0000928054FALSE00009280542023-10-052023-10-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

October 5, 2023

Date of Report (Date of earliest event reported)

Flotek Industries, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

| Delaware |

001-13270 |

90-0023731 |

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

5775 N. Sam Houston Parkway W., Suite 400

Houston, TX 77086

(Address of principal executive office and zip code)

(713) 849-9911

(Registrant’s telephone number, including area code)

(Not Applicable)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading Symbol(s) |

Name of Exchange on which registered |

| Common Stock, $0.0001 par value |

FTK |

NYSE |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

|

|

|

|

Item 1.01. |

Entry into a Material Definitive Agreement. |

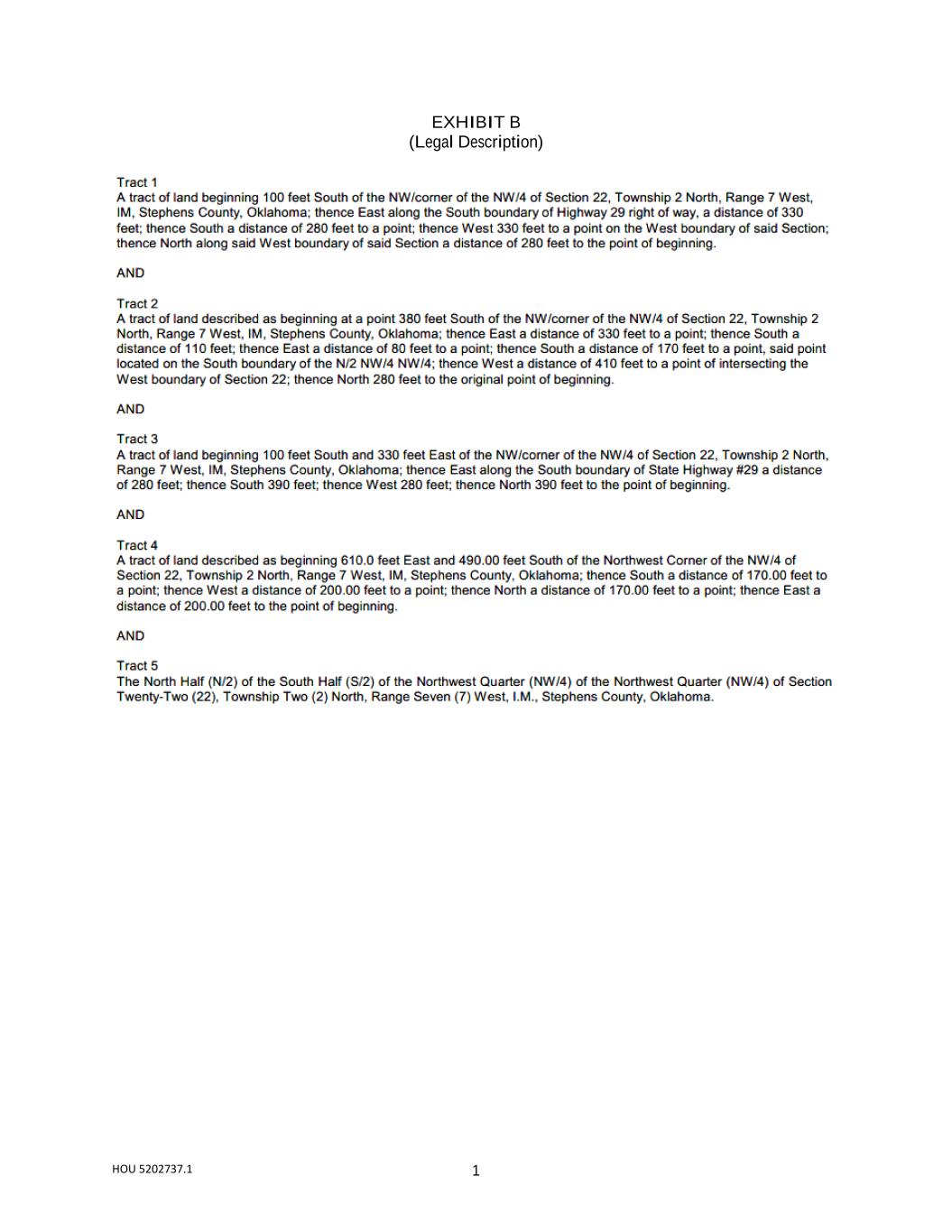

On October 5, 2023, Flotek Industries, Inc. (the “Company”) entered into the First Amendment (the “First Amendment”) to that certain Revolving Loan and Security Agreement, dated August 14, 2023 (the “Loan Agreement”) with Flotek Chemistry, LLC and JP3 Measurement, LLC, wholly owned subsidiaries of the Company (collectively with the Company, the “Borrowers”), and Amerisource Funding, Inc. (“Amerisource”), as lender, to, among other things, increase the aggregate Revolving Credit Facility Maximum from $10,000,000 to $13,812,500. The First Amendment was entered into pursuant to Section 2.08 of the Loan Agreement, which provides for a Revolving Credit Facility Maximum increase upon receipt of an appraisal and finalization of legal documentation satisfactory to Amerisource regarding certain pledged real estate, and in connection therewith, Flotek Chemistry, LLC has pledged the real estate interests described on Exhibit “B” attached to the First Amendment.

In addition to the foregoing increase in the aggregate Revolving Credit Facility Maximum, the First Amendment (i) specifies that the “net orderly liquidation value” of Eligible Inventory will be used to calculate the Revolving Inventory Sub-Limit, (ii) incorporates, as appropriate, language regarding the pledged real estate described in Exhibit “B” attached to the First Amendment, and (iii) provides that the Collateral Management Fee will be charged monthly on the Revolving Credit Facility Maximum instead of the average daily balance. All capitalized terms used and not defined herein have the same meanings herein as set out in the First Amendment or, if not so defined in the First Amendment, in the Loan Agreement. The foregoing description of the First Amendment does not purport to be complete and is qualified in its entirety by reference to the complete text of the First Amendment, which is filed herewith as Exhibit 10.1 and incorporated by reference herein.

