Document

|

|

|

|

|

|

|

|

|

|

|

|

ELDORADO GOLD | 2024 NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND MANAGEMENT PROXY CIRCULAR |

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

ELDORADO GOLD | 2024 NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND MANAGEMENT PROXY CIRCULAR |

|

|

|

|

|

|

|

|

|

|

|

|

ELDORADO GOLD | 2024 NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND MANAGEMENT PROXY CIRCULAR |

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

|

ELDORADO GOLD | 2024 NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND MANAGEMENT PROXY CIRCULAR |

|

|

|

|

|

|

|

|

|

|

|

|

ELDORADO GOLD | 2024 NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND MANAGEMENT PROXY CIRCULAR |

|

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

|

ELDORADO GOLD | 2024 NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND MANAGEMENT PROXY CIRCULAR |

|

|

|

|

|

|

|

|

|

|

|

|

ELDORADO GOLD | 2024 NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND MANAGEMENT PROXY CIRCULAR |

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 |

|

ELDORADO GOLD | 2024 NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND MANAGEMENT PROXY CIRCULAR |

Table of Contents

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2 |

|

|

|

|

|

|

| 4 |

|

|

|

|

|

|

|

|

|

68 |

|

|

|

|

|

Notice of Meeting |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Appointment of Auditors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

121 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 58 |

|

|

Sustainability Highlights |

|

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ELDORADO GOLD | 2024 NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND MANAGEMENT PROXY CIRCULAR |

|

9 |

2024 Notice of Annual Meeting of Shareholders

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| When |

|

|

Items of Business |

|

|

Tuesday, June 4, 2024

3:00p.m. Pacific time

|

|

|

|

|

|

|

|

|

|

| Where |

|

|

|

|

In person:

Fasken Martineau DuMoulin LLP

550 Burrard Street, Suite 2900

Vancouver, BC, V6C 0A3

|

|

|

3.Re-appoint KPMG as auditor for the coming year, page 15

|

|

|

|

|

|

|

Virtually:

Computershare virtual meeting platform at meetnow.global/M669DQC

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Eldorado is conducting its Annual Meeting this year in a physical and virtual hybrid format. |

Your Vote Is Important

You are entitled to receive this notice to vote at our 2024 Annual Meeting of Shareholders (“2024 Annual Meeting”) if you owned common shares of Eldorado Gold Corporation (“Eldorado” or the “Company”) as of the close of business on April 12, 2024 (“the record date” for the 2024 Annual Meeting). Registered shareholders and duly appointed proxyholders (who, if attending virtually, have been properly registered prior to the meeting) will be able to attend, participate and vote at the 2024 Annual Meeting either in person or online. Non-registered beneficial shareholders who have not duly appointed themselves as proxyholder will not be able to attend the 2024 Annual Meeting in person but may attend online as a guest. Guests attending virtually may view the webcast, but will not be able to participate or vote at the 2024 Annual Meeting. Additional information on how to attend the 2024 Annual Meeting virtually can be found on page 115.

Notice and Access

We are using notice-and-access procedures to deliver our 2024 meeting materials to shareholders. You are receiving this notice with information on how you can access the Management Proxy Circular (“Circular”) electronically, along with a proxy – or, in the case of non-registered shareholders, a voting instruction form – by which to vote at the meeting or submit your voting instructions.

The Circular, form of proxy, Annual Return Card, Annual Audited Consolidated Financial Statements and associated Management’s Discussion and Analysis (“MD&A”) are available on our website (www.eldoradogold.com/shareholder-materials) as of May 3, 2024, and will remain on the website for one full year. You can also access the meeting materials through our public filings on the SEDAR+ website (www.sedarplus.com) and the United States Securities and Exchange Commission (“SEC”) website (www.sec.gov), under Eldorado’s name.

The Circular contains important information about the meeting, including what is required to attend the meeting in person or virtually. We encourage and remind you to access and review the Circular prior to voting.

The Company will mail paper copies of the meeting materials to those shareholders who had previously elected to receive paper copies. All other shareholders will receive this notice along with a form of proxy or voting instruction form, as applicable. If you received this notice and want to obtain paper copies of the full meeting materials, they can be requested, without charge, by contacting us as follows:

|

|

|

|

|

|

|

|

|

|

information@eldoradogold.com

t: 1 604 687 4018

1 888 353 8166 (toll-free)

f: 1 604 687 4026

|

550 Burrard Street, 11th Floor

Vancouver, BC, V6C 2B5

Attention: Corporate Secretary |

|

|

|

|

|

|

|

|

|

|

|

|

ELDORADO GOLD | 2024 NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND MANAGEMENT PROXY CIRCULAR |

|

11 |

To receive the Circular in advance of the proxy deposit date and meeting date, requests for printed copies must be received at least five business days in advance of the proxy deposit date and time set out in the accompanying proxy or voting instruction form.

Shareholders are able to request future copies of the Annual Audited Consolidated Financial Statements and MD&A and/or interim consolidated financial report and MD&A by marking the appropriate box on the Annual Return Card included with this notice, as applicable. All registered shareholders will receive the Annual Audited Consolidated Financial Statements and MD&A.

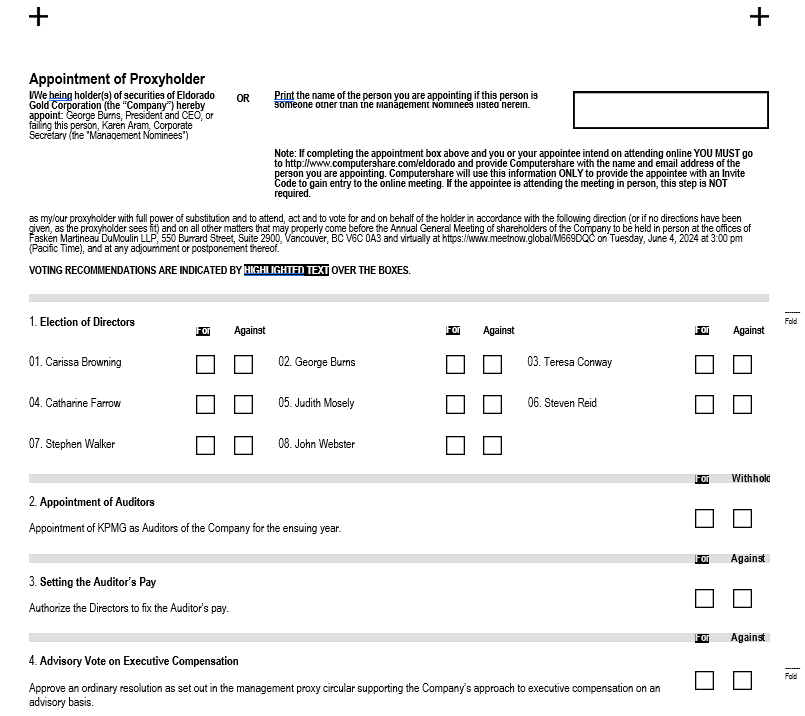

Submitting Your Vote

If you are a registered shareholder and are unable to attend the meeting either in person or online, please complete the enclosed form of proxy and return it as soon as possible. To be valid, proxies must be returned by 3:00p.m. (Pacific time) on Friday,

May 31, 2024, to our transfer agent at:

Computershare Trust Company of Canada

100 University Avenue, 8th Floor

Toronto, ON, M5J 2Y1

You may also vote by telephone or online by following the instructions on your proxy.

