Document

Exhibit 99.1

Flotek Reports Fourth Quarter and Full-Year 2023 Results Highlighted by Growth in All Profitability Metrics Including a $31 Million Improvement in Annual Gross Profit

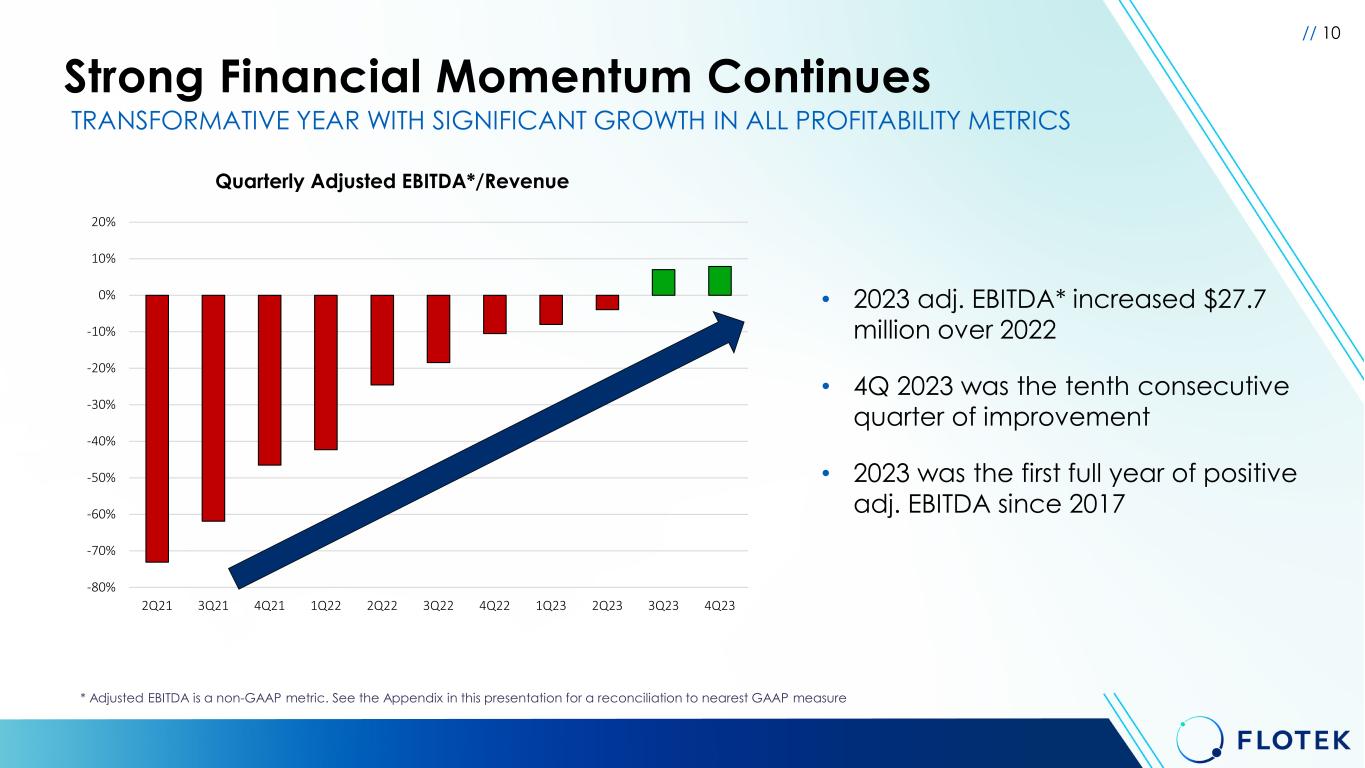

HOUSTON, March 12, 2024 - Flotek Industries, Inc. (“Flotek” or the “Company”) (NYSE: FTK) today announced operational and financial results for the fourth quarter and full-year ended December 31, 2023, highlighted by significant improvement in all profitability metrics, including net income, gross profit and adjusted gross profit(1). For the first time since 2017, the Company generated full-year positive adjusted EBITDA(1).

Financial Summary (in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended December 31, |

|

Twelve months ended December 31, |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

|

|

|

|

|

|

| Total Revenues |

$ |

42,188 |

|

|

$ |

48,217 |

|

|

$ |

188,058 |

|

|

$ |

136,092 |

|

| Gross Profit (Loss) |

$ |

9,430 |

|

|

$ |

(2,074) |

|

|

$ |

24,263 |

|

|

$ |

(6,700) |

|

Adjusted Gross Profit (Loss) (1) |

$ |

10,661 |

|

|

$ |

(522) |

|

|

$ |

28,666 |

|

|

$ |

(1,884) |

|

| Net Income (Loss) |

$ |

2,105 |

|

|

$ |

(19,026) |

|

|

$ |

24,713 |

|

|

$ |

(42,305) |

|

Adjusted EBITDA (1) |

$ |

3,953 |

|

|

$ |

(5,079) |

|

|

$ |

1,488 |

|

|

$ |

(26,169) |

|

(1)A non-GAAP financial measure. See the “Unaudited Reconciliation of Non-GAAP Items and Non-Cash Items Impacting Earnings” section in this release for more information, including reconciliations to the most comparable GAAP measures.

Full-Year 2023 Highlights

•Reported net income of $24.7 million, a $67.0 million year-over-year improvement, compared to a net loss of $42.3 million for 2022.

