| Washington | 000-26584 |

91-1691604 |

||||||||||||

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) | ||||||||||||

| Title of each class | Trading Symbol(s) |

Name of each exchange on which registered |

||||||||||||

| Common Stock, par value $.01 per share | BANR | The NASDAQ Stock Market LLC | ||||||||||||

| BANNER CORPORATION | |||||

| Date: July 16, 2025 | By: /s/ Robert G Butterfield |

||||

| Robert G Butterfield | |||||

| Executive Vice President, Treasurer and Chief Financial Officer |

|||||

|

|

CONTACT: | MARK J. GRESCOVICH, | ||||||||

| PRESIDENT & CEO | |||||||||||

| ROBERT G. BUTTERFIELD, CFO | |||||||||||

| (509) 527-3636 | |||||||||||

| NEWS RELEASE | |||||||||||

| RESULTS OF OPERATIONS | Quarters Ended | Six Months Ended | ||||||||||||||||||||||||||||||

| (in thousands except shares and per share data) | Jun 30, 2025 | Mar 31, 2025 | Jun 30, 2024 | Jun 30, 2025 | Jun 30, 2024 | |||||||||||||||||||||||||||

| INTEREST INCOME: | ||||||||||||||||||||||||||||||||

| Loans receivable | $ | 175,373 | $ | 168,677 | $ | 161,191 | $ | 344,050 | $ | 317,666 | ||||||||||||||||||||||

| Mortgage-backed securities | 15,416 | 15,744 | 16,708 | 31,160 | 33,642 | |||||||||||||||||||||||||||

| Securities and cash equivalents | 9,470 | 9,447 | 11,239 | 18,917 | 22,518 | |||||||||||||||||||||||||||

| Total interest income | 200,259 | 193,868 | 189,138 | 394,127 | 373,826 | |||||||||||||||||||||||||||

| INTEREST EXPENSE: | ||||||||||||||||||||||||||||||||

| Deposits | 49,316 | 48,737 | 48,850 | 98,053 | 93,463 | |||||||||||||||||||||||||||

| Federal Home Loan Bank (FHLB) advances | 3,370 | 860 | 3,621 | 4,230 | 6,593 | |||||||||||||||||||||||||||

| Other borrowings | 675 | 694 | 1,160 | 1,369 | 2,335 | |||||||||||||||||||||||||||

Subordinated debt |

2,499 | 2,494 | 2,961 | 4,993 | 5,930 | |||||||||||||||||||||||||||

| Total interest expense | 55,860 | 52,785 | 56,592 | 108,645 | 108,321 | |||||||||||||||||||||||||||

| Net interest income | 144,399 | 141,083 | 132,546 | 285,482 | 265,505 | |||||||||||||||||||||||||||

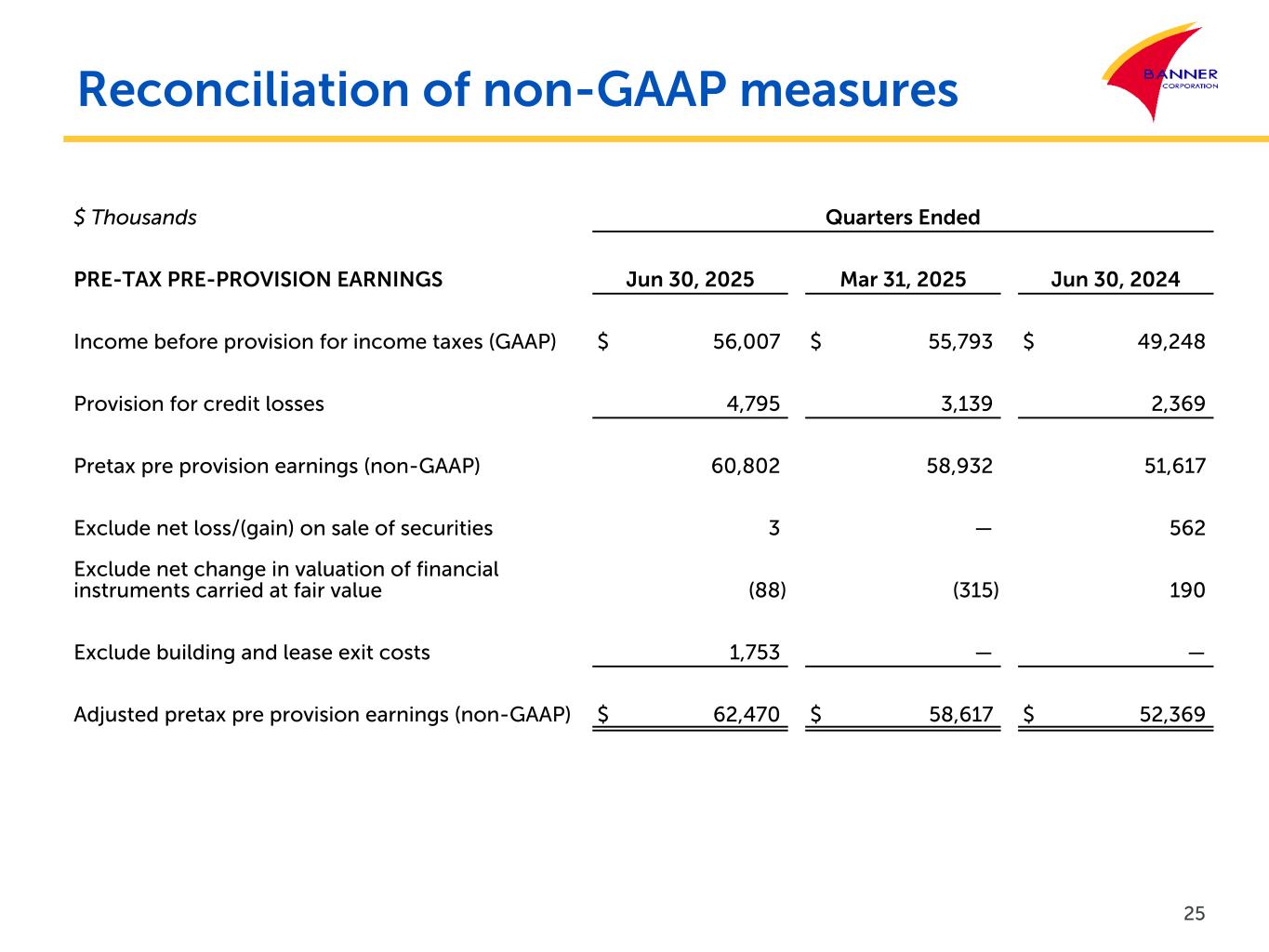

| PROVISION FOR CREDIT LOSSES | 4,795 | 3,139 | 2,369 | 7,934 | 2,889 | |||||||||||||||||||||||||||

| Net interest income after provision for credit losses | 139,604 | 137,944 | 130,177 | 277,548 | 262,616 | |||||||||||||||||||||||||||

| NON-INTEREST INCOME: | ||||||||||||||||||||||||||||||||

| Deposit fees and other service charges | 10,835 | 10,769 | 10,590 | 21,604 | 21,612 | |||||||||||||||||||||||||||

| Mortgage banking operations | 3,226 | 3,103 | 3,006 | 6,329 | 5,341 | |||||||||||||||||||||||||||

| Bank-owned life insurance | 2,384 | 2,575 | 2,367 | 4,959 | 4,604 | |||||||||||||||||||||||||||

| Miscellaneous | 1,221 | 2,346 | 1,988 | 3,567 | 3,880 | |||||||||||||||||||||||||||

| 17,666 | 18,793 | 17,951 | 36,459 | 35,437 | ||||||||||||||||||||||||||||

| Net loss on sale of securities | (3) | — | (562) | (3) | (5,465) | |||||||||||||||||||||||||||

| Net change in valuation of financial instruments carried at fair value | 88 | 315 | (190) | 403 | (1,182) | |||||||||||||||||||||||||||

| Total non-interest income | 17,751 | 19,108 | 17,199 | 36,859 | 28,790 | |||||||||||||||||||||||||||

| NON-INTEREST EXPENSE: | ||||||||||||||||||||||||||||||||

| Salary and employee benefits | 65,486 | 64,857 | 63,831 | 130,343 | 126,200 | |||||||||||||||||||||||||||

| Less capitalized loan origination costs | (4,924) | (3,330) | (4,639) | (8,254) | (8,315) | |||||||||||||||||||||||||||

| Occupancy and equipment | 12,256 | 12,097 | 12,128 | 24,353 | 24,590 | |||||||||||||||||||||||||||

| Information and computer data services | 8,199 | 7,628 | 7,240 | 15,827 | 14,560 | |||||||||||||||||||||||||||

| Payment and card processing services | 5,899 | 5,750 | 5,691 | 11,649 | 11,401 | |||||||||||||||||||||||||||

| Professional and legal expenses | 2,271 | 2,430 | 1,201 | 4,701 | 2,731 | |||||||||||||||||||||||||||

| Advertising and marketing | 1,087 | 590 | 1,198 | 1,677 | 2,277 | |||||||||||||||||||||||||||

| Deposit insurance | 2,800 | 2,797 | 2,858 | 5,597 | 5,667 | |||||||||||||||||||||||||||

| State and municipal business and use taxes | 1,416 | 1,454 | 1,394 | 2,870 | 2,698 | |||||||||||||||||||||||||||

| Real estate operations, net | 392 | (61) | 297 | 331 | 77 | |||||||||||||||||||||||||||

| Amortization of core deposit intangibles | 455 | 456 | 724 | 911 | 1,447 | |||||||||||||||||||||||||||

| Miscellaneous | 6,011 | 6,591 | 6,205 | 12,602 | 12,436 | |||||||||||||||||||||||||||

| Total non-interest expense | 101,348 | 101,259 | 98,128 | 202,607 | 195,769 | |||||||||||||||||||||||||||

| Income before provision for income taxes | 56,007 | 55,793 | 49,248 | 111,800 | 95,637 | |||||||||||||||||||||||||||

| PROVISION FOR INCOME TAXES | 10,511 | 10,658 | 9,453 | 21,169 | 18,283 | |||||||||||||||||||||||||||

| NET INCOME | $ | 45,496 | $ | 45,135 | $ | 39,795 | $ | 90,631 | $ | 77,354 | ||||||||||||||||||||||

| Earnings per common share: | ||||||||||||||||||||||||||||||||

| Basic | $ | 1.31 | $ | 1.31 | $ | 1.15 | $ | 2.62 | $ | 2.25 | ||||||||||||||||||||||

| Diluted | $ | 1.31 | $ | 1.30 | $ | 1.15 | $ | 2.61 | $ | 2.24 | ||||||||||||||||||||||

| Cumulative dividends declared per common share | $ | 0.48 | $ | 0.48 | $ | 0.48 | $ | 0.96 | $ | 0.96 | ||||||||||||||||||||||

| Weighted average number of common shares outstanding: | ||||||||||||||||||||||||||||||||

| Basic | 34,627,433 | 34,509,815 | 34,488,163 | 34,568,948 | 34,439,863 | |||||||||||||||||||||||||||

| Diluted | 34,738,948 | 34,778,687 | 34,537,012 | 34,761,044 | 34,539,620 | |||||||||||||||||||||||||||

| Increase in common shares outstanding | 94,022 | 30,140 | 60,531 | 124,162 | 107,383 | |||||||||||||||||||||||||||

| FINANCIAL CONDITION | Percentage Change | |||||||||||||||||||||||||||||||||||||

| (in thousands except shares and per share data) | Jun 30, 2025 | Mar 31, 2025 | Dec 31, 2024 | Jun 30, 2024 | Prior Qtr | Prior Yr Qtr | ||||||||||||||||||||||||||||||||

| ASSETS | ||||||||||||||||||||||||||||||||||||||

| Cash and due from banks | $ | 239,339 | $ | 213,574 | $ | 203,402 | $ | 195,163 | 12 | % | 23 | % | ||||||||||||||||||||||||||

| Interest-bearing deposits | 244,009 | 228,371 | 298,456 | 52,295 | 7 | % | 367 | % | ||||||||||||||||||||||||||||||

