UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 20, 2025

CIPHER MINING INC.

(Exact name of registrant as specified in its charter)

| Delaware | 001-39625 | 85-1614529 |

|

(State or other jurisdiction of incorporation) |

(Commission File Number) | (IRS Employer Identification No.) |

1 Vanderbilt Avenue

Floor 54

New York, New York, 10017

(Address of principal executive offices) (Zip Code)

(332) 262-2300

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

| Common Stock, par value $0.001 per share | CIFR | The Nasdaq Stock Market LLC | ||

| Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 per whole share | CIFRW | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01. Entry into a Material Definitive Agreement.

On November 20, 2025, Cipher Barber Lake LLC (“Cipher Barber Lake”), a wholly owned indirect subsidiary of Cipher Mining Inc. (the “Company”), entered into an Amended and Restated Recognition Agreement (the “A&R Recognition Agreement”), which amends the previously announced Recognition Agreement (the “Original Recognition Agreement”), dated as of September 24, 2025, among Cipher Baker Lake, Fluidstack USA II Inc. (“Fluidstack”) and Google LLC (“Google”).

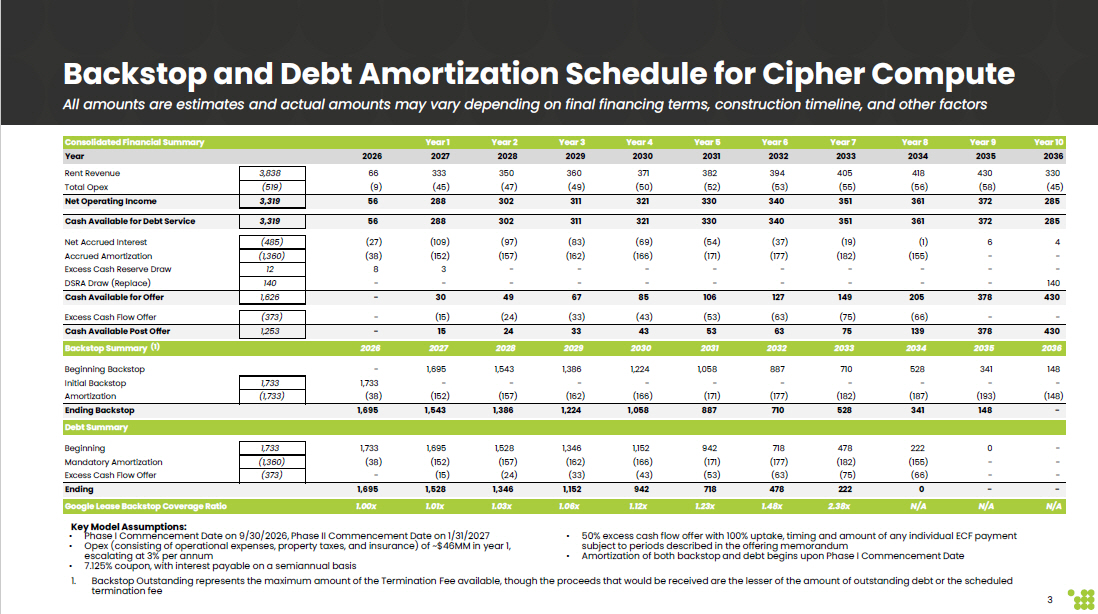

The A&R Recognition Agreement was entered into in connection with an amendment and restatement to the previously announced Datacenter Lease (the “Original Fluidstack Lease” and, as amended and restated, the “A&R Fluidstack Lease”) by and between Cipher Barber Lake and Fluidstack USA II Inc. (“Fluidstack”), dated as of September 24, 2025, which provides for the development of a data center facility on, and lease to Fluidstack of, Cipher Barber Lake’s facility located in Colorado City, Texas (the “Barber Lake Facility”) on the terms and subject to the conditions contained therein. Under the Original Fluidstack Lease, Fluidstack was entitled to 168 megawatts (MW) of critical IT load for high-performance computing data center operations. The A&R Fluidstack Lease entitles Fluidstack to an additional 39 MW of critical IT load in a second phase of development (“Phase II”). The Company continues to expect to complete phase I of the development and construction of the Barber Lake Facility (“Phase I”) and to deliver Phase I to Fluidstack by September 2026. Phase II of the development is expected to be completed and delivered to Fluidstack by January 2027. Fluidstack’s obligations to pay rent under the A&R Fluidstack Lease begin on the commencement date of operations for the applicable phase, and will continue for a 10-year term from commencement date of operations for Phase I.

Under the terms of the A&R Recognition Agreement, Cipher Barber Lake, Fluidstack and Google have agreed to make adjustments to the rights and obligations of the parties as compared to the Original Recognition Agreement in light of the A&R Fluidstack Lease including increasing the termination fee payable by Google under certain circumstances after the completion and delivery of Phase I. The terms of the A&R Recognition Agreement are otherwise substantially consistent with the terms of the Original Recognition Agreement.

Additionally, on November 20, 2025, the Company amended and restated the previously announced Warrant Agreement (the “Original Warrant Agreement”) with Google (as amended and restated, the “A&R Warrant Agreement). Pursuant to the Original Warrant Agreement, the Company issued to Google warrants to purchase 24,178,576 shares (the “Warrant Shares”) of the Company’s common stock, par value $0.001 per share (“Common Stock”), for an exercise price of $0.01 per share of Common Stock. If, on the business day prior to the beginning of the exercise period under the Original Warrant Agreement, the value of the Warrant Shares did not equal or exceed $430 million (the “Top-Up Threshold”), the Company was obligated to issue additional Warrant Shares and/or make a cash payment equal in the aggregate to such shortfall amount on the terms set forth in the Original Warrant Agreement. Under the A&R Warrant Agreement, the Top-Up Threshold was adjusted from $430 million to $435 million.

The descriptions of the A&R Recognition Agreement and the A&R Warrant Agreement are qualified in their entirety by reference to the full and complete terms of the A&R Recognition Agreement and the A&R Warrant Agreement, copies of which are filed as Exhibit 10.1 and Exhibit 4.1 to this Report, respectively.

On November 20, 2025, Cipher Baker Lake also amended and restated an additional existing recognition agreement with certain providers to make adjustments to the rights and obligations of the parties therein in light of the A&R Fluidstack Lease.

Item 7.01. Regulation FD.

On November 20, 2025, the Company issued a press release announcing the A&R Recognition Agreement, the A&R Warrant Agreement and the A&R Fluidstack Lease. A copy of the press release is furnished hereto as Exhibit 99.1. Additionally, attached as Exhibit 99.2 to this Current Report is certain illustrative financial information concerning the Barber Lake Facility.

The information contained in Item 7.01 of this Report (as well as in Exhibits 99.1 and 99.2 attached hereto) is furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and such information shall not be deemed to be incorporated by reference into any of the Company’s filings under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act.

Item 8.01. Other Events

On November 20, 2025, the Company issued a press release to announce that Cipher Compute LLC (the “Issuer”), a wholly-owned indirect subsidiary of Company, intends to offer up to $333,000,000 aggregate principal amount of 7.125% senior secured notes due 2030 of the Issuer (the “Notes”) in a private offering to persons reasonably believed to be qualified institutional buyers in reliance on Rule 144A under the Securities Act and to non-U.S. persons outside of the United States pursuant to Regulation S under the Securities Act (the “Offering”). The Notes will be part of the same series as the $1,400,000,000 aggregate principal amount of 7.125% senior secured notes due 2030 (the “Initial Notes”) issued by the Issuer pursuant to the indenture, dated as of November 13, 2025, by and among the Issuer, Cipher Songbird LLC (“Cipher Songbird”), Cipher Barber Lake and Wilmington Trust, National Association, as trustee and collateral agent. The Notes will have identical terms and conditions (other than the original issue date and issue price) as the Initial Notes. Cipher Compute intends to use the net proceeds from the sale of the Notes to finance a portion of the construction cost of phase II.

