| (Figures in millions of euros unless otherwise indicated) | Q2 2023 | Q3 2023 | ||||||

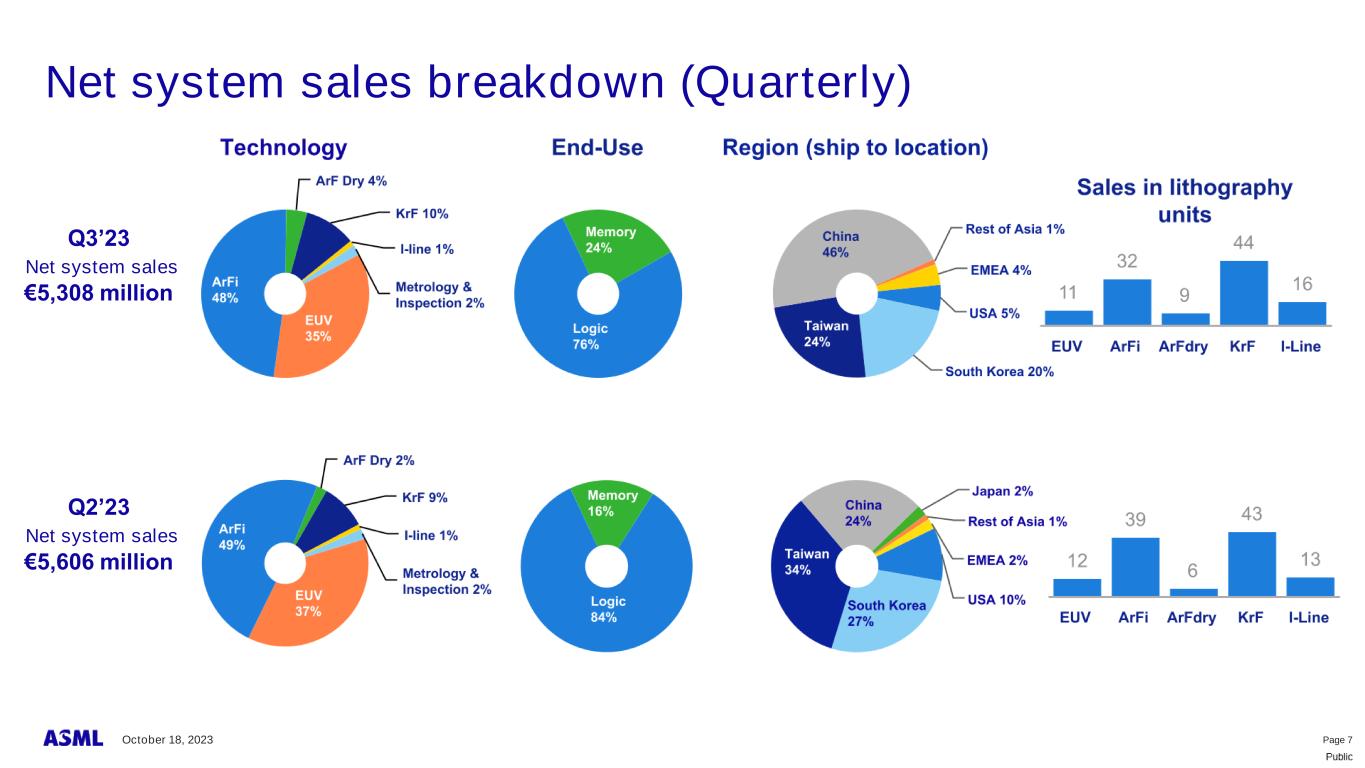

| Net sales | 6,902 | 6,673 | ||||||

...of which Installed Base Management sales1 |

1,296 | 1,365 | ||||||

| New lithography systems sold (units) | 107 | 105 | ||||||

| Used lithography systems sold (units) | 6 | 7 | ||||||

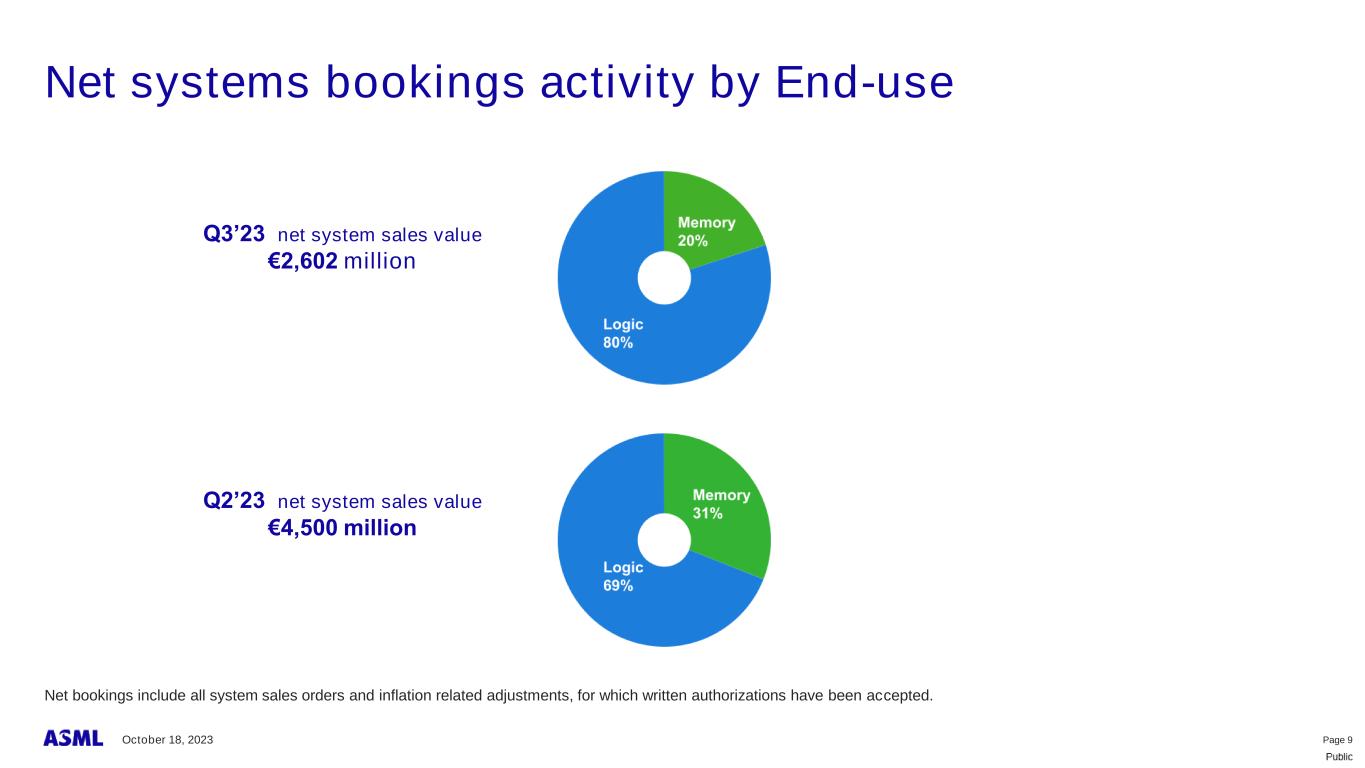

Net bookings2 |

4,500 | 2,602 | ||||||

| Gross profit | 3,544 | 3,462 | ||||||

| Gross margin (%) | 51.3 | 51.9 | ||||||

| Net income | 1,942 | 1,893 | ||||||

| EPS (basic; in euros) | 4.93 | 4.81 | ||||||

| End-quarter cash and cash equivalents and short-term investments | 6,346 | 4,981 | ||||||

Media Relations contacts |

Investor Relations contacts |

||||

| Monique Mols +31 6 5284 4418 | Skip Miller +1 480 235 0934 | ||||

| Sarah de Crescenzo +1 925 899 8985 | Marcel Kemp +31 40 268 6494 | ||||

| Karen Lo +886 939788635 | Peter Cheang +886 3 659 6771 | ||||

