|

|

By:

|

/s/ LM Goliath | |

| Name: LM Goliath | |||

| Title: Company Secretary | |||

|

Exhibit

|

Description

|

|

|

|

||

|

|

| 1. |

This Circular should be read in its entirety with particular attention to the section headed “Action Required by AGA Shareholders” commencing on page 13 of this

Circular, which sets out in detail the action required to be taken by you.

|

| 2. |

If you are in any doubt as to what action you should take, please consult your CSDP, Broker, banker, accountant, legal adviser, financial adviser or other

professional adviser immediately.

|

| 3. |

If you have disposed of all of your AGA Ordinary Shares on or before Tuesday, 27 June 2023, please forward this Circular, together with the accompanying Form of Surrender and Transfer (blue), the Notice of Shareholders’ Meeting and Form of Proxy (yellow), and the Disclosure Package to the purchaser of such AGA Ordinary Shares, or to the Broker

or agent through whom the disposal of those AGA Ordinary Shares was effected for transmission to the purchaser or transferee.

|

|

|

|

|

AngloGold Ashanti Limited

(Incorporated in the Republic of South Africa)

Registration number: 1944/017354/06

Ordinary share code: ANG ISIN: ZAE000043485

(“AGA” or the “Company”)

|

AngloGold Ashanti plc

(Incorporated in England and Wales)

Company number: 14654651

Ordinary share code: ANG ISIN: GB00BRXH2664

(“NewCo”)

|

|

COMBINED CIRCULAR TO AGA SHAREHOLDERS

|

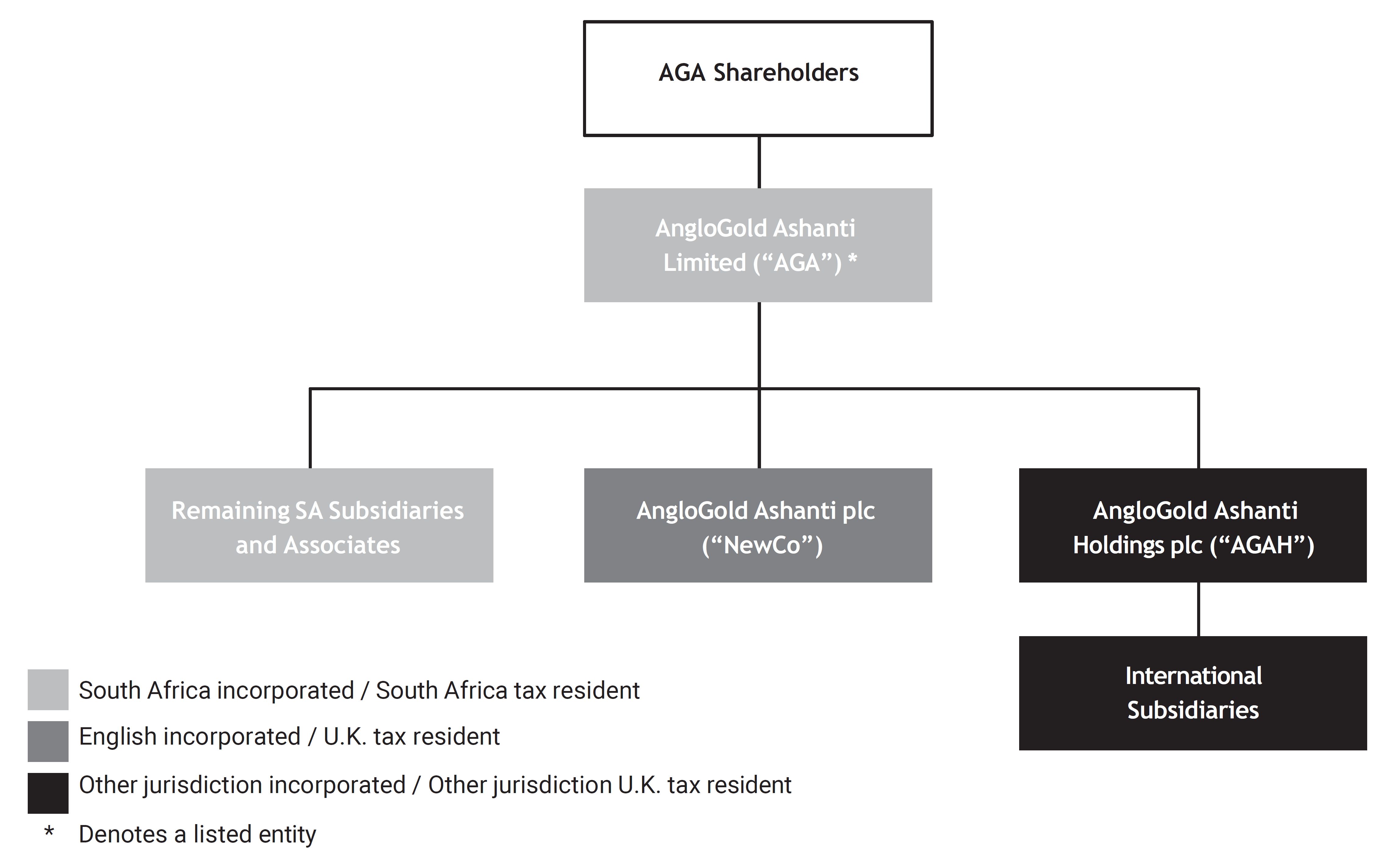

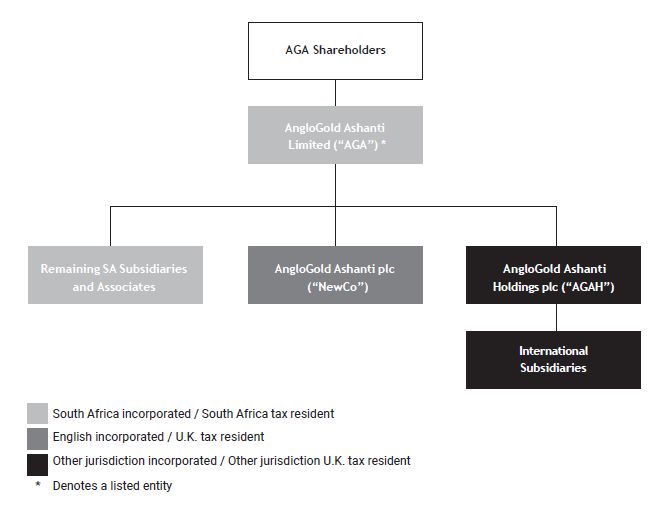

| ● |

the Spin-Off, in terms of which a distribution in specie will be effected by AGA to the AGA Shareholders recorded in the AGA Register as at the Reorganisation

Consideration Record Date, pursuant to which AGA will direct NewCo, its wholly-owned Subsidiary at that time, to issue 46,000 (forty six thousand) NewCo Ordinary Shares to such AGA Shareholders on a pro rata

basis, with the aggregate subscription price of USD 46,000 (forty six thousand Dollars) paid by AGA, resulting in NewCo ceasing to be a Subsidiary of AGA;

|

| ● |

the AGAH Sale, in terms of which NewCo has made an irrevocable offer to AGA to purchase 100% (one hundred percent) of the issued shares in AGAH. It is the present, non-binding intention of AGA to accept the

Irrevocable Offer to Purchase. The AGAH Sale, if completed, will constitute a disposal of all or the greater part of the assets or undertaking of AGA subject to approval under Chapter 5 of the Companies Act in terms of Section 112 and Section

115 of the Companies Act;

|

| ● |

the Scheme, being a scheme of arrangement in terms of Section 114(1) read with Section 115 of the Companies Act between AGA and the AGA Shareholders, proposed by the AGA Board whereby NewCo will acquire all

of the issued AGA Ordinary Shares from the AGA Shareholders in consideration for the right and obligation to receive, ipso facto and without any action on the part of such AGA Shareholders, the

respective pro rata portions of the Scheme Consideration Shares;

|

| ● |

the Spin-Off, the AGAH Sale and the Scheme are three sequential, separate and inter-conditional transaction steps, referred to as the Reorganisation, which will result in, among other things:

|

|

|

o |

AGA Shareholders recorded in the AGA Register as at the Reorganisation Consideration Record Date, receiving in aggregate one NewCo Ordinary Share for each AGA Ordinary Share (including AGA Ordinary Shares

represented by AGA ADSs);

|

|

|

o |

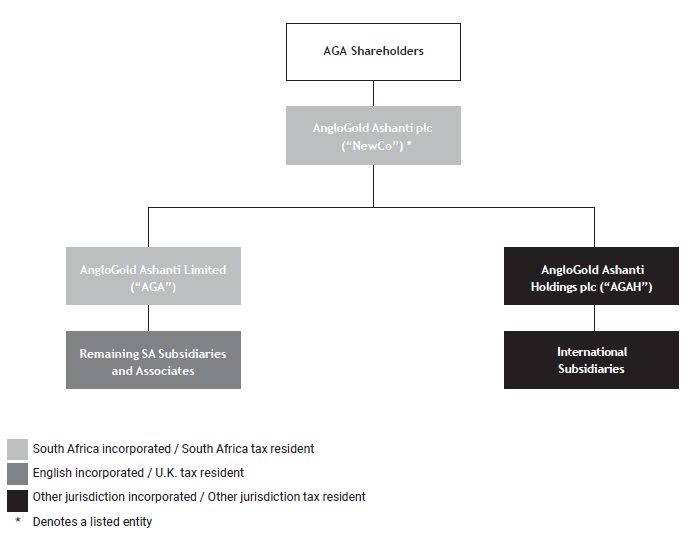

NewCo becoming the listed parent company of the Group and each of AGA and AGAH becoming a direct, wholly-owned Subsidiary of NewCo;

|

|

|

o |

the AGA Ordinary Shares being delisted from the JSE and the A2X in South Africa;

|

|

|

o |

the AGA Ordinary Shares being delisted from the GhSE in Ghana;

|

|

|

o |

the AGA GhDSs being delisted from the GhSE and replaced with the listing of NewCo GhDSs in Ghana;

|

|

|

o |

the AGA ADSs being delisted from the NYSE and the AGA ADS Program being terminated; and

|

|

|

o |

the NewCo Ordinary Shares having a primary listing on the NYSE, secondary inward listings on the JSE and the A2X in South Africa and a secondary listing on the GhSE in Ghana.

