UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 04, 2023 |

WORTHINGTON INDUSTRIES, INC.

(Exact name of Registrant as Specified in Its Charter)

Ohio |

001-08399 |

31-1189815 |

||

(State or Other Jurisdiction |

(Commission File Number) |

(IRS Employer |

||

|

|

|

|

|

200 Old Wilson Bridge Road |

|

|||

Columbus, Ohio |

|

43085 |

||

(Address of Principal Executive Offices) |

|

(Zip Code) |

||

Registrant’s Telephone Number, Including Area Code: (614) 438-3210 |

|

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Securities registered pursuant to Section 12(b) of the Act:

|

|

Trading |

|

|

Common Shares, Without Par Value |

|

WOR |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

On August 4, 2023, Worthington Industries, Inc. (the “Company”), posted two investor presentations to the Company’s website, both of which relate to the Company’s previously announced plan to separate into two independent, publicly traded companies – one company is expected to be comprised of the Company’s Steel Processing business (“Worthington Steel”), and the other company is expected to be comprised of the Company’s Consumer Products, Building Products and Sustainable Energy Solutions businesses (“New Worthington”). The presentation related to Worthington Steel is included with this Current Report on Form 8-K as Exhibit 99.1 and is incorporated herein by this reference. The presentation related to New Worthington is included with this Current Report on Form 8-K as Exhibit 99.2 and is incorporated herein by this reference.

The information furnished under Item 7.01 in this Current Report on Form 8-K (including Exhibits 99.1 and 99.2) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section and shall not be deemed incorporated by reference in any filing made by the Company under the Securities Act of 1933 or the Exchange Act, except as set forth by specific reference in such filing. This Current Report on Form 8-K shall not be deemed an admission as to the materiality of any information in this Current Report on Form 8-K that is being disclosed pursuant to Regulation FD.

Item 9.01 Financial Statements and Exhibits.

(a) through (c): Not applicable.

(d) Exhibits:

The following exhibits are included with this Current Report on Form 8‑K:

Exhibit No. |

|

Description |

|

|

|

99.1 |

|

|

99.2 |

|

|

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

WORTHINGTON INDUSTRIES, INC. |

|

|

|

|

Date: |

August 4, 2023 |

By: |

/s/Patrick J. Kennedy |

|

|

|

Patrick J. Kennedy, Vice President - |

Worthington STEEL A best-in-class, value-added steel processor with blue chip customers and expanded opportunities in electrical steel and automotive lightweighting Worthington STEEL

Worthington STEEL NOTES TO INVESTORS FORWARD LOOKING STATEMENTS. Worthington Industries, Inc. (the “Company” or “Worthington”) wishes to take advantage of the Safe Harbor provisions included in the Private Securities Litigation Reform Act of 1995 (the “Act”). Statements by the Company relating to the intended separation of Worthington’s Steel Processing business; the timing and method of the separation; the anticipated benefits of the separation; the expected financial and operating performance of, and future opportunities for, each company following the separation; the tax treatment of the transaction; the leadership of each company following the separation; and other non-historical matters constitute “forward-looking statements” within the meaning of the Act. Forward-looking statements may be characterized by terms such as “believe,” “anticipate,” “should,” “would,” “intend,” “plan,” “will,” “expect,” “estimate,” “project,” “positioned,” “strategy,” “targets,” “aims,” “seeks,” “sees” and similar expressions. Because they are based on beliefs, estimates and assumptions, forward-looking statements are inherently subject to risks and uncertainties that could cause actual results to differ materially from those projected. Any number of factors could affect actual results, including, without limitation, the final approval of the separation by our board of directors; the uncertainty of obtaining regulatory approvals in connection with the separation, including rulings from the Internal Revenue Service; the ability to satisfy the necessary closing conditions to complete the separation on a timely basis, or at all; our ability to successfully separate the two companies and realize the anticipated benefits of the separation; the effect of conditions in national and worldwide financial markets, including inflation, increases in interest rates and economic recession, and with respect to the ability of financial institutions to provide capital; the impact of tariffs, the adoption of trade restrictions affecting the Company’s products or suppliers, a United States withdrawal from or significant renegotiation of trade agreements, the occurrence of trade wars, the closing of border crossings, and other changes in trade regulations or relationships; changing oil prices and/or supply; product demand and pricing; changes in product mix, product substitution and market acceptance of the Company’s products; volatility or fluctuations in the pricing, quality or availability of raw materials (particularly steel), supplies, transportation, utilities, labor and other items required by operations (especially in light of Russia’s invasion of Ukraine); effects of sourcing and supply chain constraints; the outcome of adverse claims experience with respect to workers’ compensation, product recalls or product liability, casualty events or other matters; effects of facility closures and the consolidation of operations; the effect of financial difficulties, consolidation and other changes within the steel, automotive, construction and other industries in which the Company participates; failure to maintain appropriate levels of inventories; financial difficulties (including bankruptcy filings) of original equipment manufacturers, end-users and customers, suppliers, joint venture partners and others with whom the Company does business; the ability to realize targeted expense reductions from headcount reductions, facility closures and other cost reduction efforts; the ability to realize cost savings and operational, sales and sourcing improvements and efficiencies, and other expected benefits from transformation initiatives, on a timely basis; the overall success of, and the ability to integrate, newly-acquired businesses and joint ventures, maintain and develop their customers, and achieve synergies and other expected benefits and cost savings therefrom; capacity levels and efficiencies, within facilities, within major product markets and within the industries in which the Company participates as a whole; the effect of disruption in the business of suppliers, customers, facilities and shipping operations due to adverse weather, casualty events, equipment breakdowns, labor shortages, interruption in utility services, civil unrest, international conflicts (especially in light of Russia’s invasion of Ukraine), terrorist activities or other causes; changes in customer demand, inventories, spending patterns, product choices, and supplier choices; risks associated with doing business internationally, including economic, political and social instability (especially in light of Russia’s invasion of Ukraine), foreign currency exchange rate exposure and the acceptance of the Company’s products in global markets; the ability to improve and maintain processes and business practices to keep pace with the economic, competitive and technological environment; the effect of inflation, interest rate increases and economic recession, as well as potential adverse impacts as a result of the Inflation Reduction Act of 2022, which may negatively impact the Company’s operations and financial results; deviation of actual results from estimates and/or assumptions used by the Company in the application of its significant accounting policies; the level of imports and import prices in the Company’s markets; the impact of environmental laws and regulations or the actions of the United States Environmental Protection Agency or similar regulators which increase costs or limit the Company’s ability to use or sell certain products; the impact of increasing environmental, greenhouse gas emission and sustainability considerations or regulations; the impact of judicial rulings and governmental regulations, both in the United States and abroad, including those adopted by the United States Securities and Exchange Commission (“SEC”) and other governmental agencies as contemplated by the Coronavirus Aid, Relief and Economic Security (CARES) Act, the Consolidated Appropriations Act, 2021, the American Rescue Act of 2021, and the Dodd-Frank Wall Street Reform and the Consumer Protection Act of 2010; the effect of healthcare laws in the United States and potential changes for such laws, especially in light of the COVID-19 pandemic which may increase the Company’s healthcare and other costs and negatively impact the Company’s operations and financial results; the effect of tax laws in the U.S. and potential changes for such laws, which may increase the Company's costs and negatively impact its operations and financial results; cyber security risks; the effects of privacy and information security laws and standards; and other risks described from time to time in the filings of Worthington Industries, Inc. with the SEC, including those described in “Part I — Item 1A. — Risk Factors” of Worthington’s Annual Report on Form 10-K for the fiscal year ended May 31, 2023, and its subsequent filings with the SEC. Forward-looking statements should be construed in the light of such risks. Readers are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date made. Worthington does not undertake, and hereby disclaim, any obligation to update any forward-looking statements, whether as a result of new information, future developments or otherwise.

