UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 25, 2022

ARMSTRONG WORLD INDUSTRIES, INC.

(Exact name of registrant as specified in its charter)

Pennsylvania |

|

1-2116 |

|

23-0366390 |

|

(State or other jurisdiction of incorporation or organization) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

|

|

|

2500 Columbia Avenue P.O. Box 3001 Lancaster, Pennsylvania |

|

17603 |

||

(Address of principal executive offices) |

|

(Zip Code) |

||

Registrant’s telephone number, including area code: (717) 397-0611

NA

(Former name or former address if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, $0.01 par value per share |

|

AWI |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ◻ On October 25, 2022, Armstrong World Industries, Inc. (the "Company") issued a press release announcing its third quarter 2022 consolidated financial results. The full text of the press release is attached hereto as Exhibit 99.1.

Section 2 - Financial Information

Item 2.02 Results of Operations and Financial Condition.

The information in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, is being furnished herewith and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Act”), or the Exchange Act, except as expressly set forth by specific reference in such filing.

Section 7 – Regulation FD

Item 7.01 Regulation FD Disclosure.

On October 25, 2022, the Company issued a press release announcing that it will report its third quarter 2022 consolidated financial results via a webcast and conference call on October 25, 2022 at 10:00 a.m. Eastern Time which can be accessed through the “Investors” section of the Company’s website, www.armstrongceilings.com. During this report, the Company will reference a slide presentation, a copy of which is attached hereto as Exhibit 99.2 and incorporated herein by reference.

The information in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.2, is being furnished herewith and shall not be deemed “filed” for the purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Act, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Caution Concerning Forward-Looking Statements

This Current Report on Form 8-K includes certain forward-looking statements within the meaning of Section 27A of the Act, and Section 21E of the Exchange Act. Such forward-looking statements include, but are not limited to, statements about the plans, objectives, expectations and intentions of the Company, including the consummation of the Sale, and other statements that are not historical facts. These statements are based on the current expectations and beliefs of the Company’s management, and are subject to uncertainty and changes in circumstances. This includes both annual guidance and five-year growth targets which represent internal company estimates at a five-year compounded annual growth rate. The Company cautions readers that any forward-looking information is not a guarantee of future performance and that actual results may vary materially from those expressed or implied by the statements herein, due to changes in economic, business, competitive, technological, strategic or other regulatory factors, as well as factors affecting the operation of the business of the Company. More detailed information about certain of these and other factors may be found in filings by the Company with the U.S. Securities and Exchange Commission, including its most recent Annual Report on Form 10-K in the sections entitled “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors”, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K. Various factors could cause actual results to differ from those set forth in the forward-looking statements including, without limitation, the risk that the anticipated benefits from the Sale may not be fully realized or may take longer to realize than expected. The Company is under no obligation to, and expressly disclaims any obligation to, update or alter the forward-looking statements contained in this document, whether as a result of new information, future events or otherwise.

Section 9 – Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

|

|

No. 99.1 |

|

Press Release of Armstrong World Industries, Inc. dated October 25, 2022 |

|

|

|

No. 99.2 |

|

Earnings Call Presentation Third Quarter 2022 dated October 25, 2022 |

|

|

|

No. 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

ARMSTRONG WORLD INDUSTRIES, INC. |

||

|

|

|

By: |

|

/s/ Austin K. So |

|

|

Austin K. So |

|

|

Senior Vice President, General Counsel, Secretary and Chief Compliance Officer |

Date: October 25, 2022

3

Exhibit 99.1

Armstrong World Industries Reports Third-Quarter 2022 Results

LANCASTER, Pa., October 25, 2022 -- Armstrong World Industries, Inc. (NYSE:AWI), a leader in the design, innovation and manufacture of ceiling and wall solutions in the Americas, today reported third-quarter 2022 financial results.

“Our teams achieved another quarter of solid year-over-year sales growth in both our Mineral Fiber and Architectural Specialties segments through price and volume improvements. I'm particularly pleased that both segments also expanded EBITDA margins sequentially, even while inflation remained elevated. Our third-quarter results including our WAVE joint venture performance, however, were tempered by increased economic uncertainty and continued project delays, which slowed the momentum we brought into the quarter,” said Vic Grizzle, President and CEO of Armstrong World Industries. “Despite the deceleration in market conditions, we continued to drive year-over-year earnings growth through focused execution throughout our operations, controlling the things we can and gaining further traction with key growth initiatives.”

Third-Quarter Results from Continuing Operations

(Dollar amounts in millions except per-share data) |

|

For the Three Months Ended September 30, |

|

|

|

|||||

|

|

2022 |

|

|

2021 |

|

|

Change |

||

Net sales |

|

$ |

325.0 |

|

|

$ |

292.2 |

|

|

11.2% |

Operating income |

|

$ |

73.3 |

|

|

$ |

72.1 |

|

|

1.7% |

Earnings from continuing operations |

|

$ |

54.5 |

|

|

$ |

50.8 |

|

|

7.3% |

Diluted earnings per share |

|

$ |

1.18 |

|

|

$ |

1.06 |

|

|

11.3% |

|

|

|

|

|

|

|

|

|

||

Additional Non-GAAP* Measures |

|

|

|

|

|

|

|

|

||

Adjusted EBITDA |

|

$ |

105 |

|

|

$ |

99 |

|

|

5.3% |

Adjusted net income from continuing operations |

|

$ |

63 |

|

|

$ |

56 |

|

|

12.4% |

Adjusted diluted earnings per share |

|

$ |

1.36 |

|

|

$ |

1.17 |

|

|

16.2% |

* The Company uses non-GAAP adjusted measures in managing the business and believes the adjustments provide meaningful comparisons of operating performance between periods and are useful alternative measures of performance. Reconciliations of the most comparable GAAP measure are found in the tables at the end of this press release. Non-GAAP figures are rounded to the nearest million with the exception of per share data.

Third-quarter 2022 consolidated net sales increased 11.2% from prior-year results with higher volumes contributing $17 million and favorable Average Unit Value ("AUV") contributing $16 million. Mineral Fiber net sales increased $19 million and Architectural Specialties net sales increased $14 million from third-quarter 2021 results.

1

Third-quarter operating income increased 2% versus the prior-year period primarily due to favorable AUV performance, the positive impact from an increase in sales volumes and a reduction in incentive compensation expense, partially offset by an increase in manufacturing costs, primarily due to higher raw material and energy inflation and a benefit recorded in the prior-year period related to a 2020 Coronavirus Aid, Relief, and Economic Act Employee Retention Credit ("ERC Benefit"). Third-quarter 2022 results were also negatively impacted by an increase in acquisition-related charges, primarily due to a change in the fair value of contingent consideration related to our 2020 acquisition of TURF Design, Inc. due to improved projected financial performance over the earn-out period which ends this calendar year.

