Document

Exhibit 99.1 Press Release dated April 28, 2025

Simpson Manufacturing Co., Inc. Announces 2025 First Quarter Financial Results and Reaffirms 2025 Guidance

|

|

|

|

|

|

|

l

|

Net sales of $538.9 million increased 1.6% year-over-year |

|

|

|

l

|

Income from operations of $102.3 million, resulting in operating income margin of 19.0% |

|

l

|

Net income per diluted share of $1.85 |

|

|

|

l

|

Repurchased $25.0 million in common stock |

|

|

|

|

|

|

|

|

|

|

Pleasanton, CA - April 28, 2025: Simpson Manufacturing Co., Inc. (the “Company”) (NYSE: SSD), an industry leader in engineered structural connectors and building solutions, today announced its financial results for the first quarter of 2025. All comparisons below (which are generally indicated by words such as “increased,” “decreased,” “remained,” or “compared to”), unless otherwise noted, are comparing the quarter ended March 31, 2025 with the quarter ended March 31, 2024.

Consolidated 2025 First Quarter Highlights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Year-Over- |

|

|

|

|

|

|

|

March 31, |

|

|

Year |

|

|

|

|

|

|

|

2025 |

|

|

2024 |

|

|

Change |

|

|

|

|

|

|

|

|

|

(In thousands, except per share data and percentages) |

|

|

| Net sales |

$ |

538,895 |

|

|

|

$ |

530,579 |

|

|

|

1.6 |

% |

|

|

|

|

|

|

|

|

| Gross profit |

252,040 |

|

|

|

244,556 |

|

|

|

3.1 |

% |

|

|

|

|

|

|

|

|

| Gross profit margin |

46.8 |

% |

|

|

46.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

149,669 |

|

|

|

146,610 |

|

|

|

2.1 |

% |

|

|

|

|

|

|

|

|

| Income from operations |

102,319 |

|

|

|

96,098 |

|

|

|

6.5 |

% |

|

|

|

|

|

|

|

|

| Operating income margin |

19.0 |

% |

|

|

18.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

| Net income |

$ |

77,884 |

|

|

|

$ |

75,430 |

|

|

|

3.3 |

% |

|

|

|

|

|

|

|

|

| Net income per diluted common share |

$ |

1.85 |

|

|

|

$ |

1.77 |

|

|

|

4.5 |

% |

|

|

|

|

|

|

|

|

| Adjusted EBITDA1 |

$ |

121,769 |

|

|

|

$ |

117,282 |

|

|

|

3.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Trailing Twelve Months Ended |

|

Year-Over- |

|

|

March 31, |

|

Year |

|

|

2025 |

|

2024 |

|

Change |

|

|

(In thousands, except percentages) |

| Total U.S. Housing starts2 |

|

1,362 |

|

|

1,426 |

|

|

(4.5) |

% |

|

|

|

|

|

|

|

1 Adjusted EBITDA is a non-GAAP financial measure and is defined in the Non-GAAP Financial Measures section of this press release. For a reconciliation of Adjusted EBITDA to U.S. GAAP ("GAAP") net income, see the schedule titled "Reconciliation of Non-GAAP Financial Measures."