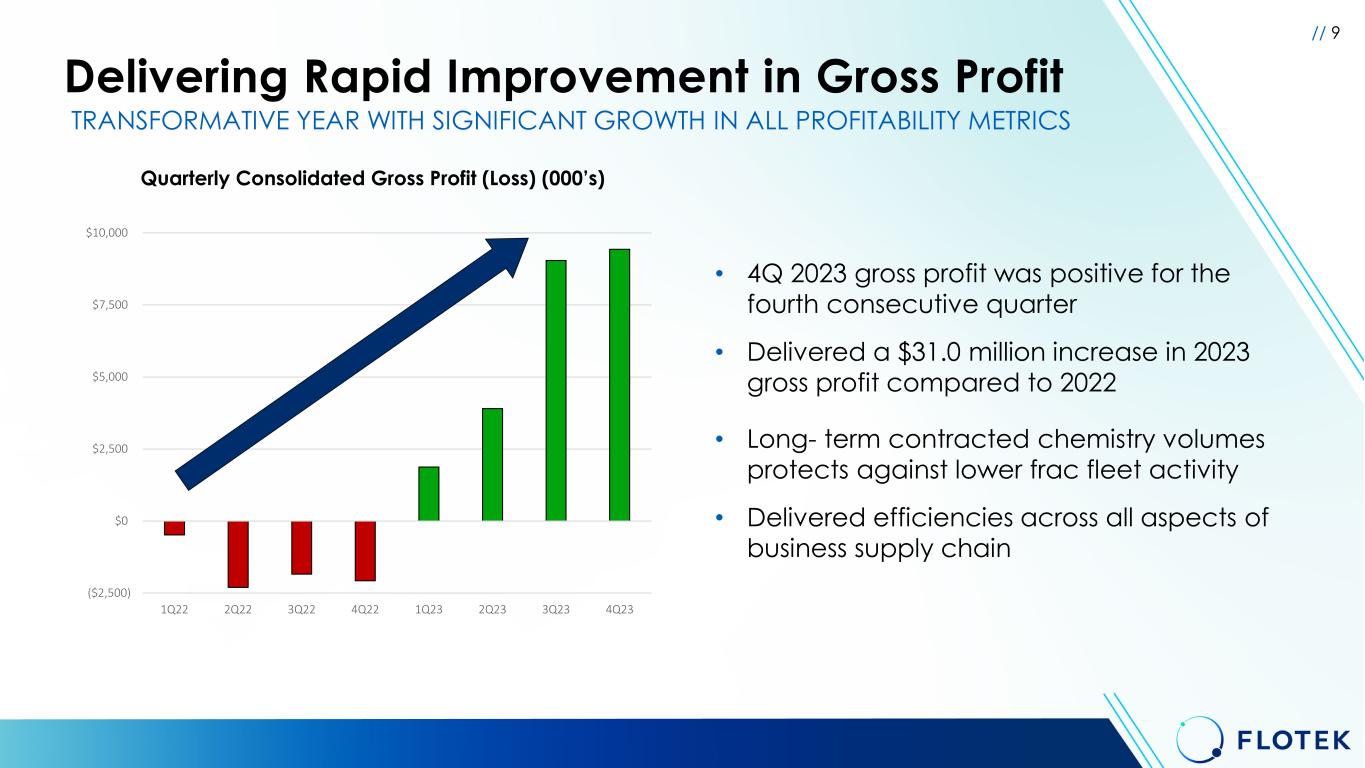

•Delivered year-over-year improvements in gross profit, adjusted gross profit(1) and adjusted EBITDA(1) of $31.0 million, $30.6 million and $27.7 million, respectively, marking the first year of positive adjusted EBITDA(1) since 2017.

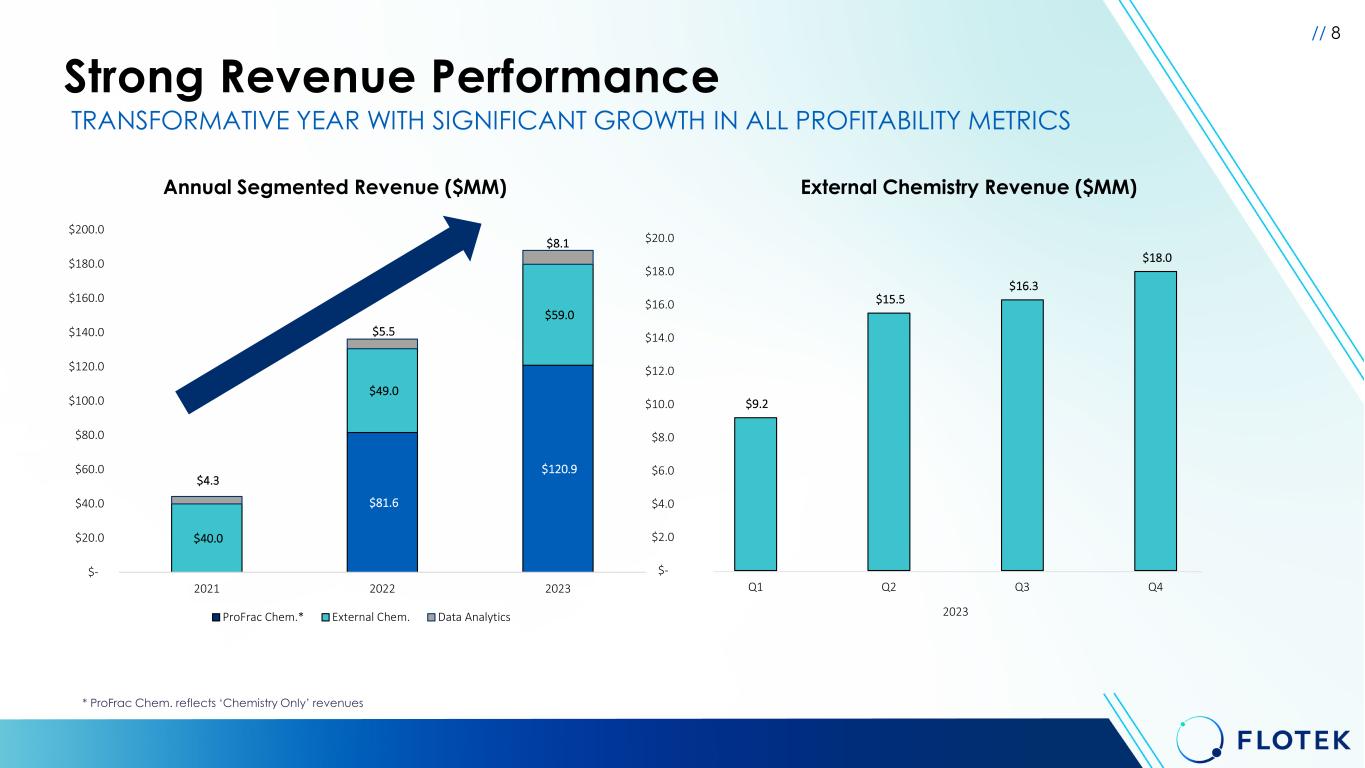

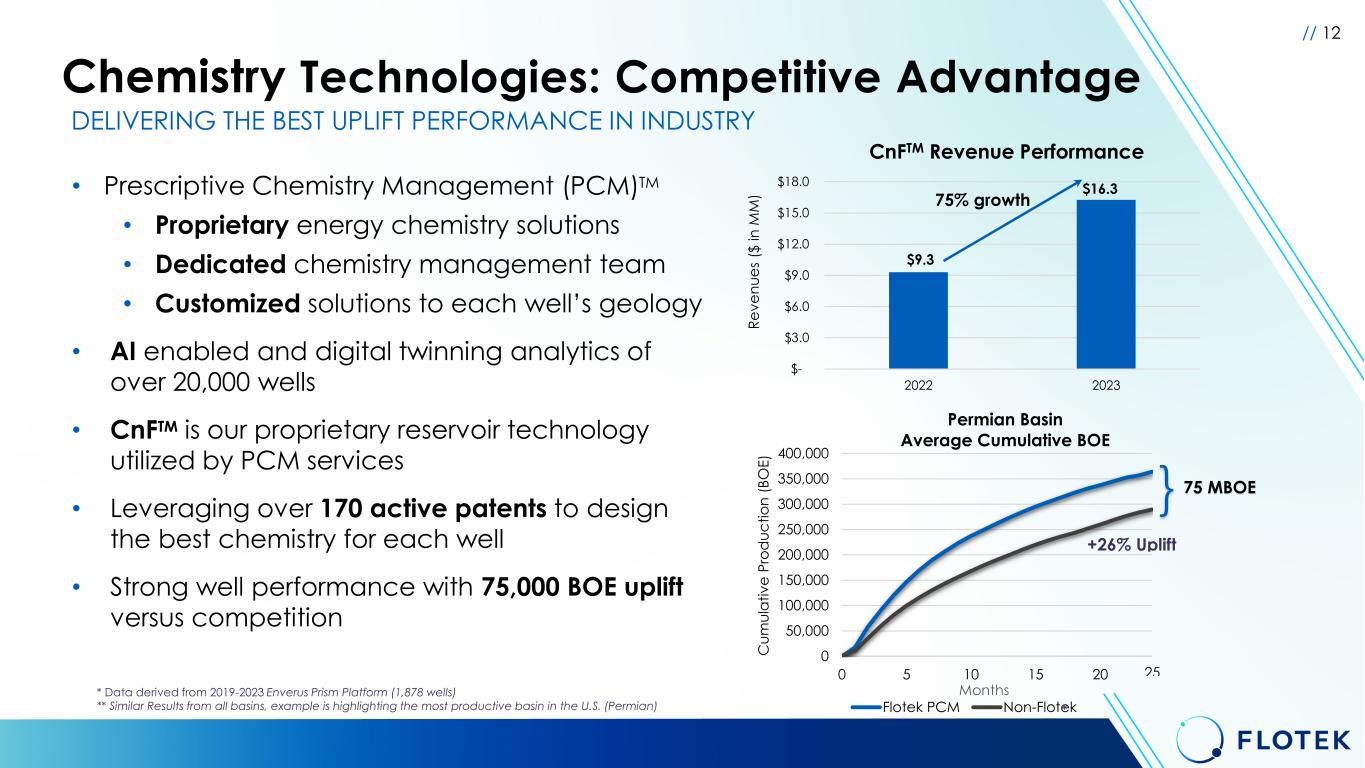

•Full year revenue of $188.1 million increased 38% compared to 2022 revenue of $136.1 million. Chemistry revenue from external customers increased 21% over 2022 revenue despite the backdrop of a slowing upstream completion environment.

