|

Exhibit

|

Description

|

|

|

DHT Holdings, Inc.

|

||||

|

(Registrant)

|

||||

|

Date: May 2, 2025

|

By:

|

/s/ Laila C. Halvorsen |

||

|

Name:

|

Laila C. Halvorsen

|

|||

|

Title:

|

Chief Financial Officer

|

|||

|

DHT HOLDINGS, INC.

Clarendon House

2 Church Street

Hamilton HM 11

Bermuda

|

|

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

|

i

|

|

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING

|

1

|

|

Who can I contact with questions about how to vote?

|

1

|

|

Why am I receiving these materials?

|

1

|

|

What information is contained in this proxy statement?

|

1

|

|

Why did I receive a notice in the mail regarding the internet availability of proxy materials instead of a full set of proxy materials?

|

1

|

|

How may I obtain DHT’s 2024 Annual Report?

|

1

|

|

What items of business will be voted on at the annual meeting?

|

1

|

|

How does the Board recommend that I vote?

|

2

|

|

What shares can I vote?

|

2

|

|

What is the difference between holding shares as a shareholder of record and as a beneficial owner?

|

2

|

|

How can I attend the annual meeting?

|

3

|

|

How can I vote my shares in person at the annual meeting?

|

3

|

|

How can I vote my shares without attending the annual meeting?

|

3

|

|

Can I change my vote?

|

3

|

|

Is my vote confidential?

|

3

|

|

How many shares must be present or represented to conduct business at the annual meeting?

|

4

|

|

How are votes counted?

|

4

|

|

What is the voting requirement to approve each of the proposals?

|

4

|

|

Is cumulative voting permitted for the election of directors?

|

4

|

|

What happens if additional matters are presented at the annual meeting?

|

4

|

|

What should I do if I receive more than one set of voting materials or Notice?

|

5

|

|

How may I obtain a separate set of voting materials?

|

5

|

|

Who will bear the cost of soliciting votes for the annual meeting?

|

5

|

|

Where can I find the voting results of the annual meeting?

|

5

|

|

What is the deadline to propose actions for consideration at next year’s annual meeting of shareholders or to nominate individuals to serve as

directors?

|

5

|

|

How may I communicate with the Board?

|

6

|

|

CORPORATE GOVERNANCE PRINCIPLES AND BOARD MATTERS

|

7

|

|

Director Independence

|

7

|

|

Information About Directors Continuing in Office

|

7

|

|

Board Diversity Matrix

|

9

|

|

Board Experience Matrix

|

9

|

|

Board Structure and Committee Composition

|

10

|

|

Director Attendance

|

13

|

|

Board Refreshment and Diversity

|

13

|

|

Communications with the Board

|

14

|

|

DIRECTOR COMPENSATION

|

15

|

|

PROPOSALS TO BE VOTED ON

|

16

|

|

PROPOSAL NO. 1:

|

|

|

Approval of the 2025 Incentive Compensation Plan

|

16

|

|

PROPOSAL NO. 2:

|

|

|

Ratification of Independent Registered Public Accounting Firm

|

16

|

|

MINORITY INVESTOR ARRANGEMENTS

|

18

|

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

21

|

|

EXECUTIVE OFFICERS

|

22

|

|

EXECUTIVE COMPENSATION

|

22

|

|

2024 Summary Compensation Table

|

23

|

|

Report of the Compensation Committee of the Board on Executive Compensation

|

23

|

|

PRINCIPAL INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FEES AND SERVICES

|

26

|

|

REPORT OF THE AUDIT COMMITTEE OF THE BOARD

|

27

|

|

Time and Date

|

Wednesday, June 11, 2025, 11:00 a.m. (Bermuda time)

