UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 26, 2022 |

BENCHMARK ELECTRONICS, INC.

(Exact name of Registrant as Specified in Its Charter)

Texas |

001-10560 |

74-2211011 |

||

(State or Other Jurisdiction |

(Commission File Number) |

(IRS Employer |

||

|

|

|

|

|

56 South Rockford Drive |

|

|||

Tempe, Arizona |

|

85281 |

||

(Address of Principal Executive Offices) |

|

(Zip Code) |

||

Registrant’s Telephone Number, Including Area Code: (623) 300-7000 |

Not Applicable |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

Securities registered pursuant to Section 12(b) of the Act:

|

|

Trading |

|

|

Common Stock, par value $0.10 per share |

|

BHE |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On October 26, 2022, Benchmark Electronics, Inc. (the “Company”) issued a press release announcing its results of operations for the quarter ended September 30, 2022. A copy of the press release and accompanying investor presentation are attached hereto as Exhibits 99.1 and 99.2, respectively, and incorporated by reference herein. The information disclosed under this Item 2.02, including Exhibits 99.1 and 99.2 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Exhibit No. |

|

Description |

|

|

|

99.1 |

|

|

|

|

|

99.2 |

|

|

|

|

|

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

BENCHMARK ELECTRONICS, INC. |

|

|

|

|

Date: |

October 26, 2022 |

By: |

/s/ Stephen J. Beaver |

|

|

|

Stephen J. Beaver, Esq. |

Exhibit 99.1

FOR IMMEDIATE RELEASE

BENCHMARK REPORTS THIRD QUARTER 2022 RESULTS

Third quarter 2022 results:

TEMPE, AZ, October 26, 2022 – Benchmark Electronics, Inc. (NYSE: BHE) today announced financial results for the third quarter ended September 30, 2022.

|

|

Three Months Ended |

|

|||||||||

|

|

Sept 30, |

|

|

June 30, |

|

|

Sept 30, |

|

|||

In millions, except EPS |

|

2022 |

|

|

2022 |

|

|

2021 |

|

|||

Sales |

|

$ |

772 |

|

|

$ |

728 |

|

|

$ |

572 |

|

Net income |

|

$ |

19 |

|

|

$ |

17 |

|

|

$ |

8 |

|

Net income – non-GAAP(1) |

|

$ |

20 |

|

|

$ |

18 |

|

|

$ |

14 |

|

Diluted earnings per share |

|

$ |

0.53 |

|

|

$ |

0.49 |

|

|

$ |

0.23 |

|

Diluted EPS – non-GAAP(1) |

|

$ |

0.57 |

|

|

$ |

0.50 |

|

|

$ |

0.39 |

|

Operating margin |

|

|

3.3 |

% |

|

|

3.1 |

% |

|

|

2.1 |

% |

Operating margin – non-GAAP(1) |

|

|

3.6 |

% |

|

|

3.1 |

% |

|

|

3.3 |

% |

(1) A reconciliation of GAAP and non-GAAP results is included below.

“Despite the well-known challenges with which we and the industry have had to navigate, Benchmark continues to execute on its strategy. Our third quarter results achieved the important financial targets within our mid-term model,” said Jeff Benck, Benchmark’s President and CEO.

Benck continued “Our third quarter results demonstrated another solid quarter of revenue growth, with five of our six targeted sectors growing more than 35% year-over-year. This has enabled us to drive non-GAAP earnings growth of more than 46% over the same period. We look forward to updating you on our long term strategy and growth potential for the company at our upcoming analyst day on November 8th.”

1

Cash Conversion Cycle

|

|

Sept 30, |

|

|

June 30, |

|

|

Sept 30, |

|

|||

|

|

2022 |

|

|

2022 |

|

|

2021 |

|

|||

Accounts receivable days |

|

|

56 |

|

|

|

55 |

|

|

|

49 |

|

Contract asset days |

|

|

22 |

|

|

|

22 |

|

|

|

25 |

|

Inventory days |

|

|

95 |

|

|

|

90 |

|

|

|

83 |

|

Accounts payable days |

|

|

(67 |

) |

|

|

(67 |

) |

|

|

(70 |

) |

Advance payments from customers days |

|

|

(27 |

) |

|

|

(23 |

) |

|

|

(16 |

) |

Cash conversion cycle days |

|

|

79 |

|

|

|

77 |

|

|

|

71 |

|

Third Quarter 2022 Industry Sector Update

Revenue and percentage of sales by industry sector (in millions) was as follows.

