|

UNITED STATES

|

|

SECURITIES AND EXCHANGE COMMISSION

|

|

Washington, D.C. 20549

|

|

FORM 6-K

|

|

REPORT OF FOREIGN PRIVATE ISSUER

|

|

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

|

|

THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the month of May 2023

|

|

Commission File Number: 000-29970

|

|

DESCARTES SYSTEMS GROUP INC

|

|

(Translation of registrant’s name into English)

|

|

120 Randall Drive

|

|

Waterloo, Ontario

|

|

Canada N2V 1C6

|

|

(Address of principal executive office)

|

|

THE DESCARTES SYSTEMS GROUP INC.

|

|

|

(Registrant)

|

|

|

By:

|

/s/ Peter V. Nguyen

|

|

Name:

|

Peter V. Nguyen

|

|

Title:

|

General Counsel

|

|

|

1. |

to receive the consolidated financial statements of the Corporation for the fiscal year ended January 31st, 2023, together with the auditors’ report thereon;

|

|

|

2. |

to elect directors;

|

|

|

3. |

to re-appoint auditors;

|

|

|

4. |

to consider and, if deemed advisable, approve the continuation, amendment and restatement of the Corporation’s Shareholder Rights Plan;

|

|

|

5. |

to consider and, if deemed advisable, approve the advisory resolution to accept the approach to executive compensation disclosed herein; and

|

|

|

6. |

to transact such further and other business as may properly come before the Meeting or any adjournment thereof.

