| SC | 00-26926 | 57-0965380 | ||||||||||||

| (State or other jurisdiction of incorporation) |

(Commission File Number) | (IRS Employer Identification No.) |

||||||||||||

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered | ||||||||||||

| Common Stock, no par value | SCSC | NASDAQ Global Select Market | ||||||||||||

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||

| Emerging growth company | ☐ | ||||

| Exhibit Number |

Description | ||||

| 99.1 | |||||

| 99.2 | |||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | ||||

| ScanSource, Inc. | |||||||||||||||||||||||

| Date: | February 6, 2024 | /s/ STEVE JONES | |||||||||||||||||||||

| Steve Jones | |||||||||||||||||||||||

| Senior Executive Vice President and Chief Financial Officer | |||||||||||||||||||||||

| Contact: | ||||||||

| Steve Jones | Mary M. Gentry | |||||||

| Senior EVP, Chief Financial Officer | SVP, Treasurer and Investor Relations | |||||||

| ScanSource, Inc. | ScanSource, Inc. | |||||||

| (864) 286-4302 | (864) 286-4892 | |||||||

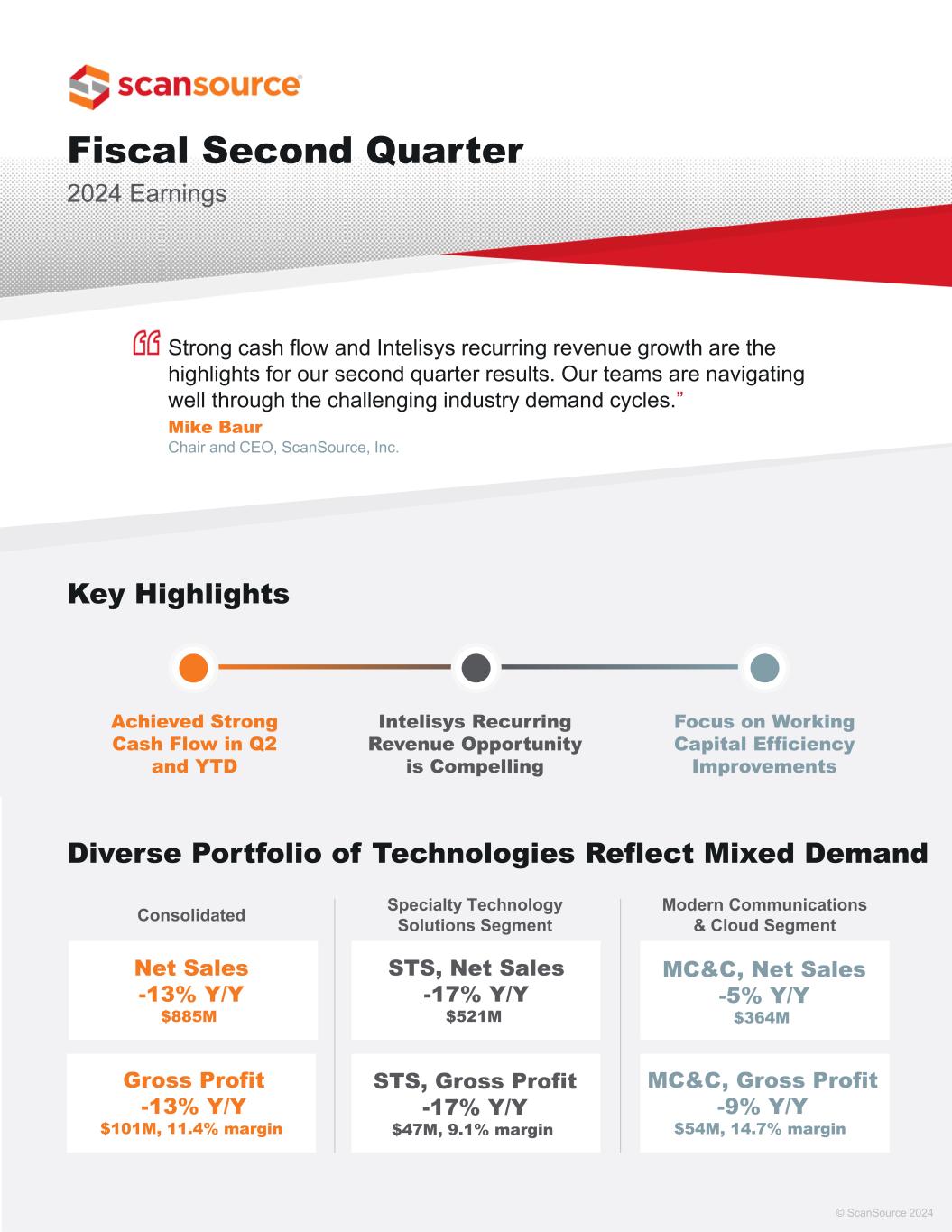

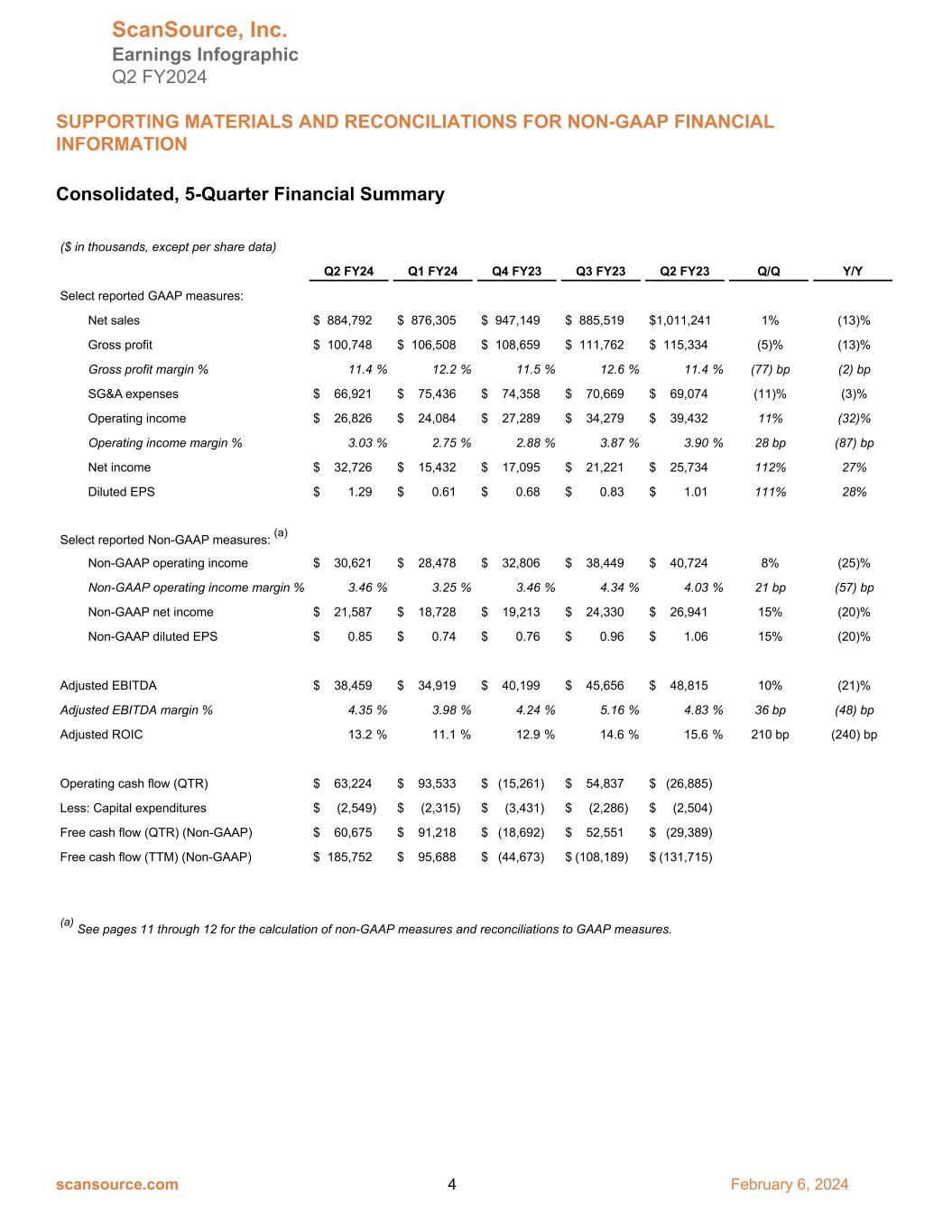

| Second Quarter Summary | |||||||||||||||||

| Q2 FY24 | Q2 FY23 | Change | |||||||||||||||

| (in thousands, except per share data) | |||||||||||||||||