Worthington STEEL One-of-a-kind business with a unique capability set and leading market positions across multiple value-added services, reliably solving complex supply chain challenges for blue chip customers Market-leading supplier to growing end markets including electric vehicles, electric grid modernization and renewable energy Sophisticated supply chain and price risk management solutions drive market share and margin enhancement Worthington Business System powers base business improvements, higher profitability and organic growth Proven management team that is focused on value creation NET SALES OF $3.5 BILLION1 3.8M TONS OF STEEL DELIVERED 52% 13% 10% 7% 5% 13% Automotive Construction Mach & Equip Agriculture Heavy Truck Other (including Toll) Key Investment Highlights Net Sales by End-Market1 1 FY2023 results. Sales exclude pro-rata share of unconsolidated JV sales. Worthington Steel

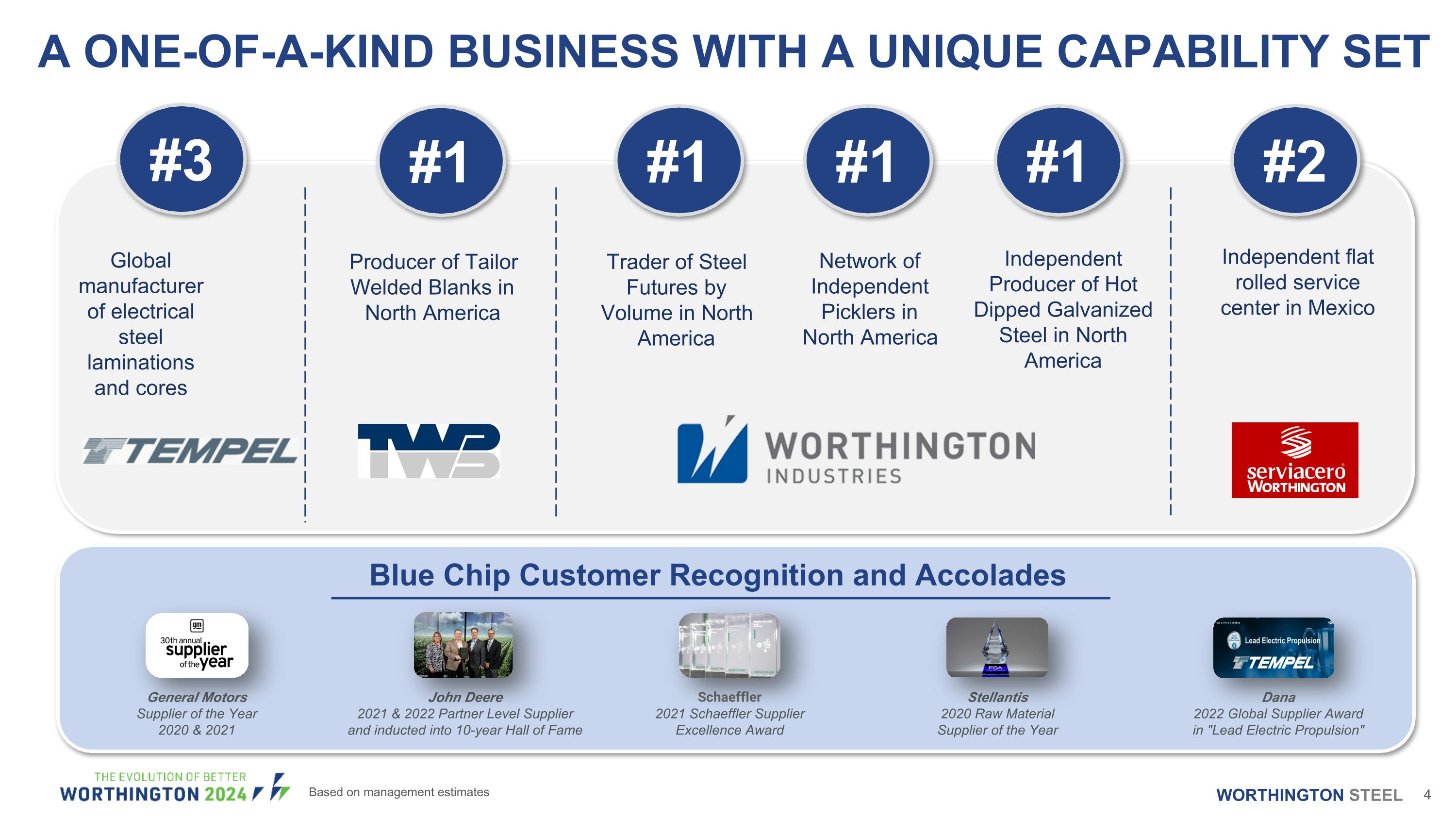

A ONE-OF-A-KIND BUSINESS WITH A UNIQUE CAPABILITY SET General Motors Supplier of the Year 2020 & 2021 John Deere 2021 & 2022 Partner Level Supplier and inducted into 10-year Hall of Fame Schaeffler 2021 Schaeffler Supplier Excellence Award Stellantis 2020 Raw Material Supplier of the Year Blue Chip Customer Recognition and Accolades Global manufacturer of electrical steel laminations and cores Producer of Tailor Welded Blanks in North America Trader of Steel Futures by Volume in North America Network of Independent Picklers in North America Independent Producer of Hot Dipped Galvanized Steel in North America Independent flat rolled service center in Mexico #3 #1 #1 #1 #1 #2 Worthington STEEL Based on management estimates Dana 2022 Global Supplier Award in "Lead Electric Propulsion"

