Service Properties Trust (Nasdaq: SVC) Investor Presentation November 2023

2SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2023 Warning Concerning Forward-Looking Statements, Disclaimers and Non-GAAP Financial Measures This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws that are subject to risks and uncertainties. These statements may include words such as “believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate”, “will”, “may” and negatives or derivatives of these or similar expressions. These forward-looking statements include, among others, statements about: SVC’s ability to pay interest on and principal of its debt, potential defaults on, or non-renewal of, leases by SVC’s tenants, decreased rental rates or increased vacancies, SVC’s policies and plans regarding investments, financings and dispositions, and SVC’s ability to issue senior secured notes to repay, along with cash on hand, its 2024 debt maturities. Forward-looking statements reflect SVC’s current expectations, are based on judgments and assumptions, are inherently uncertain and are subject to risks, uncertainties and other factors, which could cause SVC’s actual results, performance or achievements to differ materially from expected future results, performance or achievements expressed or implied in those forward-looking statements. Some of the risks, uncertainties and other factors that may cause SVC’s actual results, performance or achievements to differ materially from the expressed or implied forward-looking statements include, but are not limited to, the following: Sonesta Holdco Corporation and its subsidiaries, or Sonesta’s, ability to successfully operate the hotels it manages for SVC, SVC’s ability and the ability of SVC’s managers and tenants to operate under unfavorable market and economic conditions, rising or sustained high interest rates, high inflation, labor market challenges, disruption and volatility in the public equity and debt markets, global geopolitical hostilities and tensions and economic recessions or downturns, if and when business transient hotel business will return to historical pre-COVID-19 pandemic levels and whether any improved hotel industry conditions will continue, increase or be sustained, whether and the extent to which SVC’s managers and tenants will pay the contractual amounts of returns, rents or other obligations due to SVC, competition within the commercial real estate, hotel, transportation and travel center and other industries in which SVC’s managers and tenants operate, particularly in those markets in which SVC’s properties are located, SVC’s ability to repay or refinance its debts as they mature or otherwise become due, SVC’s ability to maintain sufficient liquidity, including the availability of borrowings under its revolving credit facility, SVC’s ability to pay interest on and principal of its debt, SVC’s ability to acquire properties that realize its targeted returns, SVC’s ability to sell properties at prices it targets, SVC’s ability to raise or appropriately balance the use of debt or equity capital, potential defaults of SVC’s management agreements and leases by its managers and tenants, SVC’s ability to increase hotel room rates and rents at its leased properties as SVC’s leases expire in excess of its operating expenses and to grow its business, SVC’s ability to increase and maintain hotel room and net lease property occupancy at its properties, SVC’s ability to pay distributions to its shareholders and to increase or sustain the amount of such distributions, the impact of increasing labor costs and shortages and commodity and other price inflation due to supply chain challenges or other market conditions, SVC’s ability to make cost-effective improvements to its properties that enhance its appeal to hotel guests and net lease tenants, SVC’s ability to engage and retain qualified managers and tenants for its hotels and net lease properties on satisfactory terms, SVC’s ability to diversify its sources of rents and returns that improve the security of its cash flows, SVC’s credit ratings, the ability of SVC’s manager, The RMR Group LLC, or RMR, to successfully manage SVC, actual and potential conflicts of interest with SVC’s related parties, including its Managing Trustees, Sonesta, RMR and others affiliated with them, SVC’s ability to realize benefits from the scale, geographic diversity, strategic locations and variety of service levels of its hotels, limitations imposed on SVC’s business and its ability to satisfy complex rules in order for it to maintain its qualification for taxation as a real estate investment trust, or REIT, for U.S. federal income tax purposes, compliance with, and changes to, federal, state and local laws and regulations, accounting rules, tax laws and similar matters, acts of terrorism, outbreaks or continuation of pandemics or other significant adverse public health safety events or conditions, war or other hostilities, supply chain disruptions, climate change or other man-made or natural disasters beyond its control, and other matters. These risks, uncertainties and other factors are not exhaustive and should be read in conjunction with other cautionary statements that are included in SVC’s periodic filings. The information contained in SVC’s filings with the Securities and Exchange Commission, or SEC, including under the caption “Risk Factors” in SVC’s periodic reports, or incorporated therein, identifies important factors that could cause differences from SVC’s forward-looking statements in this presentation. SVC’s filings with the SEC are available on the SEC’s website at www.sec.gov. You should not place undue reliance upon SVC’s forward-looking statements. Except as required by law, SVC does not intend to update or change any forward-looking statements as a result of new information, future events or otherwise. Notes Regarding Certain Information in this Presentation This presentation contains industry and statistical data that SVC obtained from various third party sources. Nothing in the data used or derived from third party sources should be construed as investment advice. Some data and other information presented are also based on SVC’s good faith estimates and beliefs derived from its review of internal surveys and independent sources and its experience. SVC believes that these external sources, estimates and beliefs are reliable and reasonable, but it has not independently verified them. Although SVC is not aware of any misstatements regarding the data presented herein, these estimates and beliefs involve inherent risks and uncertainties and are based on assumptions that are subject to change. Unless otherwise noted, all data presented are as of or for the three months ended September 30, 2023. Non-GAAP Financial Measures This presentation contains non-GAAP financial measures including FFO, Normalized FFO, EBITDA, Hotel EBITDA, EBITDAre and Adjusted EBITDAre. Calculations of, and reconciliations for these metrics to the closest GAAP metrics, are included in an Appendix hereto. Please refer to page 27 for certain definitions of terms used throughout this presentation.

3SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2023 SVC: Company Overview SVC invests in two asset categories: hotels and service-focused retail net lease properties to provide diversification to its cash flows. Necessity-based retail assets with strong rent coverage, low capex requirements and long lease terms produce stable cash flows that balance the cyclicality of the hotel portfolio. Diversified by location and industry: properties in 22 industries with 144 brands located across 46 states, Washington, D.C., Puerto Rico and Canada. Hotel Portfolio consists of Full Service, Extended Stay and Select Service assets across multiple chain scales.

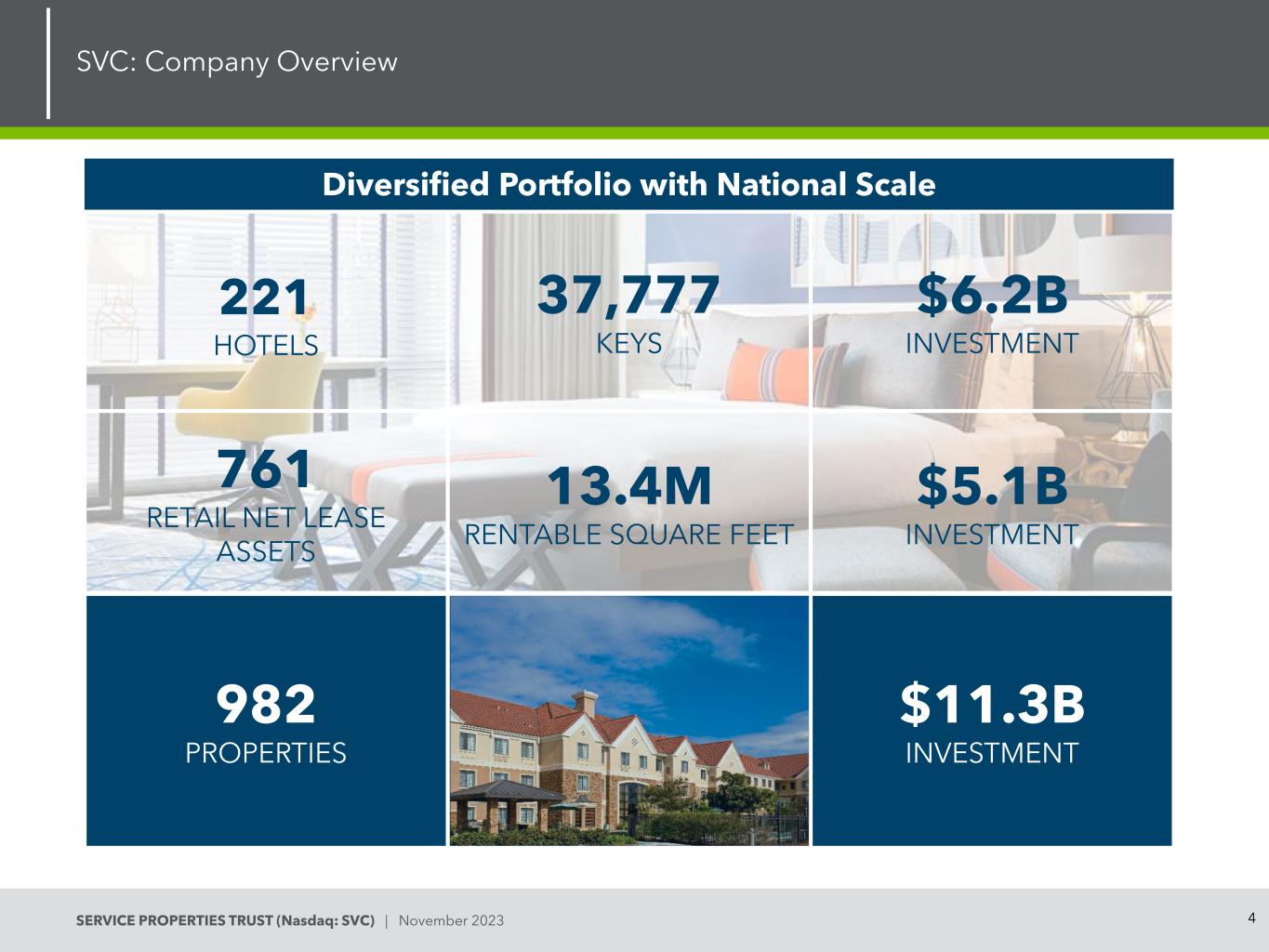

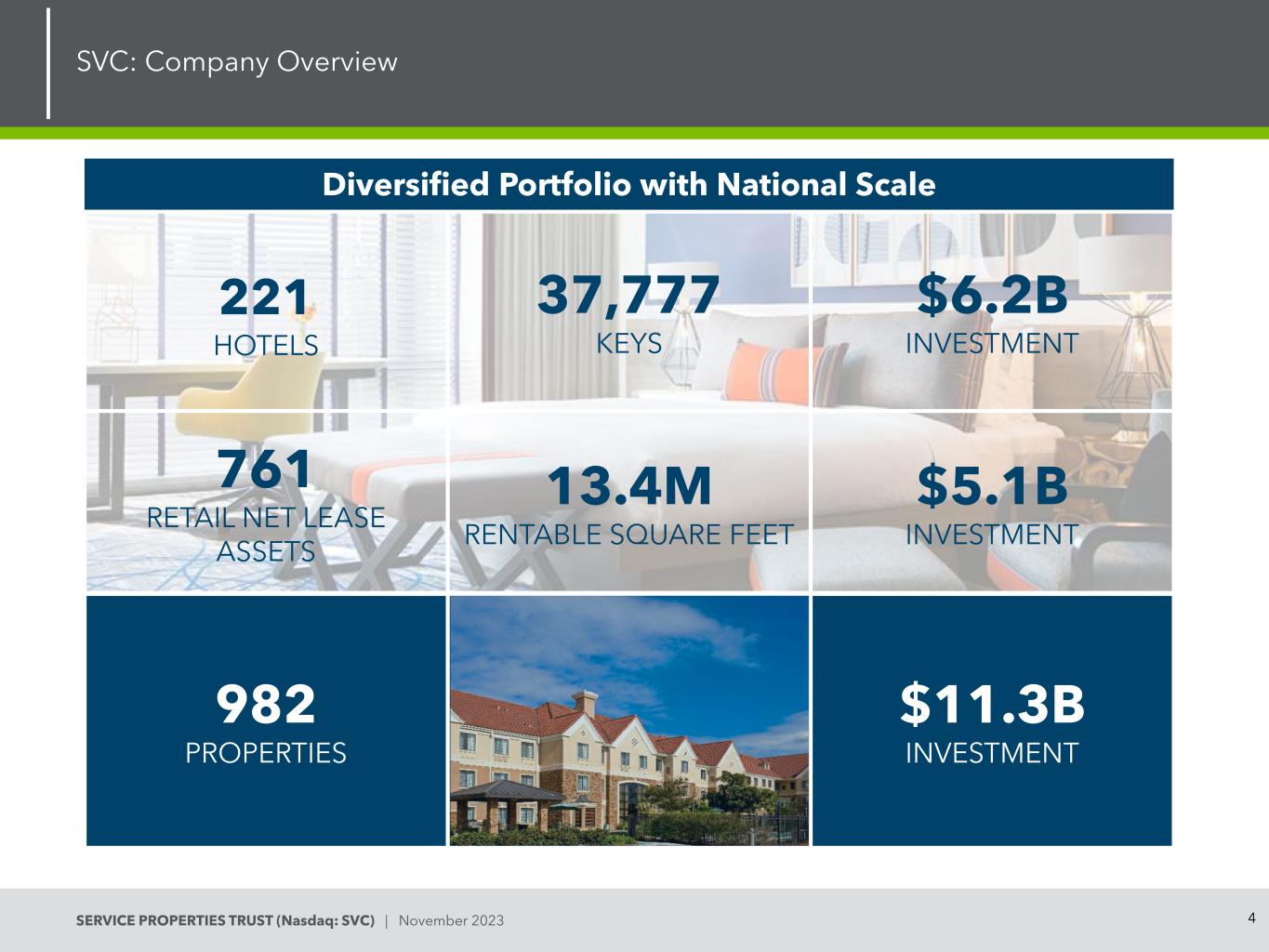

4SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2023 SVC: Company Overview 221 HOTELS 37,777 KEYS $6.2B INVESTMENT 761 RETAIL NET LEASE ASSETS 13.4M RENTABLE SQUARE FEET $5.1B INVESTMENT 982 PROPERTIES $11.3B INVESTMENT Diversified Portfolio with National Scale

5SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2023 SVC: Recent Company Highlights • In February, SVC executed a $610.2 million secured financing with a 5.6% coupon and used proceeds to redeem $500 million of 4.5% senior notes that matured in June 2023. • In May, TravelCenters of America Inc., or TA, was acquired by BP p.l.c. (NYSE: BP). o Transaction provided SVC with $379.3 million of cash for the value of the TA common shares it owned, the sale of the TA trade name and rents prepaid by BP. o Annual rental income is fixed at $254.0 million and increases 2% per year over the initial 10 year term of the lease and the 50 years of extension options. • In June, SVC acquired the oceanfront Nautilus Hotel in the South Beach neighborhood of Miami, Florida for $165.4 million, or approximately $661,600 per key. The hotel will undergo a $25 million repositioning in 2024, reopening under Sonesta’s lifestyle brand, The James. • In June, SVC entered into an amended and restated $650.0 million secured revolving credit facility with a maturity date of June 29, 2027, with two six-month extensions. • In November, SVC proactively addressed all $1.2 billion of 2024 debt maturities. o Agreed to issue $1.0 billion of 8.625% senior secured notes, and together with cash on hand, repay $1.2 billion of 2024 maturities. o Continues to demonstrate flexibility and value across the portfolio. 2023 Year to Date:

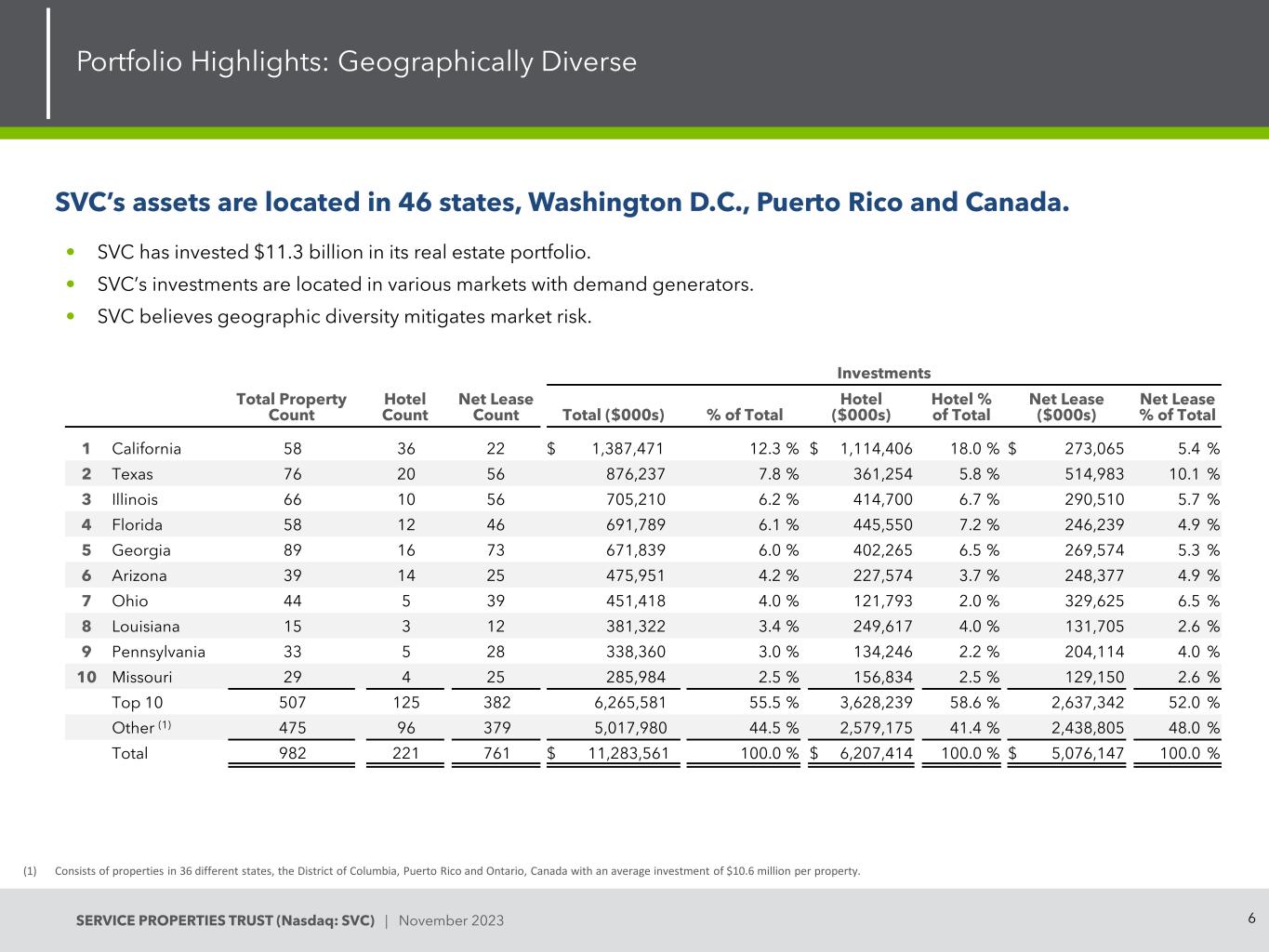

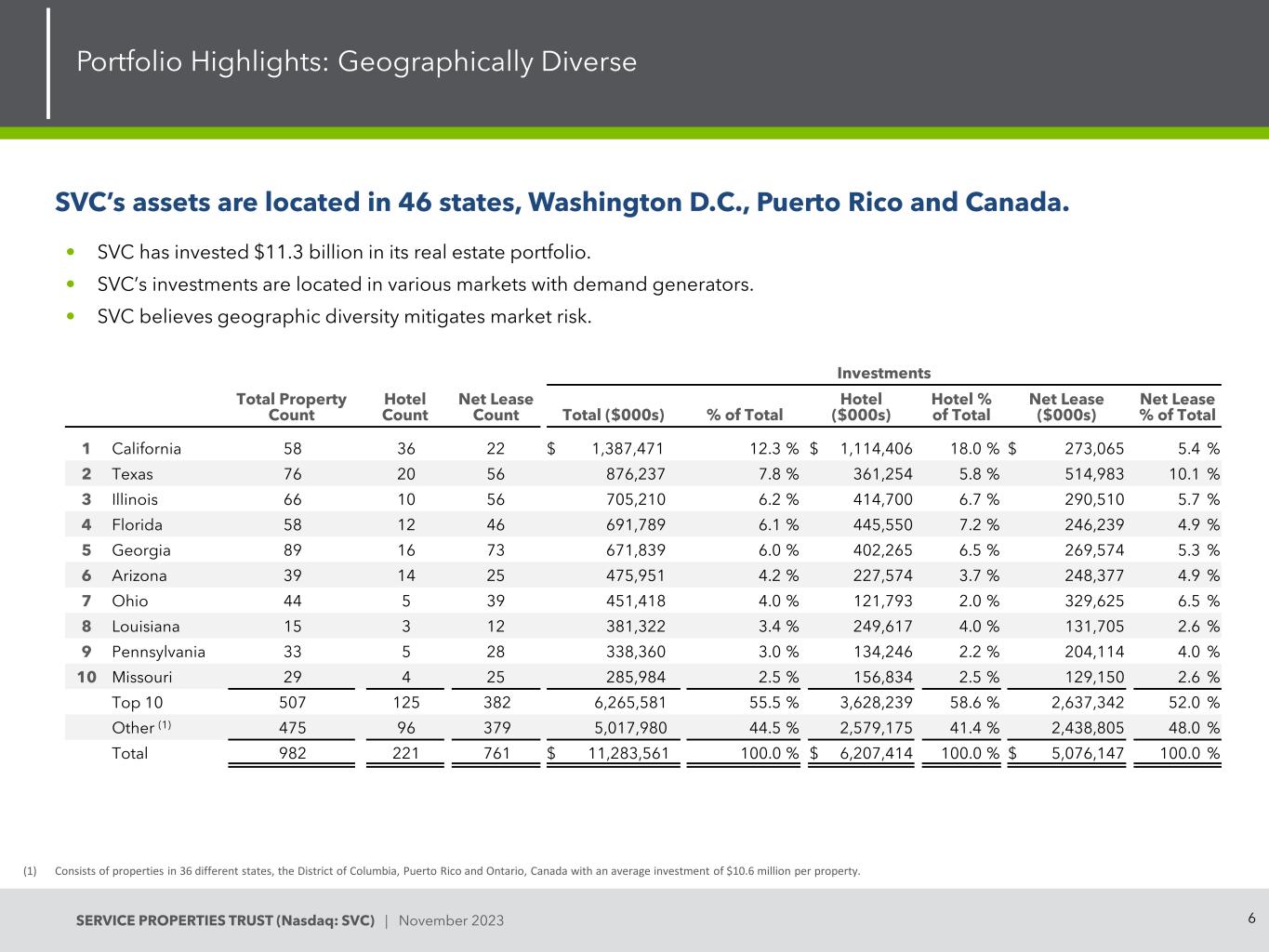

6SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2023 SVC’s assets are located in 46 states, Washington D.C., Puerto Rico and Canada. Portfolio Highlights: Geographically Diverse • SVC has invested $11.3 billion in its real estate portfolio. • SVC’s investments are located in various markets with demand generators. • SVC believes geographic diversity mitigates market risk. Investments Total Property Count Hotel Count Net Lease Count Total ($000s) % of Total Hotel ($000s) Hotel % of Total Net Lease ($000s) Net Lease % of Total 1 California 58 36 22 $ 1,387,471 12.3 % $ 1,114,406 18.0 % $ 273,065 5.4 % 2 Texas 76 20 56 876,237 7.8 % 361,254 5.8 % 514,983 10.1 % 3 Illinois 66 10 56 705,210 6.2 % 414,700 6.7 % 290,510 5.7 % 4 Florida 58 12 46 691,789 6.1 % 445,550 7.2 % 246,239 4.9 % 5 Georgia 89 16 73 671,839 6.0 % 402,265 6.5 % 269,574 5.3 % 6 Arizona 39 14 25 475,951 4.2 % 227,574 3.7 % 248,377 4.9 % 7 Ohio 44 5 39 451,418 4.0 % 121,793 2.0 % 329,625 6.5 % 8 Louisiana 15 3 12 381,322 3.4 % 249,617 4.0 % 131,705 2.6 % 9 Pennsylvania 33 5 28 338,360 3.0 % 134,246 2.2 % 204,114 4.0 % 10 Missouri 29 4 25 285,984 2.5 % 156,834 2.5 % 129,150 2.6 % Top 10 507 125 382 6,265,581 55.5 % 3,628,239 58.6 % 2,637,342 52.0 % Other (1) 475 96 379 5,017,980 44.5 % 2,579,175 41.4 % 2,438,805 48.0 % Total 982 221 761 $ 11,283,561 100.0 % $ 6,207,414 100.0 % $ 5,076,147 100.0 % (1) Consists of properties in 36 different states, the District of Columbia, Puerto Rico and Ontario, Canada with an average investment of $10.6 million per property.

SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2023 Hotel Portfolio

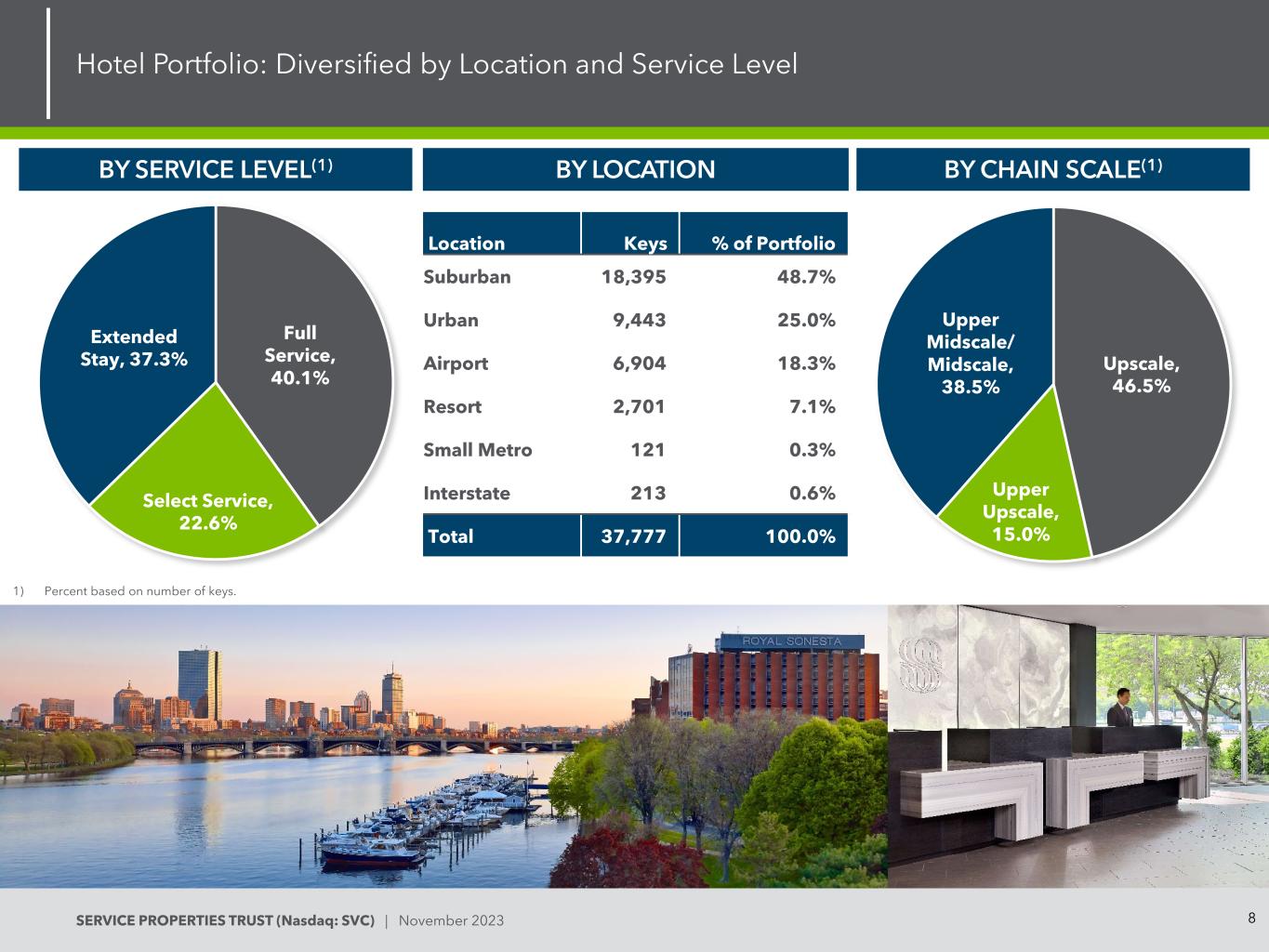

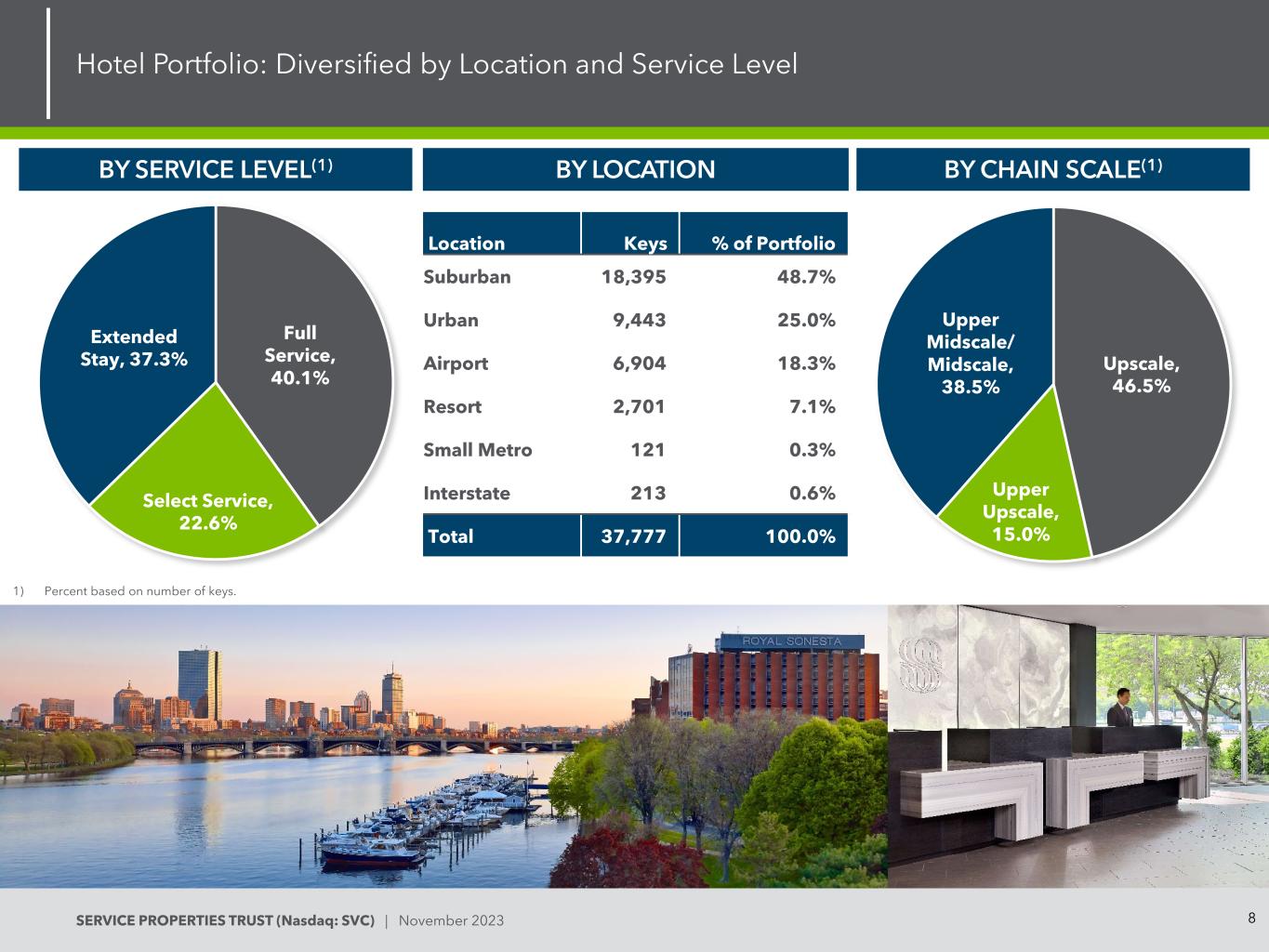

8SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2023 BY SERVICE LEVEL(1) BY CHAIN SCALE(1)BY LOCATION Location Keys % of Portfolio Suburban 18,395 48.7% Urban 9,443 25.0% Airport 6,904 18.3% Resort 2,701 7.1% Small Metro 121 0.3% Interstate 213 0.6% Total 37,777 100.0% Hotel Portfolio: Diversified by Location and Service Level 1) Percent based on number of keys. Full Service, 40.1% Select Service, 22.6% Extended Stay, 37.3% Upscale, 46.5% Upper Upscale, 15.0% Upper Midscale/ Midscale, 38.5%

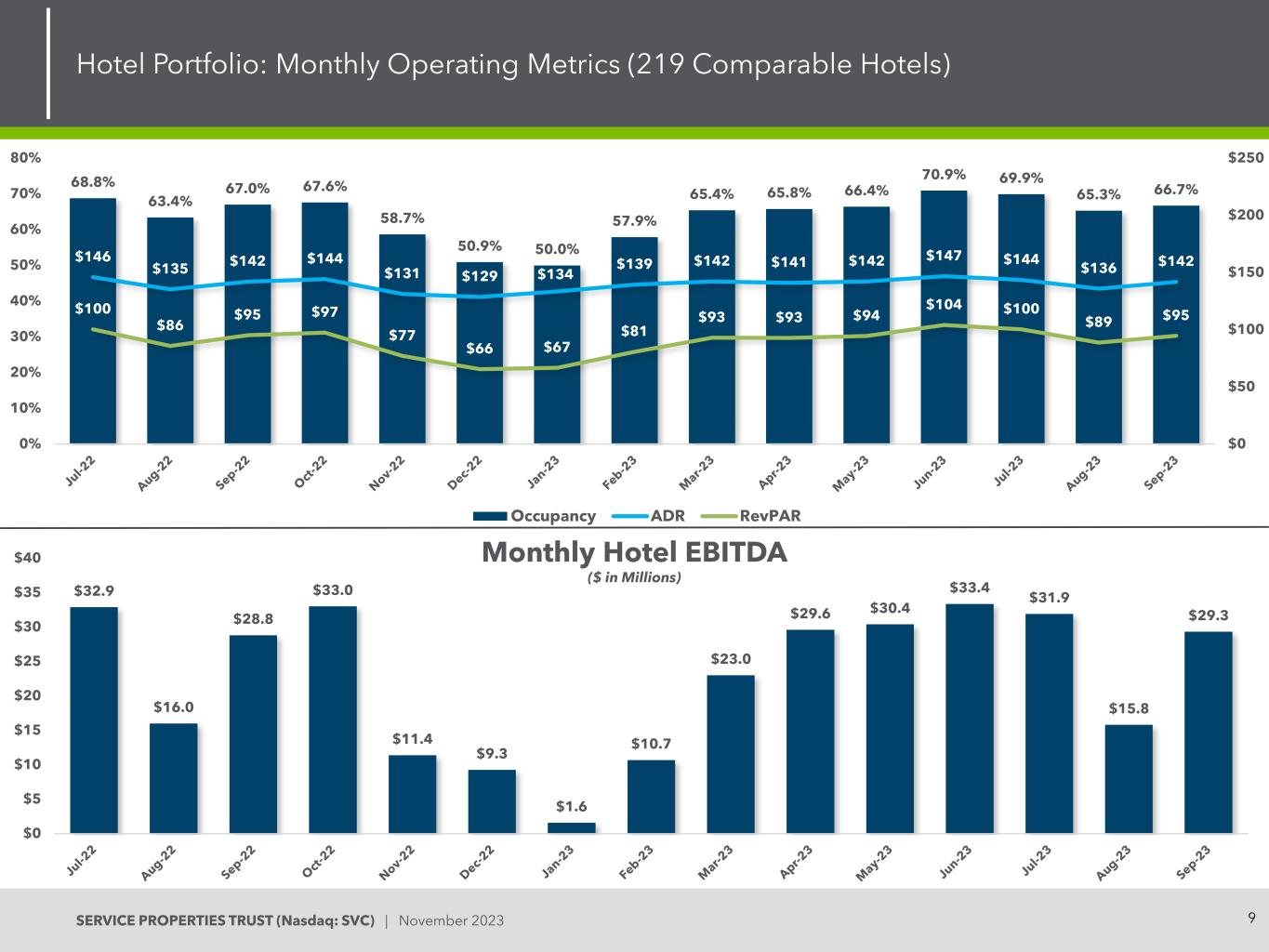

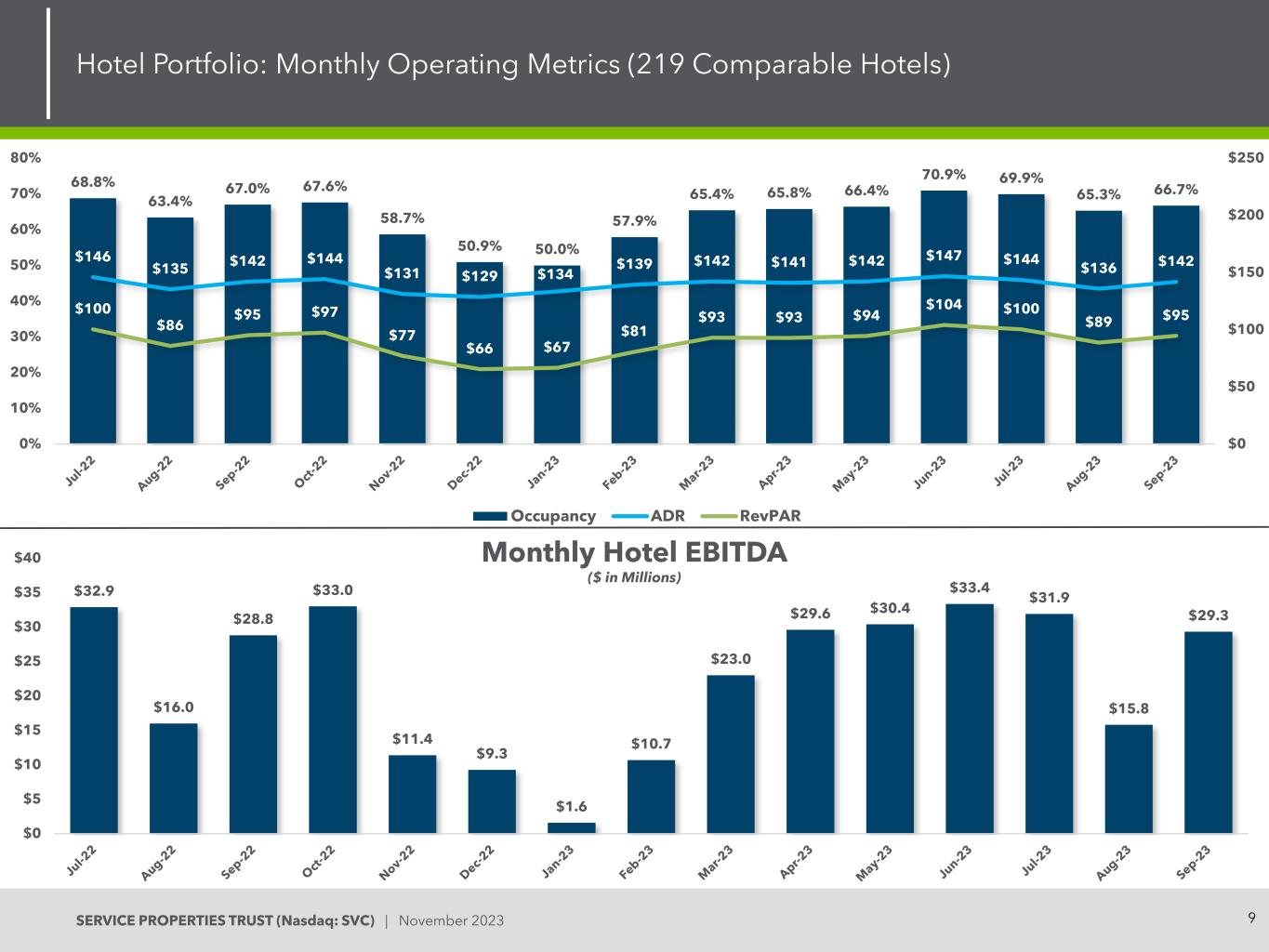

9SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2023 Hotel Portfolio: Monthly Operating Metrics (219 Comparable Hotels) Monthly Hotel EBITDA ($ in Millions) 68.8% 63.4% 67.0% 67.6% 58.7% 50.9% 50.0% 57.9% 65.4% 65.8% 66.4% 70.9% 69.9% 65.3% 66.7% $146 $135 $142 $144 $131 $129 $134 $139 $142 $141 $142 $147 $144 $136 $142 $100 $86 $95 $97 $77 $66 $67 $81 $93 $93 $94 $104 $100 $89 $95 $0 $50 $100 $150 $200 $250 0% 10% 20% 30% 40% 50% 60% 70% 80% Occupancy ADR RevPAR $32.9 $16.0 $28.8 $33.0 $11.4 $9.3 $1.6 $10.7 $23.0 $29.6 $30.4 $33.4 $31.9 $15.8 $29.3 $0 $5 $10 $15 $20 $25 $30 $35 $40

