| Delaware | 001-15393 | 42-1405748 | ||||||

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification Number) | ||||||

| 1800 Larimer Street | ||||||||

| Suite 1800 | ||||||||

| Denver, | Colorado | 80202 | ||||||

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||

| Common Stock, par value $1.00 per share | HTLF | Nasdaq Stock Market | ||||||

| Depositary Shares (each representing 1/400th interest in a share of 7.00% Fixed-Rate Reset Non-Cumulative Perpetual Preferred Stock, Series E) | HTLFP | Nasdaq Stock Market | ||||||

| Date: October 30, 2023 | HEARTLAND FINANCIAL USA, INC. | ||||||||||

| By: | /s/ Bryan R. McKeag | ||||||||||

| Bryan R. McKeag | |||||||||||

| Executive Vice President | |||||||||||

| Chief Financial Officer | |||||||||||

|

|

|||||||

| CONTACT: | FOR IMMEDIATE RELEASE | ||||

| Bryan R. McKeag | October 30, 2023 | ||||

| Executive Vice President | |||||

| Chief Financial Officer | |||||

| (563) 589-1994 | |||||

| BMcKeag@htlf.com | |||||

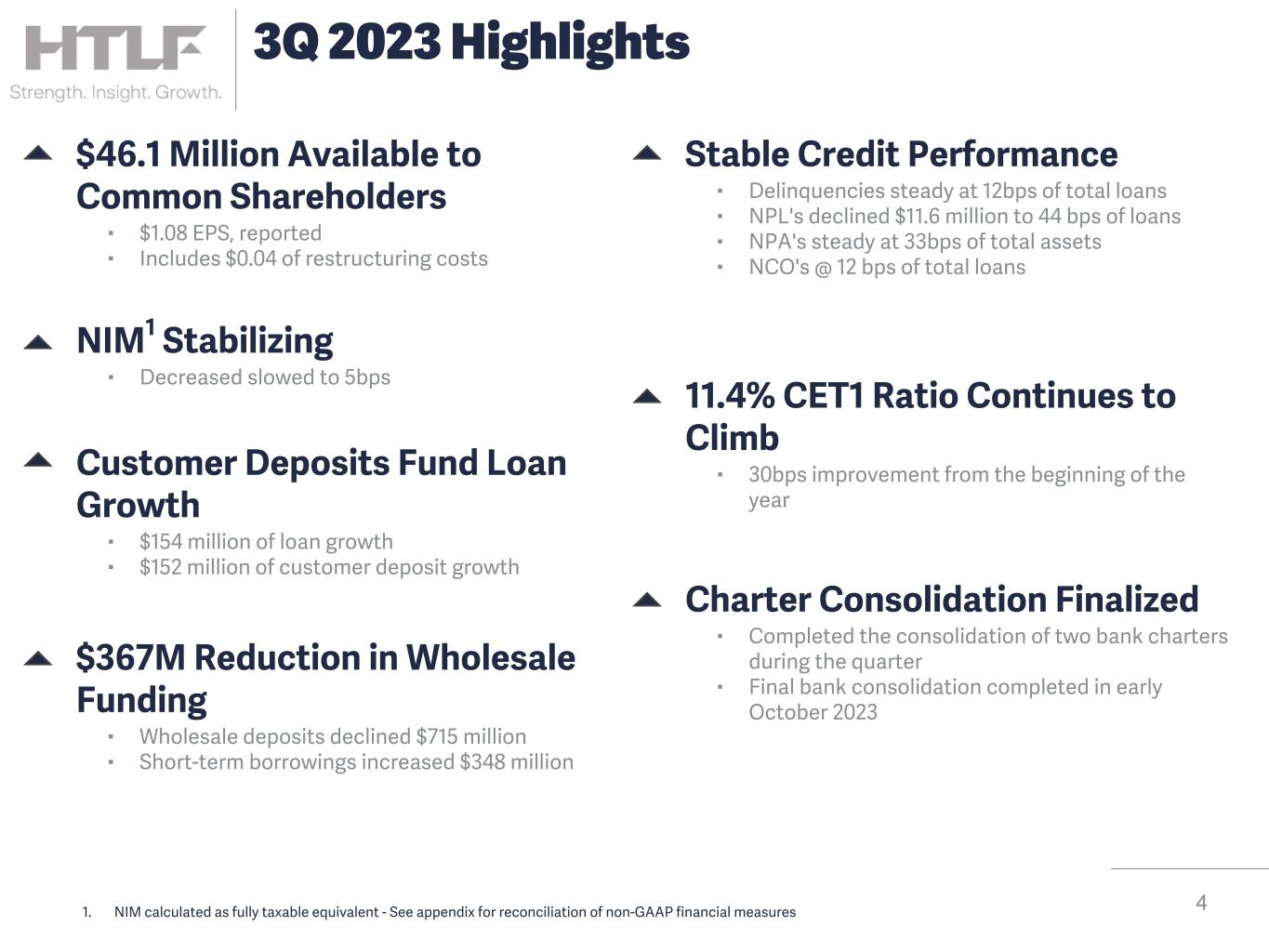

| § | Quarterly net income available to common stockholders of $46.1 million | |||||||

| § | Quarterly diluted earnings per common share of $1.08, which includes $.04 of acquisition, integration and restructuring costs | |||||||

| § | Quarterly loan growth of $154.5 million or 1% | |||||||

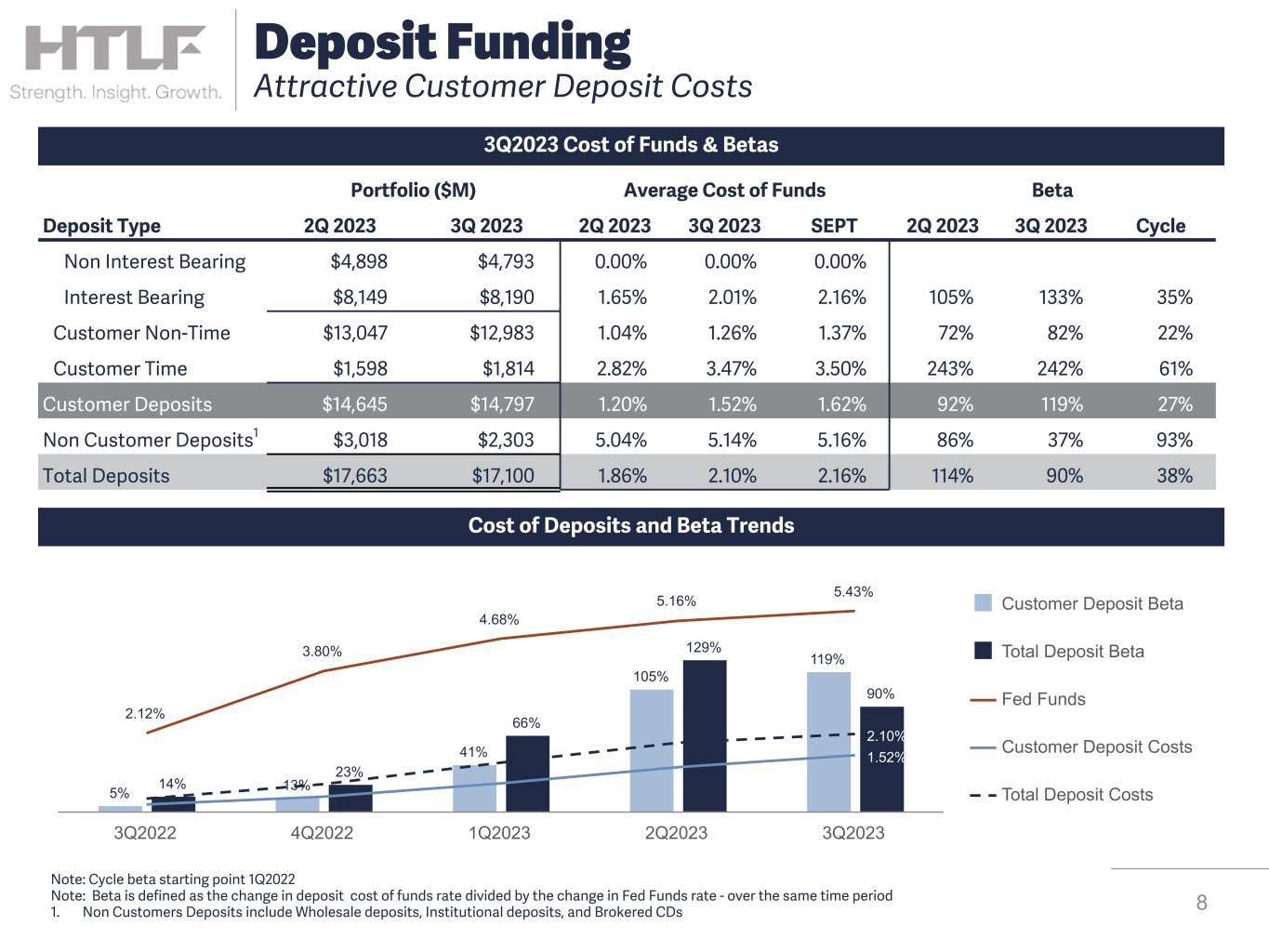

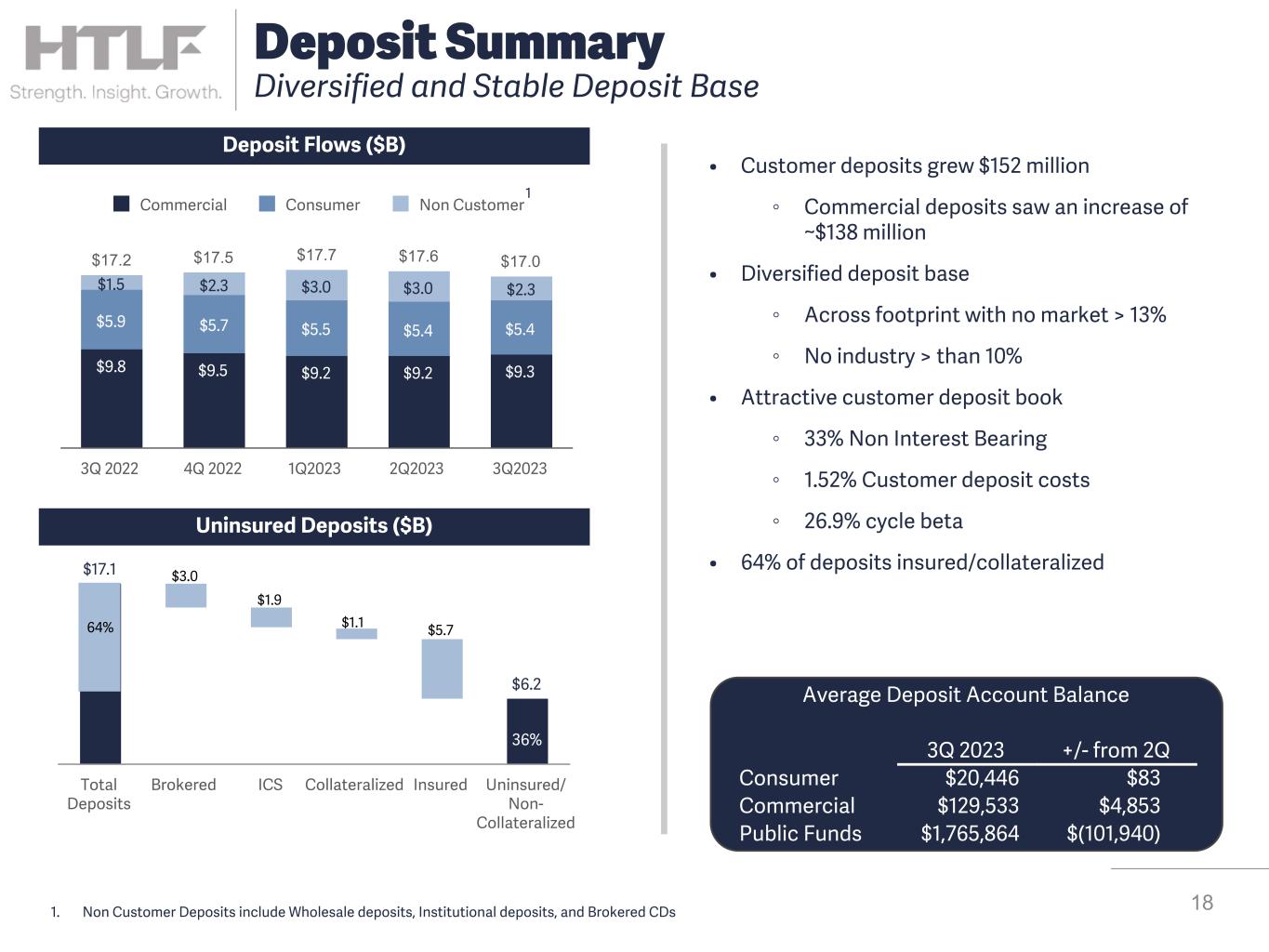

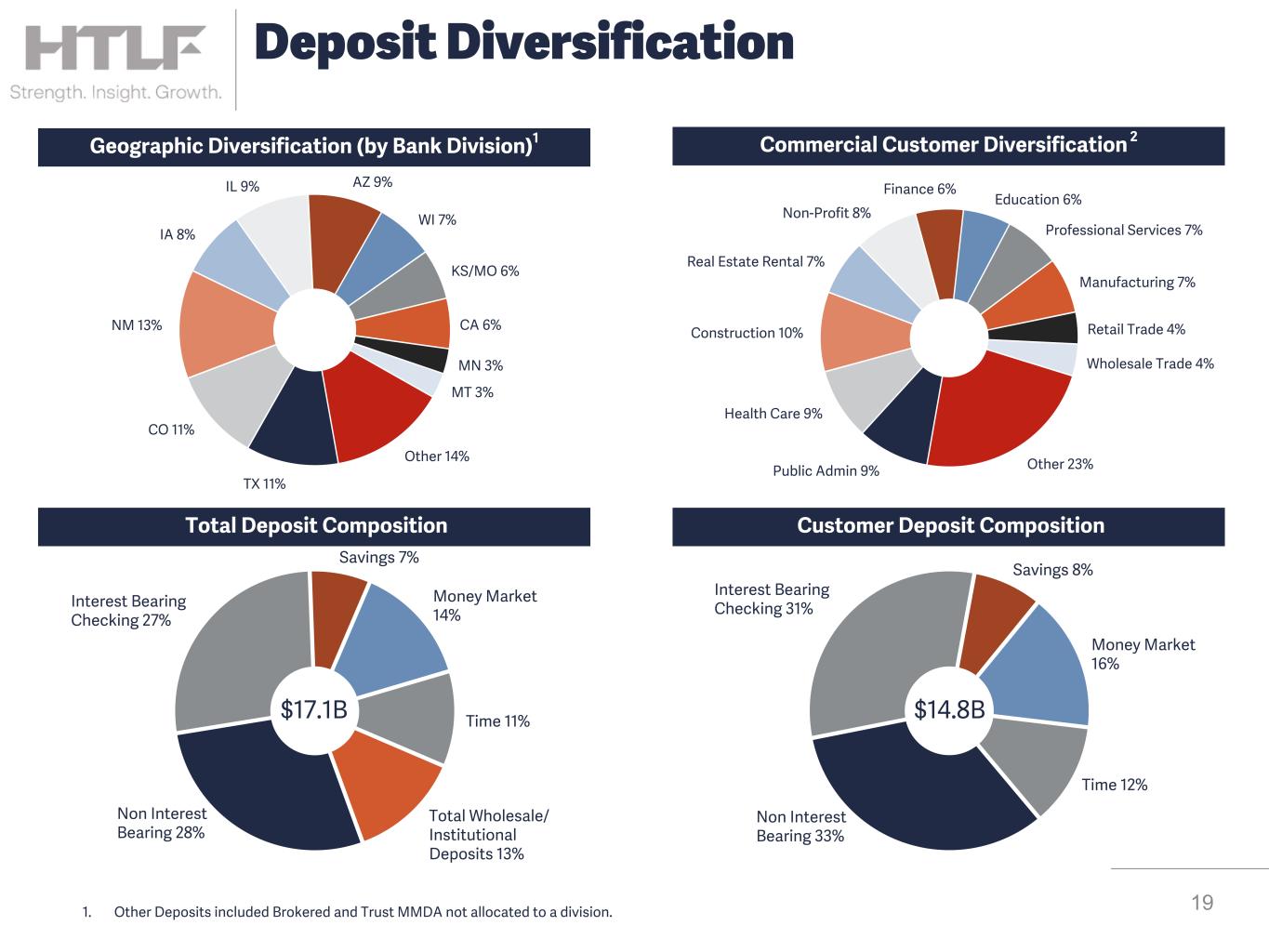

| § | Total customer deposit growth during the quarter of $152.3 million or 1% | |||||||

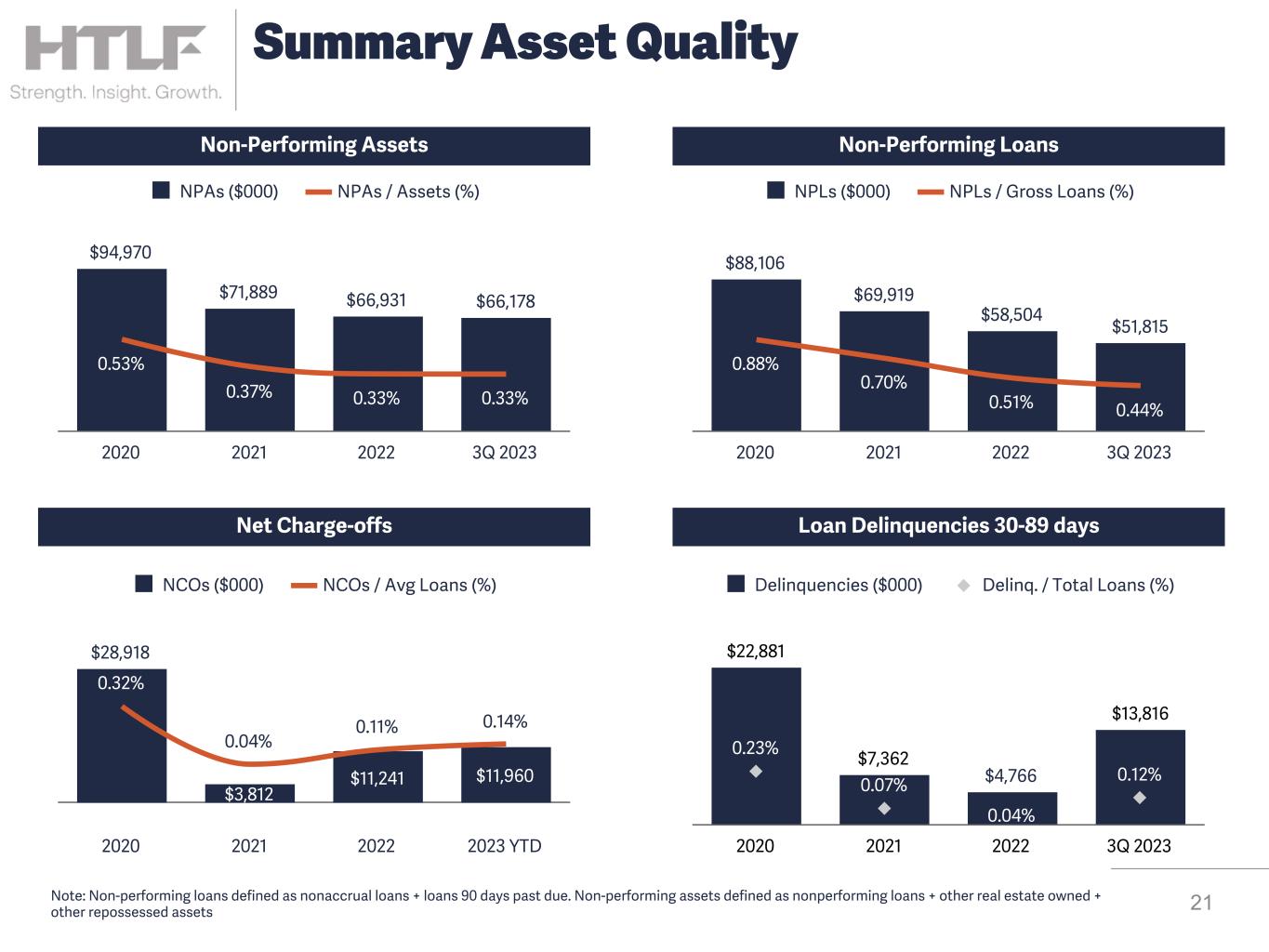

| § | Nonperforming assets to total assets and 30-89 day loan delinquencies remained unchanged at 0.33% and 0.12%, respectively | |||||||

| § | Nonperforming loans to total loans decreased to 0.44% from 0.54% at June 30, 2023 and 0.60% at September 30, 2022 | |||||||

| § | Completed the consolidation of two bank charters during the quarter, and the final charter was consolidated following the end of the quarter | |||||||

| Quarter Ended September 30, |

Nine Months Ended September 30, | ||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| Net income available to common stockholders (in millions) | $ | 46.1 | $ | 54.6 | $ | 144.2 | $ | 145.5 | |||||||||||||||