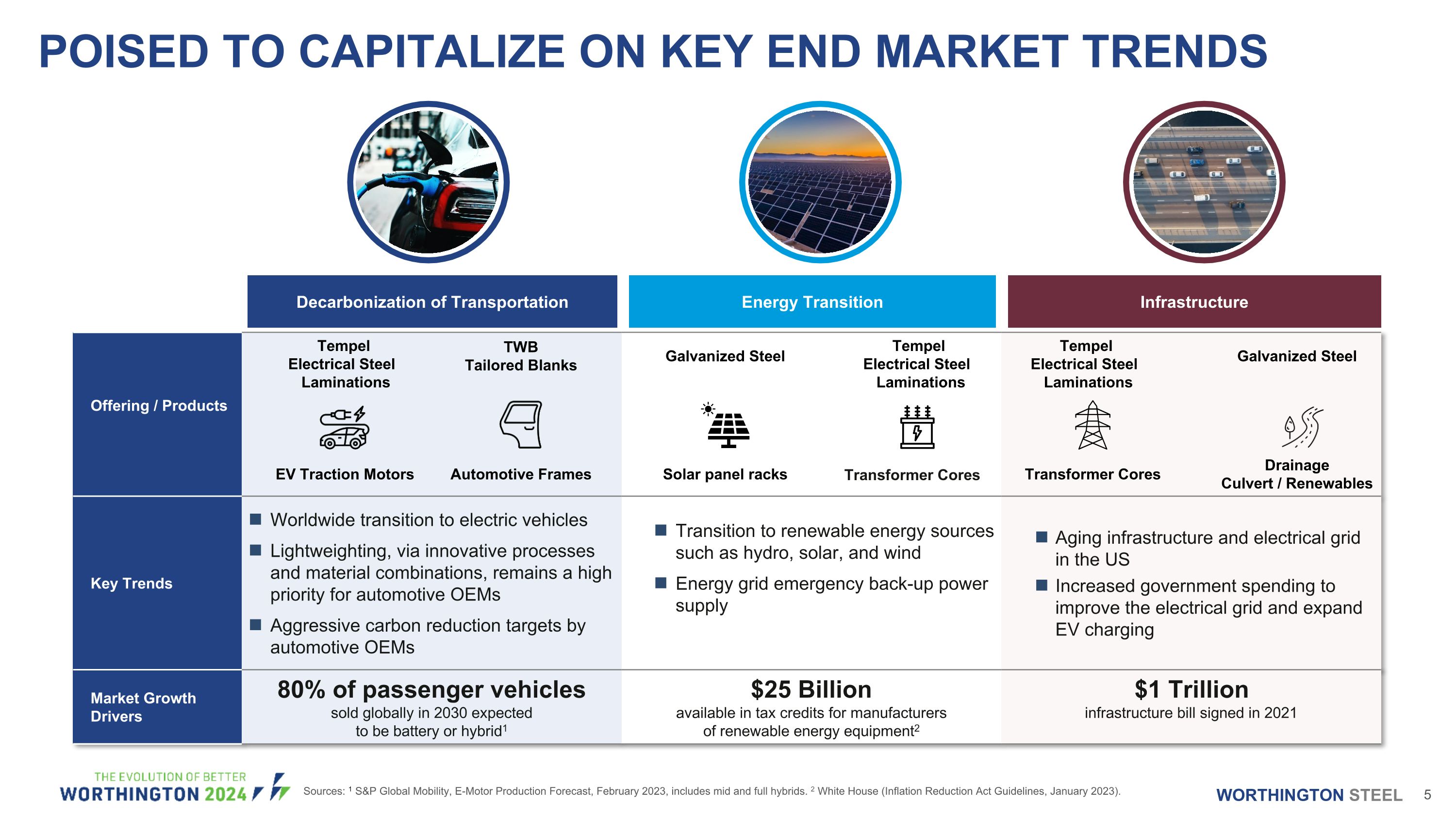

POISED TO CAPITALIZE ON KEY END MARKET TRENDS Offering / Products Key Trends Worldwide transition to electric vehicles Lightweighting, via innovative processes and material combinations, remains a high priority for automotive OEMs Aggressive carbon reduction targets by automotive OEMs Transition to renewable energy sources such as hydro, solar, and wind Energy grid emergency back-up power supply Aging infrastructure and electrical grid in the US Increased government spending to improve the electrical grid and expand EV charging Market Growth Drivers 80% of passenger vehicles sold globally in 2030 expected to be battery or hybrid1 $25 Billionavailable in tax credits for manufacturers of renewable energy equipment2 $1 Trillion infrastructure bill signed in 2021 Decarbonization of Transportation Energy Transition Infrastructure EV Traction Motors Transformer Cores Galvanized Steel Solar panel racks Galvanized Steel Drainage Culvert / Renewables TWB Tailored Blanks Automotive Frames Sources: 1 S&P Global Mobility, E-Motor Production Forecast, February 2023, includes mid and full hybrids. 2 White House (Inflation Reduction Act Guidelines, January 2023). Tempel Electrical Steel Laminations Transformer Cores Tempel Electrical Steel Laminations Tempel Electrical Steel Laminations Worthington STEEL

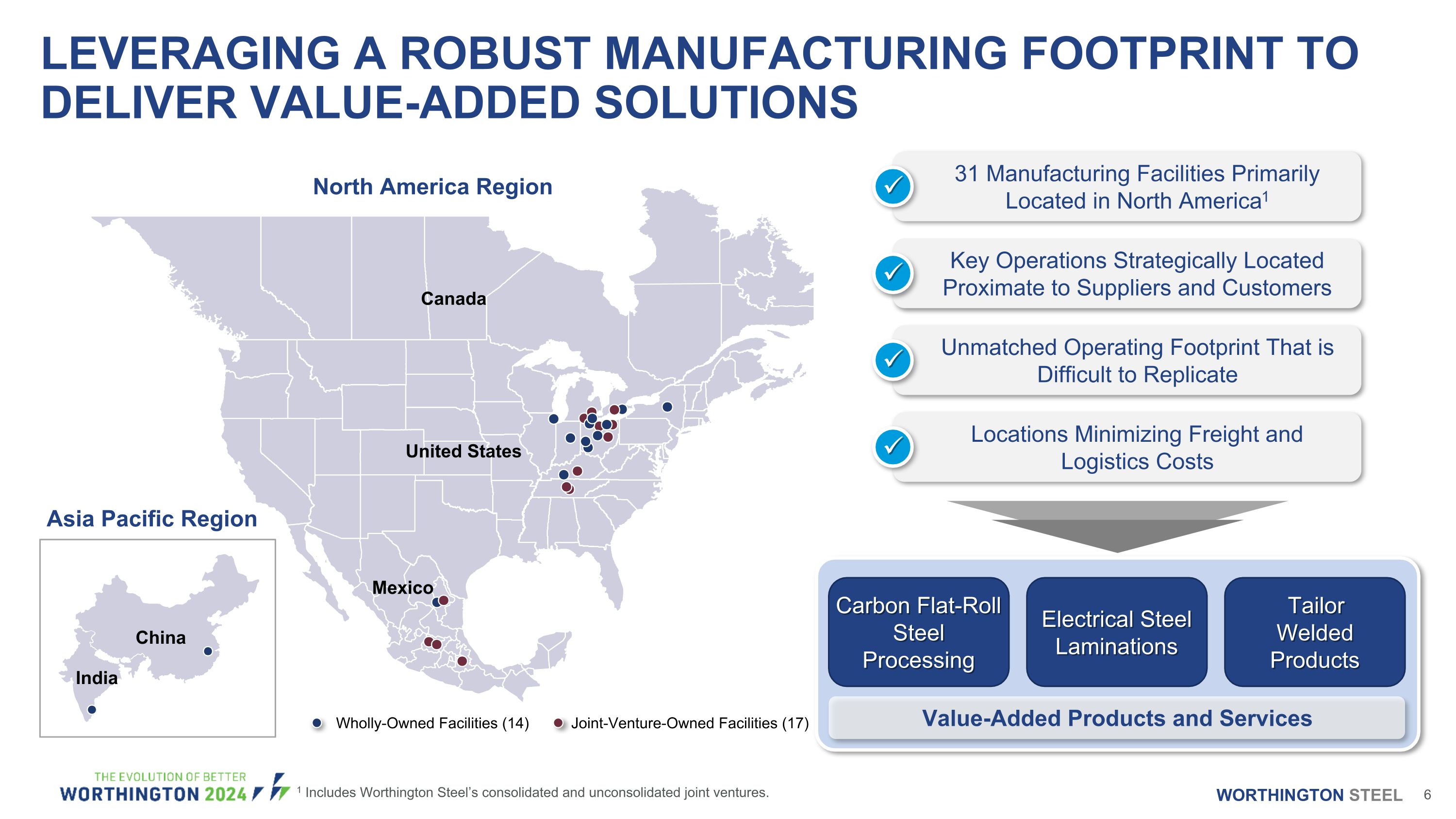

1 Includes Worthington Steel’s consolidated and unconsolidated joint ventures. LEVERAGING A ROBUST MANUFACTURING FOOTPRINT TO DELIVER VALUE-ADDED SOLUTIONS Wholly-Owned Facilities (14) Joint-Venture-Owned Facilities (17) Canada United States Mexico India China Asia Pacific Region North America Region 31 Manufacturing Facilities Primarily Located in North America1 Key Operations Strategically Located Proximate to Suppliers and Customers Unmatched Operating Footprint That is Difficult to Replicate Locations Minimizing Freight and Logistics Costs Carbon Flat-Roll Steel Processing Electrical Steel Laminations Tailor Welded Products Value-Added Products and Services Worthington STEEL

Leveraging Lean Practices and Technology for World-Class Operations Systematic approach to identifying business improvement opportunities Ongoing collaboration between sales, supply chain, and operations to optimize working capital and increase earnings Predictive analytics and automation to enhance operational efficiency, reduce unplanned downtime, and improve safety POWERED BY THE WORTHINGTON BUSINESS SYSTEM TRANSFORMATION INNOVATION ACQUISITIONS Tailored Customer Solutions Cross-functional teams developing sophisticated supply chain solutions Utilize the steel futures market to provide tailored commercial mechanisms Metallurgical expertise to co-develop custom metals solutions for customers Acquired Strategic Capabilities Enabling Green Energy Transition Tempel provides direct exposure to growth trends in the transportation and grid modernization industries, catalyzed by the acceleration of electrification TWB enables vehicle lightweighting for more fuel-efficiency and improved safety performance Worthington STEEL

