UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of March 2025

Commission File Number: 001-13184

TECK RESOURCES LIMITED

(Exact name of registrant as specified in its charter)

Suite 3300 – 550 Burrard Street

Vancouver, British Columbia V6C 0B3

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒

|

|

EXHIBIT INDEX

| Exhibit Number | Description | |

| 99.1 | Notice of Meeting and 2025 Management Proxy Circular |

|

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Teck Resources Limited | |||

| (Registrant) | |||

| Date: March 24, 2025 | By: | /s/ Amanda R. Robinson | |

| Amanda R. Robinson | |||

| Corporate Secretary | |||

|

|

EXHIBIT 99.1

Notice of Meeting and

Management Proxy Circular

Annual Meeting of Teck Resources Limited

to be held on April 24, 2025

Dear Shareholders:

On behalf of our board of directors and management, we are pleased to invite you to attend the annual meeting of shareholders of Teck Resources Limited on Thursday, April 24, 2025.

2024 was a historic year for Teck. We completed our transformation into a pure-play energy transition metals company and set the stage for significant future growth and value creation. This evolution is the foundation of our strategy to deliver transformative near-term copper growth, while simultaneously delivering significant returns to shareholders and maintaining a strong balance sheet through market cycles.

In addition to completing our portfolio transformation, we also made significant progress in the ramp-up of the expanded Quebrada Blanca Operations, a foundational asset for our growth strategy, and advancing our near-term copper growth projects, while maintaining a focus on health, safety and sustainability.

Moving forward into 2025, we turn our attention to realizing the generational opportunity we have created, with a focus on driving growth, value creation and resilience, built on a foundation of stakeholder trust and a commitment to excellence.

On behalf of the Board, we would like to extend our heartfelt gratitude to Edward C. Dowling, Jr., who is retiring from the Teck board in 2025, for his 12 years of service and leadership.

Further details about the business of the meeting are contained in the management information circular that follows. Please review and consider the information in the circular and ensure that you vote. Detailed instructions for how to submit your proxy or voting instructions or attend the meeting in person or virtually are on page 4 of the circular.

We thank you for your continued support of Teck and urge you to vote.

| “Sheila A. Murray” | “Jonathan H. Price” | |

| Sheila A. Murray | Jonathan H. Price | |

| Chair of the Board | President and Chief Executive Officer |

Notice of Annual Meeting of Shareholders

of Teck Resources Limited

| When: | Where: | |

| April 24, 2025, 2:00 p.m. (Pacific Time) |

Metropolitan Ballroom, Terminal City Club, 837 W. Hastings St., Vancouver, British Columbia And virtually at: https://virtual-meetings.tsxtrust.com/1742 |

At the Annual Meeting of shareholders (the “Meeting”) of Teck Resources Limited (“Teck”), shareholders of Teck (“Shareholders”) will be asked to:

| 1) | receive the consolidated financial statements for the year ended December 31, 2024 and the auditor’s report thereon; |

| 2) | elect 11 directors; |

| 3) | appoint PricewaterhouseCoopers LLP as auditor of Teck; |

| 4) | vote on an advisory resolution with respect to Teck’s approach to executive compensation; and |

| 5) | consider any other business that may properly come before the Meeting. |

You can read about each item of business starting on page 1 of the accompanying management proxy circular (the “Circular”), which also has information on voting and about our directors, corporate governance, and compensation.

You have the right to vote at the Meeting if you were a Shareholder as of the close of business on March 3, 2025.

Your vote is important. All Shareholders are encouraged to vote by proxy. To ensure your vote is counted, your proxy must be received by 2:00 p.m. (Pacific Time) on April 22, 2025 (the “Proxy Deadline”). See “Information about Voting” for detailed voting instructions for registered and non-registered Shareholders.

Meeting Attendance

The Meeting will be held at the Metropolitan Ballroom, Terminal City Club, 837 W. Hastings St., Vancouver, British Columbia and online at https://virtual-meetings.tsxtrust.com/1742. To virtually participate in the Meeting, Shareholders will need to log in using the control number included on your proxy form and the passcode “teck2025” (case sensitive). The meeting platform is fully supported across browsers and devices running the most updated version of applicable software plug-ins. You should ensure you have a strong, preferably high-speed, internet connection wherever you intend to participate in the Meeting and the latest version of Chrome, Safari, Edge, or Firefox. Please log in at least 15 minutes early to ensure your browser is compatible and allow ample time for online check-in procedures.

Registered Holders

Registered Shareholders and duly appointed proxyholders will be able to attend the Meeting, submit questions, and vote on the business of the Meeting, if the shares have not been voted in advance of the Meeting. If you wish to appoint someone to be your proxy other than the persons named in the form of proxy (the “Form of Proxy”), you will need to return your proxy by mail and telephone TSX Trust Company at 1-866-751-6315 (within North America) or 416-682-3860 (outside North America), or complete an online form at https://www.tsxtrust.com/control-number-request, by 2:00 p.m. (Pacific Time) on April 22, 2025 and provide TSX Trust Company with the required information for your proxyholder so that TSX Trust Company may provide the proxyholder with a 13-digit proxyholder control number. Such 13-digit proxyholder control number will differ from the control number set forth in the Form of Proxy and will allow your proxyholder to log in to and vote at the Meeting. Without a 13-digit proxyholder control number your proxyholder will only be able to log in to the Meeting as a guest and will not be able to vote.

|

Non-Registered Holders

Non-registered holders, including those holding their shares through a broker, financial institution or other intermediary, should carefully follow the instructions set out in their voting instruction form. |

Have a question for the Board or Management?

Email corporate.secretary@Teck.com to submit it in advance. |

Please note that only registered Shareholders and proxy holders are permitted to vote at the Meeting. A non-registered shareholder wishing to vote at the Meeting must appoint themselves as a proxyholder based on the instructions on their voting instruction form and telephone TSX Trust Company at 1-866-751-6315 (within North America) or 416-682-3860 (outside North America), or complete an online form at https://www.tsxtrust.com/control-number-request, by 2:00 p.m. (Pacific Time) on April 22, 2025 and provide TSX Trust Company with the required information so that TSX Trust Company can provide you with a 13-digit proxyholder control number. Such 13-digit proxyholder control number will differ from the control number set forth in the voting instruction form and will allow you to log in to and vote at the Meeting.

Notice-and-Access

We are using notice-and-access procedures to deliver our meeting materials to registered and beneficial Shareholders. You are receiving this notice with information on how you can access the Circular electronically, along with a proxy – or, in the case of non-registered Shareholders, a voting instruction form – for use in voting at the Meeting or submitting your voting instructions. Shareholders with existing instructions on their account to receive paper material will receive paper copies of Meeting materials. Requests for paper materials should be received at least 7 business days in advance of the Proxy Deadline in order to receive the meeting materials on time.

|

Are you a registered shareholder and have questions about Notice-and-Access or want to obtain free paper copies? Call: 1-888-433-6443 (from North America) 1-416-682-3801 (outside North America) Email: tsxt-fulfilment@tmx.com Are you a non-registered shareholder and want to obtain free paper copies of Meeting materials? Visit: http://www.proxyvote.com Call: 1-877-907-7643 or 1-844-916-0609 (from North America) 1-303-562-9305 (outside North America) You will need the control number from your voting instruction form. Not sure if you’re a registered shareholder? See page 4 of the Circular for more information. |

The Circular, proxy, and Teck’s 2024 annual report are available on our website at www.Teck.com/reports and will remain on the website for at least one full year. You can also access the Meeting materials, financial statements and management’s discussion and analysis under Teck’s name at www.SEDARplus.ca and www.sec.gov/edgar. Any meeting resulting from an adjournment or postponement of the Meeting will be held at a time and place to be specified either by Teck before the Meeting or by the Chair at the Meeting. Please refer to the accompanying Circular for further information regarding completion and use of the Form of Proxy and voting instruction form and other information about the Meeting. |

|

The Circular contains important information about Teck and the Meeting. We encourage you to review it prior to voting. Visit www.Teck.com/reports for more information.

| By order of the Board of Directors, “Amanda R. Robinson” Amanda R. Robinson Vice President, Legal and Corporate Secretary March 3, 2025 |

|

Interested in learning about Teck’s Sustainability practices? You can find our most recent Sustainability Report, our TCFD- and TNFD-aligned Climate Change and Nature report, and our report under the Fighting Against Forced Labour and Child Labour in Supply Chains Act at www.Teck.com/reports. |

EXECUTIVE SUMMARY

2024 Performance Highlights

Teck underwent a significant portfolio transformation in 2024, repositioning to a pure play energy transition metals business focused on copper growth following the sale of our steelmaking coal business. Our corporate strategy centers around four key pillars, core excellence, metals for the energy transition, value- driven growth and resilience. We are focused on creating value by advancing responsible growth and ensuring resilience, built on a foundation of stakeholder trust. We aim to maximize productivity and efficiency at our existing operations, maintain a strong balance sheet, deliver commercial and supply chain excellence, and be nimble in recognizing and acting on opportunities. The pursuit of sustainability guides our approach to business, and we recognize that our success depends on our ability to provide safe workplaces, engage in collaborative community relationships and support a healthy environment.