|

| ● |

the Notice of Shareholders’ Meeting in terms of which the Shareholders’ Meeting is convened;

|

| ● |

a Form of Proxy (yellow) in respect of the Shareholders’ Meeting, for use by Certificated AGA Shareholders and Dematerialised AGA Shareholders with “own name”

registration only;

|

| ● |

a Form of Surrender and Transfer (blue), for use by Certificated AGA Shareholders only;

|

| ● |

the Independent Expert Report prepared by the Independent Expert in terms of Sections 114(2) and 114(3) of the Companies Act and Regulations 90 and 110(1);

|

| ● |

certain financial information in respect of AGA and NewCo; and

|

| ● |

extracts of Section 115 of the Companies Act dealing with the approval requirements for the AGAH Sale and the Scheme and Section 164 of the Companies Act dealing with Dissenting AGA Shareholders’ Appraisal

Rights.

|

|

Legal Adviser

as to South African law

|

Legal Adviser

as to U.S. law

|

Legal Adviser

as to English law

|

|

|

|

|

Financial Adviser

|

Financial Adviser

|

Financial Adviser

|

|

|

|

|

|

Independent Expert

|

Independent Reporting Accountant

|

JSE Sponsor

|

|

|

|

|

|

|

|

Transaction Sponsor

|

Tax Adviser

as to South African tax

|

Legal Adviser

as to Ghanaian law

|

|

|

|

|

|

CORPORATE INFORMATION AND ADVISERS

|

|

AngloGold Ashanti Limited

Registration No. 1944/017354/06

|

AngloGold Ashanti plc

Company No. 14654651

|

|

|

Date and place of Incorporation

|

Date and place of Incorporation

|

|

|

29 May 1944, South Africa

|

10 February 2023, United Kingdom

|

|

|

Directors

|

Directors

|

|

|

Executive

|

Executive

|

|

|

Alberto Calderon

|

Alberto Calderon

|

|

|

Gillian Doran

|

Robert Hayes

|

|

|

Non-executive

|

Non-Executive

|

|

|

Maria Ramos (Chairperson)*

|

None

|

|

|

Kojo Busia*

|

||

|

Alan Ferguson*

|

Company Secretary

|

|

|

Albert Garner

|

Oakwood Corporate Secretary Limited

|

|

|

Rhidwaan Gasant*

|

Registration No. 07038430

|

|

|

Scott Lawson

|

3rd Floor

|

|

|

Maria Richter*

|

1 Ashley Road

|

|

|

Jochen Tilk*

|

Altrincham, Cheshire WA14 2DT

|

|

|

Jinhee Magie

|

United Kingdom

|

|

|

Diana Sands

|

Telephone: +44 (0)161 942 4700

|

|

|

* members of the Independent Board

|

Registered Office

|

|

|

4th Floor, Communications House

|

||

|

Company Secretary

|

South Street

|

|

|

LM Goliath

|

Staines-upon-Thames, Surrey TW18 4PR

|

|

|

(B.Com; MBA)

|

United Kingdom

|

|

|

Telephone: +44 (0) 203 968 3323

|

||

|

Registered Office

|

NewCo Transfer Agent

|

|

|

112 Oxford Road, Houghton Estate,

|

Computershare Trust Company, N.A.

|

|

|

Johannesburg, 2198

|

150 Royall Street

|

|

|

(Private Bag X 20, Rosebank, 2196)

|

Canton, Massachusetts 02021

|

|

|

South Africa

|

United States of America

|

|

|

Telephone: +27 11 637 6000

|

||

|

Fax: +27 11 637 6624

|

||

|

Transfer Secretaries

|

||

|

Computershare Investor Services Proprietary Limited

|

||

|

Registration No. 2004/003647/07

|

||

|

Rosebank Towers, 15 Biermann Avenue,

|

||

|

Rosebank, 2196

|

||

|

(Private Bag X9000, Saxonwold, 2132)

|

||

|

South Africa

|

||

|

Telephone: 0861 100 950 (in SA)

|

||

|

E-mail: queries@computershare.co.za

|

||

|

Website: www.computershare.com

|

||

|

JSE Sponsor

|

||

|

The Standard Bank of South Africa Limited

|

||

|

Registration No. 1962/000738/06

|

||

|

33 Baker, Rosebank, Johannesburg, 2196

|

||

|

South Africa

|

||

|

(PO Box 61344, Marshalltown, 2107)

|

||

|

Telephone: +27 11 721 0000

|

||

|

Transaction Sponsor

|

||

|

J.P. Morgan Equities South Africa Proprietary Limited

|

||

|

Registration No. 1995/011815/07

|

||

|

1 Fricker Road, Illovo, Johannesburg, 2196

|

||

| South Africa |

||

|

(Private Bag X9936, Sandton, 2196, South Africa)

|

|

Legal Adviser as to South African law

|

Legal Adviser as to U.S. law

|

|

|

Edward Nathan Sonnenbergs Incorporated

|

Cravath, Swaine & Moore LLP

|

|

|

Registration No. 2006/018200/21

|

DOS ID No. 2886667

|

|

|

The MARC, Tower 1, 129 Rivonia Road, Sandton,

|

CityPoint, One Ropemaker Street, London, EC2Y 9HR

|

|

|

Johannesburg

|

United Kingdom

|

|

|

South Africa

|

||

|

(PO Box 783347, Sandton, 2146)

|

||

|

Independent Reporting Accountants

|

||

|

Legal Adviser as to English law

|

Ernst & Young Incorporated

|

|

|

Slaughter and May

|

Registration No. 2005/002308/21

|

|

|

SRA No. 55388

|

EY, 102 Rivonia Road, Sandton, Johannesburg

|

|

|

One Bunhill Row, London, EC1Y 8YY

|

South Africa

|

|

|

United Kingdom

|

(Private Bag X14, Sandton, 2146)

|

|

|

Legal Adviser as to Ghanaian law

|

Financial Adviser

|

|

|

Bentsi-Enchill, Letsa & Ankomah

4 Momotse Avenue

Adabraka, Accra

Ghana

|

JPMorgan Chase Bank, N.A., Johannesburg Branch

Registration No. 2001/016069/10

1 Fricker Road Illovo, Johannesburg, 2196, South Africa

(Private Bag X9936, Sandton, 2146, South Africa)

|

|

|

Independent Expert

|

Tax Adviser as to South African tax

|

|

|

Barclays Bank PLC

|

Bowman Gilfillan Incorporated

|

|

|

1 Churchill Place, London E14 5HP

|

Registration No. 1998/021409/21

|

|

|

United Kingdom

|

11 Alice Lane, Sandton

|

|

|

Johannesburg

|

||

|

Financial Adviser

|

South Africa

|

|

|

Centerview Partners UK LLP

|

(PO Box 785812, Sandton, 2146)

|

|

|

Company number OC345806

|

||

|

100 Pall Mall, London, SW1Y 5NQ

|

||

|

United Kingdom

|

||

|

Financial Adviser

|

||

|

Rothschild and Co South Africa Proprietary Limited

|

||

|

7th Floor, 144 Oxford, Rosebank

|

||

|

Johannesburg

|

||

|

South Africa

|

||

|

(PO Box 411332, Craighall, 2024)

|

|

IMPORTANT LEGAL NOTICES, DISCLAIMERS AND FORWARD-LOOKING STATEMENTS

|

|

SUMMARY OF REORGANISATION

|

| 1. |

AGA, having disposed of its remaining South African operating assets in 2020, has undertaken a comprehensive review of its domicile and listing structure.

|

| 2. |

The review concluded that the most appropriate corporate structure for the Group is a UK corporate domicile with a U.S. primary listing on the NYSE and secondary inward listings on the JSE and the A2X in

South Africa and an additional listing on the GhSE in Ghana.

|

| 3. |

This change in corporate structure, domicile and listing structure is aligned with the transformation of AGA’s asset base into a diversified global portfolio of producing assets and projects.

|

| 4. |

The proposed Reorganisation is believed to have a number of benefits that will help facilitate implementation of the Company’s strategy and greater recognition of its full value, explained in more detail in

paragraph 6 of this Circular, including:

|

|

|

4.1. |

enhanced access to deeper pools of capital, including the opportunity to improve share trading liquidity;

|

|

|

4.2. |

improved competitive position in line with the Group’s global peers;

|

|

|

4.3. |

redomiciling to a leading, low-risk jurisdiction where the Group has a corporate presence;

|

|

|

4.4. |

minimal disruption for existing AGA Shareholders and other stakeholders; and

|

|

|

4.5. |

continuity of shareholding structure.

|

| 5. |

A number of inter-conditional transaction steps, implemented in sequence will be taken to implement the Reorganisation, including:

|

|

|

5.1. |

AGA will effect a distribution in specie to the AGA Shareholders as at the Reorganisation Consideration Record Date, pursuant to which AGA will direct NewCo, a new

UK incorporated company, and AGA’s wholly-owned Subsidiary at that time, to issue 46,000 (forty six thousand) NewCo Ordinary Shares (the “Spin-Off Shares”) to such AGA Shareholders on a pro rata basis, with the aggregate subscription price of USD 46,000 (forty six thousand Dollars) paid by AGA (the “Spin-Off” as more fully detailed in paragraph