3 STRATEGIC GROWTH PILLARS WILL DRIVE THE NEXT PHASE OF GROWTH Building on a Strong Leadership Position to Drive Shareholder Value Focused investment in rapidly growing electrical steel market Grow existing portfolio of highly technical electrical steel products to meet demand for infrastructure improvements and EVs Expand value-added offerings through disciplined strategic capex and acquisitions Attractive opportunities in electrical steel, tailor welded products, and carbon flat-rolled steel Drive continuous improvement using the Worthington Business System Worthington Business System powers higher profitability and is unique among service centers Worthington STEEL

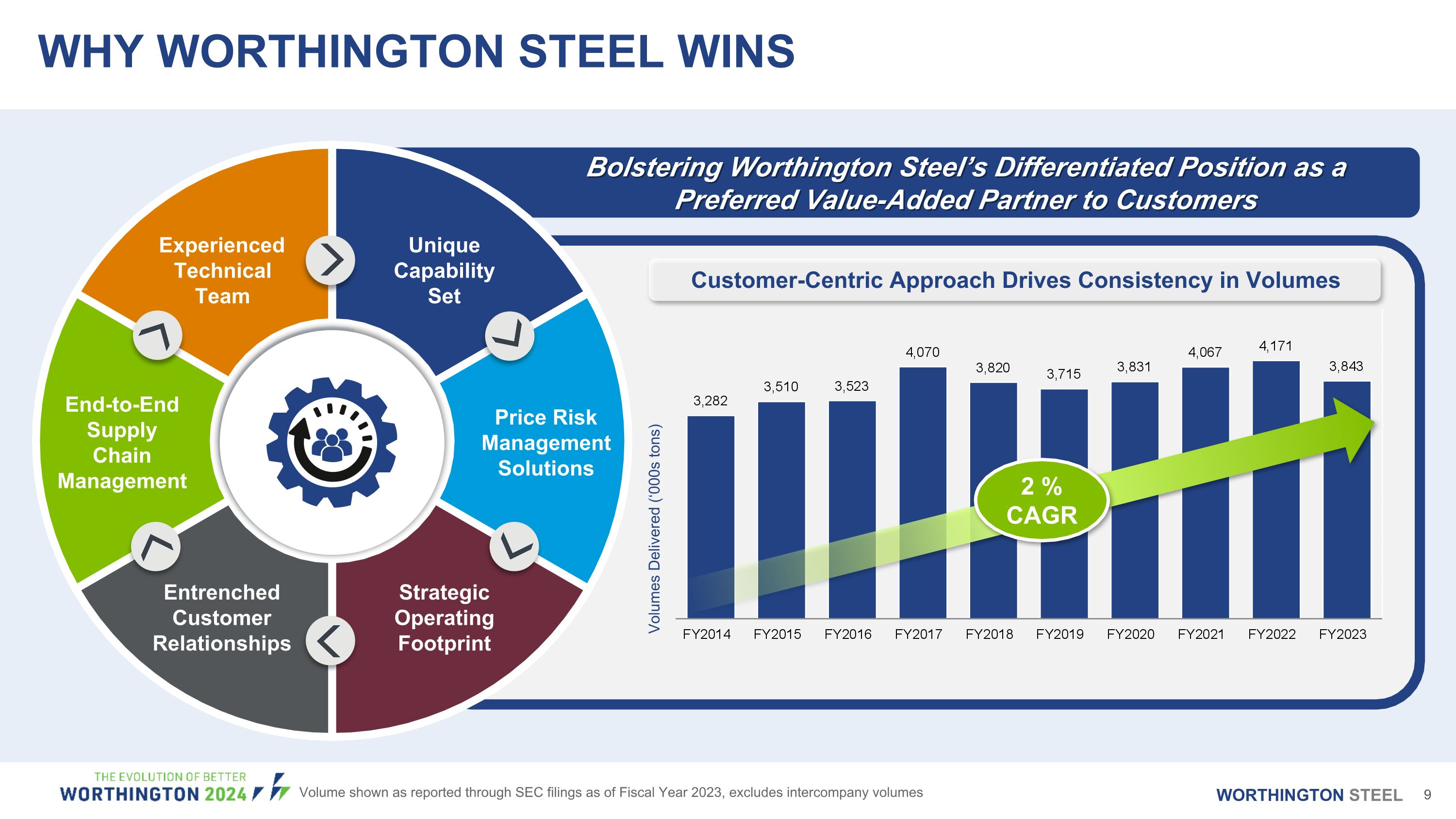

Volumes Delivered (‘000s tons) Customer-Centric Approach Drives Consistency in Volumes WHY WORTHINGTON STEEL WINS Bolstering Worthington Steel’s Differentiated Position as a Preferred Value-Added Partner to Customers End-to-End Supply Chain Management Unique Capability Set Entrenched Customer Relationships Strategic Operating Footprint Price Risk Management Solutions Experienced Technical Team 2 % CAGR Worthington STEEL Volume shown as reported through SEC filings as of Fiscal Year 2023, excludes intercompany volumes

PROVEN MANAGEMENT TEAM THAT IS FOCUSED ON VALUE CREATION Geoff Gilmore Chief Executive Officer 25 Years of Experience at Worthington Industries Jeff Klingler Chief Operating Officer 24 Years of Experience at Worthington Industries Tim Adams Chief Financial Officer 25 Years of Experience at Worthington Industries A Collective 75 Years of Industry Experience with a Proven Track Record of Execution Driving Key Initiatives Success Through Market Cycles Operational Excellence Profitable Growth Value Creation Executing & Integrating M&A Worthington STEEL

NEW Worthington A market-leading designer and manufacturer of innovative products in attractive end markets including Building Products, Consumer Products, and Sustainable Energy Solutions NEW Worthington

