Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): | |||||||||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

||||||||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

||||||||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

||||||||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||||||||

| Securities registered pursuant to Section 12(b) of the Act: | ||||||||

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

||||||

Common stock, $0.01 par value |

CIEN |

New York Stock Exchange |

||||||

Exhibit Number |

Description of Document |

||||||||||

Exhibit 99.1 |

|

||||||||||

Exhibit 99.2 |

|

||||||||||

| Exhibit 99.3 | |||||||||||

Exhibit 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document). | ||||||||||

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized. | ||

Ciena Corporation |

||||||||

Date: September 4, 2024 |

By: |

/s/ Sheela Kosaraju | ||||||

Sheela Kosaraju |

||||||||

Senior Vice President, General Counsel and Assistant Secretary |

||||||||

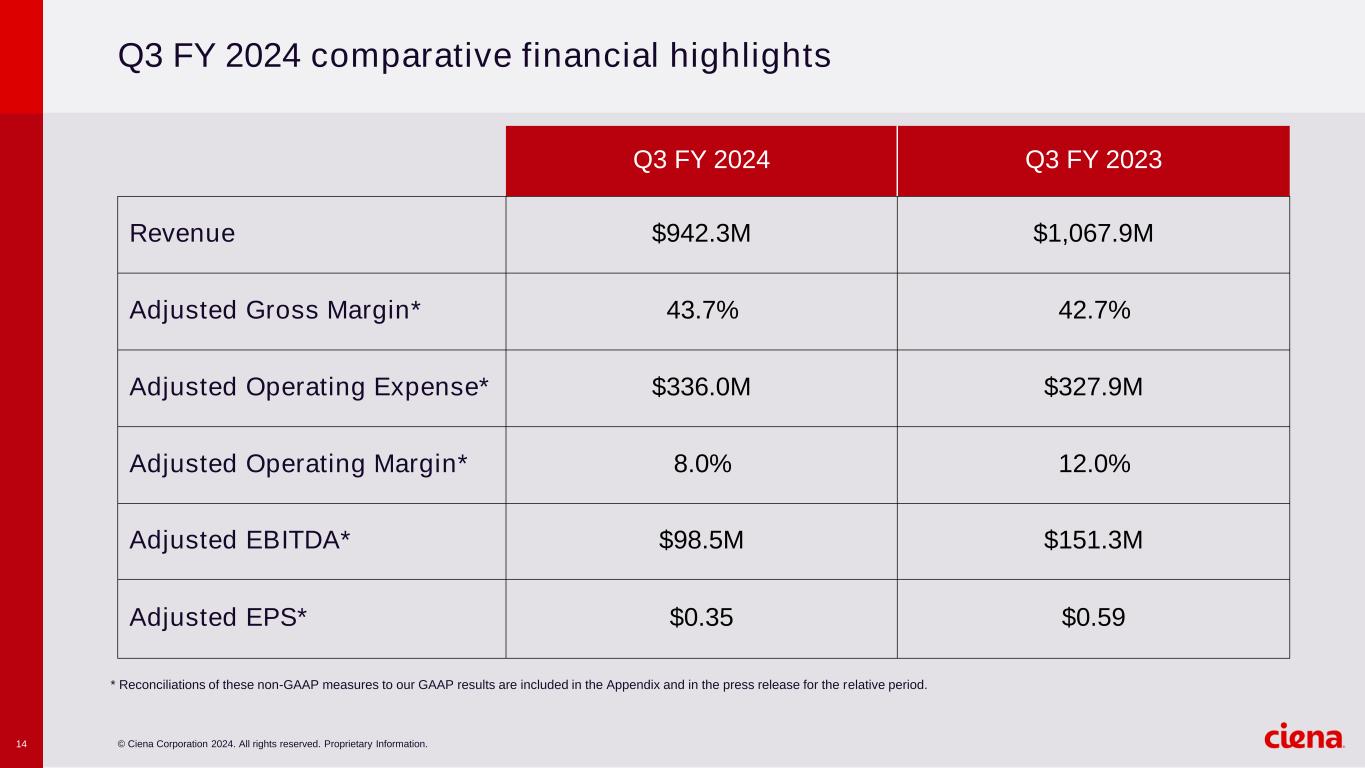

| GAAP Results (unaudited) | ||||||||||||||||||||

| Q3 | Q3 | Period Change | ||||||||||||||||||

| FY 2024 | FY 2023 | Y-T-Y* | ||||||||||||||||||

| Revenue | $ | 942.3 | $ | 1,067.9 | (11.8) | % | ||||||||||||||

| Gross margin | 42.9 | % | 42.0 | % | 0.9 | % | ||||||||||||||

| Operating expense | $ | 377.2 | $ | 370.7 | 1.7 | % | ||||||||||||||

| Operating margin | 2.9 | % | 7.3 | % | (4.4) | % | ||||||||||||||