7.12.1.3 of this Circular), resulting in NewCo ceasing to be a Subsidiary of AGA;

|

|

|

5.2. |

NewCo has made an irrevocable offer to AGA to purchase 100% (one hundred percent) of the shares in AGAH. It is the present, non-binding intention of AGA to accept the Irrevocable Offer to Purchase. The AGAH

Sale, if completed, will result in NewCo holding all of the Group’s operations and assets located outside South Africa (the “AGAH Sale”, as more fully detailed in paragraph 7.12.1.4 of this Circular);

and

|

|

|

5.3. |

NewCo will then acquire all of the issued AGA Ordinary Shares from AGA Shareholders in consideration for a right and obligation to receive, ipso facto and without

any action on the part of such AGA Shareholders, the respective pro rata portions of the Scheme Consideration Shares, pursuant to a scheme of arrangement in terms of Section 114(1) read with Section

115 of the Companies Act between AGA and the AGA Shareholders (the “Scheme”, as more fully detailed in paragraph 7.12.1.5 of this Circular).

|

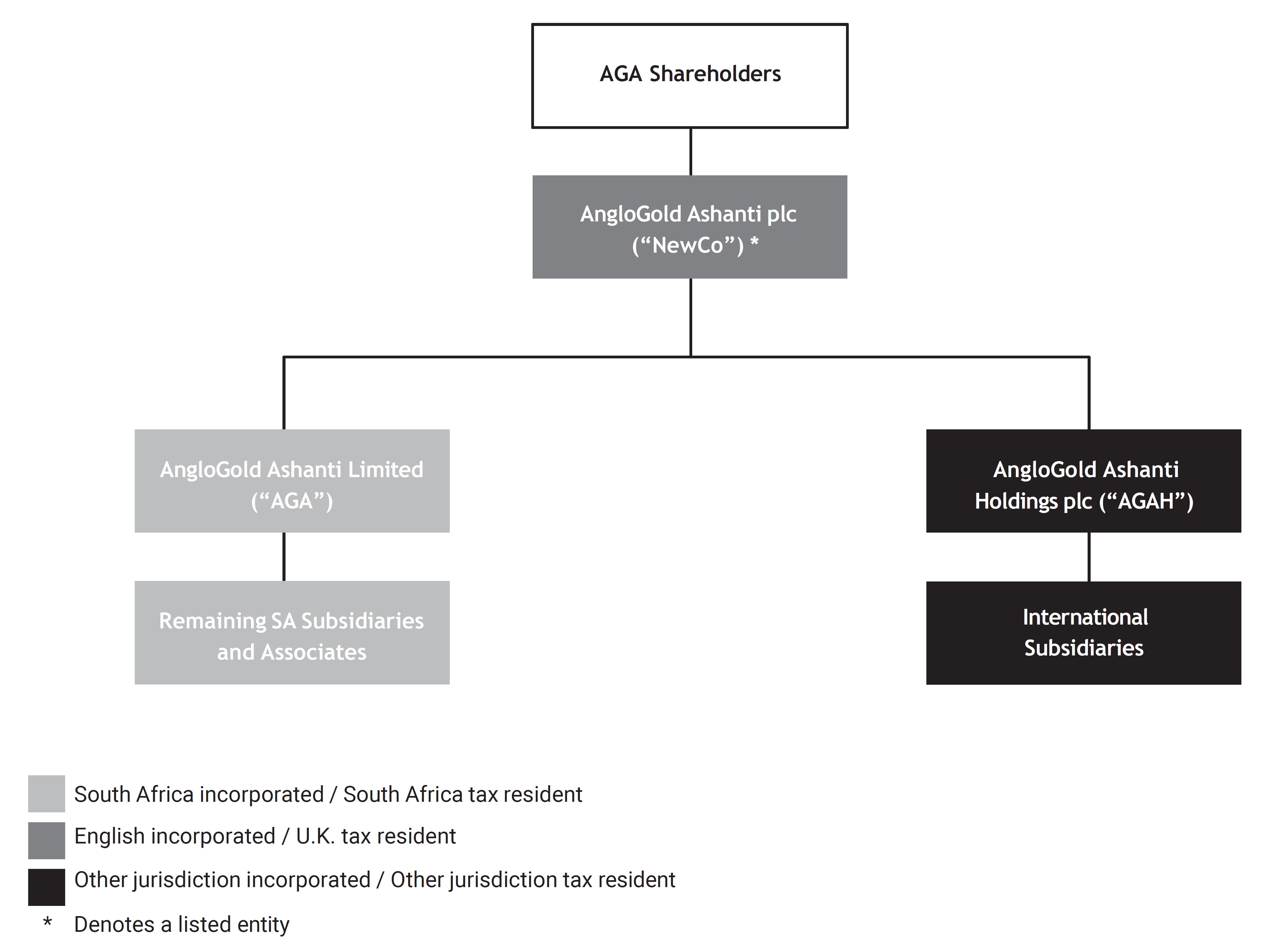

| 6. |

If successfully completed, the aforementioned Reorganisation will result in:

|

|

|

6.1. |

NewCo owning all of AGA’s existing assets with:

|

|

|

6.1.1. |

the same shareholders as AGA immediately prior to implementation of the Reorganisation (subject to any adjustments to reflect the exercise of any Appraisal Rights by AGA Shareholders);

|

|

|

6.1.2. |

the business carried out by NewCo and its Subsidiaries immediately following the Reorganisation being the same as the business carried out by AGA and its Subsidiaries immediately prior to the implementation

of the Reorganisation;

|

|

|

6.1.3. |

a primary listing on the NYSE; and

|

|

|

6.1.4. |

secondary inward listings on the JSE and A2X in South Africa and a secondary listing on the GhSE in Ghana;

|

|

|

6.2. |

NewCo becoming the listed parent company of the Group and each of AGA and AGAH being a direct, wholly-owned Subsidiary of NewCo;

|

|

|

6.3. |

the AGA Ordinary Shares being delisted from the JSE in terms of paragraph 1.17(b) of the JSE Listings Requirements, the AGA ADSs being delisted from the NYSE and the AGA Ordinary Shares being delisted from

the GhSE;

|

|

|

6.4. |

the AGA ADS Program being terminated;

|

|

|

6.5. |

AGA GhDSs being delisted from the GhSE and the NewCo GhDSs being listed on the GhSE;

|

|

|

6.6. |

NewCo being subject to English company law;

|

|

|

6.7. |

no changes to the withholding tax rates for South African shareholders of NewCo and no South African withholding tax on dividends for other shareholders of NewCo; and

|

|

|

6.8. |

South African shareholders being able to hold NewCo Ordinary Shares on the South African register of NewCo without using their foreign investment allowance and to trade their NewCo Ordinary Shares on the

South African capital markets.

|

| 7. |

The Group will incur non-recurring costs in connection with the implementation of the Reorganisation and the NewCo Notes Distribution, consisting primarily of taxes payable in South Africa.

|

| 8. |

The costs of implementing the Reorganisation and the NewCo Notes Distribution will be tied to factors such as AGA’s market value and the prevailing ZAR/USD exchange rate at the time of implementation.

|

| 9. |

The total costs of the Reorganisation and NewCo Notes Distribution are currently estimated to be in the order of c. 5% (five percent) of the market capitalisation of AGA on the Operative Date.

|

|

TABLE OF CONTENTS

|

||

|

CLAUSE NUMBER AND DESCRIPTION

|

PAGE

|

|

|

CORPORATE INFORMATION AND ADVISERS

|

3

|

|

|

IMPORTANT LEGAL NOTICES, DISCLAIMERS AND FORWARD-LOOKING STATEMENTS

|

5

|

|

|

SUMMARY OF REORGANISATION

|

9

|

|

|

ACTION REQUIRED BY AGA SHAREHOLDERS

|

13

|

|

|

INTERPRETATION AND DEFINITIONS

|

19

|

|

|

SALIENT DATES AND TIMES

|

26

|

|

|

COMBINED CIRCULAR TO AGA SHAREHOLDERS

|

28

|

|

|

1.

|

INTRODUCTION

|

28

|

|

2.

|

PURPOSE OF THIS CIRCULAR

|

29

|

|

3.

|

BACKGROUND REGARDING AGA

|

29

|

|

4.

|

BACKGROUND REGARDING NEWCO

|

29

|

|

5.

|

BACKGROUND REGARDING AGAH

|

30

|

|

6.

|

RATIONALE FOR THE REORGANISATION AND PROSPECTS

|

30

|

|

7.

|

TERMS AND CONDITIONS OF THE REORGANISATION

|

33

|

|

8.

|

ACCOUNTING MATTERS AND TREATMENT

|

46

|

|

9.

|

EXCHANGE CONTROL REGULATIONS

|

47

|

|

10.

|

TAX IMPLICATIONS FOR AGA SHAREHOLDERS

|

47

|

|

11.

|

APPLICABLE LAWS

|

47

|

|

12.

|

SHARE CAPITAL OF AGA

|

47

|

|

13.

|

MAJOR AGA SHAREHOLDERS

|

47

|

|

14.

|

FINANCIAL INFORMATION

|

48

|

|

15.

|

INFORMATION RELATING TO AGA DIRECTORS

|

48

|

|

16.

|

BENEFICIAL INTERESTS

|

49

|

|

17.

|

CONTINUATION OF THE BUSINESS OF AGA

|

51

|

|

18.

|

OPINIONS AND RECOMMENDATIONS

|

52

|

|

19.

|

MATERIAL AGREEMENTS RELATING TO THE REORGANISATION

|

52

|

|

20.

|

MATERIAL CHANGES AND LITIGATION

|

52

|

|

21.

