000093709812/312024Q1FALSE137100009370982024-01-012024-03-3100009370982024-04-19xbrli:shares0000937098tnet:ProfessionalServicesMember2024-01-012024-03-31iso4217:USD0000937098tnet:ProfessionalServicesMember2023-01-012023-03-310000937098tnet:InsuranceServicesMember2024-01-012024-03-310000937098tnet:InsuranceServicesMember2023-01-012023-03-3100009370982023-01-012023-03-31iso4217:USDxbrli:shares00009370982024-03-3100009370982023-12-3100009370982022-12-310000937098us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2023-12-310000937098us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2022-12-310000937098us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2024-01-012024-03-310000937098us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2023-01-012023-03-310000937098us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2024-03-310000937098us-gaap:CommonStockIncludingAdditionalPaidInCapitalMember2023-03-310000937098us-gaap:RetainedEarningsMember2023-12-310000937098us-gaap:RetainedEarningsMember2022-12-310000937098us-gaap:RetainedEarningsMember2024-01-012024-03-310000937098us-gaap:RetainedEarningsMember2023-01-012023-03-310000937098us-gaap:RetainedEarningsMember2024-03-310000937098us-gaap:RetainedEarningsMember2023-03-310000937098us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000937098us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000937098us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310000937098us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310000937098us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310000937098us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-3100009370982023-03-31tnet:segment0000937098us-gaap:GeographicConcentrationRiskMemberus-gaap:NonUsMemberus-gaap:SalesRevenueNetMember2024-01-012024-03-31xbrli:pure0000937098us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2024-03-310000937098us-gaap:HealthCareMember2024-03-310000937098us-gaap:HealthCareMember2023-12-310000937098us-gaap:CashAndCashEquivalentsMember2024-03-310000937098tnet:AvailableForSaleMarketableSecuritiesMember2024-03-310000937098us-gaap:CashAndCashEquivalentsMember2023-12-310000937098tnet:AvailableForSaleMarketableSecuritiesMember2023-12-310000937098tnet:PayrollFundsCollectedMemberus-gaap:CashAndCashEquivalentsMember2024-03-310000937098tnet:AvailableForSaleMarketableSecuritiesMembertnet:PayrollFundsCollectedMember2024-03-310000937098tnet:PayrollFundsCollectedMember2024-03-310000937098tnet:PayrollFundsCollectedMemberus-gaap:CashAndCashEquivalentsMember2023-12-310000937098tnet:AvailableForSaleMarketableSecuritiesMembertnet:PayrollFundsCollectedMember2023-12-310000937098tnet:PayrollFundsCollectedMember2023-12-310000937098tnet:HealthBenefitClaimsCollateralMemberus-gaap:CashAndCashEquivalentsMember2024-03-310000937098tnet:AvailableForSaleMarketableSecuritiesMembertnet:HealthBenefitClaimsCollateralMember2024-03-310000937098tnet:HealthBenefitClaimsCollateralMember2024-03-310000937098tnet:HealthBenefitClaimsCollateralMemberus-gaap:CashAndCashEquivalentsMember2023-12-310000937098tnet:AvailableForSaleMarketableSecuritiesMembertnet:HealthBenefitClaimsCollateralMember2023-12-310000937098tnet:HealthBenefitClaimsCollateralMember2023-12-310000937098tnet:WorkersCompensationClaimsCollateralMemberus-gaap:CashAndCashEquivalentsMember2024-03-310000937098tnet:AvailableForSaleMarketableSecuritiesMembertnet:WorkersCompensationClaimsCollateralMember2024-03-310000937098tnet:WorkersCompensationClaimsCollateralMember2024-03-310000937098tnet:WorkersCompensationClaimsCollateralMemberus-gaap:CashAndCashEquivalentsMember2023-12-310000937098tnet:AvailableForSaleMarketableSecuritiesMembertnet:WorkersCompensationClaimsCollateralMember2023-12-310000937098tnet:WorkersCompensationClaimsCollateralMember2023-12-310000937098tnet:TrustForOurHRISUsersCollateralMemberus-gaap:CashAndCashEquivalentsMember2024-03-310000937098tnet:TrustForOurHRISUsersCollateralMembertnet:AvailableForSaleMarketableSecuritiesMember2024-03-310000937098tnet:TrustForOurHRISUsersCollateralMember2024-03-310000937098tnet:TrustForOurHRISUsersCollateralMemberus-gaap:CashAndCashEquivalentsMember2023-12-310000937098tnet:TrustForOurHRISUsersCollateralMembertnet:AvailableForSaleMarketableSecuritiesMember2023-12-310000937098tnet:TrustForOurHRISUsersCollateralMember2023-12-310000937098tnet:InsuranceCarriersSecurityDepositsMemberus-gaap:CashAndCashEquivalentsMember2024-03-310000937098tnet:InsuranceCarriersSecurityDepositsMembertnet:AvailableForSaleMarketableSecuritiesMember2024-03-310000937098tnet:InsuranceCarriersSecurityDepositsMember2024-03-310000937098tnet:InsuranceCarriersSecurityDepositsMemberus-gaap:CashAndCashEquivalentsMember2023-12-310000937098tnet:InsuranceCarriersSecurityDepositsMembertnet:AvailableForSaleMarketableSecuritiesMember2023-12-310000937098tnet:InsuranceCarriersSecurityDepositsMember2023-12-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2024-03-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMemberus-gaap:CashAndCashEquivalentsMember2024-03-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:InvestmentsMemberus-gaap:MoneyMarketFundsMember2024-03-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMembertnet:RestrictedCashAndCashEquivalentsAndInvestmentsMember2024-03-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:USTreasurySecuritiesMember2024-03-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:USTreasurySecuritiesMemberus-gaap:CashAndCashEquivalentsMember2024-03-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:InvestmentsMemberus-gaap:USTreasurySecuritiesMember2024-03-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:USTreasurySecuritiesMembertnet:RestrictedCashAndCashEquivalentsAndInvestmentsMember2024-03-310000937098us-gaap:FairValueMeasurementsRecurringMember2024-03-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashAndCashEquivalentsMember2024-03-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:InvestmentsMember2024-03-310000937098us-gaap:FairValueMeasurementsRecurringMembertnet:RestrictedCashAndCashEquivalentsAndInvestmentsMember2024-03-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMember2024-03-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMemberus-gaap:CashAndCashEquivalentsMember2024-03-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMemberus-gaap:InvestmentsMember2024-03-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMembertnet:RestrictedCashAndCashEquivalentsAndInvestmentsMember2024-03-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMember2024-03-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:CashAndCashEquivalentsMember2024-03-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:InvestmentsMember2024-03-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMembertnet:RestrictedCashAndCashEquivalentsAndInvestmentsMember2024-03-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2024-03-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:CashAndCashEquivalentsMember2024-03-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:InvestmentsMember2024-03-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMembertnet:RestrictedCashAndCashEquivalentsAndInvestmentsMember2024-03-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:USTreasurySecuritiesMember2024-03-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:USTreasurySecuritiesMemberus-gaap:CashAndCashEquivalentsMember2024-03-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:USTreasurySecuritiesMemberus-gaap:InvestmentsMember2024-03-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:USTreasurySecuritiesMembertnet:RestrictedCashAndCashEquivalentsAndInvestmentsMember2024-03-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CertificatesOfDepositMember2024-03-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CertificatesOfDepositMemberus-gaap:CashAndCashEquivalentsMember2024-03-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CertificatesOfDepositMemberus-gaap:InvestmentsMember2024-03-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CertificatesOfDepositMembertnet:RestrictedCashAndCashEquivalentsAndInvestmentsMember2024-03-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:OtherDebtSecuritiesMember2024-03-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:OtherDebtSecuritiesMemberus-gaap:CashAndCashEquivalentsMember2024-03-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:InvestmentsMemberus-gaap:OtherDebtSecuritiesMember2024-03-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:OtherDebtSecuritiesMembertnet:RestrictedCashAndCashEquivalentsAndInvestmentsMember2024-03-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMember2023-12-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMemberus-gaap:CashAndCashEquivalentsMember2023-12-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:InvestmentsMemberus-gaap:MoneyMarketFundsMember2023-12-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Memberus-gaap:MoneyMarketFundsMembertnet:RestrictedCashAndCashEquivalentsAndInvestmentsMember2023-12-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:USTreasurySecuritiesMember2023-12-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:USTreasurySecuritiesMemberus-gaap:CashAndCashEquivalentsMember2023-12-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:InvestmentsMemberus-gaap:USTreasurySecuritiesMember2023-12-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:USTreasurySecuritiesMembertnet:RestrictedCashAndCashEquivalentsAndInvestmentsMember2023-12-310000937098us-gaap:FairValueMeasurementsRecurringMember2023-12-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:CashAndCashEquivalentsMember2023-12-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:InvestmentsMember2023-12-310000937098us-gaap:FairValueMeasurementsRecurringMembertnet:RestrictedCashAndCashEquivalentsAndInvestmentsMember2023-12-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMember2023-12-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMemberus-gaap:CashAndCashEquivalentsMember2023-12-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMemberus-gaap:InvestmentsMember2023-12-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:AssetBackedSecuritiesMembertnet:RestrictedCashAndCashEquivalentsAndInvestmentsMember2023-12-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMember2023-12-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:CashAndCashEquivalentsMember2023-12-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMemberus-gaap:InvestmentsMember2023-12-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CorporateDebtSecuritiesMembertnet:RestrictedCashAndCashEquivalentsAndInvestmentsMember2023-12-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMember2023-12-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:CashAndCashEquivalentsMember2023-12-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMemberus-gaap:InvestmentsMember2023-12-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:USGovernmentAgenciesDebtSecuritiesMembertnet:RestrictedCashAndCashEquivalentsAndInvestmentsMember2023-12-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:USTreasurySecuritiesMember2023-12-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:USTreasurySecuritiesMemberus-gaap:CashAndCashEquivalentsMember2023-12-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:USTreasurySecuritiesMemberus-gaap:InvestmentsMember2023-12-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:USTreasurySecuritiesMembertnet:RestrictedCashAndCashEquivalentsAndInvestmentsMember2023-12-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CertificatesOfDepositMember2023-12-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CertificatesOfDepositMemberus-gaap:CashAndCashEquivalentsMember2023-12-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CertificatesOfDepositMemberus-gaap:InvestmentsMember2023-12-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:CertificatesOfDepositMembertnet:RestrictedCashAndCashEquivalentsAndInvestmentsMember2023-12-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:OtherDebtSecuritiesMember2023-12-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:OtherDebtSecuritiesMemberus-gaap:CashAndCashEquivalentsMember2023-12-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:InvestmentsMemberus-gaap:OtherDebtSecuritiesMember2023-12-310000937098us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Memberus-gaap:OtherDebtSecuritiesMembertnet:RestrictedCashAndCashEquivalentsAndInvestmentsMember2023-12-310000937098tnet:A2029NotesPayableMember2024-03-310000937098tnet:A2031NotesPayableMember2024-03-310000937098tnet:A2029NotesPayableMember2023-12-310000937098tnet:A2031NotesPayableMember2023-12-310000937098tnet:TimeBasedRestrictedStockUnitsMember2024-01-012024-03-310000937098srt:MinimumMembertnet:TimeBasedRestrictedStockUnitsMember2024-01-012024-03-310000937098srt:MaximumMembertnet:TimeBasedRestrictedStockUnitsMember2024-01-012024-03-310000937098tnet:PerformanceBasedRestrictedStockUnitsandRestrictedStockAwardsMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2024-01-012024-03-310000937098tnet:TimeBasedRestrictedStockUnitsMember2023-12-310000937098tnet:TimeBasedRestrictedStockUnitsMember2024-03-310000937098tnet:PerformanceBasedRestrictedStockUnitsMember2023-12-310000937098tnet:PerformanceBasedRestrictedStockUnitsMember2024-01-012024-03-310000937098tnet:PerformanceBasedRestrictedStockUnitsMember2024-03-310000937098us-gaap:CostOfSalesMember2024-01-012024-03-310000937098us-gaap:CostOfSalesMember2023-01-012023-03-310000937098us-gaap:SellingAndMarketingExpenseMember2024-01-012024-03-310000937098us-gaap:SellingAndMarketingExpenseMember2023-01-012023-03-310000937098us-gaap:GeneralAndAdministrativeExpenseMember2024-01-012024-03-310000937098us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-03-310000937098tnet:SystemsDevelopmentAndProgrammingCostsMember2024-01-012024-03-310000937098tnet:SystemsDevelopmentAndProgrammingCostsMember2023-01-012023-03-310000937098tnet:PerformanceBasedRestrictedStockUnitsandRestrictedStockAwardsMember2024-01-012024-03-310000937098us-gaap:RestrictedStockMember2024-01-012024-03-310000937098us-gaap:RestrictedStockMember2023-01-012023-03-310000937098us-gaap:StockOptionMember2024-01-012024-03-310000937098us-gaap:StockOptionMember2023-01-012023-03-3100009370982024-02-290000937098tnet:BurtonMGoldfieldMember2024-01-012024-03-310000937098tnet:BurtonMGoldfieldMember2024-03-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2024

