Service Properties Trust Third Quarter 2023 Financial Results and Supplemental Information November 6, 2023 Exhibit 99.2TA - 065 Seymour Seymour, IN

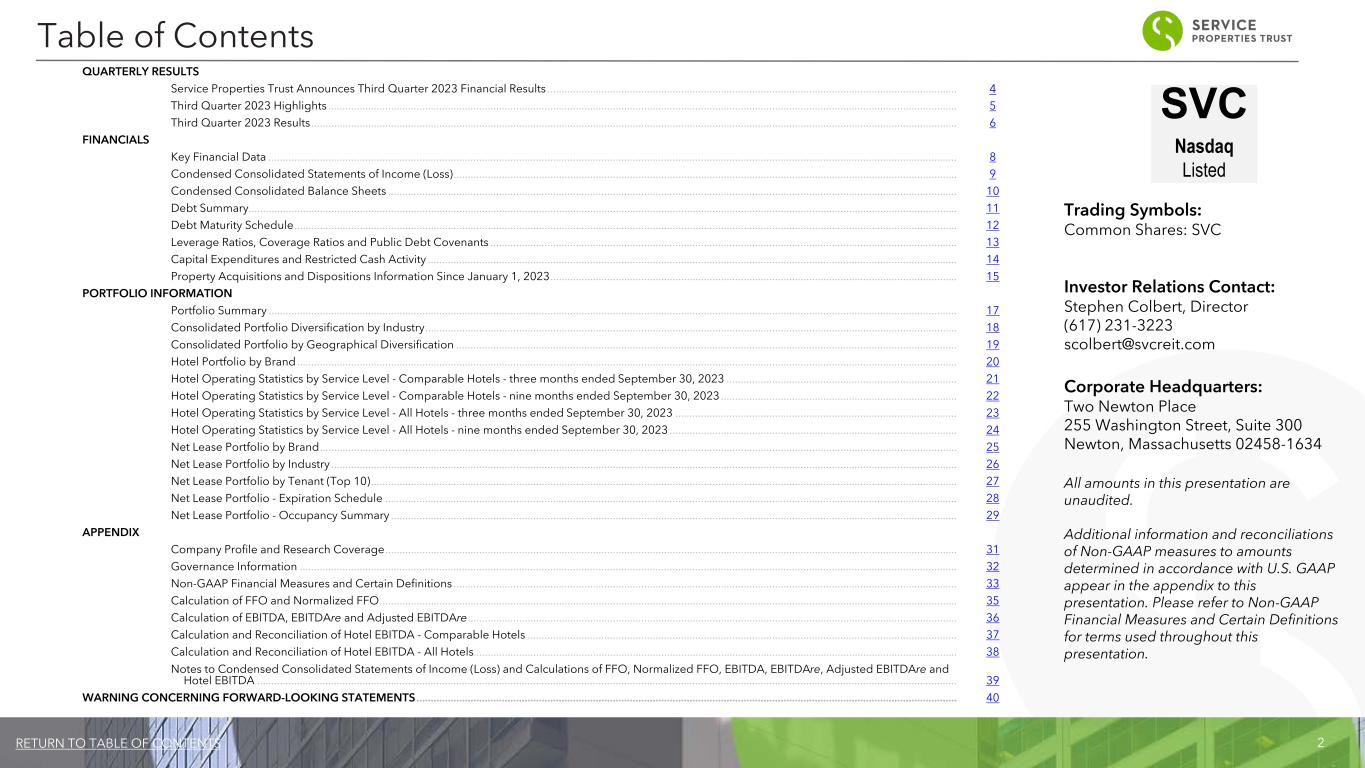

2RETURN TO TABLE OF CONTENTS Table of Contents QUARTERLY RESULTS Service Properties Trust Announces Third Quarter 2023 Financial Results ................................................................................................................................................ 4 Third Quarter 2023 Highlights ............................................................................................................................................................................................................................. 5 Third Quarter 2023 Results ................................................................................................................................................................................................................................... 6 FINANCIALS Key Financial Data .................................................................................................................................................................................................................................................. 8 Condensed Consolidated Statements of Income (Loss) ................................................................................................................................................................................. 9 Condensed Consolidated Balance Sheets ........................................................................................................................................................................................................ 10 Debt Summary ......................................................................................................................................................................................................................................................... 11 Debt Maturity Schedule ......................................................................................................................................................................................................................................... 12 Leverage Ratios, Coverage Ratios and Public Debt Covenants .................................................................................................................................................................... 13 Capital Expenditures and Restricted Cash Activity .......................................................................................................................................................................................... 14 Property Acquisitions and Dispositions Information Since January 1, 2023 ............................................................................................................................................... 15 PORTFOLIO INFORMATION Portfolio Summary .................................................................................................................................................................................................................................................. 17 Consolidated Portfolio Diversification by Industry ........................................................................................................................................................................................... 18 Consolidated Portfolio by Geographical Diversification ................................................................................................................................................................................ 19 Hotel Portfolio by Brand ........................................................................................................................................................................................................................................ 20 Hotel Operating Statistics by Service Level - Comparable Hotels - three months ended September 30, 2023 ................................................................................. 21 Hotel Operating Statistics by Service Level - Comparable Hotels - nine months ended September 30, 2023 ................................................................................... 22 Hotel Operating Statistics by Service Level - All Hotels - three months ended September 30, 2023 ................................................................................................... 23 Hotel Operating Statistics by Service Level - All Hotels - nine months ended September 30, 2023 ..................................................................................................... 24 Net Lease Portfolio by Brand ................................................................................................................................................................................................................................ 25 Net Lease Portfolio by Industry ............................................................................................................................................................................................................................ 26 Net Lease Portfolio by Tenant (Top 10) .............................................................................................................................................................................................................. 27 Net Lease Portfolio - Expiration Schedule ......................................................................................................................................................................................................... 28 Net Lease Portfolio - Occupancy Summary ....................................................................................................................................................................................................... 29 APPENDIX Company Profile and Research Coverage ......................................................................................................................................................................................................... 31 Governance Information ....................................................................................................................................................................................................................................... 32 Non-GAAP Financial Measures and Certain Definitions ................................................................................................................................................................................. 33 Calculation of FFO and Normalized FFO ........................................................................................................................................................................................................... 35 Calculation of EBITDA, EBITDAre and Adjusted EBITDAre ............................................................................................................................................................................ 36 Calculation and Reconciliation of Hotel EBITDA - Comparable Hotels ....................................................................................................................................................... 37 Calculation and Reconciliation of Hotel EBITDA - All Hotels.......................................................................................................................................................................... 38 Notes to Condensed Consolidated Statements of Income (Loss) and Calculations of FFO, Normalized FFO, EBITDA, EBITDAre, Adjusted EBITDAre and Hotel EBITDA ...................................................................................................................................................................................................................................................... 39 WARNING CONCERNING FORWARD-LOOKING STATEMENTS .............................................................................................................................................................................................. 40 SVC Nasdaq Listed Trading Symbols: Common Shares: SVC Investor Relations Contact: Stephen Colbert, Director (617) 231-3223 scolbert@svcreit.com Corporate Headquarters: Two Newton Place 255 Washington Street, Suite 300 Newton, Massachusetts 02458-1634 All amounts in this presentation are unaudited. Additional information and reconciliations of Non-GAAP measures to amounts determined in accordance with U.S. GAAP appear in the appendix to this presentation. Please refer to Non-GAAP Financial Measures and Certain Definitions for terms used throughout this presentation.

3RETURN TO TABLE OF CONTENTS Quarterly Results

4RETURN TO TABLE OF CONTENTS Newton, MA (November 6, 2023): Service Properties Trust (Nasdaq: SVC) today announced its financial results for the quarter ended September 30, 2023. Dividend: SVC has declared a quarterly distribution on its common shares of $0.20 per share to shareholders of record as of the close of business on October 23, 2023. This distribution will be paid on or about November 16, 2023. Conference Call: A conference call to discuss SVC's third quarter results will be held on Tuesday, November 7, 2023 at 10:00 a.m. Eastern Time. The conference call may be accessed by dialing (877) 329-3720 or (412) 317-5434 (if calling from outside the United States and Canada); a pass code is not required. A replay will be available for one week by dialing (412) 317-0088; the replay pass code is 4473174. A live audio webcast of the conference call will also be available in a listen-only-mode on SVC’s website, at www.svcreit.com. The archived webcast will be available for replay on SVC’s website after the call. The transcription, recording and retransmission in any way of SVC's third quarter conference call are strictly prohibited without the prior written consent of SVC. About Service Properties Trust: Service Properties Trust (Nasdaq: SVC) is a real estate investment trust, or REIT, with over $11 billion invested in two asset categories: hotels and service-focused retail net lease properties. As of September 30, 2023, SVC owned 221 hotels with over 37,000 guest rooms throughout the United States and in Puerto Rico and Canada, the majority of which are extended stay and select service. As of September 30, 2023, SVC also owned 761 retail service-focused net lease properties totaling approximately 13.4 million square feet throughout the United States. SVC is managed by The RMR Group (Nasdaq: RMR), an alternative asset management company with approximately $36 billion in assets under management as of September 30, 2023 and more than 35 years of institutional experience in buying, selling, financing and operating commercial real estate. SVC is headquartered in Newton, MA. For more information, visit www.svcreit.com. Service Properties Trust Announces Third Quarter 2023 Financial Results "SVC’s third quarter hotel portfolio performance was in line with our expectations and reflects ongoing year over year RevPAR growth. The net lease portfolio continues to provide dependable cash flows and is anchored by our TA leases, which are backed by an investment grade company in BP. With over $1 billion of total liquidity and a large portfolio of unencumbered assets, our balance sheet is well positioned to address upcoming debt maturities." Todd Hargreaves, President and Chief Investment Officer

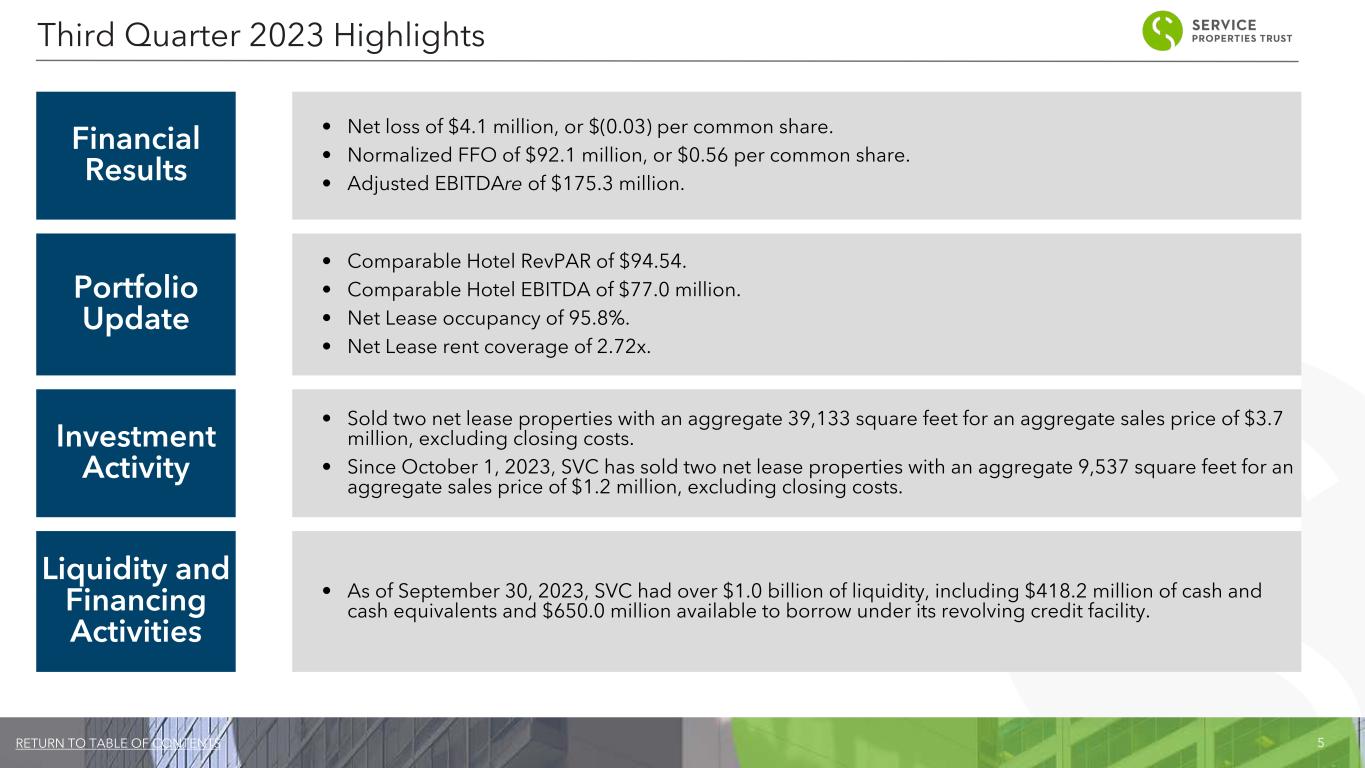

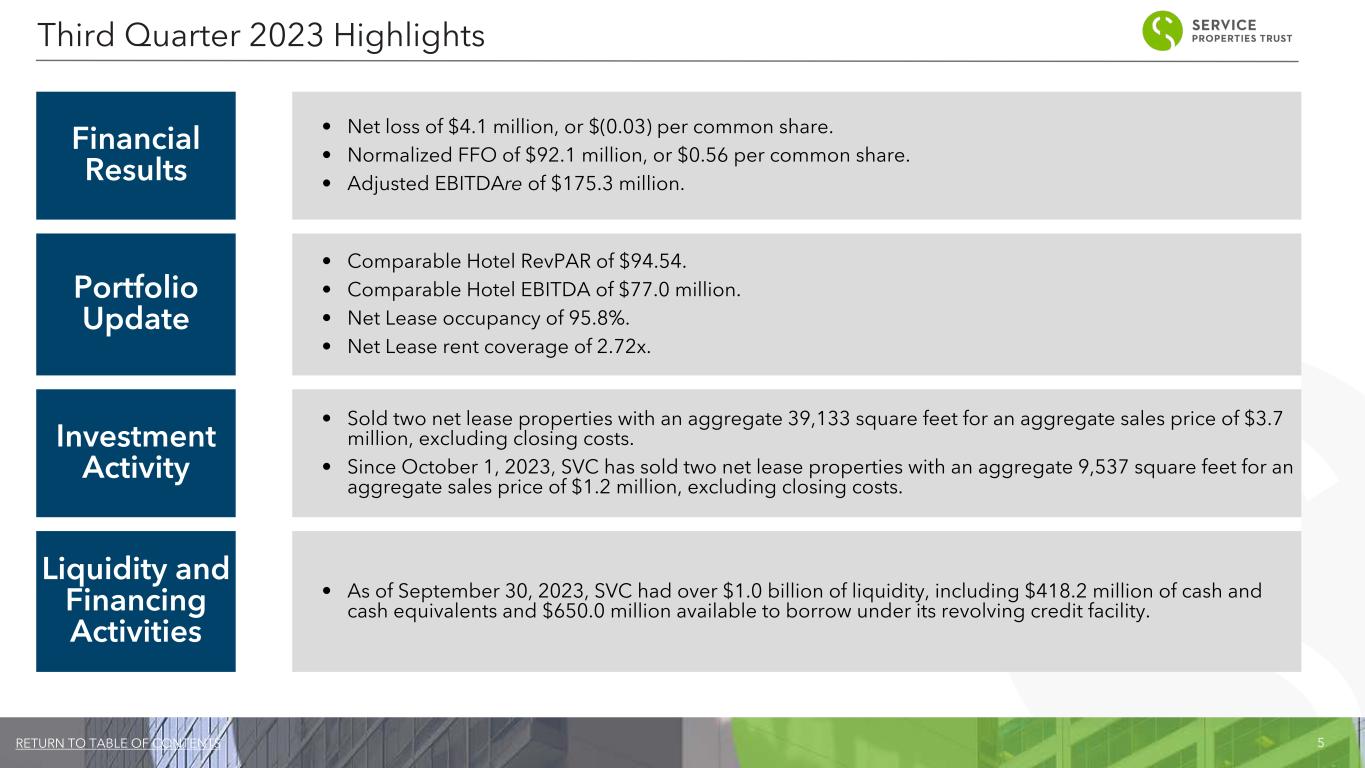

5RETURN TO TABLE OF CONTENTS Third Quarter 2023 Highlights Financial Results • Net loss of $4.1 million, or $(0.03) per common share. • Normalized FFO of $92.1 million, or $0.56 per common share. • Adjusted EBITDAre of $175.3 million. Portfolio Update • Comparable Hotel RevPAR of $94.54. • Comparable Hotel EBITDA of $77.0 million. • Net Lease occupancy of 95.8%. • Net Lease rent coverage of 2.72x. Investment Activity • Sold two net lease properties with an aggregate 39,133 square feet for an aggregate sales price of $3.7 million, excluding closing costs. • Since October 1, 2023, SVC has sold two net lease properties with an aggregate 9,537 square feet for an aggregate sales price of $1.2 million, excluding closing costs. Liquidity and Financing Activities • As of September 30, 2023, SVC had over $1.0 billion of liquidity, including $418.2 million of cash and cash equivalents and $650.0 million available to borrow under its revolving credit facility.

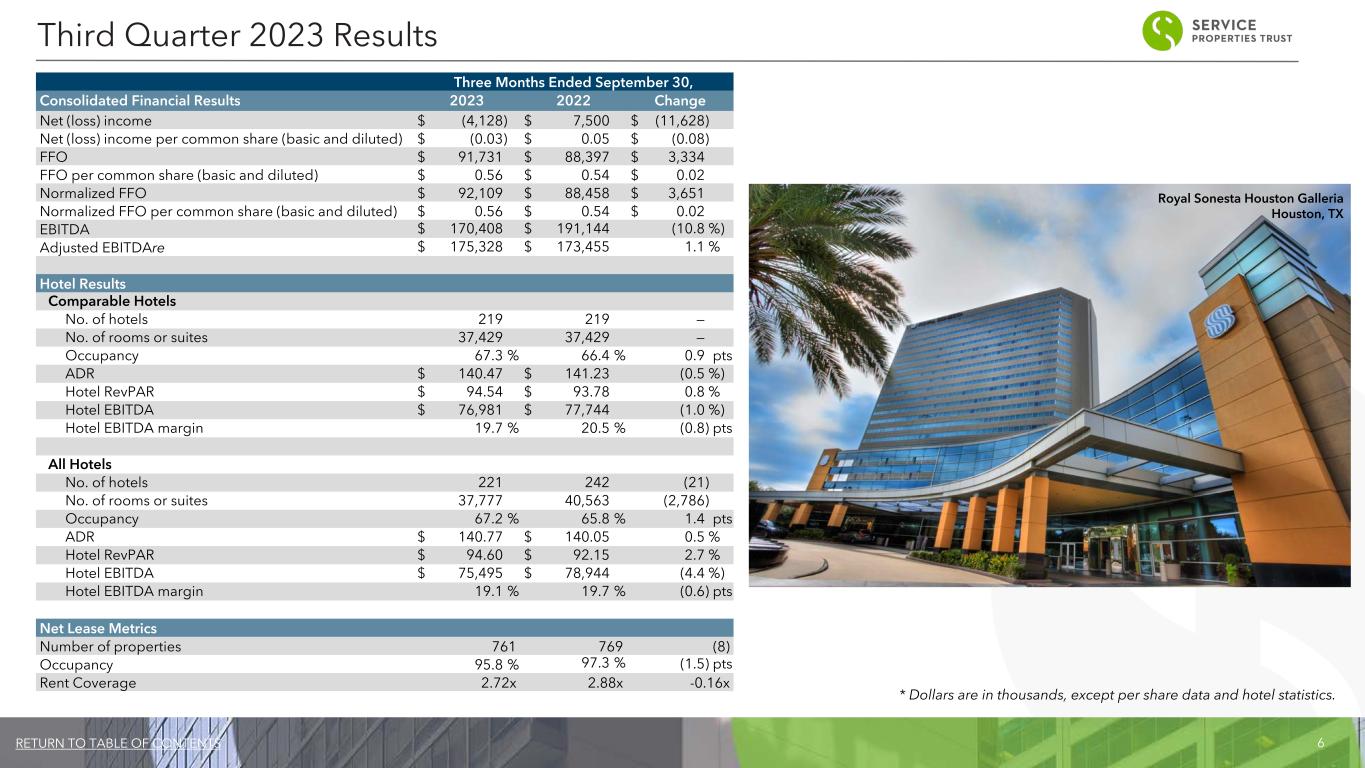

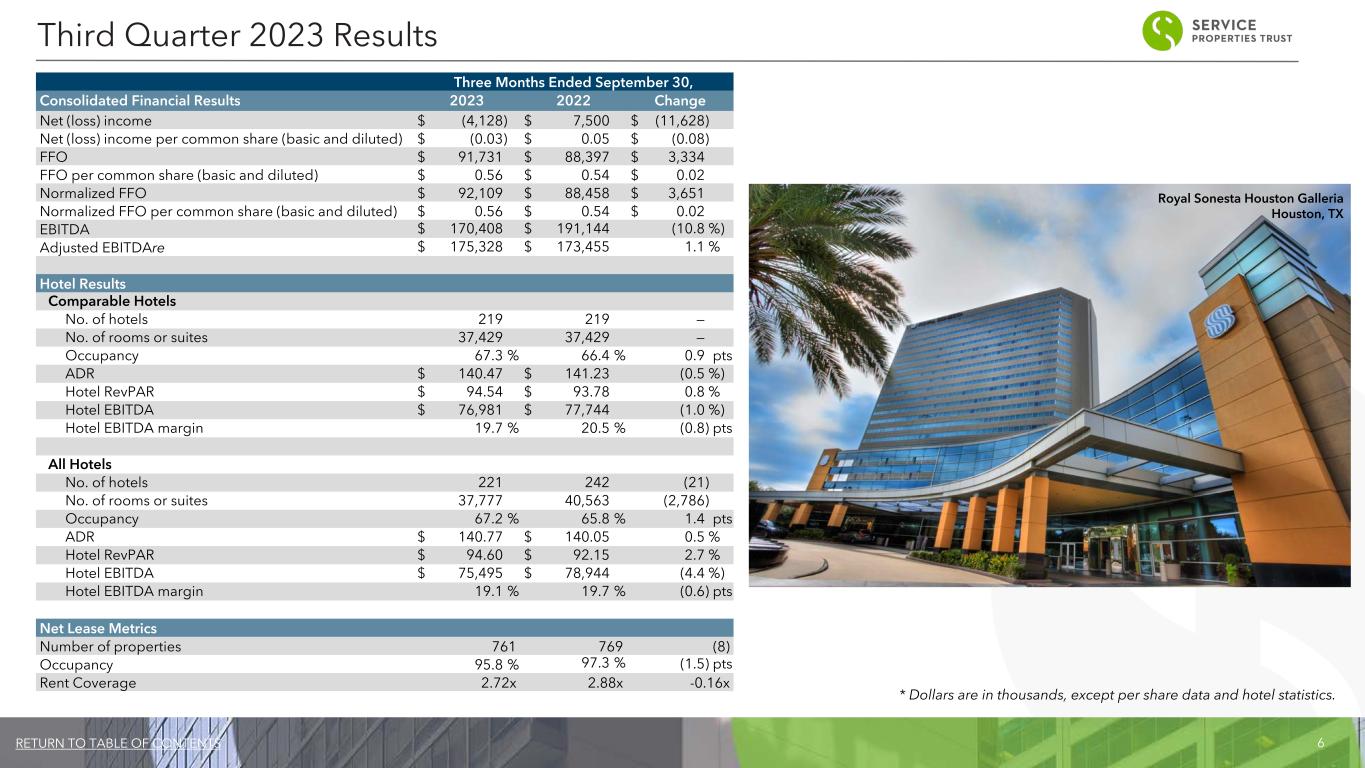

6RETURN TO TABLE OF CONTENTS Third Quarter 2023 Results Three Months Ended September 30, Consolidated Financial Results 2023 2022 Change Net (loss) income $ (4,128) $ 7,500 $ (11,628) Net (loss) income per common share (basic and diluted) $ (0.03) $ 0.05 $ (0.08) FFO $ 91,731 $ 88,397 $ 3,334 FFO per common share (basic and diluted) $ 0.56 $ 0.54 $ 0.02 Normalized FFO $ 92,109 $ 88,458 $ 3,651 Normalized FFO per common share (basic and diluted) $ 0.56 $ 0.54 $ 0.02 EBITDA $ 170,408 $ 191,144 (10.8 %) Adjusted EBITDAre $ 175,328 $ 173,455 1.1 % Hotel Results Comparable Hotels No. of hotels 219 219 — No. of rooms or suites 37,429 37,429 — Occupancy 67.3 % 66.4 % 0.9 pts ADR $ 140.47 $ 141.23 (0.5 %) Hotel RevPAR $ 94.54 $ 93.78 0.8 % Hotel EBITDA $ 76,981 $ 77,744 (1.0 %) Hotel EBITDA margin 19.7 % 20.5 % (0.8) pts All Hotels No. of hotels 221 242 (21) No. of rooms or suites 37,777 40,563 (2,786) Occupancy 67.2 % 65.8 % 1.4 pts ADR $ 140.77 $ 140.05 0.5 % Hotel RevPAR $ 94.60 $ 92.15 2.7 % Hotel EBITDA $ 75,495 $ 78,944 (4.4 %) Hotel EBITDA margin 19.1 % 19.7 % (0.6) pts Net Lease Metrics Number of properties 761 769 (8) Occupancy 95.8 % 97.3 % (1.5) pts Rent Coverage 2.72x 2.88x -0.16x Royal Sonesta Houston Galleria Houston, TX * Dollars are in thousands, except per share data and hotel statistics.

7RETURN TO TABLE OF CONTENTS Financials

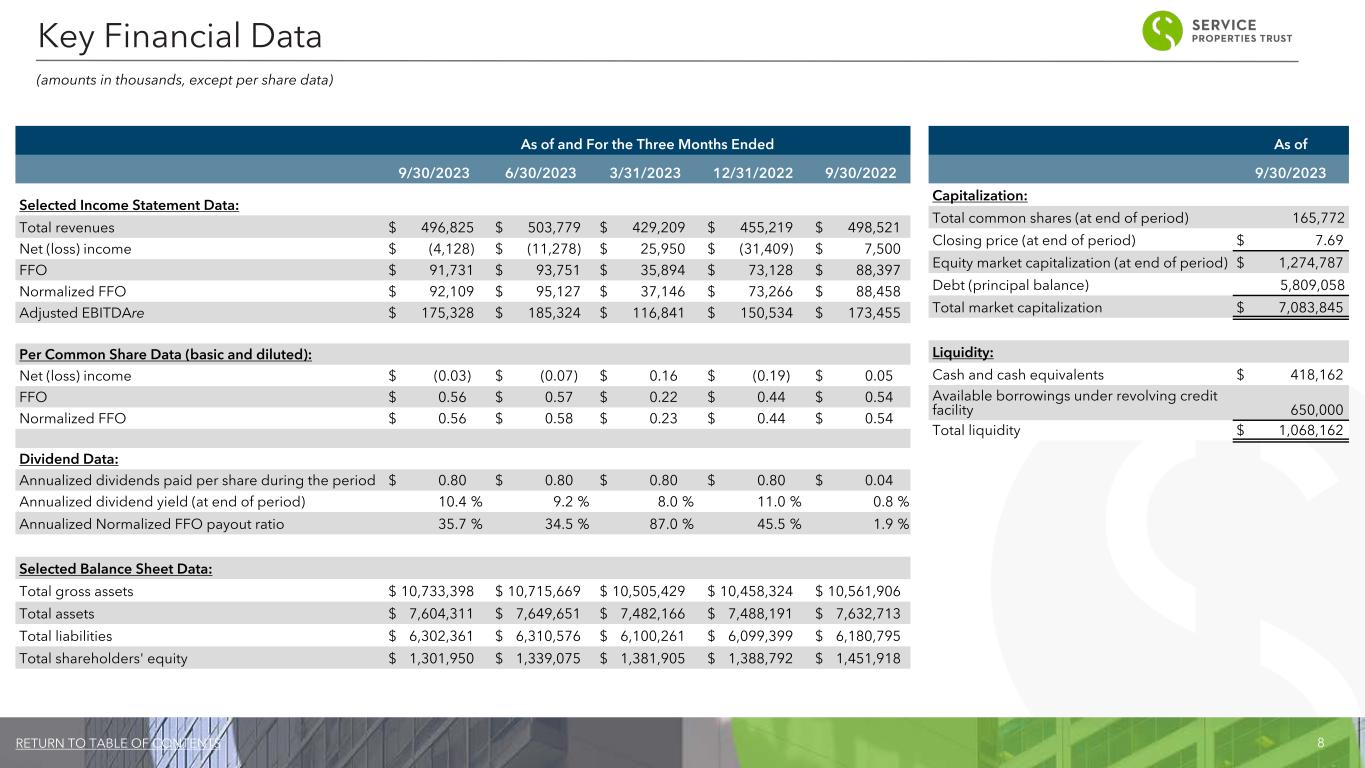

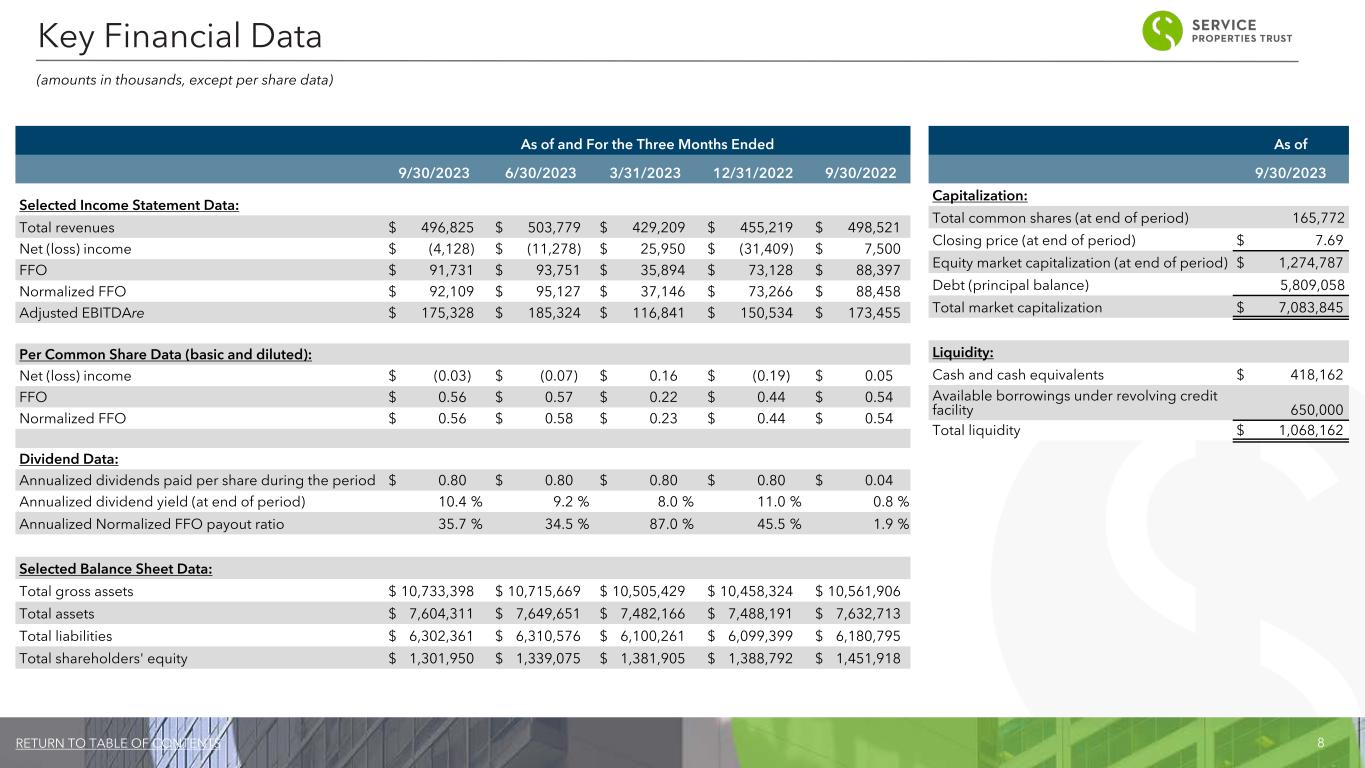

8RETURN TO TABLE OF CONTENTS As of and For the Three Months Ended 9/30/2023 6/30/2023 3/31/2023 12/31/2022 9/30/2022 Selected Income Statement Data: Total revenues $ 496,825 $ 503,779 $ 429,209 $ 455,219 $ 498,521 Net (loss) income $ (4,128) $ (11,278) $ 25,950 $ (31,409) $ 7,500 FFO $ 91,731 $ 93,751 $ 35,894 $ 73,128 $ 88,397 Normalized FFO $ 92,109 $ 95,127 $ 37,146 $ 73,266 $ 88,458 Adjusted EBITDAre $ 175,328 $ 185,324 $ 116,841 $ 150,534 $ 173,455 Per Common Share Data (basic and diluted): Net (loss) income $ (0.03) $ (0.07) $ 0.16 $ (0.19) $ 0.05 FFO $ 0.56 $ 0.57 $ 0.22 $ 0.44 $ 0.54 Normalized FFO $ 0.56 $ 0.58 $ 0.23 $ 0.44 $ 0.54 Dividend Data: Annualized dividends paid per share during the period $ 0.80 $ 0.80 $ 0.80 $ 0.80 $ 0.04 Annualized dividend yield (at end of period) 10.4 % 9.2 % 8.0 % 11.0 % 0.8 % Annualized Normalized FFO payout ratio 35.7 % 34.5 % 87.0 % 45.5 % 1.9 % Selected Balance Sheet Data: Total gross assets $ 10,733,398 $ 10,715,669 $ 10,505,429 $ 10,458,324 $ 10,561,906 Total assets $ 7,604,311 $ 7,649,651 $ 7,482,166 $ 7,488,191 $ 7,632,713 Total liabilities $ 6,302,361 $ 6,310,576 $ 6,100,261 $ 6,099,399 $ 6,180,795 Total shareholders' equity $ 1,301,950 $ 1,339,075 $ 1,381,905 $ 1,388,792 $ 1,451,918 (amounts in thousands, except per share data) Key Financial Data Sonesta ES Suites Fort Lauderdale, FL As of 9/30/2023 Capitalization: Total common shares (at end of period) 165,772 Closing price (at end of period) $ 7.69 Equity market capitalization (at end of period) $ 1,274,787 Debt (principal balance) 5,809,058 Total market capitalization $ 7,083,845 Liquidity: Cash and cash equivalents $ 418,162 Available borrowings under revolving credit facility 650,000 Total liquidity $ 1,068,162

