UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 18, 2022

EQUITY BANCSHARES, INC.

(Exact name of registrant as specified in its charter)

Kansas |

001-37624 |

72-1532188 |

|

(State or other jurisdiction of incorporation or organization) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

|

|

|

|

7701 East Kellogg Drive, Suite 300 Wichita, KS |

|

67207 |

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: 316.612.6000

Former name or former address, if changed since last report: Not Applicable

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class Class A, Common Stock, par value $0.01 per share |

Trading Symbol EQBK |

Name of each exchange on which registered The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging growth company

☐ If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

1

Item 2.02 Results of Operations and Financial Condition.

On October 18, 2022 Equity Bancshares, Inc. (the “Company”) issued a press release announcing its financial results for the third quarter ended September 30, 2022. A copy of the press release is furnished as Exhibit 99.1 and is incorporated by reference herein.

The information in this Item 2.02, including Exhibit 99.1, is being furnished pursuant to Item 2.02 of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, unless specifically identified therein as being incorporated therein by reference.

Item 7.01 Regulation FD Disclosure.

The Company intends to hold an investor call and webcast to discuss its financial results for the third quarter ended September 30, 2022, on Wednesday, October 19, 2022, at 9:00 a.m. Central Time. The Company’s presentation to analysts and investors contains additional information about the Company’s financial results for the third quarter ended September 30, 2022 and is furnished as Exhibit 99.2 and is incorporated by reference herein.

The information in this Item 7.01, including Exhibit 99.2, is being furnished pursuant to Item 7.01 of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act or the Exchange Act, unless specifically identified therein as being incorporated therein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit No. |

|

Description |

99.1 |

|

|

99.2 |

|

|

104 |

|

Cover Page Interactive Data File |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Equity Bancshares, Inc. |

|

|

Date: October 18, 2022 |

By: /s/ Eric R. Newell |

|

Eric R. Newell |

|

Executive Vice President and Chief Financial Officer |

2

Exhibit 99.1

Equity Bancshares, Inc.

PRESS RELEASE – 10/18/2022

Equity Bancshares, Inc. Reports Third Quarter Results, Continued Organic Growth

Company saw 3.5% linked quarter revenue growth led by expanding Net Interest Margin, with a 19.7% reduction in total nonperforming assets

WICHITA, Kansas, October 18, 2022 (GLOBE NEWSWIRE) – Equity Bancshares, Inc. (NASDAQ: EQBK), (“Equity”, “the Company”, “we,” “us,” “our”), the Wichita-based holding company of Equity Bank, reported net income of $15.2 million and $0.93 earnings per diluted share for the quarter ended September 30, 2022.

"In 2022, our Company has realized meaningful, organic growth while emphasizing return to our stockholders via earnings, share buybacks, and an increasing dividend. Annualized growth within our commercial and commercial real estate loan portfolios of 17.13% is a credit to our sales and operational teams,” said Brad S. Elliott, Chairman and CEO, Equity Bancshares, Inc. “We have been diligent in enhancing our sales process, expanding our marketing geography, and hiring exceptional operators which has and will continue to drive our Company’s success.”

“At the end of the quarter, our classified asset ratio is down more than 50% year-to-date and at an all-time low for our Company,” continued Mr. Elliott. “The committed efforts of our sales and credit teams to source and underwrite strong credits while meeting the financing needs of the communities we serve allows our Company to hold true to its mission as a community bank.”

Notable Items:

Financial Results for the Quarter Ended September 30, 2022

Net income allocable to common stockholders was $15.2 million, or $0.93 per diluted share, for the three months ended September 30, 2022, as compared to $15.3 million, or $0.94 per diluted share, for the three months ended June 30, 2022. The decrease for the second quarter of 2022 is primarily driven by income taxes as a true-up of rate was experienced in the second quarter that, as expected, did not repeat. Pre-tax income increased $1.9 million as the Company's net interest income benefitted from increasing interest rates.

Net Interest Income

Net interest income was $41.9 million for the three months ended September 30, 2022, as compared to $39.6 million for the three months ended June 30, 2022, an increase of $2.4 million, or 6.1%. The yield on interest-earning assets increased 44 basis points to 4.18% during the quarter ended September 30, 2022, as compared to 3.74% for the quarter ended June 30, 2022. The cost of interest-bearing deposits increased by 29 basis points during the quarter, moving from 0.28% at June 30, 2022 to 0.57% at September 30, 2022.

Equity Bancshares, Inc.

PRESS RELEASE – 10/18/2022

Provision for Credit Losses

During the three months ended September 30, 2022, there was a net release of $136 thousand compared to a provision to the allowance for credit losses of $824 thousand in the previous quarter. The minimal release of provision for the quarter is the result of having a relatively similar sized loan portfolio and similar realized loss rates; however, the Company continues to estimate the allowance for credit loss with assumptions that anticipate slowing prepayments rates and continued market disruption caused by elevated inflation, supply chain issues and the impact of monetary policy on consumers and businesses. For the three months ended September 30, 2022, we had net charge-offs of $1.6 million as compared to $176 thousand for the three months ended June 30, 2022.

Non-Interest Income

Total non-interest income was $9.0 million for the three months ended September 30, 2022, as compared to $9.6 million for the three months ended June 30, 2022, or a decrease of 6.9%, quarter over quarter. The $600 thousand decrease was primarily due to a decrease in net gain on acquisition and branch sales of $540 thousand.

Non-Interest Expense

Total non-interest expense for the quarter ended September 30, 2022, was $32.2 million as compared to $31.4 million for the quarter ended June 30, 2022. The $800 thousand change was primarily due to an increase in data processing of $496 thousand and an increase in the write-off of tax investments of $423 thousand for the quarter ended September 30, 2022, compared to the quarter ended June 30, 2022.

Asset Quality

As of September 30, 2022, Equity’s allowance for credit losses to total loans decreased to 1.4% as compared to 1.5% at June 30, 2022. Nonperforming assets were $29.7 million as of September, 2022, or 0.6% of total assets, compared to $37.0 million at June 30, 2022, or 0.7% of total assets. Non-accrual loans were $23.1 million at September 30, 2022, as compared to $18.9 million at June 30, 2022. Total classified assets, including loans rated special mention or worse, other real estate owned and other repossessed assets were $63.1 million, or 11.0% of regulatory capital, down from $72.1 million, or 13.1% of regulatory capital as of June 30, 2022.

During the quarter ended September 30, 2022, non-performing assets decreased $7.3 million due to decreases in other repossessed assets of $8.7 million and other real estate owned of $2.5 million, partially offset by increases in non-accrual loans of $4.3 million.

Regulatory Capital

The Company’s ratio of common equity tier 1 capital to risk-weighted assets was 12.1%, the total capital to risk-weighted assets was 16.0% and the total leverage ratio was 9.7% at September 30, 2022. At June 30, 2022, the Company’s common equity tier 1 capital to risk-weighted assets ratio was 12.1%, the total capital to risk-weighted assets ratio was 16.0% and the total leverage ratio was 9.1%.