Select reported measures: |

|||||||||||||||||

| Net sales | $ | 884,792 | $ | 1,011,241 | -12.5% | ||||||||||||

| Gross profit | $ | 100,748 | $ | 115,334 | -12.6% | ||||||||||||

| Gross profit margin % | 11.39 | % | 11.41 | % | -2bp | ||||||||||||

| Operating income | $ | 26,826 | $ | 39,432 | -32.0% | ||||||||||||

| GAAP net income | $ | 32,726 | $ | 25,734 | 27.2% | ||||||||||||

| GAAP diluted EPS | $ | 1.29 | $ | 1.01 | 27.7% | ||||||||||||

| Operating cash flow | $ | 63,224 | $ | (26,885) | n/m | ||||||||||||

| Select Non-GAAP measures: | |||||||||||||||||

| Adjusted EBITDA | $ | 38,459 | $ | 48,815 | -21.2% | ||||||||||||

| Adjusted EBITDA margin % | 4.35 | % | 4.83 | % | -48bp | ||||||||||||

| Non-GAAP net income | $ | 21,587 | $ | 26,941 | -19.9% | ||||||||||||

| Non-GAAP diluted EPS | $ | 0.85 | $ | 1.06 | -19.8% | ||||||||||||

| Free cash flow | $ | 60,675 | $ | (29,389) | n/m | ||||||||||||

| n/m - not meaningful | |||||||||||||||||

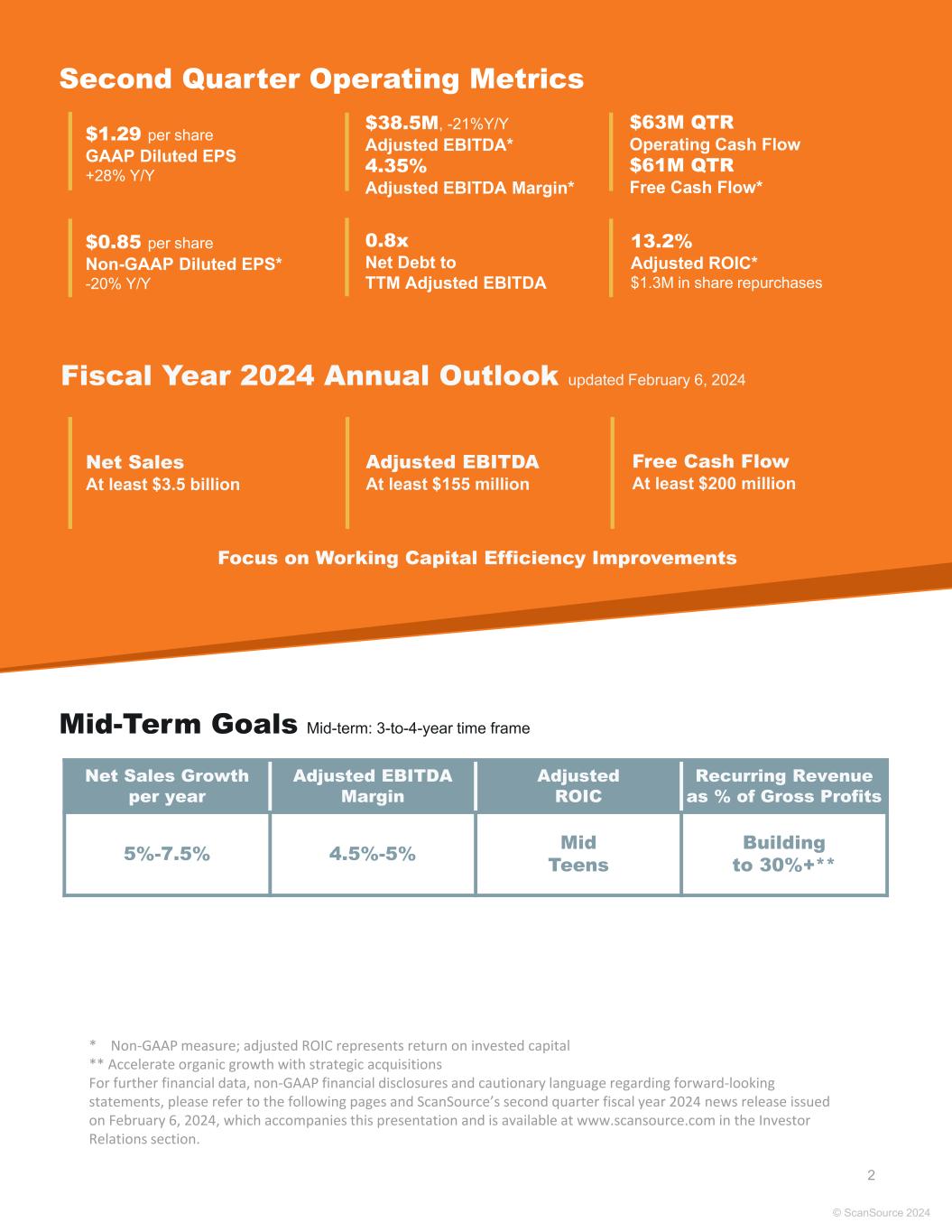

| FY24 Annual Outlook | Prior FY24 Annual Outlook | |||||||||||||

| Net sales | At least $3.5 billion | At least $3.8 billion | ||||||||||||

| Adjusted EBITDA (Non-GAAP) | At least $155 million | At least $170 million | ||||||||||||

