Document

|

|

|

|

|

|

|

NEWS RELEASE |

| WESCO International, Inc. / 225 West Station Square Drive, Suite 700 / Pittsburgh, PA 15219 |

Wesco International Reports Third Quarter 2025 Results

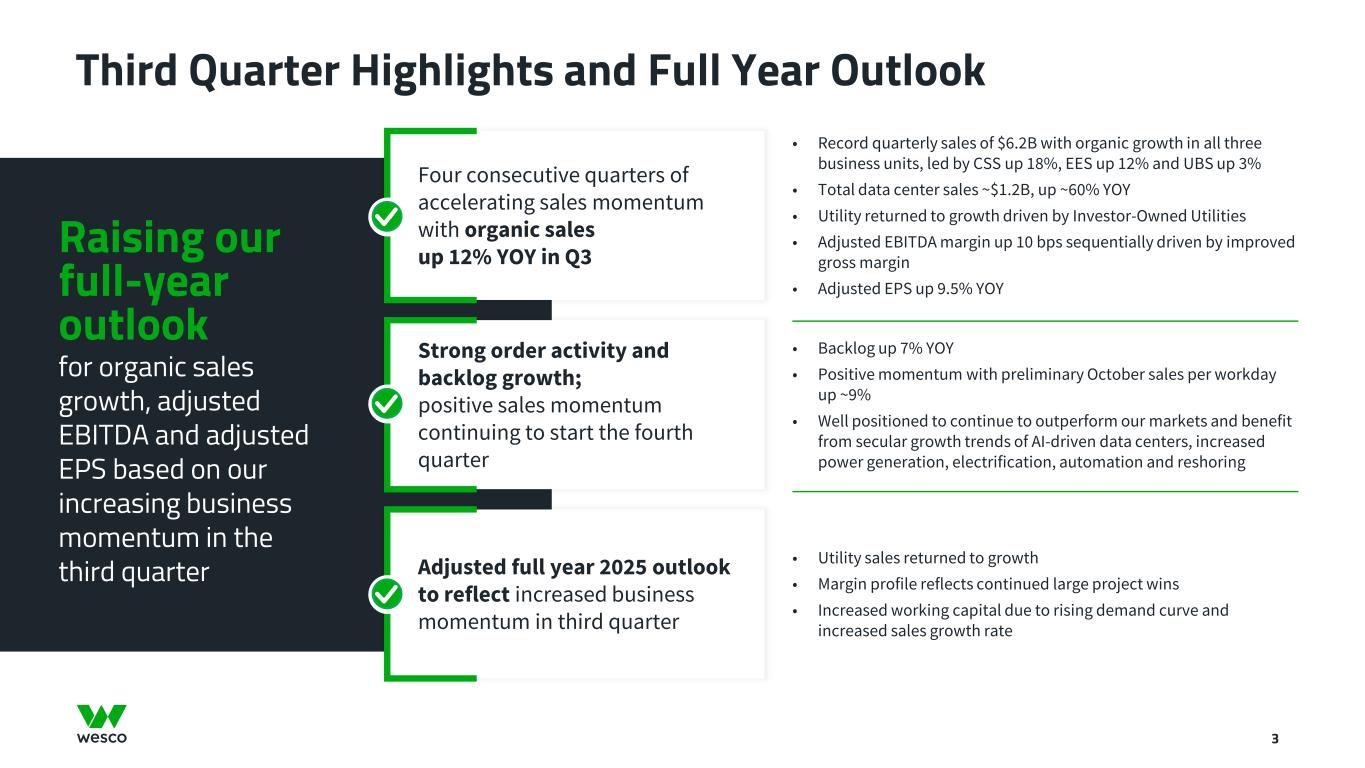

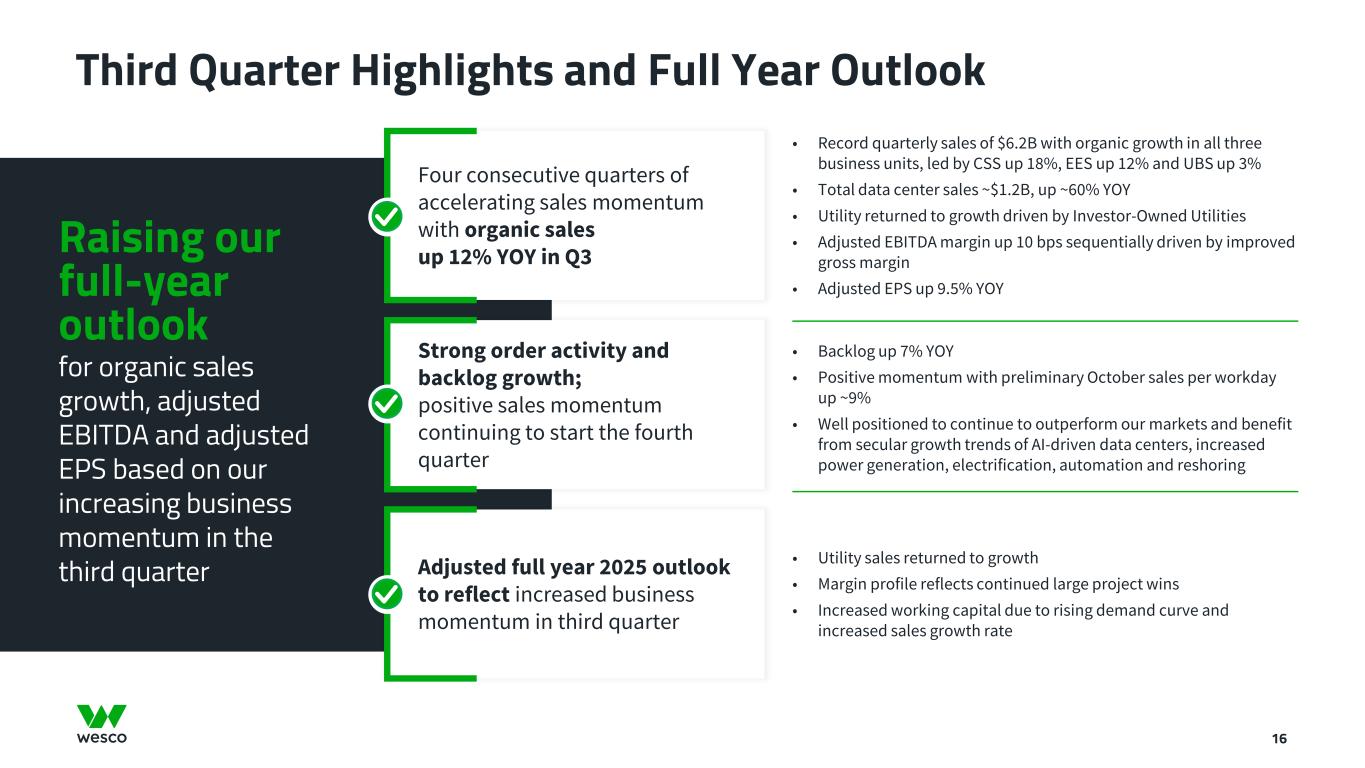

•Record third quarter reported net sales of $6.2 billion, up 12.9% YOY

–Organic sales up 12.1% YOY and 4.8% sequentially

–Data center sales of $1.2B, up ~60% YOY

–Utility return to growth in Q3

•Third quarter operating margin of 5.6%; adjusted EBITDA margin of 6.8%, up 10 basis points sequentially

•Third quarter diluted EPS of $3.79; adjusted diluted EPS of $3.92, up 9.5% YOY

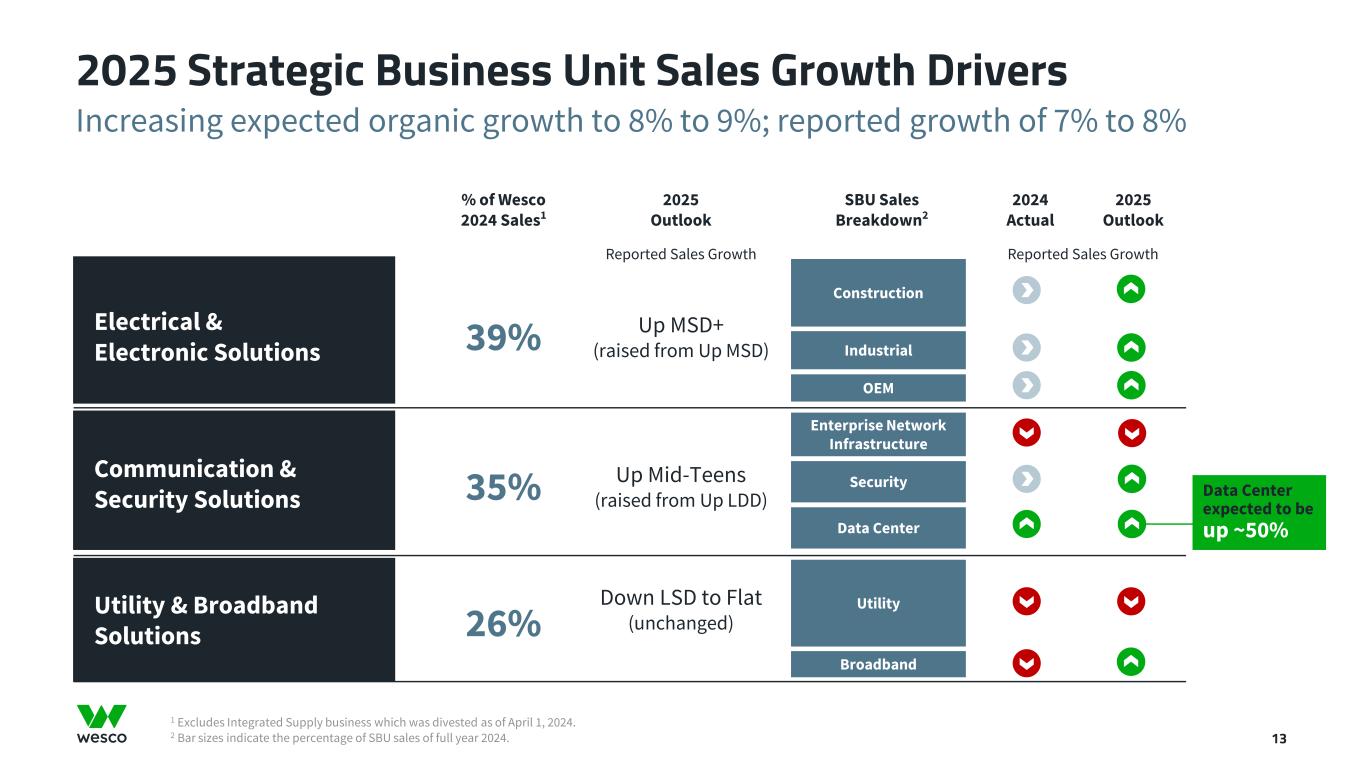

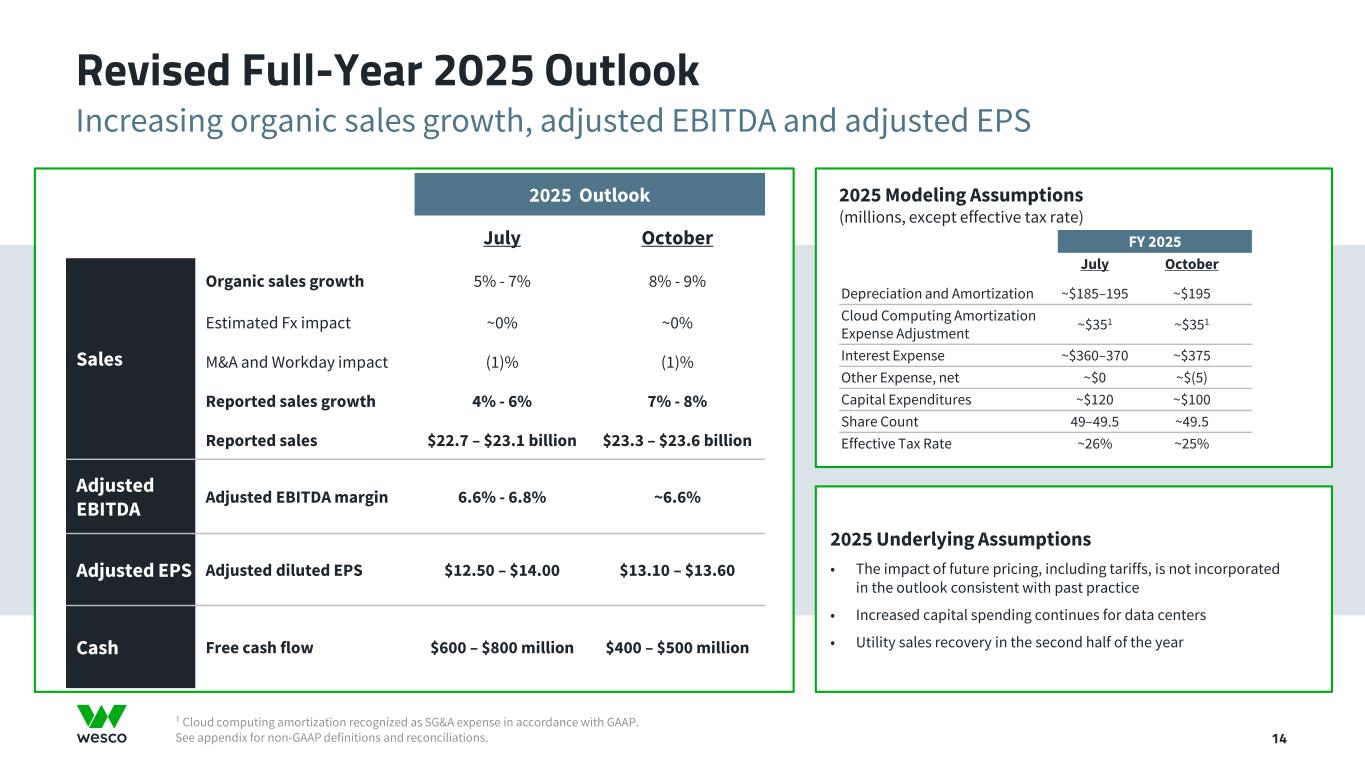

•Raising full-year 2025 outlook for sales growth, adjusted EBITDA, and adjusted EPS

PITTSBURGH, October 30, 2025 /PR Newswire/ -- Wesco International (NYSE: WCC), a leading provider of business-to-business distribution, logistics services and supply chain solutions, announces its results for the third quarter of 2025.