|

DIRECTORS’ RESPONSIBILITY STATEMENT

|

52

|

|

22.

|

COSTS OF THE REORGANISATION AND EXPENSES

|

53

|

|

23.

|

CONSENTS

|

54

|

|

24.

|

DOCUMENTS AVAILABLE FOR INSPECTION

|

54

|

|

CLAUSE NUMBER AND DESCRIPTION

|

PAGE

|

|

Annexure A – Report of the Independent Expert

|

58

|

|

Annexure B – The Summary of Consolidated Financial Information of AGA

|

72

|

|

Annexure C – The Pro Forma Financial Information

|

73

|

|

Annexure D – The Independent Reporting Accountant’s Assurance Report on the Pro Forma Financial Information

|

79

|

|

Annexure E – Information on AGA Directors

|

81

|

|

Annexure F – Section 115 – Required Approval for the Transactions Contemplated in Part A of Chapter 5 of the Companies Act

|

86

|

|

Annexure G – Section 164 – Dissenting Shareholders’ Appraisal Rights

|

88

|

|

Annexure H – Tax Implications for AGA Shareholders

|

91

|

|

Annexure I – Extract of the Exchange Control Regulations

|

100

|

|

Annexure J – Notice of Shareholders’ Meeting

|

101

|

|

Annexure K – Form of Proxy

|

109

|

|

Annexure L – Form of Surrender and Transfer

|

111

|

|

ACTION REQUIRED BY AGA SHAREHOLDERS

|

| 1. |

IF YOU ARE A DEMATERIALISED AGA SHAREHOLDER WITHOUT “OWN NAME” REGISTRATION

|

|

|

1.1. |

To Participate in the Shareholders’ Meeting

|

|

|

1.1.1. |

Your CSDP or Broker with whom you have concluded a custody agreement in respect of your AGA Ordinary Shares should contact you in the manner stipulated in such custody agreement to ascertain:

|

|

|

1.1.1.1. |

if you wish to Participate in the Shareholders’ Meeting, in which case it must furnish you with a letter of representation which gives you the necessary authorisation to do so; or

|

|

|

1.1.1.2. |

if you do not wish to Participate in the Shareholders’ Meeting, in which case, you must not complete the attached Form of Proxy (yellow), you must instead provide your CSDP or Broker with your voting instructions in the manner stipulated in such custody agreement or advised by your CSDP or Broker. The forementioned instructions must be provided to

your CSDP or Broker by the cut-off time and date advised by the CSDP or Broker for instructions of this nature.

|

|

|

1.1.2. |

If your CSDP or Broker has not contacted you, you should contact your CSDP or Broker and furnish it with your voting instructions.

|

|

|

1.1.3. |

If your CSDP or Broker does not obtain voting instructions from you, it will be obliged to vote in accordance with the instructions contained in the custody agreement concluded between you and your CSDP or

Broker.

|

|

|

1.1.4. |

You must not complete the attached Form of Proxy (yellow).

|

|

|

1.1.5. |

It is requested that the necessary letter of representation (and supporting identification documents) of Dematerialised AGA Shareholders without “own name” registration be delivered to the Transfer

Secretaries, as follows:

|

|

|

1.1.5.1. |

by email at proxy@computershare.co.za;

|

|

|

1.1.5.2. |

by hand to Computershare Investor Services Proprietary Limited, 1st Floor, Rosebank Towers, 15 Biermann Avenue, Rosebank, Johannesburg 2196, South Africa; or

|

|

|

1.1.5.3. |

by post to Computershare Investor Services Proprietary Limited, Private Bag X9000, Saxonwold, 2132,

|

|

|

1.2. |

Surrender of Documents of Title

|

|

|

1.3. |

Operation of the Reorganisation

|

| 2. |

IF YOU ARE A DEMATERIALISED AGA SHAREHOLDER WITH “OWN NAME” REGISTRATION

|

|

|

2.1. |

To Participate in the Shareholders’ Meeting

|

|

|

2.1.1. |

You may Participate in the Shareholders’ Meeting (or if you are a company or other body corporate be represented by a duly authorised person) by electronic communication as outlined in paragraph 4.

|

|

|

2.1.2. |

Alternatively, if you do not wish to or are unable to Participate in the Shareholders’ Meeting and wish to be represented thereat, you may appoint one or more proxies, who need not also be AGA Shareholders

to Participate in your place by completing the Form of Proxy (yellow), in accordance with the instructions therein, and returning it together with proof of identification (i.e. valid South African

identity document, driver’s license or passport) and authority to do so (where acting in a representative capacity), to the Transfer Secretaries, as follows:

|

|

|

2.1.2.1. |

by email at proxy@computershare.co.za;

|

|

|

2.1.2.2. |

by hand to Computershare Investor Services Proprietary Limited, 1st Floor, Rosebank Towers, 15 Biermann Avenue, Rosebank, Johannesburg 2196, South Africa; or

|

|

|

2.1.2.3. |

by post to Computershare Investor Services Proprietary Limited, Private Bag X9000, Saxonwold, 2132,

|

|

|

2.2. |

The Form of Proxy (yellow) may, however, be handed to the chairman of the Shareholders’ Meeting, at any time before the commencement of the voting on the applicable

matter at the Shareholders’ Meeting.

|

|

|

2.3. |

Surrender of Documents of Title

|

|

|

2.4. |

Operation of the Reorganisation

|

| 3. |

IF YOU ARE A CERTIFICATED SHAREHOLDER

|

|

|

3.1. |

To Participate in the Shareholders’ Meeting

|

|

|

3.1.1. |

You may Participate in the Shareholders’ Meeting (or if you are a company or other body corporate be represented by a duly authorised person) by electronic communication as outlined in paragraph 4.

|

|

|

3.1.2. |

Alternatively, if you do not wish to or are unable to Participate in the Shareholders’ Meeting and wish to be represented thereat, may appoint one or more proxies, who need not also be AGA Shareholders to

Participate in your place by completing the Form of Proxy (yellow), in accordance with the instructions therein, and returning it together with proof of identification (i.e. valid South African

identity document, driver’s license or passport) and authority to do so (where acting in a representative capacity), to the Transfer Secretaries, as follows:

|

|

|

3.1.2.1. |

by email at proxy@computershare.co.za;

|

|

|

3.1.2.2. |

by hand to Computershare Investor Services Proprietary Limited, 1st Floor, Rosebank Towers, 15 Biermann Avenue, Rosebank, Johannesburg 2196, South Africa; or

|

|

|

3.1.2.3. |

by post to Computershare Investor Services Proprietary Limited, Private Bag X9000, Saxonwold, 2132,

|

|

|

3.1.3. |

The Form of Proxy (yellow) may, however, be handed to the chairman of the Shareholders’ Meeting, at any time before the commencement of the voting at the

Shareholders’ Meeting.

|

|

|

3.2. |

Surrender of Documents of Title and Operation of the Reorganisation

|

|

|

3.2.1. |

Should the Reorganisation become unconditional and be implemented:

|

|

|

3.2.1.1. |

you will be required to surrender your Documents of Title in respect of all your AGA Ordinary Shares in order to receive the Reorganisation Consideration which will be in Dematerialised form; and

|

|

|

3.2.1.2. |

you shall only be entitled to receive the Reorganisation Consideration owed to you once you have surrendered your Documents of Title in respect thereof. This is achieved by completing the attached Form of

Surrender and Transfer (blue) in accordance with its instructions and returning it, together with the relevant Documents of Title, to the Transfer Secretaries to be received by no later than 12:00

p.m. (South Africa Standard Time) on the Reorganisation Consideration Record Date. Should you wish to expedite receipt of your Reorganisation Consideration, you are entitled to surrender your Documents of Title in anticipation of the

Reorganisation being implemented, by completing the Form of Surrender and Transfer (blue) in accordance with the provisions contained in this paragraph 3.2.1.2 of this Circular. Documents of Title

surrendered by you prior to the Operative Date, will be held in trust by the Transfer Secretaries, at your risk, pending the Reorganisation becoming unconditional. Should you surrender your Documents of Title in anticipation of the

Reorganisation being implemented and the Reorganisation then is not implemented, the Transfer Secretaries shall, within 5 (five) Business Days of either the date upon which it becomes known that the Reorganisation will not be implemented or

on receipt by the Transfer Secretaries of the required Documents of Title, whichever is the later, return the Documents of Title to you by registered post at your own risk.

|

|

|

3.2.2. |

Once you have surrendered your Documents of Title, you will not be able to trade your AGA Ordinary Shares from the date that you surrender your Documents of Title in respect of those AGA Ordinary Shares

until the Operative Date or, if the Reorganisation is not implemented, between the date of surrender and the date on which your Documents of Title are returned to you as set out in paragraph 3.2.1.2 of this Circular.

|

|

|

3.2.3. |

If:

|

|

|

3.2.3.1. |

you fail to surrender your Documents of Title by not completing and returning the Form of Surrender and Transfer (blue) in accordance with the instructions

contained therein; or

|

|

|

3.2.3.2. |

you fail to provide any account details, or provide incorrect account details, of your CSDP or Broker, into which your Scheme Reorganisation Consideration will be transferred in Dematerialised form,

|

|

|

3.2.4. |

You should note that if the Reorganisation becomes unconditional and is implemented, you will have to surrender your Documents of Title in respect of your AGA Ordinary Shares in exchange for your

Reorganisation Consideration, irrespective of whether you voted in favour of Special Resolution Number 1 and/or Special Resolution Number 2.

|

|

|

3.2.5. |

If the Reorganisation is not implemented, you will retain your AGA Ordinary Shares and will not be entitled to receive any NewCo Ordinary Shares.