|

|

Sept 30, |

|

|

June 30, |

|

|

Sept 30, |

|

|||||||||||||||

Higher-Value Markets |

|

2022 |

|

|

2022 |

|

|

2021 |

|

|||||||||||||||

Medical |

|

$ |

166 |

|

|

|

21 |

% |

|

$ |

166 |

|

|

|

23 |

% |

|

$ |

118 |

|

|

|

21 |

% |

Semi-Cap |

|

|

186 |

|

|

|

24 |

|

|

|

175 |

|

|

|

24 |

|

|

|

133 |

|

|

|

23 |

|

A&D |

|

|

86 |

|

|

|

11 |

|

|

|

90 |

|

|

|

12 |

|

|

|

101 |

|

|

|

18 |

|

Industrials |

|

|

155 |

|

|

|

20 |

|

|

|

159 |

|

|

|

22 |

|

|

|

108 |

|

|

|

19 |

|

|

|

$ |

593 |

|

|

|

76 |

% |

|

$ |

590 |

|

|

|

81 |

% |

|

$ |

460 |

|

|

|

81 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

Sept 30, |

|

|

June 30, |

|

|

Sept 30, |

|

|||||||||||||||

Traditional Markets |

|

2022 |

|

|

2022 |

|

|

2021 |

|

|||||||||||||||

Computing |

|

$ |

95 |

|

|

|

13 |

% |

|

$ |

69 |

|

|

|

10 |

% |

|

$ |

57 |

|

|

|

10 |

% |

Telecommunications |

|

|

84 |

|

|

|

11 |

|

|

|

69 |

|

|

|

9 |

|

|

|

55 |

|

|

|

9 |

|

|

|

$ |

179 |

|

|

|

24 |

% |

|

$ |

138 |

|

|

|

19 |

% |

|

$ |

112 |

|

|

|

19 |

% |

Total |

|

$ |

772 |

|

|

|

100 |

% |

|

$ |

728 |

|

|

|

100 |

% |

|

$ |

572 |

|

|

|

100 |

% |

Overall, higher-value market revenues were up 29% year-over-year from strength in the Industrials, Medical and Semi-Cap sectors. Traditional market revenues were up 60% year-over-year from strength in both Computing and Telecommunications sectors.

Fourth Quarter 2022 Guidance

Restructuring charges are expected to range between $0.8 million and $1.0 million in the fourth quarter and the amortization of intangibles is expected to be $1.6 million in the fourth quarter.

Third Quarter 2022 Earnings Conference Call

The Company will host a conference call to discuss the results today at 5:00 p.m. Eastern Time. The live webcast of the call and accompanying reference materials will be accessible by logging on to the Company's website at www.bench.com. A replay of the broadcast will also be available until Wednesday, November 2, 2022 on the Company's website.

2

About Benchmark Electronics, Inc.

Benchmark provides comprehensive solutions across the entire product life cycle by leading through its innovative technology and engineering design services, leveraging its optimized global supply chain and delivering world-class manufacturing services in the following industries: commercial aerospace, defense, advanced computing, next generation telecommunications, complex industrials, medical, and semiconductor capital equipment. Benchmark's global operations include facilities in seven countries and its common shares trade on the New York Stock Exchange under the symbol BHE.

For More Information, Please Contact:

Paul Mansky, Investor Relations and Corporate Development

512-580-2719 or paul.mansky@bench.com

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are identified as any statement that does not relate strictly to historical or current facts and may include words such as “anticipate,” “believe,” “intend,” “plan,” “project,” “forecast,” “strategy,” “position,” “continue,” “estimate,” “expect,” “may,” “will,” “could,” “predict,” and similar expressions of the negative or other variations thereof. In particular, statements, express or implied, concerning the estimated financial impact of the COVID-19 pandemic, the company’s outlook and guidance for fourth quarter 2022 results, future operating results or margins, the ability to generate sales and income or cash flow, expected revenue mix, the company’s business strategy and strategic initiatives, the company’s repurchases of shares of its common stock, the company’s expectations regarding restructuring charges and amortization of intangibles, and the company’s intentions concerning the payment of dividends, among others, are forward-looking statements. Although the company believes these statements are based on and derived from reasonable assumptions, they involve risks, uncertainties and assumptions that are beyond the company’s ability to control or predict, relating to operations, markets and the business environment generally, including those discussed under Part I, Item 1A of the company's Annual Report on Form 10-K for the year ended December 31, 2021, and in any of the company’s subsequent reports filed with the Securities and Exchange Commission. In particular, these statements also depend on the duration, severity and evolution of the COVID-19 pandemic and related risks, including the emergence and severity of its variants, the availability of vaccines and potential hesitancy to utilize them, government and other third-party responses to the crisis and the consequences for the global economy, the company’s business and the businesses of its suppliers and customers. Events relating to the possibility of customer demand fluctuations, supply chain constraints, inflationary pressures, the effects of foreign currency fluctuations, or the ability to utilize the company’s manufacturing facilities at sufficient levels to cover its fixed operating costs, may have resulting impacts on the company’s business, financial condition, results of operations, and the company’s ability (or inability) to execute on its plans. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual outcomes, including the future results of our operations, may vary materially from those indicated. Undue reliance should not be placed on any forward-looking statements. Forward-looking statements are not guarantees of performance. All forward-looking statements included in this document are based upon information available to the company as of the date of this document, and the company assumes no obligation to update.

Non-GAAP Financial Measures

Management discloses non‐GAAP information to provide investors with additional information to analyze the Company’s performance and underlying trends. A detailed reconciliation between GAAP results and results excluding certain items (“non-GAAP”) is included in the following tables attached to this document.