The Company’s subsidiary, Equity Bank, had a ratio of common equity tier 1 capital to risk-weighted assets of 14.1%, a ratio of total capital to risk-weighted assets of 15.4% and a total leverage ratio of 10.5% at September 30, 2022. At June 30, 2022, Equity Bank’s ratio of common equity tier 1 capital to risk-weighted assets was 13.9%, the ratio of total capital to risk-weighted assets was 15.1% and the total leverage ratio was 9.9%.

Equity Bancshares, Inc.

PRESS RELEASE – 10/18/2022

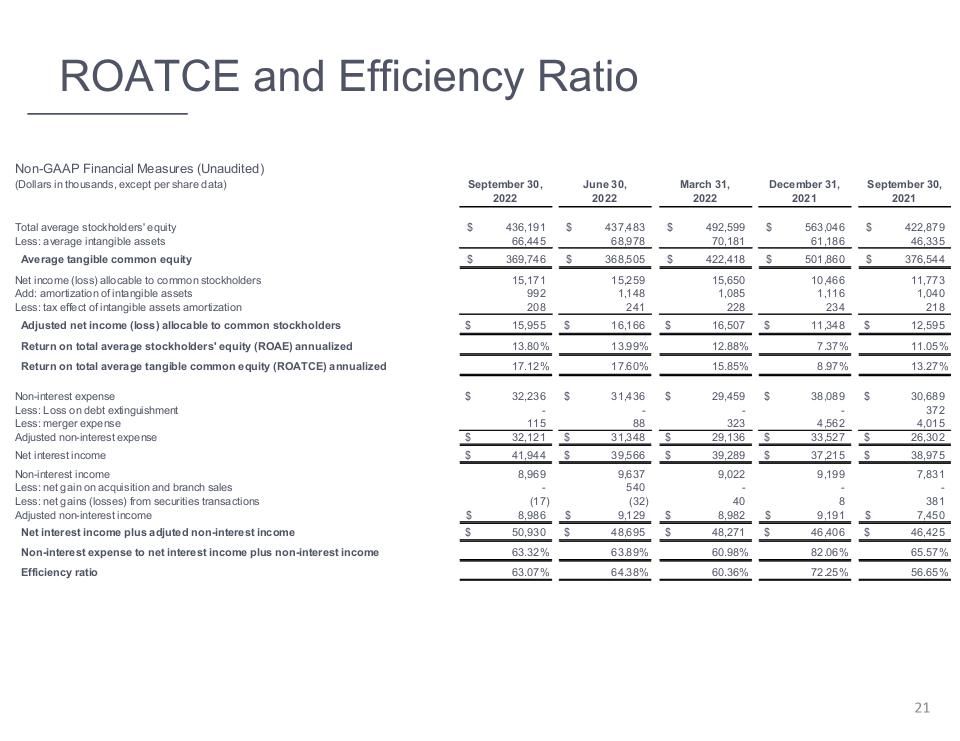

Non-GAAP Financial Measures

In addition to evaluating the Company’s results of operations in accordance with accounting principles generally accepted in the United States of America (“GAAP”), management periodically supplements this evaluation with an analysis of certain non-GAAP financial measures that are intended to provide the reader with additional perspectives on operating results, financial condition and performance trends, while facilitating comparisons with the performance of other financial institutions. Non-GAAP financial measures are not a substitute for GAAP measures, rather, they should be read and used in conjunction with the Company’s GAAP financial information.

The efficiency ratio is a common comparable metric used by banks to understand the expense structure relative to total revenue. In other words, for every dollar of total revenue recognized, how much of that dollar is expended. To improve the comparability of the ratio to our peers, non-core items are excluded. To improve transparency and acknowledging that banks are not consistent in their definition of the efficiency ratio, we include our calculation of this non-GAAP measure.

Return on average assets before income tax provision and provision for loan losses is a measure that the Company uses to understand fundamental operating performance before these expenses. Used as a ratio relative to average assets, we believe it demonstrates “core” performance and can be viewed as an alternative measure of how efficiently the Company services its asset base. Used as a ratio relative to average equity, it can function as an alternative measure of the Company’s earnings performance in relationship to its equity.

Tangible common equity and related measures are non-GAAP financial measures that exclude the impact of intangible assets, net of deferred taxes, and their related amortization. These financial measures are useful for evaluating the performance of a business consistently, whether acquired or developed internally. Return on average tangible common equity is used by management and readers of our financial statements to understand how efficiently the Company is deploying its common equity. Companies that are able to demonstrate more efficient use of common equity are more likely to be viewed favorably by current and prospective investors.

The Company believes that disclosing these non-GAAP financial measures is both useful internally and is expected by our investors and analysts in order to understand the overall performance of the Company. Other companies may calculate and define their non-GAAP financial measures and supplemental data differently. A reconciliation of GAAP financial measures to non-GAAP measures and other performance ratios, as adjusted, are included in Table 6 in the following press release tables.

Conference Call and Webcast

Equity’s Chairman and Chief Executive Officer, Brad Elliott, and Chief Financial Officer, Eric Newell, will hold a conference call and webcast to discuss third quarter results on Wednesday, October 19, 2022 at 10 a.m. eastern time or 9 a.m. central time.

A live webcast of the call will be available on the Company’s website at investor.equitybank.com. To access the call by phone, please go to this registration link, and you will be provided with dial in details. Investors, news media, and other participants are encouraged to dial into the conference call ten minutes ahead of the scheduled start time.

A replay of the call and webcast will be available two hours following the close of the call until October 26, 2022, accessible at investor.equitybank.com.

About Equity Bancshares, Inc.

Equity Bancshares, Inc. is the holding company for Equity Bank, offering a full range of financial solutions, including commercial loans, consumer banking, mortgage loans, trust and wealth management services and treasury management services, while delivering the high-quality, relationship-based customer service of a community bank. Equity’s common stock is traded on the NASDAQ Global Select Market under the symbol “EQBK.” Learn more at www.equitybank.com.

Equity Bancshares, Inc.

PRESS RELEASE – 10/18/2022

Special Note Concerning Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements reflect the current views of Equity’s management with respect to, among other things, future events and Equity’s financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “project,” “forecast,” “goal,” “target,” “would” and “outlook,” or the negative variations of those words or other comparable words of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about Equity’s industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond Equity’s control. Accordingly, Equity cautions you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although Equity believes that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. Factors that could cause actual results to differ materially from Equity’s expectations include COVID-19 related impacts; competition from other financial institutions and bank holding companies; the effects of and changes in trade, monetary and fiscal policies and laws, including interest rate policies of the Federal Reserve Board; changes in the demand for loans; fluctuations in value of collateral and loan reserves; inflation, interest rate, market and monetary fluctuations; changes in consumer spending, borrowing and savings habits; and acquisitions and integration of acquired businesses; and similar variables. The foregoing list of factors is not exhaustive.