Total cash and cash equivalents |

483,348 | 441,945 | 501,858 | 247,458 | 9 | % | 95 | % | ||||||||||||||||||||||||||||||

Securities - available for sale, amortized cost $2,372,331, $2,426,395, $2,460,262 and $2,572,544, respectively |

2,064,581 | 2,108,945 | 2,104,511 | 2,197,693 | (2) | % | (6) | % | ||||||||||||||||||||||||||||||

Securities - held to maturity, fair value $801,838, $819,261, $825,528 and $852,709, respectively |

981,312 | 991,796 | 1,001,564 | 1,023,028 | (1) | % | (4) | % | ||||||||||||||||||||||||||||||

Total securities |

3,045,893 | 3,100,741 | 3,106,075 | 3,220,721 | (2) | % | (5) | % | ||||||||||||||||||||||||||||||

| FHLB stock | 35,151 | 17,286 | 22,451 | 27,311 | 103 | % | 29 | % | ||||||||||||||||||||||||||||||

| Loans held for sale | 37,651 | 24,536 | 32,021 | 13,421 | 53 | % | 181 | % | ||||||||||||||||||||||||||||||

| Loans receivable | 11,690,373 | 11,438,796 | 11,354,656 | 11,143,848 | 2 | % | 5 | % | ||||||||||||||||||||||||||||||

| Allowance for credit losses – loans | (160,501) | (157,323) | (155,521) | (152,848) | 2 | % | 5 | % | ||||||||||||||||||||||||||||||

Net loans receivable |

11,529,872 | 11,281,473 | 11,199,135 | 10,991,000 | 2 | % | 5 | % | ||||||||||||||||||||||||||||||

| Accrued interest receivable | 64,729 | 63,987 | 60,885 | 67,520 | 1 | % | (4) | % | ||||||||||||||||||||||||||||||

| Property and equipment, net | 117,175 | 119,649 | 124,589 | 126,465 | (2) | % | (7) | % | ||||||||||||||||||||||||||||||

| Goodwill | 373,121 | 373,121 | 373,121 | 373,121 | — | % | — | % | ||||||||||||||||||||||||||||||

| Other intangibles, net | 2,147 | 2,602 | 3,058 | 4,237 | (17) | % | (49) | % | ||||||||||||||||||||||||||||||

| Bank-owned life insurance | 316,365 | 313,942 | 312,549 | 307,948 | 1 | % | 3 | % | ||||||||||||||||||||||||||||||

| Operating lease right-of-use assets | 38,754 | 37,134 | 39,998 | 39,628 | 4 | % | (2) | % | ||||||||||||||||||||||||||||||

| Other assets | 392,963 | 394,396 | 424,297 | 397,364 | — | % | (1) | % | ||||||||||||||||||||||||||||||

Total assets |

$ | 16,437,169 | $ | 16,170,812 | $ | 16,200,037 | $ | 15,816,194 | 2 | % | 4 | % | ||||||||||||||||||||||||||

| LIABILITIES | ||||||||||||||||||||||||||||||||||||||

| Deposits: | ||||||||||||||||||||||||||||||||||||||

| Non-interest-bearing | $ | 4,504,491 | $ | 4,571,598 | $ | 4,591,543 | $ | 4,537,803 | (1) | % | (1) | % | ||||||||||||||||||||||||||

| Interest-bearing transaction and savings accounts | 7,545,028 | 7,517,617 | 7,423,183 | 7,016,327 | — | % | 8 | % | ||||||||||||||||||||||||||||||

| Interest-bearing certificates | 1,477,772 | 1,504,050 | 1,499,672 | 1,525,133 | (2) | % | (3) | % | ||||||||||||||||||||||||||||||

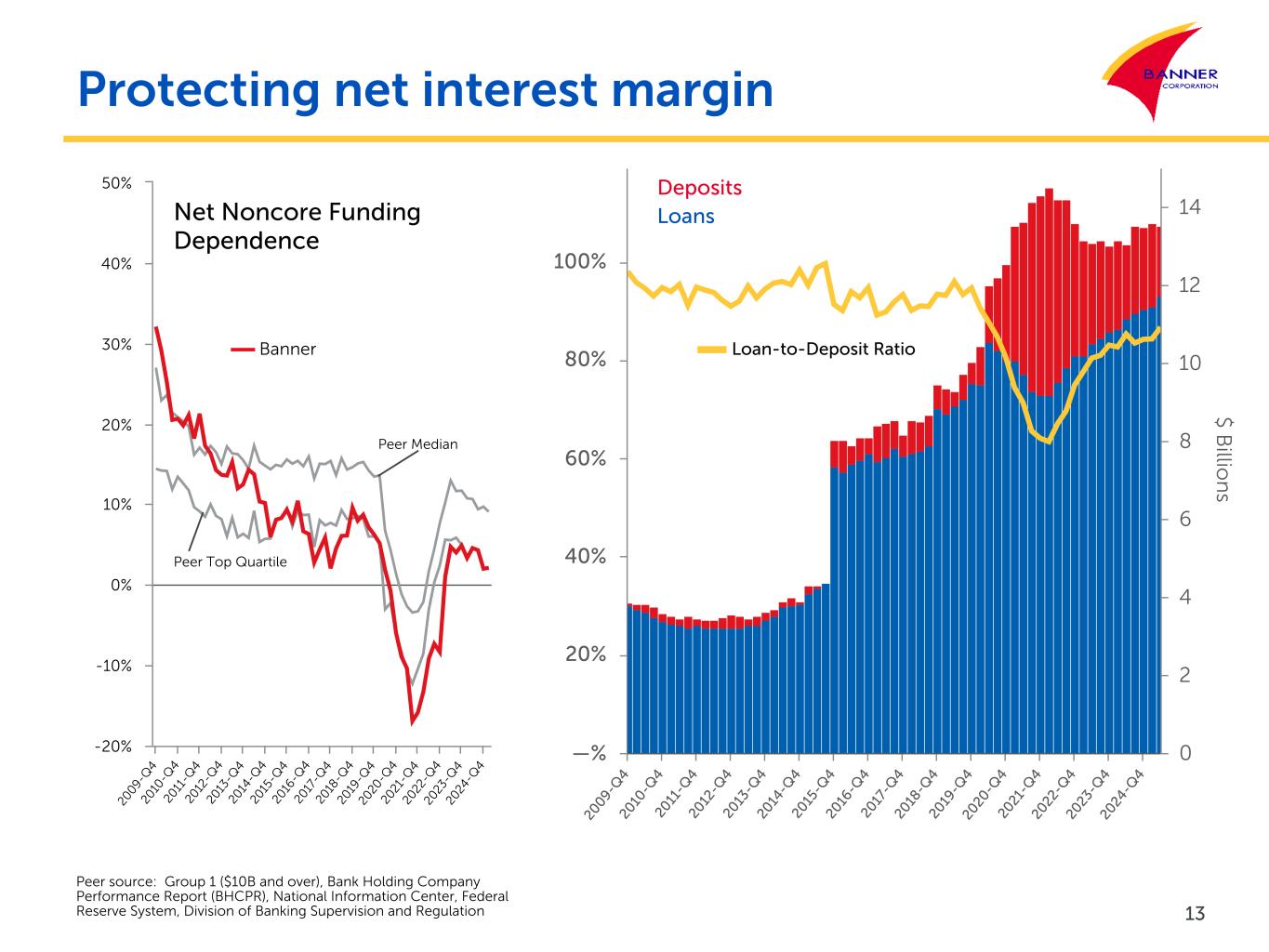

| Total deposits | 13,527,291 | 13,593,265 | 13,514,398 | 13,079,263 | — | % | 3 | % | ||||||||||||||||||||||||||||||

| Advances from FHLB | 565,000 | 168,000 | 290,000 | 398,000 | 236 | % | 42 | % | ||||||||||||||||||||||||||||||

| Other borrowings | 117,112 | 130,588 | 125,257 | 165,956 | (10) | % | (29) | % | ||||||||||||||||||||||||||||||

| Subordinated notes, net | — | 80,389 | 80,278 | 89,561 | (100) | % | (100) | % | ||||||||||||||||||||||||||||||

| Junior subordinated debentures at fair value | 73,366 | 67,711 | 67,477 | 66,831 | 8 | % | 10 | % | ||||||||||||||||||||||||||||||

| Operating lease liabilities | 41,696 | 40,466 | 43,472 | 44,056 | 3 | % | (5) | % | ||||||||||||||||||||||||||||||

| Accrued expenses and other liabilities | 200,194 | 210,771 | 258,070 | 235,515 | (5) | % | (15) | % | ||||||||||||||||||||||||||||||

| Deferred compensation | 46,846 | 46,169 | 46,759 | 46,246 | 1 | % | 1 | % | ||||||||||||||||||||||||||||||

| Total liabilities | 14,571,505 | 14,337,359 | 14,425,711 | 14,125,428 | 2 | % | 3 | % | ||||||||||||||||||||||||||||||

| SHAREHOLDERS’ EQUITY | ||||||||||||||||||||||||||||||||||||||

| Common stock | 1,309,004 | 1,308,967 | 1,307,509 | 1,302,236 | — | % | 1 | % | ||||||||||||||||||||||||||||||

| Retained earnings | 801,082 | 772,412 | 744,091 | 686,079 | 4 | % | 17 | % | ||||||||||||||||||||||||||||||

Accumulated other comprehensive loss |

(244,422) | (247,926) | (277,274) | (297,549) | (1) | % | (18) | % | ||||||||||||||||||||||||||||||

| Total shareholders’ equity | 1,865,664 | 1,833,453 | 1,774,326 | 1,690,766 | 2 | % | 10 | % | ||||||||||||||||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 16,437,169 | $ | 16,170,812 | $ | 16,200,037 | $ | 15,816,194 | 2 | % | 4 | % | ||||||||||||||||||||||||||

| Common Shares Issued: | ||||||||||||||||||||||||||||||||||||||

| Shares outstanding at end of period | 34,583,994 | 34,489,972 | 34,459,832 | 34,455,752 | ||||||||||||||||||||||||||||||||||

Common shareholders’ equity per share (1) |

$ | 53.95 | $ | 53.16 | $ | 51.49 | $ | 49.07 | ||||||||||||||||||||||||||||||

Common shareholders’ tangible equity per share (1) (2) |

$ | 43.09 | $ | 42.27 | $ | 40.57 | $ | 38.12 | ||||||||||||||||||||||||||||||

| Common shareholders’ equity to total assets | 11.35 | % | 11.34 | % | 10.95 | % | 10.69 | % | ||||||||||||||||||||||||||||||

Common shareholders’ tangible equity to tangible assets (2) |

9.28 | % | 9.23 | % | 8.84 | % | 8.51 | % | ||||||||||||||||||||||||||||||

| Consolidated Tier 1 leverage capital ratio | 11.29 | % | 11.22 | % | 11.05 | % | 10.80 | % | ||||||||||||||||||||||||||||||

| (1) | Calculation is based on number of common shares outstanding at the end of the period rather than weighted average shares outstanding. | ||||||||||||||||

| (2) | Common shareholders’ tangible equity and tangible assets exclude goodwill and other intangible assets. These ratios represent non-GAAP financial measures. See, “Additional Financial Information - Non-GAAP Financial Measures” on the final two pages of this press release for a reconciliation of non-GAAP financial measures. | ||||||||||||||||

| ADDITIONAL FINANCIAL INFORMATION | ||||||||||||||||||||||||||||||||||||||

| (dollars in thousands) | ||||||||||||||||||||||||||||||||||||||

| LOANS | Percentage Change | |||||||||||||||||||||||||||||||||||||

| Jun 30, 2025 | Mar 31, 2025 | Dec 31, 2024 | Jun 30, 2024 | Prior Qtr | Prior Yr Qtr | |||||||||||||||||||||||||||||||||

