UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 17, 2023 |

AGILYSYS, INC.

(Exact name of Registrant as Specified in Its Charter)

Delaware |

000-5734 |

34-0907152 |

||

(State or Other Jurisdiction |

(Commission File Number) |

(IRS Employer |

||

|

|

|

|

|

|

1000 Windward Concourse Suite 250 |

|

|||

Alpharetta, Georgia |

|

30005 |

||

(Address of Principal Executive Offices) |

|

(Zip Code) |

||

Registrant’s Telephone Number, Including Area Code: 770 810-7800 |

|

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Securities registered pursuant to Section 12(b) of the Act:

|

|

Trading |

|

|

Common Stock, without par value |

|

AGYS |

|

Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

Agilysys, Inc. (“the Company”) may use a slide presentation, in whole or in part, from time to time in presentation to investors, analysts and others. A copy of the slide presentation is furnished as Exhibit 99.1 to this Current Report on Form 8-K and incorporated by reference herein. A copy of the slide presentation is also available on the Company’s website at www.agilysys.com.

The information contained in this Item 7.01 as well as in Exhibit 99.1 is furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and such information shall not be deemed to be incorporated by reference into any of the Company’s filings under the Securities Act of 1933, as amended, or the Exchange Act.

Item 9.01 Financial Statements and Exhibits.

(c) Exhibits

The following item is furnished as an exhibit to this current report on Form 8-K:

Exhibit Number |

|

Description |

|

|

|

99.1 |

|

|

|

|

|

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

AGILYSYS, INC. |

|

|

|

|

Date: |

May 17, 2023 |

By: |

/s/ William David Wood III |

|

|

|

William David Wood III |

INVESTOR PRESENTATION Q4 and Full Fiscal Year 2023

Forward-looking Statements & Non-GAAP Financial Information Forward-Looking Language This presentation contains “forward-looking statements” within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as: “anticipate,” “intend,” “plan,” “goal,” “seek,” “believe,” “project,” “estimate,” “expect,” “strategy,” “future,” “likely,” “may,” “should,” “will” and similar references to future periods. Examples of forward-looking statements include, among others, our revenue, subscription revenue and Adjusted EBITDA guidance for the 2024 fiscal year and statements we make regarding expected property management room growth. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of our control. Our actual results and financial condition may differ materially from those indicated in the forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward-looking statements include, among others, the effect of the COVID-19 pandemic on our business and the success of any measures we have taken or may take in the future in response thereto; and the risks described in the Company’s filings with the Securities and Exchange Commission, including the Company’s reports on Form 10-K and Form 10-Q. Any forward-looking statement made by us in this press release is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement that may be made from time to time, whether written or oral, whether as a result of new information, future developments or otherwise. Use of Non-GAAP Financial Information To supplement the unaudited consolidated financial statements presented in accordance with U.S. GAAP in this press release, certain non-GAAP financial measures as defined by the SEC rules are used. These non-GAAP financial measures include EBITDA, Adjusted EBITDA, adjusted net income, adjusted basic earnings per share, adjusted diluted earnings per share and free cash flow. Management believes that such information can enhance investors’ understanding of the Company’s ongoing operations.

The Business We Are In We Are In The Business Of Providing A Fully Integrated Suite Of Software Solutions To Enterprise Food & Beverage And Lodging Operators In The Hospitality Space That Enable Memorable Experiences Across All Channels Of Guest Engagement

Thank You For your partnership and your business Our Mission Helping Our Customers Improve Employee & Guest Experiences, With Dedication To Past, Present & Future Customer Investments In Our Products And Services.

Agilysys Defining Strategy Pillars 100% HOSPITALITY FOCUSED STATE OF THE ART CLOUD-NATIVE & ON-PREMISE OPTIONS CORE PRODUCT FOCUS & INNOVATION DRIVEN OBSESSIVELY CUSTOMER-CENTRIC END-TO-END COMPREHENSIVE SOLUTION OFFERINGS 1 2 3 4 5

100% Hospitality Focused - Why It Matters

Obsessively Customer-Centric - Why It Matters

Core Product Focus & Innovation Driven - Why It Matters

State Of The Art Cloud-native & On-premise Options - Why It Matters

End-To-End Comprehensive Solution Offerings - Why It Matters

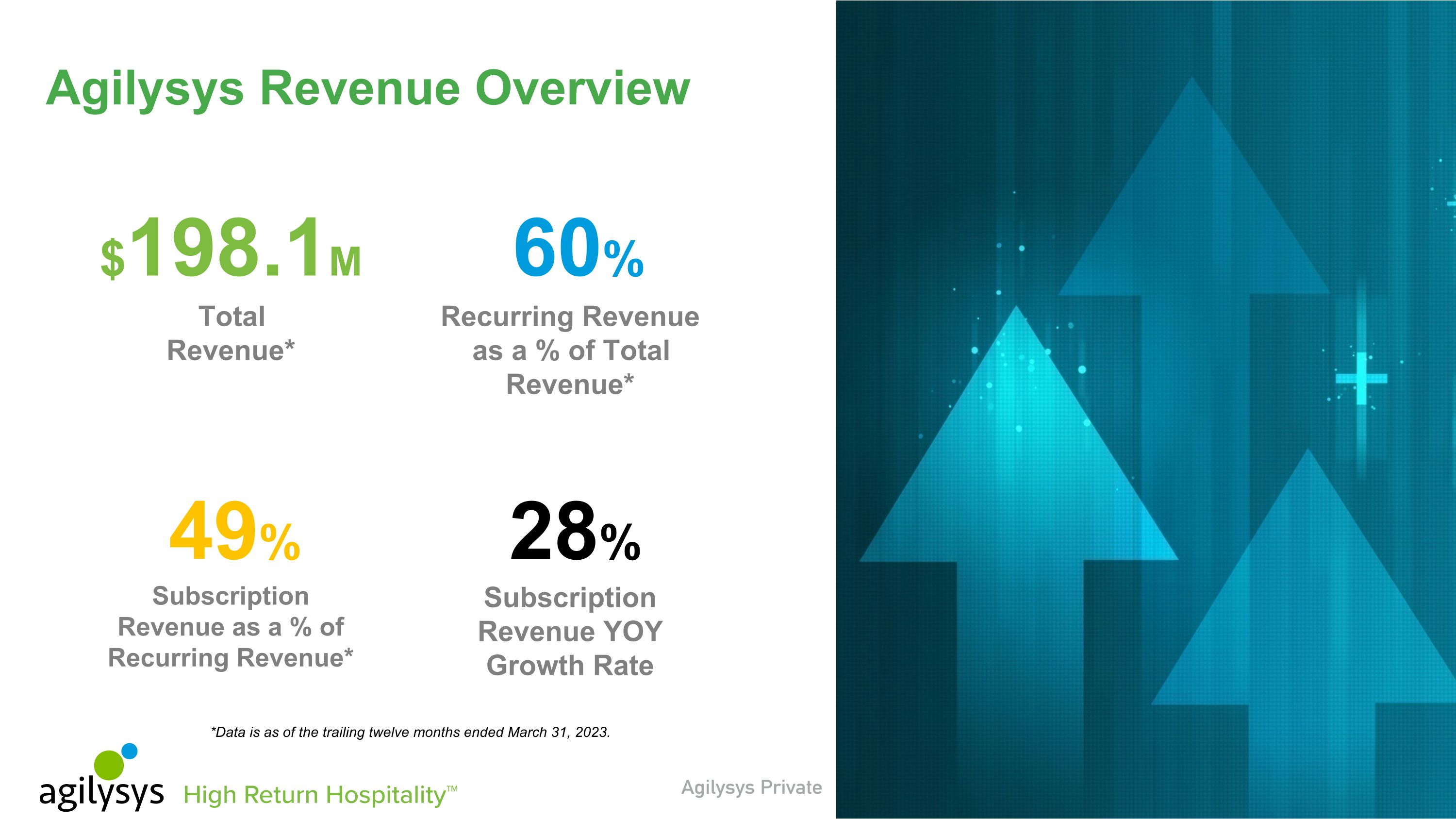

Agilysys Revenue Overview *Data is as of the trailing twelve months ended March 31, 2023. Subscription Revenue as a % of Recurring Revenue* Subscription Revenue YOY Growth Rate Total Revenue* Recurring Revenue as a % of Total Revenue* $198.1M 60% 49% 28%

We Provide Industry Leading Hospitality Solutions Lodging Solutions Food and Beverage Solutions 59% of Revenue 21% of Revenue 6% of Revenue INVENTORY & PROCUREMENT 5% of Revenue DOCUMENT MANAGEMENT PROPERTY MANAGEMENT Note: Revenue contribution figures represent percentage for the trailing twelve months ended March 31, 2023 and include an allocation of total revenue (excluding services) amounts to our 4 core product groupings and payment software related revenue. POINT-OF-SALE Region 93% of Revenue North America 7% of Revenue APAC Plus EMEA Allocation of Revenue 9% of Revenue Payment Revenue