3

In situations where a non-GAAP reconciliation has not been provided, the Company was unable to provide such a reconciliation without unreasonable effort due to the uncertainty and inherent difficulty predicting the occurrence, the financial impact and the periods in which the non-GAAP adjustments may be recognized. Management uses non‐GAAP measures that exclude certain items in order to better assess operating performance and help investors compare results with our previous guidance. This document also references “free cash flow”, which the Company defines as cash flow from operations less additions to property, plant and equipment and purchased software. The Company’s non‐GAAP information is not necessarily comparable to the non‐GAAP information used by other companies. Non‐GAAP information should not be viewed as a substitute for, or superior to, net income or other data prepared in accordance with GAAP as a measure of the Company’s profitability or liquidity. Readers should consider the types of events and transactions for which adjustments have been made.

###

4

Benchmark Electronics, Inc. and Subsidiaries

Condensed Consolidated Statements of Income

(Amounts in Thousands, Except Per Share Data)

(UNAUDITED)

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

||||||||||

|

|

September 30, |

|

|

September 30, |

|

||||||||||

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

||||

Sales |

|

$ |

771,575 |

|

|

$ |

571,882 |

|

|

$ |

2,135,687 |

|

|

$ |

1,622,265 |

|

Cost of sales |

|

|

704,825 |

|

|

|

518,177 |

|

|

|

1,952,579 |

|

|

|

1,478,420 |

|

Gross profit |

|

|

66,750 |

|

|

|

53,705 |

|

|

|

183,108 |

|

|

|

143,845 |

|

Selling, general and administrative expenses |

|

|

38,544 |

|

|

|

34,387 |

|

|

|

110,675 |

|

|

|

98,969 |

|

Amortization of intangible assets |

|

|

1,591 |

|

|

|

1,596 |

|

|

|

4,792 |

|

|

|

4,793 |

|

Restructuring charges and other costs |

|

|

1,331 |

|

|

|

6,428 |

|

|

|

4,518 |

|

|

|

9,600 |

|

Ransomware incident related costs (recovery), net |

|

|

— |

|

|

|

(500 |

) |

|

|

— |

|

|

|

(3,944 |

) |

Income from operations |

|

|

25,284 |

|

|

|

11,794 |

|

|

|

63,123 |

|

|

|

34,427 |

|

Interest expense |

|

|

(3,493 |

) |

|

|

(1,987 |

) |

|

|

(7,428 |

) |

|

|

(6,215 |

) |

Interest income |

|

|

452 |

|

|

|

122 |

|

|

|

843 |

|

|

|

451 |

|

Other income, net |

|

|

1,087 |

|

|

|

500 |

|

|

|

1,577 |

|

|

|

664 |

|

Income before income taxes |

|

|

23,330 |

|

|

|

10,429 |

|

|

|

58,115 |

|

|

|

29,327 |

|

Income tax expense |

|

|

4,501 |

|

|

|

2,364 |

|

|

|

11,105 |

|

|

|

5,976 |

|

Net income |

|

$ |

18,829 |

|

|

$ |

8,065 |

|

|

$ |

47,010 |

|

|

$ |

23,351 |

|

Earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Basic |

|

$ |

0.54 |

|

|

$ |

0.23 |

|

|

$ |

1.34 |

|

|

$ |

0.65 |

|

Diluted |

|

$ |

0.53 |

|

|

$ |

0.23 |

|

|

$ |

1.32 |

|

|

$ |

0.64 |

|

Weighted-average number of shares used in calculating earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Basic |

|

|

35,151 |

|

|

|

35,423 |

|

|

|

35,184 |

|

|

|

35,806 |

|

Diluted |

|

|

35,348 |

|

|

|

35,666 |

|

|

|

35,604 |

|

|

|

36,287 |

|

5

Benchmark Electronics, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(UNAUDITED)

(in thousands)