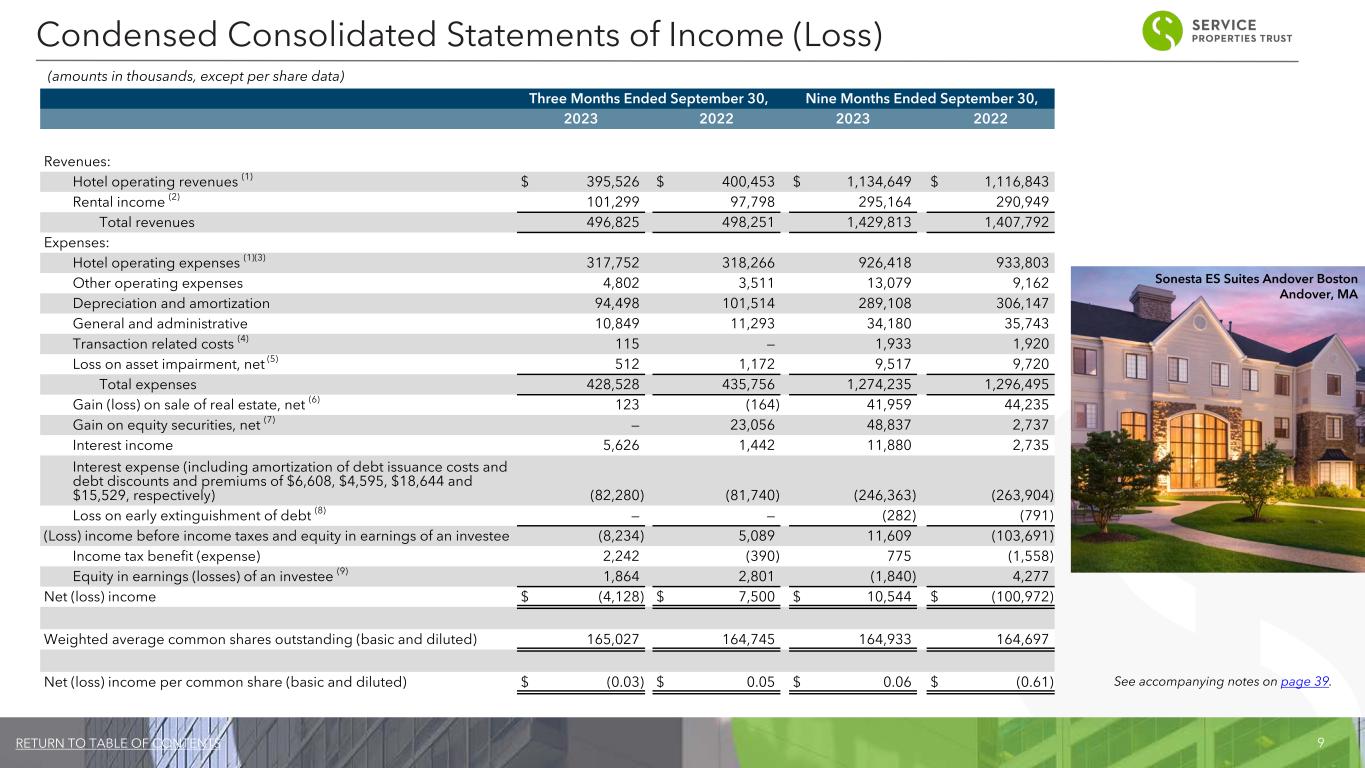

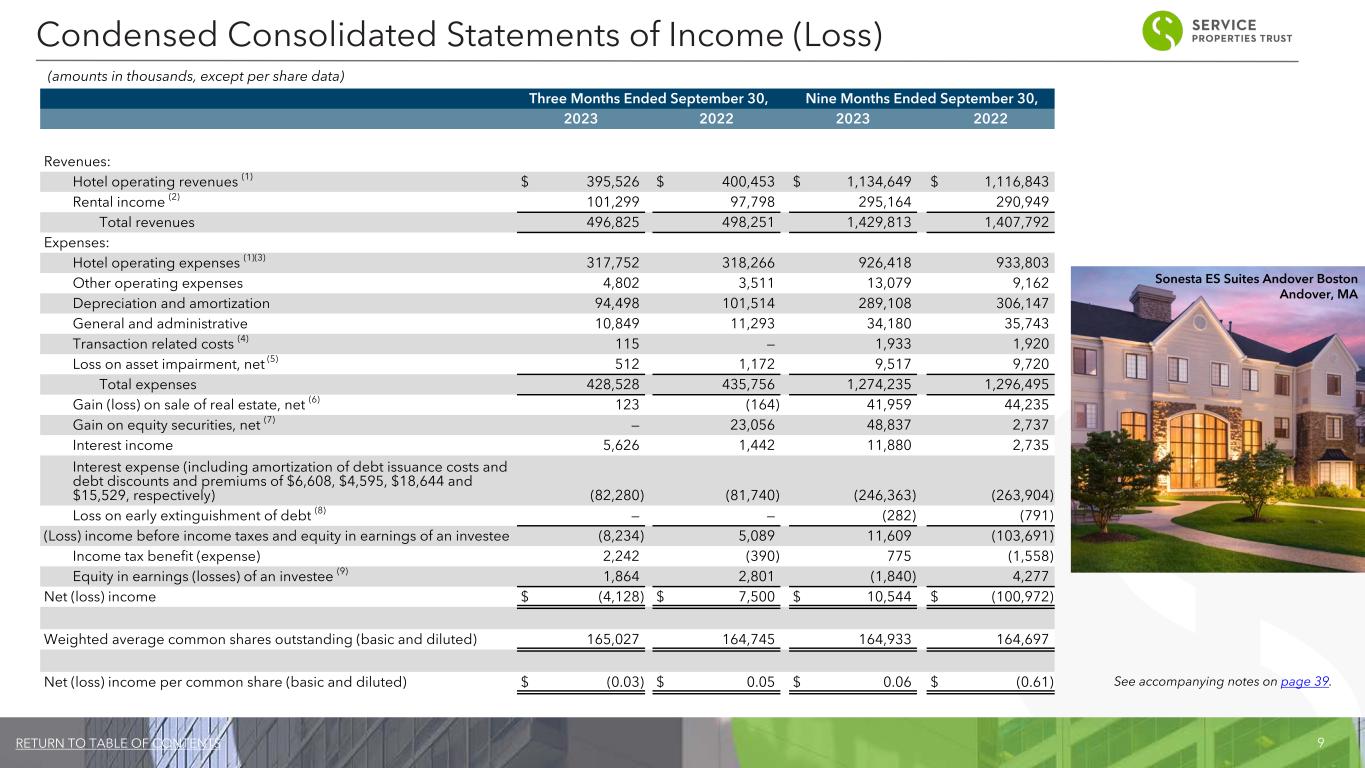

9RETURN TO TABLE OF CONTENTS Three Months Ended September 30, Nine Months Ended September 30, 2023 2022 2023 2022 Revenues: Hotel operating revenues (1) $ 395,526 $ 400,453 $ 1,134,649 $ 1,116,843 Rental income (2) 101,299 97,798 295,164 290,949 Total revenues 496,825 498,251 1,429,813 1,407,792 Expenses: Hotel operating expenses (1)(3) 317,752 318,266 926,418 933,803 Other operating expenses 4,802 3,511 13,079 9,162 Depreciation and amortization 94,498 101,514 289,108 306,147 General and administrative 10,849 11,293 34,180 35,743 Transaction related costs (4) 115 — 1,933 1,920 Loss on asset impairment, net (5) 512 1,172 9,517 9,720 Total expenses 428,528 435,756 1,274,235 1,296,495 Gain (loss) on sale of real estate, net (6) 123 (164) 41,959 44,235 Gain on equity securities, net (7) — 23,056 48,837 2,737 Interest income 5,626 1,442 11,880 2,735 Interest expense (including amortization of debt issuance costs and debt discounts and premiums of $6,608, $4,595, $18,644 and $15,529, respectively) (82,280) (81,740) (246,363) (263,904) Loss on early extinguishment of debt (8) — — (282) (791) (Loss) income before income taxes and equity in earnings of an investee (8,234) 5,089 11,609 (103,691) Income tax benefit (expense) 2,242 (390) 775 (1,558) Equity in earnings (losses) of an investee (9) 1,864 2,801 (1,840) 4,277 Net (loss) income $ (4,128) $ 7,500 $ 10,544 $ (100,972) Weighted average common shares outstanding (basic and diluted) 165,027 164,745 164,933 164,697 Net (loss) income per common share (basic and diluted) $ (0.03) $ 0.05 $ 0.06 $ (0.61) (amounts in thousands, except per share data) Condensed Consolidated Statements of Income (Loss) See accompanying notes on page 39. Sonesta ES Suites Andover Boston Andover, MA

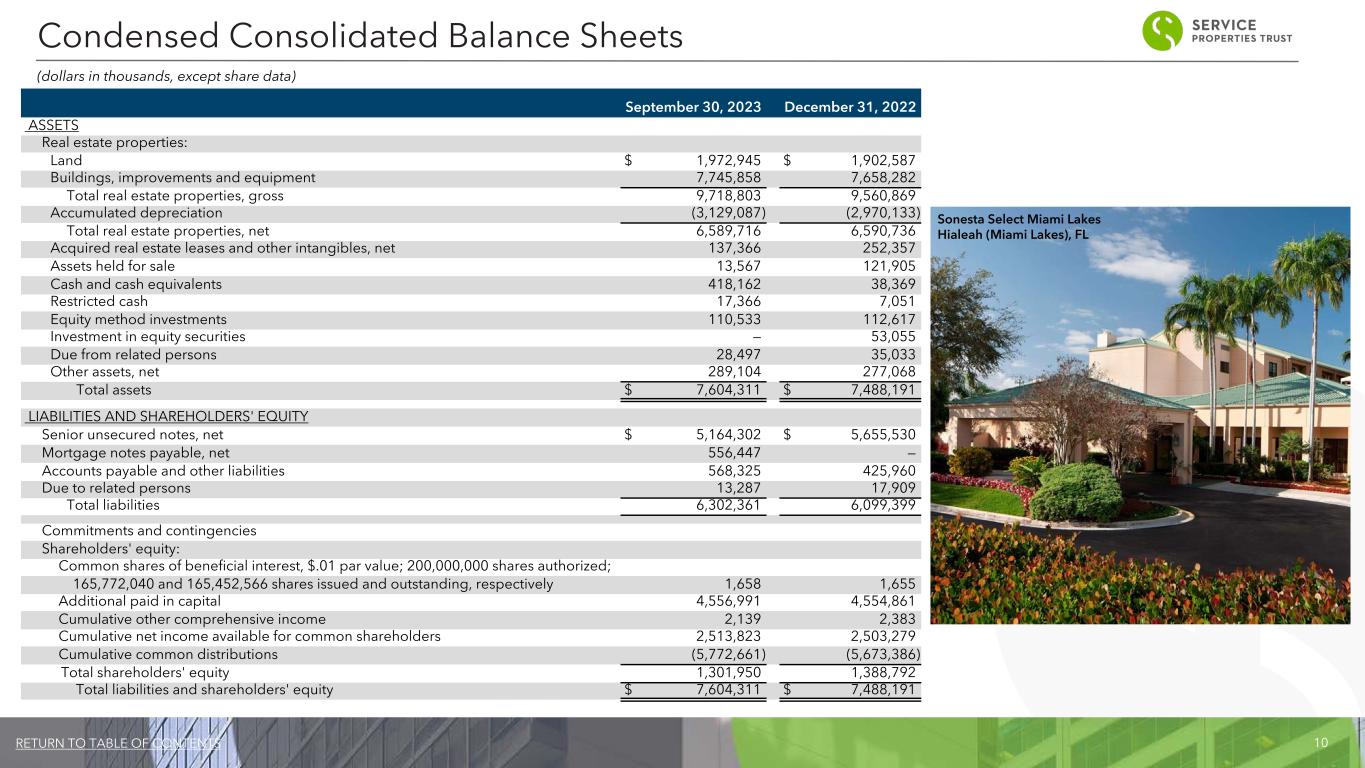

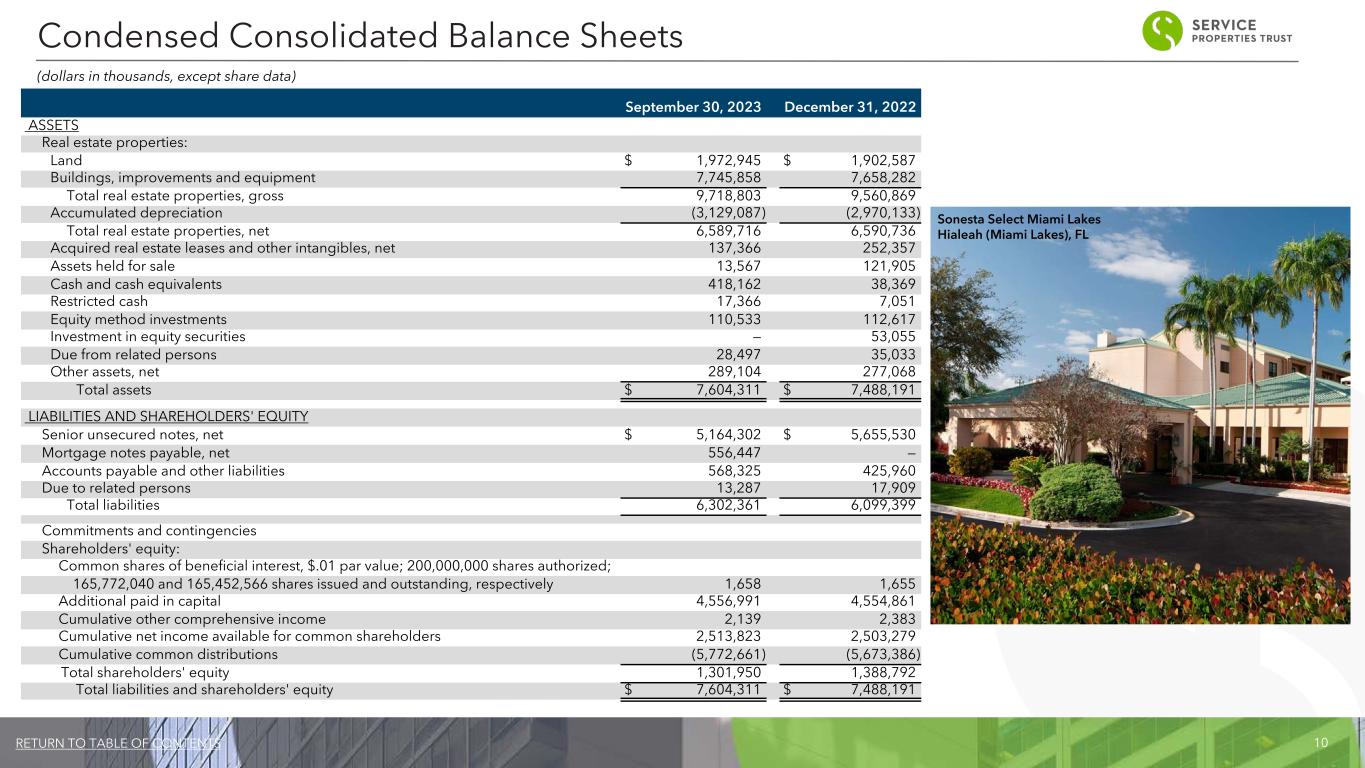

10RETURN TO TABLE OF CONTENTS September 30, 2023 December 31, 2022 ASSETS Real estate properties: Land $ 1,972,945 $ 1,902,587 Buildings, improvements and equipment 7,745,858 7,658,282 Total real estate properties, gross 9,718,803 9,560,869 Accumulated depreciation (3,129,087) (2,970,133) Total real estate properties, net 6,589,716 6,590,736 Acquired real estate leases and other intangibles, net 137,366 252,357 Assets held for sale 13,567 121,905 Cash and cash equivalents 418,162 38,369 Restricted cash 17,366 7,051 Equity method investments 110,533 112,617 Investment in equity securities — 53,055 Due from related persons 28,497 35,033 Other assets, net 289,104 277,068 Total assets $ 7,604,311 $ 7,488,191 LIABILITIES AND SHAREHOLDERS' EQUITY Senior unsecured notes, net $ 5,164,302 $ 5,655,530 Mortgage notes payable, net 556,447 — Accounts payable and other liabilities 568,325 425,960 Due to related persons 13,287 17,909 Total liabilities 6,302,361 6,099,399 Commitments and contingencies Shareholders' equity: Common shares of beneficial interest, $.01 par value; 200,000,000 shares authorized; 165,772,040 and 165,452,566 shares issued and outstanding, respectively 1,658 1,655 Additional paid in capital 4,556,991 4,554,861 Cumulative other comprehensive income 2,139 2,383 Cumulative net income available for common shareholders 2,513,823 2,503,279 Cumulative common distributions (5,772,661) (5,673,386) Total shareholders' equity 1,301,950 1,388,792 Total liabilities and shareholders' equity $ 7,604,311 $ 7,488,191 Condensed Consolidated Balance Sheets (dollars in thousands, except share data) Sonesta Select Miami Lakes Hialeah (Miami Lakes), FL

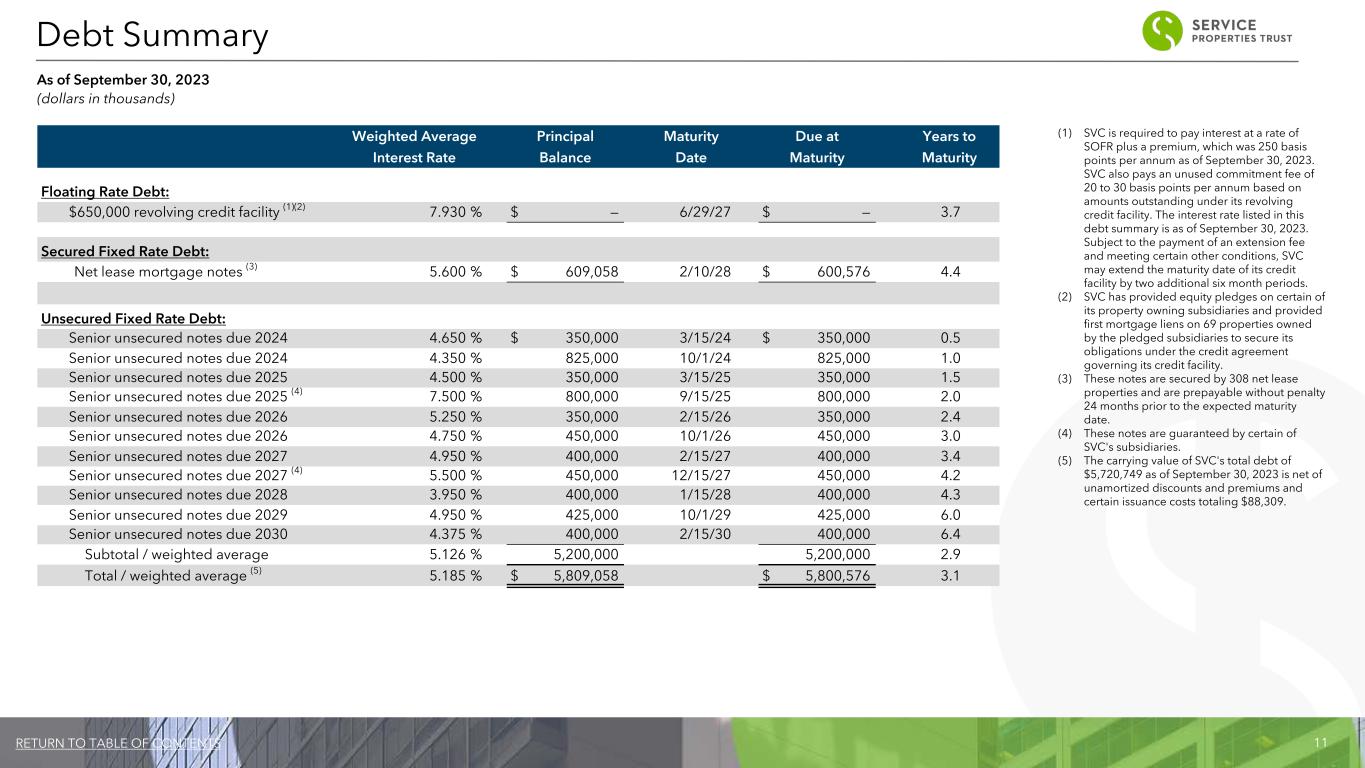

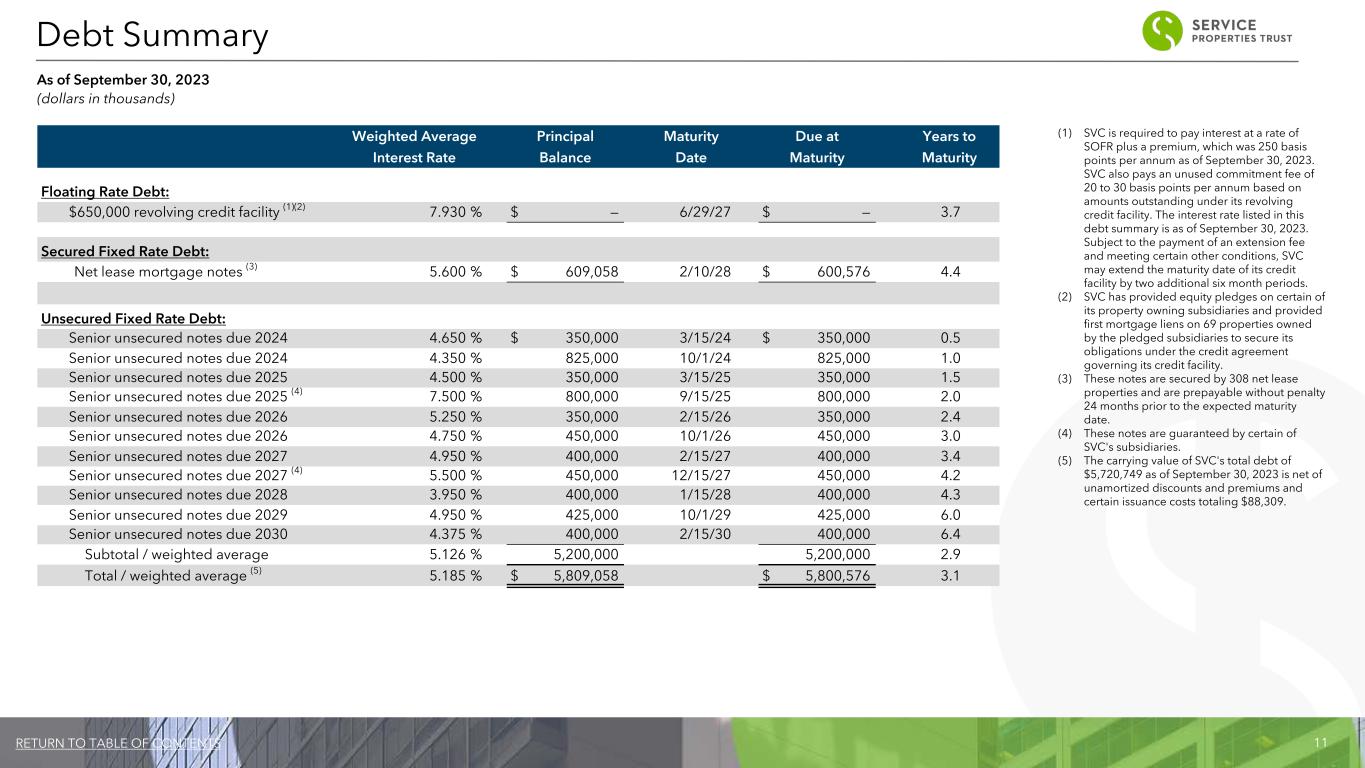

11RETURN TO TABLE OF CONTENTS (1) SVC is required to pay interest at a rate of SOFR plus a premium, which was 250 basis points per annum as of September 30, 2023. SVC also pays an unused commitment fee of 20 to 30 basis points per annum based on amounts outstanding under its revolving credit facility. The interest rate listed in this debt summary is as of September 30, 2023. Subject to the payment of an extension fee and meeting certain other conditions, SVC may extend the maturity date of its credit facility by two additional six month periods. (2) SVC has provided equity pledges on certain of its property owning subsidiaries and provided first mortgage liens on 69 properties owned by the pledged subsidiaries to secure its obligations under the credit agreement governing its credit facility. (3) These notes are secured by 308 net lease properties and are prepayable without penalty 24 months prior to the expected maturity date. (4) These notes are guaranteed by certain of SVC's subsidiaries. (5) The carrying value of SVC's total debt of $5,720,749 as of September 30, 2023 is net of unamortized discounts and premiums and certain issuance costs totaling $88,309. Weighted Average Principal Maturity Due at Years to Interest Rate Balance Date Maturity Maturity Floating Rate Debt: $650,000 revolving credit facility (1)(2) 7.930 % $ — 6/29/27 $ — 3.7 Secured Fixed Rate Debt: Net lease mortgage notes (3) 5.600 % $ 609,058 2/10/28 $ 600,576 4.4 Unsecured Fixed Rate Debt: Senior unsecured notes due 2024 4.650 % $ 350,000 3/15/24 $ 350,000 0.5 Senior unsecured notes due 2024 4.350 % 825,000 10/1/24 825,000 1.0 Senior unsecured notes due 2025 4.500 % 350,000 3/15/25 350,000 1.5 Senior unsecured notes due 2025 (4) 7.500 % 800,000 9/15/25 800,000 2.0 Senior unsecured notes due 2026 5.250 % 350,000 2/15/26 350,000 2.4 Senior unsecured notes due 2026 4.750 % 450,000 10/1/26 450,000 3.0 Senior unsecured notes due 2027 4.950 % 400,000 2/15/27 400,000 3.4 Senior unsecured notes due 2027 (4) 5.500 % 450,000 12/15/27 450,000 4.2 Senior unsecured notes due 2028 3.950 % 400,000 1/15/28 400,000 4.3 Senior unsecured notes due 2029 4.950 % 425,000 10/1/29 425,000 6.0 Senior unsecured notes due 2030 4.375 % 400,000 2/15/30 400,000 6.4 Subtotal / weighted average 5.126 % 5,200,000 5,200,000 2.9 Total / weighted average (5) 5.185 % $ 5,809,058 $ 5,800,576 3.1 Debt Summary As of September 30, 2023 (dollars in thousands)

12RETURN TO TABLE OF CONTENTS $ (T ho us an d s) $1,175,000 $1,150,000 $800,000 $850,000 $400,000 $425,000 $400,000 $489 $1,958 $1,958 $1,958 $1,958 $600,739 Unsecured Fixed Rate Debt Secured Fixed Rate Debt Revolving Credit Facility 2023 2024 2025 2026 2027 2028 2029 2030 0 250 500 750 1,000 1,250 Debt Maturity Schedule As of September 30, 2023 (1) (1) SVC's net lease mortgage notes are partially amortizing and require balloon payments at maturity. These notes are prepayable without penalty 24 months prior to the expected maturity date. (2) As of September 30, 2023, SVC had no amounts outstanding under its $650 million revolving credit facility. (2) 2215 D & B Drive Marietta, GA

