|

|

— |

|

|

|

— |

|

|

|

285 |

|

Settlement of restricted stock units |

|

|

344,836 |

|

|

|

345 |

|

|

|

(345 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

(2,470,473 |

) |

|

|

— |

|

|

|

— |

|

|

|

(2,470,473 |

) |

Deemed dividend for down round provision in warrants |

|

|

— |

|

|

|

— |

|

|

|

2,025,000 |

|

|

|

— |

|

|

|

(2,025,000 |

) |

|

|

— |

|

Balance, June 30, 2023 |

|

|

471,881,955 |

|

|

|

450,059 |

|

|

|

626,124,206 |

|

|

|

(4,480,988 |

) |

|

|

(521,843,392 |

) |

|

|

100,249,885 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Balance, April 1, 2022 |

|

|

286,927,265 |

|

|

$ |

265,106 |

|

|

$ |

467,692,775 |

|

|

$ |

608,446 |

|

|

$ |

(146,828,645 |

) |

|

$ |

321,737,682 |

|

Net loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(20,982,758 |

) |

|

|

(20,982,758 |

) |

Other comprehensive loss |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(3,056,676 |

) |

|

|

— |

|

|

|

(3,056,676 |

) |

Issuance of common stock and warrants |

|

|

37,037,039 |

|

|

|

37,037 |

|

|

|

49,962,963 |

|

|

|

— |

|

|

|

— |

|

|

|

50,000,000 |

|

Stock issuance costs |

|

|

— |

|

|

|

— |

|

|

|

(3,680,666 |

) |

|

|

— |

|

|

|

— |

|

|

|

(3,680,666 |

) |

Exercise of stock options |

|

|

402,028 |

|

|

|

402 |

|

|

|

107,750 |

|

|

|

— |

|

|

|

— |

|

|

|

108,152 |

|

Issuance of stock in connection with acquisitions |

|

|

36,443,684 |

|

|

|

36,442 |

|

|

|

67,086,069 |

|

|

|

— |

|

|

|

— |

|

|

|

67,122,511 |

|

Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

3,876,887 |

|

|

|

— |

|

|

|

— |

|

|

|

3,876,887 |

|

Balance, June 30, 2022 |

|

|

360,810,016 |

|

|

|

338,987 |

|

|

|

585,045,778 |

|

|

|

(2,448,230 |

) |

|

|

(167,811,403 |

) |

|

|

415,125,132 |

|

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

9

META MATERIALS INC.

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY (UNAUDITED)

|

|

|

|

|

|

|

|

Accumulated |

|

|

|

|

|

|

|

|

|

|

Additional |

|

Other |

|

|

|

Total |

|

|

Common Stock |

|

Paid-in |

|

Comprehensive |

|

Accumulated |

|

Stockholders’ |

||

|

|

Shares |

|

Amount |

|

Capital |

|

(Loss) Income |

|

Deficit |

|

Equity |

Balance, January 1, 2023 |

|

362,247,867 |

|

$340,425 |

|

$590,962,866 |

|

$(5,242,810) |

|

$(207,496,328) |

|

$378,564,153 |

Net loss |

|

— |

|

— |

|

— |

|

— |

|

(312,322,064) |

|

(312,322,064) |

Other comprehensive income |

|

— |

|

— |

|

— |

|

761,822 |

|

— |

|

761,822 |

Issuance of common stock and warrants |

|

105,365,182 |

|

105,365 |

|

36,219,443 |

|

— |

|

— |

|

36,324,808 |

Stock issuance costs |

|

— |

|

— |

|

(3,322,231) |

|

— |

|

— |

|

(3,322,231) |

Exercise of stock options and warrants |

|

2,635,261 |

|

2,635 |

|

708,896 |

|

— |

|

— |

|

711,531 |

Settlement of restricted stock units |

|

1,633,645 |

|

1,634 |

|

(1,634) |

|

— |

|

— |

|

— |

Stock-based compensation |

|

— |

|

— |

|

(468,134) |

|

— |

|

— |

|

(468,134) |

Deemed dividend for down round provision in warrants |

|

— |

|

— |

|

2,025,000 |

|

— |

|

(2,025,000) |

|

— |

Balance, June 30, 2023 |

|

471,881,955 |

|

$450,059 |

|

$626,124,206 |

|

$(4,480,988) |

|

$(521,843,392) |

|

$100,249,885 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance, January 1, 2022 |

|

284,573,316 |

|

$262,751 |

|

$463,136,404 |

|

$(296,936) |

|

$(128,394,104) |

|

$334,708,115 |

Net loss |

|

— |

|

— |

|

— |

|

— |

|

(39,417,299) |

|

(39,417,299) |

Other comprehensive loss |

|

— |

|

— |

|

— |

|

(2,151,294) |

|

— |

|

(2,151,294) |

Issuance of common stock and warrants |

|

37,037,039 |

|

37,037 |

|

49,962,963 |

|

— |

|

— |

|

50,000,000 |

Stock issuance costs |

|

— |

|

— |

|

(3,680,666) |

|

— |

|

— |

|

(3,680,666) |

Exercise of stock options and warrants |

|

2,755,977 |

|

2,757 |

|

472,137 |

|

— |

|

— |

|

474,894 |

Issuance of stock in connection with acquisitions |

|

36,443,684 |

|

36,442 |

|

67,086,069 |

|

— |

|

— |

|

67,122,511 |

Stock-based compensation |

|

— |

|

— |

|

8,068,871 |

|

— |

|

— |

|

8,068,871 |

Balance, June 30, 2022 |

|

360,810,016 |

|

$338,987 |

|

$585,045,778 |

|

$(2,448,230) |

|

$(167,811,403) |

|

$415,125,132 |

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

10

META MATERIALS INC.