If you are a non-registered shareholder, you should follow the instructions on your voting instruction form in order to submit your voting instructions to your intermediary or its agent. You should submit your voting instructions to your intermediary or its agent as instructed as soon as possible, so that your intermediary or its agent has sufficient time to submit your vote prior to the voting deadline of 3:00p.m. (Pacific time) on Friday, May 31, 2024.

If you have any questions or need assistance completing your form of proxy or voting instruction form, please contact Laurel Hill Advisory Group by telephone at 1 877 452 7184 toll-free in North America, or 1 416 304 0211 outside of North America, or by email at assistance@laurelhill.com.

By order of the Board,

Karen Aram

Corporate Secretary

Vancouver, BC

April 16, 2024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12 |

|

ELDORADO GOLD | 2024 NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND MANAGEMENT PROXY CIRCULAR |

General Information

Eldorado Gold

In this document, “we,” “us,” “our,” “Eldorado,” “Company” and “Corporation” mean Eldorado Gold Corporation.

Shareholders

“You,” “your” and “shareholder” mean registered holders (unless the context otherwise requires) of common shares of Eldorado.

Date of Information

Information in this document is as of April 12, 2024, unless otherwise stated.

Exchange Rate

All dollar figures are in Canadian dollars, except as noted. We used the average annual exchange rate for 2023 reported by the

Bank of Canada of CDN$1.00 = USD$0.7409, unless otherwise noted.

Additional Information

Information on our website is not part of this Circular or incorporated by reference. Filings on SEDAR+ are also not part of this Circular or incorporated by reference, except as specifically stated. For greater certainty, Eldorado’s Climate Change and GHG Emissions Report and Sustainability Report as well as the Kışladağ Technical Report, Efemçukuru Technical Report, Olympias Technical Report, Skouries Technical Report and Lamaque Technical Report are expressly excluded from incorporation by reference herein.

You can find financial information relating to Eldorado in our Annual Audited Consolidated Financial Statements and MD&A dated December 31, 2023.

See our MD&A, financial statements and our Annual Information Form (“AIF”) or Form 40-F for additional information about Eldorado. These documents and additional information relating to Eldorado are available on our website (www.eldoradogold.com) and are also available on the SEDAR+ website (www.sedarplus.com) and the SEC website (www.sec.gov), under Eldorado’s name.

You can also request copies free of charge by contacting our Corporate Secretary:

|

|

|

|

|

|

|

|

|

|

information@eldoradogold.com

t: 1 604 687 4018

1 888 353 8166 (toll-free)

f: 1 604 687 4026

|

550 Burrard Street, 11th Floor

Vancouver, BC, V6C 2B5

Attention: Corporate Secretary |

|

|

|

|

|

|

|

|

|

|

|

|

ELDORADO GOLD | 2024 NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND MANAGEMENT PROXY CIRCULAR |

|

13 |

Business of Meeting

1. Receiving Our Financial Statements and the Auditor’s Report

Both our Annual Audited Consolidated Financial Statements for the year ended December 31, 2023, and the auditor’s report are available on our website (www.eldoradogold.com) and on the SEDAR+ website (www.sedarplus.com) and the SEC website (www.sec.gov), under Eldorado’s name.

A representative from KPMG LLP (“KPMG”), our independent auditor for 2023, will be at the meeting to answer any questions about the auditor’s report.

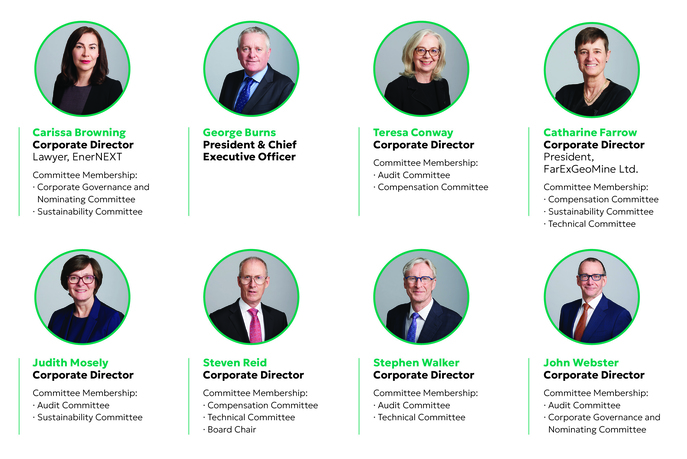

2. Electing Directors

According to our articles and by-laws, we must elect between three and 20 directors at each annual meeting, each to serve for a one-year term or until a successor is elected or appointed.

The Board has decided that eight directors will be elected this year, based on the diverse mix of skills and experience the Board believes is necessary to effectively fulfill its duties and responsibilities.

|

|

|

|

|

|

|

|

|

|

|

|

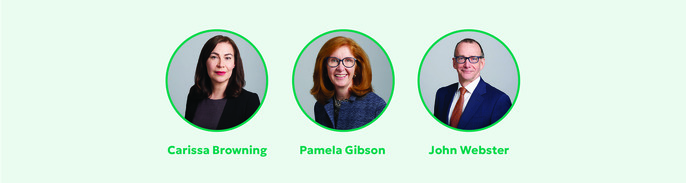

| Director Nominees for 2024 |

|

|

| Carissa Browning |

Teresa Conway |

Judith Mosely |

Stephen Walker |

| George Burns |

Catharine Farrow |

Steven Reid |

John Webster |

Each of the director nominees is well qualified and demonstrates the competencies, character and commitment that is complementary to Eldorado’s needs and culture; additionally, each has expressed their willingness to serve on the Board. Further information on each of the nominees can be found starting on page 16.

Majority Voting

The election of directors at the 2024 Annual Meeting is governed by the majority voting requirements under the CBCA, and the CBCA regulations, which came into force on August 31, 2022. These requirements provide that in an uncontested election of directors, shareholders will be allowed to vote “for” or “against” each director nominee (as opposed to “for” or “withhold” as was the case previously). A nominee will be elected as a director only if the number of shares voted “for” that nominee exceeds the number of shares voted “against” that nominee.

If a nominee does not receive a majority of votes cast by shareholders in favour of their election, they will not be elected and the director position will remain open, except that an incumbent nominee (which comprise all of the Company’s nominees for the Meeting) will be permitted to remain in office until the earlier of: (a) the 90th day after the day of the election; or (b) the day on which their successor is appointed or elected. The Board may not re-appoint an incumbent director who did not receive majority support at any time prior to the next annual shareholders meeting other than in the following limited and defined circumstances:

(i) to satisfy Canadian residency requirements; or (ii) to satisfy the requirement that at least two directors are not also officers or employees of the Company or its affiliates.

These statutory majority voting requirements only apply to uncontested elections of directors, meaning elections where the number of director nominees is the same as the number of directors to be elected to the Board of Directors (such as the election of directors to take place at the Meeting). Following the implementation of these amendments to the CBCA, the Company’s then existing Majority Voting Policy was rendered redundant and was revoked by the Board of Directors.

The majority voting requirements under the CBCA will not apply in the case of a contested election of directors, in which case the directors will be elected by a plurality of votes of the shares represented in person or by proxy at the Meeting and voted on the election of directors.