For discussion of these and other risks that may cause actual results to differ from expectations, please refer to “Cautionary Note Regarding Forward-Looking Statements” and “Risk Factors” in Equity’s Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 9, 2022, and any updates to those risk factors set forth in Equity’s subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K. If one or more events related to these or other risks or uncertainties materialize, or if Equity’s underlying assumptions prove to be incorrect, actual results may differ materially from what Equity anticipates. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and Equity does not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise, except as required by law. New risks and uncertainties arise from time to time, such as COVID-19, and it is not possible for us to predict those events or how they may affect us. In addition, Equity cannot assess the impact of each factor on Equity’s business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. All forward-looking statements, expressed or implied, included in this press release are expressly qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that Equity or persons acting on Equity’s behalf may issue.

Investor Contact:

Chris Navratil

SVP, Finance

Equity Bancshares, Inc.

(316) 612-6014

cnavratil@equitybank.com

Equity Bancshares, Inc.

PRESS RELEASE – 10/18/2022

Media Contact:

John J. Hanley

SVP, Senior Director of Marketing

Equity Bancshares, Inc.

(913) 583-8004

jhanley@equitybank.com

Unaudited Financial Tables

Equity Bancshares, Inc.

PRESS RELEASE – 10/18/2022

CONSOLIDATED STATEMENTS OF INCOME (Unaudited)

(Dollars in thousands, except per share data)

|

|

Three months ended |

|

|

Nine months ended |

|

||||||||||

|

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

||||

Interest and dividend income |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Loans, including fees |

|

$ |

41,555 |

|

|

$ |

37,581 |

|

|

$ |

114,710 |

|

|

$ |

102,392 |

|

Securities, taxable |

|

|

5,792 |

|

|

|

3,920 |

|

|

|

16,767 |

|

|

|

11,242 |

|

Securities, nontaxable |

|

|

687 |

|

|

|

655 |

|

|

|

2,020 |

|

|

|

2,096 |

|

Federal funds sold and other |

|

|

514 |

|

|

|

290 |

|

|

|

1,327 |

|

|

|

846 |

|

Total interest and dividend income |

|

|

48,548 |

|

|

|

42,446 |

|

|

|

134,824 |

|

|

|

116,576 |

|

Interest expense |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Deposits |

|

|

4,403 |

|

|

|

1,881 |

|

|

|

8,308 |

|

|

|

6,316 |

|

Federal funds purchased and retail repurchase agreements |

|

|

71 |

|

|

|

24 |

|

|

|

150 |

|

|

|

72 |

|

Federal Home Loan Bank advances |

|

|

409 |

|

|

|

10 |

|

|

|

594 |

|

|

|

155 |

|

Subordinated debt |

|

|

1,721 |

|

|

|

1,556 |

|

|

|

4,973 |

|

|

|

4,669 |

|

Total interest expense |

|

|

6,604 |

|

|

|

3,471 |

|

|

|

14,025 |

|

|

|

11,212 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Net interest income |

|

|

41,944 |

|

|

|

38,975 |

|

|

|

120,799 |

|

|

|

105,364 |

|

Provision (reversal) for credit losses |

|

|

(136 |

) |

|

|

1,058 |

|

|

|

276 |

|

|

|

(6,355 |

) |

Net interest income after provision (reversal) for credit losses |

|

|

42,080 |

|

|

|

37,917 |

|

|

|

120,523 |

|

|

|

111,719 |

|

Non-interest income |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Service charges and fees |

|

|

2,788 |

|

|

|

2,360 |

|

|

|

7,927 |

|

|

|

6,125 |

|

Debit card income |

|

|

2,682 |

|

|

|

2,574 |

|

|

|

8,120 |

|

|

|

7,603 |

|

Mortgage banking |

|

|

310 |

|

|

|

801 |

|

|

|

1,300 |

|

|

|

2,584 |

|

Increase in value of bank-owned life insurance |

|

|

754 |

|

|

|

1,169 |

|

|

|

2,355 |

|

|

|

2,446 |

|

Net gain on acquisition and branch sales |

|

|

— |

|

|

|

— |

|

|

|

540 |

|

|

|

585 |

|

Net gains (losses) from securities transactions |

|

|

(17 |

) |

|

|

381 |

|

|

|

(9 |

) |

|

|

398 |

|

Other |

|

|

2,452 |

|

|

|

546 |

|

|

|

7,395 |

|

|

|

3,902 |

|

Total non-interest income |

|

|

8,969 |

|

|

|

7,831 |

|

|

|

27,628 |

|

|

|

23,643 |

|

Non-interest expense |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Salaries and employee benefits |