CONDENSED CONSOLIDATED INTERIM STATEMENTS OF CASH FLOWS (UNAUDITED)

|

|

Six months ended |

|

|||||

|

|

June 30, 2023 |

|

|

June 30, 2022 |

|

||

|

|

$ |

|

|

$ |

|

||

Cash flows from operating activities: |

|

|

|

|

|

|

||

Net loss |

|

$ |

(312,322,064 |

) |

|

$ |

(39,417,299 |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

||

Non-cash finance (income) expense |

|

|

740,777 |

|

|

|

(12,920 |

) |

Non-cash interest expense |

|

|

147,545 |

|

|

|

273,554 |

|

Non-cash interest income |

|

|

(822,898 |

) |

|

|

— |

|

Non-cash lease expense |

|

|

831,505 |

|

|

|

488,299 |

|

Non-cash goodwill impairment |

|

|

282,173,053 |

|

|

|

— |

|

Deferred income tax |

|

|

(914,811 |

) |

|

|

(109,985 |

) |

Depreciation and amortization expense |

|

|

6,620,365 |

|

|

|

3,494,163 |

|

Impairment of assets |

|

|

18,843 |

|

|

|

— |

|

Credit loss expense |

|

|

1,701,498 |

|

|

|

— |

|

Unrealized foreign currency exchange (gain) loss |

|

|

(1,674,111 |

) |

|

|

913,101 |

|

Change in deferred revenue |

|

|

(23,006 |

) |

|

|

(165,466 |

) |

Non-cash government assistance |

|

|

— |

|

|

|

(3,047 |

) |

Gain on sale of property, plant and equipment |

|

|

— |

|

|

|

(783 |

) |

Stock-based compensation expense |

|

|

(807,678 |

) |

|

|

7,623,207 |

|

Non-cash consulting expense |

|

|

— |

|

|

|

445,664 |

|

Changes in operating assets and liabilities |

|

|

(1,554,391 |

) |

|

|

(2,531,889 |

) |

Net cash used in operating activities |

|

|

(25,885,373 |

) |

|

|

(29,003,401 |

) |

Cash flows from investing activities: |

|

|

|

|

|

|

||

Purchases of property, plant and equipment |

|

|

(6,494,362 |

) |

|

|

(8,971,435 |

) |

Proceeds from sale of property, plant and equipment |

|

|

— |

|

|

|

39,140 |

|

Proceeds from short-term investments |

|

|

— |

|

|

|

1,620,281 |

|

Proceeds from below-market capital government loan |

|

|

256,240 |

|

|

|

— |

|

Proceeds from collection of notes receivable |

|

|

1,000,000 |

|

|

|

— |

|

Acquisition of business, net of cash acquired |

|

|

— |

|

|

|

(3,486,906 |

) |

Net cash used in investing activities |

|

|

(5,238,122 |

) |

|

|

(10,798,920 |

) |

Cash flows from financing activities: |

|

|

|

|

|

|

||

Proceeds from the issuance of common stock and warrants |

|

|

36,324,808 |

|

|

|

50,000,000 |

|

Stock issuance costs paid on the issuance of common stock and warrants |

|

|

(3,322,231 |

) |

|

|

(3,680,666 |

) |

Repayments of long-term debt |

|

|

(195,780 |

) |

|

|

(182,295 |

) |

Proceeds from stock option and warrants exercises |

|

|

711,531 |

|

|

|

474,894 |

|

Net cash provided by financing activities |

|

|

33,518,328 |

|

|

|

46,611,933 |

|

Net increase in cash, cash equivalents and restricted cash |

|

|

2,394,833 |

|

|

|

6,809,612 |

|

Cash, cash equivalents and restricted cash at beginning of the period |

|

|

11,811,471 |

|

|

|

47,434,472 |

|

Effects of exchange rate changes on cash, cash equivalents and restricted cash |

|

|

263,565 |

|

|

|

(203,738 |

) |

Cash, cash equivalents and restricted cash at end of the period |

|

$ |

14,469,869 |

|

|

$ |

54,040,346 |

|

Supplemental cash flow information |

|

|

|

|

|

|

||

Accrued purchases of property, equipment and patents |

|

$ |

1,550,901 |

|

|

$ |

1,604,903 |

|

Right-of-use assets obtained in exchange for lease liabilities |

|

$ |

2,225,962 |

|

|

$ |

142,378 |

|

The accompanying notes are an integral part of these condensed consolidated interim financial statements.

11

META MATERIALS INC.

NOTES TO CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS (Unaudited)

1. Corporate information

Meta Materials Inc. (also referred to herein as the “Company”, “META”, “we”, “us”, or “our”) is a global leader in advanced materials and nanotechnology. We are developing materials that we believe can improve the performance and efficiency of many current products as well as allow new products to be developed that cannot otherwise be developed without such materials. We believe META is positioned for growth, by pioneering a new category of intelligent surfaces, which will allow us to become the metamaterials industry leader. We enable our potential customers across a range of industries - consumer electronics, 5G communications, healthcare, aerospace, automotive, and clean energy - to deliver improved products to their customers. For example, our nano-optic metamaterial technology is being used to develop anti-counterfeiting security features for a Central Bank customer and currencies and authentication for Global brands. We currently have over 500 active patent documents, of which over 300 patents have been issued.

Our principal executive office is located at 60 Highfield Park Drive, Dartmouth, Nova Scotia, Canada.

2. Significant accounting policies

Basis of Presentation

These unaudited condensed consolidated interim financial statements and related notes are presented in accordance with accounting principles generally accepted in the United States of America, or US GAAP. Our fiscal year-end is December 31. The condensed consolidated interim financial statements include the accounts of Meta Materials Inc. and its wholly-owned subsidiaries. All significant intercompany balances and transactions have been eliminated on consolidation.