|

|

|

3.2.6. |

If you wish to Dematerialise your AGA Ordinary Shares, please contact your CSDP or Broker. Although all NewCo Ordinary Shares will initially be issued in Dematerialised form, you do not need to Dematerialise

your AGA Ordinary Shares to participate in the Reorganisation or to receive any NewCo Ordinary Shares in terms of the Reorganisation.

|

|

|

3.2.7. |

No Dematerialisation or re-materialisation of AGA Ordinary Shares may take place:

|

|

|

3.2.7.1. |

from the Business Day following the Reorganisation Last Day to Trade up to and including the Shareholders’ Meeting Voting Record Date in respect of the Shareholders’ Meeting; and

|

|

|

3.2.7.2. |

if the Scheme becomes operative, on or after the Business Day following the Reorganisation Last Day to Trade.

|

|

|

3.2.8. |

If your share certificates relating to the Reorganisation Consideration to be surrendered have been lost or destroyed and you are a Certificated AGA Shareholder, you should nevertheless return the Form of

Surrender and Transfer (blue), duly signed and completed, to the Transfer Secretaries together with a duly completed indemnity form, which is obtainable from the Transfer Secretaries, as well as

satisfactory evidence that the Documents of Title have been lost or destroyed.

|

|

|

3.2.9. |

Under Strate directives, Dematerialised AGA Shareholders are required to elect to receive direct communication in the future, which includes but is not limited to the receipt of shareholder communication

documentation. Such election will facilitate the direct communication by NewCo to such holders. AGA Shareholders who are currently Certificated AGA Shareholders and will be Dematerialised NewCo Shareholders are encouraged to make such

election.

|

| 4. |

ELECTRONIC PARTICIPATION AT THE SHAREHOLDERS’ MEETING

|

|

|

4.1. |

AGA has appointed The Meeting Specialist Proprietary Limited (“TMS”) for purposes of hosting the Shareholders’ Meeting entirely by way of electronic communication and,

in particular, for TMS to provide AGA and the AGA Shareholders with access to its electronic communication platform (the “Platform”) for purpose of enabling all of the AGA Shareholders, who are present

at the Shareholders’ Meeting, to communicate concurrently with each other, without an intermediary, and to participate reasonably effectively in the Shareholders’ Meeting and exercise their voting rights at the Shareholders’ Meeting.

|

|

|

4.2. |

Please also note that in order to attend and participate in the Shareholders’ Meeting, AGA Shareholders are required to be granted access to the Platform by TMS and any AGA Shareholder who wishes to attend

the Shareholders’ Meeting is encouraged to contact TMS on proxy@tmsmeetings.co.za or +27 084 433 4836 / 081 711 4255 / 061 440 0654 as soon as possible, but not later than 2:00 p.m. (South Africa Standard Time) on Friday, 4 August 2023 to

enable TMS to verify its/his/her identity and thereafter to grant that AGA Shareholder access to the Platform. Notwithstanding the foregoing, any AGA Shareholder who wishes to attend the Shareholders’ Meeting is entitled to contact TMS at any

time prior to the conclusion of the Shareholders’ Meeting, in order to be verified and provided with access to the Platform by TMS. In order to avoid any delays in being provided with access to the Platform by TMS, AGA Shareholders are

encouraged to contact TMS at their earliest convenience.

|

|

|

4.3. |

Further details as to how you can Participate using electronic communication are set out in the Notice of Shareholders’ Meeting.

|

| 5. |

IF YOU ARE A HOLDER OF AGA ADSs

|

|

|

5.1. |

To Participate in the Shareholders’ Meeting

|

|

|

5.1.1. |

As a holder of AGA ADSs on the ADS Voting Record Date, you are entitled to instruct the ADS Depositary on how to vote the AGA Ordinary Shares that your AGA ADSs represent.

|

|

|

5.1.2. |

If you are a registered holder of AGA ADSs, you should receive a voting instruction card from the ADS Depositary, which you should mark, sign and return to the ADS Depositary, to be received prior to 12:00

p.m. (Eastern Standard Time) on Tuesday, 8 August 2023 (the “ADS Instruction Date”). If you hold AGA ADSs in a securities account through a broker or other securities intermediary, you should receive

voting materials from your intermediary, which you should use to give voting instructions to your intermediary, to be received prior to the cut-off date and time specified in those materials (which will be earlier than the ADS Instruction

Date above).

|

|

|

5.1.3. |

If you do not timely provide the ADS Depositary or relevant broker or securities intermediary with voting instructions, the AGA Ordinary Shares underlying your AGA ADSs will not be counted to establish a

quorum to open the Shareholders’ Meeting, voted in respect of the proposed resolutions, or taken into account in calculating whether the requisite majority required to approve Special Resolution Number 1 and Special Resolution Number 2 has

been achieved.

|

|

|

5.1.4. |

If you wish to attend, speak and vote at the Shareholders’ Meeting, you must:

|

|

|

5.1.4.1. |

surrender your AGA ADSs to the ADS Depositary for cancellation;

|

|

|

5.1.4.2. |

withdraw the AGA Ordinary Shares represented by your AGA ADSs from the custodian bank holding such AGA Ordinary Shares; and

|

|

|

5.1.4.3. |

be recorded in the AGA Register as an AGA Shareholder on the Shareholders’ Meeting Voting Record Date. You should note that the ADS Depositary may charge a fee for the surrender of your AGA ADSs and the

delivery of the AGA Ordinary Shares represented by your AGA ADSs. The amount of any such charge should be confirmed directly with the ADS Depositary.

|

|

|

5.1.5. |

For more information on how to provide instructions in connection with the Shareholders’ Meeting, holders of AGA ADSs should refer to the notice and instructions provided by the ADS Depositary.

|

| 6. |

FOREIGN SHAREHOLDERS

|

| 7. |

APPROVAL OF THE AGAH SALE AND THE SCHEME

|

|

|

7.1. |

The AGAH Sale must be approved by AGA Shareholders by voting in favour of Special Resolution Number 1, being a special resolution to be adopted in accordance with Section 112(2) read with Section 115(2)(a)

of the Companies Act, at the Shareholders’ Meeting and at which Shareholders’ Meeting sufficient AGA Shareholders are present (not being less than 3 (three) AGA Shareholders) to exercise, in aggregate, at least 25% (twenty five percent) of

all the voting rights that are entitled to be exercised on Special Resolution Number 1. In order to be approved, Special Resolution Number 1 will require votes in favour representing at least 75% (seventy five percent) of the voting rights

exercised at the Shareholders’ Meeting.

|

|

|

7.2. |

The Scheme must be approved by AGA Shareholders by voting in favour of Special Resolution Number 2, being a special resolution to be adopted in accordance with Section 114 read with Section 115(2)(a) of the

Companies Act, at the Shareholders’ Meeting and at which Shareholders’ Meeting sufficient AGA Shareholders are present (not being less than 3 (three) AGA Shareholders) to exercise, in aggregate, at least 25% (twenty five percent) of all the

voting rights that are entitled to be exercised on Special Resolution Number 2. In order to be approved, Special Resolution Number 2 will require votes in favour representing at least 75% (seventy five percent) of the voting rights exercised

at the Shareholders’ Meeting.

|

|

|

7.3. |

AGA Shareholders are advised that, in accordance with Section 115(3) of the Companies Act, AGA may, in certain circumstances, not implement Special Resolution Number 1 and Special Resolution Number 2,

despite the fact that they will have been adopted at the Shareholders’ Meeting, without the approval of a court or other competent authority. Please also see 7.14 (Court Approval) below. A copy of

Section 115 of the Companies Act pertaining to the required approval for the AGAH Sale and the Scheme is set out in Annexure F attached to this Circular.

|

|

|

7.4. |

No approval of the Spin-Off is being sought from AGA Shareholders or AGA ADS Holders.

|

| 8. |

DISSENTING AGA SHAREHOLDERS’ APPRAISAL RIGHTS

|

|

|

8.1. |

If an AGA Shareholders wishes to exercise his/her/its Appraisal Rights, that AGA Shareholder must give AGA written notice in terms of Section 164 of the Companies Act objecting to Special Resolution Number 1

and/or Special Resolution Number 2, at any time before Special Resolution Number 1 and Special Resolution Number 2 are to be voted on at the Shareholders’ Meeting.

|

|

|

8.2. |

Within 10 (ten) Business Days after AGA has adopted Special Resolution Number 1 and Special Resolution Number 2, AGA must send a notice stating that Special Resolution Number 1 and/or Special Resolution

Number 2 has been adopted, to each AGA Shareholder who gave AGA written notice of objection and has not withdrawn that notice and has voted against Special Resolution Number 1 and/or Special Resolution Number 2, as applicable.

|

|

|

8.3. |

An AGA Shareholder who has given AGA written notice in terms of Section 164 of the Companies Act objecting to Special Resolution Number 1 and/or Special Resolution Number 2, and who has not withdrawn that

notice and has voted against Special Resolution Number 1 and/or Special Resolution Number 2, as the case may be, and has complied with all of the procedural requirements set out in Section 164 of the Companies Act may, if Special Resolution

Number 1 and Special Resolution Number 2 have been adopted, demand in writing within:

|

|

|

8.3.1. |

20 (twenty) Business Days after receipt of the notice from AGA referred to above; or

|

|

|

8.3.2. |

20 (twenty) Business Days after learning that Special Resolution Number 1 and Special Resolution Number 2 have been adopted, if the AGA Shareholder does not receive the notice from AGA referred to above,

|

|

|

8.4. |

A copy of Section 164 of the Companies Act referred to in this paragraph 8 is attached as Annexure G to this Circular.