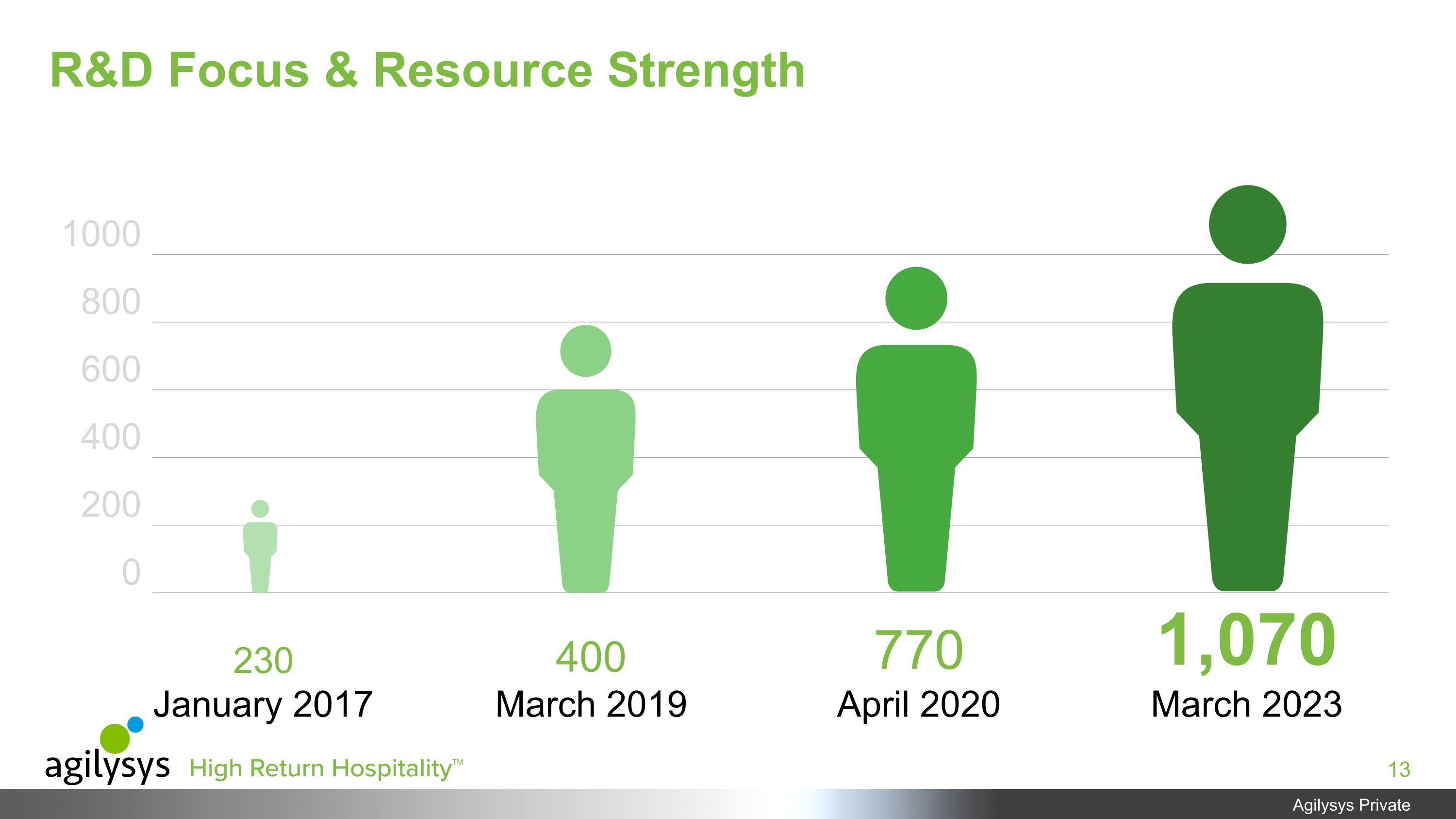

1000 800 600 400 200 0 230 400 770 1,070 January 2017 March 2019 April 2020 March 2023 R&D Focus & Resource Strength

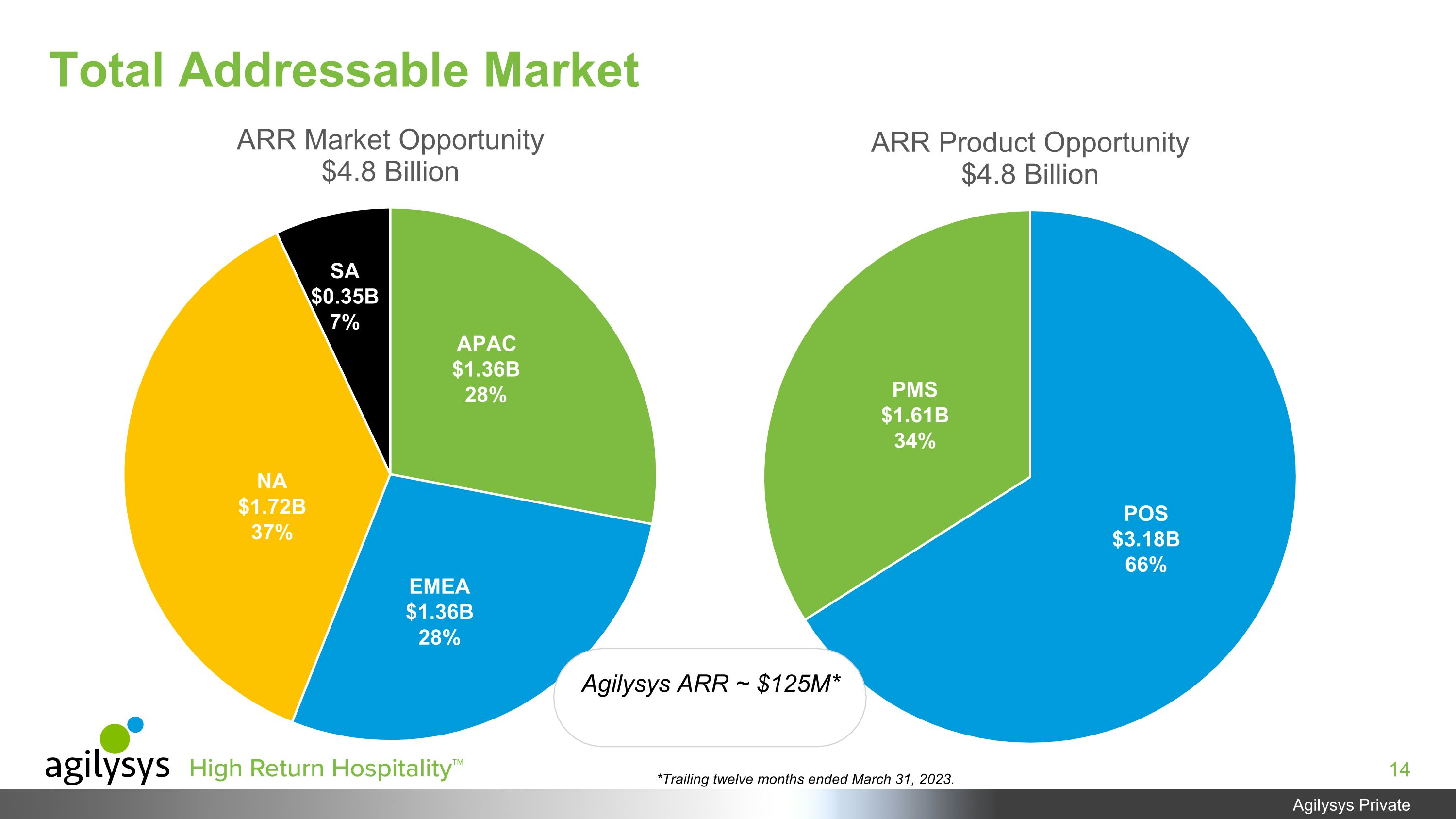

*Trailing twelve months ended March 31, 2023. Total Addressable Market SA $0.35B 7% APAC $1.36B 28% NA $1.72B 37% EMEA $1.36B 28% PMS $1.61B 34% POS $3.18B 66% Agilysys ARR ~ $125M*

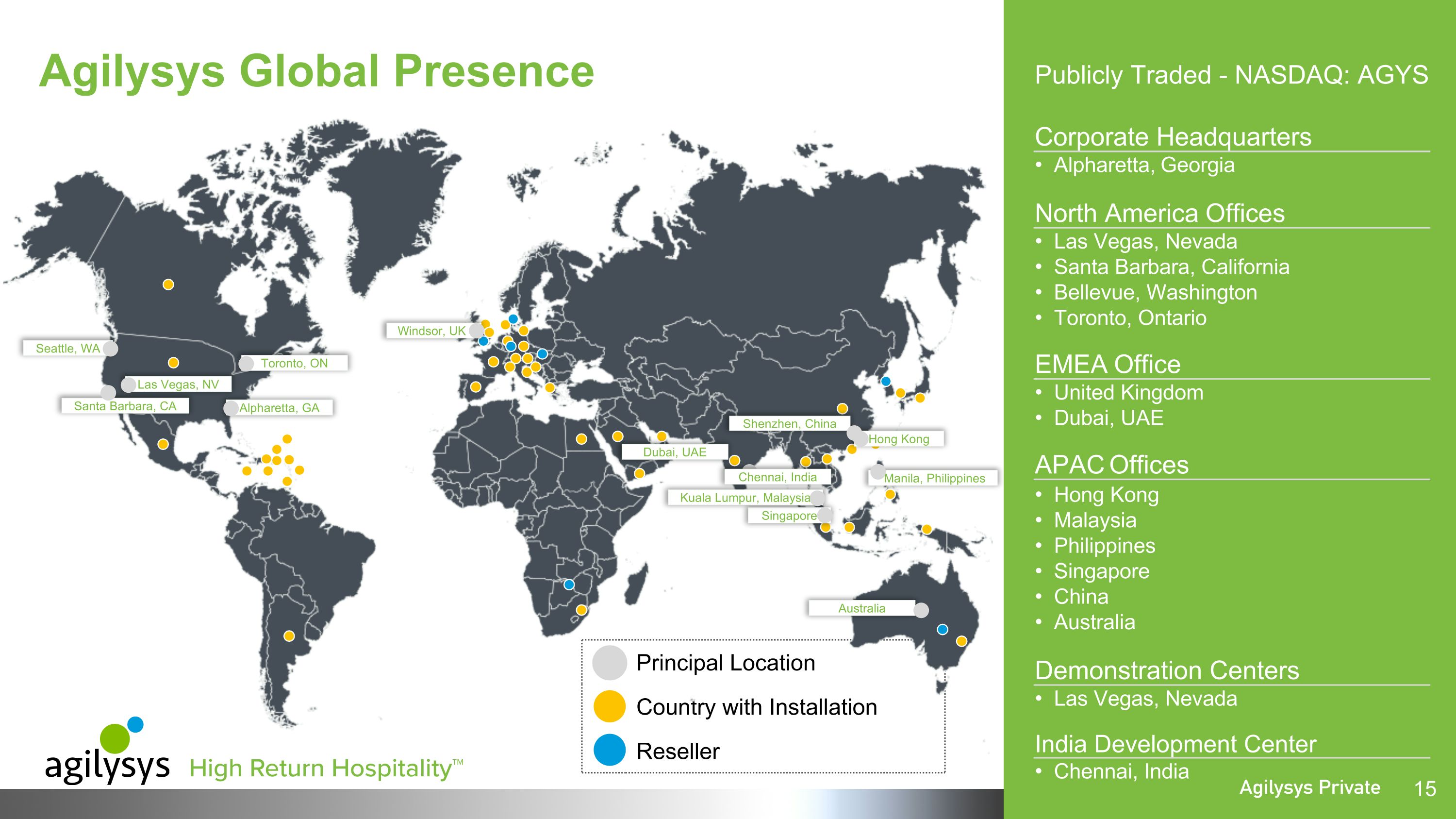

Agilysys Global Presence Principal Location Country with Installation Reseller Santa Barbara, CA Seattle, WA Las Vegas, NV Alpharetta, GA Windsor, UK Hong Kong Manila, Philippines Singapore Kuala Lumpur, Malaysia Shenzhen, China Australia Toronto, ON Chennai, India Publicly Traded - NASDAQ: AGYS Corporate Headquarters Alpharetta, Georgia North America Offices Las Vegas, Nevada Santa Barbara, California Bellevue, Washington Toronto, Ontario EMEA Office United Kingdom Dubai, UAE APAC Offices Hong Kong Malaysia Philippines Singapore China Australia Demonstration Centers Las Vegas, Nevada India Development Center Chennai, India Dubai, UAE