| Free cash flow | At least $200 million | At least $200 million | ||||||||||||

| ScanSource, Inc. and Subsidiaries | |||||||||||

| Condensed Consolidated Balance Sheets (Unaudited) | |||||||||||

| (in thousands) | |||||||||||

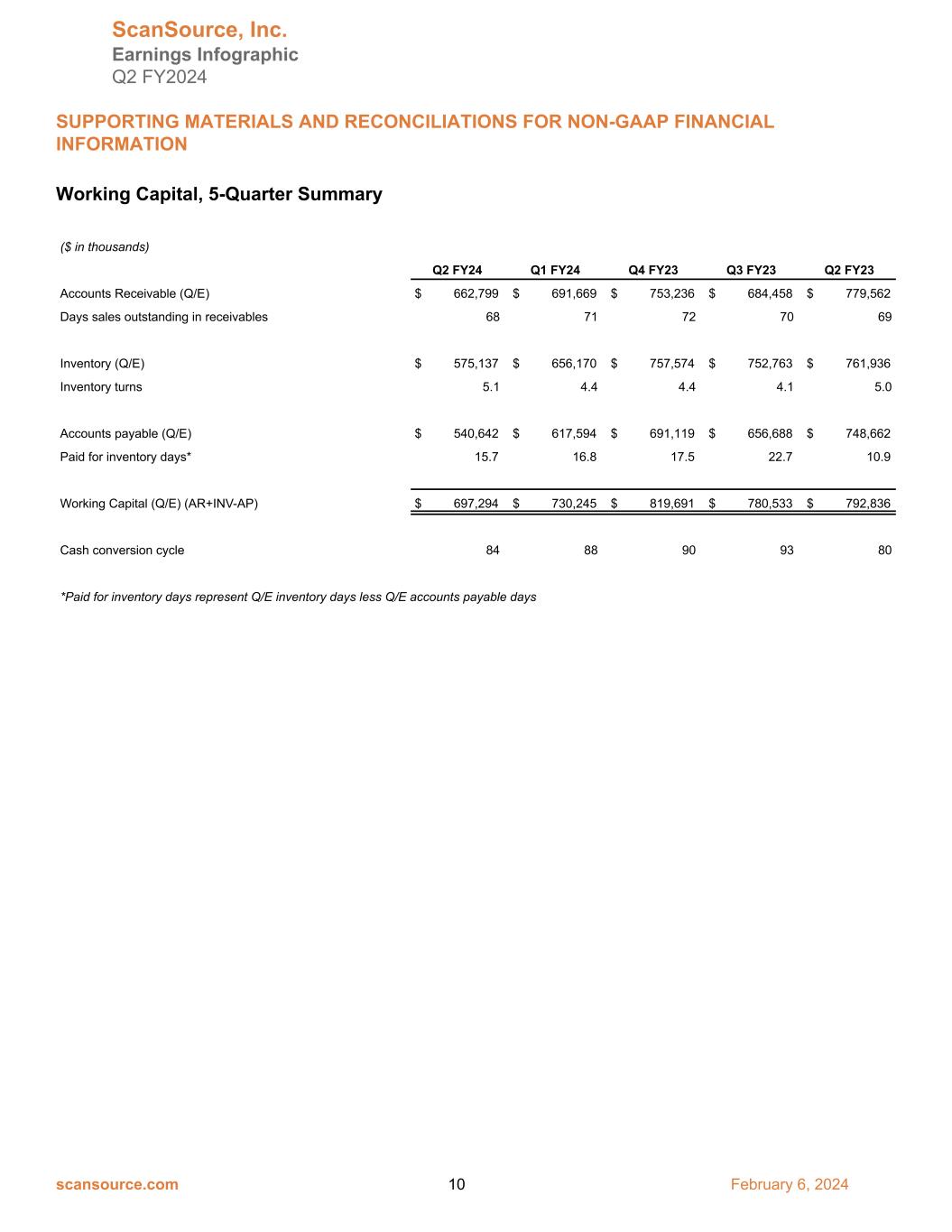

| December 31, 2023 | June 30, 2023* | ||||||||||

| Assets | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | 44,987 | $ | 36,178 | |||||||

|

Accounts receivable, less allowance of $19,243 at December 31, 2023

and $15,480 at June 30, 2023

|

662,799 | 753,236 | |||||||||

| Inventories | 575,137 | 757,574 | |||||||||

| Prepaid expenses and other current assets | 122,272 | 110,087 | |||||||||

| Total current assets | 1,405,195 | 1,657,075 | |||||||||

| Property and equipment, net | 36,546 | 37,379 | |||||||||

| Goodwill | 208,214 | 216,706 | |||||||||

| Identifiable intangible assets, net | 45,313 | 68,495 | |||||||||

| Deferred income taxes | 19,478 | 17,764 | |||||||||

| Other non-current assets | 66,059 | 70,750 | |||||||||

| Total assets | $ | 1,780,805 | $ | 2,068,169 | |||||||

| Liabilities and Shareholders’ Equity | |||||||||||

| Current liabilities: | |||||||||||

| Accounts payable | $ | 540,642 | $ | 691,119 | |||||||

| Accrued expenses and other current liabilities | 58,460 | 78,892 | |||||||||

| Income taxes payable | 3,653 | 9,875 | |||||||||

| Current portion of long-term debt | 7,857 | 6,915 | |||||||||

| Total current liabilities | 610,612 | 786,801 | |||||||||

| Deferred income taxes | — | 3,816 | |||||||||

| Long-term debt, net of current portion | 139,899 | 144,006 | |||||||||

| Borrowings under revolving credit facility | 20,878 | 178,980 | |||||||||

| Other long-term liabilities | 55,815 | 49,268 | |||||||||

| Total liabilities | 827,204 | 1,162,871 | |||||||||

| Commitments and contingencies | |||||||||||

| Shareholders’ equity: | |||||||||||

Preferred stock, no par value; 3,000,000 shares authorized, none issued |

— | — | |||||||||

Common stock, no par value; 45,000,000 shares authorized, 25,154,469 and 24,844,203 shares issued and outstanding at December 31, 2023 and June 30, 2023, respectively |

63,983 | 58,241 | |||||||||

| Retained earnings | 984,836 | 936,678 | |||||||||

| Accumulated other comprehensive loss | (95,218) | (89,621) | |||||||||

| Total shareholders’ equity | 953,601 | 905,298 | |||||||||

| Total liabilities and shareholders’ equity | $ | 1,780,805 | $ | 2,068,169 | |||||||

| ScanSource, Inc. and Subsidiaries | |||||||||||||||||||||||

| Condensed Consolidated Income Statements (Unaudited) | |||||||||||||||||||||||

| (in thousands, except per share data) | |||||||||||||||||||||||

| Quarter ended December 31, | Six months ended December 31, | ||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| Net sales | $ | 884,792 | $ | 1,011,241 | $ | 1,761,098 | $ | 1,955,054 | |||||||||||||||

| Cost of goods sold | 784,044 | 895,907 | 1,553,842 | 1,726,236 | |||||||||||||||||||

| Gross profit | 100,748 | 115,334 | 207,256 | 228,818 | |||||||||||||||||||

| Selling, general and administrative expenses | 66,921 | 69,074 | 142,356 | 140,667 | |||||||||||||||||||

| Depreciation expense | 2,964 | 2,678 | 5,759 | 5,441 | |||||||||||||||||||

| Intangible amortization expense | 4,037 | 4,150 | 8,230 | 8,391 | |||||||||||||||||||

| Operating income | 26,826 | 39,432 | 50,911 | 74,319 | |||||||||||||||||||

| Interest expense | 3,359 | 5,060 | 8,945 | 8,507 | |||||||||||||||||||

| Interest income | (2,119) | (2,027) | (3,444) | (3,618) | |||||||||||||||||||

| Gain on sale of business | (14,533) | — | (14,533) | — | |||||||||||||||||||

| Other expense, net | 73 | 207 | 750 | 955 | |||||||||||||||||||

| Income before income taxes | 40,046 | 36,192 | 59,193 | 68,475 | |||||||||||||||||||

| Provision for income taxes | 7,320 | 10,458 | 11,035 | 18,699 | |||||||||||||||||||

| Net income | $ | 32,726 | $ | 25,734 | $ | 48,158 | $ | 49,776 | |||||||||||||||

| Per share data: | |||||||||||||||||||||||

| Net income per common share, basic | $ | 1.31 | $ | 1.02 | $ | 1.93 | $ | 1.97 | |||||||||||||||

| Weighted-average shares outstanding, basic | 25,035 | 25,287 | 24,961 | 25,244 | |||||||||||||||||||

| Net income per common share, diluted | $ | 1.29 | $ | 1.01 | $ | 1.91 | $ | 1.96 | |||||||||||||||

| Weighted-average shares outstanding, diluted | 25,334 | 25,502 | 25,235 | 25,454 | |||||||||||||||||||

| ScanSource, Inc. and Subsidiaries | |||||||||||

| Condensed Consolidated Statements of Cash Flows (Unaudited) | |||||||||||

| (in thousands) | |||||||||||

| Six months ended December 31, | |||||||||||

| 2023 | 2022 | ||||||||||

| Cash flows from operating activities: | |||||||||||

| Net income | $ | 48,158 | $ | 49,776 | |||||||

| Adjustments to reconcile net income to net cash provided by (used in) operating activities: | |||||||||||

| Gain on sale of business | (14,533) | — | |||||||||

| Depreciation and amortization | 14,475 | 14,285 | |||||||||

| Amortization of debt issue costs | 193 | 385 | |||||||||

| Provision for doubtful accounts | 4,472 | 33 | |||||||||

| Share-based compensation | 5,340 | 5,679 | |||||||||

| Deferred income taxes | (1,703) | 932 | |||||||||

| Finance lease interest | 46 | 24 | |||||||||

| Changes in operating assets and liabilities, net of acquisitions: | |||||||||||

| Accounts receivable | 75,579 | (49,541) | |||||||||

| Inventories | 182,168 | (146,826) | |||||||||

| Prepaid expenses and other assets | (11,576) | 30,487 | |||||||||

| Other non-current assets | 3,208 | (7,168) | |||||||||

| Accounts payable | (135,138) | 33,820 | |||||||||

| Accrued expenses and other liabilities | (7,678) | (13,268) | |||||||||

| Income taxes payable | (6,254) | 6,036 | |||||||||

| Net cash provided by (used in) operating activities | 156,757 | (75,346) | |||||||||