| Non-GAAP Results (unaudited) | ||||||||||||||||||||

| Q3 | Q3 | Period Change | ||||||||||||||||||

| FY 2024 | FY 2023 | Y-T-Y* | ||||||||||||||||||

| Revenue | $ | 942.3 | $ | 1,067.9 | (11.8) | % | ||||||||||||||

| Adj. gross margin | 43.7 | % | 42.7 | % | 1.0 | % | ||||||||||||||

| Adj. operating expense | $ | 336.0 | $ | 327.9 | 2.5 | % | ||||||||||||||

| Adj. operating margin | 8.0 | % | 12.0 | % | (4.0) | % | ||||||||||||||

| Adj. EBITDA | $ | 98.5 | $ | 151.3 | (34.9) | % | ||||||||||||||

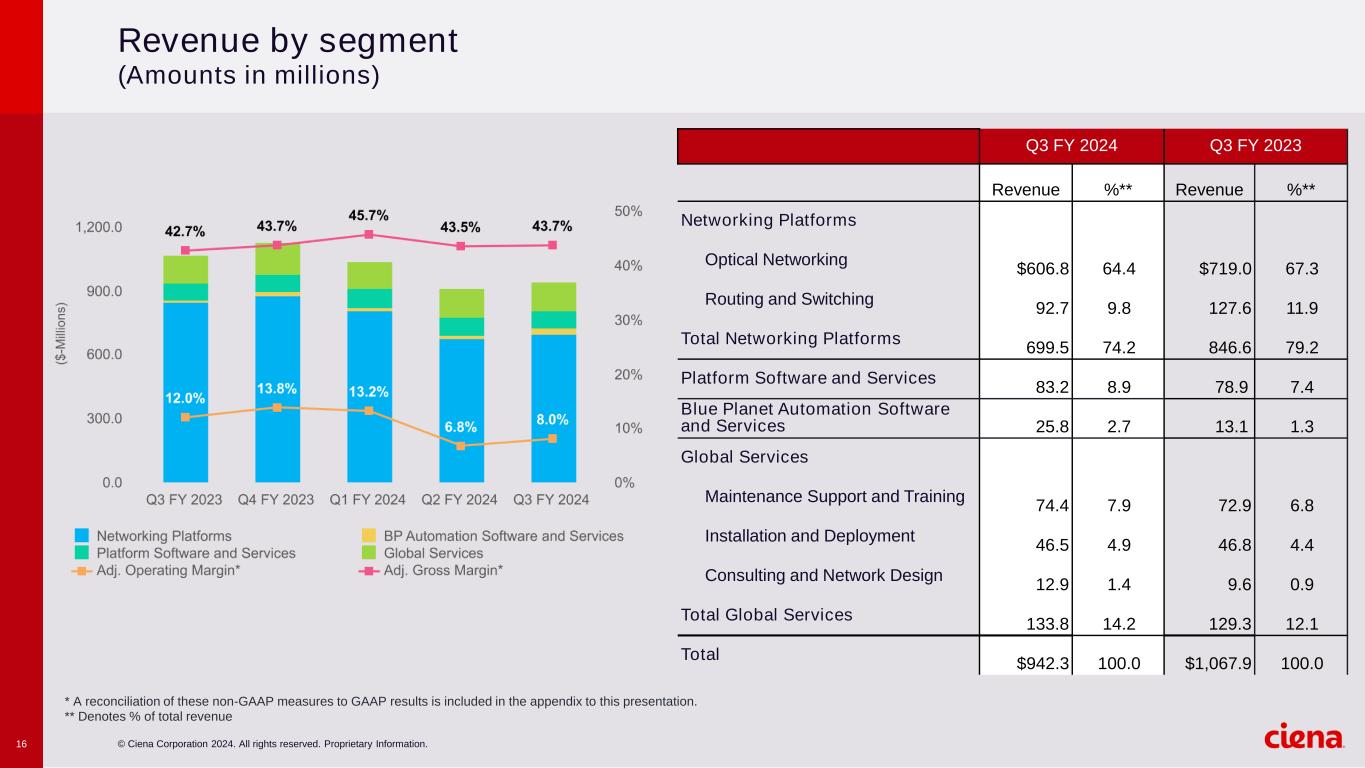

| Revenue by Segment (unaudited) | ||||||||||||||||||||||||||

| Q3 FY 2024 | Q3 FY 2023 | |||||||||||||||||||||||||

| Revenue | %** | Revenue | %** | |||||||||||||||||||||||

| Networking Platforms | ||||||||||||||||||||||||||

| Optical Networking | $ | 606.8 | 64.4 | $ | 719.0 | 67.3 | ||||||||||||||||||||

| Routing and Switching | 92.7 | 9.8 | 127.6 | 11.9 | ||||||||||||||||||||||

| Total Networking Platforms | 699.5 | 74.2 | 846.6 | 79.2 | ||||||||||||||||||||||

| Platform Software and Services | 83.2 | 8.9 | 78.9 | 7.4 | ||||||||||||||||||||||

| Blue Planet Automation Software and Services | 25.8 | 2.7 | 13.1 | 1.3 | ||||||||||||||||||||||

| Global Services | ||||||||||||||||||||||||||

| Maintenance Support and Training | 74.4 | 7.9 | 72.9 | 6.8 | ||||||||||||||||||||||

| Installation and Deployment | 46.5 | 4.9 | 46.8 | 4.4 | ||||||||||||||||||||||

| Consulting and Network Design | 12.9 | 1.4 | 9.6 | 0.9 | ||||||||||||||||||||||

