0000936528false00009365282024-02-132024-02-130000936528us-gaap:CommonStockMember2024-02-132024-02-130000936528us-gaap:SeriesAPreferredStockMember2024-02-132024-02-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________

FORM 8-K

____________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 13, 2024

____________________________________

WAFD, INC.

(Exact name of registrant as specified in its charter)

____________________________________

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Washington |

001-34654 |

91-1661606 |

|

(State or other jurisdiction of incorporation or organization) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

|

|

|

425 Pike Street |

Seattle |

Washington |

98101 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s telephone number, including area code (206) 624-7930

Not Applicable

(Former name or former address, if changed since last report)

____________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Title of Each Class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Common Stock, $1.00 par value per share |

|

WAFD |

|

NASDAQ Stock Market |

| Depositary Shares, Each Representing a 1/40th Interest in a Share of 4.875% Fixed Rate Series A Non-Cumulative Perpetual Preferred Stock |

|

WAFDP |

|

NASDAQ Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

|

|

|

|

| Item 5.07 |

Submission of Matters to a Vote of Security Holders |

The Annual Meeting of Shareholders of WaFd, Inc. (the "Company") was held on February 13, 2024. The four items voted upon by shareholders included 1) the election of three directors for a three-year term; 2) the approval of a non-binding, advisory vote on the compensation of WaFd, Inc. named executive officers; 3) the ratification of the appointment of Deloitte & Touche, LLP as the independent registered public accountants for fiscal 2024; and 4) the approval of a non-binding advisory vote on the frequency of future advisory votes on the compensation of the named executive officers of the Company. The results of the voting were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Votes Cast |

|

|

|

Votes |

|

Total |

Broker |

|

|

For |

|

Against |

|

|

|

Withheld |

|

Votes Cast |

Non-votes |

| Election of Directors |

|

|

|

|

|

|

|

|

|

|

|

Three-year term: |

|

|

|

|

|

|

|

|

|

|

|

| Brent J. Beardall |

|

52,381,970 |

|

|

— |

|

|

|

|

1,224,401 |

|

|

53,606,371 |

|

4,554,785 |

|

| Sylvia R. Hampel |

|

52,122,155 |

|

|

— |

|

|

|

|

1,484,216 |

|

|

53,606,371 |

|

4,554,785 |

|

| S. Steven Singh |

|

51,017,028 |

|

|

— |

|

|

|

|

2,589,343 |

|

|

53,606,371 |

|

4,554,785 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Votes Cast |

|

|

|

|

|

Total |

|

|

|

For |

|

Against |

|

|

|

Abstained |

|

Votes Cast |

|

| Non-binding advisory vote on |

|

|

|

|

|

|

|

|

|

|

|

| executive compensation |

|

50,789,766 |

|

|

2,683,328 |

|

|

|

|

133,277 |

|

|

53,606,371 |

|

|

| Ratify appointment of |

|

|

|

|

|

|

|

|

|

|

|

| Deloitte & Touche, LLP |

|

57,105,096 |

|

|

1,009,082 |

|

|

|

|

46,978 |

|

|

58,161,156 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Votes Cast |

|

|

|

Total |

|

|

|

3 Years |

|

2 Years |

|

1 Year |

|

Abstained |

|

Votes Cast |

|

| Non-binding advisory vote on |

|

|

|

|

|

|

|

|

|

|

|

| frequency of advisory |

|

|

|

|

|

|

|

|

|

|

|

| votes on exec. compensation |

|

7,674,043 |

|

|

166,599 |

|

|

45,633,095 |

|

|

132,634 |

|

|

53,606,371 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Based on the results above, all of the Board of Directors' recommendations were approved by shareholders.