|

|

15,442 |

|

|

|

13,588 |

|

|

|

45,893 |

|

|

|

39,079 |

|

Net occupancy and equipment |

|

|

3,127 |

|

|

|

2,475 |

|

|

|

9,304 |

|

|

|

7,170 |

|

Data processing |

|

|

4,138 |

|

|

|

3,257 |

|

|

|

11,549 |

|

|

|

9,394 |

|

Professional fees |

|

|

1,265 |

|

|

|

1,076 |

|

|

|

3,547 |

|

|

|

3,148 |

|

Advertising and business development |

|

|

1,191 |

|

|

|

760 |

|

|

|

3,139 |

|

|

|

2,241 |

|

Telecommunications |

|

|

487 |

|

|

|

439 |

|

|

|

1,399 |

|

|

|

1,531 |

|

FDIC insurance |

|

|

340 |

|

|

|

465 |

|

|

|

780 |

|

|

|

1,305 |

|

Courier and postage |

|

|

436 |

|

|

|

344 |

|

|

|

1,348 |

|

|

|

1,040 |

|

Free nationwide ATM cost |

|

|

551 |

|

|

|

519 |

|

|

|

1,593 |

|

|

|

1,504 |

|

Amortization of core deposit intangibles |

|

|

957 |

|

|

|

1,030 |

|

|

|

3,118 |

|

|

|

3,094 |

|

Loan expense |

|

|

174 |

|

|

|

207 |

|

|

|

566 |

|

|

|

626 |

|

Other real estate owned |

|

|

188 |

|

|

|

(342 |

) |

|

|

201 |

|

|

|

(805 |

) |

Loss on debt extinguishment |

|

|

— |

|

|

|

372 |

|

|

|

— |

|

|

|

372 |

|

Merger expenses |

|

|

115 |

|

|

|

4,015 |

|

|

|

526 |

|

|

|

4,627 |

|

Other |

|

|

3,825 |

|

|

|

2,484 |

|

|

|

10,168 |

|

|

|

7,050 |

|

Total non-interest expense |

|

|

32,236 |

|

|

|

30,689 |

|

|

|

93,131 |

|

|

|

81,376 |

|

Income (loss) before income tax |

|

|

18,813 |

|

|

|

15,059 |

|

|

|

55,020 |

|

|

|

53,986 |

|

Provision for income taxes |

|

|

3,642 |

|

|

|

3,286 |

|

|

|

8,940 |

|

|

|

11,972 |

|

Net income (loss) and net income (loss) allocable to common stockholders |

|

$ |

15,171 |

|

|

$ |

11,773 |

|

|

$ |

46,080 |

|

|

$ |

42,014 |

|

Basic earnings (loss) per share |

|

$ |

0.94 |

|

|

$ |

0.82 |

|

|

$ |

2.83 |

|

|

$ |

2.92 |

|

Diluted earnings (loss) per share |

|

$ |

0.93 |

|

|

$ |

0.80 |

|

|

$ |

2.79 |

|

|

$ |

2.86 |

|

Weighted average common shares |

|

|

16,056,658 |

|

|

|

14,384,302 |

|

|

|

16,303,586 |

|

|

|

14,397,146 |

|

Weighted average diluted common shares |

|

|

16,273,231 |

|

|

|

14,669,312 |

|

|

|

16,516,787 |

|

|

|

14,688,092 |

|

Equity Bancshares, Inc.

PRESS RELEASE – 10/18/2022

TABLE 2. QUARTERLY CONSOLIDATED STATEMENTS OF INCOME (Unaudited)

(Dollars in thousands, except per share data)

|

|

As of and for the three months ended |

|

|||||||||||||||||

|

|

September 30, |

|

|

June 30, |

|

|

March 31, |

|

|

December 31, |

|

|

September 30, |

|

|||||

Interest and dividend income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Loans, including fees |

|

$ |

41,555 |

|

|

$ |

36,849 |

|

|

$ |

36,306 |

|

|

$ |

34,942 |

|

|

$ |

37,581 |

|

Securities, taxable |

|

|

5,792 |

|

|

|

5,584 |

|

|

|

5,391 |

|

|

|

4,754 |

|

|

|

3,920 |

|

Securities, nontaxable |

|

|

687 |

|

|

|

678 |

|

|

|

655 |

|

|

|

747 |

|

|

|

655 |

|

Federal funds sold and other |

|

|

514 |

|

|

|

513 |

|

|

|

300 |

|

|

|

349 |

|

|

|

290 |

|

Total interest and dividend income |

|

|

48,548 |

|

|

|

43,624 |

|

|

|

42,652 |

|

|

|

40,792 |

|

|

|

42,446 |

|

Interest expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Deposits |

|

|

4,403 |

|

|

|

2,183 |

|

|

|

1,722 |

|

|

|

1,939 |

|

|

|

1,881 |

|

Federal funds purchased and retail repurchase agreements |

|

|

71 |

|

|

|

46 |

|

|

|

33 |

|

|

|

32 |

|

|

|

24 |

|

Federal Home Loan Bank advances |

|

|

409 |

|

|

|

176 |

|

|

|

9 |

|

|

|

14 |

|

|

|

10 |

|

Subordinated debt |

|

|

1,721 |

|

|

|

1,653 |

|

|

|

1,599 |

|

|

|

1,592 |

|

|

|

1,556 |

|

Total interest expense |

|

|

6,604 |

|

|

|

4,058 |

|

|

|

3,363 |

|

|

|

3,577 |

|

|

|

3,471 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Net interest income |

|

|

41,944 |

|

|

|

39,566 |

|

|

|

39,289 |

|

|

|

37,215 |

|

|

|

38,975 |

|

Provision (reversal) for credit losses |

|

|

(136 |

) |

|

|

824 |

|

|

|

(412 |

) |

|

|

(2,125 |

) |

|

|

1,058 |

|

Net interest income after provision (reversal) for credit losses |

|

|

42,080 |

|

|

|

38,742 |

|

|

|

39,701 |

|

|

|

39,340 |

|

|

|

37,917 |

|

Non-interest income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Service charges and fees |

|

|

2,788 |

|

|

|

2,617 |

|

|

|

2,522 |

|

|

|

2,471 |

|

|

|

2,360 |

|

Debit card income |

|

|

2,682 |

|

|

|

2,810 |

|

|

|

2,628 |

|

|

|

2,633 |

|

|

|

2,574 |

|

Mortgage banking |

|

|

310 |

|

|

|

428 |

|

|

|

562 |

|

|

|

722 |

|

|

|

801 |

|

Increase in value of bank-owned life insurance |

|

|

754 |

|

|

|

736 |

|

|

|

865 |

|

|

|

1,060 |

|

|

|

1,169 |

|

Net gain on acquisition and branch sales |

|

|

— |

|

|

|

540 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Net gains (losses) from securities transactions |

|

|

(17 |

) |

|

|

(32 |

) |

|

|

40 |

|

|

|

8 |

|

|

|

381 |

|

Other |

|

|

2,452 |

|

|

|

2,538 |

|

|

|

2,405 |

|

|

|

2,305 |

|

|

|

546 |

|

Total non-interest income |

|

|

8,969 |

|

|

|

9,637 |

|

|

|

9,022 |

|

|

|

9,199 |

|

|

|

7,831 |

|

Non-interest expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Salaries and employee benefits |