NEW Worthington NOTES TO INVESTORS FORWARD LOOKING STATEMENTS. Worthington Industries, Inc. (the “Company” or “Worthington”) wishes to take advantage of the Safe Harbor provisions included in the Private Securities Litigation Reform Act of 1995 (the “Act”). Statements by the Company relating to the intended separation of Worthington’s Steel Processing business; the timing and method of the separation; the anticipated benefits of the separation; the expected financial and operating performance of, and future opportunities for, each company following the separation; the tax treatment of the transaction; the leadership of each company following the separation; and other non-historical matters constitute “forward-looking statements” within the meaning of the Act. Forward-looking statements may be characterized by terms such as “believe,” “anticipate,” “should,” “would,” “intend,” “plan,” “will,” “expect,” “estimate,” “project,” “positioned,” “strategy,” “targets,” “aims,” “seeks,” “sees” and similar expressions. Because they are based on beliefs, estimates and assumptions, forward-looking statements are inherently subject to risks and uncertainties that could cause actual results to differ materially from those projected. Any number of factors could affect actual results, including, without limitation, the final approval of the separation by our board of directors; the uncertainty of obtaining regulatory approvals in connection with the separation, including rulings from the Internal Revenue Service; the ability to satisfy the necessary closing conditions to complete the separation on a timely basis, or at all; our ability to successfully separate the two companies and realize the anticipated benefits of the separation; the effect of conditions in national and worldwide financial markets, including inflation, increases in interest rates and economic recession, and with respect to the ability of financial institutions to provide capital; the impact of tariffs, the adoption of trade restrictions affecting the Company’s products or suppliers, a United States withdrawal from or significant renegotiation of trade agreements, the occurrence of trade wars, the closing of border crossings, and other changes in trade regulations or relationships; changing oil prices and/or supply; product demand and pricing; changes in product mix, product substitution and market acceptance of the Company’s products; volatility or fluctuations in the pricing, quality or availability of raw materials (particularly steel), supplies, transportation, utilities, labor and other items required by operations (especially in light of Russia’s invasion of Ukraine); effects of sourcing and supply chain constraints; the outcome of adverse claims experience with respect to workers’ compensation, product recalls or product liability, casualty events or other matters; effects of facility closures and the consolidation of operations; the effect of financial difficulties, consolidation and other changes within the steel, automotive, construction and other industries in which the Company participates; failure to maintain appropriate levels of inventories; financial difficulties (including bankruptcy filings) of original equipment manufacturers, end-users and customers, suppliers, joint venture partners and others with whom the Company does business; the ability to realize targeted expense reductions from headcount reductions, facility closures and other cost reduction efforts; the ability to realize cost savings and operational, sales and sourcing improvements and efficiencies, and other expected benefits from transformation initiatives, on a timely basis; the overall success of, and the ability to integrate, newly-acquired businesses and joint ventures, maintain and develop their customers, and achieve synergies and other expected benefits and cost savings therefrom; capacity levels and efficiencies, within facilities, within major product markets and within the industries in which the Company participates as a whole; the effect of disruption in the business of suppliers, customers, facilities and shipping operations due to adverse weather, casualty events, equipment breakdowns, labor shortages, interruption in utility services, civil unrest, international conflicts (especially in light of Russia’s invasion of Ukraine), terrorist activities or other causes; changes in customer demand, inventories, spending patterns, product choices, and supplier choices; risks associated with doing business internationally, including economic, political and social instability (especially in light of Russia’s invasion of Ukraine), foreign currency exchange rate exposure and the acceptance of the Company’s products in global markets; the ability to improve and maintain processes and business practices to keep pace with the economic, competitive and technological environment; the effect of inflation, interest rate increases and economic recession, as well as potential adverse impacts as a result of the Inflation Reduction Act of 2022, which may negatively impact the Company’s operations and financial results; deviation of actual results from estimates and/or assumptions used by the Company in the application of its significant accounting policies; the level of imports and import prices in the Company’s markets; the impact of environmental laws and regulations or the actions of the United States Environmental Protection Agency or similar regulators which increase costs or limit the Company’s ability to use or sell certain products; the impact of increasing environmental, greenhouse gas emission and sustainability considerations or regulations; the impact of judicial rulings and governmental regulations, both in the United States and abroad, including those adopted by the United States Securities and Exchange Commission (“SEC”) and other governmental agencies as contemplated by the Coronavirus Aid, Relief and Economic Security (CARES) Act, the Consolidated Appropriations Act, 2021, the American Rescue Act of 2021, and the Dodd-Frank Wall Street Reform and the Consumer Protection Act of 2010; the effect of healthcare laws in the United States and potential changes for such laws, especially in light of the COVID-19 pandemic which may increase the Company’s healthcare and other costs and negatively impact the Company’s operations and financial results; the effect of tax laws in the U.S. and potential changes for such laws, which may increase the Company's costs and negatively impact its operations and financial results; cyber security risks; the effects of privacy and information security laws and standards; and other risks described from time to time in the filings of Worthington Industries, Inc. with the SEC, including those described in “Part I — Item 1A. — Risk Factors” of Worthington’s Annual Report on Form 10-K for the fiscal year ended May 31, 2023, and its subsequent filings with the SEC. Forward-looking statements should be construed in the light of such risks. Readers are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date made. Worthington does not undertake, and hereby disclaim, any obligation to update any forward-looking statements, whether as a result of new information, future developments or otherwise.

