UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) August 3, 2022

Sprouts Farmers Market, Inc.

(Exact name of registrant as specified in its charter)

Delaware |

|

001-36029 |

|

32-0331600 |

|

(State or other jurisdiction of incorporation or organization) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

5455 E. High Street, Suite 111

Phoenix, Arizona 85054

(Address of principal executive offices and zip code)

(480) 814-8016

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange on Which Registered |

Common Stock, $0.001 par value |

|

SFM |

|

NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On August 3, 2022, Sprouts Farmers Market, Inc. (the “Company”) issued a press release announcing its results of operations for its second fiscal quarter ended July 3, 2022. On the same date, the Company posted on its investor relations website, located at investors.sprouts.com, a PowerPoint presentation (the “Earnings Presentation”) that will be used by management during the Company’s earnings conference call. A copy of the press release and the Earnings Presentation are furnished herewith as Exhibits 99.1 and 99.2, respectively, and are incorporated into this Item 2.02 by reference.

The information furnished in this Item 2.02, including Exhibits 99.1 and 99.2 attached hereto and incorporated herein, is being furnished and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference into any registration statement or other document filed pursuant to the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

The text of this Current Report on Form 8-K is available on the Company’s investor relations website located at investors.sprouts.com, although the Company reserves the right to discontinue that availability at any time.

Item 7.01. Regulation FD Disclosure.

The information set forth under Item 2.02 is hereby incorporated by reference.

The Company is also furnishing in this Current Report on Form 8-K a PowerPoint presentation (the “Investor Presentation”) to be used by the Company at various meetings with institutional investors or analysts. The Investor Presentation may be amended or updated at any time and from time to time through another Current Report on Form 8-K, a later company filing or other means. A copy of the Investor Presentation is furnished herewith as Exhibit 99.3 and is incorporated into this Item 7.01 by reference.

The information furnished in this Item 7.01, including Exhibits 99.1, 99.2 and 99.3, is being furnished and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference into any registration statement or other document filed pursuant to the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

The Company does not have, and expressly disclaims, any obligation to release publicly any updates or any changes in our expectations or any change in events, conditions, or circumstances on which any forward-looking statement in the attached press release, Earnings Presentation or Investor Presentation is based.

The text of this Current Report on Form 8-K and the attached press release, Earnings Presentation and Investor Presentation are available on the Company’s investor relations website located at investors.sprouts.com, although the Company reserves the right to discontinue that availability at any time.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit Number |

|

Description |

|

|

|

99.1 |

|

|

|

|

|

99.2 |

|

Sprouts Farmers Market, Inc. Presentation, dated August 3, 2022, entitled “Q2 2022 Earnings” |

|

|

|

99.3 |

|

Sprouts Farmers Market, Inc. Presentation, dated August 3, 2022, entitled "Investor Deck" |

|

|

|

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

SPROUTS FARMERS MARKET, INC. |

||

|

|

|

||

Date: August 3, 2022 |

|

By: |

|

/s/ Brandon F. Lombardi |

|

|

Name: |

|

Brandon F. Lombardi |

|

|

Title: |

|

Chief Legal Officer and Corporate Secretary |

Exhibit 99.1

|

|

|

Investor Contact: |

Media Contact: |

|

Susannah Livingston |

media@sprouts.com |

|

(602) 682-1584 |

|

|

susannahlivingston@sprouts.com |

|

|

Sprouts Farmers Market, Inc. Reports Second Quarter 2022 Results

Sprouts Achieves Milestone of Celebrating 20th Year Anniversary

PHOENIX, Ariz. – (Globe Newswire) – August 3, 2022 – Sprouts Farmers Market, Inc. (Nasdaq: SFM) today reported results for the 13-week second quarter ended July 3, 2022.

"The disciplined execution of our long-term strategy, with a sharp focus on near-term initiatives, delivered results that surpassed our expectations during the second quarter," said Jack Sinclair, chief executive officer of Sprouts Farmers Market. "As we celebrate our company's 20th anniversary, I want to express my sincere appreciation to all of our team members for their passion and dedication to our customers."

Second Quarter Highlights:

Leverage and Liquidity in Second Quarter 2022

Third Quarter and Full-Year 2022 Outlook

”We are relatively pleased with our financial performance year to date and continue to be encouraged by another quarter of positive traffic," said Chip Molloy, chief financial officer of Sprouts Farmers Market. “We are cautiously optimistic that we can continue to successfully navigate the remainder of the year during these highly inflationary times while simultaneously pushing forward with our long-term strategy which is supported by our strong cash generation.”

The following provides information on our Full-Year 2022 Outlook:

The following provides information on our Third Quarter 2022 Outlook:

Second Quarter 2022 Conference Call

Sprouts will hold a conference call at 2 p.m. Pacific Daylight Time (5 p.m. Eastern Daylight Time) on Wednesday, August 3, 2022, during which Sprouts executives will further discuss second quarter 2022 financial results.

A webcast of the conference call will be available through Sprouts’ investor relations webpage located at investors.sprouts.com. Participants should register on the website approximately ten minutes prior to the start of the webcast.

The audio replay will remain available for 72 hours and can be accessed by dialing 877-344-7529 (toll-free) or412-317-0088 (international) and entering the confirmation code: 7359561.

Important Information Regarding Outlook

There is no guarantee that Sprouts will achieve its projected financial expectations, which are based on management estimates, currently available information and assumptions that management believes to be reasonable. These expectations are inherently subject to significant economic, competitive and other uncertainties and contingencies, many of which are beyond the control of management. See “Forward-Looking Statements” below.

