UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2023

Commission File Number: 001-41635

Lavoro Limited

(Exact name of registrant as specified in its charter)

Av. Dr. Cardoso de Melo, 1450, 4th floor, office

401

São Paulo — SP, 04548-005, Brazil

+55 (11) 4280-0709

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

| Form 20-F |

X |

Form 40-F |

TABLE OF CONTENTS

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Lavoro Limited | |||||

| By: | /s/ Ruy Cunha | ||||

| Name: | Ruy Cunha | ||||

| Title: | Chief Executive Officer | ||||

Date: November 1, 2023

Exhibit 99.1

Lavoro Reports Fiscal Fourth Quarter 2023 Earnings Results

| • | Lavoro’s revenue reached $1.8 billion for the FY2023, marking a 24% increase compared to the previous year |

| • | FY2023 gross profit was $332 million, up 34% y/y, with gross margins expanding 140 bps to 18.5% |

| • | Lavoro successfully completed the acquisition of Referência Agroinsumos on July 31, 2023, further expanding its retail presence in the State of Rio Grando do Sul in the South of Brazil. Referência serves over 2,000 farmers, and brings an additional 25 technical sales representatives (RTVs) to the Lavoro family |

| • | On June 30, 2023, Lavoro announced a partnership with Stenon, which will enable us to offer accurate real-time soil analysis to our farmer clients, helping their decision-making and leading to improved agronomic outcomes |

| • | Lavoro provides its FY2024 outlook, expecting consolidated revenue in the range of $2.0 to $2.3 billion, consolidated Inputs revenue in the range of $1.7 to $2.0 billion, and consolidated Adjusted EBITDA in the range of $135 million to $165 million. |

SÃO PAULO – November 1, 2023 (GLOBE NEWSWIRE) — Lavoro Limited (Nasdaq: LVRO; LVROW), the first U.S.-listed pure-play agricultural inputs distributor in Latin America, today announced its financial results for the fiscal fourth quarter, ended on June 30, 2023.

“In recent months, we saw a further worsening in pricing trends in crop protection and fertilizers, as significant global pricing declines were exacerbated by excess channel inventories in Brazil, particularly in herbicides. While we are seeing signs of stabilization of the pricing trends, our expectation is for the retail ag inputs in Brazil to see overall decline of approximately -20% for our fiscal year 2024, led by these pricing headwinds. With that said, our view is that the fundamental long-term secular growth drivers for our Brazil Ag Retail segment have not changed. What we have been witnessing in the past few quarters is simply the normalization of input prices that overshot in ’21-’22 as a result of temporary factors that have now waned, namely the impact of COVID-led plant shutdowns on Chinese agrochemical production, and the effects of the War in Ukraine. We view this as a temporary effect that we expect should not persist beyond the end of this our fiscal year, and should not affect our long-term growth algorithm,” commented Ruy Cunha, CEO of Lavoro.

“Our scale, regional and product diversification, vertical integration with Crop Care, strong balance sheet, M&A capabilities, and ability to invest in technology and new services, sets us apart relative to the rest of industry. We believe we are uniquely positioned to capitalize on the current environment, accelerate our market share gains and improve our financial performance as market conditions normalize,” added Mr. Cunha.

4Q23 Financial Highlights

| • | Consolidated revenue increased by 17% to $265.6 million in 4Q23 compared to the same period in 2022, mainly driven by higher input sales from Brazil Ag Retail1, attributable to (i) increased unit volumes of fertilizers, crop protection and specialties, (ii) growth in corn seeds price and volumes, partly offset by (iii) price declines in crop protection and fertilizer product categories. Once again, Latam Ag Retail revenue was affected by the depreciation of the Colombian Peso, with a -3% y/y decline. On a constant-currency basis, Latam grew 10%. Crop Care segment revenue decreased -21% y/y, driven by phasing effects at Union Agro, though gross profit grew 60% driven by strong performance of our biologicals product line. For FY23, Lavoro consolidated revenue increased by 24% to reach $1.8 billion, with Crop Care being a notable contributor as revenue growth exceeded 90%. |

| • | Gross Profit increased by 27% to $46.9 million in 4Q23, with gross margin expanding by 140bps to 17.6%. This was mainly attributable to (i) positive segment mix shifts, led by Crop Care (ii) improved product mix in our retail distribution, as sales of specialties products as a percentage of Inputs revenue improved by nearly 300bps to 9% in 4Q22, and (iii) strong performance from biologicals, our highest margin product line which grew |

1 Our segments herein have been renamed to Brazil Ag Retail (Brazil Cluster), Latam Ag Retail (LatAm Cluster) and Crop Care (Crop Care Cluster), to be clearer with the region and business function they are performing. There is no change to the scope of their operations.

over 80% versus the prior year quarter. These positive drivers more than offset headwinds from steep price declines in crop protection and fertilizers, which in turn were partially alleviated by a $12 million benefit from planned successful renegotiation with our suppliers. For FY23, gross profit reached $331.9 million, up 34% y/y, with gross margin expanding by 140 bps to 18.5%, owing to both segment and product mix shifts.

| • | Adjusted EBITDA in 4Q23 was $2.4 million, improving by $18.7 million y/y, with positive incremental contribution from all three segments. The key drivers are similar to those outlined above for gross profit, with the addition of the benefit of an improved SG&A expense ratio vs. last year. For FY23, Adjusted EBITDA grew 64% to $149.8 million, and Adjusted EBITDA margin rose 200 bps to 8.3%. Crop Care yet again was a strong contributor, with segment Adjusted EBITDA expanding 280% y/y, resulting in Crop Care now accounting for nearly 19% of total Adjusted EBITDA in FY23, a jump from 8% in the previous year. |

| • | Non-recurring expenses increased by $4.6 million to $6.0 million in 4Q23, due to (i) IPO-related consultancy services expenses throughout fiscal year 2023 recognized as non-recurring in 4Q23 ($3.8 million); (ii) the remainder of a one-time DeSPAC bonus to employees paid in 4Q23 ($0.9 million) and (iii) M&A accounting and tax due diligence expenses ($0.8 million). For FY23, non-recurring items other than our Nasdaq listing expense, increased to $14.3 million, with key drivers being (i) $2.8 million impact from stock-based compensation; (ii) $ 5.8 million of one-time DeSPAC bonus; (iii) $3.8 million from IPO-related consultancy services, and (iv) $5.2 of M&A expenses. |

| • | Financial costs were $11.1 million higher in 4Q23 vs. the prior year, attributable to losses on fair value of commodity forward contracts, and an increase in the benchmark interest rate in Brazil. On a full fiscal year basis, financial results were $76.9 million higher than the previous year, owing to the same drivers |

Summary of 4Q23 and FY23 Results¹

| Key Financial Metrics | 4Q22 | 4Q23 | Chg. % | FY22 | FY23 | Chg. % | ||

| (in millions of US dollars)2 | ||||||||

| Revenue by Segment | 227.8 | 265.5 | 17 % | 1,447.9 | 1,794.9 | 24 % | ||

| Brazil Ag Retail | 149.5 | 197.2 | 32 % | 1,184.2 | 1,502.1 | 27 % | ||

| Latam Ag Retail | 63.7 | 61.8 | -3 % | 220.2 | 233.1 | 6 % | ||

| Crop Care | 13.5 | 10.6 | -21 % | 62.4 | 120.8 | 94 % | ||

| Intercompany3 | 1.1 | (4.1) | (18.9) | (61.1) | ||||

| Revenue by Category | 227.8 | 265.6 | 17 % | 1,448.0 | 1,794.8 | 24 % | ||

| Inputs revenue | 180.7 | 217.0 | 20 % | 1,310.5 | 1,664.6 | 27 % | ||

| Grains revenue | 47.1 | 48.6 | 3 % | 137.5 | 130.2 | -5 % | ||

| Gross Profit | 37.0 | 46.9 | 27 % | 247.5 | 332.0 | 34 % | ||

| Brazil Ag Retail | 21.6 | 26.3 | 22 % | 188.8 | 246.1 | 30 % | ||

| Latam Ag Retail | 10.3 | 9.4 | -9 % | 35.9 | 38.0 | 6 % | ||

| Crop Care | 5.1 | 8.1 | 59 % | 22.7 | 53.8 | 137 % | ||

| Intercompany | – | 3.1 | 0.1 | (5.9) | ||||

| Gross Margin | 16.2 % | 17.7 % | 150 bps | 17.1 % | 18.5 % | 140 bps | ||

| Gross Margin (% of Inputs) | 20.5 % | 21.6 % | 110 bps | 18.9 % | 19.9 % | 100 bps | ||

| SG&A excl. D&A | (59.1) | (55.5) | (166.6) | (205.1) | ||||

| Other operating income (expense) | 4.4 | 5.0 | 10.5 | (53.0) | ||||

| EBITDA | (17.7) | (3.6) | -80 % | 91.4 | 73.9 | -19 % | ||

| (+) Nasdaq listing expenses4 | – | – | – | 61.5 | ||||

| (+) Other non-recurring items | 1.4 | 6.0 | 0.2 | 14.5 | ||||

| Adjusted EBITDA | (16.3) | 2.4 | n.m. | 91.6 | 149.8 | 64 % | ||

| Adjusted EBITDA Margin % | -7.2 % | 0.9 % | 810 bps | 6.3 % | 8.3 % | 200 bps | ||

| Adjusted EBITDA Margin (% of Inputs) | -9.0 % | 1.1 % | 1,010 bps | 7.0 % | 9.0 % | 200 bps | ||

| D&A | (6.9) | (8.1) | (27.3) | (32.4) | ||||

| Finance income (costs) | (17.0) | (28.2) | (42.4) | (119.2) | ||||

| Income taxes, current and deferred | 14.6 | 20.6 | (4.6) | 34.0 | ||||

| Net profit | (27.0) | (19.3) | n.m. | 17.1 | (43.7) | n.m. | ||

| Adjusted net profit | (25.6) | (13.3) | n.m. | 17.3 | 32.3 | 87 % |

1 USD/BRL average period exchange rate used to translate our results to USD throughout this document for illustration purposes: 4.952 for FY4Q23, 5.193 for FY3Q23, 5.280 for FY1H23, 4.924 for FY4Q22, 5.226 for FY3Q22, 5.570 for FY1H22.