|

|

15,442 |

|

|

|

15,383 |

|

|

|

15,068 |

|

|

|

15,119 |

|

|

|

13,588 |

|

Net occupancy and equipment |

|

|

3,127 |

|

|

|

3,007 |

|

|

|

3,170 |

|

|

|

2,967 |

|

|

|

2,475 |

|

Data processing |

|

|

4,138 |

|

|

|

3,642 |

|

|

|

3,769 |

|

|

|

3,867 |

|

|

|

3,257 |

|

Professional fees |

|

|

1,265 |

|

|

|

1,111 |

|

|

|

1,171 |

|

|

|

1,565 |

|

|

|

1,076 |

|

Advertising and business development |

|

|

1,191 |

|

|

|

972 |

|

|

|

976 |

|

|

|

1,129 |

|

|

|

760 |

|

Telecommunications |

|

|

487 |

|

|

|

442 |

|

|

|

470 |

|

|

|

435 |

|

|

|

439 |

|

FDIC insurance |

|

|

340 |

|

|

|

260 |

|

|

|

180 |

|

|

|

360 |

|

|

|

465 |

|

Courier and postage |

|

|

436 |

|

|

|

489 |

|

|

|

423 |

|

|

|

389 |

|

|

|

344 |

|

Free nationwide ATM cost |

|

|

551 |

|

|

|

541 |

|

|

|

501 |

|

|

|

515 |

|

|

|

519 |

|

Amortization of core deposit intangibles |

|

|

957 |

|

|

|

1,111 |

|

|

|

1,050 |

|

|

|

1,080 |

|

|

|

1,030 |

|

Loan expense |

|

|

174 |

|

|

|

207 |

|

|

|

185 |

|

|

|

308 |

|

|

|

207 |

|

Other real estate owned |

|

|

188 |

|

|

|

14 |

|

|

|

(1 |

) |

|

|

617 |

|

|

|

(342 |

) |

Loss on debt extinguishment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

372 |

|

Merger expenses |

|

|

115 |

|

|

|

88 |

|

|

|

323 |

|

|

|

4,562 |

|

|

|

4,015 |

|

Other |

|

|

3,825 |

|

|

|

4,169 |

|

|

|

2,174 |

|

|

|

5,176 |

|

|

|

2,484 |

|

Total non-interest expense |

|

|

32,236 |

|

|

|

31,436 |

|

|

|

29,459 |

|

|

|

38,089 |

|

|

|

30,689 |

|

Income (loss) before income tax |

|

|

18,813 |

|

|

|

16,943 |

|

|

|

19,264 |

|

|

|

10,450 |

|

|

|

15,059 |

|

Provision for income taxes (benefit) |

|

|

3,642 |

|

|

|

1,684 |

|

|

|

3,614 |

|

|

|

(16 |

) |

|

|

3,286 |

|

Net income (loss) and net income (loss) allocable to common stockholders |

|

$ |

15,171 |

|

|

$ |

15,259 |

|

|

$ |

15,650 |

|

|

$ |

10,466 |

|

|

$ |

11,773 |

|

Basic earnings (loss) per share |

|

$ |

0.94 |

|

|

$ |

0.95 |

|

|

$ |

0.94 |

|

|

$ |

0.62 |

|

|

$ |

0.82 |

|

Diluted earnings (loss) per share |

|

$ |

0.93 |

|

|

$ |

0.94 |

|

|

$ |

0.93 |

|

|

$ |

0.61 |

|

|

$ |

0.80 |

|

Weighted average common shares |

|

|

16,056,658 |

|

|

|

16,206,978 |

|

|

|

16,652,556 |

|

|

|

16,865,167 |

|

|

|

14,384,302 |

|

Weighted average diluted common shares |

|

|

16,273,231 |

|

|

|

16,413,248 |

|

|

|

16,869,152 |

|

|

|

17,141,174 |

|

|

|

14,669,312 |

|

Equity Bancshares, Inc.

PRESS RELEASE – 10/18/2022

TABLE 3. CONSOLIDATED BALANCE SHEETS (Unaudited)

(Dollars in thousands)

|

|

September 30, |

|

|

June 30, |

|

|

March 31, |

|

|

December 31, |

|

|

September 30, |

|

|||||

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Cash and due from banks |

|

$ |

155,039 |

|

|

$ |

103,126 |

|

|

$ |

89,764 |

|

|

$ |

259,131 |

|

|

$ |

141,645 |

|

Federal funds sold |

|

|

374 |

|

|

|

458 |

|

|

|

286 |

|

|

|

823 |

|

|

|

673 |

|

Cash and cash equivalents |

|

|

155,413 |

|

|

|

103,584 |

|

|

|

90,050 |

|

|

|

259,954 |

|

|

|

142,318 |

|

Available-for-sale securities |

|

|

1,198,962 |

|

|

|

1,288,180 |

|

|

|

1,352,894 |

|

|

|

1,327,442 |

|

|

|

1,157,423 |

|

Loans held for sale |

|

|

1,518 |

|

|

|

1,714 |

|

|

|

1,575 |

|

|

|

4,214 |

|

|

|

4,108 |

|

Loans, net of allowance for credit losses(1) |

|

|

3,208,524 |

|

|

|

3,175,208 |

|

|

|

3,194,987 |

|

|

|

3,107,262 |

|

|

|

2,633,148 |

|

Other real estate owned, net |

|

|

10,412 |

|

|

|

12,969 |

|

|

|

9,897 |

|

|

|

9,523 |

|

|

|

10,267 |

|

Premises and equipment, net |

|

|

100,566 |

|

|

|

101,212 |

|

|

|

103,168 |

|

|

|

104,038 |

|

|

|

90,727 |

|

Bank-owned life insurance |

|

|

122,418 |

|

|

|

121,665 |

|

|

|

120,928 |

|

|

|

120,787 |

|

|

|

103,431 |

|

Federal Reserve Bank and Federal Home Loan Bank stock |

|

|

24,428 |

|

|

|

21,479 |

|

|

|

19,890 |

|

|

|

17,510 |

|

|

|

14,540 |

|

Interest receivable |

|

|

18,497 |

|

|

|

16,519 |

|

|

|

16,923 |

|

|

|

18,048 |

|

|

|

15,519 |

|

Goodwill |

|

|

53,101 |

|

|

|

53,101 |

|

|

|

54,465 |

|

|

|

54,465 |

|

|

|

31,601 |

|

Core deposit intangibles, net |

|

|

11,598 |

|

|

|

12,554 |

|

|

|

13,830 |

|

|

|

14,879 |

|

|

|

12,963 |

|

Other |

|

|

94,978 |

|

|

|

93,971 |

|

|

|

100,016 |

|

|

|

99,509 |

|

|

|

47,223 |

|

Total assets |

|

$ |

5,000,415 |

|

|

$ |

5,002,156 |

|

|

$ |

5,078,623 |

|

|

$ |

5,137,631 |

|

|

$ |

4,263,268 |

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Deposits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Demand |

|

$ |

1,217,094 |

|

|

$ |

1,194,863 |

|

|

$ |

1,255,793 |

|

|

$ |

1,244,117 |

|

|

$ |

984,436 |

|

Total non-interest-bearing deposits |

|

|

1,217,094 |

|

|

|

1,194,863 |

|

|

|

1,255,793 |

|

|

|

1,244,117 |

|

|

|

984,436 |

|

Demand, savings and money market |

|

|

2,335,847 |

|

|

|

2,445,545 |

|

|

|

2,511,478 |

|

|

|

2,522,289 |

|

|

|

2,092,849 |

|

Time |

|

|

673,670 |

|

|

|

651,363 |

|

|

|

612,399 |

|

|

|

653,598 |

|

|

|

585,492 |

|

Total interest-bearing deposits |

|

|

3,009,517 |

|

|

|

3,096,908 |

|

|

|

3,123,877 |

|

|

|

3,175,887 |

|

|

|

2,678,341 |

|

Total deposits |

|

|

4,226,611 |

|

|

|

4,291,771 |

|

|

|

4,379,670 |

|

|

|

4,420,004 |

|

|

|

3,662,777 |

|

Federal funds purchased and retail repurchase agreements |

|

|

47,443 |

|

|

|

52,750 |

|

|

|

48,199 |

|

|

|

56,006 |

|

|

|

39,137 |

|

Federal Home Loan Bank advances |

|

|

186,001 |

|

|

|

80,000 |

|

|

|

50,000 |

|

|

|

— |

|

|

|

— |

|

Subordinated debt |

|

|

96,263 |

|

|

|

96,135 |

|

|

|

96,010 |

|

|

|

95,885 |

|

|

|

88,030 |

|

Contractual obligations |

|

|

15,562 |

|

|

|

15,813 |

|

|

|

17,307 |

|

|

|

17,692 |

|

|

|

18,771 |

|

Interest payable and other liabilities |

|

|

32,729 |

|

|

|

37,572 |

|

|

|

35,422 |

|

|

|

47,413 |

|

|

|

36,804 |

|

Total liabilities |

|

|

4,604,609 |

|

|

|

4,574,041 |

|

|

|

4,626,608 |

|

|

|

4,637,000 |

|

|

|

3,845,519 |

|

Commitments and contingent liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Stockholders’ equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Common stock |