Third-Quarter Segment Highlights

Mineral Fiber

(Dollar amounts in millions) |

|

For the Three Months Ended September 30, |

|

|

|

|||||

|

|

2022 |

|

|

2021 |

|

|

Change |

||

Net sales |

|

$ |

233.7 |

|

|

$ |

214.5 |

|

|

9.0% |

Operating income |

|

$ |

70.8 |

|

|

$ |

68.5 |

|

|

3.4% |

Adjusted EBITDA* |

|

$ |

89 |

|

|

$ |

86 |

|

|

3.1% |

Third-quarter 2022 Mineral Fiber net sales increased 9.0% from prior-year results primarily due to $16 million of favorable AUV and $3 million from higher sales volumes. Improved AUV performance was driven by favorable like-for-like pricing, partially offset by negative customer channel mix. Third-quarter sales volumes were positive in the quarter, driven by increased volumes from the home center customer channel and growth in Latin America, partially offsetting headwinds from a deceleration of market conditions throughout the third quarter.

Third-quarter Mineral Fiber operating income increased 3.4% from prior-year results. The increase was driven by a favorable AUV margin impact of $16 million, a $3 million decrease in incentive compensation expense and a $2 million increase resulting from higher sales volumes, partially offset by a $16 million increase in manufacturing costs driven by elevated raw material and energy inflation and a $2 million ERC benefit recorded in the prior-year period.

Architectural Specialties

(Dollar amounts in millions) |

|

For the Three Months Ended September 30, |

|

|

|

|||||

|

|

2022 |

|

|

2021 |

|

|

Change |

||

Net sales |

|

$ |

91.3 |

|

|

$ |

77.7 |

|

|

17.5% |

Operating income |

|

$ |

3.4 |

|

|

$ |

5.0 |

|

|

(32.0)% |

Adjusted EBITDA* |

|

$ |

16 |

|

|

$ |

13 |

|

|

19.7% |

Third-quarter 2022 net sales in Architectural Specialties increased 17.5% from prior-year results, driven by improved performance from recent acquisitions compared to the prior-year period and positive impacts from an increase in custom project sales.

Architectural Specialties operating income was positively impacted by a $7 million margin benefit from increased sales and a $2 million reduction in intangible asset amortization, partially offset by a $2 million increase in selling expenses and a $2 million increase in manufacturing costs. The year-over-year decrease in Architectural Specialties operating income also reflects a $6 million increase in acquisition-related charges in the current period, primarily due to a change in the fair value of acquisition-related contingent consideration.

2

Cash Flow

Operating activities for the first nine months of 2022 provided $119 million of cash, compared to $138 million in the first nine months of 2021. The decrease was primarily due to negative working capital changes in accounts payable and accrued expenses, and inventory, primarily due to timing, in addition to an increase in income tax payments. These decreases were partially offset by higher cash earnings.

2022 Outlook

“While we saw strong Architectural Specialties segment sales and earnings growth in the third quarter and sequential improvement in Mineral Fiber’s price-over-inflation realization, we expect Mineral Fiber volumes to remain challenged into the fourth quarter,” said Chris Calzaretta, AWI CFO. “Due to third quarter results and overall increased economic uncertainty, we are lowering our full-year 2022 financial outlook. Looking ahead, we will continue to diligently control our costs and make necessary adjustments while still supporting our long-term growth strategy.”

|

For the Year Ended December 31, 2022 |

||||||||||||

(Dollar amounts in millions except per-share data) |

2021 Actual |

|

Current Guidance |

|

VPY Growth % |

||||||||

Net sales |

$ |

1,107 |

|

$ |

1,220 |

|

to |

$ |

1,235 |

|

10% |

to |

12% |

Adjusted EBITDA* |

$ |

372 |

|

$ |

385 |

|

to |

$ |

395 |

|

4% |

to |

6% |

Adjusted diluted earnings per share* |

$ |

4.36 |

|

$ |

4.75 |

|

to |

$ |

4.85 |

|

9% |

to |

11% |

Adjusted free cash flow* |

$ |

190 |

|

$ |

210 |

|

to |

$ |

220 |

|

11% |

to |

16% |

Earnings Webcast

Management will host a live webcast conference call at 10:00 a.m. EDT today, to discuss third-quarter 2022 results. This event will be available on the Company's website. The call and accompanying slide presentation can be found on the investor relations section of the company's website at www.armstrongworldindustries.com. The replay of this event will be available on the website for up to one year after the date of the call.

Uncertainties Affecting Forward-Looking Statements

Disclosures in this release, including without limitation, those relating to future financial results, market conditions and guidance, the impacts of COVID-19 on our business, and in our other public documents and comments, contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Those statements provide our future expectations or forecasts and can be identified by our use of words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “outlook,” “target,” “predict,” “may,” “will,” “would,” “could,” “should,” “seek,” and other words or phrases of similar meaning in connection with any discussion of future operating or financial performance. This includes annual guidance. Forward-looking statements, by their nature, address matters that are uncertain and involve risks because they relate to events and depend on circumstances that may or may not occur in the future. As a result, our actual results may differ materially from our expected results and from those expressed in our forward-looking statements. A more detailed discussion of the risks and uncertainties that could cause our actual results to differ materially from those projected, anticipated or implied is included in the “Risk Factors” and “Management’s Discussion and Analysis” sections of our reports on Form 10-K and 10-Q filed with the U.S. Securities and Exchange Commission (“SEC”). Forward-looking statements speak only as of the date they are made. We undertake no obligation to update any forward-looking statements beyond what is required under applicable securities law.

About Armstrong and Additional Information

3

Armstrong World Industries, Inc. is a leader in the design, innovation and manufacture of innovative ceiling and wall system solutions in the Americas. With $1.1 billion in revenue in 2021, AWI has approximately 3,000 employees and a manufacturing network of 15 facilities, plus six facilities dedicated to its WAVE joint venture.

More details on the Company’s performance can be found in its report on Form 10-Q for the quarter ended September 30, 2022 that the Company expects to file with the SEC today.

Contacts

Investors: Theresa Womble, tlwomble@armstrongceilings.com or (717) 396-6354

Media: Jennifer Johnson, jenniferjohnson@armstrongceilings.com or (866) 321-6677

Reported Financial Highlights

(amounts in millions, except per share data)

FINANCIAL HIGHLIGHTS

Armstrong World Industries, Inc. and Subsidiaries

(Unaudited)