|

|

SOLICITATION OF PROXIES

|

1

|

|

DELIVERY OF MEETING MATERIALS

|

1

|

|

APPOINTMENT OF PROXIES

|

2

|

|

ATTENDING THE MEETING

|

3

|

|

Registered Shareholders

|

3

|

|

Non-Registered Shareholders

|

3

|

|

Attending as a Guest

|

3

|

|

PARTICIPATING AT THE MEETING

|

4

|

|

Registered Shareholders and Duly Appointed Proxyholders

|

4

|

|

Non-Registered Shareholders

|

5

|

|

VOTING AT THE MEETING

|

5

|

|

REVOCATION OF PROXIES

|

6

|

|

VOTING OF PROXIES

|

6

|

|

VOTING OF SHARES

|

6

|

|

PRINCIPAL HOLDERS OF VOTING SHARES

|

7

|

|

CURRENCY

|

7

|

|

MATTERS TO BE ACTED UPON AT THE MEETING

|

7

|

|

1. Presentation of Financial Statements

|

7

|

|

2. Election of Directors

|

8

|

|

Director Nominees

|

8

|

|

Skill Set and Experience of Proposed Director Nominees

|

13

|

|

Board Independence

|

14

|

|

Independent Chair of the Board

|

14

|

|

Meetings of Independent Directors

|

14

|

|

Director Service on Other Boards

|

14

|

|

Director Meetings and Attendance

|

15

|

|

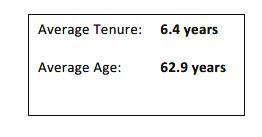

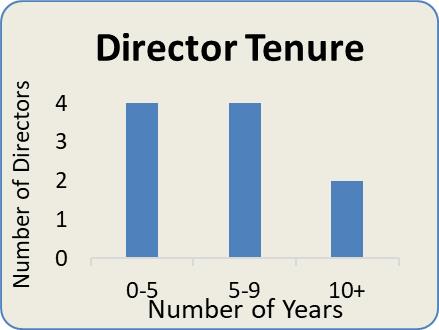

Director Tenure, Age and Board Renewal

|

15

|

|

Nomination of Directors

|

16

|

|

Orientation of New Directors

|

16

|

|

Continuing Education

|

17

|

|

Majority Voting for Director Nominees

|

20

|

|

Advance Notice Provisions

|

20

|

|

3. Appointment of Auditors

|

20

|

|

Audit Fees

|

21

|

|

4. Continuation, Amendment and Restatement of Shareholder Rights Plan

|

21

|

|

Background

|

21

|

|

Proposed Amendments

|

22

|

|

Summary of the Amended Rights Plan and Copy of the Amended Rights Plan Agreement

|

22

|

|

Objectives of the Amended Rights Plan

|

23

|

|

General Impact of the Amended Rights Plan

|

23

|

|

Vote Required

|

24

|

|

Recommendation of the Board of Directors

|

24

|

|

5. Advisory Vote on Executive Compensation (Say-On-Pay Vote)

|

25

|

|

6. Other Matters

|

25

|

|

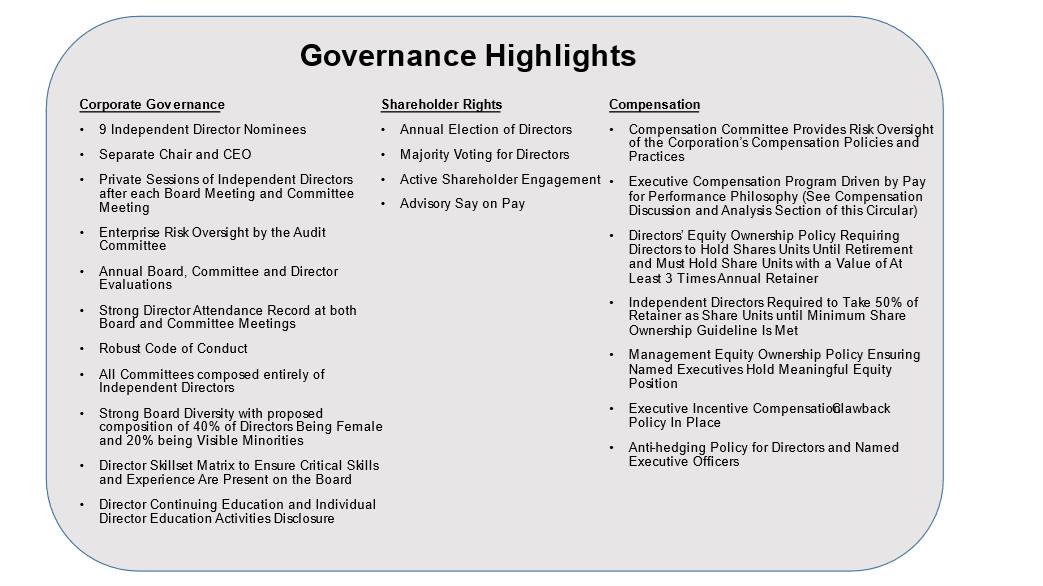

STATEMENT OF CORPORATE GOVERNANCE PRACTICES

|

26

|

|

Mandate of the Board of Directors

|

27

|

|

Risk Oversight

|

27

|

|

ESG Oversight

|

28

|

|

Role of Board in Corporate Strategy

|

28

|

|

Committee Charters and Position Descriptions

|

29

|

|

Audit Committee

|

30

|

|

Compensation Committee

|

32

|

|

Corporate Governance Committee

|

32

|

|

Nominating Committee

|

32

|

|

Board of Directors, Committee and Individual Director Assessments

|

33

|

|

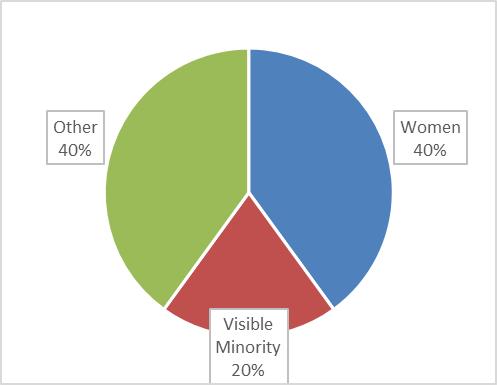

Policy on Diversity

|

33

|

|

Ethical Business Conduct

|

35

|

|

Succession Planning

|

36

|

|

Shareholder Engagement

|

37

|

|

Environmental, Social and Governance Framework

|

37

|

|

STATEMENT OF COMPENSATION GOVERNANCE

|

41

|

|

Compensation Committee

|

41

|

|

Compensation Committee Report

|

43

|

|

Compensation Discussion and Analysis

|

43

|

|

Overview of Compensation Program

|

43

|

|

Executive Officer Compensation Philosophy

|

43

|

|

Compensation Objectives

|

44

|

|

Compensation Oversight Process

|

55

|

|

Incentive Compensation Clawback Policy

|

58

|

|

Management Equity Ownership Policy

|

59

|

|

Fiscal 2023 Compensation Structures of the NEOs

|

60

|

|

Summary Compensation Table

|

66

|

|

Outstanding NEO Option-based Awards and Share-based Awards

|

67

|

|

NEO Incentive Plan Awards – Value Vested or Earned During Fiscal 2023

|

69

|

|

NEO Option Exercises During Fiscal 2023

|

69

|

|

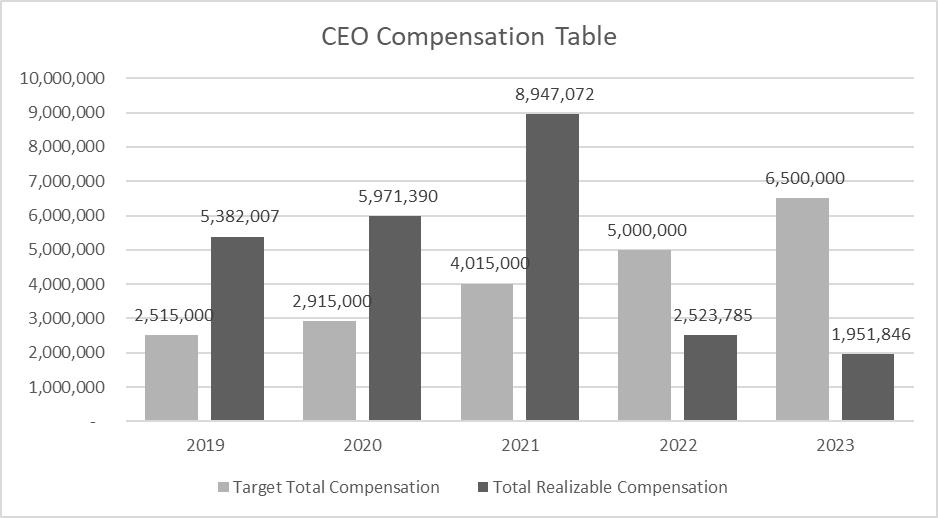

CEO Five-Year Look Back Compensation

|

70

|

|

NEO Termination and Change of Control Benefits

|

71

|

|

Quantitative Estimates of Payments to NEOs upon Termination or Change of Control

|

73

|

|

Director Compensation

|

74

|

|

Director Equity Ownership Policy

|

76

|

|

SECURITY-BASED COMPENSATION PLANS

|

77

|

|

Common Shares Authorized for Issuance Under Equity Compensation Plans

|

77

|

|

1998 Stock Option Plan

|

78

|

|

PRSU Plan

|

81

|

|

Directors’ DSU Plan

|

84

|

|

Cash-settled RSU Plan

|

85

|

|

INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS

|

85

|

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

|

85

|

|

GENERAL

|

85

|

|

SHAREHOLDER PROPOSALS

|

86

|

|

APPROVAL BY THE BOARD OF DIRECTORS

|

86

|

|

SCHEDULE “A” SUMMARY OF AMENDMENTS TO PRSU PLAN

|

A-1

|

|

SCHEDULE “B” BOARD MANDATE

|

B-1

|

|

SCHEDULE “C” RECONCILIATION OF NON-GAAP FINANCIAL MEASURES - ADJUSTED EBITDA

|

C-1

|

|

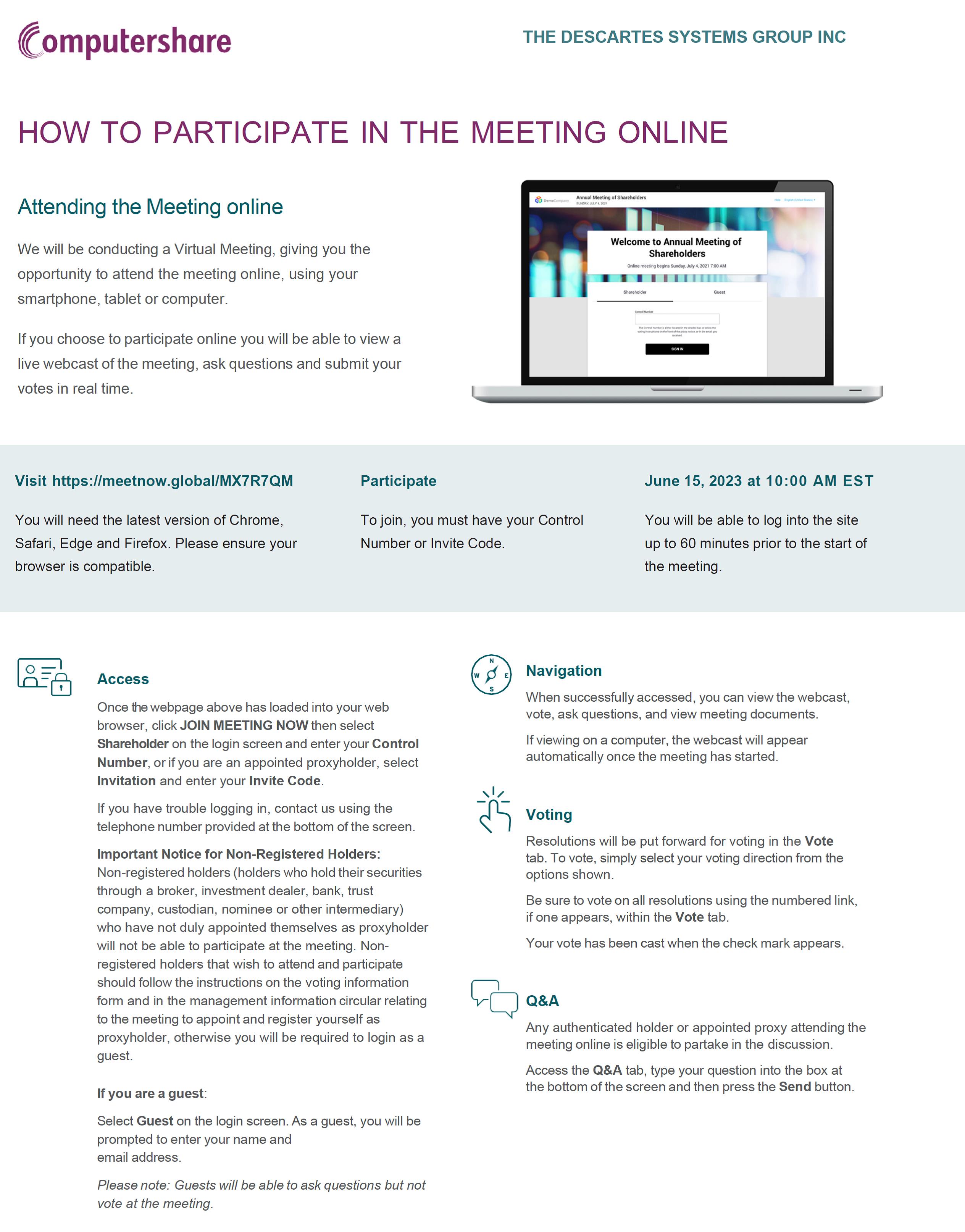

SCHEDULE “D” VIRTUAL MEETING USER GUIDE

|

D-1

|

|

|

o |

Registered shareholders – The 15-digit control number is located on the form of proxy or in the email notification you received.

|

|

|

o |

Duly appointed proxyholders – Computershare will provide the proxyholder with an invite code after the proxy cut-off has passed.

|

|

Name

|

Number of

Common Shares |

Percentage of

Class |

|

T. Rowe Price Associates, Inc.(1)

|

9,973,241

|

11.7%

|

| 1. |

Presentation of Financial Statements

|

| 2. |

Election of Directors

|

|

Nominee

|

Director Since

|

Equity Holdings

|

|

Deepak Chopra, B. Comm (Hons), FCPA, FCGA

Toronto, Ontario

Age – 59

Member – Audit Committee

Member – Nominating Committee

2022 AGM Votes in Favour: 98.94%

|

2020

|

DSUs 10,943

|

|

Mr. Chopra is a corporate director. Mr. Chopra most recently served as President and Chief Executive Officer of Canada Post Corporation from February 2011 to

March 2018. Mr. Chopra has more than 30 years of global experience in the financial services, technology, transportation, logistics & supply-chain industries. Prior to that, for more than 20 years, he worked for Pitney Bowes

Inc., a NYSE-traded technology company known for postage meters, mail automation and location intelligence services. He served as President of Pitney Bowes Canada and Latin America from 2006 to 2010. He held a number of increasingly

senior executive roles internationally, including President of its new Asia Pacific and Middle East region from 2001 to 2006 and Chief Financial Officer for Europe, Africa & Middle East (EAME) region from 1998-2001. He has

previously served on the boards of Canada Post Corporation, Purolator Inc., SCI Group, the Canada Post Community Foundation, Conference Board of Canada and the Toronto Region Board of Trade. He currently sits on the board of

Celestica, Inc. (TSX:CLS), The North West Company (TSX:NWC) and Sun Life Financial (TSX:SLF). Mr. Chopra is a Fellow of the Institute of Chartered Professional Accountants of Canada and has a Bachelor’s degree in Commerce (Honours)

and a Master’s degree in Business Management.

|

|

Nominee

|

Director Since

|

Equity Holdings

|

|

Deborah Close, B.A., ICD.D

Calgary, Alberta, Canada

Age – 69

Chair – Compensation Committee

Member – Nominating Committee

2022 AGM Votes in Favour: 99.33%

|

2015

|

DSUs 38,109

|

|

Ms. Close is a corporate director. Ms. Close held the position of President of the Production Services division of Tervita Corporation from 2010 until 2016.

Tervita Production Services, now High Artic Energy Services (TSX:HWO), delivers engineering and field-based services to the oil and gas industry. From 2002 to 2010, Ms. Close was the Executive Vice President of DO2 Technologies (now

Enverus), a software company providing electronic invoicing to the oil and gas industry. During Ms. Close’s tenure, DO2 grew from a start-up to the leading provider of e-invoicing to oil and gas companies and their suppliers. Prior

to DO2, Ms. Close served in a number of Regional Vice President roles in Halliburton Corporation’s software division, Landmark Graphics. She held executive roles in several of Landmark’s largest regions, including VP of Strategic

Accounts, Regional VP of North America and Regional VP of Europe and the former Soviet Union. During Ms. Close’s 12 years at Halliburton, she worked in Canada, the US and Europe. Ms. Close also currently serves on the board of

directors of Inter Pipeline Ltd, a privately held company but a reporting issuer for certain debt securities. Ms. Close holds a Bachelor of Arts from the University of Calgary and the ICD.D designation from the Institute of

Corporate Directors and Rotman School of Management.

|

|

Nominee

|

Director Since

|

Equity Holdings

|

|

Eric A. Demirian, BBM, C.P.A, C.G.A, C.A.