Forward-Looking Statements

Certain statements in this press release are forward-looking as defined in the Private Securities Litigation Reform Act of 1995. Any statements contained herein that are not statements of historical fact (including, but not limited to, statements to the effect that Sprouts Farmers Market or its management "anticipates," "plans," "estimates," "expects," or "believes," or the negative of these terms and other similar expressions) should be considered forward-looking statements, including, without limitation, statements regarding the company’s outlook, growth, opportunities and long-term strategy. These statements involve certain risks and uncertainties that may cause actual results to differ materially from expectations as of the date of this release. These risks and uncertainties include, without limitation, the company’s ability to execute on its long-term strategy; the company’s ability to successfully compete in its competitive industry; the company’s ability to successfully open new stores; the company’s ability to manage its growth; the company’s ability to maintain or improve its operating margins; the company’s ability to identify and react to trends in consumer preferences; product supply disruptions; equipment supply disruptions; general economic conditions that impact consumer spending or result in competitive responses; accounting standard changes; the impact of the COVID-19 pandemic; and other factors as set forth from time to time in the company’s Securities and Exchange Commission filings, including, without limitation, the company’s Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. The company intends these forward-looking statements to speak only as of the time of this release and does not undertake to update or revise them as more information becomes available, except as required by law.

Corporate Profile

Sprouts is the place where goodness grows. True to its farm-stand heritage, Sprouts offers a unique grocery experience featuring an open layout with fresh produce at the heart of the store. Sprouts inspires wellness naturally with a carefully curated assortment of better-for-you products paired with purpose-driven people. The healthy grocer continues to bring the latest in wholesome, innovative products made with lifestyle-friendly ingredients such as organic, plant-based and gluten-free. Headquartered in Phoenix, and one of the largest and fastest growing specialty retailers of fresh, natural and organic food in the United States, Sprouts employs approximately 31,000 team members and operates approximately 380 stores in 23 states nationwide. This year, Sprouts celebrates its 20th year anniversary. To learn more about Sprouts, and the good it brings communities, visit about.sprouts.com.

SPROUTS FARMERS MARKET, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

(UNAUDITED)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

|

|

Thirteen weeks ended |

|

|

Twenty-six weeks ended |

|

||||||||||

|

|

July 3, 2022 |

|

|

July 4, 2021 |

|

|

July 3, 2022 |

|

|

July 4, 2021 |

|

||||

Net sales |

|

$ |

1,595,482 |

|

|

$ |

1,521,993 |

|

|

$ |

3,236,643 |

|

|

$ |

3,097,440 |

|

Cost of sales |

|

|

1,015,125 |

|

|

|

971,912 |

|

|

|

2,044,538 |

|

|

|

1,961,185 |

|

Gross profit |

|

|

580,357 |

|

|

|

550,081 |

|

|

|

1,192,105 |

|

|

|

1,136,255 |

|

Selling, general and administrative expenses |

|

|

462,110 |

|

|

|

436,420 |

|

|

|

922,020 |

|

|

|

876,082 |

|

Depreciation and amortization (exclusive |

|

|

31,244 |

|

|

|

30,430 |

|

|

|

63,064 |

|

|

|

61,659 |

|

Store closure and other costs, net |

|

|

493 |

|

|

|

(419 |

) |

|

|

870 |

|

|

|

1,629 |

|

Income from operations |

|

|

86,510 |

|

|

|

83,650 |

|

|

|

206,151 |

|

|

|

196,885 |

|

Interest expense, net |

|

|

2,658 |

|

|

|

2,938 |

|

|

|

5,697 |

|

|

|

5,929 |

|

Income before income taxes |

|

|

83,852 |

|

|

|

80,712 |

|

|

|

200,454 |

|

|

|

190,956 |

|

Income tax provision |

|

|

21,855 |

|

|

|

19,698 |

|

|

|

50,150 |

|

|

|

46,894 |

|

Net income |

|

$ |

61,997 |

|

|

$ |

61,014 |

|

|

$ |

150,304 |

|

|

$ |

144,062 |

|

Net income per share: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Basic |

|

$ |

0.57 |

|

|

$ |

0.52 |

|

|

$ |

1.37 |

|

|

$ |

1.22 |

|

Diluted |

|

$ |

0.57 |

|

|

$ |

0.52 |

|

|

$ |

1.36 |

|

|

$ |

1.22 |

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

||||

Basic |

|

|

109,067 |

|

|

|

117,246 |

|

|

|

109,985 |

|

|

|

117,645 |

|

Diluted |

|

|

109,619 |

|

|

|

117,831 |

|

|

|

110,762 |

|

|

|

118,265 |

|

SPROUTS FARMERS MARKET, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(UNAUDITED)

(IN THOUSANDS, EXCEPT SHARE AND PER SHARE AMOUNTS)