| Cash flows from investing activities: | |||||||||||

| Capital expenditures | (4,865) | (4,262) | |||||||||

| Proceeds from sale of business, net of cash transferred | 17,978 | — | |||||||||

| Net cash provided by (used in) investing activities | 13,113 | (4,262) | |||||||||

| Cash flows from financing activities: | |||||||||||

| Borrowings on revolving credit, net of expenses | 1,134,629 | 1,232,058 | |||||||||

| Repayments on revolving credit, net of expenses | (1,292,729) | (1,137,897) | |||||||||

| Repayments on long-term debt, net | (3,165) | (1,407) | |||||||||

| Borrowings (repayments) on finance lease obligation | (442) | 17,465 | |||||||||

| Debt issuance costs | — | (492) | |||||||||

| Exercise of stock options | 4,309 | 634 | |||||||||

| Taxes paid on settlement of equity awards | (2,657) | (2,332) | |||||||||

| Common stock repurchased | (1,251) | — | |||||||||

| Net cash (used in) provided by financing activities | (161,306) | 108,029 | |||||||||

| Effect of exchange rate changes on cash and cash equivalents | 245 | 37 | |||||||||

| Increase in cash and cash equivalents | 8,809 | 28,458 | |||||||||

| Cash and cash equivalents at beginning of period | 36,178 | 37,987 | |||||||||

| Cash and cash equivalents at period end | 44,987 | $ | 66,445 | ||||||||

| ScanSource, Inc. and Subsidiaries | |||||||||||

| Supplementary Information (Unaudited) | |||||||||||

| (in thousands, except percentages) | |||||||||||

| Non-GAAP Financial Information: | |||||||||||

| Quarter ended December 31, | |||||||||||

| 2023 | 2022 | ||||||||||

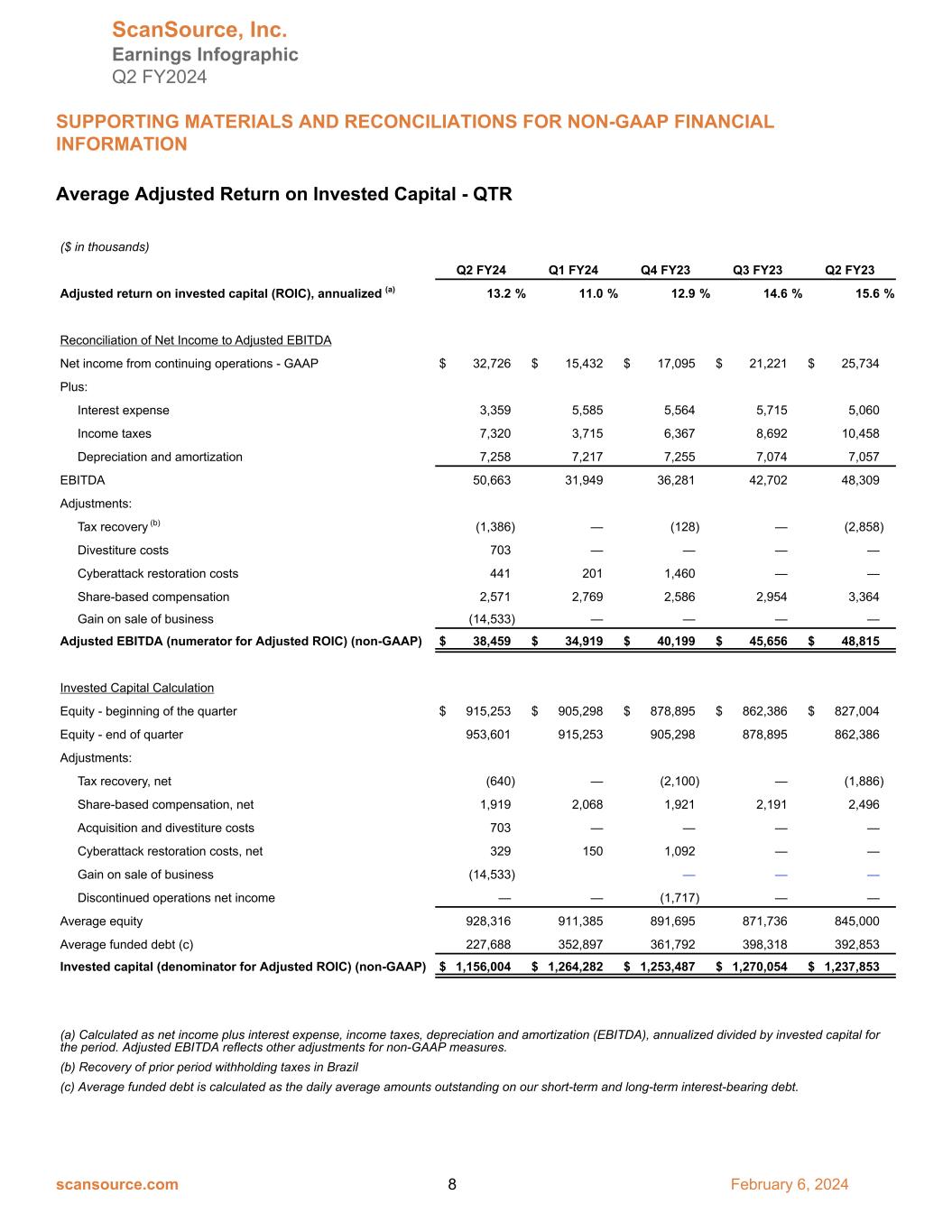

Adjusted return on invested capital ratio (Adjusted ROIC), annualized(a) |

13.2 | % | 15.6 | % | |||||||

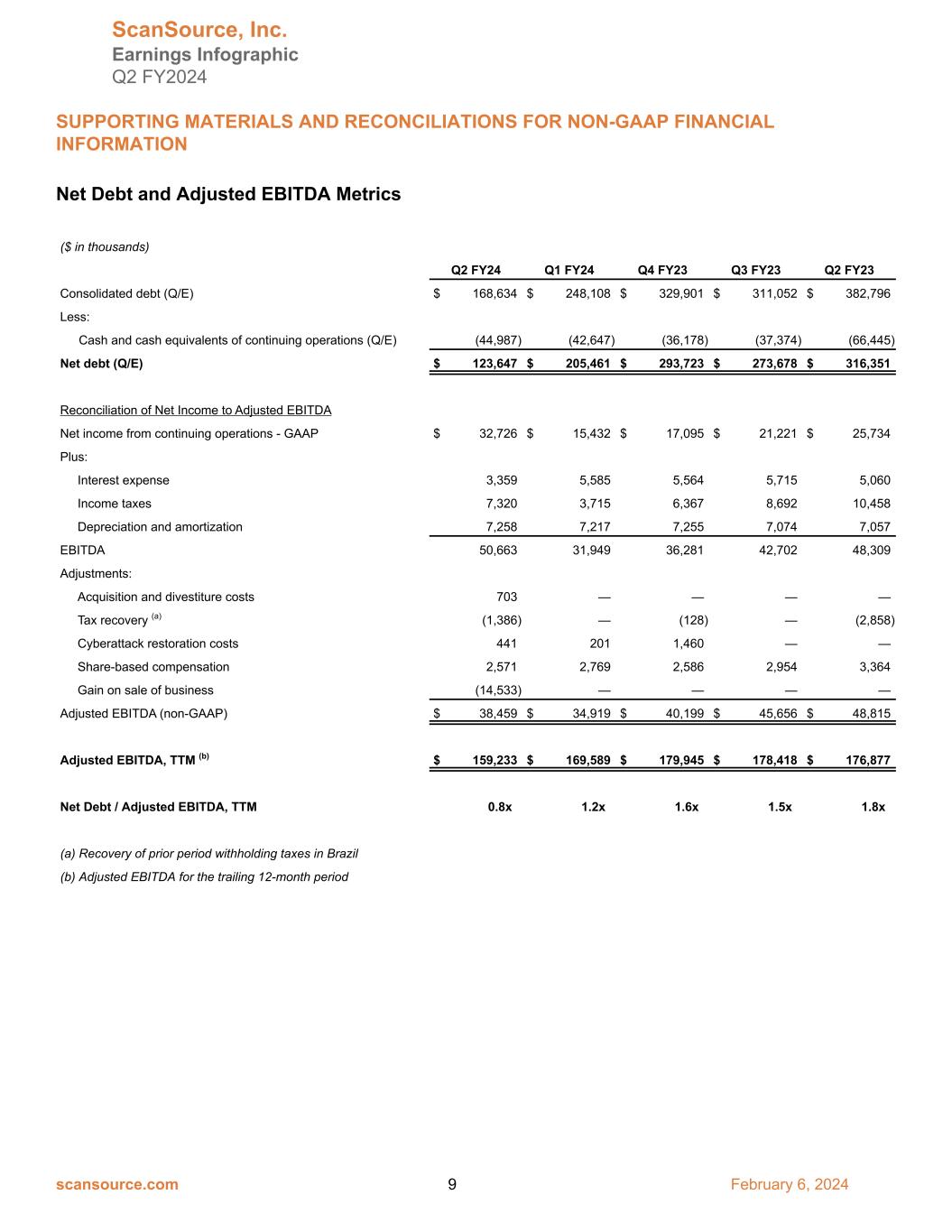

| Reconciliation of Net Income to Adjusted EBITDA: | |||||||||||

| Net income (GAAP) | $ | 32,726 | $ | 25,734 | |||||||

| Plus: Interest expense | 3,359 | 5,060 | |||||||||

| Plus: Income taxes | 7,320 | 10,458 | |||||||||

| Plus: Depreciation and amortization | 7,258 | 7,057 | |||||||||

| EBITDA (non-GAAP) | 50,663 | 48,309 | |||||||||

| Plus: Tax recovery | (1,386) | (2,858) | |||||||||

| Plus: Share-based compensation | 2,571 | 3,364 | |||||||||

| Plus: Acquisition and divestiture costs | 703 | — | |||||||||

| Plus: Cyberattack restoration costs | 441 | — | |||||||||

| Plus: Gain on sale of business | (14,533) | — | |||||||||

| Adjusted EBITDA (numerator for Adjusted ROIC) (non-GAAP) | $ | 38,459 | $ | 48,815 | |||||||

| Invested Capital Calculations: | |||||||||||

| Equity – beginning of the quarter | $ | 915,253 | $ | 827,004 | |||||||

| Equity – end of the quarter | 953,601 | 862,386 | |||||||||

| Plus: Share-based compensation, net | 1,919 | 2,496 | |||||||||

| Plus: Cyberattack restoration costs, net | 329 | — | |||||||||

| Plus: Divestiture costs | 703 | — | |||||||||

| Plus: Tax recovery, net | (640) | (1,886) | |||||||||

| Plus: Gain on sale of business | (14,533) | — | |||||||||

| Average equity | 928,316 | 845,000 | |||||||||

Average funded debt (b) |

227,688 | 392,853 | |||||||||

| Invested capital (denominator for Adjusted ROIC) (non-GAAP) | $ | 1,156,004 | $ | 1,237,853 | |||||||

(a) The annualized adjusted EBITDA amount is divided by days in the quarter times 365 days per year, or 366 days for leap year. There were 92 days in the current and prior-year quarter. | |||||||||||

(b) Average funded debt is calculated as the average daily amounts outstanding on short-term and long-term interest-bearing debt. | |||||||||||

| Quarter ended December 31, | Six months ended December 31, | ||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| GAAP operating cash flow | $ | 63,224 | $ | (26,885) | $ | 156,757 | $ | (75,346) | |||||||||||||||

| Less: Capital Expenditures | (2,549) | (2,504) | (4,865) | (4,262) | |||||||||||||||||||

| Free cash flow (non-GAAP) | $ | 60,675 | $ | (29,389) | $ | 151,892 | $ | (79,608) | |||||||||||||||