The Notes will be fully and unconditionally guaranteed by Cipher Barber Lake and will be secured by first-priority liens on (i) substantially all assets of the Issuer and Cipher Barber Lake, other than certain excluded property, (ii) all equity interests of the Issuer held by Cipher Songbird, (iii) if and when established by Fluidstack, a designated lockbox account of Fluidstack, and (iv) prior to the completion of the initial construction phase of the Barber Lake Facility, a pledge by Google of the warrants to purchase the Warrant Shares.

A copy of the press release announcing the Offering is filed hereto as Exhibit 99.3 The information included in this Current Report is neither an offer to sell nor a solicitation of an offer to buy any securities.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

* Pursuant to Item 601(a)(5) of Regulation S-K, certain schedules and similar attachments have been omitted. The registrant hereby agrees to furnish a copy of any omitted schedule or similar attachment to the U.S. Securities and Exchange Commission upon request.

Forward Looking Statements

This Current Report on Form 8-K contains certain forward-looking statements within the meaning of the federal securities laws of the United States. The Company intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and includes this statement for purposes of complying with these safe harbor provisions. Any statements made in this Current Report on Form 8-K that are not statements of historical fact, such as statements about the Company’s beliefs and expectations regarding its planned business model and strategy, the proposed offering of the Notes, its bitcoin mining and HPC data center development, timing and likelihood of success, capacity, functionality and operation of data centers, expectations regarding the operations of data centers, such as projected hashrate, potential strategic initiatives, such as joint ventures and partnerships, and management plans and objectives, are forward-looking statements and should be evaluated as such. These forward-looking statements generally are identified by the words “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “could,” “seeks,” “intends,” “targets,” “projects,” “contemplates,” “believes,” “estimates,” “strategy,” “future,” “forecasts,” “opportunity,” “predicts,” “potential,” “would,” “will likely result,” “continue,” and similar expressions (including the negative versions of such words or expressions).

These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by Cipher and its management, are inherently uncertain. Such forward-looking statements are subject to risks, uncertainties, and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements. New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this Current Report on Form 8-K, including but not limited to: volatility in the price of Cipher’s securities due to a variety of factors, including changes in the competitive and regulated industry in which Cipher operates, Cipher’s evolving business model and strategy and efforts it may make to modify aspects of its business model or engage in various strategic initiatives, variations in performance across competitors, changes in laws and regulations affecting Cipher’s business, and the ability to implement business plans, forecasts, and other expectations and to identify and realize additional opportunities. The foregoing list of factors is not exhaustive. Potential investors, stockholders and other readers are cautioned to carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of Cipher’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024 filed with the Securities and Exchange Commission (“SEC”) on February 25, 2025, Cipher’s Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2025 filed with the SEC on November 3, 2025, and in Cipher’s subsequent filings with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Cipher assumes no obligation and, except as required by law, does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

Date: November 20, 2025

| CIPHER MINING INC. | |

| By: | /s/ Will Iwaschuk |

| Name: | Will Iwaschuk |

| Title: | Co-President & Chief Legal Officer |

Exhibit 4.1

CIPHER MINING INC.

WARRANT

This warrant and the securities issuable upon exercise of this warrant have not been registered under the Securities Act of 1933, as amended (the “Securities Act”), or the securities laws of any state or other jurisdiction. This warrant and the securities issuable upon exercise of this warrant may not be sold or offered for sale, pledged or hypothecated except pursuant to an effective registration statement under the Securities Act or pursuant to an exemption from registration thereunder, in each case in accordance with all applicable securities laws of the states or other jurisdictions, and in the case of a transaction exempt from registration, such warrant and the securities issuable upon exercise of such warrant may only be transferred if the issuer and, if applicable, the transfer agent for such warrant and the securities issuable upon exercise of such warrant has received documentation reasonably satisfactory to it that such transaction does not require registration under the Securities Act.

THIS AMENDED AND RESTATED WARRANT AGREEMENT, dated as of November 20, 2025 (this “Warrant”), is by and between (a) Cipher Mining Inc., a Delaware corporation (the “Corporation”), and (b) Google LLC, a Delaware limited liability company (the “Holder”). The Corporation and the Holder are sometimes referred to herein collectively as the “Parties” or individually as a “Party.” Capitalized terms used herein and not defined in Section 1.01 have the meaning given to such terms in the A&R Fluidstack Lease.

WHEREAS, the Holder previously entered into (i) that certain Warrant Agreement (the “Original Warrant Agreement”), dated as of September 24, 2025, between the Corporation and the Holder, (ii) that certain Recognition Agreement (the “Original Recognition Agreement”), dated as of September 24, 2025, among Cipher Barber Lake LLC, a Delaware limited liability company and an indirect subsidiary of the Corporation (“Barber Lake”), Fluidstack USA II Inc., a Delaware corporation (“Fluidstack”), and the Holder and (iii) that certain Datacenter Lease (the “Original Fluidstack Lease”), dated as September 24, 2025, between Barber Lake and Fluidstack;

WHEREAS, the Holder and the other parties thereto have agreed, on the date hereof, to amend and restate the Original Recognition Agreement (as amended and restated, the “A&R Recognition Agreement”) and the Original Fluidstack Lease (as amended and restated, the “A&R Fluidstack Lease”), in each case on the terms and subject to the conditions set forth therein;

WHEREAS, in connection therewith, the Parties wish to amend, restate, supersede and replace in its entirety the Original Warrant Agreement on the terms and subject to the conditions set forth herein;

WHEREAS, pursuant to the A&R Recognition Agreement, the Holder has guaranteed (the “Google Guaranty”) certain obligations of Fluidstack under the A&R Fluidstack Lease;

WHEREAS, as a condition to receiving this Warrant prior to the effectiveness of the Google Guaranty, the Holder has pledged this Warrant for the benefit of lenders to the Corporation pursuant to the Warrant Pledge Agreement;

WHEREAS, in consideration for the Holder providing the Google Guaranty, the Corporation has agreed to issue to the Holder warrants to purchase 24,178,576 Common Shares for an exercise price of $0.01 per Common Share; and NOW, THEREFORE, in consideration of the premises and the covenants contained herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows:

WHEREAS, this Warrant is intended to set forth the terms and conditions of the right to purchase such Common Shares.

ARTICLE 1

DEFINITIONS AND REFERENCES

Section 1.01 Definitions. As used herein, the following terms have the respective meanings:

“A&R Fluidstack Lease” has the meaning set forth in the preamble.

“A&R Recognition Agreement” has the meaning set forth in the preamble.

“Affiliate” means, with respect to any Person, any other Person directly or indirectly controlling, controlled by, or under direct or indirect common control with, such Person. For purposes of this definition, “control” (including, with correlative meanings, the terms “controlling,” “controlled by” and “under common control with”) with respect to any Person, means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of such Person, whether through the ownership of voting securities, by contract or otherwise.

“Aggregate Exercise Price” means an amount equal to the product of (a) the number of Warrant Shares in respect of which this Warrant is then being exercised pursuant to Section 2.02, multiplied by (b) the then-current Exercise Price.

“Board” means the board of directors of the Corporation.

“Business Day” means any day other than a Saturday, a Sunday or a day on which banks are authorized or required to close in the City of New York, New York.

“Common Shares” means the shares of common stock, par value $0.001 per share, of the Corporation.

“Convertible Bond Shares” means (i) any Common Shares actually issued in respect of the $172.5 million aggregate principal amount of convertible notes issued by the Corporation on May 22, 2025 and (ii) any Common Shares actually issued in respect of the $1.3 billion aggregate principal amount of convertible notes issued by the Corporation on September 30, 2025.

“Corporation” has the meaning set forth in the preamble.

“Equity Interests” means shares of capital stock, partnership interests, membership interests in a limited liability company, beneficial interests in a trust or other equity ownership interests in a Person, and any warrants, options or other rights entitling the holder thereof to purchase or acquire any such Equity Interests.

“Exercise Certificate” has the meaning assigned to such term in Section 3.01(a).

“Exercise Date” means, for any given exercise of a Warrant, the earliest date that is a Business Day on which the conditions to such exercise as set forth in Section 3.01 shall have been satisfied at or prior to 5:00 p.m., New York City time.