2 Represents sales between Crop Care and Brazil Ag Retail.

3 Represents expenses related to the business combination with TPB Acquisition Corp I.

Segment Results for 4Q23 and FY235

Brazil Ag Retail

Segment revenue increased by 45% to $197 million in 4Q23, with strong unit volume growth in crop protection, fertilizer and specialty sales, more than offsetting steep price declines that the industry witnessed over the past few months. Gross margin decreased by 110 bps to 13.3%, owing to these pricing headwinds, partly offset by a previously planned $12 million supplier renegotiation benefit.

| Brazil Ag Retail | 4Q22 | 4Q23 | Chg. % | FY22 | FY23 | Chg. % | ||

| (in millions of US dollars) | ||||||||

| Inputs revenue | 102.7 | 148.7 | 45 % | 1,025.5 | 1,367.9 | 33 % | ||

| Grains revenue | 46.8 | 48.5 | 4 % | 158.8 | 134.1 | -16 % | ||

| Revenue | 149.5 | 197.2 | 32 % | 1,184.3 | 1,502.0 | 27 % | ||

| Gross Profit | 21.6 | 26.3 | 22 % | 188.8 | 246.0 | 30 % | ||

| Gross Margin | 14.4 % | 13.3 % | -110 bps | 15.9 % | 16.4 % | 50 bps | ||

| Gross Margin (% of Inputs) | 21.0 % | 17.7 % | -330 bps | 18.4 % | 18.0 % | -40 bps | ||

| Adjusted EBITDA | (19.3) | (4.0) | n.m. | 69.9 | 111.9 | 60 % | ||

| Adjusted EBITDA Margin | -12.9 % | -2.0 % | 1,090 bps | 5.9 % | 7.5 % | 160 bps | ||

| Adjusted EBITDA Margin (% of Inputs) | -18.8 % | -2.7 % | 1,610 bps | 6.8 % | 8.2 % | 140 bps |

Latam Ag Retail

The segment grew 10% on a constant currency basis (Colombian peso), primarily due to strong sales in specialties and corn seeds, partly offset by headwinds resulting from the removal of Paraquat, a financially relevant herbicide, from the product lineup one of our suppliers.The devaluation of the peso was a -13% y/y negative contributor, with revenue declining -3% on a US dollar basis. Gross Margin contracted by 100 bps in 4Q23, reflecting the deflationary pricing trends in crop protection and fertilizers.

| Latam Ag Retail | 4Q22 | 4Q23 | Chg. % | FY22 | FY23 | Chg. % | ||

| (in millions of US dollars) | ||||||||

| Inputs revenue | 63.3 | 61.7 | -3 % | 207.5 | 223.0 | 7 % | ||

| Grains revenue | 0.4 | 0.1 | -75 % | 12.7 | 10.1 | -20 % | ||

| Revenue | 63.7 | 61.8 | -3 % | 220.2 | 233.1 | 6 % | ||

| Gross Profit | 10.3 | 9.4 | -9 % | 35.9 | 38.0 | 6 % | ||

| Gross Margin | 16.2 % | 15.2 % | -100 bps | 16.3 % | 16.3 % | 0 bps | ||

| Gross Margin (% of Inputs) | 16.3 % | 15.2 % | -110 bps | 17.3 % | 17.0 % | -30 bps | ||

| Adjusted EBITDA | 2.5 | 3.3 | 32 % | 14.4 | 17.4 | 300 % | ||

| Adjusted EBITDA Margin | 3.9 % | 5.3 % | 140 bps | 6.5 % | 7.5 % | 100 bps | ||

| Adjusted EBITDA Margin (% of Inputs) | 3.9 % | 5.3 % | 140 bps | 6.9 % | 7.8 % | 90 bps |

4 USD/BRL average period exchange rate used to translate our results to USD: 4.952 for FY4Q23, 5.193 for FY3Q23, 5.280 for FY1H23, 4.924 for FY4Q22, 5.226 for FY3Q22, 5.570 for FY1H22.

Crop Care

Crop Care segment revenue for 4Q23 saw a -21% decline, resulting from the phasing effects at Union Agro, our specialty fertilizer company, which had some sales pull-forward into 3Q23. Biologicals product sales grew over 80% y/y, partly driven from phasing shift from 3Q23 to 4Q23, as a result of postponement of the timing of biopesticide input purchases by farmers. The strong growth in biologicals, which are the highest gross margin products for Lavoro, led the gross margin expansion to 76.4%, from 37.8% a year ago.

| Crop Care | 4Q22 | 4Q23 | Chg. % | FY22 | FY23 | Chg. % | ||

| (in millions of US dollars) | ||||||||

| Revenue | 13.5 | 10.6 | -21 % | 62.4 | 120.8 | 94 % | ||

| Gross Profit | 5.1 | 8.1 | 22 % | 22.7 | 53.8 | 30 % | ||

| Gross Margin | 37.8 % | 76.4 % | 3,860 bps | 36.4 % | 44.5 % | 810 bps | ||

| Adjusted EBITDA | 0.5 | 1.2 | 140 % | 7.4 | 28.1 | 280 % | ||

| Adjusted EBITDA Margin | 3.7 % | 11.3 % | 760 bps | 11.9 % | 23.3 % | 1,140 bps |

Recent Business and Commercial Updates

Partnership with Stenon

On June 30, 2023, Lavoro announced a partnership with Stenon. Stenon is a step-change evolution in soil chemistry testing, with its FarmLab solution, which is a portable sensor-based devices enabling accurate real-time analysis of Nitrogen and other agronomically relevant soil indicators. With Stenon, as a practical example, our RTVs will be able to provide clients with timely recommendations for nitrogen application across their corn planting area, resulting in improved costs and crop yields. We are planning to sample 100,000 acres in the coming crop season across the state of Parana, where 100 RTVs have been trained and are ready to execute on this service.

Recent M&As Updates

Closed agreements

Referência Agroinsumos

On July 31, Lavoro successfully completed the acquisition of a controlling interest in Referência Agroinsumos. Founded in 2006, Referência has nine distribution locations and more than 80 employees, serving approximately 2,000 customers in the South of Brazil.

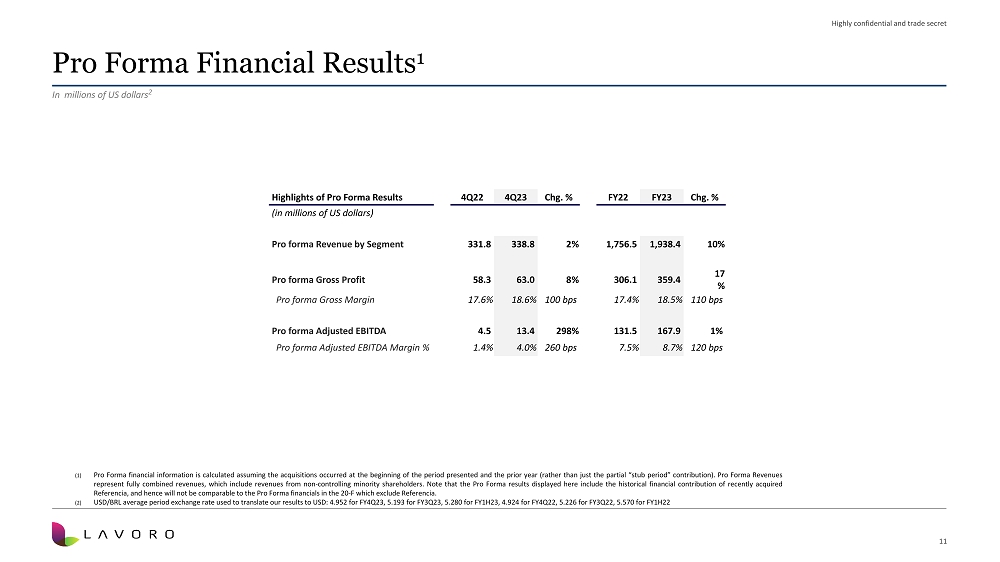

Pro forma Financial Information6

| Highlights of Pro Forma Results | 4Q22 | 4Q23 | Chg. % | FY22 | FY23 | Chg. % | ||

| (in millions of US dollars) | ||||||||

| Pro forma Revenue by Segment | 331.8 | 338.8 | 2 % | 1,756.5 | 1,938.4 | 10 % | ||

| Pro forma Gross Profit | 58.3 | 63.0 | 8 % | 306.1 | 359.4 | 17 % | ||

| Pro forma Gross Margin | 17.6 % | 18.6 % | 100 bps | 17.4 % | 18.5 % | 110 bps | ||

| Pro forma Adjusted EBITDA | 4.5 | 13.4 | 298 % | 131.5 | 167.9 | 1% | ||

| Pro forma Adjusted EBITDA Margin % | 1.4 % | 4.0 % | 260 bps | 7.5 % | 8.7 % | 120 bps |

Full Fiscal Year 2024 Consolidated Outlook7

| FY2024 | |||

| Consolidated Financials Outlook | Low | High | |

| (in millions of US dollars) | |||

| Revenue | 2,000 | 2,300 | |

| Inputs revenue | 1,700 | 2,000 | |

| Adjusted EBITDA | 135 | 165 | |

Conference Call Details

The Company will host a conference call and webcast to review its fiscal fourth quarter 2023 results on Wednesday, November 1, 2023, at 8:30 am ET / 9:30 am BRT.

Participant Numbers: 1-877-407-9716 (U.S.), 1-201-493-6779 (International)

The live audio webcast will be accessible in the Events section on the Company's Investor Relations website at https://ir.lavoroagro.com/disclosure-and-documents/events/.

Non-IFRS Financial Measures

This press release contains certain non-IFRS financial measures, including Adjusted EBITDA, Adjusted EBITDA Margin, Pro Forma Adjusted EBITDA and Pro Forma Adjusted EBITDA Margin. A non-IFRS financial measure is generally defined as a numerical measure of historical or future financial performance, financial position, or cash flow that purports to measure financial performance but excludes or includes amounts that would not be so adjusted in the most comparable IFRS measure. The Company believes these non-IFRS financial measures provide meaningful supplemental information as they are used by the Company's management to evaluate the Company's performance, and provide additional information about trends in our operating performance prior to considering the impact of capital structure, depreciation, amortization and taxation on our results, as well as the effects of certain items or events that vary widely among similar companies, and therefore may hamper comparability across periods, although these measures are not explicitly defined under IFRS. Management believes that these measures enhance a reader's understanding of the operating and financial performance of the Company and facilitate a better comparison between fiscal periods. Adjusted EBITDA is defined as profit for the period, adjusted for finance income (cost), net, income

5 Pro Forma financial information is calculated assuming the acquisitions occurred at the beginning of the period presented and the prior year (rather than just the partial “stub period” contribution). Pro Forma Revenues represent fully combined revenues, which include revenues from non-controlling minority shareholders.

6 USD/BRL average period exchange rate used to translate our results to USD: 4.88 for FY1Q24, and 5.02 for FY2Q24 to FY3Q24 taxes current and deferred, depreciation and amortization, M&A expenses that in management’s judgment do not necessarily occur on a regular basis, fair value of inventories sold from acquired companies, minus gain on bargain purchases, to provide further meaningful information to evaluate the Company’s performance.