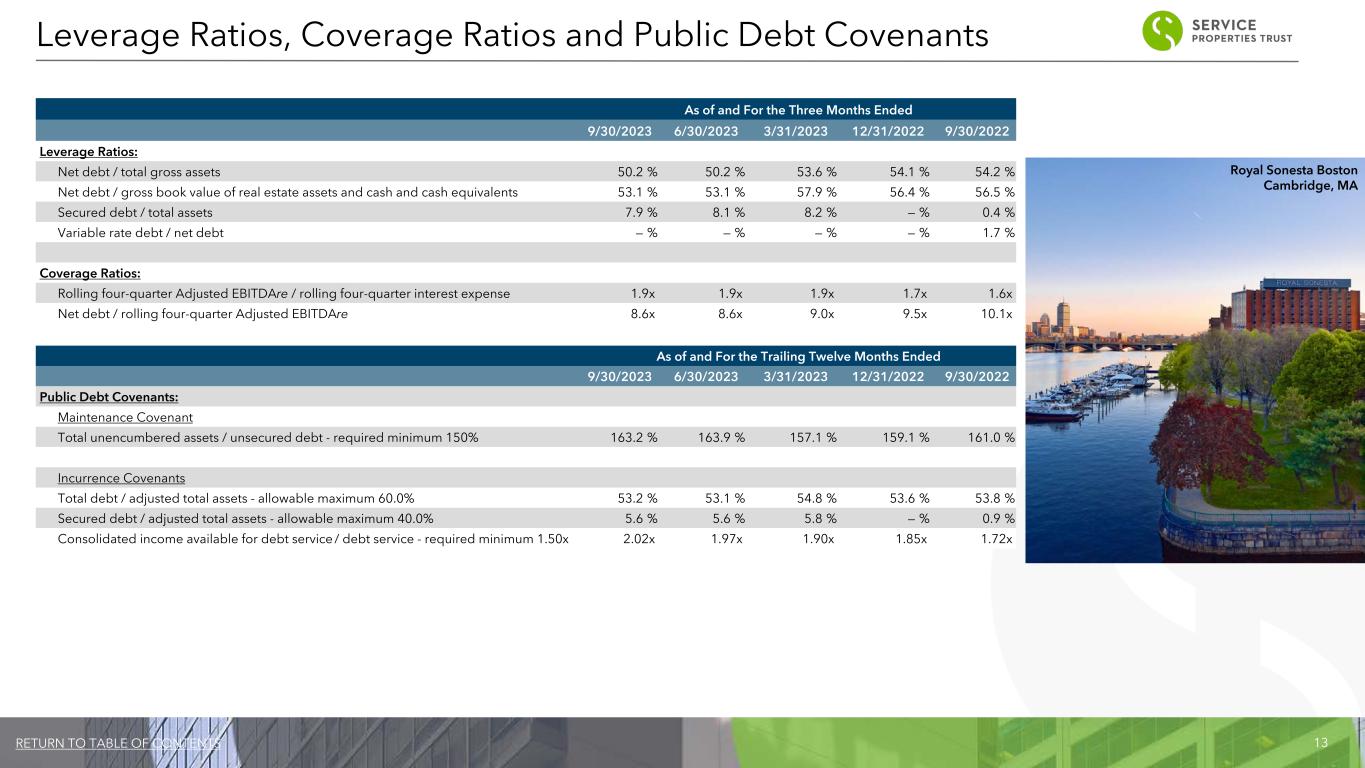

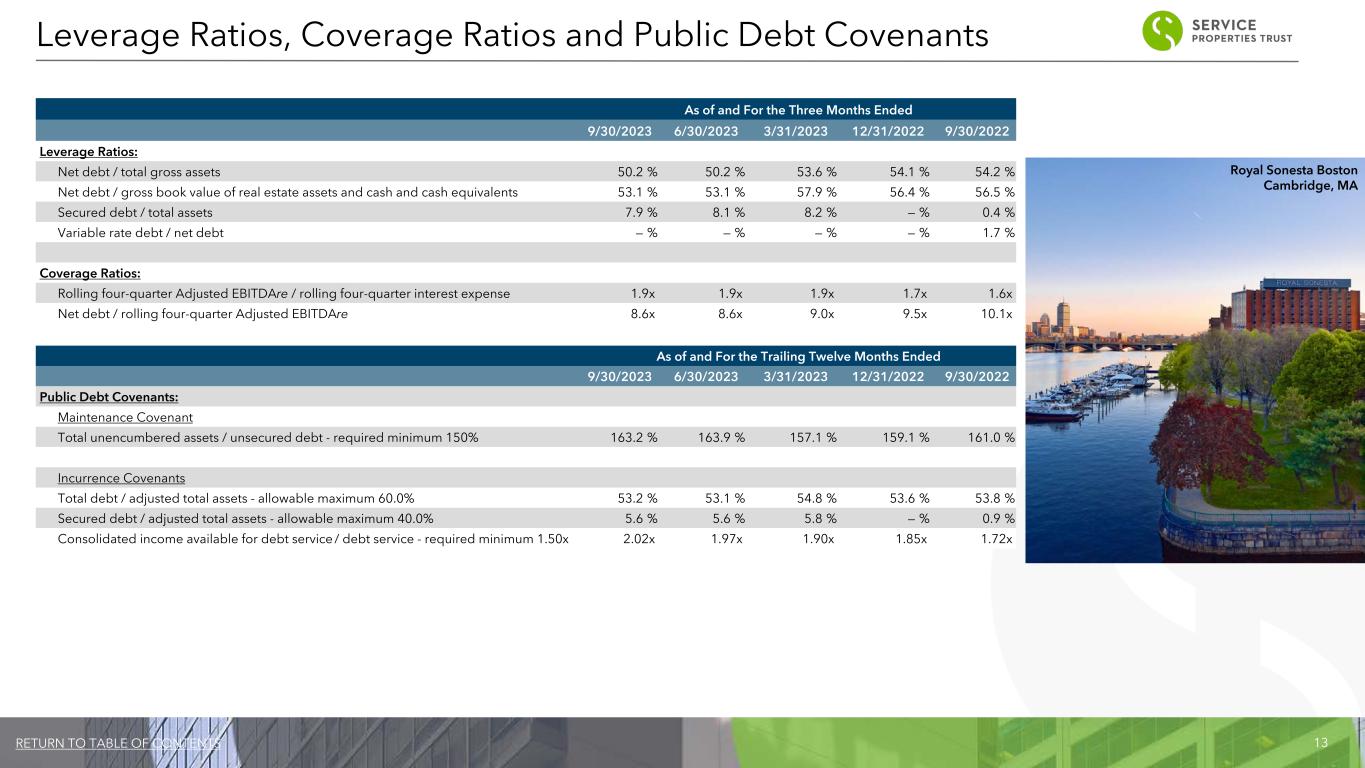

13RETURN TO TABLE OF CONTENTS As of and For the Three Months Ended 9/30/2023 6/30/2023 3/31/2023 12/31/2022 9/30/2022 Leverage Ratios: Net debt / total gross assets 50.2 % 50.2 % 53.6 % 54.1 % 54.2 % Net debt / gross book value of real estate assets and cash and cash equivalents 53.1 % 53.1 % 57.9 % 56.4 % 56.5 % Secured debt / total assets 7.9 % 8.1 % 8.2 % — % 0.4 % Variable rate debt / net debt — % — % — % — % 1.7 % Coverage Ratios: Rolling four-quarter Adjusted EBITDAre / rolling four-quarter interest expense 1.9x 1.9x 1.9x 1.7x 1.6x Net debt / rolling four-quarter Adjusted EBITDAre 8.6x 8.6x 9.0x 9.5x 10.1x As of and For the Trailing Twelve Months Ended 9/30/2023 6/30/2023 3/31/2023 12/31/2022 9/30/2022 Public Debt Covenants: Maintenance Covenant Total unencumbered assets / unsecured debt - required minimum 150% 163.2 % 163.9 % 157.1 % 159.1 % 161.0 % Incurrence Covenants Total debt / adjusted total assets - allowable maximum 60.0% 53.2 % 53.1 % 54.8 % 53.6 % 53.8 % Secured debt / adjusted total assets - allowable maximum 40.0% 5.6 % 5.6 % 5.8 % — % 0.9 % Consolidated income available for debt service / debt service - required minimum 1.50x 2.02x 1.97x 1.90x 1.85x 1.72x Leverage Ratios, Coverage Ratios and Public Debt Covenants Royal Sonesta Boston Cambridge, MA

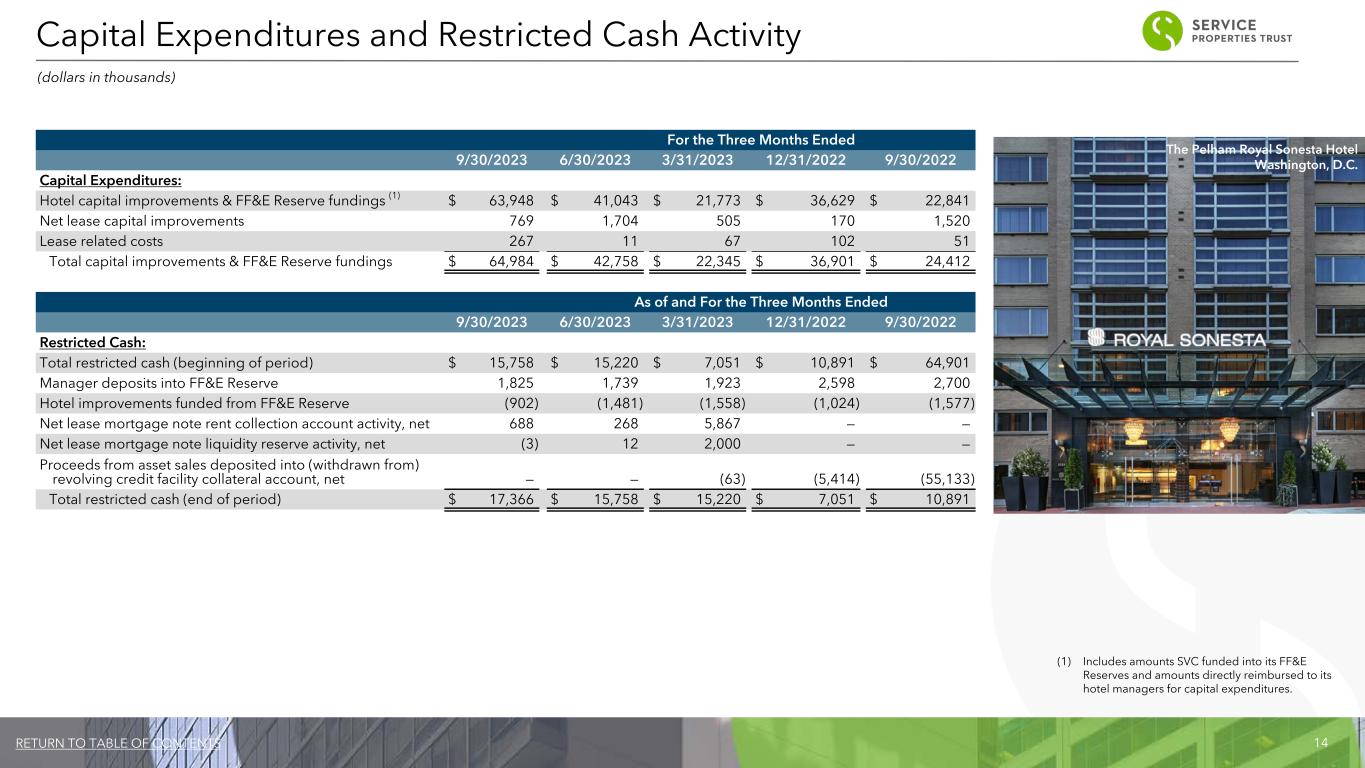

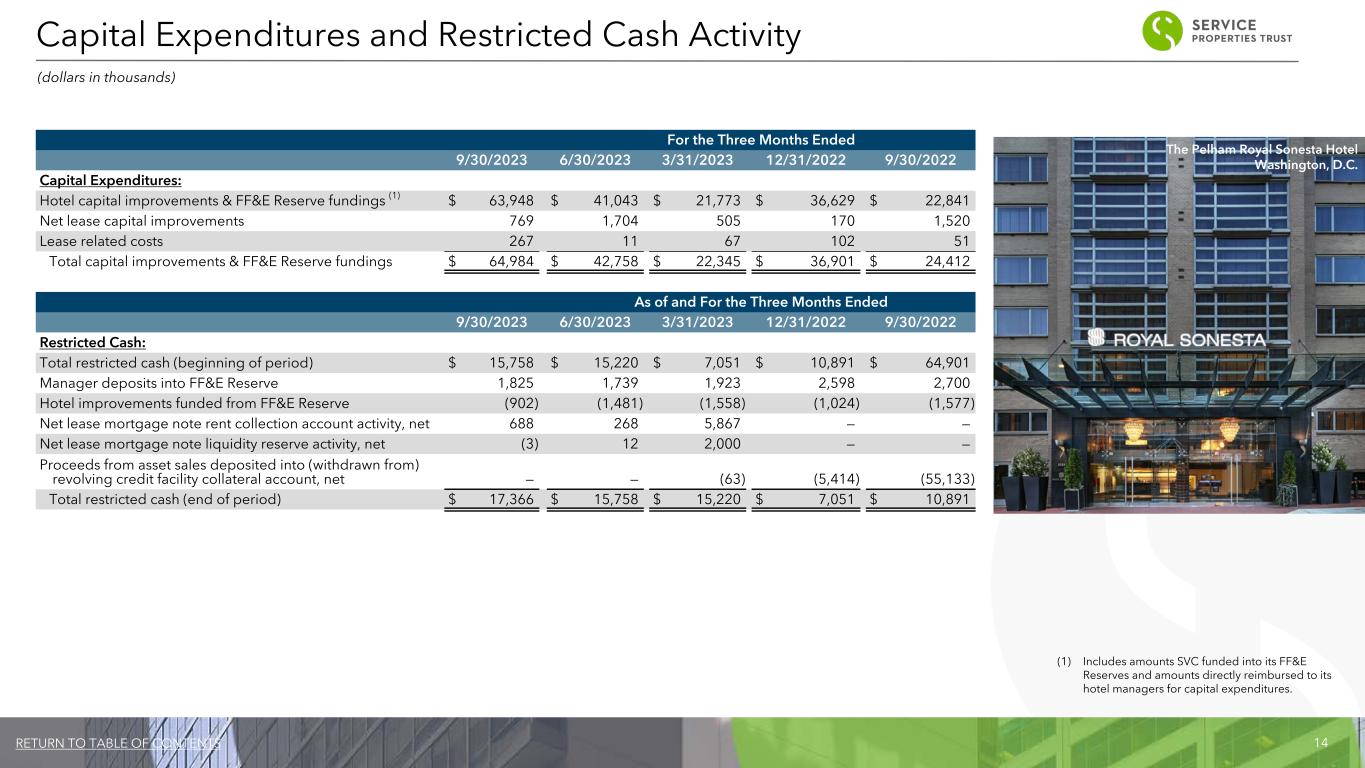

14RETURN TO TABLE OF CONTENTS For the Three Months Ended 9/30/2023 6/30/2023 3/31/2023 12/31/2022 9/30/2022 Capital Expenditures: Hotel capital improvements & FF&E Reserve fundings (1) $ 63,948 $ 41,043 $ 21,773 $ 36,629 $ 22,841 Net lease capital improvements 769 1,704 505 170 1,520 Lease related costs 267 11 67 102 51 Total capital improvements & FF&E Reserve fundings $ 64,984 $ 42,758 $ 22,345 $ 36,901 $ 24,412 As of and For the Three Months Ended 9/30/2023 6/30/2023 3/31/2023 12/31/2022 9/30/2022 Restricted Cash: Total restricted cash (beginning of period) $ 15,758 $ 15,220 $ 7,051 $ 10,891 $ 64,901 Manager deposits into FF&E Reserve 1,825 1,739 1,923 2,598 2,700 Hotel improvements funded from FF&E Reserve (902) (1,481) (1,558) (1,024) (1,577) Net lease mortgage note rent collection account activity, net 688 268 5,867 — — Net lease mortgage note liquidity reserve activity, net (3) 12 2,000 — — Proceeds from asset sales deposited into (withdrawn from) revolving credit facility collateral account, net — — (63) (5,414) (55,133) Total restricted cash (end of period) $ 17,366 $ 15,758 $ 15,220 $ 7,051 $ 10,891 (1) Includes amounts SVC funded into its FF&E Reserves and amounts directly reimbursed to its hotel managers for capital expenditures. (dollars in thousands) Capital Expenditures and Restricted Cash Activity The Pelham Royal Sonesta Hotel Washington, D.C.

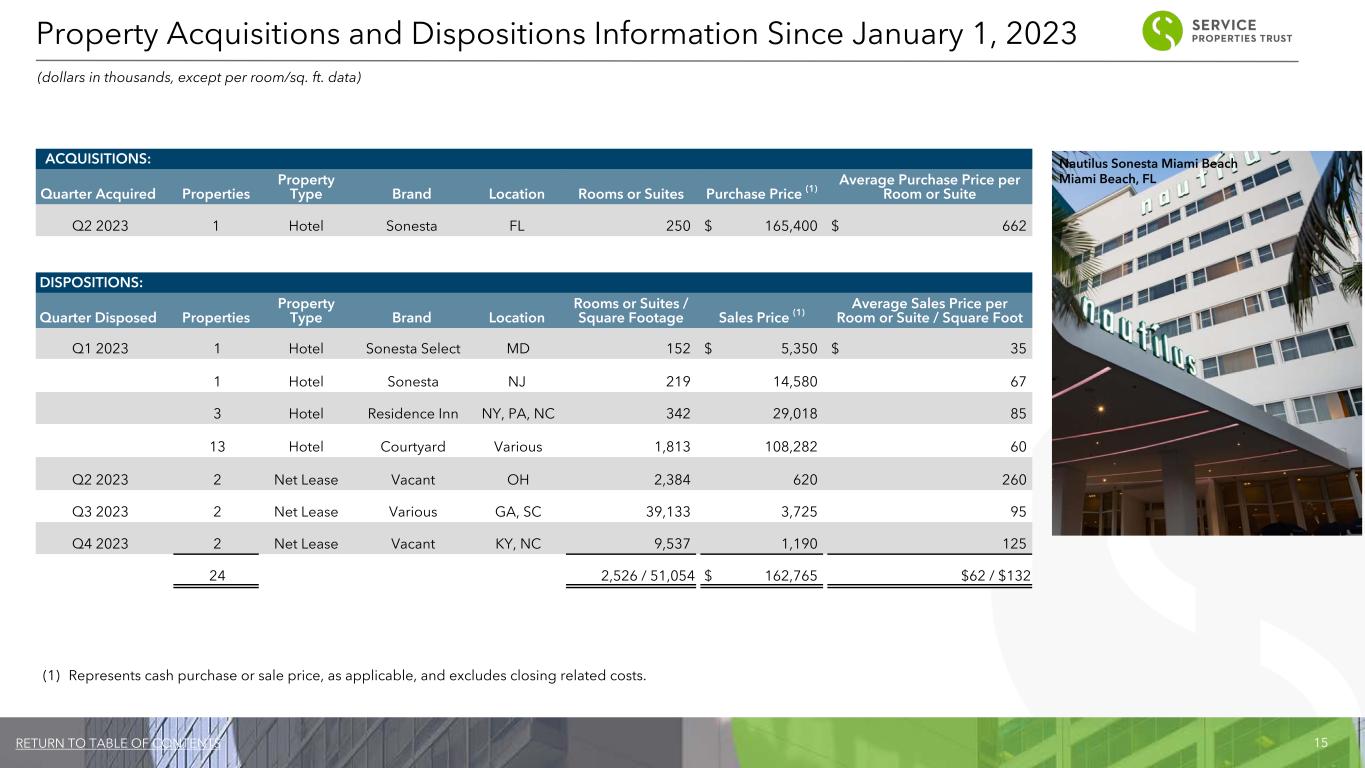

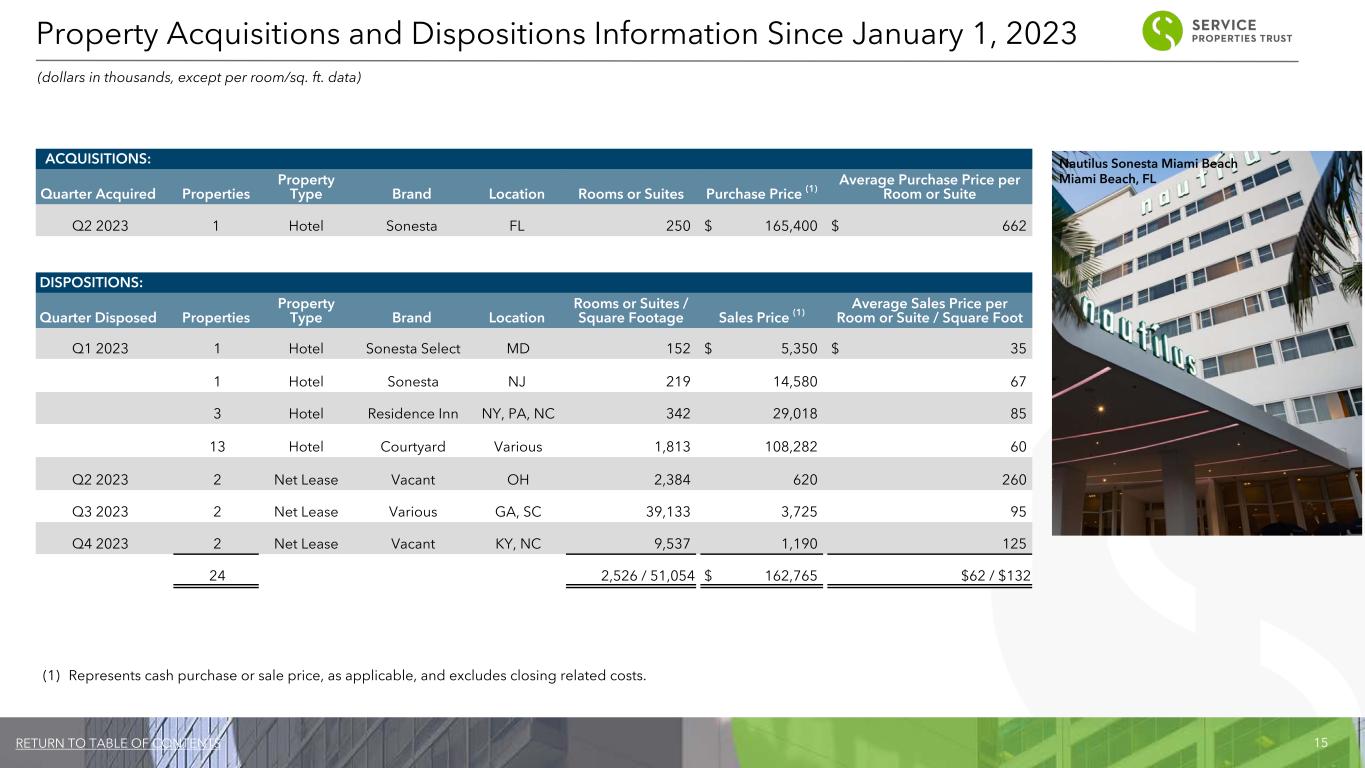

15RETURN TO TABLE OF CONTENTS ACQUISITIONS: Quarter Acquired Properties Property Type Brand Location Rooms or Suites Purchase Price (1) Average Purchase Price per Room or Suite Q2 2023 1 Hotel Sonesta FL 250 $ 165,400 $ 662 DISPOSITIONS: Quarter Disposed Properties Property Type Brand Location Rooms or Suites / Square Footage Sales Price (1) Average Sales Price per Room or Suite / Square Foot Q1 2023 1 Hotel Sonesta Select MD 152 $ 5,350 $ 35 1 Hotel Sonesta NJ 219 14,580 67 3 Hotel Residence Inn NY, PA, NC 342 29,018 85 13 Hotel Courtyard Various 1,813 108,282 60 Q2 2023 2 Net Lease Vacant OH 2,384 620 260 Q3 2023 2 Net Lease Various GA, SC 39,133 3,725 95 Q4 2023 2 Net Lease Vacant KY, NC 9,537 1,190 125 24 2,526 / 51,054 $ 162,765 $62 / $132 Property Acquisitions and Dispositions Information Since January 1, 2023 (dollars in thousands, except per room/sq. ft. data) (1) Represents cash purchase or sale price, as applicable, and excludes closing related costs. Nautilus Sonesta Miami Beach Miami Beach, FL

16RETURN TO TABLE OF CONTENTS Portfolio Information

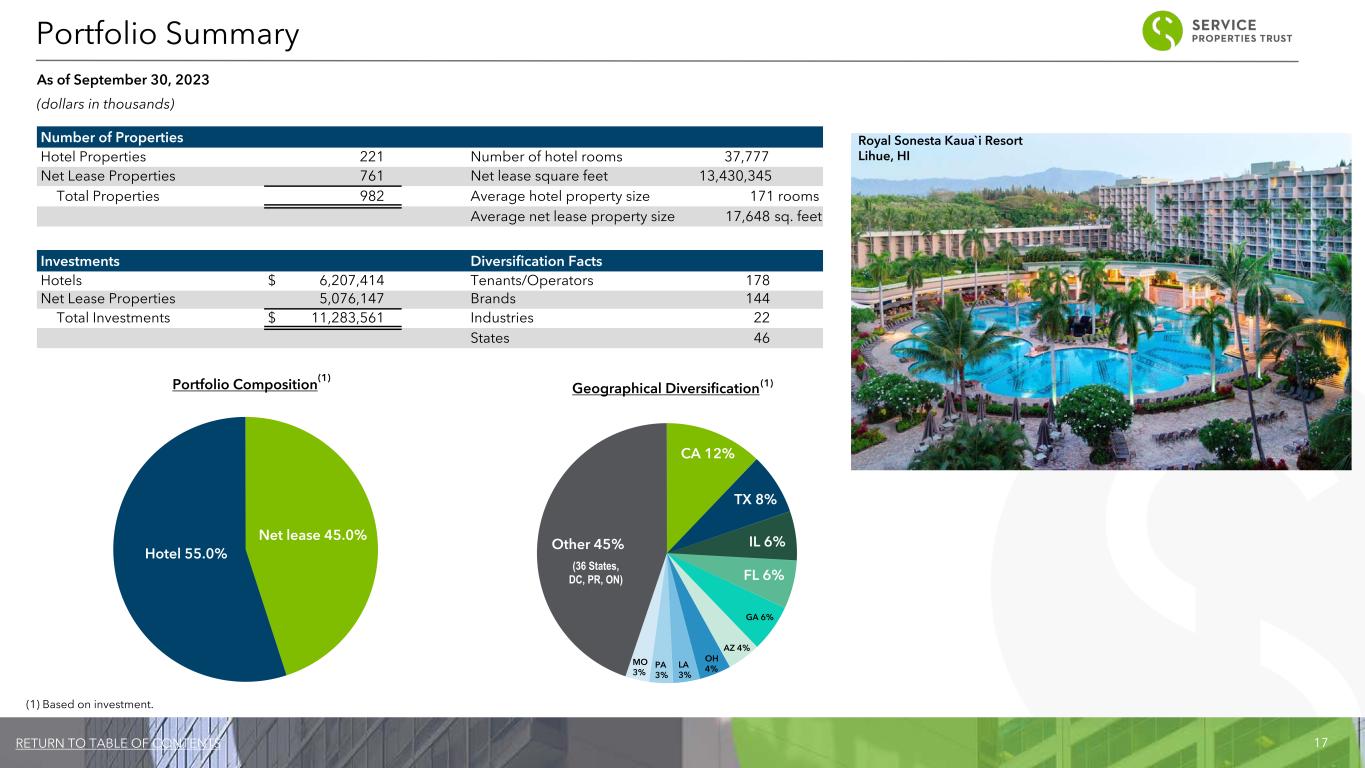

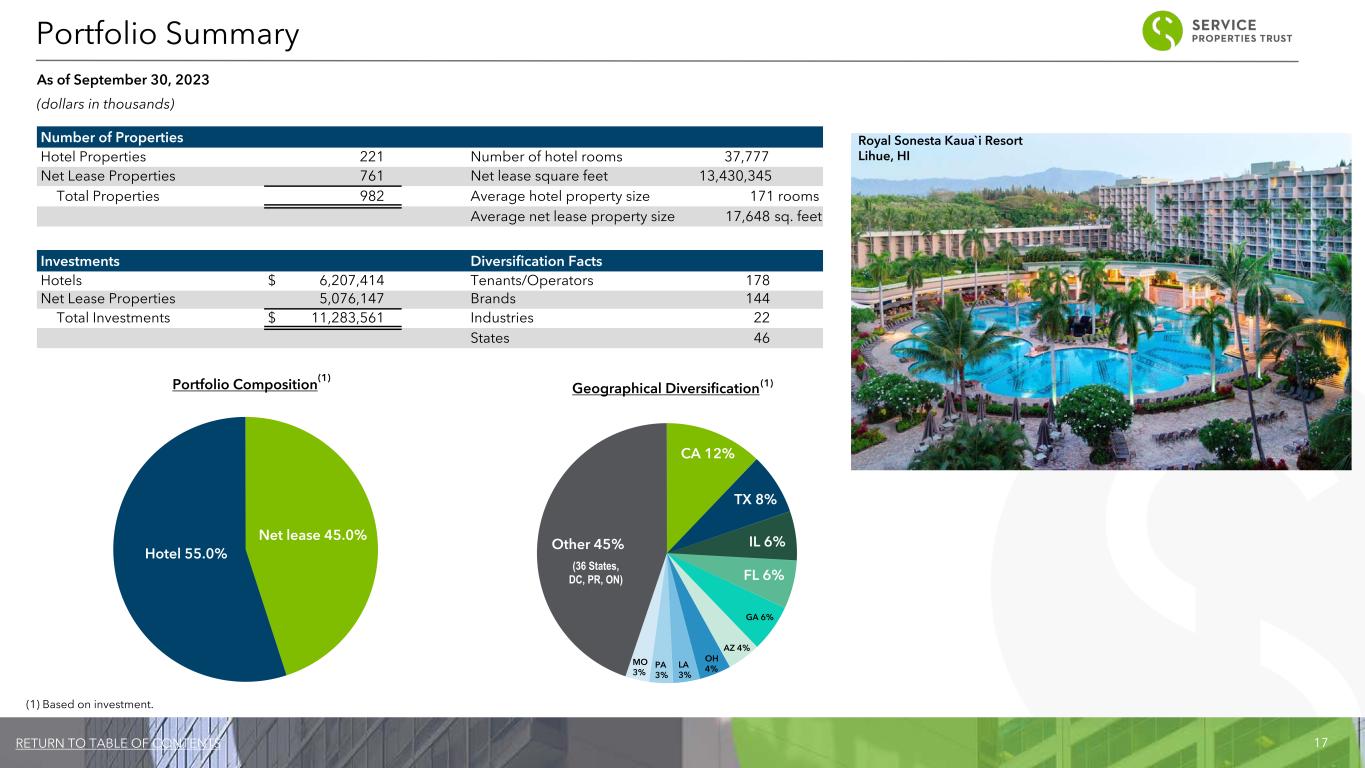

17RETURN TO TABLE OF CONTENTS Portfolio Composition Net lease 45.0% Hotel 55.0% Number of Properties Hotel Properties 221 Number of hotel rooms 37,777 Net Lease Properties 761 Net lease square feet 13,430,345 Total Properties 982 Average hotel property size 171 rooms Average net lease property size 17,648 sq. feet Investments Diversification Facts Hotels $ 6,207,414 Tenants/Operators 178 Net Lease Properties 5,076,147 Brands 144 Total Investments $ 11,283,561 Industries 22 States 46 Geographical Diversification CA 12% TX 8% IL 6% FL 6% GA 6% AZ 4% OH 4%LA 3% PA 3% MO 3% Other 45% (36 States, DC, PR, ON) Portfolio Summary As of September 30, 2023 (dollars in thousands) (1) Based on investment. (1) (1) Royal Sonesta Kaua`i Resort Lihue, HI

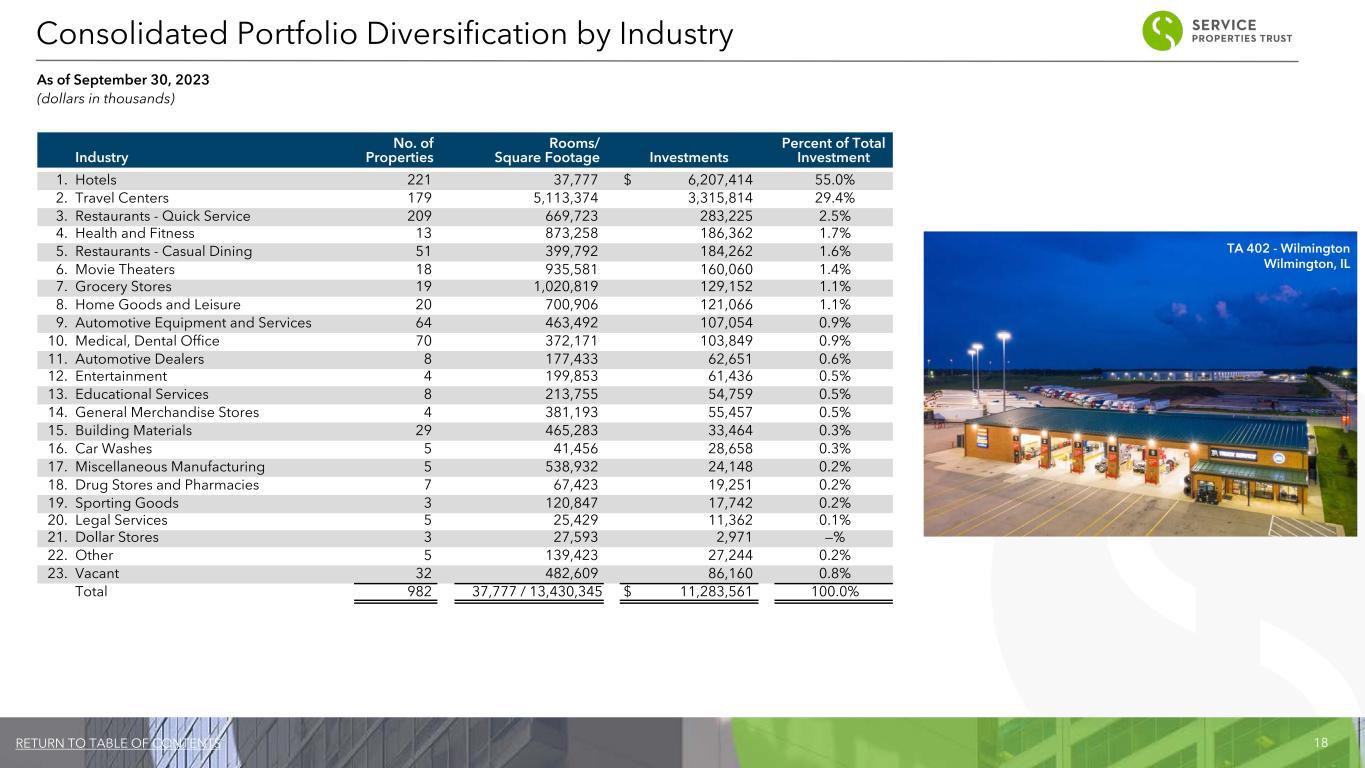

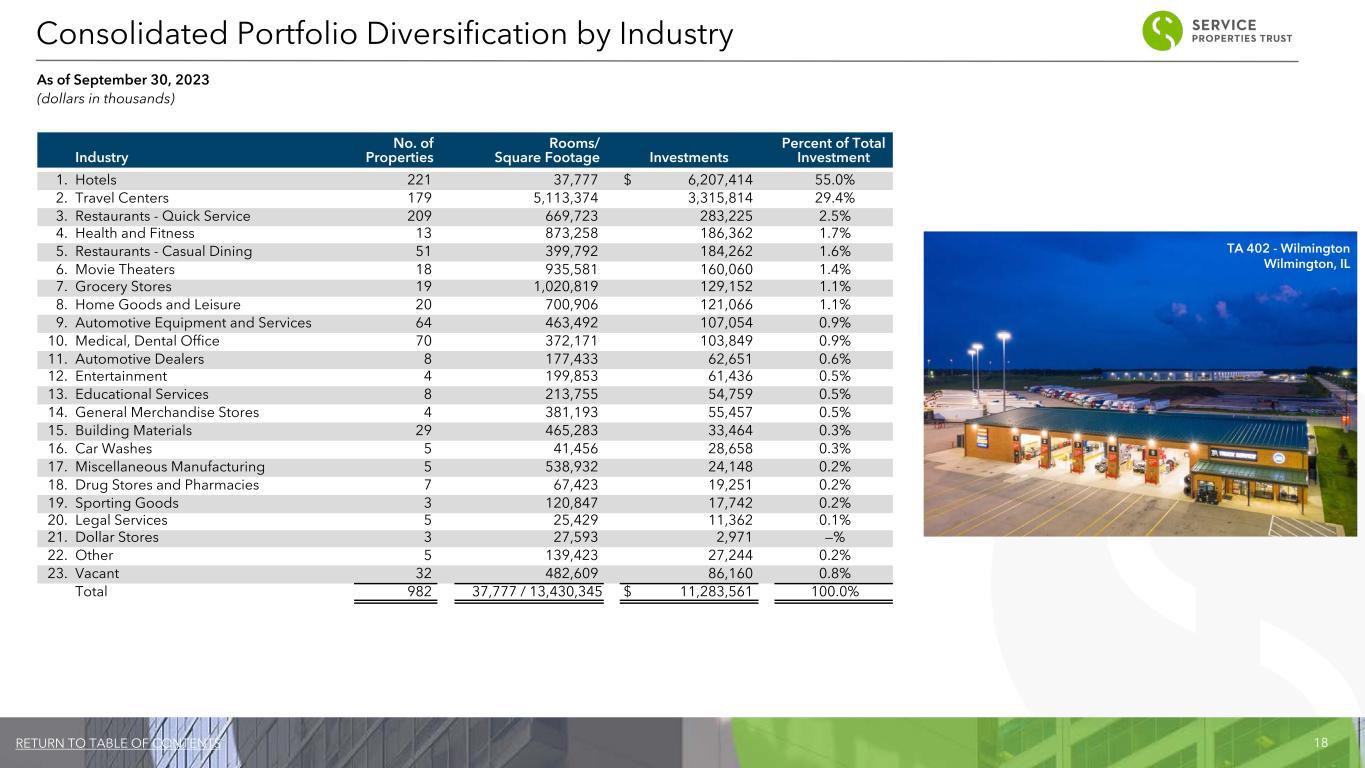

18RETURN TO TABLE OF CONTENTS Industry No. of Properties Rooms/ Square Footage Investments Percent of Total Investment 1. Hotels 221 37,777 $ 6,207,414 55.0% 2. Travel Centers 179 5,113,374 3,315,814 29.4% 3. Restaurants - Quick Service 209 669,723 283,225 2.5% 4. Health and Fitness 13 873,258 186,362 1.7% 5. Restaurants - Casual Dining 51 399,792 184,262 1.6% 6. Movie Theaters 18 935,581 160,060 1.4% 7. Grocery Stores 19 1,020,819 129,152 1.1% 8. Home Goods and Leisure 20 700,906 121,066 1.1% 9. Automotive Equipment and Services 64 463,492 107,054 0.9% 10. Medical, Dental Office 70 372,171 103,849 0.9% 11. Automotive Dealers 8 177,433 62,651 0.6% 12. Entertainment 4 199,853 61,436 0.5% 13. Educational Services 8 213,755 54,759 0.5% 14. General Merchandise Stores 4 381,193 55,457 0.5% 15. Building Materials 29 465,283 33,464 0.3% 16. Car Washes 5 41,456 28,658 0.3% 17. Miscellaneous Manufacturing 5 538,932 24,148 0.2% 18. Drug Stores and Pharmacies 7 67,423 19,251 0.2% 19. Sporting Goods 3 120,847 17,742 0.2% 20. Legal Services 5 25,429 11,362 0.1% 21. Dollar Stores 3 27,593 2,971 —% 22. Other 5 139,423 27,244 0.2% 23. Vacant 32 482,609 86,160 0.8% Total 982 37,777 / 13,430,345 $ 11,283,561 100.0% Consolidated Portfolio Diversification by Industry As of September 30, 2023 (dollars in thousands) TA 402 - Wilmington Wilmington, IL