“We delivered very strong results in the third quarter and again outperformed the market with our leading portfolio of products, services, and solutions. Sales growth accelerated this year, with organic sales up 6% in the first quarter, 7% in the second quarter, and 12% in the third quarter. Our record sales performance was led by 18% organic growth in CSS, 12% organic growth in EES, and a return to growth in UBS. Total data center sales were $1.2B, setting another new quarterly mark, and were up about 60% versus the prior year. Our Utility business also continued to show signs of improvement with increased investor-owned utility sales growth in the third quarter. Adjusted EPS grew 9.5% versus the prior year and 16% versus the second quarter, with both gross margin and operating margin improving sequentially. Working capital days continued to show improvement versus the prior year, with record sales per workday in September resulting in an increase in accounts receivable. We are building on our positive business momentum as we enter the fourth quarter and begin to prepare for continued market-leading growth in 2026,” said John Engel, Chairman, President, and CEO.

Mr. Engel concluded, “We are raising our full-year outlook for organic sales growth, adjusted EBITDA, and adjusted EPS based on our increasing business momentum in the third quarter. We now expect organic sales growth of 8% to 9%, up from our previous organic sales growth range of 5% to 7%, and expect adjusted EPS in the range of $13.10 to $13.60. We are reducing our full-year free cash flow outlook to reflect an increase in working capital dollars associated with our rising demand curve and increased sales growth rate, but expect to generate significant positive cash flow in the fourth quarter consistent with our normal seasonal pattern. We remain firmly focused on executing our cross-selling initiatives and enterprise-wide margin improvement program while delivering operational improvements enabled by our technology-driven business transformation. As the market leader, the strength of our portfolio and the enduring secular trends of AI-driven data centers, increased power generation, electrification, automation, and reshoring fuel my confidence that Wesco will continue to outperform our markets and deliver exceptional value to our customers and shareholders in 2026 and beyond.”

Key Financial Highlights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30 |

Nine Months Ended September 30 |

| ($ in millions except per share data) |

2025 Reported |

2024 Reported |

Change vs prior year quarter |

2025 Reported |

2024 Reported |

Change vs prior year |

| GAAP Results |

| Net sales |

$6,199.1 |

$5,489.4 |

12.9% |

$17,442.4 |

$16,319.1 |

6.9% |

Selling, general, and administrative expenses |

$922.9 |

$831.1 |

11.0% |

$2,631.4 |

$2,488.9 |

5.7% |

Operating profit |

$345.4 |

$335.6 |

2.9% |

$908.5 |

$922.1 |

(1.5)% |

| Net income attributable to common stockholders |

$187.5 |

$189.9 |

(1.3)% |

$480.6 |

$509.1 |

(5.6)% |

| Earnings per diluted share |

$3.79 |

$3.81 |

(0.5)% |

$9.71 |

$10.02 |

(3.1)% |

| Operating cash flow |

$(82.7) |

$302.1 |

(127.4)% |

$53.1 |

$824.6 |

(93.6)% |

| Effective tax rate |

23.5% |

25.3% |

(180) basis points |

24.4% |

25.4% |

(100) basis points |

|

|

|

|

|

|

|

| ($ in millions except per share data) |

2025 Adjusted |

2024 Adjusted |

Change vs prior year quarter |

2025 Adjusted |

2024 Adjusted |

Change vs prior year |

| Non-GAAP Results |

| Organic sales growth (decline) |

12.1% |

(0.6)% |

N/A |

8.3% |

(1.5)% |

N/A |

| Gross profit |

$1,317.4 |

$1,212.7 |

8.6% |

$3,685.7 |

$3,548.6 |

3.9% |

| Gross margin |

21.3% |

22.1% |

(80) basis points |

21.1% |

21.7% |

(60) basis points |

| Adjusted selling, general, and administrative expenses |

$914.1 |

$825.2 |

10.8% |

$2,607.3 |

$2,439.3 |

6.9% |

Adjusted EBITDA |

$423.0 |

$398.1 |

6.3% |

$1,127.8 |

$1,138.6 |

(0.9)% |

Adjusted EBITDA margin |

6.8% |

7.3% |

(50) basis points |

6.5% |

7.0% |

(50) basis points |

| Adjusted net income attributable to common stockholders |

$193.9 |

$178.1 |

8.9% |

$470.9 |

$461.0 |

2.1% |

| Adjusted earnings per diluted share |

$3.92 |

$3.58 |

9.5% |

$9.51 |

$9.07 |

4.9% |

| Free cash flow |

$(89.3) |

$279.5 |

(131.9)% |

$6.6 |

$776.8 |

(99.2)% |

Net Sales

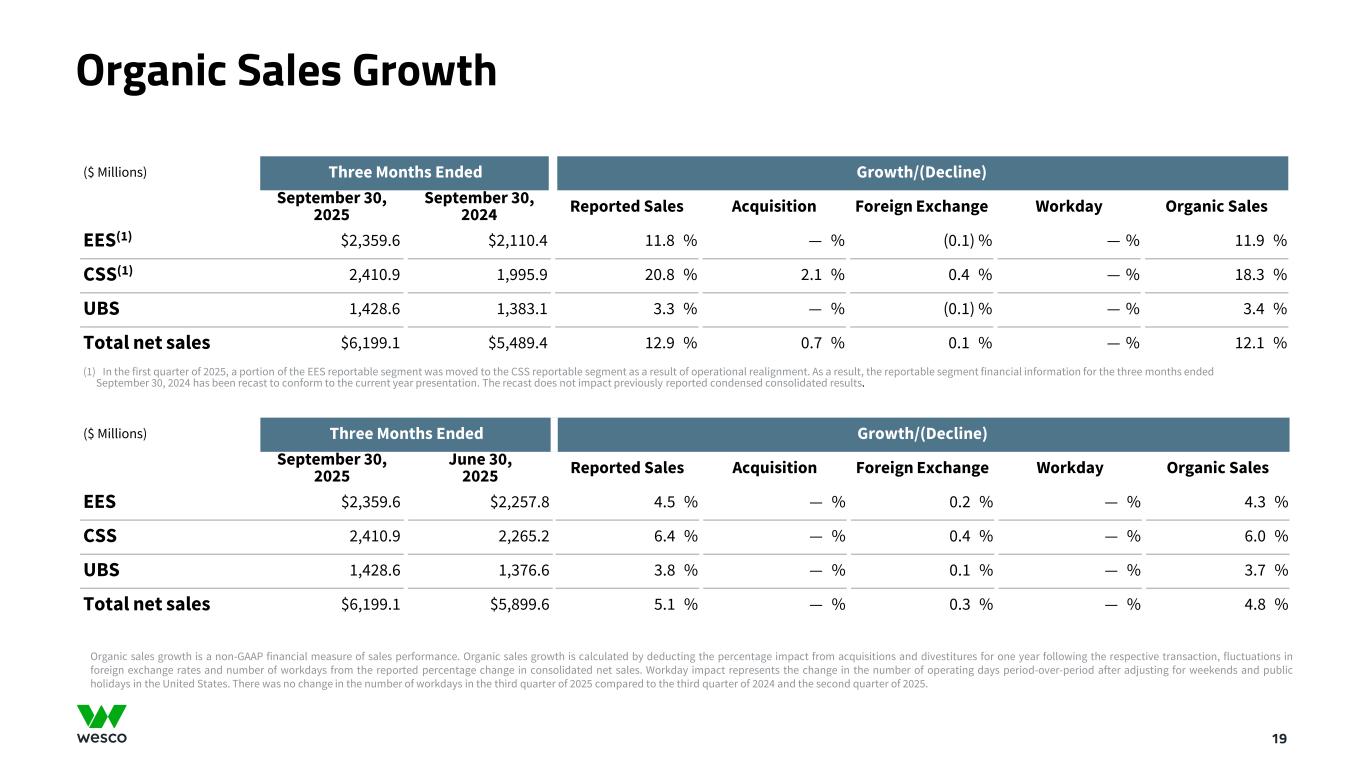

•On an organic basis, which removes the impact of the Ascent, LLC (“Ascent”) acquisition and differences in foreign exchange rates, sales for the third quarter of 2025 grew by 12.1%. The increase in organic sales reflects volume growth in all three segments (CSS, EES and UBS), as well as a favorable impact from changes in price. Sequentially, net sales increased 5.1% and organic sales grew by 4.8%. Backlog at the end of the third quarter of 2025 increased by 7% compared to the end of the third quarter of 2024.

•For the first nine months of 2025, organic sales, which removes the impact of the Wesco Integrated Supply (“WIS”) divestiture and Ascent acquisition, differences in foreign exchange rates, and the impact from the number of workdays, grew by 8.3%. The increase in organic sales reflects volume growth in the CSS and EES segments, partially offset by a volume decline in the UBS segment, as well as a favorable impact from changes in price.

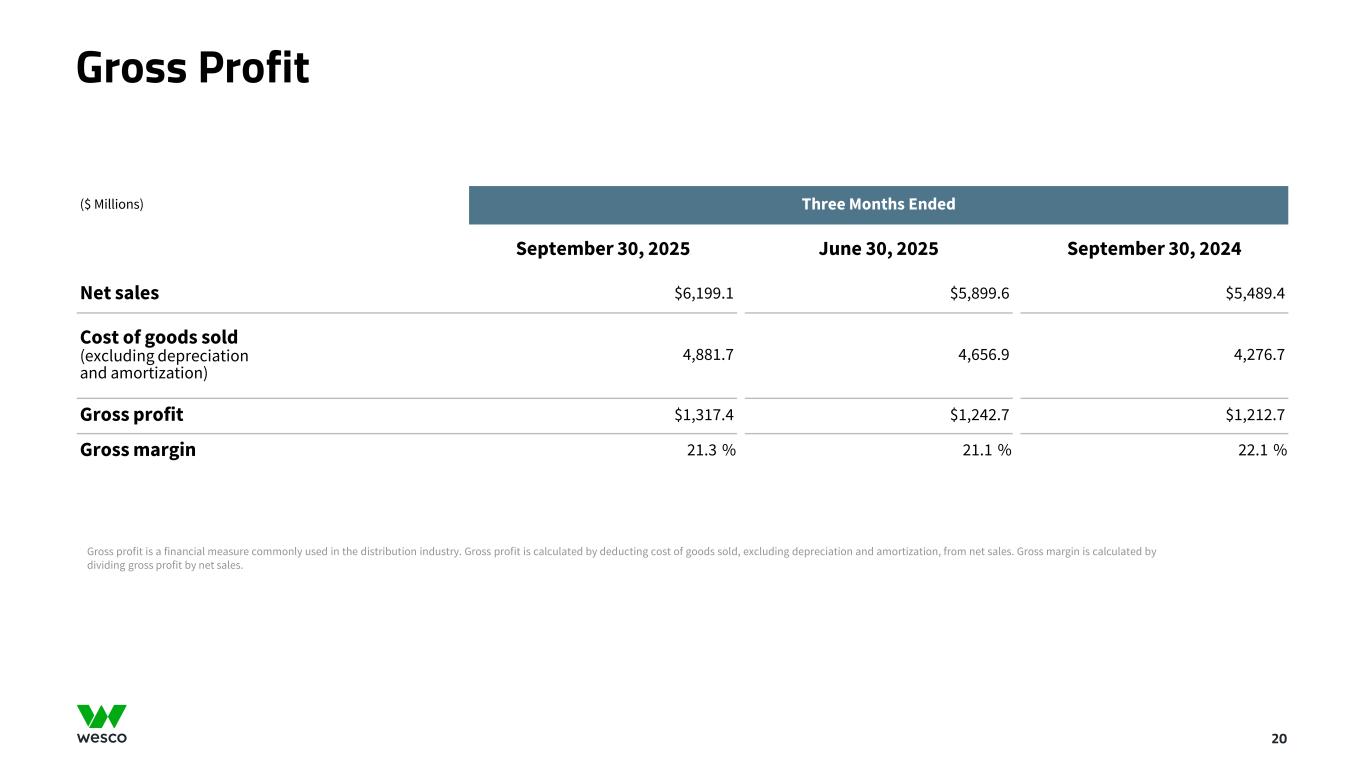

Gross Profit and Gross Margin

•The decrease in gross margin for the three and nine months ended September 30, 2025 reflects the impact of increased large project activity with lower margins and higher inventory adjustments, partially offset by favorable supplier volume rebates. Sequentially, gross margin increased by 20 basis points.