The Company is hereby furnishing the slide presentation used in the Annual Meeting of Shareholders. The slide presentation is included as Exhibit 99.1 to this report and shall not be deemed to be "filed" for the purposes of Section 18 of the Exchange Act, or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

|

|

|

|

|

|

| Item 9.01 |

Financial Statements and Exhibits |

(d) The following exhibits are being filed herewith:

|

|

|

|

|

|

|

|

| 104 |

Cover Page Interactive Data File (formatted as inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| February 14, 2024 |

|

|

|

WAFD, INC. |

|

|

|

|

|

|

|

|

By: |

|

/s/ KELLI J. HOLZ |

|

|

|

|

|

|

Kelli J. Holz |

|

|

|

|

|

|

Executive Vice President

and Chief Financial Officer |

EX-99.1

2

feb2024annualmeetingfina.htm

EX-99.1

feb2024annualmeetingfina

Annual Shareholder Meeting February 13, 2024

Executive Management Committee 2 Kelli Holz Executive Vice President Chief Financial Officer Brent Beardall President and Chief Executive Officer Ryan Mauer Executive Vice President Chief Credit Officer Cathy Cooper Executive Vice President Chief Consumer Banker Kim Robison Executive Vice President Chief Operating Officer James Endrizzi Executive Vice President Chief Commercial Banker

Board of Directors Brent Beardall Stephen M. Graham David Grant Mark N. Tabbutt Randy H. Talbot Steve Singh Linda Brower Sylvia Hampel Sean Singleton Shawn Bice 3

4 The annual report and proxy are at www.wafdbank.com or request a physical copy by emailing info@wafd.com . Anyone who wishes to revoke their proxy or who hasn’t voted must click on the “Vote Now” screen during this meeting prior to closing of the polls. Have your 16-digit control number handy. If you have already voted, you do not need to vote again. There are approximately 64.2 million shares entitled to vote at this meeting. Notice was mailed to each stockholder of record as of December 11, 2023; this meeting is therefore lawfully convened. 2024 Annual Meeting Business 4

5 1. To elect three directors for a three-year term ending in 2027, or until their successors are elected and qualified; 2. To approve, by a non-binding advisory vote, the compensation of the Named Executive Officers of the Company; 3. To ratify the appointment of Deloitte & Touche LLP as the Company's independent registered public accountants for fiscal year 2024. 4. To approve, by a non-binding advisory vote, the frequency of future advisory votes on the compensation of the Named Executive Officers of the Company. 2024 Annual Meeting Business 5