| Completed construction and continued ramp-up at our expanded Quebrada Blanca operations achieving designed mill throughput rates by the end of 2024. | Completed the sale of our steelmaking coal business, effecting a significant portfolio transformation. | Announced our new strategy and operating model under the leadership of a streamlined executive leadership team. |

Financial Performance

| · | Adjusted EBITDA1 was $2.9 billion for the year, driven by record copper production as Quebrada Blanca continued to ramp up, achieving design mill throughput rates by the end of 2024 |

| · | We recorded a loss from continuing operations before taxes of $718 million, due to an impairment charge on our Trail Operations |

| · | Adjusted profit from continuing operations attributable to shareholders1 was $605 million, or $1.17 per share for the year |

| · | We returned $1.8 billion to shareholders through share buybacks and dividends in 2024, including completing $1.25 billion of Class B subordinate voting share buybacks pursuant to our normal course issuer bid |

| · | We reduced our debt by US$2.5 billion in 2024 |

| · | We closed the year in a very strong financial position with liquidity of $11.9 billion, including $7.6 billion of cash, which will enable us to advance our industry-leading copper growth strategy and continue to return cash to shareholders |

Operating and Development

| · | Teck underwent a significant portfolio transformation in 2024, repositioning to a pure-play energy transition metals business focused on copper growth with the sale of the steelmaking coal business |

| · | With the ramp-up of QB in 2024, we achieved record annual copper production of 446,000 tonnes in 2024, up 50% from 2023 production levels |

| · | We continued to progress feasibility studies, advanced detailed engineering, prepare for the execution of advanced work programs and move forward with permitting at the Highland Valley Copper Mine Life Extension, Zafranal and San Nicolás projects, and advance optimization of QB, with a strong focus on identifying near-term growth opportunities for debottlenecking within the current asset base |

Safety and Sustainability Leadership

| · | Our High-Potential Incident (HPI) Frequency remained low at 0.12 in 2024 |

| · | We were named to the Dow Jones Best-in-Class World Index (formerly S&P Dow Jones Sustainability World Index) for the 15th consecutive year, based on the 2024 S&P Corporate Sustainability Assessment, were listed as one of the 2024 Best 50 Corporate Citizens in Canada by Corporate Knights for the 18th consecutive year, and were named to the Forbes list of the World’s Top Companies for Women 2024, an employee-driven ranking of multinational corporations from 37 countries around the world |

| · | We released our Climate Change and Nature 2024 Report, which for the first time combines the recommendations of the Taskforce on Nature-related Financial Disclosures with the recommendations of the Task Force on Climate-related Financial Disclosures to deliver an integrated report covering both the climate- and nature-related aspects of our business |

| 1 | This is a non-GAAP financial measure or ratio. See “Use of Non-GAAP Financial Measures and Ratios” for further information. |

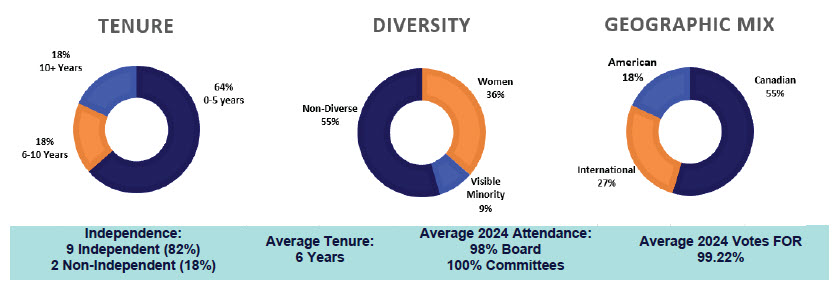

2024 Governance Highlights

Teck is committed to maintaining best practices in corporate governance. In 2024, we undertook an externally facilitated board, committee and peer evaluation process, with a focus on Board effectiveness and enabling Teck to build the Board of the future, with a continued focus on emerging risks and strategic priorities. The Board continued succession planning activities, welcoming one new independent director in 2024, with another new independent nominee standing for election at the Meeting. Each nominee has been proposed for nomination with reference to the skills determined by the Board to be required at this time, as set out in the skills matrix.

A list of our key governance practices is below and further details can be found under Information about Corporate Governance, beginning on page 18.

| Pg. | Pg. | Pg. | ||||||

| ü | Annual individual election of directors with majority voting | 8 | ü | Board Diversity target of no one gender comprising >70% of the Board | 29 | ü | Mandatory minimum share ownership for directors | 17 |

| ü | Independent Chair and 100% independent directors on committees | 23 | ü | 36% female directors and 9% directors who are members of a visible minority | 8 | ü | No options granted to non-executive directors | 16 |

| ü | In camera sessions at each Board and committee meeting | 23 | ü | Annual Board, Chair, committee, and director evaluations | 24 | ü | Independent director term limit | 23 |

| ü | Written Code of Ethics | 25 | ü | Board education and orientation program | 30 | ü | 6 years average director tenure | 8 |

| ü | Robust whistleblower practices and oversight | 25 | ü | Robust anti-bribery and corruption compliance program | 25 | ü | Director Overboarding Policy | 25 |

| ü | Refreshed enterprise risk management program | 26 | ü | No board interlocks | 25 |

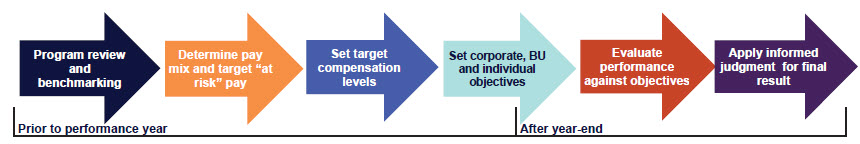

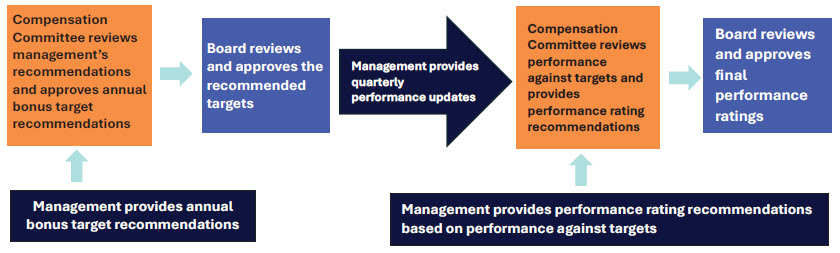

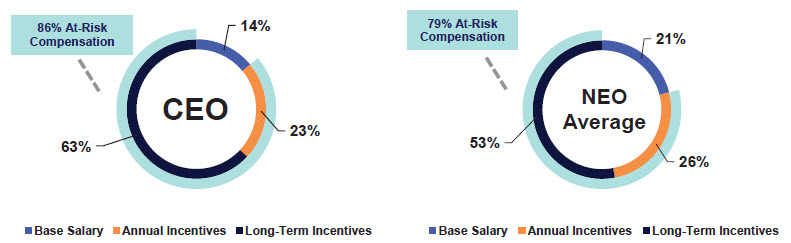

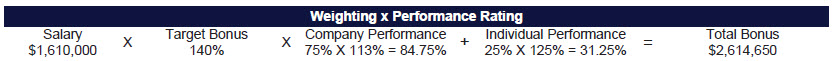

2024 Executive Compensation Highlights

Teck’s executive compensation programs are focused on paying for performance and alignment with the shareholder experience. In 2024, we focused on updating our annual incentive compensation program for our streamlined executive leadership team. The Compensation & Talent Committee continued to review Teck’s compensation and talent management programs, with a focus on attracting, retaining, and developing the talent required to become a leading pure play energy transition metals business focused on copper growth.