| Total Global Services | 133.8 | 14.2 | 129.3 | 12.1 | ||||||||||||||||||||||

| Total | $ | 942.3 | 100.0 | $ | 1,067.9 | 100.0 | ||||||||||||||||||||

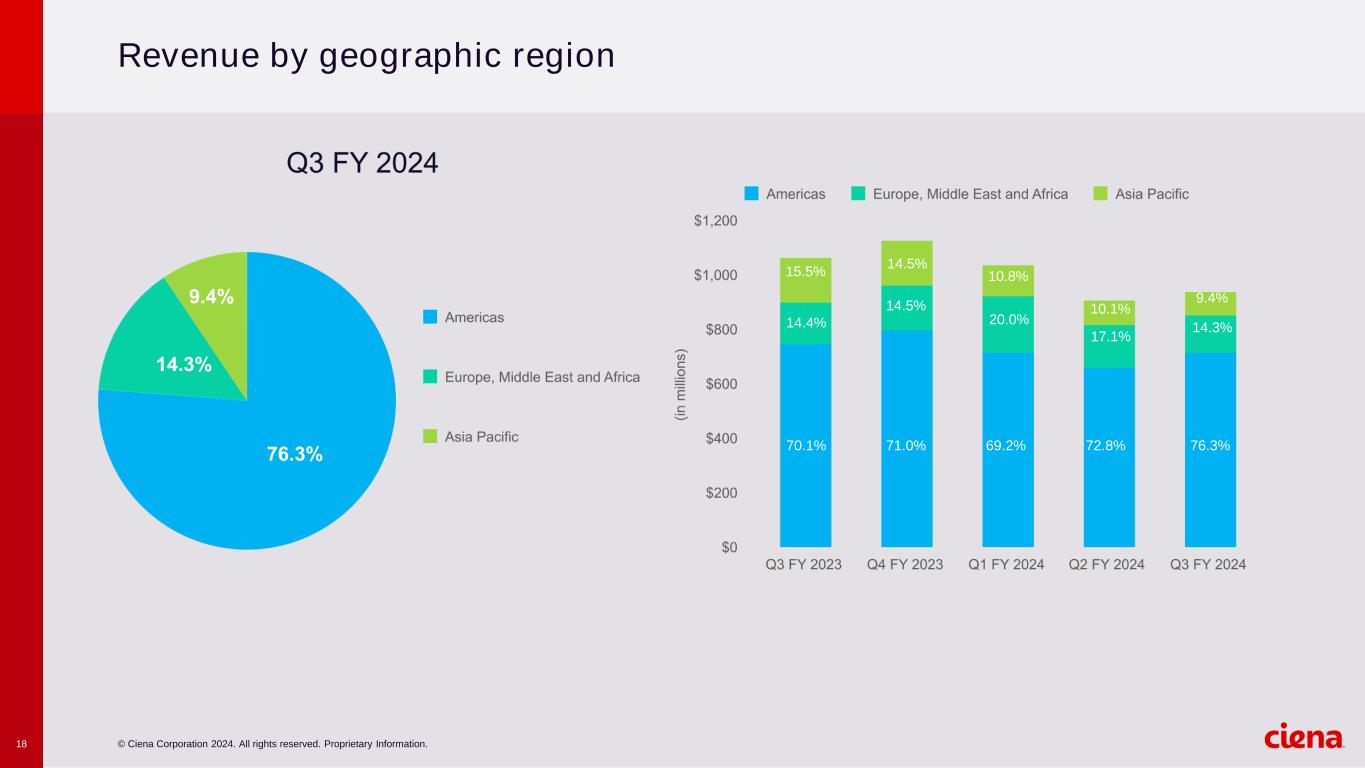

| Revenue by Geographic Region (unaudited) | ||||||||||||||||||||||||||

| Q3 FY 2024 | Q3 FY 2023 | |||||||||||||||||||||||||

| Revenue | % ** | Revenue | % ** | |||||||||||||||||||||||

| Americas | $ | 718.6 | 76.3 | $ | 749.5 | 70.2 | ||||||||||||||||||||

| Europe, Middle East and Africa | 135.0 | 14.3 | 152.8 | 14.3 | ||||||||||||||||||||||

| Asia Pacific | 88.7 | 9.4 | 165.6 | 15.5 | ||||||||||||||||||||||

| Total | $ | 942.3 | 100.0 | $ | 1,067.9 | 100.0 | ||||||||||||||||||||

| Quarter Ended | Nine Months Ended | ||||||||||||||||||||||

| July 27, | July 29, | July 27, | July 29, | ||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Revenue: | |||||||||||||||||||||||

| Products | $ | 729,503 | $ | 865,197 | $ | 2,266,596 | $ | 2,678,242 | |||||||||||||||

| Services | 212,805 | 202,689 | 624,247 | 578,820 | |||||||||||||||||||

| Total revenue | 942,308 | 1,067,886 | 2,890,843 | 3,257,062 | |||||||||||||||||||

| Cost of goods sold: | |||||||||||||||||||||||

| Products | 433,533 | 516,900 | 1,315,737 | 1,559,120 | |||||||||||||||||||

| Services | 104,830 | 102,045 | 315,538 | 305,372 | |||||||||||||||||||

| Total cost of goods sold | 538,363 | 618,945 | 1,631,275 | 1,864,492 | |||||||||||||||||||

| Gross profit | 403,945 | 448,941 | 1,259,568 | 1,392,570 | |||||||||||||||||||

| Operating expenses: | |||||||||||||||||||||||

| Research and development | 188,888 | 189,392 | 571,537 | 561,115 | |||||||||||||||||||

| Selling and marketing | 121,520 | 118,266 | 373,749 | 367,156 | |||||||||||||||||||

| General and administrative | 58,248 | 49,349 | 162,504 | 151,184 | |||||||||||||||||||

| Significant asset impairments and restructuring costs | 1,361 | 4,174 | 21,987 | 16,625 | |||||||||||||||||||

| Amortization of intangible assets | 7,185 | 9,487 | 22,384 | 26,773 | |||||||||||||||||||

| Acquisition and integration costs | — | 59 | — | 3,474 | |||||||||||||||||||

| Total operating expenses | 377,202 | 370,727 | 1,152,161 | 1,126,327 | |||||||||||||||||||

| Income from operations | 26,743 | 78,214 | 107,407 | 266,243 | |||||||||||||||||||

| Interest and other income, net | 14,013 | 10,187 | 36,460 | 50,711 | |||||||||||||||||||

| Interest expense | (24,401) | (24,060) | (72,038) | (63,819) | |||||||||||||||||||

| Income before income taxes | 16,355 | 64,341 | 71,829 | 253,135 | |||||||||||||||||||

| Provision for income taxes | 2,125 | 34,608 | 24,901 | 89,507 | |||||||||||||||||||

| Net income | $ | 14,230 | $ | 29,733 | $ | 46,928 | $ | 163,628 | |||||||||||||||

| Net Income per Common Share | |||||||||||||||||||||||

| Basic net income per common share | $ | 0.10 | $ | 0.20 | $ | 0.32 | $ | 1.09 | |||||||||||||||

| Diluted net income per potential common share | $ | 0.10 | $ | 0.20 | $ | 0.32 | $ | 1.09 | |||||||||||||||

| Weighted average basic common shares outstanding | 144,394 | 149,690 | 144,876 | 149,472 | |||||||||||||||||||