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number: 001-36373

TRINET GROUP, INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

|

|

|

|

|

|

Delaware |

|

95-3359658 |

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

| One Park Place, |

Suite 600 |

|

|

Dublin, |

CA |

|

94568 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (510) 352-5000

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common stock par value $0.000025 per share |

TNET |

New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

Large accelerated filer |

x |

Accelerated filer |

o |

|

|

|

|

| Non-accelerated filer |

o |

Smaller reporting company |

☐ |

|

|

|

|

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. Yes o No o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No x

The number of shares of Registrant’s Common Stock outstanding as of April 19, 2024 was 50,563,849.

TRINET GROUP, INC.

Form 10-Q - Quarterly Report

For the Quarterly Period Ended March 31, 2024

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

|

Form 10-Q

Cross Reference

|

Page |

|

|

|

|

|

|

|

Part I, Item 1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part I, Item 2. |

|

|

Part I, Item 3. |

|

|

Part I, Item 4. |

|

|

Part II, Item 1. |

|

|

Part II, Item 1A. |

|

|

Part II, Item 2. |

|

|

Part II, Item 3. |

|

|

Part II, Item 4. |

|

|

Part II, Item 5. |

|

|

Part II, Item 6. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TRINET |

2 |

2024 Q1 FORM 10-Q |

Glossary of Acronyms and Abbreviations

Acronyms and abbreviations are used throughout this report, particularly in Part I, Item 1. Unaudited Condensed Consolidated Financial Statements and Part I, Item 2. Management's Discussion and Analysis of Financial Condition and Results of Operations.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2022 Credits |

Includes both of our announced 2022 credits, each of which provides eligible clients with discretionary credits, subject to certain predefined conditions. |

| 2021 Credit Agreement |

Our credit agreement dated February 26, 2021, as amended, supplemented or modified from time to time, most recently August 16, 2023. |

|

|

| 2021 Revolver |

Our $700 million revolving line of credit included in our 2021 Credit Agreement |

| 2029 Notes |

Our $500 million senior unsecured notes maturing in March 2029 |

|

|

| 2031 Notes |

Our $400 million senior unsecured notes maturing in August 2031 |

| AFS |

Available-for-sale |

|

|

|

|

| CARES Act |

Coronavirus Aid Relief and Economic Security Act |

|

|

| CEO |

Chief Executive Officer |

| CFO |

Chief Financial Officer |

|

|

| COBRA |

Consolidated Omnibus Budget Reconciliation Act |

| Colleague |

TriNet’s internal employees (as distinguished from WSEs and HRIS Users) |

| COPS |

Cost of providing services |

|

|

| COVID-19 |

Novel coronavirus |

|

|

|

|

| D&A |

Depreciation and amortization expenses |

| EBITDA |

Earnings before interest expense, taxes, depreciation and amortization of intangible assets |

|

|

| EPS |

Earnings Per Share |

| ERISA |

Employee Retirement Income Security Act |

| ESAC |

Employer Services Assurance Corporation |

|

|

| ETR |

Effective tax rate |

|

|

| FFCRA |

Families First Coronavirus Response Act |

| G&A |

General and administrative |

| GAAP |

Generally Accepted Accounting Principles in the United States |

|

|

|

|

| HCM |

Human capital management |

| HR |

Human Resources |

| HRIS |

Human resources information system |

| HRIS User |

A client employee who is a user of our HR Platform (for example, employees of an HRIS client) |

|

|

|

|

|

|

| IRS |

Internal Revenue Service |

| ICR |

Insurance cost ratio |

| ISR |

Insurance service revenues |

|

|

|

|

| LIBOR |

London Inter-bank Offered Rate |

|

|

|

|

| MD&A |

Management's Discussion and Analysis of Financial Condition and Results of Operations |

|

|

|

|

|

|

| OE |

Operating expenses |

|

|

| PEO |

Professional Employer Organization |

| PFC |

Payroll funds collected |

|

|

|

|

| PSR |

Professional service revenues |

| R&D |

Research and Development |

| Reg FD |

Regulation Fair Disclosure |

| ROU |

Right-of-use |

| RSU |

Restricted Stock Unit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TRINET |