|

|

Place

|

Rosewood Bermuda

60 Tucker’s Point Dr., Hamilton Parish, HS 02

Bermuda

|

|

Items of Business

|

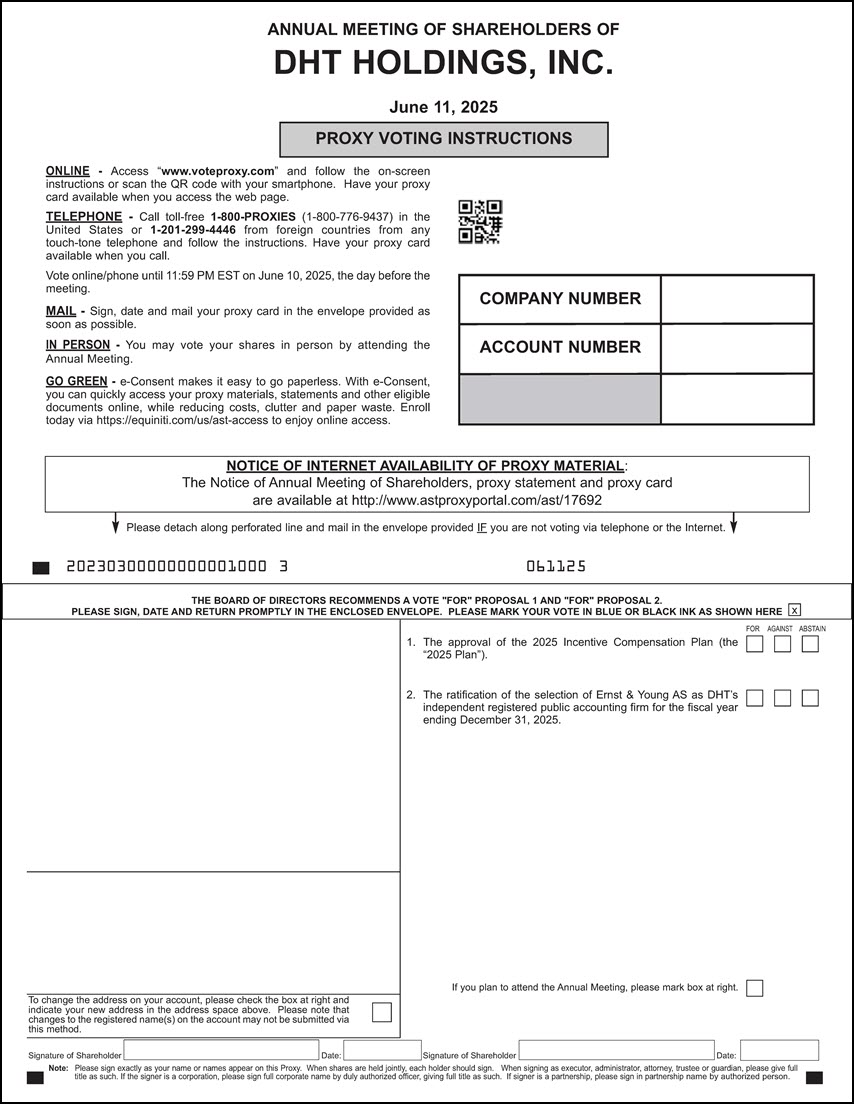

(1) To approve the 2025 Incentive Compensation Plan (the “2025 Plan”).

|

|

(2) To ratify the selection of Ernst & Young AS as DHT’s independent registered public accounting firm for the fiscal year ending December 31, 2025.

|

|

|

(3) To transact such other business as may properly come before the annual meeting or any adjournment or postponement of the meeting.

|

|

|

Internet Availability

|

We are furnishing proxy materials to our shareholders over the internet. On or about May 2, 2025, we will mail to our shareholders of record a Notice of Proxy Materials containing instructions on how to access our 2025 proxy statement and

2024 annual report via the internet and vote online. The Notice of Proxy Materials also provides instructions on how shareholders can request a paper copy of these materials.

|

|

Adjournments and Postponements

|

Any action on the items of business described above may be considered at the annual meeting at the time and on the date specified above or at any time and date to which the annual meeting may be properly adjourned or postponed.

|

|

Record Date

|

The record date for the annual meeting is April 23, 2025. Only shareholders of record at the close of business on that date will be entitled to notice of, and to vote at, the annual meeting or any adjournment or postponement of the

meeting.

|

|

Voting

|

The Board of Directors unanimously recommends that shareholders vote for the approval of the 2025 Plan and for the ratification of Ernst & Young AS as

DHT’s independent registered public accounting firm.

|

|

Whether or not you plan to attend the annual meeting, we encourage you to read this proxy statement and act promptly to vote your shares by submitting your proxy (a) by telephone or the internet following the voting instructions in the

Notice of Proxy Materials or (b) by requesting printed proxy materials over the internet and then completing, signing and dating a proxy card and returning it in the postage-paid envelope provided as soon as possible.

|

| Q: |

Who can I contact with questions about how to vote?

|

| A: |

If you have any questions or require any assistance with voting your shares, please contact DHT’s proxy solicitor:

|

| Q: |

Why am I receiving these materials?

|

| A: |

The Board of Directors (the “Board”) of DHT Holdings, Inc. (“DHT”), a corporation organized under the laws of the Republic of the Marshall Islands, is providing these proxy materials to you in connection with DHT’s annual meeting of

shareholders (the “annual meeting”), which will take place on June 11, 2025. As a shareholder, you are invited to attend the annual meeting and are entitled and requested to vote on the items of business described in this proxy statement.

|

| Q: |

What information is contained in this proxy statement?

|

| A: |

The information included in this proxy statement relates to the proposals to be voted on at the annual meeting, the voting process, the compensation of DHT’s directors and executive officers and certain other information about DHT.

|

| Q: |

Why did I receive a notice in the mail regarding the internet availability of proxy materials instead of a full set of proxy materials?

|

| A: |

We are using the internet as the primary means of furnishing proxy materials to our shareholders. Accordingly, we are sending the Notice of Proxy Materials to each of our shareholders of record as of the close of business on April 23,