2 Source: United States Census Bureau.

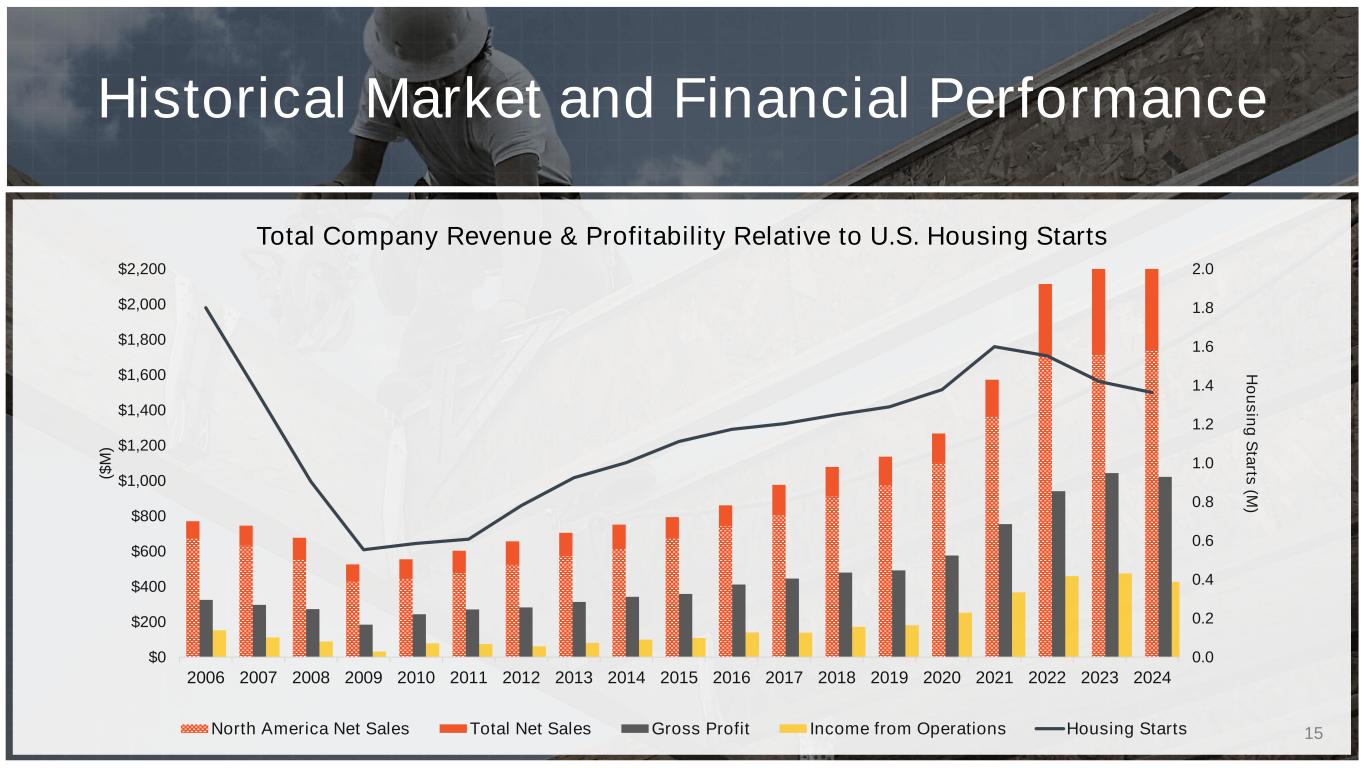

Management Commentary

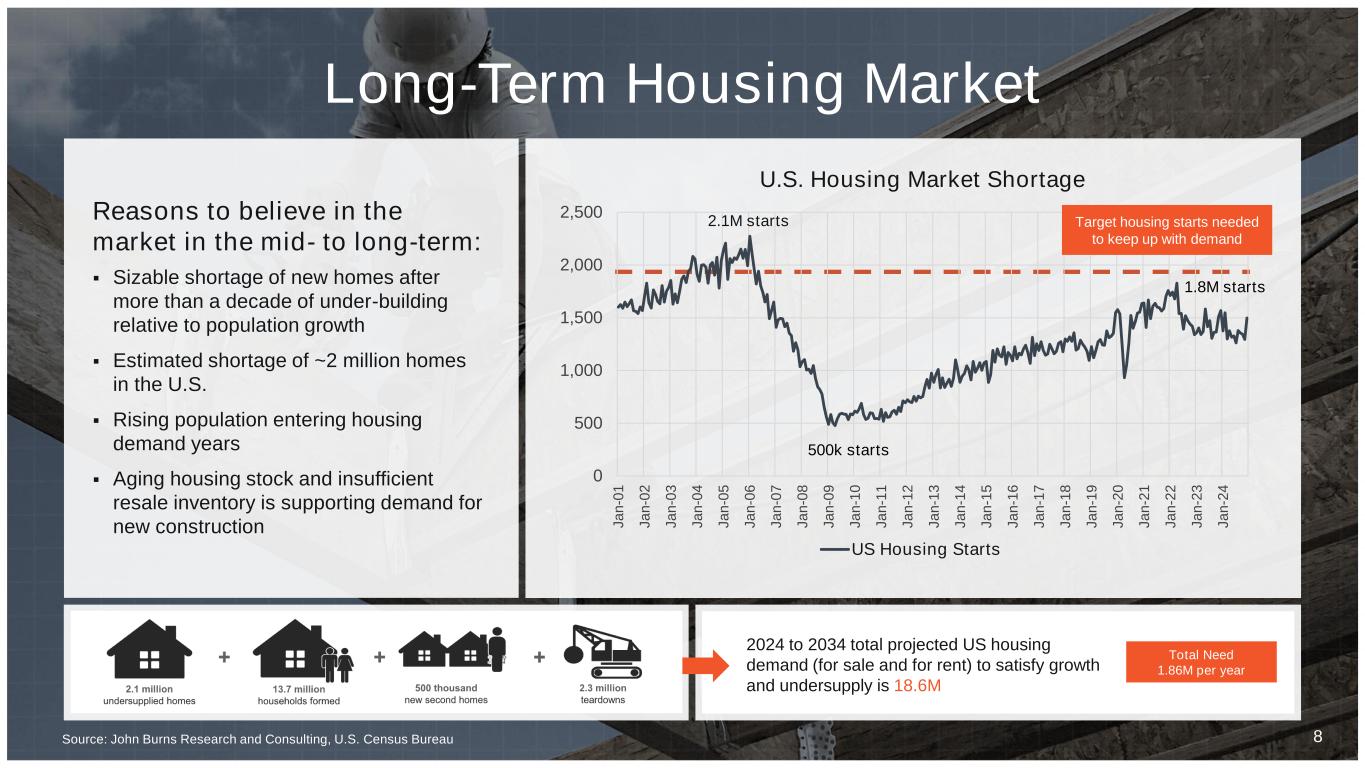

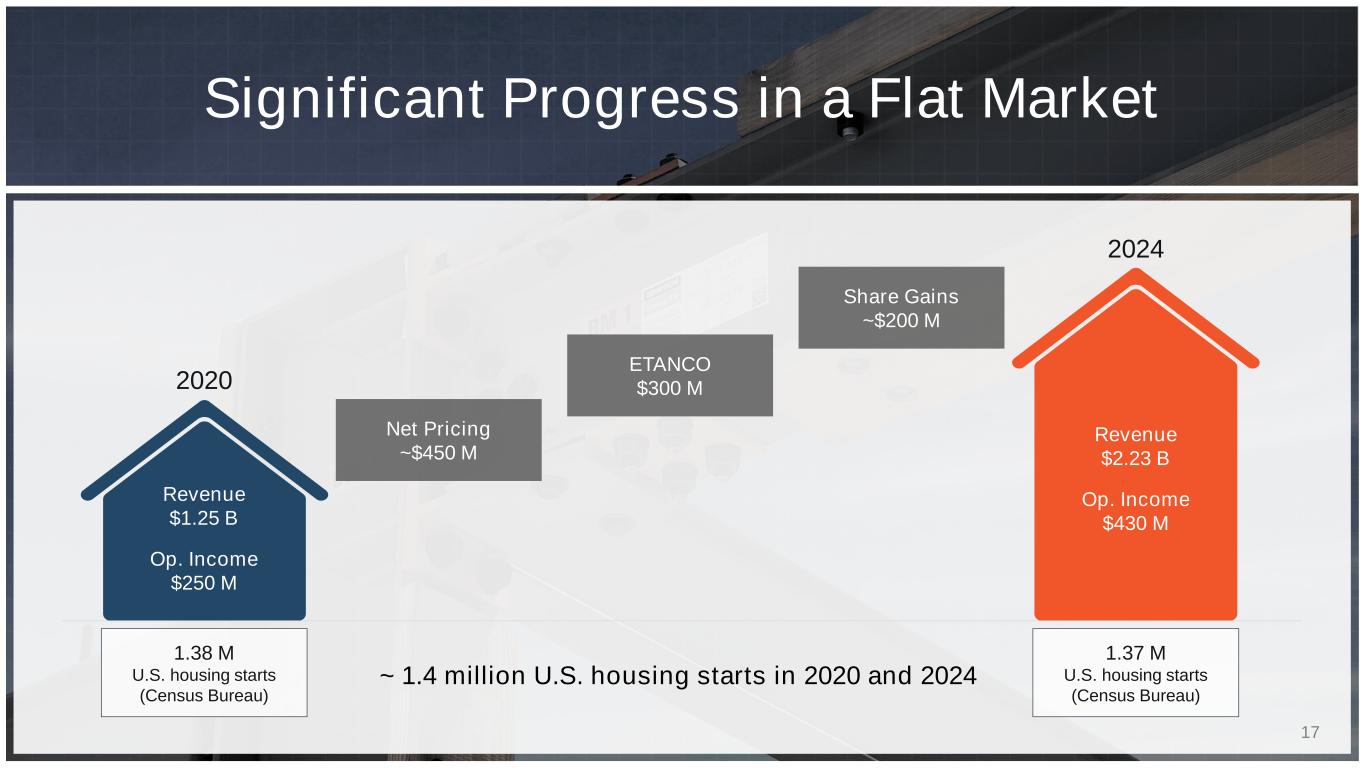

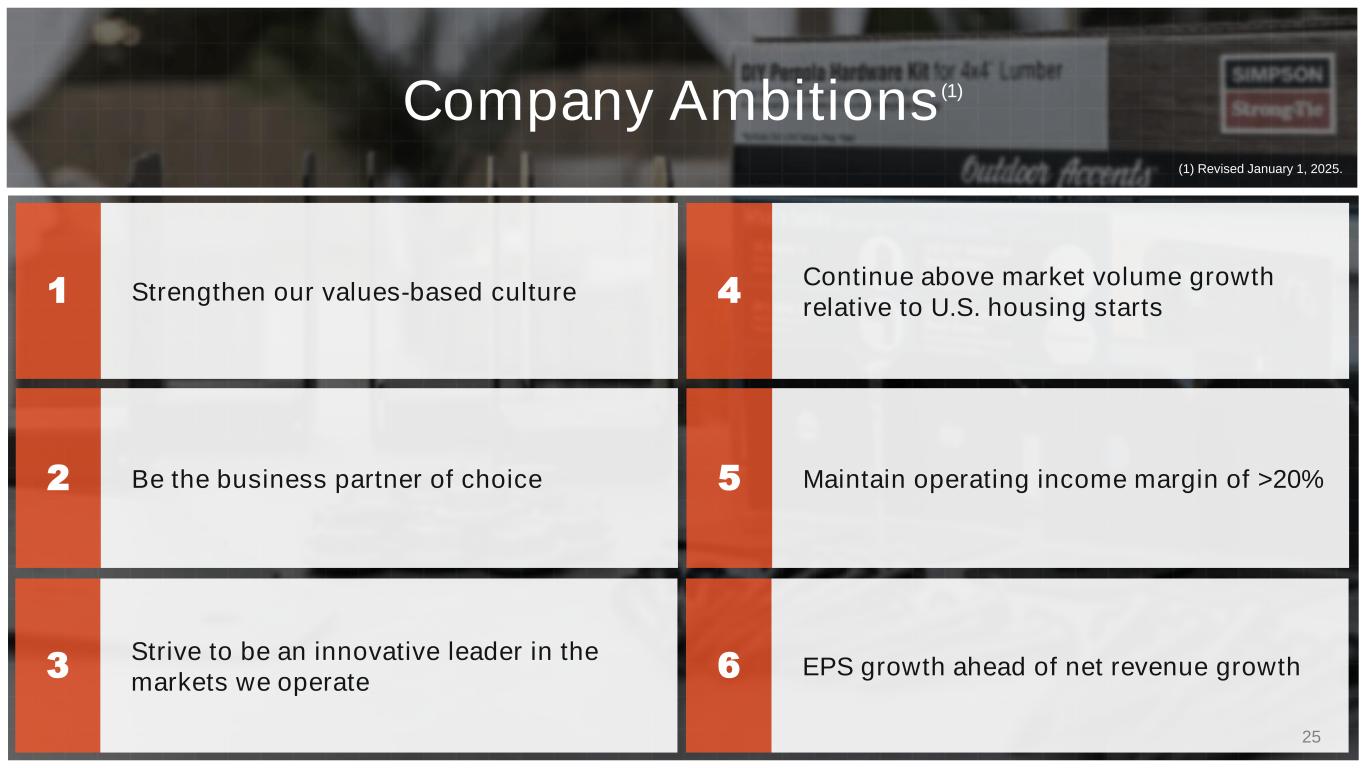

“Our first quarter net sales reflected modest growth over the prior year in a highly uncertain macroeconomic environment in both the U.S. and Europe,” commented Mike Olosky, President and Chief Executive Officer of Simpson Manufacturing Co., Inc. “I’m pleased to report that our volume performance in North America once again exceeded U.S. housing starts by approximately 420 basis points over the trailing twelve months. Our sales included a $9.0 million benefit from our 2024 acquisitions and a favorable comparison to the prior year which was adversely affected by the timing of volume discount estimates, collectively more than offsetting a modest decline in volume. Absent these factors, North America net sales were relatively flat year-over-year. In Europe, though our sales moderately declined, we believe our volumes have outperformed the broader market.”

Mr. Olosky continued, “As previously announced, we implemented price increases across our product lines in the U.S., effective June 2nd. Since our last pricing change, which was a decrease a few years ago, we have experienced significant increases in our costs. Additionally, while we are largely domestically sourced, we procure fasteners and a limited number of other products from countries that are subject to the recently announced tariffs. Accordingly, the price increases were an effort to offset rising costs across both non-material and material categories as well as a portion related to current trade policy actions. These increases, combined with cost discipline and productivity improvements, will help us maintain our current gross margin and make selective investments to provide even better customer