SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

October 11, 2024

Date of Report (Date of earliest event reported)

UNITY BANCORP, INC.

(Exact Name of Registrant as Specified in its Charter)

New Jersey

(State or Other Jurisdiction of Incorporation)

1-12431 |

22-3282551 |

(Commission File Number) |

(IRS Employer Identification No.) |

64 Old Highway 22

Clinton, NJ 08809

(Address of Principal Executive Office)

(908) 730-7630

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common stock |

UNTY |

NASDAQ |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operation and Financial Condition

The Registrant issued a press release on October 11, 2024 announcing results for the nine months ended September 30, 2024, the full text of which is incorporated by reference to this Item.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

|

UNITY BANCORP, INC. |

|

|

(Registrant) |

|

|

|

|

Date: October 11, 2024 |

|

|

|

By: |

/s/ George Boyan |

|

|

George Boyan |

|

|

Executive Vice President and Chief Financial Officer |

Exhibit 99.1

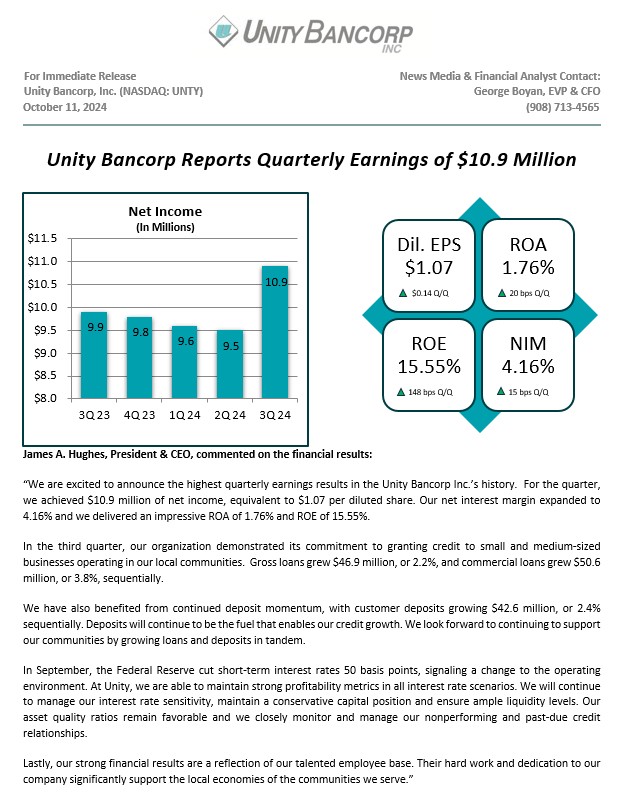

Clinton, NJ -- Unity Bancorp, Inc. (NASDAQ: UNTY), parent company of Unity Bank, reported net income of $10.9 million, or $1.07 per diluted share, for the quarter ended September 30, 2024, compared to net income of $9.5 million, or $0.93 per diluted share for the quarter ended June 30, 2024. This represents a 15.3% increase in net income and a 15.1% increase in net income per diluted share. For the nine months ended September 30, 2024, Unity Bancorp reported net income of $29.9 million, or $2.94 per diluted share, compared to net income of $29.9 million, or $2.88 per diluted share, for the nine months ended September 30, 2023. This represents no change in net income and a 2.1% increase in net income per diluted share, reflecting the Company’s repurchase of outstanding shares.

Third Quarter Earnings Highlights

| ● | Net interest income, the primary driver of earnings, was $24.9 million for the quarter ended September 30, 2024, an increase of $1.5 million, as compared to $23.4 million for the quarter ended June 30, 2024. Net interest margin (“NIM”) increased 15 basis points to 4.16% for the quarter ended September 30, 2024, compared to the quarter ended June 30, 2024. The increase was primarily due to the yield on interest-earning assets increasing and the cost of interest-bearing liabilities decreasing slightly. |

| ● | The provision for credit losses on loans was $1.0 million for the quarter ended September 30, 2024, compared to $0.3 million for the quarter ended June 30, 2024. The provision in the current quarter was primarily driven by loan growth. |

| ● | Noninterest income was $2.8 million for the quarter ended September 30, 2024, compared to $2.0 million for the quarter ended June 30, 2024. The $0.8 million increase was primarily due to increased net securities gains, gain on sale of mortgage loans, service & loan fee income and branch fee income. The increase was partially offset by lower gain on sale of SBA loans and other income. The Bank sold $0.9 million of SBA loans during the quarter ended September 30, 2024, compared to $3.9 million during the quarter ended June 30, 2024. |

| ● | Noninterest expense was $12.0 million for the quarter ended September 30, 2024, which was flat compared to the prior quarter. The increase in compensation & benefits and other expenses was offset by decreases in loan related expenses, deposit insurance and professional services. |

| ● | The effective tax rate was 25.1% for the quarter ended September 30, 2024, compared to 24.7% for the quarter ended June 30, 2024. |

Balance Sheet Highlights

| ● | Total gross loans increased $45.3 million, or 2.1%, from December 31, 2023, primarily due to increases in the commercial loan category. This was partially offset by decreases in the residential construction and residential mortgage categories. |

| ● | As of September 30, 2024, the allowance for credit losses as a percentage of gross loans was 1.22%. |

| ● | Total deposits increased $122.0 million, or 6.3%, from December 31, 2023. As of September 30, 2024, 19.1% of total deposits were uninsured or uncollateralized. The Company’s deposit composition as of September 30, 2024, consisted of 20.7% in noninterest bearing demand deposits, 15.9% in interest-bearing demand deposits, 27.4% in savings deposits and 36.0% in time deposits. |

| ● | As of September 30, 2024, the loan to deposit ratio was 108.4%, representing a continued reduction from 112.9% as of December 31, 2023. |

| ● | As of September 30, 2024, investments comprised 5.5% of total assets. Available for sale debt securities (“AFS”) were $97.7 million or 3.7% of total assets. Held to maturity (“HTM”) debt securities were $36.2 million or 1.4% of total assets. As of September 30, 2024, pre-tax net unrealized losses on AFS and HTM were $3.3 million and $5.7 million, respectively. These pre-tax unrealized losses represent approximately 3.1% of the Company’s Tier 1 capital. Equity securities were $9.8 million or 0.4% of total assets as of September 30, 2024. |

| ● | Borrowed funds decreased $89.6 million from December 31, 2023. Borrowed funds were entirely comprised of borrowings from the FHLB. |

