UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 16, 2023

Patterson-UTI Energy, Inc.

(Exact name of Registrant as Specified in Its Charter)

Delaware |

1-39270 |

75-2504748 |

|

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

10713 W. Sam Houston Pkwy N, Suite 800, Houston, Texas |

|

77064 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: 281-765-7100

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

Common Stock, $0.01 Par Value |

|

PTEN |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

Patterson-UTI will deliver an investor presentation that includes the slides attached as Exhibit 99.1 to this Current Report on Form 8-K, which are incorporated herein by reference.

The information furnished pursuant to Item 7.01, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, shall not otherwise be subject to the liabilities of that section and shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated therein by reference. The furnishing of these slides is not intended to constitute a representation that such information is required by Regulation FD or that the materials they contain include material information that is not otherwise publicly available.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit No. |

|

Description |

|

|

|

99.1 |

|

|

|

|

|

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Patterson-UTI Energy, Inc. |

||

|

|

|

|

|

May 16, 2023 |

|

By: |

|

/s/ C. Andrew Smith |

|

|

|

|

Name: C. Andrew Smith |

|

|

|

|

Title: Executive Vice President and Chief Financial Officer |

Patterson-UTI Energy, Inc. TPH & Co. Hotter ‘N Hell Conference May 16, 2023

Forward Looking Statements This material and any oral statements made in connection with this material include "forward-looking statements" within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934. Statements made which provide the Company’s or management’s intentions, beliefs, expectations or predictions for the future are forward-looking statements and are inherently uncertain. The opinions, forecasts, projections or other statements other than statements of historical fact, including, without limitation, plans and objectives of management of the Company are forward-looking statements. It is important to note that actual results could differ materially from those discussed in such forward-looking statements. Important factors that could cause actual results to differ materially include the risk factors and other cautionary statements contained from time to time in the Company’s SEC filings, which may be obtained by contacting the Company or the SEC. These filings are also available through the Company’s web site at http://www.patenergy.com or through the SEC’s Electronic Data Gathering and Analysis Retrieval System (EDGAR) at http://www.sec.gov. We undertake no obligation to publicly update or revise any forward-looking statement. Statements made in this presentation include non-U.S. GAAP financial measures. The required reconciliations to U.S. GAAP financial measures are included on our website and/or at the end of this presentation.

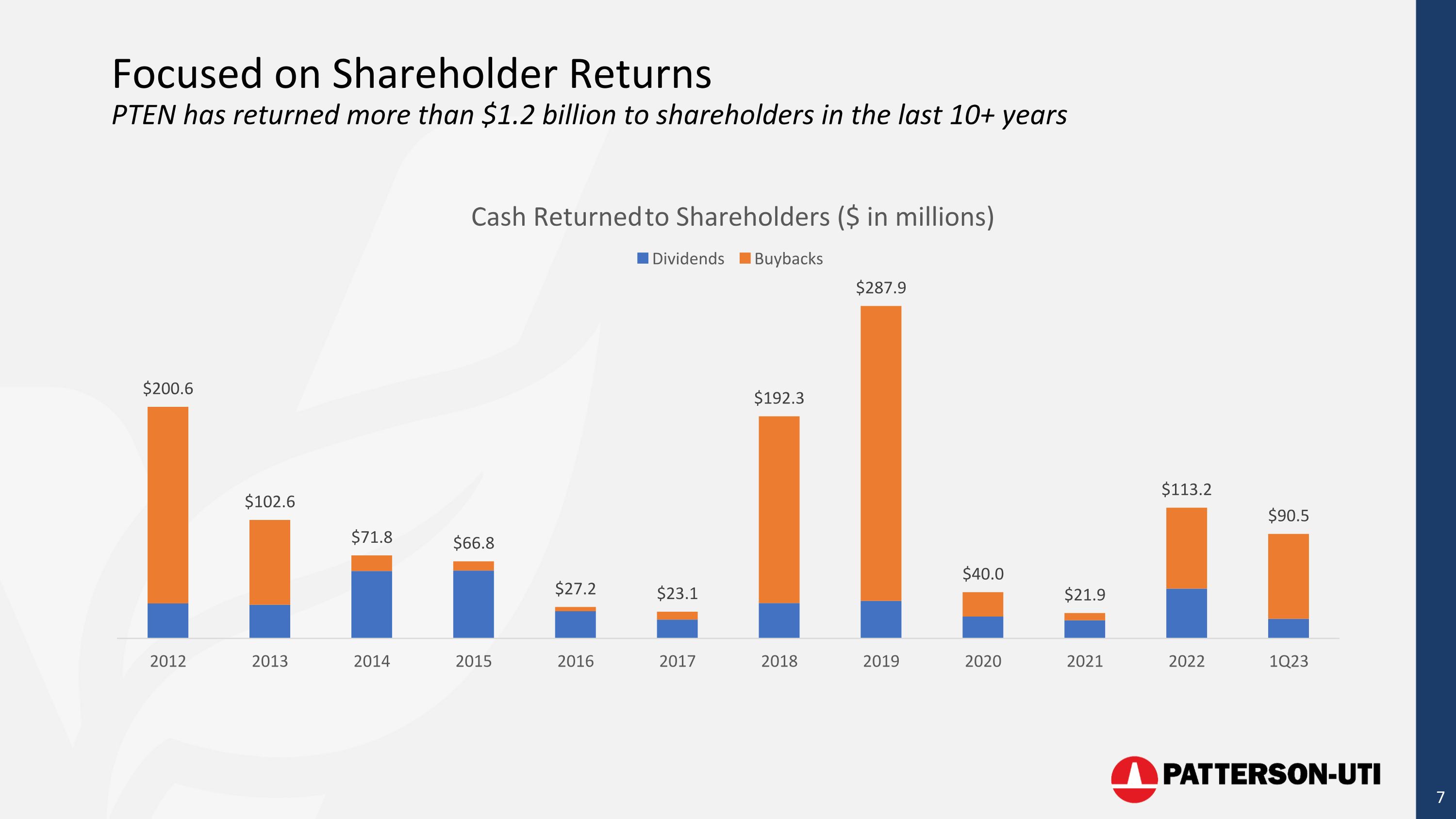

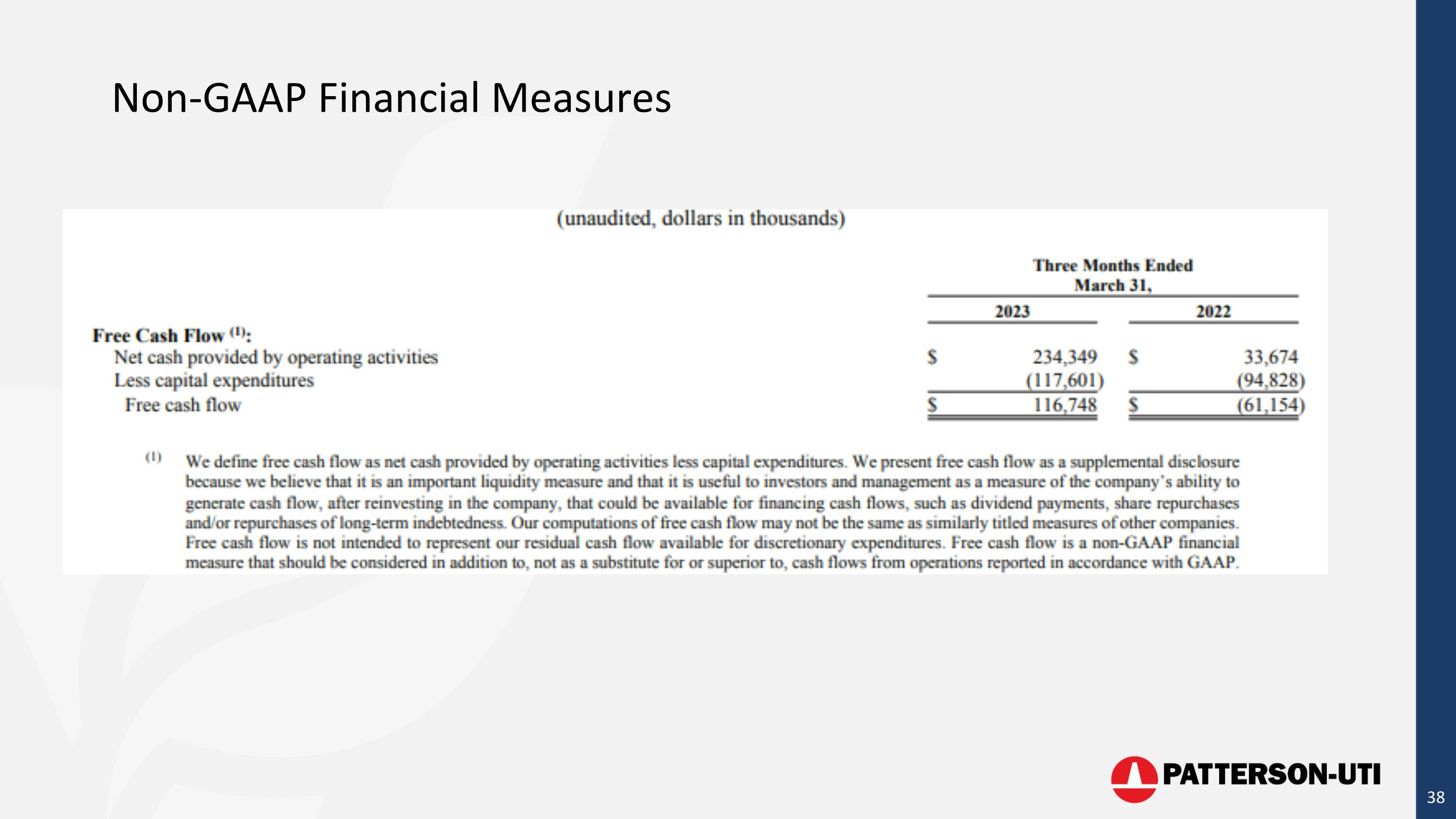

Company UpdateSolid execution and returning cash to shareholders Well positioned to generate substantial free cash flow in 2023 Generated $117 million of free cash flow in the first quarter of 2023 Prioritizing cash flow and margin over market share Benefiting from the renewal of drilling rig contracts at current rates Returned $90.5 million to shareholders in 1Q23 through share buybacks and dividends Repurchased 5.6 million shares of common stock during 1Q23 for $73.6 million Paid $16.9 million in dividends to shareholders Increased share repurchase authorization to $300 million Targeting to return 50% of free cash flow to shareholders through dividends and share buybacks Strengthened balance sheet Repurchased $9.0 million of debt for $7.8 million during 1Q23