service. We believe our focus on managing costs while improving our position in diversified end markets has strengthened our business through the cycle, particularly in a soft housing market. We remain confident in our mid to long-term housing outlook and believe Simpson is well positioned to capitalize on future growth.”

North America Segment 2025 First Quarter Financial Highlights

•Net sales of $420.7 million increased 3.4% from $406.7 million primarily due to incremental sales from the Company's 2024 acquisitions and timing of volume discount estimates that negatively impacted 2024 net sales. The increases were partly offset by the negative effect of approximately $1.5 million in foreign currency translation.

•Gross margin increased to 50.0% from 49.3% primarily due to timing of 2024 volume discount estimates, as noted above.

•Income from operations of $104.2 million increased 5.4% from $98.9 million. The increase was primarily due to higher gross profits, partly offset by higher operating expenses. The operating expense increases were driven by higher personnel costs and variable incentive compensation.

Europe Segment 2025 First Quarter Financial Highlights

•Net sales of $113.9 million decreased 5.1% from $119.9 million, primarily due to the negative effect of approximately $4.0 million in foreign currency translation.

•Gross margin decreased to 35.2% from 36.5%, primarily due to higher factory and overhead, labor, as well as warehouse costs, partly offset by lower material costs, as a percentage of net sales.

•Income from operations of $9.3 million increased 12.7% from $8.3 million primarily due to a decrease in operating expenses including variable compensation costs.

Refer to the “Segment and Product Group Information” table below for additional segment information (including information about the Company’s Asia/Pacific and Administrative and All Other segments).