Selling, General, and Administrative (“SG&A”) Expenses

•The increase in SG&A expenses for the third quarter of 2025 is driven by higher salaries, incentives, increased costs to operate our facilities, an increase in transportation costs and higher IT costs. SG&A expenses for the third quarter of 2025 include $8.8 million of digital transformation and restructuring costs, compared to $5.9 million for the third quarter of 2024. Adjusted for these costs, SG&A expenses were 14.7% and 15.0% of net sales for the third quarter of 2025 and 2024, respectively, reflecting operating cost leverage on sales growth.

•The increase in SG&A expenses for the first nine months of 2025 is driven by higher salaries and benefits, increased costs to operate our facilities and an increase in transportation costs. SG&A expenses for the first nine months of 2025 include $24.1 million of digital transformation and restructuring costs. SG&A expenses for the first nine months of 2024 include $27.0 million of digital transformation and restructuring costs, a $17.8 million loss on abandonment of assets and $4.8 million of excise taxes on excess pension plan assets. Adjusted for these costs, SG&A expenses were 14.9% of net sales for the first nine months of 2025 and 2024.

Adjusted EBITDA and Adjusted EBITDA Margin

•The increase in Adjusted EBITDA for the third quarter of 2025 primarily reflects an increase in net sales, partially offset by an increase in cost of goods sold related to large project sales with lower margins, and a $91.8 million increase in SG&A expenses as described above. Sequentially, Adjusted EBITDA margin increased 10 basis points.

•The slight decrease in Adjusted EBITDA for the first nine months of 2025 primarily reflects lower gross margin due to large project sales with lower margins, and a $142.5 million increase in SG&A expenses as described above.

Effective Tax Rate

•The lower effective tax rates for the three and nine months ended September 30, 2025 are due primarily to higher discrete income tax benefits relating to the exercise of stock-based awards as compared to the prior year periods.

Adjusted Earnings Per Diluted Share

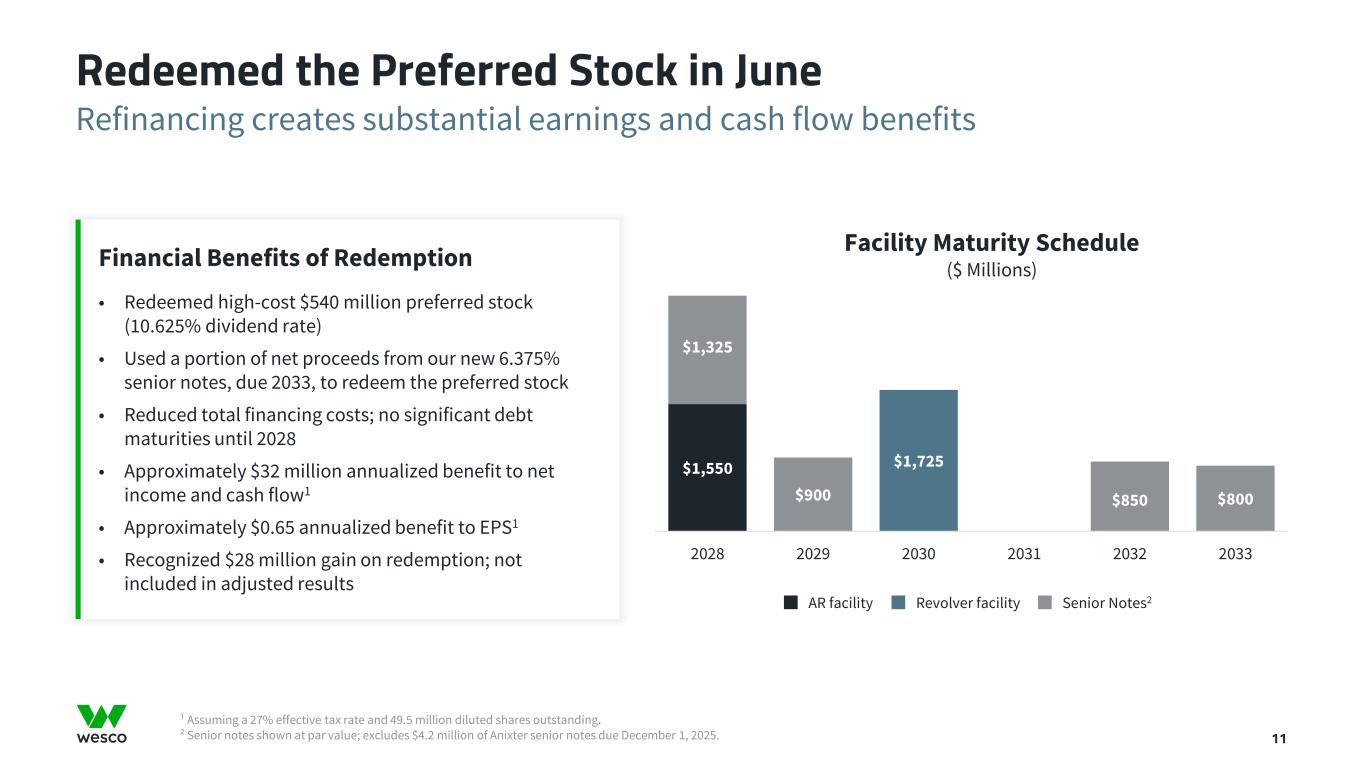

•The increase in adjusted earnings per diluted share in the third quarter of 2025 primarily reflects the favorable impact of the June 2025 Series A Preferred Stock redemption and the corresponding decrease in preferred dividends, as well as higher adjusted EBITDA, partially offset by a $3.4 million decrease in adjusted other income primarily due to fluctuations in the U.S. dollar against certain foreign currencies. We recognized a net foreign currency exchange loss of $2.1 million for the third quarter of 2025 compared to a net gain of $2.5 million for the third quarter of 2024. The increase in adjusted earnings per diluted share was further offset by a $12.5 million increase in interest expense primarily driven by the issuance of the 2033 Notes, partially offset by lower borrowings and lower interest rates on the Receivables Facility and the Revolving Credit Facility. There was a positive impact from the reduction in outstanding common shares during the third quarter of 2025 as compared to the third quarter of 2024.

•The increase in adjusted earnings per diluted share in the first nine months of 2025 primarily reflects the favorable impact of the June 2025 Series A Preferred Stock redemption and the corresponding decrease in preferred dividends, as well as a $23.1 million increase in adjusted other income primarily due to fluctuations in the U.S. dollar against certain foreign currencies, in which we recognized an immaterial net foreign currency exchange loss for the first nine months of 2025 compared to a net loss of $18.2 million for the first nine months of 2024. Further, there was a decrease of $15.8 million in preferred dividends as a result of the preferred share redemption in the second quarter of 2025. There was a positive impact from the reduction in outstanding common shares during the first nine months of 2025 as compared to the first nine months of 2024.

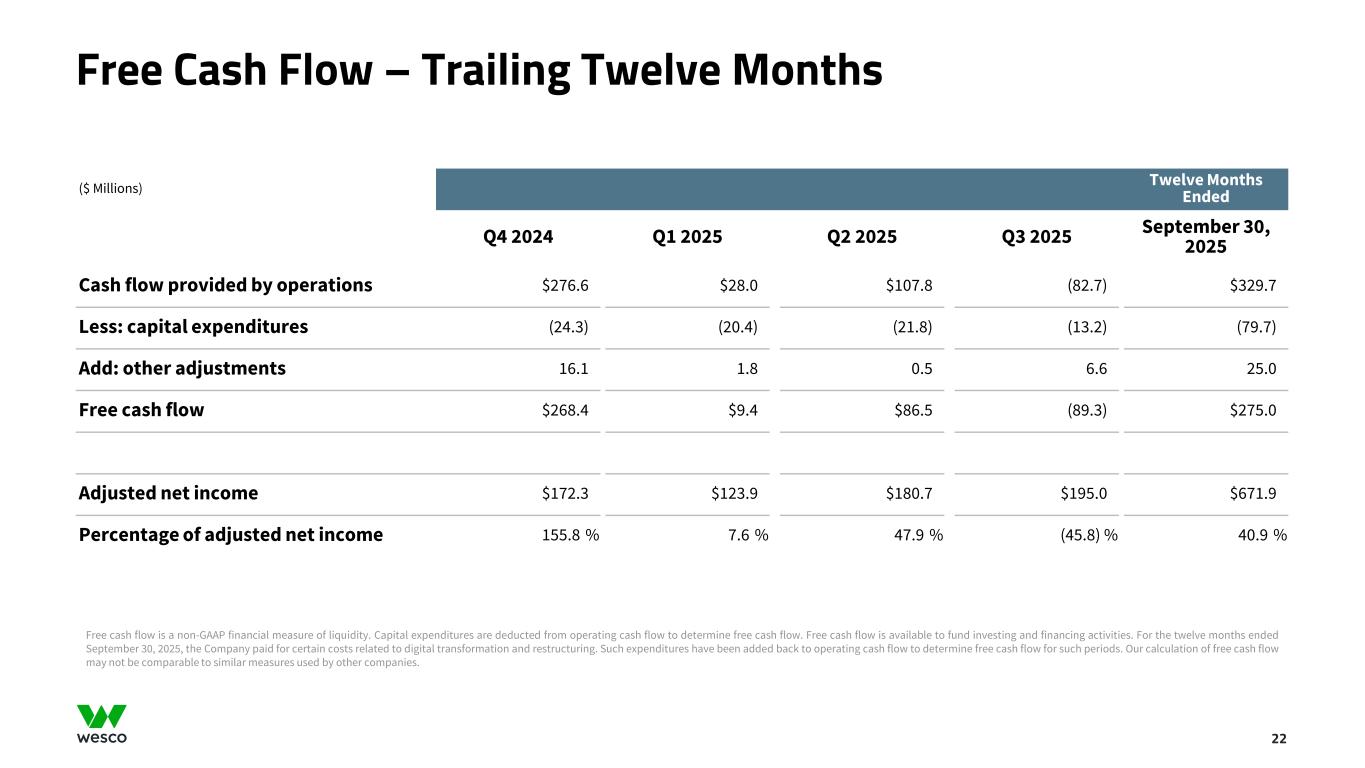

Operating Cash Flow

•Net cash used in operating activities for the third quarter of 2025 totaled $82.7 million compared to $302.1 million in cash provided by operating activities in the third quarter of 2024. The $384.8 million decrease is primarily driven by a $313.3 million impact from changes in trade accounts receivable, due to the timing of receipts from customers, and a $36.7 million impact from changes in accounts payable, due to the timing of payments to suppliers for inventory purchases.