Weighted average dilutive potential common shares outstanding 1 |

145,361 | 149,977 | 145,795 | 149,867 | |||||||||||||||||||

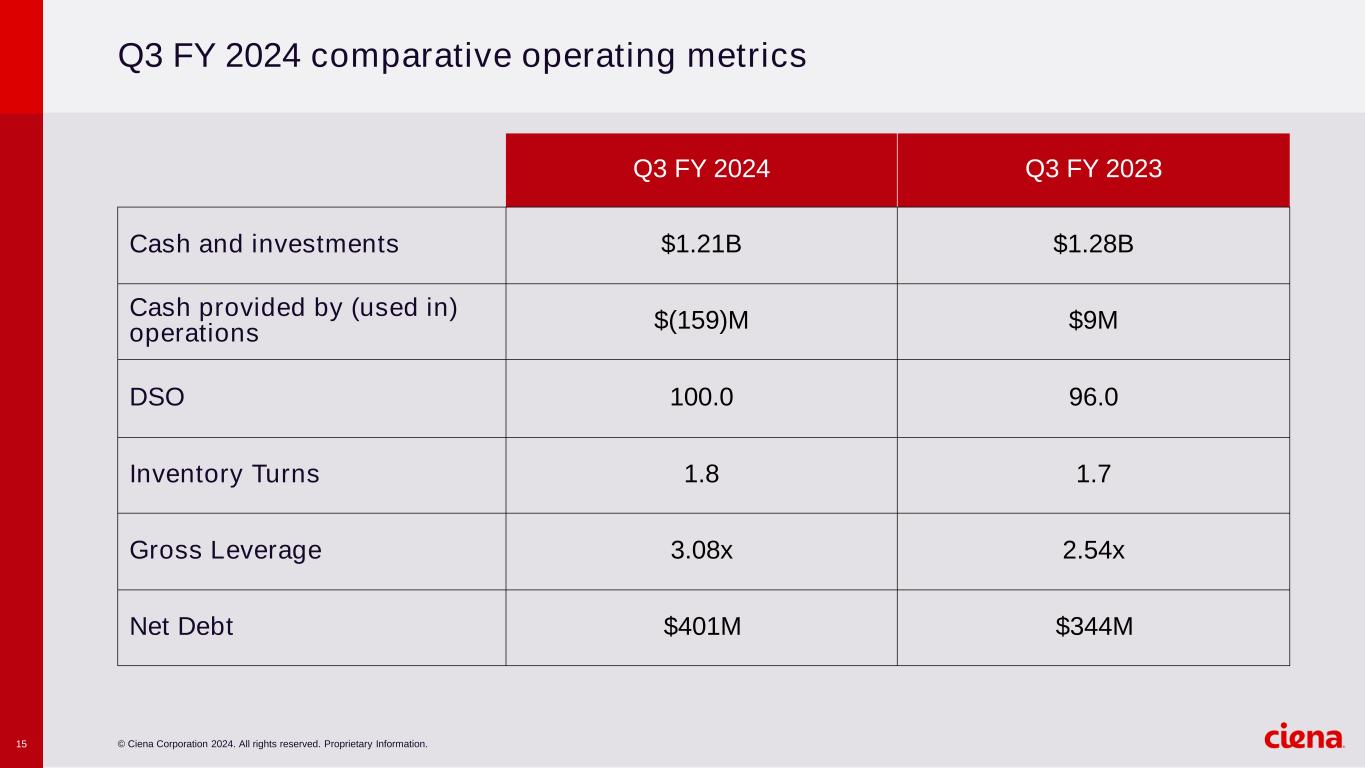

| July 27, 2024 |

October 28, 2023 |

||||||||||

| ASSETS | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | 883,365 | $ | 1,010,618 | |||||||

| Short-term investments | 217,810 | 104,753 | |||||||||

| Accounts receivable, net | 899,877 | 1,003,876 | |||||||||

| Inventories, net | 937,399 | 1,050,838 | |||||||||

| Prepaid expenses and other | 600,008 | 405,694 | |||||||||

| Total current assets | 3,538,459 | 3,575,779 | |||||||||

| Long-term investments | 111,833 | 134,278 | |||||||||

| Equipment, building, furniture and fixtures, net | 299,161 | 280,147 | |||||||||

| Operating lease right-of-use assets | 28,717 | 35,140 | |||||||||

| Goodwill | 444,791 | 444,765 | |||||||||

| Other intangible assets, net | 174,974 | 205,627 | |||||||||

| Deferred tax asset, net | 831,682 | 809,306 | |||||||||

| Other long-term assets | 145,513 | 116,453 | |||||||||

| Total assets | $ | 5,575,130 | $ | 5,601,495 | |||||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||||||

| Current liabilities: | |||||||||||

| Accounts payable | $ | 316,599 | $ | 317,828 | |||||||

| Accrued liabilities and other short-term obligations | 347,238 | 431,419 | |||||||||

| Deferred revenue | 179,457 | 154,419 | |||||||||

| Operating lease liabilities | 15,565 | 16,655 | |||||||||

| Current portion of long-term debt | 11,700 | 11,700 | |||||||||

| Total current liabilities | 870,559 | 932,021 | |||||||||

| Long-term deferred revenue | 77,628 | 74,041 | |||||||||

| Other long-term obligations | 171,014 | 170,407 | |||||||||

| Long-term operating lease liabilities | 26,742 | 33,259 | |||||||||

| Long-term debt, net | 1,538,315 | 1,543,406 | |||||||||

| Total liabilities | 2,684,258 | 2,753,134 | |||||||||

| Stockholders’ equity: | |||||||||||

Preferred stock – par value $0.01; 20,000,000 shares authorized; zero shares issued and outstanding |

— | — | |||||||||

Common stock – par value $0.01; 290,000,000 shares authorized; 144,426,873 and 144,829,938 shares issued and outstanding |