|

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

||||||||||

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

||||

Net sales |

|

$ |

325.0 |

|

|

$ |

292.2 |

|

|

$ |

928.6 |

|

|

$ |

824.1 |

|

Cost of goods sold |

|

|

207.5 |

|

|

|

181.5 |

|

|

|

591.0 |

|

|

|

521.0 |

|

Gross profit |

|

|

117.5 |

|

|

|

110.7 |

|

|

|

337.6 |

|

|

|

303.1 |

|

Selling, general and administrative expenses |

|

|

59.3 |

|

|

|

62.3 |

|

|

|

177.9 |

|

|

|

176.5 |

|

Loss (gain) related to change in fair value of contingent consideration |

|

|

7.1 |

|

|

|

(0.3 |

) |

|

|

13.3 |

|

|

|

(9.8 |

) |

Equity (earnings) from joint venture |

|

|

(22.2 |

) |

|

|

(23.4 |

) |

|

|

(61.7 |

) |

|

|

(68.1 |

) |

Operating income |

|

|

73.3 |

|

|

|

72.1 |

|

|

|

208.1 |

|

|

|

204.5 |

|

Interest expense |

|

|

7.0 |

|

|

|

6.1 |

|

|

|

17.9 |

|

|

|

17.4 |

|

Other non-operating (income), net |

|

|

(1.4 |

) |

|

|

(1.4 |

) |

|

|

(4.1 |

) |

|

|

(4.3 |

) |

Earnings from continuing operations before income taxes |

|

|

67.7 |

|

|

|

67.4 |

|

|

|

194.3 |

|

|

|

191.4 |

|

Income tax expense |

|

|

13.2 |

|

|

|

16.6 |

|

|

|

43.2 |

|

|

|

48.0 |

|

Earnings from continuing operations |

|

|

54.5 |

|

|

|

50.8 |

|

|

|

151.1 |

|

|

|

143.4 |

|

Net earnings (loss) from discontinued operations |

|

|

3.0 |

|

|

|

- |

|

|

|

3.0 |

|

|

|

(2.1 |

) |

Net earnings |

|

$ |

57.5 |

|

|

$ |

50.8 |

|

|

$ |

154.1 |

|

|

$ |

141.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Diluted earnings per share of common stock, continuing operations |

|

$ |

1.18 |

|

|

$ |

1.06 |

|

|

$ |

3.23 |

|

|

$ |

2.98 |

|

Diluted earnings (loss) per share of common stock, discontinued operations |

|

$ |

0.07 |

|

|

$ |

- |

|

|

$ |

0.06 |

|

|

$ |

(0.04 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Diluted net earnings per share of common stock |

|

$ |

1.25 |

|

|

$ |

1.06 |

|

|

$ |

3.29 |

|

|

$ |

2.94 |

|

Average number of diluted common shares outstanding |

|

|

46.1 |

|

|

|

47.8 |

|

|

|

46.7 |

|

|

|

48.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

4

SEGMENT RESULTS

Armstrong World Industries, Inc. and Subsidiaries

(Unaudited)

|

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

||||||||||

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

||||

Net Sales |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Mineral Fiber |

|

$ |

233.7 |

|

|

$ |

214.5 |

|

|

$ |

671.4 |

|

|

$ |

611.3 |

|

Architectural Specialties |

|

|

91.3 |

|

|

|

77.7 |

|

|

|

257.2 |

|

|

|

212.8 |

|

Total net sales |

|

$ |

325.0 |

|

|

$ |

292.2 |

|

|

$ |

928.6 |

|

|

$ |

824.1 |

|

|

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

||||||||||

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

||||

Segment operating income (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Mineral Fiber |

|

$ |

70.8 |

|

|

$ |

68.5 |

|

|

$ |

199.8 |

|

|

$ |

201.2 |

|

Architectural Specialties |

|

|

3.4 |

|

|

|

5.0 |

|

|

|

11.0 |

|

|

|

7.5 |

|

Unallocated Corporate |

|

|

(0.9 |

) |

|

|

(1.4 |

) |

|

|

(2.7 |

) |

|

|

(4.2 |

) |

Total consolidated operating income |

|

$ |

73.3 |

|

|

$ |

72.1 |

|

|

$ |

208.1 |

|

|

$ |

204.5 |

|

Selected Balance Sheet Information

|

|

Unaudited |

|

|

|

|

||

|

|

September 30, 2022 |

|

|

December 31, 2021 |

|

||

Assets |

|

|

|

|

|

|

||

Current assets |

|

$ |

351.8 |

|

|

$ |

321.9 |

|

Property, plant and equipment, net |

|

|

541.2 |

|

|

|

542.8 |

|

Other noncurrent assets |

|

|

846.4 |

|

|

|

845.3 |

|

Total assets |

|

$ |

1,739.4 |

|

|

$ |

1,710.0 |

|

Liabilities and shareholders’ equity |

|

|

|

|

|

|

||

Current liabilities |

|

$ |

212.4 |

|

|

$ |

209.6 |

|

Noncurrent liabilities |

|

|

1,005.8 |

|

|

|

980.7 |

|

Equity |

|

|

521.2 |

|

|

|

519.7 |

|

Total liabilities and shareholders’ equity |

|

$ |

1,739.4 |

|

|

$ |

1,710.0 |

|

Selected Cash Flow Information

(Unaudited)

|

|

For the Nine Months Ended September 30, |

|

|||||

|

|

2022 |

|

|

2021 |

|

||

Net earnings |

|

$ |

154.1 |

|

|

$ |

141.3 |

|

Other adjustments to reconcile net earnings to net cash provided by operating activities |

|

|

25.7 |

|

|

|

12.9 |

|

Changes in operating assets and liabilities, net |

|

|

(60.6 |

) |

|

|

(16.3 |

) |

Net cash provided by operating activities |

|

|

119.2 |

|

|

|

137.9 |

|

Net cash provided by (used for) investing activities |

|

|

8.1 |

|

|

|

(5.4 |

) |

Net cash (used for) financing activities |

|

|

(137.6 |

) |

|

|

(175.1 |

) |

Effect of exchange rate changes on cash and cash equivalents |

|

|

(1.0 |

) |

|

|

— |

|

Net (decrease) in cash and cash equivalents |

|

|

(11.3 |

) |

|

|

(42.6 |

) |

Cash and cash equivalents at beginning of year |

|

|

98.1 |

|

|

|

136.9 |

|

Cash and cash equivalents at end of period |

|

$ |

86.8 |

|

|

$ |

94.3 |

|

5

Supplemental Reconciliations of GAAP to non-GAAP Results (unaudited)

(Amounts in millions, except per share data)

To supplement its consolidated financial statements presented in accordance with accounting principles generally accepted in the United States (“GAAP”), the Company provides additional measures of performance adjusted to exclude the impact of certain discrete expenses and income including adjusted net sales, adjusted EBITDA, adjusted diluted earnings per share (EPS) and adjusted free cash flow. Investors should not consider non-GAAP measures as a substitute for GAAP measures. The Company excludes certain acquisition related expenses (i.e. – changes in the fair value of contingent consideration, deferred compensation accruals, impact of adjustments related to the fair value of inventory and deferred revenue) for recent acquisitions. The deferred compensation accruals are for cash and stock awards that are recorded over each award's respective vesting period, as such payments are subject to the sellers’ and employees’ continued employment with the Company. The Company excludes all acquisition-related intangible amortization from adjusted earnings from continuing operations and in calculations of adjusted diluted EPS. Examples of other excluded items include plant closures, restructuring charges and related costs, impairments, separation costs, environmental site expenses and related insurance recoveries, endowment level charitable contributions, and certain other gains and losses. The Company also excludes income/expense from its U.S. Retirement Income Plan (“RIP”) in the non-GAAP results as it represents the actuarial net periodic benefit credit/cost recorded. For all periods presented, the Company was not required and did not make cash contributions to the RIP based on guidelines established by the Pension Benefit Guaranty Corporation, nor does the Company expect to make cash contributions to the plan in 2022. Adjusted free cash flow is defined as cash from operating and investing activities, adjusted to remove the impact of cash used or proceeds received for acquisitions and divestitures, environmental site expenses and related insurance recoveries. The Company believes adjusted free cash flow is useful because it provides insight into the amount of cash that the Company generates for discretionary uses, after expenditures for capital investments and adjustments for acquisitions and divestitures. The Company uses these adjusted performance measures in managing the business, including communications with its Board of Directors and employees, and believes that they provide users of this financial information with meaningful comparisons of operating performance between current results and results in prior periods. The Company believes that these non-GAAP financial measures are appropriate to enhance understanding of its past performance, as well as prospects for its future performance. The Company also uses adjusted EBITDA and adjusted free cash flow as factors in determining at-risk compensation for senior management. These non-GAAP measures may not be defined and calculated the same as similar measures used by other companies. A reconciliation of these adjustments to the most directly comparable GAAP measures is included in this release and on the Company’s website. These non-GAAP measures should not be considered in isolation or as a substitute for the most comparable GAAP measures. Non-GAAP financial measures utilized by the Company may not be comparable to non-GAAP financial measures used by other companies.