3 |

2024 Q1 FORM 10-Q |

|

|

|

|

|

|

| SBC |

Stock Based Compensation |

| S&M |

Sales and marketing |

| S&P |

Standard & Poor's |

| SD&P |

Systems development and programming |

| SEC |

U.S. Securities and Exchange Commission |

| SMB |

Small and medium-size business |

|

|

|

|

| TriNet Clarus R+D |

Clarus R+D Solutions, LLC |

| U.S. |

United States |

|

|

| WSE |

A worksite employee who is co-employed by, or otherwise receiving services from a TriNet PEO |

| YTD |

Year to date |

| Zenefits |

YourPeople, Inc. and its subsidiaries |

|

|

|

|

|

|

|

|

|

|

|

|

| TRINET |

4 |

2024 Q1 FORM 10-Q |

|

|

|

|

|

|

| FORWARD LOOKING STATEMENTS AND OTHER FINANCIAL INFORMATION |

|

Cautionary Note Regarding Forward-Looking Statements

For purposes of this Quarterly Report on Form 10-Q (Form 10-Q), the terms “TriNet,” “the Company,” “we,” “us” and “our” refer to TriNet Group, Inc., and its subsidiaries. This Form 10-Q contains statements that are not historical in nature, are predictive in nature, or that depend upon or refer to future events or conditions or otherwise contain forward-looking statements within the meaning of Section 21 of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. Forward-looking statements are often identified by the use of words such as, but not limited to, "ability," “anticipate,” “believe,” “can,” “continue,” “could,” “design,” “estimate,” “expect,” “forecast,” “hope,” "impact," “intend,” “may,” “outlook,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “strategy,” “target,” "value," “will,” “would” and similar expressions or variations intended to identify forward-looking statements. Examples of forward-looking statements include, among others, TriNet’s expectations regarding: our ability to successfully diversify our overall service and technology offerings to support SMBs throughout their lifecycle; our plans and ability to grow our client base; the impact of our ongoing efforts to ensure that our billing practices best match the expectations of our customers and the impact on our WSE count; our expectations regarding medical utilization rates by our WSEs and the impact of inflation on our insurance costs; the effect that our stock repurchase program will have on our business; the impact of our notes; our ability to leverage our scale and industry HR experience to deliver vertical focused offerings; the impact of planned improvements to our technology platform and HRIS software and whether they will meet the needs of our current clients and attract new ones; the implementation of our ERP system and its impact on our internal financial controls and operations; our ability to improve operating efficiencies; the impact of our client service initiatives and whether they enhance client experience and satisfaction; our continued ability to provide access to a broad range of benefit programs on a cost-effective basis; our expectations regarding the volume and severity of insurance claims and insurance claim trends; the effectiveness of our risk strategies for, and management of, workers' compensation, health benefit insurance costs and deductibles, and EPLI risk; the metrics that may be indicators of future financial performance; the relative value of our benefit offerings versus those SMBs can independently obtain; the impact that our benefit offerings have for SMBs seeking to attract and retain employees; the principal competitive drivers in our market; the impact of our plans to improve our sales performance, grow net new clients and manage client attrition; our investment strategy and its impact on our ability to generate future interest income, net income, and Adjusted EBITDA; seasonal trends and their impact on our business; fluctuations in the period-to-period timing of when we incur certain operating expenses; the estimates and assumptions we use to prepare our financial statements; our belief we can meet our present and reasonably foreseeable cash needs and future commitments through existing liquid assets and continuing cash flows from corporate operating activities; and other expectations, outlooks and forecasts on our future business, operational and financial performance.

Important factors that could cause actual results, level of activity, performance or achievements to differ materially from those expressed or implied by these forward-looking statements are discussed above and throughout our Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC on February 15, 2024 (our 2023 Form 10-K), including those appearing under the heading “Risk Factors” in Item 1A, and under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Part II, Item 7 of our 2023 Form 10-K, and those appearing in the other periodic filings we make with the SEC, and including risk factors associated with: our ability to manage unexpected changes in workers’ compensation and health insurance claims and costs by WSEs; our ability to mitigate the unique business risks we face as a co-employer; the effects of volatility in the financial and economic environment on the businesses that make up our client base; loss of clients for reasons beyond our control and the short-term contracts we typically use with our clients; the impact of regional or industry-specific economic and health factors on our operations; the impact of failures or limitations in the business systems and centers we rely upon; the impact of discontinuing our discretionary credits on our business and client loyalty and retention; changes in our insurance coverage or our relationships with key insurance carriers; our ability to improve our services and technology to satisfy client and regulatory expectations; our ability to effectively integrate businesses we have acquired or may acquire in the future; our ability to effectively manage and improve our operational effectiveness and resiliency; our ability to attract and retain qualified personnel; the effects of increased competition and our ability to compete effectively; the impact on our business of cyber-attacks, breaches, disclosures and other data-related incidents; our ability to protect against and remediate cyber-attacks, breaches, disclosures and other data-related incidents, whether intentional or inadvertent and whether attributable to us or our service providers; our ability to comply with evolving data privacy and security laws; our ability to manage changes in, uncertainty regarding, or adverse application of the complex laws and regulations that govern our business; changing laws and regulations governing health insurance and employee benefits; our ability to be recognized as an employer of worksite employees and for our benefits plans to satisfy all requirements under federal and state regulations; changes in the laws and regulations that govern what it means to be an employer, employee or independent contractor; the impact of new and changing laws regarding remote work; our ability to comply with the licensing requirements that govern our solutions; the outcome of existing and future legal and tax

|

|

|

|

|

|

|

|

|

|

|

|

| TRINET |

5 |

2024 Q1 FORM 10-Q |

|

|

|

|

|

|

| FORWARD LOOKING STATEMENTS AND OTHER FINANCIAL INFORMATION |

|

proceedings; fluctuation in our results of operations and stock price due to factors outside of our control; our ability to comply with the restrictions of our credit facility and meet our debt obligations; and the impact of concentrated ownership in our stock by Atairos and other large stockholders. Any of these factors could cause our actual results to differ materially from our anticipated results.

Forward-looking statements are not guarantees of future performance but are based on management’s expectations as of the date of this Form 10-Q and assumptions that are inherently subject to uncertainties, risks and changes in circumstances that are difficult to predict. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements to be materially different from our current expectations and any past results, performance or achievements. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements.

The information provided in this Form 10-Q is based upon the facts and circumstances known as of the date of this Form 10-Q, and any forward-looking statements made by us in this Form 10-Q speak only as of the date of this Form 10-Q. We undertake no obligation to revise or update any of the information provided in this Form 10-Q, except as required by law.

The MD&A of this Form 10-Q includes references to our performance measures presented in conformity with GAAP and other non-GAAP financial measures that we use to manage our business, to make planning decisions, to allocate resources and to use as performance measures in our executive compensation plans. Refer to the Non-GAAP Financial Measures within our MD&A for definitions and reconciliations from GAAP measures.

Website Disclosures

We use our website (www.trinet.com) to announce material non-public information to the public and to comply with our disclosure obligations under Reg FD. We also use our website to communicate with the public about our Company, our services, and other matters. Our SEC filings, press releases and recent public conference calls and webcasts can also be found on our website. The information we post on our website could be deemed to be material information under Reg FD. We encourage investors and others interested in our Company to review the information we post on our website. Information contained in or accessible through our website is not a part of this report.

Our Company is the sole owner of the trademark “TriNet” and other trademarks appearing in this report. Our Company does not intend to use or display trade names or trademarks owned by others in a manner that would imply any form of association with any of those companies.

|

|

|

|

|

|

|

|

|

|

|

|

| TRINET |

6 |

2024 Q1 FORM 10-Q |

|

|

|

|

|

|

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Executive Summary

Overview

TriNet is a leading provider of comprehensive and flexible HCM solutions designed to address a wide range of SMB needs as they change over time. Our flexible HCM solutions free SMBs from HR complexities and empower SMBs to focus on what matters most - growing their business and enabling their people.

TriNet offers access to human capital expertise, benefits, payroll, risk mitigation and compliance, all enabled by industry leading technology capabilities. TriNet's suite of products also includes services and software-based solutions to help streamline workflows by connecting HR, benefits, payroll, time and attendance, and employee engagement. Clients can use our industry tailored PEO services and technology platform to receive the full benefit of our HCM services enabling their WSEs to participate in our TriNet-sponsored employee benefit plans. Clients can alternatively choose to use our self-directed, cloud-based HRIS software solution and add HR services such as payroll and access to benefits management as needed. By providing PEO and HRIS services, we believe that we can support a wider range of SMBs and create a pipeline of HRIS clients that may be able to benefit from and transition to TriNet’s higher-touch PEO services at future points in their business lifecycle. In order to better serve TriNet’s customers throughout their business lifecycle, we are investing in our technology platform so that it can accommodate both PEO and HRIS customers.

Operational Highlights

Our consolidated results for the first quarter of 2024 reflect our continuing efforts to serve our clients, attract new clients and invest in our platform.