|

|

|

|

|

|

Item 2.03. |

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

The information provided under Item 1.01 of this Current Report on Form 8-K regarding each of the transactions described therein is also responsive to Item 2.03 of this Current Report on Form 8-K and is hereby incorporated by reference into this Item 2.03.

On October 2, 2023, the Company received written notice from the New York Stock Exchange ("NYSE") that the Company had regained compliance with the NYSE’s continued listing criterion of Section 802.01C of the NYSE Listed Company Manual of a minimum share price for its common stock of $1.00 over a 30 trading-day period. If, in the future, the Company again falls below the continued listing criterion of a minimum share price of $1 over a 30-trading day period, the Company’s common stock will be subject to immediate review by the NYSE.

Forward -Looking Statements

Certain statements set forth in this Current Report on Form 8-K constitute forward-looking statements (within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934) regarding the Company’s business, financial condition, results of operations and prospects. Words such as will, continue, expects, anticipates, projects, intends, plans, believes, seeks, estimates and similar expressions or variations of such words are intended to identify forward-looking statements, but are not the exclusive means of identifying forward-looking statements in this Current Report on Form 8-K. Although forward-looking statements in this Current Report on Form 8-K reflect the good faith judgment of management, such statements can only be based on facts and factors currently known to management. Consequently, forward-looking statements are inherently subject to risks and uncertainties, and actual results and outcomes may differ materially from the results and outcomes discussed in the forward-looking statements.

|

|

|

|

|

|

Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit

Number

|

|

Description |

|

|

|

|

First Amendment to Revolving Loan and Security Agreement dated as of October 5, 2023, among Flotek Industries, Inc., Flotek Chemistry, LLC and JP3 Measurement, LLC, as borrowers, and Amerisource Funding, Inc., as lender.