| Three months ended, | Nine months ended, | ||||||||||||||||||||||||||||

| Oct 2, | Oct 1, | Oct 2, | Oct 1, | ||||||||||||||||||||||||||

| (unaudited, in millions €, except per share data) | 2022 | 2023 | 2022 | 2023 | |||||||||||||||||||||||||

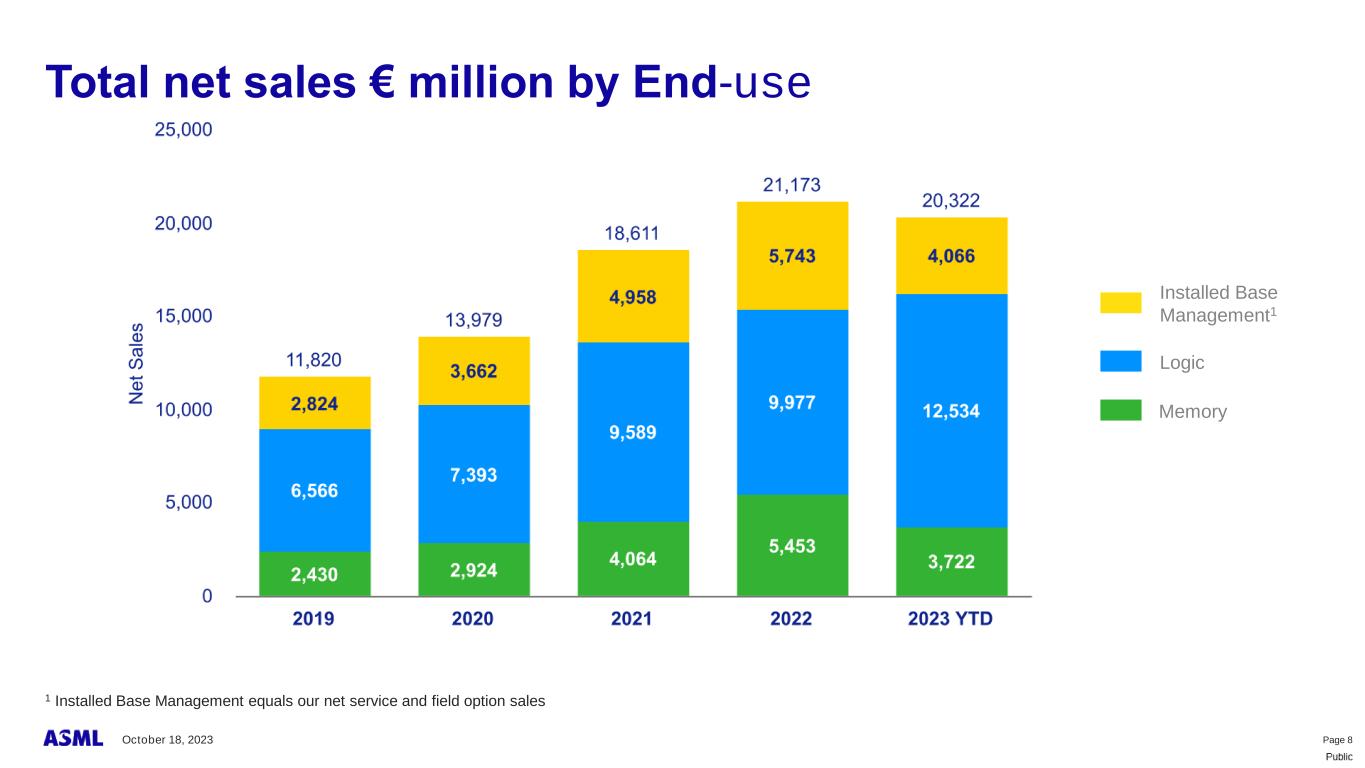

| Net system sales | 4,254.7 | 5,308.2 | 10,682.4 | 16,256.1 | |||||||||||||||||||||||||

| Net service and field option sales | 1,523.6 | 1,364.8 | 4,060.8 | 4,065.4 | |||||||||||||||||||||||||

| Total net sales | 5,778.3 | 6,673.0 | 14,743.2 | 20,321.5 | |||||||||||||||||||||||||

| Total cost of sales | (2,784.6) | (3,211.4) | (7,354.0) | (9,902.7) | |||||||||||||||||||||||||

| Gross profit | 2,993.7 | 3,461.6 | 7,389.2 | 10,418.8 | |||||||||||||||||||||||||

| Research and development costs | (819.4) | (991.4) | (2,347.2) | (2,939.3) | |||||||||||||||||||||||||

| Selling, general and administrative costs | (235.8) | (287.8) | (665.5) | (829.1) | |||||||||||||||||||||||||