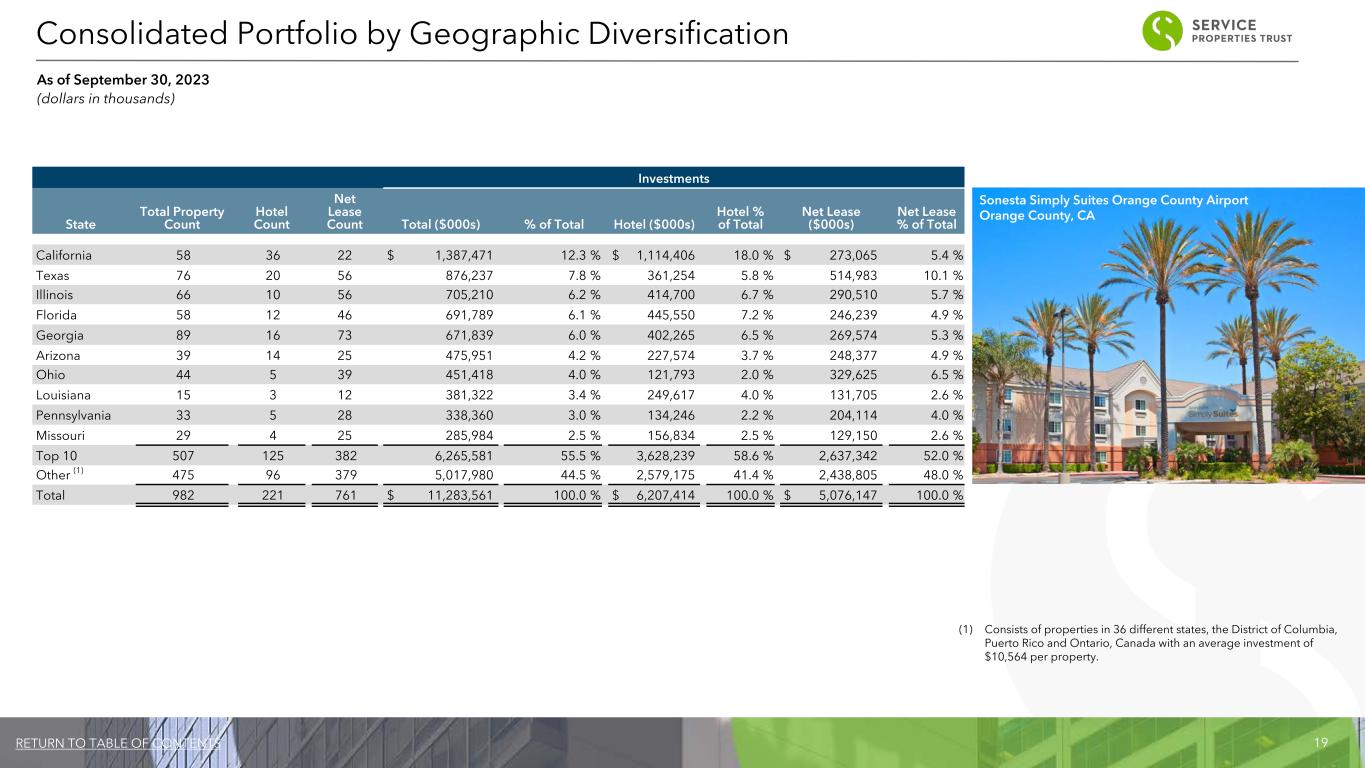

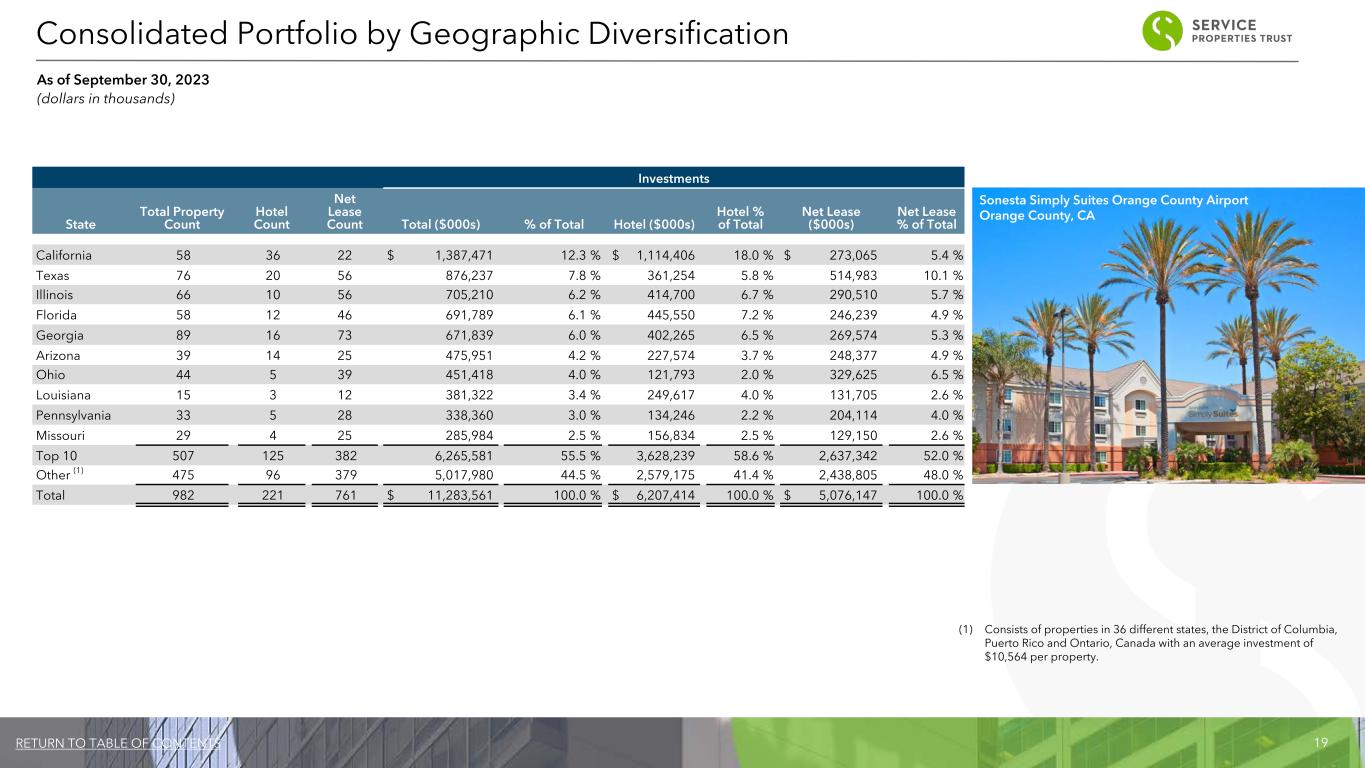

19RETURN TO TABLE OF CONTENTS Investments State Total Property Count Hotel Count Net Lease Count Total ($000s) % of Total Hotel ($000s) Hotel % of Total Net Lease ($000s) Net Lease % of Total California 58 36 22 $ 1,387,471 12.3 % $ 1,114,406 18.0 % $ 273,065 5.4 % Texas 76 20 56 876,237 7.8 % 361,254 5.8 % 514,983 10.1 % Illinois 66 10 56 705,210 6.2 % 414,700 6.7 % 290,510 5.7 % Florida 58 12 46 691,789 6.1 % 445,550 7.2 % 246,239 4.9 % Georgia 89 16 73 671,839 6.0 % 402,265 6.5 % 269,574 5.3 % Arizona 39 14 25 475,951 4.2 % 227,574 3.7 % 248,377 4.9 % Ohio 44 5 39 451,418 4.0 % 121,793 2.0 % 329,625 6.5 % Louisiana 15 3 12 381,322 3.4 % 249,617 4.0 % 131,705 2.6 % Pennsylvania 33 5 28 338,360 3.0 % 134,246 2.2 % 204,114 4.0 % Missouri 29 4 25 285,984 2.5 % 156,834 2.5 % 129,150 2.6 % Top 10 507 125 382 6,265,581 55.5 % 3,628,239 58.6 % 2,637,342 52.0 % Other (1) 475 96 379 5,017,980 44.5 % 2,579,175 41.4 % 2,438,805 48.0 % Total 982 221 761 $ 11,283,561 100.0 % $ 6,207,414 100.0 % $ 5,076,147 100.0 % (1) Consists of properties in 36 different states, the District of Columbia, Puerto Rico and Ontario, Canada with an average investment of $10,564 per property. Consolidated Portfolio by Geographic Diversification As of September 30, 2023 (dollars in thousands) Sonesta Simply Suites Orange County Airport Orange County, CA

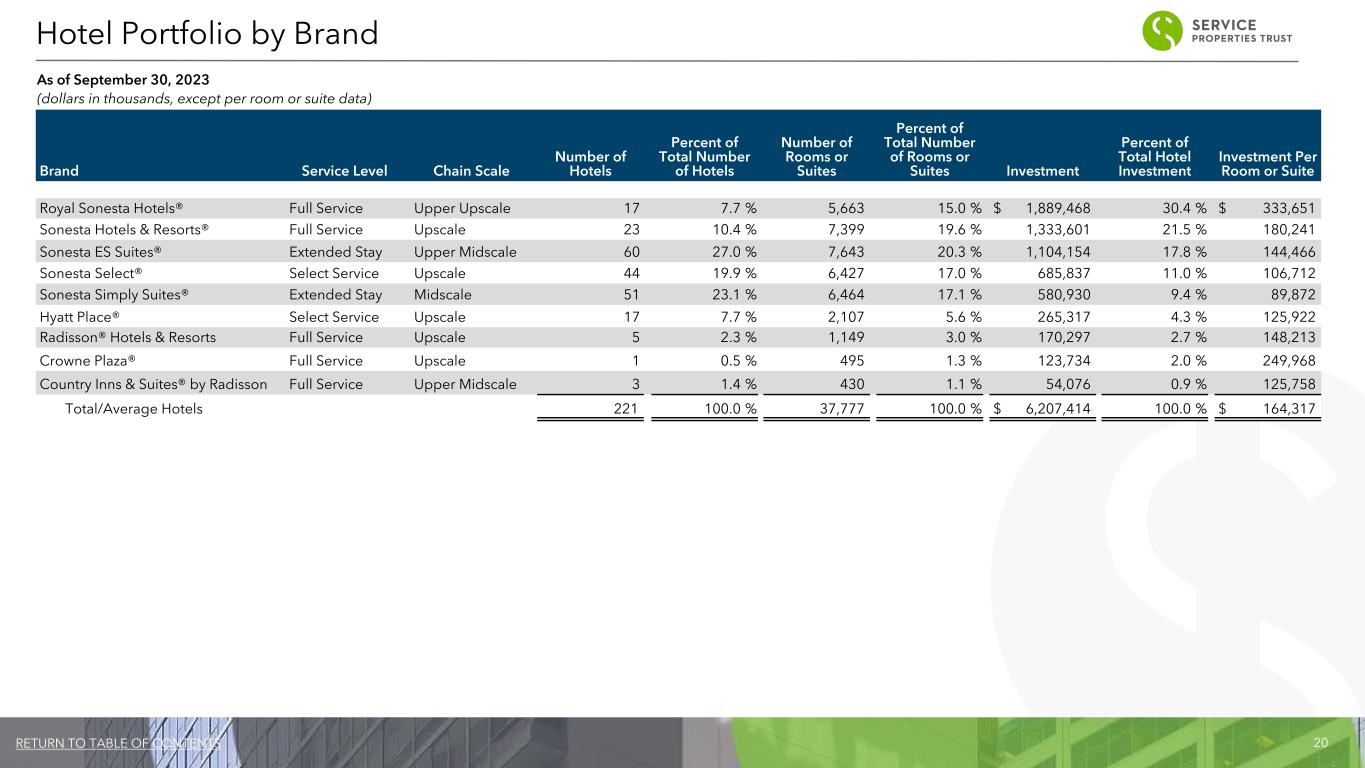

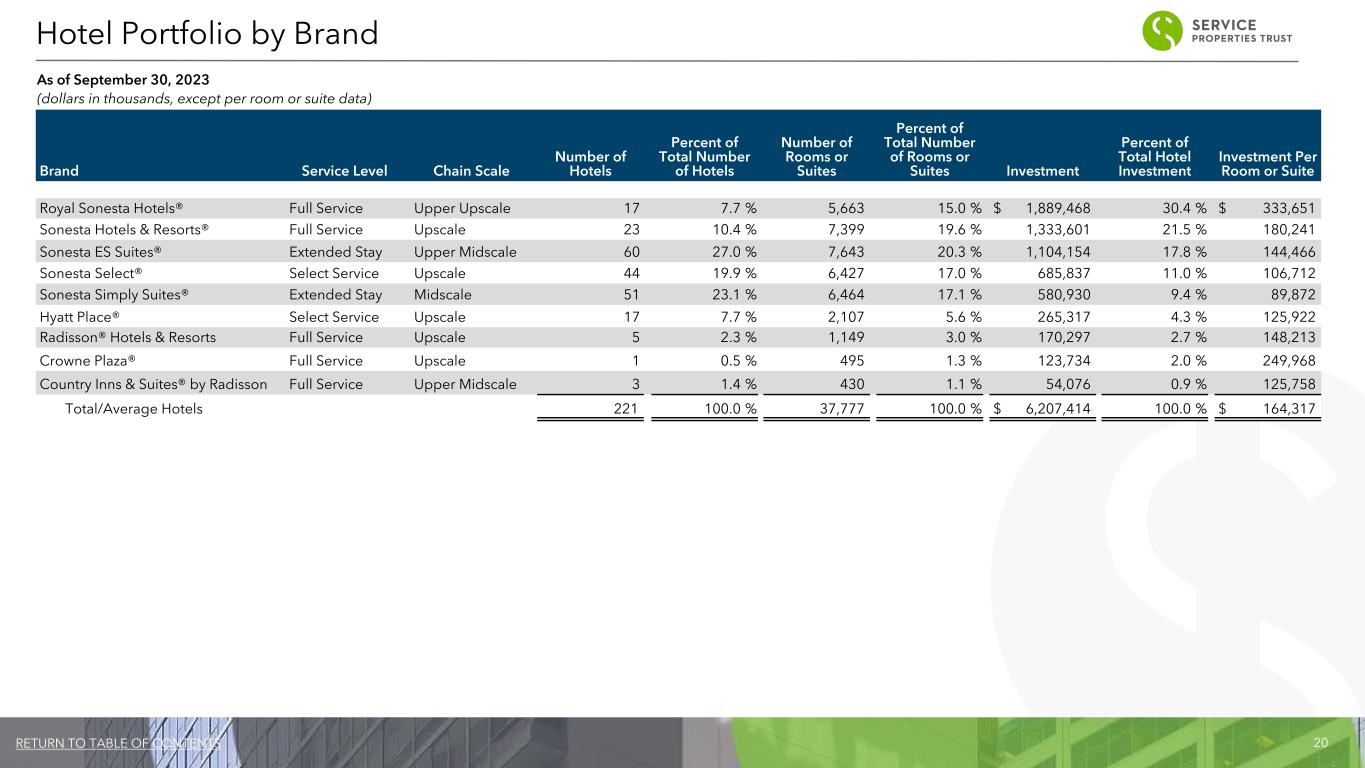

20RETURN TO TABLE OF CONTENTS Brand Service Level Chain Scale Number of Hotels Percent of Total Number of Hotels Number of Rooms or Suites Percent of Total Number of Rooms or Suites Investment Percent of Total Hotel Investment Investment Per Room or Suite Royal Sonesta Hotels® Full Service Upper Upscale 17 7.7 % 5,663 15.0 % $ 1,889,468 30.4 % $ 333,651 Sonesta Hotels & Resorts® Full Service Upscale 23 10.4 % 7,399 19.6 % 1,333,601 21.5 % 180,241 Sonesta ES Suites® Extended Stay Upper Midscale 60 27.0 % 7,643 20.3 % 1,104,154 17.8 % 144,466 Sonesta Select® Select Service Upscale 44 19.9 % 6,427 17.0 % 685,837 11.0 % 106,712 Sonesta Simply Suites® Extended Stay Midscale 51 23.1 % 6,464 17.1 % 580,930 9.4 % 89,872 Hyatt Place® Select Service Upscale 17 7.7 % 2,107 5.6 % 265,317 4.3 % 125,922 Radisson® Hotels & Resorts Full Service Upscale 5 2.3 % 1,149 3.0 % 170,297 2.7 % 148,213 Crowne Plaza® Full Service Upscale 1 0.5 % 495 1.3 % 123,734 2.0 % 249,968 Country Inns & Suites® by Radisson Full Service Upper Midscale 3 1.4 % 430 1.1 % 54,076 0.9 % 125,758 Total/Average Hotels 221 100.0 % 37,777 100.0 % $ 6,207,414 100.0 % $ 164,317 Hotel Portfolio by Brand As of September 30, 2023 (dollars in thousands, except per room or suite data)

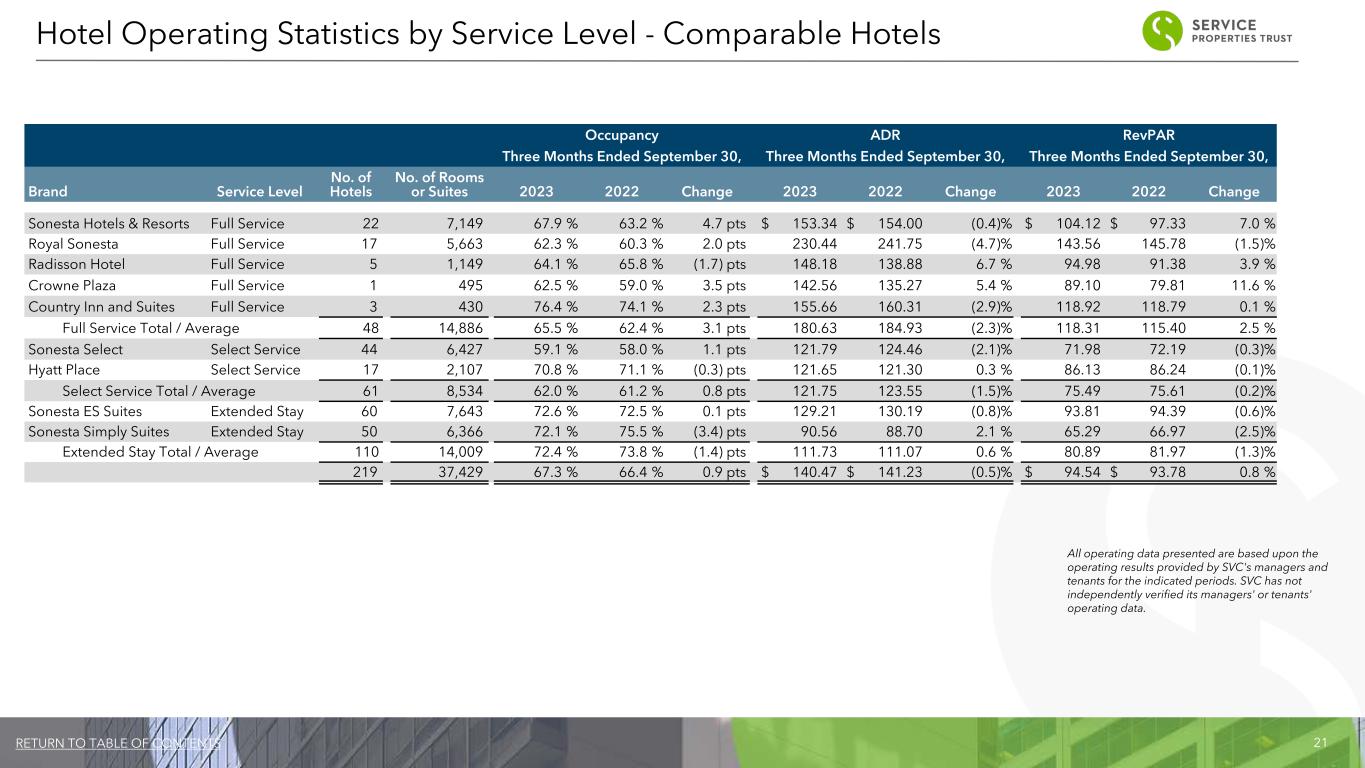

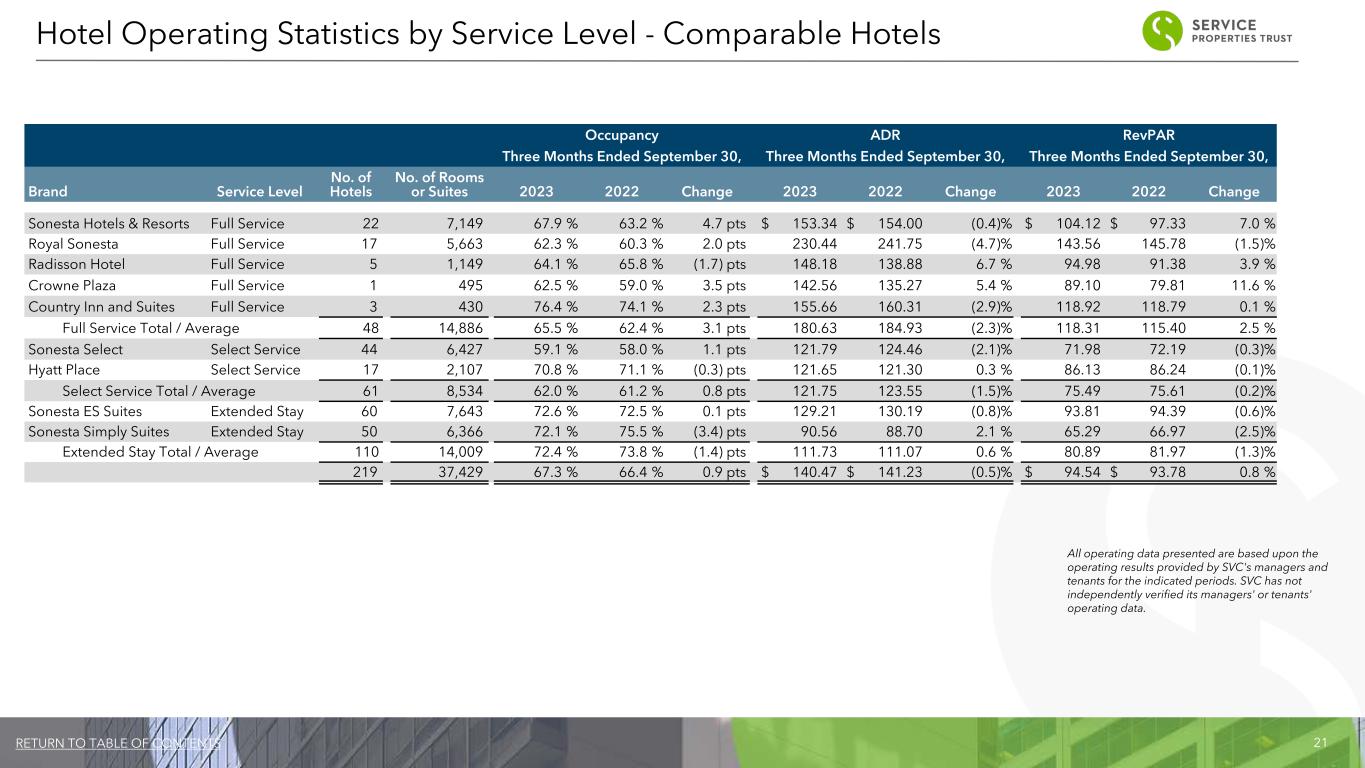

21RETURN TO TABLE OF CONTENTS Occupancy ADR RevPAR Three Months Ended September 30, Three Months Ended September 30, Three Months Ended September 30, Brand Service Level No. of Hotels No. of Rooms or Suites 2023 2022 Change 2023 2022 Change 2023 2022 Change Sonesta Hotels & Resorts Full Service 22 7,149 67.9 % 63.2 % 4.7 pts $ 153.34 $ 154.00 (0.4) % $ 104.12 $ 97.33 7.0 % Royal Sonesta Full Service 17 5,663 62.3 % 60.3 % 2.0 pts 230.44 241.75 (4.7) % 143.56 145.78 (1.5) % Radisson Hotel Full Service 5 1,149 64.1 % 65.8 % (1.7) pts 148.18 138.88 6.7 % 94.98 91.38 3.9 % Crowne Plaza Full Service 1 495 62.5 % 59.0 % 3.5 pts 142.56 135.27 5.4 % 89.10 79.81 11.6 % Country Inn and Suites Full Service 3 430 76.4 % 74.1 % 2.3 pts 155.66 160.31 (2.9) % 118.92 118.79 0.1 % Full Service Total / Average 48 14,886 65.5 % 62.4 % 3.1 pts 180.63 184.93 (2.3) % 118.31 115.40 2.5 % Sonesta Select Select Service 44 6,427 59.1 % 58.0 % 1.1 pts 121.79 124.46 (2.1) % 71.98 72.19 (0.3) % Hyatt Place Select Service 17 2,107 70.8 % 71.1 % (0.3) pts 121.65 121.30 0.3 % 86.13 86.24 (0.1) % Select Service Total / Average 61 8,534 62.0 % 61.2 % 0.8 pts 121.75 123.55 (1.5) % 75.49 75.61 (0.2) % Sonesta ES Suites Extended Stay 60 7,643 72.6 % 72.5 % 0.1 pts 129.21 130.19 (0.8) % 93.81 94.39 (0.6) % Sonesta Simply Suites Extended Stay 50 6,366 72.1 % 75.5 % (3.4) pts 90.56 88.70 2.1 % 65.29 66.97 (2.5) % Extended Stay Total / Average 110 14,009 72.4 % 73.8 % (1.4) pts 111.73 111.07 0.6 % 80.89 81.97 (1.3) % 219 37,429 67.3 % 66.4 % 0.9 pts $ 140.47 $ 141.23 (0.5) % $ 94.54 $ 93.78 0.8 % Hotel Operating Statistics by Service Level - Comparable Hotels All operating data presented are based upon the operating results provided by SVC's managers and tenants for the indicated periods. SVC has not independently verified its managers' or tenants' operating data.