Transition to Growth Subscription Revenue Growth Record Quarterly Subscription Revenue of $15.9M Q4 SaaS Revenue Crosses 50% of Total Recurring Revenue 28% FY23 year over year subscription revenue growth Sound Business Fundamentals Q4 and Full FY23 Record Total Revenue FY23 GAAP Net Income Positive Q4 FY23 $0.14 GAAP EPS Per Diluted Share Focus on Profitability $30.3M Record FY23 Adjusted EBITDA $27.2M FY23 Positive Free Cash Flow $112.8M FY23 Ending Cash Balance Recent Announcements Selected as Marriott Global PMS RFP Winner Opening of operations in Dubai UAE 25+ products available as end-to-end solutions provider

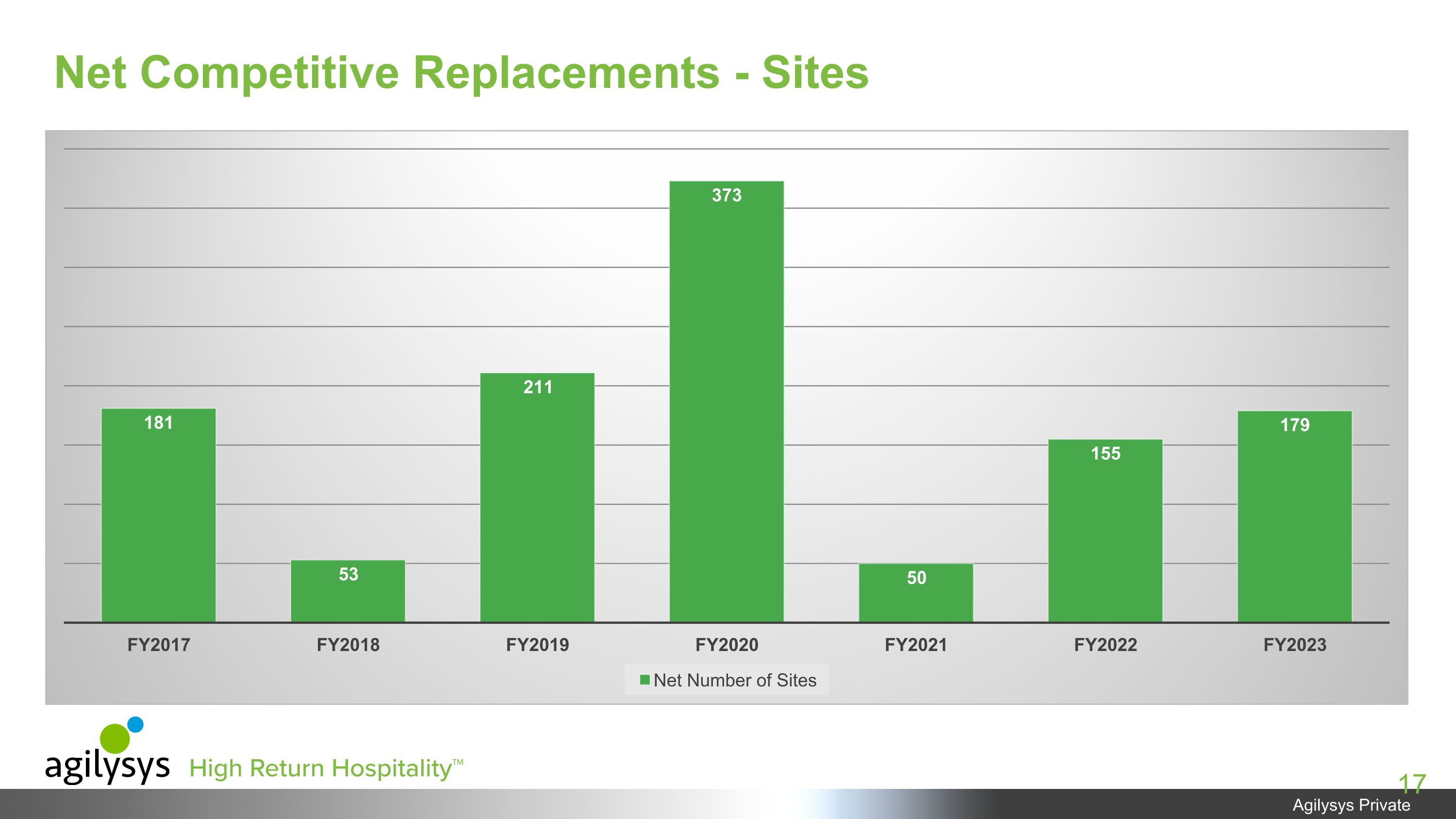

Net Competitive Replacements - Sites

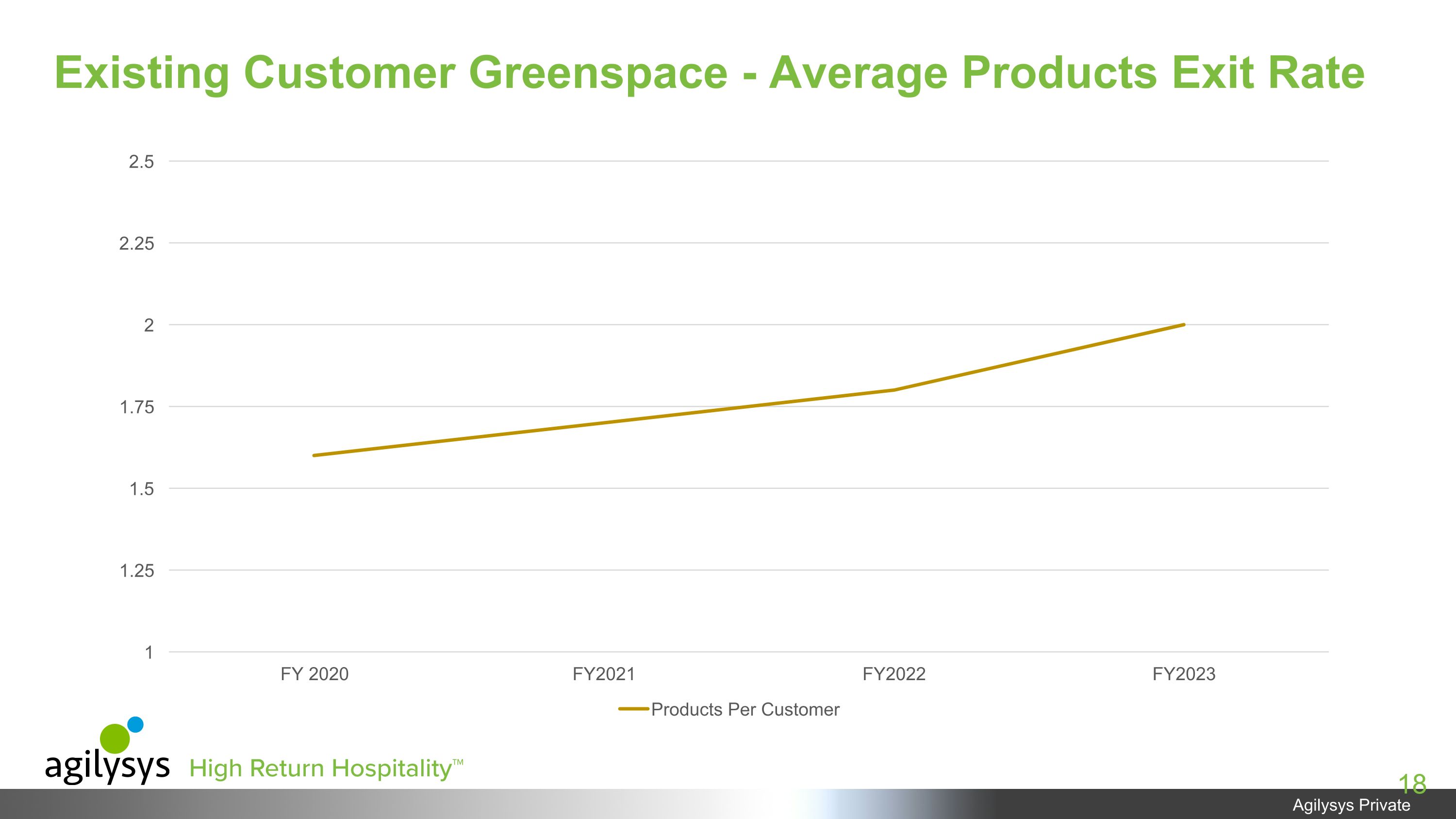

Existing Customer Greenspace - Average Products Exit Rate