|

|

September 30, |

|

|

December 31, |

|

||

|

|

2022 |

|

|

2021 |

|

||

Assets |

|

|

|

|

|

|

||

Current assets: |

|

|

|

|

|

|

||

Cash and cash equivalents |

|

$ |

247,298 |

|

|

$ |

271,749 |

|

Restricted cash |

|

|

2,039 |

|

|

|

— |

|

Accounts receivable, net |

|

|

478,835 |

|

|

|

355,883 |

|

Contract assets |

|

|

187,730 |

|

|

|

155,243 |

|

Inventories |

|

|

746,920 |

|

|

|

523,240 |

|

Other current assets |

|

|

45,381 |

|

|

|

42,029 |

|

Total current assets |

|

|

1,708,203 |

|

|

|

1,348,144 |

|

Property, plant and equipment, net |

|

|

204,154 |

|

|

|

186,666 |

|

Operating lease right-of-use assets |

|

|

95,533 |

|

|

|

99,158 |

|

Goodwill and other, net |

|

|

268,617 |

|

|

|

269,912 |

|

Total assets |

|

$ |

2,276,507 |

|

|

$ |

1,903,880 |

|

|

|

|

|

|

|

|

||

Liabilities and shareholders’ equity |

|

|

|

|

|

|

||

Current liabilities: |

|

|

|

|

|

|

||

Current installments of long-term debt and finance lease obligations |

|

$ |

3,452 |

|

|

$ |

985 |

|

Accounts payable |

|

|

522,499 |

|

|

|

426,555 |

|

Advance payments from customers |

|

|

211,601 |

|

|

|

118,124 |

|

Accrued liabilities |

|

|

111,348 |

|

|

|

108,718 |

|

Total current liabilities |

|

|

848,900 |

|

|

|

654,382 |

|

Long-term debt and finance lease obligations, less current installments |

|

|

296,425 |

|

|

|

129,289 |

|

Operating lease liabilities |

|

|

87,983 |

|

|

|

90,878 |

|

Other long-term liabilities |

|

|

42,582 |

|

|

|

55,529 |

|

Shareholders’ equity |

|

|

1,000,617 |

|

|

|

973,802 |

|

Total liabilities and shareholders’ equity |

|

$ |

2,276,507 |

|

|

$ |

1,903,880 |

|

6

Benchmark Electronics, Inc. and Subsidiaries

Condensed Consolidated Statement of Cash Flows

(in thousands)

(UNAUDITED)

|

|

Nine Months Ended |

|

|||||

|

|

September 30, |

|

|||||

|

|

2022 |

|

|

2021 |

|

||

Cash flows from operating activities: |

|

|

|

|

|

|

||

Net income |

|

$ |

47,010 |

|

|

$ |

23,351 |

|

Depreciation and amortization |

|

|

32,987 |

|

|

|

32,963 |

|

Stock-based compensation expense |

|

|

13,282 |

|

|

|

10,856 |

|

Accounts receivable, net |

|

|

(123,600 |

) |

|

|

(2,342 |

) |

Contract assets |

|

|

(32,487 |

) |

|

|

(17,415 |

) |

Inventories |

|

|

(228,501 |

) |

|

|

(151,518 |

) |

Accounts payable |

|

|

84,588 |

|

|

|

114,477 |

|

Advance payments from customers |

|

|

93,476 |

|

|

|

7,341 |

|

Other changes in working capital and other, net |

|

|

(11,473 |

) |

|

|

(19,021 |

) |

Net cash used in operations |

|

|

(124,718 |

) |

|

|

(1,308 |

) |

|

|

|

|

|

|

|

||

Cash flows from investing activities: |

|

|

|

|

|

|

||

Additions to property, plant and equipment and software |

|

|

(33,594 |

) |

|

|

(32,437 |

) |

Other investing activities, net |

|

|

5,666 |

|

|

|

294 |

|

Net cash used in investing activities |

|

|

(27,928 |

) |

|

|

(32,143 |

) |

|

|

|

|

|

|

|

||

Cash flows from financing activities: |

|

|

|

|

|

|

||

Share repurchases |

|

|

(9,391 |

) |

|

|

(40,216 |

) |

Net debt activity |

|

|

169,303 |

|

|

|

(6,458 |

) |

Other financing activities, net |

|

|

(20,127 |

) |

|

|

(20,254 |

) |

Net cash provided by (used in) financing activities |

|

|

139,785 |

|

|

|

(66,928 |

) |

|

|

|

|

|

|

|

||

Effect of exchange rate changes |

|

|

(9,552 |

) |

|

|

(4,414 |

) |

Net decrease in cash and cash equivalents and restricted cash |

|

|

(22,412 |

) |

|

|

(104,793 |

) |

Cash and cash equivalents and restricted cash at beginning of year |

|

|

271,749 |

|

|

|

395,990 |

|

Cash and cash equivalents and restricted cash at end of period |

|

$ |

249,337 |

|

|

$ |

291,197 |

|

7

Benchmark Electronics, Inc. and Subsidiaries

Reconciliation of GAAP to Non-GAAP Financial Results

(Amounts in Thousands, Except Per Share Data)

(UNAUDITED)