2025. The Notice of Proxy Materials contains instructions on how to access the proxy materials and vote your shares over the internet. The Notice of Proxy Materials also contains instructions on how to request a printed copy of the proxy

materials, which are first being made available to shareholders at http://www.astproxyportal.com/ast/17692 on or about May 2, 2025. In addition, shareholders may request to receive proxy materials in

printed form by mail or electronically by email on an ongoing basis. If you request to receive printed proxy materials, you may still access our proxy materials and submit your proxy over the internet. Shareholders may wish to take advantage

of the availability of the proxy materials on the internet to help reduce the environmental impact of our annual meeting.

|

| Q: |

How may I obtain DHT’s 2024 Annual Report?

|

| A: |

Shareholders may obtain a free copy of our 2024 Annual Report filed on Form 20-F from our website at www.dhtankers.com and through the Securities and Exchange Commission’s EDGAR database on the SEC’s website at www.sec.gov. Shareholders

may request a hard copy of the audited financial statements free of charge by sending an email to info@dhtankers.com.

|

| Q: |

What items of business will be voted on at the annual meeting?

|

| A: |

The items of business scheduled to be voted on at the annual meeting are:

|

|

|

● |

the approval of the 2025 Incentive Compensation Plan (the “2025 Plan”); and

|

|

|

● |

the ratification of our independent registered public accounting firm for the 2025 fiscal year.

|

| Q: |

How does the Board recommend that I vote?

|

| A: |

The Board recommends that you vote your shares “FOR” the approval of the 2025 Plan and “FOR” the ratification of the independent registered

public accounting firm for the 2025 fiscal year.

|

| Q: |

What shares can I vote?

|

| A: |

Each share of common stock, par value $0.01 per share, of DHT (the “Common Stock” or the “shares”), issued and outstanding as of the close of business on

April 23, 2025, the record date for the annual meeting (the “record date”), is entitled to be voted on all items of business being voted on at the annual

meeting. The record date for the annual meeting is the date used to determine both the number of shares of Common Stock that are entitled to be voted at the annual meeting and the identity of the shareholders of record and beneficial owners of those shares of Common Stock who are entitled to vote those shares at the annual meeting. On the record date for the annual meeting, there were 160,607,613 shares of Common Stock issued and outstanding. Holders of shares of Common Stock outstanding as of the close of business on the record date are entitled to one vote for each share of Common Stock they hold as of such time.

|

| Q: |

What is the difference between holding shares as a shareholder of record and as a beneficial owner?

|

| A: |

Most DHT shareholders hold their shares through a broker or other nominee rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

|

| Q: |

How can I attend the annual meeting?

|

| A: |

You are entitled to attend the annual meeting only if you were a DHT shareholder as of the close of business on April 23, 2025 or if you hold a valid proxy for the annual meeting. You should be prepared to present photo identification for

admittance. In addition, if you are a shareholder of record, your name will be verified against the list of shareholders of record on the record date prior to your being admitted to the annual meeting. If you are not a shareholder of record

but hold shares through a broker, trustee or other nominee (i.e., in street name), you should provide proof of beneficial ownership on the record date, such as your most recent account statement prior to the record date, a copy of the voting

instruction card provided by your broker, trustee or other nominee, or other similar evidence of ownership. If you do not provide photo identification or comply with the procedures outlined above upon request, you will not be admitted to the

annual meeting.

|

| Q: |

How can I vote my shares in person at the annual meeting?

|

| A: |

Shares held in your name as the shareholder of record may be voted in person at the annual meeting. Shares held beneficially in street name may be voted in person only if you obtain a legal proxy from the broker, trustee or other nominee

that holds your shares giving you the right to vote the shares. Even if you plan to attend the annual meeting, we recommend that you also submit your proxy or voting instructions as described below so that

your vote will be counted if you later decide not to attend the meeting.

|

| Q: |

How can I vote my shares without attending the annual meeting?

|

| A: |

Whether you hold shares directly as the shareholder of record or beneficially in street name, you may direct how your shares are voted without attending the meeting. If you are a shareholder of record, you may vote by submitting a proxy.

If you hold shares beneficially in street name, you may vote by submitting voting instructions to your broker, trustee or other nominee.

|

| Q: |

Can I change my vote?

|

| A: |

You may change your vote at any time prior to the vote at the annual meeting. If you are the shareholder of record, you may change your vote by granting a new proxy bearing a later date by internet, telephone or mail (which automatically

revokes the earlier proxy), by providing a written notice of revocation to DHT’s Corporate Secretary via an email received prior to your shares being voted, or by attending the annual meeting and voting in person. Attendance at the meeting

will not cause your previously granted proxy to be revoked unless you specifically so request. For shares you hold beneficially in street name, you may change your vote by submitting new voting instructions to your broker, trustee or other

nominee, or, if you have obtained a legal proxy from your broker or nominee giving you the right to vote your shares, by attending the meeting and voting in person.

|

| Q: |

Is my vote confidential?

|

| A: |

Proxy instructions, ballots and voting tabulations that identify individual shareholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within DHT or to third parties, except (1) as

necessary to meet applicable legal requirements, (2) to allow for the tabulation of votes and certification of the vote and (3) to facilitate a successful proxy solicitation. If shareholders provide written comments on their proxy card

directed to the Board or management, these comments will be forwarded to the Board or management, respectively.

