UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 01, 2023 |

BENCHMARK ELECTRONICS, INC.

(Exact name of Registrant as Specified in Its Charter)

Texas |

001-10560 |

74-2211011 |

||

(State or Other Jurisdiction |

(Commission File Number) |

(IRS Employer |

||

|

|

|

|

|

56 South Rockford Drive |

|

|||

Tempe, Arizona |

|

85281 |

||

(Address of Principal Executive Offices) |

|

(Zip Code) |

||

Registrant’s Telephone Number, Including Area Code: (623) 300-7000 |

Not Applicable |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Securities registered pursuant to Section 12(b) of the Act:

|

|

Trading |

|

|

Common Stock, par value $0.10 per share |

|

BHE |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 1, 2023, Benchmark Electronics, Inc. (the “Company”) issued a press release announcing its results of operations for the quarter and year ended December 31, 2022. A copy of the press release and accompanying investor presentation are attached hereto as Exhibits 99.1 and 99.2, respectively, and incorporated by reference herein. The information disclosed under this Item 2.02, including Exhibits 99.1 and 99.2 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Exhibit No. |

|

Description |

|

|

|

99.1 |

|

|

|

|

|

99.2 |

|

|

|

|

|

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

BENCHMARK ELECTRONICS, INC. |

|

|

|

|

Date: |

February 1, 2023 |

By: |

/s/ Stephen J. Beaver |

|

|

|

Stephen J. Beaver, Esq. |

Exhibit 99.1

FOR IMMEDIATE RELEASE

BENCHMARK REPORTS RECORD FISCAL YEAR 2022 RESULTS

Fourth quarter 2022 results:

Full year 2022 results:

TEMPE, AZ, February 1, 2023 – Benchmark Electronics, Inc. (NYSE: BHE) today announced financial results for the fourth quarter and year ended December 31, 2022.

|

|

Three Months Ended |

|

|||||||||

|

|

Dec 31, |

|

|

Sept 30, |

|

|

Dec 31, |

|

|||

In millions, except EPS |

|

2022 |

|

|

2022 |

|

|

2021 |

|

|||

Sales |

|

$ |

751 |

|

|

$ |

772 |

|

|

$ |

633 |

|

Net income |

|

$ |

21 |

|

|

$ |

19 |

|

|

$ |

12 |

|

Net income – non-GAAP(1) |

|

$ |

21 |

|

|

$ |

20 |

|

|

$ |

17 |

|

Diluted earnings per share |

|

$ |

0.60 |

|

|

$ |

0.53 |

|

|

$ |

0.35 |

|

Diluted EPS – non-GAAP(1) |

|

$ |

0.60 |

|

|

$ |

0.57 |

|

|

$ |

0.48 |

|

Operating margin |

|

|

3.6 |

% |

|

|

3.3 |

% |

|

|

2.9 |

% |

Operating margin – non-GAAP(1) |

|

|

4.3 |

% |

|

|

3.6 |

% |

|

|

3.8 |

% |

|

|

Year Ended |

|

|||||

|

|

Dec 31, |

|

|

Dec 31, |

|

||

In millions, except EPS |

|

2022 |

|

|

2021 |

|

||

Sales |

|

$ |

2,886 |

|

|

$ |

2,255 |

|

Net income |

|

$ |

68 |

|

|

$ |

36 |

|

Net income – non-GAAP(1) |

|

$ |

75 |

|

|

$ |

49 |

|

Diluted EPS |

|

$ |

1.91 |

|

|

$ |

0.99 |

|

Diluted EPS – non-GAAP(1) |

|

$ |

2.09 |

|

|

$ |

1.35 |

|

Operating margin |

|

|

3.1 |

% |

|

|

2.4 |

% |

Operating margin – non-GAAP(1) |

|

|

3.6 |

% |

|

|

3.0 |

% |

(1) A reconciliation of GAAP and non-GAAP results is included below.

1

“As we close out 2022, I’m proud to see the team’s continued execution of our strategy which culminated in our reporting a record year of revenue and earnings,” said Jeff Benck, Benchmark’s President and CEO. "These results enabled us to exceed the operating targets we laid out more than two years ago, despite the unforeseen global challenges we encountered during this period."

Benck continued “Looking forward, we have a new set of objectives, which we introduced at our analyst meeting last November. I am as confident today as I was then in our ability to deliver to our commitments, or better, over the multi-year period.”

Cash Conversion Cycle

|

|

Dec 31, |

|

|

Sept 30, |

|

|

Dec 31, |

|

|||

|

|

2022 |

|

|

2022 |

|

|

2021 |

|

|||

Accounts receivable days |

|

|

59 |

|

|

|

56 |

|

|

|

51 |

|

Contract asset days |

|

|

22 |

|

|

|

22 |

|

|

|

22 |

|

Inventory days |

|

|

97 |

|

|

|

95 |

|

|

|

82 |

|

Accounts payable days |

|

|

(56 |

) |

|

|

(67 |

) |

|

|

(67 |

) |

Advance payments from customers days |

|

|

(26 |

) |

|

|

(27 |

) |

|

|

(19 |

) |

Cash conversion cycle days |

|

|

96 |

|

|

|

79 |

|

|

|

69 |

|

Fourth Quarter 2022 Industry Sector Update

Revenue and percentage of sales by industry sector (in millions) were as follows.