In the following charts, numbers may not sum due to rounding. Non-GAAP figures are rounded to the nearest million and corresponding percentages are rounded to the nearest percent based on unrounded figures.

6

Consolidated Results from Continuing Operations – Adjusted EBITDA

|

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

||||||||||

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

||||

Earnings from continuing operations, Reported |

|

$ |

55 |

|

|

$ |

51 |

|

|

$ |

151 |

|

|

$ |

143 |

|

Add: Income tax expense, reported |

|

|

13 |

|

|

|

17 |

|

|

|

43 |

|

|

|

48 |

|

Earnings before tax, Reported |

|

$ |

68 |

|

|

$ |

67 |

|

|

$ |

194 |

|

|

$ |

191 |

|

Add: Interest/other income and expense, net |

|

|

6 |

|

|

|

5 |

|

|

|

14 |

|

|

|

13 |

|

Operating Income, Reported |

|

$ |

73 |

|

|

$ |

72 |

|

|

$ |

208 |

|

|

$ |

205 |

|

Add: RIP expense (1) |

|

|

1 |

|

|

|

1 |

|

|

|

3 |

|

|

|

4 |

|

Add: Acquisition-related impacts (2) |

|

|

9 |

|

|

|

3 |

|

|

|

19 |

|

|

|

1 |

|

Operating Income, Adjusted |

|

$ |

83 |

|

|

$ |

76 |

|

|

$ |

230 |

|

|

$ |

210 |

|

Add: Depreciation |

|

|

18 |

|

|

|

16 |

|

|

|

51 |

|

|

|

46 |

|

Add: Amortization |

|

|

4 |

|

|

|

7 |

|

|

|

13 |

|

|

|

28 |

|

Adjusted EBITDA |

|

$ |

105 |

|

|

$ |

99 |

|

|

$ |

294 |

|

|

$ |

284 |

|

(1) RIP expense represents only the plan service cost that is recorded within Operating Income. For all periods presented, we were not required to and did not make cash contributions to our RIP.

(2) Represents the impact of acquisition-related adjustments for the fair value of acquired inventory and deferred revenue, changes in fair value of contingent consideration, deferred compensation and restricted stock expenses.

Mineral Fiber

|

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

||||||||||

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

||||

Operating Income, Reported |

|

$ |

71 |

|

|

$ |

69 |

|

|

$ |

200 |

|

|

$ |

201 |

|

Operating Income, Adjusted |

|

$ |

71 |

|

|

$ |

69 |

|

|

$ |

200 |

|

|

$ |

201 |

|

Add: Depreciation and amortization |

|

|

18 |

|

|

|

18 |

|

|

|

52 |

|

|

|

53 |

|

Adjusted EBITDA |

|

$ |

89 |

|

|

$ |

86 |

|

|

$ |

252 |

|

|

$ |

254 |

|

Architectural Specialties

|

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

||||||||||

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

||||

Operating Income, Reported |

|

$ |

3 |

|

|

$ |

5 |

|

|

$ |

11 |

|

|

$ |

8 |

|

Add: Acquisition-related impacts (1) |

|

|

9 |

|

|

|

3 |

|

|

|

19 |

|

|

|

1 |

|

Operating Income, Adjusted |

|

$ |

12 |

|

|

$ |

8 |

|

|

$ |

30 |

|

|

$ |

9 |

|

Add: Depreciation and amortization |

|

|

3 |

|

|

|

5 |

|

|

|

11 |

|

|

|

21 |

|

Adjusted EBITDA |

|

$ |

16 |

|

|

$ |

13 |

|

|

$ |

41 |

|

|

$ |

29 |

|

(1) Represents the impact of acquisition-related adjustments for the fair value of acquired inventory and deferred revenue, changes in fair value of contingent consideration, deferred compensation and restricted stock expenses.

Unallocated Corporate

|

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

||||||||||

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

||||

Operating (Loss), Reported |

|

$ |

(1 |

) |

|

$ |

(1 |

) |

|

$ |

(3 |

) |

|

$ |

(4 |

) |

Add: RIP expense (1) |

|

|

1 |

|

|

|

1 |

|

|

|

3 |

|

|

|

4 |

|

Operating Income (Loss), Adjusted |

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

(1 |

) |

Add: Depreciation and amortization |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1 |

|

Adjusted EBITDA |

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

(1) RIP expense represents only the plan service cost that is recorded within Operating Income. For all periods presented, we were not required to and did not make cash contributions to our RIP.

7

Adjusted Free Cash Flow

|

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

||||||||||

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

||||

Net cash provided by operating activities |

|

$ |

56 |

|

|

$ |

56 |

|

|

$ |

119 |

|

|

$ |

138 |

|

Net cash provided by (used for) investing activities |

|

$ |

10 |

|

|

$ |

1 |

|

|

$ |

8 |

|

|

$ |

(5 |

) |

Net cash provided by operating and investing activities |

|

$ |

66 |

|

|

$ |

57 |

|

|

$ |

127 |

|

|

$ |

133 |

|

Add: Acquisitions, net |

|

|

- |

|

|

|

1 |

|

|

|

- |

|

|

|

1 |

|

Add: Payments related to sale of international, net |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

12 |

|

Add: Net environmental expenses |

|

|

- |

|

|

|

- |

|

|

|

1 |

|

|

|

- |

|

Add: Contingent consideration in excess of acquisition-date fair value (1) |

|

|

- |

|

|

|

- |

|

|

|

2 |

|

|

|

- |

|

Adjusted Free Cash Flow |

|

$ |

66 |

|

|

$ |

58 |

|

|

$ |

130 |

|

|

$ |

145 |

|

(1) Contingent compensation payments related to 2020 acquisitions recorded as a component of net cash provided by operating activities.