| ● | Shareholders’ equity was $284.3 million as of September 30, 2024, compared to $261.4 million as of December 31, 2023. The $22.9 million increase was primarily driven by 2024 earnings, partially offset by share repurchases and dividend payments. For the nine months ended September 30, 2024, Unity Bancorp repurchased 229,102 shares for approximately $6.2 million, or a weighted average price of $27.05 per share. For the three months ended September 30, 2024, Unity Bancorp repurchased 10,334 shares for approximately $0.3 million, or a weighted average price of $27.27 per share. |

| ● | Book value per common share was $28.48 as of September 30, 2024, compared to $25.98 as of December 31, 2023. This increase primarily reflects earnings partially offset by dividend payouts. |

| ● | Below is a summary of Unity Bancorp’s regulatory capital ratios: |

| o | The Leverage Ratio increased 80 basis points to 11.94% at September 30, 2024, compared to 11.14% at December 31, 2023. |

| o | The Common Equity Tier 1 Capital Ratio increased 80 basis points to 13.50% at September 30, 2024, compared to 12.70% at December 31, 2023. |

| o | The Tier 1 Capital Ratio increased 80 basis points to 13.98% at September 30, 2024, compared to 13.18% at December 31, 2023. |

| o | The Total Capital Ratio increased 80 basis points, to 15.23% at September 30, 2024, compared to 14.43% at December 31, 2023. |

| ● | At September 30, 2024, the Company held $194.5 million of cash and cash equivalents. The Company also maintained approximately $569.4 million of funding available from various funding sources, including the FHLB, FRB Discount Window and other lines of credit. Additionally, the Company has the ability to pledge additional securities to further increase borrowing capacity. Total available funding plus cash on hand represented 195.9% of uninsured or uncollateralized deposits. |

| ● | As of September 30, 2024, nonperforming assets were $15.9 million, compared to $19.2 million as of December 31, 2023 and $15.2 million as of June 30, 2024. As of September 30, 2024, nonperforming assets included $2.9 million related to debt securities available for sale. The ratio of nonperforming loans to total loans was 0.59% as of September 30, 2024. The ratio of nonperforming assets to total assets was 0.60% as of September 30, 2024. |

| ● | In the third quarter of 2024, to hedge floating rate liability exposure, the Company entered into a forward starting pay-fix, receive-float interest rate swap which will commence in the first quarter of 2025, maturing in the first quarter of 2028. The interest rate swap, which qualifies for hedge accounting, is tied to the Secured Overnight Financing Rate (SOFR) for a notional amount of $20.0 million. The effective fixed rate interest rate obligation to the Company is 2.89%. |

Other Highlights

| ❖ | In August 2024, Unity Bancorp announced the approval of a new Share Repurchase Program, authorizing the Company to repurchase up to 500 thousand shares, or approximately 5.0% of its outstanding stock. The 2024 Share repurchase plan will commence after the completion of the 2023 Share Repurchase Plan. As of September 30, 2024, the Company had approximately 685 thousand shares remaining for repurchase. |

| ❖ | In August 2024, Unity Bancorp was once again recognized in the Top 25 Banks with less than $5 billion in assets listing as published by Bank Director magazine. Unity Bank is listed as the 13th best publicly traded bank in the nation and is 5th in Return on Assets. |

| ❖ | In the third quarter of 2024, Unity Bank awarded $50 thousand in grants to local small businesses through the FHLB Small Business Recovery Grant Program. These grants assist small businesses in overcoming challenges posed by inflation, supply chain constraints, rising energy costs and a volatile interest rate environment. |

| ❖ | In the third quarter of 2024, the Company’s CEO, James Hughes, was named as the 2024 Founders Award Recipient at the Center for Hope Charity Gala and will be honored on October 17th. The Center for Hope provides hospice and palliative care, grief and bereavement counseling and community outreach services to the communities it serves. |

Unity Bancorp, Inc. is a financial services organization headquartered in Clinton, New Jersey, with approximately $2.6 billion in assets and $2.0 billion in deposits. Unity Bank, the Company’s wholly owned subsidiary, provides financial services to retail, corporate and small business customers through its robust branch network located in Bergen, Hunterdon, Middlesex, Morris, Ocean, Somerset, Union and Warren Counties in New Jersey and Northampton County in Pennsylvania. For additional information about Unity, visit our website at www.unitybank.com , or call 800-618-BANK.

This news release contains certain forward-looking statements, either expressed or implied, which are provided to assist the reader in understanding anticipated future financial performance. These statements may be identified by use of the words “believe”, “expect”, “intend”, “anticipate”, “estimate”, “project” or similar expressions. These statements involve certain risks, uncertainties, estimates and assumptions made by management, which are subject to factors beyond the Company’s control and could impede its ability to achieve these goals. These factors include those items included in our Annual Report on Form 10-K under the heading “Item IA-Risk Factors” as amended or supplemented by our subsequent filings with the SEC, as well as general economic conditions, trends in interest rates, the ability of our borrowers to repay their loans, our ability to manage and reduce the level of our nonperforming assets, results of regulatory exams, and the impact of any health crisis or national disasters on the Bank, its employees and customers, among other factors.

UNITY BANCORP, INC.

SUMMARY FINANCIAL HIGHLIGHTS

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2024 vs. |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2024 |

|

September 30, 2023 |

|

||

(In thousands, except percentages and per share amounts) |

|

September 30, 2024 |

|

June 30, 2024 |

|

September 30, 2023 |

|

|

% |

|

% |

|

|||||

BALANCE SHEET DATA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Total assets |

|

$ |

2,635,319 |

|

$ |

2,597,707 |

|

$ |

2,563,006 |

|

|

1.4 |

% |

2.8 |

% |

||

Total deposits |

|

|

2,046,137 |

|

|

2,010,831 |

|

|

1,884,910 |

|

|

1.8 |

|

8.6 |

|

||

Total gross loans |

|

|

2,217,393 |

|

|

2,170,535 |

|

|

2,173,190 |

|

|

2.2 |

|

2.0 |

|

||

Total securities |

|

|

143,712 |

|

|

145,187 |

|

|

136,091 |

|

|

(1.0) |

|

5.6 |

|

||

Total shareholders' equity |

|

|

284,257 |

|

|

273,395 |

|

|

252,384 |

|

|

4.0 |

|

12.6 |

|

||

Allowance for credit losses |

|

|

27,002 |

|

|

26,107 |

|

|

25,918 |

|

|

3.4 |

|

4.2 |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

FINANCIAL DATA - QUARTER TO DATE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Income before provision for income taxes |