|

|

Dec 31, |

|

|

Sept 30, |

|

|

Dec 31, |

|

|||||||||||||||

|

|

2022 |

|

|

2022 |

|

|

2021 |

|

|||||||||||||||

Medical |

|

$ |

144 |

|

|

|

19 |

% |

|

$ |

166 |

|

|

|

21 |

% |

|

$ |

127 |

|

|

|

20 |

% |

Semi-Cap |

|

|

178 |

|

|

|

24 |

|

|

|

186 |

|

|

|

24 |

|

|

|

163 |

|

|

|

26 |

|

A&D |

|

|

90 |

|

|

|

12 |

|

|

|

86 |

|

|

|

11 |

|

|

|

95 |

|

|

|

15 |

|

Industrials |

|

|

143 |

|

|

|

19 |

|

|

|

155 |

|

|

|

20 |

|

|

|

125 |

|

|

|

20 |

|

Advanced Computing |

|

|

92 |

|

|

|

12 |

|

|

|

95 |

|

|

|

13 |

|

|

|

60 |

|

|

|

9 |

|

Next Gen Communications |

|

|

104 |

|

|

|

14 |

|

|

|

84 |

|

|

|

11 |

|

|

|

63 |

|

|

|

10 |

|

Total |

|

$ |

751 |

|

|

|

100 |

% |

|

$ |

772 |

|

|

|

100 |

% |

|

$ |

633 |

|

|

|

100 |

% |

Overall, revenues were up 19% year-over-year from strength in the Next Gen Communications, Advanced Computing, Industrials, Medical and Semi-Cap sectors.

First Quarter 2023 Guidance

Restructuring charges are expected to range between $0.2 million and $0.6 million in the first quarter and the amortization of intangibles is expected to be $1.6 million in the first quarter.

2

Fourth Quarter 2022 Earnings Conference Call

The Company will host a conference call to discuss the results today at 5:00 p.m. Eastern Time. The live webcast of the call and accompanying reference materials will be accessible by logging on to the Company's website at www.bench.com. A replay of the broadcast will also be available for one year on the Company's website.

About Benchmark Electronics, Inc.

Benchmark provides comprehensive solutions across the entire product life cycle by leading through its innovative technology and engineering design services, leveraging its optimized global supply chain and delivering world-class manufacturing services in the following industries: commercial aerospace, defense, advanced computing, next generation telecommunications, complex industrials, medical, and semiconductor capital equipment. Benchmark's global operations include facilities in seven countries and its common shares trade on the New York Stock Exchange under the symbol BHE.

For More Information, Please Contact:

Paul Mansky, Investor Relations and Corporate Development

512-580-2719 or paul.mansky@bench.com

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are identified as any statement that does not relate strictly to historical or current facts and may include words such as “anticipate,” “believe,” “intend,” “plan,” “project,” “forecast,” “strategy,” “position,” “continue,” “estimate,” “expect,” “may,” “will,” “could,” “predict,” and similar expressions of the negative or other variations thereof. In particular, statements, express or implied, concerning the estimated financial impact of the COVID-19 pandemic, the Company’s outlook and guidance for first quarter and fiscal year 2023 results, future operating results or margins, the ability to generate sales and income or cash flow, expected revenue mix, the Company’s business strategy and strategic initiatives, the Company’s repurchases of shares of its common stock, the Company’s expectations regarding restructuring charges and amortization of intangibles, and the Company’s intentions concerning the payment of dividends, among others, are forward-looking statements. Although the Company believes these statements are based on and derived from reasonable assumptions, they involve risks, uncertainties and assumptions that are beyond the Company’s ability to control or predict, relating to operations, markets and the business environment generally, including those discussed under Part I, Item 1A of the Company's Annual Report on Form 10-K for the year ended December 31, 2021, and in any of the Company’s subsequent reports filed with the Securities and Exchange Commission. In particular, these statements also depend on the duration, severity and evolution of the COVID-19 pandemic and related risks, including the emergence and severity of its variants, the availability of vaccines and potential hesitancy to utilize them, government and other third-party responses to the crisis and the consequences for the global economy, the Company’s business and the businesses of its suppliers and customers. Events relating to the possibility of customer demand fluctuations, supply chain constraints, continued inflationary pressures, the effects of foreign currency fluctuations and high interest rates, geopolitical uncertainties including trade restrictions, or the ability to utilize the company’s manufacturing facilities at sufficient levels to cover its fixed operating costs, may have resulting impacts on the Company’s business, financial condition, results of operations, and the Company’s ability (or inability) to execute on its plans. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual outcomes, including the future results of our operations, may vary materially from those indicated. Undue reliance should not be placed on any forward-looking statements. Forward-looking statements are not guarantees of performance.

3

All forward-looking statements included in this document are based upon information available to the Company as of the date of this document, and the Company assumes no obligation to update.

Non-GAAP Financial Measures

Management discloses non‐GAAP information to provide investors with additional information to analyze the Company’s performance and underlying trends. A detailed reconciliation between GAAP results and results excluding certain items (“non-GAAP”) is included in the following tables attached to this document. In situations where a non-GAAP reconciliation has not been provided, the Company was unable to provide such a reconciliation without unreasonable effort due to the uncertainty and inherent difficulty predicting the occurrence, the financial impact and the periods in which the non-GAAP adjustments may be recognized. Management uses non‐GAAP measures that exclude certain items in order to better assess operating performance and help investors compare results with our previous guidance. This document also references “free cash flow”, which the Company defines as cash flow from operations less additions to property, plant and equipment and purchased software. The Company’s non‐GAAP information is not necessarily comparable to the non‐GAAP information used by other companies. Non‐GAAP information should not be viewed as a substitute for, or superior to, net income or other data prepared in accordance with GAAP as a measure of the Company’s profitability or liquidity. Readers should consider the types of events and transactions for which adjustments have been made.