These unaudited condensed consolidated interim financial statements do not include all of the information and notes required by US GAAP for annual financial statements. Accordingly, these unaudited condensed consolidated interim financial statements should be read in conjunction with our audited consolidated financial statements and notes for the years ended December 31, 2022 and 2021, filed with the Securities and Exchange Commission (the “SEC”) on Forms 10-K and 10-K/A, respectively.

Reclassification of Prior Year Presentation

Certain prior year amounts have been reclassified for consistency with the current year presentation. These reclassifications had no effect on the reported results of operations. An adjustment has been made to the condensed consolidated interim statement of operations and comprehensive loss.

Recently Adopted Accounting Pronouncements

ASU 2021-08:

In October 2021, the Financial Accounting Standards Board, or FASB, issued ASU 2021-08, Business Combinations (Topic 805): Accounting for Contract Assets and Contract Liabilities from Contracts with Customers, which clarifies that an acquirer of a business should recognize and measure contract assets and contract liabilities in a business combination in accordance with ASC Topic 606, Revenue from Contracts with Customers. We adopted the guidance on January 1, 2023 and its adoption did not have a material effect on our condensed consolidated interim financial statements and related disclosures.

Recently Issued Accounting Pronouncements

We currently have no material recent accounting pronouncements yet to be adopted.

3. Going concern

At each reporting period, we evaluate whether there are conditions or events that raise substantial doubt about our ability to continue as a going concern within one year after the date that the financial statements are issued. Our evaluation entails analyzing prospective operating budgets and forecasts for expectations of our cash needs and comparing those needs to the current cash and cash equivalent balances. We are required to make certain additional disclosures if we conclude substantial doubt exists and it is not alleviated by our plans or when our plans alleviate substantial doubt about our ability to continue as a going concern.

In accordance with Accounting Standards Codification, or ASC, 205-40, Going Concern, we evaluated whether there are conditions and events, considered in the aggregate, that raise substantial doubt about our ability to continue as a going concern within one year after the date that these consolidated financial statements are issued. This evaluation initially does not take into consideration the potential mitigating effect of management’s plans that have not been fully implemented as of the date the financial statements are issued.

12

When substantial doubt exists under this methodology, management evaluates whether the mitigating effect of its plans sufficiently alleviates substantial doubt about our ability to continue as a going concern. The mitigating effect of management’s plans, however, is only considered if both (1) it is probable that the plans will be effectively implemented within one year after the date that the condensed consolidated interim financial statements are issued, and (2) it is probable that the plans, when implemented, will mitigate the relevant conditions or events that raise substantial doubt about the entity’s ability to continue as a going concern within one year after the date that these condensed consolidated interim financial statements are issued. In performing its analysis, management excluded certain elements of its operating plan that cannot be considered probable.

We have incurred net losses of $312.3 million (including $282.2 million of goodwill impairment) and $79.1 million for the six months ended June 30, 2023 and the twelve months ended December 31, 2022, respectively, and have an accumulated deficit of $521.8 million as of June 30, 2023. Our expectation to generate operating losses and negative operating cash flows in the future and the need for additional funding to support our planned operations, raise substantial doubt regarding our ability to continue as a going concern for a period of one year after the date that these condensed consolidated interim financial statements are issued. Management's plans to alleviate the conditions that raise substantial doubt include reduced spending, and the pursuit of additional capital. On June 6, 2023, our board of directors approved a revised operating plan (the "Realignment and Consolidation Plan") for the remainder of 2023 pursuant to which we have begun, but not yet completed, the process of realigning our corporate structure aimed at reducing our operating expenses and focusing on key applications which represent the greatest near-term revenue potential. As part of this plan, we are exploring alternatives for certain of our technologies including Holography Technology and Wireless Sensing and Radio Wave Imaging Technology. These alternatives may include a divestiture, entering into a joint venture and/or curtailing our investment in these technologies. See Note 20 for details. Management has concluded the likelihood that its plan to successfully obtain sufficient funding from one or more of these sources, or adequately reduce expenditures, while highly possible, is less than probable because these plans are not entirely within our control and/or have not been approved by our board of directors as of the date of these condensed consolidated interim financial statements. If we are unsuccessful in obtaining financing, we will be required to assess alternative forms of action. Accordingly, we have concluded that substantial doubt exists about our ability to continue as a going concern for a period of at least twelve months from the date of issuance of these condensed consolidated interim financial statements.

The accompanying condensed consolidated interim financial statements have been prepared on a going concern basis, which contemplates the realization of assets and satisfaction of liabilities in the ordinary course of business. The condensed consolidated interim financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts or the amounts and classification of liabilities that might result from the outcome of the uncertainties described above. These adjustments may be material.

4. Acquisitions

Plasma App Ltd Acquisition

On April 1, 2022, we completed the purchase of 100% of the issued and outstanding shares of PAL, or the PAL acquisition. PAL is the developer of PLASMAfusion®, a proprietary manufacturing platform technology, which enables high speed coating of any solid material on any type of substrate. PAL’s team is located at the Rutherford Appleton Laboratories in Oxford, UK.

The acquisition was accounted for as a business combination in accordance with ASC 805.

The following table presents the final allocation of consideration paid for the PAL acquisition and fair value of the assets and liabilities acquired:

|

Amount |

Fair value of common stock issued |

$15,290,320 |

Fair value of deferred consideration |

$1,698,926 |

Total Consideration |

$16,989,246 |

Net assets of PAL: |

|

Cash and cash equivalents |

$13,822 |

Other assets |

36,104 |

Intangibles |

12,600,000 |

Deferred tax liability |

(3,150,000) |

Goodwill |

7,489,320 |

|

$16,989,246 |

Acquired intangible assets totaling $12.6 million relate to a developed technology intangible asset. The significant estimates and assumptions used by us in the determination of the fair value of the acquired developed technology intangible asset includes the revenue growth rate and the discount rate.