|

|

July 3, 2022 |

|

|

January 2, 2022 |

|

||

ASSETS |

|

|

|

|

|

|

||

Current assets: |

|

|

|

|

|

|

||

Cash and cash equivalents |

|

$ |

288,965 |

|

|

$ |

245,287 |

|

Accounts receivable, net |

|

|

13,260 |

|

|

|

21,574 |

|

Inventories |

|

|

292,862 |

|

|

|

265,387 |

|

Prepaid expenses and other current assets |

|

|

49,520 |

|

|

|

35,468 |

|

Total current assets |

|

|

644,607 |

|

|

|

567,716 |

|

Property and equipment, net of accumulated depreciation |

|

|

690,460 |

|

|

|

716,029 |

|

Operating lease assets, net |

|

|

1,083,183 |

|

|

|

1,072,019 |

|

Intangible assets, net of accumulated amortization |

|

|

184,960 |

|

|

|

184,960 |

|

Goodwill |

|

|

368,878 |

|

|

|

368,878 |

|

Other assets |

|

|

15,236 |

|

|

|

13,513 |

|

Total assets |

|

$ |

2,987,324 |

|

|

$ |

2,923,115 |

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

||

Current liabilities: |

|

|

|

|

|

|

||

Accounts payable |

|

$ |

173,687 |

|

|

$ |

145,901 |

|

Accrued liabilities |

|

|

138,659 |

|

|

|

155,996 |

|

Accrued salaries and benefits |

|

|

48,222 |

|

|

|

58,743 |

|

Current portion of operating lease liabilities |

|

|

153,651 |

|

|

|

151,755 |

|

Current portion of finance lease liabilities |

|

|

1,130 |

|

|

|

1,078 |

|

Total current liabilities |

|

|

515,349 |

|

|

|

513,473 |

|

Long-term operating lease liabilities |

|

|

1,101,148 |

|

|

|

1,095,909 |

|

Long-term debt and finance lease liabilities |

|

|

259,219 |

|

|

|

259,656 |

|

Other long-term liabilities |

|

|

38,253 |

|

|

|

36,306 |

|

Deferred income tax liability |

|

|

59,665 |

|

|

|

57,895 |

|

Total liabilities |

|

|

1,973,634 |

|

|

|

1,963,239 |

|

Commitments and contingencies |

|

|

|

|

|

|

||

Stockholders' equity: |

|

|

|

|

|

|

||

Undesignated preferred stock; $0.001 par value; 10,000,000 shares |

|

|

— |

|

|

|

— |

|

Common stock, $0.001 par value; 200,000,000 shares authorized, |

|

|

108 |

|

|

|

111 |

|

Additional paid-in capital |

|

|

715,331 |

|

|

|

704,701 |

|

Accumulated other comprehensive income (loss) |

|

|

193 |

|

|

|

(3,758 |

) |

Retained earnings |

|

|

298,058 |

|

|

|

258,822 |

|

Total stockholders' equity |

|

|

1,013,690 |

|

|

|

959,876 |

|

Total liabilities and stockholders' equity |

|

$ |

2,987,324 |

|

|

$ |

2,923,115 |

|

SPROUTS FARMERS MARKET, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

(IN THOUSANDS)

|

|

Twenty-six |

|

|

Twenty-six |

|

||

|

|

July 3, 2022 |

|

|

July 4, 2021 |

|

||

Operating activities |

|

|

|

|

|

|

||

Net income |

|

$ |

150,304 |

|

|

$ |

144,062 |

|

Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

|

|

||

Depreciation and amortization expense |

|

|

64,856 |

|

|

|

63,152 |

|

Operating lease asset amortization |

|

|

57,360 |

|

|

|

52,631 |

|

Store closure and other costs, net |

|

|

171 |

|

|

|

— |

|

Share-based compensation |

|

|

7,920 |

|

|

|

7,851 |

|

Deferred income taxes |

|

|

1,770 |

|

|

|

2,920 |

|

Other non-cash items |

|

|

324 |

|

|

|

740 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

||

Accounts receivable |

|

|

11,389 |

|

|

|

14,685 |

|

Inventories |

|

|

(27,475 |

) |

|

|

(19,873 |

) |

Prepaid expenses and other current assets |

|

|

(12,851 |

) |

|

|

(13,679 |

) |

Other assets |

|

|

164 |

|

|

|

(4,363 |

) |

Accounts payable |

|

|

32,877 |

|

|

|

23,653 |

|

Accrued liabilities |

|

|

(318 |

) |

|

|

(8,416 |

) |

Accrued salaries and benefits |

|

|

(10,521 |

) |

|

|

(28,587 |

) |

Operating lease liabilities |

|

|

(65,502 |

) |

|

|

(58,131 |

) |

Other long-term liabilities |

|

|

(1,505 |

) |

|

|

660 |

|

Cash flows from operating activities |

|

|

208,963 |

|

|

|

177,305 |

|

Investing activities |

|

|

|

|

|

|

||

Purchases of property and equipment |

|

|

(53,098 |

) |

|

|

(39,421 |

) |

Cash flows used in investing activities |

|

|

(53,098 |

) |

|

|

(39,421 |

) |

Financing activities |

|

|

|

|

|

|

||

Payments on finance lease liabilities |

|

|

(385 |

) |

|

|

(333 |

) |

Payments of deferred financing costs |

|

|

(3,373 |

) |

|

|

— |

|

Repurchase of common stock |

|

|

(111,071 |

) |

|

|

(87,484 |

) |

Proceeds from exercise of stock options |

|

|

2,710 |

|

|

|

1,246 |

|

Cash flows used in financing activities |

|

|

(112,119 |

) |

|

|

(86,571 |

) |

Increase in cash, cash equivalents, and restricted cash |

|

|

43,746 |

|

|

|

51,313 |

|

Cash, cash equivalents, and restricted cash at beginning of the period |

|

|

247,004 |

|

|

|

171,441 |

|

Cash, cash equivalents, and restricted cash at the end of the period |

|

$ |

290,750 |

|

|

$ |

222,754 |

|

Non-GAAP Financial Measures

In addition to reporting financial results in accordance with accounting principles generally accepted in the United States (“GAAP”), the company presents EBITDA and EBIT. These measures are not in accordance with, and are not intended as alternatives to, GAAP. The company's management believes that this presentation provides useful information to management, analysts and investors regarding certain additional financial and business trends relating to its results of operations and financial condition. In addition, management uses these measures for reviewing the financial results of the company, and certain of these measures may be used as components of incentive compensation.

The company defines EBITDA as net income before interest expense, provision for income tax, and depreciation, amortization and accretion.

Non-GAAP measures are intended to provide additional information only and do not have any standard meanings prescribed by GAAP. Use of these terms may differ from similar measures reported by other companies. Because of their limitations, non-GAAP measures should not be considered as a measure of discretionary cash available to use to reinvest in the growth of the company’s business, or as a measure of cash that will be available to meet the company’s obligations. Each non-GAAP measure has its limitations as an analytical tool, and they should not be considered in isolation or as a substitute for analysis of the company’s results as reported under GAAP.