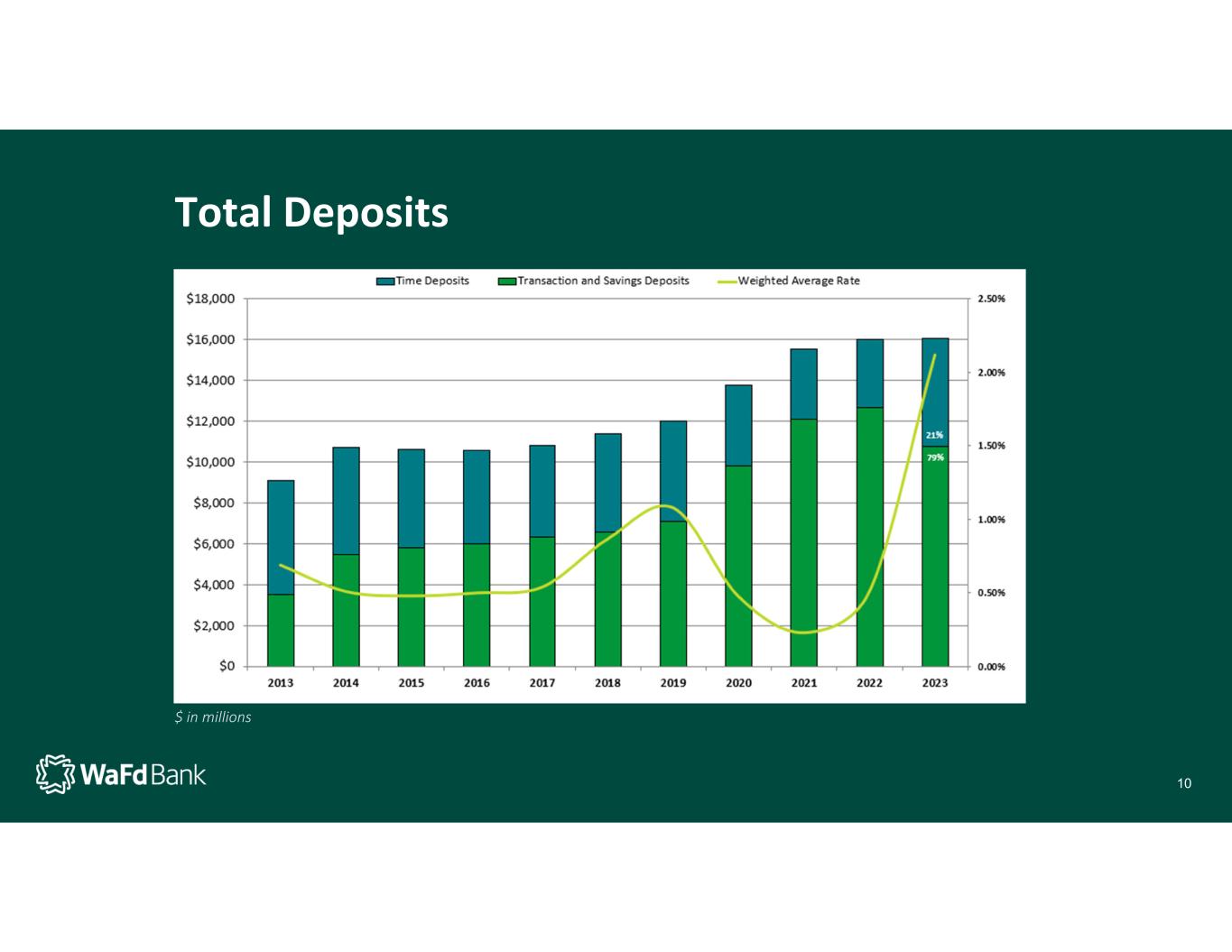

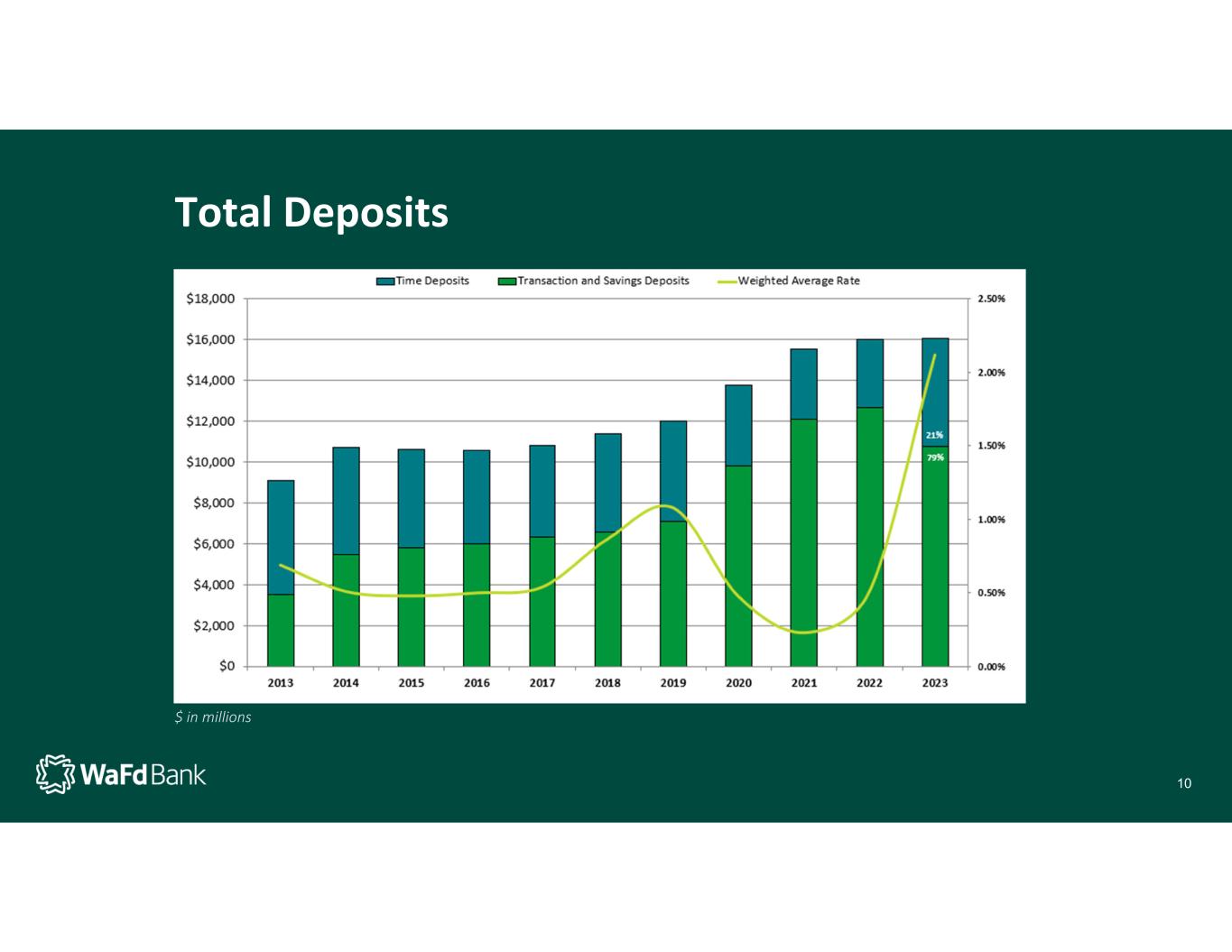

Highlights for Fiscal 2023 Record annual earnings to common shareholders of $257 million - 9.7% EPS growth Total deposits of $16.1 billion Insured or collateralized Deposits of 74% 10% Growth in tangible book value per share Net Promoter Score – all time high of 57 6

Banking Turmoil of Spring 2023 2nd and 3rd Largest Failures in US banking History Questions about deposit insurance Questions about asset quality, specifically office exposure Segmentation of banks WaFd Response Listen to our clients and respond accordingly Actions and results speak louder than words Finished the year with record profits and growth in deposits 7

Net Loans Outstanding $ in millions 8

Non-Performing Assets Near Record Lows Delinquent Loans $63 million or 0.36% of Net Loans as of 9/30/2023Non-Performing Assets to Total Assets and ACL to Total Loans 1 9

Total Deposits $ in millions 10

Net Promoter Score Approaching Best in Class 11 Our investments in customer service, usability and technology continue to translate into high customer satisfaction levels 11

Capital Ratios WaFd Bank does not seek to maximize leverage. Rather, we aspire to be a bank that can weather the storm that will inevitably come. Consistency, in good times and bad, is a differentiator. 12