“Exercise Period” means the period beginning the earlier of (i) the Phase I Commencement Date and (ii) the Outside Completion Date with respect to Phase I, and ending at 5:00 p.m., New York City time, on November 20, 2030.

“Exercise Price” means $0.01 per Common Share, as may be adjusted pursuant to Article 4 hereof.

“Fundamental Transaction” means, whether through one transaction or a series of related transactions, any (a) recapitalization of the Corporation, (b) reclassification of the stock of the Corporation (other than (i) a change in par value, from par value to no par value, from no par value to par value or (ii) as a result of a stock dividend or subdivision, split up or combination of shares to which Section 4.01 applies), (c) consolidation or merger of the Corporation with and into another Person or of another Person with and into the Corporation (whether or not the Corporation is the surviving corporation of such consolidation or merger), (d) sale or lease of all or substantially all of the Corporation’s assets (on a consolidated basis), (e) any, direct or indirect, purchase offer, tender offer or exchange offer (whether by the Corporation or another Person) is completed pursuant to which holders of Common Shares are permitted to sell, tender or exchange their shares for other securities, cash or property and has been accepted by the holders of greater than 50% of the outstanding Common Shares or greater than 50% of the voting power of the common equity of the Corporation, (f) the Corporation, directly or indirectly, consummates a stock or share purchase agreement or other business combination with another Person or group of Persons whereby such other Person or group acquires 50% or more of the outstanding shares of Common Shares or 50% or more of the voting power of the common equity of the Corporation or (g) other similar transaction, in each case, that entitles the holders of Common Shares to receive (either directly or upon subsequent liquidation) stock, securities or assets (including cash) with respect to or in exchange for Common Shares.

“Google Guaranty” has the meaning set forth in the preamble.

“Holder” has the meaning set forth in the preamble.

“HSR Act” has the meaning assigned to such term in Section 6.06.

“Issue Date” means November 20, 2025.

“NASDAQ” means The Nasdaq Stock Market LLC.

“Notice of Transfer” means a Notice of Transfer substantially in the form of Exhibit B.

“Original Fluidstack Lease” has the meaning set forth in the preamble.

“Original Recognition Agreement” has the meaning set forth in the preamble.

“Original Warrant Agreement” has the meaning set forth in the preamble.

“Parties” has the meaning set forth in the preamble.

“Person” means any individual, sole proprietorship, partnership, limited liability company, corporation, joint venture, trust, incorporated organization or government or department or agency thereof.

“Preferred Shares” means the shares of preferred stock, par value $0.001 per share, of the Corporation.

“Securities” has the meaning assigned to such term in Section 5.01.

“Securities Act” means the Securities Act of 1933, as amended.

“Shortfall Amount” has the meaning assigned to such term in Section 3.08.

“Successor Affiliate” has the meaning assigned to such term in Section 6.02.

“Transfer” has the meaning assigned to such term in Section 6.02.

“Transfer Agent” means the entity designated by the Corporation to act as transfer agent for the Common Shares.

“VWAP Price” means, as of a particular date, the volume-weighted average trading price, as displayed under the heading “Bloomberg VWAP” on Bloomberg page “CIFR <equity> AQR” (or its equivalent successor if such page is not available), as adjusted for splits, combinations and other similar transactions, of a Common Share for the consecutive period of ten Business Days ending two Business Days prior to such date, except that if the Common Shares are listed on any domestic securities exchange, the term “Business Day” as used in this sentence means Business Days on which such exchange is open for trading.

“Warrant” has the meaning set forth in the preamble.

“Warrant Pledge Agreement” means that certain Pledge Agreement, dated as of November 13, 2025, by and among the Holder, Cipher Compute LLC, a Delaware limited liability company, and Wilmington Trust, National Association, as trustee.

“Warrant Register” has the meaning assigned to such term in Section 6.05.

“Warrant Shares” has the meaning assigned to such term in Section 2.01.

Section 1.02 Rules of Construction. Unless the context otherwise requires or except as otherwise expressly provided:

(a) “herein,” “hereto” or “hereof” and other words of similar import refer to this Warrant as a whole and not to any particular Section, Article or other subdivision;

(b) the word “including” is not limiting and means “including without limitation”;

(c) definitions will be equally applicable to both the singular and plural forms of the terms defined;

(d) all references to Sections or Articles or Exhibits refer to Sections or Articles or Exhibits of or to this Warrant unless otherwise indicated;

(e) all exhibits annexed hereto or referred to herein are hereby incorporated in and made a part of this Warrant as if set forth in full herein, and any capitalized terms used in any exhibit but not otherwise defined therein will have the meaning as defined in this Warrant or in the Fluidstack Lease;

(f) all references to a Party include such Party’s successors and permitted assigns;

(g) any reference to “$” or “dollars” means United States dollars; and

(h) references to agreements or instruments, or to statutes or regulations, are to such agreements or instruments, or statutes or regulations, as amended from time to time (or to successor statutes and regulations).

ARTICLE 2

ISSUANCE, EXERCISE AND EXPIRATION OF WARRANT

Section 2.01 Issuance of Warrant. Subject to the terms and conditions hereof, this Warrant shall represent the right to purchase from the Corporation up to 24,178,576 Common Shares for an exercise price of $0.01 per Common Share; provided that if and to the extent that any Convertible Bond Shares are issued, the number of Common Shares issuable in respect of this Warrant shall be increased by a multiple equal to (i) 488,773,222 plus the number of Convertible Bond Shares issued divided by (ii) 488,773,222. The Common Shares issuable upon exercise of the warrants described in the immediately preceding sentence, as may be adjusted from time to time pursuant to Article 4 hereof, are referred to herein as “Warrant Shares”.

Section 2.02 Exercise of Warrant.

(a) Subject to the terms and conditions hereof, and pursuant to the procedures set forth in Section 3.01, the Holder may exercise such right to purchase with respect to all or any part of this Warrant Shares at any time or from time to time on any Business Day during the Exercise Period.

(b) For the avoidance of doubt, upon the commencement of the Exercise Period, no Warrants shall be subject to any vesting, cancellation or deemed cancellation.

(c) This Warrant shall have no voting rights until exercised for Warrant Shares.

Section 2.03 Expiration of Warrant. The right to purchase the Warrant Shares pursuant to this Warrant shall terminate and become void following the end of the Exercise Period.

ARTICLE 3

EXERCISE PROCEDURE

Section 3.01 Conditions to Exercise. The Holder, at its election, may exercise this Warrant during the Exercise Period upon (and only upon):

(a) execution and delivery of an Exercise Certificate in the form attached hereto as Exhibit A (each, an “Exercise Certificate”), duly completed (including specifying the number of Warrant Shares to be purchased and the Exercise Price in connection with such exercise); and

(b) payment to the Corporation of the Aggregate Exercise Price for such exercise in accordance with Section 3.02.

Section 3.02 Payment of the Aggregate Exercise Price. Payment of the Aggregate Exercise Price shall be made to the Corporation by wire transfer of immediately available funds to an account designated in writing by the Corporation, in the amount of such Aggregate Exercise Price.

Section 3.03 Delivery of Warrant Shares. As promptly as reasonably practicable on or after the Exercise Date, and in any event within two Business Days thereafter, the Corporation shall cause the Transfer Agent to issue book-entry interests representing the number of Warrant Shares issuable on such Exercise Date to the account designated by the Holder in the Exercise Certificate.

Section 3.04 Fractional Shares. The Corporation shall not be required to issue a fractional Warrant Share upon exercise of any Warrant. In lieu of any fraction of a Warrant Share that the Holder would otherwise be entitled to receive upon such exercise, the Corporation shall round down any such fractional share to the nearest whole share and pay to the Holder an amount in cash (by delivery of a certified or official bank check or by wire transfer of immediately available funds) equal to the product of (i) such fraction of a Warrant Share multiplied by (ii) the fair market value of one Warrant Share on the Exercise Date.