| ScanSource, Inc. and Subsidiaries | |||||||||||||||||

| Supplementary Information (Unaudited) | |||||||||||||||||

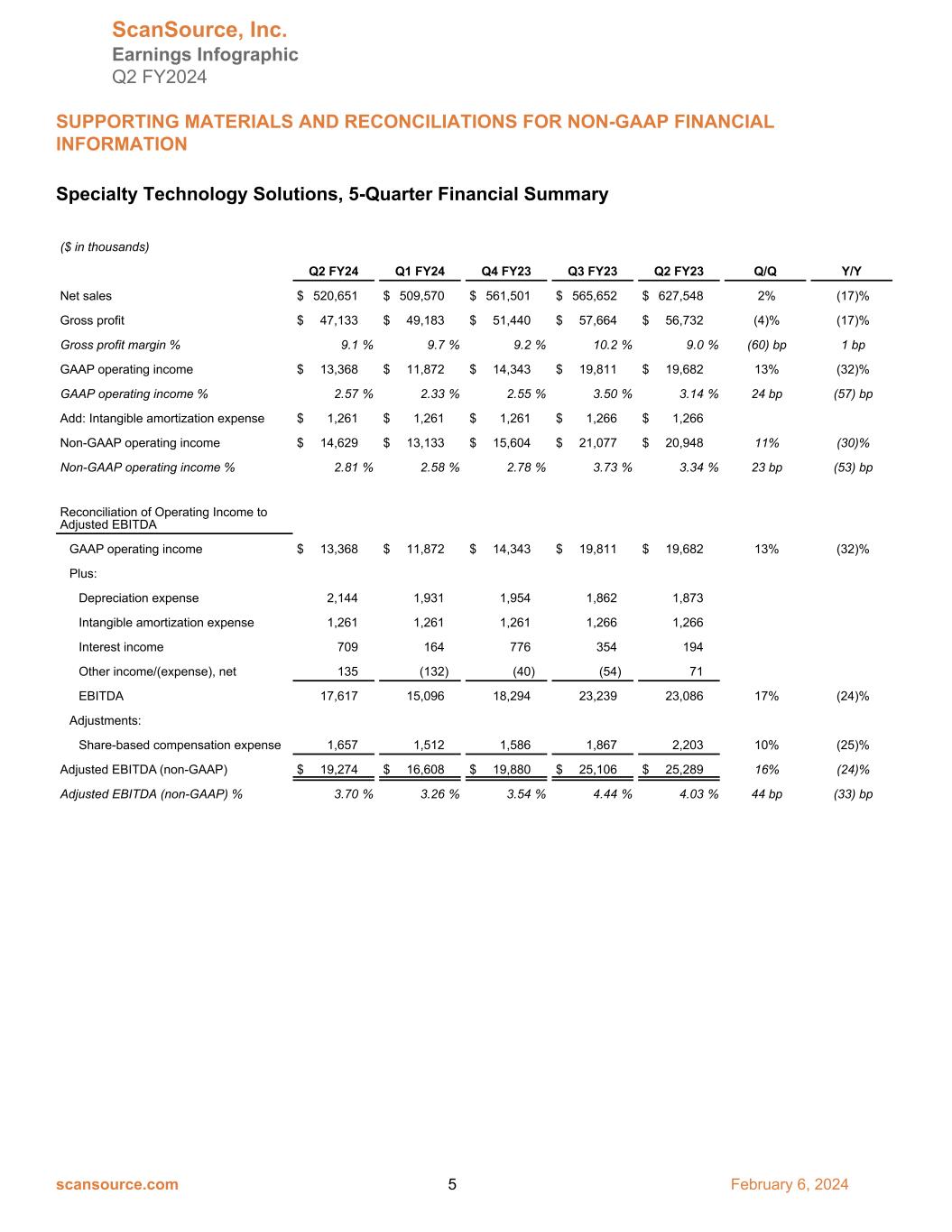

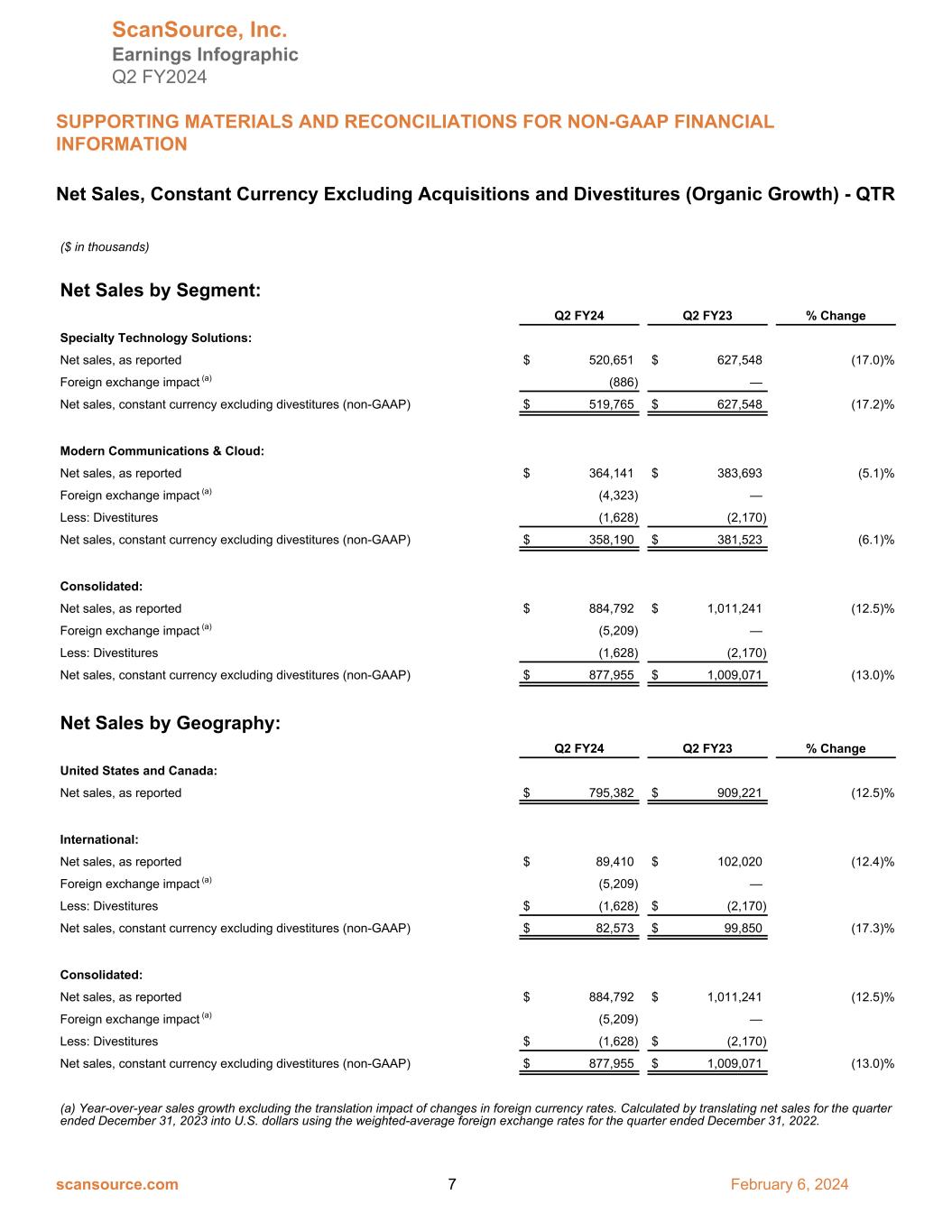

| Net Sales by Segment: | |||||||||||||||||

| Quarter ended December 31, | |||||||||||||||||

| 2023 | 2022 | % Change | |||||||||||||||

| Specialty Technology Solutions: | (in thousands) | ||||||||||||||||

| Net sales, reported | $ | 520,651 | 627,548 | (17.0) | % | ||||||||||||

Foreign exchange impact (a) |

(886) | — | |||||||||||||||

| Non-GAAP net sales | $ | 519,765 | $ | 627,548 | (17.2) | % | |||||||||||

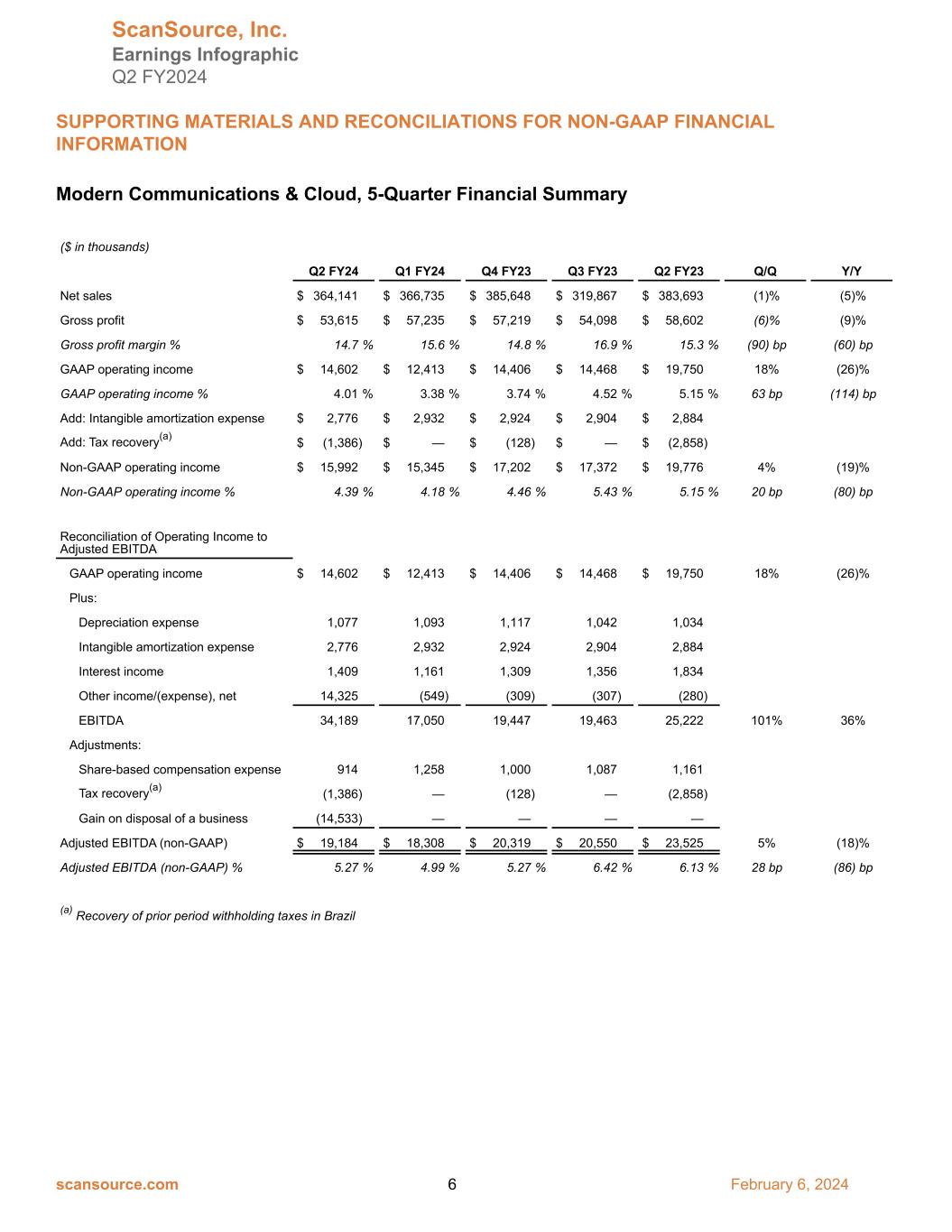

| Modern Communications & Cloud: | |||||||||||||||||

| Net sales, reported | $ | 364,141 | $ | 383,693 | (5.1) | % | |||||||||||

Foreign exchange impact (a) |

(4,323) | — | |||||||||||||||

| Less: Divestitures | $ | (1,628) | $ | (2,170) | |||||||||||||

| Non-GAAP net sales | $ | 358,190 | $ | 381,523 | (6.1) | % | |||||||||||

| Consolidated: | |||||||||||||||||

| Net sales, reported | $ | 884,792 | $ | 1,011,241 | (12.5) | % | |||||||||||

Foreign exchange impact (a) |

(5,209) | — | |||||||||||||||

| Less: Divestitures | $ | (1,628) | $ | (2,170) | |||||||||||||

| Non-GAAP net sales | $ | 877,955 | $ | 1,009,071 | (13.0) | % | |||||||||||

(a) Year-over-year net sales growth rate excluding the translation impact of changes in foreign currency exchange rates. Calculated by translating the net sales for the quarter ended December 31, 2023 into U.S. dollars using the average foreign exchange rates for the quarter ended December 31, 2022. | |||||||||||||||||