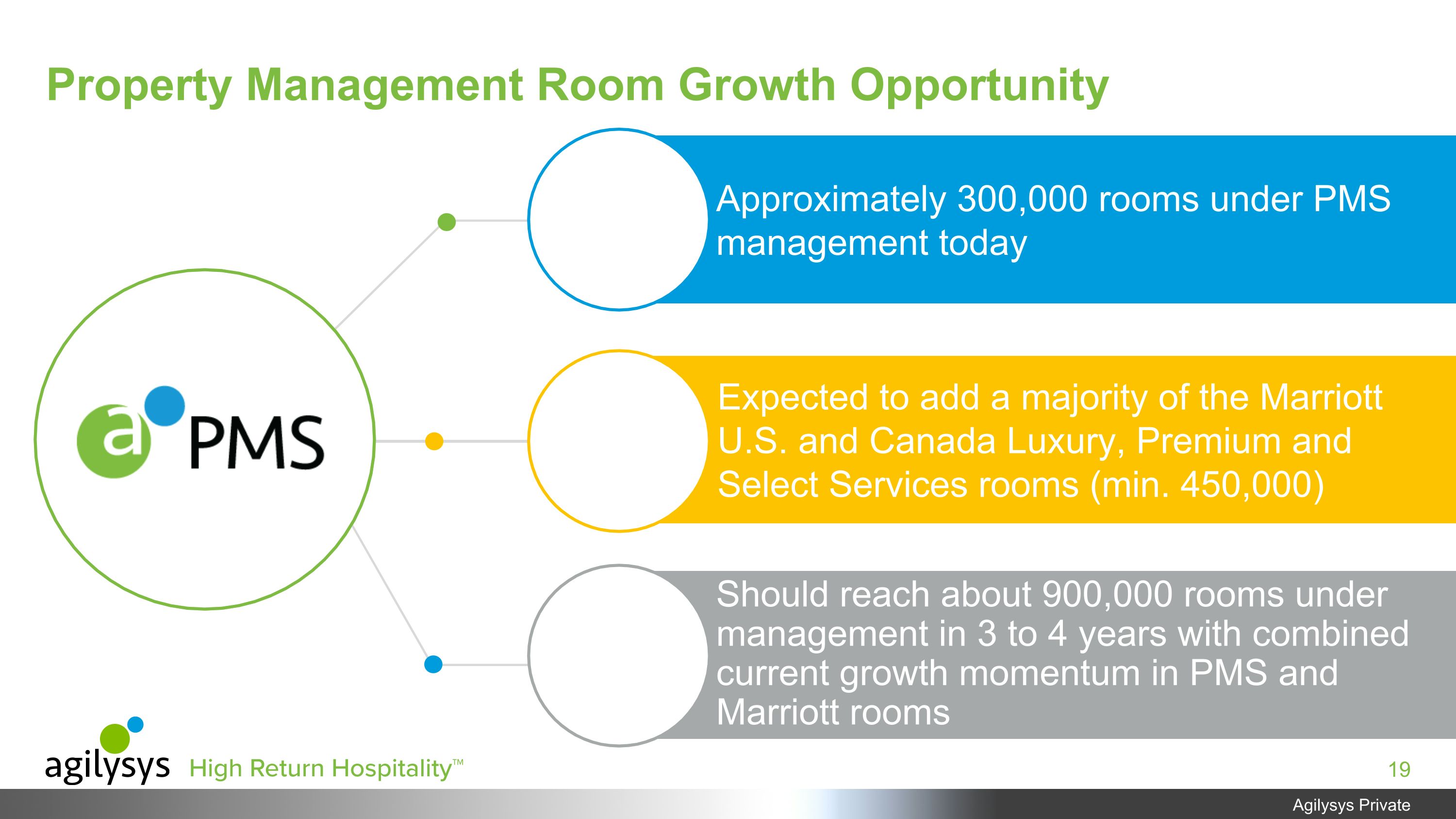

Property Management Room Growth Opportunity Approximately 300,000 rooms under PMS management today Should reach about 900,000 rooms under management in 3 to 4 years with combined current growth momentum in PMS and Marriott rooms Expected to add a majority of the Marriott U.S. and Canada Luxury, Premium and Select Services rooms (min. 450,000)

Top 100 Global Customers

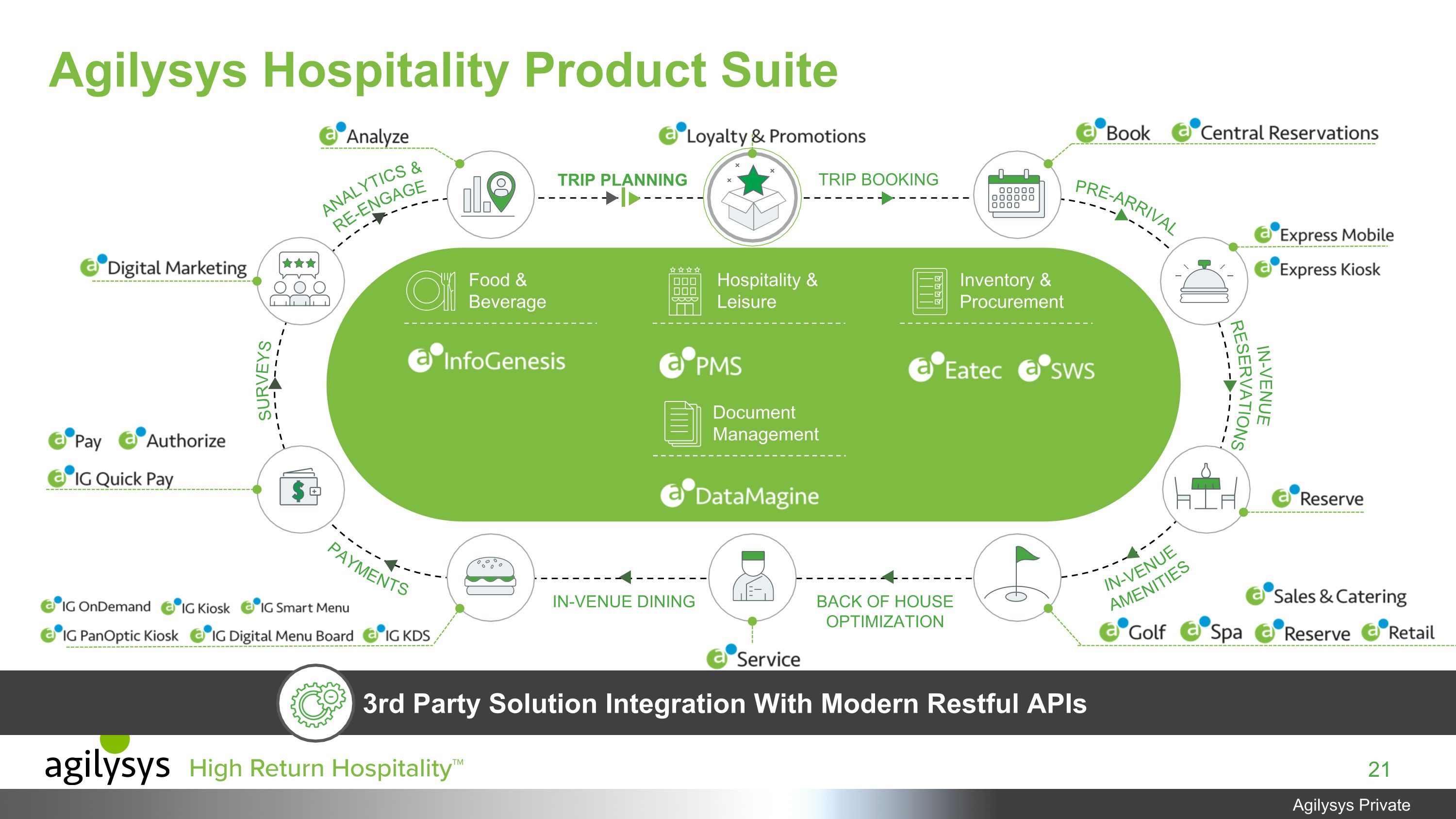

Agilysys Hospitality Product Suite PRE-ARRIVAL IN-VENUE RESERVATIONS ANALYTICS &RE-ENGAGE SURVEYS PAYMENTS IN-VENUEAMENITIES TRIP BOOKING IN-VENUE DINING BACK OF HOUSEOPTIMIZATION TRIP PLANNING Food & Beverage Document Management Hospitality & Leisure Inventory &Procurement 3rd Party Solution Integration With Modern Restful APIs