The following table shows a reconciliation of EBITDA to net income for the thirteen and twenty-six weeks ended July 3, 2022 and July 4, 2021:

SPROUTS FARMERS MARKET, INC. AND SUBSIDIARIES

NON-GAAP MEASURE RECONCILIATION

(UNAUDITED)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

|

|

Thirteen |

|

|

Thirteen |

|

|

Twenty-six |

|

|

Twenty-six |

|

||||

|

|

July 3, 2022 |

|

|

July 4, 2021 |

|

|

July 3, 2022 |

|

|

July 4, 2021 |

|

||||

Net income |

|

$ |

61,997 |

|

|

$ |

61,014 |

|

|

$ |

150,304 |

|

|

$ |

144,062 |

|

Income tax provision |

|

|

21,855 |

|

|

|

19,698 |

|

|

|

50,150 |

|

|

|

46,894 |

|

Interest expense, net |

|

|

2,658 |

|

|

|

2,938 |

|

|

|

5,697 |

|

|

|

5,929 |

|

Earnings before interest and taxes (EBIT) |

|

|

86,510 |

|

|

|

83,650 |

|

|

|

206,151 |

|

|

|

196,885 |

|

Depreciation, amortization and accretion |

|

|

32,136 |

|

|

|

31,311 |

|

|

|

64,856 |

|

|

|

63,152 |

|

EBITDA |

|

$ |

118,646 |

|

|

$ |

114,961 |

|

|

$ |

271,007 |

|

|

$ |

260,037 |

|

###

Source: Sprouts Farmers Market, Inc

Phoenix, AZ

8/3/22

Q2 2022 Earnings August 2022 Exhibit 99.2

Forward-Looking Statements Certain statements in this presentation are forward-looking as defined in the Private Securities Litigation Reform Act of 1995. Any statements contained herein (including, but not limited to, statements to the effect that Sprouts Farmers Market, Inc. (the “Company”) or its management "anticipates," "plans," "estimates," "expects," "believes," or the negative of these terms and other similar expressions) that are not statements of historical fact should be considered forward-looking statements, including, without limitation, statements regarding the Company’s guidance, outlook, strategy, financial targets, growth and opportunities. These statements involve certain risks and uncertainties that may cause actual results to differ materially from expectations as of the date of this presentation. These risks and uncertainties include, without limitation, the Company’s ability to execute on its long-term strategy; the Company’s ability to successfully compete in its competitive industry; the Company’s ability to successfully open new stores; the Company’s ability to manage its rapid growth; the Company’s ability to maintain or improve its comparable store sales and operating margins; the Company’s ability to identify and react to trends in consumer preferences; product supply disruptions; equipment supply disruptions; general economic conditions; accounting standard changes; risks associated with the COVID-19 pandemic; and other factors as set forth from time to time in the Company’s Securities and Exchange Commission filings. The Company intends these forward-looking statements to speak only as of the date of this presentation and does not undertake to update or revise them as more information becomes available, except as required by law. Non-GAAP Financial Measures We refer to EBIT, adjusted EBIT, adjusted EBIT Margin, and adjusted diluted earnings per share, each of which is a Non-GAAP Financial Measure. These measures are not prepared in accordance with, and are not intended as alternatives to, generally accepted accounting principles in the United States, or GAAP. The Company's management believes that such measures provide useful information to management, analysts and investors regarding certain additional financial and business trends relating to its results of operations and financial condition. In addition, management uses these measures for reviewing the financial results of the Company, and certain of these measures may be used as components of incentive compensation. The Company defines EBIT, as net income before interest expense and provision for income tax, and adjusted EBIT as EBIT, excluding the impact of special items. Adjusted EBIT Margin reflects adjusted EBIT, divided by net sales for the applicable period. The Company defines adjusted diluted earnings per share as diluted earnings per share excluding the impact of special items. Non-GAAP measures are intended to provide additional information only and do not have any standard meanings prescribed by GAAP. Use of these terms may differ from similar measures reported by other companies. Because of their limitations, non-GAAP measures should not be considered as a measure of discretionary cash available to use to reinvest in the growth of the Company’s business, or as a measure of cash that will be available to meet the Company’s obligations. Each non-GAAP measure has its limitations as an analytical tool, and you should not consider them in isolation or as a substitute for analysis of the Company’s results as reported under GAAP. To the extent forward looking non-GAAP financial measures are provided herein, they are not reconciled to comparable forward-looking GAAP measures due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation.

Q2 2022 Highlights Net Sales +5% Comps (1) +2.0% Diluted EPS $0.57 New Stores 2 Cash Generation $56M From Operations Share Repurchases $65M Comparable Store Sales

Second Quarter Sales Drivers – Shelves Stocked with Trend Forward Product Continued strength in convenient deli grab and go meals Differentiated departments like Grocery, Dairy, Bakery continue to see year over year growth Ecommerce grew 15% and remains elevated

Maintaining a Structurally Improved Margin Profile 5 ($ in mm) ADJUSTED EBIT & Adjusted EBIT Margin(1) See the Appendix to this presentation for a reconciliation of EBIT to adjusted EBIT – for 2021 and 2022, adjustments to EBIT were immaterial; thus, only EBIT is presented.

From 2015 through Q2, 2022: Repurchased 54 million shares Reduced shares outstanding 35% Purchased $1.3B to date $501M remaining on our share repurchase authorization* $0 Total Annual Share Repurchase Driving Shareholder Value Through An Ongoing Share Repurchase Program ($ in mm) * As of July 3, 2022

2022 Outlook 15-17 new stores Capex $130M to $150M Third Quarter, 2022: Comparable sales growth expected be 1% to 2% and EPS $0.49 to $0.53 Total sales growth between 4% and 5% Comp sales growth between 1% and 2% Slight increase to gross margins Earnings per share (EPS) $2.18 to $2.26

Appendix

SPROUTS FARMERS MARKET, INC. AND SUBSIDIARIES NON-GAAP MEASURE RECONCILIATION (UNAUDITED) (IN THOUSANDS) The following table shows a reconciliation of EBIT and adjusted EBIT to net income, as well as a reconciliation of net income and diluted earnings per share to adjusted net income and adjusted diluted earnings per share for the twenty-six weeks ended July 3, 2022, July 4, 2021, June 28, 2020, and June 30, 2019: Appendix Includes professional fees related to strategic initiatives. After-tax impact includes the tax benefit on the pre-tax charge. Includes the direct costs associated with store closures and relocation.