| ScanSource, Inc. and Subsidiaries | |||||||||||||||||

| Supplementary Information (Unaudited) | |||||||||||||||||

| Net Sales by Geography: | |||||||||||||||||

| Quarter ended December 31, | |||||||||||||||||

| 2023 | 2022 | % Change | |||||||||||||||

| United States and Canada: | (in thousands) | ||||||||||||||||

| Net sales, as reported | $ | 795,382 | $ | 909,221 | (12.5) | % | |||||||||||

| International: | |||||||||||||||||

| Net sales, reported | $ | 89,410 | $ | 102,020 | (12.4) | % | |||||||||||

Foreign exchange impact(a) |

(5,209) | — | |||||||||||||||

| Less: Divestitures | (1,628) | (2,170) | |||||||||||||||

| Non-GAAP net sales | $ | 82,573 | $ | 99,850 | (17.3) | % | |||||||||||

| Consolidated: | |||||||||||||||||

| Net sales, reported | $ | 884,792 | $ | 1,011,241 | (12.5) | % | |||||||||||

Foreign exchange impact(a) |

(5,209) | — | |||||||||||||||

| Less: Divestitures | (1,628) | (2,170) | |||||||||||||||

| Non-GAAP net sales | $ | 877,955 | $ | 1,009,071 | (13.0) | % | |||||||||||

(a) Year-over-year net sales growth rate excluding the translation impact of changes in foreign currency exchange rates. Calculated by translating the net sales for the quarter ended December 31, 2023 into U.S. dollars using the average foreign exchange rates for the quarter ended December 31, 2022. | |||||||||||||||||

| ScanSource, Inc. and Subsidiaries | ||||||||||||||||||||||||||||||||||||||||||||

| Supplementary Information (Unaudited) | ||||||||||||||||||||||||||||||||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||||||||||||||||||||||||||||||

| Non-GAAP Financial Information: | ||||||||||||||||||||||||||||||||||||||||||||

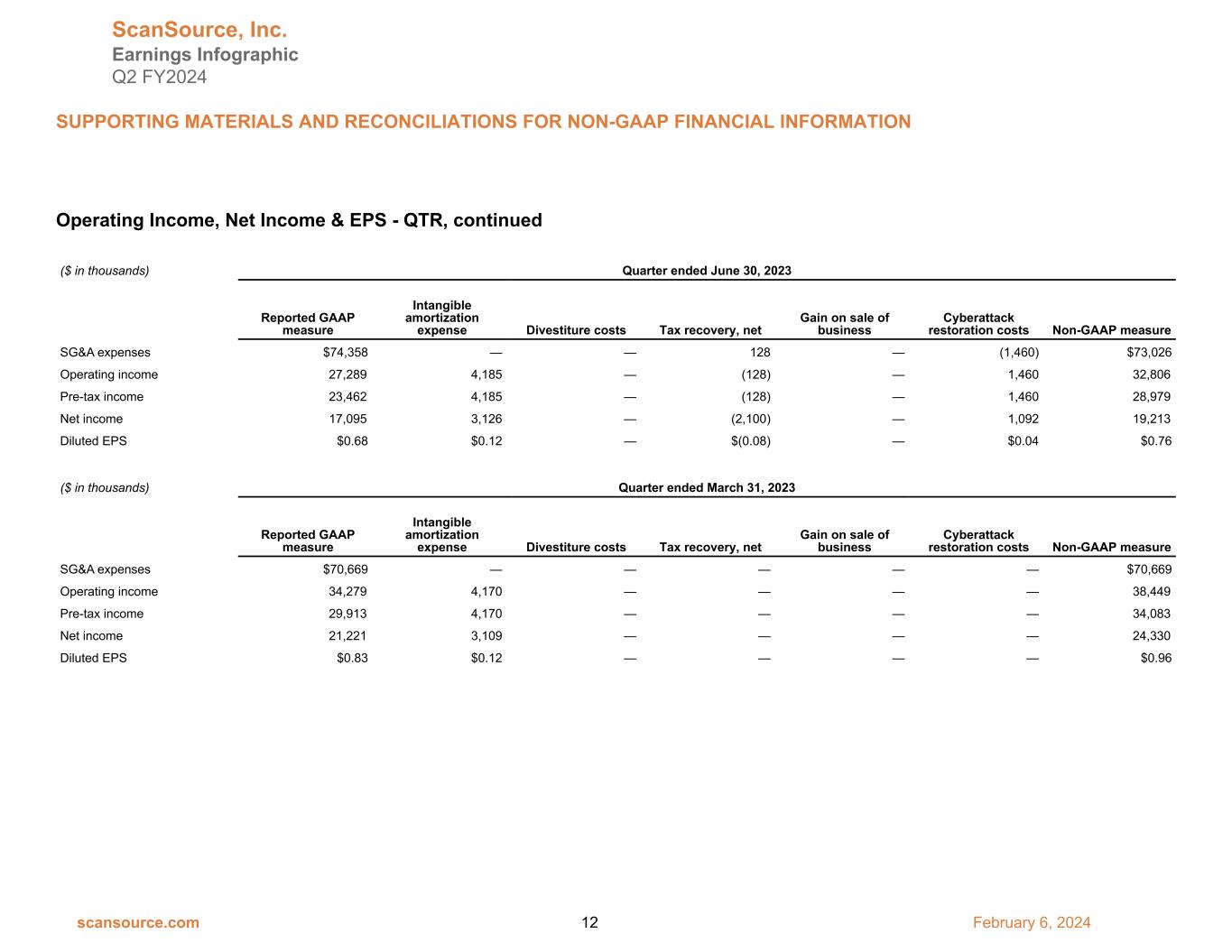

| Quarter ended December 31, 2023 | ||||||||||||||||||||||||||||||||||||||||||||

| GAAP Measure | Intangible amortization expense | Divestiture costs | Tax recovery | Cyberattack restoration costs | Gain on sale of business (a) |

Non-GAAP measure | ||||||||||||||||||||||||||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||||||||||||||||||||||||||||||

| SG&A expenses | $66,921 | — | $(703) | $1,386 | $(441) | — | $67,163 | |||||||||||||||||||||||||||||||||||||

| Operating income | 26,826 | 4,037 | 703 | (1,386) | 441 | — | 30,621 | |||||||||||||||||||||||||||||||||||||

| Pre-tax income | 40,046 | 4,037 | 703 | (1,386) | 441 | (14,533) | 29,308 | |||||||||||||||||||||||||||||||||||||

| Net income | 32,726 | 3,002 | 703 | (640) | 329 | (14,533) | 21,587 | |||||||||||||||||||||||||||||||||||||

| Diluted EPS | $1.29 | $0.12 | $0.03 | $(0.03) | $0.01 | $(0.57) | $0.85 | |||||||||||||||||||||||||||||||||||||