Corporate Developments

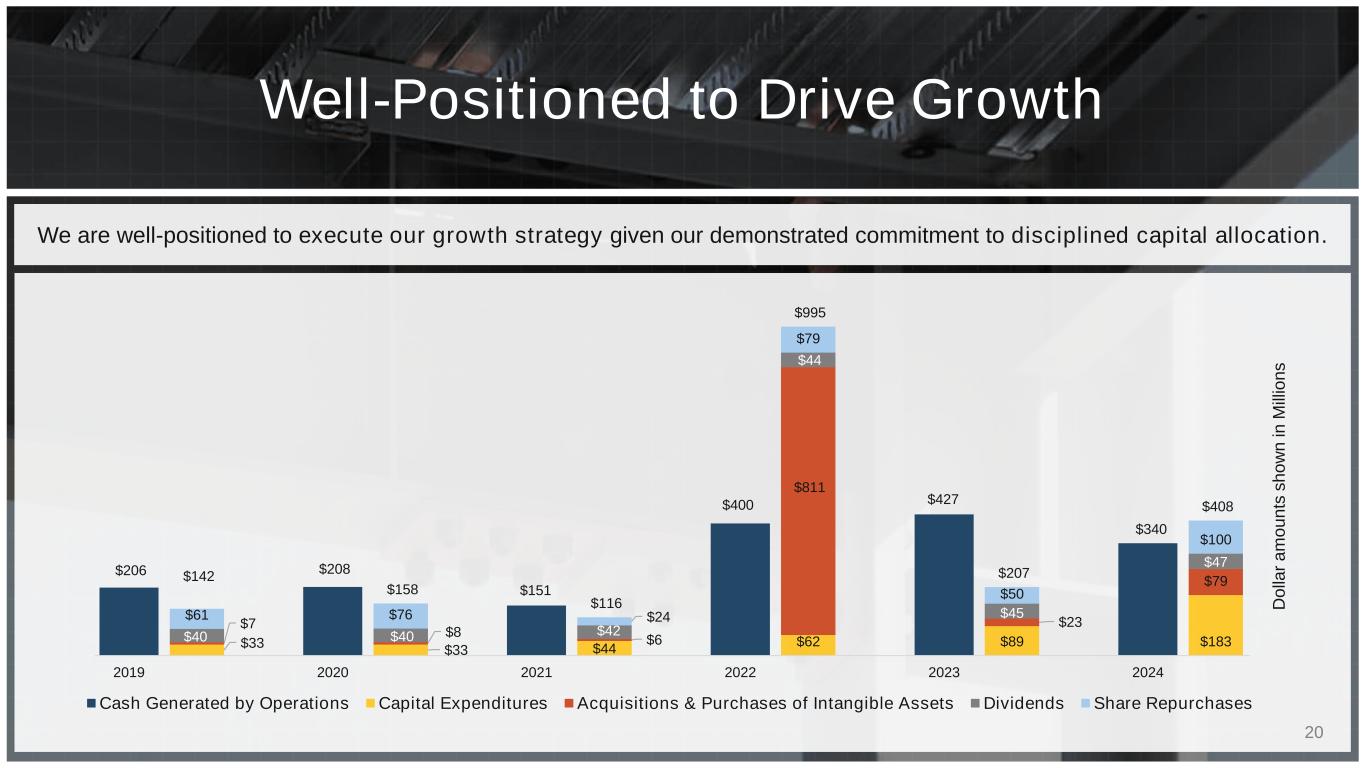

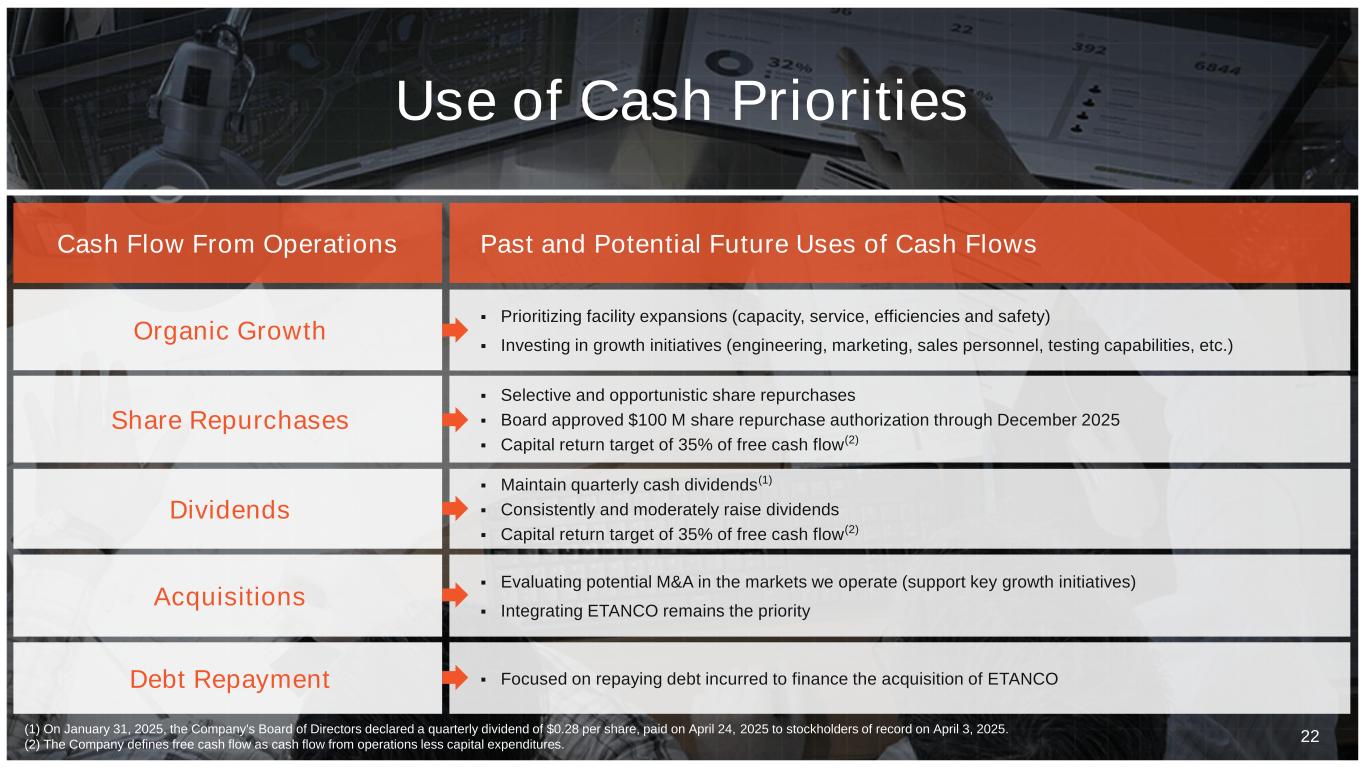

•The Company repurchased 146,640 shares of the Company’s common stock in the open market at an average price of $170.48 per share, for a total of $25.0 million. As of March 31, 2025, approximately $75.0 million remained available for share repurchases through December 31, 2025 under the Company's previously announced $100.0 million share repurchase authorization.