A list of our key compensation practices is below and further details can be found under Information about Executive Compensation, beginning on page 33.

| Pg. | Pg. | Pg. | ||||||

| ü | Annual Say on Pay vote and disclosure of detailed results by class | 1 |

ü

|

Disciplined annual incentive plan rewards underlying business performance | 40 | ü | Annual incentive payments capped at 2x target | 41 |

| ü | Significant contingent pay, with 86% of CEO and 79% of other NEO compensation at-risk in 2024 | 40 | ü | Compensation benchmarked against a size appropriate North American industry peer group | 37 | ü | Double-trigger severance and equity vesting on change of control | 49 |

| ü | Emphasis on equity-linked long-term incentives, including 50% performance-contingent share units | 41 |

ü |

Incentive compensation tied to strategic and business objectives | 40 |

ü |

Mandatory minimum share ownership for executives |

36 |

| ü | Compensation programs designed to mitigate undue risk-taking | 35 |

ü |

Compensation targets the market median | 34 |

ü |

Anti-hedging policy |

26 |

| ü | Annual compensation risk assessment | 35 | ü | Independent compensation consultant to the Board | 35 |

ü |

No option re-pricing |

A1 |

| ü | Robust clawback policy | 36 |

2024 Sustainability Highlights

Teck is focused on responsible resource development. We understand the importance of operating sustainably, protecting the health and safety of our people, and building strong relationships with communities and Indigenous People in the areas in which we operate. Safety and sustainability matters, including climate change, are under the oversight of the Board’s Safety & Sustainability Committee, which reviews Teck’s sustainability strategy, progress against sustainability goals and targets, and related disclosure. In 2024, we published our 23rd annual Sustainability Report and our first report under the Fighting Against Forced Labour and Child Labour in Supply Chains Act. We also published our Climate Change and Nature 2024 Report, which is aligned with the Task Force on Climate-Related Financial Disclosures (“TCFD”) and the Task Force on Nature-Related Financial Disclosures (“TNFD”). Our current reports are available on our website at www.Teck.com/Reports.

Teck has been recognized as a leader in sustainability and responsible resource development in several indices and through awards for our sustainability and safety performance. A selection of Teck’s recent achievements can be found under Information about Sustainability beginning on page 32.

INFORMATION ABOUT THE BUSINESS OF THE MEETING

At the Annual Meeting of shareholders of Teck Resources Limited (“Teck”) to be held on April 24, 2025 (including any postponement(s) or adjournment(s) thereof, the “Meeting”), shareholders of Teck (“Shareholders”) will be asked to consider and, if applicable, vote on the following items of business:

RECEIPT OF FINANCIAL STATEMENTS

We will present Teck’s audited consolidated financial statements for the year ended December 31, 2024, together with the auditor’s report thereon. The financial statements are contained in our 2024 Annual Report (the “Annual Report”), which is available on Teck’s website at www.teck.com/reports and under Teck’s profile on www.SEDAR+plus.ca and www.sec.gov/edgar.

ELECTION OF DIRECTORS

Eleven directors will be elected to serve on Teck’s board of directors (the “Board”) until the close of the next annual meeting or until their successors are elected or appointed. See “Election of Directors” for information about each of the nominated directors.

| The Board recommends that you vote FOR each nominated director |

APPOINTMENT OF AUDITOR

The Board recommends the re-appointment of PricewaterhouseCoopers LLP as Teck’s auditor, with its remuneration to be set by the Board. For the years ended December 31, 2024 and 2023, we paid the external auditor fees as detailed below:

|

|

Year Ended 2024 ($000) |

Year Ended 2023 ($000) |

| Audit Services(1) | 7,408 | 6,804 |

| Audit-Related Services(2) | 3,105 | 3,616 |

| Tax Fees(3) | 466 | 106 |

| All Other Fees(4) | 33 | 14 |

| (1) | Includes services that are provided by Teck’s external auditors in connection with the audit of the financial statements and internal controls over financial reporting. |

| (2) | Includes assurance and related services that are related to the performance of the audit, greenhouse gas verification and sustainability assurance, pension plan and special purpose audits. |

| (3) | Fees are for corporate and international expatriate tax services. |

| (4) | Amounts relate to a number of projects, including compliance engagements, as well as subscriptions to online accounting guidance and publications. |

The independence of the external auditor is monitored by the Audit Committee as part of a robust governance framework, which includes requirements for rotation of the lead audit partner and the auditor’s own internal independence procedures. The lead audit partner was last rotated in 2023. The Audit Committee has confirmed that it is satisfied that PricewaterhouseCoopers LLP is independent within the meaning of applicable securities laws.

In addition to annually reviewing the independence status of the external auditor, the Audit Committee annually reviews and evaluates the external auditor’s performance prior to recommending reappointment to shareholders. In 2024, the Audit Committee reviewed considerations related to auditor tenure, the process for audit tenders and related change of auditor requirements, and potential risks and benefits of conducting a tender process. The Audit Committee considered the risks and benefits of having a long tenured auditor and the controls and processes that are in place to ensure auditor independence. They also considered the necessity of having continuity of knowledge in order to ensure high-quality audit standards provided by an audit firm with the required depth and breadth of experience to effectively and efficiently audit an entity of Teck’s size with complex operations in multiple jurisdictions. Following this review, the Audit Committee determined not to conduct a tender process for its external auditor at this time, balancing considerations related to audit quality and auditor independence in the context of the current regulatory environment for Canadian reporting issuers who are also subject to Sarbanes-Oxley Act requirements. The Audit Committee expects to revisit this review periodically in addition to conducting a more comprehensive review of the external auditor on a more regular basis.

| The Board recommends that you vote FOR PricewaterhouseCoopers LLP |

ADVISORY RESOLUTION ON EXECUTIVE COMPENSATION

To provide Shareholders with an opportunity to have a “say on pay”, Teck has held a vote on a non-binding advisory resolution on our approach to executive compensation since 2011. The Compensation & Talent Committee (the “Compensation Committee”) and the Board consider the outcome of the vote as part of their ongoing review of executive compensation.

At the Meeting, Shareholders will vote on the following resolution:

|

|

“Resolved, on an advisory basis and not to diminish the role and responsibilities of the Board, that the shareholders accept the approach to executive compensation disclosed in Teck Resources Limited’s management proxy circular delivered in connection with the 2025 Annual Meeting of shareholders.”

The results of Teck’s “say on pay” vote at the previous three annual meetings are set out below:

| Year | Percentage of overall votes in favour |

Percentage of Class B Subordinate Voting Shares voted in favour |

| 2024 | 98.39% | 95.91% |

| 2023 | 98.10% | 95.22% |

| 2022 | 95.04% | 94.51% |

Teck’s executive compensation programs are focused on paying for performance and alignment with the shareholder experience. Our executive compensation programs are designed to meet the following objectives:

| • | attract, motivate, and retain highly qualified and experienced executives; |

| • | reward executives for managing the business consistent with our short and long-term operational objectives, to enable long-term shareholder value creation; |

| • | align compensation with performance over both the short- and long-term horizons; |

| • | ensure that a significant proportion of compensation is directly linked to the success of Teck, while not encouraging excessive or inappropriate risk-taking; |

| • | promote adherence to the high standards and values reflected in our Code of Ethics, Code of Sustainable Conduct, and policies concerning safety and environmental stewardship; and |

| • | protect long-term shareholder interests by ensuring named executive officers (each, an “NEO”) and other senior executive interests are aligned with those of shareholders. |

Teck operates in a highly cyclical, capital-intensive industry with a long-term view to building value for our shareholders through the commodity cycle. Teck aims for a market-competitive compensation structure that will attract, motivate and retain highly qualified executives to lead Teck and create long-term value for our shareholders.

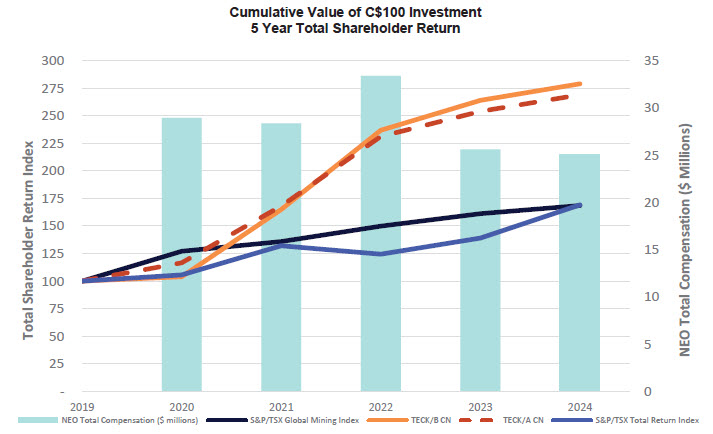

Our share price performance is strongly influenced by changes in commodity prices, regardless of the operating performance of our business, so our incentive programs focus on financial, operational, strategic and sustainability performance. The Board is committed to paying for performance and providing strong alignment with shareholder experience through:

| • | striking an appropriate balance between fixed and variable compensation, with 86% of CEO and an average of 79% of other NEO compensation at risk in 2024; |

| • | an annual incentive program that incentivizes annual financial, operational, sustainability, and health and safety performance in addition to achievement of key annual strategic objectives; |

| • | benchmarking against a comparator group of issuers with whom we compete for talent, targeting compensation at market median; and |

| • | emphasis on equity-linked long-term incentives, including 50% performance-contingent share units that pay out from 0-200% of target, depending on performance against multiple metrics, including relative performance, financial, strategic and sustainability-linked goals. |

Long term realizable pay outcomes reflect these goals. See “Executive Compensation” for detailed information on our executive compensation program, including details of the components, objectives, and administration of the program and compensation outcomes for 2024.

|

The Board recommends that you vote FOR the advisory resolution to accept our approach to executive compensation

|

Other Business

If other items of business are properly brought before the Meeting, you or your proxyholder can vote on such matters. Teck is not aware of any other items of business to be considered.

|

|

GENERAL INFORMATION

In this Circular, unless otherwise noted:

| • | all information is as of the Record Date (as defined below) of March 3, 2025 |

| • | all dollar amounts are in Canadian dollars |

| • | references to the CBCA are references to the Canada Business Corporations Act |

| • | references to “Teck”, the “Corporation”, “we”, “us”, or “our” are references to Teck and its subsidiaries |

| • | references to “you” and “your” are references to Shareholders |

SOLICITATION OF PROXIES

Proxies are being solicited by Teck’s management in connection with the Meeting. Solicitation will be primarily by mail, but may be supplemented by solicitation by Teck directors, officers, and employees without special compensation. Teck will pay the cost of any solicitation.