| Income from operations | 1,938.5 | 2,182.4 | 4,376.5 | 6,650.4 | |||||||||||||||||||||||||

| Interest and other, net | (15.1) | 7.1 | (41.5) | 36.0 | |||||||||||||||||||||||||

| Income before income taxes | 1,923.4 | 2,189.5 | 4,335.0 | 6,686.4 | |||||||||||||||||||||||||

| Income tax expense | (252.0) | (343.7) | (612.6) | (1,050.2) | |||||||||||||||||||||||||

| Income after income taxes | 1,671.4 | 1,845.8 | 3,722.4 | 5,636.2 | |||||||||||||||||||||||||

| Profit related to equity method investments | 30.1 | 47.6 | 85.3 | 154.7 | |||||||||||||||||||||||||

| Net income | 1,701.5 | 1,893.4 | 3,807.7 | 5,790.9 | |||||||||||||||||||||||||

| Basic net income per ordinary share | 4.29 | 4.81 | 9.53 | 14.71 | |||||||||||||||||||||||||

| Diluted net income per ordinary share | 4.29 | 4.81 | 9.52 | 14.70 | |||||||||||||||||||||||||

| Weighted average number of ordinary shares used in computing per share amounts (in millions): | |||||||||||||||||||||||||||||

| Basic | 396.2 | 393.4 | 399.6 | 393.8 | |||||||||||||||||||||||||

| Diluted | 396.6 | 393.7 | 399.9 | 394.0 | |||||||||||||||||||||||||

| Three months ended, | Nine months ended, | ||||||||||||||||||||||||||||

| Oct 2, | Oct 1, | Oct 2, | Oct 1, | ||||||||||||||||||||||||||

| (unaudited, in millions €, except otherwise indicated) | 2022 | 2023 | 2022 | 2023 | |||||||||||||||||||||||||

| Gross profit as a percentage of net sales | 51.8 | % | 51.9 | % | 50.1 | % | 51.3 | % | |||||||||||||||||||||

| Income from operations as a percentage of net sales | 33.5 | % | 32.7 | % | 29.7 | % | 32.7 | % | |||||||||||||||||||||

| Net income as a percentage of net sales | 29.4 | % | 28.4 | % | 25.8 | % | 28.5 | % | |||||||||||||||||||||

| Income taxes as a percentage of income before income taxes | 13.1 | % | 15.7 | % | 14.1 | % | 15.7 | % | |||||||||||||||||||||

| Shareholders’ equity as a percentage of total assets | 24.3 | % | 32.0 | % | 24.3 | % | 32.0 | % | |||||||||||||||||||||

Sales of lithography systems (in units) 1 |

86 | 112 | 239 | 325 | |||||||||||||||||||||||||

Value of booked systems 2 |

8,920 | 2,602 | 24,358 | 10,854 | |||||||||||||||||||||||||

| Number of payroll employees in FTEs | 34,720 | 39,850 | 34,720 | 39,850 | |||||||||||||||||||||||||

| Number of temporary employees in FTEs | 2,875 | 2,416 | 2,875 | 2,416 | |||||||||||||||||||||||||

| Dec 31, | Oct 1, | |||||||||||||

| (unaudited, in millions €) | 2022 | 2023 | ||||||||||||

| ASSETS | ||||||||||||||

| Cash and cash equivalents | 7,268.3 | 4,975.5 | ||||||||||||

| Short-term investments | 107.7 | 5.4 | ||||||||||||

| Accounts receivable, net | 5,323.8 | 3,910.5 | ||||||||||||

| Finance receivables, net | 1,356.7 | 1,348.2 | ||||||||||||

| Current tax assets | 33.4 | 854.3 | ||||||||||||

| Contract assets | 131.9 | 266.5 | ||||||||||||

| Inventories, net | 7,199.7 | 8,378.5 | ||||||||||||

| Other assets | 1,643.4 | 1,916.8 | ||||||||||||

| Total current assets | 23,064.9 | 21,655.7 | ||||||||||||

| Finance receivables, net | — | 423.4 | ||||||||||||

| Deferred tax assets | 1,672.8 | 1,827.4 | ||||||||||||

| Loan receivable | 364.4 | 920.7 | ||||||||||||

| Other assets | 739.8 | 859.2 | ||||||||||||

| Equity method investments | 923.6 | 1,094.3 | ||||||||||||

| Goodwill | 4,555.6 | 4,582.6 | ||||||||||||

| Other intangible assets, net | 842.4 | 756.6 | ||||||||||||

| Property, plant and equipment, net | 3,944.2 | 5,093.2 | ||||||||||||

| Right-of-use assets | 192.7 | 300.4 | ||||||||||||

| Total non-current assets | 13,235.5 | 15,857.8 | ||||||||||||

| Total assets | 36,300.4 | 37,513.5 | ||||||||||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||||||||

| Current liabilities | 17,983.6 | 16,309.5 | ||||||||||||

| Total current liabilities | 17,983.6 | 16,309.5 | ||||||||||||

| Long-term debt | 3,514.2 | 4,522.3 | ||||||||||||

| Deferred and other tax liabilities | 267.0 | 380.4 | ||||||||||||

| Contract liabilities | 5,269.9 | 3,826.0 | ||||||||||||

| Accrued and other liabilities | 454.9 | 480.4 | ||||||||||||

| Total non-current liabilities | 9,506.0 | 9,209.1 | ||||||||||||

| Total liabilities | 27,489.6 | 25,518.6 | ||||||||||||

| Total shareholders’ equity | 8,810.8 | 11,994.9 | ||||||||||||

| Total liabilities and shareholders’ equity | 36,300.4 | 37,513.5 | ||||||||||||

| Three months ended, | Nine months ended, | |||||||||||||||||||||||||

| Oct 2, | Oct 1, | Oct 2, | Oct 1, | |||||||||||||||||||||||

| (unaudited, in millions €) | 2022 | 2023 | 2022 | 2023 | ||||||||||||||||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||||||||||||||||||||||||

| Net income | 1,701.5 | 1,893.4 | 3,807.7 | 5,790.9 | ||||||||||||||||||||||

| Adjustments to reconcile net income to net cash flows from operating activities: | ||||||||||||||||||||||||||

| Depreciation and amortization | 137.9 | 176.2 | 400.4 | 527.7 | ||||||||||||||||||||||

| Impairment and loss (gain) on disposal | 13.2 | 20.4 | 25.6 | 27.5 | ||||||||||||||||||||||