Toronto, Ontario, Canada

Age – 64

Chair of the Board

Member – Audit Committee

Member – Governance Committee

2022 AGM Votes in Favour: 98.47%

|

2011

|

Common Shares 10,000

DSUs

65,088

|

|

Mr. Demirian is a Chartered Professional Accountant, Certified General Accountant and a Chartered Accountant. Since 2003, Mr. Demirian has served as president of

Parklea Capital, Inc. (“Parklea”), a boutique financial and strategy advisory firm providing services to small- and mid-market public and private companies, and President of

Demicap Inc., a private investment firm. Prior to Mr. Demirian’s position at Parklea, he held the position of Executive Vice President of Group Telecom, Inc. from 2000 to 2003. From 1983 to 2000, Mr. Demirian was with

PricewaterhouseCoopers LLP (“PwC”) where he was a partner and head of the Information and Communications Practice. Mr. Demirian serves on the boards of Enghouse Systems Ltd.

(TSX:ENGH) and Imax Corporation (NYSE:IMAX). Mr. Demirian is a former director and chair of the audit committees of a number of public companies. Mr. Demirian holds a Bachelor of Business Management degree from Toronto Metropolitan

University. Mr. Demirian has served as non-executive Chair of the Board of the Corporation since May 2014 and was previously Chair of the Corporation’s audit committee.

|

|

Nominee

|

Director Since

|

Equity Holdings

|

|

Sandra Hanington, B.A.Sc., MBA, ICD.D

Toronto, Ontario

Age - 61

2022 AGM Votes in Favour: 99.66%

|

2022

|

Common Shares 1,650

DSUs

3,173

|

|

Ms. Hanington is a corporate director. Ms. Hanington is the former President & Chief Executive Officer of the Royal Canadian Mint, a $1.4 billion global

manufacturing and marketing business, where she led a multi-year strategic and operational turnaround. Prior to that, Ms. Hanington had deep experience in the financial services sector and served in a number of progressively senior

roles in Canada and the U.S., culminating as Executive Vice-President and member of the Management Committee of BMO Financial Group. Ms. Hanington currently serves as a director for Extendicare Inc. (TSX: EXE) a private sector owner

and operator of long-term care homes and a private sector provider of publicly-funded home health care services and is a member of the Governing Council of the University of Toronto. Ms. Hanington previously served on the boards of

Aimia Inc (TSX: AIM), Canada Mortgage and Housing Corporation and Symcor, Inc. Ms. Hanington is co-founder and has served as a director of Jack.org, a Canadian youth mental health charity since 2010 and is the recipient of the

Meritorious Service Cross from the office of the Governor General for her work with the organization. Ms. Hanington was named by the Women’s Executive Network (WXN)™ as one of Canada’s Top 100 Most Powerful Women three times in a

row, from 2007 to 2009 and was inducted into the WXN Hall of Fame in 2010. Ms. Hanington holds a B.A.Sc. from University of Waterloo, an MBA from the Rotman School of Management, University of Toronto, and the ICD.D designation.

|

|

Nominee

|

Director Since

|

Equity Holdings

|

|

Kelley Irwin, B.A.Math, C.Dir

Pickering, Ontario

Age – 60

2022 AGM Votes in Favour: 99.66%

|

2022

|

DSUs 2,919

|

|

Ms. Irwin is a corporate director. Ms. Irwin holds a Chartered Director (C.Dir) designation. Ms. Irwin has 35 years of international Information Technology (IT)

experience in the financial services and regulatory industries. She held executive roles at Sun Life Financial, TD Bank, Economical Insurance, and its subsidiary, Sonnet Insurance, and the Electrical Safety Authority (ESA). From

2019 to 2023, she held the position of Chief Information Officer (CIO) at the ESA where she led a multi-year digital transformation. Ms. Irwin is a cyber advocate and is active in public forums on cyber-security. Ms. Irwin currently

serves as a director on the boards of Lakefront Utility Services Inc. and Pro-Demnity Insurance Company. Ms. Irwin holds a BA in Mathematics from the University of Western Ontario, a Computer Science Diploma from Fanshawe College,

Cyber-Security Certificate from the University of Washington, and has completed executive education at the Harvard Kennedy School.

|

|

Nominee

|

Director Since

|

Equity Holdings

|

|

Dennis Maple, B.Sc.

Malvern, Pennsylvania, U.S.A.

Age – 63

Chair – Nominating Committee

Member – Compensation Committee

2022 AGM Votes in Favour: 99.66%

|

2017

|

DSUs 26,576

|

|

Mr. Maple is currently Chairman and Chief Executive Officer of Goddard Systems, LLC, which oversees the operation of premium early childhood education schools

across the United States. Between January 2014 and August 2019, Mr. Maple was the President of First Student, Inc., a subsidiary of United Kingdom based publicly-traded First Group plc., a transport operator in the United Kingdom

and North America, that provides solutions encompassing student bus transportation and public rail. Prior to serving as President of First Group, from 2006 to January 2014, Mr. Maple was President of Aramark Education with a

provider of food preparation, facilities management and related services. Prior to his role as President of Aramark Education, from 2003 to 2006, Mr. Maple held senior executive management positions at Aramark. Prior to serving in

an executive role at Aramark, from 1994 to 2003, Mr. Maple served as an Area Vice President at Coors Brewing and in several other management roles. Prior to 1994, Mr. Maple held roles at Kraft-General Foods, PepsiCola and The Quaker

Oats Company. Mr. Maple has a Bachelor of Science, Business Administration, Accounting from the University of Tennessee. Mr. Maple has served on numerous charitable and community-based boards and has been an active participant in

organizations supporting primary and secondary schools and communities across North America.

|

|

Nominee

|

Director Since

|

Equity Holdings

|

|

Chris Muntwyler

Baech, Switzerland

Age – 70

Member – Governance Committee

Member – Compensation Committee

2022 AGM Votes in Favour: 99.66%

|

2020

|

DSUs 10,864

|

|

Mr. Muntwyler is a corporate director. Mr. Muntwyler has significant international experience in the transportation, logistics and technology sectors. Having

previously held various senior executive positions at SwissAir and the positions of Chief Executive of DHL Express (UK) Limited and Managing Director (Switzerland, Germany and Central Europe) at DHL Express, he is now a management

consultant through his business, Conlogic AG, specializing in strategic development, leadership guidance and customer orientation and process automation. Mr. Muntwyler spent 10 years in the DHL Express organization following a

27-year career with SwissAir. Mr. Muntwyler previously served as a non-executive director on the board of The Austrian Post (Vienna: Post) from 2010 to April 2023, National Express Group PLC in the United Kingdom (LSE:NEX) from 2011

to 2020 and as a director of Panalpina World Transport (Holding) Ltd. from 2010 to 2018. During the period of 2007 and 2008, Mr. Muntwyler served as a member of the President’s Committee on the United Kingdom’s Confederation of

British Industry. During his professional career, Mr. Muntwyler has lived and worked in Switzerland, Sweden, the United States, Germany and the United Kingdom.

|

|

Nominee

|

Director Since

|

Equity Holdings

|

|

Jane O’Hagan, B.A. (Hons.), ICD.D

Calgary, Alberta, Canada

Age – 59

Chair – Governance Committee

Member – Compensation Committee

2022 AGM Votes in Favour: 99.37%

|

2014

|

DSUs 56,610

|

|

Ms. O’Hagan is a corporate director with over 20 years experience in the transportation and logistics sectors. From 2010 until 2014, Ms. O’Hagan was the Executive

Vice President and Chief Marketing Officer of Canadian Pacific Railway Limited. Ms. O’Hagan also held various roles at CP including Senior Vice President, Strategy and Yield, Vice President, Strategy and External Affairs and

Assistant Vice President, Strategy and Research. Ms. O’Hagan also serves as a director of USD Partners GP LCC, the general partner of USD Partners LP (NYSE:USDP), an acquirer, developer and operator of energy-related rail terminals

and other complementary mid-stream assets, where Ms. O’Hagan serves as the Chair of USD Partners GP LLC board’s conflicts committee and as a member of the audit committee. From 2018 until its acquisition in 2021, Ms. O’Hagan was a

member of the board of Pinnacle Renewable Holdings (TSX:PL), a supplier of industrial wood pellets based in Richmond, BC where she also served as a member of the audit and risk committees. Ms. O’Hagan has a Bachelor of Arts (Hons.)

and a Bachelor of Administrative and Commercial Studies from the University of Western Ontario (London, Ontario, Canada) and has completed graduate studies in Program and Policy Studies from the University of Western Ontario. In

December 2012, Ms. O’Hagan was named one of Canada’s Top 100 Most Powerful Women by the Women’s Executive Network. Ms. O’Hagan is also a holder of the ICD.D designation from the Institute of Corporate Directors, which she achieved

in June 2016 and earned the CERT Certificate in Cyber Risk Oversight issued by Carnegie Mellon University and the National Association of Corporate Directors in February 2018.

|

|

Nominee

|

Director Since

|

Equity Holdings

|

|

Edward J. Ryan, B.A.

Fort Washington, Pennsylvania, U.S.A.