QUORUM

In order for the Meeting to proceed, there must be at least three Shareholders present in person or by proxy who hold shares representing at least 25% of the votes that could be cast at the Meeting.

VOTING SHARES AND PRINCIPAL HOLDERS OF VOTING SHARES

Teck is authorized to issue an unlimited number of Class A Common Shares (“Class A Shares”) with 100 votes per share, an unlimited number of Class B Subordinate Voting Shares, with one vote per share, and an unlimited number of preference shares, issuable in series.

On the Record Date, the following Teck shares were outstanding:

| Class | Number |

Percentage of Aggregate Votes |

| Class A Shares | 7,599,532 | 60.6% |

| Class B Subordinate Voting Shares | 494,887,272 | 39.4% |

Except as set out below, to the knowledge of Teck’s directors and officers, no person or company beneficially owns or exercises control or direction, directly or indirectly, over shares carrying more than 10% of the votes attached to any class of Teck’s voting securities.

| Name of Shareholder | Class A Number |

Class A Votes (%) |

Class B Number |

Class B Votes (%) |

Aggregate Votes (%) |

| Temagami Mining Company Limited(1) | 4,300,000 | 56.6% | - | - | 34.3% |

| SMM Resources Incorporated | 1,469,000 | 19.3% | 3,045,099 | 0.6% | 11.9% |

| (1) | Keevil Holding Corporation (“Keevil Holdco”) beneficially owns 1,742,605 Class B Subordinate Voting Shares and 51.16% of the outstanding shares of Temagami Mining Company Limited (“Temagami”). SMM Resources Incorporated, a wholly-owned subsidiary of Sumitomo Metal Mining Co., Ltd. (“SMM”), beneficially owns 48.84% of the outstanding shares of Temagami. |

The Class A Shares trade on the Toronto Stock Exchange (“TSX”) under the trading symbol “TECK.A”. The Class B Subordinate Voting Shares trade on the TSX under the trading symbol “TECK.B” and on the New York Stock Exchange (“NYSE”) under the symbol “TECK”.

SHAREHOLDER PROPOSALS

Shareholder proposals for the next annual meeting of Teck must be received between November 24, 2025 and January 23, 2026.

|

|

INFORMATION ABOUT VOTING

WHO CAN VOTE

The record date for the Meeting is March 3, 2025 (the “Record Date”). Holders of Class A Shares and Class B Subordinate Voting Shares at the close of business on the Record Date are entitled to receive notice of and vote at the Meeting, virtually or by proxy.

MATTERS TO BE VOTED ON

At the Meeting, Shareholders will be voting on:

| • | the election of directors; |

| • | the appointment of the auditor; and |

| • | the advisory resolution on executive compensation. |

Each item of business to be considered at the Meeting requires a simple majority of votes cast in favour by all holders of Class A Shares and Class B Subordinate Voting Shares present or represented by proxy at the Meeting, voting together as a single class, in order to pass.

HOW TO VOTE

| Registered Shareholders |

Non-registered (Beneficial) Shareholders |

|

|

You hold your shares directly in your own name with our transfer agent, TSX Trust Company. A form of proxy is included with your Meeting materials. The deadline for depositing proxies is April 22, 2025 at 2:00 p.m. (Pacific Time) (the “Proxy Deadline”). |

Your shares are held through a broker, trustee, financial institution, custodian, or other intermediary. Your intermediary has sent you a voting instruction form (“VIF”). |

|

| Attending the Meeting | Attending the Meeting | |

|

In person: • do not complete a proxy • attend the Meeting and register with TSX Trust Company Virtually: • attend the Meeting at https://virtual-meetings.tsxtrust.com/1592 • log in as a shareholder using the control number located on your proxy form and the passcode “teck2025” (case sensitive) |

• follow the instructions on the voting instruction form to appoint yourself as proxyholder to attend the Meeting by writing your name in the space provided, signing and returning the VIF In person: • attend the Meeting and register with TSX Trust Company Virtually: • obtain a control number at: https://www.tsxtrust.com/control-number-request or by telephone TSX Trust Company at 1-866-751-6315 (within North America) or 416-682-3860 (outside North America) by 2:00 p.m. (Pacific Time) on April 22, 2025 • attend the Meeting at: https://virtual-meetings.tsxtrust.com/1742 • log in using the control number you obtained at the link above and the passcode “teck2025” |

|

| Not Attending the Meeting | Not Attending the Meeting | |

|

Return your completed, signed, and dated proxy in one of the following ways: • vote by internet: www.meeting-vote.com • vote by telephone: 1-888-489-5760 (English only) or 1- 888-489-7352 (Bilingual) • mail to: TSX Trust Company Proxy Dept., PO Box 721, Agincourt, ON M1S 0A1 • scan and email to: proxyvote@tmx.com

See the instructions on the proxy for more details. |

Submit your voting instructions by completing and returning the VIF in accordance with the directions on the VIF in advance of the deadline indicated on the VIF: • vote by internet: www.proxyvote.com • vote by telephone: Canadian Non-Registered Shareholders call: 1-800-474-7493 (English), 1-800-474-7501; U.S. Non-Registered Shareholders call: 1-800-454-8683 • mail to: Data Processing Centre, PO Box 3700, STN, Industrial Park, Markham, ON L3R 9Z9

See the instructions on the VIF or contact your intermediary. |

|

| Revoking your Proxy | Revoking your Voting Instructions |

|

|

You can revoke your proxy by: • completing and returning a new proxy before the Proxy Deadline with a later date; • sending a notice in writing to our Corporate Secretary before the Proxy Deadline; • providing a written notice to the Chair of the Meeting at the Meeting; or • any other manner permitted by law. |

Contact your intermediary for instructions on how to revoke voting instructions previously submitted. Be sure to contact your intermediary well in advance of the Proxy Deadline. |

|

|

INFORMATION ABOUT PROXY VOTING

| • | The persons named in the provided proxy are officers of Teck. |

| • | You may appoint some other person (who need not be a shareholder) to represent you at the Meeting by inserting the person’s name in the blank space provided and returning the proxy as specified before the Proxy Deadline. Registered Shareholders will need to return your proxy by mail and telephone TSX Trust Company at 1-866-751-6315 (within North America) or 416-682-3860 (outside North America), or complete an online form at https://www.tsxtrust.com/control-number-request by 2:00 p.m. (Pacific Time) on April 22, 2025 and provide TSX Trust Company with the required information for your proxyholder so that TSX Trust Company may provide the proxyholder with a 13-digit proxyholder control number. Such 13-digit proxyholder control number will differ from the control number set forth in the Form of Proxy and will allow your proxyholder to log in to and vote at the Meeting. Without a 13-digit proxyholder control number your proxyholder will only be able to log in to the Meeting as a guest and will not be able to vote. |

| • | Please note that only registered Shareholders and proxy holders are permitted to vote at the Meeting. A non-registered shareholder wishing to vote at the Meeting must appoint themselves as a proxyholder based on the instructions on their voting instruction form and telephone TSX Trust Company at 1-866-751-6315 (within North America) or 416-682-3860 (outside North America), or complete an online form at https://www.tsxtrust.com/control-number-request, by 2:00 p.m. (Pacific Time) on April 22, 2025 and provide TSX Trust Company with the required information so that TSX Trust Company may provide you with a 13-digit proxyholder control number. Such 13-digit proxyholder control number will differ from the control number set forth in the voting instruction form and will allow you to log in to and vote at the Meeting. |

| • | The securities represented by a duly submitted proxy will be voted or withheld from voting by the proxyholder on a ballot in accordance with the instructions of the Shareholder and if the Shareholder specifies a choice with respect to any matter to be acted upon, the securities will be voted accordingly. |

| • | The accompanying form of proxy confers discretionary authority upon proxyholders with respect to amendments or variations to the matters to be acted upon and other matters that properly come before the Meeting. |

| • | Voting instructions and proxyholder appointments must be received by 2:00 p.m. (Pacific Time) on April 22, 2025 (or, if the Meeting is adjourned or postponed, two business days before the day on which the Meeting is reconvened). Nonetheless, the Chair of the Meeting has discretion to extend or waive the proxy cut-off without notice and to accept late proxies. |

|

If you do not specify how you want to vote and you appoint Teck’s representatives as your proxyholders, they will vote:

• FOR the election of directors; • FOR the appointment of the auditor; and • FOR the advisory resolution on Teck’s approach to executive compensation |

Voting Results

We will issue a news release with the voting results shortly after the Meeting and will also file the voting results with securities regulators as required. Visit www.teck.com/news to see our news releases.