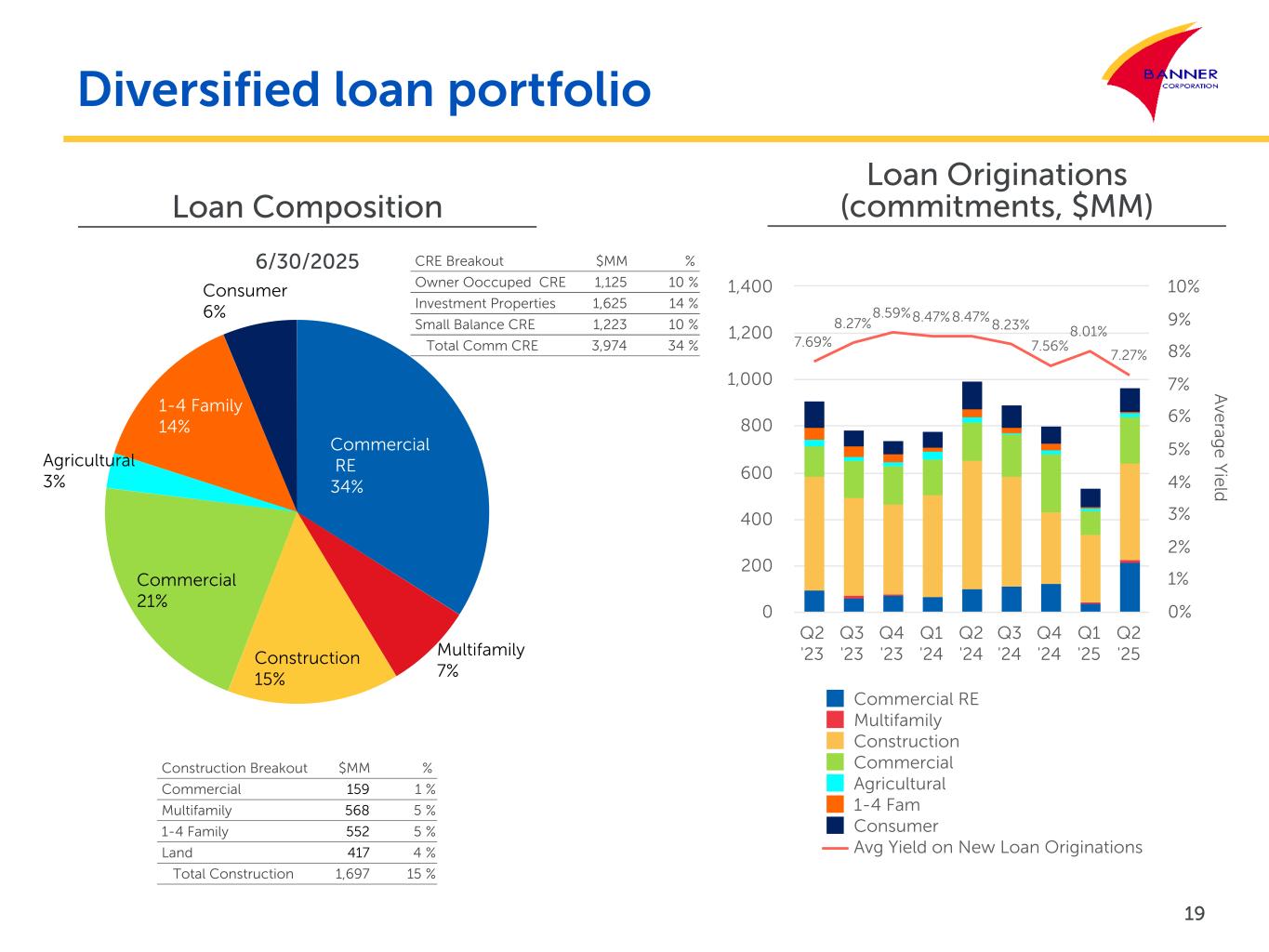

| Commercial real estate (CRE): | ||||||||||||||||||||||||||||||||||||||

| Owner-occupied | $ | 1,125,249 | $ | 1,020,829 | $ | 1,027,426 | $ | 950,922 | 10 | % | 18 | % | ||||||||||||||||||||||||||

| Investment properties | 1,625,001 | 1,598,387 | 1,623,672 | 1,536,142 | 2 | % | 6 | % | ||||||||||||||||||||||||||||||

| Small balance CRE | 1,223,477 | 1,217,458 | 1,213,792 | 1,234,302 | — | % | (1) | % | ||||||||||||||||||||||||||||||

| Multifamily real estate | 860,700 | 877,716 | 894,425 | 717,089 | (2) | % | 20 | % | ||||||||||||||||||||||||||||||

| Construction, land and land development: | ||||||||||||||||||||||||||||||||||||||

| Commercial construction | 159,222 | 146,467 | 122,362 | 173,296 | 9 | % | (8) | % | ||||||||||||||||||||||||||||||

| Multifamily construction | 568,058 | 618,942 | 513,706 | 663,989 | (8) | % | (14) | % | ||||||||||||||||||||||||||||||

| One- to four-family construction | 551,806 | 504,265 | 514,220 | 490,237 | 9 | % | 13 | % | ||||||||||||||||||||||||||||||

| Land and land development | 417,474 | 396,009 | 369,663 | 352,184 | 5 | % | 19 | % | ||||||||||||||||||||||||||||||

| Commercial business: | ||||||||||||||||||||||||||||||||||||||

| Commercial business | 1,318,483 | 1,283,754 | 1,318,333 | 1,298,134 | 3 | % | 2 | % | ||||||||||||||||||||||||||||||

| Small business scored | 1,152,531 | 1,122,550 | 1,104,117 | 1,074,465 | 3 | % | 7 | % | ||||||||||||||||||||||||||||||

| Agricultural business, including secured by farmland: | ||||||||||||||||||||||||||||||||||||||

| Agricultural business, including secured by farmland | 345,742 | 334,899 | 340,280 | 334,583 | 3 | % | 3 | % | ||||||||||||||||||||||||||||||

| One- to four-family residential | 1,610,133 | 1,600,283 | 1,591,260 | 1,603,266 | 1 | % | — | % | ||||||||||||||||||||||||||||||

| Consumer: | ||||||||||||||||||||||||||||||||||||||

| Consumer—home equity revolving lines of credit | 639,757 | 620,483 | 625,680 | 611,739 | 3 | % | 5 | % | ||||||||||||||||||||||||||||||

| Consumer—other | 92,740 | 96,754 | 95,720 | 103,500 | (4) | % | (10) | % | ||||||||||||||||||||||||||||||

| Total loans receivable | $ | 11,690,373 | $ | 11,438,796 | $ | 11,354,656 | $ | 11,143,848 | 2 | % | 5 | % | ||||||||||||||||||||||||||

| Loans 30 - 89 days past due and on accrual | $ | 10,786 | $ | 37,339 | $ | 26,824 | $ | 11,850 | ||||||||||||||||||||||||||||||

| Total delinquent loans (including loans on non-accrual), net | $ | 47,764 | $ | 71,927 | $ | 55,432 | $ | 32,081 | ||||||||||||||||||||||||||||||

| Total delinquent loans / Total loans receivable | 0.41 | % | 0.63 | % | 0.49 | % | 0.29 | % | ||||||||||||||||||||||||||||||

| LOANS BY GEOGRAPHIC LOCATION | Percentage Change | |||||||||||||||||||||||||||||||||||||||||||

| Jun 30, 2025 | Mar 31, 2025 | Dec 31, 2024 | Jun 30, 2024 | Prior Qtr | Prior Yr Qtr | |||||||||||||||||||||||||||||||||||||||

| Amount | Percentage | Amount | Amount | Amount | ||||||||||||||||||||||||||||||||||||||||

| Washington | $ | 5,438,285 | 47 | % | $ | 5,260,906 | $ | 5,245,886 | $ | 5,182,378 | 3 | % | 5 | % | ||||||||||||||||||||||||||||||

| California | 3,010,678 | 26 | % | 2,927,835 | 2,861,435 | 2,787,190 | 3 | % | 8 | % | ||||||||||||||||||||||||||||||||||

| Oregon | 2,141,185 | 17 | % | 2,122,953 | 2,113,229 | 2,072,153 | 1 | % | 3 | % | ||||||||||||||||||||||||||||||||||

| Idaho | 671,217 | 6 | % | 665,625 | 665,158 | 641,209 | 1 | % | 5 | % | ||||||||||||||||||||||||||||||||||

| Utah | 70,474 | 1 | % | 88,858 | 82,459 | 80,295 | (21) | % | (12) | % | ||||||||||||||||||||||||||||||||||

| Other | 358,534 | 3 | % | 372,619 | 386,489 | 380,623 | (4) | % | (6) | % | ||||||||||||||||||||||||||||||||||

| Total loans receivable | $ | 11,690,373 | 100 | % | $ | 11,438,796 | $ | 11,354,656 | $ | 11,143,848 | 2 | % | 5 | % | ||||||||||||||||||||||||||||||

| LOAN ORIGINATIONS | Quarters Ended | ||||||||||||||||

| Jun 30, 2025 | Mar 31, 2025 | Jun 30, 2024 | |||||||||||||||

| Commercial real estate | $ | 216,189 | $ | 37,041 | $ | 102,258 | |||||||||||

| Multifamily real estate | 13,065 | 9,555 | 2,774 | ||||||||||||||

| Construction and land | 411,210 | 287,565 | 546,675 | ||||||||||||||

| Commercial business | 203,656 | 103,739 | 167,168 | ||||||||||||||

| Agricultural business | 14,414 | 12,765 | 22,255 | ||||||||||||||

| One-to four-family residential | 5,491 | 5,139 | 34,498 | ||||||||||||||

| Consumer | 102,600 | 80,030 | 120,470 | ||||||||||||||

| Total loan originations (excluding loans held for sale) | $ | 966,625 | $ | 535,834 | $ | 996,098 | |||||||||||