###

4

Benchmark Electronics, Inc. and Subsidiaries

Condensed Consolidated Statements of Income

(Amounts in Thousands, Except Per Share Data)

(UNAUDITED)

|

|

Three Months Ended |

|

|

Year Ended |

|

||||||||||

|

|

December 31, |

|

|

December 31, |

|

||||||||||

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

||||

Sales |

|

$ |

750,644 |

|

|

$ |

633,054 |

|

|

$ |

2,886,331 |

|

|

$ |

2,255,319 |

|

Cost of sales |

|

|

678,517 |

|

|

|

570,998 |

|

|

|

2,631,096 |

|

|

|

2,049,418 |

|

Gross profit |

|

|

72,127 |

|

|

|

62,056 |

|

|

|

255,235 |

|

|

|

205,901 |

|

Selling, general and administrative expenses |

|

|

39,540 |

|

|

|

37,731 |

|

|

|

150,215 |

|

|

|

136,700 |

|

Amortization of intangible assets |

|

|

1,592 |

|

|

|

1,591 |

|

|

|

6,384 |

|

|

|

6,384 |

|

Restructuring charges and other costs |

|

|

4,049 |

|

|

|

4,099 |

|

|

|

8,567 |

|

|

|

13,699 |

|

Ransomware incident related costs (recovery), net |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(3,944 |

) |

Income from operations |

|

|

26,946 |

|

|

|

18,635 |

|

|

|

90,069 |

|

|

|

53,062 |

|

Interest expense |

|

|

(5,466 |

) |

|

|

(2,257 |

) |

|

|

(12,894 |

) |

|

|

(8,472 |

) |

Interest income |

|

|

887 |

|

|

|

89 |

|

|

|

1,730 |

|

|

|

540 |

|

Other income (expense), net |

|

|

3,860 |

|

|

|

(387 |

) |

|

|

5,437 |

|

|

|

277 |

|

Income before income taxes |

|

|

26,227 |

|

|

|

16,080 |

|

|

|

84,342 |

|

|

|

45,407 |

|

Income tax expense |

|

|

5,008 |

|

|

|

3,661 |

|

|

|

16,113 |

|

|

|

9,637 |

|

Net income |

|

$ |

21,219 |

|

|

$ |

12,419 |

|

|

$ |

68,229 |

|

|

$ |

35,770 |

|

Earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Basic |

|

$ |

0.60 |

|

|

$ |

0.35 |

|

|

$ |

1.94 |

|

|

$ |

1.00 |

|

Diluted |

|

$ |

0.60 |

|

|

$ |

0.35 |

|

|

$ |

1.91 |

|

|

$ |

0.99 |

|

Weighted-average number of shares used in calculating earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Basic |

|

|

35,166 |

|

|

|

35,209 |

|

|

|

35,179 |

|

|

|

35,655 |

|

Diluted |

|

|

35,630 |

|

|

|

35,410 |

|

|

|

35,718 |

|

|

|

36,101 |

|

5

Benchmark Electronics, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(UNAUDITED)

(in thousands)

|

|

December 31, |

|

|

December 31, |

|

||

|

|

2022 |

|

|

2021 |

|

||

Assets |

|

|

|

|

|

|

||

Current assets: |

|

|

|

|

|

|

||

Cash and cash equivalents |

|

$ |

207,430 |

|

|

$ |

271,749 |

|

Accounts receivable, net |

|

|

491,957 |

|

|

|

355,883 |

|

Contract assets |

|

|

183,613 |

|

|

|

155,243 |

|

Inventories |

|

|

727,749 |

|

|

|

523,240 |

|

Other current assets |

|

|

41,400 |

|

|

|

42,029 |

|

Total current assets |

|

|

1,652,149 |

|

|

|

1,348,144 |

|

Property, plant and equipment, net |

|

|

211,478 |

|

|

|

186,666 |

|

Operating lease right-of-use assets |

|

|

93,081 |

|

|

|

99,158 |

|

Goodwill and other, net |

|

|

270,623 |

|

|

|

269,912 |

|

Total assets |

|

$ |

2,227,331 |

|

|

$ |

1,903,880 |

|

|

|

|

|

|

|

|

||

Liabilities and shareholders’ equity |

|

|

|

|

|

|

||

Current liabilities: |

|

|

|

|

|

|

||

Current installments of long-term debt and finance lease obligations |

|

$ |

4,275 |

|

|

$ |

985 |

|

Accounts payable |

|

|

424,272 |

|

|

|

426,555 |

|

Advance payments from customers |

|

|

197,937 |

|

|

|

118,124 |

|

Accrued liabilities |

|

|

122,652 |

|

|

|

108,718 |

|

Total current liabilities |

|

|

749,136 |

|

|

|

654,382 |

|

Long-term debt and finance lease obligations, less current installments |

|

|

320,675 |

|

|

|

129,289 |

|

Operating lease liabilities |

|

|

86,687 |

|

|

|

90,878 |

|

Other long-term liabilities |

|

|

44,417 |

|

|

|

55,529 |

|

Shareholders’ equity |

|

|

1,026,416 |

|

|

|

973,802 |

|

Total liabilities and shareholders’ equity |

|

$ |

2,227,331 |

|

|

$ |

1,903,880 |

|

6

Benchmark Electronics, Inc. and Subsidiaries

Condensed Consolidated Statement of Cash Flows

(in thousands)