INVESTOR DECK August 2022 Exhibit 99.3

Forward-Looking Statements Certain statements in this presentation are forward-looking as defined in the Private Securities Litigation Reform Act of 1995. Any statements contained herein (including, but not limited to, statements to the effect that Sprouts Farmers Market, Inc. (the “Company”) or its management "anticipates," "plans," "estimates," "expects," "believes," or the negative of these terms and other similar expressions) that are not statements of historical fact should be considered forward-looking statements, including, without limitation, statements regarding the Company’s guidance, outlook, strategy, financial targets, growth and opportunities. These statements involve certain risks and uncertainties that may cause actual results to differ materially from expectations as of the date of this presentation. These risks and uncertainties include, without limitation, the Company’s ability to execute on its long-term strategy; the Company’s ability to successfully compete in its competitive industry; the Company’s ability to successfully open new stores; the Company’s ability to manage its rapid growth; the Company’s ability to maintain or improve its comparable store sales and operating margins; the Company’s ability to identify and react to trends in consumer preferences; product supply disruptions; equipment supply disruptions; general economic conditions; accounting standard changes; risks associated with the COVID-19 pandemic; and other factors as set forth from time to time in the Company’s Securities and Exchange Commission filings. The Company intends these forward-looking statements to speak only as of the date of this presentation and does not undertake to update or revise them as more information becomes available, except as required by law. Non-GAAP Financial Measures We refer to EBIT, adjusted EBIT, adjusted EBIT Margin, adjusted EBITDA, adjusted net income, adjusted diluted earnings per share and ROIC, each of which is a Non-GAAP Financial Measure. These measures are not prepared in accordance with, and are not intended as alternatives to, generally accepted accounting principles in the United States, or GAAP. The Company's management believes that such measures provide useful information to management, analysts and investors regarding certain additional financial and business trends relating to its results of operations and financial condition. In addition, management uses these measures for reviewing the financial results of the Company, and certain of these measures may be used as components of incentive compensation. The Company defines EBIT, as net income before interest expense and provision for income tax, and adjusted EBIT as EBIT, excluding the impact of special items. Adjusted EBIT Margin reflects adjusted EBIT, divided by net sales for the applicable period. The Company defines adjusted EBITDA as net income before interest expense, provision for income tax, and depreciation, amortization and accretion, excluding the impact of special items. The Company defines adjusted net income and adjusted diluted earnings per share as net income and diluted earnings per share, respectively, excluding the impact of special items. The Company defines ROIC as net operating profit after tax (“NOPAT”), including the effect of capitalized operating leases, divided by average invested capital. Non-GAAP measures are intended to provide additional information only and do not have any standard meanings prescribed by GAAP. Use of these terms may differ from similar measures reported by other companies. Because of their limitations, non-GAAP measures should not be considered as a measure of discretionary cash available to use to reinvest in the growth of the Company’s business, or as a measure of cash that will be available to meet the Company’s obligations. Each non-GAAP measure has its limitations as an analytical tool, and you should not consider them in isolation or as a substitute for analysis of the Company’s results as reported under GAAP. To the extent forward looking non-GAAP financial measures are provided herein, they are not reconciled to comparable forward-looking GAAP measures due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation.

3

A farmers market experience – open layout of fresh produce at the heart of the store, community feel, treasure hunt for unique products Intentional curation of responsibly and locally sourced products A place with happy, helpful team members Culture (care, own it, love being different) The right assortment of healthy alternatives and good-for-you options Making the highest quality fresh foods accessible to all WHAT DEFINES SPROUTS AND WHAT MAKES US DIFFERENT

Targeting at least 30 stores in 2023 with 10%+ annual unit growth beyond 2023 and incredible white space Strong and improving unit economics Sustainable robust cash flows with shareholder friendly capital allocation Building an advantaged fresh supply chain Unique farmers market experience Innovative & differentiated products with lifestyle friendly ingredients WHY INVEST IN SPROUTS? A POWERFUL GROWTH BUSINESS

CO 2021 Environment, Social, & Governance Highlights At the core of our identity is a genuine commitment to environmental sustainability. We are taking steps to reduce our carbon footprint and our natural resource intake while providing our customers with local, organic, and other sustainable food choices. We are diverting food from landfills and providing it to those in need. MTCO2e averted through food recovery programs CLIMATE 172 Sprouts brand products launched with How2Recycle logo reusable bags were used at checkout tons of plastic film recycled from customer and in-store use of our stores do not use single-use plastic bags at checkout PACKAGING & PLASTICS 11M landfill diversion rate 60% WASTE FOOD WASTE RECOVERY 78% of food waste recovered, and donated equivalent to 26 million meals 80% 60% 40% 20% 0% 2019 2020 2021 Food waste recovery rate 2 500 39% 49k tons of food and recyclables diverted from landfill 79k reduction in carbon emissions per sq. ft. over a 2019 baseline 10%

Millions of customers choose Sprouts because they can find products that are grown and produced in ways that are healthier for the planet and people. Our stores are stocked with a wide variety of organically grown, non-GMO, and plant-based options that lower the environmental impact of the food consumed. 100% of Sprouts Butcher Shop chicken and pork are raised without antibiotics 100% cage-free, organic, or free-range eggs Committed to improving chicken welfare in providing environmental enrichments by 2024, reduced stocking density by 2025, and allow for more humane processing, through CAS (controlled-atmosphere stunning), by 2026 $2.7B in sales of products with a social or environmental attribute 24% of total sales from organic products totaling nearly $1.5B in sales 100% of Sprouts Butcher Shop pork is from suppliers that utilize open-pen or group-housed facilities 7 Sustainable & Responsible Sourcing 250 local growers provide fresh seasonally grown produce 25% increase in plant-based product sales 100% responsibly sourced seafood