| ADDITIONAL FINANCIAL INFORMATION | ||||||||||||||||||||

| (dollars in thousands) | ||||||||||||||||||||

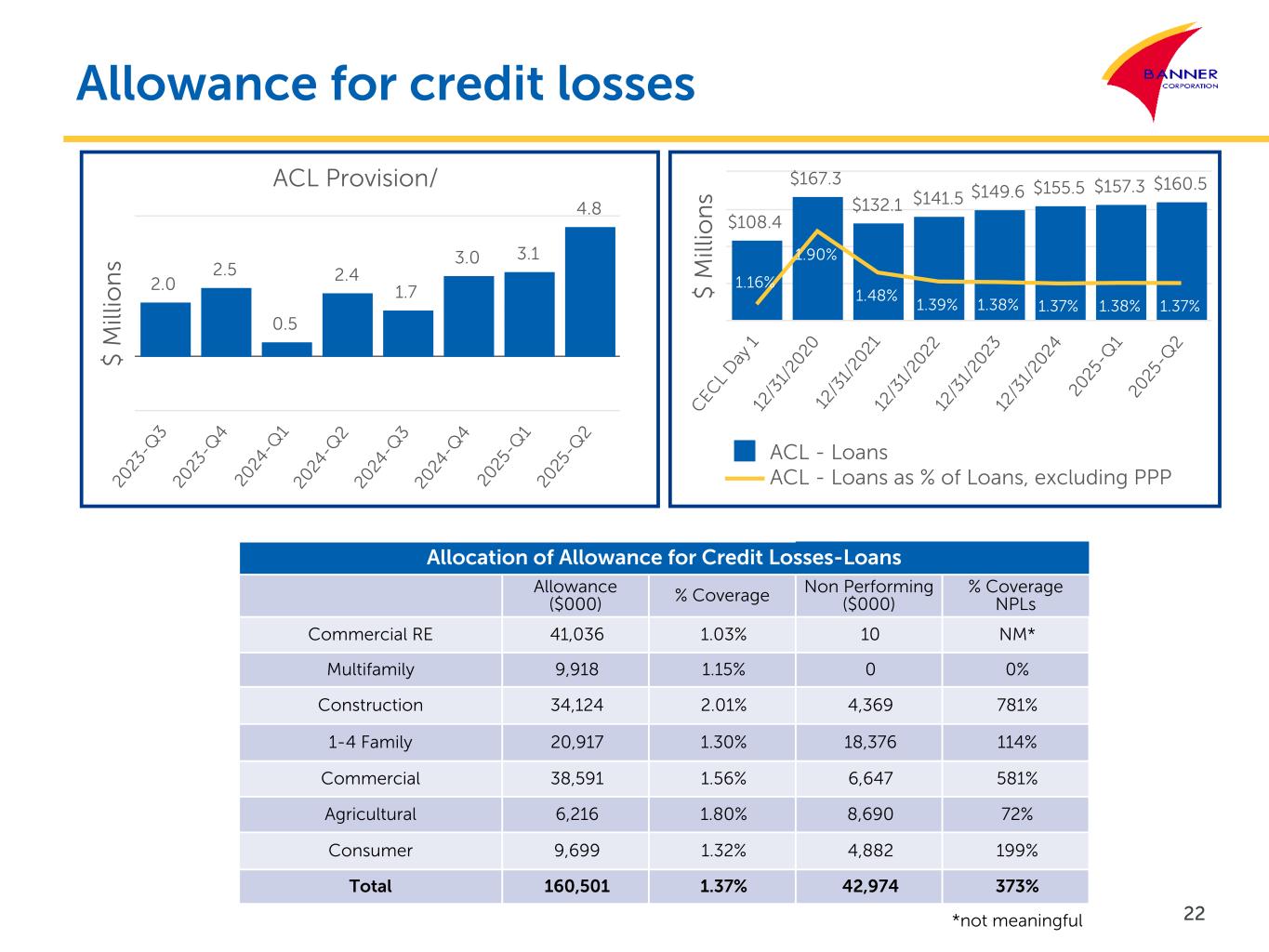

| CHANGE IN THE ALLOWANCE FOR CREDIT LOSSES – LOANS | Quarters Ended |

|||||||||||||||||||

| Jun 30, 2025 | Mar 31, 2025 | Jun 30, 2024 | ||||||||||||||||||

| Balance, beginning of period | $ | 157,323 | $ | 155,521 | $ | 151,140 | ||||||||||||||

| Provision for credit losses – loans | 4,201 | 4,549 | 1,953 | |||||||||||||||||

| Recoveries of loans previously charged off: | ||||||||||||||||||||

| Commercial real estate | 53 | 57 | 98 | |||||||||||||||||

| One- to four-family real estate | 58 | 188 | 17 | |||||||||||||||||

| Commercial business | 361 | 557 | 324 | |||||||||||||||||

| Agricultural business, including secured by farmland | 1 | 10 | 195 | |||||||||||||||||

| Consumer | 168 | 119 | 112 | |||||||||||||||||

| 641 | 931 | 746 | ||||||||||||||||||

| Loans charged off: | ||||||||||||||||||||

| Commercial real estate | — | — | (347) | |||||||||||||||||

| Construction and land | — | — | — | |||||||||||||||||

| One- to four-family real estate | — | (13) | — | |||||||||||||||||

| Commercial business | (892) | (3,301) | (137) | |||||||||||||||||

| Agricultural business, including secured by farmland | (362) | — | — | |||||||||||||||||

| Consumer | (410) | (364) | (507) | |||||||||||||||||

| (1,664) | (3,678) | (991) | ||||||||||||||||||

| Net charge-offs | (1,023) | (2,747) | (245) | |||||||||||||||||

| Balance, end of period | $ | 160,501 | $ | 157,323 | $ | 152,848 | ||||||||||||||

| Net (charge-offs) recoveries / Average loans receivable | (0.009) | % | (0.024) | % | (0.002) | % | ||||||||||||||

| ALLOCATION OF ALLOWANCE FOR CREDIT LOSSES – LOANS | Jun 30, 2025 | Mar 31, 2025 | Dec 31, 2024 | Jun 30, 2024 | ||||||||||||||||||||||

| Commercial real estate | $ | 41,036 | $ | 40,076 | $ | 40,830 | $ | 39,064 | ||||||||||||||||||

| Multifamily real estate | 9,918 | 10,109 | 10,308 | 8,253 | ||||||||||||||||||||||

| Construction and land | 34,124 | 32,042 | 29,038 | 31,597 | ||||||||||||||||||||||

| One- to four-family real estate | 20,917 | 20,752 | 20,807 | 20,906 | ||||||||||||||||||||||

| Commercial business | 38,591 | 38,665 | 38,611 | 38,835 | ||||||||||||||||||||||

| Agricultural business, including secured by farmland | 6,216 | 5,641 | 5,727 | 4,045 | ||||||||||||||||||||||

| Consumer | 9,699 | 10,038 | 10,200 | 10,148 | ||||||||||||||||||||||

| Total allowance for credit losses – loans | $ | 160,501 | $ | 157,323 | $ | 155,521 | $ | 152,848 | ||||||||||||||||||

| Allowance for credit losses - loans / Total loans receivable | 1.37 | % | 1.38 | % | 1.37 | % | 1.37 | % | ||||||||||||||||||

| Allowance for credit losses - loans / Non-performing loans | 373 | % | 404 | % | 421 | % | 498 | % | ||||||||||||||||||

| CHANGE IN THE ALLOWANCE FOR CREDIT LOSSES - UNFUNDED LOAN COMMITMENTS | Quarters Ended |

|||||||||||||||||||

| Jun 30, 2025 | Mar 31, 2025 | Jun 30, 2024 | ||||||||||||||||||

| Balance, beginning of period | $ | 12,162 | $ | 13,562 | $ | 13,597 | ||||||||||||||

| Provision (recapture) for credit losses - unfunded loan commitments | 588 | (1,400) | 430 | |||||||||||||||||

| Balance, end of period | $ | 12,750 | $ | 12,162 | $ | 14,027 | ||||||||||||||

| ADDITIONAL FINANCIAL INFORMATION | |||||||||||||||||||||||

| (dollars in thousands) | |||||||||||||||||||||||

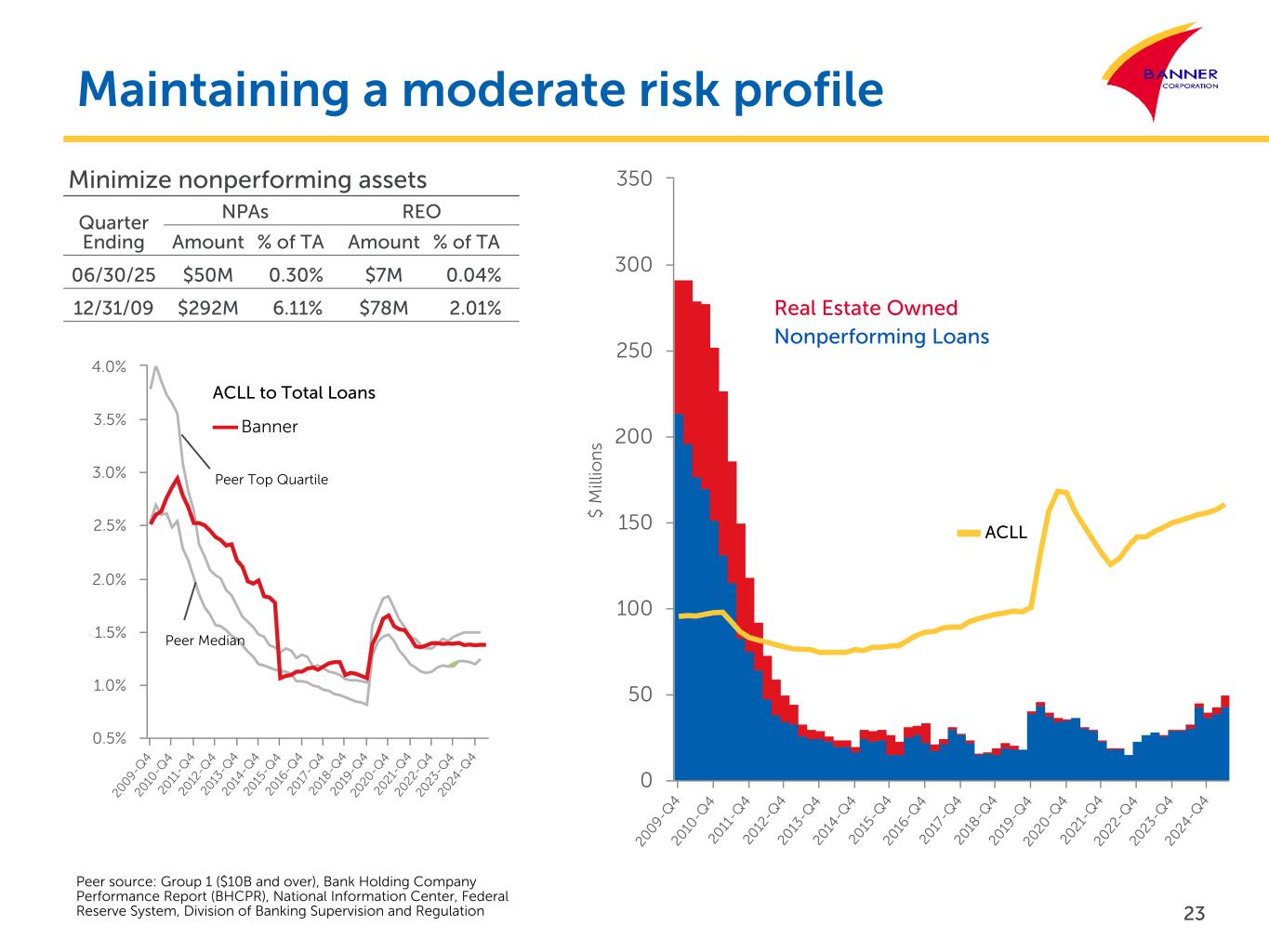

| NON-PERFORMING ASSETS | Jun 30, 2025 | Mar 31, 2025 | Dec 31, 2024 | Jun 30, 2024 | |||||||||||||||||||

| Loans on non-accrual status: | |||||||||||||||||||||||

| Secured by real estate: | |||||||||||||||||||||||

| Commercial | $ | 10 | $ | 2,182 | $ | 2,186 | $ | 2,326 | |||||||||||||||

| Construction and land | 4,369 | 4,359 | 3,963 | 3,999 | |||||||||||||||||||

| One- to four-family | 15,480 | 10,448 | 10,016 | 8,184 | |||||||||||||||||||

| Commercial business | 6,647 | 6,425 | 7,067 | 8,694 | |||||||||||||||||||

| Agricultural business, including secured by farmland | 8,690 | 10,301 | 8,485 | 1,586 | |||||||||||||||||||

| Consumer | 4,802 | 4,874 | 4,835 | 3,380 | |||||||||||||||||||

| 39,998 | 38,589 | 36,552 | 28,169 | ||||||||||||||||||||

| Loans more than 90 days delinquent, still on accrual: | |||||||||||||||||||||||

| Secured by real estate: | |||||||||||||||||||||||

| One- to four-family | 2,896 | 9 | 369 | 1,861 | |||||||||||||||||||

| Commercial business | — | 206 | — | — | |||||||||||||||||||

| Consumer | 80 | 155 | 35 | 692 | |||||||||||||||||||

| 2,976 | 370 | 404 | 2,553 | ||||||||||||||||||||

| Total non-performing loans | 42,974 | 38,959 | 36,956 | 30,722 | |||||||||||||||||||

| REO | 6,801 | 3,468 | 2,367 | 2,564 | |||||||||||||||||||

| Other repossessed assets | — | 300 | 300 | — | |||||||||||||||||||

| Total non-performing assets | $ | 49,775 | $ | 42,727 | $ | 39,623 | $ | 33,286 | |||||||||||||||

| Total non-performing assets to total assets | 0.30 | % | 0.26 | % | 0.24 | % | 0.21 | % | |||||||||||||||

| LOANS BY CREDIT RISK RATING | Jun 30, 2025 | Mar 31, 2025 | Dec 31, 2024 | Jun 30, 2024 | |||||||||||||||||||

| Pass | $ | 11,432,456 | $ | 11,207,852 | $ | 11,118,744 | $ | 10,971,850 | |||||||||||||||

| Special Mention | 68,372 | 33,133 | 43,451 | 50,027 | |||||||||||||||||||

| Substandard | 189,545 | 197,811 | 192,461 | 121,971 | |||||||||||||||||||

| Total | $ | 11,690,373 | $ | 11,438,796 | $ | 11,354,656 | $ | 11,143,848 | |||||||||||||||

| ADDITIONAL FINANCIAL INFORMATION | ||||||||||||||||||||||||||||||||||||||

| (dollars in thousands) | ||||||||||||||||||||||||||||||||||||||

| DEPOSIT COMPOSITION | Percentage Change | |||||||||||||||||||||||||||||||||||||

| Jun 30, 2025 | Mar 31, 2025 | Dec 31, 2024 | Jun 30, 2024 | Prior Qtr | Prior Yr Qtr | |||||||||||||||||||||||||||||||||

| Non-interest-bearing | $ | 4,504,491 | $ | 4,571,598 | $ | 4,591,543 | $ | 4,537,803 | (1) | % | (1) | % | ||||||||||||||||||||||||||

| Interest-bearing checking | 2,534,900 | 2,431,279 | 2,393,864 | 2,208,742 | 4 | % | 15 | % | ||||||||||||||||||||||||||||||

| Regular savings accounts | 3,538,372 | 3,542,005 | 3,478,423 | 3,192,036 | — | % | 11 | % | ||||||||||||||||||||||||||||||

| Money market accounts | 1,471,756 | 1,544,333 | 1,550,896 | 1,615,549 | (5) | % | (9) | % | ||||||||||||||||||||||||||||||

| Total interest-bearing transaction and savings accounts | 7,545,028 | 7,517,617 | 7,423,183 | 7,016,327 | — | % | 8 | % | ||||||||||||||||||||||||||||||