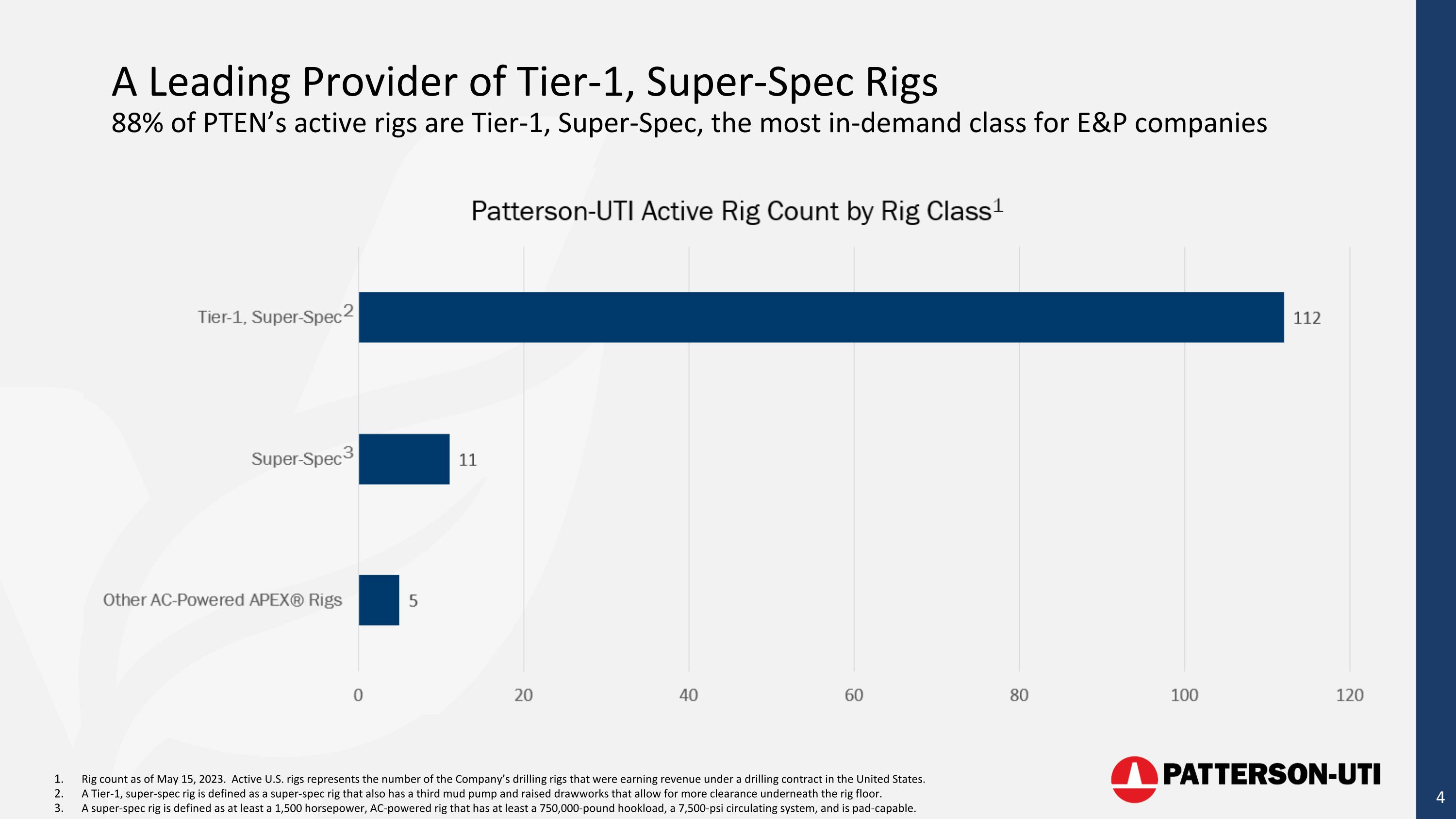

A Leading Provider of Tier-1, Super-Spec Rigs88% of PTEN’s active rigs are Tier-1, Super-Spec, the most in-demand class for E&P companies Rig count as of May 15, 2023. Active U.S. rigs represents the number of the Company’s drilling rigs that were earning revenue under a drilling contract in the United States. A Tier-1, super-spec rig is defined as a super-spec rig that also has a third mud pump and raised drawworks that allow for more clearance underneath the rig floor. A super-spec rig is defined as at least a 1,500 horsepower, AC-powered rig that has at least a 750,000-pound hookload, a 7,500-psi circulating system, and is pad-capable. 2 3

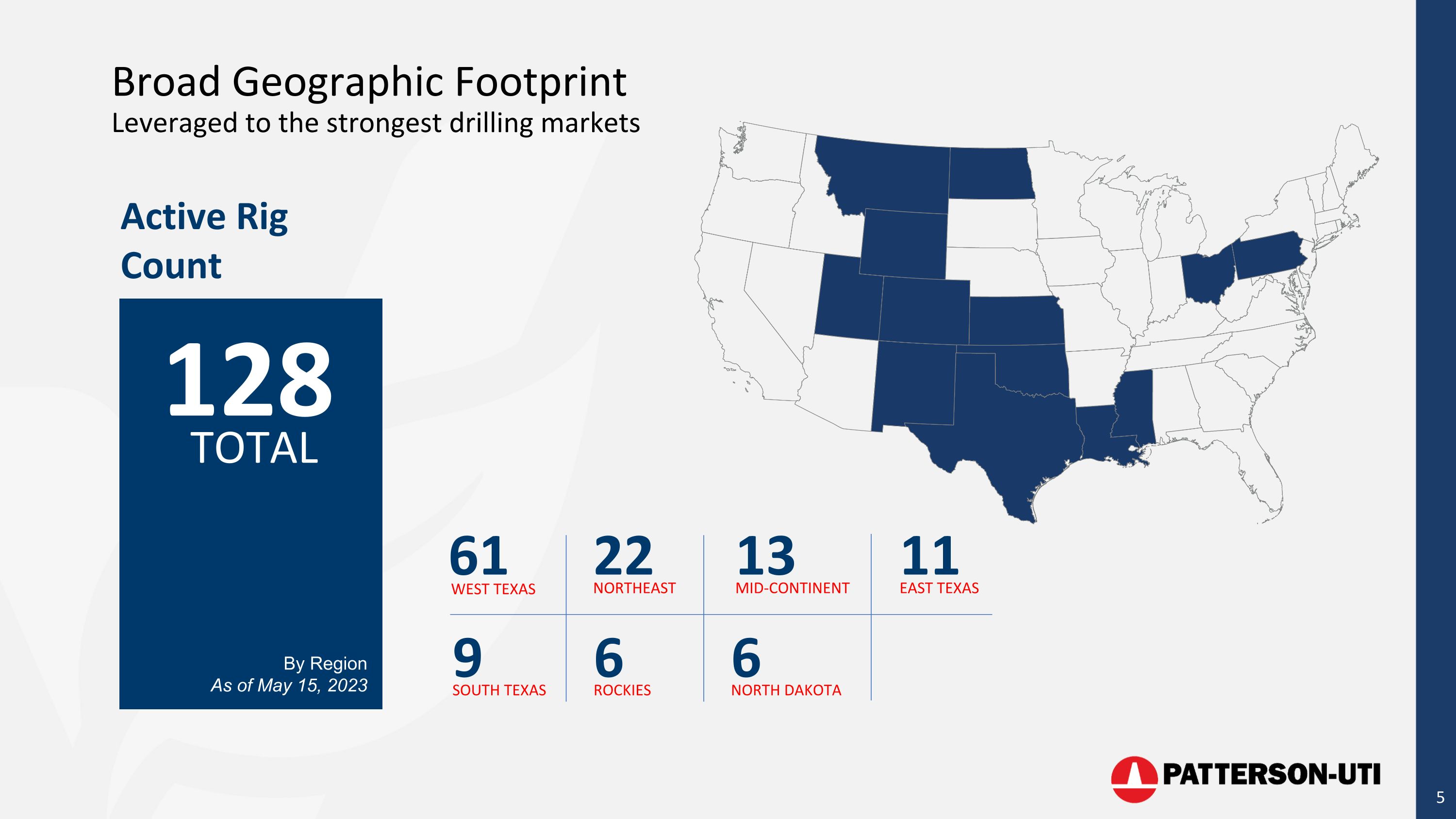

Broad Geographic FootprintLeveraged to the strongest drilling markets Active Rig Count 128 TOTAL By Region As of May 15, 2023 61 WEST TEXAS 22 NORTHEAST 13 MID-CONTINENT 11 EAST TEXAS 9 SOUTH TEXAS 6 ROCKIES 6 NORTH DAKOTA