(UNAUDITED)

|

|

Year Ended |

|

|||||

|

|

December 31, |

|

|||||

|

|

2022 |

|

|

2021 |

|

||

Cash flows from operating activities: |

|

|

|

|

|

|

||

Net income |

|

$ |

68,229 |

|

|

$ |

35,770 |

|

Depreciation and amortization |

|

|

44,252 |

|

|

|

44,152 |

|

Stock-based compensation expense |

|

|

18,485 |

|

|

|

15,262 |

|

Accounts receivable, net |

|

|

(135,955 |

) |

|

|

(46,967 |

) |

Contract assets |

|

|

(28,370 |

) |

|

|

(12,464 |

) |

Inventories |

|

|

(206,247 |

) |

|

|

(197,867 |

) |

Accounts payable |

|

|

(16,656 |

) |

|

|

139,952 |

|

Advance payments from customers |

|

|

93,476 |

|

|

|

34,002 |

|

Other changes in working capital and other, net |

|

|

(14,681 |

) |

|

|

(14,462 |

) |

Net cash used in operations |

|

|

(177,467 |

) |

|

|

(2,622 |

) |

|

|

|

|

|

|

|

||

Cash flows from investing activities: |

|

|

|

|

|

|

||

Additions to property, plant and equipment and software |

|

|

(46,774 |

) |

|

|

(42,177 |

) |

Other investing activities, net |

|

|

5,600 |

|

|

|

302 |

|

Net cash used in investing activities |

|

|

(41,174 |

) |

|

|

(41,875 |

) |

|

|

|

|

|

|

|

||

Cash flows from financing activities: |

|

|

|

|

|

|

||

Share repurchases |

|

|

(9,391 |

) |

|

|

(40,216 |

) |

Net debt activity |

|

|

194,261 |

|

|

|

(7,648 |

) |

Other financing activities, net |

|

|

(25,641 |

) |

|

|

(26,088 |

) |

Net cash provided by (used in) financing activities |

|

|

159,229 |

|

|

|

(73,952 |

) |

|

|

|

|

|

|

|

||

Effect of exchange rate changes |

|

|

(4,907 |

) |

|

|

(5,792 |

) |

Net decrease in cash and cash equivalents and restricted cash |

|

|

(64,319 |

) |

|

|

(124,241 |

) |

Cash and cash equivalents and restricted cash at beginning of year |

|

|

271,749 |

|

|

|

395,990 |

|

Cash and cash equivalents and restricted cash at end of year |

|

$ |

207,430 |

|

|

$ |

271,749 |

|

7

Benchmark Electronics, Inc. and Subsidiaries

Reconciliation of GAAP to Non-GAAP Financial Results

(Amounts in Thousands, Except Per Share Data)

(UNAUDITED)

|

|

Three Months Ended |

|

|

Year Ended |

|

||||||||||||||

|

|

Dec 31, |

|

|

Sept 30, |

|

|

Dec 31, |

|

|

Dec 31, |

|

||||||||

|

|

2022 |

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|||||

Income from operations (GAAP) |

|

$ |

26,946 |

|

|

$ |

25,284 |

|

|

$ |

18,635 |

|

|

$ |

90,069 |

|

|

$ |

53,062 |

|

Amortization of intangible assets |

|

|

1,592 |

|

|

|

1,591 |

|

|

|

1,591 |

|

|

|

6,384 |

|

|

|

6,384 |

|

Restructuring charges and other costs |

|

|

799 |

|

|

|

1,331 |

|

|

|

4,099 |

|

|

|

5,710 |

|

|

|

9,341 |

|

(Gain) loss on assets held for sale |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(393 |

) |

|

|

— |

|

Impairment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

4,358 |

|

Ransomware incident related costs (recovery), net |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(3,944 |

) |

Settlement |

|

|

3,250 |

|

|

|

— |

|

|

|

— |

|

|

|

3,250 |

|

|

|

— |

|

Customer insolvency (recovery) |

|

|

— |

|

|

|

(599 |

) |

|

|

(72 |

) |

|

|

(599 |

) |

|

|

(425 |

) |

Non-GAAP income from operations |

|

$ |

32,587 |

|

|

$ |

27,607 |

|

|

$ |

24,253 |

|

|

$ |

104,421 |

|

|

$ |

68,776 |

|

GAAP operating margin |

|

|

3.6 |

% |

|

|

3.3 |

% |

|

|

2.9 |

% |

|

|

3.1 |

% |

|

|

2.4 |

% |

Non-GAAP operating margin |

|

|

4.3 |

% |

|

|

3.6 |

% |

|

|

3.8 |

% |

|

|

3.6 |

% |

|

|

3.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Gross Profit (GAAP) |

|

$ |

72,127 |

|

|

$ |

66,750 |

|

|

$ |

62,056 |

|

|

$ |

255,235 |

|

|

$ |

205,901 |

|

Settlement |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Customer insolvency (recovery) |

|

|

— |

|

|

|

(425 |

) |

|

|

(72 |

) |

|

|

(425 |

) |

|

|

(425 |

) |

Non-GAAP gross profit |

|

$ |

72,127 |

|

|

$ |

66,325 |

|

|

$ |

61,984 |

|

|

$ |

254,810 |

|

|

$ |

205,476 |

|

GAAP gross margin |

|

|

9.6 |

% |

|

|

8.7 |

% |

|

|

9.8 |

% |

|

|

8.8 |

% |

|

|

9.1 |

% |

Non-GAAP gross margin |

|

|

9.6 |

% |

|

|

8.6 |

% |

|

|

9.8 |

% |

|

|

8.8 |

% |

|

|

9.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Selling, general and administrative expenses |

