| 1-13274 | 22-3305147 | ||||

(Commission File No.) |

(I.R.S. Employer

Identification No.)

|

||||

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Common Stock, par value $0.01 | VRE | New York Stock Exchange | ||||||

| Exhibit Number | Exhibit Title | |||||||

| 99.1 | ||||||||

| 99.2 | ||||||||

| 104.1 | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL. | |||||||

| VERIS RESIDENTIAL, INC. | ||||||||

Date: April 23, 2025 |

By: | /s/ Mahbod Nia | ||||||

| Mahbod Nia | ||||||||

| Chief Executive Officer | ||||||||

Date: April 23, 2025 |

By: | /s/ Amanda Lombard |

||||||

| Amanda Lombard | ||||||||

| Chief Financial Officer | ||||||||

| Exhibit Number | Exhibit Title | ||||

| 99.1 | |||||

| 99.2 | |||||

| 104.1 | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL. | ||||

| Page(s) | |||||

| Key Financial Data | |||||

| Operating Portfolio | |||||

| Debt | |||||

| Reconciliations and Additional Details | |||||

Annex 1: Transaction Activity

|

|||||

Annex 2: Reconciliation of NOI

|

|||||

Annex 4: Unconsolidated Joint Ventures

|

|||||

Annex 5: Debt Profile Footnotes

|

|||||

Annex 6: Multifamily Property Information

|

|||||

| Three Months Ended March 31, | ||||||||

| 2025 | 2024 | |||||||

| Net Income (loss) per Diluted Share | $(0.12) | $(0.04) | ||||||

| Core FFO per Diluted Share | $0.16 | $0.14 | ||||||

| Core AFFO per Diluted Share | $0.17 | $0.18 | ||||||

| Dividend per Diluted Share | $0.08 | $0.0525 | ||||||

| March 31, 2025 | December 31, 2024 | Change | |||||||||

Same Store Units |

7,621 | 7,621 | —% | ||||||||

| Same Store Occupancy | 94.0% | 93.9% | 0.1% | ||||||||

| Same Store Blended Rental Growth Rate (Quarter) | 2.4% | 0.5% | 1.9% | ||||||||

| Average Rent per Home | $4,019 | $4,033 | (0.3)% | ||||||||

| ($ in 000s) | Three Months Ended March 31, | ||||||||||

| 2025 | 2024 | % | |||||||||

| Total Property Revenue | $75,761 | $73,978 | 2.4% | ||||||||

| Controllable Expenses | 13,046 | 12,607 | 3.5% | ||||||||

| Non-Controllable Expenses | 11,822 | 12,057 | (1.9)% | ||||||||

| Total Property Expenses | 24,868 | 24,664 | 0.8% | ||||||||

Same Store NOI |

$50,893 | $49,314 | 3.2% | ||||||||

| Balance Sheet Metric ($ in 000s) | March 31, 2025 | December 31, 2024 | ||||||

| Weighted Average Interest Rate | 4.96% | 4.95% | ||||||

| Weighted Average Years to Maturity | 2.8 | 3.1 | ||||||

TTM Interest Coverage Ratio |

1.7x | 1.7x | ||||||

| Net Debt | $1,643,411 | $1,647,892 | ||||||

| TTM EBITDA | $144,191 | $140,694 | ||||||

| TTM Net Debt to EBITDA | 11.4x | 11.7x | ||||||

| Name ($ in 000s) | Date | Location | GAV | ||||||||

| 65 Livingston | 1/24/2025 | Roseland, NJ | $7,300 | ||||||||

| Wall Land | 4/3/2025 | Wall Township, NJ | 31,000 | ||||||||

| PI - North Building (two parcels) and Metropolitan at 40 Park | 4/21/2025 | West New York, NJ and Morristown, NJ | 7,100 | ||||||||

| Total Assets Sold in 2025-to-date | $45,400 | ||||||||||

| 2025 Guidance Ranges | Low | High | |||||||||

| Same Store Revenue Growth | 2.1% | — | 2.7% | ||||||||

| Same Store Expense Growth | 2.6% | — | 3.0% | ||||||||

| Same Store NOI Growth | 1.7% | — | 2.7% | ||||||||

| Core FFO per Share Guidance | Low | High | |||||||||

| Net Loss per Share | $(0.24) | — | $(0.22) | ||||||||

| Depreciation per Share | $0.85 | — | $0.85 | ||||||||

| Core FFO per Share | $0.61 | — | $0.63 | ||||||||

| Investors | Media | |||||||

| Mackenzie Rice | Amanda Shpiner/Grace Cartwright | |||||||

| Director, Investor Relations | Gasthalter & Co. | |||||||

| investors@verisresidential.com | veris-residential@gasthalter.com | |||||||

| March 31, 2025 | December 31, 2024 | |||||||

| ASSETS | ||||||||

| Rental property | ||||||||

| Land and leasehold interests | $456,789 | $458,946 | ||||||

| Buildings and improvements | 2,627,149 | 2,634,321 | ||||||

| Tenant improvements | 15,067 | 14,784 | ||||||

| Furniture, fixtures and equipment | 113,997 | 112,201 | ||||||

| 3,213,002 | 3,220,252 | |||||||

| Less – accumulated depreciation and amortization | (451,540) | (432,531) | ||||||

| 2,761,462 | 2,787,721 | |||||||

| Real estate held for sale, net | 9,138 | 7,291 | ||||||

| Net investment in rental property | 2,770,600 | 2,795,012 | ||||||

| Cash and cash equivalents | 7,596 | 7,251 | ||||||

| Restricted cash | 14,512 | 17,059 | ||||||

| Investments in unconsolidated joint ventures | 111,607 | 111,301 | ||||||

| Unbilled rents receivable, net | 2,409 | 2,253 | ||||||

| Deferred charges and other assets, net | 43,680 | 48,476 | ||||||

| Accounts receivable | 1,169 | 1,375 | ||||||

| Total Assets | $2,951,573 | $2,982,727 | ||||||

| LIABILITIES & EQUITY | ||||||||

| Revolving credit facility and term loans | 345,172 | 348,839 | ||||||

| Mortgages, loans payable and other obligations, net | 1,322,036 | 1,323,474 | ||||||

| Dividends and distributions payable | 8,485 | 8,533 | ||||||

| Accounts payable, accrued expenses and other liabilities | 40,648 | 42,744 | ||||||

| Rents received in advance and security deposits | 11,529 | 11,512 | ||||||

| Accrued interest payable | 5,232 | 5,262 | ||||||

| Total Liabilities | 1,733,102 | 1,740,364 | ||||||

| Redeemable noncontrolling interests | 9,294 | 9,294 | ||||||

Total Stockholders’ Equity |

1,080,486 | 1,099,391 | ||||||

| Noncontrolling interests in subsidiaries: | ||||||||

| Operating Partnership | 99,814 | 102,588 | ||||||

| Consolidated joint ventures | 28,877 | 31,090 | ||||||

| Total Noncontrolling Interests in Subsidiaries | $128,691 | $133,678 | ||||||

| Total Equity | $1,209,177 | $1,233,069 | ||||||

| Total Liabilities and Equity | $2,951,573 | $2,982,727 | ||||||

| Three Months Ended March 31, | |||||||||||

| REVENUES | 2025 | 2024 | |||||||||

| Revenue from leases | $61,965 | $60,642 | |||||||||

Management fees |

718 | 922 | |||||||||

| Parking income | 3,749 | 3,745 | |||||||||

| Other income | 1,324 | 2,031 | |||||||||

| Total revenues | 67,756 | 67,340 | |||||||||

| EXPENSES | |||||||||||

| Real estate taxes | 9,212 | 9,177 | |||||||||

| Utilities | 2,807 | 2,271 | |||||||||

| Operating services | 10,993 | 12,570 | |||||||||

| Property management | 4,385 | 5,242 | |||||||||

| General and administrative | 10,068 | 11,088 | |||||||||

Transaction-related costs |

308 | 516 | |||||||||

| Depreciation and amortization | 21,253 | 20,117 | |||||||||

| Land and other impairments, net | 3,200 | — | |||||||||

| Total expenses | 62,226 | 60,981 | |||||||||

| OTHER (EXPENSE) INCOME | |||||||||||

| Interest expense | (22,960) | (21,500) | |||||||||

| Interest and other investment income | 25 | 538 | |||||||||

Equity in earnings (loss) of unconsolidated joint ventures |

3,842 | 254 | |||||||||

| Gain (loss) on disposition of developable land | (156) | 784 | |||||||||

Gain (loss) on sale of unconsolidated joint venture interests |

— | 7,100 | |||||||||

| Other income (expense), net | (105) | 255 | |||||||||

| Total other (expense) income, net | (19,354) | (12,569) | |||||||||

Income (loss) from continuing operations before income tax expense |

(13,824) | (6,210) | |||||||||

| Provision for income taxes | (42) | (59) | |||||||||

Income (loss) from continuing operations after income tax expense |

(13,866) | (6,269) | |||||||||

Income (loss) from discontinued operations |

136 | 252 | |||||||||

| Realized gains (losses) and unrealized gains (losses) on disposition of rental property and impairments, net | — | 1,548 | |||||||||

| Total discontinued operations, net | 136 | 1,800 | |||||||||

Net Income (loss) |

(13,730) | (4,469) | |||||||||

| Noncontrolling interest in consolidated joint ventures | 2,125 | 495 | |||||||||

Noncontrolling interests in Operating Partnership of loss (income) from continuing operations |

998 | 523 | |||||||||

| Noncontrolling interests in Operating Partnership in discontinued operations | (11) | (155) | |||||||||

| Redeemable noncontrolling interests | (81) | (297) | |||||||||

Net income (loss) available to common shareholders |

$(10,699) | $(3,903) | |||||||||

| Basic earnings per common share: | |||||||||||

Net income (loss) available to common shareholders |

$(0.12) | $(0.04) | |||||||||

| Diluted earnings per common share: | |||||||||||

Net income (loss) available to common shareholders |

$(0.12) | $(0.04) | |||||||||

| Basic weighted average shares outstanding | 93,059 | 92,275 | |||||||||

Diluted weighted average shares outstanding(1) |

101,690 | 100,968 | |||||||||

| Three Months Ended March 31, | |||||||||||

| 2025 | 2024 | ||||||||||

Net loss available to common shareholders |

$ | (10,699) | $ | (3,903) | |||||||

| Add/(Deduct): | |||||||||||

| Noncontrolling interests in Operating Partnership | (998) | (523) | |||||||||

| Noncontrolling interests in discontinued operations | 11 | 155 | |||||||||

Real estate-related depreciation and amortization on continuing operations(2) |

23,445 | 22,631 | |||||||||

| Real estate-related depreciation and amortization on discontinued operations | — | 668 | |||||||||

| Continuing operations: Loss (gain) on sale from unconsolidated joint ventures | — | (7,100) | |||||||||

| Discontinued operations: Realized (gains) losses and unrealized (gains) losses on disposition of rental property, net | — | (1,548) | |||||||||