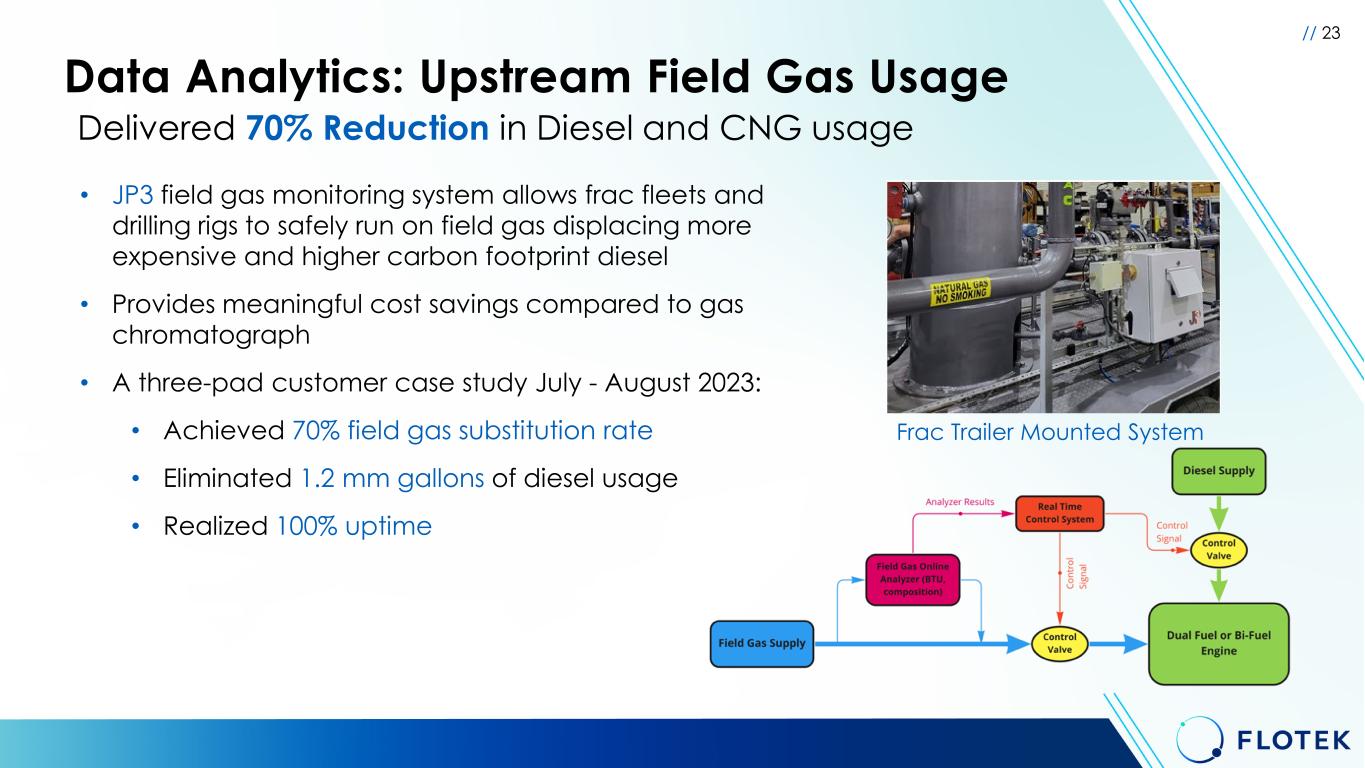

•Generated strong growth in data analytics segment as JP3 revenues grew 47% to $8.1 million over 2022 revenues of $5.5 million.

•Strengthened liquidity through an up to $13.8 million Asset Based Loan (“ABL”).

•Solidified the senior leadership team through the appointment of Dr. Ryan Ezell as Chief Executive Officer and the previous executive announcements.

•Material weakness and going concern issues identified in connection with the 2022 audit are expected to be resolved.

(1)A non-GAAP financial measure. See the “Unaudited Reconciliation of Non-GAAP Items and Non-Cash Items Impacting Earnings” section in this release for more information, including reconciliations to the most comparable GAAP measures.

Management Commentary

Chief Executive Officer Dr. Ryan Ezell commented, “2023 was a transformative year as we restored profitability and delivered significant improvement in all key financial metrics, strengthened our leadership team with the addition of several key members, enhanced our liquidity through an ABL, and positioned Flotek to be the collaborative partner of choice for sustainable chemistry and data solutions that maximize our customers’ value.

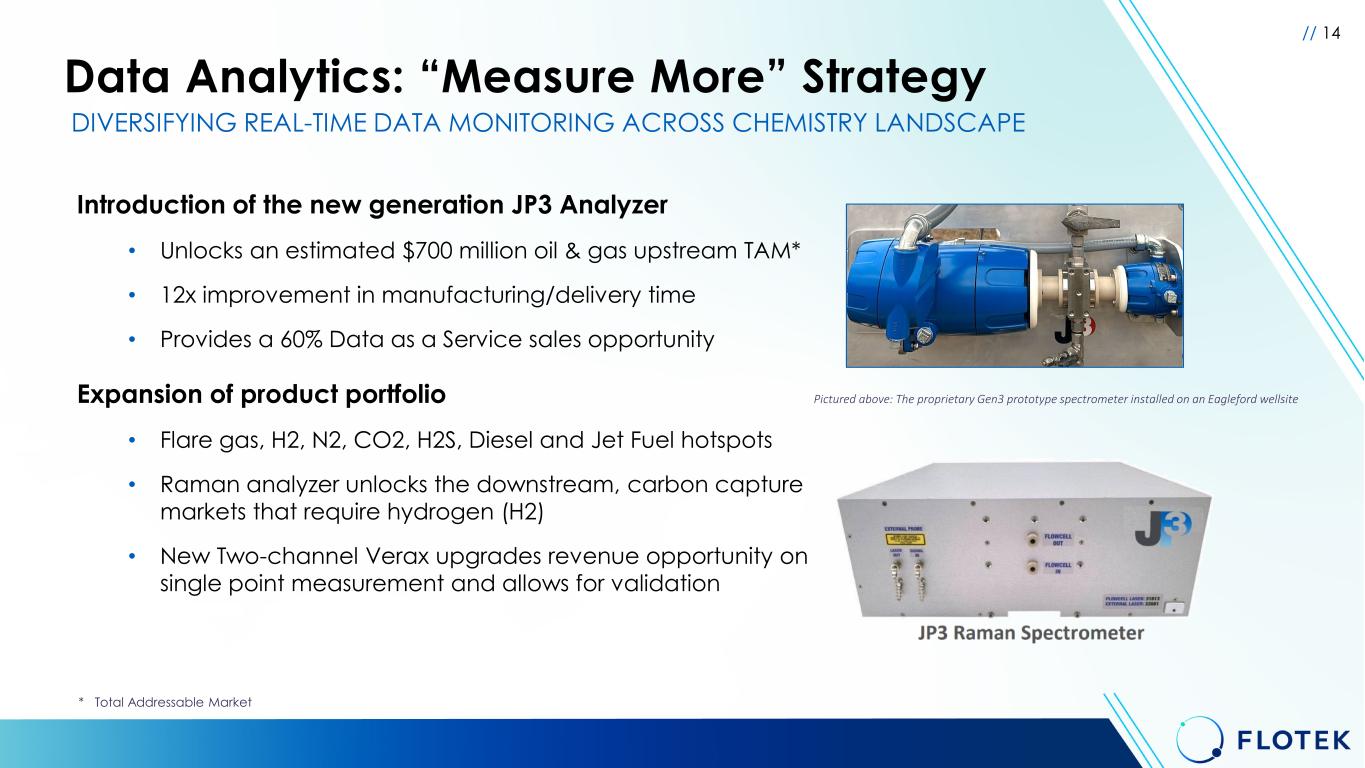

This impressive list of achievements reflects stellar execution throughout our entire organization and speaks to tremendous growth opportunities as we leverage our unique approach to chemistry as a common value creation platform to drive market share gains through our differentiated solutions. We are excited about the next generation of our JP3 Verax Near InfraRed measurement system, which will scale our Data Analytics segment more quickly and is expected to deliver associated revenue growth of greater than 50% in 2024. We also anticipate sustained growth in reservoir centric and international chemistry revenues as we expand our global footprint.”