Section 3.05 Warrant Register; Replacement Warrant. Unless this Warrant shall have been fully exercised, the Corporation shall, at the time of delivery of the Warrant Shares being issued in accordance with this Article 3, provide by notation in the Warrant Register the number, if any, of Warrant Shares that remain subject to purchase by the Holder upon exercise and the Corporation shall cause a replacement Warrant in the form of this Warrant for the unexercised portion of Warrant Shares to be issued to the Holder, for no additional consideration.

Section 3.06 Valid Issuance of Warrant and Warrant Shares. With respect to the execution and delivery of this Warrant and each exercise of this Warrant, the Corporation hereby represents, warrants, covenants and agrees:

(a) As of the close of business on September 12, 2025, the authorized capital stock of the Corporation consisted of: (i) 500,000,000 Common Shares, of which 393,286,007 shares are issued and outstanding (not including 1,797,987 Common Shares held in treasury); and (ii) 10,000,000 Preferred Shares, none of which are issued and outstanding. As of the Business Day immediately preceding the date of this Warrant, the Corporation has reserved 36,434,649 Common Shares for issuance to employees, consultants and directors, including (i) 16,234,004 Common Shares reserved for issuance pursuant to outstanding restricted stock units, (ii) 6,748,653 Common Shares reserved for issuance pursuant to outstanding performance stock units (assuming any performance-based conditions are fully satisfied at maximum performance levels) and (iii) 13,451,992 Common Shares reserved for issuance pursuant to the Cipher Mining Inc. 2021 Incentive Award Plan. Except for the: (w) Warrant and the Warrant Shares; (x) shares reserved for issuance and described in the preceding sentence; (y) warrants to purchase up to 8,613,980 Common Shares; and (z) convertible notes in an aggregate principal amount of $172.5 million, there are no options, warrants or other rights (including conversion rights) to purchase any of the Corporation’s authorized and unissued capital stock.

(b) The Corporation is duly organized, validly existing and in good standing under the laws of the jurisdiction of its organization;

(c) The Corporation has the corporate power and authority to execute and deliver this Warrant and to perform its obligations hereunder. The Corporation has taken all corporate actions or proceedings required to be taken by or on the part of the Corporation to authorize and permit the execution and delivery by the Corporation of this Warrant and the performance by the Corporation of its obligations hereunder and the consummation by the Corporation of the transactions contemplated hereby. This Warrant has been duly executed and delivered by the Corporation, and assuming the due authorization, execution and delivery by the Holder, constitutes the legal, valid and binding obligation of the Corporation, enforceable against it in accordance with its terms, except as such enforceability may be limited by bankruptcy, fraudulent conveyance, insolvency, reorganization, moratorium, and other laws relating to or affecting creditors’ rights generally and by general equitable principles (regardless of whether such enforceability is considered in a proceeding in equity or at law).

(d) The execution and delivery by the Corporation of this Warrant, the performance by the Corporation of its obligations hereunder and the consummation by the Corporation of the transactions contemplated hereby will not violate (i) any provision of law, statute, rule or regulation applicable to the Corporation, (ii) the certificate of incorporation or bylaws of the Corporation, (iii) any applicable order of any court or any rule, regulation or order of any governmental authority applicable to the Corporation or (iv) any provision of any indenture, certificate of designation for preferred stock, agreement or other instrument to which the Corporation is a party or by which its property is or may be bound, except, in each case, for any such violation that would not impair in any material way the Corporation’s ability to perform its obligations under this Warrant.

(e) Assuming the accuracy of the Holder’s several representations and warranties set forth in Article 5, the issuance of this Warrant (and the issuance of the Warrant Shares upon exercise of this Warrant) is exempt from the registration requirements of the Securities Act and all other applicable state blue sky or other securities laws, statutes, rules or regulations.

(f) None of the Corporation, its Affiliates or any Person acting on any of their behalf (other than the Holder and its Affiliates), directly or indirectly, has offered, sold or solicited any offer to buy and will not, directly or indirectly, offer, sell or solicit any offer to buy, any security of a type or in a manner which would be integrated with the issuance of this Warrant. None of the Corporation, its Affiliates or any Person acting on any of their behalf (other than the Holder and its Affiliates) has engaged or will engage in any form of general solicitation or general advertising (within the meaning of Rule 502(c) promulgated under the Securities Act) in connection with the issuance of this Warrant.

(g) This Warrant has been duly authorized and is validly issued.

(h) Each Warrant Share issuable upon the exercise of this Warrant pursuant to the terms hereof shall be, upon issuance, validly issued, fully paid and non-assessable, and free from preemptive or similar rights and free from all taxes, liens and charges with respect thereto (other than liens and charges arising solely from the actions and circumstances of the Holder).

(i) The Corporation will at all times during the Exercise Period maintain authorized and reserved for issuance solely for the purpose of effecting the exercise of this Warrant, such number of Common Shares as are then and from time to time subject to issuance upon the exercise in whole of this Warrant, which shares have not been subscribed for or otherwise committed or issued.

(j) The Corporation shall take all such action as many be necessary to ensure the par value per Warrant Share will at all times during the Exercise Period be less than or equal to the Exercise Price.

(k) The Corporation shall take all such actions as may be necessary to ensure that all Warrant Shares are issued without violation by the Corporation of its certificate of incorporation, bylaws or any other constituent document and of any applicable law, statute, rule or regulation or any requirements of any securities exchange upon which the Common Shares or other securities constituting Warrant Shares may be listed at the time of such exercise (except for official notice of issuance which will be promptly delivered by the Corporation upon each such issuance).

(l) The Corporation shall use commercially reasonable efforts to cause the Warrant Shares, promptly upon such exercise, to be listed on the NASDAQ or any domestic securities exchange upon which Common Shares are listed at the time of such exercise.

(m) The Corporation shall pay all expenses in connection with, and all taxes (other than United States federal, state or local income taxes) and other governmental charges that may be imposed with respect to, the issuance or delivery of Warrant Shares upon exercise of this Warrant.

Section 3.07 Automatic Conversion Upon Expiration. If, at the end of the Exercise Period, the fair market value of one Common Share (or other security issuable upon the exercise hereof) is greater than the Exercise Price in effect on such date, then this Warrant shall automatically be deemed on and as of such date to be exercised on a net basis as to all Warrant Shares for which it shall not previously have been exercised, and the Corporation shall, within a reasonable time, issue book-entry interests representing the Warrant Shares issued upon such exercise to the Holder. For purposes of any net exercise pursuant to this Section 3.07, the Holder shall be entitled to the number of Common Shares equal to (i) (x) the difference between (a) the then-applicable VWAP Price and (b) the Exercise Price times (y) the number of Common Shares being exercised, divided by (ii) the then-applicable VWAP Price.

Section 3.08 Top-Up Payment or Shares. If, on the Business Day preceding the Exercise Period, the product of (i) the then-applicable VWAP Price and (ii) the number of Warrant Shares issuable pursuant to Section 2.01 does not exceed $435 million (any such difference, the “Shortfall Amount”), the Corporation shall (x) issue to the Holder additional Common Shares (with such number of Common Shares calculated as determined by the Shortfall Amount divided by the then-applicable VWAP Price) pursuant to the delivery procedures set forth in Section 3.03 and/or (y) make an additional cash payment to the Holder, to be paid within three Business Days by wire transfer of immediately available funds to an account designated by the Holder, in any combination at the election of the Corporation but in an aggregate amount equal to the Shortfall Amount. For the avoidance of doubt, (i) if the Corporation issues additional shares to the Holder pursuant to this Section 3.08, in no event shall the Holder be required to pay the Corporation consideration for such additional shares in excess of the Exercise Price and (ii) the Corporation shall not issue additional Common Shares (and shall only make payments in cash) if such issuance would require the approval by the stockholders of the Corporation pursuant to applicable law or securities exchange rule without first obtaining such approval.