|

$ |

14,567 |

|

$ |

12,552 |

|

$ |

13,047 |

|

|

16.1 |

|

11.7 |

|

||

Provision for income taxes |

|

|

3,662 |

|

|

3,098 |

|

|

3,097 |

|

|

18.2 |

|

18.2 |

|

||

Net income |

|

$ |

10,905 |

|

$ |

9,454 |

|

$ |

9,950 |

|

|

15.3 |

|

9.6 |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Net income per common share - Basic |

|

$ |

1.09 |

|

$ |

0.94 |

|

$ |

0.98 |

|

|

16.0 |

|

11.2 |

|

||

Net income per common share - Diluted |

|

|

1.07 |

|

|

0.93 |

|

|

0.97 |

|

|

15.1 |

|

10.3 |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

PERFORMANCE RATIOS - QUARTER TO DATE (annualized) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Return on average assets |

|

|

1.76 |

% |

|

1.56 |

% |

|

1.61 |

% |

|

|

|

|

|

||

Return on average equity |

|

|

15.55 |

|

|

14.07 |

|

|

15.84 |

|

|

|

|

|

|

||

Efficiency ratio** |

|

|

44.23 |

|

|

47.10 |

|

|

46.59 |

|

|

|

|

|

|

||

Cost of funds |

|

|

2.71 |

|

|

2.73 |

|

|

2.45 |

|

|

|

|

|

|

||

Net interest margin |

|

|

4.16 |

|

|

4.01 |

|

|

3.96 |

|

|

|

|

|

|

||

Noninterest expense to average assets |

|

|

1.94 |

|

|

1.98 |

|

|

1.93 |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

FINANCIAL DATA - YEAR TO DATE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Income before provision for income taxes |

|

$ |

39,901 |

|

|

|

|

$ |

39,946 |

|

|

|

|

(0.1) |

|

||

Provision for income taxes |

|

|

9,956 |

|

|

|

|

|

10,009 |

|

|

|

|

(0.5) |

|

||

Net income |

|

$ |

29,945 |

|

|

|

|

$ |

29,937 |

|

|

|

|

- |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Net income per common share - Basic |

|

$ |

2.98 |

|

|

|

|

$ |

2.92 |

|

|

|

|

2.1 |

|

||

Net income per common share - Diluted |

|

|

2.94 |

|

|

|

|

|

2.88 |

|

|

|

|

2.1 |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

PERFORMANCE RATIOS - YEAR TO DATE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Return on average assets |

|

|

1.64 |

% |

|

|

|

|

1.64 |

% |

|

|

|

|

|

||

Return on average equity |

|

|

14.72 |

|

|

|

|

|

16.38 |

|

|

|

|

|

|

||

Efficiency ratio** |

|

|

46.25 |

|

|

|

|

|

45.67 |

|

|

|

|

|

|

||

Cost of funds |

|

|

2.70 |

|

|

|

|

|

2.14 |

|

|

|

|

|

|

||

Net interest margin |

|

|

4.09 |

|

|

|

|

|

4.06 |

|

|

|

|

|

|

||

Noninterest expense to average assets |

|

|

1.97 |

|

|

|

|

|

1.93 |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

SHARE INFORMATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Market price per share |

|

$ |

34.06 |

|

$ |

29.57 |

|

$ |

23.43 |

|

|

15.2 |

|

45.4 |

|

||

Dividends paid (QTD) |

|

|

0.13 |

|

|

0.13 |

|

|

0.12 |

|

|

- |

|

8.3 |

|

||

Book value per common share |

|

|

28.48 |

|

|

27.41 |

|

|

24.95 |

|

|

3.9 |

|

14.1 |

|

||

Average diluted shares outstanding (QTD) |

|

|

10,148 |

|

|

10,149 |

|

|

10,258 |

|

|

- |

|

(1.1) |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

UNITY BANCORP CAPITAL RATIOS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Total equity to total assets |

|

|

10.79 |

% |

|

10.52 |

% |

|

9.85 |

% |

|

2.6 |

|

9.5 |

|

||

Leverage ratio |

|

|

11.94 |

|

|

11.67 |

|

|

10.76 |

|

|

2.3 |

|

11.0 |

|

||

Common Equity Tier 1 Capital Ratio |

|

|

13.50 |

|

|

13.31 |

|

|

12.16 |

|

|

1.4 |

|

11.0 |

|

||

Risk-based Tier 1 Capital Ratio |

|

|

13.98 |

|

|

13.80 |

|

|

12.64 |

|

|

1.3 |

|

10.6 |

|

||

Risk-based Total Capital Ratio |

|

|

15.23 |

|

|

15.05 |

|

|

13.88 |

|

|

1.2 |

|

9.7 |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

CREDIT QUALITY AND RATIOS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Nonperforming assets |

|

$ |

15,879 |

|

$ |

15,193 |

|

$ |

18,307 |

|

|

4.5 |

|

(13.3) |

|

||

QTD annualized net (chargeoffs)/recoveries to QTD average loans |

|

|

(0.02) |

% |

|

(0.04) |

% |

|

(0.11) |

% |

|

|

|

|

|

||

Allowance for credit losses to total loans |

|

|

1.22 |

|

|

1.20 |

|

|

1.19 |

|

|

|

|

|

|

||

Nonperforming loans to total loans |

|

|

0.59 |

|

|

0.56 |

|

|

0.84 |

|

|

|

|

|

|

||

Nonperforming assets to total assets |

|

|

0.60 |

|

|

0.58 |

|

|

0.71 |

|

|

|

|

|

|

||

** The efficiency ratio is a non-GAAP measure, calculated based on the noninterest expense divided by the sum of net interest income plus non interest income, excluding net gains and losses on securities. | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

UNITY BANCORP, INC.