During the three months ended March 31, 2024, we:

•improved sales performance and customer retention,

•continued to grow total revenues and manage expenses prudently,

•launched a common stock dividend of $0.25 per share paid in April 2024,

•welcomed Mike Simonds as our new President and CEO, and

•celebrated our ten-year anniversary as a NYSE-listed company.

|

|

|

|

|

|

|

|

|

|

|

|

| TRINET |

7 |

2024 Q1 FORM 10-Q |

|

|

|

|

|

|

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

|

Performance Highlights

Our results for the first quarter ended March 31, 2024, when compared to the same period of 2023, are noted below:

Q1 2024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$1.3B |

|

$122M |

|

86% |

|

Total revenues |

|

Operating income |

|

Insurance cost ratio |

|

1 |

% |

increase |

|

(28) |

% |

decrease |

|

4 |

% |

increase |

|

|

|

|

|

|

|

|

|

|

$91M |

|

$1.78 |

|

$111M |

|

Net income |

|

Diluted EPS |

|

Adjusted Net income * |

|

(31) |

% |

decrease |

|

(18) |

% |

decrease |

|

(26) |

% |

decrease |

|

|

|

|

|

|

|

|

|

|

348,164 |

|

351,919 |

|

195,157 |

|

Average WSEs ** |

|

Total WSEs ** |

|

Average HRIS Users |

|

6 |

% |

increase |

|

7 |

% |

increase |

|

(16) |

% |

decrease |

|

|

|

|

|

|

|

|

|

| * |

|

| ** |

Total WSEs and Average WSEs include approximately 19,600 and 17,600, respectively, for incremental WSEs that were charged a platform user access fee. Additionally, Total WSEs and Average WSEs include approximately 5,300 and 5,400, respectively, of incremental additional service recipients for the quarter ended March 31, 2024. These were identified as a result of our ongoing effort to ensure that our billing practices best match the expectations of our customers. For details, refer to the heading "Operating Metrics – Worksite Employees (WSEs).” |

Our total revenues increased 1% compared to the same period in 2023, driven by rate increases, partially offset by lower health plan enrollment.

During the first quarter of 2024, our Average WSEs and Total WSEs increased 6% and 7%, respectively, compared to the same period in 2023, primarily due to additional PEO Platform Users and additional service recipients identified as a result of our ongoing effort to ensure that our billing practices best match the expectations of our customers.

Our ICR was 4 points higher compared to the same period in 2023, driven by increased health benefits utilization rates and inflation in health costs.

Higher insurance costs, operating expenses and interest expense, partially offset by higher revenues, resulted in decreases of net income and Adjusted Net income of 31% and 26%, respectively, as compared to the same period in 2023.

|

|

|

|

|

|

|

|

|

|

|

|

| TRINET |

8 |

2024 Q1 FORM 10-Q |

|

|

|

|

|

|

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

|

Results of Operations

The following table summarizes our results of operations for the first quarter ended March 31, 2024, when compared to the same period of 2023. For details of the critical accounting judgments and estimates that could affect our Results of Operations, see the

Critical Accounting Judgments and Estimates section within the MD&A in Item 7 of our 2023 Form 10-K.

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended March 31, |

| (in millions, except operating metrics data) |

2024 |

2023 |

% Change |

| Income Statement Data: |

|

|

|

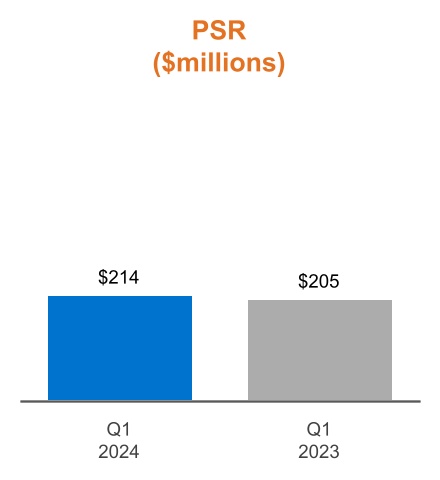

| Professional service revenues |

$ |

214 |

|

$ |

205 |

|

4 |

% |

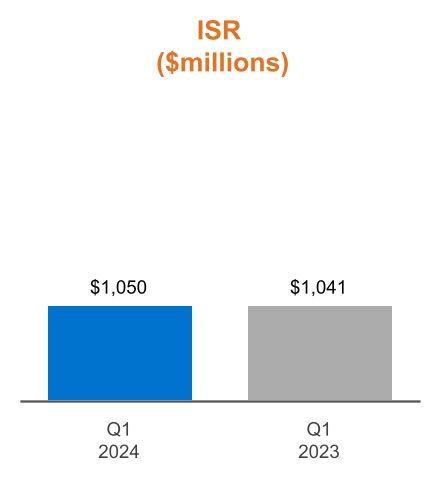

| Insurance service revenues |

1,050 |

|

1,041 |

|

1 |

|

| Total revenues |

1,264 |

|

1,246 |

|

1 |

|

| Insurance costs |

907 |

|

852 |

|

6 |

|

| Operating expenses |

235 |

|

225 |

|

4 |

|

| Total costs and operating expenses |

1,142 |

|

1,077 |

|

6 |

|

| Operating income |

122 |

|

169 |

|

(28) |

|

| Other income (expense): |

|

|

|

| Interest expense, bank fees and other |

(16) |

|

(7) |

|

129 |

|

| Interest income |

18 |

|

18 |

|

— |

|

|

|

|

|

|

|

|

|

| Income before provision for income taxes |

124 |

|

180 |

|

(31) |

|

| Income taxes |

33 |

|

49 |

|

(33) |

|

| Net income |

$ |

91 |

|

$ |

131 |

|

(31) |

% |

|

|

|

|

|

|

|

|

| Cash Flow Data: |

|

|

|

| Net cash used in operating activities |

(122) |

|

(77) |

|

58 |

|

| Net cash used in investing activities |

(47) |

|

(23) |

|

104 |

|

| Net cash provided by (used in) financing activities |

(30) |

|

200 |

|

(115) |

|

|

|

|

|

Non-GAAP measures (1): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

$ |

180 |

|

223 |

|

(19) |

|

| Adjusted Net income |

$ |

111 |

|

150 |

|

(26) |

|

| Corporate Operating Cash Flows |

201 |

|

169 |

|

19 |

|

|

|

|

|

| Operating Metrics: |

|

|

|

| Insurance Cost Ratio |

86 |

% |

82 |

% |

4 |

|

Average WSEs (2) |

348,164 |

|

327,107 |

|

6 |

% |

Total WSEs (2) |

351,919 |

|

328,299 |

|

7 |

% |

Average HRIS Users |

195,157 |

|

231,347 |

|

(16) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

(1) Refer to Non-GAAP measures definitions and reconciliations from GAAP measures under the heading "Non-GAAP Financial Measures".

(2) Total WSEs and Average WSEs include approximately 19,600 and 17,600, respectively, for incremental WSEs that were charged a platform user access fee for the first quarter ended March 31, 2024,. Additionally, Total WSEs and Average WSEs include approximately 5,300 and 5,400, respectively, incremental additional service recipients. These were identified as a result of our ongoing effort to ensure that our billing practices best match the expectations of our customers. For details, refer to the heading "Operating Metrics – Worksite Employees (WSEs).”

The following table summarizes our balance sheet data as of March 31, 2024 compared to December 31, 2023.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions) |

March 31,

2024 |

|

December 31,

2023 |

|

% Change |

|

| Balance Sheet Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Working capital |

$ |

171 |

|

|

$ |

115 |

|

|

49 |

% |

|

| Total assets |

3,968 |

|

|

3,693 |

|

|

7 |

|

|

| Debt |

1,093 |

|

|

1,093 |

|

|

— |

|

|

| Total stockholders’ equity |

143 |

|

|

78 |

|

|

83 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TRINET |

9 |

2024 Q1 FORM 10-Q |

|

|

|

|

|

|

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

|

Non-GAAP Financial Measures

In addition to financial measures presented in accordance with GAAP, we monitor other non-GAAP financial measures that we use to manage our business, to make planning decisions, to allocate resources and to use as performance measures in our executive compensation plan. These key financial measures provide an additional view of our operational performance over the long-term and provide information that we use to maintain and grow our business.

The presentation of these non-GAAP financial measures is used to enhance the understanding of certain aspects of our financial performance. It is not meant to be considered in isolation from, superior to, or as a substitute for the directly comparable financial measures prepared in accordance with GAAP.

|

|

|

|

|

|

|

|

|

| Non-GAAP Measure |

Definition |

How We Use The Measure |

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

• Net income, excluding the effects of:

- income tax provision,

- interest expense, bank fees and other,

- depreciation,

- amortization of intangible assets,

- stock based compensation expense,

- amortization of cloud computing arrangements, and

- transaction and integration costs.

|

• Provides period-to-period comparisons on a consistent basis and an understanding as to how our management evaluates the effectiveness of our business strategies by excluding certain non-recurring costs, which include transaction and integration costs, as well as certain non-cash charges such as depreciation and amortization, and stock-based compensation and certain impairment charges recognized based on the estimated fair values. We believe these charges are either not directly resulting from our core operations or not indicative of our ongoing operations.

• Enhances comparisons to the prior period and, accordingly, facilitates the development of future projections and earnings growth prospects.