ARTICLE 4 ADJUSTMENT TO NUMBER OF WARRANT SHARES

Section 4.01 Adjustment to Number of Warrant Shares. If the Corporation, at any time after the Issue Date but prior to the end of the Exercise Period (or, if earlier, the exercise in full of this Warrant), (a) makes or declares a dividend or other distribution (in part or in full) on its outstanding Common Shares payable in Equity Interests of the Corporation, (b) subdivides (by any split, recapitalization or otherwise) its outstanding Common Shares into a greater number of Common Shares or (c) combines (by combination, reverse split or otherwise) its outstanding Common Shares into a smaller number of Common Shares, then the remaining number of Warrant Shares issuable upon the exercise of this Warrant immediately prior to any such dividend, distribution, subdivision, combination or issuance shall be proportionately adjusted so the Holder will thereafter receive upon exercise in full of this Warrant the aggregate number and kind of shares of Equity Interests of the Corporation that the Holder would have owned immediately following such action if this Warrant had been exercised in full immediately before the record date for such action. Any adjustment under this Section 4.01 shall become effective at the close of business on the record date of the dividend, distribution, subdivision or combination (or, if no record date is set (whether by action of the Corporation, through statute or otherwise), the date the dividend, distribution, subdivision or combination becomes effective).

If any such event is announced or declared and the Warrant Shares are adjusted pursuant to this Section 4.01 but such event does not occur, the Warrant Shares shall be readjusted, effective as of the date the Board announces that such event shall not occur, to the number of Warrant Shares that would then be in effect if such event had not been declared. Whenever the number of Warrant Shares subject to this Warrant is adjusted pursuant to this Section 4.01, the Corporation shall provide the notice required by Section 6.01.

Section 4.02 Dissolution, Liquidation or Winding Up. If the Corporation, at any time after the Issue Date but prior to the end of the Exercise Period (or, if earlier, the exercise in full of this Warrant), commences a voluntary or involuntary dissolution, liquidation or winding up of the affairs of the Corporation, then (a) the Holder of this Warrant shall receive the kind and number of other securities or assets which the Holder would have been entitled to receive if the Holder had exercised in full this Warrant and acquired the applicable number of Warrant Shares then issuable hereunder as a result of such exercise immediately prior to the time of such dissolution, liquidation or winding up, and (b) the right to exercise this Warrant shall terminate on the date on which the holders of record of Common Shares shall be entitled to exchange their Common Shares for securities or assets deliverable upon such dissolution, liquidation or winding up.

Section 4.03 Fundamental Transactions. If the Corporation, at any time after the Issue Date but prior to the end of the Exercise Period (or, if earlier, the exercise in full of this Warrant), effects any Fundamental Transaction, then upon consummation of such Fundamental Transaction, this Warrant shall automatically become exercisable for the kind and amount of securities, cash or other assets which the Holder of this Warrant would have owned immediately after such Fundamental Transaction if the Holder had exercised in full this Warrant immediately before the effective date of such Fundamental Transaction; provided, if the holders of Common Shares are given any choice as to the securities, cash or property to be received in a Fundamental Transaction, then the Holder shall be given the same choice as to the alternate consideration it receives upon any exercise of this Warrant in connection with such Fundamental Transaction. With respect to any Fundamental Transaction that the Corporation has not publicly announced at least 15 days prior to the consummation of such Fundamental Transaction, (a) the Corporation will deliver to the Holder written notice of such Fundamental Transaction at least 15 days prior to the consummation of such Fundamental Transaction (which written notice will be treated as confidential by the Holder), and (b) the Holder agrees not to exercise this Warrant (or any portion thereof) during the two Business Days immediately preceding the consummation of such Fundamental Transaction. If this Section 4.03 applies to a transaction, Section 3.08 and Section 4.01 shall not apply.

Section 4.04 Exercise Price in the Event of an Adjustment in Number of Warrant Shares. Upon any adjustment of the number of Warrant Shares subject to this Warrant pursuant to this Article 4, the Exercise Price per Warrant Share subject to issuance upon exercise of this Warrant shall be adjusted concurrently thereto to equal the product of (a) $0.01 (or if the Exercise Price has been previously adjusted, then at such adjusted Exercise Price), times (b) a fraction, of which the numerator is the total number of Warrant Shares subject to issuance upon the exercise of this Warrant before giving effect to the adjustment, and the denominator is the total number of Warrant Shares subject to issuance upon the exercise of this Warrants as so adjusted.

ARTICLE 5 REPRESENTATIONS OF HOLDER

Section 5.01 Investment Intent. The Holder represents and warrants that it is acquiring this Warrant and the Common Shares underlying this Warrant (collectively, the “Securities”), solely for its beneficial account, for investment purposes, and not with a view to, or for resale in connection with, any distribution of the Securities in violation of applicable securities laws.

Section 5.02 Unregistered Securities. The Holder represents and warrants that it understands that the Securities have not been registered under the Securities Act or any state securities laws by reason of specific exemptions under the provisions thereof, the availability of which depend in part upon the bona fide nature of its investment intent and upon the accuracy of its representations made herein.

Section 5.03 Reliance. The Holder represents and warrants that it understands that the Corporation is relying in part upon the representations and agreements of the Holder contained herein for the purpose of determining whether the offer, sale and issuance of the Securities meet the requirements for such exemptions described in Section 5.02.

Section 5.04 Accredited Investor. The Holder represents and warrants that it is an “accredited investor” as defined in Rule 501(a) under the Securities Act.

Section 5.05 Sophisticated Investor. The Holder represents and warrants that it has such knowledge, skill and experience in business, financial and investment matters that it is capable of evaluating the merits and risks of an investment in the Securities, including experience in and knowledge of the industry in which the Corporation operates.

Section 5.06 Restricted Securities. The Holder represents and warrants that it understands that the Securities will be “restricted securities” under applicable federal securities laws and that the Securities Act and the rules of the U.S. Securities and Exchange Commission provide in substance that it may dispose of the Securities only pursuant to an effective registration statement under the Securities Act or an exemption therefrom.

Section 5.07 Information. The Holder represents and warrants that it has been furnished by the Corporation all information (or provided access to all information) regarding the business and financial condition of the Corporation, its expected plans for future business activities, the attributes of the Securities, and the merits and risks of an investment in such Securities which it has requested or otherwise needs to evaluate the investment in such Securities; that in making the proposed investment decision, the Holder is relying solely on such information, the representations, warranties and agreements of the Corporation contained herein and on investigations made by it and its representatives; that the offer to sell the Securities hereunder was communicated to the Holder in such a manner that it was able to ask questions of and receive answers from the management of the Corporation concerning the terms and conditions of the proposed transaction and that at no time was it presented with or solicited by or through any leaflet, public promotional meeting, television advertisement or any other form of general or public advertising or solicitation; and the Holder recognizes that an investment in the Securities involves risks and can result in a total loss of all funds invested.

Section 5.08 Non-Reliance. Notwithstanding anything in this Warrant to the contrary, the Holder hereby acknowledges, with respect to itself, that the Corporation may possess material non-public information with respect to the Corporation and/or its securities not known to the Holder as of the date hereof or at a time when the Holder exercises its right to purchase Warrant Shares pursuant to this Warrant and that any such information may impact the value of the Warrant and the Warrant Shares. The Holder with respect to itself irrevocably waives any claim, or potential claim, that it may have based on the failure of the Corporation or its Affiliates, officers, directors, employees, agents or other representatives to disclose such information in connection with the execution and delivery of this Warrant or the purchase of Warrant Shares hereunder; provided, however, notwithstanding anything in this Section 5.08 or otherwise to the contrary, the Holder does not and shall not be deemed to have waived or otherwise compromised any rights or claims based upon or arising out of (i) the Corporation’s disclosure obligations under the federal securities laws with respect to any untrue statement of a material fact or omission to state a material fact necessary in order to make the statements made, in the light of the circumstances under which they were made, not misleading in any public statement or filing made by the Corporation pursuant to the Securities Exchange Act of 1934, as amended, or (ii) any breach or inaccuracy of any representation or warranty of the Corporation in this Warrant or the Google Guaranty.

The Holder with respect to itself acknowledges that the Corporation would not enter into this Warrant in the absence of the agreements set forth in this Section 5.08.