FINANCIAL OVERVIEW

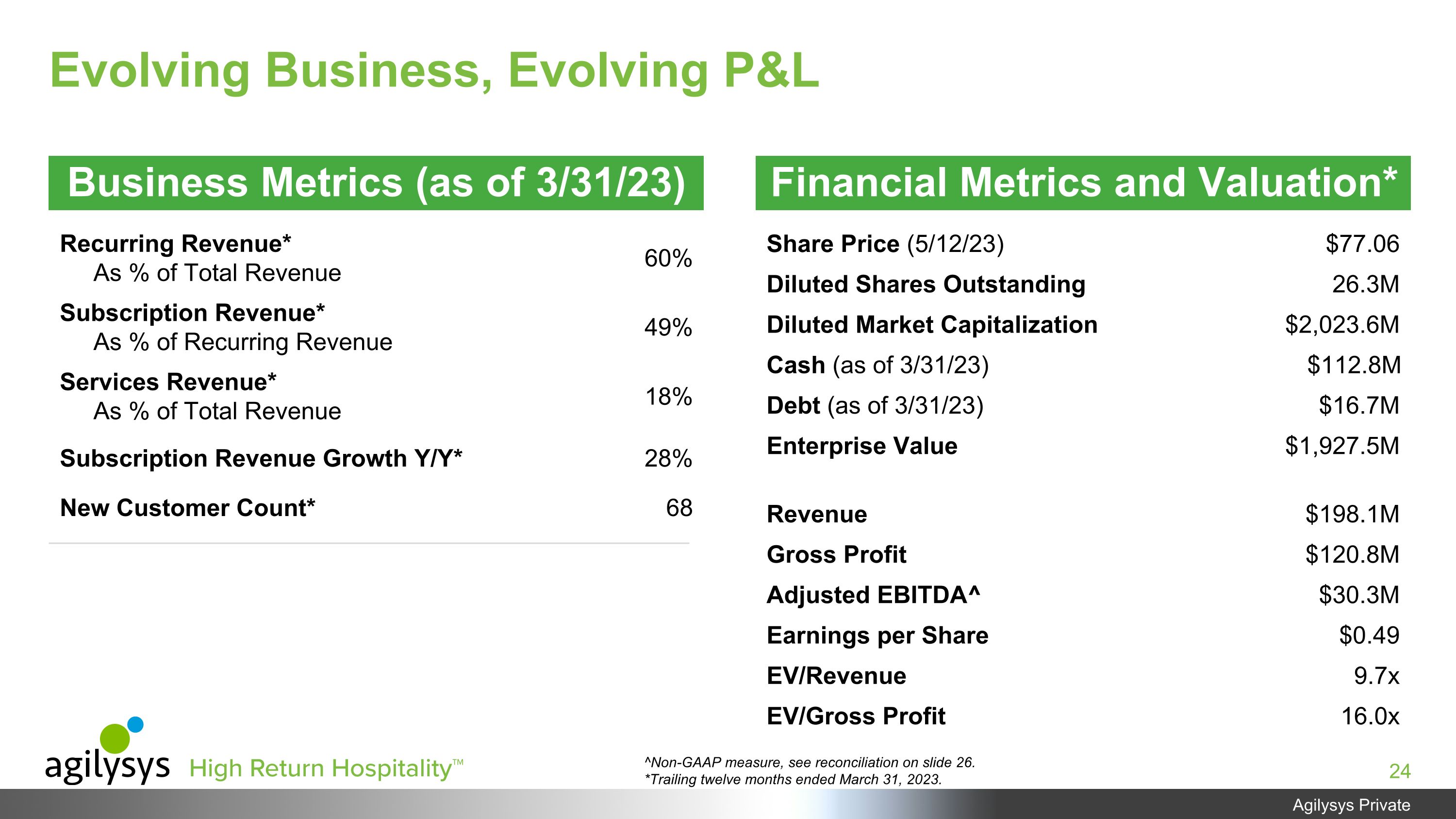

Share Price (5/12/23) $77.06 Diluted Shares Outstanding 26.3M Diluted Market Capitalization $2,023.6M Cash (as of 3/31/23) $112.8M Debt (as of 3/31/23) $16.7M Enterprise Value $1,927.5M Revenue $198.1M Gross Profit $120.8M Adjusted EBITDA^ $30.3M Earnings per Share $0.49 EV/Revenue 9.7x EV/Gross Profit 16.0x Recurring Revenue* As % of Total Revenue 60% Subscription Revenue* As % of Recurring Revenue 49% Services Revenue* As % of Total Revenue 18% Subscription Revenue Growth Y/Y* 28% New Customer Count* 68 Financial Metrics and Valuation* Business Metrics (as of 3/31/23) Evolving Business, Evolving P&L ^Non-GAAP measure, see reconciliation on slide 26. *Trailing twelve months ended March 31, 2023.

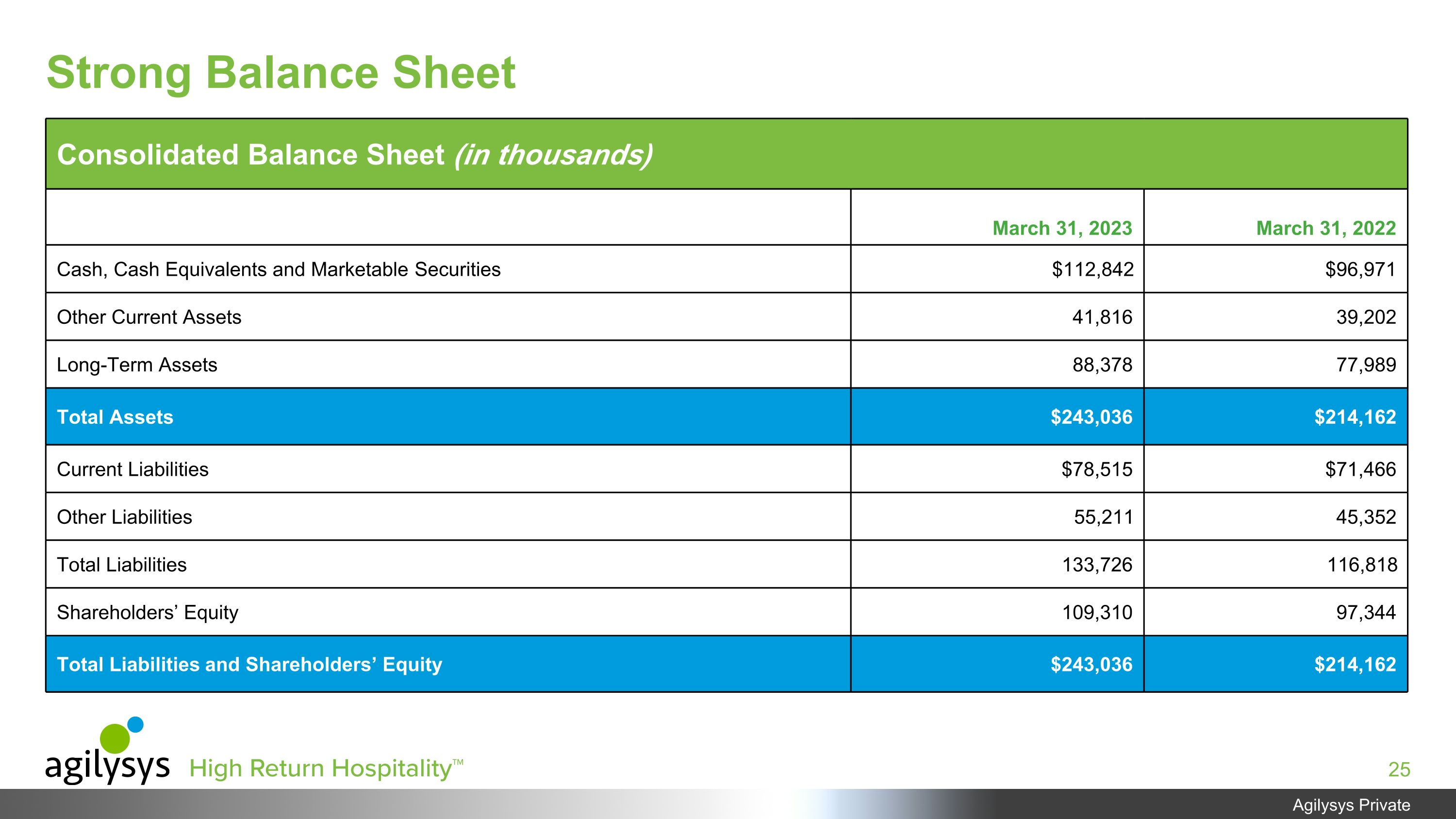

Strong Balance Sheet Consolidated Balance Sheet (in thousands) March 31, 2023 March 31, 2022 Cash, Cash Equivalents and Marketable Securities $112,842 $96,971 Other Current Assets 41,816 39,202 Long-Term Assets 88,378 77,989 Total Assets $243,036 $214,162 Current Liabilities $78,515 $71,466 Other Liabilities 55,211 45,352 Total Liabilities 133,726 116,818 Shareholders’ Equity 109,310 97,344 Total Liabilities and Shareholders’ Equity $243,036 $214,162