Consolidated Results from Continuing Operations – Adjusted Diluted Earnings Per Share (EPS)

|

For the Three Months Ended September 30, |

|

|

For the Nine Months Ended September 30, |

|

||||||||||||||||||||

|

2022 |

|

2021 |

|

|

2022 |

|

2021 |

|

||||||||||||||||

|

Total |

|

Per Diluted |

|

Total |

|

Per Diluted |

|

|

Total |

|

Per Diluted |

|

Total |

|

Per Diluted |

|

||||||||

Earnings from continuing operations, Reported |

$ |

55 |

|

$ |

1.18 |

|

$ |

51 |

|

$ |

1.06 |

|

|

$ |

151 |

|

$ |

3.23 |

|

$ |

143 |

|

$ |

2.98 |

|

Add: Income tax expense, reported |

|

13 |

|

|

|

|

17 |

|

|

|

|

|

43 |

|

|

|

|

48 |

|

|

|

||||

Earnings from continuing operations before income taxes, Reported |

$ |

68 |

|

|

|

$ |

67 |

|

|

|

|

$ |

194 |

|

|

|

$ |

191 |

|

|

|

||||

(Less): RIP (credit) (1) |

|

- |

|

|

|

|

- |

|

|

|

|

|

(1 |

) |

|

|

|

- |

|

|

|

||||

Add: Acquisition-related impacts (2) |

|

9 |

|

|

|

|

3 |

|

|

|

|

|

19 |

|

|

|

|

1 |

|

|

|

||||

Add: Acquisition-related amortization (3) |

|

2 |

|

|

|

|

4 |

|

|

|

|

|

6 |

|

|

|

|

18 |

|

|

|

||||

Adjusted earnings from continuing operations before income taxes |

$ |

78 |

|

|

|

$ |

74 |

|

|

|

|

$ |

219 |

|

|

|

$ |

210 |

|

|

|

||||

(Less): Adjusted income tax expense (4) |

|

(15 |

) |

|

|

|

(18 |

) |

|

|

|

|

(49 |

) |

|

|

|

(53 |

) |

|

|

||||

Adjusted net income from continuing operations |

$ |

63 |

|

$ |

1.36 |

|

$ |

56 |

|

$ |

1.17 |

|

|

$ |

171 |

|

$ |

3.65 |

|

$ |

157 |

|

$ |

3.28 |

|

Adjusted Diluted EPS change versus Prior Year |

|

|

16% |

|

|

|

|

|

|

|

|

11% |

|

|

|

|

|

||||||||

Diluted Shares Outstanding, as reported |

|

|

|

46.1 |

|

|

|

|

47.8 |

|

|

|

|

|

46.7 |

|

|

|

|

48.0 |

|

||||

Effective Tax Rate, as reported |

|

|

20% |

|

|

|

25% |

|

|

|

|

22% |

|

|

|

25% |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

(1) RIP (credit) represents the entire actuarial net periodic pension (credit) recorded as a component of earnings from continuing operations. For all periods presented, we were not required to and did not make cash contributions to our RIP.

(2) Represents the impact of acquisition-related adjustments for the fair value of acquired inventory and deferred revenue, changes in fair value of contingent consideration, deferred compensation and restricted stock expenses.

(3) Represents the intangible amortization related to acquired entities, including customer relationships, developed technology, software, trademarks and brand names, non-compete agreements and other intangibles.

(4) Adjusted income tax expense is calculated using the effective tax rate multiplied by the adjusted earnings from continuing operations before income taxes.

Adjusted EBITDA Guidance

8

|

|

For the Year Ending December 31, 2022 |

|

|||||

|

|

Low |

|

|

High |

|

||

Net income |

|

$ |

198 |

|

to |

$ |

203 |

|

Add: Interest expense |

|

|

25 |

|

|

|

26 |

|

(Less): RIP credit (1) |

|

|

(4 |

) |

|

|

(4 |

) |

Add: Income tax expense |

|

|

61 |

|

|

|

63 |

|

Operating income |

|

$ |

280 |

|

to |

$ |

288 |

|

Add: RIP expense (2) |

|

|

4 |

|

|

|

4 |

|

Add: Acquisition-related expense (3) |

|

|

20 |

|

|

|

21 |

|

Add: Depreciation |

|

|

66 |

|

|

|

67 |

|

Add: Amortization |

|

|

16 |

|

|

|

16 |

|

Adjusted EBITDA |

|

$ |

385 |

|

to |

$ |

395 |

|

(1) RIP credit represents the actuarial net periodic benefit expected to be recorded as a component of other non-operating income. We do not expect to and do not plan to make cash contributions to our RIP in 2022 based on guidelines established by the Pension Benefit Guaranty Corporation.

(2) RIP expense represents only the plan service cost that is recorded within Operating Income. For all periods presented, we were not required and did not make cash contributions to our RIP.

(3) Represents the impact of acquisition-related adjustments for the fair value of acquired inventory and deferred revenue, changes in fair value of contingent consideration, deferred compensation and restricted stock expenses.

Adjusted Diluted Earnings Per Share Guidance

|

|

For the Year Ending December 31, 2022 |

|

|||||||||||||

|

|

Low |

|

|

Per Diluted |

|

|

High |

|

|

Per Diluted |

|

||||

Net income |

|

$ |

198 |

|

|

$ |

4.26 |

|

to |

$ |

203 |

|

|

$ |

4.37 |

|

Add: Interest expense |

|

|

25 |

|

|

|

|

|

|

26 |

|

|

|

|

||

(Less): RIP credit (2) |

|

|

(4 |

) |

|

|

|

|

|

(4 |

) |

|

|

|

||

Add: Income tax expense |

|

|

61 |

|

|

|

|

|

|

63 |

|

|

|

|

||

Operating income |

|

$ |

280 |

|

|

|

|

to |

$ |

288 |

|

|

|

|

||

Add: RIP expense (3) |

|

|

4 |

|

|

|

|

|

|

4 |

|

|

|

|

||

(Less): Interest expense |

|

|

(25 |

) |

|

|

|

|

|

(26 |

) |

|

|

|

||

Add: Acquisition-related amortization (4) |

|

|

8 |

|

|

|

|

|

|

8 |

|

|

|

|

||

Add: Acquisition-related expense (5) |

|

|

20 |

|

|

|

|

|

|

21 |

|

|

|

|

||

Adjusted earnings before income taxes |

|

$ |

287 |

|

|

|

|

to |

$ |

295 |

|

|

|

|

||

(Less): Income tax expense (6) |

|

|

(68 |

) |

|

|

|

|

|

(70 |

) |

|

|

|

||

Adjusted net income |

|

$ |

220 |

|

|

$ |

4.75 |

|

to |

$ |

225 |

|

|

$ |

4.85 |

|

(1) Adjusted EPS guidance for 2022 is calculated based on ~46.5 million of diluted shares outstanding.

(2) RIP credit represents the actuarial net periodic benefit expected to be recorded as a component of other non-operating income. We do not expect to be required to make, nor do we plan to make cash contributions to our RIP based on guidelines established by the Pension Benefit Guaranty Corporation.

(3) RIP expense represents only the plan service cost related to the U.S. pension plan and is recorded as a component of operating income. We do not expect to be required to make, nor do we plan to make cash contributions to our RIP based on guidelines established by the Pension Benefit Guaranty Corporation.