|

|

204 |

|

|

|

204 |

|

|

|

204 |

|

|

|

203 |

|

|

|

178 |

|

Additional paid-in capital |

|

|

482,668 |

|

|

|

480,897 |

|

|

|

480,106 |

|

|

|

478,862 |

|

|

|

392,321 |

|

Retained earnings |

|

|

130,114 |

|

|

|

116,576 |

|

|

|

102,632 |

|

|

|

88,324 |

|

|

|

79,226 |

|

Accumulated other comprehensive income (loss), net of tax |

|

|

(120,918 |

) |

|

|

(77,426 |

) |

|

|

(50,012 |

) |

|

|

1,776 |

|

|

|

9,475 |

|

Treasury stock |

|

|

(96,262 |

) |

|

|

(92,136 |

) |

|

|

(80,915 |

) |

|

|

(68,534 |

) |

|

|

(63,451 |

) |

Total stockholders’ equity |

|

|

395,806 |

|

|

|

428,115 |

|

|

|

452,015 |

|

|

|

500,631 |

|

|

|

417,749 |

|

Total liabilities and stockholders’ equity |

|

$ |

5,000,415 |

|

|

$ |

5,002,156 |

|

|

$ |

5,078,623 |

|

|

$ |

5,137,631 |

|

|

$ |

4,263,268 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

(1) Allowance for credit losses |

|

$ |

46,499 |

|

|

$ |

48,238 |

|

|

$ |

47,590 |

|

|

$ |

48,365 |

|

|

$ |

52,763 |

|

Equity Bancshares, Inc.

PRESS RELEASE – 10/18/2022

TABLE 4. SELECTED FINANCIAL HIGHLIGHTS (Unaudited)

(Dollars in thousands, except per share data)

|

|

As of and for the three months ended |

|

|||||||||||||||||

|

|

September 30, |

|

|

June 30, |

|

|

March 31, |

|

|

December 31, |

|

|

September 30, |

|

|||||

|

|

2022 |

|

|

2022 |

|

|

2022 |

|

|

2021 |

|

|

2021 |

|

|||||

Loans Held For Investment by Type |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Commercial real estate |

|

$ |

1,655,646 |

|

|

$ |

1,643,068 |

|

|

$ |

1,552,134 |

|

|

$ |

1,486,148 |

|

|

$ |

1,308,707 |

|

Commercial and industrial |

|

|

607,722 |

|

|

|

578,899 |

|

|

|

629,181 |

|

|

|

567,497 |

|

|

|

569,513 |

|

Residential real estate |

|

|

573,431 |

|

|

|

578,936 |

|

|

|

613,928 |

|

|

|

638,087 |

|

|

|

490,633 |

|

Agricultural real estate |

|

|

200,415 |

|

|

|

197,938 |

|

|

|

198,844 |

|

|

|

198,330 |

|

|

|

138,793 |

|

Agricultural |

|

|

115,048 |

|

|

|

124,753 |

|

|

|

150,077 |

|

|

|

166,975 |

|

|

|

93,767 |

|

Consumer |

|

|

102,761 |

|

|

|

99,852 |

|

|

|

98,413 |

|

|

|

98,590 |

|

|

|

84,498 |

|

Total loans held-for-investment |

|

|

3,255,023 |

|

|

|

3,223,446 |

|

|

|

3,242,577 |

|

|

|

3,155,627 |

|

|

|

2,685,911 |

|

Allowance for credit losses |

|

|

(46,499 |

) |

|

|

(48,238 |

) |

|

|

(47,590 |

) |

|

|

(48,365 |

) |

|

|

(52,763 |

) |

Net loans held for investment |

|

$ |

3,208,524 |

|

|

$ |

3,175,208 |

|

|

$ |

3,194,987 |

|

|

$ |

3,107,262 |

|

|

$ |

2,633,148 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Asset Quality Ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Allowance for credit losses on loans to total loans |

|

|

1.43 |

% |

|

|

1.50 |

% |

|

|

1.47 |

% |

|

|

1.53 |

% |

|

|

1.96 |

% |

Past due or nonaccrual loans to total loans |

|

|

0.94 |

% |

|

|

0.78 |

% |

|

|

0.82 |

% |

|

|

1.18 |

% |

|

|

2.78 |

% |

Nonperforming assets to total assets |

|

|

0.59 |

% |

|

|

0.74 |

% |

|

|

0.74 |

% |

|

|

1.28 |

% |

|

|

1.74 |

% |

Nonperforming assets to total loans plus other |

|

|

0.91 |

% |

|

|

1.14 |

% |

|

|

1.15 |

% |

|

|

2.07 |

% |

|

|

2.76 |

% |

Classified assets to bank total regulatory capital |

|

|

11.03 |

% |

|

|

13.08 |

% |

|

|

17.12 |

% |

|

|

25.34 |

% |

|

|

24.25 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Selected Average Balance Sheet Data (QTD Average) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Investment securities |

|

$ |

1,272,414 |

|

|

$ |

1,319,099 |

|

|

$ |

1,397,421 |

|

|

$ |

1,330,267 |

|

|

$ |

1,061,178 |

|

Total gross loans receivable |

|

|

3,240,998 |

|

|

|

3,216,853 |

|

|

|

3,195,787 |

|

|

|

3,181,279 |

|

|

|

2,748,202 |

|

Interest-earning assets |

|

|

4,602,568 |

|

|

|

4,675,967 |

|

|

|

4,715,389 |

|

|

|

4,713,817 |

|

|

|

4,005,509 |

|

Total assets |

|

|

4,988,755 |

|

|

|

5,067,686 |

|

|

|

5,108,120 |

|

|

|

5,068,278 |

|

|

|

4,275,298 |

|

Interest-bearing deposits |

|

|

3,081,245 |

|

|

|

3,112,300 |

|

|

|

3,163,777 |

|

|

|

3,101,657 |

|

|

|

2,702,040 |

|

Borrowings |

|

|

221,514 |

|

|

|

238,062 |

|

|

|

160,094 |

|

|

|

165,941 |

|

|

|

132,581 |

|

Total interest-bearing liabilities |

|

|

3,302,759 |

|

|

|

3,350,362 |

|

|

|

3,323,871 |

|

|

|

3,267,598 |

|

|

|

2,834,621 |

|

Total deposits |

|

|

4,283,855 |

|

|

|

4,340,196 |

|

|

|

4,393,879 |

|

|

|

4,342,732 |

|

|

|

3,686,169 |

|

Total liabilities |

|

|

4,552,564 |

|

|

|

4,630,204 |

|

|

|

4,615,521 |

|

|

|

4,505,232 |

|

|

|

3,852,419 |

|

Total stockholders' equity |

|

|

436,191 |

|

|

|

437,483 |

|

|

|

492,599 |

|

|

|

563,046 |

|

|

|

422,879 |

|

Tangible common equity* |

|

|

369,746 |

|

|

|

368,505 |

|

|

|

422,418 |

|

|

|

501,860 |

|

|

|

376,544 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Performance ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Return on average assets (ROAA) annualized |