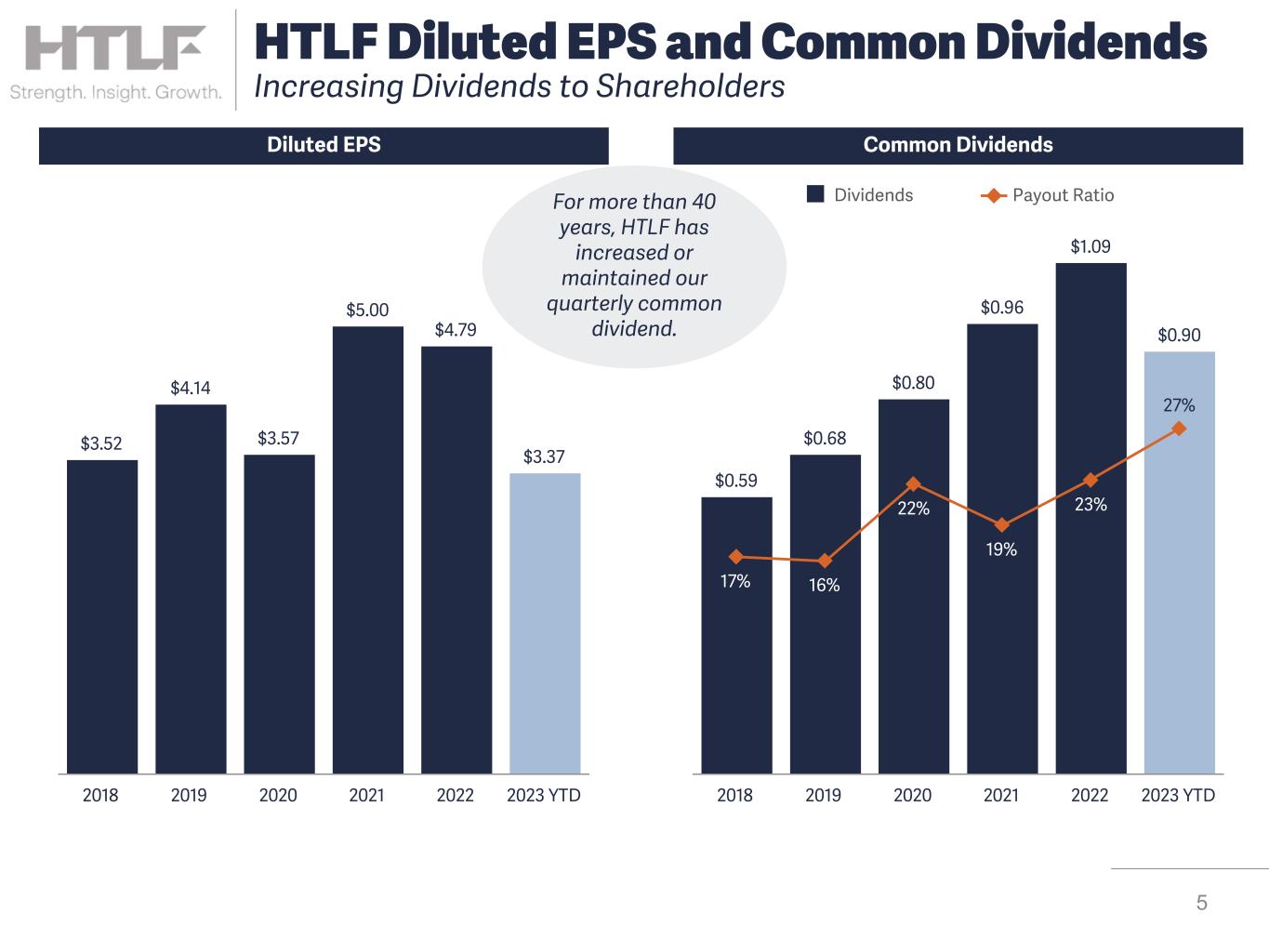

| Diluted earnings per common share | 1.08 | 1.28 | 3.37 | 3.42 | |||||||||||||||||||

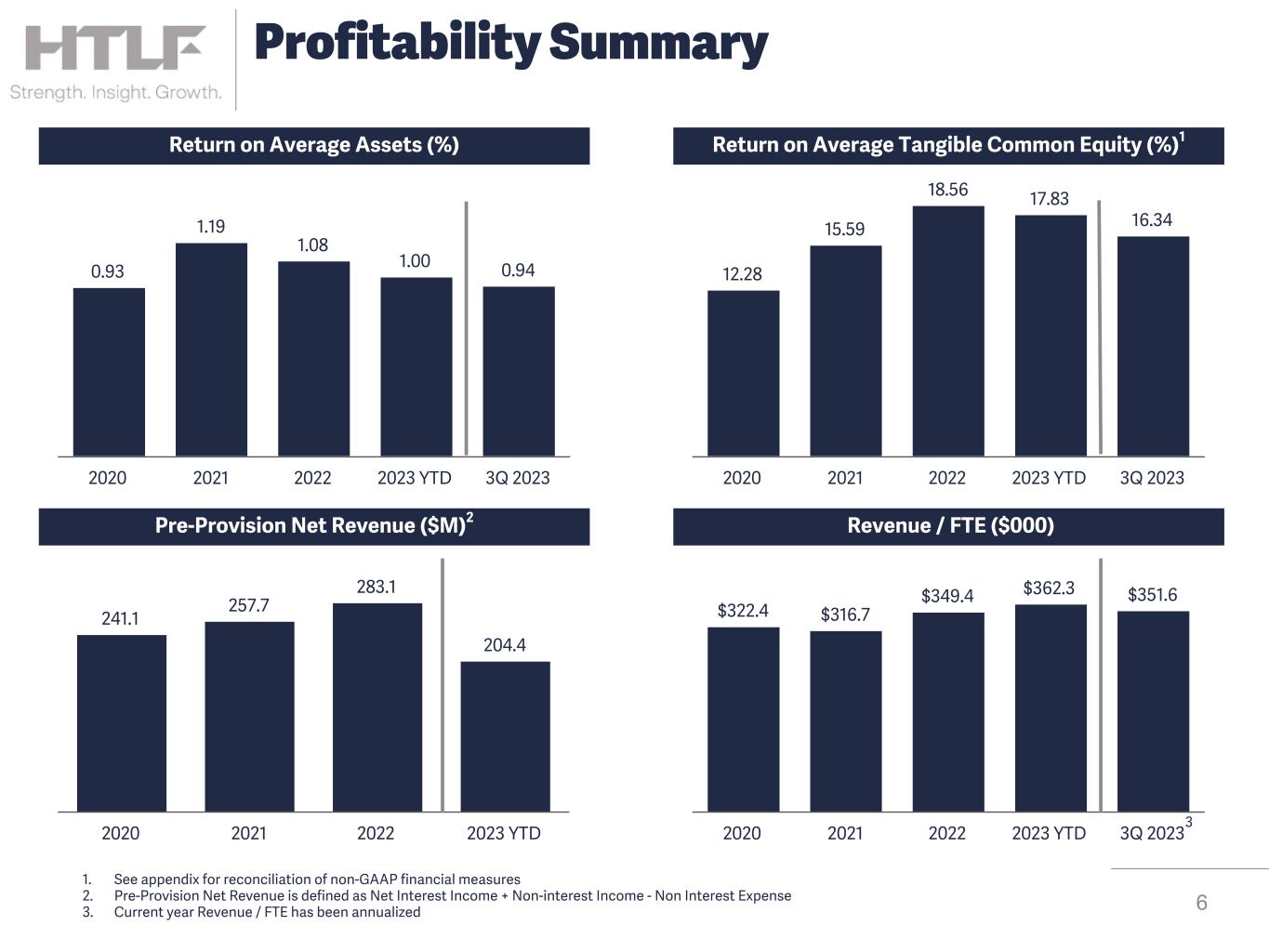

| Return on average assets | 0.94 | % | 1.13 | % | 1.00 | % | 1.04 | % | |||||||||||||||

| Return on average common equity | 10.47 | 12.93 | 11.28 | 10.80 | |||||||||||||||||||

Return on average tangible common equity (non-GAAP)(1) |

16.34 | 20.76 | 17.83 | 16.79 | |||||||||||||||||||

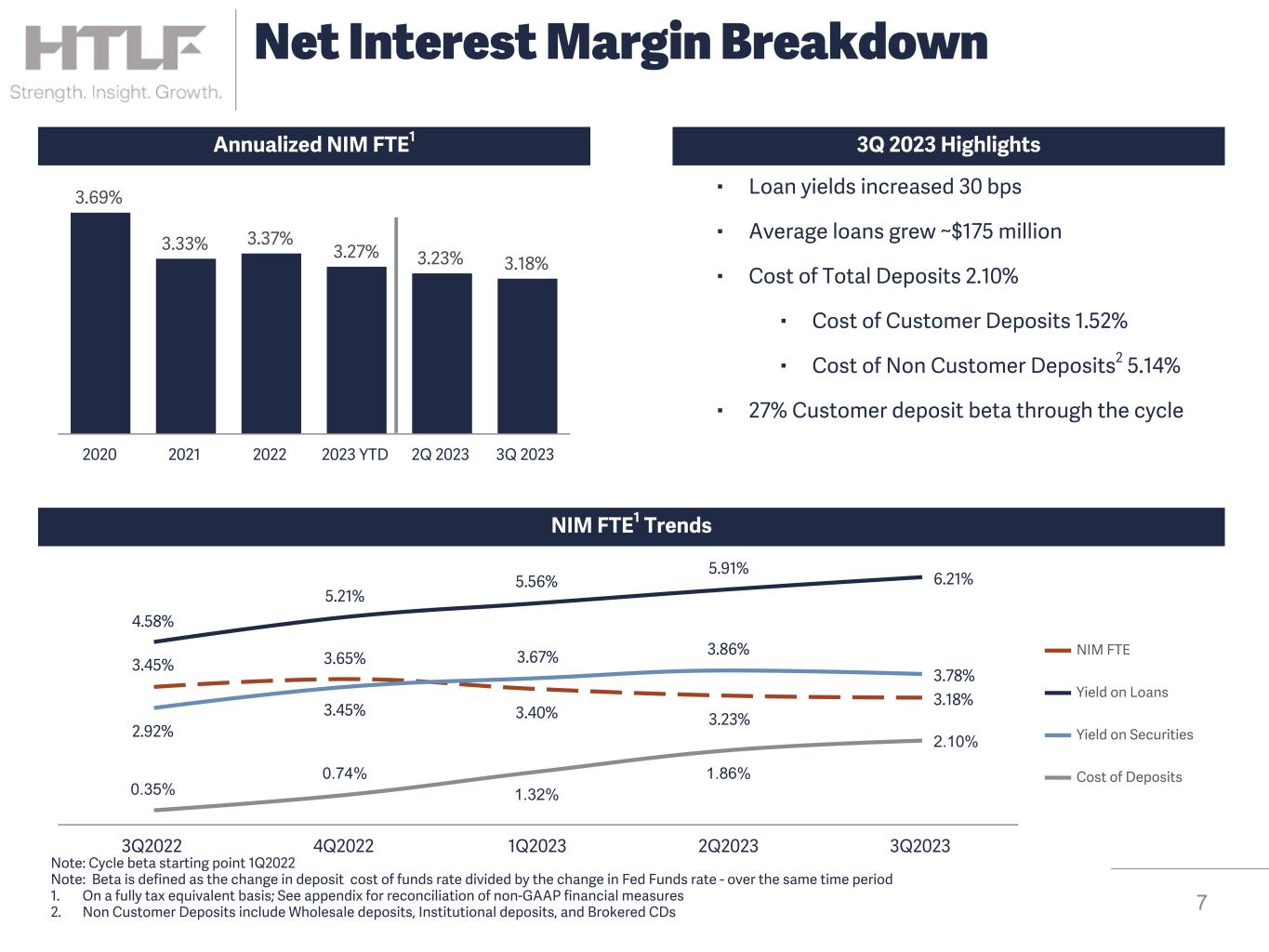

| Net interest margin | 3.14 | 3.41 | 3.23 | 3.22 | |||||||||||||||||||

Net interest margin, fully tax-equivalent (non-GAAP)(1) |

3.18 | 3.45 | 3.27 | 3.27 | |||||||||||||||||||

| Efficiency ratio | 63.77 | 58.84 | 61.86 | 61.39 | |||||||||||||||||||

Adjusted efficiency ratio, fully-tax equivalent (non-GAAP)(1) |

59.95 | 55.26 | 58.98 | 58.99 | |||||||||||||||||||

"HTLF delivered another solid quarter highlighted by loan and customer deposit growth, reduced wholesale deposits and continued stable credit quality while effectively managing core expenses. We are also pleased that we successfully completed the final charter consolidation and look forward to 2024 with this significant project behind us." | ||

| Bruce K. Lee, President and Chief Executive Officer, HTLF | ||

| HEARTLAND FINANCIAL USA, INC. | |||||||||||||||||||||||

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) | |||||||||||||||||||||||

| DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA | |||||||||||||||||||||||

| For the Quarter Ended September 30, |

For the Nine Months Ended September 30, |

||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| Interest Income | |||||||||||||||||||||||

| Interest and fees on loans | $ | 182,394 | $ | 122,913 | $ | 505,136 | $ | 334,000 | |||||||||||||||

| Interest on securities: | |||||||||||||||||||||||

| Taxable | 54,800 | 45,648 | 168,948 | 116,366 | |||||||||||||||||||

| Nontaxable | 6,584 | 6,164 | 18,990 | 17,874 | |||||||||||||||||||

| Interest on federal funds sold | 3 | — | 3 | — | |||||||||||||||||||

| Interest on deposits with other banks and short-term investments | 1,651 | 1,081 | 4,833 | 1,715 | |||||||||||||||||||

| Total Interest Income | 245,432 | 175,806 | 697,910 | 469,955 | |||||||||||||||||||

| Interest Expense | |||||||||||||||||||||||

| Interest on deposits | 92,744 | 15,158 | 231,617 | 24,665 | |||||||||||||||||||

| Interest on short-term borrowings | 1,167 | 360 | 4,437 | 494 | |||||||||||||||||||

| Interest on other borrowings | 5,765 | 4,412 | 16,756 | 11,780 | |||||||||||||||||||

| Total Interest Expense | 99,676 | 19,930 | 252,810 | 36,939 | |||||||||||||||||||

| Net Interest Income | 145,756 | 155,876 | 445,100 | 433,016 | |||||||||||||||||||

| Provision for credit losses | 1,516 | 5,492 | 9,969 | 11,983 | |||||||||||||||||||

| Net Interest Income After Provision for Credit Losses | 144,240 | 150,384 | 435,131 | 421,033 | |||||||||||||||||||

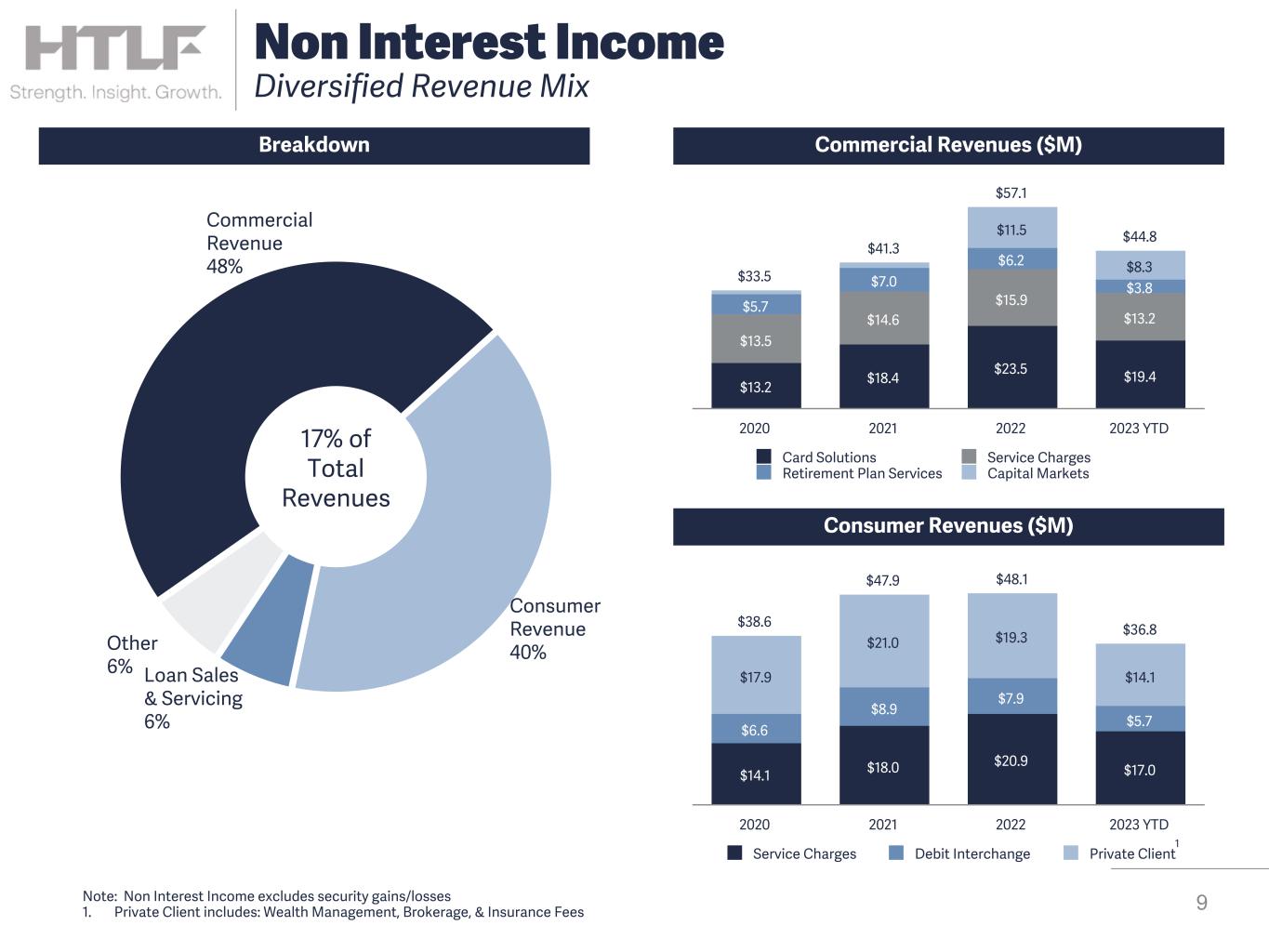

| Noninterest Income | |||||||||||||||||||||||

| Service charges and fees | 18,553 | 17,282 | 55,316 | 50,599 | |||||||||||||||||||