(4) Represents the intangible amortization related to acquired entities, including customer relationships, developed technology, software, trademarks and brand names, non-compete agreements and other intangibles.

(5) Represents the impact of acquisition-related adjustments for the fair value of acquired inventory and deferred revenue, changes in fair value of contingent consideration, deferred compensation and restricted stock expenses.

(6) Income tax expense is based on an adjusted effective tax rate of ~24%, multiplied by adjusted earnings before income tax.

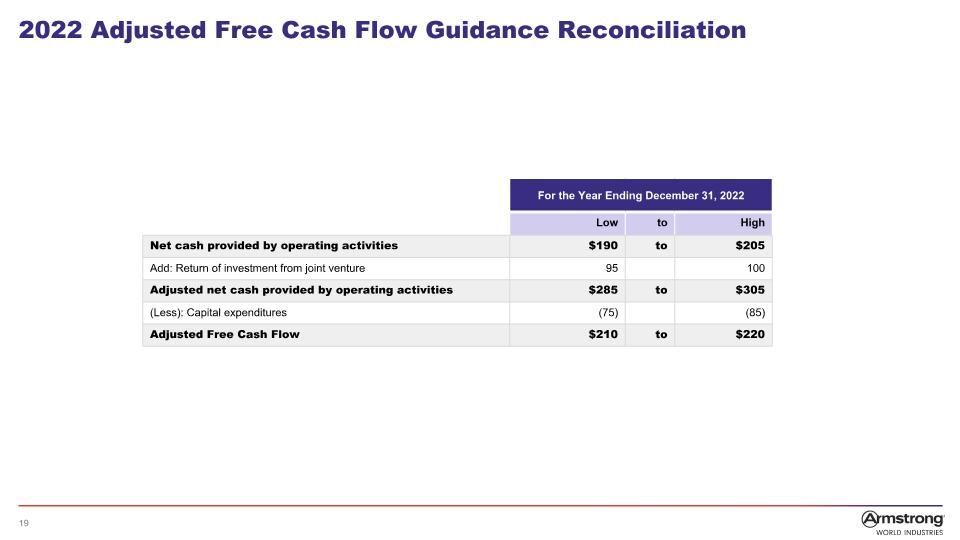

Adjusted Free Cash Flow Guidance

|

|

For the Year Ending December 31, 2022 |

|

|||||

|

|

Low |

|

|

High |

|

||

Net cash provided by operating activities |

|

$ |

190 |

|

to |

$ |

205 |

|

Add: Return of investment from joint venture |

|

|

95 |

|

|

|

100 |

|

Adjusted net cash provided by operating activities |

|

$ |

285 |

|

to |

$ |

305 |

|

Less: Capital expenditures |

|

|

(75 |

) |

|

|

(85 |

) |

Adjusted Free Cash Flow |

|

$ |

210 |

|

to |

$ |

220 |

|

9

3rd Quarter 2022Earnings Presentation October 25, 2022 Exhibit 99.2

Safe Harbor Statement Our disclosures in this presentation, including without limitation, those relating to future financial results, market conditions and guidance, the impacts of COVID-19 on our business, and in our other public documents and comments contain, forward-looking statements within the meaning of the Private Securities Litigation Reform Act. Those statements provide our future expectations or forecasts and can be identified by our use of words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “outlook,” “target,” “predict,” “may,” “will,” “would,” “could,” “should,” “seek,” and other words or phrases of similar meaning in connection with any discussion of future operating or financial performance. This includes annual guidance. Forward-looking statements, by their nature, address matters that are uncertain and involve risks because they relate to events and depend on circumstances that may or may not occur in the future. As a result, our actual results may differ materially from our expected results and from those expressed in our forward-looking statements. A more detailed discussion of the risks and uncertainties that could cause our actual results to differ materially from those projected, anticipated or implied is included in the “Risk Factors” and “Management’s Discussion and Analysis” sections of our reports on Form 10-K and 10-Q filed with the U.S. Securities and Exchange Commission (“SEC”). Forward-looking statements speak only as of the date they are made. We undertake no obligation to update any forward-looking statements beyond what is required under applicable securities law. In addition, we will be referring to non-Generally Accepted Accounting Principles (“GAAP”) financial measures within the meaning of SEC Regulation G. A reconciliation of the differences between these measures with the most directly comparable financial measures calculated in accordance with GAAP are included within this presentation and available on the Investor Relations page of our website at www.armstrongceilings.com. The guidance in this presentation is only effective as of the date given, October 25, 2022, and will not be updated or affirmed unless and until we publicly announce updated or affirmed guidance.

Basis of Presentation Explanation Results throughout this presentation are presented on a normalized basis. We remove the impact of certain discrete expenses and income in certain measures including adjusted net sales, adjusted EBITDA, adjusted diluted earnings per share (EPS) and adjusted free cash flow. The Company excludes certain acquisition related expenses (i.e. – changes in the fair value of earn-outs, deferred compensation accruals(1), impact of adjustments related to the fair value of inventory and deferred revenue) for recent acquisitions. The Company excludes all acquisition-related amortization from adjusted earnings from continuing operations and in calculations of adjusted diluted EPS. Examples of other excluded items include plant closures, restructuring charges and related costs, impairments, separation costs, environmental site expenses and related insurance recoveries, endowment level charitable contributions, and certain other gains and losses. The Company also excludes income/expense from its U.S. Retirement Income Plan (“RIP”) in the non-GAAP results as it represents the actuarial net periodic benefit credit/cost recorded. Our tax rate may be adjusted for certain discrete items which are identified in the footnotes. Investors should not consider non-GAAP measures as a substitute for GAAP measures. Non-GAAP figures are rounded to the nearest million and corresponding percentages are rounded to the nearest percent based on unrounded figures. The deferred compensation accruals are for cash and stock awards that will be recorded over each awards’ respective vesting period, as such payments are subject to the sellers’ and employees’ continued employment with the Company. All dollar figures throughout the presentation are in $ millions, except per share data, and all comparisons are versus prior year unless otherwise noted. Figures may not sum due to rounding.

1 Net Sales increased 11% from prior year driven by both Mineral Fiber (“MF”) and Architectural Specialties (“AS”) 2 Third consecutive quarter of record-setting AS sales; solid AS EBITDA growth with year-over-year margin expansion of 30 bps 3 Mineral Fiber Average Unit Value (“AUV”) growth of 8% driven by positive like-for-like pricing, partially offset by mix headwinds 4 Adjusted EBITDA growth lower than expected due to softer volumes, lower WAVE¹ equity earnings and mix headwinds Sales Up Double-Digits While EBITDA Results Pressured Q3 2022 Summary *Non-GAAP measure. See appendix for reconciliation to nearest GAAP measure. Worthington Armstrong Joint Venture (“WAVE”). Net Sales $292 $325 +9% +18% +11% +5% Adj. EBITDA*

Positive AUV & Volumes Partially Offset by Inflation Q3 2021 Q3 2022 Variance Net Sales $292 $325 11% Adj. EBITDA* $99 $105 5% Adj. EBITDA Margin*(%) 34.0% 32.2% (180bps) Adj. Diluted Earnings Per Share* $1.17 $1.36 16% (1) Includes raw material, energy, freight and inventory valuation (e.g. FIFO) impacts throughout presentation. (2) Excludes change in depreciation throughout presentation. $99 $10 $15 ($15) ($1) ($2) ($1) $105 Q3 2022 Consolidated Company Key Metrics (3) Excludes change in amortization throughout presentation. *Non-GAAP measure. See appendix for reconciliation to nearest GAAP measure.