|

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

FLOTEK INDUSTRIES, INC. |

| Date: October 5, 2023 |

/s/ Bond Clement |

|

Name: |

Bond Clement |

|

Title: |

Chief Financial Officer |

EX-10.1

2

exhibit10_1firstamendmen.htm

EX-10.1

exhibit10_1firstamendmen

Exhibit 10.1 FIRST AMENDMENT TO THAT CERTAIN REVOLVING LOAN AND SECURITY AGREEMENT DATED AUGUST 14, 2023 THIS FIRST AMENDMENT TO THAT CERTAIN REVOLVING LOAN AND SECURITY AGREEMENT DATED AUGUST 14, 2023, between Amerisource Funding, Inc., together with its successors and assigns (“Amerisource”) as the lender and Flotek Industries, Inc., a Delaware corporation (“Parent”), Flotek Chemistry, LLC, an Oklahoma limited liability company (“F-Chem”), and JP3 Measurement, LLC a Texas limited liability company (“JP3”) (together with their successors and assigns, “Borrower”, whether one or more) jointly and severally, (the “Amendment”) is entered into effective October 5, 2023 (the “Amendment Date”). RECITALS WHEREAS, Amerisource and Borrower are Parties to the Revolving Loan and Security Agreement dated August 14, 2023 (as otherwise altered, amended, changed, extended, modified, reviewed, replaced, substituted or supplemented from time to time, the “Loan Agreement”); and WHEREAS, Amerisource and Borrower desire to execute this Amendment to the Loan Agreement as set forth herein in order to provide the additional funding and credit to Borrower accomplished with the pledge of property as described in Exhibit ‘B’. the execution of a new Promissory Note (attached hereto and incorporated herein for all purposes as Exhibit ‘A’), and the execution of a new Deed of Trust. AGREEMENT NOW THEREFORE, in consideration of the above recitals and the mutual covenants herein contained, the sufficiency of which is hereby acknowledged and agreed upon, and on the terms set forth in this Amendment, the Parties hereby agree that the Loan Agreement shall continue in full force and effect and shall be modified as follows: 1. Unless otherwise defined herein, all capitalized terms used in this Amendment shall have the meaning as set forth in the Loan Agreement. Any term not capitalized in the Loan Agreement nor this Amendment shall have the meaning given to it in the then-current Uniform Commercial Code. 2. Section 1.01(d) of the Loan Agreement is hereby amended and restated as follows: 1.01 (d) “Credit Documents” This Agreement, any or all related note(s), deed(s) of trust or mortgage(s), the UCC-1 or any other form of security agreement, Guaranty Agreement (if any), and each and every other document or instrument executed or delivered, or to be executed or delivered, by the Borrower and/or Guarantor (if any) in connection herewith, in each case as amended and/or restated from time to time. 3. Section 1.01 (l) of the Loan Agreement is hereby amended and restated as follows: 1.01 (l) “Revolving Credit Facility Maximum”- THIRTEEN MILLION EIGHT HUNDRED TWELVE THOUSAND FIVE HUNDERD DOLLARS ($13,812,500.00) as may be reviewed from time to time as necessary based on the growth and working capital needs of