Revenue Growth ($M) FY17 FY18 FY19 FY20 FY21 FY22 AGYS FY23

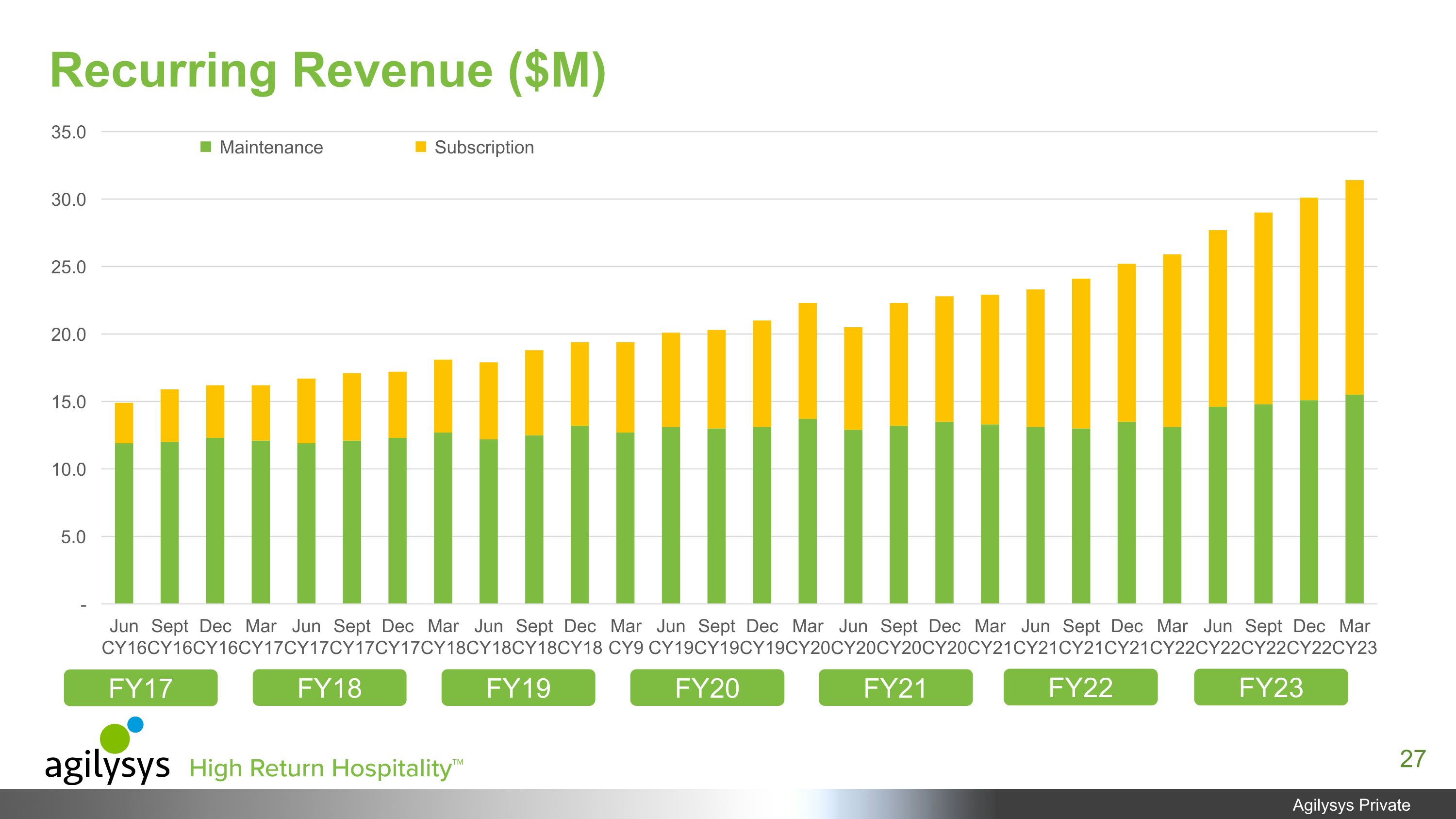

Recurring Revenue ($M) FY17 FY18 FY19 FY20 FY21 FY22 FY23

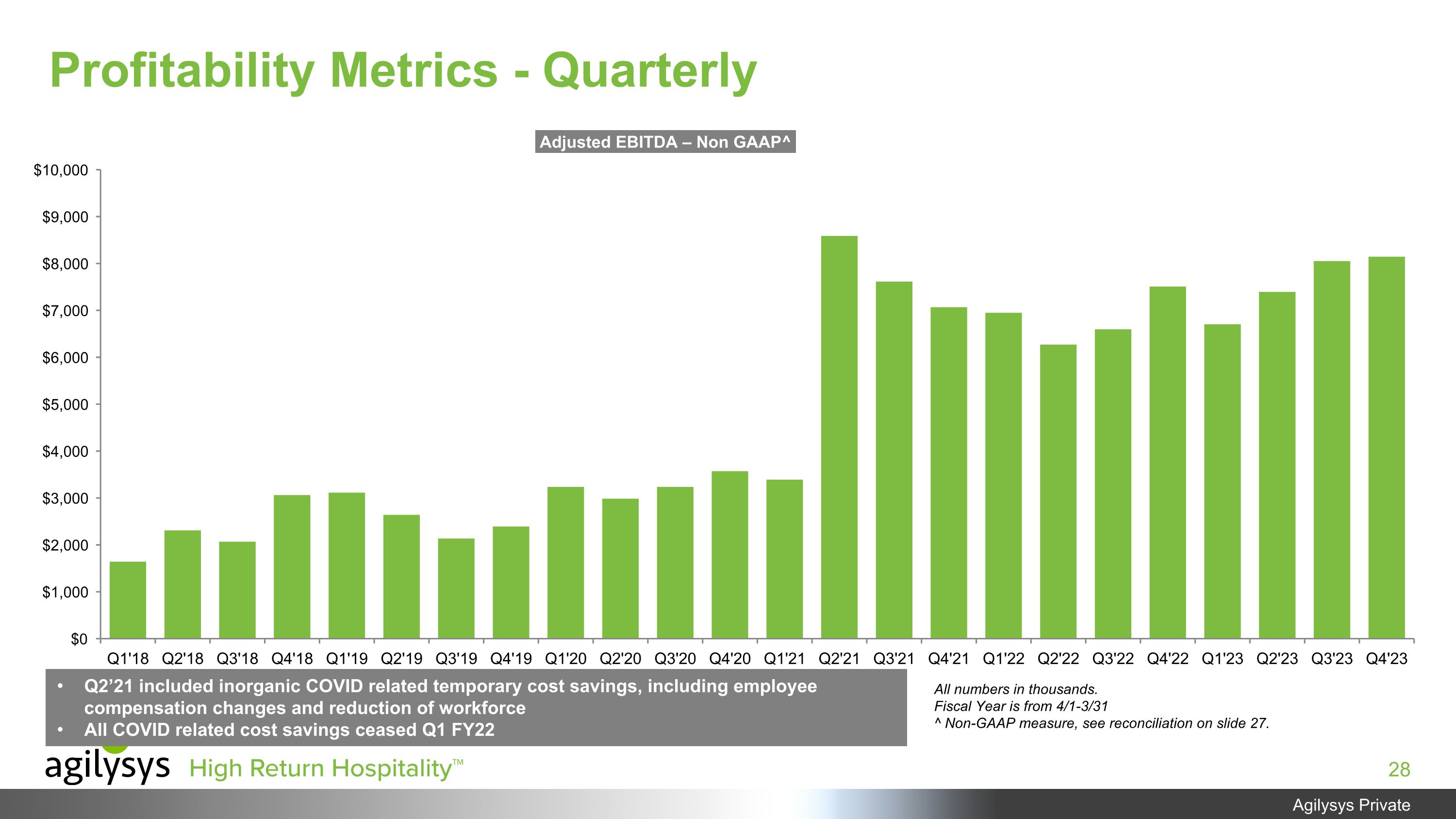

Profitability Metrics - Quarterly All numbers in thousands. Fiscal Year is from 4/1-3/31 ^ Non-GAAP measure, see reconciliation on slide 27. Q2’21 included inorganic COVID related temporary cost savings, including employee compensation changes and reduction of workforce All COVID related cost savings ceased Q1 FY22

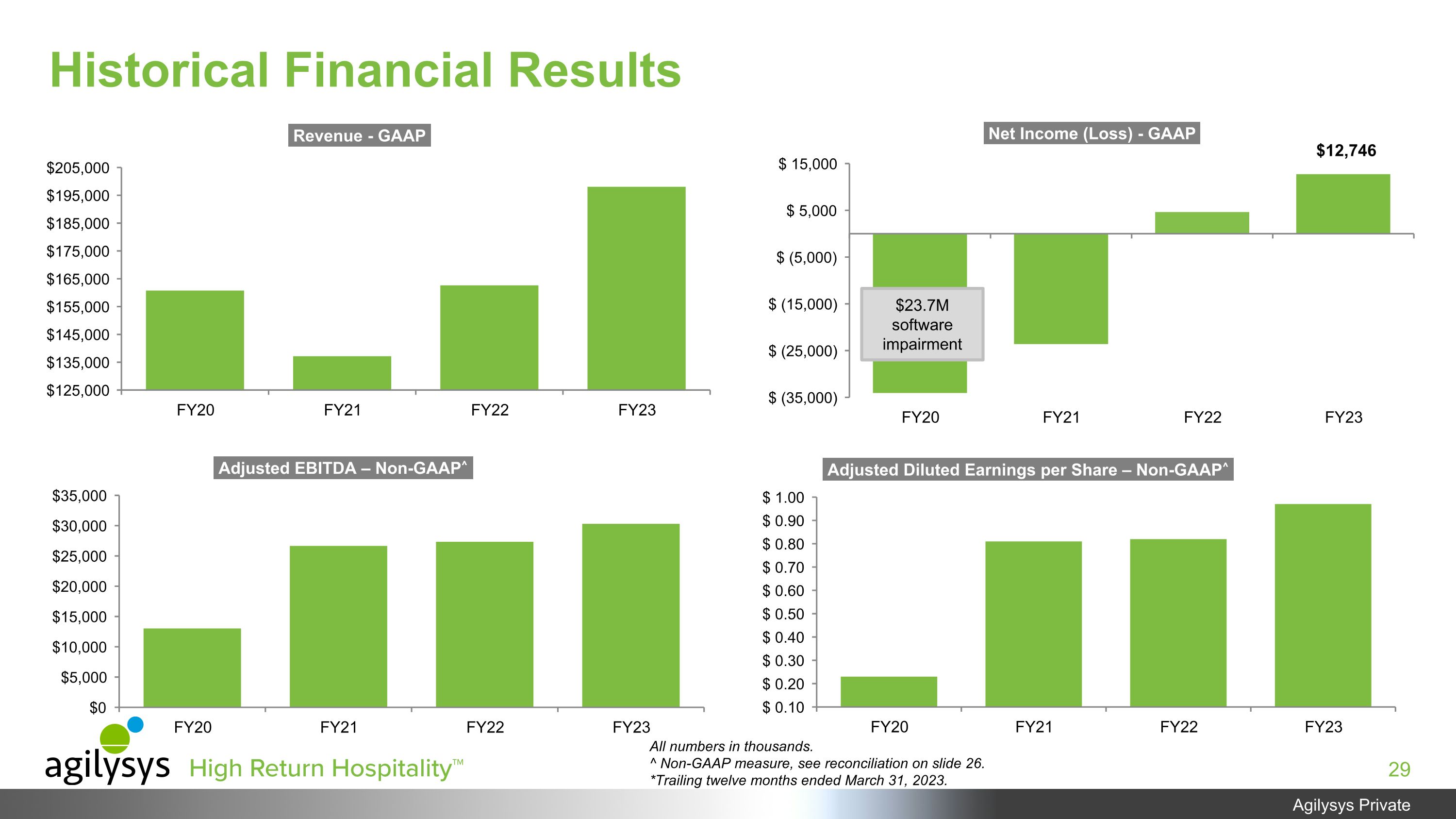

Historical Financial Results $23.7M software impairment All numbers in thousands. ^ Non-GAAP measure, see reconciliation on slide 26. *Trailing twelve months ended March 31, 2023.