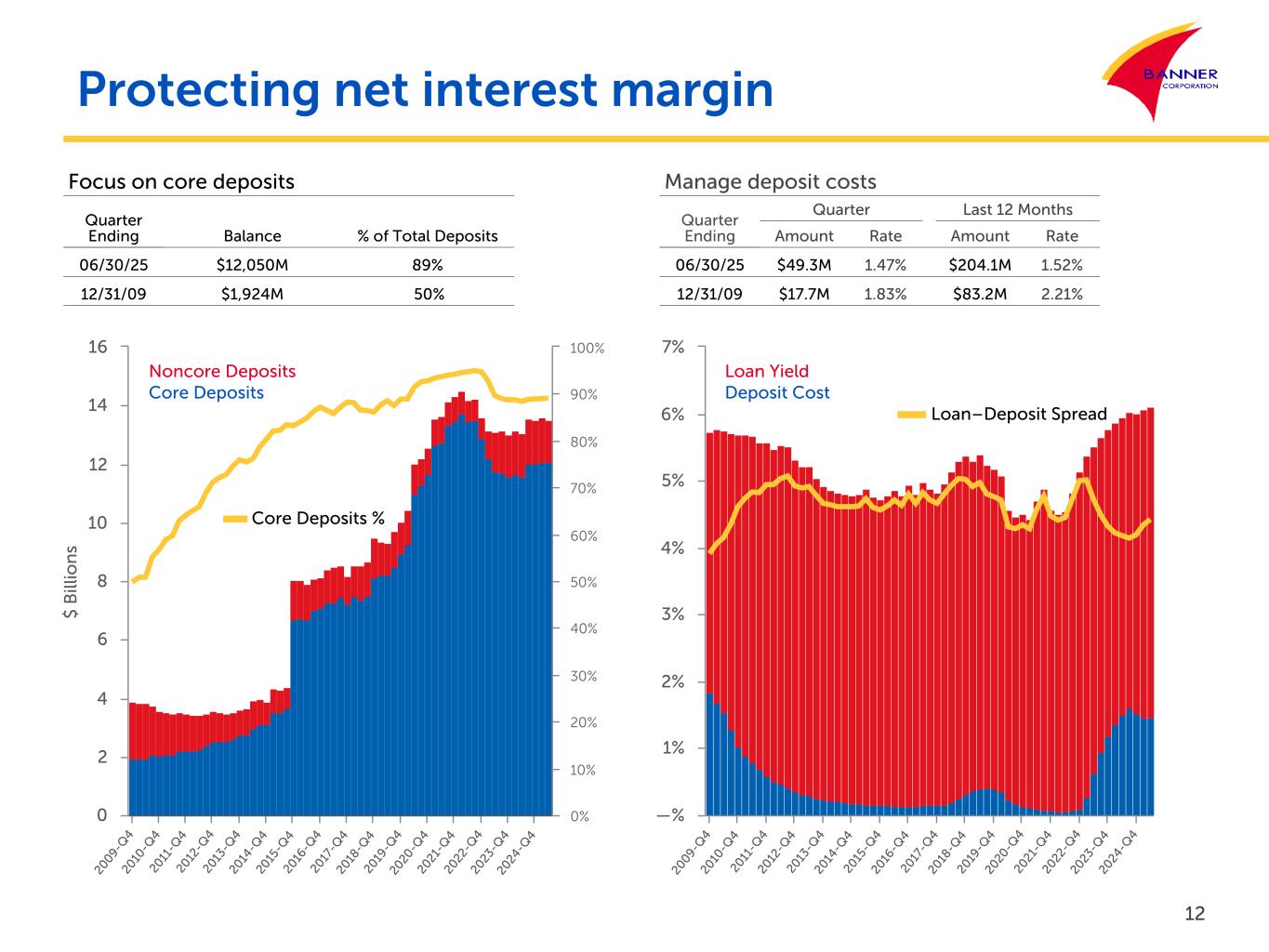

| Total core deposits | 12,049,519 | 12,089,215 | 12,014,726 | 11,554,130 | — | % | 4 | % | ||||||||||||||||||||||||||||||

| Interest-bearing certificates | 1,477,772 | 1,504,050 | 1,499,672 | 1,525,133 | (2) | % | (3) | % | ||||||||||||||||||||||||||||||

| Total deposits | $ | 13,527,291 | $ | 13,593,265 | $ | 13,514,398 | $ | 13,079,263 | — | % | 3 | % | ||||||||||||||||||||||||||

| GEOGRAPHIC CONCENTRATION OF DEPOSITS | Jun 30, 2025 | Mar 31, 2025 | Dec 31, 2024 | Jun 30, 2024 | Percentage Change | |||||||||||||||||||||||||||||||||||||||

| Amount | Percentage | Amount | Amount | Amount | Prior Qtr | Prior Yr Qtr | ||||||||||||||||||||||||||||||||||||||

| Washington | $ | 7,334,391 | 55 | % | $ | 7,394,201 | $ | 7,441,413 | $ | 7,171,699 | (1) | % | 2 | % | ||||||||||||||||||||||||||||||

| Oregon | 3,029,712 | 22 | % | 3,045,078 | 2,981,327 | 2,909,838 | (1) | % | 4 | % | ||||||||||||||||||||||||||||||||||

| California | 2,486,514 | 18 | % | 2,463,012 | 2,392,573 | 2,331,793 | 1 | % | 7 | % | ||||||||||||||||||||||||||||||||||

| Idaho | 676,674 | 5 | % | 690,974 | 699,085 | 665,933 | (2) | % | 2 | % | ||||||||||||||||||||||||||||||||||

| Total deposits | $ | 13,527,291 | 100 | % | $ | 13,593,265 | $ | 13,514,398 | $ | 13,079,263 | — | % | 3 | % | ||||||||||||||||||||||||||||||

| INCLUDED IN TOTAL DEPOSITS | Jun 30, 2025 | Mar 31, 2025 | Dec 31, 2024 | Jun 30, 2024 | ||||||||||||||||||||||

| Public non-interest-bearing accounts | $ | 151,484 | $ | 146,390 | $ | 165,667 | $ | 149,012 | ||||||||||||||||||

| Public interest-bearing transaction & savings accounts | 250,350 | 239,707 | 248,746 | 250,136 | ||||||||||||||||||||||

| Public interest-bearing certificates | 21,272 | 24,226 | 25,423 | 29,101 | ||||||||||||||||||||||

| Total public deposits | $ | 423,106 | $ | 410,323 | $ | 439,836 | $ | 428,249 | ||||||||||||||||||

| Collateralized public deposits | $ | 329,416 | $ | 313,445 | $ | 336,376 | $ | 326,524 | ||||||||||||||||||

| Total brokered deposits | $ | 49,977 | $ | 75,321 | $ | 50,346 | $ | 105,309 | ||||||||||||||||||

| AVERAGE ACCOUNT BALANCE PER DEPOSIT ACCOUNT | Jun 30, 2025 | Mar 31, 2025 | Dec 31, 2024 | Jun 30, 2024 | ||||||||||||||||||||||

| Number of deposit accounts | 451,185 | 453,808 | 460,004 | 460,107 | ||||||||||||||||||||||

| Average account balance per account | $ | 30 | $ | 30 | $ | 30 | $ | 29 | ||||||||||||||||||

| ADDITIONAL FINANCIAL INFORMATION | ||||||||||||||||||||||||||||||||||||||

| (dollars in thousands) | ||||||||||||||||||||||||||||||||||||||

| ESTIMATED REGULATORY CAPITAL RATIOS AS OF JUNE 30, 2025 | Actual | Minimum to be categorized as "Adequately Capitalized" | Minimum to be categorized as "Well Capitalized" |

|||||||||||||||||||||||||||||||||||

| Amount | Ratio | Amount | Ratio | Amount | Ratio | |||||||||||||||||||||||||||||||||

| Banner Corporation-consolidated: | ||||||||||||||||||||||||||||||||||||||

| Total capital to risk-weighted assets | $ | 1,984,862 | 14.51 | % | $ | 1,094,505 | 8.00 | % | $ | 1,368,131 | 10.00 | % | ||||||||||||||||||||||||||

| Tier 1 capital to risk-weighted assets | 1,813,814 | 13.26 | % | 820,879 | 6.00 | % | 820,879 | 6.00 | % | |||||||||||||||||||||||||||||

| Tier 1 leverage capital to average assets | 1,813,814 | 11.29 | % | 642,519 | 4.00 | % | n/a | n/a | ||||||||||||||||||||||||||||||

| Common equity tier 1 capital to risk-weighted assets | 1,727,314 | 12.63 | % | 615,659 | 4.50 | % | n/a | n/a | ||||||||||||||||||||||||||||||

| Banner Bank: | ||||||||||||||||||||||||||||||||||||||

| Total capital to risk-weighted assets | 1,909,529 | 13.96 | % | 1,094,267 | 8.00 | % | 1,367,834 | 10.00 | % | |||||||||||||||||||||||||||||

| Tier 1 capital to risk-weighted assets | 1,738,518 | 12.71 | % | 820,700 | 6.00 | % | 1,094,267 | 8.00 | % | |||||||||||||||||||||||||||||

| Tier 1 leverage capital to average assets | 1,738,518 | 10.81 | % | 643,174 | 4.00 | % | 803,968 | 5.00 | % | |||||||||||||||||||||||||||||

| Common equity tier 1 capital to risk-weighted assets | 1,738,518 | 12.71 | % | 615,525 | 4.50 | % | 889,092 | 6.50 | % | |||||||||||||||||||||||||||||

| ADDITIONAL FINANCIAL INFORMATION | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| (dollars in thousands) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| (rates / ratios annualized) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| ANALYSIS OF NET INTEREST SPREAD | Quarters Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Jun 30, 2025 | Mar 31, 2025 | Jun 30, 2024 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Average Balance | Interest and Dividends | Yield / Cost (3) |

Average Balance | Interest and Dividends | Yield / Cost (3) |

Average Balance | Interest and Dividends | Yield / Cost (3) |

|||||||||||||||||||||||||||||||||||||||||||||

| Interest-earning assets: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Held for sale loans |

$ | 29,936 | $ | 503 | 6.74 | % | $ | 22,457 | $ | 357 | 6.45 | % | $ | 11,665 | $ | 206 | 7.10 | % | |||||||||||||||||||||||||||||||||||

Mortgage loans |

9,565,357 | 143,909 | 6.03 | % | 9,366,213 | 137,724 | 5.96 | % | 9,006,857 | 129,230 | 5.77 | % | |||||||||||||||||||||||||||||||||||||||||