Advance Notice Policy

Our by-laws contain an advance-notice provision for director nominations. Shareholders who wish to nominate candidates for election as directors must provide written notice of their intention to the Corporate Secretary (550 Burrard Street, 11th Floor, Vancouver, BC, V6C 2B5) and include certain information as set out in Part 9 of our by-laws. The notice must be made not less than 30 days and not more than 65 days prior to the date of our next annual meeting, in compliance with Part 9. If you wish to submit a director nomination to be presented at our 2024 Annual Meeting, the required information must be sent to our Corporate Secretary by May 3, 2024. A copy of our by-laws can be found on the SEDAR+ website (www.sedarplus.com), under our Company’s name.

|

|

|

|

|

|

|

|

|

|

We recommend that you vote FOR the election of the director nominees. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 |

|

ELDORADO GOLD | 2024 NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND MANAGEMENT PROXY CIRCULAR |

3. Appointing the Independent Auditor and Authorizing the Board to Set the Auditor’s Pay

KPMG has been our independent auditor since 2009. Upon the recommendation of the Audit Committee and the Board, shareholders will be asked to approve the re-appointment of KPMG as auditor and also to authorize the Board to set the auditor’s pay for 2024.

KPMG conducts the annual audit of our financial statements and provides audit-related tax and other services, and reports to the Audit Committee of the Board. The table below outlines the fees paid to KPMG in the last two years.

|

|

|

|

|

|

|

|

|

|

|

|

| Years ended December 31 |

2023 (USD$) |

2022 (USD$) |

|

| Audit fees |

1,864,990 |

1,484,090 |

Total fees for audit services |

| Audit-related fees |

97,859 |

100,200 |

Majority of fees relate to French translations |

| All other services |

8,250 |

— |

|

| Total |

$1,971,099 |

$1,584,290 |

|

|

|

|

|

|

|

|

|

|

|

We recommend that you vote FOR the appointment of KPMG as our auditor for the ensuing year and FOR authorizing the Board to set the auditor’s pay. |

|

4. Advisory Vote on Executive Compensation – Voluntary Adoption of “Say on Pay”

The Board approved a policy on “say on pay” and shareholder engagement. The policy establishes the framework for conducting an annual non-binding advisory vote by our shareholders on Eldorado’s executive compensation. The advisory vote provides shareholders with the opportunity to advise the Board on their view of our executive compensation programs as presented in the Statement of Executive Compensation (referred to herein as “CD&A”) of this Circular.

As this is an advisory vote, the results will not be binding on the Board. The Board retains sole authority and remains fully responsible for the Company’s compensation decisions, and are not relieved of these responsibilities as a result of the advisory vote by shareholders. The Board will, however, take into account the results of the advisory vote when considering whether there is a need to increase shareholder engagement on compensation and other matters.

Following each annual general meeting, all voting results, including the results of the “say on pay” vote, are publicly filed under the Company’s profile on the SEDAR+ website (www.sedarplus.com).

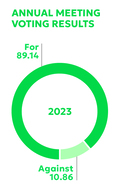

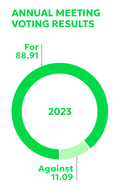

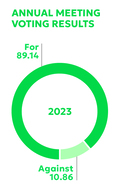

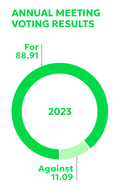

We are pleased to report that in 2023 and 2022, over 90% of our shareholders voted in support of our approach to executive compensation.

|

|

|

|

|

|

|

|

|

| Year |

Votes “for” (%) |

Votes “against” (%) |

| 2023 |

98.48 |

1.52 |

| 2022 |

94.89 |

5.11 |

BE IT RESOLVED THAT, on an advisory basis, and not to diminish the role and responsibilities of the Board, the shareholders accept that the philosophy and design of the Company’s executive compensation program, as disclosed in the Company’s Circular and the CD&A, are appropriate.

|

|

|

|

|

|

|

|

|

|

We recommend that you vote FOR the adoption of the resolution to support our approach to executive compensation. |

|

5. Other Business

We will also consider any other matters that properly come before the meeting. As of the date of this Circular, we are not aware of any other items of business to be considered at the meeting.

|

|

|

|

|

|

|

|

|

|

|

|

ELDORADO GOLD | 2024 NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND MANAGEMENT PROXY CIRCULAR |

|

15 |

Board of Director Nominees

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16 |

|

ELDORADO GOLD | 2024 NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND MANAGEMENT PROXY CIRCULAR |

Director Nominees

At the meeting, shareholders will be asked to elect eight directors. All of the nominated directors are independent, with the exception of George Burns, the Company’s President & Chief Executive Officer (“CEO”); the Board committees are also composed 100% of independent directors. The director nominees have significant and complementary experience across multiple sectors and markets, which help form a strong and independent Board. The Board is committed to deliberate Board renewal. This renewal plan has resulted in an increase in key strength areas, including:

•Board diversity

•Capital markets and financing expertise

•Compensation

•Corporate governance

•Decarbonization and climate change

•Mergers & acquisition expertise

•Strategic planning and risk assessment

•Sustainability

•Technical mining and operating expertise

Further attributes of our director nominees include:

•All of Eldorado’s independent directors meet the equity-ownership requirement

•John Webster, the Chair of the Audit Committee, and Teresa Conway are both considered to be financial experts by the SEC

•Board has adopted and adhered to Corporate Governance Guidelines

The bios starting on page 18 set forth information with respect to our proposed director nominees as of December 31, 2023.

The value of director shareholding, including deferred units (“DUs”), which represent notional Eldorado common shares based on the value of our common shares has been calculated at the higher of the value at issue date or fair market value at

December 31, 2023.

|

|

|

|

|

|

|

|

|

|

|

|

ELDORADO GOLD | 2024 NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND MANAGEMENT PROXY CIRCULAR |

|

17 |

|

|

|

|

|

|

|

|

|

Carissa Browning

Carissa Browning was appointed to the Board of Directors in January 2022. Ms. Browning is a corporate commercial lawyer at EnerNEXT Partners, a boutique legal and advisory platform focused on energy, cleantech and sustainability. She previously served as legal counsel for BC Hydro and TransAlta Corporation. She has broad industry experience in electricity and renewable energy, technology, fintech and commodity trading, and advises on matters relating to corporate governance, market regulation and sustainability. Ms. Browning is currently appointed to the Calgary Chapter Executive of the Institute of Corporate Directors, and formerly served on the boards of Women + Power, Energy Efficiency Alberta, TAMA Transmission, and Circle for Aboriginal Relations (“CFAR”). She holds a B.A. and LL.B. from the University of Calgary, and regularly contributes her thought leadership and reflections on the importance of diverse representation, reconciliation, and her views as an Indigenous woman. She identifies as a Dene from the Dehcho region (Northwest Territories).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Independent director since January 2022 |

Resides Alberta, Canada |

Age 50 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Areas of Expertise

Human capital matters

Capital markets

Legal and regulatory

Energy

Sustainability

Mergers & acquisitions

Corporate governance

Compliance

|

|

Education

LL.B., University of Calgary

B.A., Communications and

Culture, University of Calgary

Current Occupation

Lawyer, EnerNEXT Partners

|

|

Other Directorships

None

Accreditations

and Memberships

Law Society of Alberta

Law Society of British Columbia

Canadian Bar Association

Institute of Corporate Directors

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BOARD AND COMMITTEE MEMBERSHIP |

|

|

|

|

|

|

|

|

2023 Meeting

attendance

|

2023 Meetings

attended (%)

|

|

|

Board of Directors |

15 of 16 |

94 |

|

|

CGNC |

5 of 5 |

100 |

|

|

Sustainability Committee |

4 of 4 |

100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EQUITY OWNERSHIP |

|

|

|

|

|

|

OWNERSHIP REQUIREMENT |

OWNERSHIP UNDER THE GUIDELINES |

|

Ownership requirement |

Ownership

requirement value |

Total ownership value(1) |

Meets ownership requirement(2) |

|

5 x annual retainer |

$500,000 |

$320,023 |

On track |

|

|

|

|

|

|

|

|

|

|

|

|

Notes:

(1)Based on the higher of the value at acquisition date or fair market value at December 31, 2023 (CDN$17.20). For more information on director equity ownership, see page 61.