• Provides a measure, among others, used in the determination of incentive compensation for management.

• We also sometimes refer to Adjusted EBITDA margin, which is the ratio of Adjusted EBITDA to total revenues. |

Adjusted Net Income |

• Net income, excluding the effects of:

- effective income tax rate (1),

- stock based compensation,

- amortization of intangible assets, net,

- non-cash interest expense,

- transaction and integration costs, and

- the income tax effect (at our effective tax rate (1) of these pre-tax adjustments.

|

• Provides information to our stockholders and board of directors to understand how our management evaluates our business, to monitor and evaluate our operating results, and analyze profitability of our ongoing operations and trends on a consistent basis by excluding certain non-cash charges. |

| Corporate Operating Cash Flows |

• Net cash provided by (used in) operating activities, excluding the effects of:

- Assets associated with WSEs (accounts receivable, unbilled revenue, prepaid expenses, other payroll assets and other current assets) and

- Liabilities associated with WSEs (client deposits and other client liabilities, accrued wages, payroll tax liabilities and other payroll withholdings, accrued health insurance costs, accrued workers' compensation costs, insurance premiums and other payables, and other current liabilities). |

• Provides information that our stockholders and management can use to evaluate our cash flows from operations independent of the current assets and liabilities associated with our WSEs. • Enhances comparisons to prior periods and, accordingly, used as a liquidity measure to manage liquidity between corporate and WSE related activities, and to help determine and plan our cash flow and capital strategies.

|

|

|

|

(1) Non-GAAP effective tax rate is 25.6% for the first quarters of 2024 and 2023, which excludes the income tax impact from stock-based compensation, changes in uncertain tax positions, and nonrecurring benefits or expenses from federal legislative changes.

|

|

|

|

|

|

|

|

|

|

|

|

| TRINET |

10 |

2024 Q1 FORM 10-Q |

|

|

|

|

|

|

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

|

Reconciliation of GAAP to Non-GAAP Measures

The table below presents a reconciliation of Net income to Adjusted EBITDA:

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

(in millions) |

2024 |

2023 |

|

|

|

Net income |

$ |

91 |

|

$ |

131 |

|

|

|

|

Provision for income taxes |

33 |

|

49 |

|

|

|

|

Stock based compensation |

20 |

|

11 |

|

|

|

|

| Interest expense, bank fees and other |

16 |

|

7 |

|

|

|

|

| Depreciation and amortization of intangible assets |

18 |

|

18 |

|

|

|

|

| Amortization of cloud computing arrangements |

2 |

|

2 |

|

|

|

|

| Transaction and integration costs |

— |

|

5 |

|

|

|

|

| Adjusted EBITDA |

$ |

180 |

|

$ |

223 |

|

|

|

|

Adjusted EBITDA Margin |

14.2 |

% |

17.9 |

% |

|

|

|

The table below presents a reconciliation of Net income to Adjusted Net Income:

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

(in millions) |

2024 |

2023 |

|

|

|

Net income |

$ |

91 |

|

$ |

131 |

|

|

|

|

| Effective income tax rate adjustment |

1 |

|

3 |

|

|

|

|

| Stock based compensation |

20 |

|

11 |

|

|

|

|

| Amortization of other intangible assets, net |

5 |

|

6 |

|

|

|

|

|

|

|

|

|

|

| Transaction and integration costs |

— |

|

5 |

|

|

|

|

| Income tax impact of pre-tax adjustments |

(6) |

|

(6) |

|

|

|

|

| Adjusted Net Income |

$ |

111 |

|

$ |

150 |

|

|

|

|

The table below presents a reconciliation of net cash provided by operating activities to Corporate Operating Cash Flows:

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

| (in millions) |

2024 |

2023 |

| Net cash used in operating activities |

$ |

(122) |

|

$ |

(77) |

|

| Less: Change in WSE related other current assets |

(420) |

|

(178) |

|

| Less: Change in WSE related liabilities |

97 |

|

(68) |

|

| Net cash used in operating activities - WSE |

$ |

(323) |

|

$ |

(246) |

|

| Net cash provided by operating activities - Corporate |

$ |

201 |

|

$ |

169 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| TRINET |

11 |

2024 Q1 FORM 10-Q |

|

|

|

|

|

|

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

|

Operating Metrics

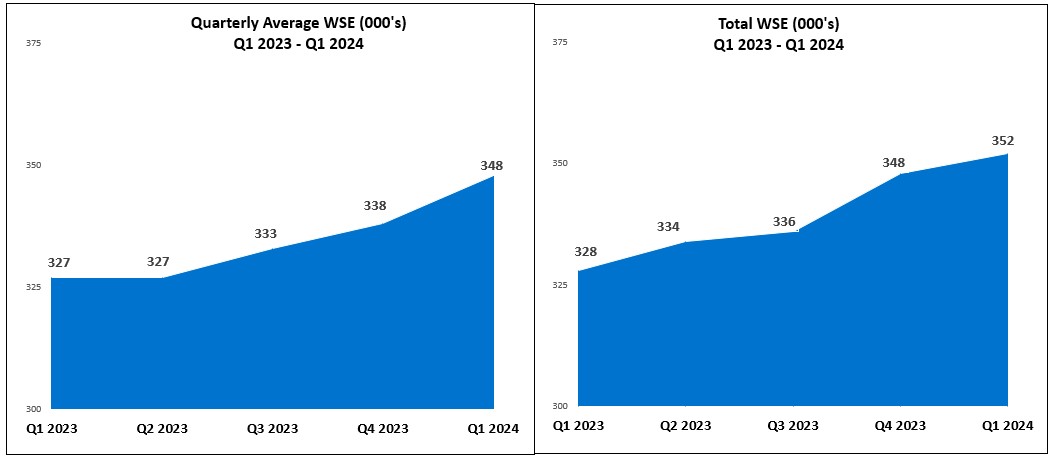

Worksite Employees (WSE)

Average WSE change is a volume measure we use to monitor the performance of our PEO business. Our PEO clients generally change their payroll service providers at the beginning of the payroll tax and benefits enrollment year; as a result, we have historically experienced our highest volumes of new PEO clients joining and existing clients terminating in the month of January. PEO client attrition, new PEO client additions and changes in employment levels within our installed PEO client base all impact our Average WSEs and Total WSEs as we move through a calendar year.

We support WSEs from the date on which their co-employment with TriNet commences through the end of their co-employment with TriNet and also after their co-employment period. We define WSEs to include co-employees and other individuals receiving PEO services, such as individuals who receive COBRA benefits post co-employment or are subject to partnership tax reporting as well as individuals who utilize our PEO platform on behalf of TriNet PEO clients. As part of an ongoing effort to ensure that our billing practices best match the expectations of our customers, in the third quarter of 2023 we determined that certain individuals such as those described above and certain co-employees were not previously or consistently counted in Total WSEs and Average WSEs. This resulting adjustment increased our reported Total WSEs by approximately 5,300 for March 31, 2024 and Average WSEs by approximately 5,400 for the first quarter of 2024. We intend to continue our ongoing effort to ensure that our billing practices best match the expectations of our customers and in the future we may identify additional individuals that should be included in Total WSEs and Average WSEs.

In December 2023, we implemented a platform user access fee to charge clients for those users of our PEO platform that may not be co-employed by us and to charge clients for co-employees for whom payroll may not be regularly run. In addition to co-employees for whom payroll may not be regularly run, this includes individuals authorized by our clients to access and use the PEO platform for functions such as bookkeeping and benefits management. The amount of the fee is comparable to the fee we charge for users of our HRIS platform. While the amount of revenue we recognized for this service to date has not been significant, these users of the PEO platform for whose access we charged this fee increased our reported Total WSEs by approximately 19,600 as of March 31, 2024 and Average WSEs by approximately 17,600 for the first quarter of 2024.

The effect of this new fee is that we are now receiving revenue from two types of users on our PEO platform, those that are co-employed in our PEO business and those that are utilizing our PEO platform, albeit in a more limited capacity. The table below illustrates how those two components comprise our Total WSE and Average WSE metrics.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended March 31, |

% Change |

|

2024 |

2023 |

|

2024 vs. 2023 |

|

|

|

|

|

|

|

| Average WSEs |

348,164 |

|

327,107 |

|

|

6 |

|

|

| Co-Employed |

330,566 |

|

327,107 |

|

|

1 |

|

|

| PEO Platform Users |

17,598 |

|

N/A |

|

N/A |

|

| Total WSEs |

351,919 |

|

328,299 |

|

|

7 |

|

|

| Co-Employed |

332,361 |

|

328,299 |

|

|

1 |

|

|

| PEO Platform Users |

19,558 |

|

N/A |

|

N/A |

|

|

|

|

|

|

|

Average WSEs increased 6% when comparing the first quarter of 2024 to the same period in 2023, primarily due to the additional Co-Employed and PEO Platform Users WSEs described above. The growth in Average WSEs was driven by our Main Street, Non-Profit and Financial Services verticals, partially offset by decreases in our Technology and Professional Services verticals.