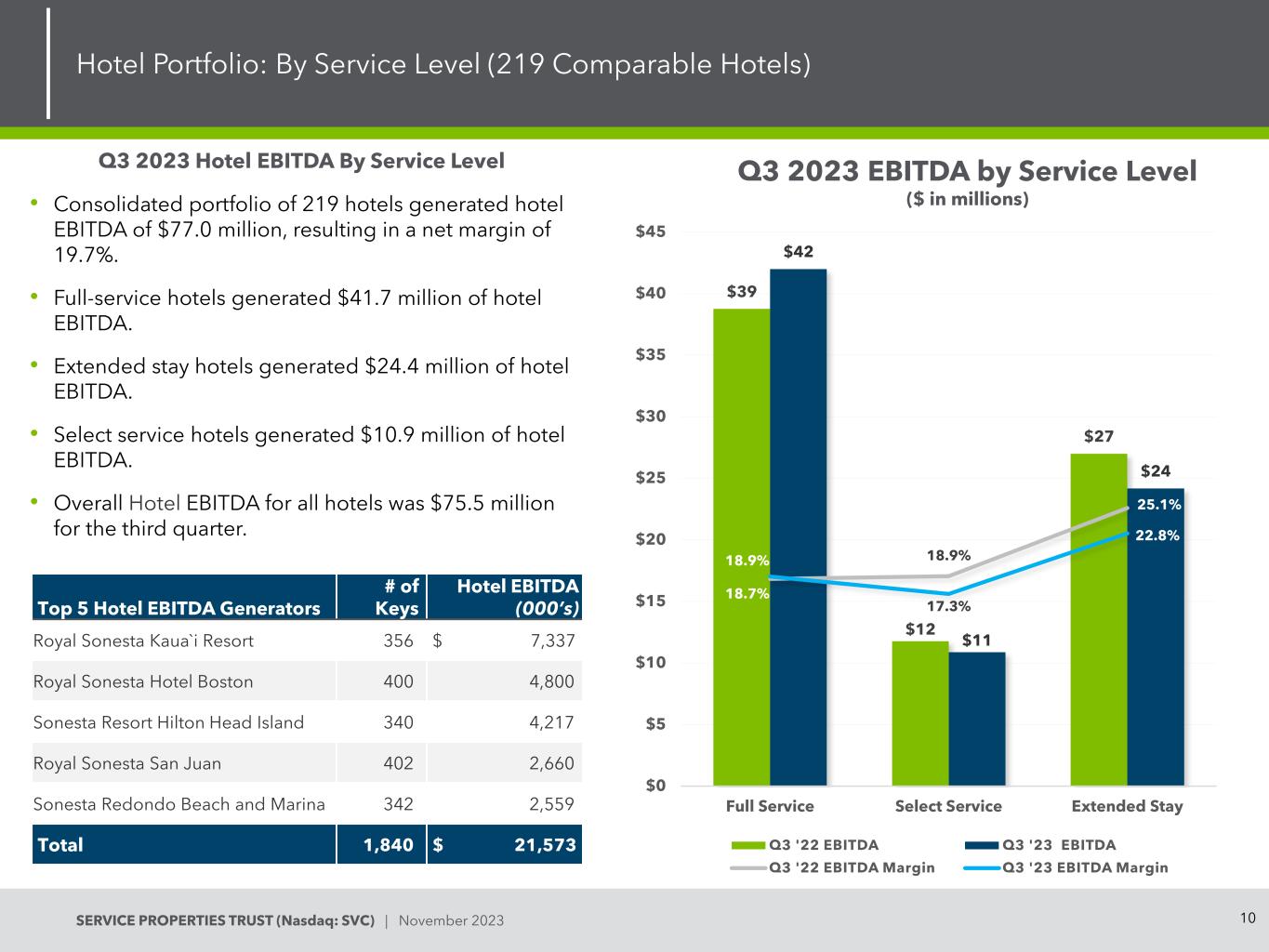

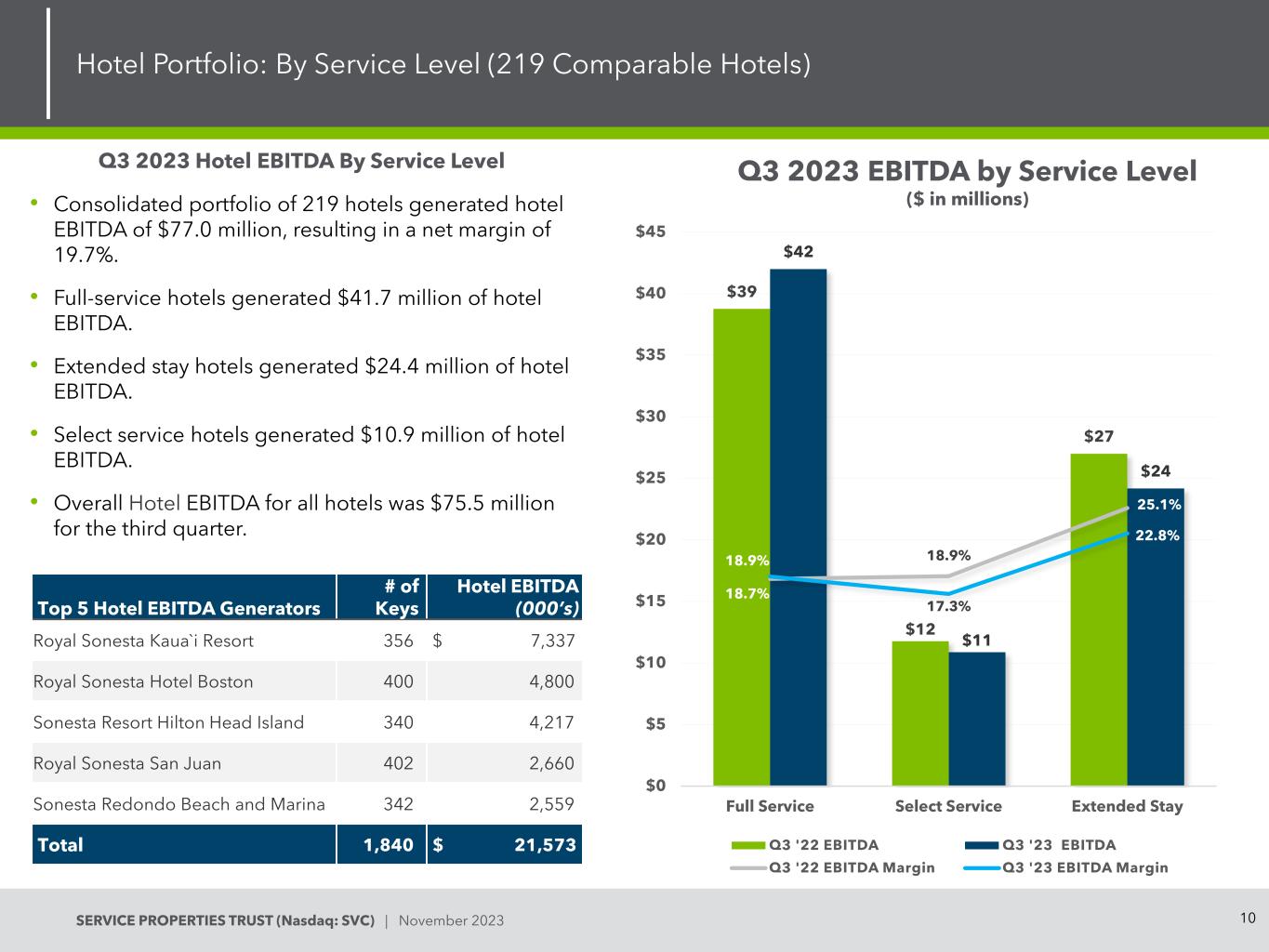

10SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2023 $39 $12 $27 $42 $11 $24 18.7% 18.9% 25.1% 18.9% 17.3% 22.8% 0% 5% 10% 15% 20% 25% 30% 35% 40% 45% 50% $0 $5 $10 $15 $20 $25 $30 $35 $40 $45 Full Service Select Service Extended Stay Q3 '22 EBITDA Q3 '23 EBITDA Q3 '22 EBITDA Margin Q3 '23 EBITDA Margin Hotel Portfolio: By Service Level (219 Comparable Hotels) Top 5 Hotel EBITDA Generators # of Keys Hotel EBITDA ( (000’s) Royal Sonesta Kaua`i Resort 356 $ 7,337 Royal Sonesta Hotel Boston 400 4,800 Sonesta Resort Hilton Head Island 340 4,217 Royal Sonesta San Juan 402 2,660 Sonesta Redondo Beach and Marina 342 2,559 Total 1,840 $ 21,573 Q3 2023 EBITDA by Service Level ($ in millions) Q3 2023 Hotel EBITDA By Service Level • Consolidated portfolio of 219 hotels generated hotel EBITDA of $77.0 million, resulting in a net margin of 19.7%. • Full-service hotels generated $41.7 million of hotel EBITDA. • Extended stay hotels generated $24.4 million of hotel EBITDA. • Select service hotels generated $10.9 million of hotel EBITDA. • Overall Hotel EBITDA for all hotels was $75.5 million for the third quarter.

11SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2023 • 8th largest hotel company according to Smith Travel Research. • Approximately 1,200 properties totaling 100,000 rooms across 19 brands in eight countries. • Manages over 200 hotels. • Franchises close to 1,000 hotels. • SVC owns 34% of Sonesta. • Equity investment has a carrying value of $111 million. • Unique owner / operator alignment. Hotel Portfolio: Sonesta at a Glance Source: Sonesta International Hotels, Inc.

SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2023 Net Lease Portfolio

13SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2023 Net Lease Portfolio: High-Quality Service & Necessity Based Assets Net Lease Portfolio Statistics 761 $374mm Properties Annualized Minimum Rent 13.4mm 9.1 Rentable Square Feet Weighted Average Lease Term(1) 95.8% 2.72x Occupancy Rent Coverage Diverse Geographical Footprint (1) (1) By annualized minimum rent. 21 Industries | 135 Brands % of Annual Minimum Rent<1% >9.0%

14SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2023 3% 81% 13% 3% Percentage Rent Fixed/Scheduled CPI Flat (1) By annualized minimum rent. Net Lease Portfolio: Reliable Income Stream and Low Capex Requirements Well-Laddered Lease Expirations (1) 97% of Leases Have Contractual Increases or Percentage Rent Lease Structures $374mm 0.1% 2.3% 2.4% 3.2% 3.3% 2.9% 1.5% 1.1% 1.3% 0.8% 81.1% 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033+

15SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2023 Net Lease Portfolio: Diversified Tenants & Industries Mitigate Risk (1) By annualized minimum rent. (2) Rent coverage information provided by tenant is for all 176 sites on a consolidated basis and is as of September 30, 2023. Tenants by Brand (1)Tenants by Industry (1) Brand % of Annualized Minimum Rent Rent Coverage TravelCenters of America / Petro Stopping Centers 67.8% 2.26x (2) The Great Escape 2.1% 6.20x Life Time Fitness 1.5% 2.35x Buehler's Fresh Foods 1.5% 3.08x AMC Theatres 1.3% 1.46x Heartland Dental 1.3% 4.24x Express Oil Change 1.0% 4.32x Norms 1.0% 3.35x Flying J Travel Plaza 0.9% 6.40x Courthouse Athletic Club 0.5% 1.25x Other 21.1% 3.63x 100% 2.72x Travel Centers, 68.6% Restaurants - Quick Service, 5.1% Health and Fitness, 2.9% Restaurants - Casual Dining, 3.0% Home Goods and Leisure, 2.8% Grocery Stores, 2.5% Movie Theaters, 2.4% Automotive Equipment and Services, 2.1% Medical, Dental Office, 2.1% Automotive Dealers, 1.3% Other, 7.2%

16SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2023 Net Lease Portfolio: TravelCenters of America, Inc. • Represents 29% of SVC’s portfolio based on investment. • 176 travel centers operate under two brands. • Difficult to replicate real estate located near exits along the U.S. Interstate Highway System. • Five master leases that run through 2033; 50 years of extension options. • Rents are guaranteed by BP Corporation North America Inc. • Pure triple net leases; SVC has no capital expenditure requirements. TA 402 – Wilmington Wilmington, IL

SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2023 Financial Information

18SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2023 $1,150 $800 $850 $400 $425 $400 $0.5 $2 $2 $2 $2 $601 $1,000 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 2023 2024 2025 2026 2027 2028 2029 2030 2031 $ (M ill io n s) Unsecured Fixed Rate Debt Secured Fixed Rate Debt Revolving Credit Facility Balance Sheet Overview (1) Debt Maturities (1) Book Capitalization Leverage/Coverage Ratios (1) Net Debt / Total Gross Assets 51.6% Net Debt / Gross Book Value of Real Estate Assets and Cash Equivalents 54.6% LTM Adjusted EBITDAre / LTM Interest Expense 1.8x Net Debt / LTM Adjusted EBITDAre 8.6x Strong Balance Sheet (1) Secured Fixed Rate Debt 23% Unsecured Fixed Rate Debt 58% Shareholder’s Equity 19% • Over $7.5 billion of unencumbered assets (gross book value). • Unsecured fixed rate senior notes: $4.0 billion with a weighted average interest rate of 5.33%. • Secured fixed rate senior notes: $1 billion at 8.625%. • Secured fixed rate net lease mortgage notes: $609.1 million with a weighted average interest rate of 5.60%. • $650 million revolving credit facility: o No amounts outstanding as of September 30, 2023. o Maturity date of June 2027. • No derivatives, off-balance sheet liabilities, or material adverse change clauses or ratings triggers. 1. September 30, 2023 balances adjusted to give effect to the anticipated issuance of senior secured notes and early redemptions of March and October 2024 debt maturities. 2. SVC's net lease mortgage notes are partially amortizing and require balloon payments at maturity in 2028. These notes are prepayable without penalty 24 months prior to the expected maturity date. 3. As of September 30, 2023, SVC had no amounts outstanding under its $650 million revolving credit facility. (3)(2) 23% 58% 19%

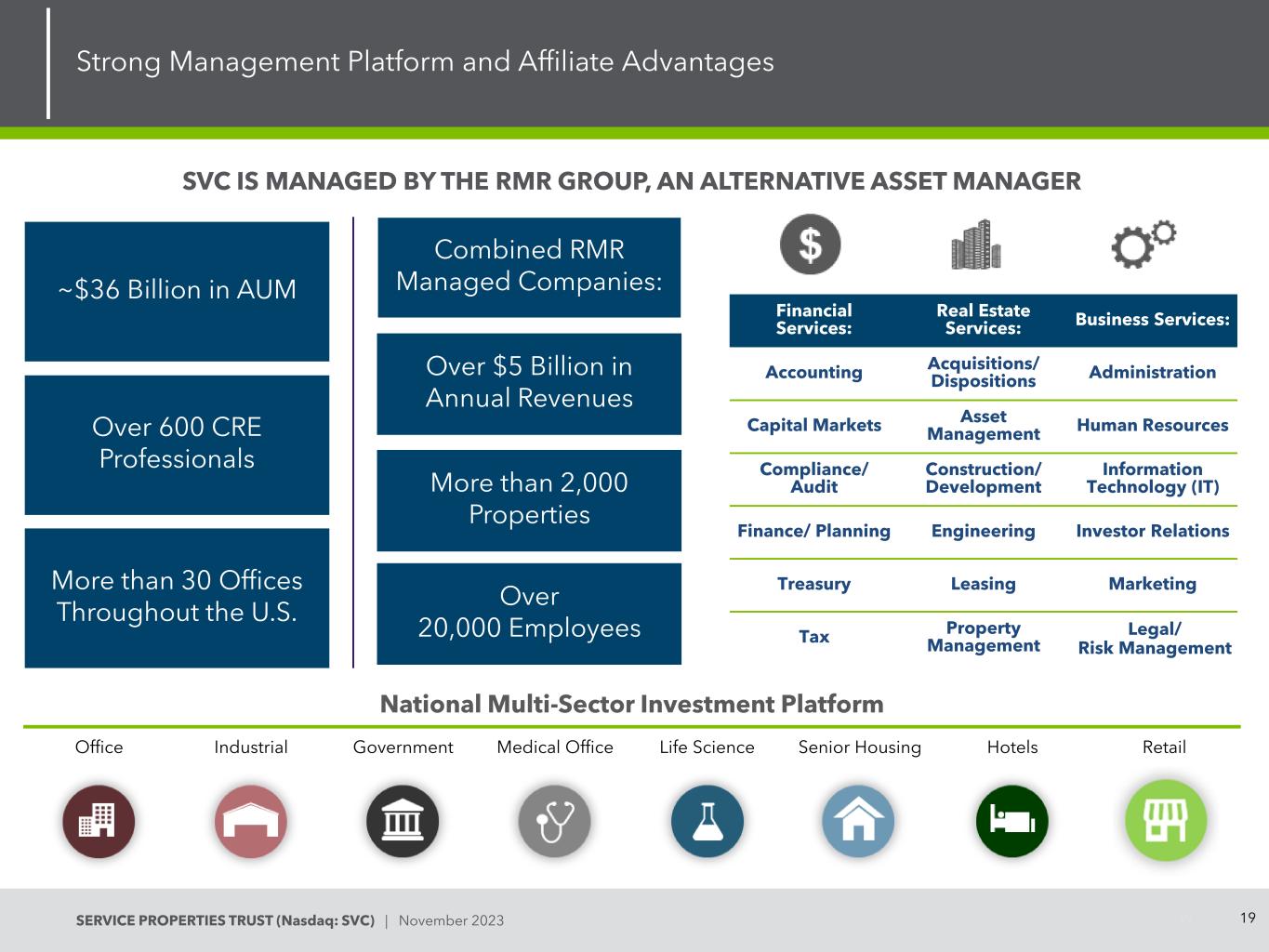

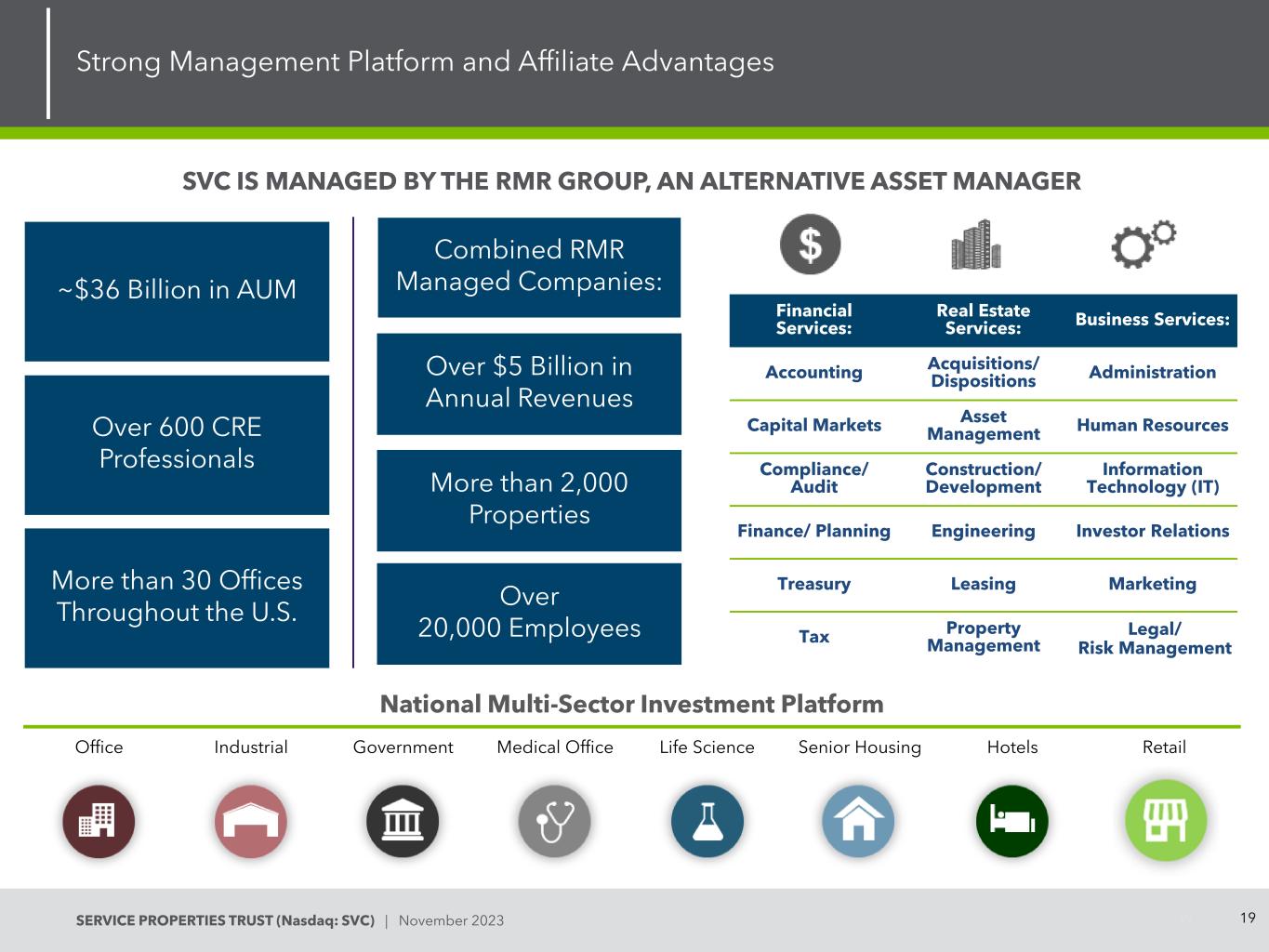

19SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2023 Financial Services: Real Estate Services: Business Services: Accounting Acquisitions/ Dispositions Administration Capital Markets Asset Management Human Resources Compliance/ Audit Construction/ Development Information Technology (IT) Finance/ Planning Engineering Investor Relations Treasury Leasing Marketing Tax Property Management Legal/ Risk Management ~$36 Billion in AUM Over 600 CRE Professionals More than 30 Offices Throughout the U.S. Over 20,000 Employees More than 2,000 Properties Over $5 Billion in Annual Revenues Combined RMR Managed Companies: SVC IS MANAGED BY THE RMR GROUP, AN ALTERNATIVE ASSET MANAGER Strong Management Platform and Affiliate Advantages 19 National Multi-Sector Investment Platform Office Industrial Government Medical Office Life Science Senior Housing Hotels Retail

20SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2023 RMR base management fee tied to SVC share price performance. RMR incentive fees contingent on total shareholder return(1) outperformance. • Equal to 12% of value generated by SVC in excess of the benchmark index total returns (MSCI U.S. REIT/HOTEL & RESORT REIT Index) per share over a three year period, subject to a cap (1.5% of equity market cap). • Absolute dollar outperformance must be positive to receive an incentive fee: it can’t be negative but better than the index. • Shareholders keep 100% of benchmark returns and 88% of returns in excess of the benchmark. Alignment of Interests If SVC’s stock price goes up and its total market cap exceeds its historical cost of real estate, RMR base management fee is capped at 50 bps of historical cost of real estate. If total market cap is less than historical cost of real estate, base fee fluctuates with share price. Incentive fee structure keeps RMR focused on increasing total shareholder return. Members of RMR senior management and RMR are holders of SVC stock, RMR is subject to long term lock up agreements. SVC shareholders have visibility into RMR, a publicly traded company. SVC benefits from RMR’s national footprint and economies of scale of $36 billion platform. (1) To determine final share price in SVC’s total return calculation, the business management agreement requires that the highest ten day share price average within the last 30 trading days of the measurement period be used. In the past, this and other less significant factors have resulted in differences between the MSCI calculation of SVC’s total return percentage and the total return percentage computed under the agreement. The RMR Group and Shareholder Alignment 20 Other fees. • Property management fee consists of an annual fee based on 3.0% of rents collected at SVC’s managed retail net lease properties (excluding TA). • Consists of an annual fee equal to generally 50 bps multiplied by the lower of: (1) SVC's historical cost of real estate, or (2) SVC's total market capitalization. • There is no incentive fee for RMR to complete any transaction that could reduce share price.

SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2023 Appendix

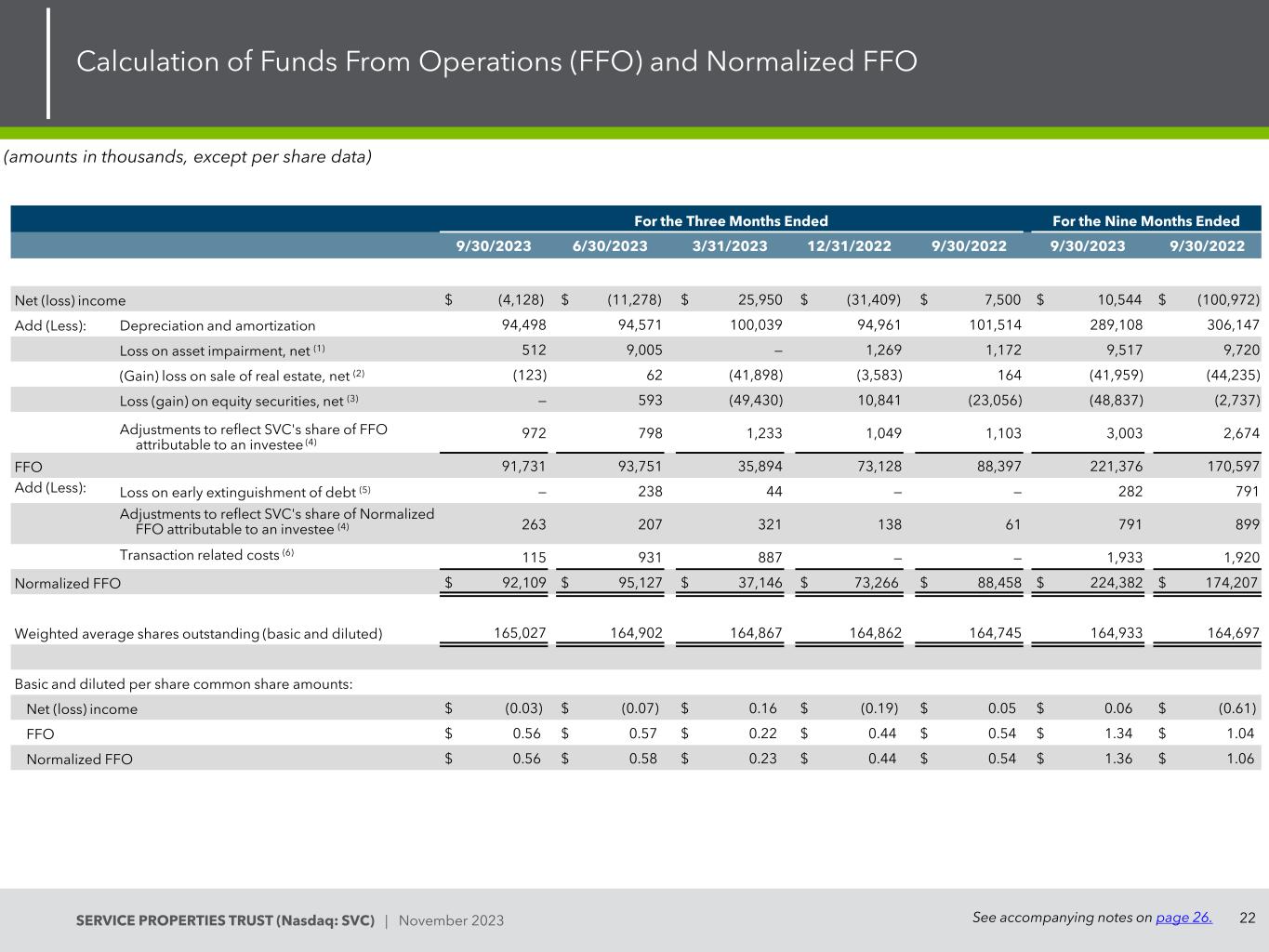

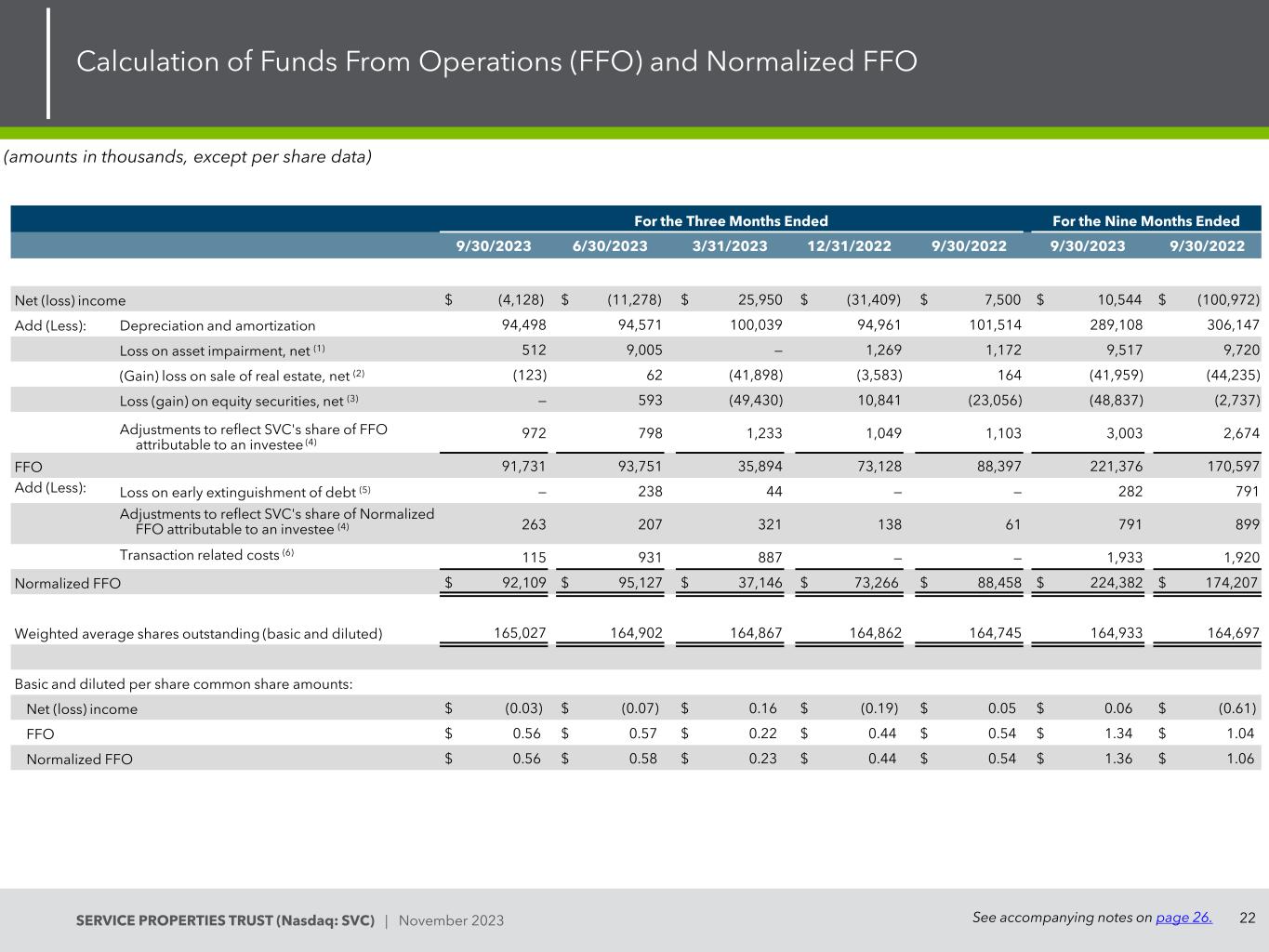

22SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2023 Calculation of Funds From Operations (FFO) and Normalized FFO See accompanying notes on page 26. (amounts in thousands, except per share data) For the Three Months Ended For the Nine Months Ended 9/30/2023 6/30/2023 3/31/2023 12/31/2022 9/30/2022 9/30/2023 9/30/2022 Net (loss) income $ (4,128) $ (11,278) $ 25,950 $ (31,409) $ 7,500 $ 10,544 $ (100,972) Add (Less): Depreciation and amortization 94,498 94,571 100,039 94,961 101,514 289,108 306,147 Loss on asset impairment, net (1) 512 9,005 — 1,269 1,172 9,517 9,720 (Gain) loss on sale of real estate, net (2) (123) 62 (41,898) (3,583) 164 (41,959) (44,235) Loss (gain) on equity securities, net (3) — 593 (49,430) 10,841 (23,056) (48,837) (2,737) Adjustments to reflect SVC's share of FFO attributable to an investee (4) 972 798 1,233 1,049 1,103 3,003 2,674 FFO 91,731 93,751 35,894 73,128 88,397 221,376 170,597 Add (Less): Loss on early extinguishment of debt (5) — 238 44 — — 282 791 Adjustments to reflect SVC's share of Normalized FFO attributable to an investee (4) 263 207 321 138 61 791 899 Transaction related costs (6) 115 931 887 — — 1,933 1,920 Normalized FFO $ 92,109 $ 95,127 $ 37,146 $ 73,266 $ 88,458 $ 224,382 $ 174,207 Weighted average shares outstanding (basic and diluted) 165,027 164,902 164,867 164,862 164,745 164,933 164,697 Basic and diluted per share common share amounts: Net (loss) income $ (0.03) $ (0.07) $ 0.16 $ (0.19) $ 0.05 $ 0.06 $ (0.61) FFO $ 0.56 $ 0.57 $ 0.22 $ 0.44 $ 0.54 $ 1.34 $ 1.04 Normalized FFO $ 0.56 $ 0.58 $ 0.23 $ 0.44 $ 0.54 $ 1.36 $ 1.06

23SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2023 Calculation of EBITDA, EBITDAre and Adjusted EBITDAre See accompanying notes on page 26. (dollars in thousands) For the Three Months Ended For the Nine Months Ended 9/30/2023 6/30/2023 3/31/2023 12/31/2022 9/30/2022 9/30/2023 9/30/2022 Net (loss) income $ (4,128) $ (11,278) $ 25,950 $ (31,409) $ 7,500 $ 10,544 $ (100,972) Add (Less): Interest expense 82,280 82,503 81,580 77,891 81,740 246,363 263,904 Income tax expense (benefit) (2,242) 5,247 (3,780) (1,757) 390 (775) 1,558 Depreciation and amortization 94,498 94,571 100,039 94,961 101,514 289,108 306,147 EBITDA 170,408 171,043 203,789 139,686 191,144 545,240 470,637 Add (Less): Loss on asset impairment, net (1) 512 9,005 — 1,269 1,172 9,517 9,720 Loss (gain) on sale of real estate, net (2) (123) 62 (41,898) (3,583) 164 (41,959) (44,235) Adjustments to reflect SVC's share of EBITDAre attributable to an investee (4) 2,707 2,275 2,614 2,340 2,787 7,596 5,541 EBITDAre 173,504 182,385 164,505 139,712 195,267 520,394 441,663 Add (less): Loss (gain) on equity securities, net (3) — 593 (49,430) 10,841 (23,056) (48,837) (2,737) Loss on early extinguishment of debt (5) — 238 44 — — 282 791 Adjustments to reflect SVC's share of Adjusted EBITDAre attributable to an investee (4) 263 207 321 (529) 272 791 1,566 Transaction related costs (6) 115 931 887 — — 1,933 1,920 General and administrative expense paid in common shares (7) 1,446 970 514 510 972 2,930 2,266 Adjusted EBITDAre $ 175,328 $ 185,324 $ 116,841 $ 150,534 $ 173,455 $ 477,493 $ 445,469