| Share-based compensation expense | 22.5 | 41.5 | 47.9 | 93.2 | ||||||||||||||||||||||

| Inventory reserves | 81.8 | 102.3 | 207.2 | 274.6 | ||||||||||||||||||||||

| Deferred tax expense (benefit) | (340.8) | (138.9) | (475.2) | (84.7) | ||||||||||||||||||||||

| Equity method investments | (36.8) | (53.8) | (105.5) | (171.5) | ||||||||||||||||||||||

| Changes in assets and liabilities | (409.8) | (913.0) | (771.8) | (4,211.3) | ||||||||||||||||||||||

| Net cash provided by (used in) operating activities | 1,169.5 | 1,128.1 | 3,136.3 | 2,246.4 | ||||||||||||||||||||||

| CASH FLOWS FROM INVESTING ACTIVITIES | ||||||||||||||||||||||||||

| Purchase of property, plant and equipment | (356.6) | (501.8) | (828.2) | (1,571.6) | ||||||||||||||||||||||

| Purchase of intangible assets | (7.7) | (8.3) | (25.2) | (22.3) | ||||||||||||||||||||||

| Purchase of short-term investments | (104.1) | (3.9) | (330.1) | (22.6) | ||||||||||||||||||||||

| Maturity of short-term investments | 199.5 | 3.6 | 758.6 | 124.7 | ||||||||||||||||||||||

| Loans issued and other investments | (240.0) | (553.0) | (240.0) | (553.0) | ||||||||||||||||||||||

| Acquisition of subsidiaries (net of cash acquired) | — | (27.6) | — | (27.6) | ||||||||||||||||||||||

| Net cash provided by (used in) investing activities | (508.9) | (1,091.0) | (664.9) | (2,072.4) | ||||||||||||||||||||||

| CASH FLOWS FROM FINANCING ACTIVITIES | ||||||||||||||||||||||||||

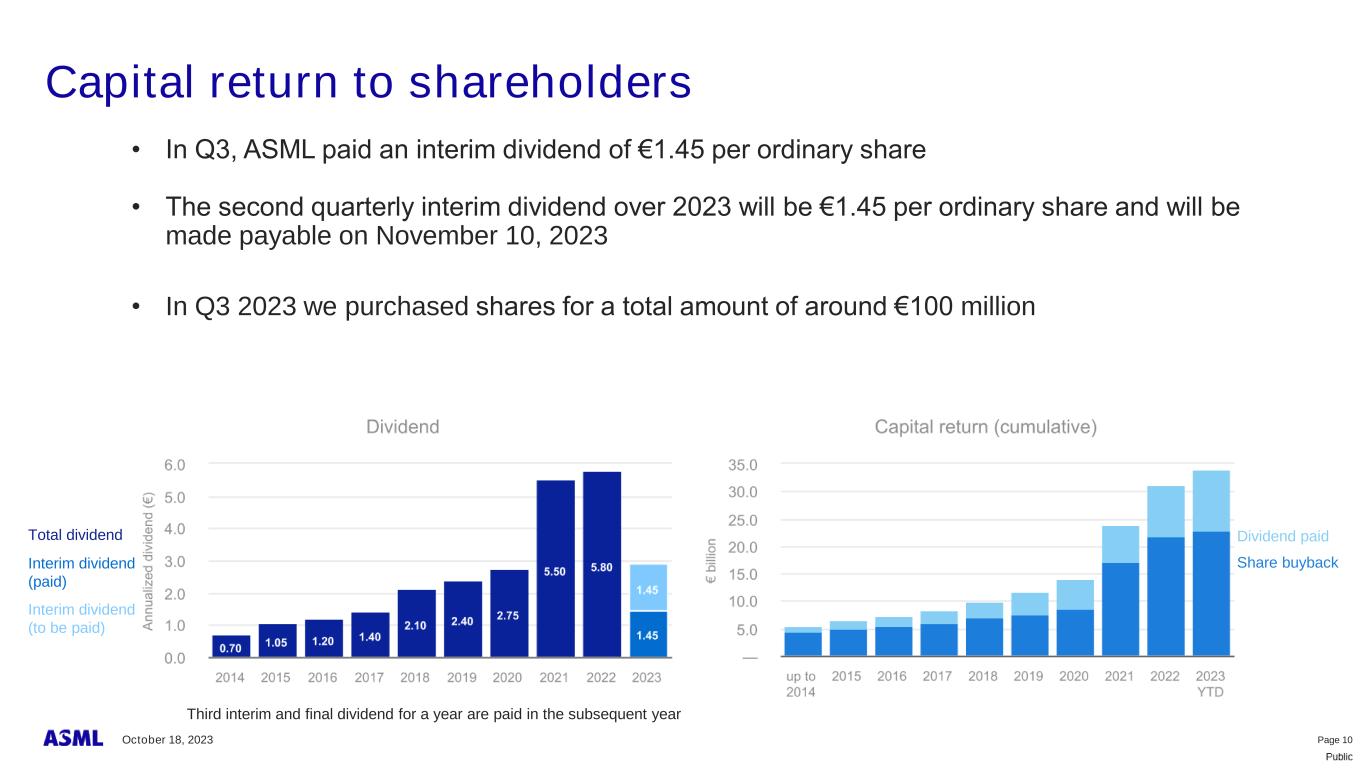

| Dividend paid | (543.5) | (570.4) | (2,018.7) | (1,777.5) | ||||||||||||||||||||||

| Purchase of treasury shares | (1,087.9) | (111.1) | (4,304.7) | (1,000.0) | ||||||||||||||||||||||

| Net proceeds from issuance of shares | 19.9 | 25.7 | 62.9 | 73.5 | ||||||||||||||||||||||

| Net proceeds from issuance of notes, net of issuance costs | — | — | 495.6 | 997.8 | ||||||||||||||||||||||

| Repayment of debt and finance lease obligations | (1.2) | (750.4) | (515.4) | (752.6) | ||||||||||||||||||||||

| Net cash provided by (used in) financing activities | (1,612.7) | (1,406.2) | (6,280.3) | (2,458.8) | ||||||||||||||||||||||

| Net cash flows | (952.1) | (1,369.1) | (3,808.9) | (2,284.8) | ||||||||||||||||||||||

| Effect of changes in exchange rates on cash | 8.4 | 3.3 | 9.9 | (8.0) | ||||||||||||||||||||||

| Net increase (decrease) in cash and cash equivalents | (943.7) | (1,365.8) | (3,799.0) | (2,292.8) | ||||||||||||||||||||||

| Cash and cash equivalents at beginning of the period | 4,096.5 | 6,341.3 | 6,951.8 | 7,268.3 | ||||||||||||||||||||||

| Cash and cash equivalents at end of the period | 3,152.8 | 4,975.5 | 3,152.8 | 4,975.5 | ||||||||||||||||||||||