HOU 5202737.1 2 Borrower, and as may be increased pursuant to Section 2.08. The Revolving Credit Facility Maximum shall include the Accounts Receivable Sub-Limit, the Revolving Inventory Sub- Limit, and the Revolving Real Estate Sub-Limit. 4. Section 1.01 (l) (ii) of the Loan Agreement shall be amended and restated as follows: (ii) “Revolving Inventory Sub-Limit”- The Revolving Credit Facility Maximum shall include availability against Eligible Inventory up to SIXTY PERCENT (60%) of net orderly liquidation value (NOLV) of Eligible Inventory subject to a sub-limit not to exceed ONE HUNDRED PERCENT (100%) of the Revolving Accounts Receivable Sub-Limit. The eligibility of Inventory shall be determined at Amerisource’s discretion and Amerisource may require Inventory verification by any reasonable means including periodic reporting, filed exam or auditing. The Revolving Inventory Sub-Limit may be reviewed and amended by Amerisource from time to time as necessary to accommodate Client’s growth in working capital needs. 5. Section 1.01(l)(iii) is added to the Loan Agreement in appropriate order as follows. (iii) “Revolving Real Estate Sub-Limit”- The Revolving Credit Facility Maximum shall include availability under the Borrowing Base Report against eligible pledged real estate of the Borrower in an amount up to fifty percent (50%) of the current appraised value not to exceed the difference between the Revolving Credit Facility Maximum minus the Revolving Accounts Receivable Sub-Limit. 6. Section 2.03(b) in the Loan Agreement shall be amended and restated as follows: (b) Collateral Management Fee: The Borrower shall pay to Amerisource on a monthly basis a Collateral Management Fee of ONE TENTH PERCENT (0.100%), to be charged monthly on the Revolving Credit Facility Maximum. 7. Section 2.05 of the Loan Agreement shall be amended and restated as follows: Section 2.05 Security Interest. As collateral securing the Obligations, Borrower grants and assigns to Amerisource a continuing security interest in and to the real estate described in Exhibit “B” attached to this Amendment, the improvements located thereon, and all of its now owned and hereafter acquired personal property and fixtures, and all direct and indirect proceeds thereof (including proceeds of proceeds), including without limitation Accounts, Chattel Paper, Goods (including Inventory), Instruments, Investment Property, Documents, General Intangibles, monies, deposit accounts, claims and credit balances, and all Intellectual Property (including Trademarks, Patents and Copyrights, Licenses, Brands), Goodwill, tax refunds, Judgments, claims under Chapter 5 of the Bankruptcy Code, and all other property (real, personal, tangible, intangible, or any combination thereof, together with a deed of trust, mortgage, assignment of rents, security pledge of other documents securing the property (the "Collateral"). 8. Section 5.03 of the Loan Agreement shall be amended and restated as follows: Section 5.03 Remedies. Upon an Event of Default that is continuing or uncured, in addition to any rights or remedies Amerisource has under this Agreement or applicable law which shall be cumulative and exclusive, Amerisource may: (i) immediately terminate this Agreement without notice, at which time all Obligations shall immediately become due and payable without notice or demand, notwithstanding the maturity date; (ii) charge the default interest rate equal to the greater of eighteen percent (18%) per annum or the maximum rate allowable by law on all Obligations until such Obligations are paid in full or until such time as Amerisource confirms the default has been cured; (iii) enter any premises of Borrower where the books, records and Collateral of