|

| Q: |

How many shares must be present or represented to conduct business at the annual meeting?

|

| A: |

The quorum requirement for holding the annual meeting and transacting business is that holders of a majority of the shares of capital stock in DHT (“DHT Capital Stock”) issued and outstanding as of the record date and entitled to vote must

be present in person or represented by proxy. As of the record date, shares of Common Stock were the only type of DHT Capital Stock issued and outstanding.

|

| Q: |

How are votes counted?

|

| A: |

For all items of business, you may vote “FOR,” “AGAINST” or “ABSTAIN.” If you “ABSTAIN,” the abstention has the same effect as a vote “AGAINST.”

|

| Q: |

What is the voting requirement to approve each of the proposals?

|

| A: |

Each of Proposal No. 1 and Proposal No. 2 requires the affirmative “FOR” vote of the holders of a majority of the voting power represented by the shares of DHT Capital Stock present in person or represented by proxy and entitled to vote on

that proposal at the annual meeting.

|

| Q: |

Is cumulative voting permitted for the election of directors?

|

| A: |

No. DHT’s Amended and Restated Articles of Incorporation provide that cumulative voting shall not be used in the election of directors.

|

| Q: |

What happens if additional matters are presented at the annual meeting?

|

| A: |

Other than the two items of business described in this proxy statement, we are not aware of any other business to be acted upon at the annual meeting. If you grant a proxy, the persons named as proxyholders, Erik A. Lind, Svein Moxnes

Harfjeld, Laila C. Halvorsen and Olesya Wehlau, will have the discretion to vote your shares on any additional matters properly presented for a vote at the meeting.

|

| Q: |

What should I do if I receive more than one set of voting materials or Notice?

|

| A: |

You may receive more than one Notice or, if you request to receive printed proxy materials, you may receive more than one set of voting materials, including multiple copies of this proxy statement and multiple proxy or voting instruction

cards. For example, if you are a shareholder of record, your shares are registered in more than one name, you may receive more than one Notice. If you hold your shares in more than one brokerage account, you may receive a separate notice or

voting instruction card for each brokerage account in which you hold shares. To make certain all of your shares are voted, please follow the instructions included on the Notice of Proxy Materials on how to access each proxy card and vote each

proxy card over the internet or by telephone. If you request to receive printed proxy materials and receive multiple proxy cards or voting instruction cards, please complete, sign, date and return each proxy

card and voting instruction card that you receive.

|

| Q: |

How may I obtain a separate set of voting materials?

|

| A: |

If you share an address with another shareholder and request a printed set of proxy materials, you may receive only one set of proxy materials unless you have provided contrary instructions. If you wish to receive a separate set of proxy

materials now or in the future, please contact D.F. King, who we have retained to assist in this proxy solicitation, at:

|

| Q: |

Who will bear the cost of soliciting votes for the annual meeting?

|

| A: |

DHT will pay the entire cost of preparing, assembling, printing, mailing and distributing these proxy materials and soliciting votes, including the cost of retaining D.F. King to assist with the solicitation of proxies. In addition to the

mailing of proxy materials, the solicitation of proxies or votes may be made in person, by telephone or by electronic communication by our directors, officers and employees, who will not receive any additional compensation for such

solicitation activities.

|

| Q: |

Where can I find the voting results of the annual meeting?

|

| A: |

We intend to announce the preliminary voting results at the annual meeting and to publish the final results in a report on Form 6-K following the annual meeting.

|

| Q: |

What is the deadline to propose actions for consideration at next year’s annual meeting of shareholders or to nominate individuals to serve as directors?

|

| A: |

You may submit proposals, including director nominations, for consideration at future shareholder meetings as indicated below.

|

| Q: |

How may I communicate with the Board?

|

| A: |

You may submit any communication intended for the Board by directing the communication by email to DHT’s Corporate Secretary at olesya.wehlau@conyers.com, with “DHT Holdings, Inc. – Attention: Erik A. Lind, Chairman” in the subject line.

|

|

Jeremy Kramer

Director since 2017

Age 63

|

Mr. Jeremy Kramer previously served on the Board of Directors of Golar LNG Partners and served as Chairman of its Conflicts Committee. He also served on the Board of Directors of 2020 Bulkers Ltd. Mr. Kramer was a Senior Portfolio Manager

in the Straus Group at Neuberger Berman from 1998 to 2016, managing equity portfolios primarily for high-net-worth clients. Prior to that, he worked at Alliance Capital from 1994 to 1998, first as a Securities Analyst and then as a Portfolio

Manager focused on small and mid-cap equity securities. Mr. Kramer also managed a closed-end fund, the Alliance Global Environment Fund. He worked at Neuberger Berman from 1988 to 1994 as a Securities Analyst. Mr. Kramer earned an M.B.A. from

Harvard University Graduate School of Business. He graduated with a B.A. from Connecticut College. Mr. Kramer is a resident and citizen of the U.S.