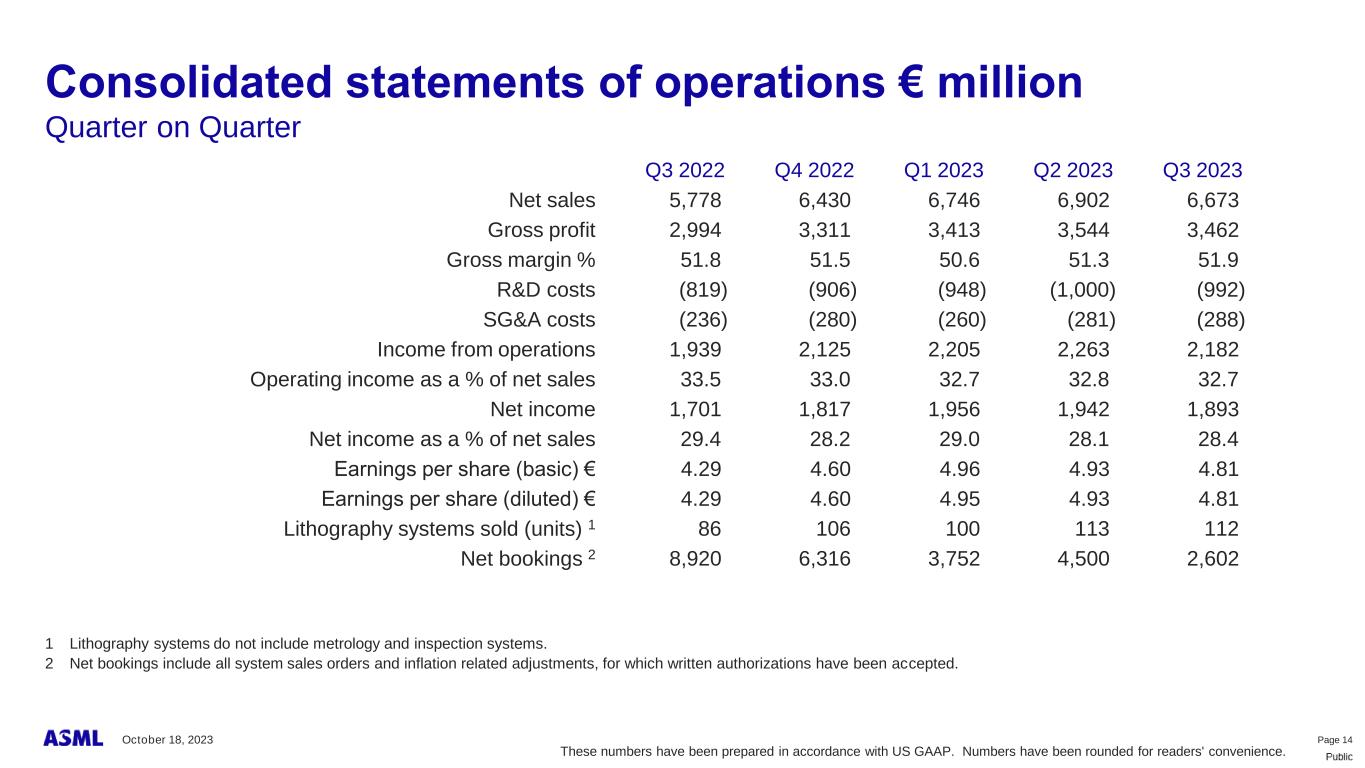

| Three months ended, | ||||||||||||||||||||||||||||||||

| Oct 2, | Dec 31, | Apr 2, | July 2, | Oct 1, | ||||||||||||||||||||||||||||

| (unaudited, in millions €, except per share data) | 2022 | 2022 | 2023 | 2023 | 2023 | |||||||||||||||||||||||||||

| Net system sales | 4,254.7 | 4,747.9 | 5,341.8 | 5,606.1 | 5,308.2 | |||||||||||||||||||||||||||

| Net service and field option sales | 1,523.6 | 1,682.3 | 1,404.4 | 1,296.2 | 1,364.8 | |||||||||||||||||||||||||||

| Total net sales | 5,778.3 | 6,430.2 | 6,746.2 | 6,902.3 | 6,673.0 | |||||||||||||||||||||||||||

| Total cost of sales | (2,784.6) | (3,119.3) | (3,333.0) | (3,358.3) | (3,211.4) | |||||||||||||||||||||||||||

| Gross profit | 2,993.7 | 3,310.9 | 3,413.2 | 3,544.0 | 3,461.6 | |||||||||||||||||||||||||||

| Research and development costs | (819.4) | (906.3) | (947.9) | (999.9) | (991.4) | |||||||||||||||||||||||||||

| Selling, general and administrative costs | (235.8) | (280.4) | (260.3) | (281.1) | (287.8) | |||||||||||||||||||||||||||

| Income from operations | 1,938.5 | 2,124.2 | 2,205.0 | 2,263.0 | 2,182.4 | |||||||||||||||||||||||||||

| Interest and other, net | (15.1) | (3.1) | 12.2 | 16.7 | 7.1 | |||||||||||||||||||||||||||

| Income before income taxes | 1,923.4 | 2,121.1 | 2,217.2 | 2,279.7 | 2,189.5 | |||||||||||||||||||||||||||

| Benefit from (provision for) income taxes | (252.0) | (357.3) | (302.6) | (403.9) | (343.7) | |||||||||||||||||||||||||||

| Income after income taxes | 1,671.4 | 1,763.8 | 1,914.6 | 1,875.8 | 1,845.8 | |||||||||||||||||||||||||||

| Profit related to equity method investments | 30.1 | 52.7 | 41.2 | 65.9 | 47.6 | |||||||||||||||||||||||||||

| Net income | 1,701.5 | 1,816.5 | 1,955.8 | 1,941.7 | 1,893.4 | |||||||||||||||||||||||||||