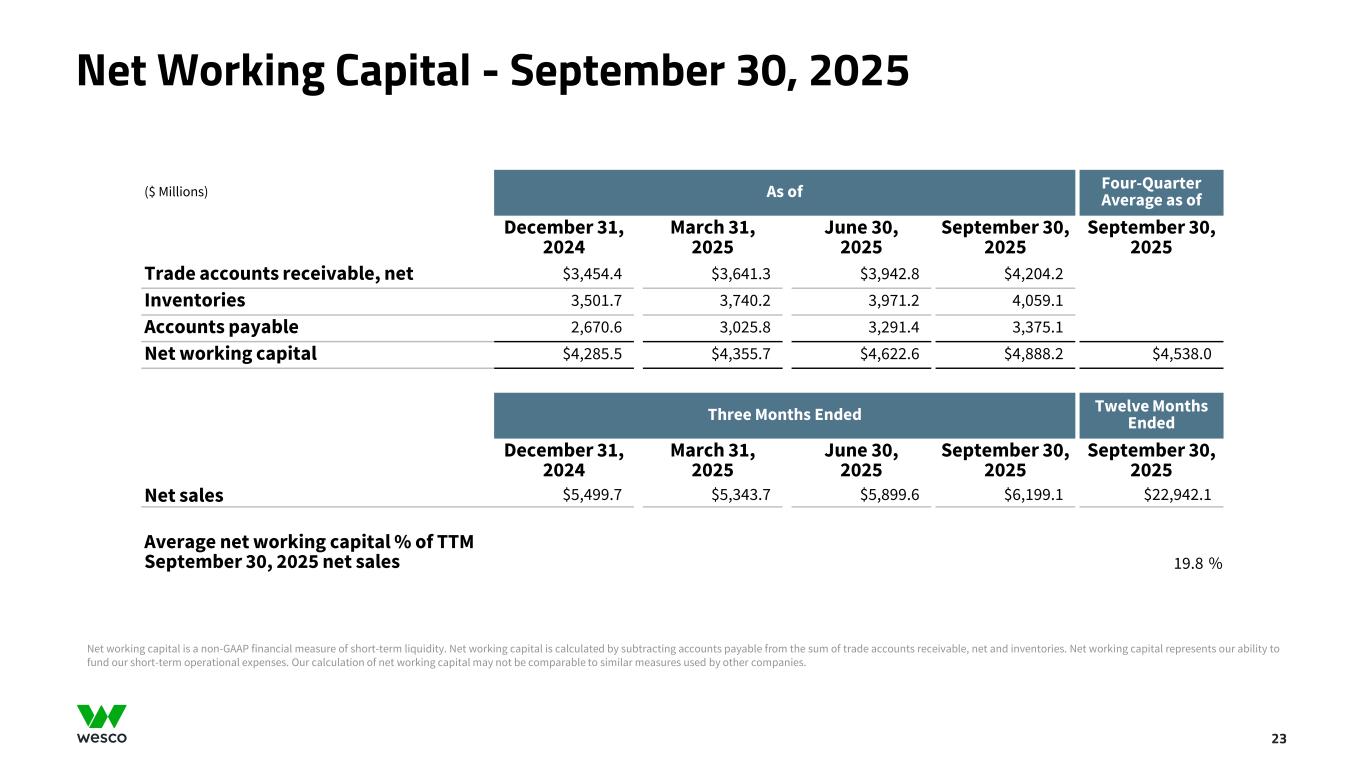

•Net cash provided by operating activities for the first nine months of 2025 totaled $53.1 million, compared to $824.6 million for the first nine months of 2024. The $771.5 million decrease is primarily driven by a $485.7 million impact from changes in trade accounts receivable, and a $421.3 million impact from changes in inventories. The impact from trade accounts receivable was primarily due to sales growth in the EES and CSS segments as well as the timing of receipts from customers as compared to the prior year. The impact from inventories was primarily due to an increase in volume related to growth in projects as compared to the prior year. These decreases were partially offset by a $196.1 million impact from changes in accounts payable. The impact from accounts payable increased primarily due to the increase in inventory, as well as the timing of purchases and payments to suppliers as compared to the prior year. Additionally an increase in net income as adjusted for certain non-cash items offset the decreases in operating cash flows.

Webcast and Teleconference Access

Wesco will conduct a webcast and teleconference to discuss the third quarter of 2025 earnings as described in this News Release on Thursday, October 30, 2025, at 10:00 a.m. E.T. The call will be broadcast live over the internet and can be accessed from the Investor Relations page of the Company's website at https://investors.wesco.com. The call will be archived on this internet site for seven days.

Wesco International (NYSE: WCC) builds, connects, powers and protects the world. Headquartered in Pittsburgh, Pennsylvania, Wesco is a FORTUNE 500® company with approximately $22 billion in annual sales in 2024 and a leading provider of business-to-business distribution, logistics services and supply chain solutions. Wesco offers a best-in-class product and services portfolio of Electrical and Electronic Solutions, Communications and Security Solutions, and Utility and Broadband Solutions. The Company employs approximately 20,000 people, partners with the industry’s premier suppliers, and serves thousands of customers around the world. With millions of products, end-to-end supply chain services, and leading digital capabilities, Wesco provides innovative solutions to meet customer needs across commercial and industrial businesses, contractors, educational institutions, government agencies, technology companies, telecommunications providers, and utilities. Wesco operates more than 700 sites, including distribution centers, fulfillment centers, and sales offices in approximately 50 countries, providing a local presence for customers and a global network to serve multi-location businesses and global corporations.

Forward-Looking Statements

All statements made herein that are not historical facts should be considered as "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results to differ materially. These statements include, but are not limited to, statements regarding business strategy, growth strategy, competitive strengths, productivity and profitability enhancement, competition, new product and service introductions, and liquidity and capital resources. Such statements can generally be identified by the use of words such as "anticipate," "plan," "believe," "estimate," "intend," "expect," "project," and similar words, phrases or expressions or future or conditional verbs such as "could," "may," "should," "will," and "would," although not all forward-looking statements contain such words. These forward-looking statements are based on current expectations and beliefs of Wesco's management, as well as assumptions made by, and information currently available to, Wesco's management, current market trends and market conditions and involve risks and uncertainties, many of which are outside of Wesco's and Wesco's management's control, and which may cause actual results to differ materially from those contained in forward-looking statements. Accordingly, you should not place undue reliance on such statements.

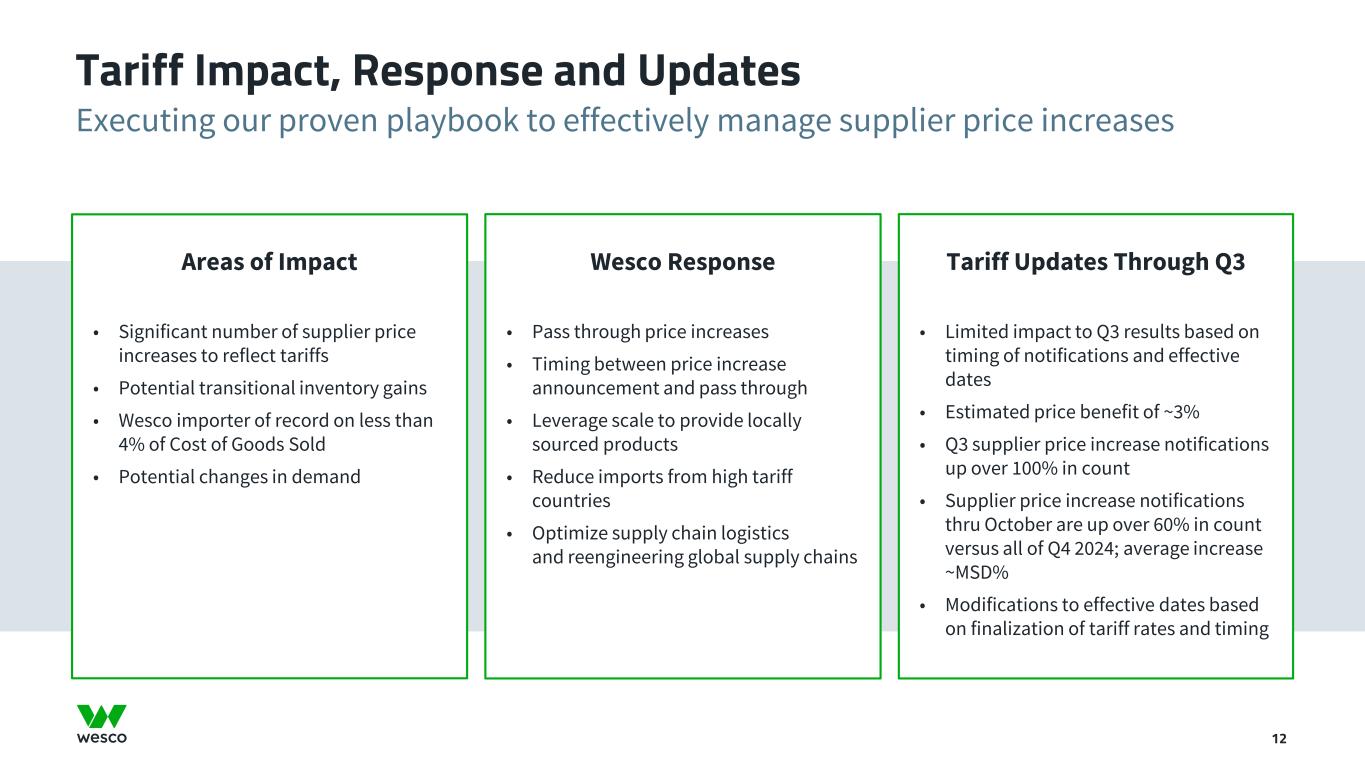

Important factors that could cause actual results or events to differ materially from those presented or implied in the forward-looking statements include, among others, the failure to achieve the anticipated benefits of, and other risks associated with, acquisitions, joint ventures, divestitures and other corporate transactions; the inability to successfully integrate acquired businesses; the impact of increased interest rates or borrowing costs; fluctuations in currency exchange rates; evolving impacts from tariffs or other trade tensions between the U.S. and other countries (including implementation of new tariffs and retaliatory measures); failure to adequately protect Wesco's intellectual property or successfully defend against infringement claims; the inability to successfully deploy new technologies, digital products and information systems or to otherwise adapt to emerging technologies in the marketplace, such as those incorporating artificial intelligence; failure to execute on our efforts and programs related to environmental, social and governance (ESG) matters; unanticipated expenditures or other adverse developments related to compliance with new or stricter government policies, laws or regulations, including those relating to data privacy, sustainability and environmental protection; the inability to successfully develop, manage or implement new technology initiatives or business strategies, including with respect to the expansion of e-commerce capabilities and other digital solutions and digitalization initiatives; disruption of information technology systems or operations; natural disasters (including as a result of climate change), health epidemics, pandemics and other outbreaks; supply chain disruptions; geopolitical issues, including the impact of the evolving conflicts in the Middle East and Russia/Ukraine; the impact of sanctions imposed on, or other actions taken by the U.S. or other countries against, Russia or China; the failure to manage the increased risks and impacts of cyber incidents or data breaches; and exacerbation of key materials shortages, inflationary cost pressures, material cost increases, demand volatility, and logistics and capacity constraints, any of which may have a material adverse effect on the Company's business, results of operations and financial condition. All such factors are difficult to predict and are beyond the Company's control. Additional factors that could cause results to differ materially from those described above can be found in Wesco's most recent Annual Report on Form 10-K and other periodic reports filed with the U.S. Securities and Exchange Commission.

|

|

|

|

|

|

| Contact Information |

| Investor Relations |

Corporate Communications |

Scott Gaffner

Senior Vice President, Investor Relations

investorrelations@wescodist.com |

Jennifer Sniderman

Vice President, Corporate Communications

717-579-6603

|

http://www.wesco.com

WESCO INTERNATIONAL, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(in millions, except per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

September 30, 2025 |

|

|

September 30, 2024 |

|

| Net sales |

$ |

6,199.1 |

|

|

|

$ |

5,489.4 |

|

|

| Cost of goods sold (excluding depreciation and amortization) |

4,881.7 |

|

78.7 |

% |

|

4,276.7 |

|

77.9 |

% |

| Selling, general and administrative expenses |

922.9 |

|

14.9 |

% |

|

831.1 |

|

15.1 |

% |

| Depreciation and amortization |

49.1 |

|

|

|

46.0 |

|

|

| Income from operations |

345.4 |

|

5.6 |

% |

|

335.6 |

|

6.1 |

% |

| Interest expense, net |

99.0 |

|

|

|

86.5 |

|

|

| Other expense (income), net |

— |

|

|

|

(24.9) |

|

|

| Income before income taxes |

246.4 |

|

4.0 |

% |

|

274.0 |

|

5.0 |

% |

| Provision for income taxes |

57.8 |

|

|

|

69.3 |

|

|

| Net income |

188.6 |

|

3.0 |

% |

|

204.7 |

|

3.7 |

% |

Less: Net income attributable to noncontrolling interests |

1.1 |

|

|

|

0.4 |

|

|

| Net income attributable to WESCO International, Inc. |

187.5 |

|

3.0 |

% |

|

204.3 |

|

3.7 |

% |

Less: Preferred stock dividends |

— |

|

|

|

14.4 |

|

|

| Net income attributable to common stockholders |

$ |

187.5 |

|

3.0 |

% |

|

$ |

189.9 |

|

3.5 |

% |

|

|

|

|

|

|

| Earnings per diluted share attributable to common stockholders |

$ |

3.79 |

|

|

|

$ |

3.81 |

|

|

| Weighted-average common shares outstanding and common share equivalents used in computing earnings per diluted common share |