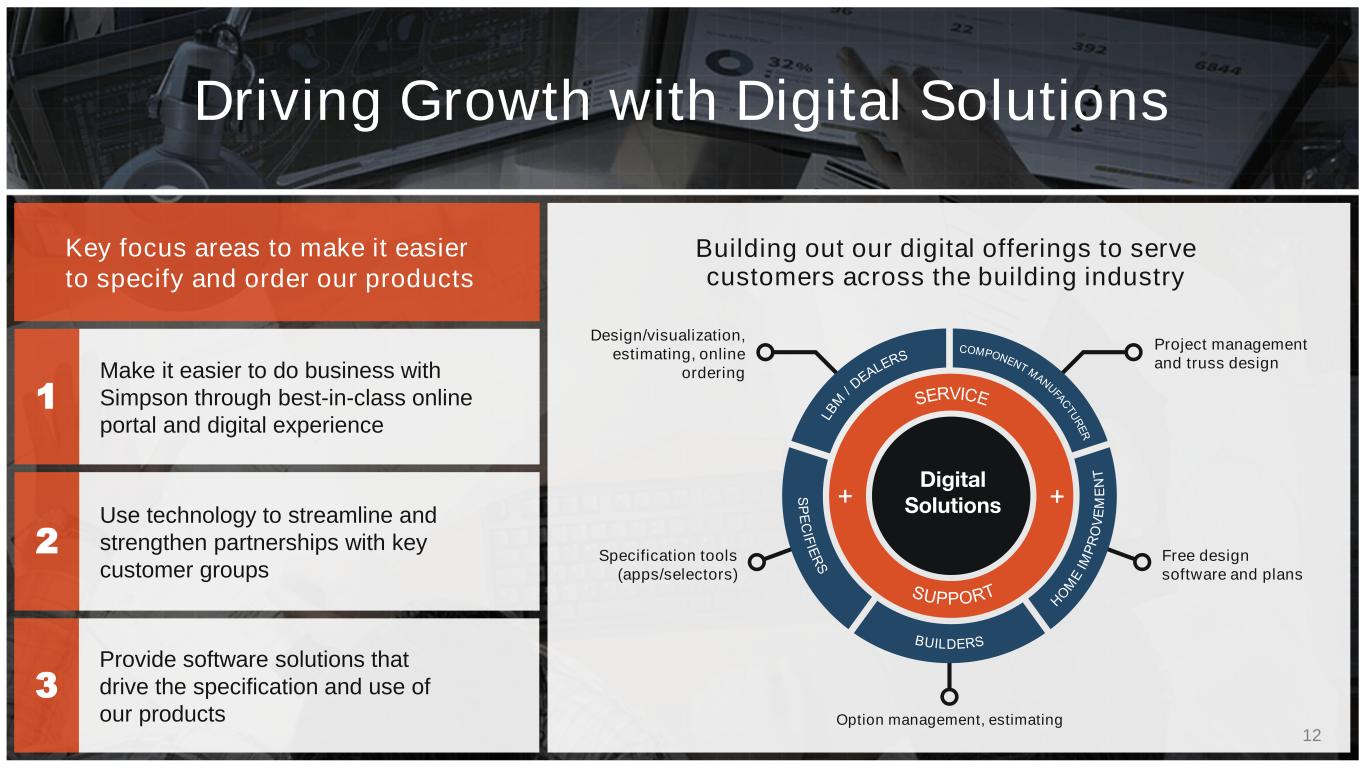

•In 2025, some of the engineering costs related to the Company's digital efforts that were part of research and development and engineering expense as well as selling expense are now being included in general and administrative expense. Accordingly, the financial results for the current period may not be directly comparable to those of previous periods.

Balance Sheet & 2025 First Quarter Cash Flow Highlights

•As of March 31, 2025, cash and cash equivalents totaled $150.3 million with total debt outstanding of $382.5 million under the Company's $450.0 million credit facility.

•Cash provided by operating activities of $7.6 million decreased from $7.9 million.

•Cash used in investing activities of $50.5 million increased from $39.4 million due to increased capital expenditures.