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

||||||||||||||

|

|

Sept 30, |

|

|

June 30, |

|

|

Sept 30, |

|

|

Sept 30, |

|

||||||||

|

|

2022 |

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|||||

Income from operations (GAAP) |

|

$ |

25,284 |

|

|

$ |

22,432 |

|

|

$ |

11,794 |

|

|

$ |

63,123 |

|

|

$ |

34,427 |

|

Amortization of intangible assets |

|

|

1,591 |

|

|

|

1,592 |

|

|

|

1,596 |

|

|

|

4,792 |

|

|

|

4,793 |

|

Restructuring charges and other costs |

|

|

1,331 |

|

|

|

1,266 |

|

|

|

2,070 |

|

|

|

4,911 |

|

|

|

5,242 |

|

(Gain) loss on assets held for sale |

|

|

— |

|

|

|

(2,376 |

) |

|

|

— |

|

|

|

(393 |

) |

|

|

— |

|

Impairment |

|

|

— |

|

|

|

— |

|

|

|

4,358 |

|

|

|

— |

|

|

|

4,358 |

|

Ransomware incident related costs (recovery), net |

|

|

— |

|

|

|

— |

|

|

|

(500 |

) |

|

|

— |

|

|

|

(3,944 |

) |

Customer insolvency (recovery) |

|

|

(599 |

) |

|

|

— |

|

|

|

(168 |

) |

|

|

(599 |

) |

|

|

(353 |

) |

Non-GAAP income from operations |

|

$ |

27,607 |

|

|

$ |

22,914 |

|

|

$ |

19,150 |

|

|

$ |

71,834 |

|

|

$ |

44,523 |

|

GAAP operating margin |

|

|

3.3 |

% |

|

|

3.1 |

% |

|

|

2.1 |

% |

|

|

3.0 |

% |

|

|

2.1 |

% |

Non-GAAP operating margin |

|

|

3.6 |

% |

|

|

3.1 |

% |

|

|

3.3 |

% |

|

|

3.4 |

% |

|

|

2.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Gross Profit (GAAP) |

|

$ |

66,750 |

|

|

$ |

58,756 |

|

|

$ |

53,705 |

|

|

$ |

183,108 |

|

|

$ |

143,845 |

|

Customer insolvency (recovery) |

|

|

(425 |

) |

|

|

— |

|

|

|

(168 |

) |

|

|

(425 |

) |

|

|

(353 |

) |

Non-GAAP gross profit |

|

$ |

66,325 |

|

|

$ |

58,756 |

|

|

$ |

53,537 |

|

|

$ |

182,683 |

|

|

$ |

143,492 |

|

GAAP gross margin |

|

|

8.7 |

% |

|

|

8.1 |

% |

|

|

9.4 |

% |

|

|

8.6 |

% |

|

|

8.9 |

% |

Non-GAAP gross margin |

|

|

8.6 |

% |

|

|

8.1 |

% |

|

|

9.4 |

% |

|

|

8.6 |

% |

|

|

8.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Selling, general and administrative expenses |

|

$ |

38,544 |

|

|

$ |

35,842 |

|

|

$ |

34,387 |

|

|

$ |

110,675 |

|

|

$ |

98,969 |

|

Customer recovery |

|

|

174 |

|

|

|

— |

|

|

|

— |

|

|

|

174 |

|

|

|

— |

|

Non-GAAP selling, general and administrative expenses |

|

$ |

38,718 |

|

|

$ |

35,842 |

|

|

$ |

34,387 |

|

|

$ |

110,849 |

|

|

$ |

98,969 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Net income (GAAP) |

|

$ |

18,829 |

|

|

$ |

17,221 |

|

|

$ |

8,065 |

|

|

$ |

47,010 |

|

|

$ |

23,351 |

|

Amortization of intangible assets |

|

|

1,591 |

|

|

|

1,592 |

|

|

|

1,596 |

|

|

|

4,792 |

|

|

|

4,793 |

|

Restructuring charges and other costs |

|

|

1,331 |

|

|

|

1,266 |

|

|

|

2,070 |

|

|

|

4,911 |

|

|

|

5,242 |

|

(Gain) loss on assets held for sale |

|

|

— |

|

|

|

(2,376 |

) |

|

|

— |

|

|

|

(393 |

) |

|

|

— |

|

Impairment |

|

|

— |

|

|

|

— |

|

|

|

4,358 |

|

|

|

— |

|

|

|

4,358 |

|

Ransomware incident related costs (recovery), net |

|

|

— |

|

|

|

— |

|

|

|

(500 |

) |

|

|

— |

|

|

|

(3,944 |

) |

Customer insolvency (recovery) |

|

|

(599 |

) |

|

|

— |

|

|

|

(168 |

) |

|

|

(599 |

) |

|

|

(353 |

) |

Settlement |

|

|

(611 |

) |

|

|

— |

|

|

|

— |

|

|

|

(611 |

) |

|

|

— |

|

Income tax adjustments(1) |

|

|

(351 |

) |

|

|

(82 |

) |

|

|

(1,491 |

) |

|

|

(1,639 |

) |

|

|

(1,955 |

) |

Non-GAAP net income |

|

$ |

20,190 |

|

|

$ |

17,621 |

|

|

$ |

13,930 |

|

|

$ |

53,471 |

|

|

$ |

31,492 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Diluted earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Diluted (GAAP) |

|

$ |

0.53 |

|

|

$ |

0.49 |

|

|

$ |

0.23 |

|

|

$ |

1.32 |

|

|

$ |

0.64 |

|

Diluted (Non-GAAP) |

|

$ |

0.57 |

|

|

$ |

0.50 |

|

|

$ |

0.39 |

|

|

$ |

1.50 |

|

|

$ |

0.87 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Weighted-average number of shares used in calculating diluted earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Diluted (GAAP) |