FFO(3) |

$ | 11,759 | $ | 10,380 | |||||||

| Add/(Deduct): | |||||||||||

Land and other impairments(4) |

1,600 | — | |||||||||

(Gain) loss on disposition of developable land |

156 | (784) | |||||||||

Rebranding and Severance/Compensation related costs (G&A)(5) |

168 | 1,637 | |||||||||

Rebranding and Severance/Compensation related costs (Property Management)(6) |

510 | 1,526 | |||||||||

Amortization of derivative premium(7) |

1,084 | 904 | |||||||||

| Derivative mark to market adjustment | 255 | — | |||||||||

| Transaction related costs | 308 | 516 | |||||||||

| Core FFO | $ | 15,840 | $ | 14,179 | |||||||

| Add/(Deduct): | |||||||||||

Straight-line rent adjustments(8) |

(146) | 25 | |||||||||

| Amortization of market lease intangibles, net | (3) | (7) | |||||||||

| Amortization of lease inducements | — | 7 | |||||||||

| Amortization of stock compensation | 3,366 | 3,727 | |||||||||

| Non-real estate depreciation and amortization | 150 | 210 | |||||||||

| Amortization of deferred financing costs | 1,707 | 1,242 | |||||||||

| Add/(Deduct): | |||||||||||

| Non-incremental revenue generating capital expenditures: | |||||||||||

| Building improvements | (3,306) | (1,040) | |||||||||

Tenant improvements and leasing commissions(9) |

(33) | (9) | |||||||||

Core AFFO(3) |

$ | 17,575 | $ | 18,334 | |||||||

Funds from Operations per share/unit-diluted |

$0.12 | $0.10 | |||||||||

| Core Funds from Operations per share/unit-diluted | $0.16 | $0.14 | |||||||||

Core Adjusted Funds from Operations per share/unit-diluted |

$0.17 | $0.18 | |||||||||

| Dividends declared per common share | $0.08 | $0.0525 | |||||||||

| Three Months Ended March 31, | |||||||||||

| 2025 | 2024 | ||||||||||

| Core FFO (calculated on a previous page) | $ | 15,840 | $ | 14,179 | |||||||

Deduct: |

|||||||||||

Equity in (earnings) loss of unconsolidated joint ventures |

(3,842) | (459) | |||||||||

| Equity in earnings share of depreciation and amortization | (2,343) | (2,724) | |||||||||

| Add: | |||||||||||

| Interest expense | 22,960 | 21,500 | |||||||||

| Amortization of derivative premium | (1,084) | (904) | |||||||||

| Derivative mark to market adjustment | (255) | — | |||||||||

| Recurring joint venture distributions | 5,801 | 1,701 | |||||||||

| Income (loss) in noncontrolling interest in consolidated joint ventures, net of land and other impairments1 | (525) | (495) | |||||||||

| Redeemable noncontrolling interests | 81 | 297 | |||||||||

| Income tax expense | 43 | 82 | |||||||||

| Adjusted EBITDA | $ | 36,675 | $ | 33,177 | |||||||

| Real Estate Portfolio | Other Assets | ||||||||||||||||

| Operating Multifamily NOI1 | Total | At Share | Cash and Cash Equivalents2 | $11,625 | |||||||||||||

| New Jersey Waterfront | $169,460 | $148,796 | Restricted Cash | 14,512 | |||||||||||||

| Massachusetts | 26,220 | 26,220 | Other Assets | 47,258 | |||||||||||||

| Other | 28,728 | 23,768 | Subtotal Other Assets | $73,395 | |||||||||||||

| Total Multifamily NOI | $224,408 | $198,784 | |||||||||||||||

| Commercial NOI3 | 2,380 | 1,949 | Liabilities and Other Considerations | ||||||||||||||

| Total NOI | $226,788 | $200,733 | |||||||||||||||

| Operating - Consolidated Debt at Share4 | $1,440,886 | ||||||||||||||||

| Non-Strategic Assets | Operating - Unconsolidated Debt at Share4 |

129,442 | |||||||||||||||

| Other Liabilities | 65,894 | ||||||||||||||||

| Estimated Value of Land Under Binding Contract | $34,250 | Revolving Credit Facility4 |

161,000 | ||||||||||||||

| Estimated Value of Remaining Land | 115,194 | Term Loan | 200,000 | ||||||||||||||

| Total Non-Strategic Assets5 | $149,444 | Preferred Units | 9,294 | ||||||||||||||

| Subtotal Liabilities and Other Considerations | $2,006,516 | ||||||||||||||||

| Outstanding Shares6 | |||||||||||||||||

| Diluted Weighted Average Shares Outstanding for 1Q 2025 (in 000s) | 102,066 | ||||||||||||||||

| Operating Highlights | |||||||||||||||||||||||||||||

|

Percentage

Occupied

|

Average Revenue per Home |

NOI1 |

Debt

Balance

|

||||||||||||||||||||||||||

| Ownership | Apartments | 1Q 2025 | 4Q 2024 | 1Q 2025 | 4Q 2024 | 1Q 2025 | 4Q 2024 | ||||||||||||||||||||||

NJ Waterfront |

|||||||||||||||||||||||||||||

| Haus25 | 100.0% | 750 | 95.6% | 95.3% | $4,969 | $4,986 | $8,195 | $7,803 | $343,061 | ||||||||||||||||||||

| Liberty Towers* | 100.0% | 648 | 80.5% | 85.6% | 4,428 | 4,319 | 4,289 | 4,543 | — | ||||||||||||||||||||

| BLVD 401 | 74.3% | 311 | 95.0% | 95.7% | 4,272 | 4,309 | 2,431 | 2,428 | 115,010 | ||||||||||||||||||||

| BLVD 425 | 74.3% | 412 | 95.9% | 95.6% | 4,143 | 4,175 | 3,426 | 3,246 | 131,000 | ||||||||||||||||||||

| BLVD 475 | 100.0% | 523 | 96.4% | 94.4% | 4,235 | 4,201 | 4,197 | 4,100 | 163,844 | ||||||||||||||||||||

| Soho Lofts* | 100.0% | 377 | 94.2% | 94.7% | 4,828 | 4,860 | 3,232 | 3,258 | — | ||||||||||||||||||||

| Sable (f.k.a. Jersey City Urby)2 | 85.0% | 762 | 94.5% | 94.4% | 4,223 | 4,322 | 5,879 | 6,455 | 181,810 | ||||||||||||||||||||

| RiverHouse 9 at Port Imperial | 100.0% | 313 | 96.4% | 95.4% | 4,493 | 4,516 | 2,715 | 2,674 | 110,000 | ||||||||||||||||||||

| RiverHouse 11 at Port Imperial | 100.0% | 295 | 95.8% | 96.3% | 4,391 | 4,405 | 2,527 | 2,479 | 100,000 | ||||||||||||||||||||

| RiverTrace | 22.5% | 316 | 94.2% | 94.4% | 3,808 | 3,851 | 2,151 | 2,243 | 82,000 | ||||||||||||||||||||

| Capstone | 40.0% | 360 | 95.6% | 95.1% | 4,603 | 4,590 | 3,323 | 3,243 | 135,000 | ||||||||||||||||||||

NJ Waterfront Subtotal |

85.0% | 5,067 | 93.4% | 93.8% | $4,430 | $4,441 | $42,365 | $42,472 | $1,361,725 | ||||||||||||||||||||

| Massachusetts | |||||||||||||||||||||||||||||

| Portside at East Pier | 100.0% | 180 | 96.4% | 95.2% | $3,283 | $3,265 | $1,156 | $1,207 | $56,500 | ||||||||||||||||||||

| Portside 2 at East Pier | 100.0% | 296 | 95.8% | 93.9% | 3,502 | 3,425 | 2,115 | 2,070 | 95,022 | ||||||||||||||||||||

| 145 Front at City Square* | 100.0% | 365 | 94.8% | 94.0% | 2,513 | 2,524 | 1,636 | 1,549 | — | ||||||||||||||||||||

| The Emery at Overlook Ridge | 100.0% | 326 | 93.9% | 92.9% | 2,845 | 2,865 | 1,648 | 1,699 | 70,279 | ||||||||||||||||||||

Massachusetts Subtotal |

100.0% | 1,167 | 95.0% | 93.9% | $2,975 | $2,962 | $6,555 | $6,525 | $221,801 | ||||||||||||||||||||

| Other | |||||||||||||||||||||||||||||

| The Upton | 100.0% | 193 | 93.3% | 91.4% | $4,355 | $4,411 | $1,290 | $1,238 | $75,000 | ||||||||||||||||||||

| The James* | 100.0% | 240 | 97.8% | 95.8% | 3,074 | 3,168 | 1,570 | 1,447 | — | ||||||||||||||||||||

| Signature Place* | 100.0% | 197 | 95.7% | 96.5% | 3,350 | 3,312 | 1,101 | 1,050 | — | ||||||||||||||||||||

| Quarry Place at Tuckahoe | 100.0% | 108 | 96.8% | 95.8% | 4,406 | 4,368 | 798 | 821 | 41,000 | ||||||||||||||||||||

| Riverpark at Harrison | 45.0% | 141 | 97.6% | 95.7% | 2,857 | 2,995 | 568 | 626 | 30,192 | ||||||||||||||||||||

| Metropolitan at 40 Park3 | 25.0% | 130 | 94.0% | 93.7% | 3,800 | 3,741 | 798 | 771 | 34,100 | ||||||||||||||||||||

| Station House | 50.0% | 378 | 93.2% | 91.8% | 2,909 | 2,989 | 1,855 | 2,005 | 86,812 | ||||||||||||||||||||

Other Subtotal |

73.8% | 1,387 | 95.2% | 94.0% | $3,396 | $3,442 | $7,980 | $7,958 | $267,104 | ||||||||||||||||||||

Operating Portfolio4,5 |

85.2% | 7,621 | 94.0% | 93.9% | $4,019 | $4,033 | $56,900 | $56,955 | $1,850,630 | ||||||||||||||||||||

| Commercial | Location | Ownership |

Rentable

SF1

|

Percentage

Leased

1Q 2025

|

Percentage

Leased

4Q 2024

|

NOI

1Q 2025

|

NOI

4Q 2024

|

Debt

Balance

|

||||||||||||||||||

Port Imperial South - Garage |

Weehawken, NJ | 70.0% | Fn 1 |

N/A | N/A | $413 | $537 | $30,957 | ||||||||||||||||||

Port Imperial South - Retail |

Weehawken, NJ | 70.0% | 18,064 | 77.0% | 92.0% | 112 | 147 | — | ||||||||||||||||||

Port Imperial North - Garage |

Weehawken, NJ | 70.0% | Fn 1 |

N/A | N/A | (54) | 25 | — | ||||||||||||||||||

Port Imperial North - Retail |

Weehawken, NJ | 100.0% | 8,400 | 100.0% | 100.0% | 89 | (275) | — | ||||||||||||||||||

| Riverwalk at Port Imperial | West New York, NJ | 100.0% | 29,923 | 80.0% | 80.0% | 35 | 61 | — | ||||||||||||||||||

| Commercial Total | 56,387 | 82.0% | 86.8% | $595 | $495 | $30,957 | ||||||||||||||||||||

| Shops at 40 Park2 | Morristown, NJ | N/A | N/A | N/A | 69.0% | — | 68 | — | ||||||||||||||||||

| Commercial Total with Shops at 40 Park | 82.0% | 78.4% | $595 | $563 | $30,957 | |||||||||||||||||||||

| Developable Land Parcel Units3 | ||||||||

| Total Units | VRE Share | |||||||

| NJ Waterfront | 1,522 | 1,400 | ||||||

| Massachusetts | 737 | 737 | ||||||

| Other | 459 | 459 | ||||||

| Developable Land Parcel Units Total at April 22, 20254 | 2,718 | 2,596 | ||||||

| Less: land under binding contract | 544 | 422 | ||||||

| Developable Land Parcel Units Remaining | 2,174 | 2,174 | ||||||

| NOI at Share | Occupancy | Blended Lease Tradeouts2 | ||||||||||||||||||||||||||||||

| Apartments | 1Q 2025 | 4Q 2024 | Change | 1Q 2025 | 4Q 2024 | Change | 1Q 2025 | 4Q 2024 | Change |

|||||||||||||||||||||||

| New Jersey Waterfront | 5,067 | $37,673 | $37,733 | (0.2)% | 93.4% | 93.8% | (0.3)% | 2.4% | 1.2% | 1.2% | ||||||||||||||||||||||

| Massachusetts | 1,167 | 6,816 | 6,787 | 0.4% | 95.0% | 93.9% | 1.2% | 2.5% | —% | 2.5% | ||||||||||||||||||||||

| Other3 | 1,387 | 6,404 | 6,299 | 1.7% | 95.2% | 94.0% | 1.1% | 2.6% | (1.7)% | 4.3% | ||||||||||||||||||||||

| Total | 7,621 | $50,893 | $50,819 | 0.1% | 94.0% | 93.9% | 0.1% | 2.4% | 0.5% | 1.9% | ||||||||||||||||||||||