49.5 |

|

|

|

49.8 |

|

|

WESCO INTERNATIONAL, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(in millions, except per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended |

|

|

September 30, 2025 |

|

|

September 30, 2024 |

|

| Net sales |

$ |

17,442.4 |

|

|

|

$ |

16,319.1 |

|

|

| Cost of goods sold (excluding depreciation and amortization) |

13,756.7 |

|

78.9 |

% |

|

12,770.5 |

|

78.3 |

% |

| Selling, general and administrative expenses |

2,631.4 |

|

15.1 |

% |

|

2,488.9 |

|

15.3 |

% |

| Depreciation and amortization |

145.8 |

|

|

|

137.6 |

|

|

| Income from operations |

908.5 |

|

5.2 |

% |

|

922.1 |

|

5.7 |

% |

| Interest expense, net |

278.2 |

|

|

|

279.8 |

|

|

| Other income, net |

(7.0) |

|

|

|

(99.3) |

|

|

| Income before income taxes |

637.3 |

|

3.7 |

% |

|

741.6 |

|

4.5 |

% |

| Provision for income taxes |

155.7 |

|

|

|

188.1 |

|

|

| Net income |

481.6 |

|

2.8 |

% |

|

553.5 |

|

3.4 |

% |

Less: Net income attributable to noncontrolling interests |

1.3 |

|

|

|

1.3 |

|

|

| Net income attributable to WESCO International, Inc. |

480.3 |

|

2.8 |

% |

|

552.2 |

|

3.4 |

% |

Plus: Gain on redemption of Series A Preferred Stock |

27.6 |

|

|

|

— |

|

|

Less: Preferred stock dividends |

27.3 |

|

|

|

43.1 |

|

|

| Net income attributable to common stockholders |

$ |

480.6 |

|

2.8 |

% |

|

$ |

509.1 |

|

3.1 |

% |

|

|

|

|

|

|

| Earnings per diluted share attributable to common stockholders |

$ |

9.71 |

|

|

|

$ |

10.02 |

|

|

| Weighted-average common shares outstanding and common share equivalents used in computing earnings per diluted common share |

49.5 |

|

|

|

50.8 |

|

|

WESCO INTERNATIONAL, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(dollar amounts in millions)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

As of |

|

September 30,

2025 |

|

December 31,

2024 |

| Assets |

|

|

|

| Current Assets |

|

|

|

| Cash and cash equivalents |

$ |

571.9 |

|

|

$ |

702.6 |

|

| Trade accounts receivable, net |

4,204.2 |

|

|

3,454.4 |

|

| Inventories |

4,059.1 |

|

|

3,501.7 |

|

| Other current assets |

731.1 |

|

|

692.7 |

|

| Total current assets |

9,566.3 |

|

|

8,351.4 |

|

|

|

|

|

| Goodwill and intangible assets |

5,120.4 |

|

|

5,116.0 |

|

| Other assets |

1,866.6 |

|

|

1,594.0 |

|

| Total assets |

$ |

16,553.3 |

|

|

$ |

15,061.4 |

|

|

|

|

|

|

|

|

|

| Liabilities and Stockholders' Equity |

|

|

|

| Current Liabilities |

|

|

|

| Accounts payable |

$ |

3,375.1 |

|

|

$ |

2,670.6 |

|

| Short-term debt and current portion of long-term debt, net |

28.0 |

|

|

19.5 |

|

| Other current liabilities |

1,176.6 |

|

|

1,113.9 |

|

| Total current liabilities |

4,579.7 |

|

|

3,804.0 |

|

|

|

|

|

| Long-term debt, net |

5,721.9 |

|

|

5,045.5 |

|

| Other noncurrent liabilities |

1,410.0 |

|

|

1,246.4 |

|

| Total liabilities |

11,711.6 |

|

|

10,095.9 |

|

|

|

|

|

| Stockholders' Equity |

|

|

|

| Total stockholders' equity |

4,841.7 |

|

|

4,965.5 |

|

| Total liabilities and stockholders' equity |

$ |

16,553.3 |

|

|

$ |

15,061.4 |

|

WESCO INTERNATIONAL, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(dollar amounts in millions)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended |

|

September 30,

2025 |

|

September 30,

2024 |

| Operating Activities: |

|

|

|

| Net income |

$ |

481.6 |

|

|

$ |

553.5 |

|

| Add back (deduct): |

|

|

|

| Depreciation and amortization |

145.8 |

|

|

137.6 |

|

|

|

|

|

| Gain on divestiture |

— |

|

|

(122.2) |

|

| Loss on abandonment of assets |

— |

|

|

17.8 |

|

| Change in trade receivables, net |

(703.6) |

|

|

(217.9) |

|

| Change in inventories |

(506.3) |

|

|

(85.0) |

|

| Change in accounts payable |

674.1 |

|

|

478.0 |

|

| Other, net |

(38.5) |

|

|

62.8 |

|

| Net cash provided by operating activities |

53.1 |

|

|

824.6 |

|

|

|

|

|

| Investing Activities: |

|

|

|

| Capital expenditures |

(55.4) |

|

|

(70.4) |

|

Acquisition payments, net of cash acquired |

(36.0) |

|

|

(41.7) |

|

| Proceeds from divestiture, net of cash transferred |

— |

|

|

354.9 |

|

| Other, net |

(9.0) |

|

|

6.9 |

|

| Net cash (used in) provided by investing activities |

(100.4) |

|

|

249.7 |

|

|

|

|

|

| Financing Activities: |

|

|

|

Debt borrowings (repayments), net(1) |

679.5 |

|

|

(318.2) |

|

| Payments for taxes related to net-share settlement of equity awards |

(35.9) |

|

|

(26.2) |

|

| Repurchases of common stock |

(75.0) |

|

|

(375.0) |

|

| Redemption of preferred stock |

(540.3) |

|

|

— |

|

| Payment of common stock dividends |

(66.3) |

|

|

(61.4) |

|

| Payment of preferred stock dividends |

(27.3) |

|

|

(43.1) |

|

| Other, net |

(28.9) |

|

|

(50.4) |

|

| Net cash used in financing activities |

(94.2) |

|

|

(874.3) |

|

|

|

|

|

| Effect of exchange rate changes on cash and cash equivalents |

10.8 |

|

|

(17.3) |

|

|

|

|

|

| Net change in cash and cash equivalents |

(130.7) |

|

|

182.7 |

|

| Cash and cash equivalents at the beginning of the period |

702.6 |

|

|

524.1 |

|

| Cash and cash equivalents at the end of the period |

$ |

571.9 |

|

|

$ |

706.8 |

|

(1) The nine months ended September 30, 2025 includes the issuance of the Company's $800 million aggregate principal amount of 6.375% Senior Notes due 2033 (the “2033 Notes”). The Company used the net proceeds from the issuance of the 2033 Notes to redeem all of the Company’s outstanding 10.625% Series A Fixed-Rate Reset Cumulative Perpetual Preferred Stock (the “Series A Preferred Stock”) and all of the related depositary shares representing fractional interests in the Series A Preferred Stock, and to repay a portion of the amounts outstanding under the Revolving Credit Facility. The nine months ended September 30, 2024 includes the issuance of the Company's $900 million aggregate principal amount of 6.375% senior notes due 2029 (the “2029 Notes”) and $850 million aggregate principal amount of 6.625% senior notes due 2032 (the “2032 Notes” and, together with the 2029 Notes, the “2029 and 2032 Notes”). The proceeds from the issuance of the 2029 and 2032 Notes were used for the redemption of the Company's $1,500 million aggregate principal amount of 7.125% Senior Notes due 2025 (the “2025 Notes”) and for other corporate purposes.

NON-GAAP FINANCIAL MEASURES

In addition to the results provided in accordance with U.S. Generally Accepted Accounting Principles (“U.S. GAAP”) above, this earnings release includes certain non-GAAP financial measures. These financial measures include organic sales growth, gross profit, gross margin, earnings before interest, taxes, depreciation and amortization (EBITDA), adjusted EBITDA, adjusted EBITDA margin, financial leverage, free cash flow, adjusted selling, general and administrative expenses, adjusted income from operations, adjusted operating margin, adjusted other non-operating (income) expense, adjusted provision for income taxes, adjusted income before income taxes, adjusted net income, adjusted net income attributable to WESCO International, Inc., adjusted net income attributable to common stockholders, and adjusted earnings per diluted share. The Company believes that these non-GAAP measures are useful to investors as they provide a better understanding of our financial condition and results of operations on a comparable basis. Additionally, certain non-GAAP measures either focus on or exclude items impacting comparability of results such as digital transformation costs, restructuring costs, cloud computing arrangement amortization, pension settlement cost and excise taxes on excess pension plan assets related to the final settlement of the Anixter Inc. Pension Plan, loss on abandonment of assets, the gain recognized on the divestiture of the WIS business, the loss on termination of business arrangement, and the related income tax effects, as well as the gain on the redemption of the Series A Preferred Stock, allowing investors to more easily compare the Company's financial performance from period to period. Management does not use these non-GAAP financial measures for any purpose other than the reasons stated above.

WESCO INTERNATIONAL, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(in millions, except per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Organic Sales Growth by Segment - Three Months Ended: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Growth/(Decline) |

|

September 30, 2025 |

|

September 30, 2024 |

|

Reported

Sales |

|

Acquisition |

|

Foreign Exchange |

|

Workday |

|

Organic Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EES(1) |

$ |

2,359.6 |

|

|

$ |

2,110.4 |

|

|

11.8 |

% |

|

— |

% |

|

(0.1) |

% |

|

— |

% |

|

11.9 |

% |

CSS(1) |

2,410.9 |

|

|

1,995.9 |

|

|

20.8 |

% |

|

2.1 |

% |

|

0.4 |

% |

|

— |

% |

|

18.3 |

% |

| UBS |

1,428.6 |

|

|

1,383.1 |

|

|

3.3 |

% |

|

— |

% |

|

(0.1) |

% |

|

— |

% |

|

3.4 |

% |

| Total net sales |

$ |

6,199.1 |

|

|

$ |

5,489.4 |

|

|

12.9 |

% |

|

0.7 |

% |

|

0.1 |

% |

|

— |

% |

|

12.1 |

% |

(1) In the first quarter of 2025, a portion of the EES reportable segment was moved to the CSS reportable segment as a result of operational realignment. As a result, the reportable segment financial information for the three months ended September 30, 2024 has been recast to conform to the current year presentation. The recast does not impact previously reported condensed consolidated results. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Organic Sales Growth by Segment - Nine Months Ended: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended |

|

Growth/(Decline) |

|

September 30, 2025 |

|

September 30, 2024 |

|

Reported

Sales |

|

Acquisition/Divestiture |

|

Foreign Exchange |

|

Workday |

|

Organic Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EES(1) |

$ |

6,682.7 |

|

|

$ |

6,309.2 |

|

|

5.9 |

% |

|

— |

% |

|

(0.7) |

% |

|

(0.5) |

% |

|

7.1 |

% |

CSS(1) |

6,676.4 |

|

|

5,605.0 |

|

|

19.1 |

% |

|

1.9 |

% |

|

(0.2) |

% |

|

(0.5) |

% |

|

17.9 |

% |

| UBS |

4,083.3 |

|

|

4,404.9 |

|

|

(7.3) |

% |

|

(4.4) |

% |

|

(0.2) |

% |

|

(0.5) |

% |

|

(2.2) |

% |

| Total net sales |

$ |

17,442.4 |

|

|

$ |

16,319.1 |

|

|

6.9 |

% |

|

(0.5) |

% |

|

(0.4) |

% |

|

(0.5) |

% |

|

8.3 |

% |

(1) In the first quarter of 2025, a portion of the EES reportable segment was moved to the CSS reportable segment as a result of operational realignment. As a result, the reportable segment financial information for the nine months ended September 30, 2024 has been recast to conform to the current year presentation. The recast does not impact previously reported condensed consolidated results. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Organic Sales Growth by Segment - Sequential: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Growth/(Decline) |

|

September 30, 2025 |

|

June 30, 2025 |

|

Reported

Sales |

|

Acquisition |

|

Foreign Exchange |

|

Workday |

|

Organic Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EES |

$ |

2,359.6 |

|

|

$ |

2,257.8 |

|

|

4.5 |

% |

|

— |

% |

|

0.2 |

% |

|

— |

% |

|

4.3 |

% |

| CSS |

2,410.9 |

|

|

2,265.2 |

|

|

6.4 |

% |

|

— |

% |

|

0.4 |

% |

|

— |

% |

|

6.0 |

% |

| UBS |

1,428.6 |

|

|

1,376.6 |

|

|

3.8 |

% |

|

— |

% |

|

0.1 |

% |

|

— |

% |

|

3.7 |

% |

| Total net sales |

$ |

6,199.1 |

|

|

$ |

5,899.6 |

|

|

5.1 |

% |

|

— |

% |

|

0.3 |

% |

|

— |

% |

|

4.8 |

% |

Note: Organic sales growth is a non-GAAP financial measure of sales performance. Organic sales growth is calculated by deducting the percentage impact from acquisitions and divestitures for one year following the respective transaction, fluctuations in foreign exchange rates and number of workdays from the reported percentage change in consolidated net sales. Workday impact represents the change in the number of operating days period-over-period after adjusting for weekends and public holidays in the United States. There was no change in the number of workdays in the third quarter of 2025 compared to the third quarter of 2024. The first nine months of 2025 had one less workday compared to the first nine months of 2024. There was no change in the number of workdays in the third quarter of 2025 compared to the second quarter of 2025.