Business Outlook

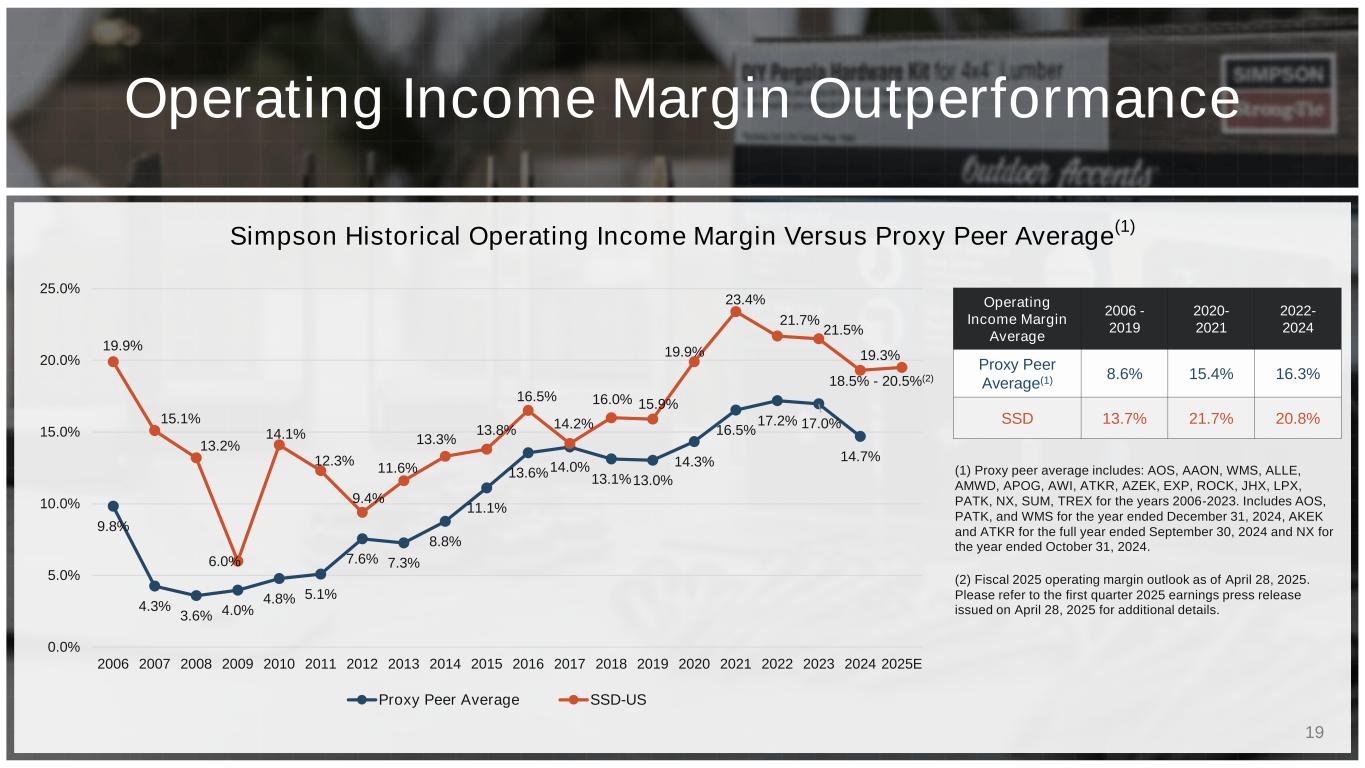

The Company is reaffirming its prior 2025 financial outlook after a reevaluation of business conditions, given the uncertainties noted below. As of today, April 28, 2025, the Company's outlook for the full fiscal year ending December 31, 2025 is as follows:

•Given the uncertainty regarding 2025 U.S. housing starts compared to prior year housing starts, consolidated operating margin is estimated to be in the range of 18.5% to 20.5% with the low end of the range based on flat to declining 2025 housing starts compared to prior year and price increases implemented in 2025. The operating margin range includes a projected benefit of between $10.0 million to $12.0 million from the sale of the Gallatin property based on a contracted sales price of $19.1 million.

•The effective tax rate is estimated to be in the range of 25.5% to 26.5%, including both federal and state income tax rates as well as international income tax rates, and assuming no tax law changes are enacted.

•Capital expenditures are estimated to be in the range of $150.0 million to $170.0 million, which includes approximately $75.0 million remaining for both the Columbus, Ohio facility expansion and the new Gallatin, Tennessee fastener facility construction.

Conference Call Details

Investors, analysts and other interested parties are invited to join the Company’s first quarter 2025 financial results conference call on Monday, April 28, 2025, at 5:00 p.m. Eastern Time (2:00 p.m. Pacific Time). To participate, callers may dial (877) 407-0792 (U.S. and Canada) or (201) 689-8263 (International) approximately 10 minutes prior to the start time. The call will be webcast simultaneously and can be accessed through https://viavid.webcasts.com/starthere.jsp?ei=1713626&tp_key=c49b3a5601 or a link on the Investor Relations section of the Company’s website at https://ir.simpsonmfg.com/events-and-presentations. For those unable to participate during the live broadcast, a replay of the call will also be available beginning that same day at 8:00 p.m. Eastern Time until 11:59 p.m. Eastern Time on Monday, May 12, 2025, by dialing (844) 512–2921 (U.S. and Canada) or (412) 317–6671 (International) and entering the conference ID: 13752753. The webcast will remain posted on the Investor Relations section of the Company’s website for 90 days.

A copy of this earnings release will be available prior to the call, accessible through the Investor Relations section of the Company's website at www.simpsonmfg.com.

About Simpson Manufacturing Co., Inc.

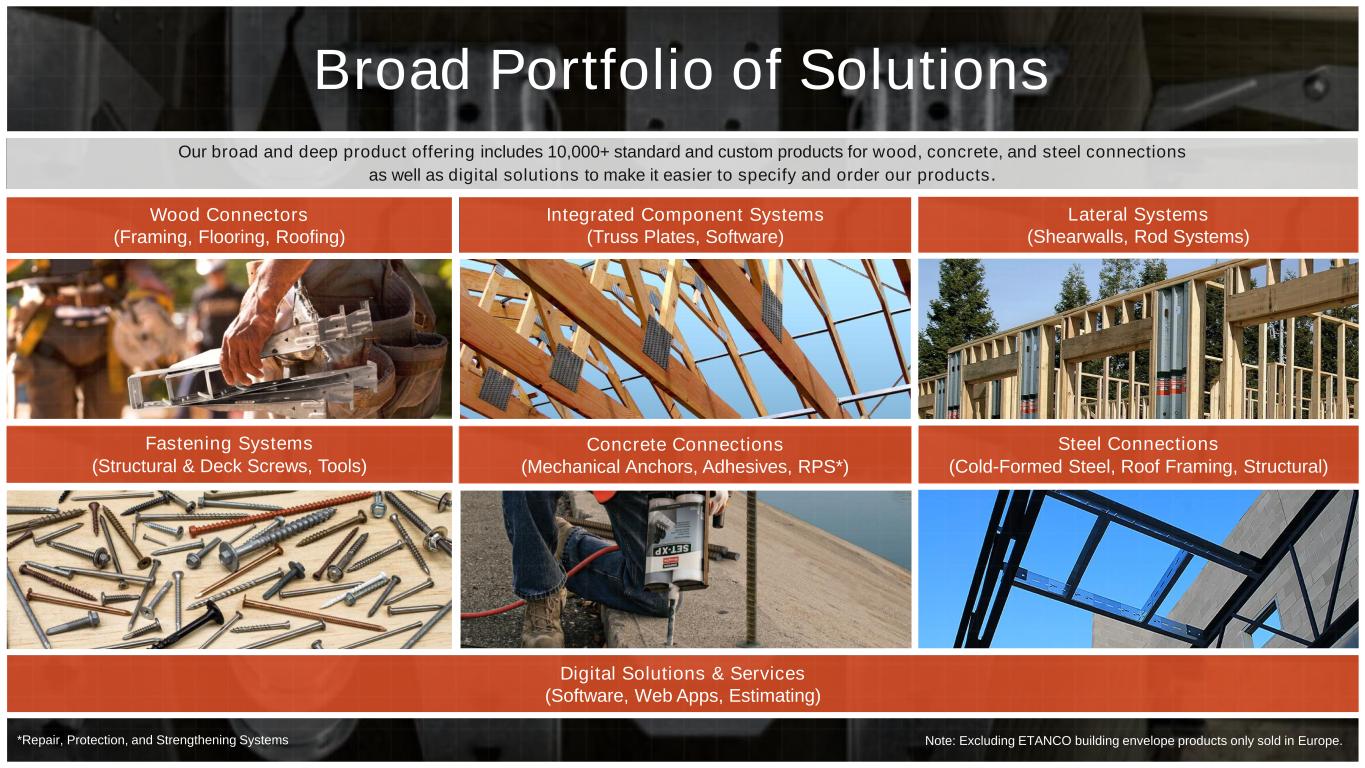

Simpson Manufacturing Co., Inc., headquartered in Pleasanton, California, through its subsidiary, Simpson Strong-Tie Company Inc., designs, engineers and is a leading manufacturer of wood construction products, including connectors, truss plates, fastening systems, fasteners and shearwalls, and concrete construction products, including adhesives, specialty chemicals, mechanical anchors, powder actuated tools and reinforcing carbon and glass fiber materials. The Company primarily supplies its building product solutions to both the residential and commercial markets in North America and Europe. The Company's common stock trades on the New York Stock Exchange under the symbol "SSD."