Circular

This Circular is delivered in connection with the solicitation of proxies by and on behalf of the management of Teck for use at the Meeting. We have not authorized any person to give any information or to make any representation in connection with the business of the Meeting other than those contained in this Circular. If any such information or representation is given or made to you, you should not rely upon it as having been authorized or being accurate.

This Circular does not constitute an offer to buy, or a solicitation of an offer to sell, any securities, or the solicitation of a proxy, by any person in any jurisdiction in which such an offer or solicitation is not authorized or in which the person making such an offer or solicitation is not qualified to do so, or to any person to whom it is unlawful to make such an offer or solicitation. Shareholders should not construe the contents of this Circular as legal, tax or financial advice and should consult with their own legal, tax, financial or other advisors.

NOTICE TO SHAREHOLDERS IN THE UNITED STATES

The solicitation of proxies in connection with the Meeting described in this Circular involves securities of a Canadian corporation and is being effected in accordance with Canadian corporate and securities laws, including disclosure requirements. Shareholders in the United States should be aware that these requirements may be different from those under United States corporate and securities laws relating to U.S. corporations. The enforcement by Shareholders of civil liabilities under U.S. securities laws may be affected adversely by the fact that Teck is organized under the laws of Canada, that some of its directors and officers are not residents of the United States, and a substantial portion of its assets may be located outside of the United States. Shareholders may not be able to sue Teck or its directors and officers in a Canadian court for violations of U.S. securities laws. It may be difficult to compel a Canadian company and its affiliates to subject themselves to a judgment by a U.S. court.

|

|

FORWARD-LOOKING STATEMENTS

This Circular contains certain forward-looking information and forward-looking statements as defined in applicable securities laws (collectively referred to as forward-looking statements). These statements relate to future events or our future performance. All statements other than statements of historical fact are forward-looking statements. The use of any of the words “anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”, “will”, “project”, “predict”, “potential”, “should”, “believe” and similar expressions is intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. These statements speak only as of the date of this Circular based on current expectations and conditions. These forward-looking statements may include statements concerning:

| • | forecast production, forecast operating costs, unit costs, capital costs and other costs, and forecast sales; |

| • | future demand for and supply, prices and price volatility of copper, zinc, steelmaking coal and other products we produce and sell; |

| • | expected mine lives of Teck’s operations and possible mine life extensions through development of new areas or otherwise; |

| • | expectations regarding the ability to maintain and renew existing permits, licenses, and leases for Teck’s properties; |

| • | expected completion of prefeasibility studies, feasibility studies and other studies and the expected timing thereof; |

| • | estimates of the quantity and quality of Teck’s mineral reserves and resources; |

| • | availability and cost of Teck’s credit facilities, bonding, letter of credit facilities, and financial assurance requirements; |

| • | our planned capital expenditures and timing for sanction, development, construction, and completion of our capital projects; |

| • | our estimates of reclamation and other costs related to environmental protection and potential impact of complying with existing and proposed laws and other regulatory frameworks that could impact our business; |

| • | our financial and operating objectives and our exploration, environmental, community, health, and safety initiatives and procedures; |

| • | our sustainability goals and strategies, including our goal to achieve net-zero Scope 2 greenhouse gas emissions by 2025, our ambition to achieve net-zero Scope 3 emissions by 2050 and our goal to become a nature positive company by 2030; |

| • | our dividend policy, capital allocation framework, and expectations regarding the amount of Class B Subordinate Voting Shares that might be purchased under normal course issuer bids and the mechanics thereof; |

| • | risks facing our operations, projects and business and general business and economic conditions; and |

| • | other statements that are not historical facts. |

Although we believe that these forward-looking statements are based on information and assumptions that are reasonable and complete, inherent in forward-looking statements are risks and uncertainties beyond our ability to predict or control, which may cause actual results to differ materially from those expressed or implied by these forward-looking statements contained, including, but not limited to the risks described in detail in Teck’s most recent annual information form available under Teck’s profile at www.sedarplus.ca. Readers are cautioned not to place undue reliance on these forward-looking statements.

Forward-looking statements in this Circular and in the documents incorporated by reference herein are based on a number of assumptions that Teck believed were reasonable on the day it made the forward-looking statement, including, but not limited to, assumptions regarding:

| • | general business and economic conditions, including interest rates, inflation, commodity and power prices, credit and financial market conditions and the impact of foreign exchange rates and tax rates and related frameworks; |

| • | acts governments and the outcome of any legal or regulatory proceedings or other disputes that we may be involved in; |

| • | supply and demand for, deliveries and price volatility of copper, zinc, steelmaking coal, and our other metals and minerals; |

| • | timing, receipt of, and our ability to comply with permits, licenses, leases and other required approvals for our development projects and operations, including mine extensions; |

| • | our ability to secure adequate transportation, including rail and port service, for our products; |

| • | results from studies on and engineering and construction timetables and capital costs for our expansion and development projects; |

| • | our costs of production and our production and productivity levels, as well as those of our competitors; |

| • | continuing availability of water and power resources for our operations; |

| • | availability of funding to refinance our borrowings as they become due or to finance our development projects on reasonable terms; |

| • | availability of letters of credit and other acceptable forms of financial assurance for reclamation and other bonding requirements; |

| • | our ability to procure sufficient equipment, operating supplies, and services on a timely basis and on commercially reasonable terms; |

| • | availability of qualified employees and contractors and our ability to attract and retain skilled employees; |

| • | satisfactory negotiation of collective agreements with unionized employees; |

| • | benefits of technology for our operations and development projects; |

| • | costs of closure, reclamation, and environmental compliance generally, of our operations and projects; |

| • | accuracy of our mineral reserve and resource estimates and the geological, operational, and price assumptions they are based on; |

| • | outcome of commodity price, volume, treatment and refining charge negotiations with customers; |

| • | financial or physical impacts of climate change and climate change initiatives on markets, our operations, and projects; |

| • | impact of geopolitical events on our operations and projects and on global markets; and |

| • | our ongoing relations with regulators, communities, and our business and joint venture partners. |

Our sustainability goals and strategies are based on a number of assumptions, including regarding the availability and effectiveness of technologies needed to achieve our goals; the availability of clean energy sources and zero-emissions alternatives for transportation on reasonable terms; our ability to implement new source control or mine design strategies on commercially reasonable terms without impacting production; and the performance of new technologies in accordance with our expectations.

We caution you that the foregoing list of important factors and assumptions is not exhaustive. If our assumptions turn out to be inaccurate, our actual results could be materially different from what we expect. Other events or circumstances could cause our actual results to differ

|

|

materially from those estimated or projected and expressed in, or implied by, our forward-looking statements. You should also carefully consider the matters discussed in the “Cautionary Statement on Forward-Looking Statements” section of our Management’s Discussion and Analysis for the year ended December 31, 2024, and subsequent filings, which can be found under Teck’s profile on SEDAR+ (www.sedarplus.ca) and on EDGAR (www.sec.gov). Except as required by law, we undertake no obligation to update publicly or otherwise revise any forward-looking statements or the foregoing list of factors, whether as a result of new information or future events or otherwise.

USE OF NON-GAAP FINANCIAL MEASURES AND RATIOS

The “Executive Summary” and “Executive Compensation” sections of this Circular contain references to certain non-GAAP financial measures and non-GAAP ratios which do not have a standardized meaning prescribed by International Financial Reporting Standards and may not be comparable to similar financial measures and ratios reported by other issuers. This includes references to “adjusted EBITDA”, “EBITDA” and “Adjusted profit from continuing operations attributable to shareholders”. These financial measures and ratios have been derived from Teck’s financial statements and applied on a consistent basis as appropriate. We disclose these financial measures and ratios because we believe they assist readers in understanding the results of Teck’s operations and financial position and provide further information about financial results to investors in the context of Teck’s executive compensation practices.

These measures should not be considered in isolation or used in substitution for other measures of performance prepared in accordance with IFRS. Additional information on the non-GAAP financial measures and non-GAAP ratios, including a reconciliation of Teck’s 2024 EBITDA, adjusted EBITDA results and Adjusted profit from continuing operations attributable to shareholders, are available in Teck’s management discussion & analysis for the year-ended December 31, 2024, available on SEDAR+ at www.sedarplus.ca or at www.Teck.com/reports.