|

|

Ana Zambelli

Director since 2023

Age 52

|

Ms. Ana Zambelli brings significant experience with more than 20 years in the energy sector in operational, commercial and finance roles. Ms. Zambelli served as a Managing Director in Brookfield’s Private Equity Group, responsible for

business operations in Brazil, as Chief Commercial Officer at Maersk Drilling, Managing Director at Transocean, and President of the Brazilian division of Schlumberger. Ms. Zambelli is an experienced board member and previously served on the

respective Boards of Directors of BRK Ambiental, Unidas, Aldo Solar, Petrobras, Braskem, and was the founder and leader of the Diversity Committee at the Brazilian Petroleum Institute (IBP) from 2018 to present. Currently, Ms. Zambelli serves

as an independent board member for Seadrill, Galp and BW Energy. Ms. Zambelli graduated in mechanical engineering from the Federal University of Rio de Janeiro, and she holds a master’s degree in petroleum engineering from Heriot Watt

University in the UK. She also has a postgraduate degree in Digital Business from Columbia University and a postgraduate degree in Management, Innovation and Technology from MIT. Ms. Zambelli is a citizen and resident of Brazil.

|

|

Erik A. Lind

Director since 2005

Age 69

|

Mr. Erik A. Lind’s professional experience dates back to 1980 and encompasses corporate banking, structured finance, investment & asset management focusing primarily on the maritime shipping sector. Mr. Lind was, until April 2022, the

Chief Executive Officer of Oceanic Finance Group Limited (formerly known as Tufton Oceanic Finance Group Limited), a position he held since 2004. Prior to this, he served two years as Managing Director of GATX Capital and six years as

Executive Vice President at IM Skaugen ASA. Mr. Lind has also held senior and executive positions with Manufacturers Hanover Trust Company and Oslobanken. Mr. Lind currently serves on the board of Oceanic Finance Group Limited, Stratus

Investments Limited and on the advisory board of A.M. Nomikos. Mr. Lind holds a Master of Business Administration degree from the University of Denver. Mr. Lind is a resident and citizen of Norway.

|

|

Sophie Rossini

Director since 2020

Age 43

|

Mrs. Sophie Rossini is Deputy Head of Public Markets within the Discretionary team at Man Group. She is responsible for overseeing Discretionary’s investment management teams and is a member of the Discretionary management team.

Previously, she was Head of Business Management at Man AHL, working closely with the senior management team to set and deliver MAN AHL’s strategic goals, and ensuring smooth operational management of the engine. Prior to this, she was the

Head of Relative Value within Man’s external multi-manager business. Prior to joining Man Group in 2008, she was at Atlas Capital. Mrs. Rossini holds an M.A. in Banking and Financial Techniques from Paris-Panthéon-Assas University. Mrs.

Rossini is a resident of the United Kingdom and a citizen of France.