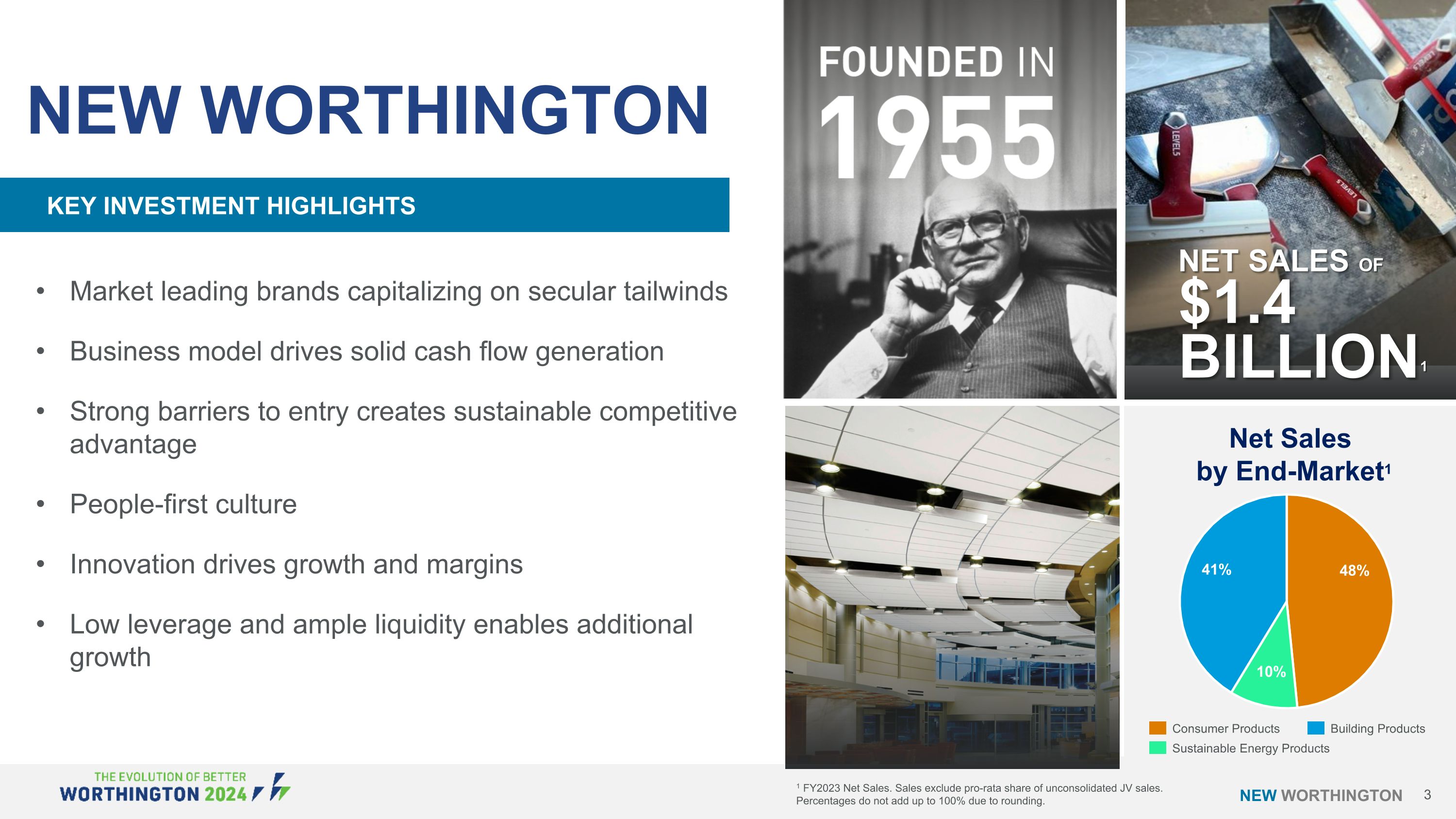

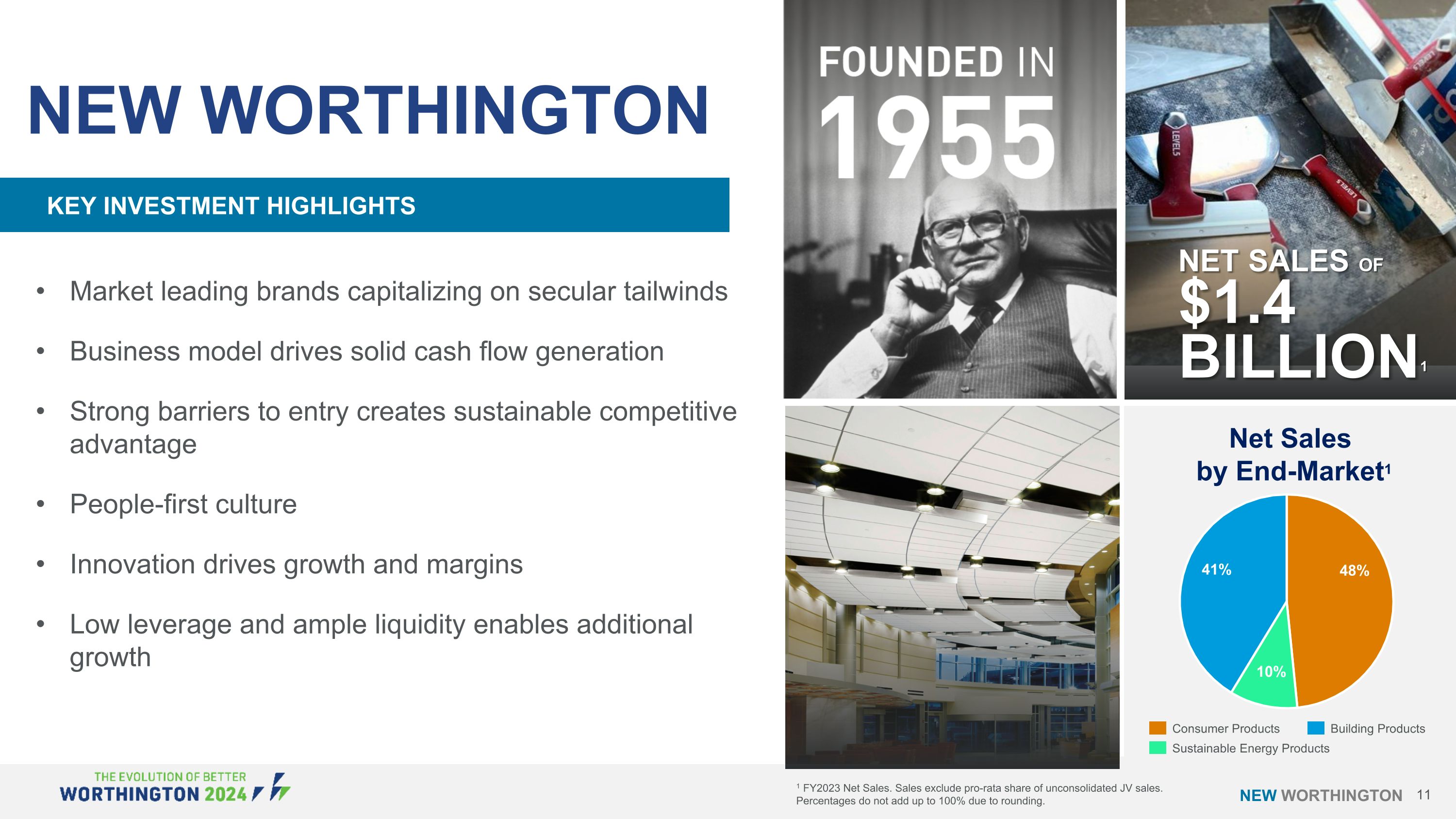

NEW Worthington Market leading brands capitalizing on secular tailwinds Business model drives solid cash flow generation Strong barriers to entry creates sustainable competitive advantage People-first culture Innovation drives growth and margins Low leverage and ample liquidity enables additional growth New Worthington NET SALES OF $1.4 BILLION1 Consumer Products Sustainable Energy Products Building Products Key Investment Highlights Net Sales by End-Market1 1 FY2023 Net Sales. Sales exclude pro-rata share of unconsolidated JV sales. Percentages do not add up to 100% due to rounding. 41% 48% 10%

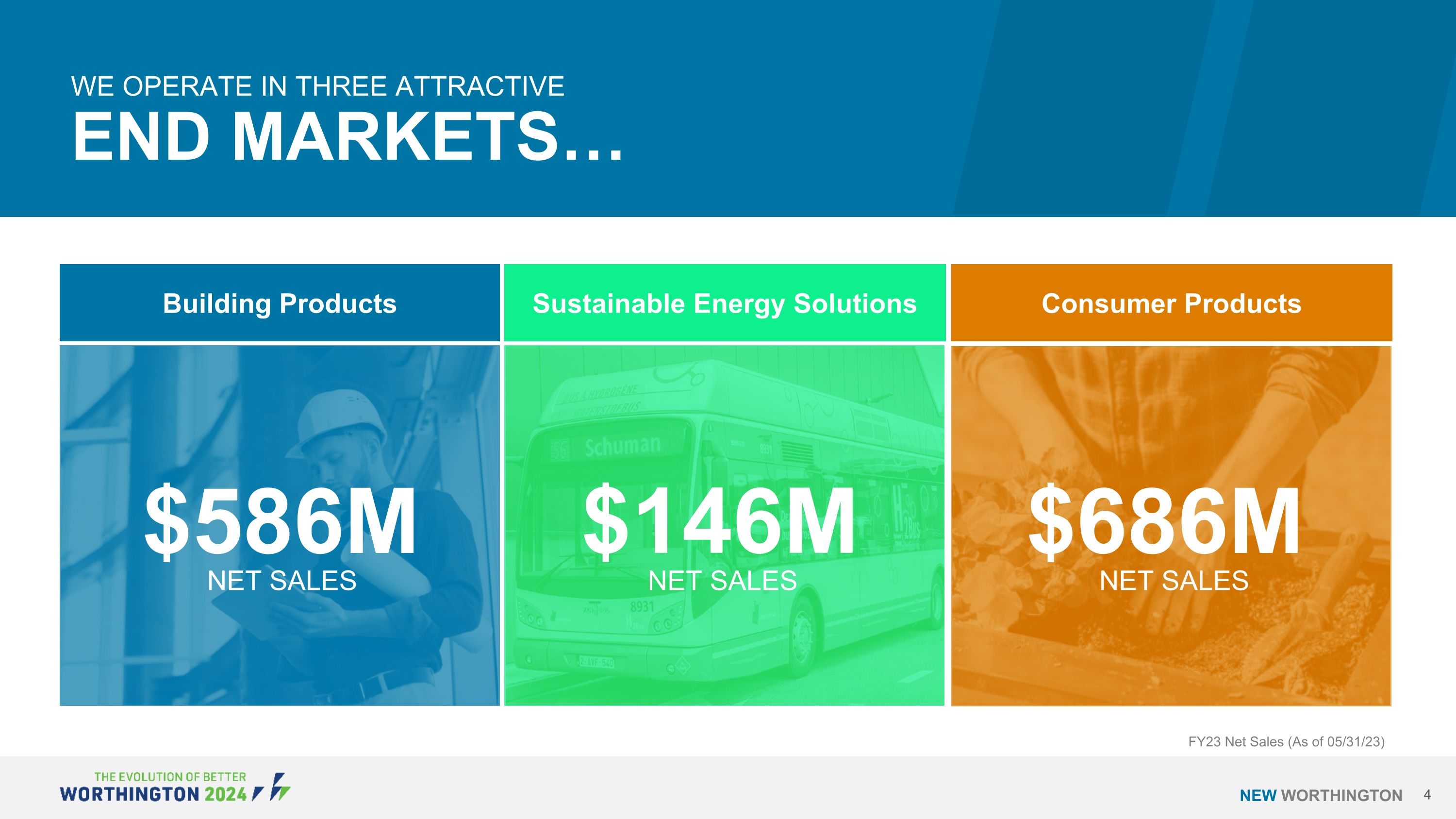

We Operate in Three attractive End Markets… Building Products Consumer Products $586M FY23 Net Sales (As of 05/31/23) $686M NET SALES NET SALES NEW Worthington Sustainable Energy Solutions $146M NET SALES