(2)Ms. Browning is on track to meet the ownership requirement and she has until January 2027 to meet her ownership requirement.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18 |

|

ELDORADO GOLD | 2024 NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND MANAGEMENT PROXY CIRCULAR |

|

|

|

|

|

|

|

|

|

George Burns

George Burns joined Eldorado on February 1, 2017, and assumed the role of President & Chief Executive Officer on April 28, 2017. Prior to joining Eldorado, Mr. Burns was Executive Vice President and Chief Operating Officer at Goldcorp. He also held the Goldcorp positions of Senior Vice President, Mexican Operations, and Vice President, Canada and United States. Prior to that he was Senior Vice President & Chief Operating Officer of Centerra Gold Inc.

Mr. Burns has over 40 years of experience in the mineral sector, including executive, operations, development and engineering leadership roles in gold, copper and coal operations. He has served in various capacities for Asarco LLC including Vice President of Mining as well as numerous capacities for Cyprus Minerals Corporation. He began his career with Anaconda Company in 1978. Mr. Burns has also served in the past as an independent director of another public mining company.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Director since April 2017(1) |

Resides British Columbia, Canada |

Age 64 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Areas of Expertise

Mining industry

Mining engineering

Sustainability

Mine and process operations,

development and construction

Mergers & acquisitions

|

|

Education

B.Sc., Mining Engineering,

Montana College of Mineral

Science and Technology

Current Occupation

President & CEO,

Eldorado Gold Corporation

|

|

Other Directorships

None

Accreditations

and Memberships

Institute of Corporate

Directors (ICD.D)

Society for Mining, Metallurgy & Exploration

Prospectors & Developers Association of Canada

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BOARD AND COMMITTEE MEMBERSHIP |

|

|

|

|

|

|

|

|

2023 Meeting attendance |

2023 Meetings attended (%) |

|

|

Board of Directors |

16 of 16 |

100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EQUITY OWNERSHIP |

|

|

|

|

|

|

OWNERSHIP REQUIREMENT |

OWNERSHIP UNDER THE GUIDELINES |

|

Ownership requirement |

Ownership

requirement value |

Total ownership value(2) |

Meets ownership requirement |

|

3 x annual salary |

$3,182,400 |

$14,080,126 |

Yes |

|

|

|

|

|

|

|

Notes:

(1)Mr. Burns is not an independent director and therefore does not receive compensation for his role as a director. See page 93 for details of Mr. Burns’ compensation.

(2)Based on the higher of the value at acquisition date or fair market value at December 31, 2023 (CDN$17.20). For more information on executive equity ownership, see page 74.

|

|

|

|

|

|

|

|

|

|

|

|

|

ELDORADO GOLD | 2024 NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND MANAGEMENT PROXY CIRCULAR |

|

19 |

|

|

|

|

|

|

|

|

|

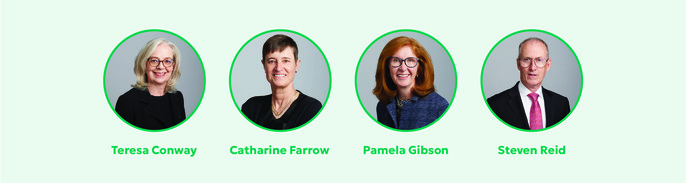

Teresa Conway

Ms. Conway was elected to the Board of Directors in June 2018. She is a former executive with over

25 years of experience in the North American renewable energy and energy markets. She was the President and CEO of Powerex (2005–2017), and prior to that held various executive positions since joining Powerex in 1993, including CFO, with accountability for information technology. She was also with PriceWaterhouseCoopers (“PWC”) and her primary focus was mining. Ms. Conway holds a B.B.A. from Simon Fraser University and is a Chartered Professional Accountant (CPA, CA). In addition, Ms. Conway has the designation ICD.D from the Institute of Corporate Directors. Ms. Conway also serves on the board of directors of Altius Minerals Corporation and Entrée Resources Ltd.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Independent director since June 2018 |

Resides British Columbia, Canada |

Age 66 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Areas of Expertise

Audit

Accounting

Finance

Energy sector

Corporate governance

Compliance

Compensation

Human capital matters

Risk management

Sustainability

|

|

Education

B.B.A., Simon Fraser University

Current Occupation

Corporate director

|

|

Other Directorships

Altius Minerals Corporation

Entrée Resources Ltd.

Accreditations

and Memberships

Chartered Professional

Accountants British Columbia

Institute of Corporate Directors (ICD.D)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BOARD AND COMMITTEE MEMBERSHIP |

|

|

|

|

|

|

|

|

2023 Meeting

attendance

|

2023 Meetings

attended (%)

|

|

|

Board of Directors |

16 of 16 |

100 |

|

|

Compensation Committee |

8 of 8 |

100 |

|

|

Audit Committee |

5 of 5 |

100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EQUITY OWNERSHIP |

|

|

|

|

|

|

OWNERSHIP REQUIREMENT |

OWNERSHIP UNDER THE GUIDELINES |

|

Ownership requirement |

Ownership

requirement value |

Total ownership value(1) |

Meets ownership requirement |

|

5 x annual retainer |

$500,000 |

$1,049,544 |

Yes |

|

|

|

|

|

|

|

|

|

|

|

|

Note:

(1)Based on the higher of the value at acquisition date or fair market value at December 31, 2023 (CDN$17.20). For more information on director equity ownership, see page 61.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20 |

|

ELDORADO GOLD | 2024 NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND MANAGEMENT PROXY CIRCULAR |

|

|

|

|

|

|

|

|

|

Catharine Farrow

Ms. Farrow was elected to the Board of Directors in April 2020. She is a Professional Geoscientist (PGO) with more than 30 years of mining industry experience. She is currently the President of FarExGeoMine Ltd., a private consulting company advising companies in geoscience, organizational issues and mining technology. From 2012 to 2017, she was Founding CEO, Director and Co-Founder of TMAC Resources Inc., a mining company formerly listed on the TSX. Before TMAC, Ms. Farrow was Chief Operating Officer of KGHM International and Chief Technology Officer of QuadraFNX Mining Inc. Previously at Quadra FNX and FNX Mining Company Inc., she held many senior roles in a wide range of disciplines including operations, technical services, corporate development and exploration. She has served on the boards of a number of private companies in mining and technology, not for profit and government advisory boards. She has been honoured as one of the 100 Global Inspirational Women in Mining (2015 and 2018), is the 2020 recipient of the Acadia University Distinguished Alumni Award, and is a past recipient of the William Harvey Gross Medal of the Geological Association of Canada (2000). Ms. Farrow also serves on the boards of Franco-Nevada Corporation, Centamin PLC and Aclara Resources Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Independent director since April 2020 |

Resides Ontario, Canada |

Age 59 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Areas of Expertise

Mining industry

Geology

Technical

Finance

Compensation

Human capital matters

Corporate governance

Sustainability

|

Education

B.Sc. (Hons.),

Mount Allison University

M.Sc., Acadia University

Ph.D., Carleton University

Current Occupation

President, FarExGeoMine Ltd.