| Basic net income per ordinary share | 4.29 | 4.60 | 4.96 | 4.93 | 4.81 | |||||||||||||||||||||||||||

| Diluted net income per ordinary share | 4.29 | 4.60 | 4.95 | 4.93 | 4.81 | |||||||||||||||||||||||||||

| Weighted average number of ordinary shares used in computing per share amounts (in millions): | ||||||||||||||||||||||||||||||||

| Basic | 396.2 | 394.9 | 394.5 | 393.8 | 393.4 | |||||||||||||||||||||||||||

| Diluted | 396.6 | 395.2 | 394.8 | 394.0 | 393.7 | |||||||||||||||||||||||||||

| Oct 2, | Dec 31, | Apr 2, | July 2, | Oct 1, | ||||||||||||||||||||||||||||

| (unaudited, in millions €, except otherwise indicated) | 2022 | 2022 | 2023 | 2023 | 2023 | |||||||||||||||||||||||||||

| Gross profit as a percentage of net sales | 51.8 | % | 51.5 | % | 50.6 | % | 51.3 | % | 51.9 | % | ||||||||||||||||||||||

| Income from operations as a percentage of net sales | 33.5 | % | 33.0 | % | 32.7 | % | 32.8 | % | 32.7 | % | ||||||||||||||||||||||

| Net income as a percentage of net sales | 29.4 | % | 28.2 | % | 29.0 | % | 28.1 | % | 28.4 | % | ||||||||||||||||||||||

| Income taxes as a percentage of income before income taxes | 13.1 | % | 16.8 | % | 13.6 | % | 17.7 | % | 15.7 | % | ||||||||||||||||||||||

| Shareholders’ equity as a percentage of total assets | 24.3 | % | 24.3 | % | 27.8 | % | 28.7 | % | 32.0 | % | ||||||||||||||||||||||

Sales of lithography systems (in units) 1 |

86 | 106 | 100 | 113 | 112 | |||||||||||||||||||||||||||

Value of booked systems 2 |

8,920 | 6,316 | 3,752 | 4,500 | 2,602 | |||||||||||||||||||||||||||

Number of payroll employees in FTEs |

34,720 | 36,112 | 37,704 | 38,866 | 39,850 | |||||||||||||||||||||||||||

| Number of temporary employees in FTEs | 2,875 | 2,974 | 2,816 | 2,676 | 2,416 | |||||||||||||||||||||||||||

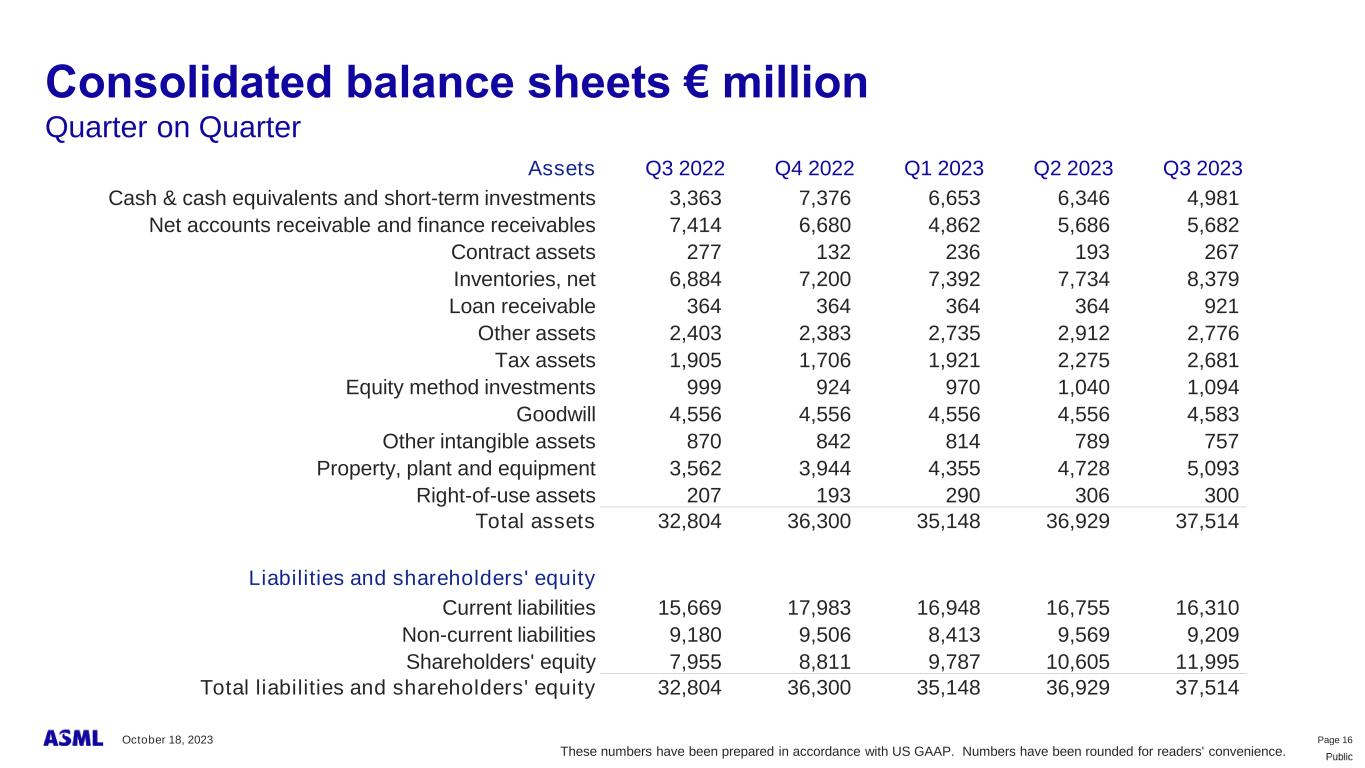

| Oct 2, | Dec 31, | Apr 2, | July 2, | Oct 1, | ||||||||||||||||||||||||||||

| (unaudited, in millions €) | 2022 | 2022 | 2023 | 2023 | 2023 | |||||||||||||||||||||||||||

| ASSETS | ||||||||||||||||||||||||||||||||

| Cash and cash equivalents | 3,152.8 | 7,268.3 | 6,647.7 | 6,341.3 | 4,975.5 | |||||||||||||||||||||||||||