Copies of Simpson Manufacturing's Annual Report to Stockholders and its proxy statements and other SEC filings, including Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, are made available free of charge on the company's website on the same day they are filed with the SEC. To view these filings, visit the Investor Relations section of the Company's website.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements generally can be identified by words such as "anticipate," "believe," "estimate," "expect," "intend," "plan," "outlook," "target," "continue," "predict," "project," "change," "result," "future," "will," "could," "can," "may," "likely," "potentially," or similar expressions. Forward-looking statements are all statements other than those of historical fact and include, but are not limited to, statements about future financial and operating results, our plans, objectives, business outlook, priorities, expectations and intentions, expectations for sales and market growth, comparable sales, earnings and performance, stockholder value, capital expenditures, cash flows, the housing market, the home improvement industry, demand for services, share repurchases, our strategic initiatives, including the impact of these initiatives on our strategic and operational plans and financial results, and any statement of an assumption underlying any of the foregoing.

Forward-looking statements are subject to inherent uncertainties, risks and other factors that are difficult to predict and could cause our actual results to vary in material respects from what we have expressed or implied by these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those expressed in or implied by our forward-looking statements include the effect of tariffs and international trade policies on our business operations, the effects of inflation and labor and supply shortages on our operations and the operations of our customers, suppliers and business partners, the effect of a global pandemic such as the COVID-19 pandemic or other widespread public health crisis and their effects on the global economy as well as those discussed in the "Risk Factors" and " Management's Discussion and Analysis of Financial Condition and Results of Operations" sections of our most recent Annual Report on Form 10-K, subsequent Quarterly Reports on Form 10-Q and other reports we file with the SEC.

We caution that you should not place undue reliance on these forward-looking statements, which speak only as of the date of this press release. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law. Readers are urged to carefully review and consider the various disclosures made in our reports filed with the SEC that advise of the risks and factors that may affect our business, results of operations and financial condition.

Non-GAAP Financial Measures

This press release includes certain financial information, not prepared in accordance with Generally Accepted Accounting Principles in the United States (“GAAP”). Since not all companies calculate non-GAAP financial information identically (or at all), the presentations herein may not be comparable to other similarly titled measures used by other companies. Further, these measures should not be considered substitutes for the performance measures derived in accordance with GAAP. The Company uses Adjusted EBITDA as an additional financial measure in evaluating the ongoing operating performance of its business. The Company believes Adjusted EBITDA allows it to readily view operating trends, perform analytical comparisons, and identify strategies to improve operating performance. Adjusted EBITDA should not be considered in isolation or as a substitute for GAAP financial measures such as net income or any other performance measures derived in accordance with GAAP. See the Reconciliation of Non-GAAP Financial Measures below.

The Company defines Adjusted EBITDA as net income (loss) before income taxes, adjusted to exclude depreciation and amortization, integration, acquisition and restructuring costs, non-qualified compensation adjustments, goodwill impairment, gain on bargain purchase, net loss or gain on disposal of assets, interest income or expense, and foreign exchange and other expense (income).

Simpson Manufacturing Co., Inc. and Subsidiaries

UNAUDITED Condensed Consolidated Statements of Operations

(In thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2025 |

|

2024 |

|

|

|

|

| Net sales |

$ |

538,895 |

|

|

$ |

530,579 |

|

|

|

|

|

| Cost of sales |

286,855 |

|

|

286,023 |

|

|

|

|

|

| Gross profit |

252,040 |

|

|

244,556 |

|

|

|

|

|

| Research and development and engineering expense |

19,839 |

|

|

21,918 |

|

|

|

|

|

| Selling expense |

54,164 |

|

|

54,499 |

|

|

|

|

|

| General and administrative expense |

75,666 |

|

|

70,193 |

|

|

|

|

|

| Total operating expenses |

149,669 |

|

|

146,610 |

|

|

|

|

|

| Acquisition and integration related costs |

127 |

|

|

2,046 |

|

|

|

|

|

| Net gain on disposal of assets |

(75) |

|

|

(198) |

|

|

|

|

|

| Income from operations |

102,319 |

|

|

96,098 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income, net and other finance costs |

1,103 |

|

|

351 |

|

|

|

|

|

| Other & foreign exchange gain, net |

1,058 |

|

|

1,969 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before taxes |

104,480 |

|

|

98,418 |

|

|

|

|

|

| Provision for income taxes |

26,596 |

|

|

22,988 |

|

|

|

|

|

| Net income |

$ |

77,884 |

|

|

$ |

75,430 |

|

|

|

|

|

| Earnings per common share: |

|

|

|

|

|

|

|

| Basic |

$ |

1.86 |

|

|

$ |

1.78 |

|

|

|

|

|

| Diluted |

$ |

1.85 |

|

|

$ |

1.77 |

|

|

|

|

|

| Weighted average shares outstanding |

|

|

|

|

|

|

|

| Basic |

41,846 |

|

|

42,386 |

|

|

|

|

|

| Diluted |

42,010 |

|

|

42,630 |

|

|

|

|

|

| Cash dividends declared per common share |

$ |

0.28 |

|

|

$ |

0.27 |

|

|

|

|

|

| Other Data: |

|

|

|

|

|

|

|

| Depreciation and amortization |

$ |

19,522 |

|

|

$ |

19,189 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Pre-tax equity-based compensation expense |