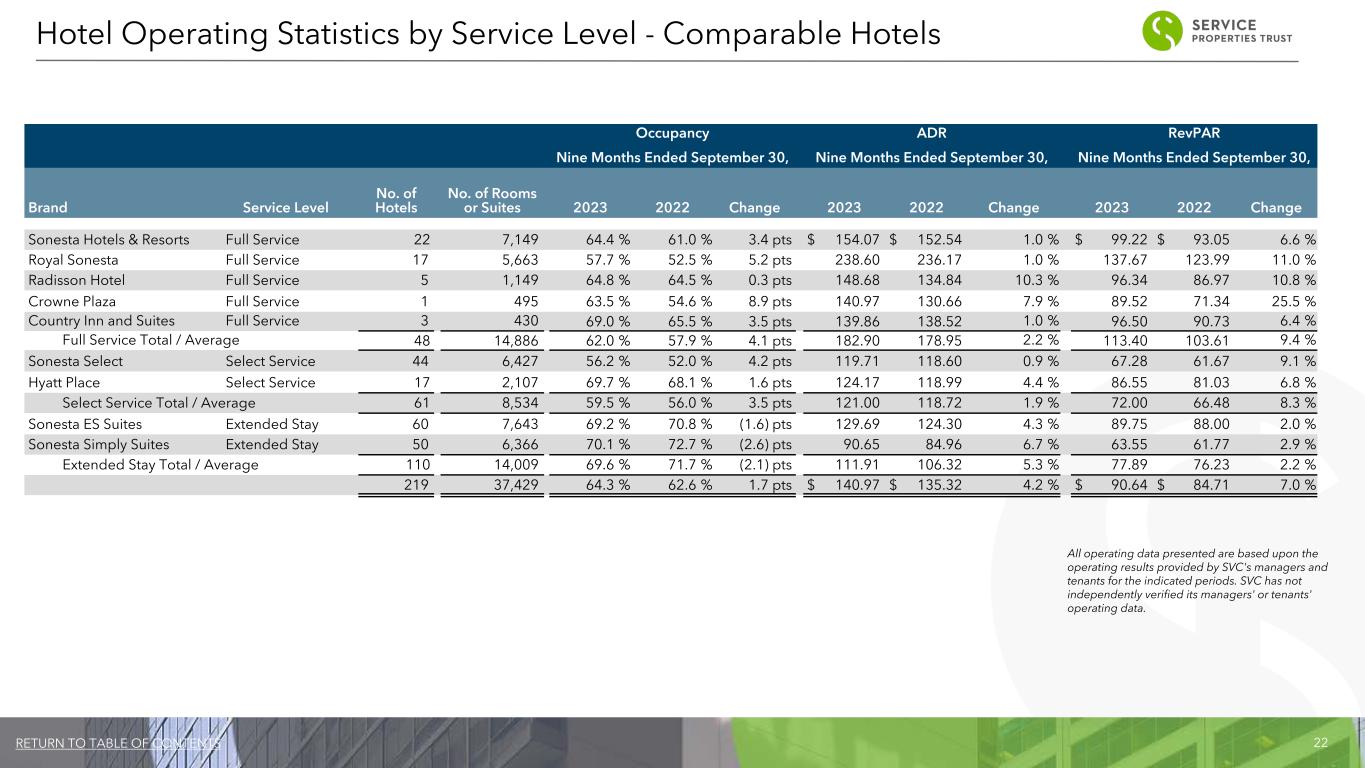

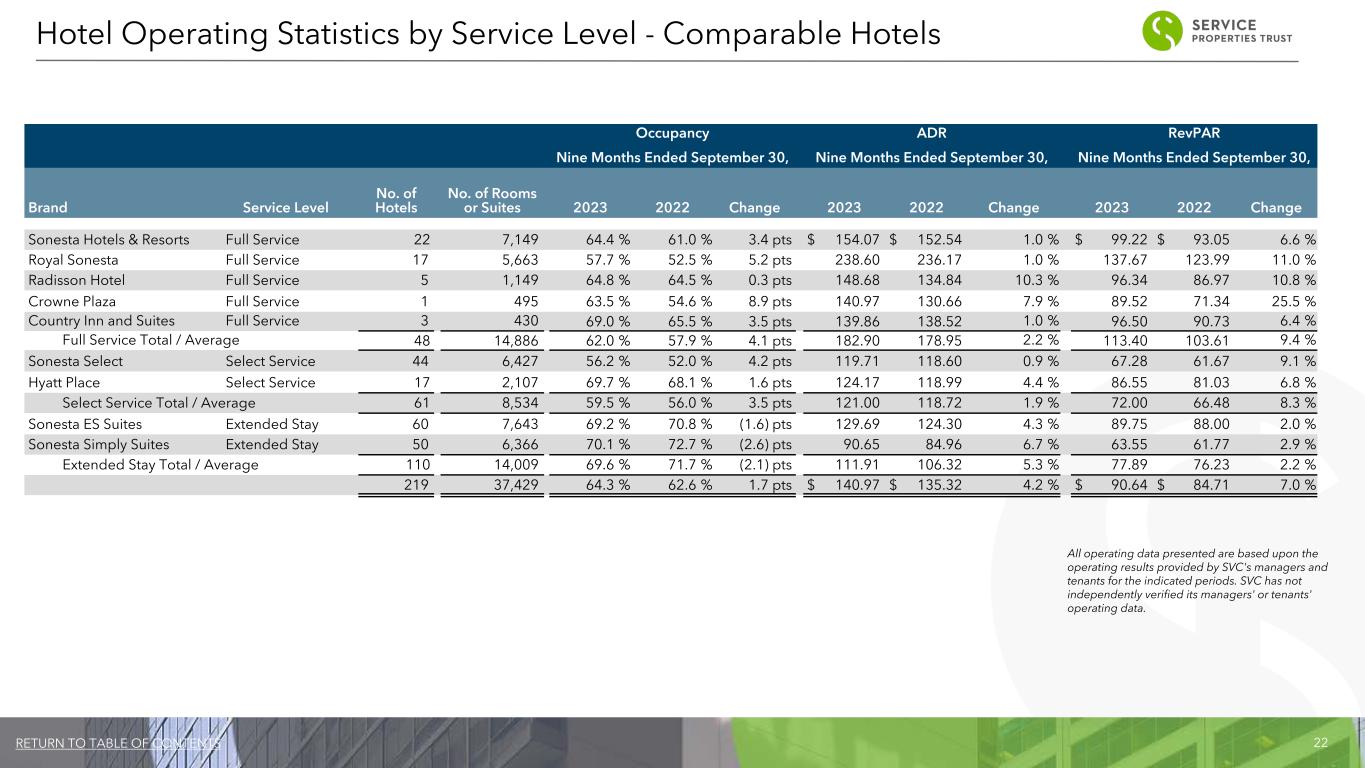

22RETURN TO TABLE OF CONTENTS Occupancy ADR RevPAR Nine Months Ended September 30, Nine Months Ended September 30, Nine Months Ended September 30, Brand Service Level No. of Hotels No. of Rooms or Suites 2023 2022 Change 2023 2022 Change 2023 2022 Change Sonesta Hotels & Resorts Full Service 22 7,149 64.4 % 61.0 % 3.4 pts $ 154.07 $ 152.54 1.0 % $ 99.22 $ 93.05 6.6 % Royal Sonesta Full Service 17 5,663 57.7 % 52.5 % 5.2 pts 238.60 236.17 1.0 % 137.67 123.99 11.0 % Radisson Hotel Full Service 5 1,149 64.8 % 64.5 % 0.3 pts 148.68 134.84 10.3 % 96.34 86.97 10.8 % Crowne Plaza Full Service 1 495 63.5 % 54.6 % 8.9 pts 140.97 130.66 7.9 % 89.52 71.34 25.5 % Country Inn and Suites Full Service 3 430 69.0 % 65.5 % 3.5 pts 139.86 138.52 1.0 % 96.50 90.73 6.4 % Full Service Total / Average 48 14,886 62.0 % 57.9 % 4.1 pts 182.90 178.95 2.2 % 113.40 103.61 9.4 % Sonesta Select Select Service 44 6,427 56.2 % 52.0 % 4.2 pts 119.71 118.60 0.9 % 67.28 61.67 9.1 % Hyatt Place Select Service 17 2,107 69.7 % 68.1 % 1.6 pts 124.17 118.99 4.4 % 86.55 81.03 6.8 % Select Service Total / Average 61 8,534 59.5 % 56.0 % 3.5 pts 121.00 118.72 1.9 % 72.00 66.48 8.3 % Sonesta ES Suites Extended Stay 60 7,643 69.2 % 70.8 % (1.6) pts 129.69 124.30 4.3 % 89.75 88.00 2.0 % Sonesta Simply Suites Extended Stay 50 6,366 70.1 % 72.7 % (2.6) pts 90.65 84.96 6.7 % 63.55 61.77 2.9 % Extended Stay Total / Average 110 14,009 69.6 % 71.7 % (2.1) pts 111.91 106.32 5.3 % 77.89 76.23 2.2 % 219 37,429 64.3 % 62.6 % 1.7 pts $ 140.97 $ 135.32 4.2 % $ 90.64 $ 84.71 7.0 % Hotel Operating Statistics by Service Level - Comparable Hotels All operating data presented are based upon the operating results provided by SVC's managers and tenants for the indicated periods. SVC has not independently verified its managers' or tenants' operating data.

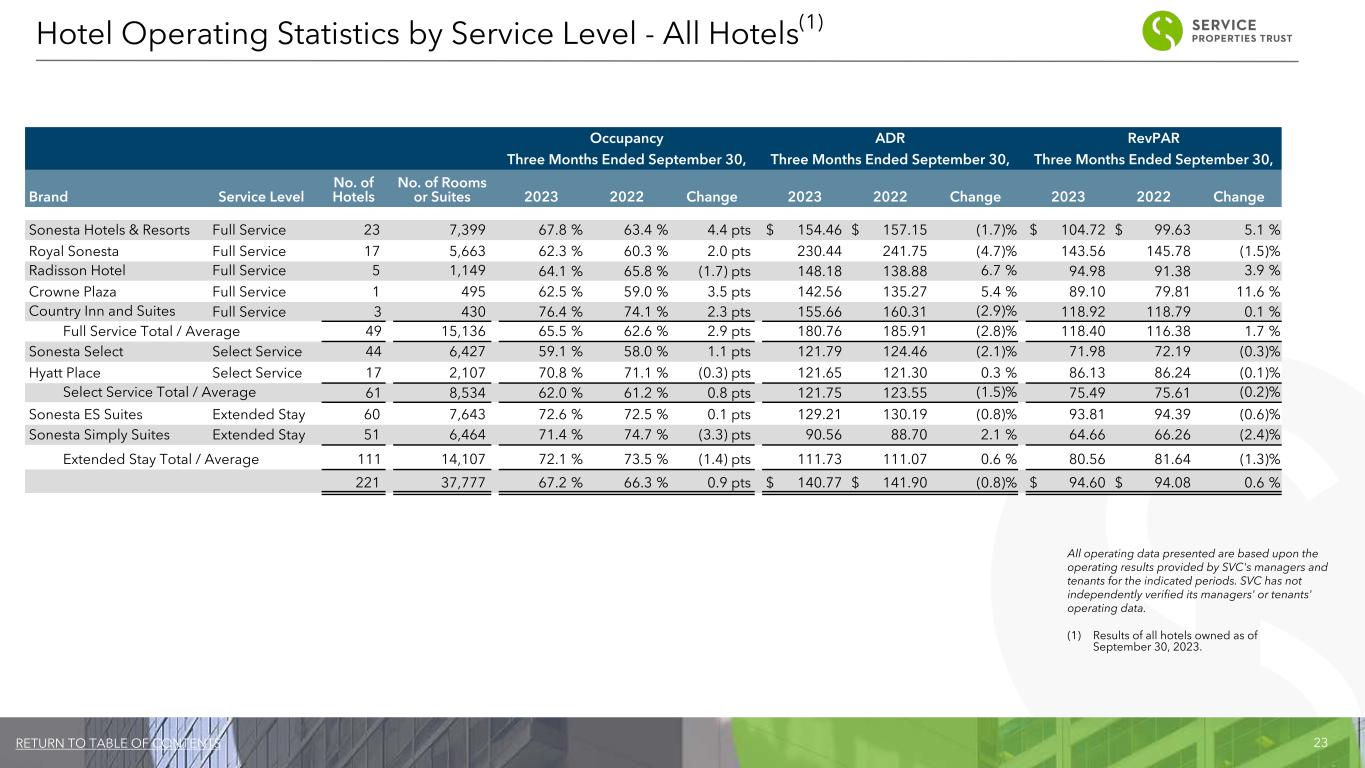

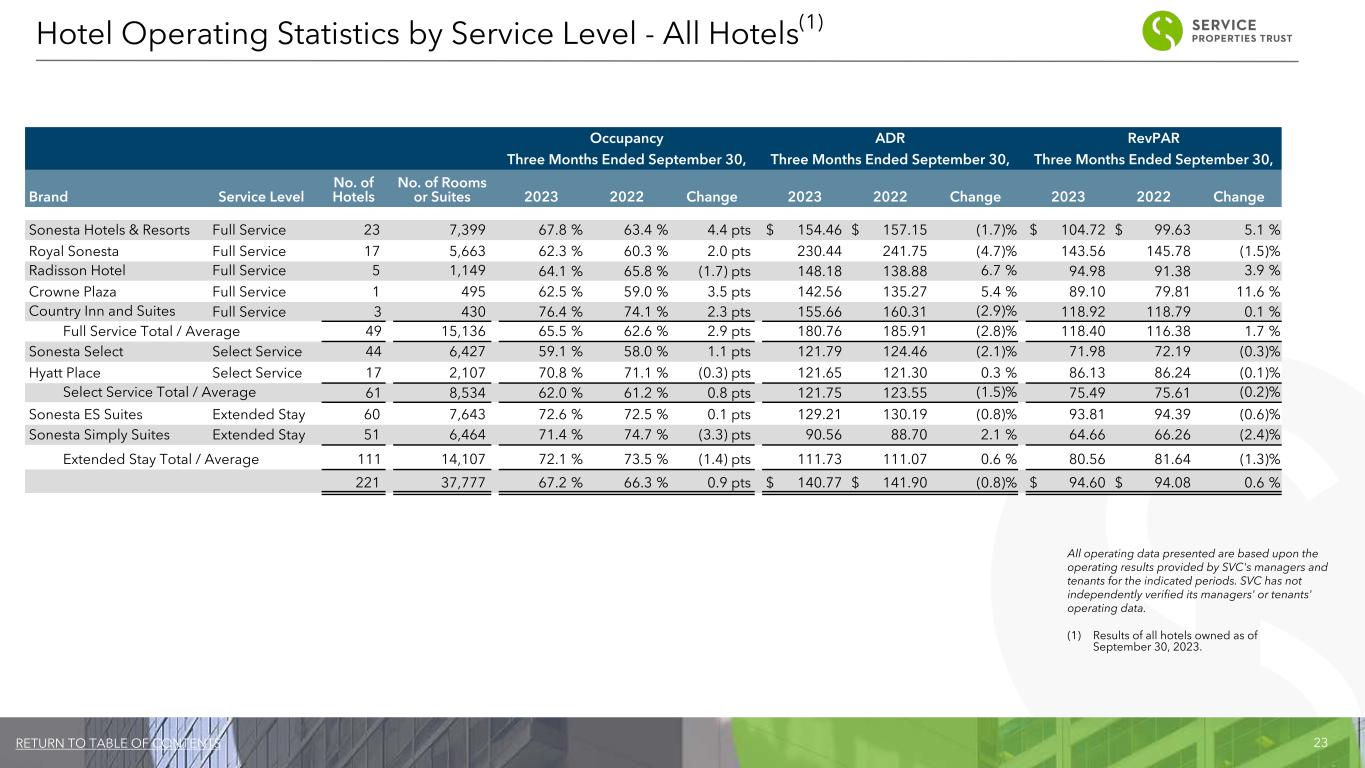

23RETURN TO TABLE OF CONTENTS Occupancy ADR RevPAR Three Months Ended September 30, Three Months Ended September 30, Three Months Ended September 30, Brand Service Level No. of Hotels No. of Rooms or Suites 2023 2022 Change 2023 2022 Change 2023 2022 Change Sonesta Hotels & Resorts Full Service 23 7,399 67.8 % 63.4 % 4.4 pts $ 154.46 $ 157.15 (1.7) % $ 104.72 $ 99.63 5.1 % Royal Sonesta Full Service 17 5,663 62.3 % 60.3 % 2.0 pts 230.44 241.75 (4.7) % 143.56 145.78 (1.5) % Radisson Hotel Full Service 5 1,149 64.1 % 65.8 % (1.7) pts 148.18 138.88 6.7 % 94.98 91.38 3.9 % Crowne Plaza Full Service 1 495 62.5 % 59.0 % 3.5 pts 142.56 135.27 5.4 % 89.10 79.81 11.6 % Country Inn and Suites Full Service 3 430 76.4 % 74.1 % 2.3 pts 155.66 160.31 (2.9) % 118.92 118.79 0.1 % Full Service Total / Average 49 15,136 65.5 % 62.6 % 2.9 pts 180.76 185.91 (2.8) % 118.40 116.38 1.7 % Sonesta Select Select Service 44 6,427 59.1 % 58.0 % 1.1 pts 121.79 124.46 (2.1) % 71.98 72.19 (0.3) % Hyatt Place Select Service 17 2,107 70.8 % 71.1 % (0.3) pts 121.65 121.30 0.3 % 86.13 86.24 (0.1) % Select Service Total / Average 61 8,534 62.0 % 61.2 % 0.8 pts 121.75 123.55 (1.5) % 75.49 75.61 (0.2) % Sonesta ES Suites Extended Stay 60 7,643 72.6 % 72.5 % 0.1 pts 129.21 130.19 (0.8) % 93.81 94.39 (0.6) % Sonesta Simply Suites Extended Stay 51 6,464 71.4 % 74.7 % (3.3) pts 90.56 88.70 2.1 % 64.66 66.26 (2.4) % Extended Stay Total / Average 111 14,107 72.1 % 73.5 % (1.4) pts 111.73 111.07 0.6 % 80.56 81.64 (1.3) % 221 37,777 67.2 % 66.3 % 0.9 pts $ 140.77 $ 141.90 (0.8) % $ 94.60 $ 94.08 0.6 % Hotel Operating Statistics by Service Level - All Hotels(1) All operating data presented are based upon the operating results provided by SVC's managers and tenants for the indicated periods. SVC has not independently verified its managers' or tenants' operating data. (1) Results of all hotels owned as of September 30, 2023.

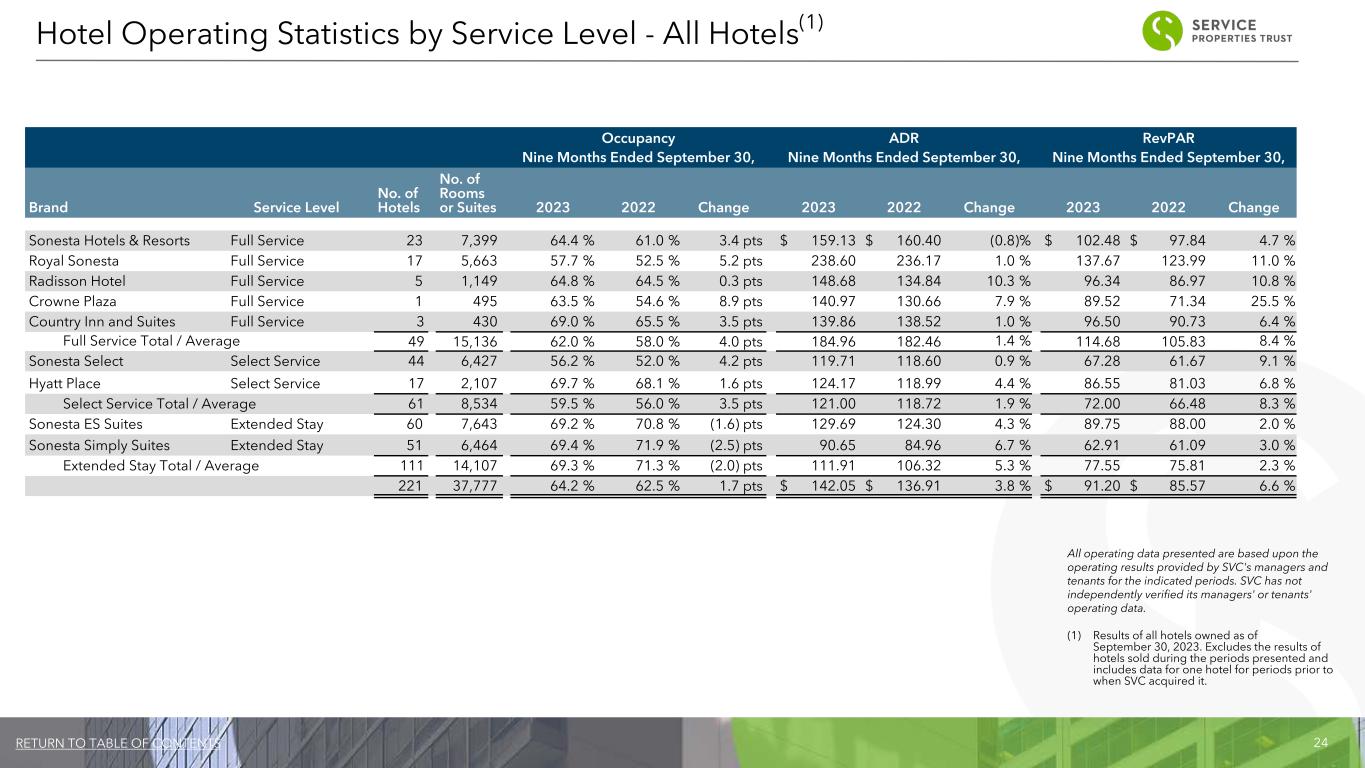

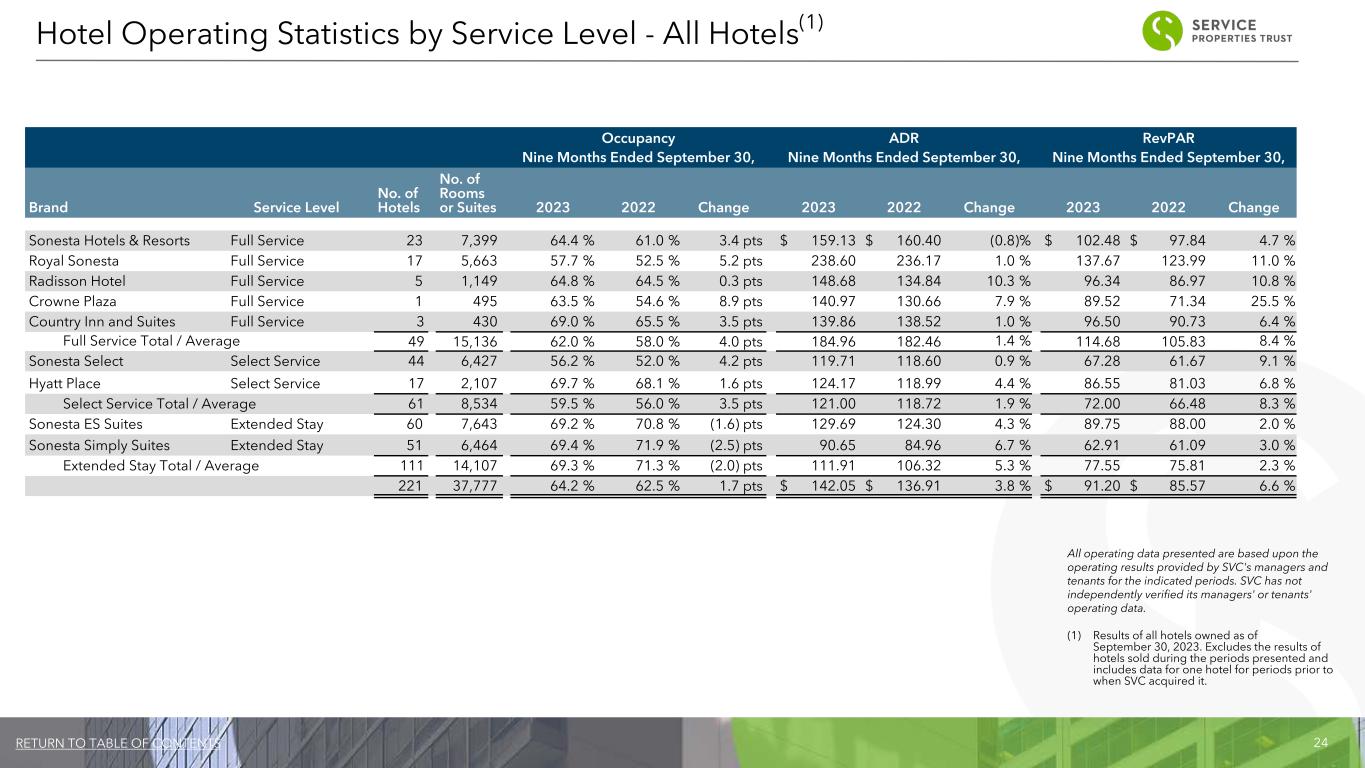

24RETURN TO TABLE OF CONTENTS Occupancy ADR RevPAR Nine Months Ended September 30, Nine Months Ended September 30, Nine Months Ended September 30, Brand Service Level No. of Hotels No. of Rooms or Suites 2023 2022 Change 2023 2022 Change 2023 2022 Change Sonesta Hotels & Resorts Full Service 23 7,399 64.4 % 61.0 % 3.4 pts $ 159.13 $ 160.40 (0.8) % $ 102.48 $ 97.84 4.7 % Royal Sonesta Full Service 17 5,663 57.7 % 52.5 % 5.2 pts 238.60 236.17 1.0 % 137.67 123.99 11.0 % Radisson Hotel Full Service 5 1,149 64.8 % 64.5 % 0.3 pts 148.68 134.84 10.3 % 96.34 86.97 10.8 % Crowne Plaza Full Service 1 495 63.5 % 54.6 % 8.9 pts 140.97 130.66 7.9 % 89.52 71.34 25.5 % Country Inn and Suites Full Service 3 430 69.0 % 65.5 % 3.5 pts 139.86 138.52 1.0 % 96.50 90.73 6.4 % Full Service Total / Average 49 15,136 62.0 % 58.0 % 4.0 pts 184.96 182.46 1.4 % 114.68 105.83 8.4 % Sonesta Select Select Service 44 6,427 56.2 % 52.0 % 4.2 pts 119.71 118.60 0.9 % 67.28 61.67 9.1 % Hyatt Place Select Service 17 2,107 69.7 % 68.1 % 1.6 pts 124.17 118.99 4.4 % 86.55 81.03 6.8 % Select Service Total / Average 61 8,534 59.5 % 56.0 % 3.5 pts 121.00 118.72 1.9 % 72.00 66.48 8.3 % Sonesta ES Suites Extended Stay 60 7,643 69.2 % 70.8 % (1.6) pts 129.69 124.30 4.3 % 89.75 88.00 2.0 % Sonesta Simply Suites Extended Stay 51 6,464 69.4 % 71.9 % (2.5) pts 90.65 84.96 6.7 % 62.91 61.09 3.0 % Extended Stay Total / Average 111 14,107 69.3 % 71.3 % (2.0) pts 111.91 106.32 5.3 % 77.55 75.81 2.3 % 221 37,777 64.2 % 62.5 % 1.7 pts $ 142.05 $ 136.91 3.8 % $ 91.20 $ 85.57 6.6 % Hotel Operating Statistics by Service Level - All Hotels(1) All operating data presented are based upon the operating results provided by SVC's managers and tenants for the indicated periods. SVC has not independently verified its managers' or tenants' operating data. (1) Results of all hotels owned as of September 30, 2023. Excludes the results of hotels sold during the periods presented and includes data for one hotel for periods prior to when SVC acquired it.

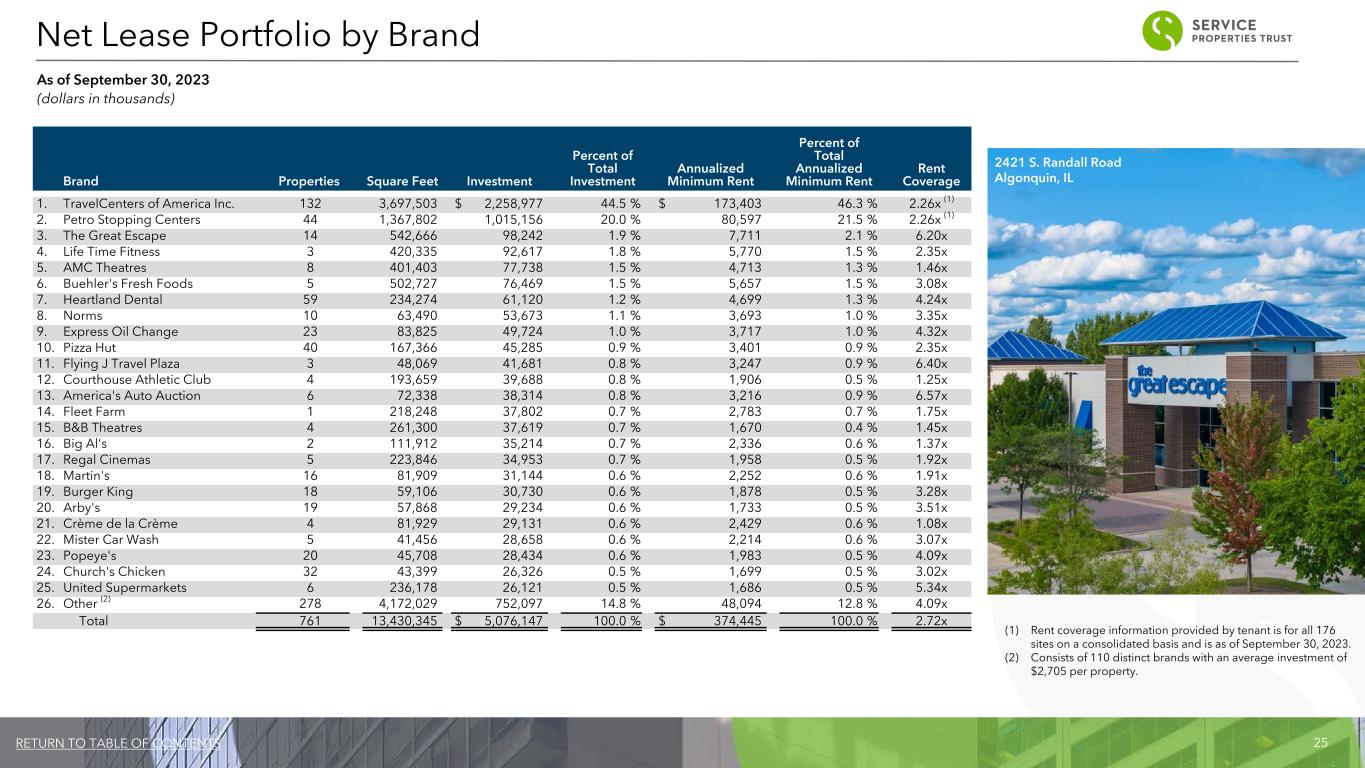

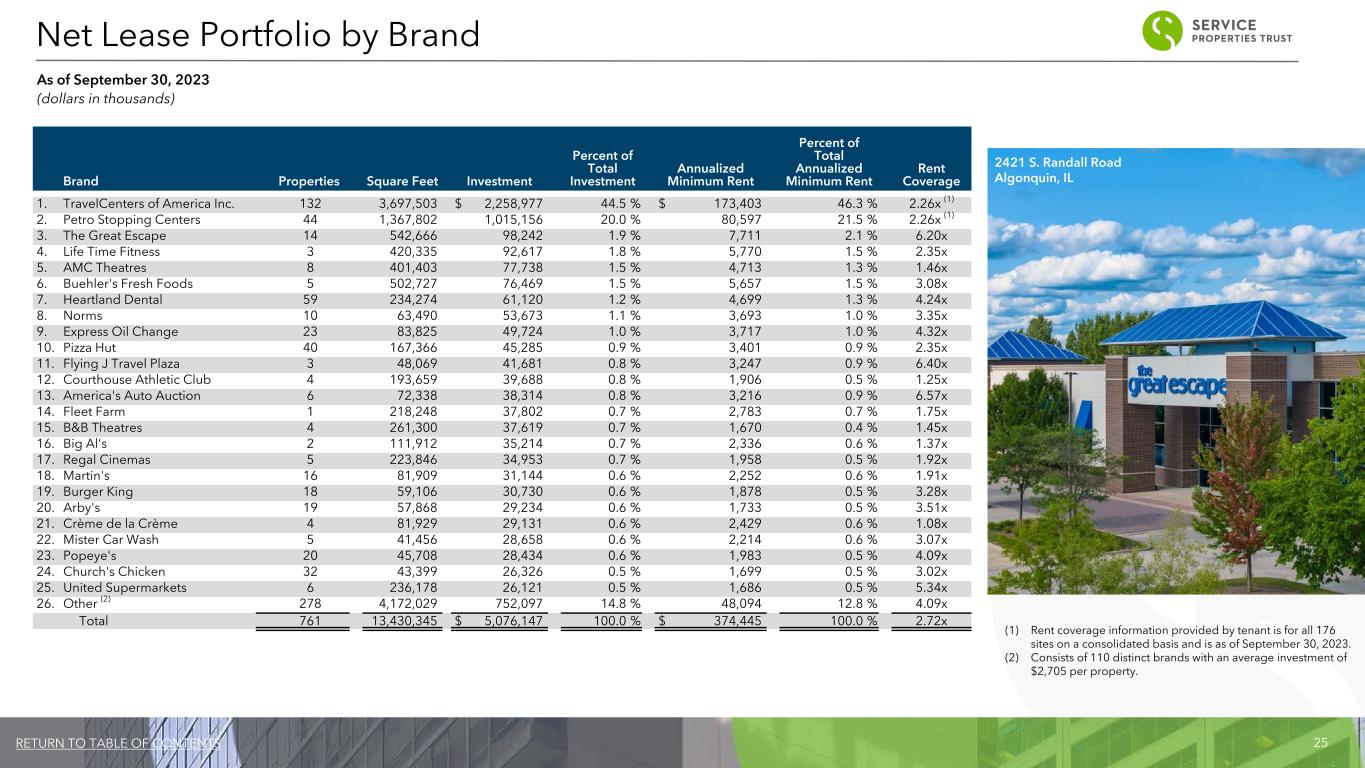

25RETURN TO TABLE OF CONTENTS Brand Properties Square Feet Investment Percent of Total Investment Annualized Minimum Rent Percent of Total Annualized Minimum Rent Rent Coverage 1. TravelCenters of America Inc. 132 3,697,503 $ 2,258,977 44.5 % $ 173,403 46.3 % 2.26x (1) 2. Petro Stopping Centers 44 1,367,802 1,015,156 20.0 % 80,597 21.5 % 2.26x (1) 3. The Great Escape 14 542,666 98,242 1.9 % 7,711 2.1 % 6.20x 4. Life Time Fitness 3 420,335 92,617 1.8 % 5,770 1.5 % 2.35x 5. AMC Theatres 8 401,403 77,738 1.5 % 4,713 1.3 % 1.46x 6. Buehler's Fresh Foods 5 502,727 76,469 1.5 % 5,657 1.5 % 3.08x 7. Heartland Dental 59 234,274 61,120 1.2 % 4,699 1.3 % 4.24x 8. Norms 10 63,490 53,673 1.1 % 3,693 1.0 % 3.35x 9. Express Oil Change 23 83,825 49,724 1.0 % 3,717 1.0 % 4.32x 10. Pizza Hut 40 167,366 45,285 0.9 % 3,401 0.9 % 2.35x 11. Flying J Travel Plaza 3 48,069 41,681 0.8 % 3,247 0.9 % 6.40x 12. Courthouse Athletic Club 4 193,659 39,688 0.8 % 1,906 0.5 % 1.25x 13. America's Auto Auction 6 72,338 38,314 0.8 % 3,216 0.9 % 6.57x 14. Fleet Farm 1 218,248 37,802 0.7 % 2,783 0.7 % 1.75x 15. B&B Theatres 4 261,300 37,619 0.7 % 1,670 0.4 % 1.45x 16. Big Al's 2 111,912 35,214 0.7 % 2,336 0.6 % 1.37x 17. Regal Cinemas 5 223,846 34,953 0.7 % 1,958 0.5 % 1.92x 18. Martin's 16 81,909 31,144 0.6 % 2,252 0.6 % 1.91x 19. Burger King 18 59,106 30,730 0.6 % 1,878 0.5 % 3.28x 20. Arby's 19 57,868 29,234 0.6 % 1,733 0.5 % 3.51x 21. Crème de la Crème 4 81,929 29,131 0.6 % 2,429 0.6 % 1.08x 22. Mister Car Wash 5 41,456 28,658 0.6 % 2,214 0.6 % 3.07x 23. Popeye's 20 45,708 28,434 0.6 % 1,983 0.5 % 4.09x 24. Church's Chicken 32 43,399 26,326 0.5 % 1,699 0.5 % 3.02x 25. United Supermarkets 6 236,178 26,121 0.5 % 1,686 0.5 % 5.34x 26. Other (2) 278 4,172,029 752,097 14.8 % 48,094 12.8 % 4.09x Total 761 13,430,345 $ 5,076,147 100.0 % $ 374,445 100.0 % 2.72x (1) Rent coverage information provided by tenant is for all 176 sites on a consolidated basis and is as of September 30, 2023. (2) Consists of 110 distinct brands with an average investment of $2,705 per property. Net Lease Portfolio by Brand As of September 30, 2023 (dollars in thousands) 2421 S. Randall Road Algonquin, IL