CONSOLIDATED BALANCE SHEETS

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2024 vs. |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2023 |

|

September 30, 2023 |

|

(In thousands, except percentages) |

|

September 30, 2024 |

|

December 31, 2023 |

|

September 30, 2023 |

|

|

% |

|

% |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and due from banks |

|

$ |

28,892 |

|

$ |

20,668 |

|

$ |

26,224 |

|

|

39.8 |

% |

10.2 |

% |

Interest-bearing deposits |

|

|

165,609 |

|

|

174,108 |

|

|

135,223 |

|

|

(4.9) |

|

22.5 |

|

Cash and cash equivalents |

|

|

194,501 |

|

|

194,776 |

|

|

161,447 |

|

|

(0.1) |

|

20.5 |

|

Securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Debt securities available for sale, at market value |

|

|

97,651 |

|

|

91,765 |

|

|

92,122 |

|

|

6.4 |

|

6.0 |

|

Debt securities held to maturity, at book value |

|

|

36,225 |

|

|

36,122 |

|

|

35,956 |

|

|

0.3 |

|

0.7 |

|

Equity securities, at market value |

|

|

9,836 |

|

|

7,802 |

|

|

8,013 |

|

|

26.1 |

|

22.8 |

|

Total securities |

|

|

143,712 |

|

|

135,689 |

|

|

136,091 |

|

|

5.9 |

|

5.6 |

|

Loans: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SBA loans held for sale |

|

|

14,621 |

|

|

18,242 |

|

|

19,387 |

|

|

(19.8) |

|

(24.6) |

|

SBA loans held for investment |

|

|

37,904 |

|

|

38,584 |

|

|

40,873 |

|

|

(1.8) |

|

(7.3) |

|

SBA PPP loans |

|

|

1,593 |

|

|

2,318 |

|

|

2,507 |

|

|

(31.3) |

|

(36.5) |

|

Commercial loans |

|

|

1,368,763 |

|

|

1,277,460 |

|

|

1,276,156 |

|

|

7.1 |

|

7.3 |

|

Residential mortgage loans |

|

|

623,529 |

|

|

631,506 |

|

|

628,628 |

|

|

(1.3) |

|

(0.8) |

|

Consumer loans |

|

|

72,291 |

|

|

72,676 |

|

|

72,189 |

|

|

(0.5) |

|

0.1 |

|

Residential construction loans |

|

|

98,692 |

|

|

131,277 |

|

|

133,450 |

|

|

(24.8) |

|

(26.0) |

|

Total loans |

|

|

2,217,393 |

|

|

2,172,063 |

|

|

2,173,190 |

|

|

2.1 |

|

2.0 |

|

Allowance for credit losses |

|

|

(27,002) |

|

|

(25,854) |

|

|

(25,918) |

|

|

4.4 |

|

4.2 |

|

Net loans |

|

|

2,190,391 |

|

|

2,146,209 |

|

|

2,147,272 |

|

|

2.1 |

|

2.0 |

|

Premises and equipment, net |

|

|

18,857 |

|

|

19,567 |

|

|

19,783 |

|

|

(3.6) |

|

(4.7) |

|

Bank owned life insurance ("BOLI") |

|

|

25,619 |

|

|

25,230 |

|

|

25,223 |

|

|

1.5 |

|

1.6 |

|

Deferred tax assets |

|

|

14,517 |

|

|

12,552 |

|

|

13,249 |

|

|

15.7 |

|

9.6 |

|

Federal Home Loan Bank ("FHLB") stock |

|

|

14,584 |

|

|

18,435 |

|

|

19,882 |

|

|

(20.9) |

|

(26.6) |

|

Accrued interest receivable |

|

|

12,913 |

|

|

13,582 |

|

|

16,101 |

|

|

(4.9) |

|

(19.8) |

|

Goodwill |

|

|

1,516 |

|

|

1,516 |

|

|

1,516 |

|

|

- |

|

- |

|

Prepaid expenses and other assets |

|

|

18,709 |

|

|

10,951 |

|

|

22,442 |

|

|

70.8 |

|

(16.6) |

|

Total assets |

|

$ |

2,635,319 |

|

$ |

2,578,507 |

|

$ |

2,563,006 |

|

|

2.2 |

% |

2.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|||

Liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest-bearing demand |

|

$ |

423,968 |

|

$ |

419,636 |

|

$ |

425,436 |

|

|

1.0 |

% |

(0.3) |

% |

Interest-bearing demand |

|

|

325,264 |

|

|

312,208 |

|

|

297,326 |

|

|

4.2 |

|

9.4 |

|

Savings |

|

|

524,607 |

|

|

497,491 |

|

|

507,401 |

|

|

5.5 |

|

3.4 |

|

Brokered deposits |

|

|

214,679 |

|

|

268,408 |

|

|

238,939 |

|

|

(20.0) |

|

(10.2) |

|

Time deposits |

|

|

557,619 |

|

|

426,397 |

|

|

415,808 |

|

|

30.8 |

|

34.1 |

|

Total deposits |

|

|

2,046,137 |

|

|

1,924,140 |

|

|

1,884,910 |

|

|

6.3 |

|

8.6 |

|

Borrowed funds |

|

|

266,798 |

|

|

356,438 |

|

|

388,610 |

|

|

(25.1) |

|

(31.3) |

|

Subordinated debentures |

|

|

10,310 |

|

|

10,310 |

|

|

10,310 |

|

|

- |

|

- |

|

Accrued interest payable |

|

|

1,765 |

|

|

1,924 |

|

|

1,412 |

|

|

(8.3) |

|

25.0 |

|

Accrued expenses and other liabilities |

|

|

26,052 |

|

|

24,265 |

|

|

25,380 |

|

|

7.4 |

|

2.6 |

|

Total liabilities |

|

|

2,351,062 |

|

|

2,317,077 |

|

|

2,310,622 |

|

|

1.5 |

|

1.8 |

|

Shareholders' equity: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock |

|

|

102,886 |

|

|

100,426 |

|

|

99,741 |

|

|

2.4 |

|

3.2 |

|

Retained earnings |

|

|

217,141 |

|

|

191,108 |

|

|

182,557 |

|

|

13.6 |

|

18.9 |

|

Treasury stock, at cost |

|

|

(33,566) |

|

|

(27,367) |

|

|

(25,954) |

|

|

22.7 |

|

29.3 |

|

Accumulated other comprehensive loss |

|

|

(2,204) |

|

|

(2,737) |

|

|

(3,960) |

|

|

(19.5) |

|

(44.3) |

|

Total shareholders' equity |

|

|

284,257 |

|

|

261,430 |

|

|

252,384 |

|

|

8.7 |

|

12.6 |

|

Total liabilities and shareholders' equity |

|

$ |

2,635,319 |

|

$ |

2,578,507 |

|

$ |

2,563,006 |

|

|

2.2 |

% |

2.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares issued |

|

|

11,570 |

|

|

11,424 |

|

|

11,411 |

|

|

|

|

|

|

Shares outstanding |

|

|

9,980 |

|

|

10,063 |

|

|

10,115 |

|

|

|

|

|

|

Treasury shares |

|

|

1,590 |

|

|

1,361 |

|

|

1,296 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*NM=Not meaningful |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UNITY BANCORP, INC.