|

|

35,348 |

|

|

|

35,336 |

|

|

|

35,666 |

|

|

|

35,604 |

|

|

|

36,287 |

|

Diluted (Non-GAAP) |

|

|

35,348 |

|

|

|

35,336 |

|

|

|

35,666 |

|

|

|

35,604 |

|

|

|

36,287 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Net cash used in operations |

|

$ |

(31,208 |

) |

|

$ |

(25,485 |

) |

|

$ |

(41,581 |

) |

|

$ |

(124,718 |

) |

|

$ |

(1,308 |

) |

Additions to property, plant and equipment and software |

|

|

(8,623 |

) |

|

|

(6,996 |

) |

|

|

(13,818 |

) |

|

|

(33,594 |

) |

|

|

(32,437 |

) |

Free cash flow (used) |

|

$ |

(39,831 |

) |

|

$ |

(32,481 |

) |

|

$ |

(55,399 |

) |

|

$ |

(158,312 |

) |

|

$ |

(33,745 |

) |

8

Benchmark Electronics Q3-22 Earnings Results October 26, 2022

Forward-Looking 2022 Statements This document contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are identified as any statement that does not relate strictly to historical or current facts and may include words such as “anticipate,” “believe,” “intend,” “plan,” “project,” “forecast,” “strategy,” “position,” “continue,” “estimate,” “expect,” “may,” “will,” “could,” “predict,” and similar expressions of the negative or other variations thereof. In particular, statements, express or implied, concerning the estimated financial impact of the COVID-19 pandemic, the company’s outlook and guidance for fourth quarter 2022 results, future operating results or margins, the ability to generate sales and income or cash flow, expected revenue mix, the company’s business strategy and strategic initiatives, the company’s repurchases of shares of its common stock, the company’s expectations regarding restructuring charges and amortization of intangibles, and the company’s intentions concerning the payment of dividends, among others, are forward-looking statements. Although the company believes these statements are based on and derived from reasonable assumptions, they involve risks, uncertainties and assumptions that are beyond the company’s ability to control or predict, relating to operations, markets and the business environment generally, including those discussed under Part I, Item 1A of the company's Annual Report on Form 10-K for the year ended December 31, 2021, and in any of the company’s subsequent reports filed with the Securities and Exchange Commission. In particular, these statements also depend on the duration, severity and evolution of the COVID-19 pandemic and related risks, including the emergence and severity of its variants, the availability of vaccines and potential hesitancy to utilize them, government and other third-party responses to the crisis and the consequences for the global economy, the company’s business and the businesses of its suppliers and customers. Events relating to the possibility of customer demand fluctuations, supply chain constraints, inflationary pressures, the effects of foreign currency fluctuations, or the ability to utilize the company’s manufacturing facilities at sufficient levels to cover its fixed operating costs, may have resulting impacts on the company’s business, financial condition, results of operations, and the company’s ability (or inability) to execute on its plans. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual outcomes, including the future results of our operations, may vary materially from those indicated. Undue reliance should not be placed on any forward-looking statements. Forward-looking statements are not guarantees of performance. All forward-looking statements included in this document are based upon information available to the company as of the date of this document, and the company assumes no obligation to update. Non-GAAP Financial Information Management discloses non‐GAAP information to provide investors with additional information to analyze the Company’s performance and underlying trends. A detailed reconciliation between GAAP results and results excluding certain items (“non-GAAP”) is included in the following tables attached to this document. In situations where a non-GAAP reconciliation has not been provided, the Company was unable to provide such a reconciliation without unreasonable effort due to the uncertainty and inherent difficulty predicting the occurrence, the financial impact and the periods in which the non-GAAP adjustments may be recognized. Management uses non‐GAAP measures that exclude certain items in order to better assess operating performance and help investors compare results with our previous guidance. This document also references “free cash flow”, which the Company defines as cash flow from operations less additions to property, plant and equipment and purchased software. The Company’s non‐GAAP information is not necessarily comparable to the non‐GAAP information used by other companies. Non‐GAAP information should not be viewed as a substitute for, or superior to, net income or other data prepared in accordance with GAAP as a measure of the Company’s profitability or liquidity. Readers should consider the types of events and transactions for which adjustments have been made.

Q3-22 Overview Achieved 35% year-over-year revenue growth to $772 million Balanced strength led by Computing, Telco and Industrials sectors Realized GAAP and non-GAAP gross margin of 8.7% and 8.6% Realized GAAP and non-GAAP operating margin of 3.3% and 3.6% Excluding supply chain premiums, revenue grew 28% year-over-year, non-GAAP gross margin of 9.5% and non-GAAP operating margin of 4.0% * Grew non-GAAP earnings 46% year-over-year delivering $0.57 per share * * Component pass-through revenue for supply chain premiums with no impact on non-GAAP operating income or EPS