1,444 | 1,448 | |||||||||

| Additional paid-in capital | 6,260,095 | 6,262,083 | |||||||||

| Accumulated other comprehensive loss | (40,192) | (37,767) | |||||||||

| Accumulated deficit | (3,330,475) | (3,377,403) | |||||||||

| Total stockholders’ equity | 2,890,872 | 2,848,361 | |||||||||

| Total liabilities and stockholders’ equity | $ | 5,575,130 | $ | 5,601,495 | |||||||

| Nine Months Ended | |||||||||||

| July 27, | July 29, | ||||||||||

| 2024 | 2023 | ||||||||||

| Cash flows provided by (used in) operating activities: | |||||||||||

| Net income | $ | 46,928 | $ | 163,628 | |||||||

| Adjustments to reconcile net income to net cash provided by (used in) operating activities: | |||||||||||

| Depreciation of equipment, building, furniture and fixtures, and amortization of leasehold improvements | 68,997 | 69,213 | |||||||||

| Share-based compensation expense | 115,433 | 95,405 | |||||||||

| Amortization of intangible assets | 30,675 | 36,274 | |||||||||

| Deferred taxes | (19,909) | (64,005) | |||||||||

| Provision for inventory excess and obsolescence | 35,400 | 18,767 | |||||||||

| Provision for warranty | 14,708 | 18,860 | |||||||||

| Gain on equity investments, net | — | (26,368) | |||||||||

| Other | 11,968 | 13,694 | |||||||||

| Changes in assets and liabilities: | |||||||||||

| Accounts receivable | 92,421 | (80,399) | |||||||||

| Inventories | 78,220 | (262,345) | |||||||||

| Prepaid expenses and other | (221,823) | 72,062 | |||||||||

| Operating lease right-of-use assets | 8,963 | 11,003 | |||||||||

| Accounts payable, accruals and other obligations | (112,352) | (133,880) | |||||||||

| Deferred revenue | 28,833 | 57,547 | |||||||||

| Short and long-term operating lease liabilities | (13,290) | (16,596) | |||||||||

| Net cash provided by (used in) operating activities | 165,172 | (27,140) | |||||||||

| Cash flows used in investing activities: | |||||||||||

| Payments for equipment, furniture, fixtures and intellectual property | (53,098) | (83,422) | |||||||||

| Purchases of investments | (197,303) | (119,240) | |||||||||

| Proceeds from sales and maturities of investments | 114,899 | 150,646 | |||||||||

| Settlement of foreign currency forward contracts, net | (362) | (3,272) | |||||||||

| Purchase of equity investments | (21,682) | — | |||||||||

| Acquisition of business, net of cash acquired | — | (230,048) | |||||||||

| Net cash used in investing activities | (157,546) | (285,336) | |||||||||

| Cash flows provided by (used in) financing activities: | |||||||||||

| Proceeds from issuance of term loan, net | — | 497,500 | |||||||||

| Payment of long term debt | (5,850) | (6,448) | |||||||||

| Payment of debt issuance costs | (2,554) | (5,422) | |||||||||

| Payment of finance lease obligations | (3,004) | (2,830) | |||||||||

| Shares repurchased for tax withholdings on vesting of stock unit awards | (33,450) | (29,794) | |||||||||

| Repurchases of common stock - repurchase program, net | (125,816) | (57,736) | |||||||||

| Proceeds from issuance of common stock | 34,292 | 31,276 | |||||||||

| Net cash provided by (used in) financing activities | (136,382) | 426,546 | |||||||||

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | 1,499 | 9,501 | |||||||||

| Net increase (decrease) in cash, cash equivalents and restricted cash | (127,257) | 123,571 | |||||||||

| Cash, cash equivalents and restricted cash at beginning of period | 1,010,786 | 994,378 | |||||||||

| Cash, cash equivalents and restricted cash at end of period | $ | 883,529 | $ | 1,117,949 | |||||||

| Supplemental disclosure of cash flow information | |||||||||||

| Cash paid during the period for interest, net | $ | 64,999 | $ | 56,709 | |||||||

| Cash paid during the period for income taxes, net | $ | 41,736 | $ | 68,058 | |||||||

| Operating lease payments | $ | 14,672 | $ | 18,038 | |||||||

| Non-cash investing and financing activities | |||||||||||

| Purchase of equipment in accounts payable | $ | 35,316 | $ | 4,579 | |||||||

| Repurchase of common stock in accrued liabilities from repurchase program, net | $ | 1,762 | $ | 3,500 | |||||||

| Operating right-of-use assets subject to lease liability | $ | 5,326 | $ | 9,771 | |||||||