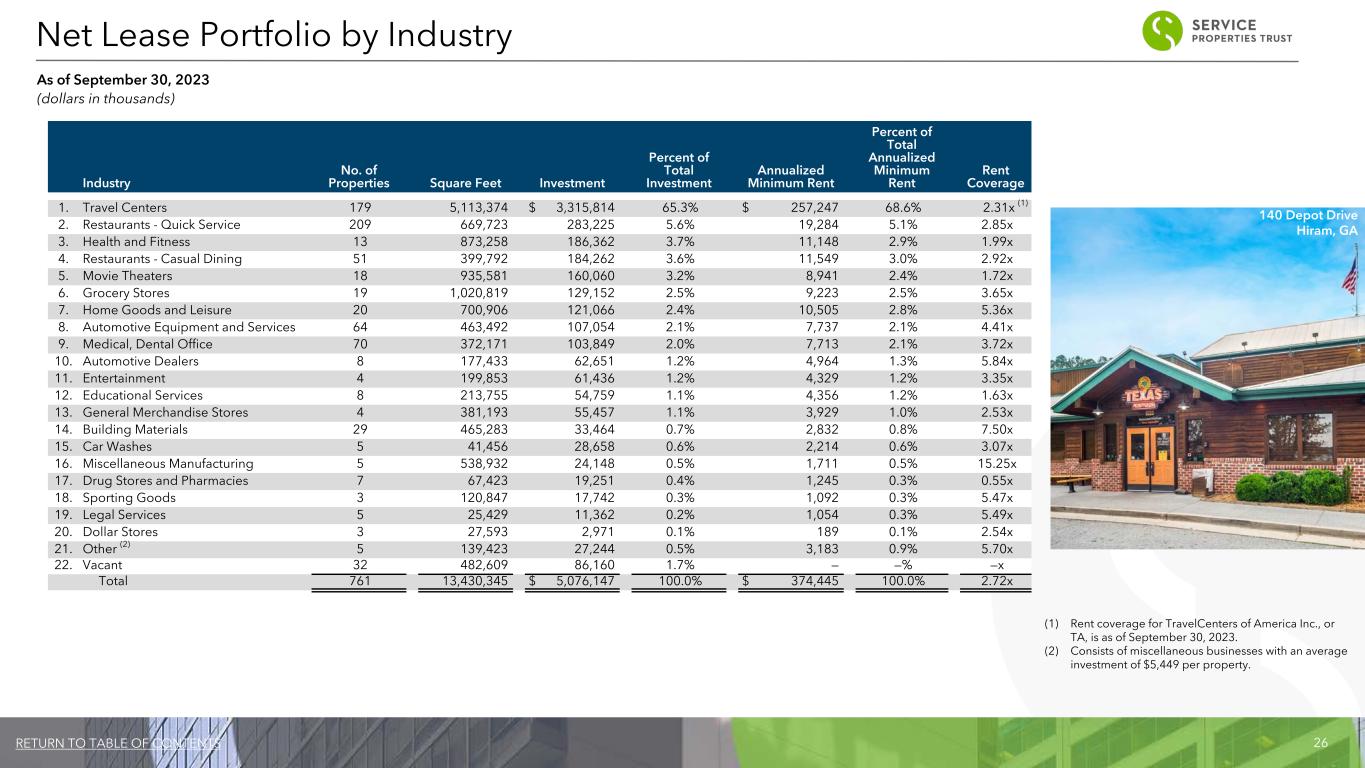

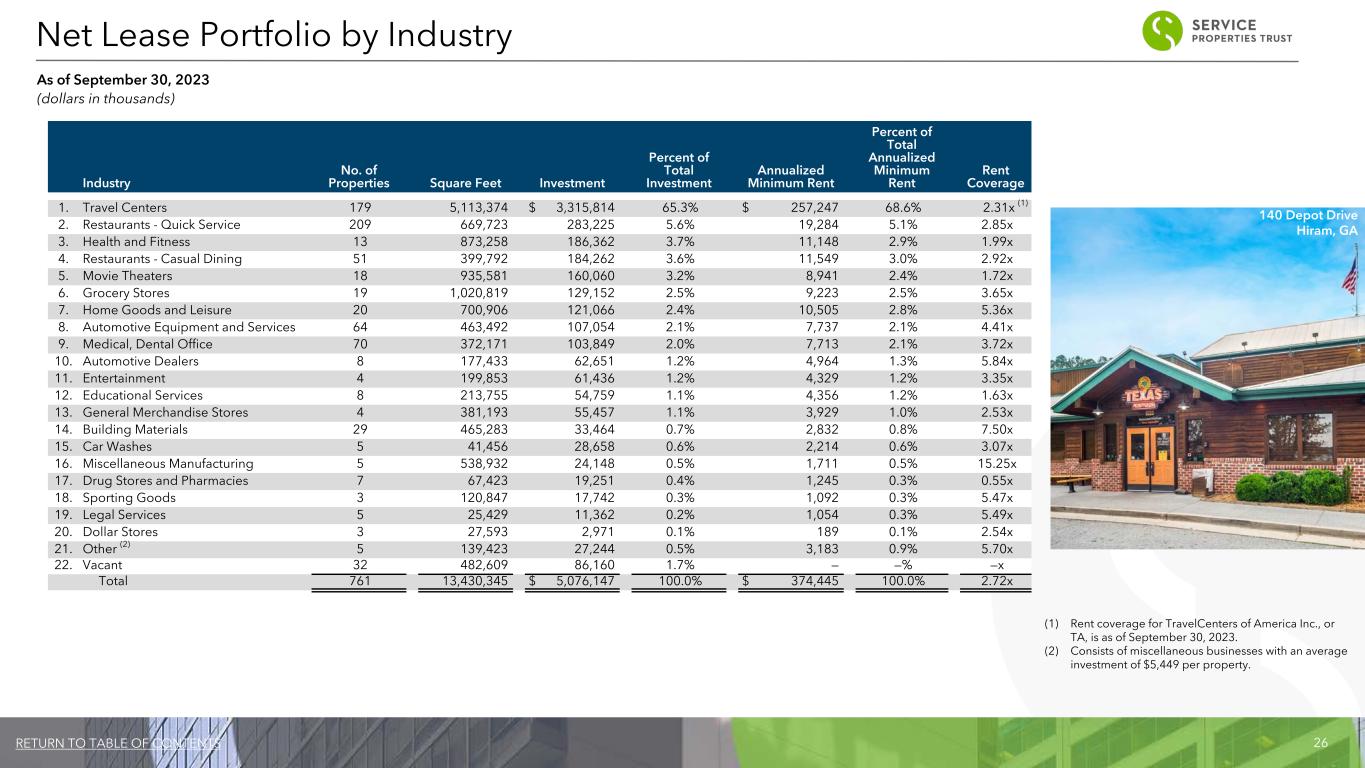

26RETURN TO TABLE OF CONTENTS Industry No. of Properties Square Feet Investment Percent of Total Investment Annualized Minimum Rent Percent of Total Annualized Minimum Rent Rent Coverage 1. Travel Centers 179 5,113,374 $ 3,315,814 65.3% $ 257,247 68.6% 2.31x (1) 2. Restaurants - Quick Service 209 669,723 283,225 5.6% 19,284 5.1% 2.85x 3. Health and Fitness 13 873,258 186,362 3.7% 11,148 2.9% 1.99x 4. Restaurants - Casual Dining 51 399,792 184,262 3.6% 11,549 3.0% 2.92x 5. Movie Theaters 18 935,581 160,060 3.2% 8,941 2.4% 1.72x 6. Grocery Stores 19 1,020,819 129,152 2.5% 9,223 2.5% 3.65x 7. Home Goods and Leisure 20 700,906 121,066 2.4% 10,505 2.8% 5.36x 8. Automotive Equipment and Services 64 463,492 107,054 2.1% 7,737 2.1% 4.41x 9. Medical, Dental Office 70 372,171 103,849 2.0% 7,713 2.1% 3.72x 10. Automotive Dealers 8 177,433 62,651 1.2% 4,964 1.3% 5.84x 11. Entertainment 4 199,853 61,436 1.2% 4,329 1.2% 3.35x 12. Educational Services 8 213,755 54,759 1.1% 4,356 1.2% 1.63x 13. General Merchandise Stores 4 381,193 55,457 1.1% 3,929 1.0% 2.53x 14. Building Materials 29 465,283 33,464 0.7% 2,832 0.8% 7.50x 15. Car Washes 5 41,456 28,658 0.6% 2,214 0.6% 3.07x 16. Miscellaneous Manufacturing 5 538,932 24,148 0.5% 1,711 0.5% 15.25x 17. Drug Stores and Pharmacies 7 67,423 19,251 0.4% 1,245 0.3% 0.55x 18. Sporting Goods 3 120,847 17,742 0.3% 1,092 0.3% 5.47x 19. Legal Services 5 25,429 11,362 0.2% 1,054 0.3% 5.49x 20. Dollar Stores 3 27,593 2,971 0.1% 189 0.1% 2.54x 21. Other (2) 5 139,423 27,244 0.5% 3,183 0.9% 5.70x 22. Vacant 32 482,609 86,160 1.7% — —% —x Total 761 13,430,345 $ 5,076,147 100.0% $ 374,445 100.0% 2.72x (1) Rent coverage for TravelCenters of America Inc., or TA, is as of September 30, 2023. (2) Consists of miscellaneous businesses with an average investment of $5,449 per property. Net Lease Portfolio by Industry As of September 30, 2023 (dollars in thousands) 140 Depot Drive Hiram, GA

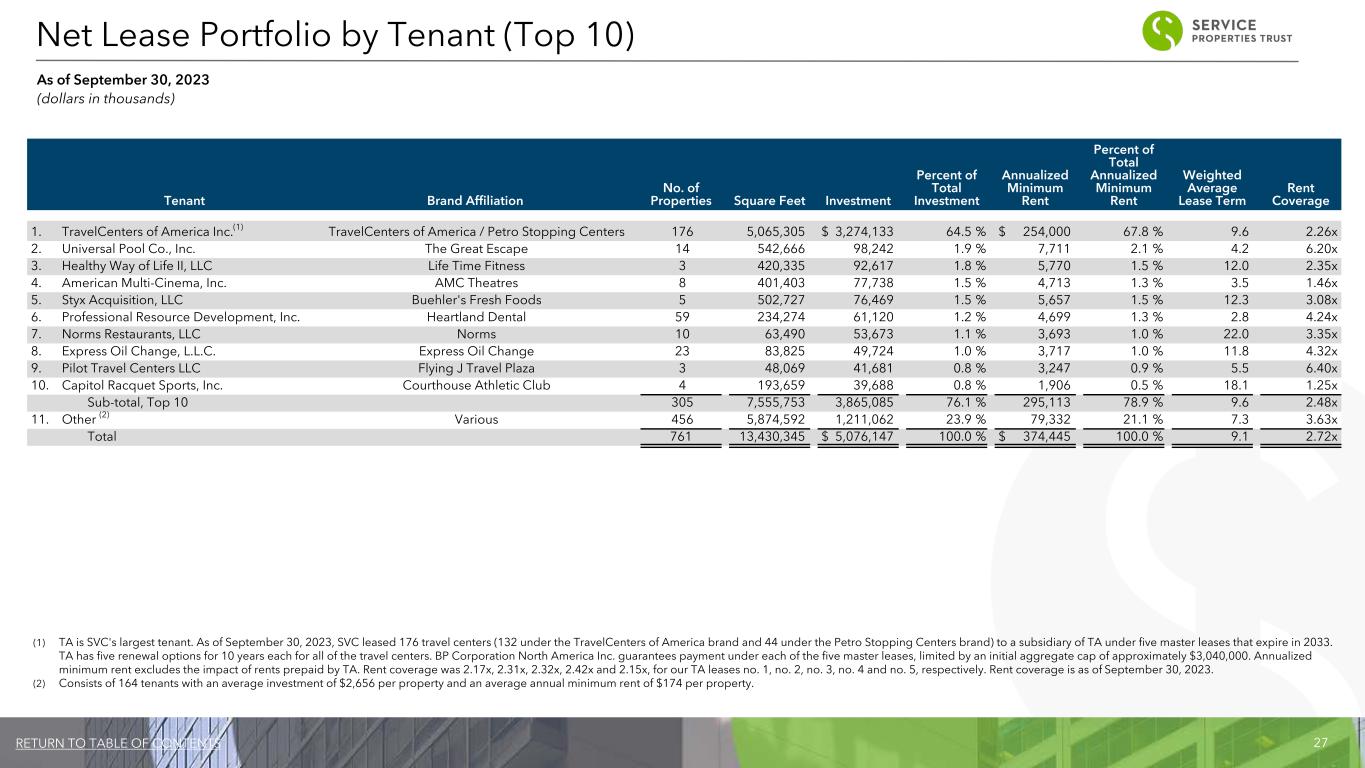

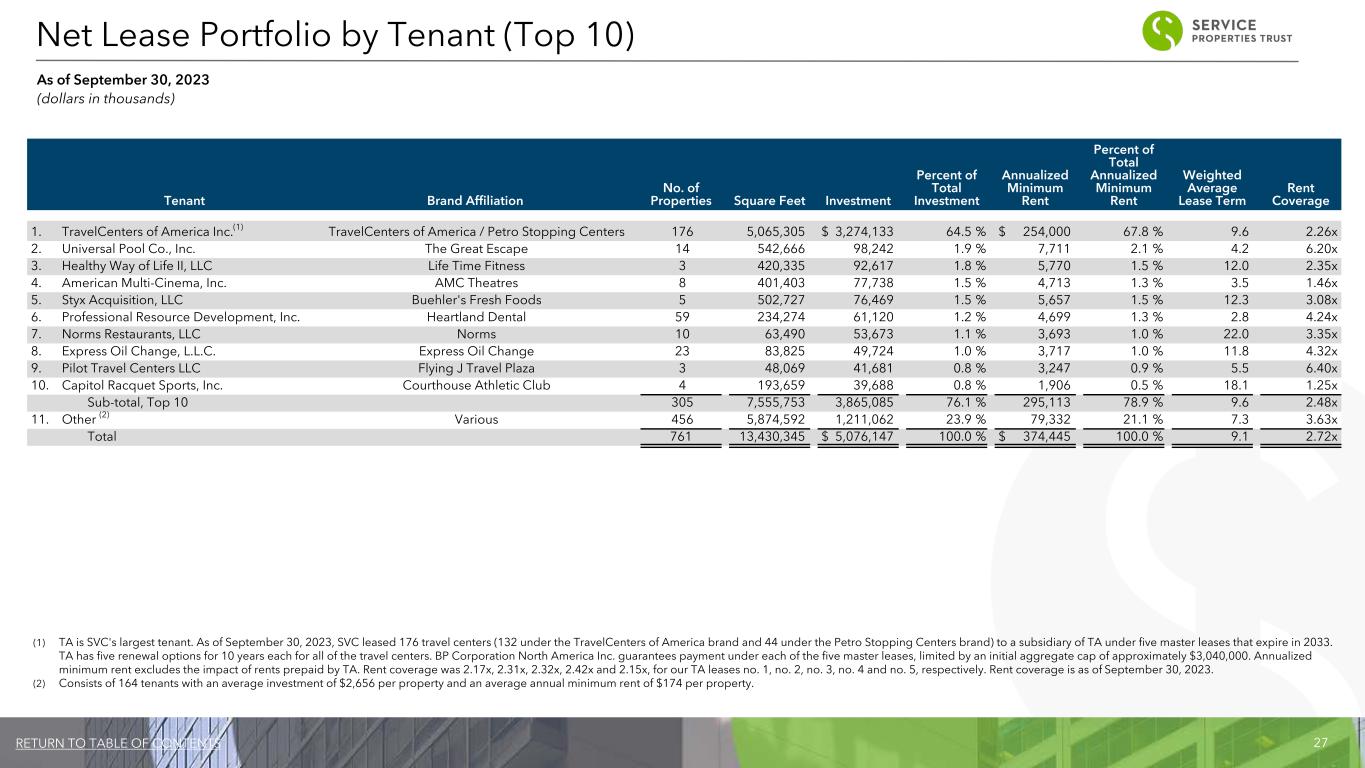

27RETURN TO TABLE OF CONTENTS Tenant Brand Affiliation No. of Properties Square Feet Investment Percent of Total Investment Annualized Minimum Rent Percent of Total Annualized Minimum Rent Weighted Average Lease Term Rent Coverage 1. TravelCenters of America Inc.(1) TravelCenters of America / Petro Stopping Centers 176 5,065,305 $ 3,274,133 64.5 % $ 254,000 67.8 % 9.6 2.26x 2. Universal Pool Co., Inc. The Great Escape 14 542,666 98,242 1.9 % 7,711 2.1 % 4.2 6.20x 3. Healthy Way of Life II, LLC Life Time Fitness 3 420,335 92,617 1.8 % 5,770 1.5 % 12.0 2.35x 4. American Multi-Cinema, Inc. AMC Theatres 8 401,403 77,738 1.5 % 4,713 1.3 % 3.5 1.46x 5. Styx Acquisition, LLC Buehler's Fresh Foods 5 502,727 76,469 1.5 % 5,657 1.5 % 12.3 3.08x 6. Professional Resource Development, Inc. Heartland Dental 59 234,274 61,120 1.2 % 4,699 1.3 % 2.8 4.24x 7. Norms Restaurants, LLC Norms 10 63,490 53,673 1.1 % 3,693 1.0 % 22.0 3.35x 8. Express Oil Change, L.L.C. Express Oil Change 23 83,825 49,724 1.0 % 3,717 1.0 % 11.8 4.32x 9. Pilot Travel Centers LLC Flying J Travel Plaza 3 48,069 41,681 0.8 % 3,247 0.9 % 5.5 6.40x 10. Capitol Racquet Sports, Inc. Courthouse Athletic Club 4 193,659 39,688 0.8 % 1,906 0.5 % 18.1 1.25x Sub-total, Top 10 305 7,555,753 3,865,085 76.1 % 295,113 78.9 % 9.6 2.48x 11. Other (2) Various 456 5,874,592 1,211,062 23.9 % 79,332 21.1 % 7.3 3.63x Total 761 13,430,345 $ 5,076,147 100.0 % $ 374,445 100.0 % 9.1 2.72x (1) TA is SVC's largest tenant. As of September 30, 2023, SVC leased 176 travel centers (132 under the TravelCenters of America brand and 44 under the Petro Stopping Centers brand) to a subsidiary of TA under five master leases that expire in 2033. TA has five renewal options for 10 years each for all of the travel centers. BP Corporation North America Inc. guarantees payment under each of the five master leases, limited by an initial aggregate cap of approximately $3,040,000. Annualized minimum rent excludes the impact of rents prepaid by TA. Rent coverage was 2.17x, 2.31x, 2.32x, 2.42x and 2.15x, for our TA leases no. 1, no. 2, no. 3, no. 4 and no. 5, respectively. Rent coverage is as of September 30, 2023. (2) Consists of 164 tenants with an average investment of $2,656 per property and an average annual minimum rent of $174 per property. Net Lease Portfolio by Tenant (Top 10) As of September 30, 2023 (dollars in thousands)

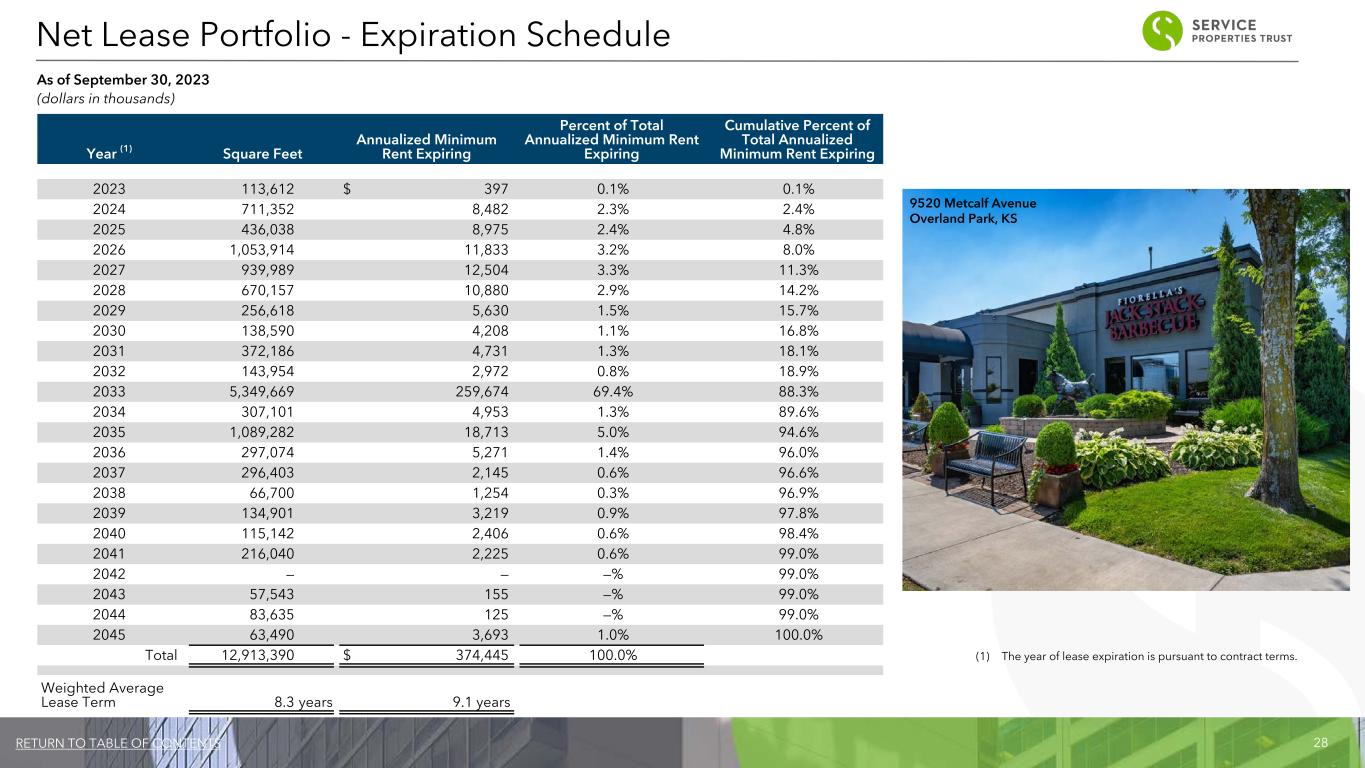

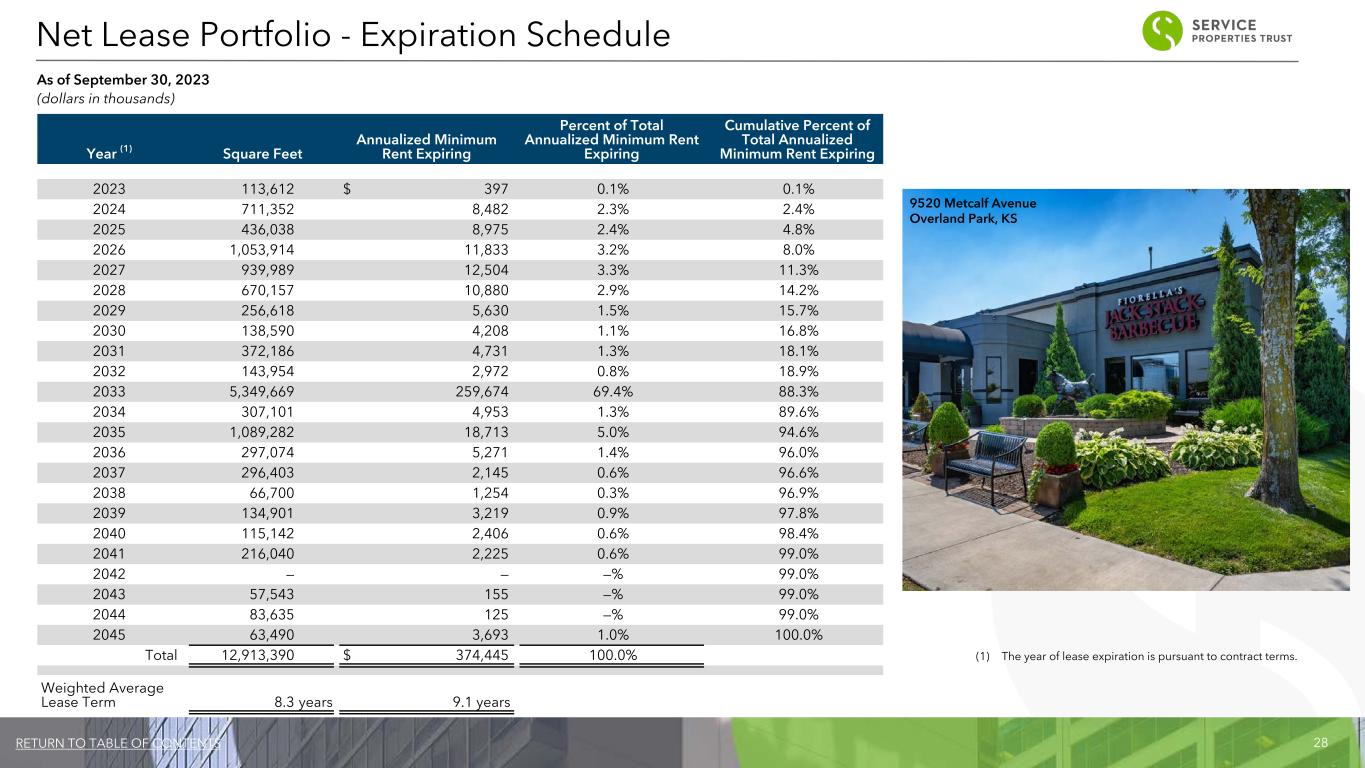

28RETURN TO TABLE OF CONTENTS Year (1) Square Feet Annualized Minimum Rent Expiring Percent of Total Annualized Minimum Rent Expiring Cumulative Percent of Total Annualized Minimum Rent Expiring 2023 113,612 $ 397 0.1% 0.1% 2024 711,352 8,482 2.3% 2.4% 2025 436,038 8,975 2.4% 4.8% 2026 1,053,914 11,833 3.2% 8.0% 2027 939,989 12,504 3.3% 11.3% 2028 670,157 10,880 2.9% 14.2% 2029 256,618 5,630 1.5% 15.7% 2030 138,590 4,208 1.1% 16.8% 2031 372,186 4,731 1.3% 18.1% 2032 143,954 2,972 0.8% 18.9% 2033 5,349,669 259,674 69.4% 88.3% 2034 307,101 4,953 1.3% 89.6% 2035 1,089,282 18,713 5.0% 94.6% 2036 297,074 5,271 1.4% 96.0% 2037 296,403 2,145 0.6% 96.6% 2038 66,700 1,254 0.3% 96.9% 2039 134,901 3,219 0.9% 97.8% 2040 115,142 2,406 0.6% 98.4% 2041 216,040 2,225 0.6% 99.0% 2042 — — —% 99.0% 2043 57,543 155 —% 99.0% 2044 83,635 125 —% 99.0% 2045 63,490 3,693 1.0% 100.0% Total 12,913,390 $ 374,445 100.0% Weighted Average Lease Term 8.3 years 9.1 years (1) The year of lease expiration is pursuant to contract terms. Net Lease Portfolio - Expiration Schedule As of September 30, 2023 (dollars in thousands) 9520 Metcalf Avenue Overland Park, KS

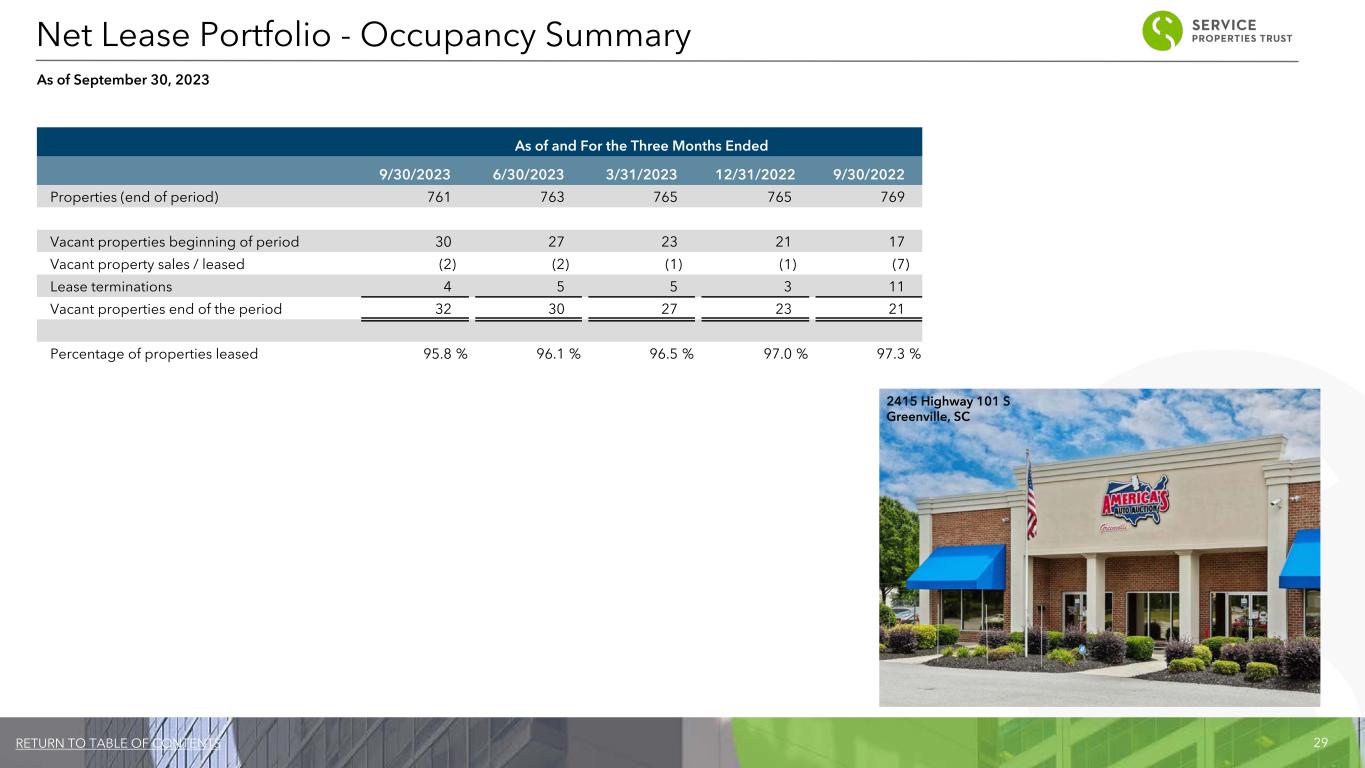

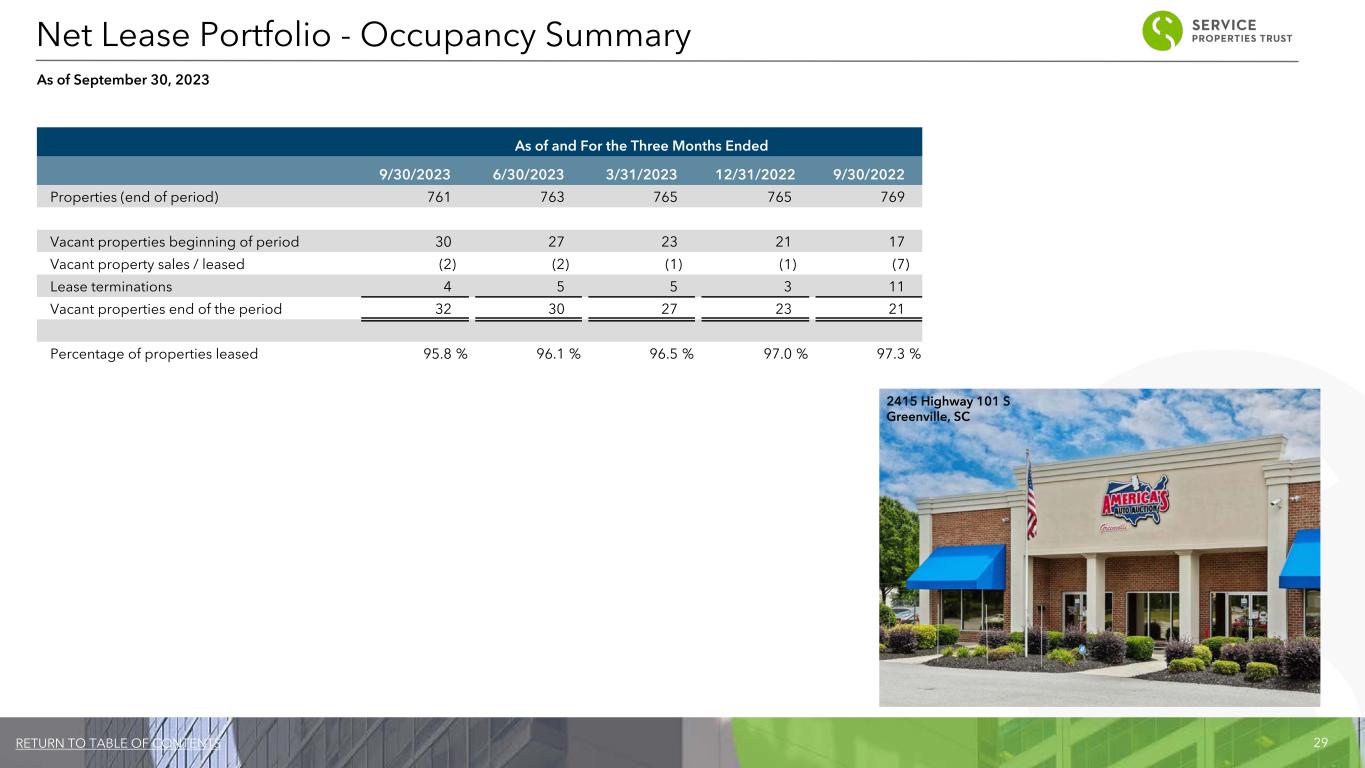

29RETURN TO TABLE OF CONTENTS As of and For the Three Months Ended 9/30/2023 6/30/2023 3/31/2023 12/31/2022 9/30/2022 Properties (end of period) 761 763 765 765 769 Vacant properties beginning of period 30 27 23 21 17 Vacant property sales / leased (2) (2) (1) (1) (7) Lease terminations 4 5 5 3 11 Vacant properties end of the period 32 30 27 23 21 Percentage of properties leased 95.8 % 96.1 % 96.5 % 97.0 % 97.3 % Net Lease Portfolio - Occupancy Summary As of September 30, 2023 2415 Highway 101 S Greenville, SC