|

|

|

8.5. |

AGA ADS Holders do not have dissenting shareholders’ Appraisal Rights, except if they surrender their AGA ADSs to the ADS Depositary, pay the ADS Depositary’s fee for surrender of the AGA ADSs and become a

registered holder of AGA Ordinary Shares prior to the Shareholders’ Meeting Voting Record Date.

|

| 9. |

OTHER

|

|

INTERPRETATION AND DEFINITIONS

|

| 1. |

the following terms shall have the meanings assigned to them hereunder and cognate expressions shall have corresponding meanings, namely:

|

|

|

1.1. |

“ADS Depositary” means The Bank of New York Mellon which acts as the depositary in respect of the AGA ADS Program;

|

|

|

1.2. |

“AGA” or “Company” means AngloGold Ashanti Limited (Registration No. 1944/017354/06), a public company duly incorporated in

accordance with the company laws of South Africa;

|

|

|

1.3. |

“AGA ADS Holder” means a registered holder of AGA ADSs;

|

|

|

1.4. |

“AGA ADS Program” means the American Depositary Share Program of AGA governed by the AGA Deposit Agreement;

|

|

|

1.5. |

“AGA ADSs” means American depositary shares representing AGA Ordinary Shares deposited or subject to deposit with the ADS Depositary under the AGA Deposit Agreement at

a ratio of 1 (one) AGA Ordinary Share to 1 (one) such American depositary share, which are listed and traded on the NYSE;

|

|

|

1.6. |

“AGA Board” means the directors of the Company, comprising, as at the Last Practicable Date, those persons whose names appear in section headed “Corporate Information

and Advisers”;

|

|

|

1.7. |

“AGA Ghana Shareholder” means the holders of the AGA Ordinary Shares on the Ghana branch of the AGA Register;

|

|

|

1.8. |

“AGA GhDSs” means Ghanaian depositary shares representing AGA Ordinary Shares at a ratio of 1 (one) AGA Ordinary Share to 100 (one hundred) such Ghanaian depositary

shares, which are listed and traded on the GhSE;

|

|

|

1.9. |

“AGA GhDS Holder” means a holder of AGA GhDS;

|

|

|

1.10. |

“AGA Deposit Agreement” means the amended and restated deposit agreement (dated as of 3 June

2008) entered into between AGA, the ADS Depositary and all owners and beneficial owners from time to time of AGA ADSs issued thereunder;

|

|

|

1.11. |

“AGA Ordinary Shares” means the ordinary shares, with a par value of R0.25 (twenty five cents) each, in the issued share capital of AGA, which are listed for trading

with ISIN No. ZAE 000043485 on, inter alia, the Main Board of the JSE;

|

|

|

1.12. |

“AGA Register” means collectively AGA’s: (a) “securities register” as defined in section 1 of the Companies Act; and (b) “uncertificated securities register” as

defined in section 1 of the Companies Act (which the Companies Act stipulates forms part of the “securities register”);

|

|

|

1.13. |

“AGA Shareholders” means the holders of AGA Ordinary Shares, who are recorded as such in the AGA Register;

|

|

|

1.14. |

“AGAH” means AngloGold Ashanti Holdings plc (Registration No. 001177V), a company duly incorporated in accordance with the company laws of the Isle of Man, which as of

the Last Practicable Date is a wholly-owned subsidiary of AGA;

|

|

|

1.15. |

“AGAH Sale” means the irrevocable offer by NewCo to AGA to purchase 100% (one hundred percent) of the shares in AGAH, and the present, non-binding intention of AGA to

accept the Irrevocable Offer to Purchase, which if completed will constitute a disposal of all or the greater part of the assets or undertaking of AGA subject to approval under Chapter 5 of the Companies Act in terms of Section 112 and

section 115(2)(b) of the Companies Act;

|

|

|

1.16. |

“AGAH Sale Shares” means 100% (one hundred percent) of the issued share capital of AGAH;

|

|

|

1.17. |

“Annexures” means the annexures to this Circular;

|

|

|

1.18. |

“Appraisal Rights” means the dissenting shareholders’ appraisal rights remedy afforded to shareholders in terms of section 164 of the Companies Act;

|

|

|

1.19. |

“Associate/s” means an associate in relation to either an individual or to a company;

|

|

|

1.20. |

“ASX” means the Australian Securities Exchange;

|

|

|

1.21. |

“ASX Delisting” means the termination of the listing of AGA from the ASX;

|

|

|

1.22. |

“AUD” or “Australian Dollars” means the Australian Dollar, being the lawful currency of Australia;

|

|

|

1.23. |

“A2X” means A2X Solutions Proprietary Limited (Registration No. 2021/439627/07), a private company duly incorporated in accordance with the company laws of South

Africa, or where the context requires, the South African securities exchange known as the A2X Markets which is operated by A2X Solutions Proprietary Limited and which is licensed to operate as a securities exchange under the Financial Markets

Act;

|

|

|

1.24. |

“A2X Listing” means the proposed secondary inward listing of NewCo Ordinary Shares on the A2X;

|

|

|

1.25. |

“Barclays” means Barclays Bank PLC, acting through its Investment Bank;

|

|

|

1.26. |

“Beneficial Interest” means an interest in one fifth of an AGA Ordinary Share retained by a Former CDI Holder;

|

|

|

1.27. |

“Broker” means any person registered as a “broker member equities” in terms of the rules of the JSE in accordance with the provisions of the Financial Markets Act;

|

|

|

1.28. |

“Business Day” means any day other than a Saturday, Sunday or proclaimed public holiday in South Africa from time to time;

|

|

|

1.29. |

“CDI” means CHESS depositary interest;

|

|

|

1.30. |

“Certificated AGA Ordinary Shares” means issued AGA Ordinary Shares that have not been Dematerialised and to which title is evidenced by a physical document of title,

including share certificates and certified transfer deeds;

|

|

|

1.31. |

“Certificated AGA Shareholders” means holders of Certificated AGA Ordinary Shares;

|

|

|

1.32. |

“Circular” means this bound document, dated 7 July 2023, including the Annexures hereto incorporating the Notice of Shareholders’ Meeting, Forms of Proxy (yellow), Form of Surrender and Transfer (blue);

|

|

|

1.33. |

“Common Monetary Area” means South Africa, the Republic of Namibia and the Kingdoms of Lesotho and Eswatini;

|

|

|

1.34. |

“Companies Act” means the South African Companies Act, No. 71 of 2008;

|

|

|

1.35. |

“Companies Regulations” means the Companies Regulations, 2011, promulgated under the Companies Act;

|

|

|

1.36. |

“Computershare” means Computershare Investor Services Proprietary Limited (Registration No. 2004/003647/07), a limited liability private company incorporated and

registered under the laws of South Africa;

|

|

|

1.37. |

“Computershare Nominees” means Computershare Nominees Proprietary Limited (Registration No. 1999/008543/07), a limited liability private company incorporated and

registered under the laws of South Africa, being the nominee of Computershare’s CSDP;

|

|

|

1.38. |

“Cravath, Swaine & Moore” means Cravath, Swaine & Moore LLP, DOS ID No. 2886667;

|

|

|

1.39. |

“Credit Support Agreement” means an agreement titled “Credit Support Agreement” concluded or to be concluded between AGAH and AGA, in terms of which, inter alia, AGAH undertakes to provide and/or provides credit support to AGA by way of a loan facility to enable AGA to meet the requirements of the solvency and liquidity test (as set out in section 4 of

the Companies Act);

|

|

|

1.40. |

“CS Depositary” means Computershare Trust Company, N.A., a national association organised under the laws of the United States;

|

|

|

1.41. |

“CS Depositary Nominee” means GTU Ops Inc., a Delaware corporation, operating as nominee to hold NewCo Ordinary Shares for the CS Depositary;

|

|

|

1.42. |

“CSDP” means a central securities depository participant authorised by a licenced central securities depository to perform custody and administration services or

settlement services or both, in terms of the central securities depository rules published in terms of the Financial Markets Act;

|

|

|

1.43. |

“Dematerialised” means the process by which securities held in certificated form are converted to or held in electronic form as uncertificated securities and recorded

in the sub-register of dematerialised shareholders, maintained by a CSDP and forming part of the AGA Register;

|

|

|

1.44. |

“Dematerialised AGA Shareholders” means the AGA Shareholders who hold Dematerialised AGA Ordinary Shares;

|

|

|

1.45. |

“Disclosure Package” means this Circular and the Pre-listing Statement, which shall be posted together;

|

|

|

1.46. |

“Dissenting AGA Shareholder” means any AGA Shareholder who has exercised and/or is exercising their Appraisal Rights;

|

|

|

1.47. |

“Documents of Title” means original versions of share certificates, transfer deeds, balance receipts or any other physical documents constituting or representing valid

legal title to the AGA Ordinary Shares;

|

|

|

1.48. |

“DTC” means The Depository Trust Company, a limited purpose trust company established under the New York Banking Law;

|

|

|

1.49. |

“ENSafrica” means Edward Nathan Sonnenbergs Inc. (Registration No. 2006/018200/21), a personal liability company incorporated and registered under the laws of South

Africa;

|

|

|

1.50. |

“Exchange Control Regulations” means the Exchange Control Regulations of South Africa, promulgated in terms of section 9 of the South African Currency and Exchanges

Act, No. 9 of 1933;

|

|

|

1.51. |

“EY” means Ernst & Young Inc. (Registration No. 2005/002308/21), a personal liability company incorporated and registered under the laws of South Africa;

|

|

|

1.52. |

“Financial Adviser” means AGA’s and/or NewCo’s (as the case may be) appointed financial advisers in respect of the Reorganisation, being Centerview Partners UK LLP