Age – 54

Chief Executive Officer

2022 AGM Votes in Favour: 99.64%

|

2014

|

RSUs 229,888

PSUs 466,527

Stock Options 226,968

|

|

Mr. Ryan is Descartes’ Chief Executive Officer, having been appointed to that position in November 2013. Since 2000, Mr. Ryan has occupied various senior

management positions within Descartes, with particular focus on the Corporation’s network and recurring business. Prior to his appointment as Chief Executive Officer, Mr. Ryan served as the Corporation’s Chief Commercial Officer

(2011-2013), Executive Vice President, Global Field Operations (2007-2011), General Manager, Global Logistics Network (2004-2007) and Vice President, Sales (2000-2004). Mr. Ryan first joined Descartes in February 2000 in connection

with the Corporation’s acquisition of E-Transport Incorporated. Mr. Ryan has a Bachelor of Arts from Franklin and Marshall College in Lancaster, Pennsylvania, U.S.A.

|

|

Nominee

|

Director Since

|

Equity Holdings

|

|

John J. Walker, B.Sc., C.P.A., C.G.M.A

Wyckoff, New Jersey, U.S.A.

Age – 70

Chair – Audit Committee

Member – Governance Committee

2022 AGM Votes in Favour: 98.80%

|

2011

|

Common Shares 5,429

DSUs

72,000

|

|

Mr. Walker is a corporate director and a Certified Public Accountant and a Chartered Global Management Accountant with 37 years overall financial and executive

management experience, including twenty-one years of experience as a Chief Financial Officer with both public and private companies. Mr. Walker served as Chief Financial Officer, and Senior Vice President of Bowne & Company, a

New York Stock Exchange-listed provider of services to help companies produce and manage their shareholder, investor and marketing & business communications, from 2006 until its acquisition by R.R. Donnelley & Sons in 2010.

Prior to Bowne & Company, from 1988 to 2006, Mr. Walker was an executive with Loews Cineplex Entertainment Corporation a motion picture theatre exhibition chain, including sixteen years as Chief Financial Officer. Prior thereto,

Mr. Walker served for six years as Controller and Principal Accounting Officer of Corporate Property Investors, then one of the largest real estate investment trusts in the United States. Mr. Walker also served for six years as

Treasurer and Assistant Corporate Controller of Princess Hotels International a company involved in the ownership and operation of luxury resort hotels, real estate and timesharing developments. Since October 2021 to the present,

Mr. Walker is a member of the Board of Schultze Special Purpose Acquisition Corp. II (Nasdaq: SAMAU, SAMA, SAMAW) where he is Chair of the Audit Committee and also serves on the Nominating and Compensation Committees. Mr. Walker was

a member of the Board of Schultze Special Purpose Acquisition Corp. I from June 2018 until December 2020 up to the completion of a “de-SPAC” business combination. Mr. Walker started his career in the New York office of then-Price

Waterhouse. Mr. Walker is a member of the American Institute of Certified Public Accountants and the New York State Society of CPAs.

|

|

Senior Executive Leadership

|

Other Public Company Board Experience

|

Risk and Compliance Management

|

Financing

|

Financial Expert

(for Audit Committee Purposes) |

Strategic Planning

|

M&A

|

Human Resources / Compensation

|

Corporate Governance

|

International Business Operations and Sales and Marketing

|

Technology / IT Industry

|

Transportation and Logistics Industry

|

|

|

Deepak Chopra

|

✔

|

✔

|

✔

|

✔

|

✔

|

✔

|

✔

|

✔

|

✔

|

✔

|

✔

|

✔

|

|

Deborah Close

|

✔

|

✔

|

✔

|

✔

|

✔

|

✔

|

||||||

|

Eric A. Demirian

|

✔

|

✔

|

✔

|

✔

|

✔

|

✔

|

✔

|

✔

|

✔

|

✔

|

✔

|

|

|

Sandra Hanington

|

✔

|

✔

|

✔

|

✔

|

✔

|

✔

|

✔

|

|||||

|

Kelley Irwin

|

✔

|

✔

|

✔

|

✔

|

✔

|

✔

|

||||||

|

Dennis Maple

|

✔

|

✔

|

✔

|

✔

|

✔

|

✔

|

✔

|

✔

|

||||

|

Chris Muntwyler

|

✔

|

✔

|

✔

|

✔

|

✔

|

✔

|

✔

|

✔

|

✔

|

✔

|

|

Senior Executive Leadership

|

Other Public Company Board Experience

|

Risk and Compliance Management

|

Financing

|

Financial Expert

(for Audit Committee Purposes) |

Strategic Planning

|

M&A

|

Human Resources / Compensation

|

Corporate Governance

|

International Business Operations and Sales and Marketing

|

Technology / IT Industry

|

Transportation and Logistics Industry

|

|

|

Jane O’Hagan

|

✔

|

✔

|

✔

|

✔

|

✔

|

✔

|

✔

|

✔

|

✔

|

|||

|

John J. Walker

|

✔

|

✔

|

✔

|

✔

|

✔

|

✔

|

✔

|

✔

|

✔

|

✔

|

✔

|

|

Director

|

Public Company Board Membership

|

|

Deepak Chopra

|

Celestica (TSX:CLS)

The North West Company (TSX:NWC)

SunLife Financial (TSX:SLF)

|

|

Deb Close

|

Inter Pipeline Ltd. (listed debt securities)

|

|

Eric A. Demirian

|

Enghouse Systems Ltd. (TSX:ENGH)

Imax Corporation (NYSE:IMAX)

|

|

Sandra Hanington

|

Extendicare Inc. (TSX:EXE)

|

|

Jane O’Hagan

|

USD Partners LP (NYSE:USDP)

|

|

John Walker

|

SCHULTZE Special Purpose Acquisition Corp II (Nasdaq: SAMUA, SAMA, SAMAW)

|

|

Year ended January 31, 2023

|

February 1, 2023 – May 5, 2023

|

Total

|

|

|

Board

|

10

|

3

|

13

|

|

Audit Committee

|

8

|

3

|

11

|

|

Compensation Committee

|

5

|

2

|

7

|

|

Corporate Governance Committee

|

6

|

1

|

7

|

|

Nominating Committee

|

7

|

1

|

8

|

|

Director

|

Board Meetings Attended

|

Audit Committee Meetings Attended

|

Compensation Committee Meetings Attended

|

Corporate Governance Committee Meetings Attended

|

Nominating Committee Meetings Attended

|

|

Deepak Chopra

|

13 of 131

|

11 of 11

|

7 of 8

|

||

|

Deborah Close

|

13 of 13

|

7 of 7

|

8 of 8

|

||

|

Eric A. Demirian

|

13 of 13

|

11 of 11

|

7 of 7

|

||

|

Dennis Maple

|

13 of 13

|

7 of 7

|

8 of 8

|

||

|

Chris Muntwyler

|

12 of 13

|

7 of 7

|

7 of 7

|

||

|

Jane O’Hagan

|

13 of 13

|

7 of 7

|

7 of 7

|

||

|

Edward J. Ryan

|

13 of 13

|

||||

|

John J. Walker

|

13 of 13

|

11 of 11

|

7 of 7

|

||

|

Sandra Hanington

|

9 of 92

|

||||

|

Kelley Irwin

|

9 of 93

|

|

|

1. |

Has a process of rigorous annual director peer evaluations that allow the Chair of the Board (or in the case of the evaluation of the Chair of the Board, the Chair of the Corporate Governance Committee) to

have a clear understanding of relative director contribution, skillset and expertise, so that an appropriate level of director turnover can be achieved by having one or more directors not stand for re-election at appropriate times;

|

|

|

2. |

Maintains a director skill set and experience matrix to ensure that, in choosing director candidates, it is focused appropriately on skills and experience critical to the Board’s responsibilities, including

assessing and providing input on the Corporation’s strategic and operating activities; and

|

|

|

3. |

Provides clear disclosure in the Corporation’s management information circular of director tenure and age and an explanation of how the Corporation’s approach ensures diversity of skills, experience,

background and gender and an appropriate level of turnover.

|

|

|

|

Date

|

Topic

|

Description

|

Director Attendance

|

|

March 1, 2022

|

Proxy Advisory Voting Guideline Updates and Emerging Themes in Corporate Governance

|

The Board received a presentation from the Corporation’s external legal counsel on the topic of key updates to the annual proxy advisory voting guidelines published by the largest proxy

advisory firms and also on general developments in the area of corporate governance and ESG.

|

All directors

|

|

March 1, 2022

|

Data Privacy

|

The Board received a presentation from the Corporation’s EVP Product Management and its Senior Legal Counsel on the overall data privacy landscape faced by the Corporation in its

operations and the approach taken by the Corporation to compliance with its data privacy obligations

|

All directors

|

|

May 31, 2022

|

Crisis Response Planning

|

The Board received a presentation from the Corporation’s SVP of Information Security and its General Counsel on the Corporation’s Crisis Response Plan and the key elements of that plan.

|

All directors

|

|

Sept 6, 2022

|

Director Duties in a Public Company

|

The Board received a presentation from the Corporation’s external counsel in the United States on the topic of director duties in a public company from an US and

Securities and Exchange Commission perspective.

|

All directors

|

|

Date

|

Topic

|

Description

|

Director Attendance

|

|

Dec 6, 2022

|

Recessionary Risks to the Industry

|

The Board received a presentation from the Corporation’s EVP Product Management discussing the potential impact of an economic downturn on the transportation and logistics market

generally and specifically in the context of potential impact to the demand for the products and services of the Corporation.