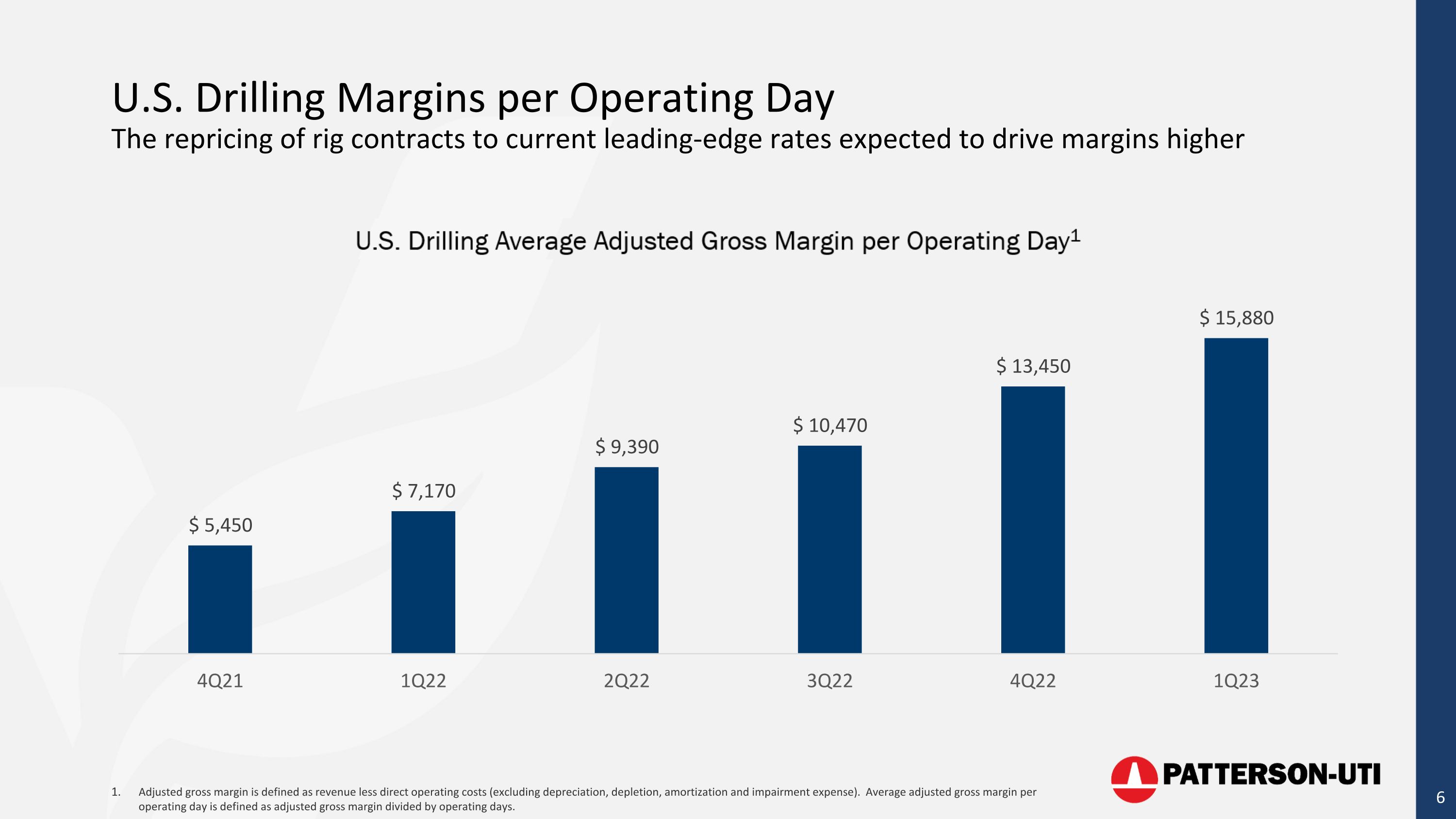

U.S. Drilling Margins per Operating DayThe repricing of rig contracts to current leading-edge rates expected to drive margins higher Adjusted gross margin is defined as revenue less direct operating costs (excluding depreciation, depletion, amortization and impairment expense). Average adjusted gross margin per operating day is defined as adjusted gross margin divided by operating days.

Focused on Shareholder Returns PTEN has returned more than $1.2 billion to shareholders in the last 10+ years

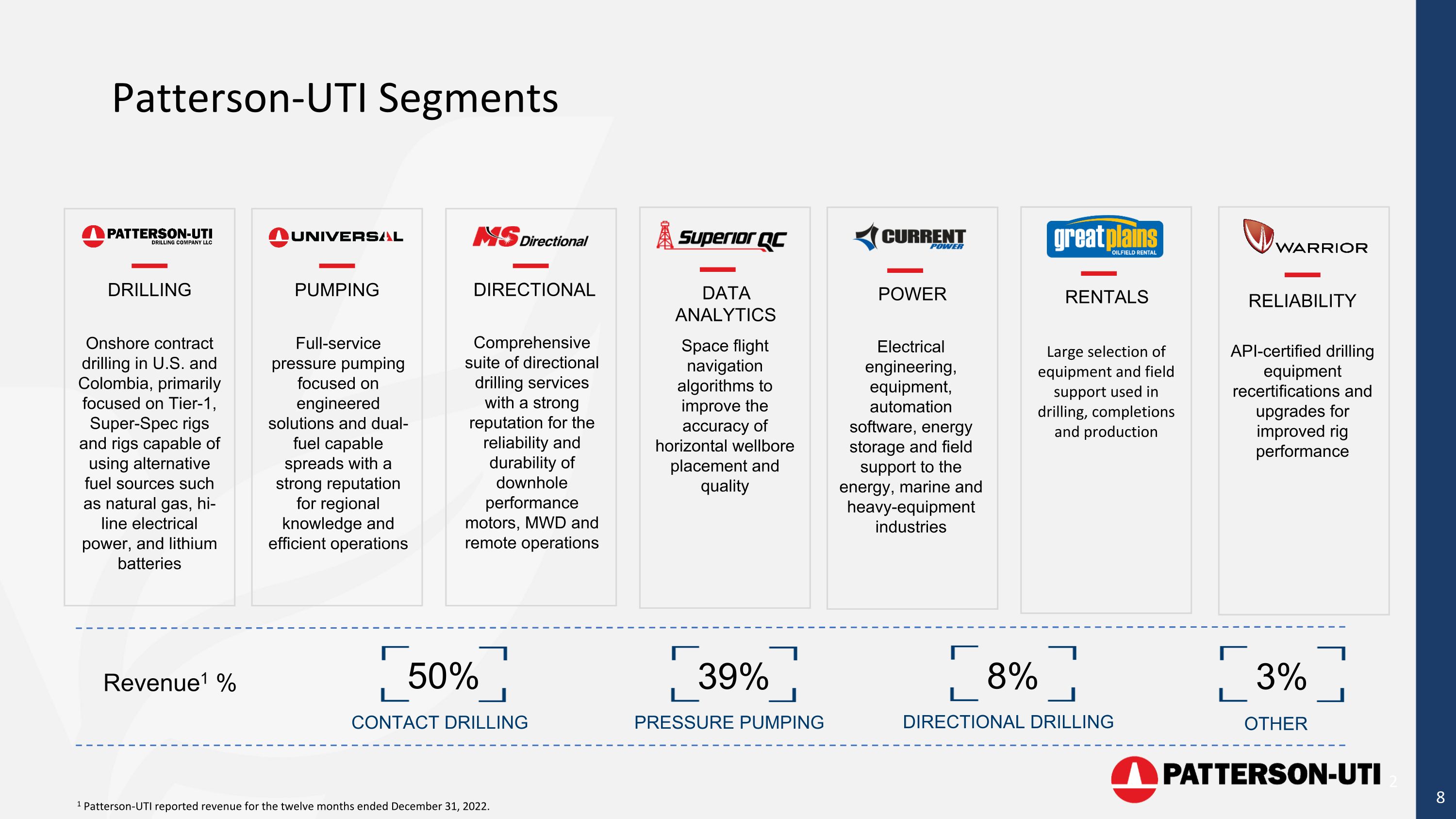

Patterson-UTI Segments 2 DRILLING PUMPING Onshore contract drilling in U.S. and Colombia, primarily focused on Tier-1, Super-Spec rigs and rigs capable of using alternative fuel sources such as natural gas, hi-line electrical power, and lithium batteries Full-service pressure pumping focused on engineered solutions and dual-fuel capable spreads with a strong reputation for regional knowledge and efficient operations DIRECTIONAL Comprehensive suite of directional drilling services with a strong reputation for the reliability and durability of downhole performance motors, MWD and remote operations RELIABILITY API-certified drilling equipment recertifications and upgrades for improved rig performance Large selection of equipment and field support used in drilling, completions and production RENTALS DATA ANALYTICS Space flight navigation algorithms to improve the accuracy of horizontal wellbore placement and quality POWER Electrical engineering, equipment, automation software, energy storage and field support to the energy, marine and heavy-equipment industries Revenue1 % 39% PRESSURE PUMPING 50% CONTACT DRILLING 3% 8% DIRECTIONAL DRILLING 1 Patterson-UTI reported revenue for the twelve months ended December 31, 2022. OTHER