Other Directorships

Franco-Nevada Corporation

Centamin PLC

Aclara Resources Inc.

|

Accreditations

and Memberships

Professional Geoscientists

Ontario (PGeo)

Institute of Corporate Directors

(ICD.D)

Society of Economic Geologists

Canadian Institute of Mining,

Metallurgy & Petroleum

Prospectors & Developers

Association of Canada

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BOARD AND COMMITTEE MEMBERSHIP |

|

|

|

|

|

|

|

|

2023 Meeting

attendance

|

2023 Meetings

attended (%)

|

|

|

Board of Directors |

16 of 16 |

100 |

|

|

Compensation Committee |

8 of 8 |

100 |

|

|

Technical Committee |

6 of 6 |

100 |

|

|

Sustainability Committee |

4 of 4 |

100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EQUITY OWNERSHIP |

|

|

|

|

|

|

OWNERSHIP REQUIREMENT |

OWNERSHIP UNDER THE GUIDELINES |

|

Ownership requirement |

Ownership

requirement value |

Total ownership value(1) |

Meets ownership requirement |

|

5 x annual retainer |

$500,000 |

$519,629 |

Yes |

Note:

(1)Based on the higher of the value at acquisition date or fair market value at December 31, 2023 (CDN$17.20). For more information on director equity ownership, see page 61.

|

|

|

|

|

|

|

|

|

|

|

|

ELDORADO GOLD | 2024 NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND MANAGEMENT PROXY CIRCULAR |

|

21 |

|

|

|

|

|

|

|

|

|

Judith Mosely

Ms. Mosely was appointed to the Board of Directors in September 2020. She has over 20 years of experience in the mining and metals sector, and most recently, held the position of Business Development Director for Rand Merchant Bank in London, with responsibility for developing the bank’s African business with international mining and metals companies. Prior to that, Ms. Mosely headed the mining finance team at Société Générale in London. Ms. Mosely holds a master’s degree in sustainability leadership from the University of Cambridge where her research focused on decarbonization in the gold mining industry. She also holds a diploma in business administration from the University of Warwick and a Master of Arts degree in modern languages from the University of Oxford. She serves on the boards of Galiano Gold Inc., BlackRock World Mining Trust plc and Women in Mining (U.K.).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Independent director since September 2020 |

Resides London, United Kingdom |

Age 59 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Areas of Expertise

Mining industry

Sustainability

Climate

Finance

Investment banking

Mergers & acquisitions

|

Education

Master of Studies in Sustainability Leadership, University of Cambridge

Diploma, Business

Administration, University

of Warwick

M.A., University of Oxford

Current Occupation

Corporate director

|

|

Other Directorships

BlackRock World Mining Trust plc

Galiano Gold Inc.

Accreditations

and Memberships

ESG Competent Boards

Certificate and Designation

(GCB.D)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BOARD AND COMMITTEE MEMBERSHIP |

|

|

|

|

|

|

|

|

2023 Meeting

attendance

|

2023 Meetings

attended (%)

|

|

|

Board of Directors |

16 of 16 |

100 |

|

|

Audit Committee |

5 of 5 |

100 |

|

|

Sustainability Committee |

4 of 4 |

100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EQUITY OWNERSHIP |

|

|

|

|

|

|

OWNERSHIP REQUIREMENT |

OWNERSHIP UNDER THE GUIDELINES |

|

Ownership requirement |

Ownership

requirement value |

Total ownership value(1) |

Meets ownership requirement(2) |

|

5 x annual retainer |

$500,000 |

$390,629 |

On track |

|

|

|

|

|

|

|

Notes:

(1)Based on the higher of the value at acquisition date or fair market value at December 31, 2023 (CDN$17.20). For more information on director equity ownership, see page 61.

(2)Ms. Mosely is on track to meet the ownership requirement and she has until January 2027 to meet her ownership requirement.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22 |

|

ELDORADO GOLD | 2024 NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND MANAGEMENT PROXY CIRCULAR |

|

|

|

|

|

|

|

|

|

Steven Reid

Mr. Reid was appointed as Chair of the Board on January 1, 2021. Mr. Reid was first elected to the Board of Directors in May 2013. He has over 45 years of experience in the mineral resource industry. Prior to his retirement, he was the Executive Vice President and Chief Operating Officer for Goldcorp Inc. from 2007 to September 2012. Before joining Goldcorp, Mr. Reid spent 13 years at Placer Dome in numerous corporate, mine management and operating roles. He holds a B.Sc. in mineral engineering from the South Australian Institute of Technology and a TRIUM Global Executive MBA. Mr. Reid is a member of AusIMM, CIM and the Society of Mining Engineers of A.I.M.E. (USA), and has the designation ICD.D from the Institute of Corporate Directors. Mr. Reid also serves on the board of directors of Gold Fields Limited as Lead Independent Director.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Independent director since May 2013 |

Resides Alberta, Canada |

Age 68 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Areas of Expertise

Mining industry

Technical

Mining engineering

Sustainability

Compensation

Human capital matters

Mergers & acquisitions

|

Education

TRIUM Global Executive MBA

B.Sc., Mineral Engineering,

South Australian Institute of

Technology

Current Occupation

Corporate director

|

Other Directorships

Gold Fields Limited

Accreditations

and Memberships

Fellow, AusIMM Member, CIM

Member, Society of Mining

Engineers of A.I.M.E. (USA)

Institute of Corporate Directors (ICD.D)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BOARD AND COMMITTEE MEMBERSHIP |

|

|

|

|

|

|

|

|

2023 Meeting

attendance

|

2023 Meetings

attended (%)

|

|

|

Board of Directors |

16 of 16 |

100 |

|

|

Compensation Committee |

8 of 8 |

100 |

|

|

Technical Committee |

6 of 6 |

100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EQUITY OWNERSHIP |

|

|

|

|

|

|

OWNERSHIP REQUIREMENT |

OWNERSHIP UNDER THE GUIDELINES |

|

Ownership requirement |

Ownership

requirement value |

Total ownership value(1) |

Meets ownership requirement |

|

5 x annual retainer |

$1,000,000 |

$2,593,136 |

Yes |

|

|

|

|

|

|

|

Note:

(1)Based on the higher of the value at acquisition date or fair market value at December 31, 2023 (CDN$17.20). For more information on director equity ownership, see page 61.

|

|

|

|

|

|

|

|

|

|

|

|

|

ELDORADO GOLD | 2024 NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND MANAGEMENT PROXY CIRCULAR |

|

23 |

|

|

|

|

|

|

|

|

|

Stephen Walker

Mr. Walker was elected to the Board of Directors in June 2022. He has over 37 years of experience in capital markets and the mineral resource industry. Prior to his retirement, he held varying roles in his

20 years with the Royal Bank, including Managing Director and Head of Global Mining Research from 2007 to 2020, Director of Canadian Equity Research from 2004 to 2006, and initially as a mining analyst.