QTD CONSOLIDATED STATEMENTS OF INCOME

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2024 vs. |

|

||||||||||

|

|

For the three months ended |

|

|

June 30, 2024 |

|

September 30, 2023 |

|

|||||||||||||||

(In thousands, except percentages and per share amounts) |

|

September 30, 2024 |

|

June 30, 2024 |

|

September 30, 2023 |

|

|

$ |

|

% |

|

$ |

|

% |

|

|||||||

INTEREST INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing deposits |

|

$ |

695 |

|

$ |

435 |

|

$ |

483 |

|

|

$ |

260 |

|

|

59.8 |

% |

$ |

212 |

|

|

43.9 |

% |

FHLB stock |

|

|

164 |

|

|

180 |

|

|

364 |

|

|

|

(16) |

|

|

(8.9) |

|

|

(200) |

|

|

(54.9) |

|

Securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable |

|

|

1,904 |

|

|

1,749 |

|

|

1,848 |

|

|

|

155 |

|

|

8.9 |

|

|

56 |

|

|

3.0 |

|

Tax-exempt |

|

|

17 |

|

|

17 |

|

|

17 |

|

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

Total securities |

|

|

1,921 |

|

|

1,766 |

|

|

1,865 |

|

|

|

155 |

|

|

8.8 |

|

|

56 |

|

|

3.0 |

|

Loans: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SBA loans |

|

|

1,153 |

|

|

1,276 |

|

|

1,379 |

|

|

|

(123) |

|

|

(9.6) |

|

|

(226) |

|

|

(16.4) |

|

SBA PPP loans |

|

|

6 |

|

|

11 |

|

|

25 |

|

|

|

(5) |

|

|

(45.5) |

|

|

(19) |

|

|

(76.0) |

|

Commercial loans |

|

|

22,283 |

|

|

21,160 |

|

|

20,299 |

|

|

|

1,123 |

|

|

5.3 |

|

|

1,984 |

|

|

9.8 |

|

Residential mortgage loans |

|

|

9,657 |

|

|

9,316 |

|

|

8,462 |

|

|

|

341 |

|

|

3.7 |

|

|

1,195 |

|

|

14.1 |

|

Consumer loans |

|

|

1,436 |

|

|

1,390 |

|

|

1,525 |

|

|

|

46 |

|

|

3.3 |

|

|

(89) |

|

|

(5.8) |

|

Residential construction loans |

|

|

2,235 |

|

|

2,453 |

|

|

2,588 |

|

|

|

(218) |

|

|

(8.9) |

|

|

(353) |

|

|

(13.6) |

|

Total loans |

|

|

36,770 |

|

|

35,606 |

|

|

34,278 |

|

|

|

1,164 |

|

|

3.3 |

|

|

2,492 |

|

|

7.3 |

|

Total interest income |

|

|

39,550 |

|

|

37,987 |

|

|

36,990 |

|

|

|

1,563 |

|

|

4.1 |

|

|

2,560 |

|

|

6.9 |

|

INTEREST EXPENSE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing demand deposits |

|

|

1,802 |

|

|

2,010 |

|

|

1,409 |

|

|

|

(208) |

|

|

(10.3) |

|

|

393 |

|

|

27.9 |

|

Savings deposits |

|

|

3,605 |

|

|

3,349 |

|

|

2,590 |

|

|

|

256 |

|

|

7.6 |

|

|

1,015 |

|

|

39.2 |

|

Brokered deposits |

|

|

2,039 |

|

|

2,181 |

|

|

2,212 |

|

|

|

(142) |

|

|

(6.5) |

|

|

(173) |

|

|

(7.8) |

|

Time deposits |

|

|

6,186 |

|

|

5,832 |

|

|

3,429 |

|

|

|

354 |

|

|

6.1 |

|

|

2,757 |

|

|

80.4 |

|

Borrowed funds and subordinated debentures |

|

|

1,062 |

|

|

1,191 |

|

|

3,817 |

|

|

|

(129) |

|

|

(10.8) |

|

|

(2,755) |

|

|

(72.2) |

|

Total interest expense |

|

|

14,694 |

|

|

14,563 |

|

|

13,457 |

|

|

|

131 |

|

|

0.9 |

|

|

1,237 |

|

|

9.2 |

|

Net interest income |

|

|

24,856 |

|

|

23,424 |

|

|

23,533 |

|

|

|

1,432 |

|

|

6.1 |

|

|

1,323 |

|

|

5.6 |

|

Provision for credit losses, loans |

|

|

1,029 |

|

|

266 |

|

|

534 |

|

|

|

763 |

|

|

286.8 |

|

|

495 |

|

|

92.7 |

|

Provision for credit losses, off-balance sheet |

|

|

51 |

|

|

13 |

|

|

22 |

|

|

|

38 |

|

|

292.3 |

|

|

29 |

|

|

131.8 |

|

Provision for credit losses, AFS securities |

|

|

- |

|

|

646 |

|

|

- |

|

|

|

(646) |

|

|

*NM |

|

|

- |

|

|

*NM |

|

Net interest income after provision for credit losses |

|

|

23,776 |

|

|

22,499 |

|

|

22,977 |

|

|

|

1,277 |

|

|

5.7 |

|

|

799 |

|

|

3.5 |

|

NONINTEREST INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Branch fee income |

|

|

420 |

|

|

266 |

|

|

278 |

|

|

|

154 |

|

|

57.9 |

|

|

142 |

|

|

51.1 |

|

Service and loan fee income |

|

|

753 |

|

|

467 |

|

|

385 |

|

|

|

286 |

|

|

61.2 |

|

|

368 |

|

|

95.6 |

|

Gain on sale of SBA loans held for sale, net |

|

|

70 |

|

|

305 |

|

|

- |

|

|

|

(235) |

|

|

(77.0) |

|

|

70 |

|

|

*NM |

|

Gain on sale of mortgage loans, net |

|

|

549 |

|

|

266 |

|

|

488 |

|

|

|

283 |

|

|

106.4 |

|

|

61 |

|

|

12.5 |

|

BOLI income |

|

|

135 |

|

|

189 |

|

|

679 |

|

|

|

(54) |

|

|

(28.6) |

|

|

(544) |

|

|

(80.1) |

|

Net securities gains (losses) |

|

|

499 |

|

|

20 |

|

|

(123) |

|

|

|

479 |

|

|

2,395.0 |

|

|

622 |

|

|

505.7 |

|

Other income |

|

|

377 |

|

|

520 |

|

|

336 |

|

|

|

(143) |

|

|

(27.5) |

|

|

41 |

|

|

12.2 |

|

Total noninterest income |

|

|

2,803 |

|

|

2,033 |

|

|

2,043 |

|

|

|

770 |

|

|

37.9 |

|

|

760 |

|

|

37.2 |

|

NONINTEREST EXPENSE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation and benefits |