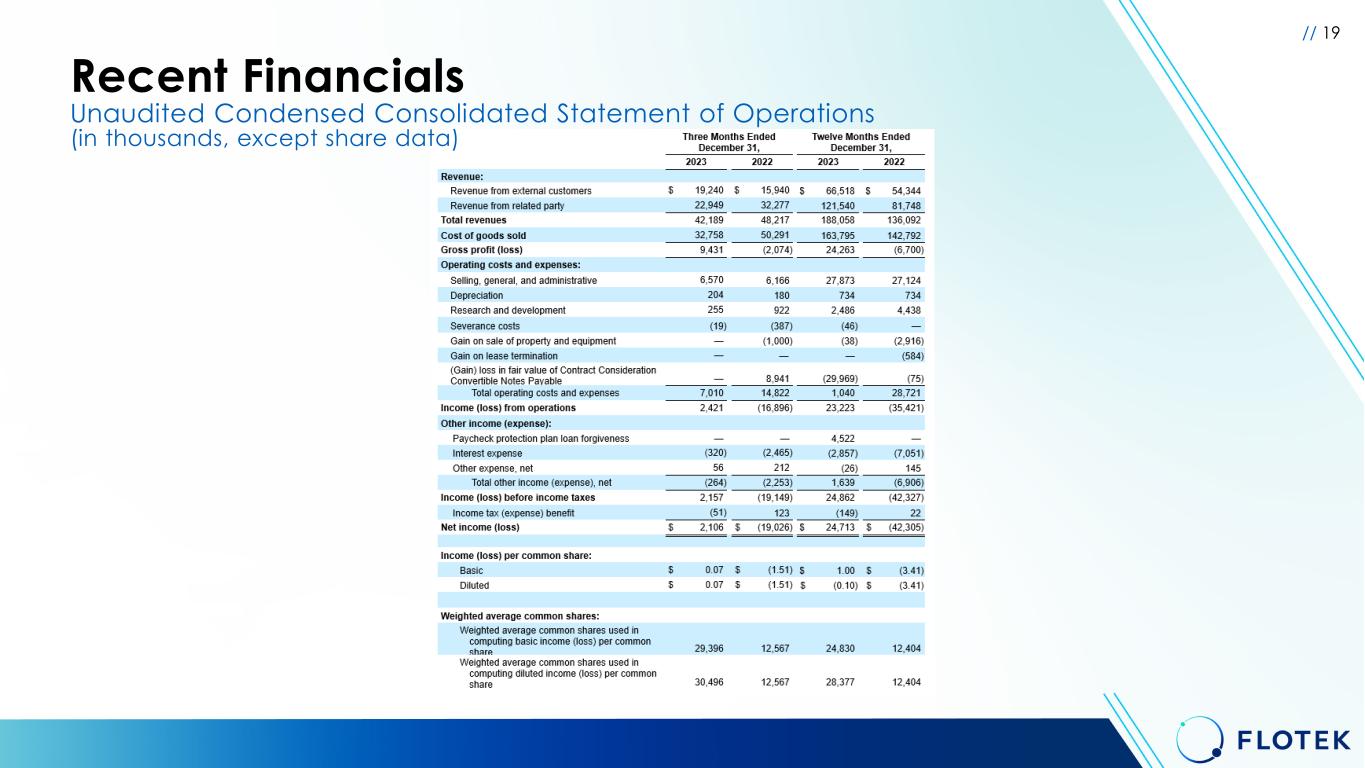

Fourth Quarter and Full-Year 2023 Financial Results

•Revenue: Flotek reported total revenues of $42.2 million for the fourth quarter 2023, which was a decrease of $6.0 million, or 13%, compared to total revenues of $48.2 million for the fourth quarter 2022. The decline in revenue as compared to the fourth quarter 2022 was the result of lower North American land completion activity during the fourth quarter 2023 partially offset by a 28% increase in chemistry revenues from external customers during the fourth quarter 2023 as compared to the 2022 period. Flotek reported total revenues of $188.1 million for the full-year 2023, which was an increase of $52.0 million, or 38%, compared to total revenues of $136.1 million for the full-year 2022. The Company's fourth quarter and full-year 2023 revenues included amounts attributable to the minimum chemistry purchase requirements contained in the ProFrac supply agreement.

•Gross Profit (Loss): The Company generated gross profit of $9.4 million during the fourth quarter 2023 as compared to a gross loss of $2.1 million for the fourth quarter 2022. The improvement in fourth quarter 2023 gross profit was the result of successful initiatives throughout 2023 to drive cost improvements with respect to freight, logistics and materials, the increase in chemistry revenues from external customers as well as revenue attributable to the minimum chemistry purchase requirements contained in the ProFrac supply agreement.

The Company generated gross profit of $24.3 million for the full-year 2023 compared to a gross loss of $6.7 million for the full-year 2022. The improvement in full-year 2023 gross profit was the result of the 38% increase in revenues combined with numerous cost improvements implemented during 2023.

•Adjusted Gross Profit (Non-GAAP)(1): Flotek generated adjusted gross profit(1) of $10.7 million during the fourth quarter 2023 compared to adjusted gross loss(1) of $0.5 million for the fourth quarter 2022. Adjusted gross profit(1) for the full-year 2023 increased to $28.7 million compared to a loss of $1.9 million for the full-year 2022. Adjusted gross profit(1) excludes non-cash items, primarily amortization of contract assets.

•Selling, General and Administrative (“SG&A”) Expense: SG&A expense totaled $6.6 million for the fourth quarter 2023 compared to $6.2 million for the fourth quarter 2022.

SG&A during the fourth quarter 2022 included a $1.9 million credit related to the reversal of a bonus accrual. SG&A expense totaled $27.9 million for full year 2023 compared to $27.1 million for full-year 2022.

•Net Income (Loss) and EPS: Flotek reported net income of $2.1 million, or $0.07 per diluted share, for the fourth quarter 2023. This compares to a net loss of $19.0 million, or ($1.51) per diluted share, for the fourth quarter 2022. Net income for the full-year 2023 was $24.7 million, or ($0.10) per diluted share, compared to a net loss of $42.3 million, or ($3.41) per diluted share, for the comparable period of 2022. Net income (loss) for the fourth quarter 2022 and full-year 2023 and 2022 included non-cash gains (losses) on the fair value measurement of convertible notes payable totaling ($8.9) million, $30.0 million, and $0.1 million, respectively.

•Adjusted EBITDA (Non-GAAP)(1): Adjusted EBITDA(1) was $4.0 million in the fourth quarter 2023 as compared to negative $5.1 million in the fourth quarter 2022. Adjusted EBITDA(1) was $1.5 million for full-year 2023 compared to negative $26.2 million for the full-year 2022.