Favorable AUV and Modest Volume Growth Offset by Inflation Mineral Fiber Q3 2022 Results Q1 Q2 Q3 Current Quarter Comments 2021 Adjusted EBITDA* $78 $90 $86 AUV 18 21 16 Strong like-for-like pricing partially offset by negative channel mix Volume (6) 1 2 Positive retail and Latin America growth offsets market deceleration Manufacturing (1) 1 1 Manufacturing productivity partially offsets impact of inflation Input costs (6) (14) (15) Persistent raw material and energy inflation; inclusive of inventory valuations SG&A (7) (7) - Lower incentive compensation, partially offset by ERC1 benefit in PY WAVE (3) (2) (1) Lower volumes partially offset by favorable AUV 2022 Adjusted EBITDA* $74 $89 $89 Q3 MF EBITDA margin contracted (220bps) % Change (5%) (2%) 3% 2020 Coronavirus Aid, Relief, and Economic Act Employee Retention Credit (“ERC”). *Non-GAAP measure. See appendix for reconciliation to nearest GAAP measure. Net Sales +9% Mineral Fiber Key Highlights AUV up 8% vs. Q3 2021 on positive like-for-like pricing partially offset by negative channel mix Sales volume growth muted by market deceleration Continued to deliver price-over-inflation dollars; sequentially improved EBITDA margin

Q1 Q2 Q3 Current Quarter Comments 2021 Adjusted EBITDA* $7 $10 $13 Adj. Net Sales* 9 6 7 Contributions from recent acquisitions and increased custom project sales Period Expense - (1) (3) Higher production costs on increased sales SG&A (3) (2) (2) Continued investments in support of increased sales 2022 Adjusted EBITDA* $13 $13 $16 Q3 AS EBITDA margin expanded 30bps % Change 88% 35% 20% A Record Sales Performance Quarter with Solid EBITDA Growth Architectural Specialties Q3 2022 Results *Non-GAAP measure. See appendix for reconciliation to nearest GAAP measure. Net Sales up 18% on recent acquisition performance and increased custom project sales Adjusted EBITDA* up 20% on sales fall-through, with adjusted EBITDA* margin expansion of 30 bps Order in-take improvement vs prior year +18% Key Highlights Net Sales

Adjusted Free Cash Flow Pressured by Working Capital Timing Impacts *Non-GAAP measure. See appendix for reconciliation to nearest GAAP measure. (1) Includes cash earnings, working capital and other current assets and liabilities. $1 ($16) $1 $0 $130 ($1) Adj. Free Cash Flow* YTD Third Quarter 2022 vs. PY

Sales Growth Pressured by Inflation and Investments YTD 2021 YTD 2022 Variance Adj. Net Sales* $825 $929 13% Adj. EBITDA* $294 $284 3% Adj. EBITDA Margin*(%) 34.4% 31.6% (280bps) Adj. Diluted Earnings Per Share* $3.28 $3.65 11% Adj. Free Cash Flow* $145 $130 (10%) *Non-GAAP measure. See appendix for reconciliation to nearest GAAP measure. $284 $18 $55 ($34) ($2) ($21) ($6) $294 Q3 YTD 2022 Consolidated Company Key Metrics

2021 Actual 2022 Guidance Key Assumptions Updating 2022 Guidance $1,107 $1,220 – $1,235 10% – 12% YoY (Prior: 11% – 13%) MF AUV +11% to +12% on positive like-for-like pricing MF volume of approximately -2% reflecting 1H distributor inventory destock and 2H market deceleration AS >15%; does not include any future acquisitions Net Sales Adjusted EBITDA* Adjusted DilutedEPS* AdjustedFree Cash Flow* $372 $385 – $395 4% – 6% YoY (Prior: 10% – 13%) Higher than average AUV realization, continued price over inflation Manufacturing productivity continues Investing to support growth initiatives AS margin expansion $4.36 $4.75 – $4.85 9% – 11% YoY (Prior: 17% – 19%) ~$26 million of interest expense ~24% book tax rate $67 million depreciation, $16 million amortization, of which $8 million of acquisition amortization is excluded ~46.5 million average diluted shares outstanding $190 $210 – $220 11% – 16% YoY (Prior: 13% – 24%) $75 - $85 million of capital expenditures $20 - $25 million of cash interest expense Cash tax rate 20% - 25% *Non-GAAP measure. See appendix for reconciliation to nearest GAAP measure. (Changes in assumptions)

Appendix

Q3 2022 Adjusted EBITDA Reconciliation RIP expense represents only the plan service cost that is recorded within Operating Income. For all periods presented, we were not required to and did not make cash contributions to our RIP. Represents the impact of acquisition-related adjustments for the fair value of acquired inventory and deferred revenue, changes in fair value of contingent consideration and deferred compensation & restricted stock expenses. For the Three Months Ended September 30th, For the Three months Ended March 31, For the Nine Months Ended September 30th, 2022 2021 V 2022 2021 V Earnings from continuing operations, Reported $55 $51 $4 $151 $143 $8 Add: Income tax expense, as reported 13 17 (3) 43 48 (5) Earnings before tax, Reported $68 $67 $ — $194 $191 $3 Add: Interest/other income and expense, net 6 5 1 14 13 1 Operating Income, Reported $73 $72 $1 $208 $205 $4 Add: RIP expense(1) 1 1 - 3 4 (1) Add: Acquisition-related impacts(2) 9 3 6 19 1 18 Add: Depreciation 18 16 2 51 46 4 Add: Amortization 4 7 (4) 13 28 (16) Adjusted EBITDA $105 $99 $5 $294 $284 $10