| Gain on equity investments, net | $ | — | $ | 26,368 | |||||||

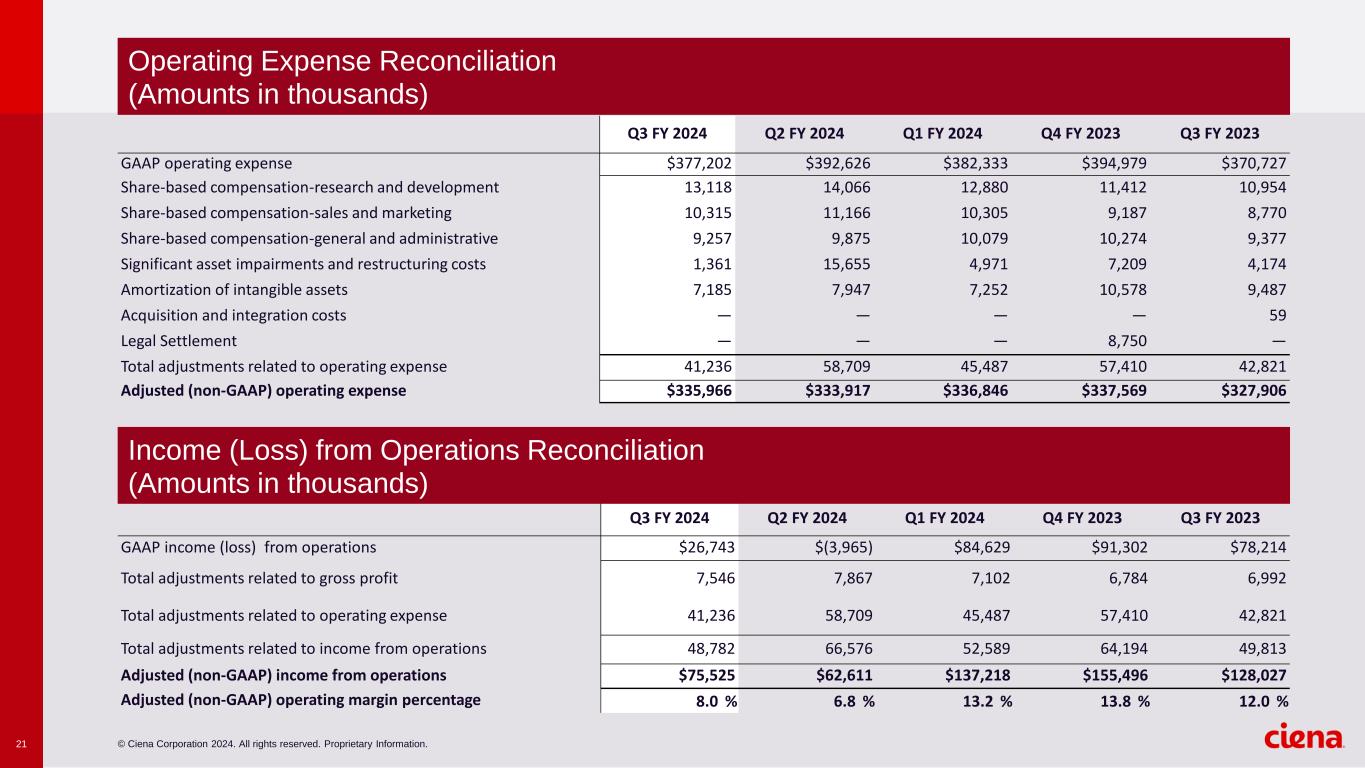

| APPENDIX A - Reconciliation of Adjusted (Non- GAAP) Measurements | ||||||||||||||

| (in thousands, except per share data) (unaudited) | ||||||||||||||

| Quarter Ended | ||||||||||||||

| July 27, | July 29, | |||||||||||||

| 2024 | 2023 | |||||||||||||

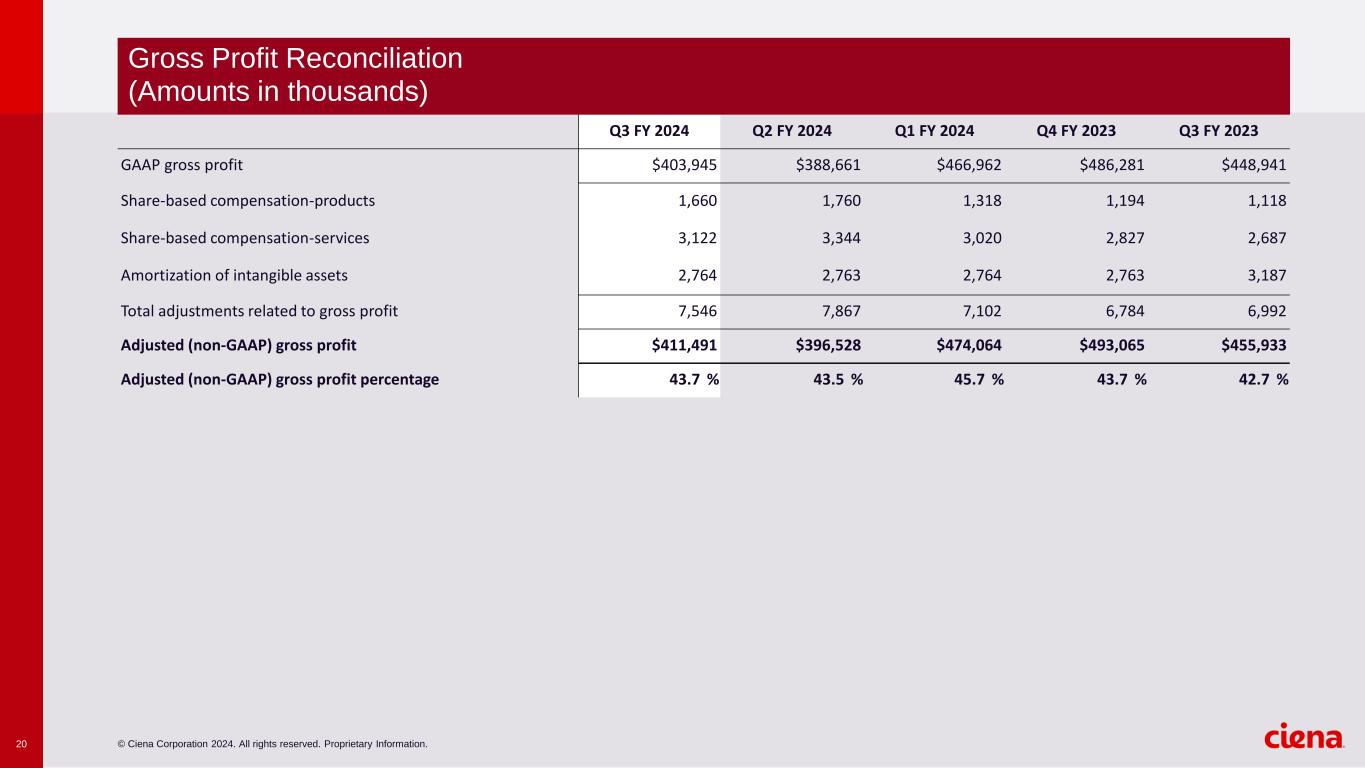

| Gross Profit Reconciliation (GAAP/non-GAAP) | ||||||||||||||

| GAAP gross profit | $ | 403,945 | $ | 448,941 | ||||||||||

| Share-based compensation-products | 1,660 | 1,118 | ||||||||||||

| Share-based compensation-services | 3,122 | 2,687 | ||||||||||||

| Amortization of intangible assets | 2,764 | 3,187 | ||||||||||||

| Total adjustments related to gross profit | 7,546 | 6,992 | ||||||||||||

| Adjusted (non-GAAP) gross profit | $ | 411,491 | $ | 455,933 | ||||||||||

| Adjusted (non-GAAP) gross profit percentage | 43.7 | % | 42.7 | % | ||||||||||

| Operating Expense Reconciliation (GAAP/non-GAAP) | ||||||||||||||

| GAAP operating expense | $ | 377,202 | $ | 370,727 | ||||||||||

| Share-based compensation-research and development | 13,118 | 10,954 | ||||||||||||