ARTICLE 6 OTHER AGREEMENTS

Section 6.01 Notice of Adjustment. Upon any adjustment of the number of Warrant Shares subject to a Warrant and the Exercise Price pursuant to Article 4 hereof, the Corporation shall promptly thereafter cause to be given to the Holder written notice of such adjustments. Where appropriate, such notice may be given in advance. Such notice shall be delivered in accordance with Section 6.09 and shall state (a) the event giving rise to the adjustment, (b) the effective date of the adjustment and (c) the adjustment to the number of Warrant Shares subject to this Warrant and the adjusted Exercise Price pursuant to Article 4 hereof.

Section 6.02 Transfer of Warrant and Warrant Shares. Prior to the Exercise Period, except as contemplated by the Warrant Pledge Agreement, the Holder may not sell, transfer, assign, pledge, hypothecate, mortgage, dispose of or in any way encumber (“Transfer”) this Warrant (or any portion thereof) to another Person; provided, that (i) the Holder may Transfer this Warrant (in whole but not in part) to any of the Holder’s Affiliates (a “Successor Affiliate”) if such Successor Affiliate expressly assumes and agrees to succeed to, in writing reasonably satisfactory to the Corporation, all the rights and obligations of the Holder under this Warrant and (ii) the parties to any Transfer pursuant to the foregoing clause (i) deliver a Notice of Transfer to the Corporation. Except as permitted pursuant to the immediately foregoing sentence, any Transfer of this Warrant prior to the Exercise Period shall be void ab initio. Notwithstanding the foregoing or anything to the contrary in the Warrant Pledge Agreement, the Holder shall in no event Transfer this Warrant (or any portion thereof) to any Person that is not a United States Person within the meaning of Section 7701(a)(30) of the Internal Revenue Code of 1986, as amended and any purported Transfer of this Warrant (or any portion thereof) to any such Person shall be void ab initio. Upon delivery to the Corporation of a Notice of Transfer to a Successor Affiliate, the Corporation shall promptly update the Warrant Register to reflect such Transfer. After the commencement of the Exercise Period, subject to the terms of the Warrant Pledge Agreement, no Transfer restrictions shall apply hereunder.

Section 6.03 Holder Not Deemed Stockholder. The Holder acknowledges that this Warrant does not confer upon the Holder any right to vote or receive dividends or confer upon the Holder any of the rights of a stockholder of the Corporation.

Section 6.04 Agreement to Comply with the Securities Act; Legend. The Holder, by acceptance of this Warrant, agrees to comply in all respects with the provisions of this Section 6.04 and the restrictive legend requirements set forth on the face of this Warrant and further agrees that the Holder shall not offer, sell, assign, transfer, pledge or otherwise dispose of this Warrant or any Warrant Shares to be issued upon exercise hereof except, in the case of any Warrant Shares, under circumstances that will not result in a violation of the Securities Act. All Warrant Shares issued upon exercise of this Warrant (unless registered under the Securities Act) shall be stamped or imprinted with a legend in substantially the following form:

“These securities have not been registered under the Securities Act of 1933, as amended (the “Securities Act”), or the securities laws of any state or other jurisdiction. These securities may not be sold or offered for sale, pledged or

hypothecated except pursuant to an effective registration statement under the Securities Act or pursuant to an exemption from registration thereunder, in each case in accordance with all applicable securities laws of the states or other jurisdictions, and in the case of a transaction exempt from registration, such securities may only be transferred if the transfer agent for such securities has received documentation reasonably satisfactory to it that such transaction does not require registration under the Securities Act.”

Section 6.05 Warrant Register. The Corporation shall keep and properly maintain at its principal executive offices books for the registration of this Warrant and any exercises thereof (the “Warrant Register”).

Section 6.06 Other Cooperation. If the purchase of any portion of Warrant Shares upon the exercise of any portion of the Warrant would give rise to a filing obligation on the part of the Holder under the Hart–Scott–Rodino Antitrust Improvements Act of 1976 (the “HSR Act”) or other similar foreign laws on the part of the Holder or its ultimate parent entity (as that term is defined in the HSR Act), then with respect to any filing under the HSR Act or other similar foreign law, the Corporation will, in consultation and cooperation with the Holder, file or submit, and assist the Holder with any filing, submission or notification it makes, in connection with the exercise of this Warrant with or to any governmental entity any filing, report or notification necessary or advisable in connection with any antitrust, competition or merger control law applicable to such exercise and cooperate with the Holder, to obtain as promptly as practicable all approvals, authorizations, terminations or expiration of applicable periods and clearances in connection therewith. If any such approval, authorization, termination or clearance is required to permit the Holder to purchase any Warrant Shares for which an Exercise Certificate has been delivered to the Corporation but has not been obtained by the end of the Exercise Period, the Exercise Period shall be deemed to be extended until such approval, authorization or clearance has been obtained, or termination or expiration of any applicable waiting period has occurred.

Section 6.07 Tax Treatment. The Parties will report the transaction for U.S. tax purposes as a transfer of the Warrant Shares to the Holder on the first day of the Exercise Period as consideration for the Google Guaranty.

Section 6.08 IRS Form W-9. Holder shall deliver to the Corporation a properly executed Internal Revenue Service Form W-9 on or prior to the Phase I Commencement Date.

Section 6.09 Notices. Any notices or other communications required or permitted hereunder will be deemed to have been properly given and delivered if in writing by such Party or its legal representative and delivered personally or sent by email or nationally recognized overnight courier service guaranteeing overnight delivery, addressed as follows:

If to the Corporation:

Cipher Mining Inc.

1 Vanderbilt Avenue, Floor 54, New York, NY 10017

Email: legal@ciphermining.com

Attention: William Iwaschuk

with a copy to (which shall not constitute notice):

Davis Polk & Wardwell LLP

450 Lexington Avenue

New York, NY 10017

Email: michael.davis@davispolk.com; david.penna@davispolk.com

Attention: Michael Davis; David Penna

If to a Holder:

To its address set forth on its signature page to this Warrant

Unless otherwise specified herein, such notices or other communications will be deemed given: (a) on the date delivered, if delivered personally; (b) one Business Day after being sent by a nationally recognized overnight courier guaranteeing overnight delivery; and (c) on the date delivered, if delivered by email during business hours (or one Business Day after the date of delivery if delivered after 5:00 p.m. in the place of receipt). Each of the Parties will be entitled to specify a different address by delivering notice as aforesaid to the other Party hereto.

Section 6.10 Entire Agreement. This Warrant is intended by the Parties as a final expression of their agreement and intended to be a complete and exclusive statement of the agreement and understanding of the parties hereto in respect of the subject matter contained herein. This Warrant amends, restates supersedes and replaces in its entirety the Original Warrant Agreement and all other prior agreements and understandings between the Parties with respect to such subject matter hereof.

Section 6.11 Assignment by the Corporation. The Corporation may not, without the prior written consent of the Holder, sell, transfer (by operation of law or otherwise, except in connection with a Fundamental Transaction in compliance herewith) or assign this Warrant or any of its rights or obligations hereunder.

Section 6.12 No Third-Party Beneficiaries. This Warrant is for the sole benefit of the Corporation and the Holder and nothing herein, express or implied, is intended to or shall confer upon any other Person any legal or equitable right, benefit or remedy of any nature whatsoever, under or by reason of this Warrant, other than pursuant to the terms of the Warrant Pledge Agreement.

Section 6.13 Headings. The headings in this Warrant are for reference only and shall not affect the interpretation of this Warrant.

Section 6.14 Amendment and Modification; Waiver. This Warrant may only be amended, modified or supplemented by an agreement in writing signed by each Party hereto. No waiver by the Corporation or the Holder of any of the provisions hereof shall be effective unless explicitly set forth in writing and signed by the Party so waiving. No waiver by any Party shall operate or be construed as a waiver in respect of any failure, breach or default not expressly identified by such written waiver, whether of a similar or different character, and whether occurring before or after that waiver. No failure to exercise, or delay in exercising, any rights, remedy, power or privilege arising from this Warrant shall operate or be construed as a waiver thereof; nor shall any single or partial exercise of any right, remedy, power or privilege hereunder preclude any other or further exercise thereof or the exercise of any other right, remedy, power or privilege.