QUESTIONS AND ANSWERS ABOUT THE MEETING

The following questions and answers about the Meeting and voting are designed to help you understand them in more detail.

Q. Why did I receive this package of information?

| A. | This Circular is furnished in connection with the solicitation of proxies by and on behalf of Teck’s management for use at the Meeting. As a Teck Shareholder at the close of business on the Record Date, you are entitled to receive notice of and vote at the Meeting. |

| Q. | Who is soliciting my proxy? |

| A. | Your proxy is being solicited by management of Teck. |

| Q. | Who pays for the proxy solicitation? |

| A. | The cost of soliciting proxies will be borne by Teck. Teck will reimburse brokers, custodians, nominees, and other fiduciaries for their reasonable charges and expenses incurred in forwarding proxy materials to beneficial Shareholders. |

| Q. | When is the Meeting? |

| A. | The Annual Meeting of Shareholders will be held on April 24, 2025 at 2:00 p.m. (Pacific Time). |

| Q. | How do I attend the Meeting? |

| A. | Registered Shareholders and duly appointed proxyholders are able to attend the Meeting in person at Metropolitan Ballroom, Terminal City Club, 837 W. Hastings St., Vancouver, BC or virtually at: https://virtual-meetings.tsxtrust.com/1742. See “Information about Voting” on page 4. |

| Q. | What am I being asked to vote on? |

| A. | Shareholders will be asked to consider: |

| • | the election of directors; |

| • | the appointment of the auditor; and |

| • | the advisory resolution on executive compensation. |

Q. Who is entitled to vote at the Meeting?

| A. | As of the Record Date, 7,624,532 Class A shares and 510,531,448 Class B subordinate voting shares were outstanding. Shareholders of record as of the close of business on that date are entitled to notice of and to vote at the Meeting. |

| Q. | How can I vote my shares? |

| A. | You can vote your Teck shares by either attending and voting such shares at the Meeting or voting by proxy in advance of the Meeting. See “Information About Voting” on page 4 for details. |

| Q. | What if I am a Registered Shareholder? |

| A. | If you were a registered shareholder at the close of business on the Record Date, you can vote at the Meeting. If you cannot attend the Meeting, please complete and return your proxy in accordance with the instructions on the proxy form. See “Information About Voting” on page 4. |

| Q. | What if I am a Non-Registered (or Beneficial) Shareholder? |

| A. | If you are a non-registered shareholder and your Teck shares are held on your behalf, or for your account, by a broker, investment dealer, bank, trust company, trustee, nominee or other intermediary, you are not entitled to vote unless you carefully follow the instructions provided by your intermediary. Instructions on how to vote are found under “Information About Voting” on page 4. |

| Q. | What happens when I sign and return the proxy form? |

| A. | When you sign the proxy form appointing the management proxyholders, you authorize an officer of Teck to vote your shares for you at the Meeting according to your instructions. If you return your proxy form and do not tell us how you want to vote your shares, your vote will be cast: |

| • | FOR the election of each of the director nominees; |

| • | FOR the appointment of the auditor; and |

| • | FOR the advisory resolution on executive compensation. |

The person named in the proxy form will also have discretion to vote your shares as he or she sees fit on any other matter that may properly come before the Meeting that you are entitled to vote on.

Q. What if amendments are made to any matter or if other matters are brought before the Meeting?

| A. | The persons named in the proxy form will have discretionary authority with respect to amendments or variations to matters identified in the Notice of Meeting and to other matters which may properly come before the Meeting. As at the date of this Circular, Teck’s management knows of no such amendment, variation or other matter expected to come before the Meeting. If any other matters properly come before the Meeting, the persons named in the proxy form will vote on them as they see fit. |

|

|

INFORMATION ABOUT THE DIRECTORS

INFORMATION ABOUT THE DIRECTOR NOMINEES

The Board has determined that 11 directors are to be elected at the Meeting to hold office until the next annual meeting of shareholders. The following pages provide relevant information on each of the director nominees.

Each of the nominees was elected at the last annual meeting in 2024, other than Mr. Gowans and Ms. McLeod-Seltzer, who are standing for election for the first time. Management does not expect that any nominee will be unable or unwilling to serve as a director.

| ARNOUD BALHUIZEN, 56 | ||

|

Laren, Netherlands Independent(2) Director Since: 2023 Term Limit: 2038

|

Arnoud Balhuizen was first elected to Teck’s Board in 2023. Mr. Balhuizen has been Managing Partner of 280ppm B.V., a Dutch investment firm focused on early-stage companies that work to mitigate the causes and effects of climate change and facilitate the energy transition, since 2020. He is a member of the advisory board of various entities, including Anthony Veder N.V., a private shipping company, Royal Den Hartogh Logistics B.V., a private logistics company, Earth AI, a start-up mining exploration technology company, and 3FBio (Enough) Ltd, a start-up sustainable protein company. From 1995 to 2019, Mr. Balhuizen held various roles at BHP Group PLC, most recently as Chief Commercial Officer from 2016 to 2019. He received a Bachelor’s Degree in Business Economics from The Hague University. | |

| Other Public | Meetings Attended: | ||||

| Company Directorships: | Board | 8 of 8 | 100% | ||

| None | Committee Meetings Attended: | ||||

| Audit | 5 of 5 | 100% | |||

| 2024 Voting Results: | Compensation & Talent | 2 of 2 | 100% | ||

| For: 99.85% | Safety & Sustainability | 2 of 2 | 100% | ||

| Against: 0.15% | Technical | 5 of 5 | 100% | ||

| Securities Held(1) | |||||

| Class A | Class B | DSUs | RSUs | Total Value | Meets share ownership requirement |

|

0 ($0) |

5,000 ($291,400) |

9,367 ($545,909) |

0 ($0) |

$837,309 | Yes |

|

|

| JAMES K. GOWANS(3), 73 | ||

|

Surrey, British Columbia Independent(2) Director Since: 2024 Term Limit: 2040 |

James

K. Gowans was first appointed to the Board of Teck in May 2024. Mr. Gowans was previously the Interim President and Chief Executive

Officer of the Trilogy Metals Inc. from September 2019 to June 2020. He was previously the President, CEO and a director of Arizona

Mining Inc. from January 2016 until it was purchased by South32 Limited in August 2018. He was Senior Advisor to the Chair of the

Board of Barrick Gold Corporation from August to December 2015, co-President from July 2014 to August 2015, and Executive Vice President

and Chief Operating Officer from January to July 2014. He served as Managing Director of the Debswana Diamond Company in Botswana

from 2011 to 2014. He has extensive experience as a senior executive in the mining industry, including at DeBeers, PT Inco in Indonesia,

and Placer Dome Ltd. Mr. Gowans is the past chair of the Mining Association of Canada. He received a Bachelor’s Degree in Applied

Science in Mineral Engineering from the University of British Columbia, attended the Banff School of Advanced Management. He is currently

a director of Trilogy Metals Inc., Treasury Metals Inc., and Premium Nickel Resources Inc. |

|

| Other Public Company Directorships: | Meetings Attended: | ||||

| Trilogy Metals Inc. | Board | 4 of 5 | 80% | ||

| NexGold Mining Corp. | Committee Meetings Attended: | ||||

| Premium Resources Ltd. | Corporate Governance & Nominating | 2 of 2 | 100% | ||

| Technical | 2 of 2 | 100% | |||

| 2023 Voting Results: N/A | |||||

| Securities Held(1) | |||||

| Class A | Class B | DSUs | RSUs | Total Value | Meets share ownership requirement |

|

0 ($0) |

8,200 ($477,896) |

3,680 ($214,470) |

0 ($0) |

$692,366 | No* |

* Mr. Gowans has until 2029 to meet share ownership guidelines.

| NORMAN B. KEEVIL, III, 61 | ||

|

Victoria, B.C., Canada Not Independent(4) Director Since: 1997 Term Limit: N/A

|

Norman Keevil, III was appointed to Teck’s Board in 1997 and was appointed Vice Chair in October 2018. He graduated from the University of British Columbia (B.A. Sc.) with a Mechanical Engineering degree. Mr. Keevil is CEO of Valence Water Inc., (previously, Boydel Wastewater Technologies Inc.), a B.C. based clean technology company specializing in advanced wastewater treatment technology for industrial and municipal water treatment plants. Prior to joining Valence, Mr. Keevil was President of Poncho Wilcox Engineering. He is a director of Lupaka Gold Corp. |

|

| Other Public Company | Meetings Attended: | ||||

| Directorships: | Board | 8 of 8 | 100% | ||

| Lupaka Gold Corp. | |||||

|

2024 Voting Results: For: 99.56% Against: 0.44% |

|||||

| Securities Held(1) | |||||

| Class A | Class B | DSUs | RSUs | Total Value | Meets share ownership requirement |

|

0 ($0) |

11,000 ($641,080) |

80,769 ($4,707,217) |

0 ($0) |

$5,348,297 | Yes |

* In addition, Mr. Keevil is a director of Keevil Holdco, which holds 1,742,605 Class B Subordinate Voting Shares and approximately 51.16% of the outstanding shares of Temagami Mining Company Limited, which as at March 3, 2025 held 4,300,000 Class A Shares.