NOI at Share |

Occupancy | Blended Lease Tradeouts2 |

||||||||||||||||||||||||||||||

| Apartments | 1Q 2025 | 1Q 2024 | Change | 1Q 2025 | 1Q 2024 | Change | 1Q 2025 | 1Q 2024 | Change |

|||||||||||||||||||||||

| New Jersey Waterfront | 5,067 | $37,673 | $36,698 | 2.7% | 93.4% | 94.2% | (0.8)% | 2.4% | 4.1% | (1.7)% | ||||||||||||||||||||||

| Massachusetts | 1,167 | 6,816 | 6,520 | 4.5% | 95.0% | 95.1% | (0.1)% | 2.5% | 2.9% | (0.4)% | ||||||||||||||||||||||

Other3 |

1,387 | 6,404 | 6,096 | 5.1% | 95.2% | 92.7% | 2.7% | 2.6% | 4.8% | (2.2)% | ||||||||||||||||||||||

| Total | 7,621 | $50,893 | $49,314 | 3.2% | 94.0% | 94.1% | (0.1)% | 2.4% | 4.6% | (2.2)% | ||||||||||||||||||||||

Apartments |

1Q 2025 | 4Q 2024 | 3Q 2024 | 2Q 2024 | 1Q 2024 | |||||||||||||||

| New Jersey Waterfront | 5,067 | $4,430 | $4,441 | $4,371 | $4,291 | $4,274 | ||||||||||||||

| Massachusetts | 1,167 | 2,975 | 2,962 | 2,946 | 2,931 | 2,893 | ||||||||||||||

Other3 |

1,387 | 3,396 | 3,442 | 3,421 | 3,411 | 3,374 | ||||||||||||||

| Total | 7,621 | $4,019 | $4,033 | $3,980 | $3,923 | $3,899 | ||||||||||||||

| Multifamily Same Store1 | ||||||||||||||||||||||||||||||||

| Three Months Ended March 31, | Sequential | |||||||||||||||||||||||||||||||

| 2025 | 2024 | Change | % | 1Q25 | 4Q24 | Change | % | |||||||||||||||||||||||||

| Apartment Rental Income | $68,679 | $66,701 | $1,978 | 3.0% | $68,679 | $69,149 | $(470) | (0.7)% | ||||||||||||||||||||||||

| Parking/Other Income | 7,082 | 7,277 | (195) | (2.7)% | 7,082 | 7,226 | (144) | (2.0)% | ||||||||||||||||||||||||

| Total Property Revenues2 | $75,761 | $73,978 | $1,783 | 2.4% | $75,761 | $76,375 | $(614) | (0.8)% | ||||||||||||||||||||||||

| Marketing & Administration | 2,145 | 2,138 | 7 | 0.3% | 2,145 | 2,618 | (473) | (18.1)% | ||||||||||||||||||||||||

| Utilities | 3,244 | 2,570 | 674 | 26.2% | 3,244 | 2,278 | 966 | 42.4% | ||||||||||||||||||||||||

| Payroll | 4,291 | 4,295 | (4) | (0.1)% | 4,291 | 4,525 | (234) | (5.2)% | ||||||||||||||||||||||||

| Repairs & Maintenance | 3,366 | 3,604 | (238) | (6.6)% | 3,366 | 4,486 | (1,120) | (25.0)% | ||||||||||||||||||||||||

| Controllable Expenses | $13,046 | $12,607 | $439 | 3.5% | $13,046 | $13,907 | $(861) | (6.2)% | ||||||||||||||||||||||||

| Other Fixed Fees | 725 | 712 | 13 | 1.8% | 725 | 719 | 6 | 0.8% | ||||||||||||||||||||||||

| Insurance | 1,467 | 1,779 | (312) | (17.5)% | 1,467 | 1,388 | 79 | 5.7% | ||||||||||||||||||||||||

| Real Estate Taxes | 9,630 | 9,566 | 64 | 0.7% | 9,630 | 9,542 | 88 | 0.9% | ||||||||||||||||||||||||

| Non-Controllable Expenses | $11,822 | $12,057 | $(235) | (1.9)% | $11,822 | $11,649 | $173 | 1.5% | ||||||||||||||||||||||||

| Total Property Expenses | $24,868 | $24,664 | $204 | 0.8% | $24,868 | $25,556 | $(688) | (2.7)% | ||||||||||||||||||||||||

Same Store GAAP NOI |

$50,893 | $49,314 | $1,579 | 3.2% | $50,893 | $50,819 | $74 | 0.1% | ||||||||||||||||||||||||

| Same Store NOI Margin | 67.2% | 66.7% | 0.5% | 67.2% | 66.5% | 0.7% | ||||||||||||||||||||||||||

Total Units |

7,621 | 7,621 | 7,621 | 7,621 | ||||||||||||||||||||||||||||

% Ownership |

85.2% | 85.2% | 85.2% | 85.2% | ||||||||||||||||||||||||||||

% Occupied |

94.0% | 94.1% | (0.1)% | 94.0% | 93.9% | 0.1% | ||||||||||||||||||||||||||

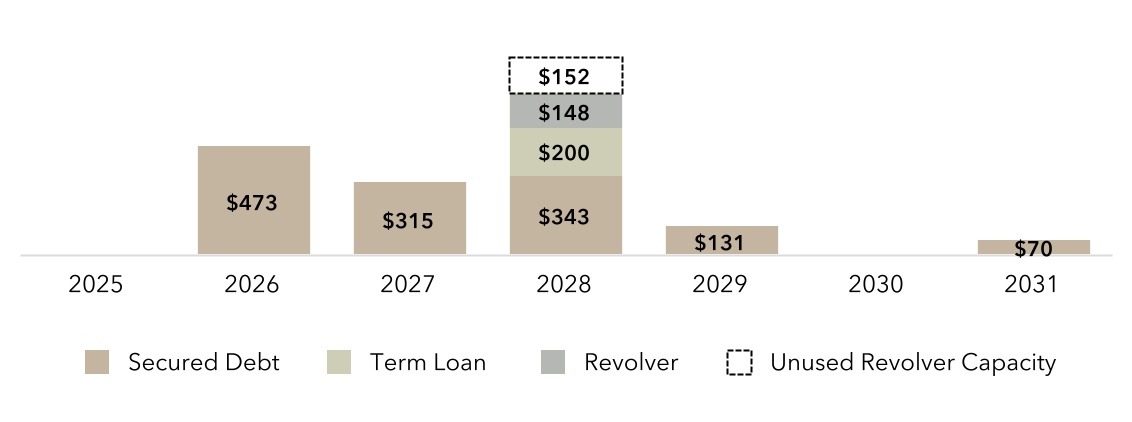

| Lender |

Effective

Interest Rate(1)

|

March 31, 2025 | December 31, 2024 | Date of Maturity |

|||||||||||||

Secured Permanent Loans |

|||||||||||||||||

| Portside 2 at East Pier | New York Life Insurance Co. | 4.56% | 95,022 | 95,427 | 03/10/26 | ||||||||||||

| BLVD 425 | New York Life Insurance Co. | 4.17% | 131,000 | 131,000 | 08/10/26 | ||||||||||||

| BLVD 401 | New York Life Insurance Co. | 4.29% | 115,010 | 115,515 | 08/10/26 | ||||||||||||

Portside at East Pier(2) |

KKR | SOFR + 2.75% | 56,500 | 56,500 | 09/07/26 | ||||||||||||

The Upton(3) |

Bank of New York Mellon | SOFR + 1.58% | 75,000 | 75,000 | 10/27/26 | ||||||||||||

RiverHouse 9 at Port Imperial(4) |

JP Morgan | SOFR + 1.41% | 110,000 | 110,000 | 06/21/27 | ||||||||||||

| Quarry Place at Tuckahoe | Natixis Real Estate Capital, LLC | 4.48% | 41,000 | 41,000 | 08/05/27 | ||||||||||||

| BLVD 475 | The Northwestern Mutual Life Insurance Co. | 2.91% | 163,844 | 164,712 | 11/10/27 | ||||||||||||

| Haus25 | Freddie Mac | 6.04% | 343,061 | 343,061 | 09/01/28 | ||||||||||||

| RiverHouse 11 at Port Imperial | The Northwestern Mutual Life Insurance Co. | 4.52% | 100,000 | 100,000 | 01/10/29 | ||||||||||||

| Port Imperial Garage South | American General Life & A/G PC | 4.85% | 30,957 | 31,098 | 12/01/29 | ||||||||||||

The Emery at Overlook Ridge(5) |

Flagstar Bank |

3.21% | 70,279 | 70,653 | 01/01/31 | ||||||||||||

| Secured Permanent Loans Outstanding | $1,331,673 | $1,333,966 | |||||||||||||||

| Unamortized Deferred Financing Costs | (9,637) | (10,492) | |||||||||||||||

Secured Permanent Loans |

$1,322,036 | $1,323,474 | |||||||||||||||

| Secured RCF & Term Loans: | |||||||||||||||||

Revolving Credit Facility(6) |

Various Lenders |

SOFR + 2.73% | $148,000 | $152,000 | 04/22/27 | ||||||||||||

Term Loan(6) |

Various Lenders |

SOFR + 2.73% | 200,000 | 200,000 | 04/22/27 | ||||||||||||

| RCF & Term Loan Balances | $348,000 | $352,000 | |||||||||||||||

| Unamortized Deferred Financing Costs | (2,828) | (3,161) | |||||||||||||||

| Total RCF & Term Loan Debt | $345,172 | $348,839 | |||||||||||||||

| Total Debt | $1,667,208 | $1,672,313 | |||||||||||||||

| Balance | % of Total |

Weighted Average Interest Rate |

Weighted Average Maturity in Years |

|||||||||||

| Fixed Rate & Hedged Debt | ||||||||||||||

| Fixed Rate & Hedged Secured Debt | $1,679,673 | 100.0% | 5.05% | 2.51 | ||||||||||

| Variable Rate Debt | ||||||||||||||

| Variable Rate Debt | — | —% | —% | — | ||||||||||

| Totals / Weighted Average | $1,679,673 | 100.0% | 5.05% | 2.51 | ||||||||||

| Unamortized Deferred Financing Costs | (12,465) | |||||||||||||

| Total Consolidated Debt, net | $1,667,208 | |||||||||||||

| Partners’ Share | (72,597) | |||||||||||||

| VRE Share of Total Consolidated Debt, net1 | $1,594,611 | |||||||||||||

| Unconsolidated Secured Debt | ||||||||||||||

| VRE Share | $292,506 | 53.2% | 4.71% | 3.80 | ||||||||||

| Partners’ Share | 257,408 | 46.8% | 4.71% | 3.80 | ||||||||||

| Total Unconsolidated Secured Debt | $549,914 | 100.0% | 4.71% | 3.80 | ||||||||||