Adjusted EBITDA Margin is calculated as Adjusted EBITDA as a percentage of revenue for the period. Pro Forma Adjusted EBITDA is defined as pro forma profit for the period, adjusted for pro forma finance income (costs), net, pro forma income taxes current and deferred, pro forma depreciation and amortization, fair value on inventories sold from acquired companies, and M&A expenses that in management’s judgment do not necessarily occur on a regular basis, minus gain on bargain purchases. Pro Forma Adjusted EBITDA Margin is calculated as Pro Forma Adjusted EBITDA as a percentage of pro forma revenue for the period.

The Company does not intend for the non-IFRS financial measures contained in this release to be a substitute for any IFRS financial information. Readers of this press release should use these non-IFRS financial measures only in conjunction with comparable IFRS financial measures. Reconciliations of the non-IFRS financial measures, Adjusted EBITDA, and Pro Forma Adjusted EBITDA, to their most comparable IFRS measures, are provided in the table below.

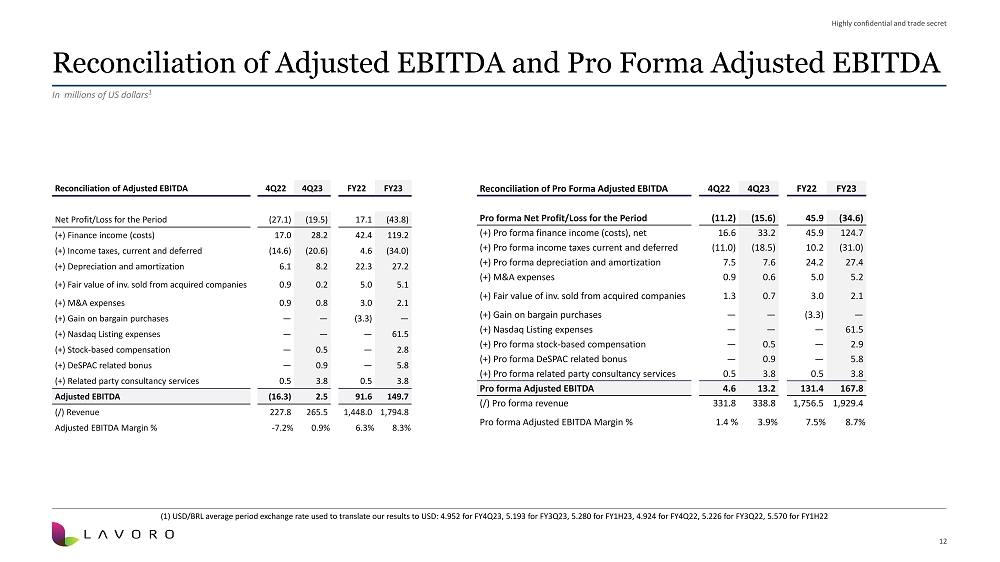

Reconciliation of Adjusted EBITDA and Adjusted EBITDA Pro forma

| Reconciliation of Adjusted EBITDA | 4Q22 | 4Q23 | FY22 | FY23 | ||

| (in millions of US dollars) | ||||||

| Net Profit/Loss for the Period | (27.1) | (19.5) | 17.1 | (43.8) | ||

| (+) Finance income (costs) | 17.0 | 28.2 | 42.4 | 119.2 | ||

| (+) Income taxes, current and deferred | (14.6) | (20.6) | 4.6 | (34.0) | ||

| (+) Depreciation and amortization | 6.1 | 8.2 | 22.3 | 27.2 | ||

| (+) Fair value of inventories sold from acquired companies | 0.9 | 0.2 | 5.0 | 5.1 | ||

| (+) M&A expenses | 0.9 | 0.8 | 3.0 | 2.1 | ||

| (+) Gain on bargain purchases | — | — | (3.3) | — | ||

| (+) Nasdaq Listing expenses | — | — | — | 61.5 | ||

| (+) Stock-based compensation | — | 0.5 | — | 2.8 | ||

| (+) DeSPAC related bonus | — | 0.9 | — | 5.8 | ||

| (+) Related party consultancy services | 0.5 | 3.8 | 0.5 | 3.8 | ||

| Adjusted EBITDA | (16.3) | 2.5 | 91.6 | 149.7 | ||

| (/) Revenue | 227.8 | 265.5 | 1,448.0 | 1,794.8 | ||

| Adjusted EBITDA Margin % | -7.2 % | 0.9 % | 6.3 % | 8.3 % |

| Reconciliation of Pro Forma Adjusted EBITDA | 4Q22 | 4Q23 | FY22 | FY23 | ||

| (in millions of US dollars) | ||||||

| Pro forma Net Profit/Loss for the Period | (11.2) | (15.6) | 45.9 | (34.6) | ||

| (+) Pro forma finance income (costs), net | 16.6 | 33.2 | 45.9 | 124.7 | ||

| (+) Pro forma income taxes current and deferred | (11.0) | (18.5) | 10.2 | (31.0) | ||

| (+) Pro forma depreciation and amortization | 7.5 | 7.6 | 24.2 | 27.4 | ||

| (+) M&A expenses | 0.9 | 0.6 | 5.0 | 5.2 | ||

| (+) Fair value of inventories sold from acquired companies | 1.3 | 0.7 | 3.0 | 2.1 | ||

| (+) Gain on bargain purchases | — | — | (3.3) | — | ||

| (+) Nasdaq Listing expenses | — | — | — | 61.5 | ||

| (+) Pro forma stock-based compensation | — | 0.5 | — | 2.9 | ||

| (+) Pro forma DeSPAC related bonus | — | 0.9 | — | 5.8 | ||

| (+) Pro forma related party consultancy services | 0.5 | 3.8 | 0.5 | 3.8 | ||

| Pro forma Adjusted EBITDA | 4.6 | 13.2 | 131.4 | 167.8 | ||

| (/) Pro forma revenue | 331.8 | 338.8 | 1,756.5 | 1,929.4 | ||

| Pro forma Adjusted EBITDA Margin % | 1.4 % | 3.9 % | 7.5 % | 8.7 % |

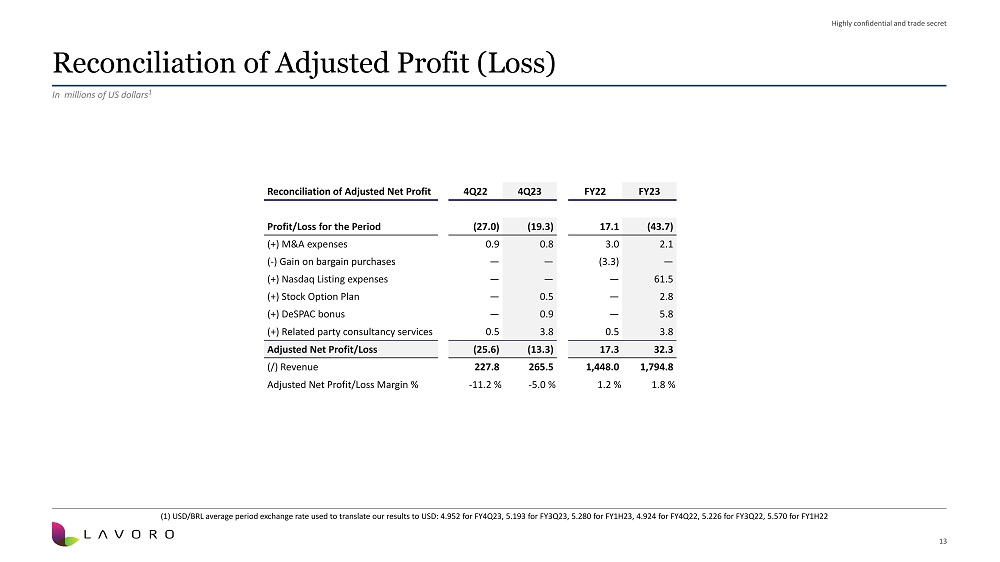

Reconciliation of Adjusted Profit (Loss)

| Reconciliation of Adjusted Net Profit | 4Q22 | 4Q23 | FY22 | FY23 | ||

| (in millions of US dollars) | ||||||

| Profit/Loss for the Period | (27.0) | (19.3) | 17.1 | (43.7) | ||

| (+) M&A expenses[8] | 0.9 | 0.8 | 3.0 | 2.1 | ||

| (-) Gain on bargain purchases[9] | — | — | (3.3) | — | ||

| (+) Nasdaq Listing expenses[10] | — | — | — | 61.5 | ||

| (+) Stock Option Plan | — | 0.5 | — | 2.8 | ||

| (+) DeSPAC bonus | — | 0.9 | — | 5.8 | ||

| (+) Related party consultancy services | 0.5 | 3.8 | 0.5 | 3.8 | ||

| Adjusted Net Profit/Loss | (25.6) | (13.3) | 17.3 | 32.3 | ||

| (/) Revenue | 227.8 | 265.5 | 1,448.0 | 1,794.8 | ||

| Adjusted Net Profit/Loss Margin % | -11.2 % | -5.0 % | 1.2 % | 1.8 % |

About Lavoro

Lavoro is Brazil's largest agricultural inputs retailer and a leading producer of agricultural biological products. Lavoro's shares and warrants are listed on the Nasdaq stock exchange under the tickers "LVRO" and "LVROW." Through its comprehensive portfolio of products and services, the company empowers small and medium-size farmers to adopt the latest emerging agricultural technologies and enhance their productivity. Since its founding in 2017, Lavoro has broadened its reach across Latin America, serving 72,000 customers in Brazil, Colombia, and Uruguay, via its team of over 1,000 technical sales representatives (RTVs), its network of over 210 retail locations, and its digital marketplace and solutions. Lavoro's RTVs are local trusted advisors to farmers, regularly meeting them to provide agronomic recommendations throughout the crop cycle to drive optimized outcomes. Learn more about Lavoro at ir.lavoroagro.com.

7 M&A expenses primarily include M&A accounting and tax due diligence expenses.

8 Difference between the fair value of the Union Agro`s net assets and the price paid by the Company, recorded as a gain.

9 Represents expenses related to the business combination with TPB Acquisition Corp I.

Reportable Segments

Lavoro’s reportable segments are the following:

Brazil Cluster (Brazil Ag Retail): comprises companies dedicated to the distribution of agricultural inputs such as crop protection, seeds, fertilizers, and specialty products, in Brazil.

LatAm Cluster (Latam Ag Retail): includes companies dedicated to the distribution of agricultural inputs outside Brazil (currently primarily in Colombia).

Crop Care Cluster (Crop Care): includes companies that produce and import our own portfolio of private label products including specialty products (e.g., biologicals and specialty fertilizers) and off-patent crop protection.