Q3 2022 Adjusted Diluted Earnings per Share Reconciliation RIP (credit) represents the entire actuarial net periodic pension (credit) recorded as a component of earnings from continuing operations. For all periods presented, we were not required to and did not make cash contributions to our RIP. Represents the impact of acquisition-related adjustments for the fair value of acquired inventory and deferred revenue, changes in fair value of contingent consideration and deferred compensation & restricted stock expenses. Represents the intangible amortization related to acquired entities, including customer relationships, developed technology, software, trademarks and brand names, non-compete agreements and other intangibles. Adjusted income tax expense is calculated using the effective tax rate multiplied by the adjusted earnings from continuing operations before income taxes. For the Three Months Ended September 30, For the Three months Ended March 31, For the Nine Months Ended September 30, 2022 Per Diluted Share 2021 Per Diluted Share V 2022 Per Diluted Share 2021 Per Diluted Share V Earnings from continuing operations, Reported $55 $1.18 $51 $1.06 ($4) $151 $3.23 $143 $2.98 $8 Add: Income tax expense, reported 13 17 (3) 43 48 (5) Earnings from continuing operations before income taxes, Reported $68 $67 $ — $194 $191 $3 (Less): RIP (credit)(1) - - - (1) - (1) Add: Acquisition-related impacts(2) 9 3 6 19 1 18 Add: Acquisition-related amortization(3) 2 4 (2) 6 18 (11) Adjusted earnings from continuing operations before income taxes $78 $74 $4 $219 $210 $9 (Less): Adjusted income tax expense(4) (15) (18) 3 (49) (53) 4 Adjusted net income from continuing operations $63 $1.36 $56 $1.17 $7 $171 $3.65 $157 $3.28 $13 Adjusted Diluted EPS change versus prior year 16% 11% Diluted Shares Outstanding, as reported 46.1 47.8 46.7 48.0 Effective Tax Rate, as reported 20% 25% 22% 25%

2022 Adjusted Free Cash Flow Reconciliation Contingent compensation payments related to 2020 acquisitions recorded as a component of net cash provided by operating activities. . For the Three Months Ended September 30, For the Three months Ended March 31, For the Nine Months Ended September 30, 2022 2021 V 2022 2021 V Net cash provided by operating activities $56 $56 $ — $119 $138 ($19) Net cash provided by (used for) investing activities $10 $1 $8 $8 ($5) $14 Net cash provided by operating and investing activities $66 $57 $8 $127 $133 ($5) Add: Acquisitions, net - 1 (1) - 1 (1) Add: Payments related to the sale of international, net - - - - 12 (12) Add: Net environmental expenses - - - 1 - 1 Add: Contingent consideration in excess of acquisition-date fair value(1) - - - 2 - 2 Adjusted Free Cash Flow $66 $58 $8 $130 $145 ($15)

2022 Segment Reported Operating Income (Loss) to Adj. EBITDA RIP expense represents only the plan service cost related to the RIP that is recorded within Operating Income. For all periods presented, we were not required to and did not make cash contributions to our RIP. Represents the impact of acquisition-related adjustments for the fair value of acquired inventory and deferred revenue, changes in fair value of contingent consideration, deferred compensation and restricted stock expenses. MINERAL FIBER ARCHITECTURAL SPECIALTIES UNALLOCATED CORPORATE UNALLOCATED CORPORATE MINERAL FIBER ARCHITECTURAL SPECIALTIES UNALLOCATED CORPORATE UNALLOCATED CORPORATE For the Three Months Ended September 30, For the Three months Ended March 31, For the Nine Months Ended September 30, For the Three months Ended March 31, 2022 2021 V 2022 2021 V 2022 2021 V 2022 2021 V 2022 2021 V 2022 2021 V Operating Income (Loss), As Reported $71 $69 $2 $3 $5 ($2) ($1) ($1) $ — $200 $201 ($1) $11 $8 $4 ($3) ($4) 2 Add: RIP expense(1) - - - - - - 1 1 - - - - - - - 3 4 (1) Add: Acquisition-related impacts(2) - - - 9 3 6 - - - - - - 19 1 18 - - - Add: Depreciation and Amortization 18 18 - 3 5 (2) - - - 52 53 (1) 11 21 (10) - 1 (1) Adjusted EBITDA $89 $86 $3 $16 $13 $3 $ — $ — $ — $252 $254 ($2) $41 $29 $12 $ — $ — $ — Adjusted EBITDA change versus prior year 3% 20% (1%) 41%

2022 Adjusted Net Sales Reconciliation Represents the impact of acquisition-related deferred revenue adjustments to fair value. For the Three Months Ended September 30, For the Three months Ended March 31, For the Nine Months Ended September 30, 2022 2021 V 2022 2021 V Reported Net Sales $325 $292 $33 $929 $824 $105 Add: Deferred revenue adjustment(1) - - - - 1 (1) Adjusted Net Sales $325 $292 $33 $929 $825 $104

2022 Adjusted EBITDA Guidance Reconciliation RIP credit represents the actuarial net periodic benefit expected to be recorded as a component of other non-operating income. We do not expect to and do not plan to make cash contributions to our RIP based on guidelines established by the Pension Benefit Guaranty Corporation. RIP expense represents only the plan service cost related to the RIP that is recorded within Operating Income. For all periods presented, we were not required to and did not make cash contributions to our RIP. Represents the impact of acquisition-related adjustments for the fair value of acquired inventory and deferred revenue, changes in fair value of contingent consideration, deferred compensation and restricted stock expenses. For the Year Ending December 31, 2022 For the Three months Ended March 31, Low to High Net Income $198 to $203 Add: Interest expense 25 26 (Less): RIP credit(1) (4) (4) Add: Income tax expense 61 63 Operating Income $280 to $288 Add: RIP expense(2) 4 4 Add: Acquisition-related expense(3) 20 21 Add: Depreciation 66 67 Add: Amortization 16 16 Adjusted EBITDA $385 to $395

2022 Adjusted Diluted EPS Guidance Reconciliation Adjusted diluted EPS guidance for 2022 is calculated based on ~46.5 million of diluted shares outstanding. RIP credit represents the actuarial net periodic benefit expected to be recorded as a component of other non-operating income. We do not expect to be required to make, nor do we plan to make cash contributions to our RIP based on guidelines established by the Pension Benefit Guaranty Corporation. RIP expense represents only the plan service cost related to the RIP and is recorded as a component of operating income. We do not expect to be required to make, nor do we plan to make cash contributions to our RIP based on guidelines established by the Pension Benefit Guaranty Corporation. Represents the intangible amortization related to acquired entities, including customer relationships, developed technology, software, trademarks and brand names, non-compete agreements and other intangibles. Represents the impact of acquisition-related adjustments for the fair value of acquired inventory and deferred revenue, changes in fair value of contingent consideration, deferred compensation and restricted stock expenses. Income tax expense is based on an adjusted effective tax rate of ~24%, multiplied by adjusted earnings before income tax. For the Year Ending December 31, 2022 For the Three months Ended March 31, Low Per Diluted Share(1) to High Per Diluted Share(1) Net Income $198 $4.26 to $203 $4.37 Add: Interest expense 25 26 (Less): RIP credit(2) (4) (4) Add: Income tax expense 61 63 Operating Income $280 to $288 Add: RIP expense(3) 4 4 (Less): Interest expense (25) (26) Add: Acquisition-related amortization(4) 8 8 Add: Acquisition-related expenses(5) 20 21 Adjusted earnings before income taxes $287 to $295 (Less): Income tax expense(6) (68) (70) Adjusted Net Income $220 $4.75 to $225 $4.85

2022 Adjusted Free Cash Flow Guidance Reconciliation For the Year Ending December 31, 2022 For the Three months Ended March 31, Low to High Net cash provided by operating activities $190 to $205 Add: Return of investment from joint venture 95 100 Adjusted net cash provided by operating activities $285 to $305 (Less): Capital expenditures (75) (85) Adjusted Free Cash Flow $210 to $220