| Loan servicing income | 278 | 831 | 1,403 | 1,951 | |||||||||||||||||||

| Trust fees | 4,734 | 5,372 | 15,810 | 17,130 | |||||||||||||||||||

| Brokerage and insurance commissions | 692 | 649 | 2,065 | 2,357 | |||||||||||||||||||

| Capital markets fees | 1,845 | 1,809 | 8,331 | 9,719 | |||||||||||||||||||

| Securities losses, net | (114) | (1,055) | (1,532) | (272) | |||||||||||||||||||

| Unrealized gain/(loss) on equity securities, net | 13 | (211) | 165 | (615) | |||||||||||||||||||

| Net gains on sale of loans held for sale | 905 | 1,832 | 3,786 | 8,144 | |||||||||||||||||||

| Valuation adjustment on servicing rights | — | — | — | 1,658 | |||||||||||||||||||

| Income on bank owned life insurance | 858 | 694 | 3,042 | 1,741 | |||||||||||||||||||

| Other noninterest income | 619 | 1,978 | 2,489 | 5,877 | |||||||||||||||||||

| Total Noninterest Income | 28,383 | 29,181 | 90,875 | 98,289 | |||||||||||||||||||

| Noninterest Expense | |||||||||||||||||||||||

| Salaries and employee benefits | 62,262 | 62,661 | 186,510 | 192,867 | |||||||||||||||||||

| Occupancy | 6,438 | 6,794 | 20,338 | 21,250 | |||||||||||||||||||

| Furniture and equipment | 2,720 | 2,928 | 8,698 | 9,480 | |||||||||||||||||||

| Professional fees | 13,616 | 14,289 | 41,607 | 42,286 | |||||||||||||||||||

| FDIC insurance assessments | 3,313 | 1,988 | 9,627 | 5,134 | |||||||||||||||||||

| Advertising | 1,633 | 1,554 | 6,670 | 4,392 | |||||||||||||||||||

| Core deposit and customer relationship intangibles amortization | 1,625 | 1,856 | 5,128 | 5,993 | |||||||||||||||||||

| Other real estate and loan collection expenses, net | 481 | 304 | 984 | 577 | |||||||||||||||||||

| (Gain)/loss on sales/valuations of assets, net | 108 | (251) | (2,149) | (3,435) | |||||||||||||||||||

| Acquisition, integration and restructuring costs | 2,429 | 2,156 | 5,994 | 5,144 | |||||||||||||||||||

| Partnership investment in tax credit projects | 1,136 | 979 | 1,828 | 1,793 | |||||||||||||||||||

| Other noninterest expenses | 15,292 | 13,625 | 46,307 | 40,678 | |||||||||||||||||||

| Total Noninterest Expense | 111,053 | 108,883 | 331,542 | 326,159 | |||||||||||||||||||

| Income Before Income Taxes | 61,570 | 70,682 | 194,464 | 193,163 | |||||||||||||||||||

| Income taxes | 13,479 | 14,118 | 44,181 | 41,637 | |||||||||||||||||||

| Net Income | 48,091 | 56,564 | 150,283 | 151,526 | |||||||||||||||||||

| Preferred dividends | (2,013) | (2,013) | (6,038) | (6,038) | |||||||||||||||||||

| Net Income Available to Common Stockholders | $ | 46,078 | $ | 54,551 | $ | 144,245 | $ | 145,488 | |||||||||||||||

| Earnings per common share-diluted | $ | 1.08 | $ | 1.28 | $ | 3.37 | $ | 3.42 | |||||||||||||||

| Weighted average shares outstanding-diluted | 42,812,563 | 42,643,940 | 42,769,872 | 42,596,301 | |||||||||||||||||||

| HEARTLAND FINANCIAL USA, INC. | |||||||||||||||||||||||||||||

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) | |||||||||||||||||||||||||||||

| DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA | |||||||||||||||||||||||||||||

| For the Quarter Ended | |||||||||||||||||||||||||||||

| 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |||||||||||||||||||||||||

| Interest Income | |||||||||||||||||||||||||||||

| Interest and fees on loans | $ | 182,394 | $ | 168,899 | $ | 153,843 | $ | 143,970 | $ | 122,913 | |||||||||||||||||||

| Interest on securities: | |||||||||||||||||||||||||||||

| Taxable | 54,800 | 58,172 | 55,976 | 53,178 | 45,648 | ||||||||||||||||||||||||

| Nontaxable | 6,584 | 6,378 | 6,028 | 6,132 | 6,164 | ||||||||||||||||||||||||

| Interest on federal funds sold | 3 | — | — | 11 | — | ||||||||||||||||||||||||

| Interest on deposits with other banks and short-term investments | 1,651 | 2,051 | 1,131 | 1,410 | 1,081 | ||||||||||||||||||||||||

| Total Interest Income | 245,432 | 235,500 | 216,978 | 204,701 | 175,806 | ||||||||||||||||||||||||

| Interest Expense | |||||||||||||||||||||||||||||

| Interest on deposits | 92,744 | 81,975 | 56,898 | 32,215 | 15,158 | ||||||||||||||||||||||||

| Interest on short-term borrowings | 1,167 | 848 | 2,422 | 2,223 | 360 | ||||||||||||||||||||||||

| Interest on other borrowings | 5,765 | 5,545 | 5,446 | 5,043 | 4,412 | ||||||||||||||||||||||||

| Total Interest Expense | 99,676 | 88,368 | 64,766 | 39,481 | 19,930 | ||||||||||||||||||||||||

| Net Interest Income | 145,756 | 147,132 | 152,212 | 165,220 | 155,876 | ||||||||||||||||||||||||

| Provision for credit losses | 1,516 | 5,379 | 3,074 | 3,387 | 5,492 | ||||||||||||||||||||||||

| Net Interest Income After Provision for Credit Losses | 144,240 | 141,753 | 149,138 | 161,833 | 150,384 | ||||||||||||||||||||||||

| Noninterest Income | |||||||||||||||||||||||||||||

| Service charges and fees | 18,553 | 19,627 | 17,136 | 17,432 | 17,282 | ||||||||||||||||||||||||

| Loan servicing income | 278 | 411 | 714 | 790 | 831 | ||||||||||||||||||||||||

| Trust fees | 4,734 | 5,419 | 5,657 | 5,440 | 5,372 | ||||||||||||||||||||||||

| Brokerage and insurance commissions | 692 | 677 | 696 | 629 | 649 | ||||||||||||||||||||||||

| Capital markets fees | 1,845 | 4,037 | 2,449 | 1,824 | 1,809 | ||||||||||||||||||||||||

| Securities losses, net | (114) | (314) | (1,104) | (153) | (1,055) | ||||||||||||||||||||||||

| Unrealized gain/(loss) on equity securities, net | 13 | (41) | 193 | (7) | (211) | ||||||||||||||||||||||||

| Net gains on sale of loans held for sale | 905 | 1,050 | 1,831 | 888 | 1,832 | ||||||||||||||||||||||||

| Valuation adjustment on servicing rights | — | — | — | — | — | ||||||||||||||||||||||||

| Income on bank owned life insurance | 858 | 1,220 | 964 | 600 | 694 | ||||||||||||||||||||||||

| Other noninterest income | 619 | 407 | 1,463 | 2,532 | 1,978 | ||||||||||||||||||||||||

| Total Noninterest Income | 28,383 | 32,493 | 29,999 | 29,975 | 29,181 | ||||||||||||||||||||||||

| Noninterest Expense | |||||||||||||||||||||||||||||

| Salaries and employee benefits | 62,262 | 62,099 | 62,149 | 61,611 | 62,661 | ||||||||||||||||||||||||

| Occupancy | 6,438 | 6,691 | 7,209 | 6,905 | 6,794 | ||||||||||||||||||||||||

| Furniture and equipment | 2,720 | 3,063 | 2,915 | 3,019 | 2,928 | ||||||||||||||||||||||||

| Professional fees | 13,616 | 15,194 | 12,797 | 16,320 | 14,289 | ||||||||||||||||||||||||

| FDIC insurance assessments | 3,313 | 3,035 | 3,279 | 1,866 | 1,988 | ||||||||||||||||||||||||

| Advertising | 1,633 | 3,052 | 1,985 | 1,829 | 1,554 | ||||||||||||||||||||||||

| Core deposit and customer relationship intangibles amortization | 1,625 | 1,715 | 1,788 | 1,841 | 1,856 | ||||||||||||||||||||||||

| Other real estate and loan collection expenses, net | 481 | 348 | 155 | 373 | 304 | ||||||||||||||||||||||||

| (Gain)/loss on sales/valuations of assets, net | 108 | (3,372) | 1,115 | 2,388 | (251) | ||||||||||||||||||||||||

| Acquisition, integration and restructuring costs | 2,429 | 1,892 | 1,673 | 2,442 | 2,156 | ||||||||||||||||||||||||

| Partnership investment in tax credit projects | 1,136 | 154 | 538 | 3,247 | 979 | ||||||||||||||||||||||||

| Other noninterest expenses | 15,292 | 15,575 | 15,440 | 15,377 | 13,625 | ||||||||||||||||||||||||

| Total Noninterest Expense | 111,053 | 109,446 | 111,043 | 117,218 | 108,883 | ||||||||||||||||||||||||

| Income Before Income Taxes | 61,570 | 64,800 | 68,094 | 74,590 | 70,682 | ||||||||||||||||||||||||

| Income taxes | 13,479 | 15,384 | 15,318 | 13,936 | 14,118 | ||||||||||||||||||||||||

| Net Income | 48,091 | 49,416 | 52,776 | 60,654 | 56,564 | ||||||||||||||||||||||||

| Preferred dividends | (2,013) | (2,012) | (2,013) | (2,012) | (2,013) | ||||||||||||||||||||||||

| Net Income Available to Common Stockholders | $ | 46,078 | $ | 47,404 | $ | 50,763 | $ | 58,642 | $ | 54,551 | |||||||||||||||||||

| Earnings per common share-diluted | $ | 1.08 | $ | 1.11 | $ | 1.19 | $ | 1.37 | $ | 1.28 | |||||||||||||||||||

| Weighted average shares outstanding-diluted | 42,812,563 | 42,757,603 | 42,742,878 | 42,699,752 | 42,643,940 | ||||||||||||||||||||||||

| HEARTLAND FINANCIAL USA, INC. | |||||||||||||||||||||||||||||

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) | |||||||||||||||||||||||||||||

| DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA | |||||||||||||||||||||||||||||

| As of | |||||||||||||||||||||||||||||

| 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |||||||||||||||||||||||||

| Assets | |||||||||||||||||||||||||||||

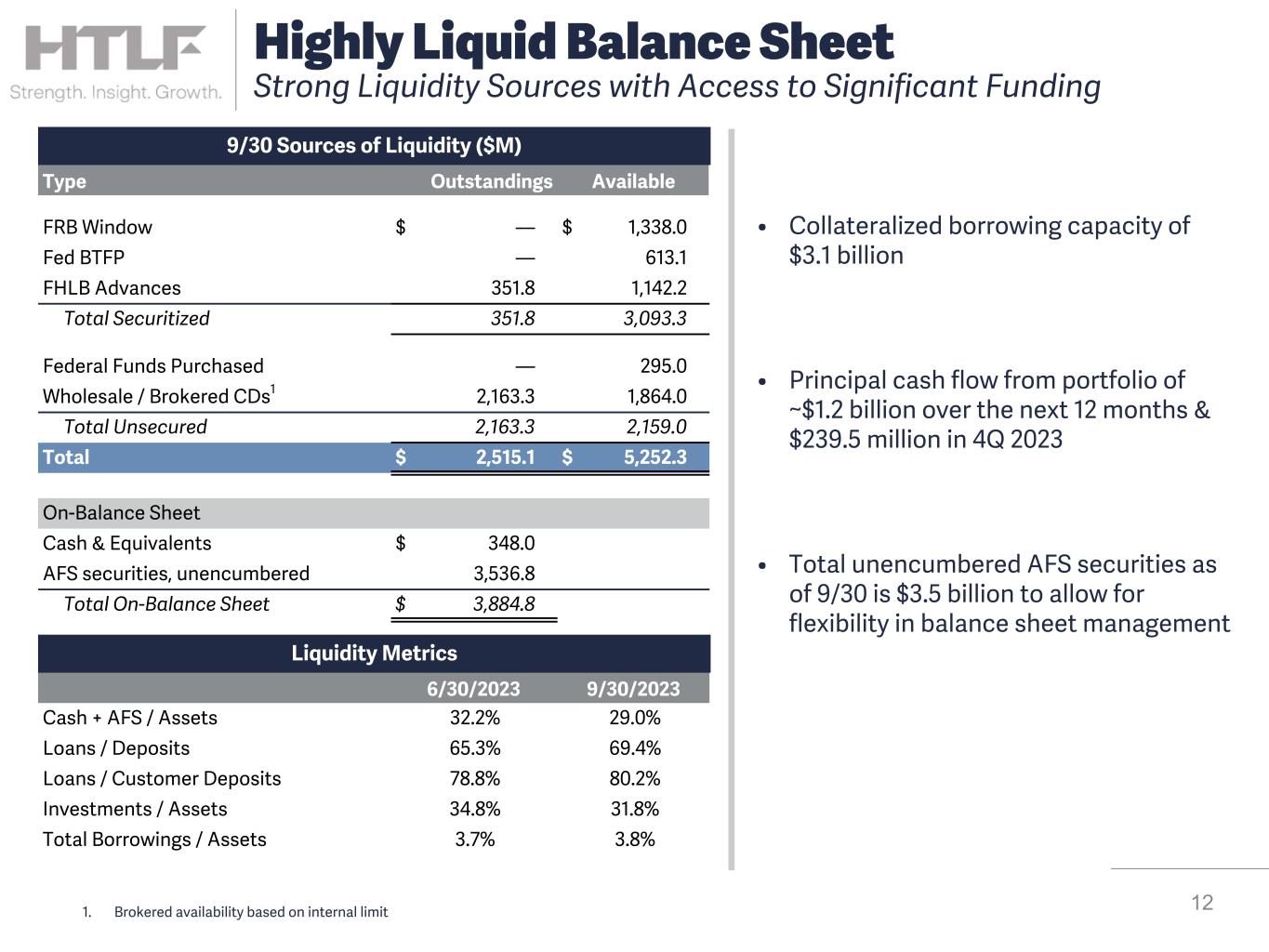

| Cash and due from banks | $ | 248,756 | $ | 317,303 | $ | 274,354 | $ | 309,045 | $ | 250,394 | |||||||||||||||||||

| Interest bearing deposits with other banks and short-term investments | 99,239 | 82,884 | 87,757 | 54,042 | 149,466 | ||||||||||||||||||||||||

| Cash and cash equivalents | 347,995 | 400,187 | 362,111 | 363,087 | 399,860 | ||||||||||||||||||||||||

| Time deposits in other financial institutions | 1,490 | 1,490 | 1,740 | 1,740 | 1,740 | ||||||||||||||||||||||||

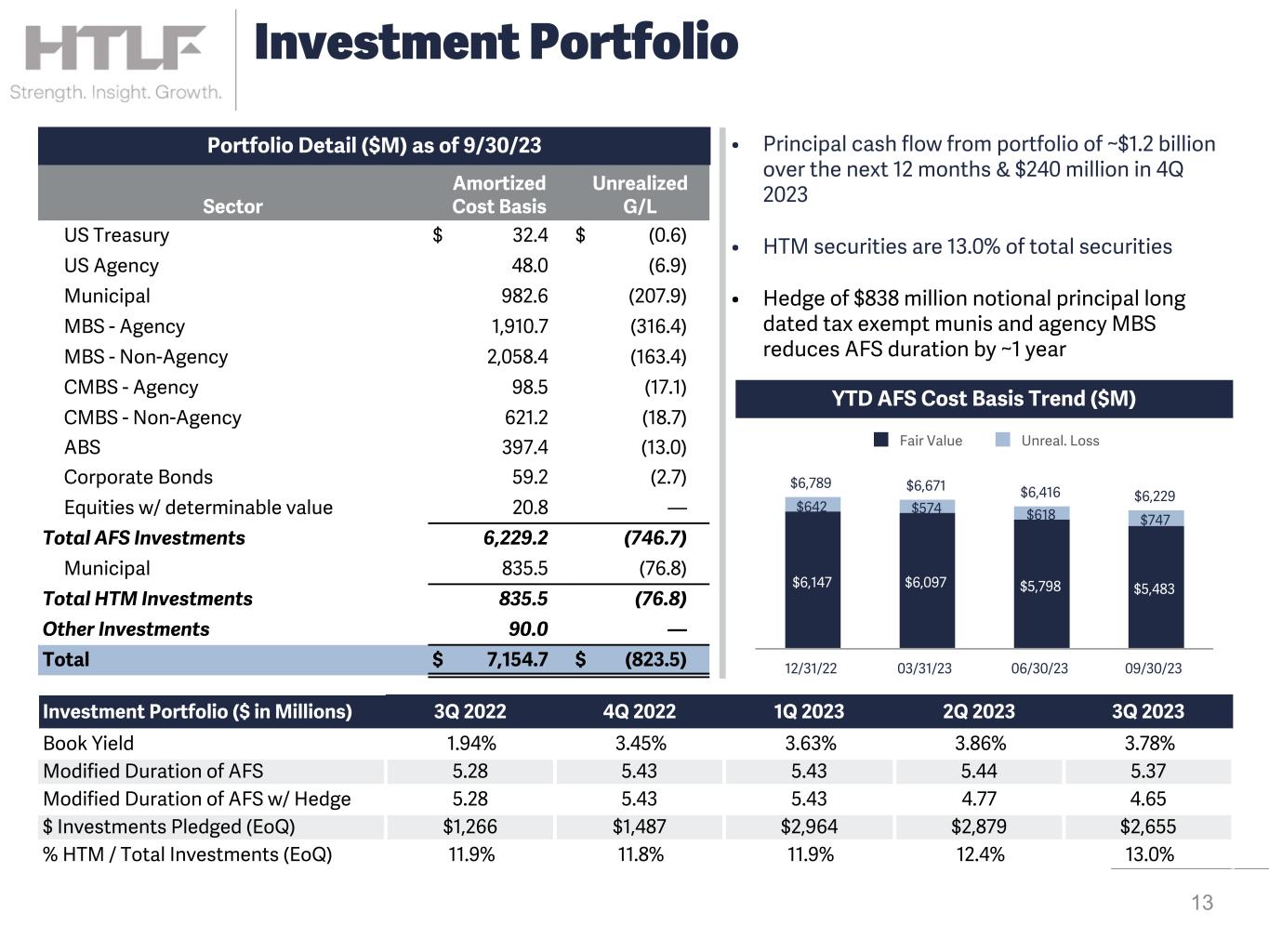

| Securities: | |||||||||||||||||||||||||||||

| Carried at fair value | 5,482,687 | 5,798,041 | 6,096,657 | 6,147,144 | 6,060,331 | ||||||||||||||||||||||||

| Held to maturity, at cost, less allowance for credit losses | 835,468 | 834,673 | 832,098 | 829,403 | 830,247 | ||||||||||||||||||||||||

| Other investments, at cost | 90,001 | 72,291 | 72,364 | 74,567 | 80,286 | ||||||||||||||||||||||||

| Loans held for sale | 6,262 | 14,353 | 10,425 | 5,277 | 9,570 | ||||||||||||||||||||||||

| Loans: | |||||||||||||||||||||||||||||

| Held to maturity | 11,872,436 | 11,717,974 | 11,495,353 | 11,428,352 | 10,923,532 | ||||||||||||||||||||||||

| Allowance for credit losses | (110,208) | (111,198) | (112,707) | (109,483) | (105,715) | ||||||||||||||||||||||||

| Loans, net | 11,762,228 | 11,606,776 | 11,382,646 | 11,318,869 | 10,817,817 | ||||||||||||||||||||||||

| Premises, furniture and equipment, net | 187,436 | 190,420 | 191,267 | 197,330 | 203,585 | ||||||||||||||||||||||||

| Goodwill | 576,005 | 576,005 | 576,005 | 576,005 | 576,005 | ||||||||||||||||||||||||