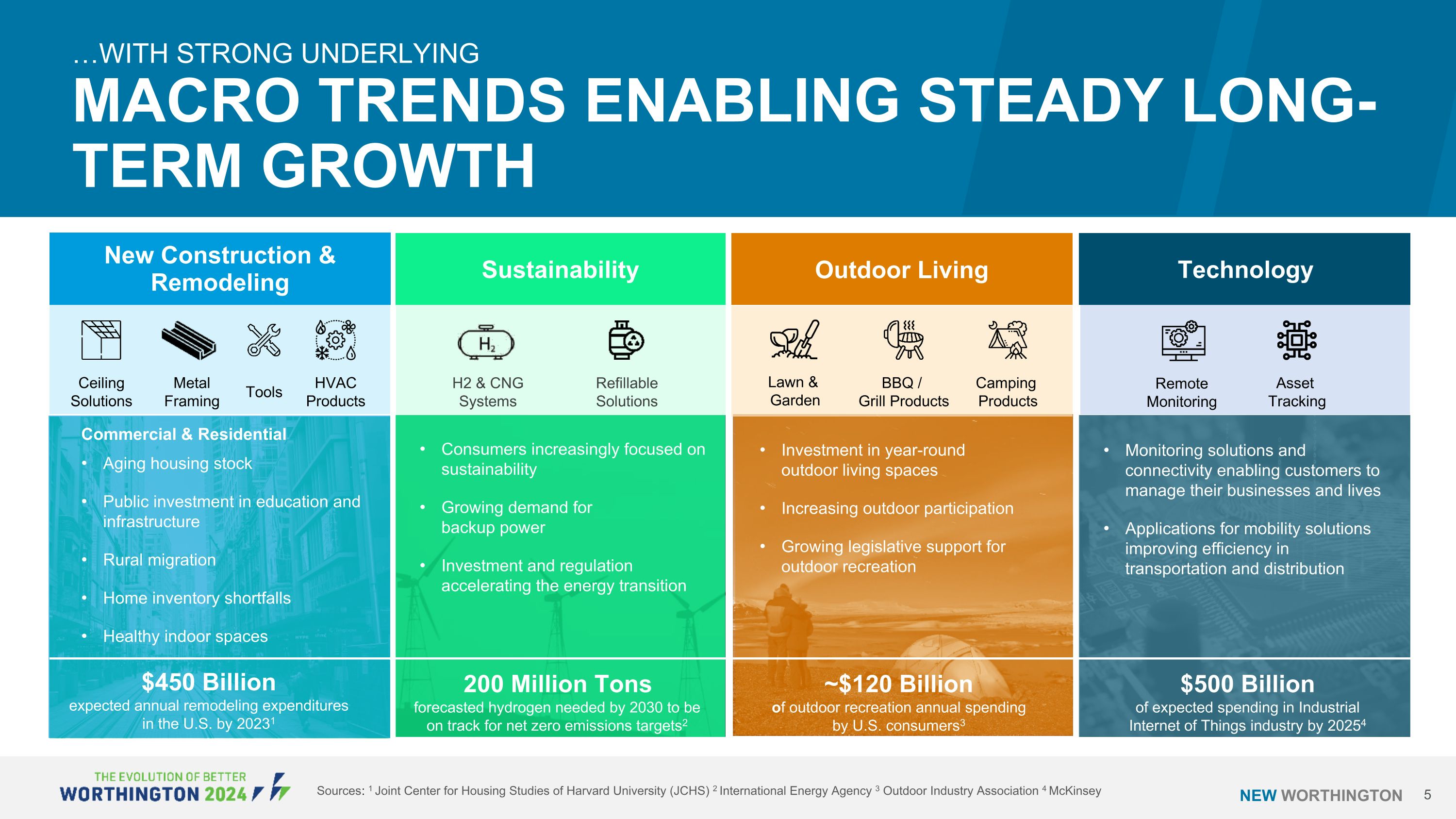

…With strong underlying MACRO Trends Enabling steady long-term growth Commercial & Residential Aging housing stock Public investment in education and infrastructure Rural migration Home inventory shortfalls Healthy indoor spaces CeilingSolutions MetalFraming Tools HVACProducts New Construction & Remodeling Sustainability H2 & CNG Systems RefillableSolutions Consumers increasingly focused on sustainability Growing demand for backup power Investment and regulation accelerating the energy transition Remote Monitoring Asset Tracking Technology Monitoring solutions and connectivity enabling customers to manage their businesses and lives Applications for mobility solutions improving efficiency in transportation and distribution NEW Worthington Investment in year-round outdoor living spaces Increasing outdoor participation Growing legislative support for outdoor recreation Lawn & Garden BBQ / Grill Products Camping Products Outdoor Living Sources: 1 Joint Center for Housing Studies of Harvard University (JCHS) 2 International Energy Agency 3 Outdoor Industry Association 4 McKinsey 200 Million Tonsforecasted hydrogen needed by 2030 to be on track for net zero emissions targets2 $500 Billionof expected spending in Industrial Internet of Things industry by 20254 $450 Billionexpected annual remodeling expenditures in the U.S. by 20231 ~$120 Billion of outdoor recreation annual spendingby U.S. consumers3

We Are Well Positioned with Ceiling suspension systems Camping fuel Hand torch and fuels Metal framing Portable helium tanks Vertical residential heating tanks NEW Worthington Market-leading Brands & Products