Contract Drilling

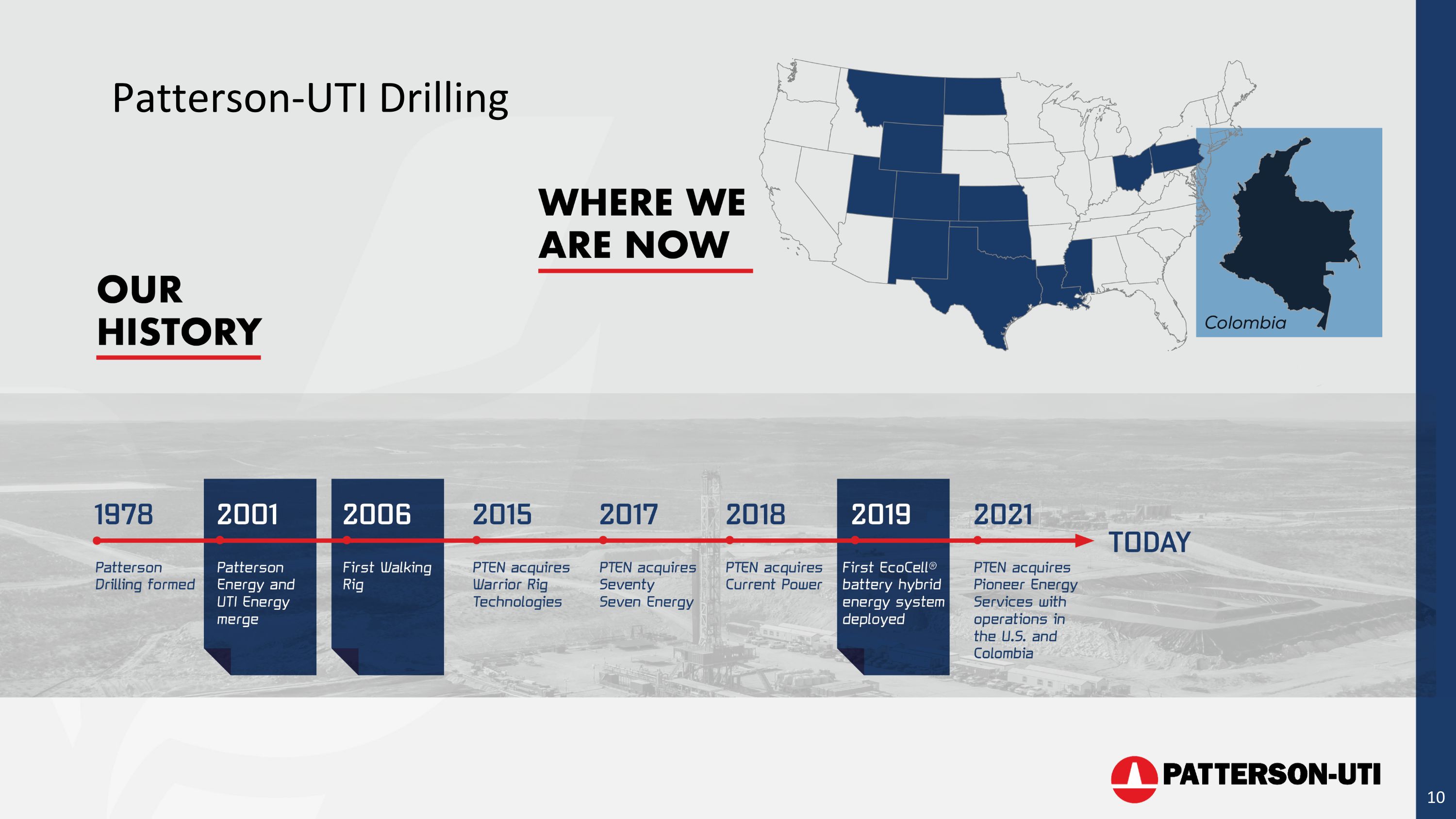

Patterson-UTI Drilling

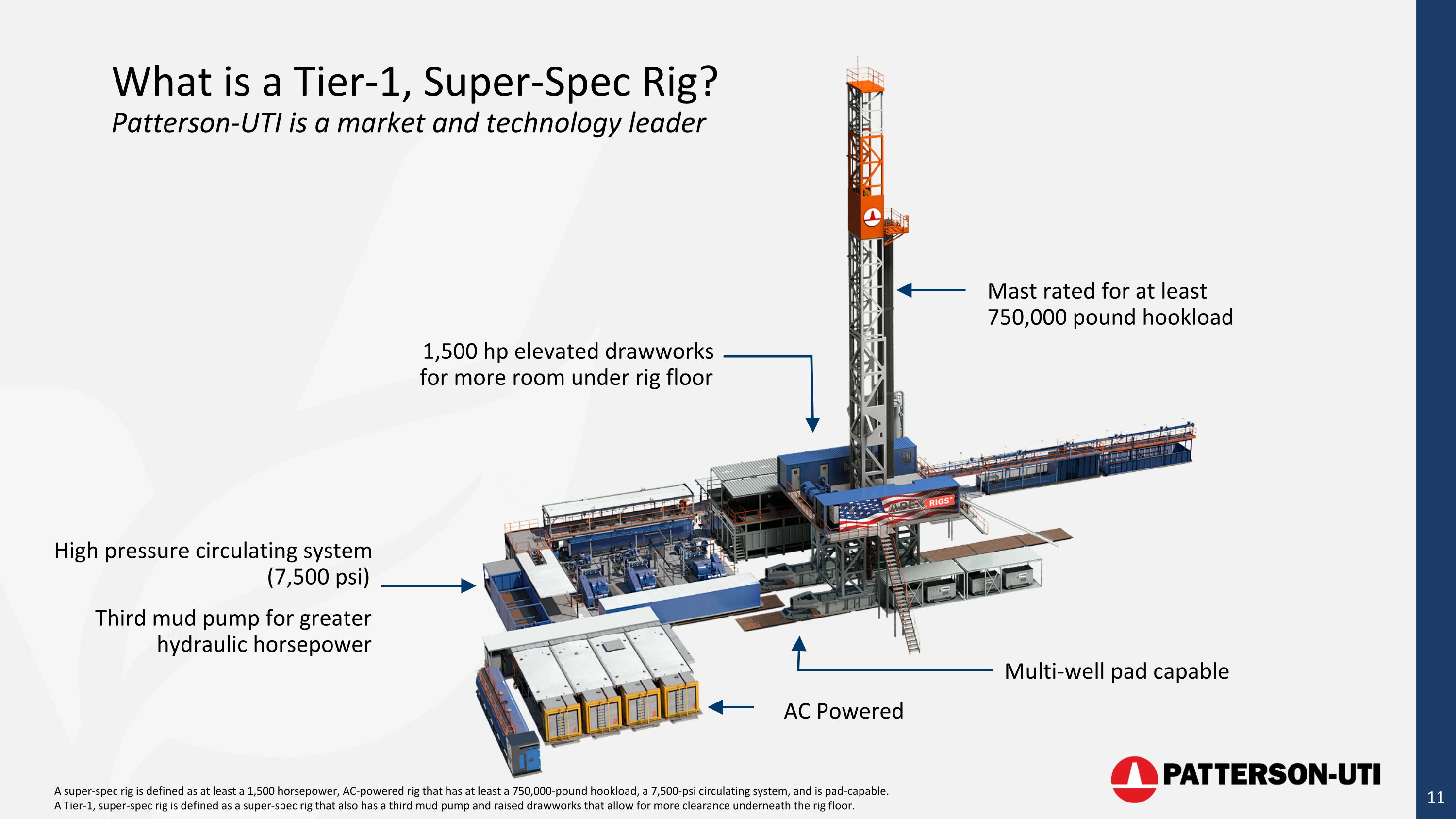

What is a Tier-1, Super-Spec Rig?Patterson-UTI is a market and technology leader 1,500 hp elevated drawworks for more room under rig floor Mast rated for at least 750,000 pound hookload High pressure circulating system (7,500 psi) Third mud pump for greater hydraulic horsepower Multi-well pad capable AC Powered A super-spec rig is defined as at least a 1,500 horsepower, AC-powered rig that has at least a 750,000-pound hookload, a 7,500-psi circulating system, and is pad-capable. A Tier-1, super-spec rig is defined as a super-spec rig that also has a third mud pump and raised drawworks that allow for more clearance underneath the rig floor.

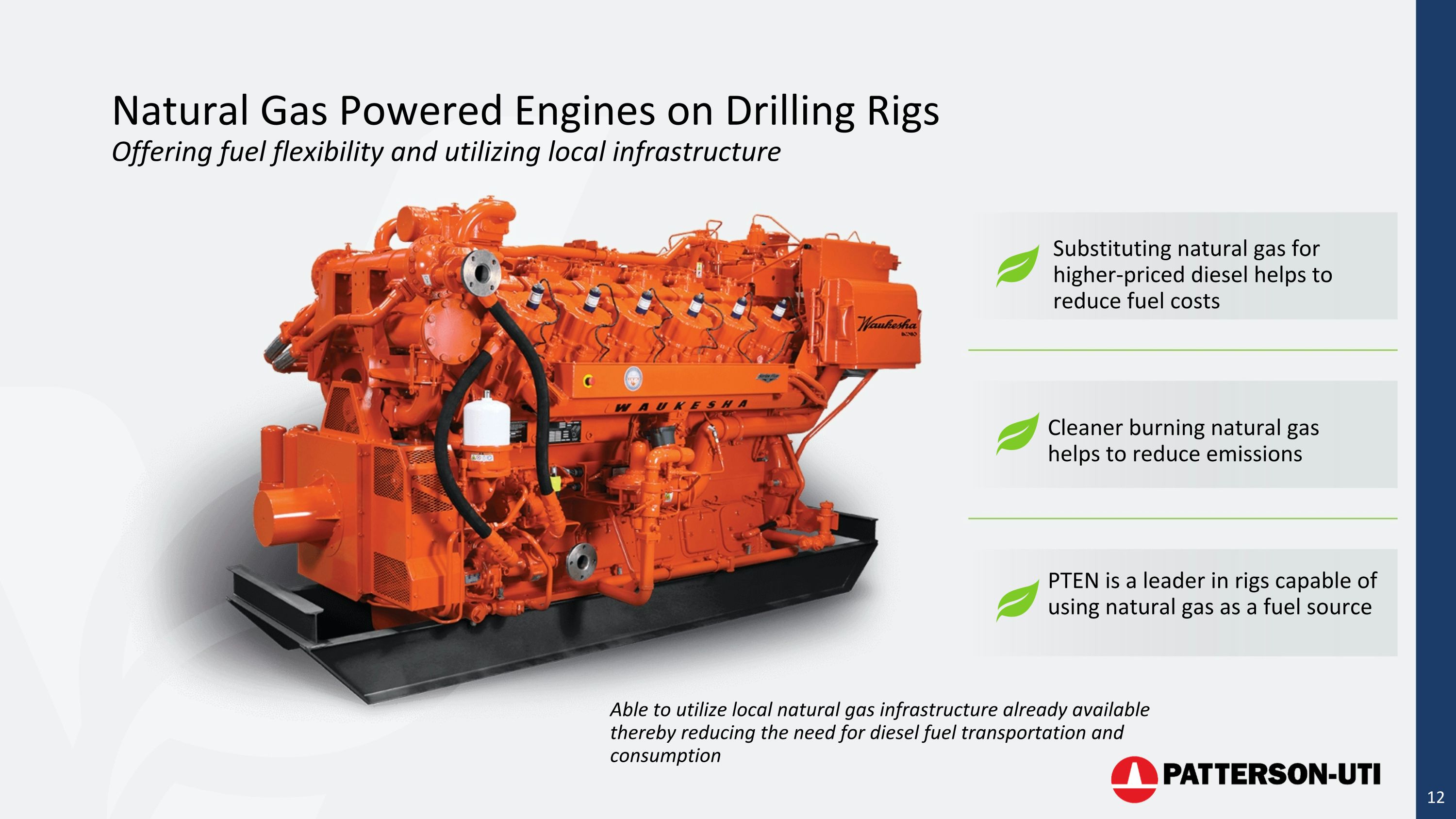

Natural Gas Powered Engines on Drilling RigsOffering fuel flexibility and utilizing local infrastructure Able to utilize local natural gas infrastructure already available thereby reducing the need for diesel fuel transportation and consumption Cleaner burning natural gas helps to reduce emissions PTEN is a leader in rigs capable of using natural gas as a fuel source Substituting natural gas for higher-priced diesel helps to reduce fuel costs

EcoCell®Optimizing efficiency and reducing the carbon footprint of our rig Leveraging stored energy helps to optimize fuel efficiency and reduce fuel costs. Reduced fuel consumption helps to reduce emissions. Patterson-UTI is a leader in the use of lithium batteries on drilling rigs.