|

|

1.21 |

% |

|

|

1.21 |

% |

|

|

1.24 |

% |

|

|

0.82 |

% |

|

|

1.09 |

% |

Return on average assets before income tax and |

|

|

1.49 |

% |

|

|

1.41 |

% |

|

|

1.50 |

% |

|

|

0.65 |

% |

|

|

1.50 |

% |

Return on average equity (ROAE) annualized |

|

|

13.80 |

% |

|

|

13.99 |

% |

|

|

12.88 |

% |

|

|

7.37 |

% |

|

|

11.05 |

% |

Return on average equity before income tax and |

|

|

16.99 |

% |

|

|

16.29 |

% |

|

|

15.52 |

% |

|

|

5.87 |

% |

|

|

15.12 |

% |

Return on average tangible common equity |

|

|

17.12 |

% |

|

|

17.60 |

% |

|

|

15.85 |

% |

|

|

8.97 |

% |

|

|

13.27 |

% |

Yield on loans annualized |

|

|

5.09 |

% |

|

|

4.59 |

% |

|

|

4.61 |

% |

|

|

4.36 |

% |

|

|

5.43 |

% |

Cost of interest-bearing deposits annualized |

|

|

0.57 |

% |

|

|

0.28 |

% |

|

|

0.22 |

% |

|

|

0.25 |

% |

|

|

0.28 |

% |

Cost of total deposits annualized |

|

|

0.41 |

% |

|

|

0.20 |

% |

|

|

0.16 |

% |

|

|

0.18 |

% |

|

|

0.20 |

% |

Net interest margin annualized |

|

|

3.62 |

% |

|

|

3.39 |

% |

|

|

3.38 |

% |

|

|

3.13 |

% |

|

|

3.86 |

% |

Efficiency ratio* |

|

|

63.07 |

% |

|

|

64.38 |

% |

|

|

60.36 |

% |

|

|

72.25 |

% |

|

|

56.65 |

% |

Non-interest income / average assets |

|

|

0.71 |

% |

|

|

0.76 |

% |

|

|

0.72 |

% |

|

|

0.72 |

% |

|

|

0.73 |

% |

Non-interest expense / average assets |

|

|

2.56 |

% |

|

|

2.49 |

% |

|

|

2.34 |

% |

|

|

2.98 |

% |

|

|

2.85 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Capital Ratios |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Tier 1 Leverage Ratio |

|

|

9.46 |

% |

|

|

9.11 |

% |

|

|

9.07 |

% |

|

|

9.09 |

% |

|

|

9.02 |

% |

Common Equity Tier 1 Capital Ratio |

|

|

12.15 |

% |

|

|

12.08 |

% |

|

|

11.81 |

% |

|

|

12.03 |

% |

|

|

12.39 |

% |

Tier 1 Risk Based Capital Ratio |

|

|

12.77 |

% |

|

|

12.71 |

% |

|

|

12.43 |

% |

|

|

12.67 |

% |

|

|

12.90 |

% |

Equity Bancshares, Inc.

PRESS RELEASE – 10/18/2022

Total Risk Based Capital Ratio |

|

|

15.99 |

% |

|

|

15.97 |

% |

|

|

15.66 |

% |

|

|

15.96 |

% |

|

|

16.63 |

% |

Total stockholders' equity to total assets |

|

|

7.92 |

% |

|

|

8.56 |

% |

|

|

8.90 |

% |

|

|

9.74 |

% |

|

|

9.80 |

% |

Tangible common equity to tangible assets* |

|

|

6.68 |

% |

|

|

7.32 |

% |

|

|

7.63 |

% |

|

|

8.48 |

% |

|

|

8.82 |

% |

Dividend payout ratio |

|

|

10.78 |

% |

|

|

8.61 |

% |

|

|

8.58 |

% |

|

|

13.05 |

% |

|

|

9.96 |

% |

Book value per common share |

|

$ |

24.71 |

|

|

$ |

26.58 |

|

|

$ |

27.47 |

|

|

$ |

29.87 |

|

|

$ |

29.08 |

|

Tangible book value per common share* |

|

$ |

20.59 |

|

|

$ |

22.42 |

|

|

$ |

23.24 |

|

|

$ |

25.65 |

|

|

$ |

25.90 |

|

Tangible book value per diluted common share* |

|

$ |

20.33 |

|

|

$ |

22.17 |

|

|

$ |

22.95 |

|

|

$ |

25.22 |

|

|

$ |

25.42 |

|

Equity Bancshares, Inc.

PRESS RELEASE – 10/18/2022

TABLE 5. YEAR-TO-DATE NET INTEREST INCOME ANALYSIS (Unaudited)

(Dollars in thousands)

|

For the nine months ended |

|

|

For the nine months ended |

|

||||||||||||||||||

|

September 30, 2022 |

|

|

September 30, 2021 |

|

||||||||||||||||||

|

Average Outstanding Balance |

|

|

Interest Income/ Expense |

|

|

Average |

|

|

Average Outstanding Balance |

|

|

Interest Income/ Expense |

|

|

Average |

|

||||||

Interest-earning assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Loans (1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Commercial and industrial |