| Pro Forma Debt Portfolio | ||||||||||||||

| Fixed Rate & Hedged Secured Debt | $1,920,328 | 99.4% | 4.94% | 2.84 | ||||||||||

| Variable Rate Secured Debt | 11,000 | 0.6% | 7.04% | 2.06 | ||||||||||

| Total Pro Forma Debt Portfolio | $1,931,328 | 100.0% | 4.96% | 2.83 | ||||||||||

| Pro Forma | |||||

| Total Consolidated Debt, gross on 3/31/25 | 1,679,673 | ||||

| Partners' Share | (72,597) | ||||

| VRE Share of Total Consolidated Debt, as of 3/31/25 | 1,607,076 | ||||

| Net Revolver activity in April | 13,000 | ||||

| Consolidation of debt associated with JV interest acquisition | 181,810 | ||||

| VRE Share of Total Consolidated Debt, as of 4/21/25 | 1,800,886 | ||||

| VRE Share of Unconsolidated Secured Debt, on 3/31/25 | 292,506 | ||||

| Consolidation of debt associated with JV interest acquisition | (154,539) | ||||

| Disposition of our interest in Metropolitan at 40 Park joint venture | (8,525) | ||||

| VRE Share of Total Unconsolidated Debt, on 4/21/25 | 129,442 | ||||

| Total Pro Forma Debt Portfolio | 1,931,328 | ||||

| $ in thousands except per SF | |||||||||||||||||

| Location | Transaction Date |

Number of Buildings | Units | Gross Asset Value |

|||||||||||||

| 2025 dispositions-to-date | |||||||||||||||||

| Land | |||||||||||||||||

| 65 Livingston | Roseland, NJ | 1/24/2025 | N/A | N/A | $7,300 | ||||||||||||

| Wall Land | Wall Township, NJ | 4/3/2025 | N/A | N/A | 31,000 | ||||||||||||

| PI North - Building 6 and Riverbend I | West New York, NJ | 4/21/2025 | N/A | N/A | 6,500 | ||||||||||||

| Land dispositions-to-date | $44,800 | ||||||||||||||||

| Multifamily | |||||||||||||||||

| Metropolitan at 40 Park | Morristown, NJ | 4/21/2025 | 1 | 130 | $600 | ||||||||||||

| Multifamily dispositions-to-date | $600 | ||||||||||||||||

| Total dispositions-to-date | $45,400 | ||||||||||||||||

| Land Under Binding Contract | |||||||||||||||||

1 Water Street |

White Plains, NY |

N/A | N/A |

N/A |

|||||||||||||

| PI South - Building 2 | Weehawken, NJ | N/A | N/A | N/A | |||||||||||||

| 2025 Acquisitions-to-Date | |||||||||||||||||

| Multifamily | |||||||||||||||||

| Sable (f.k.a Jersey City Urby) | Jersey City, NJ | 4/21/2025 | 1 | 762 | $38,5001 | ||||||||||||

| Multifamily acquisitions-to-date | $38,500 | ||||||||||||||||

| 1Q 2025 | 4Q 2024 | ||||||||||

| Total | Total | ||||||||||

Net Income (loss) |

$ | (13,730) | $ | (14,023) | |||||||

| Deduct: | |||||||||||

| Management fees | (718) | (751) | |||||||||

| Loss (income) from discontinued operations | (136) | 1,015 | |||||||||

| Realized gains (losses) and unrealized gains (losses) on disposition of rental property and impairment, net | — | (1,899) | |||||||||

| Interest and other investment income | (25) | (111) | |||||||||

Equity in (earnings) loss of unconsolidated joint ventures |

(3,842) | (1,015) | |||||||||

| (Gain) loss on disposition of developable land | 156 | — | |||||||||

| Gain on sale of unconsolidated joint venture interests | — | 154 | |||||||||

Other (income) expense, net |

105 | 396 | |||||||||

| Add: | |||||||||||

| Property management | 4,385 | 3,877 | |||||||||

| General and administrative | 10,068 | 10,040 | |||||||||

Transaction-related costs |

308 | 159 | |||||||||

| Depreciation and amortization | 21,253 | 21,182 | |||||||||

| Interest expense | 22,960 | 23,293 | |||||||||

| Provision for income taxes | 42 | 2 | |||||||||

Land and other impairments, net |

3,200 | — | |||||||||

Net operating income (NOI) |

$ | 44,026 | $ | 42,319 | |||||||

| Summary of Consolidated Multifamily NOI by Type (unaudited): | 1Q 2025 | 4Q 2024 | |||||||||

| Total Consolidated Multifamily - Operating Portfolio | $ | 42,326 | $ | 41,612 | |||||||

| Total Consolidated Commercial | 595 | 495 | |||||||||

| Total NOI from Consolidated Properties (excl. unconsolidated JVs/subordinated interests) | $ | 42,921 | $ | 42,107 | |||||||

| NOI (loss) from services, land/development/repurposing & other assets | 1,250 | 398 | |||||||||

| Total Consolidated Multifamily NOI | $ | 44,171 | $ | 42,505 | |||||||

| Property | Units |

Percentage

Occupied

|

VRE's Nominal Ownership1 |

1Q 2025 NOI2 |

Total Debt |

VRE Share of 1Q NOI |

VRE Share of Debt |

||||||||||||||||

| Multifamily | |||||||||||||||||||||||

| Sable (f.k.a Jersey City Urby)3 | 762 | 94.5% | 85.0% | $5,879 | $181,810 | $4,997 | $154,539 | ||||||||||||||||

| RiverTrace at Port Imperial | 316 | 94.2% | 22.5% | 2,151 | 82,000 | 484 | 18,450 | ||||||||||||||||

| Capstone at Port Imperial | 360 | 95.6% | 40.0% | 3,323 | 135,000 | 1,329 | 54,000 | ||||||||||||||||

| Riverpark at Harrison | 141 | 97.6% | 45.0% | 568 | 30,192 | 256 | 13,586 | ||||||||||||||||

| Metropolitan at 40 Park4 | 130 | 94.0% | 25.0% | 798 | 34,100 | 200 | 8,525 | ||||||||||||||||

| Station House | 378 | 93.2% | 50.0% | 1,855 | 86,812 | 928 | 43,406 | ||||||||||||||||

| Total Multifamily | 2,087 | 94.6% | 55.0% | $14,574 | $549,914 | $8,193 | $292,506 | ||||||||||||||||

| Total UJV | 2,087 | 94.6% | 55.0% | $14,574 | $549,914 | $8,193 | $292,506 | ||||||||||||||||

| Balance as of March 31, 2025 | Initial Spread | Deferred Financing Costs | 5 bps reduction KPI | Updated Spread | SOFR or SOFR Cap | All In Rate | |||||||||||||||||

| Secured Revolving Credit Facility | $148,000,000 | 2.10% | 0.68% | (0.05)% | 2.73% | 3.50% | 6.23% | ||||||||||||||||

| Secured Term Loan | $200,000,000 | 2.10% | 0.68% | (0.05)% | 2.73% | 3.50% | 6.23% | ||||||||||||||||

| Location | Ownership | Apartments | Rentable SF1 | Average Size | Year Complete | |||||||||||||||

NJ Waterfront |

||||||||||||||||||||

| Haus25 | Jersey City, NJ | 100.0% | 750 | 617,787 | 824 | 2022 | ||||||||||||||

| Liberty Towers | Jersey City, NJ | 100.0% | 648 | 602,210 | 929 | 2003 | ||||||||||||||

| BLVD 401 | Jersey City, NJ | 74.3% | 311 | 273,132 | 878 | 2016 | ||||||||||||||

| BLVD 425 | Jersey City, NJ | 74.3% | 412 | 369,515 | 897 | 2003 | ||||||||||||||

| BLVD 475 | Jersey City, NJ | 100.0% | 523 | 475,459 | 909 | 2011 | ||||||||||||||

| Soho Lofts | Jersey City, NJ | 100.0% | 377 | 449,067 | 1,191 | 2017 | ||||||||||||||

| Sable (f.k.a Jersey City Urby)2 | Jersey City, NJ | 85.0% | 762 | 474,476 | 623 | 2017 | ||||||||||||||

| RiverHouse 9 at Port Imperial | Weehawken, NJ | 100.0% | 313 | 245,127 | 783 | 2021 | ||||||||||||||

| RiverHouse 11 at Port Imperial | Weehawken, NJ | 100.0% | 295 | 250,591 | 849 | 2018 | ||||||||||||||

| RiverTrace | West New York, NJ | 22.5% | 316 | 295,767 | 936 | 2014 | ||||||||||||||

| Capstone | West New York, NJ | 40.0% | 360 | 337,991 | 939 | 2021 | ||||||||||||||

NJ Waterfront Subtotal |

85.0% | 5,067 | 4,391,122 | 867 | ||||||||||||||||

| Massachusetts | ||||||||||||||||||||

| Portside at East Pier | East Boston, MA | 100.0% | 180 | 154,859 | 862 | 2015 | ||||||||||||||

| Portside 2 at East Pier | East Boston, MA | 100.0% | 296 | 230,614 | 779 | 2018 | ||||||||||||||

| 145 Front at City Square | Worcester, MA | 100.0% | 365 | 304,936 | 835 | 2018 | ||||||||||||||

| The Emery at Overlook Ridge | Revere, MA | 100.0% | 326 | 273,140 | 838 | 2020 | ||||||||||||||

Massachusetts Subtotal |

100.0% | 1,167 | 963,549 | 826 | ||||||||||||||||

| Other | ||||||||||||||||||||

| The Upton | Short Hills, NJ | 100.0% | 193 | 217,030 | 1,125 | 2021 | ||||||||||||||

| The James | Park Ridge, NJ | 100.0% | 240 | 215,283 | 897 | 2021 | ||||||||||||||

| Signature Place | Morris Plains, NJ | 100.0% | 197 | 203,716 | 1,034 | 2018 | ||||||||||||||

| Quarry Place at Tuckahoe | Eastchester, NY | 100.0% | 108 | 105,551 | 977 | 2016 | ||||||||||||||

| Riverpark at Harrison | Harrison, NJ | 45.0% | 141 | 124,774 | 885 | 2014 | ||||||||||||||

| Metropolitan at 40 Park3 | Morristown, NJ | 25.0% | 130 | 124,237 | 956 | 2010 | ||||||||||||||

| Station House | Washington, DC | 50.0% | 378 | 290,348 | 768 | 2015 | ||||||||||||||