Patterson-UTI provides in-house electrical engineering, hardware packaging, and installation services to power our rigs from electric utility lines This full-service offering enables our customers to utilize an optimal power solution on our drilling rig when it comes to emission impacts at the wellsite Hi-Line Electrical PowerCurrent Power designed and manufactured utility substation

Engine AutomationAutomating efficient engine management to optimize fuel savings and emission reduction Automation to start and stop engines as needed to meet fluctuations in rig power demand Helps to reduce fuel costs and emissions by optimizing the average genset load and decreasing the overall genset run hours Improves dual-fuel substitution rates Available through Patterson-UTI’s CORTEX ® Automation platform

Power Management DashboardReal time remote monitoring of rig fuel consumption and emissions Monitors real time rig power usage to effectively manage fuel consumption and reduce fuel costs Interactive analytical tools allow monitoring of 40 different engine data fields (pressures, temps, speed, alarms, etc.) Available through Patterson-UTI’s PTEN+ customer data portal

Pressure Pumping

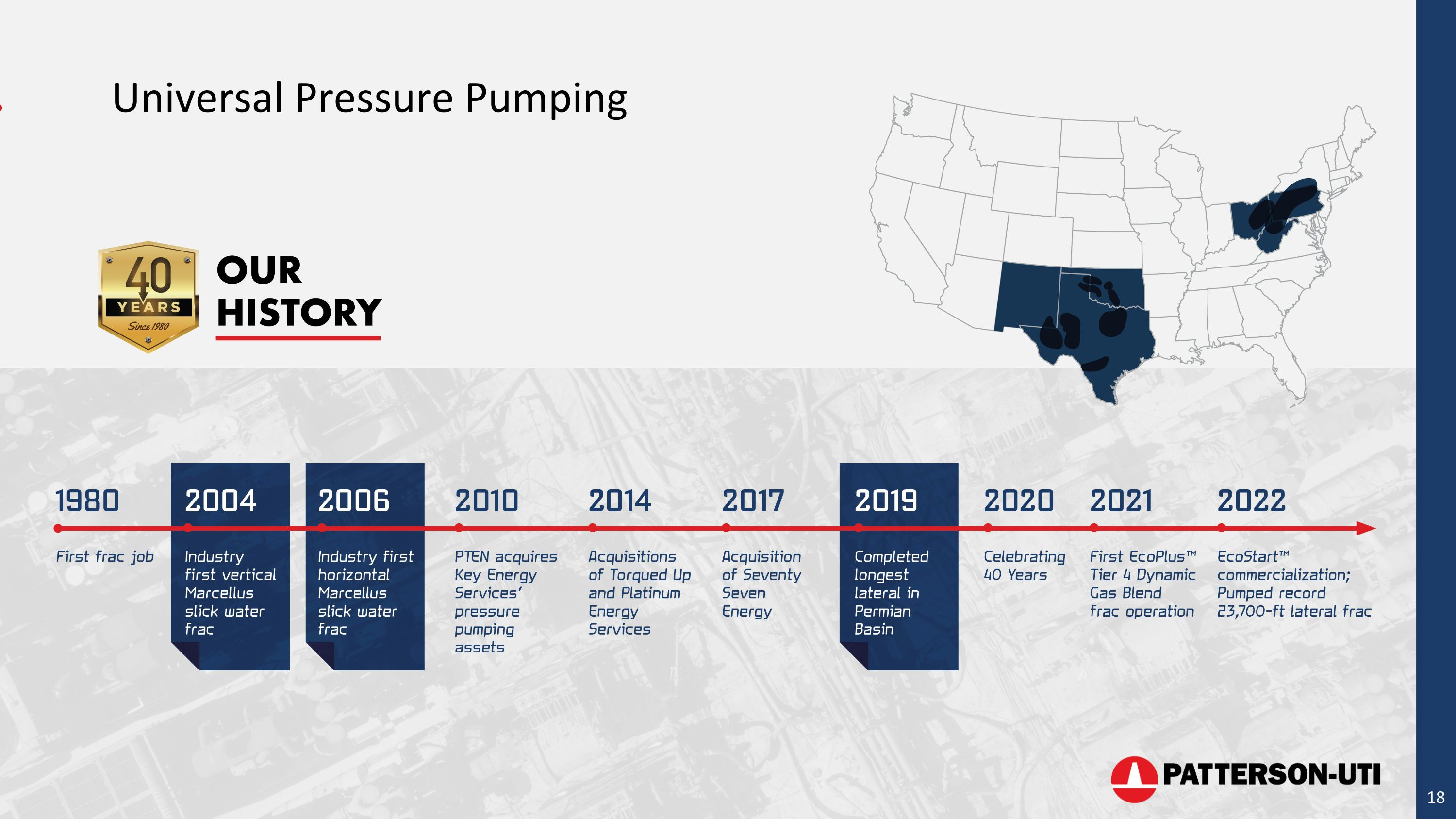

Universal Pressure Pumping

Dual-fuel equipment capable of instantaneous substitution up to 85% Natural Gas Powered Frac SpreadsImproved fuel emissions, optimized consumption Majority of frac spreads are dual-fuel Saved >35MM gal diesel >32K dual-fuel frac stages

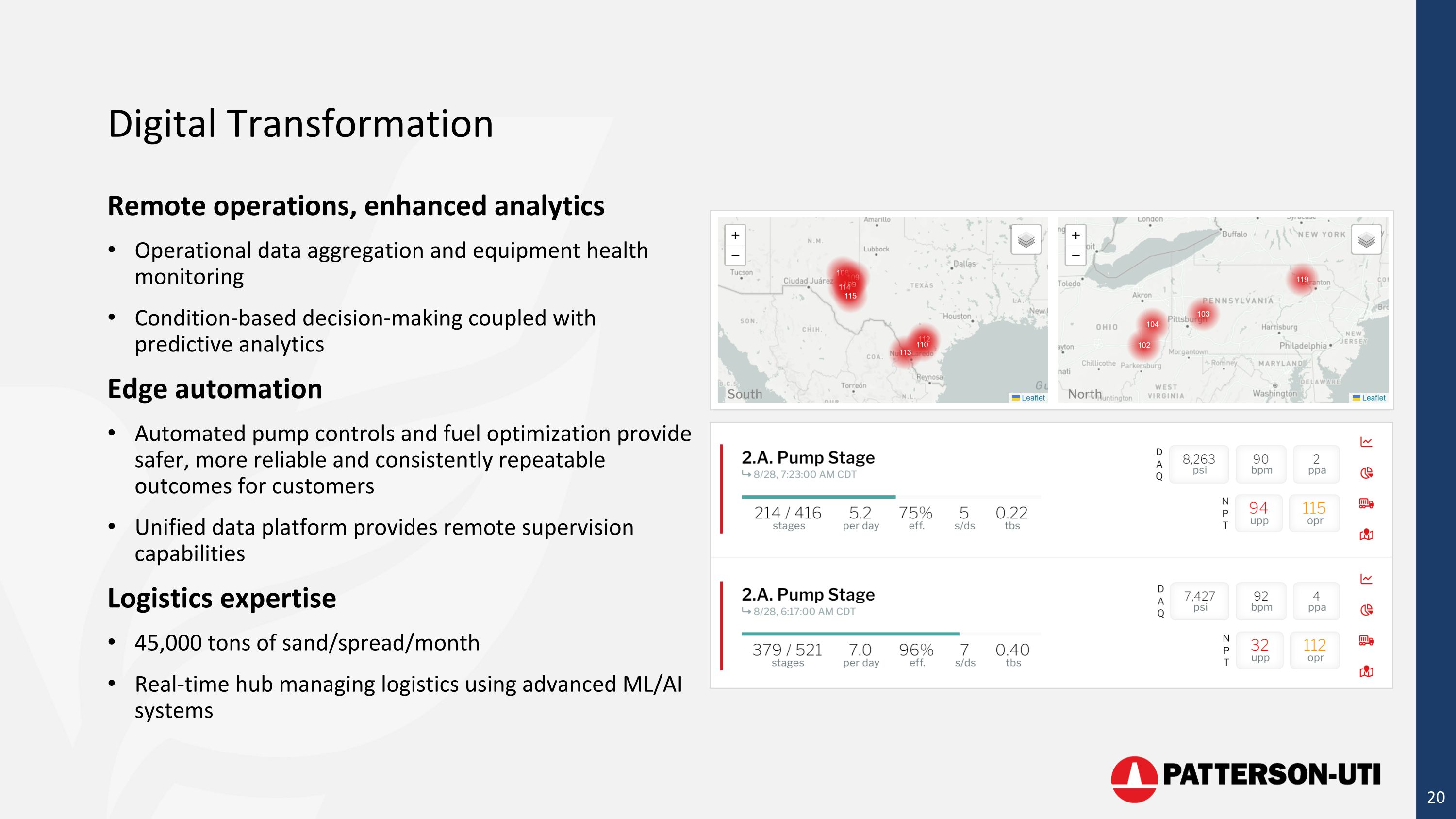

Digital Transformation Remote operations, enhanced analytics Operational data aggregation and equipment health monitoring Condition-based decision-making coupled with predictive analytics Edge automation Automated pump controls and fuel optimization provide safer, more reliable and consistently repeatable outcomes for customers Unified data platform provides remote supervision capabilities Logistics expertise 45,000 tons of sand/spread/month Real-time hub managing logistics using advanced ML/AI systems