13

The goodwill resulting from the transaction is attributable to assembled workforce, synergies, technical know-how and expertise. The fair value of acquired assets and liabilities was measured as at the acquisition date based on a valuation report provided by a third-party valuation expert.

Losses from the PAL acquisition since the acquisition date included in the condensed consolidated interim statements of operations and comprehensive loss for the three and six months ended June 30, 2023 were $0.6 million and $1.2 million, respectively, excluding impairment of goodwill recognized as part of the PAL acquisition. During the three months ended June 30, 2023, we wrote off the entire amount of goodwill. See Note 10, Intangible assets and goodwill.

We have finalized the purchase price allocation to the individual assets acquired and liabilities assumed using the acquisition method. There were no further changes to the purchase price allocation, as disclosed in the audited consolidated financial statements and notes for the year ended December 31, 2022.

Optodot Acquisition

On June 22, 2022, we completed a purchase agreement with Optodot Corporation, or Optodot, a developer of advanced materials technologies, to acquire certain assets related to patents and intellectual property for the battery and other industries, or the Optodot acquisition. The consideration transferred included the following:

The acquisition was accounted for as a business combination in accordance with ASC 805. The transaction was structured as a tax-free re-organization pursuant to Internal Revenue Code Section 368(a)(1)(c). Accordingly, the tax basis of net assets acquired retain their carryover tax basis and holding period.

The following table presents the final allocation of consideration paid for the Optodot acquisition and fair value of the assets and liabilities acquired:

|

|

Amount |

|

|

Fair value of unrestricted common stock issued or to be issued |

|

$ |

41,791,115 |

|

Fair value of restricted common stock issued |

|

|

8,342,152 |

|

Cash consideration |

|

|

3,500,000 |

|

Total consideration |

|

$ |

53,633,267 |

|

|

|

|

|

|

Net assets of Optodot: |

|

|

|

|

Intangibles |

|

|

23,300,000 |

|

Deferred tax liability |

|

|

(4,893,000 |

) |

Goodwill |

|

|

35,226,267 |

|

|

|

$ |

53,633,267 |

|

Acquired intangible assets totaling $23.3 million relate to a developed technology intangible asset. The significant estimates and assumptions used by us in the determination of the fair value of the acquired developed technology intangible asset includes the revenue growth rate and the discount rate. The goodwill resulting from the transaction is attributable to assembled workforce, synergies, technical know-how and expertise. The fair value of acquired assets and liabilities has been measured as at the acquisition date based on a valuation report provided by a third-party valuation expert.

Losses/(profit) from the Optodot acquisition since the acquisition date included in the condensed consolidated interim statements of operations and comprehensive loss for the three and six months ended June 30, 2023 were ($0.2) million and $0.3 million, respectively, excluding impairment of goodwill recognized as part of the Optodot acquisition. During the three months ended June 30, 2023, we wrote off the entire amount of goodwill. See Note 10, Intangible assets and goodwill.

We have finalized the purchase price allocation to the individual assets acquired and liabilities assumed using the acquisition method. There were no further changes to the purchase price allocation, as disclosed in the audited consolidated financial statements and notes for the year ended December 31, 2022.

5. Related party transactions

As of June 30, 2023 and December 31, 2022, receivables due from a related party, Lamda Guard Technologies Ltd, or Lamda, were $8,722 and $8,461, respectively.

6. Notes receivable

Notes receivable consists of an amount due from Next Bridge Hydrocarbons Inc., or Next Bridge, which was previously a wholly-owned subsidiary of META until the completion of the spin-off transaction on December 14, 2022.

14

One note is partially secured by a combination of shares of META’s common stock and an interest in the Orogrande Project Property. The notes receivable has been recognized at their fair value, as of December 14, 2022, subsequent to the deconsolidation of Next Bridge from our consolidated financial results.

Amounts owing from Next Bridge include:

On March 31, 2023, in exchange for a prepayment of $1.0 million of the currently outstanding principal of the aforementioned loans, we agreed with Next Bridge on the following: (a) extended the maturity date of the 2022 Note from March 31, 2023 to October 3, 2023, and (b) increased the total amount of commitments and loans made by us to Next Bridge under the Loan Agreement by $2.6 million to reflect the aforementioned costs incurred in effecting the deconsolidation.

In addition, on March 31, 2023, we amended the 2021 Note issued and payable by Next Bridge to us, to extend the maturity date from March 31, 2023 to October 3, 2023. The existing liens securing the 2021 Note were also reaffirmed by the grantors of such liens.

We assessed the fair value of the notes receivable on the deconsolidation date in accordance with ASC 820, Fair Value Measurement, and recorded $2.2 million of fair value of the Next Bridge notes receivable as of December 31, 2022. In accordance with ASC 326, Financial Instruments – Credit losses, we elected a practical expedient to account for the Next Bridge notes receivable as collateral-dependent assets, whereby estimated credit losses are based on the fair value of the collateral. For the three months ended June 30, 2023, we recorded interest income of $0.4 million and credit losses of $0.7 million. For the six months ended June 30, 2023, we recorded interest income of $0.8 million and credit losses of $1.7 million. As of June 30, 2023, the carrying value, net of the credit losses, of notes receivable was $0.3 million.

Subsequent to June 30, 2023, we entered into a Loan Sale Agreement with Gregory McCabe ("Purchaser"), under which we sold and assigned to Purchaser all of our rights, title, interests, and obligations in and to the aforementioned loans owed by Next Bridge (“Assigned Loan Interests”) in exchange for cash consideration of $6.0 million and agreeing to enter into a Stock Purchase Agreement ("SPA") for an additional $6.0 million of shares of our common stock. Assigned Loan Interests represented $24.0 million of the outstanding balance of the Next Bridge notes receivable as of the closing date of August 7, 2023 ("Closing Date"). Pursuant to the SPA, the Purchaser will be required to purchase an aggregate of $6.0 million of shares of our common stock (beginning on September 1, 2023, or as soon as possible after such date if necessary under applicable law, in monthly amounts of $250,000 for the first six months and then in monthly amounts of $500,000 for the next nine months thereafter), at a per share purchase price equal to 120% of the 5-day volume weighted average price (“VWAP”) of our common stock on the trading day preceding the date of each such purchase. See Note 22, Subsequent events, for further information.