Other Subtotal |

73.8% | 1,387 | 1,280,939 | 924 | ||||||||||||||||

Operating Portfolio4 |

85.2% | 7,621 | 6,635,610 | 871 | ||||||||||||||||

| Three Months Ended March 31, | |||||||||||

| 2025 | 2024 | ||||||||||

| BLVD 425 | $ | 152 | $ | 80 | |||||||

| BLVD 401 | (552) | (552) | |||||||||

| Port Imperial Garage South | (82) | (26) | |||||||||

| Port Imperial Retail South | 8 | 34 | |||||||||

| Other consolidated joint ventures | (1,651) | (31) | |||||||||

| Net losses in noncontrolling interests | $ | (2,125) | $ | (495) | |||||||

| Depreciation in noncontrolling interests | 736 | 721 | |||||||||

| Funds from operations - noncontrolling interest in consolidated joint ventures | $ | (1,389) | $ | 226 | |||||||

| Interest expense in noncontrolling interest in consolidated joint ventures | 782 | 788 | |||||||||

| Net operating income before debt service in consolidated joint ventures | $ | (607) | $ | 1,014 | |||||||

| Company Information | ||||||||

| Corporate Headquarters | Stock Exchange Listing | Contact Information | ||||||

| Veris Residential, Inc. | New York Stock Exchange | Veris Residential, Inc. | ||||||

| 210 Hudson St., Suite 400 | Investor Relations Department | |||||||

| Jersey City, New Jersey 07311 | Trading Symbol | 210 Hudson St., Suite 400 | ||||||

| (732) 590-1010 | Common Shares: VRE | Jersey City, New Jersey 07311 | ||||||

| Mackenzie Rice | ||||||||

| Director, Investor Relations | ||||||||

E-Mail: investors@verisresidential.com |

||||||||

| Web: www.verisresidential.com | ||||||||

| Executive Officers | ||||||||

| Mahbod Nia | Amanda Lombard | Taryn Fielder | ||||||

| Chief Executive Officer | Chief Financial Officer | General Counsel and Secretary | ||||||

| Anna Malhari | Jeff Turkanis | |||||||

| Chief Operating Officer | EVP & Chief Investment Officer | |||||||

| Equity Research Coverage | ||||||||

| Bank of America Merrill Lynch | BTIG, LLC | Citigroup | ||||||

| Jana Galan | Thomas Catherwood | Nicholas Joseph | ||||||

| Evercore ISI | Green Street Advisors | JP Morgan | ||||||

| Steve Sakwa | John Pawlowski | Anthony Paolone | ||||||

| Truist | ||||||||

| Michael R. Lewis | ||||||||

| Page(s) | |||||

| Key Financial Data | |||||

| Operating Portfolio | |||||

| Debt | |||||

| Reconciliations and Additional Details | |||||

Annex 1: Transaction Activity

|

|||||

Annex 2: Reconciliation of NOI

|

|||||

Annex 4: Unconsolidated Joint Ventures

|

|||||

Annex 5: Debt Profile Footnotes

|

|||||

Annex 6: Multifamily Property Information

|

|||||

| Three Months Ended March 31, | ||||||||

| 2025 | 2024 | |||||||

| Net Income (loss) per Diluted Share | $(0.12) | $(0.04) | ||||||

| Core FFO per Diluted Share | $0.16 | $0.14 | ||||||

| Core AFFO per Diluted Share | $0.17 | $0.18 | ||||||

| Dividend per Diluted Share | $0.08 | $0.0525 | ||||||

| March 31, 2025 | December 31, 2024 | Change | |||||||||

Same Store Units |

7,621 | 7,621 | —% | ||||||||

| Same Store Occupancy | 94.0% | 93.9% | 0.1% | ||||||||

| Same Store Blended Rental Growth Rate (Quarter) | 2.4% | 0.5% | 1.9% | ||||||||

| Average Rent per Home | $4,019 | $4,033 | (0.3)% | ||||||||

| ($ in 000s) | Three Months Ended March 31, | ||||||||||

| 2025 | 2024 | % | |||||||||

| Total Property Revenue | $75,761 | $73,978 | 2.4% | ||||||||

| Controllable Expenses | 13,046 | 12,607 | 3.5% | ||||||||

| Non-Controllable Expenses | 11,822 | 12,057 | (1.9)% | ||||||||

| Total Property Expenses | 24,868 | 24,664 | 0.8% | ||||||||

Same Store NOI |

$50,893 | $49,314 | 3.2% | ||||||||

| Balance Sheet Metric ($ in 000s) | March 31, 2025 | December 31, 2024 | ||||||

| Weighted Average Interest Rate | 4.96% | 4.95% | ||||||

| Weighted Average Years to Maturity | 2.8 | 3.1 | ||||||

TTM Interest Coverage Ratio |

1.7x | 1.7x | ||||||

| Net Debt | $1,643,411 | $1,647,892 | ||||||

| TTM EBITDA | $144,191 | $140,694 | ||||||

| TTM Net Debt to EBITDA | 11.4x | 11.7x | ||||||

| Name ($ in 000s) | Date | Location | GAV | ||||||||

| 65 Livingston | 1/24/2025 | Roseland, NJ | $7,300 | ||||||||

| Wall Land | 4/3/2025 | Wall Township, NJ | 31,000 | ||||||||

| PI - North Building (two parcels) and Metropolitan at 40 Park | 4/21/2025 | West New York, NJ and Morristown, NJ | 7,100 | ||||||||

| Total Assets Sold in 2025-to-date | $45,400 | ||||||||||

| 2025 Guidance Ranges | Low | High | |||||||||

| Same Store Revenue Growth | 2.1% | — | 2.7% | ||||||||

| Same Store Expense Growth | 2.6% | — | 3.0% | ||||||||

| Same Store NOI Growth | 1.7% | — | 2.7% | ||||||||

| Core FFO per Share Guidance | Low | High | |||||||||

| Net Loss per Share | $(0.24) | — | $(0.22) | ||||||||

| Depreciation per Share | $0.85 | — | $0.85 | ||||||||

| Core FFO per Share | $0.61 | — | $0.63 | ||||||||

| Investors | Media | |||||||

| Mackenzie Rice | Amanda Shpiner/Grace Cartwright | |||||||

| Director, Investor Relations | Gasthalter & Co. | |||||||

| investors@verisresidential.com | veris-residential@gasthalter.com | |||||||

| March 31, 2025 | December 31, 2024 | |||||||

| ASSETS | ||||||||

| Rental property | ||||||||

| Land and leasehold interests | $456,789 | $458,946 | ||||||

| Buildings and improvements | 2,627,149 | 2,634,321 | ||||||

| Tenant improvements | 15,067 | 14,784 | ||||||

| Furniture, fixtures and equipment | 113,997 | 112,201 | ||||||

| 3,213,002 | 3,220,252 | |||||||

| Less – accumulated depreciation and amortization | (451,540) | (432,531) | ||||||

| 2,761,462 | 2,787,721 | |||||||

| Real estate held for sale, net | 9,138 | 7,291 | ||||||

| Net investment in rental property | 2,770,600 | 2,795,012 | ||||||

| Cash and cash equivalents | 7,596 | 7,251 | ||||||

| Restricted cash | 14,512 | 17,059 | ||||||

| Investments in unconsolidated joint ventures | 111,607 | 111,301 | ||||||

| Unbilled rents receivable, net | 2,409 | 2,253 | ||||||

| Deferred charges and other assets, net | 43,680 | 48,476 | ||||||

| Accounts receivable | 1,169 | 1,375 | ||||||

| Total Assets | $2,951,573 | $2,982,727 | ||||||

| LIABILITIES & EQUITY | ||||||||

| Revolving credit facility and term loans | 345,172 | 348,839 | ||||||

| Mortgages, loans payable and other obligations, net | 1,322,036 | 1,323,474 | ||||||

| Dividends and distributions payable | 8,485 | 8,533 | ||||||

| Accounts payable, accrued expenses and other liabilities | 40,648 | 42,744 | ||||||

| Rents received in advance and security deposits | 11,529 | 11,512 | ||||||

| Accrued interest payable | 5,232 | 5,262 | ||||||

| Total Liabilities | 1,733,102 | 1,740,364 | ||||||

| Redeemable noncontrolling interests | 9,294 | 9,294 | ||||||

Total Stockholders’ Equity |

1,080,486 | 1,099,391 | ||||||

| Noncontrolling interests in subsidiaries: | ||||||||

| Operating Partnership | 99,814 | 102,588 | ||||||

| Consolidated joint ventures | 28,877 | 31,090 | ||||||

| Total Noncontrolling Interests in Subsidiaries | $128,691 | $133,678 | ||||||

| Total Equity | $1,209,177 | $1,233,069 | ||||||

| Total Liabilities and Equity | $2,951,573 | $2,982,727 | ||||||

| Three Months Ended March 31, | |||||||||||

| REVENUES | 2025 | 2024 | |||||||||

| Revenue from leases | $61,965 | $60,642 | |||||||||

Management fees |

718 | 922 | |||||||||

| Parking income | 3,749 | 3,745 | |||||||||

| Other income | 1,324 | 2,031 | |||||||||

| Total revenues | 67,756 | 67,340 | |||||||||

| EXPENSES | |||||||||||

| Real estate taxes | 9,212 | 9,177 | |||||||||

| Utilities | 2,807 | 2,271 | |||||||||

| Operating services | 10,993 | 12,570 | |||||||||

| Property management | 4,385 | 5,242 | |||||||||

| General and administrative | 10,068 | 11,088 | |||||||||

Transaction-related costs |

308 | 516 | |||||||||

| Depreciation and amortization | 21,253 | 20,117 | |||||||||

| Land and other impairments, net | 3,200 | — | |||||||||

| Total expenses | 62,226 | 60,981 | |||||||||

| OTHER (EXPENSE) INCOME | |||||||||||

| Interest expense | (22,960) | (21,500) | |||||||||

| Interest and other investment income | 25 | 538 | |||||||||

Equity in earnings (loss) of unconsolidated joint ventures |

3,842 | 254 | |||||||||

| Gain (loss) on disposition of developable land | (156) | 784 | |||||||||

Gain (loss) on sale of unconsolidated joint venture interests |

— | 7,100 | |||||||||

| Other income (expense), net | (105) | 255 | |||||||||

| Total other (expense) income, net | (19,354) | (12,569) | |||||||||

Income (loss) from continuing operations before income tax expense |

(13,824) | (6,210) | |||||||||

| Provision for income taxes | (42) | (59) | |||||||||

Income (loss) from continuing operations after income tax expense |

(13,866) | (6,269) | |||||||||

Income (loss) from discontinued operations |

136 | 252 | |||||||||

| Realized gains (losses) and unrealized gains (losses) on disposition of rental property and impairments, net | — | 1,548 | |||||||||

| Total discontinued operations, net | 136 | 1,800 | |||||||||

Net Income (loss) |

(13,730) | (4,469) | |||||||||

| Noncontrolling interest in consolidated joint ventures | 2,125 | 495 | |||||||||

Noncontrolling interests in Operating Partnership of loss (income) from continuing operations |

998 | 523 | |||||||||

| Noncontrolling interests in Operating Partnership in discontinued operations | (11) | (155) | |||||||||

| Redeemable noncontrolling interests | (81) | (297) | |||||||||

Net income (loss) available to common shareholders |

$(10,699) | $(3,903) | |||||||||

| Basic earnings per common share: | |||||||||||

Net income (loss) available to common shareholders |

$(0.12) | $(0.04) | |||||||||

| Diluted earnings per common share: | |||||||||||

Net income (loss) available to common shareholders |

$(0.12) | $(0.04) | |||||||||

| Basic weighted average shares outstanding | 93,059 | 92,275 | |||||||||

Diluted weighted average shares outstanding(1) |

101,690 | 100,968 | |||||||||

| Three Months Ended March 31, | |||||||||||

| 2025 | 2024 | ||||||||||

Net loss available to common shareholders |

$ | (10,699) | $ | (3,903) | |||||||

| Add/(Deduct): | |||||||||||

| Noncontrolling interests in Operating Partnership | (998) | (523) | |||||||||

| Noncontrolling interests in discontinued operations | 11 | 155 | |||||||||

Real estate-related depreciation and amortization on continuing operations(2) |

23,445 | 22,631 | |||||||||

| Real estate-related depreciation and amortization on discontinued operations | — | 668 | |||||||||

| Continuing operations: Loss (gain) on sale from unconsolidated joint ventures | — | (7,100) | |||||||||

| Discontinued operations: Realized (gains) losses and unrealized (gains) losses on disposition of rental property, net | — | (1,548) | |||||||||