30RETURN TO TABLE OF CONTENTS Appendix

31RETURN TO TABLE OF CONTENTS Company Profile and Research Coverage The Company: Service Properties Trust, or SVC, is a real estate investment trust, or REIT, that owns hotels and service-focused retail net lease properties throughout the United States and in Puerto Rico and Canada. SVC is included in 171 market indices and comprises more than 1% of the following indices as of September 30, 2023: Bloomberg Reit Hotels Index (BBREHOTL) and Invesco S&P SmallCap Financials ETF INAV Index (PSCFIV). Management: SVC is managed by The RMR Group (Nasdaq: RMR). RMR is an alternative asset management company that is focused on commercial real estate and related businesses. As of September 30, 2023, RMR had approximately $36 billion of real estate assets under management and the combined RMR managed companies had more than $5 billion of annual revenues, over 2,000 properties and over 20,000 employees. SVC believes that being managed by RMR is a competitive advantage for SVC because of RMR’s depth of management and experience in the real estate industry. SVC also believes RMR provides management services to it at costs that are lower than SVC would have to pay for similar quality services if SVC were self-managed. Equity Research Coverage B. Riley Securities, Inc. HSBC Bryan Maher Meredith Jensen (646) 885-5423 (212) 525-6858 bmaher@brileyfin.com meredith.jensen@us.hsbc.com Oppenheimer & Co. Inc. Wells Fargo Securities Tyler Batory Dori Kesten (212) 667-7230 (617) 603-4233 tyler.batory@opco.com dori.kesten@wellsfargo.com Rating Agencies and Issuer Ratings Moody’s Investors Service S&P Global Reed Valutas Alan Zigman (212) 553-4169 (416) 507-2556 alan.zigman@spglobal.com B2 (Outlook: Negative)/B1* B+ (Outlook: Negative)/BB* *B1 rating assigned to guaranteed Senior Unsecured Notes. *BB rating assigned to guaranteed Senior Unsecured Notes.

32RETURN TO TABLE OF CONTENTS Board of Trustees Laurie B. Burns Robert E. Cramer Donna D. Fraiche Independent Trustee Independent Trustee Lead Independent Trustee John L. Harrington William A. Lamkin John G. Murray Independent Trustee Independent Trustee Managing Trustee Rajan C. Penkar Adam D. Portnoy Independent Trustee Chair of the Board & Managing Trustee Executive Officers Todd W. Hargreaves Brian E. Donley President and Chief Investment Officer Chief Financial Officer and Treasurer Governance Information 233 W. Hillsboro Boulevard Deerfield Beach, FL

33RETURN TO TABLE OF CONTENTS Non-GAAP Financial Measures SVC presents certain “non-GAAP financial measures” within the meaning of the applicable Securities and Exchange Commission, or SEC, rules, including FFO, Normalized FFO, EBITDA, Hotel EBITDA, EBITDAre and Adjusted EBITDAre. These measures do not represent cash generated by operating activities in accordance with GAAP and should not be considered alternatives to net (loss) income as indicators of SVC's operating performance or as measures of its liquidity. These measures should be considered in conjunction with net (loss) income as presented in SVC's condensed consolidated statements of income (loss). SVC considers these non-GAAP measures to be appropriate supplemental measures of operating performance for a REIT, along with net (loss) income. SVC believes these measures provide useful information to investors because by excluding the effects of certain historical amounts, such as depreciation and amortization expense, they may facilitate a comparison of its operating performance between periods and with other REITs and, in the case of Hotel EBITDA, reflecting only those income and expense items that are generated and incurred at the hotel level may help both investors and management to understand the operations of its hotels. FFO and Normalized FFO: SVC calculates funds from operations, or FFO, and normalized funds from operations, or Normalized FFO, as shown on page 35. FFO is calculated on the basis defined by The National Association of Real Estate Investment Trusts, or Nareit, which is net (loss) income, calculated in accordance with GAAP, excluding any gain or loss on sale of properties and loss on impairment of real estate assets, if any, plus real estate depreciation and amortization, less any gains and losses on equity securities, as well as adjustments to reflect SVC's share of FFO attributable to an investee and certain other adjustments currently not applicable to SVC. In calculating Normalized FFO, SVC adjusts for the items shown on page 35. FFO and Normalized FFO are among the factors considered by SVC's Board of Trustees when determining the amount of distributions to SVC's shareholders. Other factors include, but are not limited to, requirements to satisfy its REIT distribution requirements, the availability to SVC of debt and equity capital, SVC's distribution rate as a percentage of the trading price of its common shares, or dividend yield, and to the dividend yield of other REITs, SVC's expectation of its future capital requirements and operating performance and its expected needs for and availability of cash to pay its obligations. Other real estate companies and REITs may calculate FFO and Normalized FFO differently than SVC does. EBITDA, EBITDAre and Adjusted EBITDAre: SVC calculates earnings before interest, taxes, depreciation and amortization, or EBITDA, EBITDA for real estate, or EBITDAre, and Adjusted EBITDAre as shown on page 36. EBITDAre is calculated on the basis defined by Nareit, which is EBITDA, excluding gains and losses on the sale of real estate, loss on impairment of real estate assets, if any, and adjustments to reflect SVC's share of EBITDAre attributable to an investee. In calculating Adjusted EBITDAre, SVC adjusts for the items shown on page 36. Other real estate companies and REITs may calculate EBITDA, EBITDAre and Adjusted EBITDAre differently than SVC does. Hotel EBITDA: SVC calculates Hotel EBITDA as hotel operating revenues less hotel operating expenses of all managed and leased hotels, prior to any adjustments required for presentation in its condensed consolidated statements of income (loss) in accordance with GAAP. SVC believes that Hotel EBITDA provides useful information to management and investors as a key measure of the profitability of its hotel operations. Other Definitions Adjusted Total Assets and Total Unencumbered Assets: Adjusted total assets and total unencumbered assets include original cost of real estate assets calculated in accordance with GAAP before impairment write- downs, if any, and exclude depreciation and amortization, accounts receivable and intangible assets. Annualized Dividend Yield: Annualized dividend yield is the annualized dividend paid during the period divided by the closing price of SVC's common shares at the end of the period. Annualized Minimum Rent: Generally, SVC's lease agreements with its net lease tenants require payment of minimum rent to SVC. Certain of these minimum rent payment amounts are secured by full or limited guarantees. Annualized minimum rent represents cash amounts and excludes adjustments, if any, necessary to record scheduled rent changes on a straight line basis or any expense reimbursements. Annualized minimum rent for TA excludes the impact of rents prepaid by TA. Average Daily Rate: ADR represents rooms revenue divided by the total number of room nights sold in a given period. ADR provides useful insight on pricing at SVC's hotels and is a measure widely used in the hotel industry. Chain Scale: As characterized by STR Global Limited, a data benchmark and analytics provider for the lodging industry. Comparable Hotels Data: SVC presents RevPAR, ADR and occupancy for the periods presented on a comparable basis to facilitate comparisons between periods. SVC generally defines comparable hotels as those that it owned on September 30, 2023 and were open and operating since the beginning of the earliest period being compared. For the periods presented, SVC's comparable results excluded two hotels, one of which was not owned for the entirety of the periods and the other of which had suspended operations during part of the periods presented. Consolidated Income Available for Debt Service: Consolidated income available for debt service, as defined in SVC's debt agreements, is earnings from operations excluding interest expense, unrealized gains and losses on equity securities, depreciation and amortization, loss on asset impairment, unrealized appreciation on assets held for sale, gains and losses on early extinguishment of debt, gains and losses on sales of property and amortization of deferred charges. Debt: Debt amounts reflect the principal balance as of the date reported. Net debt means total debt less unrestricted cash and cash equivalents as of the date reported. Non-GAAP Financial Measures and Certain Definitions

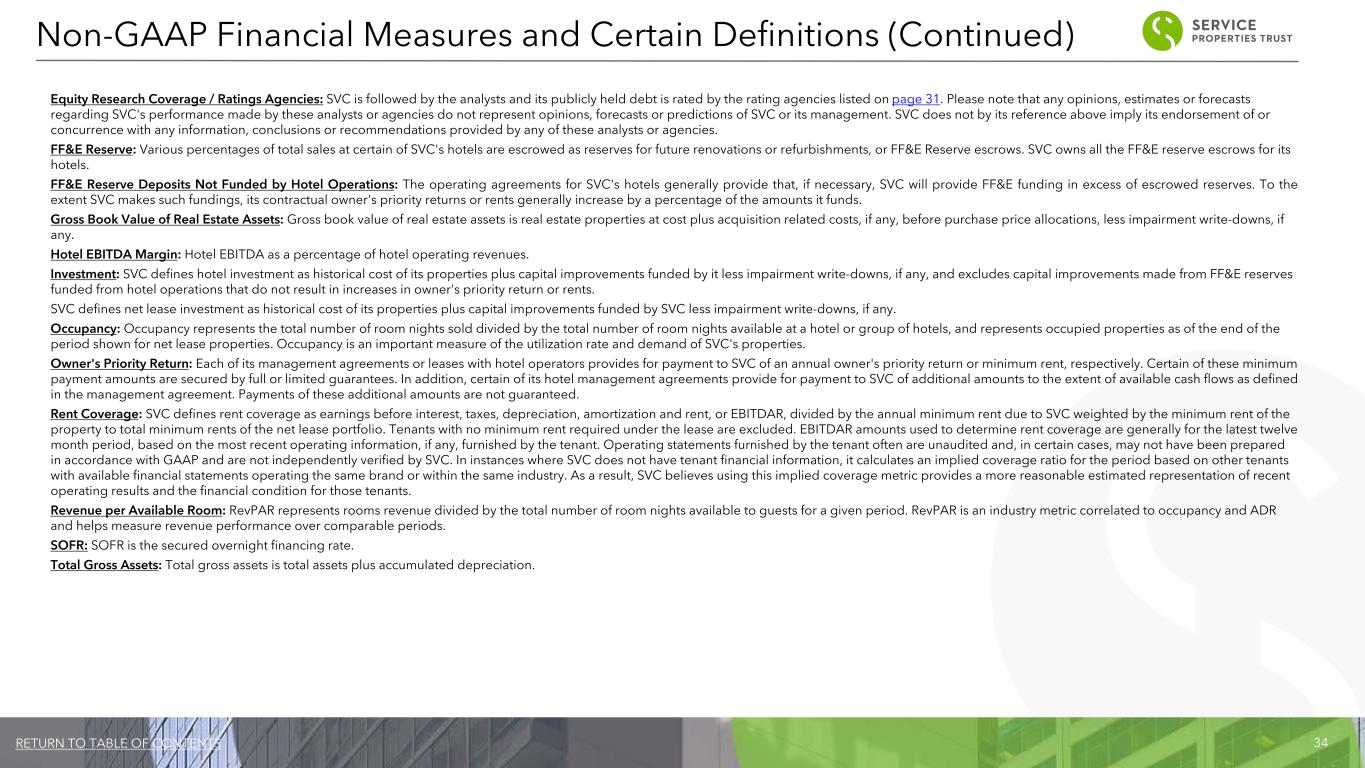

34RETURN TO TABLE OF CONTENTS Equity Research Coverage / Ratings Agencies: SVC is followed by the analysts and its publicly held debt is rated by the rating agencies listed on page 31. Please note that any opinions, estimates or forecasts regarding SVC's performance made by these analysts or agencies do not represent opinions, forecasts or predictions of SVC or its management. SVC does not by its reference above imply its endorsement of or concurrence with any information, conclusions or recommendations provided by any of these analysts or agencies. FF&E Reserve: Various percentages of total sales at certain of SVC's hotels are escrowed as reserves for future renovations or refurbishments, or FF&E Reserve escrows. SVC owns all the FF&E reserve escrows for its hotels. FF&E Reserve Deposits Not Funded by Hotel Operations: The operating agreements for SVC's hotels generally provide that, if necessary, SVC will provide FF&E funding in excess of escrowed reserves. To the extent SVC makes such fundings, its contractual owner's priority returns or rents generally increase by a percentage of the amounts it funds. Gross Book Value of Real Estate Assets: Gross book value of real estate assets is real estate properties at cost plus acquisition related costs, if any, before purchase price allocations, less impairment write-downs, if any. Hotel EBITDA Margin: Hotel EBITDA as a percentage of hotel operating revenues. Investment: SVC defines hotel investment as historical cost of its properties plus capital improvements funded by it less impairment write-downs, if any, and excludes capital improvements made from FF&E reserves funded from hotel operations that do not result in increases in owner's priority return or rents. SVC defines net lease investment as historical cost of its properties plus capital improvements funded by SVC less impairment write-downs, if any. Occupancy: Occupancy represents the total number of room nights sold divided by the total number of room nights available at a hotel or group of hotels, and represents occupied properties as of the end of the period shown for net lease properties. Occupancy is an important measure of the utilization rate and demand of SVC's properties. Owner's Priority Return: Each of its management agreements or leases with hotel operators provides for payment to SVC of an annual owner's priority return or minimum rent, respectively. Certain of these minimum payment amounts are secured by full or limited guarantees. In addition, certain of its hotel management agreements provide for payment to SVC of additional amounts to the extent of available cash flows as defined in the management agreement. Payments of these additional amounts are not guaranteed. Rent Coverage: SVC defines rent coverage as earnings before interest, taxes, depreciation, amortization and rent, or EBITDAR, divided by the annual minimum rent due to SVC weighted by the minimum rent of the property to total minimum rents of the net lease portfolio. Tenants with no minimum rent required under the lease are excluded. EBITDAR amounts used to determine rent coverage are generally for the latest twelve month period, based on the most recent operating information, if any, furnished by the tenant. Operating statements furnished by the tenant often are unaudited and, in certain cases, may not have been prepared in accordance with GAAP and are not independently verified by SVC. In instances where SVC does not have tenant financial information, it calculates an implied coverage ratio for the period based on other tenants with available financial statements operating the same brand or within the same industry. As a result, SVC believes using this implied coverage metric provides a more reasonable estimated representation of recent operating results and the financial condition for those tenants. Revenue per Available Room: RevPAR represents rooms revenue divided by the total number of room nights available to guests for a given period. RevPAR is an industry metric correlated to occupancy and ADR and helps measure revenue performance over comparable periods. SOFR: SOFR is the secured overnight financing rate. Total Gross Assets: Total gross assets is total assets plus accumulated depreciation. Non-GAAP Financial Measures and Certain Definitions (Continued)

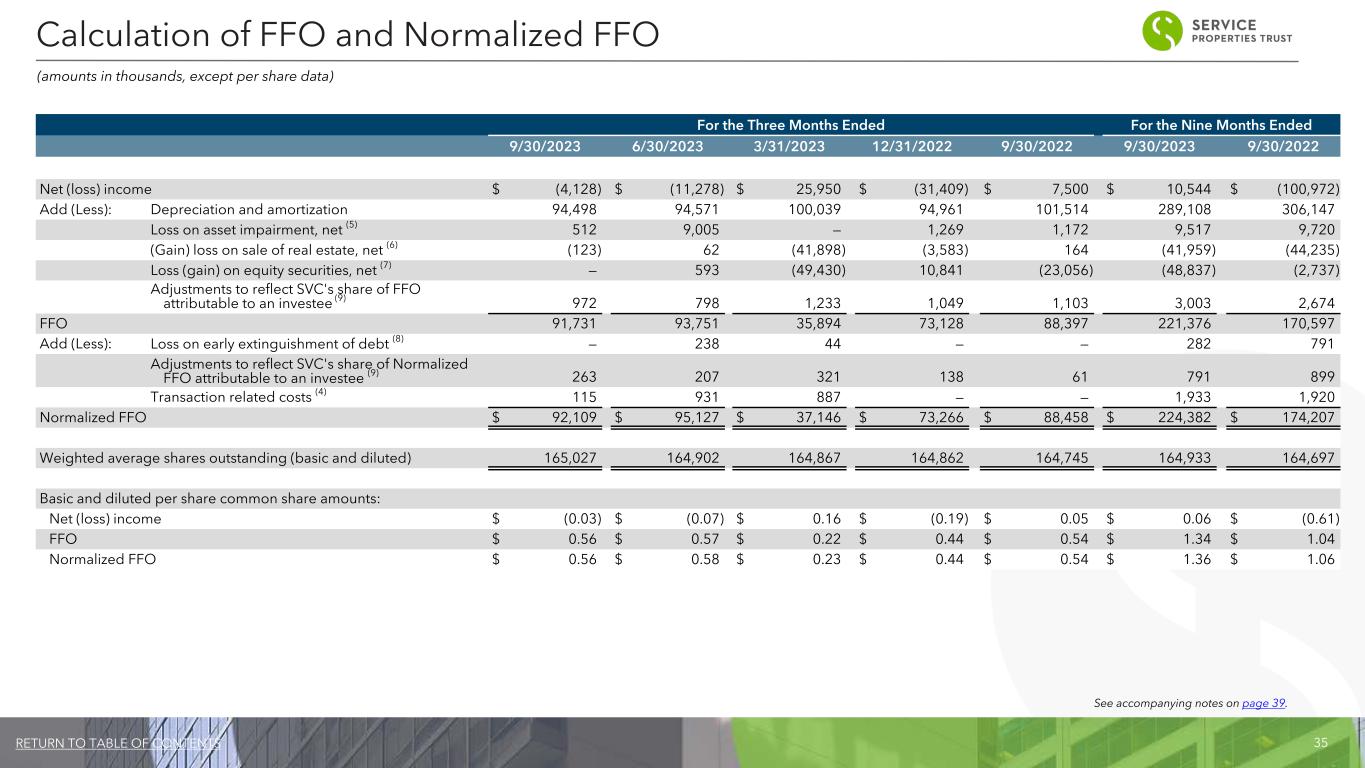

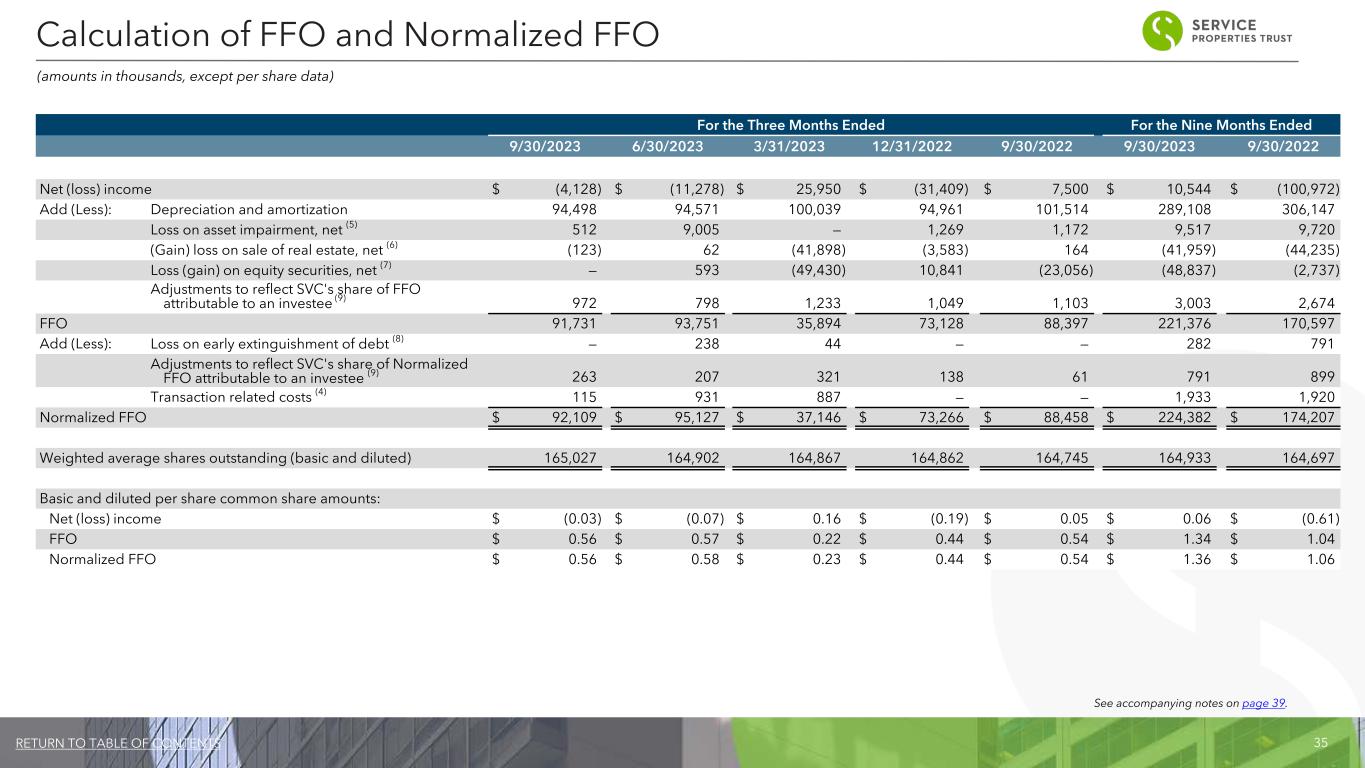

35RETURN TO TABLE OF CONTENTS For the Three Months Ended For the Nine Months Ended 9/30/2023 6/30/2023 3/31/2023 12/31/2022 9/30/2022 9/30/2023 9/30/2022 Net (loss) income $ (4,128) $ (11,278) $ 25,950 $ (31,409) $ 7,500 $ 10,544 $ (100,972) Add (Less): Depreciation and amortization 94,498 94,571 100,039 94,961 101,514 289,108 306,147 Loss on asset impairment, net (5) 512 9,005 — 1,269 1,172 9,517 9,720 (Gain) loss on sale of real estate, net (6) (123) 62 (41,898) (3,583) 164 (41,959) (44,235) Loss (gain) on equity securities, net (7) — 593 (49,430) 10,841 (23,056) (48,837) (2,737) Adjustments to reflect SVC's share of FFO attributable to an investee (9) 972 798 1,233 1,049 1,103 3,003 2,674 FFO 91,731 93,751 35,894 73,128 88,397 221,376 170,597 Add (Less): Loss on early extinguishment of debt (8) — 238 44 — — 282 791 Adjustments to reflect SVC's share of Normalized FFO attributable to an investee (9) 263 207 321 138 61 791 899 Transaction related costs (4) 115 931 887 — — 1,933 1,920 Normalized FFO $ 92,109 $ 95,127 $ 37,146 $ 73,266 $ 88,458 $ 224,382 $ 174,207 Weighted average shares outstanding (basic and diluted) 165,027 164,902 164,867 164,862 164,745 164,933 164,697 Basic and diluted per share common share amounts: Net (loss) income $ (0.03) $ (0.07) $ 0.16 $ (0.19) $ 0.05 $ 0.06 $ (0.61) FFO $ 0.56 $ 0.57 $ 0.22 $ 0.44 $ 0.54 $ 1.34 $ 1.04 Normalized FFO $ 0.56 $ 0.58 $ 0.23 $ 0.44 $ 0.54 $ 1.36 $ 1.06 Calculation of FFO and Normalized FFO (amounts in thousands, except per share data) See accompanying notes on page 39.

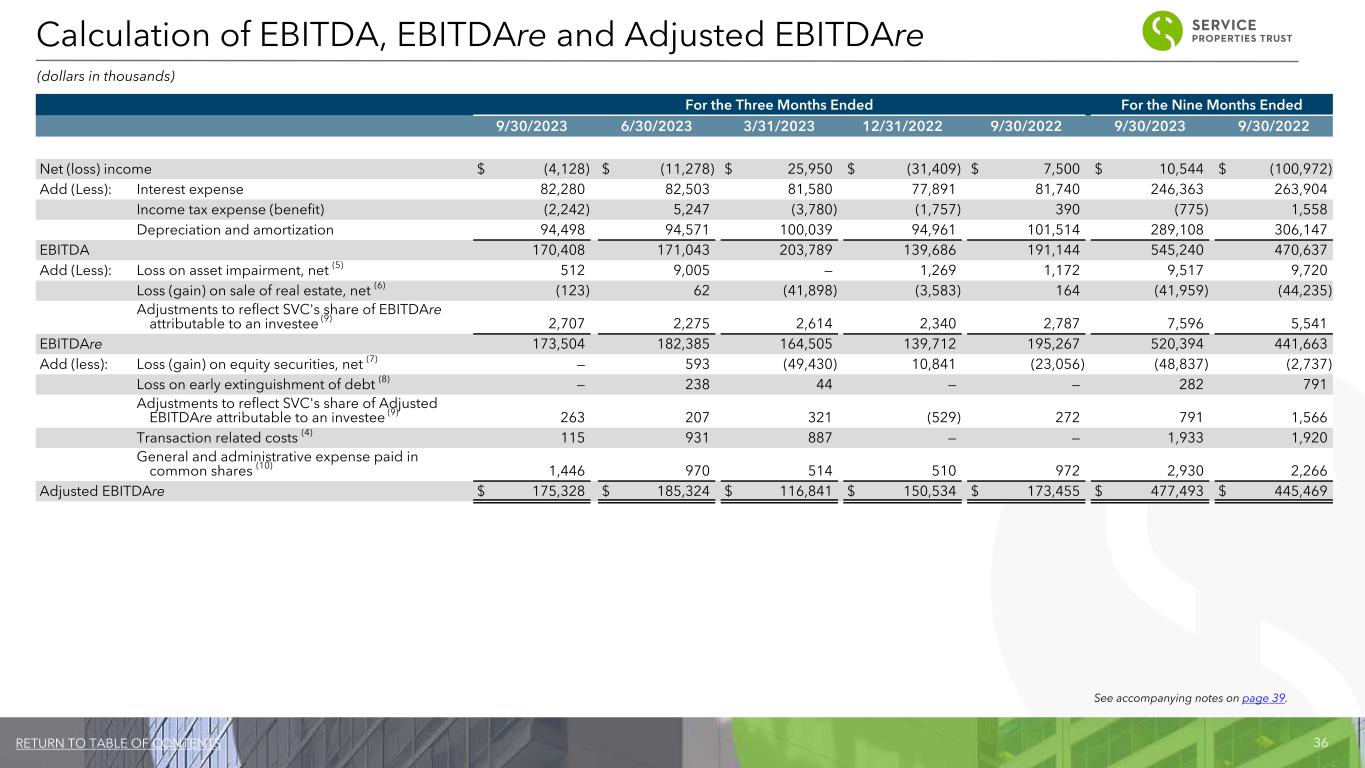

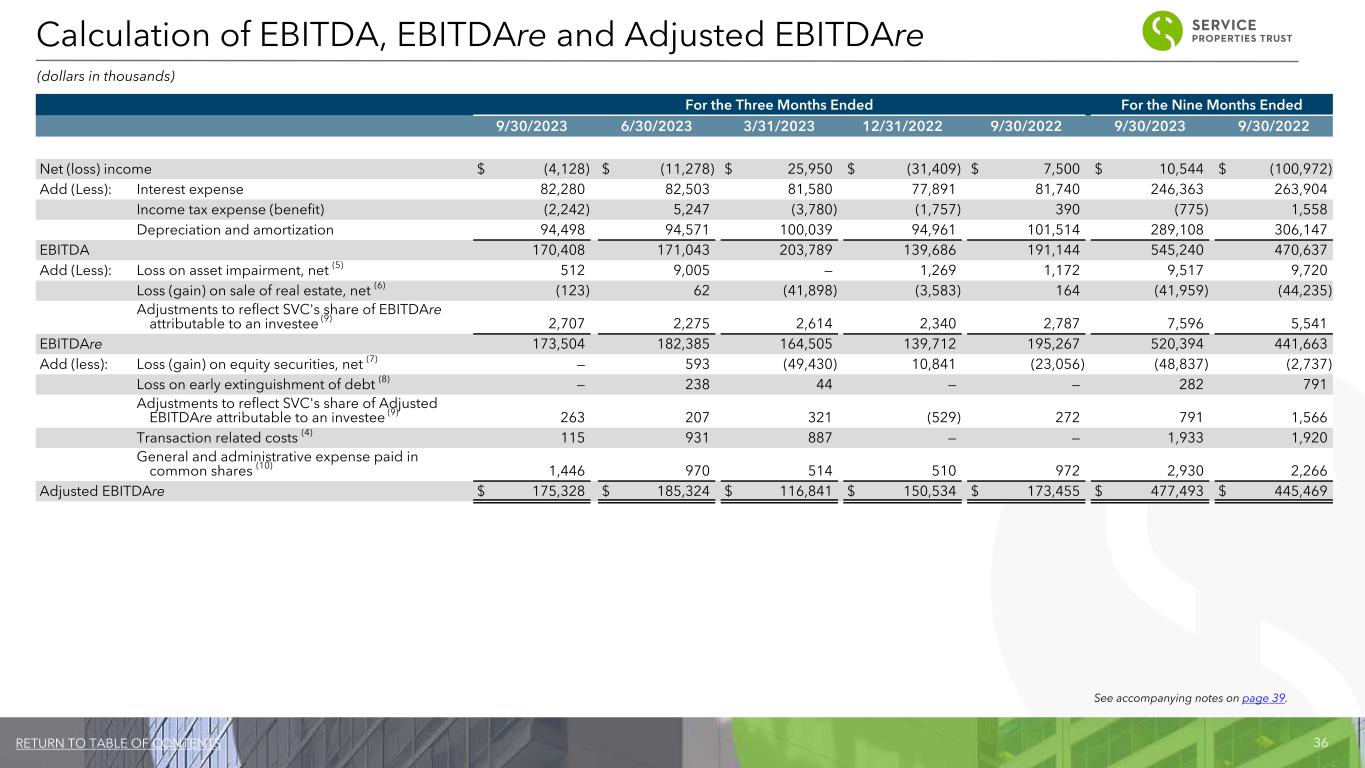

36RETURN TO TABLE OF CONTENTS For the Three Months Ended For the Nine Months Ended 9/30/2023 6/30/2023 3/31/2023 12/31/2022 9/30/2022 9/30/2023 9/30/2022 Net (loss) income $ (4,128) $ (11,278) $ 25,950 $ (31,409) $ 7,500 $ 10,544 $ (100,972) Add (Less): Interest expense 82,280 82,503 81,580 77,891 81,740 246,363 263,904 Income tax expense (benefit) (2,242) 5,247 (3,780) (1,757) 390 (775) 1,558 Depreciation and amortization 94,498 94,571 100,039 94,961 101,514 289,108 306,147 EBITDA 170,408 171,043 203,789 139,686 191,144 545,240 470,637 Add (Less): Loss on asset impairment, net (5) 512 9,005 — 1,269 1,172 9,517 9,720 Loss (gain) on sale of real estate, net (6) (123) 62 (41,898) (3,583) 164 (41,959) (44,235) Adjustments to reflect SVC's share of EBITDAre attributable to an investee (9) 2,707 2,275 2,614 2,340 2,787 7,596 5,541 EBITDAre 173,504 182,385 164,505 139,712 195,267 520,394 441,663 Add (less): Loss (gain) on equity securities, net (7) — 593 (49,430) 10,841 (23,056) (48,837) (2,737) Loss on early extinguishment of debt (8) — 238 44 — — 282 791 Adjustments to reflect SVC's share of Adjusted EBITDAre attributable to an investee (9) 263 207 321 (529) 272 791 1,566 Transaction related costs (4) 115 931 887 — — 1,933 1,920 General and administrative expense paid in common shares (10) 1,446 970 514 510 972 2,930 2,266 Adjusted EBITDAre $ 175,328 $ 185,324 $ 116,841 $ 150,534 $ 173,455 $ 477,493 $ 445,469 Calculation of EBITDA, EBITDAre and Adjusted EBITDAre (dollars in thousands) See accompanying notes on page 39.