$ |

6,538 |

|

|

$ |

5,346 |

|

|

|

|

|

Simpson Manufacturing Co., Inc. and Subsidiaries

UNAUDITED Condensed Consolidated Balance Sheets

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, |

|

December 31, |

|

|

2025 |

|

2024 |

|

2024 |

| Cash and cash equivalents |

|

$ |

150,290 |

|

|

$ |

369,122 |

|

|

$ |

239,371 |

|

| Trade accounts receivable, net |

|

373,198 |

|

|

343,414 |

|

|

284,392 |

|

| Inventories |

|

618,784 |

|

|

555,745 |

|

|

593,175 |

|

|

|

|

|

|

|

|

| Other current assets |

|

64,760 |

|

|

60,473 |

|

|

59,383 |

|

| Total current assets |

|

1,207,032 |

|

|

1,328,754 |

|

|

1,176,321 |

|

| Property, plant and equipment, net |

|

568,855 |

|

|

437,429 |

|

|

531,655 |

|

| Operating lease right-of-use assets |

|

101,701 |

|

|

65,933 |

|

|

93,933 |

|

| Goodwill |

|

526,441 |

|

|

492,767 |

|

|

512,383 |

|

| Intangible assets, net |

|

382,079 |

|

|

352,527 |

|

|

375,051 |

|

| Other noncurrent assets |

|

39,637 |

|

|

44,536 |

|

|

46,825 |

|

| Total assets |

|

$ |

2,825,745 |

|

|

$ |

2,721,946 |

|

|

$ |

2,736,168 |

|

| Trade accounts payable |

|

$ |

118,019 |

|

|

$ |

102,997 |

|

|

$ |

100,972 |

|

| Long-term debt, current portion |

|

22,500 |

|

|

22,500 |

|

|

22,500 |

|

| Accrued liabilities and other current liabilities |

|

242,917 |

|

|

226,944 |

|

|

242,876 |

|

| Total current liabilities |

|

383,436 |

|

|

352,441 |

|

|

366,348 |

|

| Operating lease liabilities, net of current portion |

|

82,913 |

|

|

52,051 |

|

|

76,184 |

|

| Long-term debt, net of current portion and issuance costs |

|

357,278 |

|

|

453,454 |

|

|

362,563 |

|

| Deferred income tax |

|

90,346 |

|

|

96,937 |

|

|

90,303 |

|

| Other long-term liabilities |

|

41,871 |

|

|

41,400 |

|

|

27,636 |

|

| Non-qualified deferred compensation plan share awards |

|

8,804 |

|

|

— |

|

|

7,786 |

|

Stockholders’ equity |

|

1,861,097 |

|

|

1,725,663 |

|

|

1,805,348 |

|

| Total liabilities, mezzanine equity, and stockholders’ equity |

|

$ |

2,825,745 |

|

|

$ |

2,721,946 |

|

|

$ |

2,736,168 |

|

Simpson Manufacturing Co., Inc. and Subsidiaries

UNAUDITED Segment and Product Group Information

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

|

|

|

March 31, |

|

% |

|

|

|

|

|

2025 |

|

2024 |

|

change* |

|

|

|

|

|

|

| Net Sales by Reporting Segment |

|

|

|

|

|

|

|

|

|

|

|

| North America |

$ |

420,699 |

|

$ |

406,749 |

|

3.4% |

|

|

|

|

|

|

| Percentage of total net sales |

78.1 |

% |

|

76.7 |

% |

|

|

|

|

|

|

|

|

| Europe |

113,860 |

|

119,938 |

|

(5.1)% |

|

|

|

|

|

|

| Percentage of total net sales |

21.1 |

% |

|

22.6 |

% |

|

|

|

|

|

|

|

|

| Asia/Pacific |

4,336 |

|

3,892 |

|

11.4% |

|

|

|

|

|

|

| Percentage of total net sales |

0.8 |

% |

|

0.7 |

% |

|

|

|

|

|

|

|

|

| Total |

$ |

538,895 |

|

$ |

530,579 |

|

1.6% |

|

|

|

|

|

|

| Net Sales by Product Group** |

|

|

|

|

|

|

|

|

|

|

|

| Wood Construction |

$ |

459,442 |

|

$ |

451,572 |

|

1.7% |

|

|

|

|

|

|

| Percentage of total net sales |

85.3 |

% |

|

85.1 |

% |

|

|

|

|

|

|

|

|

| Concrete Construction |

77,683 |

|

78,730 |

|

(1.3)% |

|

|

|

|

|

|

| Percentage of total net sales |

14.4 |

% |

|

14.8 |

% |

|

|

|

|

|

|

|

|

| Other |

1,770 |

|

277 |

|

N/M |

|

|

|

|

|

|

| Total |

$ |

538,895 |

|

$ |

530,579 |

|

1.6% |

|

|

|

|

|

|

| Gross Profit (Loss) by Reporting Segment |

|

|

|

|

|

|

|

|

|

|

|

| North America |

$ |

210,292 |

|

$ |

200,537 |

|

4.9% |

|

|

|

|

|

|

| North America gross margin |

50.0 |

% |

|

49.3 |

% |

|

|

|

|

|

|

|

|

| Europe |

40,022 |

|

43,812 |

|

(8.7)% |

|

|

|

|

|

|

| Europe gross margin |

35.2 |

% |

|

36.5 |

% |

|

|

|

|

|

|

|

|

| Asia/Pacific |

1,725 |

|

676 |

|

N/M |

|

|

|

|

|

|

| Administrative & all other |

1 |

|

(469) |

|

N/M |

|

|

|

|

|

|

| Total |

$ |

252,040 |

|

$ |

244,556 |

|

3.1% |

|

|

|

|

|

|

| Income (Loss) from Operations |

|

|

|

|

|

|

|

|

|

|

|

| North America |

$ |

104,238 |

|

$ |

98,904 |

|

5.4% |

|

|

|

|

|

|

| North America operating margin |

24.8 |

% |

|

24.3 |

% |

|

|

|

|

|

|

|

|

| Europe |

9,309 |

|

8,258 |

|

12.7% |

|

|

|

|

|

|

| Europe operating margin |

8.2 |

% |

|

6.9 |

% |

|

|

|

|

|

|

|

|

| Asia/Pacific |

359 |

|

(575) |

|

N/M |

|

|

|

|

|

|

| Administrative & all other |

(11,587) |

|

(10,489) |

|

N/M |

|

|

|

|

|

|

| Total |

$ |

102,319 |

|

$ |

96,098 |

|

6.5% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* |

Unfavorable percentage changes are presented in parentheses. |

|

** |

The Company manages its business by geographic segment but is presenting sales by product group as additional information. |

|

N/M |

Statistic is not material or not meaningful. |

Reconciliation of Non-GAAP Financial Measures

(In thousands) (Unaudited)

A reconciliation of Adjusted EBITDA to net income, the most directly comparable GAAP measure, is set forth below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2025 |

|

2024 |

|

|

|

|

| Net Income |

$ |

77,884 |

|

|

$ |

75,430 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Provision for income taxes |

26,596 |

|

|

22,988 |

|

|

|

|

|

| Interest income, net and other financing costs |

(1,103) |

|

|

(351) |

|

|

|

|

|

| Depreciation and amortization |

19,522 |

|

|

19,189 |

|

|

|

|

|

| Other* |

(1,130) |

|

|

26 |

|

|

|

|

|

| Adjusted EBITDA |

$ |

121,769 |

|

|

$ |

117,282 |

|

|

|

|

|

|

|

|

|

|

|

|

|

*Other: Includes acquisition, integration, and restructuring related expenses, non-qualified deferred compensation adjustments, other & foreign exchange loss net, and net loss or gain on disposal of assets.

CONTACT:

Addo Investor Relations

investor.relations@strongtie.com

(310) 829-5400