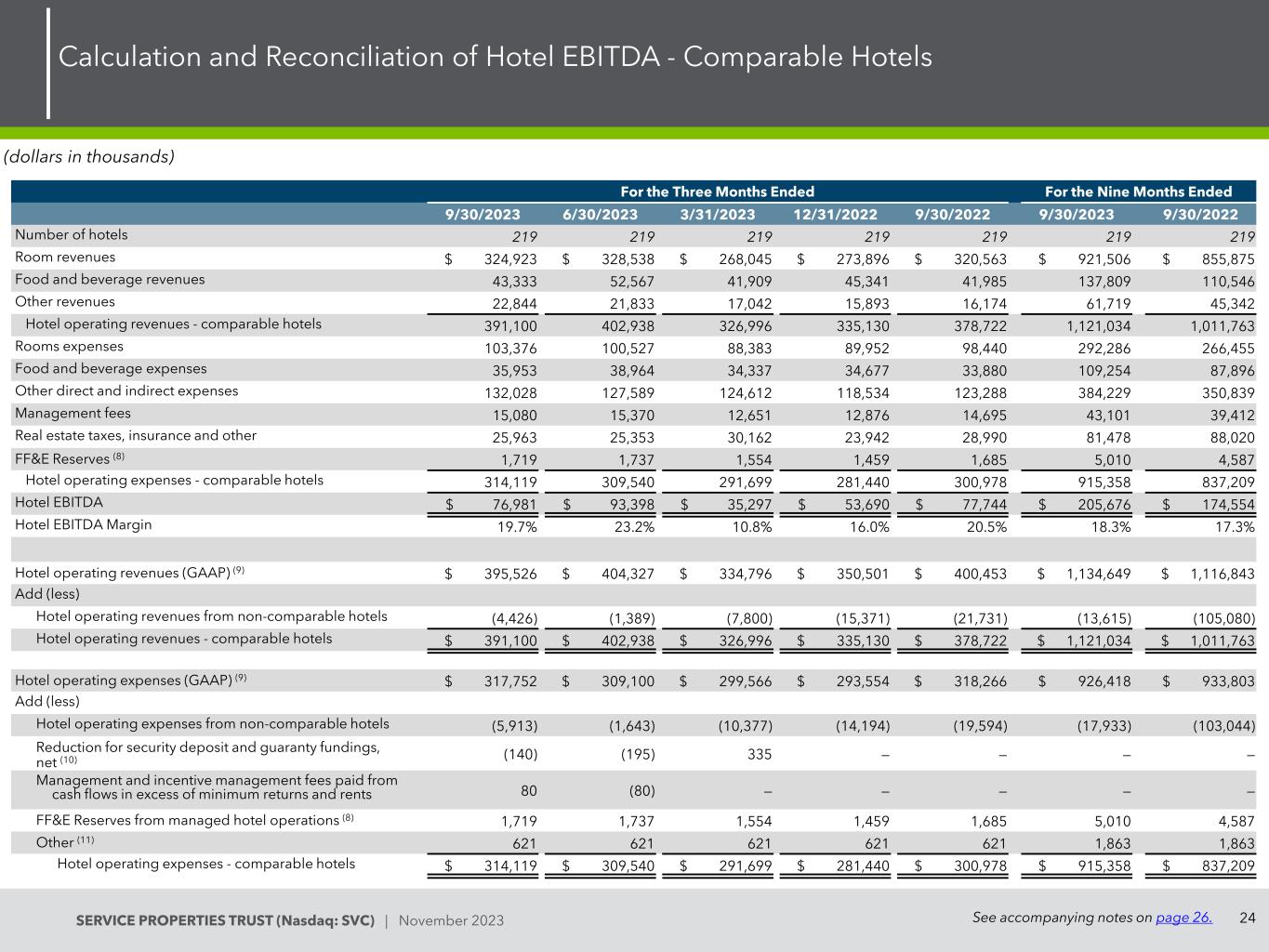

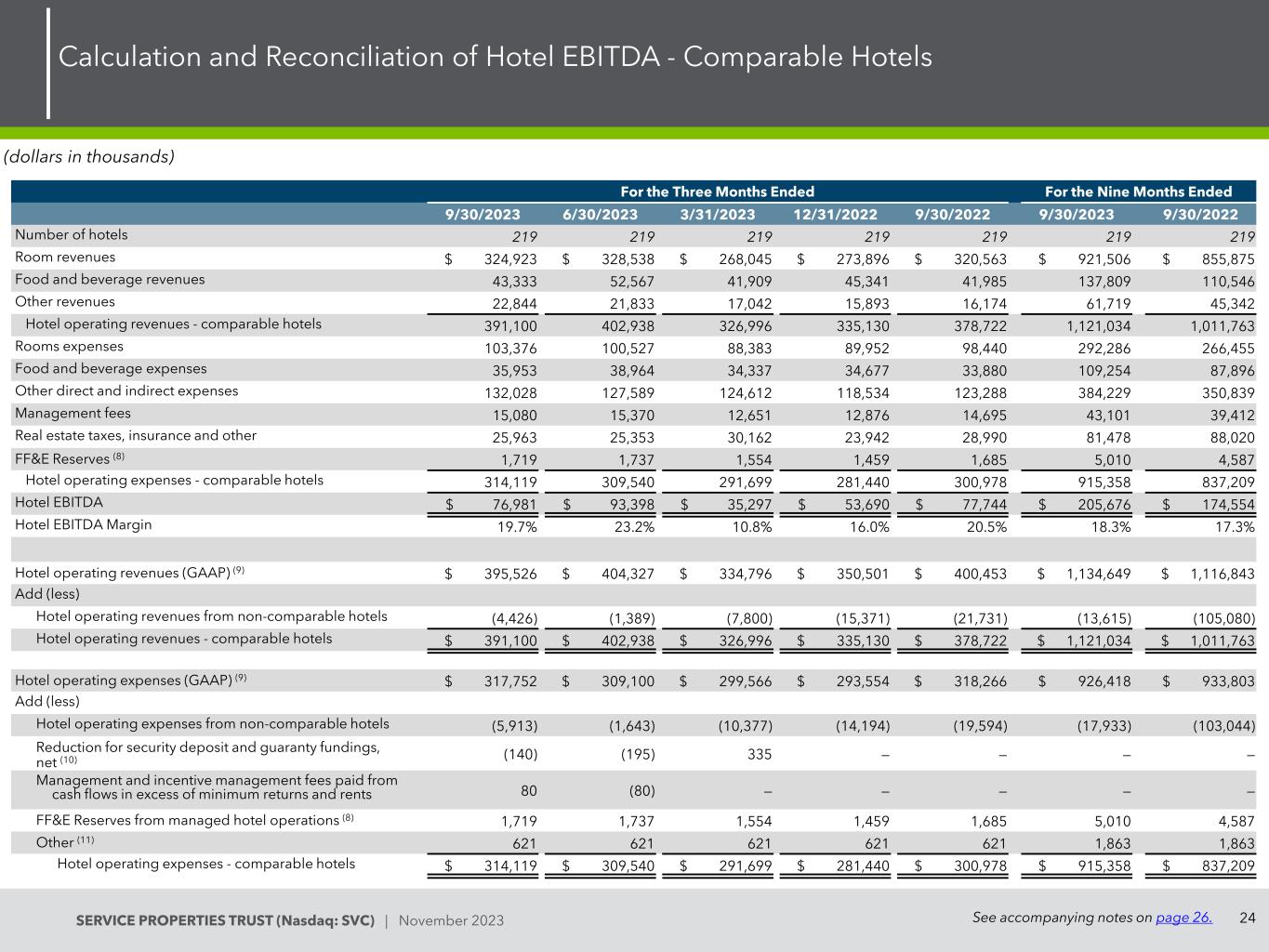

24SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2023 Calculation and Reconciliation of Hotel EBITDA - Comparable Hotels See accompanying notes on page 26. (dollars in thousands) For the Three Months Ended For the Nine Months Ended 9/30/2023 6/30/2023 3/31/2023 12/31/2022 9/30/2022 9/30/2023 9/30/2022 Number of hotels 219 219 219 219 219 219 219 Room revenues $ 324,923 $ 328,538 $ 268,045 $ 273,896 $ 320,563 $ 921,506 $ 855,875 Food and beverage revenues 43,333 52,567 41,909 45,341 41,985 137,809 110,546 Other revenues 22,844 21,833 17,042 15,893 16,174 61,719 45,342 Hotel operating revenues - comparable hotels 391,100 402,938 326,996 335,130 378,722 1,121,034 1,011,763 Rooms expenses 103,376 100,527 88,383 89,952 98,440 292,286 266,455 Food and beverage expenses 35,953 38,964 34,337 34,677 33,880 109,254 87,896 Other direct and indirect expenses 132,028 127,589 124,612 118,534 123,288 384,229 350,839 Management fees 15,080 15,370 12,651 12,876 14,695 43,101 39,412 Real estate taxes, insurance and other 25,963 25,353 30,162 23,942 28,990 81,478 88,020 FF&E Reserves (8) 1,719 1,737 1,554 1,459 1,685 5,010 4,587 Hotel operating expenses - comparable hotels 314,119 309,540 291,699 281,440 300,978 915,358 837,209 Hotel EBITDA $ 76,981 $ 93,398 $ 35,297 $ 53,690 $ 77,744 $ 205,676 $ 174,554 Hotel EBITDA Margin 19.7% 23.2% 10.8% 16.0% 20.5% 18.3% 17.3% Hotel operating revenues (GAAP) (9) $ 395,526 $ 404,327 $ 334,796 $ 350,501 $ 400,453 $ 1,134,649 $ 1,116,843 Add (less) Hotel operating revenues from non-comparable hotels (4,426) (1,389) (7,800) (15,371) (21,731) (13,615) (105,080) Hotel operating revenues - comparable hotels $ 391,100 $ 402,938 $ 326,996 $ 335,130 $ 378,722 $ 1,121,034 $ 1,011,763 Hotel operating expenses (GAAP) (9) $ 317,752 $ 309,100 $ 299,566 $ 293,554 $ 318,266 $ 926,418 $ 933,803 Add (less) Hotel operating expenses from non-comparable hotels (5,913) (1,643) (10,377) (14,194) (19,594) (17,933) (103,044) Reduction for security deposit and guaranty fundings, net (10) (140) (195) 335 — — — — Management and incentive management fees paid from cash flows in excess of minimum returns and rents 80 (80) — — — — — FF&E Reserves from managed hotel operations (8) 1,719 1,737 1,554 1,459 1,685 5,010 4,587 Other (11) 621 621 621 621 621 1,863 1,863 Hotel operating expenses - comparable hotels $ 314,119 $ 309,540 $ 291,699 $ 281,440 $ 300,978 $ 915,358 $ 837,209

25SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2023 For the Three Months Ended For the Nine Months Ended 9/30/2023 6/30/2023 3/31/2023 12/31/2022 9/30/2022 9/30/2023 9/30/2022 Number of hotels 221 221 220 238 242 221 242 Room revenues $ 327,688 $ 329,484 $ 275,267 $ 288,082 $ 341,106 $ 932,439 $ 956,843 Food and beverage revenues 44,279 52,837 42,245 45,968 42,636 139,361 112,794 Other revenues 23,559 22,006 17,284 16,451 16,711 62,849 47,206 Hotel operating revenues 395,526 404,327 334,796 350,501 400,453 1,134,649 1,116,843 Rooms expenses 104,550 100,935 91,300 93,067 104,761 296,785 300,486 Food and beverage expenses 36,997 39,282 34,750 35,248 34,497 111,029 90,064 Other direct and indirect expenses 132,254 126,360 128,202 124,396 130,470 386,816 393,586 Management fees 14,611 14,855 12,143 12,450 14,362 41,609 40,934 Real estate taxes, insurance and other 29,900 28,014 34,128 29,014 34,797 92,042 110,592 FF&E Reserves (8) 1,719 1,737 1,992 2,252 2,622 5,448 7,016 Hotel operating expenses 320,031 311,183 302,515 296,427 321,509 933,729 942,678 Hotel EBITDA $ 75,495 $ 93,144 $ 32,281 $ 54,074 $ 78,944 $ 200,920 $ 174,165 Hotel EBITDA Margin 19.1% 23.0% 9.6% 15.4% 19.7% 17.7% 15.6% Hotel operating expenses (GAAP) (9) $ 317,752 $ 309,100 $ 299,566 $ 293,554 $ 318,266 $ 926,418 $ 933,803 Add (less) Reduction for security deposit and guaranty fundings, net (10) (140) (195) 335 — — — — Management and incentive management fees paid from cash flows in excess of minimum returns and rents 80 (80) — — — — — FF&E Reserves from managed hotel operations (8) 1,718 1,737 1,993 2,252 2,622 5,448 7,012 Other (11) 621 621 621 621 621 1,863 1,863 Hotel operating expenses $ 320,031 $ 311,183 $ 302,515 $ 296,427 $ 321,509 $ 933,729 $ 942,678 Calculation and Reconciliation of Hotel EBITDA - All Hotels* * Results of all hotels as owned during the periods presented, including the results of hotels sold by SVC for the periods owned by SVC. See accompanying notes on page 26. (dollars in thousands)