APPENDIX

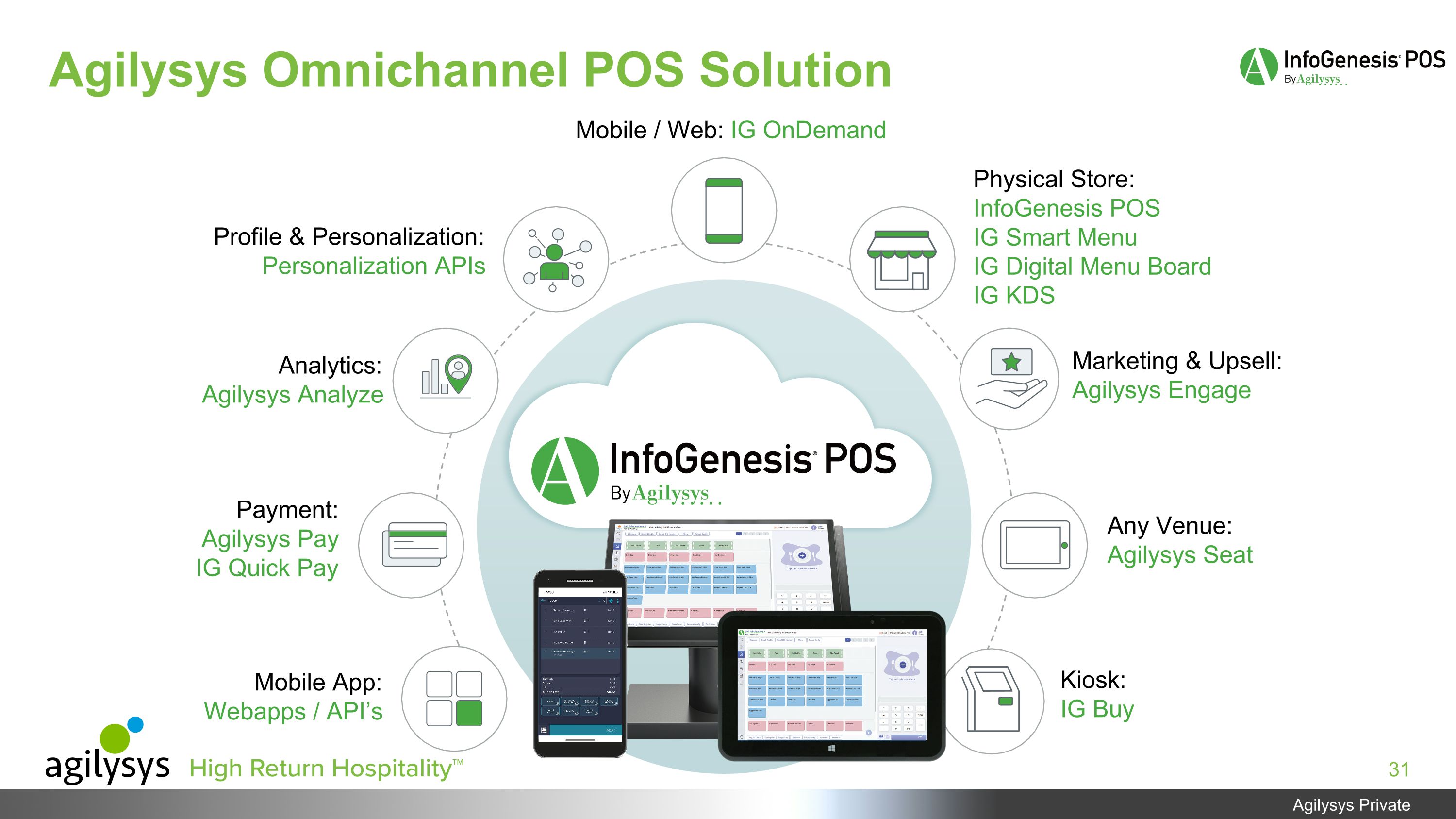

Agilysys Omnichannel POS Solution Mobile / Web: IG OnDemand Physical Store:InfoGenesis POS IG Smart Menu IG Digital Menu Board IG KDS Profile & Personalization: Personalization APIs Payment: Agilysys Pay IG Quick Pay Mobile App: Webapps / API’s Analytics: Agilysys Analyze Marketing & Upsell: Agilysys Engage Any Venue: Agilysys Seat Kiosk: IG Buy

Agilysys Lodging Ecosystem Marketing & Upsell: Agilysys Engage Agilysys Digital Marketing Activities: Agilysys Golf Agilysys Spa Payments: Agilysys Pay Agilysys Authorize Document Management: Agilysys DataMagine Business Analytics: Agilysys Analyze Sales & Catering: Agilysys Sales & Catering Point-of-Sale & Retail: Agilysys InfoGenesis POS Agilysys Retail Staff Task Management & 2-Way Guest Communication: rGuest Service Online Booking: rGuest Book Check-In/Out: rGuest Express