|

|

| CATHERINE MCLEOD-SELTZER, 64 | ||

|

Vancouver, B.C., Canada Independent(2) Director Since: N/A Term Limit: 2040

|

Catherine McLeod-Seltzer is being nominated as a new director of Teck at the Meeting. She is a leader in the mining industry, recognized for her financial expertise, access to capital and ability to create growth-focused companies that generate significant shareholder value. Ms. McLeod-Seltzer is currently the Non-Executive Chair of Bear Creek Mining, where she has been a director since 2003, and of Kinross Gold Corporation, where she has been a director since 2005. Previously, she was a director of a number of mining companies, including Lucara Diamond Corp., Miramar Mining Corporation, Francisco Gold Corp., Stornoway Diamond Corp., and Pacific Rim Mining Corp. From 1994 to 1996, she was the President, Chief Executive Officer and a director of Arequipa Resources Ltd., a publicly traded company which she co-founded in 1992. From 1985 to 1993, she was employed by Yorkton Securities Inc. as an institutional trader and broker, and as Operations Manager in Santiago, Chile from 1991 to 1992. She holds a Bachelor’s degree in Business Administration from Trinity Western University. |

|

| Other Public Company Directorships: | Meetings Attended: | ||||

| Bear Creek Mining Corporation | Board | N/A | N/A | ||

| Kinross Gold Corporation** | |||||

| Flow Capital Corp | |||||

| 2024 Voting Results: N/A | |||||

| Securities Held(1) | |||||

| Class A | Class B | DSUs | RSUs | Total Value |

Meets share ownership requirement |

|

0 ($0) |

2,000 ($116,560 ) |

0 ($0) |

0 ($0) |

$0 | No* |

* If elected, Ms. McLeod-Seltzer has until 2029 to meet share ownership guidelines.

** Ms. McLeod-Seltzer will retire from the board of Kinross Gold Corporation at the 2025 annual meeting

| SHEILA A. MURRAY, 69 | ||

|

Toronto, Ontario, Canada Independent(2) Director Since: 2018 Term Limit: 2033

|

Sheila Murray has been a director of Teck since April 2018 and was appointed Chair of the Board in February 2020. She is a graduate of Queens University (B.Comm. and LLB). Ms. Murray served as President of CI Financial Corp. from 2016 to 2019 and was previously Executive Vice-President, General Counsel and Secretary of CI Financial Corp. and a partner at Blake, Cassels & Graydon LLP, where she practised securities law with an emphasis on mergers and acquisitions, corporate finance, and corporate reorganizations. Ms. Murray is the past Chair of the Dean’s Council at Queen’s University Law School and has also taught Securities Regulation at Queen’s University and Corporate Finance at the University of Toronto’s Global Professional LLM in Business Law Program. Ms. Murray is also a director of BCE Inc./Bell Canada, and a trustee of Granite REIT. Ms. Murray has completed the Competent Boards ESG Designation program and is a member of the World Economic Forum Community of Chairpersons and Climate Governance Initiative Advisory Board. |

|

| Other Public Company Directorships: | Meetings Attended: | ||||

| BCE Inc./Bell Canada | Board | 8 of 8 | 100% | ||

| Granite REIT | |||||

|

2024 Voting Results: N/A For: 99.04% Against: 0.96% |

|||||

| Securities Held(1) | |||||

| Class A | Class B | DSUs | RSUs | Total Value | Meets share ownership requirement |

|

0 ($0) |

10,000 ($582,800) |

85,568 ($4,986,903) |

4,242 ($247,224) |

$5,816,927 | Yes |

|

|

| UNA M. POWER, 60 | ||

|

Vancouver, B.C., Canada Independent(2) Director Since: 2017 Term Limit: 2032

|

Una Power was elected to Teck’s Board in April 2017. Ms. Power is a corporate director and the former Chief Financial Officer of Nexen Energy ULC, a former publicly traded energy company. During her 24-year career with Nexen, Ms. Power held various executive positions covering financial reporting, financial management, investor relations, business development, strategic planning and investment. Ms. Power holds a B.Comm. (Honours) from Memorial University, and CPA, CA and CFA designations. She has completed executive development programs at Wharton Business School and INSEAD. Ms. Power is a director of Bank of Nova Scotia and TC Energy Corporation. |

|

| Other Public Company | Meetings Attended: | ||||

| Directorships: | Board | 8 of 8 | 100% | ||

| Bank of Nova Scotia | Committee Meetings Attended: | ||||

| TC Energy Corporation | Audit (Chair) | 5 of 5 | 100% | ||

| Compensation & Talent | 4 of 4 | 100% | |||

|

2024 Voting Results: For: 99.11% Against: 0.89% |

|||||

| Securities Held(1) | |||||

| Class A | Class B | DSUs | RSUs | Total Value | Meets share ownership requirement |

|

0 ($0) |

11,454 ($667,539) |

74,053 ($4,315,809) |

0 ($0) |

$4,983,348 | Yes |

| JONATHAN H. PRICE, 48 | ||

|

Vancouver, British Columbia Not Independent(2)(5) Director Since: 2022 Term Limit: n/a |

Jonathan Price is Teck’s President and Chief Executive Officer and has served as a director since July 2022. Previously, Mr. Price was Executive Vice President and Chief Financial Officer, having joined Teck in October 2020. He brings extensive experience in the resources sector through a variety of finance, commercial and business development roles spanning Europe, Asia and Australia, with a focus on strategy, transformational change and business improvement. Prior to joining Teck, Mr. Price was employed by BHP Group PLC from 2006 to 2020, where he was Chief Transformation Officer, Vice President Finance, and Vice President Investor Relations working in Asia, Australia and the UK. He has also worked in the Metals and Mining team at ABN AMRO Bank and held various production and technical roles with INCO. Mr. Price holds a Master of Engineering (Hons.) in Metallurgy and Materials Science from the University of Oxford and a Master of Business Administration from Cardiff University. |

|

| Other Public Company Directorships: | Meetings Attended: | ||||

| N/A | Board | 8 of 8 | 100% | ||

|

2024 Voting Results: For: 99.57% Against: 0.43% |

|||||

| Securities Held(1) | |||||

| Class A | Class B | PSUs | RSUs | Total Value | Meets share ownership requirement |

|

0 ($0) |

0 ($0) |

171,319 ($9.984,471) |

34,332 ($2,000,869) |

$11,985,340 | Yes |

|

|

| PAUL G. SCHIODTZ, 66 | ||

|

Santiago, Chile Independent(2) Director Since: 2022 Term Limit: 2037 |

Mr. Schiodtz was appointed to Teck’s Board in February 2022. He holds a Mechanical Engineering degree from the University of Santiago of Chile, along with M.Sc. degrees in Management and Operations Research from the Massachusetts Institute of Technology. Currently, he serves on the Board of Constructora Gardilcic, a Chilean contractor specializing in underground mine development. Mr. Schiodtz previously served on the Board of Codelco until May 2021 and is the former Chairman of both the Canada-Chile Chamber of Commerce and the Chilean Chemical Industry Association. His last executive role was as Senior Vice President for Latin America at Methanex Corporation, culminating a 27-year career in natural resource-based industries. |

|

| Other Public Company | Meetings Attended: | ||||

| Directorships: | Board | 8 of 8 | 100% | ||

| None | Committee Meetings Attended: | ||||

| Audit | 5 of 5 | 100% | |||

| 2024 Voting Results: | Corporate Governance & Nominating | 2 of 2 | 100% | ||

| For: 97.83% | Safety & Sustainability | 4 of 4 | 100% | ||

| Against: 2.17% | |||||

| Securities Held(1) | |||||

| Class A | Class B | DSUs | RSUs | Total Value | Meets share ownership requirement |

|

0 ($0) |

16,298 ($949,847) |

11,600 ($676,048) |

0 ($0) |

$1,625,895 | Yes |

| TIMOTHY R. SNIDER, 74 | ||

|

Tucson, Arizona, United States Independent(2) Director Since: 2015 Term Limit: 2030

|

Timothy Snider was elected to Teck’s Board in April 2015. He is a graduate of Northern Arizona University (B.Sc.) and completed the Wharton Advanced Management Program. Most recently, Mr. Snider was Chairman of Cupric Canyon Capital LP, from 2008 to 2024. Prior to this role, he had a 38-year career with Phelps Dodge Corporation and its successor, Freeport-McMoRan Copper and Gold, Inc., during which he held numerous technical, operating, and executive positions, including President and Chief Operating Officer. Mr. Snider has completed the Competent Boards ESG Designation program. |