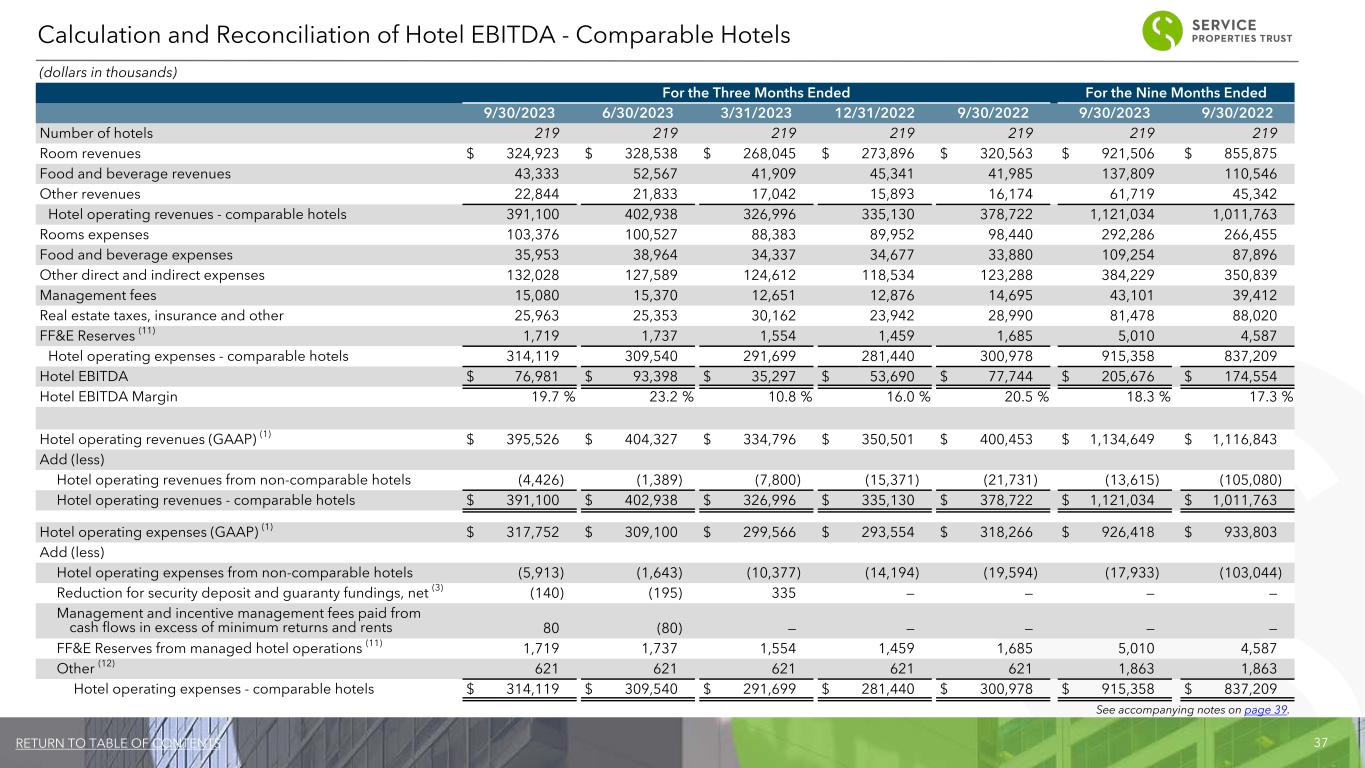

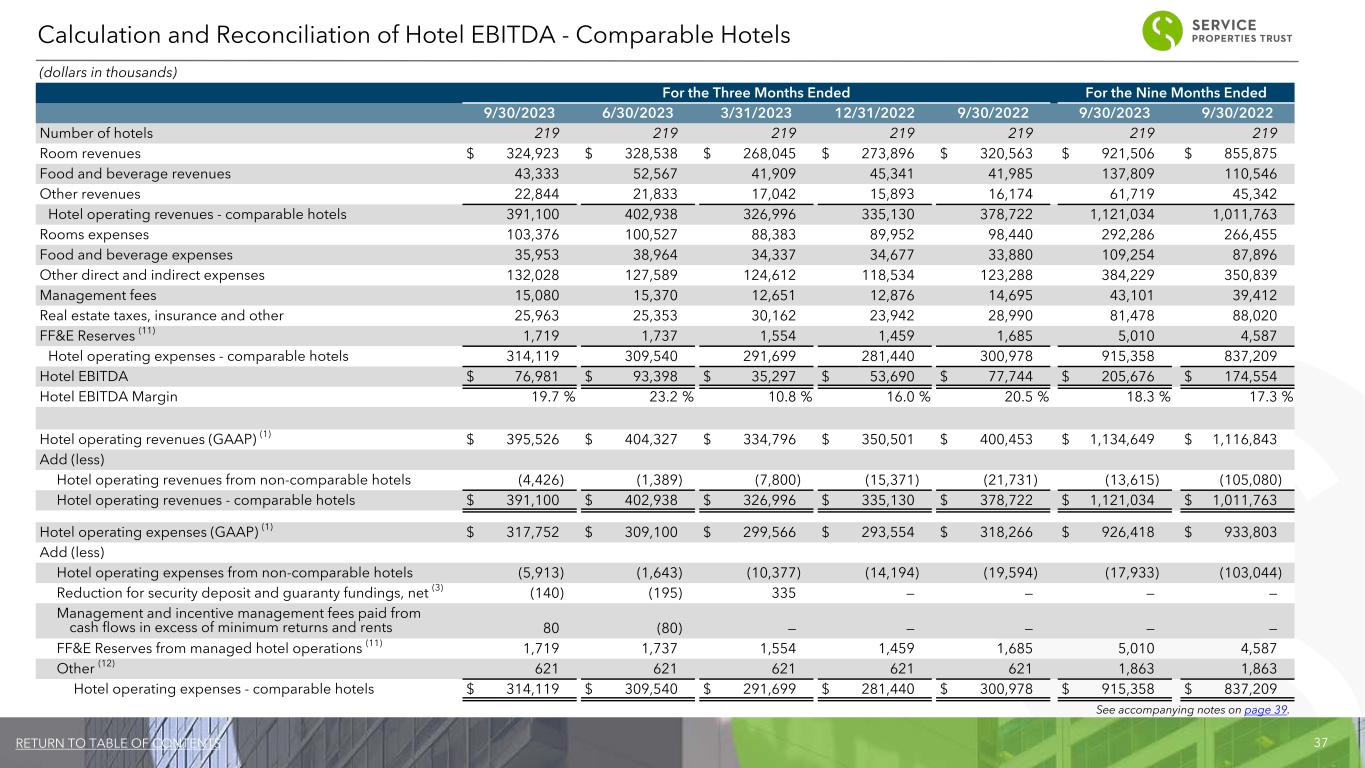

37RETURN TO TABLE OF CONTENTS (dollars in thousands) For the Three Months Ended For the Nine Months Ended 9/30/2023 6/30/2023 3/31/2023 12/31/2022 9/30/2022 9/30/2023 9/30/2022 Number of hotels 219 219 219 219 219 219 219 Room revenues $ 324,923 $ 328,538 $ 268,045 $ 273,896 $ 320,563 $ 921,506 $ 855,875 Food and beverage revenues 43,333 52,567 41,909 45,341 41,985 137,809 110,546 Other revenues 22,844 21,833 17,042 15,893 16,174 61,719 45,342 Hotel operating revenues - comparable hotels 391,100 402,938 326,996 335,130 378,722 1,121,034 1,011,763 Rooms expenses 103,376 100,527 88,383 89,952 98,440 292,286 266,455 Food and beverage expenses 35,953 38,964 34,337 34,677 33,880 109,254 87,896 Other direct and indirect expenses 132,028 127,589 124,612 118,534 123,288 384,229 350,839 Management fees 15,080 15,370 12,651 12,876 14,695 43,101 39,412 Real estate taxes, insurance and other 25,963 25,353 30,162 23,942 28,990 81,478 88,020 FF&E Reserves (11) 1,719 1,737 1,554 1,459 1,685 5,010 4,587 Hotel operating expenses - comparable hotels 314,119 309,540 291,699 281,440 300,978 915,358 837,209 Hotel EBITDA $ 76,981 $ 93,398 $ 35,297 $ 53,690 $ 77,744 $ 205,676 $ 174,554 Hotel EBITDA Margin 19.7 % 23.2 % 10.8 % 16.0 % 20.5 % 18.3 % 17.3 % Hotel operating revenues (GAAP) (1) $ 395,526 $ 404,327 $ 334,796 $ 350,501 $ 400,453 $ 1,134,649 $ 1,116,843 Add (less) Hotel operating revenues from non-comparable hotels (4,426) (1,389) (7,800) (15,371) (21,731) (13,615) (105,080) Hotel operating revenues - comparable hotels $ 391,100 $ 402,938 $ 326,996 $ 335,130 $ 378,722 $ 1,121,034 $ 1,011,763 Hotel operating expenses (GAAP) (1) $ 317,752 $ 309,100 $ 299,566 $ 293,554 $ 318,266 $ 926,418 $ 933,803 Add (less) Hotel operating expenses from non-comparable hotels (5,913) (1,643) (10,377) (14,194) (19,594) (17,933) (103,044) Reduction for security deposit and guaranty fundings, net (3) (140) (195) 335 — — — — Management and incentive management fees paid from cash flows in excess of minimum returns and rents 80 (80) — — — — — FF&E Reserves from managed hotel operations (11) 1,719 1,737 1,554 1,459 1,685 5,010 4,587 Other (12) 621 621 621 621 621 1,863 1,863 Hotel operating expenses - comparable hotels $ 314,119 $ 309,540 $ 291,699 $ 281,440 $ 300,978 $ 915,358 $ 837,209 Calculation and Reconciliation of Hotel EBITDA - Comparable Hotels See accompanying notes on page 39.

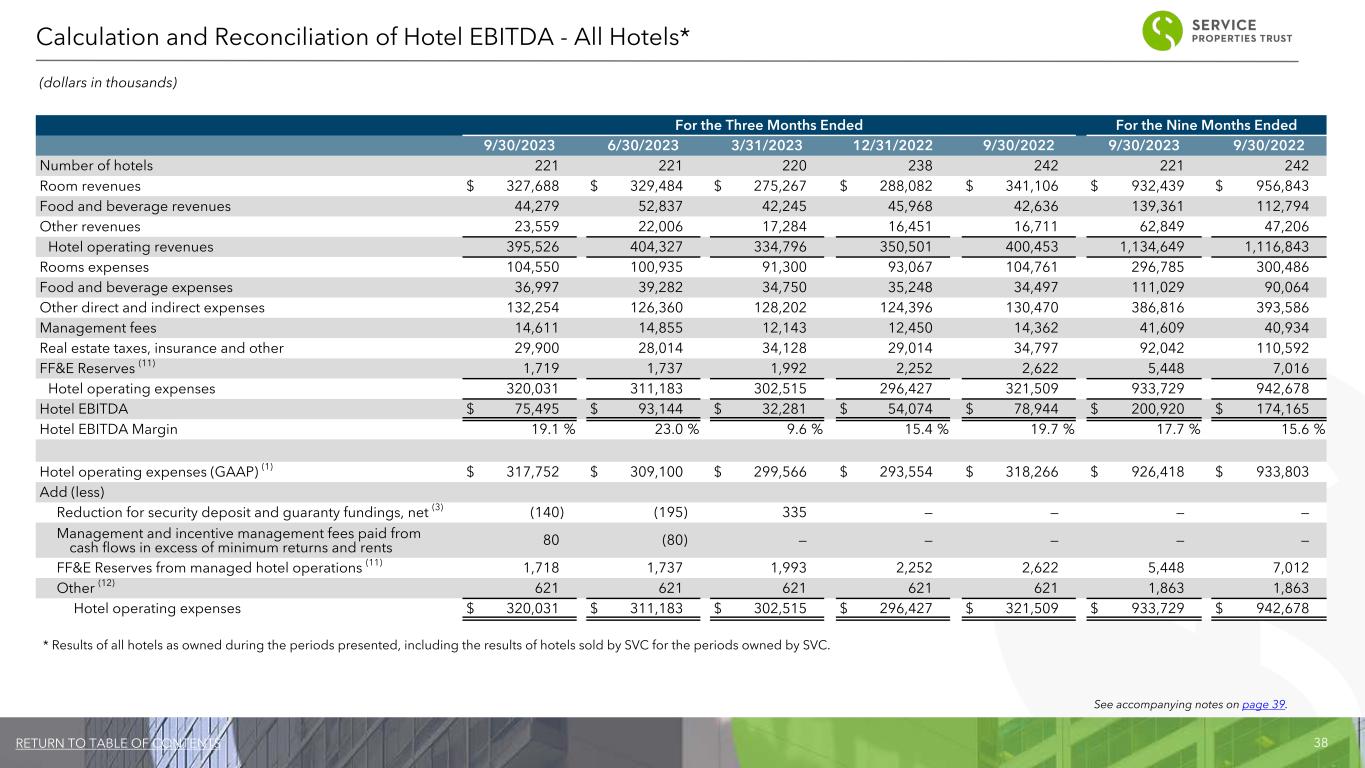

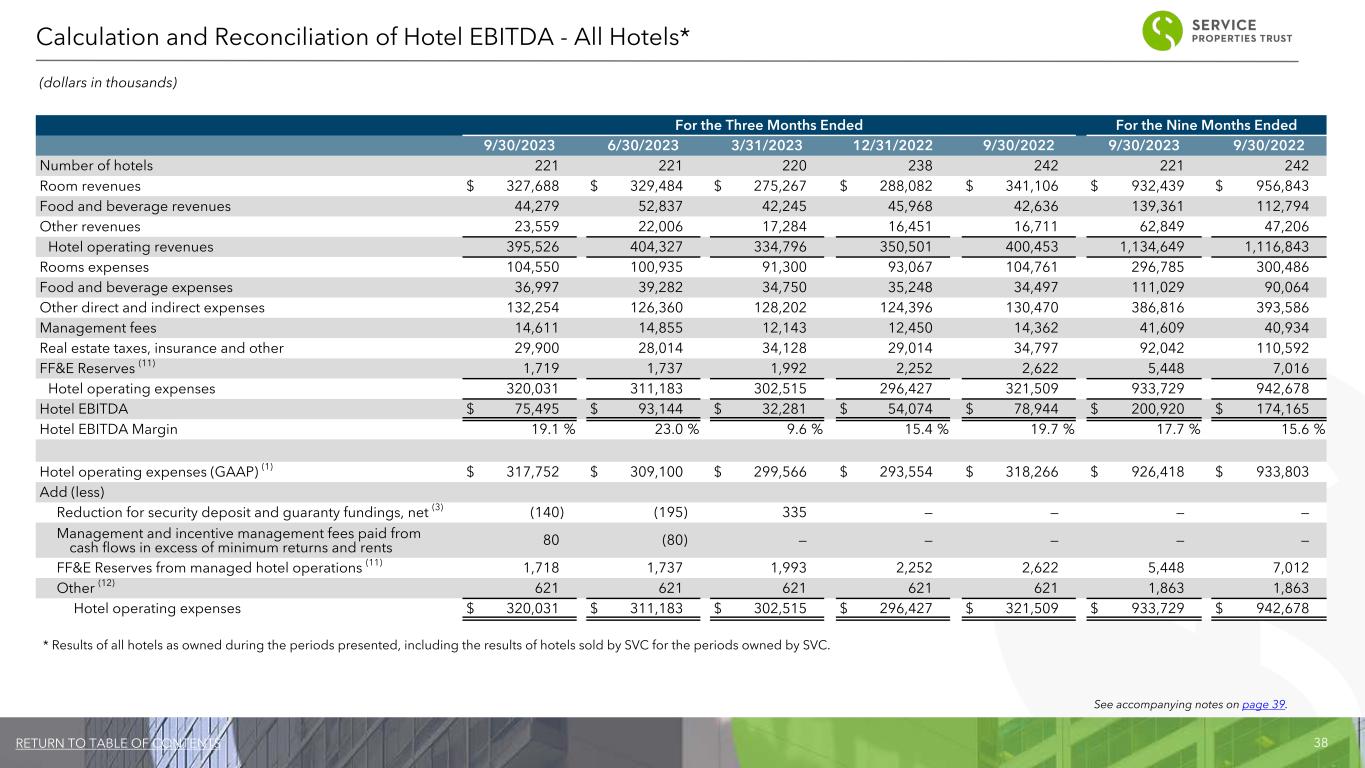

38RETURN TO TABLE OF CONTENTS (dollars in thousands) For the Three Months Ended For the Nine Months Ended 9/30/2023 6/30/2023 3/31/2023 12/31/2022 9/30/2022 9/30/2023 9/30/2022 Number of hotels 221 221 220 238 242 221 242 Room revenues $ 327,688 $ 329,484 $ 275,267 $ 288,082 $ 341,106 $ 932,439 $ 956,843 Food and beverage revenues 44,279 52,837 42,245 45,968 42,636 139,361 112,794 Other revenues 23,559 22,006 17,284 16,451 16,711 62,849 47,206 Hotel operating revenues 395,526 404,327 334,796 350,501 400,453 1,134,649 1,116,843 Rooms expenses 104,550 100,935 91,300 93,067 104,761 296,785 300,486 Food and beverage expenses 36,997 39,282 34,750 35,248 34,497 111,029 90,064 Other direct and indirect expenses 132,254 126,360 128,202 124,396 130,470 386,816 393,586 Management fees 14,611 14,855 12,143 12,450 14,362 41,609 40,934 Real estate taxes, insurance and other 29,900 28,014 34,128 29,014 34,797 92,042 110,592 FF&E Reserves (11) 1,719 1,737 1,992 2,252 2,622 5,448 7,016 Hotel operating expenses 320,031 311,183 302,515 296,427 321,509 933,729 942,678 Hotel EBITDA $ 75,495 $ 93,144 $ 32,281 $ 54,074 $ 78,944 $ 200,920 $ 174,165 Hotel EBITDA Margin 19.1 % 23.0 % 9.6 % 15.4 % 19.7 % 17.7 % 15.6 % Hotel operating expenses (GAAP) (1) $ 317,752 $ 309,100 $ 299,566 $ 293,554 $ 318,266 $ 926,418 $ 933,803 Add (less) Reduction for security deposit and guaranty fundings, net (3) (140) (195) 335 — — — — Management and incentive management fees paid from cash flows in excess of minimum returns and rents 80 (80) — — — — — FF&E Reserves from managed hotel operations (11) 1,718 1,737 1,993 2,252 2,622 5,448 7,012 Other (12) 621 621 621 621 621 1,863 1,863 Hotel operating expenses $ 320,031 $ 311,183 $ 302,515 $ 296,427 $ 321,509 $ 933,729 $ 942,678 Calculation and Reconciliation of Hotel EBITDA - All Hotels* See accompanying notes on page 39. * Results of all hotels as owned during the periods presented, including the results of hotels sold by SVC for the periods owned by SVC.

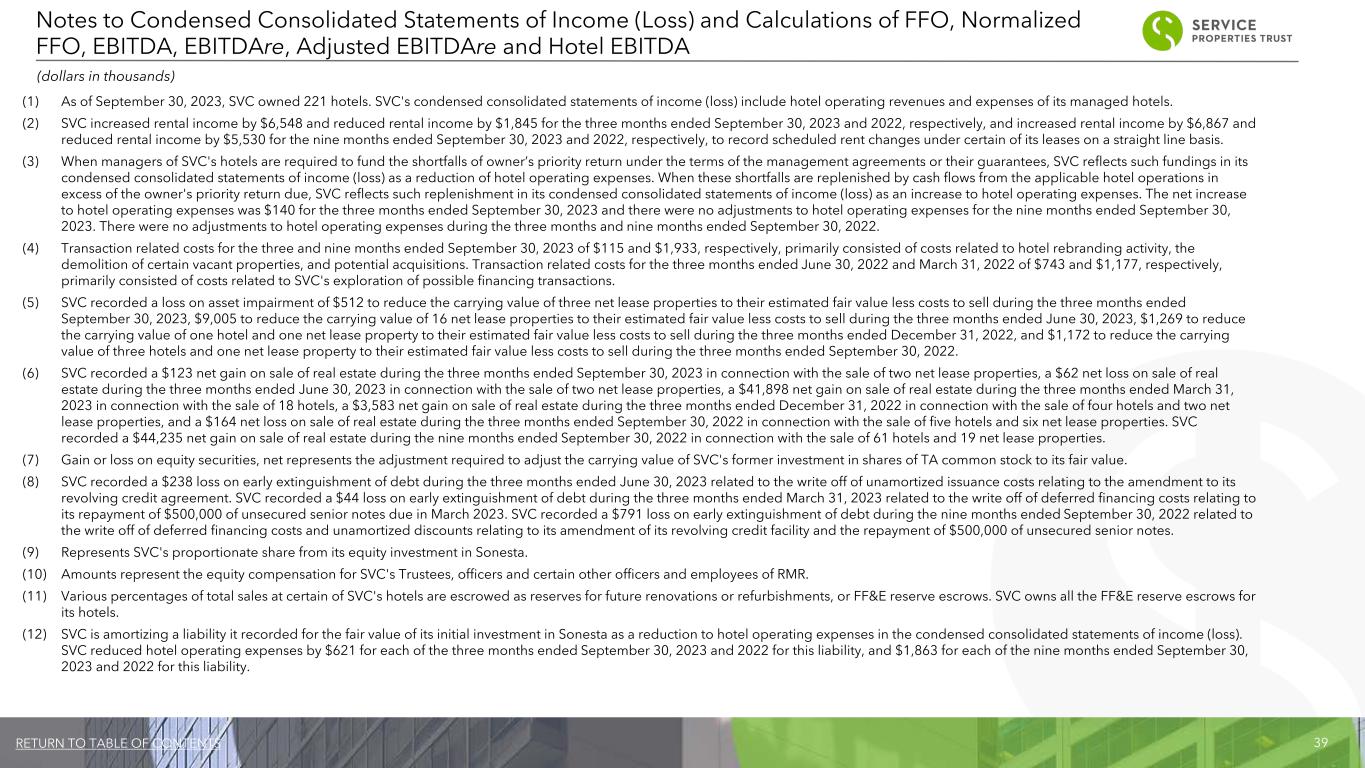

39RETURN TO TABLE OF CONTENTS Notes to Condensed Consolidated Statements of Income (Loss) and Calculations of FFO, Normalized FFO, EBITDA, EBITDAre, Adjusted EBITDAre and Hotel EBITDA (dollars in thousands) (1) As of September 30, 2023, SVC owned 221 hotels. SVC's condensed consolidated statements of income (loss) include hotel operating revenues and expenses of its managed hotels. (2) SVC increased rental income by $6,548 and reduced rental income by $1,845 for the three months ended September 30, 2023 and 2022, respectively, and increased rental income by $6,867 and reduced rental income by $5,530 for the nine months ended September 30, 2023 and 2022, respectively, to record scheduled rent changes under certain of its leases on a straight line basis. (3) When managers of SVC's hotels are required to fund the shortfalls of owner’s priority return under the terms of the management agreements or their guarantees, SVC reflects such fundings in its condensed consolidated statements of income (loss) as a reduction of hotel operating expenses. When these shortfalls are replenished by cash flows from the applicable hotel operations in excess of the owner's priority return due, SVC reflects such replenishment in its condensed consolidated statements of income (loss) as an increase to hotel operating expenses. The net increase to hotel operating expenses was $140 for the three months ended September 30, 2023 and there were no adjustments to hotel operating expenses for the nine months ended September 30, 2023. There were no adjustments to hotel operating expenses during the three months and nine months ended September 30, 2022. (4) Transaction related costs for the three and nine months ended September 30, 2023 of $115 and $1,933, respectively, primarily consisted of costs related to hotel rebranding activity, the demolition of certain vacant properties, and potential acquisitions. Transaction related costs for the three months ended June 30, 2022 and March 31, 2022 of $743 and $1,177, respectively, primarily consisted of costs related to SVC's exploration of possible financing transactions. (5) SVC recorded a loss on asset impairment of $512 to reduce the carrying value of three net lease properties to their estimated fair value less costs to sell during the three months ended September 30, 2023, $9,005 to reduce the carrying value of 16 net lease properties to their estimated fair value less costs to sell during the three months ended June 30, 2023, $1,269 to reduce the carrying value of one hotel and one net lease property to their estimated fair value less costs to sell during the three months ended December 31, 2022, and $1,172 to reduce the carrying value of three hotels and one net lease property to their estimated fair value less costs to sell during the three months ended September 30, 2022. (6) SVC recorded a $123 net gain on sale of real estate during the three months ended September 30, 2023 in connection with the sale of two net lease properties, a $62 net loss on sale of real estate during the three months ended June 30, 2023 in connection with the sale of two net lease properties, a $41,898 net gain on sale of real estate during the three months ended March 31, 2023 in connection with the sale of 18 hotels, a $3,583 net gain on sale of real estate during the three months ended December 31, 2022 in connection with the sale of four hotels and two net lease properties, and a $164 net loss on sale of real estate during the three months ended September 30, 2022 in connection with the sale of five hotels and six net lease properties. SVC recorded a $44,235 net gain on sale of real estate during the nine months ended September 30, 2022 in connection with the sale of 61 hotels and 19 net lease properties. (7) Gain or loss on equity securities, net represents the adjustment required to adjust the carrying value of SVC's former investment in shares of TA common stock to its fair value. (8) SVC recorded a $238 loss on early extinguishment of debt during the three months ended June 30, 2023 related to the write off of unamortized issuance costs relating to the amendment to its revolving credit agreement. SVC recorded a $44 loss on early extinguishment of debt during the three months ended March 31, 2023 related to the write off of deferred financing costs relating to its repayment of $500,000 of unsecured senior notes due in March 2023. SVC recorded a $791 loss on early extinguishment of debt during the nine months ended September 30, 2022 related to the write off of deferred financing costs and unamortized discounts relating to its amendment of its revolving credit facility and the repayment of $500,000 of unsecured senior notes. (9) Represents SVC's proportionate share from its equity investment in Sonesta. (10) Amounts represent the equity compensation for SVC's Trustees, officers and certain other officers and employees of RMR. (11) Various percentages of total sales at certain of SVC's hotels are escrowed as reserves for future renovations or refurbishments, or FF&E reserve escrows. SVC owns all the FF&E reserve escrows for its hotels. (12) SVC is amortizing a liability it recorded for the fair value of its initial investment in Sonesta as a reduction to hotel operating expenses in the condensed consolidated statements of income (loss). SVC reduced hotel operating expenses by $621 for each of the three months ended September 30, 2023 and 2022 for this liability, and $1,863 for each of the nine months ended September 30, 2023 and 2022 for this liability.

40RETURN TO TABLE OF CONTENTS This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws that are subject to risks and uncertainties. These statements may include words such as “believe”, “expect”, "anticipate", “intend”, “plan”, “estimate”, “will”, “may” and negatives or derivatives of these or similar expressions. These forward-looking statements include, among others, statements about: the continued growth in SVC's hotel portfolio and ongoing strength in the net lease business; the credit quality of TA; SVC's current liquidity and ability to address debt maturities; and the amount and timing of future distributions. Forward-looking statements reflect management's current expectations, are based on judgments and assumptions, are inherently uncertain and are subject to risks, uncertainties and other factors, which could cause SVC's actual results, performance, or achievements to differ materially from expected future results, performance or achievements expressed or implied in those forward-looking statements. Some of the risks, uncertainties and other factors that may cause SVC's actual results, performance or achievements to differ materially from the expressed or implied forward-looking statements include, but are not limited to, the following: Sonesta Holdco Corporation and its subsidiaries, or Sonesta’s, ability to successfully operate the hotels it manages for SVC; SVC’s ability and the ability of SVC’s managers and tenants to operate under unfavorable market and economic conditions, rising or sustained high interest rates, high inflation, labor market challenges, disruption and volatility in the public equity and debt markets, global geopolitical hostilities and tensions and economic recessions or downturns; if and when business transient hotel business will return to historical pre-COVID-19 pandemic levels and whether any improved hotel industry conditions will continue, increase or be sustained; whether and the extent to which SVC’s managers and tenants will pay the contractual amounts of returns, rents or other obligations due to SVC; competition within the commercial real estate, hotel, transportation and travel center and other industries in which SVC's managers and tenants operate, particularly in those markets in which SVC’s properties are located; SVC’s ability to repay or refinance its debts as they mature or otherwise become due; SVC’s ability to maintain sufficient liquidity, including the availability of borrowings under its revolving credit facility; SVC’s ability to pay interest on and principal of its debt; SVC’s ability to acquire properties that realize its targeted returns; SVC’s ability to sell properties at prices it targets; SVC’s ability to raise or appropriately balance the use of debt or equity capital; potential defaults of SVC’s management agreements and leases by its managers and tenants; SVC’s ability to increase hotel room rates and rents at its leased properties as SVC’s leases expire in excess of its operating expenses and to grow its business; SVC’s ability to increase and maintain hotel room and net lease property occupancy at its properties; SVC’s ability to pay distributions to its shareholders and to increase or sustain the amount of such distributions; the impact of increasing labor costs and shortages and commodity and other price inflation due to supply chain challenges or other market conditions; SVC’s ability to make cost-effective improvements to SVC’s properties that enhance its appeal to hotel guests and net lease tenants; SVC’s ability to engage and retain qualified managers and tenants for its hotels and net lease properties on satisfactory terms; SVC’s ability to diversify its sources of rents and returns that improve the security of its cash flows; SVC’s credit ratings; the ability of SVC’s manager, The RMR Group LLC, or RMR, to successfully manage SVC; actual and potential conflicts of interest with SVC’s related parties, including its Managing Trustees, Sonesta, RMR and others affiliated with them; SVC’s ability to realize benefits from the scale, geographic diversity, strategic locations and variety of service levels of its hotels; limitations imposed on SVC’s business and its ability to satisfy complex rules in order for it to maintain its qualification for taxation as a REIT for U.S. federal income tax purposes; compliance with, and changes to, federal, state and local laws and regulations, accounting rules, tax laws and similar matters; acts of terrorism, outbreaks or continuation of pandemics or other significant adverse public health safety events or conditions, war or other hostilities, supply chain disruptions, climate change or other man-made or natural disasters beyond its control; and other matters. These risks, uncertainties and other factors are not exhaustive and should be read in conjunction with other cautionary statements that are included in SVC's periodic filings. The information contained in SVC's filings with the SEC including under the caption "Risk Factors" in its periodic reports, or incorporated therein, identifies important factors that could cause differences from the forward-looking statements in this presentation. SVC's filings with the SEC are available on its website and at www.sec.gov. You should not place undue reliance on forward-looking statements. Except as required by law, SVC undertakes no obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise. Warning Concerning Forward-Looking Statements