FFO(3) |

$ | 11,759 | $ | 10,380 | |||||||

| Add/(Deduct): | |||||||||||

Land and other impairments(4) |

1,600 | — | |||||||||

(Gain) loss on disposition of developable land |

156 | (784) | |||||||||

Rebranding and Severance/Compensation related costs (G&A)(5) |

168 | 1,637 | |||||||||

Rebranding and Severance/Compensation related costs (Property Management)(6) |

510 | 1,526 | |||||||||

Amortization of derivative premium(7) |

1,084 | 904 | |||||||||

| Derivative mark to market adjustment | 255 | — | |||||||||

| Transaction related costs | 308 | 516 | |||||||||

| Core FFO | $ | 15,840 | $ | 14,179 | |||||||

| Add/(Deduct): | |||||||||||

Straight-line rent adjustments(8) |

(146) | 25 | |||||||||

| Amortization of market lease intangibles, net | (3) | (7) | |||||||||

| Amortization of lease inducements | — | 7 | |||||||||

| Amortization of stock compensation | 3,366 | 3,727 | |||||||||

| Non-real estate depreciation and amortization | 150 | 210 | |||||||||

| Amortization of deferred financing costs | 1,707 | 1,242 | |||||||||

| Add/(Deduct): | |||||||||||

| Non-incremental revenue generating capital expenditures: | |||||||||||

| Building improvements | (3,306) | (1,040) | |||||||||

Tenant improvements and leasing commissions(9) |

(33) | (9) | |||||||||

Core AFFO(3) |

$ | 17,575 | $ | 18,334 | |||||||

Funds from Operations per share/unit-diluted |

$0.12 | $0.10 | |||||||||

| Core Funds from Operations per share/unit-diluted | $0.16 | $0.14 | |||||||||

Core Adjusted Funds from Operations per share/unit-diluted |

$0.17 | $0.18 | |||||||||

| Dividends declared per common share | $0.08 | $0.0525 | |||||||||

| Three Months Ended March 31, | |||||||||||

| 2025 | 2024 | ||||||||||

| Core FFO (calculated on a previous page) | $ | 15,840 | $ | 14,179 | |||||||

Deduct: |

|||||||||||

Equity in (earnings) loss of unconsolidated joint ventures |

(3,842) | (459) | |||||||||

| Equity in earnings share of depreciation and amortization | (2,343) | (2,724) | |||||||||

| Add: | |||||||||||

| Interest expense | 22,960 | 21,500 | |||||||||

| Amortization of derivative premium | (1,084) | (904) | |||||||||

| Derivative mark to market adjustment | (255) | — | |||||||||

| Recurring joint venture distributions | 5,801 | 1,701 | |||||||||

| Income (loss) in noncontrolling interest in consolidated joint ventures, net of land and other impairments1 | (525) | (495) | |||||||||

| Redeemable noncontrolling interests | 81 | 297 | |||||||||

| Income tax expense | 43 | 82 | |||||||||

| Adjusted EBITDA | $ | 36,675 | $ | 33,177 | |||||||

| Real Estate Portfolio | Other Assets | ||||||||||||||||

| Operating Multifamily NOI1 | Total | At Share | Cash and Cash Equivalents2 | $11,625 | |||||||||||||

| New Jersey Waterfront | $169,460 | $148,796 | Restricted Cash | 14,512 | |||||||||||||

| Massachusetts | 26,220 | 26,220 | Other Assets | 47,258 | |||||||||||||

| Other | 28,728 | 23,768 | Subtotal Other Assets | $73,395 | |||||||||||||

| Total Multifamily NOI | $224,408 | $198,784 | |||||||||||||||

| Commercial NOI3 | 2,380 | 1,949 | Liabilities and Other Considerations | ||||||||||||||

| Total NOI | $226,788 | $200,733 | |||||||||||||||

| Operating - Consolidated Debt at Share4 | $1,440,886 | ||||||||||||||||

| Non-Strategic Assets | Operating - Unconsolidated Debt at Share4 |

129,442 | |||||||||||||||

| Other Liabilities | 65,894 | ||||||||||||||||

| Estimated Value of Land Under Binding Contract | $34,250 | Revolving Credit Facility4 |

161,000 | ||||||||||||||

| Estimated Value of Remaining Land | 115,194 | Term Loan | 200,000 | ||||||||||||||

| Total Non-Strategic Assets5 | $149,444 | Preferred Units | 9,294 | ||||||||||||||

| Subtotal Liabilities and Other Considerations | $2,006,516 | ||||||||||||||||

| Outstanding Shares6 | |||||||||||||||||

| Diluted Weighted Average Shares Outstanding for 1Q 2025 (in 000s) | 102,066 | ||||||||||||||||

| Operating Highlights | |||||||||||||||||||||||||||||

|

Percentage

Occupied

|

Average Revenue per Home |

NOI1 |

Debt

Balance

|

||||||||||||||||||||||||||

| Ownership | Apartments | 1Q 2025 | 4Q 2024 | 1Q 2025 | 4Q 2024 | 1Q 2025 | 4Q 2024 | ||||||||||||||||||||||

NJ Waterfront |

|||||||||||||||||||||||||||||

| Haus25 | 100.0% | 750 | 95.6% | 95.3% | $4,969 | $4,986 | $8,195 | $7,803 | $343,061 | ||||||||||||||||||||

| Liberty Towers* | 100.0% | 648 | 80.5% | 85.6% | 4,428 | 4,319 | 4,289 | 4,543 | — | ||||||||||||||||||||

| BLVD 401 | 74.3% | 311 | 95.0% | 95.7% | 4,272 | 4,309 | 2,431 | 2,428 | 115,010 | ||||||||||||||||||||

| BLVD 425 | 74.3% | 412 | 95.9% | 95.6% | 4,143 | 4,175 | 3,426 | 3,246 | 131,000 | ||||||||||||||||||||

| BLVD 475 | 100.0% | 523 | 96.4% | 94.4% | 4,235 | 4,201 | 4,197 | 4,100 | 163,844 | ||||||||||||||||||||

| Soho Lofts* | 100.0% | 377 | 94.2% | 94.7% | 4,828 | 4,860 | 3,232 | 3,258 | — | ||||||||||||||||||||

| Sable (f.k.a. Jersey City Urby)2 | 85.0% | 762 | 94.5% | 94.4% | 4,223 | 4,322 | 5,879 | 6,455 | 181,810 | ||||||||||||||||||||

| RiverHouse 9 at Port Imperial | 100.0% | 313 | 96.4% | 95.4% | 4,493 | 4,516 | 2,715 | 2,674 | 110,000 | ||||||||||||||||||||

| RiverHouse 11 at Port Imperial | 100.0% | 295 | 95.8% | 96.3% | 4,391 | 4,405 | 2,527 | 2,479 | 100,000 | ||||||||||||||||||||

| RiverTrace | 22.5% | 316 | 94.2% | 94.4% | 3,808 | 3,851 | 2,151 | 2,243 | 82,000 | ||||||||||||||||||||

| Capstone | 40.0% | 360 | 95.6% | 95.1% | 4,603 | 4,590 | 3,323 | 3,243 | 135,000 | ||||||||||||||||||||

NJ Waterfront Subtotal |

85.0% | 5,067 | 93.4% | 93.8% | $4,430 | $4,441 | $42,365 | $42,472 | $1,361,725 | ||||||||||||||||||||

| Massachusetts | |||||||||||||||||||||||||||||

| Portside at East Pier | 100.0% | 180 | 96.4% | 95.2% | $3,283 | $3,265 | $1,156 | $1,207 | $56,500 | ||||||||||||||||||||

| Portside 2 at East Pier | 100.0% | 296 | 95.8% | 93.9% | 3,502 | 3,425 | 2,115 | 2,070 | 95,022 | ||||||||||||||||||||

| 145 Front at City Square* | 100.0% | 365 | 94.8% | 94.0% | 2,513 | 2,524 | 1,636 | 1,549 | — | ||||||||||||||||||||

| The Emery at Overlook Ridge | 100.0% | 326 | 93.9% | 92.9% | 2,845 | 2,865 | 1,648 | 1,699 | 70,279 | ||||||||||||||||||||

Massachusetts Subtotal |

100.0% | 1,167 | 95.0% | 93.9% | $2,975 | $2,962 | $6,555 | $6,525 | $221,801 | ||||||||||||||||||||

| Other | |||||||||||||||||||||||||||||

| The Upton | 100.0% | 193 | 93.3% | 91.4% | $4,355 | $4,411 | $1,290 | $1,238 | $75,000 | ||||||||||||||||||||

| The James* | 100.0% | 240 | 97.8% | 95.8% | 3,074 | 3,168 | 1,570 | 1,447 | — | ||||||||||||||||||||

| Signature Place* | 100.0% | 197 | 95.7% | 96.5% | 3,350 | 3,312 | 1,101 | 1,050 | — | ||||||||||||||||||||

| Quarry Place at Tuckahoe | 100.0% | 108 | 96.8% | 95.8% | 4,406 | 4,368 | 798 | 821 | 41,000 | ||||||||||||||||||||

| Riverpark at Harrison | 45.0% | 141 | 97.6% | 95.7% | 2,857 | 2,995 | 568 | 626 | 30,192 | ||||||||||||||||||||

| Metropolitan at 40 Park3 | 25.0% | 130 | 94.0% | 93.7% | 3,800 | 3,741 | 798 | 771 | 34,100 | ||||||||||||||||||||

| Station House | 50.0% | 378 | 93.2% | 91.8% | 2,909 | 2,989 | 1,855 | 2,005 | 86,812 | ||||||||||||||||||||

Other Subtotal |

73.8% | 1,387 | 95.2% | 94.0% | $3,396 | $3,442 | $7,980 | $7,958 | $267,104 | ||||||||||||||||||||

Operating Portfolio4,5 |

85.2% | 7,621 | 94.0% | 93.9% | $4,019 | $4,033 | $56,900 | $56,955 | $1,850,630 | ||||||||||||||||||||

| Commercial | Location | Ownership |

Rentable

SF1

|

Percentage

Leased

1Q 2025

|

Percentage

Leased

4Q 2024

|

NOI

1Q 2025

|

NOI

4Q 2024

|

Debt

Balance

|

||||||||||||||||||

Port Imperial South - Garage |

Weehawken, NJ | 70.0% | Fn 1 |

N/A | N/A | $413 | $537 | $30,957 | ||||||||||||||||||

Port Imperial South - Retail |

Weehawken, NJ | 70.0% | 18,064 | 77.0% | 92.0% | 112 | 147 | — | ||||||||||||||||||

Port Imperial North - Garage |

Weehawken, NJ | 70.0% | Fn 1 |

N/A | N/A | (54) | 25 | — | ||||||||||||||||||

Port Imperial North - Retail |

Weehawken, NJ | 100.0% | 8,400 | 100.0% | 100.0% | 89 | (275) | — | ||||||||||||||||||

| Riverwalk at Port Imperial | West New York, NJ | 100.0% | 29,923 | 80.0% | 80.0% | 35 | 61 | — | ||||||||||||||||||

| Commercial Total | 56,387 | 82.0% | 86.8% | $595 | $495 | $30,957 | ||||||||||||||||||||

| Shops at 40 Park2 | Morristown, NJ | N/A | N/A | N/A | 69.0% | — | 68 | — | ||||||||||||||||||

| Commercial Total with Shops at 40 Park | 82.0% | 78.4% | $595 | $563 | $30,957 | |||||||||||||||||||||

| Developable Land Parcel Units3 | ||||||||

| Total Units | VRE Share | |||||||

| NJ Waterfront | 1,522 | 1,400 | ||||||

| Massachusetts | 737 | 737 | ||||||

| Other | 459 | 459 | ||||||

| Developable Land Parcel Units Total at April 22, 20254 | 2,718 | 2,596 | ||||||

| Less: land under binding contract | 544 | 422 | ||||||

| Developable Land Parcel Units Remaining | 2,174 | 2,174 | ||||||

| NOI at Share | Occupancy | Blended Lease Tradeouts2 | ||||||||||||||||||||||||||||||

| Apartments | 1Q 2025 | 4Q 2024 | Change | 1Q 2025 | 4Q 2024 | Change | 1Q 2025 | 4Q 2024 | Change |

|||||||||||||||||||||||

| New Jersey Waterfront | 5,067 | $37,673 | $37,733 | (0.2)% | 93.4% | 93.8% | (0.3)% | 2.4% | 1.2% | 1.2% | ||||||||||||||||||||||

| Massachusetts | 1,167 | 6,816 | 6,787 | 0.4% | 95.0% | 93.9% | 1.2% | 2.5% | —% | 2.5% | ||||||||||||||||||||||

| Other3 | 1,387 | 6,404 | 6,299 | 1.7% | 95.2% | 94.0% | 1.1% | 2.6% | (1.7)% | 4.3% | ||||||||||||||||||||||

| Total | 7,621 | $50,893 | $50,819 | 0.1% | 94.0% | 93.9% | 0.1% | 2.4% | 0.5% | 1.9% | ||||||||||||||||||||||