|

All directors

|

|

Director

|

Continuing Education

|

|

Deepak Chopra

|

Participated in several sessions, courses and presentations conducted by both management as well as outside experts as part of board education sessions at public company boards. Areas

of focus included cyber security risk oversight, emerging trends in ESG reporting and regulatory requirements, Corporate Governance and Truth and Reconciliation journey with First Nations peoples. Self-study topics included

understanding impact of Open-AI, impact of remote work on the viability of Business Districts resulting implications on public transport, municipal tax base, commercial real estate and future of workplaces, understanding impact of

macro-economic factors on Transportation & Logistics industries, M&A dynamics in Air-Cargo, and the accelerating stress on the postal services around the world.

|

|

Deborah Close

|

Attended numerous seminars conducted by the Institute of Corporate Directors, National Association of Corporate Directors and various consulting firms on topics related to oversight of

cybersecurity risks, developments and trends in executive compensation, strategy development related to diversity and inclusion, and ESG considerations impacting corporate governance. Participated in an ICD one-day course, The Board’s

Oversight of Strategy. Undertook self-study through various publications covering trends pertaining to the role of the board and corporate governance.

|

|

Eric A. Demirian

|

Attended various ongoing continuing education courses provided by outside accounting and consulting firms, including as participant at Audit Committees and Boards of other public

companies, in the areas of corporate governance, accounting and financial reporting, cyber-security, human resources and legal matters. In addition, undertook self-study of accounting, and corporate governance topics by reading trade

journals and other publications.

|

|

Sandra Hanington

|

Attended various sessions and participated in meetings offered by outside consulting firms and organizations on topics related to strategy, risk, corporate governance and executive

compensation. In addition, undertook self-study through ICD and other publications and resources on trends in corporate governance including ESG, cyber security and executive compensation.

|

|

Director

|

Continuing Education

|

|

Kelley Irwin

|

Completed the Chartered Director course and achieved the C. Dir designation through the DeGroote School of Business at McMaster University. This included modules

on Accountability and Change, Leadership and Strategy, Oversight and Finance, Governing under Complex Circumstances, and a two-day board simulation. In her role as a Chief Information Officer, owned and directed the cyber security

function at a large corporation, and created the digital strategy.

|

|

Dennis Maple

|

In his current role as Chairman and CEO Goddard Systems Inc., Mr. Maple routinely designs and leads ongoing operational reviews, assigns and directs

presentations from both internal personnel and external consultants. He also assigns, selects and directs advisors in the areas of leadership and team development, succession planning, managing and developing high performers,

integration of performance management plans, and he is leading the corporation's evaluation of compensation programs. Additionally, in his current role, Mr. Maple is leading a major corporate IT platform transformation. Mr. Maple is

also leading the development of the strategy for a new supply chain management initiative, development of a new corporate franchise development strategy, corporate growth strategy, and the revamping of several major functions

including, marketing, communications, HR, and legal / risk. In 2022, Mr. Maple led the sale of Goddard Systems, Inc. on behalf of Wind River Holdings to Sycamore Partners. He also identified and initiated the development of Goddard’s

Proprietary Education Program, leveraging a digital platform that will be the first in the industry. Finally, Mr. Maple is engaged in self-study in a number of areas related to management and corporate governance, including in the

areas of “tone from the top,” corporate ethics, and managing in a post covid employer marketplace.

|

|

Chris Muntwyler

|

In his role as CEO of the consulting company Conlogic AG, Mr. Muntwyler leads and consults in the areas of process and strategy designs in transportation and

supply chain management and information technology. As a board member at Austrian Post until April 2023 he was actively involved in the strategic development of that transportation- and supply chain organization in several countries

in Europe. He was also actively involved in the remuneration policies and cyber-security strategy of that organization. He regularly attends further education programs in cyber-security, ESG development, corporate governance and risk

management.

|

|

Jane O’Hagan

|

Attended seminars and on-line education in corporate governance matters related to emerging trends, impacts and lessons learned from the pandemic for Canadian and US issuers. Joined the

Governance Professionals of Canada and attended virtual and on demand sessions in board oversight and strategy, board effectiveness. committee and director peer assessment and board education. Participated in virtual sessions on

cyber-security and privacy governance focusing on risk, threat management and regulatory standards. Attended webinars in ESG to better understand the link between financial and ethical values into strategy, reporting, metrics and

disclosure. Undertook a benchmarking review of shareholder engagement best practices among top North American issuers and reviewed board effectiveness and peer review programs to address policy and disclosure. Completed on-line

seminars in Compensation best practices, trends in executive compensation and trends in diversity to help develop practices to improve inclusion and understand proxy advisor standards.

|

|

Director

|

Continuing Education

|

|

John J. Walker

|

Completed 38 hours of continuing professional education credits conducted by PWC, Deloitte, Marcum, EY and KPMG, in the following areas of study: corporate

governance and risk management, accounting & financial reporting; ESG emerging trends, human capital management, tax, SEC updates and hot topics, internal controls, crisis response and crisis management, cyber security, IT data

security and data privacy, enterprise wide risk oversight, supply chain and global resilience, and internal audit. In addition, undertook self-study in enterprise-wide risk management and cyber-security risk management, fraud risk,

audit committee best practices and hot topics, crisis management, succession planning and talent development and internal audit best practices.

|

| 3. |

Appointment of Auditors

|

|

Fiscal Year Ended

|

Audit Fees

|

Audit-Related Fees

|

Tax Fees

|

All Other Fees

|

Total

|

|

January 31, 2023

|

$767,832

|

$2,430

|

Nil

|

Nil

|

$770,262

|

|

January 31, 2022

|

$681,657

|

$2,430

|

Nil

|

Nil

|

$684,087

|

| 4. |

Continuation, Amendment and Restatement of Shareholder Rights Plan

|

| 5. |

Advisory Vote on Executive Compensation (Say-On-Pay Vote)

|

| 6. |

Other Matters

|

|

Director

|

Audit

|

Compensation

|

Corporate Governance

|

Nominating

|

|

Deepak Chopra

|

Member

|

Member

|

||

|

Deborah Close

|

Chair

|

Member

|

||

|

Eric A. Demirian

|

Member

|

Member

|

||

|

Dennis Maple

|

Member

|

Chair

|

||

|

Chris Muntwyler

|

Member

|

Member

|

||

|

Jane O’Hagan

|

Member

|

Chair

|

||

|

John J. Walker

|

Chair

|

Member

|

|

|

• |

The Audit Committee conducted seven committee meetings during the year with all members of the committee present at each of the meetings;

|

|

|

• |

The Corporation’s independent auditors – KPMG – attend each quarterly meeting of the Committee at which the financial results are reviewed, to report on the results of their quarterly reviews of the interim

financial statements and the annual audit of the financial statements and annual audit of internal controls over financial reporting;

|

|

|

• |

At each quarterly meeting of the Audit Committee, an in-camera meeting with the independent auditor is conducted without Management present, as well as an in-camera meeting with the head of internal audit

without Management present, and an in-camera meeting with the CFO without the other members of Management present; and

|

|

|

• |

At each meeting of the Audit Committee including both the regular quarterly meetings and any of the other ad-hoc meetings held, an in-camera meeting of the members of the Audit committee and other Board

members in attendance is conducted without Management present.

|

|

|

• |

Reviewed and discussed with Management and the independent auditor the audited annual consolidated financial statements prepared by Management, and the notes disclosures and management’s discussion and

analysis thereon; and

|

|

|

• |

Reviewed and discussed with Management and the independent auditor the results of the audit of the internal control over financial reporting.

|

|

|

• |

Reviewed the qualifications, performance and independence of the independent auditor and approved the compensation of the independent auditor;

|

|

|

• |

Reviewed the qualifications and experience of the proposed new lead engagement partner of the independent auditor as required under the partner rotation practices of the independent auditor;

|

|

|

• |

Approved audit and permitted non-audit services to be performed by the independent auditor;

|

|

|

• |

Delegated authority to the Chair of the Audit Committee to approve requests received during the year for audit and permitted non-audit services to be provided by the independent auditor and reviewed and

ratified the decisions of the Chair at the next meeting; and

|

|

|

• |

Reviewed the overall scope and plan of the annual audit with the independent auditor and Management.

|

|

|

• |

Reviewed with Management and the independent auditor prior to publication, and recommended for approval by the Board, the interim quarterly financial statements and the annual consolidated financial

statements prepared by Management and the notes and management’s discussion and analysis thereon, and the related earnings press release for each quarter;

|

|

|

• |

Reviewed the Corporation’s design plans and testing of internal controls over financial reporting in accordance with the COSO 2013 framework;

|

|

|

• |

Reviewed Management’s reports on the effectiveness of internal control over financial reporting and disclosure controls and procedures; and

|

|

|

• |

Reviewed the results of the Audit Committee whistle-blower hotline program.

|

|

|

• |

Reviewed results of annual risk assessment survey;

|

|

|

• |

Reviewed the annual fraud risk assessment prepared by management and the controls and procedures designed to monitor and manage fraud risk;

|

|

|

• |

Received regular updates from management and external consultants on approach to cyber-security risk management and mitigation;

|

|

|

• |

On a quarterly-basis considered the risk factors discussed by the Corporation with respect to its financial performance including any material climate-related risks; and

|

|

|

• |

Reviewed the Corporation’s commercial insurance coverage program.

|

|

|

• |

Reviewed the performance of the CFO, the head of internal audit and senior finance and tax staff; and

|

|

|

• |

Reviewed Management’s annual proposed budget for the Corporation and related planning initiatives.