| Core deposit and customer relationship intangibles, net | 20,026 | 21,651 | 23,366 | 25,154 | 26,995 | ||||||||||||||||||||||||

| Servicing rights, net | — | — | — | 7,840 | 8,379 | ||||||||||||||||||||||||

| Cash surrender value on life insurance | 196,694 | 195,793 | 194,419 | 193,403 | 193,184 | ||||||||||||||||||||||||

| Other real estate, net | 14,362 | 2,677 | 7,438 | 8,401 | 8,030 | ||||||||||||||||||||||||

| Other assets | 609,139 | 510,359 | 432,008 | 496,008 | 466,921 | ||||||||||||||||||||||||

| Total Assets | $ | 20,129,793 | $ | 20,224,716 | $ | 20,182,544 | $ | 20,244,228 | $ | 19,682,950 | |||||||||||||||||||

| Liabilities and Equity | |||||||||||||||||||||||||||||

| Liabilities | |||||||||||||||||||||||||||||

| Deposits: | |||||||||||||||||||||||||||||

| Demand | $ | 4,792,813 | $ | 4,897,858 | $ | 5,119,554 | $ | 5,701,340 | $ | 6,083,563 | |||||||||||||||||||

| Savings | 8,754,911 | 8,772,596 | 9,256,609 | 9,994,391 | 10,060,523 | ||||||||||||||||||||||||

| Time | 3,553,269 | 3,993,089 | 3,305,183 | 1,817,278 | 1,123,035 | ||||||||||||||||||||||||

| Total deposits | 17,100,993 | 17,663,543 | 17,681,346 | 17,513,009 | 17,267,121 | ||||||||||||||||||||||||

| Short-term borrowings | 392,634 | 44,364 | 92,337 | 376,117 | 147,000 | ||||||||||||||||||||||||

| Other borrowings | 372,059 | 372,403 | 372,097 | 371,753 | 371,446 | ||||||||||||||||||||||||

| Accrued expenses and other liabilities | 438,577 | 285,416 | 207,359 | 248,294 | 241,425 | ||||||||||||||||||||||||

| Total Liabilities | 18,304,263 | 18,365,726 | 18,353,139 | 18,509,173 | 18,026,992 | ||||||||||||||||||||||||

| Stockholders' Equity | |||||||||||||||||||||||||||||

| Preferred equity | 110,705 | 110,705 | 110,705 | 110,705 | 110,705 | ||||||||||||||||||||||||

| Common stock | 42,656 | 42,645 | 42,559 | 42,467 | 42,444 | ||||||||||||||||||||||||

| Capital surplus | 1,088,267 | 1,087,358 | 1,084,112 | 1,080,964 | 1,079,277 | ||||||||||||||||||||||||

| Retained earnings | 1,226,740 | 1,193,522 | 1,158,948 | 1,120,925 | 1,074,168 | ||||||||||||||||||||||||

| Accumulated other comprehensive loss | (642,838) | (575,240) | (566,919) | (620,006) | (650,636) | ||||||||||||||||||||||||

| Total Equity | 1,825,530 | 1,858,990 | 1,829,405 | 1,735,055 | 1,655,958 | ||||||||||||||||||||||||

| Total Liabilities and Equity | $ | 20,129,793 | $ | 20,224,716 | $ | 20,182,544 | $ | 20,244,228 | $ | 19,682,950 | |||||||||||||||||||

| HEARTLAND FINANCIAL USA, INC. | |||||||||||||||||||||||||||||

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) | |||||||||||||||||||||||||||||

| DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA AND FULL TIME EQUIVALENT EMPLOYEE DATA | |||||||||||||||||||||||||||||

| For the Quarter Ended | |||||||||||||||||||||||||||||

| 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |||||||||||||||||||||||||

| Average Balances | |||||||||||||||||||||||||||||

| Assets | $ | 20,207,920 | $ | 20,221,511 | $ | 20,118,005 | $ | 19,913,849 | $ | 19,775,341 | |||||||||||||||||||

| Loans, net of unearned | 11,800,064 | 11,625,442 | 11,378,078 | 11,117,513 | 10,783,135 | ||||||||||||||||||||||||

| Deposits | 17,507,813 | 17,689,138 | 17,505,867 | 17,319,218 | 17,282,289 | ||||||||||||||||||||||||

| Earning assets | 18,439,010 | 18,523,552 | 18,392,649 | 18,175,838 | 18,157,795 | ||||||||||||||||||||||||

| Interest bearing liabilities | 13,158,631 | 13,209,794 | 12,582,234 | 11,980,032 | 11,723,026 | ||||||||||||||||||||||||

| Common equity | 1,746,818 | 1,727,013 | 1,655,860 | 1,548,739 | 1,674,306 | ||||||||||||||||||||||||

| Total stockholders' equity | 1,857,523 | 1,837,718 | 1,766,565 | 1,659,444 | 1,785,011 | ||||||||||||||||||||||||

Tangible common equity (non-GAAP)(1) |

1,149,992 | 1,128,527 | 1,055,617 | 946,688 | 1,070,399 | ||||||||||||||||||||||||

| Key Performance Ratios | |||||||||||||||||||||||||||||

| Annualized return on average assets | 0.94 | % | 0.98 | % | 1.06 | % | 1.21 | % | 1.13 | % | |||||||||||||||||||

| Annualized return on average common equity (GAAP) | 10.47 | 11.01 | 12.43 | 15.02 | 12.93 | ||||||||||||||||||||||||

Annualized return on average tangible common equity (non-GAAP)(1) |

16.34 | 17.33 | 20.05 | 25.19 | 20.76 | ||||||||||||||||||||||||

| Annualized ratio of net charge-offs/(recoveries) to average loans | 0.12 | 0.32 | (0.04) | (0.06) | 0.00 | ||||||||||||||||||||||||

| Annualized net interest margin (GAAP) | 3.14 | 3.19 | 3.36 | 3.61 | 3.41 | ||||||||||||||||||||||||

Annualized net interest margin, fully tax-equivalent (non-GAAP)(1) |

3.18 | 3.23 | 3.40 | 3.65 | 3.45 | ||||||||||||||||||||||||

| Efficiency ratio (GAAP) | 63.77 | 60.93 | 60.94 | 60.05 | 58.84 | ||||||||||||||||||||||||

Adjusted efficiency ratio, fully tax-equivalent (non-GAAP)(1) |

59.95 | 59.88 | 57.16 | 54.33 | 55.26 | ||||||||||||||||||||||||

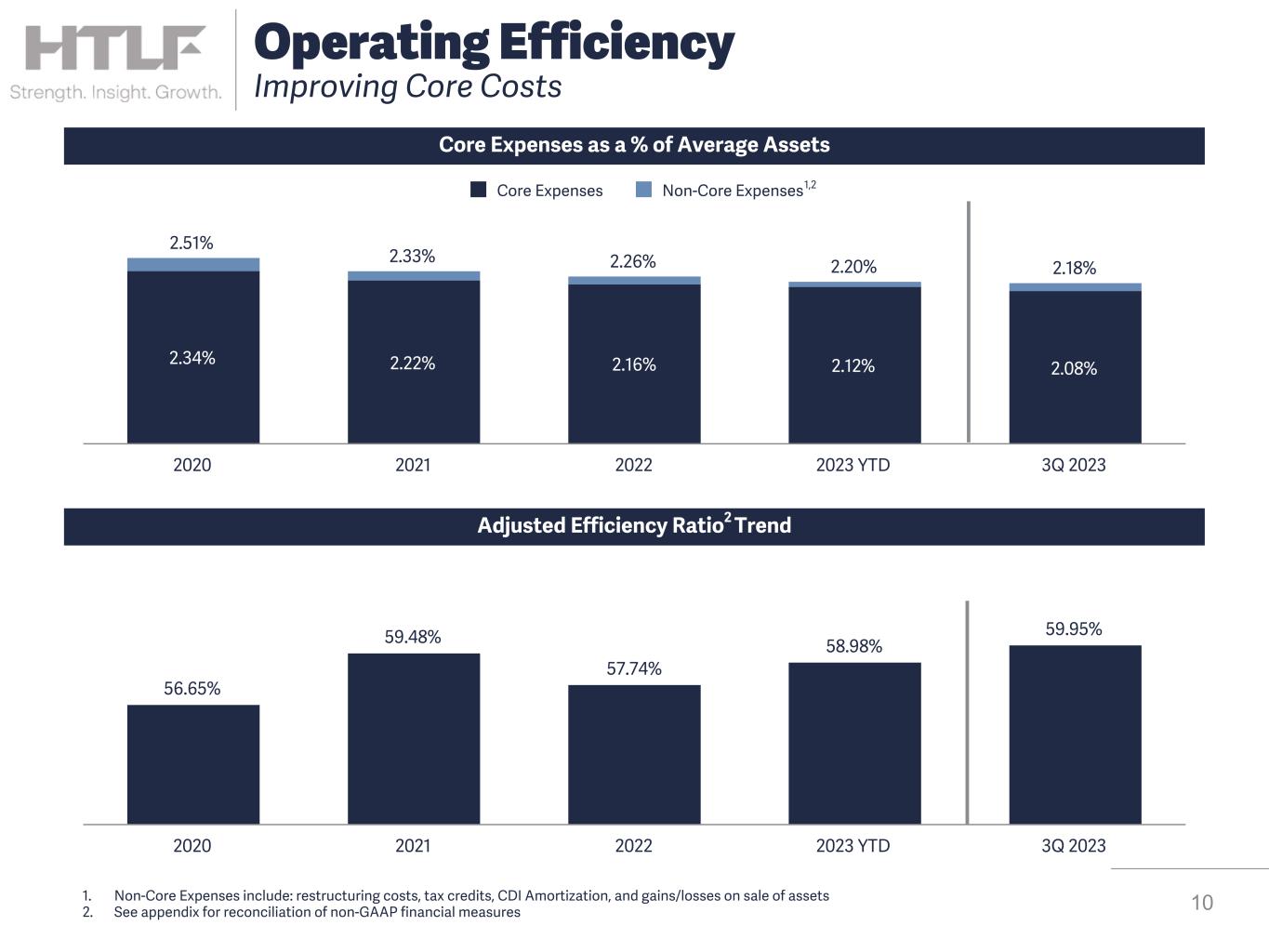

| Annualized ratio of total noninterest expenses to average assets (GAAP) | 2.18 | 2.17 | 2.24 | 2.34 | 2.18 | ||||||||||||||||||||||||

Annualized ratio of core expenses to average assets (non-GAAP)(1) |

2.08 | 2.16 | 2.14 | 2.14 | 2.09 | ||||||||||||||||||||||||

| (1) Refer to "Non-GAAP Measures" in this earnings release for additional information on the usage and presentation of these non-GAAP measures, and refer to these financial tables for the reconciliations to the most directly comparable GAAP measures. | |||||||||||||||||||||||||||||

| For the Quarter Ended September 30, |

For the Nine Months Ended September 30, |

||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| Average Balances | |||||||||||||||||||||||

| Assets | $ | 20,207,920 | $ | 19,775,341 | $ | 20,182,808 | $ | 19,523,433 | |||||||||||||||

| Loans, net of unearned | 11,800,064 | 10,783,135 | 11,602,741 | 10,437,409 | |||||||||||||||||||

| Deposits | 17,507,813 | 17,282,289 | 17,567,614 | 16,931,730 | |||||||||||||||||||

| Earning assets | 18,439,010 | 18,157,795 | 18,451,907 | 17,969,001 | |||||||||||||||||||

| Interest bearing liabilities | 13,158,631 | 11,723,026 | 12,985,665 | 11,255,232 | |||||||||||||||||||

| Common equity | 1,746,818 | 1,674,306 | 1,710,230 | 1,801,835 | |||||||||||||||||||

| Total stockholders' equity | 1,857,523 | 1,785,011 | 1,820,935 | 1,912,540 | |||||||||||||||||||

| Tangible common stockholders' equity | 1,149,992 | 1,070,399 | 1,111,724 | 1,195,952 | |||||||||||||||||||

| Key Performance Ratios | |||||||||||||||||||||||

| Annualized return on average assets | 0.94 | % | 1.13 | % | 1.00 | % | 1.04 | % | |||||||||||||||

| Annualized return on average common equity (GAAP) | 10.47 | 12.93 | 11.28 | 10.80 | |||||||||||||||||||

Annualized return on average tangible common equity (non-GAAP)(1) |

16.34 | 20.76 | 17.83 | 16.79 | |||||||||||||||||||

| Annualized ratio of net charge-offs/(recoveries) to average loans | 0.12 | 0.00 | 0.14 | 0.17 | |||||||||||||||||||

| Annualized net interest margin (GAAP) | 3.14 | 3.41 | 3.23 | 3.22 | |||||||||||||||||||

Annualized net interest margin, fully tax-equivalent (non-GAAP)(1) |

3.18 | 3.45 | 3.27 | 3.27 | |||||||||||||||||||

| Efficiency ratio (GAAP) | 63.77 | 58.84 | 61.86 | 61.39 | |||||||||||||||||||

Adjusted efficiency ratio, fully tax-equivalent (non-GAAP)(1) |

59.95 | 55.26 | 58.98 | 58.99 | |||||||||||||||||||

| Total noninterest expenses to average assets (GAAP) | 2.18 | 2.18 | 2.20 | 2.23 | |||||||||||||||||||

Core expenses to average assets (non-GAAP)(1) |

2.08 | 2.09 | 2.12 | 2.17 | |||||||||||||||||||

| (1) Refer to "Non-GAAP Measures" in this earnings release for additional information on the usage and presentation of these non-GAAP measures, and refer to these financial tables for the reconciliations to the most directly comparable GAAP measures. | |||||||||||||||||||||||

| HEARTLAND FINANCIAL USA, INC. | |||||||||||||||||||||||||||||

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) | |||||||||||||||||||||||||||||

| DOLLARS IN THOUSANDS, EXCEPT PER SHARE AND FULL TIME EQUIVALENT EMPLOYEE DATA | |||||||||||||||||||||||||||||

| As of and for the Quarter Ended | |||||||||||||||||||||||||||||

| 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |||||||||||||||||||||||||

| Common Share Data | |||||||||||||||||||||||||||||

| Book value per common share | $ | 40.20 | $ | 41.00 | $ | 40.38 | $ | 38.25 | $ | 36.41 | |||||||||||||||||||

Tangible book value per common share (non-GAAP)(1) |

26.23 | 26.98 | 26.30 | 24.09 | 22.20 | ||||||||||||||||||||||||

| ASC 320 effect on book value per common share | (16.27) | (14.04) | (13.35) | (14.58) | (15.31) | ||||||||||||||||||||||||

| Common shares outstanding, net of treasury stock | 42,656,303 | 42,644,544 | 42,558,726 | 42,467,394 | 42,444,106 | ||||||||||||||||||||||||

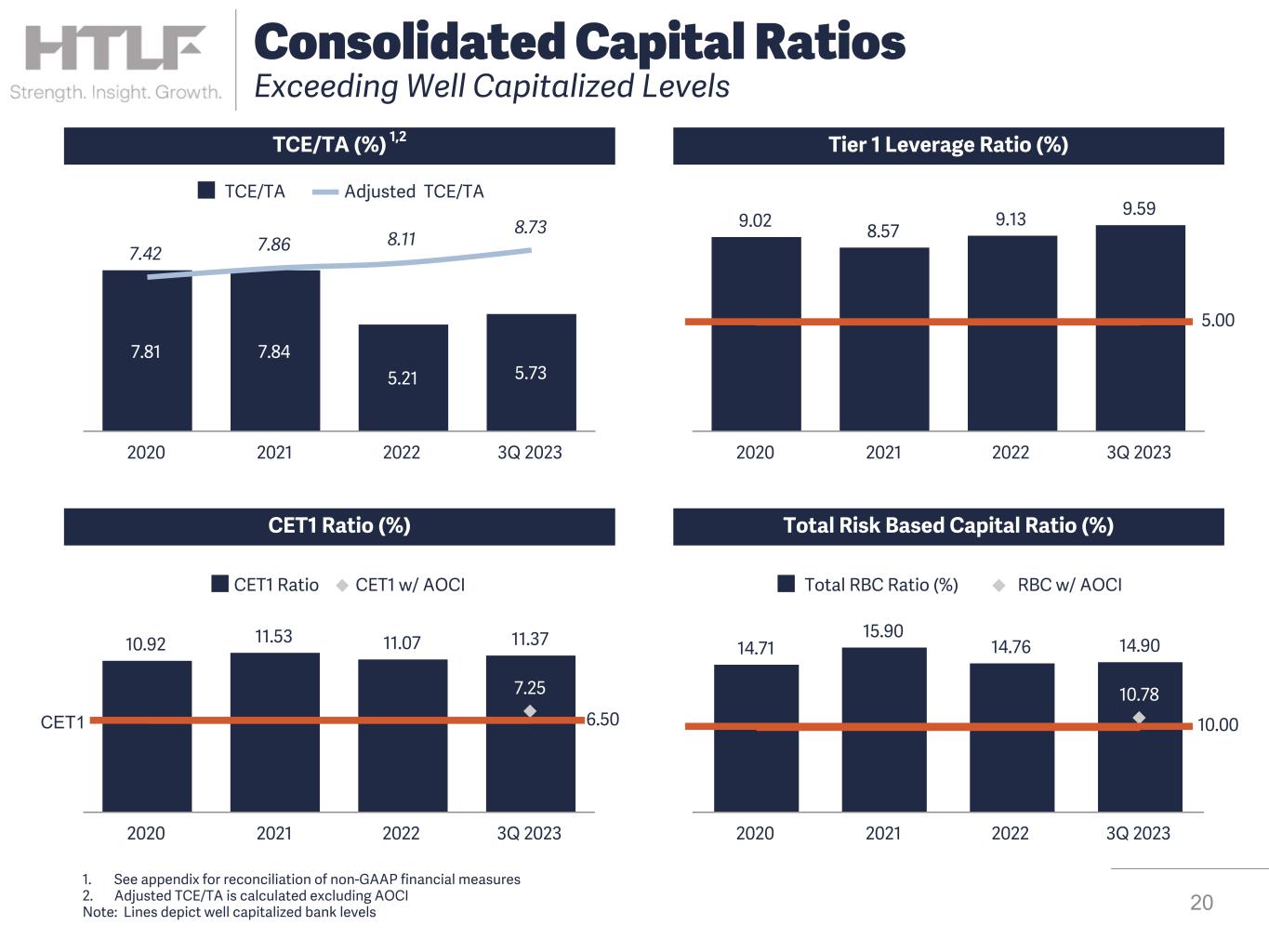

Tangible common equity ratio (non-GAAP)(1) |

5.73 | % | 5.86 | % | 5.72 | % | 5.21 | % | 4.94 | % | |||||||||||||||||||

Adjusted tangible common equity ratio (non-GAAP)(1) |

8.73 | % | 8.54 | % | 8.37 | % | 8.11 | % | 8.07 | % | |||||||||||||||||||

| Other Selected Trend Information | |||||||||||||||||||||||||||||

| Effective tax rate | 21.89 | % | 23.74 | % | 22.50 | % | 18.68 | % | 19.97 | % | |||||||||||||||||||

| Full time equivalent employees | 1,965 | 1,966 | 1,991 | 2,002 | 2,020 | ||||||||||||||||||||||||