Commercial/agricultural loans |

1,924,092 | 31,196 | 6.50 | % | 1,907,212 | 30,752 | 6.54 | % | 1,874,039 | 31,761 | 6.82 | % | |||||||||||||||||||||||||||||||||||||||||

Consumer and other loans |

121,142 | 2,087 | 6.91 | % | 121,492 | 2,092 | 6.98 | % | 132,661 | 2,156 | 6.54 | % | |||||||||||||||||||||||||||||||||||||||||

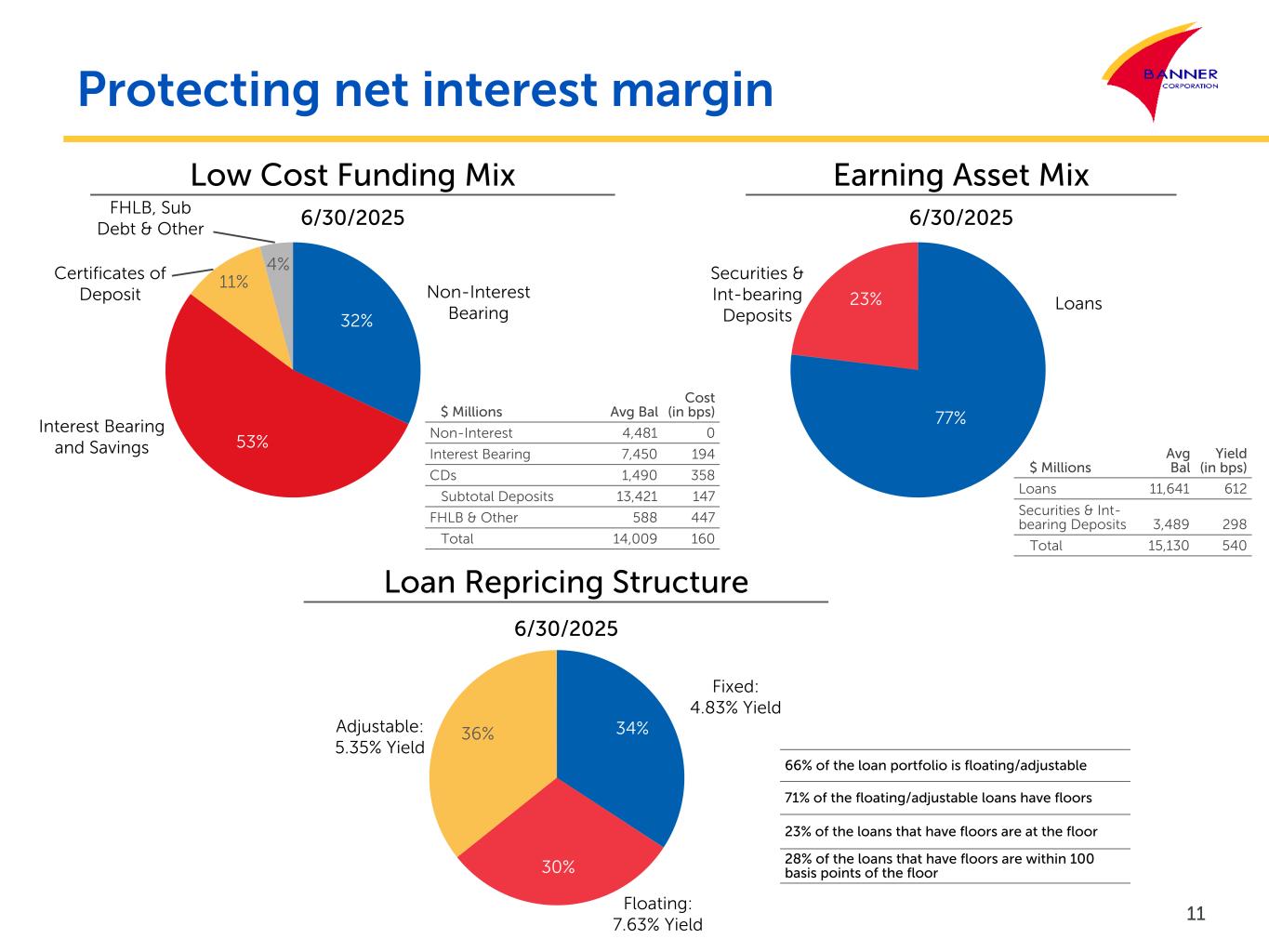

Total loans (1) |

11,640,527 | 177,695 | 6.12 | % | 11,417,374 | 170,925 | 6.07 | % | 11,025,222 | 163,353 | 5.96 | % | |||||||||||||||||||||||||||||||||||||||||

Mortgage-backed securities |

2,496,972 | 15,576 | 2.50 | % | 2,542,983 | 15,895 | 2.53 | % | 2,672,187 | 16,850 | 2.54 | % | |||||||||||||||||||||||||||||||||||||||||

Other securities |

893,062 | 9,561 | 4.29 | % | 902,732 | 9,687 | 4.35 | % | 958,809 | 11,181 | 4.69 | % | |||||||||||||||||||||||||||||||||||||||||

Interest-bearing deposits with banks |

75,539 | 577 | 3.06 | % | 65,758 | 484 | 2.99 | % | 58,022 | 578 | 4.01 | % | |||||||||||||||||||||||||||||||||||||||||

FHLB stock |

23,077 | 222 | 3.86 | % | 12,804 | 149 | 4.72 | % | 21,080 | 365 | 6.96 | % | |||||||||||||||||||||||||||||||||||||||||

| Total investment securities | 3,488,650 | 25,936 | 2.98 | % | 3,524,277 | 26,215 | 3.02 | % | 3,710,098 | 28,974 | 3.14 | % | |||||||||||||||||||||||||||||||||||||||||

Total interest-earning assets |

15,129,177 | 203,631 | 5.40 | % | 14,941,651 | 197,140 | 5.35 | % | 14,735,320 | 192,327 | 5.25 | % | |||||||||||||||||||||||||||||||||||||||||

| Non-interest-earning assets | 994,003 | 1,006,497 | 926,411 | ||||||||||||||||||||||||||||||||||||||||||||||||||

Total assets |

$ | 16,123,180 | $ | 15,948,148 | $ | 15,661,731 | |||||||||||||||||||||||||||||||||||||||||||||||

| Deposits: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

Interest-bearing checking accounts |

$ | 2,465,015 | 9,462 | 1.54 | % | $ | 2,381,106 | 8,537 | 1.45 | % | $ | 2,156,214 | 7,621 | 1.42 | % | ||||||||||||||||||||||||||||||||||||||

Savings accounts |

3,493,965 | 18,837 | 2.16 | % | 3,450,908 | 18,103 | 2.13 | % | 3,147,522 | 17,200 | 2.20 | % | |||||||||||||||||||||||||||||||||||||||||

Money market accounts |

1,492,229 | 7,729 | 2.08 | % | 1,555,262 | 7,860 | 2.05 | % | 1,659,327 | 9,124 | 2.21 | % | |||||||||||||||||||||||||||||||||||||||||

Certificates of deposit |

1,489,611 | 13,288 | 3.58 | % | 1,531,428 | 14,237 | 3.77 | % | 1,503,597 | 14,905 | 3.99 | % | |||||||||||||||||||||||||||||||||||||||||

Total interest-bearing deposits |

8,940,820 | 49,316 | 2.21 | % | 8,918,704 | 48,737 | 2.22 | % | 8,466,660 | 48,850 | 2.32 | % | |||||||||||||||||||||||||||||||||||||||||

Non-interest-bearing deposits |

4,480,579 | — | — | % | 4,526,596 | — | — | % | 4,634,738 | — | — | % | |||||||||||||||||||||||||||||||||||||||||

Total deposits |

13,421,399 | 49,316 | 1.47 | % | 13,445,300 | 48,737 | 1.47 | % | 13,101,398 | 48,850 | 1.50 | % | |||||||||||||||||||||||||||||||||||||||||

| Other interest-bearing liabilities: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

FHLB advances |

296,671 | 3,370 | 4.56 | % | 75,300 | 860 | 4.63 | % | 259,549 | 3,621 | 5.61 | % | |||||||||||||||||||||||||||||||||||||||||

Other borrowings |

122,227 | 675 | 2.22 | % | 134,761 | 694 | 2.09 | % | 175,518 | 1,160 | 2.66 | % | |||||||||||||||||||||||||||||||||||||||||

Junior subordinated debentures and subordinated notes |

168,793 | 2,499 | 5.94 | % | 169,678 | 2,494 | 5.96 | % | 179,178 | 2,961 | 6.65 | % | |||||||||||||||||||||||||||||||||||||||||

Total borrowings |

587,691 | 6,544 | 4.47 | % | 379,739 | 4,048 | 4.32 | % | 614,245 | 7,742 | 5.07 | % | |||||||||||||||||||||||||||||||||||||||||

Total funding liabilities |

14,009,090 | 55,860 | 1.60 | % | 13,825,039 | 52,785 | 1.55 | % | 13,715,643 | 56,592 | 1.66 | % | |||||||||||||||||||||||||||||||||||||||||

Other non-interest-bearing liabilities (2) |

274,407 | 324,031 | 294,794 | ||||||||||||||||||||||||||||||||||||||||||||||||||

Total liabilities |

14,283,497 | 14,149,070 | 14,010,437 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Shareholders’ equity | 1,839,683 | 1,799,078 | 1,651,294 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 16,123,180 | $ | 15,948,148 | $ | 15,661,731 | |||||||||||||||||||||||||||||||||||||||||||||||

| Net interest income/rate spread (tax equivalent) | $ | 147,771 | 3.80 | % | $ | 144,355 | 3.80 | % | $ | 135,735 | 3.59 | % | |||||||||||||||||||||||||||||||||||||||||

| Net interest margin (tax equivalent) | 3.92 | % | 3.92 | % | 3.70 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Reconciliation to reported net interest income: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjustments for taxable equivalent basis | (3,372) | (3,272) | (3,189) | ||||||||||||||||||||||||||||||||||||||||||||||||||