(Company number OC345806), JPMorgan Chase Bank, N.A., Johannesburg Branch (Registration No. 2001/016069/10) and Rothschild and Co South Africa Proprietary Limited (Registration No. 1999/021764/07);

|

|

|

1.53. |

“Form F-4” means the Registration Statement on Form F-4 (SEC File No. 333-272867) initially filed by NewCo with the SEC on 23 June 2023;

|

|

|

1.54. |

“Former CDI Holder” means a holder of a CDI on the date of the ASX Delisting who as at the Shareholders’ Meeting Voting Record Date retains a Beneficial Interest in

AGA Ordinary Shares;

|

|

|

1.55. |

“Financial Markets Act” means the South African Financial Markets Act, No. 9 of 2012;

|

|

|

1.56. |

“Firm Intention Announcement” means the firm intention announcement in respect of the Reorganisation, as released by AGA on SENS on Friday, 12 May 2023;

|

|

|

1.57. |

“Foreign Shareholder” means an AGA Shareholder who is a non-resident of South Africa as contemplated in the Exchange Control Regulations;

|

|

|

1.58. |

“Founder Share” means the 1 (one) NewCo Ordinary Share which AGA holds in NewCo as at the Last Practicable Date, which NewCo Ordinary Share was issued to AGA upon the

incorporation of NewCo;

|

|

|

1.59. |

“Fulfilment Date” means the date on which the last of the Reorganisation Conditions has been fulfilled or waived, as the case may be;

|

|

|

1.60. |

“GBP” or “Pounds” means the British Pound Sterling, being the lawful currency of the United Kingdom;

|

|

|

1.61. |

“Ghana” means the Republic of Ghana;

|

|

|

1.62. |

“GhSE” means the Ghana Stock Exchange;

|

|

|

1.63. |

“Group” means AGA and its Subsidiaries prior to the implementation of the Reorganisation and subsequent to the implementation of the Reorganisation, NewCo and its

Subsidiaries, as the context requires;

|

|

|

1.64. |

“HMRC” means His Majesty’s Revenue and Customs, being the tax authority of the United Kingdom;

|

|

|

1.65. |

“IASB” means the International Accounting Standards Board;

|

|

|

1.66. |

“IFRS” means the International Financial Reporting Standards, as issued by the IASB;

|

|

|

1.67. |

“Implementation Agreement” means the agreement titled “Implementation Agreement” entered into on or about 12 May 2023 between AGA and NewCo, and as amended on 23 June

2023, in terms of which, inter alia, NewCo undertakes to co-operate with AGA to implement the Reorganisation;

|

|

|

1.68. |

“Implementation Deadline” means the end of the third business day (or such other date as determined by the AGA Board) following the implementation of the Spin-Off;

|

|

|

1.69. |

“Income Tax Act” or “ITA” means the South Africa Income Tax Act, No. 58 of 1962;

|

|

|

1.70. |

“Independent Board” means those members of the AGA Board who AGA has indicated are to constitute the “independent board”, as contemplated in regulation 81(j) of the

Companies Regulations, for the purposes of, inter alia, the Scheme (details of each of whom are included in Annexure E (Information

on AGA Directors) attached to this Circular);

|

|

|

1.71. |

“Independent Expert” means the independent expert appointed by the Board in terms of regulation 110 of the Takeover Regulations to provide the Independent Board with

appropriate external advice in the form of the Independent Expert Report, being Barclays;

|

|

|

1.72. |

“Independent Expert Report” means the report prepared by the Independent Expert in accordance with section 114 of the Companies Act and regulation 90 and 110 of the

Takeover Regulations, and attached as Annexure A to this Circular;

|

|

|

1.73. |

“Independent External Auditor” means each of AGA’s and NewCo’s appointed independent auditor, being PwC;

|

|

|

1.74. |

“Independent Reporting Accountant” means each of AGA’s and NewCo’s appointed independent reporting accountant, being EY;

|

|

|

1.75. |

“Irrevocable Offer to Purchase” means the document titled “Irrevocable Offer to Purchase”, signed by NewCo and delivered to AGA on or about 12 May 2023, in terms of

which, inter alia, NewCo irrevocably offers, in favour of AGA, to purchase all (and not part only) of the AGAH Sale Shares in consideration for the issue by NewCo to AGA of the NewCo Notes;

|

|

|

1.76. |

“Issuer Nominee Dematerialised NewCo Shareholder” means if the Reorganisation becomes unconditional and is implemented, AGA Shareholders who, prior to implementation

of the Reorganisation and whilst they were Certificated AGA Shareholders, (a) failed to complete and return a Form of Surrender and Transfer (blue) in accordance with the instructions contained

therein; or (b) in the Form of Surrender and Transfer (blue) failed to provide any account details, or provided incorrect account details, of a CSDP or Broker, into which the relevant NewCo Ordinary

Shares were to be transferred and on whose behalf Computershare Nominees will hold the Reorganisation Consideration until such person appoints a CSDP or Broker and provides such details to Computershare Nominees with an instruction to

transfer the Reorganisation Consideration;

|

|

|

1.77. |

“JSE” means the JSE Limited (Registration No. 2005/022939/06), a public company duly incorporated in South Africa and which is licensed to operate as a securities

exchange under the Financial Markets Act;

|

|

|

1.78. |

“JSE Listing” means the proposed secondary inward listing of the NewCo Ordinary Shares on the JSE;

|

|

|

1.79. |

“JSE Listings Requirements” means the listings requirements of the JSE, as published from time to time by the JSE;

|

|

|

1.80. |

“JSE Sponsor” means The Standard Bank of South Africa Limited (Registration No. 1962/000738/06), a public company incorporated and registered under the laws of South

Africa;

|

|

|

1.81. |

“Last Practicable Date” means 15 June 2023, being the last practicable date before the issue of this Circular;

|

|

|

1.82. |

“Legal Advisers” means each of AGA’s and NewCo’s appointed legal advisers, being ENSafrica, Cravath, Swaine & Moore or Slaughter and May, as the context may

require;

|

|

|

1.83. |

“Longstop Date” means 29 February 2024 or such later date that the AGA and NewCo may agree to in writing prior to such date, being the date by which all the

Reorganisation Conditions must be fulfilled (or, where appropriate, waived);

|

|

|

1.84. |

“Material Adverse Effect” means any change, event, effect, fact, circumstance, development or occurrence (whether known, unknown or reasonably foreseeable by AGA on

the signature date of the Implementation Agreement, and including any change, event, effect, fact, circumstance, development or occurrence relating to taxation) that, individually or in the aggregate with other changes, events, effects,

facts, circumstances, developments or occurrences, in the reasonable opinion of AGA (a) relates to the Reorganisation and decreases, or could reasonably be expected to decrease, the free cash flow of the Group by at least USD 150,000,000 (one

hundred and fifty million Dollars), (b) prevents or impairs or delays (for a period of at least 60 (sixty) days), or could reasonably be expected to prevent or impair or delay (for a period of at least 60 (sixty) days), the implementation of

the Reorganisation or the ability of either AGA or NewCo to perform its obligations under the Implementation Agreement, or (c) increases, or could reasonably be expected to increase, the costs to the Group of implementing the Reorganisation

by at least USD 150,000,000 (one hundred and fifty million Dollars);

|

|

|

1.85. |

“Mineral Resource and Mineral Reserve Report” means the report titled “Mineral Resource and Mineral Reserve Report” as at 31 December 2022, an annual report prepared

by AGA in terms of paragraph 12.13 of the JSE Listings Requirements;

|

|

|

1.86. |

“NewCo” means AngloGold Ashanti plc (Registration No. 14654651), a public company duly incorporated in accordance with the laws of England and Wales;

|

|

|

1.87. |

“NewCo Board” means the board of directors of NewCo, comprising, as at the Last Practicable Date, those persons whose names appear in section headed “Corporate

Information and Advisers”;

|

|

|

1.88. |

“NewCo GhDSs” means Ghanaian depositary shares representing NewCo Ordinary Shares at a ratio of 1 (one) NewCo Ordinary Share to 100 (one hundred) such Ghanaian

depositary shares, which are to be listed and traded on the GhSE;

|

|

|

1.89. |

“NewCo Notes” means zero coupon unsecured loan notes, which have an aggregate face value equal to the fair market value of the AGAH Sale Shares (as determined pursuant

to the Irrevocable Offer to Purchase), to be issued by NewCo to AGA;

|

|

|

1.90. |

“NewCo Ordinary Shares” means ordinary shares with a nominal value of USD 1 (one Dollar) each in the share capital of NewCo;

|

|

|

1.91. |

“NYSE” means the New York Stock Exchange;

|

|

|

1.92. |

“NYSE Listing” means the proposed primary listing of the NewCo Ordinary Shares on the NYSE;

|

|

|

1.93. |

“Operative Date” means the date, after the Fulfilment Date, on which the Scheme is to be implemented, being the later of: (a) 25 September 2023; (b) the day after the

date, if any, on which the AGAH Sale has been implemented (which sale, it is recorded, shall occur after the Spin-Off Completion); or (c) such other date as may be agreed in writing between AGA and NewCo;

|

|

|

1.94. |

“Own Name Registration” means the recordal by the CSDP, in the sub-register kept by the CSDP, of Dematerialised AGA Ordinary Shares in the name of the Dematerialised

AGA Shareholder;

|

|

|

1.95. |

“Participate” means to attend, speak and vote at the Shareholders’ Meeting in person or remotely by electronic communication;

|

|

|

1.96. |

“Pre-listing Statement” means the South African pre-listing statement posted by NewCo dated 7 July 2023, including all annexures and attachments thereto, which was

prepared by NewCo in accordance with the JSE Listings Requirements for the purpose of the JSE Listing;

|

|

|

1.97. |

“PwC” means PricewaterhouseCoopers Inc. (Registration No. 1998/012055/21), a personal liability company incorporated and registered under the laws of South Africa;

|

|

|

1.98. |

“Redeemable Preference Shares” means 50,000 (fifty thousand) non-voting redeemable preference shares with a nominal value of GBP 1 (one Pound) each issued in the share

capital of NewCo;

|

|

|

1.99. |

“Reorganisation” means the series of inter-conditional transaction steps (which will be implemented in the following sequence being the Spin-Off, the AGAH Sale and the