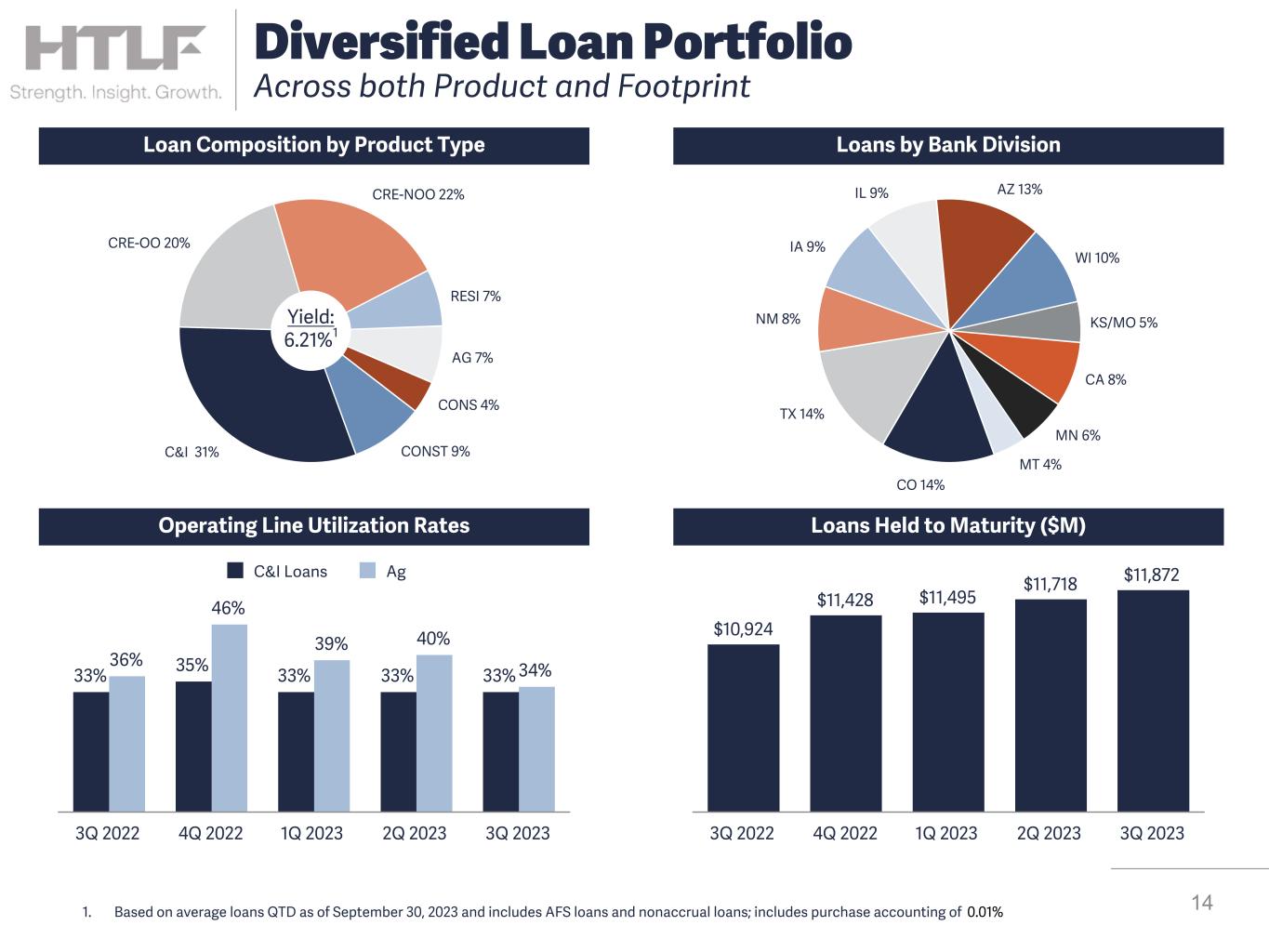

| Loans Held to Maturity | |||||||||||||||||||||||||||||

| Commercial and industrial | $ | 3,591,809 | $ | 3,590,680 | $ | 3,498,345 | $ | 3,464,414 | $ | 3,278,703 | |||||||||||||||||||

| Paycheck Protection Program ("PPP") | 3,750 | 4,139 | 8,258 | 11,025 | 13,506 | ||||||||||||||||||||||||

| Owner occupied commercial real estate | 2,429,659 | 2,398,698 | 2,312,538 | 2,265,307 | 2,285,973 | ||||||||||||||||||||||||

| Commercial and business lending | 6,025,218 | 5,993,517 | 5,819,141 | 5,740,746 | 5,578,182 | ||||||||||||||||||||||||

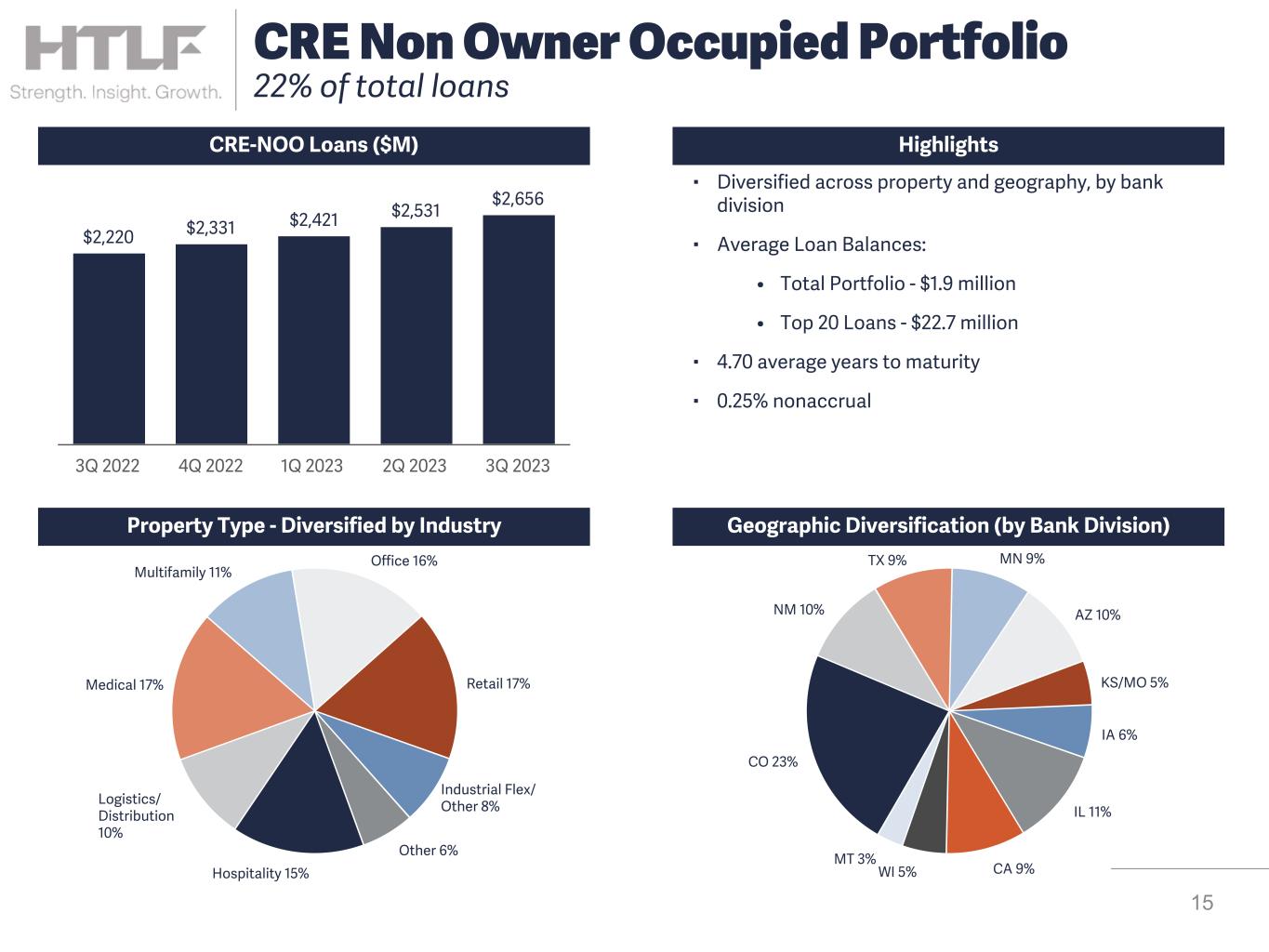

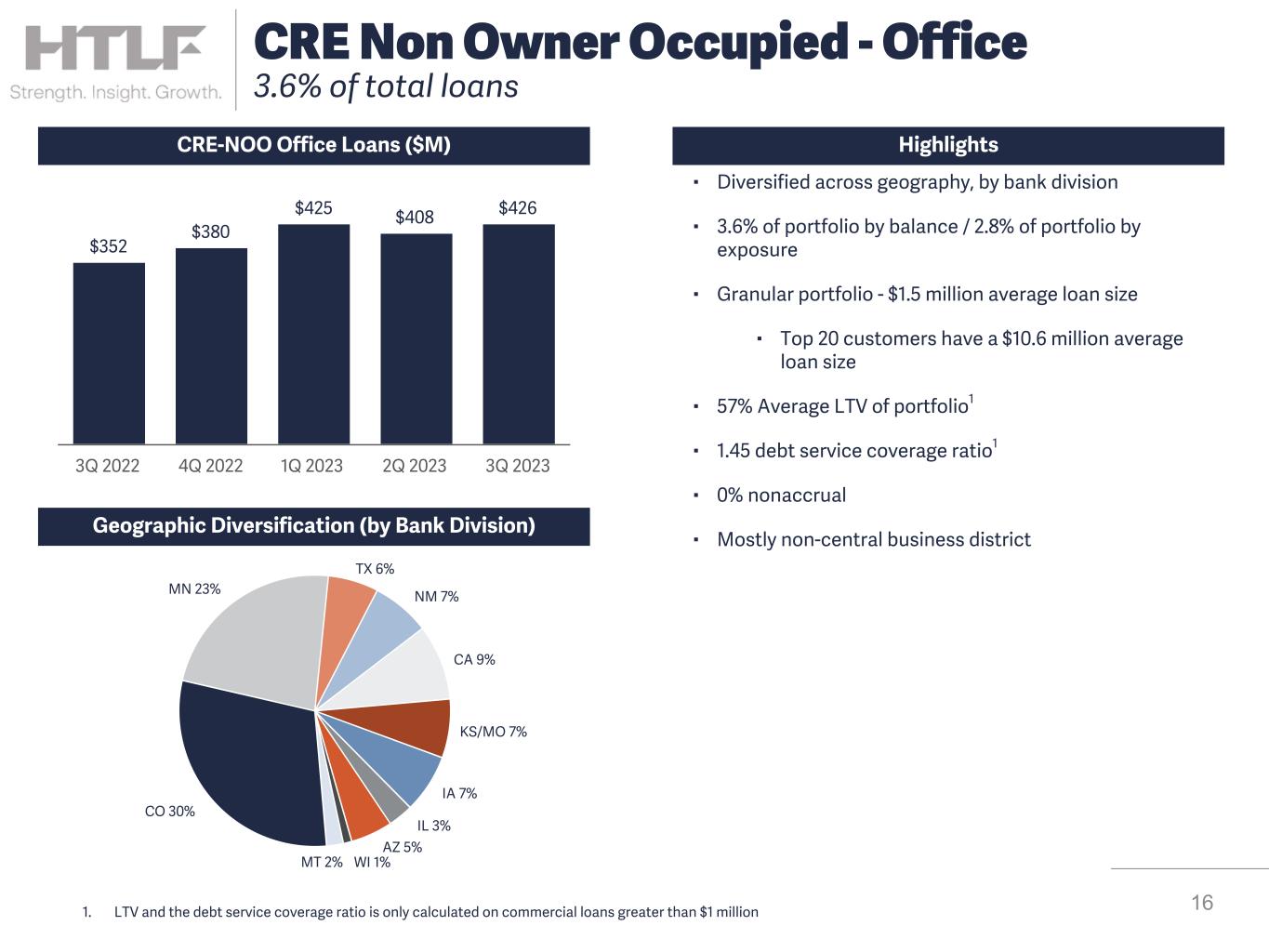

| Non-owner occupied commercial real estate | 2,656,358 | 2,530,736 | 2,421,341 | 2,330,940 | 2,219,542 | ||||||||||||||||||||||||

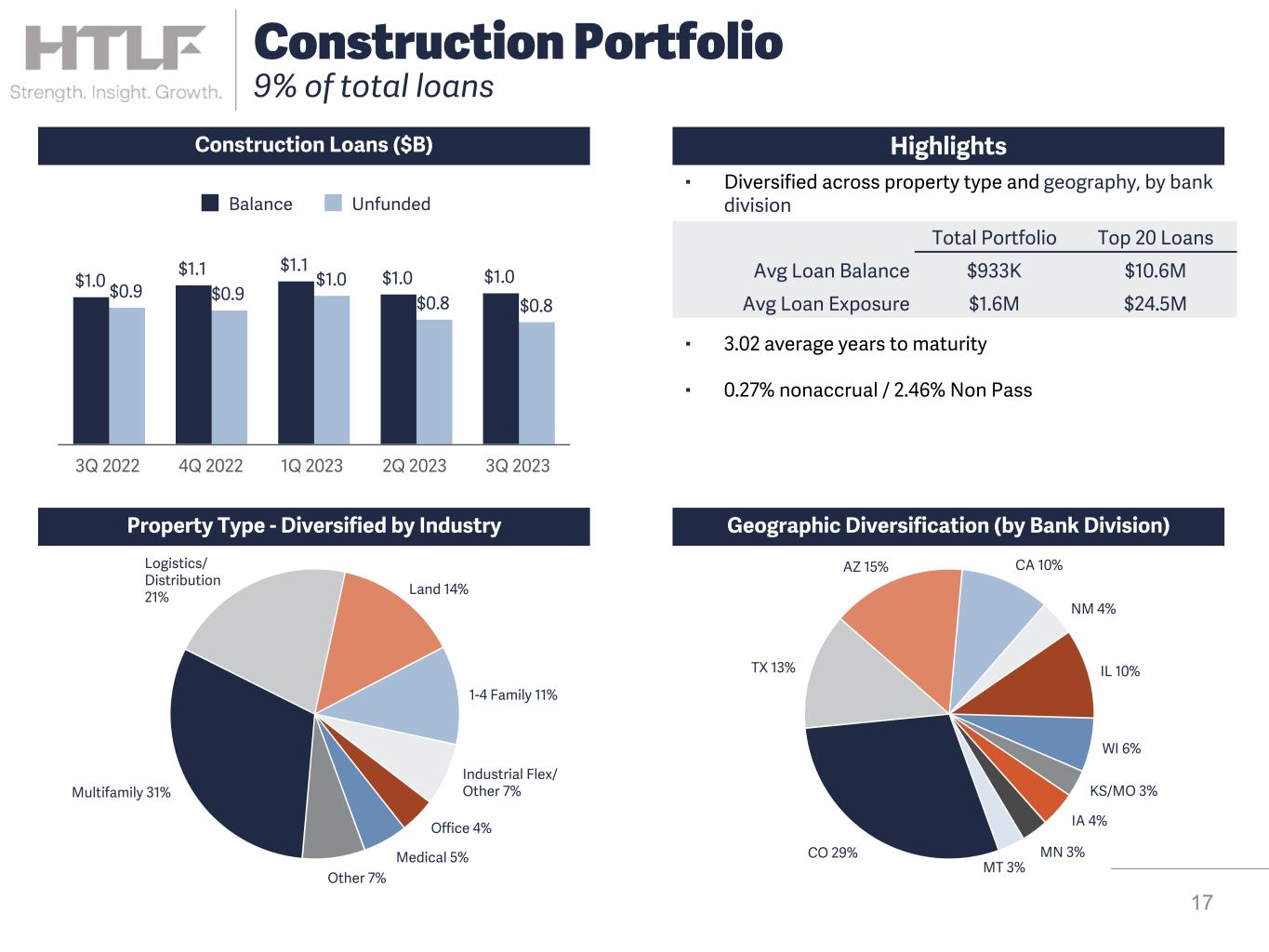

| Real estate construction | 1,029,554 | 1,013,134 | 1,102,186 | 1,076,082 | 996,017 | ||||||||||||||||||||||||

| Commercial real estate lending | 3,685,912 | 3,543,870 | 3,523,527 | 3,407,022 | 3,215,559 | ||||||||||||||||||||||||

| Total commercial lending | 9,711,130 | 9,537,387 | 9,342,668 | 9,147,768 | 8,793,741 | ||||||||||||||||||||||||

| Agricultural and agricultural real estate | 842,116 | 839,817 | 810,183 | 920,510 | 781,354 | ||||||||||||||||||||||||

| Residential mortgage | 813,803 | 828,437 | 841,084 | 853,361 | 852,928 | ||||||||||||||||||||||||

| Consumer | 505,387 | 512,333 | 501,418 | 506,713 | 495,509 | ||||||||||||||||||||||||

| Total loans held to maturity | $ | 11,872,436 | $ | 11,717,974 | $ | 11,495,353 | $ | 11,428,352 | $ | 10,923,532 | |||||||||||||||||||

| Total unfunded loan commitments | $ | 4,813,798 | $ | 4,905,147 | $ | 4,867,925 | $ | 4,729,677 | $ | 4,664,379 | |||||||||||||||||||

| Deposits | |||||||||||||||||||||||||||||

| Demand-customer | $ | 4,792,813 | $ | 4,897,858 | $ | 5,119,554 | $ | 5,701,340 | $ | 6,083,563 | |||||||||||||||||||

| Savings-customer | 8,190,430 | 8,149,596 | 8,501,337 | 8,670,898 | 8,691,545 | ||||||||||||||||||||||||

| Savings-wholesale and institutional | 564,481 | 623,000 | 755,272 | 1,323,493 | 1,368,978 | ||||||||||||||||||||||||

| Total savings | 8,754,911 | 8,772,596 | 9,256,609 | 9,994,391 | 10,060,523 | ||||||||||||||||||||||||

| Time-customer | 1,814,335 | 1,597,849 | 1,071,476 | 851,539 | 973,035 | ||||||||||||||||||||||||

| Time-wholesale | 1,738,934 | 2,395,240 | 2,233,707 | 965,739 | 150,000 | ||||||||||||||||||||||||

| Total time | 3,553,269 | 3,993,089 | 3,305,183 | 1,817,278 | 1,123,035 | ||||||||||||||||||||||||

| Total deposits | $ | 17,100,993 | $ | 17,663,543 | $ | 17,681,346 | $ | 17,513,009 | $ | 17,267,121 | |||||||||||||||||||

| Total customer deposits | $ | 14,797,578 | $ | 14,645,303 | $ | 14,692,367 | $ | 15,223,777 | $ | 15,748,143 | |||||||||||||||||||

| Total wholesale and institutional deposits | 2,303,415 | 3,018,240 | 2,988,979 | 2,289,232 | 1,518,978 | ||||||||||||||||||||||||

| Total deposits | $ | 17,100,993 | $ | 17,663,543 | $ | 17,681,346 | $ | 17,513,009 | $ | 17,267,121 | |||||||||||||||||||

| (1) Refer to "Non-GAAP Measures" in this earnings release for additional information on the usage and presentation of these non-GAAP measures, and refer to these financial tables for the reconciliations to the most directly comparable GAAP measures. | |||||||||||||||||||||||||||||

| HEARTLAND FINANCIAL USA, INC. | |||||||||||||||||||||||||||||

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) | |||||||||||||||||||||||||||||

| DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA | |||||||||||||||||||||||||||||