|

| Other Public Company | Meetings Attended: | ||||

| Directorships: | Board | 8 of 8 | 100% | ||

| N/A | Committee Meetings Attended: | ||||

| Corporate Governance & Nominating | 5 of 5 | 100% | |||

| 2024 Voting Results: N/A | Safety & Sustainability | 4 of 4 | 100% | ||

| For: 98.91% | Technical | 5 of 5 | 100% | ||

| Against: 1.09% | |||||

| Securities Held(1) | |||||

| Class A | Class B | DSUs | RSUs | Total Value | Meets share ownership requirement |

|

0 ($0) |

13,150 ($766,382) |

103,016 ($6,003,772) |

0 ($0) |

$6,770,154 | Yes |

|

|

| SARAH A. STRUNK, 63 | ||

|

Coronado, California, United States Independent(2) Director Since: 2022 Term Limit: 2037

|

Ms. Strunk was appointed to Teck’s Board in February 2022. She is a graduate of the New York University School of Law, the University of Kansas School of Law, and Wichita State University (B.A.). She is currently a Director and Shareholder of Fennemore Craig, P.C., since 2000, and was Chair from 2016 to 2023. Previously, she was Chief Corporate Counsel to the copper and molybdenum division of Cyprus Amax Minerals Company from 1992 to 2000. She is also a director of Arizona Sonoran Copper Company and was previously Chair of the Board of Brio Gold Inc. She is a member of the Foundation for Mineral and Energy Law and is called to the bar in Arizona, California, New York, Connecticut, and Kansas. |

|

| Other Public Company | Meetings Attended: | ||||

| Directorships: | Board | 8 of 8 | 100% | ||

| Arizona Sonoran Copper | Committee Meetings Attended: | ||||

| Company | Audit | 3 of 3 | 100% | ||

| Corporate Governance & Nominating (Chair) | 5 of 5 | 100% | |||

| 2024 Voting Results: | Safety & Sustainability | 4 of 4 | 100% | ||

| For: 99.25% | |||||

| Against: 0.75% | |||||

| Securities Held(1) | |||||

| Class A | Class B | DSUs | RSUs | Total Value | Meets share ownership requirement |

|

0 ($0) |

8,000 ($466,240) |

16,793 ($978,696) |

0 ($0) |

$1,246,784 | Yes |

| YU YAMATO, 52 | ||

|

Vancouver, Canada Independent(2) Director Since: 2024 Term Limit: 2039

|

Yu Yamato is standing for election for the first time in 2024. He is a graduate of the Geological Institute of the University of Tokyo with a Master of Science and a Bachelor of Science. He has held various positions with Sumitomo Metal Mining Co., Ltd. since 1999, and is currently the President and a Director of Sumitomo Metal Mining Canada, Ltd. Mr. Yamato is currently a director of Kenorland Minerals Ltd. and a member of the Society of Resources Geology, Japan. |

|

| Other Public Company | Meetings Attended: | ||||

| Directorships: | Board | 8 of 8 | 100% | ||

| Kenorland Minerals Ltd. | Committee Meetings Attended: | ||||

| Safety & Sustainability | 2 of 2 | 100% | |||

|

2024 Voting Results: For: 99.87% Against: 0.13% |

|||||

| Securities Held(1) | |||||

| Class A | Class B | DSUs | RSUs | Total Value | Meets share ownership requirement |

|

0 ($0) |

0 ($0) |

3,759 ($219,075) |

0 ($0) |

$219,075 | No* |

* Mr. Yamato has until 2029 to meet share ownership guidelines.

|

|

Notes to Director Profiles:

| (1) | Share and share unit holdings are as at the record date valued at the closing price of the Class B Subordinate Voting Shares ($58.28) on the TSX on December 31, 2024. DSUs (as defined below) granted to non-executive directors vest on the grant date. Values as at December 31, 2024 are calculated as the notional value of share unit awards, assuming full vesting, based on the closing price for Class B Subordinate Voting Shares on the TSX as at December 31, 2024. For the purposes of Mr. Price’s PSUs (as defined below) the value has been calculated assuming a performance factor of 100%. |

| (2) | The Board considers as independent a Director who is: (a) not a member of management; (b) free of any interest and any business, family or other relationship which could reasonably be perceived to interfere with the director’s ability to act with a view to the best interests of Teck other than interests and relationships arising solely from holdings in Teck, and (c) not considered to have a direct or indirect material relationship with Teck under subsection 1.4 of National Instrument 52-110 – Audit Committees. |

| (3) | Mr. Gowans was a director of Gedex Systems Inc. ("Gedex"), a company based in Mississauga, Ontario. On August 9, 2019, Gedex filed a notice of application in the Ontario Superior Court of Justice (the "Court") under the Companies' Creditors Arrangement Act (the "CCAA") requesting an order approving a sale and investor solicitation process ("SISP") in respect of the property, assets and undertakings of Gedex. On August 12, 2019, the Court made an order authorizing and approving, among other things, the commencement of the SISP, a stay of proceedings until September 11, 2019, granting Gedex protection from its creditors pursuant to the CCAA and appointing Zeifman Partners Inc. as monitor in the proceedings. On December 5, 2019, the Court certified that all matters to be attended to in connection with the CCAA proceedings had been completed and a discharge notice was filed on December 23, 2019, terminating the CCAA proceedings. |

| (4) | Mr. Keevil has a family relationship with N.B. Keevil, the former Chairman of Teck. |

| (5) | Mr. Price is an officer of Teck and holds stock options RSUs, and PSUs and is eligible for PDSUs (defined below). See Appendix A for plan details. |

SHAREHOLDINGS OF DIRECTOR NOMINEES

| As at March 3, 2025: | All Directors |

| Total Class A Shares | 0 |

| Aggregate value of Class A Shares | $0 |

| Total Class B Subordinate Voting Shares | 85,102 |

| Aggregate value of Class B Subordinate Voting Shares(1) | $4,822,302 |

| (1) | Based on the closing price of Class B Subordinate Voting Shares on the TSX on March 3, 2025, of 57.37. |

|

|

INFORMATION ABOUT DIRECTOR COMPENSATION

| The main objective of our director compensation program is to attract and retain directors with a broad range of relevant skills and knowledge and the ability to carry out the Board’s mandate successfully. Directors are required to devote significant time and energy to performing their duties, including preparing for and attending Board and committee meetings and ensuring that they stay informed about our business and the global mining industry. The Board believes that we must offer a competitive compensation package to attract and retain directors who meet these expectations. |

We pay director compensation each year consisting of cash fees and a share-based award of either deferred share units (“DSUs”) or restricted share units (“RSUs”). We do not issue stock options to non-executive directors and do not pay meeting fees, other than in respect of certain ad hoc committee work as described below. Mr. Price does not receive any additional compensation for acting as a director and his compensation is fully reflected in the section “Executive Compensation”.

We require directors to maintain minimum holdings of Teck shares or share units. See “Mandatory Shareholdings for Directors” on page 17 for more details. The Board believes that share ownership requirements and a mix of equity-linked compensation promote the objectives of director retention and alignment with the interests of long-term shareholders.

DETERMINING DIRECTOR COMPENSATION

The Compensation Committee is responsible for recommending compensation policies to the Board and reviews director compensation annually, benchmarked against Teck’s compensation peer group. In 2024, based on the results of the annual benchmarking review performed by the Compensation Committee’s independent consultant, Meridian Compensation Partners (“Meridian”), the Compensation Committee recommended in an increase in director compensation to bring target director compensation into alignment with the median director compensation for the peer group as disclosed in 2023.

The Board may from time to time approve ad hoc committees of the Board and establish meeting fees to compensate directors for extra time spent on Teck matters. There was no additional director compensation approved or paid in 2024.

COMPENSATION COMPONENTS

Annual Retainer and Committee Fees

Teck pays annual retainers and committee fees to directors as follows:

| Component | Fee |

| Cash Retainer | |

| Chair | $275,000 |

| Vice Chair | $180,000 |

| Non-executive Director (excluding Chair and Vice Chair) | $125,000 |

| Committee Chair – Audit(1) | $20,000 |

| Committee Chair – Compensation(1) | $14,000 |

| Other Committee Chair(1) | $8,000 |

| Committee Member | $10,000 |

| Share-Based Retainer | |

| Non-executive Director | $155,000 |

| Chair | $275,000 |

| Vice Chair | $165,000 |

| Additional Fees | |

| Travel Fee(2) | $1,000 |

| (1) | Committee Chairs receive Committee Chair fees in addition to Committee Member fees. |

| (2) | Directors travelling from outside British Columbia the day prior to Board or Committee meetings to attend those meetings. |

Directors are also reimbursed for out-of-pocket expenses and travel costs related their work on behalf of Teck.

Share-Based Awards