NOI at Share |

Occupancy | Blended Lease Tradeouts2 |

||||||||||||||||||||||||||||||

| Apartments | 1Q 2025 | 1Q 2024 | Change | 1Q 2025 | 1Q 2024 | Change | 1Q 2025 | 1Q 2024 | Change |

|||||||||||||||||||||||

| New Jersey Waterfront | 5,067 | $37,673 | $36,698 | 2.7% | 93.4% | 94.2% | (0.8)% | 2.4% | 4.1% | (1.7)% | ||||||||||||||||||||||

| Massachusetts | 1,167 | 6,816 | 6,520 | 4.5% | 95.0% | 95.1% | (0.1)% | 2.5% | 2.9% | (0.4)% | ||||||||||||||||||||||

Other3 |

1,387 | 6,404 | 6,096 | 5.1% | 95.2% | 92.7% | 2.7% | 2.6% | 4.8% | (2.2)% | ||||||||||||||||||||||

| Total | 7,621 | $50,893 | $49,314 | 3.2% | 94.0% | 94.1% | (0.1)% | 2.4% | 4.6% | (2.2)% | ||||||||||||||||||||||

Apartments |

1Q 2025 | 4Q 2024 | 3Q 2024 | 2Q 2024 | 1Q 2024 | |||||||||||||||

| New Jersey Waterfront | 5,067 | $4,430 | $4,441 | $4,371 | $4,291 | $4,274 | ||||||||||||||

| Massachusetts | 1,167 | 2,975 | 2,962 | 2,946 | 2,931 | 2,893 | ||||||||||||||

Other3 |

1,387 | 3,396 | 3,442 | 3,421 | 3,411 | 3,374 | ||||||||||||||

| Total | 7,621 | $4,019 | $4,033 | $3,980 | $3,923 | $3,899 | ||||||||||||||

| Multifamily Same Store1 | ||||||||||||||||||||||||||||||||

| Three Months Ended March 31, | Sequential | |||||||||||||||||||||||||||||||

| 2025 | 2024 | Change | % | 1Q25 | 4Q24 | Change | % | |||||||||||||||||||||||||

| Apartment Rental Income | $68,679 | $66,701 | $1,978 | 3.0% | $68,679 | $69,149 | $(470) | (0.7)% | ||||||||||||||||||||||||

| Parking/Other Income | 7,082 | 7,277 | (195) | (2.7)% | 7,082 | 7,226 | (144) | (2.0)% | ||||||||||||||||||||||||

| Total Property Revenues2 | $75,761 | $73,978 | $1,783 | 2.4% | $75,761 | $76,375 | $(614) | (0.8)% | ||||||||||||||||||||||||

| Marketing & Administration | 2,145 | 2,138 | 7 | 0.3% | 2,145 | 2,618 | (473) | (18.1)% | ||||||||||||||||||||||||

| Utilities | 3,244 | 2,570 | 674 | 26.2% | 3,244 | 2,278 | 966 | 42.4% | ||||||||||||||||||||||||

| Payroll | 4,291 | 4,295 | (4) | (0.1)% | 4,291 | 4,525 | (234) | (5.2)% | ||||||||||||||||||||||||

| Repairs & Maintenance | 3,366 | 3,604 | (238) | (6.6)% | 3,366 | 4,486 | (1,120) | (25.0)% | ||||||||||||||||||||||||

| Controllable Expenses | $13,046 | $12,607 | $439 | 3.5% | $13,046 | $13,907 | $(861) | (6.2)% | ||||||||||||||||||||||||

| Other Fixed Fees | 725 | 712 | 13 | 1.8% | 725 | 719 | 6 | 0.8% | ||||||||||||||||||||||||

| Insurance | 1,467 | 1,779 | (312) | (17.5)% | 1,467 | 1,388 | 79 | 5.7% | ||||||||||||||||||||||||

| Real Estate Taxes | 9,630 | 9,566 | 64 | 0.7% | 9,630 | 9,542 | 88 | 0.9% | ||||||||||||||||||||||||

| Non-Controllable Expenses | $11,822 | $12,057 | $(235) | (1.9)% | $11,822 | $11,649 | $173 | 1.5% | ||||||||||||||||||||||||

| Total Property Expenses | $24,868 | $24,664 | $204 | 0.8% | $24,868 | $25,556 | $(688) | (2.7)% | ||||||||||||||||||||||||

Same Store GAAP NOI |

$50,893 | $49,314 | $1,579 | 3.2% | $50,893 | $50,819 | $74 | 0.1% | ||||||||||||||||||||||||

| Same Store NOI Margin | 67.2% | 66.7% | 0.5% | 67.2% | 66.5% | 0.7% | ||||||||||||||||||||||||||

Total Units |

7,621 | 7,621 | 7,621 | 7,621 | ||||||||||||||||||||||||||||

% Ownership |

85.2% | 85.2% | 85.2% | 85.2% | ||||||||||||||||||||||||||||

% Occupied |

94.0% | 94.1% | (0.1)% | 94.0% | 93.9% | 0.1% | ||||||||||||||||||||||||||

| Lender |

Effective

Interest Rate(1)

|

March 31, 2025 | December 31, 2024 | Date of Maturity |

|||||||||||||

Secured Permanent Loans |

|||||||||||||||||

| Portside 2 at East Pier | New York Life Insurance Co. | 4.56% | 95,022 | 95,427 | 03/10/26 | ||||||||||||

| BLVD 425 | New York Life Insurance Co. | 4.17% | 131,000 | 131,000 | 08/10/26 | ||||||||||||

| BLVD 401 | New York Life Insurance Co. | 4.29% | 115,010 | 115,515 | 08/10/26 | ||||||||||||

Portside at East Pier(2) |

KKR | SOFR + 2.75% | 56,500 | 56,500 | 09/07/26 | ||||||||||||

The Upton(3) |

Bank of New York Mellon | SOFR + 1.58% | 75,000 | 75,000 | 10/27/26 | ||||||||||||

RiverHouse 9 at Port Imperial(4) |

JP Morgan | SOFR + 1.41% | 110,000 | 110,000 | 06/21/27 | ||||||||||||

| Quarry Place at Tuckahoe | Natixis Real Estate Capital, LLC | 4.48% | 41,000 | 41,000 | 08/05/27 | ||||||||||||

| BLVD 475 | The Northwestern Mutual Life Insurance Co. | 2.91% | 163,844 | 164,712 | 11/10/27 | ||||||||||||

| Haus25 | Freddie Mac | 6.04% | 343,061 | 343,061 | 09/01/28 | ||||||||||||

| RiverHouse 11 at Port Imperial | The Northwestern Mutual Life Insurance Co. | 4.52% | 100,000 | 100,000 | 01/10/29 | ||||||||||||

| Port Imperial Garage South | American General Life & A/G PC | 4.85% | 30,957 | 31,098 | 12/01/29 | ||||||||||||

The Emery at Overlook Ridge(5) |

Flagstar Bank |

3.21% | 70,279 | 70,653 | 01/01/31 | ||||||||||||

| Secured Permanent Loans Outstanding | $1,331,673 | $1,333,966 | |||||||||||||||

| Unamortized Deferred Financing Costs | (9,637) | (10,492) | |||||||||||||||

Secured Permanent Loans |

$1,322,036 | $1,323,474 | |||||||||||||||

| Secured RCF & Term Loans: | |||||||||||||||||

Revolving Credit Facility(6) |

Various Lenders |

SOFR + 2.73% | $148,000 | $152,000 | 04/22/27 | ||||||||||||

Term Loan(6) |

Various Lenders |

SOFR + 2.73% | 200,000 | 200,000 | 04/22/27 | ||||||||||||

| RCF & Term Loan Balances | $348,000 | $352,000 | |||||||||||||||

| Unamortized Deferred Financing Costs | (2,828) | (3,161) | |||||||||||||||

| Total RCF & Term Loan Debt | $345,172 | $348,839 | |||||||||||||||

| Total Debt | $1,667,208 | $1,672,313 | |||||||||||||||

| Balance | % of Total |

Weighted Average Interest Rate |

Weighted Average Maturity in Years |

|||||||||||

| Fixed Rate & Hedged Debt | ||||||||||||||

| Fixed Rate & Hedged Secured Debt | $1,679,673 | 100.0% | 5.05% | 2.51 | ||||||||||

| Variable Rate Debt | ||||||||||||||

| Variable Rate Debt | — | —% | —% | — | ||||||||||

| Totals / Weighted Average | $1,679,673 | 100.0% | 5.05% | 2.51 | ||||||||||

| Unamortized Deferred Financing Costs | (12,465) | |||||||||||||

| Total Consolidated Debt, net | $1,667,208 | |||||||||||||

| Partners’ Share | (72,597) | |||||||||||||

| VRE Share of Total Consolidated Debt, net1 | $1,594,611 | |||||||||||||

| Unconsolidated Secured Debt | ||||||||||||||

| VRE Share | $292,506 | 53.2% | 4.71% | 3.80 | ||||||||||

| Partners’ Share | 257,408 | 46.8% | 4.71% | 3.80 | ||||||||||

| Total Unconsolidated Secured Debt | $549,914 | 100.0% | 4.71% | 3.80 | ||||||||||

| Pro Forma Debt Portfolio | ||||||||||||||

| Fixed Rate & Hedged Secured Debt | $1,920,328 | 99.4% | 4.94% | 2.84 | ||||||||||

| Variable Rate Secured Debt | 11,000 | 0.6% | 7.04% | 2.06 | ||||||||||

| Total Pro Forma Debt Portfolio | $1,931,328 | 100.0% | 4.96% | 2.83 | ||||||||||

| Pro Forma | |||||

| Total Consolidated Debt, gross on 3/31/25 | 1,679,673 | ||||

| Partners' Share | (72,597) | ||||

| VRE Share of Total Consolidated Debt, as of 3/31/25 | 1,607,076 | ||||

| Net Revolver activity in April | 13,000 | ||||

| Consolidation of debt associated with JV interest acquisition | 181,810 | ||||

| VRE Share of Total Consolidated Debt, as of 4/21/25 | 1,800,886 | ||||

| VRE Share of Unconsolidated Secured Debt, on 3/31/25 | 292,506 | ||||

| Consolidation of debt associated with JV interest acquisition | (154,539) | ||||

| Disposition of our interest in Metropolitan at 40 Park joint venture | (8,525) | ||||