Providing safe and healthy food is at the core of our commitment to health and well-being. We collaborate with our team members, supply chain partners, community organizations, and industry experts to promote food safety, support workers’ rights, source responsibly, and develop a diverse and inclusive workplace. 5,180 safety audits completed 21,000 safety training hours completed 22% reduction in workers’ safety claims over the prior year TEAM MEMBER SAFETY $3M awarded local programs supporting youth nutrition education and food system equity 120 local non-profit partners supported in the communities we serve $3.1B in sales of products labeled to promote health and nutrition attributes 6,567 food safety audits completed Over 1M temperature checks conducted on sales floor COMMUNITY IMPACT 1,300 new jobs created 22% of team members promoted 51% female and 48% racially/ethnically diverse workforce 585,000 hours of in-store training delivered SAFE AND HEALTHY FOOD TEAM MEMBER DEVELOPMENT & INCLUSION 8 Social

We pride ourselves on operating with integrity, accountability, and transparency. Our ESG goals and initiatives are integrated throughout our business strategy, and strong oversight by our executive leadership team and Board of Directors ensures that the long-term interests of our stakeholders are factored into our decision making. 88% of board members are independent 25% of board members are female and 25% are racially/ethnically diverse Formed a board-level Risk Committee to monitor enterprise risk management program and provide oversight of our risks related to cybersecurity, critical systems, and environmental and social matters among others. RISK MANAGEMENT Maintaining our customers’ and team members’ trust by safeguarding their personal data and respecting their privacy decisions is critical to our success. We did not experience any data breaches during 2021 due to our cybersecurity best practices. DATA PRIVACY & CYBER SECURITY COPORATE GOVERNANCE (1) Acting ethically and with integrity helps us maintain our reputation with our customers as a preferred shopping destination, as a safe and welcoming place to work with our team members, and as a responsible corporate citizen with our communities and stakeholders. Established Commitment to Human Rights with Board oversight that sets forth our high standards and expectations for human rights and fair labor in our operations and supply chain. 19433 ETHICS AND COMPLIANCE 9 Governance As of June 1, 2022

Sprouts’ Five Pillar Long- Term Strategy 10+% UNIT GROWTH (1) LOW DOUBLE- DIGIT EARNINGS GROWTH EXPANDING ROIC REFINE BRAND AND MARKETING APPROACH WIN WITH TARGET CUSTOMERS UPDATE FORMAT AND EXPAND IN SELECT MARKETS CREATING ADVANTAGED SUPPLY CHAIN DIGITAL-FIRST MARKETING PROGRAM CONNECTING WITH TARGET CUSTOMERS ROBUST OMNICHANNEL EXPERIENCE PRODUCTS STEEPED IN INNOVATION SMALLER STORES HIGHER RETURNS FOCUSED ON BUILDING SCALE FRESHER PRODUCTS AND INCREASED LOCAL OFFERING Open at least 30 stores in 2023 with 10%+ unit growth starting in 2024 These are targets and not projections; they are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control of the Company and its management, and are based on assumptions with respect to future decisions, which may be subject to change. Actual results may vary and the variances may be material. Nothing in this presentation should be regarded as a representation that these targets will be achieved and the Company undertakes no duty to update its targets. See “Forward-Looking Statements.” DELIVER ON FINANCIAL TARGETS (2)

WE EXIST FOR THE HEALTH ENTHUSIASTS WE EXIST FOR THE EXPERIENCE SEEKERS What brings them together is simple: They’re into their food – like, really into it. Cover a wide range of income Age demographics - Gen Z to Baby Boomers Healthy and organic options, better for you, quality products Innovative and differentiated products Great store experience They are engaged and connected to the what they eat – how it makes them feel, where it comes from, the role it can play in their lives. Focusing on Sprouts’ Target Customers

Continue to Expand Customer Engagement 12 Currently “speaking” to nearly 6M customers via multiple digital platforms +19% + 70% +35% Growth rate is Q2 2022 vs. Q2 2021 Growth rate is May 2022 vs May 2021 due to data quality issues related to system implementation (2) (1) (1) Mobile App Downloads Active SMS Subscribers Active Email Subscribers Active Push Subscribers + 30% (1)

Once Acquired, Sprouts’ Customer Affinity is Very Strong and in-line with Best-in-Class Peers Net Promoter Score (NPS) – Among Frequent Shoppers Frequent as defined as in Respondent’s Top 3 Most Visited for Grocery Promoters Passives Detractors Source: Sprouts NPS study, September 2021 +53 +22 +27 NPS +52 +54 +35 +66 +43 +46 +69 +48 +44 +80 +66

Pivoting Our Marketing Strategy to Drive More Profitable Growth with More Meaningful Connections OUR DIGITAL-FIRST MARKETING PROGRAM IS FOCUSED ON CONNECTING WITH OUR MOST IMPORTANT CUSTOMERS Target Audience: Connect with Health Enthusiasts and Experience Seekers Geo-Targeting: Align media investments with our most valuable trading zone zip codes Continuous Optimization: Improve customer connections in real-time across all their screens Personal Relevance: Employ data-driven comms addressing target audience’s needs and affinities HIGHER VALUE CUSTOMERS TAPPING INTO CONSUMER NEEDS PRECISION TARGETING DATA-DRIVEN MEDIA Layered with Mass Media to build awareness and Seasonal “Story Telling” Initiatives with Calls-to-Action to Drive more Immediate Transactions and Deeper Engagement