| Share-based compensation-sales and marketing | 10,315 | 8,770 | ||||||||||||

| Share-based compensation-general and administrative | 9,257 | 9,377 | ||||||||||||

| Significant asset impairments and restructuring costs | 1,361 | 4,174 | ||||||||||||

| Amortization of intangible assets | 7,185 | 9,487 | ||||||||||||

| Acquisition and integration costs | — | 59 | ||||||||||||

| Total adjustments related to operating expense | 41,236 | 42,821 | ||||||||||||

| Adjusted (non-GAAP) operating expense | $ | 335,966 | $ | 327,906 | ||||||||||

| Income from Operations Reconciliation (GAAP/non-GAAP) | ||||||||||||||

| GAAP income from operations | $ | 26,743 | $ | 78,214 | ||||||||||

| Total adjustments related to gross profit | 7,546 | 6,992 | ||||||||||||

| Total adjustments related to operating expense | 41,236 | 42,821 | ||||||||||||

| Total adjustments related to income from operations | 48,782 | 49,813 | ||||||||||||

| Adjusted (non-GAAP) income from operations | $ | 75,525 | $ | 128,027 | ||||||||||

| Adjusted (non-GAAP) operating margin percentage | 8.0 | % | 12.0 | % | ||||||||||

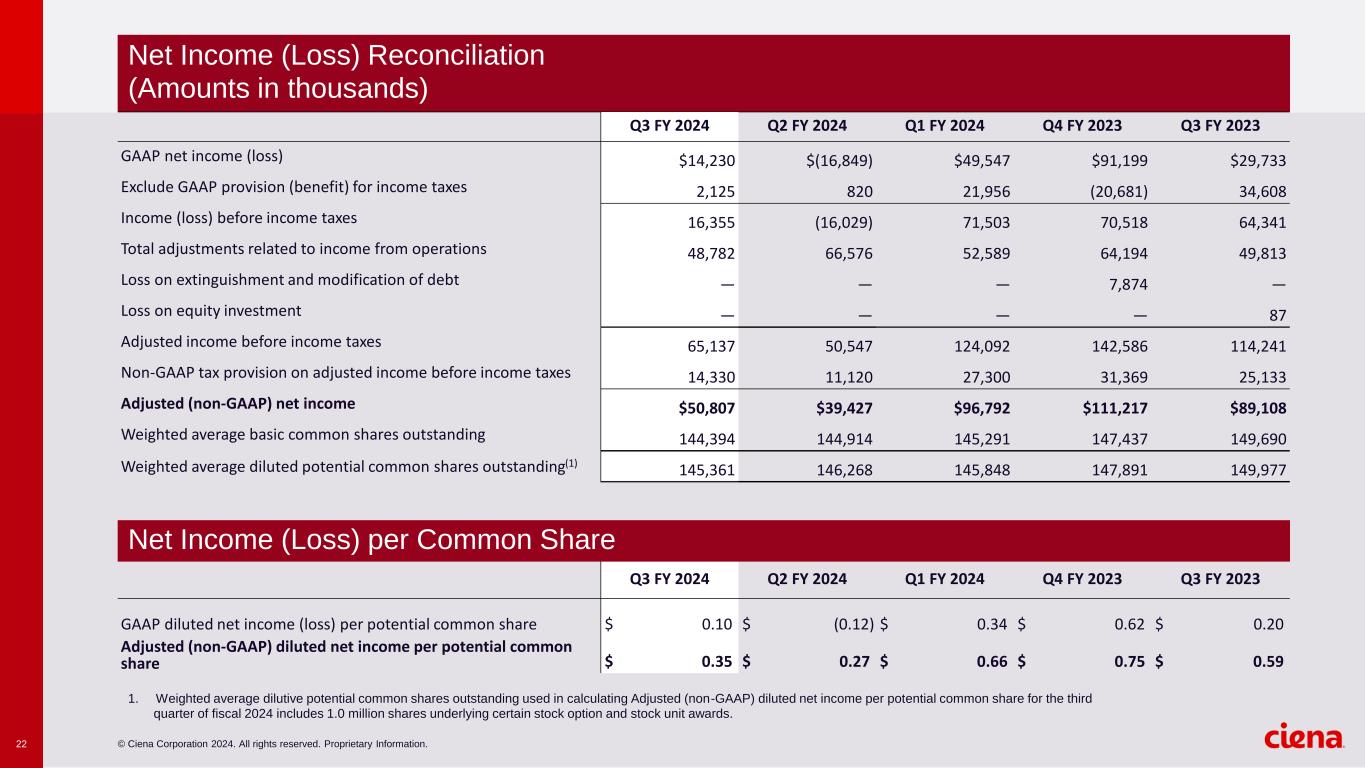

| Net Income Reconciliation (GAAP/non-GAAP) | ||||||||||||||

| GAAP net income | $ | 14,230 | $ | 29,733 | ||||||||||

| Exclude GAAP provision for income taxes | 2,125 | 34,608 | ||||||||||||

| Income before income taxes | 16,355 | 64,341 | ||||||||||||

| Total adjustments related to income from operations | 48,782 | 49,813 | ||||||||||||

| Loss on equity investment | — | 87 | ||||||||||||

| Adjusted income before income taxes | 65,137 | 114,241 | ||||||||||||

| Non-GAAP tax provision on adjusted income before income taxes | 14,330 | 25,133 | ||||||||||||

| Adjusted (non-GAAP) net income | $ | 50,807 | $ | 89,108 | ||||||||||

| Weighted average basic common shares outstanding | 144,394 | 149,690 | ||||||||||||