|

$ |

39,540 |

|

|

$ |

38,544 |

|

|

$ |

37,731 |

|

|

$ |

150,215 |

|

|

$ |

136,700 |

|

Customer recovery |

|

|

— |

|

|

|

174 |

|

|

|

— |

|

|

|

174 |

|

|

|

— |

|

Non-GAAP selling, general and administrative expenses |

|

$ |

39,540 |

|

|

$ |

38,718 |

|

|

$ |

37,731 |

|

|

$ |

150,389 |

|

|

$ |

136,700 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Net income (GAAP) |

|

$ |

21,219 |

|

|

$ |

18,829 |

|

|

$ |

12,419 |

|

|

$ |

68,229 |

|

|

$ |

35,770 |

|

Amortization of intangible assets |

|

|

1,592 |

|

|

|

1,591 |

|

|

|

1,591 |

|

|

|

6,384 |

|

|

|

6,384 |

|

Restructuring charges and other costs |

|

|

799 |

|

|

|

1,331 |

|

|

|

4,099 |

|

|

|

5,710 |

|

|

|

9,341 |

|

(Gain) loss on assets held for sale |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(393 |

) |

|

|

— |

|

Impairment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

4,358 |

|

Ransomware incident related costs (recovery), net |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(3,944 |

) |

Settlement |

|

|

(2,344 |

) |

|

|

(611 |

) |

|

|

— |

|

|

|

(2,955 |

) |

|

|

— |

|

Customer insolvency (recovery) |

|

|

— |

|

|

|

(599 |

) |

|

|

(72 |

) |

|

|

(599 |

) |

|

|

(425 |

) |

Refinancing of Credit Facilities |

|

|

— |

|

|

|

— |

|

|

|

276 |

|

|

|

— |

|

|

|

276 |

|

Income tax adjustments(1) |

|

|

(5 |

) |

|

|

(351 |

) |

|

|

(1,212 |

) |

|

|

(1,644 |

) |

|

|

(3,178 |

) |

Non-GAAP net income |

|

$ |

21,261 |

|

|

$ |

20,190 |

|

|

$ |

17,101 |

|

|

$ |

74,732 |

|

|

$ |

48,582 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Diluted earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Diluted (GAAP) |

|

$ |

0.60 |

|

|

$ |

0.53 |

|

|

$ |

0.35 |

|

|

$ |

1.91 |

|

|

$ |

0.99 |

|

Diluted (Non-GAAP) |

|

$ |

0.60 |

|

|

$ |

0.57 |

|

|

$ |

0.48 |

|

|

$ |

2.09 |

|

|

$ |

1.35 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Weighted-average number of shares used in calculating diluted earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Diluted (GAAP) |

|

|

35,630 |

|

|

|

35,348 |

|

|

|

35,410 |

|

|

|

35,718 |

|

|

|

36,101 |

|

Diluted (Non-GAAP) |

|

|

35,630 |

|

|

|

35,348 |

|

|

|

35,410 |

|

|

|

35,718 |

|

|

|

36,101 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Net cash used in operations |

|

$ |

(52,749 |

) |

|

$ |

(31,208 |

) |

|

$ |

(1,314 |

) |

|

$ |

(177,467 |

) |

|

$ |

(2,622 |

) |

Additions to property, plant and equipment and software |

|

|

(13,180 |

) |

|

|

(8,623 |

) |

|

|

(9,740 |

) |

|

|

(46,774 |

) |

|

|

(42,177 |

) |

Free cash flow (used) |

|

$ |

(65,929 |

) |

|

$ |

(39,831 |

) |

|

$ |

(11,054 |

) |

|

$ |

(224,241 |

) |

|

$ |

(44,799 |

) |

8

Benchmark Electronics Fourth Quarter and Fiscal Year 2022 Financial Results February 1, 2023

Forward-Looking 2023 Statements This document contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are identified as any statement that does not relate strictly to historical or current facts and may include words such as “anticipate,” “believe,” “intend,” “plan,” “project,” “forecast,” “strategy,” “position,” “continue,” “estimate,” “expect,” “may,” “will,” “could,” “predict,” and similar expressions of the negative or other variations thereof. In particular, statements, express or implied, concerning the estimated financial impact of the COVID-19 pandemic, the Company’s outlook and guidance for first quarter and fiscal year 2023 results, future operating results or margins, the ability to generate sales and income or cash flow, expected revenue mix, the Company’s business strategy and strategic initiatives, the Company’s repurchases of shares of its common stock, the Company’s expectations regarding restructuring charges and amortization of intangibles, and the Company’s intentions concerning the payment of dividends, among others, are forward-looking statements. Although the Company believes these statements are based on and derived from reasonable assumptions, they involve risks, uncertainties and assumptions that are beyond the Company’s ability to control or predict, relating to operations, markets and the business environment generally, including those discussed under Part I, Item 1A of the Company's Annual Report on Form 10-K for the year ended December 31, 2021, and in any of the Company’s subsequent reports filed with the Securities and Exchange Commission. In particular, these statements also depend on the duration, severity and evolution of the COVID-19 pandemic and related risks, including the emergence and severity of its variants, the availability of vaccines and potential hesitancy to utilize them, government and other third-party responses to the crisis and the consequences for the global economy, the Company’s business and the businesses of its suppliers and customers. Events relating to the possibility of customer demand fluctuations, supply chain constraints, continued inflationary pressures, the effects of foreign currency fluctuations and high interest rates, geopolitical uncertainties including trade restrictions, or the ability to utilize the Company’s manufacturing facilities at sufficient levels to cover its fixed operating costs, may have resulting impacts on the Company’s business, financial condition, results of operations, and the Company’s ability (or inability) to execute on its plans. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual outcomes, including the future results of our operations, may vary materially from those indicated. Undue reliance should not be placed on any forward-looking statements. Forward-looking statements are not guarantees of performance. All forward-looking statements included in this document are based upon information available to the Company as of the date of this document, and the Company assumes no obligation to update. Non-GAAP Financial Information Management discloses non‐GAAP information to provide investors with additional information to analyze the Company’s performance and underlying trends. A detailed reconciliation between GAAP results and results excluding certain items (“non-GAAP”) is included in the following tables attached to this document. In situations where a non-GAAP reconciliation has not been provided, the Company was unable to provide such a reconciliation without unreasonable effort due to the uncertainty and inherent difficulty predicting the occurrence, the financial impact and the periods in which the non-GAAP adjustments may be recognized. Management uses non‐GAAP measures that exclude certain items in order to better assess operating performance and help investors compare results with our previous guidance. This document also references “free cash flow”, which the Company defines as cash flow from operations less additions to property, plant and equipment and purchased software. The Company’s non‐GAAP information is not necessarily comparable to the non‐GAAP information used by other companies. Non‐GAAP information should not be viewed as a substitute for, or superior to, net income or other data prepared in accordance with GAAP as a measure of the Company’s profitability or liquidity. Readers should consider the types of events and transactions for which adjustments have been made.