15

7. Inventory

Inventory consists of photosensitive materials, lenses, laser protection film and finished eyewear, and is comprised of the following:

|

|

As of |

|

|||||

|

|

June 30, |

|

|

December 31, |

|

||

Raw materials |

|

$ |

499,387 |

|

|

$ |

490,077 |

|

Supplies |

|

|

11,373 |

|

|

|

11,345 |

|

Work in process |

|

|

51,006 |

|

|

|

51,589 |

|

Finished goods |

|

|

45,390 |

|

|

|

42,058 |

|

Inventory provision |

|

|

(129,959 |

) |

|

|

(127,042 |

) |

Total inventory |

|

$ |

477,197 |

|

|

$ |

468,027 |

|

8. Prepaid expenses and other current assets

Prepaid expenses and other current assets consist of the following:

|

|

As of |

|

|||||

|

|

June 30, 2023 |

|

|

December 31, 2022 |

|

||

Prepaid expenses |

|

$ |

1,351,938 |

|

|

$ |

2,835,660 |

|

Other current assets |

|

|

544,425 |

|

|

|

365,583 |

|

Taxes receivable |

|

|

1,397,788 |

|

|

|

4,000,856 |

|

Total prepaid expenses and other current assets |

|

$ |

3,294,151 |

|

|

$ |

7,202,099 |

|

9. Property, plant and equipment, net

Property, plant and equipment consist of the following:

|

|

Useful life |

|

As of |

|

|||||

|

|

(years) |

|

June 30, |

|

|

December 31, |

|

||

Land |

|

N/A |

|

$ |

449,396 |

|

|

$ |

439,309 |

|

Building |

|

25 |

|

|

5,179,343 |

|

|

|

5,063,091 |

|

Computer equipment |

|

3-5 |

|

|

1,400,669 |

|

|

|

775,736 |

|

Computer software |

|

1 |

|

|

660,904 |

|

|

|

606,729 |

|

Manufacturing equipment |

|

2-5 |

|

|

23,358,248 |

|

|

|

22,701,761 |

|

Office furniture |

|

5-7 |

|

|

912,411 |

|

|

|

660,549 |

|

Leasehold improvements |

|

5-10 |

|

|

21,493,571 |

|

|

|

2,172,134 |

|

Enterprise Resource Planning software |

|

5 |

|

|

202,185 |

|

|

|

197,648 |

|

Assets under construction |

|

N/A |

|

|

7,588,023 |

|

|

|

20,337,338 |

|

|

|

|

|

|

61,244,750 |

|

|

|

52,954,295 |

|

Accumulated depreciation and impairment |

|

|

|

|

(13,564,531 |

) |

|

|

(10,279,596 |

) |

|

|

|

|

$ |

47,680,219 |

|

|

$ |

42,674,699 |

|

Depreciation expense was $1.6 million and $0.8 million for the three months ended June 30, 2023 and June 30, 2022, respectively, and $3.1 million and $1.6 million for the six months ended June 30, 2023 and 2022, respectively.

Property, plant and equipment is pledged as security under a General Security Agreement, or a GSA, signed in favor of the Royal Bank of Canada, or RBC, on July 14, 2014, which is related to our corporate bank account and credit card and includes all property, plant and equipment and intangible assets.

16

10. Intangible assets and goodwill

Intangible Assets

Intangible assets consist of the following:

|

|

Useful life |

|

As of |

|

|||||

|

|

(years) |

|

June 30, |

|

|

December 31, |

|

||

Patents |

|

5-10 |

|

$ |

42,986,894 |

|

|

$ |

42,111,143 |

|

Trademarks |

|

|

|

|

127,680 |

|

|

|

124,845 |

|

Developed technology |

|

20 |

|

|

14,297,583 |

|

|

|

13,976,668 |

|

Customer contract |

|

5 |

|

|

9,818,731 |

|

|

|

9,598,348 |

|

|

|

|

|

|

67,230,888 |

|

|

|

65,811,004 |

|

Accumulated amortization and impairment |

|

|

|

|

(13,324,424 |

) |

|

|

(9,497,687 |

) |

|

|

|

|

$ |

53,906,464 |

|

|

$ |

56,313,317 |

|

Amortization expense was $1.8 million and $1.0 million for the three months ended June 30, 2023 and 2022, respectively, and $3.5 million and $1.9 million for the six months ended June 30, 2023 and 2022, respectively.

Goodwill

Goodwill at December 31, 2022 |

|

$ |

281,748,466 |

|

Effect of foreign exchange on goodwill |

|

|

424,587 |

|

Impairment |

|

|

(282,173,053 |

) |

Goodwill at June 30, 2023 |

|

$ |

— |

|

Goodwill is tested for impairment annually as of December 31 or more frequently on a reporting unit basis when events or changes in circumstances indicate that impairment may have occurred. As defined in the authoritative guidance, a reporting unit is an operating segment, or one level below an operating segment. Historically, we conducted our business in a single operating segment and reporting unit.

As a result of the continued and sustained decline in the price of our common shares in the three months ended June 30, 2023, we determined there to be an indicator of impairment for our one reporting unit to which goodwill is assigned. As a result, we performed a quantitative interim goodwill impairment assessment as of June 30, 2023. We concluded that the carrying value of the reporting unit was higher than its estimated fair value, and a goodwill impairment loss totaling $282.2 million was recognized in the three months ended June 30, 2022, representing the entirety of the goodwill.