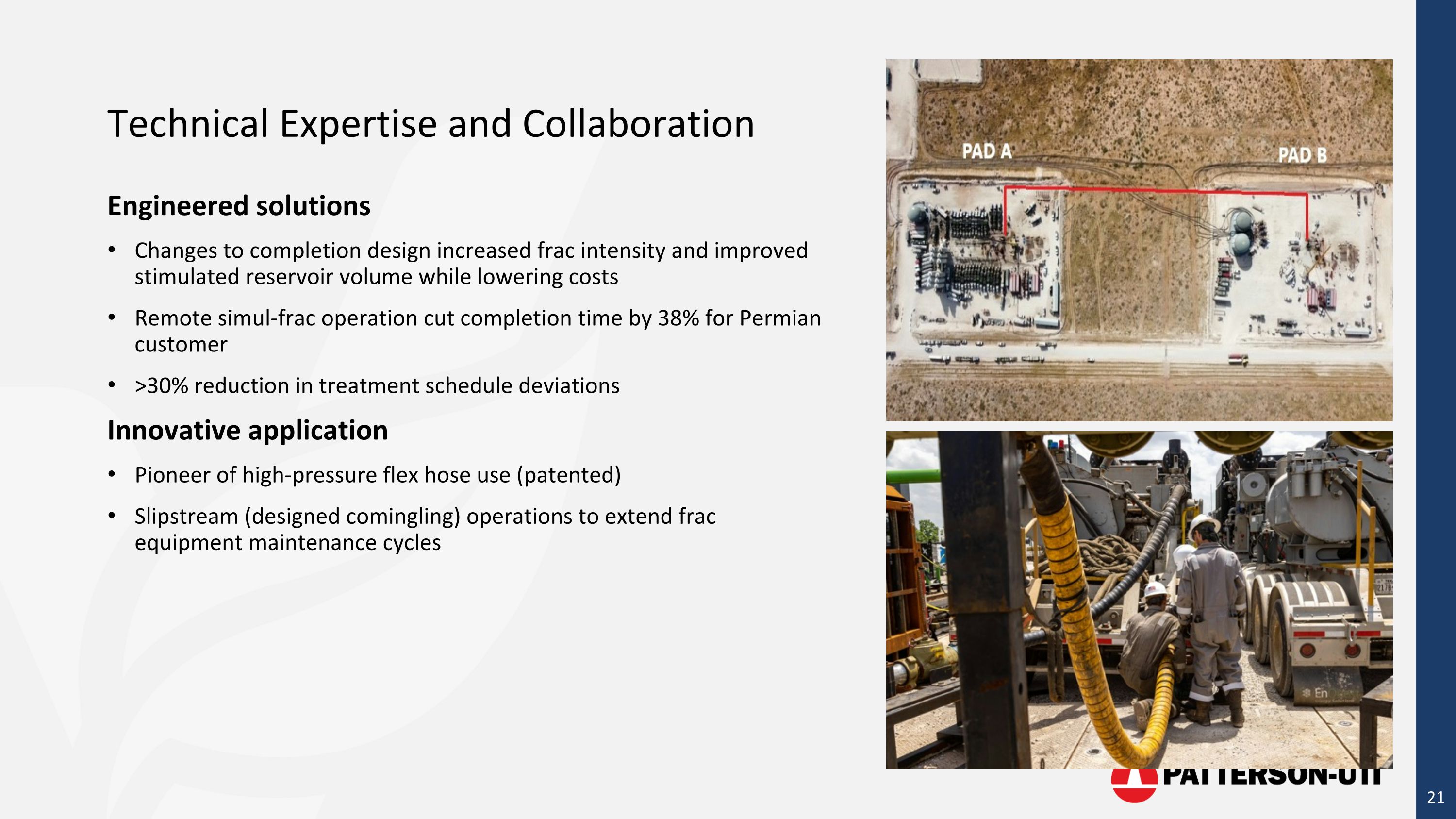

Technical Expertise and Collaboration Engineered solutions Changes to completion design increased frac intensity and improved stimulated reservoir volume while lowering costs Remote simul-frac operation cut completion time by 38% for Permian customer >30% reduction in treatment schedule deviations Innovative application Pioneer of high-pressure flex hose use (patented) Slipstream (designed comingling) operations to extend frac equipment maintenance cycles

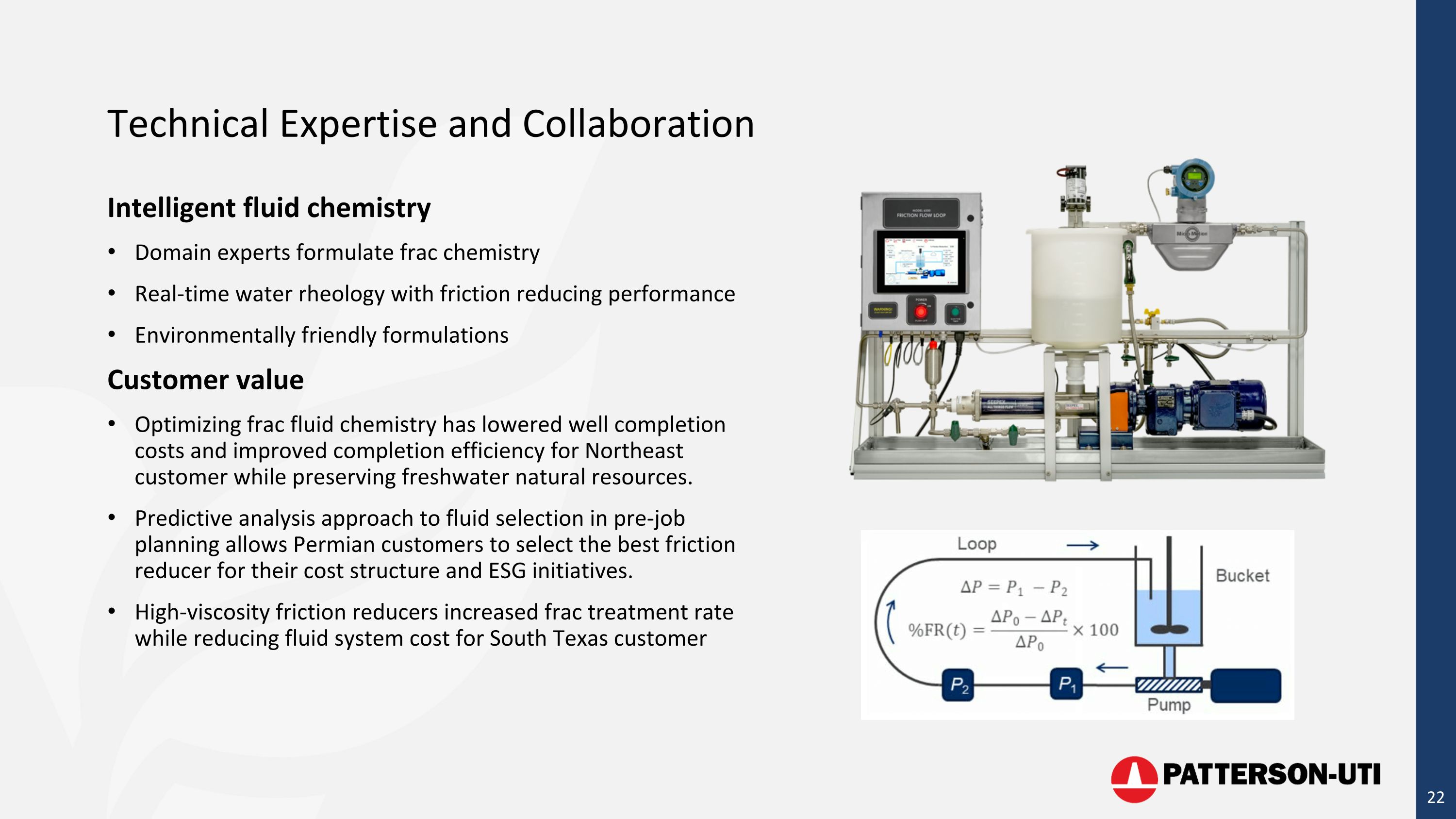

Technical Expertise and Collaboration Intelligent fluid chemistry Domain experts formulate frac chemistry Real-time water rheology with friction reducing performance Environmentally friendly formulations Customer value Optimizing frac fluid chemistry has lowered well completion costs and improved completion efficiency for Northeast customer while preserving freshwater natural resources. Predictive analysis approach to fluid selection in pre-job planning allows Permian customers to select the best friction reducer for their cost structure and ESG initiatives. High-viscosity friction reducers increased frac treatment rate while reducing fluid system cost for South Texas customer

Directional Drilling and Data Analytics

MS Directional A leading provider of directional drilling services Strong reputation for the reliability and durability of downhole performance motors and measurement-while-drilling (MWD) tools Remote MWD operations with reduced personnel are standard on all directional drilling jobs

Superior QCSpace flight navigation algorithms Improved well placement Better steering to target zones Better wellbore quality ™ ™