Mr. Walker also worked as a mining analyst for Richardson Greenshields and then Gordon Capital. Prior to working in the banking industry, Mr. Walker worked for 11 years as a geologist with Noranda Mines and Hemlo Gold in Canada. He holds a B.Sc., Geology, from Dalhousie University, an M.Sc., Geology, from the University of Western Ontario, and an MBA from Queen’s University. Mr. Walker is a member of the CFA Institute and the Canadian Institute of Mining and Metallurgy. He is currently on the Skycatch Inc. advisory board as a Capital Markets Mining Consultant, and holds an ICD.D designation.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Independent director since June 2022 |

Resides Ontario, Canada |

|

Age 68 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Areas of Expertise

Mining industry

Sustainability

Compensation

Human capital matters

Investment banking

Corporate finance

Geology

Mergers & acquisitions

|

Education

MBA, Queen’s University

M.Sc., Geology, University

of Western Ontario

B.Sc., Geology, Dalhousie

University

Current Occupation

Corporate director

|

|

Other Directorships

None

Accreditations

and Memberships

Member, CFA Institute

Prospectors & Developers Association Canada

Society for Mining, Metallurgy & Exploration

Institute of Corporate Directors (ICD.D)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BOARD AND COMMITTEE MEMBERSHIP |

|

|

|

|

|

|

|

|

2023 Meeting

attendance

|

2023 Meetings

attended (%)

|

|

|

Board of Directors |

16 of 16 |

100 |

|

|

Audit Committee |

5 of 5 |

100 |

|

|

Technical Committee |

6 of 6 |

100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EQUITY OWNERSHIP |

|

|

|

|

|

|

OWNERSHIP REQUIREMENT |

OWNERSHIP UNDER THE GUIDELINES |

|

Ownership requirement |

Ownership

requirement value |

Total ownership value(1) |

Meets ownership

requirement(2)

|

|

5 x annual retainer |

$500,000 |

$416,945 |

On track |

|

|

|

|

|

|

|

Notes:

(1)Based on the higher of the value at acquisition date or fair market value at December 31, 2023 (CDN$17.20). For more information on director equity ownership, see page 61.

(2)Mr. Walker is on track to meet the ownership requirement and he has until June 2027 to meet his ownership requirement.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

24 |

|

ELDORADO GOLD | 2024 NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND MANAGEMENT PROXY CIRCULAR |

|

|

|

|

|

|

|

|

|

John Webster

Mr. Webster was appointed to the Board of Directors in January 2015. He spent over 30 years with PriceWaterhouseCoopers LLP (“PWC”) until his retirement in June 2014. His roles included eight years as Managing Partner in British Columbia, three years as Assurance Leader in Romania and Southeast Europe, and as leader of the firm’s Mining Practice in Canada. He has extensive experience as an audit partner, and has provided advice to both venture capital and listed clients on large, complex transactions. Mr. Webster holds a B.A. (Hons.) in economic and social history from the University of Kent, and is a member of the Institute of Chartered Accountants in England and Wales. He is both a Fellow (2002) and a member of the Chartered Professional Accountants of British Columbia (1983). Mr. Webster also serves as the Chair of the board of Euro Manganese Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Independent director since January 2015 |

Resides British Columbia, Canada |

Age 69 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Areas of Expertise

Human capital matters

Mining industry

Accounting

Audit

Corporate finance

Mergers & acquisitions

Corporate governance

Compliance

|

Education

B.A. (Hons.),

University of Kent at Canterbury

Current Occupation

Corporate director

Other Directorships

Euro Manganese Inc.

|

|

Accreditations

and Memberships

ACA, Institute of Chartered Accountants in England and Wales

FCPA and FCA, Chartered Professional

Accountants of British Columbia

Accredited Director (Acc. Dir., ICD.D)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BOARD AND COMMITTEE MEMBERSHIP |

|

|

|

|

|

|

|

|

2023 Meeting

attendance

|

2023 Meetings

attended (%)

|

|

|

Board of Directors |

16 of 16 |

100 |

|

|

Audit Committee |

5 of 5 |

100 |

|

|

CGNC |

5 of 5 |

100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EQUITY OWNERSHIP |

|

|

|

|

|

|

OWNERSHIP REQUIREMENT |

OWNERSHIP UNDER THE GUIDELINES |

|

Ownership requirement |

Ownership

requirement value |

Total ownership value(1) |

Meets ownership

requirement

|

|

5 × annual retainer |

$500,000 |

$1,602,328 |

Yes |

|

|

|

|

|

|

|

Note:

(1)Based on the higher of the value at acquisition date or fair market value at December 31, 2023 (CDN$17.20). For more information on director equity ownership, see page 61.

|

|

|

|

|

|

|

|

|

|

|

|

|

ELDORADO GOLD | 2024 NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND MANAGEMENT PROXY CIRCULAR |

|

25 |

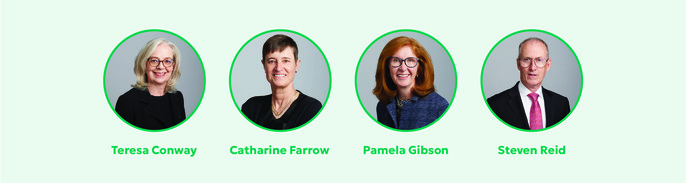

Meeting Attendance

Directors attended 99% of our Board meetings and 100% of our committee meetings in 2023; all eight of our directors that have been nominated for election were elected by shareholders at the 2023 Annual Meeting.

Meeting In-camera

The Board and each of the committees meet without management and non-independent directors present (in-camera). In 2023, the Board held in-camera sessions at each of its 16 scheduled meetings. The Audit Committee and Corporate Governance and Nominating Committee (“CGNC”) met five times, the Sustainability Committee met four times, the Compensation Committee met eight times and the Technical Committee met six times.

2023 Board and Committee Meeting Attendance

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Committee meetings |

Director |

Board

meeting

|

Audit |

Compensation |

CGNC |

Sustainability |

Technical |

Carissa Browning(1) |

15 of 16 |

|

|

5 of 5 |

4 of 4 |

|

| George Burns |

16 of 16 |

|

|

|

|

|

Teresa Conway(2) |

16 of 16 |

5 of 5 |

8 of 8 |

|

|

|

Catharine Farrow(2) |

16 of 16 |

|

8 of 8 |

|

4 of 4 |

6 of 6 |

Pamela Gibson(2) |

16 of 16 |

|

8 of 8 |

5 of 5 |

4 of 4 |

|

Judith Mosely(2) |

16 of 16 |

5 of 5 |

|

|

4 of 4 |

|

| Steven Reid |

16 of 16 |

|

8 of 8 |

|

|

6 of 6 |

Stephen Walker |

16 of 16 |

5 of 5 |

|

|

|

6 of 6 |

John Webster(2) |

16 of 16 |

5 of 5 |

|

5 of 5 |

|

|

Notes:

(1)Ms. Carissa Browning was appointed Chair of the CGNC effective January 1, 2024. Ms. Browning attended all of the regularly scheduled Board meetings and provided advance notice to the Chair of her inability to attend an unscheduled meeting.

(2)The following directors served as committee Chairs in 2023:

•Ms. Conway – Chair of the Compensation Committee

•Ms. Farrow – Chair of the Technical Committee

•Ms. Gibson – Chair of the CGNC

•Ms. Mosely – Chair of the Sustainability Committee

•Mr. Webster – Chair of the Audit Committee

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26 |

|

ELDORADO GOLD | 2024 NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND MANAGEMENT PROXY CIRCULAR |

Cease Trade Orders, Bankruptcies, Penalties or Sanctions

|

|

|

|

|

|

|

|

|

Area |

|

Director |

Cease trade orders – Has any proposed director, within the last 10 years, been a director, CEO or CFO of any company that was subject to a cease trade order (or an order similar to a cease trade order or an order that denied the company access to any exemption under securities law) that was issued while the person acted in that capacity or because of an event that occurred while the person acted in that capacity? |

|

None |

|

Bankruptcy – Has any director, within the last 10 years,

•Personally, or

•Been a director or executive officer of any company (including ours) that (while, or within a year of, the person acting in that capacity):

become bankrupt, made a proposal under legislation relating to bankruptcy or insolvency or been subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets or the assets of the nominated director?

|

|

None |

|

Penalties and sanctions – Has any director or proposed director been subject to:

(a)Any penalties or sanctions imposed by a court, securities regulatory authority, or entered into a settlement agreement with any securities regulatory authority, or

(b)Any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable security holder in deciding whether to vote for a proposed director, since December 31, 2000?

|

|

None |

Loans to Directors and Officers

We do not grant loans to our directors, officers or employees. As a result, we do not have any loans outstanding to them.