|

|

|

• |

Received and reviewed quarterly reports from the internal audit function reporting directly to the Chair of the Audit Committee; and

|

|

|

• |

Reviewed and approved the annual work plan for internal audit.

|

|

|

• |

Reviewed a new amended and restated credit facility for the Corporation that was put in place during fiscal 2023.

|

|

|

• |

Reviewed and recommended for Board approval the Corporation’s corporate governance framework;

|

|

|

• |

Periodically reviewed the Corporation’s corporate governance activities and reported to the Board on these activities at quarterly Board meetings;

|

|

|

• |

Reviewed development of and progress towards ongoing ESG initiatives, and the Corporation’s disclosure relating to those initiatives;

|

|

|

• |

Reviewed and recommended for Board approval the statement of corporate governance practices included in this Circular;

|

|

|

• |

Reviewed the Corporation’s governing documents including the Corporation’s Board Mandate and each of its committee charters;

|

|

|

• |

Reviewed the Code of Conduct and recommended for Board re-approval;

|

|

|

• |

Reviewed the Corporation’s disclosure policy;

|

|

|

• |

Reviewed the Corporation’s director orientation program;

|

|

|

• |

Oversaw the ongoing director education program and the selection of topics for director education sessions;

|

|

|

• |

Reviewed the Corporation’s directors’ and officers’ liability insurance program and recommended to Management that certain enhancements to the program be made;

|

|

|

• |

Conducted an assessment of the performance of the Board, the individual directors and each Board committee against their respective mandates;

|

|

|

• |

Evaluated each director against independence criteria applicable to the Corporation; and

|

|

|

• |

Reviewed, together with the Compensation Committee, the CEO’s recommendations for Management succession and development plans.

|

|

|

• |

Considers the criteria established by the Board for the selection of new directors, which includes professional experience, personal characteristics and Board diversity, including gender diversity;

|

|

|

• |

Maintains a list of desired competencies, expertise, skills, background and personal qualities for potential candidates for the Board;

|

|

|

• |

Identifies and recommends to the Board individuals qualified and suitable to become Board members, taking into consideration any perceived gaps in the current Board or committee composition; and

|

|

|

• |

Considers the experience and expertise of the independent members of the Board with a view to identification of a suitable potential successor for the Chair of the Board role.

|

|

|

• |

Considered the overall size of the Board and recommended an increase in the size of the Board to ten directors;

|

|

|

• |

Reviewed the composition of the Board’s committees and recommended to the Board the proposed composition of the Board’s committees having regard to succession planning within those committees in light of

changes in Board composition; and

|

|

|

• |

Successfully completed a director recruitment process whereby two new directors were added to the Board at the meeting of shareholders on June 16, 2022 adding several areas of key skills, expertise and

background to the composition of the Board.

|

|

|

|

Board Diversity Matrix as of May 5, 2023

|

|

|

Country of Principal Executive Offices

|

Canada

|

|

Foreign Private Issuer

|

Yes

|

|

Disclosure Prohibited under Home Country Laws

|

No

|

|

Total Number of Directors

|

10

|

|

Part I: Gender Identity

Directors

|

Female

4

|

Male

6

|

Non-Binary

0

|

Did Not Disclose Gender

0

|

|

Part II: Demographic Background

Directors

|

Underrepresented Individual in Home Country Jurisdiction

2

|

LGBTQ+ 0

|

Did Not Disclose Demographic Background

0

|

|

|

• |

Complying with all social, occupational health and safety and environmental legislation applicable to the Company’s services and operations;

|

|

|

• |

Encouraging each employee to take personal responsibility for the environmental, health, safety and sustainability matters within his/her/their department;

|

|

|

• |

Identifying and eliminating hazards, if practical, and mitigating risks related to environmental, health, safety and sustainability matters;

|

|

|

• |

Involving and consulting employees in addressing environmental, health, safety and sustainability risks through committees and representatives;

|

|

|

• |

Promoting the minimization of the use of energy and the elimination, reduction, reuse and recycling of waste materials as part of Company-wide initiatives to improve the life cycle

environmental effects of the Company’s services and operations;

|

|

|

• |

Fostering awareness of sustainability principles amongst the Company’s employees;

|

|

|

• |

Promoting the principles of this statement to the Company’s suppliers and partnering with suppliers and organizations that are ethically, socially and environmentally responsible;

|

|

|

• |

Engaging with the communities in which the Company operates to meet community needs and to make a positive impact;

|

|

|

• |

Continuously seeking ways to improve the Company’s performance in accordance with this statement; and

|

|

|

• |

Providing the necessary training and resources to employees to fully implement this statement.

|

|

|

(a) |

reducing paper usage by adopting paperless processes where possible;

|

|

|

(b) |

adopting electronic signing processes for documents to reduce paper copies and mail/courier usage and by default requiring two-sided printing of paper documents where a paper copy is required;

|

|

|

(c) |

adoption of several communication tools to enable remote collaboration between employees and with customers and to reduce travel where possible;

|

|

|

(d) |

reducing the number and sizes of corporate offices wherever possible to reduce heating, cooling and electrical consumption; and

|

|

|

(e) |

adoption of recycling programs in those jurisdictions and office locations where it is supported.

|

|

|

• |

Providing a safe space for employees that is free of harassment, bullying and violence as expressed in the Company’s Workplace

Violence and Harassment Policy and Program;

|

|

|

• |

Promoting ethical conduct and behaviour by our employees and suppliers through adherence to the Company’s Code of Business Conduct

and Ethics;

|

|

|

• |

Protecting the privacy of our employees, customers and suppliers and others in accordance with the Company’s various privacy policies and programs including but not limited to the General Privacy Policy, Commercial Relationship Privacy Policy and Recruitment

Privacy Policy;

|

|

|

• |

Forgoing the use of forced or child labour in compliance with applicable laws and international norms;

|

|

|

• |

Ensuring that employees and prospective employees are treated fairly and equally in the recruitment and hiring process;

|

|

|

• |

Fostering a diverse and inclusive work environment and providing opportunities for underrepresented employee groups and communities to participate and thrive;

|

|

|

• |

Recognizing the right of our employees to join associations of their own choosing or to refrain from joining, and the right to collective bargaining; and

|

|

|

• |

Maintaining safe, healthy and respectful working conditions in accordance with the Company’s Environmental, Health, Safety and

Sustainability Statement.

|

|

|

• |

reviewing and making recommendations to the Board with respect to the appointment, compensation and other terms of employment of the CEO;

|

|

|

• |

reviewing and making recommendations to the Board based on the recommendations of the CEO with respect to the appointment, compensation and other terms of employment of the CFO, the President and COO and

all other officers appointed by the Board, which includes each of the NEOs (as defined herein);

|

|

|

• |

reviewing and approving the quarterly accrual of any variable compensation in the quarterly financial results of the Corporation and confirming same to the Audit Committee for the purposes of its review of

the financial results;

|

|

|

• |

reviewing and making recommendations to the Board with respect to the Corporation’s compensation principles, policies and plans for Management, including the establishment of performance measures and

evaluation processes;

|

|

|

• |

reviewing and making recommendations to the Board with respect to the compensation arrangements for members of the Board;

|

|

|

• |

reviewing, administering and interpreting equity-based compensation plans and making recommendations to the Board with respect to the grant of compensation thereunder;

|

|

|

• |

administering and interpreting the Corporation’s equity ownership and retention policies applicable to members of the Board and senior Management;

|

|

|

• |

reviewing the CEO’s recommendations respecting any major changes to the structure, organization and responsibilities of the CEO or senior Management;

|

|

|

• |

reviewing the CEO’s recommendations respecting succession planning and executive development for the CEO, CFO, President and COO and senior Management;

|

|

|

• |

providing risk oversight of the Corporation’s compensation policies and practices and identifying and mitigating compensation policies and practices that could encourage inappropriate or excessive risk

taking by members of senior Management; and

|

|

|

• |

reviewing and approving certain compensation disclosures prior to their public release.

|

|

Name

|

Position

|

|

Edward J. Ryan

|

Chief Executive Officer

|

|

Allan Brett

|

Chief Financial Officer

|

|

J. Scott Pagan

|

President & Chief Operating Officer

|

|

Andrew Roszko

|

Chief Commercial Officer

|

|

Kenneth Wood

|

Executive Vice President, Product Management

|

|

What we do

|

What we don’t do

|

|

Link executive pay to company performance through our annual and long-term incentive plans

|

No single-trigger change-in-control provisions

|

|

Balance among short- and long-term incentives, cash and equity and fixed and variable pay

|

No golden-parachute type arrangements

|

|

Compare executive compensation and company performance to relevant peer group companies

|

No hedging or pledging by executives or directors of equity holdings

|

|

Require executives to meet minimum stock ownership requirements

|

No re-pricings of underwater stock options

|

|

Maintain a compensation claw-back policy to recapture unearned incentive pay

|

No tax gross-ups

|

|

Provide only limited perquisites

|

No aspect of our pay policies or practices pose material adverse risk to the Company

|

|

|

1. |

Attract and retain highly-qualified executive officers;

|

|

|

2. |

Align the interests of executive officers with our shareholders’ interests and with the execution of our business strategy;

|

|

|

3. |

Evaluate executive performance based on key financial measurements which we believe closely measure the performance of our business; and

|

|

|

4. |

Tie compensation directly to those measurements based on achieving and overachieving predetermined objectives.