(1)See the “Unaudited Reconciliation of Non-GAAP Items and Non-Cash Items Impacting Earnings” section in this release for more information, including reconciliations to the most comparable GAAP measures.

Data Analytics Update

Flotek continues to test the next generation version of its proprietary JP3 Verax Near InfraRed measurement system (“JP3”). JP3 represents the foundational technology behind the Company’s Data Analytics business, which supports customers through real-time data, monitoring, and visualization across the energy value chain. The new JP3 analyzer is currently undergoing extensive field-trial testing with customer deployment expected by mid-2024. The new unit’s engineering advances will facilitate scale and accelerated pace of production along with a reduction in manufacturing costs allowing access to markets that are currently unavailable.

The Company’s plans for 2024 include maintaining JP3’s strong presence in the midstream market, as well as pursuing new opportunities to accelerate penetration into the upstream market. Flotek is currently working with landowner groups to improve production allocations on lease sites and custody transfer locations through JP3’s accurate, real-time measurements. This application represents a significant market opportunity in replacing traditional allocation measurement technologies. In addition, the Company is participating in a flare monitoring pilot program with a large upstream operator to demonstrate the use of JP3’s technical solution in connection with compliance with recently enacted EPA regulations. With over 55,000 existing flares in the United States expected to be subject to monitoring regulations by 2028, this application could present a material multi-year opportunity for JP3 to expand its footprint into the upstream space.

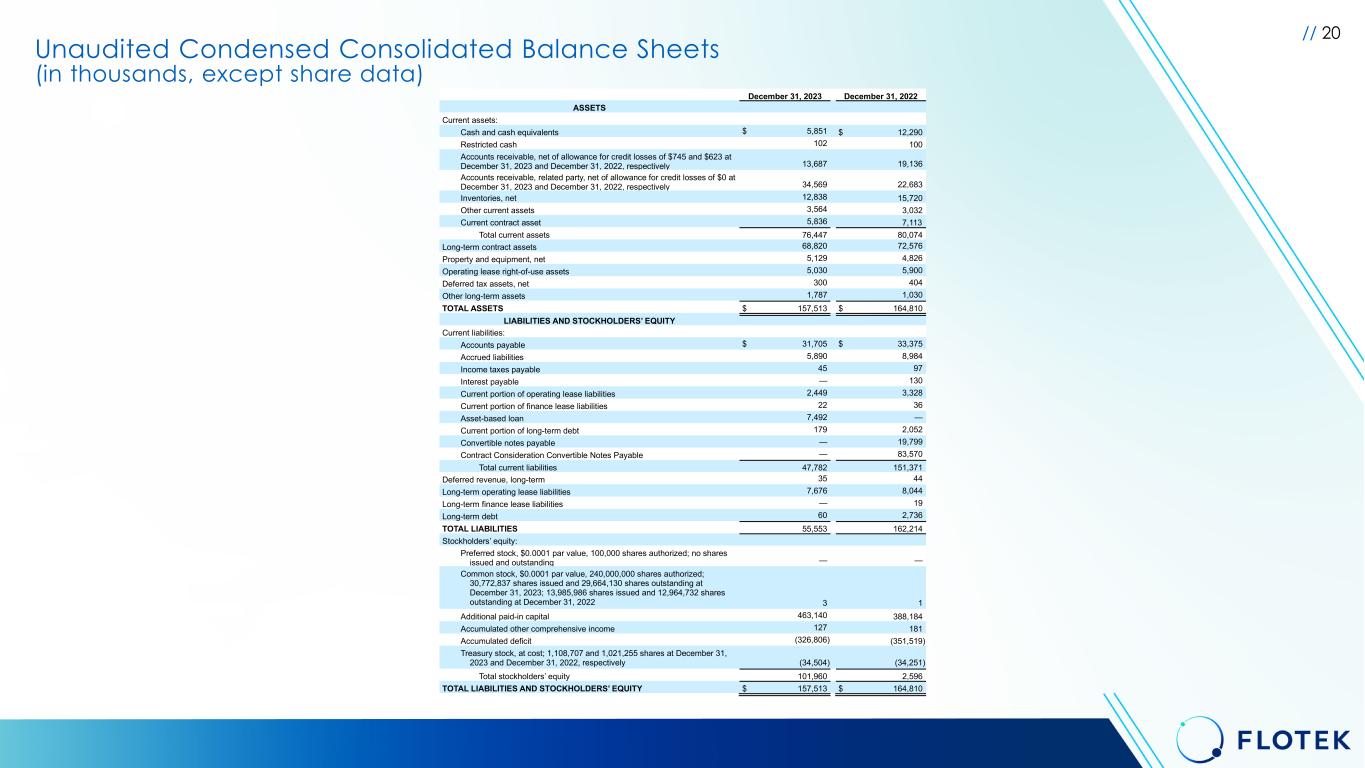

Balance Sheet and Liquidity

As of March 11, 2024, the Company’s cash and cash equivalents totaled $5.3 million. Borrowings outstanding under the Company’s Asset Based Loan at March 11, 2024 totaled approximately $0.5 million as compared to $7.5 million at December 31, 2023.

2024 Guidance

Flotek plans to issue 2024 guidance in conjunction with the release of its first quarter 2024 financial and operating results, consistent with last year’s timing.

Upcoming Investor Event

Flotek will participate in the 36th Annual Roth Conference to be held at the Ritz Carlton in Laguna Niguel, California, March 17-19, 2024. Flotek Chief Executive Officer, Ryan Ezell, will participate in an industry panel discussion on March 18 at 1:00 p.m. PT and will be joined by Chief Financial Officer, Bond Clement, in hosting one-on-one meetings with investors during the event. An updated corporate presentation that will be used in discussions at the conference will be posted to the Investor Relations section of Flotek’s corporate website at www.flotekind.com prior to the start of the conference.

Conference Call Details

Flotek will host a conference call on March 13, 2024, at 9:00 a.m. CT (10:00 a.m. ET) to discuss its fourth quarter and full year 2023 results. Participants may access the call through Flotek’s website at www.flotekind.com under “News” within the Investor Relations section or by telephone toll free at 1-800-836-8184 (international toll: 1-646-357-8785) approximately five minutes prior to the start of the call. Following the conclusion of the conference call, a recording of the call will be available on the Company’s website.

An updated corporate presentation that will be referenced on the call will be posted to the Investor Relations section of Flotek’s website at www.flotekind.com prior to the start of the earnings conference call.

About Flotek Industries, Inc.

Flotek Industries, Inc. is an advanced technology-driven, green chemical and data analytics company providing unique and innovative completion solutions that have a proven, positive impact on sustainability and reducing the overall environmental impact of energy on air, land, water and people. Flotek has an intellectual property portfolio of over 170 patents and a global presence in more than 59 countries throughout North America, Latin America, the Middle East and North Africa. Flotek has established collaborative partnerships focused on sustainable and optimized chemistry and data solutions which improve well performance and allow its customers to generate higher returns on invested capital.

Flotek is based in Houston, Texas and its common shares are traded on the New York Stock Exchange under the ticker symbol “FTK”. For additional information, please visit www.flotekind.com.

Forward-Looking Statements

Certain statements set forth in this press release constitute forward-looking statements (within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934) regarding Flotek Industries, Inc.’s business, financial condition, results of operations and prospects. Words such as will, continue, expects, anticipates, intends, plans, believes, seeks, estimates and similar expressions or variations of such words are intended to identify forward-looking statements, but are not the exclusive means of identifying forward-looking statements in this press release.