|

|

Board Diversity Matrix (as of May 2, 2025)1

|

||||

|

Foreign Private Issuer

|

Yes

|

|||

|

Total Number of Directors

|

6

|

|||

|

Female

|

Male

|

Non-Binary

|

Did Not Disclose Gender

|

|

|

Part I: Gender Identity

|

||||

|

Directors

|

2

|

4

|

–

|

–

|

|

Part II: Demographic Background

|

||||

|

African American or Black

|

–

|

–

|

–

|

–

|

|

Alaskan Native or Native American

|

–

|

–

|

–

|

|

|

Asian

|

–

|

–

|

–

|

–

|

|

Hispanic or Latin

|

1

|

–

|

–

|

–

|

|

Native Hawaiian or Pacific Islander

|

–

|

–

|

–

|

–

|

|

White

|

1

|

4

|

–

|

–

|

|

Two or More Races or Ethnicities

|

–

|

–

|

–

|

–

|

|

LGBTQ+

|

–

|

–

|

–

|

–

|

|

Did Not Disclose Demographic Background

|

–

|

–

|

–

|

–

|

|

Director1

|

|

Jeremy Kramer

|

Erik Andreas Lind

|

Joseph H. Pyne

|

Sophie Rossini

|

Einar Michael Steimler

|

Ana Zambelli

|

|

Current or Former CEO

|

Positions Held

|

x

|

x

|

x

|

|||

|

Board Chairman

|

x

|

x

|

x

|

x

|

|||

|

Board of Non-DHT Public Company

|

x

|

x

|

x

|

x

|

x

|

||

|

Marine Transportation

|

Industry Experience

|

x

|

x

|

x

|

x

|

||

|

Crude Transportation

|

x

|

x

|

x

|

x

|

|||

|

Non Crude Oil Transportation

|

x

|

x

|

x

|

x

|

|||

|

Oil Trading

|

x

|

x

|

|||||

|

Operations - Energy

|

x

|

||||||

|

Legal/Regulation

|

Additional Experience & Skills

|

x

|

|||||

|

Risk Management

|

x

|

x

|

x

|

x

|

x

|

x

|

|

|

Investment/Capital Allocation

|

x

|

x

|

x

|

x

|

x

|

x

|

|

|

Capital Intensive Business

|

x

|

x

|

x

|

x

|

x

|

||

|

Governance

|

x

|

x

|

x

|

x

|

x

|

x

|

|

|

Cross Border Transactions

|

x

|

x

|

|||||

|

Merger & Acquisitions

|

x

|

x

|

x

|

x

|

x

|

x

|

|

|

Investment Management

|

x

|

x

|

x

|

x

|

x

|

x

|

|

|

Finance

|

x

|

x

|

x

|

x

|

x

|

x

|

|

|

Marketing

|

x

|

x

|

x

|

x

|

x

|

||

|

Human Resources

|

x

|

x

|

x

|

x

|

|||

|

Cyber Security

|

x

|

||||||

|

ESG/Climate

|

x

|

x

|

|

Name of Director1

|

Audit

|

Compensation

|

Nominating and Corporate

Governance |

Sustainability Oversight Committee

|

|

Erik A. Lind, Chairman

|

X

|

X

|

||

|

Jeremy Kramer

|

X*

|

X

|

|

X

|

|

Joseph H. Pyne

|

X*

|

X

|

|

|

|

Einar Michael Steimler

|

X

|

X*

|

|

|

|

Sophie Rossini

|

X

|

|

|

X*

|

|

Ana Zambelli

|

|

X

|

X

|

|

|

X = Committee member

* = Chairperson

|

|

|

● |

management’s responsibility for DHT’s financial reporting process, including the development and maintenance of systems of internal accounting and financial controls;

|

|

|

● |

the integrity of DHT’s financial statements and its accounting and financial reporting processes;

|

|

|

● |

DHT’s risk management systems and compliance with legal and regulatory requirements and ethical standards;

|

|

|

● |

the qualifications and independence of DHT’s independent registered public accounting firm;

|

|

|

● |

the performance of DHT’s internal audit function;

|

|

|

● |

the independent registered public accounting firm’s annual audit of DHT’s financial statements;

|

|

|

● |

DHT’s cybersecurity program and initiatives;

|

|

|

● |

related party transactions; and

|

|

|

● |

such other matters as shall be mandated under applicable laws, rules and regulations (including the Securities Exchange Act of 1934 and the rules promulgated thereunder, as amended, as well as listing standards of NYSE).

|

|

|

● |

overseeing the compensation of DHT’s executives;

|

|

|

● |

overseeing the administration of DHT’s compensation and benefits plans, policies and programs;

|

|

|

● |

reviewing and determining director compensation; and

|

|

|

● |

preparing or filing any reports on compensation to the extent required by the rules and regulations of the SEC or as the Compensation Committee otherwise deems necessary or advisable.

|

|

|

● |

identifying individuals qualified to become directors in accordance with criteria approved by the Board and recommending such individuals to the Board for nomination for election to the Board;

|

|

|

● |

making recommendations to the Board concerning committee appointments;

|

|

|

● |

reviewing and making recommendations for executive management appointments;

|

|

|

● |

developing, recommending and annually reviewing corporate governance guidelines for DHT and overseeing corporate governance matters; and

|

|

|

● |

coordinating an annual evaluation of the Board and its Chairman.

|

|

|

● |

overseeing DHT’s strategies and general practices related to ESG matters;

|

|

|

● |

supporting the Board in developing, adopting and implementing ESG-related policies and procedures; and

|

|

|

● |

making recommendations to the Board related to ESG matters.

|

|

Annual cash retainer

|

$

|

75,000

|

||

|

Additional cash retainer for:

|

||||

|

● Chairman of the Board

|

$

|

95,000

|

||

|

● Chairperson of the Audit Committee

|

$

|

35,000

|

||

|

● Chairperson of the Compensation Committee

|

$

|

30,000

|

||

|

● Chairperson of the Nominating and Corporate Governance Committee

|

$

|

25,000

|

||

|

● Chairperson of the Sustainability Oversight Committee

|

$

|

25,000

|

||

|

● Member of a Committee

|

$

|

6,000

|

||

|

Reimbursement for expenses attendant to Board membership

|

Yes

|

|||

|

|

● |

each person or entity known by DHT to beneficially own more than 5% of DHT’s Common Stock;

|

|

|

● |

each member of our Board;

|

|

|

● |

each of our executive officers; and

|

|

|

● |

all current DHT directors and executive officers as a group.