|

|

7,274 |

|

|

7,121 |

|

|

7,440 |

|

|

|

153 |

|

|

2.1 |

|

|

(166) |

|

|

(2.2) |

|

Processing and communications |

|

|

868 |

|

|

840 |

|

|

705 |

|

|

|

28 |

|

|

3.3 |

|

|

163 |

|

|

23.1 |

|

Occupancy |

|

|

781 |

|

|

815 |

|

|

763 |

|

|

|

(34) |

|

|

(4.2) |

|

|

18 |

|

|

2.4 |

|

Furniture and equipment |

|

|

803 |

|

|

819 |

|

|

645 |

|

|

|

(16) |

|

|

(2.0) |

|

|

158 |

|

|

24.5 |

|

Professional services |

|

|

326 |

|

|

405 |

|

|

348 |

|

|

|

(79) |

|

|

(19.5) |

|

|

(22) |

|

|

(6.3) |

|

Advertising |

|

|

465 |

|

|

397 |

|

|

405 |

|

|

|

68 |

|

|

17.1 |

|

|

60 |

|

|

14.8 |

|

Loan related expenses |

|

|

223 |

|

|

351 |

|

|

215 |

|

|

|

(128) |

|

|

(36.5) |

|

|

8 |

|

|

3.7 |

|

Deposit insurance |

|

|

245 |

|

|

321 |

|

|

397 |

|

|

|

(76) |

|

|

(23.7) |

|

|

(152) |

|

|

(38.3) |

|

Director fees |

|

|

232 |

|

|

231 |

|

|

209 |

|

|

|

1 |

|

|

0.4 |

|

|

23 |

|

|

11.0 |

|

Other expenses |

|

|

795 |

|

|

680 |

|

|

846 |

|

|

|

115 |

|

|

16.9 |

|

|

(51) |

|

|

(6.0) |

|

Total noninterest expense |

|

|

12,012 |

|

|

11,980 |

|

|

11,973 |

|

|

|

32 |

|

|

0.3 |

|

|

39 |

|

|

0.3 |

|

Income before provision for income taxes |

|

|

14,567 |

|

|

12,552 |

|

|

13,047 |

|

|

|

2,015 |

|

|

16.1 |

|

|

1,520 |

|

|

11.7 |

|

Provision for income taxes |

|

|

3,662 |

|

|

3,098 |

|

|

3,097 |

|

|

|

564 |

|

|

18.2 |

|

|

565 |

|

|

18.2 |

|

Net income |

|

$ |

10,905 |

|

$ |

9,454 |

|

$ |

9,950 |

|

|

$ |

1,451 |

|

|

15.3 |

% |

$ |

955 |

|

|

9.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Effective tax rate |

|

|

25.1 |

% |

|

24.7 |

% |

|

23.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per common share - Basic |

|

$ |

1.09 |

|

$ |

0.94 |

|

$ |

0.98 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per common share - Diluted |

|

|

1.07 |

|

|

0.93 |

|

|

0.97 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding - Basic |

|

|

9,978 |

|

|

10,016 |

|

|

10,128 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding - Diluted |

|

|

10,148 |

|

|

10,149 |

|

|

10,258 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*NM=Not meaningful |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UNITY BANCORP, INC.

YTD CONSOLIDATED STATEMENTS OF INCOME

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

For the nine months ended September 30, |

|

|

Current YTD vs. Prior YTD |

|

||||||||

(In thousands, except percentages and per share amounts) |

|

2024 |

|

2023 |

|

|

$ |

|

% |

|

||||

INTEREST INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing deposits |

|

$ |

1,549 |

|

$ |

1,257 |

|

|

$ |

292 |

|

|

23.2 |

% |

FHLB stock |

|

|

624 |

|

|

1,037 |

|

|

|

(413) |

|

|

(39.8) |

|

Securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable |

|

|

5,503 |

|

|

5,385 |

|

|

|

118 |

|

|

2.2 |

|

Tax-exempt |

|

|

53 |

|

|

55 |

|

|

|

(2) |

|

|

(3.6) |

|

Total securities |

|

|

5,556 |

|

|

5,440 |

|

|

|

116 |

|

|

2.1 |

|

Loans: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SBA loans |

|

|

3,762 |

|

|

4,186 |

|

|

|

(424) |

|

|

(10.1) |

|

SBA PPP loans |

|

|

25 |

|

|

129 |

|

|

|

(104) |

|

|

(80.6) |

|

Commercial loans |

|

|

64,273 |

|

|

56,320 |

|

|

|

7,953 |

|

|

14.1 |

|

Residential mortgage loans |

|

|

28,192 |

|

|

25,103 |

|

|

|

3,089 |

|

|

12.3 |

|

Consumer loans |

|

|

4,228 |

|

|

4,351 |

|

|

|

(123) |

|

|

(2.8) |

|

Residential construction loans |

|

|

7,265 |

|

|

7,911 |

|

|

|

(646) |

|

|

(8.2) |

|

Total loans |

|

|

107,745 |

|

|

98,000 |

|

|

|

9,745 |

|

|

9.9 |

|

Total interest income |

|

|

115,474 |

|

|

105,734 |

|

|

|

9,740 |

|

|

9.2 |

|

INTEREST EXPENSE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing demand deposits |

|

|

5,523 |

|

|

3,705 |

|

|

|

1,818 |

|

|

49.1 |

|

Savings deposits |

|

|

10,097 |

|

|

6,138 |

|

|

|

3,959 |

|

|

64.5 |

|

Brokered deposits |

|

|

6,516 |

|

|

5,631 |

|

|

|

885 |

|

|

15.7 |

|

Time deposits |

|

|

16,718 |

|

|

7,556 |

|

|

|

9,162 |

|

|

121.3 |

|

Borrowed funds and subordinated debentures |

|

|

4,499 |

|

|

11,740 |

|

|

|

(7,241) |

|

|

(61.7) |

|

Total interest expense |

|

|

43,353 |

|

|

34,770 |

|

|

|

8,583 |

|

|

24.7 |

|

Net interest income |

|

|

72,121 |

|

|

70,964 |

|

|

|

1,157 |

|

|

1.6 |

|

Provision for credit losses, loans |

|

|

1,937 |

|

|

1,419 |

|

|

|

518 |

|

|

36.5 |

|

Provision (release) for credit losses, off-balance sheet |

|

|

66 |

|

|

(62) |

|

|

|

128 |

|

|

*NM |

|

Provision for credit losses, AFS securities |

|

|

646 |

|

|

- |

|

|

|

646 |

|

|

*NM |

|

Net interest income after provision for credit losses |

|

|

69,472 |

|

|

69,607 |

|

|

|

(135) |

|

|

(0.2) |

|

NONINTEREST INCOME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Branch fee income |