WESCO INTERNATIONAL, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(in millions, except per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

| Gross Profit: |

September 30, 2025 |

|

September 30, 2024 |

|

September 30, 2025 |

|

September 30, 2024 |

|

|

|

|

|

|

|

|

| Net sales |

$ |

6,199.1 |

|

$ |

5,489.4 |

|

$ |

17,442.4 |

|

|

$ |

16,319.1 |

|

| Cost of goods sold (excluding depreciation and amortization) |

4,881.7 |

|

4,276.7 |

|

13,756.7 |

|

|

12,770.5 |

|

| Gross profit |

$ |

1,317.4 |

|

$ |

1,212.7 |

|

$ |

3,685.7 |

|

|

$ |

3,548.6 |

|

|

|

|

|

|

|

|

|

| Gross margin |

21.3 |

% |

|

22.1 |

% |

|

21.1 |

% |

|

21.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

| Gross Profit: |

|

|

|

|

June 30, 2025 |

|

|

|

|

|

|

| Net sales |

|

|

|

|

$ |

5,899.6 |

|

| Cost of goods sold (excluding depreciation and amortization) |

|

|

|

|

4,656.9 |

|

| Gross profit |

|

|

|

|

$ |

1,242.7 |

|

|

|

|

|

|

|

| Gross margin |

|

|

|

|

21.1 |

% |

|

|

|

|

|

|

Note: Gross profit is a financial measure commonly used in the distribution industry. Gross profit is calculated by deducting cost of goods sold, excluding depreciation and amortization, from net sales. Gross margin is calculated by dividing gross profit by net sales.

WESCO INTERNATIONAL, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(in millions, except per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

September 30, 2025 |

|

September 30, 2024 |

|

September 30, 2025 |

|

September 30, 2024 |

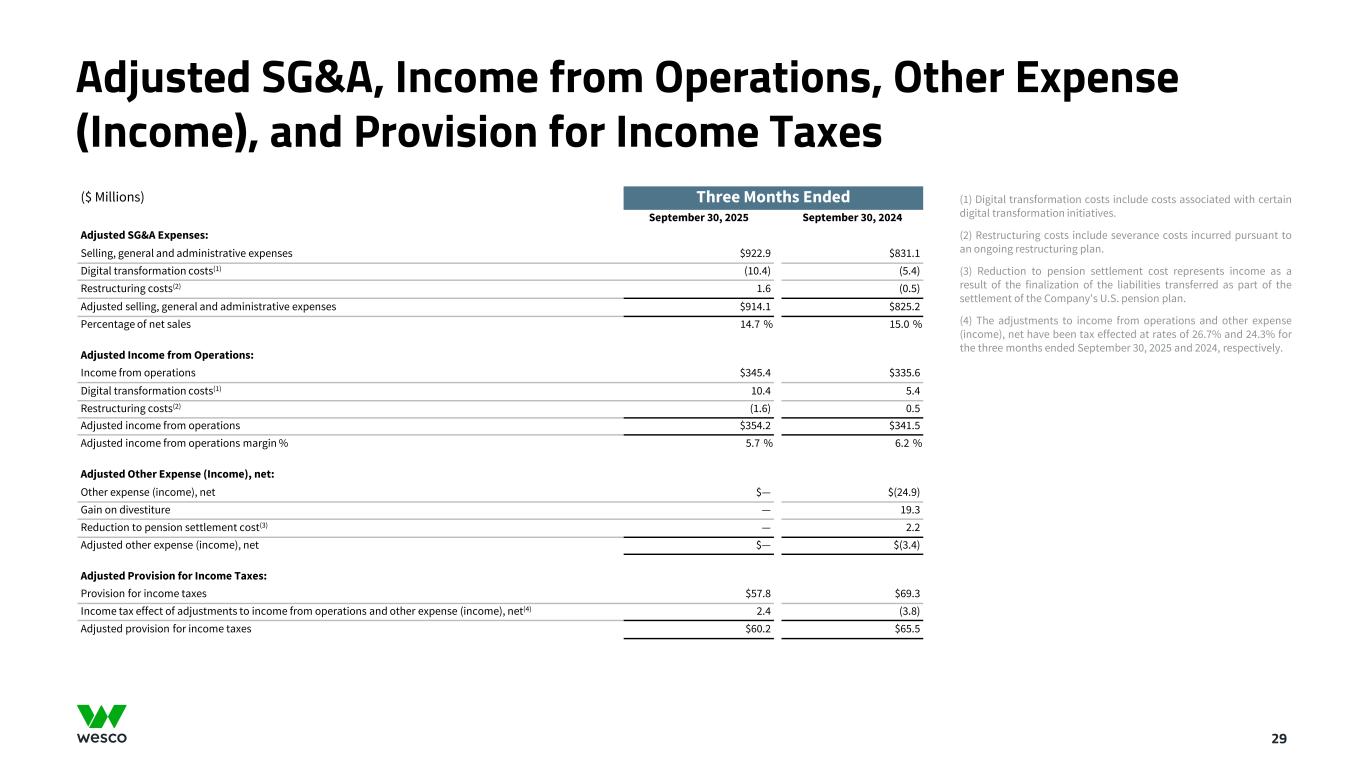

| Adjusted SG&A Expenses: |

|

|

|

|

|

|

|

| Selling, general and administrative expenses |

$ |

922.9 |

|

$ |

831.1 |

|

$ |

2,631.4 |

|

$ |

2,488.9 |

Digital transformation costs(1) |

(10.4) |

|

(5.4) |

|

(24.1) |

|

(17.5) |

Restructuring costs(2) |

1.6 |

|

(0.5) |

|

— |

|

(9.5) |

Loss on abandonment of assets(3) |

— |

|

— |

|

— |

|

(17.8) |

Excise taxes on excess pension plan assets(4) |

— |

|

— |

|

— |

|

(4.8) |

| Adjusted selling, general and administrative expenses |

$ |

914.1 |

|

$ |

825.2 |

|

$ |

2,607.3 |

|

$ |

2,439.3 |

| Percentage of net sales |

14.7 |

% |

|

15.0 |

% |

|

14.9 |

% |

|

14.9 |

% |

|

|

|

|

|

|

|

|

| Adjusted Income from Operations: |

|

|

|

|

|

|

|

| Income from operations |

$ |

345.4 |

|

$ |

335.6 |

|

$ |

908.5 |

|

$ |

922.1 |

Digital transformation costs(1) |

10.4 |

|

5.4 |

|

24.1 |

|

17.5 |

Restructuring costs(2) |

(1.6) |

|

0.5 |

|

— |

|

9.5 |

Loss on abandonment of assets(3) |

— |

|

— |

|

— |

|

17.8 |

Excise taxes on excess pension plan assets(4) |

— |

|

— |

|

— |

|

4.8 |

| Adjusted income from operations |

$ |

354.2 |

|

$ |

341.5 |

|

$ |

932.6 |

|

$ |

971.7 |

| Adjusted income from operations margin % |

5.7 |

% |

|

6.2 |

% |

|

5.3 |

% |

|

6.0 |

% |

|

|

|

|

|

|

|

|

| Adjusted Other Expense (Income), net: |

|

|

|

|

|

|

|

| Other expense (income), net |

$ |

— |

|

$ |

(24.9) |

|

$ |

(7.0) |

|

$ |

(99.3) |

| Gain on divestiture |

— |

|

19.3 |

|

— |

|

122.2 |

Loss on termination of business arrangement(5) |

— |

|

— |

|

(0.3) |

|

(3.8) |

Pension settlement cost(6) |

— |

|

2.2 |

|

— |

|

(3.3) |

| Adjusted other expense (income), net |

$ |

— |

|

$ |

(3.4) |

|

$ |

(7.3) |

|

$ |

15.8 |

|

|

|

|

|

|

|

|

| Adjusted Provision for Income Taxes: |

|

|

|

|

|

|

|

| Provision for income taxes |

$ |

57.8 |

|

$ |

69.3 |

|

$ |

155.7 |

|

$ |

188.1 |

Income tax effect of adjustments to income from operations and other expense (income), net(7) |

2.4 |

|

(3.8) |

|

6.5 |

|

(17.4) |

| Adjusted provision for income taxes |

$ |

60.2 |

|

$ |

65.5 |

|

$ |

162.2 |

|

$ |

170.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Digital transformation costs include costs associated with certain digital transformation initiatives.

(2) Restructuring costs include severance costs incurred pursuant to an ongoing restructuring plan.

(3) Loss on abandonment of assets represents the write-off of certain capitalized cloud computing arrangement implementation costs relating to a third-party developed operations management software product in favor of an application with functionality that better suits the Company’s operations.

(4) Excise taxes on excess pension plan assets represent the excise taxes applicable to the excess pension plan assets following the final settlement of the Company's U.S. pension plan.

(5) Loss on termination of business arrangement represents the loss recognized as a result of management's decision to terminate a business arrangement with a third party.

(6) Pension settlement cost represents expense related to the final settlement of the Company's U.S. pension plan. Reduction to pension settlement cost during the three months ended September 30, 2024 represents income of $2.2 million as a result of the finalization of the liabilities transferred as part of the settlement of the Company's U.S. pension plan.

(7) The adjustments to income from operations and other expense (income), net have been tax effected at rates of 26.7% and 24.3% for the three months ended September 30, 2025 and 2024, respectively, and at rates of 26.4% and 26.5% for the nine months ended September 30, 2025 and 2024, respectively.

WESCO INTERNATIONAL, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(in millions, except per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

September 30, 2025 |

|

September 30, 2024 |

|

September 30, 2025 |

|

September 30, 2024 |

| Adjusted Net Income Attributable to Common Stockholders: |

|

|

|

|

|

|

|

| Net income attributable to common stockholders |

$ |

187.5 |

|

$ |

189.9 |

|

$ |

480.6 |

|

$ |

509.1 |

Digital transformation costs(1) |

10.4 |

|

5.4 |

|

24.1 |

|

17.5 |

Restructuring costs(2) |

(1.6) |

|

0.5 |

|

— |

|

9.5 |

Loss on abandonment of assets(3) |

— |

|

— |

|

— |

|

17.8 |

Excise taxes on excess pension plan assets(4) |

— |

|

— |

|

— |

|

4.8 |

| Gain on divestiture |

— |

|

(19.3) |

|

— |

|

(122.2) |

Loss on termination of business arrangement(5) |

— |

|

— |

|

0.3 |

|

3.8 |

Pension settlement cost(6) |

— |

|

(2.2) |

|

— |

|

3.3 |

Income tax effect of adjustments to income from operations and other expense (income), net(7) |

(2.4) |

|

3.8 |

|

(6.5) |

|

17.4 |

| Gain on redemption of Series A Preferred Stock |

— |

|

— |

|

(27.6) |

|

— |

| Adjusted net income attributable to common stockholders |

$ |

193.9 |

|

$ |

178.1 |

|

$ |

470.9 |

|

$ |

461.0 |

(1) Digital transformation costs include costs associated with certain digital transformation initiatives.

(2) Restructuring costs include severance costs incurred pursuant to an ongoing restructuring plan.

(3) Loss on abandonment of assets represents the write-off of certain capitalized cloud computing arrangement implementation costs relating to a third-party developed operations management software product in favor of an application with functionality that better suits the Company’s operations.

