DISCLAIMER Certain statements contained in this document, other than statements of historical

fact, including, without limitation, those concerning the economic outlook for the gold mining industry, expectations regarding gold prices, production, total cash costs, all-in sustaining costs, all-in costs, cost savings and other

operating results, return on equity, productivity improvements, growth prospects and outlook of AngloGold Ashanti plc’s (the “Company”, “AngloGold Ashanti” or “AGA”) operations, individually or in the aggregate, including the achievement of

project milestones, commencement and completion of commercial operations of certain of AngloGold Ashanti’s exploration and production projects and the completion of acquisitions, dispositions or joint venture transactions, AngloGold

Ashanti’s liquidity and capital resources and capital expenditures, the consequences of the COVID-19 pandemic and the outcome and consequences of any potential or pending litigation or regulatory proceedings or environmental, health and

safety issues, are forward-looking statements regarding AngloGold Ashanti’s financial reports, operations, economic performance and financial condition. These forward-looking statements or forecasts are not based on historical facts, but

rather reflect our current beliefs and expectations concerning future events and generally may be identified by the use of forward-looking words, phrases and expressions such as “believe”, “expect”, “aim”, “anticipate”, “intend”, “foresee”,

“forecast”, “predict”, “project”, “estimate”, “likely”, “may”, “might”, “could”, “should”, “would”, “seek”, “plan”, “scheduled”, “possible”, “continue”, “potential”, “outlook”, “target” or other similar words, phrases, and expressions;

provided that the absence thereof does not mean that a statement is not forward-looking. Similarly, statements that describe our objectives, plans or goals are or may be forward-looking statements. These forward- looking statements or

forecasts involve known and unknown risks, uncertainties and other factors that may cause AngloGold Ashanti’s actual results, performance, actions or achievements to differ materially from the anticipated results, performance, actions or

achievements expressed or implied in these forward-looking statements. Although AngloGold Ashanti believes that the expectations reflected in such forward-looking statements and forecasts are reasonable, no assurance can be given that such

expectations will prove to have been correct. Accordingly, results, performance, actions or achievements could differ materially from those set out in the forward-looking statements as a result of, among other factors, changes in economic,

social, political and market conditions, including related to inflation or international conflicts, the success of business and operating initiatives, changes in the regulatory environment and other government actions, including

environmental approvals, fluctuations in gold prices and exchange rates, the outcome of pending or future litigation proceedings, any supply chain disruptions, any public health crises, pandemics or epidemics (including the COVID-19

pandemic), and other business and operational risks and challenges and other factors, including mining accidents. For a discussion of such risk factors, refer to AngloGold Ashanti Limited’s annual report on Form 20-F for the year ended 31

December 2022 filed with the United States Securities and Exchange Commission (“SEC”) and AngloGold Ashanti’s registration statement on Form F-4 initially filed with the SEC on 23 June 2023. These factors are not necessarily all of the

important factors that could cause AngloGold Ashanti’s actual results, performance, actions or achievements to differ materially from those expressed in any forward-looking statements. Other unknown or unpredictable factors could also have

material adverse effects on AngloGold Ashanti’s future results, performance, actions or achievements. Consequently, readers are cautioned not to place undue reliance on forward-looking statements. AngloGold Ashanti undertakes no obligation

to update publicly or release any revisions to these forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events, except to the extent required by applicable law.

All subsequent written or oral forward-looking statements attributable to AngloGold Ashanti or any person acting on its behalf are qualified by the cautionary statements herein. The information included in this presentation has not been

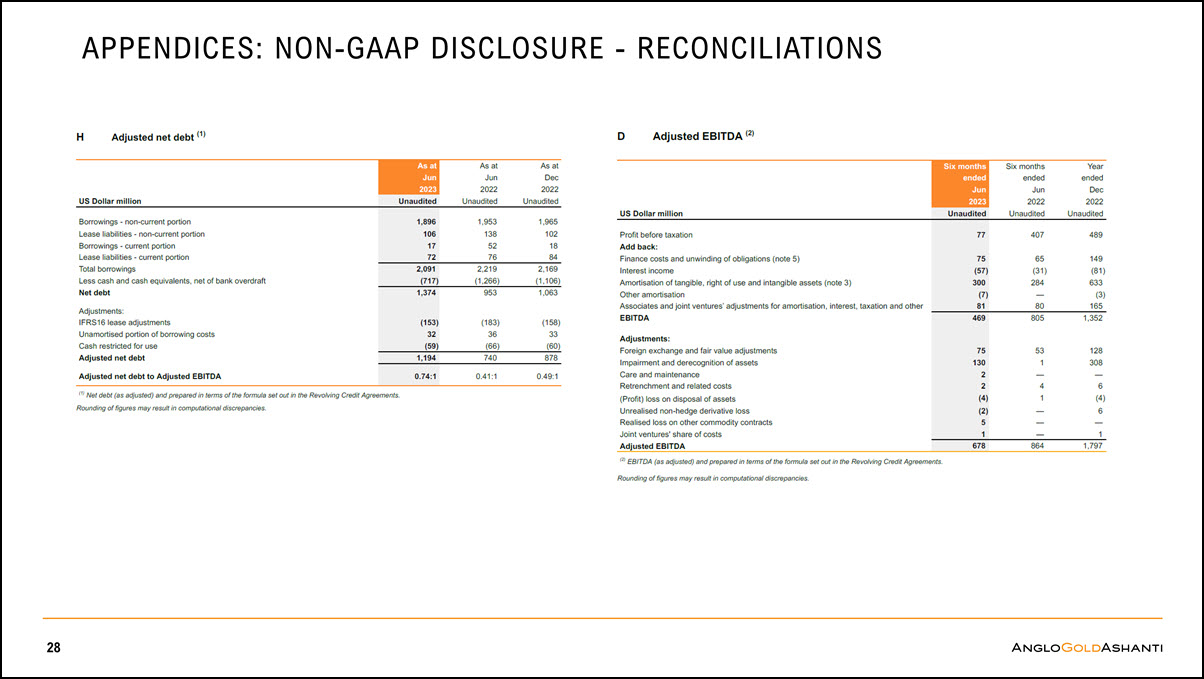

reviewed or reported on by AngloGold Ashanti’s external auditors. Non-GAAP financial measures This communication may contain certain “Non-GAAP” financial measures. AngloGold Ashanti utilises certain Non-GAAP performance measures and

ratios in managing its business. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, the reported operating results or cash flow from operations or any other measures of performance prepared in

accordance with IFRS. In addition, the presentation of these measures may not be comparable to similarly titled measures other companies may use. Website: www.anglogoldashanti.com 2