Financials

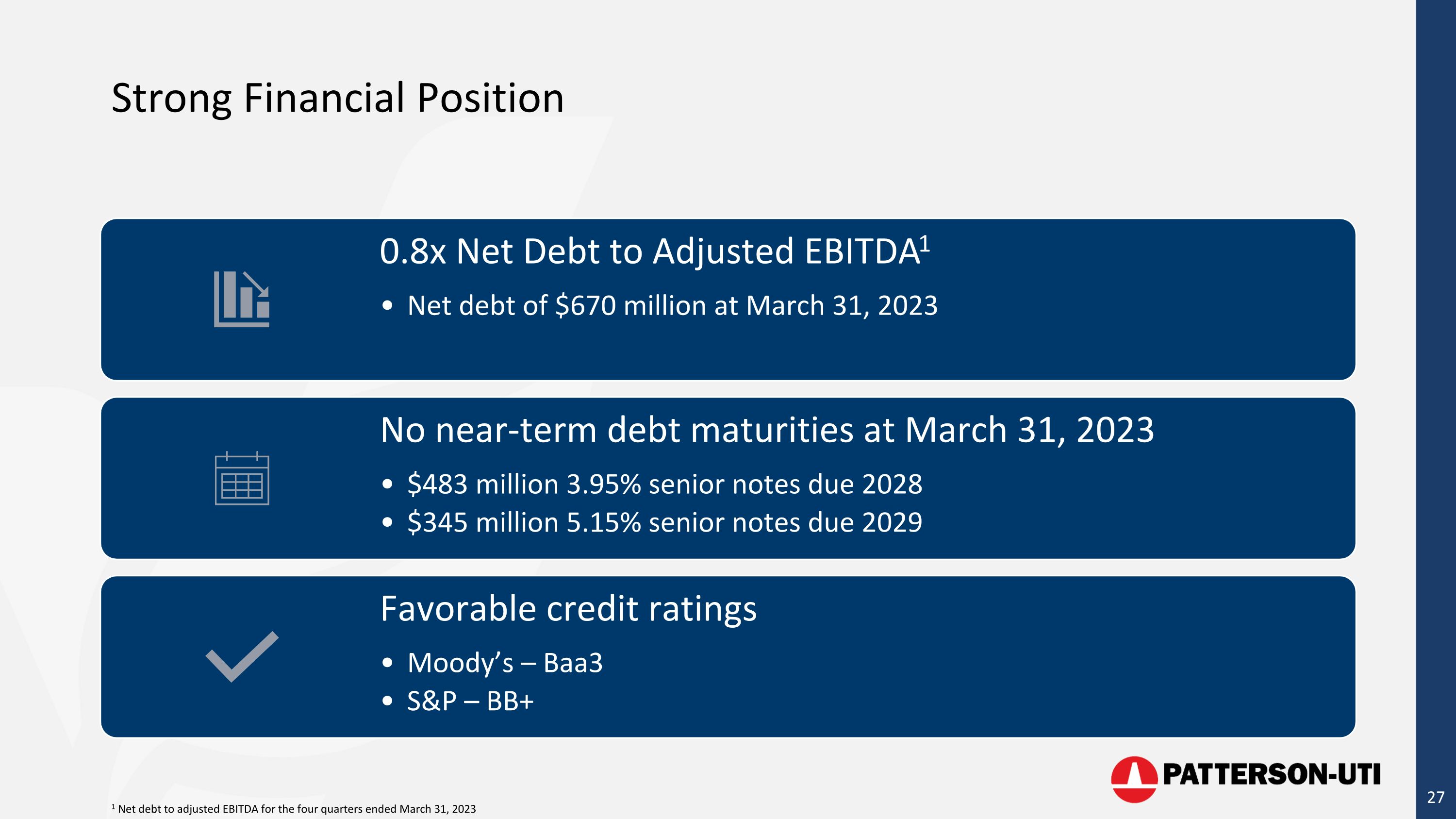

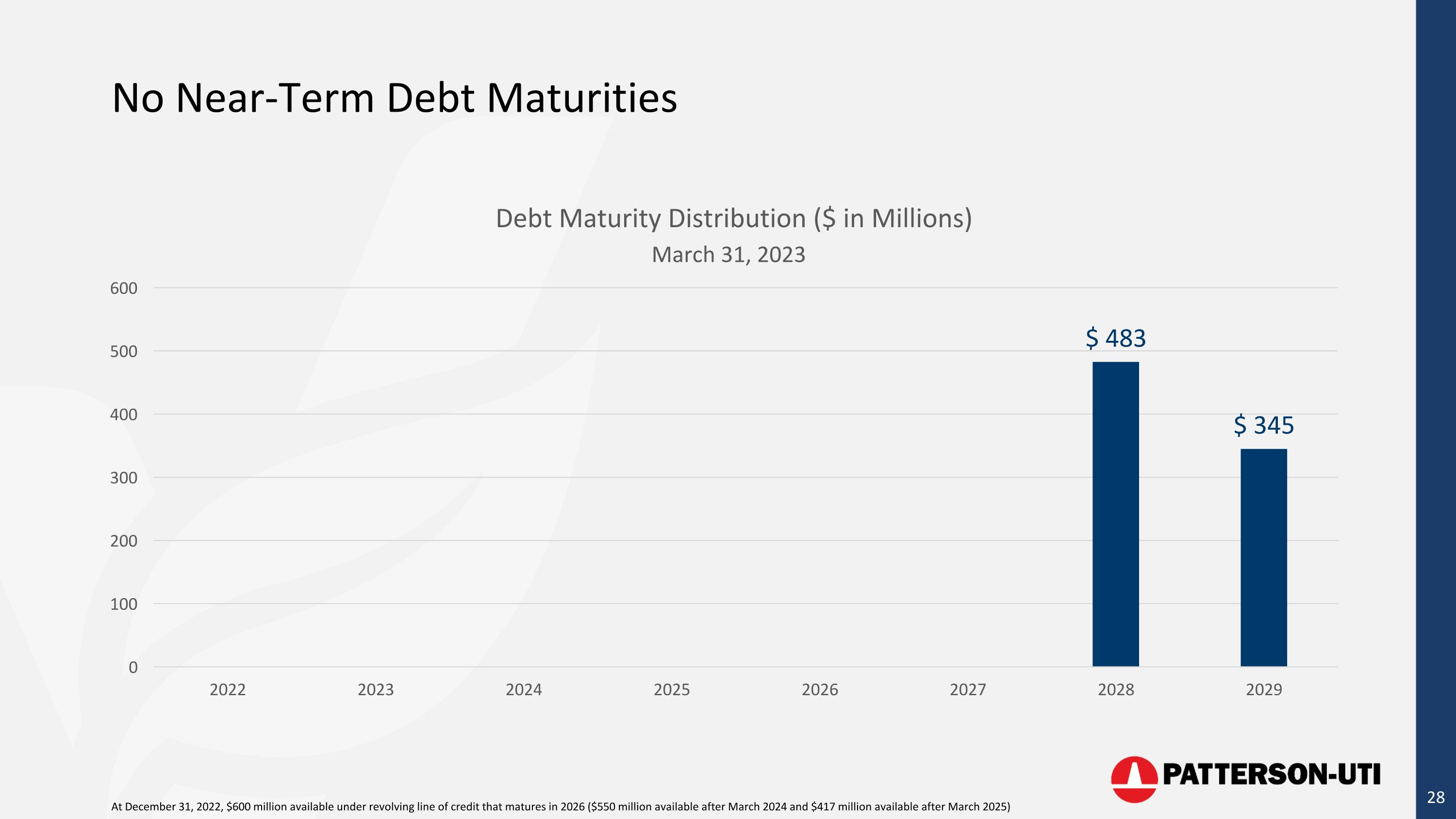

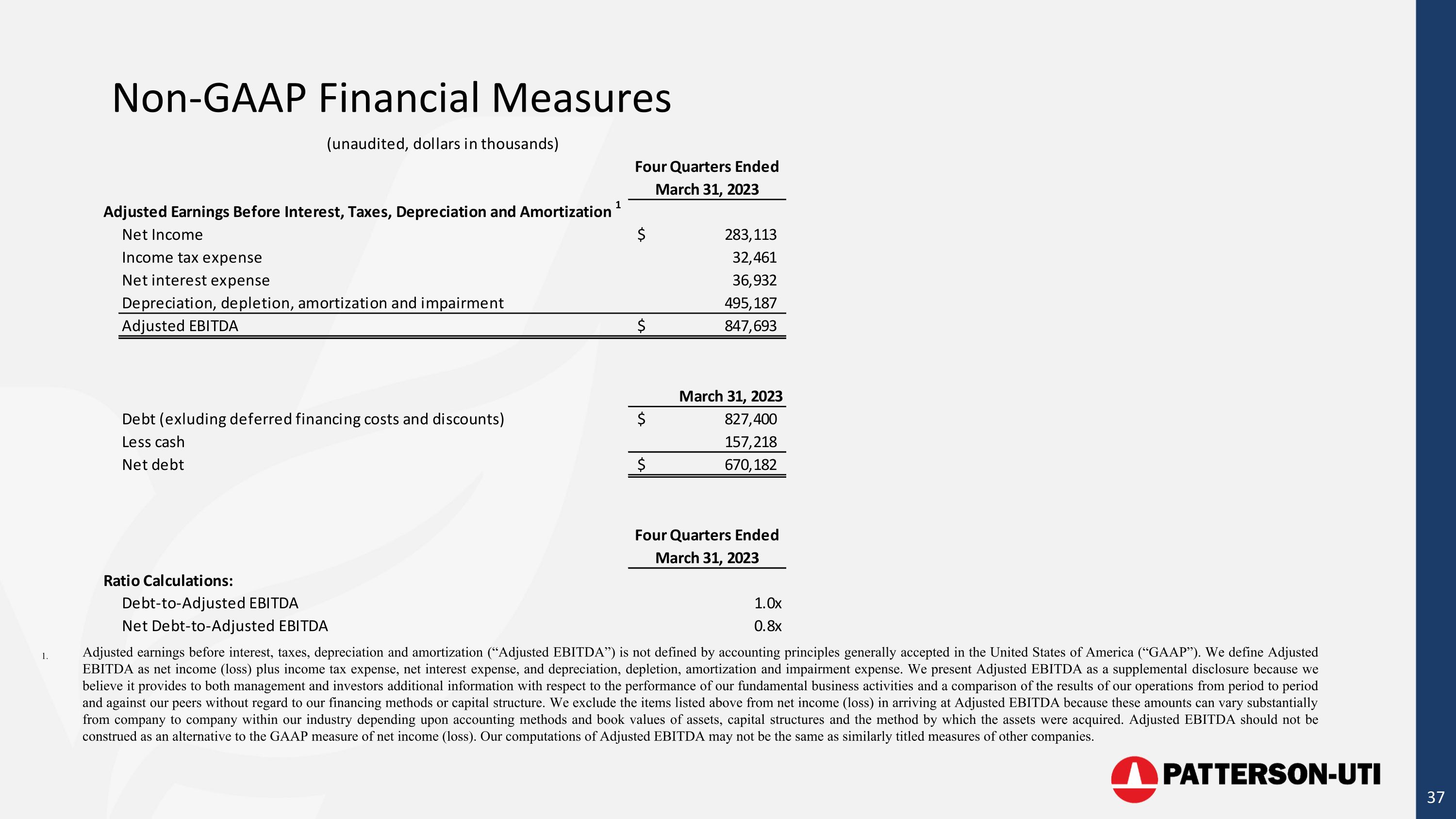

Strong Financial Position 0.8x Net Debt to Adjusted EBITDA1 Net debt of $670 million at March 31, 2023 No near-term debt maturities at March 31, 2023 $483 million 3.95% senior notes due 2028 $345 million 5.15% senior notes due 2029 Favorable credit ratings Moody’s – Baa3 S&P – BB+ 1 Net debt to adjusted EBITDA for the four quarters ended March 31, 2023

No Near-Term Debt Maturities At December 31, 2022, $600 million available under revolving line of credit that matures in 2026 ($550 million available after March 2024 and $417 million available after March 2025)

Environmental & Social Sustainability

Patterson-UTI Core Values Safety and Environment The safety of our employees and the protection of our environment is a cornerstone, and we are committed to providing a safe, incident-free work environment for all. Operational Excellence We partner with our customers to achieve their goals, through delivering high-quality performance, value-added services and with a focus on innovative technology and solutions in all aspects of our work. Honesty and Integrity We will act with honesty and integrity in everything we do. Diversity, Inclusion and Respect We are committed to diversity in recruiting, opportunity and leadership and to fostering a culture of inclusion and respect. Development of our People We are committed to support the growth, development and career advancement of every employee. Profitable Business and Financial Stability We are committed to delivering best-in-class profitability and maintaining financial strength.