|

|

|

1. |

Market Competitive Compensation for Attracting and Retaining Highly Qualified Executive Officers

|

|

Revenue (in millions)

|

Market Capitalization (in millions)

|

|

|

25th Percentile

|

$ 337

|

$ 2,124

|

|

Median

|

$ 421

|

$ 3,297

|

|

75th Percentile

|

$ 631

|

$ 5,904

|

|

Descartes

|

$ 406

|

$ 7,068

|

|

Percentile Rank

|

P48

|

P78

|

|

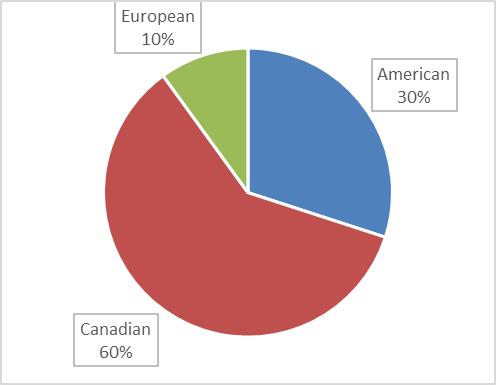

Canadian Peers

|

US Peers

|

|

Enghouse Systems Ltd.

|

Altair Engineering Inc.

|

Bottomline Technologies Inc.

|

|

Kinaxis Inc

|

Commvault Systems, Inc.

|

E2Open Parent Holdings, Inc.

|

|

Ebix, Inc.

|

EverCommerce Inc.

|

|

|

Guidewire Software, Inc.

|

Manhattan Associates Inc.

|

|

|

Australian Peer

|

Progress Software Corp

|

Qualys, Inc.

|

|

WiseTech Global Limited

|

SPS Commerce Inc.

|

Upland Software, Inc.

|

|

.

|

||

|

|

• |

Understand the competitiveness of current pay levels for the Chief Executive Officer position relative to the Comparator Group;

|

|

|

• |

Identify and understand any significant differences that may exist between current compensation levels for the Corporation’s CEO and market compensation levels; and

|

|

|

• |

Serve as a basis for determining salary adjustments and short- and long-term incentive awards for Compensation Committee consideration.

|

|

|

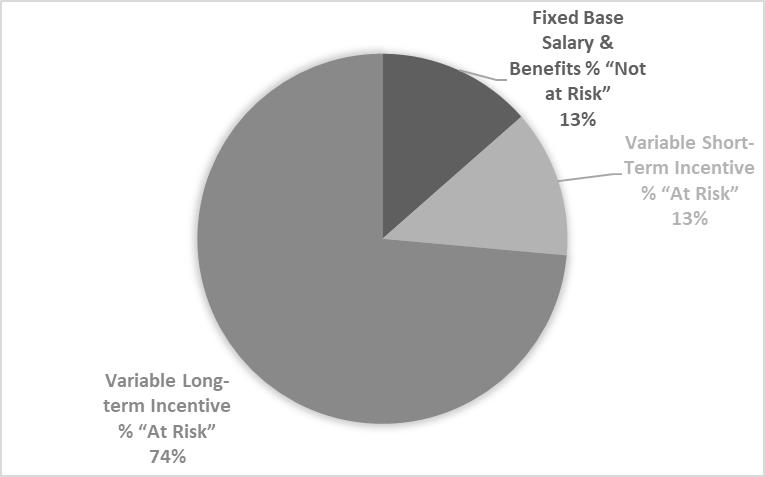

2. |

Aligning the Interests of the NEOs with the Interests of Descartes’ Shareholders and the Execution of our Business Strategy

|

|

|

i. |

Base Salary and Benefits

|

|

Name

|

Fiscal 2022 Base Salary

($)

|

Fiscal 2023 Base Salary

($)

|

Percentage Change

|

|

Edward J. Ryan

|

$500,000

|

$550,000

|

10%

|

|

Allan Brett

|

$350,000

|

$400,000

|

14%

|

|

J. Scott Pagan

|

$350,000

|

$400,000

|

14%

|

|

Andrew Roszko

|

$300,000

|

$350,000

|

17%

|

|

Kenneth Wood

|

$250,000

|

$265,000

|

6%

|

|

|

ii. |

Short-Term Incentives

|

|

Name

|

Base Salary

($)

|

On-Target STI Eligibility

(% of Base Salary)

|

On-Target STI Eligibility

($)

|

Maximum STI Eligibility (% of Base Salary)

|

Maximum STI Eligibility

($)

|

Actual STI Awarded in Fiscal 2023

|

|

Edward J. Ryan

|

$550,000

|

100%

|

$550,000

|

150%

|

$825,000

|

$550,000

|

|

Allan Brett

|

$400,000

|

100%

|

$400,000

|

150%

|

$600,000

|

$400,000

|

|

J. Scott Pagan

|

$400,000

|

100%

|

$400,000

|

150%

|

$600,000

|

$400,000

|

|

Andrew Roszko

|

$350,000

|

100%

|

$350,000

|

150%

|

$525,000

|

$350,000

|

|

Kenneth Wood

|

$265,000

|

30%

|

$79,500

|

45%

|

$119,250

|

$79,500

|

|

|

• |

Adjusted EBITDA;

|

|

|

• |

Revenue; and

|

|

|

• |

Cash generated from operations as a percentage of Adjusted EBITDA.

|

|

FY23 Adjusted EBITDA* Target

(in millions of USD)

|

FY23 Adjusted EBITDA* Target Growth

(as a % increase from FY22 Actual)

|

FY23 Adjusted EBITDA Actual

(in millions of USD)

|

FY23 Adjusted EBITDA* Actual Growth

(as a % increase from FY22 Actual)

|

|

$204.3

|

10%

|

$215.2

|

16%

|

|

FY23 Revenue Target

(in millions of USD)

|

FY23 Revenue Target Growth

(as a % increase from FY22 Actual)

|

FY23 Revenue Actual

(in millions of USD)

|

FY22 Revenue Actual Growth

(as a % increase from FY22 Actual)

|

|

$467.0

|

10%

|

$486.0

|

14%

|

|

Actual Cash Flow from Operations

(in millions of USD)

|

Target Cash Flow from Operations (% of Adjusted EBITDA)

|

Actual Cash Flow From Operations (% of Adjusted EBITDA)*

|

|

$192.4

|

80-90%

|

89%

|

|

|

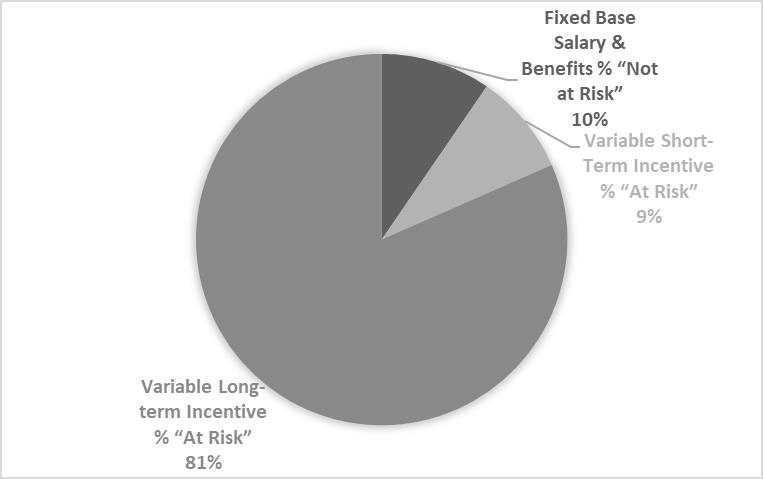

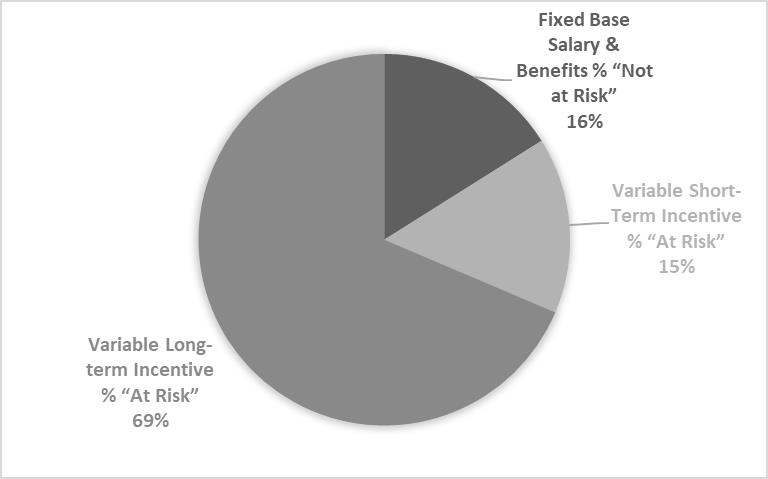

iii. |

Long-Term Incentives

|

|

|

• |

PSU grants which vest at the end of a three-year performance period (weighted 50%);

|

|

|

• |

RSU grants which vest over a period of three fiscal years (weighted 25% or 35% depending on role); and

|

|

|

• |

stock options that vest over a period of three fiscal years (weighed 15% or 25% depending on role).