HOU 5202737.1 3 Borrower may be kept and remove the same for such time as Amerisource may desire in order to protect, collect and liquidate the Collateral; (iv) foreclose any and all liens Amerisource has on any of or all of the Collateral in the manner provided for in the relevant Credit Documents and/or relevant law; and/or (v) exercise any other remedies provided for in any other Credit Documents or as allowed by law. All expenses relating thereto, including moving expenses, the leasing of additional facilities and the hiring of security guards shall be borne by Borrower. Upon request by Amerisource, Borrower shall assemble the Collateral and make it available to Amerisource at a time and place to be designated by Amerisource which is reasonably convenient to Amerisource and Borrower; Borrower shall fully cooperate with all of Amerisource's efforts to preserve the Collateral and will take such actions to preserve the Collateral as Amerisource may direct. Borrower agrees that Amerisource has no obligation to preserve rights to the Collateral against prior parties or to marshal any Collateral for the benefit of any party. In addition to any and all other remedies available to Amerisource, herein, in the event Borrower shall not deliver the documentation required in Section 3.03 in the time required, Borrower shall pay Amerisource on demand a per diem penalty of five hundred dollars ($500). 9. Representations and Warranties. Borrower represents and warrants to Amerisource that as of the date hereof (a) it possesses all requisite power and authority to execute, deliver and comply with the terms of this Amendment, (b) this Amendment has been duly authorized and approved by all requisite organizational action on the part of Borrower, (c) no other consent of any Person (other than Amerisource) is required for this Amendment to be effective, (d) the execution and delivery of this Amendment does not violate its organizational documents, (e) the representations and warranties in the Loan Agreement to which Borrower is a party are true and correct in all material respects (except for any such representations and warranties that are qualified by material adverse effect or materiality, which are true and correct in all respects) on and as of the date of this Amendment as though made on the date of this Amendment, except to the extent that such representations and warranties speak to a specific date, (f) it is in full compliance with all covenants and agreements contained in the Loan Agreement to which it is a party, and (g) no Default or Event of Default has occurred and is continuing. The representations and warranties made in this Amendment shall survive the execution and delivery of this Amendment. 10. Scope of Amendment; Reaffirmation; RELEASE. All references to the Loan Agreement shall refer to the Loan Agreement as amended by this Amendment. Except as affected by this Amendment, the Loan Agreement is unchanged and continues in full force and effect and the foregoing together with the other Loan Documents are hereby ratified and confirmed by Borrower. However, in the event of any inconsistency between the terms of the Loan Agreement (as amended by this Amendment) and any other Loan Document, the terms of the Loan Agreement shall control and such other document shall be deemed to be amended to conform to the terms of the Loan Agreement as amended hereby. Borrower hereby acknowledges, confirms and agrees that Amerisource has and shall continue to have valid, enforceable and perfected first-priority liens upon, and security interests in and to the Collateral heretofore granted to Amerisource pursuant to the Loan Agreement. Borrower hereby reaffirms its obligations under the Loan Agreement to which it is a party and agrees that all Loan Documents to which it is a party remain in full force and effect and continue to be legal, valid, and binding obligations enforceable in accordance with their terms (as the same are affected by this Amendment). AS A MATERIAL PART OF THE CONSIDERATION FOR AMERISOURCE ENTERING INTO THIS AMENDMENT, BORROWER HEREBY RELEASES AND FOREVER DISCHARGES AMERISOURCE (AND ITS SUCCESSORS, ASSIGNS, AFFILIATES, OFFICERS, MANAGERS, DIRECTORS, EMPLOYEES, AND AGENTS) FROM ANY AND ALL CLAIMS, DEMANDS, DAMAGES, CAUSES OF ACTION, OR LIABILITIES FOR ACTIONS OR OMISSIONS (WHETHER ARISING AT LAW OR IN EQUITY, AND WHETHER DIRECT OR INDIRECT) IN CONNECTION WITH THE LOAN AGREEMENT AND THE OTHER LOAN DOCUMENTS PRIOR TO THE DATE OF THIS AMENDMENT, WHETHER OR NOT

HOU 5202737.1 4 HERETOFORE ASSERTED, AND WHICH BORROWER OR ANY LOAN PARTY MAY HAVE OR CLAIM TO HAVE AGAINST AMERISOURCE. 11. Miscellaneous.No Waiver of Defaults. This Amendment does not constitute (i) a waiver of, or a consent to, (A) any provision of the Loan Agreement or any other Loan Document not expressly referred to in this Amendment, or (B) any present or future violation of, or default under, any provision of the Loan Agreement, or (ii) a waiver of Amerisource’s right to insist upon future compliance with each term, covenant, condition and provision of the Loan Agreement. Amerisource’s failure at any time or times hereafter to require strict performance of any provision of the Agreement or this Amendment shall not waive, affect or diminish any right of Amerisource thereafter to demand strict performance of the Agreement or Amendment, or any parts thereof. (b) Form. Each agreement, document, instrument or other writing to be furnished to Amerisource under any provision of this Amendment must be in form and substance satisfactory to Amerisource. (c) Headings. The headings and captions used in this Amendment are for convenience only and will not be deemed to limit, amplify or modify the terms of this Amendment, the Loan Agreement, or the other Loan Agreement. (d) Successors and Assigns. This Amendment shall be binding upon and inure to the benefit of each of the undersigned and their respective successors and permitted assigns (and, in the case of the undersigned Guarantors, their respective estates and heirs). (e) Multiple Counterparts. This Amendment may be executed in any number of counterparts with the same effect as if all signatories had signed the same document. All counterparts must be construed together to constitute one and the same instrument. This Amendment may be transmitted and signed by facsimile, portable document format (PDF), and other electronic means. The effectiveness of any such documents and signatures shall, subject to applicable law, have the same force and effect as manually-signed originals and shall be binding on Borrower, Guarantors, and Amerisource. Amerisource may also require that any such documents and signatures be confirmed by a manually-signed original; provided that, the failure to request or deliver the same shall not limit the effectiveness of any facsimile, PDF, or other electronic document or signature. (F) GOVERNING LAW. THIS AMENDMENT AND THE OTHER LOAN DOCUMENTS HAVE BEEN EXECUTED AND DELIVERED IN THE STATE OF TEXAS, AND, UNLESS OTHERWISE SPECIFIED, SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF TEXAS, WITHOUT GIVING EFFECT TO ANY CONFLICT OF LAW PRINCIPLES AND SHALL BE PERFORMABLE BY THE PARTIES HERETO IN HARRIS COUNTY, TEXAS. (G) ENTIRETY. THE LOAN AGREEMENT (AS AMENDED HEREBY) REPRESENT THE FINAL AGREEMENT AMONG BORROWER, GUARANTORS, AND AMERISOURCE WITH RESPECT TO THE SUBJECT MATTER HEREOF AND THEREOF, AND MAY NOT BE CONTRADICTED BY EVIDENCE OF PRIOR, CONTEMPORANEOUS, OR SUBSEQUENT ORAL AGREEMENTS BY THE PARTIES. THERE ARE NO UNWRITTEN ORAL AGREEMENTS AMONG THE PARTIES