Although forward-looking statements in this press release reflect the good faith judgment of management, such statements can only be based on facts and factors currently known to management. Consequently, forward-looking statements are inherently subject to risks and uncertainties, and actual results and outcomes may differ materially from the results and outcomes discussed in the forward-looking statements. Further information about the risks and uncertainties that may impact the company are set forth in the Company’s most recent filing with the Securities and Exchange Commission on Form 10-K (including, without limitation, in the “Risk Factors” section thereof), and in the Company’s other SEC filings and publicly available documents. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. The Company undertakes no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this press release.

Investor contact:

Bond Clement

Chief Financial Officer

E: ir@flotekind.com

P: (713) 726-5322

FLOTEK INDUSTRIES, INC.

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2023 |

|

December 31, 2022 |

| ASSETS |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

5,851 |

|

|

$ |

12,290 |

|

| Restricted cash |

102 |

|

|

100 |

|

| Accounts receivable, net of allowance for credit losses of $745 and $623 at December 31, 2023 and December 31, 2022, respectively |

13,687 |

|

|

19,136 |

|

| Accounts receivable, related party, net of allowance for credit losses of $0 at December 31, 2023 and December 31, 2022, respectively |

34,569 |

|

|

22,683 |

|

| Inventories, net |

12,838 |

|

|

15,720 |

|

|

|

|

|

|

|

|

|

| Other current assets |

3,564 |

|

|

3,032 |

|

| Current contract asset |

5,836 |

|

|

7,113 |

|

| Total current assets |

76,447 |

|

|

80,074 |

|

| Long-term contract assets |

68,820 |

|

|

72,576 |

|

| Property and equipment, net |

5,129 |

|

|

4,826 |

|

| Operating lease right-of-use assets |

5,030 |

|

|

5,900 |

|

|

|

|

|

| Deferred tax assets, net |

300 |

|

|

404 |

|

| Other long-term assets |

1,787 |

|

|

1,030 |

|

|

|

|

|

| TOTAL ASSETS |

$ |

157,513 |

|

|

$ |

164,810 |

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable |

$ |

31,705 |

|

|

$ |

33,375 |

|

| Accrued liabilities |

5,890 |

|

|

8,984 |

|

| Income taxes payable |

45 |

|

|

97 |

|

| Interest payable |

— |

|

|

130 |

|

| Current portion of operating lease liabilities |

2,449 |

|

|

3,328 |

|

| Current portion of finance lease liabilities |

22 |

|

|

36 |

|

| Asset-based loan |

7,492 |

|

|

— |

|

| Current portion of long-term debt |

179 |

|

|

2,052 |

|

| Convertible notes payable |

— |

|

|

19,799 |

|

| Contract Consideration Convertible Notes Payable |

— |

|

|

83,570 |

|

| Total current liabilities |

47,782 |

|

|

151,371 |

|

| Deferred revenue, long-term |

35 |

|

|

44 |

|

| Long-term operating lease liabilities |

7,676 |

|

|

8,044 |

|

| Long-term finance lease liabilities |

— |

|

|

19 |

|

| Long-term debt |

60 |

|

|

2,736 |

|

|

|

|

|

| TOTAL LIABILITIES |

55,553 |

|

|

162,214 |

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

| Preferred stock, $0.0001 par value, 100,000 shares authorized; no shares issued and outstanding |

— |

|

|

— |

|

Common stock, $0.0001 par value, 240,000,000 shares authorized; 30,772,837 shares issued and 29,664,130 shares outstanding at December 31, 2023; 13,985,986 shares issued and 12,964,732 shares outstanding at December 31, 2022 |

3 |

|

|

1 |

|

| Additional paid-in capital |

463,140 |

|

|

388,184 |

|

| Accumulated other comprehensive income |

127 |

|

|

181 |

|

| Accumulated deficit |

(326,806) |

|

|

(351,519) |

|

Treasury stock, at cost; 1,108,707 and 1,021,255 shares at December 31, 2023 and December 31, 2022, respectively |

(34,504) |

|

|

(34,251) |

|

|

|

|

|

|

|

|

|

| Total stockholders’ equity |

101,960 |

|

|

2,596 |

|

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY |

$ |

157,513 |

|

|

$ |

164,810 |

|

FLOTEK INDUSTRIES, INC.

Unaudited Condensed Consolidated Statements of Operations

(in thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

|

| |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

|

|

| Revenue: |

|

|

|

|

|

|

|

|

|

|

|

| Revenue from external customers |

$ |

19,239 |

|

|

$ |

15,940 |

|

|

$ |

66,518 |

|

|

$ |

54,344 |

|

|

|

|

|

| Revenue from related party |

22,949 |

|

|

32,277 |

|

|

121,540 |

|

|

81,748 |

|

|

|

|

|

| Total revenues |

42,188 |

|

|

48,217 |

|

|

188,058 |

|

|

136,092 |

|

|

|

|

|

| Cost of goods sold |

32,758 |

|

|

50,291 |

|

|

163,795 |

|

|

142,792 |

|

|

|

|

|

| Gross profit (loss) |

9,430 |

|

|

(2,074) |

|

|

24,263 |

|

|

(6,700) |

|

|

|

|

|

| Operating costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

| Selling, general, and administrative |

6,570 |

|

|

6,166 |

|

|

27,873 |

|

|

27,124 |

|

|

|

|

|

| Depreciation |

204 |

|

|

180 |

|

|

734 |

|

|

734 |

|

|

|

|

|

| Research and development |

255 |

|

|

922 |

|

|

2,486 |

|

|

4,438 |

|

|

|

|

|

| Severance costs |

(19) |

|

|

(387) |

|

|

(46) |

|

|

— |

|

|

|

|

|

| Gain on sale of property and equipment |

— |

|

|

(1,000) |

|

|

(38) |

|

|

(2,916) |

|

|

|

|

|

| Gain on lease termination |

— |

|

|

— |

|

|

— |

|

|

(584) |

|

|

|

|

|

| (Gain) loss in fair value of Contract Consideration Convertible Notes Payable |

— |

|

|

8,941 |

|

|

(29,969) |

|

|

(75) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating costs and expenses |

7,010 |

|

|

14,822 |

|

|

1,040 |

|

|

28,721 |

|

|

|

|

|

| Income (loss) from operations |

2,420 |

|

|

(16,896) |

|

|

23,223 |

|

|

(35,421) |

|

|

|

|

|

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

| Paycheck protection plan loan forgiveness |

— |

|

|

— |

|

|

4,522 |

|

|

— |

|

|

|

|

|

| Interest expense |

(320) |

|

|

(2,465) |

|

|

(2,857) |

|

|

(7,051) |

|

|

|

|

|

| Other expense, net |

56 |

|

|

212 |

|

|

(26) |

|

|

145 |

|

|

|

|

|

| Total other income (expense), net |

(264) |

|

|

(2,253) |

|

|

1,639 |

|

|

(6,906) |

|

|

|

|

|

| Income (loss) before income taxes |

2,156 |

|

|

(19,149) |

|

|

24,862 |

|

|

(42,327) |

|

|

|

|

|

| Income tax (expense) benefit |

(51) |

|

|

123 |

|

|

(149) |

|

|

22 |

|

|

|

|

|

| Net income (loss) |

$ |

2,105 |

|

|

$ |

(19,026) |

|

|

$ |

24,713 |

|

|

$ |

(42,305) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) per common share: |

|

|

|

|

|

|

|

|

|

|

| Basic |

$ |

0.07 |

|

|

$ |

(1.51) |

|

|

$ |

1.00 |

|

|

$ |

(3.41) |

|

|

|

|

|

| Diluted |

$ |

0.07 |

|

|

$ |

(1.51) |

|

|

$ |

(0.10) |

|

|

$ |

(3.41) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares: |

|

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares used in computing basic income (loss) per common share |

29,396 |

|

|

12,567 |

|

|

24,830 |

|

|

12,404 |

|

|

|

|

|

| Weighted average common shares used in computing diluted income (loss) per common share |