Section 6.15 Severability. If any term or provision of this Warrant is invalid, illegal or unenforceable in any jurisdiction, such invalidity, illegality or unenforceability shall not affect any other term or provision of this Warrant or invalidate or render unenforceable such term or provision in any other jurisdiction.

Section 6.16 Governing Law. This Warrant shall be governed by and construed in accordance with the internal laws of the State of Delaware without giving effect to any choice or conflict of law provision or rule (whether of the State of Delaware or any other jurisdiction) that would cause the application of laws of any jurisdiction other than those of the State of Delaware.

Section 6.17 Submission to Jurisdiction. To the fullest extent permitted by law, each Party hereby consents irrevocably to personal jurisdiction, service and venue in connection with any claim arising out of this Warrant or the transactions contemplated hereby, in the courts of the State of New York located in New York County, New York and in the federal courts in the Southern District of New York. Service of process, summons, notice or other document by certified or registered mail to such Party’s address for receipt of notices pursuant to Section 6.09 shall be effective service of process for any suit, action or other proceeding brought in any such court. To the fullest extent permitted by law, each Party hereto hereby irrevocably waives any objection which it may now or hereafter have to the laying of venue or any such suit, legal action or proceeding in such courts and hereby further waives any claim that any suit, legal action or proceeding brought in such courts has been brought in an inconvenient forum.

Section 6.18 WAIVER OF JURY TRIAL. EACH PARTY ACKNOWLEDGES AND AGREES THAT ANY CONTROVERSY WHICH MAY ARISE UNDER THIS WARRANT IS LIKELY TO INVOLVE COMPLICATED AND DIFFICULT ISSUES AND, THEREFORE, EACH SUCH PARTY IRREVOCABLY AND UNCONDITIONALLYWAIVES ANY RIGHT IT MAY HAVE TO A TRIAL BY JURY IN RESPECT OF ANY LEGAL ACTION ARISING OUT OF OR RELATING TO THIS WARRANT OR THE TRANSACTIONS CONTEMPLATED HEREBY.

Section 6.19 Remedies. The Parties agree and acknowledge that money damages may not be an adequate remedy for any breach of the provisions of this Warrant and that each Party, in its sole discretion, may apply to any court of law or equity of competent jurisdiction for specific performance and for other injunctive relief in order to enforce or prevent violation of the provisions of this Warrant.

Section 6.20 Counterparts. This Warrant may be executed in counterparts, each of which shall be deemed an original, but all of which together shall be deemed to be one and the same agreement. A signed copy of this Warrant delivered by facsimile, email or other means of electronic transmission shall be deemed to have the same legal effect as delivery of an original signed copy of this Warrant.

Section 6.21 No Strict Construction. This Warrant shall be construed without regard to any presumption or rule requiring construction or interpretation against the Party drafting an instrument or causing any instrument to be drafted.

Section 6.22 Replacement. Upon receipt of evidence reasonably satisfactory to the Corporation of the loss, theft, destruction or mutilation of this Warrant and (in the case of loss, theft or destruction) upon delivery of an indemnity agreement (without any obligation for surety or bond), or (in the case of mutilation) upon surrender and cancellation of this Warrant, the Corporation will issue, in lieu thereof, a new Warrant of like tenor.

[Signature pages follow]

IN WITNESS WHEREOF, the Corporation has duly executed this Warrant as of the date first set forth above.

|

CIPHER MINING INC. |

||

| By: | /s/ William Iwaschuk | |

| Name: | William Iwaschuk | |

| Title: | Co-President & Chief Legal Officer | |

SIGNATURE PAGE TO WARRANT

Accepted and agreed by:

|

GOOGLE LLC, as Holder |

||

| By: | /s/ Nicolas Coons | |

| Name: Nicolas Coons | ||

| Title: Assistant Treasurer | ||

Address for Notices:

Attention: Legal Department

1600 Amphitheatre Parkway

Mountain View, CA 94043

legal-notices@google.com

SIGNATURE PAGE TO WARRANT

EXHIBIT A

CIPHER MINING INC.

WARRANT EXERCISE CERTIFICATE

______________, 20____

TO [__________]:

As of the date hereof, the undersigned Holder has the right under the Amended and Restated Warrant Agreement, dated as of November 20, 2025, by Cipher Mining Inc., a Delaware corporation, and the holder named therein (the “Warrant”) to purchase up to ______________________ Warrant Shares for an exercise price of $0.01 per share. Upon payment of the Aggregate Exercise Price, the undersigned Holder hereby irrevocably elects to exercise its right represented by the Warrant to purchase ______Warrant Shares and requests that the Warrant Shares be issued in the following name:

|

Name: |

| Address |

|

Federal Tax Identification or Social Security No. |

and, if the number of Warrant Shares shall not be all the Warrant Shares purchasable by the undersigned Holder upon exercise of the Warrant, that the Corporation make appropriate notation in the Warrant Register to reflect the Warrant Shares that remain subject to purchase upon exercise of the Warrant after giving effect to this Warrant Exercise Certificate.

Capitalized terms used herein and not otherwise defined herein have the meaning given to such terms in the Warrant.

* * * * * * *

|

Sincerely, |

||

| [ ] | ||

| By: | ||

| Name: | ||

| Title: | ||

Exhibit A

EXHIBIT B

NOTICE OF TRANSFER

FOR VALUE RECEIVED, the foregoing Warrant (or portion thereof) and all rights evidenced thereby are hereby assigned to

Name: ____________________________________________________________________________________ (“Assignee”)

(please print)

Address: __________________________________________________________________________________

(please print)

Assignee agrees to take and hold the Warrant and any shares of stock to be issued upon exercise of the rights thereunder subject to, and to be bound by, the terms and conditions set forth in the Warrant to the same extent as if Assignee were the original holder thereof.

______________, 20____

Holder’s Signature: ______________________________________________________________

Holder’s Address: _______________________________________________________________

Assignee’s Signature: ____________________________________________________________

Assignee’s Address: _____________________________________________________________

NOTE: The signature to this Notice of Transfer must correspond with the name as it appears on the face of the Warrant, without alteration or enlargement or any change whatever. Officers of corporations and those acting in a fiduciary or other representative capacity should file proper evidence of authority to assign the foregoing Warrant (or portion thereof).

Exhibit B

Exhibit 10.1

Certain identified information has been excluded

from the exhibit because it is both not

material and is the type that the registrant treats as private or confidential.

AMENDED AND RESTATED RECOGNITION AGREEMENT

THIS AMENDED AND RESTATED RECOGNITION AGREEMENT (this “Agreement”) is made and entered into as of this 20th day of November, 2025 (being the latest of the parties’ dates of execution; the “Effective Date”), by and among Cipher Barber Lake LLC, a Delaware limited liability company (“Landlord”), Fluidstack USA II Inc., a Delaware corporation (“Fluidstack”), and Google LLC, a Delaware limited liability company (“Google”).

RECITALS

A. Landlord is the owner of certain real property located in Colorado City, Mitchell County, Texas, consisting of approximately 250 acres (as depicted in Schedule A attached hereto and made a part hereof, collectively, the “Property”).

B. Landlord and Fluidstack entered into that certain Datacenter Lease, dated September 24, 2025 (the “Prior Fluidstack Lease”) and Landlord, Fluidstack and Google entered into that certain Recognition Agreement, dated September 24, 2025, as amended by that certain side letter, dated November 13, 2025, relating thereto (the “Prior Google RA”).

C. Landlord and Fluidstack have agreed to amend and restate in its entirety the Prior Fluidstack Lease and enter into that certain Amended and Restated Datacenter Lease dated as of the Effective Date (attached hereto as Schedule B, as amended and restated from time to time, the “Fluidstack Lease”), pursuant to which Fluidstack is the tenant of Landlord and Landlord leases to Fluidstack the Tenant Space, as defined therein.