HOU 5202737.1 5 IN WITNESS WHEREOF, the Parties hereto have caused this Amendment to be duly executed and delivered by their respective duly authorized officers as of the date first written above. BORROWER: FLOTEK INDUSTRIES, INC., a Delaware corporation By: /s/ Seham S. Carson Chief Accounting Officer and Manager FLOTEK CHEMISTRY, LLC, an Oklahoma limited liability company By: /s/ Seham S. Carson Chief Accounting Officer and Manager JP3 MEASUREMENT, LLC, a Texas limited liability company, By: /s/ Seham S. Carson Chief Accounting Officer and Manager LENDER: AMERISOURCE FUNDING, INC. By: Signature of Authorized Representative Printed Name: Title:

HOU 5202737.1 1 EXHIBIT A PROMISSORY NOTE (Revolving Line of Credit) ( Replacement Note ) $13,812,500.00 Date: October 5, 2023 FOR VALUE RECEIVED, the undersigned, Flotek Industries, Inc., Flotek Chemistry, LLC and JP3 Measurement, LLC together with their respective successors and assigns (the “Borrower”, whether one or more, and if more than one, jointly and severally) promises to pay to the order of AMERISOURCE FUNDING, INC ( “Amerisource”, together with any and all subsequent owners and holders of this Note) at its offices at 7225 Langtry Street, Houston, Texas 77040, or such other place as Amerisource shall designate in writing to Borrower the principal sum of THIRTEEN MILLION EIGHT HUNDRED TWELVE THOUSAND FIVE HUNDERD DOLLARS ($13,812,500.00) or the principal amount of all Loans made by Amerisource from time to time pursuant to that certain REVOLVING LOAN AND SECURITY AGREEMENT dated August 14, 2023, as amended by that First Amendment to that Certain Revolving Loan and Security Agreement of approximately even date herewith, by and among Borrower and Amerisource (as the same may be amended, restated, supplemented, or otherwise modified from time to time, the “Loan Agreement”). Capitalized terms used herein and not defined herein shall have the meanings assigned thereto in the Loan Agreement. The unpaid principal amount of this Revolving Line of Credit Promissory Note (this “Note”) from time to time outstanding is subject to mandatory repayment from time to time as provided in the Loan Agreement and shall bear interest as provided in the Loan Agreement. All payments of principal and interest on this Note shall be payable to Amerisource or any other holder of this Note in lawful currency of the United States of America in immediately available funds in the manner and location indicated in the Loan Agreement or wherever else Amerisource or such holder may specify. This Note is entitled to the benefits of, and evidences the Obligations incurred under, the Loan Agreement, to which reference is made for a description of the security for this Note and for a statement of the terms and conditions on which Borrower is permitted and required to make prepayments and repayments of principal of the Obligations evidenced by this Note and on which such Obligations may be declared to be immediately due and payable. Borrower agrees, in the event that this Note or any portion hereof is collected by law or through an attorney at law, to pay all costs of collection, including, without limitation, reasonable attorneys' fees and court costs. THIS NOTE SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF TEXAS AND THE APPLICABLE LAWS OF THE UNITED STATES OF AMERICA. THIS NOTE IS PERFORMABLE IN HARRIS COUNTY, TEXAS. WAIVER OF JURY TRIAL: MAKER HEREBY WAIVES ITS RIGHT TO A TRIAL BY JURY IN THE EVENT SUIT IS FILED TO ENFORCE THE TERMS HEREOF. Borrower and each surety, guarantor, endorser, and other party ever liable for payment of any sums of money payable on this Note jointly and severally waive notice, presentment, demand for payment, protest, notice of protest and non-payment or dishonor, notice of acceleration, notice of intent to accelerate, notice of intent to demand, diligence in collecting, grace, and all other formalities of any kind, and consent to all extensions without notice for any period or periods of time and partial payments, before