Lavoro’s Fiscal Year

Lavoro follows the crop year, which means that its fiscal year comprises July 1st of each year, until June 30th of the following year. Given this, Lavoro’s quarters have the following format:

1Q – quarter starting on July 1 and ending on September 30.

2Q – quarter starting on October 1 and ending on December 31.

3Q – quarter starting on January 1 and ending on March 31.

4Q – quarter starting on April 1 and ending on June 30.

Definitions

RTVs: refer to Lavoro’s technical sales representatives (Representante Técnico de Vendas), who are linked to its retail stores, and who develop commercial relationships with farmers.

Forward-Looking Statements

The contents of any website mentioned or hyperlinked in this press release are for informational purposes and the contents thereof are not part of or incorporated into this press release.

Certain statements made in this press release are “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as “aims,” “estimate,” “plan,” “project,” “forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding the expectations regarding the growth of Lavoro’s business and its ability to realize expected results, grow revenue from existing customers, and consummate acquisitions; opportunities, trends, and developments in the agricultural input industry, including with respect to future financial performance in the industry. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as and must not be relied on by any investor as, a guarantee, an assurance, a prediction, or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Lavoro.

These forward-looking statements are subject to a number of risks and uncertainties, including but not limited to, the outcome of any legal proceedings that may be instituted against Lavoro related to the business combination agreement or the transaction; the ability to maintain the listing of Lavoro’s securities on Nasdaq; the price of Lavoro’s securities may be volatile due to a variety of factors, including changes in the competitive and regulated industries in which Lavoro operates, variations in operating performance across competitors, changes in laws and regulations affecting Lavoro’s business; Lavoro’s inability to meet or exceed its financial projections and changes in the consolidated capital structure; changes in general economic conditions, including as a result of the COVID-19 pandemic; the ability to implement business plans, forecasts, and other expectations, changes in domestic and foreign business, market, financial, political and legal conditions; the outcome of any potential litigation, government and regulatory proceedings, investigations and inquiries; costs related to the business combination and being a public company and other risks and uncertainties indicated from time to time in the proxy statement/prospectus filed by Lavoro relating to the business combination or in the future, including those under “Risk Factors” therein, and in TPB Acquisition Corp.’s or Lavoro’s other filings with the SEC. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements.

There may be additional risks that Lavoro currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements.

In addition, forward-looking statements reflect Lavoro’s expectations, plans, or forecasts of future events and views as of the date of this press release. Lavoro anticipates that subsequent events and developments will cause Lavoro’s assessments to change. However, while Lavoro may elect to update these forward-looking statements at some point in the future, Lavoro specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing Lavoro’s assessments as of any date subsequent to the date of this press release. Accordingly, undue reliance should not be placed upon the forward-looking statements.

Contact

Julian Garrido

julian.garrido@lavoroagro.com

Tigran Karapetian

tigran.karapetian@lavoroagro.com

Fernanda Rosa

fernanda.rosa@lavoroagro.com

Exhibit 99.2

4Q23 and FY23 Earnings Presentation November 1, 2023

2 Highly confidential and trade secret Disclaimer The contents of any website mentioned or hyperlinked in this presentation are for informational purposes and the contents thereof are not part of or incorporated into this presentation . Certain statements made in this presentation are “forward - looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995 . Forward - looking statements may be identified by the use of words such as “aims,” “estimate,” “plan,” “project,” “forecast,” “intend,” “will,” “expect,” “anticipate,” “believe,” “seek,” “target” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matters . These forward - looking statements include, but are not limited to, statements regarding the expectations regarding the growth of Lavoro's business and its ability to realize expected results, grow revenue from existing customers, and consummate acquisitions ; opportunities, trends, and developments in the agricultural input industry, including with respect to future financial performance in the industry . These forward - looking statements are provided for illustrative purposes only and are not intended to serve as and must not be relied on by any investor as, a guarantee, an assurance, a prediction, or a definitive statement of fact or probability . Actual events and circumstances are difficult or impossible to predict and will differ from assumptions . Many actual events and circumstances are beyond the control of Lavoro . These forward - looking statements are subject to a number of risks and uncertainties, including but not limited to, the outcome of any legal proceedings that may be instituted against Lavoro related to the business combination agreement or the transaction ; the ability to maintain the listing of Lavoro's securities on Nasdaq ; the price of Lavoro's securities may be volatile due to a variety of factors, including changes in the competitive and regulated industries in which Lavoro operates, variations in operating performance across competitors, changes in laws and regulations affecting Lavoro's business ; Lavoro's inability to meet or exceed its financial projections and changes in the consolidated capital structure ; changes in general economic conditions, including as a result of the COVID - 19 pandemic ; the ability to implement business plans, forecasts, and other expectations, changes in domestic and foreign business, market, financial, political and legal conditions ; the outcome of any potential litigation, government and regulatory proceedings, investigations and inquiries ; costs related to the business combination and being a public company and other risks and uncertainties indicated from time to time in the proxy statement/prospectus filed by Lavoro relating to the business combination or in the future, including those under “Risk Factors” therein, and in Lavoro's other filings with the SEC . If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward - looking statements . There may be additional risks that Lavoro currently believes are immaterial that could also cause actual results to differ from those contained in the forward - looking statements . In addition, forward - looking statements reflect Lavoro's expectations, plans, or forecasts of future events and views as of the date of this presentation . Lavoro anticipates that subsequent events and developments will cause Lavoro's assessments to change . However, while Lavoro may elect to update these forward - looking statements at some point in the future, Lavoro specifically disclaims any obligation to do so . These forward - looking statements should not be relied upon as representing Lavoro's assessments as of any date subsequent to the date of this presentation . Accordingly, undue reliance should not be placed upon the forward - looking statements . We have prepared this presentation solely for informational purposes . The information in this presentation does not constitute or form part of, and should not be construed as, an offer or invitation to subscribe for, underwrite or otherwise acquire, any of our securities or securities of our subsidiaries or affiliates, not should it or any part of it form the basis of, or be relied on, in connection with any contract to purchase or subscribe for any of our securities or securities of any of our subsidiaries or affiliates, nor shall it or any part of it form the basis of, or be relied on, in connection with any contract or commitment whatsoever . This presentation also includes certain non - IFRS financial information . We believe that such information is meaningful and useful in understanding the activities and business metrics of our operations . We also believe that these non - IFRS financial measures reflect an additional way of viewing aspects of our business that, when viewed with our International Financial Reporting Standards (“IFRS”) results, as issued by the International Accounting Standards Board, provide a more complete understanding of factors and trends affecting our business . Further, investors regularly rely on non - IFRS financial measures to assess operating performance and such measures may highlight trends in our business that may not otherwise be apparent when relying on financial measures calculated in accordance with IFRS . We also believe that non - IFRS financial measures are frequently used by securities analysts, investors and other interested parties in the evaluation of public companies in our industry, many of which present these measures when reporting their results . The non - IFRS financial information is presented for informational purposes and to enhance understanding of the IFRS financial statements . The non - IFRS measures should be considered in addition to results prepared in accordance with IFRS, but not as a substitute for, or superior to, IFRS results . As other companies may determine or calculate this non - IFRS financial information differently, the usefulness of these measures for comparative purposes is limited . A reconciliation of such non - IFRS financial measures to the nearest IFRS measure is included in this presentation .

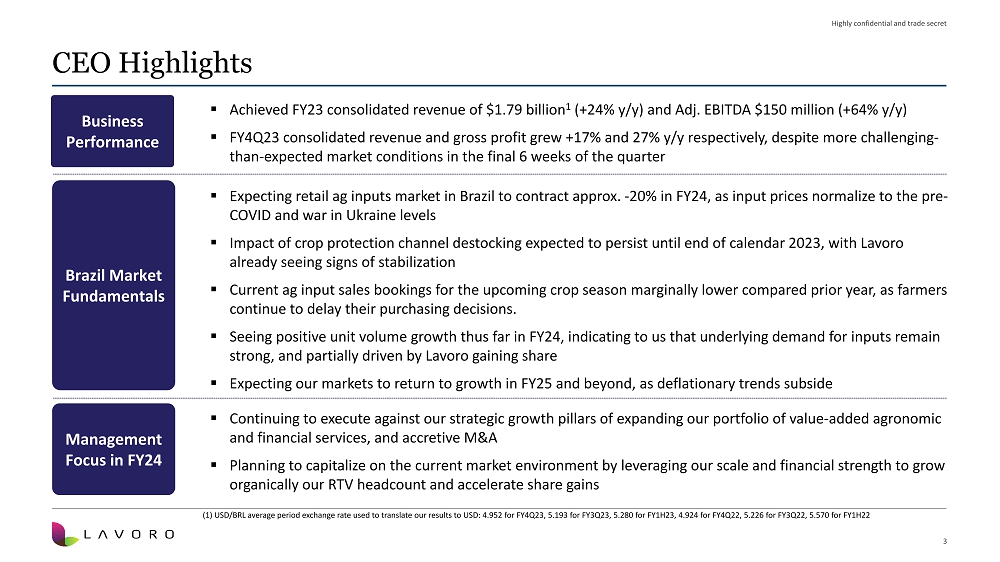

3 Highly confidential and trade secret Brazil Market Fundamentals ▪ Expecting retail ag inputs market in Brazil to contract approx. - 20% in FY24, as input prices normalize to the pre - COVID and war in Ukraine levels ▪ Impact of crop protection channel destocking expected to persist until end of calendar 2023, with Lavoro already seeing signs of stabilization ▪ Current ag input sales bookings for the upcoming crop season marginally lower compared prior year, as farmers continue to delay their purchasing decisions. ▪ Seeing positive unit volume growth thus far in FY24, indicating to us that underlying demand for inputs remain strong, and partially driven by Lavoro gaining share ▪ Expecting our markets to return to growth in FY25 and beyond, as deflationary trends subside Business Performance ▪ Achieved FY23 consolidated revenue of $1.79 billion 1 (+24% y/y) and Adj. EBITDA $150 million (+64% y/y) ▪ FY4Q23 consolidated revenue and gross profit grew +17% and 27% y/y respectively, despite more challenging - than - expected market conditions in the final 6 weeks of the quarter Management Focus in FY24 CEO Highlights ( 1 ) USD/BRL average period exchange rate used to translate our results to USD : 4 . 952 for FY 4 Q 23 , 5 . 193 for FY 3 Q 23 , 5 . 280 for FY 1 H 23 , 4 . 924 for FY 4 Q 22 , 5 . 226 for FY 3 Q 22 , 5 .