Q4 2022 Results Achieved 19% year-over-year revenue growth to $751 million, with double-digit growth in 4 of 6 sectors GAAP and non-GAAP gross margin of 9.6% GAAP and non-GAAP operating margin of 3.6% and 4.3%, respectively GAAP and non-GAAP EPS of $0.60 All items below adjusted for supply chain premiums*: Revenue grew 19% year-over-year, with double-digit growth in 5 of 6 sectors Non-GAAP gross margin of 10.2% and non-GAAP operating margin of 4.6% * Component pass-through revenue for supply chain premiums with no impact on non-GAAP operating income or EPS

FY 2022 Results Achieved record revenue of $2.9 billion, up 28% year-on-year, with double-digit growth in 5 of 6 sectors GAAP and non-GAAP gross margin of 8.8% GAAP and non-GAAP operating margin of 3.1% and 3.6%, respectively GAAP EPS of $1.91 and non-GAAP EPS of $2.09 All items below adjusted for supply chain premiums*: Revenue grew 20% year-over-year, with double-digit growth in 5 of 6 sectors Non-GAAP gross margin of 9.7% and non-GAAP operating margin of 4.0% * Component pass-through revenue for supply chain premiums with no impact on non-GAAP operating income or EPS

Roop Lakkaraju Chief Financial Officer

Fourth Quarter Reported Revenue by Market Sector Q4-22 Dec 31, 2022 Revenue by Mix and Market Sector Sept 30, 2022 Dec 31, 2021 For the Three Months Ended Dollars in Millions Sector Mix % Revenue Mix % Revenue Q/Q Growth Mix % Revenue Y/Y Growth Medical 19% $144 21% $166 (13%) 20% $127 14% Semi-Cap 24% $178 24% $186 (5%) 26% $163 9% Aerospace & Defense 12% $90 11% $86 5% 15% $95 (5%) Industrials 19% $143 20% $155 (8%) 20% $125 14% Advanced Computing 12% $92 13% $95 (2%) 9% $60 55% Next Gen Comms 14% $104 11% $84 24% 10% $63 64% Total Revenue 100% $751 100% $772 (3%) 100% $633 19%

Fourth Quarter 2022 Financial Summary (Dollars in millions, except EPS) Dec 31, 2022 Sept 30, 2022 Q/Q Dec 31, 2021 Y/Y Net Sales $751 $772 (3%) $633 19% GAAP Gross Margin 9.6% 8.7% 90 bps 9.8% (20) bps GAAP SG&A $39.5 $38.5 3% $37.7 5% GAAP Operating Margin 3.6% 3.3% 30 bps 2.9% 70 bps GAAP Diluted EPS $0.60 $0.53 13% $0.35 71% GAAP ROIC 7.4% 7.1% 30 bps 5.4% 200 bps Net Sales $751 $772 (3%) $633 19% Non-GAAP Gross Margin 9.6% 8.6% 100 bps 9.8% (20) bps Non-GAAP SG&A $39.5 $38.7 2% $37.7 5% Non-GAAP Operating Margin 4.3% 3.6% 70 bps 3.8% 50 bps Non-GAAP Diluted EPS $0.60 $0.57 5% $0.48 25% Non-GAAP ROIC 9.9% 9.8% 10 bps 8.6% 130 bps See APPENDIX 1 for a reconciliation of GAAP to non-GAAP Financial Results GAAP ROIC = (GAAP TTM income from operations – GAAP Tax Impact) / (Average Invested Capital for last 5 quarters) Non-GAAP ROIC = (non-GAAP TTM income from operations + Stock-based compensation – non-GAAP Tax Impact) ÷ [Average Invested Capital for last 5 quarters]

2022 Reported Revenue by Market Sector CY-22 Revenue by Mix and Market Sector For the Twelve Months Ended Dollars in Millions Dec. 31, 2022 Dec. 31, 2021 Sector Mix % Revenue Mix % Revenue Y/Y Medical 21% $593 20% $462 28% Semi-Cap 25% $722 24% $549 31% Aerospace & Defense 12% $348 17% $382 (9%) Industrials 21% $593 19% $428 39% Advanced Computing 10% $310 9% $199 56% Next Gen Comms 11% $320 10% $235 36% Total Revenue 100% $2,886 100% $2,255 28%