(4) Excise taxes on excess pension plan assets represent the excise taxes applicable to the excess pension plan assets following the final settlement of the Company's U.S. pension plan.

(5) Loss on termination of business arrangement represents the loss recognized as a result of management's decision to terminate a business arrangement with a third party.

(6) Pension settlement cost represents expense related to the final settlement of the Company's U.S. pension plan. Reduction to pension settlement cost during the three months ended September 30, 2024 represents income as a result of the finalization of the liabilities transferred as part of the settlement of the Company's U.S. pension plan.

(7) The adjustments to income from operations and other (income) expense, net have been tax effected at rates of 26.7% and 24.3% for the three months ended September 30, 2025 and 2024, respectively, and at rates of 26.4% and 26.5% for the nine months ended September 30, 2025 and 2024, respectively.

WESCO INTERNATIONAL, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(in millions, except per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

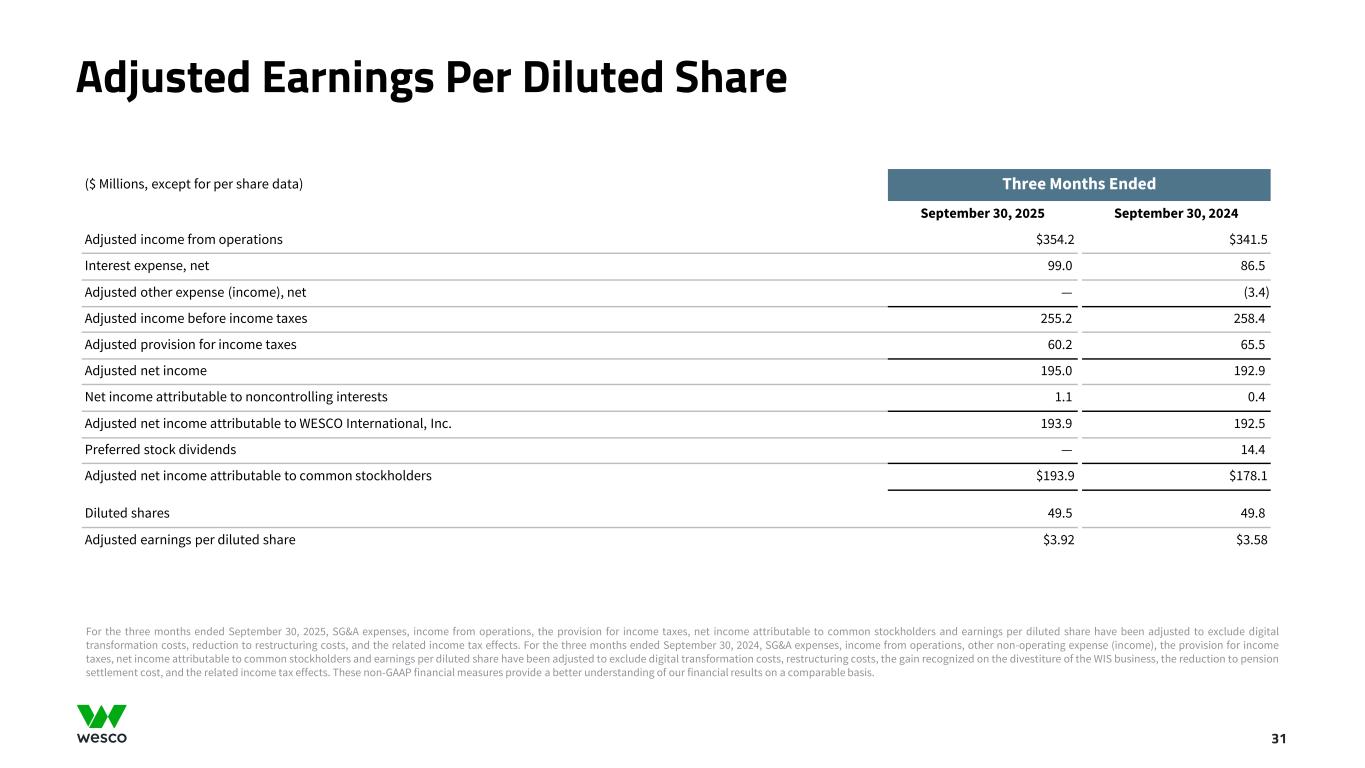

| Adjusted Earnings per Diluted Share: |

September 30, 2025 |

|

September 30, 2024 |

|

September 30, 2025 |

|

September 30, 2024 |

|

|

|

|

|

|

|

|

| Adjusted income from operations |

$ |

354.2 |

|

|

$ |

341.5 |

|

|

$ |

932.6 |

|

|

$ |

971.7 |

|

| Interest expense, net |

99.0 |

|

|

86.5 |

|

|

278.2 |

|

|

279.8 |

|

| Adjusted other expense (income), net |

— |

|

|

(3.4) |

|

|

(7.3) |

|

|

15.8 |

|

| Adjusted income before income taxes |

255.2 |

|

|

258.4 |

|

|

661.7 |

|

|

676.1 |

|

| Adjusted provision for income taxes |

60.2 |

|

|

65.5 |

|

|

162.2 |

|

|

170.7 |

|

| Adjusted net income |

195.0 |

|

|

192.9 |

|

|

499.5 |

|

|

505.4 |

|

| Net income attributable to noncontrolling interests |

1.1 |

|

|

0.4 |

|

|

1.3 |

|

|

1.3 |

|

| Adjusted net income attributable to WESCO International, Inc. |

193.9 |

|

|

192.5 |

|

|

498.2 |

|

|

504.1 |

|

|

|

|

|

|

|

|

|

| Preferred stock dividends |

— |

|

|

14.4 |

|

|

27.3 |

|

|

43.1 |

|

| Adjusted net income attributable to common stockholders |

$ |

193.9 |

|

|

$ |

178.1 |

|

|

$ |

470.9 |

|

|

$ |

461.0 |

|

|

|

|

|

|

|

|

|

| Diluted shares |

49.5 |

|

|

49.8 |

|

|

49.5 |

|

|

50.8 |

|

| Adjusted earnings per diluted share |

$ |

3.92 |

|

|

$ |

3.58 |

|

|

$ |

9.51 |

|

|

$ |

9.07 |

|

Note: For the three and nine months ended September 30, 2025, SG&A expenses, income from operations, the provision for income taxes, net income attributable to common stockholders and earnings per diluted share have been adjusted to exclude digital transformation costs, restructuring costs, and the related income tax effects, and the gain on redemption of the Company's Series A Preferred Stock. Other non-operating expense (income), the provision for income taxes, net income attributable to common stockholders and earnings per diluted share for the nine months ended September 30, 2025 was also adjusted to exclude the loss on termination of business arrangement and the related income tax effect. For the three and nine months ended September 30, 2024, SG&A expenses, income from operations, other non-operating expense (income), the provision for income taxes, net income attributable to common stockholders and earnings per diluted share have been adjusted to exclude the loss on abandonment of assets, digital transformation costs, restructuring costs, excise taxes on excess pension plan assets related to the final settlement of the Anixter Inc. Pension Plan, the gain recognized on the divestiture of the WIS business, the loss on termination of business arrangement, pension settlement cost, and the related income tax effects. These non-GAAP financial measures provide a better understanding of our financial results on a comparable basis.

WESCO INTERNATIONAL, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(in millions, except per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, 2025 |

| EBITDA and Adjusted EBITDA by Segment: |

|

EES |

|

CSS |

|

UBS |

|

Corporate |

|

Total |

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to common stockholders |

|

$ |

183.2 |

|

$ |

191.7 |

|

$ |

140.7 |

|

$ |

(328.1) |

|

$ |

187.5 |

| Net income (loss) attributable to noncontrolling interests |

|

0.3 |

|

1.2 |

|

— |

|

(0.4) |

|

1.1 |

Provision for income taxes(1) |

|

— |

|

— |

|

— |

|

57.8 |

|

57.8 |

Interest expense, net(1) |

|

— |

|

— |

|

— |

|

99.0 |

|

99.0 |

| Depreciation and amortization |

|

12.7 |

|

19.3 |

|

7.8 |

|

9.3 |

|

49.1 |

| EBITDA |

|

$ |

196.2 |

|

$ |

212.2 |

|

$ |

148.5 |

|

$ |

(162.4) |

|

$ |

394.5 |

| Other expense (income), net |

|

1.1 |

|

7.0 |

|

(0.2) |

|

(7.9) |

|

— |

| Stock-based compensation expense |

|

1.0 |

|

1.3 |

|

0.5 |

|

7.9 |

|

10.7 |

Digital transformation costs(2) |

|

— |

|

— |

|

— |

|

10.4 |

|

10.4 |

Cloud computing arrangement amortization(3) |

|

— |

|

— |

|

— |

|

9.0 |

|

9.0 |

Restructuring costs(4) |

|

— |

|

— |

|

— |

|

(1.6) |

|

(1.6) |

| Adjusted EBITDA |

|

$ |

198.3 |

|

$ |

220.5 |

|

$ |

148.8 |

|

$ |

(144.6) |

|

$ |

423.0 |

| Adjusted EBITDA margin % |

|

8.4 |

% |

|

9.1 |

% |

|

10.4 |

% |

|

|

|

6.8 |

% |

(1) The reportable segments do not incur income taxes and interest expense as these costs are centrally controlled through the Corporate tax and treasury functions. |

(2) Digital transformation costs include costs associated with certain digital transformation initiatives. |

(3) Cloud computing arrangement amortization consists of expense recognized in selling, general and administrative expenses for capitalized implementation costs for cloud computing arrangements to support our digital transformation initiatives. |

(4) Restructuring costs include severance costs incurred pursuant to an ongoing restructuring plan. |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, 2024 |

| EBITDA and Adjusted EBITDA by Segment: |

|

EES(1) |

|

CSS(1) |

|

UBS |

|

Corporate |

|

Total |

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to common stockholders |

|

$ |

163.7 |

|

$ |

155.1 |

|

$ |

168.5 |

|

$ |

(297.4) |

|

$ |

189.9 |

| Net (loss) income attributable to noncontrolling interests |

|

(1.0) |

|

0.9 |

|

— |

|

0.5 |

|

0.4 |

| Preferred stock dividends |

|

— |

|

— |

|

— |

|

14.4 |

|

14.4 |

Provision for income taxes(2) |

|

— |

|

— |

|

— |

|

69.3 |

|

69.3 |

Interest expense, net(2) |

|

— |

|

— |

|

— |

|

86.5 |

|

86.5 |

| Depreciation and amortization |

|

12.1 |

|

17.7 |

|

6.9 |

|

9.3 |

|

46.0 |

| EBITDA |

|

$ |

174.8 |

|

$ |

173.7 |

|

$ |

175.4 |

|

$ |

(117.4) |

|

$ |

406.5 |

| Other expense (income), net |

|

5.4 |

|

4.9 |

|

(19.7) |

|

(15.5) |

|

(24.9) |

| Stock-based compensation expense |

|

1.1 |

|

1.6 |

|

0.8 |

|

3.3 |

|

6.8 |

Digital transformation costs(3) |

|

— |

|

— |

|

— |

|

5.4 |

|

5.4 |

Cloud computing arrangement amortization(4) |

|

— |

|

— |

|

— |

|

3.8 |

|

3.8 |

Restructuring costs(5) |

|

— |

|

— |

|

— |

|

0.5 |

|

0.5 |

| Adjusted EBITDA |

|

$ |

181.3 |

|

$ |

180.2 |

|

$ |

156.5 |

|

$ |

(119.9) |

|

$ |

398.1 |

| Adjusted EBITDA margin % |

|

8.6 |

% |

|

9.0 |

% |

|

11.3 |

% |

|

|

|

7.3 |

% |

(1) In the first quarter of 2025, a portion of the EES reportable segment was moved to the CSS reportable segment as a result of operational realignment. As a result, the reportable segment financial information for the three months ended September 30, 2024 has been recast to conform to the current year presentation. The recast does not impact previously reported condensed consolidated results. |

(2) The reportable segments do not incur income taxes and interest expense as these costs are centrally controlled through the Corporate tax and treasury functions. |

(3) Digital transformation costs include costs associated with certain digital transformation initiatives. |

(4) Cloud computing arrangement amortization consists of expense recognized in selling, general and administrative expenses for capitalized implementation costs for cloud computing arrangements to support our digital transformation initiatives. |

(5) Restructuring costs include severance costs incurred pursuant to an ongoing restructuring plan. |

WESCO INTERNATIONAL, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(in millions, except per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