D. Google wishes to obtain from Landlord certain assurances that Google will have the option to assume the Fluidstack Lease and that, in such event, the enforcement of Landlord’s rights against Fluidstack shall affect Google to the least extent possible.

E. In connection with the execution of the Fluidstack Lease, the parties hereto wish to amend, restate, supersede and replace in its entirety the Prior Google RA as set forth herein.

F. Landlord is willing to provide such assurances to Google upon and subject to the terms and conditions of this Agreement.

AGREEMENT

NOW, THEREFORE, which are hereby acknowledged, the parties hereto do mutually agree as follows:

1. Definitions. Capitalized terms not otherwise defined herein shall have the meaning given to such terms in the Fluidstack Lease, as the context may require.

2. Confirmation Regarding Fluidstack Lease; Google Property.

a. Landlord acknowledges, agrees and represents to the other parties on the Effective Date (a) that the Fluidstack Lease is legal, valid and binding against Landlord and Fluidstack, and in full force and effect, and (b) to the knowledge of Landlord, on the date hereof, there are no events that do presently, or which may, with the passage of time, the giving of notice, or the expiration of a period of grace, constitute a breach or default by either party under the Fluidstack Lease.

Fluidstack acknowledges, agrees and represents to the other parties on the Effective Date (a) that the Fluidstack Lease is legal, valid and binding against Landlord and Fluidstack, and in full force and effect, and (b) to the knowledge of Fluidstack, on the date hereof, there are no events that do presently, or which may, with the passage of time, the giving of notice, or the expiration of a period of grace, constitute a breach or default by either party under the Fluidstack Lease.

b. Landlord and Fluidstack acknowledge and agree that if Tenant’s Personal Property under the Fluidstack Lease includes any Google Property (as defined below) and such Google Property is lost or damaged while in the Tenant Space, then Google will be a third party beneficiary of the provisions of the Fluidstack Lease that relate to Landlord’s obligations with respect to such loss or damage of such Google Property, subject to the rights and limitations with respect to such obligations as set forth in the Fluidstack Lease. “Google Property” means equipment or property owned by Google (or its affiliate) that is located in the Tenant Space as shown by reasonable documentary evidence provided by Google.

c. If there is any Google Property remaining in the Tenant Space upon expiration or termination of the Fluidstack Lease, (i) Landlord will provide Google access to the Tenant Space and the Google Property in accordance with, and subject to, the holdover provisions in the Fluidstack Lease applicable to Tenant’s Personal Property to allow Google to remove the Google Property from the Tenant Space, (ii) the Term of the Fluidstack Lease will be automatically extended for a Transition Period as described therein (the length of such period to be defined by Google, but not to exceed 120 days), and (iii) Google agrees to pay all Rent for the Transition Period; provided that, in the event such termination (or deemed termination) is the result of an Event of Default by Fluidstack under the Fluidstack Lease, or if any Colocation Agreement is then in effect (including pursuant to any holdover or transition period described in such Colocation Agreement), Fluidstack shall pay all such Rent. Notwithstanding the foregoing, Landlord agrees that no Rent will be payable for the Transition Period if termination of the Fluidstack Lease is pursuant to Google’s election (or deemed election) of the Google Rejection Option as described below. For the avoidance of doubt, this Section 2.c. will not be applicable in connection with the execution of the Novation Agreement pursuant to the Google Assumption Option as described below.

d. Fluidstack acknowledges and agrees that it is responsible to Google for the protection of any Google Property in the Tenant Space and if any such Google Property is lost or damaged by the acts or omissions of Fluidstack’s Personnel (as defined below), Fluidstack will reimburse Google for the replacement cost of such Google Property lost or damaged. For the avoidance of doubt, Fluidstack shall have no liability to Google for any damage or loss to any Google Property in the Tenant Space to the extent such damage or loss was caused by the acts or omissions of Google’s or any third party’s Personnel. “Personnel” means all employees and agents of a party and its subcontractors and agents.

e. Whereas Fluidstack (or its affiliate) is a party to a certain Site Access Agreement with certain Colocation Parties executed on or around the Effective Date of this Agreement (“Access Agreement”), in the event that the ownership of any equipment thereunder is transferred by sale to Google thus becoming Google Property, Fluidstack will grant (or will cause its affiliate to grant) to Google access to the Tenant Space and such equipment for a period of four (4) months from the date of Google’s purchase of the equipment, to allow Google to remove the equipment from the Tenant Space.

-

During such period, Fluidstack will not deem the equipment to be abandoned, notwithstanding anything to the contrary in any Colocation Agreement underlying the Access Agreement. For the avoidance of doubt, the parties acknowledge and agree that (i) Fluidstack’s rights and obligations with respect to Tenant’s Personal Property are governed by the Fluidstack Lease, and this Section 2(e) does not affect the terms of the Fluidstack Lease with respect thereto and (ii) neither Google nor Landlord is a party to or subject to the terms of the Access Agreement.

3. Right to Cure Default.

a. Landlord will not seek to terminate the Fluidstack Lease by reason of any act or omission that constitutes (or would over time constitute) a default by Fluidstack under such Fluidstack Lease, until Landlord shall have given written notice of such act or omission to Google (as required under the Fluidstack Lease, Item 3 of the Basic Lease Information); and Google shall have the right, but not the obligation, to remedy such act or omission on Fluidstack’s behalf, subject to the time periods in Section 15.1 (Events of Default By Tenant) of the Fluidstack Lease, except with respect to any failure or refusal by Tenant to timely pay any Rent or any other payments or charges required to be paid thereunder, it shall not constitute an Event of Default by Tenant under Section 15.1.1 of the Fluidstack Lease if Google gives written notice to Landlord of its intent to remedy such failure or refusal no later than the fifteenth (15th) day after Google’s receipt of the default notice and thereafter pays such Rent or other payments or charges properly due and owing no later than the thirtieth (30th) day after receipt of a correct, itemized invoice from Landlord. Landlord agrees that it will accept such performance by Google of any covenant, condition or agreement to be performed by Fluidstack under the Fluidstack Lease with the same force and effect as though performed by Fluidstack. The provisions of this Section 3 shall not be construed as obligating Google to cure any breach or default by Fluidstack under the Fluidstack Lease. Except as provided in this Section 3 and Section 4, below, nothing in this Agreement is intended to suspend or otherwise limit Landlord’s ability to exercise any other rights and remedies that Landlord may have against Fluidstack as a result of such breach or default. Any invoices submitted under this Agreement must be submitted through Google’s vendor management system.

b. Landlord represents and warrants that it owns all right, title and interest in and to the Building free and clear of all liens, encumbrances and defects, other than (i) pursuant to the indenture dated as of November 13, 2025 (the “Indenture”) by and among Cipher Compute LLC, Cipher Songbird LLC and Landlord and the Collateral Documents (as such term is defined in the Indenture) relating to the Indenture, (ii) incremental debt financing in an aggregate principal amount of approximately $333.0 million, which may be issued and incurred as “additional notes” under the Indenture, (iii) the Security Documents as described in the Fluidstack Lease or (iv) as specifically described in Schedule H hereto.

4. Google Options Related to FS Event of Default.

a. FS Default Trigger. In the event that (i) Fluidstack has become subject to an Insolvency Event or (ii) an Event of Default under Section 15.1.1 of the Fluidstack Lease has occurred (the occurrence of (i) or (ii), the “FS Default Trigger”), Landlord will immediately provide Google written notice that the FS Default Trigger has occurred. An “Insolvency Event” is the occurrence of an event identified in Section 15.1.3 of the Fluidstack Lease. Thereupon, Landlord and Google will have a period of 90 days to identify and mutually agree upon (via a signed written amendment) a tenant to assume the Fluidstack Lease as the Tenant thereunder and this Agreement in place of Fluidstack (subject to such replacement tenant entering into one or more separate agreements with Google which are deemed necessary by Google) (the foregoing process for potentially identifying and mutually agreeing upon a tenant to assume the Fluidstack Lease, the “New Tenant Process”).

-