| As of and for the Quarter Ended | |||||||||||||||||||||||||||||

| 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |||||||||||||||||||||||||

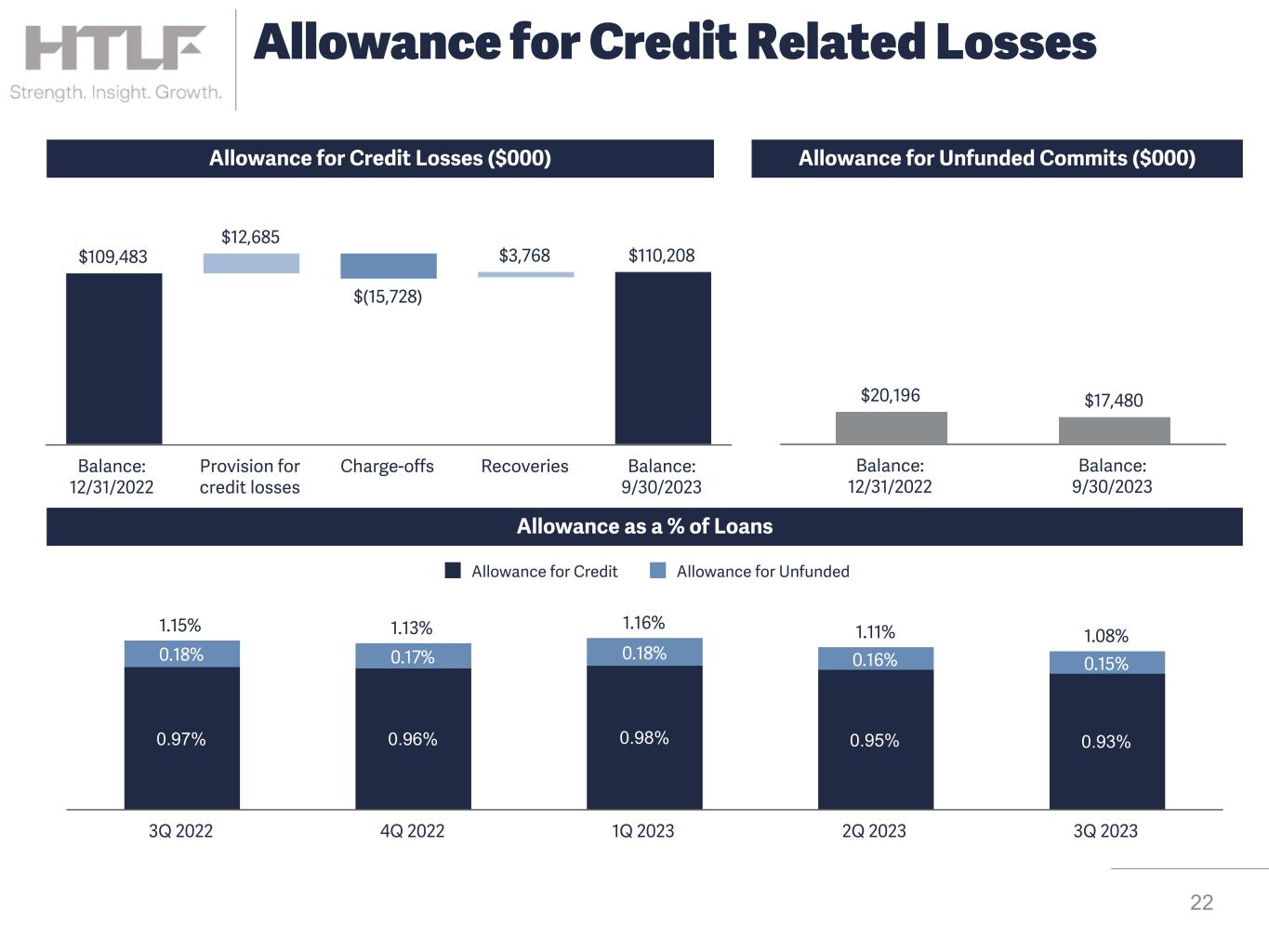

| Allowance for Credit Losses-Loans | |||||||||||||||||||||||||||||

| Balance, beginning of period | $ | 111,198 | $ | 112,707 | $ | 109,483 | $ | 105,715 | $ | 101,353 | |||||||||||||||||||

| Provision for credit losses | 2,672 | 7,829 | 2,184 | 2,075 | 4,388 | ||||||||||||||||||||||||

| Charge-offs | (3,964) | (9,613) | (2,151) | (2,668) | (938) | ||||||||||||||||||||||||

| Recoveries | 302 | 275 | 3,191 | 4,361 | 912 | ||||||||||||||||||||||||

| Balance, end of period | $ | 110,208 | $ | 111,198 | $ | 112,707 | $ | 109,483 | $ | 105,715 | |||||||||||||||||||

| Allowance for Unfunded Commitments | |||||||||||||||||||||||||||||

| Balance, beginning of period | $ | 18,636 | $ | 21,086 | $ | 20,196 | $ | 18,884 | $ | 17,780 | |||||||||||||||||||

| Provision for credit losses | (1,156) | (2,450) | 890 | 1,312 | 1,104 | ||||||||||||||||||||||||

| Balance, end of period | $ | 17,480 | $ | 18,636 | $ | 21,086 | $ | 20,196 | $ | 18,884 | |||||||||||||||||||

| Allowance for lending related credit losses | $ | 127,688 | $ | 129,834 | $ | 133,793 | $ | 129,679 | $ | 124,599 | |||||||||||||||||||

| Provision for Credit Losses | |||||||||||||||||||||||||||||

| Provision for credit losses-loans | $ | 2,672 | $ | 7,829 | $ | 2,184 | $ | 2,075 | $ | 4,388 | |||||||||||||||||||

| Provision (benefit) for credit losses-unfunded commitments | (1,156) | (2,450) | 890 | 1,312 | 1,104 | ||||||||||||||||||||||||

| Total provision for credit losses | $ | 1,516 | $ | 5,379 | $ | 3,074 | $ | 3,387 | $ | 5,492 | |||||||||||||||||||

| Asset Quality | |||||||||||||||||||||||||||||

| Nonaccrual loans | $ | 51,304 | $ | 61,956 | $ | 58,066 | $ | 58,231 | $ | 64,560 | |||||||||||||||||||

| Loans past due ninety days or more | 511 | 1,459 | 174 | 273 | 678 | ||||||||||||||||||||||||

| Other real estate owned | 14,362 | 2,677 | 7,438 | 8,401 | 8,030 | ||||||||||||||||||||||||

| Other repossessed assets | 1 | 5 | 24 | 26 | — | ||||||||||||||||||||||||

| Total nonperforming assets | $ | 66,178 | $ | 66,097 | $ | 65,702 | $ | 66,931 | $ | 73,268 | |||||||||||||||||||

| Nonperforming Assets Activity | |||||||||||||||||||||||||||||

| Balance, beginning of period | $ | 66,097 | $ | 65,702 | $ | 66,931 | $ | 73,268 | $ | 67,532 | |||||||||||||||||||

| Net loan (charge-offs)/recoveries | (3,662) | (9,338) | 1,040 | 1,693 | (26) | ||||||||||||||||||||||||

| New nonperforming loans | 19,295 | 19,805 | 4,626 | 1,439 | 8,388 | ||||||||||||||||||||||||

Reduction of nonperforming loans(1) |

(14,691) | (5,253) | (5,711) | (8,875) | (2,015) | ||||||||||||||||||||||||

| Net OREO/repossessed assets sales proceeds and losses | (861) | (4,819) | (1,184) | (594) | (611) | ||||||||||||||||||||||||

| Balance, end of period | $ | 66,178 | $ | 66,097 | $ | 65,702 | $ | 66,931 | $ | 73,268 | |||||||||||||||||||

| Asset Quality Ratios | |||||||||||||||||||||||||||||

| Ratio of nonperforming loans to total loans | 0.44 | % | 0.54 | % | 0.51 | % | 0.51 | % | 0.60 | % | |||||||||||||||||||

| Ratio of nonperforming assets to total assets | 0.33 | 0.33 | 0.33 | 0.33 | 0.37 | ||||||||||||||||||||||||

| Annualized ratio of net loan charge-offs/(recoveries) to average loans | 0.12 | 0.32 | (0.04) | (0.06) | 0.00 | ||||||||||||||||||||||||

| Allowance for loan credit losses as a percent of loans | 0.93 | 0.95 | 0.98 | 0.96 | 0.97 | ||||||||||||||||||||||||

| Allowance for lending related credit losses as a percent of loans | 1.08 | 1.11 | 1.16 | 1.13 | 1.14 | ||||||||||||||||||||||||

| Allowance for loan credit losses as a percent of nonperforming loans | 212.70 | 175.35 | 193.52 | 187.14 | 162.05 | ||||||||||||||||||||||||

| Loans delinquent 30-89 days as a percent of total loans | 0.12 | 0.12 | 0.10 | 0.04 | 0.10 | ||||||||||||||||||||||||

| (1) Includes principal reductions, transfers to performing status and transfers to OREO. | |||||||||||||||||||||||||||||

| HEARTLAND FINANCIAL USA, INC. | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| DOLLARS IN THOUSANDS | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| For the Quarter Ended | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| September 30, 2023 | June 30, 2023 | September 30, 2022 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Average Balance |

Interest | Rate | Average Balance |

Interest | Rate | Average Balance |

Interest | Rate | |||||||||||||||||||||||||||||||||||||||||||||

| Earning Assets | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Securities: | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Taxable | $ | 5,726,057 | $ | 54,800 | 3.80 | % | $ | 5,962,207 | $ | 58,172 | 3.91 | % | $ | 6,303,278 | $ | 45,648 | 2.87 | % | |||||||||||||||||||||||||||||||||||

Nontaxable(1) |

881,162 | 8,085 | 3.64 | 895,458 | 7,896 | 3.54 | 951,232 | 7,802 | 3.25 | ||||||||||||||||||||||||||||||||||||||||||||

| Total securities | 6,607,219 | 62,885 | 3.78 | 6,857,665 | 66,068 | 3.86 | 7,254,510 | 53,450 | 2.92 | ||||||||||||||||||||||||||||||||||||||||||||

| Interest on deposits with other banks and short-term investments | 142,301 | 1,651 | 4.60 | 153,622 | 2,051 | 5.36 | 222,170 | 1,081 | 1.93 | ||||||||||||||||||||||||||||||||||||||||||||

| Federal funds sold | 152 | 3 | 7.83 | — | — | — | 11 | — | — | ||||||||||||||||||||||||||||||||||||||||||||

Loans:(2) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||

Commercial and industrial(1) |

3,610,677 | 63,001 | 6.92 | 3,565,449 | 56,644 | 6.37 | 3,182,134 | 37,526 | 4.68 | ||||||||||||||||||||||||||||||||||||||||||||

| PPP loans | 3,948 | 11 | 1.11 | 6,302 | 24 | 1.53 | 17,859 | 363 | 8.06 | ||||||||||||||||||||||||||||||||||||||||||||

| Owner occupied commercial real estate | 2,412,501 | 30,127 | 4.95 | 2,366,107 | 28,031 | 4.75 | 2,272,666 | 23,601 | 4.12 | ||||||||||||||||||||||||||||||||||||||||||||

| Non-owner occupied commercial real estate | 2,586,011 | 38,779 | 5.95 | 2,462,098 | 35,583 | 5.80 | 2,258,424 | 25,895 | 4.55 | ||||||||||||||||||||||||||||||||||||||||||||

| Real estate construction | 1,027,544 | 19,448 | 7.51 | 1,028,109 | 18,528 | 7.23 | 914,520 | 12,382 | 5.37 | ||||||||||||||||||||||||||||||||||||||||||||

| Agricultural and agricultural real estate | 822,957 | 12,582 | 6.07 | 848,554 | 12,256 | 5.79 | 799,823 | 8,966 | 4.45 | ||||||||||||||||||||||||||||||||||||||||||||

| Residential mortgage | 827,402 | 9,482 | 4.55 | 840,741 | 9,383 | 4.48 | 858,119 | 8,665 | 4.01 | ||||||||||||||||||||||||||||||||||||||||||||

| Consumer | 509,024 | 9,615 | 7.49 | 508,082 | 9,068 | 7.16 | 479,590 | 6,028 | 4.99 | ||||||||||||||||||||||||||||||||||||||||||||

| Less: allowance for credit losses-loans | (110,726) | — | — | (113,177) | — | — | (102,031) | — | — | ||||||||||||||||||||||||||||||||||||||||||||

| Net loans | 11,689,338 | 183,045 | 6.21 | 11,512,265 | 169,517 | 5.91 | 10,681,104 | 123,426 | 4.58 | ||||||||||||||||||||||||||||||||||||||||||||

| Total earning assets | 18,439,010 | 247,584 | 5.33 | % | 18,523,552 | 237,636 | 5.15 | % | 18,157,795 | 177,957 | 3.89 | % | |||||||||||||||||||||||||||||||||||||||||

| Nonearning Assets | 1,768,910 | 1,697,959 | 1,617,546 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Assets | $ | 20,207,920 | $ | 20,221,511 | $ | 19,775,341 | |||||||||||||||||||||||||||||||||||||||||||||||

| Interest Bearing Liabilities | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Savings | $ | 8,737,581 | $ | 49,195 | 2.23 | % | $ | 8,935,775 | $ | 41,284 | 1.85 | % | $ | 10,059,652 | $ | 12,907 | 0.51 | % | |||||||||||||||||||||||||||||||||||

| Time deposits | 3,945,371 | 43,549 | 4.38 | 3,812,330 | 40,691 | 4.28 | 1,156,908 | 2,251 | 0.77 | ||||||||||||||||||||||||||||||||||||||||||||

| Short-term borrowings | 103,567 | 1,167 | 4.47 | 89,441 | 848 | 3.80 | 134,974 | 360 | 1.06 | ||||||||||||||||||||||||||||||||||||||||||||

| Other borrowings | 372,112 | 5,765 | 6.15 | 372,248 | 5,545 | 5.97 | 371,492 | 4,412 | 4.71 | ||||||||||||||||||||||||||||||||||||||||||||

| Total interest bearing liabilities | 13,158,631 | 99,676 | 3.01 | % | 13,209,794 | 88,368 | 2.68 | % | 11,723,026 | 19,930 | 0.67 | % | |||||||||||||||||||||||||||||||||||||||||

| Noninterest Bearing Liabilities | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noninterest bearing deposits | 4,824,861 | 4,941,033 | 6,065,729 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Accrued interest and other liabilities | 366,905 | 232,966 | 201,575 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total noninterest bearing liabilities | 5,191,766 | 5,173,999 | 6,267,304 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Equity | 1,857,523 | 1,837,718 | 1,785,011 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Total Liabilities and Equity | $ | 20,207,920 | $ | 20,221,511 | $ | 19,775,341 | |||||||||||||||||||||||||||||||||||||||||||||||

Net interest income, fully tax-equivalent (non-GAAP)(1)(3) |

$ | 147,908 | $ | 149,268 | $ | 158,027 | |||||||||||||||||||||||||||||||||||||||||||||||

Net interest spread(1) |

2.32 | % | 2.47 | % | 3.22 | % | |||||||||||||||||||||||||||||||||||||||||||||||

Net interest income, fully tax-equivalent (non-GAAP)(1)(3) to total earning assets |

3.18 | % | 3.23 | % | 3.45 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Interest bearing liabilities to earning assets | 71.36 | % | 71.31 | % | 64.56 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| (1) Computed on a tax-equivalent basis using an effective tax rate of 21%. | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| (2) Nonaccrual loans and loans held for sale are included in the average loans outstanding. | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| (3) Refer to "Non-GAAP Measures" in this earnings release for additional information on the usage and presentation of these non-GAAP measures, and refer to these financial tables for the reconciliations to the most directly comparable GAAP measures. | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| HEARTLAND FINANCIAL USA, INC. | |||||||||||||||||||||||||||||||||||

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) | |||||||||||||||||||||||||||||||||||

| DOLLARS IN THOUSANDS | |||||||||||||||||||||||||||||||||||

| For the Nine Months Ended | |||||||||||||||||||||||||||||||||||

| September 30, 2023 | September 30, 2022 | ||||||||||||||||||||||||||||||||||

| Average Balance |

Interest | Rate | Average Balance |

Interest | Rate | ||||||||||||||||||||||||||||||

| Earning Assets | |||||||||||||||||||||||||||||||||||

| Securities: | |||||||||||||||||||||||||||||||||||

| Taxable | $ | 5,927,026 | $ | 168,948 | 3.81 | % | $ | 6,407,459 | $ | 116,366 | 2.43 | % | |||||||||||||||||||||||

Nontaxable(1) |

899,613 | 23,611 | 3.51 | 990,784 | 22,625 | 3.05 | |||||||||||||||||||||||||||||

| Total securities | 6,826,639 | 192,559 | 3.77 | 7,398,243 | 138,991 | 2.51 | % | ||||||||||||||||||||||||||||

| Interest bearing deposits with other banks and other short-term investments | 133,910 | 4,833 | 4.83 | 238,819 | 1,715 | 0.96 | |||||||||||||||||||||||||||||

| Federal funds sold | 51 | 3 | 7.86 | 7 | — | — | |||||||||||||||||||||||||||||

Loans:(2) |

|||||||||||||||||||||||||||||||||||

Commercial and industrial(1) |

3,547,256 | 169,552 | 6.39 | % | 2,977,751 | 95,020 | 4.27 | ||||||||||||||||||||||||||||

| PPP loans | 6,718 | 61 | 1.21 | 63,342 | 6,487 | 13.69 | |||||||||||||||||||||||||||||

| Owner occupied commercial real estate | 2,355,545 | 84,927 | 4.82 | 2,270,486 | 67,742 | 3.99 | |||||||||||||||||||||||||||||

| Non-owner occupied commercial real estate | 2,459,965 | 105,111 | 5.71 | 2,166,873 | 69,929 | 4.31 | |||||||||||||||||||||||||||||

| Real estate construction | 1,051,298 | 56,107 | 7.14 | 880,354 | 31,673 | 4.81 | |||||||||||||||||||||||||||||

Agricultural and agricultural real estate |

835,673 | 36,191 | 5.79 | 776,127 | 23,905 | 4.12 | |||||||||||||||||||||||||||||

| Residential mortgage | 840,143 | 28,138 | 4.48 | 850,444 | 25,108 | 3.95 | |||||||||||||||||||||||||||||

| Consumer | 506,143 | 26,925 | 7.11 | 452,032 | 15,632 | 4.62 | |||||||||||||||||||||||||||||

| Less: allowance for credit losses-loans | (111,434) | — | — | (105,477) | — | — | |||||||||||||||||||||||||||||

| Net loans | 11,491,307 | 507,012 | 5.90 | 10,331,932 | 335,496 | 4.34 | |||||||||||||||||||||||||||||

| Total earning assets | 18,451,907 | 704,407 | 5.10 | % | 17,969,001 | 476,202 | 3.54 | % | |||||||||||||||||||||||||||

| Nonearning Assets | 1,730,901 | 1,554,432 | |||||||||||||||||||||||||||||||||

| Total Assets | $ | 20,182,808 | $ | 19,523,433 | |||||||||||||||||||||||||||||||

Interest Bearing Liabilities |

|||||||||||||||||||||||||||||||||||

| Savings | $ | 9,130,980 | $ | 128,372 | 1.88 | % | $ | 9,652,651 | $ | 20,673 | 0.29 | % | |||||||||||||||||||||||

| Time deposits | 3,344,434 | 103,245 | 4.13 | 1,106,095 | 3,992 | 0.48 | |||||||||||||||||||||||||||||

| Short-term borrowings | 138,157 | 4,437 | 4.29 | 124,459 | 494 | 0.53 | |||||||||||||||||||||||||||||

| Other borrowings | 372,094 | 16,756 | 6.02 | 372,027 | 11,780 | 4.23 | |||||||||||||||||||||||||||||

| Total interest bearing liabilities | 12,985,665 | 252,810 | 2.60 | % | 11,255,232 | 36,939 | 0.44 | % | |||||||||||||||||||||||||||

Noninterest Bearing Liabilities |

|||||||||||||||||||||||||||||||||||

| Noninterest bearing deposits | 5,092,200 | 6,172,984 | |||||||||||||||||||||||||||||||||

| Accrued interest and other liabilities | 284,008 | 182,677 | |||||||||||||||||||||||||||||||||

| Total noninterest bearing liabilities | 5,376,208 | 6,355,661 | |||||||||||||||||||||||||||||||||

| Stockholders' Equity | 1,820,935 | 1,912,540 | |||||||||||||||||||||||||||||||||

| Total Liabilities and Stockholders' Equity | $ | 20,182,808 | $ | 19,523,433 | |||||||||||||||||||||||||||||||

Net interest income, fully tax-equivalent (non-GAAP)(1)(3) |

$ | 451,597 | $ | 439,263 | |||||||||||||||||||||||||||||||

Net interest spread(1) |

2.50 | % | 3.10 | % | |||||||||||||||||||||||||||||||

Net interest income, fully tax-equivalent (non-GAAP)(1)(3) to total earning assets |