570 for FY 1 H 22 ▪ Continuing to execute against our strategic growth pillars of expanding our portfolio of value - added agronomic and financial services, and accretive M&A ▪ Planning to capitalize on the current market environment by leveraging our scale and financial strength to grow organically our RTV headcount and accelerate share gains 4 Highly confidential and trade secret 4Q23 Financial Performance In millions of US dollars 1 Note: Intercompany results represent sales between Crop Care and Brazil Ag Retail segments (1) USD/BRL average period exchange rate used to translate our results to USD: 4.952 for FY4Q23, 4.924 for FY4Q22 180.7 217.0 47.1 48.6 4Q22 4Q23 227.8 265.5 +17% Inputs Grains 21.6 26.3 10.3 9.4 5.1 8.1 3.1 4Q22 4Q23 37.0 46.9 +27% 3.3 - 19.3 - 4.0 2.5 0.5 4Q22 1.2 1.9 4Q23 - 16.3 2.4 149.5 197.2 63.7 61.8 13.5 1.1 4Q22 10.6 - 4.1 4Q23 227.8 265.5 +17% Intercompany / Corporate Crop Care Latam Ag Retail Brazil Ag Retail Revenue Gross Profit Adjusted EBITDA As % of Inputs revenue 20.5% 21.6% Highlights ▪ Impact from crop protection channel destocking led to more challenging - than - expected market conditions in the final 6 weeks of the quarter ▪ In spite of this, Lavoro gross profit growth of +27% y/y, led by seed and specialty sales growth, high double - digit growth in biologicals, and the $12 million benefit from agrochemical supplier renegotiations ▪ Gross Margins expanded due to segment and product mix improvements, partially offset by the deflationary impact in agrochemicals and fertilizers on our distribution margins ▪ Adj.

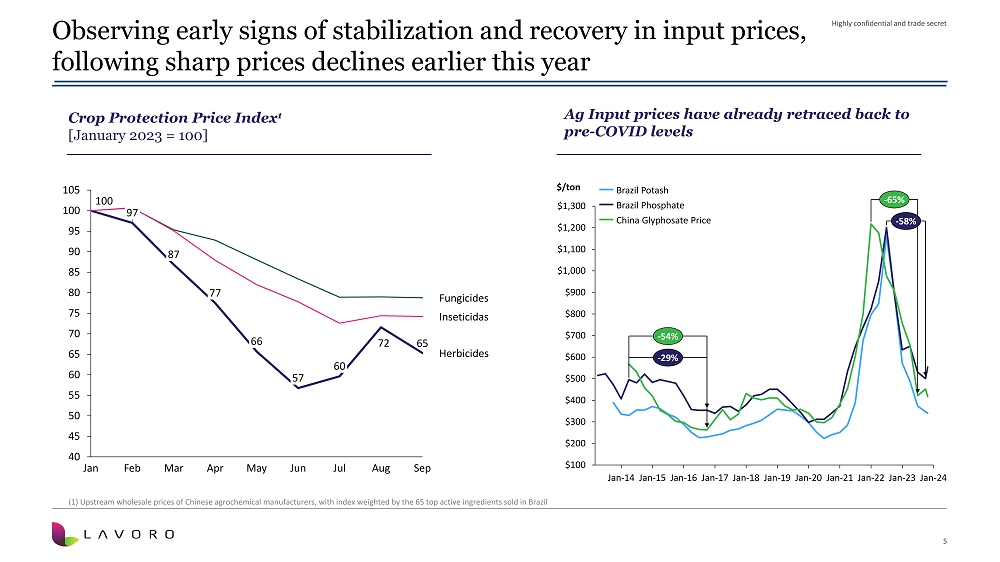

EBITDA also benefited from $4 million y/y decline in operating expenses, driven by overhead savings initiatives 5 Highly confidential and trade secret Ag Input prices have already retraced back to pre - COVID levels Crop Protection Price Index 1 [January 2023 = 100] 100 72 65 40 45 50 55 60 65 70 75 80 85 90 95 100 105 Jan 97 Feb 87 Mar 77 Apr 66 May 57 Jun 60 Jul Aug Sep Herbicides Fungicides Inseticidas $100 $200 $300 $400 $500 $600 $700 $800 $900 $1,000 $1,100 $1,200 $1,300 Jan - 16 Jan - 17 Jan - 18 Jan - 19 Jan - 20 Jan - 21 Jan - 22 Jan - 23 Jan - 14 Jan - 15 Jan - 24 $/ton - 54% - 29% - 65% - 58% Brazil Potash Brazil Phosphate China Glyphosate Price Observing early signs of stabilization and recovery in input prices, following sharp prices declines earlier this year ( 1 ) Upstream wholesale prices of Chinese agrochemical manufacturers, with index weighted by the 65 top active ingredients sold in Brazil 6 Highly confidential and trade secret $0 $500 $1,000 $1,500 $2,000 Crop Year USD / ha 11/12 12/13 13/14 14/15 15/16 16/17 17/18 18/19 19/20 20/21 21/22 22/23 23/24 24/25 Ø $ 628 - 40% - 43% Brazilian farmer profitability remains high Note : Lavoro analysis based on data from AgroConsult Mato Grosso (North) Parana (West) Goias (West) Minas Gerais (Northwest) Average of 5 major states Forecast 37% 31% 26% 31% 31% 34% 45% 51% 28% 30% Crop Year 11/12 12/13 13/14 14/15 15/16 25% 16/17 17/18 30% 18/19 19/20 20/21 43% 21/22 25% 22/23 23/24 24/25 Farmer Operating Margins (Avg.

of 5 major states) Brazil farmer profitability decline of similar magnitude as 2012 - 2014, albeit from a higher base such that we are back to 10 - year average Farmer profit margins hover around 25%, higher than most regions of the world, and forecasted by ag consultancies to improve this Crop Year ‘23/’24 Forecast 7 Highly confidential and trade secret Financial Outlook for Fiscal Year 2024 Note : USD/BRL average period exchange rate used to translate our results to USD : 4 . 88 for FY 1 Q 24 , and 5 . 02 for FY 2 Q 24 to FY 3 Q 24 FY2024 Consolidated Financials Outlook Low High (in millions of US dollars) Revenue 2,000 2,300 Inputs revenue 1,700 2,000 Adjusted EBITDA 135 165 ▪ We anticipate 40 - 50% of our FY24 Adjusted EBITDA be delivered in 2H ▪ Expect 1Q results to be low point for the year for Adjusted EBITDA ▪ Meaningful deviaition from seasonality from patterns seen in previous years is driven by: ▪ phasing effect of Crop Care and Specialty sales shifted from 1Q to 2Q - 4Q ▪ Change in farmer purchasing patterns ▪ And anticipation for improved crop protection margins in 2H as the effects from destocking of agrochemicals dissipate 9 Highly confidential and trade secret FY23 Financial Performance In millions of US dollars 1 Note: Intercompany results represent sales between Crop Care and Brazil Ag Retail segments (1) USD/BRL average period exchange rate used to translate our results to USD: 4.952 for FY4Q23, 5.193 for FY3Q23, 5.280 for FY1H 23, 4.924 for FY4Q22, 5.226 for FY3Q22, 5.570 for FY1H22 1,310 1,665 138 130 FY22 FY23 1,448 1,795 +24% Inputs Grains 188.8 246.0 35.9 37.9 22.7 53.8 FY22 - 5.9 FY23 247.5 331.9 +34% 69.9 111.9 14.4 17.4 7.3 28.1 - 7.7 FY22 FY23 91.6 149.8 +64% 1,184 1,502 220 233 121 62 - 19 FY22 - 61 FY23 1,448 1,795 +24% Intercompany / Corporate² Crop Care Latam Ag Retail Brazil Ag Retail As % of Inputs revenue 18.9% 19.9% 6.3% 8.3% Revenue Gross Profit Adjusted EBITDA

Appendix

10 Highly confidential and trade secret Summary of Financial Results for 4Q23 and FY23 ( 1 ) USD/BRL average period exchange rate used to translate our results to USD : 4 . 952 for FY 4 Q 23 , 5 . 193 for FY 3 Q 23 , 5 . 280 for FY 1 H 23 , 4 . 924 for FY 4 Q 22 , 5 . 226 for FY 3 Q 22 , 5 . 570 for FY 1 H 22 Key Financial Metrics 4Q22 4Q23 Chg. % FY22 FY23 Chg. % Revenue by Segment 227.8 265.5 17 % 1,447.9 1,794.9 24 % Brazil Ag Retail 149.5 197.2 32 % 1,184.2 1,502.1 27 % Latam Ag Retail 63.7 61.8 - 3 % 220.2 233.1 6 % Crop Care 13.5 10.6 - 21 % 62.4 120.8 94 % Intercompany 1.1 (4.1) (18.9) (61.1) Revenue by Category 227.8 265.6 17 % 1,448.0 1,794.8 24 % Inputs revenue 180.7 217.0 20 % 1,310.5 1,664.6 27 % Grains revenue 47.1 48.6 3 % 137.5 130.2 - 5 % Gross Profit 37.0 46.9 27 % 247.5 332.0 34 % Brazil Ag Retail 21.6 26.3 22 % 188.8 246.1 30 % Latam Ag Retail 10.3 9.4 - 9 % 35.9 38.0 6 % Crop Care 5.1 8.1 59 % 22.7 53.8 137 % Intercompany – 3.1 0.1 (5.9) Gross Margin 16.2 % 17.7% 150 bps 17.1 % 18.5 % 140 bps Gross Margin (% of Inputs) 20.5 % 21.6% 110 bps 18.9 % 19.9 % 100 bps SG&A excl. D&A (59.1) (55.5) (166.6) (205.1) Other operating income (expense) 4.4 5.0 10.5 (53.0) EBITDA (17.7) (3.6) - 80 % 91.4 73.9 - 19 % (+) Nasdaq listing expenses – – – 61.5 (+) Other non - recurring items 1.4 6.0 0.2 14.5 Adjusted EBITDA (16.3) 2.4 n.m. 91.6 149.8 64 % Adjusted EBITDA Margin % - 7.2 % 0.9 % 810 bps 6.3 % 8.3 % 200 bps Adjusted EBITDA Margin (% of Inputs) - 9.0 % 1.1 % 1,010 bps 7.0 % 9.0 % 200 bps D&A (6.9) (8.1) (27.3) (32.4) Finance income (costs) (17.0) (28.2) (42.4) (119.2) Income taxes, current and deferred 14.6 20.6 (4.6) 34.0 Net profit (27.0) (19.3) n.m. 17.1 (43.7) n.m. Adjusted net profit (25.6) (13.3) n.m. 17.3 32.3 87 % In millions of US dollars 1 11 Highly confidential and trade secret Pro Forma Financial Results 1 Highlights of Pro Forma Results 4Q22 4Q23 Chg.