Weighted average dilutive potential common shares outstanding 1 |

145,361 | 149,977 | ||||||||||||

| APPENDIX A - Reconciliation of Adjusted (Non- GAAP) Measurements | ||||||||||||||

| (in thousands, except per share data) (unaudited) | ||||||||||||||

| Quarter Ended | ||||||||||||||

| July 27, | July 29, | |||||||||||||

| 2024 | 2023 | |||||||||||||

| Net Income per Common Share | ||||||||||||||

| GAAP diluted net income per potential common share | $ | 0.10 | $ | 0.20 | ||||||||||

| Adjusted (non-GAAP) diluted net income per potential common share | $ | 0.35 | $ | 0.59 | ||||||||||

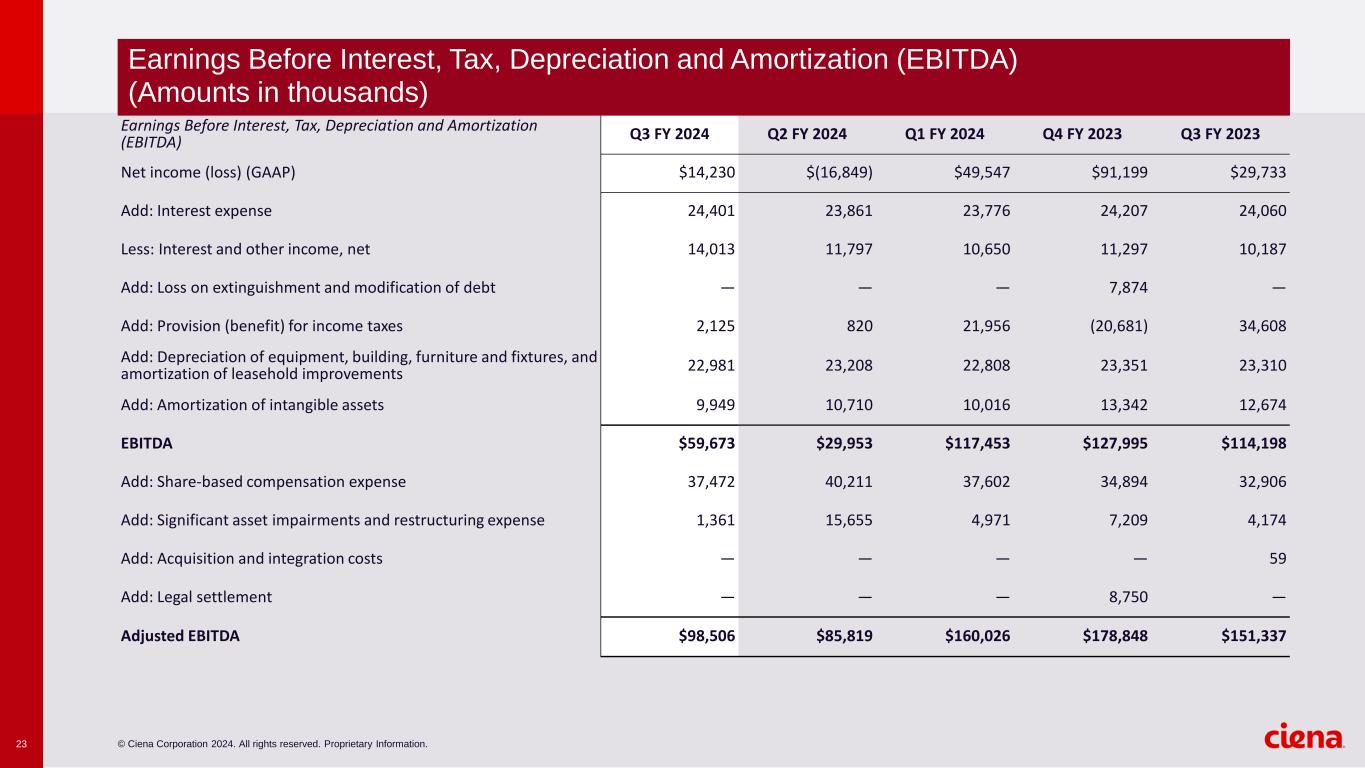

| APPENDIX B - Calculation of EBITDA and Adjusted EBITDA | ||||||||||||||

| (in thousands) (unaudited) | ||||||||||||||

| Quarter Ended | ||||||||||||||

| July 27, | July 29, | |||||||||||||

| 2024 | 2023 | |||||||||||||

| Earnings Before Interest, Tax, Depreciation and Amortization (EBITDA) | ||||||||||||||

| Net income (GAAP) | $ | 14,230 | $ | 29,733 | ||||||||||

| Add: Interest expense | 24,401 | 24,060 | ||||||||||||

| Less: Interest and other income, net | 14,013 | 10,187 | ||||||||||||

| Add: Provision for income taxes | 2,125 | 34,608 | ||||||||||||

| Add: Depreciation of equipment, building, furniture and fixtures, and amortization of leasehold improvements | 22,981 | 23,310 | ||||||||||||

| Add: Amortization of intangible assets | 9,949 | 12,674 | ||||||||||||

| EBITDA | $ | 59,673 | $ | 114,198 | ||||||||||

| Add: Share-based compensation expense | 37,472 | 32,906 | ||||||||||||

| Add: Significant asset impairments and restructuring costs | 1,361 | 4,174 | ||||||||||||

| Add: Acquisition and integration costs | — | 59 | ||||||||||||

| Adjusted EBITDA | $ | 98,506 | $ | 151,337 | ||||||||||