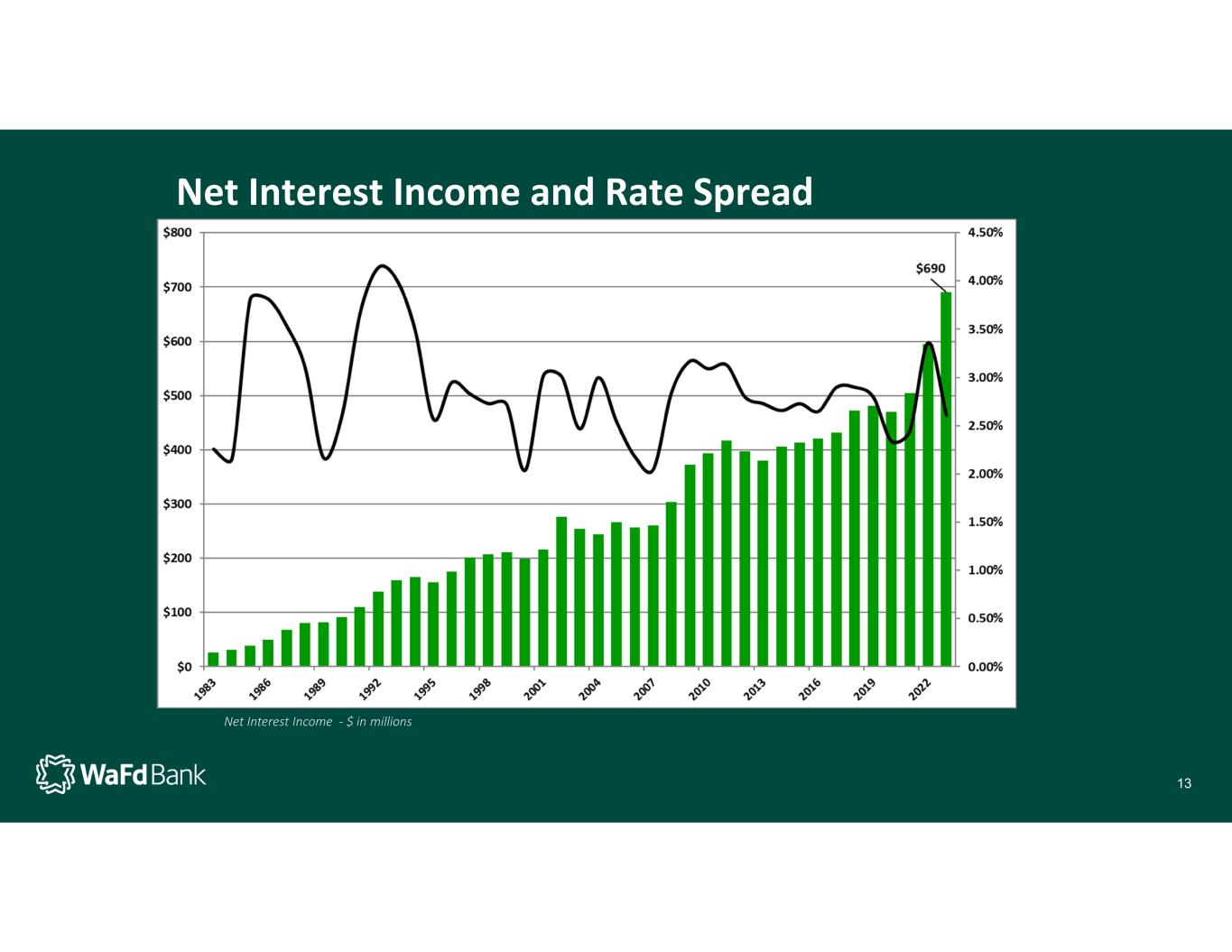

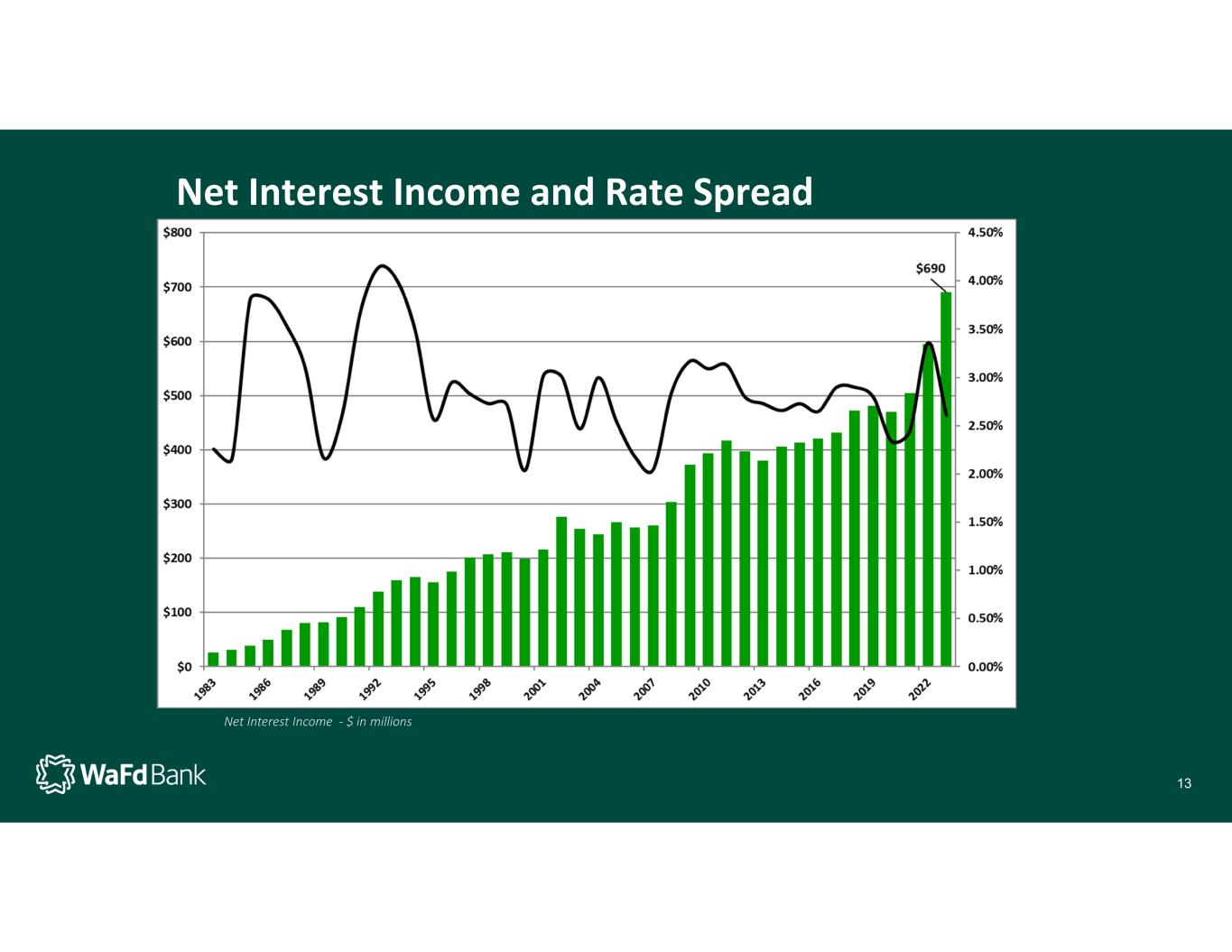

Net Interest Income and Rate Spread Net Interest Income - $ in millions 13

Earnings Per Common Share 14

Stock Price and Book Value per Share 15

Subsequent Events 16

What To Expect in 2024? Challenging interest rate environment Focus on deposits growth and on small business banking Foundational Credit quality Intentionally tempering loan growth Create raving fans - client experience Integration of Luther Burbank and growth in California Learning from 2023 bank failures 17

Thank you to our clients and the 2,100 bankers that made these results possible. Earning your trust is foundational to our success. We believe our future is as bright today as it has ever been. 18

Preliminary Results of Shareholder Voting: 1. To elect three directors for a three-year term ending in 2027, or until their successors are elected and qualified; 2. To approve, by a non-binding advisory vote, the compensation of the Named Executive Officers of the Company; 3. To ratify the appointment of Deloitte & Touche LLP as the Company's independent registered public accountants for fiscal year 2024. 4. To approve, by a non-binding advisory vote, the frequency of future advisory votes on the compensation of the Named Executive Officers of the Company. 19

Q&A Please type your questions in the chat window.

Thank you. Enjoy 2024.