Directors’ and Officers’ Liability Insurance

We maintain insurance policies with regards to directors’ and officers’ liability. These policies have an annual limit of

USD$120 million, and provide coverage for costs incurred to defend and settle claims against our directors and officers.

We paid premiums of USD$1,541,500 for the period November 1, 2023 to October 31, 2024. The policies have a deductible of USD$1,500,000 and are renewed annually.

Each director and officer has an individual indemnity agreement with us. This agreement indemnifies them from costs, charges and expenses they incur related to any civil, criminal, administrative, investigative or other proceeding they are involved with as a director or officer of Eldorado, provided certain conditions are met.

|

|

|

|

|

|

|

|

|

|

|

|

ELDORADO GOLD | 2024 NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND MANAGEMENT PROXY CIRCULAR |

|

27 |

Environmental, Social and Governance

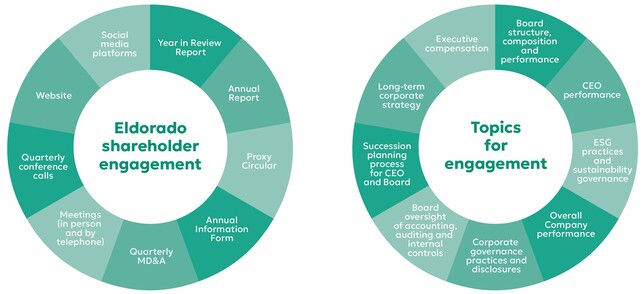

Eldorado is committed to integrating sustainability into our daily actions to help create long-term value for our shareholders and the communities where we operate. We are dedicated to the highest safety and environmental standards, establishing and maintaining good relationships with host communities and governments, and creating meaningful and lasting benefits for the people whose lives our operations touch. The information below highlights our environmental, social and governance program and policies, and environmental, social and governance initiatives. For more information on our approach, please see our Sustainability Report on our website (sustainability.eldoradogold.com).

Sustainability

We are committed to building “sustainability from the ground up,” which means we consider sustainability in everything we do, from exploration to closure to our relationships with customers, communities, investors and other stakeholders, and share this responsibility from mine site employees to our Board and executive team. Our Company values of collaboration, courage, integrity, drive and agility provide a meaningful foundation to this approach and form the basis of our sustainability framework. Our framework is supported by our management system, consisting of a suite of sustainability policies, our Sustainability Integrated Management System (“SIMS”), and site-level guidance and procedures.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

28 |

|

ELDORADO GOLD | 2024 NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND MANAGEMENT PROXY CIRCULAR |

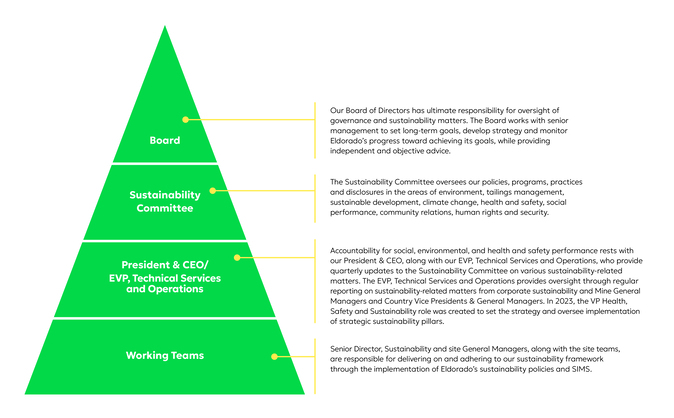

Sustainability Governance

Highlights from 2023 include:

•Eldorado successfully completed its second-ever SIMS Compliance Verification at the Kassandra Mines in 2023, covering social, occupational health and safety, environment, security, and general sustainability standards. The Olympias mine achieved externally verified MAC-TSM results of AAA in the areas of Biodiversity Conservation Management and Tailings Management, and Eldorado received independent assurance of full conformance with the WGC RGMP Year 3 requirements

•56% of our Board of Directors are women including 10% representation from other designated groups beyond women, exceeding our aspirational target of exceeding at least 40% from designated groups

•Hellas Gold Single Member S.A. was named one of “The Most Sustainable Companies in Greece 2023”

Eldorado has a full suite of sustainability policies, covering health and safety, environment, social performance and human rights. These policies are in line with our internal commitments in SIMS and embody the commitments in our sustainability framework more formally.

The policies address key obligations to external standards and recognized best practices, including Responsible Gold Mining Principles, Towards Sustainable Mining, International Organization for Standardization, United Nations Global Compact and more. We review our policies annually, as per SIMS. Our approach involves concepts such as:

Health and safety: Building a stronger culture of safety through empowerment and proactive risk management and collaboration, while remaining focused on measurable and continuous improvement

Environment: Implementing a climate change strategy, exploring low-carbon technologies and renewables, and establishing environmental objectives and targets for continuous improvement

Human rights: Respecting all human rights and not causing or contributing to human rights abuses or conflict through our operations and supply chains by undertaking a risk-based approach, with specific focus on vulnerable populations

Social performance: Managing our social impacts through engagement and a risk-based approach, seeking to avoid or mitigate adverse impacts and provide meaningful benefits to local communities

The policies can be read in full on our website (www.eldoradogold.com/about-us/governance/).

|

|

|

|

|

|

|

|

|

|

|

|

ELDORADO GOLD | 2024 NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND MANAGEMENT PROXY CIRCULAR |

|

29 |

Sustainability Highlights Timeline

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2023 |

|

|

|

•Second SIMS Compliance Verification at the Kassandra Mines, with independent assurance of full conformance with the WGC RGMP Year 3 requirements and external verification of MAC-TSM performance results |

|

|

|

•Eldorado adopts a Supplier Code of Conduct |

|

|

|

•Eldorado details its GHG Emissions Target Achievement Pathway as part of its Climate Change Strategy |

|

|

|

|

|

|

|

2022 |

|

|

|

•Eldorado is named one of the Best 50 Corporate Citizens in Canada by Corporate Knights |

|

|

|

•Undergoes its first internal SIMS Compliance Audit with independent assurance at the Lamaque mine, which includes first TSM external verification |

|

|

|

|

|

|

|

2021 |

|

|

|

•Publishes its Year 1 Responsible Gold Mining Principles Report |

|

|

|

•Adopts a Social Performance Policy |

|

|

|

•Formally begins to implement Voluntary Principles on Security and Human Rights across all operating mines |

|

|

|

•Launches its Climate Change Strategy and announces its inaugural GHG emissions target published in its first Task Force on Climate-related Financial Disclosures (“TCFD”) aligned Climate Change & GHG Emissions Report |

|

|

|

•Establishes an Independent Tailings Review Board |

|

|

|

|

|

|

|

2020 |

|

|

|

Develops its global sustainability framework and SIMS |

|

|

|

|

|

|

|

2019 |

|

|

|

Aligns its annual Sustainability Report with Sustainability Accounting Standards Board (“SASB”): Metals and Mining Standard |

|

|

|

|

|

|

|

2016 |

|

|

|

•Adopts a Human Rights Policy |

|

|

|

•Becomes signatory to the United Nations Global Compact |

|

|

|

|

|

|

|

2013 |

|

|

|

Adopts the World Gold Council’s Conflict-Free Gold Standard and publishes its first Conflict-Free Gold Report |

|

|

|

|

|

|

|

2012 |

|

|

|

•Publishes first annual Global Reporting Initiative (“GRI”) aligned Sustainability Report for 2011 |

|

|

|

•Begins participating in the Carbon Disclosure Project (“CDP”) |

|

|

|

•Becomes signatory to the International Cyanide Management Code |

|

|

|

|

|

|

|

2011 |

|

|

|

Adopts an Environmental Policy and a Health and Safety Policy |

|

|

|

|

|

|

|

2004 |

|

|

|

Implements Code of Ethics and Business Conduct |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30 |

|

ELDORADO GOLD | 2024 NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND MANAGEMENT PROXY CIRCULAR |

Social

Communities

We strive to create social and economic capital through all of our community programs. Investing in the future of our communities is core to our belief that mining can help to enrich lives and build vibrant communities.