Environmental Air Quality We utilize natural gas engines, dual-fuel equipment and other technologies that reduce our air emissions Water Quality We strive to conduct our drilling and completion activities in a manner that protects the quality of ground and surface water Land Use We employ spill prevention plans and use additional protective measures in environmentally sensitive areas

SocialOur people are our most important asset and our greatest strength Health and Safety Our goal is to provide an incident-free work environment. The safety of our employees and others is our highest priority. We regularly audit and review our HSE performance in all of our businesses. Diversity, Inclusion and Respect We are committed to fostering a work environment where all people feel valued and respected We embrace our diversity of people, thoughts and talents, and combine these strengths to pursue extraordinary results for PTEN, our employees and stockholders

Appendix

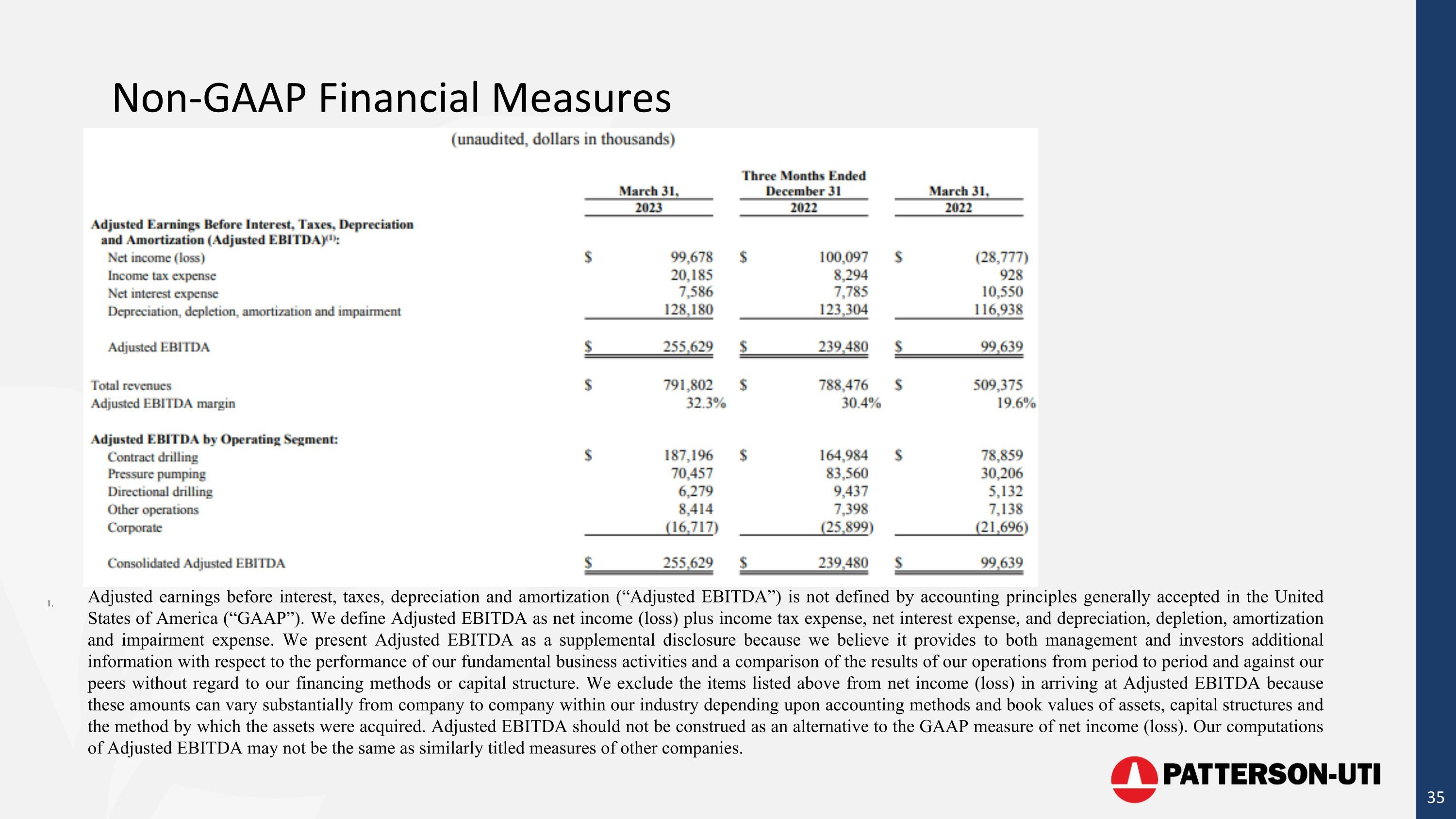

Non-GAAP Financial Measures Adjusted earnings before interest, taxes, depreciation and amortization (“Adjusted EBITDA”) is not defined by accounting principles generally accepted in the United States of America (“GAAP”). We define Adjusted EBITDA as net income (loss) plus income tax expense, net interest expense, and depreciation, depletion, amortization and impairment expense. We present Adjusted EBITDA as a supplemental disclosure because we believe it provides to both management and investors additional information with respect to the performance of our fundamental business activities and a comparison of the results of our operations from period to period and against our peers without regard to our financing methods or capital structure. We exclude the items listed above from net income (loss) in arriving at Adjusted EBITDA because these amounts can vary substantially from company to company within our industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. Adjusted EBITDA should not be construed as an alternative to the GAAP measure of net income (loss). Our computations of Adjusted EBITDA may not be the same as similarly titled measures of other companies.

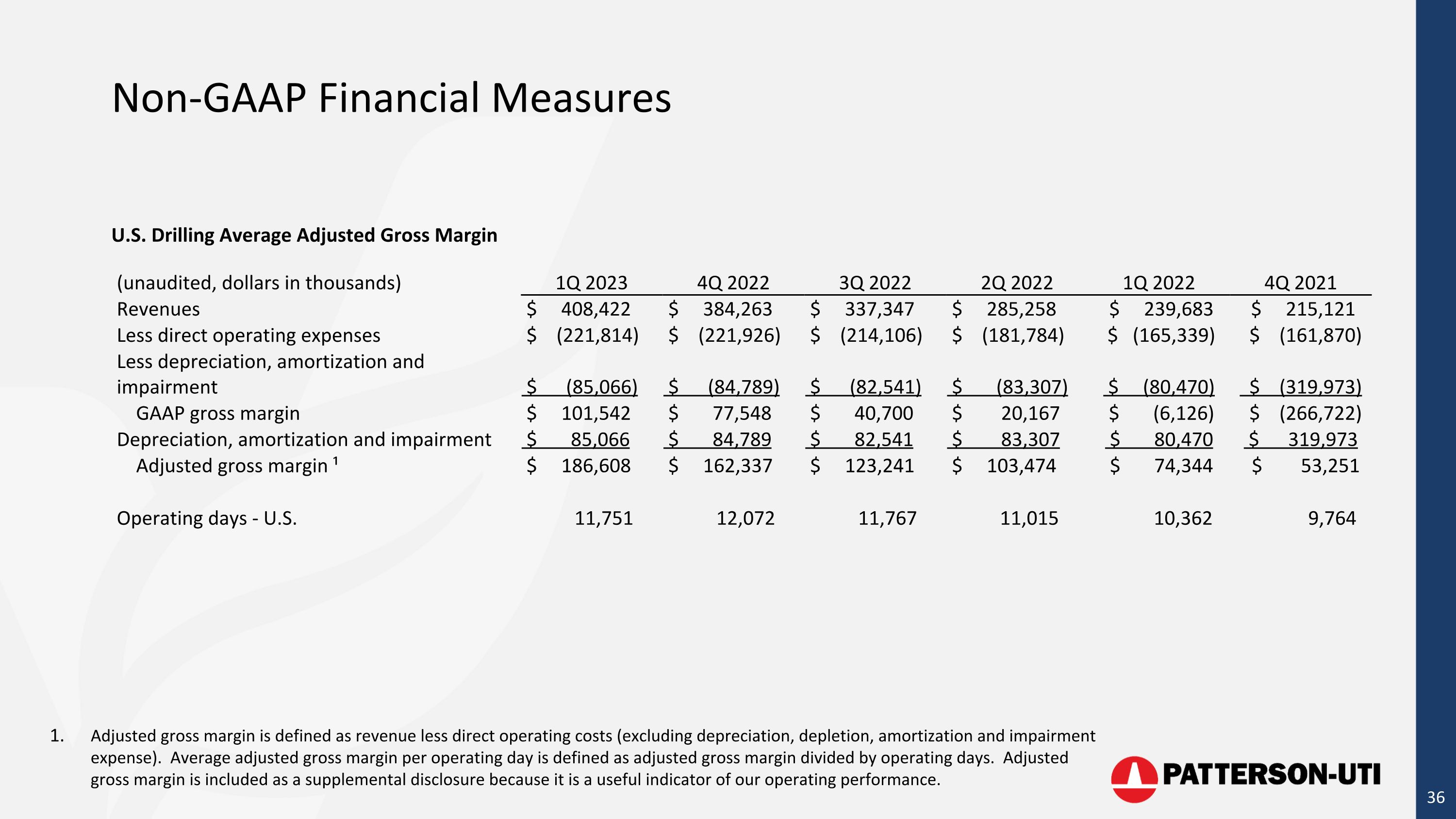

Non-GAAP Financial Measures U.S. Drilling Average Adjusted Gross Margin Adjusted gross margin is defined as revenue less direct operating costs (excluding depreciation, depletion, amortization and impairment expense). Average adjusted gross margin per operating day is defined as adjusted gross margin divided by operating days. Adjusted gross margin is included as a supplemental disclosure because it is a useful indicator of our operating performance. (unaudited, dollars in thousands) 1Q 2023 4Q 2022 3Q 2022 2Q 2022 1Q 2022 4Q 2021 Revenues $ 408,422 $ 384,263 $ 337,347 $ 285,258 $ 239,683 $ 215,121 Less direct operating expenses $ (221,814) $ (221,926) $ (214,106) $ (181,784) $ (165,339) $ (161,870) Less depreciation, amortization and impairment $ (85,066) $ (84,789) $ (82,541) $ (83,307) $ (80,470) $ (319,973) GAAP gross margin $ 101,542 $ 77,548 $ 40,700 $ 20,167 $ (6,126) $ (266,722) Depreciation, amortization and impairment $ 85,066 $ 84,789 $ 82,541 $ 83,307 $ 80,470 $ 319,973 Adjusted gross margin ¹ $ 186,608 $ 162,337 $ 123,241 $ 103,474 $ 74,344 $ 53,251 Operating days - U.S. 11,751 12,072 11,767 11,015 10,362 9,764

Non-GAAP Financial Measures Adjusted earnings before interest, taxes, depreciation and amortization (“Adjusted EBITDA”) is not defined by accounting principles generally accepted in the United States of America (“GAAP”). We define Adjusted EBITDA as net income (loss) plus income tax expense, net interest expense, and depreciation, depletion, amortization and impairment expense. We present Adjusted EBITDA as a supplemental disclosure because we believe it provides to both management and investors additional information with respect to the performance of our fundamental business activities and a comparison of the results of our operations from period to period and against our peers without regard to our financing methods or capital structure. We exclude the items listed above from net income (loss) in arriving at Adjusted EBITDA because these amounts can vary substantially from company to company within our industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. Adjusted EBITDA should not be construed as an alternative to the GAAP measure of net income (loss). Our computations of Adjusted EBITDA may not be the same as similarly titled measures of other companies.

Non-GAAP Financial Measures