Scheme), in order to procure that, following implementation of the foregoing, NewCo is established as the new holding company of the Group, with its primary listing on the NYSE and with secondary inward listings on the JSE and the A2X and a

secondary listing on the GhSE;

|

|

|

1.100. |

“Reorganisation Conditions” means the suspensive conditions to which the completion of the Reorganisation is subject, as set out in paragraph 7.2 of this Circular;

|

|

|

1.101. |

“Reorganisation Consideration” means collectively the Scheme Consideration Shares and the Spin-Off Shares;

|

|

|

1.102. |

“Reorganisation Consideration Record Date” means 5:00 p.m. (South Africa Standard Time) on the date upon which an AGA `Shareholder must be recorded in the AGA

Register, in order to participate in the Spin-Off and the Scheme and to consequently receive the Spin-Off Shares and the Scheme Consideration Shares, being the “record date” set by the AGA Board for such purpose in terms of section 59(1) of

the Companies Act and the JSE Listings Requirements;

|

|

|

1.103. |

“SARB” means the South African Reserve Bank;

|

|

|

1.104. |

“Scheme” means the scheme of arrangement in terms of section 114 read with section 115 of the Companies Act, to be proposed by AGA to the AGA Shareholders, in terms of

which the Scheme Participants will exchange their Scheme Shares for the right and obligation to receive, ipso facto and without any action on the part of such Scheme Participants, the respective pro rata portions of the Scheme Consideration Shares;

|

|

|

1.105. |

“Scheme Consideration Shares” means such number of new NewCo Ordinary Shares as equate to the total number of Scheme Shares less the total number of Spin-off Shares;

|

|

|

1.106. |

“Scheme Participants” means the AGA Shareholders who are recorded as such in the AGA Register on the Reorganisation Consideration Record Date and are entitled to

receive the Scheme Consideration Shares, being those AGA Shareholders who are registered as such in the AGA Register at the Reorganisation Consideration Record Date and who, by the Reorganisation Consideration Record Date, either:

|

|

|

1.106.1. |

have not timeously delivered an Appraisal Rights demand to AGA in terms of section 164(5) to (8) of the Companies Act; or

|

|

|

1.106.2. |

have timeously delivered an Appraisal Rights demand to AGA in terms of section 164(5) to (8) of the Companies Act but have had their rights reinstated in terms of section 164(10) of the Companies Act;

|

|

|

1.107. |

“Scheme Shares” means all of the AGA Ordinary Shares held by the Scheme Participants at the Reorganisation Consideration Record Date;

|

|

|

1.108. |

“SEC” means the Securities and Exchange Commission of the United States;

|

|

|

1.109. |

“Securities Act” means the U.S. Securities Act of 1933;

|

|

|

1.110. |

“SENS” means the Stock Exchange News Service

of the JSE;

|

|

|

1.111. |

“Shareholders’ Meeting” means the meeting of the AGA Shareholders that will be held entirely by way of electronic communication on Friday, 18 August 2023 at 2:00 p.m.

(South Africa Standard Time) or such other postponed date and time or location as determined in accordance with the provisions of the AGA Memorandum of Incorporation, the Companies Act and the JSE Listings Requirements, at which AGA

Shareholders will be requested to consider and, if deemed fit, to pass, with or without modification, the resolutions set out in the Notice of Meeting of Shareholders attached to this Circular;

|

|

|

1.112. |

“Slaughter and May” means Slaughter and May,

an English general partnership whose offices are at One Bunhill Row, London EC1Y 8YY;

|

|

|

1.113. |

“South Africa” means the Republic of South

Africa;

|

|

|

1.114. |

“Spin-Off” means the distribution in specie to all the Scheme Participants, pursuant to which AGA will direct NewCo, its

wholly owned subsidiary, to issue 46,000 (forty six thousand) NewCo Ordinary Shares to such Scheme Participants on a pro rata basis, with the Spin-Off Subscription Consideration paid by AGA;

|

|

|

1.115. |

“Spin-Off Completion” shall have the meaning ascribed thereto in paragraph 7.12.1.3;

|

|

|

1.116. |

“Spin-Off Shares” means 46,000 (forty six thousand) NewCo Ordinary Shares;

|

|

|

1.117. |

“Spin-Off Subscription Date” means the date, after the Fulfilment Date, on which the Spin-Off Shares Subscription is to be implemented, being the later of: (a) 22

September 2023; or (b) such other date as may be agreed in writing between AGA and NewCo (which date may not be before the date referred in (a));

|

|

|

1.118. |

“Spin-Off Shares Subscription” means the transaction in terms of which AGA will subscribe for the Spin-Off Shares in consideration for the payment by AGA of an amount

equal to the Spin-Off Subscription Consideration;

|

|

|

1.119. |

“Spin-Off Subscription Consideration” means USD 46,000 (forty six thousand Dollars) to be paid by AGA to NewCo in consideration for the Spin-Off Shares;

|

|

|

1.120. |

“Sponsors” means each of the Transaction Sponsor and the JSE Sponsor, as the context may require;

|

|

|

1.121. |

“Strate” means, as appropriate, the electronic clearing and settlement system for transactions that take place on the JSE and A2X which is managed by Strate

Proprietary Limited (Registration Number: 1998/022242/07), a private company duly incorporated in accordance with the laws of South Africa;

|

|

|

1.122. |

“Subsidiary” means a subsidiary of a company as contemplated by section 3 of the Companies Act including, for the avoidance of doubt, entities registered and

incorporated outside of South Africa which would otherwise constitute a subsidiary if such entities were registered and incorporated in South Africa;

|

|

|

1.123. |

“Takeover Regulations” means the Takeover Regulations set forth in chapter 5 (Fundamental Transactions and Takeover Regulations) of the Companies Regulations;

|

|

|

1.124. |

“Tax Adviser” means Bowmans Inc. (Registration No. 1998/021409/21), a personal liability company incorporated and registered under the laws of South Africa;

|

|

|

1.125. |

“Transaction Advisers” means collectively the Financial Advisers, Transaction Sponsor, JSE Sponsor, Independent Reporting Accountant, Tax Adviser and Legal Advisers;

|

|

|

1.126. |

“Transaction Sponsor” means J.P. Morgan Equities South Africa Proprietary Limited

(Registration No. 1995/011815/07), a private company incorporated and registered under the laws of South Africa, in its capacity as transaction sponsor;

|

|

|

1.127. |

“Transfer Secretaries” means Computershare Investor Services Proprietary Limited (Registration No. 2004/003647/07), a private company incorporated under the

company laws of South Africa, in its capacity as transfer secretary of AGA;

|

|

|

1.128. |

“TRP” or “Takeover Regulation Panel” means the Takeover Regulation Panel, established by section 196 of the Companies Act;

|

|

|

1.129. |

“United Kingdom” or “UK” or “U.K.” means the United Kingdom of Great Britain and

Northern Ireland, as constituted from time to time;

|

|

|

1.130. |

“United States” or “US” or “U.S.” means the United States of America;

|

|

|

1.131. |

“USD” or “Dollar” or “US$” or “$” or “U.S. dollars” means the United States Dollar, being the lawful currency of the United States;

|

|

|

1.132. |

“U.S. Exchange Agent” means Computershare Trust Company, N.A., a national association organised under the laws of the United States;

|

|

|

1.133. |

“Voting Last Day to Trade” means the last day to trade in AGA Ordinary Shares in order to be recorded in the AGA Register on the Voting Record Date, being Monday, 7

August 2023;

|

|

|

1.134. |

“Voting Record Date” or “Shareholders’ Meeting Voting Record Date” means the date on which AGA Shareholders must be recorded in

the AGA Register in order to be eligible to attend and vote at the Shareholders’ Meeting, being Friday, 11 August 2023; and

|

|

|

1.135. |

“ZAR” or “Rand” or “R” means the South African Rand, being the lawful currency of South

Africa.

|

| 1. |

any word or expression defined in the JSE Listings Requirements, the Companies Act and/or the Takeover Regulations and not expressly defined in this Circular shall have the meaning given in the JSE Listings

Requirements, the Companies Act and/or the Takeover Regulations (as applicable);

|

| 2. |

headings are to be ignored in construing this Circular;

|

| 3. |

words importing:

|

|

|

3.1 |

any one gender include the other of masculine, feminine and neuter;

|

|

|

3.2 |

the singular include the plural and vice versa; and

|

|

|

3.3 |

natural persons include created entities (corporate or unincorporate) and the state and vice versa;

|

| 4. |

if figures are referred to in numerals and in words in this Circular and if there is any conflict between the two, the words shall prevail;

|

| 5. |

expressions defined in the main body of this Circular shall bear the same meanings in schedules and/or annexures to this Circular which do not themselves contain their own conflicting definitions.

|

| 6. |

references to a paragraph or Annexure are to a paragraph of, or Annexure to, this Circular;

|

| 7. |

any reference to a time of day is a reference to South Africa Standard Time (SAST), unless a contrary indication appears;

|

| 8. |

a reference to any statute or statutory provision shall be construed as a reference to the same as it may have been, or may from time to time be, amended, modified, replaced or re-enacted;

|

| 9. |

a reference to any other document referred to in this Circular is a reference to that other document as amended, revised, varied, novated or supplemented at any time;

|

| 10. |

where any number of days is prescribed, those days shall be reckoned exclusively of the first and inclusively of the last day unless the last day falls on a day which is not a Business Day, in which event