Examples of contributions made over the course of 2023 are noted below:

Community Investment Highlights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kışladağ, Türkiye |

|

|

|

Efemçukuru, Türkiye |

|

|

|

|

|

|

|

|

|

•Continued contributions toward improved quality of education through provision of school materials, maintenance of critical community infrastructure, such as water supply lines to local villages, and promotion of cultural heritage through traditional festivals in the towns of Eşme and Ulubey

•Implemented its Women Entrepreneur Vision Program, in partnership with Women-Friendly Brands, which aims to support local communities, particularly members of the Eşme Women Entrepreneur Cooperative, with educational and entrepreneurial opportunities. In 2023, the program helped deliver entrepreneurial mentorship, support in seeking grants and financial incentives for cooperatives, and trainings on key topics, such as financial literacy, e-commerce and digital marketing

|

|

|

|

•Continued implementation of the Productive Women, Strong Futures project, which aims to address historical socio-economic barriers and foster opportunities for local women through education and entrepreneurship. In 2023, the project focused on upstarting beekeeping businesses, with the involvement of 25 female entrepreneurs |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lamaque, Canada |

|

|

|

Kassandra Mines, Greece |

|

|

|

|

|

|

|

|

|

•Sponsorship toward the construction of the Institute of Mining and Environmental Research pavilion of the l’Université du Québec en Abitibi-Témiscamingue Foundation

•Supported the Maison de la Famille de Val-d’Or to acquire a new property and to improve services offered to families, including newcomers

•Composting project in partnership with the

Vallée-de-l’Or regional county municipality to purchase local compost to rehabilitate the mine’s tailings facilities

|

|

|

|

•Continued support for long-term partnerships, including the EduAct program to deliver STEM workshops across local communities and wildfire monitoring by the Aero-Club of Thessaloniki

•Funding provided for historically significant studies, including the establishment of a Alexis Zorbas House museum in Paleochori and additions to Aristotle Park in the ancient village of Stagira

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ELDORADO GOLD | 2024 NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND MANAGEMENT PROXY CIRCULAR |

|

31 |

Human Capital Management

The Board believes that attracting, developing and retaining diverse talent globally is vital to Eldorado’s long-term success. The Board, through various committees, and notably the CGNC and Compensation committees, is responsible for oversight of human capital management (“HCM”) as illustrated below.

Executive Succession Planning

HCM strategies are discussed and monitored quarterly with in-depth discussions on executive succession management annually. Executive succession planning forms an important component of HCM, and our Board views ensuring we have the appropriate management in place to execute our long-term strategy as one of our most important responsibilities. The Company has a formal development and succession plan for senior management positions in place, and it is reviewed on an ongoing basis, and at least annually, by the full Board.

The formal succession plan is reviewed in detail and includes:

•Profiling candidate assessments, considering both external and internal candidates

•Processing and timeline, including candidate readiness: ready now, ready in one year, ready in three to five years, ready in over five years

•Emergency designates for each of the senior executives

•Succession development planning for the CEO and senior executives

•Leadership pipeline and development for the next generation of leadership

•Diversity, equity, and inclusion initiatives, and how we can increase representation from among other designated groups as defined in our Diversity Policy

In April, July, and October 2023, the Board met to review the executive succession plan for the CEO and other senior management positions.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

32 |

|

ELDORADO GOLD | 2024 NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND MANAGEMENT PROXY CIRCULAR |

Diversity, Inclusion and Employee Engagement

We believe diverse and inclusive boards and teams are a source of competitive advantage. Decisions about people – including who to hire or promote or which entities to partner with – are among the most critical business decisions we make. These decisions involve finding people and partners with the necessary skills, knowledge, experiences, and other attributes required for the work ahead. In mining, those skill sets are often very specialized, so cognitive diversity is paramount to achieve our vision to build a sustainable, high-quality business in the gold sector.

Because a culture of inclusion starts with the tone at the top, our leadership model, known as Valuable Leadership, is designed with inclusive leadership at its foundation. Through this model and various development modules made available on-demand to our global leadership team, we emphasize the principles of building psychological safety among teams, encouraging worker voice, mitigating unconscious bias in decision-making, and fostering a growth-mindset philosophy among teams. Our site teams build on this foundation, incorporating similar principles and techniques in their local leadership development offerings.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Key Human Capital Initiatives in 2023

•Completed a global Employee Engagement survey

•Executing on our inclusive-diversity roadmaps

•Completed a Health & Safety Perception Survey

•Fostered a strategic partnership to advance representation of women in the procurement function

•Conducted gender pay-equity reviews using best-in-class third-party analytic software to identify any unintended and systemic bias in our compensation processes

|

|

|

|

As We Move into 2024,

Momentum Will Continue

•Embed MAC TSM Equitable, Diverse & Inclusive Workplaces and Safe, Healthy, and Respectful Workplace protocols within SIMS

•Complete a Global Inclusion Survey, measuring trending relative to 2021/2022 baseline surveys

•Continue initiatives focused on improving worker voice, respect, and belonging through site-specific initiatives

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ELDORADO GOLD | 2024 NOTICE OF ANNUAL MEETING OF SHAREHOLDERS AND MANAGEMENT PROXY CIRCULAR |

|

33 |

Key Diversity Milestones

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2023 |

|

Our Diversity Policy included aspirational targets for year end 2023 and, as such, was updated at the end of the year. The new Diversity Policy ensures that the CGNC, which is responsible for recommending director nominees to the Board, will continue to consider director candidates on merit, based on a balance of skills, background, experience and knowledge. In identifying the highest-quality directors, the CGNC considers identity diversity and cognitive diversity, with a view to ensuring that the Board benefits from a broader range of perspectives and relevant experience.

As unconscious bias can adversely impact members of other designated groups in the selection process, we endeavour to mitigate bias by:

• Directing third-party recruiters to include at least 50% of candidates from the designated groups, and use blind recruitment techniques

• Ensuring the shortlist to be interviewed includes a balanced number of candidates representing members of designated groups

As part of our Board renewal process and senior management succession planning, our Board of Directors and senior management:

• Survey the Board and senior management team to self-identify among one (or more) of the designated groups

• Review the number of individuals in designated groups on the Board and in senior management positions

• Consider opportunities to enhance diversity from designated groups at the Board and senior management levels aligned with our Diversity Policy

|

|

|

Updated our Diversity Policy for 2024 to reflect intention to maintain at least 30% women and at least 10% from other designated groups (beyond women), for a combined aspirational target of at least 40% from one or more designated groups |

|

|

|

|

|

|