| Short-term investments | 210.0 | 107.7 | 4.8 | 5.1 | 5.4 | |||||||||||||||||||||||||||

| Accounts receivable, net | 5,840.2 | 5,323.8 | 3,454.7 | 3,963.6 | 3,910.5 | |||||||||||||||||||||||||||

| Finance receivables, net | 1,399.4 | 1,356.7 | 1,349.2 | 1,650.8 | 1,348.2 | |||||||||||||||||||||||||||

| Current tax assets | 305.6 | 33.4 | 253.6 | 595.8 | 854.3 | |||||||||||||||||||||||||||

| Contract assets | 276.9 | 131.9 | 236.4 | 191.9 | 266.5 | |||||||||||||||||||||||||||

| Inventories, net | 6,884.0 | 7,199.7 | 7,392.0 | 7,734.4 | 8,378.5 | |||||||||||||||||||||||||||

| Other assets | 1,657.5 | 1,643.4 | 1,722.4 | 1,915.3 | 1,916.8 | |||||||||||||||||||||||||||

| Total current assets | 19,726.4 | 23,064.9 | 21,060.8 | 22,398.2 | 21,655.7 | |||||||||||||||||||||||||||

| Finance receivables, net | 174.9 | — | 58.3 | 71.7 | 423.4 | |||||||||||||||||||||||||||

| Deferred tax assets | 1,599.6 | 1,672.8 | 1,667.4 | 1,679.1 | 1,827.4 | |||||||||||||||||||||||||||

| Loan receivable | 364.4 | 364.4 | 364.4 | 364.4 | 920.7 | |||||||||||||||||||||||||||

| Other assets | 745.2 | 739.8 | 1,012.8 | 996.3 | 859.2 | |||||||||||||||||||||||||||

| Equity method investments | 998.7 | 923.6 | 969.6 | 1,040.4 | 1,094.3 | |||||||||||||||||||||||||||

| Goodwill | 4,555.6 | 4,555.6 | 4,555.6 | 4,555.6 | 4,582.6 | |||||||||||||||||||||||||||

| Other intangible assets, net | 870.1 | 842.4 | 813.7 | 789.2 | 756.6 | |||||||||||||||||||||||||||

| Property, plant and equipment, net | 3,561.7 | 3,944.2 | 4,354.8 | 4,727.9 | 5,093.2 | |||||||||||||||||||||||||||

| Right-of-use assets | 206.9 | 192.7 | 290.2 | 305.7 | 300.4 | |||||||||||||||||||||||||||

| Total non-current assets | 13,077.1 | 13,235.5 | 14,086.8 | 14,530.3 | 15,857.8 | |||||||||||||||||||||||||||

| Total assets | 32,803.5 | 36,300.4 | 35,147.6 | 36,928.5 | 37,513.5 | |||||||||||||||||||||||||||

| LIABILITIES AND SHAREHOLDERS’ EQUITY | ||||||||||||||||||||||||||||||||

| Current liabilities | 15,668.6 | 17,983.6 | 16,948.1 | 16,754.3 | 16,309.5 | |||||||||||||||||||||||||||

| Total current liabilities | 15,668.6 | 17,983.6 | 16,948.1 | 16,754.3 | 16,309.5 | |||||||||||||||||||||||||||

| Long-term debt | 3,503.1 | 3,514.2 | 3,536.0 | 4,517.8 | 4,522.3 | |||||||||||||||||||||||||||

| Deferred and other tax liabilities | 283.0 | 267.0 | 293.0 | 372.8 | 380.4 | |||||||||||||||||||||||||||

| Contract liabilities | 4,918.6 | 5,269.9 | 4,147.4 | 4,205.3 | 3,826.0 | |||||||||||||||||||||||||||

| Accrued and other liabilities | 475.1 | 454.9 | 436.8 | 473.4 | 480.4 | |||||||||||||||||||||||||||

| Total non-current liabilities | 9,179.8 | 9,506.0 | 8,413.2 | 9,569.3 | 9,209.1 | |||||||||||||||||||||||||||

| Total liabilities | 24,848.4 | 27,489.6 | 25,361.3 | 26,323.6 | 25,518.6 | |||||||||||||||||||||||||||

| Total shareholders’ equity | 7,955.1 | 8,810.8 | 9,786.3 | 10,604.9 | 11,994.9 | |||||||||||||||||||||||||||

| Total liabilities and shareholders’ equity | 32,803.5 | 36,300.4 | 35,147.6 | 36,928.5 | 37,513.5 | |||||||||||||||||||||||||||