| VRE Share of Total Unconsolidated Debt, on 4/21/25 | 129,442 | ||||

| Total Pro Forma Debt Portfolio | 1,931,328 | ||||

| $ in thousands except per SF | |||||||||||||||||

| Location | Transaction Date |

Number of Buildings | Units | Gross Asset Value |

|||||||||||||

| 2025 dispositions-to-date | |||||||||||||||||

| Land | |||||||||||||||||

| 65 Livingston | Roseland, NJ | 1/24/2025 | N/A | N/A | $7,300 | ||||||||||||

| Wall Land | Wall Township, NJ | 4/3/2025 | N/A | N/A | 31,000 | ||||||||||||

| PI North - Building 6 and Riverbend I | West New York, NJ | 4/21/2025 | N/A | N/A | 6,500 | ||||||||||||

| Land dispositions-to-date | $44,800 | ||||||||||||||||

| Multifamily | |||||||||||||||||

| Metropolitan at 40 Park | Morristown, NJ | 4/21/2025 | 1 | 130 | $600 | ||||||||||||

| Multifamily dispositions-to-date | $600 | ||||||||||||||||

| Total dispositions-to-date | $45,400 | ||||||||||||||||

| Land Under Binding Contract | |||||||||||||||||

1 Water Street |

White Plains, NY |

N/A | N/A |

N/A |

|||||||||||||

| PI South - Building 2 | Weehawken, NJ | N/A | N/A | N/A | |||||||||||||

| 2025 Acquisitions-to-Date | |||||||||||||||||

| Multifamily | |||||||||||||||||

| Sable (f.k.a Jersey City Urby) | Jersey City, NJ | 4/21/2025 | 1 | 762 | $38,5001 | ||||||||||||

| Multifamily acquisitions-to-date | $38,500 | ||||||||||||||||

| 1Q 2025 | 4Q 2024 | ||||||||||

| Total | Total | ||||||||||

Net Income (loss) |

$ | (13,730) | $ | (14,023) | |||||||

| Deduct: | |||||||||||

| Management fees | (718) | (751) | |||||||||

| Loss (income) from discontinued operations | (136) | 1,015 | |||||||||

| Realized gains (losses) and unrealized gains (losses) on disposition of rental property and impairment, net | — | (1,899) | |||||||||

| Interest and other investment income | (25) | (111) | |||||||||

Equity in (earnings) loss of unconsolidated joint ventures |

(3,842) | (1,015) | |||||||||

| (Gain) loss on disposition of developable land | 156 | — | |||||||||

| Gain on sale of unconsolidated joint venture interests | — | 154 | |||||||||

Other (income) expense, net |

105 | 396 | |||||||||

| Add: | |||||||||||

| Property management | 4,385 | 3,877 | |||||||||

| General and administrative | 10,068 | 10,040 | |||||||||

Transaction-related costs |

308 | 159 | |||||||||

| Depreciation and amortization | 21,253 | 21,182 | |||||||||

| Interest expense | 22,960 | 23,293 | |||||||||

| Provision for income taxes | 42 | 2 | |||||||||

Land and other impairments, net |

3,200 | — | |||||||||

Net operating income (NOI) |

$ | 44,026 | $ | 42,319 | |||||||

| Summary of Consolidated Multifamily NOI by Type (unaudited): | 1Q 2025 | 4Q 2024 | |||||||||

| Total Consolidated Multifamily - Operating Portfolio | $ | 42,326 | $ | 41,612 | |||||||

| Total Consolidated Commercial | 595 | 495 | |||||||||

| Total NOI from Consolidated Properties (excl. unconsolidated JVs/subordinated interests) | $ | 42,921 | $ | 42,107 | |||||||

| NOI (loss) from services, land/development/repurposing & other assets | 1,250 | 398 | |||||||||

| Total Consolidated Multifamily NOI | $ | 44,171 | $ | 42,505 | |||||||

| Property | Units |

Percentage

Occupied

|

VRE's Nominal Ownership1 |

1Q 2025 NOI2 |

Total Debt |

VRE Share of 1Q NOI |

VRE Share of Debt |

||||||||||||||||

| Multifamily | |||||||||||||||||||||||

| Sable (f.k.a Jersey City Urby)3 | 762 | 94.5% | 85.0% | $5,879 | $181,810 | $4,997 | $154,539 | ||||||||||||||||

| RiverTrace at Port Imperial | 316 | 94.2% | 22.5% | 2,151 | 82,000 | 484 | 18,450 | ||||||||||||||||

| Capstone at Port Imperial | 360 | 95.6% | 40.0% | 3,323 | 135,000 | 1,329 | 54,000 | ||||||||||||||||

| Riverpark at Harrison | 141 | 97.6% | 45.0% | 568 | 30,192 | 256 | 13,586 | ||||||||||||||||

| Metropolitan at 40 Park4 | 130 | 94.0% | 25.0% | 798 | 34,100 | 200 | 8,525 | ||||||||||||||||

| Station House | 378 | 93.2% | 50.0% | 1,855 | 86,812 | 928 | 43,406 | ||||||||||||||||

| Total Multifamily | 2,087 | 94.6% | 55.0% | $14,574 | $549,914 | $8,193 | $292,506 | ||||||||||||||||

| Total UJV | 2,087 | 94.6% | 55.0% | $14,574 | $549,914 | $8,193 | $292,506 | ||||||||||||||||

| Balance as of March 31, 2025 | Initial Spread | Deferred Financing Costs | 5 bps reduction KPI | Updated Spread | SOFR or SOFR Cap | All In Rate | |||||||||||||||||

| Secured Revolving Credit Facility | $148,000,000 | 2.10% | 0.68% | (0.05)% | 2.73% | 3.50% | 6.23% | ||||||||||||||||

| Secured Term Loan | $200,000,000 | 2.10% | 0.68% | (0.05)% | 2.73% | 3.50% | 6.23% | ||||||||||||||||

| Location | Ownership | Apartments | Rentable SF1 | Average Size | Year Complete | |||||||||||||||

NJ Waterfront |

||||||||||||||||||||

| Haus25 | Jersey City, NJ | 100.0% | 750 | 617,787 | 824 | 2022 | ||||||||||||||

| Liberty Towers | Jersey City, NJ | 100.0% | 648 | 602,210 | 929 | 2003 | ||||||||||||||

| BLVD 401 | Jersey City, NJ | 74.3% | 311 | 273,132 | 878 | 2016 | ||||||||||||||

| BLVD 425 | Jersey City, NJ | 74.3% | 412 | 369,515 | 897 | 2003 | ||||||||||||||

| BLVD 475 | Jersey City, NJ | 100.0% | 523 | 475,459 | 909 | 2011 | ||||||||||||||

| Soho Lofts | Jersey City, NJ | 100.0% | 377 | 449,067 | 1,191 | 2017 | ||||||||||||||

| Sable (f.k.a Jersey City Urby)2 | Jersey City, NJ | 85.0% | 762 | 474,476 | 623 | 2017 | ||||||||||||||

| RiverHouse 9 at Port Imperial | Weehawken, NJ | 100.0% | 313 | 245,127 | 783 | 2021 | ||||||||||||||

| RiverHouse 11 at Port Imperial | Weehawken, NJ | 100.0% | 295 | 250,591 | 849 | 2018 | ||||||||||||||

| RiverTrace | West New York, NJ | 22.5% | 316 | 295,767 | 936 | 2014 | ||||||||||||||

| Capstone | West New York, NJ | 40.0% | 360 | 337,991 | 939 | 2021 | ||||||||||||||

NJ Waterfront Subtotal |

85.0% | 5,067 | 4,391,122 | 867 | ||||||||||||||||

| Massachusetts | ||||||||||||||||||||

| Portside at East Pier | East Boston, MA | 100.0% | 180 | 154,859 | 862 | 2015 | ||||||||||||||

| Portside 2 at East Pier | East Boston, MA | 100.0% | 296 | 230,614 | 779 | 2018 | ||||||||||||||

| 145 Front at City Square | Worcester, MA | 100.0% | 365 | 304,936 | 835 | 2018 | ||||||||||||||

| The Emery at Overlook Ridge | Revere, MA | 100.0% | 326 | 273,140 | 838 | 2020 | ||||||||||||||

Massachusetts Subtotal |

100.0% | 1,167 | 963,549 | 826 | ||||||||||||||||

| Other | ||||||||||||||||||||

| The Upton | Short Hills, NJ | 100.0% | 193 | 217,030 | 1,125 | 2021 | ||||||||||||||

| The James | Park Ridge, NJ | 100.0% | 240 | 215,283 | 897 | 2021 | ||||||||||||||

| Signature Place | Morris Plains, NJ | 100.0% | 197 | 203,716 | 1,034 | 2018 | ||||||||||||||

| Quarry Place at Tuckahoe | Eastchester, NY | 100.0% | 108 | 105,551 | 977 | 2016 | ||||||||||||||

| Riverpark at Harrison | Harrison, NJ | 45.0% | 141 | 124,774 | 885 | 2014 | ||||||||||||||

| Metropolitan at 40 Park3 | Morristown, NJ | 25.0% | 130 | 124,237 | 956 | 2010 | ||||||||||||||

| Station House | Washington, DC | 50.0% | 378 | 290,348 | 768 | 2015 | ||||||||||||||

Other Subtotal |

73.8% | 1,387 | 1,280,939 | 924 | ||||||||||||||||

Operating Portfolio4 |

85.2% | 7,621 | 6,635,610 | 871 | ||||||||||||||||

| Three Months Ended March 31, | |||||||||||

| 2025 | 2024 | ||||||||||

| BLVD 425 | $ | 152 | $ | 80 | |||||||

| BLVD 401 | (552) | (552) | |||||||||

| Port Imperial Garage South | (82) | (26) | |||||||||

| Port Imperial Retail South | 8 | 34 | |||||||||

| Other consolidated joint ventures | (1,651) | (31) | |||||||||

| Net losses in noncontrolling interests | $ | (2,125) | $ | (495) | |||||||

| Depreciation in noncontrolling interests | 736 | 721 | |||||||||

| Funds from operations - noncontrolling interest in consolidated joint ventures | $ | (1,389) | $ | 226 | |||||||

| Interest expense in noncontrolling interest in consolidated joint ventures | 782 | 788 | |||||||||

| Net operating income before debt service in consolidated joint ventures | $ | (607) | $ | 1,014 | |||||||

| Company Information | ||||||||

| Corporate Headquarters | Stock Exchange Listing | Contact Information | ||||||

| Veris Residential, Inc. | New York Stock Exchange | Veris Residential, Inc. | ||||||

| 210 Hudson St., Suite 400 | Investor Relations Department | |||||||

| Jersey City, New Jersey 07311 | Trading Symbol | 210 Hudson St., Suite 400 | ||||||

| (732) 590-1010 | Common Shares: VRE | Jersey City, New Jersey 07311 | ||||||

| Mackenzie Rice | ||||||||

| Director, Investor Relations | ||||||||

E-Mail: investors@verisresidential.com |

||||||||

| Web: www.verisresidential.com | ||||||||

| Executive Officers | ||||||||

| Mahbod Nia | Amanda Lombard | Taryn Fielder | ||||||

| Chief Executive Officer | Chief Financial Officer | General Counsel and Secretary | ||||||

| Anna Malhari | Jeff Turkanis | |||||||

| Chief Operating Officer | EVP & Chief Investment Officer | |||||||

| Equity Research Coverage | ||||||||

| Bank of America Merrill Lynch | BTIG, LLC | Citigroup | ||||||

| Jana Galan | Thomas Catherwood | Nicholas Joseph | ||||||

| Evercore ISI | Green Street Advisors | JP Morgan | ||||||

| Steve Sakwa | John Pawlowski | Anthony Paolone | ||||||

| Truist | ||||||||

| Michael R. Lewis | ||||||||