% FY22 FY23 Chg. % (in millions of US dollars) Pro forma Revenue by Segment 331.8 338.8 2 % 1,756.5 1,938.4 10% Pro forma Gross Profit 58.3 63.0 8 % 306.1 359.4 17 % Pro forma Gross Margin 17.6% 18.6% 100 bps 17.4% 18.5% 110 bps Pro forma Adjusted EBITDA 4.5 13.4 298% 131.5 167.9 1% Pro forma Adjusted EBITDA Margin % 1.4% 4.0% 260 bps 7.5% 8.7% 120 bps (1) Pro Forma financial information is calculated assuming the acquisitions occurred at the beginning of the period presented and the prior year (rather than just the partial “stub period” contribution) . Pro Forma Revenues represent fully combined revenues, which include revenues from non - controlling minority shareholders . Note that the Pro Forma results displayed here include the historical financial contribution of recently acquired Referencia , and hence will not be comparable to the Pro Forma financials in the 20 - F which exclude Referencia . (2) USD/BRL average period exchange rate used to translate our results to USD : 4 . 952 for FY 4 Q 23 , 5 . 193 for FY 3 Q 23 , 5 . 280 for FY 1 H 23 , 4 . 924 for FY 4 Q 22 , 5 . 226 for FY 3 Q 22 , 5 .

570 for FY 1 H 22 In millions of US dollars 2 12 Highly confidential and trade secret Reconciliation of Adjusted EBITDA and Pro Forma Adjusted EBITDA Reconciliation of Adjusted EBITDA 4Q22 4Q23 FY22 FY23 Net Profit/Loss for the Period (27.1) (19.5) 17.1 (43.8) (+) Finance income (costs) 17.0 28.2 42.4 119.2 (+) Income taxes, current and deferred (14.6) (20.6) 4.6 (34.0) (+) Depreciation and amortization 6.1 8.2 22.3 27.2 (+) Fair value of inv. sold from acquired companies 0.9 0.2 5.0 5.1 (+) M&A expenses 0.9 0.8 3.0 2.1 (+) Gain on bargain purchases — — (3.3) — (+) Nasdaq Listing expenses — — — 61.5 (+) Stock - based compensation — 0.5 — 2.8 (+) DeSPAC related bonus — 0.9 — 5.8 (+) Related party consultancy services 0.5 3.8 0.5 3.8 Adjusted EBITDA (16.3) 2.5 91.6 149.7 (/) Revenue 227.8 265.5 1,448.0 1,794.8 Adjusted EBITDA Margin % - 7.2% 0.9% 6.3% 8.3% Reconciliation of Pro Forma Adjusted EBITDA 4Q22 4Q23 FY22 FY23 Pro forma Net Profit/Loss for the Period (11.2) (15.6) 45.9 (34.6) (+) Pro forma finance income (costs), net 16.6 33.2 45.9 124.7 (+) Pro forma income taxes current and deferred (11.0) (18.5) 10.2 (31.0) (+) Pro forma depreciation and amortization 7.5 7.6 24.2 27.4 (+) M&A expenses 0.9 0.6 5.0 5.2 (+) Fair value of inv. sold from acquired companies 1.3 0.7 3.0 2.1 (+) Gain on bargain purchases — — (3.3) — (+) Nasdaq Listing expenses — — — 61.5 (+) Pro forma stock - based compensation — 0.5 — 2.9 (+) Pro forma DeSPAC related bonus — 0.9 — 5.8 (+) Pro forma related party consultancy services 0.5 3.8 0.5 3.8 Pro forma Adjusted EBITDA 4.6 13.2 131.4 167.8 (/) Pro forma revenue 331.8 338.8 1,756.5 1,929.4 Pro forma Adjusted EBITDA Margin % 1.4 % 3.9% 7.5% 8.7% ( 1 ) USD/BRL average period exchange rate used to translate our results to USD : 4 . 952 for FY 4 Q 23 , 5 . 193 for FY 3 Q 23 , 5 . 280 for FY 1 H 23 , 4 . 924 for FY 4 Q 22 , 5 . 226 for FY 3 Q 22 , 5 .

570 for FY 1 H 22 In millions of US dollars 1 13 Highly confidential and trade secret Reconciliation of Adjusted Profit (Loss) Reconciliation of Adjusted Net Profit 4Q22 4Q23 FY22 FY23 Profit/Loss for the Period (27.0) (19.3) 17.1 (43.7) (+) M&A expenses 0.9 0.8 3.0 2.1 ( - ) Gain on bargain purchases — — (3.3) — (+) Nasdaq Listing expenses — — — 61.5 (+) Stock Option Plan — 0.5 — 2.8 (+) DeSPAC bonus — 0.9 — 5.8 (+) Related party consultancy services 0.5 3.8 0.5 3.8 Adjusted Net Profit/Loss (25.6) (13.3) 17.3 32.3 (/) Revenue 227.8 265.5 1,448.0 1,794.8 Adjusted Net Profit/Loss Margin % - 11.2 % - 5.0 % 1.2 % 1.8 % ( 1 ) USD/BRL average period exchange rate used to translate our results to USD : 4 . 952 for FY 4 Q 23 , 5 . 193 for FY 3 Q 23 , 5 . 280 for FY 1 H 23 , 4 . 924 for FY 4 Q 22 , 5 . 226 for FY 3 Q 22 , 5 . 570 for FY 1 H 22 In millions of US dollars 1

Exhibit 99.3

Content

Report of Independent Registered Public Accounting Firm

To the Shareholders and the Board of Directors of

Lavoro Limited

Opinion on the Financial Statements

We have audited the accompanying consolidated statement of financial position of Lavoro Limited (Lavoro or the Company) as of June 30, 2023 and 2022, the related consolidated statement of profit or loss, comprehensive income or loss, changes in equity and cash flows for each of the three years in the period ended June 30, 2023, and the related notes (collectively referred to as the “consolidated financial statements”). In our opinion, the consolidated financial statements present fairly, in all material respects, the financial position of the Company at June 30, 2023 and 2022, and the results of its operations and its cash flows for each of the three years in the period ended June 30, 2023, in conformity with International Financial Reporting Standards (IFRS), as issued by the International Accounting Standards Board (IASB).

Basis for Opinion

These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on the Company’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Critical Audit Matters

The critical audit matters communicated below are matters arising from the current period audit of the financial statements that were communicated or required to be communicated to the audit committee and that: (1) relate to accounts or disclosures that are material to the financial statements and (2) involved our especially challenging, subjective or complex judgments. The communication of critical audit matters does not alter in any way our opinion on the consolidated financial statements, taken as a whole, and we are not, by communicating the critical audit matters below, providing separate opinions on the critical audit matters or on the accounts or disclosures to which they relate.

SPAC Transaction

Description of the Matter

As discussed in Notes 1(a) and 22 to the consolidated financial statements, the Company consummated on February 28, 2023, a corporate reorganization as a result of the SPAC Transaction between Lavoro and TPB Acquisition Corp. The transaction was accounted for as a capital reorganization in accordance with IFRS 2, Share-based Payment, being TPB Acquisition Corp. identified as the “acquired” company and Lavoro as the accounting “acquirer”. As a result, on the date the corporate reorganization was consummated Lavoro received assets and assumed liabilities to certain of its shareholders of TPB Acquisition Corp. The amount of R$319,554 thousand representing the excess of fair value of Lavoro’s ordinary shares issued over the fair value of TPB Acquisition Corp identifiable net assets acquired represents a compensation for the service of a stock exchange listing for its shares and was registered in the statement of profit and loss as listing expenses incurred.

Auditing this transaction was specially challenging due to the complexity of the transaction in determining the accounting acquirer and assess it as a corporate reorganization, the significant amounts involved in the determination of the value of the listing expenses, including the Monte Carlo simulation used by management to determine the fair value of equity instruments, and accounting treatment of the financial instruments related to this transaction.

How We Addressed the Matter in Our Audit

Our audit procedures included, among others, assessing the terms of the agreements related to the SPAC transaction, assessing management`s evaluation for determining the accounting acquirer, assessing the classification and valuation of financial instruments such as warrants and forward purchase agreement and the Company's calculations of listing expense. We also involved our valuation specialists to assist in evaluating the Company's use of a Monte Carlo simulation for valuing the vesting and unvested founder shares.

We also evaluated the corresponding disclosures in Notes 1(a) and 22.

Goodwill impairment test

Description of the Matter

As of June 30, 2023, the carrying amount of goodwill in the Company’s statement of financial position is R$546,665 thousand. As discussed in Note 16 to the consolidated financial statements, the Company performs goodwill impairment testing at the cash generating unit (CGU) level annually to assess whether there is an indicator of impairment.

Auditing the Company’s annual goodwill impairment test was complex and highly judgmental due to the significant estimation required to determine the value in use of the CGUs utilizing a discounted cash flows model. In particular, the value in use estimate was sensitive to significant assumptions, such as changes in the revenue growth rate, operating margin and discount rate, which are affected by expectations about future market or economic conditions and those related to sales of each of the Company’s CGUs.

How We Addressed the Matter in Our Audit

We evaluated management’s assumptions by performing audit procedures that included, among others, comparing the significant assumptions used by management to current market and economic trends and evaluated whether changes to the Company’s assumptions would affect the value in use. We assessed the historical accuracy of management’s estimates and performed sensitivity analyses of significant assumptions, such as revenue growth rate and discount rate, to evaluate the changes in the value in use of the cash generating units that would result from changes in the assumptions. We also involved our valuation specialists in assessing valuation methodology used by the Company, to assist in testing the discount rate used and to recalculate the discounted cash flows.

We also assessed the adequacy of the related disclosures in Note 16.

/s/ ERNST & YOUNG Auditores Independentes S/S Ltda.

ERNST & YOUNG

Auditores Independentes S/S Ltda.