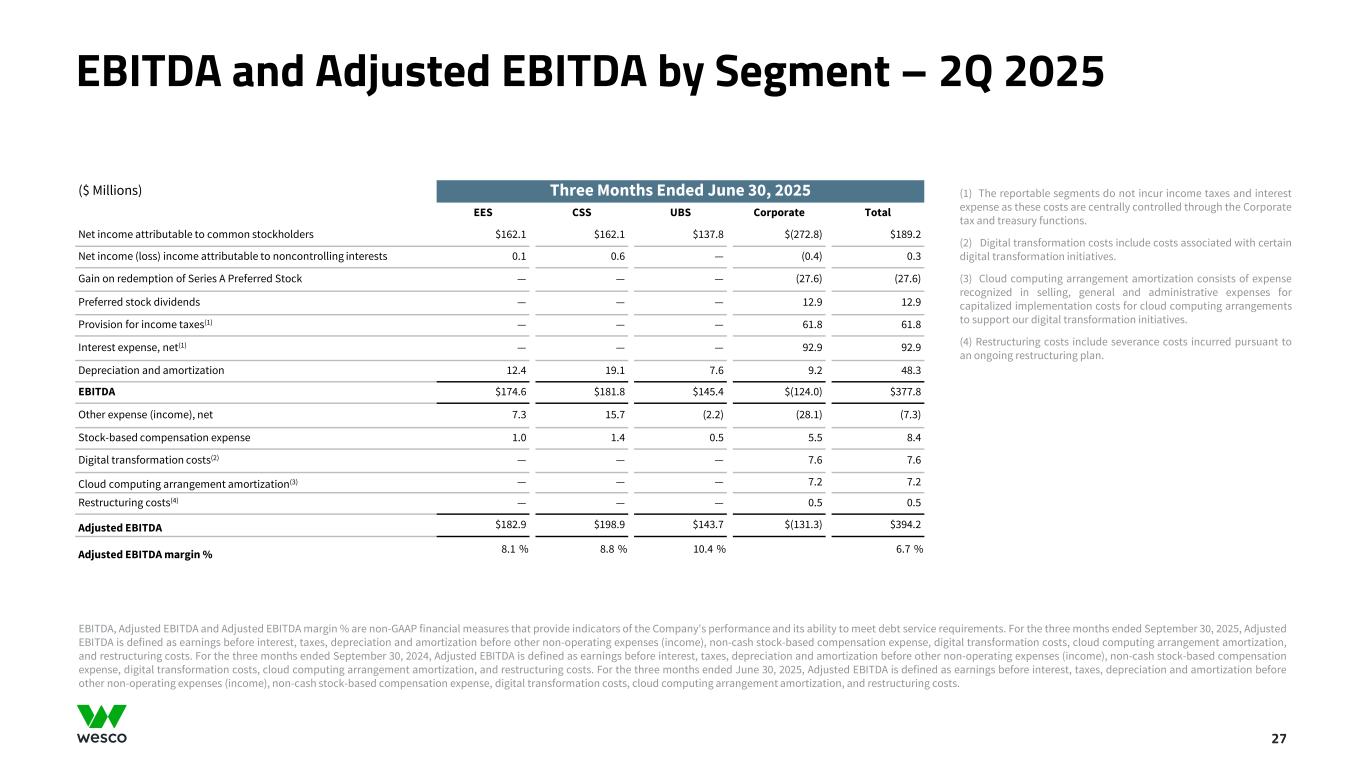

Three Months Ended June 30, 2025 |

| EBITDA and Adjusted EBITDA by Segment: |

|

EES |

|

CSS |

|

UBS |

|

Corporate |

|

Total |

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to common stockholders |

|

$ |

162.1 |

|

$ |

162.1 |

|

$ |

137.8 |

|

$ |

(272.8) |

|

$ |

189.2 |

Net income (loss) attributable to noncontrolling interests |

|

0.1 |

|

0.6 |

|

— |

|

(0.4) |

|

0.3 |

| Gain on redemption of Series A Preferred Stock |

|

— |

|

— |

|

— |

|

(27.6) |

|

(27.6) |

| Preferred stock dividends |

|

— |

|

— |

|

— |

|

12.9 |

|

12.9 |

Provision for income taxes(1) |

|

— |

|

— |

|

— |

|

61.8 |

|

61.8 |

Interest expense, net(1) |

|

— |

|

— |

|

— |

|

92.9 |

|

92.9 |

| Depreciation and amortization |

|

12.4 |

|

19.1 |

|

7.6 |

|

9.2 |

|

48.3 |

| EBITDA |

|

$ |

174.6 |

|

$ |

181.8 |

|

$ |

145.4 |

|

$ |

(124.0) |

|

$ |

377.8 |

| Other expense (income), net |

|

7.3 |

|

15.7 |

|

(2.2) |

|

(28.1) |

|

(7.3) |

| Stock-based compensation expense |

|

1.0 |

|

1.4 |

|

0.5 |

|

5.5 |

|

8.4 |

Digital transformation costs(2) |

|

— |

|

— |

|

— |

|

7.6 |

|

7.6 |

Cloud computing arrangement amortization(3) |

|

— |

|

— |

|

— |

|

7.2 |

|

7.2 |

Restructuring costs(4) |

|

— |

|

— |

|

— |

|

0.5 |

|

0.5 |

| Adjusted EBITDA |

|

$ |

182.9 |

|

$ |

198.9 |

|

$ |

143.7 |

|

$ |

(131.3) |

|

$ |

394.2 |

| Adjusted EBITDA margin % |

|

8.1 |

% |

|

8.8 |

% |

|

10.4 |

% |

|

|

|

6.7 |

% |

(1) The reportable segments do not incur income taxes and interest expense as these costs are centrally controlled through the Corporate tax and treasury functions. |

(2) Digital transformation costs include costs associated with certain digital transformation initiatives. |

(3) Cloud computing arrangement amortization consists of expense recognized in selling, general and administrative expenses for capitalized implementation costs for cloud computing arrangements to support our digital transformation initiatives. |

(4) Restructuring costs include severance costs incurred pursuant to an ongoing restructuring plan. |

Note: EBITDA, Adjusted EBITDA and Adjusted EBITDA margin % are non-GAAP financial measures that provide indicators of the Company's performance and its ability to meet debt service requirements. For the three months ended September 30, 2025, Adjusted EBITDA is defined as earnings before interest, taxes, depreciation and amortization before other non-operating expenses (income), non-cash stock-based compensation expense, digital transformation costs, cloud computing arrangement amortization, and restructuring costs. For the three months ended September 30, 2024, Adjusted EBITDA is defined as earnings before interest, taxes, depreciation and amortization before other non-operating expenses (income), non-cash stock-based compensation expense, digital transformation costs, cloud computing arrangement amortization, and restructuring costs. For the three months ended June 30, 2025, Adjusted EBITDA is defined as earnings before interest, taxes, depreciation and amortization before other non-operating expenses (income), non-cash stock-based compensation expense, digital transformation costs, cloud computing arrangement amortization, and restructuring costs. Adjusted EBITDA margin % is calculated by dividing Adjusted EBITDA by net sales.

WESCO INTERNATIONAL, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(in millions, except per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, 2025 |

| EBITDA and Adjusted EBITDA by Segment: |

|

EES |

|

CSS |

|

UBS |

|

Corporate |

|

Total |

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to common stockholders |

|

$ |

470.4 |

|

$ |

481.0 |

|

$ |

408.8 |

|

$ |

(879.6) |

|

$ |

480.6 |

| Net income (loss) attributable to noncontrolling interests |

|

0.3 |

|

1.9 |

|

— |

|

(0.9) |

|

1.3 |

| Gain on redemption of Series A Preferred Stock |

|

— |

|

— |

|

— |

|

(27.6) |

|

(27.6) |

| Preferred stock dividends |

|

— |

|

— |

|

— |

|

27.3 |

|

27.3 |

Provision for income taxes(1) |

|

— |

|

— |

|

— |

|

155.7 |

|

155.7 |

Interest expense, net(1) |

|

— |

|

— |

|

— |

|

278.2 |

|

278.2 |

| Depreciation and amortization |

|

37.3 |

|

57.4 |

|

23.2 |

|

27.9 |

|

145.8 |

| EBITDA |

|

$ |

508.0 |

|

$ |

540.3 |

|

$ |

432.0 |

|

$ |

(419.0) |

|

$ |

1,061.3 |

| Other expense (income), net |

|

12.7 |

|

33.7 |

|

(2.6) |

|

(50.8) |

|

(7.0) |

| Stock-based compensation expense |

|

3.1 |

|

4.0 |

|

1.3 |

|

20.9 |

|

29.3 |

Digital transformation costs(2) |

|

— |

|

— |

|

— |

|

24.1 |

|

24.1 |

Cloud computing arrangement amortization(3) |

|

— |

|

— |

|

— |

|

20.1 |

|

20.1 |

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

$ |

523.8 |

|

$ |

578.0 |

|

$ |

430.7 |

|

$ |

(404.7) |

|

$ |

1,127.8 |

| Adjusted EBITDA margin % |

|

7.8 |

% |

|

8.7 |

% |

|

10.5 |

% |

|

|

|

6.5 |

% |

(1) The reportable segments do not incur income taxes and interest expense as these costs are centrally controlled through the Corporate tax and treasury functions. |

(2) Digital transformation costs include costs associated with certain digital transformation initiatives. |

(3) Cloud computing arrangement amortization consists of expense recognized in selling, general and administrative expenses for capitalized implementation costs for cloud computing arrangements to support our digital transformation initiatives. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, 2024 |

| EBITDA and Adjusted EBITDA by Segment: |

|

EES(1) |

|

CSS(1) |

|

UBS |

|

Corporate |

|

Total |

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to common stockholders |

|

$ |

483.1 |

|

$ |

365.9 |

|

$ |

597.8 |

|

$ |

(937.7) |

|

$ |

509.1 |

| Net (loss) income attributable to noncontrolling interests |

|

(1.3) |

|

1.9 |

|

— |

|

0.7 |

|

1.3 |

| Preferred stock dividends |

|

— |

|

— |

|

— |

|

43.1 |

|

43.1 |

Provision for income taxes(2) |

|

— |

|

— |

|

— |

|

188.1 |

|

188.1 |

Interest expense, net(2) |

|

— |

|

— |

|

— |

|

279.8 |

|

279.8 |

| Depreciation and amortization |

|

34.5 |

|

54.2 |

|

21.3 |

|

27.6 |

|

137.6 |

| EBITDA |

|

$ |

516.3 |

|

$ |

422.0 |

|

$ |

619.1 |

|

$ |

(398.4) |

|

$ |

1,159.0 |

| Other expense (income), net |

|

13.7 |

|

40.0 |

|

(122.1) |

|

(30.9) |

|

(99.3) |

| Stock-based compensation expense |

|

3.3 |

|

4.9 |

|

2.4 |

|

9.0 |

|

19.6 |

Loss on abandonment of assets(3) |

|

— |

|

— |

|

— |

|

17.8 |

|

17.8 |

Digital transformation costs(4) |

|

— |

|

— |

|

— |

|

17.5 |

|

17.5 |

Cloud computing arrangement amortization(5) |

|

— |

|

— |

|

— |

|

9.7 |

|

9.7 |

Restructuring costs(6) |

|

— |

|

— |

|

— |

|

9.5 |

|

9.5 |

Excise taxes on excess pension plan assets(7) |

|

— |

|

— |

|

— |

|

4.8 |

|

4.8 |

| Adjusted EBITDA |

|

$ |

533.3 |

|

$ |

466.9 |

|

$ |

499.4 |

|

$ |

(361.0) |

|

$ |

1,138.6 |

| Adjusted EBITDA margin % |

|

8.5 |

% |

|

8.3 |

% |

|

11.3 |

% |

|

|

|

7.0 |

% |

(1) In the first quarter of 2025, a portion of the EES reportable segment was moved to the CSS reportable segment as a result of operational realignment. As a result, the reportable segment financial information for the nine months ended September 30, 2024 has been recast to conform to the current year presentation. The recast does not impact previously reported condensed consolidated results. |

(2) The reportable segments do not incur income taxes and interest expense as these costs are centrally controlled through the Corporate tax and treasury functions. |

(3) Loss on abandonment of assets represents the write-off of certain capitalized cloud computing arrangement implementation costs relating to a third-party developed operations management software product in favor of an application with functionality that better suits the Company’s operations. |

(4) Digital transformation costs include costs associated with certain digital transformation initiatives. |

(5) Cloud computing arrangement amortization consists of expense recognized in selling, general and administrative expenses for capitalized implementation costs for cloud computing arrangements to support our digital transformation initiatives. |

(6) Restructuring costs include severance costs incurred pursuant to an ongoing restructuring plan. |