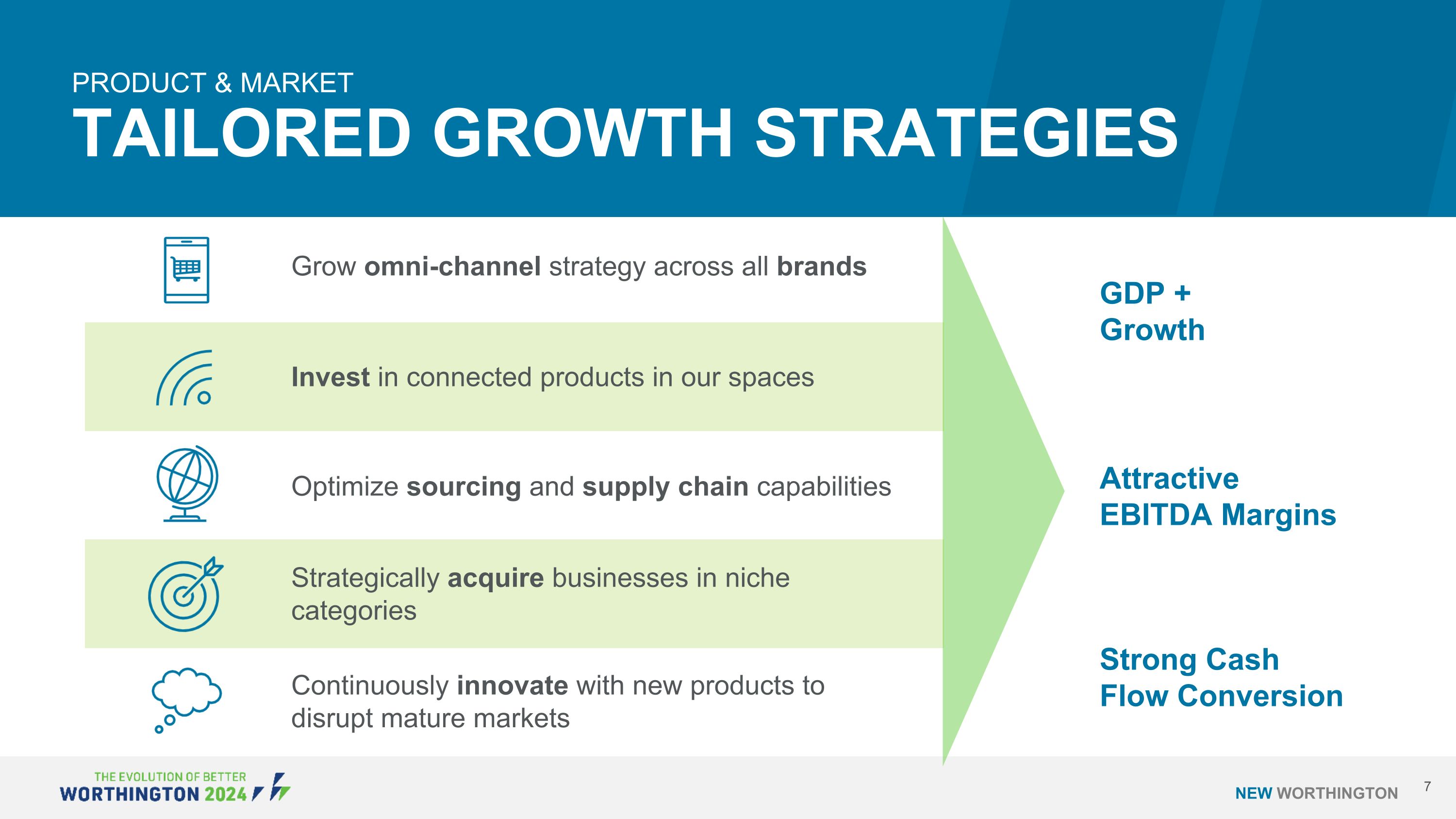

GDP + Growth Attractive EBITDA Margins Strong Cash Flow Conversion Grow omni-channel strategy across all brands Continuously innovate with new products to disrupt mature markets Strategically acquire businesses in niche categories Optimize sourcing and supply chain capabilities Invest in connected products in our spaces Product & MarketTailored Growth Strategies NEW Worthington Product & MarketTailored Growth Strategies

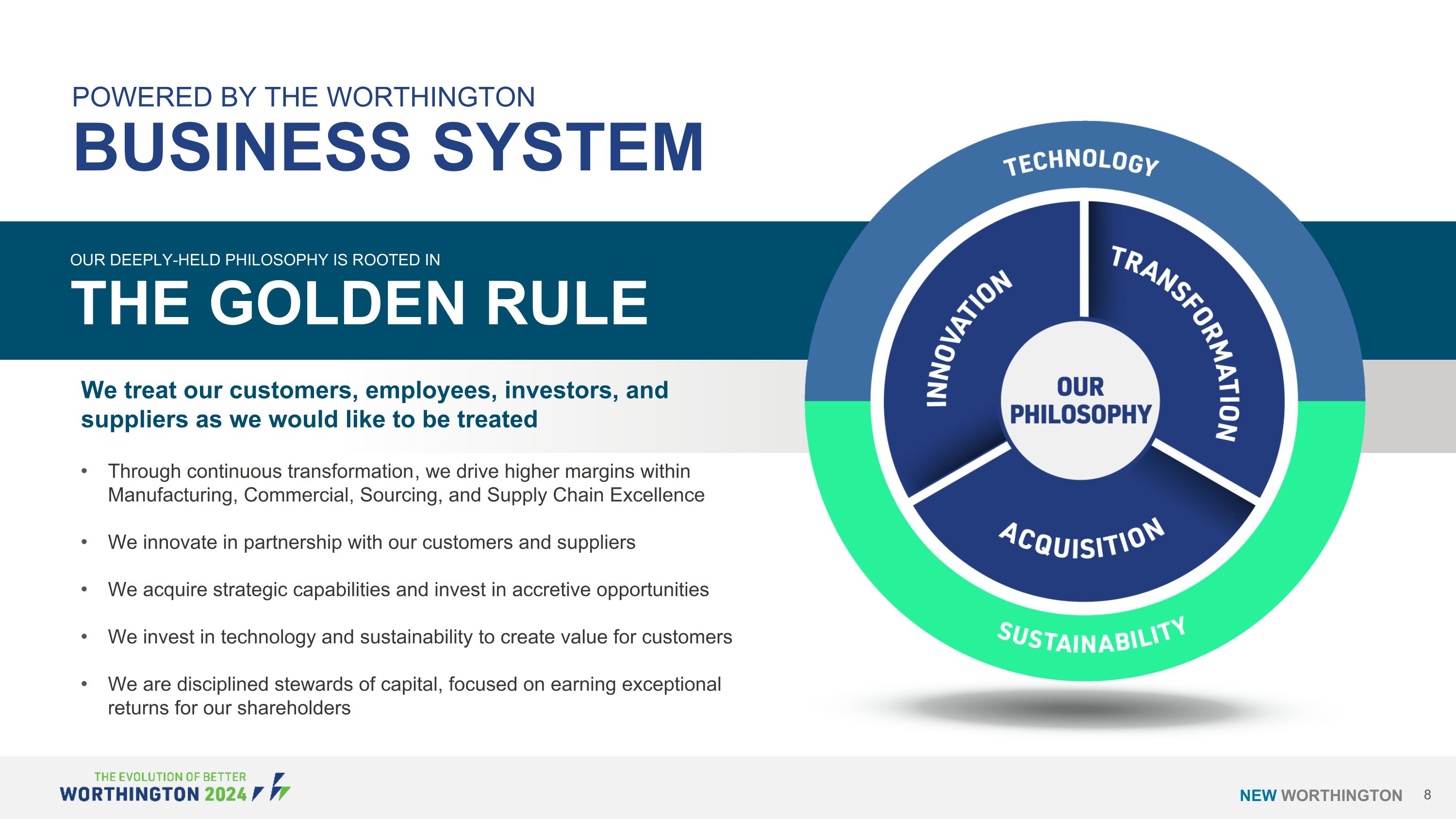

Through continuous transformation, we drive higher margins within Manufacturing, Commercial, Sourcing, and Supply Chain Excellence We innovate in partnership with our customers and suppliers We acquire strategic capabilities and invest in accretive opportunities We invest in technology and sustainability to create value for customers We are disciplined stewards of capital, focused on earning exceptional returns for our shareholders NEW Worthington Our deeply-held Philosophy is rooted in the Golden Rule POWERED BY The WorthingtonBusiness system We treat our customers, employees, investors, and suppliers as we would like to be treated

NEW Worthington Predominantly #1 or #2 brand or market position Higher margin, higher growth brands or products Asset-light or low capital intensity business model Exposure to the channels where we have leadership positions Additive capabilities – must make us better! Demonstrated sustainable competitive advantage NEW WORTHINGTON’S ACQUISITION CRITERIA WILL DRIVE profitable growth

NEW Worthington Building Products Ceiling Solutions Heating & Cooling Products Andy Rose Chief Executive Officer Joseph Hayek Executive Vice President CFO & COO Back-Up Power Metal Framing Sustainable Energy Solutions Transport and Storage Offerings H2 Ecosystems Mobility Solutions Transport & Storage Offerings Consumer Products DIY & Pro Tools Outdoor Living Eric Smolenski PresidentBuilding Products & Sustainable Energy Solutions Steve Caravati PresidentConsumer Products Camping Celebrations New Worthington is built on a solid foundationLED BY A PROVEN MANAGEMENT TEAM

NEW Worthington Market leading brands capitalizing on secular tailwinds Business model drives solid cash flow generation Strong barriers to entry creates sustainable competitive advantage People-first culture Innovation drives growth and margins Low leverage and ample liquidity enables additional growth New Worthington NET SALES OF $1.4 BILLION1 Consumer Products Sustainable Energy Products Building Products Key Investment Highlights Net Sales by End-Market1 1 FY2023 Net Sales. Sales exclude pro-rata share of unconsolidated JV sales. Percentages do not add up to 100% due to rounding. 41% 48% 10%