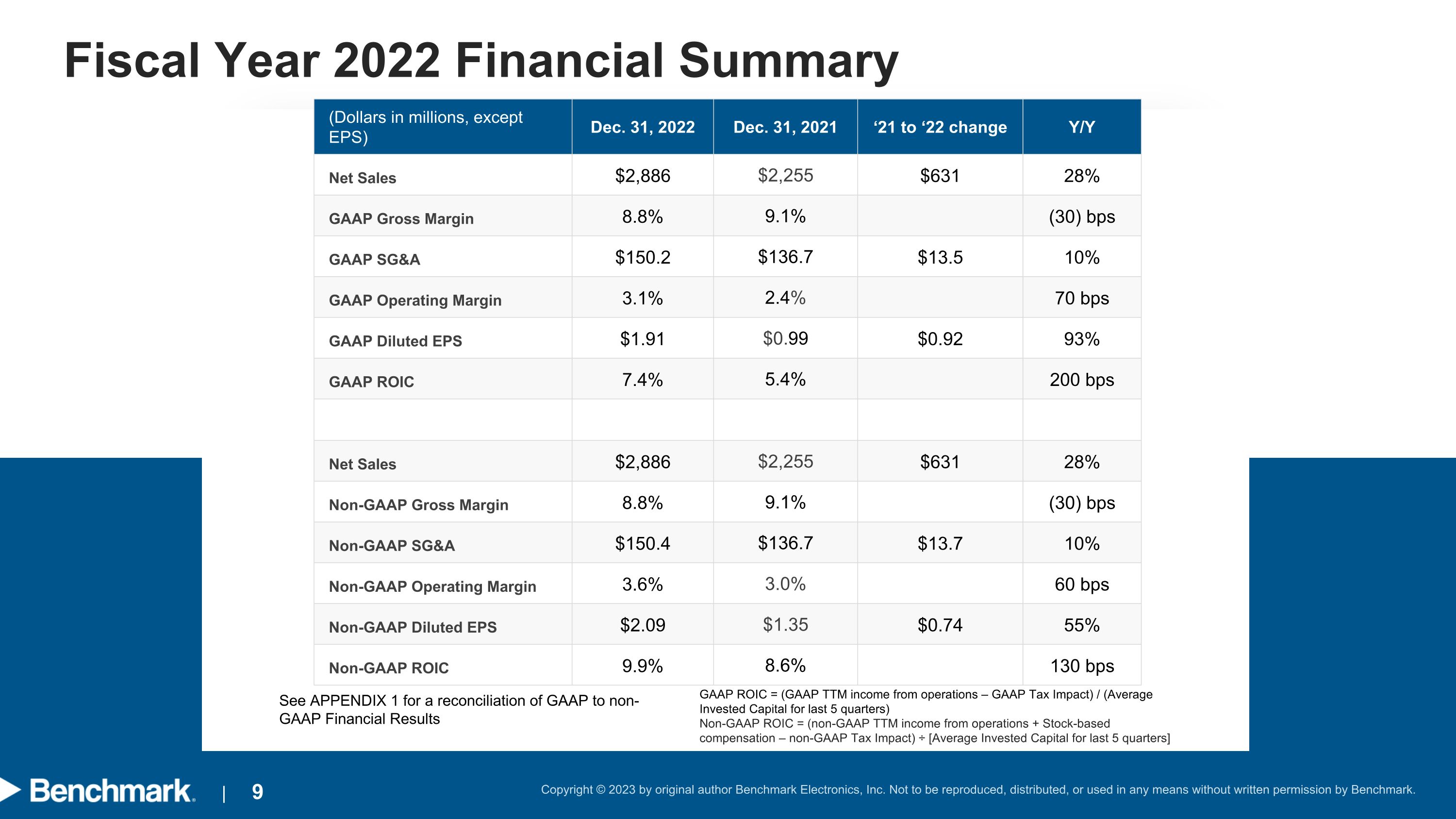

Fiscal Year 2022 Financial Summary (Dollars in millions, except EPS) Dec. 31, 2022 Dec. 31, 2021 ‘21 to ‘22 change Y/Y Net Sales $2,886 $2,255 $631 28% GAAP Gross Margin 8.8% 9.1% (30) bps GAAP SG&A $150.2 $136.7 $13.5 10% GAAP Operating Margin 3.1% 2.4% 70 bps GAAP Diluted EPS $1.91 $0.99 $0.92 93% GAAP ROIC 7.4% 5.4% 200 bps Net Sales $2,886 $2,255 $631 28% Non-GAAP Gross Margin 8.8% 9.1% (30) bps Non-GAAP SG&A $150.4 $136.7 $13.7 10% Non-GAAP Operating Margin 3.6% 3.0% 60 bps Non-GAAP Diluted EPS $2.09 $1.35 $0.74 55% Non-GAAP ROIC 9.9% 8.6% 130 bps See APPENDIX 1 for a reconciliation of GAAP to non-GAAP Financial Results GAAP ROIC = (GAAP TTM income from operations – GAAP Tax Impact) / (Average Invested Capital for last 5 quarters) Non-GAAP ROIC = (non-GAAP TTM income from operations + Stock-based compensation – non-GAAP Tax Impact) ÷ [Average Invested Capital for last 5 quarters]