|

|

929 |

|

|

741 |

|

|

|

188 |

|

|

25.4 |

|

Service and loan fee income |

|

|

1,677 |

|

|

1,379 |

|

|

|

298 |

|

|

21.6 |

|

Gain on sale of SBA loans held for sale, net |

|

|

613 |

|

|

896 |

|

|

|

(283) |

|

|

(31.6) |

|

Gain on sale of mortgage loans, net |

|

|

1,134 |

|

|

1,195 |

|

|

|

(61) |

|

|

(5.1) |

|

BOLI income |

|

|

389 |

|

|

843 |

|

|

|

(454) |

|

|

(53.9) |

|

Net securities gains (losses) |

|

|

573 |

|

|

(610) |

|

|

|

1,183 |

|

|

193.9 |

|

Other income |

|

|

1,238 |

|

|

1,131 |

|

|

|

107 |

|

|

9.5 |

|

Total noninterest income |

|

|

6,553 |

|

|

5,575 |

|

|

|

978 |

|

|

17.5 |

|

NONINTEREST EXPENSE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation and benefits |

|

|

21,751 |

|

|

21,801 |

|

|

|

(50) |

|

|

(0.2) |

|

Processing and communications |

|

|

2,615 |

|

|

2,172 |

|

|

|

443 |

|

|

20.4 |

|

Occupancy |

|

|

2,394 |

|

|

2,312 |

|

|

|

82 |

|

|

3.5 |

|

Furniture and equipment |

|

|

2,306 |

|

|

2,024 |

|

|

|

282 |

|

|

13.9 |

|

Professional services |

|

|

1,167 |

|

|

1,071 |

|

|

|

96 |

|

|

9.0 |

|

Advertising |

|

|

1,263 |

|

|

1,108 |

|

|

|

155 |

|

|

14.0 |

|

Loan related expenses |

|

|

959 |

|

|

520 |

|

|

|

439 |

|

|

84.4 |

|

Deposit insurance |

|

|

905 |

|

|

1,362 |

|

|

|

(457) |

|

|

(33.6) |

|

Director fees |

|

|

709 |

|

|

629 |

|

|

|

80 |

|

|

12.7 |

|

Other expenses |

|

|

2,055 |

|

|

2,237 |

|

|

|

(182) |

|

|

(8.1) |

|

Total noninterest expense |

|

|

36,124 |

|

|

35,236 |

|

|

|

888 |

|

|

2.5 |

|

Income before provision for income taxes |

|

|

39,901 |

|

|

39,946 |

|

|

|

(45) |

|

|

(0.1) |

|

Provision for income taxes |

|

|

9,956 |

|

|

10,009 |

|

|

|

(53) |

|

|

(0.5) |

|

Net income |

|

$ |

29,945 |

|

$ |

29,937 |

|

|

$ |

8 |

|

|

- |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Effective tax rate |

|

|

25.0 |

% |

|

25.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per common share - Basic |

|

$ |

2.98 |

|

$ |

2.92 |

|

|

|

|

|

|

|

|

Net income per common share - Diluted |

|

|

2.94 |

|

|

2.88 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding - Basic |

|

|

10,040 |

|

|

10,255 |

|

|

|

|

|

|

|

|

Weighted average common shares outstanding - Diluted |

|

|

10,192 |

|

|

10,381 |

|

|

|

|

|

|

|

|

*NM=Not meaningful |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UNITY BANCORP, INC.

QUARTER TO DATE NET INTEREST MARGIN

|

|

For the three months ended |

|

||||||||||||||||

(Dollar amounts in thousands, interest amounts and |

|

September 30, 2024 |

|

September 30, 2023 |

|

||||||||||||||

interest rates/yields on a fully tax-equivalent basis) |

|

Average Balance |

|

Interest |

|

Rate/Yield |

|

Average Balance |

|

Interest |

|

Rate/Yield |

|

||||||

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-earning assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing deposits |

|

$ |

50,232 |

|

$ |

695 |

|

|

5.50 |

% |

$ |

34,597 |

|

$ |

483 |

|

|

5.54 |

% |

FHLB stock |

|

|

7,530 |

|

|

164 |

|

|

8.67 |

|

|

15,485 |

|

|

364 |

|

|

9.32 |

|

Securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable |

|

|

141,682 |

|

|

1,904 |

|

|

5.38 |

|

|

135,132 |

|

|

1,848 |

|

|

5.47 |

|

Tax-exempt |

|

|

1,579 |

|

|

18 |

|

|

4.48 |

|

|

1,692 |

|

|

18 |

|

|

4.27 |

|

Total securities (A) |

|

|

143,261 |

|

|

1,922 |

|

|

5.37 |

|

|

136,824 |

|

|

1,866 |

|

|

5.45 |

|

Loans: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SBA loans |

|

|

52,346 |

|

|

1,153 |

|

|

8.81 |

|

|

60,108 |

|

|

1,379 |

|

|

9.18 |

|

SBA PPP loans |

|

|

1,641 |

|

|

6 |

|

|

1.51 |

|

|

2,523 |

|

|

25 |

|

|

3.94 |

|

Commercial loans |

|

|

1,321,336 |

|

|

22,283 |

|

|

6.60 |

|

|

1,266,185 |

|

|

20,299 |

|

|

6.27 |

|

Residential mortgage loans |

|

|

628,299 |

|

|

9,657 |

|

|

6.15 |

|

|

628,544 |

|

|

8,462 |

|

|

5.39 |

|

Consumer loans |

|

|

70,740 |

|

|

1,436 |

|

|

7.94 |

|

|

75,246 |

|

|

1,525 |

|

|

7.93 |

|

Residential construction loans |

|

|

99,865 |

|

|

2,235 |

|

|

8.76 |

|

|

139,045 |

|

|

2,588 |

|

|

7.28 |

|

Total loans (B) |

|

|

2,174,227 |

|

|

36,770 |

|

|

6.62 |

|

|

2,171,651 |

|

|

34,278 |

|

|

6.18 |

|

Total interest-earning assets |

|

$ |

2,375,250 |

|

$ |

39,551 |

|

|

6.62 |

% |

$ |

2,358,557 |

|

$ |

36,991 |

|

|

6.22 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest-earning assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and due from banks |