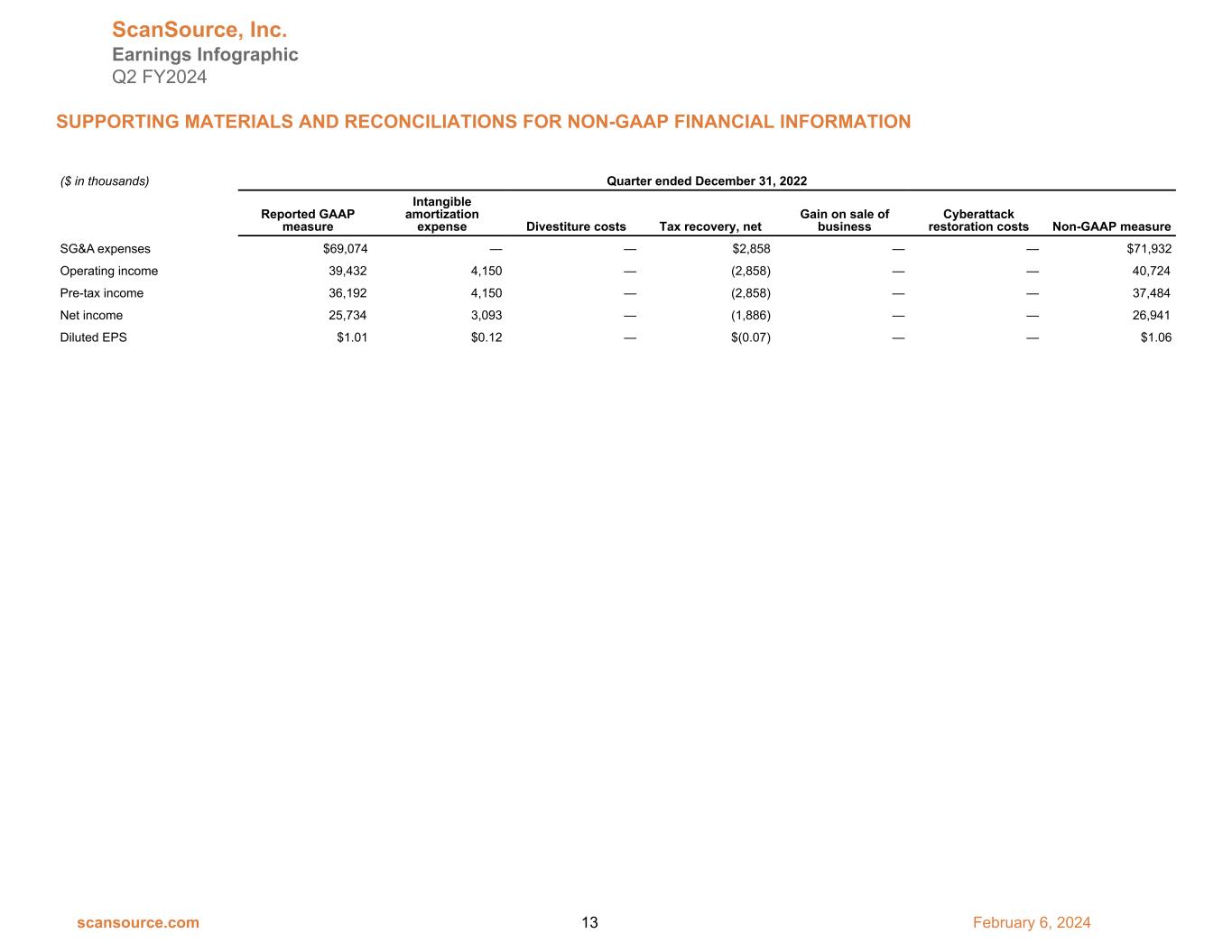

| Quarter ended December 31, 2022 | ||||||||||||||||||||||||||||||||||||||||||||

| GAAP Measure | Intangible amortization expense | Divestiture costs | Tax recovery | Cyberattack restoration costs | Gain on sale of business (a) |

Non-GAAP measure | ||||||||||||||||||||||||||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||||||||||||||||||||||||||||||

| SG&A expense | $69,074 | — | — | $2,858 | — | — | $71,932 | |||||||||||||||||||||||||||||||||||||

| Operating income | 39,432 | 4,150 | — | (2,858) | — | — | 40,724 | |||||||||||||||||||||||||||||||||||||

| Pre-tax income | 36,192 | 4,150 | — | (2,858) | — | — | 37,484 | |||||||||||||||||||||||||||||||||||||

| Net income | 25,734 | 3,093 | — | (1,886) | — | — | 26,941 | |||||||||||||||||||||||||||||||||||||

| Diluted EPS | $1.01 | $0.12 | — | $(0.07) | — | — | $1.06 | |||||||||||||||||||||||||||||||||||||

(a) Reflects gain on the sale of the UK-based intY business. This transaction resulted in a capital loss for tax purposes. ScanSource did not record a tax provision on the capital loss since there were no offsetting capital gains. |

||||||||||||||||||||||||||||||||||||||||||||

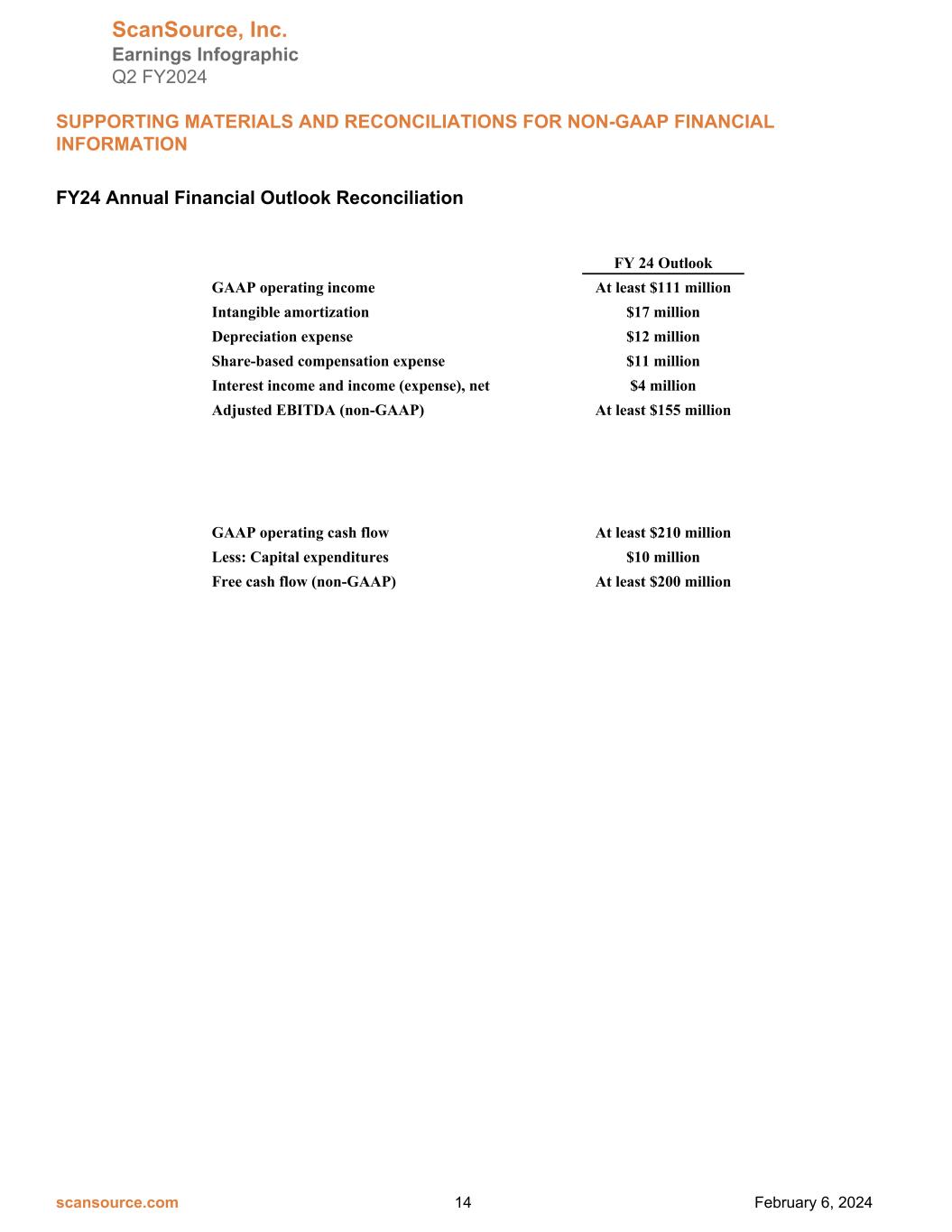

| FY 24 Outlook | |||||

| GAAP operating income | At least $111 million | ||||

| Intangible amortization | $17 million | ||||

| Depreciation expense | $12 million | ||||

| Share-based compensation expense | $11 million | ||||

| Interest income and income (expense), net | $4 million | ||||

| Adjusted EBITDA (non-GAAP) | At least $155 million | ||||

| GAAP operating cash flow | At least $210 million | ||||

| Less: Capital expenditures | $10 million | ||||

| Free cash flow (non-GAAP) | At least $200 million | ||||