Total WSEs can be used to estimate our beginning WSEs for the next period and, as a result, can be used as an indicator of our potential future success in generating revenue, growing our business and retaining clients. Total WSEs increased 7% when compared to the same period in 2023, primarily due to the additional Co-Employed and PEO Platform Users WSEs described above.

Anticipated revenues for future periods can diverge from the revenue expectation derived from Average WSEs or Total WSEs due to pricing differences across our HCM solutions and services and the degree to which clients and WSEs elect to participate in our solutions during future periods. In addition to focusing on growing our Average WSE

|

|

|

|

|

|

|

|

|

|

|

|

| TRINET |

12 |

2024 Q1 FORM 10-Q |

|

|

|

|

|

|

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

|

and Total WSE counts, we also focus on pricing strategies, benefit participation and service differentiation to expand the value we provide to our clients and our resulting revenue opportunities. We report the impact of client and WSE participation differences as a change in mix.

We continue to invest in efforts intended to enhance client experience, improve our new sales performance, and manage client attrition, through product development as well as operational and process improvements. As we continue our work in combining our PEO platform and our HRIS SaaS capabilities into a single platform, these various types of TriNet users will all be served from the same platform. In addition to focusing on retaining and growing our WSE base, we continue to review acquisition opportunities that would expand our product offering and provide further scale.

HRIS Users

Average HRIS Users is a volume measure we use to monitor the performance of our cloud-based HRIS services. Average HRIS Users for the first quarter 2024 and 2023, was 195,157, and 231,347, respectively. This decline is being driven by both higher client attrition as compared to new client additions and lower hiring by HRIS clients similar to SMB hiring trends that we have observed in our PEO business.

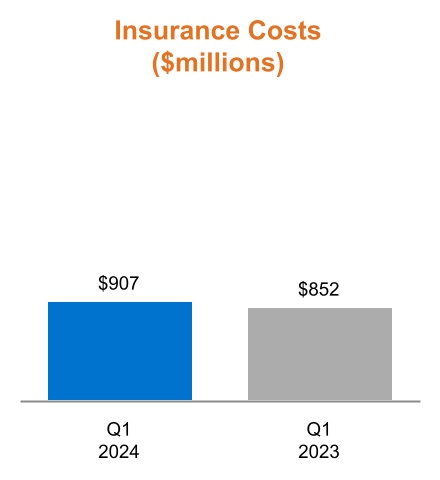

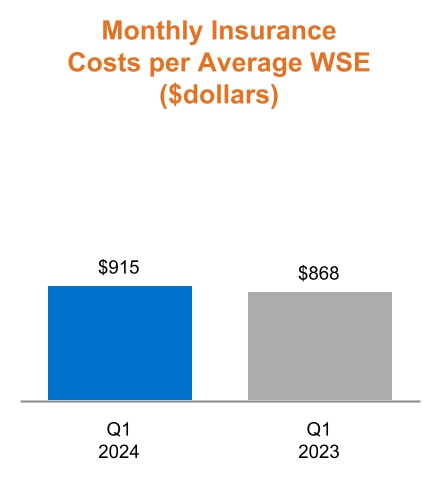

Insurance Cost Ratio (ICR)

ICR is a performance measure calculated as the ratio of insurance costs to insurance service revenues. We believe that ICR promotes an understanding of our insurance cost trends and our ability to align our relative pricing to risk performance.

We purchase workers' compensation and health benefits coverage for our WSEs. Under the insurance policies for this coverage, we bear claims costs up to a defined deductible amount. Our insurance costs, which comprise a significant portion of our overall costs, are significantly affected by our WSEs’ health and workers' compensation insurance claims experience. We set our insurance service fees for workers’ compensation and health benefits in advance for fixed benefit periods. As a result, increases in insurance costs above our projections, reflected as a higher ICR, result in lower net income. Decreases in insurance costs below our projections, reflected as a lower ICR, result in higher net income, but can be an indicator that insurance costs are developing more slowly than our projections, which are reflected in our fees, and this can have a negative impact over time on client retention and new sales.

|

|

|

|

|

|

|

|

|

|

|

|

| TRINET |

13 |

2024 Q1 FORM 10-Q |

|

|

|

|

|

|

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

|

Under our fully-insured workers' compensation insurance policies, we assume the risk for losses up to $1 million per claim occurrence (deductible layer). The ultimate cost of the workers’ compensation services provided cannot be known until all the claims are settled. Our ability to predict these costs is limited by unexpected increases in frequency or severity of claims, which can vary due to changes in the cost of treatments or claim settlements.

Under our risk-based health insurance policies, we assume the risk of variability in future health claims costs for our enrollees. This variability typically results from changing trends in the volume, severity and ultimate cost of medical and pharmaceutical claims, due to changes to the components of medical cost trend, which we define as changes in participant use of services, including the introduction of new treatment options, changes in treatment guidelines and mandates, and changes in the mix, cost of providing treatment and timing of services provided to plan participants. These trends change, and other seasonal trends and variability may develop. As a result, it is difficult for us to predict our insurance costs with accuracy and a significant increase in these costs could have a material adverse effect on our business.

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended March 31, |

|

|

| (in millions) |

2024 |

2023 |

|

|

|

| Insurance costs |

$ |

907 |

|

$ |

852 |

|

|

|

|

| Insurance service revenues |

1,050 |

|

1,041 |

|

|

|

|

| Insurance Cost Ratio |

86 |

% |

82 |

% |

|

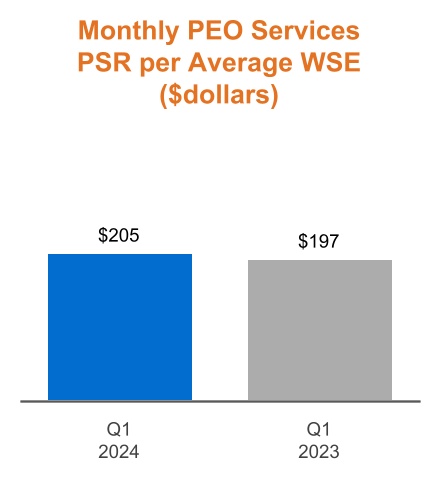

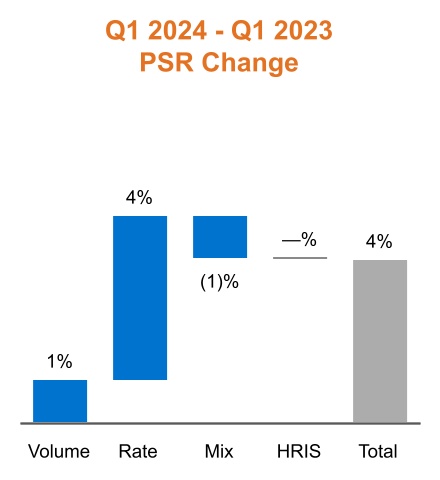

|

|

|

|

|

|

|

|

ICR increased for the first quarter as compared to the same period in 2023, primarily driven by higher insurance costs. Insurance costs increased due to higher costs associated with medical services utilization, in particular pharmacy costs and outpatient services. This was partially offset by favorable prior period development in workers' compensation.

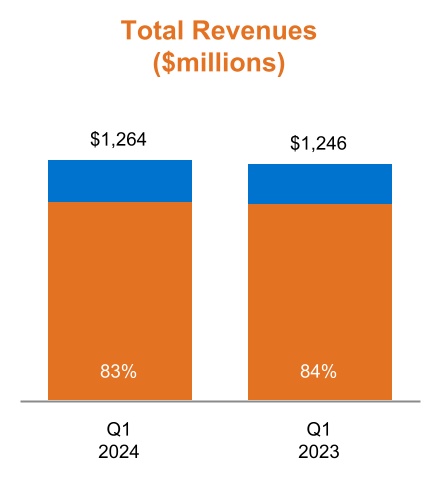

Total Revenues

Our revenues consist of PSR and ISR. PSR represents fees charged to clients for processing payroll-related transactions on behalf of our PEO and HRIS clients, access to our HR expertise, employment and benefit law compliance services, other HR-related and tax credit filing services and fees charged to access our cloud-based HRIS services. ISR consists of insurance-related billings and administrative fees collected from PEO clients and withheld from WSEs for workers' compensation insurance and health benefit insurance plans provided by third-party insurance carriers.