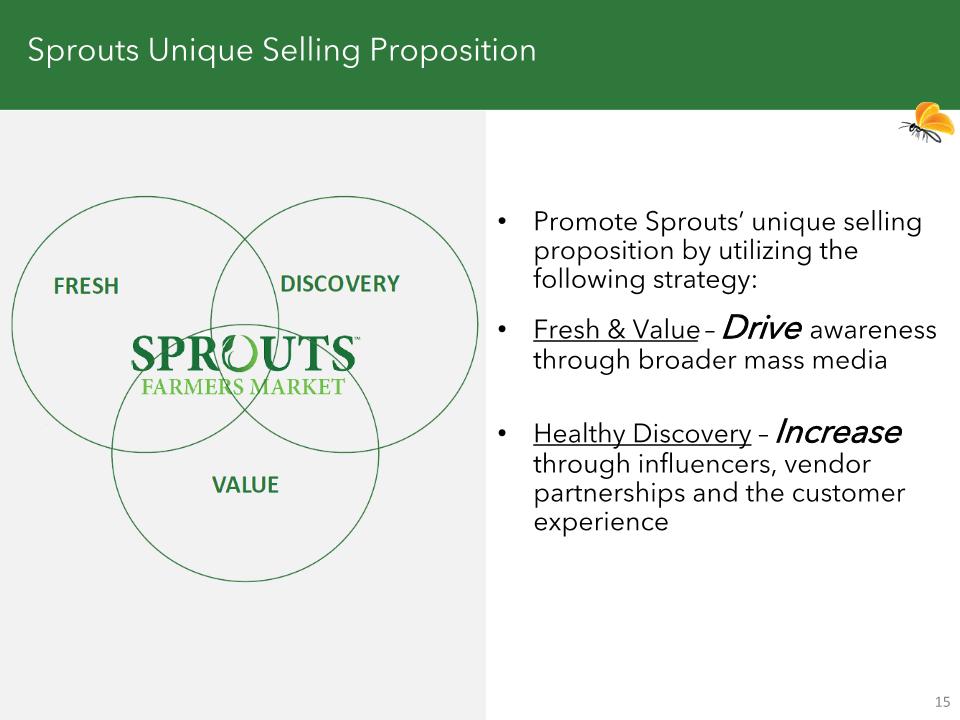

Sprouts Unique Selling Proposition Promote Sprouts’ unique selling proposition by utilizing the following strategy: Fresh & Value – Drive awareness through broader mass media Healthy Discovery – Increase through influencers, vendor partnerships and the customer experience

Ecommerce Remains Here to Stay and Sales Appear to be Settling at New Levels In store Pick-up & Delivery available to all customers in all stores & markets Ecommerce Penetration 50% of online orders can be identified to a customer

Produce Remains the Heart of the Store and Priced Well Below Most in the Marketplace Hybrid produce buying model – centralized and regional teams allow us to be flexible and react to the produce markets quickly Meaningful farmer partnerships which deliver new varietals and favorable pricing to our customers through spot buys New distribution channels will allow for increased local buying and deliver fresher products to our customers Building a path forward to grow with farmers as we grow

18 Sprouts’ Stores are Filled with a Curation of Differentiated Good-For-You Products More than 70% of Products Sold in Sprouts are Attribute Driven: Organics, Paleo, Keto, Plant Based, Non-GMO, Gluten Free, Vegan, Dairy-free, Grass Fed, Raw Includes all produce

19 Sprouts Aims To Grow and Establish a Differentiated Private Label Private Label Sales Penetration

20 Deliver a Unique, Friendly Experience with Healthy, Innovative Products in a Smaller Box with Higher Returns Format to Stay True to our Fresh-focused Farmers Market Heritage Prioritize Categories For Growth Potential Continue to Offer all Categories New store size to decrease from 30K to 23K square feet

21 Small Store Benefits Reduce Operating Cost Lower Cost to Build Reduce Non-Selling Space Decrease Occupancy Cost Sales to Remain Flat Strong Returns & Ability to Accelerate Growth

High Growth Retailer Unit growth (1) 300-400 New Stores in Expansion Markets 2019, 2020, 2021 actual unit growth, 2022 outlook, at least 30 stores in 2023 & 10% unit growth in 2024 and thereafter Expansion Markets Existing DCs Future DCs Existing Markets

23 Creating an Advantaged Fresh Supply Chain of DCs within 250 Miles of the Majority of Stores DCs Focused on Fresh, Local and Organic Offerings Meet our Local Farmer Partners

24 Long-Term Strategic Financial Targets (1) Low Double-Digit Earnings Growth and Expansion of ROIC Cost to Build Reduced & Attractive New Store Economics 10+% unit growth or more (2) Low single digit comps Stable to Expanding EBIT Margins These are targets and not projections; they are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control of the Company and its management, and are based on assumptions with respect to future decisions, which may be subject to change. Actual results may vary and the variances may be material. Nothing in this presentation should be regarded as a representation that these targets will be achieved and the Company undertakes no duty to update its targets. See “Forward-Looking Statements.” Open at least 30 stores in 2023 with 10%+ unit growth starting in 2024

25 Low Single Digit Comps Targets with Stable to Expanding EBIT Margins (1) All Stores Smarter Promotions Improved Buying Supply Chain Optimization Labor Productivity Improving Shrink Headwinds from Labor & Benefit Costs Key Comp Drivers Brand and marketing Innovative, differentiated products Omnichannel offering Better new store ramp with smarter promotional approach New Stores Reduction in Cost to Build (improved DA) Lower Rents driven by Smaller Boxes Less Efficient Operations during maturity ramp-up These are targets and not projections; they are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control of the Company and its management, and are based on assumptions with respect to future decisions, which may be subject to change. Actual results may vary and the variances may be material. Nothing in this presentation should be regarded as a representation that these targets will be achieved and the Company undertakes no duty to update its targets. See “Forward-Looking Statements.”