The estimated fair value of the reporting unit was determined using the market valuation method, which is consistent with the methodology we used in the annual impairment test conducted at December 31, 2022. The most significant assumption used in applying this method was our share price.

17

11. Long-term debt

|

|

As of |

|

|||||

|

|

June 30, |

|

|

December 31, |

|

||

Atlantic Canada Opportunities Agency, or ACOA, Business Development Program, or BDP, 2012 interest-free loan1 with a maximum contribution of CA$500,000, repayable in monthly repayments commencing October 1, 2015, of CA$5,952 until June 1, 2023. Loan repayments were temporarily paused effective April 1, 2020, until January 1, 2021, as a result of the COVID-19 outbreak. As of June 30, 2023, the amount of principal drawn down on the loan, net of repayments is CA$Nil (2022 - CA$35,714). |

|

$ |

— |

|

|

$ |

25,880 |

|

ACOA Atlantic Innovation Fund, or AIF, 2015 interest-free loan1,2 with a maximum contribution of CA$ 3,000,000. Annual repayments, commencing June 1, 2021, are calculated as a percentage of gross revenue for the preceding fiscal year, at Nil when gross revenues are less than CA$1,000,000, 5% when gross revenues are less than CA$10,000,000 and greater than CA$1,000,000, and CA$500,000 plus 1% of gross revenues when gross revenues are greater than CA$10,000,000. As of June 30, 2023, the amount or principal drawn down on the loan, net of repayments, is CA$2,661,293 (2022 - CA$2,661,293). |

|

|

1,442,185 |

|

|

|

1,449,493 |

|

ACOA BDP 2018 interest-free loan1,3 with a maximum contribution of CA$3,000,000, repayable in monthly repayments commencing June 1, 2021, of CA$31,250 until May 1, 2029. As of June 30, 2023, the amount of principal drawn down on the loan, net of repayments, is CA$2,218,750 (2022 - CA$2,406,250). |

|

|

1,106,506 |

|

|

|

1,136,556 |

|

ACOA PBS 2019 interest-free loan1 with a maximum contribution of CA$100,000, repayable in monthly repayments commencing June 1, 2021, of CA$1,400 until May 1, 2027. As of June 30, 2023, the amount of principal drawn down on the loan, net of repayments, is CA$65,278 (2022 - CA$73,611). |

|

|

32,853 |

|

|

|

34,750 |

|

ACOA Regional Relief and Recovery Fund, or RRRF, 2020 interest-free loan with a maximum contribution of CA$390,000, repayable on monthly repayments commencing April 1, 2023, of CA$11,000 until April 1, 2026. As of June 30, 2023, the principal amount drawn down on the loan is CA$357,000 (2022 - CA$390,000). |

|

|

171,732 |

|

|

|

159,642 |

|

Economic Development Agency of Canada for the Regions of Quebec, or EDC, 2022 interest-free loan4 with a maximum contribution of CA$2,000,000 (CA$1,000,000 for building renovations and CA$1,000,000 for acquisition of equipment for Nanotech). Repayable in 60 monthly installments of CA$ 30,000, with the first repayment due in January 2026. As of June 30, 2023, the principal amount drawn down on the loan is CA$1,800,000 (2022 - CA$1,454,167). |

|

|

975,331 |

|

|

|

747,634 |

|

|

|

|

3,728,607 |

|

|

|

3,553,955 |

|

Less: current portion |

|

|

547,336 |

|

|

|

483,226 |

|

|

|

$ |

3,181,271 |

|

|

$ |

3,070,729 |

|

1 We were required to maintain a minimum balance of positive equity throughout the term of the loan. However, on November 14, 2019, ACOA waived this requirement for the period ending June 30, 2019 and for each period thereafter until the loan is fully repaid.

2 The carrying amount of the ACOA AIF loan is reviewed each reporting period and adjusted as required to reflect management’s best estimate of future cash flows, discounted at the original effective interest rate.

3 A portion of the ACOA BDP 2018 loan was used to finance the acquisition and construction of manufacturing equipment resulting in $425,872 that was recorded as deferred government assistance, which is being amortized over the useful life of the associated equipment.

4 The EDC 2022 loan was used to finance building renovations and equipment purchase resulting in $409,401 of deferred government assistance as of June 30, 2023, which is being amortized over the useful life of the associated building and equipment.

12. Capital stock

Common Stock

Authorized: 1,000,000,000 common shares, $0.001 par value.

During the six months ended June 30, 2023, 2,635,161 stock options were exercised to purchase an equal number of common shares. In addition, 1,633,645 restricted stock units have vested and settled into an equal number of common shares.

18

At-the-Market Equity Offering Program:

On February 10, 2023, we entered into a sales agreement, or the ATM Agreement, which was amended on June 20, 2023, with an investment bank to conduct an "at-the-market" equity offering program, or the ATM, pursuant to which we may issue and sell, shares of our common stock, par value $0.001 per share, up to an aggregate of $100.0 million of shares of common stock, or the ATM Shares, from time to time.

Under the ATM Agreement, we set the parameters for the sale of ATM Shares, including the number of ATM Shares to be issued, the time period during which sales are requested to be made, limitations on the number of ATM Shares that may be sold in any one trading day and any minimum price below which sales may not be made. Sales of the ATM Shares, if any, under the ATM Agreement may be made in transactions that are deemed to be “at-the-market offerings” as defined in Rule 415 under the Securities Act of 1933, as amended, or the Securities Act.

During the three months ended June 30, 2023, we sold a total of 4,457,879 shares of our common stock under the ATM at a weighted average price of $0.19 per share, generating proceeds of $0.8 million, net of offering expenses.

During the six months ended June 30, 2023, we sold a total of 22,031,848 shares of our common stock under the ATM at a weighted average price of $0.51 per share, generating gross proceeds of $11.3 million and net proceeds of $11.0 million after offering expenses. As of June 30, 2023, $88.7 million of common stock remained eligible for sale under the ATM Agreement.