3.27 | % | 3.27 | % | |||||||||||||||||||||||||||||||

| Interest bearing liabilities to earning assets | 70.38 | % | 62.64 | % | |||||||||||||||||||||||||||||||

| (1) Computed on a tax-equivalent basis using an effective tax rate of 21%. | |||||||||||||||||||||||||||||||||||

| (2) Nonaccrual loans and loans held for sale are included in the average loans outstanding. | |||||||||||||||||||||||||||||||||||

| (3) Refer to "Non-GAAP Measures" in this earnings release for additional information on the usage and presentation of these non-GAAP measures, and refer to these financial tables for the reconciliations to the most directly comparable GAAP measures. | |||||||||||||||||||||||||||||||||||

| HEARTLAND FINANCIAL USA, INC. | |||||||||||||||||||||||||||||

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) | |||||||||||||||||||||||||||||

| DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA AND FULL TIME EQUIVALENT EMPLOYEE DATA | |||||||||||||||||||||||||||||

| For the Quarter Ended | |||||||||||||||||||||||||||||

| 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |||||||||||||||||||||||||

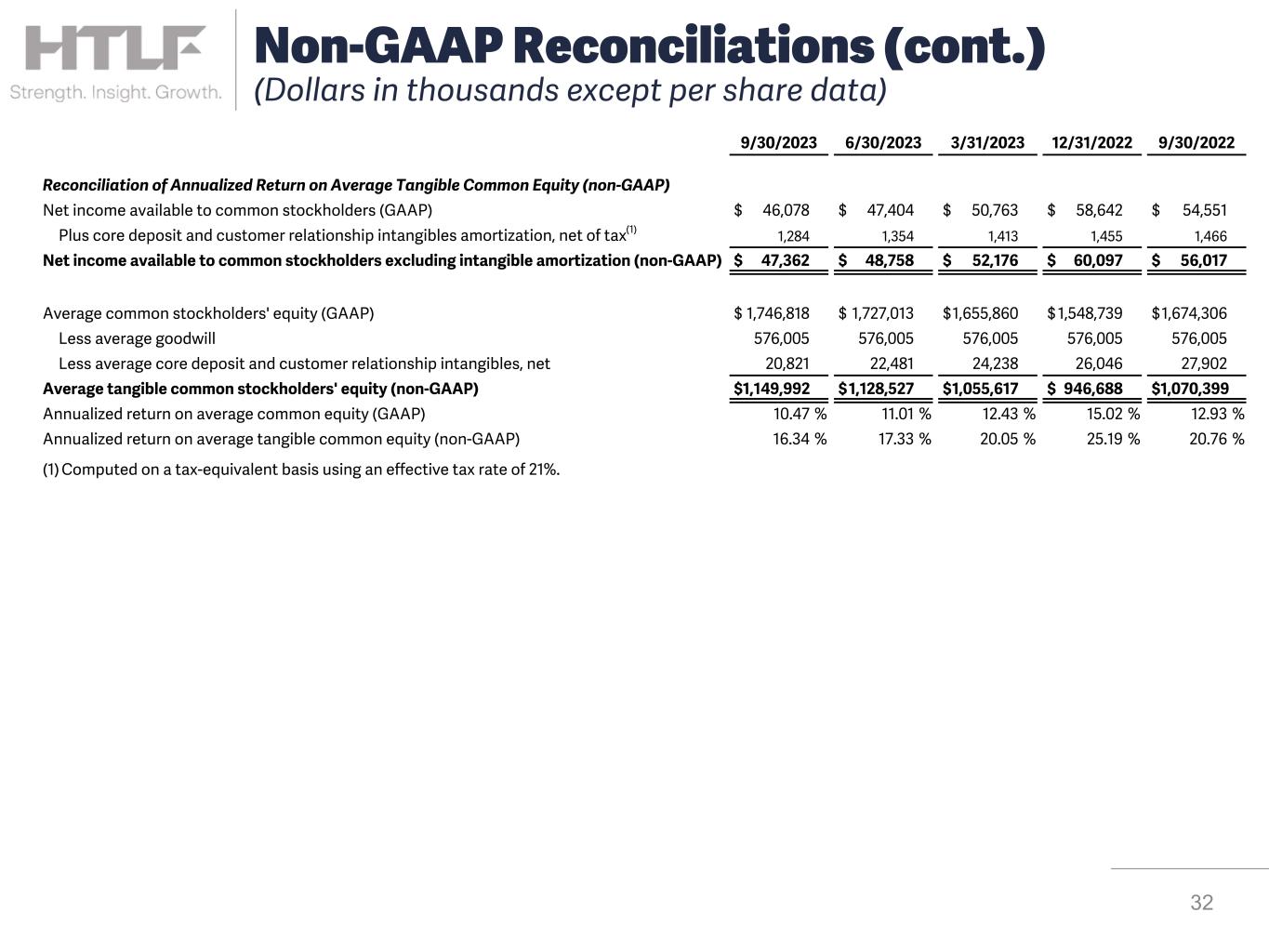

| Reconciliation of Annualized Return on Average Tangible Common Equity (non-GAAP) | |||||||||||||||||||||||||||||

| Net income available to common stockholders (GAAP) | $ | 46,078 | $ | 47,404 | $ | 50,763 | $ | 58,642 | $ | 54,551 | |||||||||||||||||||

Plus core deposit and customer relationship intangibles amortization, net of tax(1) |

1,284 | 1,354 | 1,413 | 1,455 | 1,466 | ||||||||||||||||||||||||

| Net income available to common stockholders excluding intangible amortization (non-GAAP) | $ | 47,362 | $ | 48,758 | $ | 52,176 | $ | 60,097 | $ | 56,017 | |||||||||||||||||||

| Average common equity (GAAP) | $ | 1,746,818 | $ | 1,727,013 | $ | 1,655,860 | $ | 1,548,739 | $ | 1,674,306 | |||||||||||||||||||

| Less average goodwill | 576,005 | 576,005 | 576,005 | 576,005 | 576,005 | ||||||||||||||||||||||||

| Less average core deposit and customer relationship intangibles, net | 20,821 | 22,481 | 24,238 | 26,046 | 27,902 | ||||||||||||||||||||||||

| Average tangible common equity (non-GAAP) | $ | 1,149,992 | $ | 1,128,527 | $ | 1,055,617 | $ | 946,688 | $ | 1,070,399 | |||||||||||||||||||

| Annualized return on average common equity (GAAP) | 10.47 | % | 11.01 | % | 12.43 | % | 15.02 | % | 12.93 | % | |||||||||||||||||||

| Annualized return on average tangible common equity (non-GAAP) | 16.34 | % | 17.33 | % | 20.05 | % | 25.19 | % | 20.76 | % | |||||||||||||||||||

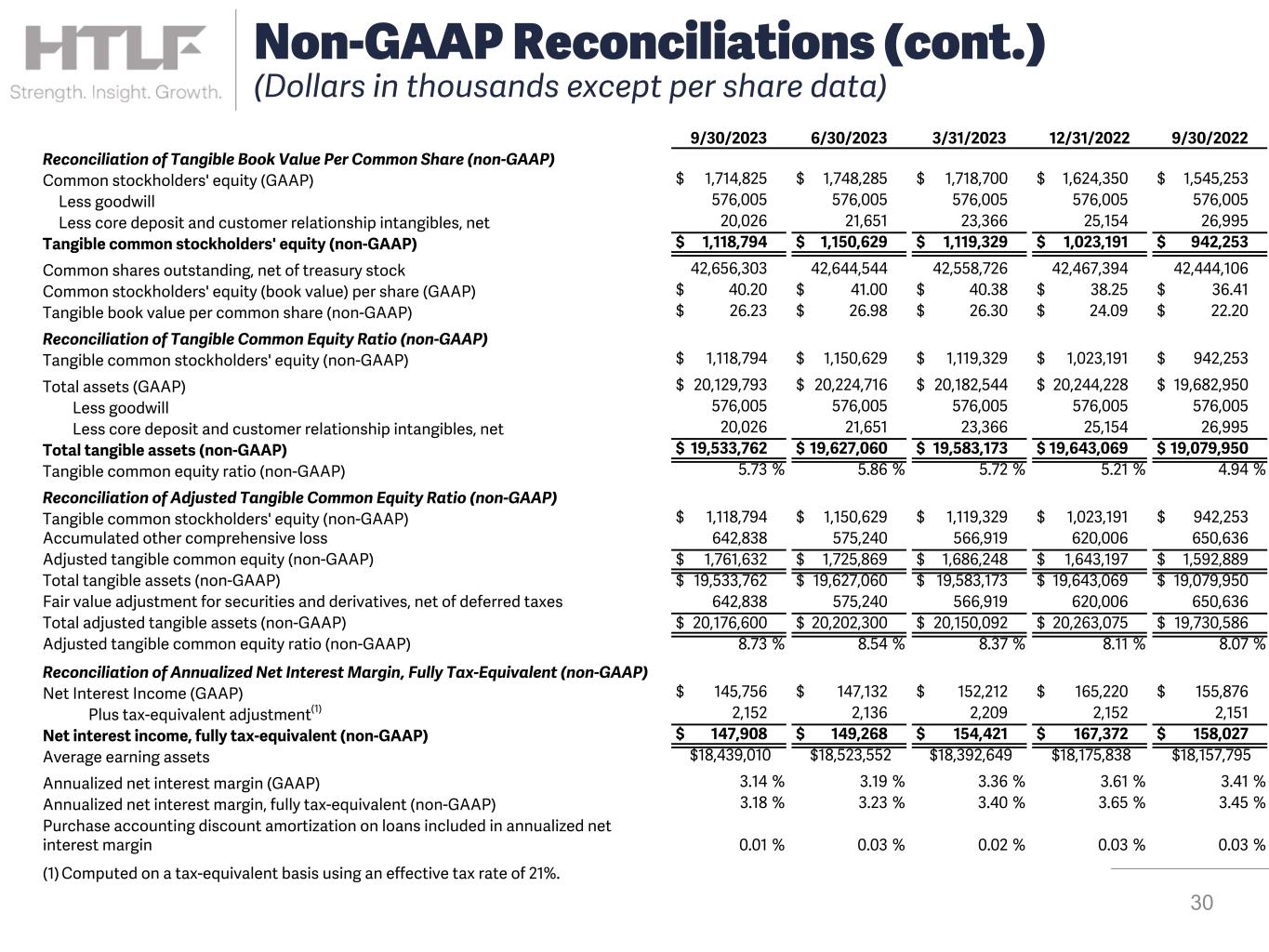

| Reconciliation of Annualized Net Interest Margin, Fully Tax-Equivalent (non-GAAP) | |||||||||||||||||||||||||||||

| Net Interest Income (GAAP) | $ | 145,756 | $ | 147,132 | $ | 152,212 | $ | 165,220 | $ | 155,876 | |||||||||||||||||||

Plus tax-equivalent adjustment(1) |

2,152 | 2,136 | 2,209 | 2,152 | 2,151 | ||||||||||||||||||||||||

| Net interest income, fully tax-equivalent (non-GAAP) | $ | 147,908 | $ | 149,268 | $ | 154,421 | $ | 167,372 | $ | 158,027 | |||||||||||||||||||

| Average earning assets | $ | 18,439,010 | $ | 18,523,552 | $ | 18,392,649 | $ | 18,175,838 | $ | 18,157,795 | |||||||||||||||||||

| Annualized net interest margin (GAAP) | 3.14 | % | 3.19 | % | 3.36 | % | 3.61 | % | 3.41 | % | |||||||||||||||||||

| Annualized net interest margin, fully tax-equivalent (non-GAAP) | 3.18 | 3.23 | 3.40 | 3.65 | 3.45 | ||||||||||||||||||||||||

| Net purchase accounting discount amortization on loans included in annualized net interest margin | 0.01 | 0.03 | 0.02 | 0.03 | 0.03 | ||||||||||||||||||||||||

| Reconciliation of Tangible Book Value Per Common Share (non-GAAP) | |||||||||||||||||||||||||||||

| Common equity (GAAP) | $ | 1,714,825 | $ | 1,748,285 | $ | 1,718,700 | $ | 1,624,350 | $ | 1,545,253 | |||||||||||||||||||

| Less goodwill | 576,005 | 576,005 | 576,005 | 576,005 | 576,005 | ||||||||||||||||||||||||

| Less core deposit and customer relationship intangibles, net | 20,026 | 21,651 | 23,366 | 25,154 | 26,995 | ||||||||||||||||||||||||

| Tangible common equity (non-GAAP) | $ | 1,118,794 | $ | 1,150,629 | $ | 1,119,329 | $ | 1,023,191 | $ | 942,253 | |||||||||||||||||||

| Common shares outstanding, net of treasury stock | 42,656,303 | 42,644,544 | 42,558,726 | 42,467,394 | 42,444,106 | ||||||||||||||||||||||||

| Common equity (book value) per share (GAAP) | $ | 40.20 | $ | 41.00 | $ | 40.38 | $ | 38.25 | $ | 36.41 | |||||||||||||||||||

| Tangible book value per common share (non-GAAP) | $ | 26.23 | $ | 26.98 | $ | 26.30 | $ | 24.09 | $ | 22.20 | |||||||||||||||||||

| Reconciliation of Tangible Common Equity Ratio (non-GAAP) | |||||||||||||||||||||||||||||

| Tangible common equity (non-GAAP) | $ | 1,118,794 | $ | 1,150,629 | $ | 1,119,329 | $ | 1,023,191 | $ | 942,253 | |||||||||||||||||||

| Total assets (GAAP) | $ | 20,129,793 | $ | 20,224,716 | $ | 20,182,544 | $ | 20,244,228 | $ | 19,682,950 | |||||||||||||||||||

| Less goodwill | 576,005 | 576,005 | 576,005 | 576,005 | 576,005 | ||||||||||||||||||||||||

| Less core deposit and customer relationship intangibles, net | 20,026 | 21,651 | 23,366 | 25,154 | 26,995 | ||||||||||||||||||||||||

| Total tangible assets (non-GAAP) | $ | 19,533,762 | $ | 19,627,060 | $ | 19,583,173 | $ | 19,643,069 | $ | 19,079,950 | |||||||||||||||||||

| Tangible common equity ratio (non-GAAP) | 5.73 | % | 5.86 | % | 5.72 | % | 5.21 | % | 4.94 | % | |||||||||||||||||||

| HEARTLAND FINANCIAL USA, INC. | |||||||||||||||||||||||||||||

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) | |||||||||||||||||||||||||||||

| DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA | |||||||||||||||||||||||||||||

| For the Quarter Ended | |||||||||||||||||||||||||||||

| 9/30/2023 | 6/30/2023 | 3/31/2023 | 12/31/2022 | 9/30/2022 | |||||||||||||||||||||||||

| Reconciliation of Adjusted Tangible Common Equity Ratio (non-GAAP) | |||||||||||||||||||||||||||||

| Tangible common equity (non-GAAP) | $ | 1,118,794 | $ | 1,150,629 | $ | 1,119,329 | $ | 1,023,191 | $ | 942,253 | |||||||||||||||||||

| Accumulated other comprehensive loss | 642,838 | 575,240 | 566,919 | 620,006 | 650,636 | ||||||||||||||||||||||||

| Adjusted tangible common equity (non-GAAP) | $ | 1,761,632 | $ | 1,725,869 | $ | — | $ | 1,686,248 | $ | 1,643,197 | $ | 1,592,889 | |||||||||||||||||

| Total tangible assets (non-GAAP) | $ | 19,533,762 | $ | 19,627,060 | $ | 19,583,173 | $ | 19,643,069 | $ | 19,079,950 | |||||||||||||||||||

| Fair value adjustment for securities and derivatives, net of deferred taxes | 642,838 | 575,240 | 566,919 | 620,006 | 650,636 | ||||||||||||||||||||||||

| Total adjusted tangible assets (non-GAAP) | $ | 20,176,600 | $ | 20,202,300 | $ | 20,150,092 | $ | 20,263,075 | $ | 19,730,586 | |||||||||||||||||||

| Adjusted tangible common equity ratio (non-GAAP) | 8.73 | % | 8.54 | % | 8.37 | % | 8.11 | % | 8.07 | % | |||||||||||||||||||

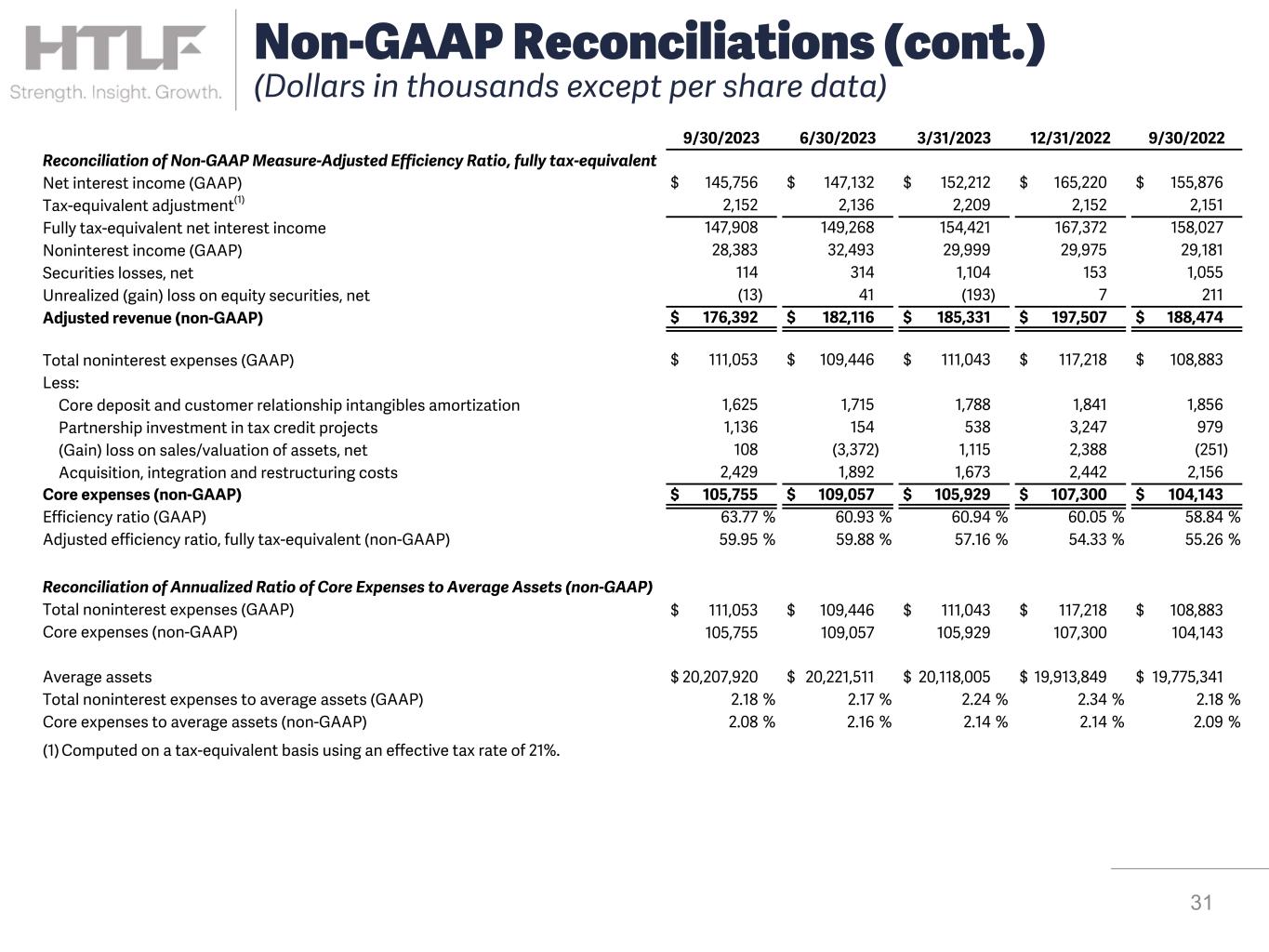

| Reconciliation of Adjusted Efficiency Ratio, fully tax-equivalent (non-GAAP) | |||||||||||||||||||||||||||||

| Net interest income (GAAP) | $ | 145,756 | $ | 147,132 | $ | 152,212 | $ | 165,220 | $ | 155,876 | |||||||||||||||||||