$ |

579,610 |

|

|

$ |

22,994 |

|

|

|

5.30 |

% |

|

$ |

752,795 |

|

|

$ |

34,609 |

|

|

|

6.15 |

% |

Commercial real estate |

|

1,236,282 |

|

|

|

45,995 |

|

|

|

4.97 |

% |

|

|

990,803 |

|

|

|

34,943 |

|

|

|

4.72 |

% |

Real estate construction |

|

362,543 |

|

|

|

12,443 |

|

|

|

4.59 |

% |

|

|

264,344 |

|

|

|

7,195 |

|

|

|

3.64 |

% |

Residential real estate |

|

604,218 |

|

|

|

16,336 |

|

|

|

3.61 |

% |

|

|

457,761 |

|

|

|

14,167 |

|

|

|

4.14 |

% |

Agricultural real estate |

|

201,566 |

|

|

|

8,046 |

|

|

|

5.34 |

% |

|

|

135,795 |

|

|

|

5,203 |

|

|

|

5.12 |

% |

Agricultural |

|

132,485 |

|

|

|

5,254 |

|

|

|

5.30 |

% |

|

|

93,680 |

|

|

|

3,432 |

|

|

|

4.90 |

% |

Consumer |

|

101,341 |

|

|

|

3,642 |

|

|

|

4.80 |

% |

|

|

84,285 |

|

|

|

2,843 |

|

|

|

4.51 |

% |

Total loans |

|

3,218,045 |

|

|

|

114,710 |

|

|

|

4.77 |

% |

|

|

2,779,463 |

|

|

|

102,392 |

|

|

|

4.93 |

% |

Securities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Taxable securities |

|

1,220,045 |

|

|

|

16,767 |

|

|

|

1.84 |

% |

|

|

898,461 |

|

|

|

11,242 |

|

|

|

1.67 |

% |

Nontaxable securities |

|

109,142 |

|

|

|

2,020 |

|

|

|

2.47 |

% |

|

|

100,495 |

|

|

|

2,096 |

|

|

|

2.79 |

% |

Total securities |

|

1,329,187 |

|

|

|

18,787 |

|

|

|

1.89 |

% |

|

|

998,956 |

|

|

|

13,338 |

|

|

|

1.79 |

% |

Federal funds sold and other |

|

116,997 |

|

|

|

1,327 |

|

|

|

1.52 |

% |

|

|

175,761 |

|

|

|

846 |

|

|

|

0.64 |

% |

Total interest-earning assets |

$ |

4,664,229 |

|

|

|

134,824 |

|

|

|

3.86 |

% |

|

$ |

3,954,180 |

|

|

|

116,576 |

|

|

|

3.94 |

% |

Interest-bearing liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Demand savings and money market deposits |

$ |

2,480,113 |

|

|

|

5,461 |

|

|

|

0.29 |

% |

|

$ |

2,076,643 |

|

|

|

2,728 |

|

|

|

0.18 |

% |

Time deposits |

|

638,692 |

|

|

|

2,847 |

|

|

|

0.60 |

% |

|

|

606,151 |

|

|

|

3,588 |

|

|

|

0.79 |

% |

Total interest-bearing deposits |

|

3,118,805 |

|

|

|

8,308 |

|

|

|

0.36 |

% |

|

|

2,682,794 |

|

|

|

6,316 |

|

|

|

0.31 |

% |

FHLB advances |

|

54,100 |

|

|

|

594 |

|

|

|

1.47 |

% |

|

|

16,325 |

|

|

|

155 |

|

|

|

1.27 |

% |

Other borrowings |

|

152,682 |

|

|

|

5,123 |

|

|

|

4.49 |

% |

|

|

131,516 |

|

|

|

4,741 |

|

|

|

4.82 |

% |

Total interest-bearing liabilities |

$ |

3,325,587 |

|

|

|

14,025 |

|

|

|

0.56 |

% |

|

$ |

2,830,635 |

|

|

|

11,212 |

|

|

|

0.53 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Net interest income |

|

|

|

$ |

120,799 |

|

|

|

|

|

|

|

|

$ |

105,364 |

|

|

|

|

||||

Interest rate spread |

|

|

|

|

|

|

|

3.30 |

% |

|

|

|

|

|

|

|

|

3.41 |

% |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Net interest margin (2) |

|

|

|

|

|

|

|

3.46 |

% |

|

|

|

|

|

|

|

|

3.56 |

% |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

(1) Average loan balances include nonaccrual loans. |

|

||||||||||||||||||||||

(2) Net interest margin is calculated by dividing annualized net interest income by average interest-earning assets for the period. |

|

||||||||||||||||||||||

(3) Tax exempt income is not included in the above table on a tax-equivalent basis. |

|

||||||||||||||||||||||

(4) Actual unrounded values are used to calculate the reported yield or rate disclosed. Accordingly, recalculations using the amounts in thousands as disclosed in this report may not produce the same amounts. |

|

||||||||||||||||||||||

Equity Bancshares, Inc.

PRESS RELEASE – 10/18/2022

TABLE 6. QUARTER-TO-DATE NET INTEREST INCOME ANALYSIS (Unaudited)

(Dollars in thousands)

|

For the three months ended |

|

|

For the three months ended |

|

||||||||||||||||||

|

September 30, 2022 |

|

|

September 30, 2021 |

|

||||||||||||||||||

|

Average Outstanding Balance |

|

|

Interest Income/ Expense |

|

|

Average |

|

|

Average Outstanding Balance |

|

|

Interest Income/ Expense |

|

|

Average |

|

||||||

Interest-earning assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Loans (1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Commercial and industrial |

$ |

575,149 |

|

|

$ |

7,750 |

|

|

|

5.35 |

% |

|

$ |

630,622 |

|

|

$ |

13,646 |

|

|

|

8.59 |

% |

Commercial real estate |

|

1,307,244 |

|

|

|

18,023 |

|

|

|

5.47 |

% |

|

|

1,009,141 |

|

|

|

12,072 |

|

|

|

4.75 |

% |

Real estate construction |

|

360,579 |

|

|

|

4,847 |

|

|

|

5.33 |

% |

|

|

283,106 |

|

|

|

2,664 |

|

|

|

3.73 |

% |

Residential real estate |

|

582,938 |

|

|

|

5,464 |

|

|

|

3.72 |

% |

|

|

512,135 |

|

|

|

5,073 |

|

|

|

3.93 |

% |

Agricultural real estate |

|

200,534 |

|

|

|

2,740 |

|

|

|

5.42 |

% |

|

|

134,673 |

|

|

|

1,819 |

|

|

|

5.36 |

% |

Agricultural |

|

113,351 |

|

|

|

1,406 |

|

|

|

4.92 |

% |

|

|

91,878 |

|

|

|

1,370 |

|

|

|

5.92 |

% |

Consumer |

|

101,203 |

|

|

|

1,325 |

|

|

|

5.20 |

% |

|

|

86,647 |

|

|

|

937 |

|

|

|

4.29 |

% |

Total loans |

|

3,240,998 |

|

|

|

41,555 |

|

|

|

5.09 |

% |

|

|

2,748,202 |

|

|

|

37,581 |

|

|

|

5.43 |

% |

Securities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Taxable securities |

|

1,164,697 |

|

|

|

5,793 |

|

|

|

1.97 |

% |

|

|

966,651 |

|

|

|

3,920 |

|

|

|

1.61 |

% |

Nontaxable securities |

|

107,717 |

|

|

|

687 |

|

|

|

2.53 |

% |

|

|

94,527 |

|

|

|

655 |

|

|

|

2.75 |

% |

Total securities |

|

1,272,414 |

|

|

|

6,480 |

|

|

|

2.02 |

% |

|

|

1,061,178 |

|

|

|

4,575 |

|

|

|

1.71 |

% |