|

|

RELATIVE PERFORMANCE

|

ADJUSTMENT FACTOR

|

|

Less than the 30th percentile

|

0

|

|

30th percentile

|

.50

|

|

50th percentile

|

1.00

|

|

75th percentile

|

1.50

|

|

90th percentile

|

2.00

|

|

Name

|

On-Target Total LTI

|

Value of PSUs at time of grant (and percentage of total LTI)

|

Value of RSUs at time of grant (and percentage of total LTI)

|

Value of stock options at the time of grant (and percentage of total LTI)

|

|

Edward J. Ryan

|

$5,400,000

|

$2,700,000 (50%)

|

$1,890,000 (35%)

|

$810,000 (15%)

|

|

Allan Brett

|

$1,907,250

|

$953,625 (50%)

|

$667,538 (35%)

|

$286,088 (15%)

|

|

J. Scott Pagan

|

$2,430,500

|

$1,215,250 (50%)

|

$850,675 (35%)

|

$364,575 (15%)

|

|

Andrew Roszko

|

$1,300,000

|

$650,000 (50%)

|

$325,000 (25%)

|

$325,000 (25%)

|

|

Kenneth Wood

|

$555,500

|

$277,500 (50%)

|

$138,750 (25%)

|

$138,750 (25%)

|

|

|

• |

Which NEOs and others are eligible for a grant of options;

|

|

|

• |

The number of options to be granted under the plan in general and to each recipient;

|

|

|

• |

The exercise price for each stock option granted (which may not be less than fair market value of a Common Share at the date of the grant);

|

|

|

• |

The date on which each option is granted (which may not be earlier than the date the grant is approved by the Board);

|

|

|

• |

The vesting period;

|

|

|

• |

The expiration date; and

|

|

|

• |

Other material terms and conditions of each stock option grant.

|

|

|

3. |

Evaluating Individual Executive Performance

|

|

|

a) |

Contribution to the achievement of the Corporation’s longer-term financial and corporate development plan;

|

|

|

b) |

Contribution to the achievement of annual corporate financial targets;

|

|

|

c) |

Contribution to the achievement of the Corporation’s corporate development goals in acquiring businesses and integrating acquired businesses;

|

|

|

d) |

Contribution to advancing the Corporation’s ESG Initiatives;

|

|

|

e) |

Customer service, satisfaction and retention;

|

|

|

f) |

Infrastructure development;

|

|

|

g) |

Investor communication;

|

|

|

h) |

Organizational development;

|

|

|

i) |

Succession planning and initiatives;

|

|

|

j) |

Strategic planning; and

|

|

|

k) |

Other corporate and individual qualitative factors.

|

|

|

4. |

Evaluating Overall Corporate Performance

|

|

|

a. |

Longer-term Financial and Corporate Development Plan

|

|

|

b. |

Annual Corporate Financial Targets

|

|

Revenue Minimum Target

(millions)

|

Revenue High-End Target

(millions)

|

Revenue Actual

(millions)

|

Adjusted EBITDA Minimum Target

(millions)

|

Adjusted EBITDA High-End Target

(millions)

|

Adjusted EBITDA Actual

(millions)

|

|

$467.0

|

$484.0

|

$486.0

|

$204.3

|

$213.6

|

$215.2

|

|

|

c. |

Common Share Price

|

|

Market

|

January 31, 2022 (closing price)

|

January 31, 2023 (closing price)

|

% Increase

|

|

TSX

|

Cdn. $92.48

|

Cdn. $97.10

|

5.0%

|

|

NASDAQ

|

$72.77

|

$73.02

|

0.3%

|

|

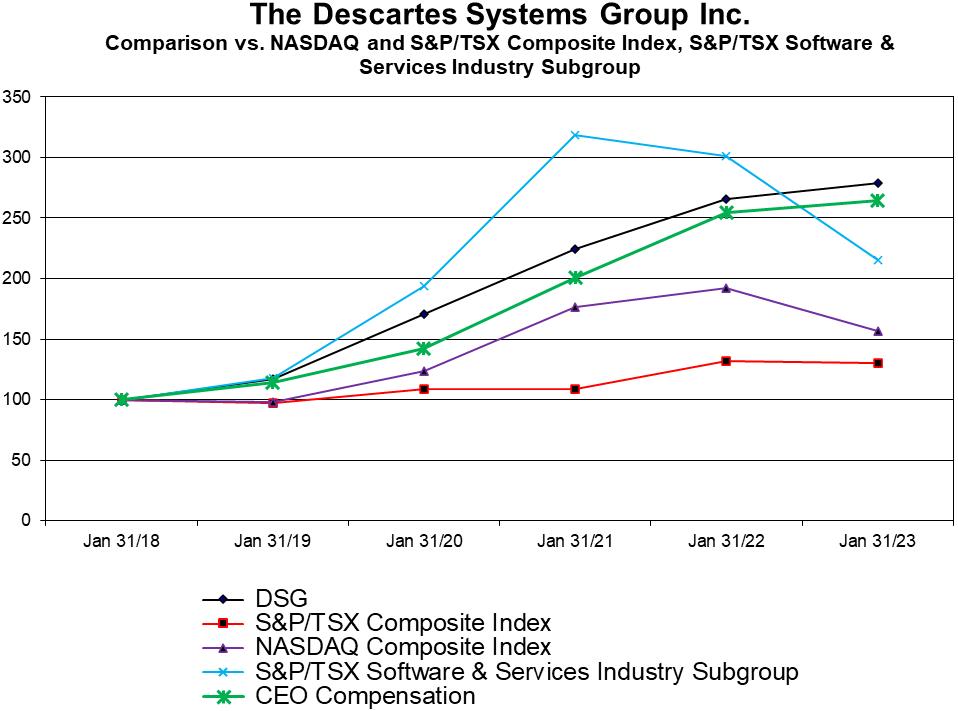

Jan 31, 2018

|

Jan 31, 2019

|

Jan 31, 2020

|

Jan 31, 2021

|

Jan 31, 2022

|

Jan 31, 2023

|

|

|

Actual Data

|

||||||

|

Descartes (DSG) (Cdn.$)

|

34.80

|

40.84

|

59.33

|

77.98

|

92.48

|

97.10

|

|

S&P/TSX Composite Index

|

15951.67

|

15540.60

|

17318.49

|

17337.02

|

21098.30

|

20767.38

|

|

NASDAQ Composite Index

|

7411.48

|

7281.74

|

9150.94

|

13070.69

|

14239.88

|

11584.55

|

|

Software & Services Industry Subgroup

|

5199.02

|

6119.32

|

10075.20

|

16553.19

|

15669.94

|

11211.38

|

|

CEO Compensation1

|

2331340

|

2651788

|

3314980

|

4687068

|

5926482

|

6157116

|

|

Nominal Data

|

||||||

|

Descartes (DSG) (Cdn.$)

|

100

|

117

|

170

|

224

|

266

|

279

|

|

S&P/TSX Composite Index

|

100

|

97

|

109

|

109

|

132

|

130

|

|

NASDAQ Composite Index

|

100

|

98

|

123

|

176

|

192

|

156

|

|

Software & Services Industry Subgroup

|

100

|

118

|

194

|

318

|

301

|

216

|

|

CEO Compensation1

|

100

|

114

|

142

|

201

|

254

|

264

|

|

|

d. |

Shareholder Engagement

|

|

Fiscal year ended

|

Executive Compensation-Related Fees

|

All Other Fees(2)

|

|

January 31, 2023

|

$59,515

|

$53,000

|

|

January 31, 2022

|

$77,285

|

$53,000

|

|

|

(1) |

Amounts included in this table have been converted to US dollars at the indicative foreign exchange rate on the last business day of the applicable year as reported by the Bank of Canada, which was 1 US

dollar = 1.335 Canadian dollars at January 31, 2023 and 1 US dollar = 1.2719 Canadian dollars at January 31, 2022.

|

|

|

(2) |

The Other Fees consist of an annual subscription to global compensation and benefits survey data published by Mercer and subscribed to by the Corporation’s Human Resources department independent of the

relationship with Mercer as a compensation consultant to the Compensation Committee.

|

|

|

• |

An appropriate balance of fixed and variable compensation, and an appropriate weighting of share-based compensation and short- and long-term compensation;

|

|

|

• |

An appropriate equity ownership policy for Management;

|

|

|

• |

Quantitative and qualitative Corporation-wide metrics used to form a balanced scorecard to determine the amount of awards to NEOs under the Corporation’s short-term incentive plans;

|

|

|

• |

Board and Compensation Committee discretion to adjust the amount, if any, of awards under the Corporation’s short-term incentive programs, to take into account the quality of the results and the level of

risk required to achieve results, with awards historically being made only out of the Corporation’s operating profits;

|

|

|

• |

A clawback policy under which incentive compensation may be clawed back if there is misconduct of an executive resulting in a restatement of financial results;

|

|

|

• |

A mix of equity compensation vehicles in the long-term incentive program, which measure both relative and absolute performance;

|

|

|

• |

Periodic share-based compensation awards with overlapping vesting periods to provide ongoing retention incentives to Management and long-term share-based exposure to the risks Management undertakes;

|

|

|

• |

Annual incentive awards that have historically been a reasonable percentage of revenues and Adjusted EBITDA to ensure an appropriate sharing of value created between management and shareholders;

|

|

|

• |

Annual incentive awards that are not determined until the completion of the audit of the Corporation’s consolidated annual financial statements by the independent auditor;

|

|

|

• |

An insider trading policy that prohibits hedging and restricts pledging of the Common Shares and Common Share-based incentives;

|

|

|

• |

An organizational culture of prudent risk-taking, which is maintained by a practice of promoting from within the organization;

|

|

|

• |

A strong shareholder outreach program designed, in part, to ensure that the Corporation’s compensation programs are aligned with shareholder interests and expectations;

|

|

|

• |