Tax-equivalent adjustment(1) |

2,152 | 2,136 | 2,209 | 2,152 | 2,151 | ||||||||||||||||||||||||

| Fully tax-equivalent net interest income | 147,908 | 149,268 | 154,421 | 167,372 | 158,027 | ||||||||||||||||||||||||

| Noninterest income (GAAP) | 28,383 | 32,493 | 29,999 | 29,975 | 29,181 | ||||||||||||||||||||||||

| Securities losses, net | 114 | 314 | 1,104 | 153 | 1,055 | ||||||||||||||||||||||||

| Unrealized (gain)/loss on equity securities, net | (13) | 41 | (193) | 7 | 211 | ||||||||||||||||||||||||

| Gain on extinguishment of debt | — | — | — | — | — | ||||||||||||||||||||||||

| Valuation adjustment on servicing rights | — | — | — | — | — | ||||||||||||||||||||||||

| Adjusted revenue (non-GAAP) | $ | 176,392 | $ | 182,116 | $ | 185,331 | $ | 197,507 | $ | 188,474 | |||||||||||||||||||

| Total noninterest expenses (GAAP) | $ | 111,053 | $ | 109,446 | $ | 111,043 | $ | 117,218 | $ | 108,883 | |||||||||||||||||||

| Less: | |||||||||||||||||||||||||||||

| Core deposit and customer relationship intangibles amortization | 1,625 | 1,715 | 1,788 | 1,841 | 1,856 | ||||||||||||||||||||||||

| Partnership investment in tax credit projects | 1,136 | 154 | 538 | 3,247 | 979 | ||||||||||||||||||||||||

| (Gain)/loss on sales/valuation of assets, net | 108 | (3,372) | 1,115 | 2,388 | (251) | ||||||||||||||||||||||||

| Acquisition, integration and restructuring costs | 2,429 | 1,892 | 1,673 | 2,442 | 2,156 | ||||||||||||||||||||||||

| Core expenses (non-GAAP) | $ | 105,755 | $ | 109,057 | $ | 105,929 | $ | 107,300 | $ | 104,143 | |||||||||||||||||||

| Efficiency ratio (GAAP) | 63.77 | % | 60.93 | % | 60.94 | % | 60.05 | % | 58.84 | % | |||||||||||||||||||

| Adjusted efficiency ratio, fully tax-equivalent (non-GAAP) | 59.95 | % | 59.88 | % | 57.16 | % | 54.33 | % | 55.26 | % | |||||||||||||||||||

| Reconciliation of Annualized Ratio of Core Expenses to Average Assets (non-GAAP) | |||||||||||||||||||||||||||||

| Total noninterest expenses (GAAP) | $ | 111,053 | $ | 109,446 | $ | 111,043 | $ | 117,218 | $ | 108,883 | |||||||||||||||||||

| Core expenses (non-GAAP) | 105,755 | 109,057 | 105,929 | 107,300 | 104,143 | ||||||||||||||||||||||||

| Average assets | $ | 20,207,920 | $ | 20,221,511 | $ | 20,118,005 | $ | 19,913,849 | $ | 19,775,341 | |||||||||||||||||||

| Total noninterest expenses to average assets (GAAP) | 2.18 | % | 2.17 | % | 2.24 | % | 2.34 | % | 2.18 | % | |||||||||||||||||||

| Core expenses to average assets (non-GAAP) | 2.08 | % | 2.16 | % | 2.14 | % | 2.14 | % | 2.09 | % | |||||||||||||||||||

| Acquisition, integration and restructuring costs | |||||||||||||||||||||||||||||

| Salaries and employee benefits | $ | 94 | $ | 93 | $ | 74 | $ | 424 | $ | 365 | |||||||||||||||||||

| Occupancy | — | — | — | — | — | ||||||||||||||||||||||||

| Furniture and equipment | — | — | — | — | — | ||||||||||||||||||||||||

| Professional fees | 1,617 | 1,068 | 934 | 1,587 | 1,480 | ||||||||||||||||||||||||

| Advertising | 178 | 222 | 122 | 95 | 131 | ||||||||||||||||||||||||

| (Gain)/loss on sales/valuations of assets, net | — | — | — | — | — | ||||||||||||||||||||||||

| Other noninterest expenses | 540 | 509 | 543 | 336 | 180 | ||||||||||||||||||||||||

| Total acquisition, integration and restructuring costs | $ | 2,429 | $ | 1,892 | $ | 1,673 | $ | 2,442 | $ | 2,156 | |||||||||||||||||||

After tax impact on diluted earnings per common share(1) |

$ | 0.04 | $ | 0.03 | $ | 0.03 | $ | 0.05 | $ | 0.04 | |||||||||||||||||||

| (1) Computed on a tax-equivalent basis using an effective tax rate of 21%. | |||||||||||||||||||||||||||||

| HEARTLAND FINANCIAL USA, INC. | |||||||||||||||||||||||

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) | |||||||||||||||||||||||

| DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA | |||||||||||||||||||||||

| For the Quarter Ended September 30, |

For the Nine Months Ended September 30, |

||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

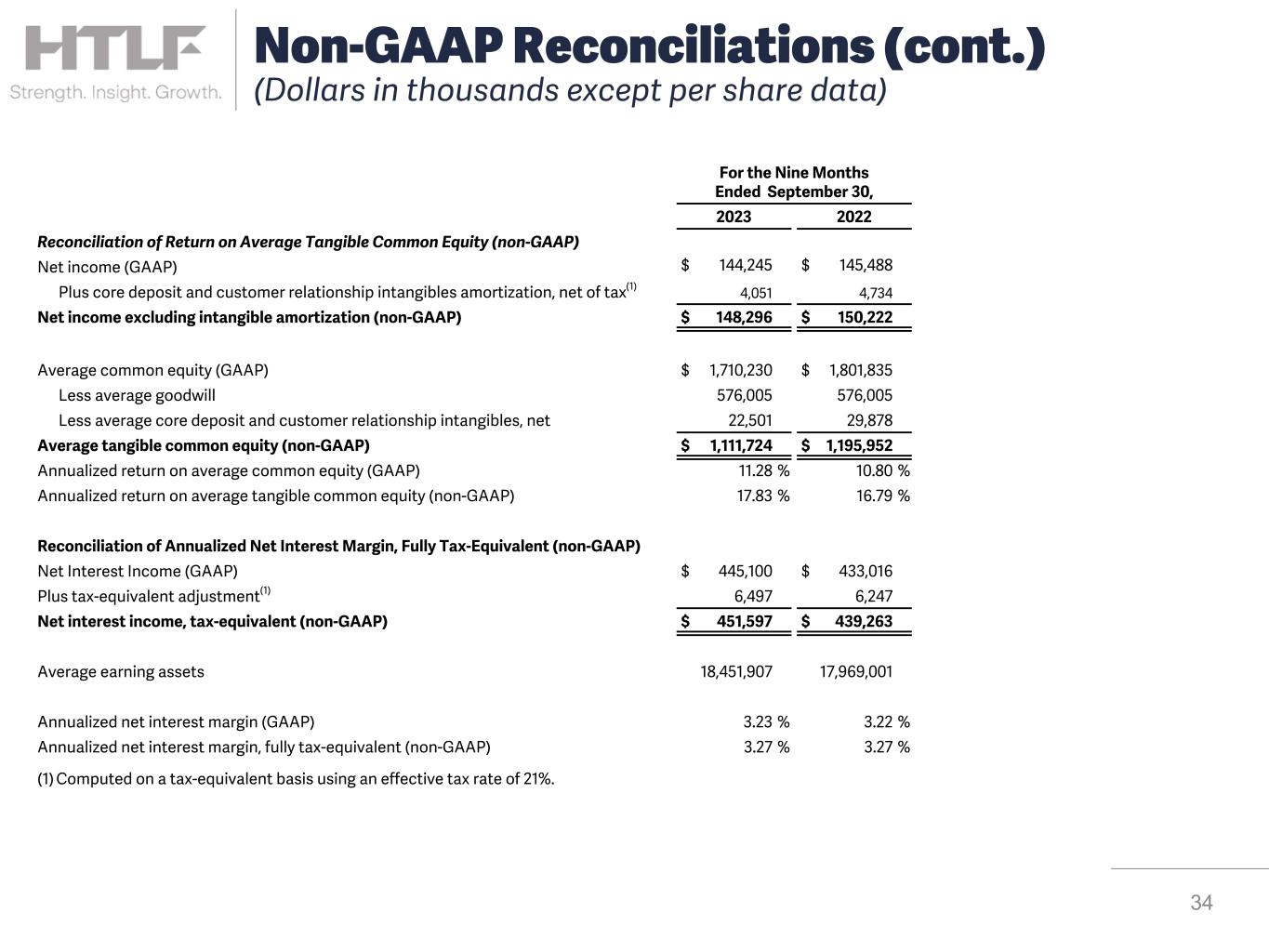

| Reconciliation of Annualized Return on Average Tangible Common Equity (non-GAAP) | |||||||||||||||||||||||

| Net income available to common stockholders (GAAP) | $ | 46,078 | $ | 54,551 | $ | 144,245 | $ | 145,488 | |||||||||||||||

Plus core deposit and customer relationship intangibles amortization, net of tax(1) |

1,284 | 1,466 | 4,051 | 4,734 | |||||||||||||||||||

| Net income available to common stockholders excluding intangible amortization (non-GAAP) | $ | 47,362 | $ | 56,017 | $ | 148,296 | $ | 150,222 | |||||||||||||||

| Average common equity (GAAP) | $ | 1,746,818 | $ | 1,674,306 | $ | 1,710,230 | $ | 1,801,835 | |||||||||||||||

| Less average goodwill | 576,005 | 576,005 | 576,005 | 576,005 | |||||||||||||||||||

| Less average core deposit and customer relationship intangibles, net | 20,821 | 27,902 | 22,501 | 29,878 | |||||||||||||||||||

| Average tangible common equity (non-GAAP) | $ | 1,149,992 | $ | 1,070,399 | $ | 1,111,724 | $ | 1,195,952 | |||||||||||||||

| Annualized return on average common equity (GAAP) | 10.47 | % | 12.93 | % | 11.28 | % | 10.80 | % | |||||||||||||||

| Annualized return on average tangible common equity (non-GAAP) | 16.34 | % | 20.76 | % | 17.83 | % | 16.79 | % | |||||||||||||||

| Reconciliation of Annualized Net Interest Margin, Fully Tax-Equivalent (non-GAAP) | |||||||||||||||||||||||

| Net Interest Income (GAAP) | $ | 145,756 | $ | 155,876 | $ | 445,100 | $ | 433,016 | |||||||||||||||

Plus tax-equivalent adjustment(1) |

2,152 | 2,151 | 6,497 | 6,247 | |||||||||||||||||||

| Net interest income, fully tax-equivalent (non-GAAP) | $ | 147,908 | $ | 158,027 | $ | 451,597 | $ | 439,263 | |||||||||||||||

| Average earning assets | $ | 18,439,010 | $ | 18,157,795 | $ | 18,451,907 | $ | 17,969,001 | |||||||||||||||

| Annualized net interest margin (GAAP) | 3.14 | % | 3.41 | % | 3.23 | % | 3.22 | % | |||||||||||||||

| Annualized net interest margin, fully tax-equivalent (non-GAAP) | 3.18 | 3.45 | 3.27 | 3.27 | |||||||||||||||||||

| Purchase accounting discount amortization on loans included in annualized net interest margin | 0.01 | 0.03 | 0.02 | 0.05 | |||||||||||||||||||

| (1) Computed on a tax-equivalent basis using an effective tax rate of 21%. | |||||||||||||||||||||||

| HEARTLAND FINANCIAL USA, INC. | |||||||||||||||||||||||

| CONSOLIDATED FINANCIAL HIGHLIGHTS (Unaudited) | |||||||||||||||||||||||

| DOLLARS IN THOUSANDS, EXCEPT PER SHARE DATA | |||||||||||||||||||||||

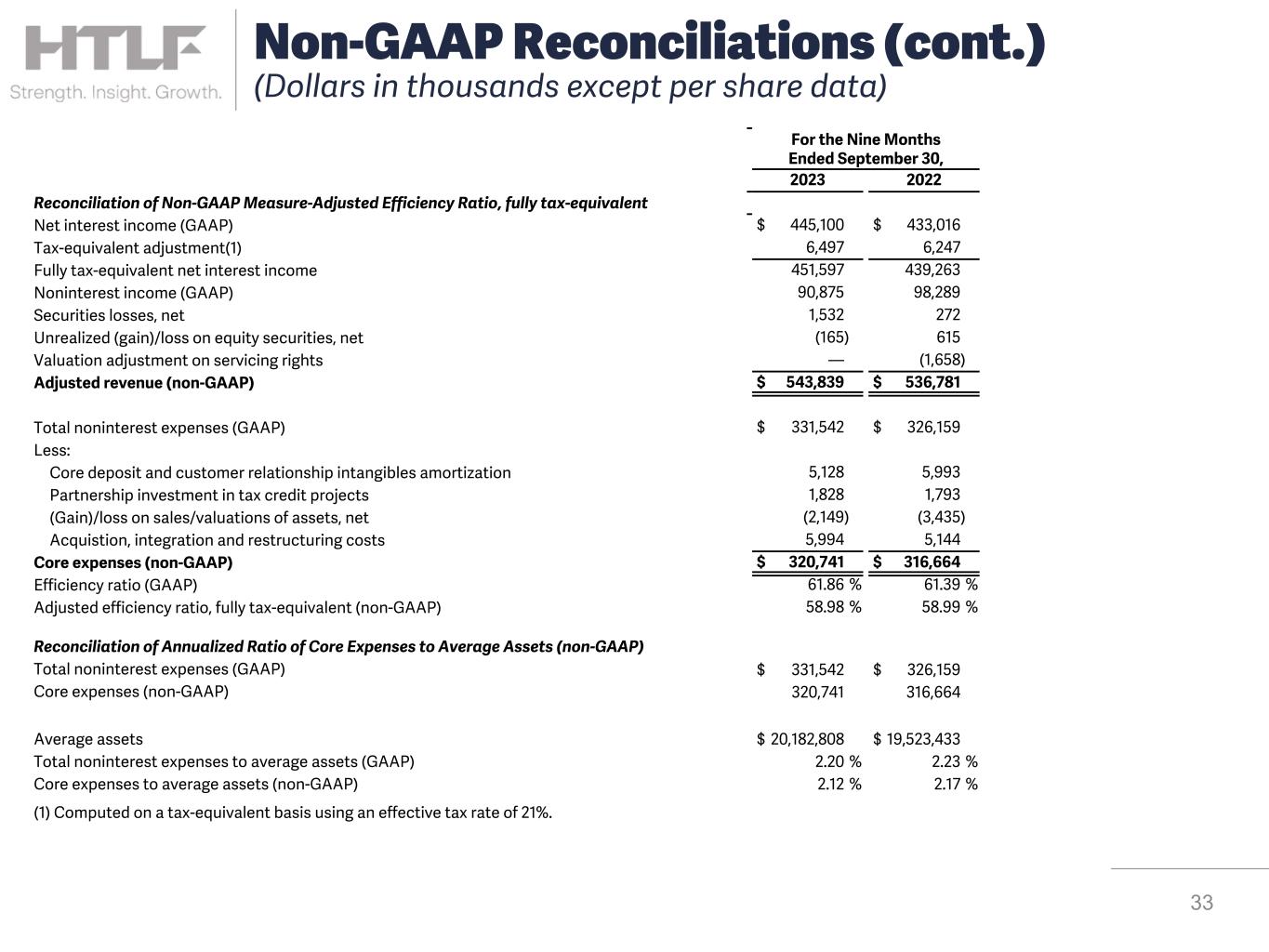

| Reconciliation of Adjusted Efficiency Ratio, fully tax-equivalent (non-GAAP) | For the Quarter Ended September 30, |

For the Nine Months Ended September 30, |

|||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| Net interest income (GAAP) | $ | 145,756 | $ | 155,876 | $ | 445,100 | $ | 433,016 | |||||||||||||||

Tax-equivalent adjustment(1) |

2,152 | 2,151 | 6,497 | 6,247 | |||||||||||||||||||

| Fully tax-equivalent net interest income | 147,908 | 158,027 | 451,597 | 439,263 | |||||||||||||||||||

| Noninterest income (GAAP) | 28,383 | 29,181 | 90,875 | 98,289 | |||||||||||||||||||

| Securities (gains)/losses, net | 114 | 1,055 | 1,532 | 272 | |||||||||||||||||||

| Unrealized (gain)/loss on equity securities, net | (13) | 211 | (165) | 615 | |||||||||||||||||||

| Valuation adjustment on servicing rights | — | — | — | (1,658) | |||||||||||||||||||

| Adjusted revenue (non-GAAP) | $ | 176,392 | $ | 188,474 | $ | 543,839 | $ | 536,781 | |||||||||||||||

| Total noninterest expenses (GAAP) | $ | 111,053 | $ | 108,883 | $ | 331,542 | $ | 326,159 | |||||||||||||||

| Less: | |||||||||||||||||||||||

| Core deposit and customer relationship intangibles amortization | 1,625 | 1,856 | 5,128 | 5,993 | |||||||||||||||||||

| Partnership investment in tax credit projects | 1,136 | 979 | 1,828 | 1,793 | |||||||||||||||||||

| (Gain)/loss on sales/valuation of assets, net | 108 | (251) | (2,149) | (3,435) | |||||||||||||||||||

| Acquisition, integration and restructuring costs | 2,429 | 2,156 | 5,994 | 5,144 | |||||||||||||||||||

| Core expenses (non-GAAP) | $ | 105,755 | $ | 104,143 | $ | 320,741 | $ | 316,664 | |||||||||||||||

| Efficiency ratio (GAAP) | 63.77 | % | 58.84 | % | 61.86 | % | 61.39 | % | |||||||||||||||

| Adjusted efficiency ratio, fully tax-equivalent (non-GAAP) | 59.95 | % | 55.26 | % | 58.98 | % | 58.99 | % | |||||||||||||||

| Reconciliation of Annualized Ratio of Core Expenses to Average Assets (non-GAAP) | |||||||||||||||||||||||

| Total noninterest expenses (GAAP) | $ | 111,053 | $ | 108,883 | $ | 331,542 | $ | 326,159 | |||||||||||||||

| Core expenses (non-GAAP) | 105,755 | 104,143 | 320,741 | 316,664 | |||||||||||||||||||

| Average assets | $ | 20,207,920 | $ | 19,775,341 | $ | 20,182,808 | $ | 19,523,433 | |||||||||||||||

| Total noninterest expenses to average assets (GAAP) | 2.18 | % | 2.18 | % | 2.20 | % | 2.23 | % | |||||||||||||||

| Core expenses to average assets (non-GAAP) | 2.08 | % | 2.09 | % | 2.12 | % | 2.17 | % | |||||||||||||||

| Acquisition, integration and restructuring costs | |||||||||||||||||||||||

| Salaries and employee benefits | $ | 94 | $ | 365 | $ | 261 | $ | 980 | |||||||||||||||

| Professional fees | 1,617 | 1,480 | 3,619 | 3,495 | |||||||||||||||||||

| Advertising | 178 | 131 | 522 | 287 | |||||||||||||||||||

| Other noninterest expenses | 540 | 180 | 1,592 | 382 | |||||||||||||||||||

| Total acquisition, integration and restructuring costs | $ | 2,429 | $ | 2,156 | $ | 5,994 | $ | 5,144 | |||||||||||||||

After tax impact on diluted earnings per common share(1) |

$ | 0.04 | $ | 0.04 | $ | 0.11 | $ | 0.10 | |||||||||||||||

| (1) Computed on a tax-equivalent basis using an effective tax rate of 21%. | |||||||||||||||||||||||