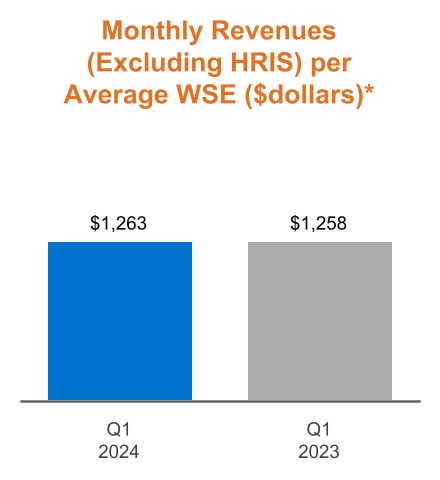

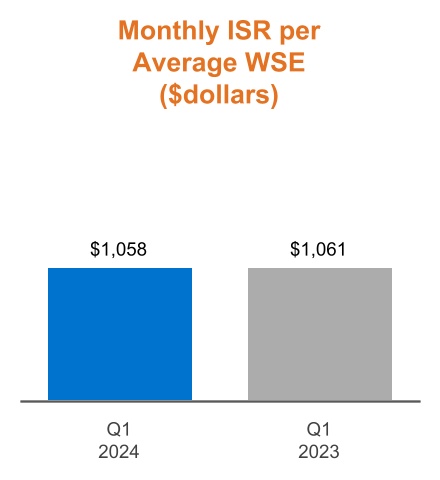

Monthly total revenues per Average WSE is a measure we use to monitor our PEO pricing strategies. This measure was flat during the first quarter of 2024 compared to the same period in 2023.

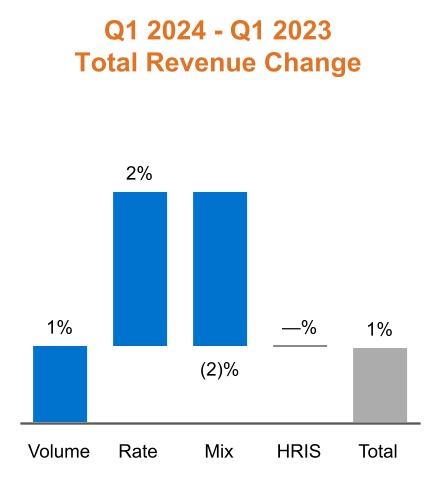

We also use the following measures to further analyze changes in total revenue:

•Volume - the percentage change in period over period co-employed Average WSEs,

•Rate - the combined weighted average percentage changes in service fees for each vertical service and changes in service fees associated with each insurance service offering,

•Mix - the change in composition of Average WSEs within our verticals combined with the composition of our enrolled WSEs within our insurance service offerings and the composition of products and services our clients receive, including TriNet Clarus R+D, and

•HRIS - incremental HRIS cloud services revenue.

|

|

|

|

|

|

|

|

|

|

|

|

| TRINET |

14 |

2024 Q1 FORM 10-Q |

|

|

|

|

|

|

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PSR |

|

|

|

|

|

|

|

|

|

|

ISR - % represents proportion of insurance service revenues to total revenues |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*Total revenues generated from PEO services only |

|

|

The increase in total revenue for the first quarter of 2024 was primarily driven by rate increases, partially offset by lower health plan enrollment.

Operating Income

Our operating income consists of total revenues less insurance costs and OE. Our insurance costs include insurance premiums for coverage provided by insurance carriers, expenses for claims costs and risk management and administrative services, and changes in accrued costs related to contractual obligations with our workers' compensation and health benefit carriers. Our OE consists primarily of our colleagues' compensation related expenses, which includes payroll, payroll taxes, SBC, bonuses, commissions and other payroll-and benefits-related costs.

The table below provides a view of the changes in components of operating income for the first quarter of 2024, as compared to the same period in 2023.

|

|

|

|

|

|

|

|

|

|

| (in millions) |

|

| $169 |

|

First Quarter 2023 Operating Income |

|

+18 |

|

|

Higher total revenues primarily driven by rate increases from our PEO services, partially offset by lower health plan enrollment. |

|

-55 |

|

|

Higher insurance costs primarily driven by higher health insurance utilization and rate inflation. |

|

-10 |

|

|

OE increased due to higher compensation expenses partially offset by lower transaction and integration costs and discretionary spending. |

| $122 |

|

First Quarter 2024 Operating Income |

|

|

|

|

|

|

|

|

|

|

|

|

| TRINET |

15 |

2024 Q1 FORM 10-Q |

|

|

|

|

|

|

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

|

Professional Service Revenues

Our PEO and HRIS clients are primarily billed on a fee per WSE or HRIS User per month per transaction. Our vertical approach provides us the flexibility to offer our PEO clients in different industries with varied services at different prices, which we believe potentially reduces the value of solely using Average WSE and Total WSE counts as indicators of future potential revenue performance.

PSR from PEO Services customers and HRIS cloud services clients was as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

| (in millions) |

2024 |

2023 |

|

|

|

| PEO Services |

$ |

203 |

|

$ |

193 |

|

|

|

|

HRIS Cloud Services |

11 |

|

12 |

|

|

|

|

| Total |

$ |

214 |

|

$ |

205 |

|

|

|

|

We also analyze changes in PSR with the following measures:

•Volume - the percentage change in period over period co-employed Average WSEs,

•Rate - the weighted average percentage change in fees for each vertical,

•Mix - the change in composition of Average WSEs across our verticals and the composition of products and services our clients receive, including TriNet Clarus R+D, and

•HRIS - incremental HRIS cloud services revenue.

The increase in PSR for the first quarter of 2024 was primarily driven by higher Average WSEs and rates, partially offset by changes in composition of Average WSEs across our verticals and the composition of products and services our clients receive, including TriNet Clarus R+D.

Insurance Service Revenues

ISR consists of insurance services-related billings and administrative fees collected from PEO clients and withheld from WSE payroll for health benefits and workers' compensation insurance provided by third-party insurance carriers.

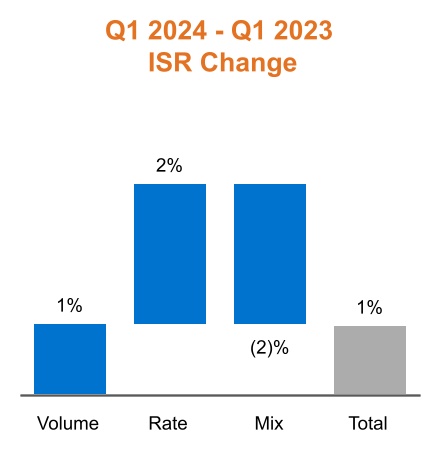

We use the following measures to analyze changes in ISR:

•Volume - the percentage change in period over period co-employed Average WSEs,

•Rate - the weighted average percentage change in fees associated with each of our insurance service offerings, and

•Mix - all other changes including the composition of our enrolled WSEs within our insurance service offerings (health plan enrollment).

|

|

|

|

|

|

|

|

|

|

|

|

| TRINET |

16 |

2024 Q1 FORM 10-Q |

|

|

|

|

|

|

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

|

The increase in ISR for the first quarter was primarily driven by rate increases, partially offset by lower health plan enrollment.

Insurance Costs

Insurance costs include insurance premiums for coverage provided by insurance carriers, payments for claims costs and expenses for other risk management and administrative services, reimbursement of claims payments made by insurance carriers or third-party administrators below a predefined deductible limit, and changes in accrued costs related to contractual obligations with our workers' compensation and health benefit carriers.

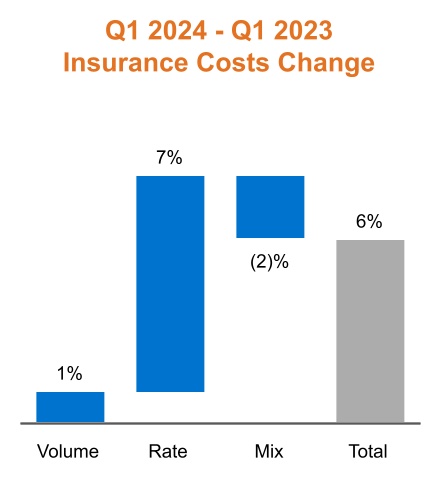

We use the following measures to analyze changes in insurance costs:

•Volume - the percentage change in period over period co-employed Average WSEs,

•Rate - the weighted average percentage change in cost trend associated with each of our insurance service offerings, and

•Mix - all other changes including the composition of our enrolled WSEs within our insurance service offerings (health plan enrollment).