Roop Lakkaraju Chief Financial Officer

Third Quarter Revenue by Market Sector Q3-22 Sept 30, 2022 Revenue by Mix and Market Sector June 30, 2022 Sept 30, 2021 For the Three Months Ended Dollars in Millions Higher-Value Markets Mix % Revenue Mix % Revenue Q/Q Growth Mix % Revenue Y/Y Growth Medical 21% $166 23% $166 0% 21% $118 41% Semi-Cap 24% $186 24% $175 7% 23% $133 39% Aerospace & Defense 11% $86 12% $90 (4%) 18% $101 (14%) Industrials 20% $155 22% $159 (2%) 19% $108 44% Higher-Value Subtotal 76% $593 81% $590 1% 81% $460 29% Traditional Markets Mix % Revenue Mix % Revenue Q/Q Mix % Revenue Y/Y Computing 13% $95 10% $69 38% 10% $57 67% Telecommunications 11% $84 9% $69 20% 9% $55 52% Traditional Subtotal 24% $179 19% $138 29% 19% $112 60% Total Revenue 100% $772 100% $728 6% 100% $572 35%

Third Quarter 2022 Financial Summary (In millions, except EPS) Sept 30, 2022 June 30, 2022 Q/Q Sept 30, 2021 Y/Y Net Sales $772 $728 6% $572 35% GAAP Gross Margin 8.7% 8.1% 60 bps 9.4% (70) bps GAAP SG&A $38.5 $35.8 8% $34.4 12% GAAP Operating Margin 3.3% 3.1% 20 bps 2.1% 120 bps GAAP Diluted EPS $0.53 $0.49 8% $0.23 130% GAAP ROIC 7.1% 6.3% 80 bps 4.9% 220 bps Net Sales $772 $728 6% $572 35% Non-GAAP Gross Margin 8.6% 8.1% 50 bps 9.4% (80) bps Non-GAAP SG&A $38.7 $35.8 8% $34.4 13% Non-GAAP Operating Margin 3.6% 3.1% 50 bps 3.3% 30 bps Non-GAAP Diluted EPS $0.57 $0.50 14% $0.39 46% Non-GAAP ROIC 9.8% 9.6% 20 bps 7.8% 200 bps See APPENDIX 1 for a reconciliation of GAAP to non-GAAP Financial Results GAAP ROIC = (GAAP TTM income from operations – GAAP Tax Impact) / (Average Invested Capital for last 5 quarters) Non-GAAP ROIC = (Non-GAAP TTM income from operations + Stock-based compensation – Non-GAAP Tax Impact) ÷ [Average Invested Capital for last 5 quarters]

Non-GAAP Financial Summary Excluding Supply Chain Premiums (In millions, except EPS) Gross Margin without pass-through revenue

Trended Non-GAAP Return on Invested Capital * ROIC grew by 53% between Q1:21 and Q3:22 Fueled by growth of 53% in revenue and 137% in operating income since Q1:22 Anticipating 10% or better ROIC exiting fiscal 2022 * Non-GAAP ROIC = (Non-GAAP TTM income from operations + Stock-based compensation – Non-GAAP Tax Impact) ÷ [Average Invested Capital for last 5 quarters

Cash Conversion Cycle Update Q3-21 Q4-21 Q1-22 Q2-22 Q3-22 Accounts Receivable Days 49 51 54 55 56 Contract Asset Days 25 22 24 22 22 Inventory Days 83 82 95 90 95 Accounts Payable Days (70) (67) (71) (67) (67) Advance Payments from Customers Days (16) (19) (20) (23) (27) Cash Conversion Cycle 71 69 82 77 79

Liquidity and Capital Resources (1) Free cash flow (used) (FCF) defined as net cash provided by (used in) operations less capex Debt Structure (In millions) Sept 30, 2022 Senior Secured Term Loan $131 Revolving Credit Facility Drawn Amount $170 Strong balance sheet and available debt facilities Strategically investing in inventory which impacted cash flow For the Three Months Ended Cash (In millions) Sept 30, 2022 June 30, 2022 Sept 30, 2021 Cash Flows from (used in) Operations ($31) ($25) ($42) FCF (1) ($40) ($32) ($55) Cash $249 $264 $291 International $189 $185 $185 US $60 $79 $106

Capital Allocation Update Dividends Quarterly dividend of $0.165 per share totaling $5.8 million paid in July 2022 Recurring quarterly dividend of $0.165 per share paid to shareholders as of September 30, 2022 on October 14, 2022 Recurring quarterly dividends to continue until further notice Share Repurchases No Share repurchases in Q3 2022 Share repurchase program remaining authorization of $155 million as of September 30, 2022 Will consider share repurchases opportunistically

Fourth Quarter 2022 Guidance * This guidance takes into consideration all known constraints for the quarter and assumes no further significant interruptions to our supply base, operations or customers. Q4:2022 Guidance Net Sales $760 - $800 million Diluted EPS – GAAP $0.52 - $0.56 Diluted EPS – non-GAAP* $0.58 - $0.62 SG&A expenses ~ $39 million Operating Margin – non-GAAP* 4.1% Other Expenses, Net $5.4 million Effective Tax Rate 18% - 20% Weighted Average Shares ~ 35.4 million