|

|

Number of Shares of Common

Stock |

Percentage of Shares of Common

Stock (1) |

|||||||

| Persons owning more than 5% of a class of our equity securities |

||||||||

|

FMR LLC (2)

|

24,193,013

|

15.1

|

%

|

|||||

|

BW Group (3)

|

20,457,995

|

12.7

|

%

|

|||||

|

Scorpio Tankers (4)

|

11,910,730

|

7.4

|

%

|

|||||

|

Dimensional Fund Advisors LP (5)

|

11,513,966

|

7.2

|

%

|

|||||

|

Directors

|

||||||||

|

Erik A. Lind

|

181,482

|

*

|

||||||

|

Einar Michael Steimler

|

146,994

|

*

|

||||||

|

Joseph H. Pyne

|

205,839

|

*

|

||||||

|

Jeremy Kramer

|

71,332

|

*

|

||||||

|

Sophie Rossini

|

53,731

|

*

|

||||||

|

Ana Zambelli

|

-

|

-

|

||||||

|

Executive Officers

|

||||||||

|

Svein Moxnes Harfjeld

|

1,390,019

|

*

|

||||||

|

Laila Cecilie Halvorsen

|

189,359

|

*

|

||||||

|

Directors and executive officers as a group (8 persons)

|

2,201,847

|

1.4

|

%

|

|||||

| * |

Less than 1%

|

| 1 |

The above matrix includes Joseph H. Pyne and Einar Michael Steimler, both of whom are retiring at the 2025 Annual Meeting and will not be standing for re-election to our Board of Directors, but who served on the Board of Directors through

Fiscal 2024 and the first half of Fiscal 2025.

|

| (1) |

Calculated based on Rule 13d-3(d)(1) under the Securities Exchange Act of 1934 (the “Exchange Act”), using 160,607,613 shares of common stock issued and outstanding as of April 23, 2025.

|

| (2) |

Based on a Schedule 13G/A filed with the SEC on November 12, 2024, by FMR LLC, which, as investment manager, possesses the power to direct investments or power to vote shares owned by various investment companies, commingled group trusts

and separate accounts. For purposes of the reporting requirements of the Exchange Act, FMR LLC was deemed to be a beneficial owner of such shares as of September 30, 2024. As of September 30, 2024, FMR LLC possessed the sole power to vote or

direct the vote of 24,188,658 shares and the sole power to dispose or to direct the disposition of 24,193,013 shares. The percentage of shares of Common Stock held by FMR LLC decreased to 11.3% as of March 15, 2024, and then increased to

15.1% as of March 15, 2025. All shares beneficially owned are shares of Common Stock.

|

| (3) |

Based on Schedule 13D/A filed with the SEC on May 7, 2024, by BW Group Limited, the BW Group possesses the sole voting power over 20,457,995 shares, a decrease compared to 23,969,469 shares as of April 23, 2024 based on the Schedule 13D/A

filed with the SEC on April 25, 2024. For purposes of the reporting requirements of the Exchange Act, BW Group Limited was deemed to be a beneficial owner of such shares as of May 3, 2024. As of March 15 2024, BW Group held 16.0% of shares of

Common Stock. The percentage of shares of Common Stock held by BW Group decreased to 12.7% as of March 15, 2025. All shares beneficially owned are shares of Common Stock.

|

| (4) |

Based on Schedule 13D filed with the SEC on January 29, 2025, by Scorpio Tankers Inc., Scorpio Holdings Limited (“Scorpio Holdings”), Scorpio Services Holding Limited, a wholly-owned subsidiary of Scorpio Holdings, and Annalisa

Lolli-Ghetti, the majority shareholder of Scorpio Holdings, Scorpio possesses the sole voting power over 11,910,730 shares. For purposes of the reporting requirements of the Exchange Act, Scorpio was deemed to be a beneficial owner of such

shares as of January 29, 2025. All shares beneficially owned are shares of Common Stock.

|

| (5) |

Based on a Schedule 13G/A filed with the SEC on January 23, 2025, by Dimensional Fund Advisors LP (“Dimensional”), which, as investment manager, possesses the power to direct investments or power to vote shares owned by various investment

companies, commingled group trusts and separate accounts. For purposes of the reporting requirements of the Exchange Act, Dimensional was deemed to be a beneficial owner of such shares as of January 23, 2025. As of January 23, 2025,

Dimensional possessed the sole power to vote or direct the vote of 11,513,966 shares and the sole power to dispose or to direct the disposition of 11,681,341 shares. All shares beneficially owned are shares of Common Stock .

|

|

Name

|

Age

|

Position

|

|

Svein Moxnes Harfjeld

|

61

|

President & Chief Executive Officer

|

|

Laila C. Halvorsen

|

50

|

Chief Financial Officer

|

|

Executive Officer

|

Salary(1)

|

Cash Bonus(2)

|

Restricted Stock Awards(3)

|

|||||||||

|

Svein Moxnes Harfjeld, CEO(4)

|

$

|

863,618

|

$

|

800,000

|

150,000

|

|||||||

|

Laila C. Halvorsen, CFO(4)

|

$

|

307,925

|

$

|

400,000

|

50,000

|

|||||||

| (1) |

In 2024, Mr. Harfjeld was paid a salary in both Norwegian Kroner and Euro and Ms. Halvorsen was paid a salary in Norwegian Kroner. U.S. dollar equivalents calculated using a NOK/USD exchange rate of NOK 10.7433 to $1 and a EUR/USD exchange

rate of EUR 0.9224 to $1.