30,496 |

|

|

12,567 |

|

|

28,377 |

|

|

12,404 |

|

|

|

|

|

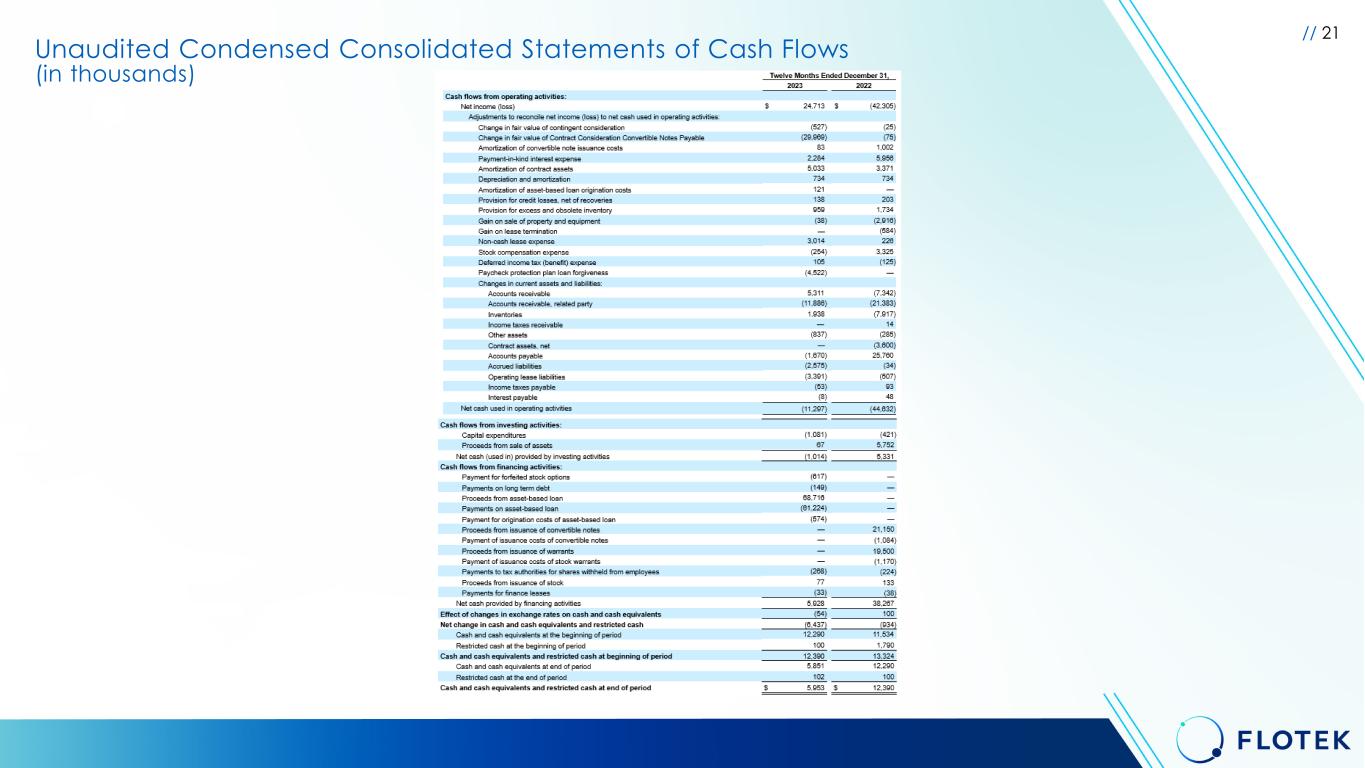

FLOTEK INDUSTRIES, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

| |

Twelve Months Ended December 31, |

| |

2023 |

|

2022 |

| Cash flows from operating activities: |

|

|

|

| Net income (loss) |

$ |

24,713 |

|

|

$ |

(42,305) |

|

| Adjustments to reconcile net income (loss) to net cash used in operating activities: |