Registered Direct Offering:

April 2023 Offerings

On April 14, 2023, we entered into an underwriting agreement, or the Underwriting Agreement, with Ladenburg Thalmann & Co. Inc. and A.G.P/Global Alliance Partners, or the underwriters, relating to our public offering of (i) 83,333,334 shares of our common stock, par value $0.001 and (ii) warrants to purchase up to an aggregate of 83,333,334 shares of our common stock. The shares of common stock and warrants were sold together as a fixed combination, consisting of one share of common stock and a warrant to purchase one share of common stock, but are immediately separable and were issued separately in the offering. Each warrant is immediately exercisable to purchase one share of common stock at a price of $0.375 per share, or Exercise Price, subject to certain adjustments in the case of a Share Combination Event or a Dilutive Issuance as described below, and expires five years from the date of issuance. The combined price to the public in the offering for each share of common stock and accompanying warrant was $0.30. After deducting underwriting discounts and commissions and the offering expenses payable by us, the net proceeds were $22.1 million.

The gross proceeds of $25.0 million were allocated between common stock and accompanying warrants based on their relative fair values. The fair value of common stock was calculated based on the closing share price on the Issuance Date of $0.22. The fair value of the warrants was estimated using the Black-Scholes option pricing model. Accordingly, we have allocated $15.7 million as the fair value of common stock and $9.3 million as the fair value of warrants.

The warrants contain a down round provision that requires the exercise price to be adjusted if the Company sells shares of common stock below the current exercise price. If at any time and from time to time on or after April 18, 2023, the issue date of warrants, or Issue Date, and prior to the second anniversary of the Issue Date there occurs any Share Combination Event (as defined below) and the Event Market Price (as defined below) is less than the Exercise Price, then on the sixth trading day immediately following such Share Combination Event, the Exercise Price on such sixth trading day shall be reduced (but in no event increased) to the Event Market Price; provided, however, that in no event shall the Event Market Price be less than $0.076 (appropriately adjusted for any Share Combination Event occurring after the Issue Date), or the Floor Price.

A Share Combination Event occurs when we (i) pay a stock dividend or otherwise make a distribution or distributions on shares of our common stock or any other equity or equity equivalent securities payable in shares of common stock (which, for avoidance of doubt, shall not include any shares of common stock issued by us upon exercise of this warrant), (ii) subdivide outstanding shares of common stock into a larger number of shares, (iii) combine (including by way of reverse stock split) outstanding shares of common stock into a smaller number of shares, or (iv) issue by reclassification of shares of our common stock any shares of our capital stock. “Event Market Price” means, with respect to any Share Combination Event Date, the quotient determined by dividing (x) the sum of the volume weighted average price of the shares of common stock for each of the five trading days following such Share Combination Event divided by (y) five. All such determinations shall be appropriately adjusted for any stock dividend, stock split, stock combination, recapitalization or other similar transaction during such period.

In addition, if at any time prior to April 18, 2024, we grant, issue or sell, or are deemed to have granted issued or sold, any shares of our Common Stock, subject to certain exceptions, for a consideration per share, or the New Issuance Price less than a price equal to the exercise price of the warrants then in effect, the foregoing a Dilutive Issuance, then immediately after such Dilutive Issuance, the exercise price then in effect will be reduced to an amount equal to the greater of the New Issuance Price and the Floor Price.

19

We have evaluated the warrants as either equity-classified or liability-classified instruments based on an assessment of the warrants’ specific terms and applicable authoritative guidance in ASC 480, Distinguishing Liabilities from Equity, and ASC 815, Derivatives and Hedging. We have concluded that the warrants are considered indexed to our common shares and as such they have been classified as equity.

During the three months ended June 30, 2023, we sold shares of common stock for $0.174 under the ATM Arrangement; therefore, the exercise price of these warrants was adjusted from $0.375 to $0.174. The change in fair value between the value of the warrants using the new exercise price versus the old exercise price was $2.0 million. The amount was recorded as a deemed dividend in the condensed consolidated interim statement of changes in stockholders' equity during the three months ended June 30, 2023.

June 2022 Offerings

On June 24, 2022, we entered into a securities purchase agreement (the "SPA"), as amended and restated on June 27, 2022, with certain institutional investors for the purchase and sale in a registered direct offering of 37,037,039 shares of our common stock at a purchase price of $1.35 per share and warrants to purchase 37,037,039 shares at an exercise price of $1.75 per share. This resulted in gross proceeds from the offering of $50.0 million and net proceeds of $46.3 million.

The gross proceeds were allocated between common stock and accompanying warrants based on their relative fair values. The fair value of common stock was calculated based on the closing share price on June 27, 2022 of $1.15. The fair value of the warrants was estimated using the Black-Scholes option pricing model. Accordingly, we have allocated $27.9 million as the fair value of common stock and $18.5 million as the fair value of warrants.

The warrants are exercisable six months after the date of issuance, expire five and a half years from the date of issuance and have an exercise price of $1.75 per share of common stock. We have evaluated the warrants as either equity-classified or liability-classified instruments based on an assessment of the warrants’ specific terms and applicable authoritative guidance in ASC 480, Distinguishing Liabilities from Equity, and ASC 815, Derivatives and Hedging. We have concluded that the warrants are considered indexed to our common shares and as such they have been classified as equity.