2022 Outlook Jeff Benck - CEO

Q3-22 New Business Wins Medical Precision optical ultrasound system (Manufacturing) Automatic external defibrillator (Manufacturing) Cardiology treatment platform (Design) Semi-Cap Wafer surface conditioning tools (Manufacturing) Process control tools (Engineering) Automated vacuum curing tools (Manufacturing) Aerospace & Defense UAV communication system (Design and Manufacturing) Defense aviation radar system (Manufacturing) Defense artillery pilot controls (Manufacturing) Industrials Power inverter for integrated energy storage system (Manufacturing) Autonomous mobile robots (Engineering) Industrial drives, power and control systems (Manufacturing) Computing & Telco LTE/5G smart coverage solutions (Manufacturing) RF filter for 4G (Manufacturing) New super computing program (Engineering) YIELD ENGINEERING SYSTEMS PARNTERS WITH BENCHMARK FOR GLOBAL ENGINEERING and manufacturing support Benchmark to partner with Yield Engineering Systems (YES) to manufacture the YES flagship product line, as well as provide engineering and manufacturing support for their innovative modular wet process systems.

Q4-22 Sector Outlook Medical CY2022 Revenue Semi-Cap A&D Industrials Computing Telco Sector Revenue Drivers Strong year-over-year growth fueled by recovery in existing programs and new ramps Continued impact from supply constraints Limited semi-cap demand softening due to memory weakness and new China restrictions CHIPs Act is a multi-year driver Some modest easing of supply constraints Unfulfilled demand persists Healthy year-over-year growth due to new programs and strong demand in existing products HPC ramp continues in support of large supercomputer builds Expected strength to continue into 2023 Next Gen Networking infrastructure program ramping Government broadband initiatives fueling growth Q4-22 Revenue Outlook

Expecting to Achieve Mid-Term Model 2022 Mid-Term Model FY:22E Performance Excluding Supply Chain Premium Revenue growth at ~4x target rate Non-GAAP Gross Margin within the target range Operating Expenses achieved target Non-GAAP Operating Income achieved high end of range in Q3:22 and expected to exceed range on the full year Q3-22 Adjusted(1) FY:22E Results(2) Year-over-Year Revenue Growth 21% Non-GAAP Gross Margins 9.6% SG&A Expenses 5.7% Non-GAAP Operating Margins 3.9% (1) Adjusted to reflect operating performance excluding the effect of supply chain premiums (2) Assumes the mid-point of Q4:22 guidance and excluding the effect of supply chain premiums Year-over-Year Revenue Growth 28% Non-GAAP Gross Margins 9.5% SG&A Expenses 5.6% Non-GAAP Operating Margins 4.0%

Highlights 2022 Mid-Term Model expected to be achieved for the full year Strong demand across market sectors Diversified portfolio with limited exposure to consumer or commoditized markets Anticipate 56% non-GAAP earnings growth in fiscal 2022 Well positioned for growth in 2023 and a return to positive free cash flow Hosting Investor and Analyst Day on November 8th at NYSE

Appendix

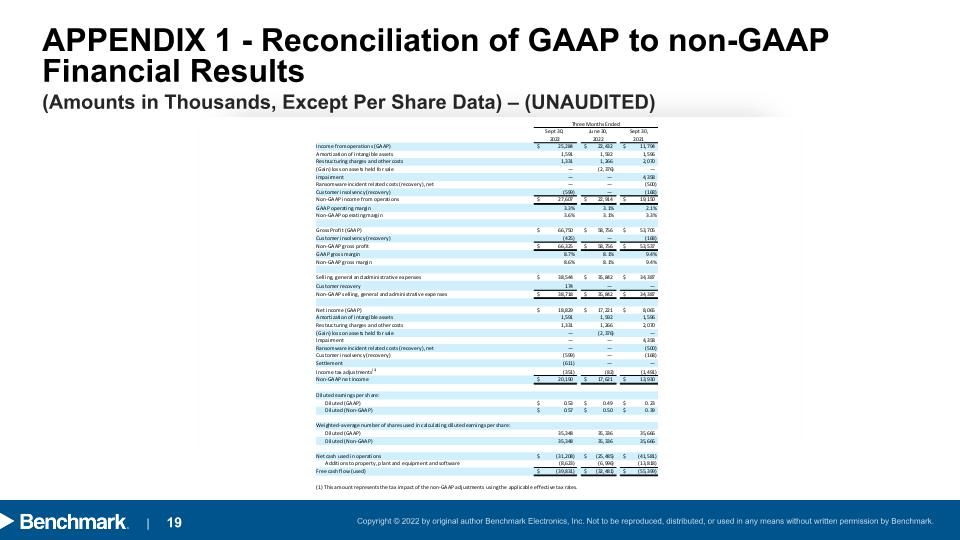

(Amounts in Thousands, Except Per Share Data) – (UNAUDITED) APPENDIX 1 - Reconciliation of GAAP to non-GAAP Financial Results

(Amounts in Millions) – (UNAUDITED) APPENDIX 2 - Reconciliation of Supply Chain Premiums