|

| (2) |

Amounts reported in this column refer to the annual bonus amounts paid to each of Mr. Harfjeld and Ms. Halvorsen with respect to the year ended December 31, 2024, which were paid in 2025, and do not include the annual bonus amounts paid to

each of the CEO and the CFO, during 2024, with respect to the year ended December 31, 2023.

|

| (3) |

In January 2024, Mr. Harfjeld was awarded 150,000 shares of restricted stock, of which 30,000 shares vested in January 2025, 30,000 shares will vest in January 2026 and 30,000 shares will vest in January 2027, subject to continued

employment with us. The remaining 60,000 shares vested in December 2024, subject to certain market conditions. In January 2024, Ms. Halvorsen was awarded 50,000 shares of restricted stock, of which 12,500 shares vested in January 2025, 12,500

shares will vest in January 2026 and 12,500 shares will vest in January 2027, subject to continued employment with us. The remaining 12,500 shares vested in December 2024, subject to certain market conditions. During the relevant vesting

periods of the restricted stock, each executive officer will be credited with additional shares of restricted stock in an amount equal to the value of the dividends that would have been paid on the awarded restricted stock had it been fully

vested on the date of grant. These additional shares will be transferred to Mr. Harfjeld and Ms. Halvorsen at the same time as the corresponding shares of restricted stock vest. Amounts reported in this column do not include the awards of

150,000 and 50,000 shares of restricted stock granted to each of Mr. Harfjeld and Ms. Halvorsen, respectively, at the beginning of 2025 based on performance in 2024. For additional details concerning the restricted stock granted in 2024 and

2023, see the section below, “Components of Executive Compensation—Long-term Incentive Program”.

|

| (4) |

In 2024, $90,634 and $39,557 were accrued for pension and retirement benefits for Mr. Harfjeld and Ms. Halvorsen, respectively.

|

|

|

● |

overseeing the compensation of DHT’s executives;

|

|

|

● |

overseeing the administration of DHT’s compensation and benefits plans, policies and programs;

|

|

|

● |

reviewing and determining director compensation; and

|

|

|

● |

preparing or filing any reports on executive compensation to the extent required by the rules and regulations of the SEC or as the Compensation Committee otherwise deems necessary or advisable.

|

|

|

● |

attract, retain and motivate highly qualified executives;

|

|

|

● |

pay competitively and consistently within an appropriately defined market;

|

|

|

● |

align executive compensation with shareholder interests; and

|

|

|

● |

link pay to DHT and individual performance.

|

|

Fees

|

2024

|

2023

|

||||||

|

Audit Fees (1)

|

$

|

640,185

|

$

|

584,867

|

||||

|

Audit-Related Fees (2)

|

66,907

|

44,307

|

||||||

|

Tax Fees (3)

|

8,979

|

8,935

|

||||||

|

All Other Fees

|

—

|

—

|

||||||

|

Total

|

$

|

716,071

|

$

|

638,111

|

||||

| (1) |

Audit fees for 2024 and 2023 represent fees for professional services provided in connection with the audit of our consolidated financial statements as of and for the periods ended December 31, 2024 and 2023, respectively.

|

| (2) |

Audit-related fees for 2024 consisted of $48,801 in respect of quarterly procedures. Audit-related fees for 2023 consisted of $44,307 in respect of quarterly procedures.

|

| (3) |

Tax fees for 2024 and 2023 represent fees for professional services provided in connection with tax compliance.

|

|

|

● |

management’s responsibility for DHT’s financial reporting process, including the development and maintenance of systems of internal accounting and financial controls;

|

|

|

● |

the integrity of DHT’s financial statements and its accounting and financial reporting processes;

|

|

|

● |

DHT’s risk management systems and compliance with legal and regulatory requirements and ethical standards;

|

|

|

● |

the qualifications and independence of DHT’s independent registered public accounting firm;

|

|

|

● |

the performance of DHT’s internal audit function;

|

|

|

● |

the independent registered public accounting firm’s annual audit of DHT’s financial statements;

|

|

|

● |

DHT’s cybersecurity program and initiatives;

|

|

|

● |

related party transactions; and

|

|

|

● |

such other matters as shall be mandated under applicable laws, rules and regulations (including the Securities Exchange Act of 1934 and the rules promulgated thereunder, as amended, as well as listing standards of NYSE).

|

| 1. |

The Audit Committee has reviewed and discussed the audited consolidated financial statements for fiscal year 2024 with DHT’s management.

|

| 2. |

The Audit Committee has discussed with Ernst & Young AS the matters required to be discussed by PCAOB Auditing Standard No. 16, Communication with Audit Committees, as amended or modified.

|

| 3. |

The Audit Committee has received the letter and written disclosures from Ernst & Young AS required by PCAOB Rule 3526, Communication with Audit Committees Concerning Independence, and has

discussed the matter of independence with Ernst & Young AS.

|

| 4. |

Based on the review and discussions referred to in paragraphs (1) through (3) above, the Audit Committee has recommended to the Board, and the Board has approved, that DHT’s audited consolidated financial statements be included in DHT’s

Annual Report on Form 20-F for fiscal year 2024, for filing with the SEC.

|