Non-GAAP Financial Summary Excluding Supply Chain Premiums (Dollars in millions, except EPS) See APPENDIX 1 for a reconciliation of GAAP to non-GAAP Financial Results

Cash Conversion Cycle Update

Liquidity and Capital Resources (1) Free cash flow (FCF) defined as net cash provided by (used in) operations less capex Debt Structure (In millions) Senior Secured Term Loan $131 Revolving Credit Facility Drawn Amount $195 * Leverage ratio is Net debt/LTM adjusted EBITDA, as defined in the credit facility, which are non-GAAP measures Strong balance sheet and appropriate debt structure Refinanced credit facility in December 2021 which matures December 2026 Focused investments in inventory which impacted cash flow For the Twelve Months Ended For the Three Months Ended Cash (In millions) Dec. 31, 2022 Dec. 30, 2021 Dec. 31, 2022 Sept. 30, 2022 Dec. 30, 2021 Cash Flows from (used in) Operations ($177) ($3) ($53) ($31) ($1) FCF (1) ($224) ($45) ($66) ($40) ($11) Cash $207 $272 $207 $249 $272 International $168 $195 $168 $189 $195 US $39 $77 $39 $60 $77

Capital Allocation Update Capital Expenditures Share Repurchases FY’22: paid $47M in capital expenditures Since 2018 invested $227M in additions to property, plant and equipment and software Strategic capital expenditures for future organic growth Cash Dividends FY’22: paid cash dividends of $23M Since 2018 paid cash dividends of $113M Instituted a recurring quarterly cash dividend in February 2018 of $0.15 which was increased to $0.16 in February 2020 and to $0.165 in May 2021 FY’22: repurchased 0.4M shares for $9M Since 2018, 15.7M shares repurchased for $409M Approximately $155M remains available under Board authorized program

First Quarter and Fiscal Year 2023 Update * Adjusted for supply chain premium revenue This guidance takes into consideration all known constraints for the quarter and assumes no further significant interruptions to our supply base, operations or customers. Q1:2023 Net Sales* $640 - $680 million Diluted EPS – GAAP $0.35 - $0.40 Diluted EPS – non-GAAP $0.39 - $0.45 Operating Margin – non-GAAP 3.6% - 3.8.% Other Expenses, Net $6 million Effective Tax Rate 18% - 20% Weighted Average Shares ~ 35.5 million FY 2023 Net Sales Growth * 7 – 9% Diluted EPS – GAAP $1.96 - $2.06 Diluted EPS – non-GAAP $2.18 - $2.28 Operating Margin – non-GAAP 4.1% - 4.5% Free Cash Flow $70-90 million

Business Trends Jeff Benck - CEO

Sector Year-Over-Year Outlook* * Excludes supply chain premiums (SCP) revenue in forecast and comparable period(s). Fiscal Year 2022 Results ($MM) Total Revenue Supply chain premiums (SCP) Revenue adjusted for SCP * Revenue growth adjusted for SCP* Q1:23 FY2023 Sector Commentary Semi-Cap $722 $(16) $706 30% Memory weakness and trade restrictions are impacting current demand and visibility Multi-year industry catalysts remain in place; investing through downturn and gaining share Medical $593 $(95) $498 13% Strong year-over-year growth fueled by strong demand in existing programs and new ramps Improving supply chain is a tail-wind Industrials $593 $(111) $482 24% Healthy year-over-year growth due to new programs and strong demand from existing products Supply chain to ease throughout the year A&D $348 $(6) $342 (10%) Weapons systems replenishment could be a new driver Unfulfilled demand persists, particularly in Defense Next Gen Comms $320 $(37) $283 24% Sequential performance impacted by strong Q4 but confident in annual growth led by sizable wins Broadband Infrastructure deployments fueling growth Adv. Computing $310 $(3) $307 58% Some push-out from Q4 into 1H not demand related Major program concluding in 2023 will weigh on growth potential this year Outlook *

Q4-22 New Business Wins Medical Cosmetic surgery treatment system (Manufacturing) Minimally invasive surgical robotic platform (Design) Novel rapid cancer diagnostics solution (Design) Semi-Cap Wafer handling equipment (Manufacturing) Test development solutions supporting metrology and lithography (Engineering) Design support for new wafer fab tools (Engineering) Aerospace & Defense Compact flight computer for space applications (Manufacturing) Advance communications module for fighter jet (Design, Manufacturing) Secure communication module for ground vehicles (Manufacturing) Industrials Wind energy management system (Manufacturing) Energy-efficient heat pump replacing fossil fuel systems (Manufacturing) Test development and programming stations for climate controllers (Engineering) Advanced Computing & Next Generation Comms Secure biometric comms reader (Manufacturing) High performance optical transceiver module (Manufacturing) Large functional tester for advanced computing (Engineering)

Highlights Executed through adversity, culminating in record results in 2022 Strategically diversified portfolio enabled solid growth in 5 of 6 sectors in 2022* Supply chain remains a challenge, but continued improvement expected in 2023 Expecting growth in at least 4 of 6 sectors in 2023* Continued ESG Focus: MSCI upgraded to AA; top 10% of 73 in peer group * Excluding supply chain premium revenue in forecast and comparable period(s).

Appendix

(Dollars in Thousands, Except Per Share Data) – (UNAUDITED) APPENDIX 1 - Reconciliation of GAAP to non-GAAP Financial Results

(Dollars in Millions) – (UNAUDITED) APPENDIX 2 - Reconciliation of Supply Chain Premiums

(Dollars in Millions) – (UNAUDITED) APPENDIX 3 - Reconciliation of Supply Chain Premiums by Sector