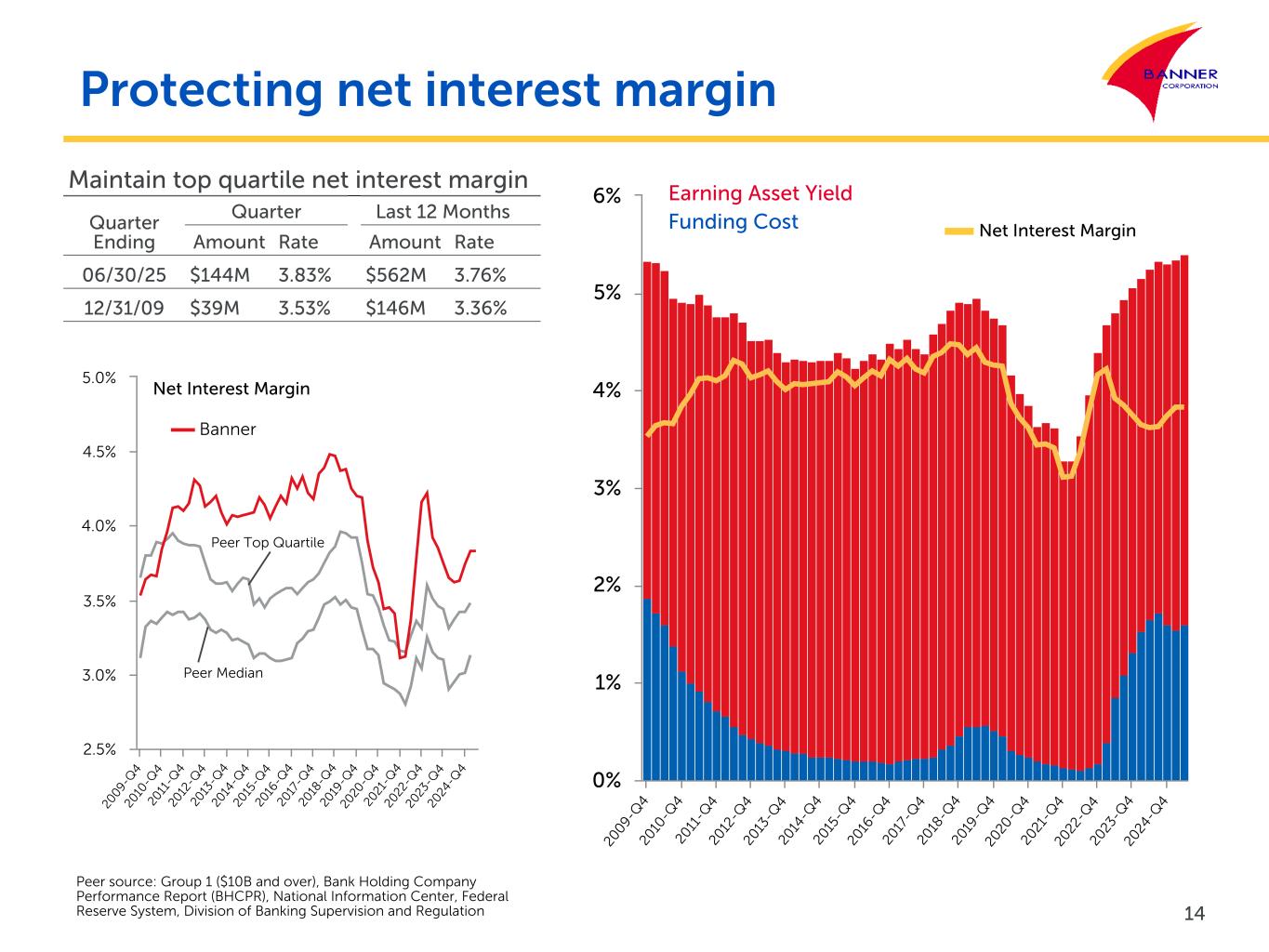

| Net interest income and margin, as reported | $ | 144,399 | 3.83 | % | $ | 141,083 | 3.83 | % | $ | 132,546 | 3.62 | % | |||||||||||||||||||||||||||||||||||||||||

| Additional Key Financial Ratios: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Return on average assets | 1.13 | % | 1.15 | % | 1.02 | % | |||||||||||||||||||||||||||||||||||||||||||||||

Adjusted return on average assets (4) |

1.16 | % | 1.14 | % | 1.04 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Return on average equity | 9.92 | % | 10.17 | % | 9.69 | % | |||||||||||||||||||||||||||||||||||||||||||||||

Adjusted return on average equity (4) |

10.20 | % | 10.12 | % | 9.83 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Average equity/average assets | 11.41 | % | 11.28 | % | 10.54 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Average interest-earning assets/average interest-bearing liabilities | 158.78 | % | 160.69 | % | 162.27 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Average interest-earning assets/average funding liabilities | 108.00 | % | 108.08 | % | 107.43 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Non-interest income/average assets | 0.44 | % | 0.49 | % | 0.44 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Non-interest expense/average assets | 2.52 | % | 2.57 | % | 2.52 | % | |||||||||||||||||||||||||||||||||||||||||||||||

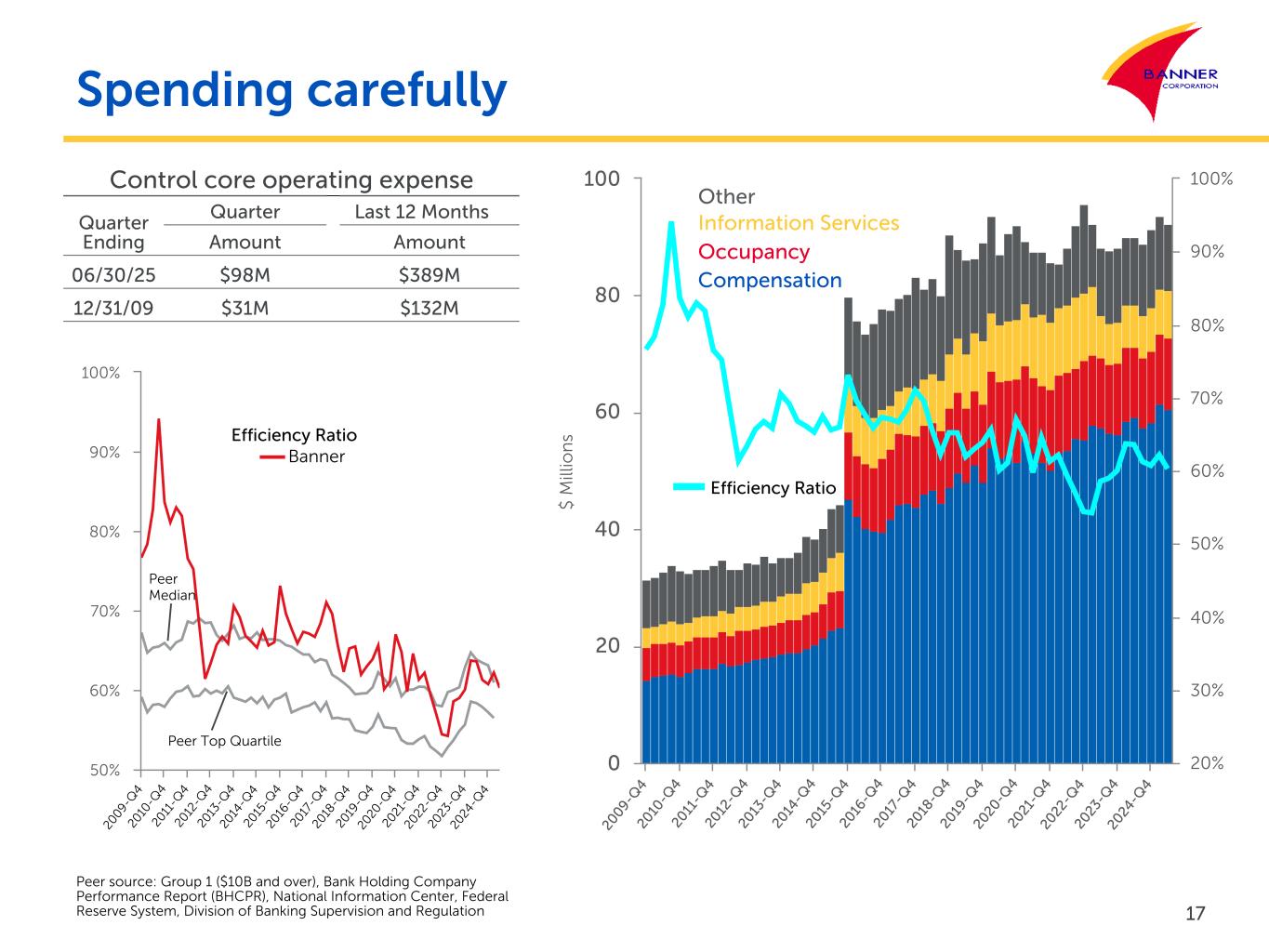

| Efficiency ratio | 62.50 | % | 63.21 | % | 65.53 | % | |||||||||||||||||||||||||||||||||||||||||||||||

Adjusted efficiency ratio (4) |

60.28 | % | 62.18 | % | 63.60 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| ADDITIONAL FINANCIAL INFORMATION | |||||||||||||||||||||||||||||||||||

| (dollars in thousands) | |||||||||||||||||||||||||||||||||||

| (rates / ratios annualized) | |||||||||||||||||||||||||||||||||||

| ANALYSIS OF NET INTEREST SPREAD | Six Months Ended | ||||||||||||||||||||||||||||||||||

| Jun 30, 2025 | Jun 30, 2024 | ||||||||||||||||||||||||||||||||||

| Average Balance | Interest and Dividends | Yield/Cost (3) |

Average Balance | Interest and Dividends | Yield/Cost (3) |

||||||||||||||||||||||||||||||

| Interest-earning assets: | |||||||||||||||||||||||||||||||||||

Held for sale loans |

$ | 26,217 | $ | 860 | 6.61 | % | $ | 10,802 | $ | 373 | 6.94 | % | |||||||||||||||||||||||

Mortgage loans |

9,466,335 | 281,633 | 6.00 | % | 8,949,709 | 254,514 | 5.72 | % | |||||||||||||||||||||||||||

Commercial/agricultural loans |

1,915,699 | 61,948 | 6.52 | % | 1,852,067 | 62,608 | 6.80 | % | |||||||||||||||||||||||||||

Consumer and other loans |

121,316 | 4,179 | 6.95 | % | 133,258 | 4,352 | 6.57 | % | |||||||||||||||||||||||||||

Total loans (1) |

11,529,567 | 348,620 | 6.10 | % | 10,945,836 | 321,847 | 5.91 | % | |||||||||||||||||||||||||||

Mortgage-backed securities |

2,519,851 | 31,471 | 2.52 | % | 2,700,413 | 33,926 | 2.53 | % | |||||||||||||||||||||||||||

Other securities |

897,870 | 19,248 | 4.32 | % | 971,724 | 22,682 | 4.69 | % | |||||||||||||||||||||||||||

Interest-bearing deposits with banks |

70,675 | 1,061 | 3.03 | % | 51,643 | 1,037 | 4.04 | % | |||||||||||||||||||||||||||

FHLB stock |

17,969 | 371 | 4.16 | % | 20,077 | 574 | 5.75 | % | |||||||||||||||||||||||||||

| Total investment securities | 3,506,365 | 52,151 | 3.00 | % | 3,743,857 | 58,219 | 3.13 | % | |||||||||||||||||||||||||||

Total interest-earning assets |

15,035,932 | 400,771 | 5.38 | % | 14,689,693 | 380,066 | 5.20 | % | |||||||||||||||||||||||||||

| Non-interest-earning assets | 1,000,216 | 935,068 | |||||||||||||||||||||||||||||||||

Total assets |

$ | 16,036,148 | $ | 15,624,761 | |||||||||||||||||||||||||||||||

| Deposits: | |||||||||||||||||||||||||||||||||||

Interest-bearing checking accounts |

$ | 2,423,292 | 17,999 | 1.50 | % | $ | 2,130,228 | 14,337 | 1.35 | % | |||||||||||||||||||||||||

Savings accounts |

3,472,556 | 36,940 | 2.15 | % | 3,106,985 | 32,479 | 2.10 | % | |||||||||||||||||||||||||||

Money market accounts |

1,523,571 | 15,589 | 2.06 | % | 1,666,743 | 17,512 | 2.11 | % | |||||||||||||||||||||||||||

Certificates of deposit |

1,510,404 | 27,525 | 3.67 | % | 1,502,013 | 29,135 | 3.90 | % | |||||||||||||||||||||||||||

Total interest-bearing deposits |

8,929,823 | 98,053 | 2.21 | % | 8,405,969 | 93,463 | 2.24 | % | |||||||||||||||||||||||||||

Non-interest-bearing deposits |

4,503,461 | — | — | % | 4,673,330 | — | — | % | |||||||||||||||||||||||||||

Total deposits |

13,433,284 | 98,053 | 1.47 | % | 13,079,299 | 93,463 | 1.44 | % | |||||||||||||||||||||||||||

| Other interest-bearing liabilities: | |||||||||||||||||||||||||||||||||||

FHLB advances |

186,597 | 4,230 | 4.57 | % | 236,269 | 6,593 | 5.61 | % | |||||||||||||||||||||||||||

Other borrowings |

128,459 | 1,369 | 2.15 | % | 178,105 | 2,335 | 2.64 | % | |||||||||||||||||||||||||||

Junior subordinated debentures and subordinated notes |

169,233 | 4,993 | 5.95 | % | 180,379 | 5,930 | 6.61 | % | |||||||||||||||||||||||||||

Total borrowings |

484,289 | 10,592 | 4.41 | % | 594,753 | 14,858 | 5.02 | % | |||||||||||||||||||||||||||

Total funding liabilities |

13,917,573 | 108,645 | 1.57 | % | 13,674,052 | 108,321 | 1.59 | % | |||||||||||||||||||||||||||