We have served as the Company's auditor since 2020. São Paulo, Brazil

October 31, 2023

|

Consolidated statement of financial position |

|

|

As of June 30, 2023 and 2022 (In thousands of Brazilian reais - R$, except if otherwise indicated) |

| Notes | 2023 | 2022 | ||||

| Assets | ||||||

| Current assets | ||||||

| Cash equivalents | 5 | 564,294 | 254,413 | |||

| Trade receivables | 6 | 2,667,057 | 1,794,602 | |||

| Inventories | 9 | 1,868,204 | 1,749,041 | |||

| Taxes recoverable | 10 | 57,001 | 93,725 | |||

| Derivative financial instruments | 8 | 40,410 | 7,677 | |||

| Commodity forward contracts | 11 | 114,861 | 32,800 | |||

| Advances to suppliers | 12 | 192,119 | 383,257 | |||

| Other assets | 32,701 | 60,165 | ||||

| Total current assets | 5,536,646 | 4,375,680 | ||||

| Non-current assets | ||||||

| Restricted cash | 22 | 139,202 | 1,344 | |||

| Trade receivables | 6 | 41,483 | 39,751 | |||

| Other assets | 8,390 | 2,473 | ||||

| Judicial deposits | 8,820 | 3,887 | ||||

| Right-of-use assets | 13 | 173,679 | 140,179 | |||

| Taxes recoverable | 10 | 282,903 | 50,937 | |||

| Deferred tax assets | 23 | 329,082 | 200,986 | |||

| Property, plant and equipment | 14 | 196,588 | 146,205 | |||

| Intangible assets | 15 | 807,192 | 724,321 | |||

| Total non-current assets | 1,987,339 | 1,310,083 | ||||

| Total assets | 7,523,984 | 5,685,763 |

The accompanying notes are an integral part of the consolidated financial statements.

|

|

|

|

As of June 30, 2023 and 2022 (In thousands of Brazilian reais - R$, except if otherwise indicated) |

| Notes | 2023 | 2022 | ||||

| Liabilities | ||||||

| Current liabilities | ||||||

| Trade payables | 17 | 2,575,701 | 2,301,700 | |||

| Trade payables – Supplier finance | 17(c) | 26,157 | - | |||

| Lease liabilities | 13 | 85,865 | 69,226 | |||

| Borrowings | 18 | 922,636 | 681,217 | |||

| Obligations to FIAGRO quota holders | 19 | 150,018 | - | |||

| Payables for the acquisition of subsidiaries | 20 | 221,509 | 111,684 | |||

| Derivative financial instruments | 8 | 44,008 | 7,121 | |||

| Commodity forward contracts | 11 | 207,067 | 27,038 | |||

| Salaries and social charges | 223,376 | 187,285 | ||||

| Taxes payable | 37,105 | 34,216 | ||||

| Dividends payable | 1,619 | 411 | ||||

| Warrant liabilities | 22 | 36,446 | - | |||

| Advances from customers | 25 | 488,578 | 320,560 | |||

| Other liabilities | 34,388 | 95,893 | ||||

| Total current liabilities | 5,054,473 | 3,836,351 | ||||

| Non-current liabilities | ||||||

| Trade payables | 17 | 2,547 | - | |||

| Lease liabilities | 13 | 98,554 | 86,027 | |||

| Borrowings | 18 | 42,839 | 29,335 | |||

| Payables for the acquisition of subsidiaries | 20 | 53,700 | 52,747 | |||

| Provision for contingencies | 24 | 8,845 | 2,966 | |||

| Liability for FPA Shares | 22 | 139,133 | - | |||

| Other liabilities | 223 | 1,119 | ||||

| Taxes payable | 963 | - | ||||

| Deferred tax liabilities | 23 | 12,351 | 7,491 | |||

| Total non-current liabilities | 359,155 | 179,685 | ||||

| Equity / Net investment | 27 | |||||

| Net investment from the parent | - | 1,451,647 | ||||

| Share Capital | 591 | - | ||||

| Additional Paid-in Capital | 2,134,339 | - | ||||

| Capital reserve | 14,533 | - | ||||

| Other comprehensive loss | (28,634) | - | ||||

| Accumulated losses | (260,710) | - | ||||

| Equity attributable to shareholders of the Parent Company / Parent Company's Net investment | 1,860,119 | 1,451,647 | ||||

| Non-controlling interests | 250,238 | 218,080 | ||||

| Total equity / net investment | 2,110,357 | 1,669,727 | ||||

| Total liabilities and equity / net investment | 7,523,984 | 5,685,763 |

The accompanying notes are an integral part of the consolidated financial statements.

|

|

|

|

|

For the years ended June 30, 2023, 2022 and 2021 (In thousands of Brazilian reais - R$, except if otherwise indicated) |

| Notes | 2023 | 2022 | 2021 | |||||

| Revenue | 28 | 9,347,413 | 7,746,534 | 5,098,545 | ||||

| Cost of goods sold | 29 | (7,616,606) | (6,421,037) | (4,362,657) | ||||

| Gross profit | 1,730,807 | 1,325,497 | 735,888 | |||||

| Operating expenses | ||||||||

| Sales, general and administrative expenses | 29 | (1,228,128) | (1,022,388) | (619,506) | ||||

|

Other operating

(expenses) income, net

|

31 | (275,810) | 56,759 | 15,618 | ||||

| Operating profit | 226,869 | 359,868 | 132,000 | |||||

| Finance Income (costs) | ||||||||

| Finance income | 30 | 371,060 | 426,933 | 227,099 | ||||

| Finance costs | 30 | (988,867) | (646,377) | (312,892) | ||||

| Profit (loss) before income taxes | (390,938) | 140,424 | 46,207 | |||||

| Income taxes | ||||||||

| Current | 23 | 37,499 | (111,409) | (61,676) | ||||

| Deferred | 23 | 134,757 | 78,747 | 37,000 | ||||

| Profit (loss) for the year | (218,682) | 107,762 | 21,531 | |||||

| Attributable to: | ||||||||

| Net investment of the parent/ Equity holders of the parent | (260,710) | 78,170 | 38,390 | |||||

| Non-controlling interests | 42,028 | 29,592 | (16,859) | |||||

| Earnings (loss) per share | ||||||||

| Basic, profit (loss) for the year attributable to net investment of the parent/ equity holders of the parent | 27 | (2.29) | 0.69 | 0.34 | ||||

| Diluted, profit (loss) for the year attributable to net investment of the parent/ equity holders of the parent | 27 | (2.29) | 0.69 | 0.34 |

The accompanying notes are an integral part of the consolidated financial statements.

|

|

|

|

|

For the years ended June 30, 2023, 2022 and 2021 (In thousands of Brazilian reais - R$, except if otherwise indicated) |

| 2023 | 2022 | 2021 | ||||

| Profit (loss) for the year | (218,682) | 107,762 | 21,531 | |||

| Items that may be reclassified to profit or loss in subsequent years | ||||||

| Exchange differences on translation of foreign operations | (30,600) | (34,263) | (16,436) | |||

| Total comprehensive (loss) income for the year | (249,282) | 73,499 | 5,095 | |||

| Attributable to: | ||||||

| Net investment of the parent/ equity holders of the parent | (289,344) | 45,630 | 22,346 | |||

| Non-controlling interests | 40,062 | 27,869 | (17,251) |

The accompanying notes are an integral part of the consolidated financial statements.

|

|

|

|

|

For the years ended June 30, 2023, 2022 and 2021 (In thousands of Brazilian reais - R$, except if otherwise indicated) |

| Notes | Net investment of the Parent | Share Capital | Additional

Paid-in Capital |

Share-Based Compensation reserve | Acumulated gain/losses | Foreign

currency translation reserve |

Total | Non-controlling interest | Total Equity/ Net Investment |

|||||||||

| At June 30, 2020 | 787,707 | - | - | - | - | - | 787,707 | 68,922 | 856,629 | |||||||||

| Capital contributions | 27 | 554,735 | - | - | - | - | - | 554,735 | 100,350 | 655,085 | ||||||||

| Acquisition of non-controlling interests | 27 | (22,071) | - | - | - | - | - | (22,071) | (57,422) | (79,493) | ||||||||

| Acquisition of subsidiaries | 21 | 2,789 | - | - | - | - | - | 2,789 | 28,065 | 30,854 | ||||||||

| Profit for the year | 38,390 | - | - | - | - | - | 38,390 | (16,859) | 21,531 | |||||||||

| Exchange differences on translation of foreign operations | (16,436) | - | - | - | - | - | (16,436) | - | (16,436) | |||||||||

| At June 30, 2021 | 1,345,114 | - | - | - | - | - | 1,345,114 | 123,056 | 1,468,170 | |||||||||

| Capital contributions | 27 | 190,003 | - | - | - | - | - | 190,003 | 12,422 | 202,425 | ||||||||

| Dividends paid | (131,979) | - | - | - | - | - | (131,979) | (1,090) | (133,069) | |||||||||

| Acquisition of non-controlling interests | 27 | (3,257) | - | - | - | - | - | (3,257) | (31,094) | (34,351) | ||||||||

| Acquisition of subsidiaries | 21 | 6,136 | - | - | - | - | - | 6,136 | 86,917 | 93,053 | ||||||||

| Profit for the year | 78,170 | - | - | - | - | - | 78,170 | 29,592 | 107,762 | |||||||||

| Exchange differences on translation of foreign operations | (32,540) | - | - | - | - | - | (32,540) | (1,723) | (34,263) | |||||||||

| At June 30, 2022 | 1,451,647 | - | - | - | - | - | 1,451,647 | 218,080 | 1,669,727 | |||||||||

| Capital contributions | 27 | 60,880 | - | - | - | - | - | 60,880 | - | 60,880 | ||||||||

| Acquisition of non-controlling interests | 27 | (64,711) | - | - | - | - | - | (64,711) | (36,176) | (100,887) | ||||||||

| Non-controlling dilution on capital contributions | 27 | (7,475) | - | - | - | - | - | (7,475) | 7,475 | - | ||||||||

| Dividends paid | - | - | - | - | - | - | - | (3,485) | (3,485) | |||||||||

| Acquisition of subsidiaries | 21 | 8,809 | - | - | - | - | - | 8,809 | 14,389 | 23,198 | ||||||||

| Share-based payments | 27 | 12,112 | - | - | - | - | - | 12,112 | - | 12,112 | ||||||||

| Profit for the period | 209,310 | - | - | - | - | - | 209,310 | 54,579 | 263,889 | |||||||||

| Exchange differences on translation of foreign operations | (27,481) | - | - | - | - | - | (27,481) | (1,007) | (28,488) | |||||||||

| Pre reorganization | 1,643,091 | - | - | - | - | - | 1,643,091 | 253,855 | 1,896,946 | |||||||||

| Changes in parent company's net investment | 27 | (1,643,091) | 514 | 1,464,083 | 12,112 | 209,310 | (42,928) | - | - | |||||||||

| SPAC merger transaction | 22 | - | 77 | 670,256 | - | - | - | 670,333 | 670,333 | |||||||||

| Exchange differences on translation of foreign operations | - | - | - | - | - | 14,294 | 14,294 | 763 | 15,057 | |||||||||

| Loss for the period | - | - | - | - | (470,020) | - | (470,020) | (12,550) | (482,570) | |||||||||

| Share-based payment | 27 | - | - | - | 2,421 | - | - | 2,421 | 2,421 | |||||||||

| Acquisition of subsidiaries | 21 | - | - | - | - | - | - | - | 8,169 | 8,169 | ||||||||

| At June 30, 2023 | - | 591 | 2,134,339 | 14,533 | (260,710) | (28,634) | 1,860,119 | 250,238 | 2,110,357 |

The accompanying notes are an integral part of the consolidated financial statements.