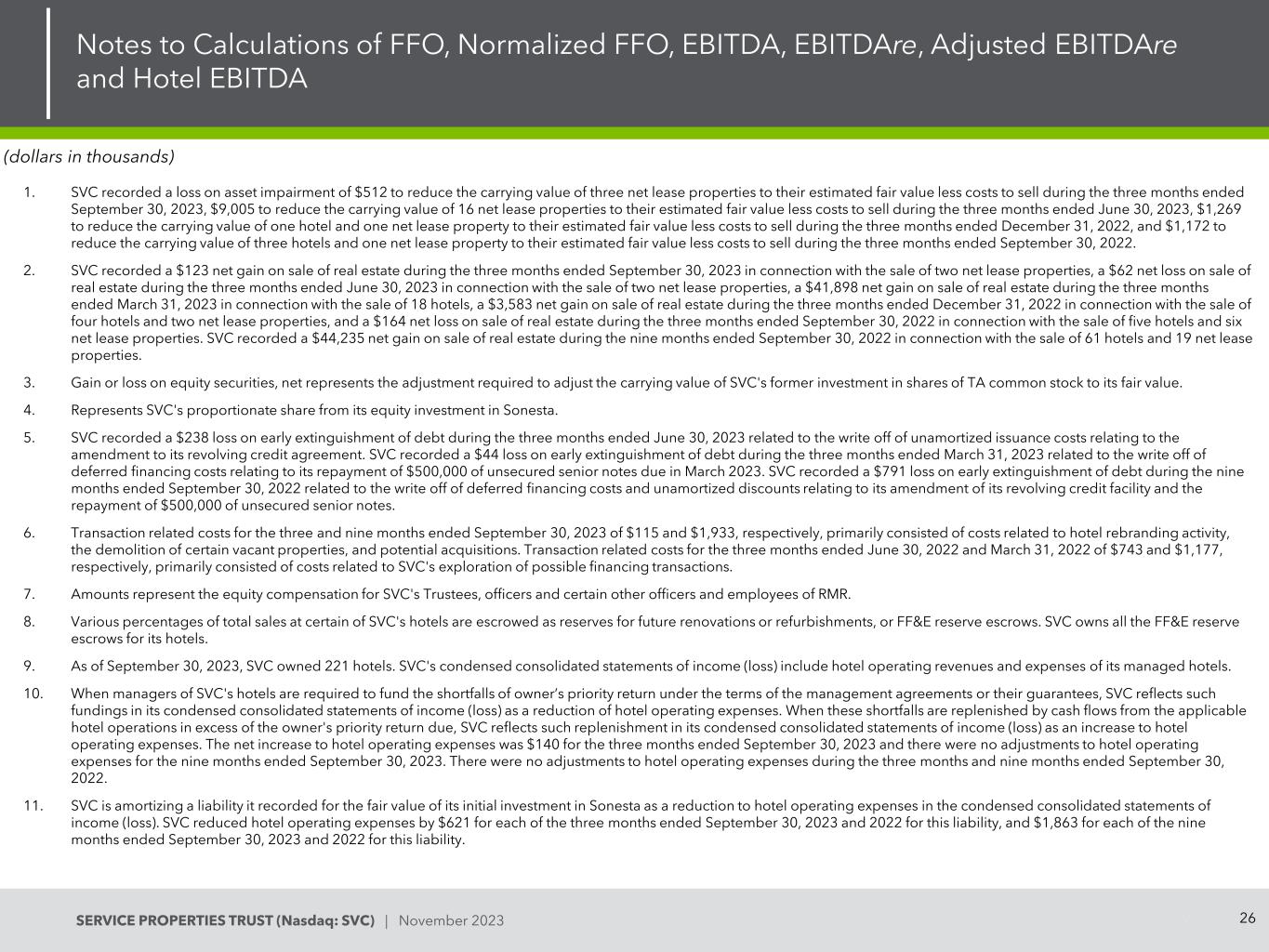

26SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2023 Notes to Calculations of FFO, Normalized FFO, EBITDA, EBITDAre, Adjusted EBITDAre and Hotel EBITDA 26 1. SVC recorded a loss on asset impairment of $512 to reduce the carrying value of three net lease properties to their estimated fair value less costs to sell during the three months ended September 30, 2023, $9,005 to reduce the carrying value of 16 net lease properties to their estimated fair value less costs to sell during the three months ended June 30, 2023, $1,269 to reduce the carrying value of one hotel and one net lease property to their estimated fair value less costs to sell during the three months ended December 31, 2022, and $1,172 to reduce the carrying value of three hotels and one net lease property to their estimated fair value less costs to sell during the three months ended September 30, 2022. 2. SVC recorded a $123 net gain on sale of real estate during the three months ended September 30, 2023 in connection with the sale of two net lease properties, a $62 net loss on sale of real estate during the three months ended June 30, 2023 in connection with the sale of two net lease properties, a $41,898 net gain on sale of real estate during the three months ended March 31, 2023 in connection with the sale of 18 hotels, a $3,583 net gain on sale of real estate during the three months ended December 31, 2022 in connection with the sale of four hotels and two net lease properties, and a $164 net loss on sale of real estate during the three months ended September 30, 2022 in connection with the sale of five hotels and six net lease properties. SVC recorded a $44,235 net gain on sale of real estate during the nine months ended September 30, 2022 in connection with the sale of 61 hotels and 19 net lease properties. 3. Gain or loss on equity securities, net represents the adjustment required to adjust the carrying value of SVC's former investment in shares of TA common stock to its fair value. 4. Represents SVC's proportionate share from its equity investment in Sonesta. 5. SVC recorded a $238 loss on early extinguishment of debt during the three months ended June 30, 2023 related to the write off of unamortized issuance costs relating to the amendment to its revolving credit agreement. SVC recorded a $44 loss on early extinguishment of debt during the three months ended March 31, 2023 related to the write off of deferred financing costs relating to its repayment of $500,000 of unsecured senior notes due in March 2023. SVC recorded a $791 loss on early extinguishment of debt during the nine months ended September 30, 2022 related to the write off of deferred financing costs and unamortized discounts relating to its amendment of its revolving credit facility and the repayment of $500,000 of unsecured senior notes. 6. Transaction related costs for the three and nine months ended September 30, 2023 of $115 and $1,933, respectively, primarily consisted of costs related to hotel rebranding activity, the demolition of certain vacant properties, and potential acquisitions. Transaction related costs for the three months ended June 30, 2022 and March 31, 2022 of $743 and $1,177, respectively, primarily consisted of costs related to SVC's exploration of possible financing transactions. 7. Amounts represent the equity compensation for SVC's Trustees, officers and certain other officers and employees of RMR. 8. Various percentages of total sales at certain of SVC's hotels are escrowed as reserves for future renovations or refurbishments, or FF&E reserve escrows. SVC owns all the FF&E reserve escrows for its hotels. 9. As of September 30, 2023, SVC owned 221 hotels. SVC's condensed consolidated statements of income (loss) include hotel operating revenues and expenses of its managed hotels. 10. When managers of SVC's hotels are required to fund the shortfalls of owner’s priority return under the terms of the management agreements or their guarantees, SVC reflects such fundings in its condensed consolidated statements of income (loss) as a reduction of hotel operating expenses. When these shortfalls are replenished by cash flows from the applicable hotel operations in excess of the owner's priority return due, SVC reflects such replenishment in its condensed consolidated statements of income (loss) as an increase to hotel operating expenses. The net increase to hotel operating expenses was $140 for the three months ended September 30, 2023 and there were no adjustments to hotel operating expenses for the nine months ended September 30, 2023. There were no adjustments to hotel operating expenses during the three months and nine months ended September 30, 2022. 11. SVC is amortizing a liability it recorded for the fair value of its initial investment in Sonesta as a reduction to hotel operating expenses in the condensed consolidated statements of income (loss). SVC reduced hotel operating expenses by $621 for each of the three months ended September 30, 2023 and 2022 for this liability, and $1,863 for each of the nine months ended September 30, 2023 and 2022 for this liability. (dollars in thousands)

27SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2023 Non-GAAP Financial Measures and Certain Definitions 27 Non-GAAP Financial Measures: SVC presents certain “non-GAAP financial measures” within the meaning of the applicable Securities and Exchange Commission, or SEC, rules, including FFO, Normalized FFO, EBITDA, Hotel EBITDA, EBITDAre and Adjusted EBITDAre. These measures do not represent cash generated by operating activities in accordance with GAAP and should not be considered alternatives to net (loss) income as indicators of SVC's operating performance or as measures of its liquidity. These measures should be considered in conjunction with net (loss) income as presented in SVC's condensed consolidated statements of income (loss). SVC considers these non-GAAP measures to be appropriate supplemental measures of operating performance for a REIT, along with net (loss) income. SVC believes these measures provide useful information to investors because by excluding the effects of certain historical amounts, such as depreciation and amortization expense, they may facilitate a comparison of its operating performance between periods and with other REITs and, in the case of Hotel EBITDA, reflecting only those income and expense items that are generated and incurred at the hotel level may help both investors and management to understand the operations of its hotels. FFO and Normalized FFO: SVC calculates funds from operations, or FFO, and Normalized Funds From Operations, or Normalized FFO, as shown on page 22. FFO is calculated on the basis defined by The National Association of Real Estate Investment Trusts, or Nareit, which is net (loss) income, calculated in accordance with GAAP, excluding any gain or loss on sale of properties and loss on impairment of real estate assets, if any, plus real estate depreciation and amortization, less any gains and losses on equity securities, as well as adjustments to reflect SVC's share of FFO attributable to an investee and certain other adjustments currently not applicable to SVC. In calculating Normalized FFO, SVC adjusts for the items shown on page 22. FFO and Normalized FFO are among the factors considered by SVC's Board of Trustees when determining the amount of distributions to SVC's shareholders. Other factors include, but are not limited to, requirements to satisfy its REIT distribution requirements, the availability to SVC of debt and equity capital, SVC's distribution rate as a percentage of the trading price of its common shares, or dividend yield, and to the dividend yield of other REITs, SVC's expectation of its future capital requirements and operating performance and its expected needs for and availability of cash to pay its obligations. Other real estate companies and REITs may calculate FFO and Normalized FFO differently than SVC does. EBITDA, EBITDAre and Adjusted EBITDAre: SVC calculates earnings before interest, taxes, depreciation and amortization, or EBITDA, EBITDA for real estate, or EBITDAre, and Adjusted EBITDAre as shown on page 23. EBITDAre is calculated on the basis defined by Nareit, which is EBITDA, excluding gains and losses on the sale of real estate, loss on impairment of real estate assets, if any, and adjustments to reflect SVC's share of EBITDAre attributable to an investee. In calculating Adjusted EBITDAre, SVC adjusts for the items shown on page 23. Other real estate companies and REITs may calculate EBITDA, EBITDAre and Adjusted EBITDAre differently than SVC does. Hotel EBITDA: SVC calculates Hotel EBITDA as hotel operating revenues less hotel operating expenses of all managed and leased hotels, prior to any adjustments required for presentation in its condensed consolidated statements of income (loss) in accordance with GAAP. SVC believes that Hotel EBITDA provides useful information to management and investors as a key measure of the profitability of its hotel operations. Other Definitions: Annualized Minimum Rent: Generally, SVC's lease agreements with its net lease tenants require payment of minimum rent to SVC. Certain of these minimum rent payment amounts are secured by full or limited guarantees. Annualized minimum rent represents cash amounts and excludes adjustments, if any, necessary to record scheduled rent changes on a straight line basis or any expense reimbursements. Annualized minimum rent for TA excludes the impact of rents prepaid by TA. Average Daily Rate: ADR represents rooms revenue divided by the total number of room nights sold in a given period. ADR provides useful insight on pricing at SVC's hotels and is a measure widely used in the hotel industry. Chain Scale: As characterized by STR Global Limited, a data benchmark and analytics provider for the lodging industry.

28SERVICE PROPERTIES TRUST (Nasdaq: SVC) | November 2023 Non-GAAP Financial Measures and Certain Definitions (continued) 28 Comparable Hotels Data: SVC presents RevPAR, ADR and occupancy for the periods presented on a comparable basis to facilitate comparisons between periods. SVC generally defines comparable hotels as those that it owned on September 30, 2023 and were open and operating since the beginning of the earliest period being compared. For the periods presented, SVC's comparable results excluded two hotels, one of which was not owned for the entirety of the periods and the other of which had suspended operations during part of the periods presented. Consolidated Income Available for Debt Service: Consolidated income available for debt service, as defined in SVC's debt agreements, is earnings from operations excluding interest expense, unrealized gains and losses on equity securities, depreciation and amortization, loss on asset impairment, unrealized appreciation on assets held for sale, gains and losses on early extinguishment of debt, gains and losses on sales of property and amortization of deferred charges. Debt: Debt amounts reflect the principal balance as of the date reported. Net debt means total debt less unrestricted cash and cash equivalents as of the date reported. FF&E Reserve: Various percentages of total sales at certain of SVC's hotels are escrowed as reserves for future renovations or refurbishments, or FF&E reserve escrows. SVC owns all the FF&E reserve escrows for its hotels. Gross Book Value of Real Estate Assets: Gross book value of real estate assets is real estate properties at cost plus acquisition related costs, if any, before purchase price allocations, less impairment write-downs, if any. Hotel EBITDA Margin: Hotel EBITDA as a percentage of hotel operating revenues. Investment: SVC defines hotel investment as historical cost of its properties plus capital improvements funded by it less impairment write-downs, if any, and excludes capital improvements made from FF&E reserves funded from hotel operations that do not result in increases in owner's priority return or rents. Occupancy: Occupancy represents the total number of room nights sold divided by the total number of room nights available at a hotel or group of hotels, and represents occupied properties as of the end of the period shown for net lease properties. Occupancy is an important measure of the utilization rate and demand of SVC's properties. Owner's Priority Return: Each of its management agreements or leases with hotel operators provides for payment to SVC of an annual owner's priority return or minimum rent, respectively. Certain of these minimum payment amounts are secured by full or limited guarantees. In addition, certain of its hotel management agreements provide for payment to SVC of additional amounts to the extent of available cash flows as defined in the management agreement. Payments of these additional amounts are not guaranteed. Rent Coverage: SVC defines rent coverage as earnings before interest, taxes, depreciation, amortization and rent, or EBITDAR, divided by the annual minimum rent due to SVC weighted by the minimum rent of the property to total minimum rents of the net lease portfolio. Tenants with no minimum rent required under the lease are excluded. EBITDAR amounts used to determine rent coverage are generally for the latest twelve month period, based on the most recent operating information, if any, furnished by the tenant. Operating statements furnished by the tenant often are unaudited and, in certain cases, may not have been prepared in accordance with GAAP and are not independently verified by SVC. In instances where SVC does not have tenant financial information, it calculates an implied coverage ratio for the period based on other tenants with available financial statements operating the same brand or within the same industry. As a result, SVC believes using this implied coverage metric provides a more reasonable estimated representation of recent operating results and the financial condition for those tenants. Revenue per Available Room: RevPAR represents rooms revenue divided by the total number of room nights available to guests for a given period. RevPAR is an industry metric correlated to occupancy and ADR and helps measure revenue performance over comparable periods. Total Gross Assets: Total gross assets is total assets plus accumulated depreciation.

Service Properties Trust (Nasdaq: SVC) Investor Presentation November 2023 Two Newton Place 255 Washington Street Suite 300 Newton, MA 02458 SVCREIT.COM