Other non-interest-bearing liabilities (2) |

299,082 | 299,103 | |||||||||||||||||||||||||||||||||

Total liabilities |

14,216,655 | 13,973,155 | |||||||||||||||||||||||||||||||||

| Shareholders’ equity | 1,819,493 | 1,651,606 | |||||||||||||||||||||||||||||||||

| Total liabilities and shareholders’ equity | $ | 16,036,148 | $ | 15,624,761 | |||||||||||||||||||||||||||||||

| Net interest income/rate spread (tax equivalent) | $ | 292,126 | 3.81 | % | $ | 271,745 | 3.61 | % | |||||||||||||||||||||||||||

| Net interest margin (tax equivalent) | 3.92 | % | 3.72 | % | |||||||||||||||||||||||||||||||

| Reconciliation to reported net interest income: | |||||||||||||||||||||||||||||||||||

| Adjustments for taxable equivalent basis | (6,644) | (6,240) | |||||||||||||||||||||||||||||||||

| Net interest income and margin, as reported | $ | 285,482 | 3.83 | % | $ | 265,505 | 3.63 | % | |||||||||||||||||||||||||||

| Additional Key Financial Ratios: | |||||||||||||||||||||||||||||||||||

| Return on average assets | 1.14 | % | 1.00 | % | |||||||||||||||||||||||||||||||

Adjusted return on average assets (4) |

1.15 | % | 1.06 | % | |||||||||||||||||||||||||||||||

| Return on average equity | 10.04 | % | 9.42 | % | |||||||||||||||||||||||||||||||

Adjusted return on average equity (4) |

10.16 | % | 10.03 | % | |||||||||||||||||||||||||||||||

| Average equity/average assets | 11.35 | % | 10.57 | % | |||||||||||||||||||||||||||||||

| Average interest-earning assets/average interest-bearing liabilities | 159.72 | % | 163.21 | % | |||||||||||||||||||||||||||||||

| Average interest-earning assets/average funding liabilities | 108.04 | % | 107.43 | % | |||||||||||||||||||||||||||||||

| Non-interest income/average assets | 0.46 | % | 0.37 | % | |||||||||||||||||||||||||||||||

| Non-interest expense/average assets | 2.55 | % | 2.52 | % | |||||||||||||||||||||||||||||||

| Efficiency ratio | 62.85 | % | 66.52 | % | |||||||||||||||||||||||||||||||

Adjusted efficiency ratio (4) |

61.22 | % | 63.65 | % | |||||||||||||||||||||||||||||||

| ADDITIONAL FINANCIAL INFORMATION | |||||||||||||||||||||||||||||

| (dollars in thousands) | |||||||||||||||||||||||||||||

| * Non-GAAP Financial Measures | |||||||||||||||||||||||||||||

| In addition to results presented in accordance with generally accepted accounting principles in the United States of America (GAAP), this earnings release contains certain non-GAAP financial measures. Tangible common shareholders’ equity per share and the ratio of tangible common equity to tangible assets, and references to adjusted revenue, adjusted earnings, the adjusted return on average assets, the adjusted return on average equity and the adjusted efficiency ratio represent non-GAAP financial measures. Management has presented these non-GAAP financial measures in this earnings release because it believes that they provide useful and comparative information to assess trends in Banner’s core operations reflected in the current quarter’s results and facilitate the comparison of our performance with the performance of our peers. However, these non-GAAP financial measures are supplemental and are not a substitute for any analysis based on GAAP. Where applicable, comparable earnings information using GAAP financial measures is also presented. Because not all companies use the same calculations, our presentation may not be comparable to other similarly titled measures as calculated by other companies. For a reconciliation of these non-GAAP financial measures, see the tables below: | |||||||||||||||||||||||||||||

| ADJUSTED REVENUE | Quarters Ended | Six Months Ended | |||||||||||||||||||||||||||

| Jun 30, 2025 | Mar 31, 2025 | Jun 30, 2024 | Jun 30, 2025 | Jun 30, 2024 | |||||||||||||||||||||||||

| Net interest income (GAAP) | $ | 144,399 | $ | 141,083 | $ | 132,546 | $ | 285,482 | $ | 265,505 | |||||||||||||||||||

| Non-interest income (GAAP) | 17,751 | 19,108 | 17,199 | 36,859 | 28,790 | ||||||||||||||||||||||||

| Total revenue (GAAP) | 162,150 | 160,191 | 149,745 | 322,341 | 294,295 | ||||||||||||||||||||||||

| Exclude: Net loss on sale of securities | 3 | — | 562 | 3 | 5,465 | ||||||||||||||||||||||||

| Net change in valuation of financial instruments carried at fair value | (88) | (315) | 190 | (403) | 1,182 | ||||||||||||||||||||||||

| Losses incurred on building and lease exits | 919 | — | — | 919 | — | ||||||||||||||||||||||||

| Adjusted revenue (non-GAAP) | $ | 162,984 | $ | 159,876 | $ | 150,497 | $ | 322,860 | $ | 300,942 | |||||||||||||||||||

| ADJUSTED EARNINGS | Quarters Ended | Six Months Ended | |||||||||||||||||||||||||||

| Jun 30, 2025 | Mar 31, 2025 | Jun 30, 2024 | Jun 30, 2025 | Jun 30, 2024 | |||||||||||||||||||||||||

| Net income (GAAP) | $ | 45,496 | $ | 45,135 | $ | 39,795 | $ | 90,631 | $ | 77,354 | |||||||||||||||||||

| Exclude: Net loss on sale of securities | 3 | — | 562 | 3 | 5,465 | ||||||||||||||||||||||||

| Net change in valuation of financial instruments carried at fair value | (88) | (315) | 190 | (403) | 1,182 | ||||||||||||||||||||||||

| Building and lease exit costs | 1,753 | — | — | 1,753 | — | ||||||||||||||||||||||||

| Related net tax (benefit) expense | (401) | 76 | (180) | (325) | (1,595) | ||||||||||||||||||||||||

| Total adjusted earnings (non-GAAP) | $ | 46,763 | $ | 44,896 | $ | 40,367 | $ | 91,659 | $ | 82,406 | |||||||||||||||||||

| Diluted earnings per share (GAAP) | $ | 1.31 | $ | 1.30 | $ | 1.15 | $ | 2.61 | $ | 2.24 | |||||||||||||||||||

| Diluted adjusted earnings per share (non-GAAP) | $ | 1.35 | $ | 1.29 | $ | 1.17 | $ | 2.64 | $ | 2.39 | |||||||||||||||||||

| Return on average assets | 1.13 | % | 1.15 | % | 1.02 | % | 1.14 | % | 1.00 | % | |||||||||||||||||||

Adjusted return on average assets (1) |

1.16 | % | 1.14 | % | 1.04 | % | 1.15 | % | 1.06 | % | |||||||||||||||||||

| Return on average equity | 9.92 | % | 10.17 | % | 9.69 | % | 10.04 | % | 9.42 | % | |||||||||||||||||||

Adjusted return on average equity (2) |

10.20 | % | 10.12 | % | 9.83 | % | 10.16 | % | 10.03 | % | |||||||||||||||||||

| ADDITIONAL FINANCIAL INFORMATION | ||||||||||||||||||||||||||||||||

| (dollars in thousands) | ||||||||||||||||||||||||||||||||

| ADJUSTED EFFICIENCY RATIO | Quarters Ended | Six Months Ended | ||||||||||||||||||||||||||||||

| Jun 30, 2025 | Mar 31, 2025 | Jun 30, 2024 | Jun 30, 2025 | Jun 30, 2024 | ||||||||||||||||||||||||||||

| Non-interest expense (GAAP) | $ | 101,348 | $ | 101,259 | $ | 98,128 | $ | 202,607 | $ | 195,769 | ||||||||||||||||||||||

| Exclude: CDI amortization | (455) | (456) | (724) | (911) | (1,447) | |||||||||||||||||||||||||||

| State/municipal tax expense | (1,416) | (1,454) | (1,394) | (2,870) | (2,698) | |||||||||||||||||||||||||||

| REO operations | (392) | 61 | (297) | (331) | (77) | |||||||||||||||||||||||||||

| Building and lease exit costs | (834) | — | — | (834) | — | |||||||||||||||||||||||||||

| Adjusted non-interest expense (non-GAAP) | $ | 98,251 | $ | 99,410 | $ | 95,713 | $ | 197,661 | $ | 191,547 | ||||||||||||||||||||||

| Net interest income (GAAP) | $ | 144,399 | $ | 141,083 | $ | 132,546 | $ | 285,482 | $ | 265,505 | ||||||||||||||||||||||

| Non-interest income (GAAP) | 17,751 | 19,108 | 17,199 | 36,859 | 28,790 | |||||||||||||||||||||||||||

| Total revenue (GAAP) | 162,150 | 160,191 | 149,745 | 322,341 | 294,295 | |||||||||||||||||||||||||||

| Exclude: Net loss on sale of securities | 3 | — | 562 | 3 | 5,465 | |||||||||||||||||||||||||||

| Net change in valuation of financial instruments carried at fair value | (88) | (315) | 190 | (403) | 1,182 | |||||||||||||||||||||||||||

| Losses incurred on building and lease exits | 919 | — | — | 919 | — | |||||||||||||||||||||||||||

| Adjusted revenue (non-GAAP) | $ | 162,984 | $ | 159,876 | $ | 150,497 | $ | 322,860 | $ | 300,942 | ||||||||||||||||||||||

| Efficiency ratio (GAAP) | 62.50 | % | 63.21 | % | 65.53 | % | 62.85 | % | 66.52 | % | ||||||||||||||||||||||

Adjusted efficiency ratio (non-GAAP) (1) |

60.28 | % | 62.18 | % | 63.60 | % | 61.22 | % | 63.65 | % | ||||||||||||||||||||||

| TANGIBLE COMMON SHAREHOLDERS’ EQUITY TO TANGIBLE ASSETS | ||||||||||||||||||||||||||

| Jun 30, 2025 | Mar 31, 2025 | Dec 31, 2024 | Jun 30, 2024 | |||||||||||||||||||||||

| Shareholders’ equity (GAAP) | $ | 1,865,664 | $ | 1,833,453 | $ | 1,774,326 | $ | 1,690,766 | ||||||||||||||||||

| Exclude goodwill and other intangible assets, net | 375,268 | 375,723 | 376,179 | 377,358 | ||||||||||||||||||||||

| Tangible common shareholders’ equity (non-GAAP) | $ | 1,490,396 | $ | 1,457,730 | $ | 1,398,147 | $ | 1,313,408 | ||||||||||||||||||

| Total assets (GAAP) | $ | 16,437,169 | $ | 16,170,812 | $ | 16,200,037 | $ | 15,816,194 | ||||||||||||||||||

| Exclude goodwill and other intangible assets, net | 375,268 | 375,723 | 376,179 | 377,358 | ||||||||||||||||||||||

| Total tangible assets (non-GAAP) | $ | 16,061,901 | $ | 15,795,089 | $ | 15,823,858 | $ | 15,438,836 | ||||||||||||||||||

| Common shareholders’ equity to total assets (GAAP) | 11.35 | % | 11.34 | % | 10.95 | % | 10.69 | % | ||||||||||||||||||

| Tangible common shareholders’ equity to tangible assets (non-GAAP) | 9.28 | % | 9.23 | % | 8.84 | % | 8.51 | % | ||||||||||||||||||

| TANGIBLE COMMON SHAREHOLDERS’ EQUITY PER SHARE | ||||||||||||||||||||||||||

| Shareholders’ equity (GAAP) | $ | 1,865,664 | $ | 1,833,453 | $ | 1,774,326 | $ | 1,690,766 | ||||||||||||||||||

| Tangible common shareholders’ equity (non-GAAP) | $ | 1,490,396 | $ | 1,457,730 | $ | 1,398,147 | $ | 1,313,408 | ||||||||||||||||||

| Common shares outstanding at end of period | 34,583,994 | 34,489,972 | 34,459,832 | 34,455,752 | ||||||||||||||||||||||

| Common shareholders’ equity (book value) per share (GAAP) | $ | 53.95 | $ | 53.16 | $ | 51.49 | $ | 49.07 | ||||||||||||||||||

| Tangible common shareholders’ equity (tangible book value) per share (non-GAAP) | $ | 43.09 | $ | 42.27 | $ | 40.57 | $ | 38.12 | ||||||||||||||||||