26 New Store Four Wall Box Target Economics (1) Sales EBITDA Margins Box opens on average at $13M in year 1 annual sales Grows 20% to 25% over next the next 4 years Break even year 1 Grows to a blended ~8% EBITDA Margins over the next 4 years Cash on Cash Return Low to mid thirties by year 5 Cash Investment $3.8M average new store build including CapEx, Inventory and Pre-opening expenses2 These are targets and not projections; they are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control of the Company and its management, and are based on assumptions with respect to future decisions, which may be subject to change. Actual results may vary and the variances may be material. Nothing in this presentation should be regarded as a representation that these targets will be achieved and the Company undertakes no duty to update its targets. See “Forward-Looking Statements.” Reflective of inflationary environment

27 NET SALES $6.1B + 8% vs 2019 NET CASH PROVIDED by OPERATIONS $365M + 3% vs 2019 ADJUSTED DILUTED Earnings Per Share $2.10 + 68% vs 2019 ($ in mm) ($ in mm) (1) (3) (3) (3) See the Appendix to this presentation for a reconciliation of adjusted diluted EPS to net income The Company’s results for FY2020 were significantly impacted by the Covid-19 pandemic. Accordingly, this presentation also includes comparisons to result in FY 2019 2020 is presented on a 53-week basis Sprouts is on a Stronger Foundation with Strategic Initiatives Beginning to Take Hold in 2021 (2) (2) (2)

Gross Margin Has Increased and Structurally Changed Since 2019 Structural Changes Driven By: Promotional strategy changes Differentiated products Operational improvements Addition of two new distribution centers in FL & CO Quarterly Gross Margin %

Maintained a Structurally Improved Margin Profile 29 ($ in mm) YTD ADJUSTED EBIT & Adjusted EBIT Margin (1) See the Appendix to this presentation for a reconciliation of EBIT to adjusted EBIT; For 2021 & 2022, adjustments to EBIT were immaterial; thus, only EBIT is presented.

In-line with Strategic Goals…Improving ROIC 30 ROIC (1) ROIC is a non-GAAP measure that we define as net operating profit after taxes divided by average invested capital. See the Appendix to this presentation for a reconciliation of ROIC to net income 2020 is presented on a 53-week basis (2)

Capital Expense Driven by New Stores Capex Spend as % of Sales 3.0% 1.5% ~2.5% to 3.5% 2.8% Capital Expenditures is net of landlord reimbursement 2022 and beyond are estimates 1.3% 2.4%

From 2015 through Q2, 2022: Repurchased 54 million shares Reduced shares outstanding 35% Purchased $1.3B to date $501M remaining on our share repurchase authorization* $0 Total Annual Share Repurchase ($ in mm) In Addition To Investing In Growth, We Drive Shareholder Value Through An Ongoing Share Repurchase Program * As of July 3, 2022

DELIGHT IN THE GOODNESS OF FRESH, HEALTHY FOODS… Sprouts delivers a unique farmers market experience that brings together passionate, knowledgeable team members and the best assortment of high-quality food that is good for us, and good for the world.

APPENDIX

Executive Management Team with Leading Grocery & Retail Experience Jack Sinclair Chief Executive Officer since 2019 Lawrence “Chip” Molloy Chief Financial Officer since 2021 Scott Neal Chief Merchandising Officer since 2022 (joined SFM in 2020) Dan Sanders Chief Store Operations Officer since 2022 (joined SFM in 2016) Dave McGlinchey Chief Strategy Officer since 2022 (joined SFM in 2017) Brandon Lombardi Chief Legal Officer since 2012 Kim Coffin Senior VP, Chief Forager since 2022 (joined SFM in 2012) Joe Hurley, Senior VP, Supply Chain since 2019 Hunter Bennett Senior VP, Information Technology since 2020 (joined SFM in 2014) Timmi Zalatoris Senior VP, Human Resources since 2020 (joined SFM in 2017) Nick Konat President & Chief Operating Officer since 2022

SPROUTS FARMERS MARKET, INC. AND SUBSIDIARIES NON-GAAP MEASURE RECONCILIATION (UNAUDITED) (IN THOUSANDS) The following table shows a reconciliation of EBITDA and adjusted EBITDA to net income, as well as a reconciliation of net income and diluted earnings per share to adjusted net income and adjusted diluted earnings per share for the fifty-two weeks ended January 2, 2022, January 3, 2021 (53 weeks), December 29, 2019, and December 30, 2018: Appendix

Appendix Income tax provision includes approximately $12 million (or $0.10 per diluted share) benefit during the fifty-two weeks ended December 30, 2018 in excess federal and state tax benefits for share based compensation primarily associated with the exercise of expiring pre-IPO options. Includes professional fees related to strategic initiatives. After-tax impact includes the tax benefit on the pre-tax charge. During the fifty-two weeks ended December 30, 2018, the Company recorded one-time pretax compensation charges of $4 million, associated with the resignation of the former CEO. The after-tax impact includes incremental tax expense associated with certain nondeductible executive compensation costs. Includes the direct costs associated with store closures and relocation. During the fifty-two weeks ended December 30, 2018, in connection with the closure of two stores, the Company recorded one-time non-cash pre-tax charges of $8 million primarily related to the estimated fair value of the lease termination obligations and asset impairments. After-tax impact includes the tax benefit on the pre-tax charge. During the fifty-two weeks ended December 30, 2018, the Company adopted a tax calculation method change for the accelerated deduction of certain items, resulting in a discrete tax benefit of $3 million.

SPROUTS FARMERS MARKET, INC. AND SUBSIDIARIES NON-GAAP MEASURE RECONCILIATION (UNAUDITED) (IN THOUSANDS) The following table shows a reconciliation of EBIT and adjusted EBIT to net income, as well as a reconciliation of net income and diluted earnings per share to adjusted net income and adjusted diluted earnings per share for the twenty six weeks ended July 3, 2022, July 4, 2021, June 28, 2020, and June 30, 2019: Appendix Includes professional fees related to strategic initiatives. After-tax impact includes the tax benefit on the pre-tax charge. Includes the direct costs associated with store closures and relocation.

Appendix The following table shows a reconciliation of ROIC to net income for the Company’s 2018, 2019 , 2020, 2021 fiscal years and second quarter of 2022. SPROUTS FARMERS MARKET, INC. AND SUBSIDIARIES NON-GAAP MEASURE RECONCILIATION (UNAUDITED) (IN THOUSANDS)