|

|

|

|

|

For the years ended June 30, 2023, 2022 and 2021 (In thousands of Brazilian reais - R$, except if otherwise indicated) |

| Notes | 2023 | 2022 | 2021 | |||||

| Operating activities: | ||||||||

| Profit (loss) before income taxes | (390,938) | 140,424 | 46,207 | |||||

| Adjustments to reconcile profit (loss) for the year to net cash flow: | ||||||||

| Allowance for expected credit losses | 29 | 36,769 | 27,393 | 11,094 | ||||

| Listing expense | 31 | 319,554 | - | - | ||||

| Foreign exchange diferences | (10,955) | 1,957 | (12,759) | |||||

| Accrued interest expenses | 30 | 844,885 | 594,076 | 295,169 | ||||

| Interest arising from revenue contracts | 30 | (250,337) | (407,449) | (204,744) | ||||

| Loss (gain) on derivatives | 30 | (79,375) | 26,323 | 4,883 | ||||

| Interest from tax benefits | 30 | (27,153) | - | - | ||||

| Other finance loss, net | 30 | 24,122 | 22,440 | 12,042 | ||||

| Fair value on commodity forward contracts | 30 | 98,674 | (9,200) | (6,337) | ||||

| Amortization of intangibles | 29 | 67,927 | 57,607 | 29,717 | ||||

| Amortization of right-of-use assets | 29 | 56,236 | 51,203 | 17,997 | ||||

| Depreciation | 29 | 16,408 | 9,697 | 5,717 | ||||

| Losses and damages of inventories | 29 | 19,127 | 23,339 | 9,808 | ||||

| Gain on bargain purchase | - | (18,295) | - | |||||

| Provisions for contingencies | 5,879 | (11,998) | (3,564) | |||||

| Share-based payment expense | 27 | 14,533 | - | - | ||||

| Others | (2,681) | (26,495) | (7,484) | |||||

| Changes in operating assets and liabilities: | ||||||||

| Assets | ||||||||

| Trade receivables | (608,550) | 19,563 | 262,671 | |||||

| Inventories | 49,745 | (721,602) | 5,745 | |||||

| Advances to suppliers | 191,138 | 74,542 | (201,351) | |||||

| Derivative financial instruments | (32,732) | (7,677) | - | |||||

| Taxes recoverable | (66,345) | (41,685) | (23,374) | |||||

| Other receivables | 77,567 | (6,765) | 4,493 | |||||

| Liabilities | ||||||||

| Trade payables | (117,567) | 273,611 | (316,575) | |||||

| Advances from customers | 106,903 | (207,440) | 187,035 | |||||

| Derivative financial instruments | 116,262 | (24,328) | (14,250) | |||||

| Salaries and social charges | 36,091 | 91,540 | 46,363 | |||||

| Taxes payable | (3,360) | (39,463) | 25,518 | |||||

| Other payables | (66,051) | (2,237) | 25,051 | |||||

| Interest paid on borrowings | 18 | (95,739) | (7,401) | (30,424) | ||||

| Interest paid on trade payables and lease liabilities | (346,749) | (360,665) | (208,938) | |||||

| Interest paid on acquisition of subsidiary | (4,875) | (14,907) | (2,797) | |||||

| Interest received from revenue contracts | 206,430 | 310,967 | 179,796 | |||||

| Income taxes paid | (76,775) | (76,546) | (85,682) | |||||

| Net cash flows from (used in) operating activities | 108,068 | (259,471) | 51,027 | |||||

| Investing activities: | ||||||||

| Acquisition of subsidiary, net of cash acquired | 20 and 21 | (157,442) | (198,305) | (280,374) | ||||

| Additions to property, plant and equipment and intangible assets | (65,376) | (47,697) | (34,940) | |||||

| Proceeds from the sale of property, plant and equipment | 2,084 | 1,309 | 4,242 | |||||

| Net cash flows used in investing activities | (220,734) | (244,693) | (311,072) | |||||

| Financing activities: | ||||||||

| Proceeds from borrowings | 18 | 1,449,445 | 615,984 | 466,280 | ||||

| Repayment of borrowings | 18 | (1,456,017) | (299,613) | (472,909) | ||||

| Payment of principal portion of lease liabilities | 13 | (60,570) | (45,814) | (7,957) | ||||

| Proceeds from FIAGRO quota holders, net of transaction costs | 19 | 150,018 | - | - | ||||

| Trade payables – Supplier finance | 17(c) | 16,569 | - | - | ||||

| Dividend payments | (2,277) | (139,512) | - | |||||

| Proceeds from SPAC merger, net | 22 | 391,572 | - | - | ||||

| Acquisition of non-controlling interests | 27 | (100,887) | (34,351) | (79,493) | ||||

| Capital contributions | 27 | 60,880 | 202,425 | 655,085 | ||||

| Net cash flows provided by financing activities | 448,733 | 299,119 | 561,006 | |||||

| Net increase (decrease) in cash equivalents | 336,068 | (205,045) | 300,961 | |||||

| Net foreign exchange difference | (26,187) | - | - | |||||

| Cash equivalents at beginning of year | 254,413 | 459,458 | 158,497 | |||||

| Cash equivalents at end of year | 564,294 | 254,413 | 459,458 |

The accompanying notes are an integral part of the consolidated financial statements

|

|

|

Notes to the consolidated financial statements |

|

|

(In thousands of Brazilian reais - R$, except if otherwise indicated) |

| 1. | Background information |

Lavoro Limited is a Cayman Island exempted company incorporated on August 22, 2022.

Lavoro Limited is a public company listed with the US Securities and Exchange Commission (“SEC”) and its shares are traded on Nasdaq Global Select Market under ticker symbol “LVRO”.

Lavoro Limited (“Lavoro” and collectively with its subsidiaries, the “Group”) is one of the main agricultural input distribution platforms in Latin America, with relevant agricultural input distribution operations in Brazil and Colombia, and an early stage agricultural input trading company in Uruguay. Also, as a result of a verticalization strategy, the Group produces agricultural biological and special fertilizers products through its own facilities. The Group offers farmers a complete portfolio of products and services with the goal of helping farmer customers succeed by providing multi-channel support.

As of June 30, 2023, the Group is controlled by investment funds, managed by general partners which are ultimately controlled by Patria Investments Limited (the “Parent” or “Patria”), a manager of alternative assets with its shares listed on the NASDAQ.

| (a) | The SPAC Transaction |

On September 14, 2022, Lavoro and TPB Acquisition Corporation I (“TPB Acquisition Corp.”), a special purpose acquisition company sponsored by The Production Board LLC, signed an agreement pursuant to which they entered into a definitive business combination agreement (the “Business Combination Agreement”) that resulted in Lavoro becoming a U.S. publicly listed company on the NASDAQ Global Market.

The SPAC Transaction was approved at an extraordinary general meeting of TPB Acquisition Corp’s shareholders on February 22, 2023.

On February 28, 2023, as a result of the SPAC Transaction Lavoro and TPB Acquisition Corp consummated a corporate reorganization, as further explained below, pursuant to which (i) Lavoro Agro Limited’s shareholders contributed their shares in Lavoro Agro Limited to Lavoro in exchange of Lavoro’s shares at a pre-determined exchange ratio, becoming Lavoro’s controlling shareholders (ii) TPB Acquisition Corp’s shareholders contributed the net assets of TPB Acquisition Corp, which primarily consisted of cash and marketable securities held in the trust account and certain public and private warrants liabilities in exchange of Lavoro’s shares, becoming Lavoro’s non-controlling shareholders.

See Note 22 for further information.

|

|

|

Notes to the consolidated financial statements (In thousands of Brazilian reais - R$, except if otherwise indicated) |

| (b) | Corporate reorganizations |

The Group’s operations include the operations of the following entities (i) Lavoro Agro Holding S.A. and its subsidiaries (“Lavoro Holding”) which was incorporated in 2017 and is domiciled in the city of São Paulo, Brazil, (ii) Crop Care Holding S.A., and its subsidiaries (“Crop Care”) which was incorporated in 2018 and is domiciled in the city of São Paulo, Brazil and (iii) Lavoro Colombia S.A.S. and its subsidiaries (“Lavoro Colombia”) which was incorporated in 2021 and is domiciled in the city of Bogotá, Colombia.

In January 2023, as part of the SPAC Transaction, a corporate reorganization was completed whereby Lavoro Brazil, Crop Care and Lavoro Colombia were contributed to, and became subsidiaries of Lavoro Agro Limited, a Cayman Islands exempted company with limited liability which was incorporated on November 21, 2021, to become the holding company of all the operations of the Group.

As mentioned above, following the consummation of the SPAC Transaction, Lavoro became the parent company of Lavoro Agro Limited and the holding company of all the operations of the Group.

| (c) | The Group’s business |

The Group initiated its operations in 2017 and has expanded mainly through mergers and acquisitions in the distribution of agricultural inputs such as crop protection products, fertilizers, seeds and specialty inputs (foliar fertilizers, biologicals, adjuvants and organominerals) and its production through its proprietary portfolio of products under the crop care segment.

Through Crop Care, the Group operates as an importer of post-patent agricultural inputs and producer of specialties products through its own factories’ manufacturing plants. The inputs produced are delivered through the Group’s own distribution channels and by means of direct sales to customers.

The Group operates in Brazil, Colombia and Uruguay in the agricultural input distribution market through its own stores and sells agricultural inputs and products, in particular fertilizers, seeds and pesticides. The Group’s customers are rural producers that operate in the production of cereals, mainly soybeans and corn, in addition to cotton, citrus and fruit and vegetable crops, among others.

Seasonality

Agribusiness is subject to seasonality throughout the year, especially due to the crop cycles that depend on specific weather conditions. Operations, especially in Brazil, have unique weather conditions compared to other countries producing agricultural commodities, making it possible to harvest two to three crops in the same area per year. Thus, considering that the activities of the Group’s customers are directly related to crop cycles, which are seasonal in nature, revenues and cash flows from sales may also be substantially seasonal.

The sale of our products is dependent upon planting and growing seasons, which vary from year to year, and are expected to result in both highly seasonal patterns and substantial fluctuations in quarterly sales and profitability. Demand for our products is typically strongest between October and December, with a second period of strong demand between January and March. The seasonality of agricultural inputs results in our sales volumes and net sales typically being the highest during the period between September to February and our working capital and total debt requirements typically being the highest just after the end of this period.

|

|

|

Notes to the consolidated financial statements (In thousands of Brazilian reais - R$, except if otherwise indicated) |

| (d) | Other relevant events |

| · | Acquisitions |

The Group concluded several business acquisitions during the year ended June, 30, 2023, for which the total consideration was R$302,468 including cash, amounts payable in installments and issuance of shares. These acquisitions are further described in Note 21. Additionally, the Group completed an acquisition subsequent to June 30, 2023, which are described in note 33.

| · | Ongoing armed conflict between Russia and Ukraine |