HOU 5202737.1 2 or after maturity, and any impairment of any collateral securing this Note, all without prejudice to the holder. The holder shall similarly have the right to deal in any way, at any time, with one or more of the foregoing parties without notice to any other party, and to grant any such party any extensions of time for payment of any of said indebtedness, or to release or substitute part or all of the collateral securing this Note, or to grant any other indulgences or forbearances whatsoever, without notice to any other party and without in any way affecting the personal liability of any party hereunder. In no event shall the rate herein ever exceed the highest lawful rate. This Note is issued as an amendment and restatement of (but not a novation of or an accord and satisfaction of ) that Promissory Note dated as of August 14, 2023, by Borrower and payable to the order of Amerisource Funding, Inc. in the original principal amount of $10,000,000.00. THIS WRITTEN AGREEMENT REPRESENTS THE FINAL AGREEMENT BETWEEN THE PARTIES AND MAY NOT BE CONTRADICTED BY EVIDENCE OF PRIOR, CONTEMPORANEOUS OR SUBSEQUENT ORAL AGREEMENTS OF THE PARTIES. "THERE ARE NO UNWRITTEN ORAL AGREEMENTS BETWEEN THE PARTIES." BORROWER AGREES NOT TO SEND AMERISOURCE PAYMENTS MARKED “PAID IN FULL,” “WITHOUT RECOURSE,” OR SIMILAR LANGUAGE. IF BORROWER SENDS SUCH A PAYMENT, AMERISOURCE MAY ACCEPT IT WITHOUT LOSING ANY OF AMERISOURCE'S RIGHTS UNDER THIS NOTE, AND BORROWER WILL REMAIN OBLIGATED TO PAY ANY FURTHER AMOUNT OWED TO AMERISOURCE. ALL WRITTEN COMMUNICATIONS CONCERNING DISPUTED AMOUNTS, INCLUDING ANY CHECK OR OTHER PAYMENT INSTRUMENT THAT INDICATES THAT THE PAYMENT CONSTITUTES “PAYMENT IN FULL” OF THE AMOUNT OWED OR THAT IS TENDERED WITHOUT CONDITIONS OR LIMITATIONS OR AS FULL SATISFACTION OF A DISPUTED AMOUNT MUST BE MAILED OR DELIVERED TO “AMERISOURCE FUNDING, INC. AT THE ADDRESS LISTED ABOVE” FLOTEK INDUSTRIES, INC., a Delaware corporation By: /s/ Seham S. Carson Seham S. Carson, Chief Accounting Officer and Manager FLOTEK CHEMISTRY, LLC, an Oklahoma limited liability company By: /s/ Seham S. Carson Seham S. Carson, Chief Accounting Officer and Manager

HOU 5202737.1 3 JP3 MEASUREMENT, LLC, a Texas limited liability company, By: /s/ Seham S. Carson Seham S. Carson, Chief Accounting Officer and Manager

HOU 5202737.1 1 EXHIBIT B (Legal Description)