|

|

23,728 |

|

|

|

|

|

|

|

|

22,841 |

|

|

|

|

|

|

|

Allowance for credit losses |

|

|

(26,406) |

|

|

|

|

|

|

|

|

(26,478) |

|

|

|

|

|

|

|

Other assets |

|

|

93,000 |

|

|

|

|

|

|

|

|

100,428 |

|

|

|

|

|

|

|

Total noninterest-earning assets |

|

|

90,322 |

|

|

|

|

|

|

|

|

96,791 |

|

|

|

|

|

|

|

Total assets |

|

$ |

2,465,572 |

|

|

|

|

|

|

|

$ |

2,455,348 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing demand deposits |

|

$ |

320,256 |

|

$ |

1,802 |

|

|

2.24 |

% |

$ |

302,800 |

|

$ |

1,409 |

|

|

1.89 |

% |

Savings deposits |

|

|

530,954 |

|

|

3,605 |

|

|

2.70 |

|

|

503,676 |

|

|

2,590 |

|

|

2.09 |

|

Brokered deposits |

|

|

217,851 |

|

|

2,039 |

|

|

3.72 |

|

|

245,557 |

|

|

2,212 |

|

|

3.65 |

|

Time deposits |

|

|

560,297 |

|

|

6,186 |

|

|

4.39 |

|

|

396,918 |

|

|

3,429 |

|

|

3.50 |

|

Total interest-bearing deposits |

|

|

1,629,358 |

|

|

13,632 |

|

|

3.33 |

|

|

1,448,951 |

|

|

9,640 |

|

|

2.64 |

|

Borrowed funds and subordinated debentures |

|

|

120,067 |

|

|

1,062 |

|

|

3.46 |

|

|

300,608 |

|

|

3,817 |

|

|

4.97 |

|

Total interest-bearing liabilities |

|

$ |

1,749,425 |

|

$ |

14,694 |

|

|

3.34 |

% |

$ |

1,749,559 |

|

$ |

13,457 |

|

|

3.05 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest-bearing liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest-bearing demand deposits |

|

|

408,376 |

|

|

|

|

|

|

|

|

429,321 |

|

|

|

|

|

|

|

Other liabilities |

|

|

28,761 |

|

|

|

|

|

|

|

|

27,192 |

|

|

|

|

|

|

|

Total noninterest-bearing liabilities |

|

|

437,137 |

|

|

|

|

|

|

|

|

456,513 |

|

|

|

|

|

|

|

Total shareholders' equity |

|

|

279,010 |

|

|

|

|

|

|

|

|

249,276 |

|

|

|

|

|

|

|

Total liabilities and shareholders' equity |

|

$ |

2,465,572 |

|

|

|

|

|

|

|

$ |

2,455,348 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest spread |

|

|

|

|

$ |

24,857 |

|

|

3.28 |

% |

|

|

|

$ |

23,534 |

|

|

3.17 |

% |

Tax-equivalent basis adjustment |

|

|

|

|

|

(1) |

|

|

|

|

|

|

|

|

(1) |

|

|

|

|

Net interest income |

|

|

|

|

$ |

24,856 |

|

|

|

|

|

|

|

$ |

23,533 |

|

|

|

|

Net interest margin |

|

|

|

|

|

|

|

|

4.16 |

% |

|

|

|

|

|

|

|

3.96 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (A) | Yields related to securities exempt from federal and state income taxes are stated on a fully tax-equivalent basis. They are reduced by the nondeductible portion of interest expense, assuming a federal tax rate of 21 percent and applicable state rates. |

| (B) | The loan averages are stated net of unearned income, and the averages include loans on which the accrual of interest has been discontinued. |

UNITY BANCORP, INC.

QUARTER TO DATE NET INTEREST MARGIN

|

|

For the three months ended |

|

||||||||||||||||

(Dollar amounts in thousands, interest amounts and |

|

September 30, 2024 |

|

June 30, 2024 |

|

||||||||||||||

interest rates/yields on a fully tax-equivalent basis) |

|

Average Balance |

|

Interest |

|

Rate/Yield |

|

Average Balance |

|

Interest |

|

Rate/Yield |

|

||||||

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-earning assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-bearing deposits |

|

$ |

50,232 |

|

$ |

695 |

|

|

5.50 |

% |

$ |

32,237 |

|

$ |

435 |

|

|

5.43 |

% |

FHLB stock |

|

|

7,530 |

|

|

164 |

|

|

8.67 |

|

|

7,951 |

|

|

180 |

|

|

9.12 |

|

Securities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxable |

|

|

141,682 |

|

|

1,904 |

|

|

5.38 |

|

|

140,501 |

|

|

1,749 |

|

|

4.98 |

|

Tax-exempt |

|

|

1,579 |

|

|

18 |

|

|

4.48 |

|

|

1,571 |

|

|

18 |

|

|

4.55 |

|

Total securities (A) |

|

|

143,261 |

|

|

1,922 |

|

|

5.37 |

|

|

142,072 |

|

|

1,767 |

|

|

4.97 |

|

Loans: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SBA loans |

|

|

52,346 |

|

|

1,153 |

|

|

8.81 |

|

|

55,922 |

|

|

1,276 |

|

|

9.13 |

|

SBA PPP loans |

|

|

1,641 |

|

|

6 |

|

|

1.51 |

|

|

1,782 |

|

|

11 |

|

|

2.49 |

|

Commercial loans |

|

|

1,321,336 |

|

|

22,283 |

|

|

6.60 |

|

|

1,300,754 |

|

|

21,160 |

|

|

6.44 |

|

Residential mortgage loans |

|

|

628,299 |

|

|

9,657 |

|

|

6.15 |

|

|

625,086 |

|

|

9,316 |

|

|

5.96 |

|

Consumer loans |

|

|

70,740 |

|

|

1,436 |

|

|

7.94 |

|

|

69,943 |

|

|

1,390 |

|

|

7.86 |

|

Residential construction loans |

|

|

99,865 |

|

|

2,235 |

|

|

8.76 |

|

|

112,272 |

|

|

2,453 |

|

|

8.64 |

|

Total loans (B) |

|

|

2,174,227 |

|

|

36,770 |

|

|

6.62 |

|

|

2,165,759 |

|

|

35,606 |

|

|