|

|

|

| Change in fair value of contingent consideration |

(527) |

|

|

(25) |

|

| Change in fair value of Contract Consideration Convertible Notes Payable |

(29,969) |

|

|

(75) |

|

| Amortization of convertible note issuance costs |

83 |

|

|

1,002 |

|

| Payment-in-kind interest expense |

2,284 |

|

|

5,956 |

|

| Amortization of contract assets |

5,033 |

|

|

3,371 |

|

| Depreciation and amortization |

734 |

|

|

734 |

|

| Amortization of asset-based loan origination costs |

121 |

|

|

— |

|

| Provision for credit losses, net of recoveries |

138 |

|

|

203 |

|

| Provision for excess and obsolete inventory |

959 |

|

|

1,734 |

|

| Gain on sale of property and equipment |

(38) |

|

|

(2,916) |

|

| Gain on lease termination |

— |

|

|

(584) |

|

| Non-cash lease expense |

3,014 |

|

|

226 |

|

| Stock compensation expense |

(254) |

|

|

3,325 |

|

| Deferred income tax (benefit) expense |

104 |

|

|

(125) |

|

| Paycheck protection plan loan forgiveness |

(4,522) |

|

|

— |

|

| Changes in current assets and liabilities: |

|

|

|

| Accounts receivable |

5,311 |

|

|

(7,342) |

|

| Accounts receivable, related party |

(11,886) |

|

|

(21,383) |

|

| Inventories |

1,938 |

|

|

(7,917) |

|

| Income taxes receivable |

— |

|

|

14 |

|

| Other assets |

(836) |

|

|

(285) |

|

| Contract assets, net |

— |

|

|

(3,600) |

|

| Accounts payable |

(1,670) |

|

|

25,760 |

|

| Accrued liabilities |

(2,575) |

|

|

(34) |

|

| Operating lease liabilities |

(3,391) |

|

|

(507) |

|

| Income taxes payable |

(53) |

|

|

93 |

|

| Interest payable |

(8) |

|

|

48 |

|

| Net cash used in operating activities |

(11,297) |

|

|

(44,632) |

|

FLOTEK INDUSTRIES, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

Twelve Months Ended December 31, |

|

2023 |

|

2022 |

| Cash flows from investing activities: |

|

|

|

| Capital expenditures |

(1,081) |

|

|

(421) |

|

| Proceeds from sale of assets |

67 |

|

|

5,752 |

|

| Net cash (used in) provided by investing activities |

(1,014) |

|

|

5,331 |

|

| Cash flows from financing activities: |

|

|

|

| Payment for forfeited stock options |

(617) |

|

|

— |

|

| Payments on long term debt |

(149) |

|

|

— |

|

| Proceeds from asset-based loan |

68,716 |

|

|

— |

|

| Payments on asset-based loan |

(61,224) |

|

|

— |

|

| Payment for origination costs of asset-based loan |

(574) |

|

|

— |

|

| Proceeds from issuance of convertible notes |

— |

|

|

21,150 |

|

| Payment of issuance costs of convertible notes |

— |

|

|

(1,084) |

|

| Proceeds from issuance of warrants |

— |

|

|

19,500 |

|

| Payment of issuance costs of stock warrants |

— |

|

|

(1,170) |

|

| Payments to tax authorities for shares withheld from employees |

(268) |

|

|

(224) |

|

| Proceeds from issuance of stock |

77 |

|

|

133 |

|

| Payments for finance leases |

(33) |

|

|

(38) |

|

| Net cash provided by financing activities |

5,928 |

|

|

38,267 |

|

| Effect of changes in exchange rates on cash and cash equivalents |

(54) |

|

|

100 |

|

| Net change in cash and cash equivalents and restricted cash |

(6,437) |

|

|

(934) |

|

| Cash and cash equivalents at the beginning of period |

12,290 |

|

|

11,534 |

|

| Restricted cash at the beginning of period |

100 |

|

|

1,790 |

|

| Cash and cash equivalents and restricted cash at beginning of period |

12,390 |

|

|

13,324 |

|

| Cash and cash equivalents at end of period |

5,851 |

|

|

12,290 |

|

| Restricted cash at the end of period |

102 |

|

|

100 |

|

| Cash and cash equivalents and restricted cash at end of period |

$ |

5,953 |

|

|

$ |

12,390 |

|

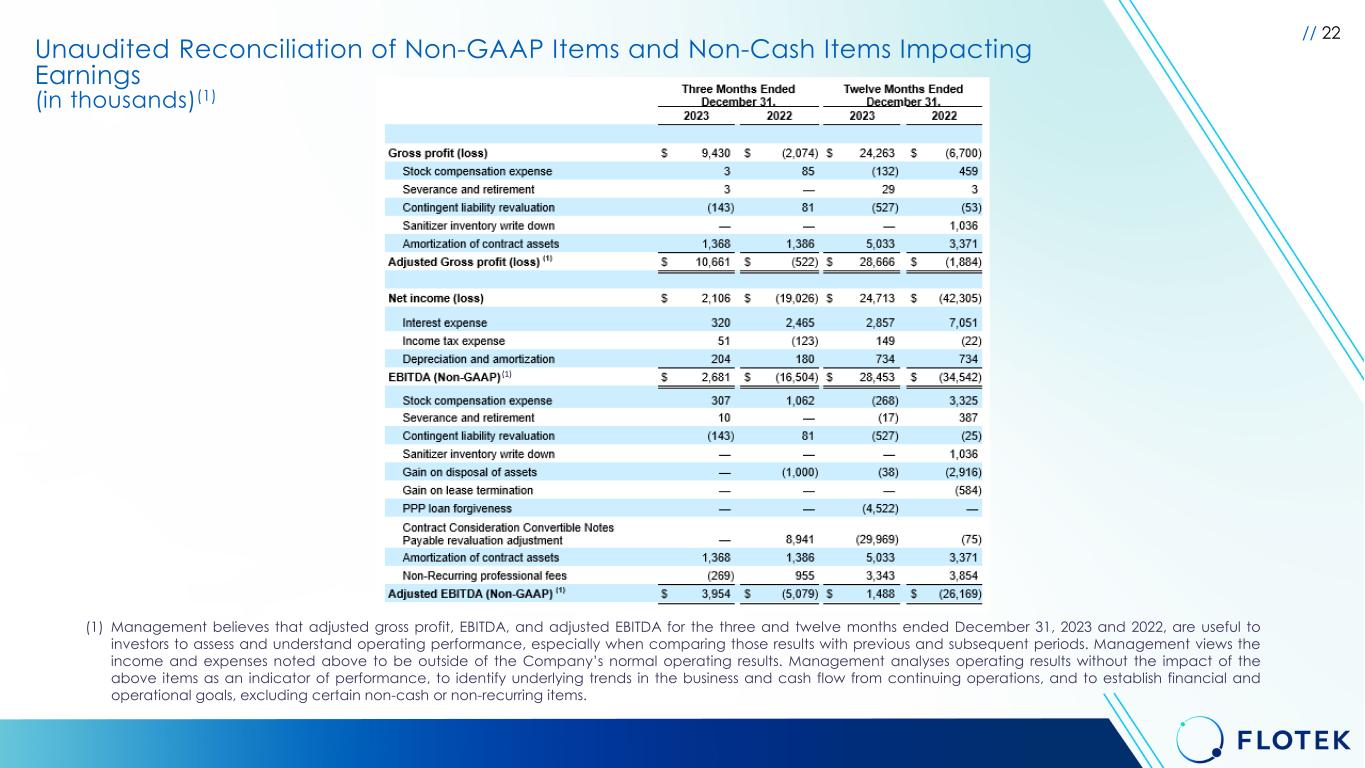

FLOTEK INDUSTRIES, INC.

Unaudited Reconciliation of Non-GAAP Items and Non-Cash Items Impacting Earnings

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

| |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit (loss) |

$ |

9,430 |

|

|

$ |

(2,074) |

|

|

$ |

24,263 |

|

|

$ |

(6,700) |

|

|

|

|

| Stock compensation expense |

3 |

|

|

85 |

|

|

(132) |

|

|

459 |

|

|

|

|

| Severance and retirement |

3 |

|

|

— |

|

|

29 |

|

|

3 |

|

|

|

|

| Contingent liability revaluation |

(143) |

|

|

81 |

|

|

(527) |

|

|

(53) |

|

|

|

|

| Sanitizer inventory write down |

— |

|

|

— |

|

|

— |

|

|

1,036 |

|

|

|

|

| Amortization of contract assets |

1,368 |

|

|

1,386 |

|

|

5,033 |

|

|

3,371 |

|

|

|

|

Adjusted Gross profit (loss) (Non-GAAP) (1) |

$ |

10,661 |

|

|

$ |

(522) |

|

|

$ |

28,666 |

|

|

$ |

(1,884) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

$ |

2,105 |

|

|

$ |

(19,026) |

|

|

$ |

24,713 |

|

|

$ |

(42,305) |

|

|

|

|

| Interest expense |

320 |

|

|

2,465 |

|

|

2,857 |

|

|

7,051 |

|

|

|

|

| Income tax expense |

51 |

|

|

(123) |

|

|

149 |

|

|

(22) |

|

|

|

|

| Depreciation and amortization |

204 |

|

|

180 |

|

|

734 |

|

|

734 |

|

|

|

|

EBITDA (Non-GAAP) (1) |

$ |

2,680 |

|

|

$ |

(16,504) |

|

|

$ |

28,453 |

|

|

$ |

(34,542) |

|

|

|

|

| Stock compensation expense |

307 |

|

|

1,062 |

|

|

(268) |

|

|

3,325 |

|

|

|

|

| Severance and retirement |

10 |

|

|

— |

|

|

(17) |

|

|

387 |

|

|

|

|

| Contingent liability revaluation |

(143) |

|

|

81 |

|

|

(527) |

|

|

(25) |

|

|

|

|

| Sanitizer inventory write down |

— |

|

|

— |

|

|

— |

|

|

1,036 |

|

|

|

|

| Gain on disposal of assets |

— |

|

|

(1,000) |

|

|

(38) |

|

|

(2,916) |

|

|

|

|

| Gain on lease termination |

— |

|

|

— |

|

|

— |

|

|

(584) |

|

|

|

|

| PPP loan forgiveness |

— |

|

|

— |

|

|

(4,522) |

|

|

— |

|

|

|

|

| Contract Consideration Convertible Notes Payable revaluation adjustment |

— |

|

|

8,941 |

|

|

(29,969) |

|

|

(75) |

|

|

|

|

| Amortization of contract assets |

1,368 |

|

|

1,386 |

|

|

5,033 |

|

|

3,371 |

|

|

|

|

| Non-Recurring professional fees |

(269) |

|

|

955 |

|

|

3,343 |

|

|

3,854 |

|

|

|

|

Adjusted EBITDA (Non-GAAP) (1) |

$ |

3,953 |

|

|

$ |

(5,079) |

|

|

$ |

1,488 |

|

|

$ |

(26,169) |

|

|

|

|

(1) Management believes that adjusted gross profit, EBITDA and adjusted EBITDA for the three and twelve months ended December 31, 2023 and 2022, are useful to investors to assess and understand operating performance, especially when comparing those results with previous and subsequent periods. Management views the income and expenses noted above to be outside of the Company’s normal operating results. Management analyzes operating results without the impact of the above items as an indicator of performance, to identify underlying trends in the business and cash flow from continuing operations, and to establish financial and operational goals, excluding certain non-cash or non-recurring items.