Insurance costs increased for the first quarter, primarily due to higher utilization, primarily due to prescription and outpatient services as well as inflationary increases in rates paid for services. This was partially offset by lower health plan enrollment.

|

|

|

|

|

|

|

|

|

|

|

|

| TRINET |

17 |

2024 Q1 FORM 10-Q |

|

|

|

|

|

|

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

|

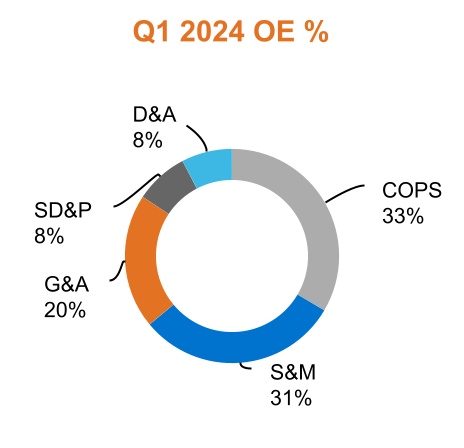

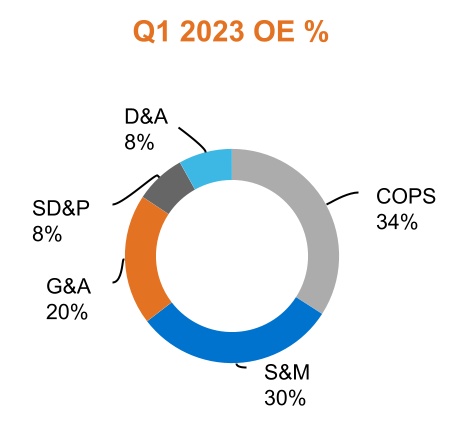

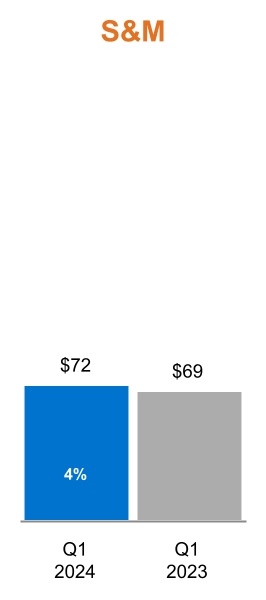

Operating Expenses

OE includes COPS, S&M, G&A, SD&P, and D&A.

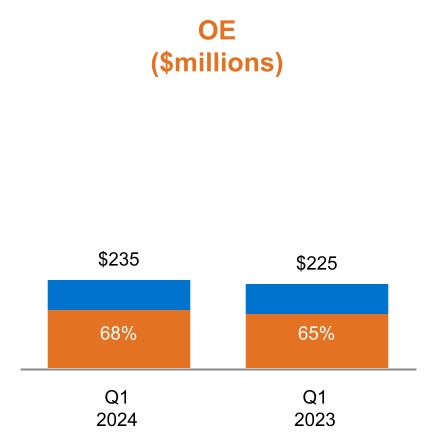

We had approximately 3,600 colleagues as of March 31, 2024 primarily across the U.S. but also in India and Canada. Compensation costs for our colleagues include payroll, payroll taxes, SBC, bonuses, commissions and other payroll- and benefits-related costs. Compensation-related expense represented 68% and 65% of our OE in the first quarters of 2024 and 2023, respectively.

Transaction and integration costs associated with our acquisitions of Zenefits and Clarus R+D are included in G&A. These costs include advisory, legal, and employee retention costs tied to ongoing employment.

During the first quarter of 2024 , OE increased 4% when compared to the same period in 2023. The ratio of OE to total revenues was 19% for the first quarters of 2024 and 2023.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% represents portion of compensation related expense included in operating expenses |

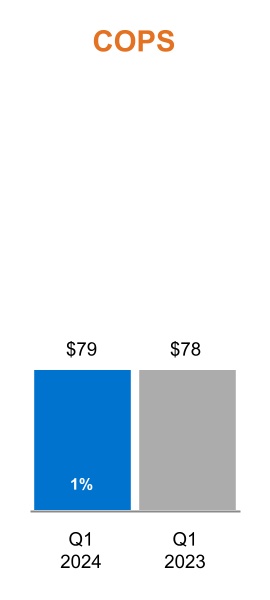

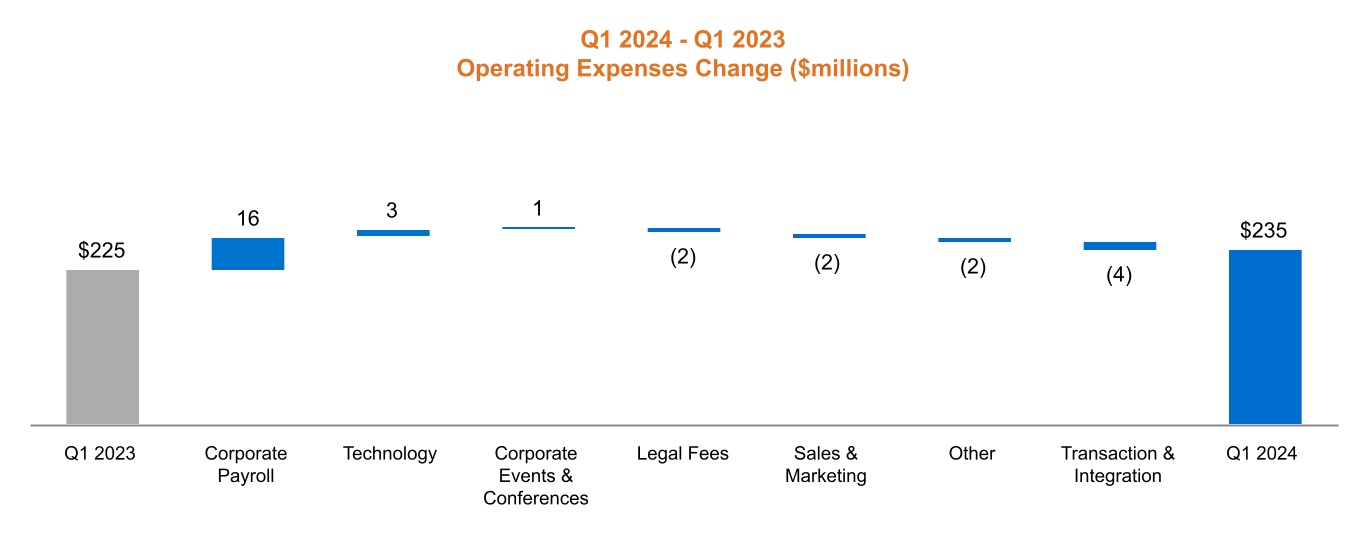

We analyze and present our OE based upon the business functions COPS, S&M, G&A and SD&P and D&A. The charts below provide a view of the expenses of the business functions. Dollars are presented in millions and percentages represent year-over-year change.

|

|

|

|

|

|

|

|

|

|

|

|

| TRINET |

18 |

2024 Q1 FORM 10-Q |

|

|

|

|

|

|

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

|

|

|

|

|

|

|

|

|

|

| (in millions) |

|

| $225 |

Q1 2023 Operating Expenses |

|

+1 |

|

COPS increased slightly due to higher compensation expense. |

|

+3 |

|

S&M increased, driven primarily by higher compensation to support our sales force together with higher corporate events expenses, partially offset by lower advertising costs. |

|

+5 |

|

G&A increased due to higher compensation expense partially offset by lower transaction and integration expense. |

|

+1 |

|

SD&P was consistent with the prior period as higher compensation expense was offset by lower consulting expense. |

|

— |

|

D&A was consistent with the prior period. |

|

$235 |

Q1 2024 Operating Expense |

The primary spend type drivers to the changes in our OE are presented below:

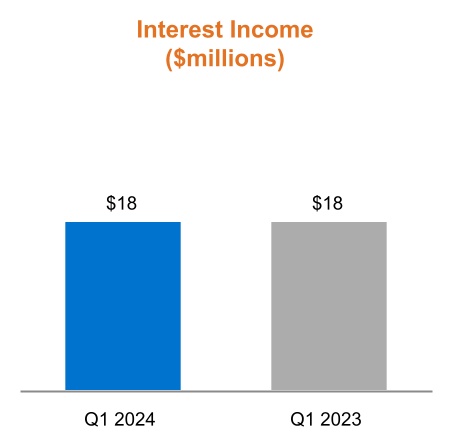

Other Income (Expense)

Other income (expense) consists primarily of interest income from cash and investments and interest expense on our outstanding debt.

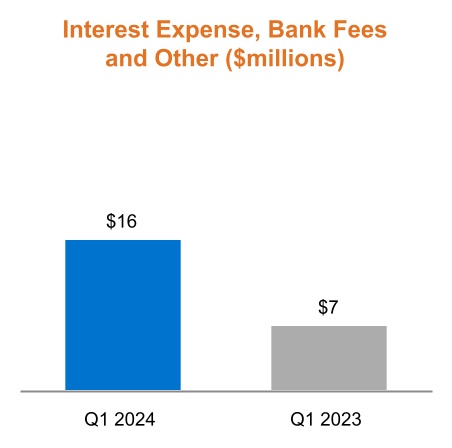

Interest income for the first quarter of 2024 was consistent with the prior period. The higher interest expense, bank fees and other for the first quarter of 2024 was primarily due to the additional interest on our 2031 Notes issued in the third quarter of 2023.

|

|

|

|

|

|

|

|

|

|

|

|

| TRINET |

19 |

2024 Q1 FORM 10-Q |

|

|

|

|

|

|

| MANAGEMENT'S DISCUSSION AND ANALYSIS |

|

Income Taxes