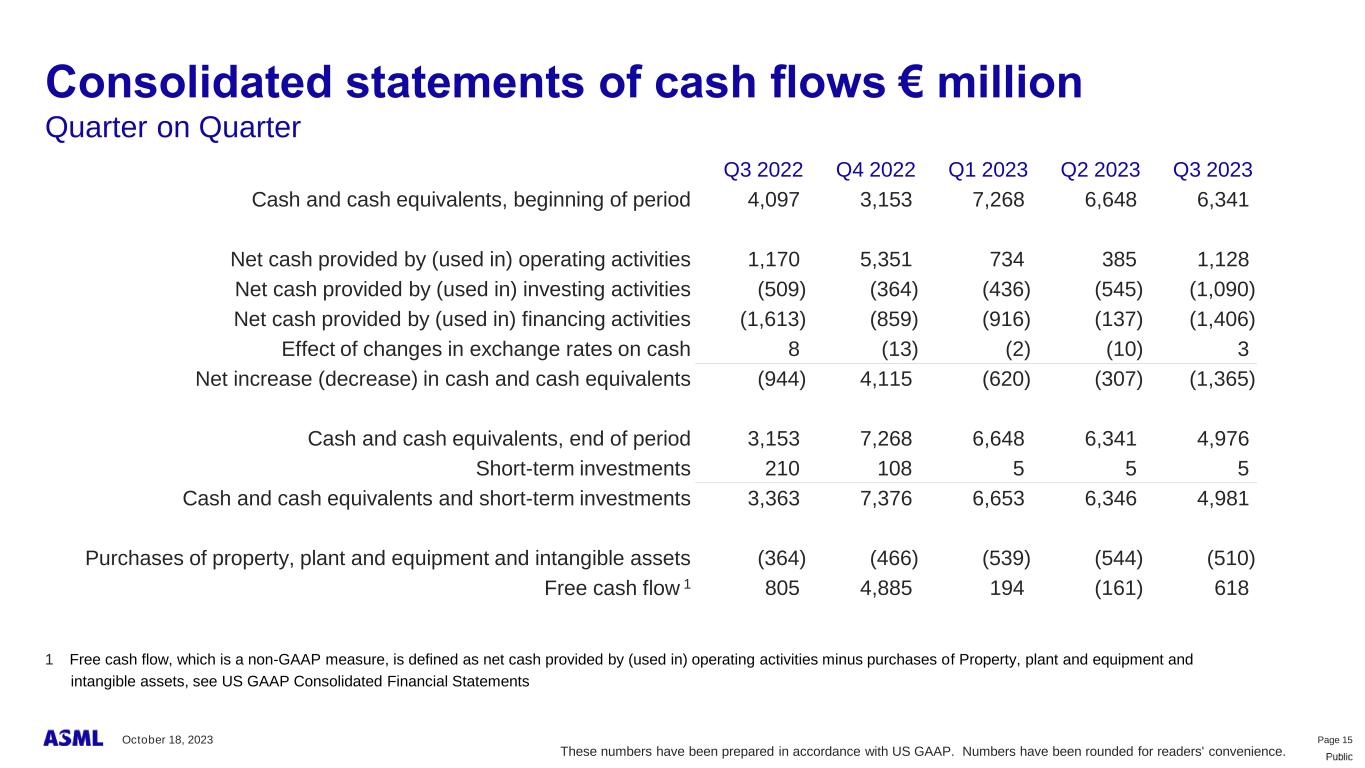

| Three months ended, | |||||||||||||||||||||||||||||||||||

| Oct 2, | Dec 31, | Apr 2, | July 2, | Oct 1, | |||||||||||||||||||||||||||||||

| (unaudited, in millions €) | 2022 | 2022 | 2023 | 2023 | 2023 | ||||||||||||||||||||||||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | |||||||||||||||||||||||||||||||||||

| Net income | 1,701.5 | 1,816.5 | 1,955.8 | 1,941.7 | 1,893.4 | ||||||||||||||||||||||||||||||

| Adjustments to reconcile net income to net cash flows from operating activities: | |||||||||||||||||||||||||||||||||||

| Depreciation and amortization | 137.9 | 183.2 | 170.3 | 181.2 | 176.2 | ||||||||||||||||||||||||||||||

| Impairment and loss (gain) on disposal | 13.2 | 13.7 | 3.2 | 3.9 | 20.4 | ||||||||||||||||||||||||||||||

| Share-based compensation expense | 22.5 | 21.0 | 18.3 | 33.4 | 41.5 | ||||||||||||||||||||||||||||||

| Inventory reserves | 81.8 | 71.3 | 81.7 | 90.6 | 102.3 | ||||||||||||||||||||||||||||||

| Deferred tax expense (benefit) | (340.8) | (89.0) | 12.7 | 41.5 | (138.9) | ||||||||||||||||||||||||||||||

| Equity method investments | (36.8) | 120.8 | (46.8) | (70.9) | (53.8) | ||||||||||||||||||||||||||||||

| Changes in assets and liabilities | (409.8) | 3,213.0 | (1,461.6) | (1,836.7) | (913.0) | ||||||||||||||||||||||||||||||

| Net cash provided by (used in) operating activities | 1,169.5 | 5,350.5 | 733.6 | 384.7 | 1,128.1 | ||||||||||||||||||||||||||||||

| CASH FLOWS FROM INVESTING ACTIVITIES | |||||||||||||||||||||||||||||||||||

| Purchase of property, plant and equipment | (356.6) | (453.6) | (532.0) | (537.8) | (501.8) | ||||||||||||||||||||||||||||||

| Purchase of intangible assets | (7.7) | (12.3) | (7.4) | (6.6) | (8.3) | ||||||||||||||||||||||||||||||

| Purchase of short-term investments | (104.1) | (4.2) | (18.2) | (0.5) | (3.9) | ||||||||||||||||||||||||||||||

| Maturity of short-term investments | 199.5 | 106.1 | 121.1 | — | 3.6 | ||||||||||||||||||||||||||||||

| Loans issued and other investments | (240.0) | — | — | — | (553.0) | ||||||||||||||||||||||||||||||

| Acquisition of subsidiaries (net of cash acquired) | — | — | — | — | (27.6) | ||||||||||||||||||||||||||||||

| Net cash provided by (used in) investing activities | (508.9) | (364.0) | (436.5) | (544.9) | (1,091.0) | ||||||||||||||||||||||||||||||

| CASH FLOWS FROM FINANCING ACTIVITIES | |||||||||||||||||||||||||||||||||||

| Dividend paid | (543.5) | (541.1) | (541.1) | (666.1) | (570.4) | ||||||||||||||||||||||||||||||

| Purchase of treasury shares | (1,087.9) | (335.0) | (396.2) | (492.6) | (111.1) | ||||||||||||||||||||||||||||||

| Net proceeds from issuance of shares | 19.9 | 18.9 | 22.7 | 25.1 | 25.7 | ||||||||||||||||||||||||||||||

| Net proceeds from issuance of notes, net of issuance costs | — | — | — | 997.8 | — | ||||||||||||||||||||||||||||||

| Repayment of debt and finance lease obligations | (1.2) | (0.8) | (1.5) | (0.7) | (750.4) | ||||||||||||||||||||||||||||||

| Net cash provided by (used in) financing activities | (1,612.7) | (858.0) | (916.1) | (136.5) | (1,406.2) | ||||||||||||||||||||||||||||||

| Net cash flows | (952.1) | 4,128.5 | (619.0) | (296.7) | (1,369.1) | ||||||||||||||||||||||||||||||

| Effect of changes in exchange rates on cash | 8.4 | (13.0) | (1.6) | (9.7) | 3.3 | ||||||||||||||||||||||||||||||

| Net increase (decrease) in cash and cash equivalents | (943.7) | 4,115.5 | (620.6) | (306.4) | (1,365.8) | ||||||||||||||||||||||||||||||

| Cash and cash equivalents at beginning of the period | 4,096.5 | 3,152.8 | 7,268.3 | 6,647.7 | 6,341.3 | ||||||||||||||||||||||||||||||

| Cash and cash equivalents at end of the period | 3,152.8 | 7,268.3 | 6,647.7 | 6,341.3 | 4,975.5 | ||||||||||||||||||||||||||||||