The following table summarizes the changes in warrants:

|

|

Six months ended |

|

|||||

|

|

June 30, 2023 |

|

|||||

|

|

Number of |

|

|

|

|

||

|

|

warrants (#) |

|

|

Amount |

|

||

Outstanding, December 31, 2022 |

|

|

39,920,919 |

|

|

$ |

25,319,193 |

|

Issued |

|

|

83,333,334 |

|

|

|

9,317,080 |

|

Exercised |

|

|

(100 |

) |

|

|

(14 |

) |

Deemed dividend for down round provision in warrants |

|

|

— |

|

|

|

2,025,000 |

|

Outstanding, June 30, 2023 |

|

|

123,254,153 |

|

|

$ |

36,661,259 |

|

The fair value of warrants that were issued and estimated using the Black-Scholes option pricing model have the following inputs and assumptions:

|

|

Six months ended |

|

|

June 30, 2023 |

Weighted average grant date fair value ($) |

|

0.22 |

Weighted average expected volatility |

|

84.70% |

Weighted average risk-free interest rate |

|

3.65% |

Weighted average expected life of the warrants |

|

5.0 years |

13. Stock-based payments

On December 3, 2021, our shareholders approved the 2021 Equity Incentive Plan to utilize the 3,500,000 shares reserved and unissued under the Torchlight 2015 Stock Option and Grant Plan and the 6,445,745 shares reserved and unissued under the MMI 2018 Stock Option and Grant plan to set the number of shares reserved for issuance under the 2021 Equity Incentive Plan at 34,945,745 shares.

20

The 2021 Equity Incentive Plan allows the grants of non-statutory stock options, restricted stock, restricted stock units, or RSUs, stock appreciation rights, performance units and performance shares to employees, directors, and consultants.

DSU Plan

On March 28, 2013, we implemented a Deferred Stock Unit, or DSU, Plan for our directors, employees and officers. Directors, employees and officers are granted DSUs with immediate vesting as a form of compensation. Each unit is convertible at the option of the holder into one common share. Eligible individuals are entitled to receive all DSUs (including dividends and other adjustments) no later than December 1st of the first calendar year commencing after the time of termination of their services.

The following table summarizes the change in outstanding DSUs:

|

|

Number of |

|

|

Weighted |

|

||

|

|

# |

|

|

$ |

|

||

Outstanding, December 31, 2022 |

|

|

3,910,186 |

|

|

$ |

0.32 |

|

Granted |

|

|

525,210 |

|

|

$ |

0.22 |

|

Outstanding, June 30, 2023 |

|

|

4,435,396 |

|

|

$ |

0.31 |

|

X |

|

|

|

|

|

|

||

Vested, June 30, 2023 |

|

|

3,910,186 |

|

|

$ |

0.32 |

|

We recognized $15,045 of stock-based compensation expense related to DSUs during the three and six months ended June 30, 2023.

RSU Plan

Each unit is convertible at the option of the holder into one common share of our shares upon meeting the vesting conditions.

Total stock-based compensation expense related to RSUs included in the condensed consolidated interim statements of operations was as follows:

|

|

Three months ended |

|

|

Six months ended |

|

||||||||||

|

|

June 30, |

|

|

June 30, |

|

||||||||||

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

||||

Cost of sales |

|

$ |

(180,281 |

) |

|

$ |

157,818 |

|

|

$ |

(36,376 |

) |

|

$ |

208,471 |

|

Selling & marketing |

|

|

(246,314 |

) |

|

|

114,707 |

|

|

|

(125,770 |

) |

|

|

130,200 |

|

General & administrative |

|

|

(497,918 |

) |

|

|

396,997 |

|

|

|

(94,711 |

) |

|

|

517,162 |

|

Research & development |

|

|

(654,206 |

) |

|

|

1,096,021 |

|

|

|

(235,185 |

) |

|

|

1,193,232 |

|

|

(1) |

$ |

(1,578,719 |

) |

|

$ |

1,765,543 |

|

|

$ |

(492,042 |

) |

|

$ |

2,049,065 |

|

(1) Estimated forfeiture rate has been changed to 45% from 0% during the second quarter ended June 30, 2023 due to the Realignment and Consolidation Plan.

21

The following table summarizes the change in outstanding RSUs:

|

|

Number of |

|

|

Weighted |

|

||

Outstanding, December 31, 2022 |

|

|

6,506,922 |

|

|

$ |

1.71 |

|

Granted |

|

|

525,210 |

|

|

$ |

0.22 |

|

Vested and settled |

|

|

(1,633,645 |

) |

|

$ |

2.49 |

|

Awards forfeited |

|

|

(710,930 |

) |

|

$ |

1.38 |

|

Outstanding, June 30, 2023 |

|

|

4,687,557 |

|

|

$ |

1.34 |

|

|

|

|

|

|

|

|

||

Vested, but not yet settled, June 30, 2023 |

|

|

(85,169 |

) |

|

$ |

1.27 |

|

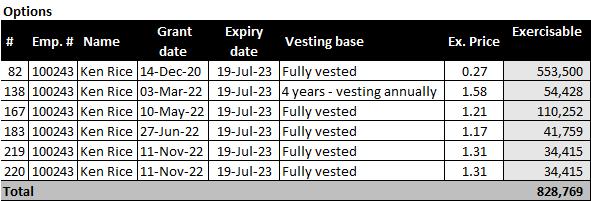

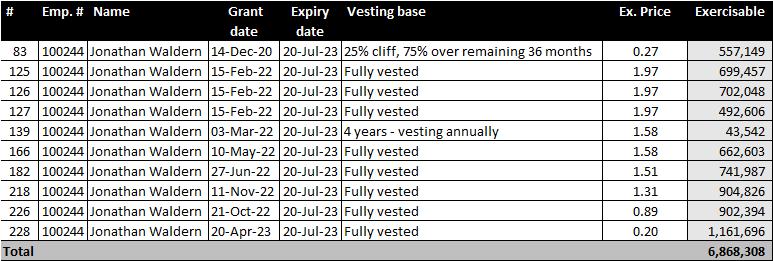

Employee Stock Option Plan

Each stock option is convertible at the option of the holder into one common share upon payment of the exercise price.