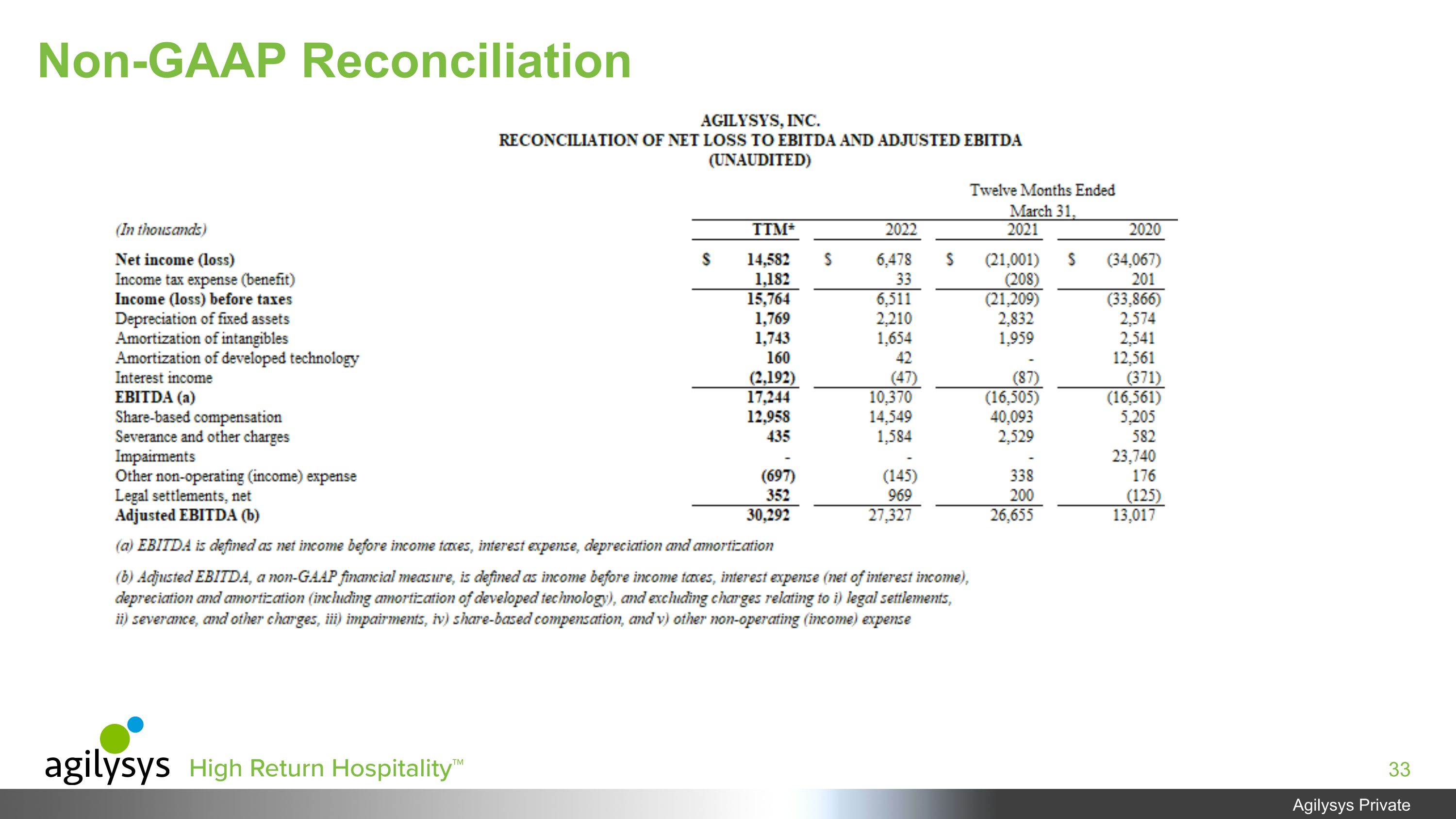

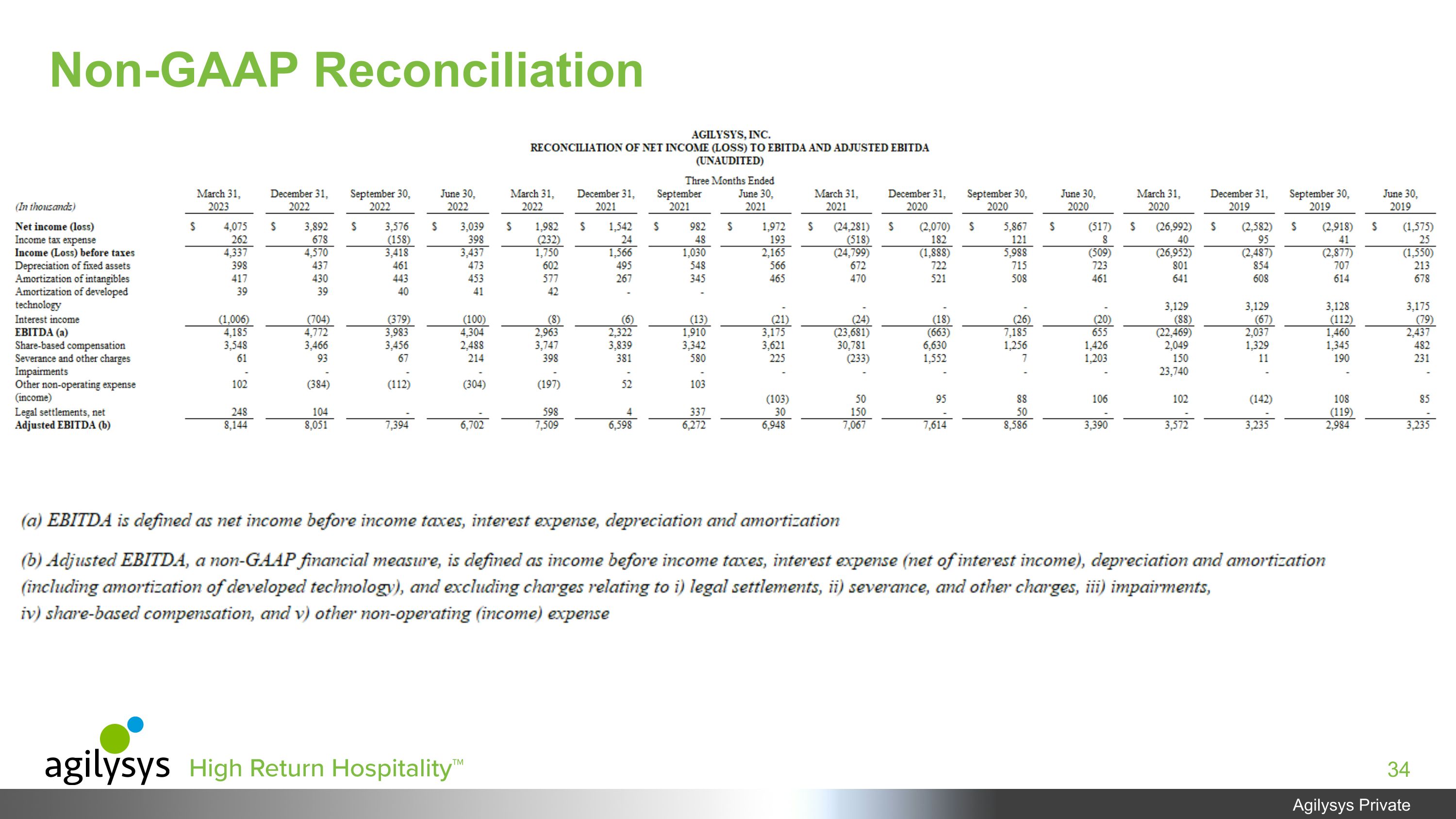

Non-GAAP Reconciliation

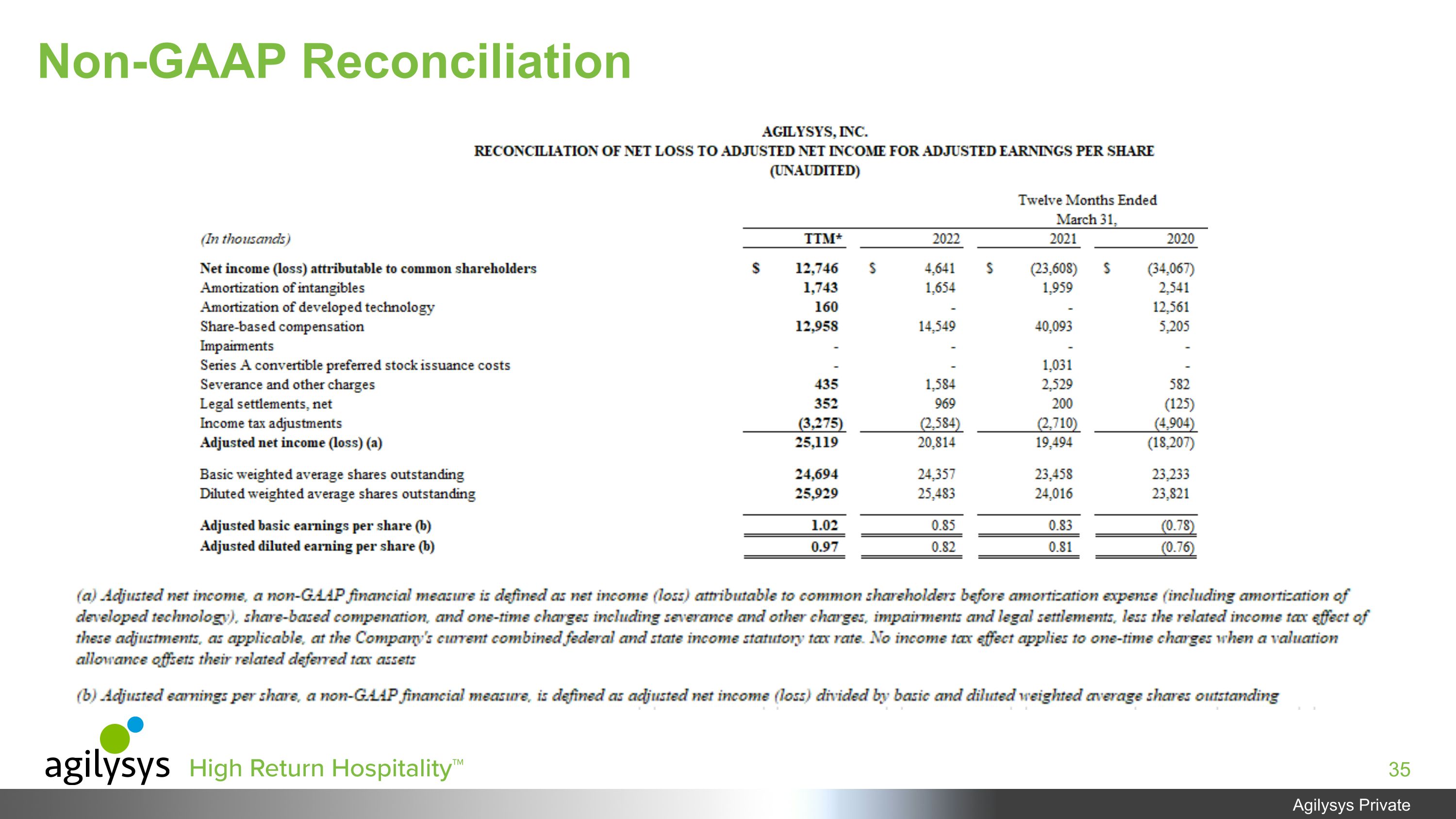

Non-GAAP Reconciliation

Non-GAAP Reconciliation

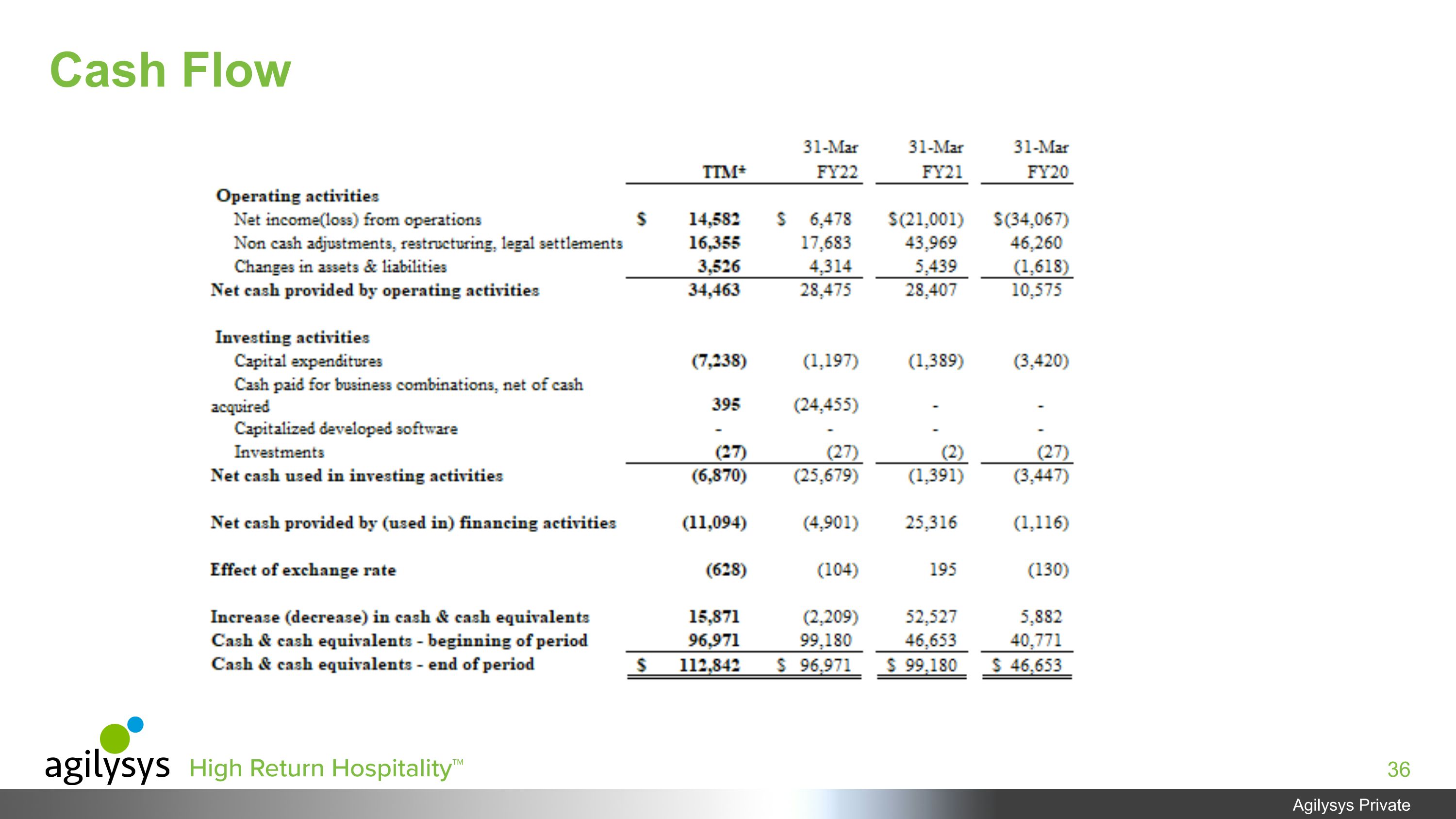

Cash Flow

Jessica Hennessy Senior Director Corporate Strategy and Investor Relations (770) 810-6116 InvestorRelations@agilysys.com